You can have the best of intentions with your time...

7 tips to help your small business! Equipment

Important terms and conditions to protect you and your business.

WANTED

‘Employers’ and ‘Employees’

Listing the employers wanting employees

www.aussiepaintersnetwork.com.au Spend Your Time Intentionally

Adjust for Inflation

Hire Agreements

From the Editor

Hey Everyone,

Welcome to the 122nd edition of the Aussie Painting Contractor Magazine.

I hope everyone had a fabulous break and came back ready to hit the ground running.

From all reports, 2023 has started for everyone with a bang!! Prices are up and not enough staff to do the work. Aussie Painters Network have been working on a way to assist you with your staffing problems. This will be launched next month.

APN have been having great success with finding apprentices and getting people into work within the industry. It has been an exciting start to the year. If you are looking for staff, reach out and contact Brina in our office. 0430 399 800.

The Painters Podcast has got off to a great start with interviews with people within the industry sharing their stories. If you would like to join Glenn and myself to have a chat, just reach out. We would love to hear from you.

On a personal note, thanks to all the supporters of APN, we are here to support you in any way that you require, please remember, if you need any assistance, reach out, APN are here to help.

CONTRIBUTORS

• Jim Baker

• Kylie Shiels

• Leo Babauta

• Lauren A. Keating

• Mary Cairns

• Oliver Kay

• Peter A. Heslin

• Robert Bauman

• Sandra Price

• Tania Driver

• Ute-Christine Klehe EDITOR

Nigel Gorman

GRAPHIC DESIGNER

Nigel Gorman

nigel@aussiepaintersnetwork.com.au

07 3555 8010

J. Anne Delgado

'Til next month, Happy Painting!!

Advertise with us... 1800 355 344 07 3555 8010 info@aussiepaintersnetwork.com.au www.aussiepaintingcontractor.com

Contents

7 tips to help your small business Adjust for Inflation

How to Set Up Your Business to Thrive Spend Your Time INTENTIONALLY

24 32

How much do tradies spend ON INSURANCE?

Growth hacks for your Small Business

12 ways to finally achieve YOUR MOST ELUSIVE GOALS

Everyone wants it Work/Life Balance

Equipment Hire Agreements

34 37 38 43 46 47

What’s the plan for this year?

Do you stand out from the crowdAre you unique?

WANTED ‘Employers’ and ‘Employees’

What is income protection insurance – and how’s it different to total and permanent disability insurance?

