FERROUS SCRAP SCRAP METAL IN THE UK

Ferrous scrap: a key factor in decarbonization, says ArcelorMittal.

Since 1866

Ferrous scrap: a key factor in decarbonization, says ArcelorMittal.

Since 1866

Q-ONE reduces EAF overall OPEX with a shorter power-on time and very low network disturbances. It is a scalable system that can be implemented on new or existing AC EAFs, and it can be directly powered by renewable energy sources.

Via Bonaldo Stringher, 4 33042 Buttrio (UD) Italy Phone +39 0432 518 111 www.digi-met.com www.dca.it

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Editorial assistant Catherine Hill Tel:+44 (0) 1737855021

Consultant Editor Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

Front cover photo courtesy of KOCKS

KOCKS RSB® 370/6 operating at GMH in Germany for decades. KOCKS blocks are made to last, giving you the highest performance in a long-term relationship.

Photo: Oliver Pracht | oliverpracht.com

2 Leader by Matthew Moggridge. 4 News round-up Six pages of global steel news. 10

Scrap is a key factor in steel decarbonization, says ArcelorMittal. 20

Steel, scrap and the foundations of the future, by Liberty Steel’s Jeff Kabel. 24

Avoiding a bear’s service to the climate, by Rutger Gyllenram of Kobolde & Partners. 30

Challenges for scrap recycling by Jeremy Jones of CIX Inc.

34 How to increase scrap recycling by K1-Met and Montanuniversitaet, Leoben. 40 Digital scrap optimization by Danieli. 46 ‘Crafted’ scrap explained by Primetals Technologies and SICON Germany. 52

From domestic to global player – we profile scrap metal and recycling specialist, Ward. 56 Scrap - the new precious metal? Myra Pinkham on the USA’s scrap market. 60

Perspectives Q&A: CPL Industries

We talk to Jason Sutton, chief financial officer.

As the global steel industry continues to transform itself from its ‘smoke stacks’ image of recent years to being a little more leaner and greener, the importance of scrap metal hoves into view and even seasoned professionals begin to refer to it as the new ‘precious metal’. In many ways, that’s what it is as steelmakers continue to decarbonize the production process. Leading the charge is the electric steelmaking industry.

Matthew Moggridge Editor matthewmoggridge@quartzltd.com

In the US, over 70% of steel is made using an electric arc furnace, or EAF. It is estimated that by 2050 90% of steel produced in the US will be from an EAF which, when it was first introduced by Nucor Corporation in the 1960s – (correct me if I’m wrong on that date) – integrated steelmakers claimed it was a process only fit to make trash cans. Things have changed considerably and today, with technological advances developed by the likes of Big River Steel and Steel Dynamics Inc, there is pretty much nothing an integrated mill can do that an EAF facility can’t. The fact that electric steelmaking relies heavily upon scrap as a feedstock makes it the ‘poster boy’ for green steelmaking and it also means that more

attention is being given to the world of scrap metal. In fact, the importance of scrap metal in the USA is reinforced by the fact that a number of big steelmakers there are going about acquiring their own scrap metal businesses in order to ensure supply as the commodity gains greater importance and the industry becomes ‘greener’. Ron Ashburn, executive director of the Association for Iron & Steel Technology believes that the need for scrap will increase in line with demand for less carbon-intensive steel. Recycling steel from automobiles alone, he says, is estimated to save an amount of energy equivalent to powering 18 million homes in the US.

In the UK, Jeff Kabel, Liberty Steel’s chief transformation officer, argues that scrap is undervalued and a major missed opportunity in terms of creating a circular economy. By increasing its use of existing technologies, such as electric steelmaking, and facilitating the availability of scrap, the UK can take the necessary steps towards investing in green steel and helping the legal net zero targets that it has set itself. Currently, scrap is seen as a low-cost export and not a strategic asset, he says.

Brazilian mining giant, Vale, expects to complete feasibility studies for its three planned green steel hubs in the Middle East next year. The appropriate capacity for each hub is being studied, says a company spokesman, and an investment estimate will be available for the project once the feasibility studies are completed next year. “These mega hubs shall supply different markets across the globe supporting the decarbonization of the steelmaking industry,” the spokesperson added.

Source: Zaywa, 8 November 2022

PepsiCo, Apple, and mining company Rio Tinto are the newest members of a corporate alliance committing $12 billion to purchasing nearzero-carbon steel, aluminium, cement and other products. The aim is to decarbonize the global supply chain. The alliance is targeting highintensity carbon emitters within multiple manufacturing sectors. Other members include General Motors Co. and Swedish power provider Vattenfall AB, which have both vowed to buy low-carbon cement and concrete for a portion of their businesses by 2030.

Source: MarketWatch, 8 November 2022

Brazilian steelmaker, Gerdau SA, has said that low water levels in the Mississippi River have affected its scrap purchases due to bottlenecks in barge traffic. Gerdau is the largest recycler in Latin America and uses scrap as a main raw material – with around 70% of the steel it produces made from it. The low water levels are the result of a recent drought, which has affected waterborne trade, with the shallow water making it costly and challenging to transport goods to export terminals.

Source: BNN Bloomberg, 9 November 2022

Green hydrogen to support steel production in Sheffield, UK, is being considered after government funding was secured. E.on, the city’s university and industrial partners are collaborating, with biomass to be explored as a feedstock. Michael Lewis, E.ON UK chief executive, said that hydrogen will 'play a significant role in our energy future, mainly powering energy-intensive industries and long-distance transport'. "It sits alongside the drive for heat pumps meeting domestic heating needs and a greater role for district energy schemes in urban areas,’’ he said. Source: Business Live, 10 November 2022

India’s trade ministry is considering extending an export promotion scheme to the steel industry. An Indian government official said that authorities are looking into reimbursing domestic steel producers as the industry

suffers from a sharp drop in foreign supplies. Currently, steel exports are not covered by the Remission of Duties and Taxes on Export Products scheme, which provides for reimbursement of various embedded charges in sectors such as automobiles and agricultural products. It is claimed that the Indian government will have to allocate almost $244 million per year to offer compensation to the steel industry.

Source: GMK Center, 10 November 2022

In collaboration with Belgium, Morocco has launched a project for the production and storage of thermal energy from renewable energy sources within the Noor Ouarzazate solar complex, located in the Drâa-Tafilalet region in Morocco. Dubbed SOLHEATAIR, the project is ‘an integrated renewable solution for the production, storage, and valorization of heat produced by renewable energy sources,’ stated renewable energy agency Masen.

Source: Morocco World News, 12 November 2022

Fortescue Future Industries (FFI) has engaged with one of Indonesia’s largest private steelmakers to undertake an ambitious decarbonization strategy. Fortescue chairman Andrew Forrest said that FFI and Gunung Raja Paksi (GRP) will investigate how green hydrogen and green ammonia, produced by FFI, can be used in GRP’s steelmaking operations. Forrest said FFI was in green steel discussions in Europe that could be on a larger scale than the GRP collaboration ‘but this is our biggest play in Asia’.

Source: Financial Review, 13 November 2022

ArcelorMittal South Africa hopes to restart its Saldanha Bay operations on the Western Cape, and re-employ hundreds of people as a result, an energy application lodged with the energy regulator has shown. After stating for some time that it might reopen the facility using hydrogen made from renewable energy, the steel giant hopes to make lowcarbon iron at the facility. The company is also in talks with Eskom, an energy company, regarding a three-year electricity supply deal.

Source: IOL, 13 November 2022

PD Ports, a UK-based port, shipping and logistics business, has announced a £10m investment to build a steel distribution centre at UK steel distributor Barrett Steel’s Groveport site. The proposed facility will strengthen Barrett Steel’s national distribution network and allow for just-in-time deliveries to be made across the UK; it will be the first building in the country to be constructed with X-Carb steel, made using 100% recycled content, and 100% renewable energy from steelmaker ArcelorMittal.

Source: Steel Orbis, 14 November 2022

A Tata Steel worker has sustained bullet injuries after an unidentified attacker allegedly fired at him in India’s Odisha’s Dhenkanal district. The victim, a crane worker, was rescued in a critical condition and admitted to the Angul District Headquarters Hospital. Police have started an investigation to identify and convict the accused.

Source: Sambad English, 14 November 2022

Critical Minerals Association founder Jeff Townsend has joined the Materials Processing Institute as the latest member of its PRISM Advisory Board. PRISM is a five-year research and innovation programme, led by the Institute to decarbonize and boost productivity within the steel and metals sector. Funded through Innovate UK, part of UK Research

Trane Technologies, a heating, ventilating, and air conditioning system manufacturer, plans to use low-carbon Econiq steel from US steel giant Nucor and verdeX from US Steel to reduce the company’s overall carbon impact, according to a company report. The low-carbon steel products will be used in sustainable heating, ventilation, and air conditioning products.

Source: Kallanish, 14 November 2022

and Innovation, it supports Government aims to achieve net zero by 2050, while levelling up the UK regions. The programme focuses on projects and investment that support the transition to a low carbon economy by supporting innovation in decarbonization, digital technologies, and the circular economy.

