Spring 2023

Hydrogen Sensing for Safety and Reliability

03 Comment

04 Green vs blue

Chris Warnes, Oliver Wyman, UK, offers a perspective on scaling low-carbon hydrogen production.

10

Accelerating change

Rajesh D. Sharma, Schneider Electric, discusses how and why hard-to-abate sectors should consider transitioning to green hydrogen, and details the three challenges associated with this shift.

15 Blue mood

Viswadeb Ganguly and Adrienne Moreno, Flowserve, USA, explain why significant investment in blue hydrogen infrastructure is required to help accelerate the transition to net zero.

20 Optimising opportunities

Bill Howe and Geoff Skinner, Gasconsult Ltd, alongside James Primrose, McDermott, discuss the importance of optimising hydrogen liquefaction to support the development of the sector.

26 The safe decarbonisation of combustion

Increasing the efficiency of both new and existing steam methane reformers (SMRs) is an essential consideration for decarbonising operations. Tim Tallon, AMETEK Process Instruments, and James Cross, AMETEK Land, discuss two ways in which this can be done.

31

Driving a safe future

Jørg Aarnes, DNV, Norway, describes methods to ensure safety during the hydrogen revolution.

34

Assisting transformation

Jens Voss, ROSEN Group, introduces the diagnostic solutions that are available for supporting future fuel pipelines.

38

Compression ‘Down Under’

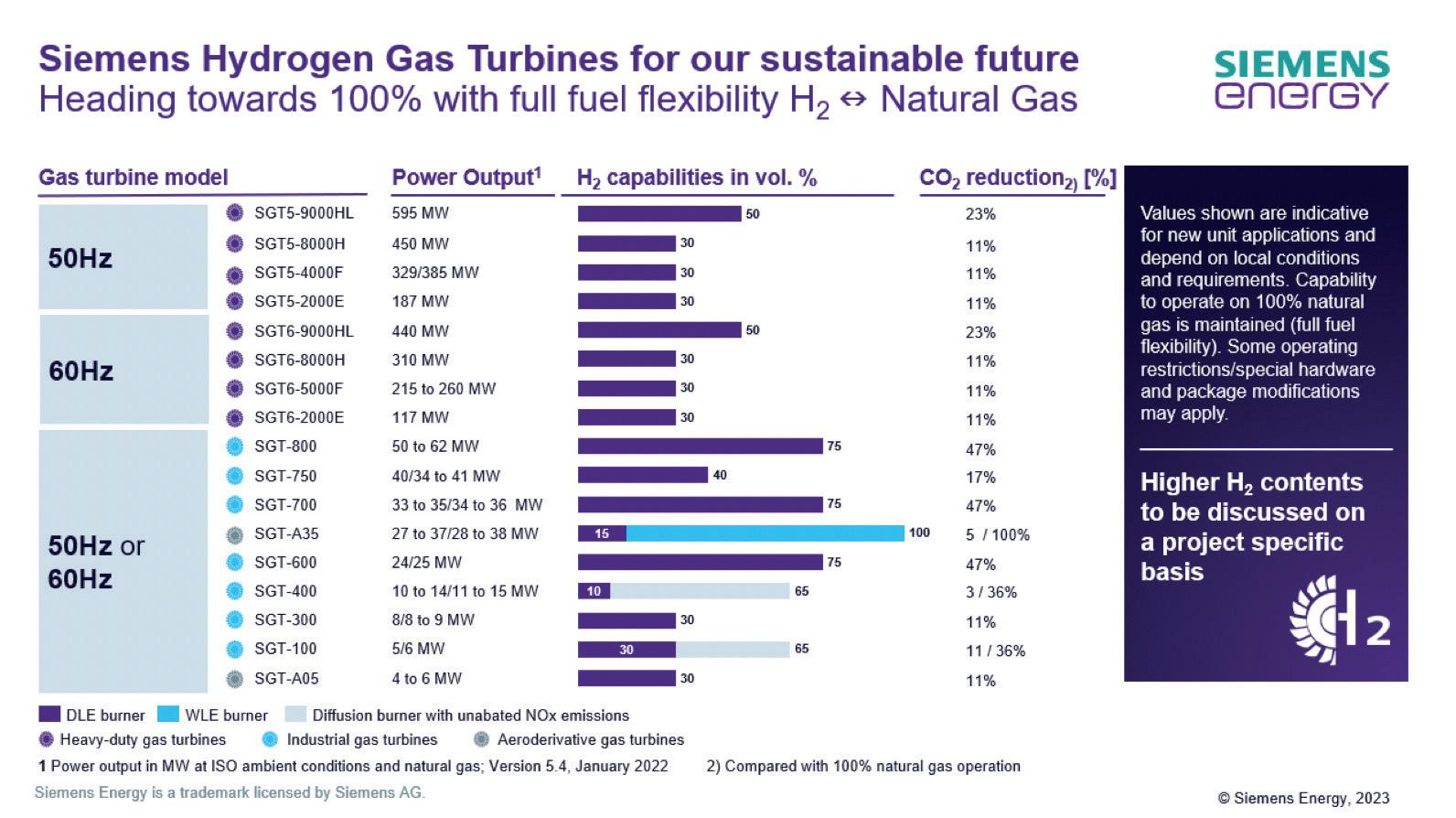

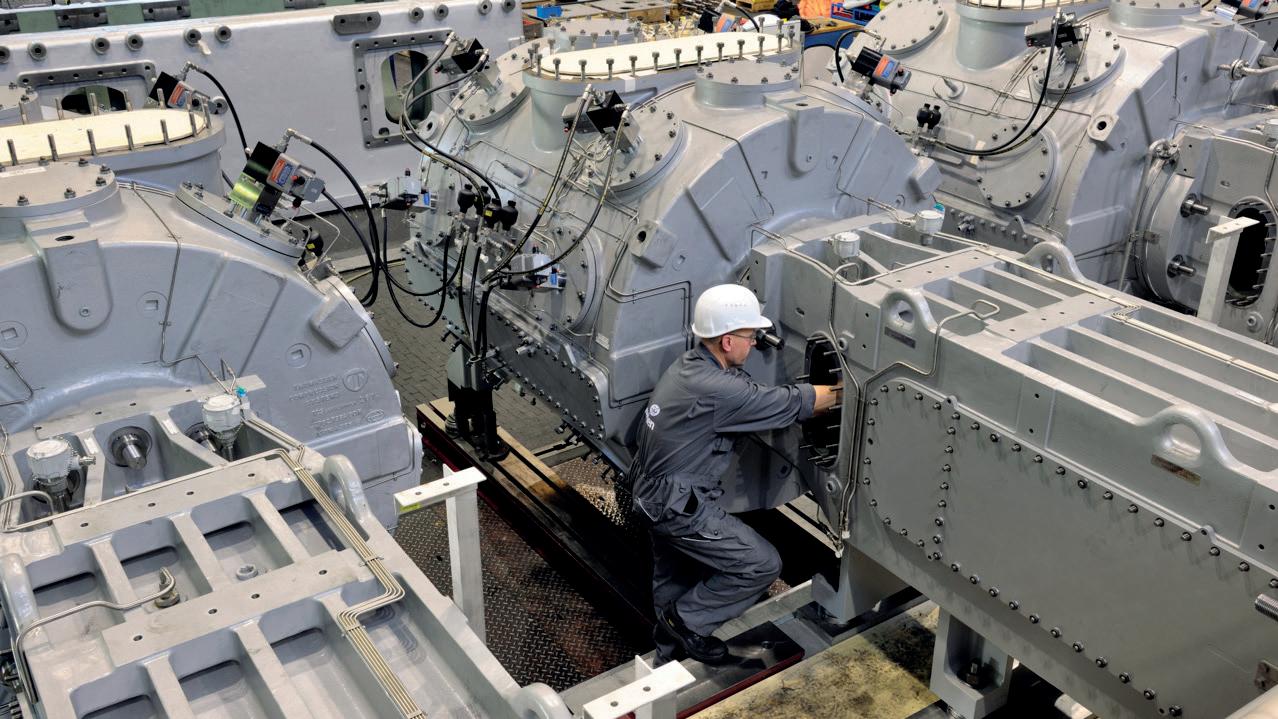

Brian Mason and Chirag Sehgal, Siemens Energy, discuss how Australia is preparing for the hydrogen economy by way of retrofitting existing compression and transportation

44 The challenge of atmospheric hydrogen compression

Octavian Partenie, Pascal Pasman, Svitlana Snelder and Theo Peperkamp, Howden, explain why it can be challenging to design reciprocating compressors for hydrogen produced at atmospheric pressure.

48 Getting a sense of hydrogen

David Meyers, H2scan, USA, discusses the importance of hydrogen sensing within the emerging hydrogen economy.

53 A means to monitor quality

Global efforts to protect the environment have increasingly focused on lowering carbon emissions. Dr. Florian Adler and Jim Belanger, Process Insights, suggest that the key to meeting this challenge lies in replacing fossil fuels with alternative, renewable fuel sources, particularly to power vehicles.

57 Getting the green light

Allan Rushforth, First Hydrogen, UK, describes how green hydrogen is supporting the UK’s transport sector on the path to becoming a net zero industry.

61 Withstanding hydrogen

Dr. Thomas Gallinger and Simon Schlei, TÜV SÜD Industrie Service, discuss the testing methods behind determining whether components and materials are compatible with hydrogen.

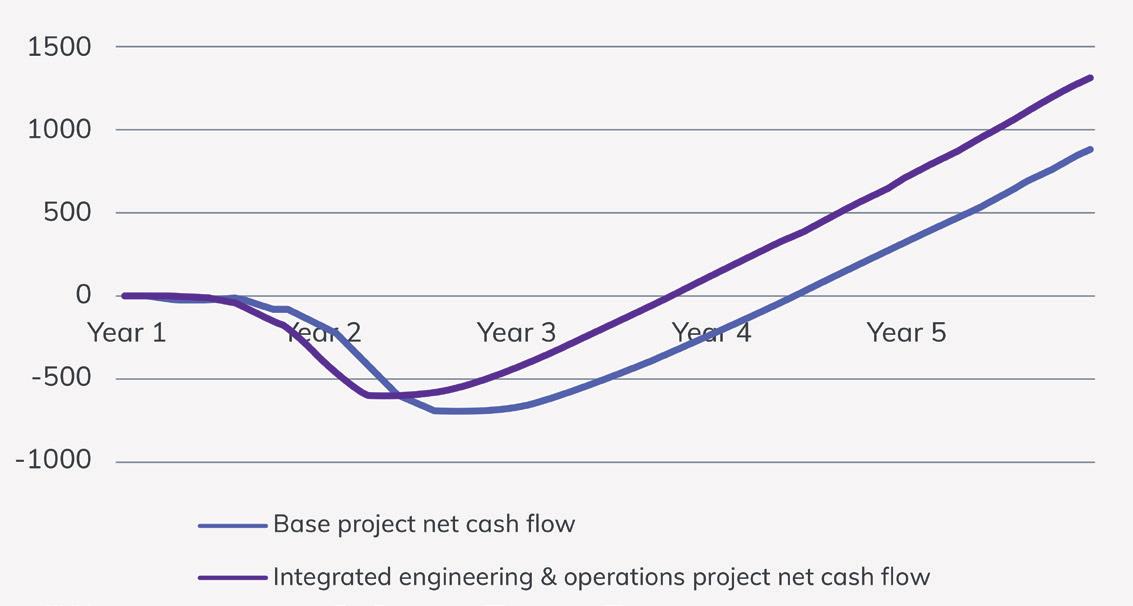

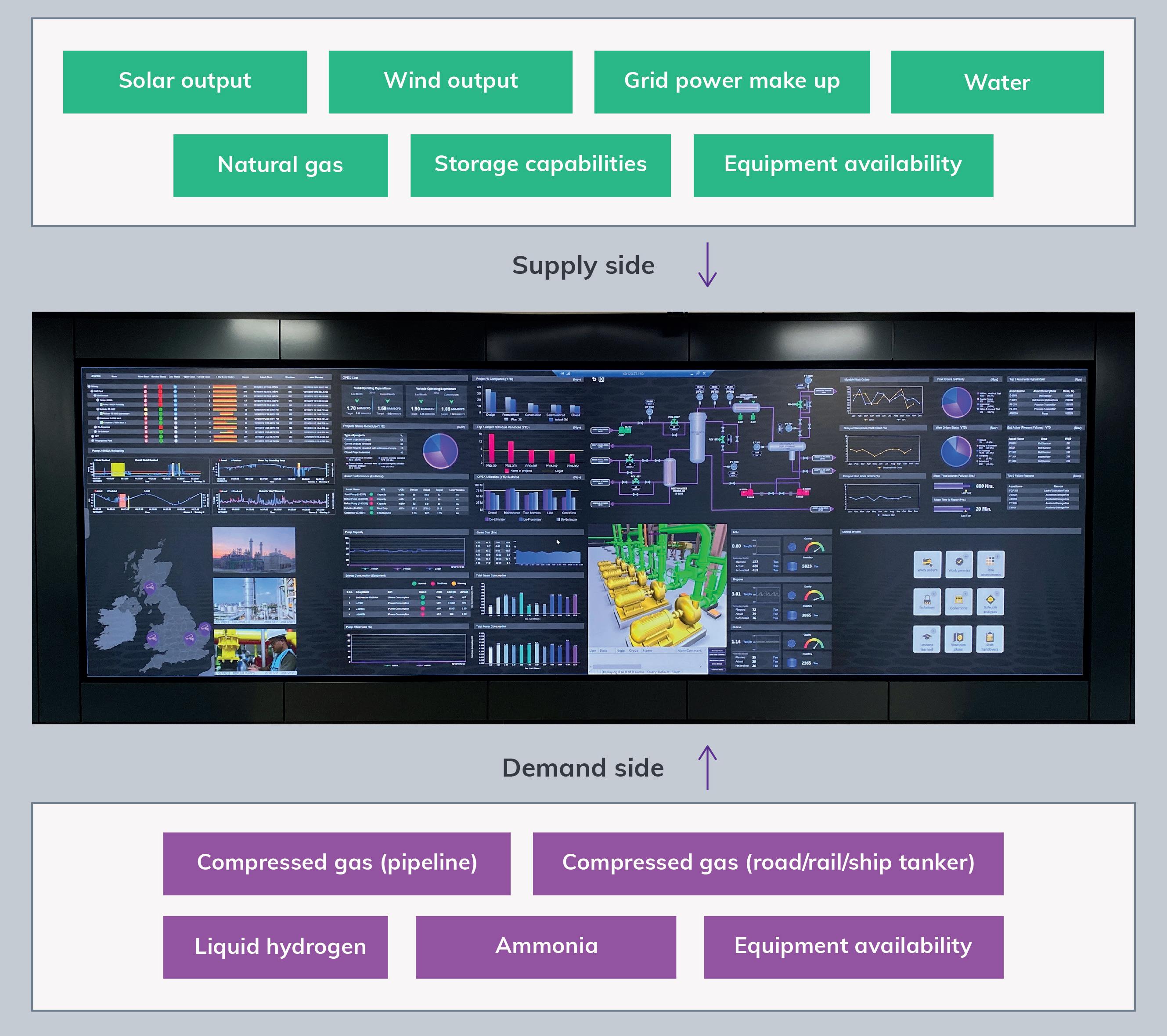

64 The digital delivery of a complex hydrogen network

Roy Calder, AVEVA, UK, explains the importance of developing digital environments to support the success of hydrogen projects.

