18 Breaking records

As the fourth largest oilseed producer in Europe, Poland’s rapeseed output has risen significantly over the past few years. However, the ongoing war in Ukraine has impacted its import and export patterns, along with tight EU environmental rules

Palm Olein

22 Quality assessment

Iodine value and cloud point are the most commonly used parameters to define palm olein quality in industrial processing but it is very challenging to measure cloud point directly

Commodity Trading

26 Prices trend higher

Stagnating global production, rising demand and higher biodiesel mandates are expected to reduce palm oil supplies and raise prices this year

28 Pressure on industry

Russia has plans to expand oilseed production and processing capacities but a serious labour shortage and lack of access to foreign planting material, pesticides and equipment – due to its invasion of Ukraine – is putting pressure on the industry

Margarine & Spreads

30 Future proofing an industry

Margarine and spread producers have taken steps to improve the health profile of their products, as well as sustainably sourcing their raw materials, while stressing the plant-based credentials of the industry

Comment

2 Setback for EU green rules News

4 EU delays deforestation rankings for countries

Biofuel News

10 EU rules on palm-based biofuels ‘discriminatory’

Renewable News

12 Repsol begins production at Cartagena plant

Transport News

14 New terminal at Brazil’s Port of Santos

Biotech News

16 Bayer calls of break-up plans

Diary of Events

17 International events listing Statistics

32 World statistical data

VOL 40 NO 4 MAY 2024

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The EU has been at the forefront in formulating anti-deforestation-related legislation but several recent developments may delay its measures.

On 8 March, the Financial Times (FT) reported that the EU’s plan to classify countries as ‘low’, ‘standard’ or ‘high’ risk under its landmark EU Deforestation Regulation (EUDR) – set to come into force in December – would be delayed (see p4).

The EUDR applies to palm oil, soyabeans, cattle, wood, cocoa, coffee and rubber, with firms wanting to sell these commodities or their products in the EU having to prove that they do not come from land where forest has been destroyed or degraded since 31 December 2020.

The plan to rank a country’s risk, with low-risk nations subject to simplified checks, has been put off, three EU officials told the FT. “We will simply not classify which means everywhere will be medium risk – we need more time to get the system in place,” said one official. “[The delay] means no country will have an advantage over another.”

Several governments in Asia, Africa and Latin America have been particularly concerned that the EUDR was passed in June last year without clear guidance on how to comply with its geolocation data requirements, the report said. In a further effort to placate developing countries, officials also confirmed that Brussels would take a regional rather than a national approach, so that the southern plains of major soyabean-producing Brazil would eventually be classified as lower risk than the Amazon region, where vast tracts of rainforest have been cleared, the FT wrote.

Malaysia’s trade minister Zafrul Aziz said his country and others needed time and assistance to implement the EUDR’s costly transparency and disclosure requirements.

And in another development which Malaysia has hailed as a victory against discrimination, the World Trade Organization (WTO) issued a ruling on 5 March on the EU’s measures to limit the use of palm oil as a biofuel under its Renewable Energy Directive (RED II) (see p10). Malaysia launched complaints against the EU and France in 2021, arguing that the bloc had violated international trade rules when it decided to cap and phase out palm oilbased biofuels under its 2019 Delegated Act.

In its ruling, the WTO said that although it was valid for the EU to establish rules against crop-based fuels like palm oil due to the deforestation and emissions risks of indirect land use change (ILUC), there were deficiencies in the design and implementation of the low ILUC-risk criteria that constituted “arbitrary or unjustifiable discrimination” against Malaysia. The panel ruled that the EU’s use of data gathered between 2008-2016 to assess the ILUC risk of palm oil was potentially outdated. It also pointed to the EU’s use of a 10-year limit to determine which crops can be certified as having low ILUC-risk, which makes sense for annual crops like soyabean, rapeseed and sunflowerseed; but not for oil palm trees that have a 25-30 year lifespan and only begin to fruit after seven to eight years.

The EU’s Directorate-General for Trade says the bloc “intends to take the necessary steps to adjust the Delegated Act”, which defines the criteria for high-risk ILUC biofuels [currently only palm oil], capping them at 2019 levels until 2023 and phasing them out by 2030.

These developments highlight the fact that while the passing of regulations is an important first step in addressing deforestation and sustainability, the devil is in the detail. And to provide the latest updates on these regulations and their implementation, as well as the many other issues facing our industry, OFI will be holding a major show in Rotterdam from 9-11 September, incorporating the 3rd Sustainable Vegetable Oil Conference organised by the Council of Palm Oil Producing Countries (CPOPC), a Technical Commercial Conference, and a Trade Outlook & Logistics conference. We hope to see many of you there!

Serena Lim, serenalim@quartzltd.com www.ofimagazine.com/ofievent

Glycerine Distillation & Refining

IIG/Enzymatic Biodiesel & Methylester Fractionation

CMB Worldwide

Oil Refining & Fat Modification

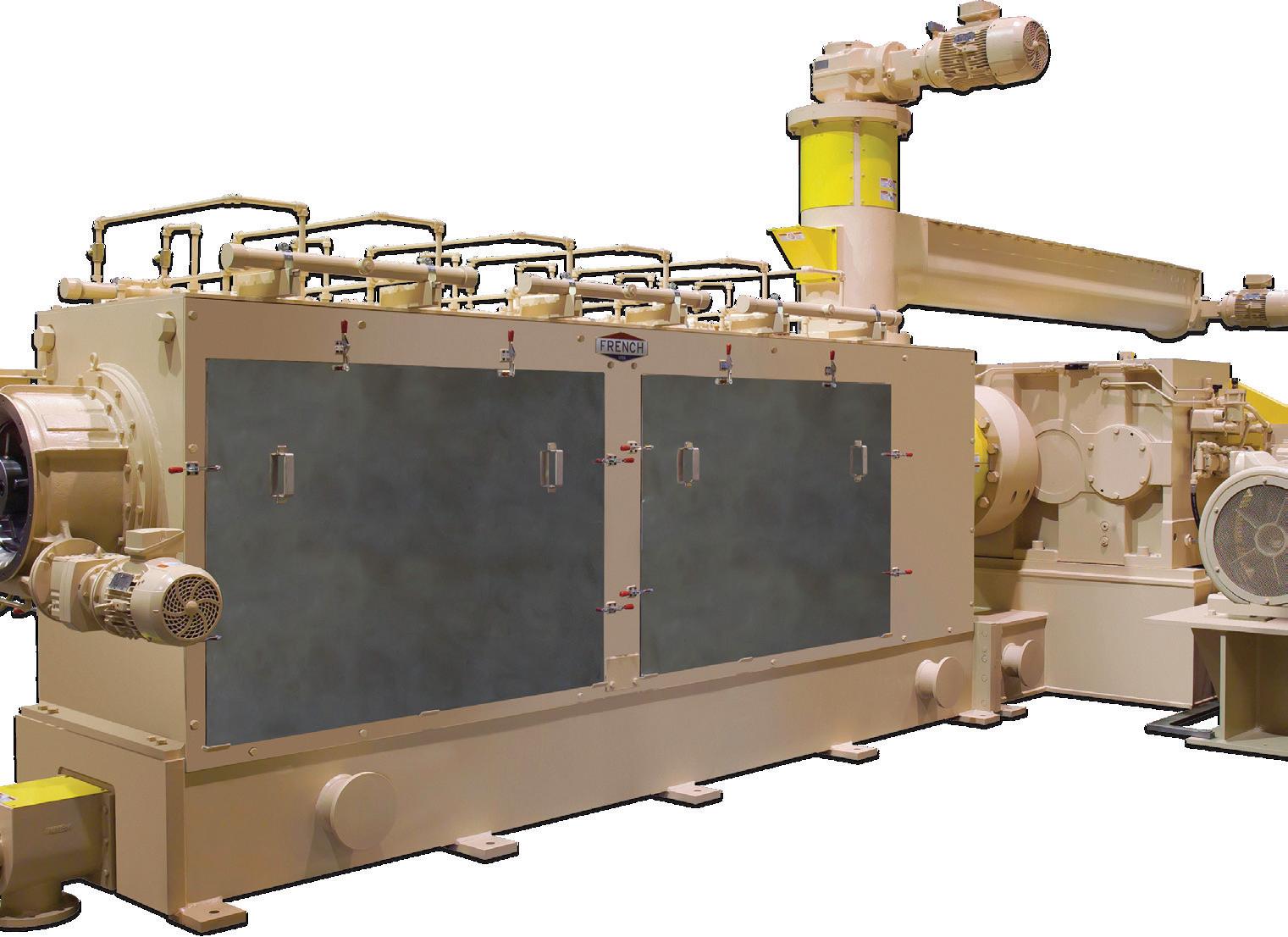

Oilseed Preparation & Solvent Extraction

In-house workshop

CMB S.p.A. Via Appia Km 55,900 – 04012 Cisterna di Latina (LT), Italy

CMB MALAYSIA ENGINEERING FOR OILS AND FATS SDN. BHD. D-23A-03, Menara Suezcap Tower 1 KL Gateway, Jalan Kerinchi 59200 Kuala Lumpur W.P. Kuala Lumpur Malaysia

CMB INDIA ENGINEERING FOR OILS AND FATS Pvt. Ltd. 501, A Pinnacle Corporate Park 5th Floor, Near Trade mark Center, BKC Bandra East, Mumbai, Mumbai City, Maharashtra, India

WORLD: Global sunflowerseed production is expected to total 58.5M tonnes in 2024/25, according to forecasts by the International Grains Council (IGC).

The increase in production volume was due to anticipated higher yields despite an approximate 2% reduction in planted area, a 22 March report by Germany’s Union for the Promotion of Oil and Protein Plants said.

According to the IGC, the expected area decline is due to good global sunflowerseed supply and low prices.

Sunflowerseed production in the EU27 was expected to total 10.5M tonnes, a slight rise on the 10.2M tonnes produced in 2023/24.

The IGC forecast a production volume of 17.4M tonnes for world's largest supplier Russia, 200,000 tonnes lower than the current season. For Ukraine, the forecast was 16.2M tonnes, a drop of some 300,000 tonnes.

No significant changes in production were expected in China while larger harvests are expected for Argentina, Brazil, Bulgaria and Romania, according to the IGC.

The EU has proposed delaying its country classification system to police deforestation-prone commodities, following claims by several developing nations that the rules would be burdensome, unfair and put off investors, the Financial Times (FT) reported on 8 March.

Brussels would hold off classifying countries into low, standard or high risk – a system which had been due to be introduced by December under its EU Deforestation Regulation (EUDR). Instead, every country would be designated as standard risk to give them more

time to adapt to the regulation, three EU officials told the FT.

The EUDR applies to palm oil, soyabeans, cattle, wood, cocoa, coffee and rubber and their products, with firms selling them in the EU having to prove – with geolocation data – that they do not come from land where forest has been destroyed or degraded since 31 December 2020.

The level of checks on imports would depend on the area of origin’s classification, with EU customs authorities expected to carry out checks on 3% of goods from medi-

um-risk nations and 9% from high-risk countries.

Developing countries were concerned that the EUDR was passed in June last year without clear guidance on how to comply, the FT report said.

Major palm oil producing countries Indonesia and Malaysia sent a letter to the European Commission in September raising their concerns, saying: “The legislation disregards local circumstances and capabilities, national legislation and certification mechanisms of developing producer countries."

Companies had said they could pull out of 'high-risk' areas, while several had started to favour supply deals with bigger producers that could afford to deploy sophisticated geolocation technology, the FT wrote.

Officials also confirmed that Brussels would take a regional rather than a national approach, meaning, for example, that Brazil's southern plains would eventually be classified as lower risk than the Amazon region, where rainforest had been cleared, the report said.

Global agribusiness giant Louis Dreyfus Company (LDC) reported a US$60M loss in 2023 following the divestment of its Russian business but has said it would be maintaining its presence in Ukraine.

Since stopping grain exports from Russia on 3 April 2023, the company had started to sell its business and assets in the country “on terms that satisfy the requirements of the Russian authorities,” LDC said on 21 March when announcing its 2023 financial results.