Source: Bdaily News, 14 November 2022

Primetals Technologies (Primetals), a UK-based engineering and plant construction company, has

completed the modernization of Gerdau's Monroe electric steel plant in Michigan, USA. Primetals supplied the technical equipment for the facility's electric arc furnace, a new twin ladle furnace, a material handling system, auxiliary equipment, and steel engineering design and also oversaw the construction and commissioning of all units.

Source: Yieh Corp, 15 November 2022

Employees of one of Iran’s largest steel companies have joined other steel and oil workers going on strike in solidarity with the current wave of protests as a result of ‘government mismanagement and unfair wages’. Esfahan Steel Company – also known as Zob Ahan – is Iran's third largest steel producer and is the largest factory in Iran producing steel for the construction industry.

Source: Iran International Newsroom, 16 November 2022

AJ Steel, a UAE-based steel pipe manufacturer and exporter, has signed an agreement with Kezad Group, an integrated trade and logistics company, for the development and operation of a large-scale steel pipe production facility in Abu Dhabi, to meet growing consumer demand. Under the agreement, AJ Steel will expand its current operations through the development of a plot covering close to 96,000 sq m, which will bring its total to 200,000 sq m of leased land under industrial use.

Source: Zawya, 16 November 2022

British Steel has secured an order to support an underground gold mine in Australia. The first shipment, comprising 250 tonnes of special profiles – or ‘tophats’– has begun its journey from the company's mill in Skinningrove, UK, to Australia, where the profiles will help construct a 1,460m shaft for the Tanami gold mine expansion. A further two shipments later this year will complete the order. Tophats, so called because their crosssection resembles a top hat, are used as shaft guides, guiding cages and skips in mineshafts.

Source: Insider Media, 17 November 2022

The last batch of bracelets made from metal produced by the Azovstal steel plant in Mariupol, a symbol of Ukrainian resistance to Russia's invasion, have gone on sale across Ukraine. Proceeds from the bracelets will go to an organisation helping finance the procurement and maintenance of drones used by the Ukrainian military. "We are proud to be Ukrainian when we wear this bracelet. This is a very strong feeling," said Yurii Ryzhenkov, the director of Metinvest, which owns Azovstal.

Source: Reuters, 17 November 2022

Chris Evans, the UK Labour Party's shadow defence minister, has criticized the decision to partially construct Royal Navy supply ships in Spain, claiming that 6,000 jobs would have been created had work been carried out entirely in the UK. The £1.6 billion contract will see final assembly for the three vessels – each the length of two Premier League football pitches – take place at Harland & Wolff's shipyard in Belfast, with the rest of the work being carried out at the Cadiz shipyard of Navantia. Evans commented: "This is about creating British jobs for British workers, with British ships, using British steel. Source: News Letter, 19 November 2022

Devki Steel Mills Ltd of Kenya has opened a raw steel production factory, one of the largest in East and Central Africa, in Kwale. The steel mill is envisaged to employ thousands of local youths and has been fitted with the latest machinery to produce steel from iron

ore. The integrated mill is expected to revive the iron and steel industry in Kenya and drive infrastructure, manufacturing and affordable housing development projects that will ‘transform the lives of millions of Kenyans’.

Source: Capital Business, 20 November 2022

Beijing Benz Automotive Co (BBAC) and Baosteel have signed a memorandum of understanding (MOU) to jointly promote the application of cleaner raw materials in vehicle manufacturing and to build a green automotive steel supply chain, according to a post on the company's WeChat account. Under the ‘Supply Chain 2039 Carbon Neutrality Action Plan’ set by BBAC, the joint venture has raised requests on carbon emission reduction to its suppliers in a bid to achieve carbon neutrality across its entire supply chain by 2039.

Source: Gasgoo, 23 November 2022

Pramod Mittal, former steel magnate, and brother of ArcelorMittal’s CEO Lakshmi Mittal, has had his proposal to pay 0.18% of his £2.5 billion debt to creditors revoked, due to a ‘material irregularity’. The judgment came as Moorgate Industries Ltd, whose petition got Mittal declared bankrupt for the outstanding debt of £140 million, objected to the individual voluntary arrangement on the ground that it involved sham

Germany steelmaker

Salzgitter has announced that its subsidiary, Salzgitter Flachstahl GmbH, has signed a memorandum of understanding with German automotive supplier Mubea to co-operate on sustainable steel production, green steel product processing, and steel recycling. Mubea claims to be committed to reducing its carbon emissions by at least 25% by 2025, while Salzgitter plans to incrementally switch its production of steel to hydrogen-based processes, with the aim of being virtually carbon neutral by 2033.

Source: Steel Orbis, 23 November 2022

Mining giant Rio Tinto has shown the effectiveness of a low-carbon iron-making process using ores from its mines in Australia in a smallscale pilot plant in Germany. The company is now planning the development of a largerscale pilot plant to further assess its potential to help decarbonize the steel value chain. The process, known as BioIron, uses raw biomass instead of metallurgical coal as a reductant, and microwave energy to convert Pilbara iron ore to metallic iron in the steelmaking process. BioIron, says Rio Tinto, has the potential to support near-zero CO2 steelmaking, and can result in net negative emissions if linked with CCS technology.

Source: Green Car Congress, 23 November 2022

ArcelorMittal Kryvyi Rih has reduced its electricity consumption by three times compared to the pre-war period. Normally, the plant consumes 400 MWh, while now it consumes 120 MWh, stated Mauro Longobardo, CEO of ArcelorMittal. The reduction of consumption is due to ‘mass shelling of the energy infrastructure of Ukraine by Russian troops’, he said.

Source: GMK Center, 24 November 2022

creditors, which prejudiced its interest, and would have meant that they would have received just £252,000.

Source: MoneyControl, 26 November 2022

More than 1,000 former members of the British Steel pension scheme who received unsuitable advice from financial advisers accused of ‘enriching’ themselves, will receive an average payout of £45,000 in compensation. The Financial Conduct Authority will also temporarily ban the firms who gave the advice

from paying shareholders dividends or giving bonuses to directors in order to ensure they do not shift money out of the business before compensation is paid. They will be forced to make payouts totalling £49m by February 2024.

Source: The Guardian, 28 November 2022

Baby product company Green Sprouts has voluntarily recalled its stainless-steel straw bottles, sippy cups and straw cups that were sold at Whole Foods, Buy Buy Baby, Amazon and Bed Bath & Beyond, due to a lead poisoning hazard. The company, based in North Carolina, USA, stated that the bottom of the recalled bottles can break off, which would expose a solder dot that contains lead. Source: ClickonDetroit, 26 November 2022

Steel producer Gerdau has announced that it has signed a binding agreement via its subsidiary Gerdau Next, with Newave Energia, in a joint venture to produce 2.5 GW of energy from renewable sources, solar and wind based, in its greenfield projects. According to Gerdau, Newave is 'accelerating the energy transition in Brazil’, and ‘promoting the power of choosing renewable and competitive energy’.

Source: Steel Orbis, 28 November 2022

ArcelorMittal Mining Canada has won an EnviroLys Award in the ICI+ Green Project category for introducing the use of pyrolytic oil at its Port-Cartier site. The awards recognize ‘expertise in the green economy, entrepreneurship and innovation of companies in the environmental services industry’. They are awarded by the Council of Environmental Technology Companies of Quebec. Mapi Mobwano, president and CEO of ArcelorMittal Mining Canada, said that replacing part of the heavy fuel oil used in Port-Cartier with pyrolytic oil is the first step in the company's energy transition. "We are delighted to receive this recognition by the industry," he said.

Source: Cision, 28 November 2022

Steel production in Russia will have decreased by 6-8% year-on-year by the end of 2022, according to the Russian Ministry of Industry and Trade. Production is expected to stabilize next year, and won't witness a further decrease, it is claimed. The World Steel Association stated that at the beginning of Putin’s invasion of Ukraine, it was expected that Russia’s demand for steel in 2022 would decrease by 20% compared to the previous year. High oil prices and state support for construction led to a revision of the forecast.

Source: GMK Center, 28 November 2022

Dutch prosecutors have inspected Tata Steel’s IJmuiden facility as part of a criminal investigation into pollution around the site. The Public Prosecution Service stated that its visit was to gain greater insight into the steel production process, ‘specifically into the operation of the coke and gas factories.’ In February, officials said they would investigate Tata and Harsco Metals Holland BV over whether they intentionally and unlawfully introduced hazardous substances into the soil, air or surface water.

Source: Bloomberg UK, 29 November 2022

ArcelorMittal’s Solihull site in the UK has relocated to new offices at Friars Gate, also in Solihull in the West Midlands. The 45-strong team are now fully operational in the 7,060 sq ft office space. The relocation process was led by KWB Workplace director Adrian Southall. Karen Reading, company secretary at ArcelorMittal, said: “We’re really happy with KWB’s work and delighted to be in our new office".

