DECARBONIZATION INDUSTRY SPOTLIGHT PROFILE

Is net-zero by 2050 too great a challenge?

ELECTRIC VEHICLES

A look behind the scenes of product management.

Growing demand in US markets, says Myra Pinkham. Since

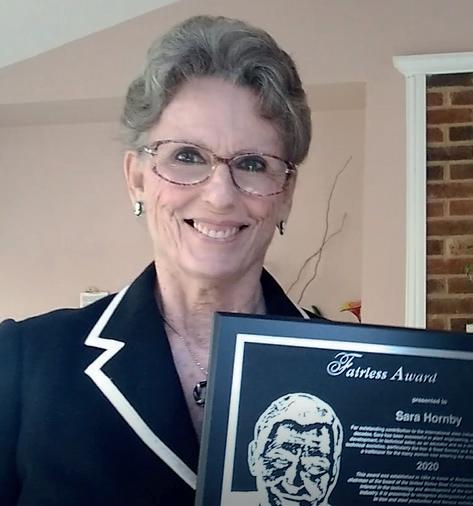

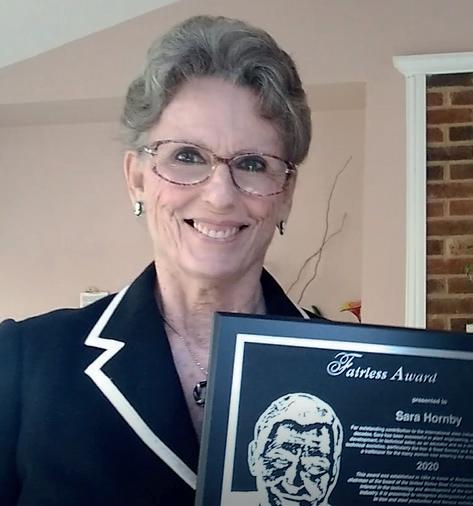

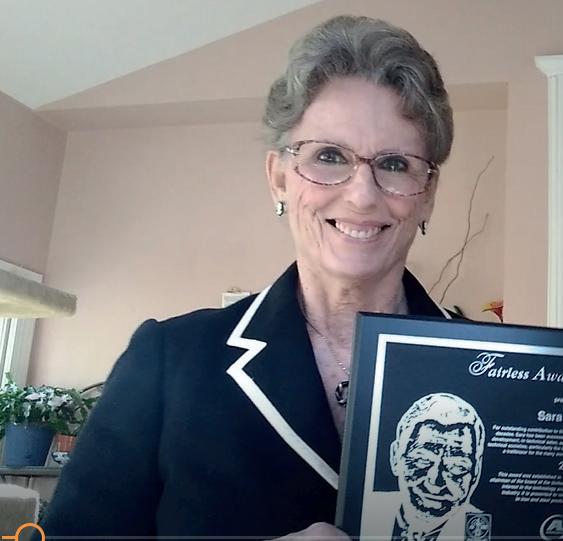

We talk to Sarah Hornby, president of Global Strategic Solutions.

ARE WOMEN CHANGING THE FACE OF STEEL?

www.steeltimesint.com Digital Edition - February 2023 - No.25

1866

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Editorial assistant Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood subscriptions@quartzltd.com Tel +44 (0) 1737 855028

1 www.steeltimesint.com

FEBRUARY

DECARBONIZATION INDUSTRY SPOTLIGHT Since 1866 ARE WOMEN CHANGING THE FACE OF STEEL?

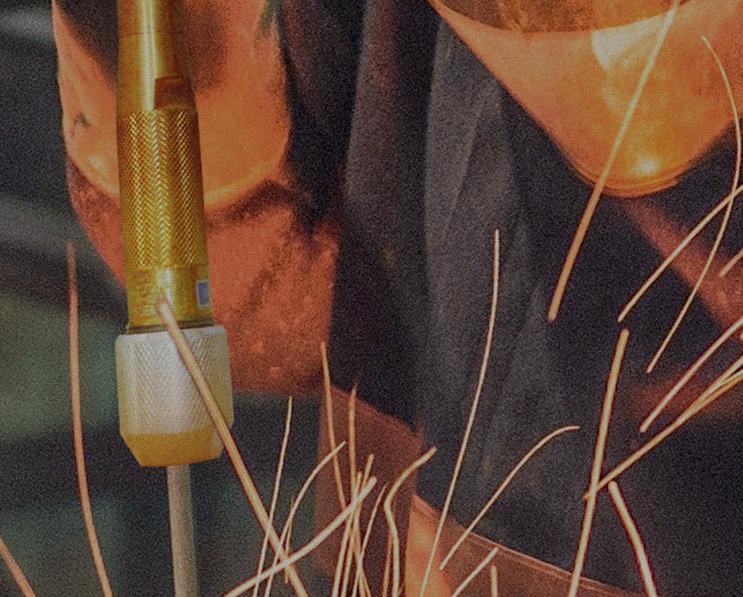

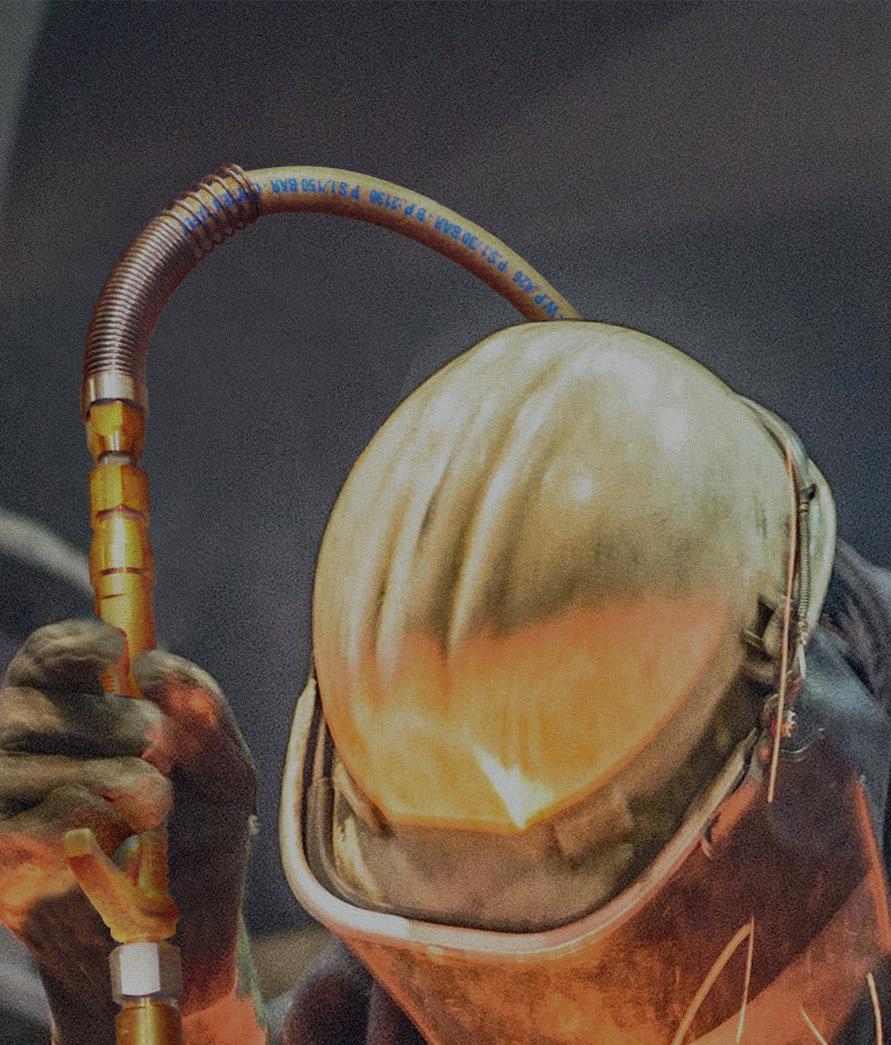

ISSN0143-7798 Front cover photo courtesy of KOCKS CONTENTS – DIGITAL EDITION

2023

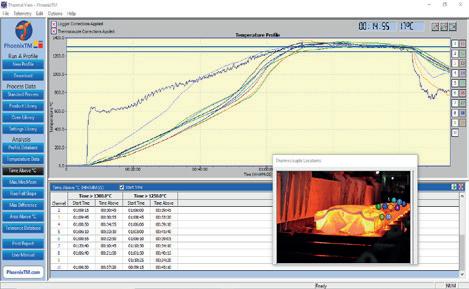

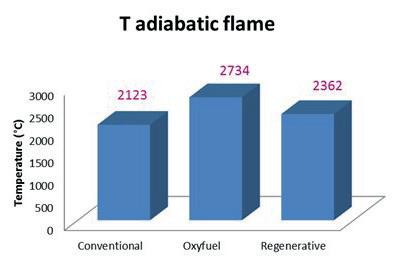

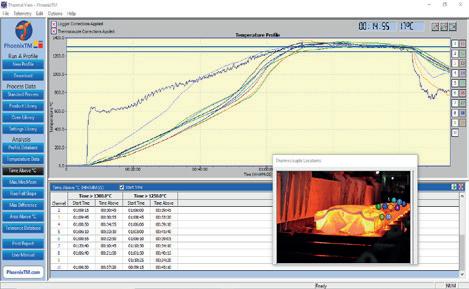

12 times a year (including four digital issues) and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00 2 years subscription: UK £387.00 Other countries: £510.00 3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Pensord, Tram Road, Pontlanfraith, Blackwood, Gwent NP12 2YA, UK ©Quartz Business Media Ltd 2023 2 Leader by Catherine Hill. 4 News round-up Six pages of global steel news. 12 Innovations New products and contracts. 20 Future Steel Forum 2023 Details of the upcoming Forum. 22 Innovations Special Metal tags with InfoSight. 24 Electric vehicles Driving toward the green. 29 Decarbonization The decade of delivery. 36 Profile: Sarah Hornby Breaking the rules. 40 Industry spotlight: Ametek Changing tradition. 44 Furnaces Advances in reheating furnaces. 48 Software Developing the future. 51 Decarbonization Pedal to the metal. 60 Perspectives Q&A: HWI Industry renaissance. 62 Book review Women in steel, Women of steel. 36 48 48 60 40

Fax +44 (0) 1737 855034 Steel Times International is published

Changing the face of steel

‘What is the problem with men’, opens a recent article in The New Yorker, which details the conditions besetting the male population; stagnation in wages, climbing opiate addiction, increased diagnosis of ADHD, and high university dropout rates.

‘’As far as I can tell, nobody predicted that women would overtake men so rapidly, so comprehensively, or so consistently around the world,” writes Richard V Reeves. What is to blame? Erik Hurst, an economist at the University of Chicago, thinks that the rapid improvement in video-game quality could account for much of the especially deep drop in work among younger men.

Economists Marianne Bertrand and Jessica Pan believe that ‘boys raised outside of a traditional family’ are set up for failure. One thing is clear, however, that change is already on its way.

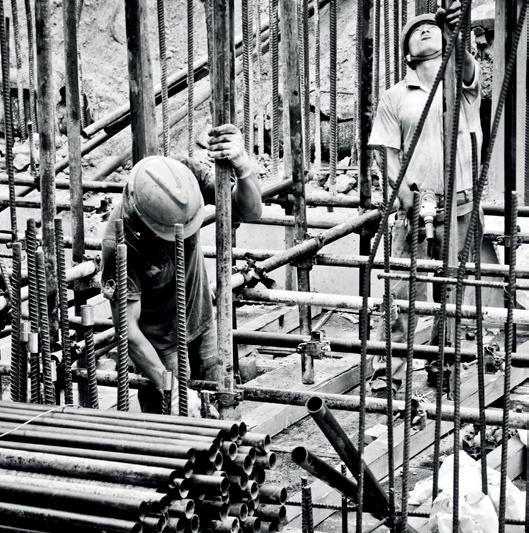

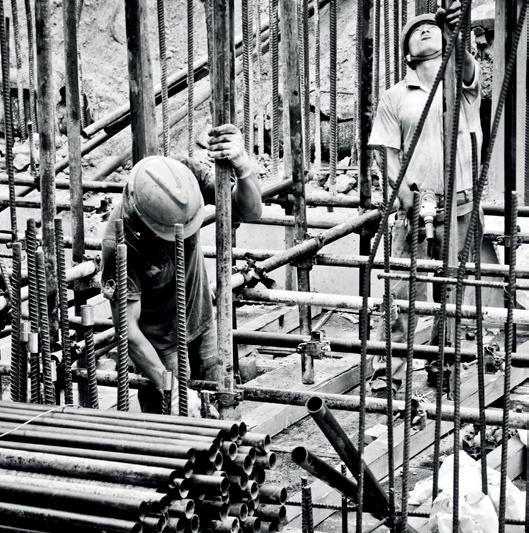

exist as an amalgamation of the most male dominated workforces according to data from Eurostat: manufacturing, construction, mining, and transportation.

With its transition toward a more sustainable future, it is resultingly drawing in a younger, more liberal crowd; and a diversified workforce is imperative to both incentivise its progress, as well as sustain the changes that have already taken place.

Catherine Hill Editorial assistant catherinehill@quartzltd.com

Women are increasingly taking up space in roles that were previously only available to their male counterparts–images of a ‘blue-collar’ workforce are shifting toward diversified labour pools. The steel industry serves as a microcosmic example of tradition transformed; as its primary and secondary suppliers

As more women graduate in STEMrelated fields, there is greater opportunity to hire labour that drives statistics that companies feel proud to present, rather than forced to justify. In this sense, even those set against change are inclined to see its potential-new voices offer new ideas. Every editorial feature in this issue is either written by a woman, has a female lead-author, or, in the case of Tim Smith’s book review (page 62) is regarding a book based on women in the industry. It is imperative to drive these voices forward until they can be heard. Whatever the problem is, the solution lies in futures that are undetermined by gender, and uplifted by talent, creativity, and passion enough to leave a mark.

