SCALING THE HYDROGEN ECOSYSTEM

Comment

04 Are we there yet?

Jamie Maule, Cornwall Insight, UK, assesses the developments and ambitions of the hydrogen market in the UK and Europe.

10 Collaboration, communication and commitment

Sanders Anderson, Yokogawa, discusses why uniting policies, stakeholders, and communities is vital in building a sustainable hydrogen future.

15 Building an industry to last James Steven, DNV, explains how creating integrated industry standards will provide the consistency that the hydrogen sector needs to prove its viability.

19 CCUS: the viable interim solution

Nadim Chaudhry, World Hydrogen Leaders, looks at the opportunities for CCUS-enabled low-carbon hydrogen and how US policy is accelerating the advancement of this vital fuel of the future.

22 From colour to carbon intensity: reassessing the hydrogen colour spectrum

Dr. Balagopal Nair, John Crane, explains how embracing carbon intensity as a quantitative metric for evaluating hydrogen can drive emissions reduction.

27 Real-time quality measurement

In the second part of a two part article, Justin Distler and Vince Mazzoni, Black & Veatch, discuss the importance of developing safety codes and standards to ensure safe hydrogen use for all production pathways.

31 Precious cargo

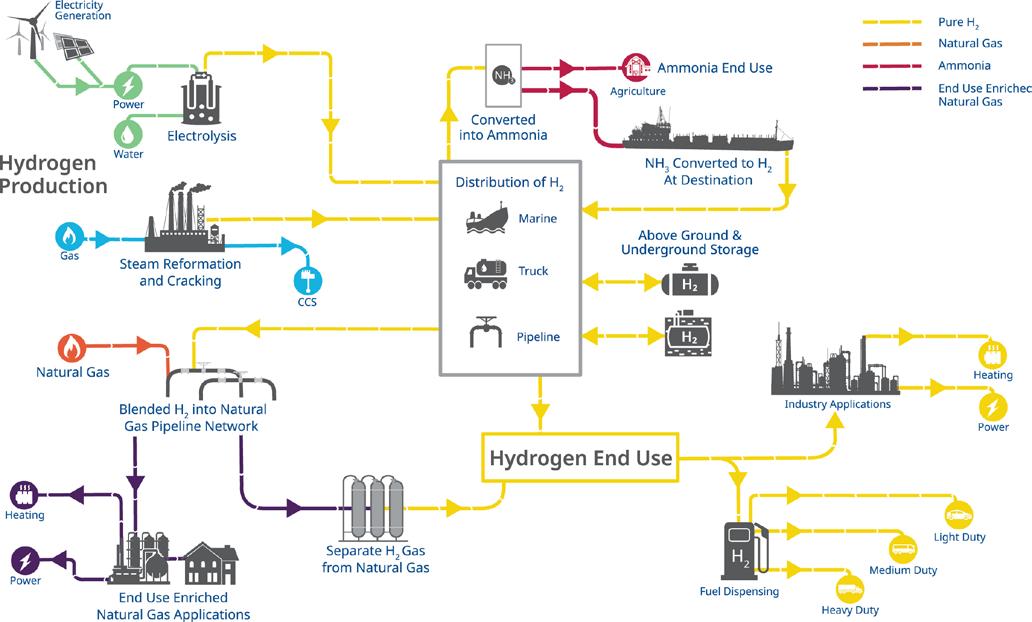

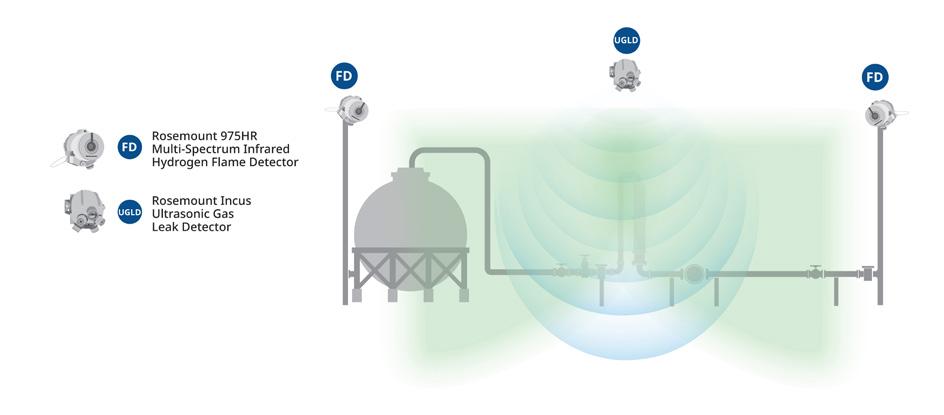

Laura Chemler, Emerson, USA, evaluates hydrogen storage methods and examines current and developing measurement instrumentation technologies for buffer storage within the hydrogen value chain.

37 Adapt or develop?

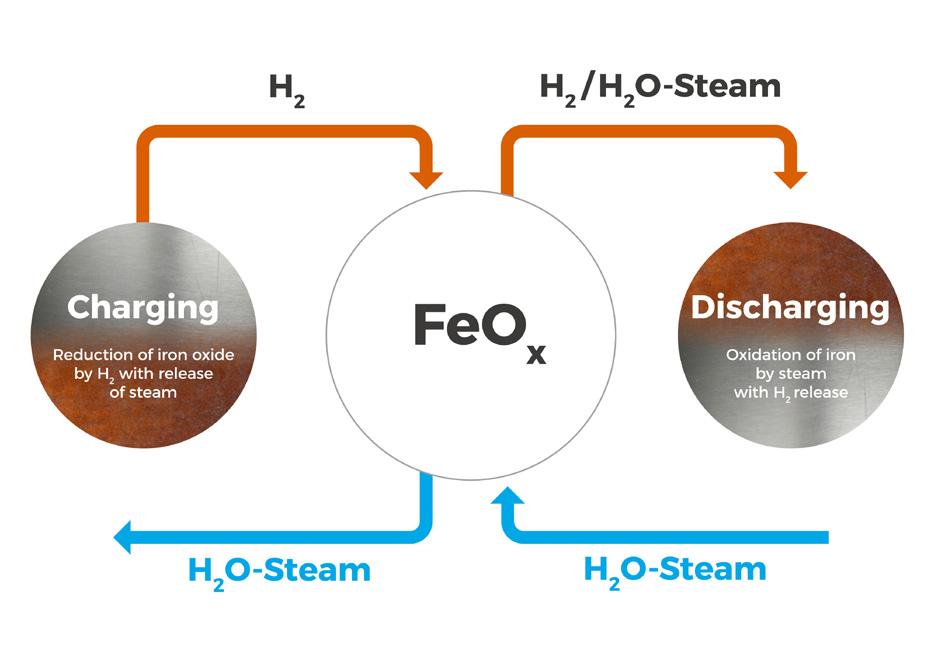

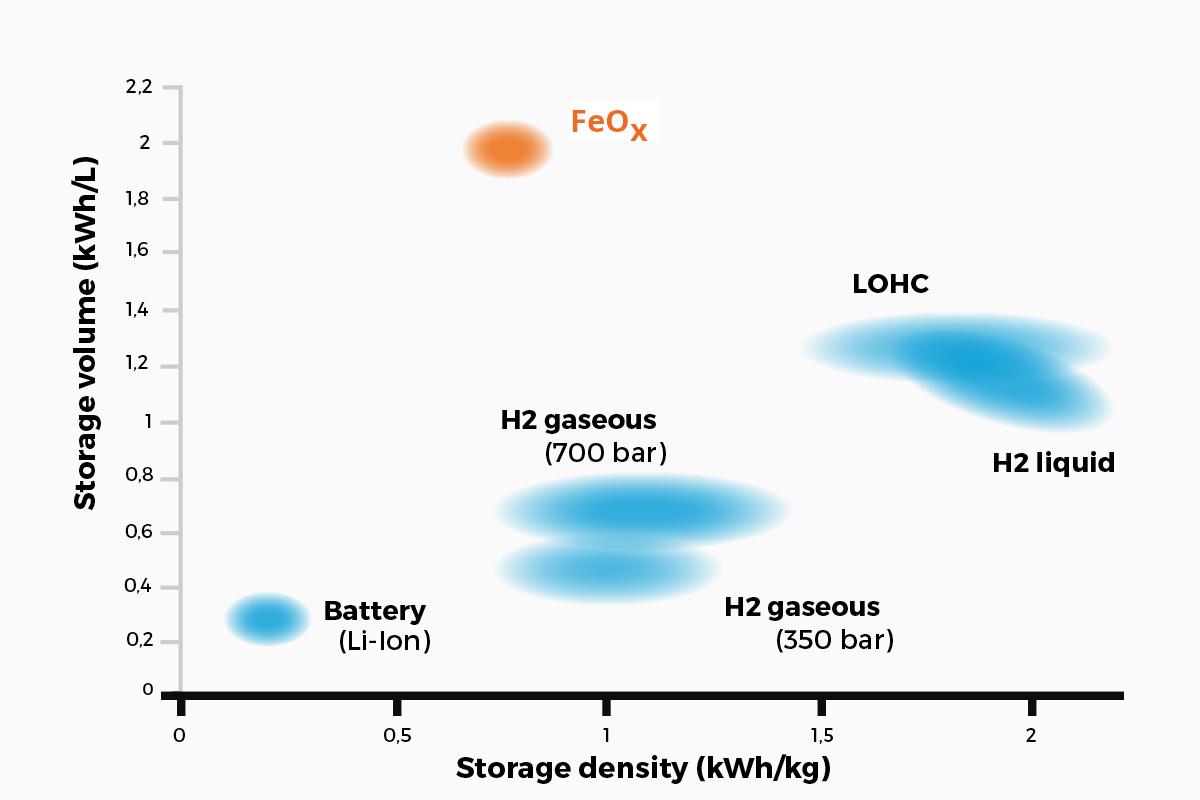

Matthias Rudloff and Ines Bilas, AMBARtec, Germany, consider potential solutions to the challenges presented by hydrogen storage and transportation, and discuss the use of cyclic reduction of iron oxide as a storage medium.

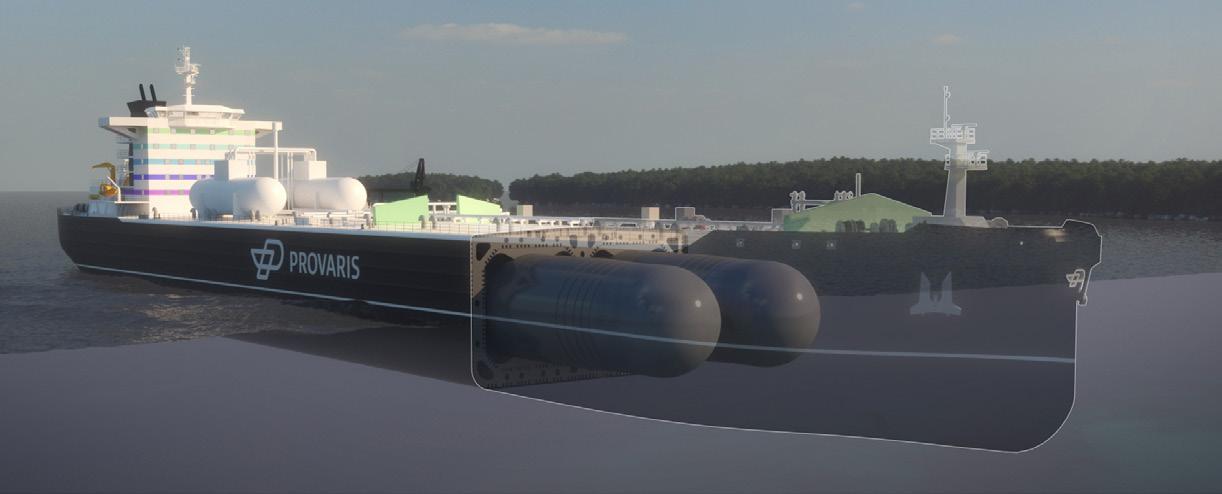

43 Forging the missing link of Europe’s hydrogen value chain

Gareth Burton, ABS, and Per Roed, Provaris Energy, discuss how innovative compressed hydrogen carrier design can offer cost-competitive and efficient regional energy transport.

