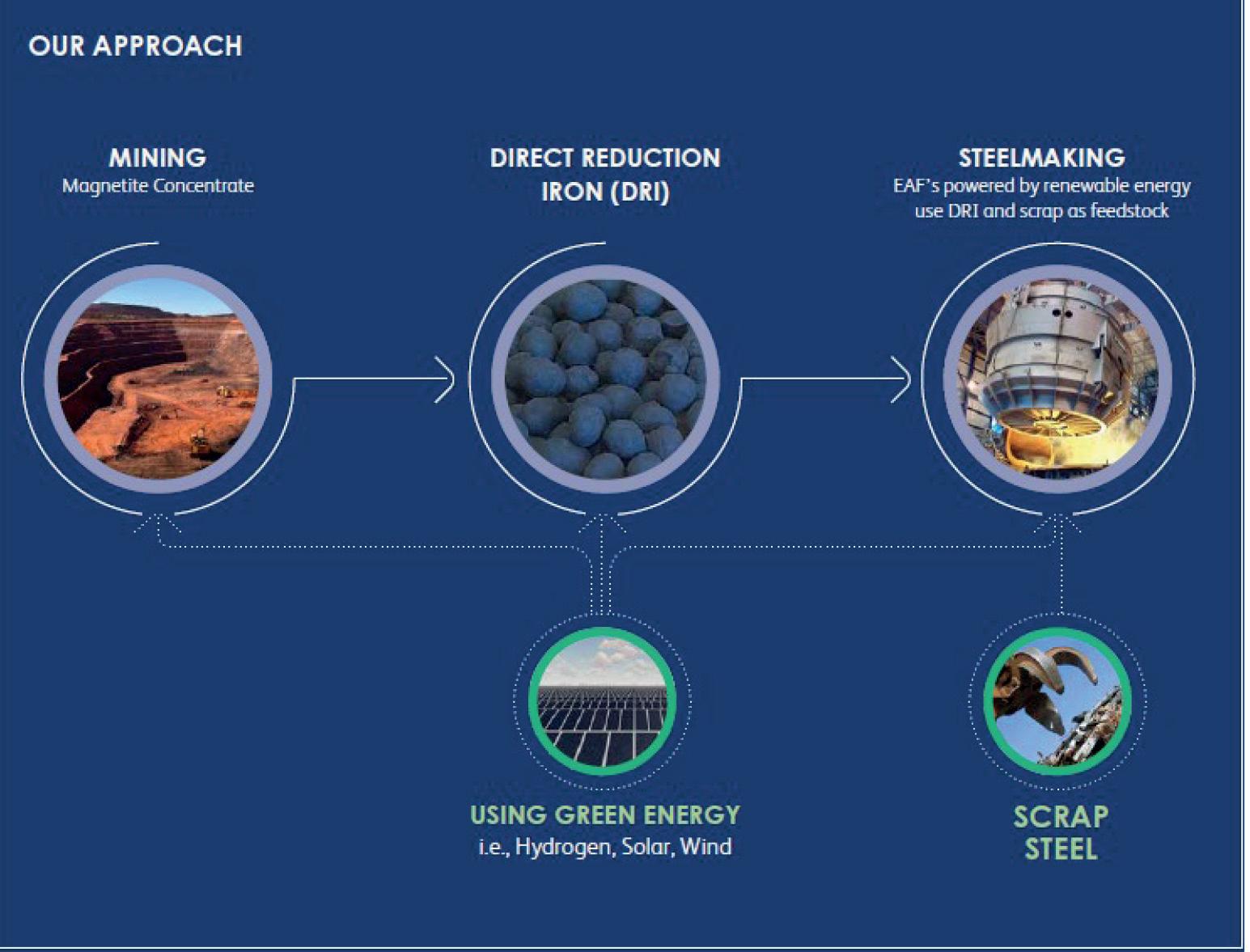

We must move urgently to decarbonize steelmaking. Producing DRI at scale needs the right process equipment.

US politicians oppose Nippon acquisition of US Steel.

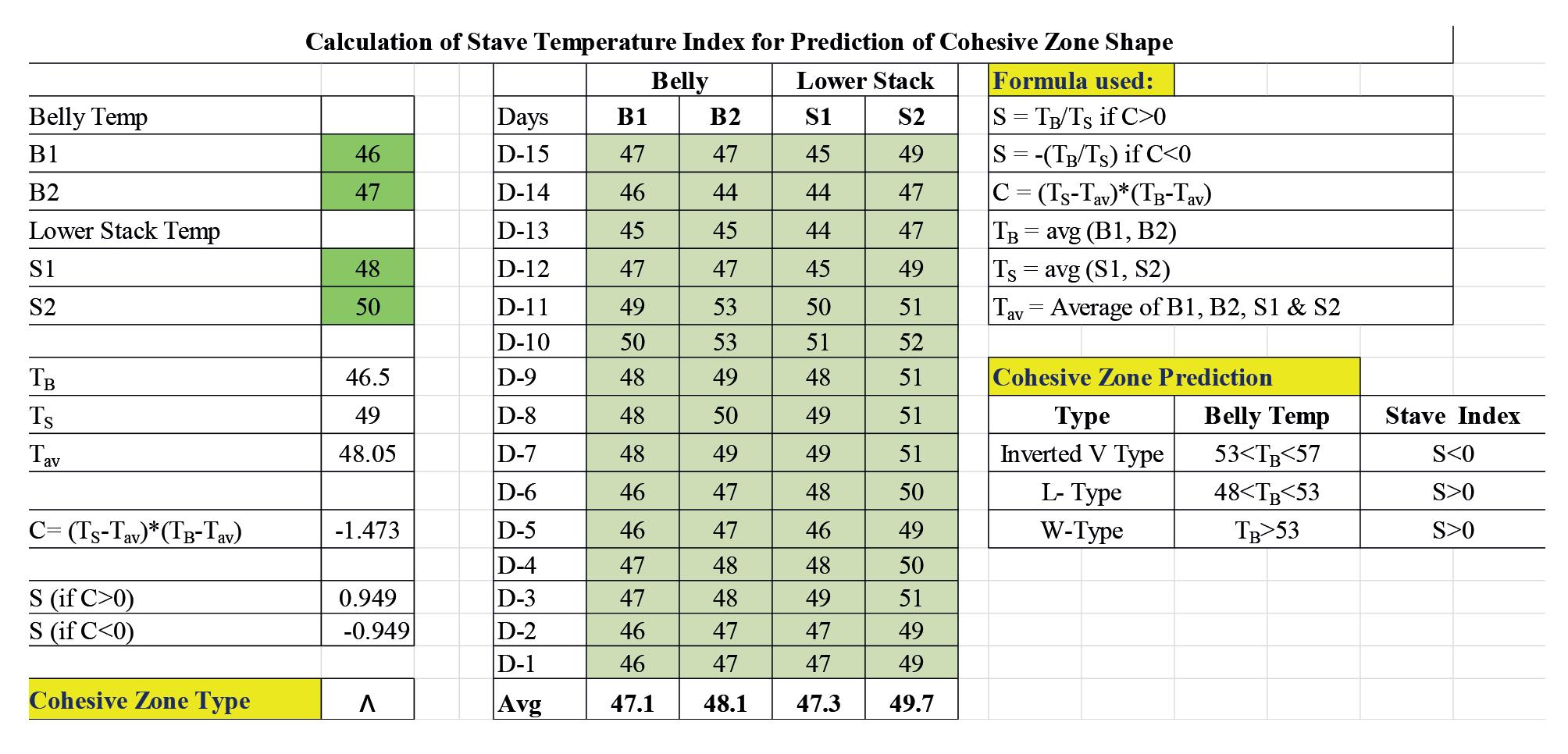

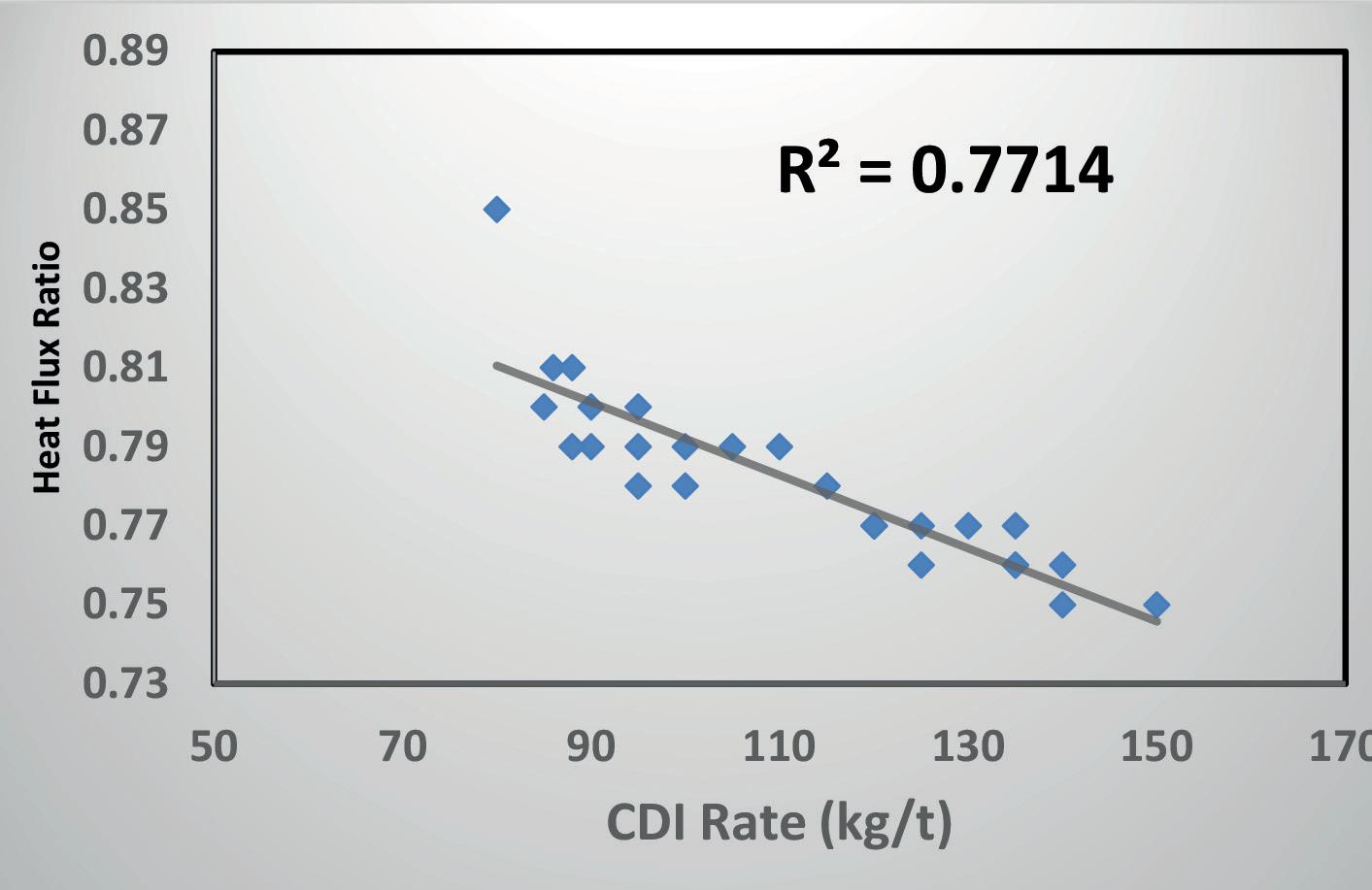

The aerodynamic aspects of blast furnace performance.