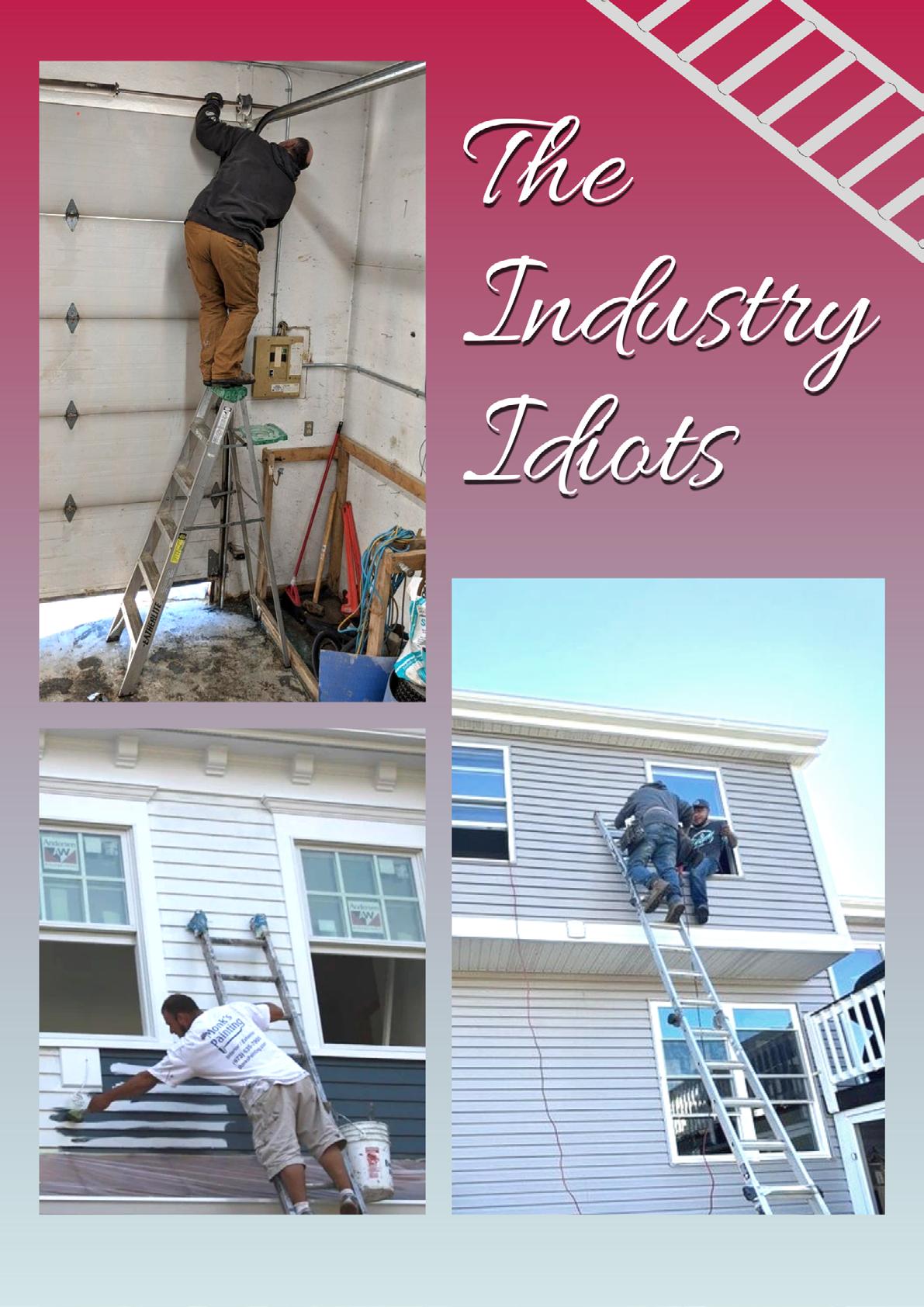

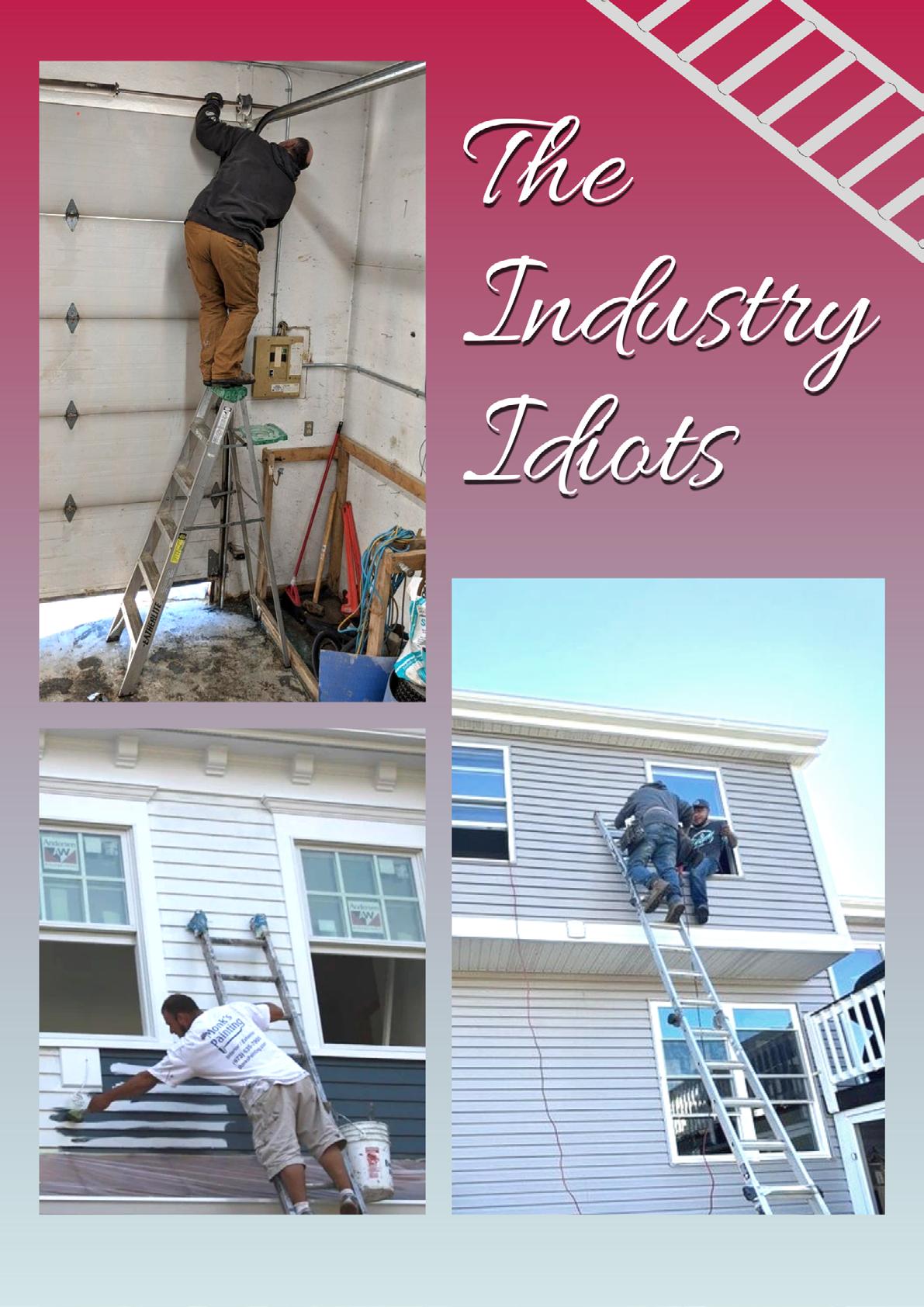

Industry Idiots

Important Contacts

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you January incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

06 08 12 15 20

22

7 tips to help your small business Adjust for Inflation

Inflation has ballooned worldwide in recent months, and there’s no question that small businesses are feeling the pinch. Supplies cost more, employees are hard to find, and your profits are shrinking.

It’s undoubtedly challenging, but you can weather the storm with the following tips.

1. Study your data

Your numbers are always helpful, but in times of rapid inflation, you’ll be especially thankful that you keep a nice, clean set of books. Analyze your data to learn what products and services make you the most money, which ones cost the most to offer, and to identify where you can save.

2. Cut expenses

Now that you’ve identified where you can save money, go ahead and cut what you can. It’s nice to be able to offer many products and services, but this is a time to tighten your belt.

Focus on the items that keep your business as healthy as possible, and ditch the rest – at least for the time being. It’s okay to simplify, especially when times are tough.

3. Adjust your prices

Nobody likes to raise their prices, but the reality is you likely have no choice. Keeping prices the same would indeed be wonderful for your customers or clients. However, if you’re offering your products or services at the same prices as before inflation started to climb rapidly, you’re absorbing the cost.

When you dig into your data, you may find that some things you offer actually cost you a lot of money. That’s not a sustainable business model – raise your prices to keep yourself afloat, or find items that cost less for you to sell.

4. Simplify and automate

If aspects of your business take a long time to complete, see if there’s anything you can do to reduce those hours. Switching to cloud accounting or inventory management software would be excellent examples, as doing so would allow you to use your valuable time elsewhere.

Identify where you can simplify and automate, and then do it. Then, even when inflation comes back under control, you will undoubtedly find that the saved time helps.

6 | Aussie Painting Contractor

5. Focus on your customer

Remember that your customers are keeping you in business and experiencing inflation in their lives too – both at home and in their own businesses.

Keep the lines of communication clear and open, especially if you’re going to alter your offerings or raise your prices. It’s a lot easier to retain loyal customers than it is to gain new ones, so make sure they know how much you value them and communicate openly to maintain their trust and loyalty.

6. Consider your employees

Good help is hard to find. Those who work for you are feeling the pinch as well. While it’s essential to automate what you can, you must consider the consequences it will have on your staff. Identify how you can better use their talents if parts of their roles become automated.

7. Remember, this will pass

Inflation has happened before and will undoubtedly happen again after this. Historically, periods of inflation last anywhere from a few months to several years. One thing, however, must be remembered: all periods of inflation end.

FINAL THOUGHTS

While inflation is difficult for small businesses, there are steps you can take to reduce its impact. Focus on what you can control and face what you can’t with confidence and creativity. With some planning, clear communication, and smart adjustments, you will come out of this inflationary period intact.

Need some help?

Book a strategy session HERE to see how we can improve your bottom line.

Sandra Price www.tradiebookkeepingsolutions.com.au

2023 January Issue | 7

How to Set Up Your Business to Thrive

When a business first starts out, it’s natural for the owner to be a jack of-all-trades. You may not have the capital to hire specialists or access to the technology that can help you. As your business grows–or as you look to take a smaller role in your company–you may find the business has become over-reliant on you, which makes it difficult for you to take a step back.

Here are some steps you can take to enable your business to thrive, even if you can’t be there all the time.

