Summer 2024

Capture up to 99% of your low-carbon hydrogen production emissions.

Unleash your full blue potential.

With our new ATR technology powered by Casale and Technip Energies expanding our extensive range of proprietary SMR technologies, BlueH₂ by T.EN™ now delivers tailored, largecapacity, ultra-blue solutions with up to 99% emissions capture.

Unleash low-carbon hydrogen at any scale or type of plant with minimum carbon footprint for the lowest levelized cost now.

technipenergies.com

03 Comment

04 First mover problem delays US progress

Geoff Tuff, Deloitte Consulting LLP, explains some of the holdups in the US clean hydrogen economy and how companies can begin moving forward.

11 Hydrogen innovation odyssey: from business model to technology

Florence Carlot, Arthur D. Little, Belgium, outlines why harnessing innovation will boost the potential of the green hydrogen economy.

17 No easy switch

Krzysztof Koziol, Cranfield University, UK, discusses the challenges associated with the switch to zero-carbon fuels and the importance of material research in the energy transition.

21 TRL: turbomachinery readiness for liquefaction

Daniel Patrick, Atlas Copco, USA, considers the technology readiness level of turbomachinery for large-scale hydrogen liquefaction.

27 Methanol-to-hydrogen for distributed electrical power generation

Dave Edlund, Element 1 Corp., outlines the potential of methanol-to-hydrogen generators in the development of the hydrogen economy.

32 The evolving future of hydrogen transport

Laura Chemler, Emerson, USA, explains some of the challenges related to delivering hydrogen where and when it is needed.

37 Real-time quality measurement

Antonella Colucci, Endress+Hauser, Germany, explores the importance of optical analysis technologies in safely and reliably determining hydrogen purity.

41 Mitigating embrittlement, maximising safety

Specifying the right components for fluid and fuels systems can aid proper function and protect operators and the environment from accidental gas leaks. Buddy Damm, Swagelok, presents hydrogen handling best practices.

45 Accelerating hydrogen mobility in Wales

Allan Rushforth, First Hydrogen, UK, explains what the creation of a hydrogen vehicle ecosystem with gas distribution network, Wales & West Utilities (WWU), means for hydrogen mobility.

50 Advancing sustainable construction

Mathias Kurras, Maximator Hydrogen, Germany, explores the use of hydrogen as a fuel for construction machinery and the role of mobile hydrogen refuellers on construction sites.

53 Pioneering sustainable aviation

Ekaterina Skorobogatova and Kai Murtagh, Aerodelft, the Netherlands, discuss the steps that a student team is taking to pioneer the development of hydrogen-powered aircraft.

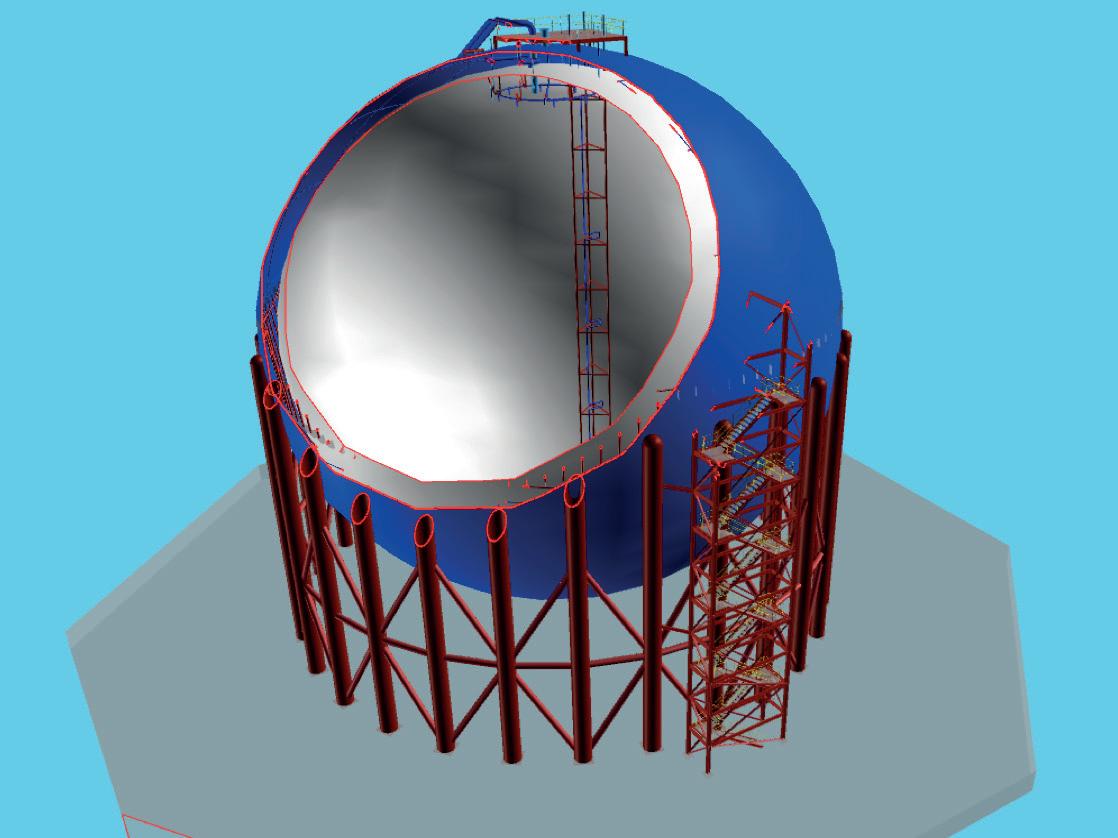

57 Another bite of the energy elephant

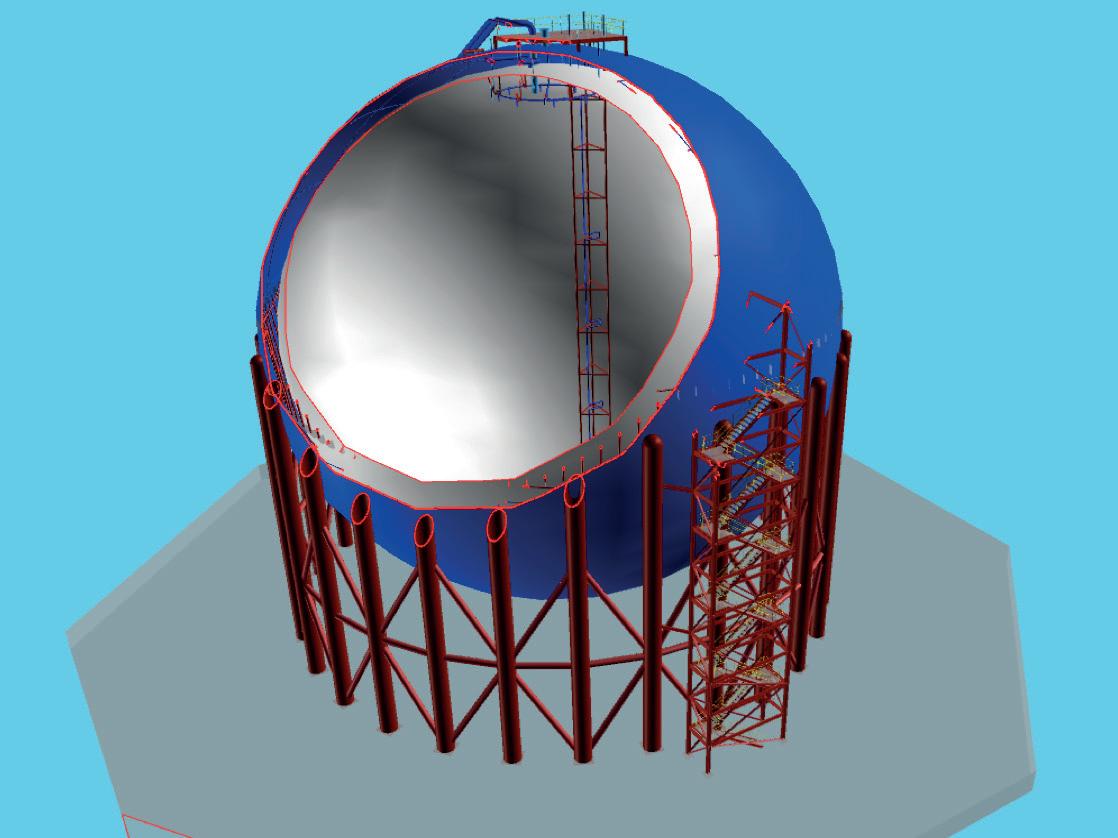

Greg Arnold, Whessoe Engineering Ltd, UK, discusses the transition to a hydrogen economy and important design considerations for large-scale liquid hydrogen storage.

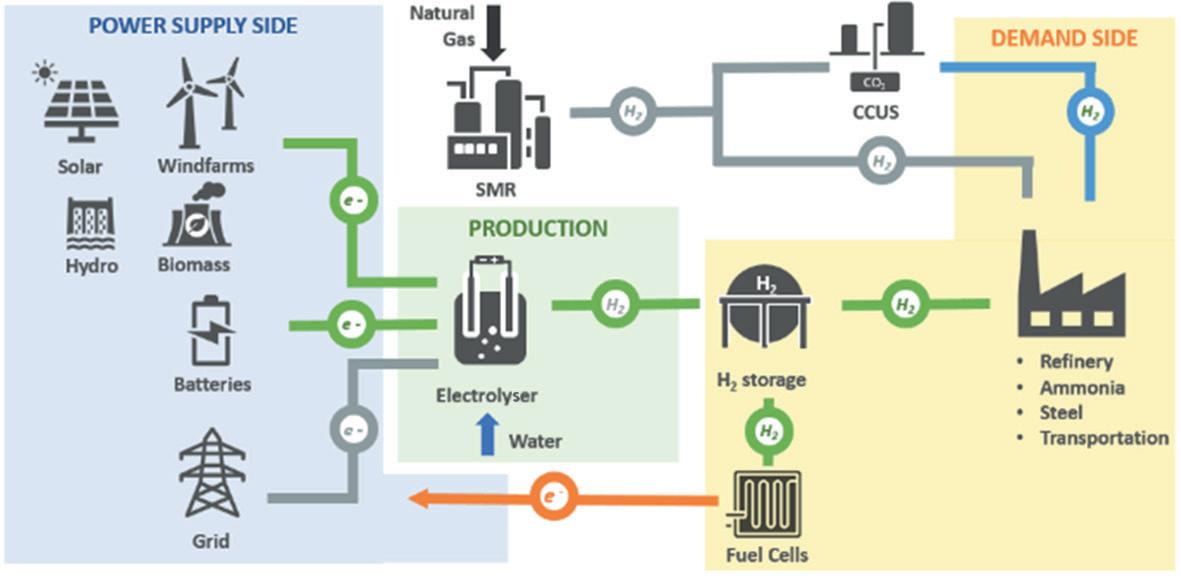

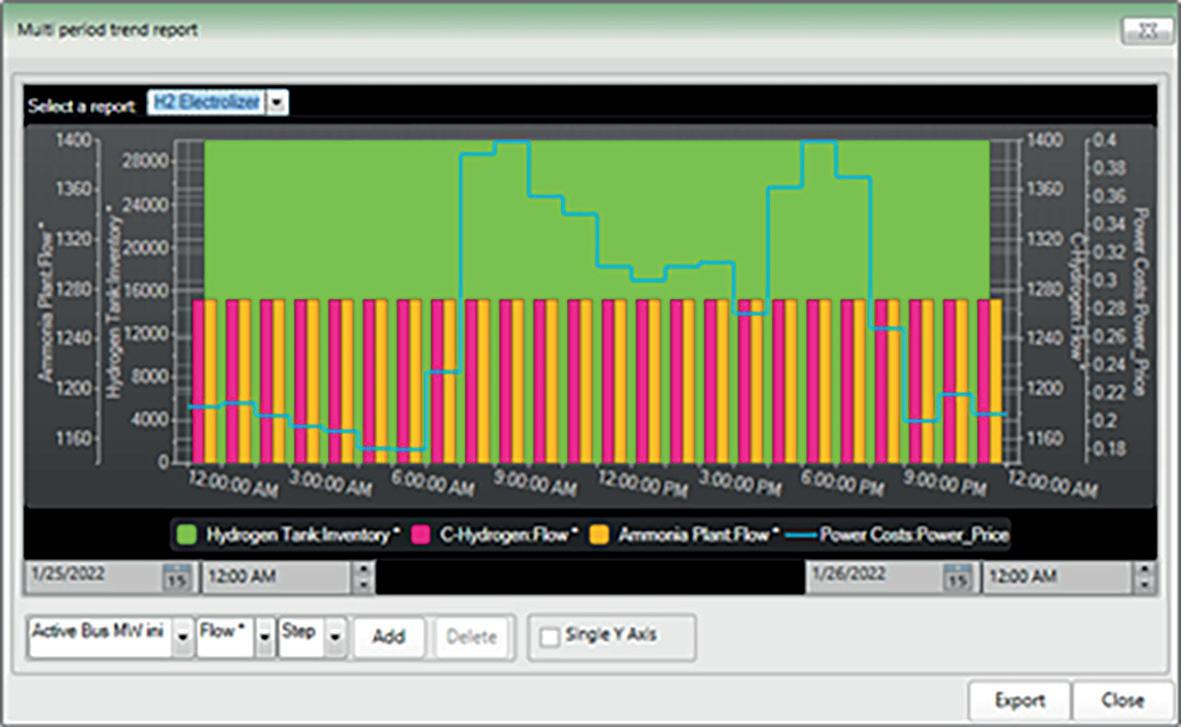

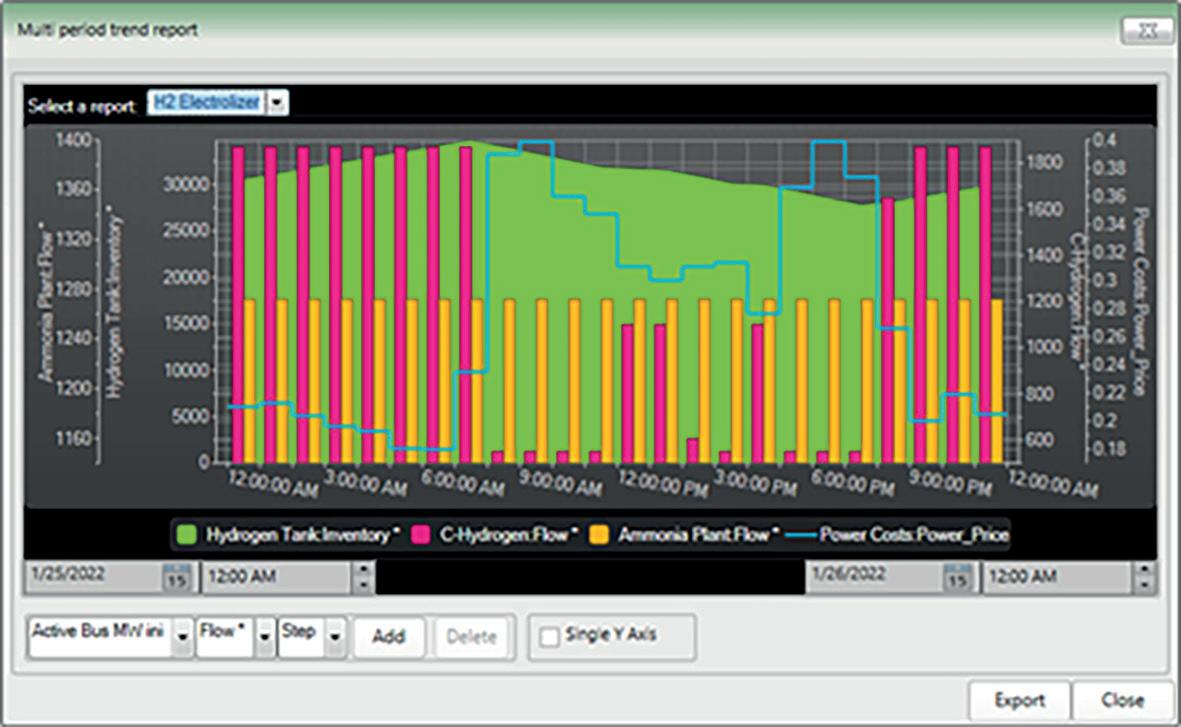

61 Decarbonising the energy ecosystem

Juan Ruiz, Carlos Ruiz and Michelle Wicmandy, KBC (A Yokogawa Company), explain the real-world impact of energy management systems for green hydrogen on cost, emissions, and efficiency.

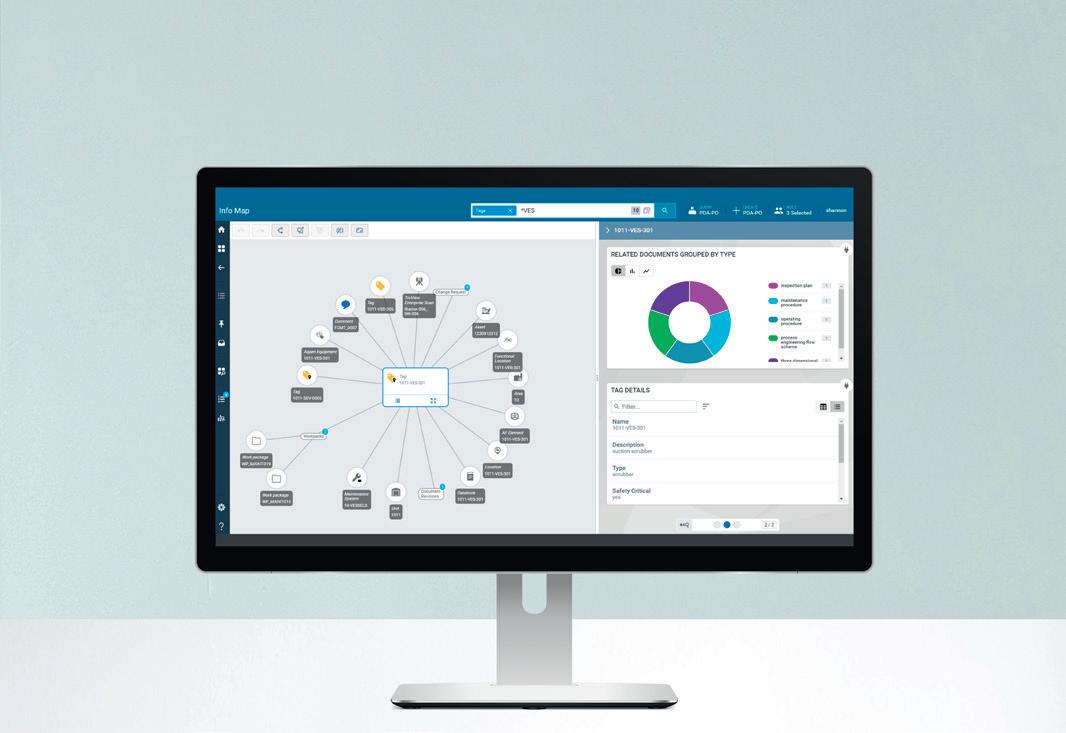

67 Less risk, more reward

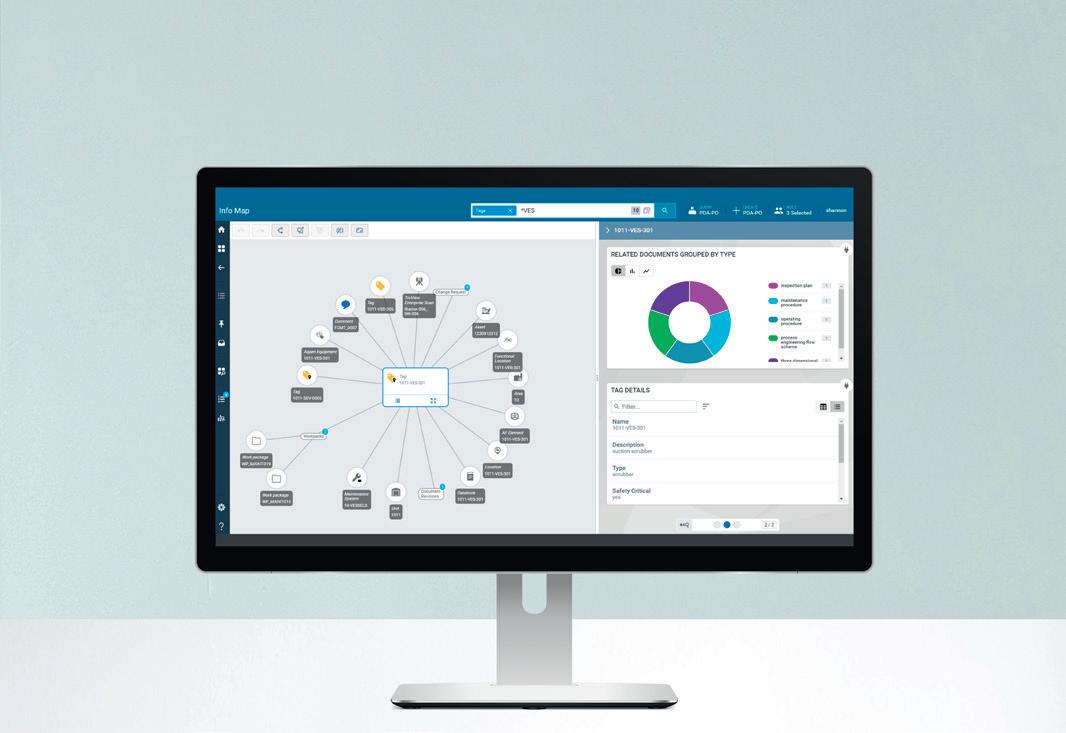

Peter Wilson, Hexagon, considers four key ways digital technologies can help de-risk green hydrogen projects