We must move urgently to decarbonize steelmaking. Producing DRI at scale needs the right process equipment.

US politicians oppose Nippon acquisition of US Steel.

The aerodynamic aspects of blast furnace performance.

Technologies turning steelmakers’ decarbonization goals into reality.

John Cockerill Industry is committed to help its steelmaking clients enhance product performance and effectively reduce emissions, all while preparing for the needs of tomorrow’s steels.

The JVD line is a genuine alternative to Electro- and Hot-Dip Galvanizing considerably reducing the cost of galvanized steel and providing multiple advantages when it comes to quality, speed and OPEX. Developed for ArcelorMittal with the help of our experts, John Cockerill is in charge of commercializing this unique technology worldwide.

High-performance Acid Regeneration supporting responsible steel making and the circular economy

John Cockerill Industry’s ARPs are providing the lowest emissions in the market. They come with smart plant control systems, provide waste energy recovery and drastically reduce pickling process plants’ fresh acid demands and waste streams in general.

Our E-SiTM equipment and processing lines are designed for the production of strong, ultrathin, lightweight, and high-quality Non-Grain Oriented (NGO) steel grades essential for the future of e-mobility.

Matthew Moggridge Editor

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

Things are never quite what they seem, ask Philip K Dick – although that’s impossible as he’s been dead since 1982. He did, however, write a lot about alternative universes. In The Man in the High Castle, for example, he imagined a world where Hitler had won the war, and there are many other examples in the many strange and thought-provoking novels written by the great man. You might have noticed of late that steel magazines and conferences have focused heavily on decarbonization. All the talk about hydrogen steelmaking and the importance of scrap and DRI and renewable energy might intimate that lots is being done and it won’t be long before the global steel industry is as green as the grass courts at Wimbledon. Well, a lot is being done – a hell of a lot – and there are many companies busy working on ultracutting-edge tech that will most certainly lead to fossil-free steelmaking, most notably SSAB with its HYBRIT initiative and H2 Green Steel’s planned hydrogen steelmaking facility in Boden, Northern Sweden. Stuff is happening elsewhere too, but Sweden is where it’s at and that’s why this year’s Future Steel Forum will be held in Stockholm (17-19 June).

In fact, you really should register and check out the programme, which is now online at https://www.futuresteelforum. com, but getting back to those alternative universes, this month’s Steel Times International carries a thought-provoking article by Global Steel Monitor, which is a real eye opener. While it is heartening to hear all the good news coming out of Sweden – and elsewhere in the world – it’s important to remember that while we’re all talking the talk about getting rid of blast furnaces and installing EAFs, we have many mountains still to climb. Dates like 2030 and 2050 are all very well, but of late 2060 (for when China’s steel industry might become fossil-free) and 2070 when India could make the grade, have entered the textual output of magazines like this one. In short, blast furnaces are still being relined and rebuilt and millions of dollars are being spent on them. The BF will be around for much longer than we all anticipated and in so many ways, their extended stay needs to be shortened. I’m beginning to think that 2080 or even 2090 might soon find their way on to the pages of this magazine as dates when we might expect our industry to be fossil-free.

The reliability of an entire production line or individual production areas can be increased by integrating our X-Pact ® Battery Storage units into the production facilities’ power supply.

Using either new batteries or second-life batteries with very large storage capacities, they provide emergency power or reactive power, offer an autonomous energy supply, support area networks, and optimize the supply using self-generated electricity.

Learn more about stationary battery e-storage as an integral part of your operational infrastructure. Find out more at www.sms-group.com/services/x-pact-battery-storage

Jindal Stainless has commenced the maiden usage of green hydrogen in its stainless-steel plant in Hisar, India. The fully automated plant utilizes an alkaline bipolar electrolyser, which has a capacity of 350 Nm3/ hr, guaranteeing an aroundthe-clock supply of green hydrogen using dedicated solar energy and storage. The facility aims at abating around 54kt of CO2 emissions over 20 years and is based on a longterm off-take agreement.

Source: Hydrogen Central, 5 March 2024.

Outokumpu, the sustainable stainless steelmaker, has been certified by Fair Pay Workplace (FPW) for its efforts to create sustainable fair pay across the company, which employs 8,500 people in almost 30 countries. Outokumpu is the first in the stainless steel

A deal supported by the UK government’s export credit agency has landed a £4.5 million export contract for structural steel firm Severfield. Headquartered in York, Severfield has five manufacturing sites in the UK and two in mainland Europe. Since securing the contract, Severfield has fabricated steel for this project at its Dalton site in North Yorkshire. The company has now shipped 1.9kt of structural steel to Guyana where it will be used by VAMED Engineering GmbH as it builds the new hospital in the capital, Georgetown.

Source: Gov.uk, 8 March 2024

industry – and one of the very few companies in Europe – to receive the official verification by FPW. “We have invested in pay equity for many years and have worked with FPW to review and independently verify the impact of our efforts to achieve true equal pay between genders,’’ said Johann Steiner, executive vice president for sustainability, people and communications at Outokumpu.

Source: Cision, 8 March 2024.

US-based Boston Metal has opened the first phase of its metals plant in Brazil's Minas Gerais state. “This first commercial deployment represents a beacon of progress in advancing sustainable metals production,” CEO Tadeu Carneiro said in a statement.“Our high-value metals business will expand rapidly and will support us as we scale our MOE [molten oxide electrolysis] platform to meet the growing global demand for green steel.”

Source: BN Americas, 8 March 2024

South Yorkshire steel firm Sheffield Forgemasters is taking on 14 apprentices to work in defence and civil nuclear manufacturing. The firm was bought by the UK Ministry of Defence (MoD) in 2021, and plays a key

ArcelorMittal Kryvyi Rih plans to increase the utilization of its iron and steel divisions by improving maritime logistics, as stated by the company’s CEO Mauro Longobardo in an interview with Delo.ua, a news-based website. ‘‘In 2024, we plan to increase production as we have good news about the opening of maritime logistics. I won’t go into details, but the Black Sea ports are available for our type of products – iron ore concentrate, pig iron and rolled metal,’’ he said. The company plans to maximize the capacity of its mining division and launch two BFs in the second quarter of this year, in April, to start the steel division.

Source: GMK Center, 8 March 2024

role in the national nuclear submarine supply chain. It said apprentices would work in one of the ‘most advanced engineering facilities of its kind’, gaining a qualification while getting paid.

The company said it wanted ‘the most capable and committed individuals’.

Source: BBC, 9 March 2024

Czech steelmaker Liberty Ostrava will cut costs by $218.4 million and reduce production by more than half in a restructuring plan aimed at restarting its idled blast furnace, according to local media reports. A regional court spokesman said that the company had pledged to deliver a completed restructuring plan to creditors by early March, after the court upheld a moratorium on debt it owed.

Source: Nasdaq, 11 March 2024

In the realm of metallurgy, there are no compromises. And neither are our transport solutions. No matter the challenge, we deliver the optimal solution. Our products showcase their full strength even under the toughest conditions, ensuring your production runs around the clock. www.tii-kamag.com

A towering steel monolith has appeared on a hill in Wales' Hay-on-Wye region, with its origins remaining unknown. Similar structures discovered in Utah and California in 2020 were later revealed to be the handiwork of an artist group named 'The Most Famous Artist', hailing from New Mexico. The global monolith phenomenon also reached Romania and Ukraine in late 2020, with other UK sightings closer to Wales, such as the Isle of Wight and the Merry Maidens stone circle in Cornwall, England.

Source: Money Control, 12 March 2024.

Swedish steelmaker SSAB has confirmed that it is in discussions with Tata Steel

India’s JSW Steel is set to launch a new blast furnace at its Dolvi steel plant in Maharashtra with a production capacity of 4.5Mt/ yr in 2026. Construction of the blast furnace is expected to be completed in March 2026. The steelmaker’s steel production capacity is currently 10Mt/ yr, with a blast furnace and an electric arc furnace in operation. The new unit will increase production by 45%.

Source: GMK Center, 13 March 2024.

concerning a potential acquisition of Tata Steel Europe’s IJmuiden steel mill and related downstream assets. SSAB has participated in several different discussions concerning consolidations in the European steel industry. The discussions with Tata are on-going but no decisions have yet been made.

Source: Army Technology, 16 March 2024

Sustainable energy developer Orsted will be offered the first batch of lower-emission steel from Dillinger, subject to availability and commercial terms and conditions. The metal plates form a part of the offshore wind monopile foundations and are intended to be used for future projects. The reduction of the processrelated carbon emissions from production is expected to be around 55-60 % compared to conventional heavy plate steel manufacture, Orsted said.

Source: ReNews, 13 March 2024.

Tata Steel Netherlands has scrapped its plan to cut 800 jobs, the trade union FNV stated, after meeting with the company. All employees at risk of layoffs will hear from the company that they will remain employed by Tata Steel. Some may have to move to a different job within the company, the union said. The company previously announced in November that it was going to cut 800 office jobs in the human resources, finance, and purchasing departments and outsource office work.

Source: NL Times, 14 March 2024.

Steelmaker Thyssenkrupp and research organization Fraunhofer have partnered to develop solid oxide electrolyzer cell (SOEC) technology for large-scale

hydrogen production.

According to reports, the high energy efficiency of SOEC technology will primarily benefit industries where industrial waste heat is generated during production as its use significantly reduces electricity consumption. Waste heat is generated in the production of green steel, ammonia, methanol, fertilizers and energy storage, among other things.