Source: The Business Desk, 29 November 2022

The Sabah Oil and Gas Development Corporation (SOGDC) has signed a memorandum of understanding with Esteel Enterprise Sabah Sdn Bhd for a green steel project, which is expected to have a total investment value of $4.39 billion. According to a statement by SOGDC, the deal reflects the importance of reducing the steel industry's carbon footprint.

Source: The Star, 30 November 2022

The Federal Ministry of Germany for Economic Affairs and Climate Action has granted around €880,000 to local steelmaker Georgsmarienhutte GmbH’s decarbonization project. The steelmaker plans to build a bar tempering plant, which will use green electricity instead of natural gas, resultantly reducing carbon emissions and dependence on natural gas imports. The plant is scheduled to be in operation by mid-2023.

Source: Steel Orbis, 29 November 2022

For more steel industry news and features, visit www.steeltimesint.com

Harsco Corporation, provider of environmental solutions for industrial and specialty by-products, has announced that its Harsco Environmental division has renewed its contract with Tata Steel at the Port Talbot steelworks in the UK for a period of five years. Tata Steel is the UK’s largest steel producer. Harsco has been providing critical services, including metal recovery, scrap processing, slag handling and oxygen steelmaking services at Port Talbot for more than 40 years.

Source: yahoo! finance, 30 November 2022

Russian steelmaker Severstal has lost over $400 million as a result of Western sanctions, chairman of the company's board of directors Alexei Mordashov said at a plenary meeting as part of the Russian Industrialist Forum. “We all understand that, now, it is very difficult to return foreign exchange earnings to the country, partly impossible,” he noted.

Source: Kallanish, 30 November 2022

ArcelorMittal is planning to use the Energiron direct reduced iron (DRI) technology developed by Tenova and Danieli to decarbonize its Dofasco plant in Hamilton, Ontario, according to a report from Kallanish. ArcelorMittal has contracted the Energiron Alliance, a joint operation between Tenova and Danieli, to design and construct an Energiron DRI plant boasting a production capacity of 2.5Mt/ yr.

Source: Kallanish, 30 November 2022

Metinvest has allocated UAH 4 million to the ‘development of tactical medicine for Ukrainian military personnel.’ According to a company statement; “First aid skills are an integral part of the modern training of servicemen of the armed forces of Ukraine. They provide an opportunity to support the life of the injured person until qualified medical assistance is provided. During the war, the number of defenders of Ukraine increased

significantly, so the need for qualified medical training of the military also increased.”

Source: GMK Center, 1 December 2022

Jindal Shadeed Iron & Steel (JSIS), has unveiled plans to invest over $4 billion aimed at positioning the Omanbased company, as well as the Sultanate of Oman, among the leading producers of green steel globally. It includes initiatives to establish an integrated steel plant in the Special Economic Zone (SEZ) in Duqm, Oman, complete with renewable and hydrogenpowered components to enable the production of green steel. “JSIS’s plan is to collaborate with the Government of Oman and create a renewable powerdriven hydrogen ecosystem in Duqm,” said a company official. Source: Zawya, 1 December 2022 Tata Steel which has made investments of over Rs 75,000 crore in Odisha, Eastern India, will continue to invest in the state (which accounts for 25% of India's total steelmaking capacity) says managing director and CEO T V Narendran. Narendran was speaking at the 'Make in Odisha Conclave 2022' in Bhubaneswar, Odisha. "The Tata group of companies, and more specifically Tata Steel, has invested over Rs 75,000 crore in Odisha in the last five years. We will continue to invest to support the growth in Odisha," he stated.

Source: Business Standard, 1 December 2022

The Liège Company Court has appointed a provisional administrator and a legal representative for Liberty Steel, a move that should speed up the sale of its two Liège plants. The decision should accelerate the sale of Liberty's two sites in Liège – the galvanisation unit in Tilleur and the tinplate packaging unit in Flémalle. Both were taken over in 2018 by the steel subsidiary of the GFG Alliance, with its ownership having since been contested due to the collapse of Greensill Capital, and criminal investigations over suspected fraud.

Source: The Brussels Times. 2 December 2022

IN the 1950s and 1960s, demand for high quality steel encouraged manufacturers to produce large quantities of steel in integrated mills through iron ore refining. This steel had a very high-quality and a very well controlled chemical composition, characteristics that made it possible to meet all product quality requirements. The energy crisis of the 1970s made thermal efficiency in steel mills a priority and while the furnaces used in the integrated plants were very efficient, the production practices had to be improved. The plants from the 50s and 60s produced steel in batches so some equipment was idle while others were in use. To reduce energy consumption, continuous casting was developed and blast furnaces were continuously fed to use heat more efficiently.

Environmental concerns became more relevant in the 80s and 90s, making regulations more stringent and prompting further changes in the steelmaking industry. Competition increased during this period due to decreasing local markets and increasing numbers of foreign steel production plants. Such competition forced steelmakers to reduce expenses and increase quality. To meet these changing needs, just-in-time technology became more common and integrated steel plants started to be replaced by minimills that use ferrous scrap as raw material. At this time, the main drawback of the minimills was that they were not able to attain a tight control over the chemical composition and, thus, could not produce high quality steel consistently.

In the second decade of the 21st century, overcapacity became one of the main

*Area leader, primary and EAF decarbonization, ArcelorMittal

Throughout human history, steel has been considered one of the prime global industrial materials. However, with the technological evolution of society, the ways of producing steel have been adapting to the evolution of political, social and technological trends, says Asier Vicente*Fig 1. Technology route share estimation based on plausible scenarios Fig 2. World DRI production by regions

concerns from the industrial benefits’ point of view due to the global economic situation. This concern needs a major focus on innovation to face the new challenging scenario. Apart from this, the need for new measures to abate global climate change is provoking a new shift in the steelmaking paradigm as the steel industry is responsible for 7-9%1 of the 40Gt of CO2 emitted by human activities each year. Consequently, the international steel industry is under immense pressure to lower its CO2 emissions.

The top steel producers have already set ambitious goals to become carbon neutral in the coming years (EU by 20502 and China, by far the largest steel-producing country, by 20603). To fulfil these goals, a large number of technologies are being suggested, developed and evaluated.

Some of the largest steelmakers (China Baowu Group4, ArcelorMittal5, Nippon

Steel6, POSCO7, Salzgitter8, Tata Steel9 and Voestalpine10) have already published their global decarbonization roadmaps. The proposed strategies cover the following actions:

• Short term: pellets to replace sinter, increase ferrous scrap usage, increase the energy efficiency of the processes and start replacing natural gas with hydrogen.

• Mid-term: include carbon capture solutions and start using hydrogen as a reductant.

• Long term: full deployment of hydrogen technologies to produce steel and use of renewable energy sources.

Within this context, the Electric Arc Furnace (EAF), the main scrap-based steelmaking process, and hydrogenbased DRI, are gaining more and more importance in terms of new steelmaking trends. However, integrated steelmaking

industries (BF-BOF) are keenly aware of the current global environmental issues and are also taking action to reduce their CO2 footprint. Hydrogen plays a critical role in the decarbonization pathway and this can be seen by looking at some of the ongoing hydrogen-based steelmaking projects in Europe11:

• HYBRIT, a joint venture between SSAB, LKAB and Vattenfall to produce fossil-free steel by 2025

• ArcelorMittal, in collaboration with MIDREX, is building a 100kt/year production site using 100% hydrogen in Hamburg

• Thyssenkrupp, in association with REW, is transforming the current BF-BOF operation into H2-DRI in Germany

• LKAB will start producing sponge iron with hydrogen from renewable energy sources

• Voestalpine, in collaboration with

Siemens, Verbund, K1-MET, TNO and the Austrian power grid, will implement a 6MW electrolyzer in Austria

• Salzgitter will study the technoeconomic feasibility of hydrogenbased steelmaking (SALCOS project)

Although replacing natural gas with hydrogen as the reductant element seems to be one of the main pillars in the decarbonization road map, no technoeconomic feasibility study of the technology nor the industrial gas volume availability for coping with future steel demands are assured for the time frame set by the steelmakers. Moreover, all the models are based on predictions over energy markets, CO2 taxes and the evolution of prices for novel technologies.

Apart from hydrogen-based technologies, near-zero-emissions ironmaking and carbon capture technologies/projects are also worth-mentioning:

• Top gas recovery from BF/BOF to reduce BF coke consumption and generate electricity using the gas to feed a turbine by STEPWISE (Sweden) and ArcelorMittal (Belgium)

• Partial replacement of coal and coke with biomass in the TORERO project by ArcelorMittal (Belgium).

• Several carbon capture technologies in the primary route and C02 recycling from BF projects: Steelanol (Belgium), Lanzatech (China), Carbon2Chem (Germany), FReSMe or Carbon4PUR (Europe) and IGAR (Belgium).

• Hydrogen injection as a reductant in the BF (Thyssenkrupp).

• Carbon capture solutions applied to DRI emissions by AI Reyadah (AbuDhabi)

• Natural gas substitution by hydrogen in DRI production by MIDREX.

