The Top 3 Routines that keep your Business On Track

If there’s one thing Tradies Love... IT’S GETTING THE JOB DONE

Cash Flow Advice for Small Businesses

You can have the best of intentions with your time...

RETAINING Customers

You may even get re-considered because you went the extra mile.

www.aussiepaintersnetwork.com.au

From the Editor

Hey Everyone,

Welcome to the 123rd edition of the Aussie Painting Contractor Magazine.

What a massive month this has been, with me training apprentices from North Qld to the Gold Coast, and of course our training facility in Salisbury. I saw and trained 38 students this month with them learning an array of new things.

We have found that with the shortage of painters throughout the country that we are getting an influx of people wanting to come into painting and decorating as a career pathway. Over the last month we have had 38 applications for people wanting to start their painting career journey with 22 currently in trials and 10 in the process of being signed up into their apprenticeship.

This has been a massive undertaking from Brina in the APN office. If you are considering getting an apprentice or looking for staff, reach out and contact us.

In March, we are involved in a Skilling for Work Program on the Gold Coast. We will have a couple of potential apprentices in a few months in the area looking at starting their career. I would like to welcome Matthew Christopher to the team for this project.

CONTRIBUTORS

• Helen Kay

• Jim Baker

• Leo Babauta

• Marion Terrill

• Mark Humphery-Jenner

• Natasha Bradshaw

• Robert Bauman

• Sandra Price EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Nigel Gorman

nigel@aussiepaintersnetwork.com.au

07 3555 8010

'Til next month, Happy Painting!!

Advertise with us... 1800 355 344 07 3555 8010 info@aussiepaintersnetwork.com.au www.aussiepaintingcontractor.com

Contents

The Top 3 Routines that keep your Business On Track

Cash Flow Advice for Small Businesses

15 20

Create Exquisite Focus AMIDST CHAOS

How to save $4 billion a year: reform a fuel tax credit scheme with no real rationale

If there’s one thing tradies love... IT’S GETTING THE JOB DONE

25 35 38 40 42 43

The Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022

28 33

Is Your Business

Your Passion?

Retaining Customers

How to pick your BUSINESS NAME

Efficient business systems REALLY PAY OFF

Australia’s new pay equality law risks failing women – unless we make this simple fix

Industry Idiots

Important Contacts

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you March incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

06

08 12

The Top 3 Routines that keep your Business On Track

When you start a new project for your clients you probably have certain routines to get them up and running.

Everything runs a certain way when you do business, from quoting for the job, scheduling it in your calendar of work commitments, to making sure you’ve got enough help and materials to undertake the project... and finally, delivering a job that your client is happy with.

You know how to get it done because you’ve done it before, you have established routines that work for you and your team to deliver the desired result.

It’s the same with doing the ‘behind the scenes’ work, the work that clients don’t see, the work that in effect is the engine room of your business. It’s the work that keeps the money ticking over, what you pay to your providers and creditors, what you pay yourself and your team and what you get from your clients.

Unfortunately this is the work that is often put in the ‘later on’ pile and, at worst, is being overlooked or ignored. The solution to this are routines... habits you set up that, once you’ve established them, you’ll do them as a matter of course, like clockwork. I’m talking about financial administration routines, of course. Let me explain what I mean, and it’s really simple, anyone can follow this advice:

1. Weekly: Look at your debtors and creditors on the same day, every week

Depending on your business type you may have more big jobs or you may have a majority of smaller jobs, which all start and finish at different times. You may source varying amount of materials or contractors that hit the budget at different times. The same goes for your invoice payments. So the most important thing is that you keep track of what’s going in an out on a regular basis for all the jobs that you have on.

To really get a handle on this, the best thing you can do for your business is to schedule a regular time every week to go through your debtors and creditors. If you have a bookkeeper helping you with your financial administration, schedule a meeting with them to discuss the week’s necessary financial transactions, what’s outstanding and what needs paying. Its’ that simple!

This is the time when you delegate or do all your invoicing and actioning of any payments that are due. You could even tell your suppliers that you attend to bill payments once a week, and that is... say a Friday. It could be any day of the week, really, as long as it’s a regular appointment in your diary, and you stick to it.

If you need help with setting up a complete debt collection system including follow up scripts, please visit the Resource Centre at www.straighttalkat.com.au.

6 | Aussie Painting Contractor

2. Monthly: Check your budget once a month

You can see where this is going, can’t you? Yes, the next step is to look at your budget once a month. Again, schedule an appointment in your calendar for at least one hour, once a month, at the beginning or end of the month, whatever suits you best, and turn up! This is a high priority activity in your business, as it can help you correct course in time, if necessary.

best way to appreciate the information you can gain from it is to have a meeting with your accountant and talk about it. They know what to look for. These reports are generated in a standard way looking at all the available financial data you’ve got recorded, and there are certain markers, that can tell a detailed story about your business performance.

Knowledge is power, that much is true. And knowledge about the financial performance of your business is not only power, but it is also a motivator to do better next month. Setting financial goals is only the start of it.

There’s a saying that ‘Rome wasn’t built in a day.’ In that sense, I want to encourage you to take more time to work ‘on your business’ than ‘in your business’. Set up routines! It’s about taking the helicopter view, being a strategist who knows where they’re going, because they’ve surveyed where they’ve been. Keep at establishing working ‘on the business’ routines and try to perfect them... it will keep your business profits on track.

There is a great advantage to having a broader perspective and not getting lost in the daily grind. When you look at your last month’s business performance, you can see how your weekly financial meetings will have had an effect. All the weekly activities of making payments and issuing invoices, or sending out follow up notices, will have produced a result that is plain to see in last month’s data. It will also show up where you need to tighten up your follow up procedures.

