Tunisia is the largest olive oil producer outside the EU. With presidential elections this year amid a troubled economy, what are the prospects for the oils and fats sector and the country?

Tunisia is the largest olive oil producer outside the EU. With presidential elections this year amid a troubled economy, what are the prospects for the oils and fats sector and the country?

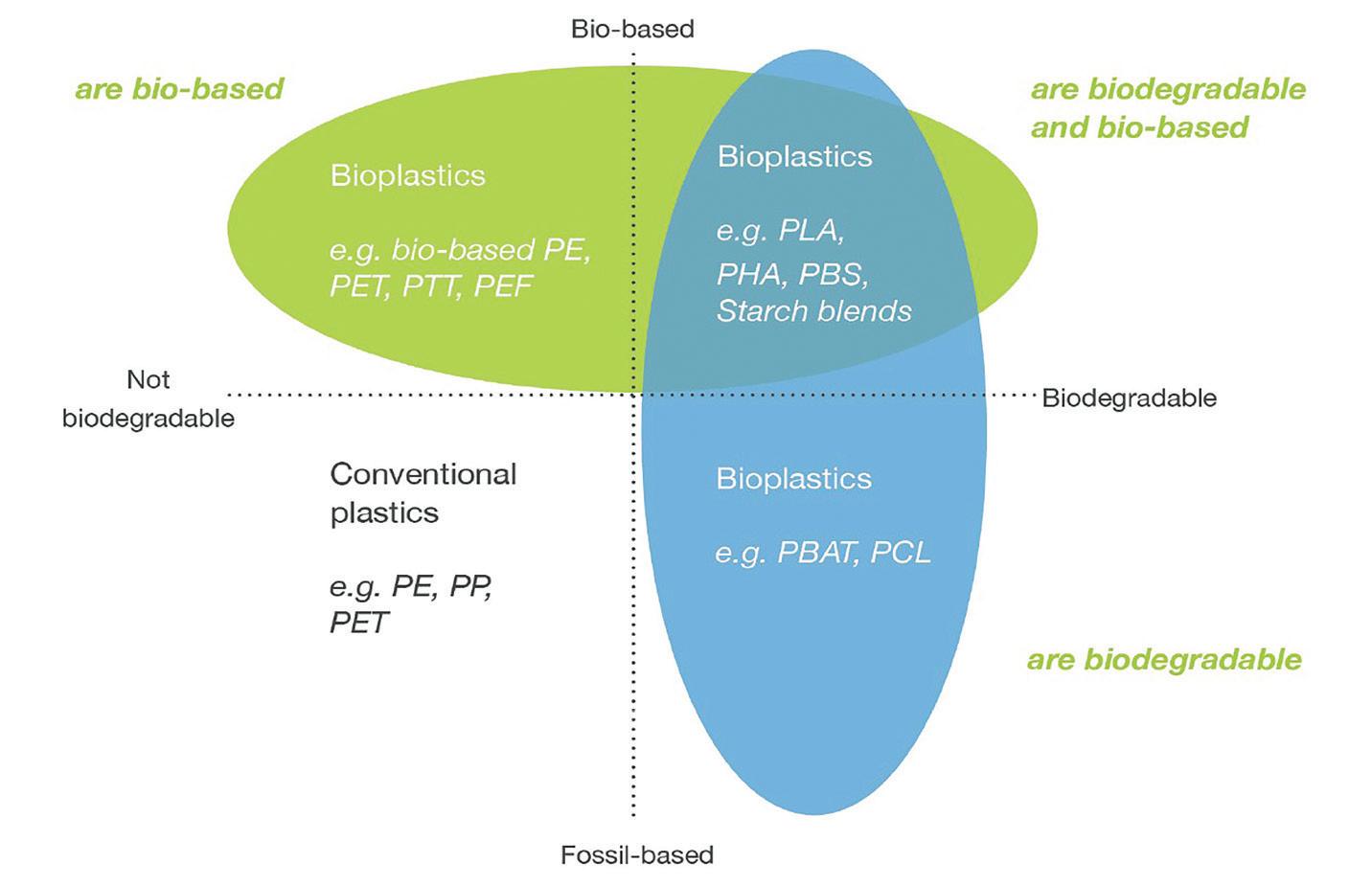

Bioplastics

34 Growth in high oleics

With global demand for peanuts forecast to reach 54M tonnes by 2026, new high oleic varieties are being developed, including by leading producer India

38 Set for growth

While bioplastics still only represent some 0.5% of plastics produced globally, their production is growing, presenting an opportunity for the oils and fats sector Deep Frying

41 Regulatory update

A range of regulations govern deep frying to safeguard consumer health, covering the quality of fresh and used cooking oil, as well as additives, allergens, trans fatty acids, genetically modified oils and compounds such as acrylamide, 3-MCPDEs and GEs

Comment

2 The future of HVO, SAF News

4 COFCO delivers its first deforestation-free soya

Biofuel News

10 Tighter checks urged on EU imports of biofuels

Renewable News

14 Unilever to reduce palm oil content in Indian soap brands

Transport News

16 Bunge, Zen-Noh buy stake in Brazil terminal

Biotech News

18 ADM expands with non-GM line

Diary of Events

19 International events listing OFI International 2024

20 Full event and conference programmes

International Market Review

26 Oil output growth leans on soya

Statistics

44 World statistical data

VOL 40 NO 6

JULY/AUG 2024

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd

Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed

by

Pensord Press, Merthyr Tydfil, Wales

These days, it seems that not a day goes by without the announcement of a new renewable diesel (HVO) or sustainable aviation fuel (SAF) project.

According to the International Air Transport Association, total renewable fuel production capacity could reach 51M tonnes by 2030, while SAF volumes will grow six-fold from 0.25M tonnes in 2022 to 1.5M tonnes this year. This is still just a drop in the ocean in proportion to our fossil fuel needs – 1.5M tonnes of SAF is just 0.5% of aviation’s total fuel consumption, while to meet all of 2022 US diesel fuel consumption in the transportation sector would require more than 160M tonnes of feedstock, 10 times the US production of vegetable oils that year, according to the US Energy Information Administration. Yet even the relatively small amount of HVO and SAF currently being produced is already having a significant impact across major sectors of the oils and fats market.

Increased US renewable diesel production has led to dramatic rises in American imports of vegetable oils and animal fats, according to a 14 June US Department of Agriculture (USDA) Foreign Agricultural Service (FAS) report. US import values of all animal fats and vegetable oils more than doubled from 2020 to 2023, while the US share of Canadian canola oil exports has risen from some 50-60% in recent years to 91% in 2023.

With so much US soyabean oil going into the renewable diesel sector, domestic soya crushing is expected to reach record levels for the fourth consecutive year, with the country becoming a net soyabean oil importer for the first time in 2023. As a by-product of soyabean oil production, soya meal supplies and exports have also surged but “US crush and renewable diesel growth could be limited by the ability to find an outlet for surplus soyabean meal,” the USDA report says.

Waste oils and fats have benefitted from the boom in HVO/SAF production as they have a lower carbon score than vegetable oils. US imports of Brazilian tallow soared 377% in the first four months of this year (see p10) and Global Data has said oleochemical use of tallow is falling due to greater competition and higher prices.

The UCO market is even more controversial with both the USA and Europe concerned about fraudulent, adulterated UCO imports from countries like China and Malaysia.

With the fierce competition and concerns about feedstocks, what is the real picture of future HVO and SAF volumes? A lot will depend on government policies and mandates.

Much of the recent renewable diesel growth has come from the conversion of crude oil refineries, according to Jeremy Martin, director of fuels policy at the Union of Concerned Scientists. Their capacities may be overstated as these may be based on the size of existing infrastructure, while the decision to convert forestalls the need to begin the costly process of decommissioning an old refinery. “The realistic potential for biofuel conversions is quite small because of the limited availability of suitable feedstocks,” Martin writes.

It is worth noting that global oil majors bp and Shell have both just announced that they are actually scaling back their SAF and HVO development plans (see p10).

The need to decarbonise transport and tackle global emissions is urgent and the most achievable way to do this currently is to use HVO and SAF made from virgin and waste oils and fats. However, there is no long term future in using oils and fats for fuels on an unsustainable scale and the world needs to develop other low carbon technologies to achieve our climate goals.

Issues like the impact of HVO and SAF on the global vegetable oil market and prices will all be addressed by leading industry experts at OFI International 2024 in Rotterdam on 9-11 September. Our full conference programmes are on p20-25 and we hope to see as many of you there as possible.

Serena Lim, serenalim@quartzltd.com

POLAND: Global agribusiness giant ADM and German chemical firm Bayer have extended their regenerative agriculture partnership following the completion of a year-long rapeseed study in Poland, World Grain wrote on 13 June.

As part of the study into the impact of regenerative agriculture in curbing carbon emissions, increasing biodiversity and improving soil health, the companies worked with rapeseed farmers covering approximately 9,000ha in Poland.

Assessments showed that carbon emissions from farmland relying on at least one regenerative agricultural practice were 15% lower than those of conventional farms, World Grain wrote. Emission reduction could be up to 40% for farmers comprehensively adopting regenerative agriculture practices.

As part of the next stage of the partnership, the programme would be expanded into a broader range of crops such as corn, wheat and barley, and geographically across Eastern Europe, the report said.

Farmers would be provided with financial and technical support to introduce qualifying regenerative agriculture practices, including minimum tillage, cover crops, companion crops, nutrient management, use of organic matter/manure and crop rotation.

ADM would compensate participating farmers for each qualifying hectare measured and verified using Bayer’s digital capabilities in collaboration with Trinity Agtech’s Sandy platform. In addition to financial support, participating farmers would receive agronomic guidance from specialised professionals.

China’s largest food processor and manufacturer COFCO International has delivered its first shipment of deforestationand conversion-free (DCF) Brazilian soyabeans, World Grain reported on 4 June.

The 50,000 tonne shipment delivered on 31 May to Tianjin, China, was part of an agreement with the Mengniu Group.

The deal was the first in China to include a DCF clause and was initiated through the World Economic Forum's and Tropical Forest Alliance’s Taskforce on

Value Chains for

World Grain wrote.

As a major exporter of Brazilian soyabeans, COFCO International said it was taking steps to improve traceability, risk management and supplier performance. It had set a target of achieving a deforestation-free soyabean supply chain by 2025 and to reduce emissions from land use change.

As part of these targets, the company was working with industry initiatives such as the Taskforce on Green Value

Chains for China, the Soft Commodities Forum and the Agricultural Sector Roadmap to 1.5°C, the report said.

To ensure the soyabeans reaching Mengniu Group were deforestation- and conversion-free, COFCO used a mass balance model, a volume-tracking system that enables a specific quantity of soyabeans to be sold as certified.

As the world’s largest buyer and importer of soyabeans from Brazil, China was key in the transition towards DCF soyabean production and trade, COFCO said.

In preparation for the EU Deforestation Regulation (EUDR), the company also had plans to source, process and ship segregated soyabeans, where certified volumes are kept physically separate from source through to processing, storage and distribution. COFCO loaded its first fully traceable and segregated shipment of soyabean meal out of Argentina for delivery to Ireland in May.

