Our conveyors? They are running smoothly.

Thousands of chain installations in the industry operate smoothly, convincing operators day by day of their reliability.

We move industries.

Thousands of chain installations in the industry operate smoothly, convincing operators day by day of their reliability.

We move industries.

Carbon capture is a critical technological pathway for cement decarbonization. That’s a challenge. But there are ways to make it easier. Like converting to oxyfuel combustion. Oxyfuel raises the CO2 concentration in cement plant exhaust gases and makes capturing that CO2 much more cost-efficient.

Here at KHD we’ve been involved in oxyfuel development since 2010. We also come with a long history of excellence in innovation, plant design, and process engineering. So, when it comes to implementing oxyfuel at your cement plant, we are your expert partner.

Discover more on our website or connect with our experts to discuss your specific oxyfuel application needs and let’s deliver Cement beyond Carbon together.

LEARN MORE

Empowering carbon capture with oxyfuel

khd.com/oxyfuel

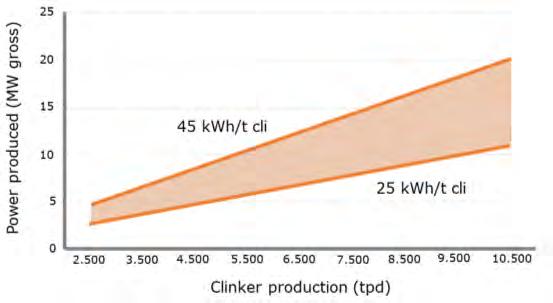

49 Unlocking Eco-Friendly Energy Solutions

Mirko Ferrari, Turboden, examines the role of ORC waste heat recovery technology as a tool to decarbonise the cement sector.

ROAD TO NET ZERO

10 Cementing A Net-Zero Future

Fabian Apel, Johanna Hoyt, Francisco Marques, Sebastian Reiter and Patrick Schulze, McKinsey, explore potential pathways for the cement industry to accomplish the transition to net zero.

14 Upgrading The US Infrastructure Industry

Mike Ireland, PCA, explains how Portland-limestone cement is just one of many methods being used by cement producers to reduce their environmental impact.

20 Laying The Foundations

McKenzie Smith, Climate Action Reserve, explains how a voluntary carbon market can help fund industries, including cement, to reduce their greenhouse gas emissions.

27 Say Hi To Hydrogen UTIS considers the role of hydrogen technology in not only improving combustion efficiency but also decarbonising cement production.

33 Consolidating Carbon Capture

Jeffrey Tyska, Honeywell UOP, explores key technologies for enabling carbon capture from cement plants.

40 Scaling Up And Cutting Costs

Andrew Baxter, Chart Industries, and Dr Bodil Recke, FLSmidth, discuss a collaboration to identify cost-competitive pathways to reduce CO2 emissions in the cement industry.

43 Zero Waste For Net Zero

Arun Mote, Triveni Turbines, discusses waste heat recovery and waste-to-energy as potential strategies for reaching net zero by 2050.

54 No Waste Heat, A Sustainable Feat

Andrea De Finis and Sara Milanesi, Exergy International srl, explore the benefits of ORC technology over steam Rankine cycle systems and consider the importance of turbine design and configuration.

62 Logistics From Portugal To The World Cachapuz elaborates on the implementation of automation and logistics optimisation systems in the cement industry.

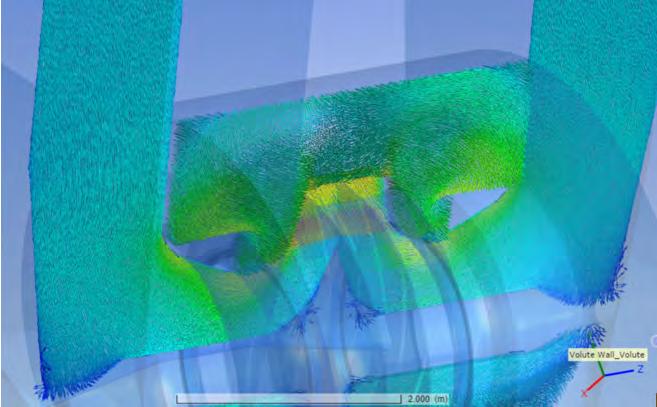

68 Focusing On Air Flow

Ozan Can Ülgen, Araz Cabbarli, Halil İbrahim Karabulut, & Kadir Körükcü, ALFER Engineering, discuss how to optimise fans and ducts, emphasising the importance of inlet line design.

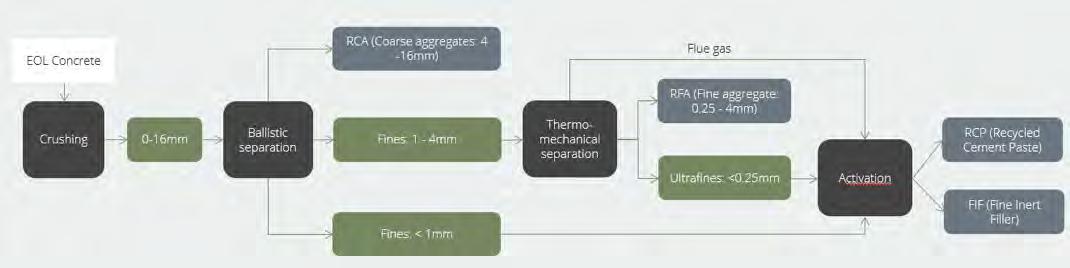

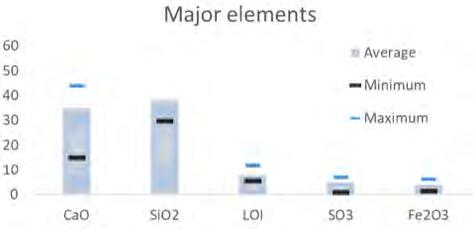

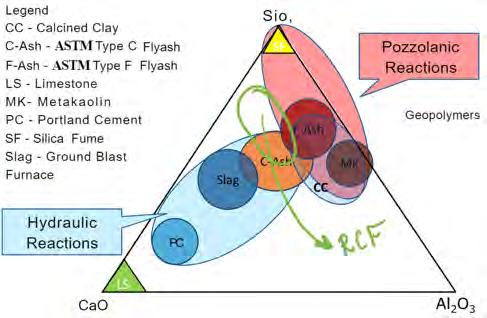

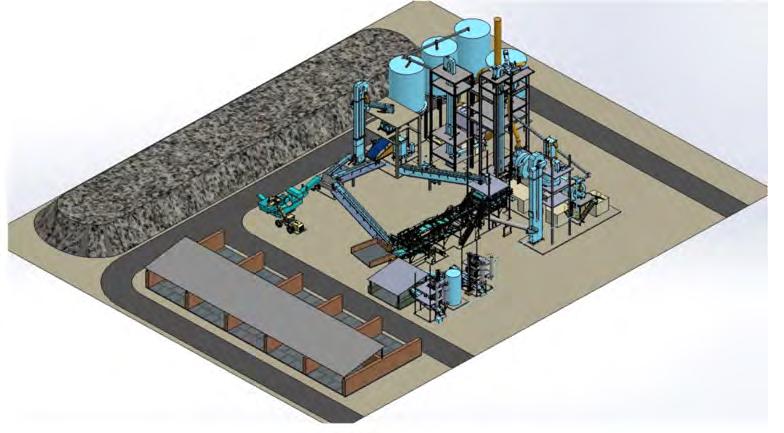

72 Next Generation Construction Materials

Martin Paterson, C2CA, predicts the next best SCMs in the race beyond slag and fly ash.

78 Making White Cement Sustainable

Michele Di Marino, Stefano Zampaletta and Frank Brandt, Cementir Group, explain how to reduce the environmental impact of white cement production, while securing a superior performance.

HEKO Ketten GmbH, Germany, has supplied conveyor chains for the bulk handling industry for more than 100 years. Chains made in Germany are running in thousands of conveyors worldwide. No matter if it is cement, clinker, ash, or fertilizer that needs handling, HEKO’s customers agree that the company’s chains run smoothly. HEKO´s experience solves conveyor problems together with the customers. A wide range of chains and sprockets – even individually manufactured for a specific problem – provide a solution for all demands.