2 www.steeltimesint.com LEADER

Digital Edition - February 2023

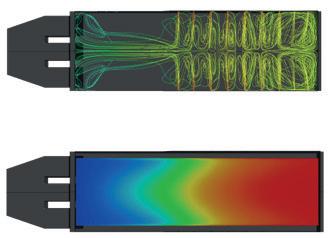

DANIELI INTELLIGENT PLANT A NEW CONCEPT FOR PLANT AND PROCESS SUPERVISION Data-driven approach, AI and machine learning for continuous improvement of plant performances, simplifying metals complexity Via Bonaldo Stringher, 4 33042 Buttrio (UD) Italy Phone +39 0432 518 111 www.digi-met.com www.dca.it Follow us on Linkedin

ArcelorMittal has announced plans to supply steel service centre EMW Stahl Service with low-emission steel as well as certificates for CO2 savings. EMW will receive low-carbon steel from ArcelorMittal Commercial Germany under the ‘XCarb’ umbrella brand. The steel is produced from 70% scrap, with production powered by 100% renewable electricity.

Source: Kallanish, 5 January 2023

UK environmental activist group Friends of the Earth is filing legal claims against the British government, saying that it did not factor in the climate impacts of the controversial Cumbria coal mine, which was approved for construction at the end of last year. West Cumbria Mining has been seeking to build a colliery on 689 acres near Whitehaven since 2017. The mine would be used to aid in the production of steel and not in generating power. Friends of the Earth lawyer Niall Toru described the approval of the mine as ‘the wrong decision for our economy and the climate’.

Source: North West Place, 6 January 2023

China is looking to invest in Western Africa’s Simandou iron ore mine, located in the Simandou mountain range of southern Guinea's Nzérékoré Region, to secure further supply of iron ore for steelmaking. The mine is said to have the world’s largest untapped high-quality reserve but has remained undeveloped because there is no railway line to transport the ore. Baowu, China’s biggest iron and steel producer, is among those investing in the project at a time when the country is trying to diversify its supply.

Source: South China Morning Post, 8 January 2023

Russian-Belgian strip producer NLMK La Louvière aims to restart rolling operations following a temporary shut-down after a fire broke out within the facility. The fire impacted the finishing stand, prompting the plant to announce a force majeure on its deliveries. La Louvière is located 50 km south of the Belgian capital of Brussels. The plant can roll up to 1.68Mt/yr of hot rolled coil.

Source: NXT Mine, 9 January 2023

The Philippines is expecting up to $2 billion in investments from China to ‘rebuild’ its steel industry, as part of 14 agreements that Philippine President Ferdinand Marcos Jr. signed during his state visit to China in early January

2023. Other areas covered in the agreement included agriculture, infrastructure, tourism and trade. According to Philippine ambassador Jaime Florcruz, the country expects Chinese investments to the amount of $1.5-2 billion to build a ‘state-of-the-art’ steel plant, creating 2,000 to 3,000 jobs.

Source: GMK Center, 9 January 2023

Zaporizhstal, one of the largest steel companies in Ukraine, reduced its steel production by 2.6 times – or by 2.4Mt in 2022 to 1.49Mt, according to a report by the Ukrainian News Agency. "The decrease in production level compared to the same period last year is associated with a shortage of raw materials and logistical problems caused by full-scale military actions in Ukraine. In addition, due to massive missile attacks on energy infrastructure facilities and, as a result, a power shortage in the power system, the plant reduced production, thus reducing the consumption of purchased electricity," the report said.

Source: Ukranews, 9 January 2023

Italy’s government has approved a new ‘urgent measure for strategic national installations order’ to inject €1 billion into steelmaker Acciaierie d’Italia (ADI), a joint venture between steel company ArcelorMittal and the state, formerly known as Ilva. The company is currently facing a liquidity crisis as a result of accumulated debt from suppliers. The aid will be divided into two instalments, the first of which will amount to €680 million, and the second – to €320 million.

Source: GMK Center, 9 January 2023

4 NEWS ROUND-UP

Alexey Mordashov, the chairman of the board of directors of Russian steel and mining company Severstal, topped the list of the most ‘impoverished’ Russian billionaires in 2022 with his wealth falling by $11.1 billion to $18.4 billion due to the impact of Western sanctions, the Russian edition of Forbes reported. In 2021, Mordashov and his family were named the richest Russians by Forbes, with their fortune estimated at $29.1 billion.

Source: Urdu Point, 10 January 2023

The United Arab Emirates' renewable energy company Masdar has signed a memorandum of understanding (MoU) with four Dutch companies to explore exporting green hydrogen from Abu Dhabi to Europe. Masdar signed an MoU with Port of Amsterdam, SkyNRG, Evos Amsterdam and Zenith Energy to join efforts to develop a green hydrogen supply chain that focuses on production in Abu Dhabi and exporting green hydrogen

According to the prime minister of Kazakhstan, the government is ready to support the development of the domestic iron and steel industry and is preparing to implement ‘constructive business proposals’. The iron and steel sector's share in the national GDP is 8.5%. In 2022, the industry launched 19 new investment projects worth over $502 million, creating 3,500 permanent jobs. The Kazakh government is planning to take measures to expand the country’s mineral and raw material base and introduce a single online platform for mineral mining companies.

Source: GMK Center, 12 January 2023

to the Netherlands through the port of Amsterdam. The signing parties are aiming to explore several hydrogen transportation methods, with a focus on liquid organic hydrogen carriers and liquid hydrogen, the company statement read.

Source: Reuters, 13 January 2023

The companies of billionaire iron-ore magnate Andrew Forrest and giants of the global steel and oil sectors are among the companies allocated government land in Western Australia’s Pilbara region, to develop green industrial projects worth an estimated $70 billion. Western Australia’s Labour government announced the land allocation for seven projects in the Boodarie and Ashburton North Strategic Industrial Areas (SIAs), established to help transform the Pilbara into a ‘green industry hub’.

Source: Renew Economy, 12 January 2023

British Steel is preparing to commission its largest single investment since Jingye took over the company – a £54m billet caster, part of an investment worth £330 million that the company has been committed to since 2020. Other significant recent investments include: three new cranes worth £27 million at the company’s Immingham Bulk Terminal; a £14.6m investment to enhance energy operations; and an IT systems upgrade. Xifeng Han, British Steel’s CEO, said: ‘‘To make sure we can deliver the steel Britain requires, we’re undergoing the biggest transformation in our 130year history.’’

Source: Lincolnshire Today, 13 January 2023

Scientists from China claim to have created a new kind of steel that is ‘ultrastrong, yet stretchable.’ According to researchers, the newly-found ductile metal can stretch by 18 to 25%, and support the weight of a two-tonne automobile on a piece of steel no larger than a fingernail. The group from Northeastern

University in Shenyang, Shenyang National Laboratory for Materials Science and Jiangyin Xingcheng Special Steel Works in eastern China, as well as the Max Planck Institute for Iron Research in Germany, issued their findings in a peer-reviewed journal.

Source: WION, 14 January 2023

6 NEWS ROUND-UP

When you need to know it’s safe

Metal is the backbone of our society. It’s in the structures we ride, work and live on every day. That’s why you’ve trusted the detection technology inside every ARL iSpark for over 80 years to ensure every piece of steel and metal you produce is safe. With so much riding on that, why would you choose anything else?

* ARL iSpark. The trusted standard.

on a data comparison, completed by Thermo Fisher Scientific in 2021, of detection limits for OES systems using data published in specifications and applications notes for ARL iSpark and competitors. ©2022 Thermo Fisher Scientific Inc. All rights reserved. All trademarks are the property of Thermo Fisher Scientific and its subsidiaries unless otherwise specified. AD41408 0922 Find out more at thermofisher.com/ispark

*Based

International defence company, Babcock, has manufactured and fitted what are believed to be the first 3D printed metal parts to be used across the British Army’s active armoured fleets. The steel components were created specifically to tackle the growing challenges of technical and commercial obsolescence, and were fitted onto in-service fleets, forming part of the ‘periscope’ system to ensure Army crews have visibility of their immediate surroundings. This milestone is part of Babcock’s longerterm global advanced manufacturing investment programme – which is focused on developing the ability to print parts anywhere in the world, when needed.

Source: 3D Printing Media Network, 14 January 2023

A rare Second World War helmet of the type worn by a little-known section of the home front originating from Hull, northern England, is one of the highlights of an unusual auction, taking place this month. The steel ‘Brodie’ style helmet worn by civil defence mortuary volunteers is believed to be one of only three thought to have survived the Hull Blitz. It is going under the hammer at an ‘out of the ordinary sale’ by Sworders fine art auctioneers. A Sworders’ spokesperson said: “The helmet in our out of the ordinary auction is one of a handful of survivors that emanate from the Hull area.’’

Source: Hull Live, 15 January 2023

The Australian Steel Institute (ASI) has confirmed its call for a national ban on the export of unprocessed ferrous scrap. According to ASI executive director Mark Kane, Australia is now facing a situation where steel mills are importing processed ferrous scrap to meet growing demand for steel when they can use their own. Mark Kane stated that the export ban would free up an additional 800kt of recycled scrap on the domestic market, reduce greenhouse gas emissions in the industry, and help prevent coastal environmental damage from Australia’s landfill ban on unprocessed waste.

Source: GMK Center, 15 January 2023

The Metalfer Steel Mill in Serbia received a €21.4 million loan from the European Bank for Reconstruction and Development (EBRD) in order to decarbonize its production facilities, according to the EBRD. The loan will finance the construction of a new rolling mill for processing semi-finished products and scrap metal. Part of the funds will be directed to the construction of a mini-solar power plant that will produce 4MW of renewable energy to meet production needs.

Source: GMK Center, 18 January 2023

ArcelorMittal is considering restarting blast furnace A at its Asturias plant in Spain this month. The furnace will run at reduced capacity if restarted. The steel giant idled the unit at the end of September, in response to weak market demand and economic uncertainty. The Asturias plant has two blast furnaces and produces heavy plate, wire rod and rails.

Source: Argus Media, 18 January 2023

Steel manufacturer Metal One Corporation (Metal One) and power plant supplier Clean Energy Systems (CES) have announced an agreement to deploy CES' proprietary carbon capture technology to accelerate the decarbonization of the global steel industry. Metal One has made an initial investment in CES, and the parties will immediately work to promote the use of green steel across all industries, helping major corporations that have pledged to achieve net zero carbon emissions. ‘‘By partnering with Metal One with their global presence, we'll be able to access the global steel market exponentially faster than we could achieve on our own,’’ said Keith Pronske, president and CEO of CES.

Source: Cision, 17 January 2023

Schnitzer Steel Industries, a leader in metals recycling, has been named the most sustainable company in the world by Corporate Knights, a media and research organization focused on corporate sustainability performance. The 19th annual Global 100 List of the world’s most sustainable corporations by Corporate Knights is based on a detailed assessment of 6,720 companies, each with more than $1 billion in revenue, where performance across a range of sustainability metrics is evaluated.

Source: Business Wire, 18 January 2023

8 NEWS ROUND-UP

A joint venture between ArcelorMittal and Nippon Steel has received the Odisha government's approval for a $4.68 billion steel plant project. The project is expected to have an annual production capacity of 7Mt, and create 11,000 jobs. Earlier this month, ArcelorMittal and Nippon Steel launched the steel slag brand ‘Aakar’. The steelmakers have pioneered the technology for reusing steel slag, a by-product obtained during the primary steel manufacturing process, in the construction of roads and national highways.

Source: Mint, 19 January 2023

Nucor has introduced Elcyon, a new sustainable heavy gauge steel plate product made specifically to meet the growing demands of America’s offshore wind energy producers. Nucor will manufacture Elcyon at the firm’s new $1.7 billion Nucor Brandenburg steel mill in Kentucky, which produced its first steel plate at the end of December 2022. The new mill will be able to produce 97% of plate products consumed domestically, with a potential output of 1.2Mt/yr of steel, said Nucor. Elcyon is made using Nucor’s recycled scrapbased electric arc furnace manufacturing process.

Source: Offshore Wind.Biz, 19 January 2023

ArcelorMittal will receive direct aid of around €450 million for the transformation of its facilities in Asturias, Spain, after having received authorization from the European Commission for the Spanish Government to grant the steel giant the subsidy. It is expected that ArcelorMittal will use the money to relaunch activity at its plants in Spain, which has been impacted by low demand and imports from outside the European Union.