Source: Energy Central, 15 March 2024

ArcelorMittal Kryvyi Rih has received approval from the Environmental Protection and Natural Resources of Ukraine (MEPR) for a new tailings dump. The planned activity envisages the construction of a tailings storage facility due to the fact that the existing facilities have reached ‘the limits of economic feasibility and physical possibility of their expansion.’

Source: GMK Center, 15 March 2024

Spain has officially launched the construction of a pilot hydrogen production plant for industrial needs as part of the public-private project Hydrogen Hub Asturias (H2Asturias) led by global steelmaker ArcelorMittal. The facility, called GasLab, will be built on the site of the ArcelorMittal plant in Gijon. The unit will process all types of industrial gases, which expands the range of research that will be conducted on hydrogen recovery processes.

Source: GMK Center, 18 March 2024.

Apologies to Amir Badiee of the University of Lincoln's School of Engineering in the UK. Mr. Badiee's name was spelt incorrectly in the introduction to an article titled Challenges and strategies which appeared in the March 2024 edition of Steel Times International.

Italian plant builder Tenova has secured a contract to furnish an experimental direct reduction plant commissioned by Nippon Steel Corporation.

Source: ChemAnalyst News, 20 March 2024.

Brazil’s industry ministry has launched a number of investigations into the alleged dumping of industrial products by China. At the request of industry bodies, the ministry has in the past six months opened at least half a dozen probes on products ranging from metal sheets and pre-painted steel to chemicals and tyres. Developed markets have started taking extensive measures against imports from China, with the EU launching an anti-subsidy probe into Chinese EVs and the Biden administration recently raising security concerns over China’s market growth.

Source: The Financial Times, 16 March 2024.

ArcelorMittal has patented a hot-rolled plate or forging of an austenitic steel resistant to relaxation cracking. The composition includes specific percentages of elements including copper, manganese, and silicon, ensuring high performance and durability

Gerdau, Brazil’s largest steel producer, has announced the sale of its operations in Colombia and the Dominican Republic with the aim of focusing on an asset optimization strategy and long-term growth. Gerdau will invest in projects designed to increase the competitiveness of its operations in other, more relevant markets and expand its presence in long, flat, and special steel in the Americas, sharing value with its clients, investors, and other stakeholders, it said in a public statement.

Source: American Recycler, 19 March 2024.

Swedish state-owned utility Vattenfall faces accusations of breaking contracts and the law with its decision not to allocate a 500MW grid connection in the Luleå area to H2 Green Steel and its flagship Boden project – a move that could halve its expected production capacity scheduled for this decade. H2 Green Steel had in 2021 reserved 2.6GW of new power from Vattenfall, with 1.75GW already allocated to the project since then. However, in January, Vattenfall reportedly opted to allocate 500MW of power in Luleå to the Hybrit green steel project–of which it is a member of the development consortium–rather than H2 Green Steel.

Source: Hydrogen Insight, 19 March 2024

in industrial applications. The patent covers reactor vessels, forgings, or pipelines made from the hot-rolled plate or forging as described in the claims.

Source: Mining Technology, 19 March 2024.

Pakistan's steel producers have sounded the alarm on the resurgence of large-scale smuggling, mis-declaration, and under-invoicing of steel primarily from Iran. In a letter addressed to the federal finance minister, the Pakistan Association of Large Steel Producers (PALSP) has highlighted how illicit activities are ‘systematically crippling the local steel sector.’ “Our steel industry is in a fight for survival amidst significant challenges such as currency depreciation, soaring financial costs, and escalating input expenses,” PALSP stated.

Source: Pakistan Today, 20 March 2024.

We understand how it is important to efficiently extract and process precious metals and minerals.

You save valuable resources while keeping your employees and the environment safe.

Improve your processes with our comprehensive portfolio of measuring instruments, solutions and services:

Liquiline CM44 and CPS11E:

Versatile transmitter and Memosens

pH sensors ensure reliable measurement and safe calibration in the lab.

FieldPort SWA50:

Intelligent Bluetooth or WirelessHART adapter for the easy connection of all HART field devices to the Netilion Cloud via Edge Devices.

Do you want to learn more?

www.de.endress.com/primaries-metal

Cerabar PMC71B:

Absolute and gauge pressure transmitter combining measurement accuracy with IIoT functionalities.

Tenova, solutions provider for the metals and the mining industries, thanks to the project SafeForPorts, has won a call for proposals issued by the Istituto Italiano di Tecnologia (IIT) under the banner of RAISE (Robotics and AI for Socio-economic Empowerment), implemented under the National Recovery and Resilience Plan, Mission 4, funded by the European Union – NextGenerationEU.

SafeForPorts is a new project tasked with creating smart and sustainable ports by implementing key Industry 4.0 technologies. It aims to revolutionize the safety of machine operators improving the efficiency of port operations by offering an innovative solution that integrates training on one side and assisted maintenance on the other to address critical needs in port areas.

Through the use of a Virtual Reality simulator, the project will develop a comprehensive solution for the remote training of operators and on-field assistance for the operation and maintenance of bucket ship unloaders (a rail-mounted mobile unit typically installed on port docks). The VR simulator will be accessible to operators via headsets, while remote assistance will be enhanced through the processing of structured photographic material using Computer Vision algorithms.

Designed and developed in Tenova’s virtual laboratory in Genoa, the VR prototype will include a workstation cabin with handheld controls simulating the 3D operational environment of the machine. The final system will advance the labo-

ratory model by developing interactive elements and refining operational logic to achieve full virtual operational capability.

The project falls within RAISE’s activities, which include the implementation of robotics and AI systems for the management of port traffic, contributing to the advancement of intelligent solutions in the maritime industry. It is being developed in partnership with Prosoft Intesys and InformAmuse as technology providers.

Silvio Leoni, executive vice-president of Tenova’s material handling business unit commented: “SafeForPorts holds strategic significance for

Together with Shougang Zhixin Electromagnetic, a Chinese steelmaker, Fives, an international engineering group, produced the first electrical steel product for electric vehicle motors at its Zhixin plant. The project, claims Fives, demonstrates its commitment to provide dedicated solutions for demanding steel production.

Shougang built a new annealing and pickling line (APL) to produce high-grade, non-grain oriented (NGO) electrical steel for the booming e-vehicle market. The new line required thermal technology that could keep up with its high capacity of 650kt/yr.

Fives designed and supplied an annealing furnace that featured advanced heating technology and a flexible cooling system to meet the challenging thermal requirements for electrical steel. The furnace included dedicated models specifically designed for electrical steel to achieve metallurgical control, oxygen control, high temperature thermal technology, and an emission reduction system.

The engineering and manufacturing of the main equipment were provided from China, while the burners, automation, and process instrumentation were delivered from France.

“We had a very challenging schedule, but we managed to produce the first commercial coil on 1 February 2024, just 16 months after the contract enforcement,” said Benoit Crunelle, project manager at Fives Stein Metallurgical Technology, Shanghai, a Fives subsidiary in China. “This success is due to our rigorous planning, well in advance of manufacture and delivery, regular and transparent communication with the client and the good working relationship between both teams,” he added.

For further details, log on to www.fives.com

Tenova, not just in terms of business, but also for actively contributing to the development of new technologies and the design of increasingly intelligent, optimized processes for smart and sustainable ports. This project testifies our commitment to prioritizing and enhancing a core value at Tenova: safety. As we embark on this initiative, we recognize it as a catalyst for innovation and a cornerstone toward shaping the future with new possibilities and perspectives.”

For further details, log on to www.tenova.com

Haver & Boecker Niagara has opened a new service and support facility, Haver & Boecker Andina Sucursal Peruana, located in Arequipa, Peru. The company hopes the facility will amplify its serviceability to mining operations by

Industrial machinery company Metso’s crushing and screening offering is expanding with a new software application named Metso Remote IC. The new Metso Remote IC is used for remote control and monitoring of the crushing and screening process, and it connects wirelessly all the Lokotrack® crushers and screens at the site.

With the Metso Remote IC app, the operator can view all the Lokotrack train machines and their main process parameters using a single dashboard. The feeder and crusher settings can be adjusted from the excavator cabin, and the overall visibility of the process allows the operator to adjust the feeding for an optimal production level, says Metso. In problem situations, the Remote IC automatically stops the feeder, thus preventing overloading. It also instantly alerts and provides a reason for the stoppage, which the company claims makes it quicker and easier to get back to operation. With a lower overflow risk, the process can be run closer to maximum capacity.

“One of the key features of the Remote IC is that there is no need for the operator to exit the excavator cabin to adjust the crushers or to stop the feeder in an overflow situation,” com-

increasing access to supply parts and equipment service. The facility provides service and support for mining operations throughout the region through diagnostics, equipment refurbishment, parts stocking and more. In addition to servicing existing equipment and supplying new parts, Haver & Boecker Niagara will both produce and repair exciters here, with a dedicated service shop

mented Toni Peltomäki, director, automation, at Metso’s Aggregates business area. “The ability to control and monitor the crushing and screening process from a single application has a significant impact on safety and eventually process productivity, since unnecessary process stops can be avoided.”

“We are constantly developing our products and digital tools to help our customers improve their productivity. Remote IC not only increases the productivity and safety of the plant, but it can also positively impact the employees’ experience and help attract a new skilled workforce,” said Renaud Lapointe, senior vice president at Metso’s Aggregates business area.

The Metso Remote IC app can be used on an Android tablet or mobile phone. It is available for all new Lokotrack models and can also be installed as a retrofit to all models that have the latest Metso Metrics installed. Metso Metrics is a cloud-based service for real-time performance information, maintenance planning and fleet management that works as a remote monitoring tool off-site.

For further details, log on to www.metso.com

specifically for exciters.

“Haver & Boecker Niagara opened its first South American subsidiary more than 50 years ago in response to the country’s booming aggregates and mining industry,” said Roberto Montiglio, managing director of Haver & Boecker Niagara’s Andean Region. “We have only seen the industry continue to thrive, which is why we are offering dedicated service and support facilities throughout the country, including the Arequipa operation. This allows us to better serve our customers, all while continuing to provide new and innovative solutions to the market.”

“At Haver & Boecker Niagara, we pride ourselves in the unmatched quality service and support we offer to our customers – no matter their brand of equipment,” Montiglio said. “We make an effort not just to provide a service but be a partner to our customers by offering the service and the support they need to increase production and equipment longevity. With the addition of the Arequipa facility in the heart of Peru’s mining region, we can do just that – provide easier access to on-site support for our customers.”

For further details, log on to www.haverniagara.com

In late 2023, Chiquita Guatemala (Chiquita) received the first two of three Konecranes reach stackers for their Terminal Ferroviaria in Puerto Barrios. With one more scheduled for delivery in 2024, all three will help raise Chiquita’s banana business to the next level, claims Konecranes.