Meanwhile, LDC has maintained its presence in Ukraine, with the company saying it had “no intention” of discontinuing its business in the country for the foreseeable future. LDC holds total assets of US$211M and total liabilities of

US$126M in Ukraine.

LDC's earnings before interest, taxes, depreciation and amortisation fell from US$2.347bn in 2022 to US$2.222bn in 2023. The company’s net sales dropped by 15.5% in 2023 to US$50.6bn from US$59.9bn the previous year due to declining global commodity prices.

“Market volatility decreased in 2023, compared with 2022, as logistical bottlenecks eased, while the ongoing Russia-Ukraine crisis, export quotas in India, the devaluation of the Argentine peso, and concerns about the slowdown in global growth and uncertain crop size prospects continued to cause disruptions,” the 2023 financial report said.

The Value Chain segment, which in-

cludes the Grain & Oilseeds platform, saw operating results of US$1.91M, up from US$1.817M in 2022. Segment net sales fell 11.4% year-on-year mainly due to the lower price environment throughout the period for grain and oilseeds, LDC said.

Processing activities had significantly contributed to the platform’s performance, with strong crush margins –particularly in North America, and large crop yields in Brazil, LDC said. As part of its plan to strengthen its core merchandising activities, LDC said it had increased its grains and oilseeds processing capacity in China, started work to expand its canola processing complex in China and had announced the construction of a new soyabean processing plant in Ohio, USA.

Maximize high-quality yield and minimize process costs with Crown.

Achieve a high-quality, solvent-free, end product — regardless of input — when you partner with Crown. As a leader in oilseed extraction for 70 years, Crown provides the technical expertise, guidance and proven technologies to improve current processes and develop new products. Crown’s Global Innovation Center and state-of-the-art pilot plant meet your needs with a full range of drying and desolventization equipment, including continuous vacuum drying and energy-ef cient vertical drying. With Crown, you can test evaporation of water and solvent-wet products in a con dential, real-world environment and identify the best options to maximize product quality and yield, more sustainably and cost-effectively. Master drying and desolventization — choose Crown for superior innovation, equipment and aftermarket support.

The European Commission (EC) has proposed increasing tariffs on Russian and Belarus imports of cereals, oilseeds and grain products into the EU in a bid to placate farmers and prevent market destabilisation, AgriCensus reported on 22 March.

Depending on the product, the tariffs would increase to either €95 (US$102.66)/ tonne or to an ad valorem duty of 50%.

In addition, Russia and Belarus would no longer have access to any of the EU’s World Trade Organization quotas on grain and oilseeds offering better tariff treatment

CHINA: Chinese soyabean imports from Brazil in the first two months of 2024 surged by over 200% compared to the previous year to 6.96M tonnes, according to figures from the country’s General Administration of Customs (GACC) reported by AgriCensus on 20 March.

Brazilian imports comprised 53.4% of the 13.04M tonnes imported by China in the January-February period. US imports fell by 49.6% to 4.96M tonnes, with the US import share falling to 38.03% compared to 68.2% the previous year.

The figures contrast with 2023's January-February volumes, when Brazilian imports comprised 15.5% of China’s soyabean imports at 2.24M tonnes and the USA was the top soyabean supplier at 9.84M tonnes of the total 14.4M tonnes imported.

China was also expected to import more soyabeans from South America in the months following the report when the soyabean harvest would take place in Argentina and Brazil, with the China National Grain and Oil Information Centre estimating soyabean imports for March at 6.5M tonnes and averaging 10M tonnes/ month from April-June.

for some products.

“We propose the imposition of tariffs on these Russian imports to mitigate the growing risk to our markets and our farmers,” EC president Ursula Von der Leyen was quoted as saying.

The tariffs are also aimed at preventing the export of illegally acquired grain and oilseed produced in Ukrainian territories from being sold in the EU, AgriCensus wrote.

The proposal would continue to allow Russian grains’ transit through the EU, storage in EU customs warehouses, trans-

portation on EU vessels, and the provision of insurance and financing services for the trading of Russian grain, the report said.

Russia exported 4.2M tonnes of cereals, oilseeds and derived products – worth €1.3bn (US$14bn) – to the EU in 2023, according to the EC.

Further data from the EC showed that Russia was the second largest supplier of sunflower meal to the EU this marketing year after Ukraine, while Russia’s share of total supply of sunflower meal to the EU ranged from 21.5%-38%.

Consumer goods giant Unilever is splitting off its ice cream business unit and cutting jobs as part of an extensive three-year cost-saving plan, the BBC reported on 19 March.

The manufacturer of ice cream products including the Wall’s, Ben & Jerry’s and Magnum brands, said the plan would involve the loss of 7,500 jobs worldwide and see the ice cream

division become a stand-alone business unit.

“Ice cream has a very different operating model … and the board has decided that the separation of the unit best serves the future growth of both the unit and Unilever,” the company said on 19 March.

“The ice cream unit has distinct characteristics compared with Unilever’s other operating businesses. These include a supply chain and point of sale that supports frozen goods, a different channel landscape, more seasonality and greater capital intensity.”

Unilever said the move would help it to “do fewer things better”.

A demerger of the unit was the most likely separation route, the company said. The spin off, which was expected to start immediately, was scheduled for completion by the end of 2025.

After the separation, Unilever would have four divisions – beauty and wellbeing, personal care, home care and nutrition.

Unilever’s other brands include Marmite spread, Hellmann’s mayonnaise and Dove soap.

Palestinians are using firewood from their family olive groves for cooking and heating as fuel runs out in Gaza due to the ongoing conflict there, Olive Oil Times wrote on 14 March.

Health officials in Gaza estimate that at least 30,000 Palestinians have been killed since Israel’s invasion, which came in response to an attack on 7 October when militants from Hamas, and other groups killed 1,143 Israelis.

The start of the war coincided with the beginning of the olive harvest, the report said.

“Instead of [harvesting] olives, we are cutting any tree we can find to survive,” Shahd al-Modallal, a resident of Rafah in southern Gaza, told The Guardian newspaper.

Olives are a major agricultural crop in Palestine with nearly half of the cultivated land in the West Bank and Gaza – an area of almost 41,900 ha – planted with more than 10M olive trees, mostly local, drought-resistant cultivars such as the Souri and Nabali. Around 100,000 families in Palestine are estimated to rely on olive trees for their livelihoods, according to the Olive Oil Times report.

Before the Israeli invasion, the International Olive Council had estimated that Palestine would produce 12,000 tonnes of olive oil, Olive Oil Times wrote. Palestine, including the West Bank and Gaza, produced 23,000 tonnes of olive oil in the 2022/23 crop year, according to the council.

A US$190M merger between Australian Oilseed Investments (AOI) and US company EDOC Acquisitions Corporation would create an Asian oilseed giant, Grain Central reported on 8 March.

The merger was expected to lead to investment in AOI’s Central Queensland crushing plant, which would quadruple the company’s total Australian crushing capacity to 160,000 tonnes/year.

Following the merger, EOC would merge with AOI to form a subsidiary under the new Australian Oilseeds Holdings (AOH) entity, which was expected to become the

Global agribusiness giant Cargill and leading Australian grain cooperative CBH Group have announced plans to work together on a large-scale oilseed crushing plant south of Perth, the Australian Financial Review wrote on 28 March.

Cargill had been in talks with the West Australian government about securing a site next to CBH’s Kwinana grain terminal. The new plant could supply feedstock to a biofuel production hub proposed by global energy giant BP at its former oil import terminal at Kwinana, the report said.

Cargill Australia managing director Zsolt Kocza said the plant would add capacity to process Western Australian canola to oil and meal, as well as supply the emerging biofuel market in Australia and internationally.

Farmers in Western Australia produced about 2.5M tonnes of canola in the last harvest, down from 4.3M tonnes in 2022/23.

Last year, Cargill invested US$50M in upgrading and expanding its Newcastle, Narrabri and Footscray oilseed crushing facilities in Australia, the report said.

The CBH Group is Australia's largest co-operative, with operations in storage and handling; marketing and trading; and fertiliser. It has a network of more than 100 grain receival sites across western Australia, four export port terminals and its own rail fleet to tranfer grain and oilseeds to port terminals.

largest cold-pressed oil and meal producer in the Asia Pacific region, Grain Central wrote.

AOI currently produces cold pressed organic food-grade oils and vegetable protein meals from canola, linseed, olive, safflower, soyabean, sunflower and soyabean crops. Although its key investment is the Cootamundra Oilseeds crushing facility in southern New South Wales, the company also owns a sales and marketing arm, Good Earth Oils, which distributes and promotes cold-pressed canola oil produced at Cootamundra.

Under AOH, the company would push forward plans to construct a multi-oilseed crushing plant near Emerald at an estimated cost of A$25M (US$16.49M), the report said.

“The facility will produce edible oil feedstocks to meet the growing Asia-Pacific market and biodiesel feedstock to fuel the renewable energy revolution,” AOI said.

Construction was expected to be completed by March 2025. The facility would have a total oilseed crushing capacity of 200 tonnes/day along with capabilities to bleach and deodorise 50 tonnes/day of oil.

MALAYSIA: Futures and options exchange Bursa Malaysia Derivatives Berhad announced on 18 March that it is now trading soyabean oil futures.

Bursa Malaysia Derivatives said its Dalian Commodity Exchange (DCE) Soybean Oil Futures (FSOY) contract marked the first non-palm-based edible oil futures contract to be listed on the exchange.

“We are pleased to be the first exchange outside of China to be granted licence to DCE futures settlement prices into our product offering,” said Muhamad Umar Swift, chairman of Bursa Malaysia Derivatives. The two firms announced the licensing of DCE's soyabean oil futures settlement price in November last year.

FSOY is a US dollar (US$)-denominated cash-settled contract, with the final settlement price calculated based on the DCE Soyabean Oil Futures Contract’s one-off delivery settlement price on DCE’s 10th trading day of the delivery month. The price is then adjusted for conversion from Renminbi (CNY) into US$ and rounded to the nearest US$0.25.

The contract is available for trading from Monday to Friday, 9am to 6pm; and Monday to Thursday, 9pm to 11:30pm (Malaysia Time).

Glencore-backed grain handling business Viterra reported record annual sales volumes of 127M tonnes in 2023 ahead of its merger with leading US agribusiness Bunge, World Grain reported.

The company recorded a revenue of US$54.67bn, earnings before income tax, depreciation and amortisation (EBITDA) of US$2.147bn and net income of US$453M in 2023, the 3 March report said.

Vittera’s pending merger with Bunge Global SA to create an approximately US$34bn agricultural trading giant was expected to be completed later this year, World Grain wrote.

Viterra said its total sales volume growth was due to the successful integration of Gavilon

following its acquisition in October 2022 and growth in origination volumes in Argentina, Brazil and Europe. The company’s marketing volumes in 2023 included 75.9M tonnes of grain – up 17% from the previous year – while oilseeds jumped 40% to 47.8M tonnes. Oilseeds revenue totalled US$25.93bn last year.

In October, Viterra sold all its Russian businesses for a combined total of US$82M, resulting in a gain of US$3M. The disposals included the wholly-owned subsidiaries MZK Export LLC, Rostovsky KHP LLC and Antex+ LLC, sold for a total of US$42M cash, and a 50% equity interest in a joint venture, Taman Grain Terminal Holdings, sold for US$40M cash.

Dutch algal oil supplier Veramaris has been authorised to provide its products to the Canadian aquafeed industry as an alternative to fish oils.

The company said the authorisation – the first in

Canada – would allow it to provide the Canadian salmon industry with eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) certified by the Aquaculture Stewardship Council and Marine Steward-

ship Council. Canada was the world’s fourth largest producer of salmonids, including farmed Atlantic salmon, Veramaris said on 11 March, adding that its algal oil supported the industry’s move towards adopting alternative omega-3 sources and reducing dependency on fish oil as a primary source of essential fatty acids for salmon feed.

Veramaris is a joint venture between global science and speciality chemicals firms DSM and Evonik.

