22 Exports drive flaxseed

One of the leading global flaxseed producers, Kazakhstan is expecting a bumper crop this year following last year’s below average harvest

18 Challenges ahead

The onset of UCO exports, an ageing fleet, contraction of tonnage and regulations to cut emissions will all have an impact on the shipping sector

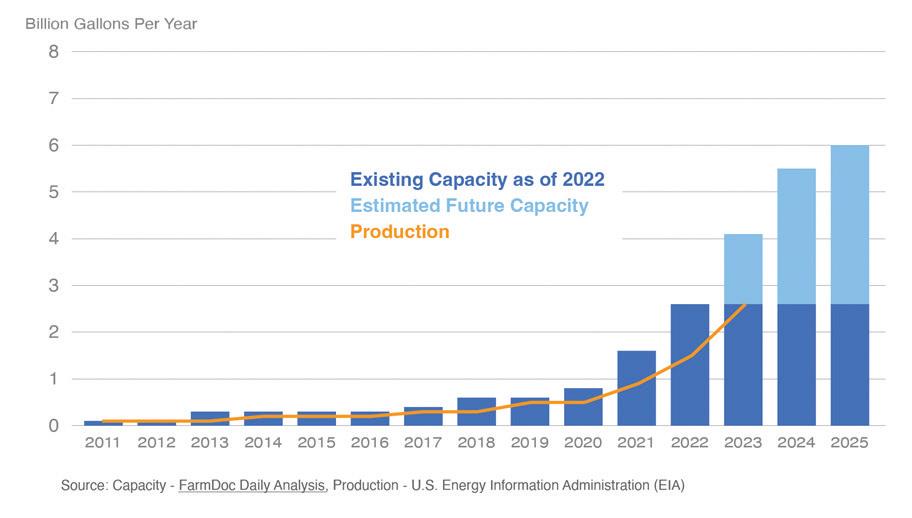

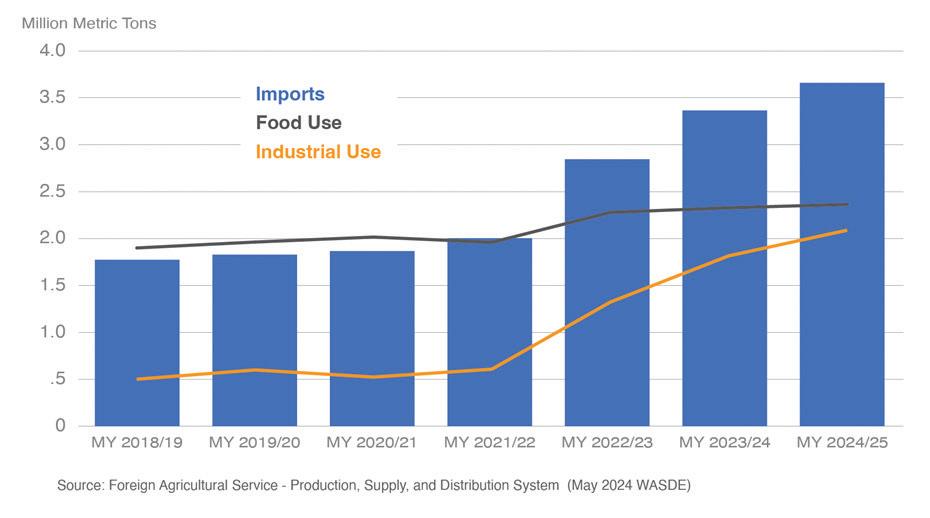

USA, Biodiesel/HVO

28 Impacting global trade

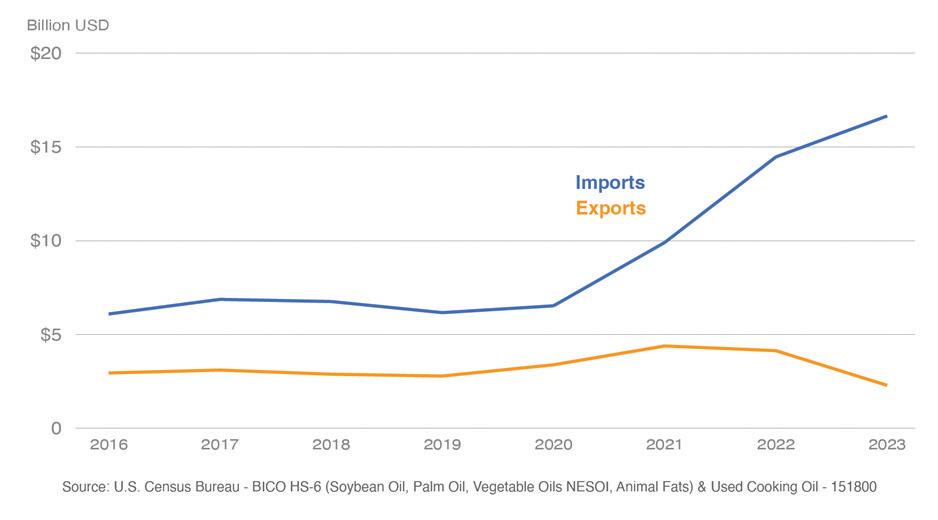

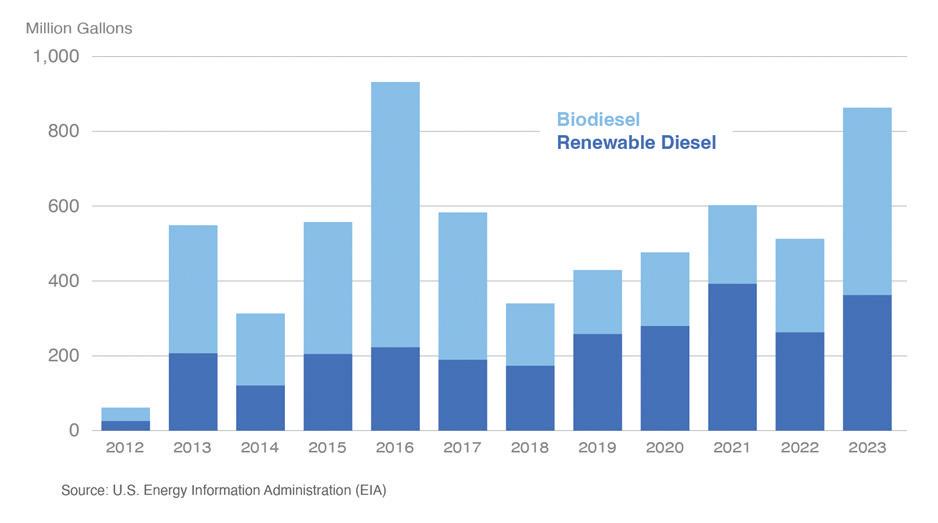

The boom in US renewable diesel production has impacted global trade of soyabean meal, as well as the country’s imports of oils and fats

Standards, Testing & Analysis

33 MOHs update

Mineral oil hydrocarbons (MOHs) are chemical compounds mainly derived from crude petroleum oil which can end up in food during harvesting and production processes, with mineral oil aromatic hydrocarbon (MOAH) being of concern to human health

2 What now for EU deforestation law?

4 European Commission proposes delaying EUDR

10 Chinese biodiesel exports to EU fall by 91% in July Renewable News

12 Argent Energy launches glycerine facility

Viterra to acquire five sites from Cargill

16 Food retailers, producers demand GE food labelling

events listing

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING:

Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

Just three months before the landmark EU Deforestation Regulation (EUDR) was due to come into force, the European Commission (EC) has proposed delaying its implementation for a year.

The move announced on 2 October (see p4) has been met with dismay by environmentalists and companies which have invested heavily in being compliant on time, but has been welcomed by some business and farming lobbies, key EU trading partners such as the USA and Brazil, and top palm oil producers Indonesia and Malaysia.

Adopted in December 2022 with the noble aim of tackling the EU’s contribution to deforestation, the EUDR requires companies selling or exporting seven commodities in the EU (cocoa, coffee, palm oil, soyabean, cattle, rubber and timber) to ensure they are deforestation-free and legally sourced.

Companies would have faced significant fines (40% of their EU turnover) if they were not compliant by 30 December. And some have invested heavily in being ready on time. “Those companies will inevitably suffer losses in their investments,” says the EU vegetable oils and protein meal industry association FEDIOL.

A major problem with the EUDR has been a lack of clarity relating to compliance, with the EC only producing its ‘additional guidance’ when it announced the EUDR delay.

“It’s inexcusable that the Commission took so long to issue the supporting documents for the implementation of the law,” said Sébastien Risso, Greenpeace forest policy director.

The EUDR requires huge amounts of data to be collected by all players in the supply chain to carry out due diligence and assess deforestation risk. This includes geolocation and polygon mapping data of where the commodities have been produced, and documents to prove legal compliance with land use and human rights, as well as tax, anti-corruption, trade and customs regulations. One product could have hundreds of due diligence statements that need to be searchable, tied together and shared with customers and traders, all to be submitted onto an Information System with a file size limit of 25MB.

It’s clear that some businesses and countries were not ready. But for the companies that have invested to be ready, the delay is an unfair penalty.

The larger question is whether the EUDR will actually come into force in a year’s time as it stands. Many of those who pushed for the postponement want to abandon the EUDR altogether. It was the conservative European Peoples’ Party – the largest group in the European Parliament – which launched a concerted push for a delay immediately after the EU elections in June, with support from political groups further to the right, according to a euronews article.

The European Commission has stressed that the delay does not change the aim and substance of the EUDR. But there will be fears that this delay may indicate a weakening of the EU’s resolve to tackle agricultural deforestation.

Serena Lim, serenalim@quartzltd.com

UKRAINE: A Russian missile struck a grain ship docked at Ukraine’s Port of Odessa, killing one person and injuring five crew members, Reuters reported on 8 October.

The strike on 7 October followed an attack the previous day on a vessel carrying 6,000 tonnes of corn at the nearby Port of Pivdennyi. No injuries were reported in the earlier strike but the grain ship was severely damaged, the report said.

The ship which struck at the Port of Odessa was the 21st civilian vessel to be damaged by Russian missile strikes since the conflict began in February 2022, Reuters said.

Despite the attacks, Ukraine’s agriculture ministry said on 7 October that the country had exported 11.2M tonnes of grain since the start of the 2024/25 marketing year in July compared to 7.2M tonnes in the same period the previous year.

WORLD: The practice of discharging waste palm oil into the sea may be included in a revised sustainability standard to be drafted by the Roundtable on Sustainable Palm Oil (RSPO) next year, Eco-Business reported on 14 August.

The RSPO’s statement followed two recent incidents of palm oil dumping reported off the coast of Malaysia. Although banned in European waters, palm oil discharging was still legally permissible under international pollution regulations in certain conditions, Eco-Business wrote.

The International Maritime Organization (IMO) said waste reception facilities at ports were crucial for avoiding waste dumping by ships at sea but such facilities were often lacking in Southeast Asia, and ships sometimes discharged palm oil residues at sea to avoid paying to use waste reception facilities.

The European Commission (EC) has proposed delaying the EU Deforestation Regulation (EUDR) by 12 months following lobbying by companies and governments around the world.

Originally due to take effect on 30 December, the regulation will ban the sale in the EU of seven commodities linked to deforestation - palm oil, soyabean, timber, rubber, coffee, cocoa and cattle. The delay must be approved by EU ministers and the European parliament to take effect.

If approved, the regulation would come into force on 30 December 2025 for large companies and 30 June 2026 for small enterprises.