The European Bank for Reconstruction and Development (EBRD) is set to loan €60M (US$64.44M) to Ukrainian company Lan-Oil to finance the construction of a new biofuels project in the country.

Backed by a financial guarantee from the EBRD’s first investment in a biofuels project in the country since Russia’s invasion in 2022 was part of efforts to counteract Russian strikes on Ukrainian power infrastructure, the EBRD said on 12 June.

Signed at the Ukraine Recovery Conference (URC) in Berlin on the day of the report, the project would contribute to Ukraine’s energy security and the decarbonisation of the sector by building a domestic source of renewable fuel supply – bioethanol – with 70% lower greenhouse gas emissions than traditional fuel, the bank said.

The sponsor is JSC Concern Galnaftogaz and

OKKO Group, a leading Ukrainian distributor of transportation fuels.

As of December 2023, JSC Concern Galnaftogaz owned and operated 396 OKKO-branded filling stations.

The biofuel produced was expected to be compliant with the EU Renewable Energy Directive (RED III), the EBRD said.

Energy security is one of the EBRD’s five investment priorities for Ukraine, along with support for vital infrastructure, food security, trade and the private sector.

Since the start of the war, the EBRD said it had made over €4.2bn (US$4.5bn) available to Ukraine and its shareholders and had recently agreed to provide a €4bn (US$4.29bn) paid-in capital increase to enable the bank to continue investing at current levels in wartime, with the potential for more investments when reconstruction started.

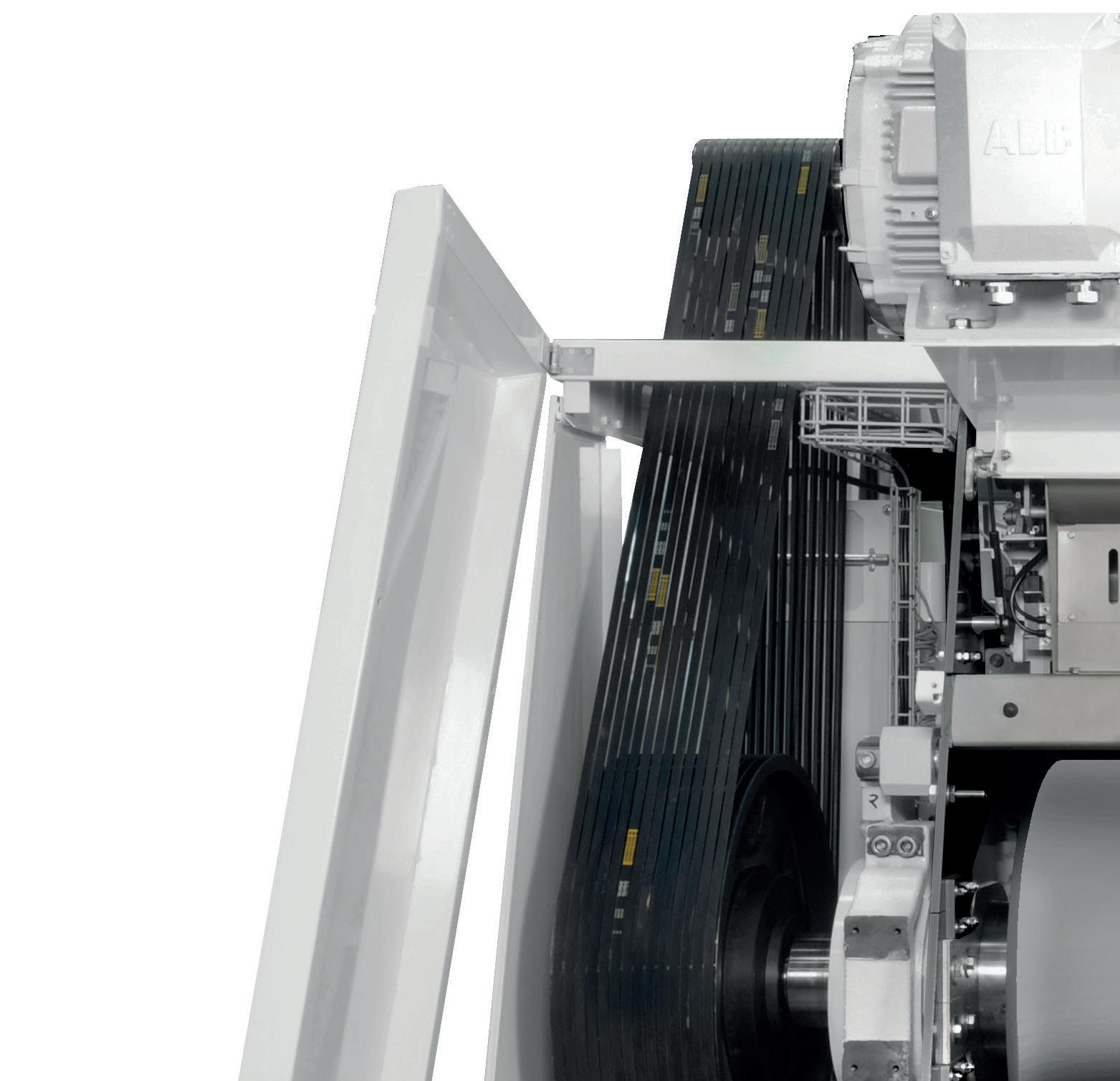

Maximize your Hemp CBD Oil market opportunity in an environmentally responsible way with Crown.

From hemp preparation to CBD extraction— full spectrum and broad spectrum oils—Crown gets you up and running with optimized ef ciencies. As a leader in oilseed extraction for 70 years and botanical extraction for 30 years, Crown equips you to achieve input capacities ranging from 5 to 50+ MTPD with an environmentally responsible >99% solvent recovery rate and only 2 plant operators required. Crown’s Continuous Extraction System for Hemp CBD Oil delivers exceptional performance and full scalability to meet the speed and capacity your customers demand, now and in the future.

Hit your launch date and growth targets with Crown’s Continuous Extraction System for Hemp CBD Oil. Contact CPM and Crown today 1-651-894-6029 or visit our website at www.crowniron.com

The Turkish government has partially lifted its ban on olive oil exports introduced in August to lower domestic prices, following intense lobbying from the sector, Olive Oil Times wrote on 12 June.

Turkish producers would now be able to export 50,000 tonnes of bulk olive oil until 1 November. However, with forecasts of a bumper harvest in 2024/25, the sector continued to call for the ban to be lifted completely, the report said.

Istanbul Commodity Exchange chair Ali

BRAZIL: Recent floods in southern Brazil and lower yields across several states have reduced the country’s soyabean production expectations to 150M tonnes in the 2023/24 marketing year, according to a US Department of Agriculture (USDA) Foreign Agricultural Service (FAS) report.

The reduction was mainly due to May’s unprecedented floods in the southernmost state of Rio Grande do Sul in May and lower yields in Mato Grosso, Mato Grosso do Sul, Paraná and São Paulo, the 1 July Global Agricultural Information Network (GAIN) report said.

Revised national yields totalled 3,275kg/ha, 10% lower than record productivity in 2022/23.

The FAS reduced its export estimates for 2023/24 to 94M tonnes, while increasing crushing volumes to 55.1M tonnes to meet domestic demand.

For 2024/25, the FAS increased its soyabean area forecast to 46.3M ha.

Soyabean production in 2024/25 was forecast at 160M tonnes, and exports at 99M tonnes due to sustained international demand, higher harvested volumes, a favourable exchange rate and higher competitiveness.

Kopuz was quoted as saying that Turkey had twice the amount of olive oil it needed to supply the domestic market.

The Aegean Olive and Olive Oil Exporters’ Association (EZZIB) has forecast Turkish production to reach 400,000 tonnes in 2024/25, slightly below the record high yield in the 2022/23 crop year but significantly above the previous year’s harvest.

Combined with existing olive oil stocks of 200,000 tonnes and production from Afrin, a region in northern Syria occupied

by Turkey, EZZIB chairman Mehmet Emre Uygun estimated that the country could have 650,000 tonnes of olive oil available by the end of the harvest.

“If bans are left behind, we believe we will reach the export target of US$1bn (€932M) for the first time in our history in the 2024/25 crop year,” Uygun said.

Turkey ranks among the top five olive oil producers in the world, behind Spain, which accounts for around half of the 3M tonnes/year of olive oil produced globally.

Global agribusiness giant Bunge Global and feed ingredient firm Bangkok Produce (BKP) have jointly tested a soyabean tracing platform using blockchain technology.

The test involved three shipments from Brazil totalling 185,000 tonnes of deforestation-free soyabean meal for delivery to Thailand, Bunge said on 11 June. Through the shipments, Thailand food conglomerate Charoen Pokphand

Foods (CPF) said it would be able to trace the soyabeans from farm origin, processing and transportation to delivery at destination. CPF is the parent company of BKP.

Three additional ships were due to deliver 180,000 tonnes of soyabean meal by July.

The two companies have been working in collaboration since October 2023, when they announced a partnership to develop a blockchain traceability solution aimed at building a sustainable and digitally integrated supply chain. The agreement involves oilseeds and their byproducts sourced by Bunge in Brazil for shipment to several countries in Asia, where BKP and CPF produce and sell feed and food.

In addition to compliance with a range of socio-environmental criteria, their blockchain platform offered customers access to information including the carbon footprint of volumes sold and details of regenerative agricultural practices adopted by farms, Bunge said, adding that since the end of 2022, its supplier monitoring system had covered more than 16,000 farms on around 20M ha of land in South America.

The US state of Michigan’s Cannabis Regulatory Agency (CRA) is set to ban medium chain triglyceride (MCT) oil in vape pens.

As part of its Sampling and Testing Technical Guidance for Marijuana Products, cannabis oil in vapes would have to be tested for MCTs from 1 October, the CRA said on 27 June.

Commonly derived from coconut or palm oil, MCT oil is mainly used in oral supplements and food products. However, when aerosolised and inhaled, MCT oil could be harmful to respiratory health, the CRA said.

“From a public health and safety standpoint, the potential for adverse effects with MCT oil underscores the importance of safety guidelines

for product development,” CRA executive director Brian Hanna was quoted as saying.

“Michigan’s licensed marijuana businesses must prioritise respiratory safety when formulating or using inhalable products, opting for ingredients that have been thoroughly evaluated for their compatibility with lung health.”

Welcoming the CRA’s move, the Michigan branch of the National Organization for the Reform of Marijuana Laws (MiNORML) said emerging evidence "suggests that inhaling MCT oil can pose serious respiratory risks, and it’s imperative that we take proactive measures to prevent potential harm,” MiNORML executive director Anqunette Sarfoh was quoted as saying.

China's first food security law aimed at achieving "absolute self-sufficiency" in staple grains – comprising wheat, rice, corn, soyabeans and coarse grains – came into force on 1 June, Reuters reported on 3 June.