Its algal oil – produced in Nebraska, USA – is made from corn sugar and marine algae in a fermentation process which converts dextrose into omega-3 fatty acids.

Agro-food enterprise Invictus Investment reported on 1 April that it had acquired a 60% stake in Moroccan agribusiness Graderco from Morocco's Zalar Holding.

Invictus said the move was part of its long-term strategy to expand into key African markets and was its first major stake in local warehousing and distribution capabilities in Morocco.

The company is active in the Middle East, Africa and Asia (MENA) and its portfolio

includes grains, oilseeds, edible oils, animal feed, pulses, gum arabic and meat.

“Graderco’s diverse product portfolio, robust sourcing network, and extensive in-country warehousing and distribution capabilities will generate significant synergies with our global trading operations,” Invictus CEO Amir Daoud Abdellatif said.

The partnership would enable Graderco to expand its product range and capitalise on its long history as a grain importer

operating out of four Moroccan ports and six terminals distributed across the country, Zalar Holding CEO Driss Chaouni added.

Graderco imports, stores and trades 2.5M-3M tonnes/year of grain and derivatives for human and animal nutrition, comprising over 25% of the country’s imports.

Invictus said its focus was now on exploring further acquisitions with the aim of becoming a vertically integrated agro-food leader in the MENA and Asia.

USA: Leading US energy firm Chevron and global agribusiness giant Bunge have finalised their Bunge Chevron Ag Renewables joint venture and started work on a new oilseed processing plant next to their existing processing facility on the Gulf Coast in Destrehan, Los Angeles, Bunge said on 4 March.

The plant would be able to process soyabeans as well as soft seeds, including novel winter oilseed crops, such as winter canola and CoverCress.

Expected to become operational in 2026, the processing facility would help Bunge Chevron Ag Renewables meet increased demand for renewable fuel feedstocks and would also produce meal products, Bunge said. Bunge would operate the joint venture’s processing plants in Destrehan and Cairo, Illinois, and Chevron has purchase rights for the oil to be used as a feedstock to manufacture fuels with lower life cycle carbon intensity.

Bunge Chevron Ag Renewables’ focus is on developing renewable fuel feedstocks by combining Bunge’s expertise in oilseed processing and Chevron’s expertise in renewable fuels production and marketing.

The World Trade Organization (WTO) has ruled that there were deficiencies in the design and implementation of the EU’s indirect land use change (ILUC)-risk criteria on palm-based biofuels.

The panel ruling, published on 5 March, follows a 2021 challenge by Malaysia which claimed that the EU had violated international trade rules when it decided to cap and phase out palm-based biofuels under its 2019 Delegated Act to the Renewable Energy Directive (RED) II.

The WTO said that although it was valid for the EU to establish rules against crop-based fuels like palm oil due to ILUC risks, there were deficiencies in the design and implementation of its low ILUCrisk criteria that constituted “arbitrary or unjustifiable discrimination” against Malaysia, Eco-Business wrote on 12 March.

The panel ruled that the EU’s use of data collected between 2008-2016 to assess the ILUC risk of palm oil was potentially outdated. It also pointed to the EU’s use of a 10-year limit to determine which crops could be certified as having low ILUC-risk, which made sense for annual crops like soyabean and rapeseed but not for oil palm trees that had a 25-30 year lifespan and only began to fruit after seven to eight years, Eco-Business said.

A European Commission Directorate-General for Trade article said on 5 March that the EU intended to take the necessary steps to adjust the Delegated Act. The ruling should be adopted by the WTO Dispute Settlement Body within 60 days unless the EU appealed, and would become binding between Malaysia and the EU.

The Singapore government has launched a plan to decarbonise the country’s aviation sector, with flights departing Singapore required to be fuelled with sustainable aviation fuel (SAF) starting in 2026, SAF magazine reports.

Under the Singapore Sustainable Air Hub Blueprint launched on 19 February, the Civil Aviation Authority of Singapore (CAAS) would work with aviation stakeholders to reduce domestic aviation emissions from airport operations by 20% by 2030 when compared to a 2019 baseline, SAF magazine wrote on 28 February. The programme’s aim was to achieve net-zero domestic and international emissions by 2050.

Scheduled to be phased in starting at 1% in 2026, the SAF volume would be increased to 3%-5% in 2030, subject to global developments and the wider availability and adoption of SAF. In addition, CAAS would also introduce a levy to purchase SAF, with passengers in premium classes paying higher levies.

British multinational oil and gas company bp is planning to restructure its Gelsenkirchen site in Germany to produce lower-emission fuels including sustainable aviation fuel (SAF).

Following a gradual conversion, the site would be fully adapted by the end of the decade, bp said on 6 March.

bp operates two plants in Horst and Scholven in Gelsenkirchen as an integrated refinery and petrochemical site. The plants produce some 12M tonnes/year of crude oil. In addition to petrol, diesel, jet fuel and

heating oil, the site produces more than 50 different products, primarily for the chemical industry.

“Our refinery location in Gelsenkirchen is currently not competitive. We are too complex and – not only because of this –burdened with structural costs that are too high,” Arno Appel, head of the refinery in Gelsenkirchen, said. “We want to give the Gelsenkirchen location a perspective and greater potential for its contributions to the energy transition.”

To prepare the refineries for the transi-

tion, bp said it needed to reduce the site’s complexity and shut down parts of the plant which would need to be used less in the future. As a first step, the five systems in the Horst and Scholven plants would be decommissioned from 2025, bp said.

This could lead to a controlled reduction in the site’s total production capacity to approximately 8M tonnes/year.

In addition, bp said it planned to produce lower-emission fuels – including SAF – using co-processing in the hydrocracker plant at the Gelsenkirchen-Scholven site.

Photo: Adobe Stock

Spanish multi-energy company Repsol has started large-scale production of renewable fuels in Cartagena.

The US$272M plant on the Iberian Peninsula would produce 250,000 tonnes/ year of renewable diesel and sustainable aviation fuel (SAF) from 300,000 tonnes of waste, including used cooking oil (UCO), the company said on 3 April.

The new plant would be followed by a second facility in Puertollano in 2025, where an investment of US$130M would

USA: A research team at the University of California San Diego and materials science company Algenesis have proven that their algae-based polymer is completely biodegradable.

The results were published in a Nature Scientific Reports paper on 12 March.

To test the product’s biodegradability, the team ground it into fine microparticles and conducted tests to check that, when placed in a compost, the material was being digested by microbes, the UC San Diego website said on 21 March.

In a water flotation test, the team found that after 90-200 days, almost 100% of petroleum-based microplastics were recovered while after 200 days, only 3% of the algae-based microplastics were recovered.

Algenesis has partnered with several companies to make products using the algae-based polymers including Trelleborg for use in coated fabrics and RhinoShield for use in the production of mobile phone cases.

“This is the first time we’ve measured [our material – first created six years ago] – at the microparticle level,” said Robert Pomeroy, a professor of chemistry and biochemistry and an Algenesis co-founder.

convert a unit to produce 240,000 tonnes of renewable fuel. Repsol also planned to build a similar facility at a third industrial centre in Spain before 2030.

Repsol had also teamed up with global agribusiness giant Bunge to develop lower carbon intensity feedstocks in Spain. As part of the deal, Repsol would acquire 40% of three industrial facilities that were part of Bunge Iberica – one of Bunge’s subsidiaries in the Iberian Peninsula – for US$300M and up to US$40M in contin-

gent payments, the companies said on 26 March. Bunge would continue to operate its three oils and biofuel plants in Bilbao, Barcelona and Cartagena, all close to Repsol’s industrial complexes in the same regions.

Repsol said it expected to increase its renewable fuel output by up to 55% from 1.1M tonnes/year to 1.7M tonnes/year in 2027. It also aimed to increase the number of 100% renewable fuel pumps at its service stations from 120 currently to 600 by the end of the year and 1,900 by 2027.

A research team in the USA has developed a lipid-based lung surfactant to help premature babies with respiratory distress breathe while their lung cells finish developing.

The synthetically-produced formulation could provide a cheaper and more widely available alternative to Infasurf, an animal-derived medication

used to prevent and treat respiratory distress in premature babies, according to scientists quoted in the 25 March Respiratory Therapy report.

The new surfactant could also be used to treat adults with lung injuries as a result of diseases such as chronic obstructive pulmonary disorder, miner’s lung or emphysema.

It could potentially have a longer shelf life, lower production costs, have less batch variability, and pose less risk of an immune response compared to animal-derived lung surfactants, said lead researcher Suzanne Farver Lukjan, a chemistry lecturer at Alabama’s Troy University.

The research team created candidate surfactants from synthetic lipids (fats) and peptides (short chains of amino acids) and then tested their surface-tension-lowering capabilities.

As a next step, the research team said it planned to continue to refine and test the formulation to improve the combination of lipids and peptides. The surfactant would also need to undergo safety testing before it was available for clinical use.

US biomass refining specialist New Energy Blue has formed a new subsidiary, New Energy Chemicals, to produce bio-ethylene for sustainable aviation fuel (SAF) and renewable plastics, World Bio Market Insights reported on 22 March.

After initially producing bio-ethylene for the renewable plastics sector, the new subsidiary would expand operations at its Texas facility to produce SAF in an ethanol-to-ethylene process.

“Our new end-to-end alternative to Brazilian ethanol for making SAF … will begin in the American Midwest by refining agricultural waste,” New Energy Blue president Albury Fleitas said.

The New Energy Freedom biomass refinery in

Mason City, Iowa, is scheduled to begin converting corn stalks into 60.56M-75.70M litres/ year of cellulosic ethanol and 120,000 tonnes/ year of lignin in late 2025. Once converted into bio-ethylene at the company’s facility in Texas, the product would be transported via pipeline to US material science company Dow’s US Gulf Coast operations for use in renewable plastics production, the report said.

Dow’s use of bio-based feedstocks from New Energy Blue was expected to be certified by ISCC Plus, an international sustainability certification programme, World Bio Market Insights wrote.

Brazil’s larget private freight railway operator Rumo has signed an agreement with global supply chain logistics company DP World to build a new port terminal for grains, oilseeds and fertiliser at the Port of Santos in the south of the country, Globe Newswire reported on 26 March.

Brazil produces more than 155M tonnes/ year of soyabeans and is the world’s largest exporter of the oilseed. The Port of Santos currently handles around 30% of the country’s total soyabean exports, followed by the ports of Paranaguá and Rio Grande.

The new terminal would increase Santos’ handling capacity by up to 12.5M tonnes/ year, comprising 9M tonnes of grains and

HONG KONG: Global transport company COSCO Shipping Lines has completed a pilot in Hong Kong using blockchain technology for not-for-profit consortium Global Shipping Business Network (GSBN) to issue traceable green certificates for biofuel use.

GSBN’s blockchain network links Proof of Sustainability (PoS) certificates, which document biofuel purchases by the carrier, and Green Certificates issued to corporations.

“The completion of this pilot is a positive step towards ensuring that green claims are traceable and verifiable,” GSBN Bertrand Chen said on 2 April.

GSBN’s network includes shipping lines, terminals, banks and other consortia.

3.5M tonnes of fertilisers, the report said. It would be built at DP World’s private use terminal on the port’s left bank and was expected to take 30 months to construct.

Rumo, a subsidiary of Cosan, had committed an estimated US$500M (BRL$2.5bn) towards the project, Globe Newswire wrote.

“Combined with the State Railway of Mato Grosso, which we are building to expand rail reach in the Midwest, the new terminal reinforces the prominence of the Port of Santos as the main logistics corridor for agriculture,” Rumo CEO Pedro Palma said.

As part of the initiative, DP World would oversee port operations, including cargo

movement, the report said.

The agreement between the two companies would be in place for an initial operating period of 30 years, with an option for extension subject to DP World approval.

Rumo provides transportation for agricultural commodities, fuels, fertilisers, corn, wheat, rice, soyabeans, sugar and industrialised products. It manages approximately 14,000km of railways in the states of Paraná, Santa Catarina, Rio Grande do Sul, São Paulo, Mato Grosso do Sul, Mato Grosso, Minas Gerais, Goiás, and Tocantins. The company operates nine trans-shipment terminals and six port terminals in the main Brazilian ports.