1. Review workflows

Have someone interview everyone in the company to find out what their job is and how they fulfill their tasks. Look at their processes to see if there are ways to make their tasks more efficient and seamless–you could even look at best practices in other companies to see how they manage their tasks.

The goal here is to make processes as simple and efficient as possible. Take out any unnecessary steps and ensure each process only involves tasks that are vital to successful completion.

2. Automate what you can

Often in business, people continue doing a task inefficiently simply because they got used to doing

it that way. That can lead to hours being spent in activities that could be automated. Look at activities that are carried out regularly and investigate whether software exists to make that process easier for you.

For example, if your staff spends hours each day updating your customer database, it’s worth looking into customer relationship management (CRM) software, which automatically takes care of that for you, saving you time and reducing the risk of errors. Likewise, if your team spends time following up on unpaid invoices, consider an online invoicing system that automatically sends out overdue notices.

3. Document the processes

Once you have an idea of how people carry out their responsibilities and have identified ways to improve or automate them, write the processes out. If possible, keep the documents digital, so they can be updated as your business evolves and so everyone can easily find them. If you’ve purchased software to automate processes, make sure everyone who would use the software knows how to access it and can do so easily.

Finally, ensure the documents are stored somewhere safe and accessible for your staff. You could use Google Docs or software designed to help with business process management.

8 | Aussie Painting Contractor

4. Train your staff

Now is the time to train your team in your optimal workflows. Make sure everyone has read and understood the documented processes and knows how to access and use any software or technology you’ve purchased. Ideally, you’ll have a couple of people trained to cover each area of your business, so if one is ill or unable to work for a while, someone else can easily step in to carry out those responsibilities.

you and look for ways to foster self-reliance. This may mean identifying gaps in your employees’ expertise and hiring people with complementary skills, finding new ways to automate workflows, working with consultants and outside service providers to fill in gaps, or creating an FAQ document where questions you’re commonly asked are answered.

As your business grows and you step away, you’ll need to ensure you have staff who can take over various activities. Reviewing and documenting your processes, automating what you can, and identifying areas where your business is overly reliant on you will set you up for success.

If you want a second opinion on whether your business systems and processes are actually effective, visit our website at www.straighttalkat.com.au and complete your details on our Home page to request a free appointment.

5. Make your business self-reliant

You want your business to function without you so it still thrives if you become ill, need a vacation or otherwise can’t work for a while. Examine your processes for areas where the company is still overly reliant on

A D V A N T A 6 [ Eliminate the B.S. in your business and your mates will be asking... "how do you have time to go fishing on the weekend?" Tradies Advantage offers you the COMPLETE FINANCIAL SOLUTION under one roofbookkeeping and accounting at a monthly FIXED price. • Get your invoices out on time • Stop ch asing debtor s and get paid quicker • Better manage rece ipts and paperwork • Lodge your BAS on time - don't cop a fine • Stop mi ssing deductions • Plan ahead and measure how you're going CONTACT US 07 3333 2415 info@tradiesadvantage.com.au 191 Wynnum Road, Norman Park QLD 4170

Spend Your Time INTENTIONALLY

I’ve seen a lot of people with goals about changing how they spend their time, things like:

• Spend more time with family

• Have a better work/life balance

• Spend more time outdoors

• Spend more time with friends

• Read more

• And so on

These are wonderful goals! They all involve something that theoretically is pretty simple: simply change how you spend your time.

But it’s rarely that simple, is it? Something causes us to spend our time in ways we want to change, but struggle to change.

Today we’ll look at what pulls us off goals like this, and how to shift to being more intentional about how you spend your time.

What Pulls Us Off Our Time Intentions

Let’s say you have a goal like, “Spend more time with family (or friends)” … why do you need a goal like that in the first place? Without any judgment, it’s worth asking, Why aren’t you already doing that?

Or another way to ask it: What will likely pull you away from that goal?

We can have the best of intentions with our time, but there are a few things that commonly cause us to get pulled away from those intentions:

• Unexpected things come up — an urgent work situation, a new request for our time, a crisis, really anything that needs to be dealt with that we didn’t anticipate.

• Things take longer than we thought they would. This is really common. We think we’ll take an hour to write that report, and it takes four. We think we’ll just run to the store for 20 minutes for a quick errand, and it takes 45 minutes.

• We forget to plan for things that don’t usually go on our schedule, like eating, rest, showering, brushing our teeth, folding laundry, cooking and cleaning up, and so on. So our ideal schedule rarely has everything we really need to do, and as a result, the schedule will often be thrown way off.

My suggestion for these is to put some padding into your plan, so you can deal with the unexpected. If you have time intentions blocked off on a calendar... don’t make it too tightly planned. Give space for rest, taking care of yourself, catching up, and so on.

12 | Aussie Painting Contractor

But there’s one bigger reason we get pulled off our intentions: fear vs. comfort.

For example:

• We might want to spend time with family … but when we’re getting a bunch of requests from clients (or coworkers), we might decide to work late instead of getting home on time.

• We might want to read more … but we abandon that when we’re feeling stressed about a project and decide to fill our available time with work.

• Or maybe we end up scrolling on our phones, or browsing or watching on the Internet, instead of doing what we planned … because we’re feeling stressed and want to comfort ourselves with distractions.

When we’re feeling stress, fear or resistance, we might get pulled towards work or distractions because we think that will allay the fear or comfort the stress. That’s the biggest reason we get pulled away from our intentions.

Then block it off on your calendar, and commit to others. Maybe you do your walks with your partner or best friend. Plan your weekends and weeknights with your family. Join a reading challenge or have reading time with the family.

Set a reminder to review your intentions every morning or evening.

How to Spend Your Time More Intentionally

The first thing is to think about what intentions you have for your time that you’re not already doing. For example:

• Read more

• Get outdoors more

• Spend more time with family

Once you’ve got those intentions, you can get clearer: 30 mins of reading everyday, an hourlong walk or hike in nature 4x a week, evenings with family after 6pm on weekdays and half day fun on both Saturdays and Sundays.

Those are the first steps. The real work will come when you get confronted by fear, resistance or stress … and look to get out of these intentions by working or going to distractions.

When this happens:

• Bring awareness to what you’re feeling that’s pulling you from your intentions. Can you feel it in your body?

• Find a way to calm or soothe the fear / stress. Do you need a few minutes of walking? Deeper breath? Some love? Someone to talk to?

• Once you’re calmer, remind yourself of your intentions. Take a minute to remember why you wanted to do this. Is this intention more important than the temporary discomfort of fear or stress?

• Return to your intentions with love/devotion.

This is a practice, and it doesn’t come naturally to most of us. But if you’d like to live a more intentional life, this is the practice. What would you like to do?

