AISTECH 2023 DETROIT FURNACES PERSPECTIVES SUSTAINABILITY

We preview the AISTech exhibition. Electric smelting furnaces past, present and future.

Liberty Steel discusses its decarbonization plans.

We talk to Quoc Pham, CTO of US-based Electra.

We preview the AISTech exhibition. Electric smelting furnaces past, present and future.

Liberty Steel discusses its decarbonization plans.

We talk to Quoc Pham, CTO of US-based Electra.

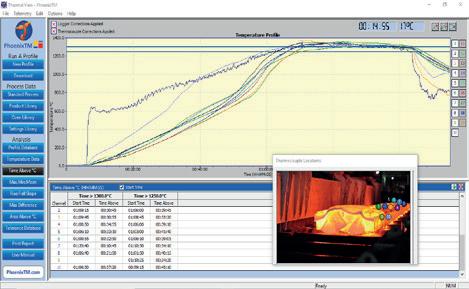

Software Excellence for Steel and Aluminium Producers

EDITORIAL

Editor Matthew Moggridge Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Editorial assistant

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com

matthewmoggridge@quartzltd.com

The Future Steel Forum 2023 is looking good. There are, however, a couple of changes that all potential visitors to the event need to be aware of. First, there’s the date, which is currently billed as 2122 September. That is now incorrect. The date has changed and is now 2021 September. Please bear this in mind. Second, the venue. The Forum is no longer hosted by the Hilton Vienna Danube. Instead, it will take place at the Hilton Vienna Garden. I have it on good authority – from somebody who lives in the city –that the new venue is a cut above the old one. In other words, all is good. So, just to summarise: Future Steel Forum 2023, 20-21 September, Hilton Vienna Garden. Please disregard previous information. It goes without saying that I look forward to seeing you in Vienna where we have some very interesting speakers on the programme, including representatives from POSCO, South Korea; Ternium of Argentina; Tata Steel India and JFE from Japan. Hopefully some other major global players from the world of steelmaking will be speaking too and I will, of course, keep you updated.

The Future Steel Forum is now in its

seventh successful year and has become a calendar event for the global steel industry. I like to think that the steel industry looks forward to the Future Steel Forum as much as I look forward to visiting the USA for the AISTech exposition and conference (8-11 May). This year it’s in the so-called Motor City, aka Detroit, home of Motown and Marshall Bruce Mathers lll (Eminem). I hope to see some of you there as the event is jam-packed with stuff of interest from the world of North American and global steelmaking. My personal favourite will always be the Town Hall Forum where senior-level executives from the world of North American steelmaking get together to thrash out some of the big issues affecting the industry. This year’s event features Traci L Forrester, executive vice president, environmental and sustainability, Cleveland Cliffs; Sushma Walker, president, Nucor Business Technology; Michael S Williams, president and CEO of Timken Steel; Richard L Fruehauf, senior vice president – chief strategy and sustainability officer, US Steel; and Barry T Schneider, president and chief operating officer, Steel Dynamics Inc. Sounds like another winner to me!

US steelmaker Cleveland-Cliffs Inc has announced that it will continue to address food insecurity as one of its key areas of social responsibility. The company held its third annual ‘Souper Bowl Food Drive’ across all of its operations earlier this year and collected 240,000 pounds of non-perishable food items. In conjunction with the food donations, ClevelandCliffs and The ClevelandCliffs Foundation have also made cash contributions totalling $500,000 to more than 48 food distribution organizations in the local communities where the company operates throughout the United States and Canada.

Source: Business Wire, 15 March 2023.

Severfield, a North Yorkshirebased steel fabrication firm, has bought a Dutch steel contractor as it seeks to expand its European operations. The firm spent €24m on the acquisition of Voortman Steel Construction Holding B.V., which is based in Rijssen, in the east of the Netherlands. The acquisition will give Severfield a manufacturing base in Europe and will ‘open up attractive opportunities’, including access to the electricity distribution sector, which according to Severfield, is ‘high growth’.

Source: Construction News, 15 March 2023

China plans to cut annual crude steel production in 2023, according to a report from Bloomberg, marking the third year in a row that the government has mandated reduced output in order to rein in carbon emissions. China is the world’s biggest producer and consumer of the alloy. Since output hit a record of 1.053 billion tons in 2020, it has declined each year to remain just above 1 billion tons. The sector accounts for about 15% of national emissions, second only to electricity generation. As part of the plan, the government will also ban new steelmaking capacity.

Source: CNBC, 15 March 2023

UK council chiefs have vetoed plans for a sign showing the former Redcar steelworks buildings as the location was deemed ‘too political’, it has been claimed. The sign, designed by schoolchildren, was earmarked for a roundabout in Dormanstown, but this would have put it next to Teesworks industrial estate which is housed on the defunct steelworks site. The blast furnace was demolished in November 2022, after dominating the Redcar skyline for 43 years. UK Labour party group leader Alec Brown said Redcar and Cleveland Council probably ‘did not want to upset Teesworks’.

Source: BBC, 17 March 2023

SSAB and Vestre have started a collaboration, whereby the Norwegian urban furniture producer will be the first company globally using fossilfree steel to make a piece of

furniture. Vestre will present the first collaboration project later this spring. Thomas Hörnfeldt, head of sustainable business at SSAB, said: ‘‘It is fantastic to start this sustainability journey with Vestre since they share our goal of reducing the carbon footprint throughout the value chain. At the same time, the collaboration also shows the breadth of uses for our fossilfree steel”. Source: Hydrogen Central, 18 March 2023.

Canada has adopted bans on the import of all primary Russian steel products, such as iron and non-alloy steel, and semi-finished and finished products such as tubes and pipes. These trade sanctions follow a package of Russia sanctions adopted alongside the other members of the G7 to mark the one-year anniversary of Russia’s actions

27 Indian steel companies have signed 57 memorandums of understanding with the Indian Ministry of Steel to produce coated/plated steel products, high-strength/wear-resistant steel, specialty rails, alloy steel products, steel wires and electrical steel. According to the Indian government, this will see an additional investment of Rs 30,000 crore in the domestic steel sector, leading to a capacity addition of 25Mt/yr and creating 55,000 new job opportunities.

Source: Zee Business, 19 March 2023

in Ukraine on 24 February.