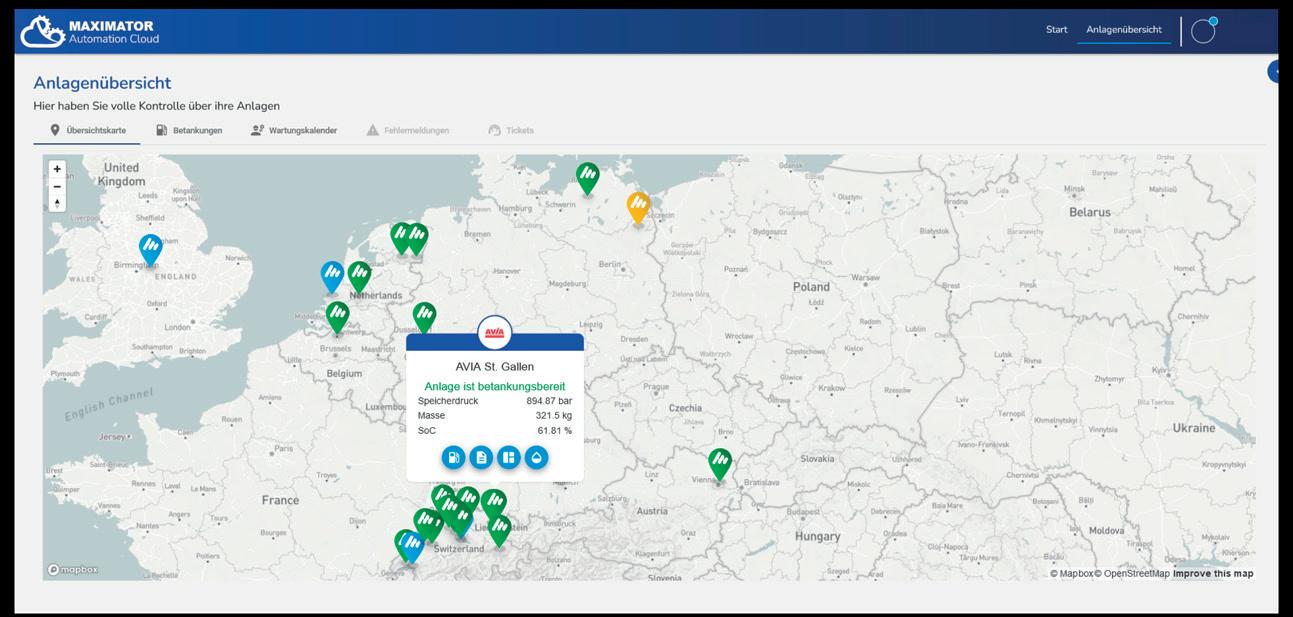

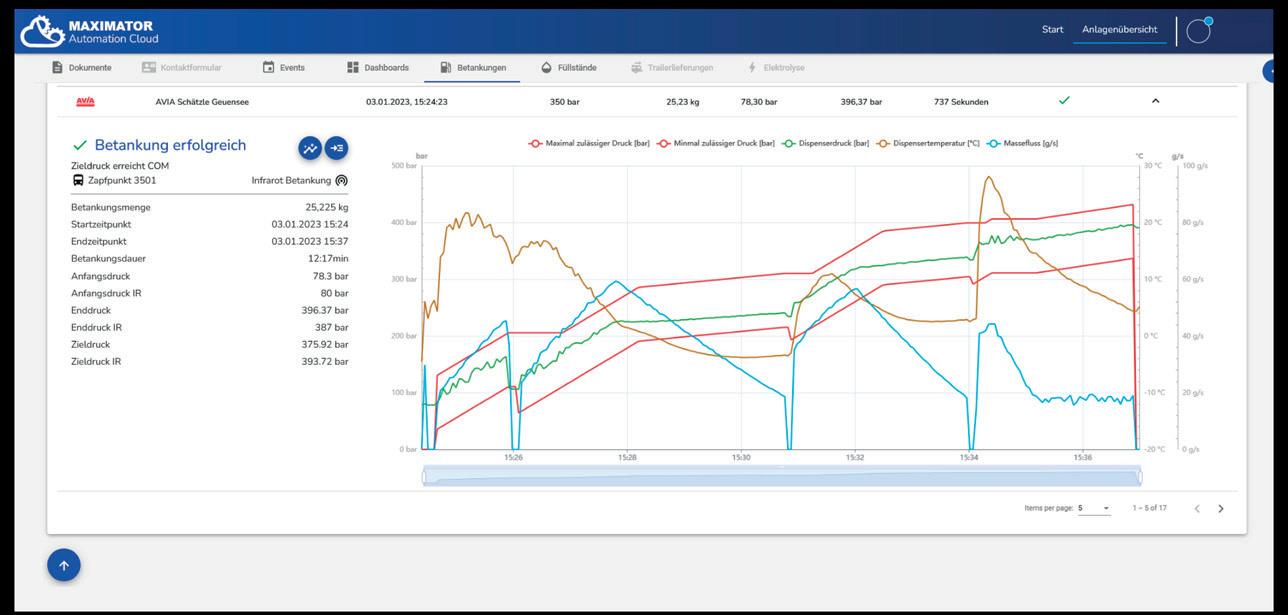

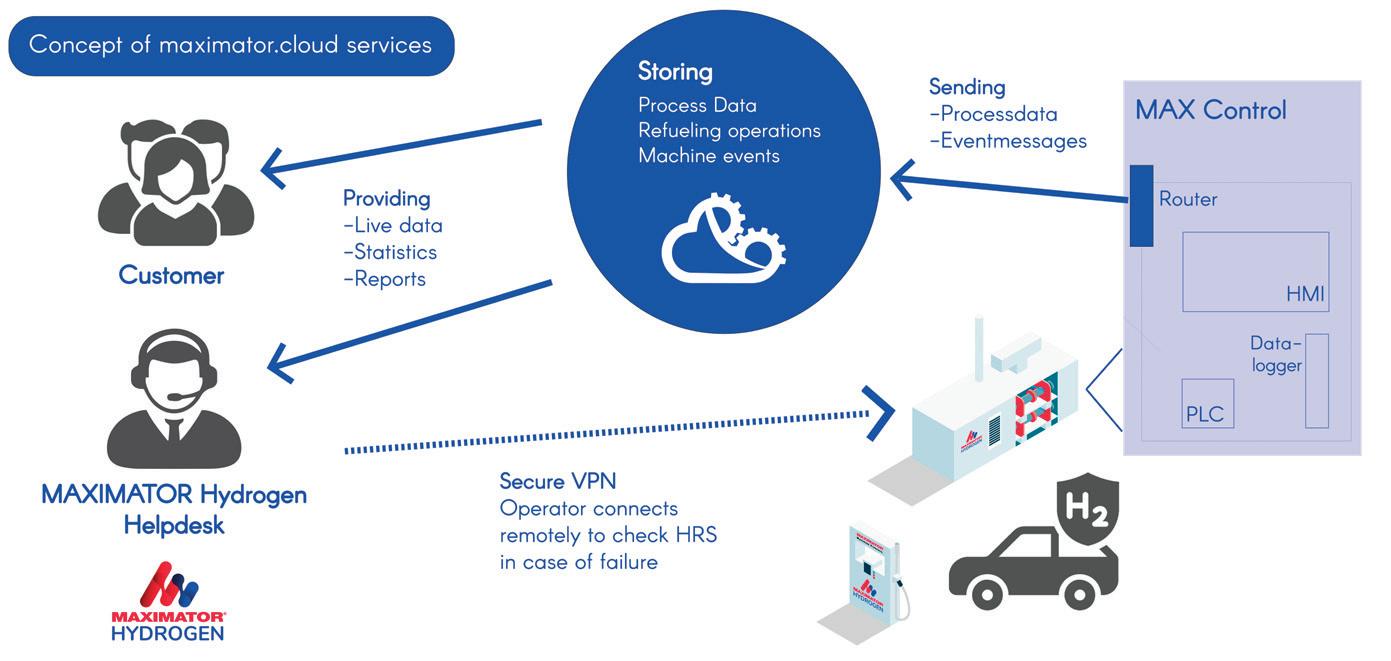

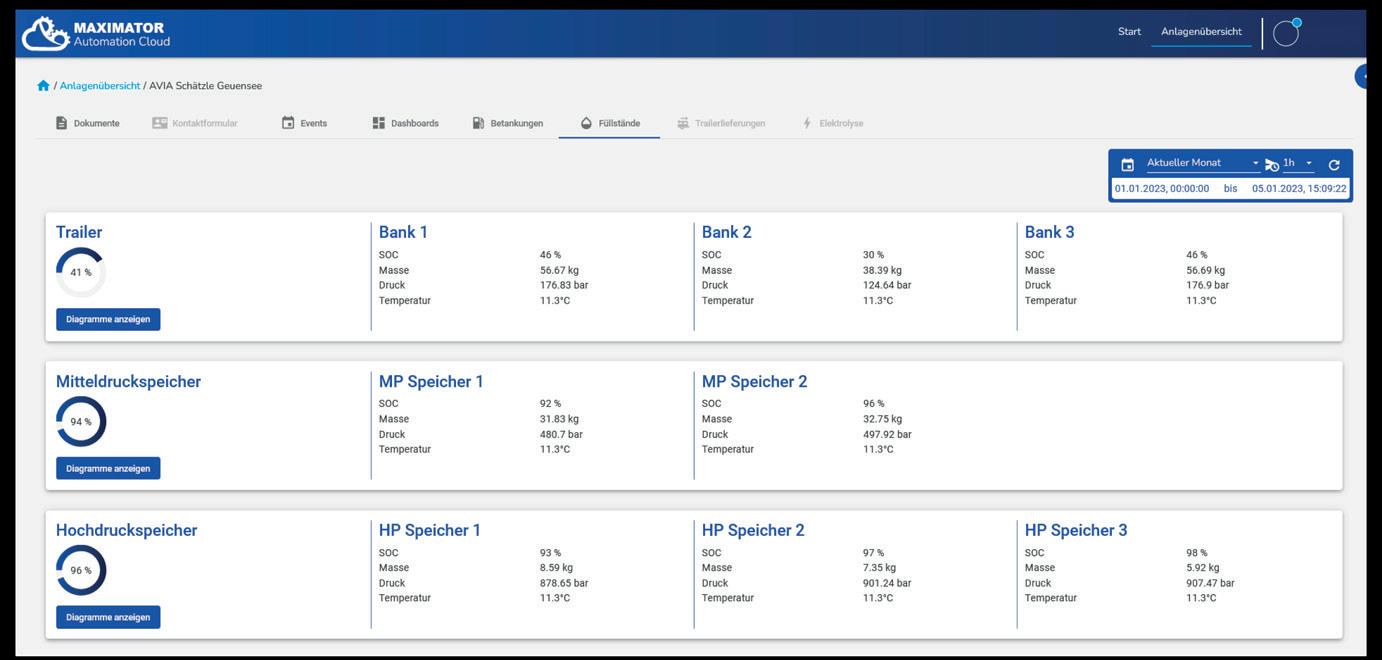

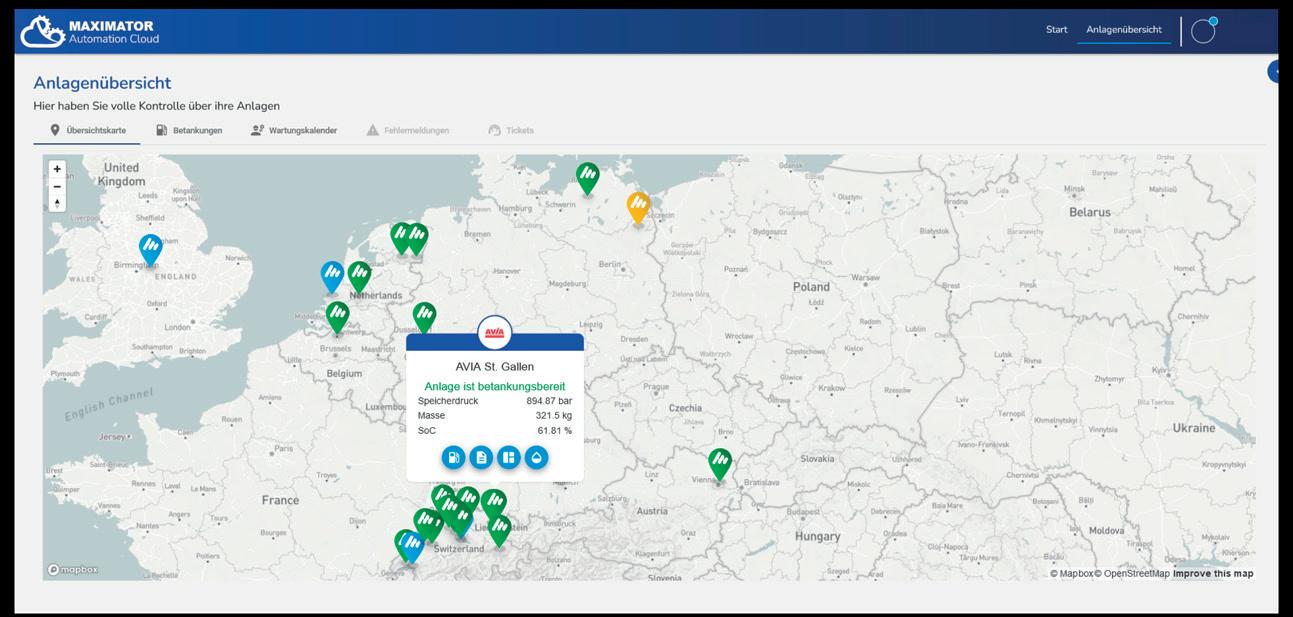

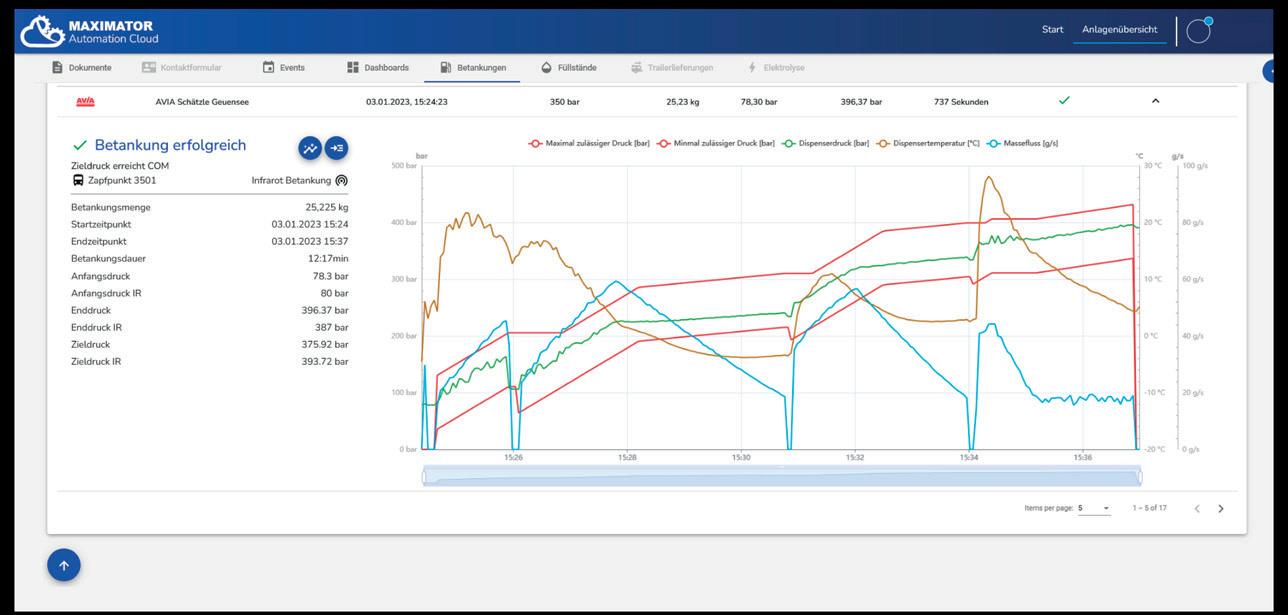

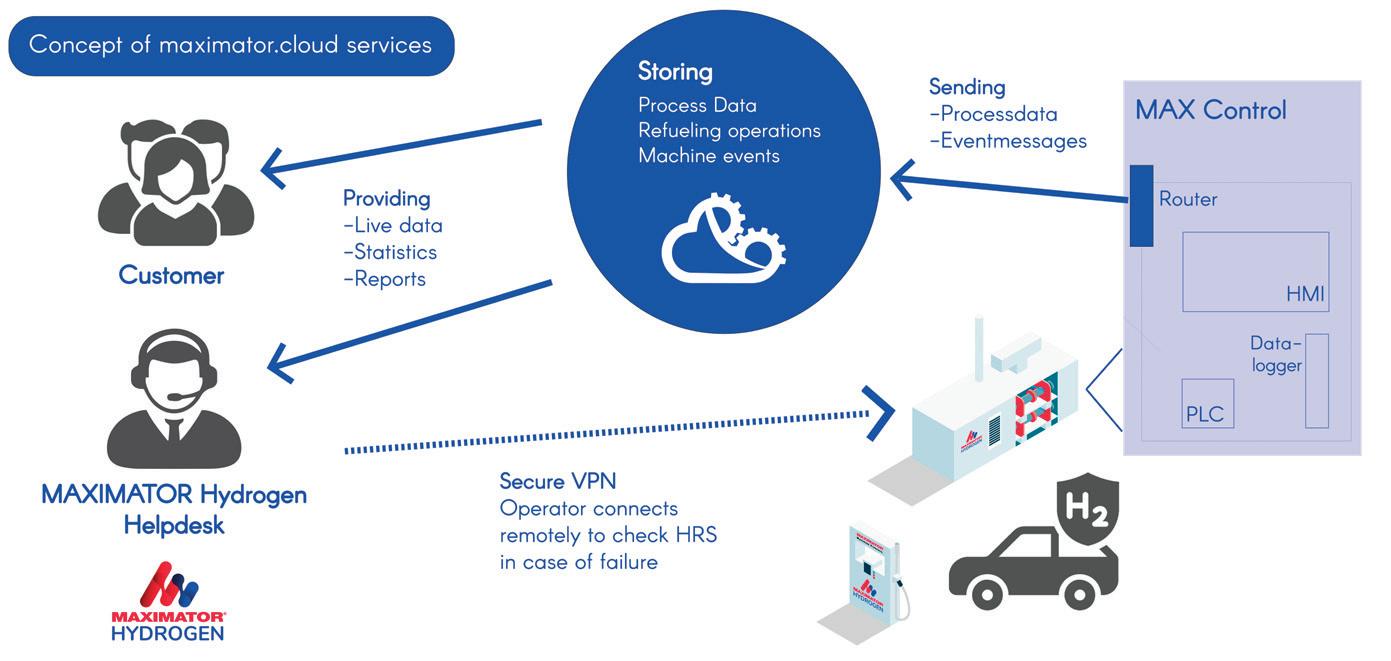

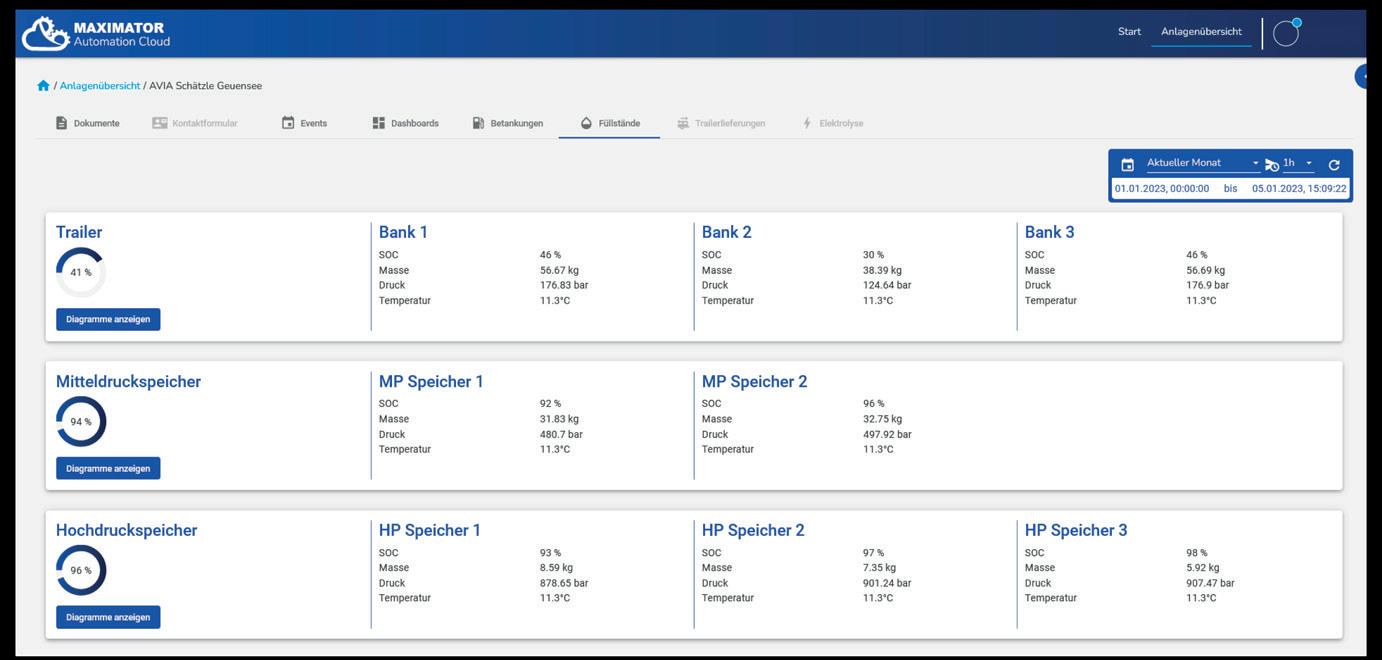

69 The digitisation of hydrogen filling stations

Mathias Kurras, Maximator Hydrogen GmbH, Germany, explains how digitisation makes hydrogen filling stations safer, more efficient, and continuously available.