Source: The Corner, 23 January 2023

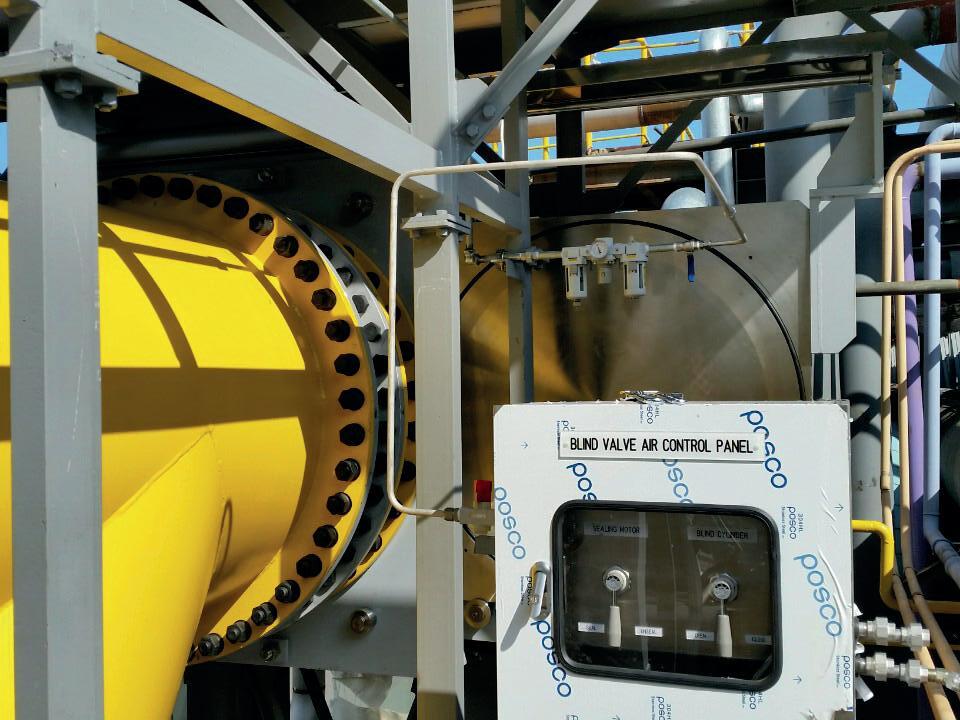

France-based pipe manufacturer Vallourec has announced that it will supply 25kt of line pipe for USbased oil and gas exploration company LLOG Exploration

Offshore for the latter’s Salamanca deep-water project on the US coast of the Gulf of Mexico. The pipes will be produced at Vallourec’s Jeceaba mill in Brazil. The Salamanca development is based on a floating production unit created from the refurbishment of a previously decommissioned production facility.

Source: Steel Orbis, 23 January 2023

Tata Steel has begun construction of its scrap-based steel plant in Ludhiana, Punjab, announced the region’s chief minister, Bhagwant Mann. ''This is just the beginning as we deliver what we say and the day is not far when we will make Punjab a frontrunner state in the industrial growth across the country,'' Mann stated during a meeting with the representatives of the Tata group in Mumbai. According to the Punjab government, the project is the first ever investment made by Tata Steel in the state, and the second biggest in the country after Jamshedpur.

Source: Devdiscourse, 24 January 2023

Netherlands-based Hardt Hyperloop, a hyperloop network technology platform, has announced that it has secured new funding from trading corporation POSCO International and investment company Urban Impact Ventures with participation from existing EU- and US-based investors. The Dutch hyperloop company says it will use the capital to fund the construction of the European Hyperloop centre test facility in Groningen. The announcement comes over a year after being awarded €15M by the European Commission.

Source: Silicon Canals, 24 January 2023

www.steeltimesint.com NEWS ROUND-UP 9

Digital Edition - February 2023

AD Ports Group, an industry, trade and logistics facilitator, has signed a memorandum of understanding (MoU) with Tosyalı, one of Turkey’s largest private steel producers, which has operations in three continents. The MoU looks to establish the framework for AD Ports Group to collaborate with Tosyalı on a broad range of shipping, logistics, ports, and freight forwarding services, including potentially jointly investing in new port facilities to support its export operations.

Source: Zawya, 25 January 2023

Slovakian steelmaker US

Steel Kosice is resuming the operation of its three furnaces after having restarted blast furnace two – idled for 60 days of maintenance in September – this month,

meaning all its units are running. It had restarted blast furnace one, which it said would be idled at the start of December, a few weeks prior. The company has a crude steel capacity of about 4.5Mt/ yr across the three furnaces. Capacity is coming back online in response to rising coil prices and an increase in apparent demand, driven by service centre restocking since December.

Tata Steel has been recognised as a Global Diversity Equity & Inclusion (DEI) Lighthouse 2023 by the World Economic Forum (WEF). The company’s efforts towards improving

Source: Argus Media, 25 January 2023 gender diversity at the workplace have been chosen as one of the eight case studies which have been featured in the Global Parity Alliance: Diversity, Equity and Inclusion Lighthouses 2023 report published to coincide with the World Economic Forum 2023 held in Davos, Switzerland.

Source: Tata Steel, 27 January 2023

Korean steelmaker POSCO has launched a task force, led by vice chairman Kim Hagdong, for its steel operations, due to concerns that a global recession could slow demand. “Last year, we braced for the global economic downturn group-wide, following higher interest rates, a strong won and higher prices. This time, we launched a steel-specific task force to look into cost reductions, better profitability, and liquidity,” the steelmaker said. In September, POSCO’s Pohang plant was hit by Typhoon Hinnamnor, with a large part of the facility submerged by flooding. All of its steel plants were back in operation as of 20 January, 135 days after the flooding, but the steelmaker later declared an ‘emergency’ status as a result of the wider economic impacts.

Source: Pulse, 26 January 2023

A consortium of ArcelorMittal Nippon Steel India Ltd and Bothra Shipping Services has won a 30-year contract to mechanise and run two bulk cargo berths at the state-owned Visakhapatnam

Port, officials said, as the steelmaker seeks to bolster its logistics chain to support manufacturing. “The letter of award for the project was issued to ArcelorMittal Nippon Steel-Bothra Shipping

One of the only steel tube factories in the UK has said that it is shutting down before the evening energy peak to help prevent electricity shortages. Tata Steel’s Corby plant, located in Northamptonshire, has an electric furnace which uses the equivalent energy of 11,000 households, as well as a gas furnace for heating the steel. Plant manager Paul Ilko commented: "We've deliberately scheduled our operations to avoid those evening hours, because that's when the peak demand for electric is on the system,’’ adding that the plant, which has produced steel tubes for Wembley and the Millennium Stadium in Cardiff, is now only operating between 09:00 and 17:00. Source: yahoo!news, 30 January 2023

Services consortium after the bid was approved by the board of Visakhapatnam Port Authority,” the port official said.

Source: ET Infra, 28 January 2023

10 NEWS ROUND-UP

Danieli Group, an Italian plant supplier, has announced that it will provide Lucchini RS Group’s plant in Lovere, Bergamo, Italy, with a new open-die forging press. The new equipment will ‘improve Lucchini RS’s product portfolio, energy and raw-material optimization, and cost reduction’, says Danieli. The new equipment will be produced in Danieli workshops, and Lucchini RS Group will supply the components. It is expected to be put into operation by early 2024.

Source: Yieh Corp, 30 January 2023

Oil field services company Baker Hughes has announced a memorandum of understanding (MoU) with Fortescue Future Industries (FFI) to jointly explore potential opportunities for the scale up and adoption of novel technology solutions

for green hydrogen, green ammonia and geothermal projects. According to a press release, the companies see new pathways to accelerate the energy transition thanks to their respective expertise and portfolio of technologies on new projects. These technologies will potentially benefit the reduction of greenhouse gas emissions in both energy production and hard-to-abate industrial sectors including mining, steel and cement.

Source: Baker Hughes, 30 January 2023

In a presentation to investors, Indiana-based EAF steelmaker Steel Dynamics Inc. (SDI) said that its six scrap-fed mills emit 0.43 tons of CO2 per ton of steel made, placing it at less than half of the North American average of 1 ton and at less than onethird the global average of 1.7 tons. “Our steelmaking operations already meet the 2050 intensity targets under the Paris Agreement and its 2 degrees Celsius scenario,” the company stated in one of its presentation slides.

Source: Recycling Today, 30 January 2023

China is set to receive at least two cargoes of Australian coal in early February, according to traders and shiptracking data, the first since an unofficial ban on imports was lifted earlier this month. About 72kt of metallurgical coal was loaded on to bulk vessel Magic Eclipse at Hay Point,

Australia, and is expected to arrive at the southern Chinese city of Zhanjiang in Guangdong province shortly. China's largest steelmaker Baowu Group bought the cargo, according to a trader familiar with the deal and the shiptracking data.

Source: Reuters, 30 January 2023

A blood donation camp was organised by ArcelorMittal at its Thakurani iron ore mines located in Odisha, India, in collaboration with Keonjhar Blood Bank. A total of 50 units of blood was collected, with company officials, workers, operators and security personnel all participating. ArcelorMittal said that the objective of organising blood camps at regular intervals was to create ‘awareness amongst people on the importance of maintaining a healthy life.’

Source: Orissa Diary, 30 January 2023

APOLOGY: In a news story in the January/February edition of Steel Times International, Ford, Mercedes Benz, and BMW were listed as having collaborated with Kobe Steel. However, Nissan is the first carmaker that will use Kobenable Steel, commercialised by Kobe Steel, for mass-produced vehicles. We apologise to Kobe Steel for this error.

Indiana, USA, led the nation in steel production last year, accounting for nearly a fourth of the nation’s output. The state kept its spot as the top steel producer nationally. It has made more steel than any other state for more than four decades, said Lisa Harrison, senior vice president of communications for the American Iron and Steel Institute. “Over the past 12 months ending in November 2022, Indiana produced about 21.5Mt of steel,” she said.

Source: NWI Times, 4 January 2023

11 NEWS ROUND-UP

Schneider Electric partners with AVEVA and Shell

Schneider Electric, leader in the digital transformation of energy management and automation, AVEVA, an industrial software company, and Shell, a global energy and petrochemicals company, have formed a global strategic alliance to support their respective and wider sectors’ transition to net-zero agendas. The organisations will explore opportunities to co-develop integrated end-to-end energy solutions designed to power the decarbonization of their customers in hardto-abate industries.

Energy-intensive and heavy industry companies need trusted partners and solutions that can reduce greenhouse gas (GHG) emissions, increase the effectiveness of their operational processes, and deliver greater energy efficiency, security, resilience, availability and reliability, claims Schneider Electric. The partnership agreement between the three companies aims to bring customers an enhanced set of integrated solutions with a range, scale, and scope that is greater than each could offer alone.

Focusing on the cement sector initially, the newly formed alliance aims to reduce emissions by up to 15% for customers in a typical

deployment. The approach will focus on enabling a more efficient transition to renewable energy sources. More accurate process analytics, improvements to dynamic tactical simulation, and digital integration for furnace and mill grinding process improvements will drive a reduction in resource use.

AVEVA and Schneider Electric will contribute integrated digital engineering, operational process, and energy optimisation technologies, combined with deep sustainability expertise, to the alliance. These capabilities will support the design, construction, and more efficient operation of increasingly carbon neutral facilities. They will also help to create production plans that optimise the value chain and reduce GHG emissions.

Shell brings to the partnership end-to-end sustainable energy supply solutions, global project engineering capabilities, a large renewable energy generation and asset portfolio, as well as a broad range of sectoral sustainability solutions.

Harry Brekelmans, projects and technology director at Shell, said: “Our companies have strong ambitions to achieve net zero emissions. This partnership represents another significant

step forward. Shell, AVEVA and Schneider Electric intend to explore potential opportunities across digital solutions, technology, sustainability consulting, and energy supply capabilities to develop end-to-end integrated energy solutions to decarbonise our own businesses and wider sectors”.

Jean-Pascal Tricoire, chairman and CEO, Schneider Electric, said, “Partnerships are vital for decarbonization. They provide benefits to all parties and accelerate the global energy transition. The combined capabilities and expertise of Shell, AVEVA, and Schneider Electric will result in innovative sustainability solutions critical to the journey to net-zero.”

“We are pleased once again to extend our relationship with Shell,” said Peter Herweck, CEO, AVEVA. “We have already seen the benefits in terms of safety, reliability and efficiency with many previous successful engagements, and we will continue to deliver our vision of a responsible use of the world’s resources.”

For further information, log on to www.se.com

INNOVATIONS 12 www.steeltimesint.com Digital Edition - February 2023

Swiss steelmaker buys DigitARC® PX3 ERS

AMI Automation, an international automation and control solutions company based in Mexico, has supplied the DigitARC® PX3 ERS for a ladle furnace to Switzerland-based steel producer, Stahl Gerlafingen.

After the decision taken by Stahl Gerlafingen to upgrade its Electrode Regulation System as part of its secondary steelmaking process, AMI supplied the DigitARC® PX3 ERS which was delivered in May 2022, with all on-site commissioning work finished in mid-2022.

Start-up was carried out within the shortest possible time to minimize production downtime.

Stahl Gerlafingen, as a part of the Beltrame Group specializes in the supply of products for the construction, automotive, energy and heavy industries. Its 80-ton 11 MVA ladle furnace was updated with the objective to reduce electrode consumption, increase the heating rate and decrease ladle refractory wear.

The transition from Z to I-Z regulation control took place as part of the improvements done

to the regulation system, looking for better arc stability and reducing electrode consumption by giving the right amount of energy to the steel being produced.

The interface includes a set of diagnostic tools and configurable screens to control almost every aspect of the furnace. This, claims AMI, allows customers to standardize the operation process.

For further information, log on to www.amiautomation.com

13 www.steeltimesint.com Digital Edition - February 2023 INNOVATIONS

ABB expands monitoring services

ABB, a global technology company, and Samotics, a high-growth scale-up company based in the Netherlands, have entered a strategic long-term partnership to provide enhanced condition monitoring services. The approach will leverage each company’s capabilities to deliver more insight into machine health and energy efficiency. As a first step, ABB will integrate Samotics’ plug-andplay monitoring solution into its digital portfolio.