3. Quarterly: Schedule a meeting with your accountant

When I say the word ‘quarterly’ most of my business clients think ‘BAS time’. The Business Activity Statement (BAS) is used for reporting and paying goods and services tax (GST), pay as you go (PAYG) instalments, PAYG withholding tax and other tax obligations.

So business owners, who have to submit a BAS statements every quarter, have to have their financial house in order. They need to understand how much profit they make and what their tax obligations are. This is where a look at your business’ Profit & Loss report can help you identify further tax minimisation opportunities.

This report requires specialist knowledge to be generated from your current financial data, and the

For proven strategies that will guaranteed increase your profits grab a copy of my free eBook 7 Financial Strategies to Maximise Your Profits & Future Proof Your Construction Business!

Copyright © 2023 Robert Bauman.

2023 March Issue | 7

Cash Flow Advice for Small Businesses

Solid cash flow management is vital to ensuring your business survives, but not everyone understands what cash flow is or how to manage it. That’s likely what makes it a leading cause of stress for small business owners. In fact, a Capital One study found that 42% of small business owners say cash flow management is a major concern for them.

Cash flow refers to the movement of money into and out of your business. It’s based on the amount of money you bring in minus the amount you spend. A positive cash flow means you’re bringing in more than you’re spending. A negative cash flow means you aren’t bringing in enough to cover your expenses. Your company can run into problems by not charging enough for goods or services, having clients who are chronically late to pay, growing too quickly or simply spending too much money.

Cash flow can vary throughout the year, depending on sales cycles or whether you’ve made a large purchase. Here are three strategies you can use to gain control over your cash flow.

1. Understand your profitability

Managing your cash flow is great, but it won’t help you if your business isn’t profitable. Take a look at each of your products and services to determine how much

they bring into your business compared with how much you spend to provide them. Find any inefficiencies in your processes and eliminate them if possible. Figure out where your business is most profitable and where you’re dealing with cost overruns.

The basis of a solid cash flow is ensuring you offer goods and services that are profitable and help you obtain your goals, while reducing those that negatively affect your finances. You may need to increase your prices to reflect the cost of goods sold, or stop selling lower-margin products or services.

Similarly, take a look at your clients. Are there some that you are undercharging or spending too much time and energy on? Can you increase their fees or find higher-paying clients?

8 | Aussie Painting Contractor

2. Write a cash flow forecast

Your cash flow forecast (also called a cash flow projection) predicts how your business will perform financially over a set period. It’s a good idea to have a cash flow forecast for a year, broken down into quarters and months.

The projection takes into account your revenue and expenses over those set periods, and helps you figure out how much you need to make in that period to cover your expenses. It can also allow you to anticipate any upcoming cash flow issues, such as slower periods that may require you to cut back on expenses. If you have any anticipated big-ticket items you’ll need to buy or plans to expand your business, include those in your forecast.

Periodically check your actual cash position against your projection to see how you’re doing and if you need to make any adjustments.

3. Use technology to keep on track

There are plenty of software solutions that can help you gain insight into your company’s cash flow. They can help you build projections and get a real-time view of how your business is doing. This information can then be shared among company managers, so everyone has an idea of how the company is doing financially and where strategies need to be put in place or altered to get you back on track.

Additionally, invoicing software and project management software can be used to encourage faster, easier payment from clients and keep projects on budget. This will also improve your cash flow.

Final thoughts

Many business owners find cash flow management stressful, but with a little information, and planning, and by using the right tools, you can have better insights into your company’s financial situation. Those insights will help you make better decisions for your business and gain control over your cash flow.

Get in touch

If you need some guidance for your business, feel free to drop us a message so we can schedule a oneon-one consultation.

Sandra Price

www.tradiebookkeepingsolutions.com.au

Create Exquisite Focus AMIDST CHAOS

I’ve worked with lots of incredible people who want to create something — whether it’s art, a book, a business, or some impact on the world.

One of the stories we often have when we want to create is that we’re too busy, pulled in too many direction, or need to clear out our lives before we can focus.

Basically, the story is that everything needs to be clear before I can focus and create.

But that never comes. We never clear everything else out, we never have a life without some chaos. And so if that’s our story — that we need to have pristine clearness before we focus — we’ll never create anything.

As I write this, I’m proving that story wrong. There’s chaos in my life, from things going on in my family to my uncertainty about my projects to a thousand demands on my time. And yet I’m finding some beautiful focus right this minute, to write. I’m not exceptional — we can all do this, if we commit to changing this story.

In this article, I’ll share some ways you might do that.

The Old Story

Before you can create a new story, it’s important to get present to your old story: that you need to clear out your life and have no chaos before you can have focus.

This story flies under the radar, unnoticed, but it can feel very true and control our actions. You just operate as if it’s the truth.

The way you might notice this is first to reflect on how things are going. Are you writing that book or launching that business you wanted to create? If not, what’s been getting in the way of that? It’s easy to blame external circumstances, but you might notice what story you have that makes those external circumstances a blocker.

Next, you might commit yourself to finding focus every day to create. Block off some time. Then see what shows up – are you able to actually focus, or do you tell yourself something that allows you to put it off?

You might also notice what this story protects you from. For me, it protects me from having to create something I feel shaky about, and fall flat on my face.

12 | Aussie Painting Contractor

The New Story

Once you’ve gotten clear on the old story, and noticed it showing up, you can start to create a new one that’s more empowering. What new story would allow you to focus when there’s chaos, and what’s more, to feel lit up about it?

For me, part of my story is that I love a little oasis of calm and focus in the midst of my chaos. It’s peaceful, rejuvenating. I love moving something important forward, and feeling that incredible progress.

Another part of my story, even more important, is that this is a way for me to express my love for my readers. That’s important enough to create some space for.

