bleaching earths 26 Waste not, want not

18 Role in biodiesel/HVO production

The various processes to produce biodiesel and HVO have their own requirements for feedstock quality, leading to different pre-treatment technology and bleaching earths

Adsorbents

22 Design and use of activated carbon

Activated carbon is used to remove a wide range of impurities during edible oil processing and producers must take into account properties such as particle size, activation level and base materials when designing an activated carbon to meet refining requirements

Spent bleaching earth oil is a sustainable feedstock for HVO and SAF but lack of logistics and volumes remain as obstacles to its development Port of Rotterdam 31 Biofuels hub

The Port of Rotterdam is home to several large-scale biofuel producers and refiners and is a key transport hub for the fuels and their feedstocks

Equipment & Technology

OFI 2024 annual guide

Oils & Fats International features a global selection of plant and equipment suppliers to the oils and fats industry, with an A-Z listing plus a company activities guide

VOL 40 NO 5

JUNE 2024

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd

Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

Russia’s invasion of Ukraine and attempts to block Ukrainian agricultural exports – along with its booming exports of cheap wheat – have had a major impact on the global grain market.

And in another sign of Moscow’s attempts to influence global food dynamics and challenge Western-led trade, Russia has proposed a BRICS grain exchange which President Vladimir Putin publicly backed in March.

Such an exchange would bring together some of the world’s largest grain buyers and exporters. Last year, founding members of BRICS (Brazil, Russian, India, China and South Africa) accounted for some 42% or nearly 1.2M tonnes of global grain production, and 40% of global consumption. With new members Egypt, Ethiopia, Iran and UAE joining in January, the figures are 1.24bn tonnes and 1.23bn tonnes respectively. Apart from grain, BRICS’ top exports also include crude petroleum oil from Iran and the UAE; iron ore, soyabeans, corn and sugar from Brazil; fertilisers from Russia and China; rice from India; and coffee from Ethiopia.

For Russia, the benefits of a BRICS grain exchange are clear. The country accounts for nearly a quarter of global grain exports and its proposal would allow it to trade grain through sanction-proof channels and challenge the dominance of Western exchanges such as the US CME Group and France’s MATIF, as well as European and American traders such as ADM, Cargill and Viterra.

If a new exchange is launched and widens beyond grain, it would also achieve one of the BRICS’ main goals – weakening the US dollar as the world’s main trading currency.

About 50% of all global trade is US dollar-denominated, according to data from The Bank of International Settlements, and BRICS’ long-term strategy is to replace the greenback with ‘R5’ – the currencies of BRICS founding members – the real, ruble, rupee, renminbi and rand. Eighty percent of trade between Russia and China is now settled in Russian rubles or Chinese yuan, according to Russia, and the UAE and India signed a deal last year to enable trade payments to be paid in Rupees instead of US dollars.

This is not just anti-American policy – typically, countries wanting to regain control over their monetary and exchange rate policy, and reduce foreign exchange risk, may try to move away from the US dollar in favour of their local currency. They may also wish to reduce exposure to US dollar debt in the form of bonds, to avoid the risk of US sanctions, according to an FXStreet article in April.

“Sanctions means you freeze other assets, and those assets are US Treasury bonds. There is the thinking that if I hold the bonds, can [sanctions] happen to me? Why am I transacting in this third currency rather than transacting directly,” FXStreet quoted Bridgewater Associates CEO Ray Dalio as saying.

In reality, creating and regulating a BRICS grain exchange would face numerous hurdles, such as ensuring a level of liquidity for trading and attracting participants, including from the private sector, according to a 5 May World Grain article.

Canadian Agri-Food Trade Alliance executive director Michael Harvey also doubts the exchange will ever come to fruition. “BRICS members are not aligned on very many issues and it is not easy to see how they could come to a common position on international grain markets,” The Western Producer quoted him as saying. With Egypt and Brazil among major wheat importers, “you can’t imagine the Egyptians having the same point of view about setting supplies and prices as what Vladimir Putin has,” he said in the 18 April report.

On the other hand, it would be foolish to dismiss Russia’s proposal outright given the current geopolitical and trade tensions between Western countries and Russia and China.

Serena Lim, serenalim@quartzltd.com

EU/RUSSIA: The EU Council has approved the introduction of tariffs on grain and oilseeds from Russia and Belarus, effective from 1 July, World Grain reported on 30 May.

The tariffs would cover imports of cereals, oilseeds and derived products as well as beet-pulp pellets and dried peas from Russia and Belarus, which currently incurred no or low tariffs. In addition, the listed goods would be barred from access to the EU’s tariff rate quotas.

Applied to products originating in, or exported directly or indirectly from the Russian Federation or Belarus to the EU, the regulation would increase duties to a point that would effectively halt imports of the listed products, the Council was quoted as saying. They would not affect transit through the EU from both countries to other third countries, World Grain wrote.

“These measures will … prevent the destabilisation of the EU’s grain market, halt Russian exports of illegally appropriated grain produced in the territories of Ukraine and prevent Russia from using revenues from exports to the EU to fund its war of aggression against Ukraine," Belgian Minister for Finance Vincent Van Peteghem said.

Although Russia remained a relatively small supplier of the listed products to the EU market, it was a leading global producer and exporter of those products.

Due to the current global volume of Russian exports, the country could redirect significant volumes of supplies of those products to the EU, causing a sudden inflow from its large existing stocks and potentially disrupting the EU market, the Council said.

Brazil’s soyabean output is set to fall following floods which have killed at least 150 people in Rio Grande do Sul state left a quarter of the state's soyabean crop still to be collected, Reuters wrote on 3 May.

Three weeks after one of Brazil’s worst-ever floods forced 540,000 people from their homes, experts warned that water levels would take at least another two weeks to drop and five of the state’s seven main rivers were still above

maximum water levels, The Guardian wrote on 19 May.

The floods in Brazil's second largest soya producing state after Mato Grosso had also destroyed logistics and power infrastructure and left cities and farms underwater, according to a 10 May report by Splash.

Rio Grande do Sul's soyabean production could end up some 15% down to total around 1920M tonnes, Leandro da Silva, a manager at farm cooperative Cotrisal, was quoted as saying

by Reuters.The losses could boost soyabean futures in Chicago as national production of the world’s largest soyabean producer and exporter could fall, Reuters wrote.

“There will be quantitative and qualitative losses,” Silva said by telephone from Sarandi, in the northwest of the state.

“For me, what remains to be harvested will be 30% to 40% damaged (on average). In the most affected areas, you will have 70% to 80% of [soya] beans damaged.”

Although the US Department of Agriculture had forecast Brazil’s soyabean exports to total 103M tonnes this season, 7.8% higher year-on-year, market players could readjust their expectations for the remainder of the season, Splash wrote.

Prior to the floods, national crop agency Conab had forecast soyabean output in Rio Grande do Sul at 21.89M tonnes and Brazilian production in 2023/24 at 146.5M tonnes.

A protest by Polish farmers at the Rava-Ruska border crossing with Ukraine has been suspended, lifting a blockade that had been maintained for months, Reuters reported on 29 April.

Following months of diplomacy by Kyiv, the farmers ended their last blockade on 29 April, Ukrainian border official Andriy Demchenko was quoted as saying.

Ukrainian farm minister Mykola Solsky had praised what he said was “constructive work” by Poland, the report said.

The blockade was initially started by Polish truckers at the end of last year angry at what they claimed was Ukraine’s use of a wartime easing of border restrictions to win market share, Reuters wrote. Polish farmers then joined the protest, claiming that Ukrainian grain and oilseeds were flooding their market, lowering wholesale prices and hitting farmer incomes.

In April, in a bid to address the protesters’ demands, Poland decided to pay 2.1bn zlotys

(US$520M) in subsidies to farmers to compensate them for low grain prices, Reuters wrote.

The dispute has stemmed from Russia's invasion of Ukraine in February 2022. To help Ukraine's economy, the EU scrapped tariffs on Ukrainian agricultural imports, allowing grains, oilseeds and other goods intended for export to countries around the world to flow across Ukraine's western border by land and river into neighbouring countries.

However, the 'frontline five' EU states of Poland, Slovakia, Hungary, Romanian and Bulgaria claimed these imports had suppressed prices for their domestic products. The EU then introduced a temporary ban on Ukrainian grain and oilseed sales to these five countries in May 2022, only allowing their transit. When the EU lifted its restrictions in September 2023, Poland, Hungary and Slovakia immediately resumed state-level bans on Ukrainian imports of grain and oilseeds.

Give your hydrotreater catalyst more life.

Crown technology delivers maximum contaminant removal to extend hydrotreater catalyst life.

Get the cleanest possible feedstock delivered to your hydrotreater and achieve up to double catalyst life with Crown technology. Our rugged, robust RD Ready ™ Pretreatment System is guaranteed to meet product specs for all common contaminants and drastically improve plant uptime by reducing the need for catalyst changeovers. Backed by the construction of 50+ biodiesel plants, design of 10+renewable diesel pretreatment plants, and a propriety database of feedstock specs and results, Crown RD Ready ™ Pretreatment System protects your investment now, and in the future. Protect your hydrotreater and your Renewable Diesel operation with CPM and Crown.