Samotics’ technology is complementary to the well-established ABB Ability™ Condition Monitoring service for powertrains, a sensor-based solution that analyzes the health and performance of rotating equipment. Samotics’ SAM4 technology, based on electrical signature analysis (ESA),

will expand ABB’s application of asset health monitoring of motor-driven industrial equipment as it does not rely on mounting sensors in the field. This means that SAM4 can be deployed on machines in harsh and submerged environments, says ABB.

Adrian Guggisberg, president of ABB Motion Services said: “Our strategy is to build an ecosystem with leading service providers who can contribute to our customers’ overall success. With Samotics, we share the ambition to co-develop digital services that will offer even greater insight across a wider range of applications to help our customers taking better decisions. The partnership will also create even more value from digital

service solutions to grow our annual recurring revenues.”

Jasper Hoogeweegen, CEO of Samotics commented: “Entering into a strategic partnership with ABB will open doors with potential customers around the world and help us scale our business. At the same time, we share a mindset and commitment to help solve reliability and energy efficiency challenges.”

ABB plans to roll out Samotics technology to customers before the end of 2022 as part of its growing service portfolio for rotating equipment.

For further information, log on to www.global.abb/group

INNOVATIONS 14 www.steeltimesint.com Digital Edition - February 2023

#itsmorethanjustamachine

UNIQUE

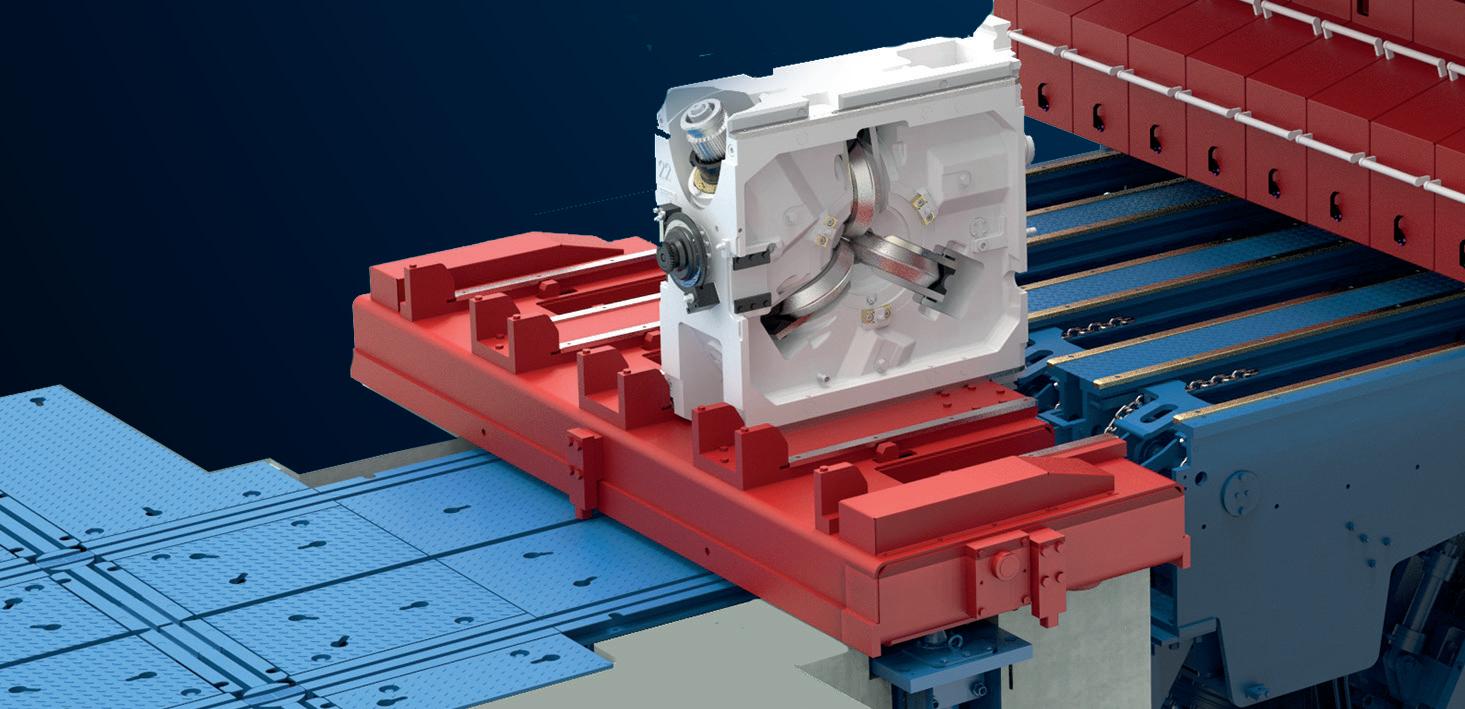

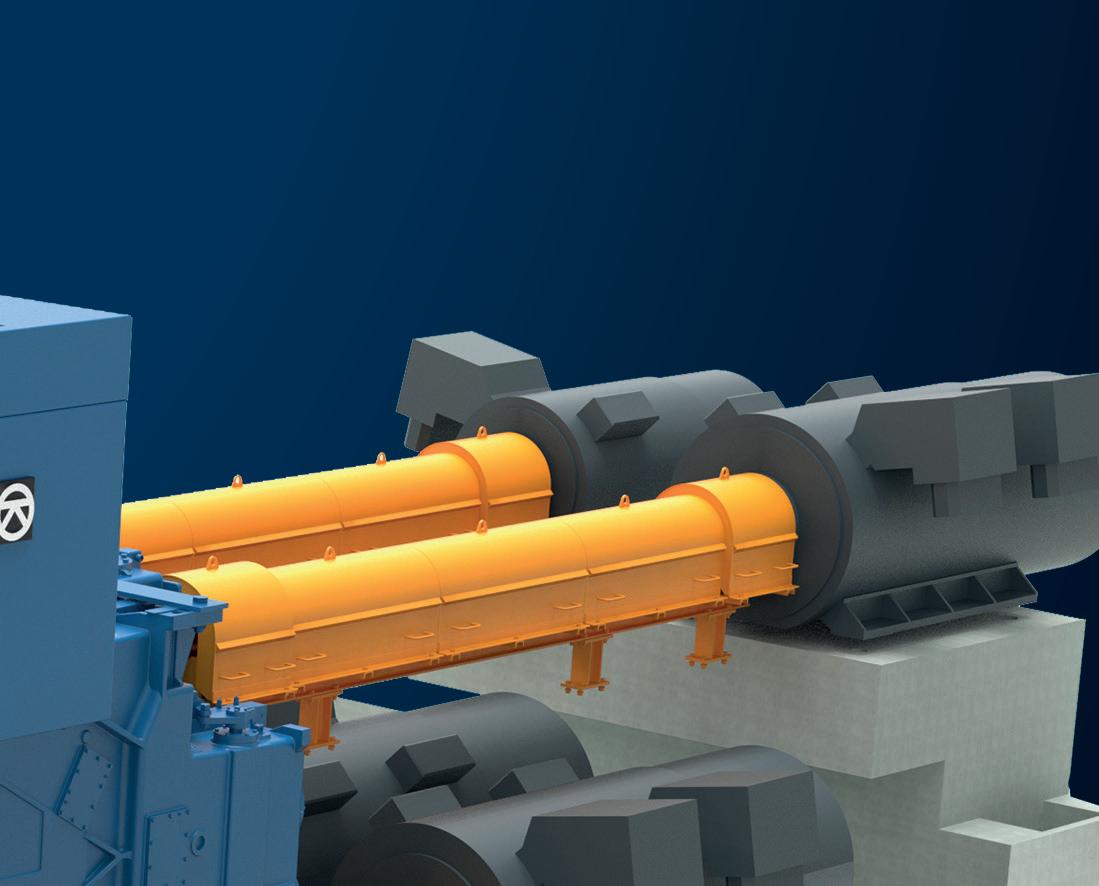

3-ROLL TECHNOLOGY FOR SBQ SIZING. A Reducing & Sizing Block for long products keeping its promises. Achieve your goals with KOCKS RSB®

VISIT US

12.-16.6.2023

Hall 1 / Booth A79

up to 160mm

finishing size in round or hexagonal dimensions

up to 20% up to 10% energy savings in the mill line

increase in production

WE MAKE YOUR PRODUCT GOLD www.kocks.de

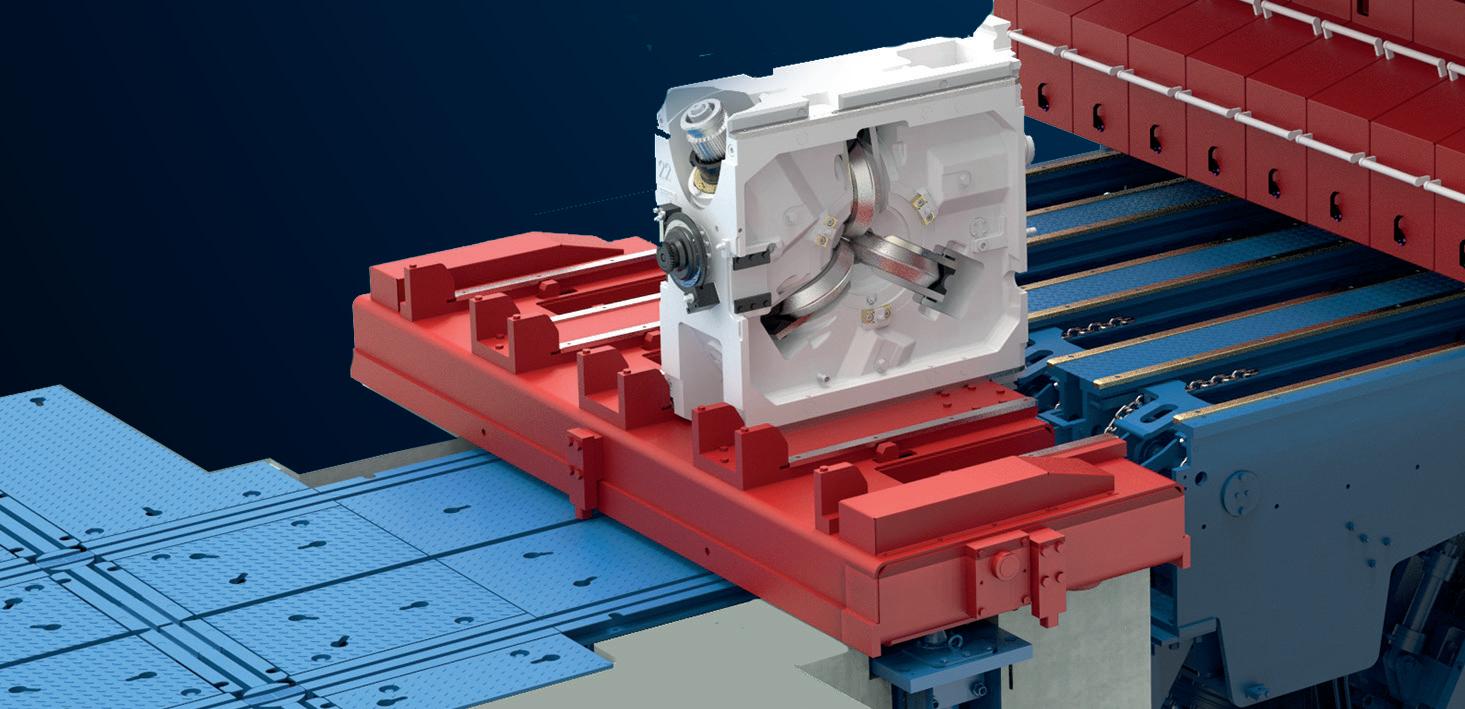

Tata Steel Long Products orders KOCKS 3-roll RSB®

Tata Steel Long Products has placed an order with Friedrich KOCKS GmbH for the supply of a RSB® 370++/4(5) in 5.0 design. The Reducing & Sizing Block will be part of the company’s new rolling mill complex in Jamshedpur, India.

According to KOCKS, the long products segment is poised to witness significant growth as India further builds its infrastructure and invests in industrialization. With its ‘booming economy’,

KOCKS says, India is aiming to expand its infrastructure and its automotive industry and create new jobs, which means the country is investing heavily in steel production.

The new RSB® 370++/4(5) will be located as a finishing unit after a reversing mill and 12 stands in H/V arrangement in a 500kt/yr combined SBQ and wire rod mill. It will produce straight bars within a dimension of Ø 20.00 to 90.00

mm onto the cooling bed, and will produce the feeders for the wire rod line to finish dimensions of Ø 5.0 to 27.0 mm. The scope of supply further includes the equipment for the roll-shop. The RSB® is scheduled to be commissioned during the first few months of 2024.

For further information, log on to www.kocks.de

INNOVATIONS 16 www.steeltimesint.com Digital Edition - February 2023

PROFILEMASTER® SPS Profile Measuring System

The PROFILEMASTER® SPS is a light section measuring device for measuring contours and dimensions on profiles of all kinds in cold and hot steel applications.