But you don’t have to use my story: what would be empowering for you? Try three drafts, and pick one to practice. Then commit to focus blocks, and practice believing the new story during those blocks.

It will feel a bit wrong, so you have to create structure to actually show up for the focus blocks — some accountability, for example.

Some Other Notes

What I’ve shared is the most important bit. But there are some other things that help me:

* Create space and commit to it. I will block off focus sessions and tell others that I’m going to do it, and hold myself accountable. This actually empowers my focus, rather than needing to feel like a burden.

* Clear the decks. It’s not bad to try to clear things - small tasks, emails, messages — before you focus. I give myself a limited time, like 20 minutes, to clear things out, before I start my focus session. My goal is not to clear my whole life out, and not have any chaos. It’s to clear things out a little, just to an extent that feels helpful, not to the extent that feels like avoidance of my focus.

* Use a single-tasking tool. I use various writing tools that don’t have distractions. As I write this, I’m using Ommwriter, which is an old one, but there are plenty of others. Block off your internet connection if you need to. Put your phone on airplane mode. Tell others you are focusing, if needed.

* Think things through a bit beforehand. For writing, I like to spend some time before the focus session thinking about what I want to write. I’ll go for a walk, or think about it in the shower. This helps me get the focus session going with a running start.

* Create a little ritual. If you think of the focus session as a ritual, it elevates it above the usual tasks you have to do. Think of it as sacred. You might create a little space for focus, or do your writing in one spot. You might play music, get some lovely tea, light a candle. Start with intention, and remind yourself of your new story. Close with gratitude.

* Relax in the chaos. In the focus session, and even before you start, you’ll feel the chaos swirling around within you, if you pay attention. This is the very feeling that has us feel like we need to clear out our lives first. It’s completely OK to feel! What if you could take a few deep breaths, and allow yourself to relax with the feeling of chaos? It doesn’t need to go away. It’s just a part of the experience of creating.

These help me. Are you willing to commit to giving them a try?

Leo Babauta ZEN HABITS

2023 March Issue | 13

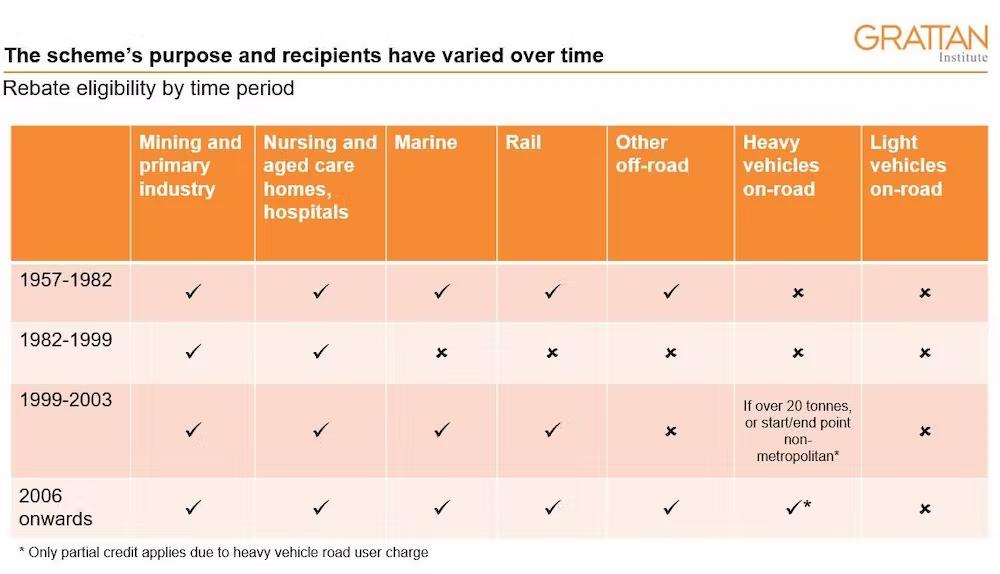

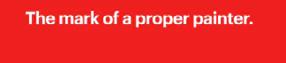

How to save $4 billion a year: reform a fuel tax credit scheme with no real rationale

Revising the generous fuel tax credits given to businesses should be a priority for the Albanese government, because keeping them would conflict with two other pressing priorities: reducing carbon emissions and repairing the budget.

Fuel tax exemptions have existed for as long as the federal government has taxed fuel, starting in 1957. With the rationale for the tax being to pay for building and maintaining roads, initially all off-road users were exempt.

But the earmarking of all fuel tax revenue for spending on roads ended in 1959 – more than 60 years ago. With the tax becoming a general revenue raiser, the rationale for exemptions or tax credits has shifted with the disposition of the government of the day.

The settings inherited by the Albanese government now cost the budget almost $8 billion a year.

2023 March Issue | 15

As long ago as 1991, the Australian National Audit Office recommended the credit scheme “clarify its purpose and objectives”. Yet those objectives remain unclear today.

Who benefits most?

Previous governments have argued exemptions and tax credits support regional industries, and people living in regional areas.

In 1999, when the credit was extended to marine, rail, and some trucks and buses, the then-deputy prime minister (and National Party leader) John Anderson said the goal was to reduce transport costs, particularly for “those people living in regional, rural and remote areas”.

In 2006, when expanding the credit to include all off-road users and on-road vehicles weighing over 4.5 tonnes, the then-assistant treasurer Peter Dutton said: “This is good news for business, and regional Australia in particular.”

But if the aim of the policy is to support regional areas, fuel tax credits are a poorly targeted way to do so.

Read more: We pay billions to subsidise Australia’s fossil fuel industry. This makes absolutely no economic sense

In the five industries that receive almost 90% of the value of credits, more than 60% of businesses, and 67% of employees, are in major cities.

