INDUSTRY NEWS FUTURE ALUMINIUM FORUM ARTIFICIAL INTELLIGENCE THE JOURNAL OF ALUMINIUM PRODUCTION AND PROCESSING www.aluminiumtoday.com July/August—Vol.36 No.4 UK SUPPLEMENT

Volume 36 No. 4 – July/August 2023

Editorial Editor: Nadine Bloxsome

Tel: +44 (0) 1737 855115 nadinebloxsome@quartzltd.com

Assistan Editort: Zahra Awan Tel: +44 (0) 1737 855038 zahraawan@quartzltd.com

Production Editor: Annie Baker

Sales

Commercial Sales Director: Nathan Jupp nathanjupp@quartzltd.com

Tel: +44 (0)1737 855027

Sales Director: Ken Clark kenclark@quartzltd.com

Tel: +44 (0)1737 855117

Advertisement Production

Production Executive: Martin Lawrence

Managing Director: Tony Crinion

CEO: Steve Diprose

Circulation/subscriptions

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

email subscriptions@quartzltd.com

Annual subscription: UK £257, all other countries £278. For two year subscription: UK £485, all other countries £501. Airmail prices on request.

Single copies £47

COVER

FAF REVIEW

6 Future Aluminium Forum: Québec City, 2023

13 Tecnar: Real-time monitoring for molten aluminium composition

15 Suspicious minds: Aluminium production in the Amazon

19 ADE Solutions: Smart plants of the future

23 The Haulers’ Evolution

ARTIFICIAL INTELLIGENCE

27 Writing the future of AI to drive digitalisation in the metals industry

THE

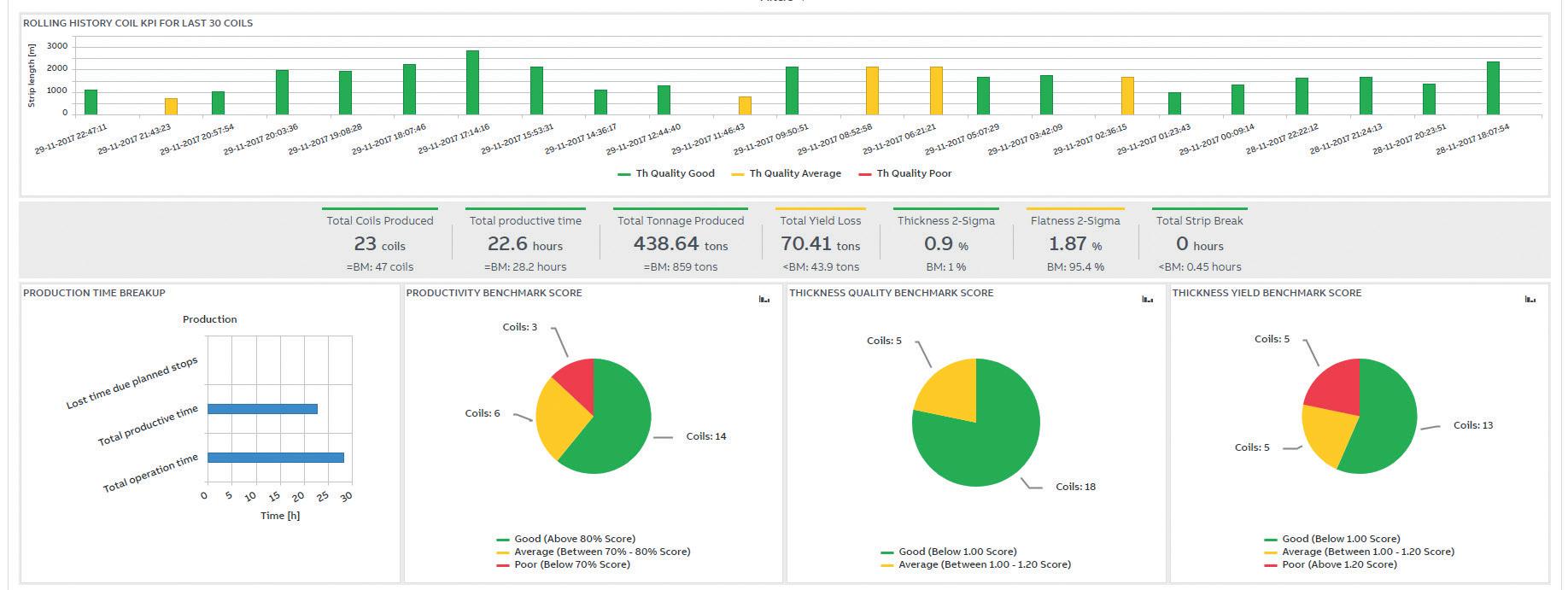

31 Aluminium Industry in India

FOCUS

39 India’s potential to increase extrusion production capacity

Cover picture courtesy of PRIMETALS

UK SUPPLEMENT

45 Metals for the future: Creating a circular economy for aluminium

48 50 years of innovation and excellence: Celebrating a milestone anniversary in business

49 BCAST, circularity and aluminium, the upstart competitor

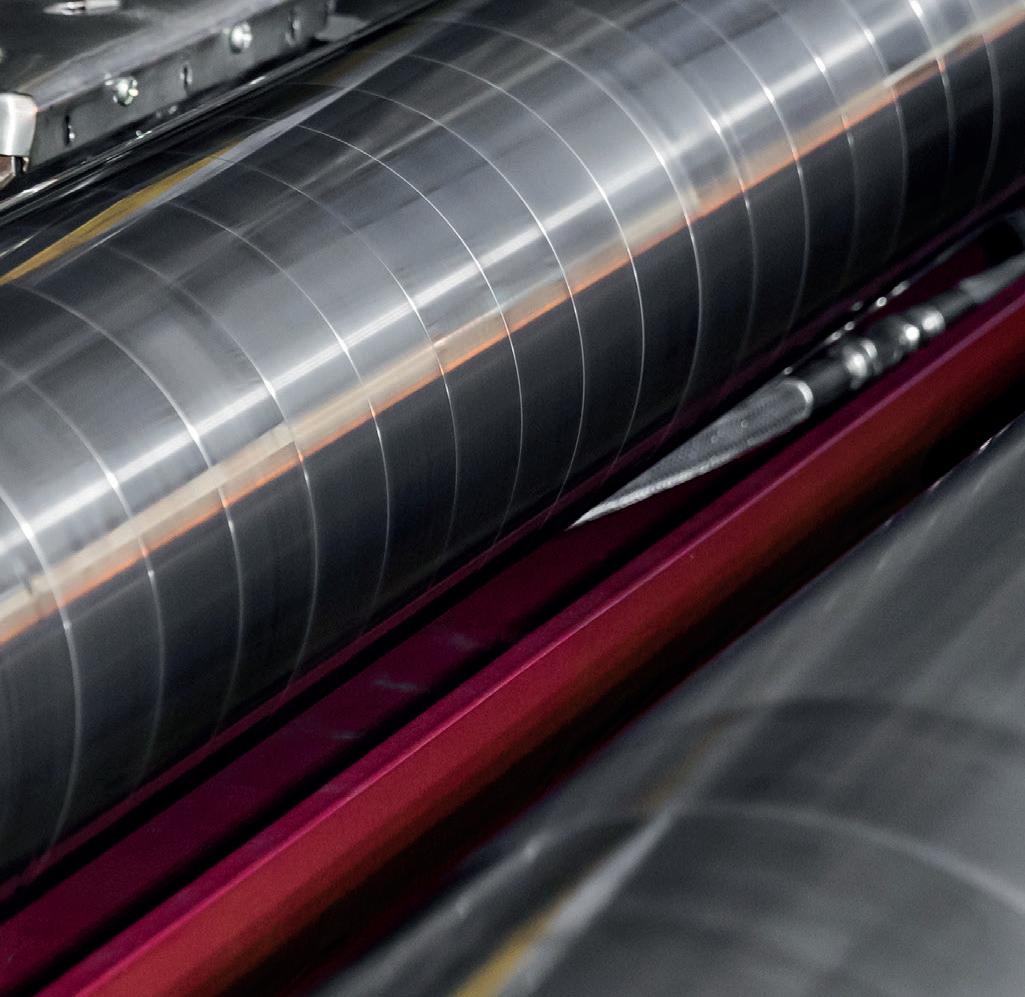

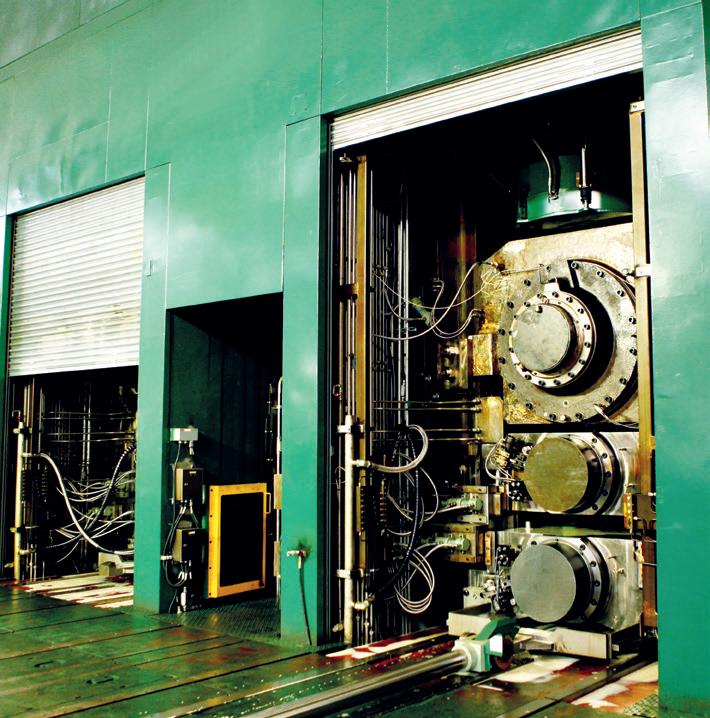

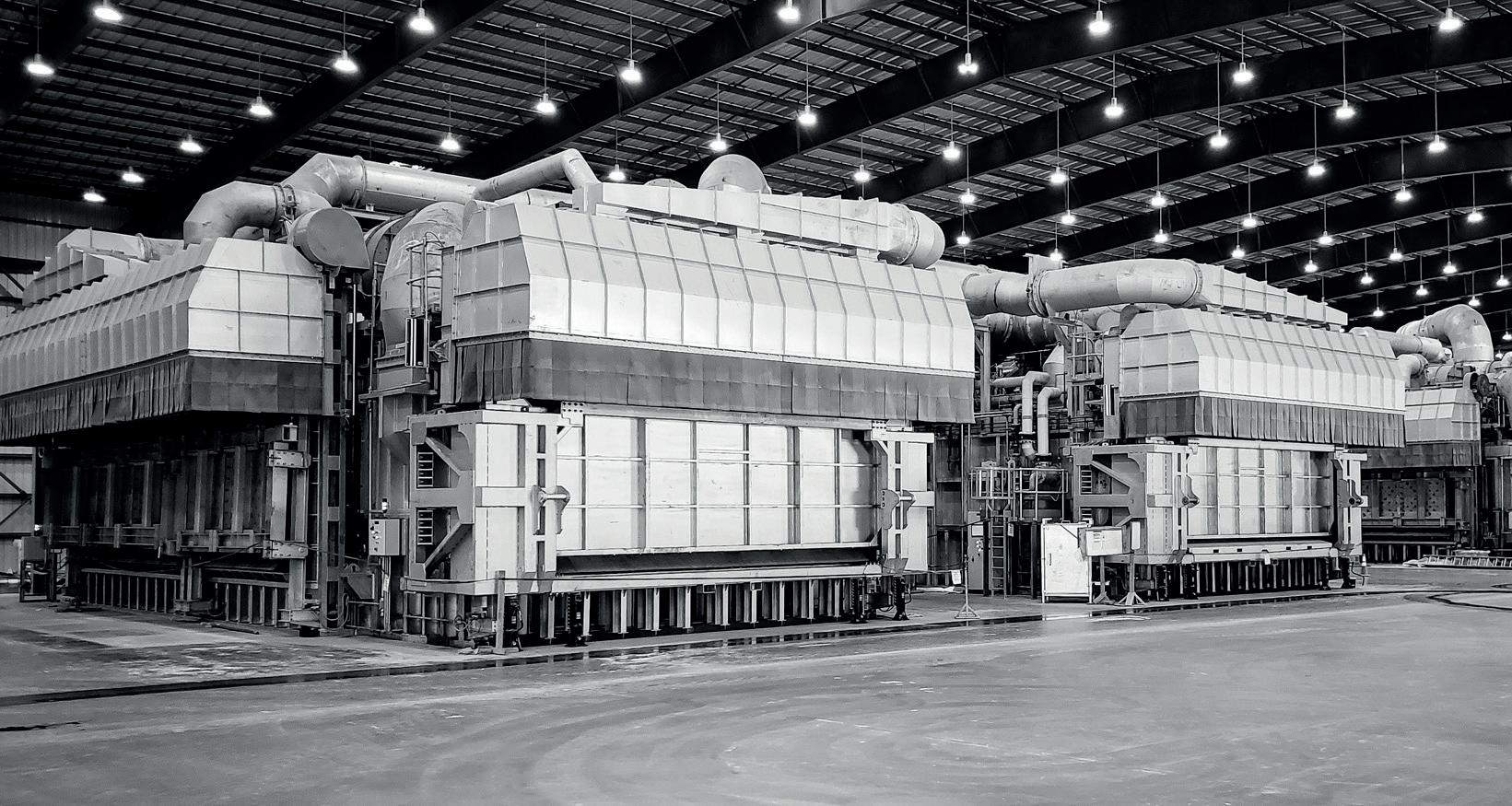

52 Flat Rolling and a 50th Anniversary: Primetals Technologies

ALUMINIUM INTERNATIONAL TODAY is published six times a year by Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, UK. Tel: +44 (0) 1737 855000

Fax: +44 (0) 1737 855034

Email: aluminium@quartzltd.com

Aluminium

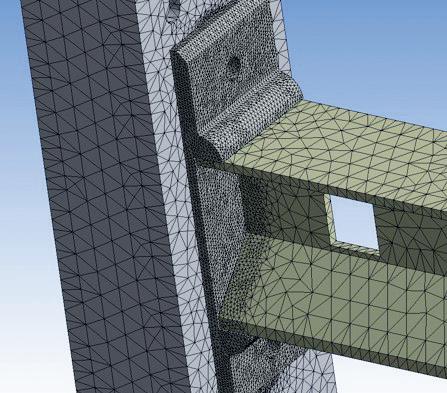

55 Stress analysis of a structural extruded profile

CRU

60 Sustainability tops the CRU agenda

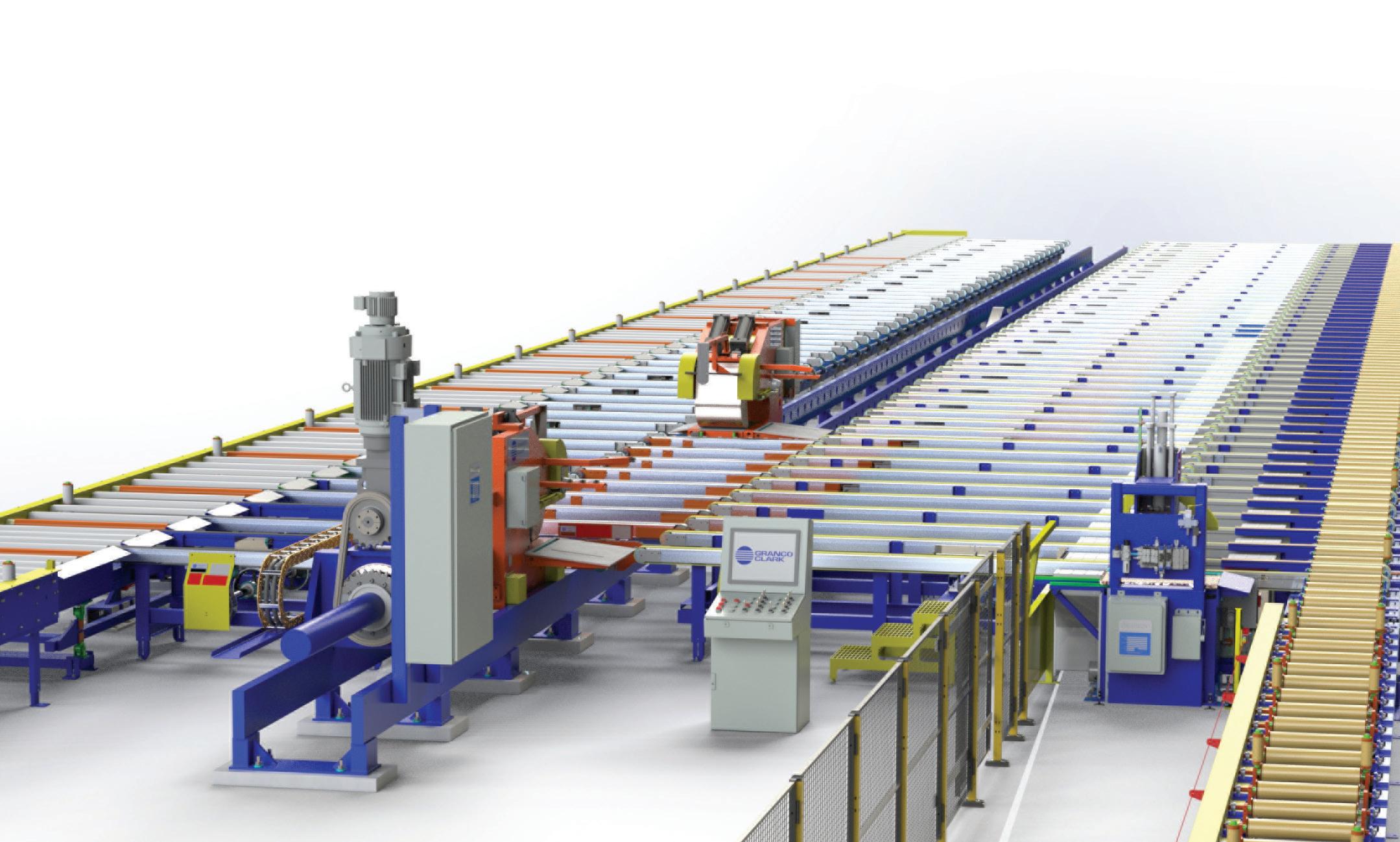

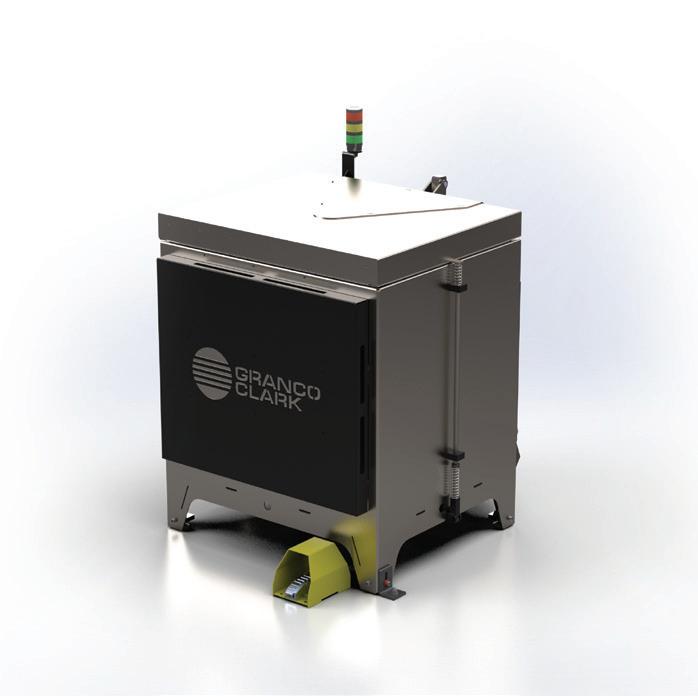

SORTING

64 Tomra launches Autosort pulse with dynamic LIBS technology

CONTENTS 1 www.aluminiumtoday.com Aluminium

Today July/August 2023 2 LEADER 2 NEWS

International

Stephens and George Ltd, Goat Mill Road, Dowlais, Merthyr Tydfil, CF48 3TD. Tel: +44 (0)1685 352063 www.stephensandgeorge.co.uk © Quartz Business Media Ltd 2023 ISSN1475-455X Supporters of Aluminium International Today SEARCH FOR ALUMINIUM INTERNATIONAL TODAY 6 60 27 48

