7 minute read

Region on the rise

The Middle East and North Africa (MENA) region presents opportunities for the oils and fats sector due to increasing geopolitical stability in the area and growth in consumer demand linked to a rising population Gill Langham

Stretching from Iran in the East to Tunisia and Morocco in the West, the Middle East/North Africa (MENA) region – with its rising population and subsequent Region increase in demand for oils and fats – offers growth opportunities for the sector. on the Comprising 25 countries with a population of almost 700M people, representing about 10% of the global population, the MENA region spans three continents and has a culturally diverse demographic. It also has vast reserves of rise oil and natural gas. Although there is no specific way to define the MENA region, the general understanding is that it includes Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates (UAE) and Yemen.

Opportunities

The opportunities for packaged oil and speciality fats in the MENA region, were discussed by Sandeep Singh, the founder and director of trading consultancy The Farm Trade, in his presentation at the Palm Oil Internet Seminar (POINTERS) webinar hosted by the Malaysian Palm Oil Council’s (MPOC) on 28 March-1 April. With a focus on palm oil demand and Malaysia’s market share, Singh joined a panel of industry experts to discuss the opportunities and challenges facing the sector, against a backdrop of the COVID-19 pandemic, rising freight rates, and record high palm oil prices.

Topics covered included major markets in the MENA region and the overall demand for oils and fats.

His discussion also focused on the shift to local packaging at destination and the benefits of developing long-term partnerships.

The harsh terrain in some areas of the region did not support the production of agricultural commodities, he said.

Apart from the problematic terrain issues in some of the region, regional conflicts in the area have also been driving food and commodity price increases, he said.

“Conflict is driving MENA’s food security problems.

“Technological change and trade development need to be much faster to prevent food insecurity from worsening in the near term.”

Potential for growth

The region is heavily dependant on imports to supplement domestic demand for oils and fats, Singh said, and would remain so in the medium and long-term.

With a good population growth rate, the second fastest globally just behind Sub-Saharan Africa, the region presents opportunities for expansion in the sector. u

u

“This region holds good potential as a fast-growing market with increasing geopolitical stability and growth in consumer demand,” he said. "With the market reaching record highs this year, the benefits of long-term relationships become imperative. It is equally important to develop a long term supply chain so that the production and distribution processes are not disrupted."

Growing consumption

The MENA region consumes approximately 15M tonnes of oils and fats, according to Singh, with a per capita consumption of about 20kg, although there is a wide disparity with some countries like Somalia, Sudan and Yemen having a per capita consumption of less than 10kg.

The region’s consumption comprises 40% palm oil, 40% sunflower oil and soyabean oil, and 20% other oils.

However, the vast region is not without its challenges, Singh added.

“Regional integration in the MENA region is still lacking,” he says.

“With the exception of Gulf Cooperation Council (GCC) countries, most of the region is interconnected but not integrated. "If we have more cooperation in the region, a lot of movement between the countries would become more seamless and there would also be better management in terms of stock.”

There had also been some positive developments, he added, including the discussion of an African Continental Free Trade Agreement (AfCFTA).

“What is lacking is not a rationale or capacity to integrate, but rather a sense of urgency to prioritise and move forward with integration. "In anticipation of the AfCFTA agreement, now is the time to expand and deepen the existing platform for regional cooperation.”

There have also been some recent positive developments in terms of the reconstruction of Iraq and certain social and economic reforms in Egypt and Saudi Arabia, Singh said.

“Over time, we expect there will be more reconstruction and more economic reform in the region and that will help the growth in demand especially for the food industry.”

Palm oil share

Out of total imports into the MENA region of about 15M tonnes/year, palm oil’s share is about 5.5M tonnes/year, representing about 40% of total edible oil imports, Singh said.

“With the versatility of palm oil, this particular demand and volume will continue increasing.”

Malaysia has a reasonable market share in the region of 2.134M tonnes/year or 39%, with the Middle East consuming 1.696M tonnes/year and North Africa consuming 0.4M tonnes/year.

The leading importers of palm oil in the region from Malaysia are Iran and the UAE, and also Turkey, which borders the MENA region, according to Singh, where the products are mainly used in the frying, margarine and vanaspati sectors with “huge growth” also seen in use by bakery and confectionery producers.

The signing of a free trade agreement (FTA) between Malaysia and Turkey in 2015 contributed to the increase in Malaysian palm oil’s share of the Turkish market, he said.

Malaysian palm oil dominates the Iran market, with a 92% share, he said, while its share of the market in Saudi Arabia is 26%.