Russia has seized companies belonging to agricultural firm AgroTerra, including some backed by Dutch investment firms, according to a decree signed by President Vladimir Putin, Reuters reported on 9 April.

The move followed similar asset seizures by Russia involving Western firms including multinational brewing company Carlsberg, Finnish energy firm Fortum and German energy company Uniper, in alleged retaliation for steps taken against Russian companies by other countries, the report said.

ROMANIA: The European Commission has approved the acquisition of Romania’s East Grain by Czech company Agrofert, concluding that it would not raise competition concerns, World Grain wrote on 13 May.

Active in Romania, Hungary and Serbia, East Grain’s main activity is cereals and oilseeds trading. It also provides a range of related services including logistics, storage and processing.

Agrofert – a leading player in the Central European agriculture, food and fertiliser industries – said its majority stake (65%) in East Grain provided it with a launch pad into the Romanian agri-commodities market.

EU: Trade associations representing the EU grain, oilseeds, crushing and animal feed sectors have endorsed the EU’s adoption of the Corporate Sustainability Due Diligence Directive, which establishes legal liability for corporations on environmental and human rights issues in European courts. The new law would be phased in over five years and includes rules on supply chain due diligence, affecting companies with more than 1,000 employees and US$482M in annual turnover.

In the decree signed on 8 April, AgroTerra’s assets were listed as being placed under temporary management of Russia’s federal property management agency Rosimushchestvo, Reuters wrote. The decree listed Dutch-registered firms AgroTerra Investments and AgroTerra Holdings as part owners of some of the company’s assets, the report said.

AgroTerra said it had not received any further details on the decree, but was operating as usual and focused on the

ongoing planting campaign.

According to BEFL consultancy, AgroTerra is one of Russia's top 20 agricultural landholders as of May 2023, farming an area of 265,000ha.

Founded in 2008, AgroTerra is a producer and supplier of mass commodity crops and speciality, value-added crops to top food processors. The company specialises in soyabeans, wheat, sugar beet, sunflowerseed, corn and rapeseed, according to its LinkedIn page.

The Malaysian government has proposed giving orangutans as gifts to major palm oil trading partners in a similar policy to China’s diplomatic exchange of pandas, Minister of Plantation Industries and Commodities Johari Abdul Ghani was quoted as saying in an 8 May BBC report. Malaysia hoped the policy would generate

the same goodwill as China’s panda diplomacy, Johari said. Major importers of palm oil such as China, India and the European Union would be offered the apes as gifts, Johari said.

“This will prove to the global community that Malaysia is committed to biodiversity conservation,” he was quoted as saying on social media. However, conservation groups had raised concerns about the plan, the BBC report said.

The World Wide Fund for Nature (WWF) said the focus should be on protecting orangutans in their natural habitat. “WWF supports in-situ conservation of wildlife and would urge that trading partners are brought to Malaysia to support this initiative, as opposed to sending orangutans out of the country,” the charity said. Native to Malaysia and Indonesia, orangutans are a critically endangered species as logging and agricultural expansion have led to a loss of natural rainforests where they live. WWF said there were around 105,000 orangutans on the island of Borneo and a few thousand on Sumatra.

China’s largest food processor and manufacturer COFCO International announced on 16 May that its Argentine branch had made its first fully traceable and segregated soyabean meal shipment aligned with the upcoming EU Deforestation Regulation (EUDR), due to come into force on 30 December.

The company loaded 18,000 tonnes of certified deforestation-free soyabean meal on the MV Dublin Eagle on 16 May at its Timbúes port terminal on the Paraná River near Rosario for delivery to Irish feed manufacturer R&H Hall.

The segregated model applied to the shipment required the certified produce to be separated from non-certified produce throughout the whole supply chain, the company said.

COFCO said the shipment, along with previ-

ous shipments of deforestation-free soyabeans to China, were important steps towards meeting its commitments to achieve deforestation and conversion-free soyabean supply chains and reduce emissions from land use change.

“Thanks to ... investments in Argentina’s Visec monitoring platform, the country is now well placed to supply Europe with EUDR-compliant soyabeans, meal and related products,” COFCO said. Visec was set to cover all Argentine soya shipments by the end of 2024.

Under the EUDR, any operator or trader who places soyabeans, palm oil, coffee, cattle, cocoa, wood and rubber or their derivatives on the EU market must prove that the products do not originate from land deforested since 2020 or have contributed to forest degradation.

INDIA: PepisCo India has been testing a new oil blend of sunflower oil and palm olein in place of a palm oilpalm olein mix for its Lay’s potato chip range in India, India Today wrote on 9 May.

“There are often different recipes for foods or drinks in different countries, which is attributable to factors such as local preferences, manufacturing capabilities, ingredient availability and market dynamics. Ingredients are listed on every product we sell in India, allowing consumers to make conscious decisions about their purchases,” a PepsiCo India spokesperson was quoted as saying.

“In this context, PepsiCo India initiated trials of a blend of sunflower oil and palm olein oil in certain parts of our portfolio last year, becoming one of the few players in the food industry in India to do so.”

PepsiCo’s move came against a backdrop of concerns over the use of palm oil in packaged foods in India due to its high saturated fats content, India Today wrote.

Palm oil was common among packaged food brands in India, including salty snacks, biscuits, chocolates, noodles, bread and ice cream, the report said.

In the USA, PepsiCo used oils like sunflower, corn and canola for its potato chips rather than palm, India Today wrote.

A surge in imports of used cooking oil (UCO) and other biofuel feedstocks is having an impact on the US soyabean sector, Farm Progress reported from a Bloomberg report.

The increase in UCO imports was hitting soyabean processors’ profits, forcing them to slow down production and affecting expansion plans, the 27 April report said. Faced with weaker demand, companies were starting seasonal maintenance work earlier than usual and closing plants for longer periods, Farm Progress wrote.

According to soyabean marketing and consulting company CrushTraders, around 540,000 tonnes of crushing capacity were offline across the Corn Belt in April – a record for the month – including at major plants operated by agribusiness giants Archers Daniels Midland and Cargill.

In January, soyabean oil accounted for 32% of the feedstocks used to produce biodiesel in the USA, down by 44% on the previous year and a record low. This was partly due to lower cost alternative sources, which also had lower carbon-intensity scores, making them eligible for higher subsidies, the report said. Meanwhile, the number of renewable diesel plants was rising, totalling 539 in January, up from 384 the previous year.

The increased competition was also raising questions about future soyabean capacity.

Bunge global chief financial officer John Neppl was quoted as saying that several proposed projects or those in early stages had been put on hold. According to agricultural consultant Gordon Denny, there are 21 outstanding projects to expand soyabean processing capacity in the USA.

US cocoa-free chocolate producer Voyage Foods has signed a distribution agreement with global agribusiness giant Cargill and raised US$52M in funding, according to an 8 May The Star report,

quoting Bloomberg Voyage’s chocolate is made with blended vegetable oils, sugar, grape seeds and sunflower protein. The firm, which has raised US$94M in total, also produces a peanut-free

spread from a mix of seeds, sugar, legumes and palm oil, a hazelnut-free Nutella-style spread and bean-free coffee.

Voyage said there was a growing market for its products due to increasing demand for cocoa and coffee beans and extreme weather disrupting their production and supply.

Cargill’s category director of chocolate confectionery and ice cream Anne Mertens-Hoyng said Voyage’s products “offer more stable pricing and reliance on raw materials that are less subject to market volatility”.

As part of its plans to scale up its business, Voyage was building a new facility in the US Midwest, The Star wrote.

Malaysia's Sime Darby Plantation (SD Plantation) has received shareholder approval to change its name to SD Guthrie Bhd, The Star reported on 29 May.

The world’s largest palm oil producer by acreage said in a statement that a special resolution was passed at an Extraordinary general meeting (EGM) approving the move, with overwhelming support from

shareholders, The Star wrote.

SD Plantation has been subject to a brand and trademark licensing agreement to use the 'Sime Darby' brand since its demerger from its former parent company, Sime Darby Berhad, six-and-a-half years ago.

This had imposed significant constraints on SD Plantation’s ability to make its own strategic decisions for the brand and

business, the company said when it first reported on the proposal.

Additionally, the brand SD Guthrie was a central part of SD Plantation’s history, referencing its recent past as part of the Sime Darby group and its origins more than 200 years ago with Alexander Guthrie, who founded Guthrie & Co, which started out as a trading house in Singapore in 1821.

USA: The US treasury has issued guidelines for tax breaks aimed at boosting production of sustainable aviation fuel (SAF) under the Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model, Associated Press News reported on 30 April.

Congress approved the credits – from US$1.25US$1.75/gallon – as part of US President Joe Biden’s 2022 Climate and Health Care bill. To qualify for the tax cuts, SAF had to cut greenhouse gas emissions by at least half compared with conventional jet fuel and feedstock producers would need to follow climate-smart agriculture practices including specific fertilisers and farming methods.