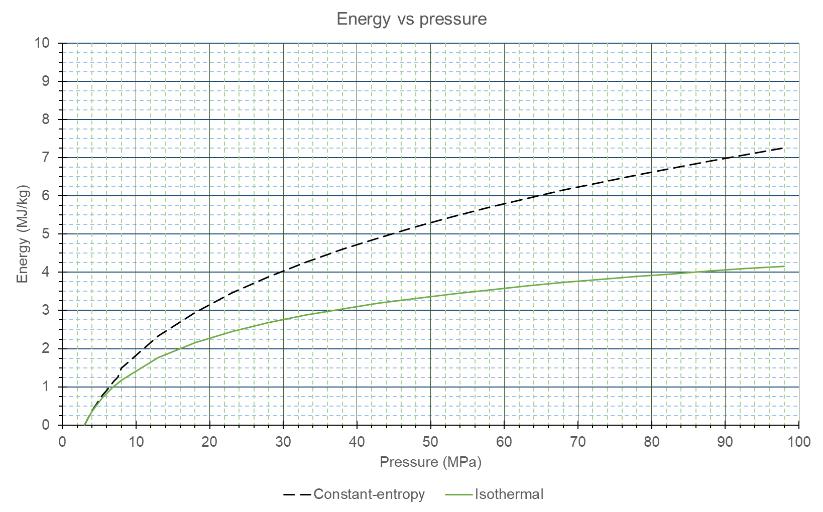

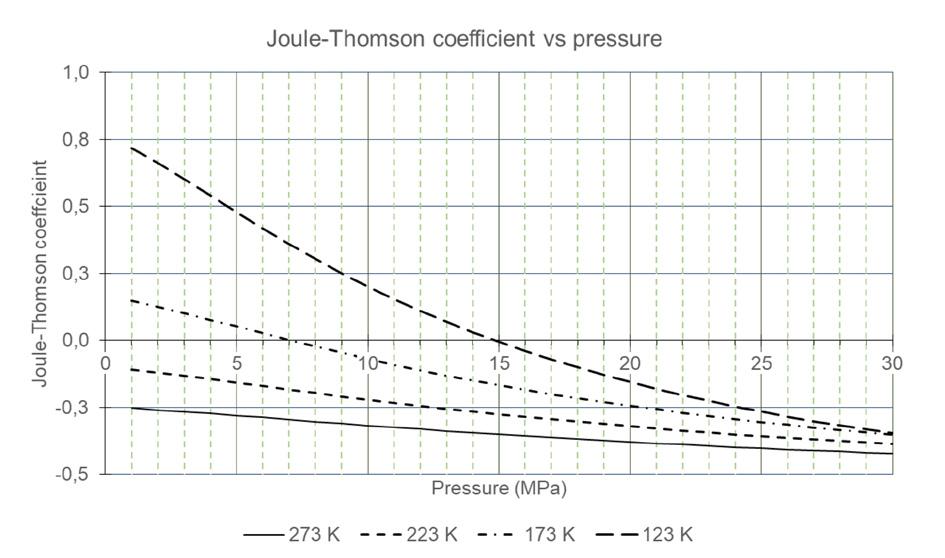

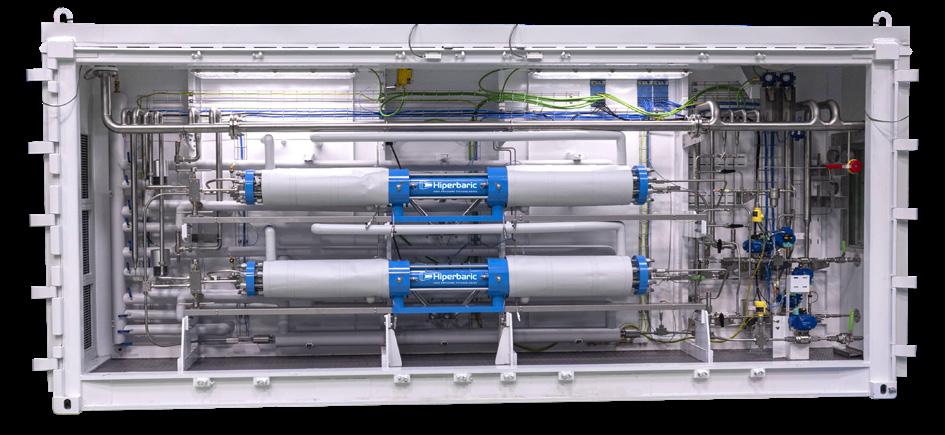

45 An energetic comparison

Daniel Ballorca, Hiperbaric, Spain, presents a comparison between the production of compressed hydrogen and liquid hydrogen energy storage systems.

49 In the spotlight: hydrogen compression

Chris Goulet and Ben Williams, Ariel Corp., explain the value of reciprocating compressors for use in the evolving hydrogen economy and sustainable fuel refineries.

55 Rethinking refuelling

Danny Seals, ANGI Energy Systems, considers how new regulations are shaping the future of hydrogen as a fuel for heavy-duty vehicles.

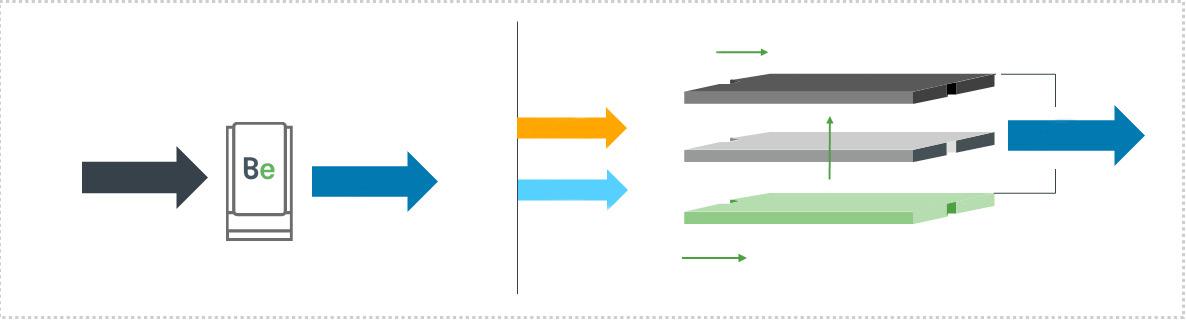

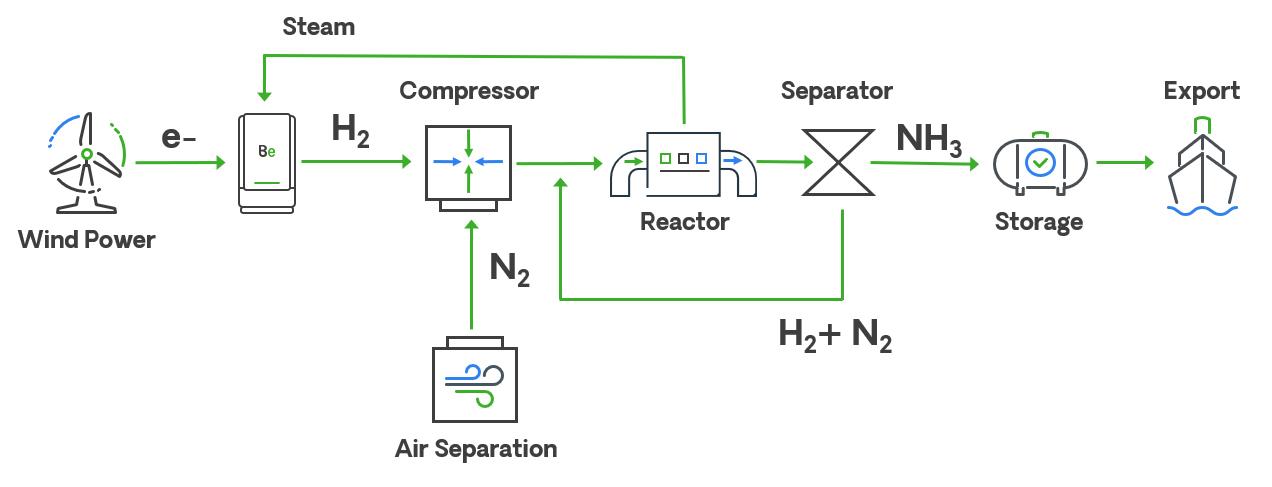

58 Profitable production

Akhil Batheja, Bloom Energy, USA, explores how the integration of solid oxide electrolysis cells (SOECs) and green ammonia can provide an efficient method of hydrogen production.

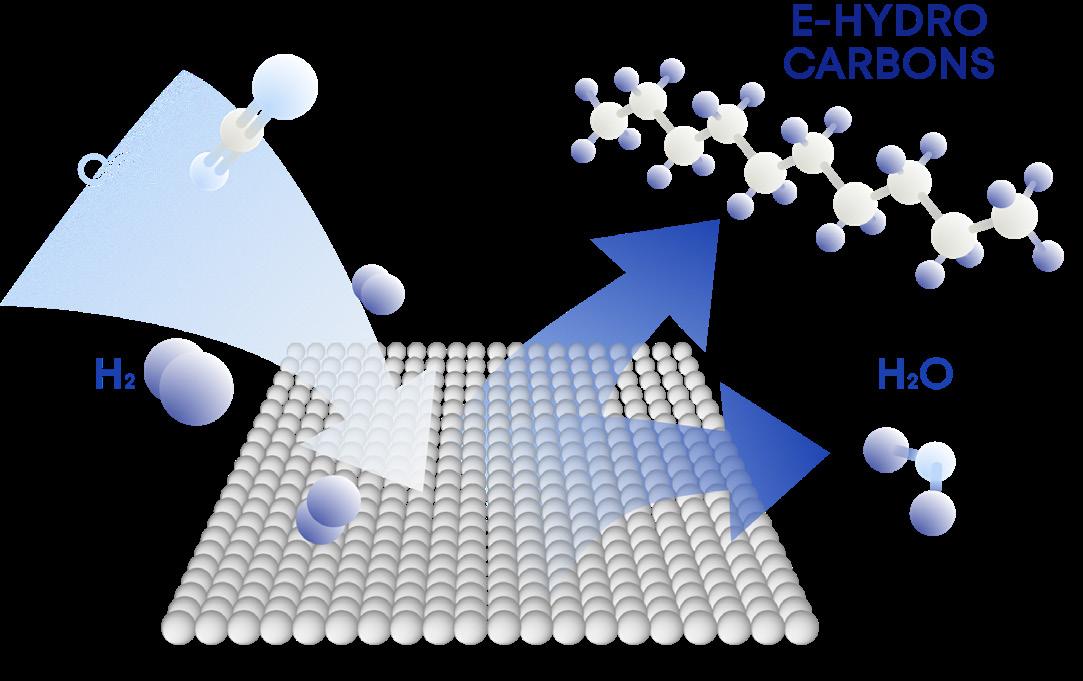

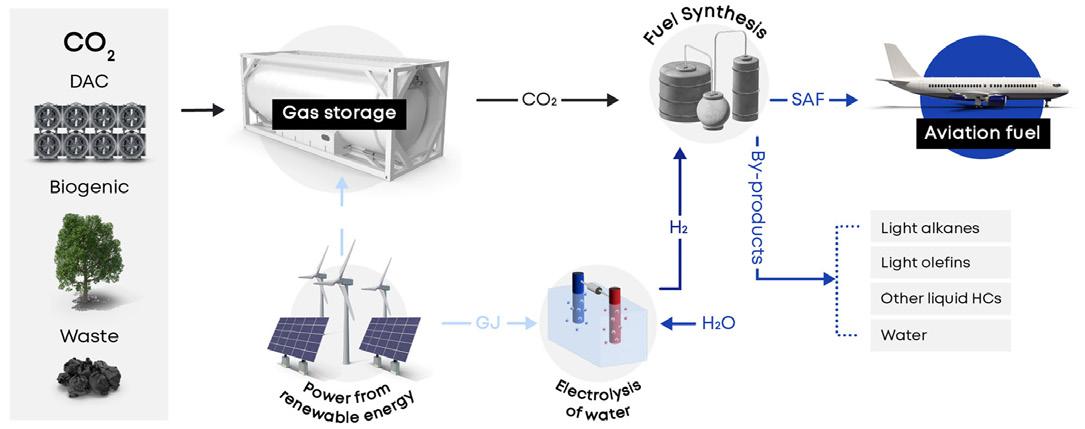

63 Hydrogen in the fuel, rather than as the fuel

Andrew Symes, OXCCU, UK, explains the key role of hydrogen in the creation of synthetic e-hydrocarbons and e-fuels.

Yokogawa provides advanced technologies and services in the areas of measurement, control, and information to customers across a broad range of industries, including energy, chemicals, materials, pharmaceuticals, food, and water. Yokogawa addresses customer issues regarding increasingly complex production, operations management, and the optimisation of assets, energy, and the supply chain with digitally enabled smart manufacturing, enabling the transition to autonomous operations.

MARENÉ RAUTENBACH

Principal Scientist

Topsoe

KNOWING YOUR LOW-CARBON POTENTIAL

Poppy Clements Assistant Editor

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Callum O'Reilly callum.oreilly@palladianpublications.com

Assistant Editor Poppy Clements poppy.clements@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Chris Atkin chris.atkin@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Sales Executive Ella Hopwood ella.hopwood@palladianpublications.com

Production Manager Kyla Waller kyla.waller@palladianpublications.com

Head of Events Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Admin Manager Laura White laura.white@palladianpublications.com

As this issue of Global Hydrogen Review goes to press, the autumn equinox is imminent in the Northern Hemisphere. The equinox marks a rare point of balance where the day and night are almost exact equal lengths – soon after this however, light summer evenings become a thing of the past as the nights draw in and temperatures drop. Two people who won’t be observing these changes on Earth this autumn are NASA astronauts, Barry Wilmore and Sunita Williams, who are currently stuck in space.

After taking off for an eight-day mission on 5 June, the spacecraft carrying the astronauts, Boeing’s Starliner, experienced multiple helium leaks and five thruster failures before its arrival at the International Space Station, causing NASA to question the safety of its planned return journey. Whilst awaiting a decision regarding their return, Wilmore and Williams have been floating 400 km above Earth at the Space Station, which, fortunately, is larger than a six-bedroom house and features a gym, a 360° viewing window providing extraordinary views, and also receives regular deliveries of fresh fruit sent up on cargo missions. On 24 August, it was finally announced that the two veteran astronauts would have to stay on the International Space Station until February 2025, extending the original eight-day mission to more like eight months.

Steve Stich, Manager of NASA’s Commercial Crew Program, said that the reason for the delayed return ultimately came down to the ‘uncertainty’ regarding the safety of another crewed journey on the Starliner.

Certainty surrounding safety standards is an issue of equal gravity in the burgeoning hydrogen industry. Just how it was questioned whether the Starliner was safe enough to transport humans back to their home planet, similar concerns surround the safety of transportation methods for hydrogen. Where helium leaks triggered issues on the spacecraft, the threat of hydrogen leaks in pipelines transporting the fuel to its point of use back on earth is also a serious safety hazard. Hydrogen’s tiny molecule size risks leakage through even the smallest openings, causing potential embrittlement, with its high flammability and nearly-invisible flames providing yet another cause for concern. Strategies for managing these issues are explored in more detail in an article from Emerson on p.31 of this issue.

Upon its now unmanned return to Earth, all the data from Starliner will be scrupulously reviewed to confirm what steps are required to ensure the spacecraft meets NASA’s safety certifications for future missions. Comparably, ongoing research and analysis concerning risk mitigation and safe practice will be essential in helping to minimise the risks associated with the use of hydrogen as the industry grows. Sharing this research so it is understood industry-wide will provide the hydrogen economy with the foundation of trust it requires to flourish.