72 Big data to support big decisions

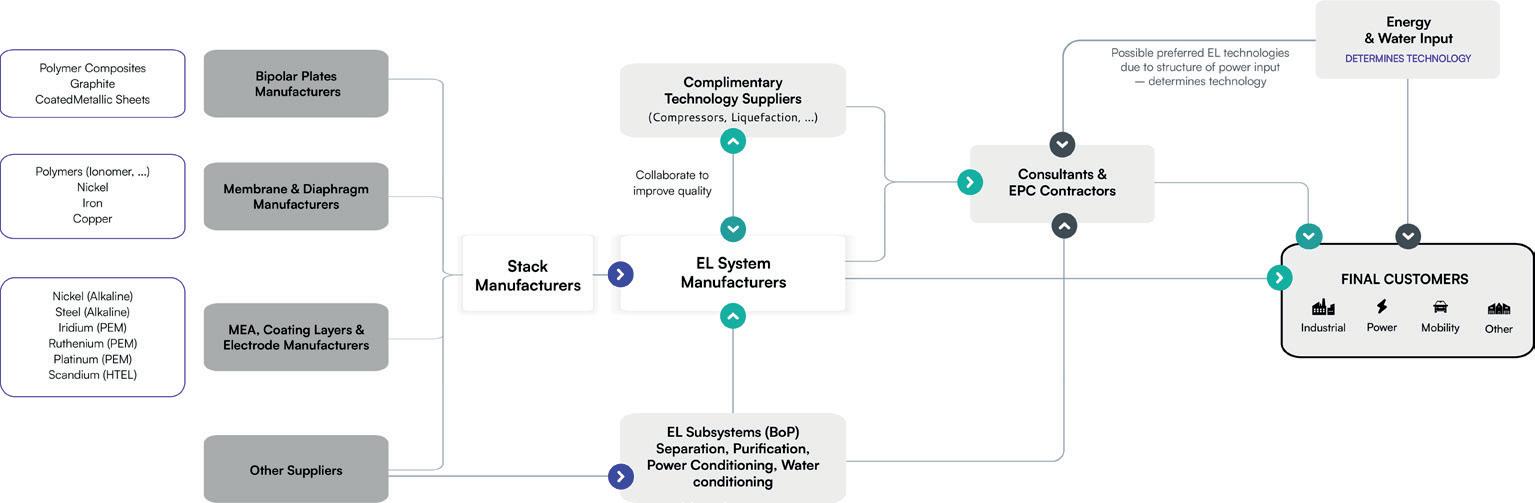

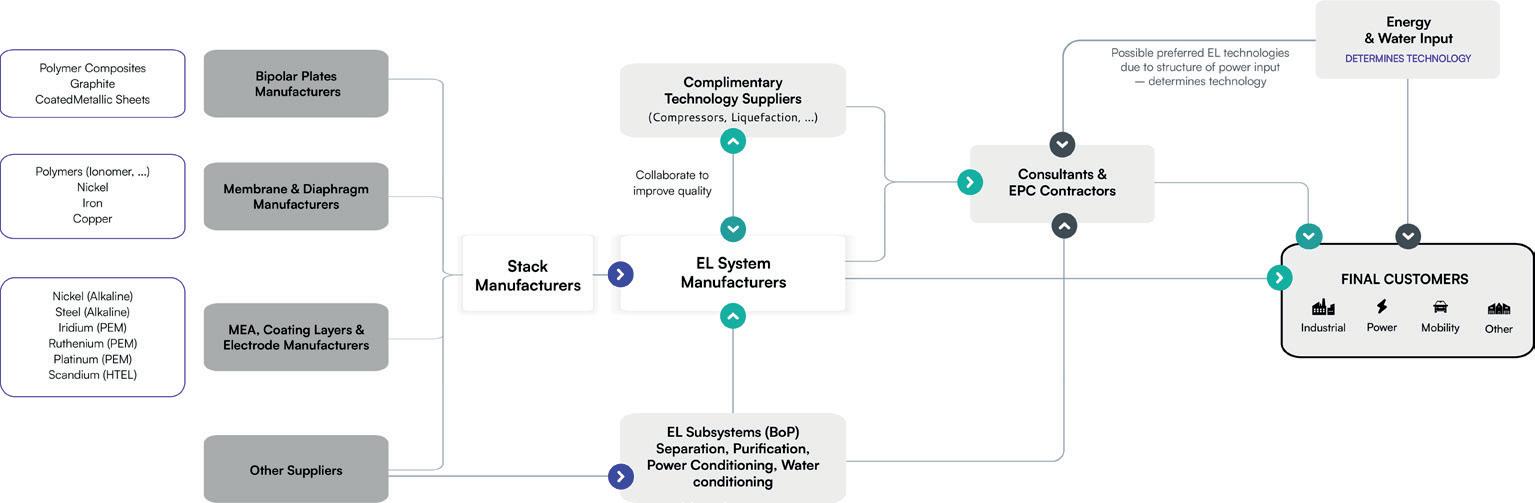

Lukas Strohmeier, Delphi Data Labs GmbH, Austria, explains how big data helps companies to identify the right customers, partners or suppliers in the emerging green hydrogen economy.

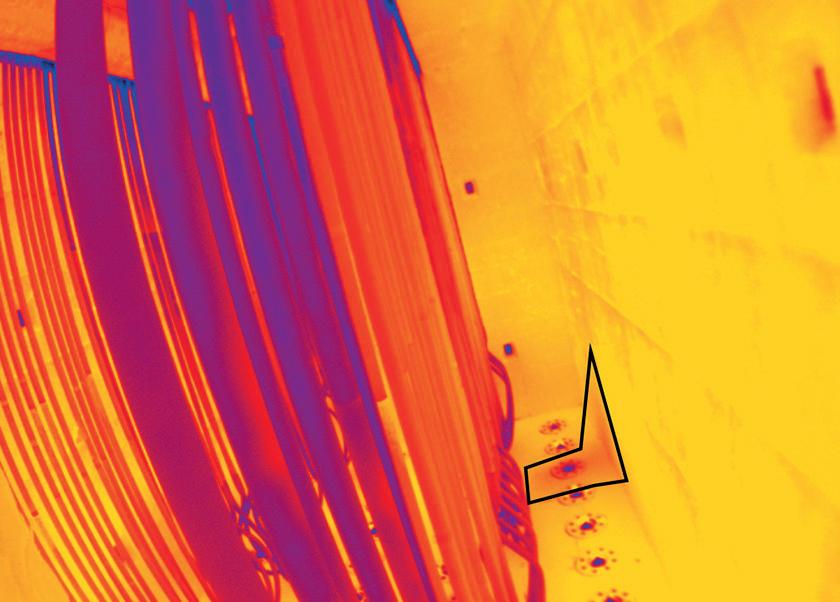

This month's front cover

H2scan’s proven sensing technology, based on R&D, engineering and production excellence, helps to ensure the safe and effective operation of the hydrogen economy. Turn to p. 48 to learn why sensors are vital for hydrogen reliability and safety.

Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements.

@HydrogenReview like join Global Hydrogen Review @Hydrogen_Review follow

Join the conversation

Spring 2023

MORE BUSINESS LESS CARBON NATURAL GAS, FUTURE READY.

The case for blue hydrogen is clear.

Topsoe is ready to help you scale up and bring emissions down using natural gas resources.

Take the lowest energy route to ultra-low carbon intensity hydrogen with Topsoe’s industry-leading reforming technologies and integrated carbon capture.

Find out how: topsoe.com/bluehydrogen

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Callum O'Reilly callum.oreilly@palladianpublications.com

Deputy Editor Bella Weetch bella.weetch@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Chris Atkin chris.atkin@palladianpublications.com

Sales Executive Sophie Birss sophie.birss@palladianpublications.com

Production Manager Kyla Waller kyla.waller@palladianpublications.com

Events Manager Louise Cameron louise.cameron@palladianpublications.com

Events Coordinator Stirling Viljoen stirling.viljoen@palladianpublications.com

Digital Content Assistant Merili Jurivete merili.jurivete@palladianpublications.com

Digital Administrator Leah Jones leah.jones@palladianpublications.com

Admin Manager Laura White laura.white@palladianpublications.com

As I write this, we have just come to the end of the 2022/2023 ‘film awards season’. One of the movies nominated for a prestigious Academy Award was ‘Glass Onion: A Knives Out Mystery’. The murder mystery adventure, which features a star-studded cast including Daniel Craig, Edward Norton and Janelle Monáe, was up for the ‘Best Adapted Screenplay’ award. And although the Oscar in this category eventually went to ‘Women Talking’, the writers of ‘Glass Onion’ can take comfort in the commercial success of the film, which reportedly racked up an estimated 35 million views within three days of its release on Netflix.

For those of you who haven’t seen the film, I’ll briefly explain why I am talking about it (warning: some spoilers ahead). As you may have already guessed, Glass Onion centres around the murder of a key character, and the audience is left guessing ‘whodunnit’ throughout. But aside from dramatic plot twists and red herrings aplenty, the story revolves around a conflict between the characters over the commercialisation of a fictional hydrogen-based fuel made of abundant seawater called ‘Klear’. Now, as you would expect from a Hollywood blockbuster, the line between fantasy and reality is more than a little blurred. For starters, Klear is a solid hydrogen fuel that resembles a crystal, which can be slipped into your pocket. In reality, pure hydrogen would need to be -260˚C (-434˚F) to exist in a solid state, which would make placing it in your pocket pretty difficult.

There are plenty of other misconceptions about hydrogen scattered throughout the film, including a somewhat lazy reference to its role in the 1937 Hindenburg disaster, and exaggerations about its propensity to leak compared to other fuels. And the film’s final scene leaves viewers in little doubt about the combustibility of the fuel, perpetuating the myth that hydrogen is inherently more dangerous than other hydrocarbon fuels. If you’d like to read more about the hydrogen plot holes throughout the film, there are plenty of articles available online (and I have included links to a couple at the bottom of this page).

However, these misconceptions are not helpful to hydrogen’s reputation, especially at a time when the sector is really starting to gain momentum. As an article from Hydrogen Forward (a coalition of companies working across the hydrogen value chain) summarises: “Hydrogen has been used throughout society for decades, complying with safety and logistics standards to enhance public safety. If net zero is to be achieved, building trust in all climate solutions, including hydrogen, will be required.”

And that is precisely our aim at Global Hydrogen Review. This issue is full of fascinating articles on topics including how to ensure safety during the hydrogen revolution (p. 31), and the vital role of sensors for hydrogen reliability and safety (p. 48). Other key themes throughout this issue include the green vs blue hydrogen debate (pp. 4 – 19), hydrogen liquefaction technology (p. 20), future fuel pipelines (p. 34), compressors (pp. 38 – 47), digitalisation (pp. 64 – 72), and much more.

Editorial/advertisement offices: Palladian Publications

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999 www.globalhydrogenreview.com

I’d also like to invite you to attend our annual Global Hydrogen Conference on 20 April. This year’s virtual conference will be full of interesting presentations from the likes of Cornwall Insight, Honeywell, Topsoe and Svante. You can find out more, and register for your free space, by clicking here.

• https://www.hydrogenfwd.org/spoilers-glass-onions-klear-hydrogen-fuel-is-clearly-the-stuffof-hollywood-fiction/

• https://www.plugpower.com/shattering-hydrogen-myths-in-glass-onion-a-knives-outmystery/

Callum O'Reilly Senior Editor

Producing low-carbon hydrogen at competitive costs is one of the key factors behind achieving net zero emissions. Not only could it be used as a replacement for fossil fuels in hard-to-decarbonise industries such as steel production, but it may also eventually be used as fuel for space heating and vehicles, as well as for the creation of sustainable aviation fuels (SAFs).

Today, the most common form of hydrogen that is produced is grey hydrogen, but this emits around 1 billion t of carbon dioxide (CO2) – 2% of global CO2 equivalent (CO2e) emissions. While industries and governments are exploring lower-carbon solutions such as blue and green hydrogen as long-term tools that can improve security of energy supply, and reduce reliance on Russian gas, there is considerable debate over what is the most cost-effective and environmentally-attractive production route.

Blue hydrogen is not zero-carbon because not all carbon is captured, and methane leakages during gas production can be sizeable contributors to global warming. Therefore, green hydrogen seems more environmentally-advantageous than blue – and ideally, that would be the case. However, in certain circumstances, green hydrogen emissions can be twice those of grey hydrogen. If the goal is decarbonisation, industries and governments need to be thoughtful as to when and where green hydrogen projects are deployed if they are to successfully lower emissions and increase security of supply.

Green hydrogen: the full-system carbon footprint and economics

Green hydrogen is produced by electrolysing water using electricity generated by renewables. Besides producing molecules of hydrogen, the principal byproduct is oxygen.

4

Chris Warnes, Oliver Wyman, UK, offers a perspective on scaling low-carbon hydrogen production.

Today, green hydrogen production is expensive, but with the falling cost of renewables and improved electrolysers, there is an expectation that it will become cost-competitive with other fuels over time. Long-term, it is the most environmentally-friendly approach to producing low-carbon hydrogen.

However, this is not necessarily the case over the medium-term. If green electricity is diverted from the grid for hydrogen production, then this has its own environmental implications. Where baseload electricity is taken from the grid and used to produce hydrogen, this electricity must be replaced by incremental power generation. As existing renewables are already running at full power, the incremental power typically must be produced from natural gas-powered generation or, in many markets including Germany and China, coal – the most carbon-intensive fossil fuel.

Figure 1 examines the relative environmental impacts of grey and green hydrogen, in the case where the electricity is diverted from the grid and needs replacing with natural gas-fired power generation. Only 1.4 MWh of gas is required to produce 1 MWh of grey hydrogen, with an associated 0.28 t of CO2 emissions. To produce the same amount of green hydrogen, 2.8 MWh of natural gas is burned in a gas-fired power plant (combined cycle gas turbine) to generate the electricity to replace the diverted green electricity, resulting in a 100% increase in carbon emissions overall, to 0.56 t. If the electricity is generated from coal, then the total emissions would be over 1 t.

On a full-power-system basis, both paths start with gas. However, by going through two process steps, the green hydrogen is inherently less efficient, with typical conversion losses for gas-fired power stations of 50%, followed by a further 30% loss at the electrolyser, resulting in

5

a cumulative 65% loss, whereas steam reformation losses are of the order of 30%.

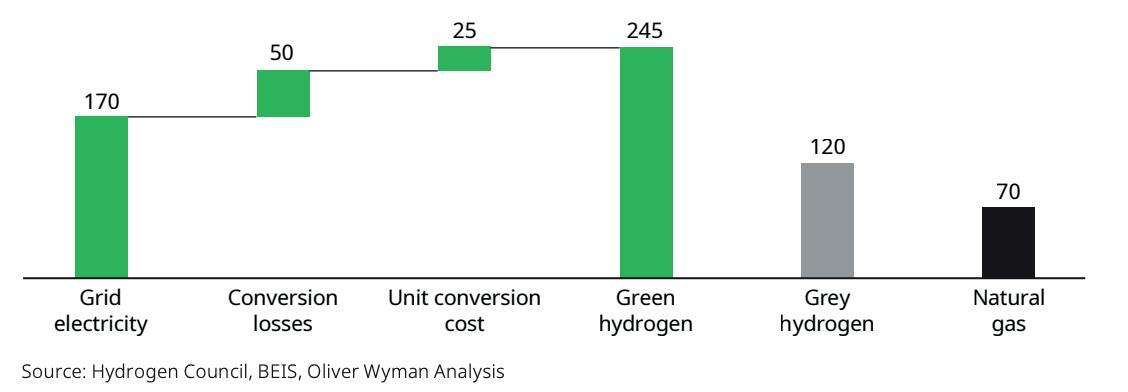

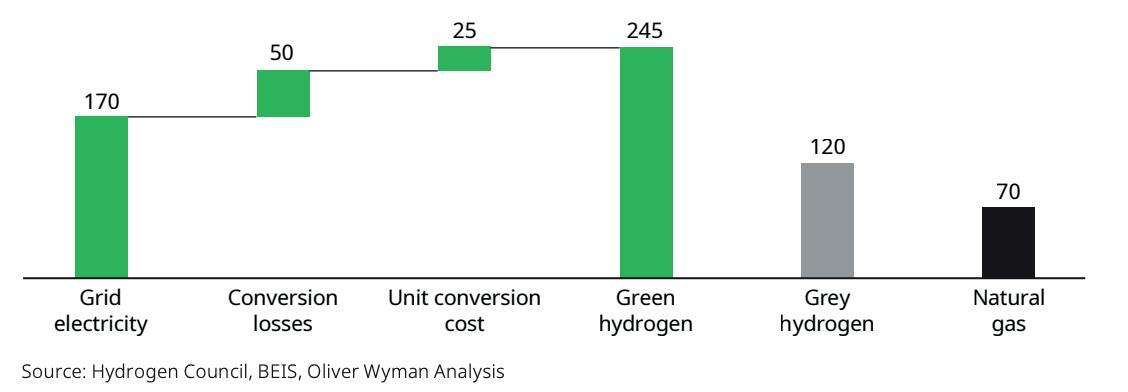

In addition to the questions surrounding decarbonisation benefits, green hydrogen appears to be economically-inefficient, since its production requires electricity, a high-value product, to make a generally lower-value product: hydrogen. For example, markets currently indicate prices of around US$170/ MWh for electricity, and US$70/ MWh for natural gas in Europe in 2025. Once the cost of the electrolyser conversion is factored in, converting grid electricity to green hydrogen results in a hydrogen cost of around US$245/MWh (see Figure 2), compared to grey hydrogen at around US$120/MWh. Using green hydrogen at US$245/MWh to replace natural gas (at US$70/MWh) is even less efficient. This is also the case when looking at prices that prevailed before the current energy crisis.

A standalone green hydrogen plant receiving electricity from an offshore wind farm can produce green hydrogen for a total cost of around US$130/MWh – considerably cheaper than green hydrogen from the grid. However, this effectively relies on the wind farm selling the electricity to the electrolyser at around US$60/MWh, which is not a logical choice when the alternative is to sell the electricity to the grid at US$170/MWh.

If hydrogen is produced from excess green electricity that has no other use, or from a standalone renewable project that cannot be connected to the local grid because of transmission constraints, then this is clearly a green product. However, in many markets today, increasing electricity demand to produce green hydrogen will result in an overall

increase in gas or coal demand and carbon emissions, as a gas-fired or coal-fired generation plant is required to supply the increased electricity demand.

With strong renewable growth predicted across the world, periods of excess low-carbon electricity will increase. The UK’s department for Business, Energy, and Industrial Strategy (BEIS) estimates that in a market with excess electricity for 25% of the year, truly green hydrogen can be produced for a cost of US$80/MWh by only running the electrolyser during the periods of excess electricity, when electricity prices will be close to zero. However, while the supply of renewable energy is growing, so too is the demand for it. A number of other market developments are likely to limit the growth of periods of excess low-carbon electricity:

y Increased demand for power: the growth in the number of electric vehicles (EVs) and heat pumps will increase overall demand.

y Changing customer demand patterns: energy suppliers are encouraging demand to shift to periods of high renewables production by way of lower electricity rates during this time.

y Increased interconnection between national power grids: this is diversifying the renewable supply, reducing the likelihood that any one particular market will have excess electricity. Connecting the UK market with Norway, for instance, makes it possible for the UK to effectively use Norway’s large hydropower capacity as long-term storage, importing power when the wind is not blowing and exporting excess renewables during high wind, allowing Norway to conserve future hydropower resources.

y More battery storage: growth in lithium-ion batteries offers a far more economical solution for any renewable over-supply than green hydrogen production for short periods of over-supply, with only about a 15% efficiency loss and a lower capital cost per megawatt than an electrolyser. With battery costs falling rapidly, their deployment is expected to scale up rapidly, allowing their economic use case to extend into longer periods of over-supply.

� Battery research and development (R&D): alternative battery technology is receiving significant R&D investment, encouraging the development of longer-duration batteries, such as flow batteries, and creating competition with green hydrogen for excess renewable electricity.

Together, these trends suggest that the potential of truly green hydrogen over the next two decades may be lower than believed. Thus, it is important to look more seriously at blue hydrogen to fill the gap in the meantime.