Passed just six months after its first reading, the rush to adopt the law reflected China's urgency to resolve issues that had curbed production, such as a lack of arable land and water resources, labour shortages and a lack of agriculture technology, the report said. The law would hold central

Bulgaria's rapeseed imports nearly doubled in the 2023/24 marketing year while its crush was 134% higher compared with 2022/23, according to the US Department of Agriculture (USDA) 25 June Foreign Agricultural Service (FAS) Bulgaria: Oilseeds and Products Market Update report.

Rapeseed imports increased by 90% to reach 182,000 tonnes in 2023/24 against the previous year's 96,000 tonnes, with most of the imports coming from Ukraine and Moldova.

Crushing totalled 197,000 tonnes in 2023/24, 134% higher than in the previous year.

“As a result, trade in processed products has accelerated. Rapeseed oil exports in the first three quarters of 2023/24 reached 20,000 tonnes, a growth of 82% compared to the same period in 2022/23.”

Exports of rapeseed meal surged by 430% from 19,000 tonnes in 2022/23 to 103,000 tonnes, the FAS said. The main export markets for rapeseed oil were in the EU –Spain and the Netherlands – Israel and Morocco were the main destinations for rapeseed meal.

Bulgaria’s rapeseed production was forecast 4% down for 2024/25 to about 200,000 tonnes.

Sunflowerseed production declined by 16% in 2023/24 to 1.78M tonnes but Bulgaria increased its sunflowerseed crushing by reducing exports, allowing it to keep its position as the top EU exporter of sunflower oil.

and provincial governments accountable for incorporating food security into their economic and development plans, without giving details on how it would be implemented.

The law included protection of farmland from being converted to other uses, protecting germplasm resources and preventing wastage.

As the world’s leading agricultural importer with the second largest population at 1.4bn people, China had made reducing reliance on overseas suppliers a priority in

recent years, World Grain wrote on 3 June. China produced one-fourth of the world’s grain and fed one-fifth of the world’s population with less than 10% of the world’s arable land, the report said.

Analysts said the law was worded vaguely and might not have a significant impact on how China boosted food production.

"Food security is already among the top national priorities and can't go any higher," Even Pay, agriculture analyst at Beijing-based consultancy Trivium China, was quoted as saying.

WORLD: The US Department of Agriculture (USDA) Foreign Agricultural Service (FAS) has lowered its 2024/ 25 oilseeds production forecast by more than 1M tonnes to 686M tonnes, due to a reduced rapeseed outlook in Australia.

In its June Oilseeds: World Markets and Trade report, the FAS also reduced its 2024/25 estimate for global oilseeds trade due to lower Australian rapeseed exports.

Oilseed ending stocks were forecast down by almost 1M tonnes due to reduced stocks of Brazilian soyabeans and global rapeseed.

The FAS also lowered its estimate for global crushing due to reduced rapeseed consumption.

Despite an increase in Ukrainian rapeseed, the global oilseeds production forecast for 2023/24 was lowered due to a reduction in Brazilian soyabeans and Indian peanuts.

“Global oilseeds trade is up slightly on higher Ukraine rapeseed exports exceeding lower Canada rapeseed exports,” the report said.

World ending stocks were down almost 600,000 tonnes due to a decline in Brazil soyabean stocks, while oilseed crushing was reduced due to lower Indian peanut crushing.

Ultra-processed food is responsible for about 391,000 deaths a year in Europe, according to new World Health Organization (WHO) report, 'Commercial Determinants of Non-communicable Diseases in the WHO European Region.'

When taken alongside alcohol, fossil fuels and tobacco, the four industries were responsible for more than 2.7M deaths a year – about one quarter of all fatalities – in Europe, and at least one third of deaths [19M] and 41% of non-communicable disease deaths globally, WHO said on 12 June.

Although there was no formal definition of ultra-processed food, the widely used Nova classification – a system used worldwide in nutrition and public health research, policy and guidance –described ultra-processed foods as “formulations

made mostly or entirely from substances derived from foods and additives” with negligible use of raw or natural foods in the preparation, Olive Oil Times wrote on 25 June.

The report found that diets high in sodium were responsible for 252,187 deaths/year –2.27% of the total – followed by diets high in processed meat (117,290 deaths/year, 1.07%), diets high in sugar-sweetened beverages (15,606 deaths/year, 0.14%) and diets high in trans fatty acids (6,056 deaths/year, 0.05%).

The WHO report called on governments to adopt stronger regulations and legislation to curb the marketing of health-harming products; increase the transparency of lobbying and conflicts of interest in industry-funded health research; and raise taxes on multinationals.

Worldwide sunflowerseed production in 2024/25 is forecast at 57.21M tonnes compared to 57.4M tonnes the previous year due to

smaller harvests in Argentina, China and Russia, according to the latest forecast by the International Grains Council (IGC) reported by Germany’s

Union for the Promotion of Plants and Protein on 31 May.

Above average yields would only partially compensate for a reduced planted area.

Russia was forecast to produce 17.2M tonnes, 1.1% lower than in 2023/24, but was still set to remain the world’s leading supplier.

The EU was projected to produce 10.7M tonnes this season, 500,000 tonnes more than in the previous year.

Ukraine was expected to produce 6.2M tonnes.

At 700,000 tonnes, US production would be the smallest in 48 years.

Trade associations have raised concerns about the EU Deforestation Regulation (EUDR) information system with European Commission President Ursula von der Leyen in a letter to her on 17 May.

"The impact an inoperable information system will have leads us to bring this to your attention,” the letter said, which urged:

• Opening up the information system for all users as soon as possible and at the start of November at the very latest.

• A second round of testing with the business community.

• Making the Application Programming Interface (API) specifications ready for businesses to prepare.

• Lifting the 25MB limitation or substantially increasing the size for uploading files as part of the due diligence system.

• Accepting other data formats in addition to the GeoJson standard.

Signatories of the letter included EU trade association for cereals, rice, feedstuffs, oilseeds, olive oil, oils and fats (COCERAL) and EU vegetable oil and protein meal industry association (FEDIOL).

Under the EUDR, which takes effect on 30 December, any operator or trade which places soyabeans, palm oil, coffee, cattle, cocoa, wood and rubber or their derivatives on the EU market must prove that the products do not originate from land deforested since 2020 and provide geographical information on the land where these commodities have been grown.

USA/BRAZIL: The US government is opening the door to Brazilian used cooking oil (UCO) by accepting the International Health Certificate on Vegetable Products (CSIV), Bloomberg reported on 20 June.

Based on audits of storage facilities’ and exporters’ self-regulation protocols, the Department of Inspection of Products of Plant Origin of Brazil’s Ministry of Agriculture and Livestock (Mapa) would certify the UCO’s traceability, identity and origin to comply with US regulations, the report said.

According to the US International Trade Commission, US imports of UCO more than tripled in 2023 compared to the previous year, with more than half shipped from China.

The increase in UCO imports from China had raised concerns that some shipments were allegedly fraudulent, Bloomberg wrote.

US trade groups and biofuel representatives have been calling for tighter regulation of imports, including improved methods of testing UCO purity, while a US soyabean trade association had also called for increased tariffs on Chinese UCO, the report said.

The governments of France, Germany and the Netherlands have called on the EU to adopt stricter checks on overseas suppliers of biofuel as the bloc investigates allegedly fraudulent imports from Asia, Reuters reported on 31 May.

The European biodiesel industry – worth some €31bn (US$33.6bn)/year – has reported a surge in Chinese biodiesel imports which it claims involve supplies produced with virgin oil despite being declared as made with recycled oils and fats. In a note submitted to a meeting of EU energy ministers on 30 May, France, Germany and the Netherlands said it was necessary to tighten checks on biofuel production sites “wherever they are located in the world”.

Certification of foreign biofuel as sustainable should be “rejected in case of refusal of access to the premises”, the note said.

Although no objections to the proposal had been raised at the meeting, no action had been taken, with the matter left with the European Commission (EC) to follow up, an EU diplomat was quoted as saying.

The EC is conducting several investigations into biofuel imports, including one on biodiesel from Indonesia allegedly circumventing EU duties and another on alleged dumping of lowpriced biodiesel from China. Some US producers had also reported an increase in shipments of recycled oil from China, Reuters wrote.

The International Air Transport Association (IATA) said on 3 June that its forecast for sustainable aviation fuel (SAF) production to triple in 2024 to 1.5M tonnes – accounting for 0.53% of aviation’s total fuel needs – is on track.

“SAF will provide about 65% of the mitigation needed for airlines to achieve net zero carbon emissions by 2050. The … expected

tripling of SAF production in 2024 from 2023 is encouraging, [but] we still have a long way to go,” IATA director general Willie Walsh said.

With some 140 renewable fuel projects capable of producing SAF scheduled to be in production by 2030, total renewable fuel production capacity could reach 51M tonnes by 2030, the date governments had set to achieve a 5% CO₂ emissions reduction for international aviation from SAF, IATA said. To achieve this, around 27% of all expected renewable fuel production capacity available in 2030 would need to be SAF. Currently, SAF accounted for just 3% of all renewable fuel production. With a typical three-to-five-year time lag from planning to production, investment announcements as late as 2027 could be in production by 2030, although not all announcements reached final investment decisions, IATA said.

US imports of Brazilian tallow for biofuel production surged by 377% in the first four months of this year compared to the previous year, Bloomberg reported on 13 June.

According to US government trade data, US tallow imports had increased four-fold since 2019 to a record 779,300 tonnes in 2023, with Brazil’s share of the shipments jumping from 23% last year to 40% in the first four months of this year.

US biofuel producers including Diamond Green Diesel and Marathon Petroleum had been sourcing cheaper raw materials

from overseas in a bid to boost margins, the report said. Renewable diesel made from waste fat or used cooking oil (UCO) had a lower carbon score than soyabean oil and was eligible for higher tax credits in California, where a high percentage of US green diesel was consumed, Bloomberg wrote.

With a new federal tax credit also due to be introduced next year, tallow and UCO would become more lucrative as feedstocks compared with US soyabean oil, affecting the profits and expansion plans of

leading soyabean producers such as Bunge and Archer Daniels Midland (ADM).

Tallow is abundant in Brazil, which slaughters more cows than any other country except China, according to the report.

Brazil rarely exported tallow until 2022, when Texas-based Darling Ingredients acquired Brazil’s largest independent rendering company FASA Group.

Since then, FASA had become a waste fat supplier to Diamond Green Diesel, a biofuel venture between Darling and Valero Energy Corp, Bloomberg wrote.

Global oil giant Shell has announced it will be pausing construction at its 820,000 tonnes/year biofuels facility at the company’s chemicals park in Rotterdam, the Netherlands.

Shell subsidiary Shell Nederland Raffinaderij said the decision to halt construction at the site was made to address project delivery and ensure future competitiveness given current market conditions.

In a statement on 2 July, Shell said that following the decision to pause construction, “contractor numbers will reduce on site and activity will slow down, helping to control costs and optimise project sequencing”.

“Temporarily pausing on-site construc-

GERMANY: The government has approved the unrestricted sale of 100% renewable diesel (also known as HVO100) in the country as part of the DIN EN 15940 fuel standard, EuropaWire (EW) wrote on 29 May.