There is no evidence fuel tax credits particularly benefit regional areas, or that they are more effective than other policies in doing so.

It is hard to avoid the conclusion that fuel tax credits are mostly a gift to the mining and agricultural industries – the only non-care industries that have always received an exemption from paying taxes on fuel, and the major recipients of fuel tax credits today.

16 | Aussie Painting Contractor

Budgetary needs have prompted changes

Changes to fuel tax credits have also aligned with the budgetary needs of the government of the day.

In 1982, when government debt as a share of GDP was rising steadily, the Fraser government narrowed the scheme to just mining, primary industries and care industries. Many businesses previously exempt – including in rail, marine, construction and manufacturing – were forced to pay fuel taxes.

In 2006, the Howard government broadened the scheme during the mining boom when budget surpluses meant no net debt for the first time in 30 years.

Despite the straightened fiscal position the government now faces, the credit scheme remains unchanged.

Out of step with net zero and budget repair

The Albanese government has several growing spending obligations, particularly in health, aged care, disability care and interest expenses on its debt.

After stripping out the effects of temporary factors such as high commodity prices, there remains a stubborn gap between government receipts and spending of about $40 billion a year.

In a new report published by Grattan Institute, Fuelling budget repair: How to reform fuel taxes for business, we argue fuel tax credits should be removed for on-road users, and roughly halved for off-road users. This would save about $4 billion a year.

It would also reflect the environmental and health costs of diesel use.

Read more: Australia's government gives more support to fossil fuel research than is apparent

Giving businesses tax credits on for consuming fuel without having to pay for or reduce their carbon emissions is sharply at odds with the government’s goal of net zero emissions by 2050. Diesel combustion currently accounts for 17% of Australia’s emissions.

In 2020, the top five industry recipients of fuel tax credits directly produced more than half of Australia’s emissions. That share is expected to reach 64% by 2030.

As well as helping repair the budget, reducing fuel tax credits would signal to businesses that they need to consider emissions in their investment decisions, minimising the costs to future consumers, taxpayers and shareholders.

Marion Terrill Transport and Cities Program Director, Grattan Institute

Natasha Bradshaw Grattan Institute

IF THERE’S ONE THING TRADIES LOVE... IT’S GETTING THE JOB DONE

But let's be real ...Sometimes we forget that we're not just a bunch of lone wolves out there trying to impress our clients with our mad skills.

First and foremost, let's talk about teamwork. Now, I know some of you might think that working with other people is like herding cats - impossible. But hear me out. When you work as a team, you can get more done in less time. Plus, you don't have to carry the entire weight of the job on your shoulders. Your team can divide and conquer, allowing you to focus on what you do best. And let's face it, who doesn't love getting the job done faster and with less stress?

But teamwork is more than just efficiency. It's about building relationships with your colleagues. When you have a good relationship with your team members, you can communicate more effectively, trust each other more, and create a positive working environment. And who doesn't want to work in a positive environment where everyone has each other's backs? I mean, it beats working with a bunch of sourpusses who couldn't care less about whether you fall off a ladder or not.

The truth is, the key to success in any tradie business is teamwork and toolbox meetings.

Yeah, I know, they sound about as fun as a root canal, but trust me, they're actually pretty important.

20 | Aussie Painting Contractor

THE ACCELERATED GROWTH SERVICE THAT DELIVERS THE RESULT, PROFIT AND LIFESTYLE THAT YOU DESERVE.

Now, let's talk about toolbox meetings. I know, I know, they sound about as fun as watching paint dry. But the truth is, they can be a lifesaver (literally). Toolbox meetings are an opportunity to review safety procedures and potential hazards, which can help prevent accidents and injuries on the job. Plus, it shows your team members that you care about their safety and well being. And who doesn't love a boss who cares about whether you lose a finger or not?

But let's be real, toolbox meetings can be pretty boring. So why not spice things up a bit? Bring some donuts, or maybe some coffee. Heck, bring some beer (just make sure you wait until after the meeting to crack one open). You might be surprised at how much your team members appreciate the gesture. And who knows, maybe they'll actually pay attention to what you're saying instead of scrolling through their phone.

In conclusion, teamwork and toolbox meetings might not be the most exciting part of your job, but they're essential to the success of any tradie business. So, grab a donut, crack open a cold one (after the meeting), and get ready to work together to get the job done safely and efficiently.

Trust me, your team members (and your fingers) will thank you for it.

WANT MORE FREE INFO, VISIT OUR WEBSITE AND CHECK OUT OUR BLOGS OR EVEN DOWNLOAD

FREE RESOURCES

KYLIE SHIELS

MARKETING

2023 March Issue | 21

US ON FACEBOOK PRIVATE GROUP: INSIDE TRADIES

AND ADVERTISING CURATOR JOIN

WORKPLACE SAFETY: WHY NOW?

Organisations have become more accountable to their customers, shareholders, and employees.

Increased safety improves the bottom line, and the links between a safe working environment and enhanced productivity are proven.

Safer workplaces result in better processes, because it sets the standard for greater efficiency and increased ingenuity all ‘round.

Above all, it saves lives. Workplace safety increases productivity, makes organisations accountable, and protects the entire team.

SAFETYONSITE

IT'S ALL ABOUT SURVIVAL

As processes become faster, deadlines get tighter, and customers demand greater efficiency, the worksite has become a hectic hive of activity.

But these increased expectations can make it all too easy to cut corners, and the safety of Aussie job sites is now more important than ever before.

SafeWork Australia recorded 194 worker fatalities in 2020 alone, with machinery operators and drivers representing the highest number of fatalities, and labourers, managers, and technicians and trades workers close behind.

That’s why SURVIVAL - a 33-year, Aussie family businessis dedicated to ensuring every worksite has the right first aid equipment on hand.