SINGAPORE: Singapore Airlines (SIA) Group has ordered 1,000 tonnes of sustainable aviation fuel (SAF) from Finnish renewable fuels producer Neste.

The delivery would mark the first direct supply of Neste’s SAF to airlines at Changi Airport following the completed expansion of the company’s Singapore refinery in May 2023, which now had a 1M tonnes/year of SAF capacity, Neste said on 6 May.

US biofuel groups are challenging the EU’s ReFuelEU Aviation Regulation and are demanding an annulment of sections that exclude cropbased biofuels from the definition of sustainable aviation fuel (SAF), Argus Media wrote on 3 May.

The Renewable Fuels Association (RFA), US Grains Council, biofuel trade association Growth Energy and SAF company LanzaJet had filed an “application for leave to intervene” before the General Court of the EU, arguing that the regulation would “have a detrimental effect on the US ethanol industry”, the Argus Media report said.

The RFA said their application supported a challenge brought by European ethanol producer association ePURE and Pannonia Bio, one of Europe’s largest ethanol producers, against the regulation, which was adopted by the EU in

2023 and set to take effect in 2025.

“[T]he contested provisions give rise to a de facto ban on the supply of crop-based biofuels to the aviation sector in the EU,” the organisations said. “Due to the substantial difference in cost between biofuels and fossil fuels in the EU, aviation fuel suppliers will not purchase biofuels instead of fossil fuels unless they are obliged or incentivised to do so.

“Since using crop-based biofuels will not help aviation fuel suppliers meet their obligations under the regulation, they will not purchase those biofuels.”

The RFA said it had also filed a petition supporting a legal challenge brought by European ethanol producers against the EU’s FuelEU Maritime Regulation, set to take effect in 2025.

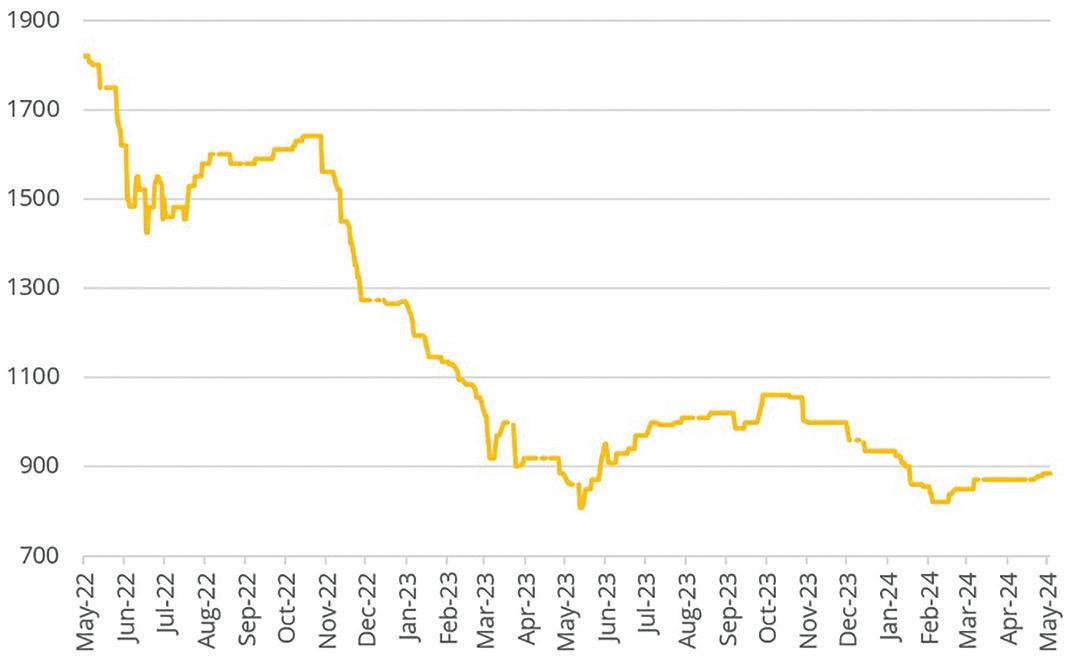

The Indonesian government will need to pay US$1.75bn (Rp 28.5tn) to meet the funding gap for the country’s B35 biodiesel blending programme, according to an official from the Oil Palm Plantation Fund Management Agency

(BPDPKS) quoted in a Jakarta Post report.

At 55.5% higher than last year’s subsidy, the increase was due to a projected gap in global diesel and biodiesel prices this year, the 29 April report said.

“The agency is targeting US$1.68bn (Rp 27.3tn) in palm oil export levies and US$1.75bn (Rp 28.5tn) in biodiesel [subsidy] in 2024,” BPDPKS corporate head Achmad Maulizal Sutawijaya was quoted as saying by local news agency Bisnis. BPDPKS paid out US$8.5M (Rp1.39tn) for the subsidised biodiesel programme in the first quarter.

The Indonesian government introduced mandatory B35 blending nationwide in August 2023 in a bid to reduce the country’s reliance on fuel imports.

US biofuel and oilseed groups are becoming increasingly concerned that large volumes of allegedly fraudulent Chinese used cooking oil (UCO) could be coming into the country, Bloomberg reported on 7 May.

According to US International Trade Commission data, US imports of UCO more than tripled in 2023 – compared to the previous year – to total 1.4M tonnes, with more than 50% coming from China.

The industry groups were urging the government to act to tighten checks on UCO imports, the report said. Similar con-

cerns about UCO from China were raised last year by the European biofuel sector.

One of the main concerns was that Chinese shippers were mixing UCO and palm oil, Bloomberg wrote. In addition, UCO was a third cheaper than refined soyabean oil and any alleged fradulent imports were benefiting from renewable incentives at the expense of US farmers, the report said.

US Environmental Protection Agency (EPA) spokesman Nick Conger said the agency was aware of the increased imports and that would be a factor in establishing

volumes for the Renewable Fuel Standard (RFS), which mandated how much biofuel must be blended into the country’s fuel supply each year.

“We are concerned that unless EPA and other agencies get a handle on this pretty quickly, it could potentially undermine the integrity of the RFS,” Renewable Fuels Association CEO Geoff Cooper said.

Asia is by far the world’s biggest UCO supplier, led by China, the report said.

China’s Ministry of Commerce did not respond to Bloomberg’s request for comment.

Photo: Adobe StockBiofuel producers in China have plans to invest more than US$1bn in the country’s first plants to turn waste cooking oil into sustainable aviation fuel (SAF) for export and to meet domestic demand, Reuters reported on 17 May.

Chinese firms – including Junheng Industry Group Biotech, Zhejiang Jiaao Enprotech and Tianzhou New Energy – are planning to start up plants over the next 18 months to produce more than 1M tonnes/year of SAF, according to six SAF investors quoted in the report. That volume would be equivalent to 2.5% of China’s current annual demand for aviation fuel, Reuters wrote.

Once operational, the projects would use up supplies of used cooking oil (UCO) feedstock that China currently exported, the company

executives were quoted as saying.

Last year, China exported a record 2.05M tonnes of UCO, mostly to the USA and Singapore, and also supplied feedstock to biofuel refiners such as Finnish firm Neste.

China is the world’s second largest aviation market, accounting for about 11% of global jet fuel use, according to the report. The country currently produced less than 100,000 tonnes of SAF, mostly at an EcoCeres plant, which had been in operation since 2022.

The companies planning to produce SAF expected a compulsory blend mandate of 2%-5% into an aviation fuel market forecast to reach 50M tonnes in 2030, according to industry executives, who spoke on condition of anonymity.

The Singapore Airlines (SIA) Group has ordered 1,000 tonnes of sustainable aviation fuel (SAF) from Finnish renewable fuels producer Neste.

The agreement would make SIA and the group’s subsidiary, Scoot, the first airlines operating out of Singapore’s Changi Airport to receive SAF produced at Neste’s refinery in the country, made from renewable waste and residue raw materials, such as used cooking oil (UCO) and animal fat waste, Neste said on 6 May.

After blending Neste’s SAF with conventional jet fuel, Neste said it would deliver the fuel to Changi Airport’s fuel hydrant system in two batches, firstly in the second quarter of this year and again in the fourth quarter. The delivery would also mark the first direct supply of Neste’s SAF to airlines at Changi Airport following the completed expansion of the company’s Singapore refinery in May 2023, which now had 1M tonnes/year of SAF capacity, Neste said.

PHILIPPINES: On 20 May, the Department of Energy announced new guidelines for oil industry participants to blend coconut methyl ester (CME) blend in all diesel fuel sold nationwide of 3% from 1 October, 4% by October 2025 and 5% by October 2026.

The DoE said increasing CME blending was expected to increase market opportunities for coconut farmers, biodiesel producers and other stakeholders in the coconut industry, with a 1% mandatory increase in CME blending requiring around 900M additional nuts to produce around 100M-120M litres of additional CME. To ensure a smooth transition, the oil industry would have to maintain sufficient storage capacity, blending facilities, transport systems, dedicated storage tanks and dispensing pumps, the DoE said.

fat and meal production The high-quality product specifications you require, and the flexibility to

Dupps-Gratt decanters and centrifuges.