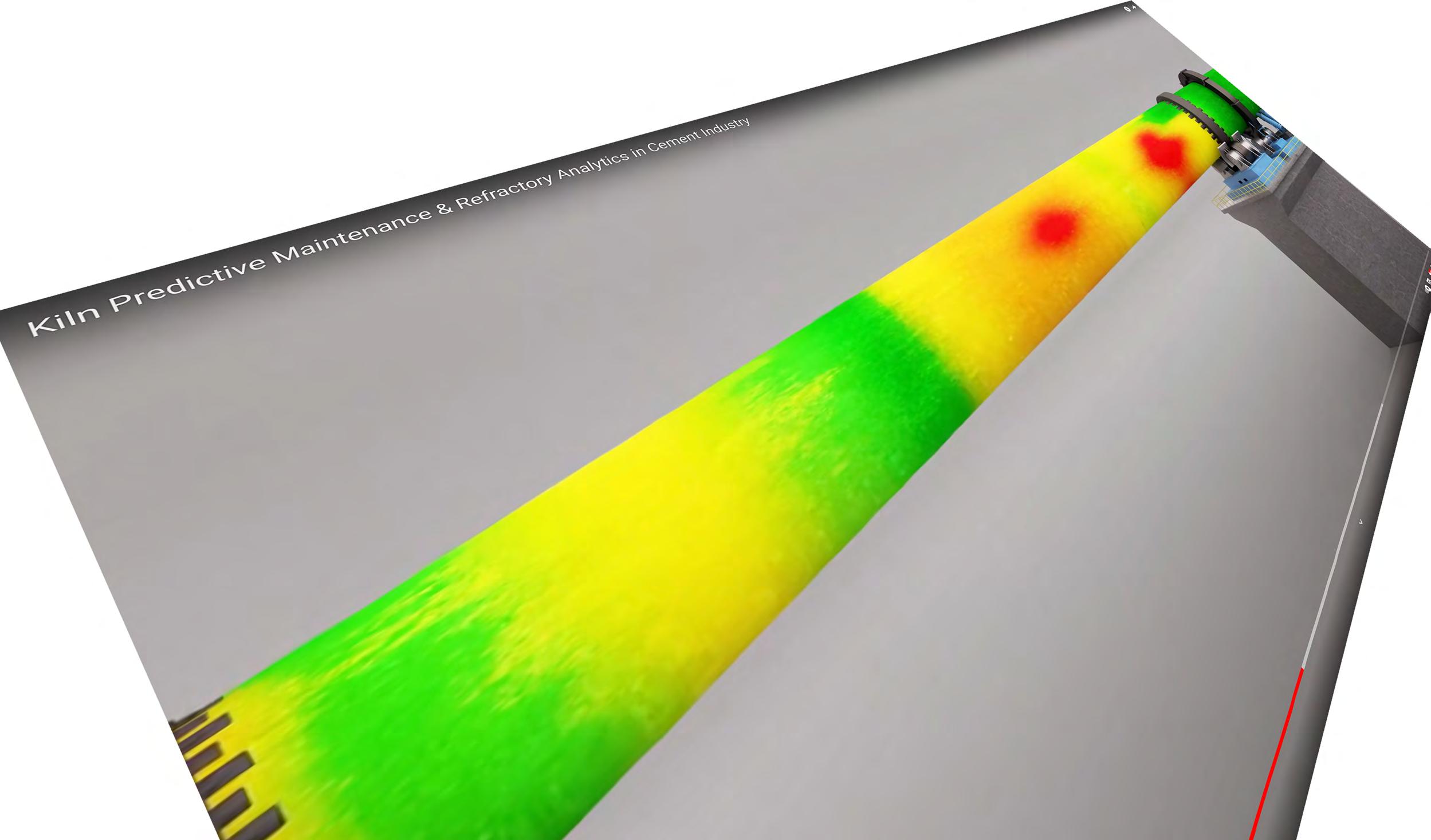

FLSmidth Cement is a technology and service supplier with a passion to help our customers produce cement efficiently. After 140+ years of pioneering new innovations, we are uniquely positioned to be at the forefront of our industry’s green transition.

Find out more at www.flsmidth-cement.com

Production: Iona MacLeod

iona.macleod@palladianpublications.com

Sales Director: Rod Hardy rod.hardy@palladianpublications.com

Sales Manager: Ian Lewis ian.lewis@palladianpublications.com

Sales Executive: Louise Graham louise.graham@palladianpublications.com

Events Manager: Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@palladianpublications.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager: Laura White laura.white@palladianpublications.com

Reprints reprints@worldcement.com

DAVID BIZLEY, EDITOR

DAVID BIZLEY, EDITOR

Hello Dear Reader, and welcome to the March issue of World Cement. Looking at the Contents page this month, you might notice that things are a little ‘greener’ than usual in terms of topics. That’s because the contents of this issue have been specially curated to focus on the challenge of decarbonisation and various aspects of the cement industry’s transition to net zero.

And there’s no doubting the scale of that challenge. By most estimates, the cement industry is responsible for ~8% of all man-made CO2 emissions, making it a major contributor to mankind’s environmental footprint. And demand is only set to grow over the long term as the world builds the vital infrastructure for an increasingly urbanised, energy-hungry, and growing global population. Indeed, the UN predicts that by 2050 – the date that many industries (including cement) and nation states are targeting for net zero – the global population will have risen to 9.7 billion people, 68% of which will live in urban areas.

The cement industry thus finds itself tied to the twin challenges of building the world of the future, whilst playing a pivotal role in limiting the impacts of climate change.

CBP019982

Annual subscription (published monthly): £160 UK including postage/£175 (€245) overseas (postage airmail)/US$280 USA/Canada (postage airmail). Two year subscription (published monthly): £256 UK including postage/£280 (€392) overseas (postage airmail)/US$448 USA/Canada (postage airmail). Claims for non receipt of issues must be made within 4 months of publication of the issue or they will not be honoured without charge.

Applicable only to USA and Canada: WORLD CEMENT (ISSN No: 0263-6050, USPS No: 020-996) is published monthly by Palladian Publications, GBR and is distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to World Cement, 701C Ashland Ave, Folcroft PA 19032

Copyright © Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Uncaptioned images courtesy of Adobe Stock. Printed in the UK.

Palladian Publications Ltd 15 South Street, Farnham, Surrey GU9 7QU, UK Tel +44 (0)1252 718999

Email: mail@worldcement.com

Website: www.worldcement.com

Thankfully, as even a brief flick through the pages of this issue will reveal, these challenges are far from insurmountable. By acting today, developing the necessary expertise, and taking advantage of new technologies, processes, and ways of thinking about operations, the cement industry can become a leader in the green transition and help build a world we can be proud of.

But of course, the sheer importance of this topic isn’t the only reason I bring it up this month – I have an ulterior motive. And if you’re currently reading this whilst enjoying the surroundings of Hotel Cascais Miragem on Lisbon’s Atlantic coast, then you’ll likely have guessed what that is. I am, of course, referring to EnviroTech – World Cement’s first in-person conference and exhibition, devoted to discussing the cement industry’s decarbonisation journey.

If you are one of those who’ve joined us in Lisbon for EnviroTech, then: Welcome! Or as the locals might say: Bem-vindo a Lisboa!

We have a fantastic presentation agenda lined up for you; featuring industry leaders and technical experts from many of the world’s foremost cement producers and equipment suppliers, covering everything from alternative fuels, to carbon capture, to energy efficiency, digitalisation, SCMs, and more. On top of all that, be sure to take part in the multiple Q&A sessions taking place throughout the agenda, enjoy our evening networking events featuring local cuisine, and attend our closing Panel Discussion on 13 March, showcasing insightful commentary from leading industry stakeholders.

And for those of you reading who were unable to join us for EnviroTech this year, I hope this issue whets your appetite and provides you with a taste of the kind of things we have going on. Perhaps you’ll be able to join us next time? Until then, tchau.

Heidelberg Materials North America has announced a significant milestone in its two-stage competitive procurement process as it works to select the capture technology and contractor for providing the CO2 separation solution for its Edmonton, Alberta, Carbon Capture, Utilisation, and Storage (CCUS) Project. This project will be the first full-scale application of CCUS in the cement sector.

As part of this process, Technip Energies, a world-leading engineering and technology player for the energy transition, has been selected as one of the partners for this effort and has been awarded a front-end engineering and design (FEED) contract for the carbon capture technology for the Edmonton CCUS project. Powered by the Shell CANSOLV® CO2 capture system, the Technip Energies solution which will be the basis of the FEED study, offering cutting-edge performance based on regenerable amine technology.

“We are excited to take this latest step in our journey to produce the world’s first net-zero cement”, said Joerg Nixdorf, Vice President Cement Operations, Northwest Region for Heidelberg Materials North America. “With each milestone we come closer to realising our vision of leading the decarbonisation of the cement industry.”

“We are pleased to have been selected by Heidelberg Materials North America to provide the FEED of this groundbreaking project in Canada”, said Christophe Malaurie, SVP Decarbonisation Solutions for Technip Energies. “Leveraging our carbon capture solution powered by the Shell CANSOLV® CO2 capture system, we are committed to supporting the decarbonisation of the cement industry and Heidelberg towards the production of net-zero cement.”

Heidelberg Materials North America will be commissioning the world’s first net-zero cement plant at its Edmonton location by adding CCUS technology to an already state-of-the-art facility. The plant will eventually capture and store an estimated 1 million t of carbon dioxide each

year, which is the equivalent of taking 300 000 cars off the road annually. Subject to finalisation of federal and provincial funding agreements, the company anticipates carbon capture to begin in late 2026.

Lafarge Canada has announced the completion of another important milestone in the company’s commitment to drive both sustainable and innovative products – the full transition of production from traditional general-use cement to OneCem®, a greener product that results in significantly lower CO2 emissions, at the St-Constant Cement Plant in Quebec.

“We are excited to take another crucial step in our sustainability journey. The transition to OneCem production at our St-Constant plant indicates Lafarge Canada’s nonstop commitment to driving positive change within our construction industry. Our teams have been engaged in reducing our products’ environmental impact by embracing greener practices and materials”, expressed David Redfern, president & CEO of Lafarge Canada (East).

OneCem is a limestone blended cement manufactured using less clinker than traditional Portland cement. By converting the St-Constant Plant’s production to OneCem, Lafarge Canada projects a reduction of about 60 000 t of CO2 emissions in 2024. This equates to CO2 emissions from 16 267 passenger vehicles or 877 972 tree seedlings grown for 10 years.

The St-Constant plant has been at the forefront of driving sustainability and innovation in cement production in Quebec for many years. Building upon its achievements in carbon reduction, the plant has implemented initiatives such as circularity through ECOcycle, as well as collaborating with organisations like CarbiCrete and Patio Drummond to facilitate the production of zero-carbon concrete. This transition to OneCem production at the plant reinforces the company’s decarbonisation strategy, widening the availability of environmentally improved options to customers.

“Our team at St-Constant is proud to be taking actions towards sustainability. With this transition, we are not only reducing our carbon footprint but

also aligning with our organisation’s drive to be a leader for sustainable construction throughout Eastern Canada”, added Andrew Stewart, Vice President of Cement, Lafarge Canada (East). “This is a significant development, and we are eager to contribute to the realisation of a net-zero future.”

CONFERENCE

April 28 – 02 May, 2024

Denver, Colorado

www.cementconference.org

ACHEMA 2024

10 – 14 June, 2024

Frankfurt, Germany

www.achema.de

HILLHEAD 2024

25 – 27 June, 2024

Buxton, UK

www.hillhead.com

FICEM TECHNICAL CONGRESS

02 – 04 September, 2024

Guatamala

www.ficem.org

SOLIDS

09 – 10 October, 2024

Dortmund, Germany

www.solids-dortmund.de

VDZ CONGRESS

06 – 08 November, 2024

Düsseldorf Germany

www.vdz-online.de

By exclusively offering OneCem for general use from its St-Constant cement plant, Lafarge is not only contributing to environmental sustainability but also empowering customers to diminish their own carbon footprint in the built environment.