In a statement on its website on 2 October, the EC said the extra 12 months could serve as a phasing-in period to ensure proper and effective implementation.

“The Commission recognises that three months ahead of the intended implementation date, several global partners have repeatedly expressed concerns about their state of preparedness,” the statement said. “The state of preparations amongst stakeholders in Europe is also uneven. While many expect to be ready in time ... others have expressed concerns.”

The EC added that the extension proposal did not change the objectives or the substance of

the law, as agreed by EU co-legislators.

At the same time as announcing the proposed delay, the EC published additional guidance to help ensure uniform interpretation of the law covering a range of issues such as legality requirements, the application time frame, agricultural use and clarifications on the product scope.

The EC also published the principles of the methodology it would apply to the EUDR benchmarking exercise, serving to classify countries as low, standard or high risk.

“Following the methodology applied, a large majority of countries worldwide will be classified as ‘low risk’,” the EC said.

The information system where businesses would register their due diligence statements would be ready to start accepting registrations in early November, the EC said. Due diligence statements could be submitted before the law’s entry into force.

The EC said it would also present a strategic framework for international co-operation engagement on the EUDR and had identified five priority areas of action such as support to smallholders, eight key principles such as a human rights-centred approach and several implementation tools including dialogue and financing.

SD Guthrie International (SDGI), formerly known as Sime Darby Plantation (SD Plantation), announced on 19 September that it had delivered its first shipment of palm oil compliant with the EU Deforestation Regulation (EUDR).

In its first delivery, 24,250 tonnes of palm oil arrived at SDGI’s Zwijndrecht Refinery in the Netherlands a week prior to the report and a second shipment of 16,000 tonnes arrived at SDGI’s Liverpool Refinery in the UK on the day of the announcement. The palm oil was sourced from 102,337ha of oil palm plantations and smallholder farms.

To achieve EUDR compliance, SDGI said it worked closely with SD Guthrie’s upstream division to ensure detailed polygon maps and deforestation-free assessments of all plantations were

available. By using satellite imagery and partnering with a third-party verifier, SD Guthrie said it had been able to assess a forest baseline covering 6bn ha and had analysed around 600,000ha of its plantations for deforestation risks.

This work was supported by audit reports that also documented adherence to national legislation, International Labour Organisation (ILO) standards

and respect for native customary rights, SDGI said.

As part of its No Deforestation, No Peat and No Exploitation policy introduced in 2016, SDGI had been using Crosscheck since 2019, an online traceability tool mapping its palm oil from source to supply, SDGI said. The tool allowed traders and buyers to pinpoint issues in the supply chain and raise alerts for necessary action.

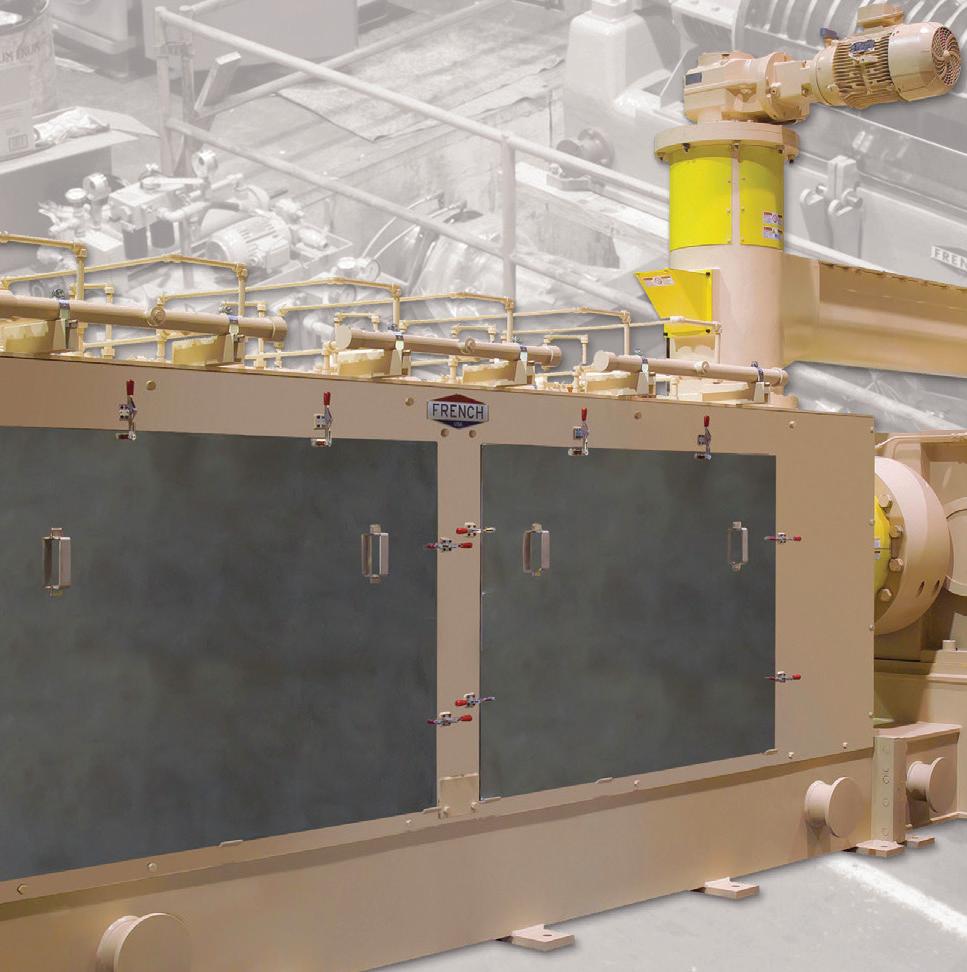

Unleash the power of reliability when you partner with CPM’s Crown. As the world leader in oilseed processing solutions, our equipment is backed by proven technology, superior design and more than a century of engineering expertise. Test and verify product and process feasibility at our Global Innovation Center: a fully functional pilot plant, analytical lab and training facility that helps you discover how to minimize downtime and overcome inef ciencies. By partnering with Crown, you will consistently honor customer commitments with more con dence and control. And, from risk management to environmental management, Crown applies a global lens to your operations. Count on our problem-solving expertise to help ful ll your sustainability commitments. Superior equipment. Unparalleled support. Every step of the way.

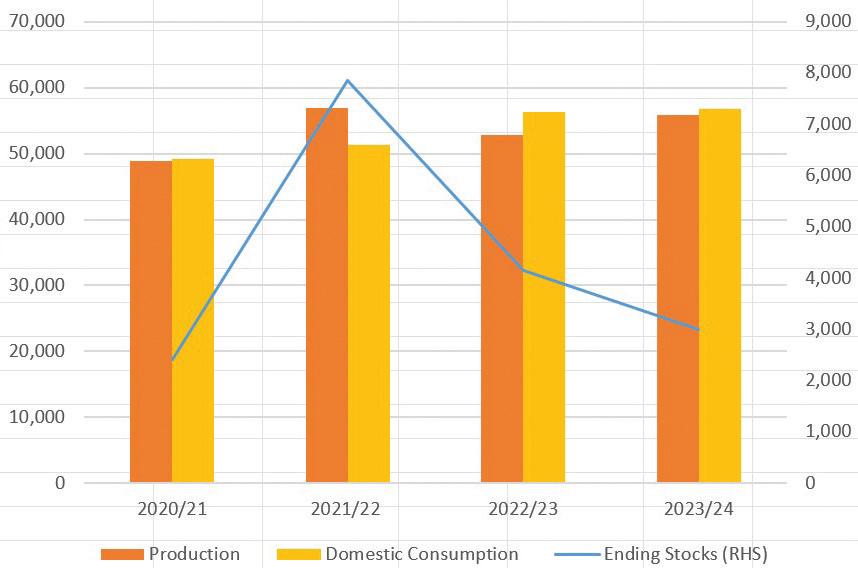

INDONESIA: Palm oil exports are expected to fall by 2M tonnes this year to 30.2M tonnes due to increased domestic consumption and reduced output, a 19 September Reuters article quoted Fadhil Hasan of the Indonesian Palm Oil Association as saying.

Production was expected to drop by 1M tonnes to 53.8M tonnes in 2024 as last year’s dry weather had lowered yields, he added.

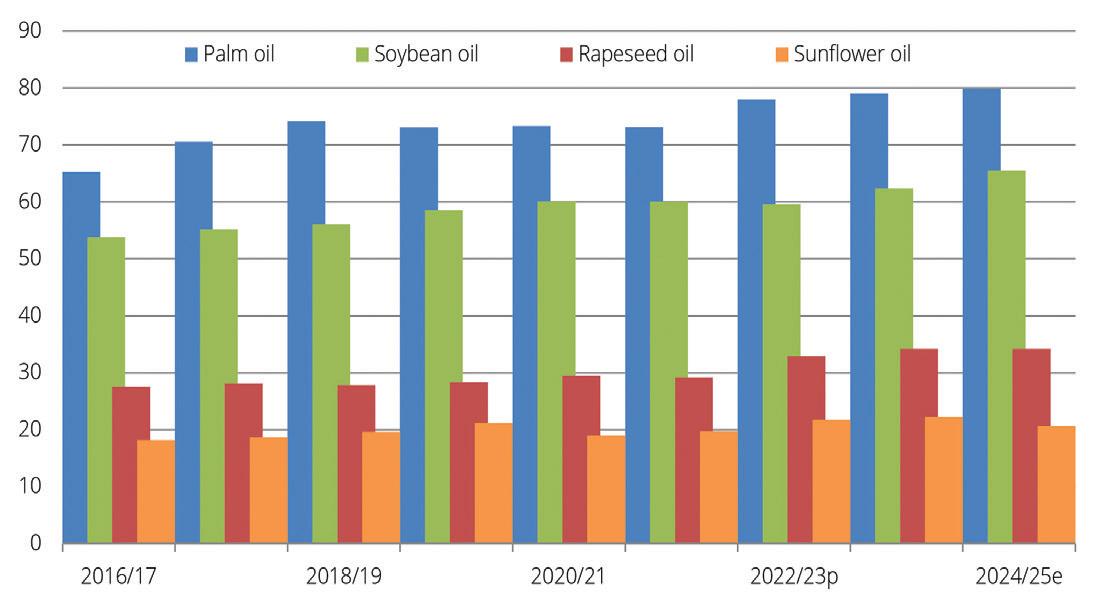

Indonesia increased its palm oil biodiesel blending mandate to 35% in 2023, lifting domestic palm oil consumption from 23.2M tonnes to a record expected 24.2M tonnes in 2024.

In August, Indonesia’s energy ministry announced plans to raise the biodiesel blending rate to 40% in January 2025.

ARGENTINA: Global agribusiness giant Louis Dreyfus Company (LDC) announced on 9 August that it had launched a regenerative agriculture programme in Argentina aimed at bringing together agricultural stakeholders to help reduce carbon emissions, conserve natural ecosystems and resources, and boost climate resilience in farming communities. Focusing on soyabeans, corn and camelina crops, the programme aimed to cover 205,000ha and would involve 400 farmers in the country by 2030.

The Chinese government has announced an anti-dumping investigation into Canadian canola imports, RealAgriculture reported on 3 September.

The move was part of a series of actions announced by the Chinese government in response to the Canadian government’s plan to introduce a 100% tax on Chinese electric vehicle (EV) imports and a 25% tax on Chinese steel and aluminium.

China had previously banned canola imports from Canada’s two largest exporters Richardson and Vittera – from March 2019 to May 2022 –following Canada’s arrest of Huawei executive Meng Wanzhou on an extradition request by the USA, RealAgriculture wrote.