Italian energy group Eni has plans to sell stakes in its biofuel and bioplastic units in a bid to speed up its energy transition, Reuters reported three sources as saying.

The group had started preliminary discussions with industrial investors to find a partner interested in a stake of up to 10% in its biofuel unit Enilive, which could be valued at €10bn (US$10.64bn) or more including debt, the sources were quoted as saying in the 15 April report.

Eni was also in talks with two potential

VIETNAM: Leading global spandex maker Hyosung, South Korea, announced on 3 April that it planned to invest US$1bn in a Vietnam site to produce bio-based 1,4-butanediol (BDO), a raw material for poly-tetramethylene-ether-glycol (PTMG), which is used to make spandex. Other BDO applications include engineering plastics, biodegradable packaging, footwear insoles and industrial compounds.

Using Genomatica’s fermentation technology, sugar would be converted into BDO at the new site, which would be used to mass-produce spandex at Hyosung’s Dong Nai Spandex factory, the firm said, adding that it planned to produce 50,000 tonnes/year of BDO by 2026 and 200,000 tonnes/year by 2035.

THAILAND: Finnish start-up Nordic Bioproducts Group (NBG) has signed an agreement with Thai bioplastic producer PTT MCC Biochem to develop next-generation bioplastics, specifically new grades of bio-polybutylene succinate (BioPBS), NBG said on 11 April. The project would focus on ‘home compostable’ materials, targeting single-use products such as coffee capsules, cutlery, containers, plates and mugs.

buyers to sell up to 30% of its bioplastic business Novamont, which could be valued around €1bn (US$1.64bn) including debt, the sources said.

These efforts were part of the €50bn (US$53.11bn) group’s overall strategy to set up separate entities – or “satellite” companies – that could attract specialised investors, helping Eni to fund greener businesses without impacting resources for its oil and gas activities, Reuters wrote.

Eni may also consider listing Enilive in

a second step, two of the sources said, either through an initial public offering or a spin-off depending on market conditions and the group’s needs.

Enilive comprises multi-fuel service stations and biorefineries in Italy and overseas.

In its 2024-2027 plan Eni had forecast the unit’s core earnings rising to €1.2bn (US$1.27bn) in 2025 from €1bn (US1.06bn) expected this year, the report said.

chemical firm BASF has launched a compostable biopolymer for commercial greenhouse twines.

Comprising BASF’s part petroleum-based compostable plastic called ecoflex FS and polylactic acid (PLA) from corn starch, ecovio T 2206 had

been certified as industrial compostable according to EN13432 and was biodegradable in compost within four weeks, BASF said on 26 April.

“Both components of ecovio – ecoflex and PLA – are biodegradable,” BASF head of research for biopolymers Prof

Andreas Künkel said. “For a material to be biodegradable, it is unimportant whether the feedstock is plant- or petroleum-based. What matters is the structure of the molecules. Because this synthetic polymer has been engineered for … biodegradability, microorganisms can easily digest it.”

As the twines were biodegradable, BASF said they could be collected together with plant residues after harvesting, and transported to industrial composting facilities.

“In the controlled conditions of an industrial composting plant – high temperature and humidity and defined oxygen levels – microorganisms such as fungi and bacteria break the plastic down into water, CO2 and biomass,” BASF said.

Belgian start-up AmphiStar announced on 17 April that it had secured €6M (US$6.43M) in funding to launch its range of waste-based biosurfactants and planned to build a 1,000 tonnes/ year plant to commercialise the range.

Following the launch of the company’s first commercially-available biosurfactant last year with sustainable cleaning product company Ecover, AmphiStar co-founder and CEO Sophie Roelants said the firm – established in 2021 – was now looking to form further partnerships.

AmphiStar’s range of microbial surfactants are produced from locally-sourced waste and side-steams from the agri-food industry, such as supermarket food waste. It uses a technology

similar to brewing beer, based on the yeast organism Starmerella bombicola, to produce over 25 specific variants of glycolipid biosurfactants suitable for a range of drop-in functions, including cleaning and cosmetic products. Both conventional first-generation biomass feedstocks, such as glucose and fatty acids, and second generation biomass feedstocks such as crude glycerine and food waste, could be used in the process. Roelants said the €6M investment from the European Circular Bioeconomy Fund, Qbic III and Flanders Future Tech Fund would also be used for research and development into its biosurfactant platform and for the completion of regulatory and certification protocols.

The Argentine government has announced plans to invest approximately US$550M in building a new grain port in the country’s Rosario region, World Grain reported presidential spokesperson Manuel Adorni as saying.

The Rosario region is considered an important agricultural centre for Argentina and accounts for more than 80% of the South American country’s agricultural and agro-industrial exports, according to the 22 April report.

Work on the construction of the new port, located in Timbúes on the Paraná

River, had started in March, presidential spokesperson Manuel Adorni said.

Timbúes plays a key role in getting Rosario’s maize, soyabeans, wheat and other commodities to global markets and is one of Argentina’s most important agricultural export hubs. Located 30km outside the city of Rosario, Timbúes is also the location of global agribusiness giant COFCO International’s largest facility in Argentina.

According to COFCO’s website, the facility can unload 1,200 trucks/day, process grains and biodiesel, and store 800,000 tonnes of dry commodities.

Other companies operating grain handling facilities along the Rosario port network included global agribusiness giants Bunge, Cargill and Louis Dreyfus, World Grain wrote.

Argentina is one of the world’s top leading exporters of soyabean oil and meal and the third largest corn exporter, according to an 11 March report by Seatrade Maritime News. According to estimates by the Rosario Stock Exchange (BCR), Argentina’s 2023/2024 soyabean and corn harvests will total 49.5M tonnes and 57M tonnes respectively.

The expansion of HES Gdynia’s grain storage facility in in the northeast of Poland is scheduled for completion at the end of this year.

HES Gdynia Bulk Terminal (pictured) is one of the largest bulk sea terminals in Poland, handling between 6M-7M tonnes of commodities/year, according to a 30 April International Bulk Journal (IBJ) report.

As part of the expansion plans for the facility at Slaskie Quay in the Port of Gydnia, a new 64,000 tonne capacity grain warehouse and transfer conveyor system on supply and discharge routes would be built, HES said. The project

UKRAINE: Wilmar International’s vegetable oil export plant in Pivdennyi was hit by a Russian missile on 19 April, Riverside Tanker Chartering wrote in its May report. The damaged tank terminal was owned by Wilmar’s Ukrainian subsidiary, Delta Wilmar Ukraine. The group said it would take about six months to rebuild the burnt oil tanks but as only a few were destroyed, operations were expected to resume in a matter of weeks.

would also include new loading and discharge points for trucks and rail wagons.

The new warehouse would help alleviate recent grain storage capacity shortages at Pol-

ish ports resulting from supply chain disruptions triggered by the war in Ukraine, IBJ wrote.

Gdynia is the larger of the two Baltic Sea ports in Poland – ahead of Gdansk – with an

annual agricultural product throughput of 4-5M tonnes, including oilseeds. It was also one of the most important hubs for wheat in the region, IBJ said.

Grain and seed processing and handling firm Cimbria has provided equipment for the HES Gdynia project, World Grain wrote on 30 April.

Cimbria was also extending the Szczecin Bulk Terminal in Stettin, western Poland, and delivering four silos with a total capacity of almost 28,000 tonnes and a ship loading line with an intake capacity of 1,000 tonnes/hour. The Stettin project was scheduled for completion by 2024/25.

Drought conditions at the Panama Canal are expected to end soon with normal operations resuming by 2025, Freight Waves reports.

Ships faced long delays last year at the Panama Canal – one of the world’s busiest trade routes linking the Atlantic and Pacific oceans – as shallow water levels caused by drought reduced the number of vessels able to pass.

However, the man-made Gatun Lake, which supplies the canal’s water supply, had been boosted by recent rainfall and transits of product tankers and container ships had almost fully recovered, with both types averaging near 90% of normal activity, Freight Waves wrote on 15 April.

The state-owned Panama Canal Authority (ACP) said it was optimistic that canal operations

would return to normal by 2025, the report said. According to forecasts by the US National Weather Services’ Climate Prediction Center, the region’s warm and dry El Niño conditions were expected to end in the coming months and there was a 60% chance of La Niña conditions developing by August, which would bring cooler temperatures and potentially increased rainfall. The ACP recently proposed a US$2bn project to dam the nearby Indio River and drill an 8km mountain tunnel to connect the new reservoir to Gatun Lake. The six-year project could enable 1115 more transits a day through the canal but had been criticised by local farmers, whose land was at risk of being flooded by the adjacent reservoir, Freight Waves wrote.

The Mexican government has delayed the introduction of a ban on imports of genetically modified (GM) corn into the country from the USA until 2025, the Farms News website reported on 15 April.

Originally due to come into force by March 2024, the delay would allow more time for Mexican officials and industry to analyse the potential economic impact of a ban and explore alternative practices, the report said.