Cemex and Orcan Energy extend waste heat recovery collaboration to a broad decarbonisation partnership

Cemex and Orcan Energy have announced a large-scale partnership to decarbonise cement production through waste heat recovery (WHR).

Building on the initial WHR collaboration at the cement plant in Rüdersdorf, Germany, the partners will now start to exploit Orcan Energy’s flexible and modular technology for Cemex globally. The goal of this multi-site portfolio approach is to convert large waste heat volumes into clean energy, profitably reducing carbon emissions for Cemex overall.

The global construction materials company Cemex and Orcan Energy AG, a leading cleantech company turning waste heat into clean electricity, will analyse the scale-up of the heat-to-power solutions pioneered by Orcan Energy in parallel at several Cemex plants to capitalise on the benefits resulting from a portfolio of installations. The representative findings will be collected to draw a holistic picture for an upcoming global WHR programme. The portfolio approach with detailed multi-site data collection allows the partners to efficiently and quickly deploy Orcan Energy’s modular applications at scale in the second phase of the collaboration.

Sergio Menéndez, President of Cemex Europe, Middle East, Africa & Asia, said: “We already have an initial collaboration with Orcan. Based on the modularity of their solution, Orcan offers the flexibility of both installation and contracts. Thanks to this crucial flexibility, we can adapt to any upcoming changes in our plants. The approach enables us to reduce carbon emissions right now without limiting ourselves in implementing any future technologies such as carbon capture, utilisation, and storage. This partnership will help us achieve our sustainability targets and contribute to our aim to use all available heat.”

Andreas Sichert, CEO of Orcan Energy, said: “We are looking forward to entering this large-scale decarbonisation partnership with Cemex after our initial cooperation in Germany. This step is a testament to Cemex’s forward-looking strategy and the company’s commitment to achieving net zero. For Orcan Energy, this is another milestone in scaling the business internationally with global enterprises. We are proud to be the partner of choice for the cement industry. Our large footprint across the industry shows the economic capability and the technical excellence of our modular and flexible solution, especially

We understand how it is important to efficiently extract and process precious metals and minerals.

You save valuable resources while keeping your employees and the environment safe.

Improve your processes with our comprehensive portfolio of measuring instruments, solutions and services:

Micropilot FMR67B: 80 GHz radar level measurement even under demanding process conditions for smart safety and increased productivity.

Do you want to learn more? www.endress.com/mining

Cerabar PMC51B: Absolute and gauge pressure transmitter combining measurement accuracy with IIoT functionalities.

Field Xpert SMT70: Tablet PC allows mobile device configuration and plant asset management, even in hazardous areas Ex Zone 2.

in view of uncertain future economic and regulative developments.”

In 2021, Cemex and Orcan Energy started their first joint project in Rüdersdorf, Germany, near Berlin, with the installation of six WHR modules which could produce up to 8000 MW/hr per year, reducing CO2 emissions by more than 3000 t. Following this ongoing cooperation, the companies decided to enter a large-scale decarbonisation partnership, exploring the deployment of WHR solutions in several further sites, multiplying today’s electricity savings and CO2 reductions.

In industrial production, usually 30 – 60% of the energy is lost in the form of heat. Cement production is particularly energy and CO2-intensive. Therefore, the cement industry is actively searching for ways to reduce carbon emissions and utilise its waste heat. Modular WHR technology is a proven and commercially viable energy efficiency solution that can be flexibly installed in several applications. The heat-to-power modules can be placed at the pre-heater as well as the clinker cooler. Both heat sources can either be utilised combined or separately. If the waste heat availability changes over time, the modules can be redeployed at other waste heat sources and sites or even be returned. Thanks to this flexibility, various other heat users can be included in the future – the heat extraction will retain its value in any event.

In response to the demands of a changing market, Aggregate Industries’ cement business has announced the second in a series of planned import operation investments – with expansion into a major new cement storage facility for deep sea shipping lines at the port of Southampton.

As part of a 20-year agreement, Aggregate Industries will be working with port owner Associated British Ports and industry-leading cargo handler Solent Stevedores who will be operating the new substantial cement import facility. This latest investment will help the business maintain a continuous supply of lower carbon cementitious solutions throughout the South and South West of England, and together with the

expansion of storage capacities and enhanced infrastructure, the Port will be able to accommodate larger vessels and improve overall transport efficiencies.

It constitutes an important first step in the cement leader’s ambitious strategy to transition to deep sea terminals, with a number of further import network improvements planned and due to be announced over the coming years.

With each import investment strategically chosen to support the firm’s regional logistics infrastructure, this growth in distribution capability will help Aggregate Industries to offer best in class service to local customers – with minimal lorry miles from terminals to sites – for the ultimate in sustainable, agile, secure supply.

Matt Owen, Head of Supply Chain at Aggregate Industries Cement Division commented: “This is a significant project for us. It constitutes the first stage in a wider programme of planned investments over the short to medium term in deep sea imports designed to enable us to serve growing demand.

“The Southern construction market remains buoyant with lots of major projects in the pipeline this year and beyond. Constituting one of the few deep-sea vessel facilities of its kind in the region, this facility will enable us to remain primed and ready to meet our customers rising demand for lower carbon solutions.”

“Our investment in this Port is indicative of the key role freight is playing in helping us to build resilience and surety of supply for customers, so we can always respond in an agile way to customer demand.”

Clive Thomas, Commercial Director at Solent Stevedores, said: “Welcoming Aggregate Industries to the port with this long-term contract will facilitate a significant upgrade in the facilities and increase the range of products Team Solent handles through the Bulks terminal.”

Harry Eves, ABP Southampton Commercial Manager said: “We are delighted to invest in this development project which will convert an existing building into a state-of-the-art cement terminal enabling Aggregate Industries to import sustainable cement into the UK. The facility and the cargo is a first for Southampton and provides a great addition to bulk operations in the Port.”

Fabian Apel, Johanna Hoyt, Francisco Marques, Sebastian Reiter and Patrick Schulze, McKinsey, explore potential pathways for the cement industry to accomplish the transition to net zero.

The cement and concrete industry has established new targets to lower and even eliminate emissions, such as those set by the Global Cement and Concrete Association (GCCA). These targets aim for a 20% reduction of CO2 per metric ton of cement and a 25% reduction of CO2 per cubic metre of concrete by 2030 compared to 2020 levels. The GCCA calls for complete decarbonisation by 2050.

For the past few decades, cement players have relied on traditional levers to reduce their emissions, such as increasing fuel efficiency, and substituting clinker and traditional fuels with more sustainable options. However, to reach net-zero emissions by 2050, annual capital spending will need to almost double to US$60 billion on average from 2021 to 2050.

McKinsey’s analysis suggests that in the short term, the supply of lower-carbon

cement is unlikely to keep up with increasing demand from end consumers with ambitious CO2 targets, particularly in Europe. This is likely to drive short-term green premiums for cement however, as more low-carbon materials become available to end consumers, especially in Europe, these premiums are expected to decline.

In addition, supportive regulation could help speed decarbonisation. For instance, the 45Q tax credit in the US Inflation Reduction Act offers tax incentives for carbon capture, utilisation and storage technology (CCUS) for projects started before January 2033. Similarly, the EU Innovation Fund supports industry decarbonisation in Europe by funding innovative technologies.

Four pathways show particular promise for effectively targeting the carbon-intensive aspects of cement and reducing its use in concrete. Although some of these solutions require further development to be scalable, each holds significant abatement potential.

Lower-carbon clinker facilitated by CCUS

Clinker, an intermediary used as a binder in cement, is a core component of cement products, but its production process is highly emissive. Lower-carbon clinker uses CCUS technology to capture and manage these carbon emissions before they are released. Other than moving away from clinker entirely, CCUS is the only known technology that addresses the process emissions in clinker production.

Admixtures are substances added to concrete to improve its performance, such as its durability and workability. They can also reduce the amount of cement needed in concrete, which both lowers cement-related costs and reduces concrete’s carbon footprint. However, a few obstacles currently hinder the widespread adoption of admixtures.

Alternative cementitious materials have historically struggled to scale. However, current investment trends and rapid technological advancements have allowed start-ups to disrupt the alternative cementitious space with low-carbon offerings. In particular, supplementary cementitious materials (SCMs) offer promising ways to significantly reduce the carbon footprint of traditional cement and concrete.

Circular economies aim to minimise the environmental impact of concrete by using less

virgin cement – and therefore less clinker – in its production. A few strategies can help cement and concrete players increase circularity, such as reusing concrete waste and incorporating recycled materials in new concrete production.

Although these four pathways are complementary, they will compete for growth and investment among players, and the pace at which they are adopted may differ markedly across markets. Down the value chain, new admixtures and recycling could create great value, although recycling is difficult to scale.

For cement players in the middle, balancing CCUS-driven lower-carbon clinker and innovative cementitious solutions will hold the key to their near- and long-term success as different technologies mature. Their choices will be driven by cost and facilitated by regulators, industry organisations and specifiers building pathways toward decarbonisation.

McKinsey’s analysis has identified nine potential future business models for cementitious producers and solution providers in the pursuit of net-zero cement.

f Low-cost traditional cement players – As lower-carbon options take greater market share, the last remaining producers of traditional cement are expected to be players focused on lowering costs.

f Retrofitted lower-carbon cement producers –Existing cement producers can be retrofitted to manufacture cement with low- to net-zero carbon by leveraging decarbonisation technologies such as CCUS.

f Lower-carbon clinker and cement disruptors – New clinker megaplants and grinding facilities with CCUS capabilities could produce net-zero cement, although cement products using lower-carbon clinker could vary in how emissive they are, depending on the mix of materials they use and their production process. This could be facilitated by offtake agreements and direct collaboration with forward-looking real estate developers and contractors.

f Specialised players monetising CO2 (mineralisation) – Another emerging space is monetising CO2 via mineralisation. Specialised players could use CO2 or carbonated recycled waste in aggregates and SCMs, or directly in the production of concrete during manufacturing and curing processes.

f SCM producers – Players focusing on novel processes and materials could provide SCMs as partial or full replacements for clinker. These may be challengers or existing

suppliers of incumbents. Players in this space also have the opportunity to license their technology.