“It’s clear that worksites need to ensure they’re never caught short, because when you’re in the trades industry, the chances of accident or injury are very real,” says SURVIVAL’s CEO, Mike Tyrrell.

“And despite the latest advances in technology and an increased awareness of the associated risks, these sobering stats from

SafeWork Australia show us that even more needs to be done.

“We know that providing immediate, effective first aid to people injured on the job can reduce the severity of their injury or illness.

“And even more than that – it can save your life, or that of a mate,” adds Mike.

SURVIVAL’s Director of Marketing & IT, Jordan Green, says the company is constantly looking at ways to make first aid more accessible for people in trades and other 'hands-on' professions.

“In addition to our line of first aid products, we’ve just released the latest update to our free iFirstAid app, which features step-by-step instructions and video resources to guide people, including trade professionals, through common emergencies,” says Jordan.

“Our SURVIVALSWAP audit compliance program also ensures worksites remain stocked and compliant – without the headaches or hassle.”

For the best first aid for your workplace, visit survival.net.au

2023 March Issue | 23

Exclusive discount just for APN readers: get 13% off all SURVIVAL products sitewide!* Visit survival.net.au and use code 'APN13' at checkout. *Excludes defibrillators.

L-R: SURVIVAL's Director of Marketing & IT, Jordan Green, and CEO Mike Tyrrell

www.gorillaladders.com.au ® australia’s most trusted ladder australia’s most trusted ladder

The Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022

Is it February already? The year is already moving at a rapid pace and we are keen to ensure we are continuing to support you in achieving your business goals for 2023. Whether it’s keeping you up to date on the latest legislation changes; helping you to better understand your people and how they communicate and work together; or just making sure you are equipped to minimise the risks and navigate the challenges associated with managing people – we’ve got your back!

Flexible Work Arrangements

We know that by allowing employees to have a better work-life balance, we are supporting them to become happier and more fulfilled in their personal lives, as well as being happier at work. An increase in employee engagement and morale means more productive employees; improved health and wellbeing and reduced stress and burnout rates.

At HR Maximised we also know that when we recruit for jobs that include flexible work arrangements, our response rate is significantly higher than jobs with that don’t include these benefits . Employers need to give Flexible Work Arrangements serious consideration if they want to be competitive in the current market – both in enticing and retaining high quality staff. But what does this mean for employers?

The Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022 amends the Fair Work Act 2009 to strengthen the right to request flexible working arrangements to assist employees to negotiate workplace arrangements that suit both them and their employer.

Who can request a FWA?

An employee (if they have completed 12 months of continuous service) can request a change to their working arrangements if the employee is:

• a parent, or has responsibility for the care, of a child who is of school age or younger;

• the employee is a carer (as defined by the Carer Recognition Act 2010);

• the employee has a disability;

• the employee is 55 or over;

• the employee is experiencing violence from a member of the employee’s family;

• the employee provides care or support to a member of the employee’s immediate family, or a member of the employee’s household, who requires care or support because the member is experiencing violence from the member’s family. For casual employees:

• the employee is a regular casual employee who has been employed on that basis for a sequence of periods of employment during a period of at least 12 months; and

• the employee has a reasonable expectation of continuing employment.

Following recent amendments, from 6 June 2023, in addition to the above, more employees will be able to request flexible working arrangements and the right to request flexible working arrangements will also apply to:

• employees, or a member of their immediate family or household, experiencing family and domestic violence; and

• employees who are pregnant.

2023 March Issue | 25

FEBRUARY’S SPOTLIGHT

Can an employer refuse a request?

Before they can refuse a request from an employee for a flexible working arrangement, employers will have to:

• discuss the request with the employee;

• make a genuine effort to find alternative arrangements to accommodate the employee’s circumstances;

• consider the consequences of refusal for the employee; and

• provide a written response that includes:

• an explanation of the reasonable business grounds for refusing the request and how these grounds apply to the request

• other changes the employer is willing to make that would accommodate the employee’s circumstances or that says there aren’t any changes

• information about referring a dispute to the Fair Work Commission (the Commission).

If an employer and employee have discussed the request and agreed to make changes to the employee’s working arrangements, that differ to what the employee requested, the employer must confirm these changes in writing within 21 days of the request.

The Fair Work Commission will be able to hear and make orders if disputes about flexible working arrangement arise and the parties can’t resolve the dispute at the workplace level. For example, if an employer refuses a request or doesn’t respond to a request within 21 days. The FWC has the power to start court proceedings for alleged breaches of these provisions.

Is Your Business Your Passion?

Waking up in the morning, knowing that you have a long day ahead, are you energised knowing that you are doing something you love and just want to get to, or do you dread having to drag yourself to your desk?

Passion for what you do will show through when you talk about your business. More than likely, you chose to start your business because you were passionate about the subject or product. Your chance of success and personal satisfaction shines through when you speak your message if you are doing what you love! If you have lost your passion, that will shine through too!

To start and keep a business these days you need to have an entrepreneurial spirit and an overwhelming wish to make a difference. If your business is a means to an end, you will find that it may be short lived as any passion you had moves to a personal state of dislike or lack of interest.

If you started your business to create wealth and you do not have the skills, contacts, business acumen or experience, more than likely, you will be one of those who find themselves in a situation of closing the doors

and looking for another way to bring in an income.

According to the Small Business Administration in the USA (Australia I believe is similar), only 44% of new businesses make it to their fourth year. If you are new in business, these numbers shouldn't discourage you if your business is also your passion, as you will be prepared to do whatever it takes to bring your dream to fruition.