Editorial/advertisement offices: Palladian Publications

15 South Street, Farnham, Surrey GU9 7QU, UK

Tel: +44 (0) 1252 718 999 www.globalhydrogenreview.com

This issue of Global Hydrogen Review is the perfect place to start, with articles from experts including Black & Veatch, ANGI Energy Systems and DNV amongst others all providing critical insights into the development of hydrogen safety standards, covering all aspects of the value chain, from production and transportation, to the refuelling of vehicles.

Jamie Maule, Cornwall Insight, UK, assesses the developments and ambitions of the hydrogen market in the UK and Europe.

In recent years, the drive towards low-carbon hydrogen has been strong across the globe. This is evidenced in the number of countries publishing national hydrogen strategies, with around 60 in effect as of June 2024. Among these are major economies in every continent, all with ambitions to produce, utilise, and trade low-carbon hydrogen.

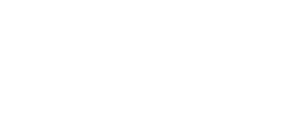

Covering these strategies in more detail, Cornwall Insight’s Low-carbon Hydrogen Policy (LCHP) Index interrogates the policy and strategy frameworks presented by 16 countries who have branded themselves as potential leaders in the new low-carbon hydrogen economy. In the latest iteration of the LCHP Index, published in April 2024, it was found that Germany had built the most ambitious and robust hydrogen policy framework so far, with the US close behind (Table 1).

While these aspirational national strategy documents are undoubtedly important and worth discussing, this article takes a closer look at the policies driving ‘on-the-ground’ change across Europe’s emerging low-carbon hydrogen sector, with a specific focus on the UK.

General trends across Europe

Across Europe, there have been many positive developments in the emergent low-carbon hydrogen sector in 2023 and early 2024. Over this period, the regulatory seedbed has been sewn to aid in the sector’s future success. In doing so, both the UK and EU have introduced detailed production standards for low-carbon hydrogen and set out robust mechanisms to provide revenue support and funding to prospective producers, with an aim to allow them to better compete with fossil hydrogen. Both jurisdictions have also been considering how the sector could evolve over time and what industries could take advantage of the fuel as they seek to decarbonise. With this in mind, plans for the transport and storage of low-carbon hydrogen have also been posed, with the first steps towards achieving them already in progress.

Following the successful implementation of these regulatory frameworks – which continue to be developed – the first low-carbon hydrogen production projects have been granted revenue support following successful auction rounds in the UK and EU. This is an encouraging development as while low-carbon hydrogen has been a subject of intense discussion over the past few years, it is now beginning to bear fruit, or more accurately, fuel.

Regardless of these successes, however, there are many areas of uncertainty surrounding the still-nascent sector. Among these are questions around the cost, viability of production methods, security of supply, certification, and transport and storage of low-carbon hydrogen. Moreover, while the potential use cases are well documented, the eventual end users are also uncertain as this will be partially determined by the economics of alternative pathways (e.g. electrification of domestic heat). The energy sector at large is also still feeling the effects of the macroeconomic and supply chain difficulties characterising the post COVID-19 period.

With supply chains for electrolysers and the renewable generation technologies that they rely upon located outside of Europe – largely in China1 – there has been economic and political pressure to further back domestic industry to support itself. Adding to these difficulties, the spectre of international competition looms large over the UK and Europe. For many low-carbon energy technologies, including hydrogen, concerns remain that the substantial subsidy and regulatory support offered in the US could lead to a partial offshoring of capital.2 Ultimately, continuing to develop a strong policy framework to support low-carbon hydrogen should help to alleviate these issues. Over the past year, both the UK and EU have been successful in this regard as both jurisdictions have implemented schemes to encourage the growth of domestic industry and supply chains – the Green Industries Growth Accelerator3 in the UK and the Green Deal Industrial Plan4 in the EU – and have successfully carried out the first auction rounds for electrolytic hydrogen.

Going once, going twice, sold!

In July 2022, the UK’s Department for Energy Security and Net Zero (DESNZ) announced its Hydrogen Allocation Round (HAR) scheme to provide revenue support to electrolytic low-carbon hydrogen producers, funded by the Hydrogen Production Business Model (HPBM). This came shortly after the announcement of the UK’s first two carbon capture use and storage (CCUS) clusters in November 2022 and one month

before the first successful projects therein – including four low-carbon hydrogen producers – were listed in August 2022.5 Following the Royal Assent of the Energy Act 2023 on 26 October 2023 – which included the legal basis for HPBM contracts, known as Low Carbon Hydrogen Agreements – DESNZ announced the first successful projects to receive HBPM funding in December 2023. Under Hydrogen Allocation Round 1 (HAR 1), 11 projects received contracts across eight areas in the UK, and totalled 125 MW of capacity scheduled to come online in 2025 at the earliest.6 Assuming the projects are able to successfully produce low-carbon hydrogen in accordance with the UK’s Low Carbon Hydrogen Standard (LCHS)7 – which sets a maximum greenhouse gas emissions intensity of 20gCO2e/MJ –they will receive a weighted average strike price of £241/MWh over a period of 15 years. DESNZ notes that this is comparable to the strike price set for similarly nascent technologies – such as floating offshore wind – in the Contracts for Difference scheme. Projects will also receive over £90 million in funding from the Net Zero Hydrogen Fund (NZHF) to support construction.

Source: Cornwall Insight.

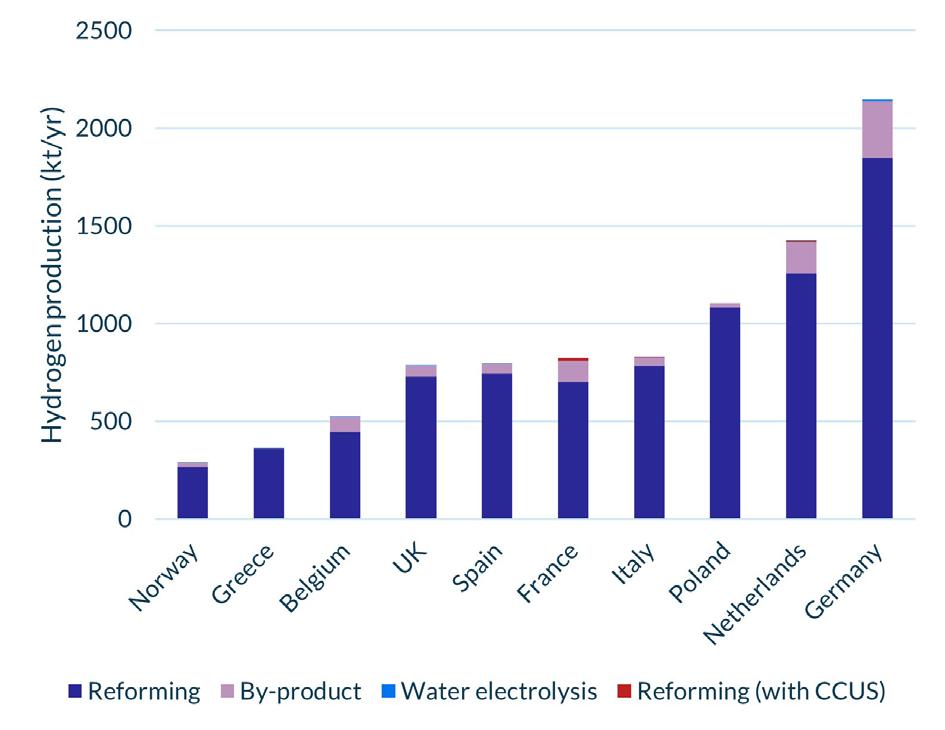

HAR 1 is an undoubtedly important step in the right direction for the UK as these first of a kind projects will contribute to a significant increase in production volumes of low-carbon hydrogen – which stood at only 1120 tpy in 2022 (Figure 1) –and contribute to decarbonisation efforts for hard-to-abate industries. DESNZ also contends that HAR 1 will offer significant value to the UK economy, with £413 million of private investment and 760 direct jobs created by the mid-2020s. Moreover, as HAR 1 projects are the first of their kind, they can offer valuable lessons for producers and off-takers looking to get involved in future rounds. By identifying best practice and encouraging efficiencies – such as how and when to use the plant’s inherent flexibility or the optimum size of on-site storage – they can help to reduce costs and perhaps give prospective developers the certainty they need to commit to enter future HARs. This is certainly the position the government takes as DESNZ contends that successfully delivering HAR 1 on time will give hydrogen developers, investors and supply chain companies the certainty they need to commit to the UK. The extent of this certainty will perhaps become evident with HAR 2, which aims to support up to 875 MW of electrolytic capacity, and opened applications in December 2023.8

While this is good news for the sector, there were some shortcomings from HAR 1. Principally, the round was only able to procure half of the government’s initially targeted capacity, with six projects representing 118 MW of capacity unsuccessful in securing support. Three further projects did not enter final negotiations. While the government addressed some of these issues in its December 2023 report, ‘Hydrogen Allocation Round 2022: process evaluation’, some concerns remain. Moreover, successful projects have encountered stumbling blocks as they seek to progress towards production, although strides have been made to help developers here. Most recently, for instance, Ofgem published its new Retail Energy Code R0160 to ‘compel suppliers to disclose the information needed to ensure electricity generated and consumed during the production of hydrogen is compliant with the LCHS.’ Once entered into application from 28 June 2024, this will go a long way to helping producers ensure that they are compliant with the LCHS and therefore satisfying the conditions of their HAR contract.9

Table 1. Low-carbon hydrogen policy index rankings, April 2024

Figure 1. The 10 largest European hydrogen producers, 2022. Source: European Clean Hydrogen Observatory.

Accelerating decarbonised hydrogen together

The world’s energy systems are changing. Hydrogen is becoming a key part of the future energy mix, with a need for very large volumes of hydrogen on the horizon. Decarbonised (blue) hydrogen can help meet that need, and Shell Catalysts & Technologies has developed a low cost, high capacity way to match those production requirements through the Shell Blue Hydrogen Process. This brings together several proven technologies to deliver 1,000 te/day of hydrogen from a single train with up to 99% CO2 capture rate at a very competitive Levelized Cost of Hydrogen (LCOH). It is a hydrogen solution designed to help decarbonise hard-to-abate industries, lower the CO2 footprint of heavy transport, and reduce home heating emissions.

Learn more at catalysts.shell.com/bluehydrogen.

What about the EU?

Low-carbon hydrogen is progressing down a similarly positive path in the EU. Following its announcement in September 2022,10 the European Hydrogen Bank’s (EHB’s) first auction round launched in November 2023. By the time the auction had closed in February 2024, it had attracted bids from 132 projects across 17 European countries, representing 8.5 GW of prospective electrolyser capacity. In April 2024 the EU published the final results of the auction, announcing seven successful projects comprising 1.5 GW electrolyser capacity, set to receive a share of approximately €720 million – ranging from €8 - 245 million per project – from the European Innovation Fund.11 Moreover, the EU established its ‘Auction-as-a-Service’ scheme wherein projects unsuccessful in the EHB auction but otherwise suitable to produce low-carbon hydrogen in line with EU standards, could be eligible for State Aid should Member States choose to participate in the scheme. Thus far, only Germany has chosen to do so, allocating €350 million to support 90 MW of capacity.12 While beneficial, it is felt that with a similar amount of funding, the EHB could have procured significantly more capacity. Additional support schemes are also in place at the Member State level.

Where do we go from here?

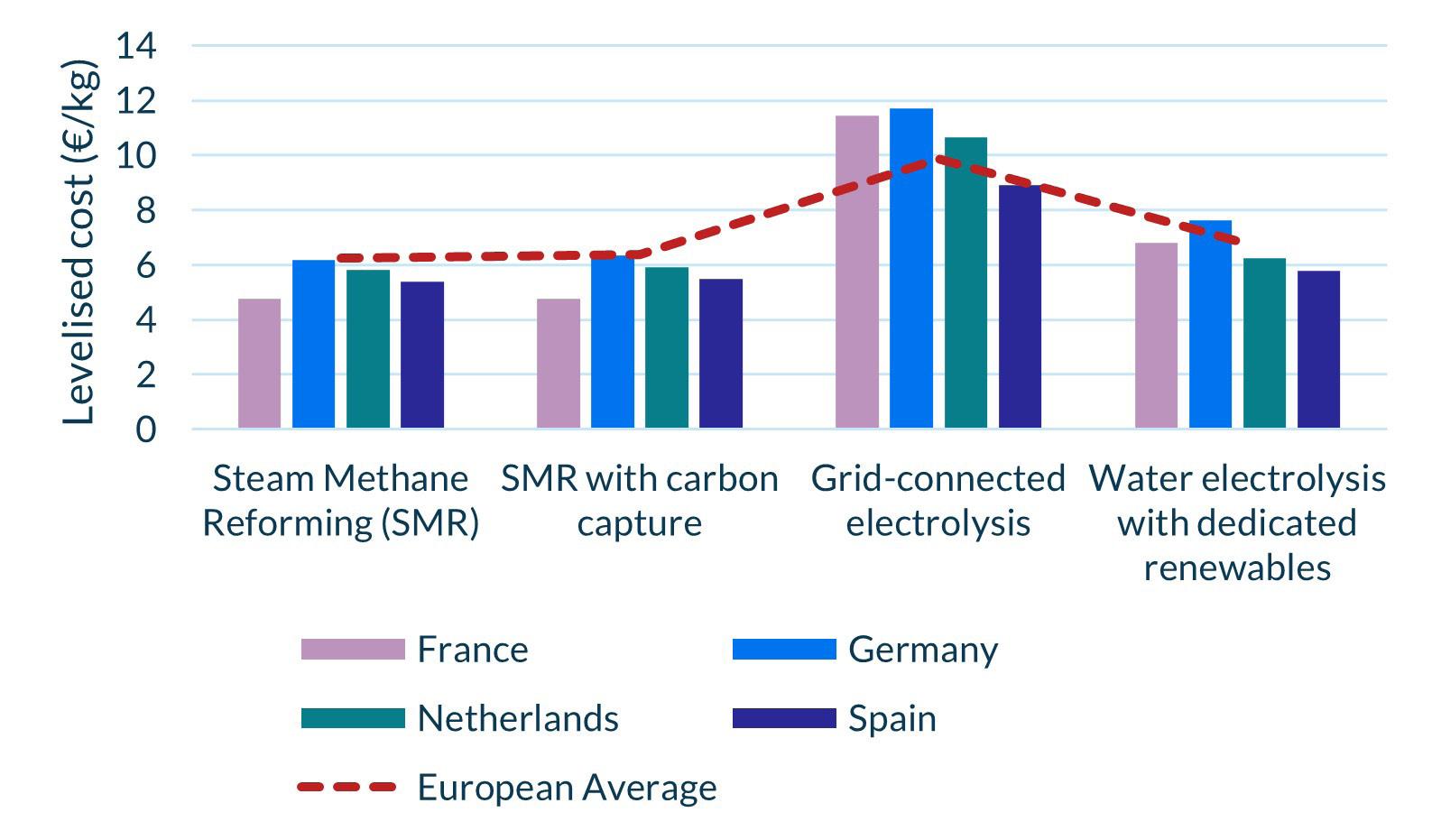

Building a low-carbon hydrogen economy is always going to take time, not least due to the nascency of the sector and the ongoing debates around its efficacy and safety as a ‘fuel of the future’. Nonetheless, recent successes across Europe have put the sector in a prime position to prove its worth by demonstrating its use-cases and working to bring its costs in line with carbon-intensive alternatives (Figure 2). In the first phase of development, this will be dependent on government support, but continued successes could enable a transition to merchant trading in the coming decades.