With this approval, Germany followed other EU countries such as Belgium, Finland, the Netherlands, and Sweden, where the sale of 100% renewable diesel at petrol stations was allowed, EW wrote. Sales of unblended, 100% renewable diesel in Germany had previously been restricted to specific segments, such as in nonroad vehicles and public transportation.

tion now will allow us to assess the most commercial way forward for the project,” Shell’s downstream, renewables and energy solutions director Huibert Vigeveno said.

“We are committed to our target of achieving net-zero emissions by 2050, with low-carbon fuels as a key part of Shell’s strategy.”

Given the go ahead by Shell in September 2021, the Netherlands plant was due to become operational in 2025, Reuters wrote on 2 July.

According to the report, the facility, which would produce sustainable aviation fuel (SAF) and renewable diesel from waste, was now expected to start produc-

tion towards the end of the decade. Biofuel prices had come under pressure in recent months due to weaker demand in Europe and rising supplies in the USA, Reuters wrote.

The market is expected to remain well supplied in the coming years as more production comes online, according to analysts quoted in the report.

Shell had warned investors that it would take an impairment charge of up to US$2bn in its second quarter results, due to be published in August, as a result of halting the Rotterdam plant and selling off its refinery and petrochemical assets in Singapore, The Guardian wrote on 5 July.

British multinational oil and gas company bp has announced it would be scaling back plans to develop new sustainable aviation fuel (SAF) and renewable diesel projects at existing sites.

In a statement on its website on 20 June, the company said it was pausing plans for two potential projects while continuing to assess three for progression.

Meanwhile, bp said it had agreed to take full ownership of its Brazilian joint venture bp

Bunge Bioenergia, acquiring global agribusiness giant Bunge’s 50% share of the industrial-scale sugarcane and ethanol company. The transaction was expected to close by the end of this year, subject to regulatory approvals.

As well as increasing the company’s production volumes of ethanol, bp said full ownership would also offer the potential for further growth opportunities in the region, with the chance to develop new platforms for bioenergy such as next generation ethanol, SAF and biogas.

Speaking about the developments in Brazil, Emma Delaney, bp’s executive vice president, customers and products, said the company had been an early entrant into the bioenergy business in Brazil and was looking forward to continuing to grow and develop there.

bp said its co-processing investment plans remained unchanged and it expected to more than double its biofuel production co-processing volumes to 20,000 barrels/day by 2025.

Leading global used cooking oil (UCO) producer China, will run out of waste oil due to demand from Europe and the USA outstripping supply, according to a 18 June report by clean transport campaign group Transport & Environment (T&E).

The report said Europe consumed 130,000 barrels/day (bpd) of UCO – eight times more than it collected, while US consumption totalled more than 40,000 bpd.

To fill the supply gap, both Europe and the USA were importing increasing ship-

ments of UCO from China, as well as from Indonesia and Malaysia, with China exporting more than half of its UCO capacity to the two regions.

In addition, worldwide SAF targets in 2030 would require at least twice the UCO that could be collected in the USA, Europe and China combined, the study found.

The report also showed further evidence of allegedly fraudulent UCO supplies from China, saying that while China’s collection capacity appeared to correspond to export

levels, a huge illegal gutter oil market meant the country was likely to be consuming significant volumes of UCO domestically. In addition, major palm oil producer Malaysia exported three times more UCO than it collected domestically.

T&E called for Europe to move away from industry-led voluntary schemes towards stricter EU and national UCO regulation and controls. It also urged governments to stop counting imported UCO in sustainability targets.

The effective technology and complex services

STATE-OF-THE ART OILSEEDS AND OIL PROCESSING TECHNOLOGIES

■ Horizontal agriculture

■ Local mechanical processing

■ Patented system of energy recovery

■ Complex approach including Physical Oil Re ning

■ Unique combination of extruders and screw presses

EUROPE: A research team has developed a new glue spray made from edible oils to trap plant pests as an alternative to synthetic pesticides, The Guardian wrote on 18 May.

Researchers from Germany’s Wageningen University & Research (WUR) and Leiden universities in the Netherlands oxidised vegetable rice waste oil to make it sticky and then mixed it with water and a small amount of soap to stop the droplets sticking together.

This solution was sprayed on strawberries and the leaves of chrysanthemum plants, the favourite food of thrips, a common pest which could attack more than 500 species of vegetable, fruit and ornamental crops, The Guardian wrote. During a two-day testing period, more than 60% of thrips were captured and the drops remained sticky for weeks. Field trials later this year would test the process at scale.

The WUR and Leiden researchers have applied for a patent to set up a spin-off company – expected to start by the end of this year – to commercialise the new pesticide with a focus on using a range of waste oils.

By making small adjustments to the process, any type of vegetable oil could be used to make the pesticide, the researchers said.

The cost of the sticky drop pesticide was uncertain as it was not yet known how much would need to be applied and how often.

Nick Mole, from Pesticide Action Network UK, said the research could result in a decrease in synthetic pesticide usage but more research was required to assess the impact on the environment and non-target insect species, The Guardian wrote.

Global consumer goods giant Unilever is reducing the palm oil content in its soaps in India by 25% as part of a wider strategy to offset volatility in commodity prices and reduce environmental impact, the Economic Times wrote on 13 June.

Under its Indian subsidiary Hindustan Unilever (HUL), the fast-moving consumer goods company markets its Lux and Lifebuoy soap ranges in India.

Unilever took almost five years to develop its Stratos technology, which replaced palm oil with a mix of plant-derived polysaccharides, vitamin blends and natural fatty acids, the report said.

The technology would also be introduced in other countries, the Economic Times wrote.

In response, the Asian Palm Oil Alliance urged HUL to reconsider its decision, saying the move could impact millions of oil palm farmers worldwide, particularly smallholders.

In a 18 June The Edge Malaysia report, the alliance said commodity prices were influenced by demand and supply factors and that palm oil was no different.

With a 38% share of India’s soap market, HUL is the country’s leading soap supplier.

“Since there is less palm oil used, that allows us a huge amount of savings, which we can use to reinvest in other ingredients,” the Economic Times quoted HUL vice president, skin cleansing, Ankush Wadehra, as saying.

“A reduction in TFM (total fatty matter) certainly helps us in managing the inflation-deflation cycles of commodities.”

Palm oil and its derivatives accounted for over 20% of the input costs of consumer companies, including HUL, and were among the most volatile of their inputs, according to the Economic Times

Speciality chemical company Evonik has officially inaugurated its new triple-digit million-euro biosurfactants plant in Slovakia (pictured).

Based at the Evonik Fermas site in Slovenská Ľupča, the facility was the first in the world to produce industrial-scale quantities of rhamnolipids, Evonik said on 29 May.

“Rhamnolipids are increasingly in demand because they provide a sustainable alternative to surfactants based on fossil sources or tropical oils,” the company said.

They were fully biodegradable, with a low toxicological and ecotoxicological profile, and their foam-forming properties and mildness made them ideal for use in house-

hold cleaners and personal care products, Evonik said. They also had industrial applications such as in coatings, mining, and oil and gas.

Evonik produces its rhamnolipids from European corn feedstocks using a fermentation-based process.

German biotechnology company Insempra said on 7 May that it had raised US$20M in funding to expand production of yeast-fermented lipids for food and cosmetics, following an initial US$15M seed round in 2021.

Insempra uses a range of second-generation feedstocks such as lignocellulosic biomass (crop

Evonik Fermas was a joint venture between Degussa AG and Biotika before becoming a 100% subsidiary of Evonik in 1998 and expanding to produce fermentation-based products for animal nutrition, pharmaceuticals, cosmetics and personal care.

residues) in its fermentation process. The company said it was also developing technology to offer bio-based alternatives to everyday materials, such as polymers and textiles, and to create new natural molecules for use in functional ingredients, such as antioxidants, preservatives, flavours and fragrances.

Confirmed speakers include:

Thomas Mielke, Editor and CEO of Oil World

Elwin de Groot, Head of Macro Strategy, RaboResearch –Global Economics and Markets (GEM)

Caroline Midgley, Director of Oleochemicals and Biofuels Research, Agr i-business division, GlobalData

Darren Cooper, Senior Economist, International Grains Council (IGC)

Sven Kuhlmann, Vice President for the Production of Renewables, Neste, Finland

Veerle Vanheusden, PhD, Policy officer - Unit E2 – Food processing and novel food, Directorate General Health and Food Safety, European Commission

Kerstin Krätschmer, Wageningen Food Safety Research

Ludger Brühl, Max Rubner-Institut (MRI)

Agribusiness giant Bunge Global and Zen-Noh Grain Corp – the US subsidiary of Japan’s Zen-Noh Group – have agreed through a joint venture to buy a 50% stake in a grain terminal at the Port of Santos in Brazil, World Grain reported on 30 May.

The partners would hold an equal stake in the 135,000 tonne XXXIX grain terminal in the south of the country, according to the report, based on a Reuters article.

The companies had acquired the terminal from Brazilian rail operator Rumo for BRL 600M (US$115.3M), with the deal subject to regulatory approval.

THE NETHERLANDS:

Finnish renewable fuels producer Neste announced on 27 May that it had commissioned capacity at energy storage and infrastructure developer VTTI’s ETT terminal for the storage and blending of its sustainable aviation fuel (SAF).

VTTI’s terminal – sited at one of Europe’s largest fuel logistics hubs – would enable more sustainable and efficient fuel supply to customers and airports across Europe, Neste said.

THE NETHERLANDS: International liquid bulk storage company Koole Terminals Group announced on 19 June that it would now operate under the name Chane.

“The rebranding signifies a further unification of the company, after strengthening its position in the European liquid bulk storage market with the acquisitions of Alkion Terminals in 2022 and Maastank in 2023,” the company said.

Chane operates 22 tank terminals with a total capacity of 5.4M m3, located in seven countries – the Netherlands, France, Italy, Poland, Portugal, Spain and the United Kingdom.

Brazilian food and fuel processor Caramuru Alimentos, one of the country’s largest grain crushing companies, would continue to hold the remaining 50% share of the terminal, World Grain wrote.

Located on São Paulo state’s coastline, the Port of Santos is the largest in Latin America and the most important foreign trade route in Brazil, with almost 27% of the country’s trade balance (US$112.3bn) passing through the port, according to Santos Port Authority. The Port of Santos also handled around 30% of the country’s total soyabean exports, followed by Paranaguá

and Rio Grande ports, the authority said. Rumo, a Cosan subsidiary, provides transportation for agricultural commodities, fuels, fertilisers, corn, wheat, rice, soyabeans, sugar and industrialised products. It manages some 14,000km of railways in Brazil and operates nine trans-shipment terminals and six port terminals in the main Brazilian ports.

In March, Rumo and supply chain solutions provider DP World also reached an agreement to build a new port terminal for grains and fertilisers at DP World’s private-use terminal at the Port of Santos.

Spanish petroleum logistics firm Exolum announced on 29 May that it would invest US$218M in a new terminal for the storage of biofuel and bulk liquid products next to its facility in Zierbena at the Port of Bilbao.