• Molten pig iron production using coal instead of coke in Hlsarna by Tata Steel.

• Iron ore electrolysis to reduce the ore in a solvent at low temperatures (SIDERWIN, Europe)

Steel recycling will play a major role in every decarbonization scenario. Although EAFs can consume 100% scrap, nowadays BF-BOF steel mills cannot use more than 20% scrap to reduce their carbon footprint. Approximately 70% of the world’s existing BFs will reach their end-of-life before 203012 and technology investments will be required to continue their operation as BFs. Another alternative is that these plants are replaced with EAFs fed by the

Fig 4. Scrap availability trends

Fig 5. Recyclability of steel products at the end-of-life

same proportion of scrap (20%) and further reduce their emissions by 55% by 2030. These reductions could reach 73% (scrap + DRI from H2), including 41% reduction from optimized scrap use13

Consequently, scrap-based steelmaking and replacement of the BF-BOF route with the DRI-EAF route seems to be the industrial trend for most steelmakers, as

displayed in Fig 1. The baseline considers the lowest total cost of ownership (TCO) of investments without a net zero constraint. Carbon cost includes a carbon cost for the emitted CO2 and Tech Moratorium is the carbon cost confining investments to zeroemission technologies, to reach net zero from 2030 onwards.

To proceed with this transition, DRI and

Optimize your Flow Control –from ladle to mold

Let’s go beyond refractories and dive into our customized solutions for clean steel, safety, productivity, and green steel that will support you in achieving all your goals. beyond-refractories.com

scrap should be available in the market. DRI production in 2021 was 119.2Mt15 and the production distribution by regions is shown in Fig 2. It is expected that an additional 108Mt of DRI will be required to cope with the BF-BOF to DRI-EAF transition to fulfil the new green steel demands. A deficit gap of 41Mt (demand versus supply) of seaborne DR pellets16 has been estimated by comparing the current and 2030 predictions for seaborne demand/supply.

Due to the deficit gap, some countries will probably have high quality DRI supply problems or additional costs due to supply logistics (this will be Europe’s case as the main DRI importer). This fact makes steel recycling the best cost-competitive option to decarbonize the steel sector. Worldwide ferrous scrap supply in 2021 was 667Mt and it is expected to grow to 866Mt by 203018. As an example, Fig 3 shows the

ferrous scrap availability estimations for Europe for the coming decades:

Despite the significant increase in scrap availability shown in Fig 3, all models predict a negative balance between scrap availability and steel industry demand (see Fig 4).

The amount of available scrap depends on the theoretically recoverable scrap volume (ie all products reaching their endof-life) and the share of that amount that is actually recovered, (ie the collection rate).

Fig 5

The endless cyclic use of scrap as a raw material is one of the most important characteristics from a sustainability point of view and one of the strengths of steel. In fact, when scrap is recycled, the new steel inherits the properties of the original materials and these can be modified during the steelmaking process or through ulterior

thermal processes.

As it has already been mentioned, although scrap-based processes will gain importance in future steelmaking, primary steel production will remain. One of the main reasons is due to scrap availability, defined by past production, and the recycling rate at the moment under consideration. Nowadays, steel’s recycling rate is around 85%, since there is some low-quality scrap that is not being reused.

Fig 6

The current recycling rate is important to define the future recycling strategies and maximize the availability of natural resources. It should also be noted that obsolete scrap characteristics are expected to drastically change and worsen because of the increasing complexity and heterogeneity of the available ferrous material. Looking at these forecasted steel scrap demands, a 100% recycling rate should be reached to boost steel decarbonization through scrapbased steelmaking. Fig 7

To increase the recycling capacity and energy efficiency, innovative technologies to ‘treat’ the scrap before it reaches the steelmaking reactors needs to be implemented; impurities in post-consumer scrap should be reduced before melting the scrap with a better classified one. In this way, scrap use would increase while achieving the same quality in the finished product. To achieve this, the following goals are proposed:

• Identify and characterize new

Fig 9. Penalties in €/ton of scrap due to %FeO (left), %SiO2 (centre) and %CaO (right)

opportunities to use and reuse lower-quality scrap by having a better understanding of the scrap market and the opportunities.

• Select and integrate the best available technologies to upgrade, sort and characterize lower-quality scrap to enhance the scrap quality

• Industrial demonstrator of scrap sorting/cleaning based on innovative combinations of BATs

• Define the valorization routes of waste generated by upgrading the schemas

In order to measure the material quality after the upgrading processes, the Value In Use (VIU) concept23 has proved to be very useful as it relates scrap quality with the operating cost of the EAF. This tool estimates the melting costs of scrap compared to a reference cost. It has been demonstrated that there is a clear relationship between the VIU and the process performance (mainly its metallic yield) of each scrap grade. However, the nature of the non-metallic materials, as well as the degree of iron oxidation, has a great influence on the material

performance in the process too. For this reason, establishing a criterion to compare different scrap grades, not only enables the evaluation of the influence of the scrap chemical composition over the steelmaking processes, but also the pre-processing (dismantling, shredding...) and postprocessing (storage, mixing...) techniques used for each grade.

The VIU of a particular scrap grade includes the purchasing costs, the metallic yield and the additional costs associated with the extra energy consumption and other material consumption (electrode, refractories, fluxes …) that arise from the melting of the non-metallic materials in the scrap. Fig 8 and Fig 9 quantify the impact of the non-quality materials of the scrap in the EAF process24

Contrary to widespread belief, scrap quality does not make it impossible to replace BF-BOF with EAFs in the production of highend steel, provided that scrap management is improved and that scrap impurities are diluted by the addition of some ‘virgin’

iron such as DRI. Nonetheless, optimizing the use of scrap would mainly require an improvement of the collection and segregation strategy of scrap categories, the implementation of the material upgrading schemas and an improved assessment of the scrap features that are most suitable for each steel production technology considering the needs and constraints (see Fig 10).

Due to stringent restraints to abate climate change and efforts to reach carbon neutrality, EAF steelmaking is expected to become the most popular route for steelmakers due to its link to the circular economy and industrial symbiosis concepts. Nevertheless, steel will still be produced through the integrated route although some actions should be taken to make it more sustainable (for example, scrap upgrading) and profitable (VIU).

Scrap is an extremely complex material as it contains a ferrous matrix of iron and other metals together with undesired elements such as coatings, dirt, sterile, foreign materials (plastics, wood, glass) and oxidized layers. To optimize the

Fig 10. Overall analysis of raw material quality considerations for steel production

overall EAF process, detailed information on the quality of the raw material is crucial. Therefore, tools/methods that can quickly and efficiently provide information (chemical composition, distribution, physical

1. https://worldsteel.org/

morphology, material degradation, presence of moisture) are a must and R&D should look for tools and means to ensure the steel sector’s capacity for delivering high-quality steel grades using different raw materials

while contributing to the sustainable value chain for steel. Consequently, further efforts to improve EAF-based production and to integrate it in the future carbon neutral steel production scenario are needed. �

2. https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2050-long-term-strategy_en

3. https://www.nature.com/articles/d41586-020-02927-9

4. http://www.chinadaily.com.cn/specials/sasac/Baowu2020CSR.pdf

5. https://corporate-media.arcelormittal.com/media/bg1n545s/arcelor-mittal-integrated-annual-review-2021.pdf

6. https://www.google.es/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwjtuort0sH6AhXR8IUKHd1fCvAQFnoECAYQAQ&url=https%3A%2F%2Fwww.nipponsteel.com%2Fcommon%2Fsecure%2Fen%2Fcsr%2Freport%2Fnsc%2Fpdf%2Freport2021.pdf&usg= AOvVaw3fVa2QDYAJr2WFXsEc-88t

7. https://www.posco.co.kr/homepage/docs/eng6/jsp/dn/irinfo/posco_report_2020.pdf

8. https://salcos.salzgitter-ag.com/en/index.html?no_cache=1

9.https://www.tatasteeleurope.com/sites/default/files/TSE%20Sustainability%20report%202019-20%20%28EN%29.pdf

10.https://www.voestalpine.com/group/static/sites/group/.downloads/en/share/corporate-responsibility/2020-corporate-responsibility-report.pdf 11.Carbon-free steel Production: Cost reduction options and usage of existing gas infrastructure; EPRS | European Parliamentary Research Service (2021) 12. Global Steel at a Crossroads Why the global steel sector needs to invest in climate-neutral technologies in the 2020s. Global Steel at a Crossroads, Agora Industry, November 2021 13. Romain Su and Adrien Assous, Sandbag smarter climate policy (2022) 14. https://dash-mpp.plotly.host/mpp-steel-net-zero-explorer/ 15. www.midrex.com 16. Boston Consulting Group

MidrexSTATSBook2021 18. https://worldsteel.org/media-centre/blog/ 19. LOW CARBON ROADMAP - Pathways to a CO2-neutral European steel industry, EUROFER, 2019. 20. https://missionpossiblepartnership.org/wp-content/uploads/2022/09/Making-Net-Zero-Steel-possible.pdf 21. http://spain.arcelormittal.com/who-we-are/management.aspx 22. ArcelorMittal - Global corporate responsibility report 2014 23. J.-P. Birat, X. Le Coq, P. Russo, E. Gonzales, J.J. Laraudogoitia, Quality of heavy market scrap: development of new and simple methods for quality assessment and quality improvement. (2002 - RFCS) 24 Asier Vicente Rojo. New methods for ferrous raw materials characterization in electric steelmaking. PhD thesis (2020)

RISING inflation, a cost-of-living crisis and forecast economic slowdown makes the UK’s path to industrial decarbonisation look increasingly tough. Against this backdrop policymakers cannot afford to ignore the chance to create value and deliver broader economic benefits from already available resources – especially when they can play a role in advancing environmental sustainability. Scrap steel is currently undervalued in the UK’s industrial policy, and a potential major missed opportunity in creating a sustainable circular economy.