The ban was decreed on 1 January 2021 in a bid to protect native corn varieties and

CHINA: The Ministry of Agriculture has approved a gene edited (GE) wheat genome resistant to powdery mildew for the first time in the country, the South China Morning Post (SCMP) reported on 12 May, paving the way for the crop to be grown for food.

China had been cautious in adopting biotechnology, with the first approvals for GM corn and soyabeans –mainly imported for animal feed – only occurring a few years ago, and the first approval guidelines for submitting genome edits only released in 2022, the SCMP said.

The approval for GE wheat was seen as a milestone, as the crop would be mainly grown for food consumption, the report said.

eliminate the use of the herbicide glyphosate.

Mexico imports about 17M tonnes of corn from the USA, mainly yellow corn for use in feed production, while white corn totals around 5% of that volume. The majority of US corn is genetically modified.

After the USA threatened trade retaliation, the Mexican government announced another decree in February relaxing some of the restrictions but maintained the ban on GM corn for certain uses, specifically human consumption, including tortillas and

dough made mainly from white corn.

Most of Mexico’s imports from the USA are yellow corn for use in animal feed and industrial purposes.

Farm News wrote that the new interim period was crucial for the seed industry, which may need to move towards producing non-GM and alternative crops.

During the postponement period, Mexico’s relevant ministries and the Federal Commission for Protection against Health Risks would continue to look for alternatives to glyphosate, the report said.

Food ingredient company Moolec Science said on 22 May that the US Department of Agriculture (USDA) had approved its range of soyabeans containing pork proteins.

The USDA’s Animal and Plant Health Inspection Service (APHIS) had found that Moolec’s genetically engineered Piggy Sooy product

was unlikely to pose an increased risk of pests compared to non-modified soyabeans. Following regulatory clearance, the company would be able to plant and transport Piggy Sooy soyabeans without permits, Moolec co-founder and CEO Gastón Paladini said.

Moolec has been developing a range of meat proteins in plants aimed at improving the taste, appearance, texture and nutrition of meat alternatives. The firm’s product portfolio includes other crops such as safflower and pea.

In June 2023, the company announced that Piggy Sooy seeds had achieved high levels of expression of pork protein (up to 26.6% of the total soluble protein) and had patented its technology, which produces beans with a pink hue like pork. At the time of launching the product, Moolec said the company’s technology could be used across a wide variety of proteins for industries such as food, pharma, cosmetic and diagnostic re-agents.

Moolec said its next step was the completion of its consultation with the US Food and Drug Administration (FDA) before making the Piggy Sooy ingredient available commercially.

German chemical giant Bayer has asked the US Environmental Protection Agency (EPA) to approve different uses for its banned Xtendimax herbicide, designed for dicamba-tolerant soyabeans and cotton, AgriPulse reported on 5 May.

On 6 February, a federal judge in Arizona had cancelled the EPA’s registrations of dicamba-based weedkillers from 2020, saying the agency violated procedures mandating public input, a 7 February Reuters report said at the time. The ruling affected Bayer’s XtendiMax, BASF’s Engenia and Sygnenta’s Tavium herbicides and was supported by environmental activists as the sprays were

known to drift away and damage crops not tolerant to the chemical.

In Bayer’s new label application, the firm had proposed a 12 June cut-off date for application in soyabeans and an end to post-emergence or ‘over the top’ spraying to reduce drift, AgriPulse wrote. For cotton, it had proposed post-emergent use up to 30 July, the same current cut-off date. The proposal also specified up to two applications, while the current one did not specify the number of applications permitted.

However, the Center for Biological Diversity (CBD) said the modifications were not meaningful. “These changes would not fix

the key issues that have resulted in past calamities,” the CBD said. “Cotton growers would still be allowed to spray into the heat of summer, when volatility is worst, promising continued massive drift wherever cotton is grown.”

Farmers had been using dicamba sold before 6 February this season, but were concerned that there would not be enough seed or herbicide for 2025 as Bayer’s new application carried a 17-month statutory review time frame, AgriPulse wrote.

The EPA has opened Bayer’s proposed label for a 30-day comment period, ending 3 June.

8-10 July 2024

5th International Symposium on Lipid Oxidation and Antioxidants

Bologna, Italy

https://eurofedlipid.org/5th-internationalsymposium-on-lipid-oxidation-andantioxidants

14-19 July 2024

26th International Symposium on Plant Lipids Lincoln, Nebraska, USA https://ispl2024.unl.edu/

19-20 July 2024

1st International Camelina Conference Lincoln, Nebraska, USA https://eurofedlipid.org/internationalcamelina-conference/

29 July-1 August 2024

Hands on Practical Course on Vegetable Oil/Animal Fats/Products Processing including Biodiesel-Biofuel (VOP-2024) College Station, Texas, USA https://fatsandoilsrnd.com/annualcourses/

1-2 August 2024

Palmex Thailand Suratthani, Thailand www.thaipalmoil.com

20-24 August 2024

21st International Sunflower Conference Bayannur, China www.esanrui.com/isc

28-29 August 2024

Palmex Malaysia

Kuala Lumpur Convention Centre, Malaysia https://asiapalmoil.com

9-11 September 2024

OFI International 2024

Rotterdam Ahoy Convention Centre, the Netherlands www.ofimagazine.com/ofievent

11-12 September 2024

International Agro-Industrial ExhibitionOil and Fat Industry

National Complex Expocentre of Ukraine, Kyiv, Ukraine https://oil.agroinkom.com.ua

For a full events list, visit: www.ofimagazine.com

Registration is now open for this year’s unmissable industry event – OFI International 2024 –being held at the Rotterdam Ahoy Convention Centre, the Netherlands, on 9-11 September 2024. OFI International 2024 will bring together all members of the oils and fats community under one roof and features:

• The one-day OFI Trade Outlook & Logistics Conference on 11 September focusing on prices and trends impacting the world’s major vegetable oils including war and climate impacts on shipping; and the impact of sustainability regulations such as the EU Deforestation Regulation. Confirmed speakers include Oil World CEO Thomas Mielke, RaboResearch’s Elwin de Groot and Odfjell’s Nils Jørgen Selvik.

16-17 September 2024

6th International Symposium on Dietary Fat and Health Frankfurt, Germany https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11686&sp_id=1

23-26 September 2024

19th GERLI Lipidomics Meeting at the End of the World Plouzané, France

https://eurofedlipid.org/19th-gerlilipidomics-meeting-at-the-end-of-theworld

30 September-2 October 2024

2nd Berlin Symposium on Structured Lipid Phases

Berlin, Germany

https://eurofedlipid.org/ofiinternational-2024-2

2-3 October 2024

4th ICIS Pan American Oleochemicals Conference

Ritz Carlton Coconut Grove, Miami, USA https://events.icis.com/website/13907

2-4 October 2024

Sustainable Aviation Futures North America Congress Marriott Marquis, Houston, Texas, USA www.safcongressna.com

• The two-day OFI Technical Commercial Conference on 10-11 September addressing latest industry issues on sustainability, waste feedstocks and contaminants such as MCPDEs, GEs, MOSH/MOAH and chlorinated paraffins. Confirmed speakers include Neste Vice President for Renewables Production Sven Kuhlmann and the European Commission’s Veerle Vanheusden.

• The 3rd Sustainable Vegetable Oil Conference on 10 September organised by the Council of Palm Oil Producing Countries (CPOPC).

• A two-day exhibition of suppliers to the oils and fats industry.

• A site visit at the Port of Rotterdam.

For more information and to register, go to: www.ofimagazine.com/ofievent

9-11 October 2024

Palmex Indonesia Medan, Indonesia https://palmoilexpo.com/index.html

22-23 October 2024

Oil and Fats International Congress (OFIC) 2024 (+ Online)

Kuala Lumpur Convention Centre, Malaysia https://mosta.org.my/events/ofic-2024

22-26 October 2024

2024 North American Renderers Association Annual Convention Ritz Carlton Bacara, Santa Barbara, USA https://nara.org/about-us/events

4-6 November 2024

Sustainable Aviation Futures APAC Congress

PARKROYAL Marina Bay, Singapore www.safcongressapac.com

7-9 November 2024

5th YABITED Fats and Oils Congress Antalya, Turkey www.yabited2024.com/EN/Default.aspx

12-14 November 2024

Global Grain Geneva 2024 Geneva, Switzerland www.fastmarkets.com/events/globalgrain-geneva/

The effective technology and complex services

■ Horizontal agriculture

■ Local mechanical processing

■ Patented system of energy recovery

■ Complex approach including Physical Oil Re ning

■ Unique combination of extruders and screw presses

CAPACITY RANGE:

30-130 KG/H

FOR TESTING A WIDE RANGE OF HIGH-QUALITY

MARGARINE PRODUCTS SUCH AS:

• Table margarine

• Industrial margarine

• Puff Pastry

• Shortening

• Low fat spreads

• Recombined butter

The equipment will be sold fully overhauled, and carefully tested before shipment. Mechanically warrantee is granted. Ex works factory in Denmark.