As cementitious producers navigate the materials transition, other forward-thinking players will be able to find business opportunities supporting them. These solutions providers could offer lower-carbon clinker, fillers, and special cement blends, which will be critical for retrofitted low-carbon cement producers.

As players innovate tailored solutions to meet customer needs, a number of cementitious-solutions providers could emerge:

f Construction material recyclers –These players will own construction and demolition waste, controlling a significant source of raw materials for new construction.

f CCUS as a service provider – Emerging players can offer end-to-end CCUS capabilities, from technology and operation of carbon capture units to CO2 storage and transportation to sinks.

f Providers of construction chemical solutions – New and established players can develop innovative chemicals and additives that allow for a higher share of cementitious materials in cement, less cement in concrete, and higher recyclability of concrete.

f RMC mix optimisation platform players – New platforms could offer data-based software-as-a-service models for RMC mix optimisation, which could reduce the dependency of manufacturers on specific cement types.

To reach net zero, the cement industry will need to engage in active efforts. This will be a real transformation from past ways of operating, and the time to start building this muscle is now. If incumbents and disruptors can invest strategically in innovative technologies and business models, they could be well positioned to lead in the industry landscape to come.

Fabian Apel is an associate partner in McKinsey’s London office, Johanna Hoyt is a consultant in the Toronto office, Francisco Marques is an associate partner in the Lisbon office, Sebastian Reiter is a partner in the Munich office, and Patrick Schulze is a partner in the Berlin office.

SOME THINK THAT WASTE IS WORTHLESS. WE THINK DIFFERENT.

Mike Ireland, PCA, explains how Portland-limestone cement is just one of many methods being used by cement producers to reduce their environmental impact.

From 3D printing changing the face of manufacturing to the untold new levels of productivity promised by artificial intelligence, every industry is incorporating innovation into its products to arrive at new solutions that meet business and sustainability goals.

The cement industry is also experiencing this change, with major investments being made in technology and innovation to meet rising demand while cutting CO2 emissions.

PCA’s Roadmap to Carbon Neutrality, now in its third year, calls for the entire cement-concrete-construction value chain to work together to create new ways to manufacture cement and concrete with an added benefit of being more sustainable. By collaborating, it will be possible to meet consumer and regulatory demands to cut emissions and build for a better future.

This innovation is happening across the industry, from lower-carbon inputs to greener products,

and none has been more widespread than the development of Portland-limestone cement (PLC) and other ternary blends, as well as a new batch of small-scale startups creating new lower-carbon products. Cement has always been a material that is constantly evolving – and producers have always innovated with sustainability in mind.

Going mainstream

PLC is engineered with a higher limestone content, resulting in approximately 10% fewer emissions. Most people consider cement and concrete to be basic building materials that have remained unchanged for decades, but as both PCA and the wider industry know, these materials are anything but mundane – cement and concrete are some of the most versatile, adaptable, and customisable materials in the world. And PLC now allows the industry to, quite literally in some cases, create a new pathway with cement and concrete to reduce the carbon footprint of every project.

With PLC, construction professionals can now conduct repairs with greater sustainability in mind, particularly on projects that have been

historically focused on strength. They can also do this knowing that PLC has been used in virtually every segment of construction, from residential homes and commercial office space to interstate paving and bridges, high-rise construction, parking lots, airport paving, and more.

The demand for lower-carbon cement and concrete is increasing as more consumers understand the need for sustainable concrete, and PLC is one of the most widely available options for cutting emissions in the immediate term and meeting that demand. It performs just like the cement that construction workers are used to working with – having the same specifications and mix design – but with a better carbon profile. PLC can be used anywhere traditional Portland cement is used. All that is needed to ensure the same results is consistent communication among the industry professionals on the job.

The production of PLC in the US has grown significantly in recent years. Currently, there are 34 US states that house cement plants. PLC is produced in at least 24 of them. Based on public announcements, PCA has determined that at least 35% of the domestic cement industry, measured by clinker capacity, has announced the transition from traditional Portland cement production to full PLC production. This translates to roughly 34 million t.

This trend is expected to grow. At least 50 plants are producing or have announced plans to produce PLC in the US. Overall, this accounts for more than 60% of US clinker capacity. And most encouragingly, PLC is starting to become the mainstream option. Statistics from the United States Geological Survey show that by June 2023, the market share for blended cements was 54.5%, and PLC’s share of blended cement was 95%. This marked the first time PLC represented more than 51% of the American cement market.

This growth is remarkable, considering that as recently as mid-2021, the market share for blended cements remained below 5%. All in all, by using PLC and other blended cements, the domestic cement industry managed to avoid more than 2.2 million t of CO2 in 2023 without compromising the strength and reliability of traditional Portland cement.

Continental Cement Company facility, Hannibal, Missouri.

People think shipping automation for the cement industry is a complex thing.

And it is. All the processes and the machinery to be controlled takes thought, skill and experience to accomplish.

All of it so that when people use the resulting software and hardware it makes their day go a lot smoother. Less hassle. Fewer errors.

It’s hard to make things so easy, but at PSCL that’s what we do.

Cement Distribution Management Suite

Raw Materials

Receiving

Self-Service Loading Plant Portal

Across the entire cement-concrete-construction value chain, sustainability means very little if it is not backed by performance. Testing new PLC mixes, with test pours and scenarios in a variety of temperatures, wind conditions, and humidities, is crucial.

This innovation is being deployed at scale, with exacting testing to match. In late 2021, The Monarch Cement Company made the strategic decision to test PLC’s efficacy by becoming its own guinea pig. The company used PLC it manufactured in a major capital improvement project: construction of a new raw material storage facility at its Humboldt, Kansas, plant. The plant is a 1.3 million tpy operation that requires well-informed handling and preparation of raw materials before they enter the kiln.

The enormous 97 500 ft2 industrial building, which required 6000 yd3 of cast-in-place concrete, offered Monarch an opportunity to test the new cement’s performance versus its traditional Type I/II product in a demanding application.

The construction comprised above- and below-grade members, as well as vertical and horizontal members, including the foundation, piers and piles, walls, interior floor slab, and surrounding pavement. These members would be put to the test, as operations at the storage facility involve fully loaded tractor-trailers delivering materials inside the building, as well as other heavy equipment, such as front-end loaders and 75 t dump trucks, handling materials within the 300-by-325 ft structure.

Complicating matters is the facility’s Midwest location. Concrete at the Humboldt facility must be highly durable to withstand the numerous freeze-thaw cycles that occur annually to provide a long lifespan.

Acting as both a research and bona fide construction project, the process included testing

of more than 250 concrete samples, with the PLC concrete showing virtually identical performance to the Portland cement concrete. Compressive strengths at seven days were 4400 psi, increasing to 5500 psi by 28 days, and 5800 psi by 56 days.

Despite temperatures ranging from 48 – 94˚F, with winds up to 25 mph at times and relative humidities ranging from quite low (23%) to very high (97%), the result was a successful concrete placement with a more sustainable mix design. More importantly, it was a tangible, large-scale proof of concept of this new product that advances sustainability while maintaining strength and durability.

Carbon capture: cutting emissions at the source PCA members are prioritising the development of carbon capture, utilisation, and storage (CCUS), as this can be a key tool to harness emitted CO2 before it escapes into the atmosphere during the manufacturing process. And beyond capture, the industry is focused on reuse, which brings added value to captured CO2

The technology is nascent, but companies are already making advances toward implementing this solution in their day-to-day operations. To do so, they can leverage significant government assistance, as both the private sector and the government share similar goals of using innovation to stimulate greater efficiencies with lower emissions.

For example, Heidelberg Materials expects the CCUS system on its Brevik plant in Norway – the world’s first industrial-scale carbon capture system on a cement plant – to start operating this year. In 2026, the company plans to begin operating a CCUS system at its Edmonton, Alberta, facility in Canada, which is designed to capture 95% of plant CO2 emissions. Heidelberg has also been selected by the US Department of Energy’s Office of Fossil Energy and Carbon Management to conduct a front-end engineering design (FEED) study on carbon capture.

Greener fuels in, greener cement out Made with everything from tyres to pistachio shells, lower-carbon alternative fuels are becoming more prevalent in cement plants across the United States. As the industry progresses toward carbon neutrality, the

adoption of new fuel sources is taking shape not just at scale, but also at an institutional level.

For example, Continental Cement Company launched Green America Recycling, which provides waste treatment, storage, and disposal facilities at its Hannibal, Missouri, and Davenport, Iowa, cement plants to replace coal with locally available materials to power its manufacturing operations with far fewer emissions. Continental Cement currently has a 42% fuel substitution rate; in 2019, it used more than 130 000 t of discarded materials as fuel throughout its two locations. The company is also working to expand the Green America Recycling facility at its Davenport cement plant to increase the use of non-coal fuels, reducing landfill waste and significantly cutting net emissions.

Continental Cement is also working with the utility companies it relies on to ensure incoming power to the plant comes from renewable energy sources. In 2021, MidAmerican Energy provided 86% of the power for the Davenport plant from renewable electricity sources such as wind and solar. Continental Cement saved more than 150 000 t of CO2 in 2021 alone by using renewable electricity.

These notable activities from PCA member companies are just the beginning. PCA is committed to collaborating with the entire cement-concrete-construction value chain and enhancing overall communication. The industry is stepping on the gas (or the electric vehicle accelerator pedal, if we wish to keep cutting our CO2 emissions) and revving forward in all respects – whether it is optimising cement with PLC or advocating for carbon uptake research so the industry can understand the full use-phase benefits of concrete. Together, the industry is working to meet the demand for a more sustainable future.

Michael Ireland is the president and CEO of the Portland Cement Association (PCA). Previously, Mike was associate executive director of the American Society of Mechanical Engineers (ASME), as well as CEO of two other professional associations. He is a seasoned association executive with expertise in all phases of organisational management, including executive leadership, marketing and communications, workforce development, philanthropy and fundraising, and membership development. Throughout his career, he has been known for fostering a culture of camaraderie and customer focus, thanks to his sense of creativity and ability to help organisations positively navigate strategic change.