Blue hydrogen: the full-system carbon footprint and economics

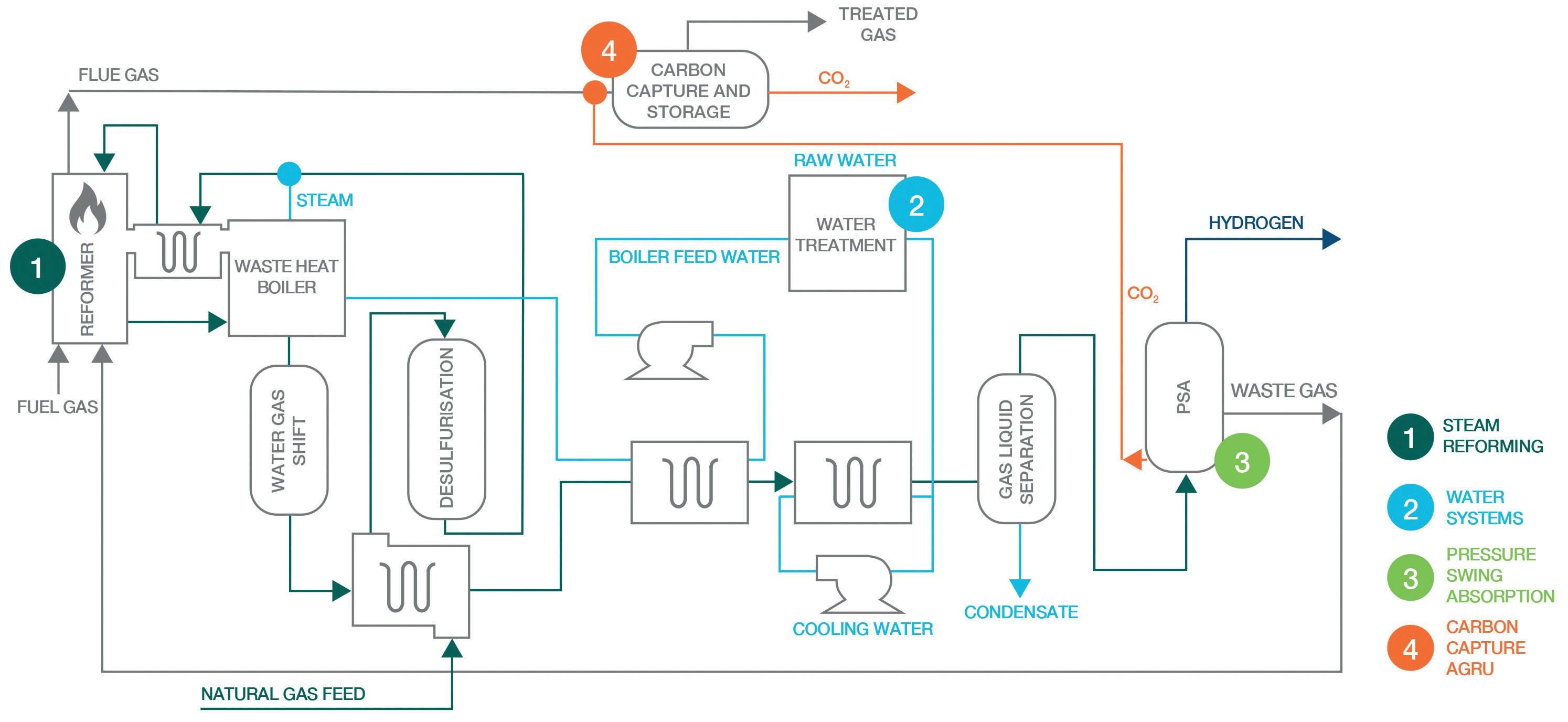

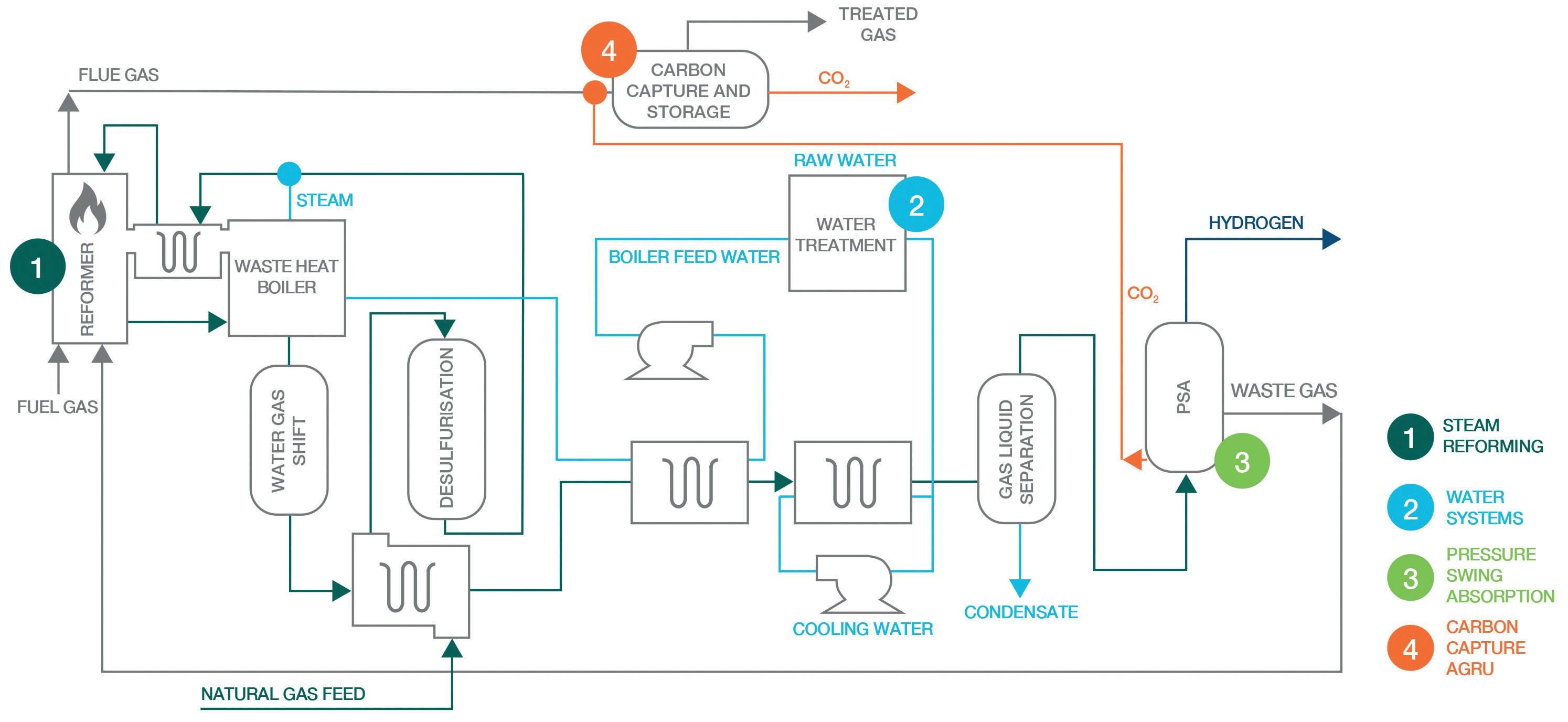

Blue hydrogen is produced by reformation of natural gas, through heating natural gas to high temperatures using steam methane reformation (SMR) or auto thermal reformation to convert it into hydrogen and CO2. The concentrated CO2 is then captured and stored. Typically, the heat to drive

6 Spring 2023 GlobalHydrogenReview.com

Figure 1. Why green hydrogen can be more carbon-intensive than grey.

Figure 2. Green hydrogen – projected production costs vs grey hydrogen and natural gas in 2025 (US$/MWh).

ACCELERATING BLUE HYDROGEN TOGETHER

The world’s energy systems are changing; and hydrogen is becoming a key part of the future energy mix. With that need for very large volumes of hydrogen on the horizon, Shell Catalysts & Technologies has developed a low cost, high capacity way to match those production needs via the Shell Blue Hydrogen Process. The processes bring together several proven technologies to deliver 500 te/day of hydrogen with >95% CO2 capture rate at the lowest levelized cost. It’s a hydrogen solution designed to help decarbonize hard to abate industries, lower the CO2 footprint of heavy transport, and reduce home heating emissions.

Learn more at http://catalysts.shell.com/bluehydrogen

the process is also produced using natural gas, creating a secondary, more dilute CO2 stream. An average capture efficiency of approximately 90% over both streams is expected to be achievable.

Presently, blue hydrogen is expected to have a lower production cost than green hydrogen. The key concern with blue hydrogen is its reliance on fossil fuel production and the resulting environmental risks by way of methane emissions associated with the gas production, and the less than 100% capture of CO2

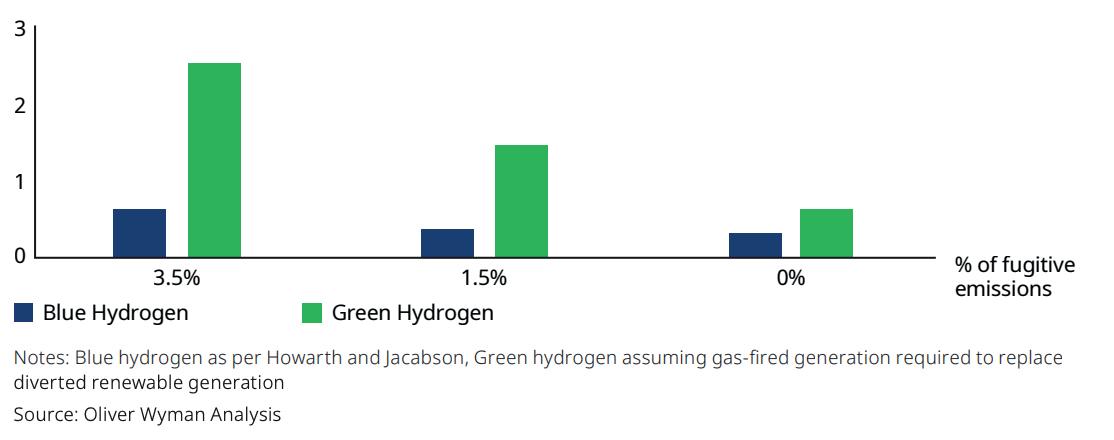

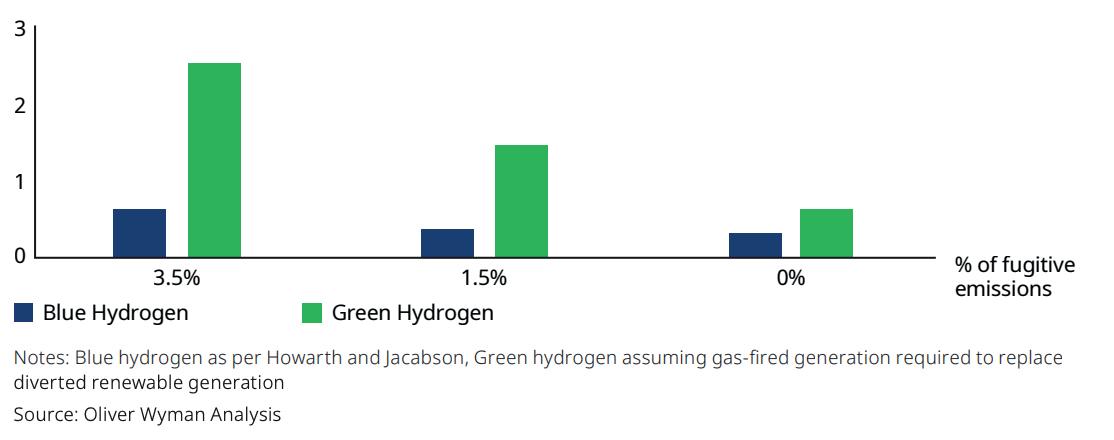

Methane has a much higher greenhouse gas (GHG) impact than CO2 – about 86 times more when measured over a 20-year period. So, only small levels of methane leakage can increase the carbon footprint significantly. In 2021, Professor Robert Howarth of Cornell University, and Professor Mark Jacobson of Stanford University estimated the level of fugitive emissions at 3.4% (based on measurements in the US) and calculated that at this level of emissions, blue hydrogen has a similar carbon footprint to grey. They concluded that the world should focus on green hydrogen. However, by applying the whole-system concept, it is clear that green hydrogen is often effectively generated from gas-fired power, so fugitive emissions can be as much of a challenge for green hydrogen as they are for blue.

Figure 3 shows the relative GHG emissions levels of green vs blue hydrogen at differing fugitive emission level assumptions. The 3.4% appears a rather high estimate as to the long-term level of fugitive emissions from gas production. For example, the Oil and Gas Climate Initiative, a CEO-led council of 12 leading oil and gas producers that support the 2015 Paris Agreement targets, reported 0.2% of fugitive emissions in 2020. As demonstrated in Figure 3, the carbon footprints of both green and blue hydrogen are highly sensitive to these assumptions. However, in all cases, blue hydrogen’s footprint is significantly smaller than green hydrogen, where green hydrogen is produced from baseload power taken from the grid.

This analysis reinforces the importance of tight control of fugitive emissions for gas in all areas, but it should not be used as an argument against blue hydrogen.

The key challenge for blue hydrogen: public acceptance

While commercial-scale carbon capture plants have been envisaged for more than 15 years, few currently exist outside

of the oil and gas industry. Today there is some 40 million tpy of worldwide carbon capture and storage (CCS) capacity, representing about 0.1% of global carbon emissions, of which 80% is used to support enhanced oil recovery rather than primarily for carbon abatement. This is despite all of the key technology elements being in place, and cost estimates for this kind of carbon abatement are similar to other well-supported low-carbon technologies.

Blue hydrogen and carbon capture have faced considerable political challenges, with some viewing them as a smoke screen to enable the continued production of fossil fuels. Consequently, governments have been slow to put in place the financial and legal support frameworks that investors need. Prices in existing carbon markets, such as Europe, have been insufficient to incentivise CCS on their own.

Today, support for blue hydrogen is growing, with several countries now planning blue hydrogen development projects – a number of which are situated close to the North Sea, with access to natural gas and offshore storage locations. However, many are also prioritising strong green hydrogen development. For example, the EU’s hydrogen strategy envisages positive growth in green hydrogen to deliver decarbonisation and increase energy security.

Conclusion

The view that green hydrogen is lower-carbon than blue hydrogen is an oversimplification. Longer-term, once electricity is predominately produced from renewable electricity and there are significant periods of excess renewables with no market on the power grid, then this will be the case. But in the short- and medium-term, policymakers and hydrogen generators need to understand the nuances of when green hydrogen is truly green, and to not discount blue hydrogen prematurely before its economics and environmental performance have been fully tested.

Done incorrectly, large-scale deployment of green hydrogen production will result in an increase of emissions and gas consumption vs continuing to use grey hydrogen. This will only cease to be the case when significant excess renewable electricity is produced that can be dedicated to the production of green hydrogen.

Renewable generation capacity is scaling rapidly worldwide, yet there are limitations across the supply chain as to how quickly capacity can increase. Consequently, renewable power should initially be deployed in situations where it delivers the most effective carbon abatement, i.e. decarbonising existing grids, supplying additional power required for EVs and heat pumps, and providing growing electricity demand in developing economies – before seeking to convert it to green hydrogen.

Given the challenges facing green hydrogen, the need to scale blue hydrogen cannot afford to be overlooked.

Note

8 Spring 2023 GlobalHydrogenReview.com

• All price data in this article is valid as per October 2022.

Figure 3. Blue vs green hydrogen – GHG emissions with differing fugitive methane assumptions (t CO2 per MWh).

Chart’s HLH2 vehicle fuel systems provide greater range and payload advantages using liquid hydrogen storage and an integrated heat exchanger for Fuel Cell Electric Trucks (FCETs).

HLH2 vs. H35/H70

• Lighter Weight

• Smaller Footprint

• Easier to Install

• Faster Fill Times

• Customized Integration with Truck Manufacturer’s Fuel Cell Engine

www.ChartIndustries.com/Hydrogen hydrogen@chartindustries.com

Americas: +1 800 400 4683

Germany: +49 (0)2823 328 224

China: +86 519 8596 6000

Chart’s liquid hydrogen fuel stations allow for quicker fueling of vehicles with more dense liquid hydrogen, using simpler equipment and requiring less infrastructure investment.

Scan to download our

brochure

Rajesh D. Sharma, Schneider Electric, discusses how and why hard-to-abate sectors should consider transitioning to green hydrogen, and details the three challenges associated with this shift.

10

Carbon dioxide (CO2) emissions from energy combustion and industrial processes accounted for close to 89% of energy sector greenhouse gas (GHG) emissions in 2021. CO2 emissions from gas flaring accounted for another 0.7%. Beyond CO2, fugitive and combustion-related methane emissions represented 10% of the total, and combustion-related emissions of nitrous oxides (NOx) 0.7%, according to the IEA’s report, ‘Global Energy Review: CO2 Emissions in 2021’.1

Today, fossil-based energy is the global economy’s fuel. It is an enabler, but it also comes with the inherent challenge of associated GHG emissions. It is important to continue innovating technology that will sustain both our planet and society.

Over the decades, renewable forms of energy have been encouraged and new technologies have been developed. The world, however, is still facing many challenges in terms of transitioning from fossil fuel to carbon-neutral energy – especially with the current energy

crisis demanding more sustainable forms of energy.

Although we have been producing hydrogen for industrial processes for a long time, the majority of such production is by way of using fossil fuels. Today, in order to meet the current demand for hydrogen – which is estimated to be approximately 90 million t – 6% of global natural gas and 2% of global coal are used, according to the World Bank.2

Green hydrogen as a vector for renewable electricity generation has been touted as a potential substitute to fossil fuels, mainly in hard-to-abate sectors, which will help us to accelerate the race to reducing our carbon footprint. The growing popularity behind this innovative solution stems from how it can facilitate a transition away from hydrocarbons. Made with renewable energy, it will be an essential contributor to effecting this necessary change. Determining how to achieve cost-effective production, however, presents a formidable challenge.

11

The desire to move toward green hydrogen is real, but the transition is faced with three critical challenges.

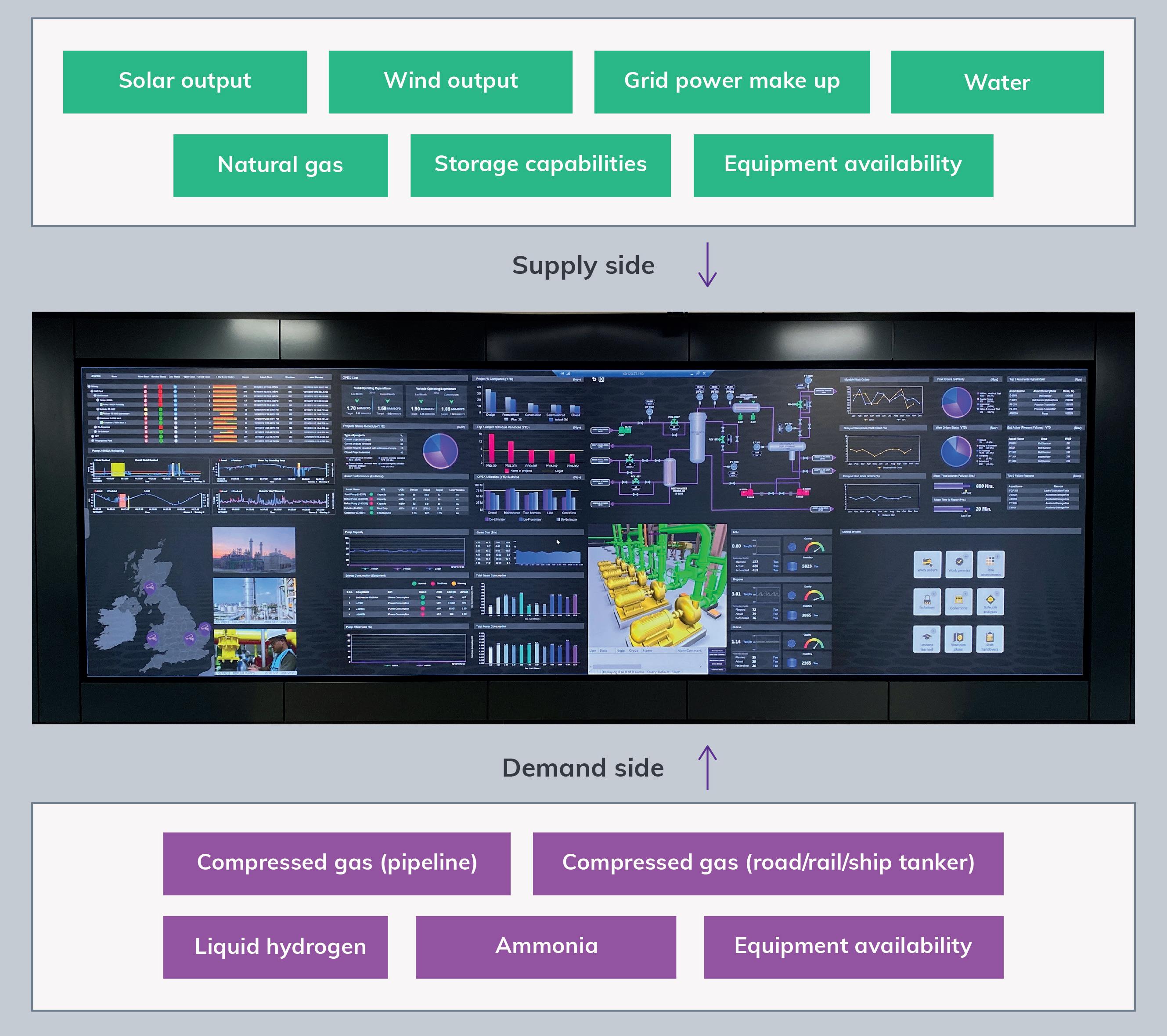

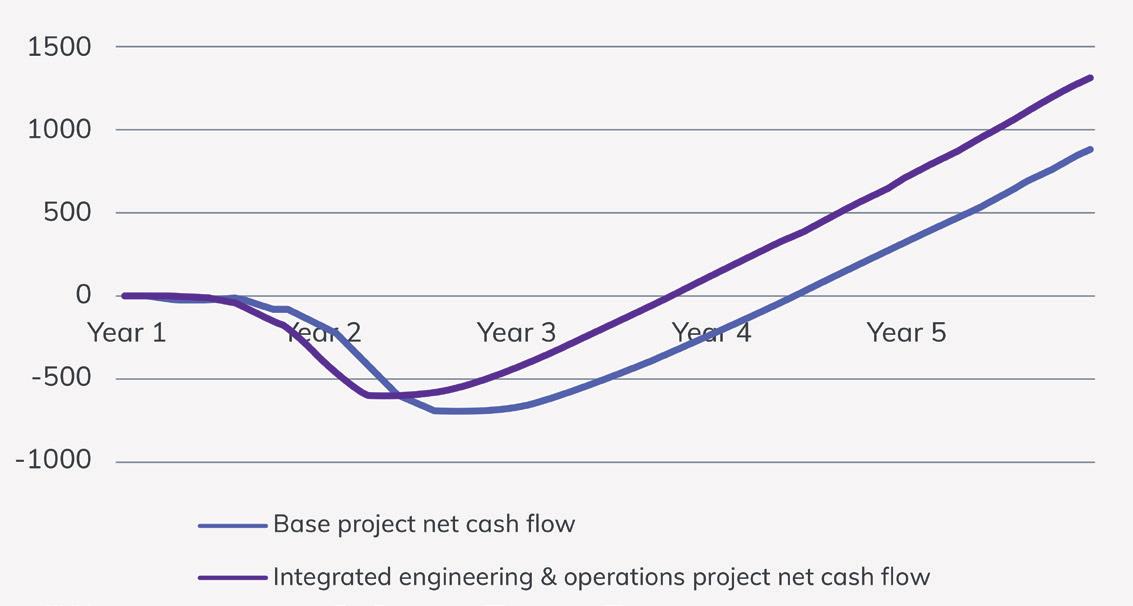

Improving knowledge, design, and engineering results

Finding the path forward towards efficient green hydrogen production requires new technologies and new thinking. Moreover, many individuals still lack the necessary training and skills required to support the hydrogen economy. Integrated engineering using a digital twin and process modelling are currently key technology solutions for green hydrogen production and design. However, as production continues to evolve, technology of this nature should continue to be evaluated and improved.