The facility was expected to become operational in 2027 and would enable the receipt, storage, blending and dispatch of biofuels and

other alternative fuels and oils. It would be linked to Exolum facilities in Zierbena and Santurce and the company’s network in Spain.

The project’s first phase was due to start next year and would involve the construction of five tanks with a total storage capacity of 29,000m³. In subsequent phases, capacity and services would be increased by adapting logistics to the requirements of each raw material type.

Active in 11 countries, Exolum operates a 6,000km pipeline network, 69 storage terminals and 47 airport facilities, with a total storage capacity of more than 11M m³. In Spain, it manages three storage terminals in the municipalities of Santurce, Zierbena and Rivabellosa; has operations at Bilbao and San Sebastián airports; and operates a 152km pipeline connecting its three terminals with a petroleum refinery in Muskiz and the Port of Bilbao.

Leading Ukrainian agribusiness Nibulon says it will be modernising its entire grain elevator network in terms of automation, service unification and mechanisms.

“Volumes are growing,” Nibulon director for elevators operation Valeriy Reutsoi said on 29 May. “The elevator sector is the heart of agribusiness … and grain heading for export depends on its proper operation.”

Nibulon said it would also expand capacities at its Khmilnyk branch, AK Vradiivskyi and Kolosivskyi elevators, and Transshipment Terminal. US$3.9M would be invested at Khmilnyk branch, Vinnytsia region, including the second stage of elevator construction, new transport equipment, four silos and installation of two grain dryers to increase drying capacity up to 2,200 tonnes/day.

Investments at AK Vradiivskyi and Kolosivskyi

elevators in the Mykolaiv region would include changes to receipts and shipments, allowing several crops to be handled simultaneously at AK Vradiivskyi to reduce waiting times and doubling grain receipt at Kolosivskyi. At the Transshipment Terminal in Mykolaiv, US$720,00 would be invested to enable water transport cargo receipt and rail trans-shipment for delivery to Nibulon’s Bessarabska branch, reducing logistics costs to Izmail ports caused by the Russian blockade of the Mykolaiv port hub.

Nibulon is one of Ukraine’s largest grain and oilseed growers and processors, producing more than 320,000 tonnes/year of grain and oilseeds such as wheat, corn, barley, sunflower, soyabean and rapeseed. It runs its own fleet, has 2.25M tonnes of total grain storage capacity and operates 27 trans-shipment terminals in the country.

Global agribusiness giant ADM has expanded its facility in Mainz, Germany, with the addition of a new non-genetically modified (GM) soyabean processing facility.

ADM said the investment would increase the company’s ability to offer differentiated products and enable it to keep up with increasing demand in Europe for GM-free soyabeans.

“The expansion of capacity at our Mainz site and investment in new … processing facilities underscores the growing sig-

USA/UK: US agricultural bioscience firm Yield10

Bioscience announced on 17 June that Rothamsted Research, UK, had granted it an exclusive global licence to produce omega-3 oil and meal from GE camelina. The potential market for eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) fatty acids produced from camelina included use in pharmaceutical products, dietary supplements, and food and feed ingredients, the company said.

ISRAEL: Castor cultivation firm Casterra Ag, a subsidiary of Israel’s Evogene, is set to expand its production of castor seeds in Africa after signing agreements with existing and new seed producers in the country.

The deals were expected to add approximately 500 tonnes to Casterra’s total castor production this year and reduce production risks, Casterra CEO Yoash Zohar said on 21 May. Casterra said it had developed its castor bean seeds from a collection of more than 300 castor lines, using Evogene’s plant genomics tools to enable industrial-scale production of castor beans to produce oil for use in bio-based industries, such as biopolymers and biofuels.

nificance of GM-free soyabeans within the German food sector,” ADM Straubing general manager Rene van der Poel said on 7 May. “This investment is a key component of our … growth strategy … to meet growing demand for non-GM and local products.”

In addition, the expansion of the Mainz facility would offer local farmers further incentives to increase their cultivation of nonGM soyabeans and integrate soyabeans into their crop rotation practices, ADM said.

The Mainz facility can process both GM and non-GM soyabeans and its expansion was part of ADM’s broader focus on strengthening its network of soyabean processing facilities across Europe, the company said.

“This enhancement allows us to produce a diverse range of products including soyabean oil for various industries, soyabean meal for food, feed, beverage and petrochemical applications, as well as biodiesel,” van der Poel added.

A US federal court decision blocking German chemical giant Bayer AG and two other companies from selling their dicamba herbicides could boost sales for Corteva Agriscience’s products, according to an industry source quoted in a May Des Moines Register report.

The US Environmental Protection Agency (EPA) issued an order barring Bayer, BASF and Syngenta Crop Protection from selling dicamba following a federal court ruling in February, although allowing farmers to use dicamba they had already purchased, the report said.

Environmental groups had opposed the EPA’s registration of dicamba products, claiming they drifted from fields when sprayed on soyabeans

and cotton, killing other crops and trees not genetically modified to be resistant to it, as well as pollinators like monarch butterflies and bees, Des Moines wrote. Bayer had reformulated dicamba, saying it had reduced its volatility and tendency to drift, but problems had continued, the report said.

Against this backdrop, Corteva had introduced a product that used 2,4-D, a 1940s herbicide that had been reformulated to avoid past drifting problems.

To date, the Corteva products have not experienced the regulatory troubles that dicamba had, according to analysts. The product also had fewer application restrictions compared to new dicamba products, the analysts said.

With more US agricultural land becoming resistant to glyphosate every year, farmers wanted more options, according to Seth Goldstein, a Morningstar Research Services analyst. “Farmers are looking for alternative soyabean seeds ... that don’t require dicamba or glyphosate use.”

Without dicamba-based products, BASF said farmers would lose up to US$10bn in soyabean and US$800M in cotton yields annually.

Global crop protection and seed company Syngenta Group announced on 4 June that it is opening rights to some of its genome editing (GE) technologies for academic research globally.

The rights related to optimised CRISPRCas12a and GE-enabled breeding tools and would be available through the ‘Shoots by Syngenta’ collaboration platform, created last year to bring together academics, research institutes and Syngenta’s network of more than 6,000 scientists to develop solutions that mitigated climate change and enhanced biodiversity, the firm said.

Syngenta Group is owned by Chinese state

enterprise Sinochem and has four business units – Syngenta Crop Protection, Syngenta Seeds, ADAMA and Syngenta Group China.

The Syngenta seeds business unit sells genetically modified (GM) seeds for corn and soyabean crops, with the percentage of company revenues generated from biotech seeds totalling some 6% in 2020, representing about 40% of global seeds sales, according to the company’s website.

Key countries where the group’s GM corn and/or soyabean seeds were cultivated included Argentina, Brazil, Canada, the Philippines, Vietnam and the USA, the group said.

1-2 August 2024

Palmex Thailand Suratthani, Thailand www.thaipalmoil.com

20-24 August 2024

21st International Sunflower Conference Bayannur, China www.esanrui.com/isc

28-29 August 2024

Palmex Malaysia Kuala Lumpur Convention Centre, Malaysia https://asiapalmoil.com

9-11 September 2024

OFI International 2024

Rotterdam Ahoy Convention Centre, the Netherlands www.ofimagazine.com/ ofievent

11-13 September 2024

North American SAF Conference & Expo Saint Paul Rivercentre Saint Paul, Minnesota USA

https://saf.bbiconferences. com/ema/DisplayPage. aspx?pageId=Home

11-13 September 2024

Argus Sustainable Marine Fuels Conference Houston, Texas, USA https://www.argusmedia. com/en/events/conferences/ sustainable-marine-fuels

16-17 September 2024

6th International Symposium on Dietary Fat and Health Frankfurt, Germany https://veranstaltungen. gdch.de/microsite/index. cfm?l=11686&sp_id=1

16-18 September 2024

Argus North Amercia n Biofuels, LCFS & Carbon Markets Summit Monterey, California,USA www.argusmedia.com/ en/events/conferences/ north-american-biofuels-lcfscarbon-markets-summit

18-20 September 2024

Globoil India

The Westin Mumbai Powai Lake, Mumbai, India https://www.globoilindia.com

23-26 September 2024

19th GERLI Lipidomics

Meeting at the End of the World Plouzané, France

https://eurofedlipid.org/19thgerli-lipidomics-meeting-atthe-end-of-the-world

25-27 September 2024

Canadian Lipids and Proteins Conference Ottawa, Ontario

Canada

https://payments.carleton.ca/ canadian-lipids-and-proteinsconference-2024

30 Sept-2 Oct 2024

2nd Berlin Symposium on Structured Lipid Phases

Berlin, Germany

https://eurofedlipid.org/ofiinternational-2024-2

2-3 October 2024

4th ICIS Pan American Oleochemicals Conference

Ritz Carlton Coconut Grove Miami, USA

https://events.icis.com/ website/13907/

2-4 October 2024

Sustainable Aviation Futures

North America Congress Houston, Texas USA

www.safcongressna.com

For a full events list, visit: www.ofimagazine.com Information subject to change

9-11 October 2024

Palmex Indonesia Medan, Indonesia https://palmoilexpo.com/ index.html

15-17 October 2024

Argus Biofuels Europe Conference & Exhibtion London, UK www.argusmedia.com/en/ events/conferences/biofuelseurope-conference-andexhibition

22-23 October 2024

Oil and Fats International Congress (OFIC) 2024 (+ Online)

Kuala Lumpur Convention Centre, Malaysia https://mosta.org.my/events/ ofic-2024

22-26 October 2024

2024 North American Renderers Association Annual Convention

Ritz Carlton Bacara, Santa

Barbara, USA

https://nara.org/about-us/ events

4-6 November 2024

Sustainable Aviation Futures APAC Congress

PARKROYAL Marina Bay, Singapore www.safcongressapac.com

7-9 November 2024

5th YABITED Fats and Oils Congress

Antalya, Turkey www.yabited2024.com/EN/ Default.aspx

12-14 November 2024

Global Grain Geneva 2024 Geneva, Switzerland www.fastmarkets.com/ events/global-grain-geneva

14-15 November 2024

Biofuels Expo 2024

Renaissance London Heathrow Hotel, UK

https://biofuelsconference.org

www.ofimagazine.com

Brought to you from the same team behind the leading global magazine, Oils & Fats International (OFI) is delighted to announce the launch of OFI International 2024, to be held at the Rotterdam Ahoy Convention Centre on 9-11 September 2024.

OFI International 2024 will bring together major players across the European, Asian and global oils and fats community under one roof, with a focus on ‘Solutions for Sustainability, Processing & Trade’.

9-11 SEPTEMBER 2024 | ROTTERDAM AHOY CONVENTION CENTRE

09 SEPT 2024

Site visits & port tours

Port of Rotterdam (subject to availability –places are limited)

The Port of Rotterdam is one of the world’s key trading hubs, housing six vegetable oil refining complexes, four biofuel manufacturers, and four oils and fats storage terminals.

As part of OFI International 2024, site visits will be organised to some of the major companies located in the port, giving delegates first-hand experience of their operations.

