9 minute read

UCO grows to supply HVO market

The used cooking oil (UCO) market is expanding to meet increased feedstock demand from the renewable diesel sector. Correct UCO storage and transport are key but there is potential for fraud related to its collection Kathryn Wortley

Growing environmental concerns and rising awareness of sustainable energy resources are driving considerable growth in the global used cooking oil (UCO) market. Production is also being boosted by recent technological advancements in UCO processing, expanding supplies from the food service industry, and government to promote UCO for industrial use. The global UCO market is expected to grow from US$6bn in 2021 to US$10.1bn in 2028, equating to a CAGR (compound annual growth rate) of 7.8% over the period, according to a January 2022 report by market research firm Fortune Business Insights. And, although 2020 saw a 12.5% decline in production due to the COVID-19 pandemic, the market began to bounce back in 2021 once consumers resumed eating out and restrictions hampering the collection, processing and transport of UCO were lifted.

Industry experts agree that the UCO market growth is being driven by the uptick in its use as biofuel, the main application in recent years.

In Europe and the USA, UCO has been used for biodiesel production in the past 15 years to support the decarbonisation of road transport, notes Leonidas Kanonis, director of communication and analysis at the European Waste-based & Advanced Biofuels Association (EWABA).

Since 2011, use of UCO for biodiesel (including renewable diesel) has tripled and now represents almost 20% of total biofuel production in Europe, adds Emanuela Peduzzi, spokesperson for the European Federation for Transport and Environment, commonly known as Transport & Environment.

UCO is also an important feedstock for renewable fuels for maritime shipping and aviation, while also being used to make animal feed in China, India and the USA. Its use in the oleochemicals industry for producing soap and other products, however, is negligible.

The key to the growth of UCO for biofuels is favourable government policy and legislation, says Tenny Kristiana, associate researcher at the fuels programme in the International Council on Clean Transportation (ICCT).

As a “low-carbon feedstock for biofuel that is both technologically mature and commercially available,” UCO “is ideal for meeting biofuel mandates in Europe and the United States,” notes a February 2022 report by the ICCT. The European Union’s (EU) renewable energy directive (RED II), for example, incentivises the use of UCO biofuels to meet renewable energy targets in transport, while UCO is “an attractive option” to help meet California’s Low Carbon Fuel Standard in the USA, the paper continues.

According to Transport & Environment, UCO accounted for about 20% or 3M tonnes of the feedstock used in biodiesel production in Europe in 2020. However, the region does not produce enough UCO for its biodiesel consumption.

Data from the ICCT shows that Asian UCO imports are crucial, with China, India, Indonesia, Japan, Malaysia and South Korea being the main Asian producers exporting to Europe as well as the USA. There is also intra-Asia trade among these six Asian producers, particularly in exports from China and Indonesia to Malaysia and South Korea and from Japan to South Korea.

“The EU is the main producer [of UCO] and the largest buyer of UCO globally,” says Kanonis, pointing out that in 2020, Europe imported around 1.7M tonnes of UCO, mainly from Asia.

Correct storage and transport

With UCO an important global commodity, its correct storage and transport is key, both for the food service industry and households; and relating to country-wide systems or international trade. According to the European Biomass Industry Association, there are three u

u main options for industry and household storage and transport of UCO – door-todoor collection by a collection company, centralised collection by producers, or a combination of UCO collection and cooking oil supply by a collection firm.

In the case of businesses, if the UCO is to be transported from the fryer to a collection tank, specialised industry equipment should be used, says Illinoisbased UCO recycling company Mahoney Environmental in a note. Once the oil has cooled to 150C, the extender of the company’s shuttle device can be attached onto the spigot of the fryer, allowing the oil to drain into the extender.

For this method, Oregon-based largescale biodiesel producer SeQuential warns of the risk of theft of UCO (either by siphoning from the container or theft of the container) for selling on the black market. When keeping UCO outside, the company says that lights, security cameras or locks are recommended.

Other storage options are the portable filter machine, which has a hose that can be connected to the fryer to receive the UCO and then to the tank to pump out the UCO, and the direct connection system, a closed loop set-up where all the UCO is transported via piping, according to Mahoney Environmental.

For households and municipal facilities, the ‘Not a Drop!’ system run by Hungarybased Biotrans Ltd is an example of good practice according to EU-funded cooperation programme Interreg Europe. Launched in 2020, the scheme allows anyone in a community to deposit their UCO into a 240-litre container that includes a drip tray underneath to avoid contaminating the ground underneath.

Once large volumes of UCO are collected, there are no particular technical challenges, says Dr Dave Howells, UK-based director of the Feed Oil Company Ltd, a member of the UKbased Federation of Oils, Seeds and Fats Association (FOSFA) technical committee and former senior partner at UK-based Advanced Liquid Feeds. However, he adds that the industry does have to follow additional environmental controls regarding storage and transport as it is classified under EU Category 1 Animal Fats and related UK regulations.

Howells says that in shipping, there are tighter restrictions on which vessels are prepared to take UCO, adding that edible oil shipments should not go through a tank where the immediate predecessor is UCO. This can raise logistical issues but as large companies tend to arrange storage for the long-term, it is “in practice not a burden in the operation of the industry”.

UCO for FAME and HVO

Within the biofuel sector, UCO can be used to produce biodiesel such as fatty acid methyl ester (FAME) and used cooking oil methyl ester (UCOME), or hydrotreated vegetable oil (HVO), also known as renewable diesel.