Source: European Sanctions, 19 March 2023

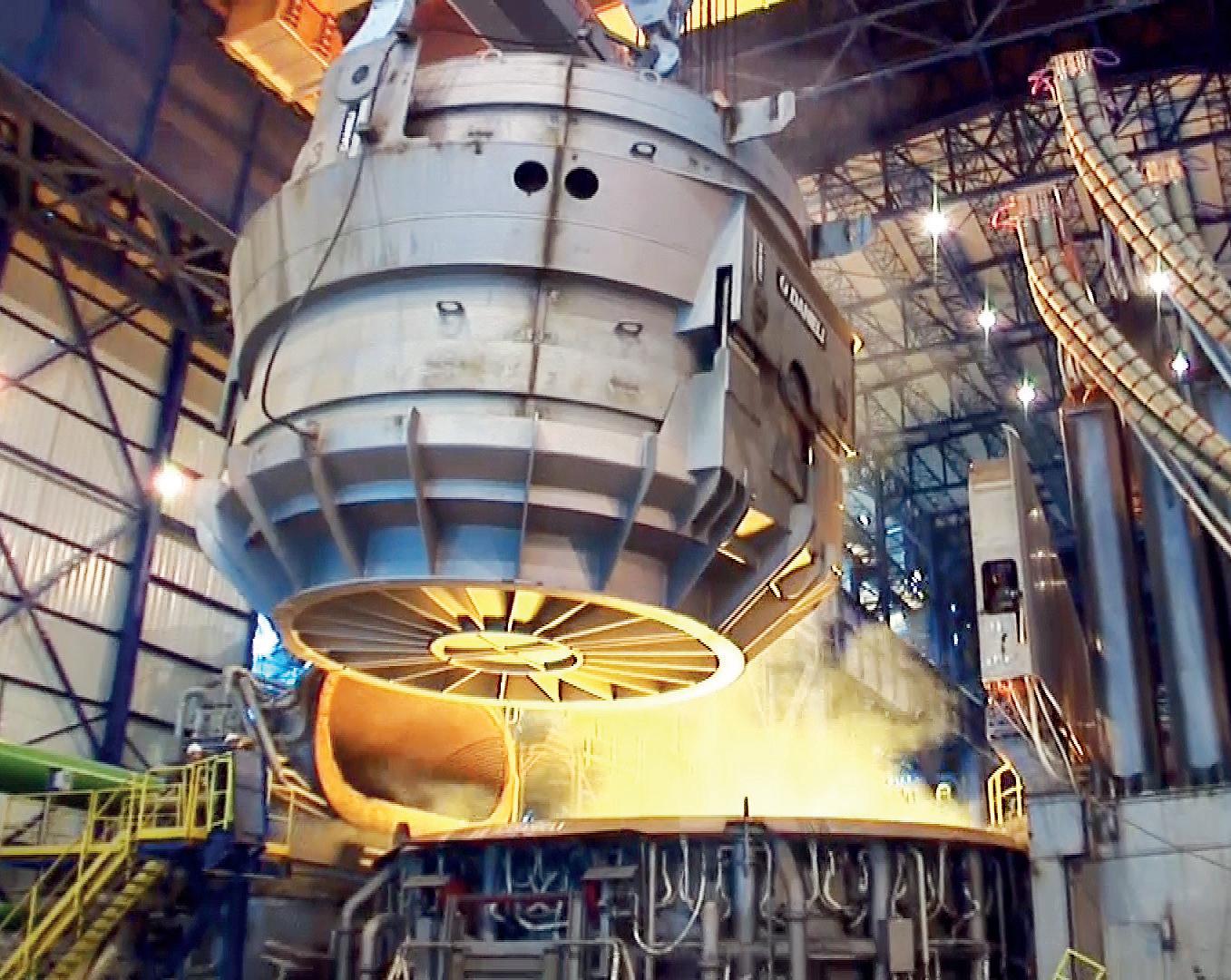

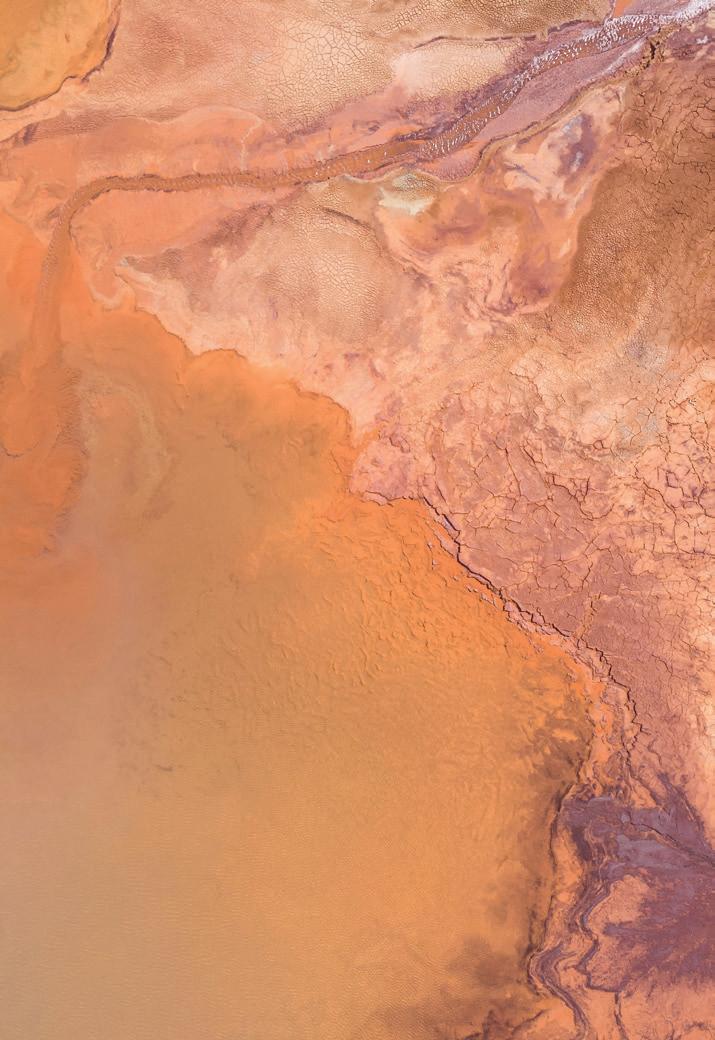

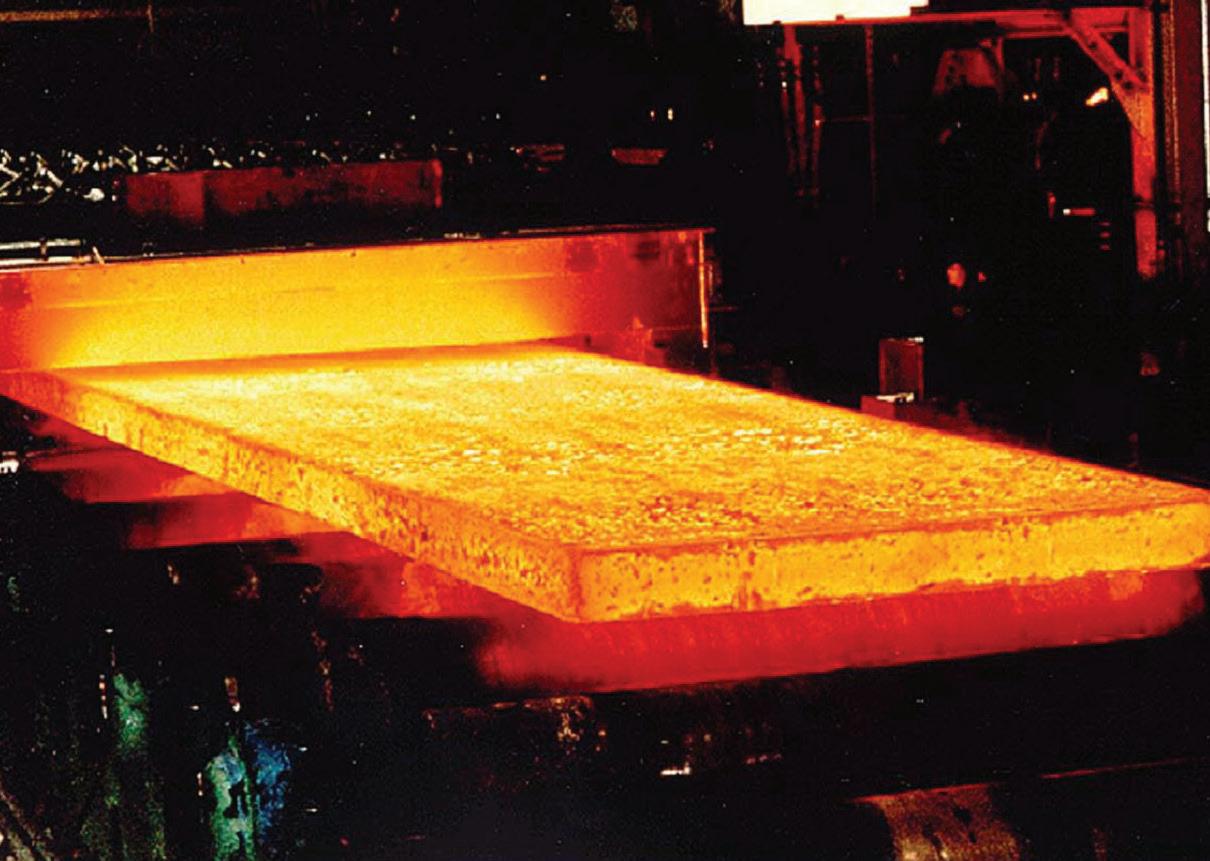

As the metals industry transforms in pursuit of green steel, the future of sustainability demands pioneers and leaders with vision, courage, and a willingness to push the boundaries of innovation and eco-friendly metals production. Primetals Technologies is redefining sustainable metals production.

We’re making orange the new green.

Tata Steel, which operates two blast furnaces in Port Talbot, UK, has warned that it may shut down one of the furnaces unless the British government outlines longterm plans to support the industry by this summer. The Indian company has informed ministers that it needs details of support by July to justify a potential multi-billionpound investment in green steelmaking facilities at its South Wales site. Officials are in negotiations with Tata Steel and British Steel, the only other firm operating blast furnaces in the UK, to provide £300 million each to boost investment in green technology.

Source: Energy Live News, 20 March 2023.

US Steel has launched its first podcast series, ‘Steel Stories by US Steel’, a look at the ever-changing world of steel, featuring interviews with industry experts and leaders with insights on events and developments shaping the future of steel and the shifting landscape of American manufacturing. Hosted by David Kirkpatrick, technology and business journalist and founder of Techonomy Media, Steel Stories explores US Steel and the steel industry’s contributions to modern society and its journey toward decarbonization.

Source: Business Wire, 20 March 2023

Bhilai Steel Plant (BSP), an arm of state-run Steel Authority of India Limited (SAIL), has been given license to produce a full range of IS 7904 Grade steel wire rods, which are used in bridge cables and tyre reinforcement materials. “Developing customised grades of products with specifications and chemistry as desired by customers has always been a thrust area for SAIL-Bhilai Steel Plant. Not only do these new grades fulfill customer demands and find newer applications, development and supply of value-added grades also fetch higher net sales realisation,” a BSP spokesperson said.

Source: Business Standard, 20 March 2023

The namesake for the Carrie Furnace, a former blast furnace located along the Monongahela River in the Pittsburgh area industrial town of Swissvale, Pennsylvania, has been uncovered by non-profit organization Rivers of Steel’s director of historic resources and facilities, Ron Baraff, through researching an article from the Pittsburgh Daily Post. Caroline ‘Carrie’ Clark was the daughter of William Clark, one of the founders, owners, and the first president of the Carrie Furnace Company. When she was 21 years old, Carrie was the first to light the fires and christen the furnaces. Thus, they were named in her honour. Source: WESA, 21 March 2023

The Indian steel industry has asked India’s Federal Board of Revenue (FBR) to urgently introduce interim tax relief measures to ensure

availability of steel scrap until the ‘issue of letters of credit’ is resolved. Members of the industry have asked the FBR to temporarily reduce withholding tax to 0.25% on scrap supplies and increase sales tax by 1% on supply from non-registered scrap dealers until the issue is resolved by the State Bank of Pakistan.

Source: Business Recorder, 21 March 2023.

Steel production rose by 10kt in the Great Lakes, North America region in March, and is up by 37kt from February, according to the American Iron and Steel Institute. Locally, steel mills in the Great Lakes region, clustered mainly along the south shore of Lake Michigan in Northwest Indiana, made 557kt of metal in the week that ended 18 March, up from 547kt the

previous week.

Source: NWI.com, 21 March 2023.

EIT RawMaterials, a company within the EIT (European Institute of Innovation and Technology) committed to supporting Europe’s transition towards a green economy, has partnered with Anglo American, a leading global mining company, to initiate steel decarbonization. Speaking of the policy to tackle steel decarbonization, Bernd Schäfer, CEO of EIT RawMaterials, said: “It is the mandate of EIT RawMaterials to drive innovation and decarbonise the raw materials sector, from mining to recycling. However, it takes a global village and outstanding industry leadership and collaboration to look beyond their boundaries to solve solutions for the greater good – that is, to address the challenges of climate change.” Source: Innovation News Network, 21 March 2023.

At SMS group, we have made it our mission to create a carbon-neutral and sustainable metals industry. We supply the technology to produce and recycle all major metals. This gives us a key role in the transformation towards a green metals industry.

The collapse of banks has rattled both the construction sector and the steel industry, but with future demand in scrap steel forecast to grow, the long-term outlook is mostly positive, says Manik Mehta*

THE construction industry – and, with it, the steel industry which provides large volumes of steel for construction purposes – was ostensibly unnerved by the collapse of banks, notably the Silicon Valley Bank (SBV) and the Signature Bank. The latest information from the construction sector suggests that the banks’ collapse could be a wake-up call for the construction sector which will have to make a re-assessment of its needs in 2023.

Trepidations were also felt within the so-called affordable housing market in California’s Bay Area (a specialized construction industry and important steel consumer) amid concerns that the SVB collapse could affect mortgage lending. Given the severity of the short-term impact for the construction sector, the path to a long-term recovery appears arduous, with many crystal-ball gazing pundits suggesting that the SVB’s failure could have a stronger impact than presently assumed.

The timing of the SVB’s failure was also

very critical for the construction sector, which had only recently begun to stage a recovery following a turbulent 2022. However, while it does face challenges such as a growing shortage of workers coupled with high-interest rates, there is optimism within – and also outside – the construction industry that the long-term future outlook is good. Government sources have been suggesting that investments in the construction sector will gradually rise, particularly in infrastructure construction because of the massive government allocations for modernizing and developing infrastructure. The funding will sustain infrastructure construction for years to come. Nevertheless, it would be myopic to ignore the fact that the SVB’s collapse will not ‘just pass away’ without causing setbacks to private and affordable housing, particularly on the west coast.

One dark cloud that continues to hover over the US economy – and the steel industry – is the fear of a recession, a word

*US correspondent, Steel Times International

that is being uttered more often now than before. Jean Bolvin, the head of the BlackRock Investment Institute, observed recently during a press briefing at the New York Foreign Press Centre, that central banks would not intervene. “…That’s the kind of regime phase that we’ve been [in] since last year, where the message from central banks has been all about bringing inflation [down] to 2%. I think we’re still in that regime, and I think from the central banking community it’s really about the cost of losing control of inflation, [which] is way higher than creating a recession, and while they would like to avoid a recession and they speak as if they hope it’s going to happen, they’re going to be more comfortable with having a recession than being held responsible for having created a big inflation problem.”

Notwithstanding the optimistic longterm outlook for construction projects, which will benefit from the infrastructure investment of some $225 billion under the

Infrastructure Investment and Jobs Act, the industry faces other short-term problems beyond the SVB fiasco and the highinterest rates. The recession that experts are predicting, will not just envelope the US but will also affect the world; this, in turn, is very likely to affect the construction professionals, particularly those involved in the logistics and sourcing of materials from around the world.

This being said, steel prices are influenced by several factors. Prices can surge following breakdowns in supply of raw materials, which has happened following the Ukraine war, and the resulting rawmaterial shortages that have sent prices spiraling. As the year 2023 started, US service centres had low levels of inventories, driven by the fear of accumulating highpriced inventory.

But things seemed to have changed with many looking for additional steel as supplies remain tight resulting from lower utilization levels at steel mills. The lower inventories with service centres suggest that buyers have less quantity available to buy from; indeed, many have been operating without certain types of steel products in their inventories. As a result, steel mills such as Steel Dynamics or Nucor’s Gallatin mill in Kentucky have been operating below the expected levels, though both corporations expect to improve their performance in the second quarter. Steel mill outages are also limiting the US market and are expected to last until May.

The bottlenecks in steel supply have been exacerbated by declining steel imports, thus eliminating a supply source that helped bridge the short supply from domestic production by sourcing foreign steel which

offers the consolation of costing less than domestically produced steel. Indeed, the February data from the US Commerce Department suggests that the country recorded the ninth consecutive month of declining imports.

Meanwhile, steel producer US Steel has resumed operation of its blast furnace no. 8 at its Gary steel mill. It had idled both the no.3 blast furnace at Mon Valley Works in Pennsylvania and the no. 8 furnace in Gary in 2022 after steel prices had plummeted from the high levels of 2021 as fears spread of an impending recession. The steel producer resumed operation of both blast furnaces, and the outlook for steel has resultantly improved. US steel producers have benefited from the increased production levels of car manufacturers who had earlier adopted a cautious approach because of recent shortages in semiconductor chips and other materials.

US Steel confirmed in a press release that the flat-rolled segment’s order book ‘reflects broad improvements across most end-markets’.

The No. 8 blast furnace at Gary Works can produce up to 1.5Mt of iron annually.

It was originally idled for a planned maintenance project last year and was supposed to be restarted in August after three months of construction, but then market conditions deteriorated and US Steel opted to idle it until demand returned.

In positive news, analysts expect scrap demand to rise, as market conditions suggest impressive growth in the coming years. According to the latest industry report by Fact.MR, a provider of market research and competitive intelligence, the global steel scrap market is projected to grow at a CAGR (Compound Annual Growth Rate) of 4.9% and reach a total volume of 1.05Mt by 2033.

Steel is one of the most recycled materials in the world; one of the main components used to make steel is recycled steel. Steel is simple to separate from the waste stream and be recycled due to the metal’s high magnetic characteristics. Steel recycling also aligns well with the global call for decarbonization; besides contributing to a significant decline in CO2 emissions, it reduces consumption of iron ore, and contributes to huge energy savings. Scrap is anticipated to make up a sizeable amount of metal production in the future as deposits across the world become scarce and the costs of obtaining ore keep rising.

Future demand for steel scrap is anticipated to rise in tandem with an increase in the demand for raw materials used in the manufacturing process from emerging economies such as China, India, and Brazil. Steel has been able to meet the challenge provided by competitor materials due to the development of new lightweight goods, bake-hardened grades, and highstrength steels. �

Technologies offering enhanced product performance and a more environmentally sustainable production process.

John Cockerill Industry’s ARPs come with smart plant control systems, provide waste energy recovery and drastically reduce pickling process plants’ fresh acid demands and waste streams in general. What is more, they are providing the lowest emissions in the market.

Our E-Qual® equipment and processing lines are designed for the production of strong, ultrathin, lightweight, and high-quality Non-Grain Oriented (NGO) steel grades essential for the future of e-mobility.

8 - 11 May | Détroit, Mich., USA

BOOTH #2165

johncockerill.com/industry

JVD (Jet Vapor Deposition) offering the lowest ‘global warming potential’ according to life-cycle assessment measures

A world first and a technological breakthrough in steel coating, this unique technology providing multiple advantages, was developed for steel giant, ArcelorMittal with the help of our experts.

Today John Cockerill Industry is in charge of commercializing this unique technology worldwide.

In the second part of an ongoing feature, Germano Mendes de Paula* discusses the restructurings of Mannesmann Brazil; including its transformation into a whole subsidiary, its technological developments, and the opening of a new greenfield mill.

ALONG the first decade of this century, Mannesmann Brazil experienced two important corporate restructurings; the first regarding its parent company, with the second being its transformation into a whole subsidiary.