Transport on the Mississippi River could be problematic this year following an unusually warm and dry winter which could lead to drought conditions in key areas of the Mississippi River Basin over the coming months, FreightWaves wrote on 29 March.

“Of growing concern will be the potentially

low flows on the Mississippi River this summer into autumn due to well-below [average] snowpack and precipitation in most of the Northern Plains and Midwest,” National Oceanic and Atmospheric Administration (NOAA) National Water Center director Ed Clark said in a 21 March NOAA report.

“This could have potential impacts on those navigation and commercial interests that depend on water from the Mississippi River.”

The Mississippi is vital for US barge shipping including for soyabeans, with more than 60% of the crop transported along the river.

According to estimates by the US Department of Agriculture, a 9% year-on-year increase in US soyabean exports is expected this year although this would be 12% below the average of the previous three years.

If the NOAA’s forecast was accurate, it would be the third consecutive year in which the Mississippi was at risk of bottlenecks, FreightWaves wrote. The river was impacted by extreme drought in 2022, followed by further drought conditions last year which brought water levels to historic lows.

The US Renewable Fuels Association (RFA) has filed a petition in support of a legal challenge brought by European ethanol producers against the EU FuelEU Maritime Regulation, set to take effect in 2025.

The association said the regulation effectively banned the use of renewable, cropbased marine fuels as a tool for decarbonising the maritime sector by arbitrarily

assuming crop-based biofuels like ethanol had the same lifecycle carbon emissions as fossil-based marine fuels.

RFA CEO Geoff Cooper said in a statement on 29 March that the regulation would impact biofuel trade opportunities with European partners. It would also hold back US producers from selling low-carbon fuels to maritime shippers in the USA as

the regulation applied to ships arriving at EU ports, affecting the fuel choices made by EU-bound ship operators when they refuelled outside the EU.

The RFA petition, filed on 29 March, supports a challenge by EU ethanol association ePURE and Pannonia Bio to annul relevant provisions of the FuelEU Maritime Regulation, adopted by the EU in 2023.

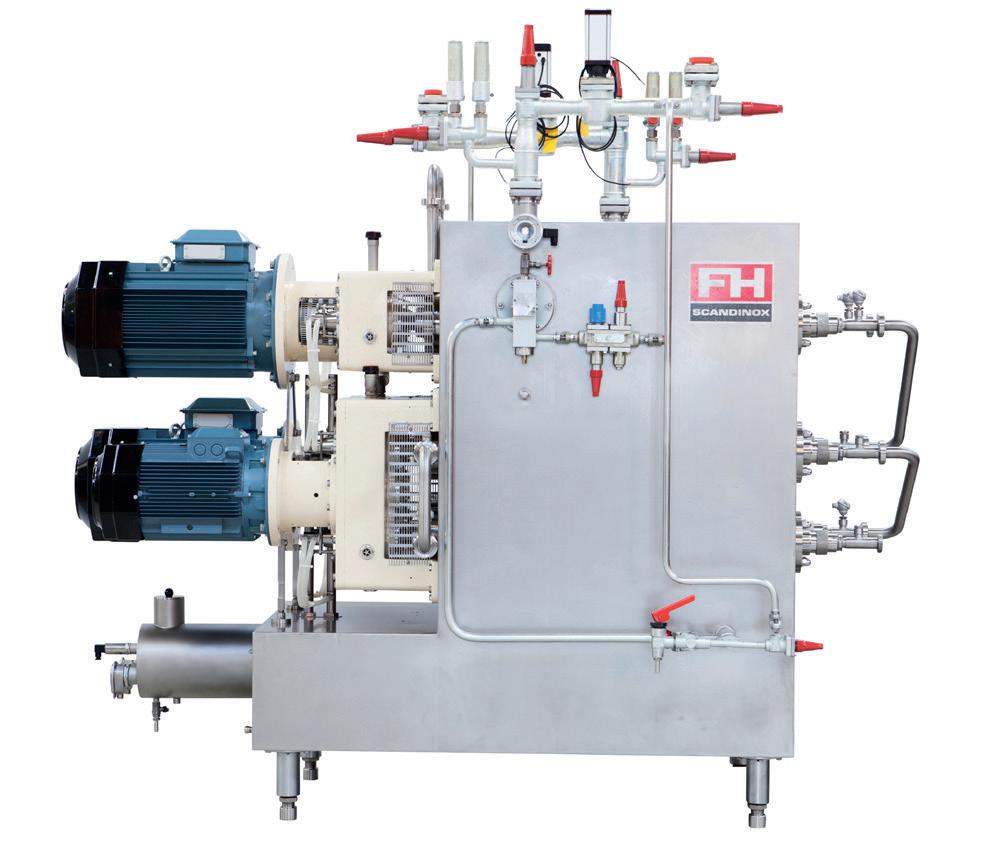

CAPACITY RANGE:

600 KG/H – 1200 KG/H – 1500 KG/H

2000 KG/H – 3000 KG/H – 3600 KG/H

4500 KG/H – 6000 KG/H - 9000 KG/H

FOR PRODUCING A WIDE RANGE OF HIGH-QUALITY MARGARINE PRODUCTS SUCH AS:

• Table margarine

• Industrial margarine

• Puff Pastry

• Shortening

• Low fat spreads

• Recombined butter

The equipment will be sold as a mix of new- and second-hand, fully overhauled, and carefully tested before shipment. Mechanically warrantee is granted. Ex works factory in Denmark.

INSPECTION & SALE CONTACT:

Torben From FH SCANDINOX A/S - DENMARK

Phone head office: +45 7534 3434

Mobile phone/WattsApp: +45 4055 5359

E-mail: TFR@fhscandinox.com www.fhscandinox.com

THE PROCESSING PLANTS CONSIST OF THE FOLLOWING MAIN EQUIPMENT:

• Oil in-take system

• Emulsifier preparation

• Water Phase preparation

• Emulsion pre-mix and buffer

• Pasteurisation

• Crystallisation (Gerstenberg & Agger)

Incl. HP pump and pinmixers

• Resting tube

• Continuously rework

• CIP plant (in case needed)

• Hot water system

• SCADA automation system

German chemical giant Bayer has called off plans to break up the group to allow its new chief executive officer (CEO) to focus on issues including debt and litigation, Reuters reported on 5 March.

“On the question of structure, our answer is ‘not now’ – and this shouldn’t be misunderstood as ‘never’,” Bayer CEO Bill Anderson was quoted as saying on a media call. Anderson had previously said he was looking at options to separate, spin off or sell businesses. However, for the next 24 to 36 months, Anderson said Bayer’s priorities would be to strengthen the pharmaceutical development pipeline, ad-

CHINA: The Ministry of Agriculture and Rural Affairs announced on 19 March that it had approved 27 genetically modified (GM) corn and three GM soyabean varieties as part of China’s aim to increase the development and planting of high-yielding crops, Reuters reported on the same date.

The varieties included seed varieties owned by Dabeinong 002385.SZ and China National Seed Group, a unit of Syngenta Group.

The list of approved varieties was open for public comment until 17 April.

After a cautious approach to GM crops, China said in January that it would expand GM soyabean and corn planting after pilot projects had shown good results in improving yields and lowering costs compared to conventional seeds, Reuters wrote. The world’s leading soyabean and corn buyer aimed to raise domestic production while reducing imports, the report added.

“The planting area should also comply with the relevant arrangements for national biological breeding industrialisation,” the ministry said.

dress litigation, reduce debt and to further pursue job cuts which would reduce annual costs by €2bn (US$2.2bn) from 2026.

Anderson faced a range of problems when he was appointed in June last year to turn the business around, most relating to Bayer’s 2018 US$63bn takeover of Monsanto and its glyphosate-based herbicide brand Roundup. The company has been ordered to pay billions of dollars by US courts to plaintiffs alleging that Roundup had caused their cancers, with most cases still under appeal. With a number of upcoming cases this year, Anderson said the company was looking to appoint a litigation

expert to its supervisory board and he was “considering every possible means to bring closure” to the US glyphosate lawsuits. At the end of January, 54,000 claims were still outstanding in the USA out of 167,000 initially registered.

Anderson also said the company had plans to introduce a substitute for glyphosate within four years.

“We are testing this new substance on real plants. It’s the first … innovation in this area in 30 years. Our objective is to have it on the market in 2028,” Anderson told German Sunday newspaper Frankfurter Allgemeine Sonntagszeitung

Castor cultivation firm Casterra Ag, a subsidiary of Israeli computational biology company Evogene, is set to expand its production of castor seeds in Brazil and Africa after signing agreements with existing and new seed producers in the two countries.

The agreements were expected to add

approximately 400 tonnes to Casterra’s total castor production this year, establish long-term production infrastructure and lower production risks, Evogene said on 5 March.

“These agreements strengthen our supply chain and mark a strategic change towards diversifying our production sources,” Casterra CEO Yoash Zohar said.

Casterra has developed its high-yielding castor bean seeds from a collection of more than 300 castor lines from over 40 different geographic and climatic regions.

The company applies advanced breeding methods from Evogene, which uses plant genomics tools to enable industrial-scale production of castor beans. The resulting castor oil is used in oleochemical, biofuel and biopolymer applications.

The US Department of Agriculture’s Animal & Plant Health Inspection Service has approved US agricultural bioscience company Yield10 Bioscience’s genetically modified (GM) camelina varieties to be grown and bred in the USA.

The approvals would help commercialise camelina in the USA for the production of omega-3 oil for industries including aquafeed and human nutrition, the company said on 21 March.

“In 2024, we plan to focus on executing our development programme, building seed inventory in anticipation of commercial-scale planting and engaging with potential commercial partners to enable future commercial sale of omega-3 oil and meal in target markets,” Yield10 Bioscience chief scientific officer Kristi Snell said. The use of omega-3 oil and meal in target markets could

still be subject to regulation from other regulatory authorities in target geographies, Snell added. Yield10 said it also planned to work towards setting up a partnership agreement with global aquaculture feed firm BioMar Group.

The company is also engineering second generation omega-3 camelina lines with herbicide tolerance traits for large-scale commercial planting.

On 14 February, it announced that it had granted a global three-year licence to Vision Bioenergy Oilseeds to commercialise the traits and varieties of its herbicide-tolerant camelina for use in biofuels production. As part of the deal, Yield10 would supply Vision with spring and winter camelina varieties including those that were tolerant to glufosinate and soil residual Group 2 herbicides.

IN BRIEF Photo: Adobe Stock14-16 May 2024

GrainCom24 Geneva, Switzerland www.graincomevents.com

22-23 May 2024

Future of Surfactants Summit Seville, Spain

www.wplgroup.com/aci/ event/surfactants-summit

22 May 2024

European Sustainable Palm Oil Dialogue (SPOD) 2024

Double Tree by Hilton, Brussels, Belgium www.spod-europe.eu

4-5 June 2024

Advanced Oil Processing: Palm, Palm Kernel & Coconut Oil Processing & Food Applications

Bogotá, Colombia www.smartshortcourses.com/ oilprocess31/index.html

7 June 2024

FOC 2024: Fats and Oils Conference Almaty, Kazakhstan www.apk-inform.com/en/ news/1540355

11-12 June 2024

International Grains Conference London, UK www.igc.int/en/conference/ confhome.aspx

12-13 June 2024

Oleofuels 2024 Summit Milan, Italy

www.wplgroup.com/aci/ event/oleofuels

12-13 June 2024

Black Sea & Danube Way For Grain Bucharest, Romania

https://ukragroconsult.com/ en/black-sea-danube-way-forgrain

12-15 June 2024

22nd EFPRA Congress Amsterdam, the Netherlands https://efpra.eu/events

14 June 2024

VegOils & Meals Trade Seville, Spain

www.apk-inform.com/en/ conferences/Veg-Oils-MealsTrade-2024/about

8-10 July 2024

5th International Symposium on Lipid Oxidation and Antioxidants

Bologna, Italy

https://eurofedlipid.org/ 5th-international-symposiumon-lipid-oxidation-andantioxidants

20-24 August 2024

21st International Sunflower Conference Bayannur, China www.esanrui.com/isc

9-11 September 2024

OFI International 2024 Rotterdam Ahoy Convention Centre, the Netherlands www.ofimagazine.com/ ofievent

2-4 October 2024

Sustainable Aviation Futures North America Congress Houston, Texas, USA www.safcongressna.com

22-23 October 2024

Oil and Fats International Congress (OFIC) 2024 (+ Online)

Kuala Lumpur, Malaysia https://mosta.org.my/events/ ofic-2024

22-26 October 2024

2024 North American Renderers Association Annual Convention

Ritz Carlton Bacara, Santa Barbara, USA https://nara.org/about-us/ events

7-9 November 2024

5th YABITED Fats and Oils Congress Antalya, Turkey www.yabited2024.com/EN/ Default.aspx

Oil World CEO Thomas Mielke, Neste Vice President for Renewables Production Sven Kuhlmann, RaboResearch’s Elwin de Groot, Odfjell’s Nils Jørgen Selvik and the European Commission’s Veerle Vanheusden will be among a host of industry experts who will be speaking at OFI International 2024, being held at the Rotterdam Ahoy Convention Centre, the Netherlands, on 10-11 September 2024.