According to Finland-based renewable diesel and sustainable aviation fuel (SAF) producer Neste, HVO not only has better storage properties, but also lower emissions than standard biodiesel.

Sweden-based biofuel company Biofuel Express also recognises the material’s benefits to the market, stating in a note that “HVO can be used immediately without modification of engines or infrastructure. In addition, HVO has better combustion, filterability and cold temperature resistance than other diesel products on the market.”

HVO is appealing due to its ease of use as a drop-in fuel but is more expensive than UCOME, with consumption of both increasing yearly, according to Kanonis.

Howells says major growth in recent years has been with HVO.

“There is the older production capacity for manufacture of biodiesel [FAME], which is still being used, but the newer, larger plants have moved towards the Neste-type process of HVO.”

Kristiana says she is also seeing many new facilities or converted oil refineries becoming biorefineries to produce renewable diesel and SAF. Retrofitting refineries to become biorefineries which can produce HVO is possible with few modifications, thereby assisting growth in the HVO sector, she says.

In Europe, FAME production is stable, growing from 10,400–13,000M litres/ year from 2012 to 2021, while annual HVO production rose from 960M litres to 4,000M litres over the same period, says Kristiana, noting that HVO growth is only set to increase further.

Indeed a 2021 report by the International Energy Agency (IEA) predicts that demand for HVO is likely to nearly triple from 2020 to 2026 under policies that support greenhouse gas reductions in Europe and the USA.

Kristiana stresses that growth in biodiesel usage in Asia and Latin America will also boost demand in these regions.

Potential for fraud

The further expansion of the biofuel market is welcome news to UCO traders but comes alongside increased sustainability standards covering biofuels. In the EU, biofuels must comply with RED II sustainability criteria.

Under these regulations, auditors work closely with certification bodies to check if biodiesel facilities, UCO collectors, traders and other supply chain partners are implementing the relevant quality requirements.

And, as with any industry, there is scope for fraud.

Howells notes that “the scope for gross abuse is limited” but Transport & Environment’s Peduzzi says the current certification schemes “can’t fully guarantee the sustainability of the biofuels used in Europe, including UCO”.

Dutch independant research and consultancy CE Delft has identified a few weaknesses in the biofuels certification schemes that may lead to these practices, he says. These include “low transparency along the supply chain, low traceability (down to the point of origin), lack of verification in the voluntary schemes and opportunity for double book-keeping”.

Kristiana of the ICCT goes further, citing concerns about the possibility of fraud: “We are worried that ambition in the recently proposed climate legislation in the EU, including changes to the RED II, will drive UCO fraud,” she says.

“We therefore suggest the EU put a cap on waste oil (UCO) in both the proposed ReFuelEU Aviation and FuelEU Maritime regulations” promoting biofuels in these transport sectors, thereby aligning the rules with the RED II.

As for what importers and buyers can do to detect tampered product, she adds: “Let’s say 30% [virgin] vegetable oils are mixed into 70% UCO; it is hard to see the difference or test for it.”

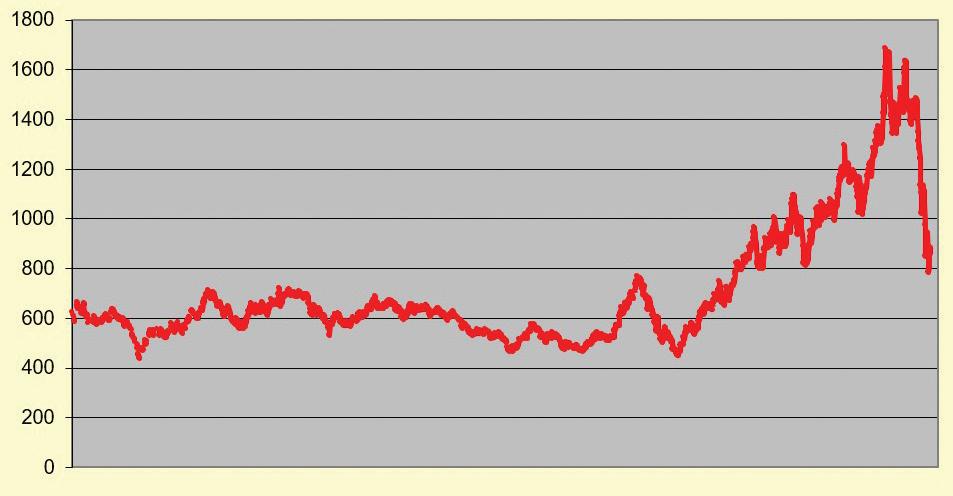

Other issues in the UCO market have included the COVID-19 outbreak and subsequent lockdowns, Kanonis says. This led to a significant fall in UCO collection globally (particularly in China, a major supplier of UCO to Europe) and pushed prices to all-time highs. Flexitank and ISO tank freight rates from Asia also increased from around US$40-50/tonne to US$200-250/tonne, increasing costs for smaller vessels and encouraging larger players to trade UCO in bulk.

Despite these challenges, experts agree there is immense potential for the UCO market, particularly in densely populated countries with nascent UCO sectors. Kanonis says China, Indonesia and Malaysia are among the countries where industrial collection still has some way to go.

An increase in dining out globally also bodes well for greater UCO collection and supply to support growing demand, according to the report by Fortune Business Insights. Kathryn Wortley writes for International News Services Ltd, UK