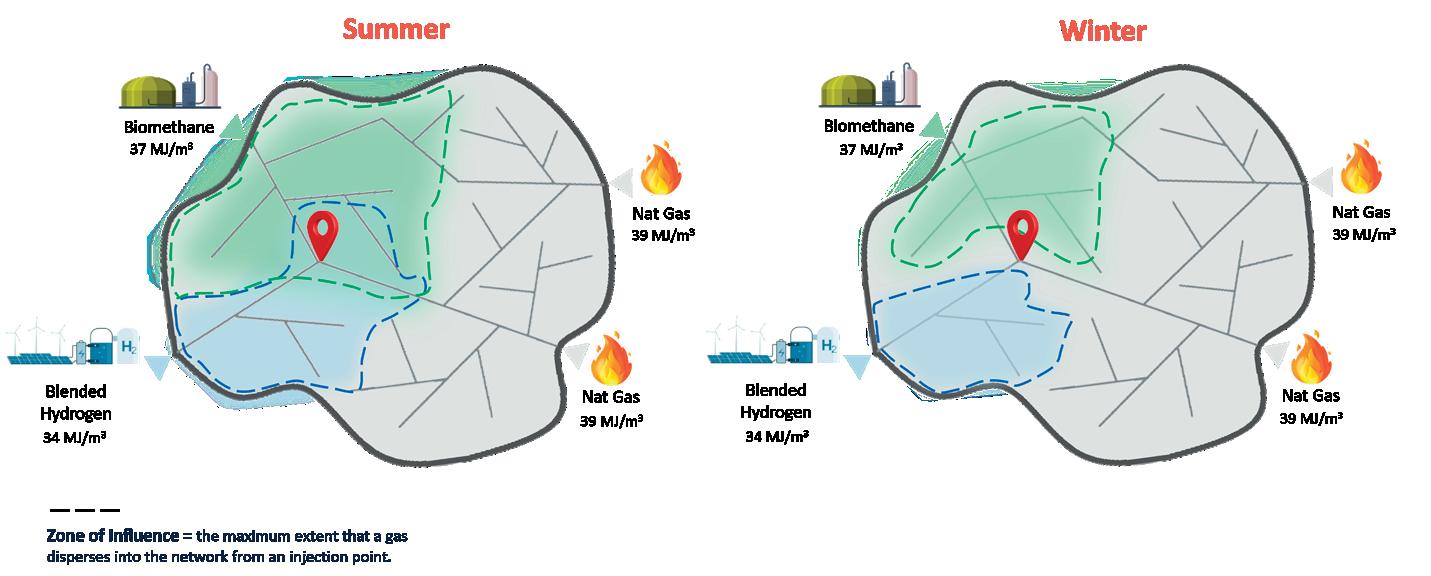

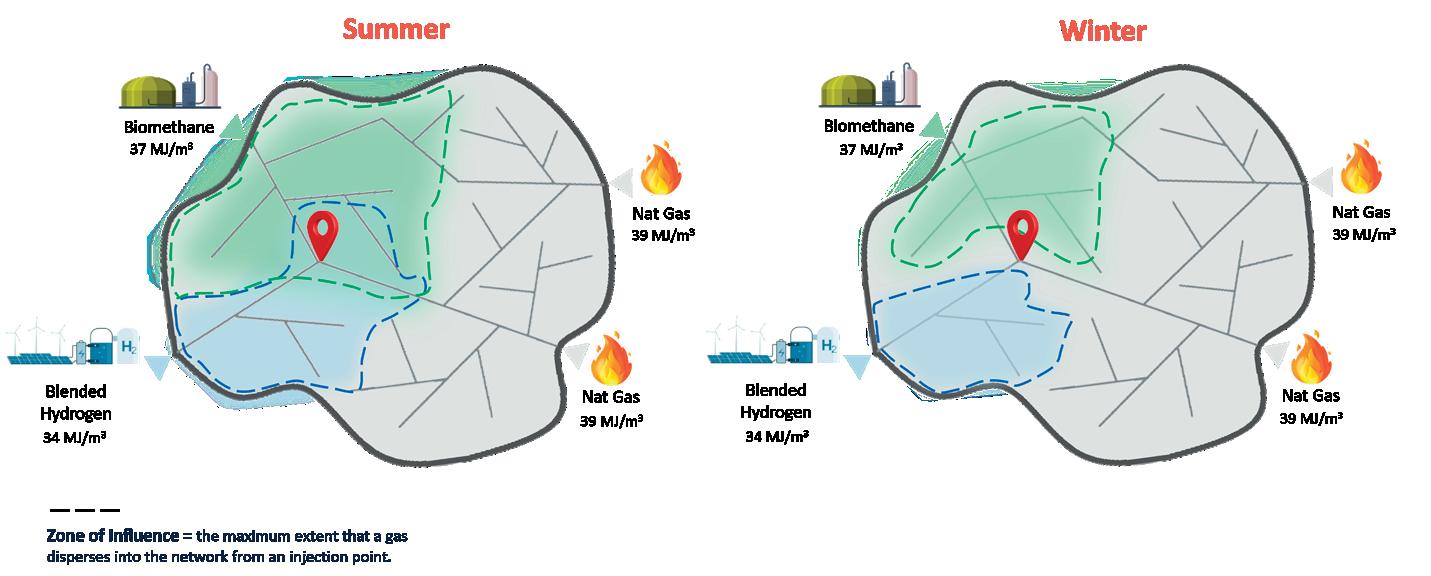

71 Future-proofing the UK’s gas data system

John Elsegood, Xoserve, UK, outlines how the UK’s gas network will have to adapt for use with hydrogen and alternative fuels in order to reach net-zero goals.

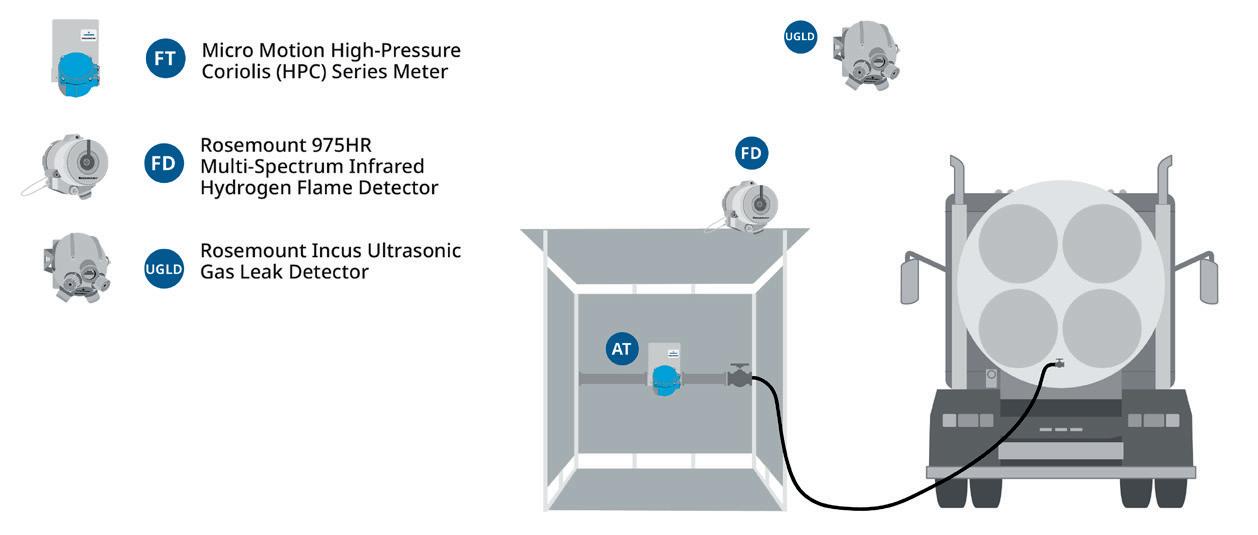

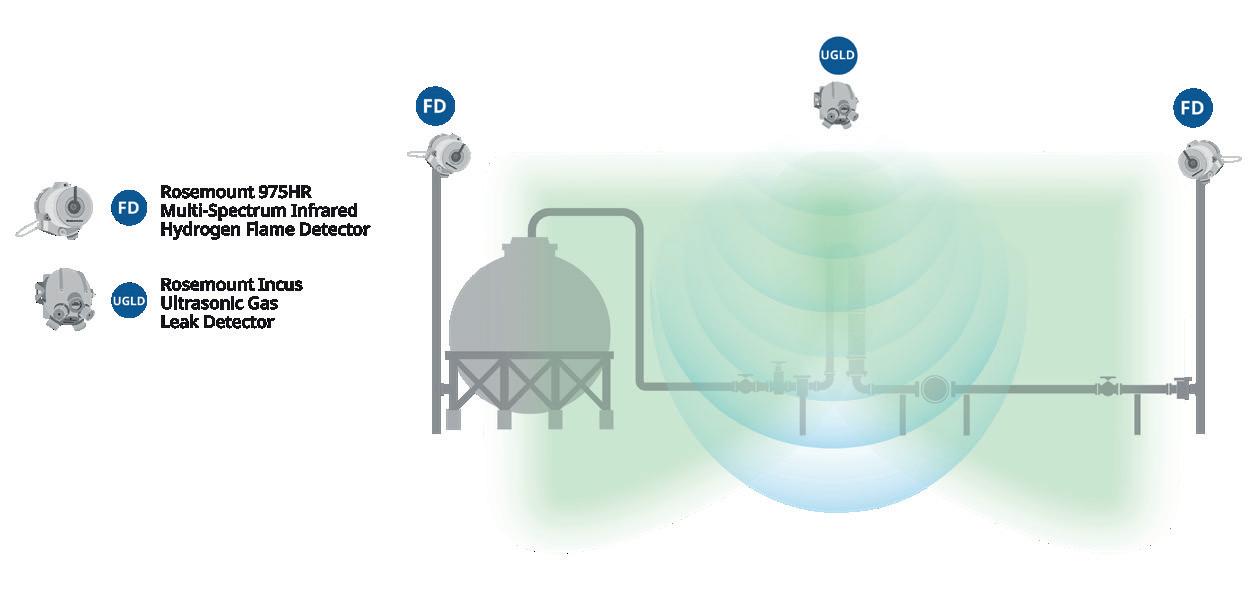

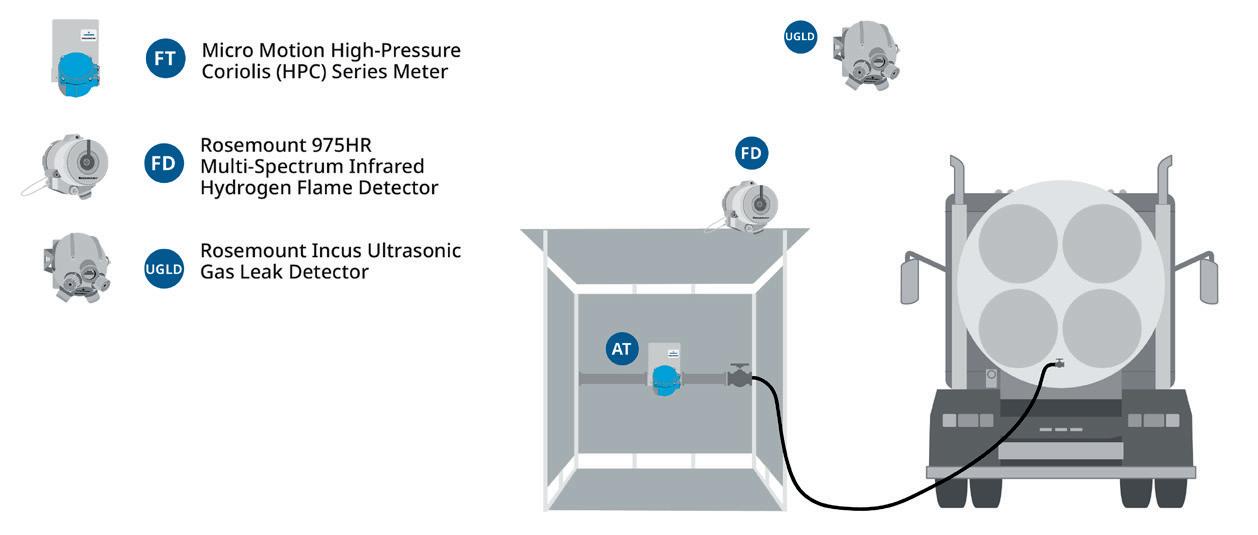

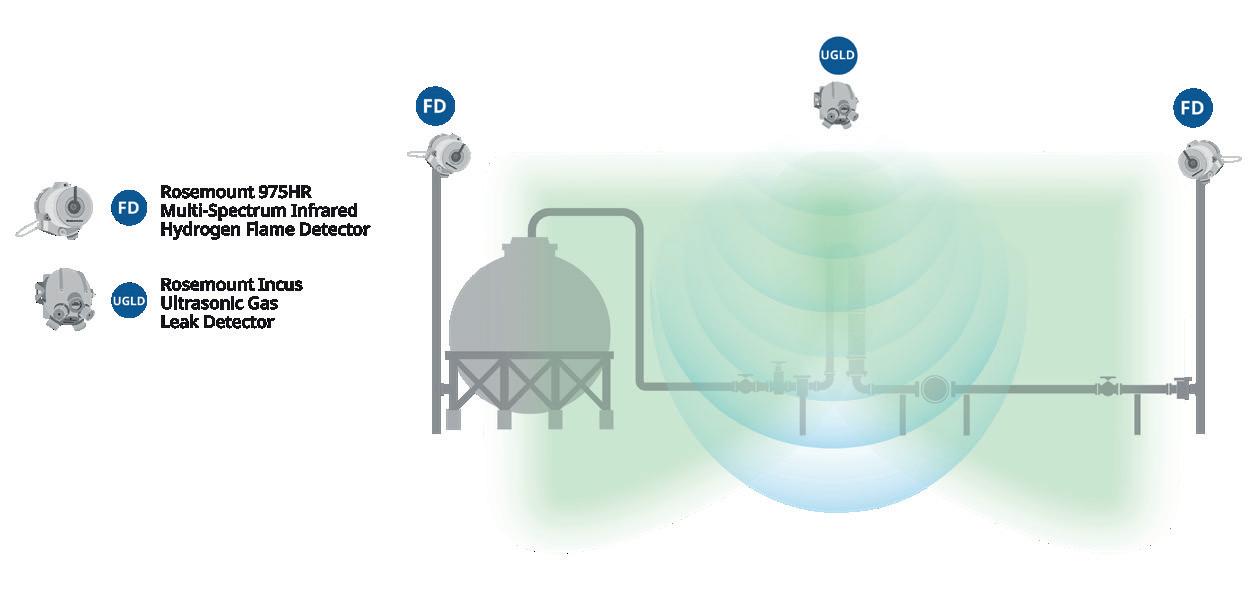

Emerson has decades of hydrogen industry experience providing advanced solutions crucial for hydrogen production, transportation, storage, and distribution. As a global technology and software company, Emerson offers innovative solutions for various end markets, helping process, hybrid, and discrete manufacturers optimise operations, protect personnel, reduce emissions, and improve sustainability.

Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK.

Join the conversation @HydrogenReview like join Global Hydrogen Review @Hydrogen_Review follow Summer 2024 Volume 3 Number 2 ISSN 2977-1927 CBP019982

The case for blue hydrogen is clear. Topsoe is ready to help you scale up and bring emissions down using natural gas resources. Achieve the lowest energy consumption to ultralow carbon intensity hydrogen with Topsoe’s industry-leading SynCOR™ autothermal reforming technology and integrated carbon capture. Find out how: topsoe.com/bluehydrogen MORE BUSINESS LESS CARBON NATURAL GAS, FUTURE READY.

Callum O'Reilly Senior Editor

Callum O'Reilly Senior Editor

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Callum O'Reilly callum.oreilly@palladianpublications.com

Editorial Assistant Poppy Clements poppy.clements@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Chris Atkin chris.atkin@palladianpublications.com

Sales Executive Sophie Birss sophie.birss@palladianpublications.com

Production Manager Kyla Waller kyla.waller@palladianpublications.com

Events Manager Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Admin Manager Laura White laura.white@palladianpublications.com

2024 has been touted as the ‘year of elections’, with more than 50 countries around the world taking to the polls. As I write this, the results are just coming in from the general election in India, where Narendra Modi’s Bharatiya Janata Party (BJP) has lost its parliamentary majority, forcing the Prime Minister to negotiate with coalition partners in order to return to power. Although the result was a shock – Modi’s party had been expected to win by a landslide – the BJP has sufficient support from its political allies to form a majority government. This is potentially good news for the country’s hydrogen sector, as it should ensure the continuation of the BJP’s ‘National Green Hydrogen Mission’, which aspires to position the country as a global hub for green hydrogen production, utilisation and export. The mission targets a green hydrogen production capacity of 5 million tpy, as well as the addition of 125 GW of renewable energy capacity, by 2030. This will result in the abatement of nearly 50 million tpy of greenhouse gas emissions by the end of this decade.

Turning our attention from the world’s most populous country to the world’s most powerful economy, election season is also heating up in the US. A potential Trump presidency could have significant implications for the country’s green hydrogen sector, if his administration chooses to prioritise traditional energy as it did during his first term in office (in the run-up to this election, Donald Trump has summarised his energy policy with the slogan “drill, baby, drill”). During his previous term, Trump also rolled back a number of environmental regulations. His re-election would leave question marks surrounding Joe Biden’s signature Inflation Reduction Act (IRA), which includes substantial incentives for clean energy and hydrogen projects. Although a full repeal of the IRA is unlikely due to significant investments in Republican states, it remains to be seen what aspects of the policy would be at risk under a Trump presidency.

Meanwhile, here in the UK, a shock summer general election was called for 4 July. Both of the country’s main political parties have made the transition to renewable and low carbon sources of energy a key part of their pitches to voters. However, if opinion polls are to be believed, it is likely the UK will have a new Labour government in power following the election, and the party has pledged to set up a publicly-owned company, Great British Energy, to invest in clean and renewable energy. As part of this plan, the Labour party has said that it will double the current government’s target on green hydrogen, with 10 GW of production for use in flexible power generation, storage and industries like green steel.

Editorial/advertisement offices: Palladian Publications

15 South Street, Farnham, Surrey GU9 7QU, UK

Tel: +44 (0) 1252 718 999 www.globalhydrogenreview.com

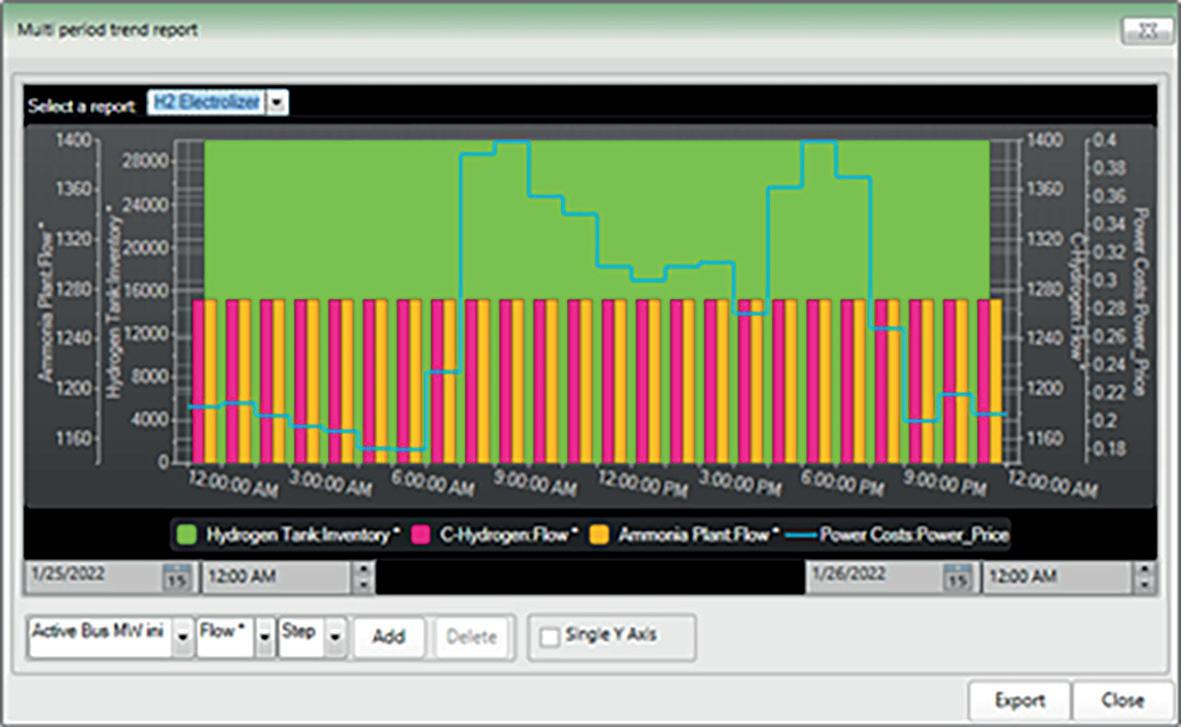

This issue of Global Hydrogen Review includes a regional report from Deloitte Consulting exploring the US clean hydrogen economy, as well as a number of articles looking at current hydrogen initiatives in the UK. On p. 45, First Hydrogen details the results of a trial to create a hydrogen vehicle ecosystem in Wales, while Xoserve considers how to future-proof the UK’s gas data system (starting on p. 71). This issue also includes an interesting article written by Krzysztof Koziol, Professor of Composites Engineering and Head of Composites and Advanced Materials Centre at the UK’s Cranfield University. This piece details some of the university’s work into material research and development for a future hydrogen economy.

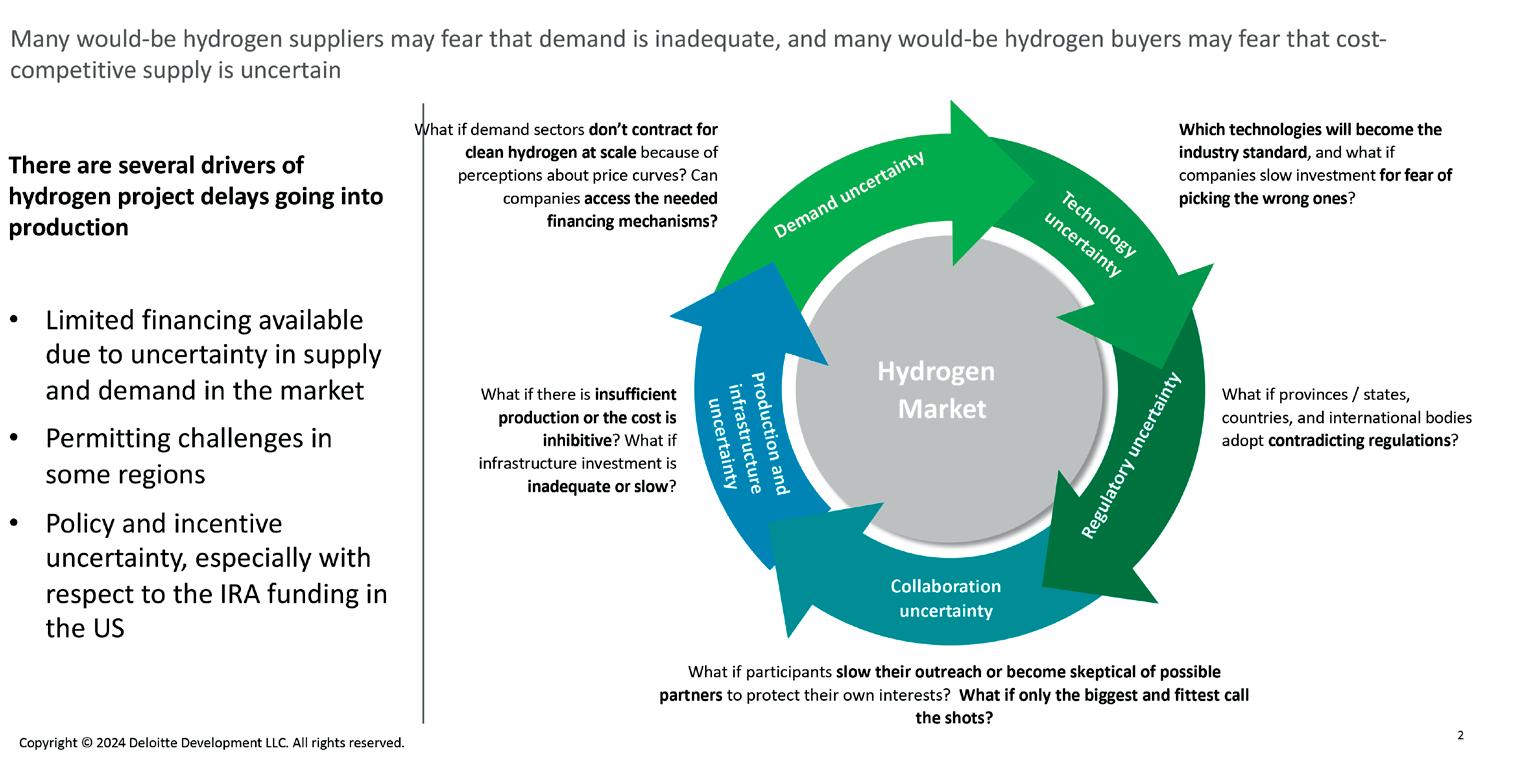

Geoff Tuff, Deloitte Consulting LLP, explains some of the holdups in the US clean hydrogen economy and how companies can begin moving forward.