INSPECTION & SALE CONTACT:

Torben From - FH SCANDINOX A/S - DENMARK

Phone head office: +45 7534 3434

Mobile phone/WattsApp: +45 4055 5359

E-mail: TFR@fhscandinox.com www.fhscandinox.com

THE PILOT PLANT IS SKID MOUNTED AND CONSISTS OF THE FOLLOWING MAIN EQUIPMENT:

• Water Phase preparation

• Water Phase pre-heating (Gerstenberg & Agger consistator)

• Emulsion pre-mix and buffer

• Crystallisation (Gerstenberg & Agger) Incl. HP pump, pinmixers, phase inverter

• Resting tube

• NH3 refrigeration unit for Perfector

• Integrated Hot water system

• SCADA automation system

The varying processes to produce biodiesel and HVO have their own requirements for feedstock quality, leading to different pre-treatment technology and bleaching earths

Dr Patrick Howes

There has been increasing interest in biofuels due to finite supplies of fossil fuels, the desire to reduce the carbon intensity of fuels in order to cut greenhouse gas contribution to global warming, and the general desire for a more sustainable future.

The first generation of biofuels included bioethanol and biodiesel. Bioethanol is utilised in blends with petroleum for spark ignition engines (petrol internal combustion engines), whereas biodiesel is used in compression combustion engines (diesel engines).

Bioethanol can be manufactured via the fermentation of sugars or other carbohydrates sources such as corn, maize, sugar beet and waste straw. Bioethanol is usually blended at a rate of 15% in petrol, although up to 85% bioethanol can be handled by some engines. Bioethanol is biodegradable and, due to being distilled, is clear and colourless.

Biodiesel can be manufactured from

edible oils (triglyceride oils) or fatty acids, yielding fatty acid methyl esters (FAMEs).

FAME biodiesel is typically blended with mineral diesel at levels of up to 30%, although 100% FAME biodiesel can be utilised in some engines.

The use of edible feedstocks to produce fuel has raised ‘food vs fuel’ concerns and is considered undesirable.

FAME biodiesel can also be manufactured from used cooking oils (UCO) or waste oils provided that the oils have been appropriately pre-treated before esterification and/or transesterification processes.

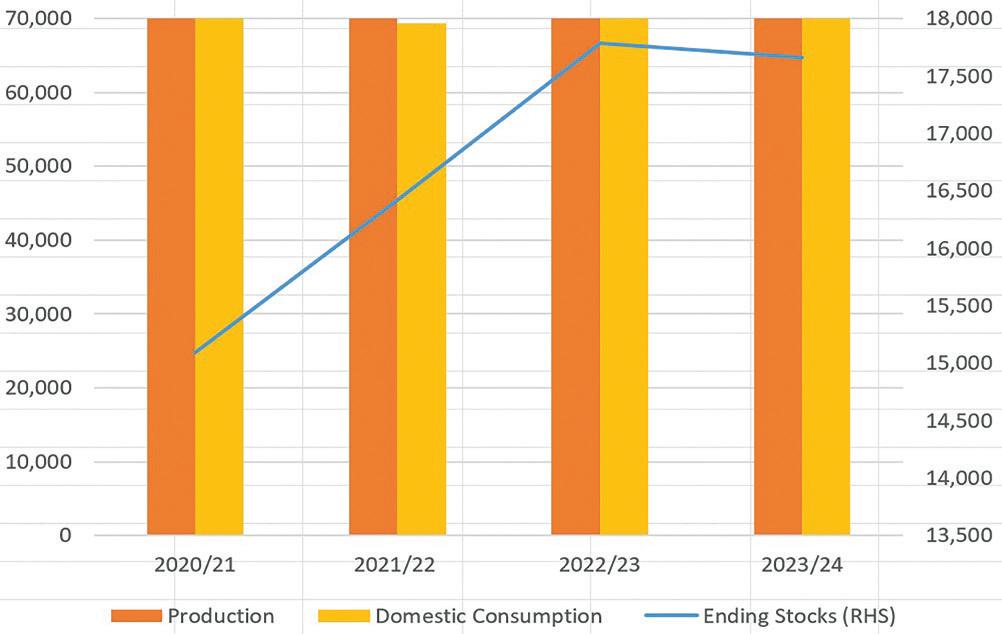

Sources of materials for the sustainable manufacturing of biodiesel are plentiful. The current global production of edible oils is more than 200M tonnes/year and continually increasing. From this, more than 40M tonnes/year of UCO is produced. There are also animal- and vegetable-based waste oils such as palm oil mill effluent (POME) and palm press

Photo: Adobe Stock The growing focus on renewable energy and fuel is leading to greater production of biofuels from waste feedstocks

fibre oil (PPFO) that can be utilised as feedstocks for biofuels once properly pretreated. Other renewable feedstocks are continually being developed to achieve the vision of a sustainable future.

Most UCO and waste oils are collected from restaurants or industrial food processing factories, with a lesser amount from domestic users due to difficulties in logistics.

The variability in quality of the various feedstocks sometimes requires blending before feeding to the treatment plant, to keep the levels of the impurities within the capabilities of the processing plant.

The main issues with FAME biodiesel are that it easily oxidises, absorbs water from the atmosphere, has a low cloud point and, in cold weather, leads to clogging of fuel filters. At high blend ratios, FAME biodiesel can damage engine seals.

To overcome the issues related to FAME biodiesel, the next generation of biofuels are paraffinic hydrogenated vegetable oil or hydrotreated vegetable oil (HVO) fuels. Paraffinic fuels are usually made from UCO, sludge oils or other waste oils. Paraffinic oils can be utilised at 100% as a replacement for mineral diesel, or in blends with mineral diesel. HVO paraffinic oils are cleaner than mineral diesel and are more environmentally friendly as they do not contain any aromatic hydrocarbons.

Paraffinic biofuel is typically manufactured by the hydrogenation of used or waste triglyceride oils or fatty acid distillates. After thorough pre-treatment of the feedstock, the hydrogenation process removes all the remaining oxygen, nitrogen, chlorine and sulphur. This produces a very clean, low-carbon oil with good oxidative and cold stability, with low sulphur and aromatics content and no tendency to absorb water, which has a higher hydrogen content and calorific value compared with esterified or transesterified biodiesels.

The composition of HVO paraffinic fuels are close to mineral diesels. One of the most promising uses of HVO is as a sustainable aviation fuel (SAF). Singapore has already mandated that from 2026, all aircraft departing from Singapore must use fuel containing SAF, with increasing proportions of SAF being phased in over successive years.

The three processes for producing biodiesel – esterification, transesterification and hydrogenation – each have their own requirements for the quality of the feedstock. For this reason,

the pre-treatment of feedstocks must be designed to meet the individual needs.

When starting from virgin edible oils the pre-treatment process can be the same as that normally utilised in edible oil refineries. When the feedstock is used or waste oil, the pre-treatment processes need to be more thorough.

For the manufacture of FAME when the pre-treated oil has high free fatty acid (FFA) levels, methanol solvent with homogenous acid-catalysed esterification is used, for example, with sulphuric acid or para-toluene sulphonic acid (PTSA). This is followed by alkali trans-esterification, with methanol and a homogeneous alkaline catalyst such as sodium methoxide. For esterification and trans-esterification, the catalysts are homogeneous. For HVO, the catalyst is heterogeneous.

The composition of UCOs and waste oils can be very variable. UCO can contain a wide spectrum of impurities that need to be removed. These impurities include:

• Solids such as burnt food fragments

• Spices and salts from seasonings including sodium chloride and MSG

• Phosphorous and nitrogen compounds

• Proteins from foodstuffs

• Metals such as sodium, calcium, magnesium, iron, copper and other trace metals from the foodstuff or implements that have been in contact with the oil.

• Oxidised and polymerised oils and fats including those from the foodstuffs that have been cooked in the oil.

• Plastics that have inadvertently entered the oil such as from packaging materials or ear tags from animals in the rendering process, or deliberately added to the oil in the form of straws or plastic bags to increase the crispness of products deep-fried in the oil.

• Dark brown melanoidin pigments formed from the Maillard reaction between amino acids and reducing sugars at the high temperatures of deep fat frying.

All these impurities need to be reduced or removed during pre-treatment of the oil, otherwise downstream processing will be adversely affected and the desired product specification will not be met.

An important first step in the treatment of UCO and waste oils is to filter the oil to remove any solid impurities such as sand, food solids and plastic solids.

Water washing the filtered oil is beneficial for reducing or removing watersoluble impurities such as soaps, salts and

some other polar organometallics.

Wet or dry degumming with phosphoric or citric acid, other degumming agents or enzymatic degumming is required to remove or condition the phosphorous gums and metals salts as far as possible before the bleaching stage.

Chelative degumming with citric acid enhances the removal of phosphorous and metals.

Wet degumming is preferred for UCO and waste oils even if the phosphorous level is below 50ppm, as wet degumming will also enhance the removal of other impurities, thereby reducing the demands on the bleaching earth and minimising bleaching earth consumption.

If gums and soaps are not removed, they can block the surface and the pores of the bleaching earth, reducing its efficiency.

