Instrumentation

Rendering/Biofuels

18 Rise of animal fats in biofuels

The use of animal fats in biofuels has been growing and is set to rise to meet the demands of the renewable fuels sector

Rendering/Sustainability

24 Circular protein in feed

The easing of EU regulations on using PAPs to feed pigs and chickens has opened up a sustainable feed source which can reduce EU imports of soyabean meal

Plant, Equipment & Technology

28 Global round-up of news

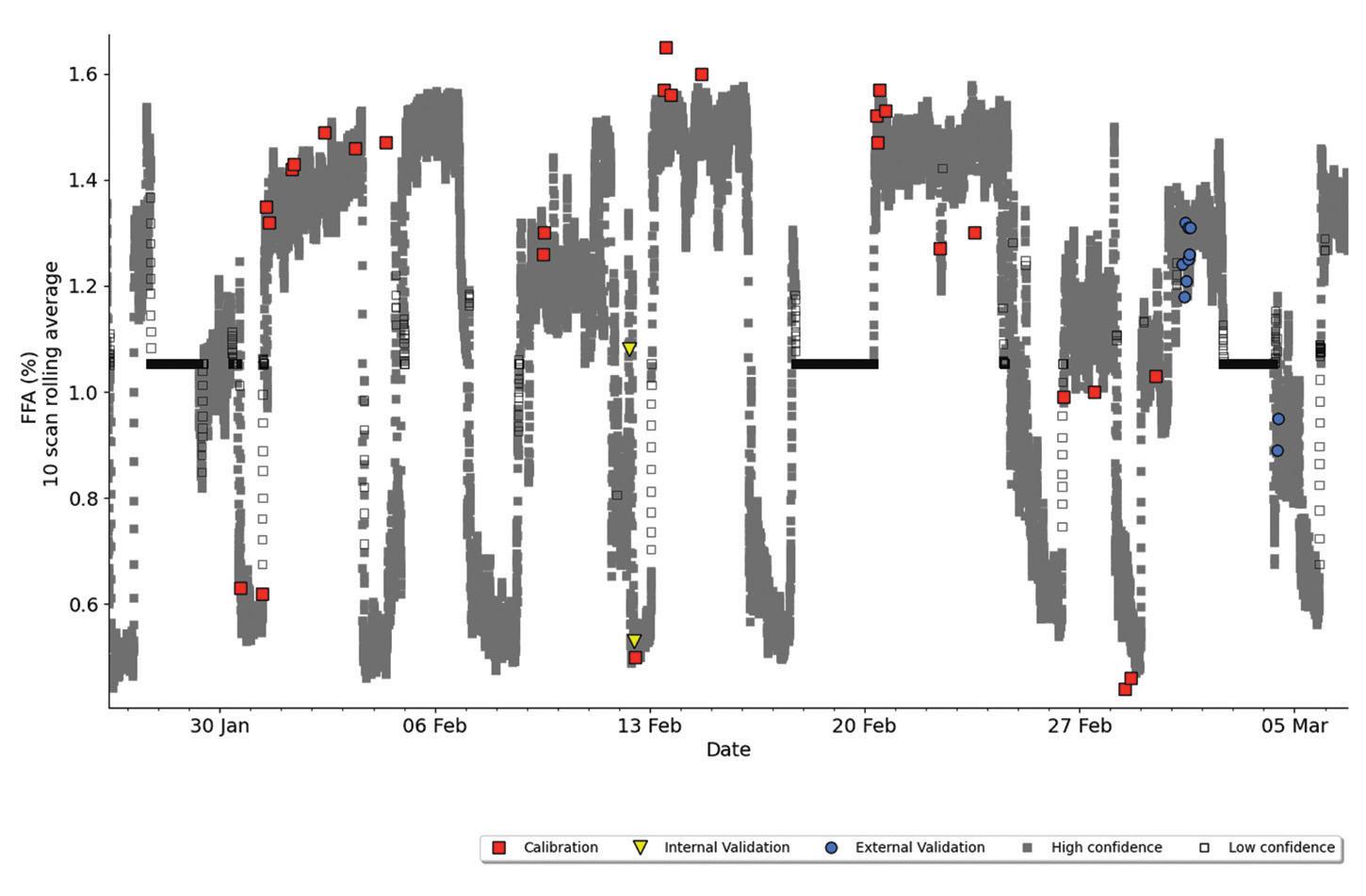

34 MIR for real-time plant monitoring

The use of MIR spectroscopy offers more accurate and precise real-time information to monitor and optimise oils and fats production

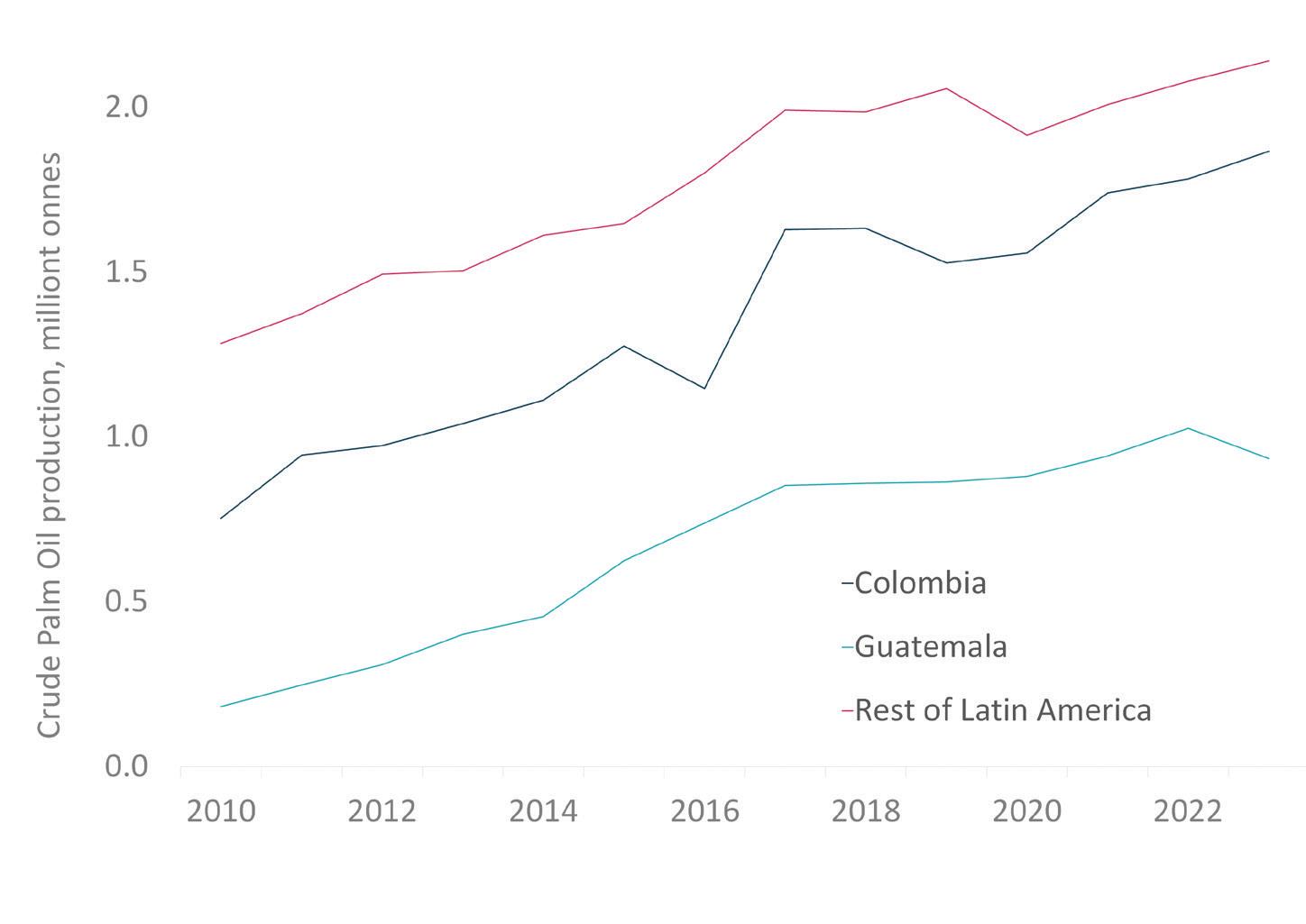

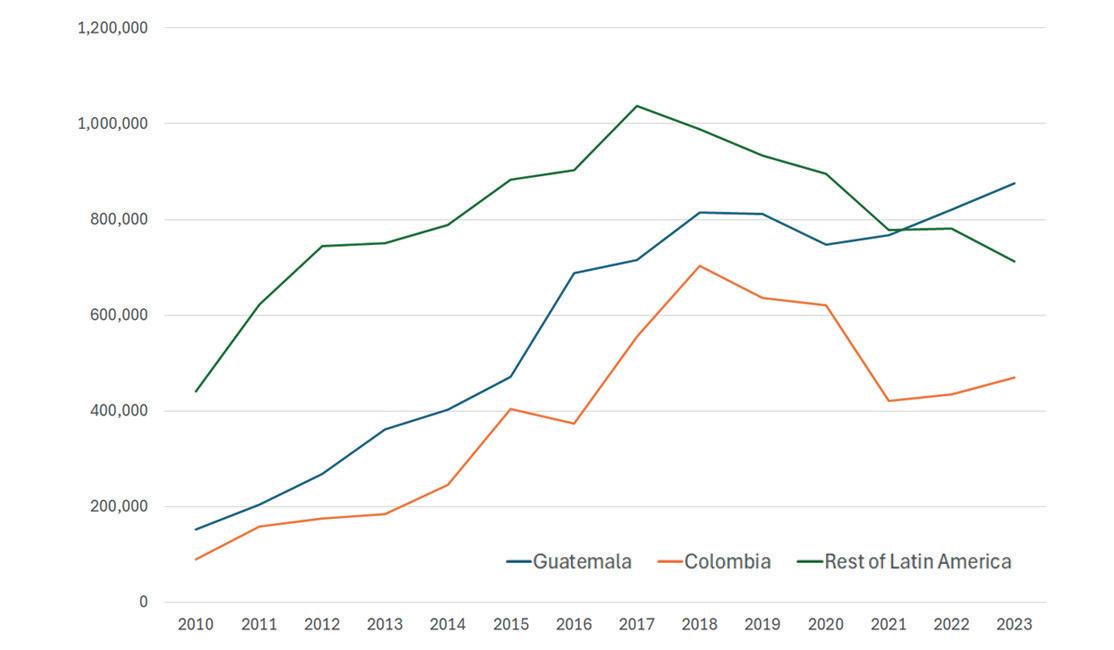

36 Latin America emerges

Although global palm oil production is dominated by Indonesia and Malaysia, Latin American countries are emerging as important players in the sector, showing leadership in adopting sustainable practices

39 The path to sustainability

How prepared is the oils and fats industry for the EU Deforestation Regulation and similar legislation in the USA? OILS & FATS

OFI reports on some of the latest projects, technology and process news and developments around the world

Comment

2 Individual choice?

News

4 EU approves merger of Bunge and Viterra

Biofuel News

10 EU imposes duties on Chinese HVO/FAME

Renewable News

12 Adani Wilmar acquires 67% stake in Omkar Chemicals

Transport News

14 Grampet opens new rail terminal in Romania

Biotech News

16 Bayer seeks protection from lawsuits

Diary of Events

17 International events listing Statistics

41 World statistical data

OFI International 2024

42 Show catalogue

VOL 40 NO 7

SEPTEMBER/ OCTOBER 2024

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 (0)1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 (0)1737 855157

SALES:

Sales Manager: Mark Winthrop-Wallace markww@quartzltd.com +44 (0)1737 855114

Sales Consultant: Anita Revis anitarevis@quartzltd.com +44 (0)1737 855068

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 (0)1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 (0)1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

© 2024, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020-747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA.

POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd

Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 (0)1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

Tobacco, ultra-processed foods, alcohol and fossil fuels kill 19M people globally and lead to 34% of all deaths, says a new World Health Organization (WHO) report.

The blame for this lies not on individuals making poor choices but on “big industry” wielding significant power and undermining measures to reduce smoking, drinking and obesity, according to the ‘Commercial Determinants of Non-communicable diseases (NCDs) in the WHO European Region’ report.

“A small number of trans-national corporations … wield significant power over the political and legal contexts in which they operate, and obstruct public interest regulations which could impact their profit margins,” WHO says. With goals to generate profit, maximise product sales and drive consumption, industry tactics include marketing strategies targeted at children and young people, misleading consumers, making false claims about products or environmental credentials, political lobbying, and funding research or consumer groups for influence.

Launching the report on 12 June, Belgian deputy prime minister Frank Vandenbroucke said: “For too long, we have considered risk factors as being mostly linked to individual choices. We need to reframe the problem as a systemic one, where policy has to counter ‘hyper-consumption environments’.”

The report says 53% of the world’s population are now overweight or obese, with the idea that individuals are the problem illustrated by PepsiCo’s chief executive saying “if all consumers exercised … did what they had to do, the problem of obesity wouldn’t exist”.

Promoting the idea that individuals – rather than businesses – are responsible for NCDs allows companies to present their own products, such as ‘low fat’ or ‘low sugar’, as solutions and portray themselves as protectors of individual freedom, WHO says. However, people may live in unhealthy living or working environments, or do not have the time or resources to make the “right” choice, the report says.

Individual-level policy interventions – which require changing, often addictive, behaviours – are also less effective than population-level policies and therefore least likely to reduce commercial sales and profits, WHO adds.

The report is damning but FoodDrinkEurope food safety, research and innovation director Rebeca Fernández, has countered this, saying: “To connect the consumption of processed foods with the tobacco and fossil fuel industries is irresponsible and outrageously misleading. We all need food – and we all need processed food.”

Wherever the responsibility lies, the scale of the NCDs problem is not in doubt.

WHO estimates that tobacco accounted for more than one million deaths a year or 10% of all deaths in the WHO European region in 2021. This was followed by alcohol (426,857 deaths, 3.84%) and diets high in processed meat, salt, sugary drinks and trans fatty acids (*ultra-processed foods) – said to be behind more than 350,000 deaths (3.52%).

WHO says there have been positive contributions to public health when companies implement health interventions such as reformulation to reduce salt content in food and the elimination of trans fats from the global food supply.

The challenge is whether individual, environmental, public policy and political economic systems can go far enough to tackle cardiovascular diseases, cancers and diabetes, and their risk factors.

Health policies, as well as government and industry regulations, will be among some of the many topics being addressed at OFI International 2024 on 9-11 September in Rotterdam. This issue contains our show guide and we warmly welcome everyone to our event.

Serena Lim,

serenalim@quartzltd.com

*Ultra-processed foods can be described as industrially-manufactured ready foods, with low nutritional value and high levels of sugars, sweeteners, salt, fat, trans fat and other additives, lacking in dietary fibre and vitamins and minerals found in unprocessed foods

Spain’s imports of Argentinian olive oil more than doubled in 2023 compared to the previous year due to a poor harvest and rising prices, according to a 26 June Olive Oil Times report.

At 660,000 tonnes, Spain’s 2022/23 harvest was its lowest in more than a decade, the report said. In addition, harvests had been poor across the Mediterranean basin, while Turkey – one of the few countries where production exceeded expectations – had introduced a bulk export ban.

Meanwhile, Argentina’s bumper 2023 harvest of 35,000 tonnes, had given the world’s largest producer outside the Mediterranean basin increased export capacity.

According to Argentine agricultural association Rural Rosario, the country’s virgin and extra virgin olive oil exports increased by 137% in the first 10 months of 2023 – reaching a record high 30,567 tonnes – against the same period in 2022. Spain was the largest market for Argentine olive oil exporters in 2023, with 34% of exports by value and 33% by volume. The USA and Brazil were other leading destinations.

CANADA: The government will invest up to C$3.04M (US$2.16M) over five years to support research for grain and oilseeds producers in the Atlantic region, World Grain wrote on 15 July.

Expected to focus on regional issues such as growing conditions, production challenges and agronomy, the funds would be given to the Atlantic Grains Council via the AgriScience Program – Projects Component, an initiative under the Sustainable Canadian Agricultural Partnership.

The European Commission (EC) has approved Bunge Global’s acquisition of Viterra on condition that the companies divest of Viterra’s oilseed businesses in Hungary and Poland and logistical assets connected to those operations, World Grain wrote on 2 August.

Last June, the two companies announced they had agreed to a merger that would create one of the world’s largest agribusiness companies, moving it closer in size and scope to leading agribusiness giants Cargill and ADM, the report said.

“We had concerns that the transaction could affect the supply chains of rapeseed and sunflowerseed in Central Europe, with potential ramifications across the food, feed, and biofuel industries," the EC said on 1 August.

However, following positive feedback during market testing, the EC concluded that the transaction would no longer raise competition concerns if its conditions were followed.

"The divestiture of Viterra’s entire oilseeds business in Hungary and Poland will preserve

competition in these markets.”

The EC decision was conditional on full compliance with its recommendations, which would be monitored by an independent trustee under commission supervision.

“Preventing market concentration in agricultural supply chains is crucial for both farmers and consumers,” EC executive vice president in charge of competition policy Margrethe Vestager said.

Regulatory approval for the transaction would also be needed in North and South America and China, World Grain wrote.

Headquartered in the USA, Bunge is mainly active in processing, selling and trading of oilseed meals and oils. The company also sells grains, milled products and unprocessed oilseeds, sugar and other agricultural products.

Viterra, which is headquartered in the Netherlands, trades agricultural commodities including grains, oilseeds and oilseed-based meals as well as oils. The company also sells other unprocessed products, such as cotton and milled products.

A California-based startup – backed by Microsoft co-founder billionaire and climate tech investor Bill Gates – has developed a dairy-free butter alternative, The Guardian reported.

Savor had developed the new product following trials to create dairy-free alternatives to ice cream, cheese and milk using a thermochemical process to build fat molecules, creating chains of carbon dioxide, hydrogen and oxygen, the 16 July report said.

According to the company, its product will have a significantly lower carbon footprint, potentially having less than 0.8g CO2 equivalent per calorie compared to “real” 80% fat unsalted

butter’s standard climate footprint of approximately 2.4g CO2 equivalent per calorie.

“We are currently working through regulatory approval to be able to sell our butter. We are not expecting to be able to move forward with any kind of sales until at least 2025,” Savor’s chief executive Kathleen Alexander said.

Although meat and dairy alternatives have become increasingly popular, replicating the flavour of butter had not always been achieved, The Guardian wrote.

According to Savor, the flavour of its butter alternative is more exact. “We had informal taste panels … and we expect to perform a more formal panel as part of our commercialisation and scale-up efforts,” Alexander said.

Speaking about the dairy-free initiative in an online blogpost, Gates wrote: “The idea of switching to lab-made fats and oils may seem strange at first. But their potential to significantly reduce our carbon footprint is immense. By harnessing proven technologies and processes, we get one step closer to achieving our climate goals."

According to the United Nation’s Food and Agriculture Organization (FAO), the livestock industry – comprising all dairy and meat agricultural farming – accounts for 14.5% of global greenhouse gas (GHG) emissions.

Develop, scale and commercialize with Crown – the proven, single-source partner for product and process optimization.

Bring new products to market faster and more sustainably with Crown. As a leader in oilseed extraction for 70 years, Crown’s technical expertise, guidance, proven technologies and Global Innovation Center transform your ideas for protein concentrates, food/beverage, botanicals and other new product segments into pro table realities. With Crown’s full-scale, state-of-the art pilot plant, analytical lab and training facilities, you can test product and process feasibility, run benchtop scale to custom processing and commercialize with ef cient, continuous operations backed by Crown’s aftermarket support and eld services. Accelerate your market opportunity — partner with Crown for a full lifecycle solution. Start up, scale up and expand with CPM and Crown’s expertise.

and Crown

Global agribusiness giant ADM is offering fully verified, segregated and traceable soyabean meal and oil to European customers as EU deforestation regulations are set to take effect later this year.

Aimed at promoting the consumption of deforestation-free products within the EU to bring down greenhouse gas emissions and biodiversity loss, the EU Deforestation Regulation (EUDR) was adopted by the European Parliament in 2023 and will come into force on 30 December.

Under the EUDR, any operator or trader who places soyabeans, palm oil, coffee, cattle, cocoa, wood and rubber or their derived products on the EU market must

WORLD: The United Nations’ Food and Agriculture Organization (FAO)'s Vegetable Oil Price Index rose by 3% in June compared to the previous month.

The benchmark Food Price Index (FFPI) tracks changes in the international prices of the most globally traded food commodities and the FAO’s Vegetable Oil Price Index illustrates changes in international prices of the 10 most important vegetable oils in world trade, weighted according to their export shares.

According to a 5 July FAO report, the increase in the Vegetable Oil Index in June was driven by higher global prices for palm, sunflower and soyabean oils.

“After declining for two consecutive months, international palm oil prices rebounded in June, mainly underpinned by a reviving global import demand due to increased price competitiveness,” the FAO said.

“Meanwhile, world soyabean and sunflower oil prices continued to rise, underpinned, respectively, by firm demand from the biofuel sector in the Americas and declining export availabilities in the Black Sea region.”

be able to prove that the products do not originate from land deforested since 2020 or have contributed to forest degradation. They will also have to provide precise geographical information on the land where these commodities have been grown.

“Thanks to the … participation of our farmer network and our … US elevators and segregated transportation and logistics capabilities, we are in a position to supply all of our existing customers in Europe with soyabean meal and oil once new rules go into effect at the end of this year,” Sebastian Kuck, ADM general manager, EMEA Soy Crush, said on 8 July.