OFI International 2024 will feature:

• The one-day 3rd Sustainable Vegetable Oil Conference organised by the Council of Palm Oil Producing Countries (CPOPC) on 10 September.

• The one-day OFI Trade Outlook & Logistics Conference on 11 September focusing on prices and trends impacting the world’s major vegetable oils including war and climate impacts on shipping; and what traders and producers must do to meet sustainability regulations such as the EU Deforestation Regulation (EUDR).

• The two-day OFI Technical Commercial Conference addressing latest industry issues on sustainability, waste feedstocks and contaminants such as MCPDEs, GEs, MOSH/MOAH, chlorinated paraffins and other persistent organic pollutants (POPs).

For more information and to register, go to: www.ofimagazine.com/ofi-international-2024

As the fourth largest oilseed producer in Europe, Poland’s rapeseed output has risen significantly over the past few years. However, the ongoing war in Ukraine is impacting its import and export patterns, along with tight EU environmental rules

Poland, with its expansive fields of rapeseed, is the fourth largest oilseed producer in the EU, according to 2023 statistics from the European Commission.

The country’s rapeseed production and crush have broken multiple all-time records in recent years but Poland’s oils and fats sector also faces significant hurdles. Tight EU environmental regulations have impacted farm outputs and led to widespread demonstrations throughout the country. The past two years have also seen a significant increase in oilseed imports stemming from the ongoing war in Ukraine, which has led to international lawsuits.

Oilseed and oil production

Rapeseed is the undisputed leader when it comes to Polish oilseed production, with constant annual increases in harvests over the past few years, according to data from the Food and Agriculture Organization of the United Nations (FAOSTAT).

“Last year, we had the historically biggest rapeseed harvest in Poland,” Adam Stępień, general director of the Polish Association of Oil Producers (PSPO), tells Oils & Fats International (OFI). “Farmers harvested more than 3.7M tonnes of rapeseed.”

In 2022, Poland’s rapeseed harvest stood at 3.47M tonnes, while the preceding years saw harvests of 3.05M tonnes, 2.90M tonnes and 2.26M tonnes. The harvests in 2019 and 2018, however, were both below that of 2017, when farmers grew 2.69M tonnes of rapeseed.

Poland also grows sunflowerseed, production of which has grown significantly in the past few years. FAOSTAT data shows that the 2022 sunflowerseed harvest

reached 61,850 tonnes, nearly twice as much as the 32,660 tonnes harvested in 2021, which was also double the 15,130 tonnes from 2020. Just as with rapeseed, however, Poland saw a significant drop in production between 2018-2019, when the sunflowerseed harvest fell from 9,240 tonnes to 3,930 tonnes.

Poland is also a minor soyabean producer. In 2022, Polish soyabean production stood at 43,780 tonnes, up significantly from 20,970 tonnes in 2021 and 15,960 tonnes in 2020. Additionally, Poland produced 55,850 tonnes of other oilseeds in 2022. This category saw a significant jump, rising 18,000 tonnes from 37,240 tonnes in 2021.

Although rapeseed production in Poland is far above any other oilseeds, Stępień says Polish farmers do not have any particular real preference for the crop.

“In general, there aren’t too many options for farmers in what to grow. In Poland, you have around 10M ha of agricultural land and you can’t cover it only with maize and grains,” Stępień says.

“Rapeseed is needed for proper soil management and it’s still a good option for the farms’ economy.” Farmers also know PSPO members and other domestic vegetable oil refiners are there to purchase their entire harvest, he says.

When it comes to Poland’s domestic oilseed processing, the country broke another rapeseed record in 2023 when processors crushed 246,000 tonnes more than in 2022 (another record year), reaching a total crush of 3.52M tonnes.

“We’re above the magic barrier of 3.5M tonnes of rapeseed. This is the highest

amount ever,” Stępień says.

Out of those 3.52M tonnes of crushed rapeseed, 1.5M tonnes of crude rapeseed oil was produced, up 146,000 tonnes from 2022. This translates to a roughly 42.5% seed oil content, which Stępień says is also a historical record. Additionally, Poland refined 547,000 tonnes of crude rapeseed oil in 2023, the same as in 2022.

The five largest players in the Polish market include ADM (operating two sites), BestOil, Bunge Polska (on two sites), Komagra and Statoil (both part of the same group) and Viterra Polska.

Food consumption of vegetable oils is growing in Poland, albeit very slowly. According to Euromonitor International Data cited in the study “Changes in the Vegetable Oil Market, with Particular Emphasis on Market Instability in Relation to the War in Ukraine”, Polish vegetable oil retail sales have grown from 150M litres in 2015 to roughly 160-170M litres in 2023.

Stępień would go so far as to say that the domestic Polish vegetable oil market is growing so slowly that in real market terms, the growth is negligible. “Bottled edible oil is a very stable market. There are some changes between, say, sunflower oil, olive oil and rapeseed oil but still, rapeseed oil is hugely dominant. But, in general, bottled oil sales are not growing – unfortunately.”

Although total food use consumption of edible oils in Poland is seeing minimal growth, the industry’s internal trends are shifting. The Euromonitor data indicates that the share of margarine and other solid fats in Poland’s edible oil consumption is declining (down from roughly 47% in 2012 to 36% in 2020) and being taken over mostly by liquid

u

vegetable oils, such as rapeseed oil. Olive oil is also seeing a small share increase.

With negligible growth in food consumption, it is the biodiesel industry which is absorbing Poland’s increased rapeseed oil production.

“When you have such rapeseed oil volumes – some 1.5M tonnes of which around 400,000 tonnes is oil that we can consume as food in the internal market –and we’re refining 550,000 tonnes, then you still have 900,000-plus tonnes for biodiesel,” says Stępień. “In the last three or so years, we’ve produced more or less 1M tonnes of biodiesel, and around 90% of that is produced from rapeseed oil.”

Although Poland’s production of rapeseed and oil have been increasing over the past few years, it is a net importer of vegetable and animal oils and fats overall.

Typical market patterns have also been massively disrupted in the last few years due to the ongoing Russia-Ukraine war.

In terms of rapeseed, Poland is nearly self-sufficient, satisfying roughly 90% of its demand through domestic production, Stępień says. Some refining facilities were not able to access domestically-produced oil only because some PSPO members were exporting it as they were part of large international companies.

This trend, however, changed massively with Russia’s invasion of Ukraine in February 2022. That year, Poland imported slightly over 1.03M tonnes of rapeseed, compared to roughly 500,000 tonnes in 2021, according to recently released figures from Statistics Poland. Of the 2022 total, nearly 670,000 tonnes originated from Ukraine. Poland’s rapeseed imports then crashed in 2023 to around 380,000 tonnes due to both EUwide and domestic import bands.

Poland’s rapeseed exports did not initially see fluctuations outside the norm with the war – exported amounts rose from around 351,000 tonnes in 2021 to 364,000 tonnes in 2022. In 2023, however, there was an enormous jump, with rapeseed exports totaling around 850,000 tonnes, the second highest level surpassed only in 2015.

Germany was responsible for the majority of the increase, purchasing around 660,000 tonnes of Polish rapeseed in 2023, compared to roughly 310,000 tonnes in 2022. Other new importers that had not bought Polish rapeseed previously included the Netherlands (around 82,500 tonnes in 2023) and Belgium (just under 40,000 tonnes).

The significant changes in rapeseed have not been seen with sunflowerseed,

another significant import from Ukraine. According to FAOSTAT, Poland’s sunflowerseed imports increased from roughly 60,200 tonnes to 67,300 tonnes between 2021-2022. While 2023 statistics on sunflowerseed imports were not available at the time of writing, AgriCensus indicates that Ukraine’s sunflowerseed exports fell to zero in 2023. Meanwhile, Poland’s sunflowerseed exports more than doubled, jumping from 24,100 tonnes in 2021 to 52,600 tonnes in 2022.

Other significant oilseed and oils and fats imports to Poland include soyabean cake (2.7M tonnes in 2022); crude rapeseed oil (289,000 tonnes); crude sunflowerseed oil (268,700 tonnes); palm oil (247,000 tonnes); crude safflower seed oil (240,800 tonnes); soyabean oil (228,000 tonnes); soyabeans (148,000 tonnes); coconut oil (31,700 tonnes); and olive oil (20,800 tonnes). On the export side, the top products include rapeseed cake (664,200 tonnes); crude rapeseed oil (132,900 tonnes); crude safflower seed oil (111,200 tonnes); crude sunflowerseed oil (95,300 tonnes); soyabean oil (93,400 tonnes); linseed (63,100 tonnes); and pig fat (48,700 tonnes).

When it comes to transportation, Stępień states that most oilseed cargoes –especially to Germany – move in and out of Poland by truck. That said, there are two significant Baltic Sea ports in Poland

– Gdynia and Gdansk. Gdynia is the larger of the two, with an annual agricultural product throughput of 4-5M tonnes, which includes oilseeds.

Gdania is also a respectable agriproduct port, handling roughly 3.1M tonnes of grains in 2023, up from 1.9M tonnes in 2022. However, although some oilseed exports go through the ports, Stępień says they are not the main avenue for Polish oilseeds to move out of the country. “The ports are mainly used right now for the export of grains.”

Stępień adds that the ports have signed some agreements with new investors so their capacity will be developing.

Polish oilseed farmers may be setting new records but they, along with processors, face a few significant challenges, including the ongoing war in Ukraine.

When Russia’s 2022 invasion blocked Ukraine’s traditional grain and oilseed shipment routes through the Black Sea, these products began moving into Central and Western Europe overland. The glut of grains and oilseeds depressed prices for local farmers, prompting the EU to ban imports of Ukrainian agricultural products.

The EU-wide ban expired in September 2023 but Hungary, Poland and Slovakia introduced their own import restrictions immediately afterwards.

In Poland, the import ban still stands and, according to Stępień, the new Polish government sworn in in December 2023 does not plan to lift it.

“The new Polish government is similarly interested in maintaining the ban as the previous one because of the hard situation for farmers. They are more or less keeping the same line, trying to defend farmers’ interests. We expect they will continue the same approach we’ve seen in the past two years,” says Stępień.

Poland has not shut its borders entirely. Shipments of Ukrainian oilseeds and grains are still allowed to move through the country, provided that they are not sold in the country.

“Europe – not Poland – needs Ukrainian oilseeds. The Ukrainian market is not as large as some people imagine so the impact is rather local. We don’t intend to block everything from Ukraine just because of the war. We need to find some solution, which isn’t easy, but I think that if all things go correctly in line with regulations, then it should work,” Stępień says.