Benefits:

Maximum measuring accuracy thanks to temperature-stabilized measuring systems

Shape fault detection (SFD) thanks to high sampling rate

High-precision measurements

Detects process problems at an early stage

Fast maintenance and easy cleaning

Zumbach Electronic AG | Hauptstrasse 93 | 2552 Orpund | Schweiz Telefon: +41 (0)32 356 04 00 | Fax: +41 (0)32 356 04 30 | sales@zumbach.ch | www.zumbach.com 4 - 8 Number of cameras min 5 Min. object diameter (mm) max 720 Max. object diameter (mm)

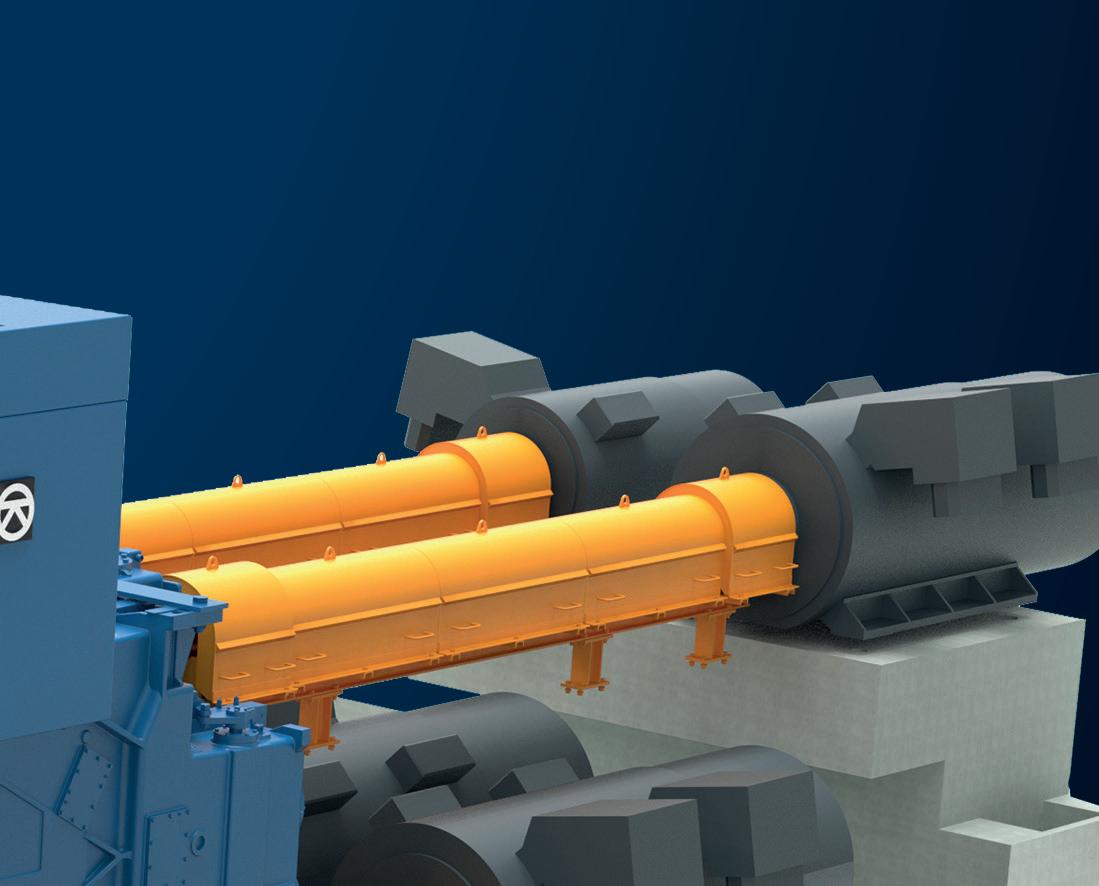

Huaigang Special Steel rolls first bar with new KOCKS RSB®

The steel producer Huaigang Special Steel Co. Ltd., a subsidiary of the Shagang Group – the world’s sixth largest steel producer – has rolled the first bar on its new KOCKS RSB® 500++/4 in 5.0 design.

This is the third KOCKS Reducing & Sizing block installation for Huaigang, following previous projects in 2010 and 2019. A fourth installation is in the process of being set up. With the installation of the KOCKS block in Huaigang’s existing bar mill line, the Chinese SBQ producer is extending its capacity for the production of high-quality special steel for various industries.

The 3-roll technology of the KOCKS RSB® is designed to improve both the overall efficiency of operations and production capabilities. In addition to providing the RSB® 500++/4, KOCKS also supplied equipment for the roll shop and proprietary software solutions.

For further information, log on to www.kocks.de.

INNOVATIONS 18 www.steeltimesint.com Digital Edition - February 2023

19 www.steeltimesint.com Digital Edition - February 2023 INNOVATIONS

FUTURE STEEL FORUM

2023

SEPTEMBER 2023 VIENNA, AUSTRIA

DIGITALIZATION AND

The Future Steel Forum, now in its SEVENTH successful year, is heading for Vienna in September to examine the important relationship between digital manufacturing and the decarbonization of the steelmaking process. Come and listen to experts from the two most important areas of global steelmaking at present. This is a must-attend conference for anybody with an interest in the fast-developing world of Industry 4.0 technologies and those responsible for sustainable steel manufacturing.

www.FutureSteelForum.com @Future_Steel Join our Future Steel Forum Group

SOMETHING TO SAY AND WANT TO CONTRIBUTE?

are now accepting abstracts for The Future Steel Forum. If you'd like to be a part of this event as a speaker, please contact Matthew Moggridge now on matthewmoggridge@quartzltd.com

EXHIBIT

Sponsored by O cial Media Partner Since 1866 Organised by BUSINESS MEDIA LTD To be the first to hear when registration opens for the Future Steel Forum event in Vienna, please scan this QR code

DECARBONIZATION HAVE

We

SPONSOR OR

To discuss any sponsorship opportunities or exhibition enquires, please contact Paul Rossage now on paulrossage@quartzltd.com

Jennifer Mikus*

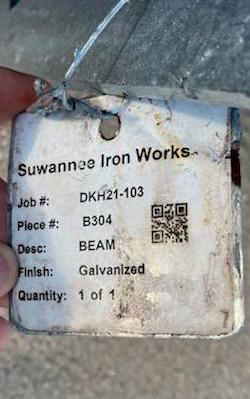

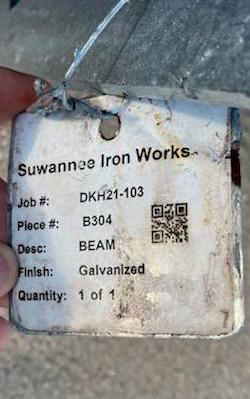

InfoSight was born of a desire to innovate. Founded in the 1990s by Dr. John A. Robertson, who enjoyed solving impossible problems more than anything, the company has made a name for itself providing unique, on-demand, automatically traceable identification for products and assets that exist in destructive environments. InfoSight takes two approaches to providing identification to the steel industry: durable metal barcoded identification tags and automated marking solutions.

As automation and digitalization become increasingly important in the steel industry, durable identification that is machine readable also becomes increasingly important. InfoSight was a leader in bringing durable barcoded metal tags to the steel industry with InfoTag® Hot Tag. From there, a broad range of tags have been developed to survive a range of harsh environments, including temperatures up to 1800oF (980oC) and exposure to various chemicals and processes. While there is no ‘one-size fits all’ durable tag, InfoSight ensures that each of their customers uses the proper tag in their process by offering trial samples. Furthermore, InfoSight welcomes the opportunity for product development when unique requirements mean there isn’t a suitable tag yet.

Recently, InfoSight introduced the KettleTag®PLUS EZ metal barcoded tag for galvanized steel, an evolution on the proven KettleTag PLUS technology. Both tags are designed to survive the entire galvanizing process, meaning fabricators and galvanizers can identify a fabricated piece of steel before it goes through the galvanizing process. When KettleTag was introduced, having any identification that could survive the process was incredible. The original KettleTag PLUS incorporates the use of a laminate to protect the tag during certain steps. This laminate needs to be applied after the tag is printed. It also creates the need to cut the tags apart, usually with a large paper cutter. InfoSight has been working for some time to eliminate this need for post-printing lamination and solved the problem with the

Tracing the lines

KettleTag PLUS EZ tag. It has the same survivability as the original but removes time-consuming steps from the process. InfoSight recommends printing this tag on the LabeLase 30XX Metal Tag Laser Printer.

Along with metal barcoded identification tags, InfoSight provides automated marking solutions for the steel industry. The marking technologies include stencil marking, stamp marking, direct laser marking, and automated tagging. InfoSight engineers work with each customer to determine the most suitable marking technology for their process and design a system that fits within the customer’s facility. Traditional, or hard, automation can be utilized in any of these systems with jib, gantry, and self-contained systems being very common. However, robotic automation is becoming a popular choice for integrating any of these marking technologies. Robots are generally

* Technical writer, InfoSight

smaller and faster than traditional systems, making them more desirable to increase efficiency in steel mills where floor space is at a premium.

InfoSight is currently building a robotic stencil marking system for marking continuous cast bar stock produced on a multi-strand caster. This system will replace manual marking of the up to 1200oF (6500C) bars. InfoSight engineers performed an on-site demonstration of the Hot Spray I-Dent® marking head to the customer’s satisfaction. There was some discussion of hard automation for this system, but InfoSight engineers and the customer agreed that utilizing a robot would be the best solution. The End Of Arm Tool will be a marking head with seven nozzles that marks large character programmable message data on the top of each bar. The automated marking system provides two significant benefits to the customer. One is a safety benefit –

INNOVATIONS SPECIAL: INFOSIGHT 22 www.steeltimesint.com Digital Edition - February 2023

The changes within InfoSight mimic the changes that have taken place within the steel industry; research, development, increased digitalization, and automation. With these focuses, the company is building its solutions, and constantly looking for ways to improve efficiency and durability.

By

the operator can now control the marking system from a pulpit and will no longer be exposed to extreme temperatures. Additionally, more data can be added to the message, including barcodes if and when the customer determines they need automated tracking.

As a small company with a loyal workforce, InfoSight is looking ahead to a period of growth and change. In November, InfoSight announced changes in the leadership of the company effective 1 January 2023.

Dave Hudelson is stepping away from his duties as president to become the executive chairman. Rob Underhill is assuming the helm as president and CEO. This mindful transition of leadership ensures continuity for InfoSight’s employees and ensures the momentum of growth continues.

A second part of that organization announcement included welcoming Aaron Thaler as the new director of research and product development at InfoSight. In the few short months of

Thaler’s tenure, he has established a plan to develop new or improved products that will solve specific problems for our customers. Companies turn to InfoSight when their identification methods either are not working, or they’ve never encountered an identification method that survives their process. Under Thaler’s direction, a team of InfoSight engineers and technicians will develop these solutions. While durable identification is InfoSight’s reputation, the research and development efforts will not be limited to marking technology.

The steel industry has seen many changes over the centuries. The ability to access information anywhere is an expectation. Accessing information about an individual piece of steel at any point in its lifespan is necessary for the way the industry operates.

That information relies upon accurate durable identification. Steel mills, fabricators, and end users rely upon InfoSight to provide identification that guarantees the traceability of steel. �

23 www.steeltimesint.com

E xcellence in Ox ygen lancing ww w. beda .com INNOVATIONS SPECIAL: INFOSIGHT

WHILE there has been an upswing, the US is lagging behind the rest of the world where demand for electric vehicles (EVs) is concerned – and this includes both electrified light vehicles and heavyduty trucks. However, the impact of this upon companies that supply steel to the automotive industry is somewhat uncertain depending upon the types of steel products they produce.

“Clearly we are seeing a pretty sizable, although incremental, growth in the adoption of EVs,” Philip Gibbs, a senior equity analyst at KeyBanc Capital Markets

said, observing that globally EVs currently account for about 10% of light vehicle sales with that penetration expected to continue to grow – albeit at different rates depending on region.

There is also some growing interest in electrified heavy-duty trucks, Jeffrey Short, vice president of the American Transportation Research Institute (ATRI), noted, although the rate of adoption for those vehicles have been much slower, given that the average weight of freight makes battery range issues even more challenging due to there being minimal

heavy duty truck charging infrastructure other than at the company’s home base. He noted that of the three million heavy duty trucks on the road in the US today, less than 10,000 are EVs.

John Anton, a director of S&P Global Market Intelligence’s pricing and purchasing service noted that when it comes to passenger cars and light trucks, as recently as 2018 global battery electric vehicle (BEV) production was quite low – less than three million light vehicles. However, he said that by 2022 it had already increased to just under nine million light vehicles and it is

ELECTRIC VEHICLES 24 www.steeltimesint.com Digital Edition - February 2023

*North America correspondent

Driving toward the green

drive, which means there isn’t as much range anxiety there. Also, Hites noted that Europe has effectively mandated a transition to EVs through its regulations for reduced carbon dioxide emissions which include heavy penalties for OEMs that exceed those limits on a fleet level. She added that high gasoline prices and expected gasoline shortages resulting from the war in Ukraine have contributed to a strong consumer transition to EVs in Europe, even though recent studies have shown that the cost to operate EVs isn’t significantly lower than for operating internal combustion engine (ICE) vehicles.