With climate effects and reports ever more alarming, US government and industry are moving forward with decarbonisation initiatives based, in part, on low-carbon hydrogen. The programmes are backed by funding, attention, and current policy initiatives. But there is still far to go before functioning markets emerge.

Thus far, US climate efforts have largely focused on electrification and adding renewable energy to power grids; solar and wind power are expanding even in states that traditionally promote and produce fossil fuels. At a consumer level, electric vehicle production, sales, and use have drawn the lion’s share of coverage. Only recently has much attention turned to the thorny problem of decarbonising so-called

hard-to-abate industries, collectively responsible for the majority of greenhouse gas emissions: aviation, chemicals, steel, heavy transport, and food. And that has contributed to making hydrogen a major part of the conversation about how to move forward.

US industry currently uses hydrogen extensively, primarily in oil refining and ammonia production. But production is predominantly grey – dirty and energy-intensive, powered by fossil fuels – rather than blue, green, pink, turquoise, or other types of lower-emissions production. While many see green hydrogen (producing the element by electrolysis using renewable energy) as the ideal, the ultimate goal is, simply, producing affordable low-carbon hydrogen at scale, no matter the method or colour.

4

A US hydrogen market

The US has lagged behind Europe and India in initiating low- and zero-carbon projects, and that should change: to help slow further climate impacts, government and industry have roles to play in creating a functioning US hydrogen market as soon as possible. Deloitte anticipates that achieving global climate neutrality by 2050 requires a clean hydrogen market producing 170 million t of equivalent hydrogen in 2030 and 600 million t of equivalent hydrogen in 2050, with North America playing a major role as both exporter and user. Globally, Deloitte anticipates the clean hydrogen market growing rapidly and steadily, from US$642 billion in annual revenue in 2030 to US$1.4 trillion in 2050.

5

But creating a market in the US, with its extensive industrial and heavy transportation industries built on fossil fuel infrastructure, requires overcoming more challenges than in some other nations. So, in an effort to help catch up or even leapfrog other regions, the US government has put forth various decarbonisation incentives: for consumers considering solar panels or electric vehicles, for companies willing to invest in reducing their production’s carbon footprint, and for public and private organisations looking to be the foundation of a clean hydrogen market.

Toward a national network

In October 2023, the US Department of Energy (DOE) advanced its Regional Clean Hydrogen Hubs Program by announcing that seven regional hubs – out of 79 original applicants – had been selected to work toward creating functional markets and, eventually, form a nationwide network. The hubs, authorised by the 2021 Federal Infrastructure Investment and Jobs Act, each use a unique blend of energy sources – from renewables to natural gas

with carbon capture – along with existing and new infrastructure; they will cover 17 states.

The goal: to catalyse US$40 billion in private investment and kickstart ‘a national hydrogen economy’, eliminating 25 million tpy of CO 2 emissions from end uses.

But in the months since the announcement, it has become clear the extent to which these regional hubs are very much works in progress. Project developers are still ironing out the details of working with the DOE, much less with other hubs or even other companies in their hubs. Companies and investors are waiting for further Treasury Department guidance and clarification on 45V hydrogen tax credits. With community benefits and equity key elements of the proposals and planning, developers will need to earn a ‘social licence to operate’, since the funding – up to US$1.2 billion per hub – is conditional on standards being met. (It is worth noting that some of the proposed hubs that the DOE programme did not select for funding are moving forward regardless, albeit subject to the same delays and hesitancy.)

Who will make the first move?

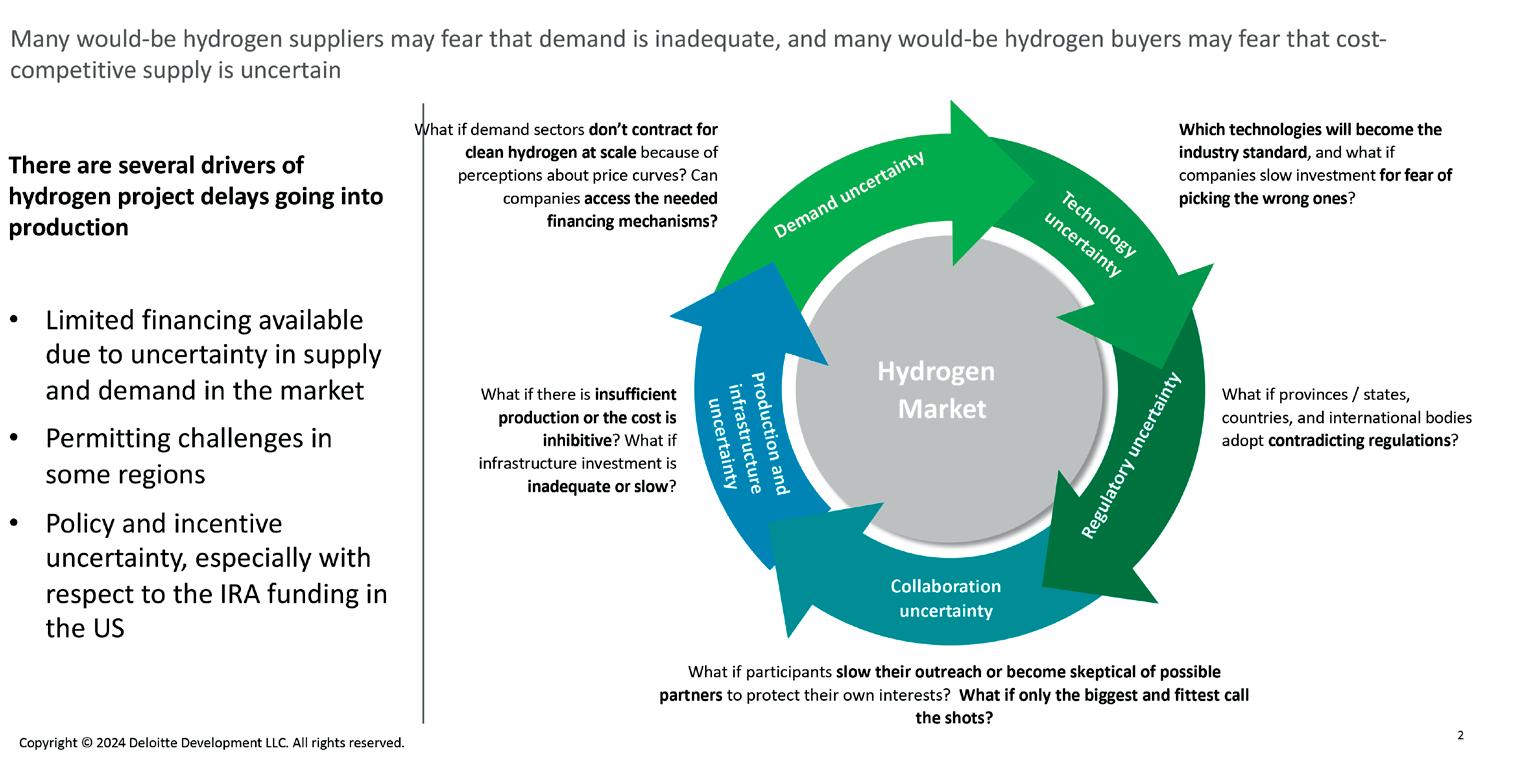

With enthusiasm, planetary urgency and funding pouring in, one might expect a national hydrogen economy to emerge imminently. It may not be that simple, as those that are part of a clean hydrogen market likely know. The difficulty is especially acute with regard to desirable green hydrogen, which is far more expensive than hydrogen produced using fossil fuels.

First-mover hesitancy is paralysing the system. Many companies are interested in developing low-carbon hydrogen supply, which at scale would bring down the price, but they cannot get funding for those capital projects until demand is certain. And with the price level still high, few, if any, will sign on to long-term uptake agreements at scale. With no one agreeing to purchase green hydrogen at scale, no manufacturer is yet producing it at scale. That is why a North American market does not currently

6 Summer 2024 GlobalHydrogenReview.com

Figure 1. Achieving clean hydrogen at scale requires advanced existing and new technologies.

Figure 2. The investment dilemma is rooted in five key uncertainties present in today’s clean hydrogen market.

Sustainable Solutions for Hydrogen Production

From site selection to technology processes, sustainable solutions play a critical role in the future of hydrogen production. Taking an integrated approach, Black & Veatch works with developers to plan, design and build systems that enable business growth while reducing carbon footprints and improving resilience. Scan to learn four water resiliency tips for hydrogen production.

exist – because, for practical purposes, neither does green hydrogen.

Hundreds of global capital projects in green hydrogen are in the works – production facilities, storage infrastructure, transportation, etc. – with upbeat announcements and updates. But virtually none of those projects have made it from the front-end stages to the final investment decision stage. No one is yet putting in the necessary capital, and without long-term commitments, banks are not approving construction.

Uncertainties do not end with supply and demand. Technologies are largely untested; regulations remain in flux. A working market system depends on factories churning out gigawatts of hydrogen capacity, and no such

factories are in operation. In short, the economics do not yet make green hydrogen bankable.

Making the maths work

The Inflation Reduction Act (IRA) attempts to shift the economics for clean hydrogen and other renewable energy generators and end-use products through a variety of incentives. The law aims to increase the supply of clean energy, encouraging producers with incentives for clean inputs at every stage, from the energy necessary to cleanly manufacture the infrastructure (electrolysers, etc.) to the transmission equipment. But for hydrogen production –green hydrogen in particular, which the IRA incentivises most – the momentum these tax credits have created is tempered by guidelines and restrictions that, pending further Treasury guidance, some in the industry see as somewhat stringent, but that many insist are necessary to ensure the hydrogen market actually reduces emissions.

The federal government is not the only entity working to promote clean hydrogen. At state level, California is explicitly making hydrogen part of its efforts to deploy statewide infrastructure for the entire range of zero-emission vehicles, creating what the

8 Summer 2024 GlobalHydrogenReview.com

Figure 3. Proposed rules for the 45V clean hydrogen production tax credit provide new guidance with significant considerations for green hydrogen production.

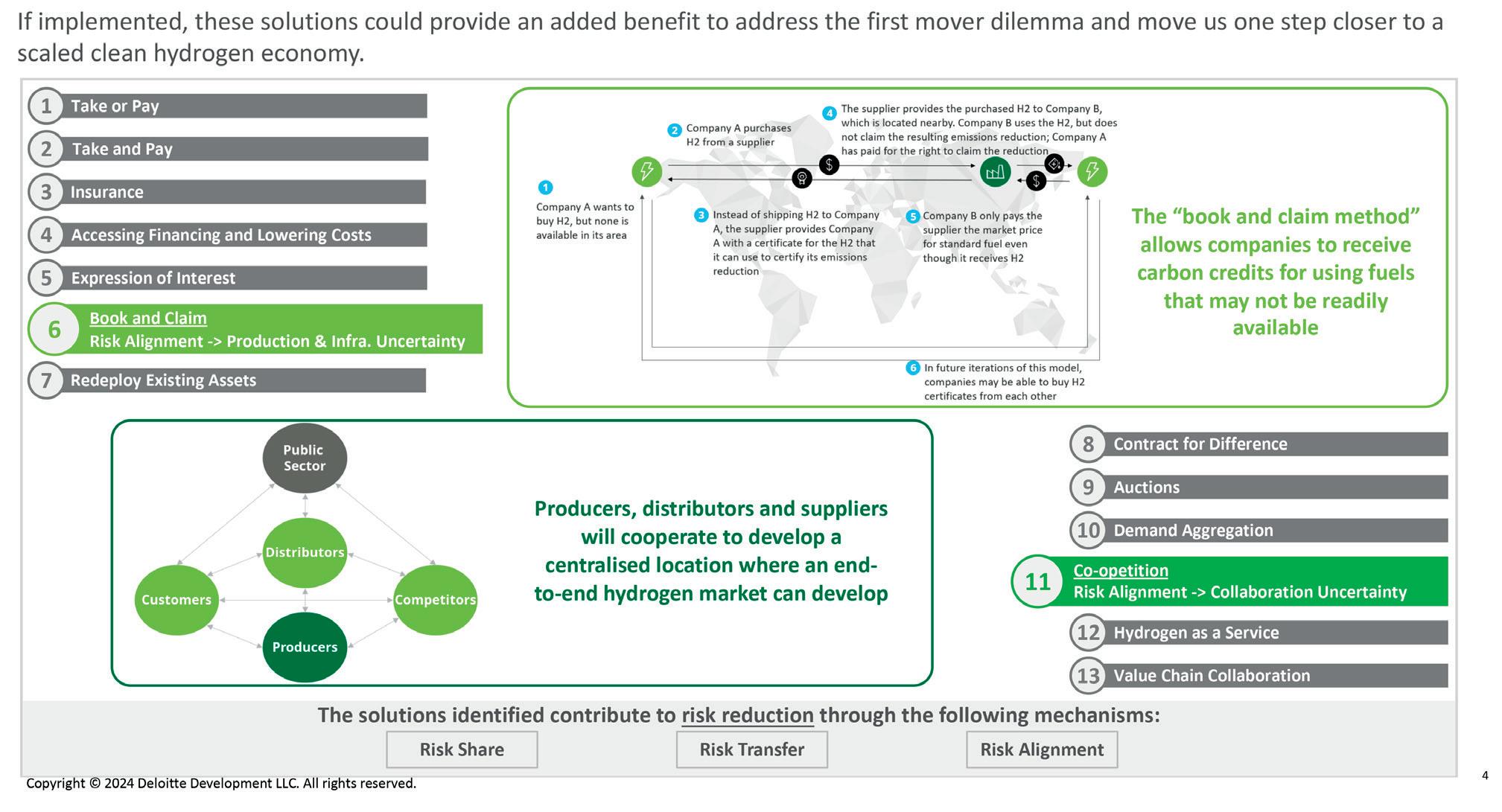

Figure 4. A collection of emerging business models to break the ‘chicken and egg’ problem.

The Emerson logo is a trademark and a service mark of Emerson Electric Co. © 2022 Emerson Electric Co. Choose Emerson as your trusted partner and advisor in the hydrogen industry. With the most comprehensive portfolio of control, isolation, relief valves, regulators, and actuators, we offer advanced solutions crucial for the success of blue hydrogen production. Go blue hydrogen. Learn more: Emerson.com/BlueH2Valves

California Energy Commission calls ‘the most extensive charging and hydrogen refuelling network in the country.’

The 2023-27 US$1.9 billion funding plan includes US$1 billion earmarked for zero-emission truck and bus infrastructure, covering vehicles powered by both battery-electric and hydrogen fuel cells. When green hydrogen fuel cells become available for buses and trucks ready for them, California drivers can expect to have refuelling sites.

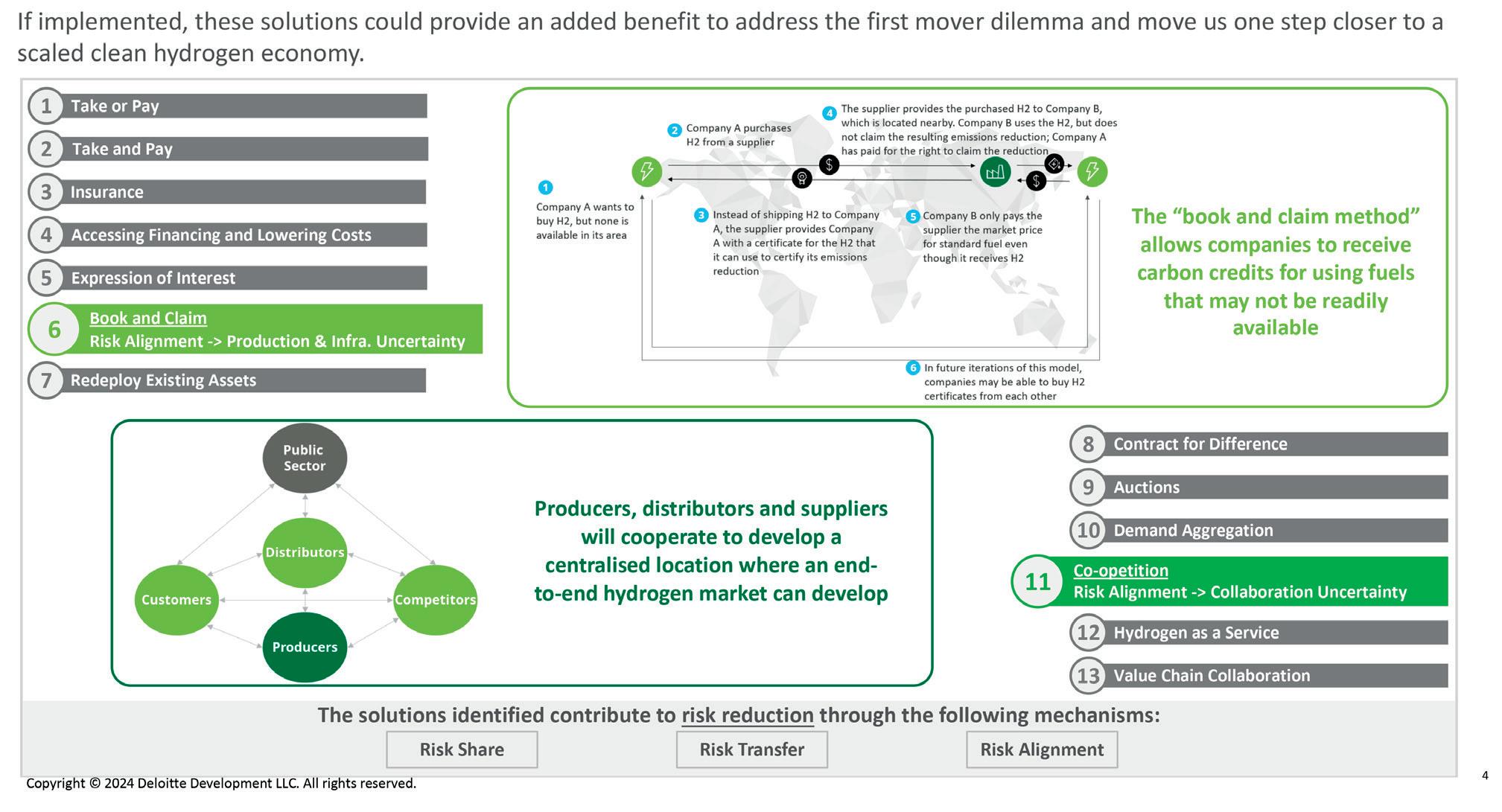

New business models

Forward-thinking US business leaders can move ahead with clean hydrogen – whether as a producer or a consumer, driving demand or supply – without allowing government incentives to show the way. The question is how to solve the first-mover (or, if you prefer, chicken-and-egg) problem: the fact that traditional investment and accounting models are waiting for prices to dramatically fall. That may take a while – the federal government is offering up to a US$3/kg incentive for hydrogen production, but even that might not adequately level the playing field.

But there may be a solution that could get market participants at least partway there. With companies already rethinking their business models as digital transformation and supply chain chaos force a reconsideration, leaders can look to a set of emerging business models as potential ways to introduce clean hydrogen into processes. If a handful of companies try different models with demonstrated success, other leaders

should recognise the possibilities of other viable ways to do business.

What’s next for US hydrogen?

New business models offer a path for corporate leaders to move forward while waiting for regional hubs to come online and markets to materialise. But a mindset shift for regulators and other policymakers whose work thus far prioritises and incentivises the production of zero-carbon green hydrogen should also be considered.

Realistically, even with new accounting methods, companies, industries, and government agencies are unlikely to be able to scale up green hydrogen quickly enough to decarbonise the hard-to-abate sectors as urgently as overall climate strategies demand. At a time of climate crisis, the ‘perfect’ should not be the enemy of the ‘good’; low-carbon hydrogen can make a huge difference. The regional hubs, some of which plan to use hydrogen made with carbon capture or nuclear power, are a step in the right direction.

Deloitte fully expects the US to eventually have a fully functioning clean hydrogen market as part of a global network, contributing strongly to efforts to decarbonise the planet. Until then, business and government leaders should consider moving forward as firmly as possible.

Bibliography

1. A full bibliography is available at https://www. globalhydrogenreview.com/hydrogen/01042024/first-moverproblem-delays-us-progress--bibliography/

from business model to technology

Florence Carlot, Arthur D. Little, Belgium, outlines why harnessing innovation will boost the potential of the green hydrogen economy.