ON SILICON

a ticking clock for ‘Aluminium’? REFRACTORIES

Prevent to protect

International Today (USO No; 022-344) is published bi-monthly by Quartz Business Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: send address changes to Aluminium International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in the UK by:

FOCUS

66 Silicon -

68

ALUMINA CHRONICLES

ON INDIA

EVENT

UK SUPPLEMENT

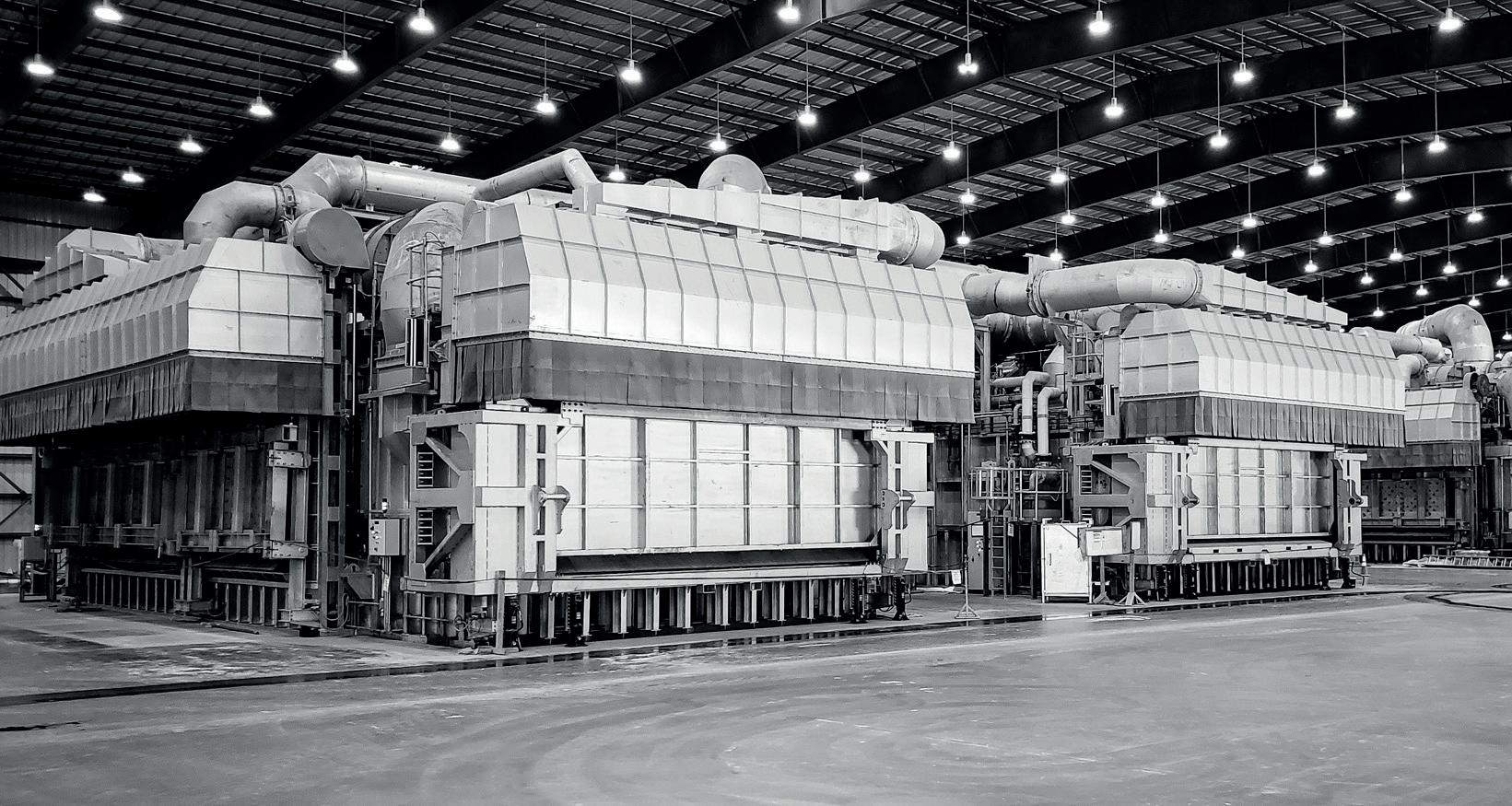

With the recent announcement by Hydro of the world’s first batch of recycled aluminium using hydrogen fuelled production, the shift towards producing carbon-free aluminium is experiencing exciting new developments.

By testing the fuel switch from natural gas to hydrogen and the effects on metal quality, these findings can also be relevant for using hydrogen in primary aluminium casthouses and other high temperature processes, like glass or cement.

Novelis has also recently been awarded £4.6 Million to establish hydrogen burning trials as part of the UK Government’s £55m Industrial Fuel Switching Competition, as part of the £1bn Net Zero Innovation Portfolio (NZIP), and the wider regional HyNet project.

This all ties in nicely with this year’s Greener Aluminium Online Summit which will return on the 7th of September and invites the industry to join virtually to discuss how the industry must continue to adapt, minimising the impacts associated with production of the metal today, while also developing technological pathways for the future.

On the topic of the future, this issue features a collection of articles, kindly contributed by speakers who joined us at the Future Aluminium Forum back in May. There is also a full review of the event and details of how you can be involved in the next Forum, which is planned to take place in Turkey in 2024.

A closer date in the calendar and one that is fast approaching is the UK Metals Expo in September. To celebrate this event being even bigger than last year, there is a full update from the UK sector for you to enjoy!

nadinebloxsome@quartzltd.com

World’s first: Hydrogen fuelled aluminium production

Hydro has produced the world’s first successful batch of aluminium using green hydrogen as an energy source. The test is another step towards carbon-free aluminium.

Carbon-free green hydrogen replaced natural gas as fuel for the recycling of aluminium during the test. The test was carried out at a casthouse in Hydro’s extrusion plant in Navarra, Spain.

“We are excited to be conducting this test and it demonstrates Hydro’s commitment to decarbonization. By removing the car-

bon emissions from the energy source, we will be able to produce carbon-free aluminium from recycling post-consumer scrap,” says Paul Warton, Executive Vice President for Hydro Extrusions.

The test was conducted and led by hydrogen experts from Hydro Havrand, Hydro’s green hydrogen company, in partnership with Fives, an industrial engineering group with expertise in hydrogen burner technology and solutions for the aluminium industry. Fives has contributed with design and

supplying of key components and controls needed to operate safely and effectively.

“This test is part of developing commercial fuel switch solutions and to demonstrate that hydrogen can be used in aluminium production. Green hydrogen can remove hard to abate emissions from fossil fuels, in processes where electricity is not an alternative, both in the aluminium industry and in other heavy industries,” says Per Christian Eriksen, Head of Hydro Havrand.

Novelis to trial use of hydrogen

Novelis Inc have announced that its Latchford plant in the UK has been awarded £4.6 million to establish hydrogen burning trials as part of the UK Government’s £55m Industrial Fuel Switching Competition, as part of the £1bn Net Zero Innovation Portfolio (NZIP), and the wider regional HyNet project.

Novelis joined HyNet in 2017 and has been supporting the development of the regional infrastructure project as well as conducting its own technical feasibility studies

on the use of hydrogen as a direct replacement for natural gas.

“Switching to renewable energy sources is a key initiative to advance on our journey toward carbon-neutral production,” said Emilio Braghi, Executive Vice President, Novelis Inc. and President, Novelis Europe. “Besides decarbonising our own facility, this collaboration drives the industrial decarbonisation of the whole North-West region in UK.”

With the recently awarded grant by the Department for En-

ergy Security & Net Zero, Novelis’ Latchford plant will test the use of hydrogen on one of its recycling furnaces in a demonstration phase in 2024.

“We are proud to be one of the pioneers using hydrogen within the aluminium industry and that these trials at Latchford will additionally advance research on the viability of integrating hydrogen power in our recycling operations around the world,” said Allan Sweeney, Plant Manager, Novelis Latchford.

COMMENT 2

July/August 2023 TOP STORIES

Hydrogen hype

HAI Group groundbreaking

Rio Tinto to expand smelter

Rio Tinto will invest $1.1 billion (CAN$1.4 billion) to expand its state-of-the-art AP60 aluminium smelter equipped with low-carbon technology at Complexe Jonquière in Canada. The total investment includes up to $113 million (CAN$150 million) of financial support from the Quebec government. This expansion, which will coincide with the gradual closure of potrooms at the Arvida smelter on the same site, will enable Rio Tinto to continue meeting customers’ demand for low-carbon, high-quality aluminium for use in transportation, construction, electrical and consumer goods.

The investment will add 96 new AP60 pots, increasing capacity by approximately 160,000 metric tonnes of primary aluminium per year, enough for 400,000 electric cars. As a result, there will be a total of 134 AP60 pots and a capacity of approximately 220,000 tonnes per annum. Construction will run over two and a half years, with commissioning of the new pots expected to start in the first half of 2026 and the smelter fully ramped up by the end of 2026. Once completed, the expanded smelter is expected to be in the first quartile of the industry cost curve.

This new capacity will offset the 170,000 tonnes of capacity lost through the gradual closure of potrooms at the Arvida smelter from 2024. In addition, Rio Tinto will add 30,000 tonnes of new capacity through the commissioning of the previously announced recycling facility at Arvida in the first quarter of 2025. These facilities will ensure Rio Tinto’s casting facilities at Complexe Jonquière continue to provide value added products that meet customers’ needs, including integrating recycled post-consumer aluminium into primary aluminium alloys.

Alcoa and EGA: Alumina agreement

Alcoa and Emirates Global Aluminium (EGA) have announced a new multi-year agreement for Alcoa to supply EGA with smelter grade alumina.

Over the life of the 8-year agreement, which commences in 2024, volume options will allow EGA to procure as much as 15.6 million metric tons of alumina from Western Australia. The supply agreement will represent a significant portion of Alcoa’s annual third-party alumina sales.

The supply agreement will make Alcoa EGA’s largest third-party supplier of alumina. EGA’s Al Taweelah alumina refinery in Abu Dhabi met 47 percent of EGA’s to-

tal alumina needs in 2022.

“Alcoa operates the world’s largest third-party alumina business with low-carbon processes, and we’re proud to be recognised with this significant additional volume from EGA as a leading global

Alba strengthens ties

Aluminium Bahrain B.S.C. (Alba)’s Chairman of the Board of Directors, Shaikh Daij bin Salman bin Daij Al Khalifa, highlighted the Company’s keenness on strengthening ties with key aluminium producers in the Arab World during a meeting with the Egyptian Minister of Public Enterprises Sector, His Excellency Dr. Eng. Mahmood Kamal Esmat, that was held on 24 May 2023 in Cairo, Egypt.

The meeting – attended by Alba’s Chief Executive Officer, Ali Al Baqali, the Managing Director of the Metallurgical Industries Holding Company Eng. Mohammed Al Saadawy and the Chief Executive Officer of Egyptalum – Egypt’s largest aluminium producer, Dr. Mahmoud Agour – aimed to enhance mutual cooperation and develop potential opportunities for investment in the aluminium

producer,” said Alcoa President and CEO Roy Harvey. “The agreement is the largest alumina supply contract ever signed between Alcoa and EGA will strengthen the long-term supply relationship between our two companies.”

EGA is the largest industrial company in the United Arab Emirates outside of oil and gas, operating smelters in Abu Dhabi and Dubai, an alumina refinery in Abu Dhabi, and a bauxite mine in the Republic of Guinea.

The contract includes options for EGA to choose Alcoa’s low-carbon EcoSourceTM alumina, the aluminium industry’s only low-carbon alumina brand.

Hammerer Aluminium Industries (HAI) has celebrated the official ground-breaking ceremony for the capacity expansion with a 40 MN extrusion line at the Cris site (Romania). The investments in Cris are part of a 125-million-euro investment package for the entire HAI Group.

Automotive part innovation

industry. Alba’s Chairman of the Board of Directors, Shaikh Daij bin Salman bin Daij Al Khalifa, praised the investor sentiment climate in Egypt and welcomed the efforts which will be made on studying the feasibility.

Novelis Inc has announced the start-up of its new roll forming development line. The new development line will help Novelis meet industry demand for a process that can produce large volumes of high-strength aluminium auto parts.

MoU announced

TAHA International has announced it has “deepened” its partnership with Hwarim Tech in signing a Memorandum of Understanding (MOU), aligned with TAHA’s objective of promoting sustainable development within the global aluminium industry and transitioning towards a greener economy.

3 NEWS IN BRIEF July/August 2023 NEWS Aluminium International Today

New UK rolling plant

Diageo has announced that it has provided funding to establish the British Aluminium Consortium for Advanced Alloys (BACALL), a collective of industry experts who will create a circular economy for aluminium in the UK. They will build a plant to roll hundreds of thousands of tonnes of aluminium sheet in the UK, more than enough for over 400 million cans of Guinness and pre-mixed Gordon’s and tonic.

Currently, to recycle and remake cans, the UK is reliant on an energy-intensive supply chain that is based on the unsustainable exporting and importing of aluminium.

The consortium will build an advanced aluminium recycling and manufacturing plant, to establish a new circular economy supply chain for aluminium. This will keep the recycling of aluminium in the UK and cement the UK’s position as a leader in the adoption of carbon reduction and manufacturing.

Once the plant is up and running, the recycled aluminium will significantly contribute to Diageo’s 10-year sustainability action plan by increasing the use of recycled aluminium with Guinness cans made of 100% recycled material reducing the carbon emissions needed to export and import

ASI visits Aludium plant

aluminium sheet reducing the dependency on raw materials needed to create aluminium contributing to a reduction in Diageo’s Scope 3 carbon emissions, as the plant will use 95% less energy in the production of its aluminium sheet versus traditional prime production methods.

SEPTEMBER

13th - 14th

UK Metals Expo

The UK Metals Expo will host the entire industry under one roof. According to Chris McDonald, Chair, UK Metals Council: “Anyone with a career in the metals industry will want to attend, any organisations providing goods or services to this industry will want to be represented.” Held in Birmingham, UK www.ukmetalsexpo.com

OCTOBER

11th - 13th

Inalco 23

During the visit, the Management and Experts of Aludium and ASI discussed and exchanged views about the aluminium value chain’s present and future in the light of sustainable development. Following the meeting and visiting the

plant, Fiona Solomon declared: “The tour provided us with a solid understanding of the processes involved in rolled aluminium production and the aspects of quality and safety that are integrated throughout the facility. The tour has given us valuable insights into the capabilities of the plant and how the policies and processes align with ASI’s goals and certification criteria”. “We were pleased to learn that Aludium has a range of lower-carbon products at levels that are in line with the ASI Performance Standard criteria, and that the company has made transparency of its emissions data a priority. We also appreciated hearing about the company’s setting of targets to reduce average carbon

footprint per ton by 50% by 2025, alongside investments in recycling capacity and efficiency, and plans to increase renewable electricity consumption to 100%,” Solomon added.

On the occasion, Lionel Chapis, Aludium’s CEO, expressed his enthusiasm following the very productive encounter. “We are happy to receive ASI at our plant in Amorebieta. We think it’s important that certification bodies continuously keep contact with the ‘Real Life’. Over the last years we have spent many hours for ASI related aspects and it’s good to see the persons behind this and to have the opportunity for a direct exchange and feedback,” Chapis asserted.