Ukrainian grains and oilseeds going through Poland, however, have drawn the ire of Polish farmers. Like their counterparts virtually all over Europe, Polish farmers took to the streets in late

2023 and the protests are continuing. In addition to Ukrainian imports pushing European agriproduct prices down, the farmers are protesting against the EU’s various environmental regulations that are making farming difficult due to increasing red tape and restrictions on pesticides, land use, and other matters.

“All these so-called ‘green regulations’ in the Common Agriculture Policy are negatively affecting production and the economy, and pushing Europe to be more orientated towards imports which, at the same time, are not produced in line with the same regulations. It is totally crazy, in terms of climate policy and climate change mitigation,” Stępień says.

The tense situation has led to some legal and illegal altercations. In September 2023, Ukraine filed a lawsuit against Poland’s import ban with the World Trade Organization although, at the time of writing, the case appears to have stalled. Meanwhile, Polish farmers have stopped and deliberately spilled shipments of Ukrainian grain on the border between the two countries. According to a Reuters report from February 2024, Ukraine’s Deputy Prime Minister Oleksandr Kubrakov said some 160 tonnes of Ukrainian grains had been destroyed in the protests. Polish

Agriculture Minister Czeslaw Siekierski has apologised for the vandalism and Polish police have reportedly opened investigations. The EU has announced new plans to curb Ukrainian farm imports to appease angry farmers throughout the continent.

Stępień, for his part, is waiting to see the practical effects of any new legislation. “Polish farmers are very active and try to show their problems to the new government. For example, last year, farmers didn’t harvest their maize in many regions because the cost of drying was so high that even previous relatively high prices didn’t meet this cost. The situation is not improving so they are angry,” he says.

Although the Polish oils and fats industry faces various challenges, Stępień remains optimistic. Poland’s farmers grow primarily winter rapeseed so they have already planted their 2024 crops. Stępień expects a good harvest but keeps a realistic outlook on the prospects of yet another record year.

“I’m not expecting another record as it’s not possible to beat production every year. Still, I think that we can expect a good harvest, taking into account the 1.1M ha

production area. Farmers know how to do their jobs so I’m not expecting the harvest to decline under 3.5M tonnes next season.”

Stępień’s longer-term forecast is also positive, assuming Polish farmers can keep producing similar levels of rapeseed and soyabeans. According to him, biofuels remain a significant part of the EU’s goal of decarbonising the transport sector, allowing producers and processors to continue to enjoy a growing market.

Additionally, Stępień believes Poland may have a future in becoming a protein meal producer on a larger scale.

The main challenge in Stępień’s view is not Ukraine but complying with the EU’s environmental requirements, together with mitigating the Polish oilseed sector’s emissions and environmental footprint.

Stępień says Polish vegetable oil producers are constantly improving their processes both in effectiveness and environmental standards. As long as they and farmers are able to resolve their issues with EU legislation, Poland’s vegetable and animal oil industry will continue developing.

“I think the future is bright and stable. As the food and energy industry, we will always be needed,” Stępień concludes. ● Ile Kauppila is a former assistant editor of Oils & Fats International

Koole Terminals is a leading and independent storage, processing, and logistics company, enabling business growth through integrated and innovative service offerings for large-volume products. Driving the energy transition forward for a sustainable future by supporting its world-class customers. With 21 strategically located terminals in Europe and a total volume of 5,387,000 CBM, Koole reflects the diversity of its customers’ needs.

21 TERMINALS IN 7 EUROPEAN COUNTRIES CREATING A SUSTAINABLE FUTURETOGETHER WITH A TOTAL STORAGE CAPACITY OF 5,387,000 CBM

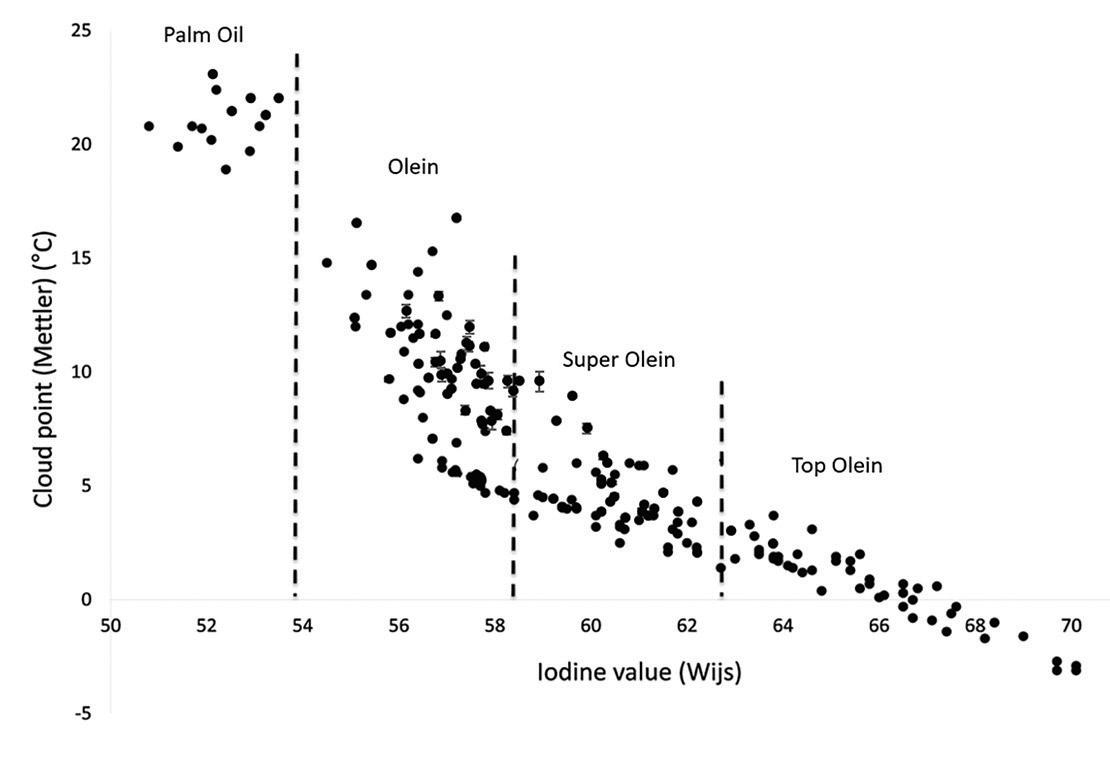

Iodine value and cloud point are the most commonly used parameters to define palm olein quality in industrial processing but it is very challenging to measure cloud point directly

Dr Andrea Pallares Pallares, Sin Lu Liew, Dr Gijs Calliauw

The fractionation of palm oil into solid palm stearin and liquid palm olein is the most common modification to the product.

In regions such as Latin America and West Africa, palm olein is predominantly processed into a direct-to-customer frying oil, typically blended with other oils like soyabean, sunflower and rapeseed.

To ensure sufficient cold stability of palm olein during transport and to prevent it from turning opaque during its shelf life (in transparent bottles), a sufficiently high degree of unsaturation needs to be reached. This is achieved by crystallising and filtering off the more saturated fatty acids during the fractionation process.

The iodine value (IV) of palm olein, which measures its degree of unsaturation, typically needs to reach IV 58-61 for the product to have wide applicability as a liquid oil ingredient in these regions. In Southeast Asia and India, however,

palm olein is more commonly produced at a lower IV (56-57), typically for B2B purposes and for its trading as a feedstock to produce purer and more valuable palm oil fractions, such as super olein and various palm mid-fractions.

The final quality and value of palm olein is very much determined by its cold stability. Unfortunately, it is very challenging to measure this quality parameter directly. In the context of quality assurance in an industrial production plant, there is simply not enough time to carry out an actual cold test for 24, 36, 72 hours or longer on every produced batch.

A quick approximation of the cold

stability of an olein can be obtained by determining its cloud point, which can be defined as the onset temperature at which crystal formation starts upon (controlled, yet relatively fast) cooling. The determination of cloud point and IV is the most commonly used combination to analyse the quality of palm olein and should therefore enable a reasonably confident prediction of cold stability over long periods of time. However, this is not always the case and there are difficulties and pitfalls to consider when defining palm olein quality with respect to cold stability.

Both cloud point and IV can be considered multi-factorial variables linked to several oil composition parameters, such as triglyceride profile and diglyceride content. IV is a variable that is easier to predict using parameters frequently measured in oil samples, whereas the effect of compositional properties on cloud point is not yet fully understood.