OFI Technical Commercial Conference

Rotterdam Ahoy Convention Centre

A two-day Technical Commercial Conference with the theme, ‘Innovations in Processing & Refining – Addressing Sustainability and Traceability Challenges in the Supply Chain’.

With oils and fats processors facing increasing pressure to maximise yields in the most competitive and sustainable way, this two-day conference will focus on the latest refining, and processing technologies, addressing latest industry issues on sustainability, waste feedstocks and contaminants such as MCPDEs, GEs, MOSH/MOAH, chlorinated paraffins and other persistent organic pollutants (POPs).

18.00 – 19.30

Rotterdam Ahoy Convention Centre 10-11 SEPT 2024 11 SEPT 2024

Rotterdam Ahoy Convention Centre

A two-day exhibition of major suppliers to the oils and fats industry.

• The Evening Welcome Reception at the Ahoy Rotterdam on 9 September

• OFI Technical Commercial Processing & Refining Conference on 10-11 September

• OFI Trade Outlook and Logistics Conference on 11 September

OFI Trade Outlook and Logistics Conference

Rotterdam Ahoy Convention Centre

This one-day conference under the theme ‘Managing Risks and Building Supply Chain Resilience’ will focus on current and future price trends impacting the world’s major vegetable oils including war and climate impacts on shipping; and what traders and producers must do to meet sustainability regulations such as the EU Deforestation Regulation (EUDR) and the EU Union Database Biofuels (UDB).

• The OFI International 2024 Exhibition on 10-11 September

• Daily delegate lunch and refreshments

• The opportunity to join a company tour at the Port of Rotterdam (subject to availability)

09:00 – 09:05 Welcome from organisers and opening remarks from the conference chair

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

09:05 – 09:35 Processing and refining from the producer’s perspective and the use of waste feedstocks – the Neste experience

Sven Kuhlmann, Vice President for the Production of Renewables, Neste, Finland

09:35 – 10:05 Sustainable approaches to oils and fats processing and refining

Gabriele Bacchini, Global Sales Director, CMB, Italy

10:05 – 10:35 Special refining of low-grade oils for food and fuel consumption

Andrea Bernardini, Commercial Director, Technoilogy, Italy

10:35 – 10:45 Q&A with speakers

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

10:45 – 11:30 Networking break

11:30 – 12:00 Production and processing of renewable diesel (HVO) and Sustainable Aviation Fuel (SAF)

Priscilla Costa, Sales & Business Development Manager, Renewable Fuels, Crown Iron Works, USA

12:00 – 12:30 Press-Oil Clarification and Lecithin Production. The secret‘s in the process: The link between press-oil-clarification and Lecithin production

Patrick Schuermann, Application Sales Manager for Renewable Resources, GEA

12:30 – 13:00 Designing bleaching earths and activated carbon – the science and art

Dr Pat Howes, Technical & Marketing Director, NATURAL BLEACH SDN BHD

13:00 – 13:10

Q&A with speakers

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

13:10 – 14:40 Lunch

14:40 – 14:50 Opening remarks from the conference chair

Chair: Paolo Telles, Fats & Oils Processing Specialist

14:50 – 15:20 Optimising filtration in the bleaching process

Bart Scholten, Group Business Development Manager, Envirogen Group, The Netherlands

15:20 – 15:50

The role and benefits of enzymatic deep degumming for various feedstocks in biofuel production

Jorge Moreno, Product Application Expert & Technical Service Manager, EMEA, dsm-Firmenich

15:50 – 16:20 Networking Break

16:20 – 16:50

Speciality fats - new crystallisation and separation technologies to improve melting technologies.

Dr Veronique Gibon, Consultant, Artemis Lipids by VG, Belgium

16:50 – 17:20

17:20 – 17:30

The growing demand for waste feedstocks - optimising yields and energy efficiency in rendering

Björn Schlüter, Sales & Service Director, HF Press+LipidTech, HarburgFreudenberger Maschinenbau GmbH

Q&A with speakers and closing remarks from the conference chair

Chair: Paolo Telles, Fats & Oils Processing Specialist

08:55 – 09:00 Welcome from the conference chair

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

09:00 – 09:30 The state of play of the activities of the European Commission on mineral oil hydrocarbons in food (remote presentation)

Veerle Vanheusden, PhD, Policy officer - Unit E2 – Food processing and novel food, Directorate General Health and Food Safety, European Commission

09:30 – 10:00 Ensuring the safety and quality of fried goods with a focus on formation of arcylamide and trans fatty acids – latest regulations and developments

Dr. Ludger Brühl, Department of Safety and Quality of Cereals, Max Rubner-Institut (MRI), Germany

10:00 – 10:30 Chlorinated paraffins – the latest contaminant of concern

Dr. rer. nat. Kerstin Krätschmer, Project Leader Scientist, Wageningen Food Safety Research, the Netherlands

10:30 – 10:45 Q&A with speakers

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

10:45– 11:30 Networking break

11:30 – 12:00 MOSH/MOAH origins and mitigation in the supply chain

Michele Marazzato, Process Development Scientist / R&D Lead Contaminants, Cargill Global Edible Oil Solutions

12:00 – 12:30 MOSH/MOAH in coconut oil

Speaker TBC, Philippines Coconut Authority (PCA)

12:30 – 12:40 Q&A with speakers and closing remarks from chair

Chair: Kevin Warren Smith, Chairman, Lipids Group of the Society of Chemical Industry and Lipid Scientist, Fat Science Consulting

12:40 – 14:10 Lunch

14:10 – 14:15 Opening remarks from the conference chair

Chair: Paolo Telles, Fats & Oils Processing Specialist

14:15 – 14:45

14:45 – 15:15

Mitigation of MCPDEs, glycidyl esters (GE) and MOSH/MOAH and in edible oils – latest processing and refinining strategies

Antonios Papastergiadis, Senior R&D Engineer and Laboratory Manager, Desmet

Recent developments in analysis of processing and environmental contaminants in edible oils and fats including MOSH/MOAH and Persistent Organic Pollutants (POPs)

i. A. Dr. Torben Küchler, Health and Nutrition, Food Chemist / Product Manager, SGS, Germany

15:15 – 15:25

Q&A with speakers

Chair: Paolo Telles, Fats & Oils Processing Specialist

15:25 – 15:55 Networking break

15:55 – 16:25 Interpretation of processing contaminant analysis, including MOSH/MOAH

Dr. Payam Aqai, QTI Services, the Netherlands

16:25 – 16:55

16:55 – 17:05

Analytical perspective of MCPD esters and glycidyl esters in processed food

Ian de Bus, PhD, Project Lead Organic Contaminants, Wageningen Food Safety Research (WFSR)

Q&A with speakers and closing remarks from the conference chair

Chair: Paolo Telles, Fats & Oils Processing Specialist

This one-day conference will focus on current and future price trends impacting the world’s major vegetable oils; and shipping and logistical challenges affecting the cost of trade, as well as the impact of new sustainability regulations on producers and traders.

CURRENT AND FUTURE MARKET TRENDS FOR VEGETABLE OILS

09:00 – 09:05 Welcome from organisers and opening remarks from the conference chair

Chair: Frans Claassen, Managing Director, MVO

09:05 – 09:35 Global vegetable oil market –current prices and future trends

Thomas Mielke, CEO, Oil World

09:35 – 10:05 World markets for soyabeans: observations and expectations for the year ahead

Darren Cooper, Senior Economist, International Grains Council (IGC)

10:05 – 10:35 Regional oil market developments: India and China

Tim Worledge, Editorial Director, Fastmarkets

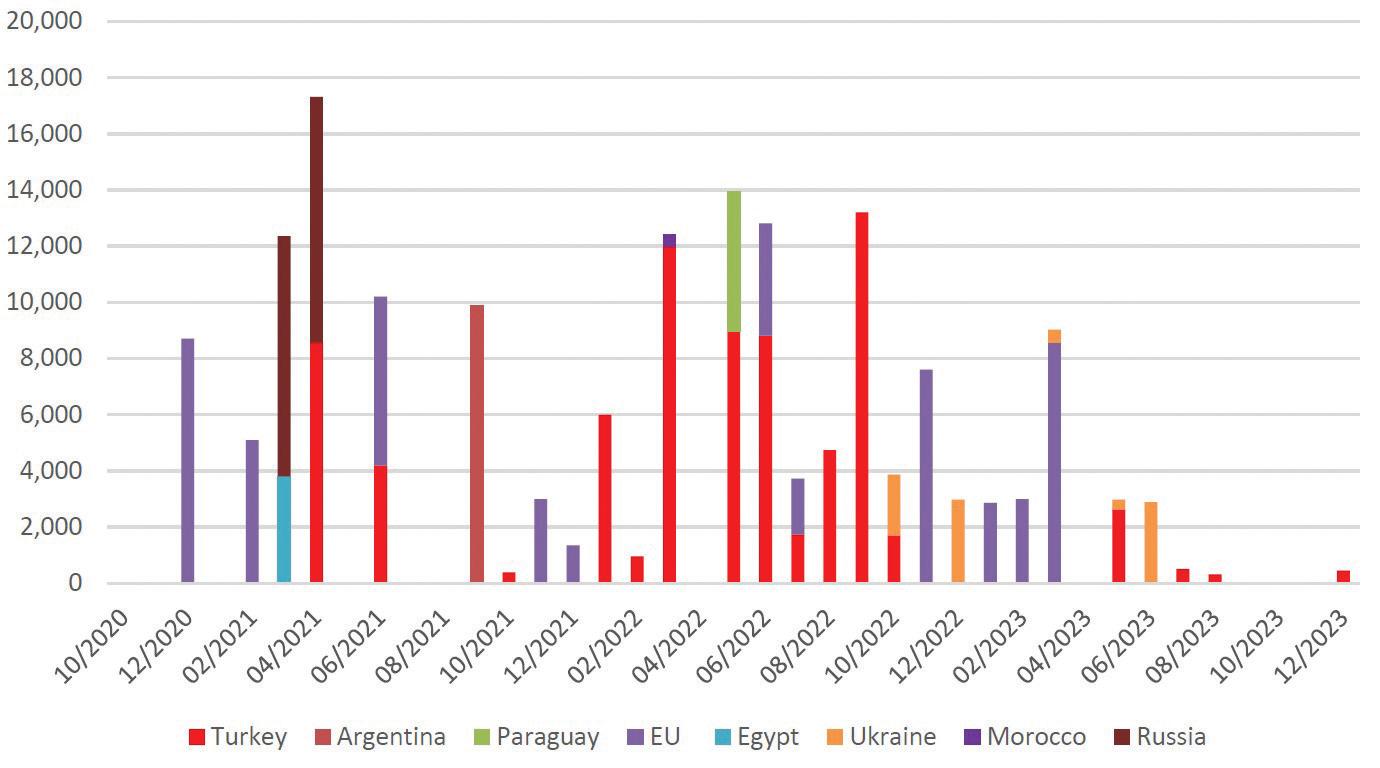

10:35 – 11:05 Black Sea vegetable oils trade – update on Ukraine and Russia and Ukraine’s export corridors