In March, the company launched a fully

traceable North American soyabean programme, re:source, which involved almost 5,300 farmers across 15 US states for the 2024 season. The programme verified, traced and segregated soyabeans from farms to their final destination.

In addition, the company said it would use the sustainability measurement platform TRACT, an industry-led joint venture, to provide enhanced traceability solutions to its customers across the supply chain.

Beyond North America, ADM said it continued to work across other key regions to pilot soyabean crushing and exporting of both soyabeans and meal to the EU in fully traceable and segregated supply chains.

Malaysia's FGV Holding has produced its first batch of European Union Deforestation Regulation (EUDR)-compliant crude palm kernel oil (CPKO), New Straits Times reported.

The achievement made FGV one of the first Malaysian companies to produce EUDR-compliant CPKO, the company said on 8 August.

The EUDR is set to take effect from 30 December, with companies having to prove that the

soya, cattle, palm oil, wood, cocoa, coffee and rubber products that they import into the EU, export from the EU or place on the EU market do not come from any area deforested since December 2020.

FGV said it had focused on sourcing its fresh fruit bunches (FFB) from three key sources: its own estates, FELDA’s settlers, and independent smallholders who were already in line with the EUDR, Malaysian Sustainable Palm Oil Certification (MSPO) or Roundtable on Sustainable Palm Oil (RSPO) traceability requirements.

According to its website, FGV is one of the world’s largest crude palm oil (CPO) producers, accounting for 3% of global and 14% of Malaysian production. The company’s palm upstream business forms the core of the group, which manages a total land bank of 439,725ha in Malaysia and Indonesia, producing approximately 3M tonnes/year of CPO. FGV operates in seven countries across Asia, Europe and North America and, apart from the palm oil sector, its operations also include sugar, integrated farming and logistics & support businesses.

Ukrainian rapeseed exports to the EU rose by around 6% in 2023/24 to just under 3.2M tonnes, making it the leading supplier of the oilseed to the bloc, Germany’s Union for the Promotion of Oil and Protein Plants (UFOP) reports.

Meanwhile, at just under 5.7M tonnes, EU-27 rapeseed imports from non-EU countries dropped by 24% from the 2022/23 total of 7.5M tonnes to 5.7M tonnes, the 19 July report said.

EU rapeseed imports from Moldova tripled to just under 250,000 tonnes although a major proportion of that could have originated from Ukraine, UFOP said.

At 18.3M tonnes, the Canadian harvest in 2023 was larger than in the previous year. However, the country delivered less than 100,000 tonnes to the EU in 2023/24 – a 59% drop year-on-year – due to increased domestic consumption and exports to the USA, both for biofuel production.

For example, shipments from Australia declined by around 43% to just less than 1.9M tonnes due to a smaller rapeseed harvest, which was down approximately 1.2M tonnes compared to the previous year to 4.9M tonnes.

The US Food and Drug Administration (FDA) has introduced a nationwide ban on the use of brominated vegetable oil (BVO) as an additive in food.

BVO – a vegetable oil that has bromine added to it – is used in small amounts to keep the citrus flavouring from floating to the top in some soft drinks.

Already banned in Europe and Japan, the FDA’s move followed a ban introduced in California in October.

After first proposing the ban in November, the FDA concluded that the use of

The Chinese government is looking to import more food from South Africa in a bid to reduce its reliance on agricultural exports from USA and Australia, the South China Morning Post (SCMP) quoted the Chinese ambassador to South Africa Wu Peng as saying to local media.

For decades, South Africa’s exports to China had been mainly minerals and metals but recently had included products such as soyabeans, wine, aloe gel and citrus fruits, the 16 July report said.

“This year, we are working hard with the South African side towards signing export protocols for … more goods,” Wu told IOL News.

South Africa has been China’s largest trading partner in Africa for 14 consecutive years, with trade in the first half of this year totalling US$27.5bn, according to China’s General Administration of Customs.

In the same period, imports from South Africa increased by 10.7% to US$17.29bn year-onyear, while Chinese exports to the African nation dropped by 18.6% in that period to US$10.2bn.

Lauren Johnston, an associate professor at the University of Sydney’s China Studies Centre, saidBeijing wanted to increase trade with African countries to reduce its dependence on countries such as the USA and Australia – particularly for products such as soyabeans, which were a vital source of feed for China’s large pig population.

BVO in food was no longer considered safe following the results of research conducted in collaboration with the National Institutes of Health, which found the potential for adverse health effects in humans.

“The FDA is taking this action as part of our regulatory authority over ingredients added to food, which includes re-assessing previously evaluated food ingredients and addressing safety concerns,” the agency said on 2 July.

The FDA has regulated BVO as a food additive since its removal from the codified

list of Generally Recognized As Safe or “GRAS” substances in 1970. As authorised, manufacturers were required to list BVO or the specific vegetable oil, such as brominated soyabean oil, in the ingredients list.

Few soft drinks in the USA currently contain BVO, according to the FDA.

The ban takes effect on 2 August but the FDA said the date for compliance was one year later to allow companies to reformulate, relabel and remove the inventory of BVO-containing products before the final rule was enforced.

WORLD: Global agribusiness giant ADM’s net earnings dropped 48% in the second quarter of this year due to lower soyabean crushing margins, World Grain reported on 31 July.

The company’s net earnings in the quarter ended 30 June were US$486M compared with US$927M in the previous year.

Operating profit in ADM’s Ag Services and Oilseeds segment fell 56% to US$459M from US$1.05bn.

Lower margins came from a smaller crop in the Brazilian state of Mato Grosso.

North American origination results were also lower as increased supply from Brazil and Argentina shifted export competitiveness to South American origins.

“Our services and oilseeds results are significantly lower than the record results of prior years due to the ongoing rebalancing of the supply-and-demand environment and overall lower farmer selling,” ADM president and CEO Juan Luciano was quoted as saying in a 30 July earnings call.

Global soyabean crushing margins fell due to more balanced supply-and-demand conditions and lower soyabean values caused by increased imports of used cooking oil (UCO).

The number of obese adults will reach 1.2bn globally by 2030, says a new report by five United Nations (UN) specialised agencies.

Published on 24 July, the latest annual ‘State of Food Security and Nutrition in the World’ report recorded a steady increase in adult obesity over the last decade, from 12.1% in 2012 to 15.8% in 2022. By 2030, the world was projected to have more than 1.2bn obese adults.

The double burden of malnutrition – the co-existence of undernutrition alongside levels of being overweight and obesity – had also surged globally across all age groups.

The report said that in 2023, around 2.33bn people globally faced moderate or severe food

insecurity. The lack of economic access to healthy diets also remained a critical issue, affecting over one-third of the global population.

The report revealed that over 2.8bn people were unable to afford a healthy diet in 2022.

"This disparity is most pronounced in low-income countries, where 71.5% of the population cannot afford a healthy diet, compared to 6.3% in high-income countries," the report said.

“Food insecurity and malnutrition are [also] worsening due to a combination of factors, including persisting food price inflation. Major drivers like conflict, climate change and economic downturns are becoming more frequent and severe.”

Worldwide rapeseed demand in 2024/25 is expected to exceed production, according to research by Agrarmarkt Informations-Gesellschaft reported by Germany’s Union for the Promotion of Oil and Protein Plants (UFOP).

Although global rapeseed consumption was expected to decline by 0.5% in 2024/25 to

88.7M tonnes, the International Grains Council (IGC) forecast world production at 87.2M tonnes, leaving a supply shortfall of 1.5M tonnes due to a reduction in planted area and forecasts of lower yields, the 4 July report said.

End-of-year stocks were therefore likely to decrease more sharply than previously expected, with the volume of rapeseed in storage forecast at 5.6M tonnes, 21% below the previous year’s level.

UFOP said it expected strong to rising prices during the planting season this year and advised farmers to plan rapeseed production areas to meet crop rotation requirements.

“Demand for rapeseed oil in biodiesel fuel and future hydrotreated vegetable oil (HVO) production is supported by the discontinuation of the option to credit palm oil-based biofuels towards greenhouse gas reduction obligations in Germany and other member states, including France and Sweden,” UFOP said.

The EU has reported a record number of potential olive oil fraud and mislabelling cases in the first quarter of this year, The Guardian newspaper wrote on 29 July.

The increase came against a backdrop of supply shortages and higher prices.

In the first quarter of this year, the EU recorded 50 “cross-border EU notifications” including mislabelling, potential fraud and safety cases involving contaminated oils, compared with 15 in 2018.

As the total was limited to cases reported

by member states to the EU directorate general for health, and did not include domestic cases, the true scale of incidents was likely to be much higher, the report said.

Incident reports included oils contaminated with unauthorised substances such as pesticides, mineral oils and one case where glass fragments were discovered. In addition, there were many cases where extra virgin olive oil was judged to be adulterated, for example by mixing it with poorer or cheaper quality oils, cases where

virgin olive oil was labelled as extra virgin, and several cases of misleading or false origin labelling, The Guardian wrote.

In total, 182 olive oil fraud and non-compliance notifications were sent to the EU since the start of 2023.

According to provisional figures from the International Olive Council, global olive oil production levels are expected to fall to 2.4M tonnes in 2023/24, down 27% from 2018/19 and lower than estimated consumption of 2.6M tonnes.

The European Commission (EC) is set to impose provisional anti-dumping duties on imports of hydrotreated vegetable oil (HVO) and fatty acid methyl esters (FAME) from China, according to the European Biodiesel Board (EBB).

Announced by the EC in a pre-disclosure document on 19 July, duties ranging from 12.8% to 36.4% would be introduced four weeks after the announcement.

In the interim period, the EBB said on 19 July that it would ask for automatic registration of imports during the pre-disclosure stage to help the EU biodiesel sector before the duties took effect.

The association, which represents European biodiesel (HVO & FAME) produc-

UK: The UK Department for Transport (DfT) said on 22 July that – subject to parliamentary approval – a 2% sustainable aviation fuel (SAF) mandate would be introduced in the country on 1 January 2025.

The proposed mandate would be introduced in phases starting at 2% in 2025 and increasing on a linear basis to 10% in 2030 and 22% in 2024. From 2040, the mandate would remain at 22% until there was greater certainty regarding SAF supply.

Hydro-processed esters and fatty acids (HEFA) supply would not be capped for the first two years but was expected to be set at 71% in 2030 and 35% in 2040.

ers, said it would closely monitor imports during the interim period and if there was an increase, it might request retroactive imposition of duties.

However, the EBB said it was “gravely concerned” at the EU’s unexpected exclusion of allegedly dumped Chinese sustainable aviation fuel (SAF) from the provisional measures.

“Today we obtained measures that will start to rebalance the scales. Our next step is to work with the EU to close loopholes that will otherwise undermine this good work and also to work with member states and the Commission to ensure any fraudulent practices are dealt with in the future by a more robust sustainability certification

system,” EBB president Dickon Posnett said.

“Our European businesses have been suffering for far too long under the pressure of unfairly priced Chinese.”