Leo Babauta ZEN HABITS

2023 January Issue | 13

12 ways to finally achieve YOUR MOST ELUSIVE GOALS

It’s that time of year to muse on what you hope to accomplish over the next 12 months.

The best advice when making resolutions is to set goals that are “SMART” – specific, measurable, achievable, relevant (to you) and time-bound.

Read more: Three ways to achieve your New Year’s resolutions by building ‘goal infrastructure’

Once you’ve set your goals, what can help you achieve them? Based on our research, we’ve distilled 12 goal-enablers. These cover four broad principles you can use to keep yourself on track.

You don’t have to do all 12. Just focusing on the most relevant three to five can make a big difference.

Set relevant supporting goals

An outcome goal isn’t enough. Set clear supporting goals that equip you to attain that outcome.

1. Behavioural goals stipulate the actions required to reach your outcome goal. If you want to change jobs, for example, behavioural goals could include working out what job you want, networking with relevant people, getting advice on your resume, and submitting at least three job applications each month.

2. Learning goals are the knowledge and skills you need to achieve your goal. Ways to identify your highest-priority learning goals, and how to attain them, include seeking advice from others who have mastered the skill you aim to learn, working with a coach, or watching instructional videos.

3. Sub-goals are small milestones on the way to your goal. They indicate your rate of progress towards attaining your ultimate goal. They can also provide a motivating sense of momentum.

2023 January Issue | 15

Sub-goals are stepping stones on your way to achieving your end goal. Shutterstock

Build your internal motivation

This is the inner energy and focus that fuels, directs and sustains your efforts to reach your goals.

4. Connect goals to passions. If you like feeling like you’re on a mission, try framing your goals as reflecting a novice, apprentice or master level of development. If competition gets you going, perhaps frame your learning or sub-goals as indicating a bronze, silver, gold or platinum level of performance.

5. Engage in mental contrasting. This involves toggling between focusing on a vivid written or visual depiction of your present state with your desired future state. Mental contrasting increases goal achievement in areas such as eating more healthily, exercising more, improving grades and cutting down on alcohol consumption.

7. Implementation intentions stipulate when to pursue behavioural goals. These intentions increase the odds of attaining any goal. Two types are: When-then intentions (for example: “When I am tempted to eat a snack, then I will drink a glass of water and wait 10 minutes to see if I still feel I need that snack”)

After-then intentions (for example: “After I eat lunch each day, then I’ll walk for at least 15 minutes somewhere green with my phone off”).

8. Ensure adequate resources. These could include adequate materials, technology, support of others, time and energy (enabled by an effective recovery routine).

Read more: Exhausted by 2020? Here are 5 ways to recover and feel more rested throughout 2021

Mental contrasting between current and desired state can increase goal attainment. Shutterstock

6. Build self-efficacy. Your self-efficacy is your belief in your capacity to succeed at a particular task. Set modest initial goals you are likely to achieve (see point 3). Ensure you have adequate resources and support (see point 8). If you find yourself thinking defeatist thoughts – “I don’t think I can do this” or “I’m too old for this” – then stop and think more encouraging thoughts instead.

Craft an enabling context

An enabling context helps keep your goals front of mind and sustains you in working to achieve them.

9. Seek useful feedback to help gauge your progress and correct errors. Try asking the following questions: What happened? What went right? What went not so well and why? What can be learned? What are one or two things I can now do differently?

Anticipate and manage obstacles

As boxer Mike Tyson once said: “Everybody has a plan until they get punched in the mouth.” You need to be realistic about competing priorities and distractions bound to get in the way.

16 | Aussie Painting Contractor

WORKPLACE SAFETY: WHY NOW?

Organisations have become more accountable to their customers, shareholders, and employees.

Increased safety improves the bottom line, and the links between a safe working environment and enhanced productivity are proven.

Safer workplaces result in better processes, because it sets the standard for greater efficiency and increased ingenuity all ‘round.

Above all, it saves lives. Workplace safety increases productivity, makes organisations accountable, and protects the entire team.

SAFETYONSITE

IT'S ALL ABOUT SURVIVAL

As processes become faster, deadlines get tighter, and customers demand greater efficiency, the worksite has become a hectic hive of activity.

But these increased expectations can make it all too easy to cut corners, and the safety of Aussie job sites is now more important than ever before.

SafeWork Australia recorded 194 worker fatalities in 2020 alone, with machinery operators and drivers representing the highest number of fatalities, and labourers, managers, and technicians and trades workers close behind.

That’s why SURVIVAL - a 33-year, Aussie family businessis dedicated to ensuring every worksite has the right first aid equipment on hand.

“It’s clear that worksites need to ensure they’re never caught short, because when you’re in the trades industry, the chances of accident or injury are very real,” says SURVIVAL’s CEO, Mike Tyrrell.

“And despite the latest advances in technology and an increased awareness of the associated risks, these sobering stats from

SafeWork Australia show us that even more needs to be done.

“We know that providing immediate, effective first aid to people injured on the job can reduce the severity of their injury or illness.

“And even more than that – it can save your life, or that of a mate,” adds Mike.

SURVIVAL’s Director of Marketing & IT, Jordan Green, says the company is constantly looking at ways to make first aid more accessible for people in trades and other 'hands-on' professions.

“In addition to our line of first aid products, we’ve just released the latest update to our free iFirstAid app, which features step-by-step instructions and video resources to guide people, including trade professionals, through common emergencies,” says Jordan.

“Our SURVIVALSWAP audit compliance program also ensures worksites remain stocked and compliant – without the headaches or hassle.”

For the best first aid for your workplace, visit survival.net.au

18 | Aussie Painting Contractor

Exclusive discount just for APN readers: get 13% off all SURVIVAL products sitewide!* Visit survival.net.au and use code 'APN13' at checkout. *Excludes defibrillators.

L-R: SURVIVAL's Director of Marketing & IT, Jordan Green, and CEO Mike Tyrrell

10. Identify and plan to manage points of choice, where other temptations may divert you from pursuing your goal. Points of choice may arise from within yourself (such as feeling tired, distracted or uninspired) or your surroundings (such as work pressures or family responsibilities). Plan ahead as to what you will do when these points of choice arise.

Errors are a natural part of the learning process.

I have made an error. Great! That gives me something to learn from.

12. Keep building your commitment. Lose that and all bets are off! All the above steps will help. It can also help to share your goals and progress with others, but choose carefully. Share your journey with people you respect, whose opinion of you matters, and whom you know won’t be a wet blanket.

Good luck. You’ve got this!