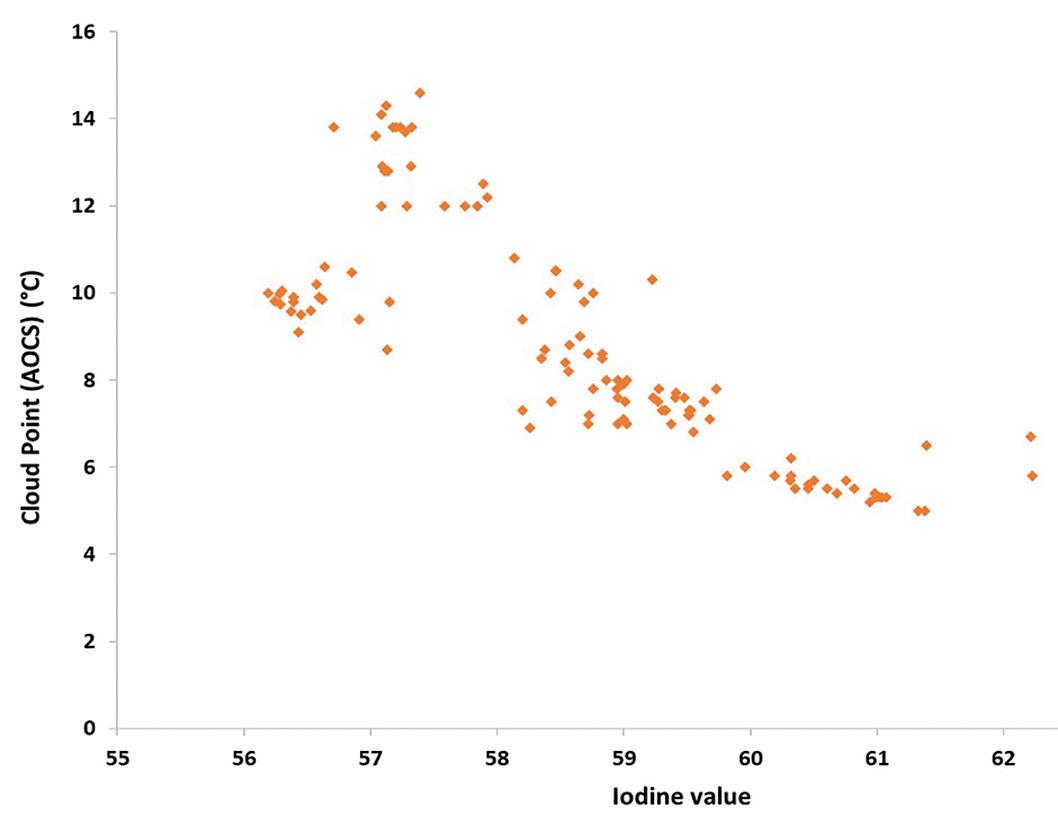

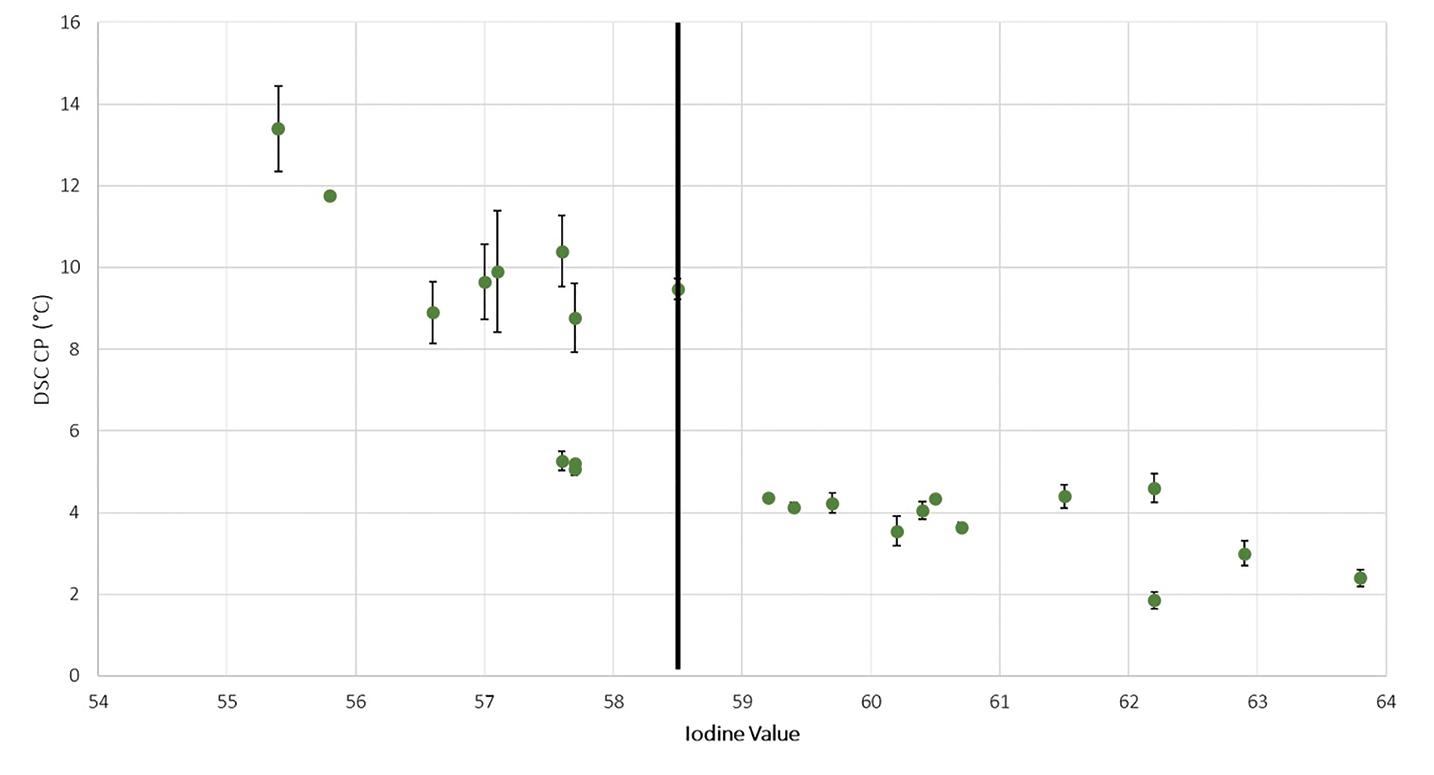

The relationship between cloud point and IV, containing data from laboratory analyses, is shown for different liquid fractions obtained during multi-step fractionation of palm oil in Figure 1 (below). In Figure 2 (below), the same relationship is shown for industrial palm olein samples generated after single fractionation.

As a rule, the cloud point of olein will drop with increasing IV, yet this relationship is stronger for fractions with higher iodine values (>60). This can be explained by the fact that more and longer fractionation

Photo: Adobe Stock

Photo: Adobe Stock

steps will lead to more extensive depletion/ enrichment of specific (groups of) triglycerides. Thus, super olein and top olein fractions, in particular, are relatively pure fractions compared to the original palm oil.

In olein with IVs 56-58, the correlation between cloud point and IV is very weak. Such fractions are the product of a relatively mild (short) fractionation process that is not severe enough to ‘erase’ all compositional variability of the natural product palm oil. The data points in this lower IV range are so scattered that for these products, the IV alone cannot sufficiently explain all the variability of cloud points observed. Therefore, low IV seems a weak predictor of the cloud point and, by extension, the actual cold stability.

The current methods used to quantify IV and cloud point can also add to the scattering of data. The quantification of IV and cloud point can be carried out following official American Oil Chemist Society (AOCS) protocols.

The official method for IV (AOCS Cd 1d-92) relies on automatic determination via titration, a routine analysis with

well-defined conditions, allowing good reproducibility across numerous laboratory and industrial environments, and often a subject of ring tests. On the other hand, the official method for cloud point (AOCS Cc 6-25) relies on manual assessment –observation of the onset of cloudiness in the test sample upon cooling in an ice/water bath and recording of the temperature at which the observation is made. No reference is made in this method about controlled cooling conditions, except an indication to keep the water bath to a temperature “not less than 2°C, nor more than 5°C below the cloud point”. Inherent to the manual assessment is a heavy reliance on the (subjective) perception of the analyst and, consequently, significant variability of the data reported due to analyst bias. In practice, oil refinery labs try to iron out this source of variability as much as possible by assigning cloud point determination only to a limited group of skilled analysts. Nevertheless, the margin of error of these measurements can remain unsatisfyingly large.

In order to decrease subjectivity and increase reproducibility, significant efforts

have been made to gauge cloud point using automated method of analysis, such as optical measurements relying on light transmittance (using cloud point apparatus like the FP 900 Mettler Toledo thermo-system) and Differential Scanning Calorimetry (DSC). Although a good correlation between automated values and those obtained via the official method (manual assessment) can be demonstrated, determination of cloud point via automated methods of analysis is not a widely adopted practice in industrial quality control environments. Furthermore, significant variability in cloud point values obtained through automated methods remains, especially for palm olein with IV 56-58. Figure 3 (following page) shows increased intra-day variability in cloud points obtained via DSC of palm olein samples compared with palm super olein samples. This is also the case when repeated automated measurements of the same sample were carried out during different days, hence inter-day variability is also present and more predominant in palm olein samples of IV 56-58.

Finally, there is no official guideline nor a best practice regarding analytical instruments to measure cloud point in

Source: Desmet

Source: Desmet

determined regularly for the same type of olein and a certain value is expected.

Although there is a lack of relationship between IV and cloud point, as well as difficulties in measuring cloud point with high precision and accuracy, the underlying premise is that cloud point is believed to be an effective predictor of the cold stability of palm olein.

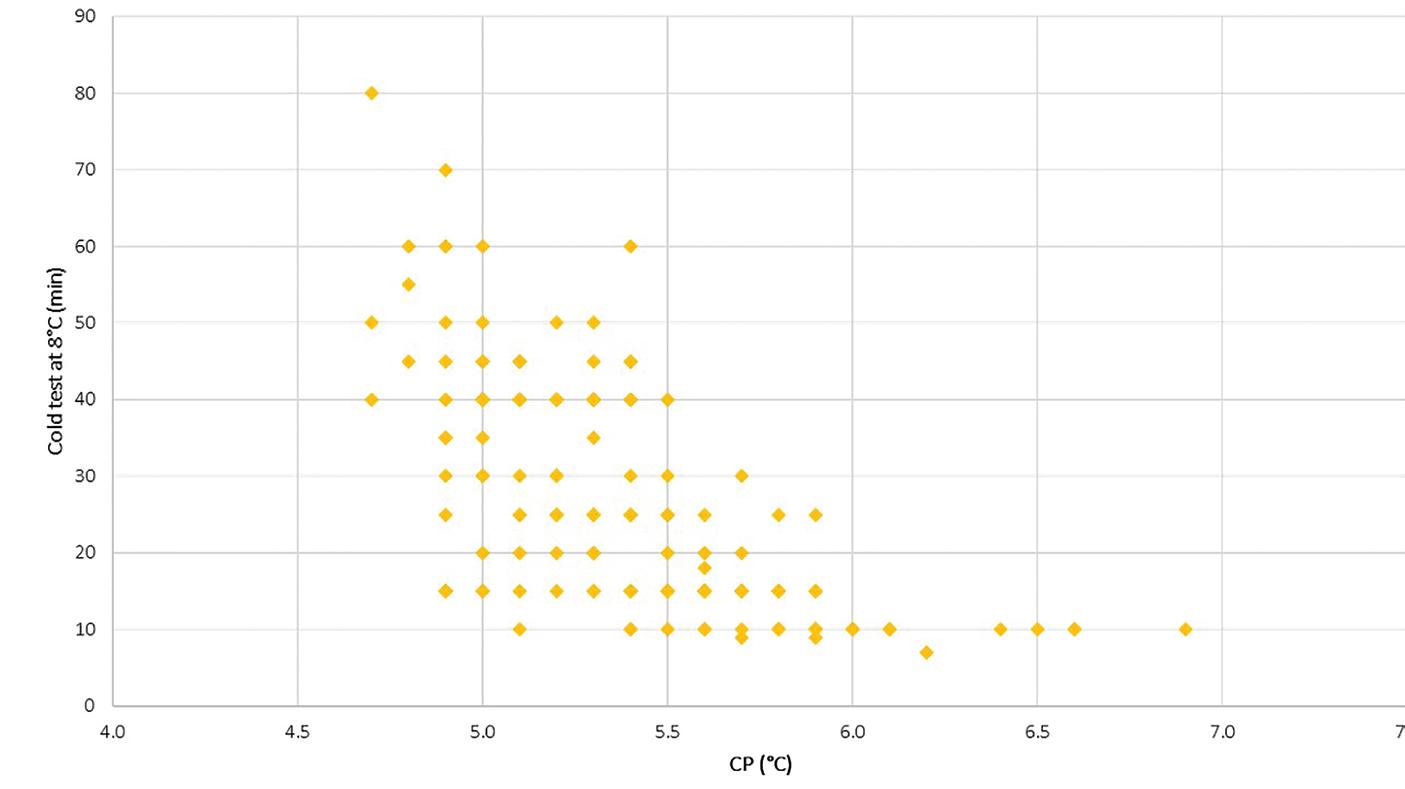

Figure 4a (left) plots the relationship between cold stability and manuallyassessed cloud point for a set of olein samples with IV 56-58, all produced at the same industrial installation from the same feedstock in the same week.

There is a trend that with lower cloud points, more cold stability is expected but as a whole, the plot shows scattering rather than strong correlation. Knowing that a rather large error flag on cloud point measurements is present, it is not straightforward to distinguish how much of this mismatch is due to an actual incomplete correlation between the two parameters and how much is due to the low confidence level of the cloud point measurement.

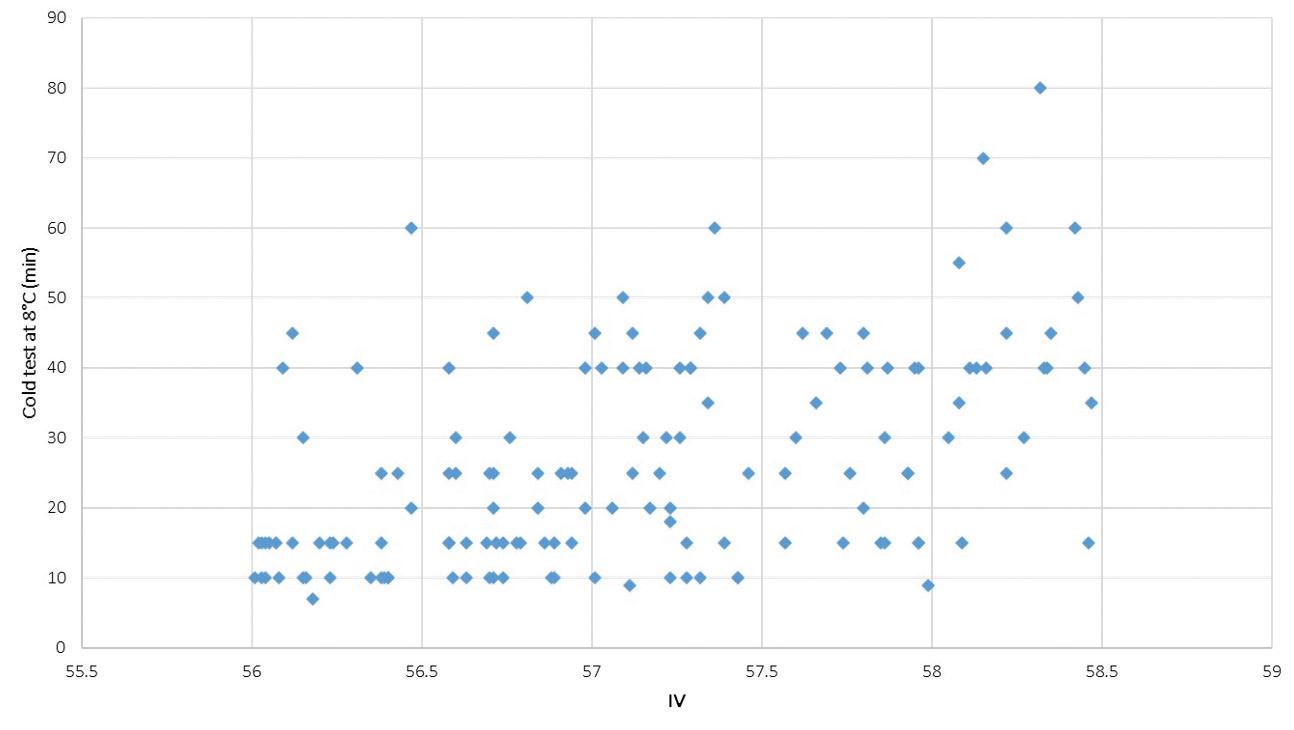

Figure 4b (left) shows the relationship between cold stability and IV for the same set of industrial samples. As expected, based on low IV (56-58) being a weak predictor of cloud point, IV does not allow a reliable prediction of cold stability in IV 56-58.