In fact, 2000 was decisive year for Mannesmann group, as it was the target of a hostile take-over by the British telecoms company Vodafone. To comprehend this transaction, it is necessary to consider the previous process of productive diversification undertaken by Mannesmann. In 1970, the company’s original tubes and trade division still represented 77% of total sales, with this figure falling to 54% in 1980 and even to 8% in 1999. Meanwhile, the share of the capital goods and automotive divisions in the revenues increased from 16% in 1970 to 44% in 1980, reverting partially to 41% in 1999. The telecommunications division, which was set up in the 1990s, came to represent 39% of total sales in 1999. It is estimated that roughly about two thirds of Mannesmann’s investments in the 1990-1999 period were

directed to the telecoms sector. For this reason, Mannesmann became a target of Vodafone in 2000.

After the takeover, the German steelmaker Salzgitter acquired a majority interest in Mannesmannröhren-Werke (MRW), which had made heavy losses, for the symbolic price of one Deutschmark. However, since 1997, Mannesmann’s tube operations were under the umbrella of Vallourec & Mannesmann Tubes (V&M Tubes), a joint-venture between the French tubemaker Vallourec (55%) and MRW (45%). In addition, MRW controlled 21% of Vallourec.

In July 2000, MRW sold its 76% stake in the Brazilian subsidiary to V&M Tubes, which can be understood as an intra-group ownership restructuring. The Brazilian firm was renamed as V&M do Brasil. Moreover, it promoted a share purchase offering, aiming to acquire all the shares held by minority shareholders. V&M Tubes improved its participation to 93% of the Brazilian subsidiary, which was delisted from São Paulo Stock Exchange as of September 2000.

In 2005, Vallourec gained full control of V&M Tubes by purchasing MRW’s 45% stake in the company. In the following year, Salzgitter sold its remaining 17% participation in Vallourec. Consequently, for the Brazilian subsidiary, its original parent company was Mannesmann, then V&M Tubes, and then Vallourec during the period 1997-2005.

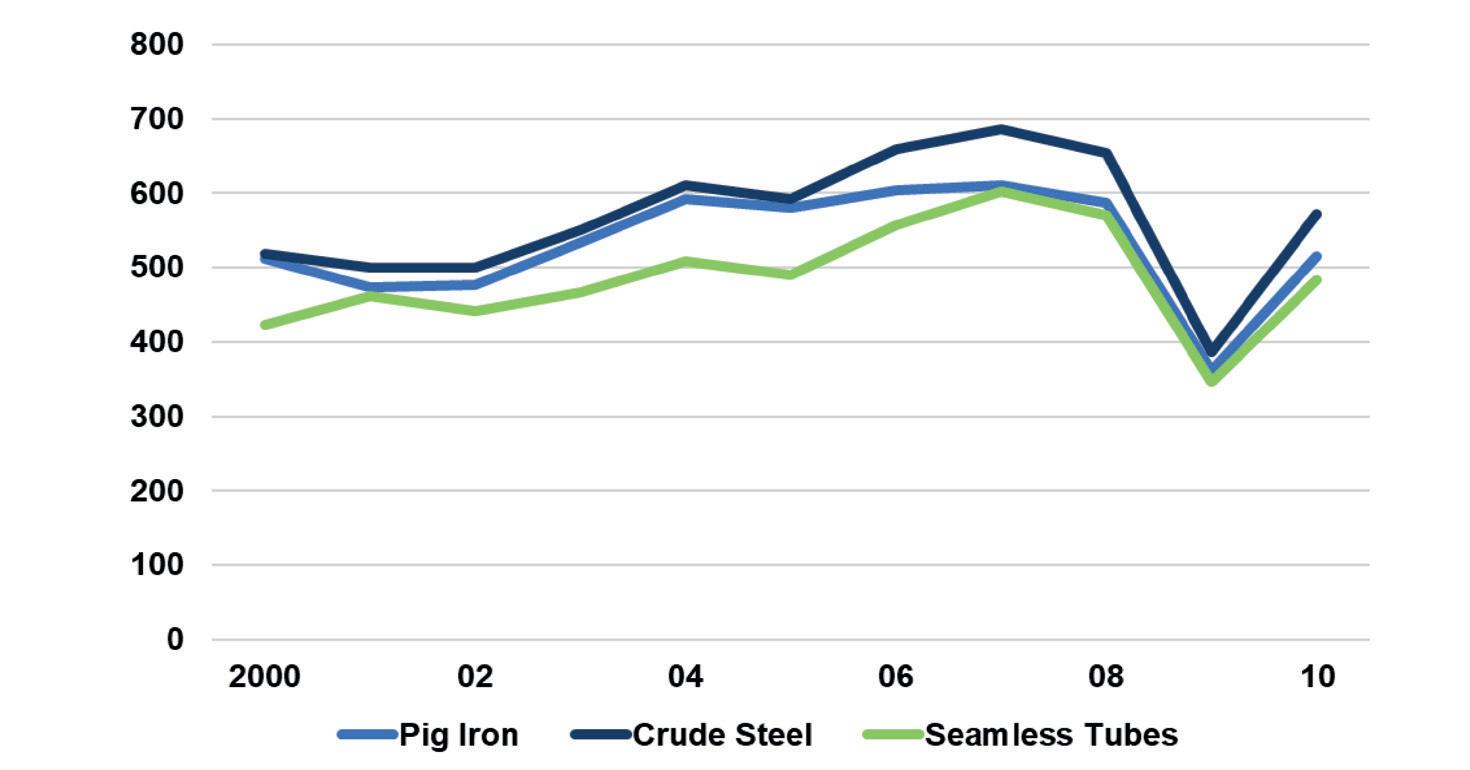

Graph 1 shows the evolution of the Brazilian subsidiary, in its Barreiro mill, during the years 2000-2010. Underpinned by technological improvements developed in the previous decade, the company was able to obtain a good productive performance, before the global financial crisis of 2008-2009. Pig iron production increased from 512kt in 2000 to 610kt in 2007, whereas the crude steel output was respectively 519kt and 686kt. The fabrication of seamless tubes also rose from 423kt to 603kt during the aforementioned period. However, not surprisingly, all operations were severely impacted by the global financial turmoil from 2008 onwards.

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

In 2005, Tubos Soldados Atlântico (TSA) was established, as a joint-venture between Europipe (70%), V&M do Brasil (25%), and trading company Interoil (5%). It startedup its 90kt/yr large diameter welded tubes operation, at a cost of $65M, in 2007. The new plant is located in Serra, in the State of Espírito Santo, close to the ArcelorMittal Tubarão steelworks, which supplies hotrolled coils. In 2012, V&M increased its stake from 25% to 96% in TSA. In 2020, the plant was renamed as Vallourec

Tubular Solutions (VTS) – Serra, reflecting Vallourec’s full ownership.

More importantly, the negotiations between Vallourec and the Japanese steelmaker Sumitomo Metals (SMI) regarding the construction of a large greenfield project to produce seamless tubes in Jeceaba, in the State of Minas Gerais, began in 2006. In the following year, Vallourec & Sumitomo Tubos do Brasil (VSB), a joint-venture between Vallourec (56%), SMI (40%) and Sumitomo Corp. (4%), was established.

Jeceaba’s project consisted of a 1.5Mt/yr pelletising plant, a 300kt/yr blast furnace, a 1Mt/yr EAF-base steel shop and a 600kt/ yr rolling mill, for tubes with a diameter between 168-406mm. Concerning round bars output, approximately 70% would be consumed at the same site, whereas the rest would be used in the Barreiro mill and exported. The new mill would be primarily dedicated to the manufacturing of tubular petroleum products. The start-up was scheduled for 2010, while the total investment was estimated at approximately $1.6bn. The increase in supply was much higher than the projected domestic demand growth, so that 80% of the production of the new plant would be exported.

Jeceaba was chosen because of the following reasons: a) it is just 100km away from the Barreiro mill, so they can coordinate their operations; b) it is only 70km from the Pau Branco mine, which is the captive source of iron ore; c) it is 500km from Sepetiba and Rio Janeiro harbours; d)it has good rail access to the mentioned ports and Barreiro mill; e) it has a good supply of electricity and gas; f) there is room for future expansion.

Jeceaba’s construction commenced in 2008, while the foundation for rolling mill building occurred in 2009, followed by the start-up of the blast furnace in 2010. The mill was officially started-up in September 2011, one year after its original planning. This is a small delay, considering that the global steel industry was shaken by the collapse of Lehman Brothers in 2008.

It is interesting to note that Jeceaba has implemented a 0.96Mt/yr Consteel®, facility which was the first and only piece of equipment to pre-heat scrap in Brazil so far. It came on stream, jointly with other equipment in the melt shop, in August 2011. Nevertheless, the blast furnace had its assembly completed as was ready to start operations at the end of 2011. However, the retraction of the steel market led to the beginning of the operation being delayed to July 2014. While it can operate with both coke and charcoal, it has been consuming the latter since its start-up. Jeceaba’s original plans included another blast furnace of the same size, but the company is still waiting for market conditions to improve before completing its assembly. The evolution of Barreiro and Jeceaba’s productive performance from 2011 onwards will be discussed in the next part of the article.�

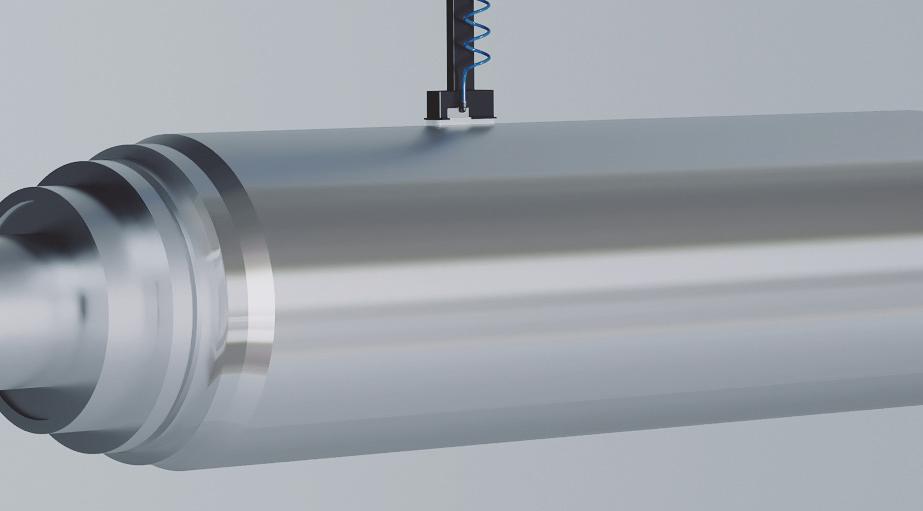

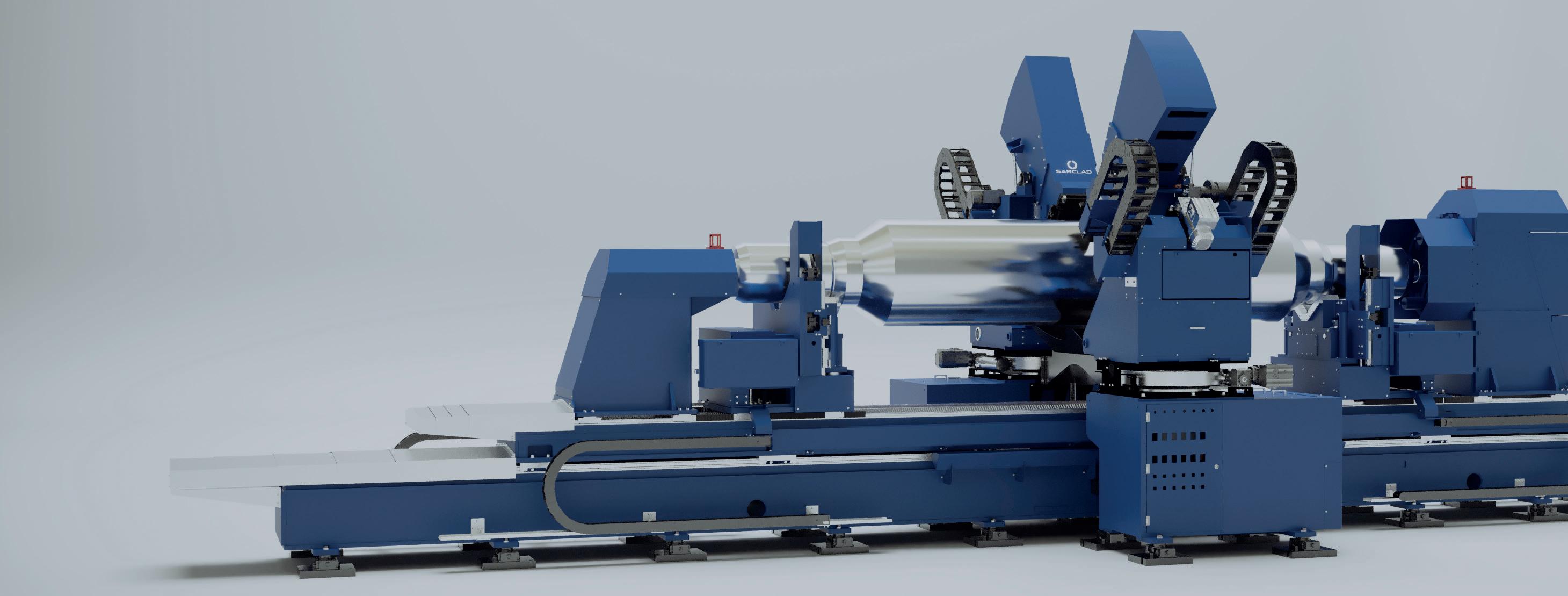

World leading technology for applying texture to rolling mill rolls using state of the art Electro Discharge Texturing techniques.