Peter A. Heslin Professor of Management and Scientia Education Academy Fellow, UNSW Sydney

Be prepared for points of choice. Shutterstock

11. Remind yourself it’s OK to make mistakes. Repeating “error management training” mantras has been shown to improve learning and performance, particularly on complex tasks where people need to learn their way to a solution. Try these:

Lauren A. Keating Assistant Professor of Organisational Behaviour and Psychology, EM Lyon

Ute-Christine Klehe Full Professor of Work and Organizational Psychology, University of Giessen

The Biggest Challenge for “Trade Business Owners”

“Time Management: The Biggest Challenge for Trade Business Owners”

Everyone wants it… Work / Life Balance!

As a tradie, managing your time effectively is crucial to your success. From scheduling appointments and meetings to completing projects on time, every moment counts. However, many tradesmen find that managing their time is one of the biggest challenges they face on the job.

One of the biggest problems is balancing the demands of multiple projects at once. Tradies often have to juggle multiple jobs at the same time, each with its own set of deadlines and requirements. This can make it difficult to prioritize tasks and stay on top of everything.

Another challenge is dealing with unexpected changes and delays. Whether it's a client changing their mind about a project, or a supplier being unable to deliver materials on time, unexpected events can throw a wrench in even the best-laid plans.

Tradies also often struggle with time management due to their on-the-go nature of their job. Being

out in the field, running errands, and traveling to different job sites can make it difficult to stay organized and on schedule.

To overcome these challenges, tradies can take several steps to improve their time management skills. One of the most important is to create a schedule and stick to it. This means setting aside specific times of the day to complete certain tasks, and making sure to allocate enough time for each task.

Another key step is to prioritize tasks based on their importance and urgency. This means focusing on the most important and time-sensitive tasks first, and delegating or outsourcing less important tasks if possible.

Tradesmen can also make use of technology, such as project management software, to keep track of multiple projects, schedule appointments and meetings, and share information with other team members.

20 | Aussie Painting Contractor

“Time Management”

TOP 3 TIPS

Create a schedule and stick to it: One of the most important steps to managing time as a tradesperson is to create a schedule and stick to it. This means setting aside specific times of the day to complete certain tasks, and making sure to allocate enough time for each task. This will help you stay organized and on schedule, and ensure that you are able to complete all of your tasks in a timely manner.

Prioritize tasks based on importance and urgency: Another key step to managing time as a tradesperson is to prioritize tasks based on their importance and urgency. This means focusing on the most important and time-sensitive tasks first, and delegating or outsourcing less important tasks if possible. This will help you stay focused and ensure that you are completing the most important tasks first.

Utilize technology: Tradesmen can make use of technology, such as project management software, to keep track of multiple projects, schedule appointments and meetings, and share information

with other team members. This will help you stay organized and on schedule, and ensure that you are able to complete all of your tasks in a timely manner. Additionally, using apps or software to track time, invoicing, and expenses can help streamline your business operation and save time for other tasks.

In conclusion, managing time is a crucial aspect of success for tradespeople. While it can be a challenge, by creating a schedule, prioritizing tasks, and making use of technology, tradespeople can improve their time management skills and stay on top of their workload.

Read all our Time Management Blogs here: https://tradiematepro.com.au/blog/

Download our Time Management Tools here: https://tradiematepro.com.au/downloads/

Kylie Shiels

Marketing and Advertising Curtator

Tradiematepro - The accelerated growth service that delivers the results, profit & lifestyle that you deserve. www.tradiematepro.com.au

Equipment Hire AGREEMENTS

One strategic decision you may decide to make this year is to buy equipment rather than keep on hiring it. Then, rather than have expensive pieces of equipment sat dormant between jobs and costing you money you may decide to get them to work making money for you. How? By renting the equipment out to other people when you don’t need it.

If you decide to do this though you need two things in place first; good insurance and an equipment hire agreement drafted for you by a commercial lawyer.

What is an Equipment Hire Agreement?

A legally drafted equipment hire agreement outlines the terms and conditions that customers are bound by when hiring equipment from your business. This agreement forms a contract between you and your customer and provides a safety net for your business if something goes wrong.

Often it is a requirement of the insurers that you have in place a properly legally drafted equipment hire agreement in place with your customers.

What should be included in an Equipment Hire Agreement?

A typical , well-drafted hire agreement should include:

• a description of the equipment you hire out to customers;

• obligations of the customer to you and your business;

• a disclaimer of liability for your business if loss/

injury/damage is suffered by the customer when hiring the equipment;

• key payment terms including; the price of the equipment hire, invoicing, payment requirements and the availability of refunds (according to Australian Consumer Law); and

• the availability of good dispute resolution process if a party is wronged in the process of the equipment hire arrangement.

Why do I need a legally drafted Equipment Hire Agreement?

This essential contract contains important terms and conditions to protect you and your business. We’ve set out 5 critical clauses to consider in your equipment hire agreement:

1. Payment Terms

Perhaps the most important aspect of any business arrangement is ensuring that you get paid for the provision of your goods/services.

Make sure that your agreement sets outs the Hire Fees (wet and dry hire fees as appropriate) as well as all additional expenses (for example delivery fees) and that the customer agrees to pay those fees. Also, be clear about any minimum hire periods.

Did you know that you cannot charge interest on late payments or include a late fee unless this right is expressly included in your hire contract? Furthermore, a well-drafted hire contract should include the right to engage debt collectors and pass on those costs to the customer.

22 | Aussie Painting Contractor

Including robust payment terms such as these into your equipment hire agreement will help to ensure you are paid on time by your customer. If you require a Deposit or up-front payment to secure the hire dates, this will also need to be drafted into your equipment hire agreement. This is a great way to prevent last minute cancellations and ensure that your equipment is not left unhired.

2. Security Deposit

If you are hiring out valuable equipment, it is wise to collect a suitable security deposit in advance from your customers. This ensures your equipment is protected and helps to manage your business’ risks against theft or damage to equipment by the customer. There are certain clauses that must be included in your hire agreement to give you the contractual obligation to be able to use the security deposit if the equipment is damaged by your customer.

You should also include any special conditions specific to the equipment being hired (e.g. about vehicle towing capacity and refuelling of vehicles etc).

4. Delivery/Returns

Depending on the type of equipment, your equipment hire agreement should set out:

whether the client needs to collect and return the equipment from your business premises or whether the customer needs a trailer to pick up the equipment; or whether your business delivers the equipment to the client and collects it at the end of the hire period.

Also be clear on delivery fees and requirements.

5. Title retention

To ensure that your equipment remains your property at all times, add in a suitable title retention clause. This should ensure that your customer acknowledges that you retain title to the Equipment and that they will have limited rights to use the Equipment. The customer must agree not to sell, assign, sub-let, charge, lend, let or hire or otherwise part with personal possession of, or create any security interest over, the Equipment.

An experienced commercial lawyer who regularly prepares equipment hire agreements will know the types of clauses you need to include for this purpose.