Chiquita bananas are famous worldwide, and Puerto Barrios is an important regional distribution hub. With high volumes and tight time constraints to ensure freshness, Chiquita needs modern, reliable container handling that can operate almost 24/7.

“We are leaders in the tropical fruit market. To maintain our position, we need the best quayside equipment available. Konecranes offered us reach stackers that are already improving our efficiency, simplifying our processes, and lowering our costs. Once all three are on-site, their high performance and advanced systems will further streamline our operations,” said Ramses Lobo Ortiz, regional manager logistics, Chiquita.

“These reach stackers represent a new stage in our partnership with Chiquita as they employ the latest in lifting technology. State-of-the-art digital features will help Chiquita maintain their strong position in a highly competitive industry,” commented Paco Pruden, product support manager Americas, Lift Trucks, Konecranes.

The first two reach stackers, a Konecranes SMV 4632 TC5 and a Konecranes SMV 4632 TC6H are already on-site. The third one, currently on its way, is a Konecranes Liftace 4532 TCE5. All three vehicles are Smart Connected Lift Trucks on which TRUCONNECT® Remote Monitoring collects usage and functional diagnostics to improve safety, optimize performance and maintenance, and reduce environmental impact. Tyre Pressure Monitoring provides alerts for pressure changes, and the SOLAS-compliant Konecranes Static Weighing System eliminates the need for a separate scale. All measurement data is transmitted directly from the reach stackers to the yourKONECRANES customer portal.

For further details, log on to www.konecranes.com

Italy, Germany, Sweden, Austria, France, The Netherlands, UK, Spain, Turkey, USA, Brazil, Thailand, India, China, Japan

Danieli Headquarters in Buttrio, Udine, Italy

www.danieli.com

MIDA–QLP and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE Equipment and layout may be copied, but experts know that details make the difference.

Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

GIANPIETRO

GIANPIETRO

This year’s AISTech promises the usual line-up of optimizing technologies, innovative systems, and automation solutions in the exhibition hall, but all with an edge of sustainability, and digitalization. As is apt for the so-named ‘Discovery City’, read below for more details on what to encounter this May.

KOCKS, a supplier of solutions for long products rolling mills, has partnered with laser measurement provider LAP to develop the 4D Eagle S Measuring Gauge, which combines profile measurement capabilities with surface inspection in one system. The gauge uses advanced laser light sectioning technology to measure the complete profile of the long products and accurately detect and classify various rolling defects.

The associated SMART CORE X software encompasses all the necessary features to meet requirements, including easy-toaccess profile data, 3D imaging of defects, detection of periodic defects, export capabilities, and individual statistics over a user-friendly surface. OPC-UA allows access to all relevant data through a modern interface. Data-driven insights can be gained from this, which can ultimately be used to tap into a wide range of potential in everyday rolling mill operations. The team in the rolling mill benefits from transparency and the opportunity to optimize process and product quality sustainably.

Two 4D EAGLE S systems have been successfully implemented in the mill lines of a German steel producer, enabling quality assurance for round long products in a wide diameter range.

KOCKS will be exhibiting at booth #2816

Global technology leader ABB will be presenting safer and smarter solutions and innovative products and services for more efficient operations across the metals industry

One recent solution that the company will highlight at its booth is ABB Ability™ Smart Melt Shop, which combines real-time crane and ladle tracking, automatic and optimized crane scheduling, and heat loss prediction. Proven benefits from projects over the last year

include raising casting speeds by 4-5%, 5°C less arcing per heat, reduced delays, less material rejection and increased human safety.

ABB and metals industry supplier Tenova will also receive the 2024 AIST Charles W. Briggs Award for the collaborative work entitled ‘Tenova Large Electric Arc Furnace Equipped with ABB Electromagnetic Stirrer as a Model for the Efficient and Reliable Transition of the Steel Industry’. This comes as ABB’s ArcSave® electromagnetic stirrer (EMS) can be deployed in the melt shop to create equilibrium in the melt, which the company claims enables more steel to be made, using fewer resources.

ABB will be exhibiting at booth #1527

Polytec, an Italian company that has been developing automation systems and robotics for critical industrial processes for over 30 years, will be showcasing its cooling bed sampling robot, PolyTEST. PolyTEST is a fully automated robot with an artificial vision system for the complete cutting of steel samples from bars (and other products) positioned on a cooling bed. The main components of the system include a six-axis industrial robotic arm with a custom-designed tool to perform the sample cutting and moving, and an artificial vision system, which determines the best position to collect the sample and communicates it to the robot that executes the movement. Highlights, claims Polytec, are improved system reliability, quality increase, and productivity improvement.

Polytec will be exhibiting at booth #2415

Tenova, a leading company specialized in sustainable solutions for the metals and mining industries, will be featuring its recent contract with steelmaker Ternium, for the delivery of sustainable technology for the steelmaker’s new state-of-the-art steel mill in Pesquería, Mexico.

Tenova’s scope of work includes a direct reduction (DR) plant with integrated material handling system (MH) complete with a stockyard/train unloading system, an electric arc furnace (EAF) equipped with Consteel® and electromagnetic stirrer Consteerrer®, two ladle furnaces (LF), and a fume treatment plant that guarantees a total production capacity of 2.6Mt of steel for the automotive sector.

The MH system will be designed to

feed the DR plant with the specified flow and quality of iron ore and will also provide handling and storage for DRI production. It will also ensure safe and reliable operations, claims Tenova, including advanced dedusting equipment specifically designed to minimize pollution and drastically reduce impact on the environment.

The DR plant, based on the cutting-edge ENERGIRON® Direct Reduction technology jointly developed by Tenova and Danieli, will directly charge the Consteel® EAF with hot DRI, thanks to the Hytemp® pneumatic transport system.

Tenova will be exhibiting at booth #1929

Multi energy company TotalEnergies will present its ROLKLEEN range, a lubricant engineered to elevate the cold rolling process.

Products from the ROLKLEEN range can be used with reverse osmosis and deionizing water. According to TotalEnergies, its multiple benefits extend from energy savings to production levels while delivering superior strip quality. ROLKLEEN products utilize an

oxidation-resistant lubricant, minimizing the formation of sticky by-products and ensuring a clean surface. The ROLKLEEN range includes rust protection, which ensures no residue is left after degreasing, and protects against corrosion while matching environmental standards.

TotalEnergies will be exhibiting at booth #3203

Sarclad will be launching the Contamination Monitoring System (CMS) for strip coating lines, which the company claims will revolutionise capability in the field. The CMS utilises Laser Induced Breakdown Spectroscopy (LIBS) to provide strip producers and line manufacturers with an

Nel Hydrogen, a global, dedicated hydrogen company, delivering optimal solutions to produce, store, and distribute hydrogen from renewable energy, will be showcasing the PSM; a proton exchange membrane (PEM)-based water electrolyser module that integrates eight 1.25 MW cell stacks to generate hydrogen from deionized (DI) water and four DC electrical power inputs. The PSM includes the PEM cell stacks, associated piping, DC power connections, and related critical monitoring instrumentation.

The PSM employs a modular approach to hydrogen production designed to offer guaranteed, repeatable performance per module to provide a cost-effective solution for hydrogen production at all scales.

automated, non-contact, online measure of very low levels of iron fines and carbon contamination on coils after the cleaning section on the galvanising line.

It is the first continuous monitor of strip cleanliness providing real time data with unprecedented precision that distinguishes

between oil and iron fines contamination, says Sarclad. Introduced under licence from CRM, the CMS is designed to be positioned post cleaning and pre-furnace. The system has been designed in a compact format to ensure that it can be fitted to any line, either new build or retrofit to existing lines. The sensor can be fitted to an automated and integrated traverse to allow measurement at various points across the width of the strip.

Sarclad will be exhibiting at booth #1855

Dassault Systèmes provides businesses and people with collaborative 3D virtual environments to imagine sustainable innovations. A solution that Dassault Systèmes will be exhibiting is DELMIA, which delivers solutions to address the most challenging situations metals manufacturers experience today. It connects the virtual

and real worlds to empower customers worldwide to collaborate, model, optimize, and execute supply chains, manufacturing, logistics, and service to achieve strategic business results.