“Ethiopia was one of the major markets for Malaysia, but due to financial reasons, that market has taken a bit of a dip. However, we are sure this market will come back as one of the major buyers going forward,” he said.

Effects of COVID

There has been a change in the type of demand for oils and fats over the last two years due to the effects of the COVID-19 pandemic, Singh said.

“What we have seen is a paradigm shift both in terms of prices but also in the way business is operating.”

Container freight rates have gone up by six, eight and even ten-fold, he said.

“As operators are very price sensitive, these big increases in freight rates were not really helpful in reaching out to the market,” he added.

“While container shipments have decreased, bulk shipments to these countries increased.”

As an example, Singh cited Afghanistan, which was importing huge volumes from Malaysia prior to the pandemic but, since then, a lot of shipments had started to move from the UAE or Pakistan where freight rates were much cheaper.

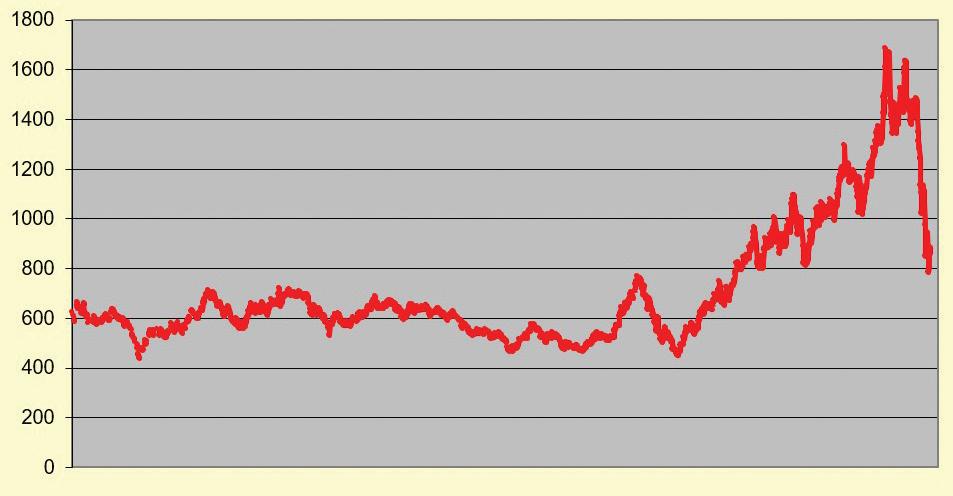

Freight rates from Malaysia to Karachi, for example, rose from around US$200US$250/tonne to as high as US$2,500US$3,000/tonne, he said.

Due to high freight rates, there had been increased refining operations and packaging facilities in the region.

“This is only happening because the bulk freight rates were cheaper. These refineries are able to reach out to the region with shorter haul freight or even land transport at much cheaper rates and also on a faster shipment basis.

“There was an economy of scale for these refiners to run the plants at a higher capacity. And these refiners are able to reach out to the markets in the region.”

Possible solutions

To solve some of the challenges in the area, Singh said the focus should be on developing a seamless supply chain with buyers in the region.

“More free trade agreements also need to be made which will help food security in the region,” he said.

There was also the potential for barter agreements in the region, he added, with opportunties with countries who traded in coffee or mineral oil, for example.

As described in the World Bank Group’s approach to regional integration in Africa, Singh said it was also critical to strengthen and enable the strong historical and socio-economic linkages that exist between countries of the Maghreb – the North African countries of Algeria, Libya, Mauritiana, Morocco and Tunisia – and those of Sub-Saharan Africa.

Singh highlighted the role that the Malaysian Palm Oil Board (MPOB) and Malaysian Palm Oil Council (MPOC) had played in developing measures to develop palm oil trade in the region, with their efforts helping Malaysian palm oil to reach out to different corners of the world.

Looking ahead

On a positive note, Singh said there had been a recent trend in terms of an increase in sustainable oil sales to the region. "The region's import of Roundtable on Sustainable Palm Oil (RSPO)-palm oil, palm olein and palm stearin is on the rise as more and more multinationals, who have good footprints in the area, expand their base in the MENA region.

“This volume is expected to increase much faster compared to any other region.”

Overall, the prospects for the oils and fats sector in the region are promising, he says.

“As we know, the MENA region and particularly the GCC countries are wellconnected in terms of oil and gas and they have a major position in the world as an exporter for these mineral oils, so the structure is there, only a bit of strategy needs to be developed so that the edible oil industry also flourishes and is co-ordinated in a better way in the region”. ● Gill Langham is the assistant editor of OFI