The EBB filed an anti-dumping complaint with the EC in October 2023.

In an earlier statement on 9 July, the EBB said that in Europe, Chevron Renewable Energy Group had furloughed German workers, Shell had paused the construction of a biodiesel plant in the Netherlands, bp was pausing a biofuel project in Germany and Argent Energy had closed a biorefinery.

“While Chinese imports are not the only reason for these decisions, the biodiesel dumping has contributed to the difficulties producers face.”

The US oilseed sector is calling for biofuel produced from imported feedstocks to be excluded from tax credits, according to a 10 July Agri-Pulse report.

Biofuel tax credits offered more for feedstocks like used cooking oil (UCO) or tallow, which had a lower carbon intensity.

The National Oilseed Processors Association (NOPA) said the tax credits included in the In-

flation Reduction Act were incentivising a sharp increase in feedstock imports and impacting domestic soyabean processors.

US imports of animal fat and vegetable oil more than doubled between 2020 and 2023, according to the US Department of Agriculture (USDA)’s Foreign Agricultural Service (FAS).

Imports of UCO from China, which more than tripled in 2023, have contributed significantly to the rise, according to the FAS data.

“Every pound of imported feedstock really does take a pound of domestic soyabean capacity,” NOPA president and CEO Kailee Tkacz Buller was quoted as saying.

The current 40B credit for sustainable aviation fuel (SAF) – set to be replaced by the 45Z incentive next year – allowed registered fuel importers to receive incentives, she said.

The association was planning to push for the new 45Z tax credit to be solely for domestic feedstock producers, she added. “We’re okay with it [imported feedstock] coming in, but we don’t think it should qualify for the tax credit.”

British multinational oil and gas company bp is set to invest US$48.54M (CNY 353M) in acquiring a 15% stake in Chinese renewable diesel and sustainable aviation fuel (SAF) producer Lianyungang Jiaao New Energy, S&P Global reported on 10 July.

Lianyungang Jiaao New Energy was owned by Zhejiang-based Jiaao Enprotech, which had 100,000 tonnes/year of SAF capacity, and the deal came amid market speculation that China was set to announce

SAF mandates, the report said.

In July 2023, China’s Civil Aviation Administration drafted a fuel standard to ensure the viability of alternative fuels in the aviation sector, S&P Global wrote.

According to a market source quoted in the report, the SAF industry is complex and requires significant funding with producers needing to plan for a potential used cooking oil (UCO) feedstock supply shortage.

“It makes sense for state-owned and

leading companies to take on SAF projects, given the high costs and intricate nature of the industry,” the source added.

Some industry participants are working on co-locating, converting and integrating their facilities to enter the SAF industry, according to another market source.

“I think some industry players are anticipating that the Chinese government will release SAF mandates, so most of them are getting themselves prepared.”

USA: Global agribusiness giant ADM and chemical company LG Chem have announced that they would not be moving forward with their joint venture project to produce lactic and polylactic acid (PLA) at production facilities in Decatur, Illinois.

The two joint ventures include GreenWise Lactic, of which ADM is a majority owner, and LG Chem Illinois Biochem, which is majority-owned by LG Chem.

PLA is a thermoplastic monomer derived from renewable sources, such as corn starch or sugarcane, and is used in a wide range of applications such as appliances, electronics, packaging, 3D printing and fibres.

“Since we originally announced our two joint ventures with LG Chem for lactic and polylactic acid in 2022, construction costs have skyrocketed,” Chris Cuddy, president of ADM’s carbohydrate solutions business, said on 12 July.

“We looked at a variety of options, but when the time came to make final investment decisions, it had become clear that these projects no longer represented a prudent use of our investors’ capital.”

UAE: Global Biopolymers has partnered with SS Royal Kit Emirates Investment to form a new bioplastics company based in Dubai.

The new company, Emirates Biotech, said on 22 July that it would focus on the production and marketing of polylactic acid (PLA) biopolymers across the Middle East, Africa and India.

Emirates Biotech said it expected commercial operations to start in early 2025, with construction of its first PLA production plant in the UAE starting before 2026.

Indian multinational food and beverage conglomerate Adani Wilmar, which also produces oleochemicals, has acquired a 67% stake in speciality chemical company Omkar Chemicals, Startup Story reported on 13 July.

Omkar Chemicals operates a manufacturing plant in Panoli, Gujarat, India, with a production capacity of some 20,000 tonnes/year of surfactants. The company has plans to scale up production at the plant, which currently uses less than 10% of its capacity, according to the report.

As the deal did not require government or regulatory approval, Adani Wilmar – a joint venture between the Adani Group and leading Singapore agribusiness Wilmar International – was quoted as saying it expected to finalise the acquisition within three to four months.

The acquisition was a strategic step for Adani Wilmar as it looked to establish a strong production footprint in the speciality chemicals market,

Startup Story wrote. Although Adani Wilmar was active in the speciality chemicals sector through third-party manufacturing and by importing from Wilmar’s plants, the acquisition would enable in-house production, the report said.

Adani Wilmar is a market leader in food and edible oils in India. Its edible oil products include soyabean, palm, sunflower, rice bran, mustard, groundnut, cottonseed and blended oils, vanaspati and speciality fats. Its flagship edible oil brand Fortune was the largest selling product of its type in India, the company’s website said. As well as edible oils, Adani Wilmar also supplies pulses, rice, sugar and wheat flour.

The company produces oleochemicals including stearic acids, soap noodles, palmitic acid, oleic acid and glycerine for home and personal care products, including soaps, detergents, cosmetics, polymer, pharmaceuticals and industrial rubber.

A research team at Michigan State University, USA, has found that poplar trees can be engineered to produce squalene, offering an alternative to harvesting the oil compound from shark livers.

“Using engineered, nonfood crops like poplar may provide a more sustainable alternative for generating chemicals typically derived from fossil fuels, or even new speciality chemicals altogether,” the study team led by Björn Hamberger said on the university website on 8 July.

Squalene is used in cosmetic products and vaccines.

As part of the project, the team engineered poplars to produce squalene along two distinct chemical pathways.

One pathway used the gel-like substance known as cytosol found in the centre of cells, while another focused on producing squalene in chloroplasts, the organelles responsible for photosynthesis.

While the cytosol pathway

was discovered to interfere with poplar root formation, the chloroplast route produced 0.63mg/gm of squalene in leaves.

The team’s next step was to calculate the minimum sales price that poplar-produced squalene would need to be sold at to be commercially successful.

Shark-derived squalene was marketed at US$40/kg and the price for the poplar-produced compound was also calculated at US$40/kg.

However, Hamberger said

several options were available to boost the value of poplar-produced squalene.

“One way is increasing overall production, and the other brings us to the … world of perfumes and another marine animal product – ambergris.”

Produced in the digestive system of sperm whales, ambergris is used as a fixative in perfumes to prolong scents.

Hamberger said it should be possible to “upgrade” squalene to ambrein, another high-value terpene that made up ambergris.

Private rail freight and logistics operator Grampet Group has opened a new 3M tonnes/year agricultural rail terminal in Romania, World Grain wrote on 21 June.

The grain trans-shipment terminal in Dornesti was set to strengthen Romania’s position as a railway and logistics hub in central and southeast Europe while boosting grain traffic from Ukraine, the report said.

Built through a public-private partnership with the Grampet Group providing an investment of €10M, the terminal had been designed for around-the-clock operations, the company was quoted as saying. As it

BRAZIL: Brazil’s privately-owned Grupo Potencial will invest BRL 200M (US$37M) in building two biofuel pipelines in the south of the country, the company’s vice president Carlos Hammerschmidt was quoted as saying in a Reuters report.

Scheduled for construction next year and subject to regulatory approval, the 55km pipelines would be the longest of their type in the South American country, the 24 June report said.

Hammerschmidt said the investment would boost Brazil’s energy pipeline network, which was about 5% of that of the USA.

One of the new pipelines would transport biodiesel, connecting Potencial’s Lapa biodiesel plant to fuel distributors, Reuters wrote.

The Lapa plant sold 65,000m³/month of biodiesel and planned to transport half of this volume via one of the new pipelines.

Potencial also had plans to produce corn ethanol and soyabean-based sustainable aviation fuel at the plant.

By 2027, Hammerschmidt said the country would expect 1% of fuel used in the aviation sector to be SAF.

used similar technology and equipment to Romania’s river and seaports, it was expected to streamline trans-shipments to the Port of Constanta, World Grain wrote.

Situated on the Ukraine border in northwest Romania, the new terminal was also expected to enable grain shipments from Ukraine – a major supplier of wheat, corn, barley and sunflower oil – to global markets, the report said.

Romania was one of several EU countries that had been used as alternative transit routes for Ukrainian grain to help offset slower exports via Ukraine’s Black

Sea ports after Russia’s invasion in February 2022, World Grain wrote.

During an inauguration ceremony at the terminal, Grampet Group president Gruia Stoica said the facility would allow simultaneous trans-shipment of eight Ukrainiantype wide gauge grain wagons and eight normal gauge Romanian-type wagons.

The group said it was the largest private freight rail transporter in south-eastern Europe, offering transportation, logistics, locomotive and wagon production, as well as other rolling stock components and leasing services.

China’s COFCO International and agricultural cooperative GROWMARK have agreed to exchange grain assets in Illinois state, USA, for an undisclosed sum, World Grain wrote on 28 June.

COFCO agreed to purchase GROWMARK’s minority stake in a grain and by-product transloading facility in Cahokia located on the Mississippi River, in St Louis Harbour.

GROWMARK agreed to buy the B-House Chicago grain warehouse facility from COFCO, located on the Calumet River.

The B-House facility would allow GROWMARK to handle 1.1bn bushels/year of grain and oilseeds, the report said.

COFCO’s ownership of the Cahokia facility had raised concerns from two members of the US Congress, Nikki Budzinski and Mike Bost, who sent a letter to US Treasury Secretary Janet Yellen on 27 June asking for a thorough review, World Grain wrote.

“While we support expanding access to foreign markets, it is alarming that a majority of US ports and terminals are owned and operated by foreign entities, especially China,” the letter said.

COFCO International is the overseas agriculture platform for China’s largest food and agriculture company COFCO Corporation.

Asia-based biofuels company EcoCeres has secured 100,000m³ of storage capacity for sustainable aviation fuel (SAF) and hydrotreated vegetable oil (HVO) at Dialog Terminals Langsat (DTL3)’s facility in Malaysia.

The deal followed EcoCeres’ announcement of a significant investment in a new production facility in Pasir Gudang, Johor Darul Ta’zim, DTL3’s parent company DIALOG said on 29 July.

The new biorefinery was expected to be operational in the second half of 2025 while the storage expansion at the terminal was due for completion in the first quarter of 2027.

In an earlier report on 22 April, EcoCeres chief commercial officer Jeremy Baines said the unit would have a total capacity of 350,000 tonnes/ year of biofuels, comprising 220,000 tonnes/ year of SAF and 130,000 tonnes/year of HVO.