Hydro: Land acquired for recycling plant

Hydro has signed an agreement to purchase land in Torija, Spain, with the aim of constructing a stateof-the-art aluminium recycling plant.The plant will have 120,000 tonnes of annual capacity and around 65 direct employees. The facility will strengthen Hydro’s capabilities to produce low-carbon aluminium and ensure more scrap is kept in Europe.

The agreement has been signed with a subsidiary of the Pulsar Properties Group. The total project

investment is currently estimated to be between EUR 130-140 million, depending on the final facility design, market conditions and macroeconomic development. Hydro aims to make a final investment decision by the end of 2023.

“The European and Iberian market for aluminium continues to

grow. This investment will be an important step towards Hydro’s ambition to recycle more post-consumer aluminium, strengthening our position to capture value from growing demand for greener and circular aluminium,” says Eivind Kallevik, Executive Vice President for Hydro Aluminium Metal.

Organized by the Aluminium Cluster AluQuébec and the Aluminium Research Centre REGAL, this 3-day conference proposes various sessions where the results of recent research activities from all over the world in the field of aluminium constructions are presented.

Held in Québec City, Canada https://event.fourwaves. com/inalco2023/pages

25th - 26th

ALUMINIUM USA

ALUMINUM USA is an industry event covering the entire value chain from upstream (mining, smelting) via midstream (casting, rolling, extrusions) to downstream (finishing, fabrication).

Music City Center, Nashville, Tennessee www.aluminum-us.com

NOVEMBER

7th - 8th

Aluminium Business Summit

The ALUMINIUM Business Summit will be returning for a second round. The event at Altes Stahlwerk in Düsseldorf will be the best place for the aluminium industry to attend keynotes and panel discussions as well as to network. Düsseldorf, Germany www.aluminiumexhibition.com/en-gb.html

For a full listing visit www.aluminiumtoday.com/ events

Aluminium International Today www.aluminiumtoday.com

2023 DIARY

4

July/August 2023 GREEN NEWS

ST. LOUIS, MISSOURI, USA 800 325 7075 | www.gillespiepowers.com | 314 423 9460 ✓SINGLE CHAMBER / MULTI CHAMBER FURNACES ✓SCRAP DECOATING SYSTEMS ✓TILTING ROTARY MELTING FURNACES ✓SCRAP CHARGING MACHINES ✓LAUNDER SYSTEMS ✓CASTING / HOLDING FURNACES ✓HOMOGENIZING OVENS ✓COOLERS ✓SOW PRE-HEATERS ✓REPAIR & ALTERATIONS

Future Aluminium Forum: Québec City, 2023

From the UK, Québec is roughly 9 hours and 40 mins away. One attendee told me he flew 20 hours, from China, another flew almost 24 from Australia. The Future Aluminium Forum 2023, held from 10-12th May 2023, welcomed more than 175 delegates from all corners of the globe to Québec City, Canada. Zahra Awan* reports on the event.

Welcomed by the sun, the Future Aluminium Forum opened the doors to its delegates. The forum was structured to begin with an exclusive site visit to the Alcoa Deschambault Smelter.

A select few of the delegates attending the forum were able to visit the site to discover and witness the Alcoa aluminium production process first hand. Visitors to the smelter were invited to walk through all main sectors of the facility, from the anode production plant to the electrolysis area and cast house. Along the route, informative sessions were given to attendees by the smelter

DAY ONE

employees on various topics including maintenance, environment, and energy, as well as shown Alcoa’s Aluminium Center of Excellence. The Deschambault team personally received and directed the tour, allowing for a unique opportunity for the attendees to ask questions. The tour proved successful with the attendee’s feedback being overtly positive, noting the importance of seeing the smelters in the flesh and understanding why conferences and forums are so vital to the industry’s development.

“The Future Aluminium Forum in Québec City was a great meeting. I enjoyed the

presentations as well as the exhibits by pertinent and competent suppliers. The social opportunities allowed me to meet old friends in the industry and meet new, motivated new people with fresh ideas on how to improve our industry. The whole event was well communicated and organized, with an interesting visit to the nearby, impeccable Alcoa plant. Thanks to the organisers for conveying a friendly and positive feel to the activities that made this meeting fruitful for all.” – Pierre Reny Chief Engineer, Hydro.

Aluminium International Today July/August 2023 FAF REVIEW 6

*Assistant Editor, Aluminium International Today

Following on from the tour was the Future Aluminium Forum Opening Event, hosted by AluQuébec. Located in the centre of the beautiful, historic Eurocentric city, all delegates and associates of the Future Aluminium Form were greeted by Mr Alain Sans Carter, Sous-Minister des Relations Internationales de la Francophonie, who opened the evening with a focus on where the sector now stands: “Aluminium is a metal of the future. It is unique and infinitely recyclable, and it’s been produced in Québec for over 120 years… I’d like to highlight the Québec aluminium development strategy, which enables players in our industry, including the equipment manufacturers here tonight, to accelerate the 4.0 shift, focus on innovation, and showcase our green aluminium.”

Francois Racine, President at AluQuébec followed, stating, “Québec’s aluminium ecosystem is a world-renowned industry known for its expertise and innovations. … The ecosystems biggest strength has resided in its synergy where all sectors work towards a common goal of facilitating aluminium use and promoting it globally.”

After the formalities, the industry reconnected with its experienced members and welcomed its new ones. Anticipating the hubbub, AluQuébec organised a graceful exhibit named the 5th Element. The concept explored nature’s five elements: Water, earth, air, fire, and Québec’s Aluminium!

DAY TWO

With delegates relationships rekindled, and perhaps a bit of fizz to warm the vocal chords, the introductory day set the grounds for a two-day conference. The forum conference focused on the automation and advancement of the aluminium industry.

Opened by Nadine Bloxsome, Editor of Aluminium International Today and Event Organiser for the Future Aluminium Forum, she set the theme which threaded itself throughout the conference sessions: “Sustainability goes hand in hand with efficiency”.

Opening the event were Keynote Speakers from three major aluminium producers in Canada: Rio Tinto, Hydro and Alcoa. The session was opened by Gaby Poirier, Vice President of Operations - North America, Alcoa who discussed the “Spirit of Innovation”, and its importance to the success of the industry in overcoming the challenges we face. He noted that this spirit is one that must continue to grow to progress and succeed beyond company units, and out to the entire industry.

Speaking next was Marie-Eve Pomerleau, Specialist Product Advancement, Rio Tinto, who brought discussions on the circular economy of the industry to the audience, as well as the latest initiatives for Quebec aluminium regarding scrap material and recycling schemes.

Closing the Keynote Session, Pierre Rény, Chief Engineer, Primary Metal, Technology and Operational Support, Hydro Aluminium Canada. He spoke about Hydro’s future for the production of sustainable aluminium, namely on HalZero. HalZero is a new process for the production of primary aluminium. Instead of carbon dioxide, only oxygen is emitted from the process of primary aluminium production, a concept which is in competition with the commonly known ELYSIS.

The next session entitled: Status,

EQUIBRAS

FAF REVIEW 7 Aluminium International Today

“Everything worked out perfectly, your team is very thoughtful and always available to listen, many thanks!

”

Strategy and Capabilities, started off with a presentation from Jean-Denis Carrier, Global Director - Aluminium, HATCH, who introduced Digital Twins. The use of digital twins also enables the mapping and collection of data, which can be used for future experiments and projects. Quantillion speaker, Hilbrand Kuiken, CEO, noted the importance of data collection with the use of Predictive Intelligence, linking back to the concept of Digital Twins. Quantillion aims to utilise Artificial Intelligence to find the most efficient method for a solution, as well as use the data collect to anticipate and assist in future scenarios.

The third session looked at whether Sustainability & Technology are a ‘Perfect Match’. The speakers for this session were: Adrien Berthier, Decarbonation Project Manager, Aluminium Dunkerque, Linlin Wu, Manager – Statistical Analysis, International Aluminium Institute, and Gunther Schober, Sales Manager, PSI Metals, Non Ferrous GmbH.

Technology, as mentioned by Nadine Bloxsome, goes hand in hand with

sustainability. Adrien Berthier discussed the Carbon Capture Usage and Storage (CCUS), “a breakthrough carbon mitigated for smelters.” Linlin Wu spoke on the possibilities available, across heavy industries, in maximising the use of bauxite residue, in cement. The largest ByProduct presents a huge opportunity for extending the circular nature of aluminium production and sustainable ethics. Finally, Gunther Schober, Sales Manager, PSI Metals, Non Ferrous GmbH, presented on utilising software to optimise efficient energy scheduling to energy availability,

with the target of finding the most optimal solution. All three presenters noted the need for partnership within the industry to address each challenge we face, as well as a partnership with technology.

Closing the day was a session on the Advance of Automation. Technology extends to machinery. This was presented by: Simone Tadiello, Automation Project Engineer, BM Group - Polytec, Malcolm Caron-Boivin, International Business Development Manager, EPIQ Machinery, and Mileidy Hernandez, CPI in Automated Systems - Industrial Computing, WSP Canada. Between the three speakers, they presented the full range of automated machinery available, designed to replace humans in dangerous situations, spoke on how their machinery has transformed to electric vehicles and discussed how autonomous tools, such as WSP’s ADE, is designed to assist the industry shift to Industry 4.0 by providing autonomy to the operation team and centralise all systems into the same interface.

The first day of the conference came to a close, yet the socialising was set to continue. With the sun still shinning, and the balcony doors open, attendees were invited back to the venue for a sit down three-course meal. With opportunities to network throughout the day, the dinner provided downtime and a more casual setting for the industry to unwind.

FAF REVIEW 8

“The event was well organised, staff were welcoming and dedicated, and the location is perfect!”

THOMAS GARGON, SOFTWARE ANALYST, MAESTRIA

“Overall the event was very good, we had the chance to meet a lot of our business partners”

JEAN- CHRISTOPHE BOUCHEN, BUSINESS DEVELOPMENT, STAS

+44 (0121) 684 0175 info@mqpltd.com mqpltd.com The next dimension in grain refinement... Contact us today to discuss your refinement needs. made with low carbon aluminium 125% relative efficiency 5:1 125 5:1 125

DAY THREE

We awoke to the final day of the forum on the 12th May.

With a slight change in topic, the forum switched to a focus on Environmental and Social Sustainability. Presenting on Aluminium from the Amazon: Lessons for Sustainability, Simon Lobach, Researcher, Geneva Graduate Institute discussed the need for industries to take more responsibility over their actions. Simon Lobach discussed this in relation to local communities and biodiversity; he called for aluminium industries to change their attitudes towards their impact on native/ indigenous populations and the local environment. The Amazonia presents a number of strengths for the aluminium industry: Aluminium in the Amazonia is fully produced with hydroelectric power and is at the forefront of technological developments for sustainable aluminium, reforestation programmes have been implemented, and the aluminium sector has “significantly improved its relationships in a democratic Brazil.” However, issues as a result of industry still remain a major concern.

The Future Aluminium Forum will be returning in 2024, and will be hosted in Turkey.

Working in collaborating with Turkish Aluminium Association, TALSAD, the event aims to bring together the West and East to discuss and share best practices in automating the industry.

Keep following for more information on how you and your company can take part!

Returning to the topic of automation, was David Roth, Americas Business Representative at RiA Cast House, Andrew Sauerwald, Product Leader - LIBS at Tecnar spoke next on LIBS technology and Jean -Benoit Pineault, MBA CEO at Refraco. Focusing on removing operators from hazardous areas, first mentioned by David Roth, the three discussed how working with automated technology can improve safety of the higher risk areas in a factory.

For example: The implementation of cameras to not only monitor furnace efficiency but also remove an operator from the high temperatures. The implementation of LIBs, which is based on “patented technology from the National Research Council Canada”, to sample metal removes the labour-intensive process, and high-risk factors from an operators role. And automated machinery to remove workers from certain situations.

“Informative speakers, good mix of big industry players, with some smaller businesses too” – George Giles, Regional Sales Manager, Molten Metal Innovation

Aluminium International Today July/August 2023 FAF REVIEW 10

“

For the first time attending this event and visiting Canada, it was very useful to establish contacts in the industry. Professional, well organised and a well-run event.”

PETER SELBIE, INDUSTRIAL SALES AND MARKETING MANAGER, BRUK TEXTILES.

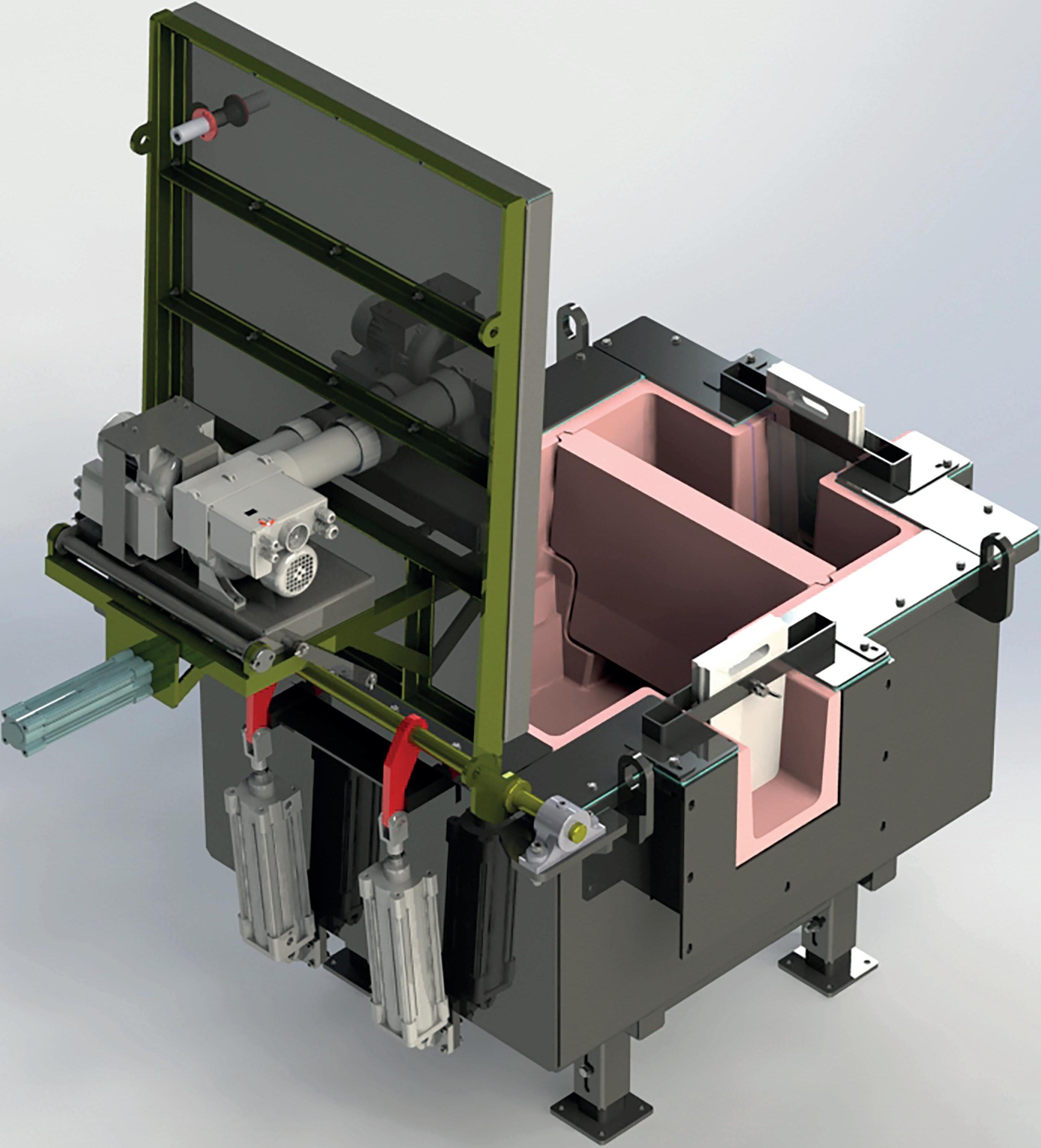

Industry-leading dross press technology

Maximising metal recovery from your dross

The Altek Tardis Gen III is the most advanced dross press in the market, utilising several key features to enhance in-house drain and ensure excellent secondary recovery benefits for the highest aluminium recovery potential from dross.

• 10x dross press model sizes

• Quick pressing cycles –typically 6 minutes

• 60+ dross pan designs: 50kg to 2,500kg capacity

• Clean working environment

• 5% - 25% in-house drain

• Flexible, reliable and robust

• 40% - 70% secondary recovery

• Low operation and maintenance costs

PART OF OUR LEADING END-TO-END DROSS MANAGEMENT SOLUTION Altek Europe Limited, Lakeside House, Burley Close, Chesterfield, Derbyshire, S40 2UB, UK +44 (0) 1246 383737. © 2023 Harsco Corporation. All Rights Reserved.

altsales@harsco.com | www.altek-al.com

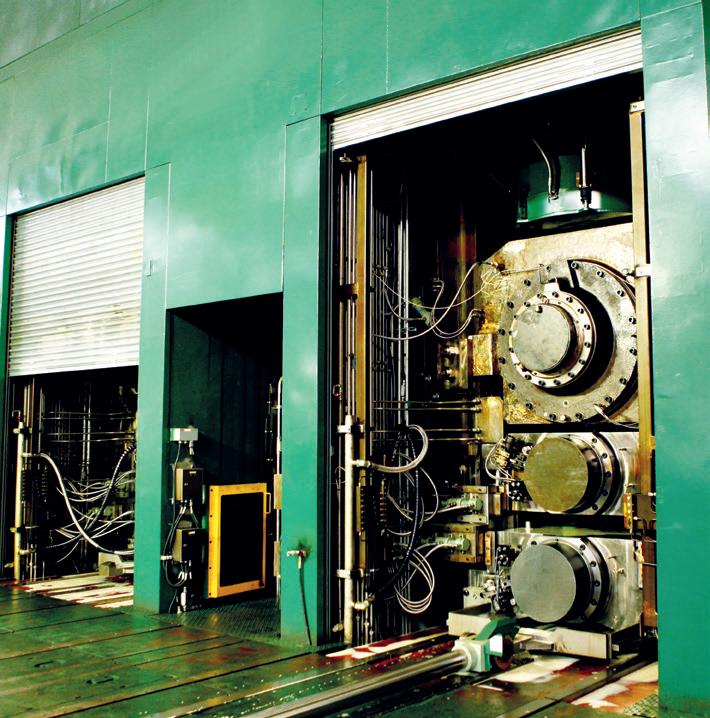

PRECISION ONLINE SHAPE MEASUREMENT AIR BEARING SHAPEMETER

With 50 years of operation and continual innovation under its belt, the Air Bearing ShapeMeter offers market leading levels of continuous measurement feedback for flatness control.

