ON THE ROAD TO A

CIRCULAR ECONOMY

AAPA’S EXECUTIVE DIRECTOR FOR WESTERN AND SOUTH AUSTRALIA PETER DAMEN EXPLAINS HOW CHANGES TO THE INTERNATIONAL EXPORT MARKET ARE DRIVING THE ROAD INDUSTRY TOWARDS CIRCULAR ECONOMY PRACTICES.

T

he circular economy is an economic system aimed at eliminating waste and the continual use of resources. It is based on keeping products, equipment and infrastructure in use for longer. Circular systems adopt a hierarchy of reduce, reuse, repair, recycle and recover or refurbish to create a closed loop system. This minimises resource inputs and the creation of waste, pollution and carbon emissions. The circular economy can apply to the roads industry with typical solutions. The first is reduce. The roads industry can strive to achieve increased durability, quality management and asset life. This can be done through better design, construction quality, reduction of energy, waste and resource usage (for example, warm mix asphalt) and the use of renewable energy (such as solar power). The industry can also look to repair its pavements by resurfacing, rehabilitating, rejuvenating and restoring road pavements using best practice maintenance techniques.

Recycling is the third solution, with a focus on upcycling. This involves using materials such as crumb rubber that provide performance benefits. Lastly, recovery can be applied by reprocessing road pavements at the end of life, such as using reclaimed asphalt pavement. Sustainability is a major focus of the flexible pavements industry, and the Australian Asphalt Pavement Association (AAPA) membership is leading best practice on how roads can contribute. The association and its members recognise there is an increasing demand for the use of recycled products in roads and are continuing to investigate whether this is the right circular economy answer. Until recently, Australia exported a substantial amount of waste overseas. In 2016-17, Australia recycled 37 million tonnes of waste, with 746,000 tonnes exported to China. However, on 1 January 2018, the China

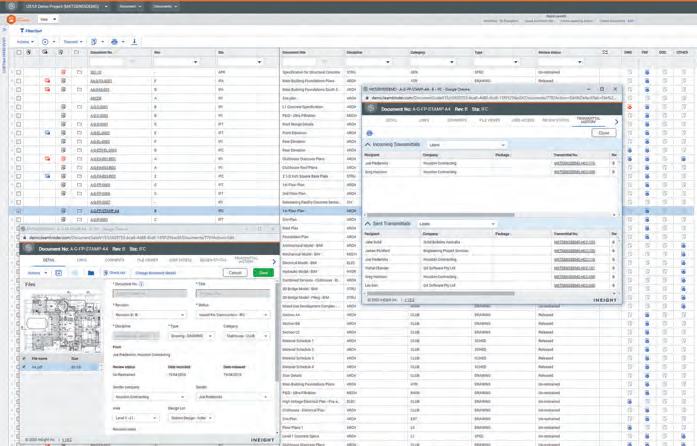

In February an industry forum featuring experts from around Australia shared the latest thinking on the circular economy.

20

ROADS APRIL 2020

Sword Policy came into effect, resulting in restrictions on the importation of 24 categories of solid waste into China. It further constrained any remaining materials being imported to China to less than 0.5 per cent of contaminants. During the financial year 2017-18, the quantity of waste exports from China to Australia fell dramatically, but was largely offset by higher exports to other countries, according to Blue Environment’s analysis “Data on exports of Australian wastes”. Nevertheless, the report highlights that a significant proportion of the overseas waste exports tap could soon be turned off. On 1 March 2019, this move was followed by a complete ban on solid plastic waste to India. Reports indicate several Asian countries are also reviewing their waste import policies. The Blue Environment report highlighted that if Malaysia, Vietnam and Thailand enacted waste import bans similar to China’s, Australia would need to find sustainable domestic or export markets for around 1.2 million tonnes, or $530 million per annum, based on 2017-18 export amounts. But despite all this, governments have responded with a collaborative approach across Australia. Most state governments pledged to support local governments and the industry financially, temporarily allowing an increase in stockpiling limits. In November 2019, at a meeting of environment ministers, the ministers agreed that waste plastic, paper, glass and tyres that have not been processed into valueadded material should be subject to an export ban. In addition to a host of policy pledges, all ministers committed to identify any procurement opportunities in major road