Considering that we can reuse knowledge captured, it is essential to use a digital design tool that can embed such knowledge of complex chemical and physical processes. This type of digital design tool can assist in decision making throughout all phases of project delivery and plant optimisation activities. As such, a digital twin becomes a necessary tool to successfully design and operate green hydrogen production and distribution facilities. To increase efficiency and lower risk, manufacturers may now incorporate a digital twin platform to manage all phases of an asset’s lifespan – from engineering and design, through to financing, building and operation.

By integrating design and construction processes on a single platform, companies can work with global enterprise footprints and remote work models. An integrated, single platform enables engineers from anywhere in the world to explore all dimensions of a potential project and quantify its impact on sustainability, feasibility and profitability.

In the modern industrial organisation, every aspect of the production process is monitored and analysed with sensors that are capable of generating hundreds of thousands of data points. When this information is aggregated across siloed departments and regions, it improves visibility from the edge to the business, while promoting integration and collaboration across functional departments. Integrated power and process systems help to improve day-to-day activities and processes. A system such as this reveals operational inefficiencies and enables critical decisions and changes that directly impact profitability.

Ensuring safety and efficiency; improving operations

One of the main advantages of hydrogen is its high energy content per mass. However, this poses a significant security risk. Electrolysis produces hydrogen and oxygen. Hydrogen has a very broad flammability range: a 4 – 74% concentration in air, and 4 – 94% in oxygen. Therefore, preventing air or oxygen from mixing with hydrogen inside confined spaces is very important. A small leak from a pipe or storage vessel can easily ignite, resulting in a fire or explosion.

It is inevitable, then, that proper handling of hydrogen along the value chain will be an essential consideration. A robust design and operation process will be crucial at all stages: production, storage, transportation (by pipeline, truck, or rail), and end use.

While hydrogen is a not a toxic gas, it is still highly flammable and relatively complex to de-risk. Moreover, the severity and frequency of damage related to hydrogen, for example, is dependent on the extent to which the gas has been blended with other materials. In short, hydrogen should be consistently monitored through a combined safety, power, and process control system. On top of the safety regulations required during production, the massive consumption of power needed for green hydrogen production also makes power safety and efficiency critically important.

Combined power and process safety systems help reduce the likelihood of such incidents. A well-designed safety system can eliminate all risks associated with process failures.

Injuries, fatalities, or damage to infrastructure can negatively impact public acceptance of hydrogen and ultimately slow the energy transition. Process safety is therefore an important element to be considered when designing and operating hydrogen production plants.

Reducing downtime is a constant challenge for industrial companies, and the same is true for hydrogen production plants. Early warnings and diagnostics of equipment performance are essential to ensuring that equipment is operating at full capacity when needed, and to prevent mechanical or process failures. Artificial intelligence (AI) is making a big difference in helping asset-intensive businesses to reduce equipment downtime and increase reliability, while lowering operating and maintenance costs. Tools such as predictive analytics and advanced process control can help producers to achieve maximum plant uptime and efficiency.

On the other hand, when operating hydrogen production with electrolysis, voltage surges or sags, deviations in power quality, as well as supply interruptions, negatively impact production throughput and product quality. Additionally, inadvertent trips due to power shortage, generation overload and other electrical constraints need to be quickly analysed from correlated sequences of events across both electrical and process domains. Quickly understanding how and why these events occur is crucial to maintaining operation value and uptime.

A combined power and process strategy from design into the engineering, operation and maintenance stages improves the efficiency of green hydrogen production, resulting in savings across the complete life cycle of the asset. Digital twins, combined power and process control systems, integrated safety, and predictive analytics should be considered by green hydrogen developers as ‘must-have’ solutions.

When multiple systems control a process, manage electrical equipment, or provide security to a facility, it becomes more difficult for each operator to simultaneously maintain tight and efficient control over each process, while maximising performance. Energy-intensive industries such as the hydrogen industry must strive to boost uptime, maximise throughput, and reduce total expenditures (TotEx) by lowering the end-to-end life cycle costs of the assets. Integrated digitised systems offer additional benefits, including faster commissioning, less cabling, simpler maintenance, and a reduced footprint. With the potential to improve process and energy efficiency while lowering risks to operational continuity, digitised process and power control solutions make sound business sense in an unpredictable environment.

12 Spring 2023 GlobalHydrogenReview.com

Invisible. Invaluable.

You can’t see hydrogen, a zero-carbon fuel that perfectly complements— and even accelerates–the integration of renewable energy sources for ammonia producers. But the impact of this essential element creates an invaluable path forward towards decarbonization, supporting expansion and energy transition for multiple energy consumers, including maritime, industrial, and power generation facilities.

Black & Veatch delivers on:

• Safe, reliable, and informed innovation across the hydrogen value chain

• Solutions across green hydrogen for power generation and storage, as well as the processing of blue hydrogen with carbon capture technology

• Diversity of experience and depth of knowledge, offering practical insight and access to the right resources at the right time

Let’s find ways to help you.

Developing and implementing requirements for green certification

It is very likely that producing renewable energy close to the green hydrogen production facility may not be possible in some cases. It is also likely that some independent renewable energy producers may want to sell their produced energy to green hydrogen producers.

In such cases, the power will be transmitted to the green hydrogen production facility through the grid. When grid power is used for green hydrogen production, it becomes important for the producer to know that the produced hydrogen is generated from green electrons, and this information should be made available to hydrogen users. Such certification will be necessary for any rebate that hydrogen users may receive from authorities. Blockchain is going to be the solution for these certifications, and this will have to be adopted by power utility companies, hydrogen producers, and users.

Conclusion

New technologies such as green hydrogen will pave the way in the move from fossil fuels towards renewable energy sources. Leveraging the experience that has been gathered in the energy and chemicals industry can help operators to improve project design and operations, ultimately providing an opportunity to create a cleaner ecosystem.

There is significant investment to be made in green hydrogen production in the coming years. According to DNV’s forecast, global expenditure on hydrogen generation for energy will be US$6.8 trillion by 2050, with an additional US$180 billion for hydrogen pipelines and US$530 billion for the construction and

operation of ammonia terminals.3 The International Renewable Energy Agency (IRENA)’s ‘2021 World Energy Transitions Outlook’ estimates that hydrogen and its derivatives will account for 12% of final energy consumption by 2050, with two-thirds coming from green hydrogen (made with clean electricity) and one-third from blue hydrogen (made from fossil fuels and using carbon capture).4

Governments also need to create policies and regulatory frameworks that encourage investments. Capacity building and the provision of technical assistance to governments, particularly in emerging and developing countries, are essential to developing these regulations and ensuring their enforcement and compliance. It is also necessary to have a globally-recognised definition of green hydrogen and methods to guarantee and certify the origin of the fuel. The need to help workers develop the skills required in this booming sector is also essential, especially considering net zero goals and the energy transition agenda.

References

1. ‘Global Energy Review: CO2 Emissions in 2021’, IEA, https://www. iea.org/reports/global-energy-review-co2-emissions-in-2021-2

2. ‘Green Hydrogen: A key investment for the energy transition’, World Bank Blogs, (23 June 2022), https://blogs.worldbank.org/ ppps/green-hydrogen-key-investment-energy-transition

3. ‘Energy Transition Outlook 2022’, DNV, https://www.dnv. com/energy-transition-outlook/download.html?utm_ source=Google&utm_medium=Search&utm_campaign= eto22&gclid=CjwKCAiA5sieBhBnEiwAR9oh2k94tsRKebN_ GxIFYhSgZ57zwqevQ94BFKjziBgxa0h4tVpX7L6mvBoC3_wQAvD_BwE

4. ‘World Energy Transitions Outlook’, IRENA, https://www.irena.org/-/ media/Files/IRENA/Agency/Publication/2021/Jun/IRENA_World_ Energy_Transitions_Outlook_2021.pdf

Global Hydrogen Review Online

Visit our website today: www.globalhydrogenreview.com Home to the latest hydrogen news, analysis and events

Creating a robust, sustainable and safe hydrogen value chain at scale will require significant efforts and infrastructural investments across a broad spectrum of end users, industries and regions. Producers, end users and everyone in between must continue innovating and collaborating to commercialise hydrogen technologies at scale.

As the International Energy Agency (IEA) notes, current hydrogen production is primarily based on fossil fuel technologies. More than one-sixth of global hydrogen supply comes from ‘byproduct’ hydrogen, mainly from facilities and processes in the refining and petrochemical industry. Low-emission production represents less than 1% of hydrogen from 1999 to 2021.1

To achieve net zero objectives, it is estimated that more than half of the hydrogen produced globally by 2030 needs to be low-emission hydrogen.

However, there is a wide gap between the world’s high-emission hydrogen production today and the amount of low-emission hydrogen needed.

The current worldwide production of hydrogen utilising fossil fuels without carbon capture, utilisation and storage (CCUS) is 77 million tpy. Another 16.5 million tpy is produced as an industrial byproduct, mainly from refining and petrochemical processes.1 Reaching net zero objectives calls for action surrounding how hydrogen is made from fossil fuels without CCUS:

� Going forward, it is expected that approximately two-thirds of low-emission hydrogen production will be based on electrolysis to make green and pink hydrogen.

� A further third will be produced from fossil fuels with CCUS, to make blue hydrogen.

� The world will need to construct more than 700 GW of electrolysers for green and pink

15

Viswadeb Ganguly and Adrienne Moreno, Flowserve, USA, explain why significant investment in blue hydrogen infrastructure is required to help accelerate the transition to net zero.

hydrogen, which is equivalent to a hydrogen output of 128 million tpy.

� Production of another 37 million tpy of blue hydrogen will require the construction of plants using fossil fuels with CCUS or with advanced, low-carbon-intensity technologies.

Canada and the US lead in the production of blue hydrogen from fossil fuels with CCUS, with more than 80% of global capacity production. Today, 16 projects for producing hydrogen from fossil fuels with CCUS are operational, producing 0.7 million tpy of blue hydrogen.2

Globally, about 50 CCUS projects are under development and could increase the annual blue hydrogen production to more than 9 million t by 2030.2 Most of these are located in the Netherlands and the UK.

Blue hydrogen: the proven, available choice

Blue hydrogen represents the best low-carbon option available today because its production can be increased with proven and widely-available CCUS technologies or other advanced, low-carbon-intensity technologies.

Scaling up hydrogen production and consumption will be critical to reducing the cost at the point of usage, which is largely linked to the costs of production, storage and transportation. However, until a large-scale, cost-effective green hydrogen economy is developed, blue hydrogen can create a low-carbon market architecture. This will facilitate its end use acceptability as a transition energy carrier, and help to stagger the investments of storage and distribution over time.

In the near-term, the following is required:

� CCUS technological improvements in reliability, efficiency and cost.

� Gas compression, transportation and storage infrastructure deployment.

� The deployment of hydrogen technologies to support growing end use applications and cost-competitiveness.

� Supportive governmental policies and economic incentives to minimise investment risks and mandate emissions reductions.

Building cost-effective collection and distribution hubs

Hydrogen may one day be among the low-cost options to help decarbonise industrial heating, heavy-duty transportation, off-road vehicles, and off-grid equipment such as generators. Today, however, most hydrogen is consumed in-situ or near its point of production. Typical applications are in oil refining, ammonia (NH3)/fertilizer production, chemical processing and steelmaking.

Total hydrogen demand from all industrial use is expected to increase 44% by 2030, with low-carbon hydrogen becoming ever more important, the IEA reports.

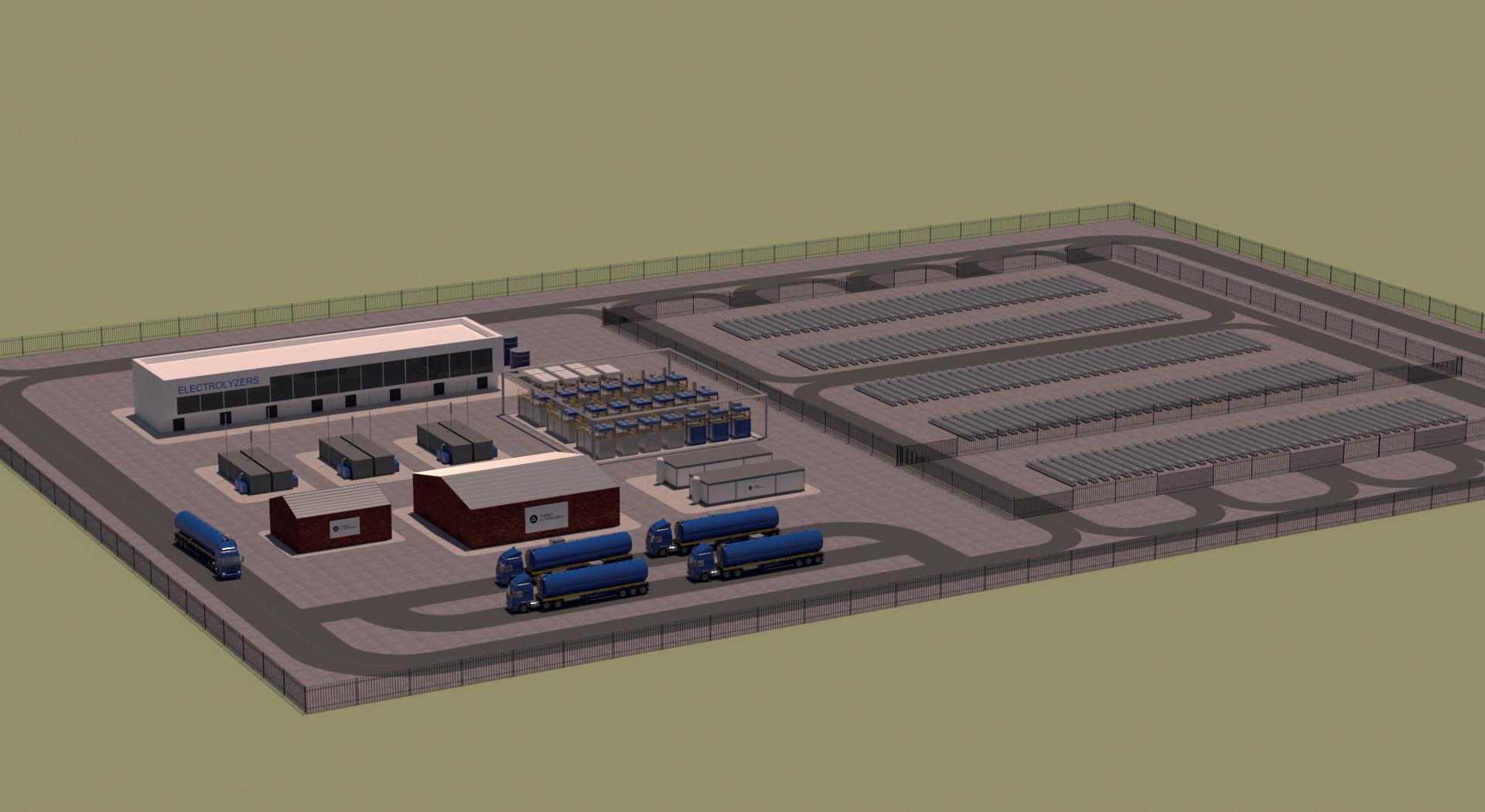

Moving hydrogen into a dominant position in the world’s energy mix will require the development of centralised hubs in the initial stages, to take advantage of economies of scale. These hubs will deliver low-carbon hydrogen to nearby end users while also minimising or eliminating emissions.

Public policy and governmental support can encourage this transition. The US Department of Energy (DOE) is launching major initiatives3 such as:

� US$8 billion for regional hubs that will expand the use of clean hydrogen in the industrial sector.

� Another US$500 million for clean hydrogen manufacturing and recycling initiatives to support equipment manufacturing and strong domestic supply chains.

New distribution networks that include pipelines, ships and tank trucks to enable the delivery of hydrogen between regions will also be necessary. Storage options for liquid and/or alternate gaseous hydrogen will need to be developed. Additionally, NH3 and methanol (CH3OH) are extremely efficient carriers of hydrogen in their native forms. The hydrogen can be further converted to NH3 and CH3OH to be transported for later conversion into hydrogen, or used in its converted form. NH3 and CH3OH are easier to transport and store because their energy densities per unit volume are greater than pure hydrogen and they do not require extreme cryogenic conditions for storage.