3. Conditions of Use/ Limits of Liability

Limit your risk, by setting out clear conditions of use that your customer must comply with and limit your liability. These may include:

• the type of licence that the customer must have before hiring equipment;

• the minimum age that the customer must be to hire and use equipment;

• that the business is not liable for loss, theft, damage and destruction of the equipment;

• that the business is not liable for personal injury or death etc caused by the equipment;

• only the customer can be in control of the equipment, not a third party;

• that the customer must secure the equipment and not part with possession of it at any time; that the customer must exercise reasonable care and diligence when operating the equipment.

How do I go about implementing a legally drafted Equipment Hire Agreement into my business?

If you want to hire out your equipment it is crucial to get an equipment hire agreement drafted by a lawyer.

Rise Legal can assist you with creating an equipment hire agreement that is tailored to the unique needs of your business and will protect you from liabilities that could otherwise arise from the equipment hire, such as damage, injury, and theft.

To get started, book in for a free 15-minute consultation with one of our lawyers.

2023 January Issue | 23

How much do tradies spend ON INSURANCE?

f you own a trade business, how do you know how much you should be budgeting for your business insurance?

We’ve crunched the numbers from thousands of trade businesses throughout Australia, and have come up with some great data on what business owners are actually spending.

Where do you start?

We speak to some clients who think their $600 insurance renewal is too expensive, and others who don’t blink when we quote them $20,000+.

Looking at the dollar figure is quite pointless though. A business turning over $100k a year will obviously have a completely different cost to a company turning over $10m a year.

So if we’re looking for a more relevant figure, the cost of your insurance as a percentage of your annual revenue would be the one to look at.

To make this work we’re going to look at a range of different Trade Risk clients of different sizes, and see how their insurance cost stacks up. We’ll start off at the smaller end and move our way up.

This should give you a rough idea of how much you should be budgeting for your own trade business.

Keep in mind that all clients have different attitudes towards their insurance, which will impact upon their insurance spend.

Some clients want complete protection and are willing to pay whatever it costs. Other clients may case less about insurance, and only want the minimum requirements for their licence.

If you’re paying more for your business insurance than our averages, it doesn’t necessarily mean you’re overpaying. It more likely means that you have more comprehensive cover.

Likewise, if you’re paying less for your business insurance than our average, it doesn’t mean you’re getting some amazing deal, it probably just means you have less coverage in place.

But either way, these figures should still give you a great starting point for how much you could expect to be budgeting for your business insurance.

Don't DIY your business insurance

Small trade business

Revenue: $50k to $150k

Although we look after businesses with multi-million dollar revenues, we also look after thousands of sole traders with revenues of $150k or less.

24 | Aussie Painting Contractor

www.gorillaladders.com.au ® australia’s most trusted ladder australia’s most trusted ladder

Some clients in this range will have personal accident and/or vehicle insurance with us, which will drive up the average.

Assuming we’re talking about a standard trade, not working in any hazardous locations (such as mines and airports) and without an adverse claim history, their numbers might look something like this:

Average revenue: $97.2k

Average insurance spend: $1,010

Percentage of revenue spent on insurance: 1.09%

If you’re paying less than the average, it’s likely that you’re in a lower risk trade and not undertaking any work in hazardous locations.

It’s also likely that you have a relatively low level of insurance in place.

You’ll notice that the percentage of revenue spent on insurance has actually shrunk as the business grows.

This isn’t because the business needs less insurance, but more so down to economies of scale.

Whilst your insurance cost (especially for public liability) is closely linked with your revenue, it doesn’t correlate exactly.

For example, if your revenue doubled from one year to the next your insurance would certainly increase, but it wouldn’t double.

Mid-size trade business

Revenue – $1m to $5m

At Trade Risk, what we’d consider to be a mid-size trade business would be anything from $1m to $5m turnover, which is quite a broad range.

At this point you’ve not only employed a number of staff, but might also operate from your own rented or owned premises, and have invested in your own plant and equipment.

Average revenue: $1.9m

Average insurance spend: $6,473

Percentage of revenue spent on insurance: 0.34%

It’s at this point that trade business owners will really start paying attention to those premiums!

If you’re paying more than the average, it’s likely that you’re in a higher risk trade (or working in higher risk locations), or simply have a more comprehensive level of insurance in place.

Small – but growing – trade business

Revenue: $150k to $500k

This next band looks at trade businesses with revenue between $150k and $500k. Typically, this is a business that has employed its first employee or two.

Average revenue: $290k

Average insurance spend: $1,692

Percentage of revenue spent on insurance: 0.62%

When your annual insurance bill is only a grand or so, it’s often just another bill to be paid and move on from.

But once they start hitting $5k or $10k (or more) you start taking a lot more notice.

Some business owners will at this point start making this mistake of only looking at the premium amount without considering other factors.

They’ll complain that their insurance costs are increasing, without realising that as a percentage of their revenue, their costs are actually decreasing!

2023 January Issue | 27

You might have gone from spending $1,000 to $6,000 a year, but as a percentage of your revenue, your insurance costs have dropped by two thirds. That’s huge!

So the lessen here is to focus on your insurance costs as a percentage of your revenue, and not simply as dollars.

Would you complain if your material costs when up by 50%, but your revenue increased by 150%?

Probably not!

Large trade business

Revenue – $5m to $50m

What we refer to as a “large” trade business isn’t a big national construction company doing billions of dollars a year.

We’re looking at companies ranging anywhere from around $5m to $50m annual turnover.

Average revenue: $14.6m

Average insurance spend: $33,966

Percentage of revenue spent on insurance: 0.23%

Now we’re looking at some serious premiums, with some clients in this range paying in excess of $100k annually for their insurance.

But as you can see, the cost of their insurance as a percentage of revenue has deceased yet again.

When looking at these figures – and all figures in this report – it’s important to keep in mind that not all clients have all of their insurance with Trade Risk.

Some clients might have us looking after their public liability and tools, but have their vehicles insured directly through an insurance.

Or they might have us looking after their business premises, but another broker looking after their liability and vehicles.

So the percentages in this report are by no means perfect, but in covering thousands of clients it gives a very good starting point.

What does Trade Risk pay?

Whilst not necessarily relevant to a trade business, we thought it would be interesting to look at what percentage of our own revenue we spend on business insurance.

We haven’t included workers compensation, but we don’t look after workers compensation for most of our clients anyway, so that keeps the comparison more relevant.

28 | Aussie Painting Contractor

Our figure comes in at 2.1%.

And we’ve never claimed on any of our policies in 12 years of operation!

That is multiple times higher than the typical Trade Risk client. A large part of it relates to our professional indemnity insurance, which protects you – our clients – if we get something wrong.

Like all of you we’d love to be spending less! But it’s good to know we’re all protected if something goes wrong, which is the whole point of insurance.