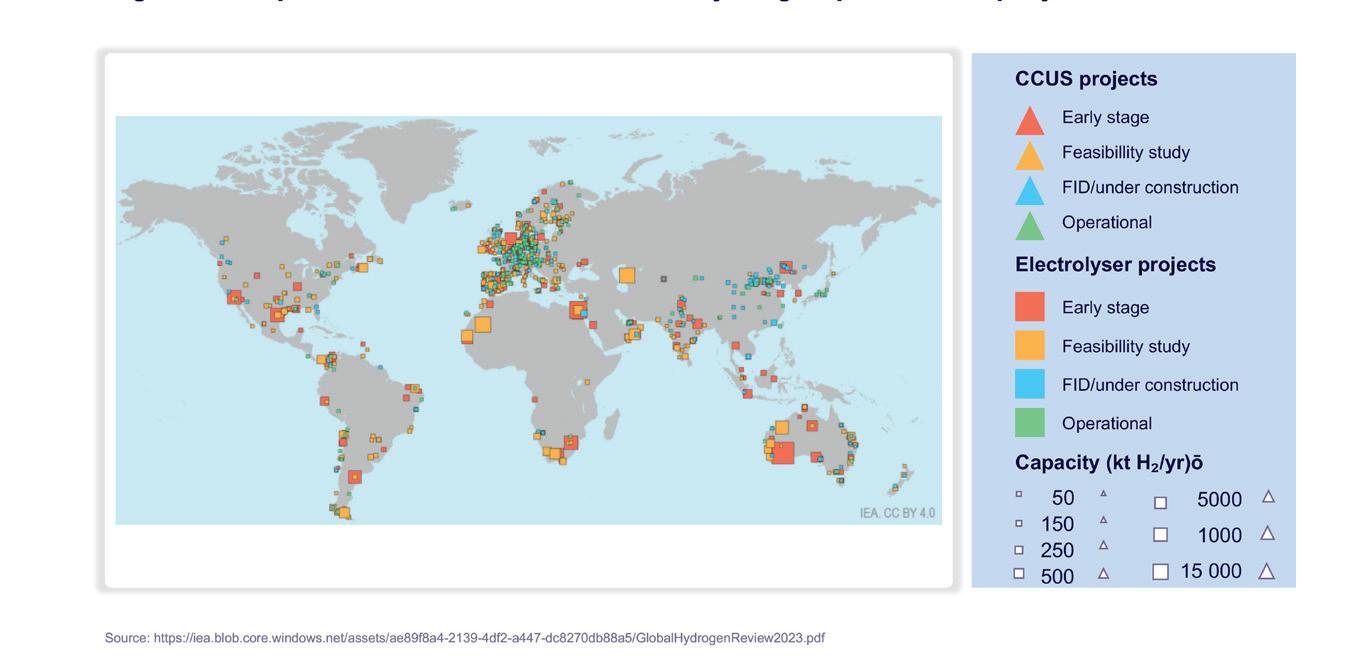

While global hydrogen use increased in 2022, green hydrogen still makes up less than 1% of total production volumes, according to the IEA.1

This leaves a mountain to climb – production will need to grow more than 100 times by 2030 to achieve the 2050 Net Zero Emission (NZE) scenario.

While there has been considerable interest in green hydrogen, it faces considerable challenges to its wider adoption. Innovation is therefore required across business models, technologies, financing, regulation, and cross-sector collaboration if hydrogen is to deliver on its potential to underpin progress to net zero emissions. Looking at these dimensions individually, how can innovation boost hydrogen development?

Transforming business models to drive demand at scale

Unlocking demand for green hydrogen is critical to driving greater downstream customer usage. While many green hydrogen projects have been announced or launched, the majority focus on dedicated participants, with demand concentrated on industry and refining, rather than delivering wide availability of green hydrogen to new applications and customers. The cost of building and maintaining infrastructure for customers remains a major hurdle to adoption.

Innovative new business models can help to overcome these challenges, particularly by harnessing leasing or service-based concepts to reduce upfront customer costs and stimulate demand.

11

These provide peace of mind, remove infrastructure overheads for customers and, importantly, enable them to meet pressing regulatory requirements to decarbonise.

Hydrogen-as-a-Service

For example, Hydrogen-as-a-Service (HaaS) models involve producers supplying green hydrogen as a fuel or feedstock, managing the end-to-end process without customers having to invest in infrastructure or build internal capabilities, and simply paying a fixed fee. This delivers greater customer confidence, flexibility, and scalability, and provides potential opportunities for customer-facing gas suppliers.

Demonstrating this approach, in transport, vehicle company Nikola is now producing hydrogen-powered trucks, while also supplying hydrogen to customers through its HYLA energy business. Working with partners including Renault, ACCIONA and SK Group, Plug Power is building an end-to-end green hydrogen ecosystem, from production, storage, and delivery to energy generation, offering customers a complete service around fuel cells for forklift trucks, stationary power, and on-road applications.

Power purchase agreements

Power purchase agreements (PPAs) provide a further approach to reduce risk and uncertainty, for both customers and suppliers as they deliver longer-term, fixed fee contracts. Traditionally used within the energy generation sector, they are now being applied to green hydrogen projects.

For example, Ørsted, a Danish renewable energy company, has signed a green PPA with fertilizer producer Yara to supply green hydrogen for ammonia production, using renewable energy from its offshore wind farms. However, given the current immaturity of green hydrogen technologies, prices are likely to drop over the medium-term, leading to a risk of PPA customers being locked in to higher, fixed costs.

Co-investment

Co-investment between customers and suppliers delivers a further business model option, with green hydrogen equipment built at a customer site/complex and excess production supplied to other nearby companies. This works particularly well in industrial clusters around ports linked to offshore renewable power grids.

Across all these options, players in the hydrogen ecosystem have to innovate their operations and offerings. This will require the development of new skills, capabilities, and structures to support a successful green hydrogen ecosystem.

Focusing on increasing technology maturity and lowering costs

Innovation is also required to bring down the cost and increase the efficiency of green hydrogen technologies across production, storage, transport, and applications.

Production technology

On the production side, electrolysers are mature as a technology but remain expensive in terms of capital cost, due to traditionally small production volumes and the rising cost of key materials such as iridium and platinum. Advances in the maturity of new electrolyser technologies, such as solid oxide electrolysis (SOEC) and anion exchange, should increase hydrogen production efficiency, while global manufacturing capacity for electrolysers grew by nearly 25% between 2021 and 2022 in reaction to increased demand. If all announced electrolyser production increases come to fruition, global capacity could reach more than 130 GW/yr by 2030 according to the IEA.

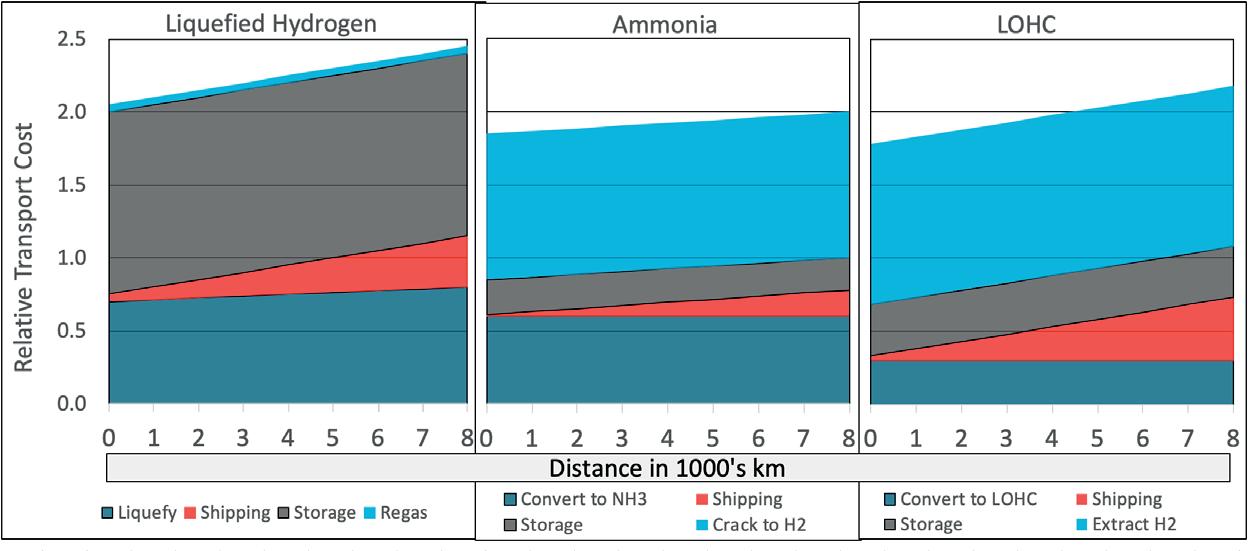

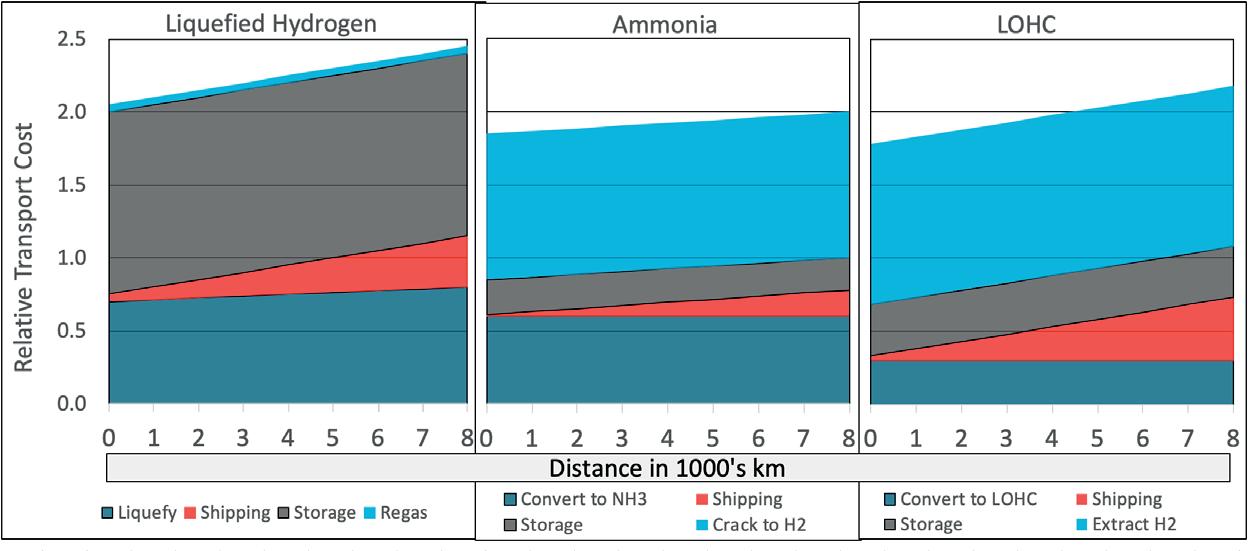

Storage and transport

Innovation is also required to optimise hydrogen storage and transport, particularly around the challenges of hydrogen’s low volumetric density and high risk of leakage at normal pressure/temperature conditions. Advances in areas such as cryocompressed hydrogen storage are required, along with scaling the use of liquid organic hydrogen carriers (LOHCs) such as ammonia for transport over long distances beyond pilots, especially when it comes to reducing

12 Summer 2024 GlobalHydrogenReview.com

Figure 1. Hydrogen production by technology, 2020 - 2022.

Figure 2. Map of announced low-emissions hydrogen projects.

Hydrogen Compression

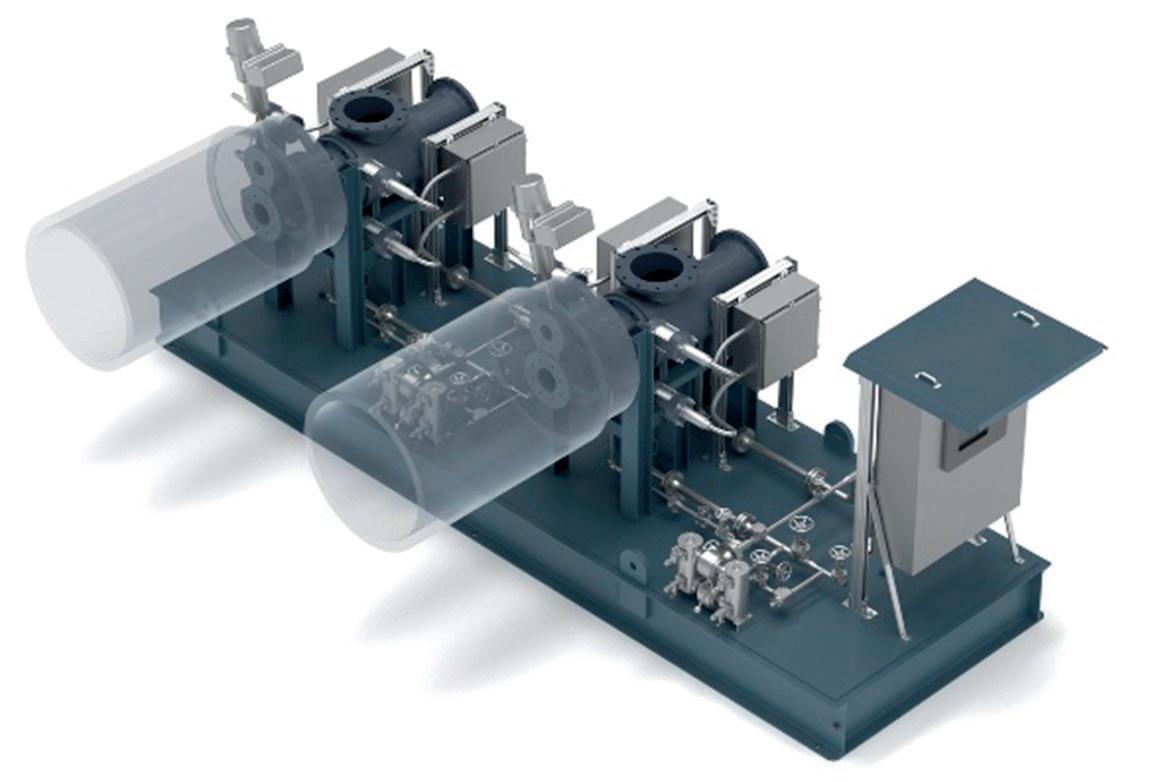

Elliott’s Flex-Op® Hydrogen Compressor features flexible, configurable, and economical compression options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Who will you turn to?

n Learn more at www.elliott-turbo.com

COMPRESSORS | TURBINES | PUMPS | GLOBAL SERVICE

Turn To Ebara Elliott Energy for operational flexibility in hydrogen applications.

transport costs. This would unlock the potential to create green hydrogen in regions with plentiful renewable energy (such as the Middle East, Australia, and Morocco) and then ship it cost-effectively to where it is required.

Application technology

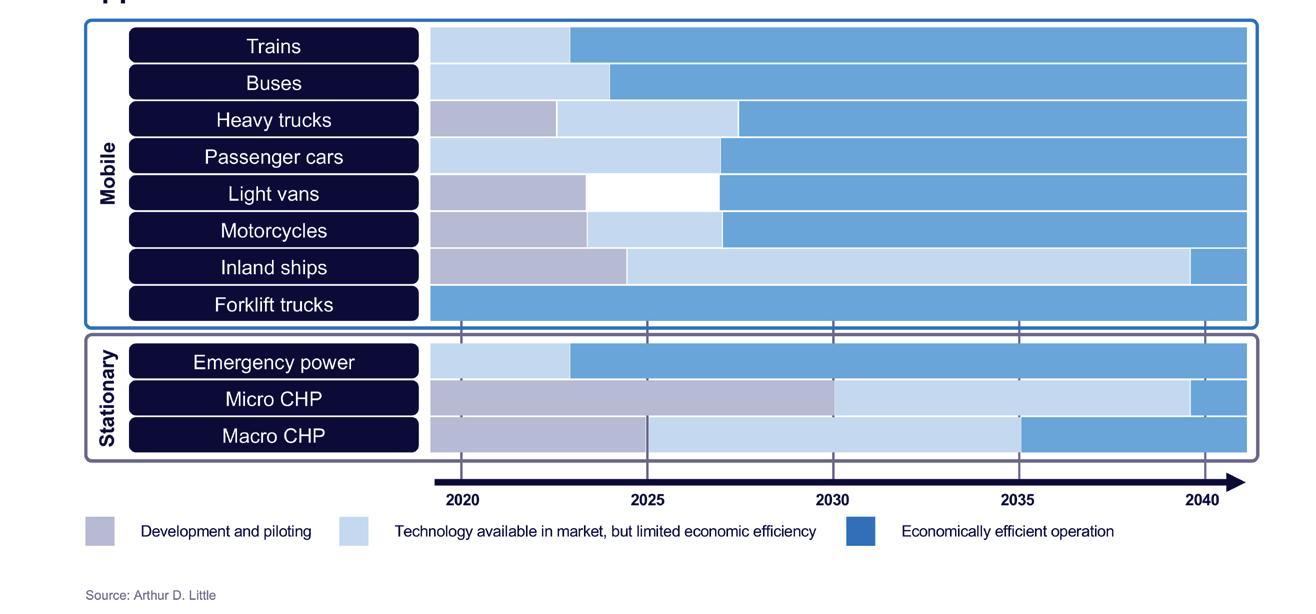

Application technology is also advancing, with the growth of hydrogen-powered vehicles (particularly in the heavy-duty transport segment, where electric batteries reduce range/carrying capacity). Further innovation is required to grow demand by reducing costs, such as of hydrogen-powered trucks and buses. On the industrial side, the need to decarbonise should drive greater use of green hydrogen for both feedstock and thermal processes.

Adopting more innovative funding methods to unlock capital

At its core, green hydrogen faces two interlinked financial challenges. Firstly, it is currently not cost-competitive with fossil fuel-produced equivalents, due to factors such as immature/expensive technologies and, in particular, the cost and availability of renewable energy sources. According to BloombergNEF, while the cost of green hydrogen fell by 40% between 2015 and 2020, it is still currently around three times higher than hydrogen produced with natural gas.2 Secondly, projects, whether production, distribution, or renewables, require significant capital investment and time to build, making them a risk without securing customer demand.

Addressing the funding gap

Finance is therefore needed to increase technology innovation – making it more mature and therefore cheaper and more scalable – to build new infrastructure and underpin new business models within the ecosystem. Total costs for establishing a green hydrogen economy vary – analysis from the Financial Times puts the figure for creating an industry capable of producing 500 million tpy of hydrogen by 2050 at US$20 trillion.3

By comparison, the 1000 projects already announced globally require investment of US$320 billion according to the Hydrogen Council.4 Showing the funding gap, just US$29 billion has been committed to them so far.

The importance of sustainable finance

As they look to fund green projects, a growing number of organisations are looking to environmental, social and governance (ESG) bonds, a market which could reach US$4.5 trillion/yr by 2025. These bonds tap into the growing investor demand for greener investments, moving ESG beyond equities to financing specific projects in areas such as green hydrogen. As they are directly linked to sustainable projects, green/ESG bonds normally provide better terms for issuers as well as increasing investor confidence.

The government dimension

Innovative funding methods are therefore required to both finance new projects and bring down the current price of green hydrogen to stimulate demand. Given its importance to decarbonisation, governments are particularly active in creating policy frameworks and providing funding sources in both areas. Globally, almost US$30 billion of government funding for hydrogen has been announced as part of national/regional hydrogen strategies.

In the US, the Inflation Reduction Act provides US$260 billion in tax credits to boost investment in the development of renewable energy, including renewable hydrogen, while the US Department of Energy is spending US$1.5 billion to increase innovation in electrolyser and other technologies. The aim is to cut the cost of green hydrogen from its current US$5/kg to under US$2/kg by 2026.

Across the Atlantic, the EU plans to invest US$500 billion over 10 years in green hydrogen, along with providing tax credits for green hydrogen producers. The UK has announced funding of £2 billion over 15 years and confirmed suppliers will receive a guaranteed price for energy generated from green hydrogen. Initiatives such as these help to create a favourable environment that stimulates private investment in hydrogen projects.

14 Summer 2024 GlobalHydrogenReview.com

Figure 3. Hydrogen use by sector and region.

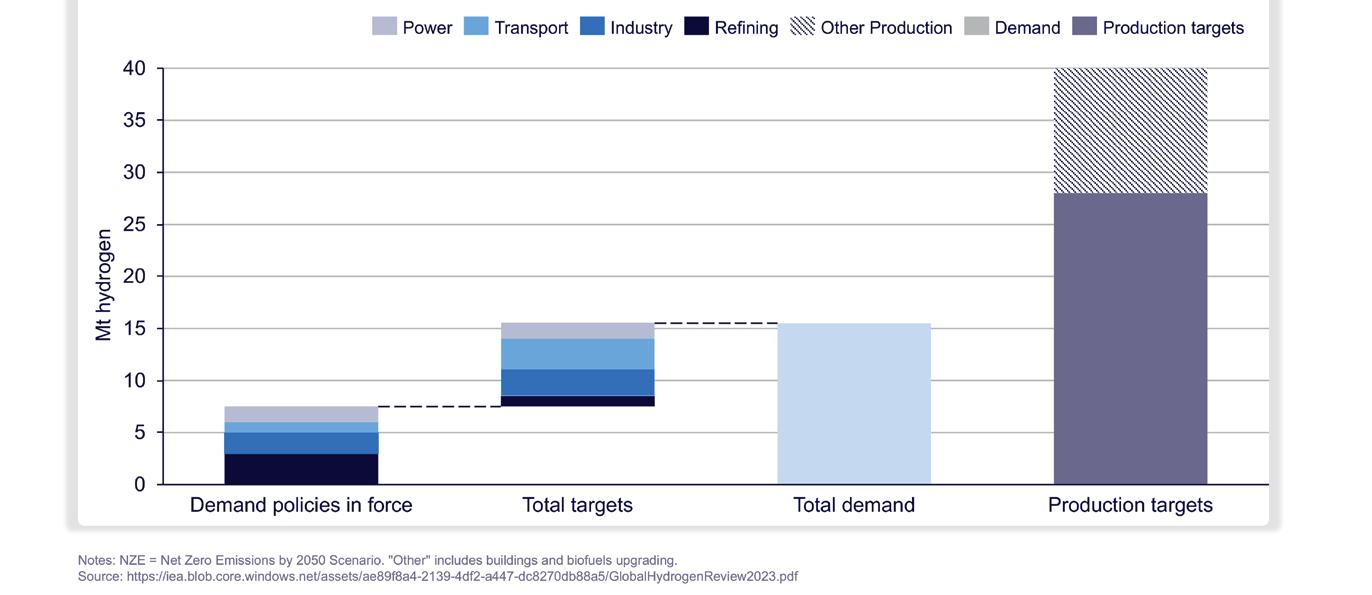

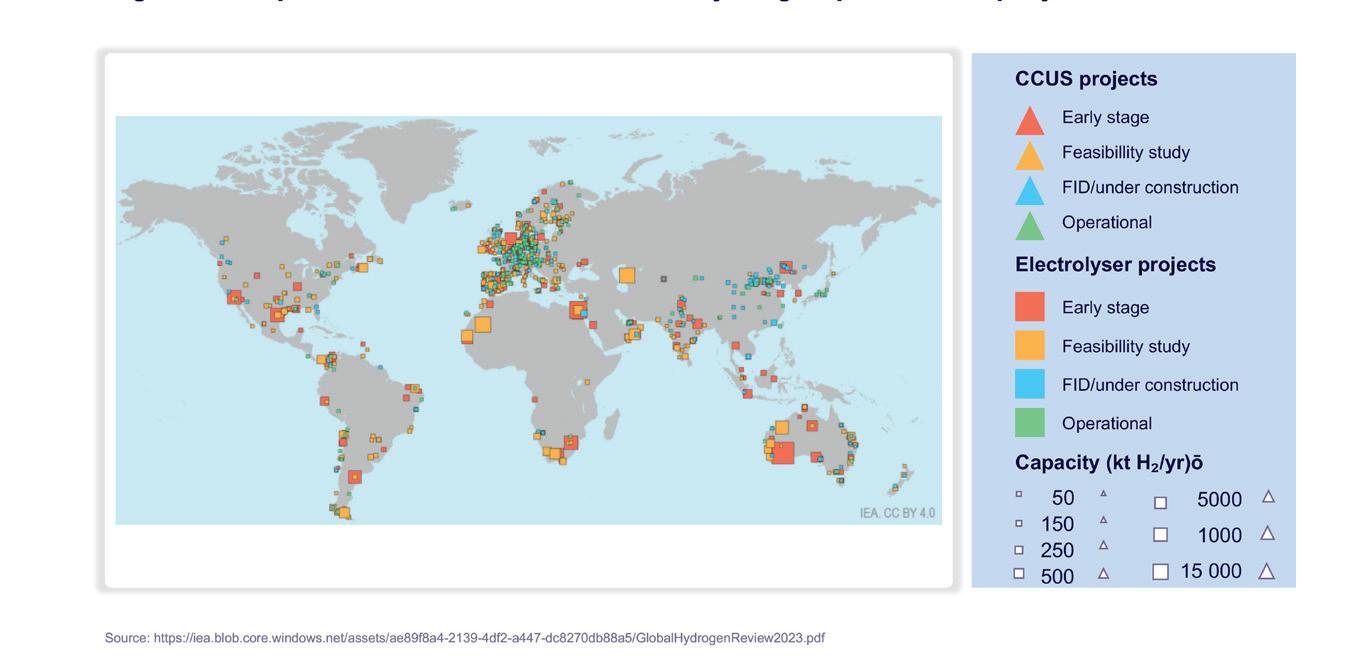

Figure 4. Potential demand for low-emission hydrogen created by implemented policies and government targets, and production targeted by governments, 2030.