Located less than 1km from DTL3, the new biorefinery would be directly connected to DTL3’s storage tanks via rundown pipelines.

DIALOG said the remaining 50,000m³ of storage capacity at the terminal in Tanjung Langsat, Johor Darul Ta’zim, was expected to be leased to third party customers such as multinational companies and trading houses.

Inclusive of the 24,000m³ under construction, DTL3 would have a total storage capacity of approximately 230,000m³ for short to medium term energy traders and multinational companies storing energy products. DTL3 is located next to two other terminals – DIALOG Terminals Langsat 1 and DIALOG Terminals Langsat 2.

Following the expansion at DTL3, the combined storage capacity of DTL1, DTL2 and DTL3 would exceed 1M m³, the company said.

German chemical giant Bayer is seeking protection in the latest US farm bill from thousands of lawsuits involving its Roundup weedkiller, according to an 18 July report by WVPE and Harvest Public Media

The company is lobbying Congress to pass legislation that could protect it from lawsuits alleging that its glyphosate-based product causes cancer.

A draft of the upcoming farm bill includes language that would make it harder for farmers and others to claim in court

USA: US agricultural bioscience company Yield10

Bioscience said on 17 July that it had signed a memorandum of understanding and licensing agreement with Nuseed Nutritional US – the seed technology platform of Nufarm – for omega-3 assets to produce camelina oil.

The US$5M deal granted Australian agricultural chemical firm Nufarm a commercial licence to Yield10’s omega-3 intellectual property assets, materials and know-how to produce camelina oil.

Yield10 also agreed to negotiate with Nufarm for the sale of its remaining assets, subject to Yield10 shareholder approval.

THE NETHERLANDS: Dutch start-up NoPalm Ingredients has raised US$5.4M to scale up production of its palm oil alternative.

The company processes locally-sourced agri-food waste – such as potato peel – via a fermentation process using non-genetically modified (GM) yeasts into oil.

“This funding is pivotal for us to demonstrate large-scale production and reach our next milestone of producing 1.5M kg/year of sustainable oil.”

that they were not sufficiently warned of the potential dangers associated with prolonged use of glyphosate.

According to a Washington Post report, the provision was drafted by lawyers with the help of Bayer and seeks to create uniformity on national pesticide labelling and to prevent individual states from making their own warnings.

It would also stop courts from penalising or holding companies like Bayer liable if their products only included labels that had

previously been approved by the Environmental Protection Agency (EPA), the WVPE and Harvest Public Media report said.

Bayer, which acquired Roundup as part of its US$63bn acquisition of US agrochemical company Monsanto in 2018, has repeatedly said that decades of studies had shown the product and its active ingredient, glyphosate, were safe for human use.

The current farm bill expires on 30 September and the House has yet to vote on the proposed version.

Global agribusiness giant Cargill is working in partnership with a research platform at the University of Minnesota’s College of Food, Agricultural and Natural Resource Sciences to develop camelina (pictured above) and pennycress as cash crops in the USA.

Planted in rotation with corn and soyabeans or after crops like wheat, winter camelina and pennycress could help protect soil health and improve water quality, Cargill said on 10 July.

In addition, the high oil content of camelina

and pennycress could provide farmers with an opportunity to grow them as cash crops.

Cargill said its collaboration with the Forever Green Initiative would focus on the development of high performing seed varieties and farming techniques adapted for growing conditions in the Upper Midwest.

The initiative would combine Cargill’s crop improvement knowledge – including trait discovery, high throughput geno typing, genomic selection, trait development and cellular biology – with the University of Minnesota’s diverse genetics to develop improved varieties of camelina and pennycress, the company said.

“This support from Cargill will take our breeding and genomics work to the next level and help us develop even better varieties of camelina and pennycress for farmers in Minnesota and beyond,” Forever Green Initiative associate director Mitch Hunter said.

The project followed a previously announced US$2.5M grant from Cargill to the University to accelerate research into crop biology and management.

An Australian court has dismissed a class action lawsuit brought by more than 1,000 people claiming that German chemical firm Bayer’s Roundup weedkiller had caused their type of blood cancer, Reuters reported on 25 July.

Australian Federal Court Justice Michael Lee ruled that there was insufficient evidence to conclude that the glyphosate-based herbicide could cause non-Hodgkins lymphoma (NHL).

In his ruling on 25 July, Justice Lee said he had reviewed three types of scientific studies –epidemiological, animal studies and mechanistic evidence – looking at the links between glyphosate and lymphoma and was not satisfied there was sufficient evidence that the chemical caused

the cancer in humans. The claimants’ law firm, Maurice Blackburn, said it was reviewing the ruling before deciding whether to appeal.

The lead claimant, 41-year-old Kelvin McNickle, had used Roundup for over two decades on his family’s property and while working for a vegetation management company. He developed non-Hodgkins lymphoma, aged 35.

The class action against Bayer was one of around 40 similar cases filed outside the USA, Reuters wrote. In the USA, Bayer faced 50,000 outstanding claims. Although the company had won 15 out of the last 20 US trials, it has had to pay more than US$4bn in damages in cases in late 2023 and early 2024, Reuters wrote.

11-13 September 2024

North American SAF Conference & Expo Saint Paul Rivercentre, Minnesota, USA

https://saf.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Home

11-13 September 2024

Argus Sustainable Marine Fuels Conference Houston, Texas, USA

https://www.argusmedia.com/en/events/ conferences/sustainable-marine-fuels

16-17 September 2024

6th International Symposium on Dietary Fat and Health

Frankfurt, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11686&sp_id=1

16-18 September 2024

Argus North Amercia n Biofuels, LCFS & Carbon Markets Summit Monterey, California, USA www.argusmedia.com/en/events/ conferences/north-american-biofuelslcfs-carbon-markets-summit

18-20 September 2024

Globoil India

The Westin Mumbai Powai Lake Mumbai, India

https://www.globoilindia.com

23-26 September 2024

19th GERLI Lipidomics Meeting at the End of the World Plouzané, France

https://eurofedlipid.org/19th-gerlilipidomics-meeting-at-the-end-of-theworld

25-26 September 2024

Polish Chamber of Biofuels (KIB) Transport Biofuels Conference Lake Hill Mazury Resort & Spa Ostróda, Poland

https://kib.pl/en/konferencja-2

25-27 September 2024

Canadian Lipids and Proteins Conference Ottawa, Ontario, Canada

https://payments.carleton.ca/canadianlipids-and-proteins-conference-2024

For a full events list, visit: www.ofimagazine.com

30 September-2 October 2024

2nd Berlin Symposium on Structured Lipid Phases

Berlin, Germany https://eurofedlipid.org/ofiinternational-2024-2

2-3 October 2024

4th ICIS Pan American Oleochemicals Conference

Ritz Carlton Coconut Grove, Miami, USA https://events.icis.com/website/13907/

2-4 October 2024

Sustainable Aviation Futures North America Congress

Marriott Marquis, Houston, Texas, USA www.safcongressna.com

9-11 October 2024

Palmex Indonesia

Medan, Indonesia https://palmoilexpo.com/index.html

15 October 2024

Black Sea Veg Oil Trade

InterContinental Hotel, Bucharest, Romania

https://ukragroconsult.com/en/ conference/black-sea-oil-trade2024/?utm_source=sendpulse&utm_ medium=email&utm_campaign=blacksea-oil-trade-2024-first&spush=c2VyZW 5hbGltQHF1YXJ0emx0ZC5jb20=

15-17 October 2024

Argus Biofuels Europe Conference & Exhibition London, UK www.argusmedia.com/en/events/ conferences/biofuels-europe-conferenceand-exhibition

22-23 October 2024

Oil and Fats International Congress (OFIC) 2024 (+ Online)

Kuala Lumpur Convention Centre, Malaysia https://mosta.org.my/events/ofic-2024

22-25 October 2024

2024 North American Renderers Association Annual Convention

Ritz Carlton Bacara, Santa Barbara, USA https://convention.nara.org/

4-6 November 2024

Sustainable Aviation Futures APAC Congress

PARKROYAL Marina Bay, Singapore www.safcongressapac.com

7-9 November 2024

5th YABITED Fats and Oils Congress Antalya, Turkey

www.yabited2024.com/EN/Default.aspx

11-13 November 2024

RT2024

Amari Bangkok Thailand https://rspo.org/rt2024-save-the-date

12-14 November 2024

Global Grain Geneva 2024 Geneva, Switzerland www.fastmarkets.com/events/globalgrain-geneva

14-15 November 2024

Biofuels Expo 2024 Renaissance London Heathrow Hotel UK https://biofuelsconference.org

9-11 December 2024

Hands-on Annual Vegetable Oil Deep Frying Course with Live Demonstrations College Station, Texas, USA https://fatsandoilsrnd.com/ annual-courses

24-26 February 2025

Palm & Lauric Oils Price Outlook Conference & Exhibition (POC 2024) Kuala Lumpur, Malaysia

18-20 March 2025

International Biomass Conference & Expo Cobb Galleria Centre Atlanta, Georgia, USA https://ibce.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Home

4-7 June 2025

EFPRA Congress 2025 Riga, Latvia https://efpra.eu/events

29 June-2 July 2025

16th Congress of the International Society for the Study of Fatty Acids and Lipids (ISSFAL)

Quebec City, Canada www.issfalcongress.com

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany

https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

www.ofimagazine.com

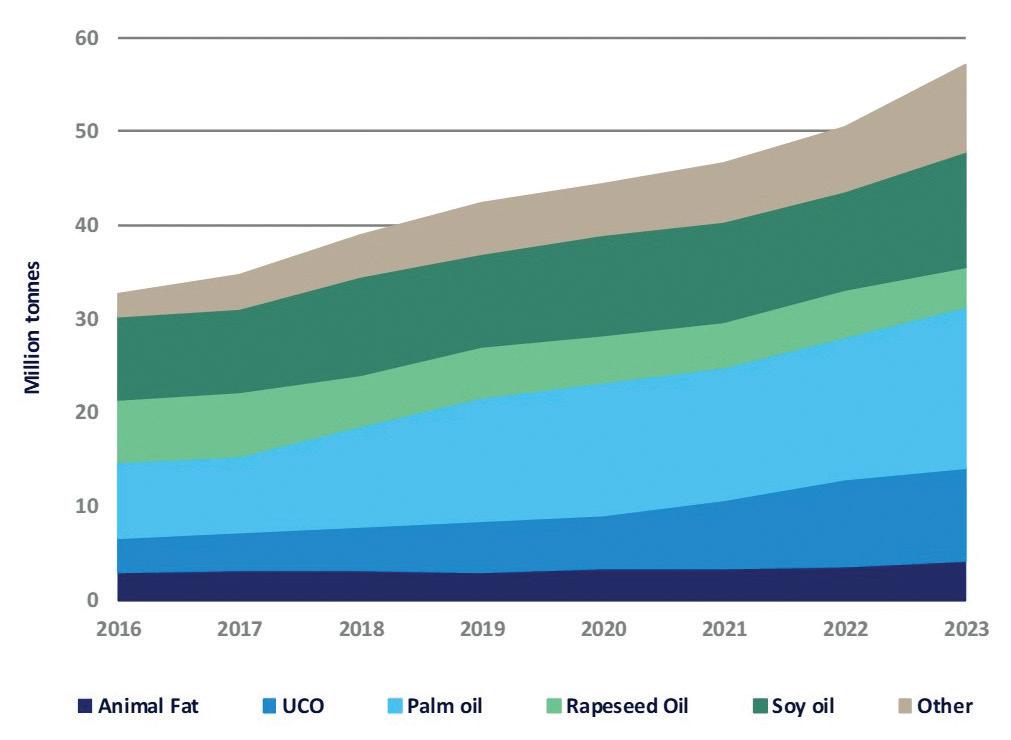

The use of animal fats in biofuels has been growing –accounting for a third of all animal fats produced globally last year. This upward trend is set to increase to meet the demands of the renewable fuels sector OFI

