8 minute read

Ambiguous laws impede growth

A lack of federal regulation governing cannabis, hemp and CBD oil in the USA is impeding growth of the industry but across the Atlantic, EU legislation due to come into effect in January 2023 is expected to smooth trade and ease operations Jens Kastner

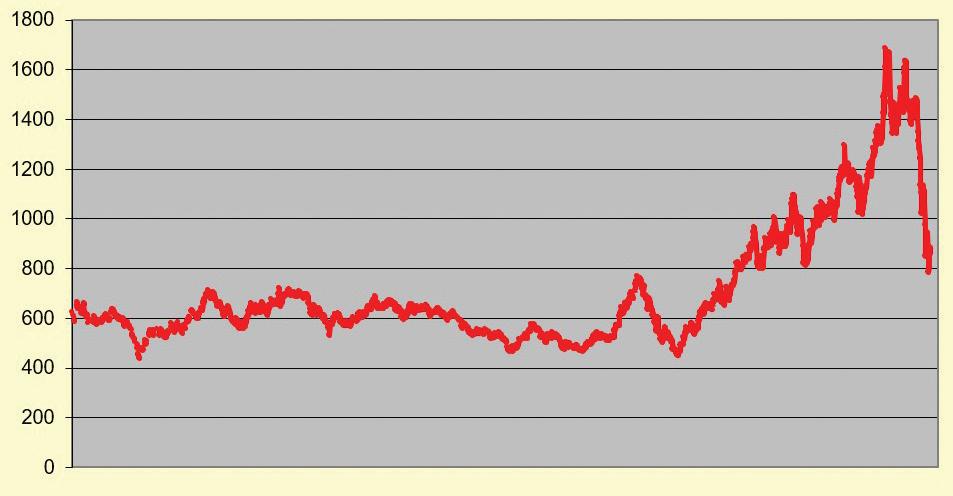

Demand for cannabidiol (CBD) oil has steadily been on the rise due to its growing usage in food, pharmaceuticals, supplements, nutraceuticals, lotions, shampoos, soaps, bath gels, massage oils and cosmetics.

With the growing liberalisation of cannabis products containing CBD compounds (and, to a lesser extent, the psychoactive tetrahydrocannabinol [THC] compound), sales are growing in the major market of the USA.

As of May 2022, 19 US states allow recreational cannabis use and 38 permit medical sales, with US legal cannabis sales growing by 40% year-on-year in 2021 to US$25bn, according to research from New York-based BofA Securities Inc. Of this total, approximately 50% of sales related to oils, says Oregon-based hemp consultancy Whitney Economics.

Another statistical snapshot by UKbased market researcher Euromonitor International shows that North American (USA and Canada) retail sales of tinctures and sprays for prescription medical uses and non-prescription medical uses that are extracts of cannabinoids dissolved in oils (as well as alcohol, vinegar and/or glycerine) totalled €1.7bn in 2021.

With cannabis completely legalised across Canada, boosting sales in North America, Euromonitor predicts CBD

solution sales of €1.9bn this year.

While Europe has yet to follow the liberalised Canadian model on THC (although CBD oils are widely available), sales are forecast to grow to €1.8bn this year, against €1.2bn in 2021.

“In Germany and Switzerland, tinctures and sprays as well as topicals are the most dynamic categories in CBD whereas the Swiss market has reached somewhat more maturity compared to the German market, where CBD products are still a relatively new lifestyle product,” Euromonitor told Oils & Fats International (OFI).

In truth, legalisation for various kinds of cannabis products is a developing process.

Cannabis, hemp and CBD: the differences

Cannabis is a family of plants with two primary classifications – Indica and Sativa. While marijuana can be considered a member of either classification, hemp is a member of the Sativa family. Cannabis contains a variety of different compounds called cannabinoids, the two most common ones being cannabidiol (CBD) and tetrahydrocannabinol (THC). THC induces psychoactive effects (a ‘high’) while CBD does not contain any psychoactive properties. Hemp contains a very low concentration of THC (0.3% or less) while marijuana has 15%-40% THC. As a result, hemp is mainly grown for industrial purposes while marijuana is grown for recreational and medicinal purposes. However, with the fast-growing popularity of CBD, hemp is also used to produce a wide variety of THC-free CBD products.

Lack of federal regulation in USA

In the USA, hempseed oil has been legalised federally since 2018, when hemp made from the Cannabis sativa L variety, including products with CBD, was legalised under the 2018 Farm Bill, where it has no more than 0.3% THC content.

However, the regulatory picture for other cannabis varieties is less clear because of the lack of federal regulation.

Cannabis industry insiders told OFI that CBD oil market dynamics will be much stronger once regulatory ambiguity is removed, as large players are still shying

away from getting involved in grey zone operations.

This includes hemp oil given that in the USA, the federal level-regulation of cannabis is the responsibility of the United States Department of Agriculture (USDA) while the plant is still in the ground, whereas the United States Food & Drug Administration (FDA) regulates once the plant has been harvested.

And while the USDA approved regulations to produce hemp under the 2018 Farm Bill in March 2021, the FDA has yet to do so in terms of rules for processing, retail and consumer safety. The California-based Hemp Industries Association (HIA) hopes this could happen later this year.