The UK Government has set itself the legal target of ensuring the country has Net Zero emissions by 2050 in the Climate Change Act. Businesses are already working on the assumption that implementing environmental sustainability in their operations is no longer just a ‘nice-tohave’. While the politicians are wrestling about the tension between decarbonisation and economic growth, there is significant opportunity for both the UK Government and UK industry to take a leading role in the green transformation.

In July, new reports by influential think tanks Green Alliance and Bright Blue both identified that scrap steel can play a major role in enabling the steel sector to decarbonise its UK operations by 2035.

The reports, produced as part of a policy partnership convened by Liberty Steel and launched at COP26 in Glasgow, both highlight the possibility of transforming scrap’s current role as low-cost export into a strategic asset.

The Green Alliance and Bright Blue reports highlight that a consensus view is now emerging around which technological approaches will be necessary for decarbonising the UK steel industry, involving three approaches: increased utilisation of scrap and electric arc furnaces (EAFs), hydrogen-based steelmaking, and conventional (primary) steelmaking with Carbon Capture and Storage (CCS).

EAFs hold particular promise: they can be implemented relatively quickly, are costeffective and make use of the abundance of scrap in many developed economies.

As Green Alliance notes in its report: “Rapidly shifting more UK steelmaking towards electric production, using scrap steel and EAFs, would offer guaranteed emissions reductions in the short term”. In fact, Green Alliance predicts that expanding EAF steel production, while phasing out blast furnaces by 2035, would cut emissions by over 87%, relative to 2019

levels, through process substitution and grid decarbonisation.

By prioritising EAF production, there would also be the additional benefit that it would “allow the UK to maintain a level of ore-based production in future, based on the hydrogen direct reduction process”. This would reduce the number of valuable assets that are written off prematurely and support the industry in decarbonising in an environmentally and economically sustainable way.

As the reports emphasise, it is essential that the Government recognises the importance of EAFs in addressing the climate problem and as the main pathway for decarbonising the steel industry today.

EAF production recycles scrap metal and turns it into crude steel, or ‘secondary steel’. This preserves ‘the value of steel already in circulation by recycling steel into new alloys and products while reducing waste and emissions’ and helps steel to play an active role in the circular economy.

Fortunately, the UK is well placed to expand its EAF steel production.

The UK produces more scrap each year than virgin steel. However, much of this valuable resource is exported overseas,

rather than used domestically. The UK generates 10Mt/yr of steel scrap of which 80% is exported to other countries for recycling.

Since EAFs present an existing way to produce low-carbon steel using relatively little energy, the number of arc furnaces globally will undergo a dramatic increase in the coming years. Already accounting for around 30% of global production, they

will increasingly replace primary plants that require reinvestment, meaning that the proportion of scrap in total worldwide steel production is likely to reach 40% in 2050.

As a result, demand for scrap is likely to grow: competition for scrap is a material concern for the industry, with EAFs requiring higher quality inputs than blast furnaces. Scrap steel – currently a low-value export – can become a high-value, strategic

asset, and its export should be approached with national strategic benefits and risks in mind.

There are various methods which would help to increase access to these crucial raw materials and, therefore, help the steel industry to decarbonise.

By adapting incentives and standards to encourage investment in scrap processing and domestic retention of scrap steel, the Government could drastically improve the efficiency of EAF production and the quality of steel it is capable of producing.

In the reports, Bright Blue notes that, with ‘the right incentives and standards to encourage higher quality scrap processing and a domestic scrap market, a more resilient and resource-efficient steel sector could be created’.

Moreover, this will help to retain these valuable materials in the UK market, helping us to achieve a more circular economy and reducing the need for primary steel through traditional blast furnace methods. Incentivising scrap processing and improved standards would drastically ‘improve material circularity, leading to a significant and rapid reduction in emissions from domestic steelmaking’.

Another added benefit of investment in sorting and processing would be the additional rare earth metals – used to make parts, equipment and machinery – which would otherwise be lost.

The reports, therefore, recommend introducing specific incentives for the domestic retention of scrap steel to ensure a higher quality scrap supply for domestic producers and enable a lower carbon, more circular UK steel industry, better protected against global supply chain shocks.

Bright Blue also recommends introducing a cap – reducing over time – on the total weight of scrap metal exports, with the intention of at least halving scrap exports by 2030.

Despite the clear benefits of moving towards EAF production, there remain limitations around the types of products that EAFs can produce.

Certain product ranges are difficult to produce with higher scrap content or require very high-grade scrap with low residual levels and/or a targeted chemical analysis, due to contaminants like copper.

However, increased investment has already seen EAF capabilities expand to be

able to produce more products. Most types of steel products can be manufactured in a carbon-neutral way in certain jurisdictions globally.

What is now required is increased investment into scrap sorting and processing technologies.

The UK produces large quantities of scrap, in excess of what UK steelmakers require for their own production. However, it is often in a poor condition.

Despite this, there are various methods by which we can upgrade scrap that is in poor condition and convert it to lowresidual scrap, which has greater value to UK steelmakers, by processing it to remove contaminants.

Furthermore, investment in sorting technologies will create other benefits outside of steelmaking, since the innovations will be transferable to other metals including iron, lead, aluminium, copper and zinc.

To offset some of the higher costs associated with processing and upgrading scrap metal in the UK, Bright Blue recommends that the Government provides total VAT relief on the purchase of lowresidual scrap.

Green Alliance’s analysis also supports scrap incentives, saying that any emissions

not cut by expanding EAF production and phasing out blast furnaces by 2035, could also be further reduced by targeting the residual emissions from EAFs and developing our processing capabilities.

Therefore, the reports highlight that shifting to EAF technologies and investing in scrap is a ‘no-regrets option’ for the UK Government and an opportunity that we can take advantage of in the short-term.

Countries which are the first to decarbonise their steel making will gain the greatest economic advantage internationally in a strategic sector. This makes addressing the issue both an opportunity as well as a necessity, with steel as the leading source of industrial emissions on the plant and a building block for future development.

For the UK steel industry, this presents us with a stark choice. As Frank Aaskov, energy & climate change policy manager at UK Steel, told the Environmental Audit Committee recently, “Either you have a decarbonised steel sector or you do not

have a steel sector at all”.

The technology to produce lowcarbon steel exists now and, through the development of a supportive policy environment, the UK steel industry is well placed to take a leading role in the push towards decarbonisation.

By increasing our use of existing, mature technologies, such as electric steelmaking (EAFs) and facilitating the availability of scrap, the UK Government can assist the industry in making the necessary steps to invest in green steel and help to achieve the legal net zero targets that it has set itself.

GFG Alliance and Liberty Steel believe that now is the time for the steel industry to come together with Government to develop world leading solutions to the issues ahead of it and facilitate the roll-out of EAFs in the decarbonisation process.

By taking these steps, industry, thought leaders and Government could ensure a resilient and low-carbon future for an industry which is critical for both the nation’s growth, development and net zero ambitions. �

IN the Rumi fables written in the 13th century there is a story about a man that helps a bear, and in return, the animal decides to protect its helper from evil. When the newly adopted protégé was fast asleep an insect settled on the forehead and immediately the bear killed it with a strong blow of its paw. Unfortunately, the man also died and the concept ‘a bear’s service’, meaning an act with good intentions but fatal outcome, was born. We still use that expression in our daily life in many languages around the world; acting with good intentions with unintended, negative, results is evidently part of human nature and a close companion in our history. The relevance to circular economy and the concept of ‘recycled content’ is that an uncritical use may lead to more greenhouse gas emissions, not less, and that there are other concepts that better support decarbonization and circularity. Demanding a certain recycled content for steel might turn out to be a bear’s service to the climate.

In order to optimise the environmental properties of a product, you have to look at its entire life cycle and the continuation of the used materials into the next. This is studied in Life Cycle Assessment (LCA) projects and used in Environmental Product Declarations (EPDs). For buildings the standard EPD, EN 15804, divides the assessment into a number of modules (as shown in fig 1). Module A describes the process that starts with virgin and recycled material as well as reused products, leading to a building that is ready to use. Module B describes the operations, environmental loads, and resource use during the building’s life time, and module C shows the deconstruction stage where materials are recovered for either reuse or recycling, if not deposited as waste, which is almost never the case for metals. Building a bridge from stainless steel means having a high environmental burden in module A compared to other materials which becomes lower in module B when taking maintenance and product life into account.