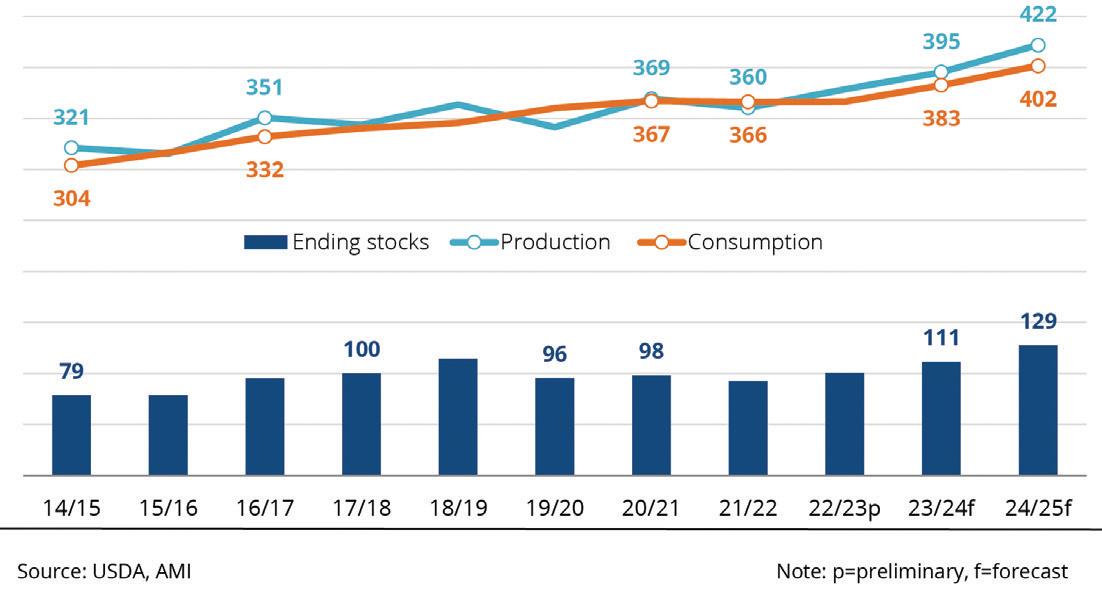

The use of animal fats in biofuels has experienced “stunning growth”, reaching over 4.1M tonnes in 2023 worldwide – or one third of animal fats produced globally, the European Fat Processors and Renderers Association (EFPRA) Congress heard in Amsterdam on 12-14 June.

Over two-thirds of this total is used in the EU and the USA, due to policy incentives which give additional value to lower carbon fuels, Yuen Moon, biofuels analyst at Global Data Agri, UK, said.

Historically, the animal feed sector has been the largest end user of animal fats in Europe. However, in 2023, the biofuels market overtook the feed sector to consume over half of animals fats supplied by the rendering industry (see Figure 1, below and Figure 4, p20). Much of this demand for animal fats has been met from falling food and oleochemical use.

Biofuel policies

Global consumption of biodiesel and sustainable aviation fuel (SAF) has risen strongly over the last decade, reaching 59M tonnes in 2023 (see Figure 2, p20).

Policy has been the main driver as countries around the world seek to support lower emission fuels or domestic

agricultural sectors, according to Moon.

“By 2030, the global market is set to nearly double thanks to rising targets in the road and aviation sectors.”

In Europe, consumption of biodiesel and SAF had risen steadily over the last decade, reaching nearly 18M tonnes in 2023.

The key policy promoting EU biofuel is the Renewable Energy Directive (RED) (see Figure 3, p20). By 2030 the EU market (including the UK) is set to rise moderately to 21M tonnes, according to Moon.

Source: Yuen Moon, Global Data Agri, EFPRA 2024 Congress

Key biofuel trends around the world included a move towards low greenhouse gas (GHG) emission policies, an increasing need for SAF, growing interest to decarbonise the maritime sector, and changing market shares within the global biofuels markets, Moon told the EFPRA Congress.

Low GHG emission policies include the third version of the EU’s RED (RED III), Canada’s Clean Fuel Standard (CFS) and low carbon fuel standards (LCFS) in California, New Mexico, Oregon and Washington.

“These policies give additional value to fuels made from low carbon/waste-based feedstocks such as used cooking oil (UCO) and animal fats,” Moon said.

There had also been a flurry of biofuel mandates and support for SAF announced in the past year.

“The aviation industry is difficult to decarbonise and currently the most achievable way to lower emissions is to use SAF made from oils and fats using HVO [hydrotreated vegetable oil/ renewable diesel] technology.”

Several countries had introduced policies to decarbonise the maritime sector but while this could represent a new market for biodiesel, unlike in aviation, a wide range of decarbonisation

e. taikoclaymkt@taikogroup.net

t. +603 7660 7716

w. taikoclaymarketing.com

e. office@taikogroup.eu

t. +31 10 800 5479 Be the first to know.

u

options existed for marine transport, meaning traditional liquid biofuels would only make up a small proportion of this market.

Finally, while the EU remained the largest biofuels market in the world, its share had fallen considerably over the last decade – from 40% to 25% – and the region was expected to be overtaken by Brazil, Indonesia and the USA, driven by rising electrification, Moon said.

“A newer trend in trade is the USA becoming a net importer of animal fats in the last two years, ramping up imports from Australia, Brazil and Canada.”

New HVO/SAF plants due to come online, along with strong incentives for non-crop feedstocks were expected to keep strong import demand in the country for waste oils, she said.

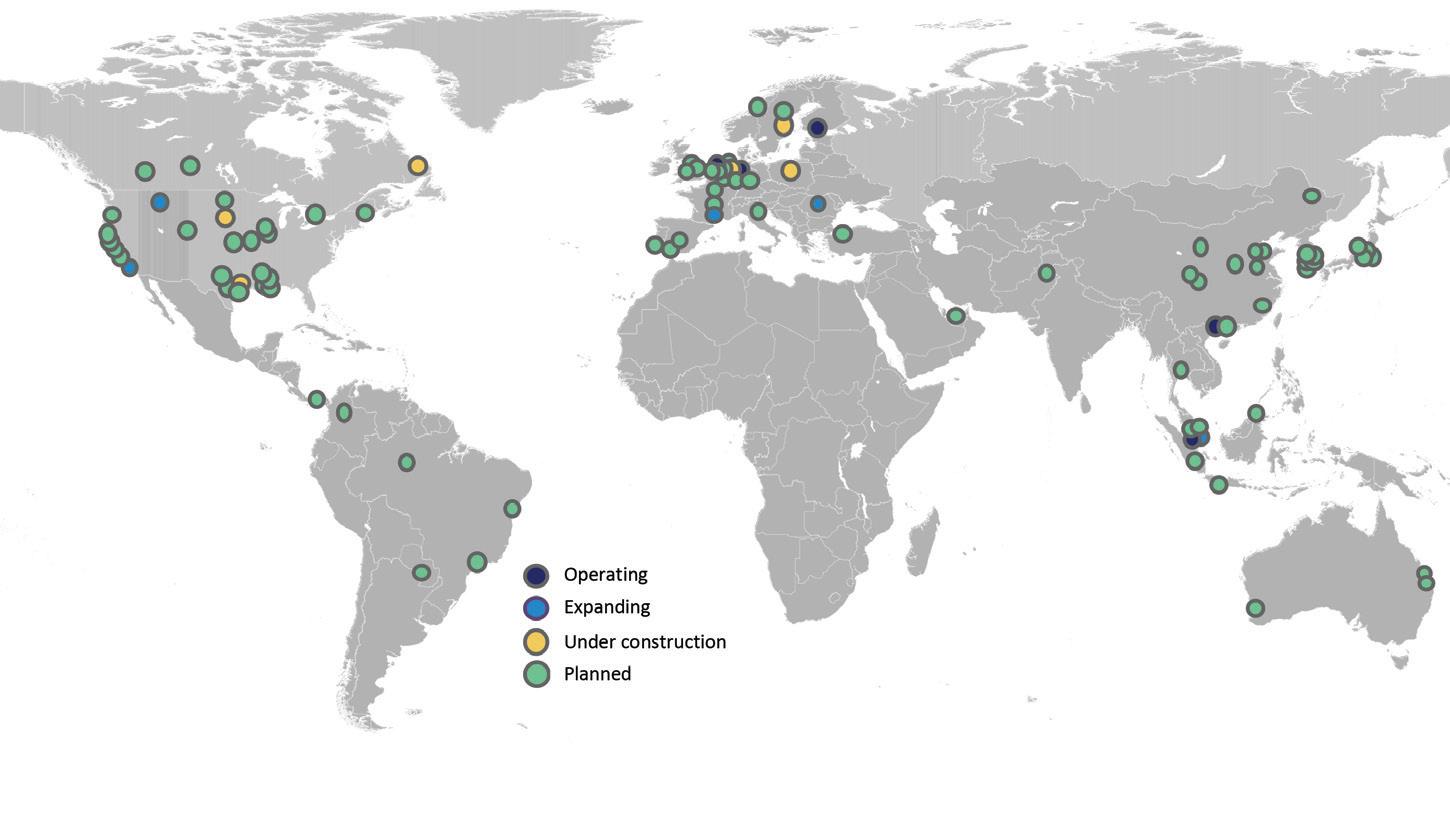

Renewable diesel capacity was due to expand rapidly over the next few years to 42M tonnes by 2030 (see Figure 5, p22). New plants were clustered in Europe, North America and Asia.

SAF would take longer to come onstream, but nearly 25M tonnes of new SAF capacity was planned (see Figure 6, p32). Locations were similar to those for renewable diesel, with many plants planning to produce both HVO and SAF.

The EU’s RED was introduced in 2009 and the updated REDIII entered into force on 20 November 2023, with member states required to implement the policy into national law by 21 May 2025.

REDIII doubles the share of renewable energy in transport from the 2030 target of 14% to 29%, with member states having the option to change to a GHG target of 14.5% GHG reduction in 2030.