Dassault Systèmes will be exhibiting at booth #1422

Nel Hydrogen will be exhibiting at booth #1729

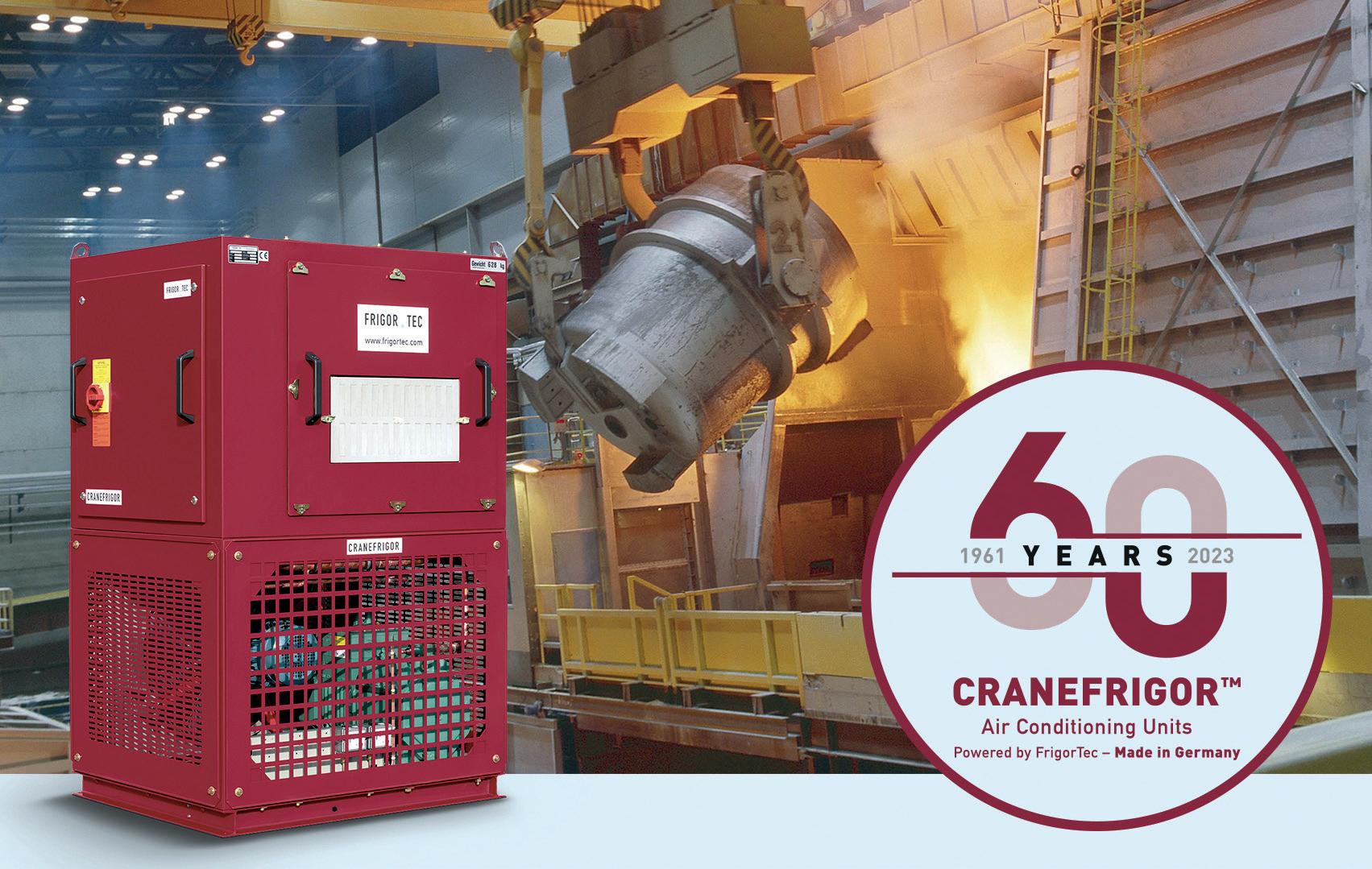

For more than 60 years FrigorTec has been manufacturing crane air conditioning for metal production, container terminals, coking plants, mining, oil and gas, paper production, chemical plants, cement plants, offshore applications, and power plants. This May, the company will be exhibiting its CRANEFRIGOR™ Crane air conditioning units, (heating - cooling - dehumidifying), electronic rooms, and control cabinets for safe and optimal working conditions. In

addition, further details on FrigorTec’s filter systems will be available – which ensure the oxygen supply and reduce the dust load in the conditioned room. The units, which have been tested worldwide, are available in many installation variants and performance levels.

FrigorTec will be exhibiting at booth #2825

The Systems Group’s mission is to provide engineered solutions for a safer, more productive steel industry, with divisions including Systems Plant Services, Systems Contracting, Systems Spray-Cooled, Systems Fab & Machine, Systems Engineering, and Systems Clean Air. The company will be showcasing its latest product offering, Systems Big Ass Strainers (BASS), which is designed to optimize water filtration. With a maximum flow rate of 5600 GPM, the Systems Group’s BASS aims to ensure optimal protection for mill process equipment. Its design incorporates two quad seal rings, providing four heavyduty seal points to guarantee against secure filters from being displaced by reverse water flow through the outlet. The BASS is also equipped with an electric davit crane for assisted cover opening and closing. With a pressure rating of 150 PSI and manufactured in the USA, it integrates into any process water filtration system.

The Systems Group will be exhibiting at booth #2329

EMG, supplier of automation and control systems, will be featuring five of its solutions at its booth this May. The technologies include iTiM strip thickness measurement with X-ray, isotope, and laser technology, which incorporates X-ray, isotope, and laser technologies, and the iCAM® for strip and slit strip width measurement, which caters to a wide range of widths, from narrow to wide strips, and is particularly adept at measuring slit strips post-slitting process. EMG will also highlight its new EMG SORM® system,

which the company claims introduces a new era in online roughness measurement. Utilizing a confocal chromatic measuring principle, it measures surface micro profiles at production speed without mechanical contact, offering real-time data on roughness parameters. This innovation, says EMG, allows for early detection and correction of roughness deviations, enhancing the efficiency and quality of the manufacturing process.

EMG will be exhibiting at booth #2161

AIC Group is a global system integrator that designs, manufactures, and commissions plants worldwide, providing advanced and tailored automation plus mechatronics solutions for the metals industry. This May, AIC’s Robotics department will present tailor-made solutions for the metals industry to ensure an advanced process in the processing line, improving the oftenharsh conditions customers operate in. AIC’s robots can be floor-mounted or ceiling-mounted and can be integrated

into new layouts or in existing ones. An anthropomorphic AIC robot typically has six degrees of freedom and a wrist load of up to 40 kg.

AIC offers anthropomorphic robots, AI and 3D vision systems, control units and safety PLC, tags, QR readers and marking tools, metal support and welding machines, and all tools required for mechatronic applications.

AIC will be exhibiting at booth #2215

Political scrutiny continues from both sides in the US, as Nippon Steel’s acquisition of US Steel enters into the clearance stage.

By Manik Mehta*THE United Steelworkers (USW) union’s opposition against the Nippon Steel takeover bid of Pittsburgh-based US Steel is now followed by politicians opposing Nippon Steel’s move; Nippon Steel has quoted a purchase price of $14.9 billion which is roughly twice the offer made by US rival steelmaker Cleveland-Cliffs.

“It’s not just Nippon’s attractive price offer. Remember, this is an election year and both president Joe Biden and his potential rival Donald Trump (he has, as of writing this update, not yet been officially nominated though he is leading over the other Republican candidates), are reacting to Nippon’s takeover of US Steel,” explained Joseph Marciano, a New York-based analyst. “Then there is the national security element … and no candidate would like to appear less nationalistic when it comes to protecting American interests.”

In an otherwise free economy, inherent with opportunities for foreign companies investing in the US corporate sector, nationalism is today on a high pitch, and politicians seem to be outdoing each other in opposing a takeover by a foreign company, although Nippon Steel is based in

an allied country.

JD Vance, a Republican senator, argued that it was ‘not just this transaction I’m worried about, but that this could be a precedent’, fearing that US Steel would be less responsible to US national security needs and that this would allow Nippon Steel to avoid US tariffs on imported steel through the purchase. He has called for a blanket ban on any foreign buyer of a US company that benefitted from the tariffs. Foreign companies, keen to access the US market, should engage in greenfield investments.

Former president Donald Trump has vowed to block Nippon Steel’s acquisition of US Steel if he becomes president.

“I would block it instantaneously. Absolutely,” Trump said after meeting the president of the Teamsters labour union, which represents workers in the transportation industry. “We saved the steel industry. Now, US Steel is being bought by Japan. So terrible.”

Biden’s election strategists face pressure with the growing number of Republicans opposing the Nippon Steel acquisition. Biden has in the past underlined the

importance of US alliances and has welcomed foreign investment; nevertheless, he knows Nippon’s acquisition would anger the USW which had endorsed Biden’s 2020 candidacy and wields a constituency of over a million members, with many thousands in swing states Ohio, Pennsylvania, Michigan, Wisconsin, etc.

While foreign investments for new US factories were welcomed months back, Nippon Steel’s venture has rung alarm bells among politicians over security issues. Foreign investors can generally benefit from the administration’s massive infrastructure allocations of roughly $3.5 trillion, combined with subsidies.

Experts argue that tariffs on imported steel would draw foreign companies to invest in production in the US, reminding that Japanese carmakers invested in the US in the past; former president Trump in 2018 imposed 25% tariffs on imported steel and Biden continued with the tariffs, though he reached agreement with the EU replacing tariffs on European products with quotas, extending the arrangement until 2025. US Steel’s chief executive David Burritt had also remarked that his company benefitted

Reduced carbon footprint using hydrogen or carbon neutral fuels and equipment upgrades.

Emissions reduction solutions to help customers achieve near-zero methane targets.

Energy optimization to minimize lifecycle costs.

SoLoNOx™ combustion system to reduce NOx emissions.

For more information, visit us at www.solarturbines.com, call +1-619-544-5352 or email infocorp@solarturbines.com

from ‘accelerating de-globalization’; other countries also reviewed their risks of growing interdependence.

Meanwhile, both Nippon Steel and US Steel, trying to allay the doubts in the US, said that they would submit their agreement to the Committee on Foreign Investment in the US (COFIUS) which is chaired by treasury secretary Janet L. Yellen, to examine if the deal would affect any national security interest.

However, the COFIUS scrutiny, guarded and discussed by responsible members of the agency, is a protracted process and the wheels move slowly.

Some critics object to national interests being put in jeopardy but others argue that the US military uses roughly 3% of total domestic steel production. According to Pentagon data, modern fighter systems today consume less steel than in the past, using instead more materials such as titanium and aluminium.

Besides, the Defense Department does not directly purchase any materials from US Steel, though the latter has said that some customers, with defense and commercial businesses, may use the company’s raw steel for defense hardware.

COFIUS has taken controversial stands on deals with Chinese companies though Japan is considered a US ally. Also, Nippon Steel is known to have some stakes in eight US steel companies.

Nippon Steel representatives have been

talking to US lawmakers to allay their concerns, promising that US Steel would remain in Pittsburgh, with its name intact, and they would honour the steelworkers’ collective bargaining agreement. Nippon Steel, operating 11 blast furnaces, is expected to improve the efficiency of US Steel’s furnaces and also reduce the carbon footprint.

US Steel had spurned the nearly $8 billion offer made by Cleveland-Cliffs which, as details now emerge, had come close to winning over US Steel.

Nippon Steel, which eventually won the bid, was not, apparently, interested in other plants in the region but in US Steel’s minimills in Arkansas and the latter’s iron-ore

mining operations in Minnesota.

Nippon originally estimated the value of US Steel’s modern electric arc-furnace plants and the mines at $9.2 billion, according to regulatory filings; in late September, it indicated that it had bid at $9.5 billion. Its nearly $15 billion offer, made two months later, was finally accepted. But US Steel had some concerns about Nippon Steel; CEO David Burritt had called, two days before the deal’s finalization, Nippon’s executive vice president Takahiro Mori, to get assurance that Nippon would work with COFIUS. Nippon finally agreed on ‘all actions required’ to obtain COFIUS’ clearance, if it did not hurt its business.

Indeed, both companies sought the COFIUS review even before the Biden administration called for a ‘serious scrutiny’ of the deal and the opposition by lawmakers of both parties.

Meanwhile, US steel imports totalled 2.08Mt (net tons) in December 2023, including 1.61Mt (net tons) of finished steel (+ 2.6% and 7.7 respectively) over November 2023. For the year 2023, total and finished steel imports were 28.15Mt and 21.6Mt (net tons), down 8.7% and 14.1% respectively over 2022, the American Iron and Steel Institute (AISI) reported.