The Chinese Ministry of Commerce was quoted as saying it was launching the anti-dumping investigation to safeguard domestic businesses following a 170% rise in Canadian canola seed

imports in 2023, the first full year after the lifting of the embargo.

The Canola Council of Canada (CCC) was working closely with the Canadian government while waiting for further details on the investigation, the report said. “We are confident that an investigation into Canada’s canola trade with China will demonstrate alignment with, and reinforce our support for, rules-based trade.” CCC president and CEO Chris Davison was quoted as saying.

According to Statistics Canada, exports of canola seed to China in the 2023 calendar year totalled almost 4.6M tonnes, up from 2.2M tonnes in 2022 but below the 4.8M tonnes shipped in 2018, prior to the last canola trade disruption with China. In the first six months of this year, 2.7M tonnes of canola seed were shipped from Canada to China.

Daabon UK, part of the Daabon Group, has launched a carbon-neutral organic palm oil

range produced at its CI Tequendama SAS mill in northern Colombia (pictured), the

company said on 4 October.

“Our next step is to replicate this at our other refinery, with the eventual goal of making all the palm oil we offer become carbon-negative and climate-positive,” Manuel Davila, managing director of Daabon UK and the EU, said. “Of course, there is still some way to go to cut the emissions associated with onward transport and global shipping.”

Daabon has committed to having net zero carbon emissions by 2040.

As well as palm oil, the family-owned Daabon Group also produces avocados, bananas, cocoa, coffee and limes.

Olive trees in Italy’s major olive-growing regions have been damaged by heatwaves and severe drought conditions ahead of this year’s harvest, Olive Oil Times wrote.

The damage was expected to lead to production dropping to historic lows this year, the 9 August report said.

Southern regions in the country, responsible for most Italian olive oil production, had been the most impacted by the harsh weather conditions, Olive Oil Times said.

Numerous rain-fed olive trees in Puglia, for example, were showing signs of water

stress, with many olives desiccating on branches, the report said.

“Severe and prolonged drought is compelling farmers to undertake emergency irrigation at exorbitant costs, driven by the high fuel prices needed to extract water from wells and transport it via tankers,” farmers’ association Coldiretti Puglia said.

“We have already lost the entire olive production for the current season,” added Paolo Colonna, president of olive producers’ association Oprol.

“If these weather conditions persist, next

season’s production could also be at risk.”

Slightly less severe drought and temperature conditions had also affected central olive growing regions, including Lazio and Umbria, Olive Oil Times wrote.

Olive growers’ association Italia Olivicola had forecast that the ‘off-year’, combined with extreme weather conditions, would reduce Italian olive oil production by at least 23% compared to the previous season.

According to EU estimates, Italy produced 328,000 tonnes of olive oil in the 2023/24 crop year.

The Indian government has raised customs duty on edible oils in a bid to support oilseed farmers, Reuters wrote.

Effective from 14 September, a 20% basic customs duty on crude palm oil, crude soyabean oil and crude sunflower oil was introduced, the finance ministry’s notification on the same date said.

As the three oils were also subject to India’s Agriculture Infrastructure and Development Cess and Social Welfare Surcharge, the move would effectively increase the total import duty on the three oils from 5.5% to 27.5%.

Malaysian oil palm company Kuala Lumpur Kepong (KLK) has formed a joint venture with vegetable oil product and consumer goods firm Alami Commodities to manufacture, market and sell palm oil and speciality fats in the Middle East.

Trading as KLK Alami Edible Oils (KAEO), the joint venture would operate a refinery and packaging plant in Selangor, Malaysia, scheduled to be commissioned in 2025, the companies said in a joint statement on 25 September.

KLK would own 65% of KAEO and oversee all technical operations, including the sourcing of raw materials, while Alami would hold the remaining share and manage global sales and marketing efforts “with a focus on the Middle East”.

Established as a plantation company more than 100 years ago, KLK is focused on oil palm development and had about 300,000ha of planted area across Malaysia (Peninsular and Sabah), Indonesia (Belitung Island, Sumatra, as well as Central and East Kalimantan) and Liberia, as of September 2022.

The group has oleochemical and refinery operations in Malaysia, Indonesia, China, Switzerland, Germany, the Netherlands, Belgium and Italy.

Part of the Alami Group of companies, Alami Commodities exports vegetable oil derivatives and downstream products to more than 60 global destinations.

The import tax on imports of refined palm, soyabean and sunflower oils increased from 13.75% to 35.75%.

The move could raise edible oil prices and dampen demand, leading to a reduction in imports of the three oils, the report said.

In August, Reuters reported India was looking into increasing import taxes on vegetable oils to help domestic soyabean growers ahead of regional elections due in Maharashtra later this year.

“After a long time, the government has been attempting to balance the interests

of both consumers and farmers,” Sandeep Bajoria, CEO of vegetable oil brokerage Sunvin Group, was quoted as saying.

The move had increased the likelihood of farmers receiving the minimum support price set by the government for their soyabean and rapeseed harvests, Bajoria said.

According to the report, India meets more than 70% of its vegetable oil demand through imports, buying palm oil mainly from Indonesia, Malaysia and Thailand, while it imports soyabean oil and sunflower oil from Argentina, Brazil, Russia and Ukraine.

INDIA: The government has launched two missions to boost edible and palm oil production in a bid to ensure food security and end its reliance on imports, Policy Circle wrote on 7 October.

As part of the National Mission of Edible Oils – Oil Palm (NMEO-OP) initiative, seed gardens and oil palm nurseries would be set up to ensure the domestic availability of seedlings. The mission would run from 2024/25 to 2030/31.

Under the national oilseeds scheme, the government planned to increase oilseeds production from 39M tonnes of oilseeds in 2022/23, to 69.7M tonnes by 2030-31, Policy Circle wrote. It also aimed to raise domestic edible oil production from 12.7M tonnes in 2022/23 to 20.2M tonnes in 2030/31.

The report said India imported around 9M tonnes/ year of palm oil, around 56% of total edible oil imports, but the schemes aimed to reduce this to some 28% over the next seven years.

To curb imports, the focus would be on boosting the production of key crops such as mustard, groundnut, soyabean, sunflower and sesame and to increase oil extraction from secondary sources like cottonseed, rice bran and tree-borne oils.

In addition, the government would support the development of high-quality seeds using global technologies such as genome editing, the report said.

US farmers were reeling from the impact of Hurricane Helene on crops as Florida continued to assess the damage caused by Hurricane Milton, Fox5 reported on 9 October.

Hurricane Milton, a category 3 storm, hit Florida on 9 October, causing extensive property damage and leaving millions of homes and businesses without power, The Guardian wrote on 10 November. At the time of the report, the death toll from Milton had reached at least 10.

Milton came just two weeks after Hurricane Helene slammed into Florida’s Gulf coast on 26 September – dumping unprecedented amounts of rain in Georgia, the Carolinas, Tennessee, Virginia and Kentucky – and killing at least 232 people.

The US Department of Agriculture had deployed surge teams to assist with recovery efforts to help with the billions of dollars wreaked on US crops and farmland, Agriculture

Dive wrote on 7 October.

Hurricane Helene had destroyed large portions of Georgia’s cotton, peanut and pecan crops, causing significant losses across the state, Fox5 said. Nearly 30% of the peanut crop had been destroyed and one-third of the state’s cotton crop was considered a total loss, the Georgia Department of Agriculture said.

In North Carolina, damage from Hurricane Helene was expected to be “major”, said Andrea Ashby, director of public affairs for North Carolina Department of Agriculture and Consumer Services. Some of the key commodities affected included corn, soyabean, tobacco and cotton.

Soyabean farmers in North Carolina were facing a range of issues including flooded fields and sprouting in pods causing a decline in seed quality, said North Carolina State University soyabean specialist Rachel Vann.

The Malaysian government has announced a revised adopt-anorangutan plan for major palm oil trading partners, Reuters reported Minister of Plantation Industries and Commodities

Johari Abdul Ghani as saying on 18 August.

Companies that imported Malaysian palm oil would be able to adopt orangutans but the apes would not leave the country. In May, the minister had put forward a plan to

send orangutans overseas as trading gifts but conservation groups had raised concerns over the orangutans' welfare.

Johari said funds raised from companies which adopted orangutans would be distributed to NGOs and the Sabah government to monitor forested areas where the primates lived, and their safety and condition.

Orangutans are found only in the rainforests of the Southeast Asian islands of Borneo and Sumatra and are a critically endangered species due to deforestation of their natural habitat. World Wide Fund for Nature (WWF), said the orangutan population on the island of Borneo was less than 105,000.

China is expected to increase oilseed crushing in 2024/25 due to a moderate rise in demand for protein meals from the feed sector, according to US Department of Agriculture (USDA) data reported by World Grain on 9 September.

Total oilseed crushing was forecast at 137.3M tonnes in 2024/25, up from an estimated 135.3M tonnes the previous year.

Overall feed consumption continued to grow, driving soyabean meal use, the USDA’s Foreign Agricultural Service (FAS) report said. “Additionally, a moderate recovery of vegetable oil demand and greater soyabean use for food also drove up consumption of oilseeds,” the FAS said.

Soyabean crushing was estimated at 99M tonnes in 2024/25, up from 97.5M

tonnes the previous year. Meal consumption for feed in 2024/25 was estimated at 102.7M tonnes, a moderate growth from the 101.3M tonnes the previous year.

Soyabean meal was forecast to account for over 74% of meal consumption.

Total vegetable oil for food use in 2024/25 was also forecast to rise, up from 35.1M tonnes the previous year.

USA: The US Environmental Protection Agency (EPA) has launched investigations into the supply chains of at least two renewable fuel producers amid concerns that some may be using fraudulent feedstocks for biodiesel in a bid to secure government subsidies.

EPA spokesperson Jeffrey Landis told Reuters that the agency had launched audits over the past year but declined to identify the companies involved as the investigations were ongoing.

Under the EPA-administered Renewable Fuel Standard (RFS) programme, refiners can earn a range of state and federal environmental and climate subsidies, including tradable credits.

However, following a surge in used cooking oil (UCO) exports from Asia – involving high volumes relative to the amount of cooking oil used and recovered in the region – concerns had been raised that some supplies labelled as UCO might be cheaper and less sustainable virgin palm oil, the 7 August report said.

The European Union was also investigating the alleged use of fraudulent feedstocks, Reuters wrote.

The EPA audits began after the agency updated domestic supply-chain accounting requirements in July 2023 for renewable fuel producers seeking to earn credits under the RFS.

European Union (EU) imports of biodiesel from China fell by 91% in July compared to the previous month following the European Commission (EC)’s introduction of anti-dumping duties, according to Eurostat data reported by Palm Oil Magazine

Chinese biodiesel exports to the EU dropped from 109,457 tonnes in June to 9,835 tonnes in July – the lowest level since April 2021, according to the analysis. In July, the EU

imposed temporary anti-dumping duties ranging from 12.8% to 36.4% on biodiesel and hydrotreated vegetable oil (HVO) imports from China, the 27 September report said citing Quantum Commodity Intelligence data.

However, China’s export data did not correspond with EU import figures, with China reporting exports of 74,343 tonnes in May and 43,412 tonnes in June, Palm Oil Magazine wrote.

The discrepancies had raised concerns about potential gaps in sustainable certification, which traders claimed could be used to bypass anti-dumping duties, the report said.

European Biodiesel Board (EBB) general secretary Xavier Noyon welcomed the import data saying it showed the duties were delivering relief for EU industries.

“But the potential to avoid duties would still be our concern,” he added.