Climate change poses a serious threat to society, ecosystems, and the planet. The UN Paris Agreement, signed by nearly every global nation, sets the target of limiting global warming to 1.5˚C above pre-industrial levels. However, the world is already projected to propel right past that target, and it is now critical for the global community to enact rapid and far-reaching transitions across all economic sectors, including land, energy, industry, buildings, and transport to avoid the most catastrophic effects of climate change.

The cement industry is well poised to contribute to the low-carbon transition by significantly reducing its climate impact. Globally, cement production accounts for approximately 8% of all carbon dioxide emissions. Most of these emissions result from the calcination process involved in producing clinker, the primary intermediate component of Portland cement (PC). Replacing PC with supplementary cementitious materials (SCMs) or alternative cementitious materials (ACMs) can eliminate the need for clinker and significantly lower overall emissions from this sector. There are a variety of cementitious materials that can be naturally derived, manufactured, or result as a by-product of other industrial processes.

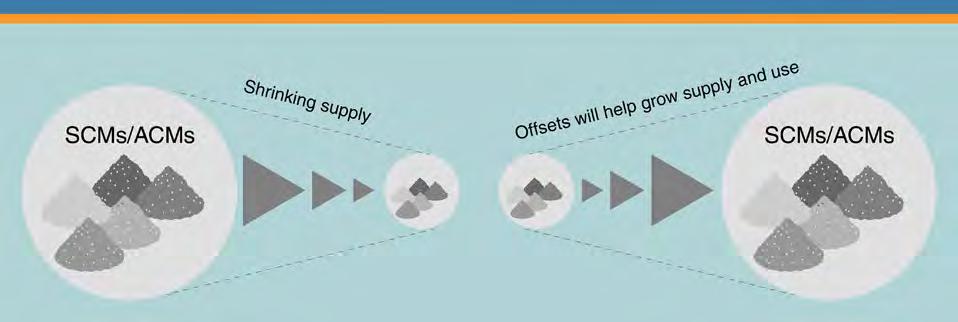

The current supply of traditional SCMs, primarily fresh ash from coal-fired power plants or traditional slag from steel manufacturing, is shrinking and insufficient to meet growing global demands. Although this is concerning for SCM sourcing, the decline of these emission-intensive by-products signals a positive transition to cleaner energy and industrial operations. To bring new SCMs/ACMs to market and further drive overall, there is a need to incentivise the development and deployment of novel technologies at scale. This is where the voluntary carbon market (VCM) can help. Financial incentives, in the form of carbon credits, can help increase production, availability, and use of new lower-emission SCMs/ACMs. This will ultimately reduce the emissions associated with the cement sector by reducing or removing an emission intensive component (clinker) in the end product.

The Climate Action Reserve’s US Low-Carbon Cement Protocol provides the accounting guidelines for issuing carbon credits to low-carbon cement projects, incentivising industrial-scale availability and use of SCMs/ACMs that can replace PC and reduce associated greenhouse gas (GHG) emissions. The protocol offers a pathway for the voluntary carbon market to help offset costs to competitively bring these SCMs/ACMs to market, which is arguably the most important decarbonisation pathway for the cement industry to meet its environmental goals and significantly reduce emissions.

Under the protocol, the Climate Action Reserve issues carbon credits for emissions reductions achieved from the combination of both:

f The production of SCMs or ACMs that can partially or fully replace PC in ready-mix or concrete products; and

f The use of these products instead of PC to displace associated emissions.

Credits are issued upon reasonable assurance that PC was displaced with verifiable mechanisms.

Emission reduction quantification is calculated as the delta between project emissions, SCM/ACM production, and baseline emissions, PC production.

The US Low-Carbon Cement Protocol sets stringent eligibility and accounting standards to ensure that emissions reductions associated with the production and use of SCMs/ACMs are real, additional, and permanent.

The project developer by default is the SCM/ACM supplier or manufacturer, but can also be low-carbon cement technology suppliers, PC manufacturers, ready-mix concrete facilities, and/or entities that specialise in carbon offset project development. The project developer is expected to provide all necessary parameters to quantify project emissions at a facility-specific level. For baseline emissions, project developers must use site-specific PC parameters if available.

Figure 2. The Reserve’s US Low-Carbon Cement Protocol requires both the manufacture and use of SCMs/ACMs in cement production to achieve GHG reductions and receive carbon credits.

Figure 2. The Reserve’s US Low-Carbon Cement Protocol requires both the manufacture and use of SCMs/ACMs in cement production to achieve GHG reductions and receive carbon credits.

• Multipurpose infeed system for front wheel loader suitable for chipped tyres and other fuel qualities

• Air supported FuelBelt for low friction / wearing and minimum power consumption

• FuelBelt for enclosed transport of RDF to the injection point

• Automatic sampling station to take samples without danger for operator from the RDF

• FLEXIBLE and MODULAR to allow the project to be adjusted to the needs of each step and adapted to the needs of each plant

AUMUND

Foerdertechnik GmbH

alternative-fuels@aumund.de

www.aumund.com

In the absence of this information, a regional and conservative PC emission factor is applied.

The protocol’s performance standard is based on a national and state level assessment of common practice for the production and use of SCMs/ACMs to replace PC. Only the production and use of SCMs/ACMs that exceed common practice are determined to generate additional GHG reductions. Eligible products have a usage rate in concrete at near zero (first-of-its-kind) or less than 5%. Examples of eligible SCMs/ACMs include:

f Beneficiated coal ash (upgraded and/or harvested coal ash), which includes the major co-benefit of targeting coal ash disposed across the country.

f Raw natural pozzolans (i.e. volcanic ash).

f Calcined clays/shale and/or metakaolin.

In 2020, the US concrete industry utilised approximately 11 million t of coal ash and 2.6 million t of traditional slag cement. Based on current market penetration rates of commonly used SCMs in the US for cement and concrete production, the following are ineligible:

f Portland Limestone Cement

f Traditional fresh coal ash

f Traditional slag cement

f Silica fume

Silica fume is a niche product for the cement and concrete industry. Therefore, while it is not commonly used in concrete products in the US, it is readily available making it a ‘business as usual’ case and ineligible for crediting under this protocol.

Legal requirement test

For a project to pass the legal requirement test, the production and use of a SCM/ACM in cement production must be voluntarily undertaken, and not have occurred due to laws, statutes, regulations, court orders, environmental mitigation agreements, permitting conditions, or other legally binding mandates, such as cap-and-trade programmes.

The Reserve did not identify any existing federal regulations that obligate the production or use of SCMs/ACMs. However, some states have legal requirements that would deem a project ineligible:

f CalTrans has a threshold to include a minimum percentage of SCMs in concrete used for state projects. SCMs sold to and used by Caltrans must be above the minimum threshold to be eligible.

f The North Carolina Coal Ash Management Act requires the installation and operation of ash beneficiation projects from three specific sites in North Carolina. Other coal ash harvesting projects not mandated under this act are eligible if they meet all other eligibility requirements.

f Emission reductions from SCM/ACM production facilities that are included under an emissions cap are not eligible. Therefore, SCMs/ACMs being sold to a PC facility under the California Cap-and-Trade regulation are ineligible for crediting.

Project activities must not cause material violations of applicable laws, including air and water quality, labour, and safety. Additionally, the protocol

includes social and environmental safeguards that must be considered in the project design and implemented throughout the lifetime of the project, including mitigation of potential releases of pollutants that may cause degradation of the quality of soil, air, surface and groundwater.

Eligible SCMs/ACMs must meet applicable quality standards to ensure the product is competitive in the market and able to displace PC. ASTM International, a standard setting body, establishes procedures and standards for certifying specific cement and concrete products. For a project to be eligible, the SCM/ACM must meet any applicable ASTM standards and project developers must provide their ASTM standard report when an ASTM standard is available. If the SCM/ACM product does not have a specific ASTM standard, the project developer must provide verifiable evidence (via other standards specifications) that the quality of the product meets end-use requirements and will be used to displace PC.

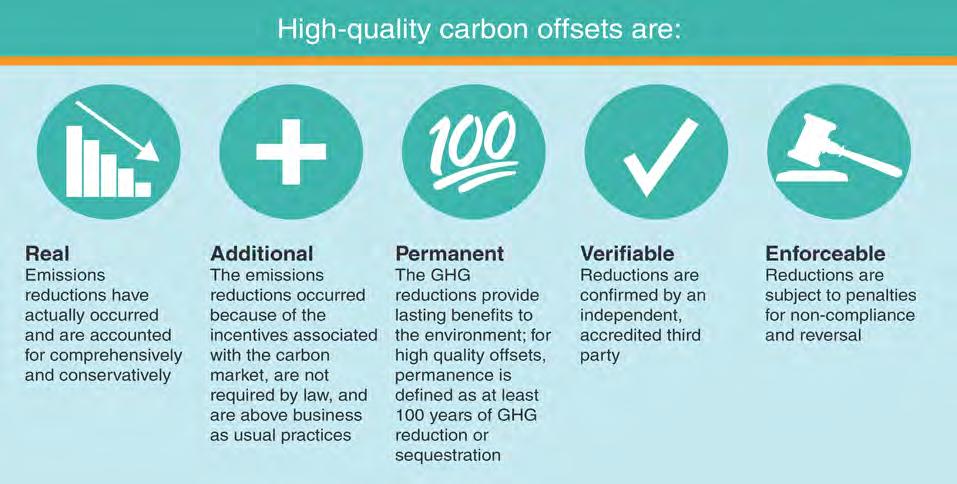

To achieve the outlined principles in Figure 3, the Reserve employs several measures to ensure the high quality of credits. With multi-stakeholder, local, and public input, the Reserve develops a protocol-specific performance standard threshold to assess project additionality, meaning research is conducted up front to determine common practice and activities above common practice. GHG reduction activities that fall within the business as usual threshold are presumed to be financially viable without access to GHG credits and therefore are not additional. Similarly, all projects are subject to a legal requirement test and all projects undergo independent verification by ISO-accredited verification bodies that have received and passed training both for verifying under the Reserve programme and for verifying under each specific protocol.