In the UK, all eyes are on HAR 1 as the successful delivery of projects will signal to developers that the UK is a prime location to site their projects. HAR 2 should provide an early sign of whether this confidence is growing. Similarly, the launch of the first allocation round for Transport and Storage Business Models is set to commence in late 2024, giving the sector further insight into how and where hydrogen networks could operate.

While much of the sector’s future remains an open question, it is imperative that the government gives as much certainty as possible on its use-cases to give the market a better idea of how demand could evolve. For instance, despite public disapproval and sentiment across industry, the government is yet to make its decision on whether hydrogen can be used within home heating systems. The decision, to be taken in 2026, will only be informed by one project within the UK – SGN’s H100 project in Fife, Scotland – as all other pilot projects have been cancelled or postponed until after 2026. A similar decision is also pending on blending hydrogen up to 20% in British gas distribution networks. Without answers to these questions, it is hard to get an idea of how the sector will emerge and what need the UK will have for the fuel moving forward. As such, delays to the uptake of alternative net-zero technologies are not unrealistic. This is certainly the argument made by heat pump manufacturers as continued delays to the hydrogen home heating decision is thought to be negatively impacting their sales as some consider all potential decarbonisation alternatives and their up-front associated costs.

Ultimately, despite some setbacks, the UK is making strong progress towards the development of its low-carbon hydrogen economy. While some key questions remain unanswered, the now former government took strides to provide the market with certainty and has moved at pace to develop the country’s first swathe of projects. It is imperative that the new government carries this strong progress forward to ensure that future auction rounds are as successful and streamlined as possible. In doing so, the UK will find itself among the frontrunners to develop a low-carbon hydrogen economy.

References

1. International Energy Agency, Global Hydrogen Review 2023, www.iea.org/reports/global-hydrogen-review-2023, (2023).

2. United States Department of the Treasury, Inflation Reduction Act 2022, https://home.treasury.gov/policy-issues/inflation-reduction-act, (2022).

3. Department for Energy Security and Net Zero, www.gov.uk/government/ calls-for-evidence/green-industries-growth-accelerator-hydrogen-andccus-supply-chains, (2023).

4. European Commission, Green Deal Industrial Plan, https://commission. europa.eu/strategy-and-policy/priorities-2019-2024/european-greendeal/green-deal-industrial-plan_en, (2023).

5. Department for Energy Security and Net Zero, https://www.gov.uk/ government/publications/cluster-sequencing-phase-2-eligible-projectspower-ccus-hydrogen-and-icc/cluster-sequencing-phase-2-shortlistedprojects-power-ccus-hydrogen-and-icc-august-2022, (2022).

6. Department for Energy Security and Net Zero, https://www.gov.uk/government/publications/hydrogenproduction-business-model-net-zero-hydrogen-fundshortlisted-projects/hydrogen-production-business-modelnet-zero-hydrogen-fund-har1-successful-projects, (2023).

7. Department for Energy Security and Net Zero, www.gov. uk/government/publications/uk-low-carbon-hydrogenstandard-emissions-reporting-and-sustainability-criteria, (2023).

8. Department for Energy Security and Net Zero, https://www.gov.uk/government/publications/hydrogenallocation-round-2, (2023).

9. Ofgem, www.ofgem.gov.uk/decision/authority-decisionretail-energy-code-rec-modification-r0160-electricitysupply-hydrogen-electrolysers#:~:text=Industry%20 sector&text=This%20is%20the%20Authority%20 decision,Electricity%20Supply%20to%20Hydrogen%20 Electrolysers, (2024).

10. European Commission, https://state-of-the-union. ec.europa.eu/state-union-2022_en, (2022).

11. European Commission, https://ec.europa.eu/commission/ presscorner/detail/en/IP_24_2333, (2024).

12. European Commission, https://ec.europa.eu/commission/ presscorner/detail/en/ip_24_657, (2024).

Figure 2. Levelised cost of hydrogen across major European economies, 2022.

economical options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s™ compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Turn to the experts at Ebara Elliott Energy for a partnership you can trust.

Learn more about our clean energy initiatives at elliott-turbo.com.

Advanced energy technologies for a sustainable future.

Sanders Anderson, Yokogawa, discusses why uniting policies, stakeholders, and communities is vital in building a sustainable hydrogen future.

Scaling the hydrogen ecosystem is not just an engineering and technology endeavour; it is a multi-faceted effort that requires navigating intricate policies, engaging diverse stakeholders, and seeding community support.

As the world continues to pivot toward sustainable energy solutions, hydrogen stands out as a potential game-changer. Nevertheless, the success of hydrogen projects hinges on the ability to skillfully move through the regulatory landscape, cultivate stakeholder relationships, and build strong community ties. This article delves into the importance of these elements, how they influence our considerations, and potential strategies to bridge the gap between policies, stakeholders, and communities.

The importance of policies, stakeholder engagement and communities

Policies play a pivotal role in shaping the hydrogen ecosystem. They provide a regulatory framework that can either accelerate or slow down the development of hydrogen projects. Effective policies in theory ensure safety, environmental sustainability, and economic viability, making them a tide riser for a clean hydrogen ecosystem.

Stakeholder engagement is crucial because hydrogen projects often involve various parties, including government agencies, private sector companies, non-governmental organisations, and the citizens in states, cities, and neighbourhoods. Engaging broad stakeholders early and often consistently helps to align interests, address concerns like environmental and economic impact, and foster collaborative efforts.

Community support is a consistent theme at hydrogen conventions, summit events, and a key element of the H2 Hubs programme from the US Department of Energy and the Office of Clean Energy Demonstrations. And for good reason – community support

is essential for the successful implementation of hydrogen projects. Communities are not just end-users; they are also impacted by the ecological and economic changes brought to life by such projects. Gaining community buy-in can lead to smoother project execution, long-term sustainability, and economic success.

Navigating policies

The first step in navigating policies is understanding the regulatory landscape at the local, state, and national levels. This includes becoming familiar with the existing laws, regulations, and standards that govern hydrogen production, distribution, and usage. For instance, safety regulations for hydrogen storage and transport are critical to preventing accidents and ensuring public trust. The US Department of Energy publishes information on codes and standards that is accessible to all.1

Active engagement with policymakers through advocacy and relationship-building is also vital. This involves presenting data-informed insights like the clean hydrogen market exceeding US$3.8 billion2 which help to buoy the benefits of hydrogen projects. Engaging with policymakers can help shape favourable regulations and secure incentives that support the development of hydrogen infrastructure.

Ensuring compliance with regulations cannot be avoided. This means adopting best practices and technologies that meet or exceed regulatory requirements. Additionally, remaining fluid when faced with changes in the regulatory environment is crucial for the long-term success of the hydrogen ecosystem.

Engaging stakeholders

Identifying all relevant stakeholders is the foundation of effective engagement. This includes government entities, industry partners, environmental groups, and local communities. Each stakeholder group has a unique interest focus and concerns that should be addressed.

Building trust through transparent communication is essential. Regular updates, open forums, and public consultations can help keep stakeholders informed and involved. Transparency fosters trust and can prevent misinformation and opposition to your project goals.

Forming collaborative partnerships can influence the support of hydrogen projects. Public-private partnerships, for instance, can leverage the strengths of both sectors to advance project goals. Similarly, collaborating with research institutions can

drive innovation and technological advancements. An example of a research institution doing great work in this space is the Stanford University Hydrogen Initiative, which is a collaboration between researchers in engineering, science, policy, and business working with industry and governments to use hydrogen to decarbonise the world’s energy systems.3

Getting to know regional players is equally important. There may be hydrogen hubs, associations, or coalitions near you. For instance, the ARCHES Hub in California is an initiative to accelerate renewable hydrogen infrastructure and projects. Its network is composed of industries, labour, government, and communities dedicated to creating a greener California.4

Industrial automation partners are pivotal in this journey, providing the expertise and technology necessary to streamline processes, optimise operations, and ensure safety and efficiency.

Building community support

Involving the community from the outset is crucial. This includes conducting impact assessments to understand how the project will affect the local area and addressing potential concerns.

Community meetings and workshops can provide platforms for dialogue and feedback. This is also an opportunity to hear about critical issues that may have not been addressed.

Educating the community about the benefits and safety of hydrogen early on is important. This can be achieved through informational campaigns, school programmes, and public demonstrations. An informed community is more likely to support hydrogen projects.

Highlighting the economic and social benefits of hydrogen projects can help gain community support. When communities see tangible benefits, they are more willing to jump on board and champion projects. Community support can influence decision-makers of future projects, such as Europe’s largest renewable hydrogen plant.5 Additionally, many posit that growing a robust middle class is the foundation for strong and sustainable economic growth. Clean hydrogen can create lift here with job creation, economic development, and the benefits of improved environmental quality.

Bridging the gap

Bridging the gap between policies, stakeholders, and communities requires an integrated approach. This means developing strategies that address regulatory compliance, on the one hand, and stakeholder and community engagement on the other. Joint project studies can effectively alleviate community concerns by fostering transparency, collaboration, and trust between stakeholders. For instance, the joint study to achieve carbon neutrality aims to make the Goi and Soga industrial complex carbon neutral by 2050.6

Conducting stakeholder mapping and analysis can help identify the interests, influence, and potential impact of each stakeholder group. This analysis can inform engagement strategies and help to prioritise efforts.

Combining policy advocacy with community engagement can create a powerful synergy. For example, advocating for policies that provide community benefits, such as local hiring requirements or underserved community investment funds, can align policy goals with community interests and economic growth. The Justice 40 Initiative is one such example of this kind of advocacy in action.7

Figure 1. A glimpse into our sustainable future – CO2 emissions decline, a necessary milestone in the energy transition.

Conclusion

Navigating the complex landscape of policies, stakeholder engagement, and communities is crucial for the success of clean hydrogen projects. Each element plays a vital role in shaping the project’s trajectory and ensuring its sustainability. By understanding the regulatory landscape, engaging stakeholders transparently, and building strong community ties, hydrogen projects can overcome challenges and achieve long-term success.

Scaling the hydrogen ecosystem and accelerating the path to net zero is not just a technical challenge; it is a comprehensive undertaking that requires collaboration, communication, and commitment. By bridging the gap between policies, stakeholders, and communities, hydrogen’s potential can be unlocked.

As industry moves forward, it is important to be fluid and responsive to the evolving landscape. The journey of clean hydrogen is a marathon, not a sprint, and its success will require continuous effort, innovation, and cooperation.

Establishing feedback loops input from stakeholders and the community can improve project outcomes. This includes regular surveys, feedback sessions, and being open to suggestions. Incorporating feedback into project planning and implementation demonstrates that a company is thinking about more than just the business bottom line.

Monitoring and evaluation are essential to assess policies, stakeholder engagement, and community involvement. This includes tracking key performance indicators, conducting regular reviews, and adjusting as needed. Continuous improvement ensures the project remains on track without leaving community concerns behind.

With the right strategies and partnerships, the complexities on the path to net zero can be navigated with both a practical and conscientious vision for the future.

References

1. https://www.hydrogen.energy.gov/program-areas/codes-standards

2. https://www.alliedmarketresearch.com/clean-hydrogen-market-A53698#

3. https://hydrogen.stanford.edu/

4. https://archesh2.org/community-benefits-2/

5. https://www.yokogawa.com/us/library/resources/articles/yokogawaselected-as-mac-for-constructing-europes-largest-renewable-hydrogenplant/

6. https://www.agc.com/en/news/detail/1204306_2814.html

7. https://www.whitehouse.gov/environmentaljustice/justice40/

Figure 2. Sustainable success is built on collaboration. When teams and stakeholders align, good things happen.

James Steven, DNV, explains how creating integrated industry standards will provide the consistency that the hydrogen sector needs to prove its viability.

Debates about hydrogen’s role in the energy transition, its potential uses and which colour is best, have been commonplace in the industry in recent years. DNV has made its stance on the matter abundantly clear – hydrogen is critical for decarbonising economies and moving hard-to-electrify sectors towards net zero emissions. At the same time however, it is important to remain realistic about its ability to make the difference needed in the short-run.

In order to meet the Paris Agreement targets, hydrogen must account for approximately 15% of the world’s energy demand by 2050. But forecasts, included in DNV’s latest Energy Transition Outlook, indicate that the global adoption of hydrogen and its derivatives are well behind where they need to be, with hydrogen making up just 0.5% of the global final energy mix in 2030 and 5% in 2050. Nevertheless, developments in hydrogen technology and infrastructure over the next three decades will be significant, with the potential to transform various industries.

At a more granular level, DNV’s latest UK Energy Transition Outlook forecasts that the primary driver for long term hydrogen demand will be the increasing need for the fuel, as well as its derivatives, in the transport sector

But this is a long-term view, and without the swift creation of a clear business model or market support mechanism, high production costs likely mean that hydrogen will be uncompetitive for use in heavy industry and domestic heating, even by 2050 when the UK is aiming to be a net-zero nation.