• Low maintenance and maximum equipment reliability.

• Aerospace precision product designed to withstand heavy industrial environments.

• Modular design enables easy installation with minimal downtime.

950 INSTALLED GLOBALLY

primetals.com

Real-time monitoring for molten aluminium composition

Tecnar is a technology company that takes breakthrough science created in a lab and transforms it into novel industrial products to enhance productivity.

The family-owned company was founded in St. Bruno, Quebec in 1989 by members of Canada’s National Research Council (NRC).

Today, Tecnar still maintains strong ties with the NRC, partnering on new technologies. The company has diversified into four technology divisions: automated pipe and vessel welding, thermal and cold spray sensors, molten metal LIBS analyser and laser ultrasonics. Products based on these technologies can be found in more than 30 countries worldwide among over 500 clients.

The Alulibs advantage

Now Tecnar’s molten metal LIBS analyser division introduces its latest innovation: the Alulibs. This innovation was inspired by the aluminium industry’s need for automated real-time multi-element composition measurements in molten aluminium. The benefits of inline analysis are time savings, efficiency, and worryfree measurements.

All molten aluminium lines must wait for laboratory analysis results before production can continue. Until then, production is idle, increasing downtime. The Alulibs system eliminates the wait for lab results, which can take up to 30 minutes. This saves a plant that conducts around 2,000 analyses annually the equivalent of over 20 days of production each year.

The Alulibs helps increase quality and efficiency by giving operations a better understanding of the melt. For instance, knowing the starting chemistry of a new batch and tracking real-time additions to understand homogeneity time means more efficient material use and less waste due to incorrect additions.

Automating chemistry monitoring virtually eliminates the uncertainty associated with error-prone manual sample measurements. What’s more, automating metal analysis significantly minimises direct contact with molten metal, creating a safer working environment.

The inception of the technology

Tecnar briefly entered the aluminium market in 2007 when it partnered with a primary aluminium company to conduct trials with the Alulibs to automate the chemical analysis of crucibles entering the cast house to quickly sort and direct material. The trial’s goals were to test the validity of the Alulibs in measuring silicon and iron concentrations within a specific range with an accuracy of +/10pmm within two minutes at varying temperatures.

The trial results were successful and achieved all the trial’s goals while proving that measurements were independent of temperature. Discussions turned to a field installation, but the project stalled when operations did not see its value. Tecnar decided not to pursue the project, turning

its focus to the use of the LIBS analyser for galvanizers.

Today, Tecnar has installed over 60 LIBS (Laser Induced Breakdown Spectroscopy) analysers at galvanizers worldwide. We gain knowledge from field experience, improving the design and creating a product trusted for 24/7 operation in the harshest environments. The LIBS is also used in a galvanizing process similar to aluminium production: aluminized galvanizing is 90% Al and 10% Si, with melt temperatures exceeding 700˚C.

Overview of the technology

LIBS is a laboratory method used to determine the quantity of elements in a sample. LIBS is performed by using a laser to produce plasma on a surface and the light produced by the plasma contains

FUTURE ALUMINIUM 13 Aluminium International Today July/August 2023

Alulibs-Tecnar

information about the elements present. Collection and analysis of the light and its intensity provide elemental concentration information.

Tecnar’s LIBS design creates the environment for this laboratory analysis to occur beneath the surface of molten metal. This is performed by inserting a ceramic hollow lance attached to our analyser into the melt. High-purity argon is fed through the lance to prevent molten metal from entering the lance and produce a fresh bubbling surface. The analyser then fires the laser down into the bubbles, producing plasma that emits elemental light that travels up the lance to the spectrometer. Tecnar’s software analyses this light, producing a calibrated multielement concentration measurement.

Tecnar’s software has been in development for the past decade, incorporating numerous essential features for raw signal processing. It encompasses data logging functionality and facilitates the assessment of previous events to identify potential production issues. Additionally, the system is compatible with industry 4.0 standards, enabling data transfer from Siemens PLC or Windows industrial HMI. The software operates

on a sequel-server-based PC and can be customised to facilitate data integration with a business network.

Operators have the option to configure a main screen detailing critical elements that need monitoring, along with the desired element concentrations and their acceptable ranges. This main screen also showcases user-configurable historical and future trends, helping operators to understand the evolution of the melt.

The Alulibs has been carefully designed to have a hardware lifespan of 15 years, while the longevity of the overall construction is uncertain but likely to surpass that timeframe, given the existence of operational units. Emphasising durability, the device has been engineered with a focus on minimising the need for preventative maintenance and spare parts, ensuring longevity and reliability.

In field development

In March 2021, Tecnar installed its first new generation Alulibs at a US-based secondary aluminium producer that produces a wide variety of cast alloys. The Alulibs is currently measuring 11 elements at varying concentrations. The system was installed at a bump out of the

furnace and is still operating today. Since it was installed, the system hasn’t required recalibration and still shows the same signal strength as it did at start-up.

This year, another Alulibs installation will be carried out in collaboration with a European aluminium producer. Tecnar has designed a long lance option specifically for this installation, enabling a through furnace wall installation. The extended lance option will be available once field testing is successfully concluded.

In both the in-field installation and the blind experiment, the Alulibs was bench tested against the client’s lab. This comparison allowed us to see how well we were aligned with the current analysis.

Alulibs in the future

As we introduce more Alulibs to the market, we plan to develop more features that will provide the industry with more knowledge about their molten aluminium. In the future, our goal is to expand the concentration ranges for all heavily produced alloys, provide easier calibration with an automatic calibration unit (already developed with Galvalibs) or a single-point calibration and become a certified analyser of quality assurance. �

Aluminium International Today July/August 2023 FUTURE ALUMINIUM 14

Suspicious minds: Aluminium production in the Amazon

By Simon Lobach*

The Amazon region in South America extends over nine different countries. It contains vast bauxite deposits, which have been exploited since 1915. During the Second World War, Suriname – then a Dutch colony – was the largest bauxite exporter worldwide, helping the Allied aircraft industry to victory. Aluminium has been produced in the Amazon since the late 1960s, when the first hydroelectric dam was built in Suriname.

In the context of a several-year PhD research project, I have looked at the past and present of aluminium production in the Amazon, and assessed this industry from the perspective of this very fragile and ecologically essential ecological biome. To provide insights into the environmental performance of aluminium production in the Amazon, I performed a SWOT analysis, citing three strengths, three weaknesses, three opportunities and three threats for the industry. This SWOT analysis concerns the full supply chain of primary aluminium, including bauxite mining, alumina production and hydropower generation,

besides aluminium smelting.

Five aluminium smelters exist in the Amazon, but only two are currently active. These two are located in the Brazilian Amazon: Albrás in Barcarena (Pará), operated by Norsk Hydro, and Alumar in São Luís (Maranhão), operated by Alcoa. The aluminium smelter in Paranam, Suriname, is permanently closed, while the two aluminium smelters in Venezuela (Alcasa and Venalum, both in Ciudad Guayana) are only producing a fraction of their original capacity, if they produce anything at all. The SWOT analysis below is therefore primarily concerned with the two active smelters, both in Brazil.

Strengths

� Aluminium in the Amazon is produced with hydroelectric energy. As a result, aluminium production in the Amazon emits much less CO2 than most of the newer aluminium smelters that have been built since the 1990s. And, while early hydroelectric power projects, like Brokopondo (Suriname) and Tucuruí

(Brazil) still had very considerable socioenvironmental impacts, the more recently built Belo Monte hydroelectric dam is designed to have a smaller impact on the environmental functioning of the river and the lands of traditional populations.

� The companies active in the Amazon (Hydro, Alcoa) are among the frontrunners in reducing the environmental footprint of aluminium production. This can be concluded from the reforestation projects that both have implemented at bauxite mining sites, alumina plants, and aluminium smelters, but also from technologies like the dry tailing management implemented in Hydro’s bauxite mine in Paragominas, and the bauxite slurry pipeline running from Paragominas to Barcarena.

� Whereas community relationships of aluminium producers in the Amazon have been heated and difficult in the past, aluminium companies are increasingly taking their responsibility towards affected populations, through social projects and emergency assistance.

FUTURE ALUMINIUM 15 Aluminium International Today July/August 2023

*Centre for International Environmental Studies, Geneva Graduate Institute (Switzerland)

Fig 1. Industrial development in the Amazon has chased hundreds of thousands of people from their lands. These people cannot always find another suitable spot to live, farm and fish. Photo: Author, 2023.

Weaknesses

� This relationship with affected communities is also a weakness. Since the beginning of bauxite mining in the Amazon, aluminium companies have ignored property rights of traditional populations. This was possible because property rights in the Amazon function in different, more informal ways, than in the companies’ countries of origin. Thousands of people have been displaced from their ancestral lands where they farmed, fished and lived, in order to make way for bauxite mines, and later for industrial facilities, harbours, and reservoirs for hydroelectric plants. Many of these people are still living close to the production facilities, and if they have not taken up alternative, more polluting activities in order to survive, many of them still claim compensation for what they have lost. Fig 1

� The aluminium sector was one of the ‘first movers’ into the Amazonian space, meaning that the industry built roads and power lines into areas where none of these existed before. While presented as vehicles for progress and development, such roads and power lines also opened forest areas to other sectors, like logging, cattle farming, gold seeking, etc. Especially around the hydroelectric plants that were built exclusively to power aluminium plants,

large-scale environmental destruction can be observed, caused by other actors that were inadvertently given access to these areas. Fig 2

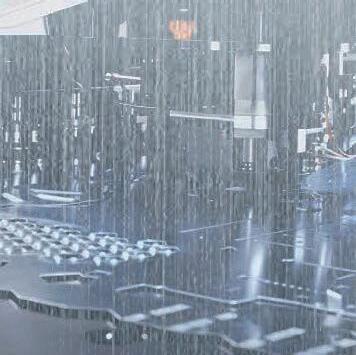

� As the Amazon is a rather flat region, the hydropower produced in the Amazon is not particularly efficient in terms of the amount of territory flooded for each additional unit of electricity. The large reservoirs in the Amazon produce rather small amounts of energy when compared to reservoirs in mountainous regions elsewhere. Furthermore, these reservoirs have flooded extensive forested areas, which functioned as carbon sinks before. Since the forest cover was not removed when the dams were constructed, these rotting forests continue emitting methane, a much more powerful greenhouse gas

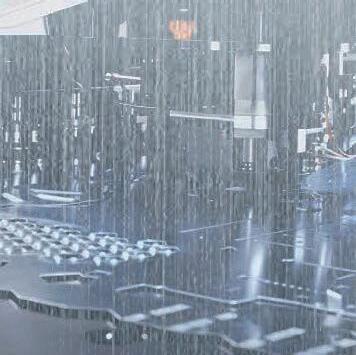

than CO2. As a result, one could put some question marks at claims of hydropower in the Amazon being a ‘green’ energy source. Fig 3

Opportunities

� Opportunities abound in the Amazon for companies willing to genuinely improve local environments and living conditions, but they need to adopt a more holistic view to make a positive impact. Amazonian populations are strong and resilient, and their environment provides them with many livelihoods. Their problem is not poverty, but threats to their lands and environmental assets. Insufficient levels of governance, weak institutions and inadequate monitoring play a crucial role herein. Companies that extract riches from the Amazon and wish to return something to the region should not focus on community projects only, but also help improve the overarching institutional structure. This would enable Amazonians to look after their own interests, so they won’t need to depend on charity work any longer. In order to

Aluminium International Today July/August 2023 FUTURE ALUMINIUM 16

Fig 2. The hydroelectric plant at Tucuruí was built specifically to power the aluminium smelter in Barcarena. Back then, it was built in the middle of the forest. Currently, the entire area around the reservoir has been deforested, with the exception of two Indigenous reserves. Source: Google Maps, 2022

Fig 3. The rather shallow reservoirs in the flat Amazonian lands cause hydroelectric dams here to be rather inefficient, while the drowned forest continues emitting methane for decades to come. Photo: Ted Sun, 2020.

Fig 4. Amazonian soils provide people with many opportunities for farming, but in order not to exhaust the soil, it is done in a circular fashion. Photo: Author, 2020.

achieve this, aluminium companies in the Amazon should cooperate much more closely together with environmental agencies within governments, and be open to learn from social scientists and research institutions in the region as well as abroad. Fig 4

huge waste problem in the Amazon. This is due to failing waste collection services, while the very substantial rainfall and the fluctuating water levels enable garbage to make its way into ecosystems very quickly. Aluminium, in the form of beverage cans for example, is an important contributor to garbage in the region, but aluminium waste, if collected at all, is currently shipped to far-away recycling plants. Aluminium companies could take up an important responsibility dealing with aluminium and other waste in Amazonian cities.

Threats

� A major threat caused by aluminium production is ‘red mud’ deposition in the alumina production stage. Over the past twenty years, several accidents have occurred with red mud leaking into streams and rivers. The resultant water pollution and loss of soil fertility have direly affected local communities.

� The monitoring of dangerous substances, like red mud, often stops after an industry has left a country. This may not be on anyone’s mind in Brazil today, but sooner or later alumina production will stop here, and it may become unclear who should be responsible for the management of these toxic basins after that, especially if the state lacks the capacity to take this responsibility. The cases of Suriname and Venezuela have taught us that such a moment may arrive sooner than anyone expects. Fig 6

� Finally, the very difficult historical relation between aluminium industry and traditional populations constitutes a major threat. There is a threat in terms of reputation, as affected communities have become increasingly vocal to bring their concerns to local and international audiences. But discontent can also constitute a physical threat, as the Surinamese case shows, where the power lines linking the hydroelectric dam to the aluminium smelter were blown up by a collective of people whose lands had been flooded by the reservoir. Repairing this relationship is an absolute necessity, because, as Elvis Presley sang, “we can’t go on together with suspicious minds”.

� The arrival of foreign companies in the Amazon is normally defended with reference to the supposed ‘progress’ and ‘development’ they would bring. Many Amazonians hope to be employed by these companies. The aluminium industry has not yet fulfilled this promise. A major problem of the aluminium industry is that it is energy-intensive, not labour-intensive, while the Amazon is a region that is poor in energy resources but in need of jobs for the many people who for numerous reasons have been displaced from their lands. For this reason, the aluminium industry could make a difference by not only producing aluminium ingots in the Amazon, but also erecting industries for consumer products. In doing so, a leading principle should be to maximise the number of jobs created, while providing the necessary training so that, rather than attracting more in-migration, an Amazonian workforce can take up these opportunities.

� Another opportunity is linked to the

While security of red mud deposits has improved significantly since then, red mud deposition still needs continued close monitoring to prevent it from threatening local populations again. The Amazonian torrential rains, exacerbated even more by climate change, amplify the risks of basins overflowing. Fig 5

Overall, the aluminium industry in the Amazon is moving towards increasingly sustainable practices. However, challenges remain that are of extreme importance for local populations. There is a dire need for stronger community relations, mitigation of unintended environmental consequences, and responsible waste management. By seizing opportunities to enhance the region’s well-being and livelihoods, the industry can contribute to sustainable development in the Amazon. It has taken the first steps in this direction, but much remains to be done. �

Elements of this research were funded by the European Research Council (grant 950672).

FUTURE ALUMINIUM 17 Aluminium International Today July/August 2023

Fig 5. Storm clouds gathering above Hydro’s Albrás-Alunorte complex in Barcarena (Brazil). Heavy rainfall compounds the risk of red mud basins overflowing or leaking into the many river and streams, on which locals depend. Photo: Author, 2022.

Fig 6. The smelter in Paranam, Suriname, owned by Suralco/Alcoa, closed in the early 2000s. Who will take care of cleaning up the rustbelt and the red mud deposits? Photo: Author, 2022.