The latest technology in non-contact surface & sub-surface inspection of hot and cold rolling mill rolls with Eddy Current, Compression Wave and Creep Wave capabilities.

Bespoke In-Chain and off-line strand condition monitoring systems for continuous casting.

Sarclad UK sales@sarclad.com

Sarclad North America sales@sarcladna.com

Sarclad China sales.china@sarclad.com

sarclad.com

Sarclad India sarclad.india@sarclad.com

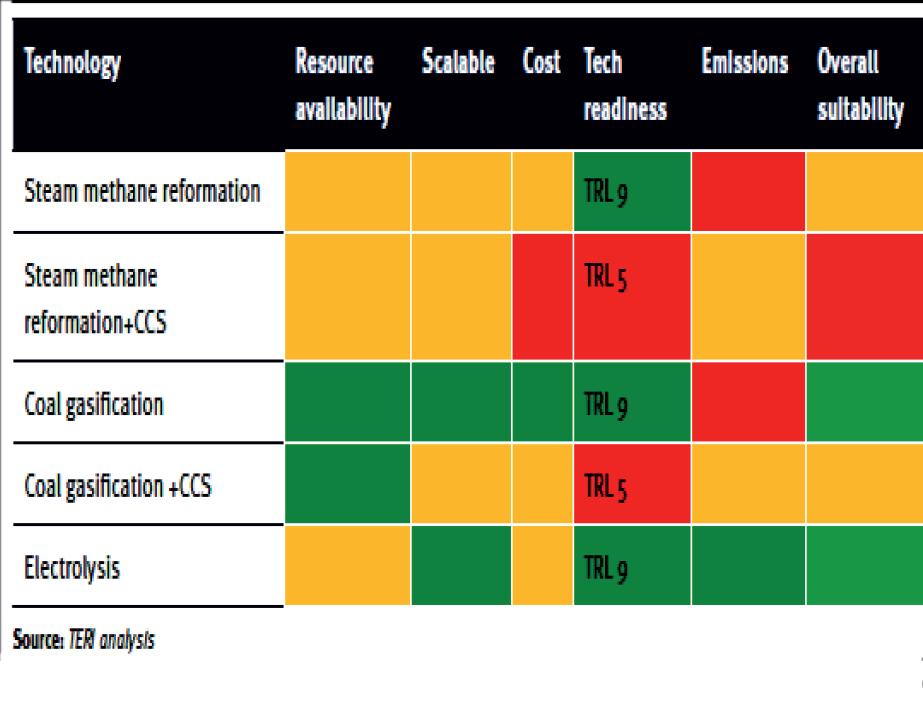

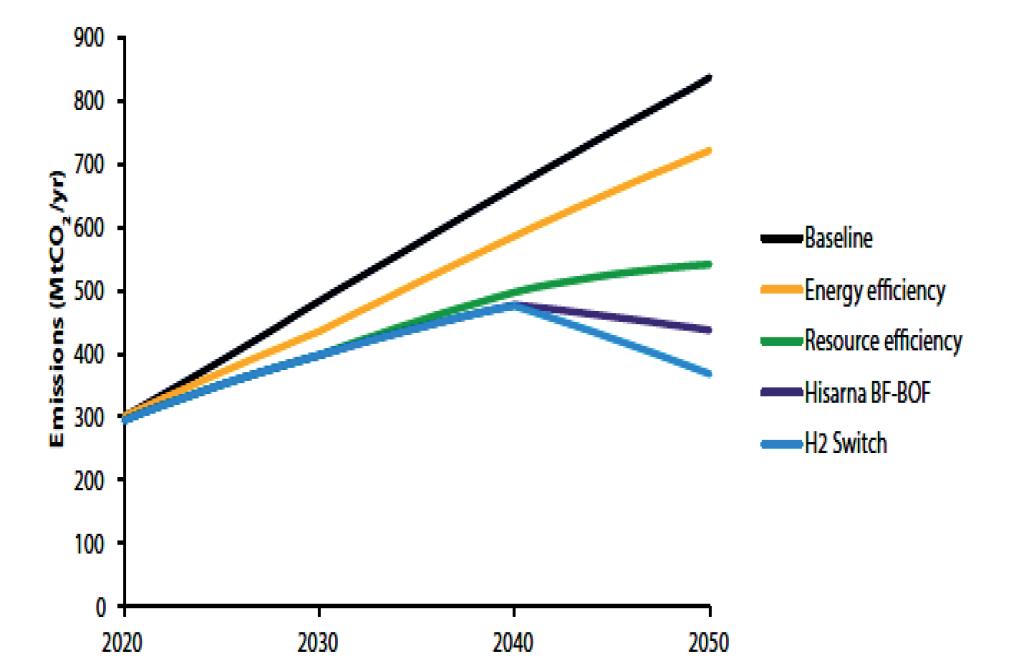

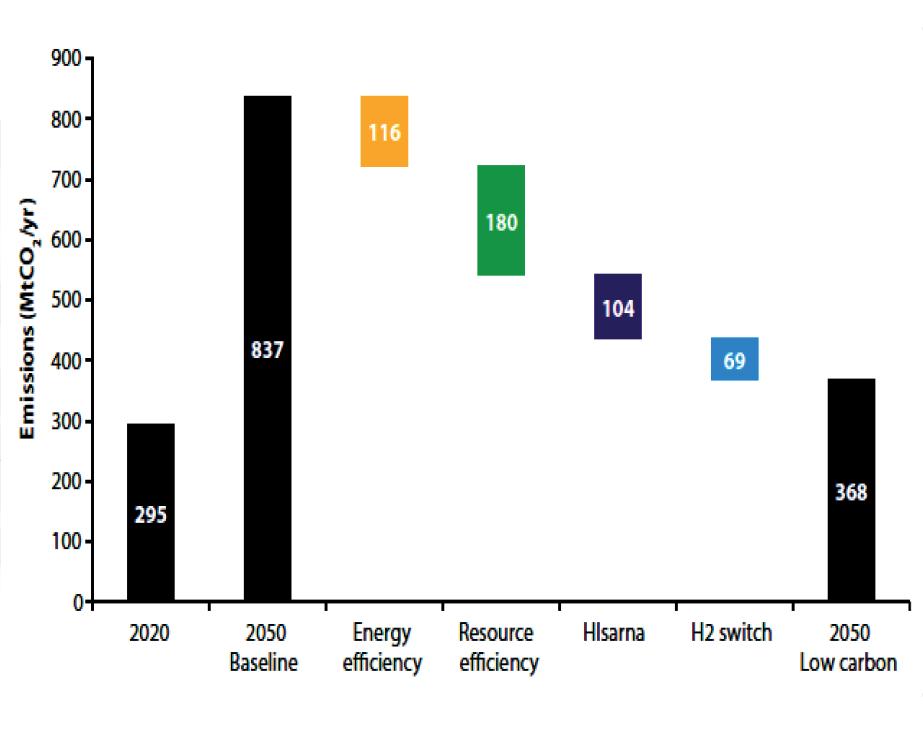

CARBON emission reduction has been at the forefront of every global discussion since the United Nations’ 26th Cooperation of Partnership (COP26) meeting held in Glasgow in 2021. All UN members voluntarily declared their ‘net zero’ plans. Following them, India also announced plans to become carbon neutral by 2070. With this declaration, the government of India took several measures to reduce CO2 emissions through various means. Industries were asked to allocate funds and upgrade their plant and machinery, as consumer markets across the world started focusing on low-carbon products. In order to remain competitive in the world market and continue business unabated, the Indian steel industry also advanced its facilities with next-generation plants and machinery and started producing low-carbon products without compromising on quality.

India’s steel sector accounts for 12% of total CO2 emissions with an intensity of 2.55 tonnes CO2/TCS as against the global average emission intensity of 1.85 tonnes CO2/TCS. This clearly indicates that India needs to adopt more industry-friendly initiatives to reduce emissions and achieve the world average. To reduce carbon emissions, India’s Ministry of Steel has been continuously engaging with stakeholders in the environment, renewable energy, mines, and other such ministries for the past several months. With this, the government focused on carbon emissions reduction technologies such as green hydrogen in steel making, carbon capture, storage, and utilization (CCUS), and the best available technologies on energy efficiency as well as

transitioning to renewable energy.

In the Ministry of Environment, Forest and Climate Change’s (MOEF&CC) biennial update report to the United Nations’ Framework Convention on Climate Change (UNFCCC), its estimation of India’s total release of CO2 in 2016 was 135.42Mt. But, with the expansion plans as per the National Steel Policy presently underway, India’s overall CO2 emissions are all set to increase substantially as a result of the steel industry.

India’s steel industry plays a pivotal role in crucial sectors including construction, infrastructure, automotive, engineering, and defence. It has witnessed phenomenal growth over the last few years, and is now the second largest producer in the world, beaten only by China.

Both production and consumption of steel have increased significantly in the last few years. Data compiled by the Joint Plant Committee (JPC) under India’s Steel Ministry showed crude steel production at a record 103.18Mt between April 2022 and January 2023 period as against 99.03Mt reported for the previous full financial year (i.e. April

2021-March 2022). Similarly, finished steel production during April 2022-January 2023 stood at a high of 98.26Mt compared to 93.41Mt in the previous full financial year. Further, India’s finished steel consumption was reported at 96.38Mt between April 2022 and January 2023 in comparison with 86.97Mt in the last financial year (April 2021-March 2022).

From the steel industry’s point of view, the government has divided the entire 2070 plan into three broad categories. Focusing on the short term – until 2030 – the Indian government has decided to promote energy efficiency in the steel industry and encourage steel producers to emphasize resource efficiency and renewable energy for a sustainable future. For the medium term – between 2030 and 2047 – the focus area could be green hydrogen and carbon capture, utilization, and storage. For the long-term perspective – between 2047 and 2070 – disruptive alternative technological innovations are the primary focus that can help achieve the transition to net zero.

To promote healthy growth in the steel industry with its focus on low-carbon and

best-quality products, India has introduced the Steel Scrap Recycling Policy which enhances the availability of domestically generated scrap to reduce the consumption of coal in steel making. Also, the Ministry of New and Renewable Energy (MNRE) has announced the Green Hydrogen Mission for the production and consumption of green hydrogen as a fuel and replacing fossil fuels like coal. Additionally, India introduced the Motor Vehicles Recycling Rule under which old vehicles were scrapped and sent for recycling. The hope is to eventually increase the availability of steel scrap in the country. A national solar mission was also launched to promote solar energy and help the steel sector to reduce overall CO2 emissions. Also, a Perform, Achieve,

and Trade (PAT) scheme was introduced to incentivize the steel industry to reduce energy consumption.

According to the World Steel Association, scrap plays a key role in suppressing industry emissions and resource consumption. Every tonne of scrap used for steel production avoids the emission of 1.5 tonnes of CO2 and the consumption of 1.4 tonnes of iron ore, 740 kg of coal, and 120 kg of limestone.

India’s Steel Policy estimates the country’s crude steel production will reach 300Mt by the financial year 2030-31, by expanding capacity through both greenfield and brownfield projects.

The government has emphasized the lower use of power in existing steel production factories. To achieve this goal, however, the government has encouraged steel producers to cut down on their use of iron ore and coking coal as raw materials to manufacture the best quality products for application in infrastructure and construction projects. Barring specific applications where iron ore is required to be

used as raw materials, the government has encouraged producers to use ferrous scrap to produce steel products, especially for rural consumption.

The government plans for secondary steelmaking using ferrous scrap as raw material to account for 40% of India’s total steel production. Presently, India imports a huge quantity of ferrous scrap to meet the raw material demand for producing secondary steel. Production of secondary steel by using scrap is estimated to utilize 74% less energy than the production of steel from iron ore.

The International Energy Agency (IEA) has called upon local government and the steel industry to adopt ways and means to reduce carbon emissions at least by 50% by 2050 and continue to bring down the release of greenhouse gas to make the world’s climate goals successful. Overall, green steel production and consumption in India has started gaining momentum as steel companies make efforts to reduce their carbon footprint, but the transition is very costly. �

Solar Turbines offers solutions for unsteady flows of wide composition fuel gases such as high H2, CO, CO2 and HCs. Transform what you thought was waste gas into valuable power and heat.

2023

The Future Steel Forum, now in its SEVENTH successful year, is heading for Vienna this September to examine the important relationship between digital manufacturing and the decarbonization of the steelmaking process. Come and listen to experts from the two most important areas of global steelmaking at present. This is a must-attend conference for anybody with an interest in the fast-developing world of Industry 4.0 technologies and those responsible for sustainable steel manufacturing.

CONFIRMED SPEAKERS FOR FUTURE STEEL FORUM IN VIENNA INCLUDE:

AISTech 2023, held 8-11 May in Detroit, USA, promises an array of new products, systems, and solutions from its vast list of exhibitors. See below for what not to miss at North America’s largest iron and steel technology conference and exposition.

AMI Automation, an international automation and control solutions company, will be exhibiting a range of new products at AISTech 2023. The SmartFurnace, which is an artificial intelligence expert system, is designed to dynamically select the best operating points for electrical and chemical energy input based on the actual heat conditions adapting to every aspect of the furnace operation. The Off Gas Module, says AMI, will interact with the SmartFurnace Oxygen Module to control the carbon injection and oxygen, reducing the emissions of CO, increasing the CO2 produced during the combustion of carbon and oxygen, and optimizing the chemical energy input in the furnace. Another product to be showcased at the event is AMI’s Infrared Off Gas Sensor system, which has the capability of measuring CO, CO2, H2O, temperature, velocity and flow. The modular design allows these gases to be measured as required, says AMI, with the main advantages being the extremely easy installation and tested reliability.