The replacement molecule

By the middle of the century, DNV forecasts a 50/50 split between blue hydrogen (produced from natural gas through reformers with carbon capture and storage [CCS]) and green (electrolytic) hydrogen, with the fuel playing a vital role in decarbonising hard-to-abate sectors, like aviation and heavy industry where the energy demands render electrification unsuitable.

Numerous hydrogen projects, both blue and green and spanning the length of the UK, are in various stages of development, hoping to capture a share of what has the potential to be a £13 billion market by 2050. In the short to medium term, blue hydrogen will be key to priming the sector and establishing its associated supply chain. As we pass net zero, there will be a shift with green hydrogen capturing an ever-greater share of the market, becoming the carbon free molecule that will power much of the world for generations to come.

Earning trust through thorough planning

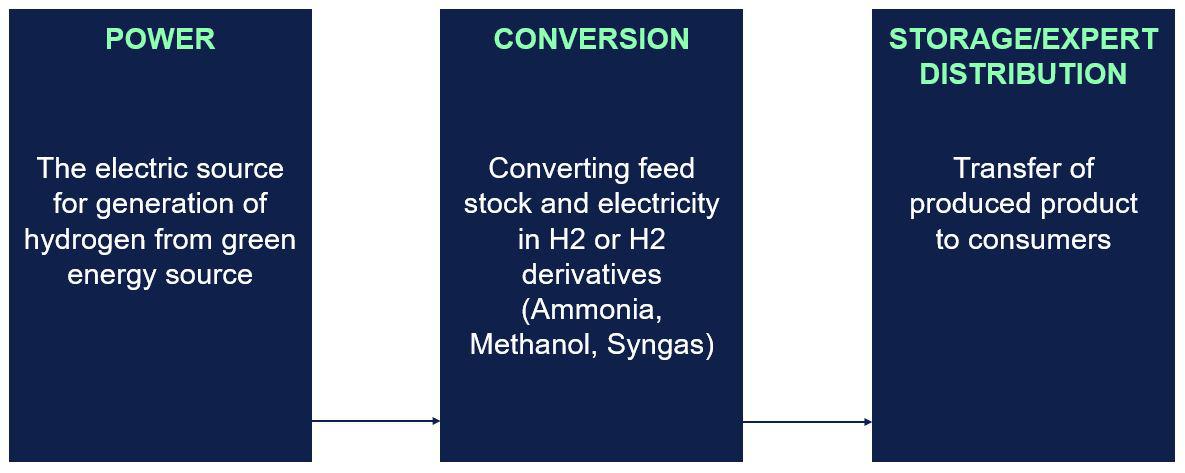

At this early stage for the sector, building trust and confidence across the three main green hydrogen project stages remains essential. Developers must be certain that they will have access to a reliable power source for generation, that their technology performs as expected in the conversion process, and that there is a consumer in place to receive the finished product.

Confidence does not occur organically however; it needs to be earned and shaped. Green hydrogen still has its detractors and concerns remain about its safety and efficacy. To allay these fears, it is important to get under the bonnet of projects and prove that all the components right across the chain function as promised and expected.

Going beyond regional regulations

It is often found that projects are solely focused on meeting the regional accreditation and regulations around green hydrogen, but are sometimes stopping short of addressing the technical and safety elements. While this is an important factor, it is all about apportioning blame should something go wrong. It is an essential box to tick from a legality and regulatory perspective, but it does not help to ensure there is a safe final product. This is already causing huge issues on projects and big delays, because companies are buying in equipment without properly assessing its compliance and safety performance.

This is fuelling much of the negativity and scepticism that is levelled at the hydrogen sector. Moreover, it underscores the need for the industry to have a standardised method that projects across the globe can follow with certainty. If this blueprint is in place, then developers are all approaching projects from the same place. They can follow a validated

path that starts with the components, builds them up into a package, and then shapes them into a green hydrogen production facility.

Proving concepts in the field

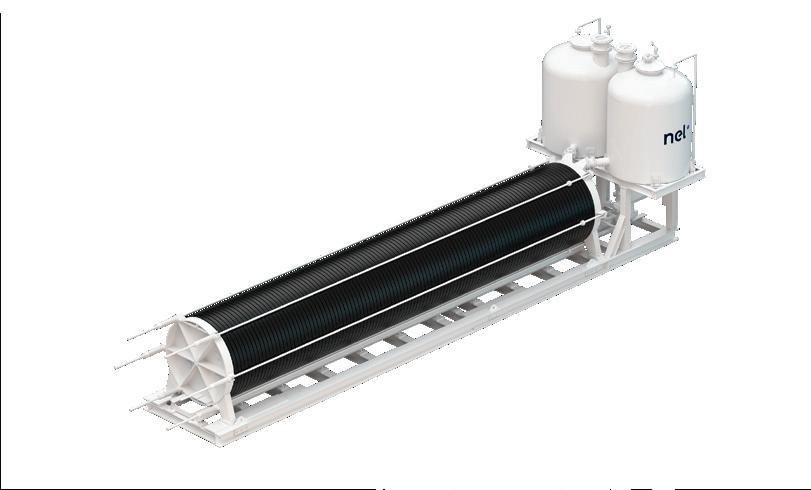

In order to steer the technical compliance and safety aspects of the green hydrogen industry, DNV teamed up with over 25 financial, end users and manufacturing partners. The aim was to come up with a new certification and industry best practice for hydrogen production systems to facilitate successful water electrolysis projects. It was inspired by a similar approach that DNV undertook for the wind energy industry about 30 years ago that helped to drive standardisation and safety in the sector.

Featuring some of the biggest names in the energy industry, the findings from this joint industry partnership have helped to validate the criteria for managing the safety risks arising from main electrolyser components and assembled systems. It also entailed the assessment of all the potential hazards of the electrolyser technologies currently on the market, as well as providing an oversight framework to reduce the threats faced by projects and financial stakeholders.

Crucially this initiative yielded new DNV standards to inform the equipment used in the production of green hydrogen and hydrogen derivatives, providing the consistency in certification and verification that the sector needs to prove its viability.

Amongst them is the first fully integrated standard for electrolysers, DNV-ST-J301, which addresses all potential hazards associated with this emerging technology. Complementary standards, such as DNV-ST-J302 (designed to benchmark electrolyser performance and allow for standardised methods of evaluation that do not currently exist) and DNV-ST-J30x (a product standard), are also in the pipeline and will be released soon.

DNV-ST-J301 is built on a risk-based approach, encompassing all technical safety considerations. This standard goes beyond typical guidelines, consolidating all safety aspects into a single, comprehensive document, making it more accessible and easier to follow. It includes detailed requirements and guidance on specific issues related to the use of hydrogen and its derivatives. By defining proportionate actions based on risk severity, this approach ensures thorough, yet cost-effective compliance. This proactive risk management methodology has gained global endorsement and is becoming the standard for ensuring safety and compliance in major projects.

Taken with regional product requirements, as well as other ISO or international standards, these new qualifications are the blocks that build DNV-SE-0674, the latest service specification for the verification and certification of Power-to-X equipment, reducing risk and independently documenting a high level of safety and compliance to all stakeholders.

Figure 1. Main stages of green hydrogen production.

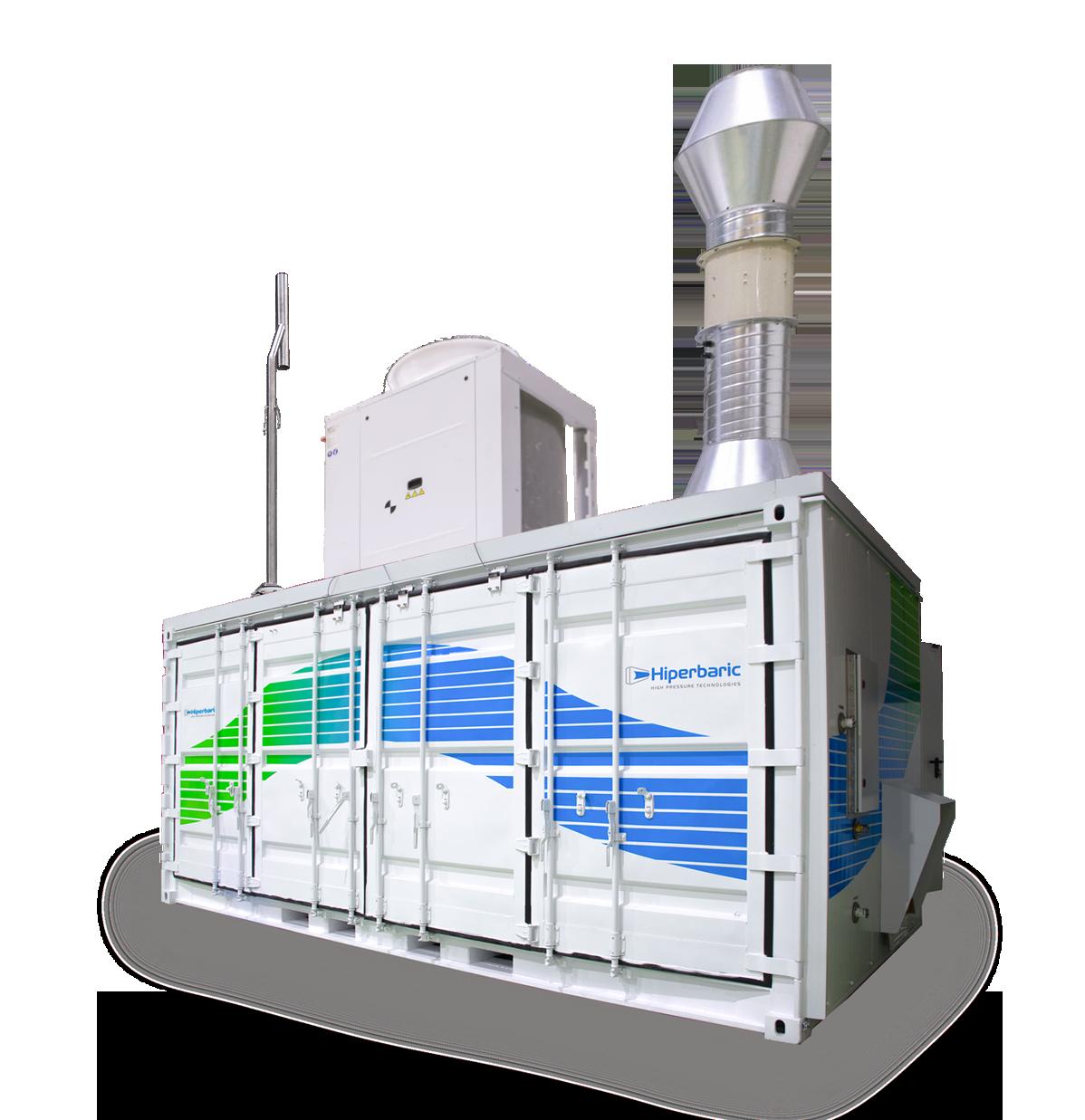

HIGH PRESSURE HYDROGEN COMPRESSION TECHNOLOGY

Advanced reciprocating piston compression technlogy of up to 500 - 1,000 bar

Oil Free design compressors, with a complete turndown: 0% to 100%

Modular and scalable design that can include one or two compressors

24/7 Aftersales service for installation and start-up, supply and manteinance

Validating green hydrogen production from the bottom to the top

This approach evaluates not only individual components, but also their collective contribution to green hydrogen production plants’ safety and compliance. It outlines various certification and verification requirements, along with the processes for achieving them, including guidelines for non-DNV standards. This ensures developers can comprehensively demonstrate their processes across the entire green hydrogen production chain, minimising oversights and ensuring equipment compliance and plant safety. The forthcoming introduction of additional product and system standards in 2024 will facilitate the assessment and certification of all products utilised in hydrogen or its derivatives, extending the standardisation efforts to other related products and supporting the accelerated adoption of hydrogen, alongside users of gases and e-fuels. Such measures are crucial in aiding users’ transition towards low-carbon fuels.

In turn, DNV-SE-0674 stands as a pivotal element within DNV-SE-0656, DNV’s comprehensive service specification for verifying (and soon certifying) Power-to-X facilities as an integrated whole. The other two bolt on factors that comprise this overarching benchmark are regional accredited services, which address provincial-specific regulations pertinent to projects, and DNV-SE-0654, a standard designed to authenticate developers’ claims regarding the environmental sustainability of the hydrogen produced. Together, they ensure a rigorous evaluation of Power-to-X facilities, considering both regulatory compliance and environmental impact, thereby fostering transparency and accountability in the green energy sector.

Released last year, DNV-SE-0656 covers the physical site where green hydrogen is actually produced, building up from the component level to create a fully functioning facility. It also allows the certification of systems that are already operational.

Conclusion

It is this ability to show the full transition, right through the validation pyramid, that will be vital to the establishment of a global green hydrogen industry. Not only will it pave the way for the standardisation of electrolysers and associated equipment, a prerequisite for scaling up the sector to meet demand, but it will confirm that the fuel and its derivatives can safely fill the gap that will one day be left by oil and gas.

Initiatives spearheaded by many of the world’s biggest energy companies, underpinned by government backing, mean the green hydrogen sector is inevitably set for growth, spurred on by the need for hard-to-abate sectors to clean up their act. But to what extent this growth is realised depends on the sector’s ability to iron out the creases now. In tandem, the government must do its bit to create a robust market, through the creation of clear business models and market support mechanisms designed to make this most vital of fuels cost-effective.

DNV’s collaborative efforts with industry partners have yielded standards and certifications that provide a foundation for the safe and efficient production of green hydrogen. As the transition progresses, the industry must continue to work together to ensure that set green hydrogen standards can help to deliver the decarbonisation that the world so desperately needs.

Valves Qualified

Hydrogen qualified valves for topside, subsea, and pipeline applications, endurance tested to over 400 Cycles with ZERO Leakage. Also available are 10/14/20mm full bore gaseous fuel station ball valves.