The International Air Transport Association (IATA) has announced it will be launching a Matchmaker Platform to link airlines and sustainable aviation fuel (SAF) suppliers.

Announcing the initiative on 24 September at the World Sustainability Symposium held in Miami, USA, IATA said the initiative was scheduled for launch in the first quarter of next year.

“Our vision is to create a transparent, efficient and accessible matchmaking platform that will accelerate the uptake of SAF as the aviation industry progresses towards net zero CO₂ emissions by 2050,” IATA’s senior vice president of Sustainability and chief economist Marie Owens Thomsen said.

IATA said the SAF Matchmaker Platform would cover three specific areas – connectivity, visibility and efficiency.

SAF producers and suppliers would be able to post available or planned SAF volumes and airlines would be able to register their interest in purchasing shown or desired SAF volumes. Any subsequent trade would take place outside the platform. The platform would also provide information on available SAF including volumes,

feedstock used, the location and technology of production, emission reductions, as well as compliance with the Carbon Offsetting Reduction Scheme for International Aviation (CORSIA) or the EU’s Renewable Energy Directive (EU RED). IATA said the central platform would simplify SAF procurement by making it easier and faster for all parties to connect.

US oilseed associations have welcomed a bill to support the production of renewable fuels from domestically-sourced feedstocks.

The National Oilseed Processors Association (NOPA) and the American Soybean Association (ASA) welcomed the move in an announcement on 24 September.

In addition to restricting eligibility for the Section 45Z Clean Fuel Production Tax Credit to fuels produced from domestic

feedstocks, the Farmer First Fuel Incentives Act would make the tax credit a 10-year credit by extending it to 2034.

“NOPA commends this bipartisan, bicameral legislative effort which puts US fuel producers, US crushers and US farmers first,” NOPA president and CEO Kailee Tkacz Buller said.

“We support free trade and open markets, but do not believe foreign feedstocks should benefit on the backs of US taxpay-

ers to the detriment of US farmers. Without this fix, the 45Z credit will incentivise the use of foreign feedstocks over those grown by US farmers. Our industry has made significant investments to expand US crushing capacity by 30% and this fix is pivotal to ensuring these investments are delivered.”

ASA president Josh Gackle said US farmers needed the support of a final 45Z rule prioritising domestically-sourced feedstock.

t

t.

w.

e

Leading European biofuels manufacturer Argent Energy has launched a glycerine facility at its Port of Amsterdam site in the Netherlands.

The 50,000 tonnes/year refinery will upgrade crude glycerine – a by-product of Argent’s waste-based biodiesel process –into 99.7% technical-grade glycerine, the company said on 1 October.

“By upgrading glycerine from our processes into a technical-grade prod-

JAPAN: A research team at Osaka Metropolitan University has developed a new catalyst that converts a glycerol derivative into bio-based propylene, the American Association for the Advancement of Science reported on 24 September on its EurekAlert website. Typically produced from petroleum, propylene is used in the manufacture of plastics, such as car bumpers and food containers.

The research from the Graduate School of Science developed a catalyst that selectively breaks down the oxygen-carbon bond in allyl alcohol, a derivative of glycerol, the report said.

The catalyst contained a special molecule, known as a metalloligand, which was designed to facilitate the reversible binding of two metals within the catalyst. This feature enhanced the reaction’s efficiency, providing high selectivity and minimising the formation of byproducts.

uct, we’re giving the chemical industry a bio-based option they can … use in their own products,” Argent Energy CEO Louise Calviou said.

The refined glycerine could be used to produce ethylene glycol or propylene glycol, which act as anti-freezing agents, the company said.

It can also be used as a plasticiser agent in the production of polymers, such as plastics and foams; and is suitable for use

in the production of epichlorohydrin, a key component in the creation of epoxy resins; and other applications.

Argent Energy, which currently produces over 190,000 tonnes/year of wastebased biodiesel for use in road transport, marine and power generation, said its aim to scale up its operations and decarbonisation efforts included plans to triple biofuel production at its Amsterdam site.

Global bio-polymer producer Braskem SA has launched a bio-polypropylene (bio-PP) product produced from used cooking oil (UCO).

Sold under the brand name WENEW, the product was aimed at the restaurant and snack food industries, Braskem said on 16 September.

“Our bio-circular PP is currently being supplied to various converters which support the Quick Service Restaurant (QSR) industry. Ideal users include QSR chains, retail food suppliers, traditional restaurants and snack food companies, especially those seeking to enhance circularity from their cooking oil usage,” Braskem America Polyolefins vice president Bill Diebold said.

The bio-PP was suitable for a range of applications, including food packaging, flexible packaging (such as films) and consumer goods, Diebold said.

Braskem said it had partnered with several suppliers in the value chain who, through their production facilities, converted bio-circular feedstock

into polypropylene, creating a sustainable loop.

The company has set out a plan to reduce scope 1 and 2 greenhouse gas emissions by 15% by 2030 and to achieve carbon neutrality by 2050.

Founded in 2002, Braskem is a Brazilian petrochemical company and a leading global producer of thermoplastic resins. Active in more than 71 countries, the company has

Estonian startup company Äio has secured US$6.8M to build a fermentation facility to produce food-grade fats and oils from forestry waste, Green Queen wrote on 27 September.

Although the new facility’s location had not been finalised, the company was aiming for completion by 2026.

Äio uses specialised yeast to turn byproducts from the wood and agricultural industries – like sugars extracted from

sawdust – into food-grade fats and oils.

Using a ‘red yeast’ microbe created and patented by Bonturi, the industrial byproducts were fermented in a process similar to brewing beer, Green Queen wrote. The resulting fats were rich in essential fatty acids and antioxidants, according to Bonturi.

To date, the company had developed three fats: encapsulated oil as an alternative to palm oil in the food industry; buttery fat as a substitute for animal fats,

business units in Brazil, Mexico, the USA, Asia and Europe. With a portfolio of petrochemicals and thermoplastics, including polyethylene (PE), green polyethylene (biopolymer), polypropylene (PP) and PVC, the company’s products are used in the food packaging, home furniture, industrial and automobile components, and paints and coatings sectors.

shortening and coconut oil; and RedOil as an alternative to fish oil and seed oils, which could be used in cosmetic and household products.

The company had also attracted interest from major food, cosmetics and household consumer packaged goods companies, which had agreed to co-develop products, the Green Queen report said.

The alternative fat market was projected to reach US$4.5bn by 2032, the report said.

Toymaker Lego has announced plans to make half the plastic in its toy building bricks from renewable materials by 2026, The Guardian reported.

Last year, the Danish company halted plans to make bricks entirely from recycled bottles due to cost and production issues, the 28 August report said.

The company has been testing more than 600 alternative materials as part of its long-term plan to switch entirely to renewable and recycled plastic by 2032, according to the report.

As part of that aim, the company planned to gradually reduce the amount of fossil oil-based plastic it used by paying up to 70% more for certified renewable resin – the raw plastic used to make its bricks – in a bid to encourage manufacturers to increase production, the report said.

Lego’s plastic producers are replacing fossil fuels with alternatives such as cooking oil or food industry waste fat, as well as recycled materials, but costs can be two or three times higher as the market is still developing, according to the report.

Niels Christiansen, the chief executive of Lego, was quoted as saying the shift towards more sustainable materials would lead to a significant increase in the cost of producing its bricks.

Last year, the group committed to triple spending on sustainability to 3bn Danish kroner (US$444M)/year by 2025, without passing on higher costs to consumers.

“So far, we have decided that we will bear the burden of it, and [the extra cost] comes out of our bottom line,” Christiansen said.

Canadian grain handling business Viterra said on 23 September that it had agreed to buy five sites in Australia from global agribusiness giant Cargill.

Viterra would acquire Cargill’s GrainFlow storage and handling facilities in Maitland, Crystal Brook, Mallala and Pinnaroo in South Australia; and Dimboola in Victoria, along with a mobile ship loader in Adelaide, South Australia. GrainFlow operates a network of 16 grain and oilseed storage centres in the states of Queensland, New South Wales, Victoria and South Australia.

In addition, Viterra said it had plans

CANADA: Canadian agribusiness Parrish & Heimbecker (P&H) has partnered with Picton Terminals by Doornekamp to build a new bulk agricultural marine terminal in Prince Edward County, Ontario.

The new facility would increase delivery options available to corn, soyabean and wheat producers in eastern Ontario, the companies said on 15 August.

In addition to significantly reducing travel time for local farmers, easing traffic on Highway 401 and improving the overall efficiency of the agricultural supply chain, the new facility would expand P&H’s export capacity, the companies said.

The construction of storage silos and related buildings was due to start later this year with the terminal expected to be operational by 2026.

P&H’s operations include grain handling and merchandising, flour milling, crop inputs and feed mills.

P&H has 40 grain storage facilities with 23.4M bushels of licensed storage, according to Sosland Publishing Co’s 2024 Grain & Milling Annual

Picton Terminals by Doornekamp provides logistics and port services in the St Lawrence Seaway & Great Lakes region.

to make significant initial and ongoing investments to optimise the operations in line with the company’s strategy of linking up-country sites to deep water ports by fast rail to move the maximum tonnage of grain to market during the first half of the year.

Cargill would have a long-term deal to source grain from Viterra’s export supply chain, allowing it to continue buying grain from growers at the acquired facilities and across Viterra’s Australian network.

In July, Viterra announced an A$35M (US$24M) investment at its Wolseley storage and handling facility, including an

expansion of the site and the introduction of fast rail loading to connect the site with Viterra’s deepwater Outer Harbour terminal. Viterra said it expected the acquisition to close in the first half of next year, subject to customary closing conditions, including approval by the Australian Competition and Consumer Commission and the Foreign Investment Review Board.

Viterra is active in 130 countries and handles over 125M tonnes/year of agricultural products including grains, oilseeds, pulses, rice, sugar and vegetable oil, according to its website.

Louis Dreyfus Company (LDC) said on 12 August that it had expanded its barge fleet in Paraguay including 12 new Paraguayan-flagged jumbo barges with a total capacity to transport 30,000 tonnes of solid products, representing a 20% increase in Logico Paraguay‘s river fleet.

Comprising four tugboats and 92 barges, with a total static capacity of 150,000 tonnes and a capacity to transport 1.6M tonnes/year of products, LDC said it expected the expanded fleet to be operational in January 2025.

LDC said it used the fleet to transport corn, soyabean and its derivatives (soyabean meal and oil) from various ports in Paraguay to ports in Argentina and Uruguay, where

they were processed by the company and/or trans-shipped to ocean-going vessels for subsequent shipment globally.

On the return journey to Paraguay, the upstream flow supported the import of other agricultural goods – such as

fertilisers – for the domestic market, the company said.

Logico Paraguay was established by LDC in 2007 to transport agricultural goods through the Paraná-Paraguay waterway for export to global markets.

Leading Ukrainian agribusiness Nibulon announced on 30 September that it had increased grain storage and handling capacity at its AK Vradiivskyi and Kolosivskyi elevator complexes.

Nibulon’ director for elevator operations Valerii Reutsoi said capacities at both facilities were increased to receive late grain crops.

At AK Vradiivskyi, a second trans-shipment line had doubled capacity and the facility’s unloading capacity had risen from 50-80 tonnes/hour to 150-180 tonnes/hour. In addition, two new 40-tonne capacity silos at Kolosivskyi Elevator were speeding up grain loading onto trucks, Nibulon said.

With a land bank of over 76,000ha, Nibulon is one of Ukraine’s largest grain and oilseed growers

and traders and is active in wheat, corn, barley, sunflower, soyabean, rapeseed and sorghum.