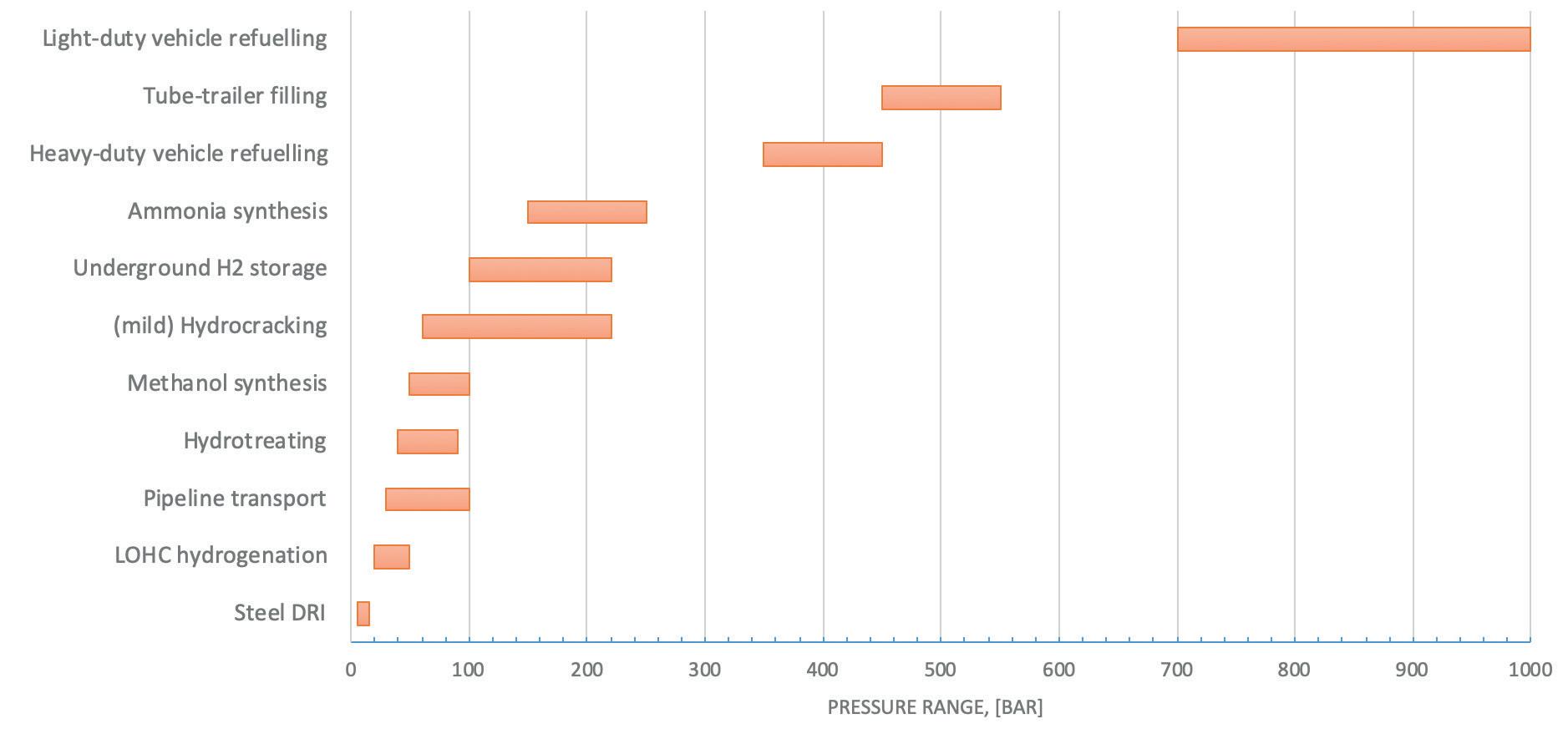

Figure

Fuelling hydrogen growth with policy changes

Blending hydrogen into the existing natural gas infrastructure can offer national and regional benefits for energy

16 Spring 2023 GlobalHydrogenReview.com

1. A typical large-scale hydrogen plant’s pressure swing absorption (PSA) unit is vulnerable to production constraints when control valves fail or deviate from expected behaviour. Increasing uptime by even 1% can lead to a significant positive impact on throughput. Flowserve offers RedRaven, a predictive maintenance solution that provides remote sensing, condition monitoring and analytics to enable plant operators to identify and address issues before they disrupt production.

Hydrogen Compression

Turn to Elliott Group for operational flexibility in hydrogen applications.

Elliott’s Flex-Op® Hydrogen Compressor features flexible, configurable, and economical compression options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Who will you turn to?

n Learn more at www.elliott-turbo.com

The World Turns to Elliott COMPRESSORS |

|

CRYODYNAMICS®

GLOBAL

TURBINES |

SERVICE

transportation, resiliency and emissions reductions. End users of natural gas can then burn the blend to generate power and heat.

Hydrogen can add value to hard-to-abate industrial sectors such as steel and cement production, while acting as a bridging energy carrier that supplements and accelerates the integration of renewables into the energy system.

For that to happen at a pace necessary to meet climate goals, governmental policies will need to make changes. These might include auctions, mandates, quotas and hydrogen-specific requirements in public procurement. Requiring hydrogen use can help industry de-risk investment and improve the economic feasibility of low-emission hydrogen, according to the IEA.

The eventual goal will be a wider deployment of green hydrogen production by renewable solar and wind power. However, that is a long-term ambition. Green hydrogen development needs near-term expansion of blue hydrogen to increase market demand, expand infrastructure, and improve the financial feasibility of the hydrogen economy.

To that end, the US government has established its ‘Hydrogen Shot’ effort to reduce the cost of clean hydrogen by 80% to US$1/kg in one decade.3 The US Department of Energy (DOE) has US$28 million available for research as well as engineering design projects to advance clean hydrogen in industrial uses, and in the transportation and electricity sectors.3

There is also what the DOE calls ‘H2 Matchmaker’.4 This resource can help clean hydrogen producers, end users and others to find opportunities to develop networks of production, storage and transportation infrastructure. The H2 Matchmaker online tool enables hydrogen producers and end users to connect with others nearby.

These are examples of the policies, research and funding that will be needed to encourage and accelerate the transition to hydrogen. Adopting the right technologies and further critical technological advancements, along with significant financial investment, are what is needed for large-scale hydrogen deployment in the US. Other nations have also begun to

prioritise hydrogen and fuel ammonia projects. Examples include:

� The Hydrogen Public Funding Compass5 from the EU provides information regarding the €9.3 billion (US$9.6 billion) of funding that is available for hydrogen projects, from 15 countries.6

� Australia plans to spend AUS$100 million to update the Port of Newcastle to enable the country to become a major hydrogen supplier to Japan and other Asian nations.7 Another AUS$150 million is available from the Australian Clean Hydrogen Trade Program for hydrogen supply chain projects that secure overseas investments.8

� Japan has decided that clean hydrogen imports are key to achieving carbon neutrality by 2050, and will spend ¥2 trillion (US$24.5 billion) to encourage hydrogen projects through its Green Innovation Fund.9

� India will offer free interstate transmission for hydrogen projects for 25 years; help producers access provincial utility networks; and allow storage bunkers near ports. Additionally, the country plans to sell federal government bonds to finance projects.10

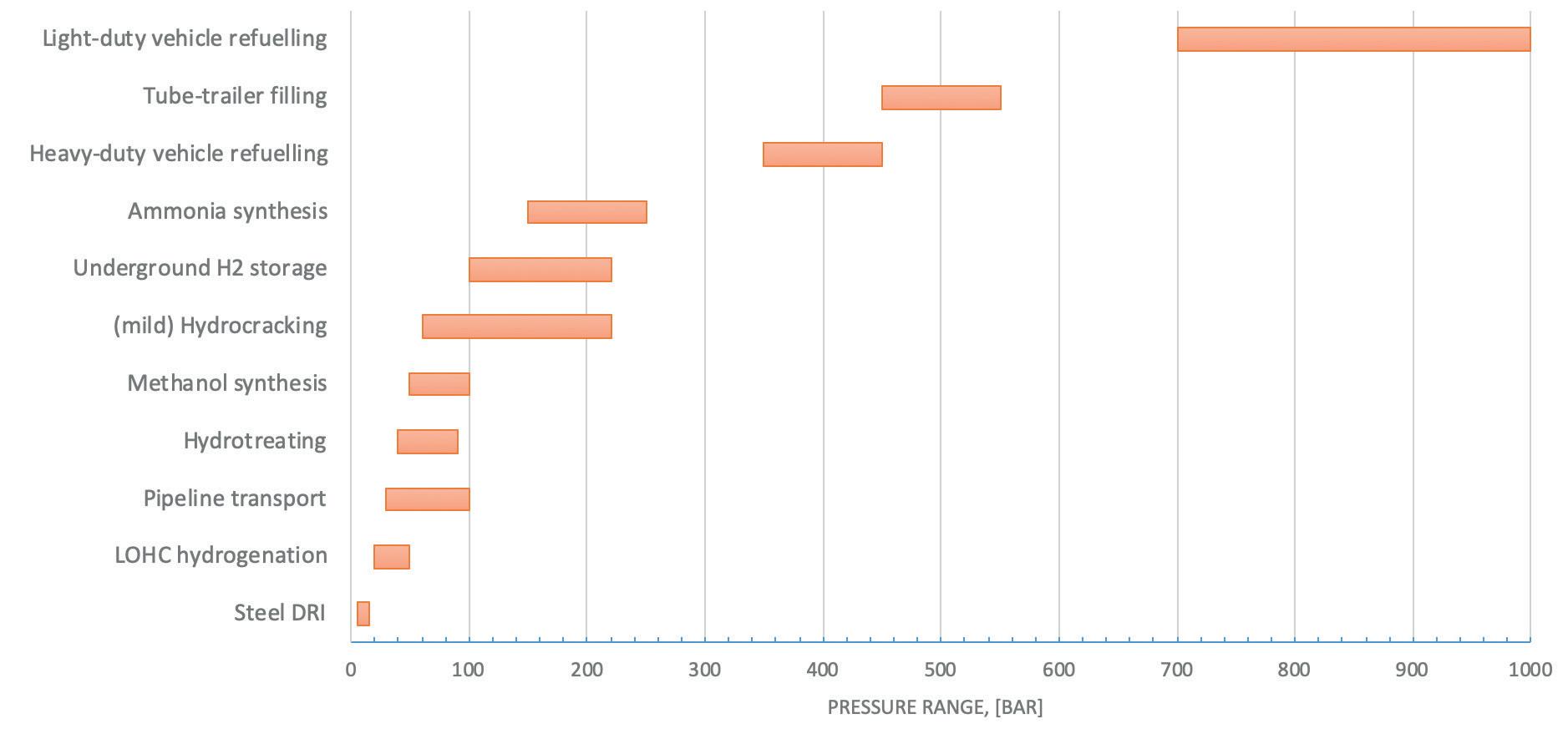

Investing in compression, transportation and storage infrastructure

Advancing the transition to a hydrogen economy will also require the development of gas compression, transportation and storage infrastructure.

Hydrogen is typically produced at relatively moderate pressures in gas form and must be compressed and liquefied prior to transportation. Advancements in compression and liquid hydrogen pumping technologies are critically important to this.

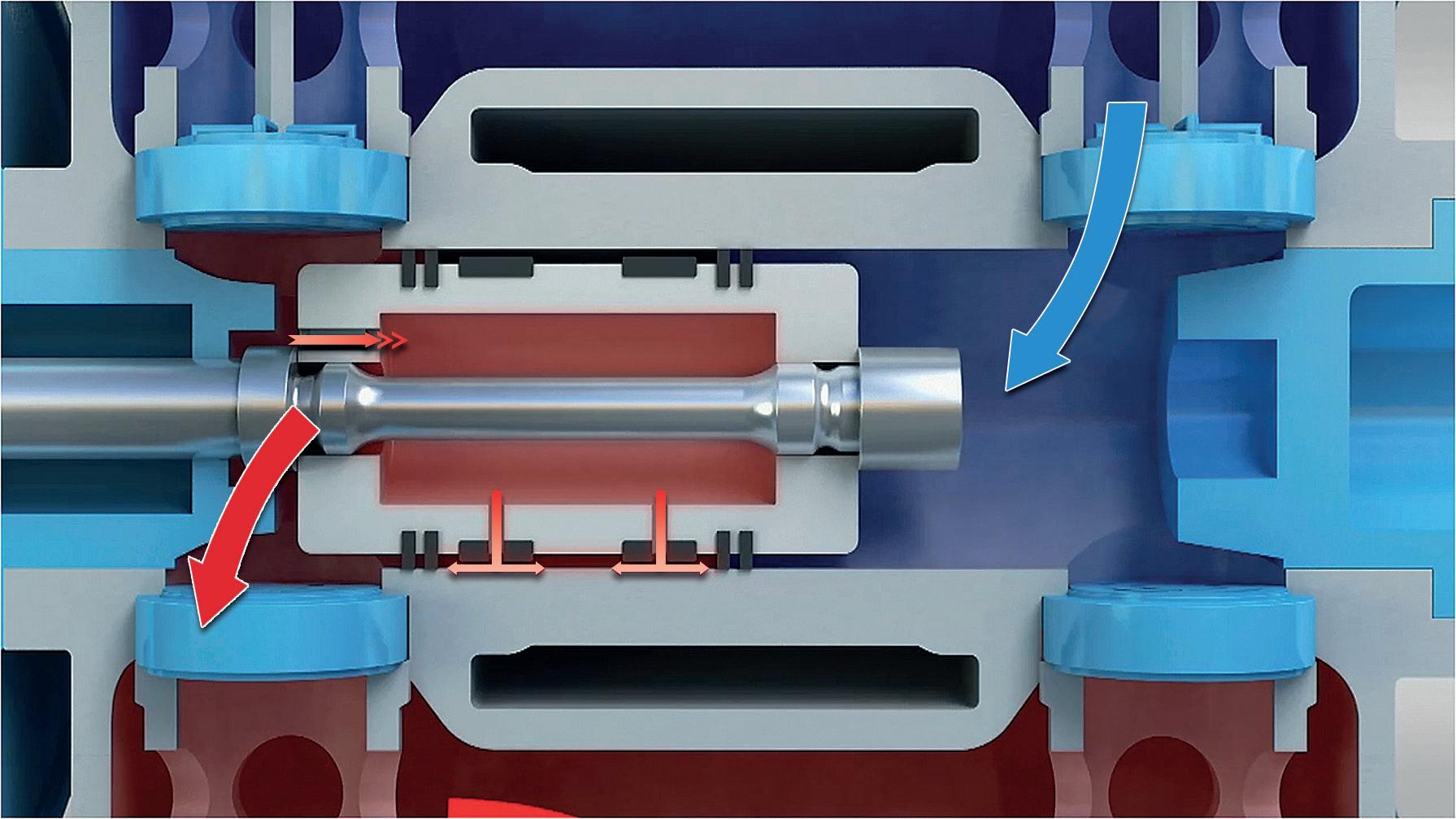

The liquefaction process involves pre-cooling the compressed hydrogen though a heat exchanger and then cooling fully through Joule-Thomson expansion to obtain liquid hydrogen. This is one of the most significant processes for storing hydrogen as a liquid, and poses challenges related to extremely low temperatures.

The liquid hydrogen is then transported from its production site to points of use via pipelines and in cryogenic liquid tanker trucks or gaseous tube trailers. Pipelines are typically deployed in regions with substantial demand, whereas liquefaction plants, liquid tankers and tube trailers are deployed in regions with smaller-scale demand.

Some equipment, such as tube trailers, haul high-pressure bullets of up to 250 bar (3626 psi) for hydrogen transportation.

18 Spring 2023 GlobalHydrogenReview.com

Figure 2. Blue hydrogen production adds CCUS to steam methane reforming. Flowserve has differentiated experience in PSA and acid gas removal to support the best flow control equipment.

Hydrogen can be stored physically either as a gas or a liquid. Storage of hydrogen as a gas typically requires high-pressure tanks. Storing hydrogen as a liquid requires maintaining cryogenic temperatures and handling high pressures.

Finding a blue hydrogen partner

The hydrogen energy industry needs more than engineered-to-order (ETO) systems. Equipment manufacturers with complete fluid motion control portfolios can be leveraged to arrive at the right solutions through the entire value chain. This starts with low-carbon hydrogen production, continues through storage and distribution, and ends with safe and efficient dispensing.

Paramount to successful development of blue hydrogen infrastructure will be the ability to detect, diagnose and quickly respond to equipment and system issues. In addition to the most complete and flexible flow control solutions portfolio, investors in hydrogen infrastructure will need a partner offering an end-to-end Internet of Things (IoT) solution that provides remote sensing, condition monitoring and predictive analytics. This solution can enable companies to identify and proactively respond to equipment problems to eliminate leakage, address safety risks, or avoid unplanned downtime.

These companies need proven collective engineering prowess in conventional applications for pumps, valves, seals and flow control automation. With these partnerships and expertise, companies can transform the promise of hydrogen into a marketplace reality.

Worldwide Coverage

References

1. BERMUDEZ , J., EVANGELOPOULOU, S., and PAVAN, F., ‘Hydrogen, More efforts needed,’ IEA, (September 2022), https://www.iea.org/reports/hydrogen

2. ‘Global Hydrogen Review 2021’, IEA, (October 2021), https://www. iea.org/reports/global-hydrogen-review-2021/executive-summary

3. ‘Fact Sheet: Biden-Harris Administration Advances Cleaner Industrial Sector to Reduce Emissions and Reinvigorate American Manufacturing,’ White House, (15 February 2022), https://www.whitehouse.gov/briefing-room/statementsreleases/2022/02/15/fact-sheet-biden-harris-administrationadvances-cleaner-industrial-sector-to-reduce-emissions-andreinvigorate-american-manufacturing

4. ‘H2 matchmaker’, Office of Energy Efficiency & Renewable Energy, https://www.energy.gov/eere/fuelcells/h2-matchmaker

5. ‘Hydrogen public funding compass’, European Commission, https://single-market-economy.ec.europa.eu/industry/strategy/ hydrogen/funding-guide_en

6. ‘In focus: Renewable hydrogen to decarbonise the EU’s energy system,’ European Commission, (15 November 2022), https://ec.europa.eu/info/news/renewable-hydrogendecarbonise-eus-energy-system-2022-nov-15_en

7. ‘Australia plans to be a big green hydrogen exporter to Asian markets – but they don’t need it,’ The Conversation, (3 April 2022), https://theconversation.com/australia-plans-to-bea-big-green-hydrogen-exporter-to-asian-markets-but-they-dontneed-it-179381

8. TAYLOR, A., ‘Australia Japan Clean Hydrogen Trade Partnership,’ (7 January 2022), https://www.minister.industry.gov.au/ ministers/taylor/media-releases/australia-japan-clean-hydrogentrade-partnership#:~:text=The%20Program%20will%20be%20 funded,of%20related%20renewable%20energy%20infrastructure

9. ‘Overview of the Green Innovation Fund Projects,’ New Energy and Industrial Technology Development Organization, (October 2020), https://green-innovation.nedo.go.jp/en/about

10. SINGH, R. K., and CHAKRABORTY, D., ‘India Unveils Hydrogen Plan to Speed Shift From Fossil Fuels,’ Bloomberg, (17 February 2022), https://www.bloomberg.com/news/articles/2022-02-17/indiaunveils-hydrogen-roadmap-to-speed-shift-from-fossil-fuels

Subscribe online at www.hydrocarbonengineering.com/subscribe For in-depth coverage of the

global hydrocarbon processing sector

20

Bill Howe and Geoff Skinner, Gasconsult Ltd, alongside James Primrose, McDermott, discuss the importance of optimising hydrogen liquefaction to support the development of the sector.

Hydrogen, a zero-carbon fuel, will be a significant contributor towards meeting 2050 net zero targets. Liquefaction of hydrogen, by reducing gas volumes by a factor of 800, enables the following:

y The reduction of regional transportation costs.

y The facilitation of intercontinental energy shipments (similar to LNG).

y Bulk energy storage, and the provision of back-up fuel for intermittent renewable power.

With this in mind, it is clear that liquefaction will be a key support to many hydrogen developments.

Current liquefaction plant designs, comprising pre-cooling and liquefaction sections, are characterised by low capacity (typically < 15 000 tpy) and high specific power

(typically 11 – 15 kWh/kg). They are unsuited to the future market, which will ultimately require production facilities at least an order of magnitude higher than existing practice.