The environmental value of reuse, including refurbishment or formatting of a product, and recycling including remelting, is calculated in module D, where calculation rules make sure greenwashing is avoided.

*Founder and CEO, Kobolde & Partners AB

*Founder and CEO, Kobolde & Partners AB

For both reuse and recycling, module D should take into account any deterioration in quality due to circulation. Since remelting is avoided in the reuse case, the gain is higher than for recycling if the quality can be kept at a reasonably high level. The quality of recycling is included in the model but unfortunately seldom analysed in depth.

What is discussed, however, is that using virgin material has a higher environmental impact than using scrap – and regardless of the fact that in a growing global economy both virgin and recycled material are necessary for the economy – the ‘recycled content’ measure is used as an index for good environmental performance while it at best is irrelevant, and this will be discussed further on.

Steel recycling in the circular economy Steel is an 100% recyclable material which means that all collected steel scrap from industry, that is ‘new’ or often called

‘prompt’ scrap, or ‘old’ scrap, can be used in the production of steel. Scrap circulated within a plant belongs to a third category and is called ‘home’ scrap – this scrap is normally not reported in scrap statistics. Since the price of scrap is in the range of hundreds of euros per ton, the recycling rate is high – and with few exceptions steel stays in the circular economy. Losses occur for steel that are hard to recover, for example sunken ships and piping in the ground, material contaminated by radioactivity, material used in a way that it is consumed, and finally oxides in slag and dust. Even rebar, which for a long time was used for backfilling together with the surrounding concrete, is nowadays liberated and recovered for remelting. According to scrap dealers in Sweden, about 40% of traded scrap is prompt scrap and the rest is old scrap.

Steel gets its properties from its chemical

content with alloys and impurities, casting conditions, hot and cold forming, heat treatment, surface treatment etc. These operations together add to the performance as well as the environmental burdens of the steel. When reusing a steel product all these properties may be recovered in a new function whereas remelting may make use of only the iron and alloy content, but often only the iron is taken into account.

In the same way alloys may give steel desired properties, the same elements may in other cases be considered unwanted ‘tramp’ elements. Furthermore, alloys have significantly higher carbon footprints than iron since they come from ores with lower metal content than iron and often use more energy-intensive processes for extraction. Carbon footprints that are double or 10 to 20 times that of iron or even higher is not uncommon and the same goes for alloy prices.

When it comes to valorising the alloy content in scrap, the business is about

separating and sorting at the scrap processing end and storing and blending at the steel plant. Information about the scrap average chemical composition together with lot sizes play important roles in optimising alloy recovery. Most important, however, is the ambition to actually make the alloys in scrap recoverable and to use the recovery potential of scrap alloys in full. Scrap with a known chemical analysis within narrow limits has a much higher environmental and economic value than scrap with just a maximum level for certain tramp elements.

For prompt scrap, the analysis of the scrap flows is normally initially known, but keeping scrap from different steel qualities separate requires scrap management to be included in the factory design. Unfortunately, that is often a detail that is omitted when trying to decrease the investment cost of a new plant. There is an abundance of examples where end cuttings in steel rolling mills, cuttings from steel coils in the automotive industry, and turnings from machining plants in the foundry industry end up in single scrap

streams where alloys are difficult to recover due to widely varying chemical analysis and combinations of alloys that do not fit the steel products for which the scrap is used. Keeping track of scrap chemistry is seldom a priority down the production line where it is sometimes viewed as a problem and not an opportunity.

Old scrap is collected from discarded constructions, products or packaging and sorted according to one of many scrap classification systems. The sorting is done by skilled personnel often with an XRF, a hand-held instrument with which the chemical analysis of larger objects can be measured. Complex products like cars, are shredded and the resulting scrap is then automatically sorted in one magnetic and one non-magnetic fraction.

The non-magnetic flow is much smaller than that of the magnetic and contains scrap with higher metal/alloy value, and in modern shredding plants is then processed by copper, brass, different kinds of aluminium and different kinds of stainless steel being separated into different flows for further processing, which makes use of the full value of the content.

The magnetic fraction contains all ferritic steels like unalloyed steel with less than 1% of alloys and alloyed steel with nickel, chromium, molybdenum typically under 10%, ferritic stainless steel like the drum in a washing machine or the inside of a dishwasher, which typically contains more than 13% chromium. Non-magnetic metals may be trapped in ferritic steel parts and then go with the magnetic stream. The biggest problem is probably copper wire from motors that are wound up around iron kernels or wedged in a scrap piece. Examples of where copper goes with the ferritic flow are shown in Fig 2 and Fig 3; with Fig 1 showing a motor where the copper was part of the product and Fig 2 representing a situation where two pieces of different origin are wedged together. This scrap is well-suited for the production of weathering steel that is alloyed with copper but in most steel qualities, copper is a tramp element and not valorised. The scrap piece shown in Fig 4 may be nonalloyed steel, high strength steel with high manganese content, or ferritic stainless steel with high chromium etc. Such scraps increase the uncertainty of the chemical content and the loss of valuable alloys.

Finally, the circuit board in Fig 5 that also was found in a ferritic flow contains lead and tin in the solders which are detrimental in certain steel qualities.

With new technology, the magnetic flow can be processed where individual parts are identified with laser technology and directed into different streams for optimal alloy recovery and avoidance of tramp elements. The environmental benefit of such sorting both from a carbon footprint and a resource conservation perspective is

evident, but costs for the new technology are still an obstacle. The EU directives for vehicles, appliances or waste are still focusing on weight and not the recycling value so little help is in place at the moment, but hopefully the next generation of directives will look in this direction. Why is ‘recycled content’ a concept of the past that should be avoided for metals?

1) There is only a certain amount of scrap to make scrap-based steel from, and when

it runs out, only steel from iron ore remains. Scrap from end-of-life products in society is used directly and there are no large reserves of unused scrap. This means that insisting on only buying scrap-based steel does not improve anything. It is irrelevant. It may however increase transportation and add to emissions from that sector.

2) Not buying steel from virgin sources in the western world may divert virgin production to countries with less efficient ore-based steel production. This may be detrimental when fossil-free ore reduction processes emerge.

3) In many cases, although not all, it has just been a way of making a virtue of something companies have done for a long time for cost reasons, which does not indicate a real interest in circularity. This makes the label less trustworthy and valuable and indicates complacency. Using a concept without real environmental impact and not fostering continuous improvement is, perhaps, the most serious flaw.

Preparing for the product label ‘reuse and recycling

How do you design a product that avoids the problems of poor recycling of alloys discussed above? It is a million-euro question that companies engaged in meeting circularity, climate goals, and other demands from society must ask themselves. If we invent the concept ‘reuse and recycling ready’ ensuring a smooth prolongation of the products’ life and recycling of the alloys as alloys, what should it include? It is likely that we must look at the entire life cycle with repair and maintenance and then the end-of-life operations. For reuse, you need to make the product deconstruction-friendly, and for recycling you need to decide whether the product needs laser sorting or may do well with just magnetic separation. Deciding on that and dealing with labelling and documentation might be a first step. The second step would then be to make reuse and recycling work in practice with reuse-product management and different waste management streams – and finding entrepreneurs taking on the task. And sorting out the financing. That would be a real service to circularity and the climate. �

When it comes to decarbonizing the steel manufacturing process, scrap and how it is processed presents a major challenge to those wanting to lower the carbon footprint of steelmaking. This article outlines projections of scrap availability, examines different types of scrap and argues for better design of products, such as cars and appliances, with a view to endof-life dismantling so that free copper and other residuals can be removed more easily. By Jeremy Jones*

MUCH attention is being placed on EAF technology as a means of transitioning to lower carbon footprint steelmaking. However, as one begins to evaluate the opportunities that the EAF brings to this endeavour, one quickly realizes that the future of EAF technology is closely entwined with the selection of raw materials that we utilize to make the steel. In fact, it is impossible to separate the two topics when one is attempting to develop low carbon solutions for steelmaking.

The Electric Arc Furnace (EAF) is currently the technology with the lowest carbon footprint. Typically, 500 to 800 kg of C02 are generated for each tonne of steel produced. In addition to 100% scrap-based EAF steelmaking, the EAF production route has shown that it can produce the same higher value products as the integrated route (coke ovens, blast furnace, basic oxygen furnace) if up to 40 % of the metallic charge consists of ore-based metallics, aka OBMs, such as pig iron, direct reduced iron (DRI) or hot briquetted iron (HBI). It is also clear that a circular economy for steel scrap is contingent on residual dilution from OBMs to meet product requirements. This will continue to be the

case until we develop technology capable of economically removing residuals from steel scrap.