Nadim Chaudhry, World Hydrogen Leaders, looks at the opportunities for CCUS-enabled low-carbon hydrogen and how US policy is accelerating the advancement of this vital fuel of the future.

While its relevance in helping to reach climate goals has long been recognised, deployment of carbon capture, utilisation and storage (CCUS) has been slow and consistently accounting for less than 0.5% of global investment in clean energy technologies.

Although CCUS is not a new technology and there are currently around 41 operational facilities globally, it has typically been deployed at a small scale – mainly for research and development (R&D) projects and for enhanced oil recovery. In order for CCUS to meaningfully contribute to climate change goals, the amount of CO2 captured would need to grow four-fold from current levels by 2030). However, stronger climate targets and investment incentives are now starting to drive increased momentum into CCUS – and one of the key strategies to provide a boost to the technology is the efficient production of hydrogen.

The role of CCUS in low-carbon hydrogen production

Hydrogen is a versatile energy carrier that can help support the decarbonisation of a range of hard-to-abate sectors where electrification from renewable sources cannot deliver the level of energy output required. These include iron, steel, chemicals and cement production – as well as hydrogen-based fuels for aviation, shipping and long distance haulage.

CCUS can facilitate the production of low-carbon hydrogen (sometimes referred to as ‘blue’ hydrogen) from natural gas and provide an opportunity to bring it into new markets in the near term – and at reasonable cost.

It can also help alleviate pressure on already constrained electricity grids, allowing renewable electricity generation and electrolytic hydrogen production to scale at a more manageable pace. This benefit of CCUS-enabled hydrogen over

the next decade has been recognised in the Committee on Climate Change’s recently published Climate Change Committee’s 2023 Progress Report to Parliament.

Today, the cost of CCUS-enabled hydrogen production is likely to be around 50% of hydrogen production via electrolysis powered by renewables-based electricity. While the cost of electrolytic hydrogen is anticipated to reduce over time with the onset of increasingly cheaper electrolysers and renewable electricity, CCUS-equipped hydrogen will most likely remain a competitive option across regions typically associated with low-cost fossil fuels.

Recently there has been a significant increase in the appetite to develop CCUS projects, with a 50% increase in CO2 capture in the 12 months between 2022 to 2023. This has been driven by governments internationally coming under increasing pressure to meet global climate targets, implementing robust legislation and providing clear pricing signals in order to make CCUS commercially viable.

Despite this positive news, there remain three significant issues. From the many announced CCUS projects, only around 5% have taken firm investment decisions due to the uncertainty of demand, a lack of clarity around certification and regulation and, a critically important factor, the lack of infrastructure available to actually deliver the hydrogen to customer sites. According to the IEA, to help deliver a heavily decarbonised heavy industry by 2030, a third of all hydrogen production will need to be dedicated to those hard to abate sectors – and currently these applications only account for around 0.1%. So, there is considerably more work to do.

Challenges with deploying CCUS at scale

Due to the fact that CCUS is far from a mature industry, a single stakeholder is typically unable to take on all the expertise, risk and CAPEX needed across the whole value chain. As such, the most significant challenges with deploying CCUS at scale are the multiple different, distinct stakeholders that need to be coordinated including: the industrial plants which are the CO2 emitters themselves; the various CCUS technology suppliers which separate and capture the CO2; providers of processing, compression solutions transportation solutions, and, finally, experienced storage providers who can inject and store the CO2 underground.

It is evident that urgent policy action is needed to create demand for low-carbon hydrogen and unlocking the necessary investment to accelerate the scale-up of production and the building of delivery infrastructure.

The US leading the way

Currently, different policy approaches are being undertaken by governments to encourage the deployment of CCUS at scale. In particular, the US has provided a much-needed shot in the arm for the infrastructure required to scale up technologies.

Incentives under the Inflation Reduction Act (IRA) provide project developers with a US$50/t of CO2 tax reduction where CO2 is stored in dedicated storage sites. Additionally, the Infrastructure Investment and Jobs Act passed in November 2021 provided a combined US$15 billion to support CCUS and low-carbon hydrogen production.

The IRA has had a considerable positive impact on hydrogen, enabling the US to have the largest hydrogen project pipeline of any country. It currently accounts for 18% of total announced capacity, allocating Australia to second place at 14%. And while the percentage of hydrogen projects in the EU surpass both of those (at 29%), it should be remembered that this figure accounts for the whole of the EU (consisting of 27 countries) and the UK, which ultimately results in relatively minor pipelines per country.

While Europe may be advancing the highest number of projects overall, the US is considerably closer to offering early scale-up, with the generous IRA tax credits, eventually helping

Figure 1. CCUS delivered hydrogen can help alleviate pressure on already constrained electricity grids.

Figure 2. The US is considerably closer to offering early CCUS hydrogen scale-up.

Figure 3. Despite relevance to help reach climate goals, deployment of CCUS has been slow.

a strong flow of US projects towards Final Investment Decision (FID).

The majority of announced projects are for green hydrogen, which is produced using renewable energy and electrolysis and is the cleanest form of hydrogen production. However, it is also expensive, making access to cheaper clean power necessary to achieve the desired economics.

While most of the recently announced projects are for carbon-free hydrogen, the projects that are most advanced are dominated by blue hydrogen, especially in the US. Blue hydrogen is mainly produced from natural gas and creates CO2 as a by-product – so it is a low-carbon solution, but not strictly a ‘clean’ one. However, it enjoys a significant cost advantage over green hydrogen, particularly where natural gas is cheap, as in the US and Canada.

Today, the cost of CCUS-enabled hydrogen production remains around half that of producing hydrogen through electrolysis powered by renewables-based electricity. While the cost of electrolytic hydrogen will decline over time, with cheaper electrolysers and renewable electricity, CCUS-equipped hydrogen will most likely remain a competitive option in regions with low-cost fossil fuels and CO2 storage resources.

Greg Bean, Director, Gutierrez Energy Management Institute at the University of Houston, commented: “Recent federal government policies affecting low-carbon intensity (LCI) hydrogen – specifically the funding of seven hydrogen hubs, along with IRA production tax credits for LCI hydrogen and enhanced CCUS tax credits – should accelerate the initial wave of CCS hydrogen given its current cost advantage over electrolytic hydrogen, especially in the US with low natural gas prices. However, the more favourable tax treatment for electrolytic hydrogen in the IRA and the likely reduction in electrolytic hydrogen cost suggests that it might ultimately have a larger market share in an aggressive decarbonisation scenario.”

Hydrogen trading is still at a relatively nascent stage but could see significant growth this decade. Even low-carbon hydrogen will be crucial for net importers to reach net-zero targets and for net exporters like the US to maximise benefits from clean energy deployment. CCUS-based hydrogen is likely to become an internationally traded commodity to help countries meet their hydrogen demand in a more economical way.

With main export markets likely to be in Europe and North Asia, there could be policy actions in these countries that penalise or limit CCS hydrogen imports. A relevant example is the ‘maximum methane intensity values’ and associate penalty structure being discussed for LNG imports into Europe. Only time will tell.

Conclusion

This is a decisive decade and it is essential to scale solutions today if the worst climate impacts on society and the global ecosystem are to be avoided. Both CCUS and low-carbon hydrogen are well-tested and the US has shown that they can be rapidly scalable solutions that can deliver decarbonised industries at a lower cost.

The significant opportunities for low-carbon hydrogen can only be delivered through coordinated international collaboration. This requires cross-industry partnerships that must work together based on guiding principles of lower costs, speed, and uncompromising quality.

Dr. Balagopal Nair, John Crane, explains how embracing carbon intensity as a quantitative metric for evaluating hydrogen can drive emissions reduction.

Hydrogen, which does not create any carbon emissions when burned, is a pivotal resource in the energy transition. This abundantly available natural element has the potential to accelerate decarbonisation, making it an essential part of a carbon-neutral society. As hydrogen continues to garner new levels of interest, so do the impacts of hydrogen production. But as the new energy economy matures, the hydrogen colour spectrum –which assigns colours to various production techniques with different levels of carbon emissions –is no longer the preferred approach to evaluating hydrogen’s environmental footprint. The colour spectrum ranges from green hydrogen, which is produced with renewable energy only and has the lowest carbon emissions, to black hydrogen, which is produced with the highest emissions. Not all hydrogen is created equally, and the colour spectrum can be a useful tool for understanding these various production methods at a high level. However, considering production methodologies in isolation from other factors is a misleading indicator. Simply put, a quantitative measure of the emissions associated with hydrogen will be essential as the hydrogen economy matures. An approach based on carbon intensity can provide a transparent, universal measure of hydrogen’s environmental impact across the value chain.

Blue hydrogen vs green hydrogen: understanding the colour spectrum

The colour spectrum categorises various approaches for producing hydrogen. Each colour describes a production method. While blue hydrogen vs green hydrogen is the most talked about, many other process colours exist.

Green hydrogen

Electrolysis splits water into oxygen and hydrogen, utilising renewable electricity. The energy must come from renewable sources such as wind or solar, as this classification is intended to be emissions-free. John Crane supports one of the world’s largest green hydrogen projects with its dry gas seals, high-performance couplings, and gas filters. Planned for operations in 2026, the plant is set to produce 600 tpd of zero-carbon hydrogen.

Blue hydrogen

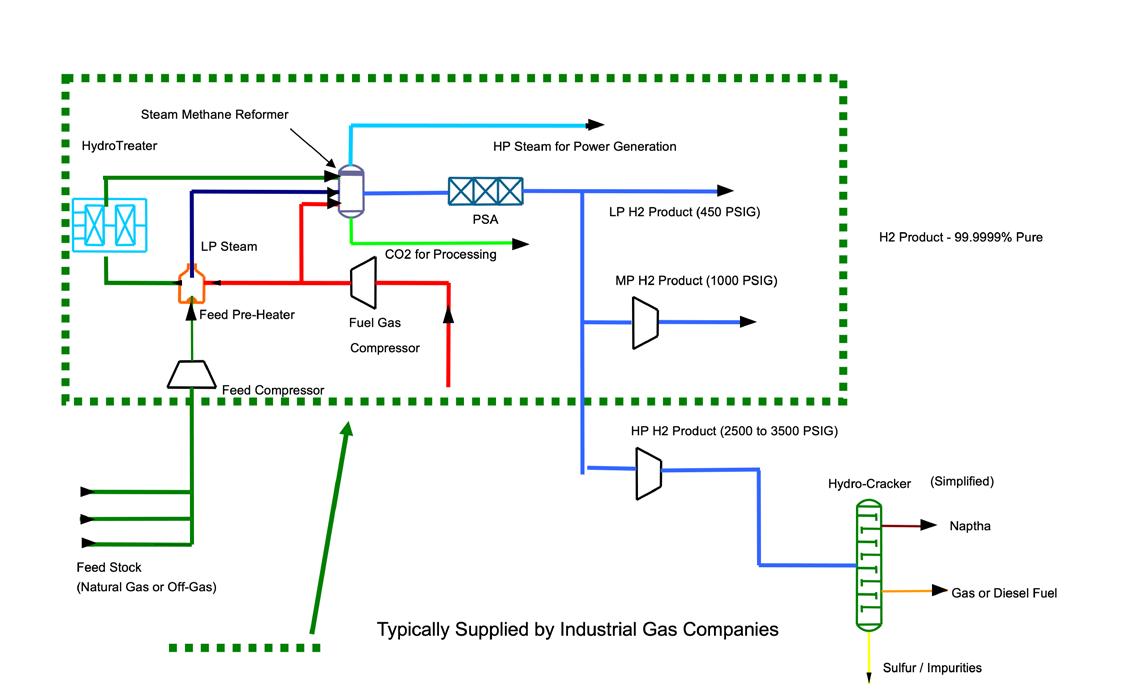

Natural gas feedstock undergoes reforming, such as steam methane reforming (SMR) and partial oxidation or autothermal reforming (ATR), converting methane into hydrogen and CO2

The process pairs with carbon capture utilisation and storage (CCUS) to prevent the release of emissions. John Crane provides the sealing technology for one of Canada’s largest blue hydrogen production sites in Edmonton, Canada.

Grey hydrogen

Natural gas is separated into hydrogen and CO2 by reforming. Unlike blue hydrogen, CO2 emissions are discharged into the atmosphere.

Pink hydrogen

Nuclear-powered electrolysis produces hydrogen from water – the energy spent is non-renewable, but the process is low-carbon.

Turquoise hydrogen

A process called methane pyrolysis thermally decomposes methane into hydrogen and solid carbon, significantly reducing the release of CO2 gas.

Black and brown hydrogen

The gasification of hard coal (black) or soft lignite (brown) produces hydrogen. These production methods are considered some of the least environmentally conscious.

Yellow hydrogen

Electrolysis powered by a mix of solar energy and other non-renewable sources produces hydrogen. This mix could create a significant carbon footprint depending on the amount and type of non-renewable energy sources used.

White or gold hydrogen

Hydrogen production occurs underground through natural processes and chemical reactions. When conducted in abandoned gas or oil wells, microbes break down organic matter in the absence of oxygen, yielding ‘gold’ hydrogen gas as a byproduct. Gold hydrogen can also be

extracted via drilling similar to natural gas production, which offers a potentially attractive pathway if large and accessible underground hydrogen resources can be found.

While these colours offer a simple way to distinguish between blue hydrogen and green hydrogen and more, the descriptors only tell part of the story. Investors, industry leaders, and the public deserve to understand the complete picture when it comes to the hydrogen source’s carbon impact.

Looking beyond the hydrogen colour spectrum

The limitations of the hydrogen colour spectrum lie in its simplicity and the absence of any formal definition. It groups production methods but does not account for variations in carbon emissions within a colour category.

There is no simple answer to the question, ‘what is green hydrogen?’. Even terms such as ‘low-carbon’ or ‘clean’ hydrogen are inconsistent across projects, countries, and regulatory bodies.

A pragmatic characterisation of environmental impact is essential to hydrogen’s role in decreasing emissions. Carbon intensity (CI), a technology-agnostic measure of carbon footprint, offers a framework for describing hydrogen with universal commonality. CI is the quantity of carbon in CO2 equivalent emitted per unit of hydrogen produced. The higher the CI score, the more adverse the environmental footprint.