Sergey Feofilov, Director General, UkrAgroConsult, Ukraine

11:05 – 11:15 Q&A with speakers

Chair: Frans Claassen, Managing Director, MVO

11:15 – 12:00 Networking break

SUPPLY CHAIN RESILIENCE IN SHIPPING

12:00 – 12:30 The impact of climate and geopolitical risks on oilseeds and vegetable oil trade flows

Elwin de Groot, Head of Macro Strategy, RaboResearch – Global Economics and Markets (GEM)

12:30 – 13:00 Trends in palm and soft oil freight rates

Francesco Morici, Chartering, Navquim Spain

13:00 – 14:00 Lunch

14:00 – 14:30

14:30 - 15:00

The Port of Rotterdam - key vegetable oil hub - and future challenges

Kesih van den Berg, Business Manager Bulk Cargo and Shipping, Port of Rotterdam

The shipping market, an owner’s perspective

Nils Jørgen Selvik, VP Corporate Analysis & IR, Odfjell SE

15:00– 15:15

Q&A with speakers

Chair: Frans Claassen, Managing Director, MVO

15:15 – 15:45 Networking break

SUSTAINABILITY & TRACEABILITY IN THE SUPPLY CHAIN

15:45 – 16:15

16:15 – 16:45

EU sustainability demands – a round-up of EU policies, feedstock pressures and the availability of used cooking oil (UCO) and tallow

Rohaise Low, Director of Oleochemicals and Biofuels Research, Agri-business division, GlobalData, UK

The EU Deforestation Regulation (EUDR) – meeting sustainability requirements

Allison Kopf, CEO, TRACT

16:45 – 17:15

17:15 – 17.45

Palm oil and the EU Deforestation Regulation (EUDR): A new Roundtable on Sustainable Palm Oil (RSPO) traceability system for enhanced trade and regulatory compliance

Ruben Brunsveld, Deputy Director

Market Transformation EMEA, RSPO

Soyabean oil and the EUDR

Gustavo Idigoras, President, Chamber of Vegetable Oil Industry of Argentina (CIARA)

17:45 – 18.00

Q&A with speakers and closing remarks from the conference chair

Chair: Frans Claassen, Managing Director, MVO

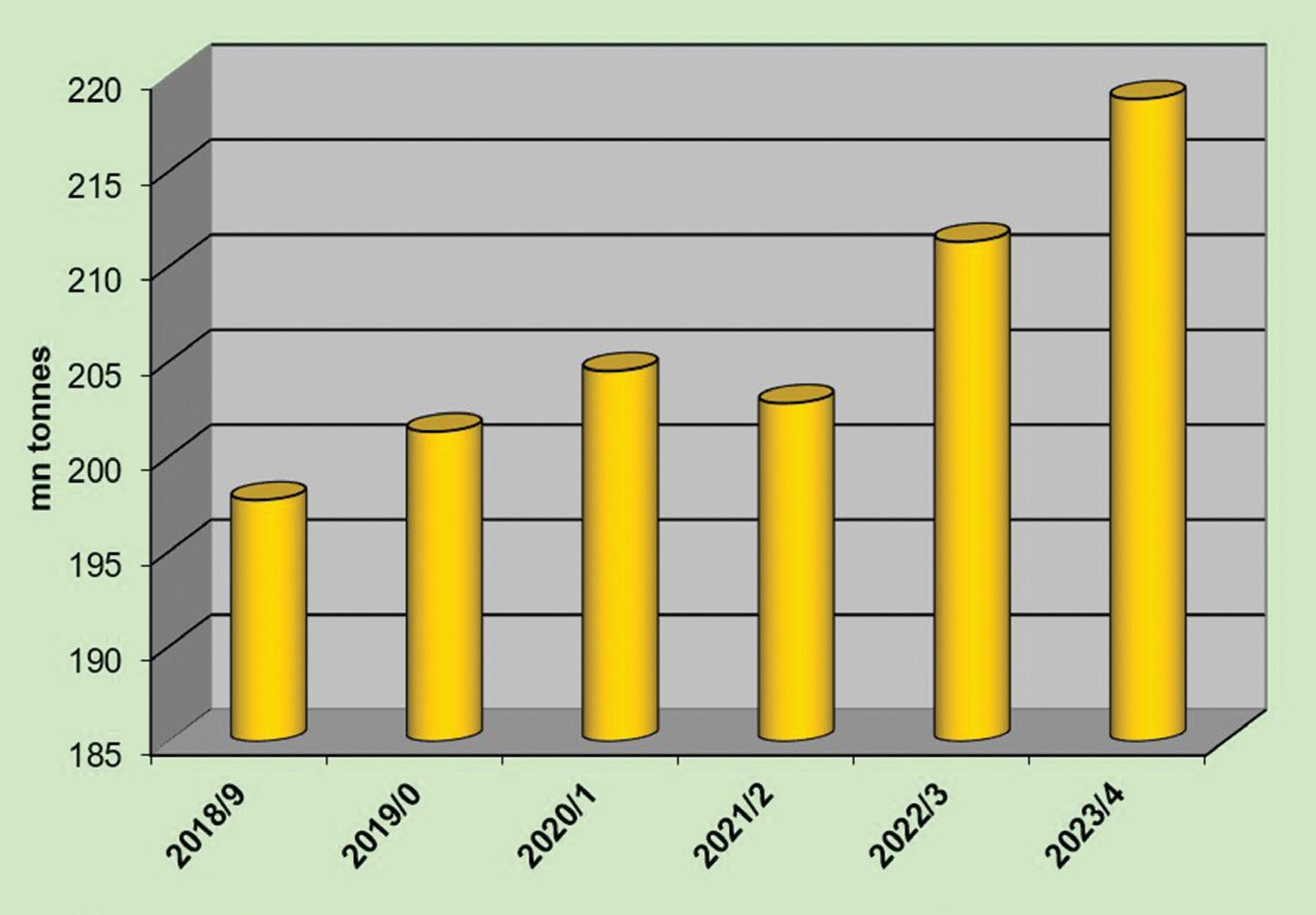

Global vegetable oil consumption has risen by more than 10% over the past five years and this upward trend is likely to continue. However, with little significant growth in the output of palm, rapeseed and sunflower oils, the world will be heavily dependent on soyabean oil to meet demand in the season ahead

John Buckley

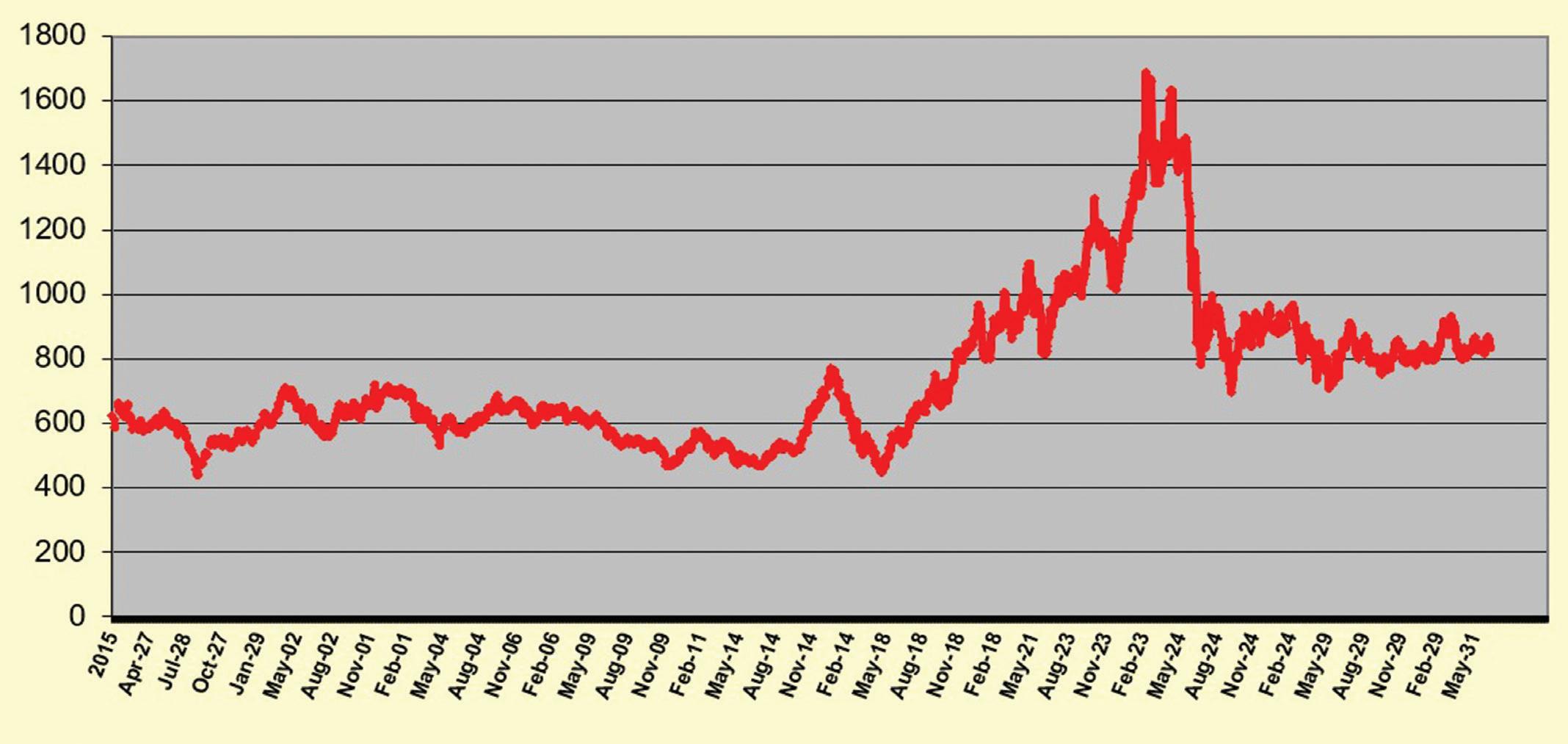

Global consumption of vegetable oils has increased by about 10.7% over the past five years, amounting to over 21M tonnes of extra demand (see Figure 1, right).

Growth might have been greater still if not for the negative period starting in the 2021/22 season, when COVID disrupted logistics and the conflict in Ukraine, which helped drive up the costs of many food commodities, including vegetable oils, to record highs.

The market made up for that with a stellar 8.4M tonne rebound in oil consumption in 2022/23, despite all the problems arising from the war between the world’s two largest sunflower oil suppliers, Russia and Ukraine.

The 2023/24 season now drawing to a close is expected by the US Department of Agriculture (USDA) to see only a moderate dip in the demand growth rate for vegetable oils, at 7.55M tonnes. For the new marketing year starting in October, expansion is forecast at just over 6M tonnes.

Where has demand been growing fastest? Five principal outlets have accounted for over 89% of total world demand over the past five-year period.