At the adsorbent stage, the bleaching earth adsorbs or decomposes oxidation products such as hydroperoxides, aldehydes, ketones, heterocyclics, polymers, pigments, residual soaps, phosphorous compounds and trace metals.

There are differences in the ways natural and acid activated earths perform.

Natural bentonite clays act mainly as adsorbents and have a higher cation exchange capacity (CEC) compared with acid-activated bleaching earths.

Acid-activated bleaching earths have adsorbent properties and are solid acid catalysts. The acid catalytic properties allow acid-activated bleaching earths to decompose the primary oxidation products – hydroperoxides – into secondary oxidation products such as aldehydes and ketones, which may then be adsorbed by the bleaching earth.

Residual soaps can be adsorbed onto the exterior surface of the bleaching earth particles and may form a barrier that reduces the performance of the bleaching earth.

Acidic sites on the surface of acidactivated bleaching earths can split the soap, yielding metal cations and free fatty acids. The acidic sites can also crack or protonate pigments so that they are no longer visible. Removal of some of the pigments is cosmetic, but larger pigments need to be removed to prevent them blocking the pores and deactivating the heterogenous catalyst utilised in the hydrogenation process.

While the acid catalytic function of acid-activated bleaching earths is useful for cracking impurities, there is also a downside in that undesirable acid-catalysed isomerisation and

polymerisation reactions may occur, depending on the processing conditions at the bleaching stage.

Natural bentonites have larger pores than acid-activated bentonite but a lower nitrogen surface area and lower pore volume.

Activated carbons have a high surface area and pore volume, and can have a full range of micro-, meso- and macropores.

Each material has its own advantageous properties.

A wide range of adsorbents can be utilised to produce biofuels including natural and acid-activated clays, activated carbons, zeolites, magnesium silicates and silicas. Each adsorbent has its own special properties. Bleaching earths are often formulated from two or more adsorbents to achieve all the desirable functions to remove impurities, while minimising any undesirable side reactions.

The selection of the bleaching earth is very important as some bleaching earths cause the oil to gel when mixed with UCO or waste oils, making it impossible to filter the spent bleaching earth from the oil.

It is important to remove chlorides and organochlorines prior to hydrogenation for the HVO process, otherwise the hydrochloric acid produced during hydrogenation could lead to excessive corrosion of the process equipment.

This can be achieved by utilising bleaching earths together with activated carbons, as activated carbons can adsorb both residual chloride and organochlorines.

Natural- and acid-activated bleaching earths pre-blended with activated carbon are now increasingly utilised as a costeffective adsorbent system for refining a wide range of oil qualities and oil types.

For the HVO process, it is necessary to remove those impurities that could adversely affect the performance or lifespan of the heterogenous hydrotreating catalyst by blocking its pores and surfaces. The filtration stage for the spent bleaching earth can be considered as a guard bed that protects the hydrogenation catalyst.

Spent bleaching earth typically contains about 20-25% residual organic materials. It is therefore beneficial to utilise the spent bleaching earth directly as a fuel –such as in in the cement industry – or the spent bleaching earth oil can be extracted and converted into biofuel. Fortunately, the hydrogenation process

that takes place at high temperature enables removal of residual sulphur as hydrogen sulphide gas, nitrogen as ammonia gas, and oxygen as gaseous water.

The sulphur can be beneficially recovered from the hydrogen sulphide. The distillation process following hydrogenation leads to very clean paraffinic fuel with no aromatics or oxygenated products.

Although current biofuels such as SAF can only be viable when they are subsidised or legislated for by governments, the desire for a sustainable future and the efforts to utilise a wide

range of waste foodstuffs and agricultural wastes as alternative sources of oil-based feedstocks indicates that biofuels will have increasing importance in the years to come.

Process plant contractors and bleaching earth manufacturers will continue to innovate their products to meet the challenges as sustainable biofuels markets expand.

●

Dr Patrick Howes is technical director of Natural Bleach Sdn Bhd, Malaysia and will be speaking on ‘Designing Bleaching Earths and Activated Carbon’ at OFI International 2024 in Rotterdam on 9-11 September www.ofimagazine.com/ofievents

Activated carbon is used to remove a wide range of impurities during edible oil processing, and producers must take into account properties such as particle size, activation level and base materials when designing an activated carbon to meet refining requirements

Dr Patrick Howes

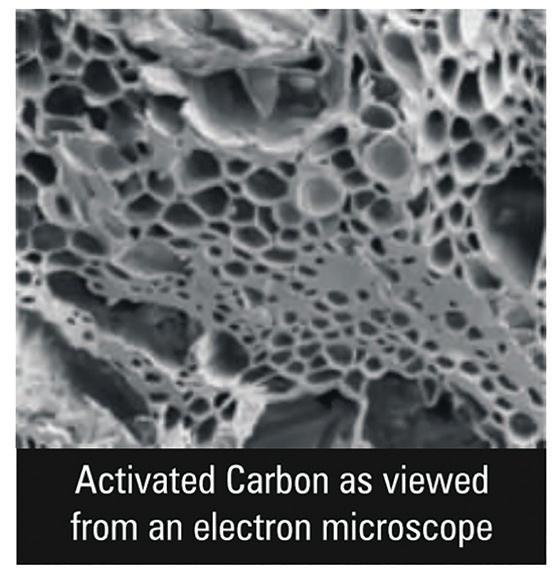

Activated carbon has been utilised as an adsorbent for many years in the refining of edible oils, particularly for the removal of impurities that are not so efficiently dealt with by bleaching earths alone. Activated carbons also impart clarity and enhanced stability in fully refined oil.

The ability to remove a wide range of impurities including pigments, dioxins, pesticides, polycyclic aromatic hydrocarbons (PAHs), polychlorinated biphenyls (PCBs), chlorine, chloride and organo-chlorine molecules makes activated carbon an important processing aid in the refining of edible oils.

While activated carbons are very useful adsorbents of impurities, historically, there have been problems associated with their use. This has been mainly due to the breakdown of the activated carbon particles into fines, the high unit cost of the activated carbons, and high oil retention of the spent activated carbons. High oil retention in the spent carbon results in increased refining costs.

The activated carbons utilised in edible

oil refining are in powdered form and are either added separately or preblended with bleaching earths. Due to the difficulty of cleanly handling 100% activated carbon, it is more convenient for refiners to utilise activated carbons that are pre-blended with bleaching earths.

The above mentioned factors need to be considered when designing activated carbons for use in edible oil refining.

Particle size distribution is an important factor in an activated carbon. Generally, it is a good idea to have an average particle size slightly larger than that of bleaching earths, for example, 29 microns versus about 25 microns for bleaching earths.

The proportion of fine particles below 5 microns should be lower than that for bleaching earths, thus minimising the likelihood of breakdown into sub-micron fines that are problematic with poorly designed activated carbons.

It is important to utilise a low-shear blender when mixing activated carbons

u

Activated carbons are used to remove a wide range of impurities in edible oils including pigments, dioxins, pesticides, PAHs, PCBs, chlorine and chloride and organo-chlorine molecules

with bleaching earths. Pneumatically conveying the activated carbon and its blends with bleaching earths should be carried out in pipework, with no sharp or small radius bends to reduce shearing forces. This is to minimise particle breakdown into fines.

Fines generated from the breakdown of the activated carbon particles at the bleaching stage are mainly due to interparticle attrition from shear at pumps. The fines can break through at the filters, passing through the polishing filters into the deodoriser. They can also break through at the deodoriser polishing filters into the storage tanks, and thereafter carried forward to a certain extent in the fully refined oil.

When it comes to activation levels in activated carbon, it should be noted that higher levels result in greater porosity, resulting in more oil loss in the spent activated carbon and weaker, less durable particles. It is therefore necessary to activate the carbon only to a level where it still retains sufficient mechanical strength to withstand the forces encountered during the bleaching and filtration processes.

These activated carbons will not have the highest possible performance but can be utilised without encountering the problems of fines generation and high oil retention.

The yield of moderately activated carbons is higher than that for highly activated carbons, so the production costs are lower. For this reason, a greater

dosage of activated carbon can be more affordable.

Once the activation level has been matched to the strength/attrition resistance requirements, the next step is to consider the type of carbon-rich base material from which to produce an activated carbon.

Activated carbons can be manufactured from a wide range of carbon-containing materials.

There is an increasing move towards sustainable sources and particular interest in the utilisation of ‘waste’ materials.

The selection of the material from which activated carbon is made from is important in terms of the durability and adsorption properties of the resulting activated carbon.

Some common materials from which activated carbons are made from are coals (bituminous, lignite, anthracite); shells (including coconut, palm kernel and hazelnut shells); woods (such as pine, acacia and eucalyptus); and other materials such as peat, olive stones and bamboo. Waste materials such as sugarcane waste, used tyres, agricultural waste (seeds, shells), plastics (PET), clothes (polyacrylnitrile – PAN), and biomass rich in lignocellulosic materials (such as palm fronds and trunks) can also be utilised for the manufacture of activated carbons for certain edible and non-edible applications.