As well as grain and oilseed processing, Nibulon’s activities also include logistics, storage and shipment. It runs its own fleet, has a total grain storage capacity of 2.25M tonnes and operates a network of 27 trans-shipment terminals and grain and oilseeds complexes in the country.

Founded in 1991 by Oleksiy Vadaturskyy, Nibulon produces more than 300,000 tonnes/ year of grain and oilseeds, mostly for export, from a planted area of 51,908ha. Vadaturskyy turned Nibulon into a major global grain player but was killed during Russian aerial bombardment of Mykolaiv city in 2022. In November 2022, Andriy Vadaturskyy succeeded his father as company CEO.

The Panama Canal Authority (ACP) has proposed a US$1.6bn project to dam the Indio River in a bid to reduce the impact of future droughts, FreightWaves reported on 26 August.

Key trade routes connected by the Panama Canal include shipments between the US East Coast and Asia, and Europe and South America.

The canal experienced its worst drought since 1950 last year, with low water levels reducing ship transits to 18/day from the typical 36/day.

The proposed project would involve

damming the Rio Indio River and drilling an 8km mountain tunnel to connect a newly constructed reservior to Gatun Lake, which supplied water to the canal, FreightWaves wrote.

The proposal could take five years or more to complete but would allow up to 15 additional ship transits/day.

However, the project had faced criticism from local farmers and communities whose land risked being flooded by the construction of the reservoir, FreightWaves wrote.

ACP administrator Ricaurte Vasquez said while the Rio Indio project was a major

initiative, the authority was also looking at other ways to handle future droughts including dredging, moving water intakes to a different location and taking control of water salinity and Gatun Lake.

The canal’s move to 50ft (15.24m) of draft would allow Neopanamax container ships to travel through the waterway, Vasquez added.

Neopanamax ships hauling commodities such as liquefied natural gas and grains had been forced to use other routes during parts of 2023 and earlier this year due to the reduced draft.

Maputo Port Development Co (MPDC) said on 13 September that it had signed a deal with Maputo Grain Terminal SA (MGT) to expand capacity at Mozambique’s Port of Maputo.

As part of the US$5M project, MGT’s static capacity would rise from 25,000 tonnes to 45,000 tonnes, increasing annual ca-

pacity from 170,000 tonnes to 350,000 tonnes. The expansion followed a rise in grain volumes moving through the terminal, which handled 166,000 tonnes of grain last year.

MGT said it also planned to improve rail infrastructure and build four new silos, in addition to five existing silos, each with

5,000 tonnes of capacity.

Privately-owned MGT acts as a base for the transit of grains to South Africa and Zimbabwe, according to the MPDC website. The terminal can handle wheat, maize, soyabeans and soyabean meal.

The Port of Maputo also handles vegetable oils at the Ma-

Chane is a liquid bulk storage partner, specialising in end-to-end services for storage, processing and logistics. Collaborating closely with our customers, we provide reliable services that help their businesses run smoothly, as well as creating the infrastructure that facilitates their growth. We make storage active by connecting supply and demand in new ways and thinking ahead towards the future.

Chane offers storage facilities at strategic locations across the Netherlands, France, the United Kingdom, Spain, Portugal and Poland, and Italy. With a total capacity of over 5,400,000 cubic metres (CBM), our terminals handle a highly diversified base of liquid bulk products and offer excellent integrated and innovative service solutions.

Marine fuels SAF & Biofuels

Base oils &

puto Liquids Storage Company (MLSC) comprising six heated storage tanks with a total storage capacity of 10,000m³.

MLSC’s parent company, African Tank Terminals Limited, is a wholly-owned subsidiary of Equatorial Trading of Malaysia, part of Asian agribusiness Wilmar International.

NEW ZEALAND: The government has announced it will be introducing new legislation to simplify the process for companies and researchers to develop and commercialise products using gene technologies such as gene editing (GE), Reuters reported on 13 August.

Science, Innovation and Technology minister Judith Collins said that current rules and time-consuming processes had made research outside the laboratory almost impossible.

Current regulations in New Zealand meant that genetically modified organisms (GMOs) could not be released out of containment without going through a complex and vigorous process and it was difficult to meet the set standard.

In addition, GE was considered the same as genetic modification, even when it did not involve the introduction of foreign deoxyribonucleic acid (DNA).

Under the new law, low-risk GE techniques that produced changes indistinguishable from conventional breeding would be exempt from regulation; local authorities would no longer be able to prevent the use of GMOs in their regions; and there would be a new industry regulator, Reuters wrote.

The government hoped to have the legislation passed and the regulator in place by the end of 2025.

“These changes will ensure we can capitalise on the benefits [of GE],” Collins said.

Hundreds of food producers and retailers have handed a petition to Hungary’s agriculture minister István Nagy calling for strict labelling of food derived from gene-edited (GE) crops, Euronews reported on 4 September.

Hungary had reopened a debate on whether GE crops should be treated as broadly equivalent to conventionally-bred crops, the report said.

The petition urged ministers to align with the position of the European Parliament, which had agreed that all products derived from New Genomic Techniques (NGT) crops should be clearly labelled, Euronews wrote.

The petition warned that without labelling requirements, consumers would lack choice and the organic sector could face a threat.

The vice president of French organic food retailer Biocoop, Fréderic Faure, said modern GE crops shared some of the drawbacks of conven-

tional genetically modified organisms (GMOs), which he listed as “patentability, additional dependence of farmers on the seed and pesticide industry, outcrossing into the environment and the resulting negative impact on biodiversity”.

Faure’s view was shared by several member states responding to Hungary's reopening of the NGT debate.

In a statement which the EU Council published at the end of August, Spain said a February compromise text drafted by the previous EU Council Belgian presidency, which would not require labelling of NGT food products, should remain the basis for further talks. The Czech Republic and Denmark were also against reopening the debate.

However, Austria and Greece said all GM products should be subject to mandatory labelling from farm to fork, Euronews wrote.

A new genetically modified variety of wheat which uses a gene derived from sunflowerseed has been commercialised in Argentina and Brazil, World Grain reported on 27 August.

The new drought-resistant HB4 wheat variety had been developed by Argentine biotechnology company Bioceres.

After the USA, South America’s major grain and oilseeds producers – Brazil and Argentina – were the second and third largest growers of biotech crops globally, the report said.

“With more than 26M ha planted with genetically engineered (GE) soyabean, corn and cotton crops, Argentina has the third largest area of GE crops under cultivation in the world,” an Argentine government spokesperson was quot-

ed as saying. “The commercial adoption of GE crops began in 1996 with the introduction of herbicide-tolerant soyabeans and has seen unprecedented growth in area planted since.”

Bioceres manager of global seed and trait Martin Mariani said HB4 wheat could stabilise production in traditional

regions experiencing longer and more regular incidents of drought, and was the only available drought-tolerant wheat technology. HB4 wheat had also been approved for food and feed in Australia, New Zealand, Indonesia, Nigeria, South Africa, Colombia, Thailand and Chile.

German chemical and biotech giant BASF is preparing its agricultural chemicals business for an initial public offering (IPO) in the next few years as part of expected restructuring measures, according to a Reuters report based on a 18 September Bloomberg News article.

BASF’s agricultural unit comprises seeds & traits, crop protection, digital farming,

public health, urban & rural pest control, turf & ornamentals and animal nutrition divisions. The division focuses on selected crops: wheat, canola (oilseed rape) and sunflower in North America and Europe; soyabeans, corn (maize) and cotton in the Americas; rice in Asia; and fruit and vegetables globally.

The seeds & traits division uses germ-

plasms and trait-technologies designed to improve yields in countries including Brazil, Canada, Europe and the USA.

Since taking over as CEO in April, Markus Kamieth had continued his predecessor’s push to reduce BASF’s reliance on subdued European markets, while building a U$11bn chemical complex in southern China to tap into faster Asian growth, the report said.

30 October 2024

Fat & Oil Industry

InterContinental Hotel, Kyiv, Ukraine www.apk-inform.com/en/conferences/ fat-and-oil-indastry-2024/about

31 October 2024

3th Grain Academy Varna, Bulgaria https://grain-academy.com/

4-6 November 2024

Sustainable Aviation Futures APAC Congress

PARKROYAL Marina Bay, Singapore www.safcongressapac.com

6-8 November 2024

20th Indonesian Palm Oil Conference and 2025 Price Outlook (IPOC 2024) Bali Convention Center (BICC), Indonesia www.gapkiconference.org/ conference-details/agenda

7 November 2024

FOSFA Annual Dinner

The Brewery, London, UK https://fosfaannualdinner.co.uk/

7-9 November 2024

5th YABITED Fats and Oils Congress Antalya, Turkey www.yabited2024.com/EN/Default.aspx

11-13 November 2024

Roundtable Conference on Sustainable Palm Oil (RT2024)

Amari Bangkok, Thailand https://rspo.org/rt2024-save-the-date

12-14 November 2024

Global Grain Geneva 2024 Geneva, Switzerland www.fastmarkets.com/events/globalgrain-geneva

14-15 November 2024

Biofuels Expo 2024

Renaissance London Heathrow Hotel UK https://biofuelsconference.org

20-21 November 2024

10th ICIS Asian Surfactants Conference

Park Royal Collection Hotel, Kuala Lumpur, Malaysia https://events.icis.com/website/14105/

www.ofimagazine.com

9-11 December 2024

Hands-on Annual Vegetable Oil Deep Frying Course with Live Demonstrations College Station, Texas, USA https://fatsandoilsrnd.com/ annual-courses

20-21 January 2025

Fuels of the Future 2025 Berlin, Germany www.fuels-of-the-future.com/en

20-23 January 2025

Clean Fuels Conference 2025 San Diego California, USA www.cleanfuelsconference.org

30 January 2025

International Rendering Symposium, part of the International Production & Processing Expo

Atlanta, Georgia, USA www.ippexpo.org/education-programs

24-26 February 2025

Palm & Lauric Oils Price Outlook Conference & Exhibition (POC 2025) Kuala Lumpur, Malaysia

6-8 March 2025

Fats & Oils International Conference –Exhibition

JW Marriott Sahar, Mumbai, India https://foic.org.in/

10-11 March 2025

2nd The Future of Oilseeds: Prospects for Plant based Proteins? Frankfurt, Germany www.dgfett.de/meetings/aktuell/

16-19 March 2025

NIOP Annual Convention

Omni Rancho, Las Palmas Resort & Spa California, USA

https://niop.org/annual-convention-2024/

18-20 March 2025

International Biomass Conference & Expo Cobb Galleria Centre, Atlanta, Georgia, USA https://ibce.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Home

7-8 April 2025

8th Leipzig Symposium Leipzig, Germany www.dgfett.de/meetings/aktuell/

27-30 April 2025

AOCS Annual Meeting & Expo Portland, Oregon, USA https://annualmeeting.aocs.org/

4-7 June 2025

EFPRA Congress 2025

Radisson Blu Latvija Conference & Spa Hotel, Riga, Latvia https://efpra.eu/events

9-11 June 2025

Sustainable Fuels Summit: SAF & Renewable Diesel & Biodiesel Chi Health Center, Omaha, Nebraska, USA https://few.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Sustainable_ Fuels_Summit__SAF__Renewable_ Diesel__Biodiesel

10-11 June 2025

IGC International Grains Conference London, UK www.igc.int/en/conference/reginfo.aspx

11-12 June 2025

Oleofuels 2025

Barcelona, Spain www.wplgroup.com/aci/event/oleofuels

29 June-2 July 2025

16th Congress of the International Society for the Study of Fatty Acids and Lipids (ISSFAL) Quebec City, Canada www.issfalcongress.com