Using this information

The figures we have used in this guide are averages. They give you a great starting point, but there are so many variables to take into account.

Whilst knowing that a similar business to yours spends 0.62% of their revenue on insurance with Trade Risk, you don’t know exactly what types of policies they have or exactly what their business activities include.

Use this information as a starting point, but don’t rely on it for setting your annual insurance budget.

In a perfect world your insurance spend should be based on your actual risk management needs rather

than being limited by budget, but of course we understand that managing costs are an important part of business.

Our team of brokers have looked after thousands of trade and building businesses, from those wanting the absolute minimum cost through to those who want the maximum protection irrespective of cost.

Talk to us about managing your insurance costs and getting the maximum value out of your annual business insurance budget.

We can also help you with risk mitigation strategies to help manage the cost of your insurance.

We’re not just here to give quotes and manage claims. We’re here as your risk mitigation and business protection partners.

2023 January Issue | 29

Growth hacks for your Small Business

Deciding on an online marketing plan can be overwhelming for small business owners looking for affordable ways to nurture steady, sustainable growth. With time in short supply, the key is to find one or two growth strategies that will get results at minimal cost.

These proven growth hacks offer business owners a few simple, cost-effective ideas for attracting new customers, increasing brand awareness, and ultimately, getting more sales.

Build your email list

Recent research shows that e-mail marketing works; in fact, it’s been shown to promote a 17% greater conversion rate than social media marketing. Permission-based marketing is based on a friendly exchange – your customer’s email address for a promise to provide value. As you nurture a positive relationship via your newsletter, with special offers, useful or inspiring content and discounts, over time your customers will be more inclined to buy from you.

Incentives new customers to sign up with contests, giveaways, referral bonuses and webinars. The bigger your list, the greater the return when you have a new product to promote – so if you decide to launch a company e-newsletter, be sure you make a consistent effort to attract new subscribers. This Forbes article offers 50 ideas on how to grow your list.

Offer social proof

One of the biggest challenges for small business owners is converting online leads into paying customers. It comes down to convincing people you’ve never met that you deserve their trust – which is why social proof is so important.

Adding testimonials to your website is a simple way to convince potential customers they won’t regret buying from you. In fact, it’s been shown that this simple form of social proof can increase conversions by 34%. Let your customers know you’d like their feedback, and ask for permission to include their positive comments on your company website.

32 | Aussie Painting Contractor

Other kinds of social proof you can use to win over customers online include:

• Case studies

• Media mentions

• Customers logos

• Accreditations and certifications.

• Create partnerships

This simple growth hack is effective both on and offline. Initiating a partnership with a company that provides complementary products or services can quickly increase each of your email lists – give your sales figures a big boost.

There are many ways a business partnership could work – you might negotiate a joint venture, host an event where you promote each other’s products, run a give away together or launch a combined product or service.

Final Tip

As you try out new ways to market your business, be sure to set actionable and achievable goals. For instance, you might make 1,000 newsletter sign ups over the next quarter one of your priorities – or increasing your blog traffic by 50% by end of the year. Make it a habit to review your metrics on a regular basis to see how well your strategies are working. Then use that data to set new goals to keep winning over customers and expanding your business.

2023 January Issue | 33

What’s the plan for

What are your business goals this year? Increasing profits? Diversifying your product offering? Downsizing for more balance and flexibility? Whatever it is that you are looking to achieve in 2023, your employees have the ability to make or break those targets – if they know what you’re trying to achieve and how their day-to-day activity and role contributes. This doesn’t need to be an onerous task we’ve developed EDGE Conversations – Engage, Develop, Goals and Excel – to assist.

EDGE Conversations are built to ensure you, your business and your team remain on target, build stronger connections, improve engagement and alignment and ensure together you have every chance to reach or surpass your 2023 goals.

EDGE conversations are monthly 10-15 minute face to-face conversations, targeting key topics designed to build rapport, engagement and action, with prompts resulting in constructive feedback, proactive, forward-thinking discussions, and focused action plans. Because you are checking in with your people

on a regular basis, your ability to monitor and measure the business’ ‘pulse’ and performance is greatly enhanced; meaning you can keep on top of targets and address issues early.

Understanding what drives your people and what stops them from performing at their best is powerful information that directly impacts employee satisfaction and retention; and therefore, the bottom-line. Highly engaged and motivated staff are your best performers and when staff feel listened to and suggestions or grievances are acted upon, engagement levels improve.

Let us know when you are ready to gain the EDGE and grow your people and business further!

34 | Aussie Painting Contractor

www.hrmaximised.com.au THIS

YEAR?

36 | Aussie Painting Contractor THE SUMMIT OF PAINT BRUSH TECHNOLOGY WITHOUT THE PEAK PRICE For more details visit www.sequencerokset.com.au

Do you stand out from the crowdAre you unique?

To be successful in the business world today, you need to be uniquely different ….. so, what is unique and different about you and your business?

Consider these questions below and learn where sort if you stand out. As the internet and social media become more prominent we have to find our own niche market. We need to know how to bring it down to such an extent that we are seen as the only one in the marketplace.

So, I ask you ….

• Do you stand out from everyone else?

• How are you positioning yourself?

• Who or what is your target market?

• Are you niched correctly?

• Do you have competitors or are they collaborators?

• Why would I choose you over them?

• Are you a key person of influence in your industry?

• If your name is mentioned, are you known?

• Are you networking in the correct circles for your business?

If you can answer the above questions in the positive, you will then KNOW that you are making a difference and are ‘on the money’!

2023 January Issue | 37

WANTED ‘Employers’and‘Employees’

38 | Aussie Painting Contractor

I’m hearing in the industry that the most difficult job for a business owner now is finding an employee. I remember 10 to 20 years ago, if you placed an employment advert in the paper, you would get dozens of eager painters applying for the position. Now, because there’s so much work about, painters are like ‘hens’ teeth’. They’re just not around.

This all derives back to early 2020 when Covid 19 made its presence known. People were restricted to travelling locally, and going interstate and overseas, was a definite ‘No-No’. Suddenly everyone had spare cash in their bank accounts. So, what did we all do?

We spent it on vehicles, appliances, 75in televisions and renovations. My wife and I fell into this category ourselves. Both our 2020 and 2021 overseas trips were deferred, so we put in a new kitchen, vinyl flooring and a small renovation downstairs. All that money, instead of it being spent overseas, stayed here in Australia. Millions of people did the same which boosted the economy and led to trade businesses being inundated with work. As they couldn’t keep up to meet the demand, they had to hire more people.

It’s 2023 and the building construction industry hasn’t slowed down at all, which is why trying to find a tradesperson to do a job is extremely difficult and comes with at least a 4-12 month waiting time.