Was your business created around a dream or vision to do or be something? Is it something you have thought about for a long time, an inner knowing telling you to create ‘the dream’ for the betterment of others, in some way? Does your business make you want to cry or bring up an emotion when you talk about it? If so, I believe that you are creating your souls purpose that only someone who has experienced that feeling can understand.

Small business statistics from the Australian Government show that 95% of businesses are small businesses, with nearly 1 million people running a business from home at this time.

28 | Aussie Painting Contractor

This figure is growing according to the Australian Home Based Business Statistics. As employment becomes harder, especially for people over 50, starting a small home-based business becomes the one thing that people can create without the large overheads that are created by having a shop front.

If you're paying attention to your life at all, the things you are passionate about won't leave you alone. They're the ideas, hopes, and possibilities your mind naturally gravitates to, the things you would focus your time and attention on for no other reason than that doing them feel right." Strickland believes that only by following your passion will you unlock your deepest potential. "I never saw a meaningful life that wasn't based on passion. And I never saw a life full of passion that wasn't, in some important way, extraordinary."

Finding your true passion is something that others just know, and for many others, it is something that just clicks in when the time is right. Do you ever wonder and ask how can you find your true passion? This is something within you that only you can know and find.

Bill Strickland, author of Make the Impossible Possible offers some clues, writing: "Passions are irresistible.…

Look around your community and city and see who the real entrepreneurs are … seeing how they follow their passion. So many aspiring entrepreneurs follow the crowd and end up disappointed because they feared following their heart. So, as a business owner, be passionate about your product, service, company or cause. Make a difference and shine your light.

A D V A N T A 6 [ Eliminate the B.S. in your business and your mates will be asking... "how do you have time to go fishing on the weekend?" Tradies Advantage offers you the COMPLETE FINANCIAL SOLUTION under one roofbookkeeping and accounting at a monthly FIXED price. • Get your invoices out on time • Stop ch asing debtor s and get paid quicker • Better manage rece ipts and paperwork • Lodge your BAS on time - don't cop a fine • Stop mi ssing deductions • Plan ahead and measure how you're going CONTACT US 07 3333 2415 info@tradiesadvantage.com.au 191 Wynnum Road, Norman Park QLD 4170

RETAINING Customers

The goal when creating a customer is to give them an unexpected positive experience that keeps you and your business at the top of their mind.

Your goal is to have a frequent interaction, so when the time arrives for another paint job, they will think about you and your business first.

By doing this you start to add value that your competitors aren't doing. This value is often the point of difference that sets you apart and stops your competitors moving in on your key customers.

Remember, it is always easier for your competitors to steal your market share rather than trying to find a new customer.

By using some of the following ideas, you not only give your customers a reason to return to your business, but also you build a brick wall around your customers against the influence of your competitors.

Using the following techniques will make it easy to create a unique point of difference for yourself.

Send a ‘Thankyou’ note: One of the most powerful ways to create a point of difference is by saying, ‘Thank you for your business’ or ‘I appreciate the opportunity to quote your project'.

What to do if you don't get the acceptance: Just as you say thank you for the business, you need to say thank you if you don't win the quote.

‘Why?’

1. Because you were given an opportunity to be considered in the first place as some people are not even asked.

2. You get the last say.

If the successful business doesn’t produce the right results, then you are at the top of the list for next time. You may even get re-considered because you went the extra mile. Not all are totally satisfied after they make their decision. Usually 60% of people give up after the first rejection and 95% have given up after the sixth, so perseverance is a positive, proactive approach.

Follow up phone calls: Everything you do needs to be followed up with a phone call or an e-mail. Never assume that they received the information and totally understood the quote.

Keep a database of all customers; accepted or not: You have spent a lot of effort, money and time to create a new customer. Once the job is completed, give them a call after 6-12 months to make sure they don’t have any concerns with the work. If you did any clear coating on an exterior, let them know you will give them a ‘Free Inspection’ to see if it is holding up to the weather and advise them if it requires a freshen up coat for that extra protection.

Keeping in contact with them after, 2, 5 or 10 years is also an excellent way of letting them know you happy to give them a quote on any more work. You can also ask for a referral to their friends and family.

Although you may have missed out on some customers, give them a notification after a few years to see if you could be considered on any future work. You never know, they could have been very disappointed on the previous painter’s work.

Jim Baker www.mytools4business.com

2023 March Issue | 33

How to pick your BUSINESS NAME

Picking a business name is a really important and exciting part of starting a new business.

But, before investing your time and resources into a business name, you need to ensure it is feasible to use. This can be done by making sure the name is not already taken by another business owner, and the domain name is free for you to use.

To ensure that your business name is able to be protected against others using it, you should also check that it is trademarkable.

Penalties apply if you trade without owning the business name.

If the name you were hoping for is already taken, you may still be able to register a similar one (but this is not recommended). Note that no one is allowed to purchase an identical name that is already registered with ASIC. You should also check that the name is not on ASIC’s excluded word list. Words on this list include words such as ‘police’ or ‘ANZAC’ which require consent prior to use.

Is the domain name available?

When registering your business name, the next step is to check that the website address you want is available. This is referred to as a ‘domain name’. You can register a domain name for a year, at a low cost.

Here are the steps you need to take so that you can lock in a business name, and make sure no one else can use it:

Is the business name available?

It is critical to ensure that the potential name is not already in use and is available to register with ASIC.

You can check to see if the domain name you want is not already taken by doing research to see if anyone is already using a similar or the same website address. To avoid confusing potential clients, you should make sure your domain name is individual and not substantially similar to one already in use.

Social media handles are also a really important tool for businesses, so you should check to see if you can secure the same social media handles across all platforms so that clients can easily find you.

2023 March Issue | 35

Is the business name able to be trademarked?