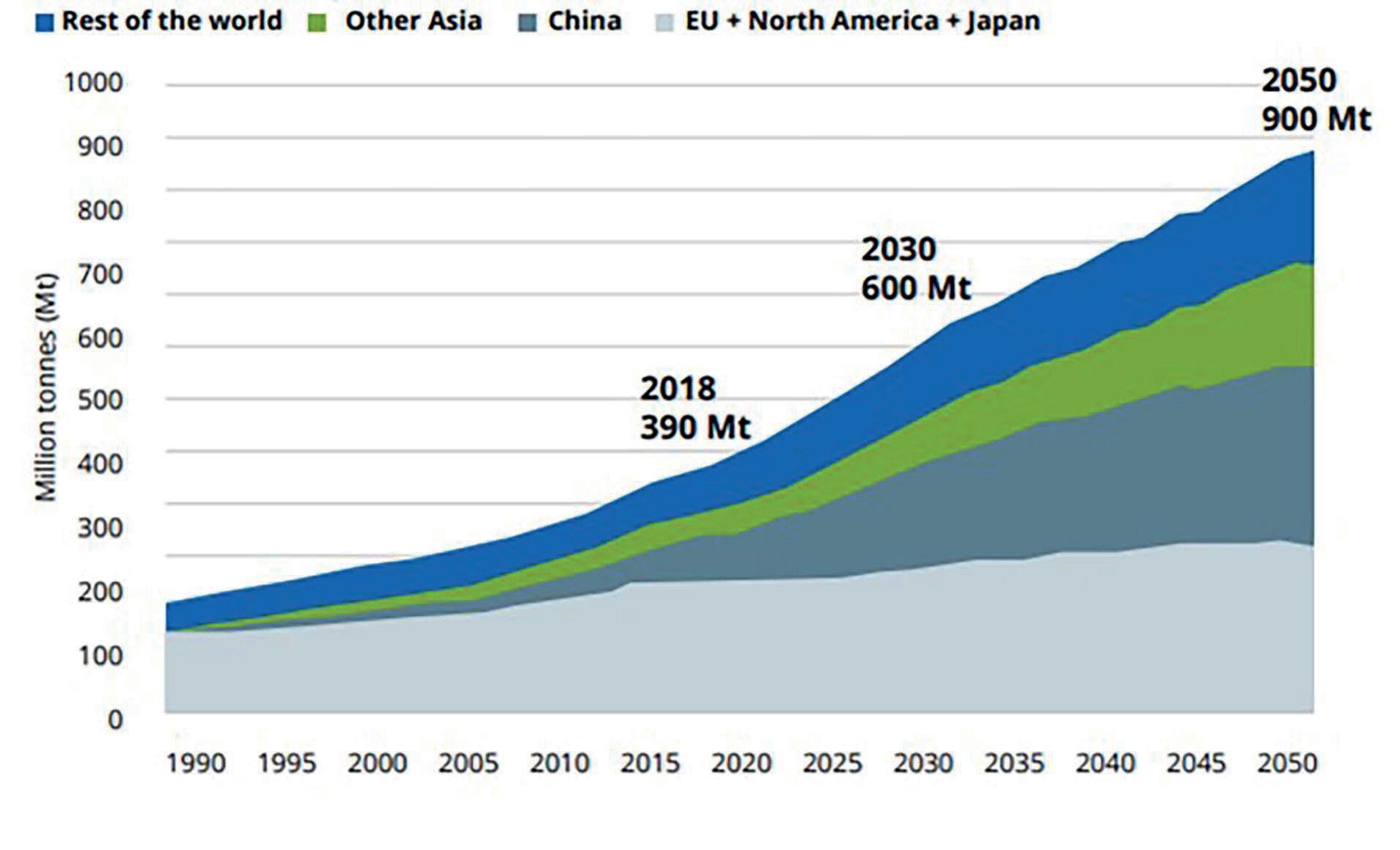

Projections of scrap availability between now and 2050 indicate that the quantity of scrap available for recycling will grow considerably. This is good news for the EAF steelmaker as scrap makes up the majority of the metallic charge to the furnace. Fig 1 below from the World Steel Association (worldsteel) shows projections out to 2050 by geographical region.

From 2020 onwards there has been a small amount of growth in EU/NAFTA/ Japan. The largest growth is in China and the rest of the world. Of course, the amount of scrap is only one part of the story. Scrap quality is also of key interest for the EAF steelmaker. The quality of the scrap is dependent on the product group that the scrap is sourced from. If the steel scrap comes from structural works, the copper level is probably about 0.3 wt%. If the steel scrap comes from products made with sheet steel, the copper content could be from 0.04 - 0.1 wt%. If the steel scrap is sourced from tubular products, the copper content is likely to be 0.12 – 0.15 wt%.

Special bar products will provide scrap

*Partner, CIX Inc.with a copper content of 0.15 – 0.3 wt%. Recycled rebar can contain 0.3 – 0.8 wt% copper. In addition, the age of the steel and the region where it is sourced will also likely impact on copper content. It is well known that the life cycle of steel varies greatly by geographical region.

As more EAFs are installed, the demand for feed materials will increase. Some companies are proposing the use of hydrogen-based DRI to fill this metallics void. However, the availability of sufficient quantities of DR grade pellets is questionable and in general ore quality is declining globally. The situation is exacerbated by increasing residual levels in scrap coupled with declining generation rates of prompt scrap. The quality of the ferrous feedstocks impacts directly on EAF productivity, yield and efficiency. These critical qualities include, but are not limited to: metallization, gangue content, carbon content, phosphorous and sulfur levels and unwanted tramp elements such as copper, chrome, tin and lead.

In the last 10 years, co-mingling of different scrap types has become more common and scrap blends such as 80/20 #1/#2 heavy melt can have a copper

content in the range of 0.5 – 0.6 wt%. As a result, the historic nomenclature utilized to describe various scrap types has become less meaningful and the nomenclature also varies by geographical region. The World Steel Association’s EAF experts group addressed this issue several years ago by generating a matrix of scrap nomenclature equivalencies. However, in the last few years the situation has become worse, and, in many cases, higher quality scrap is being deliberately contaminated with lower grade scrap. This increases the requirement for OBMs to dilute residual levels to achieve the necessary steel product specifications. Utilization of lower grade ores to produce OBMs can result in an increased EAF carbon footprint. Co-mingling of scrap grades also leads to an increased carbon footprint.

Prompt scrap is defined as material that is generated in the manufacturing process. The chemistry of this material is generally well known. An example would be bushellings. Obsolete scrap is defined as material that is reclaimed when a steel product reaches its’ end of life. Examples would be shredded automobiles, white goods or rebar. It is important to recognize that many different grades of scrap exist within these two broad classifications and that these various scrap grades contain different levels of residuals, inert content and other components. Home scrap is defined as scrap generated within the steelmaking facility in the process of producing steel. Examples would include ladle and tundish skulls, steel recovered

from slag pots and trim losses that occur in the rolling/finishing processes.

Fig 2 shows worldsteel’s global projections for the amounts of prompt, obsolete and home scrap that will be available out to 2050 (x axis is year, y axis is Mt). Home scrap is expected to grow a little post 2020 as more steelmaking capacity comes online. Prompt scrap supply is also expected to grow post 2020, but most of this will be in the developing economies. In the developed economies (Europe, NAFTA, Japan), the supply of prompt scrap is on the decline as manufacturing efficiency

improvements result in reduced quantities of scrap. Obsolete scrap supply will grow enormously post 2020 as buildings and infrastructure reach the end of their useful life in the developed countries and are replaced.

In order to produce sheet grades, pipe grades and many SBQ grades, it will be necessary to dilute the residuals in the obsolete scrap by adding OBMs which, being made from iron ore, have minimal traces of residual metallic impurities. Until an effective and economically viable means is discovered that allows for residuals to

Fig 2. worldsteel projection of scrap availability by type

be removed from the steel scrap, the solution is dilution – OBMs enable the circular economy for steel. Without OBMs in the scrap mix, a significant portion of steel scrap will become impossible to recycle and will be destined for land fill. It is very clear that as an industry, we must do a better job of segregating scrap based on its physical and chemical properties in order to achieve a circular economy for steel scrap while also minimizing utilization of virgin materials.

Better design of products, such as automobiles and appliances, must be focused on easy dismantling at end of life so that free copper and other residuals can be more easily removed and thus improving the utility (VIU) of the scrap. For example, the contained copper in auto bodies may be 0.1 –0.12 wt% but most shredded scrap currently contains from 0.15 – 0.35 wt% copper. This additional copper is ‘free’ copper which must be removed to maintain the potential value of the scrap. This free copper has an economic value and can be recycled. Methods now exist for the removal of at least a portion of the free copper, but until the steelmaker recognizes that each point of copper in the scrap brings with it a cost, most steelmakers will not pay the added cost to carry out this additional separation. However, some steel plants are now processing scrap at the steel plant site achieving a payback on the equipment in less than six months.