Innovations that benefit the climate can be expensive to implement, preventing their widespread adoption. The voluntary carbon market is designed to provide the necessary lift above this financial barrier to make these innovations economically feasible. GHG emission reduction projects are undertaken voluntarily, beyond legal requirements, above business as usual, and in adherence to a rigorous set of eligibility criteria and accounting standards. In accordance with a specific protocol developed by a carbon credit registry, projects can earn carbon credits, with one credit equivalent to

one metric ton of CO2e emissions reduced, sequestered or avoided. Carbon credits have been around for decades (the Reserve’s first offset protocol was adopted in June 2005) and have successfully created an avenue for channelling investments to GHG reduction projects that result in real, additional, permanent, verifiable, and enforceable emissions reductions. Once issued, carbon credits can then be purchased by a company/organisation/individual to mitigate their GHG emissions profile.

Carbon markets have received negative press recently for allowing low-quality credits in the market. As with all sectors of the economy, there are varying degrees of quality when it comes to offsets. The VCM is making strides to address legitimate concerns about ensuring and distinguishing carbon credit quality. One initiative that market participants find very promising is the Integrity Council for the Voluntary Carbon Market (ICVCM), which has developed Core Carbon Principles (CCPs) that provide thresholds for accounting principles, disclosure and transparency, and sustainable development benefits that high-integrity carbon credits should meet. The ICVCM CCP label will distinguish high-quality carbon credits that channel finance towards genuine and additional GHG reductions and removals.

PC makes up only a small portion of the concrete mix by mass (approximately 10%); however, it comprises roughly 80 – 90% of concrete’s total GHG emissions. Thus, one of the most effective strategies to reduce GHG emissions associated with concrete production is to replace some or all of the PC clinker with SCMs/ACMs.

Despite the potential for SCMs/ACMs to significantly reduce concrete’s GHG footprint, they are not ready to be deployed at scale due to significant economic hurdles. The concrete, cement, and SCM/ACM industries require innovative yet costly technological advancements to bring new SCMs/ACMs to market. The voluntary carbon market can provide the financial incentive to increase the supply and use of low-carbon cement, which will result in significant emission reductions.

McKenzie Smith is an Associate Director at the Climate Action Reserve, where she is responsible for advancing the Reserve’s protocol development and update process, leading the implementation, evolution, and expansion of agricultural carbon offset protocols, and applying her technical background and experience to support protocols and projects in the industrial processes and gases sector.

UTIS considers the role of hydrogen technology in not only improving combustion efficiency but also decarbonising cement production.

The Portuguese company, UTIS (Ultimate Technology to Industrial Savings), was established in April 2018 after more than three years in Research & Development (R&D), which included full scale tests with thousands of working hours, specifically in clinker production kilns. The company developed a new and disruptive approach, UC3® technology, using hydrogen (H2) injection in continuous combustion, helping hard-to-abate sectors, such as cement, by improving combustion efficiency (lower fuel consumption), thus allowing an effective and sustainable decarbonisation pathway.

With a multidisciplinary team possessing deep knowledge in different sciences and fields, such as hydrogen, project design/concept/industrialisation, and dozens

The

of years of experience in clinker and cement production, the cement industry was the first industrial sector where the patented UC3 technology was applied (8 years ago).

Since April 2018, more than 140 projects have been implemented in the cement sector, spanning 27 countries, where UC3 technology is widely adapted, including across the world’s major cement producers.

Being a transversal technology capable of optimising all continuous combustion processes (as fuels applied), UTIS is today present in several other sectors, including power plants (e.g., biomass, MSW – Municipal Solid Waste) and steel, with the same purpose and commitment: higher combustion efficiency of the combustion processes to reduce the carbon footprint.

With continuous organic growth, UTIS is today also present, through its subsidiaries, in Brazil and New Zealand, enabling a closer presence with the market, as aftersales.

The UC3 technology, currently at TRL9 (Technology Readiness Level), has been full-scale since 2016, operating for hundreds of thousands of hours, whilst remaining environmentally friendly. The main principles are:

f Hydrogen as an enhancer and never as a fuel (energy basis), maintaining the fossil and/ or alternative fuels (AF) as the source of energy (MW) needed for the clinkerisation process.

f Faster oxidation of the fuel carbon chains (lower CO emissions), enabling a quicker release of its potential energy per unit of time, meaning that more MW are available for the fuel NCV (net calorific value) (more energy (MW) is released from the same mass of fuel).

f Minimised excess of air, for the same burning conditions, providing a lower supply of total energy needed (direct reduction of specific heat consumption (SHC)).

Through a kinetic effect (and not stoichiometric), the addition of H2 promotes a radical mechanism reaction, speeding up the combustion process, allowing higher combustion efficiency of fuels with much worse burn-out (by default, AF and/or fossil fuels are more difficult to burn).

Reaching this new balance, with UC3 technology, specifically in the cement sector, several benefits/ savings can be reached in the very short term. This makes UTIS a great competitor when compared with other BAT (Best Available

27 countries with the UC3 technology implemented in the cement sector.

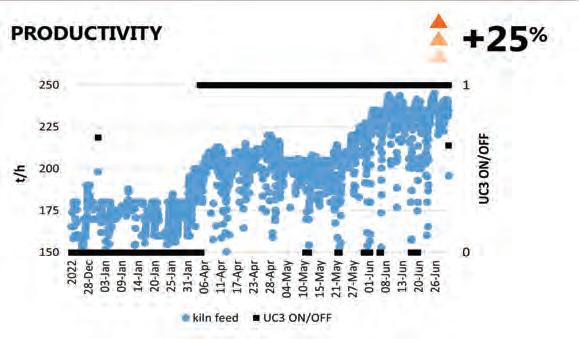

Higher productivity. Case study No. 1.

27 countries with the UC3 technology implemented in the cement sector.

Higher productivity. Case study No. 1.

•

• Removes 95 to 99% of carbon dioxide emissions

• Easy retrofit

• Suitable for existing and new plants

• Modular solution scales up to all plant capacities

• Less pre-treatment than alternative technologies

•

Technologies), even for kilns retrofits, both from an environmental and economical point of view (with ROI rates, much lower than the usual ones in the industry).

Benefits when applied to clinker production

In this framework, several benefits from this higher combustion efficiency can be translated into:

f Higher productivity

f Lower SHC (less CO2)

f Higher AF rate (less CO2)

f Solid fossil fuel trade-off

f Higher sulfur volatilisation control

f Lower ammonia consumption (less NOx)

f Higher clinker quality (less CO2)

Case studies

1. Higher productivity

An increased oxygen availability for the same draft, allows the kiln to operate with a higher production level, even for ID fans at full capacity.

Considering the absence of external bottlenecks (e.g. feeding systems and/or lack of raw meal), disruptive kiln productivity improvements can be achieved.

2. Lower SHC (less CO2)

Through a more stable kiln operation and increased resilience to process perturbations with lower excess of air, remarkable reductions of SHC can be achieved with direct impact on the decarbonisation pathway.

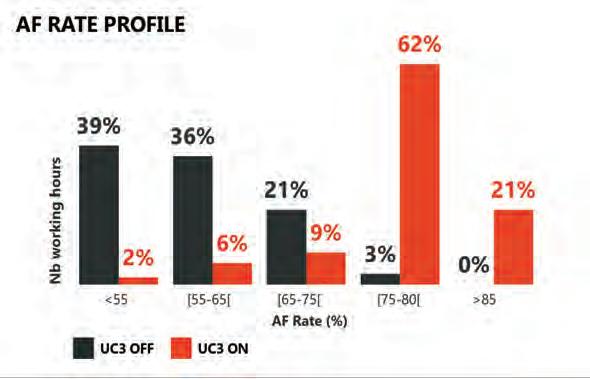

3. Higher AF rate (less CO2)

With an extended kiln stability limit, through better fuel burn-out, a much higher AF consumption is allowed without compromising the clinker quality. UTIS has a customised solution for total CO2 reduction from fossil fuels usage.

4. Fossil fuel trade-off

The UC3 technology allows the usage of fuels with worse burn-out (by default, with lower specific cost), without losing kiln efficiency. Different types of coals (low to high ashes) and different types of petcokes (low to high sulfur), are the most common requests, fully accomplished.

5. Higher sulfur volatilisation control

The UC3 technology promotes a very high control of sulfur volatilisation (εSO2), even with much higher inputs of sulfur, both from fuels and/or raw/secondary materials.

AF rate profile. Case study No. 3.

Fossil fuels mix. Case study No. 4.

AF rate profile. Case study No. 3.

Fossil fuels mix. Case study No. 4.

An industry-leading performance spectrum coupled with exceptionally low energy consumption and other technological advantages ensure that Pfeiffer mills and machines keep your CO2 footprint smaller than that of others. Ask us about it!

Sustainability going forward – Getting it done!

www.gebr-pfeiffer.com

Whenever applied, petcoke additives for sulfur volatilisation control can be avoided.

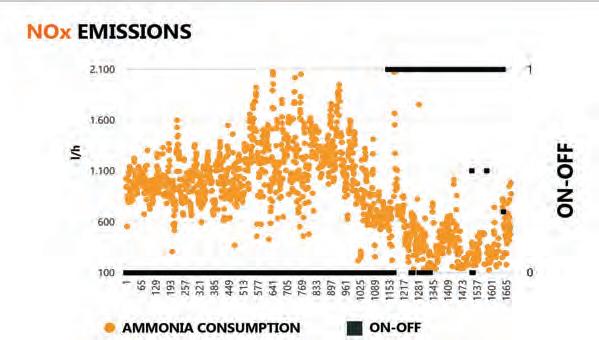

6. Lower ammonia consumption (less NOx emissions)

The UC3 technology decreases NOx emissions, and reduces up to 100% ammonia/urea

consumption (if used), due to three main drivers: higher kiln stability, lower excess of air and higher TSR (Total Substitution Rate), whenever AFs are in place.

7. Higher clinker quality (less CO2)

The UC3 technology also improves clinker reactivity, both from higher kiln stability, due to the improved fuel burning process. Increased early strength up to 25% can be reached, which opens further opportunities for CO2 reduction in the cement industry.