Other products to be exhibited include the IoConveyor, for controlled scrap feeding, the IoTrode, for optimizing electrode consumption and controlling the rate of watercooling sprays, and the SmartKnB – a graphical programming platform to develop complex solutions in which process engineers and customers can build, test and validate models to improve EAF operation.

AMI Automation will be exhibiting at booth #2257

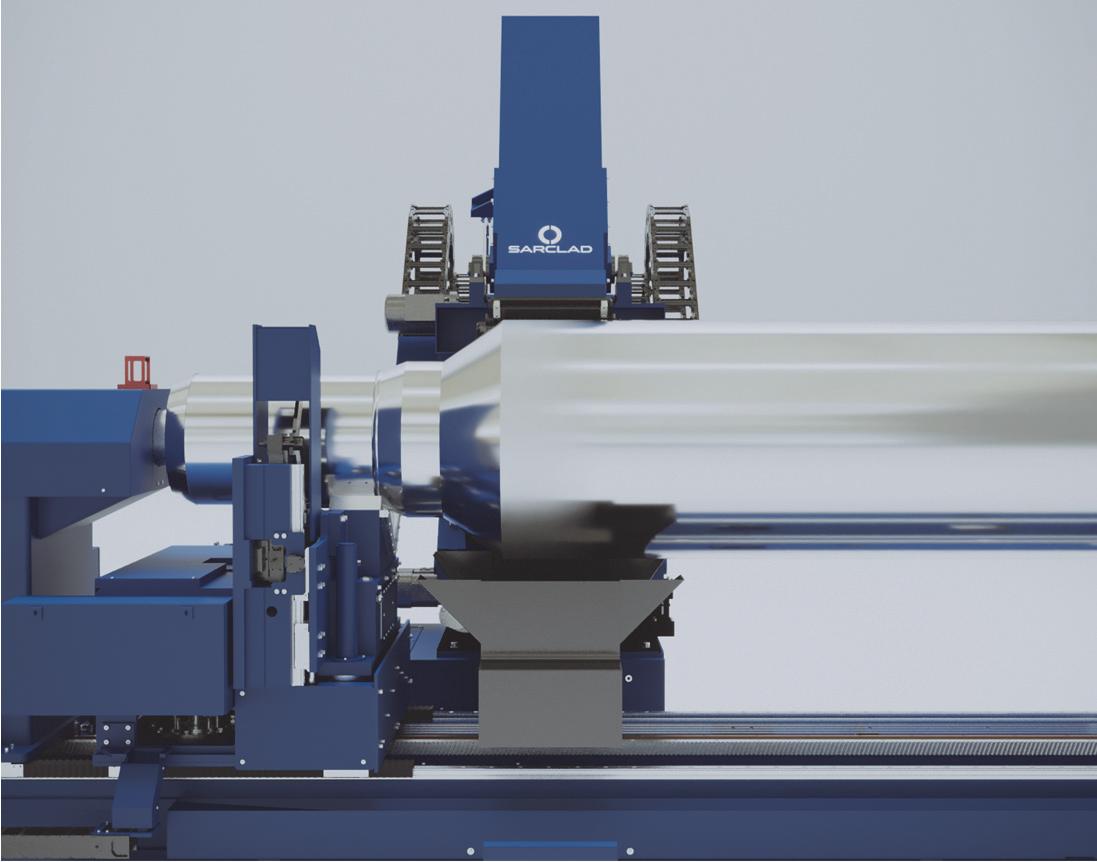

Global technology provider Sarclad will be launching its Multi-Servo Array EDT, which the company claims is targeting applications that require the highest possible texture quality and consistency. Sarclad’s EDT MSA has a single or double texture station design, which then traverses the full width of the roll barrel, combining individual servo control for each electrode, with

an innovative formed array. The control system employs a novel closed-loop power delivery design, which ensures that the energy delivered by each spark is precisely controlled,

Primetals Technologies, a leader in plant solutions, will be showcasing its Arvedi Endless Strip Production, which provides flat steel producers with a means of producing thick 25mm to ultra-thin gauges of just 0.6mm in an endless casting and rolling arrangement that is both compact and energy efficient. Compared to the conventional casting and rolling process, says Primetals, Arvedi ESP combines the slab casting, cooling, storage, reheating, hot strip mill, and rolling processes into one effective process. The range of steel grades produced using an Arvedi ESP includes advanced steels such as HSLA, pipe grades – e.g., up to API X80 –, silicon steel, HSS and AHSS grades, DP, and multi-phase steel grades. One of the qualities of the strip made with Arvedi ESP is the fact that it can be regarded as a ‘cold-rolled substitute,’ meaning that it fulfils the quality criteria normally only achieved through additional cold rolling. Arvedi ESP produces gauges from 0.8mm to 1mm, e.g., 1mm thick steel with yield limits up to 315 MPa, 1.2 mm thick steel with yield limits up to 420 MPa, 1.4mm for DP 600, and 2mm thick HSS with yield limits up to 700/800 MPa. Checkered plates with 1.5 to 3.5mm thicknesses were also recently produced on an Arvedi ESP line.

Primetals will also be exhibiting its electric steelmaking portfolio, which includes the EAF Ultimate and EAF Quantum, designed to deliver high-quality results with advanced technologies. The EAF Ultimate provides a comparable tapping weight to converter steelmaking routes, and the EAF Quantum features scrap-preheating via waste heat recovery, decreasing energy consumption to 280 kWh/t, resulting in overall savings. Key features of all electric arc furnaces from Primetals Technologies include reliability, low energy consumption, and a rapid return on investment.

ensuring greater consistency of the surface texture. The texturing process is closely monitored in real-time by an advanced digital control system, designed to provide the highest levels of process control, while simultaneously communicating detailed feedback to the control system and machine operator. Each texture head can be equipped with a range of custom options from 12 to 36 electrodes per station, with a double station machine providing a

maximum capacity of 72 electrodes, for those seeking a roll texturing capacity in excess of 10,000 rolls per year.

Speaking on the launch of the new application, Grant McBain, head of sales and marketing at Sarclad commented: “The MSA can be applied and tailored to each customer’s own specific set of requirements. Providing roll shops with the ability and versatility to provide textures specific to their own needs and applications is paramount and that is what the Sarclad EDT Multi Servo Array concept delivers.’’

Sarclad will be exhibiting at booth #1786

Thermal processing equipment supplier Inductotherm Heating & Welding will be showcasing its recent award: the Silver Ecovadis Sustainability Rating. This new accolade follows on from Inductotherm Heating & Welding’s triple BSI - ISO accreditation awarded in June 2022, which included ISO9001 for Quality, ISO45001 for Occupational Health & Safety and ISO14001 for the Environment.

Inductotherm Heating & Welding is undertaking a process of developing and improving its environmental and sustainability practices to ensure it is ‘sensitive and responsible to the local and wider environment’. Via implementing a wide range of changes in all areas of the business, from adopting renewable energy to changing to eco-friendly supplies and engaging with suppliers, the company hopes to commit further to sustainability.

In addition to its commitment of social and environmental responsibility, the company hopes that these accolades provide its customer base with the reassurance that they are engaging with a forward-thinking and ethical company committed to providing its customers with the environmentally sound and continually improving service. Achieving the Silver rating has allowed Inductotherm Heating and Welding to attain ‘Preferred Supplier Status’ with existing Tier 1 customers who highly value sustainability across all areas of their business.

INDUCTOTHERM will be exhibiting at booth #2463

AMETEK Land and AMETEK Surface Vision have joined forces to present their solutions for temperature measurements and surface inspection in steel manufacturing to visitors at the AISTech 2023 exhibition hall.

AMETEK Land is an experienced supplier of non-contact temperature measurement solutions to the steel industry, with dedicated solutions and flexible instrumentation that can be customised for specific processes. These solutions include the SPOT family of fully featured, high-performance pyrometers for fixed non-contact infrared spot temperature measurements. These are available in a variety of operating wavelengths and temperature ranges to meet different process requirements. The advanced SPOT GS model is specifically designed for continuous, accurate measurement of coated steel strip temperature during galvanizing and galvannealing.

Also on display will be the Cyclops L portable pyrometer range of highly accurate hand-held instruments. Ergonomically designed for singlehanded use, these non-contact thermometers provide easy, accurate point-and-measure temperature

readings. The Cyclops 055L model will be of particular interest to iron and steel manufacturers, with a measurement range of 1000 to 2000 °C (1832 to 3632 °F) and Meltmaster measurement mode designed for molten metal and foundry applications. At AISTech, the company will demonstrate its SmartView and SmartAdvisor solutions for a wide range of surface inspection applications. These flexible, modular systems are used throughout the steelmaking process to assure the highest level of quality, says AMETEK.

Larry Smith, LAND director of sales – Americas, said: “AISTech is the number one industry event for iron and steel manufacturers, and we are looking forward to meeting old and new customers alike. Most of all, we’re excited to introduce them to our range of solutions that will help them to improve thermal efficiency, increase product quality and control emissions, and support industrial decarbonization.”

AMETEK Land and AMETEK Surface Vision will be exhibiting at booth #2023

Kelk, a leader of performance sensors and systems for the steel and aluminium industries, will be exhibiting its ACCUCAMB Camber Gage Model C885; an advanced solution for true bar shape measurement and strip steering applications. The ACCUCAMB C885 Camber Gage is a non-contact optoelectronic instrument, which measures the camber (curvature), strip angle, centreline and width of a transfer bar during the rough rolling process. In the True Bar Shape configuration, the gage will also determine the shape of an entire bar. The ACCUCAMB C885 Camber gage also measures the centreline deviation and width of a strip during the finish rolling process.

The sensor uses an area array camera to image a portion of the bar. The lines that best match the bar edges are extracted from the data and used to determine width, centreline deviation and bar angle. The image data is also analysed to estimate bar camber. Advanced algorithms provide accurate edge detection and allow for limited temperature gradients, scale and steam.

The scan rate is optimized for each application and held constant. The measurements are most accurate where the strip height above the roll table is predictable, and a standard MODBUS/ TCP communications protocol provides access to all process data and gage status information.

Kelk will be exhibiting at booth #2042

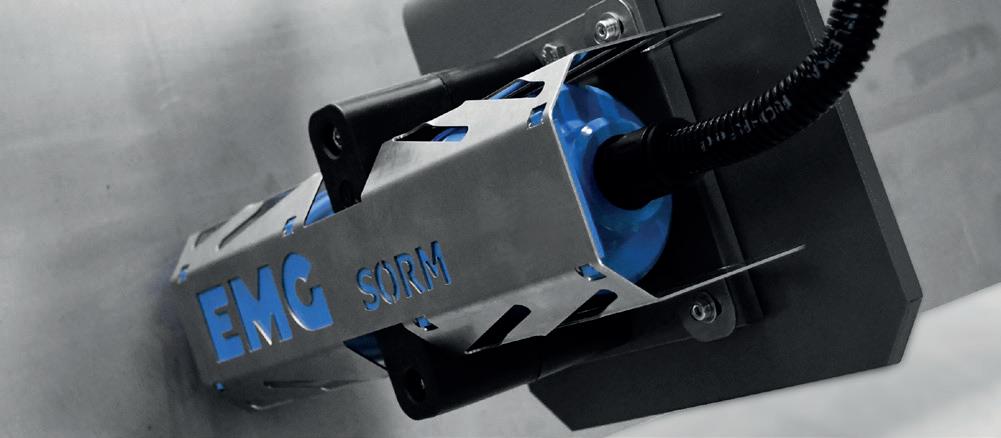

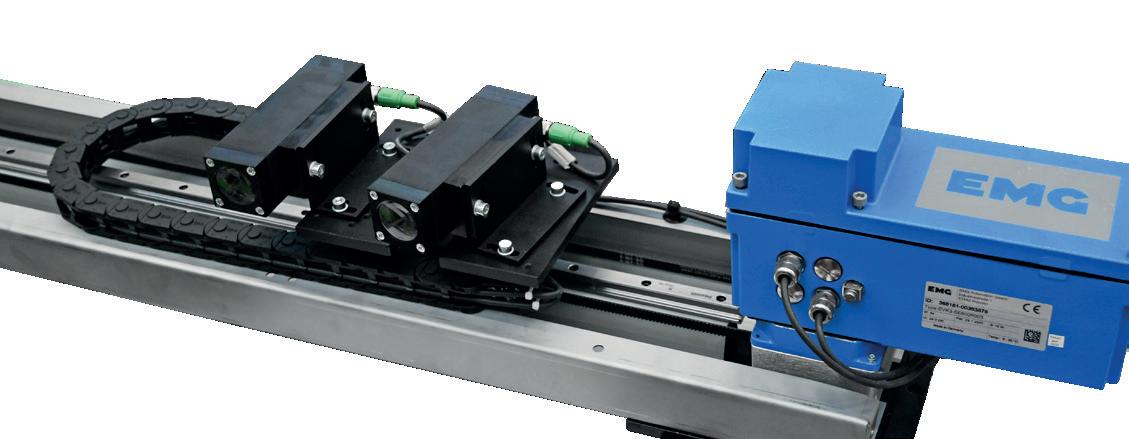

Our solutions for strip processing lines enable you to optimise your manufacturing processes and increase your production quality:

» EMG iTiM: Online thickness measurement

» EMG SOLID®: Online oil layer measurement for electrical steel

» EMG iCAM®: Online strip and slit strip width measurement & Edge crack and hole detection

» EMG SORM®: Online roughness measurement

» EMG EVK3: New optical sensor generation

emg.elexis.group

AIC, an Italian company specialized in industrial systems for the iron and steel sector, will showcase new updates on its all-electric patented mechatronics station, introduced on the market as TRIMBOT, combining mechatronics, industrial robotics and 3D vision systems with a high level of automation and artificial intelligence. The system is able to perform autonomous trimming and sampling of finished coiled products’ head and tail ends and operate within any type of coil handling area, whether vertical, horizontal, or a combination of both. The target of the system is to eliminate the actual manual trimming activities based on counting rings, performing the trimming process more than 600 times more accurately compared with the conventional manual trimming, or any other ring-counting trimming solution, according to AIC.