A quantitative measure like CI is more telling than the process colour alone. The transparency CI adds could help accelerate hydrogen projects by bolstering confidence with investors, creating consistency for astute market decisions, and enabling interoperability between regulatory bodies worldwide.

However, establishing CI is complex, and a clear approach to determining CI is critical to its success.

Factors contributing to CI

Carbon emissions along the hydrogen value chain fall into various categories: feedstock, production, transportation, storage, and final use. CI must consider emissions at every step of the value chain to accurately represent hydrogen’s potential in global decarbonisation.

For example, a study by Wood Mackenzie found that water electrolysis (typically associated with ‘green hydrogen’ production) could result in higher CO2 emissions than brown hydrogen if the electricity for the process came from grid power generated with unabated fossil fuels.1

Accounting for all the emissions released throughout the hydrogen lifecycle is particularly challenging in terms of production and transportation.

Hydrogen production

The CI of hydrogen varies greatly across production methods, so one colour is not always less carbon-intensive than another.

Take the following example: although using natural gas for SMR feedstock generates higher emissions than water electrolysis, the final CI depends on several factors, including the energy source powering the production, as well as the carbon capture rate.

Consider a situation that uses renewable power to produce hydrogen through electrolysis (green hydrogen). Due to the intermittent nature of solar and wind, it may be necessary to leverage grid energy to support electrolysis at scale. However, grid energy impacts CI, as it may be fossil fuel-based, and emissions may be abated or unabated at the power plant level. However, incorporating energy storage into renewable hydrogen production, rather than grid power, can enable 100% renewable hydrogen production.

As another example, the range of CI associated with blue hydrogen varies broadly depending on where carbon capture is used in the process. There are two opportunities to decarbonise the production of blue hydrogen by SMR: at the point where feedstock gas (methane) is burned to enable SMR, and after the SMR process has produced CO2. According to the International Energy Agency (IEA), capturing both sources of CO2 can result in a 93% capture rate, as contrasted with a much lower 60% for partial capture.2

Hydrogen transportation

A complete evaluation of CI considers whether and in which form hydrogen is delivered by pipeline, truck, rail, or ship. The fuels that power these transportation modes emit carbon, driving higher CI scores. There are a few challenges.

Preparing hydrogen for transportation may involve liquefaction, which requires energy to maintain cryogenic temperatures. Pipeline transportation is possible at ambient temperature, but power is still needed to compress hydrogen gas, which impacts CI.

Converting hydrogen to ammonia for transportation is an appealing alternative. The infrastructure and expertise for this is already well-established. However, the Haber-Bosch process for creating ammonia consumes significant energy, and a large amount of energy is required to crack the ammonia back into hydrogen at the point of use.

There are, however, advantages in terms of carbon footprint when utilising the ammonia molecule instead of cracking it back into hydrogen and nitrogen. For example, advancements within the maritime sector suggest that using transported ammonia as fuel could lower carbon emissions and CI compared to using common marine fuels. Another idea is to use the boil-off gas from

Figure 1. Green hydrogen gas for clean electricity solar and wind turbine facility.

Figure 2. Hydrogen facility.

Chart’s HLH2 vehicle fuel systems provide greater range and payload advantages using liquid hydrogen storage and an integrated heat exchanger for Fuel Cell Electric Trucks (FCETs).

Chart’s liquid hydrogen fuel stations allow for quicker fueling of vehicles with more dense liquid hydrogen, using simpler equipment and requiring less infrastructure investment.

HLH2 vs. H35/H70

• Lighter Weight

• Smaller Footprint

• Easier to Install

• Faster Fill Times

• Customized Integration with Truck Manufacturer’s Fuel Cell Engine

www.ChartIndustries.com/Hydrogen hydrogen@chartindustries.com

Americas: +1 800 400 4683

Germany: +49 (0)2823 328 224 China: +86 519 8596 6000

Scan to download our brochure

liquid hydrogen as a fuel or part of the fuel in a liquid hydrogen carrier ship. To date, these technologies have yet to be widely adopted. Marine transport remains a significant contributor to CI, particularly for long-distance trade between Chile and Japan, for example.

CI as a standard definition for hydrogen

A report by the IEA states that “clear regulations and certification systems based on the emissions intensity of hydrogen production can bring much-needed transparency and be a useful enabler of investments in production and demand applications as well as infrastructure for hydrogen trade”.3

It is apparent that CI, rather than colour schemes like blue hydrogen vs green hydrogen, can provide a unified method for evaluating environmental impact. This clarity is especially important in regions with limited potential for locally producing low-carbon hydrogen. Economies in these areas will rely heavily on imports and must be aware of the carbon impact of the products they purchase and transport.

The role of policy

Regulation and certification are a critical aspect of hydrogen’s path forward. Policymakers should ensure that hydrogen is represented in a consistent way, ideally across the globe. CI could be a basis for internationally recognised hydrogen regulations.

Currently, Europe, the US, Canada, Korea, and Japan evaluate the environmental impact of hydrogen using slightly different schemes and system boundaries. Definitions from the IEA for system boundaries include:

y Well-to-gate: emissions produced by the supply of the fuels used in the hydrogen production process.

y Well-to-point-of-delivery or well-to-tank: includes all well-to-gate emissions and emissions associated with transport, as well as possible conversion and reconversion of hydrogen into other carriers.

y Well-to-wheel: includes all well-to-gate and well-to-point-of-delivery emissions, in addition to those associated with the use of hydrogen.

A unified CI scope and definition could encourage consistency and transparency across borders, smoothing the way to a scaled-up international hydrogen market.

A clear path to accelerating the hydrogen economy

While the simplicity of the hydrogen colour spectrum is useful at a high level, it does not provide a comprehensive measure of environmental impact. Embracing CI as a quantitative metric for evaluating hydrogen can aid decision-making, ultimately helping achieve emissions reduction and sustainability goals.

Hydrogen will undoubtedly play a role in the future global energy landscape. As the hydrogen economy continues to mature, industry must embrace the full spectrum of possibilities it offers – not just in colour, but in CI as well.

References

1. https://www.woodmac.com/horizons/hydrogen-colours-value-chaincarbon-intensity/

2. https://www.iea.org/data-and-statistics/charts/comparison-of-theemissions-intensity-of-different-hydrogen-production-routes-2021

3. https://www.iea.org/reports/towards-hydrogen-definitions-based-ontheir-emissions-intensity

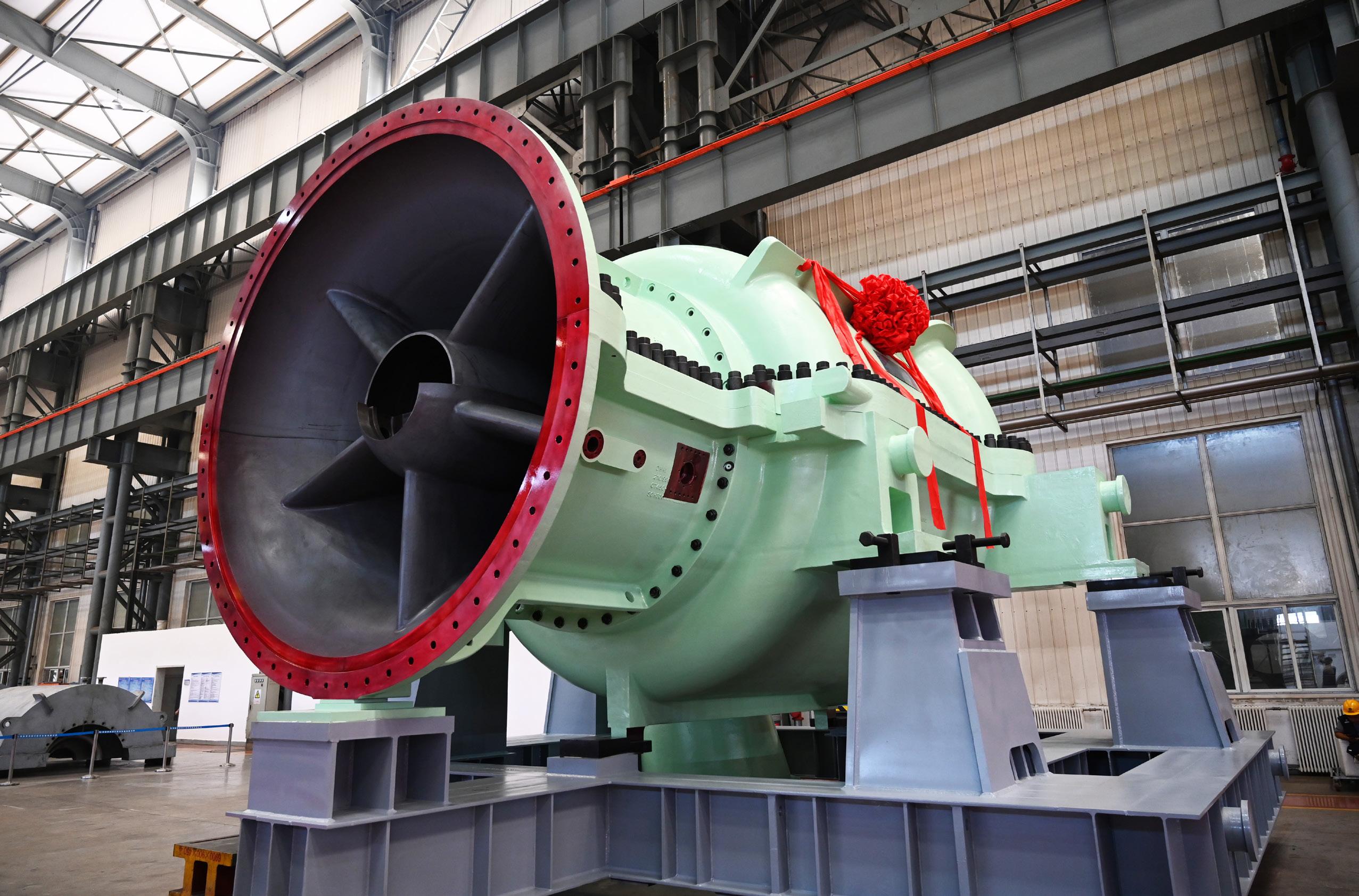

Hydrogen’s use as a decarbonised fuel for power generation is a peak interest for utilities looking to future-proof their power plant systems. Combined cycles, as pictured in Figure 1, are particularly of interest due to their high efficiency relative to other thermal power generation technologies, a large existing fleet, and their ability to provide grid stability required for the expanding renewable resource portfolio. Currently, there are limits to the level of hydrogen blending in natural gas-fuelled combined cycles, due to limitations in combustion turbine combustor design, as well as criteria air

In the second part of a two part article, Justin Distler and Vince Mazzoni, Black & Veatch, discuss the importance of developing safety codes and standards to ensure safe hydrogen use for all production pathways.

pollutant (e.g., nitrogen oxide or NOx) emission limitations. Currently the greatest impediment for widespread hydrogen blending in natural gas is the availability and economics of ‘green’ hydrogen rather than technical restrictions.

However, additional technical limitations and considerations also exist, including but not limited to:

� Embrittlement concerns of existing and future fuel gas piping based on the process flow, temperature, and pressure.

� Hydrogen attack at high fuel gas temperatures (particularly downstream of fuel gas heaters with temperatures above 200°C).

y Predictable, homogenous, and controlled hydrogen blending into natural gas.

y Retrofitting required for instruments in enclosures with hydrogen blended systems at 30% or more blend by volume (Class 1 Division 1 Group B NEC classification based on codes like NFPA 497 and API 500).1,2

Power generation projects using a hydrogen blend should first consider where the hydrogen is being blended with another fuel. If the hydrogen is blended upstream of the gas custody exchange, fuel gas compressors may also need to be evaluated for hydrogen use. As hydrogen is introduced, volumetric flowrate increases, which may result in larger fuel gas compression systems. However, if hydrogen is introduced on site, fuel gas compressor modifications may not be required. Thorough and controlled mixing of hydrogen into natural gas is important to stay within the allowed Wobbe Index and the rate of change requirements of the combustion turbine original equipment manufacturer (OEM). While hydrogen readily mixes with natural gas, depending on the distance between the mixing and the point of use, a baffled mixing drum or static mixer in the pipe may be required. Mixing drums may also be required if there was a disruption in the flow of hydrogen, which would otherwise result in a large swing of the Wobbe Index of the fuel.

Any system interacting with hydrogen should be evaluated on a case-by-case basis for embrittlement. In particular, any high-strength carbon steel systems and associated ancillaries require careful consideration. While low strength carbon steels can be used under certain hydrogen conditions (e.g., low pressure, low temperature, low cycling, etc.), austenitic stainless-steel grades like 304 or 316L are considered the best for high-pressure, high-temperature hydrogen applications.3 When using reduced hardness carbon steels, post weld heat treatment may be required to reduce the weld hardness. High temperature applications should also consider API RP 941 for material selection to avoid high temperature hydrogen attack.4 Piping should also minimise flanged joints and threaded joints within enclosures due to higher likelihood of hydrogen leakage. American Society of Mechanical Engineers (ASME) B31.3, ASME B31.12, and International Organization for Standardization (ISO) 15649 should be considered when designing hydrogen piping.

In addition, plants adding hydrogen cofiring capabilities at an existing natural gas fired facility should review the existing fuel gas system electrical area classifications for reclassification based on NEC requirements. For hydrogen blended volumes

of 30% or more, the hazardous area classification is typically Class 1 Division 1 or 2 Group B.5,6

Gaseous hydrogen production

There is an increasing interest in using electrolysers to produce green hydrogen, at both large scale, centralised production applications and small scale, decentralised applications. Electrolysers split water into hydrogen and oxygen using direct current (DC) power and water as inputs to an electrolytic cell stack. The product gaseous hydrogen discharge from the electrolyser typically exits at pressures ranging from atmospheric to as high as approximately 600 psi(g) (40 barg) where it can be liquefied or further compressed for storage or usage. The gaseous oxygen is typically vented to atmosphere.