Many people do not realise that owning a business name does not give you the Intellectual Property (IP) protection where you could prevent others using the name. While you cannot register an identical business name with ASIC, you can register a name that is a character different. A registered trademark is the only way that you are able to stop someone else using an identical or deceptively similar name within your registered class.

It can be quite difficult to successfully register a trademark with IP Australia. There are 45 different classes that you can register your trademark in. Depending on the nature of your business and the kind of goods or services you provide, your business may fall under one class, or numerous classes. You will only be protected in the classes that you register so it is important to get this right. Other factors which may prevent the successful registration of a trademark include whether your mark is deemed to be descriptive of the goods/services offered, uses a common name, or is geographical. You must also consider the already registered marks within the relevant class/es as these could serve to block yours.

It is essential to trademark your business name, so that only you can use it! It is a huge value add for your business if you can protect your IP in this way.

Is the business name already trademarked to someone else?

This is a definitive No No. If the business name you intend to use is already trademarked within the class of goods and services step away!

You cannot use a business name that is already trademarked by someone else in Australia. A trademark is a legal right granted to a person or company that prevents others from using a similar name for similar goods or services in the same jurisdiction. Infringing on someone else’s trademark can result in legal action, including fines and the requirement to change your business name. It is therefore advisable to conduct a trademark search before using a new business name to ensure that it is not already trademarked by someone else.

What should I do?

It can be costly if you invest your time and money on a business name and later realise one of these key areas has not been addressed and you can’t use it. If you need assistance assessing the feasibility of your potential business names beforehand, we offer a competitive fixed fee Brand Check Service : Our clients find this service invaluable!

For further details Book in free call here.

Helen Kay

If you require any assistance with your business legals or any other commercial legal issue, please do not hesitate to contact me.

P: 1300 064 707 | E: helen.kay@riselegal.com.au

36 | Aussie Painting Contractor

Efficient business systems REALLY PAY OFF

Too many businesses fall over because the owner has not established efficient business systems. This typically happens because the business owner is so caught up in the day to day running of the business that the fundamentals of good business management get forgotten. Often too it must be said that the owner simply doesn’t like bookkeeping or other administrative tasks, so these get put on the back burner.

The symptoms are familiar, and their results disastrous:

• Poor or non-existent record-keeping.

• Tax obligations are not met.

• Invoices go out late and debts remain uncollected.

• There is one cashflow crisis after another.

• Goods and services are incorrectly costed/ priced.

Any of these factors can lead the business down the slippery path to failure, but all are avoidable. The whole point about putting in good systems is that they free you to spend more time working ON your business, not in it. Here are some tips on good business housekeeping.

Be business-like

To be in business and to remain in business, become a business person! In order to run a business, you must be business-like. It’s not sufficient just to be very good at what you do. Lots of people who are ‘very good at what they do’ have failed. The common cry: “I’m far too busy for that” is also no excuse. Are you ‘too busy’ to be a competent businessperson? If so, your business won’t last long. You must continue to develop your business skills.

To be a businessperson you have to make the effort to become something of an ‘all rounder’, not just a specialist player. You can offer outstanding goods or services, but if you don’t develop good business systems then you are not a fully rounded business person and your business will be in danger of failing.

Remember that other stakeholders in your business, such as the building material suppliers who give you credit and the bankers who extend loans and financing terms, are always assessing your business skills. If you consistently pay people late or can’t meet the terms of your debt agreements they will draw the obvious conclusions about your business skills.

38 | Aussie Painting Contractor

How good business systems will help you

Good business systems will make your business stronger, more efficient and easier to run. They will also make your business far more attractive to future buyers because if you have developed clear operating and procedures manuals the business will be seen as an independently viable unit and less dependent on you.

Think for instance of what makes franchises so successful: it’s because they are designed so that people can buy a proven system and operate it after minimal training.

They can do this because the business procedures are captured in simple, clear operating manuals. Here are five steps to a better business:

1. Good record-keeping and bookkeeping will help you keep on-side with the Inland Revenue Department. If you’re able to meet your tax obligations through sensible planning you’ll sleep better at night. You won’t fear a tax audit and you’ll know how your business is doing. You won’t be caught by a ‘sudden tax demand out of the blue’ because no such thing exists for a well-run business. You should always know which taxes are due, and when. You’ll suffer less stress.

2. Good business planning will help you set goals for your business, with specific steps on how to achieve these goals. Without goals, where do you think you’re going? Running a business without goals is like turning up at an airport and saying, “I’d really like to go somewhere.” The person at the ticket desk would think you’re clueless, to say the least!

3. Good cashflow forecasting will enable you to anticipate a possible cashflow problem (something all growing businesses experience from time to time) and take steps before the problem becomes a crisis. Banks will respect you if you anticipate problems and make plans in advance. Banks will not respect you—and will indeed categorise you as incompetent—if you tell them you’ve been ‘caught out’ by a crisis. Banks don’t like crises. They like you to go to them well in advance of any possible crisis with a plan in hand. This shows them you’re in charge of your business.

4. Good creditor and debtor control will improve your cash flow. Invoicing promptly and collecting debts on time gives you the cash to pay suppliers on time and get more favourable

credit terms from them. It is a virtuous circle. Sloppiness in this department is one of the most common (and unnecessary) causes of business owners experiencing stress and anxiety. So pay your creditors on time and don’t let your debtors use you as a free banking service.

5. Realistic pricing and costing will ensure that you run your business in a competitive but profitable way. Poor skills in this regard could mean that you’re operating at unrealistic levels—even at a loss. For example, if you let costs get out of hand (such as overhead costs) your profits will erode. There is no point in increasing sales if you’re not increasing your profits.

In business you don’t have to be an expert at everything. For example, you might hate bookkeeping. Fine—but do get someone else to do it for you, don’t rely on a shoebox for your accounts! And you should at least understand the processes and the overall accounting picture even if you don’t want to do the ‘drudge work’ yourself.