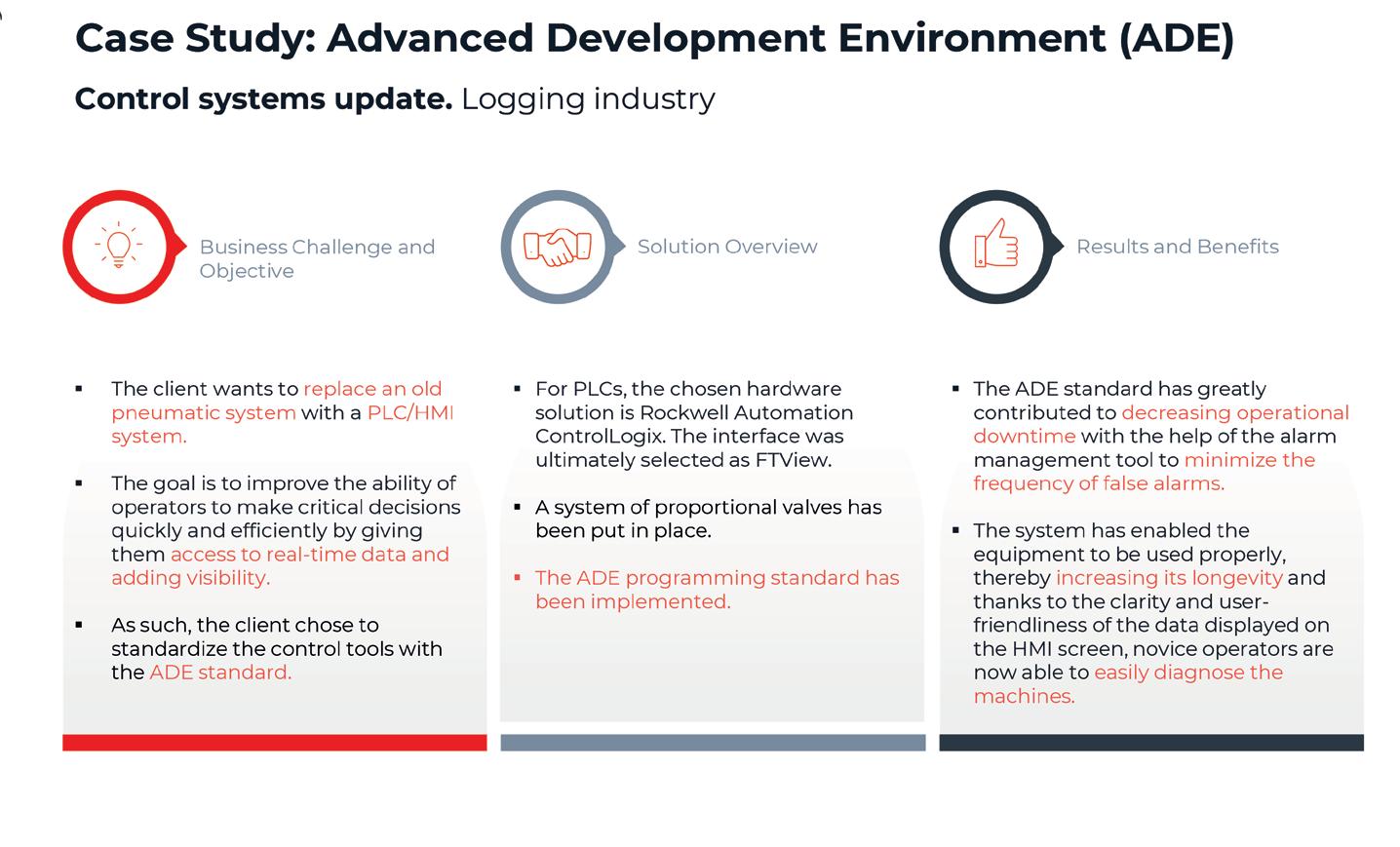

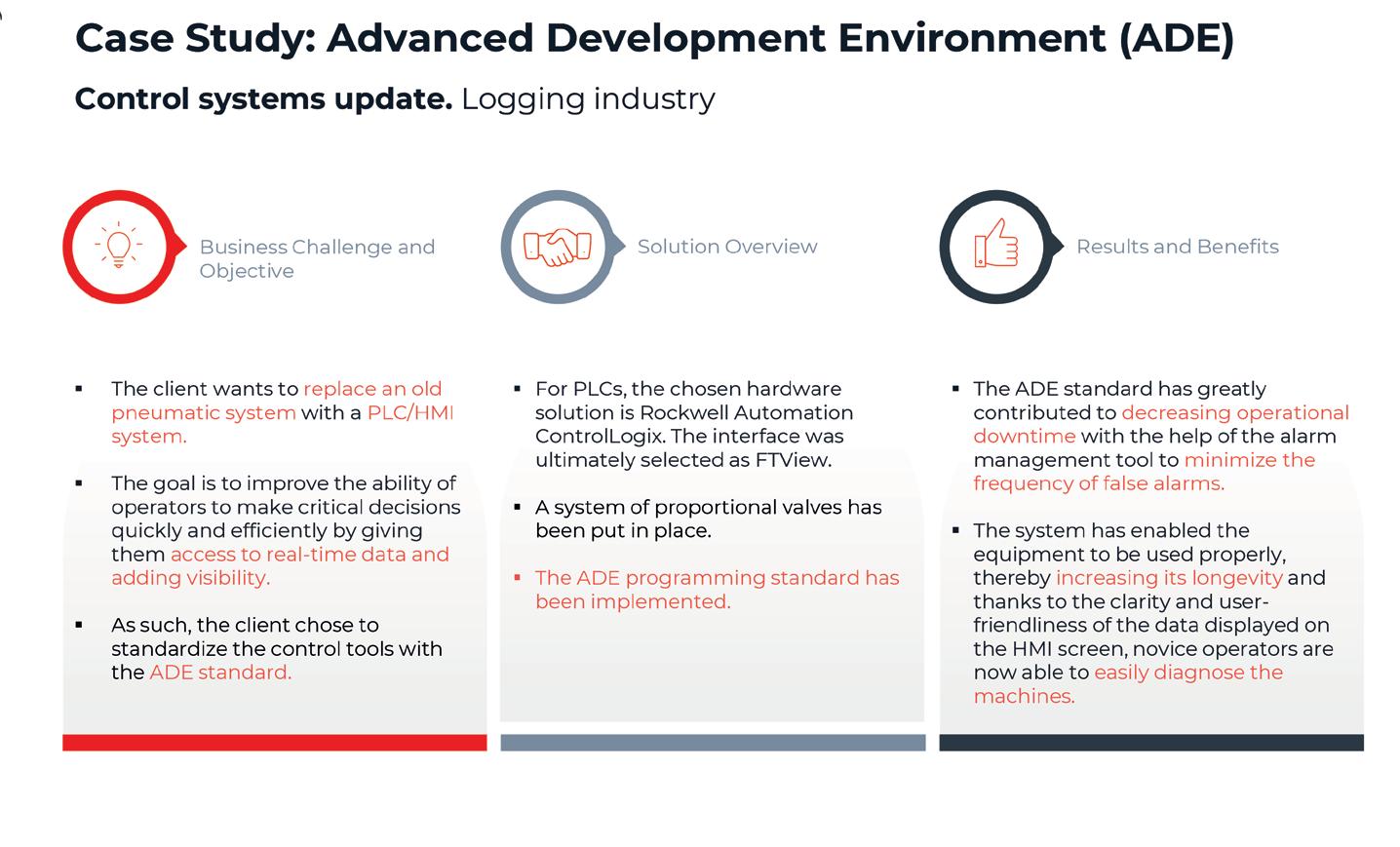

ADE Solutions: Smart plants of the future

By Mileidy Hernandez*

By Mileidy Hernandez*

In 2021, the demand for primary aluminium reached an estimated 68.7 million tonnes, which is an increase of 8% compared to 20201. This growth is part of a larger trend, as world aluminium demand has grown at an average annual rate of 5% between 2012 and 20212 Aluminium smelters must adopt Industry 4.0 to meet demand. The transition to smart manufacturing can be challenging due to complex operations and critical equipment, but integrating advanced technologies and digital solutions can improve efficiency and productivity.

WSP’s Advanced Development Environment (ADE) helps aluminium smelters transition to advanced manufacturing. It provides a comprehensive range of functions for developing, testing, and maintaining automation systems, integrating control, visualisation and communication to improve industrial process efficiency.

ADE is the foundation of a smart plant, offering real-time data analysis that reduces downtime and increases output quality. By logging all actions, ADE enables factories to optimise operations, increase efficiency, and remain competitive.

Learn how ADE can help your aluminium smelter achieve operational excellence and transition to Industry 4.0. Discover key features and real-world examples of improved operations. Become a smart plant, reduce costs, and increase efficiency with ADE.

ADE Solution in terms of industry 4.0

ADE is the foundation of smart plants, enabling aluminium smelters to use new technologies to improve industrial processes while reducing costs and waste. It fills gaps left by humanmachine interface (HMI) software and programmable controllers3, providing a comprehensive solution with added functionalities. ADE offers a structured environment based on a library of “AddOn Instructions,” with corresponding HMI faceplates and objects4

Productivity Aspect

One of the key benefits of ADE is that it reduces the number of alarms,

enhancing normal operations, increasing productivity, and improving efficiency. It also eliminates cascading alarms for quicker problem detection, identification, and resolution. In addition, ADE “ensures complete operator autonomy by providing maximum information on the operator interface5” enabling informed decisionmaking without relying on external sources. This is crucial for aluminium smelters where quick decisions based on real-time data are necessary for a smooth production process. Centralising all systems on a single interface6 with ADE provides a comprehensive overview of operations, simplifies identifying areas for improvement and implementing changes on a single platform for quicker and more efficient processes. This improves overall performance and maintains a competitive edge.

Quality Aspect

ADE’s advanced monitoring and analysis capabilities allow companies to quickly identify equipment failures and other issues, reducing the risk of costly production errors and downtime. ADE’s centralised interface and failure analysis tools provide operators with maximum information and autonomy, enabling them to diagnose and resolve issues more quickly and efficiently. Moreover, the process control PID loop function incorporated in ADE plays a crucial role in delivering high-quality products. Several advanced control features enhance the quality of production, resulting in fewer errors and reduced waste. By reducing waste and enhancing quality, companies can save on raw materials and energy costs, while simultaneously boosting their overall efficiency.

Security Aspect

ADE brings numerous benefits to the aluminium smelter industry in terms of Industry 4.0, not least of which is improved security. ADE employs systemwide global management to ensure that

all actions are secured, and users can only access equipment in read mode when navigating beyond the boundaries of their responsibility7. This is achieved through three concurrent restriction levels:

1. Security based on user group.

2. Security based on sector or department.

3. Security based on operator station. This multi-layered approach provides enhanced protection against unauthorised access and ensures that critical operations are only accessible by authorised personnel.

Sustainability of Industrial Processes Aspect

The ADE’s advanced PID plays a fundamental role in optimising industrial processes. Initially developed to provide advanced process control with Allen-Bradley Control Logix, the PID has evolved to become a standard product with all the functionalities required for different ADE-supported platforms.

The PID’s optimisation capabilities enable industries to maximise the efficiency of their processes while minimising energy consumption. ADE PID features allow for a straightforward and comprehensive handling of cascading loops therefore considering process limits and unusual operating modes. Also, built-in external reset feedback allows for deadtime compensation, optimal loop synchronisation in override control schemes as well as other advanced control strategies. Moreover, an alternate PID algorithm is available to handle intermittent process signals. Increasingly, results from lab testing are used as process variables for closed-loop control which is often essential for advanced product quality control. Such signals are typically updated a few times per day or, at best, a few times per hour and require a dedicated PID algorithm which can be enabled on any PID loop with a single click

FUTURE ALUMINIUM 19 Aluminium International Today July/August 2023

* CPI in Automated Systems - Industrial Computing at WSP in Canada

in ADE. By optimising processes, industries can reduce their carbon footprint and contribute to a more sustainable future.

Traceability and Accountability

ADE provides traceability and accountability for industrial settings, particularly factories. Complete records of all actions taken in the factory are logged in ADE to ensure safe and efficient production processes. This includes operator commands, parameter changes, and PLC logic-initiated actions. ADE also logs all alarms and events. This level of traceability helps factories quickly identify and correct issues, and provides valuable data for optimising operations. Analysis of the logged data helps identify areas for process improvement, resulting in increased productivity.

Reducing Cost Aspect

ADE uses advanced technology to provide powerful tools that streamline

operations, reduce costs, and extend the life of factory machinery. This allows factories to avoid purchasing new equipment and save money by optimising and modernising existing machinery using ADE.

ADE’s pre-configured functionalities offer key advantages to factories, including security, navigation, configuration, and more, without requiring additional resources or development time. This streamlines the development process, saves time and money, and includes analog and digital inputs, process control functionalities, group start/stop management, and code generator, all working seamlessly to optimise operations and reduce costs.

The advantage of ADE in terms of cost reduction lies in its ability to allow operators to solve problems independently during production. For instance, if a non-critical

equipment whose process has already been established that it can be bypassed fails overnight, operators can bypass it via the HMI without calling an electrician, ensuring continuous production and saving costs. The next day, electricians can easily understand the bypassed equipment thanks to ADE’s HMI graphics, clearly listed and visually displayed, making a significant contribution to the aluminium smelters’ bottom line.