The company will also showcase its Ring Processing Turret; a circular guide with a shape that follows the natural circular shape of the coiled wire, that identifies, measures, cuts and separates the trimmed material from the rest of the coil. The Ring Processing Turret is mounted to a large diameter slewing ring which is bolted to the main trolley, and the rotation of the Ring Processing Turret is generated by a gear motor mounted on the main trolley.

AIC will be exhibiting in booth #1156

Falkonry, an AI software provider, will be presenting its industrial analytics application, Falkonry Insight, which can ingest and process large volumes of time series data to reveal both process and machine anomalies. According to Falkonry, the application allows operational users to review patterns that deviate from expected behaviour, compare signals, diagnose issues and generate reports. By utilizing patented AI technology that can process all available data, Insight is able to automatically surface related behaviour that could potentially lead to production problems.

The underlying approach of Insight is founded on encodings using an autoencoder that represents time series data based on a novel deep learning architecture, and a fully unsupervised approach to detect an anomaly. The application securely connects to existing automation control systems or data acquisition systems, such as iba, and ingests the time series data into the Falkonry AI platform. Within a few days, the self-supervised

learning starts surfacing the discovered anomalies automatically, which are then scored based on their severity and flagged for review. The maintenance and automation users then review these anomalies and diagnose the root causes, getting a view of the anomaly state across a process or a sub-process, and resultantly can compare the signal behaviours over different time periods to have a quantitative understanding.

Falkonry will be exhibiting at booth #2452

With the global steel industry looking to move toward direct reduced iron (DRI)-based production to reduce emissions, the Middle East and North Africa (MENA) region has the opportunity to capitalize on the switch.

By Soroush Basirat*

By Soroush Basirat*

THE global steel industry is eyeing a switch to direct reduced iron (DRI) using green hydrogen to reduce emissions.

Unlike the blast furnace-basic oxygen furnace (BF-BOF) process that uses coal to make iron, the direct reduced iron-electric arc furnace (DRI-EAF) route predominantly uses natural gas, which produces lower carbon emissions.

The Middle East and North Africa (MENA) region is potentially in a good position to begin producing carbon-neutral or green steel, as it has particular advantages over other areas in the world.

Its steel sector is already dominated by DRI with an established supply of DR-grade iron ore. Technical barriers may make it difficult to ramp up DR-grade iron ore production to supply other regions.

MENA’s transition to H2DRI-EAF could commence immediately due to the region having more DRI plants than anywhere else globally.

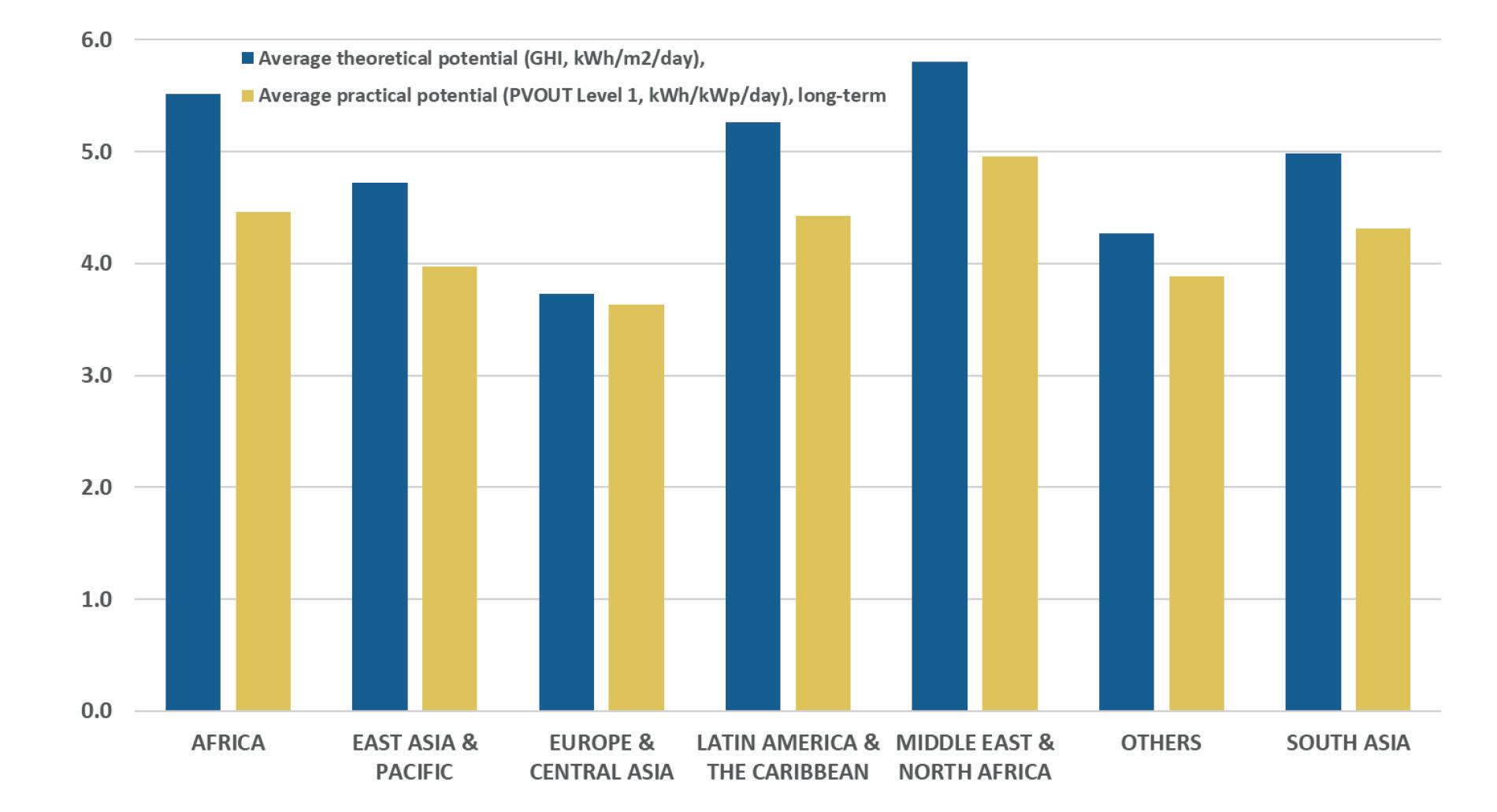

MENA has excellent solar resources to aid in the production of green hydrogen via renewable electricity. Access to such rich solar energy resources will allow for production of green hydrogen at a competitive price. If it acts fast, MENA has the potential to lead the world in green steel production.

In 2021, MENA accounted for nearly half of the world’s DRI production. The region produced only 3% of global crude steel output, of which about 95% was based on EAF production, predominantly from DRI-

EAF1. This is explained by the abundance of natural gas in the region as well as the lack of high-quality coking coal reserves.

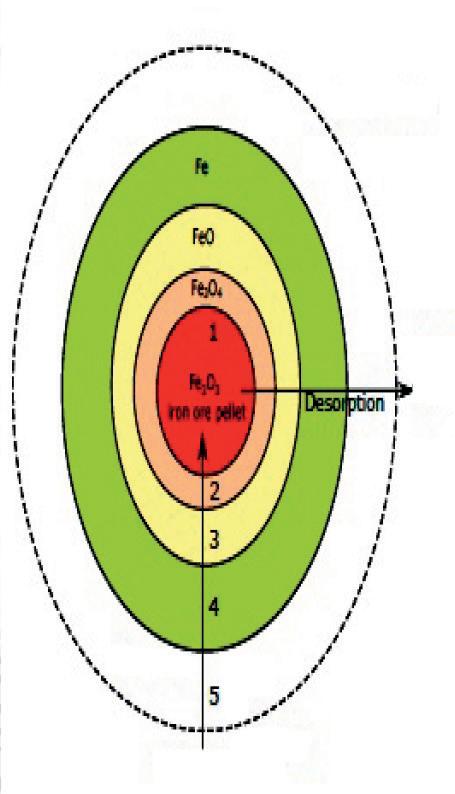

Fig 1 illustrates DRI production around the world. With more than 55Mt, MENA was highest followed by Asia and Oceania

World Steel Association and Midrex*

Note: At the time of writing, 2021 crude steel production figures for Bahrain, Libya and Qatar were not published and 2020 figures were applied. Table excludes countries in the region that produce steel from scrap-EAF: Morocco, Tunisia, Kuwait, Jordan and Israel.

(including India) with about 39Mt2. India is the world’s largest producer of DRI utilising gasified thermal coal, a more carbonintensive process compared to gas-based technology3. Mexico, Russia and the US are other significant producers.

Iran, Saudi Arabia and Egypt are the leading steel players in the MENA region, producing more than 80% of the region

total. Table 1 shows MENA’s production of crude steel and DRI in 2021.

In 2021, the Middle East produced more than 45Mt of crude steel, with 94% produced from the EAF route and the rest from the BF-BOF route. Iran is the only country in the area that used BF-BOF with just 2.8Mt produced via this technology in 20214. For North Africa, the proportions are almost similar.

The International Energy Agency (IEA) modelled in its 2021 Net Zero Emissions scenario that H2DRI-EAF’s share of global primary steel production would reach 29% by 20505. Under its own net zero by 2050 scenario, BloombergNEF models suggest

that 56% of primary steel production would come from H2DRI-EAF by 2050, equivalent to 840Mt/yr6

The current global share of the DRI-EAF route is less than 5%, yet the future appears bright for this technology and MENA is likely to be one of the leading players due to the region’s competitive advantages.

In 2020, steelmaking capacity in the Middle East increased by 7.2Mt. It will rise further in the coming decades mainly due to the expansion of Iran’s steel sector.

MENA’s steel industry is relatively low carbon compared to the rest of the world, where steel production is dominated by blast furnaces using coal, both as a source

of energy and iron ore reduction. According to the IEA, direct and indirect carbon emissions of BF-BOF is 2.2 tonnes per tonne (t/t) of crude steel while the DRI-EAF emits 1.4 t/t7

As the cost of renewable energy has fallen dramatically in the past 10 years, solar photovoltaic (PV) and onshore wind could now compete with fossil-based electricity (generated from coal or natural gas) in most regions8

As with the region’s steel industry, electricity production in MENA predominantly relies on gas-fired power plants. MENA’s share of renewable energy is currently much lower than the global average, although the region has high potential for solar energy9

In fact, MENA has the highest PV power potential globally10, according to the World Bank (Fig 2).

Renewable investment has been gaining momentum in MENA predominantly due to the dramatic reduction in the cost of solar PV projects. The global levelized cost

of solar electricity (or LCOE) has fallen from $0.381/kWh in 2010 to $0.057 in 2020 – that is, an 85% reduction in 10 years. In 2020, the bids for solar PV recorded some new low prices in the Middle East from $0.0157/kWh in Qatar to $0.0135 in the United Arab Emirates (UAE) and even $0.0104 in Saudi Arabia. The International Renewable Energy Agency (IRENA) assessed that producing solar PV electricity in the Middle East at $0.01/kWh is possible11

Major projects are under construction in Saudi Arabia, Morocco, UAE, Israel and Egypt. The IEA estimates that MENA’s renewable energy capacity growth will double over the 2021–2026 period compared to the previous five years and reach 32GW, up from 15GW12

New renewable capacities will change the power mix in MENA by 2050. IHS Markit forecasts that 83GW of wind and 334GW of solar capacities will be added by 2050, which will increase the respective shares of wind and solar from 1% and 2% to 9% and 24%13

Green hydrogen is produced from water electrolysis, by splitting the bond between

hydrogen and oxygen in water molecules. Producing green hydrogen requires the use of renewable electricity and it has yet to reach global price competitiveness.

With the global energy transition accelerating, green hydrogen has become one of the most important investment options in the energy sector. The IEA predicts that by 2030, the installed global capacity of electrolysers will reach 54GW and the Middle East with 3GW will sit below Europe, Australia and Latin America14

Having access to cheap solar energy is a regional competitive advantage for MENA countries in the future hydrogen economy. Scaling up solar power capacities to produce green hydrogen is a big challenge although the MENA region has two main advantages: land availability and solar radiation.

Table 2 illustrates the difference between a European and North African country in terms of needed capacities and cost of production to change technology in a steel plant with an annual capacity of 4Mt from BF-BOF to H2DRI-EAF using green hydrogen. Based on calculations by Hydrogen Europe, Tunisia requires 31% lower PV solar capacity and consequently lower electrolyser capacity15

The cost of hydrogen production via electrolysis is currently lower than blue hydrogen in Middle Eastern countries. In July 2022, the cost of alkaline electrolysis in Qatar was $2.59/kg, Saudi Arabia $3.20, Oman $3.55 and UAE $5.14.