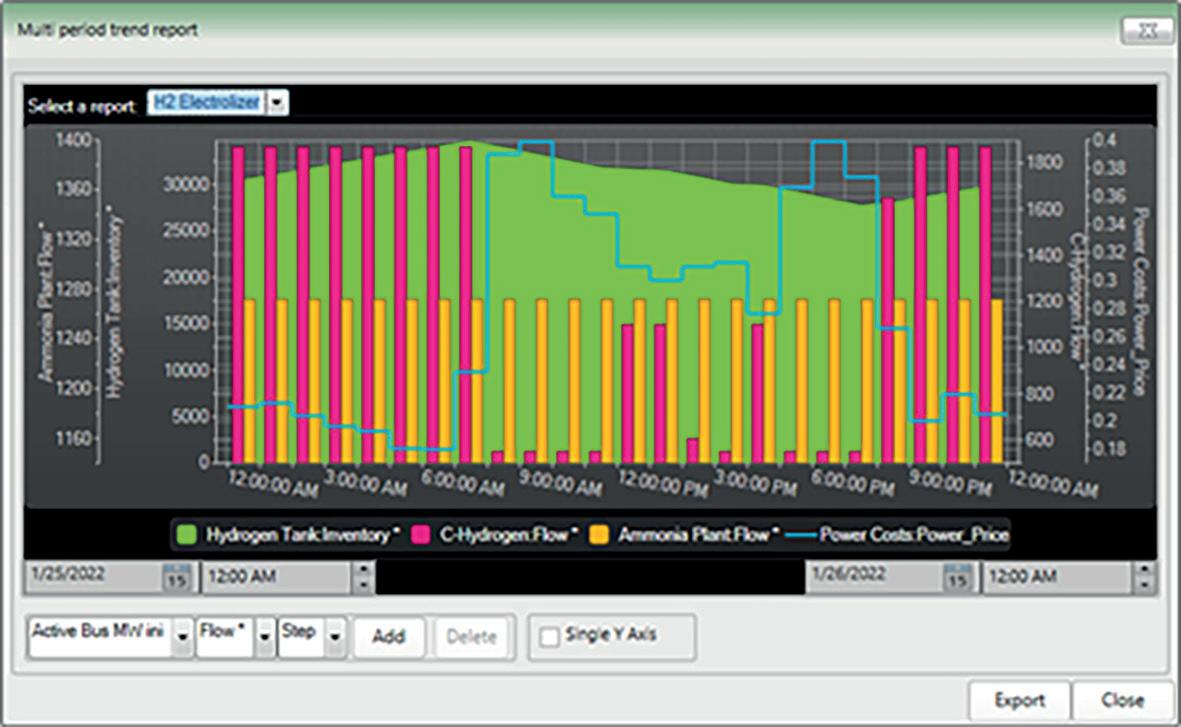

Power Independence with Element 1

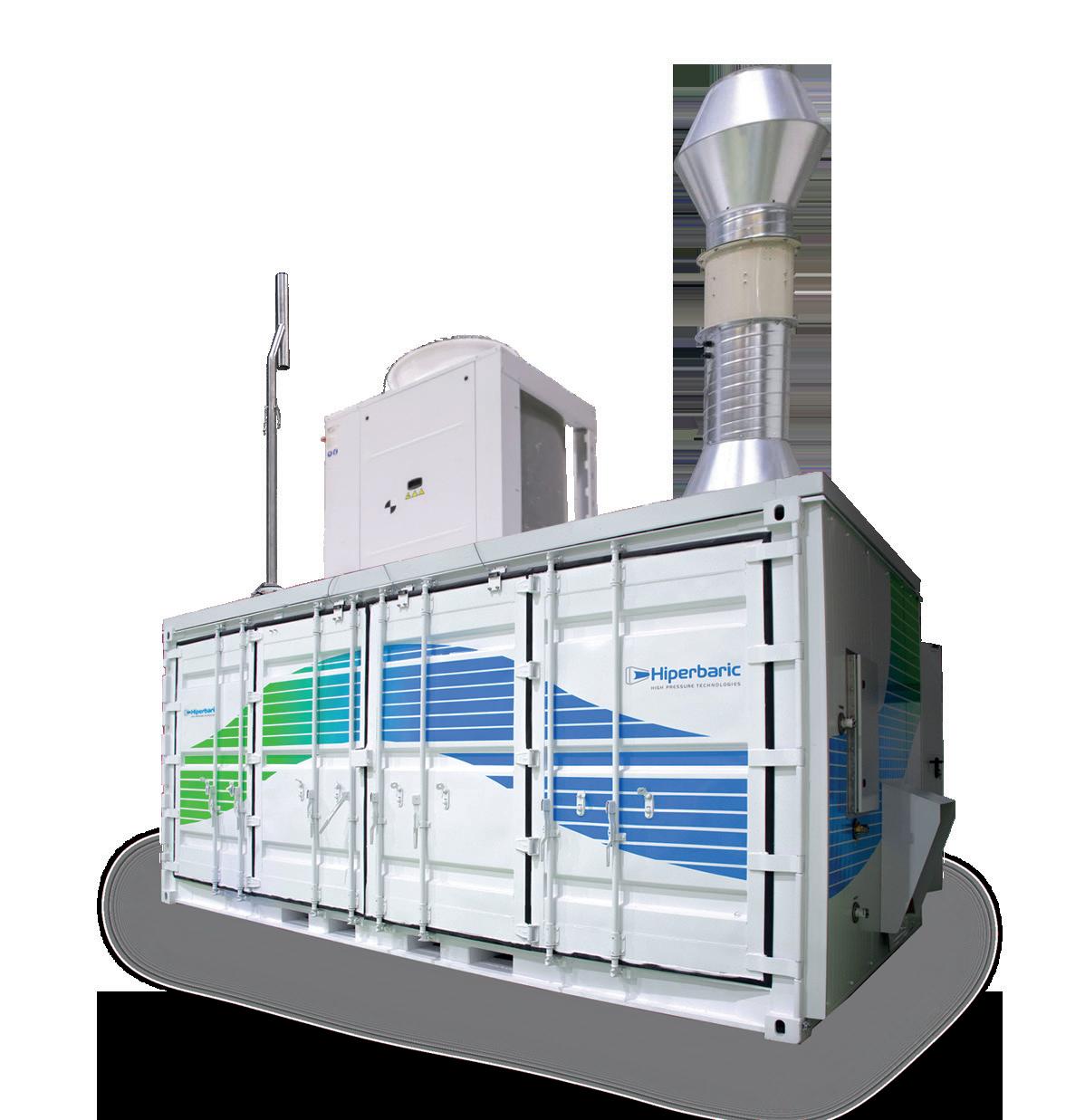

The future of sustainable energy is Containerised Hydrogen Generators

Element 1 Corporation CEO, Dave Edlund, discusses high efficiency, low cost, off-grid power generation technology in this month’s featured article – hydrogen generators that transform methanol into clean, efficient hydrogen and electric power. Perfect for charging stations and remote power needs, offering a reliable alternative to the traditional grid:

• High Efficiency: Our systems use minimal electricity to generate hydrogen, significantly cutting energy costs.

• Portable Solutions: Easily transported and installed, ideal for diverse settings, from urban centers to isolated areas.

• Cost-Effective Feedstock: Methanol is a readily available and economical carrier for hydrogen, offering substantial savings in transport and conversion costs.

• Reduced Emissions: Utilizing green methanol, our generators lower carbon footprints, supporting your eco-friendly initiatives.

Redefine your energy approach. Visit www.e1na.com to learn more.

Explore more about our technology and its benefits in Dave Edlund’s article in this issue.

The importance of subsidies

Governments are also looking to bridge the current gap between the production costs of green hydrogen and fossil fuel-generated equivalents. For example, the German government has committed €900 million over 10 years to compensate providers taking part in auctions of green hydrogen and its derivatives organised by the H2Global Foundation.

Innovative ideas to reduce investment needs are also being put into practice. Given that substantial OPEX finance will be required for hydrogen pipeline transportation (US$3.6 billion/yr in Europe alone), many countries are establishing regional hydrogen hubs to minimise the cost of infrastructure construction and operation.

The energy security risk

Following the supply shocks to the gas market caused by sanctions on Russia, government investment in local facilities, including renewables, also enables energy security as well as decarbonisation. Given that electrolysis-based green hydrogen production typically requires 4000 - 5000 hours of electricity per year, ensuring there is sufficient cost-effective renewable capacity will be a challenge in regions such as Europe and Asia. For example, by 2030 the LCOH in key South East Asian countries is predicted to be between US$3.5 - 4.3/kg, compared to under US$2.5 in the US, Spain, and the Middle East. Without access to renewable energy, there is a risk that economies will swap a reliance on Russian gas with reliance on hydrogen from countries within the Middle East and North Africa, creating new dependencies.

Supporting transformation through regulation

Alongside funding technology advances, infrastructure and subsidies, governments also need to innovate in two other areas. They need to provide regulatory penalties and incentives to force industries away from fossil fuel-produced hydrogen, and to standardise certification of green hydrogen internationally. For example, by generating hydrogen without emitting carbon, companies will be able to earn carbon credits, which can be sold or used to offset emissions across their wider operations, providing a further financial incentive for hydrogen investment. Stronger certification will increase customer confidence that they are buying and using genuinely green hydrogen, enabling them to meet their decarbonisation targets and justify current price premiums. The COP28 summit in 2023 saw progress

on certification, with announced initiatives including a new ISO methodology for assessing the emissions of hydrogen production and a declaration of intent by 37 countries that they will work towards mutual recognition of each other’s certification schemes around renewable/low-carbon hydrogen production. Continuing innovation in this area will create a truly global green hydrogen industry, delivering common standards that underpin confident investment.

Increasing collaboration to create a green hydrogen ecosystem

As well as advances within generation, storage and transport innovation, hydrogen’s versatility will enable multiple sectors to innovate, create synergies and optimise energy systems. Building this green hydrogen ecosystem will require inventive new partnerships that span traditionally separate industries and stretch around the globe. These can provide a more stable environment for hydrogen projects, reducing political and regulatory risks that might deter investors.

For example, data centres could switch from diesel to hydrogen for back-up power, generating and storing it on site. Energy companies could leverage excess renewable energy to produce hydrogen, rather than relying on battery storage. Existing hydrogen suppliers should look to collaborate with companies using solar power to create hydrogen in regions such as the Middle East and Australia, as well as forming joint venture agreements with worldwide customers to guarantee large-scale, stable demand.

Partnerships between the public and private sector will drive change. One example is the establishment of Thailand Hydrogen Group, initiated by oil and gas company PTT, which aims to engage public and private sector players to promote the development and adoption of hydrogen in Thailand.

Building a green hydrogen economy based on innovation

A stronger focus on innovation is crucial if green hydrogen is to meet ambitious objectives around decarbonisation. Harnessing innovation will be a driving force in making hydrogen initiatives more financially viable, reducing risk, and attracting diverse sources of investment. Whether through technological advancements, business model innovation, or policy frameworks, embracing innovation is essential for unlocking the full potential of green hydrogen as a sustainable energy carrier.

References

1. https://www.iea.org/reports/breakthroughagenda-report-2023/hydrogen

2. ‘‘Hydrogen Economy’ Offers Promising Path to Decarbonization’, BloombergNEF, https:// about.bnef.com/blog/hydrogen-economyoffers-promising-path-to-decarbonization/, (March 2020).

3. ‘Lex in depth: the staggering cost of a green hydrogen economy, Financial Times, https:// www.ft.com/content/6e22930b-a007-4729951f-78d6685a7514.

4. ‘Hydrogen Insights 2023’, Hydrogen Council, https://hydrogencouncil.com/en/ hydrogen-insights-global-project-funnelgains-momentum-across-value-chain-andgeographies/#:~:text=The%20report%20 tracks%201%2C040%20projects,20%25)%20 related%20to%20mobility, (May 2023).

16 Summer 2024 GlobalHydrogenReview.com

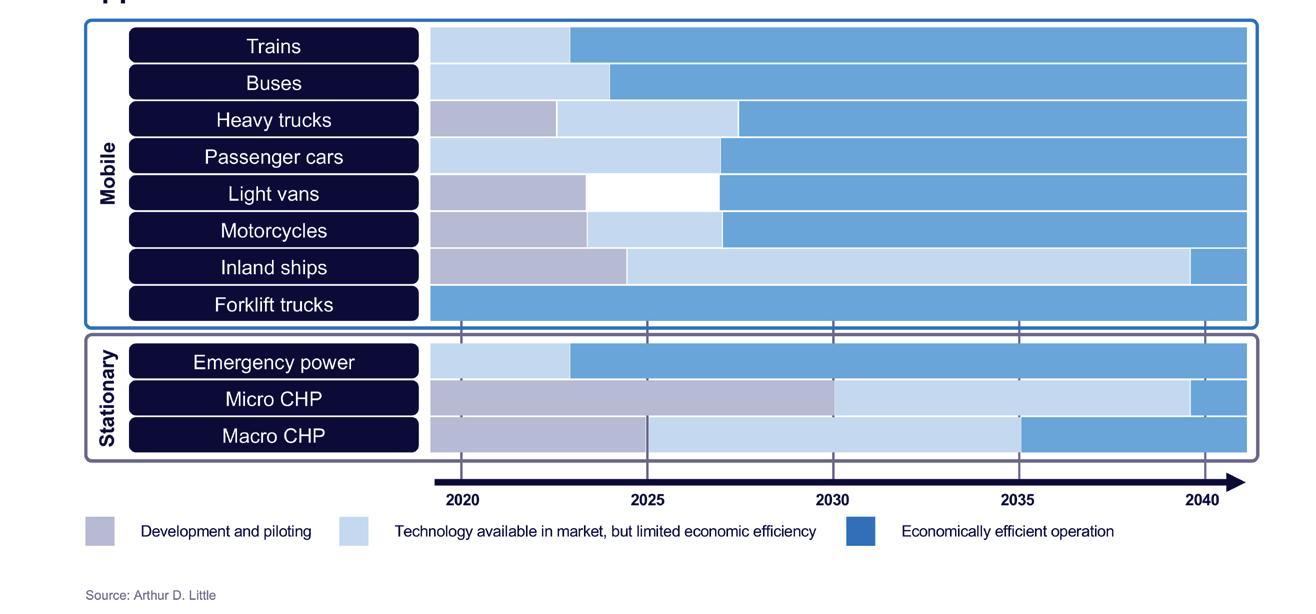

Figure 5. Technology maturity and economic efficiency of major hydrogen applications.

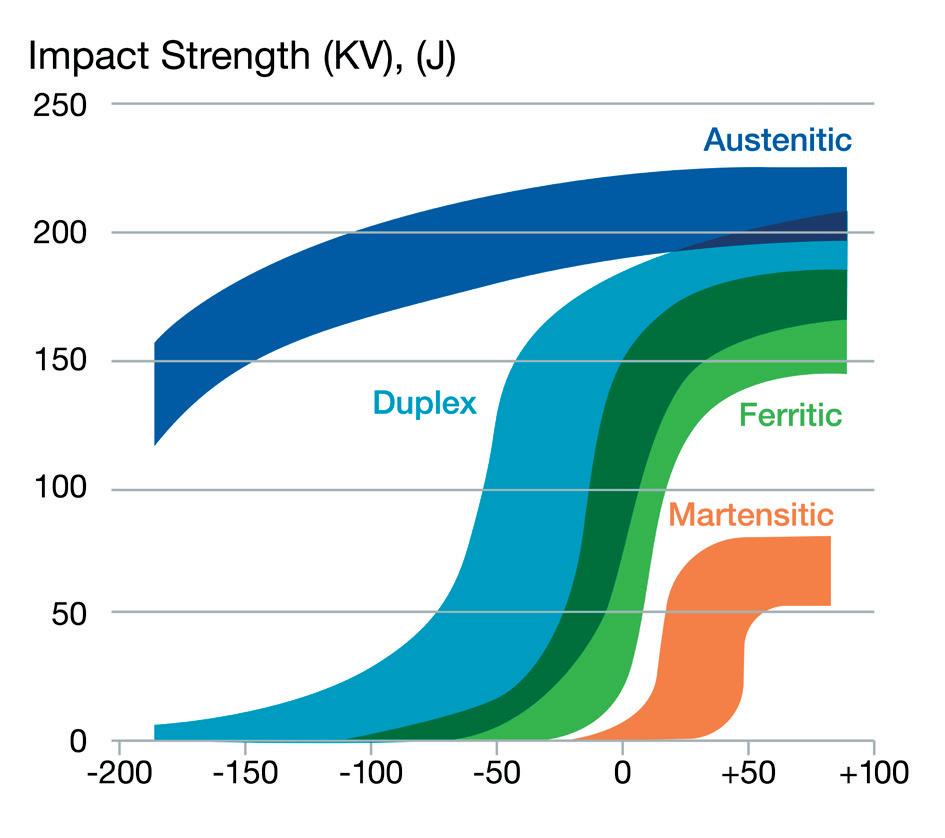

Krzysztof Koziol, Cranfield University, UK, discusses the challenges associated with the switch to zero-carbon fuels and the importance of material research in the energy transition.

There is no easy switch to new fuels – particularly when it comes to hydrogen and the need for networks of storage, transport and supply pipelines that can cope with different behaviours and qualities.