Top 2023 suppliers were Canada, Mexico, Brazil, South Korea and Japan. �

Brazil’s high import rate of Chinese steel is set to increase further after China’s touted investments in Brazil-based production facilities. By Germano Mendes de Paula*

IN 2023, China produced 1.019 billion net tons of crude steel, slightly up from the 1.018 billion net tons registered the previous year, according to worldsteel. However, the country’s domestic steel consumption was deeply impacted by a property sector crisis. Indeed, investments in the property sector declined by 9% in 2023, after a 10% drop in 2022. As a result, Chinese companies aggressively amplified their steel product exports by 36.2% to 90.3Mt in 2023, in order to offset low local demand.

Chinese domestic steel consumption in 2023 was supported by the automotive, shipbuilding, and solar photovoltaic sectors, according to Reuters. In 2023, shipbuilding completions totalled 42.32M deadweight tonnage, almost 12% higher y-o-y, while new orders in the sector jumped by 56% to 71.2M deadweight tonnage, official statistics showed. The China Association of Automobile Manufacturers (CAAM) claimed that the country’s auto production surged by almost 12%, rising to 30.16M units. Meanwhile, Chinese auto exports skyrocketed 58% to 4.91M units in 2023

(Table 1), helped by soaring sales in Russia after numerous brands withdrew from this market due to the invasion of Ukraine. Thus, the expansion of steel consumption due to the automotive sector in China during 2023, resulted in substantial indirect steel exports.

According to MySteel, China produced 96 million refrigerators in 2023, implying a 14.5% y-o-y evolution, while corresponding exports amplified by 22.4% (Table 1). The respective figures for washing machines was 105 million, 19.3% and 39.8%, highlighting that export growth was equivalent to the doubling of output amplification. For televisions, the amount

reached 193 million, with exports growing 7.5% even with a 1.3% production drop. Air conditioners, with a figure of 245 million, can be considered an exception in this context, because exports grew lower (4.6%) rather lower than the output (13.5%). That said, in the general context of household appliances, they followed a similar trend as the automotive sector.

Primary steel international trade statistics are released fairly frequently and they are typically updated. This is not the case for downstream steel industry data, which is often published after a considerable lag. A good exception regarding the latter is that, for the Brazilian steel market, downstream

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

steel statistics are unveiled monthly by the Brazil Steel Institute, with a delay less than 25 days. Furthermore, the mentioned trade association employs the same methodology developed by worldsteel.

Brazil-China steel international trade Brazil increased its direct steel imports from China (1.8Mt in 2022) to 2.9Mt in 2023, showing a 62% jump. Consequently, the Chinese market share concerning Brazilian steel imports increased from 53.4% to 57.7%, respectively. In the interim, Brazil’s exports to China were almost insignificant, reaching 49kt in 2022 and 54kt in 2023, or equivalent to 0.4% and 0.5%, correspondingly.

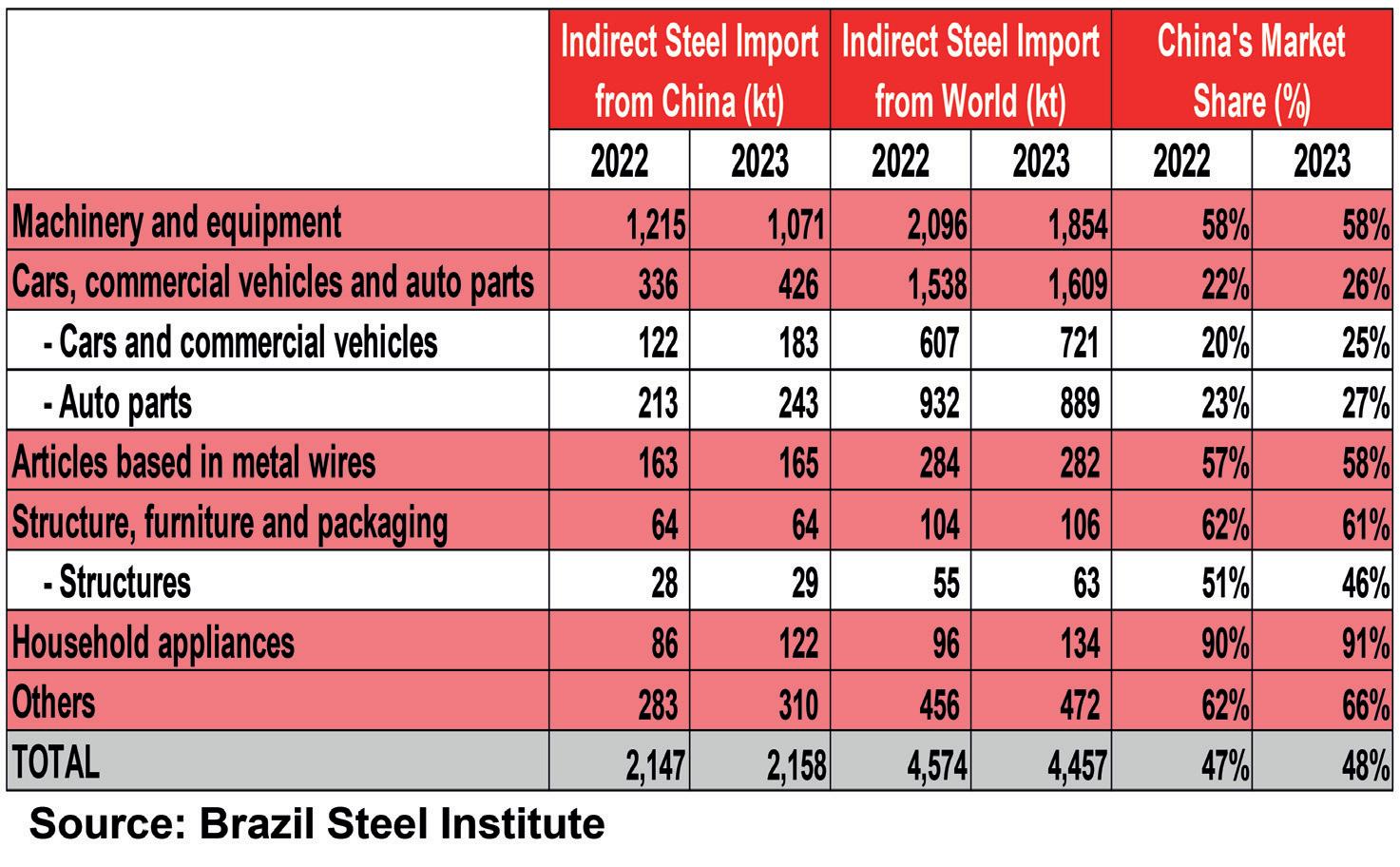

Brazil imported 2.15Mt of steel contained in manufactured products (in particular related to the metal-mechanical value chain) from China in 2022, with a small increase to 2.16Mt in 2023. The respective Brazilian indirect steel exports to China achieved 15kt and 17kt, correspondingly.

When Brazilian direct and indirect steel imports are combined, the Chinese figures grow from 3.9Mt in 2022 to 5.1Mt in 2023. This is equivalent to 16.7% and 21.5% of the national steel apparent consumption, respectively. This explains why the country’s steelmakers pushed the government to increase the import tariff from the current 10.8% to 25% of selected steel products, with a goal to protect from the ‘import tsunami’ captained by China, following the initiative that many countries have already adopted.

Table 2 shows a disaggregated view of

the composition of Brazilian indirect steel imports from China. The most important item is machinery and equipment, which decreased from 1.2Mt in 2022 to 1.1Mt in 2023.

Concerning the automobile industry, auto parts rose from 213kt to 243kt in years 2022-2023, demonstrating an increase of its market share from 23% to 27%. In the meantime, the car and commercial vehicle market expanded from 122kt to 183kt (or from 20% to 25%). For instance, automotive company BYD did not sell (export) even 300 cars in Brazil in 2022. In just one year, this number jumped to 18k.

Metal wires hit a plateau during the aforementioned years, not only in volumes (both from the world and China), but also in terms of high Chinese dominance (with a 57%-58% relevance). A similar performance was observed by the ‘structure, furniture and packaging’ category, with China’s respective market share being even higher (61%-62%).

Regarding household appliances, Brazilian indirect steel imports from China rose from 86kt in 2022 to 122kt in 2023, allowing a marginal gain in Chinese market share from 90% to 91%, which is a significant dominance.

As a whole, almost half of Brazil’s indirect steel imports in 2022-2023 originated in China.

Nonetheless, it is reasonable to expect that this already large ratio might increase in the coming years, because Chinese automakers BYD and GWM are investing to produce locally in Brazil, which tends to foster the import of auto parts. �

By Dilip Kumar Jha*

By Dilip Kumar Jha*

ACCOUNTING for nearly two-thirds of India’s steel consumption, the infrastructure and construction sector has led the country’s steel sector growth since the industry’s deregulation in 1991. Barring the Covid-19 period between 2020 and 2021, India’s steel sector growth amplified during the rest of the period in the last 10 years, following the government’s extended focus on public welfare schemes such as ‘Housing for All, and ‘Nal se Jal’ (tap water supply), among others.

With all these schemes in focus, the government is confident of achieving India’s steel production capacity of 300Mt by the financial year (FY) (April-March) 2030-31, up from 165Mt at present. Additionally, the metal’s per capita consumption in India is projected to rise to 160 kg by FY203031 from the existing 70 kg in FY2022-23. Dilip Oommen, president of the Indian Steel Association, stated, “The highest-ever investment of INR2,400 billion for railways will translate into robust domestic steel demand, thus spurring private investments and job creation. First-and-last-mile connectivity for sectors like steel, ports and coal, with an investment of INR750 billion, will improve logistics efficiency and help India’s steel sector growth.” Sajjan Jindal, chairman of the Jindal Group, echoed a similar response.

To improve steel consumption, the

government’s push for infrastructure development through the ‘Gati-Shakti Master Plan (a confluence of seven growth engines including railways, roads, ports, waterways, airports, mass transport, and logistics),’ ‘Make-in-India’ initiative for the manufacturing sector (focusing on Indiamade products to reduce dependence on imports), Pradhan Mantri Awas Yojna (PMAY) (Narendra Modi’s Housing Plan),

etc. is expected to stimulate demand and consumption of steel in the country. Further, the Ministry of Steel has also set up a Joint Working Group (JWG) with the Ministry of Housing & Urban Affairs (MoHUA), having members from the Bureau of Indian Standards (BIS), Central Public Works Department (CPWD), technical institutions, and industries for fostering steel usage in the housing and construction sector.