Electrolyser systems are typically installed indoors in a building or within a stand-alone enclosure. Outside of the electrolyser building, the electrolyser system includes balance of stack and balance of plant systems such as rectifiers, separators, water treatment equipment, pumps, piping, control rooms, and other supporting equipment. Hydrogen systems should be analysed using hazard and risk analysis processes. However, electrolysers pose specific risks with the potential for explosive mixtures to occur. All hydrogen system enclosures should provide proper ventilation and be designed to maintain hydrogen in air mixtures below 1% by volume.5 Additional considerations for the system include proper hydrogen venting, nitrogen purging, electrical equipment classification, proper leak/flame detection, combustion event arrestor design considerations, automated shutdown systems, and more.

Electrolysers present increased explosion risk due to the presence of both hydrogen and oxygen in high concentrations with co-located electrical systems that could be an ignition source. Continuous monitoring of crossover via electrochemical degradation is imperative to preventing an explosion risk. For example, electrochemical degradation of the membrane structure can be monitored through voltage and current abnormalities. Operators should work closely with electrolyser OEMs to understand the specific risk associated with their design. Typically, additional compression is required for most gaseous storage applications, and can go upwards of 14 500 psig (1000 barg). Compatible materials for compressor equipment, piping, valving, and instrumentation should be used. Routine maintenance and inspection of compressor components should be performed to ensure the equipment is in a safe working condition and is not in need of repair or replacement. Hydrogen discharged from pressure relief devices and other hydrogen vents, or hydrogen vented during startup or shutdown should be discharged to a vent/flare stack that is routed to a safe location. Because hydrogen gas temperature rises as it is compressed, interstage-coolers should be provided to maintain hydrogen temperature within the design temperature limit of the compressor system components. Design consideration should be given to any potential cross-leakage of high-pressure hydrogen to cooling systems from the compressor and other hydrogen equipment.

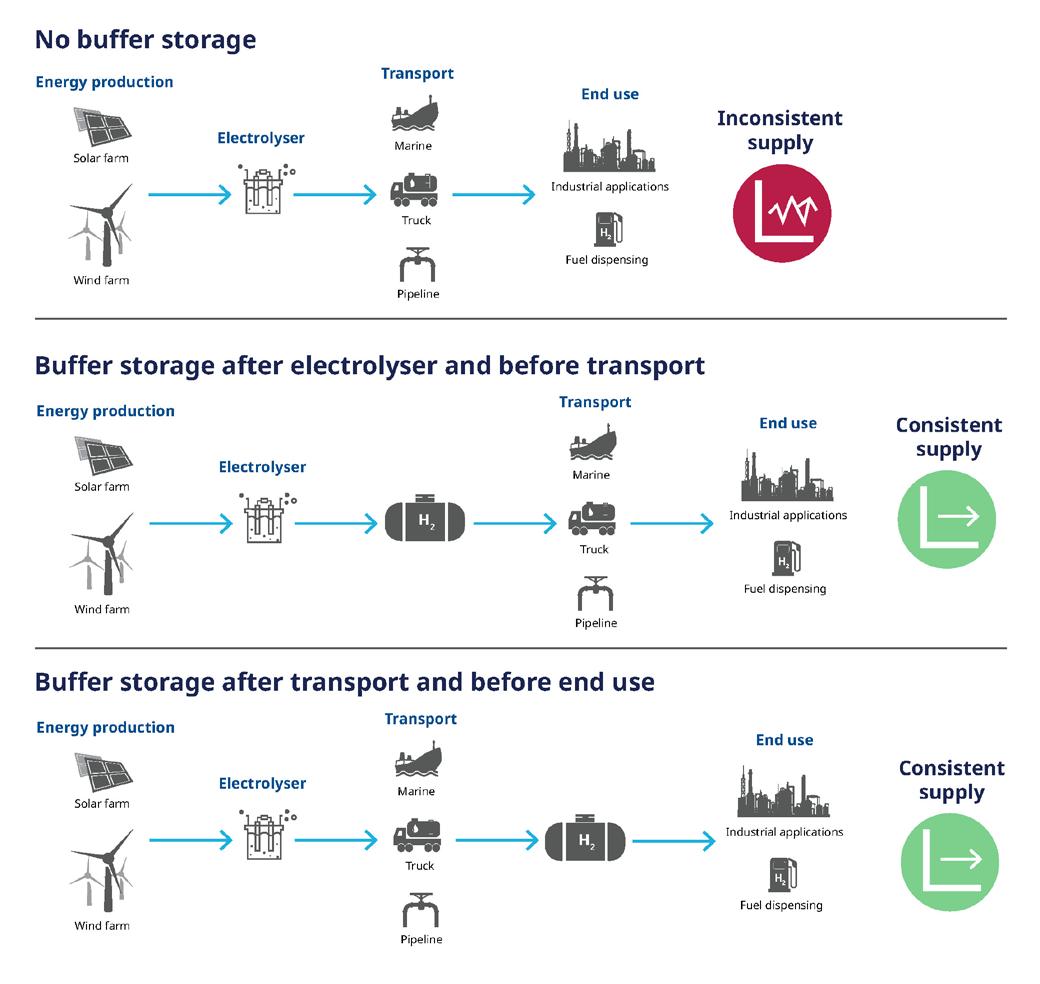

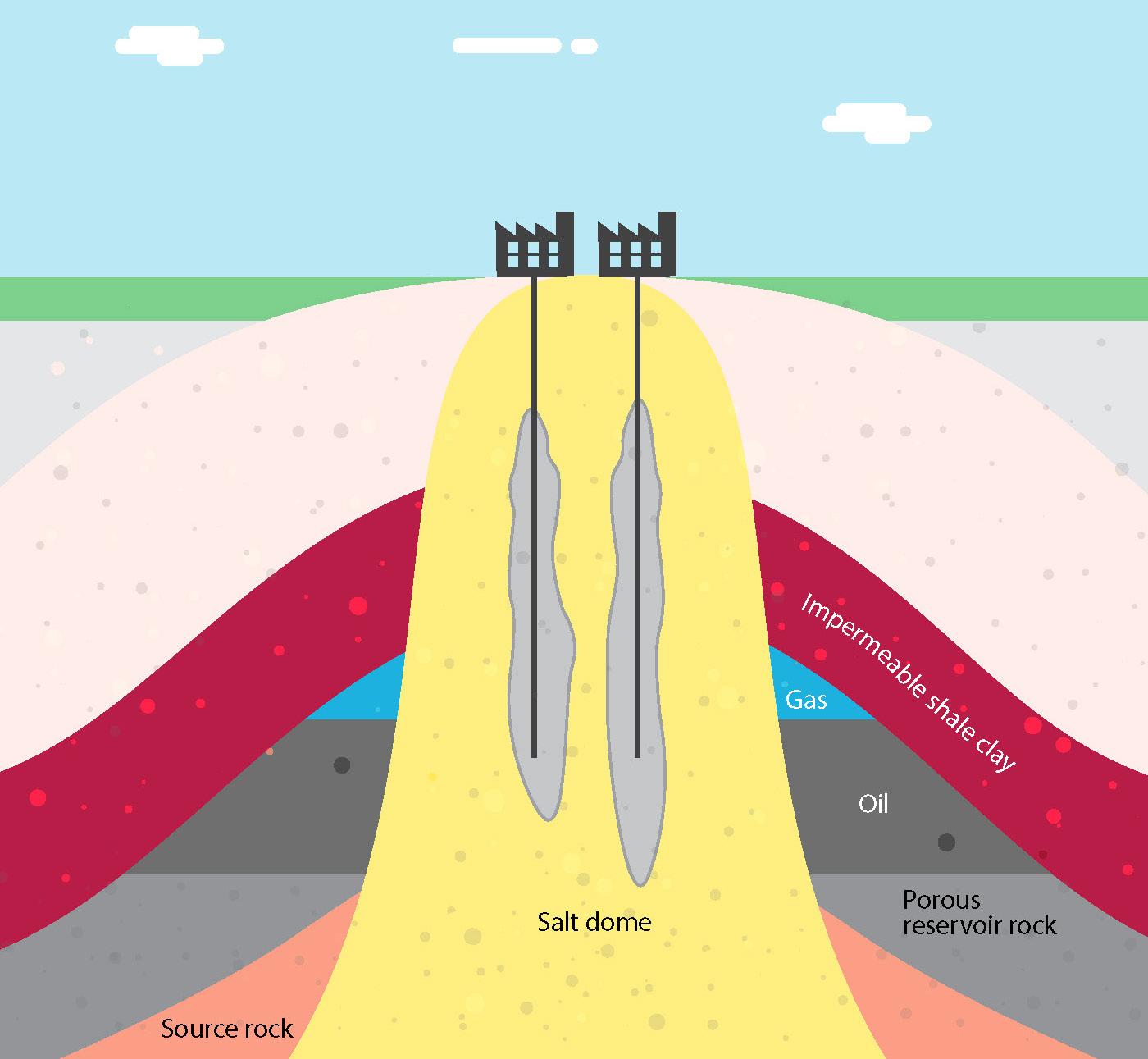

Hydrogen storage

Many hydrogen applications also require storage. Depending on the operation of the electrolyser and end use, storage can range from short-duration buffering to long-duration

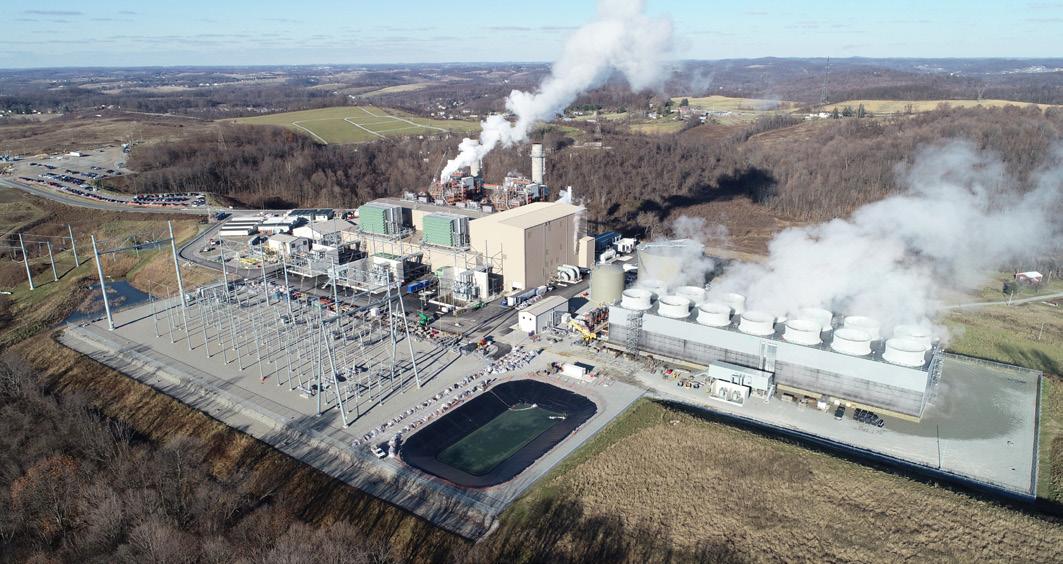

Figure 1. Combined cycle power plant.

bulk storage, with hours to weeks of hydrogen stored. Hydrogen is also being evaluated to provide seasonal and long-duration energy storage for certain applications. Hydrogen storage should always be located outside if possible to mitigate risks associated with a leak. While alternative storage methods exist (e.g., metal hydride, geophysical storage, liquefied hydrogen, liquid organic hydrogen carriers, etc.), high-pressure gaseous hydrogen storage is typically the most common method for short term, low-quantity applications. Hydrogen compression and storage is typically included in project design to ensure enough hydrogen is available for use. Finite element analysis should be conducted by the storage equipment manufacturer with input from the project team on pressure cycle duration, frequency, and amplitude to better ensure safe operation for the life of the project. While typically hydrogen systems in buildings should be avoided, if compressors are installed indoors or inside enclosures, these areas should be properly ventilated. If compressors are located outdoors under a canopy or another form of weather protection, the covering should be properly sloped to avoid accumulation of hydrogen. Compressor equipment should be equipped with leak and flame detection that is integrated into the plant control system.

A hydrogen leak from storage poses a safety hazard because hydrogen is frequently stored at high pressures and in quantities that present the risk for a sustained release and creation of a hazardous environment. Pressurised hydrogen leaking from storage or downstream piping and components diffuses rapidly and turbulently and can easily ignite, resulting in a jet fire. Hydrogen jet fires are not visible in daylight and have low radiant heat, so may impinge on personnel, equipment, or other exposures initially undetected. Large, unignited releases can form a hydrogen plume which can later ignite, producing a deflagration or detonation. The fire and resulting pressure wave from the deflagration or detonation can cause harm to personnel, equipment, or other exposures.

NFPA 2 has developed guidelines for separation of gaseous hydrogen storage from different types of exposures. Exposures include people, equipment, property, and property characteristics. Gaseous hydrogen storage is classified as non-bulk storage when the quantity of hydrogen stored is less than 5000 ft3, and bulk storage when greater than or equal to 5000 ft3 6 NFPA 2 also considers whether the hydrogen is located indoors or outdoors.

In NFPA 2, bulk storage exposures are organised as Group 1 through 3 exposures, with separation distances applied to each group. These distances were developed by determining the distance at which the maximum allowable radiant heat flux criteria for the exposure group was met for an ignited hydrogen jet, along with other criteria. Pressure and the diameter of piping upstream of the source valve are considered as these parameters impact the size of the hydrogen jet in a leak scenario. Separation distances can be reduced for certain exposures by placing a barrier between the storage and the exposure.

While NFPA 2 is an important resource in hydrogen system design, it is not all encompassing, and siting of hydrogen storage should also consider best practices, and other requirements as prescribed in local codes and standards and/or by the local authority having jurisdiction (AHJ). Some examples of engineering best practices and other safety considerations include:

y During operation of the storage system, there will be pressure cycling when loading and unloading the hydrogen. Pressure cycling can lead to premature fatigue and failure of the