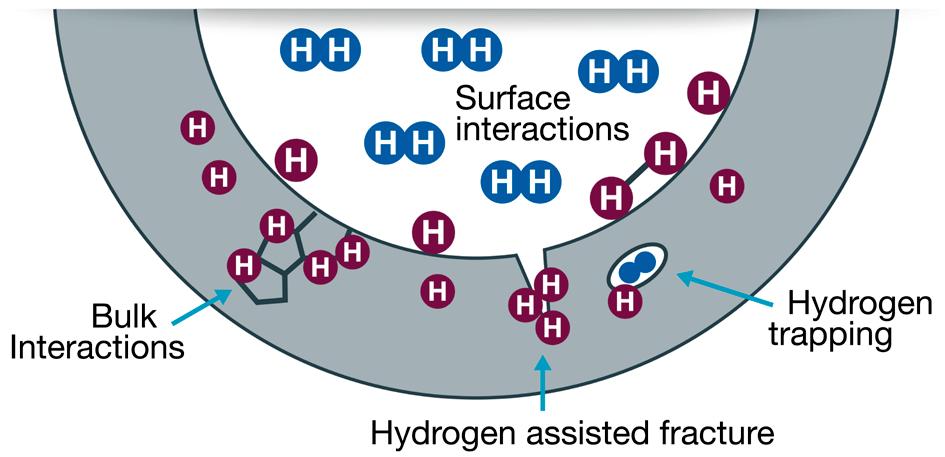

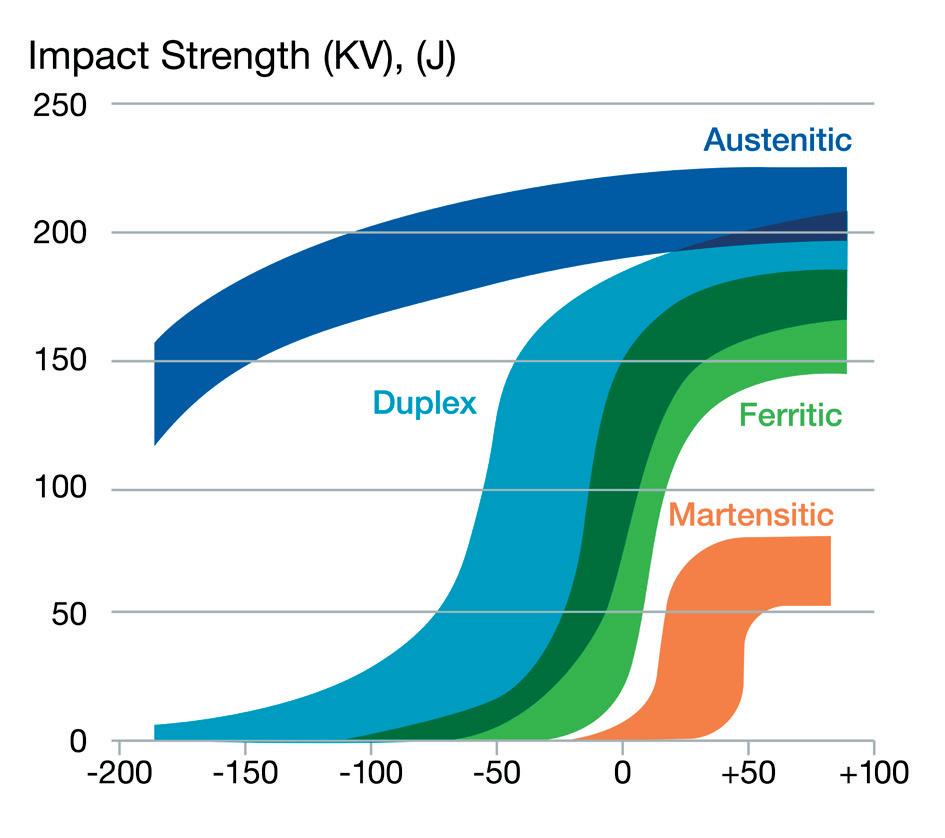

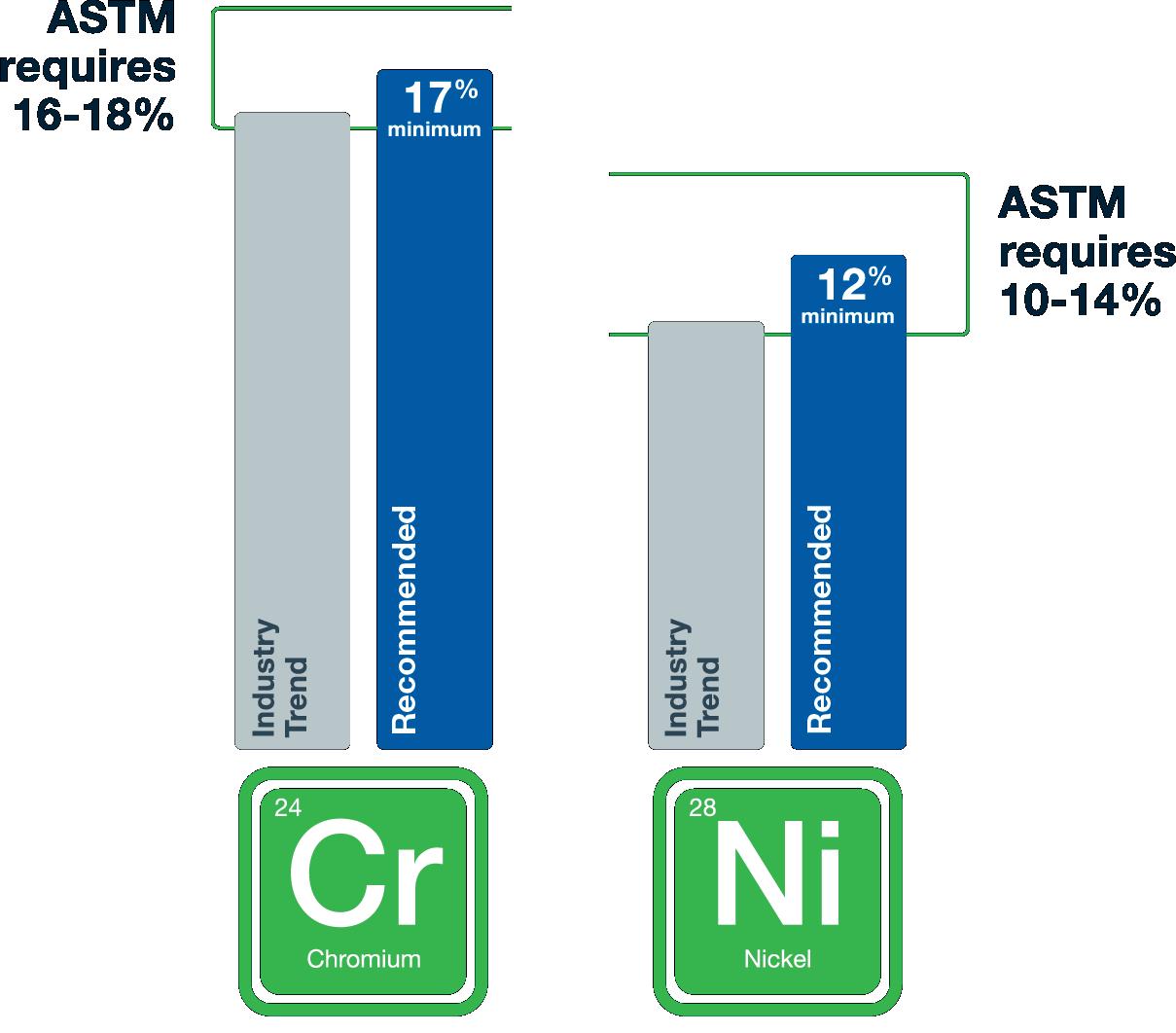

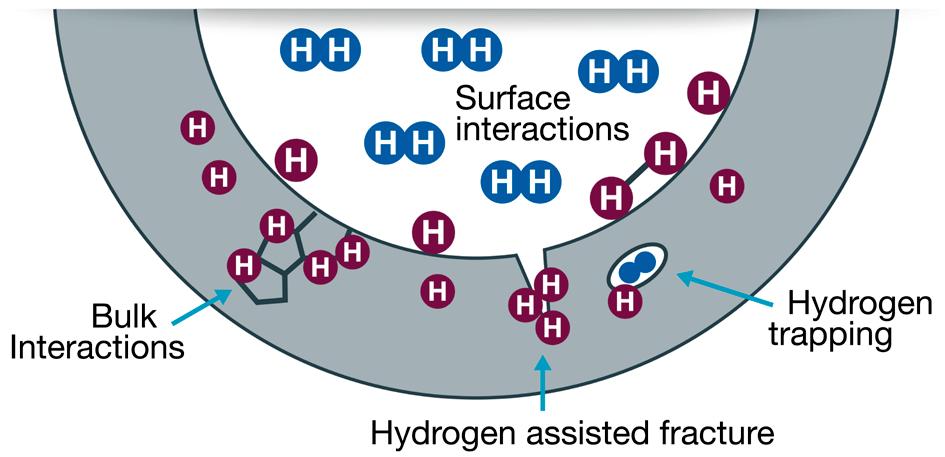

When using traditional metals – for example, steel or aluminium – hydrogen works its way into the lattice of the metal and causes it to become brittle over time, leading to cracking. And with polymers – using a glass-fibre tank with a coating inside – the hydrogen will penetrate through the lining with the constant emptying and filling of the tank and the coating will buckle.

Full hydrogen delivery systems will rely on pressurised tank storage, liquefaction tank storage and salt caverns, each with the potential to involve loss through pressurisation, depressurisation, permeation leakage, and accidents. The expected loss of hydrogen across the life-cycle from transportation and storage systems is estimated at 2%, according to a US Department of Energy study in 2022.1 The scaling up of a hydrogen network is expected to lead to much larger issues: the International Energy Agency has predicted a 5.6% economy-wide leakage rate by 2050 (based on an annual supply of 528 million t).2 Scenario modelling by the Environmental Defense Fund has suggested that

17

continuous emissions of hydrogen over a 10 year period would have a 100x stronger global warming effect than CO2

Cranfield University has been researching hydrogen for decades, and in response to the growing body of evidence supporting the potential applications, now has a hydrogen research network which spans work into forms of hydrogen production with ultra-low carbon emissions, hydrogen storage, operations and propulsion. An underlying element of the work is materials, assessing the potential, the scope for wholly new combinations and configurations that make hydrogen a viable option.

Replacing natural gas pipelines

The most obvious challenge around replacing natural gas with hydrogen is around the existing network of pipelines in the UK, made up of around 7600 km of pipes. National Gas Transmission, the UK’s gas network operator, has made a commitment to upgrading the full network to allow for a switch to hydrogen, and has an objective of connecting up with continental Europe’s network of hydrogen-ready pipelines by the early 2030s.

Cranfield University has been tasked with improving the performance of the most common form of mild steel pipelines (low-carbon, so they are more ductile and weldable) to ensure there is no hydrogen diffusion or containment failures. The issue here is not only the risks from diffusion of the much smaller molecules of hydrogen compared with natural gas, but also the potential for impurities in natural gas (such as hydrogen sulfide) which can accelerate damage to materials in the gas blending

environment. While natural gas does not have moisture issues, it is very important to make sure that hydrogen – particularly that coming from electrolysis – is separated from any moisture as its addition to the pipeline will, again, accelerate the internal pipe damage through corrosion leading to accelerated hydrogen diffusion into the steel lattice and cracking.

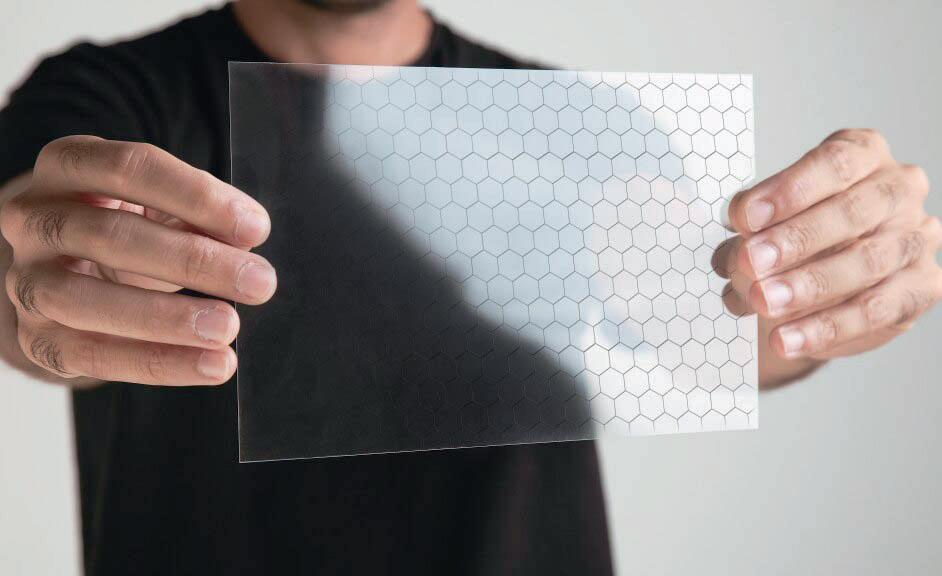

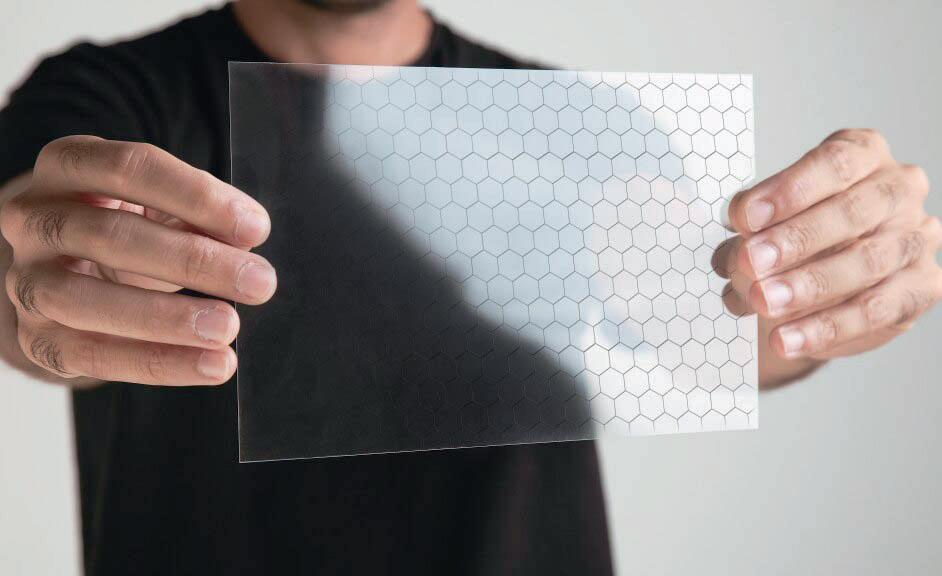

National Gas Transmission has required a solution that is both low cost and is net zero in terms of carbon. Digging up long stretches of pipeline would have a huge carbon footprint and undermine the efforts to move to a more environmentally-friendly system from the outset. Cranfield, in partnership with Levidian Nanosystems, has developed a graphene-based paint which can be used to secure pipelines for safe hydrogen use. Graphene itself is a simple material made solely from a single layer of carbon atoms, assembled in a hexagonal pattern. The simplicity of the structure means it is easy to anticipate how it will behave – as well as being incredibly strong (estimated to be 200 times stronger than steel).

The effectiveness of the new paint has been validated in the laboratory environment following National Gas standards. The next step is for large-scale production of the graphene paint, expected to begin this year, leading to general market availability for industry. The graphene itself will come from a new, scalable process developed by Levidian Nanosystems. The company makes use of greenhouse gases such as methane as a feedstock, diverting a stream of gases away from the environment; methane into graphene processes are already being used with sources such as organic wastes from agriculture and the venting and flaring release of natural gas.

Hydrogen aviation

Other industries face even more complex and difficult challenges in switching to zero carbon fuels. In aviation, the hydrogen option provides a long-term solution to the need for a sustainable basis for the industry. In the short to medium-term, the sector continues to focus on sustainable aviation fuels (SAFs), but the production processes and burning of SAFs only involves a reduction in CO2 emissions, an interim solution while sustainable technologies are developed.

The introduction of a new world of hydrogen flight means a full re-design of aircraft and the fuelling infrastructure of supplies and storage on the ground. While hydrogen gas can be used for short haul flights, longer distance flights will need a higher energy density, meaning the storage on-board of liquid hydrogen. Liquid hydrogen has a higher energy density than conventional aviation fuels and offers a much leaner combustion than any hydrocarbon fuel, as well as ultra-low nitrogen oxide emissions. However, the future viability of liquid hydrogen flight is dependent on safe storage on-board. Storage tanks need to be able to withstand extreme variations in temperature: between -253°C and room temperature. Given the nature of temperatures involved, an incorrect selection of materials or issues with the cryogenic system would lead to a catastrophic failure. The design of tanks needs to involve lightweight materials to minimise overall aircraft weight and fuel demands. Stainless steel tanks might provide safety, but are unrealistic in terms of added tonnage.

Over the past year, Cranfield University has been working on developing the most efficient aircraft designs, hydrogen combustion systems and workable materials for next generation fuel tanks. This is part of the Airbus driven project to develop

18 Summer 2024 GlobalHydrogenReview.com

Figure 1. Professor Krzysztof Koziol in the Composites and Advanced Materials Centre labs, Cranfield University.

Figure 2. The hexagonal composition of graphene.

Chart’s HLH2 vehicle fuel systems provide greater range and payload advantages using liquid hydrogen storage and an integrated heat exchanger for Fuel Cell Electric Trucks (FCETs).

Chart’s liquid hydrogen fuel stations allow for quicker fueling of vehicles with more dense liquid hydrogen, using simpler equipment and requiring less infrastructure investment.

HLH2 vs. H35/H70

• Lighter Weight

• Smaller Footprint

• Easier to Install

• Faster Fill Times

• Customized Integration with Truck Manufacturer’s Fuel Cell Engine

www.ChartIndustries.com/Hydrogen hydrogen@chartindustries.com

Americas: +1 800 400 4683

Germany: +49 (0)2823 328 224 China: +86 519 8596 6000

Scan to download our brochure

the world’s first commercial hydrogen aircraft by 2035. The streams of research and development, jointly funded by the UK government’s Aerospace Technology Institute (ATI), are based around the company’s new Zero Emission Development Centre (ZEDC) for hydrogen technologies in Filton, Bristol, UK.

Cryogenic tanks

In order to use hydrogen as fuel in the skies, there is the need for a design of a type VI cryogenic tank. This involves a new bill of materials and deployment of three levels of safety features –each one of which means exploring new generations of materials. The first level is ensuring that the hydrogen is kept at the right temperature; the second that there is the guarantee that even if the energy input and active cooling or other systems fail, the materials being used will keep the liquid hydrogen at a safe temperature and pressure environment for long enough for the aircraft to land and the issues to be resolved. The third is that if there is an unforeseen and uncontrollable event, the fuel or the tank itself can be disposed of safely – and the aircraft still has enough fuel to land.

One type of material under development is based around a new form of self-healing polymers. To minimise safety concerns, there is the need for a material that is capable of both self-diagnosis and self-healing of damage caused to its structure. A self-healing polymer is particularly effective in repairing minor cracks and avoiding a worsening of the damage. The next critical material for the tank is made up of high performance, lightweight insulators like aerogels: the synthetic porous ultralight materials

derived from a gel which retain their form even when the liquid element is replaced with a gas. The nature of the materials makes them the lightest possible material yet created. Finally, a two-dimensional graphene layer is being used to maximise the reduction of hydrogen leaks and to take the mechanical stability of the overall structure to another level.

Extensive work is ongoing at Cranfield around the material development and molecular tuning to achieve the levels of performance required, as well as the use of different combinations in order to find the optimal mix of tank materials for performance and safety. The very first prototype of the type VI cryogenic hydrogen tank will be tested over the coming year, with flight testing (possibly from Cranfield airport) expected to start in 2026, and a system in use between 2030-35.

Electric energy still has the greatest potential for delivering a low-carbon world, but it has its limitations when it comes to storage from renewable sources like wind and solar, as well as a lack of energy density for heavy industries. Hydrogen can play a crucial role in the mix of sustainable energy supplies – especially when it comes to transforming aviation and for decarbonising industry – and materials research is going to be essential for ensuring it continues to be a practical solution.

References

1. ‘DOE Technical Targets for Hydrogen Delivery’, US Department of Energy, https://www.energy.gov/eere/ fuelcells/doe-technical-targetshydrogen-delivery, (2022).

2. ‘Global Hydrogen Review 2021’, International Energy Agency, https://doi.org/10.1787/39351842-en, (October 2021).

VIRTUAL CONFERENCE 5 SEPTEMBER 2024 Join us for an interactive virtual conference exploring innovative decarbonisation technologies and solutions that are driving the transition to a low-carbon energy future. Register for free

Daniel Patrick, Atlas Copco, USA, considers the technology readiness level of turbomachinery for large-scale hydrogen liquefaction.

Yes, yes, TRL actually stands for ‘technology readiness levels’, but the alternate acronym in the title has a nice ring to it. Technology readiness levels is an important topic in emerging markets like hydrogen. These days, in just about every hydrogen sales presentation, the slide deck will include shiny models of new equipment with attractive features. The designs may look great, but how many have been built and are in operation? Often, especially in the hydrogen market, the equipment is in the pilot phase. That low TRL is partially because there is plenty of new technology in development for the emerging hydrogen market, and partially because the demand for large-scale hydrogen production has not previously existed. This article will explore the maturity of turbomachinery technology for one of the crucial aspects of the emerging hydrogen infrastructure: large-scale hydrogen liquefaction. Simultaneous to the challenge of technology readiness, a universally understood requirement in the hydrogen market is the need to scale production to help reach lower costs. From scaling electrolyser manufacturing to increasing truck payload, and from storage tank size

21

to larger fuel cell stacks, bigger seems to be better, and maybe even necessary, for hydrogen to be economically viable against the incumbents. This issue of scale applies to liquefaction technology as well. As production capacities increase, so too will that of liquefiers. As of today, hydrogen liquefaction trains seem to have plateaued around the 30 tpd capacity range. This is a not an insignificant growth from the previous status quo of 5 - 10 tpd liquefiers, but it is clear that larger-scale liquefaction capacity is needed to effectively transport the large volumes of hydrogen required to support the demand from the ever-growing hydrogen mobility market, not to mention the future liquid hydrogen (LH2) export terminals for international trade. Let us put the 30 tpd capacity into perspective. A single 30 tpd liquefier can distribute enough hydrogen for approximately 300 heavy duty trucks per day (assuming an average fuel-tank capacity of 100 kg per truck). Considering 400 000 heavy duty fuel-cell electric vehicle (FCEV) trucks are expected to be deployed globally by 2030 (according to the International Energy Agency’s ‘Energy Technology Perspectives 2023’ report1) – and according to that same report, the majority of these FCEV trucks will rely on liquid hydrogen distribution to refuelling stations – it is clear that hydrogen liquefier

capacities will need to scale significantly to 60 tpd, 100 tpd, 200 tpd and larger in order to meet demand.

Liquefaction machinery

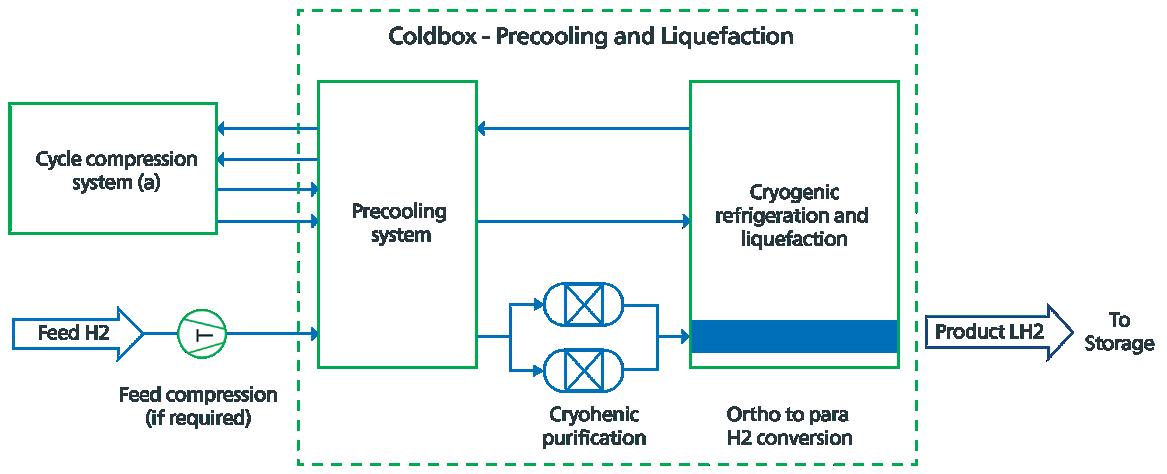

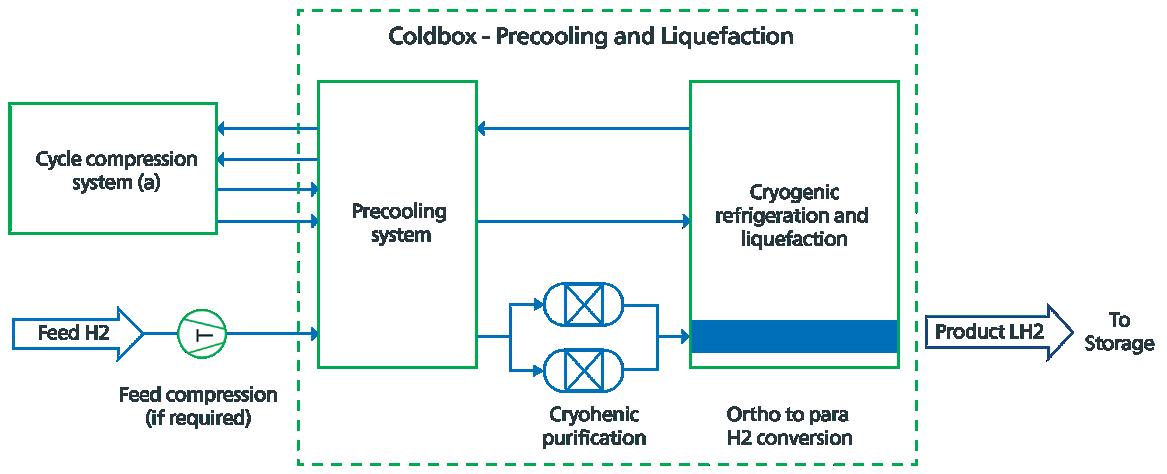

Hydrogen liquefaction involves one or more refrigeration cycles to cool the hydrogen gas to below -253°C, when it liquefies. Key components to the liquefier include refrigeration compressors, cryogenic turboexpanders (also known as expansion turbines), and braised aluminium heat exchanger(s) (BAHX) located inside a coldbox. Figure 1 provides a simplified hydrogen liquefier schematic.