Continuous research & development

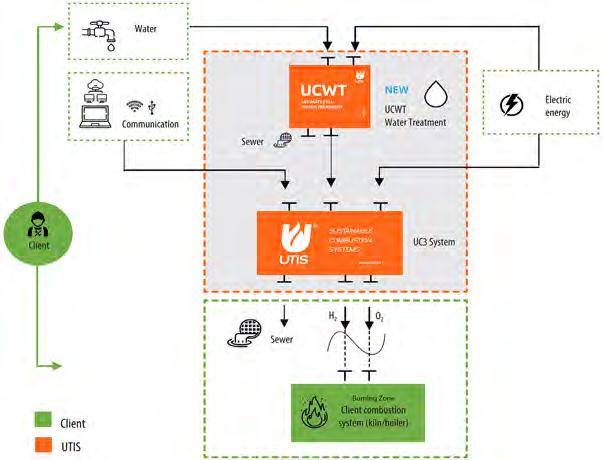

While UTIS continues to develop its UC3 technology for the cement sector, offering a customised solution for 100% CO2 reduction from fossil fuels, UTIS is also investing in the UC3® Systems (ULTIMATE CELL® CONTINUOUS COMBUSTION), which allow the company to deploy its technology, while keeping safety as the highest priority and concern.

The company is proud to announce that no losses have ever been reported across its operations.

The UC3 System is designed for industrial environments, producing both H2 and O2, on demand (without mid storage), complying with local permits and certifications. The system is designed for a plug and play installation, being fully automated, with local command via HMI control and remote control, both from the client’s CCR (centralised control room), as well as UTIS’ own CCR.

Also developed by UTIS is the water pre-treatment system, UCWT – ULTIMATE CELL WATER TREATMENT, which guarantees both higher UC3 system reliability (whenever the root cause is due to lack of water specification fulfilment), and reduced maintenance costs.

Fully committed and capable of bringing industrial savings, UTIS can provide a customised solution for the cement sector to help solve future challenges.

NOx emissions. Case study No. 6. UC3 inputs and outputs (UC3 system with UCWT supply).

Jeffrey Tyska, Honeywell UOP, explores key technologies for enabling carbon capture from cement plants.

Decarbonising the industry of cement production is crucial to limiting global warming to 1.5˚C, a target set by the United Nations. According to the GCCA 2050 Cement and Concrete Industry Roadmap, cement producers will have to fully decarbonise by 2050 to meet this goal.1 This decarbonisation process will require major CO2 reductions, as cement currently accounts for nearly 7% of global emissions according to the UN.2 While improved efficiency and savings in cement clinker production will also help reduce emissions, perhaps the most promising method of reducing carbon emissions from cement plants is carbon capture. By 2050, over 1 Gt/y of CO2 will need to be captured by cement producers, which is a more than 400% increase from the 2030 goal of 258 million tpy.3 Honeywell UOP has a portfolio of carbon capture solutions that can help producers achieve these goals while also helping to minimise energy usage and cost of capture. These include solvent, adsorbent, and cryogenic CO2 capture solutions.

Traditional solvents such as MEA (monoethanolamine) have been used for over 80 years to capture acid gases such as

CO2 in natural gas plants, however they face significant challenges in flue gas services due to large regeneration energy requirements, tall absorbers, and high rates of solvent degradation in the presence of oxygen.4 Honeywell UOP’s Advanced Solvent Carbon Capture technology (ASCC) was developed in collaboration with the University of Texas in Austin to help address these challenges and provide a cost-effective solution for carbon capture.

ASCC uses a proprietary solvent in tandem with a high-pressure stripper and a novel heat exchange flow scheme (Figures 1 and 2) to mitigate the effect of these challenges. The solvent enables a high mass transfer rate, leading to shorter and less expensive absorbers. The solvent also has high thermal stability,

enabling high regeneration pressures of 4 – 6 bar (g). The high regeneration pressure significantly reduces the amount of electricity required to compress the captured carbon dioxide to the desired product pressure for sequestration, while also lowering the CAPEX required for CO2 compression. Both the solvent and novel heat exchange scheme enable low regeneration energy requirements, typically ranging from 2.1 – 2.4 GJ/Mt of CO2. While flue gas conditioning is generally required to manage contaminants such as NO2, the ASCC solvent is more resistant to oxidative degradation than many other solvents, leading to reduced makeup requirements and less reclaiming.

While ASCC units often use steam to regenerate the solvent, they can also be configured to run using only electricity. To help lower overall costs, the design involves a unique heat recovery scheme which leverages heat available in the incoming flue gas and overhead compressor discharge.

The ASCC solvent has been tested for over 8500 hours at the National Carbon Capture Centre (NCCC) in Wilsonville, Alabama using flue gas CO2 concentrations of 4 – 12 vol% and a variety of contaminant concentrations, with higher concentration testing performed at the University of Texas. The testing has included a skid specific to the unique heat exchange set up for ASCC, along with the high-pressure stripper setup. The unit has demonstrated low rates of solvent degradation and low energy consumption along with testing metallurgy, effects of contaminants, and emissions. The unit has demonstrated solvent emissions under 1 ppmv and produces CO2 with less than 1 ppmv of SOx and NOx content.5 ASCC has been selected

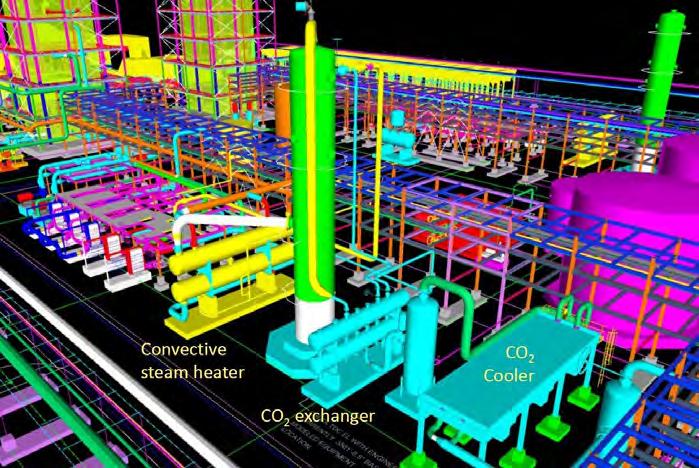

Figure 2. Front-end engineering design for ASCC.

for multiple DOE funded FEED studies, and Korean conglomerate SK has recently selected ASCC to help demonstrate CO2 capture viability at a natural gas power plant.6

Honeywell UOP also offers the UOP CO2 Fractionation Process Unit for carbon capture. This unit combines Honeywell UOP’s pressure swing adsorption (PSA) and CO2 fractionation technologies to provide a low energy and cost-effective solution for CO2 capture. The benefits of the UOP CO2 Fractionation process include low energy usage, an inherently all-electric design, less pre-treatment required than most solvent systems, and a liquid CO2 product. The energy usage per tonne of CO2 product depends on the flue gas composition due to the need for flue gas compression. The energy decreases significantly with increasing CO2 concentration, especially above 15 vol% CO2 on a dry basis. For cement plants with high CO2 concentrations, energy usage can be well below 400 kwh/MT CO2 while maintaining over 95% recovery.7

The significant variation in energy usage with varying inlet CO2 concentration contrasts with chemical solvent systems, which are less sensitive to the inlet CO2 concentration. The lack of solvent also enables reduced flue gas pre-treatment for most cement flue gas, lowering the overall cost of capture. The liquid CO2 product from the cryogenic tower is a key differentiator for customers that need to produce a liquid product,

as liquefying CO2 vapour can be energy intensive. In addition, the amount of power required to produce a dense phase CO2 product is greatly reduced versus solvent systems, as the energy required to pump the CO2 is much less than what is required to compress it. Finally, the UOP CO2 Fractionation Process Unit is all electric, and furthermore, all-electric ASCC is often a great fit for customers with limited steam or fuel gas availability, or those seeking lowest cost of CO2 avoided.

Honeywell UOP has a CO2 Fractionation Process Unit with over 10 years of commercial operating experience on natural gas and has used this experience to help guide the design of the post-combustion CO2 Fractionation Process Unit. The operating UOP CO2 Fractionation Process Unit has demonstrated high recovery (>95%) during operation. Honeywell UOP has also delivered over 1100 PSA systems within the last half century, with user reported operating data confirming onstream reliability claims of up to 99.95%.8

In some areas, the required CO2 purity will be roughly 97% or lower and the required CO2 product pressure will be under 30 bar(g). In these scenarios a PSA unit may be sufficient to concentrate the CO2 up to the product specification. The PSA will operate at a higher pressure than seen in the CO2 fractionation scheme described above, however the simplicity of the unit can sufficiently reduce energy usage to compete with these designs. If there are tight specifications around oxygen, additional purification may be required via hydrogenation or other methods.

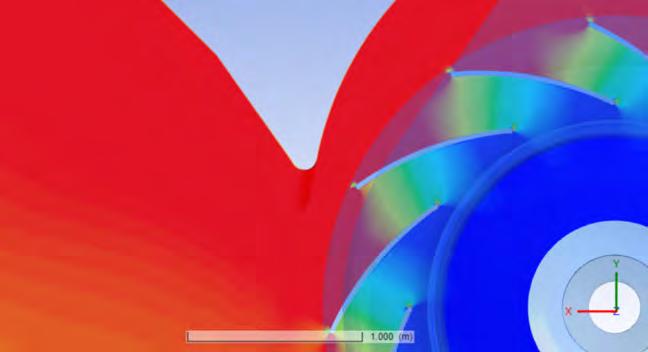

Another way to help reduce the energy usage of a cement plant is to utilise an oxyfuel configuration. Air is separated into nitrogen and oxygen, and the oxygen is used for combustion in the cement plant in place of air. This design helps concentrate the CO2 in the flue gas, significantly decreasing the downstream compressor power required and increasing the partial

pressure of CO2 to the CO2 fractionation section. In most cases, an oxyfuel plant will only require cryogenic separation; enrichment via PSA is not needed. CO2 may be recycled back to the kiln if needed. The oxyfuel system typically requires larger expenditures in the cement plant but results in a simpler carbon capture solution with lower utility requirements.