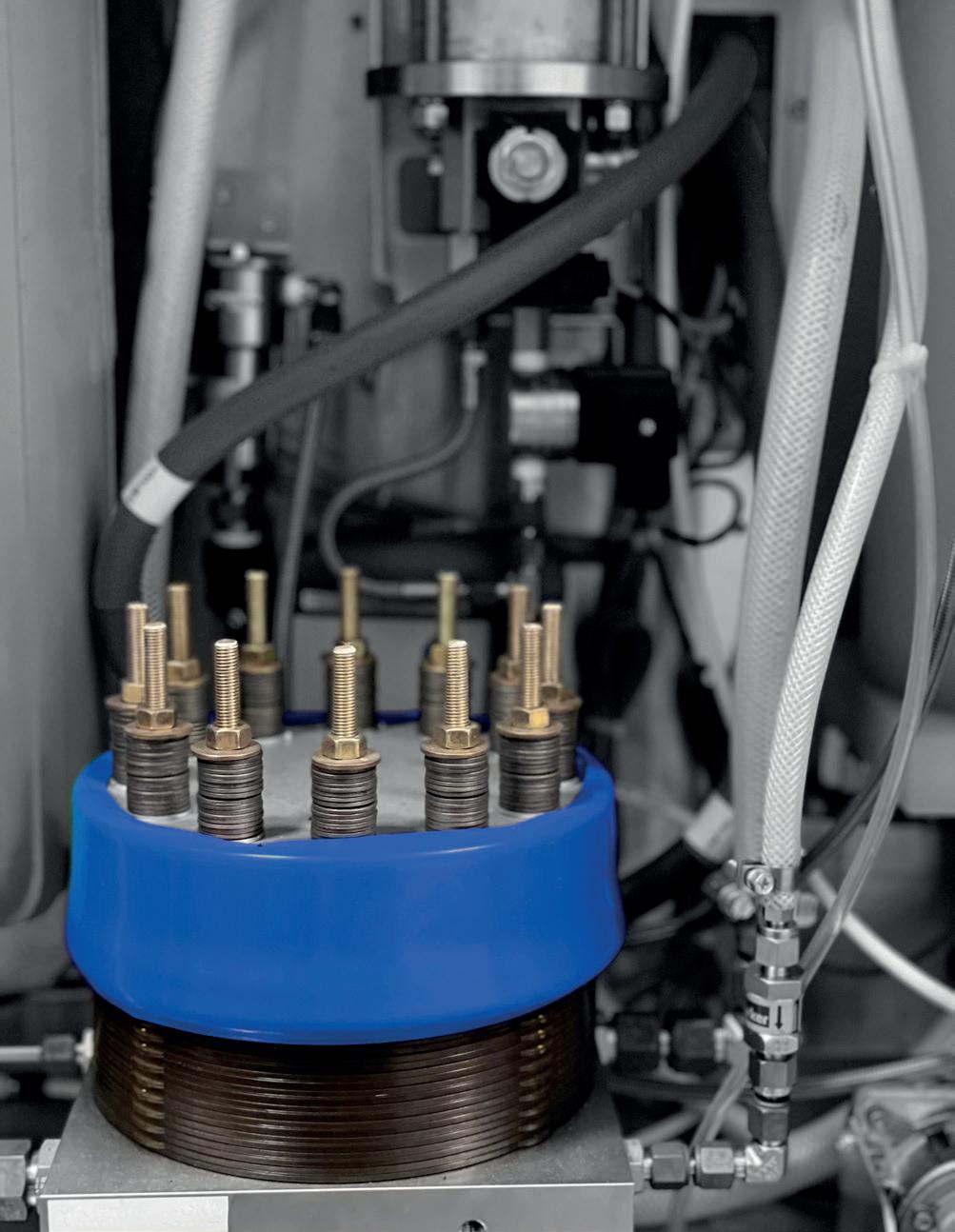

To support this, Gasconsult has developed its Optimised Hydrogen Liquefaction (OHL) process and patented a pre-cooling arrangement, using methane (natural gas) or nitrogen in a closed circuit. The resulting plant design has been further developed by McDermott in two plant capacities (50 tpd and 300 tpd), and offers a significant investment saving, together with a much-reduced specific power.

Process design considerations

Future liquid hydrogen (LH2) plants, with the higher production capacities required to contribute to a meaningful level of decarbonisation, will require a lower power demand

21

and an alternative to the current use of liquid nitrogen as the pre-cooling medium. This pre-cooling configuration is thermally inefficient and, in order to ensure liquid nitrogen availability, requires LH2 plant integration with or close to an air separation plant. To overcome these challenges, Gasconsult developed two pre-cooling designs using either dual-methane or dual-nitrogen liquefying expanders in a closed circuit.

For the final liquefaction section, the avoidance of expensive and scarce refrigerants, such as helium and neon, was preferred. Therefore, the design utilised hydrogen, which is integral to the process, in a patent-pending expander configuration.

Scope of plant and basis of design

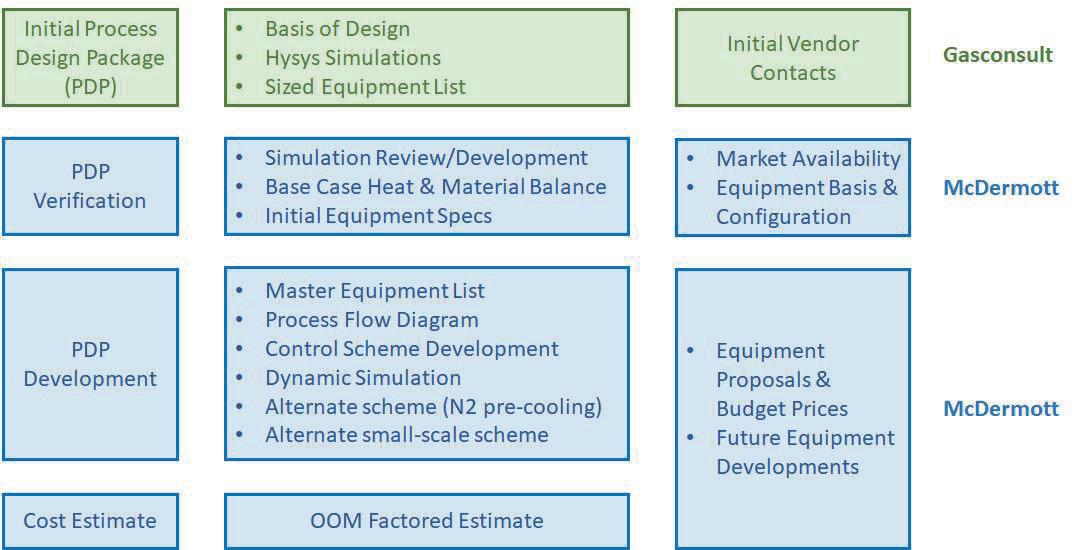

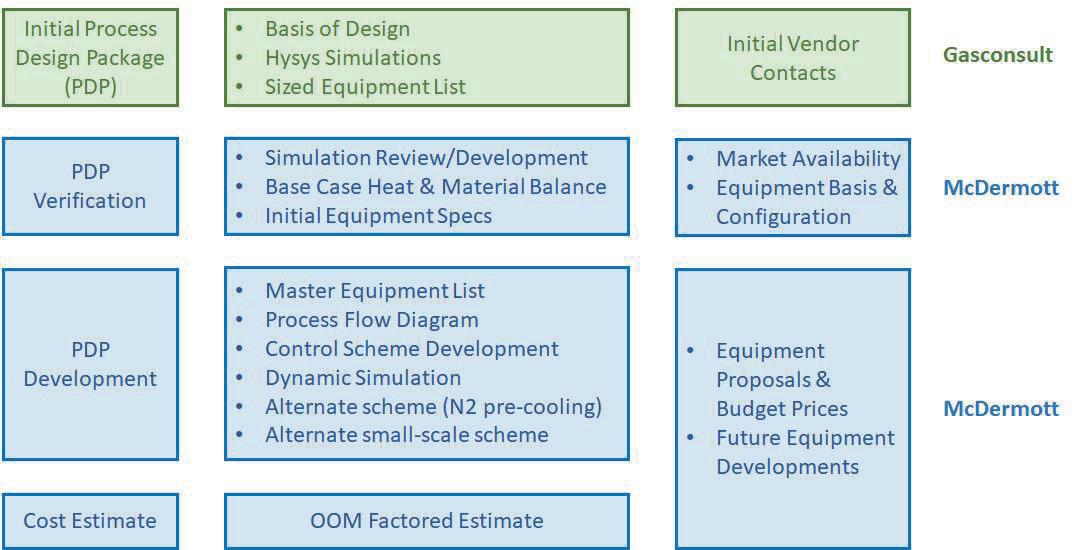

Figure 1 shows the scope of plant covered by McDermott’s validation and engineering development. For the utilities and offsites (other than refrigerant storage), only the aspects directly associated with the liquefaction train were included in the scope/estimate.

The plant was located in northwest Europe with a capacity of 300 tpd of LH2. Construction was based on Asian-built pre-fabricated modules. Seawater cooling via a closed-loop cooling water circuit was assumed.

The feed to the facility could be either blue or green hydrogen. The validation and engineering development focused on the liquefaction block, the relevant utilities, and the required refrigerant storage and transfer facilities. Hydrogen production/pre-treatment facilities and liquefaction interaction with LH2 storage were not addressed. Table 1 shows the Basis of Design (BoD).

A product specification in line with ISO 14687 was selected (for Type II liquid fuels, Grades C and D) with a minimum 95%

para hydrogen. For the initial work, LNG was selected as the methane refrigerant source, as it is readily-available and is of a purity suitable for use within cryogenic systems. Pre-treated pipeline gas may be substituted for LNG if preferred. Nitrogen is, however, emerging as the preferred pre-cooling refrigerant for future developments, as it has several practical advantages and a lower specific power.

Design verification

Figure 2 indicates Gasconsult’s input into the OHL design, and McDermott’s scope of work for verification and design development.

McDermott assessed the practicality of the pressure and temperature profile; equipment availability and performance; the ortho-to-para hydrogen conversion; inclusion of the heat of reaction; and refrigerant compositions.

Multiple suppliers were contacted to confirm the availability, performance, and level of maturity of the required equipment. Key highlights of the verification process are listed in the next section.

Simulation platform and property package selection

McDermott evaluated Gasconsult’s heat and material balance using AspenTech’s HYSYS process simulation software, and updated the equations of state as follows:

y For the methane precooling section, the Peng Robinson equation of state was used with the Lee Kesler enthalpies.

y The hydrogen liquefaction section was assessed using the RefProp model developed by NIST, which is accepted to be the most accurate available model for hydrogen across the expected operating temperature and pressure range.

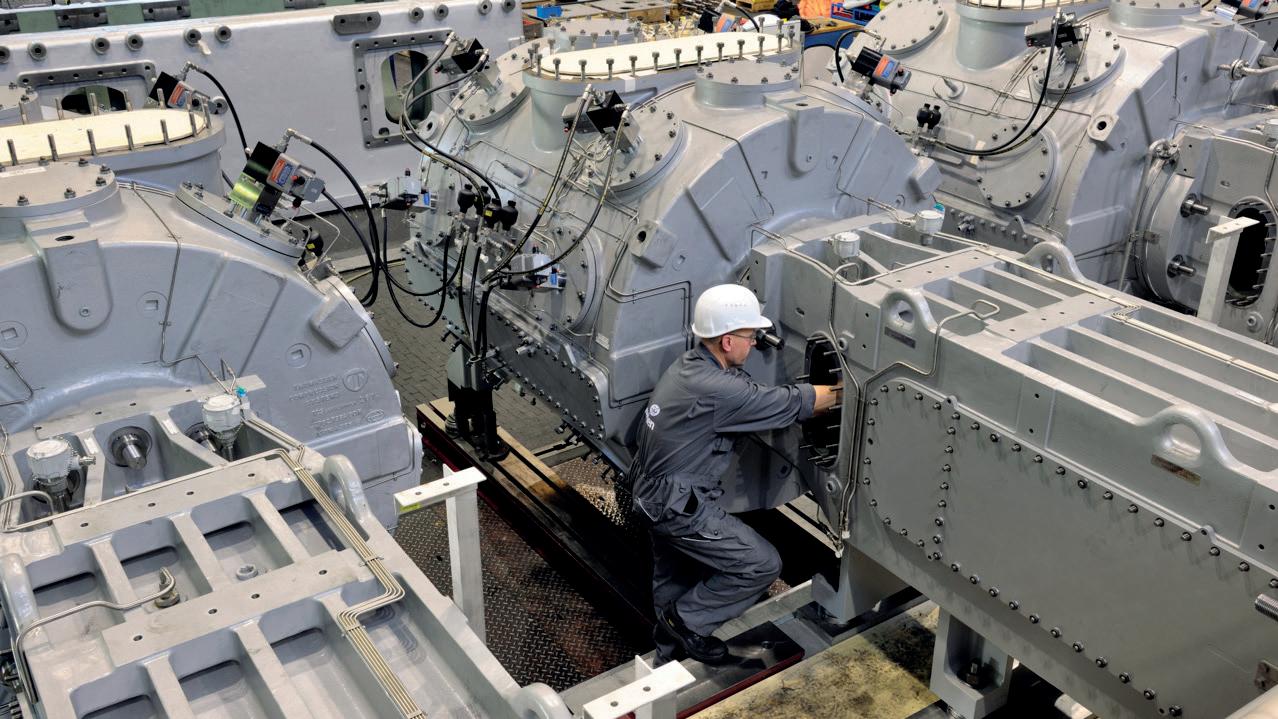

Rotating equipment performance

Rotating equipment performance has a significant impact on overall process efficiency. As such, McDermott engaged with multiple rotating machinery suppliers to obtain estimates of machine performance when operating on pure hydrogen, and to identify limitations on aerodynamic performance or material/component selection.

Hydrogen compressor supplier feedback included:

� Centrifugal multi-impeller casing compressors:

� Achievable pressure ratios are currently in the range of 1.3 – 1.5, with potential solutions under development with compression ratios of greater than 1.8 – 2.0.

� Expected polytropic efficiencies in the range of 82 – 85%.

� For reciprocating compressors:

� The largest individual API machine currently operating is 17 MW. Multiple reciprocating machines in parallel are required for a 300 tpd hydrogen liquefaction plant.

Centrifugal compressors were selected for the base case.

Design development

McDermott developed enhanced Process Flow Diagrams (PFDs) and a process control philosophy. A dynamic analysis was performed to confirm OHL’s transient response to turndown/turn-up, equipment trips, and start-up from ambient.

22 Spring 2023 GlobalHydrogenReview.com

Figure 1. Hydrogen liquefaction facility and study scope boundaries.

Property Value Hydrogen feed flow rate 300 tpd Hydrogen feed composition > 99.99 mol% Hydrogen feed pressure 25 bar absolute Hydrogen feed temperature 30 ˚C Seawater temperature 11 ˚C LNG refrigerant storage 2 x 100 m3

Table 1. Basis of Design (BoD)

WE’RE COMMITTED TO A BETTER FUTURE

WE’RE COMMITTED TO A BETTER FUTURE

Optimizing combustion for a greener tomorrow

There has never been a greater need to decarbonize fired equipment, produce cleaner energy sources, and operate in a more environmentally responsible way.

Optimizing combustion for a greener tomorrow

There has never been a greater need to decarbonize fired equipment, produce cleaner energy sources, and operate in a more environmentally responsible way.

Optimized combustion and enhanced predictive analytics are key to reducing plant emissions and ensuring equipment uptime. Designed for safety systems, our Thermox® WDG-V combustion analyzer leads the way, monitoring and controlling combustion with unparalleled precision.

Optimized combustion and enhanced predictive analytics are key to reducing plant emissions and ensuring equipment uptime. Designed for safety systems, our Thermox® WDG-V combustion analyzer leads the way, monitoring and controlling combustion with unparalleled precision.

Setting the industry standard for more than 50 years, AMETEK process analyzers are a solution you can rely on. Let’s decarbonize tomorrow together by ensuring tighter emission control, efficient operations, and enhanced process safety for a greener future.

Setting the industry standard for more than 50 years, AMETEK process analyzers are a solution you can rely on. Let’s decarbonize tomorrow together by ensuring tighter emission control, efficient operations, and enhanced process safety for a greener future.

AMETEKPI.COM/CLEANENERGY

AMETEKPI.COM/CLEANENERGY

The objectives were to confirm:

y That the proposed configuration of equipment and controls enabled robust operation across multiple scenarios.

y A start-up sequence, both from ambient and cold conditions.

y Interactions between rotating equipment and cold boxes during unsteady operating conditions.

The main findings indicated that the:

y Control scheme readily handled flow changes between 50 – 100%.

y Main expander trips do not cause the plant to trip or shutdown, with the control system able to automatically reduce LH2 production to a new steady state.

y Transient temperature excursions are within acceptable limits for the main brazed aluminium exchangers.

y Estimated start-up time from ambient to full production was less than 20 hours.

Design update

The BoD was finalised and the flow scheme (see Figure 3) was updated based on the verification work, feedback from equipment suppliers, and engineering development. The next sections detail the process at length.

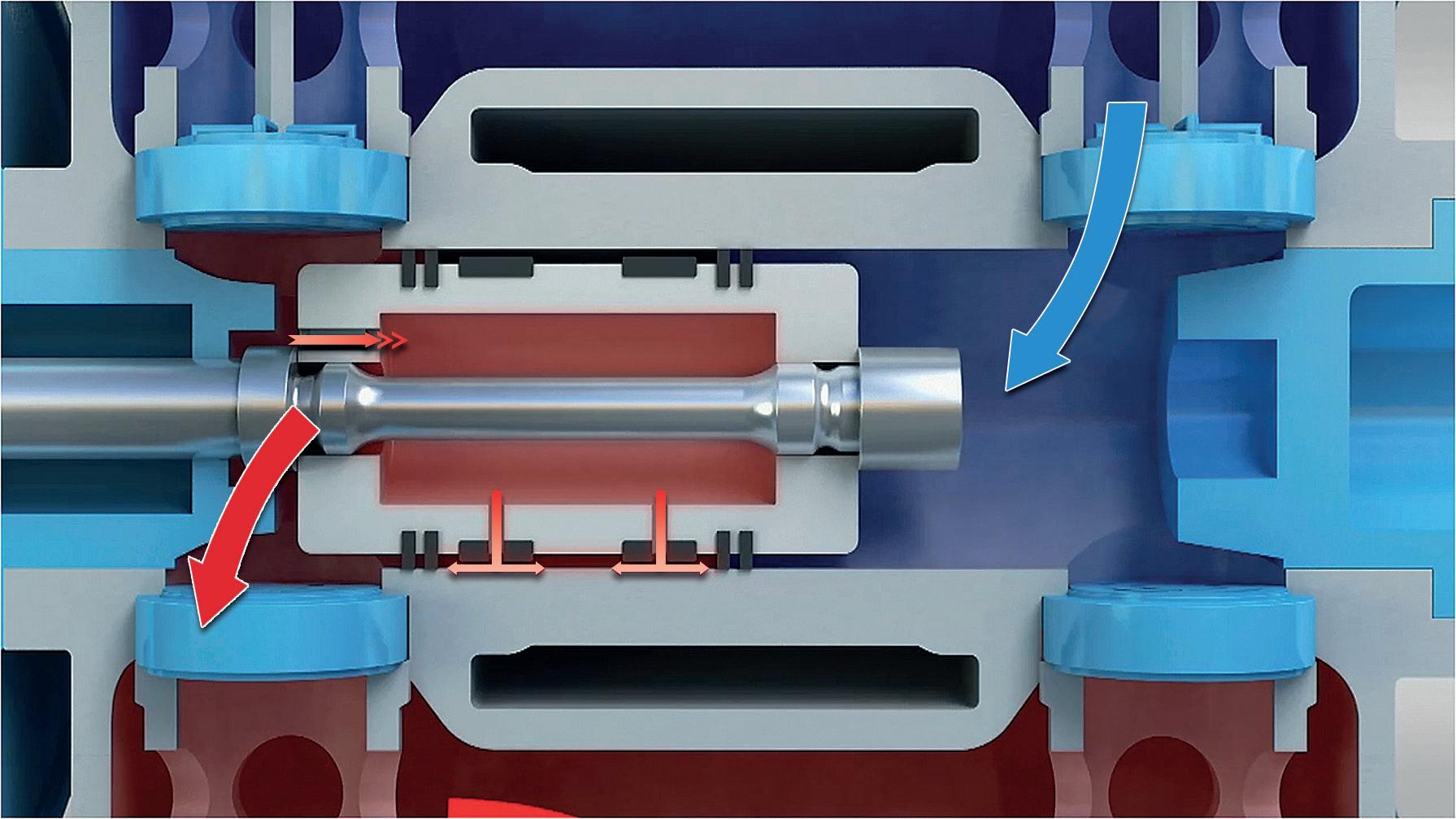

Hydrogen feed gas circuit (green)

Hydrogen is supplied to the liquefaction unit at 25 bara and 19°C. The feed gas is combined with recycled hydrogen refrigerant from the H2 Recycle Compressor (CP4) before being

routed to the Precooling Cold Box (PCB) where it is cooled to approximately -150°C using methane refrigerant. Some cooling is also provided by returning low-pressure hydrogen refrigerant streams.