Hydrogen liquefaction is energy-intensive, especially on a small-scale. Therefore, a variety of process configurations have been built or conceptually proposed for large-scale applications using different refrigerants and refrigeration cycles. The main goal of optimising a liquefier design is to improve two main key performance indicators (KPIs): specific energy consumption (SEC), (KWh/KgH2) and specific liquefaction cost (SLC), which includes capital, operation, and maintenance costs. Larger-scale liquefiers improve both of these KPIs. The first benefit of scale is an improved cost basis (lower SLC), which is largely attributable to the turbomachinery’s ability to scale without the need for additional units. Turbomachinery size simply scales around the volumetric flow of the process and is often quantified by a manufacturer’s frame size (or wheel diameter). For example, scaling a turboexpander from a 30 tpd capacity to a 60 tpd capacity does not double the machine cost. Instead, only a marginal cost increase is expected due to the larger frame size requiring marginally more raw material.

The second benefit is the increased performance, meaning more liquid hydrogen produced per kilowatt-hour. High-capacity liquefaction enables significant reduction in the specific energy consumption (SEC) of the liquefier. Again, focusing on the turbomachinery, as the machinery scales to higher flows, the secondary losses are proportionally lower, enabling higher efficiency and better overall performance. It is also common to run into mechanical speed limits on small-scale liquefier capacities, especially when considering integrally geared or magnetic-bearing turboexpander designs. The aerodynamic designer needs to make some sacrifices when designing an impeller for a non-optimum (slower) speed, which has a negative impact on performance. As flow increases with larger-scale liquefiers, this allows the machine to run at slower speeds, and avoid mechanical speed limitations. The ability to run at an ideal speed enables optimum aerodynamic performance – another point for large-scale liquefaction. Lastly, large-scale liquefaction opens up new opportunities for turboexpander power to be recovered via a compressor or generator. Energy recovery has a direct impact on specific energy consumption, making the liquefaction process more efficient.

22 Summer 2024 GlobalHydrogenReview.com

Figure 1. Simplified process configuration for hydrogen liquefaction (Cardella 2018).

Figure 2. Simplified definitions of technology readiness levels (image source: TWI-global).

COMMITTED TO A BETTER FUTURE

Optimizing combustion for a greener tomorrow WE’RE

There has never been a greater need to decarbonize fired equipment, produce cleaner energy sources, and operate in a more environmentally responsible way.

Optimized combustion and enhanced predictive analytics are key to reducing plant emissions and ensuring equipment uptime. Designed for safety systems, our Thermox® WDG-V combustion analyzer leads the way, monitoring and controlling combustion with unparalleled precision.

Setting the industry standard for more than 50 years, AMETEK process analyzers are a solution you can rely on. Let’s decarbonize tomorrow together by ensuring tighter emission control, efficient operations, and enhanced process safety for a greener future.

AMETEKPI.COM/CLEANENERGY

What is TRL?

Technology readiness levels is an approach for estimating the maturity of an emerging technology. The 9-point scale was developed by NASA in the 1970s to demonstrate where a particular machinery or system stood in its development life, with TRL 1 being the least mature, and TRL 9 being the most mature (see Figure 2 for a basic definition of the nine TRLs). The TRL approach is widely used because it provides a common understanding of technology status and risk management. This enables informed decision making, but its definitions do not always apply to a particular product-system operational environment, so it sometimes requires interpretation, or even alternate methods.

Experience and references have long served as cornerstones in all sorts of technology applications – and a highly engineered product like turbomachinery is no different. Purchasers have long valued the assurance they get when they buy from an original equipment manufacturer (OEM) that has proven experience. It is no surprise that buyers want the same thing in the hydrogen industry. But therein lies the crux – the hydrogen industry is entering uncharted territory in regard to scale. No one has the experience above 30 tpd train capacities. Therefore, companies need to take a bit of a calculated leap, leveraging all of the experience from similar applications.

Turbomachinery readiness

By examining a few similar turbomachinery applications, it may be possible to glean some TRL points from that experience. The refrigeration compressors that drive these cycles operate in the warm sections of the process and are generally unaffected by the temperature needs of the process (except by the refrigerant selection and size). Turboexpanders operate in the cryogenic portion of the cycle and are directly affected by the feed-gas boiling point (or liquefaction temperature), so this example will focus on them for the following TRL analysis. Natural gas liquefaction occurs at -162°C. Not quite the -253°C boiling point of hydrogen, but the cryogenic expertise and design practices developed from the LNG industry are a great foundation for the requirements of hydrogen liquefaction. In fact, the LNG process designs, including both the nitrogen Brayton cycle and mixed refrigerant cycles, can be directly applied to the pre-cooling process of a large-scale hydrogen liquefaction plant (1 point for technology readiness).

Nevertheless, there is more than LNG experience alone behind the high TRL for the turboexpander design. One can also take a look at some other applications from the petrochemical industry that provide the hydrogen experience. Turboexpanders applied in ethylene and propane dehydrogenation (PDH) processing operate in the cryogenic portion of the plant where the hydrogen-rich process gas can reach levels up to 96% hydrogen by mole fraction. It is known from this cryogenic hydrogen experience that industrial-scale flow rates (high-capacity petrochemical production) directly translate to the large-scale hydrogen liquefaction application. Even better, different turboexpander configurations are deployed in each of these applications –expander-compressors with active magnetic bearings (AMB) are typically applied in ethylene applications. The compressor-loaded configuration provides energy recovery to the process to reduce the tail-gas compressor load. Conversely, in PDH applications, integrally geared expander-generator configurations have historically been applied. This provides the cryogenic hydrogen experience with some additional design features from this configuration, such as dry gas seals and high-speed gearbox pinion designs.

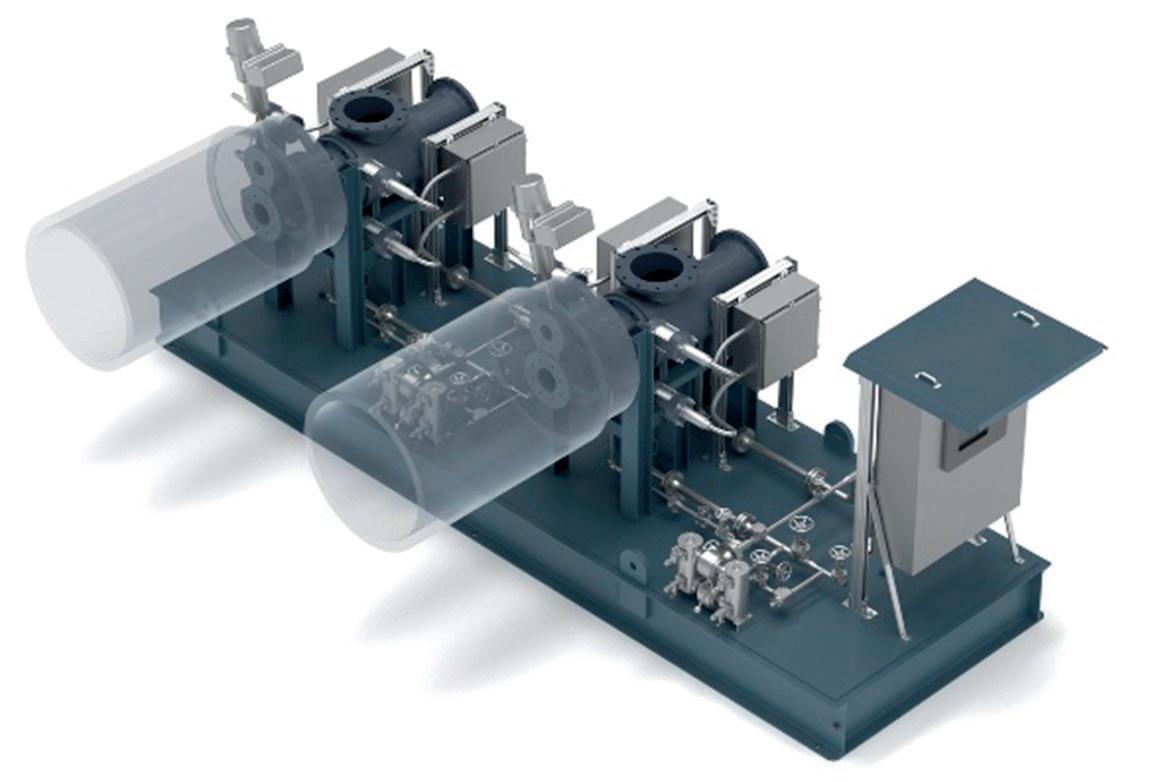

Still not convinced? Ok, let us look at direct experience in hydrogen liquefaction, where turbomachinery has been supplied up to 30 tpd. Like the other applications, this example will focus on cryogenic turboexpanders. Similar to ethylene applications, the heat exchanger and vacuum coldbox of a hydrogen liquefaction plant are extremely sensitive to oil contamination and therefore, oil-free machinery is preferred for this application. While dynamic gas bearings provide an oil-free solution, they lack the ability to scale due to limitations in radial and axial load capacity, meaning turboexpanders with AMBs are the preferred oil-free solution for the large scale liquefiers. AMBs have no permanent magnets and are fully

24 Summer 2024 GlobalHydrogenReview.com

Figure 3. Active magnetic bearing turboexpander with power recovery via compressor load.

Figure 4. Turboexpander package for hydrogen liquefaction.

Scaling the Hydrogen Ecosystem

Reduce your carbon footprint and advance to net zero

Decarbonize today with our groundbreaking solutions for clean hydrogen production and usage. Our advanced technologies enable lowering carbon footprints, contributing to a sustainable future, and running a profitable enterprise. By working together, we can build a successful, environmentally friendly hydrogen economy advancing us on the path toward net zero.

yokogawa.com

compatible with hydrogen service. As previously mentioned, turboexpanders with ABMs have been used in hydrogen-rich service for more than 30 years in the petrochemical industry, so this is a mature technology.

Path to maturity (TRL 9)

To achieve the desired TRL 9, the equipment needs to be operated commercially in the actual environment. This means that someone will need to take the risk of being the first to deploy the turbomachinery in a large-scale liquefier. But how much ‘risk’ are we really talking about? Considering the previously mentioned experience in relevant environments from LNG, petrochemical, and medium-scale (up to 30 tpd) hydrogen liquefaction applications, the resulting technology readiness is already well into the ‘deployment’ stage. One might argue that the turbomachinery stands around a TRL 8 (as we are already past the prototype stage mentioned in level 7). No technical barrier stands in the way. The turbomachinery technology is just waiting for the opportunity to be deployed in a large-scale liquefier. In the past few decades, the majority of turbomachines in the traditional energy industry (oil and gas) were placed in a ‘new’ operating environment with little to no review of TRL. Design practices at turbomachinery OEM’s like Atlas Copco Gas and Process are well suited to accommodate this dilemma. It is normal practice for custom-engineered machinery to be pushing the limits where process designs are constantly optimised and performance is key. One may dare to say that turbomachinery OEMs thrive on advancing the technology to accommodate

requirements of new applications. Large-scale hydrogen liquefaction is not the first time we have pushed the design limits to enter an emerging market, and it is unlikely to be the last.

Conclusion

The maturity of turbomachinery for large-scale hydrogen liquefaction is vital to improve hydrogen supply chains and achieve cost parity with traditional fuels. Thankfully, turbomachinery is already a well-established technology with a high TRL from similar operating environments. By striving for higher TRL levels in emerging markets like hydrogen, companies are not just advancing machinery, but paving the way for a more sustainable future. The collaboration between hydrogen project developers, EPC companies, and the innovative spirit of turbomachinery OEMs offer promising solutions to meet the growing demand to create large-scale hydrogen infrastructure. Ultimately, the goal is not just technological advancements around turbomachinery and hydrogen liquefiers, but economic viability and ensuring that hydrogen becomes a competitive alternative to traditional fuels. This convergence of technology, experience, and sustainability will shape the future energy mix as the world continues to decarbonise.

Reference

1. ‘Energy Technology Perspectives 2023’, International Energy Agency (IEA), Paris, France, https://www.iea.org/reports/ energy-technology-perspectives-2023, Licence: CC BY 4.0, (2023).

Global Hydrogen Review Online

Visit our website today: www.globalhydrogenreview.com Home to the latest hydrogen news, analysis and events

Dave Edlund, Element 1 Corp., outlines the potential of methanol-to-hydrogen generators in the development of the hydrogen economy.

With a global population of more than 8 billion people, the demand for electrical power is enormous and growing at a rapid pace. Factors driving growth in electricity demand include electrification of regions that have insufficient supply of electricity; exponential growth in data storage and e-commerce; and adoption of battery

electric vehicles (BEVs) including personal automobiles, light duty delivery vans and trucks, buses, and medium/heavy duty trucks.

Historically, electricity has been generated at centralised facilities connected by a network of wires for distribution, often over long distances, to local consumers. This so-called electrical grid represents a dynamic balance

27

between electricity generation and electricity consumption. A correctly functioning electric grid may be taken for granted; but expansion of large grids is not an easy task and involves large investments of both time and money, as well as disruption within urban centres, ports, and industrial zones.

However, when looking at the history of telecommunications, another model for electrification that minimises the use of wires can be seen. Just as telephones used to all be interconnected with copper wire, only to be displaced over the past several decades by wireless cell phones, a parallel approach can be implemented for new electrification projects and grid capacity expansion. Large, centralised power generation and distribution via wires can be replaced with local microgrids based on distributed electricity generation very close to the point of use.

Of course, this is not a new idea – diesel-electric generators have been, and still are, used in this capacity to electrify remote villages and outposts. But with a desire to reduce greenhouse gas (GHG) emissions, as well as other toxic pollution from diesel engines, hydrogen fuel cells have a unique opportunity to play an important role in this space.

Methanol as a practical hydrogen carrier

The single biggest barrier to the wide-spread commercial adoption of hydrogen as an energy vector is cost. At the point of use, hydrogen is often three- to ten-times more expensive than gasoline (for an equivalent amount of energy) based on US pump prices. Most hydrogen, whether compressed gas or liquid, is transported from the manufacturing location to the point of use by heavy-duty trucks. It costs about US$1 to transport 1 kg of compressed hydrogen a distance of 100 km. Liquid hydrogen is more affordable to move by truck, but it is disfavoured by boil-off losses, high energy requirement to liquefy hydrogen, and general lack of liquefaction facilities around the world.

In contrast, liquid methanol is transported using the same infrastructure that today delivers gasoline, diesel, and aviation fuels to pumps and airports globally. In comparison, the cost of transporting methanol by truck is more than 20-times less expensive (on a US$/kg hydrogen basis) compared to transporting compressed hydrogen.

Element 1 Corp. has developed a methanol-to-hydrogen generator that is being sold for commercial applications and is offered by several licensed manufacturing partners in Europe and North America.

Of course, methanol is not the only hydrogen carrier, or hydrogen precursor, proposed to overcome the high cost of hydrogen produced at centralised facilities and transported to the point of use. All processes for making hydrogen from a precursor (e.g., methanol, natural gas, water, ammonia) result in an impure product stream in which the hydrogen is mixed with other gases and hydrogen purification is required. As examples, natural gas reforming and methanol reforming result in a product stream that is predominantly hydrogen with varying amounts of carbon dioxide, carbon monoxide, methane, and water vapour (generically called syngas). Hydrogen from water electrolysis is contaminated with traces of nitrogen as well as water vapour, and ammonia cracking results in hydrogen contaminated with nitrogen and ammonia.

Although many contaminants are not harmful to low-temperature PEM fuel cells (PEMFCs), some gases –especially carbon monoxide and ammonia – will chemically react with the electrocatalyst or the electrolyte within the PEMFC, causing a decline in output power. ISO 14687, the international hydrogen purity specification for fuel cell applications, limits carbon monoxide contamination in product hydrogen to less than 0.2 ppm, whereas ammonia is a more severe fuel cell poison, with a maximum allowable concentration of 0.1 ppm. A further important distinction between carbon monoxide and ammonia contamination in hydrogen is that carbon monoxide effects on PEMFCs are reversible, whereas ammonia has a non-reversible and cumulative adverse impact on fuel cell output power.

For the above reasons – as well as the fact that methanol is being adopted as a motor fuel in China and the International Maritime Organization (IMO) views methanol as a preferred future fuel for ships – methanol is the ideal precursor for most on-site hydrogen generation deployments. The most efficient and cost-effective method for separating high-purity hydrogen from syngas is to utilise

28 Summer 2024 GlobalHydrogenReview.com

Figure 1. Containerised power generator (10 ft shipping container) rated to deliver nominal 140 kW at the fuel cell (image courtesy of Element 1 Corp.).

Figure 2. Nominal 140 kW power generator energising a microgrid to charge Extreme E battery-electric race cars. (image courtesy of Kaizen Clean Energy).

Significant investments in modern technologies, materials and infrastructure are enabling hydrogen to gain momentum and scale as one of the most promising alternative fuel source towards global sustainability targets.

Greene Tweed experts developed a range of new materials and sealing solutions to address hydrogen’s most critical challenges throughout the supply chain:

• Permeability

• Low lubricity

• Extreme temperatures

• High pressures

ARE

READY FOR THE FUTURE OF HYDROGEN?

YOU

Learn more at gtweed.com/h2sealsolutions HYDROGEN APPLICATIONS ELECTROLYSERS | FUEL CELLS | VALVES | COMPRESSORS gtweed.com

a high-temperature, hydrogen-selective metal membrane. This membrane process is pressure-driven and integrates directly with the temperature limits used in reforming methanol so that no interstage heat transfer is required prior to hydrogen purification. Currently, state-of-the-art hydrogen purification membrane modules deliver product

Figure 3. Backup 10 kW power system combining a small methanol-to-hydrogen generator with a PEMFC for telecom applications (image courtesy of Co-Win Hydrogen Power Ltd).

Figure 4. Backup power system using a 5 kW Horizon PEM fuel cell – the methanol-to-hydrogen generator is at the top of the cabinet (image courtesy of Bambili Energy Systems).

hydrogen exceeding 99.99% purity with less than 0.1 ppm of carbon monoxide.

Although fuel cells are most often paired with methanol-to-hydrogen generators to deliver electricity for a range of loads, in the near future, hydrogen could also be consumed by internal combustion engines. Engines burning hydrogen offer advantages for decarbonising transportation and could also provide a cleaner alternative to diesel engine gensets.

Water electrolysis is a well-known process for generating hydrogen. However, it requires large amounts of electricity – approximately 50 kWh per kg of product hydrogen – and the resulting hydrogen is only as green as the electricity consumed in the process. Since electricity is the most valuable form of energy produced and consumed, hydrogen made by electrolysis is expensive unless very low-cost electricity is used. This may be possible in limited cases, but is certainly not a widespread solution. Additionally, water electrolysis requires about 10 kg of water to make 1 kg of product hydrogen; another drawback in regions where water is in limited supply. The water must also be pure.

In comparison, methanol/steam reforming uses less than 0.1 kWh of electricity to make 1 kg of hydrogen because the process is thermochemical – not electrochemical – in nature. This is 500-times less electricity consumed per kg of hydrogen produced. Also, methanol/steam reforming requires less than 5 kg of water to make 1 kg of product hydrogen – a significant advantage in arid regions. Furthermore, water electrolysers are at least three times more expensive than methanol-to-hydrogen generators of equivalent hydrogen output, and many times larger in physical size.

Significant greenhouse gas reductions

Methanol is an alcohol with a single carbon atom; the molecular formula is CH3OH. 1 m3 of methanol, liquid under normal conditions, contains 98.8 kg of hydrogen, whereas 1 m3 of liquid hydrogen contains only 70.8 kg of hydrogen. Conversion of methanol to molecular hydrogen necessarily results in the release of 69 g CO2/MJ of methanol. However, if synthesised from renewable feedstocks, methanol is considered ‘green’ with well-to-wheel emissions that are below the US Clean Hydrogen Standard (2 kg CO2eq/kg hydrogen). With many biogenic feedstocks, or flare gas as a feedstock, the resulting methanol has negative carbon intensity, largely due to avoided methane emissions. In comparison to combustion engines, the emission profile of methanol-to-hydrogen conversion is appealing.

A diesel genset (US EPA Tier 3) has a carbon intensity of approximately 800 g CO2eq/kWh (combined CO2 and nitrogen oxide emissions). In contrast, when using grey methanol to hydrogen, the carbon intensity is lower at 590 g CO2eq/kWh and when using green methanol, the carbon intensity is only 150 g CO2eq/kWh (assuming green methanol at 16.7 g CO2eq/MJ). It is also important to note that methanol conversion to hydrogen does not result in emissions of other harmful pollutants – including nitrogen oxides, sulfur oxides and particulate matter – and carbon monoxide emissions are close to zero.

30 Summer 2024 GlobalHydrogenReview.com

Commercial applications

An immediate commercial opportunity is presented by the advent of BEV earth moving machinery in the construction and mining sectors. These vehicles require large amounts of electricity to recharge the onboard batteries once or twice daily. A single excavator or front loader will use 500 kWh or more each day.