The cost of polymer electrolyte membrane (PEM) electrolysis is generally around $1/kg higher than alkaline technology. The price of blue hydrogen, produced by the combination of steam methane reforming (SMR) and carbon capture and storage (CCS), is about $7/kg in the Middle East16

The IEA foresees the Middle East as an area with scope for the lowest cost of green hydrogen production.

The IEA reported that by 2030 the cost of hydrogen production in the Middle East powered by solar PV could be less than $1.5/kg based on capital expenditure of $320/kW and electricity at $17/MWh. By 2050, the hydrogen price could fall further to $1/kg as capex and electricity costs decrease to $250/kW and $12/MWh17

BloombergNEF suggests that with delivered green hydrogen priced below $1.5/kg, H2DRI-EAF technology could be

cost competitive by 205018

As MENA could produce hydrogen domestically, the cost of transportation to steel producers could be lower than other areas. Based on the hydrogen carrier and the distance, the transportation price varies. MENA has good infrastructure and pipelines that could facilitate cheaper transportation domestically.

DR-grade pellet supply

DRI-EAF technology currently needs a different feedstock to meet rigid specifications for quality and physical properties. The DR-grade pellet must contain at least 67% of iron, requiring further processing of iron ore. Some steelmakers are investigating new technology combinations that could allow use of lower-grade iron ore in DRI process19

MENA’s steel and mining sector has already invested in the upstream value chain and can supply the high-quality pellets to feed steel companies.

Headwinds

In addition to the technical barriers of using hydrogen for DRI production on a commercial scale, other headwinds include the supply of DR-grade pellet for further expansion projects, scaling up the renewables and green hydrogen value chain and the fact that MENA is a water-stressed region.

Although MENA has access to DR-grade pellet for the current capacity of DR plants, any further development and capacity increase must be planned simultaneously with the aim of balancing the whole value chain based on H2DRI-EAF.

The solar PV and electrolysers also occupy hectares of land. A 1GW PV installation covers more than 6,000–8,000 acres20, a matter of lesser importance in the MENA area given the expanse of uninhabited lands with ample sunlight to allocate to this

purpose. Twelve out of 17 countries with extremely high baseline water stress are in the MENA21region. Locating in such an arid areas is a challenge for any industry.

To produce 1kg of green hydrogen via solar PV and wind requires on average about 32kg and 22kg of water, respectively. Despite hydrogen’s small global share in total water demand, it could be difficult to supply water as a feedstock reliably in MENA due to scarcity.

The IEA suggests that added energy input

breakthrough, though MENA could be a global leader of steel decarbonization if the region shifts promptly towards green hydrogen and renewables.

There is no single solution for rapid steel decarbonization. Tailored solutions are required for each country’s capabilities and competitive economic advantage.

As well as producing green hydrogen for export, the MENA region could also use more domestically to produce low-carbon steel for export.

Providing green electricity, a big challenge for steel producers in some parts of the world, is less of a barrier in MENA.

With ample renewable energy potential, MENA could become a leader in hardto-abate and carbon-intensive industries, specifically steel.

Compared to other regions, MENA has in situ capacity of DRI-EAF, which means no extra investment is needed to replace the base technology.

All new investment could be focused on producing green hydrogen and expanding renewables.

MENA could possibly replace 30% of its natural gas with hydrogen in the existing fleet of DR plants without major modification of the equipment, then move towards 100% green hydrogen in a second phase.

via desalination could increase the total cost of hydrogen production by only $0.01–0.02/kg. As such, water is not included as a main cost driver22. In another study, IRENA found using desalination plants in water-scarce regions will increase the cost of hydrogen production by $0.05/kg, which is negligible23

Developed nations including Australia, Germany, the US and China have been the first movers in the green hydrogen

1. World Steel Association. 2022 World Steel in Figures. 2022. 2.

to

14 February 2022.

Many mining companies face the challenges of iron ore quality and the production of DR-grade pellets. The former is not an issue in MENA, though finding reliable resources for future expansion could be a challenge for steel producers in this region.

MENA’s knowledge of this specific steel technology is an invaluable asset. Among the most important steel decarbonization pillars, this production knowledge, coupled with further work on iron ore beneficiation, pelletising and DR plants, will greatly assist MENA’s green transition. �

2022. 3.

6. BloombergNEF. Decarbonising Steel. A Net-Zero Pathway. 1 December 2021. 7. IEA. Iron and Steel Technology Roadmap. October 2020. 8. IRENA. Renewable Power Generation Costs in 2020. June 2021. 9. World Bank. Global Solar Atlas. Solargis. 2022. 10. World Bank. Global Photovoltaic Power Potential by Country. June 2020. 11. IRENA. Renewable Power Generation Costs in 2020. June 2021. 12. IEA. Renewables 2021. December 2021.

13. IHS Markit. Middle East and North Africa Power and Renewables Market Briefing. April 2022. 14. IEA. Global Hydrogen Review 2021. October 2021, p. 117. 15. Ibid. 16. S&PGlobal. Platts hydrogen price wall. July 2022. 17. IEA. Global Hydrogen Review 2021. October 2021. 18. BloombergNEF. Decarbonising Steel Technologies and Costs. 25 August 2021. 19. IEEFA. Solving iron ore quality issues for low-carbon steel. 9 August 2022. 20. Green Coast. Solar Farm Land Requirements: Top 7 Tips for Farmers, Ranchers, and Landowners. 5 December 2021. 21. World Resource Institute. 17 Countries, Home to One-Quarter of the World’s Population, Face Extremely High Water Stress. 6 August 2019. 22. IEA. Global Hydrogen review 2021. October 2021. 23. IRENA. Global Hydrogen Trade to Meet the 1.5°C Climate Goal: Green Hydrogen Cost and Potential. May 2022.

Midrex. 2021 World Direct Reduction Statistics.

IEEFA. India’s technology path key

global steel decarbonisation.

4. World Steel Association. 2022 World Steel in Figures. 2022. 5. IEA. Net Zero by 2050 Scenario. May 2021.

Scarabaeus pelletizing discs provided by HAVER & BOECKER NIAGARA are used for sustainable and efficient production of iron ore pellets. The unit’s design minimizes circulation, increasing productivity and profitability. The pelletizing discs used for agglomerating iron ore concentrates into pellets are remarkable for their very narrow particle size distribution with a target size of 10 to 14 mm, important for DR-Processes.

The Scarabaeus process creates higher quality pellets, which can be sold at better prices due to significantly tighter particle size distribution spread and a higher iron ore content.

The Scarabaeus process generates higher tonnages by minimizing the material return rates and avoids double processing of over or undersized pellets due to automatic machine parameter adjustments, which can also adapt to varying material property fluctuations in the feed material.

The Scarabaeus process creates pellets so high in quality that they can be utilized for the direct reduction process. This in return can create e normous CO2 emission savings, thus minimizing the mine’s impact on the environment.

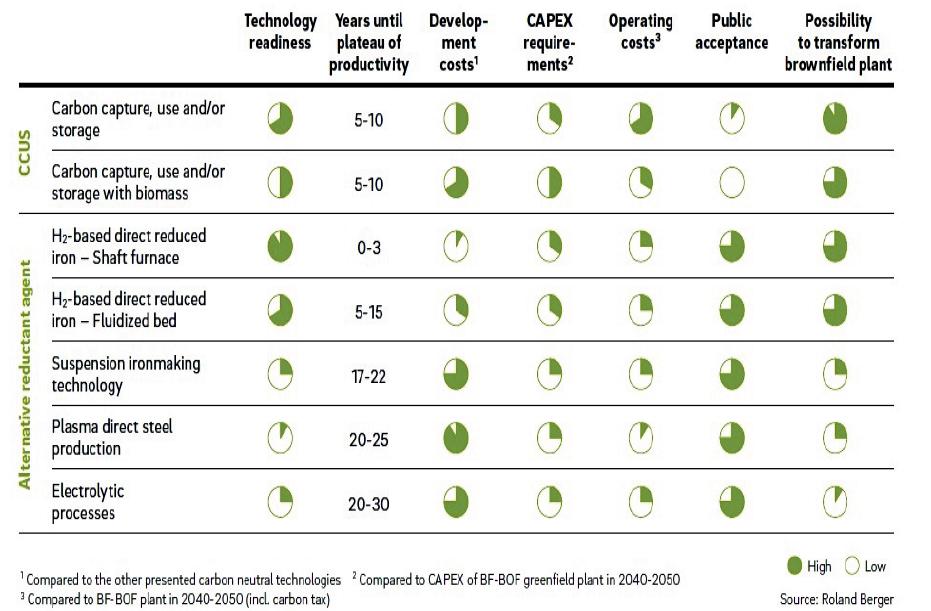

This article covers the work being done at LIBERTY Steel to transform assets, as well as crucial policy requirements for the steel industry in Europe to remain competitive while continuing to lead on decarbonization.

By Marian D’Auria*

By Marian D’Auria*

THE advent of the Inflation Reduction Act (IRA) in the United States has kicked off what some market commentators have termed a ‘Subsidy Arms Race’ with the EU Green Deal Industrial Plan announced in February this year. The Industrial Plan has seen mixed responses, with EU member states questioning the feasibility of incentives funded in very different fiscal contexts, the relaxation of state aid regulations, and businesses highlighting its complexity and lack of focus.

Policy is a hugely important lever for decarbonization; implementing supportive policies and incentives, alongside tax and protection mechanisms is key to delivering decarbonization goals and respective technology. Without this, we are unlikely to unlock the pools of capital needed to fund the long-term transition to lower carbon production in industry.

The EU steel industry context

It’s a complex story: the aftermath of

COVID, the disruption from the war in Ukraine and fears over energy security are underpinning worldwide trends towards economic nationalism. The European steel industry is having to react to these significant short-term market changes, while at the same time progressing its

decarbonization plans.

LIBERTY has significant investment planned in Europe to meet our ambition to be carbon neutral by 2030, reflecting the global imperative to halve emissions this decade and reach net zero emissions by 2050. We believe decarbonization is the route to creating a more sustainable and economically resilient industry while supporting the EU’s Green Deal goals. Goals that are not just important in Europe, but that carry weight and significance in the global efforts to decarbonize.

Europe is a huge market and will continue to be an attractive destination for investors provided it remains competitive as a low carbon advanced manufacturing economy. Europe already benefits from a high skills base and supportive conditions for technology development and decarbonization. But we’re in a global race and other countries are catching up and, in some cases, overtaking, as demonstrated in the USA with its IRA.

Bit by bit, we’re seeing decarbonization moving from a moral principle to having a pragmatic competitive edge, and in some cases even business as usual.

The challenge, as many readers will recognise, is decarbonizing an energyintensive industry and doing so while remaining internationally competitive.

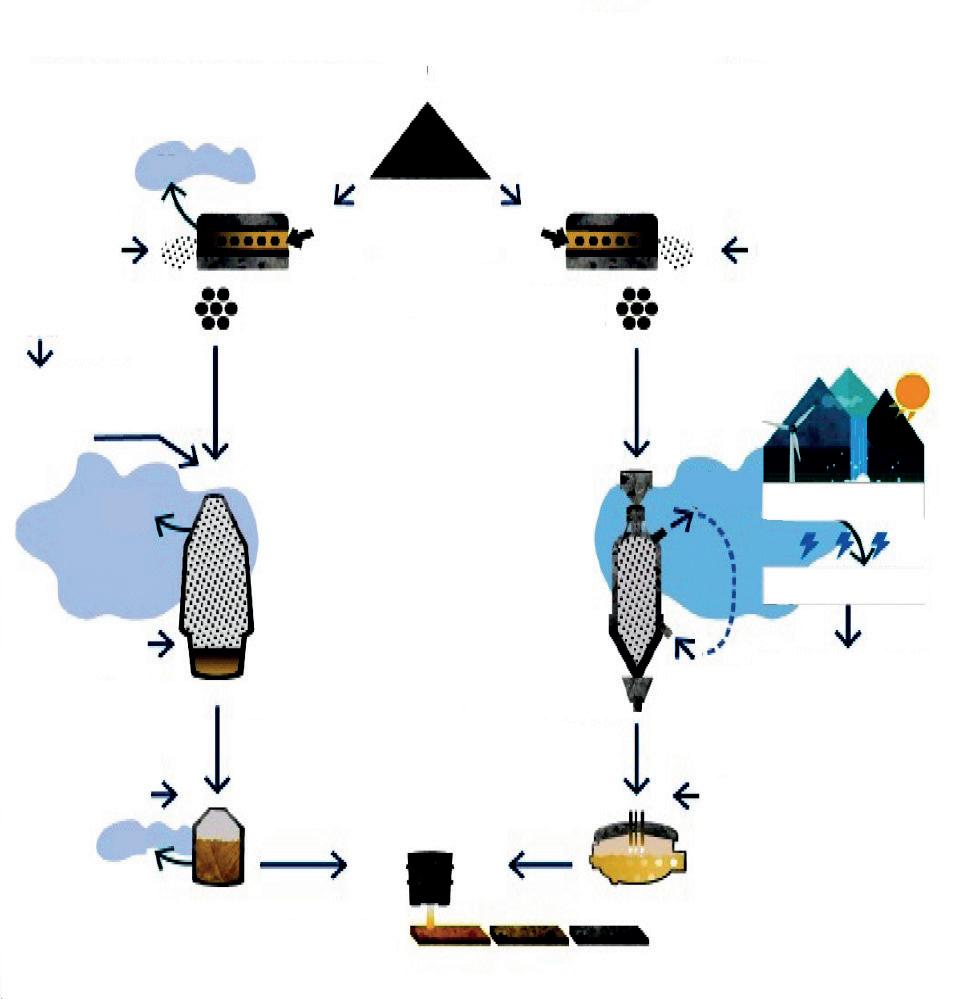

Currently, both primary production of steel from iron, and secondary production in an electric arc furnace, rely on huge amounts of fossil fuels – and, therefore, carbon emissions – to produce steel.