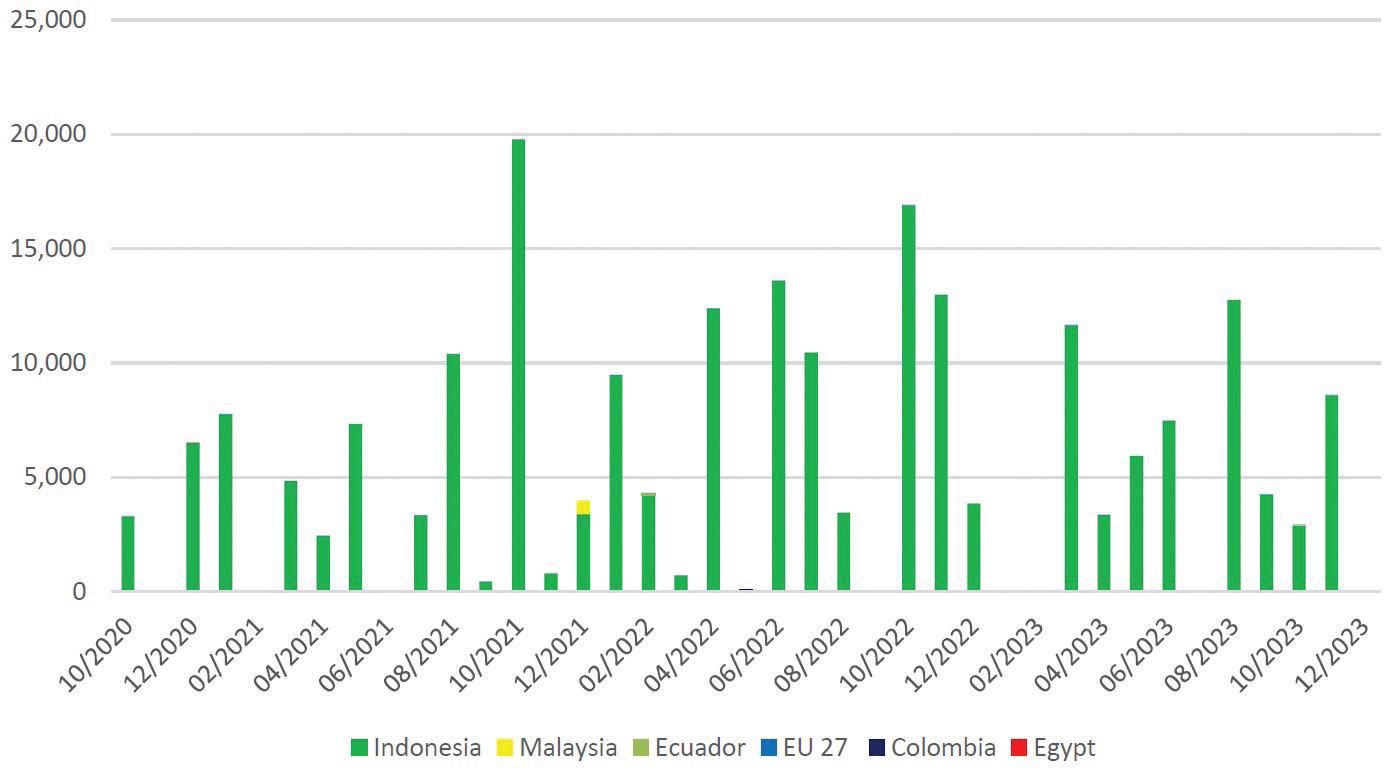

Indonesia comes out a clear leader, adding a staggering 8.2M tonnes of growth. One of the world’s most populous nations, its food oil consumption – on the back of economic development and population growth – has been a factor. Even more important, though, has been the country’s soaring use of its palm oil for biofuel, currently forecast to take another big

step up in the year ahead with a planned 40% blend rate of palm oil in biodiesel.

Amid an accompanying slowdown in its palm output expansion, Indonesia’s own growing usage clearly has implications for the world’s largest palm oil supplier’s future exports, growth of which has already stagnated after a sharp drop during the 2021/22 COVID season.

In second place on the consumption growth list is the one-time world leader in soyabean oil exports, the USA.

Once thought a ‘mature’ market, the USA has added over 4M tonnes to its total vegetable oil demand over the five years, accelerating in the past two seasons. Again, biofuel demand is boosting growth and there seems plenty more to come from this direction, especially for home-grown soyabeans and imported rapeseed oil.

Not surprisingly – in terms of their vast populations and economic development –India and China are still key components of the top five growth markets for vegetable oils – up about 2.5M and 2M tonnes respectively over the full five-year period. However, in contrast to the USA, the two countries’ consumption growth is still centred mainly on food oil.

Finally, Brazil has added about 2.1M tonnes of vegetable oil demand since 2018/19, also accelerating for the past two seasons after the 2021/22 slowdown. Here too, growing use of soyabean oil in the fuel sector has been a key factor.

For the season ahead, the USDA data

assumes that the big five growth countries will continue their consumption uptrend, with China adding 1.16M tonnes, the USA 0.92M tonnes, India 0.79M tonnes, Indonesia 0.78M tonnes and Brazil 0.55M tonnes. These big five countries in total will account for about 70% of world total vegetable oil consumption growth.

As in past years, the question remains –will the supply be there to meet foreseen demand at a reasonable cost?

In the past five-year period, four leading oils met most of the consumption growth – palm oil at 6.5M tonnes, soyabean oil at 6.2M tonnes, rapeseed oil at 5.4M tonnes and sunflower oil at 2.7M tonnes.

Soyabean oil is well in the lead for the 2024/25 season, expected to add 3M tonnes to world oil production, followed by palm oil at a mere 700,000 tonnes, quite a shift from past decades when rapidly expanding oil palm plantations were a key factor in keeping global vegetable oil prices in check.

For rapeseed and sunflower oils, there is little appreciable growth on the cards.

The small balance of extra supply is expected to come mainly from cottonseed, olive and peanut oils.

The likely heavy dependence on soyabean oil supply growth has kept its crop developments in sharp focus over the late spring and early summer months, during which the market has absorbed a mix of good as well as less encouraging news.

Higher soya crop and stocks

Bullish news has come from all the leading soyabean producing countries. Floods and other weather issues have hit Brazil and Argentina but both still expect largerthan-usual crops.

Some erratic planting and early growing conditions have also been seen in the USA, although the current crop outlook there is very promising.

In effect, increases in planted area in Brazil appear to more or less offset some likely decline in its yields from initial estimates. For Argentina, a return to more normal yields from the recent drought year is likely to ensure a more than adequate crop. In the USA, the still relatively favourable returns from soyabeans versus their old land rival corn has led to an estimated 3.5% increase in sowings which, if current yield pointers hold good, suggest a big crop rebound from last year’s disappointing 113M tonnes. If the crop stays on course, the USA should not only raise crushing but export significantly more soyabeans and products as well.

Recently, the soyabean supply outlook, and expected Latin American competition, has put Chicago soyabean futures on a steep downward curve towards four-year lows. However, the products have held up relatively well, thanks in part to soyabean oil’s support from the robust biofuel outlook.

Despite expected strong demand growth, at this stage, the soyabean market is still expected to build stocks quite substantially during 2024/25 for a third year running. That could put the global stocks total as high as 35.5M tonnes or 38% more than the 2021/22 carry-out low of 92.6M tonnes.

Against this backdrop, the USDA expects a decline in US domestic soyabean prices (11.6% down last season) will continue at a similar (10.8%) pace in 2024/25.

Soyabean oil prices are also expected to ease somewhat, with the 2024/25 season average currently projected at US$0.42/lb compared with the past season’s US$0.48/ lb and the 2022/23 average of US$0.65. Average US soyabean meal prices are, meanwhile, forecast to fall to US$330/ tonne against the past season’s US$380/ tonne and 2022/23’s US$452/tonne.

Floods hit the Brazilian soyabean crop coming into mid-harvest and earlier crop predictions of 163M tonnes (against last year’s 162M tonnes) have recently

been slashed by most analysts closer to 152/153M tonnes. The usually conservative government body CONAB recently forecast only just over 147M tonnes. The quality of later wet-harvested soyabeans could as well be affected.

Brazil’s soyabean and product costs could also be hoisted by planned tax changes, raising the export price.

While better Brazilian output is predicted for the subsequent 2024/25 season, with a USDA forecast of 169M tonnes, planting is months away and subject to unknown weather, making the figure somewhat speculative.

These factors might help the USA fare

a little better on soyabean exports than it expected a few months ago. However, a bigger issue for the US market may be where top soyabean importer China places its custom.

With frequently cheaper offers and fewer political handicaps than the USA, Brazil has been winning the bulk of Chinese demand for some time and, as we went to press in mid-July, has only just placed its first forward order for US new crop soyabeans.

Reduced Chinese demand for last year’s US crop has been a factor in lowering US total exports (to all destinations) some 16% down on those seen this time last year.

Will that situation change in the new 2024/25 season starting 1 September, let alone after the current volatile US presidential election outlook?

Argentine 2023/24 soyabean crop forecasts have also been trimmed recently but production should still be good –around 50M tonnes – a figure the USDA expects to see repeated next season.

Currently, analysts are forecasting a higher Argentine crush that should allow it to increase product exports, countering to some extent, Brazil’s lower-thanexpected crop and the possible export tax changes.

Palm’s contribution to world vegetable oil supply growth seems likely to continue to be smaller than the market has been used to for much of the past decade or two.

Plantation expansions have slowed and some weather upsets linked to the El Niño/La Niña climate cycle have been affecting both major producers, Indonesia and Malaysia.

Plantations also appear to be still in recovery mode after weather and COVID labour shortages of recent seasons.

Replanting schemes with their potential for higher yields can make a contribution to supply growth, along with more switching from smallholder to organised plantations. But for the next few years at least, this market may have to pin its hopes for increased supply on compliant weather improving yields.

Despite the slowdown in output growth, palm oil prices have been under some pressure recently from slowing exports and building stocks in Malaysia –the latter not unusual as production starts

its seasonal recovery.

Dealers and analysts have also cited the unusually narrow discount offered by palm against soyabean and sunflower oils, both recently picking up more business in pricesensitive importing countries like India.

A quick glance at the other main oil sources suggests rapeseed output could be down a little from last season at around 87M tonnes as potential gains in Canada are offset by lower harvest areas in Europe and Ukraine.

Hopes that previously up-and-coming exporter Australia might contribute more have retreated, with its current crop now forecast slightly below last year’s 5.7M tonnes. That may prove too pessimistic as yields might benefit from a retreating La Niña system usually favouring normal, rainfall. In 2022/23, Australia produced a record 8.27M tonnes after good rains boosted yields.

Canadian rapeseed values have rallied off their February lows on the Winnipeg futures market but softened more recently on hopes of a moderate 2024 crop increase.

The European market has recently looked firmer, however, as traders absorb acreage cuts in France and Germany, forced mainly by difficult planting weather and some flooding. The outlook for a smaller Ukrainian contribution to supply (with a lower harvest area and potential lower yields as well) has also helped firm EU values. However, Russia’s output is current seen close to last year’s 4.2M tonnes, which may help.

So far, large Asian consumers China and India appear to be heading for adequate

rapeseed crops.