Real-world applications

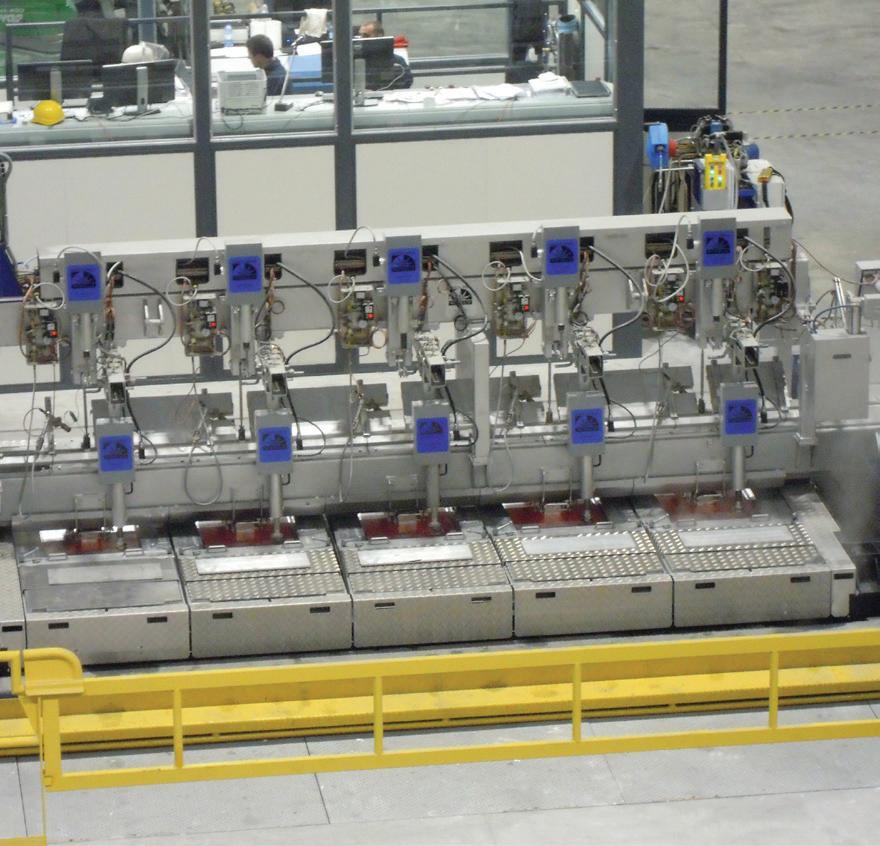

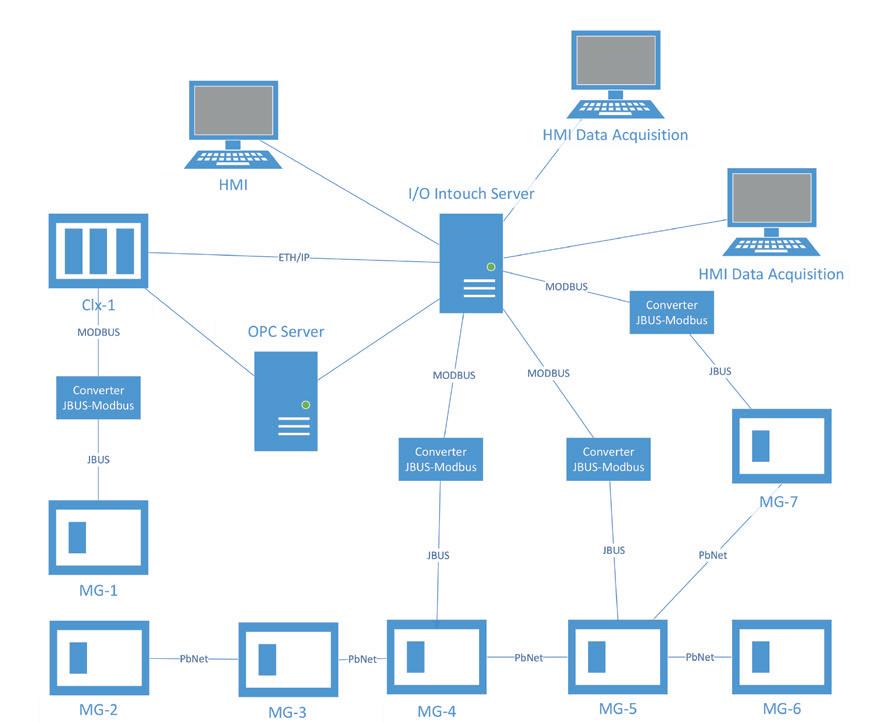

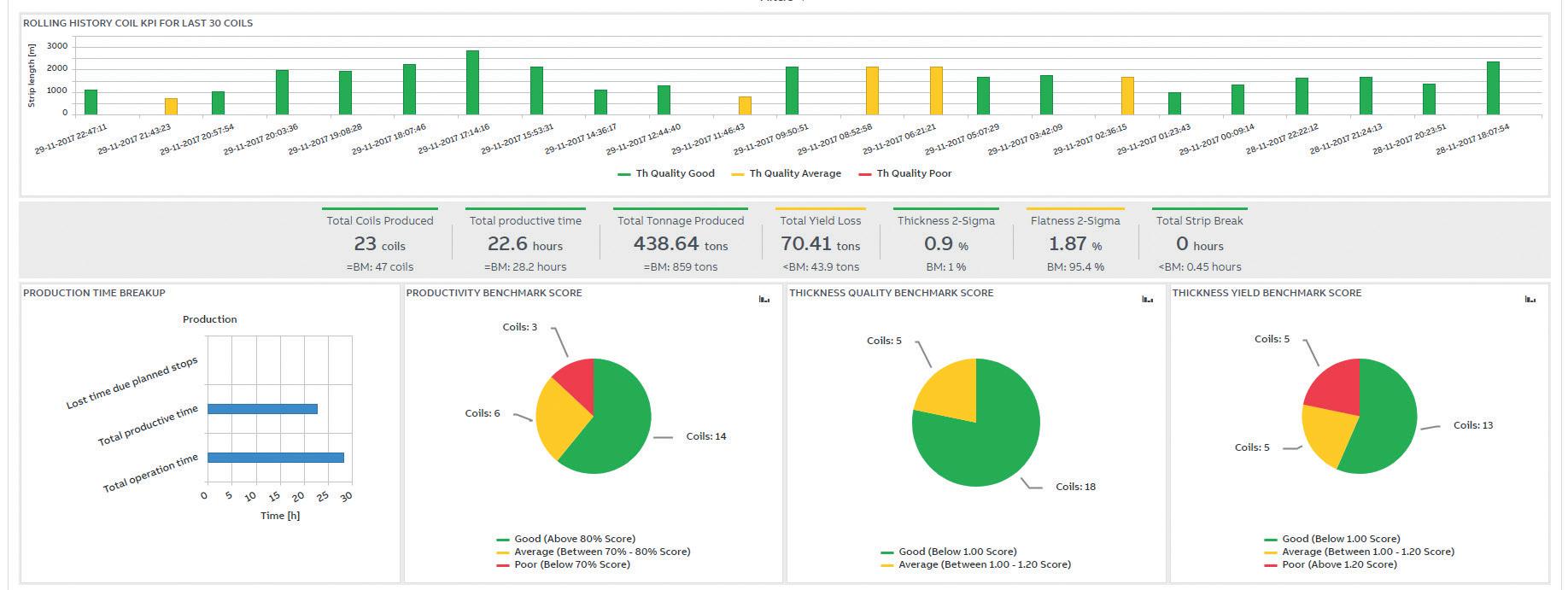

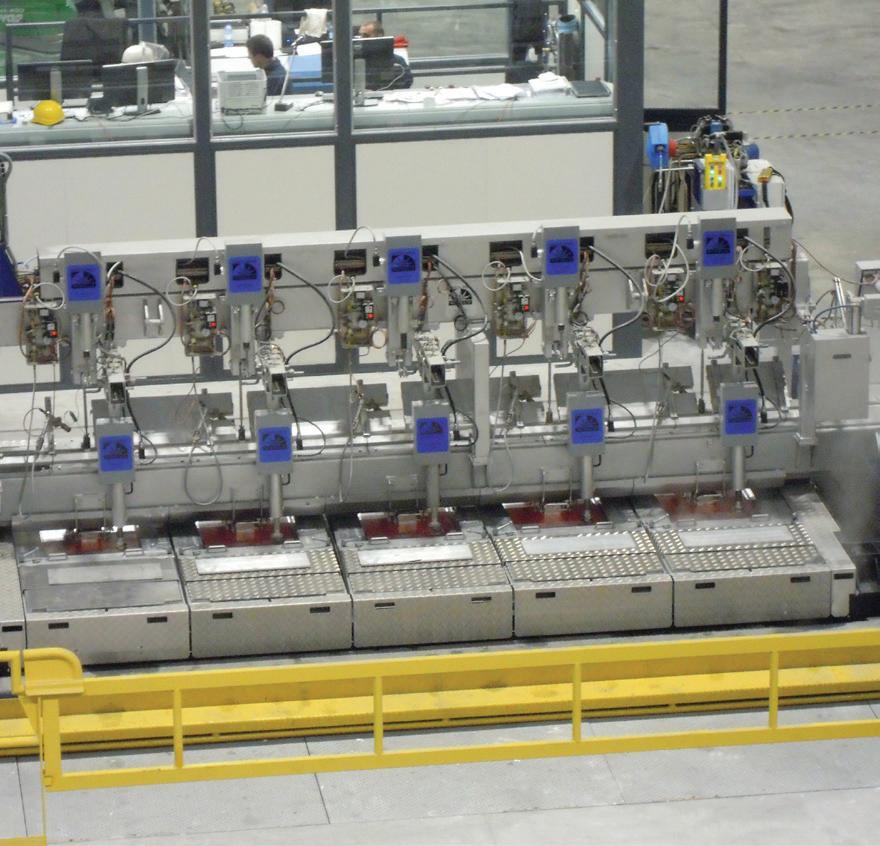

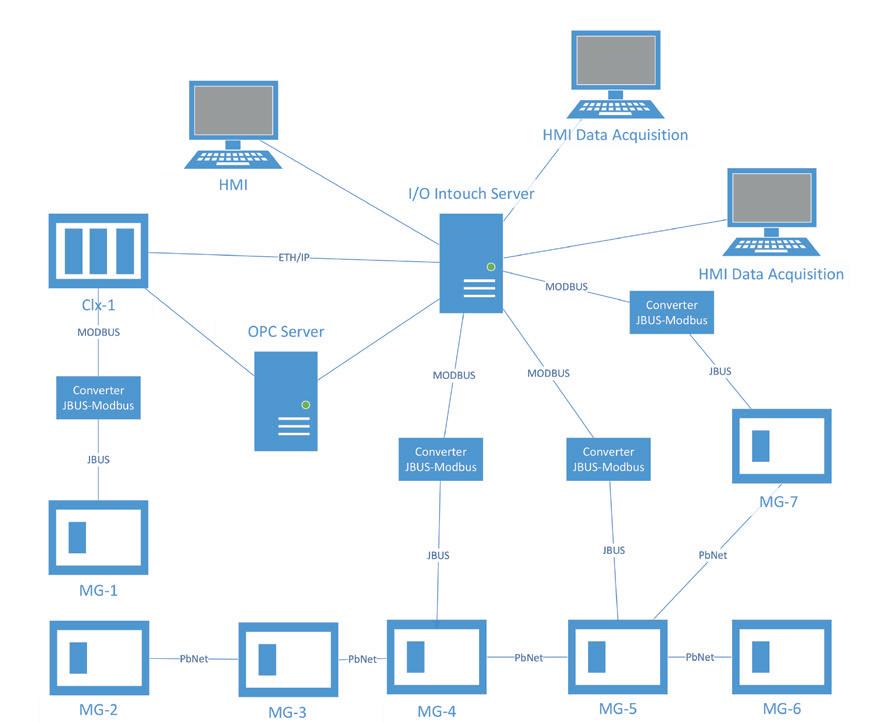

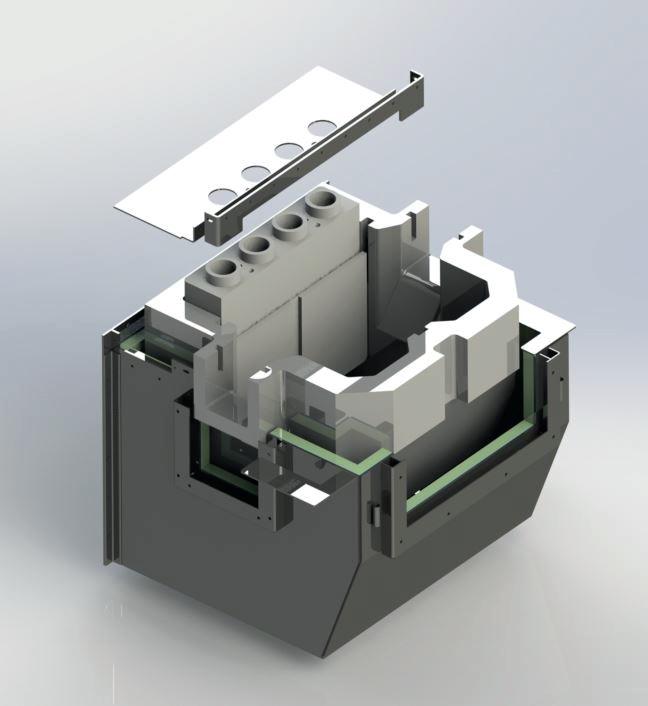

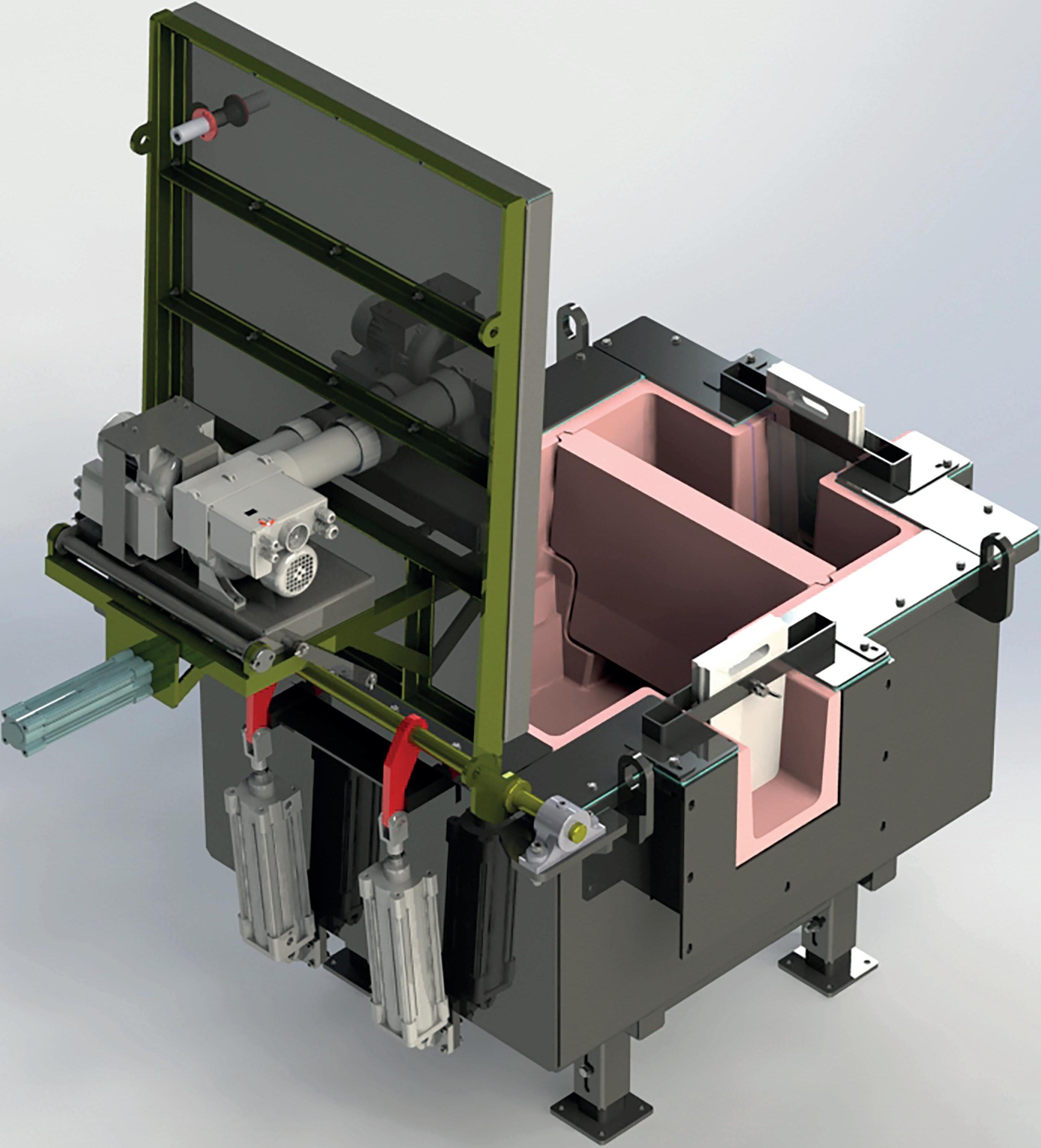

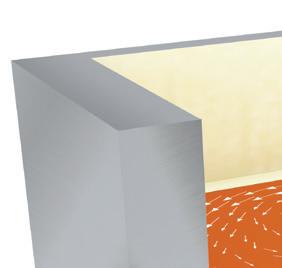

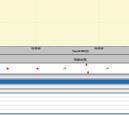

ADE provides an efficient approach to Industry 4.0 tech implementation, as demonstrated by in WSP’s project for an aluminium smelter. ADE consolidates the factory’s systems, enabling better communication and memory capabilities. This enables the implementation of IoT, AI, and data analytics, improving efficiency and productivity. ADE streamlines communication to just two channels, providing a solid foundation for future growth and innovation. Figs 1 and 2

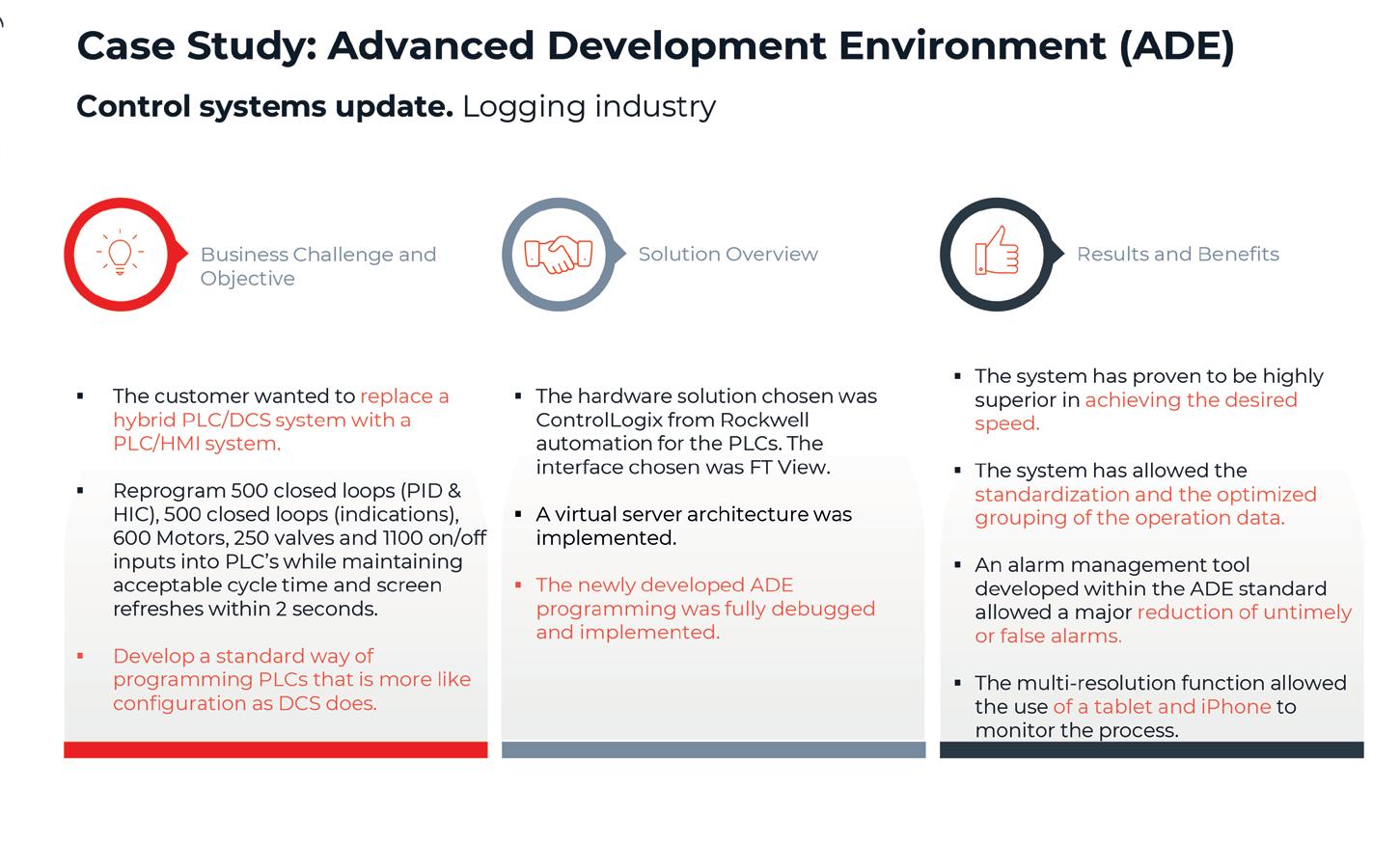

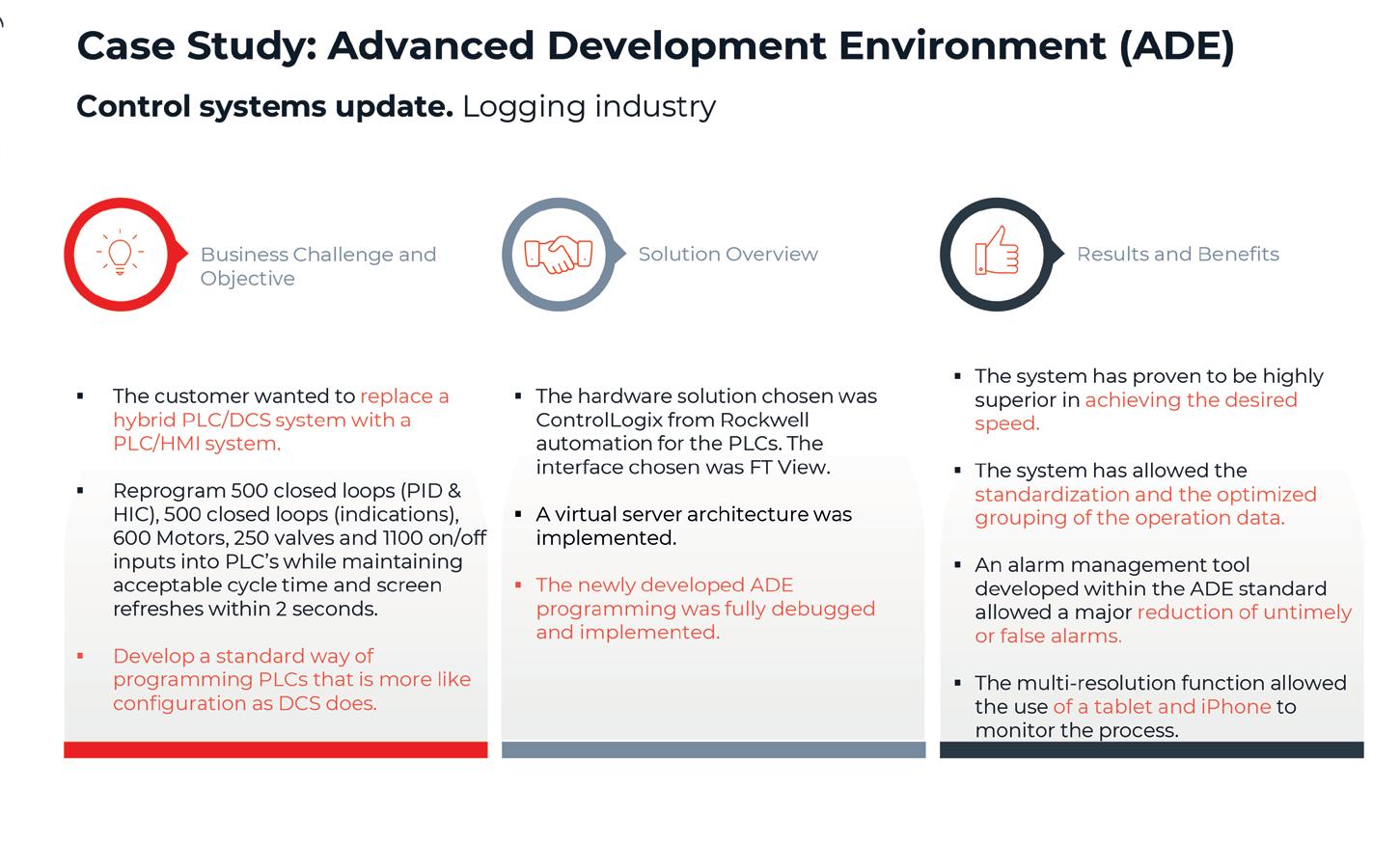

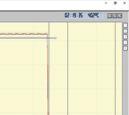

The first ADE project was very successful, yielding impressive results such as scan time optimisation, data standardisation, reduction of nuisance alarms and a unique multi-resolution feature that allowed for mobile tracking. These results demonstrated the potential for future implementations. Fig 3