The good news is that technology is advancing solutions to decarbonize. But, support is required to further develop and scale these solutions in order to be competitive and rapidly replace legacy processes.

The main available and proven technology route is to maximise Electric Arc Furnace (EAF) production, as these furnaces emit a fraction of the direct emissions compared with the blast furnace route.

Modern so-called ‘hybrid-EAFs’ can run on renewable energy which nearly eliminates scope 1 & 2 emissions from the process. Hybrid EAFs also have the advantage of being able to process a range of materials – hot metal, DRI and scrap – making them a very flexible technology and ideal for transitioning away from blast furnaces.

This transformation is underway across all three of our major steel making sites in the EU; at Czestochowa in Poland, at Ostrava in the Czech Republic, and at Galati in

Romania. Each site has a role to play in our carbon reduction plan that will drastically reduce the 5Mt of carbon they currently emit annually.

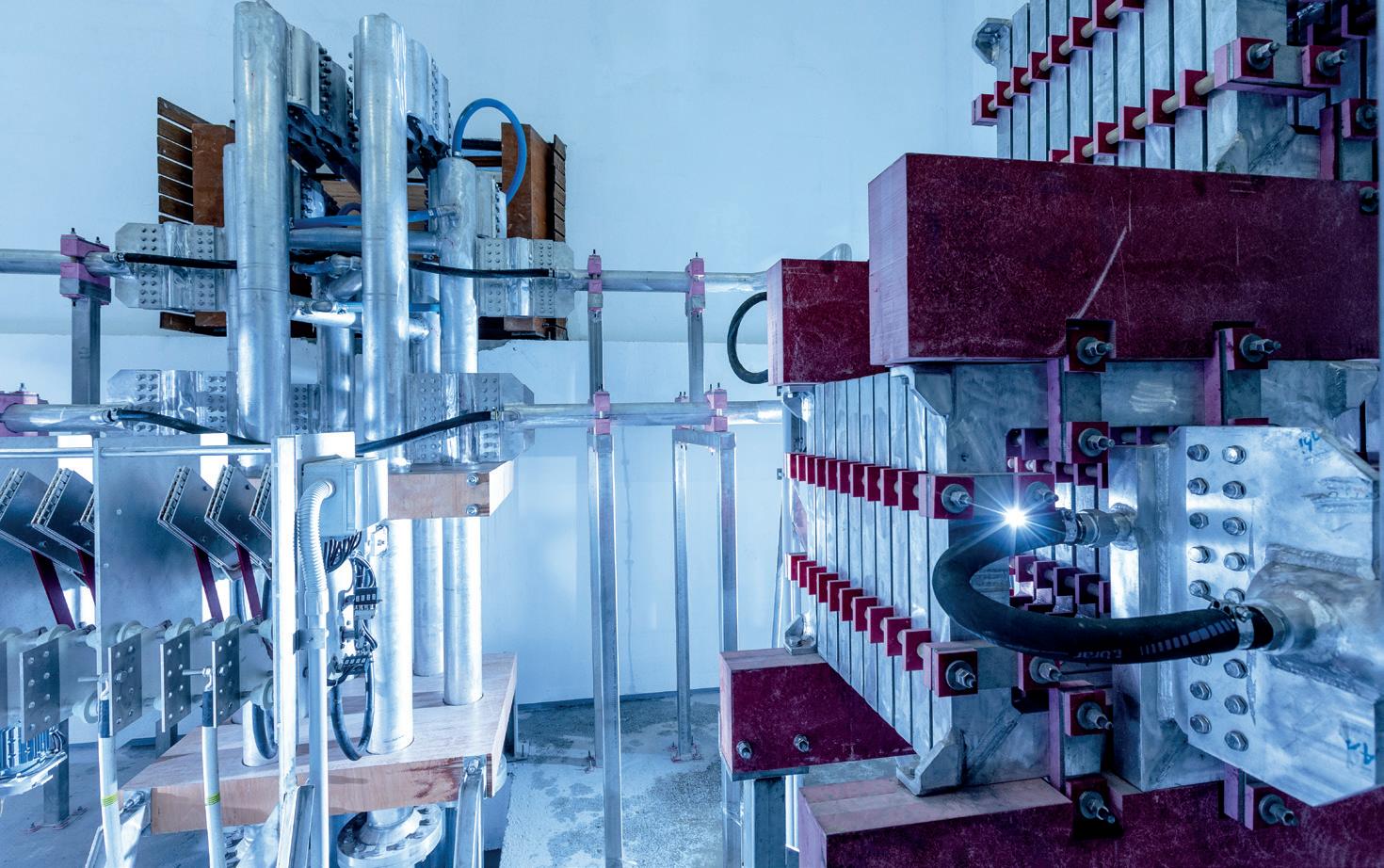

In Galati and Ostrava, we’re dedicating up to €2 billion in green steel transformation investment to reduce carbon emissions by up to 90%. Last year in Ostrava, with our technical partner Danieli, we announced the first project in Europe that will entirely replace its blast furnaces with hybrid EAFs, which will reduce carbon emissions by 80% by 2027.

In Galati we are making similar investments in electric melting furnaces and solar energy, while in Czestochowa we’re focused on installing 3 MW of renewable energy capacity to further decarbonize its existing EAF operations.

The second decarbonization route we’re focused on is removing coking coal from primary steel production. It works by replacing coal first with natural gas as the reducing agent for iron ore and eventually with green hydrogen produced by renewable power.

Using natural gas through Direct Reduced Iron (DRI) furnaces can reduce carbon emissions from primary steel production by half and using green hydrogen will get us down to low-digit carbon emissions.

Today, this route is only truly viable in certain locations across the world where conditions are just right.

Our plant in Whyalla in South Australia is perhaps the best example globally. There we have vast high quality magnetite reserves, fantastic solar and wind resources, a deep-water port, a well-connected rail

network, and a super-skilled workforce.

This rich mix in Whyalla makes it among the best locations in the world to decarbonize primary steel making, and is made even more appealing by the South Australian government’s commitment to invest AUD$593m in a hydrogen power plant in Whyalla to support the industrial production of the green hydrogen required.

In either technology route, the key to speeding up the transition to green steel is contingent on access to large-scale competitive clean power, access to critical raw materials such as steel scrap and iron ore, investment incentives and protection from unfair competition from markets that do not produce to the same standards as Europe.

There are specific key enabling factors that are vital to the transition to clean steel production.

First, the EU needs effective long-term industrial and trade policies. Policies that support European industry overall, protect its steel industry against imports of cheap, carbon-intensive steel from third countries, and help the industry to invest in innovation and decarbonization. What’s required here is for the EU to mobilise incentive mechanisms that are tailored to high impact sectors like steel.

Second, ensure the Carbon Border Adjustment Mechanism is effective. We have already seen outstanding work done in reaching an agreement on the CBAM and ETS. The next step is a concrete and effective solution for exports and ensuring

that plants emitting less carbon – such as those using hybrid EAFs – are appropriately recognised.

Third, tackle the energy crisis. The EU needs to ensure the supply of abundant, secure and affordable low-carbon energy as a transition to EAF production will require a four-fold increase in the industry’s electricity usage.

The outcome of the review of the Electricity Market Design will be key for the steel industry and we are hopeful that the commission will adopt measures that support and prioritise energy-intensive industries.

Fourth – and particularly important for the long-term – support the industrial deployment of hydrogen. The upcoming revised European legislation on hydrogen and gas decarbonization is a strategic tool that can clearly prioritise the use and supply of hydrogen to those sectors, such as steel, where its use can deliver huge carbon emissions reductions, as Whyalla will show.

Fifth, start treating steel scrap as a critical raw material. Europe currently exports more than 20Mt/yr of scrap, much of it to third countries who use it to produce steel to import back into Europe. However, as steel manufacturers switch to EAF technology, our demand for this material is likely to more than triple. The upcoming EU Waste Shipment Regulation trialogue will be instrumental in making sure that shipment

outside the EU is subject to stronger monitoring systems and anti-circumvention measures. Scrap is a critical raw material and as such it should be included in the Critical Raw Materials Act.

Sixth – and finally – human capital is vital. If we are to successfully transition to sustainable production, this relies on the industry finding and attracting good, qualified people to help transform the steel industry. As an industry, we should rise to the challenge of revitalising the image of the sector as a force for good and a place where young steelmakers can make a difference. EU stakeholders will need to collaborate to ensure that the right training and academic opportunities are put in place to ensure the EU has the right talent and avoid ‘expertise leakage’.

To advance this aim, last year we launched the GREENSTEEL Academy and the GFG Foundation in Czechia and Romania to help upskill our current employees and build interest in the sector among younger generations.

The transition to sustainable industry in Europe (and elsewhere) will have to be a team effort where manufacturers, investors, customers and governments come together to transform processes, share knowledge and protect our strategic and business futures. We will continue to be at the heart of that debate as we continue to transform our businesses for that low carbon future. �

In the past decade or so, ‘sustainability’ has become one of those buzz words used often by business people throughout the world, including leaders within the steel industry. But one of the key things to consider when discussing ‘sustainability’ in the steel industry is what does that word mean exactly?

By Richard McDonough*TO different entities, ‘sustainability’ means different things: a focus on the raw ingredients used to produce steel in some cases. In others, the focus is on the longterm viability of a business or the industry overall in terms of investments to assure job opportunities in the future. For others, it refers to the input supplies utilised in the steel making process. Still others focus on the emissions produced and the utilisation of products left over from manufacturing steel.

“We look at sustainability broadly,” stated Kevin Dempsey, president and chief executive officer of the American Iron and Steel Institute (AISI). “Most of our focus is on the environment – carbon emissions and water usage, for example. Other pillars include social aspects, economic aspects, and job creation. All are important.”

Members of the AISI include firms that have steel production facilities in the United States (US). The organisation describes its mission as one “…to influence public policy, educate and shape public opinion in support of a strong, sustainable American steel industry committed to manufacturing products that meet society’s needs.”

“We’re working towards net zero or near zero carbon emissions,” said Mr. Dempsey. He indicated that there are several processes and techniques being utilised today in the American steel industry that provide a strong foundation for long-term

sustainability.

Among those processes and techniques he cited are the high percentage of steel produced by electric arc furnaces (EAFs), the high level of recycling scrap steel products, the increased use of natural gas in place of coal, and the increased use of renewable energy sources – wind and solar, in particular – in steel production in the US.

Together, Mr. Dempsey explained, these efforts have helped to lower carbon emissions emitted per tonne of steel produced in the US today; these processes and techniques are also anticipated to be part of the plans for the continued decline in carbon emissions per tonne of steel produced in the future.

“Electric arc furnaces produce less than half of a tonne of carbon per tonne of steel produced,” he explained. “As compared to most of the rest of the world, American steel producers have a higher share of production through the use of electric arc furnaces.”

The circular economy is one of the critical

aspects helping steel manufacturers reduce carbon emissions for each tonne of steel produced. Several sources confirm that steel is the number one recycled product in the US.

“Our members are pushing on all fronts with investments to recycle scrap steel as well as to create new steel,” Mr. Dempsey said. He noted that marketplace competition among a number of businesses had helped to lead to innovations in steel recycling: “Each firm is competing with each other to better separate components in the recycling processes.”

To reduce carbon emissions even further, Mr. Dempsey indicated that improvements in the supply chain and the use of alternative fuels – alternatives to coal – will continue to help reduce carbon emissions by steel producers and enhance the sustainability of the industry.

“The steel industry in the US is shifting away from the use of coal,” he stated.

Mr. Dempsey said that one alternative to coal is iron pellets.

“With iron pellets, steel producers use natural gas as fuel rather than coal,” Mr. Dempsey said. “Down the road in the future, hydrogen will be an option for steel producers.”

He noted that several steel manufacturers – as well as businesses and organisations in other industries – are in discussions with the US Department of Energy on ways to utilise hydrogen energy for operations.

In addition, Mr. Dempsey stated that

in the US involve a range of locales and industries – not just steel manufacturers and the communities where they are located. Several large-scale carbon capture and storage facilities are being planned and constructed in the Midwest and Northern Plains of the US. Among those industries initially being targeted to utilise carbon capture and storage facilities are businesses active in agricultural pursuits.

sustainability in a context of businesses investing in their operations so that there is a future for skilled workers.

“The USW views capital expenditures that go beyond routine maintenance and repair at represented facilities as investments in the sustainability of our plants,” according to a statement from a spokesperson for the USW. “Sustainable employers also invest in training workers and modernizing plants, showing a long-term commitment to our communities. We often bargain capital expenditures and investment commitments into our contracts because it directly impacts the long-term security and sustainability of our jobs.”

The USW describes itself as “…North America’s largest industrial union. We’re 1.2 million members and retirees strong in the United States, Canada and the Caribbean. We proudly represent men and women who work in nearly every industry there is.”

Big River Steel – United States Steel Corporation

United States Steel Corporation (US Steel) is one of the major steel producers with facilities throughout the US and beyond.