Having poor systems is the road to stress and burnout. On the other hand good business systems will enable you to work smarter, not harder. They free you to work on your business rather than in it. That way, you’re more likely to avoid burnout and you’ll be able to take time off work because you can train others to follow your clearly documented systems and procedures. Systems are the way to build a better business and liberate yourself from it.

2023 March Issue | 39

Australia’s new pay equality law risks failing women – unless we make this simple fix

The Albanese government’s efforts to address the gender pay gap are laudable. Despite all the attention given to the issue over the past decade or so, sectoral pay discrimination is very real and workplace biases persist.

But the federal government’s new tool to address the problem, the Workplace Gender Equality Amendment Bill, may not achieve much.

The amendment to the Workplace Gender Equality Act (enacted by the Gillard Labor government in 2012) requires all companies with more than 100 employees to report their “gender pay gap”.

Read more: How the jobs summit shifted gender equality from the sidelines to the mainstream

Help shape our Voice to Parliament coverage.

Much like the Modern Slavery Act, the idea is that public reporting will concentrate employers’ attention on the problem, leading to greater gender equality.

But will it?

The problem is the type of data companies must report to the Workplace Gender Equality Agency, which has been publishing pay-gap statistics since being established by the Workplace Gender Equality Act in 2012.

As with the other statistics the agency has published over the past decade, the new amendment requires only publishing simple aggregates:

The Agency must publish aggregate information, for each relevant employer for each reporting period, for the purpose of showing the employer’s performance and progress in achieving gender equality in relation to remuneration for the employer’s workforce"

This may seem like a positive step. But aggregate numbers – which in practice translates into reporting summary statistics – do not help us to either identify or understand the pay gap. Those aggregates also don’t help us come up with the right fixes.

To do that requires better data that enables more precise analysis for the factors affecting pay disparities.

The problem with averages

Averages are ubiquitous in statistics. They can serve a important service, such as identifying trends. I’ll even be using averages to illustrate a few points.

But their limitations should be understood. They are particularly problematic when it comes to areas of endemic inequality, such as income.

Consider a company with 101 employees, one being the founder and chief executive. The other 100 employees, split 50/50 between men and women, are all paid the same salary.

But suppose the chief executive pays himself ten times as much as the other employees. This isn’t ridiculous; the average CEO of a listed company in Australia is paid 132 times the average income. This creates a 17.6% gender pay gap.

40 | Aussie Painting Contractor

Now consider a similar company, run by a “tech bro” who doesn’t draw a salary but does pay every woman 2% less than every man. The aggregate numbers will show no gender pay gap.

In the first case, where there’s no explicit gender discrimination, aggregate numbers can be misread as indicating there is. In the second case, actual gender discrimination is obscured.

The WGEA’s pay gap results

This is progress of a kind, but not the progress needed to address the complex causes of gender pay inequality for ordinary people.

How to fix this problem

So how then to improve the reporting of gender pay statistics generally?

Reporting median statistics would help mitigate the skewing problem with averages. Unless the government demands this, the agency will more than likely keeping taking the same approach as over the past decade – relying on averages.

There’s also a case for companies to report other relevant factors that could influence pay, such as qualifications, skill, tenure, seniority and productivity.

This would enable the Workplace Gender Equality

Agency to provide more sophisticated analysis, breaking down the factors contributing to the figures that get the headlines.

Workplace Gender Equality Agency, CC BY

Poor data leads to poor analysis

The widespread use of averages often skew our sense of things. If you compare your own income to the Australian average (A$90,324 a year in 2021), the probability is you’ll feel left behind. But if you compare yourself to the median income – the income at which half the population earns more, and half less – you’ll feel much better: it’s only $62,868 a year.

Bad data leads to bad analysis, and bad policy responses.

Here’s another scenario. Consider our first company again. The CEO is concerned about the publicity from reporting a 17% gender pay gap to the agency. So he employs his wife as deputy CEO, paying her five times the rest of the staff, and cuts his own salary by half. He no longer has a gender pay gap to report.

The agency defines equal pay as “men and women performing the same work are paid the same amount”. To achieve this, it is essential to ensure apples are being compared with apples. This is only possible if we control for the factors that can influence pay, and don’t lose the necessary nuance.

Blunt data does not properly inform us about the pay gap, why it arises, nor how to solve it. This risks policy responses that focus on the wrong issues and which achieve little.

Decision-makers, both in public and private sectors, risk making bad decisions on poor-quality data. The wrong fixes could even make things worse. We will not eradicate the gender pay gap using bad statistics.

Mark Humphery-Jenner Associate Professor of Finance, UNSW Sydney

2023 March Issue | 41

42 | Aussie Painting Contractor

IMPORTANT Contacts 2023 March Issue | 43 Aussie Painters Network aussiepaintersnetwork.com.au National Institute for Painting and Decorating painters.edu.au Australian Tax Office ato.gov.au Award Rates fairwork.gov.au Australian Building & Construction Commission www.abcc.gov.au Mates In Construction www.mates.org.au Workplace Health and Safety Contacts Cancer Council Australia Ph. 0430 399 800 Ph. 1300 319 790 Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111 Comcare WorkSafe ACT Workplace Health and Safety QLD WorkSafe Victoria SafeWork NSW SafeWork SA WorkSafe WA NT WorkSafe WorkSafe Tasmania comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au 1300 366 979 02 6207 3000 1300 362 128 1800 136 089 13 10 50 1300 365 255 1300 307 877 1800 019 115 1300 366 322 ACT NSW NT QLD SA VIC WA actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au cancersa.org.au cancervic.org.au cancerwa.asn.au (02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333