ADE’s recent project for a paper mill factory resulted in decreased downtime, fewer false alarms, improved equipment usage, and extended equipment life. This success highlights ADE’s potential to improve productivity in industrial settings. Moreover, this case study demonstrates the versatility of ADE’s technology, as it can be successfully implemented in several types

Aluminium International Today July/August 2023 FUTURE ALUMINIUM 20

ABI before ADE

1. Natural Resources Canada. (2023, February 24). Aluminum Facts. Retrieved from Government of Canada: https://natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/aluminum-facts/20510. 2 (Natural Resources Canada, 2023). 3. WSP Canada Inc. (2018). ADE – The Solution for an Integrated System. Brochure. 4. (WSP Canada Inc, 2018). 5. WSP Canada Inc. - Smart Industry. (2018). Advanced Development Environment (ADE). PowerPoint Presentation.6. (WSP Canada Inc. - Smart Industry, 2018). 7. (WSP Canada Inc. - Smart Industry, 2018)

Fig 1. Aluminum smelter Network Architecture prior to ADE

Fig 2. Aluminum smelter Network Architecture with ADE

Fig 3. Case-Study ADE, Logging industry

of factories, regardless of their specific manufacturing processes. ADE’s ability to adapt to different industrial settings and provide exceptional results demonstrates its potential to revolutionise operations across a wide range of industries. Fig 4

Summary

WSP’s ADE is a crucial tool for aluminium smelters shifting to Industry 4.0. It reduces alarms, centralises systems, and ensures complete autonomy which can improve efficiency, boost productivity, and maintain competitiveness.

ADE has advanced monitoring and analysis capabilities to track faulty equipment and improve output quality. It eliminates PLC program interventions, and features advanced security functions to reduce errors and oversights, ensuring reliability and efficiency. ADE also offers real-time data collection and analysis, leading to sustainable industrial processes, improved productivity, reduced downtime, and increased savings. It optimises operations and ensures competitiveness in a dynamic market.

Aluminium smelter factories can benefit from adopting WSP’s ADE for increased efficiency, reduced downtime, and

improved profitability. �

References

Natural Resources Canada. (2023, February 24). Aluminium Facts. Retrieved from Government of Canada: https://naturalresources.canada.ca/our-natural-resources/ minerals-mining/minerals-metals-facts/

Discover

aluminium-facts/20510

WSP Canada Inc. (2017). ADE - The Solution for an Integrated System. Marketing Brochure.

WSP Canada Inc. (2018). ADE – The Solution for an Integrated System. Brochure. WSP Canada Inc. - Smart Industry. (2018). Advanced Development Environment (ADE). PowerPoint Presentation.

Gain a leading edge in aluminum recycling with our in-house developed XRT and Dynamic LIBS sorting technology. Designed to maximize purity and yield, our sorting systems ensure a quick return on investment.

FUTURE ALUMINIUM 21 Aluminium International Today July/August 2023

Fig 4. Case-Study ADE, Logging industry

in aluminum and alloy

with X-TRACT™ and AUTOSORT™ PULSE .

maximum potential

sorting

Double your opportunity in aluminum recycling. See our machines in action INT2323_Aluminium International Today_Aluminum_185x128mm_v1.indd 1 09.05.23 11:42

DEGASSING UNITS RELINE KITS DBF REPAIR KITS CERAMIC FOAM FILTER SYSTEM CERAMIC FOAM FILTERS APHITE ROTORS METAL TREATMENT More Info: ventas@rodabell.com www.rodabell.com Get the most benefit of our customized reline kits, and after sale service!

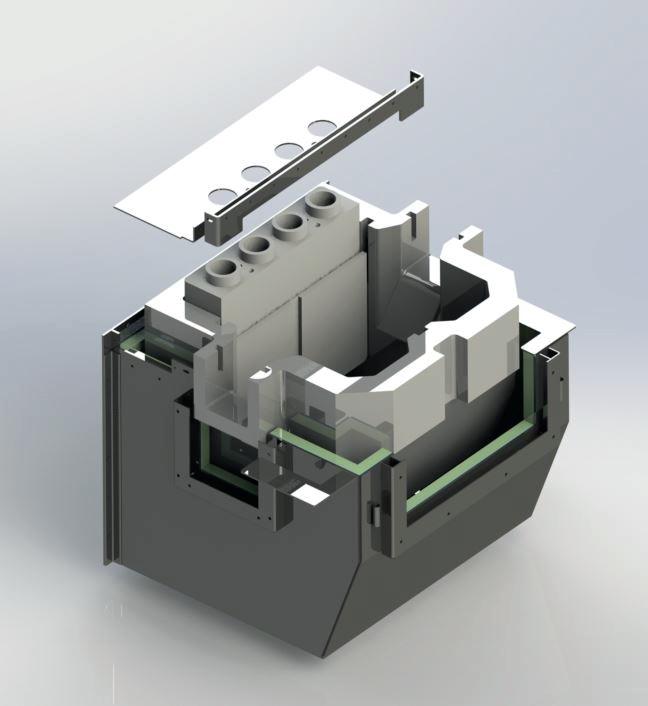

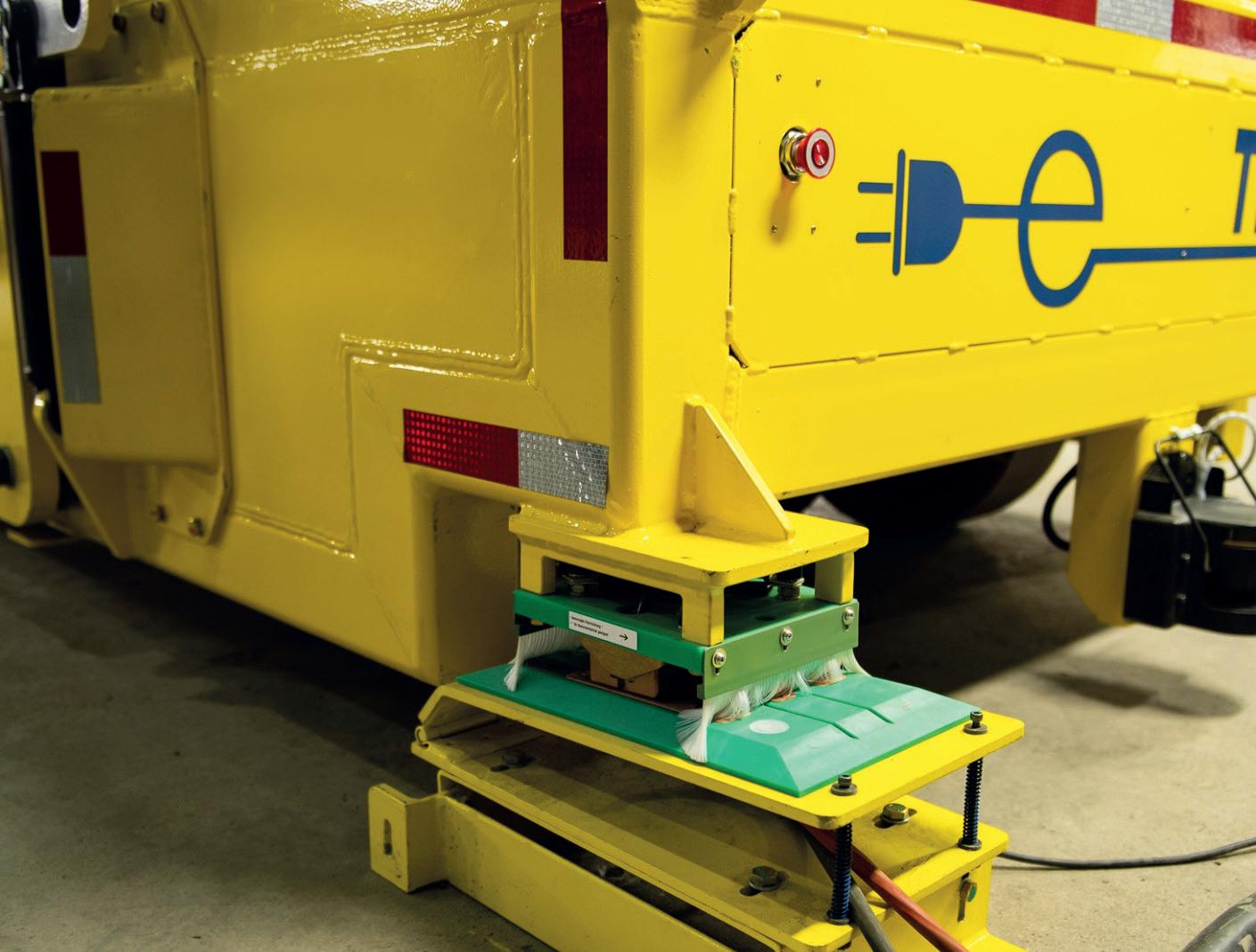

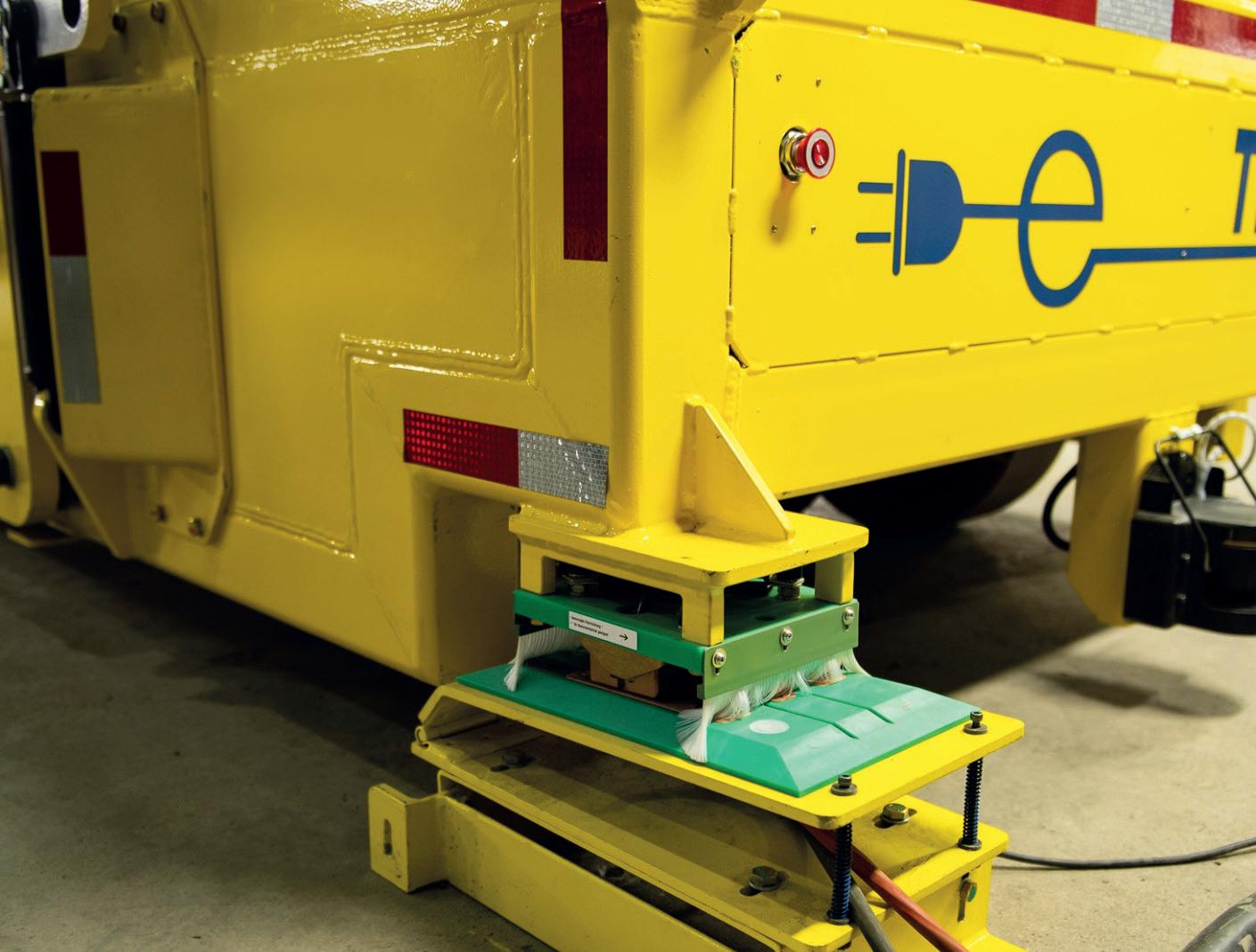

The Haulers’ Evolution

By Malcolm Caron-Boivin*

There are many discussions within the industry regarding the restructuring and establishment of standards to promote the decarbonisation of aluminium production. Important initiatives are deployed to reduce the overall environmental footprint of the industry across the value chain and emerge from close collaboration between smelters, customers, suppliers, equipment manufacturers, employees, and the community.

The enthusiasm that comes with the industrial drive towards net-zero emissions goes to show that aluminium and equipment manufacturers have a pivotal role to play. This is why we, at EPIQ Machinery, decided to develop a new fully electrical motorisation for one of our existing MECFOR tractor model, the MTA30. Timing is right; this initiative is supported by our customers and governments and the prototype is already planned to be tested in real operation environment.

Follow the ‘green’ brick road

The International Aluminium Institute identified three pathways to reduce greenhouse gas emissions (Aluminium Sector Greenhouse Gas Pathways to 2050, 2021):

1. Electricity decarbonisation by using clean energy instead of fossils fuels: The aluminum sector currently produces 1.1 billion tonnes of CO2, and more than 60% of it is from the production of electricity consumed during the smelting process. The opportunity is big there.

2. Direct emissions potential: Emissions from fuel combustion make up 15% of the industry’s emissions. A little bit less then the previous one, but still significant. Of course, this is exactly where the electrification of diesel solutions is going to help.

3. Recycling and resource efficiency: By increasing collection rates to near 100% as well as other resource efficiency progress by 2050 would reduce the need for primary aluminium by 20%.

Aluminium is turning green and big players are leading the way. Many of

our customers have set ambitious goals to achieve net zero emissions by 2050. EPIQ MECFOR has chosen to embrace the challenge and is working in offering equipment to reduce direct emissions.

From Diesel to Electric Hauler

EPIQ MECFOR haulers are criss-crossing halls of primary aluminium smelters for more than 25 years, cumulating over 100,000 hours of operations. With 100+ haulers in operation, hauling different types of trailers with the same attachment system, we figured that our customers already own a lot of spare parts for them, and not to mention that their teams of operators are well-trained making them extremely efficient and accustomed to the way it drives and the way it maneuvers.

Plus, our haulers have gone through several iterations based on customer’s feedback and the expertise developed along the way. It was inconceivable for

EPIQ MECFOR to start designing from scratch. That is why the decision was made to use the same overall design, so most components remain the same (cabin, frame, wheels, operation approach, etc.), except anything related to the motorisation. From the outside, it will be difficult to make the difference; the revolution is from the inside.

This approach will also allow our customers to perform the Anodes or Molten Metal crucibles hauling operations about the same. The vehicle will have the same dimensions and manoeuverability. Pick-up and drop off locations of the payloads can be kept the same. It is an articulated model, it can be coupled to any existing trailers, and future EPIQ MECFOR trailers can be built using the same design, no engineering needed to adapt.

In its portfolio, EPIQ MECFOR has two tractor designs: MTA (narrow) and MTC (large). The Engineering and Design team is currently designing the prototypes of

FUTURE ALUMINIUM 23 Aluminium International Today July/August 2023

*Eng., International Business Development Manager, EPIQ Machinery

EPIQ MECFOR Diesel engine powered Anode hauler

the MTE – the electric version – based on the MTA30. The team has started to instrument existing vehicles that are in operation in customers’ plants. Data is collected and analysed to determine the duty cycle of a hauler in operation. That way EPIQ MECFOR can make sure the tractor has the right autonomy and charging time to be integrated in a smelter’s operation seamlessly.