Iodine value and cloud point continue to be the most used parameters in the refining industry to define the quality of palm olein and make predictions about its cold stability.

Unfortunately, the accurate and repeatable determination of the cloud point, by the classic manual assessment and even by automated analytical techniques is not easy. Also, the correlation between IV and cloud point for palm olein samples with IV 56-58 is unsatisfyingly low. This can be explained to a large extent by the higher compositional heterogeneity of palm olein fractions in this IV range and the poor accuracy and precision of the available analytical techniques.

an automated way. Nor are there low purchase-and-operating cost instruments – for example, the thermo-system from Mettler Toledo is no longer commercially available, and DSC is expensive and not entirely suited for quality control purposes. Overall, both manual and automated

methods for quantification of cloud point in olein samples experience accuracy and repeatability issues.

Automated analysis methods do eliminate bias associated with analysts, which is an advantage, especially in environments where cloud point is

Hence, cloud point not only has to be analysed but also interpreted with great care before concluding on the cold stability of a given palm olein.

● Dr Andrea Pallares Pallares is an R&D engineer at the Desmet Innovation Centre, Oils & Fats in Zaventem, Belgium.

Sin Lu Liew is Technical Director at Desmet Malaysia and Dr Gijs Calliauw is Process Technology Manager at Desmet Belgium

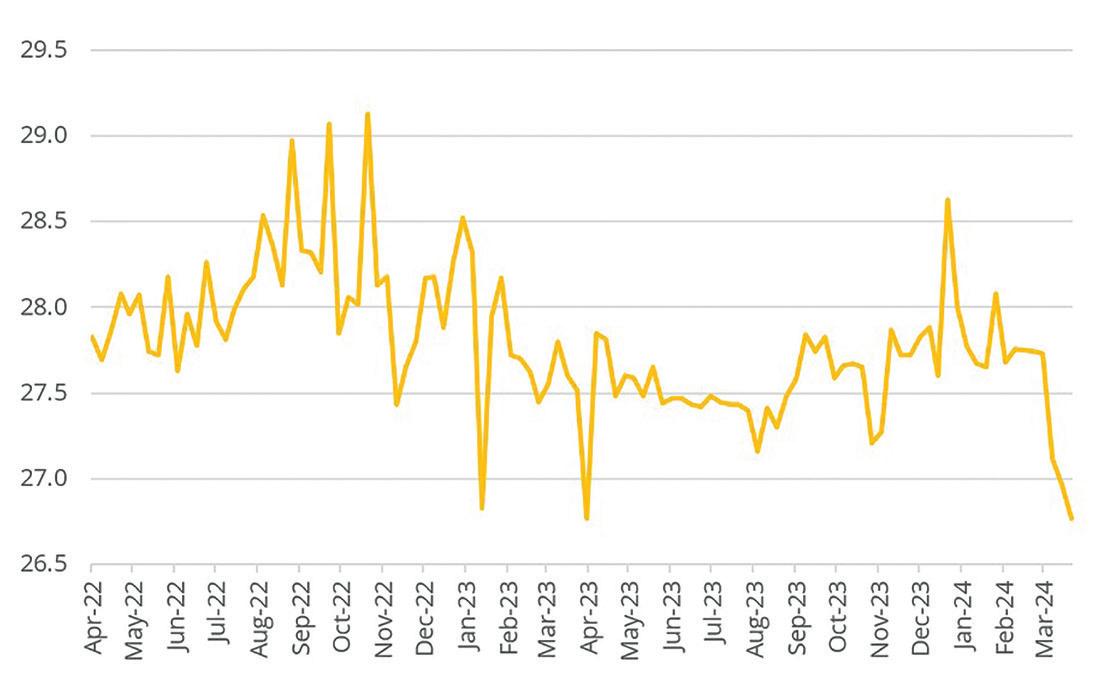

Against a backdrop of geopolitical tensions, potential trade restrictions, ongoing labour shortage concerns and uncertain weather patterns, palm oil remains the price leader in the oils and fats sector, delegates at POC2024 heard.

However, with global palm oil demand increasing and production stagnant or dropping, further price hikes are likely, according to analysts at the event, organised annually by Bursa Malaysia Derivatives Berhad on 4-6 March in Kuala Lumpur, Malaysia.

Despite global market challenges in 2023, Malaysia’s palm oil industry remained a significant contributor to the country’s economy, with the commodity being one of its main exports, Bursa Malaysia Berhad chairman Abdul Wahid Omar said. In the fourth quarter of 2023, the gross domestic product (GDP) growth of Malaysia’s agriculture sector increased by 1.9%, compared to 0.9% in the previous quarter.

“This growth was primarily driven by the oil palm sub-sector, which increased by 1.6% due to higher production of fresh fruit bunches (FFBs),” Abdul Wahid added.

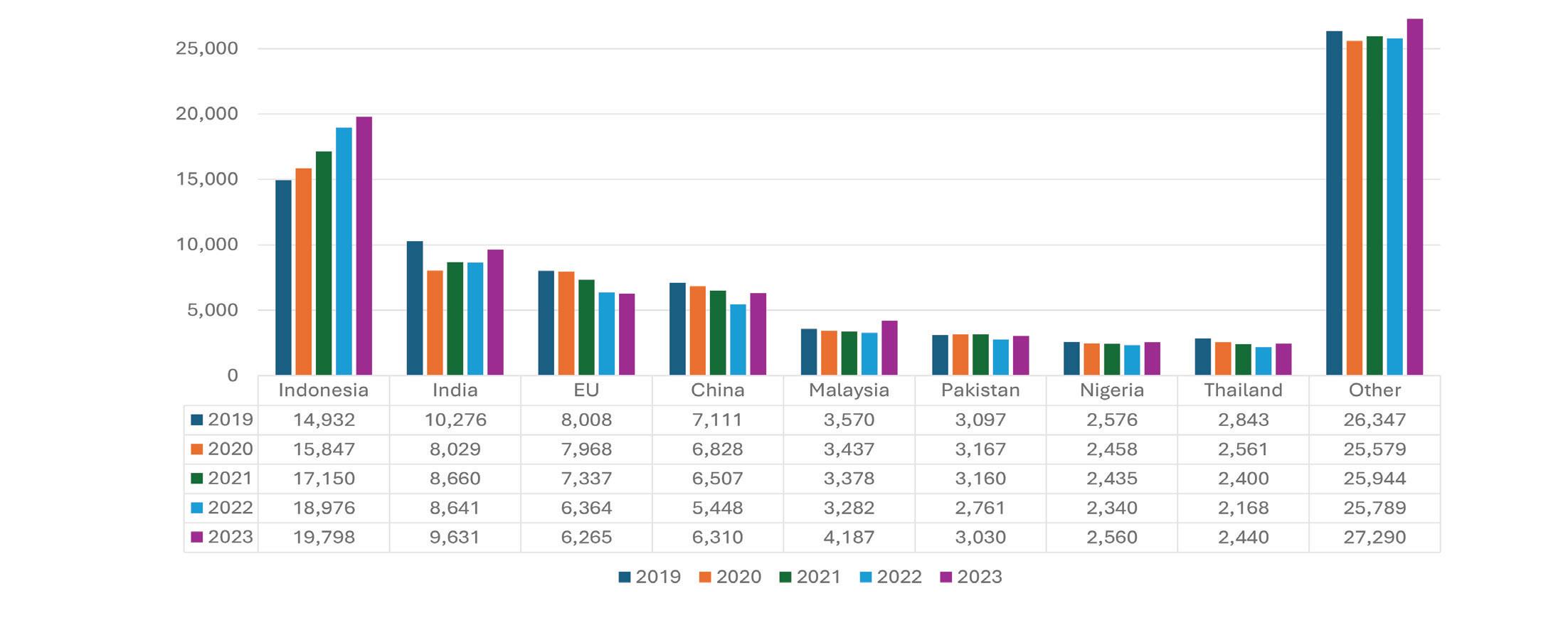

Malaysia’s Minister of Plantation and Commodities Johari Abdul Ghani (pictured above) said the market outlook for this year looked positive, driven by expected strong demand from key export destinations such as China, India and the EU (see Figure 1, following page).

“The demand is further supported by the interests in replenishing stocks to ensure food security and the overall viability of business activities.”

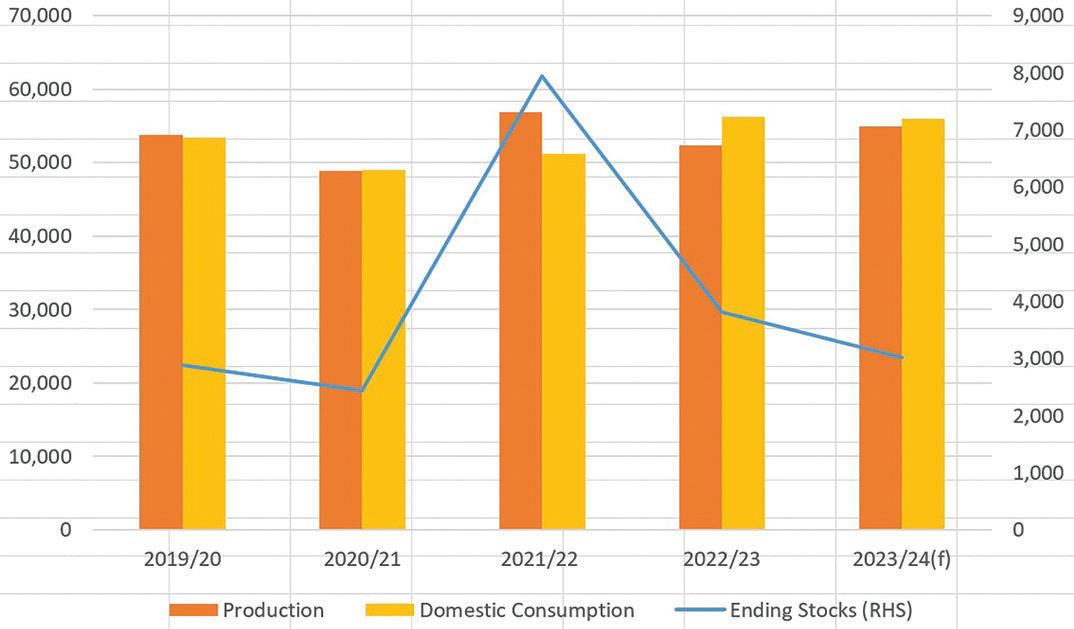

Stagnating global production, rising demand and higher biodiesel mandates are expected to reduce supplies of palm oil this year, leading to further price increases, the recent Palm & Lauric Oils Price Outlook Conference & Exhibition (POC2024) heard Gill Langham