Kosher and Halal requirements must

always be adhered to when verifying the source of the carbon-rich base material as the activated carbon will be utilised in the processing of edible oils.

Most activated carbons manufactured in China and the USA are coal-based.

The first step in the production of activated carbon is called pyrolysis. It involves heating the carbon-rich base material at about 4500C in the absence of air, to remove most of the volatile components, to form charcoal.

This stage may be followed by a washing step to remove components such as soluble ashes.

The charcoal is then further activated with steam and/or chemicals such as zinc chloride (ZnCl2), sulphuric acid (H2SO4), phosphoric acid (H3PO4), potassium hydroxide (KOH) and hydrochloric acid (HCl) to enhance the porosity and modify the surface of the activated carbon.

Steam activation at about 1,1000C develops the pore structure by removing some of the carbon via the following reaction:

C (s) + H2O (g) = CO (g) + H2 (g)

The carbon monoxide and hydrogen formed are burnt to provide energy for the heating of the carbon and generation of steam:

2CO (g) + O2 (g) = 2CO2 , and 2H2 (g) + O2 (g) = 2H2O (g)

The steaming process takes about one hour and removes some of the carbon, increasing the porosity.

The removal of carbon results in reduced yield of the activated carbon, thus increasing the production costs for the activated carbon.

Chemical activation is carried out at lower temperatures, for a much shorter period, resulting in an increased production rate, lower energy costs and higher yields. These factors help to reduce the production costs.

Steam-activated carbons are preferred for many applications as their surfaces tend to adsorb impurities without otherwise modifying the oil being processed.

Chemically-activated carbons, while still predominantly adsorbents, are more likely to act as catalysts that can modify the oil being processed.

Such modifications of the oil may not be beneficial to the colour and oxidative stability of the oil.

The nutritional benefits of the oil may also be adversely affected by cis- to transisomerisation or a double bond shift.

However, the different nature of the

surfaces in chemically-activated carbons can be advantageous for the adsorption of certain impurities. The structure of the carbon-rich base material can be beneficially retained in some activated carbons, whereas other activated carbons may be less structured or amorphous.

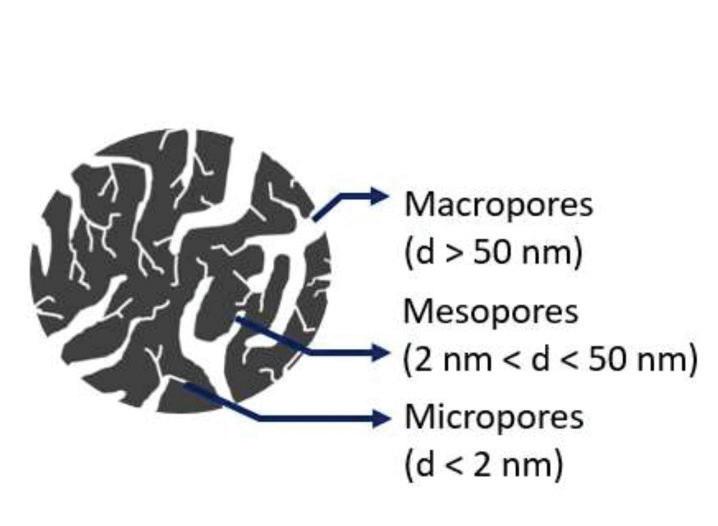

Activated carbons can have a wide range of pore sizes within a single material. These pores are classified into micro-, meso- and macro-pores (see Figure 1, right) and their ranges are shown in the following table (see Table 2, below). It should be noted that there is no poreclassification system that is universally accepted.

The various sizes of pores are beneficial as each type allows preferential adsorption of impurities of a size that fits snuggly into that size of pore. The macropores and mesopores also act as pathways for the impurities to be transported to the micropores. The tenacity at which the impurities are held in the pores depends on the nature of the various sites on the adsorption surface.

Adsorption measurements in activated carbons normally utilise one or more of the following materials: nitrogen, butane, iodine, methylene blue, molasses and tannins (see Table 1, below).

While nitrogen Brunauer-Emmett-Teller (BET) measurements can measure both the surface area and pore size distribution of activated carbons, it should be noted that the surface area as measured in nitrogen BET measurements may not be available for all the impurities to be removed, as it depends on the size, shape and nature of the impurity.

That is why it is useful to consider the adsorption properties using a range of probe molecules of different sizes and shapes.

Molasses have a molecular weight of about 200. Tannins are large molecules with molecular weights from about 500 to over 3,000 and are useful for measuring the larger pores in activated carbons.

The nature of the surface of the activated carbon is also important with respect to the tenacity with which the various impurities are held within the activated

IUPAC (1985)

carbon. This is particularly important during the steaming/blowing stage for the spent adsorbent on the filters, where the impurities could be lost back into the filtered oil if not held strongly within the activated carbon containing filter-cake.

The nature of the surfaces has been designated H- and L-type activated carbons. H-type steam-activated carbons – being hydrophobic – absorb H+ ions from water and are alkaline.

L-types absorb hydroxide (OH) from water and are acidic.

3Å (angstroms) = 0.3nm 4.7Å 4.94Å

17.0 x 7.6 x 3.3Å

There are several types of different adsorption sites possible on activated carbon surfaces including graphitic and oxidised sites.

When selecting activated carbon for a specific application, factors such as the molecular size, shape and type of the particular impurity to be removed are important. This may be difficult when refining an edible oil as there can be a wide range of impurities present, all of which need to be removed. One strategy is to use more than one type of activated carbon blended with the bleaching earth, so that a wide range of impurities can be removed at the bleaching stage.

Activated carbons pre-blended with bleaching earth are now the choice of many for everyday refining, as the blended products remove the widest range of impurities, resulting in fully refined oils of good colour, enhanced stability, and crisp bright appearance. ●

Dr Patrick Howes is technical director of Natural Bleach Sdn Bhd, Malaysia and will be speaking on ‘Designing Bleaching Earths and Activated Carbon’ at OFI International 2024 in Rotterdam on 9-11 September www.ofimagazine.com/ofievents

>20Å >30Å for micropores (BET pore size distribution) for micropores for micropores for large micropores >15Å and mesopores for mesopores above 20Å for larger mesopores and macropores

McDougall 1991

< 2nm (<20Å) 2 to 50nm (20-500Å) > 50nm (> 500Å)

0.8 to 10nm (8-100Å) 10 to 50nm (100-500Å) 50 to 2,000nm (50-20,000Å)

<10nm (<100Å) 10-100nm (100-1,000Å) >100nm (>1,000Å) OFI (TIGG)

Spent bleaching earth oil is a sustainable feedstock for renewable diesel and sustainable aviation fuel but lack of logistics and volumes remain as obstacles to its development

Andreia Nogueira

The number of companies producing spent bleaching earth (SBE) oil as a biofuel feedstock has been increasing, but despite the opportunities that new regulations and technologies offer, logistics, the lack of feedstocks and manufacturing costs remain major challenges.

That utilising spent bleaching earths and clays is a good idea is clear.

Egypt-based Central Metallurgical Research and Development Institute noted in a 2023 paper that while these minerals act as effective adsorbers –removing impurities from vegetable oils and improving their “visual aspect, taste, flavour and consistency” – the waste spent bleaching earth left behind “has been considered one of the main problematic hazardous wastes of the food industry”.

The paper, published by Science Direct, noted that SBE “is typically disposed of in landfill, which is costly, unfriendly to the environment, and represents an inefficient use of a potentially useful and valuable byproduct”.

Dr Patrick Howes, technical director at Malaysia-based bleaching earths manufacturer Natural Bleach Sdn Bhd, tells Oils & Fats International (OFI) that “there are many SBE oil producers globally”, including in several regions of Malaysia.

“It is our customers that generate the SBE that is sent to companies like [Malaysia-based] EcoOils or Gamalux Oils, who extract the oil from the SBE, and then sell the spent bleaching earth oil to biofuels producers and others,” he explains.

“Typically, SBE contains about 2025% oil. After extraction of the oil using chemicals like solvent, the residual oil in the SBE drops to about 1-3%. The extracted oil is then sold for use in a number of applications including biofuels production,” he says.

Waste oil recycling firm EcoOils prides itself on “deploying cutting-edge recycling technology to divert waste away from landfills while simultaneously generating” SBE oil, which can be used as a biofuels feedstock that can then be applied to produce sustainable low carbon fuel, the company website says.

Aware of growing opportunities in this segment, in November 2022, Singaporebased Shell Eastern Petroleum, a whollyowned subsidiary of the multinational oil and gas company Shell, acquired EcoOils.

The acquisition – which included 100% of EcoOils’ Malaysian subsidiaries and 90% of its Indonesian subsidiary – was part of “Shell’s ambition to increase production of sustainable low carbon

fuels for transport, including sustainable aviation fuel,” Shell said in a press release.

Shell said low carbon fuels such as SBE oil will “help to meet growing demand for decarbonisation solutions from customers in the transport sector, including hard-todecarbonise sectors such as aviation.”

Dr Howes notes that “many companies in various countries buy SBE oil”.