The pre-cooled hydrogen feed is then routed to cryogenic contaminant removal where any residual trace contaminants (hydrocarbons, oxygen, nitrogen, other air gases such as argon, and potentially KOH, depending on the source) from the upstream pre-treatment are removed to (i) protect the ortho-para catalyst (ii) prevent freeze out in the liquefaction section, and (iii) achieve the LH2 specification. Contaminant removal is a regenerative adsorption process with multiple parallel beds, allowing for online regeneration with a slipstream of warmed feed gas.

Pre-cooled hydrogen is then routed into the vacuum-insulated Liquefying Cold Box (LCB) where it is further cooled and makes contact with the ortho-to -para hydrogen conversion catalyst. The enthalpy removed during hydrogen liquefaction, along with the heat of reaction from the ortho -to-para conversion, is absorbed by the hydrogen refrigerant stream. Final cooling is achieved by flashing the liquid hydrogen across a Joule Thompson (JT) valve into separator SP1. The flash gas is routed via CP4 and combined with the feed gas stream; and the liquid hydrogen is routed to storage.

Methane precooling circuit (red)

The process utilises a closed circuit dual-expander methane pre-cooling cycle. The loop contains small amounts of nitrogen, ethane, propane and C4+ from the source LNG. Heavier component build-up may be bled out during start-up and operation.

The methane refrigerant is compressed and circulated by the electrically-driven Methane Refrigerant Compressor (CP1).

The methane stream is then routed through the compressor stages of the Cold and Warm Expander-Compressors (EC2 and EC1) which are direct-coupled and driven by the corresponding expander sections. The compressed methane refrigerant then enters the warm end of the PCB.

A slipstream of cooled methane refrigerant is withdrawn from the PCB and sent to expander EC1 where it is reduced in pressure and then routed back to the PCB to provide warm end cooling. The stream is then routed to CP1 suction.

The split to EC1/2 is flow ratio controlled with the hydrogen feed gas.

The remainder of the methane refrigerant is further cooled in the PCB and routed to expander EC2 where pressure is reduced, resulting in partial liquefaction of the stream, with vapour/liquids separation in SP2. The cold vapour is routed back to the PCB and the liquid is flashed to near-ambient pressure. The liquid phase is routed back to the PCB where it is vaporised to provide cold end refrigeration. The resulting vapour stream is routed to the Methane Recycle Compressor

24 Spring 2023 GlobalHydrogenReview.com

Figure 2. Work scope and split.

Figure 3. Base flow scheme.

(CP2) from which it rejoins the methane refrigerant stream from SP2 before being compressed in CP1 and recycled.

Hydrogen refrigerant circuit (blue)

The hydrogen refrigerant cycle operates as a closed circuit with recycled hydrogen compressed and circulated by the electrically-driven H2 Refrigerant Compressor (CP3). CP3 has two feeds that float on the Warm and Cold H2 Expander (EX1 and EX2) outlet pressures. The hydrogen stream is then routed to the warm end of the PCB where it is cooled against the methane refrigerant.

The pre-cooled hydrogen refrigerant stream is then split, with approximately half routed to the LCB and half routed to EX1. The warm expander duty is let down across three expansion stages to provide the first section cooling for the LCB.

The remaining hydrogen refrigerant is further cooled before being reduced in pressure across EX2 and providing the final level of cooling for the LCB.

The hydrogen refrigerant returns through the LCB and PCB to CP3.

Summary of the study’s outcomes

The verification and engineering development work confirmed that Gasconsult’s OHL process has the capability to achieve an overall performance of approximately 6.8 – 7.1 kWh/kg LH2 under the BoD conditions for a 300 tpd LH2 capacity. This represents a power demand reduction of 25 – 40% relative to current operating practice. The overall CAPEX for the 300 tpd facility is estimated to be US$500 million.

Alternative LH2 technologies that are being developed may have a dependence on high cost and scarce refrigerants such as helium and neon. They can also have more complex pre-cooling, using mixed refrigerants that have high refrigerant infrastructure costs to store and blend a range of liquid hydrocarbons. Operation can also be more complex, as mixed refrigerant processes require regular composition adjustment to run at their design point.

Further developments

Following completion of the study, development of the OHL technology has continued.

As an alternative, nitrogen replaces methane (LNG) as the pre-cooling refrigerant. This has practical and operational benefits. All LH2 plants need nitrogen for purging, and the additional consumption of nitrogen required for the OHL process is extremely low, essentially to compensate for leakage losses.

A further benefit of nitrogen pre-cooling is that there are fewer hydrogen expanders required. The configuration of the final cooling/liquefaction was also updated, resulting in a much-reduced installed power of the Hydrogen Recycle Compressor CP4. Overall, the expected kWh/kg LH2 is reduced by 5%.

In a further development, a two-stage pre-cooling arrangement may reduce the power requirement by a further 5%, prospectively reducing the expected specific power to 6.2 – 6.5 kWh/kg under the BoD design conditions (which is typical for a northwestern European coastal site).

Valves Qualified With 99.9% Hydrogen QUALIFIED WITH 99.9% HYDROGEN +44 (0)1565 632 636 | sales@valves.co.uk | www.valves.co.uk Oliver Valves Ltd Parkgate Industrial Estate, Knutsford, Cheshire, WA16 8DX, United Kingdom For more information, contact your local Oliver Valves supplier or call: +44 (0)1565 632 636 Hydrogen qualified valves for topside, subsea, and pipeline applications, endurance tested to over 400 Cycles with ZERO Leakage. Also available are 10/14/20mm full bore gaseous fuel station ball valves.

Increasing the efficiency of both new and existing steam methane reformers (SMRs) is an essential consideration for decarbonising operations. Tim Tallon, AMETEK Process Instruments, and James Cross, AMETEK Land, discuss two ways in which this can be done.

Optimising combustion and ensuring tube integrity in steam methane reformers (SMRs) can help to maximise efficiency and safety, and play an important role in the global movement towards decarbonisation. Increasingly, governments and corporations around the world are evaluating their role in protecting the climate by reducing greenhouse gas (GHG) emissions –particularly carbon dioxide (CO2).

Nevertheless, combustion – one of the main sources of CO2 emissions – will remain essential for power and heat across many industries. The steel, cement and chemical industries, for example, are especially challenging to decarbonise, as are mobility solutions including ships, airplanes and automotive vehicles. Recognising that combustion processes will remain important in our future, large-scale decarbonisation initiatives have developed a number of solutions.

For example, carbon capture methods allow carbon emissions to be removed from the flue gas emissions

generated by combustion. Alternative methods of heat production are also being investigated. Electrification is just one way to generate heat in place of combustion, though this is not suitable where very high temperatures are required. Additionally, hydrogen fuels can generate heat without creating CO2 emissions.

Much of the industrial energy transition is focused on migrating to hydrogen fuels and their production, so there is a huge investment in new hydrogen infrastructure. Hydrogen has been positioned as the low/zero-carbon fuel of the future, driving this transition, and partnerships for blue hydrogen production (where CO2 is captured and stored) and green hydrogen production (where there is a net zero emission of CO2) have brought down costs.

Throughout this transition, SMRs provide the essential backbone of modern day hydrogen production, manufacturing more than 95% of the world’s hydrogen. However, much of this installed base is looking to reduce its CO2 footprint and optimise

its processes for near-term emission targets – with safety in mind.

Increasing the efficiency of both new and existing SMRs is now an essential consideration in decarbonisation. This article will focus particularly on existing assets, looking at ways to increase efficiency, along with the impact on flexibility and safety.

Existing SMRs have the opportunity to achieve efficiency gains to safely decarbonise. One way to accomplish this is by lowering oxygen levels to reduce emissions, though this does create safety margin risks. While carbon capture systems offer a long-term emission reduction strategy, efficiency gain by the SMR can reduce near-term emissions within the operator’s control.

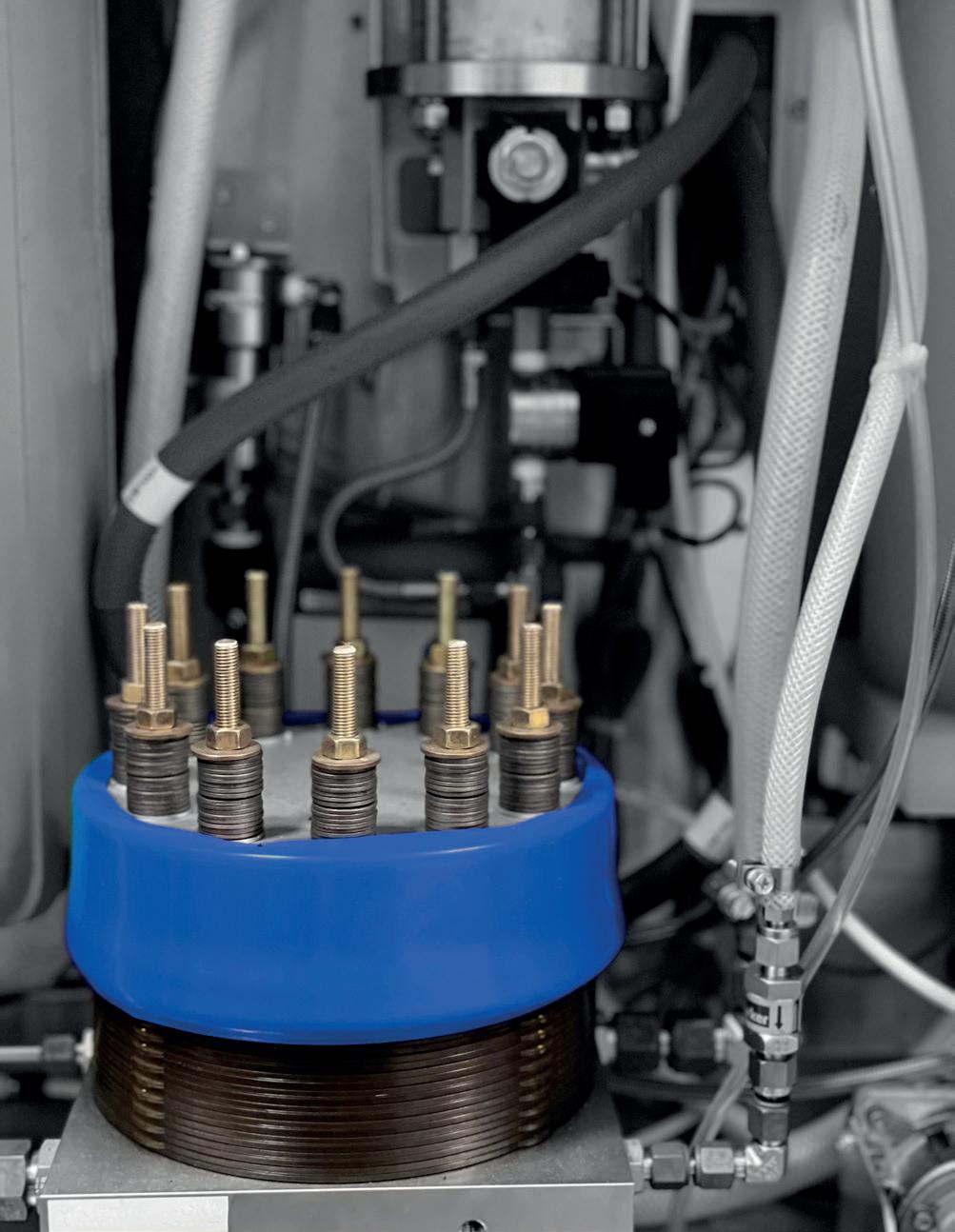

SMR combustion safety and efficiency

SMRs are widely used in hydrocarbon processing applications. The process requires combustion to heat the reaction tubes,

converting methane and steam – via a catalyst – into hydrogen. Combustion is critical to delivering the temperatures required. A range of burner configurations exist, including down-fired, side-fired, terrace-fired, top-fired, and bottom-fired, but the same principles apply in each case. For further elaboration, this article will highlight two key principles for SMR combustion safety and efficiency: combustion optimisation, and tube wall temperature (TWT) monitoring.

Combustion optimisation

Based on the ‘fire triangle’, combustion requires three things: oxygen (usually from the air), fuel, and heat – remove any one of these, and you cannot create a flame. Any combustion process will be incomplete to some extent, and this creates combustibles (typically in the form of carbon monoxide [CO] and hydrogen). Incomplete combustion may be a result of poor mixing of the air and fuel, changing load conditions, malfunctioning burners, or variable fuels.

27

When it comes to operating fired processes, the perfect combustion reaction is known as stoichiometric combustion. This is when the air-fuel mixture is at the ideal level for the fuel and oxygen to react and create CO2 and water with perfect efficiency. In SMR applications, it allows the maximum useful heat to be transferred to the tubes.

In stoichiometric combustion, there is no excess oxygen to be measured, as all of the available oxygen is fully consumed in the reaction. However, in reality, operations are usually performed in conditions of slight excess oxygen in the flue gas – typically 2% – as a safety margin. This inevitably leads to the generation of low-level combustibles.

On the other hand, oxygen-deficient (or fuel-rich) conditions produce high levels of combustibles and can be very dangerous, as well as being much less efficient. Therefore, measuring excess oxygen, by itself, becomes very important in ensuring a safe operating set point for combustion.

However, when it comes to optimising combustion, additional information is needed. If excess oxygen levels are too high, more fuel is also consumed, causing greater levels of CO2 and nitrogen oxides (NOx) emissions.

This is where measuring combustibles provides a critical secondary reference point for optimisation. As noted in Figure 1, combustibles are very high when there is little excess oxygen but eventually stabilise after a certain ‘breakthrough’ point. Above the breakthrough point, combustibles are too high for safe operating conditions and pose a safety concern. However, below the breakthrough point, the combustibles gradually decrease with added amounts of excess oxygen.

By measuring excess oxygen and combustibles together, with a combustion analyser, operators can lower their excess oxygen levels while also monitoring to ensure that they are safely below the combustibles breakthrough point. The result is optimised combustion: a lower, more optimal excess oxygen set point that drives lower fuel consumption at the burner and fewer emissions at the stack.

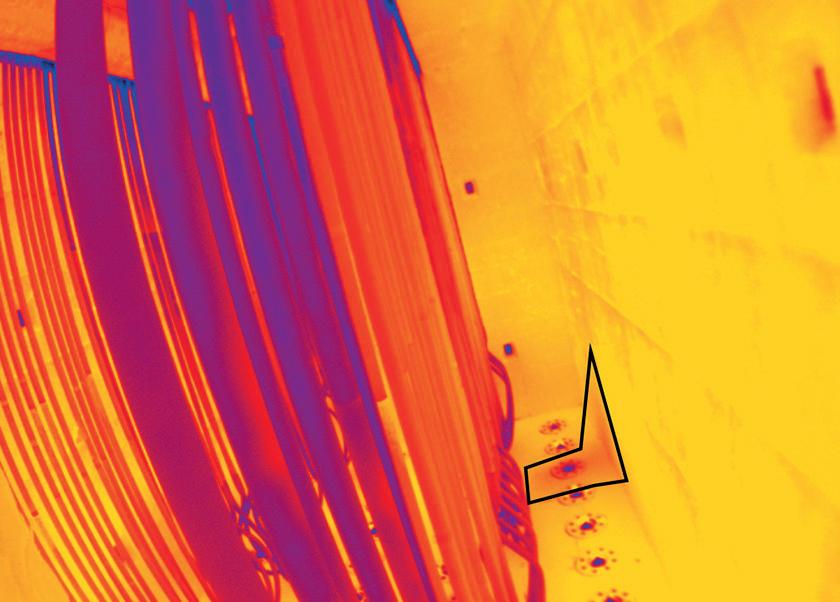

TWT and the effect on tube lifespan

As mentioned, when excess oxygen in the combustion reaction is reduced, the level of combustibles increases. However, this also increases the TWT in the SMRs, so lowering the excess oxygen too much can result in damage to the tubes themselves. An accurate measurement of TWT is very important for optimised operation, safety, and maximising infrastructure assets.

Typically, the operating window for TWTs is between 300 – 1300°C (572 – 2372°F). Exceeding this temperature is above the design limit of the tube and will shorten its lifespan. Falling below this range, on the other hand, will lead to a loss of production.

Measurement accuracy – through proper data correction – is key: reading inaccurately high can lead to high methane slip (inside of the tubes from the SMR reaction), as the process is not running at the expected temperature and the catalytic reaction is lower than it should be. This will increase unwanted emissions. There will also be a margin loss, via low plant load/yield, as the methane is not used optimally in the reaction. An inaccurate high temperature reading can also lead operators to chase false alarms, investing time and resources into fixing issues which do not exist.

Conversely, an inaccurate measurement that is lower than the real temperature will create safety and reliability issues, as the tubes may become damaged or ruptured. This loss of reliability will damage margins again. If the measurement is off by 20 – 30°C, this can affect tube lifespan by as much as 10 years.

Carbon formation in SMR tubes

One of the major causes of overheating tubes – and ultimately inefficiency – is carbon. Carbon formation on the inside of the tube can be caused by a number of factors, including a low steam-to-carbon ratio (i.e. a rich process gas); heavy hydrocarbons in the feedstock (which occurs more often as gas wells approach the end of their useful life); issues with the catalyst or loading; insufficient purging of residual hydrocarbons prior to restart; or a complete loss of steam. Additionally, when catalyst activity drops, the tube inside wall and process gas temperature both increase, so the carbon formation rate exceeds the carbon gasification rate.

Carbon formation inside the tube is normally visible as hot bands on the reformer tubes. Once carbon is formed, it reduces the inside tube wall heat transfer coefficient and the inter-pellet heat transfer coefficient.

As the active nickel sites are covered by carbon, reducing their temperature, catalyst activity is reduced. Carbon formation also leads to an increase in resistance to flow through the affected tube – a pressure drop. This decreases the heat sink available and further increases the TWT.

28 Spring 2023 GlobalHydrogenReview.com

Figure 1. Overlay of the efficiency losses caused by excess oxygen and by combustibles, which reveal an optimal combustion control point.

Figure 2. The Cyclops C100L and C390L are a single point handheld pyrometer used to measure TWTs across a range of fired heaters.

As the leading innovator, we continue to supply our customers with the technology, methods, and consultancy to make the best integrity management decisions for their assets. No matter what the future holds, renewable hydrogen as a flexible energy carrier plays a vital role in moving the industry further; we want to make sure you are ready.

Fit for the Future. Ready for Hydrogen.

www.rosen-group.com