All this led me to an idea. I will try and alleviate some of the frustration for the employers (in Australia and New Zealand) and help to find the suitable staff they require. This is by a register listing the employers wanting employees (a small fee of $8.75), and employees looking for work (free).

The way I am targeting employees are through Facebook and Community groups, Personal pages, LinkedIn, and my own database. I am now posting on Facebook groups in England. This is proving to be quite successful as I am getting a lot of interest. These are painters wanting to either immigrate or wanting to come over on a working holiday, (which I specify six months minimum employment).

If you fall under either of these categories and would like to be included, please let me know by email:

Employer: Name; Business Name; Area of work; Contact phone; Type of person requiring (skilled, brush hand, apprentice, etc).

Employee: Name; Area of work; Contact phone; Description of experience (skilled, qualifications, apprenticeship, etc).

If I do refer you to someone, (either employer or employee), I will send the full details with your authority to do so. My job ends there as it is up to both parties to discuss employment terms.

NB: Employers have been eagerly signing up and willing to pay the ‘Token gesture’ I call it, of $8.75. This will put you on my register for twelve months with no more to pay, even if I refer you to someone. There is no referral charge to the employee either. I must stress though I CANNOT guarantee a result, but I WILL try my best, as it does depend on when an employee registers in your area. So far it looks like I have placed four employees with employers, and I only stated this a few weeks ago.

Jim Baker info@mytools4business.com

2023 January Issue | 39

What is income protection insurance – and how’s it different to total and permanent disability insurance?

Many of us have car insurance, home insurance and health insurance. But what about income protection insurance?

Having income protection insurance means that if you get sick or injured and can’t work, you’ll still get paid. The insurance company will cover a portion of your earnings, so you can still pay everyday living expenses and bills.

But how exactly does income protection insurance work, and how’s it different to total and permanent disability insurance (sometimes shortened to TPD)?

Here’s what you need to know.

How does income protection insurance work?

Income protection insurance usually covers only 75% of the first A$20,000 of your gross monthly income, and 50% of gross monthly income that exceeds A$20,000 per month.

This gap is supposed to incentives you to return to work.

There’s usually a waiting period. In other words, you need to be unable to work for a certain number of days before the benefits start to be paid.

Generally, the longer the waiting period, the lower the premiums (“premium” means what you pay for the insurance). The usual waiting periods are: 14 days, 30 days, 60 days, 90 days, 180 days, one year or two years.

The “benefit period” refers to the period of time you will get paid the benefit. The usual benefit periods

are one year, two years, five years, or up until you’re 55, 60, 65 or 70.

How’s that different to permanent disability insurance?

Total and permanent disability insurance gets you a lump sum of money if you’re permanently unable to work in your occupation or in any occupation for which you’re suited by training, education or experience – or if you’ve lost the ability to function cognitively or physically. Or, you can get a payment if you have permanent loss of sight or limbs.

The money can be used for things like modifying the house, medical care or medical procedures.

You can choose a policy that covers you if you’re unable to work in your own occupation, or one that covers you if you’re unable to work in any occupation for which you’re appropriately trained. You can get a standalone policy or one that is built into your life insurance policy.

Under a standalone policy, the amount you get is not restricted to the amount insured under your life insurance policy. (That’s not the case when a total and permanent disability insurance is part of your life insurance policy.)

The main difference between income protection insurance and total and permanent disability insurance is that the former gives you an income stream and the latter provides a lump sum payment.

2023 January Issue | 43

The other key difference is the amount insured under income protection cover is usually limited to 75% of your income, whereas you could have any amount of insurance coverage under your total and permanent disability policy.

Hang on, isn’t this included in my superannuation? Many people have their income protection insurance, life insurance or total and permanent disability insurance built into their superannuation. In fact, more than 70% of life insurance policies in Australia are held inside superannuation funds.

The advantages of having personal insurance in your superannuation fund include:

• lower costs due to super funds often having more bargaining power with insurers to get a good price

• it can be more streamlined, because the insurance premium is paid directly from your super account; the balance of your super goes down but you don’t have to take money from your salary to pay for it

• people with pre-existing conditions might find it easier to get certain insurances via their super fund than if they went out on their own

• potential tax benefits (best to discuss these with a financial adviser).

It’s worth noting all benefits within superannuation, including insurance proceeds, are subject to Superannuation Industry Supervision legislation. It’s difficult to satisfy the legislation’s definition of “permanent disability”; it’s often more restrictive than definitions used by insurance companies.

So even if you satisfy the insurer’s definition of “permanent disability” and the money is paid to your superannuation account, you might not satisfy the legislation’s definition. The proceeds can be trapped in the superannuation fund until a condition of release is satisfied.

Why do people get income protection insurance?

For my research, I interviewed financial advisers and consumers about why people get income protection insurance. Motivations included getting married, having children, buying a house, having a brush with tragedy or knowing someone who did.

Financial advisers often told me immigrants from the United Kingdom, the United States, South Africa or New Zealand are more likely to purchase income protection insurance, as were people they saw as “intelligent”, “conservative” or “more responsible”.

They also said consumers are more likely to consider insurances they thought would be most claimable, such as life insurance and income protection insurance.

People often (wrongly) believe income protection insurance would be paid out if the person was unable to work due to losing their job for any reason.

Financial advisers often commented Australians tend to be relaxed and think unfortunate events are unlikely to happen.

If you’re considering purchasing income protection insurance, make sure you understand the risk of buying it within your superannuation policy (possible downsides include a short benefit period and inability to claim a tax deduction on the cost of the insurance).

And seek professional financial advice when deciding on the appropriate policy.

Tania Driver Lecturer in Financial Planning, James Cook University

44 | Aussie Painting Contractor

Many people get personal insurances after having a brush with tragedy or knowing someone who did. Shutterstock

46 | Aussie Painting Contractor

IMPORTANT Contacts 2023 January Issue | 47 Aussie Painters Network aussiepaintersnetwork.com.au National Institute for Painting and Decorating painters.edu.au Australian Tax Office ato.gov.au Award Rates fairwork.gov.au Australian Building & Construction Commission www.abcc.gov.au Mates In Construction www.mates.org.au Workplace Health and Safety Contacts Cancer Council Australia Ph. 0430 399 800 Ph. 1300 319 790 Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111 Comcare WorkSafe ACT Workplace Health and Safety QLD WorkSafe Victoria SafeWork NSW SafeWork SA WorkSafe WA NT WorkSafe WorkSafe Tasmania comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au 1300 366 979 02 6207 3000 1300 362 128 1800 136 089 13 10 50 1300 365 255 1300 307 877 1800 019 115 1300 366 322 ACT NSW NT QLD SA VIC WA actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au cancersa.org.au cancervic.org.au cancerwa.asn.au (02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333