With cannabis from other varieties still a controlled substance under federal law, receiving payments for products across state lines can be legally problematic.

And even though CBD oil from hemp is federally legalised, the lack of FDA regulation means there is no way of shipping it legally from one US state to the other, with the perceived legal risks discouraging investors and university researchers,” says Jody McGinness, executive director of the HIA.

Speaking to OFI, he adds that “we are waiting for the FDA to provide clarity for manufacturers and researchers and safety for the consumers, as the latter still face a lot of unregulated products on the shelves”.

McGinness says the persistent regulatory ambiguity has promoted market instability, as the hemp-CBD legalisation in 2018 attracted many farmers and processors into the business at a premature stage when there was no developed market for their products. This led to an oversupply of hemp in 2019-21, with extractors closing their processing plants and many forced to sell their equipment at bargain prices. As a result, a consolidation of the CBD oil extraction sector occurred, accelerated by US states still requiring vastly different licence fees in the absence of a complete federal regulatory approach. “In Louisiana, where a licence costs around US$150, extractors can use ethanol for inexpensive small-batch CBD oil extraction whereas, in California, the fees are so high that only large-scale CO2 extraction is feasible,” McGinness says, referring to the two main CBD oil extraction systems – using ethanol or CO2.

Changes in EU legislation

In Europe, cannabis liberalisation is also proceeding, albeit at a slower pace than in North America, notes the European Industrial Hemp Association (EIHA).

It has welcomed the latest update to the European Union (EU) Common Agricultural Policy (CAP) – approved by the European Parliament in December 2021). This authorises maximum THC levels for hemp (the Cannabis sativa L variety), rising from 0.2 % to 0.3 %. Moreover, once the new CAP enters into force on 1 January 2023, EU member states can also authorise hemp with higher THC levels for their jurisdictions, (for example 0.6% in Italy; and 1% in the Czech Republic).

Another looming regulatory change is an amendment of the European Commission Regulation No. 1881/2006 (3), which mandates maximum levels of THC in final cannabis hemp variety products derived from seeds, including oils, of 3mg/kg. This change also comes into effect on 1 January 2023.

“The new regulation will smooth trade – there will be no more border issues within the EU, and operators will be relaxed, as it will be easier to avoid a quick and costly product recall under the EU’s RASFF [Rapid Alert System for Food and Feed],” says Lorenza Romanese, the EIHA managing director.

“Nevertheless, as hemp is grown in open fields and therefore subject to weather, birds and insects, THC contamination will still be something processors will have to tackle.”

Romanese adds that the higher THC threshold will allow EU countries to maximise the benefits of different hemp plant varieties under varying climatic conditions across Europe.

This is a promising aspect for food production, says Bruno Xavier, associate director of the Cornell Food Venture Center, in New York state, USA, whose unit is part of the Ivy League Cornell University.

“There seems to be a lot of opportunity to improve the plant – via traditional breeding or even using genetic modification – aiming, for example, to further reduce irrigation needs and pesticide use, or make the materials easier to process on a commercial scale,” Xavier says.

Researchers at the neighbouring Cornell AgriTech unit support the New York state hemp industry by researching the most viable commercially available varieties, fostering the development of new cultivars and navigating barriers related to seed problems, diseases and insect pests.

“Nevertheless, it all depends very much on political decisions because you will need processing facilities that are as large as those used for soyabeans or corn to make them financially viable, and we are certainly not even close to that point, given the regulatory ambiguity,” adds Xavier.

Beau Whitney, founder of Whitney Economics and chief economist for the National Industrial Hemp Council of America (NIHC) and the National Cannabis Industry Association (NCIA), also stresses that market success will be underpinned by decisions by politicians and regulators. The latter, he says, are currently overwhelmed with the hemp industry’s steady stream of confusing new products. Whitney stresses that hemp is currently grown on some 40,000ha of land worldwide, compared to corn’s 34M ha in the USA alone.

But he predicts that the sector is undoubtably very promising for oil processors: “We see major growth potential not only for food or pharmaceutical uses, but also industrial lubricants, as hemp oils do not contain hydrocarbons and do not involve environmentally-precarious mining.” Jens Kastner is a freelance journalist

Ethanol and CO2 extraction

Solvent extraction is used to extract vegetable oil from oilseeds (see p31). In the case of CBD extraction, a solvent (typically ethanol) is mixed with the hemp plant matter. This strips the cannabinoid compounds into the liquid, which is then evaporated to leave behind a concentrated oily residue containing hemp compounds.

Supercritical CO2 extraction runs pressurised carbon dioxide across the hemp plant to strip away the desired phytochemicals. The liquid form of CO2 is heated and pressurised until it becomes ‘supercritical’, meaning the CO2 has properties of both gas and liquid: it is able to fill a container like a gas, while also having the density of a liquid.

In this supercritical state, CO2 acts as a solvent when applied to the hemp plant without denaturing any of the compounds.

Once the supercritical CO2 has been passed through the hemp extract, the resultant solution is passed into a separator to be separated. The desired hemp compounds are removed and taken to the next step in the process. Extracted from Vitality CBD website