“The GHG option is seen as more

sophisticated and takes into account carbon emissions,” Moon said.

The policy change to include all transport, not just road, would increase the amount of renewable energy needed, with the road portion declining over time because of electrification.

REDIII included a combined subtarget for advanced biofuels and green hydrogen of 5.5%, with double counting. At least 1% of this target needs to be supplied from Renewable Fuels of Non-Biological Origin (RFNBO) – green hydrogen e-fuels.

REDIII would result in a maximum share of advanced biofuels of 4.5% with double counting, equivalent to 2.25% in real energy terms, Moon said.

“Biofuels made from UCO and tallow are capped at 1.7% of the energy in transport fuel but member states may request a higher cap subject to availability.”

New multipliers were agreed for biofuels used in the marine (x1.2), aviation (x1.2), rail (x1.5) and electric cars (x4) sectors.

After a long delay, revisions to Annex IX (the list of REDIII approved waste feedstocks) were also finalised in May.

Annex IX sets out feedstocks for advanced biofuels, divided into Part A feedstocks and Part B feedstocks (UCO and Category 1 and 2 animal fats ( below).

Moon said a major revision was the categorisation of Category 3 animal fats. This would will fall under the ‘Other’ category (Part 3 fuels – biofuels from feedstocks that are neither food crops nor listed in Annex IX) (see Figure 7, p22 would compete with renewable electricity.

So while the market for categories 1 and 2 animal fats would remain stable under REDIII, the potential market for category

3 animal fats had risen considerably but would compete with renewable electricity under the same category, Moon said.

The EU has also adopted sustainable aviation and maritime fuel policies.

Aviation and maritime initiatives

The EU had also introduced ambitious SAF targets, Moon told the Congress.

The ReFuelEU regulation was adopted on 9 October to boost EU SAF supply, taking effect on 1 January 2024.

The regulation will require EU airports and fuel suppliers to ensure that at least 2% of aviation fuels are ‘green’ by 2025,

rising to 70% in 2050.

Moon said the regulation included subtargets for synthetic SAF (which cannot be fat-based) and strict regulations over feedstocks for non-synthetic SAF.

SAF includes certain biofuels made from agricultural or forestry residues, algae, biowaste, UCO and category 3 animal fats, but not feed and food feedstocks.

There was a cap of 3% for non-waste, non-crop feedstocks (including category 3 animal fats), Moon said.

The Fuel EU maritime initiative was introduced to ensure that the GHG intensity of fuels used by the shipping

In the European Union (EU), animal by-products (ABPs) are divided into three categories based on the risks they pose.

Category 1 materials have the highest risk of spreading diseases such as bovine spongiform encephalopathy (BSE).

Category 2 materials are classed as high risk.

Category 3 materials are classed as low risk and include processed animal proteins (PAP).

u

Source: Yuen Moon, Global Data, EFPRA 2024 Congress

Source: Yuen Moon, Global Data, EFPRA 2024 Congress

sector would fall by 2% in 2025 to as much as reaching 80% by 2050, to come into force from 1 January 2025.

Rising targets and new HVO capacity offer huge potential for increased sales of animal fat to the renewable fuels sector, Moon told the EFPRA Congress.

As a by-product, animal fat had an advantage over crop oils and was more highly valued in the EU, Canada and USA.

In the EU, expected growth was set to more than total animal fat supply in the region. As the cap on “established wastes” was already being maximised, the category 1 and 2 animal fats market would remain unaffected. The GHG value for category 3 animal fats, meanwhile, would be based on emissions from the rendering process, allowing more savings compared with crops due to its status as a by-product.

“However, there are risks in the EU market for animal fats, from changes in policy and through competition from other technologies in the longer term,” Moon said.

“The European Commission is wary of feedstocks which can be used in feed so there is a risk they will limit the use of Category 3 animal fats in road or aviation policies.”

Member states could also choose to exclude feedstocks under REDIII, as Germany had done with animal fats.

In the aviation sector, the easiest way to decarbonise was to use oils and fats, including Category 3 animals fats.

“This could lead to considerable demand,” Moon said.

The SAF market presented a huge potential new market with many plants starting up and seeking to secure low GHG feedstocks.

Moon estimated the current potential market at around 1.5M tonnes of SAF. Due to losses in the HVO process, this would require around 2.1M tonnes of fat.

Biofuels derived from high ILUC risk & feed crops eg palm oil

Biofuels derived from low ILUC risk & feed crops eg rapeseed oil

Biofuels derived from feedstocks listed in Annex IX Part A eg POME, tall oil

Biofuels derived from feedstocks listed in Annex IX Part B eg animal fats, UCO

Biofuels from feedstocks that are neither food crops nor listed in Annex IX

‘Part C’ fuels Advanced biofuels

Renewable fuels of nonbiological origin (RFNBO) Recycled carbon fuels (RCF)

* Part A feedstocks: Algae if cultivated on land in ponds or photobioreactors; biomass fraction of mixed municipal waste; biowaste from private households subject to separate collection; biomass fraction of industrial waste not fit for use in the food or feed chain; straw; animal manure and sewage sludge; palm oil mill effluent and empty palm fruit bunches; crude glycerine; bagasse; grape marcs and wine lees; nut shells; husks; cobs cleaned of kernels of corn; biomass fraction of wastes and residues from forestry and forest-based industries; other non-food cellulosic material; ligno-cellulosic material except saw logs and veneer logs. ** Part B feedstocks: Used cooking oil (UCO) and category 1 and 2 animal fats

However, in the EU, there was a cap of 3% for non-waste, non-crop feedstocks (including category 3 animal fats) for SAF.

In the longer term, competition from alternative technologies (electricity in road and non-lipid based SAF in aviation) may limit the market for lipid-based biofuels.

“However, as a low carbon feedstock, fats will keep their share of the sector for longer than other feedstocks. In addition, the scale of targets mean that lipids will still be needed for a long time.” ●

This article is based on a presentation made by Yuen Moon, a biofuels analyst at Global Data Agri, UK, at the European Fat Processors and Rendering Association (EFPRA) Congress in Amsterdam, 12-14 June 2024

The easing of European regulations on using poultry and porcine processed animal proteins (PAPs) to feed pigs and chickens has opened up a sustainable feed source which can reduce EU imports of soyabean meal

Serena Lim

The use of processed animal proteins (PAPs) in animal feed offers a circular protein source and a more sustainable way to produce livestock, with the potential to reduce EU imports of soyabean meal, the European Fat Processors and Renderers Association (EFPRA) Congress heard.

In the EU, PAPs are produced from Category 3 rendered material (animal byproducts fit for human consumption at the point of slaughter).

A ban on feeding PAPs to farmed animals bred for food had been in place in the EU since 2001, when regulations to combat the spread of ‘mad cow disease’ (bovine spongiform encephalopathy – BSE) were introduced. In 2021, the European Commission (EC) relaxed the ban, allowing PAPs from pigs to be used in poultry feed and PAPs from poultry to be used in pig feed.

“Half a year later, the first delivery of PAP to a dedicated feed mill in the Netherlands was made in March 2022 – a historic event after a more than 20 year ban,” Carine van Vuure, nutrition and regulatory affairs manager at Darling Ingredients, told the congress on 12-14 June.

Van Vuure outlined the advantages of using PAP in compound feed including the fact that chickens and pigs were omnivores eating both animal and vegetable proteins. In addition, PAPs contained digestible essential amino acids to help keep animals healthy. Feeding PAPs to chickens and pigs also resulted in drier litter among broilers, less feather pecking in laying hens and less ear necrosis for piglets, van Vuure said, adding that European PAPs were locally sourced and produced, with a lower carbon footprint than imported soyabean meal.

Rob Kiers, chief operating officer of feed

supplier ForFarmers, told the EFPRA congress that his firm was an early adopter of PAPs, introducing porcine PAP in poultry diets in the EU in March 2022.

He said the company included around 2-5% of porcine PAP in poultry feed, with a 5% PAP inclusion rate resulting in a 7.5% reduction in soyabean meal.

“Every 100,000 tonnes of feed including PAP reduces the inclusion of soyabean meal by 7,500 tonnes,” he said.

Compared with feed containing Roundtable on Responsible Soya (RTRS) soyabean meal, feed containing porcine PAP had a reduced CO2 footprint due to lower transport costs and environmental impact, Kiers said.

Porcine PAP also contained about 5860% protein compared with around 48% in soyabean meal, van Vuure told OFI.

“Animals also do well when PAP is used, with drier litter leading to less footpad dermatitis,” Kiers said. In addition, using PAP led to less mining and use of inorganic minerals to meet the phosphorous requirements of animals bred for food.

Jeffrey de Rooij, poultry specialist and nutritionist at animal feed company AgruniekRijnvallei, said PAPs were able to lower the carbon footprint of animal feed while improving animal welfare in hens laying eggs.

Outlining the results of trials carried out by his company on brown hens fed

on diets with and without PAPs, he said PAPs showed a positive effect on feather quality, as well as on hen mortality due to a reduction in cannibalism.

It also led to improved gut health (with no fermentable carbohydrates) and lower water consumption leading to drier litter (resulting in less foot pad lesions and lower infection pressure), with no differences in egg production.

There are challenges, however, in using PAPs in feed, according to Kiers. These included market acceptance among consumers, retailers, slaughterhouses, NGOs and governments.

PAPs were already used in pet food and it was not always competitive in price, he said. Its availability was also limited, due to segregation, tolerance and logistics considerations.

Van Vuure said strict regulations existed in the supply chain for animal proteins, each step requiring dedicated and registered or approved facilities, along with dedicated transport or cleaning protocols.

There were also stringent traceability requirements to prevent cross contamination, including single species segregated feed lines in mills and a requirement that PAP was only fed on farms where no other livestock species were present.

Specific retailers also had limits, such

Continuous Rendering Systems

Cookers and Dryers

Screw Presses

Decanters and Centrifuges

Size Reduction Equipment

Process Control Systems

Material Handling Equipment

Total Service and Support

• Optimized fat and meal production

The high product quality specifications you require, and the flexibility to adjust to changing demands.

• Dramatically reduced downtime

Unsurpassed reliability backed up by the rapid response of the largest field service team and parts inventory in the industry

• Complete systems integration

Every type of major equipment — including new Dupps-Gratt horizontal bowl decanters and disctype vertical centrifuges — as well as unsurpassed engineering expertise in creating better ways to recycle protein by-products into profitable fats and meals.

as Tesco and Marks & Spencer in the UK requiring ‘vegetarian’ bacon.

French retailer Carrefour also had a ban in place for animal products in diets for food-producing animals. In addition, Belgian retailer Colruyt did not allow the use of PAP in feeds for food-producing animals.