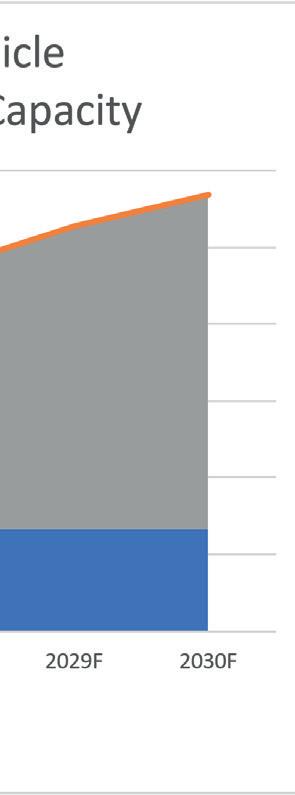

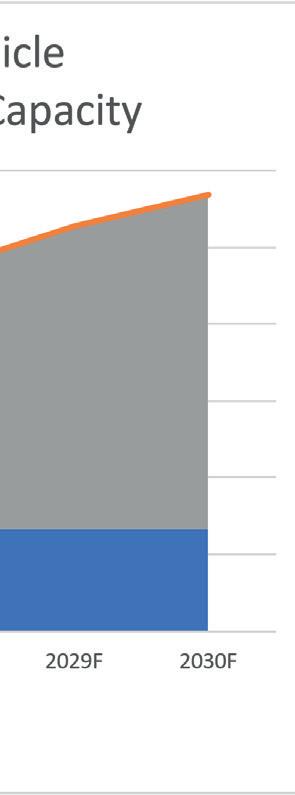

EVs are starting to catch on at a continually increasing rate in the US. However, Kristock pointed out that electrified vehicles (mainly BEVs, but also plug-in hybrids (PHEVs) only accounted for 5-7% of total US light vehicle sales last year. But, according to Kevin Riddel, a North American analyst for LMC Automotive, at 708,461 vehicles in 2022, US BEV light vehicle sales were up 75.5% year-on-year and are expected to increase by another 54.9% this year and to account for 14% of new US light vehicle sales by 2025. Similarly, he said, North American BEV light vehicle production increased 46.2% last year (accounting for 5.7% of NA light vehicles produced) and is expected to increase another 49.1% this year and have a 14.0% share of all NA light vehicle output by 2025. Graph 2

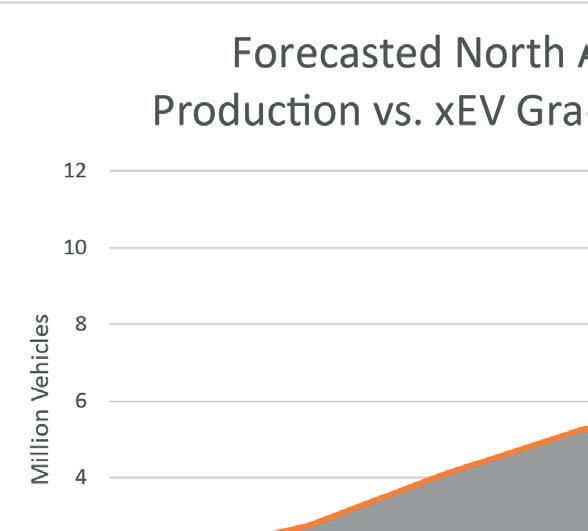

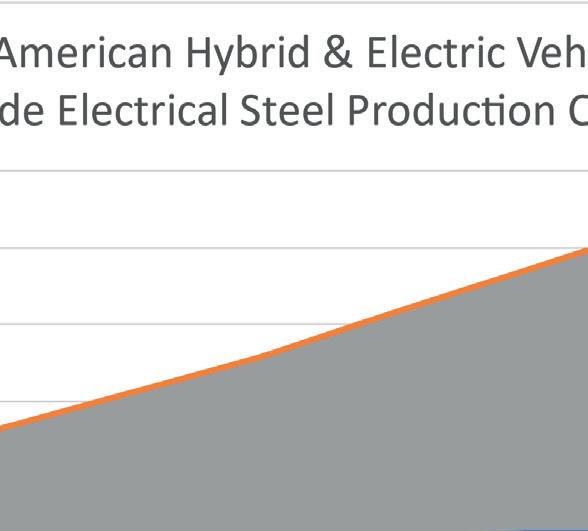

expected that within another three years 20 million or more BEVs could be produced globally, and that 10 years from now – as long as there is enough electric steel and battery materials to support it – global BEV production could rise to about 40 million (a little less than half of total light vehicle production.) Graph 1

While it has recently made some inroads, currently US EV production and sales are not as strong as those in some other parts of the world. Chris Kristock, vice president of the automotive programme for the American Iron and Steel Institute (AISI) noted that China leads the way because they have the infrastructure in place for

battery production as well as having the availability of the necessary raw materials. Also, Becky E. Hites, president of Steel-Insights, pointed out that through a combination of tax incentives (which were targeted to be removed in 2022 but have been extended through to the end of 2023) and the availability of regional license plates, in 2022, China exceeded the mandate put in place by its central government that its ‘New Energy Vehicle’ sales were more than 25% of its total vehicle sales by 2025.

Kristock said that Europe comes just behind China, partly because of the average vehicle size and the limited miles people

In fact, Cox Automotive reported that a record number of EVs were sold in the US during the third quarter of 2022 – more than 200,000 vehicles – which the report attributed to new entries. Not only have new companies gained more market share in the US market, which Tesla has traditionally dominated, but that increase has come from the midsized SUV, compact SUV and full-sized light truck models, which are segments that are very important to US consumers and accounted for 47% of total third quarter sales.

A Cox spokesperson noted that not only were there 19 launches and redesigns of EVs in 2022, but there will be another 27 launches or critical refreshes of light EV models this year. Also, she said certain barriers to US EV purchases – including the

ELECTRIC VEHICLES 25 www.steeltimesint.com Digital Edition - February 2023

With demand for electric vehicles rising, questions remain on what impacts will be incurred on steel markets, in terms of demand, and types of production. By Myra Pinkham*

availability of charging stations and battery issues – are starting to ease and that 50% of consumers say that the tax credits in the recently passed Inflation Reduction Act (IRA) will encourage them to purchase an EV for personal use.

Riddel said that another supportive factor has been the recently passed Advanced Clean Cars II standard, which requires that all light vehicle sales be EVs – either BEVs or PHEVs in California by 2035. Reportedly, 14 other states and the District of Columbia

have adopted similar emissions standards and Canada is working on achieving a national zero emissions policy.

ATRI’s Short noted that California is also offering incentives, including rebates, to encourage heavy duty EV truck sales as well, which he said is needed given that those trucks are two to three times more expensive than ICE models. He said that because of this, and growing interest by their customers to decrease their carbon footprint, several truck companies, such as

LMC Automotive Light Vehicle Outlook

Volvo and Freightliner, have been testing the use of EV trucks, but, to date, volumes remain low.

He said one limiting factor is that currently there is no meaningful amount of public charging infrastructure for heavy duty trucks, requiring them to go back to their home base to recharge. With the average BEV truck only getting 200-300 miles per charge, Short added that ‘in the long-haul industry, we want to go about 500 miles per day.’

Charging is also a big issue for EV passenger cars and light trucks, Gibbs said, noting that if every light vehicle in the US goes electric, over 100 million vehicles would need to be charged and even with new, faster charging stations, it takes more time to charge an EV than to fill up an ICE vehicle with gasoline or, in the case of heavy-duty trucks, with diesel. Even though he maintained that while range anxiety will never go away, S&P Global’s Anton said there is a growing realization that it is somewhat overblown given that with new battery technologies, EVs’ ranges have already improved.

While at first glance it would appear that increased demand for electric vehicles would be positive for producers of the steel, aluminium and other metals used in their production, Timothy Van Audenaerde, Accenture’s global metals lead, said that

ELECTRIC VEHICLES 26 www.steeltimesint.com Digital Edition - February 2023

2020 2021 2022 2023 2024 North American LV Production 12,941,518 12,989,491 14,191,094 15,199,650 15,914,753 North American LV BEV Production 409,864 555,174 812,079 1,211,364 1,642,628 US LV BEV Sales 254,295 403,585 708,461 1,097,583 1,650,130

Graph 2. Source: LMC Automotive

Graph 1. Data Sources: S&P Global Mobility / IHS Markit, xEL Mobility, Metals Technology Consulting, and Steel-Insights, LLC.

it isn’t so clear cut given that EVs are displacing internal combustion engine (ICE) vehicles, and that factors such as range and battery expense will also affect the demand for those metals. “EVs manufactured for increased range – with bigger or more advanced batteries and a lighter weight overall design – typically use aluminium alloys over steel,” Audenaerde said, even though those alloys are higher cost.