If on average obsolete scrap contains 0.3 wt% copper, then to produce flat products with a maximum copper content of 0.08 wt%, the metallics blend would need to contain approximately three parts of OBM with one-part obsolete scrap. Even a pipe grade with a maximum copper specification of 0.15 wt% would require a metallic feed blend with one-part OBM to one part obsolete scrap. These examples demonstrate how important the role of OBMs is to the future of EAF steelmaking.

Within a given scrap grade, the residual levels can vary enormously. For example, historically, shredded scrap was derived from shredded

automotive and white goods and the copper content varied from 0.15 to 0.20 wt%. Recently, shredded scrap in some regions has contained 0.35 wt% Cu and in an extreme case 0.52 wt% Cu. Shredders are a top offender with respect to the aforementioned comingling of end-oflife scrap streams. Shredded scrap is now produced with whatever will fit into the shredder itself and has little relation to the source of the scrap. Even the scrap pricing indices reported by many steel market intelligence groups have diminished utility because of the high degree of variability in the various scrap grades which is not captured in their reporting.

Dirt levels in recycled scrap have also been on the rise (from 1% to as high as 7%) over the past 10 to 15 years and pose another quality issue. For a million tonne per year facility, an extra 1% dirt in the scrap can negatively impact the steelmaker’s conversion costs to the tune of $11/tonne and increase the C02 footprint by 50 kg/ tonne. The higher dirt content requires more basic flux addition, generating extra slag mass, resulting in higher Fe losses, higher energy consumption, greater electrode consumption and longer tap-totap times. Some facilities have implemented equipment to remove the dirt at the scrap yard and have obtained equipment payback times of less than one year.

How can we be proactive? So, the question is ‘what should we be doing now to ensure circularity of scrap recycling and provide sustainability to the steel industry? The following are a few key takeaways:

• The availability of ‘prime’ scrap is shrinking in many of the mature economies as manufacturers become more efficient and generate lower quantities of scrap. As technology evolves (such as advanced highstrength steels), the quantity of steel being used in products is also shrinking.

• OBMs enable a circular economy for steel scrap.

• Need better definition and tracking of scrap characteristics and scrap nomenclature so these can be used to better understand value-in-use (VIU) and drive behaviour conducive to better segregation of scrap based on these parameters

• Scrap processing at the steel plant site is a highly effective method to remove free

copper/dirt which will improve operating costs, improve Fe yield, reduce flux and energy consumption and reduce the carbon footprint of EAF steelmaking.

• Steelmakers must also work more closely with scrap processors to segregate lower-residual, high-value scrap and to reduce the blending of lower-grade materials into ‘cleaner’ scrap. Thus the pricing structure of various scrap commodities will show greater separation related to residual content and dirt content. Essentially steelmakers will have to pay more to maintain the availability of cleaner scrap grades. At the same time, there needs to be an economic incentive for scrap processors to do a better job of free copper removal and for vehicle manufacturers to design vehicles for easier free copper removal.

• Technologies that can economically reduce the amount of free copper in scrap must be improved and applied universally to slow the rise of copper (and other deleterious) residual levels in steel scrap.

The pro-active measures that we implement in the next 10 years will have a profound impact on our ability to implement a circular economy for steel scrap. What is less well understood is that these measures can also significantly impact steelmaking C02 footprint, costs, efficiency and consumption of virgin materials. It is imperative that we begin our implementation of a cohesive strategy now. �

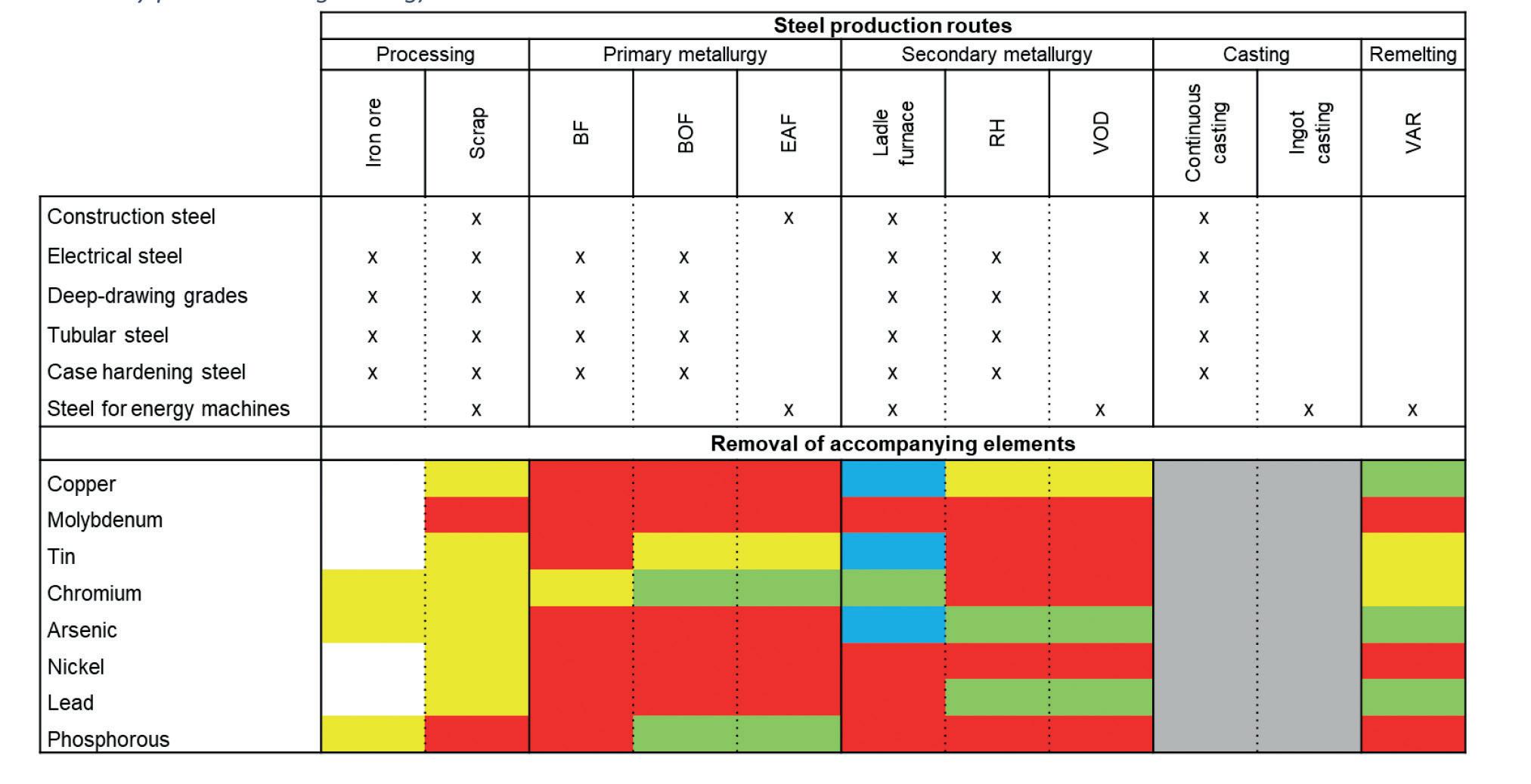

Scrap is an essential secondary raw material within the steelmaking process and its increased recycling is an important pillar on the path to achieving European climate targets such as the Green Deal or the ‘Fit-for-55’ initiative. This article examines technological developments in scrap processing as well as how the metallurgical process and the material properties of the product influence the accompanying elements incorporated in the scrap. By M. Häuselmann1, J. Rieger1, J. Schenk1,2, R. Schnitzer3, A. Sakic3, S. K. Michelic2,4 , J. Cejka4

WHILE, in theory, steel can be infinitely recycled without compromising quality, certain accompanying elements hamper the reuse of post-consumer scrap, such as an expected surplus of low-grade scrap in Europe, massive scrap exports and the loss of valuable secondary raw materials. Consequently, improved technologies need to be developed to acquire detailed knowledge about the composition and quality of scrap to enhance its utilization.

The iron and steel industry’s ambition to reduce its process-related CO2 emissions by at least 55% (compared to 1990’s levels) by 2030 and to achieve climateneutral steel production by 2050 involves significant changes and challenges. Three C02 mitigation pathways for the steel industry have been established by the Clean Steel Partnership (CSP), a publicprivate partnership of the European steel sector led by the European Steel

Association (EUROFER) and the European Steel Technology Platform (ESTEP). These pathways comprise carbon direct avoidance, smart carbon usage and circular economy as an overarching approach5 Compared to steel production from primary raw materials, melting scrap requires less resources and decreases process-related C02 emissions by up to 75% 6. The production of high-performance steel from scrap necessitates an accurate knowledge of the available scrap grades so that the required product specifications can be obtained. Particularly post-consumer scrap often cannot meet the required quality criteria concerning its composition. This induces a high export rate of low-quality scrap, and thus, an exclusion of iron resources from the material cycle. A significant change in scrap management, i.e., precise characterization and separation, determination of the appropriate scrap mix,