Likewise, public and private charging stations are needed to support the growing deployment of BEV automobiles and BEV delivery vans. Expanding grid infrastructure to charge fleet vehicles is challenging, and deployment of power generators using methanol and hydrogen fuel cells can provide immediate benefits in terms of taking a short time to deploy and a short payback time.

Figure 1 shows a nominal 140 kW power generator incorporating a low-temperature PEM fuel cell (PEMFC) and a single methanol-to-hydrogen generator (235 kg hydrogen per day), plus battery bank and power inverters. This system has been in operation at Element 1 Corp. since mid-2023 and has logged over 5000 operating hours, producing more than 35 MWh of electricity (480 VAC / 3 phase). This pre-commercial demonstration system has performed reliably even during cold winter periods when temperatures dropped to -21°C.

Kaisen Clean Energy (Houston, Texas, US) has contracted electricity production with Extreme E racing to support charging of BEV race cars at remote locations including Sardinia, Chile, and Saudi Arabia. Figure 2 shows a containerised power generator including a single methanol-to-hydrogen generator, single low-temperature

PEMFC, power electronics and related equipment, all within a modified 20 ft shipping container, to deliver nominal 140 kW of clean power to a micro grid. The race vehicles are charged from the micro grid. Green, or renewable, methanol is converted first into hydrogen and then to electricity, resulting in a very low carbon intensity for the generated power. More than 10 MWh of electrical power have been generated to recharge the off-road race cars.

Another application, perhaps less exciting than off-road racing but more important, is primary and backup electrical power for cellular communications. In Asia, Co-Win Hydrogen Power Ltd (Guangzhou, China) is pairing smaller methanol-to-hydrogen generators with 10 kW PEMFCs, plus batteries and power electronics as a replacement for battery-only, or battery plus diesel generator, power systems (see Figure 3). The adoption of 5G cellular technology requires the towers to be located closer to each other and therefore a large number of new towers are required, all needing secure power to maintain communications even during local disruptions due to weather and other natural events such as earthquakes and floods. In South Africa, multiple 5 kW fuel cell systems utilising the methanol-to-hydrogen generator have been deployed at a military hospital to provide backup power without the toxic emissions from operating diesel generators (Figure 4).

As society grapples with satisfying the enormous demand for electricity while also reducing harmful air pollutants, there is an opportunity for many different solutions relying on hydrogen, and methanol-to-hydrogen will certainly play a vital role.

The premier source of technical and analytical information for the renewable energy industry Register for free at www.energyglobal.com

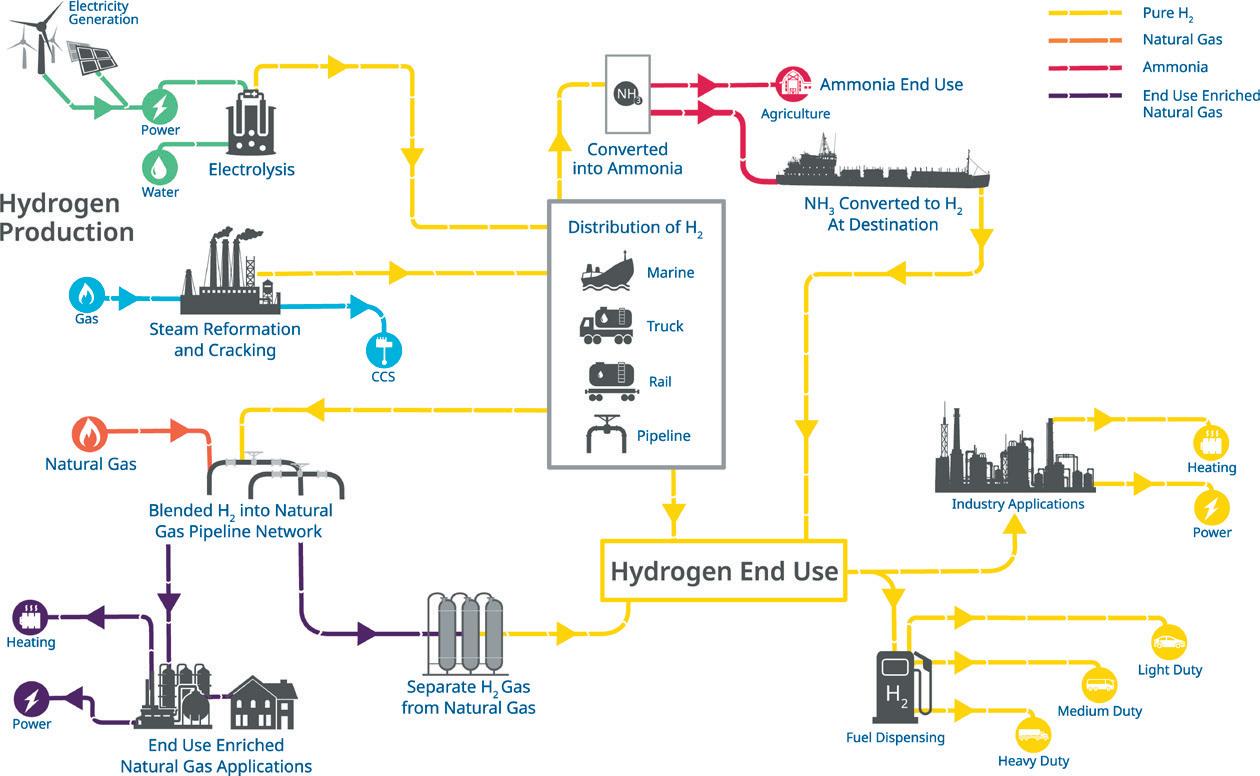

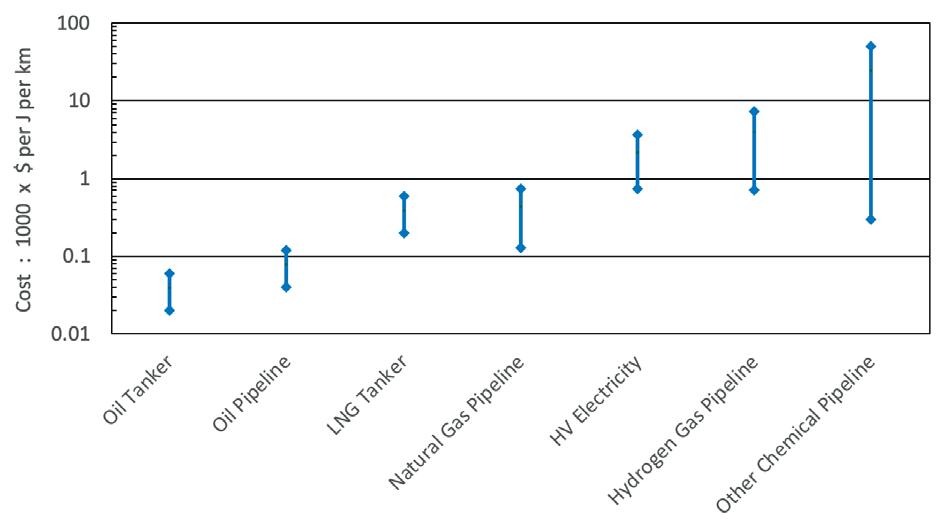

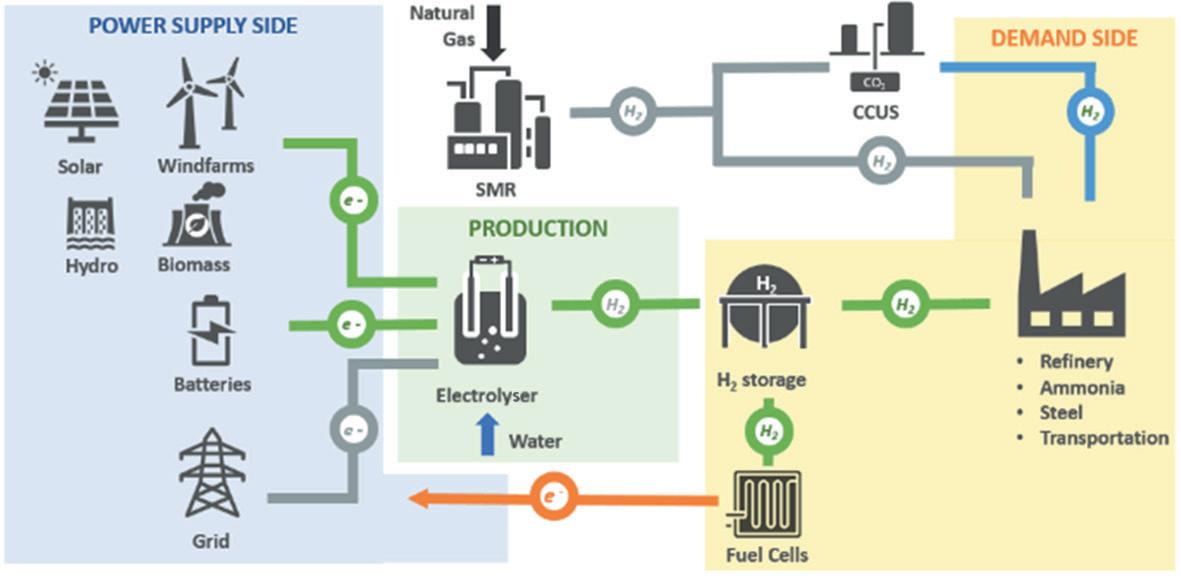

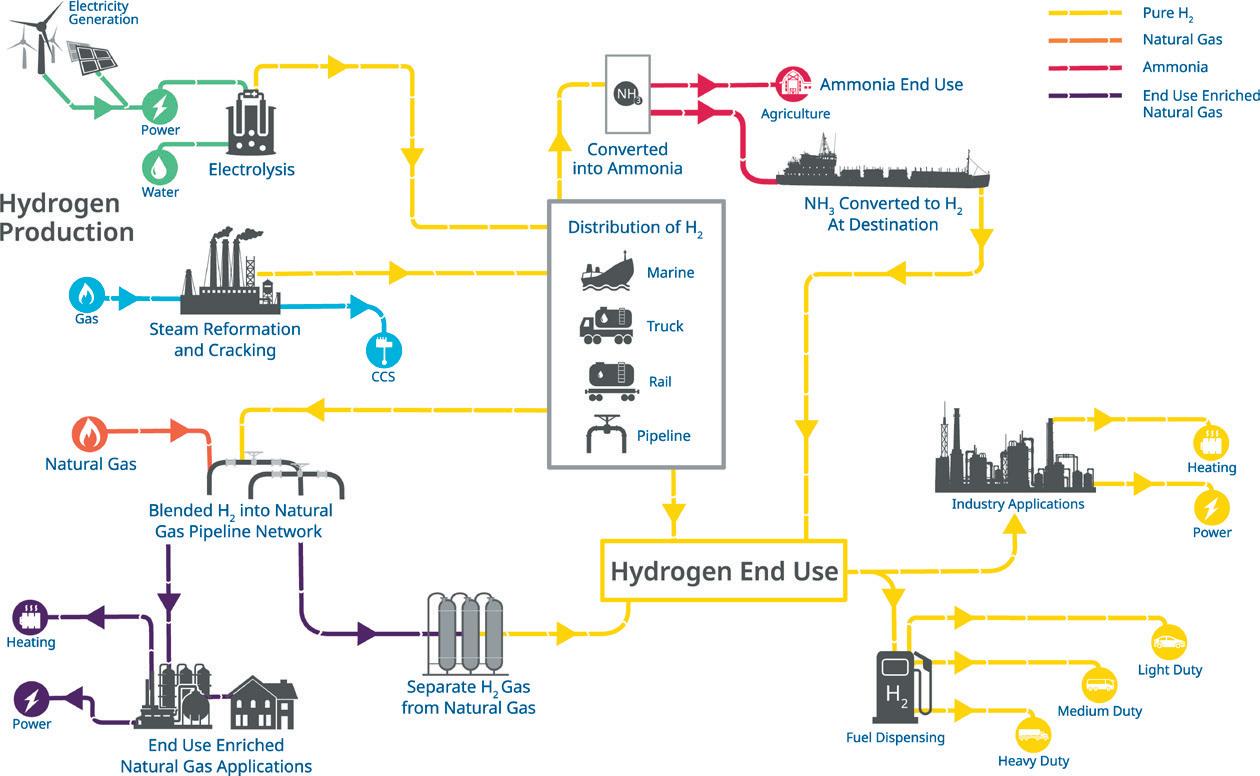

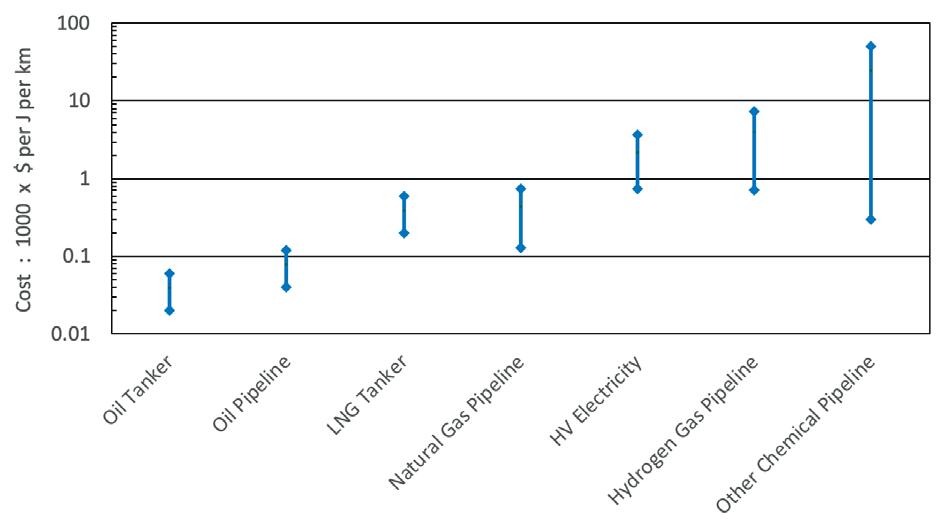

The world’s sources of energy are not always conveniently located next to energy consumers – which is why there are tens-of-thousands of kilometres of oil and natural gas pipelines around the world, and fleets of oil and LNG tankers crossing our oceans.

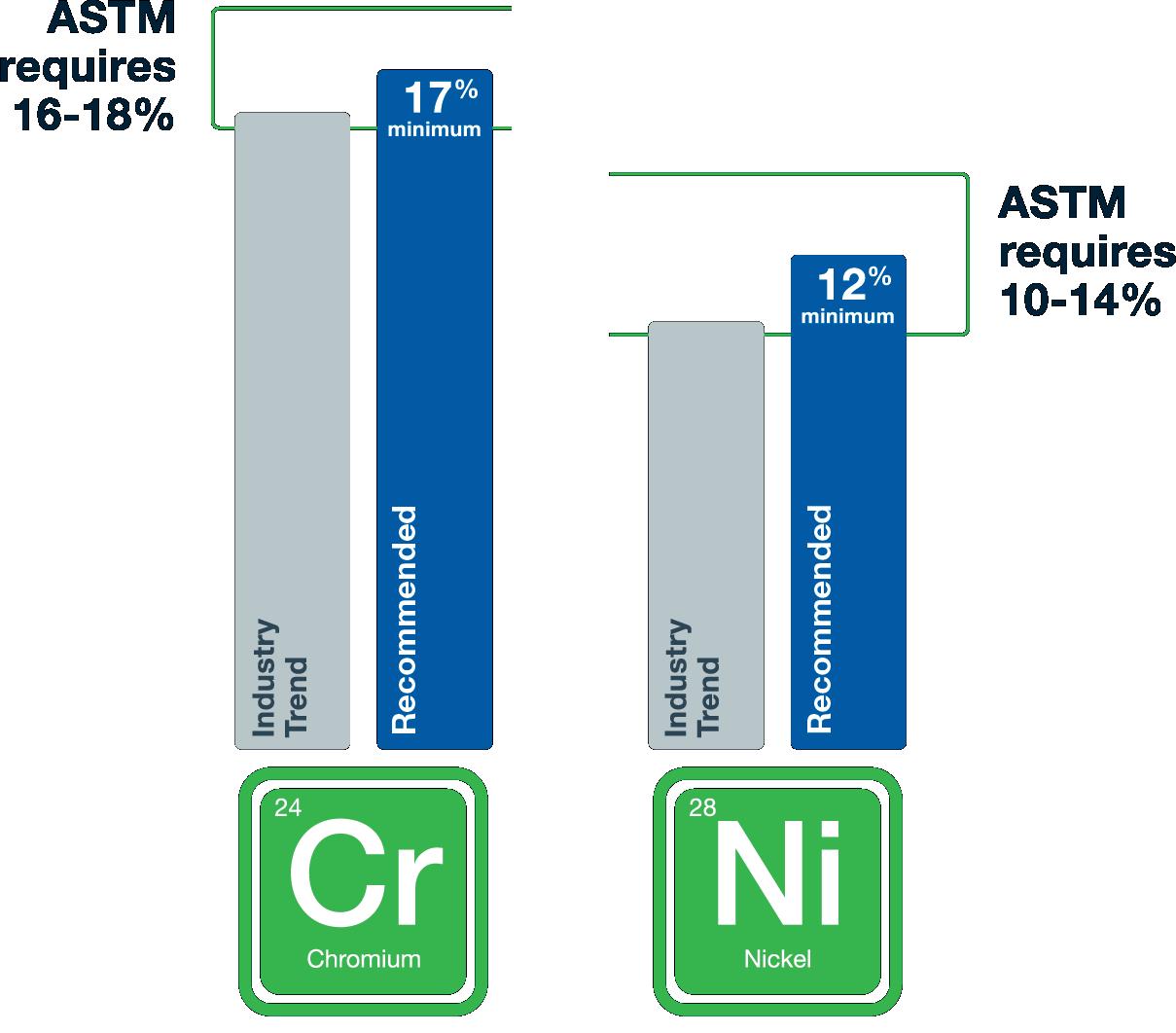

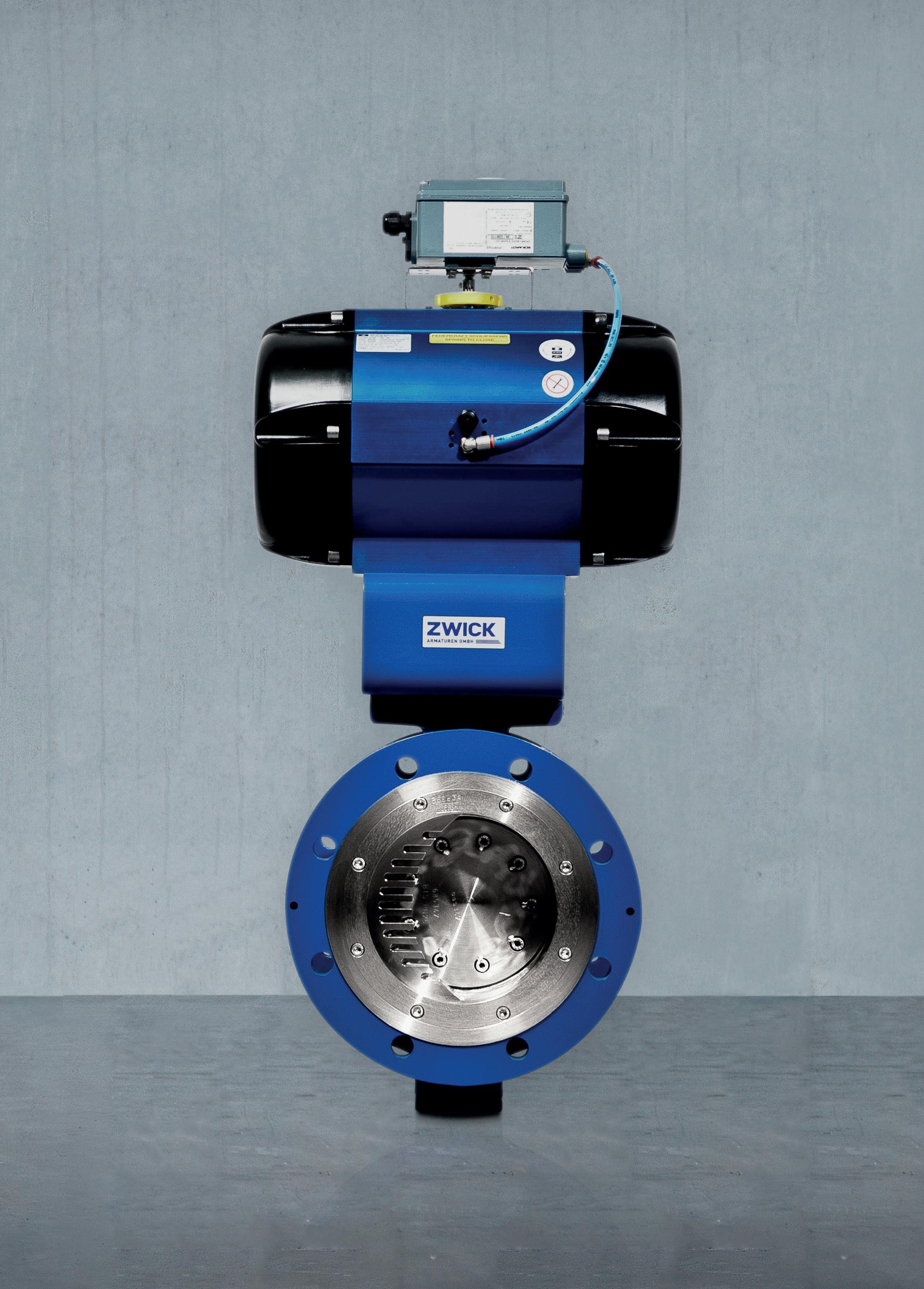

Hydrogen will be no exception as it grows in use as a low carbon means of energy, but to properly utilise hydrogen it is essential to understand it:

� Hydrogen is created by breaking down a larger molecule, typically methane (CH4) through steam methane reforming, or water (H2O) through electrolysis.

� Hydrogen is the smallest molecule in the universe and tends to permeate through molecular lattice structures, creating hydrogen embrittlement. This makes material compatibility essential for hydrogen infrastructure, especially at high temperatures and pressures.

� Hydrogen has a low energy density, meaning ambient temperature hydrogen will take up a much larger volume than the equivalent energy potential of natural gas. This is why hydrogen is compressed to pressures or liquified at cryogenic temperatures to increase its energy density.

� Hydrogen’s energy potential can be released through chemical reactions in a hydrogen fuel cell or burned in a combustion process, as with diesel or natural gas.