Multifaceted challenges: two key elements to consider

There are multifaceted challenges to this decarbonisation process across all levels. The transition to ‘green’ energy Anode Haulers requires facility modifications (e.g.: charging station) along with new skills for maintenance teams. The same maintenance team that has been working with diesel fleets will now have to develop a brand-new expertise with electric vehicles: maintaining high voltage batteries, electric drives, charging stations, etc.

Hauling anodes may seem simple. However, when we take a closer look at the operating environment of aluminium producers, we quickly come to understand the complex challenges that comes with operating electrified haulers in this environment. The involvement and the cooperation of the end-users, aka the aluminium producers, is necessary.

a. Analysis of vehicle usage

The first key element to consider is the analysis of vehicle usage. This is what we are doing at the moment by instrumenting existing vehicles. However, we cannot use that data for any plant, as every operation is different, from facility to facility, and even from an operator to another.

Type of driving. We have jacks on the articulation that provide steering to the vehicle. This can take a lot of energy. The way you drive, and steer can have a lot of impact on the autonomy.

Acceleration and deceleration. If you have an operator that tends to put the pedal to the floor every time he or she wants to move forward, that’s going to affect and drain a lot more energy than a smooth ramp up. Speed management is important; when and where you are going to reach top speed, optimal speeds in function of distances to travel, etc.

Duty cycle in a shift. Several shifts need to be studied to provide the right solution and maintain the same operation as with a diesel fleet. Operators also need to be prepared to adapt the way they drive. Even with electric city buses, operators need to go to through a whole training to ensure vehicles are operated the same way by different operators. Instrumenting also allows to monitor and log the way it

is being operated.

b. Analysis of work processes and practices

The second key element is the analysis of work processes and practices. A transition strategy needs to be defined to make sure it is seamless, and it doesn’t impact production.

Choice of charging strategy; are we swapping battery packs, having a charger on board, chargers outboard? Where do you put the chargers to optimise operations, at pick-up and drop off locations? How many of them? When are you charging? This needs to be studied at the very beginning of the project and can all be simulated using real operational data from instrumented vehicles to ensure precise results.

Are we switching to a 100% electric haulers fleet or are we doing it gradually? A hybrid fleet might be a good approach for now until battery technology, which evolves extremely rapidly, improves.

Vehicle maintenance plan needs to be considered as it is very different than a diesel fleet: less maintenance, but a different type. Limitations due to space constraints, for charging stations and parking spots need to be well-thought.

The conversion goes further: from electric rigid hauler to AGV

Back in September 2022, EPIQ Machinery announced its partnership with DTA S.A., a Spanish company. DTA’s core business is to deliver heavy-duty and tailored made AGV solutions. EPIQ, in cooperation with, is working on a non-articulated singlehulled electric model. This rigid design could be more easily converted later in AGVs. Our prognostic is that, once the transition to electric equipment is well underway, some producers will be ready to step up with auto guided haulers.

Based on what we’ve seen so far with AGVs in the aluminum industry, customers are not yet ready to go with a fully autonomous solution. The great

thing about the rigid electric design is that it can be converted into an AGV later if wanted.

The cabin can be removed or not to maintain a hybrid operational mode during the transition. Being electric, it has low maintenance, longer lifetime, it is very compact and has innovative traction allowing more flexibility, multidirectional steering allowing crabbing (side movement), which offers great manoeuvrability in limited spaces.

EPIQ and DTA will deliver and put in operations their first rigid electric hauler project by end of this year.

Once the risks mitigated, the industry will be in a reassuring position to shift to full AGV solutions that will allow the optimisation of human resources, which are getting scarcer, towards value added tasks (less repetitive). Also, AGVs will enhance safety in harsh operation environments using natural navigation. This type of navigation prevents from extensive infrastructure modifications (wire, paint lines, heavy-maintenance reflectors, etc.) It is connected to a stateof-the-art fleet management which is fully integrated to the plant management system.

Today’s talk of the town: Industry 4.0 All of this can be fully integrated to the whole 4.0 solution. EPIQ vehicles, autonomous or not, can-do real-time data gathering which includes but are not limited to localisation and traceability of the payload, fleet management, live monitoring of equipment health, predictive maintenance, etc.

The order management of the AGVs would be integrated to the plant control system (MES, ERP, etc.) allowing data gathering and management.

We can also imagine in a near future the ability to treat this data with AI to optimise production. In short, converting heavy-duty mobile equipment from diesel to electric is a step further to a new technological era. At EPIQ, we’re in. �

Aluminium International Today July/August 2023 FUTURE ALUMINIUM 24

Battery charging Station

precimeter.com

AUTONOMOUS CHARGING & SKIMMING MACHINES

Writing the future of AI to drive digitalisation in the metals industry

Exhibiting at METEC, GIFA, ThermProcess, and NewCast, ABB’s Frederik Esterhuizen** and Tarun Mathur*** spoke with Zahra Awan* on the development of Artificial Intelligence (AI) tools for the metals industry and how they are implemented. The global technology leader also described some of the decarbonisation challenges facing the sector and how they may be overcome by working together.

“Decarbonisation is a target across the whole metals industry, but also within ABB’s manufacturing sites and facilities. We have a responsibility to lead by example, focusing on our customers, our supply chain and ourselves.”

- Frederik Esterhuizen

What is the position of AI in the metals industry, what is the current uses, and how is it beneficial to the industry?

Tarun Mathur (TM): Industry 4.0 is making an impact across many industries, including metals, through aspects of operational excellence, process performance, asset performance, sustainability and connected worker, all underpinned by cyber security. Looking at a customer’s digitalisation journey, big data and AI have become more significant if you look at the maturity of the metals market today. Even five years ago, only 10-20% of the industry was connected. Most producers had some automated systems, but they were working in silos. Since then, there has been a transition where these islands of automation have been broken down, pieced together or replaced to create either an edge or a cloud where all the data can be stored, accessed and shared, enabling gains in productivity, quality and yield. It means that an industry traditionally known as conservative has taken a big and important first step. We have now seen, in the last two years, more AI applications relevant to the industry.

It is still a new area, but the potential is immense. We have more and more unrestricted or available data from across customer sites and the wider industry. Large organisations like ABB can also help to leverage big data from across the many industries we serve, adopting from others and working together. For any organisation, greater certainty of future conditions is valuable and AI can improve that forecasting.

Do you think that AI and automation has a role in combatting industry specific workforce issues?

TM: It’s well known that workers are reaching retirement age and working beyond because companies cannot lose their experienced, knowledgeable people. This is unsustainable and the use of AI and automation can help retain information for the next generations. ABB is exploring the implementation of an app for connected workforces. AI as an assistant can go some way to addressing metals industry challenges.

What does ABB do regarding AI in the metals industry?

TM: ABB is investing in AI applications across many industries. For us, in the metals industry, workforce is one area with tremendous potential to grow. We have built AI packages starting from the upstream stock yards, through pellet plants, into the steel melt shop, and then the downstream rolling mills. The applications will improve the operations or improve the asset reliability or the overall performance of the plants.

ARTIFICIAL INTELLIGENCE 27 Aluminium International Today July/August 2023

*Assistant Editor, Aluminium International Today **Global Business Line Manager, Metals, ABB ***Global Industry Consultant, Metals Digital, ABB

Frederik Esterhuizen

Tarun Mathur

At the recent ESTAD conference, which took place in conjunction with the METEC fair, ABB presented on the topic ‘The Role of Artificial Intelligence in Digital Transformation of the Steel Industry’. We outlined some of the tangible ways AI applications can optimise energy purchase and production including at site power plants and turbines. It can lead to more efficient energy use and improved electricity procurement forecasts, with difference of 10-15% compared to alternative solutions. Data and optimisation modelling and rule-based energy management algorithms can lead to optimised energy consumption and energy security in operations.

Frederik Esterhuizen (FE): At ABB, across the process industries, we have examples of customers choosing to use our Collaborative Operations Center, based in India, where we serve our global network 24/7. This deploys AI to help predict any future failures or potential maintenance issues, as well as pinpointing where the initial fault occurred, which makes it easier for the operator to find

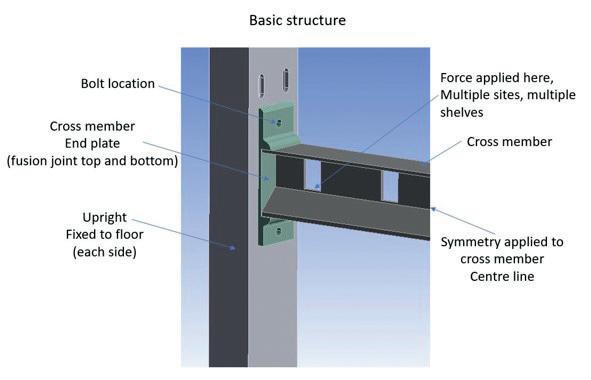

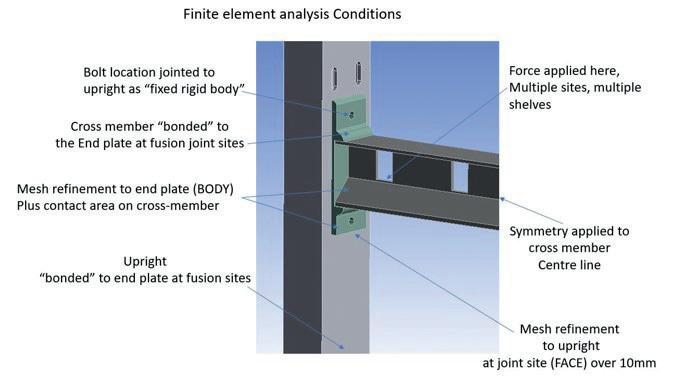

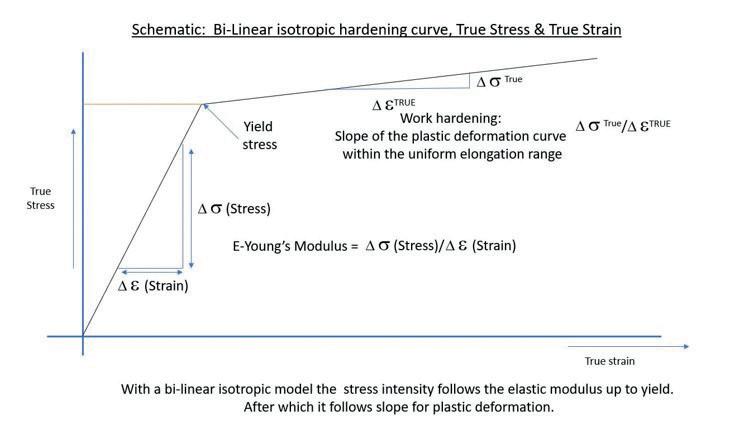

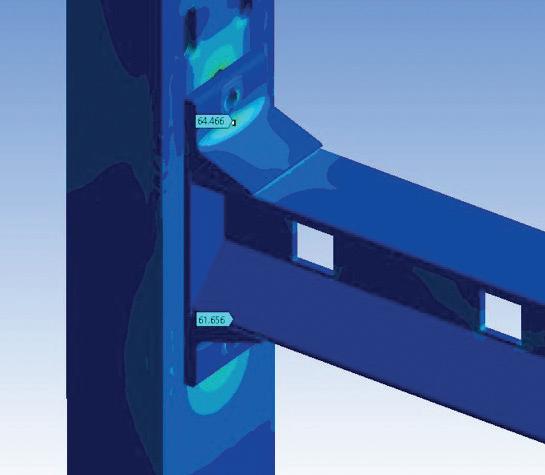

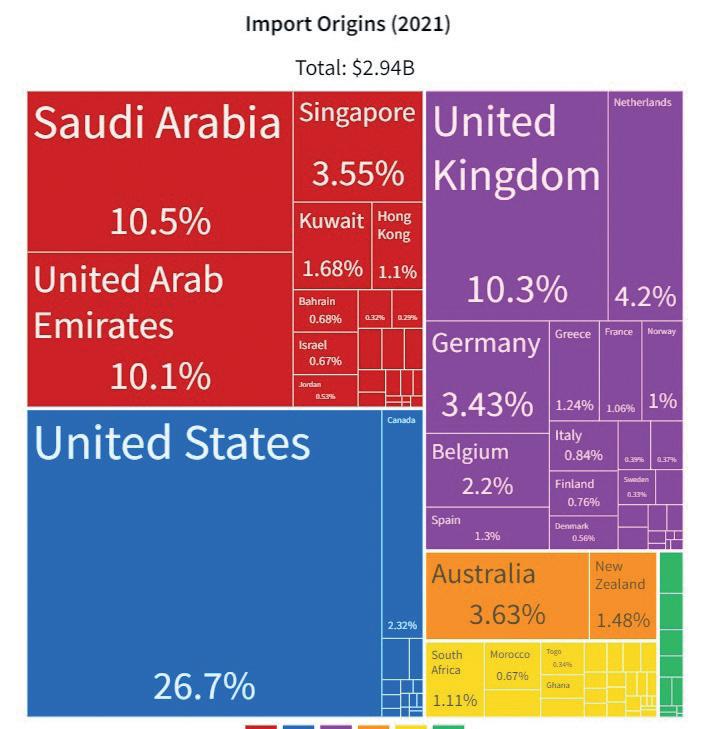

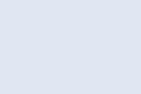

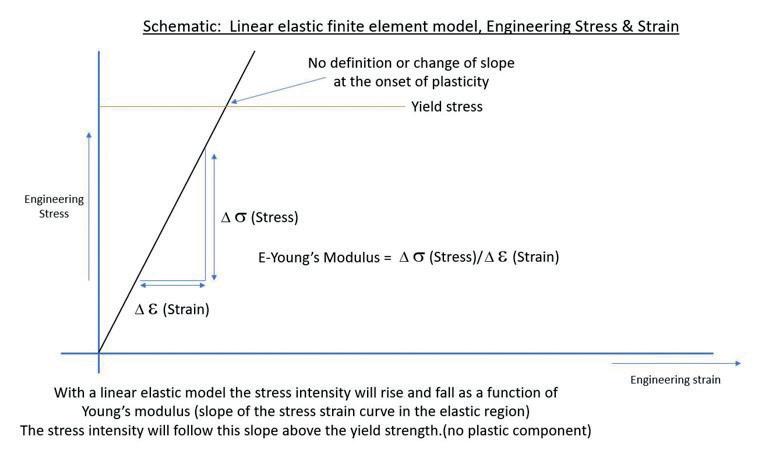

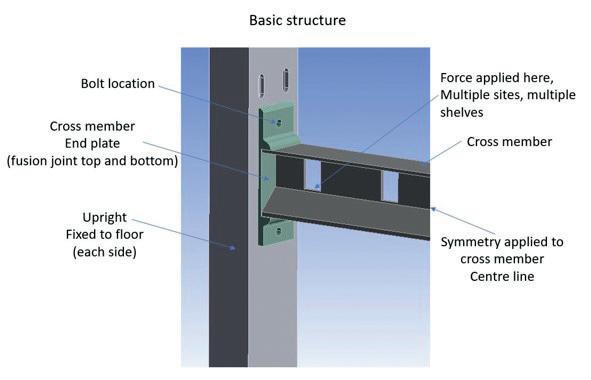

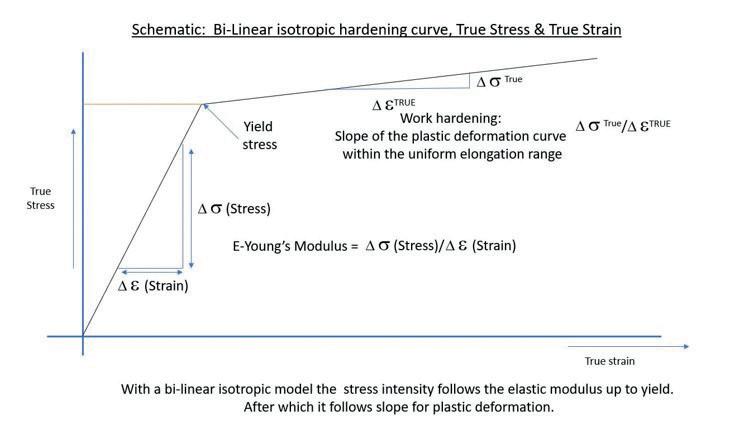

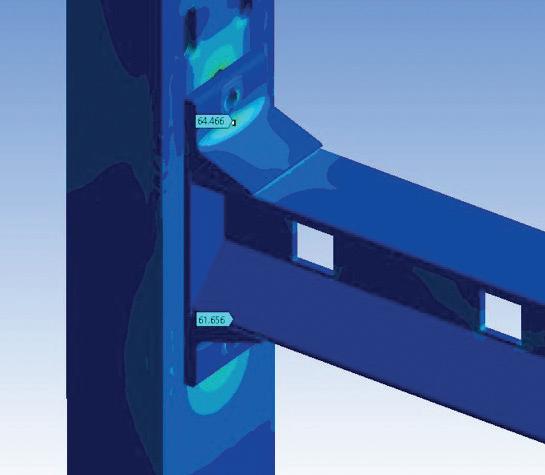

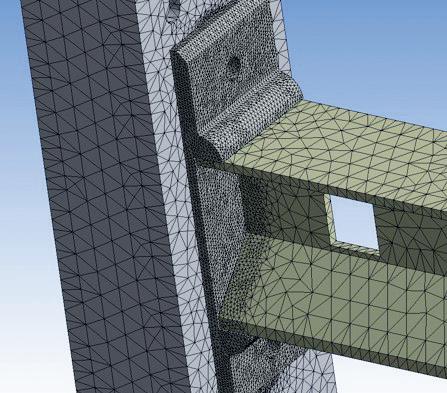

Do you have any examples of the implementation of AI in the aluminium industry?