3 minute read

World statistical data

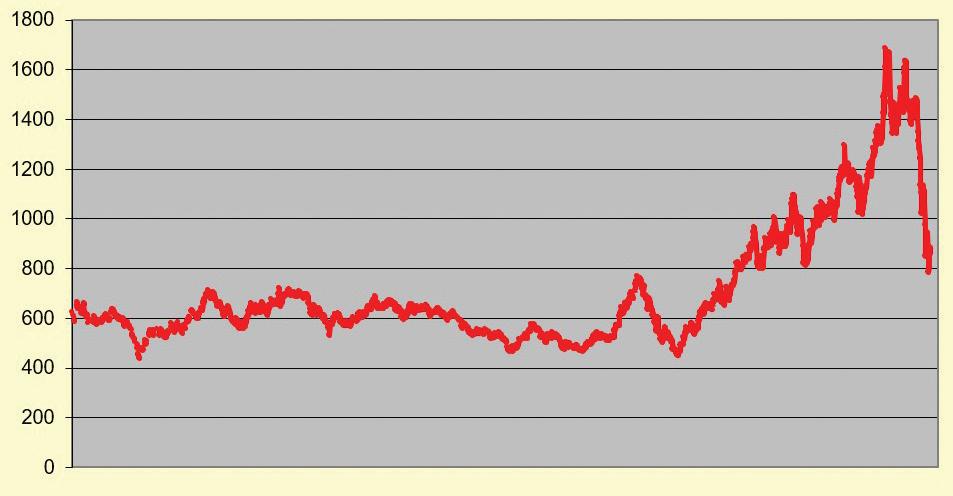

Rapeseed oil price, fob Rotterdam (Mintec Category Index) – €/tonne Mintec

Global soyabean oil supply and demand – million tonnes Mintec

BO40 - Castor oil IN – €/tonne Mintec

Prices of selected oils (US$/tonne)

Jan 22 Feb 22 Mar 22 Apr 22 May 22 June 22 Soyabean 1,421.8 1,537.3 1,922.7 1,868.3 1,859.2 1,695.9 Crude palm 1,320.1 1,497.0 1,669.6 1,578.6 1,623.8 1,440.5 Palm olein 1,223.3 1,422.3 1,605.4 1,445.6 1,515.3 1,406.0 Coconut 1,928.3 2,145.3 2,180.4 2,000.8 1,698.3 1,645.5 Rapeseed 1,773.7 1,666.0 2,057.6 2,120.9 1,909.0 1,746.8 Sunflower 1,390.8 1,517.0 2,351.0 2,136.0 2,096.8 1,774.9 Palm kernel 2,017.5 2,262.5 2,320.0 1,977.3 1,724.8 1,474.1 Average 1,582.0 1,721.0 2,015.0 1,875.0 1,755.0 1,598.0 Index 375.0 408.0 478.0 444.0 421.0 379.0

STATISTICAL NEWS

Rapeseed and rapeseed oil

The Euronext rapeseed price decreased by 10.7% monthon-month (m-o-m) to €679/tonne on 12 July. The global rapeseed crop for the 2022/23 marketing year is forecast to increase by 11.3% year-on-year (y-o-y) to 80M tonnes, mainly due to a recovery in production from Canada following adverse weather conditions in 2021/22, which had kept the global rapeseed market tight.

In addition, the average Mintec Benchmark Price (MBP) for EU rapeseed oil decreased by 6.2% m-o-m but remained up by 51.9% y-o-y to €1,670/MT in June. The decline was attributable to demand rationing following improvements in palm oil supply after top global palm oil exporter Indonesia revoked its palm oil export ban on 23 May. Additionally, expectations of higher domestic and global output for the upcoming 2022/23 marketing year further supported prices. The ongoing Russia-Ukraine war has kept EU rapeseed prices elevated, with price volatility expected to continue due to tight supply conditions of alternative vegetable oils, particularly, sunflower oil. High input costs, logistical disruptions and inflationary pressure could also pose an upside risk to prices.

Soyabean and soyabean oil

The CBOT soyabean price declined by 13% m-o-m to US$496/tonne on 13 July due to weakened demand and expectations of a record crop (122M tonnes) in the USA for the October 2022-September 2023 marketing year. Weather conditions in the USA from now until August will continue to drive sentiment in the soyabean market. Furthermore, global soyabean output is forecast to increase in the 2022/23 marketing year (up by 11% y-o-y to 391M tonnes) on improved production in Brazil and Argentina, following a decline in output in 2021/22 on the back of adverse weather conditions.

The MBP for EU soyabean oil fell by 15.1% m-o-m to €1,410/tonne on 15 July, a fall from the record high of €1,950/MT reached on 29 April. Improvements in global supply conditions of alternative vegetable oils (sunflower oil and palm oil), contributed to the decline from the unprecedented levels reached in March and April. Additionally, slower import demand from China due to COVID-19 lockdowns further supported the price decline.

Castor seed and castor seed oil

The Indian castor seed price declined by 3.3% m-o-m to INR72,650 (US$909)/tonne on 15 July. However, the price remained up by 34.5% y-o-y. The Indian castor oil price was down by 2.8% m-o-m due to reduced global export demand, particularly from China. However, the price remained up by 33% y-o-y at INR148,300 (US$1,855)/ tonne on 14 July.

Mintec provides independent insight and data to help companies make informed commercial decisions. Tel: +44 (0)1628 851313 E-mail: sales@mintecglobal.com Website: www.mintecglobal.com