The only fully enclosed conveyor of its kind for HDRI transportation/charging

• High Dependability and Uptime Redundant patented mesh system

• Low Thermal Drop HDRI can be charged to the EAF at up to 700 °C (1,292 °F)

• Extremely Low Nitrogen Requirements Just one-third of conventional technologies

• Low Maintenance No chains, sprockets, hinges, or rails

• Challenging geometries up to 75 degrees Available as a pan plate or bucket conveyor

• Great flexibility Capable of transporting materials from fine-grained to lumpy

Number of

Delays in the completion of these projects and cost overruns, however, have raised concerns about the possibility of achieving these milestones. As of 1 January, 2024, a total of 1,820 such projects were under the surveillance of the Ministry of Statistics and Programme Implementation (MoSPI). Out of these, 848 projects, or 46.6% of the proposed ones, were delayed. This marks a significant improvement as at the end of March 2023 when the ratio of delayed projects to total projects was much higher, at 56.7%. This is still much higher than the pre-pandemic period, i.e., January 2020 when the ratio was just at 32.6%. On the positive side, a total of 618 projects are on schedule, and 56 are ahead of schedule so far. For the remaining 298 projects, data on the year of commissioning/gestation period remains unavailable. There are 198 projects showing delays beyond expectations.

A significant number of projects are also showing cost overruns. The cost of the 1,820 projects under monitoring stands at INR 30,700 billion which is approximately 18.7% above the original cost of INR 25,900 billion. Understandably, the cost overrun of India’s infrastructure projects has declined significantly from the level of 22% in March 2022. Surprisingly, 32% or 323 of the proposed projects are showing a delay of two-to-five years, driving the cost overruns. On the other hand, around 48% of projects have time overruns between one and 24 months. Also, 123 projects are experiencing a delay of more than five years. Thus, the average delay across 848 projects works out to three years.

Sector-wise projects, such as road transport and highways, remained the major sectors with the highest number of monitoring and delays at 1,021 projects and 450 projects, respectively. These sectors accounted for over 50% of the

total projects delayed. When compared with the pre-pandemic period (19.4% in January 2020), the cost overrun works out to be lower. Notably, the period just after the pandemic saw the highest cost overrun as the phase of reopening along with the Russia-Ukraine war, led to a sharp increase in input prices. With the correction seen in global commodity prices, the cost overrun is also trending lower.

In terms of major sectors, road transport, and highways, which have the highest number of projects under monitoring at

1,021, also recorded the highest number of delayed projects at 450. These accounted for over 50% of total projects delayed. Even as a percentage of total projects in the sector, the share of delayed projects is quite high at over 40%. Apart from this, the railway sector, which also has 250 projects under monitoring, recorded a delay of about 42%. For petroleum and coal, the share of delayed projects stood at 10.7% and 5.7%, respectively. In terms of the range of time overruns, which is defined as the difference between the anticipated date of commissioning and the original date of commissioning, railways and atomic energy seem to be lagging the most.

With the government laying a strong focus on capital expenditure by successively increasing the outlay, completing stalled projects on time will help boost current steel demand and also plan for new ones for the future. Meanwhile, the falling share of stalled projects in the last three months is an encouraging sign. �

CHAR Technologies is pledging itself as a sustainable gamechanger for heavy industries, with its proprietary technologies offsetting the use of high-emission fossil fuels, lowering costs as well as carbon fumes. Catherine Hill* spoke to Andrew White** on the company’s projects, processes, and journey from Master’s thesis to collaborating with the world’s second largest steelmaker, ArcelorMittal.

1. CHAR TECHNOLOGIES, AND MORE SPECIFICALLY PYROLYSIS, SEEMS TO BE A BIG POTENTIAL PLAYER IN INDUSTRIAL DECARBONIZATION. HOW DOES IT ALL WORK?

The technology is called high temperature pyrolysis. What that means is we’re heating stuff up. Pyrolysis means without oxygen, and the temperatures, as in the name, are high. Being in the steel industry, maybe it’s not as high as other processes, but within the world of pyrolysis, 800-900°c is what classifies high temperature pyrolysis. What we do is we take wood waste wood chips, or other organic residuals, and we put it through a high temperature

pyrolysis system. We then crack it apart to produce two valuable streams. The gas stream is called syngas, which can be used directly for its thermal benefits, if you put it through a burner or something similar. Alternatively, we can upgrade it to things like renewable green hydrogen or renewable natural gas. So that’s the gas stream. And then the carbon stream, because we can run at high temperatures without oxygen and we have a good level

of control over the process, we can create different biocarbons. The biocarbon we create can be well suited for PCI for blast furnace injection and the biocoal can be blended to make it a nut coke replacement. In addition, we can create carbons to go into electric arc furnaces, as well as biocarbon which allows for the offsetting of fossil fuel, and a lot of the steel making processes where that physical solid carbon is necessary.

2. COULD YOU SPEAK FURTHER ON THE USE OF SYNGAS AND HYDROGEN IN THE PROCESS, AS WELL AS AFTER?

If you could take a step back; what is wood made of? It’s cellulose, hemicellulose and lignin, which are basically carbon chains. You have carbons linked together with hydrogens connected to them, right? So, as we heat it up, what we’re after is fixed carbon – basically just carbon. When you look at an any coal or a biocoal that we make, it’s pushing 90% fixed carbon. It has almost no hydrogen, almost no oxygen. The biomass needs to go somewhere. Where it goes, is into a gas. And by operating at a high temperature, we can control a little bit of the make-

up of the gas. Our gas, as we make it directly out of the kiln, is on the order of 60+% hydrogen, and then some other components. We use that gas to run the plant by using some of it to create the heat we need. We self-consume somewhere around 15% of the gas we make, and we self-consume to heat it which is important. We’re not using fossil fuels to make biobased outputs. But then the rest of that gas, we can do a couple of things with it. We can use it directly. So that can go into burners. If we’re co-located with someone who needs a lot of heat, that

gas can just go directly through a burner and create heat. And through a separation process, we can pull the hydrogen out of the rest of the gas. With this process, we’ve then got this stream of marketable hydrogen – green hydrogen – and in the US, you would be able to qualify for these production tax credits of about $3 per kilogram of hydrogen – which is fantastic, because a kilogram of hydrogen goes for around a dollar, often less than a dollar. Alternatively, we can take that hydrogen and the rest of the gas we make, and we can convert it through catalysis into

3. HOW DID THE COMPANY START?

In 2010, I defended my thesis, which was on a related area to CHAR Tech’s current processes, and in 2013, after founding the company, CHAR Tech got its first round of funding. It was pretty small, like CA$100,000, but enough to do some testing and, and scale-up work. And then by 2018 we had commissioned our first pilot demonstration unit–and we’re still running that system.

4. CHAR HAS RECENTLY BEEN AWARDED $5M AS PART OF ARCELORMITTAL’S XCARB INNOVATION FUND. HOW DID THIS DEVELOP, AND WHAT DO YOU HOPE TO ACHIEVE AS PART OF THE INVESTMENT?

Around 2017 we started working with ArcelorMittal Dofasco, the plant based in Hamilton, Ontario. Initially, they were targeting PCI coal replacement, and then deploying an electric arc furnace to replace the blast furnaces. We’re now collaborating to manufacture our product, ‘CleanFyreTM’ biocoal, tailored for EAF purposes. Working closely with ArcelorMittal, we got a clear picture of what the biocoal needed to look like. Since 2017 we were sending them material, and they were testing it and giving us feedback. And then, this past July, we closed the investment from their XCarb Innovation fund, part of their low carbon green steel programme. Our long-standing

collaboration with Dofasco played a big role in this, providing solid technical validation. And then of course, getting the corporate investment was fantastic for us. Of all the companies they’ve made investments in, we’re the only ones in the biocoal space. If you look at [ArcelorMittal’s] climate action report, pyrolysis is one of the key elements of really being able to create green steel. And then, as part of that investment brand, we also received a fixed off-take agreement for the biocoal that we’re going to be producing at our commercial scale-up, which we’re in the process of building right now.

5. COULD YOU ELABORATE ON THE COMMERCIAL SCALE-UP FURTHER?

Our existing process plant can process about 500 kilos per hour of wood waste. So, we feed in 500 kilos per hour of wood waste to produce our output products. The commercial unit is going to consist of two larger processing lines. Each process line is capable of processing about three tons per hour of wood waste. So, we’ll be scaling up our input quite a bit. On the output side, we will also be scaling up to about 10kt/yr of biocarbon production. This came about

thanks to the US$14 million in government funding that we were fortunate to receive. The funding comes from funds and loans from the province of Ontario, and federally from the government of Canada. The facility will be making the biocoal and it’ll also be making renewable natural gas that we can inject into the gas pipeline here and sell for a premium because it’s renewable. So, it has huge environmental benefits.

6. HAS FEDERAL FUNDING ALWAYS BEEN A LARGE SOURCE OF FUNDING?

The programmes from the [Canadian] Province of Ontario, and the federal government, are a combination of grants and loans. They’re not taking an equity position. I think it is really important in the clean tech space because, ultimately, to scale up, especially the scale-up to the industrial demand that steel companies would need, there’s a really big jump from pilot to commercial scale. Sometimes that jump is challenging to get project level financing on its own, it can be hard to get offtake agreements for that first plant. These government programmes help in getting the first commercial project off the ground. I really like the programmes and I think the way the federal and provincial governments here roll them out, works really well. There’s a bit of a contrast, with the US being big fans of tax code, and they’ve gone down the tax code process with the Inflation Reduction Act, the IRA. There are some elements of that that I think would be good to see rolled out, particularly around the PTCs or production tax credits being a little bit more broadly applied. PTCs could provide growing companies like ours with more certainty around project finance, reducing contracting risks and attracting more project-level debt and equity partners.Both approaches have their merits, but these programmes are vital for getting that first commercial plant operational and to get the client using the product and then being able to expand from there.

renewable natural gas. And in North America and in Europe, there tends to be a good premium on renewable natural gas. So for us, a lot of the benefit and importance of the gas is that we’re really extracting the maximum value out of this biomass. We’re not just turning biomass into a solid carbon. We’re turning it into a solid carbon for steel making. We’re turning it into a gas that can go into steel making. It can go into the pipeline, it can go to other customers to really extract all the value out of that biomass stream.

woodings.com // smco.net

Superior Machine has joined the Woodings’ group creating the most capable hot metal equipment supplier group in North America. Offering the combined knowledge, engineering, manufacturing, and construction expertise for all your equipment needs.

Wherever hot metal is produced, you will find equipment from Woodings, Superior Machine, and

Munroe operating at the highest level in the most demanding conditions. Our products and professional installation services reduce downtime and extend campaign cycles.