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

21-26 October 2025

North American Renderers Association Annual Convention Ritz Carlton Amelia Island, Florida, USA https://convention.nara.org

18-20 November 2025

MPOB International Palm Oil Congress and Exhibition (PIPOC 2025) Kuala Lumpur, Malaysia https://pipoc.mpob.gov.my/

For a full events list, visit: www.ofimagazine.com Information subject to change

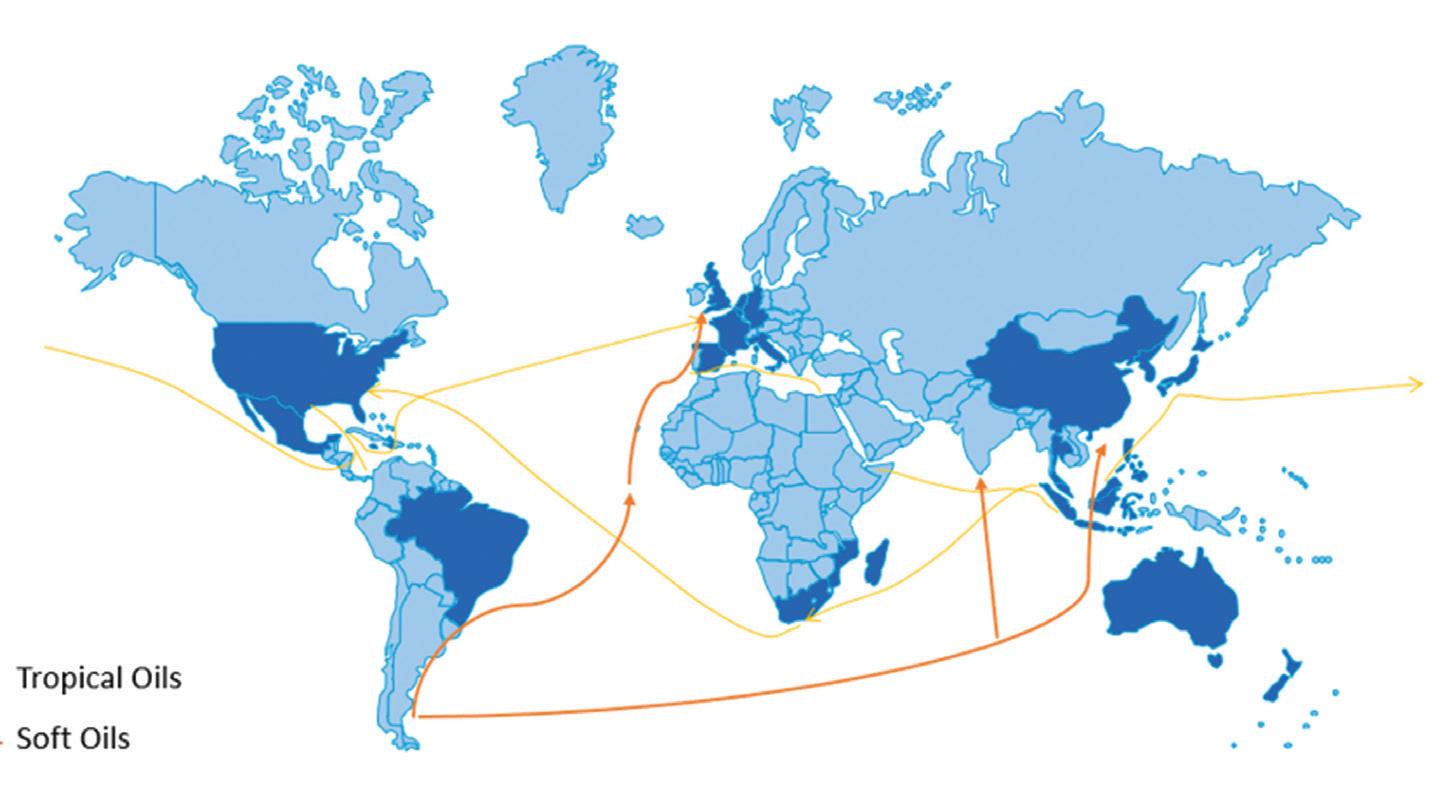

Edible oils have been transported worldwide since the late 1970s from the same countries to the same destinations.

What has changed for the freight market has been the volumes transported, from small quantities loaded on general cargo ships to specialised chemical tankers now carrying up to 70,000-80,000 tonnes of palm or soyabean oils.

The main vegetable oil trade routes are from Asia to Europe, South America to Europe, and South America to China/India (see Figure 1, below).

Several dramatic changes have affected

Although the shipping of edible oils has remained relatively stable for decades, the onset of UCO exports, an ageing fleet, contraction of tonnage and regulations to cut emissions will all have an impact on the market going forward Francesco Morici

vegetable oil freight in the past three to four years.

Many companies, traders and producers have started to invest in the shipping of used cooking oil (UCO) and UCO methyl ester (UCOME) due to demand for these

Source: Navquim

products as feedstocks for renewable diesel and sustainable aviation fuel (SAF). There has been a swing in tonnage, with vessels ships operating in the Clean Petroleum Products (CPP) and vegetable oil markets relocating their vessels to China, which has been a major shipper of UCO and UCOME to Europe.

This flow is now diminishing slightly due to new EU import taxes on Chinese biofuels announced in July. This may create a surplus of tonnage of vessels previously shipping these cargoes from China.

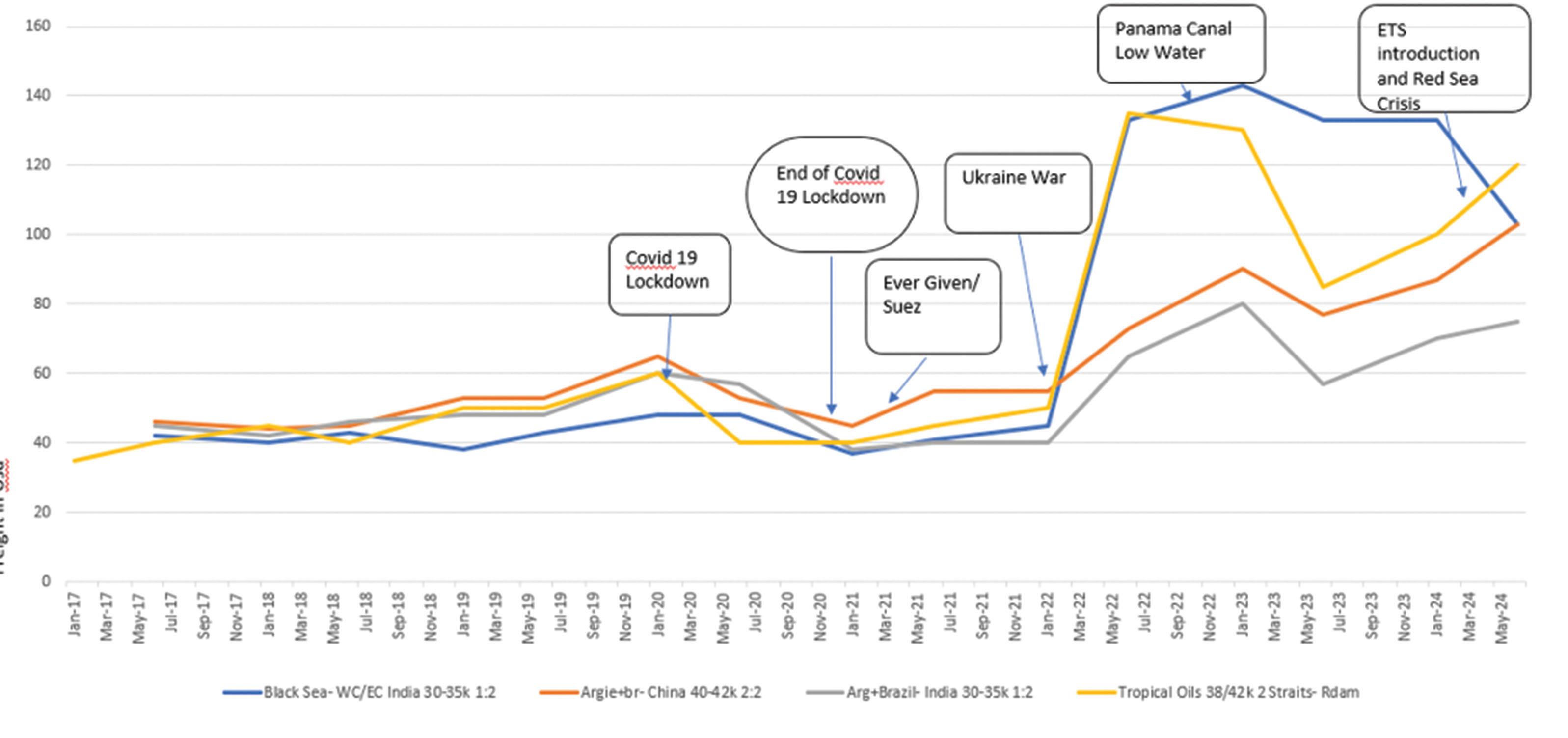

Vegetable oil freight rates have remained relatively stable since 2016/2017 even during the COVID-19 pandemic when other shipping markets – such as for containers – suffered big swings.

The first major shift in vegetable oil freight rates came when drought affected water levels at the Panama Canal at the end of 2023 (see Figure 2, following page).

From some 20 ships per day travelling northbound and southbound via the canal,

numbers fell to some four to five ships per day. This caused major delays on both sides of the canal, with bidding rates to secure passage on arrival rising from the normal US$10,000–$15,000 premium to US$350,000–$400,000 for container, cruise and LNG ships.

For producers shipping some 30,000–40,000 tonnes of palm or soyabean oils, the premium could have represented almost the entire cost of their freight.

Vegetable oil cargoes from Asia to the USA therefore re-routed via the Cape of Good Hope to avoid the Panama Canal, increasing their voyage time by about 15 days.

The other big spike in the vegetable oil freight market resulted from Houthi attacks on vessels in the Red Sea, affecting ships passing through the Suez Canal – the quickest sea route between Asia and Europe. Most ships bound from Asia to Europe re-routed around the Cape of Good Hope, increasing their transit time by about 12-15 days, as well as incurring additional costs such as for bunker fuel and emission credits.

The classic sunflower oil route from the Black Sea to India was around US$40/ metric tonne, but tripled to some US$$120/metric tonne following Russia’s invasion of Ukraine in February 2022. The price of insurance became very high and many ship owners avoided Ukraine due to high costs and risk.

Some traders and producers in Ukraine invested heavily in second hand tonnage

because the cost of freight and insurance was becoming so high that it was cheaper for them to buy a second hand vessel to ship their product locally or a short distance than to charter a ship. Two years on, there is a fair amount of this tonnage owned by non-ship owners impacting the Intra-Mediterranean freight market. Freight rates as of June 2024 for this route were around US$100/metric tonne.

The Argentina/Brazil route to China/ India has been more consistent, with geopolitical factors showing less of an influence and no need to pass through the Panama or Suez canals. Rates to move Argentine and Brazilian soyabean oil to China and India have increased due to tonnage moving to Asia to ship UCO and UCOME from China to Europe, and are currently around US$60-80/metric tonne.

The Palm Oil Straits to ARA (Antwerp/ Rotterdam/Amsterdam) route has hovered around the US$40-60/metric tonne level since 2017 but rose four-fold following the drought problems at the Panama Canal and the Red Sea crisis. Most reputable large chemical and palm oil companies now avoid using the Red Sea.