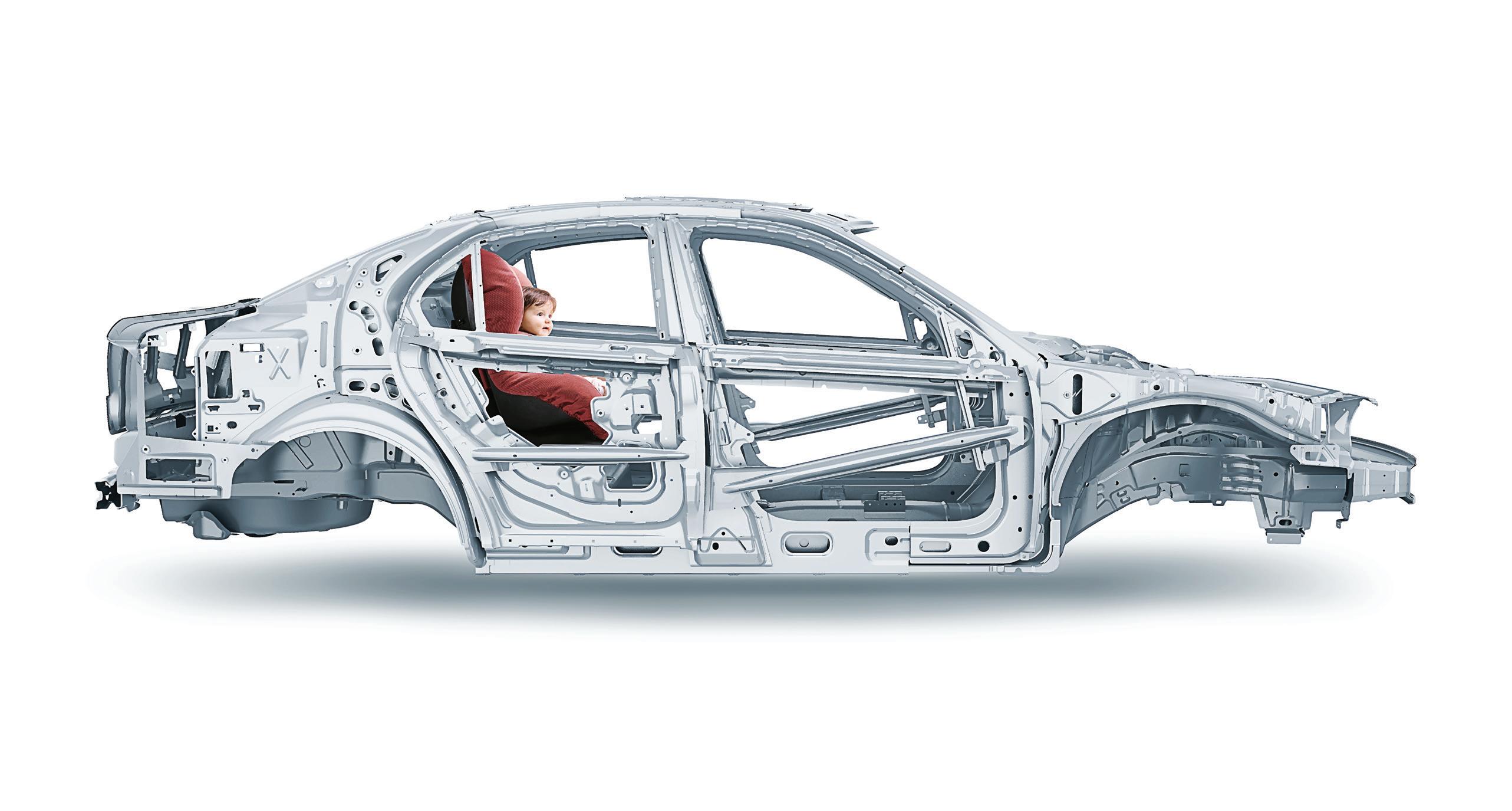

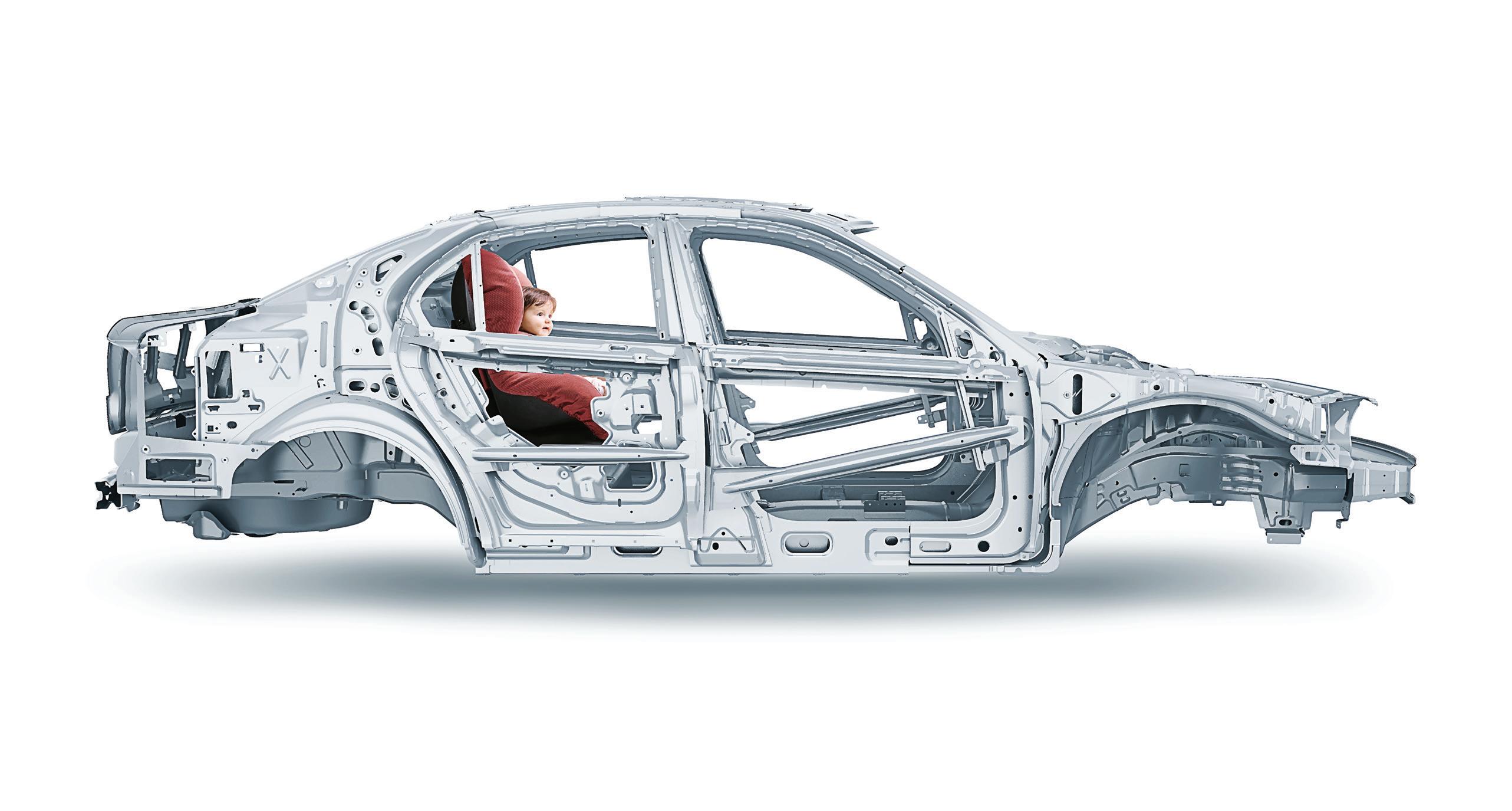

Advanced High Strength Steels

AISI’s Kristock, however, maintained that the lightweighting opportunity of using aluminium in some applications where steel is now used isn’t as straightforward as just comparing the density of the two metals. He explained that, for example, to maintain stiffness or rigidity of parts converted from steel to aluminium, thicker gauges would need to be used. “At the same time, steel’s thicknesses, therefore weight, is coming down because of the properties of new advanced high strength steel (AHSS) grades, which are able to be formed into complex shapes because of its improved strength and ductility.

Because of this, Audenaerde said that AHSS will be the primary steel utilized for EVs and that mills will continue to develop and produce AHSS close to where it is most needed and wanted – with near end users seeking greater energy efficiency and lower carbon emissions from their products.

With the two metals meeting somewhere in the middle for a number of components, Kristock said it has been shown that automakers can produce a very nearly mass equivalent vehicle out of steel at a significantly lower cost. Anton pointed out that lightweighting has been on automakers’ minds for the past 15-20 years for all of their vehicles and that materials used in the body of EVs, while moving more

towards AHSS, really doesn’t vary greatly from the body of ICE vehicles.

“The major difference in EVs is that they don’t have engine blocks, exhaust or cooling systems, all of which currently use a good amount of steel,” Anton said. But the engine block is replaced by electric motors, which require non-grain oriented electric steel (NOES), and there is also a need for grain oriented electric steel for the EVs’ charging and discharging systems.

been on allocation since early last year and is expected to continue to be so for the foreseeable future, Anton said, adding that because of the tight supply of electric steel, lead times for industrial generators and electric motors are out 80-100 week and are growing. Similarly, lead times for industrial transformers go out into 2026. Anton said that there is a need for multiple electric steel mills to be added each year over the next five to 10 years given the expected BEV growth rate over that time period. But, he said that to date such public announcements by steelmakers have been limited.

Hites said that currently the AK Steel division of Cleveland-Cliffs, which at the end of last year introduced a new NOES product line, called MOTOR-MAX™, for high frequency motors and generators, is the only North American NOES producer. But, she said that even with Cliffs’ additional production capacity and with US Steel’s Big River Steel unit starting to produce electrical steel in mid-2023, that will be insufficient to meet long-term EV electrical steel demand.

There is, however, a strategic gap and supply chain vulnerability when it comes to electric steel, Hites said, given that the majority of the electrical steel used for EVs doesn’t originate in the US. That, according to Dr. Gwynne Johnston, president of Metal Technology Consulting (MTC), will put the automakers producing EVs between a rock and a hard place in the future. They not only don’t want to be exposed to long supply chains based on imports, but they are under pressure to reduce the cost of EVs.

Already, at current EV production levels, non-oriented electrical steel (NOES) has

Johnston said that the higher cost of NOES in the US is resulting in most EV motors being imported. She said, “Cliffs’ announcement is a step in the right direction, but we need to find better ways to support our domestic steel and manufacturing industry to reduce costs.”

“Overall BEVs is a growth market for steel,” Anton said, maintaining that what could hold it back isn’t demand, but the availability of steel – particularly electric steel – and other raw materials used in EVs and EV batteries such as copper and lithium. Kristock said he believes that the steel industry will continue to make the necessary investment to make the steel grades needed to support its demand as EV production grows. �

ELECTRIC VEHICLES 27 www.steeltimesint.com Digital Edition - February 2023

The decade of delivery The decade of delivery

The stakes in achieving climate goals lie in turning ‘ambition into action’, says Cécile Seguineaud*, and as we draw closer to net-zero deadlines, fundamental changes to the industry are required in order to increase momentum and support a clean, green transition.

The steel sector plays a key role in achieving climate goals, as it accounts for nearly 8% of global emissions from the energy sector. However, the path to net-zero requires a deep transformation, bringing new challenges that are likely to reshape the steel industry.

Considering this decarbonization imperative, an increasing number of initiatives have been launched in recent years. Whether driven by governments, industry, or multi-faceted partnerships, they aim to support and guide this transformation (Box 1). Equally, through the Breakthrough Agenda, COP 26 has further increased this momentum (COP26, 2021[1]).

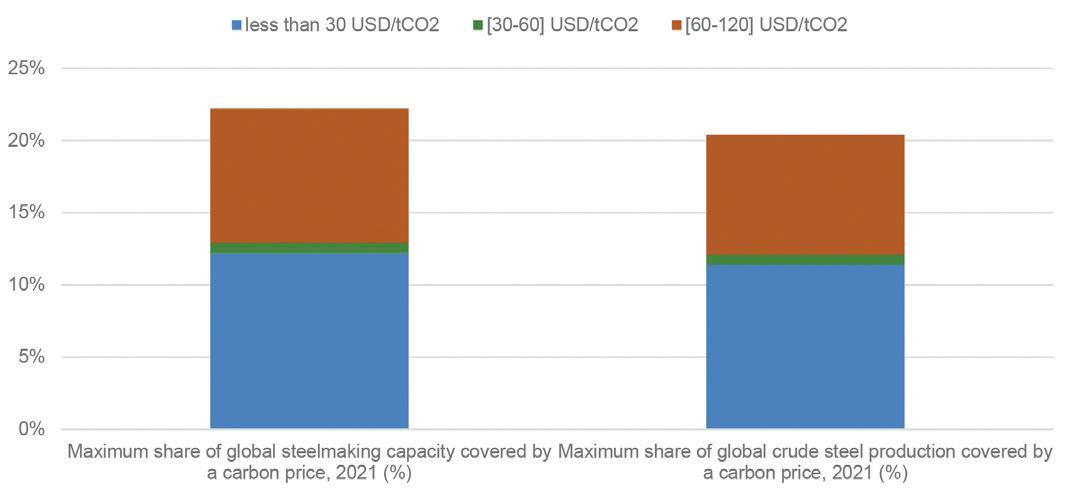

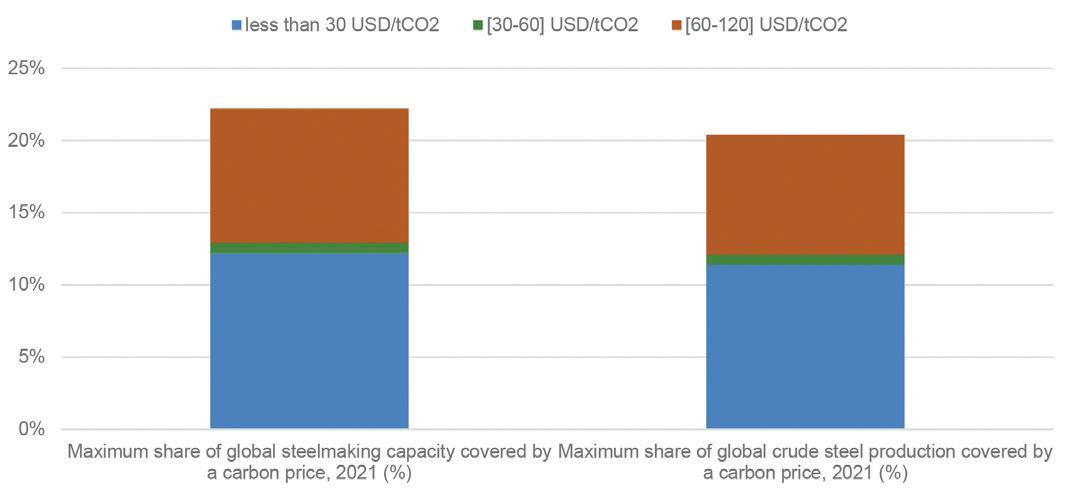

While the nature of the transformation and its implications have been explored extensively, the stake now lies in turning ambition into action. This echoes the COP 27 presidency’s call for implementation, the current decade being depicted as critical to achieve the Paris Agreement’s objectives ((COP26, 2021[2]) (COP27, 2022[3])). This brief aims to provide evidence-based trends on key indicators of steel decarbonization progress to support the COP27 call for action. The focus includes carbon emissions, countries’ and companies’ net-zero targets, production, capacity, breakthrough technologies, and carbon pricing.

1. The decarbonization journey: the starting point and the end goal

The steel industry is a key sector to reach climate goals…

BOX 1.

CONNECTING THE DOTS ON STEEL DECARBONIZATION INITIATIVES [1]).

In September 2022, the OECD hosted an event called “Connecting the Dots on Steel Decarbonization Initiatives: Contributing to a Global Inclusive Dialogue”. The goal of this event was to explore the wide landscape of initiatives that have been launched in recent years to accelerate the decarbonization of the steel sector and to identify where possible gaps may exist, but especially where synergies could be created among them. In addition, the event aimed to uncover how the collaboration between policymakers, steel industry associations and private, as well as public-led initiatives can be leveraged to support this transition, recognizing that each actor has an important role to play.

The event focused on two particular areas where efforts are increasing but remain too fragmented: data and trade. First, data represent the backbone of any true implementation effort as they are crucial to measure and compare progress across industries and countries on their path to net-zero emissions. To this aim, stakeholders underlined the importance to have access to disaggregated data for embedded steel carbon emissions at the plant and national level. These data will also be crucial to reach agreement on standards and definitions for “near zero or low-carbon emission steel production”, which in turn, will be foundational to shape trade measures.

As steel account as a highly export-oriented commodity, trade policies are essential to underpin decarbonization efforts. With countries and companies undertaking costly investments to transition the steel industry towards near zero emissions, carbon leakage has become a major concern and levelling the playing field an urgent response to this issue. In this regard, many proposals have been advanced in recent years, which include a Carbon Border Adjustment Mechanism (CBAM), but also a Carbon Alliance or Carbon Clubs. Although a multilateral solution is not yet within reach, the importance to push for a common adoption of standard and definition has been widely reiterated, which recalled how they are a prerequisite of any effective anti-carbon leakage policy.

DECARBONIZATION 29 www.steeltimesint.com Digital Edition - February 2023

*Analyst, steel decarbonization, OECD.

Notes:

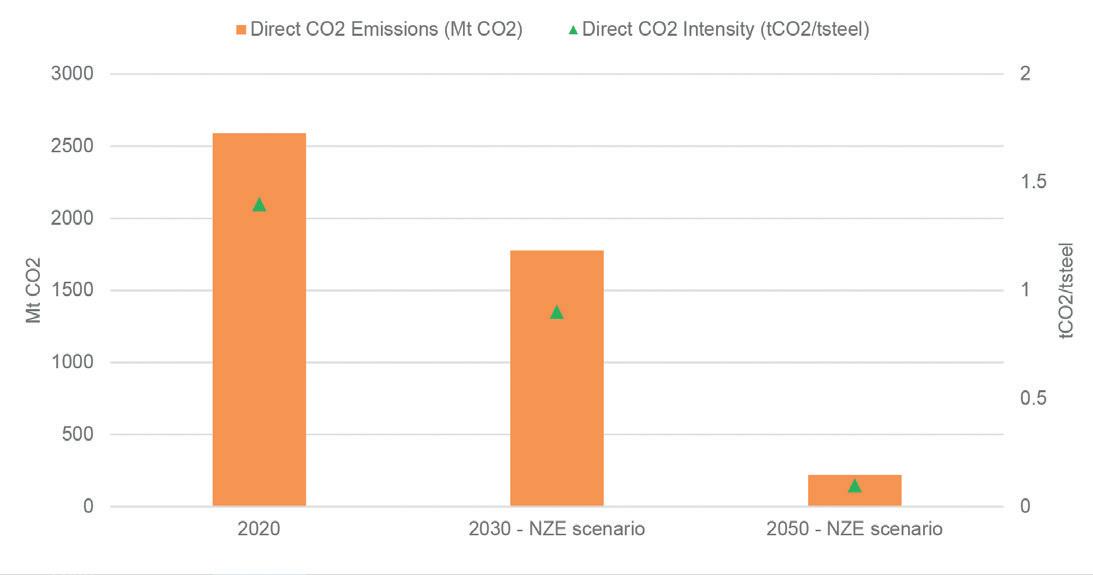

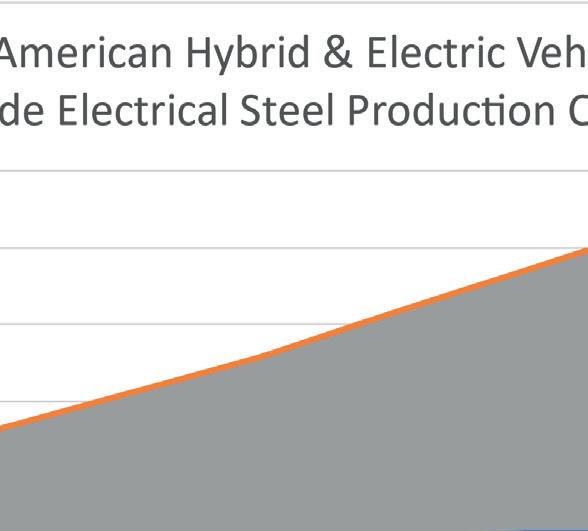

With direct emissions equating to 2,591

Mt CO2 in 2020 (IEA, 2021[4]), the iron and steel sector accounts for nearly 8% of global emissions from the energy sector. It further ranks as the largest emitting sector in industry, representing 30% of industrial carbon emissions (IEA, 2021[4]). With such a large carbon footprint, decarbonizing the steel sector is key to achieve climate goals.