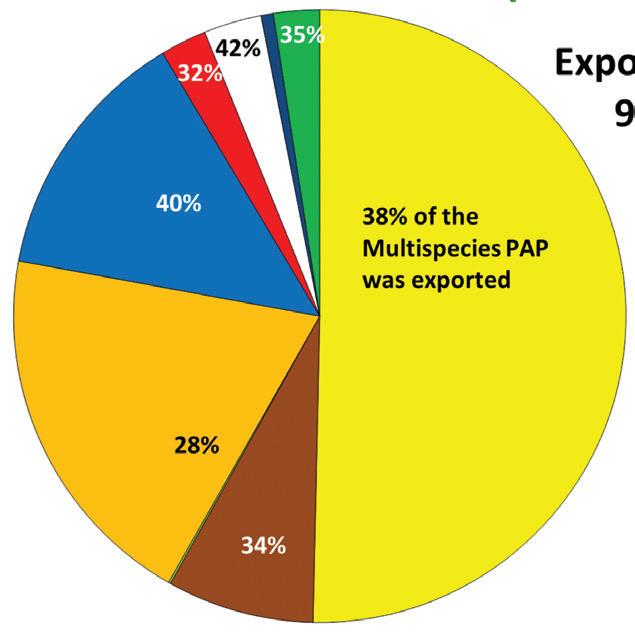

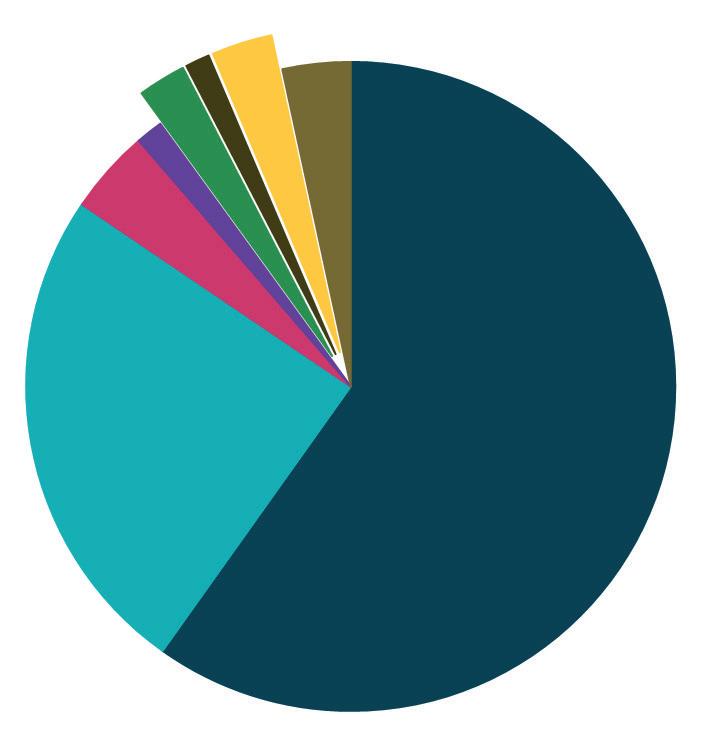

Another limitation is that most PAPs produced in the EU are multispecies PAP. Last year, 2.65M tonnes of PAP and food grade protein was produced in the EU, almost half of which (46%) was multispecies, EFPRA secretary general Dirk Dobbelaere told the congress (see Figure 1 below). A quarter of PAPs produced was poultry meal (25%) and 8% was single species feather meal which can also be used in pig feed, adding up to 33% of meal from poultry. Porcine meal accounted for 12% of total PAP and food

grade protein production.

The vast majority of EU PAP and food grade protein (77%) still ends up in pet food (see Figure 1, below), while 7% goes into fish feed and just 5% into the terrestrial animal feed, according to Dobbelaere’s figures.

The EU also exported more than a third (35%) of all the PAPs it produced, with total protein exports amounting to 928,500 tonnes in 2023 (see Figure 2, right).

The congress also heard from Francisco Gordejo, head of the EC health and food safety unit, on EFPRA’s request to revise standards for the production of porcine PAP.

EFPRA technical director Martin Alm told Oils & Fats International (OFI) that only Method 1 (pressure sterilisaton) was currently approved.

The EC asked the European Food Safety

Authority to provide scientific opinions on the efficacy of Methods 2-5 and Method 7 in inactivating relevant pathogens when producing porcine PAP for feed poultry and aquaculture animals.

Gordejo told the congress that having received the opinions, the EC planned to authorise safe and conditionally safe methods described in Methods 2-5, but not Method 7, which was not based on specific time/temperature/pressure processes, but on the absence of relevant pathogens after testing.

Despite the obstacles, Kiers said PAP was still a valuable feed ingredient with good sustainability credentials. “It’s still a long road, but there are many opportunities to enhance circularity in animal feed.” ● Serena Lim is the editor of OFI

International reports on some of the latest projects, technology and process news and developments around the world

FRANCE: Global jet fuel supplier Avfuel has expanded its supply of sustainable aviation fuel (SAF) to three French airports.

The SAF supply agreements at Paris Le Bourget Airport (LBG), Bordeaux-Mérignac Airport (BOD) and Clermont-Ferrand Auvergne Airport (CFE), meant operators could purchase SAF at all three locations via the Avfuel Contract Fuel programme, the company said on 28 May.

“We’re a global company, so expanding SAF access to our customer base beyond North America’s borders has been a … focus for our team,” Avfuel’s executive vice president CR Sincock II said.

Avfuel’s SAF supply, produced in France, averages a blend ratio of 30% SAF to 70% traditional jet fuel. Made from a tallow feedstock, the fuel in its concentrated form provided up to a 90% reduction in carbon emissions across its lifecycle, the company said.

Avfuel said it had also made investments in new fuel technology companies, such as Alder Renewables, which is focused on producing SAF from woody biomass.

The company provides fuel and services to the global aviation industry and supplies 17 airports and fixed base operators (FBOs) in the USA.

Spanish agribusiness Elian Barcelona has started processing soyabeans at its renovated plant at the Port of Barcelona, in Spain, World Grain reported on 23 May.

A subsidiary of Viserion Oilseed Processing, a newly formed subsidiary of Viserion International, Elian Barcelona

announced the acquisition of the soyabean crushing plant in Moll Álvarez de la Campa from global agribusiness giant Cargill in October, the report said.

At the time of the acquisition, Elian Barcelona said it planned to expand the plant’s capabilities to produce a wider range of food and speciality

feed ingredients, including concentration and textured protein, key to supporting the delivery of farm-to-food products across European and Mediterranean markets.

According to the Catalonia Trade & Investment agency, the plant serves the Catalan, Spanish and European feed and food ingredient sectors.

The plant produced 2,500 tonnes/day of concentrated and textured protein for use in plant-based alternative foods and animal feed, and also manufactured soyabean oil for use in food, cosmetics, adhesives and fuels, World Grain wrote.

Viserion International is backed by a fund managed by Pinnacle Asset Management, a US-based alternative asset management firm focused on global commodities markets.

Biofuel producers in China have plans to invest more than US$1bn in the country’s first plants to turn waste cooking oil into sustainable aviation fuel (SAF) for export and to meet domestic demand once Beijing introduces mandates for its use, Reuters reported on 17 May.

The Chinese firms are planning to start up plants over the next 18 months to produce a total of more than 1M tonnes/year of SAF, according to six SAF investors quoted in the report. That volume would be equivalent to 2.5% of China’s current annual demand for aviation fuel, Reuters wrote.

Once operational, the projects would use up supplies of used cooking oil (UCO) feedstock that China currently exported, the company executives were quoted as saying.

The companies included Junheng Industry Group Biotech, Zhejiang Jiaao Enprotech and Tianzhou New Energy.

Last year, China exported a record 2.05M tonnes of UCO, mostly to the USA and Singa-

pore, and also supplied feedstock to biofuel refiners such as Finnish firm Neste.

According to the report, China currently produces less than 100,000 tonnes of SAF, mostly at a plant operated by EcoCeres, which has been making the fuel since 2022 in the eastern region for export.

The companies planning to make SAF expected a mandate for a compulsory blend of 2%-5% of SAF into an aviation fuel market forecast to reach 50M tonnes in 2030, according to industry executives familiar with policy discussions, who spoke to Reuters on condition of anonymity. Although modest compared to EU and Japanese targets of 6% and 10% respectively, a 5% mandate would be a jump from the 50,000 tonne SAF target for 2025 outlined by Beijing a few years previously and would equate to 2.5M tonnes of SAF use in China by 2030, the executives said. Accounting for about 11% of global jet fuel use, China was the world’s second largest aviation market, Reuters wrote. u

Kinetics Technology (KT) – part of the Maire Tecnimont Group –has been awarded a US$400M project to develop a hydrotreated vegetable oil (HVO) complex in Hamburg, Germany, for HOLBORN Europa Raffinerie.

Situated inside HOLBORN’s existing refinery in Hamburg, once completed, the plant would produce approximately 220,000 tonnes/year of

IN BRIEF

USA: US energy company

Phillips 66 has achieved full production rates of renewable diesel and sustainable aviation fuel (SAF) at its Rodeo facility in California.

Production at the facility in the San Francisco Bay Area reached approximately 50,000 barrels/day (bpd) (800M gallons/year), achieving the company’s goal of full capacity by the second quarter of 2024, Phillips 66 said on 26 June.

“The facility running at full capacity supports the growing demand for renewable fuels, [and] lowers our carbon footprint,” Phillips 66 executive vice president of Refining Rich Harbison said.

The company launched the Rodeo Renewed project in 2020 to produce renewable diesel and SAF, alongside other products.

In addition to supplying Californian markets, the complex provides renewable diesel to other areas along the West Coast.

Featuring new pre-treatment units for processing lower carbon intensity feedstocks, such as used cooking oil, fats, greases and vegetable oil, the Rodeo complex started producing approximately 30,000 bpd of renewable fuel at the end of the first quarter of 2024.

Phillips 66 is active in the midstream, chemicals, refining, and marketing and specialities sectors.

renewable diesel and sustainable aviation fuel (SAF) from waste and residues feedstocks, biomasses and agribusiness industry residues, as well as low carbon hydrogen, MAIRE announced on 18 June.

The plant was due to be operational in early 2027, including the pre-treatment and HVO units, the company said.

Delivered by KT, MAIRE said

the engineering, procurement and construction (EPC) project would also involve the use of technology by NEXTCHEM, one of its other divisions.

“This [project] confirms the MAIRE Group’s ability to take on the decarbonisation challenges in hard-to-abate sectors,” MAIRE Group CEO Alessandro Bernini said.

The HOLBORN Europa Raf-

finerie oil refinery processes up to 5M tonnes/year of crude oil into gasoline, diesel, heating oil and feedstock for the chemical industry and supplies Hamburg and northern Germany with fuels and heating oil.

Italian technology and engineering group MAIRE is active in the nitrogen fertiliser, hydrogen, circular carbon, fuel, chemical and polymer sectors.

Spanish multinational oil and gas company Cepsa and the European Investment Bank (EIB) have signed a €285M (US$312M) loan agreement to finance the construction of an advanced biofuels plant in Spain.