The workhorse vessel used by most vegetable oil majors in the trade is the Japanese-built, 19,000 dwt, stainless steel J19 vessel, dating back to the early 2000s. The ship is flexible and used by the palm oil and chemical trades because of its flexibility and stainless steel tanks, allowing carriage of different kinds of products. The hire rate for this benchmark ship

was around US$14,000-15,000/day until the COVID-19 pandemic. Soon after from the summer of 2022, rates peaked at around U$50,000/day, due to the Panama and Red Sea crises, for J19s trading between Asia to Europe shipping UCO and UCOME to Europe. Rates have since fallen from those peaks.

The CPP market also has a direct influence on the chemical/vegetable oil market. CPP vessels of 50,000-60,000 tonnage like to enter the chemical/ vegetable oil market when these markets are stagnant as they can offer a cheaper cost per tonne of cargo rate. When the CPP market picks up, these ships quickly disappear and the market returns to the traditional chemical owner.

The shipping industry reacts to any major events relatively slowly, with changes only appearing months after the event itself.

One of the biggest challenges currently facing the vegetable oil trade, and the chemical market in general, is an ageing fleet and contraction of tonnage, with very few new ships coming into market.

Most of the world’s major shipyards – in Japan and China – are very busy renewing tonnage for container companies which, after many years of losses, have been enjoying astonishing results in the last two to three years. Danish shipping firm Mærsk A/S, for example, reported a profit of US$15bn in just one quarter.

Container companies are now investing heavily in new and bigger ships and may typically order 10-15 ships, compared to just two to five new chemical ship orders. u

Most Chinese and Japanese shipyards are more interested in constructing container ships – which are easier to build and require less labour – than highly specialised stainless steel ships which need specialised shipyards, a larger workforce, as well as more stainless steel material.

Ship owners coming out of many years of losses since the 2007/2008 global financial crisis are therefore refraining from ordering new specialised vessels because the price of these ships is currently too high and because it is difficult to find the specialised shipyards to build them.

The current average age of vessels shipping vegetable oils is around 16 years old, with no new ships forecast to come on line until 2026/2027, and only amounting to a fraction of what the market needs.

The European Commission’s announcement on 19 July that it would impose provisional anti-dumping tariffs of up to 36.4% on biodiesel imports from China will have an impact on shipping from the country.

Clean fuel advocacy group Transport & Environment has said that the tariffs are a step in the right direction in limiting imports of potentially fraudulent UCO from China, which has flooded the European market in the past two years.

The EU import duties may lead to the USA taking in more UCO and UCOME for its renewable diesel/SAF sector.

The definition of what is UCO and UCOME is also having an impact on the shipping and labelling of these products.

All cargoes are classified by the International Convention for the Prevention of Pollution from Ships (MARPOL) according to their environmental risk.

MARPOL sets out guidelines for products such as UCO, UCOME, palm oil methyl ester (POME) and fatty acid methyl ester (FAME), such as how to dispose of their residual slop following tank cleaning.

Adopted in July 2023 and coming into force on 1 January 2025, the FuelEU Maritime Regulation promotes the use of renewable, low-carbon fuels and clean energy technologies for ships to support decarbonisation in the sector.

FuelEU Maritime sets maximum limits for the yearly average greenhouse gas (GHG) intensity of the energy used by ships above 5,000 gross tonnage calling at European ports. Shipping companies need to reduce their GHG emissions by 2% next year, and gradually by 80% by 2050 by implementing the use of biofuels blending for their ships.

Currently, there are no fuels available on a large scale to help shipping companies comply with this mandate.

One tonne of marine fuel may require 3-5 tonnes of alternative fuel, meaning about 1.4-1.5M tonnes are needed in Europe to reduce GHG emissions by 2%.

There is currently not enough alternative fuels for marine consumption, and not enough available in every part of the world. In addition, the marine sector will need to compete with the similar EU ReFuelEU SAF mandate for the aviation sector coming into force in 2025.

The engines of the current 16-year-old worldwide fleet shipping vegetable oils are also not technologically equipped to change from traditional fuel to alternative fuel, such a methanol and ammonia, without substantial modification that, due to the ships’ age, may not be justified and promptly recovered.

New builds the sector may see in 2026/27 may have dual capacity to use e-methanol or ammonia but the market still requires these fuels to be available on a large scale. These fuels are also new technologies very much in their infancy.

The EU Emissions Trading System (ETS) launched in 2005 requires polluters to pay for their greenhouse gas (GHG) emissions to help bring overall EU emissions down. Since January 2024, the EU ETS has been extended to cover carbon dioxide (CO2) emissions from all large ships (5,000 gross tonnage and above) entering EU ports. The system covers:

• 50% of emissions from voyages starting or ending outside of the EU (allowing the third country to decide on appropriate action for the remaining share of emissions);

• 100% of emissions that occur between two EU ports and when ships are within EU ports.

The ETS covers CO2, methane and nitrous oxide emissions, but the latter two only from 2026.

In practice, shipping companies have to purchase and use EU ETS emission allowances for each tonne of reported CO2 emissions in the scope of the EU ETS system. Shipping companies only have to surrender allowances for a portion of their emissions during an initial phase-in period:

• 2025: for 40% of their emissions reported in 2024

• 2026: for 70% of their emissions reported in 2025

• 2027 onwards: for 100% of their reported emissions

The first surrendering deadline is due in September 2025 in all EU member states, with respect to emissions reported as taking place from 1 January 2024 to 31 December 2024.

This will add an extra layer of cost that is not easily recoverable by charterers. ● This article is based on a presentation made by Francesco Morici, chartering manager at Navquim, Spain, at OFI International 2024 on 9-11 September. Morici is also a member of the FOSFA Oils and Fats Technical Committee and an accredited FOSFA arbitrator

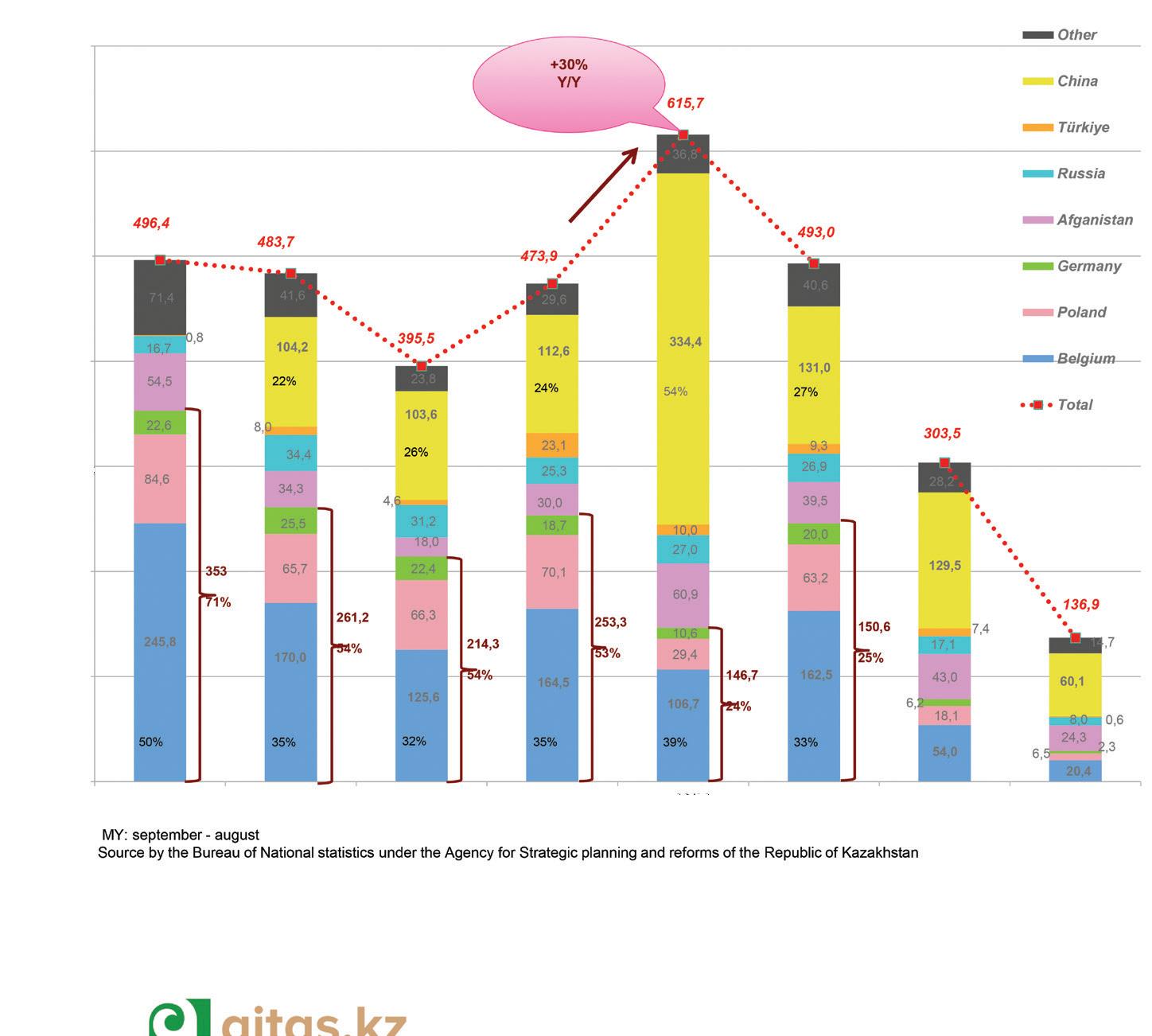

Until three years ago, Kazakhstan was the world’s leading global flaxseed producer, according to a report by the US Department of Agriculture (USDA).

By the time of the 20 August Kazakhstan: Grain and Feed Update report, however, Kazakhstan had dropped into second place behind Russia.

Together with Canada, the three countries account for 88% of global production, according to the USDA Foreign Agricultural Service (FAS) report.

Other major flaxseed producers include China, India and the USA.

A number of outside factors could benefit Kazakhstan’s flaxseed sector, such as the European Union (EU)’s import duty on all Russian wheat and oilseeds, the USDA report said.

Introduced on 1 July, the EU’s 10% import duty on Russian wheat and oilseed is set to increase to 20% on 1 January 2025 and to 50% on 1 January 2026.

“This year, farmers expect wheat prices will go down and flaxseed prices will go up as the European Union introduced an import duty on all Russian wheat and oilseeds,” the FAS said.

“Kazakhstan producers plan to replace Russia and supply flaxseed to [the] European Union.”

One of the leading global flaxseed producers, Kazakhstan is expecting a bumper crop this year following last year’s below average harvest Gill Langham

In its Kazakhstan report, the USDA said: “Kazakhstan is expected to have a bumper crop following last year’s troubled production.

“After heavy rains and flooding in May delayed planting, Kazakhstan’s primary growing regions have had near perfect weather, greatly raising the outlook for the upcoming harvest.”

Talgat Aldazharov, managing partner and CEO of Kazakhstan-based vertically integrated holding company Aitas Agro and head of the production committee at the Kazakh Grain Union, agrees.

The Kazakh Grain Union has 171 grain market members, comprising producing companies and farmers, trading companies, storage elevators, chemical and machinery suppliers, and survey and certification companies.