We can provide you with more value than ever before from concept to installation, service to replacement, our size, scope, and experience gives us a unique ability to help you increase productivity and solve problems.

We are better together. Let us show you.

7. TOUCHING ON GREEN PREMIUMS, WHAT IS YOUR VIEW OF THE PLACE THEY HOLD IN THE MARKET, AND HOW DO YOU BELIEVE THEY WILL EVOLVE?

I think, generally because of the nature of steel making, green steel tends to lend itself a little bit better to a demand-driven pathway versus a regulatory pathway. I think that is particularly stark when you look at, say, Canadian production of steel, and then you look at what’s going on in Europe. If Canada implemented some sort of a carbon tariff to make green steel here competitive, and you know, especially when we talk about imports and then we look at our largest trading partner in the United States who doesn’t have it, it creates a real challenge for the production of steel.

I think there’s obviously a strong commitment to decarbonize steel making. But, because of the nature of the industry and the trade exposed nature of it, it’s

really a hard thing to come in on the sort of regulatory side of things. I’m not advocating against a carbon tariff because ultimately, I started the company to affect global change and try to reduce our impact on the climate. But I think as different procurement programmes are developed and demand for green steel starts to increase – whether its demand being from EV manufacturers who are looking to show that their entire vehicle is carbon neutral or from municipal or government contract – this is what should be driving the market for green steel. Having industries proactively ask for it is the best pathway to create a real marketplace for low carbon and carbon neutral steel. Because all the other trade issues can make this very complicated.

8. WHAT PROJECTS ARE CURRENTLY IN THE PIPELINE FOR CHAR?

We’ve got three additional projects that we’ve talked about publicly that are in the development cycle. One near Lake Nipigon, Ontario, one in Kirkland Lake, also Ontario, and one in St. Felicién, Québec. All of them were partnering with local feedstock suppliers, so local biomass. In the case of Lake Nipigon and Kirkland Lake, we are partnering with the local First Nation communities that are responsible for forestry operations. And then in, in St. Felicién, we’re partnering with the regional and municipal and city governments on

getting the biomass supported, as well as a biomass fired power plant to help with procurement of biomass. So, those are the three next projects. And really the intention is, how do we get to more meaningful biocarbon production numbers? How do we get to 100kt/yr, 500kt/yr? It’s really through this for us, that we’ll see development, through this rapid project deployment process. We are actively looking to build a couple of additional projects in the very near term.

9. WHAT DO YOU BELIEVE ARE THE BIGGEST CHALLENGES THE STEEL INDUSTRY IS CURRENTLY FACING?

Broadly speaking, the technology often uses a lot more carbon. The easy one to pick on is the difference between an EAF and a basic oxygen furnace process, because it’s just the amount of carbon that’s needed. But there’s actually some additional nuance there. From a challenge perspective, especially from our type of technology, it’s that biocarbon at its current stage of development can’t be a 100% coke replacement because of the strength properties of coke. We can replace PCI, we can replace nut coke, but replacing coke is a big challenge. That’s something that research organizations are working on. What I am really encouraged by is that in Canada, there’s the Canadian Carbonization Research Association that the main steel companies in Canada participate in. It’s supported through a government lab. In any regard, there’s the challenges that we’re facing on decarbonization, especially on the use of carbon. How do we get together and solve these problems? We can be competitors and we can have our own trade secrets and our abilities to try and be more competitive and create more margins than others. But some of these bigger challenges, I think, necessitate collaboration. The encouragement that I have is seeing this type of industry collaboration here in Canada. I imagine it exists in different ways and in different jurisdictions as well. But, industry collaboration on decarbonization is a great thing to see.

DELIVER IMPROVED YIELDS, HIGHER-QUALITY STEEL AND REDUCE COSTLY DOWNSTREAM

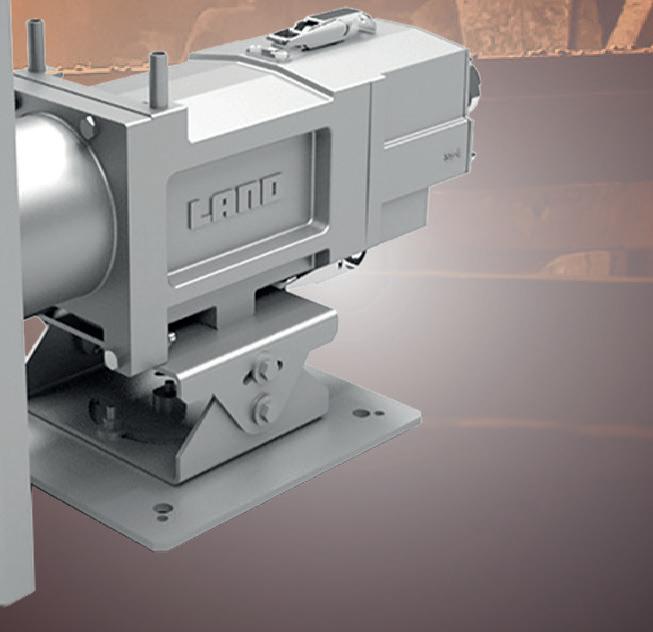

The high-resolution Slag Detection System (SDS) thermal imaging camera detects the transition between steel and slag and has been specifically designed to survive in harsh operating conditions, whilst utilising a particular wavelength to reduce obscuration caused by smoke and fumes.

Suitable for operators of secondary steel making vessels including stainless steel, SDS can also be used in other smelting operations such as copper and platinum. Its automatic operation ensures that only the predefined amount of slag is carried over before an alarm is triggered.

SDS is AMETEK Land’s definitive solution for monitoring and reducing slag carry-over in steel production facilities whilst saving money and improving operator safety.

Automatic detection and tracking accurately identifies the stream, reducing background interference

Accurate detection independent of charge weight

Fully automatic operation and clear alarm notifications

Improved connectivity through the use of Open Data Interface

The climate movement is finally beginning to shine a light on the iron and steel industry, which is responsible for 11% of global carbon dioxide emissions and 7–9% of global greenhouse gas emissions. The heightened focus on the iron and steel sector is evidenced by the incorporation of heavy industry decarbonization targets and technology investments at the national, international, and corporate levels in the past year.

By Caitlin Swalec* and Astrid Grigsby-Schulte**ONCE thought of as an industry without feasible decarbonization options (ie, ‘hardto-abate’), the steel industry now has a range of technologies and tools that can enable a meaningful shift to a low-emission sector. Still, as 2030 decarbonization targets and 2050 net zero targets draw near, the urgency of mitigating the carbon footprint of the global iron and steel industry grows even more quickly than the current ambition from governments and the private sector. The steel industry is currently not on track for net-zero scenarios, let alone 1.5 degree alignment.

The coal-based technologies prevalent in iron and steel production today are not sustainable in net-zero emissions scenarios. Blast furnace-basic oxygen furnace (BF-BOF) steelmaking needs to be phased out in favour of scrap and DRI-based electric arc furnace (EAF) production. EAF steelmaking

only produces 10–20% of the carbon dioxide emissions of BF-BOF steelmaking, depending on the input material (scrap, pig iron, direct reduced iron and so on). While scrap-based EAF steelmaking should be prioritized to lower industry emissions, scrap supplies are finite, and alternative iron production methods must be implemented to further eliminate emissions from the sector. New technologies such as green hydrogen-based direct reduced iron (DRI) hold promise for achieving net zerocompliant steel production if the necessary investments in development – including clean energy and hydrogen production –are made.

Society will continue to rely on steel for engineering, construction, medical, and energy applications as it builds new energy projects, replaces and develops infrastructure, and innovates for a bright future. As economies develop, the global demand for steel will continue increasing. The continued dominance of fossil fuels in steel production processes in operating and developing plants must be challenged and emissions reduced through a combination of strategies including material efficiency to lessen demand, increased reuse and recycling, and production decarbonization

through retrofits and advanced technology. The momentum to decarbonize the iron and steel industry must shift into high gear.

Current status of global iron and steel plant fleet

Global steelmaking capacity

The Global Steel Plant Tracker (GSPT) covers 2,271Mt/yr of operating crude steelmaking capacity, or 92% of global capacity according to OECD estimates. The GSPT also includes 1,486Mt/yr operating blast furnace capacity and 144Mt/yr operating DRI capacity, representing 93% and 99% of world capacities, respectively, or 93% of operating ironmaking capacity altogether. Additionally, the GSPT covers all crude iron and steel plants under development as of 1 March 2023, making this the most up-todate comprehensive tracker of changes in global steel capacity. Fig 1

According to the GSPT, 62% (1,397Mt/ yr) of global crude steel capacity currently uses the BOF route, 29% (665Mt/yr) uses EAF steelmaking, and <1% (<6Mt/yr) uses open hearth furnace (OHF) steelmaking. The remaining 9% (204Mt/yr) of capacity has not been distinguished between these routes. From the steelmaking capacity of known technologies, 68% is BF-BOF, 32% is

EAF, and <1% is OHF.

Over two-thirds of current steelmaking capacity is in Asia; China accounts for 49% (1112Mt/yr) of the operating capacity in the GSPT, followed by India at 5.3% (121Mt/yr) and Japan at 5.1% (115Mt/ yr). Outside of Asia, Europe has the most operating capacity at 13% (297Mt/yr) while the United States holds another 5.1% (115Mt/yr). When only BF-BOF steelmaking is considered, China accounts for 59% (819Mt/yr) of global capacity (Fig 2a).

Global ironmaking capacity

Asia also holds most of the world’s operating iron capacity with around threequarters of global ironmaking belonging to the region. China accounts for 55% (897Mt/yr, followed by India (122Mt/yr) and Japan (95Mt/yr). Europe, as in steelmaking, comes in second for regional ironmaking, representing 10% (158Mt/yr) of global operating capacity; Germany (33Mt/yr) and Ukraine (30Mt/yr), representing 2.0% and 1.8% of global capacity respectively, lead the region. Other notable countries include Russia (65Mt/yr), the United States (34Mt/ yr), and Brazil (34Mt/yr). Iran not only has a sizable operating ironmaking capacity overall (44Mt/yr), but also has the highest operating DRI capacity in the world (38Mt/ yr).

Per the GSPT, 91% (1,486Mt/yr) of global crude iron capacity currently uses BF technology and 9% (144Mt/yr) uses DRI technology, mainly a mix of natural gas-based and coal-based DRI. Less than 1% (9Mt/yr) of iron capacity in the GSPT has not been distinguished as BF or DRI technology.

Ironmaking units typically operate for

Fig 4. Current plans for steelmaking capacity development put shift towards EAF production behind decarbonization targets