Dehydration

Dehydration is key for carbon capture. For solvent systems, it is typically required on the overhead CO2 product to ensure that the CO2 meets product specifications. For CO2 fractionation systems, a dehydration unit is required to avoid ice formation and to ensure the product meets the desired specifications. Honeywell UOP’s molecular sieve process technology has been used in over 2400 units worldwide, including dehydrating streams with high concentrations of CO2.

Summary

Capturing carbon from cement plants is key to reaching net-zero emissions goals and minimising the extent of global warming. There are multiple approaches to capturing CO2 from cement plants, all of which have unique benefits. Honeywell UOP has a dynamic suite of carbon capture technologies that can be tailored to meet the preferences and requirements of individual cement plants.

Advanced Solvent Carbon Capture (ASCC) is a solvent solution that has low energy requirements due to its unique solvent, high pressure stripping, and a patented heat exchange flow scheme. It has demonstrated very low solvent emissions while also ensuring less than 1 parts per million of SOx and NOx in the product. The unique solvent also allows for shorter absorbers than first generation solvents such as MEA. ASCC can be designed as a steam regenerated system or an all-electric system, depending on customer preference.

Honeywell UOP’s CO2 fractionation system allows for efficient CO2 capture via pressure swing adsorption and cryogenic fractionation. This system lowers the amount of flue gas conditioning needed compared to traditional solvent systems and is a great option for high NOx flue gas. The liquid product is inherent to the design of the unit and can help greatly reduce utilities where a liquid or dense phase CO2 product is required.

When oxyfuel combustion is considered for cement kilns, a more simple and lower energy carbon capture design can be used.

Honeywell UOP’s CO2 fractionation system is a good fit for the high concentrations of CO2 in the flue gas and can minimise energy while producing a liquid product.

Honeywell UOP’s MOLSIV dehydration unit can be used in CO2 Fractionation Units or CO2 product from solvent systems such as ASCC.

This adsorbent can reduce water content of the gas to less than 1 ppmv and performs well even with high CO2 concentrations in the gas.

Honeywell UOP has developed a leading position in separations by providing state of the art technology in gas treating (including CO2 removal), membranes, absorption, cryogenics, distillation, and heat transfer.

Honeywell UOP has demonstrated ASCC technology through over 8500 hours of operating at NCCC, has commercial experience with CO2 fractionation on a natural gas unit, and has commercial experience with MOLSIV dehydration in high CO2 gas feeds. Honeywell UOP’s experience and wide range of technologies helps ensure an efficient solution can be found for cement plants looking to decrease their CO2 emissions.

1. UNECE, ESCWA, ‘Technology brief: Carbon neutral energy intensive industries,’ – https://unece. org/sites/default/files/2022-11/Industry%20brief_ EN_2.pdf

2. UNECE, ‘COP27: UN report shows pathways to carbon-neutrality in “energy intensive” steel, chemicals and cement industries,’ – https://unece. org/media/press/372890

3. IEA, ‘CCUS in the transition to net-zero emissions,’ – https://www.iea.org/reports/ccus-inclean-energy-transitions/ccus-in-the-transition-to-netzero-emissions

4. HERZOG, H., ‘An Introduction to CO2 Separation and Capture Technologies,’ (1999), – https:// sequestration.mit.edu/pdf/introduction_to_capture. pdf

5. Based on internal data from solvent testing at the National Carbon Capture Centre in 2023.

6. ‘Honeywell to collaborate with SK E&S to deploy carbon capture technology across Korea and Southeast Asia,’ – https://www.prnewswire.com/apac/ news-releases/honeywell-to-collaborate-with-sk-es-todeploy-carbon-capture-technology-across-korea-andsoutheast-asia-301941319.html

7. Based on internal study for cement flue gas.

8. Based on reliability data from the 2010 North American User Meeting feedback. 99.95% (1 shutdown/hr) achieved with a preventative maintenance project versus 99.8% (2 – 6 shutdowns/ yr) without a preventive maintenance programme.

Jeffrey Tyska is a Lead R&D Engineer for carbon capture technologies at Honeywell UOP. Since 2011, he has designed various technologies including gas separations.

Jeffrey earned his B.S. in Chemical Engineering at the University of Illinois at Chicago and his M.S. in Chemical Engineering at North Carolina State University.

in September 2021, FLSmidth A/S entered into a MOU with Chart to advance carbon capture technology to significantly reduce CO2 emissions from cement production.

The agreement has seen the initiation of a pilot project at Sugar Creek Cement Plant, for Chart’s end-of-pipe Cryogenic Carbon Capture™ technology (CCC) to capture 30 tpd of CO2 emissions.

The captured CO2 will be liquefied and produced in a state ready for a variety of traditional and emerging utilisation and conversion applications, in addition to geologic sequestration.

The project at Sugar Creek will demonstrate that capture and purification of CO2 at cement plants can be accomplished at a lower cost and with less need for pre-treatment than first-generation carbon capture technologies like monoethanolamine (MEA) solvent.

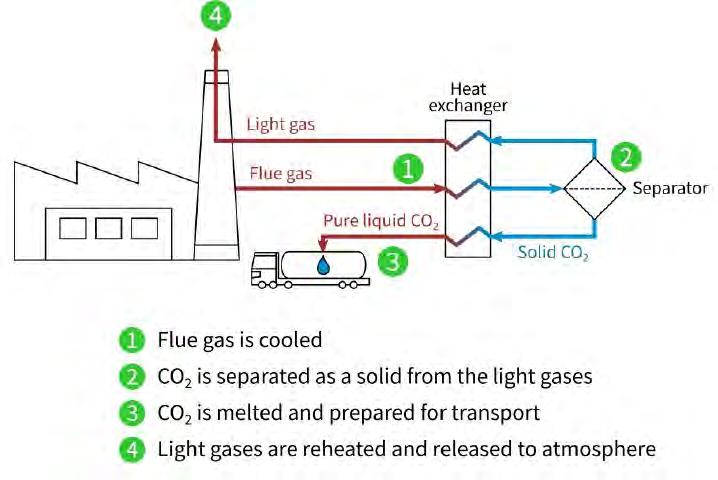

Chart’s CCC removes CO2 from flue gases by cooling the gas past the condensation point of the CO2 and separating the frozen CO2 from the cleaned oxygen and nitrogen that can be safely released back into the atmosphere.

Once separated, the CO2 and cleaned gas streams are warmed up recovering the energy that went into cooling them down, making this a very energy efficient process. This post-combustion process removes up to 95 – 99% of CO2 emissions without using toxic chemicals or membrane technologies.

Andrew Baxter, Chart Industries, and Dr Bodil Recke, FLSmidth, discuss a collaboration to identify cost-competitive pathways to reduce CO2 emissions in the cement industry.

Because heat recuperation is used, most of the energy required for the process is recovered making it extremely efficient. CCC also offers the added benefit of removing harmful SOx, NOx and mercury pollutants from exhaust gases.

The highlighted features have positioned CCC as one of the most cost effective and efficient processes for carbon capture in difficult to abate industries, including cement, with the added benefit of the captured liquid CO2 available at sufficient quality to be used directly in a multitude of applications.

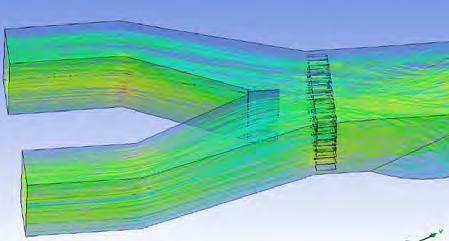

Recent process innovations have replaced unit operations which represented some scaling risk. Consequently, the process now planned to be built at Sugar Creek will be able to scale to full-industrial scale with no significant process changes.

Minimising the cost of carbon capture Chart and FLSmidth are both determined to make carbon capture more cost-competitive not only for greenfield projects, but also for the existing install base. With approximately 2275 cement plants across the globe accounting for 7% of global CO2 emissions there is a massive environmental incentive for the companies to succeed.

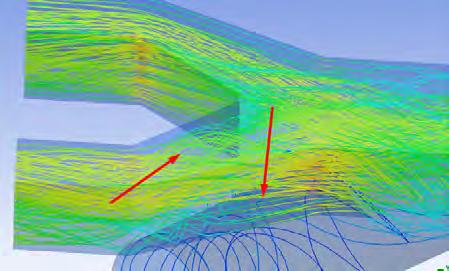

“While end-of-pipe capture technologies like Chart’s CCC can be directly applied without modifications to upstream process, we see opportunities to bring costs down through low-risk modifications and optimisation, with modest investment in the cement plant scope.” says David Leonardus Williamson, Process Engineer and CCUS Specialist at FLSmidth. “It’s encouraging to see that these modifications have already been validated to reduce the cost of capture by 10 – 20% through our collaboration with Chart, and there are still further integration opportunities on the horizon.”

Preparing customers for carbon capture is all part of the process. While a range of technologies is being developed and explored, cement plants are preparing to invest significant sums to meet the demand for a low-CO2 cement process. Knowing where to direct this investment is a concern. FLSmidth helps cement plants understand their options and what is likely to be the best fit for their circumstances.

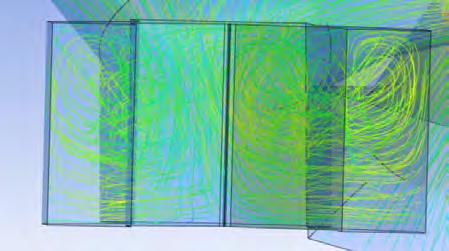

“The carbon capture unit and the clinker manufacturing process should be integrated, in both design and operation, to yield the best results on a commercial scale”, says David Jayanth, Project Manager –Carbon Capture at FLSmidth. “We also see opportunities for our process automation software to play a key role in optimising both cost and efficiency. Focus for the next years would be on scaling up capture technologies from pilot to commercial systems.”

FLSmidth and Chart are exploring options for scaling-up with optimised capture configurations for site-specific cost reductions and are engaged with several key players in the industry on pre-FEED studies for large scale CO2 emissions reduction. From a capture perspective, Chart offers all the products for a one-stop solution. Refrigerant compressors, multi-stream heat exchangers, and air coolers that make up the bulk of the CCC package are all Chart built, as are the liquid tanks and trailers required for storage and distribution of liquid CO2 to the point of use.