Its members farm more than 3M ha of land (17% of the country’s total planted area), offer more than 6.5M tonnes of grain storage capacity and export more than 5M tonnes/year of grains.

production estimates for this year are around 1M tonnes – compared to 361,000 tonnes in 2023 – following a 2030% increase in planted area (see Figure 1, following page)

“We are also expecting a much higher yield. Last year we had a very poor year but this season, the expectation is we will have the highest flaxseed yield historically,” Aldazharov says.

“Improved weather conditions are also helping to improve yields but we still have a very high risk of rainfall during harvesting.”

Agriculture is a key part of Kazakhstan’s economic, social and environmental development. The country is Central Asia’s largest grain producer and the region’s only significant exporter, according to World Bank data reported by World Grain

The ninth largest country in the world, Kazakhstan has significant agriculture potential and has the world’s fifth largest area of agricultural land, comprising

According to Aldazharov, flaxseed u

25M ha of arable land and more than 70M ha of pastureland, according to the 24 June World Grain report.

In its May report, Republic of Kazakhstan: Climate Adaptation Options and Opportunities in the Agriculture Sector, the World Bank says there has been a gradual increase in the cultivation of oilseed crops (flaxseed, sunflower and safflower) in Kazakhstan between 2012-2021 from 1.29M ha to 2.67M ha. The planted area for pulses (dry peas, soyabeans, lentils and chickpea) also increased from 200,000ha to 290,000ha in this period.

Crop diversity has gradually increased in Kazakhstan over the last five to 10 years, the World Bank says.

The area for oilseed crops, especially flaxseed, sunflower and safflower in the Northern, Eastern and Western zones, has increased while pulses (dry peas, soyabeans, lentils and chickpeas) have been gradually increasing across all

zones except the South.

According to the USDA report on the country, the Bureau of National Statistics recorded the country’s total planted area at 23.31M ha on 2 August. This comprised a wheat area of 13.15M ha and a barley area of 2.28M ha. Oilseed crops were planted on 2.9M ha.

Kazakhstan produces up to 25M tonnes of main grain and oil crops with more than half of it going to export, Aldazharov says.

Neighbouring Russia, China, Central Asia countries, Iran and the Caucasus, the country benefits from an advantageous geographical location, favourable conditions for agriculture, a stable political environment and government support for investment projects, he adds.

According to the country’s Bureau of National Statistics, the country had a population of around 20M in 2024 as of 1 August 2024.

Kazakhstan also enjoys proximity to

large markets and growing investment in transport and trade corridors, the World Bank says.

The government is looking to take advantage of the agriculture sector’s untapped potential for exports, jobs and inclusive and sustainable growth, according to the World Bank.

However, critical investments and transformations are needed in the public and private sectors.

Kazakhstan developed a national agricultural sector development project plan for 2021-25 to increase competitiveness by improving labour efficiency, doubling agricultural exports, domestically producing key food products and increasing rural incomes, the World Bank says.

Plans to increase labour efficiency include subsidies to agricultural producers to purchase equipment, increasing land area under irrigation, increasing the average cattle weight, increasing the use of high-quality seeds, fertilisers and pesticides, and introducing agricultural research and development to producers.

Since the 2000s, Kazakhstan has seen impressive economic growth driven by the first generation of market-orientated reforms, abundant mineral resources extraction and strong foreign direct investments, according to the World Grain June report.

Sustained economic growth has transformed the country into an upper middle-income economy, raising living standards and reducing poverty, the report says.

Over the last 10 years, however, Kazakhstan’s growth has slowed from 10% from 2000-2007 to below 4%, highlighting the vulnerabilities of the economy.

After rebounding from the adverse impacts of Russia’s invasion of Ukraine in 2022, the World Bank expects the country’s growth to slow to 3.4% year-onyear in 2024 due to lower-than-expected oil production, with a rise to 4.7% in 2025.

Kazakhstan’s economic outlook for the next two years is steady growth, driven in part from its continued reliance on hydrocarbons and by stronger consumer spending, according to World Bank report Kazakhstan Economic Update, Winter 202324 - Shaping Tomorrow: Reforms for Lasting Prosperity

Looking ahead, adjusting to the global green transition presents significant challenges for the country, according to the World Grain report.

Kazakhstan’s flaxseed is mainly sold for its oil content

Wheat is Kazakhstan’s largest crop by acreage, covering a planted area of around 11M ha and accounting for 80% of grain production.

Production in 2024/25 is estimated at 15.8M tonnes, according to an USDA Foreign Agricultural Service (FAS) report on 17 June.

In addition to flaxseed and wheat, Kazakhstan produces barley, cotton, durum, sunflowerseed and rice.

Barley covers a planted area of just over 2M ha, durum around 0.5 ha, corn just under 0.2M ha, with all other cereals covering around 0.5M ha, Aldazharov says.

Oilseed crops cover around 3M ha of land and the main oilseed crops are sunflowerseed (around 1.3M ha) and flaxseed (around 1M ha), he says. All other oil crops cover around 0.5M ha.

Lentil is the main legume crop, covering up to 0.3M ha and peas are planted on 0.2M ha of land.

A combination of factors has increased the popularity of flaxseed as a crop among local farmers, Aldazharov explains.

Factors include: lower prices for wheat – the country’s main crop – last year; the effects of a 20% or minimum €100 (US$111) export duty on sunflowerseeds; increased interest from China; and the low cost required to introduce flaxseed into existing crop rotation systems.

The three main flaxseed producing

provinces are North Kazakhstan, Akmola and Kostanay.

With low domestic flaxseed consumption, the country’s flaxseed exports are steady and increasing alongside expanding production, Aldazharov explains.

Kazakhstan’s flaxseed is mainly sold for its oil content, he says.

“There is almost no domestic consumption and even when the flaxseed is processed locally, the oil usually goes to export, with the meal going to the livestock industry.”

Flaxseed oil, also known as linseed oil, is used in the production of paint, printing inks, linoleum and varnish and is also used in the pharmaceutical and general chemical sectors.

Food-grade linseed oil can be taken as a nutritional supplement and can also be used in cooking.

Kazakhstan’s government sees China as an important trading partner and is working to build relations with its eastern neighbour, according to the World Grain June report.

The countries have proposed the creation of a joint sub-committee on co-operation in agriculture, with a working group made up of transport and agriculture employees from Kazakhstan and railway and customs employees from China, the report says.

Against this backdrop, Kazakhstan’s flaxseed exports to China have increased,

particularly last season, Aldazharov says (see Figure 2, previous page)

“Five years ago, there were almost no exports to China but the country has now become more and more important as an importer.

“This is due to its geographical proximity, lower logistics costs and reduced pressure on quality.”

Other important export destinations include Belgium, other EU countries like Poland, while there has been some interest from Turkey and Afghanistan, Aldazharov says.

Although a large flaxseed crop is anticipated in Kazakhstan this year, a lack of demand from traditional markets like Iran and transit issues and barriers in China and Russia all present active challenges to exports, according to the USDA report.

For example, only the Vistotsky Port on the Baltic Sea in Russia was available for Kazakhstan exporters of flaxseed shipments to Belgium, an important importer, the USDA said.

According to Aldazharov, the country’s flaxseed sector faces a number of challenges, including increasing pressure on key markets from Russian commodities, more competition for the Chinese market and logistical challenges.

“The main challenge is logistics to the main markets. Europe is so distant and the main road is through Russia. China is an important importer but, at times, there is an issue with rail access.”

There is also a risk of sanctions on all commodities that transit Russia – still the main route for Kazakhstan to export commodities to Europe, Aldazharov says.

Due to weather conditions, an increase in weeds and pests is also expected this season, he adds.

On a positive note, Aldazharov says local farmers and traders are showing increasing flexibility and Russian supplies could be curtailed due to drought conditions in southern regions and frost in central Russia earlier this year.

A combination of improving export infrastructure to China and EU sanctions on Russian commodities could also open up opportunities for flaxseed exports, he adds.

“I expect the sector will continue to develop or at least to maintain this year’s level due to increasing demand from China and the decreasing profitability of other main crops.”

● Gill Langham is the assistant editor of OFI

The effective technology and complex services

STATE-OF-THE ART OILSEEDS AND OIL PROCESSING TECHNOLOGIES

■ Horizontal agriculture

■ Local mechanical processing

■ Patented system of energy recovery

■ Complex approach including Physical Oil Re ning

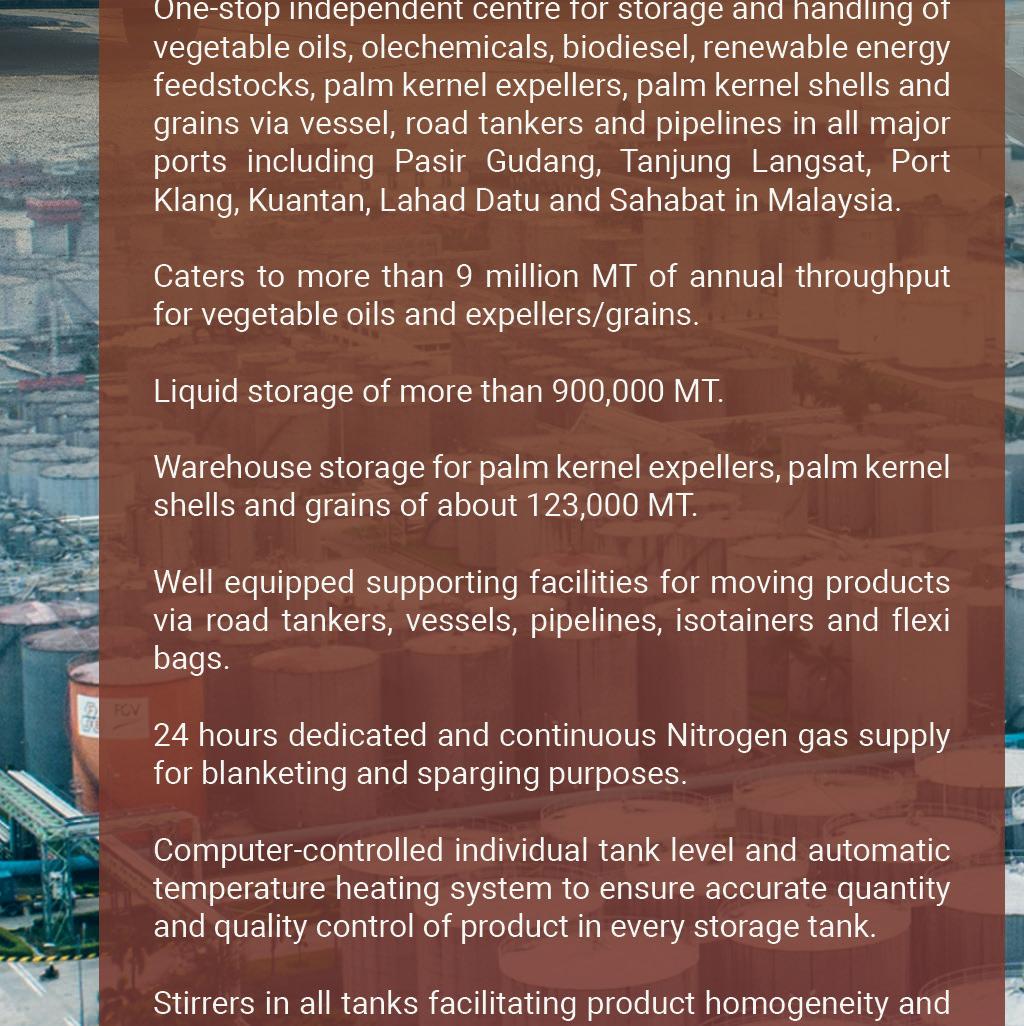

■ Unique combination of extruders and screw presses