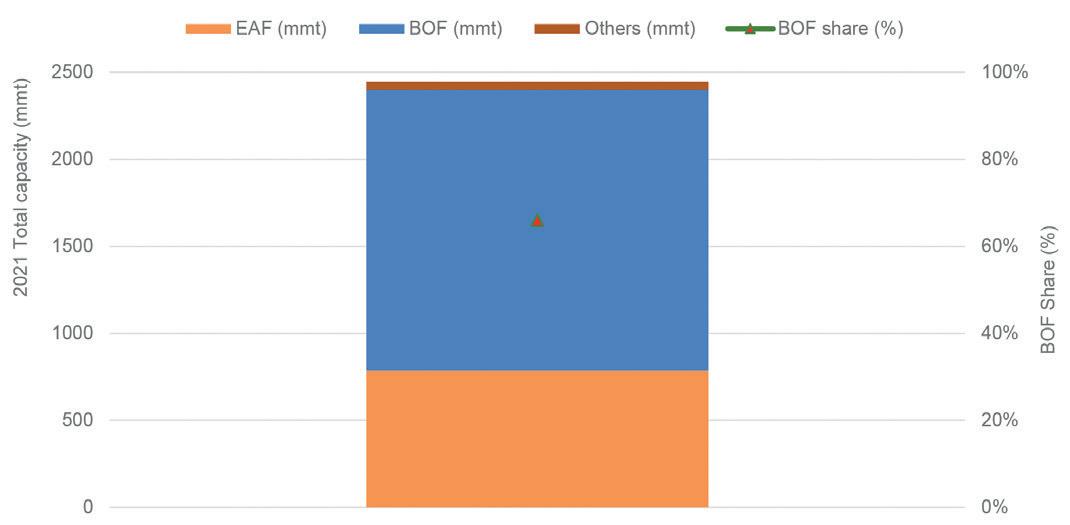

… largely dominated by highly carbonintensive production

Steel production and its related CO2 emission intensity form the core drivers of carbon emissions. In 2020, global steel production reached 1,878Mt (worldsteel, 2021[5]), with an average direct carbon intensity of 1.4 tCO2/tsteel (IEA, 2021[6]).

BOF is by far the predominant steelmaking route accounting for 73% of total output (worldsteel, 2021[5]).

This outlines the dominance of high carbon-intensive production processes, underpinned by a 75% share of coal in final energy demand in the steel sector (IEA, 2021[7]).

A long way to go for reaching near zero emission

To meet the Paris Agreement objective of limiting global warming to 1.5°C,

Notes:

NZE:

global CO2 emissions must decline on an unprecedented scale, reaching net-zero in 2050 (IPCC, 2022[8]). To comply with this overall goal, direct emissions of the steel sector and related carbon intensity have to decrease by 90% from 2020 levels by 2050 (IEA, 2021[9]) (Fig 1). This shows that the steel industry has a long way to go for reaching near zero emission and how the carbon neutrality target is a game changer for the steel industry, calling for a deep transformation of the sector.

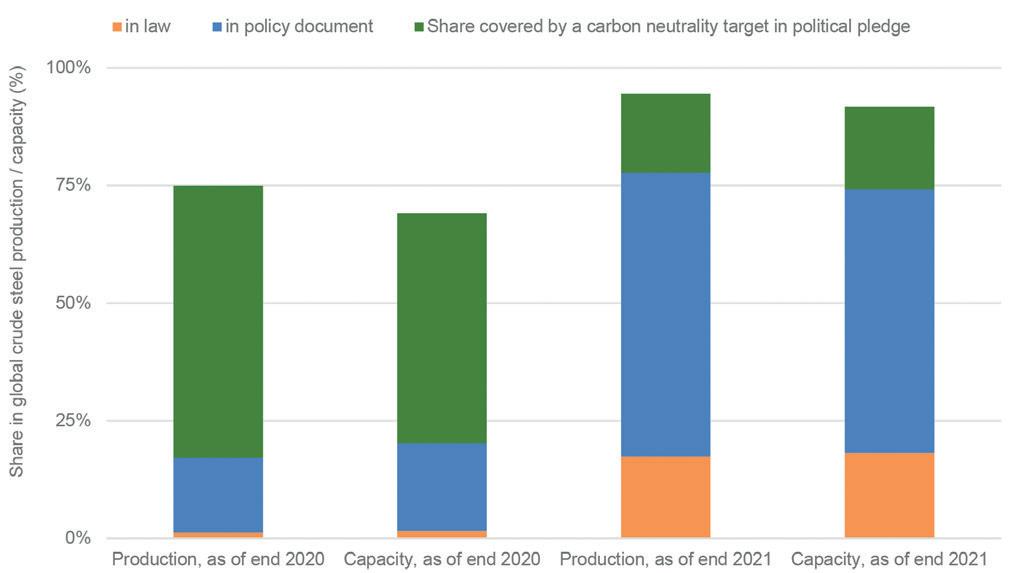

2. Is the level of ambition of steel producing countries up to the task?

With net-zero pledges booming, the steel sector must decarbonize

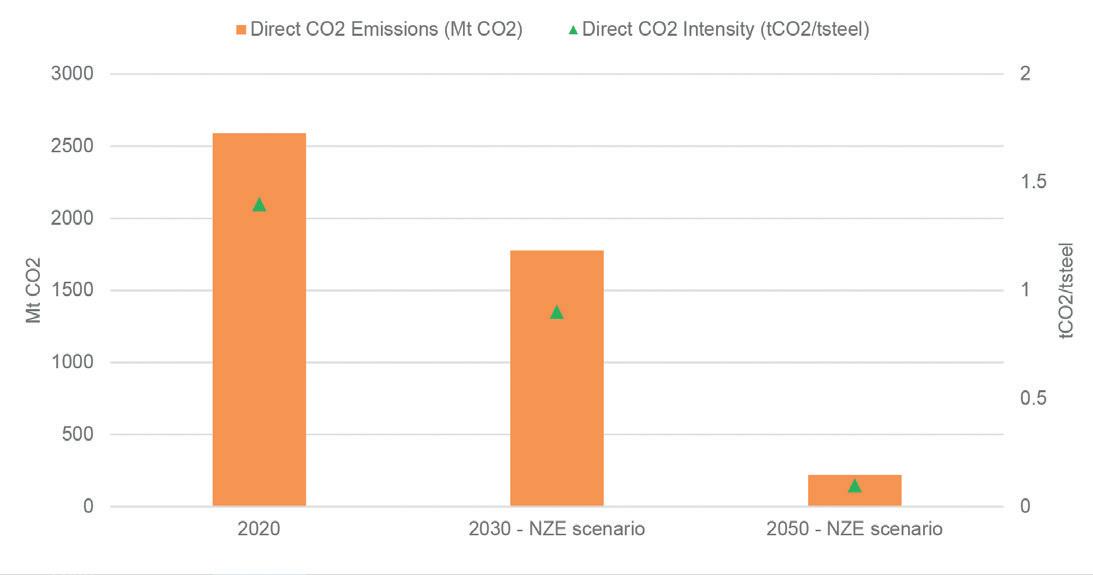

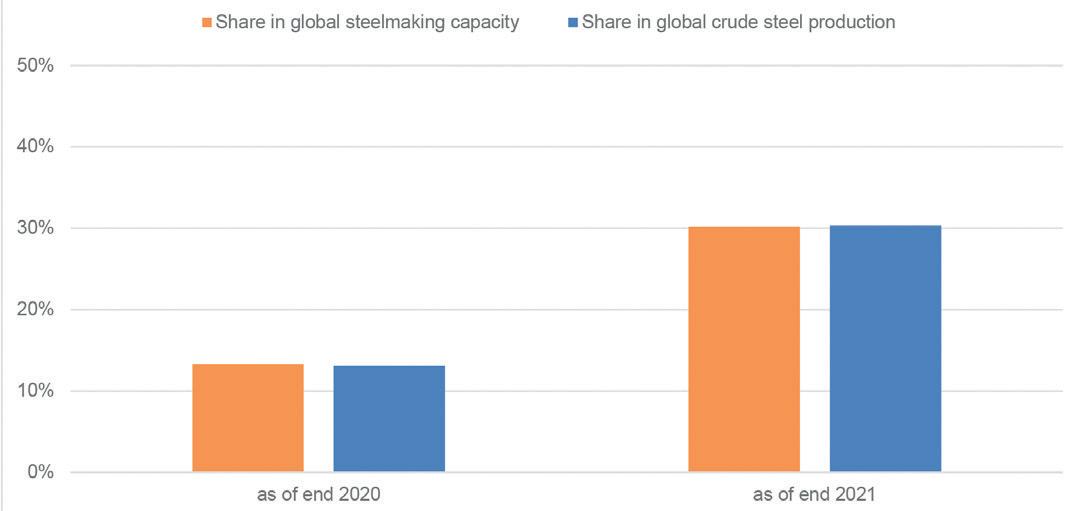

As of the end of 2021, more than 90% of global steelmaking capacity and crude steel production were in countries that had announced a net-zero target. This represents a sharp increase compared to 2020 (Fig 2). Given these pledges, the global steel industry is bound to follow a net-zero pathway1

Despite encouraging progress, uneven levels of ambition nuance such high scores

The nature of announced targets provides a more balanced perspective (World

Resources Institute, 2020[10]). As of end2021, only 18% of global steelmaking capacity and production was in countries with a net-zero target enshrined ‘in law’, about 60% related to a ‘policy document’ status, and 18% upon a ‘political pledge’ (Fig 2).

However, the comparison with 2020 levels reveals some encouraging signs. The 2021 growth in net-zero capacity and production coverage has been combined with a significant change in target types. There has been an overall increasing level of ambition, with most of the capacity covered by a ‘political pledge’ in 2020 shifting to ‘in policy document’ in 2021. Equally, major steel producing countries raised their level of ambition, from a net-zero target ‘in policy document’ to an ‘in law’ status.

While being an essential step, pledging is not enough

Setting a net-zero target is a first crucial step but does not by itself guarantee that emission reductions will be achieved. Such targets should be seen as a commitment to take ambitious actions to curb emissions, thus the starting point for developing decarbonization strategies.

When moving to implementation, a major pitfall lies in the fact that net-zero

1. While net-zero pledges are not directed to the steel sector itself (but to the whole economy), such targets imply a deep decarbonization of steel production. In this policy brief, capacity/production ‘subject to a net-zero target’ or ‘covered by a net-zero target’ refers to capacity/production ‘located in countries covered by a net-zero target’.

2. Objective to reach carbon neutrality (or similar) by 2050 or before, depending on the companies.

3. Whereas this rationale primarily relates to the BF-BOF route (given its relative high carbon intensity), it also applies to fossil fuels-based DRI EAF. Even if less carbon intensive, such facilities are nevertheless not aligned with near zero emission steel production, if not transitioning to low-carbon hydrogen or equipped with CCUS (IEA, 2022[19]).

4. Direct Reduced Iron (DRI).

DECARBONIZATION 30 www.steeltimesint.com Digital Edition - February 2023

Fig 1. Direct CO2 emissions and intensity trajectory in the NZE scenario.

CO2 emissions refer to direct emissions only (including energy and process emissions). NZE: IEA Net Zero Emissions by 2050 scenario. Source: (IEA, 2021[4]), (IEA, 2021[6]), (IEA, 2021[9]).

Fig 2. Share of global crude steel production and capacity covered by a net-zero target.

CO2 emissions refer to direct emissions only (including energy and process emissions).

IEA Net Zero Emissions by 2050 scenario. Source: (IEA, 2021[4]), (IEA, 2021[6]), (IEA, 2021[9]).

pledges are not sector specific but cover the whole economy. By providing a focused objective, setting sectoral targets could support the development of strategies and policies considering sectoral specificities. Equally, acknowledging that there is no ‘one-size-fits all approach’ calls for defining tailored approaches, in particular taking into account a country’s specificities.

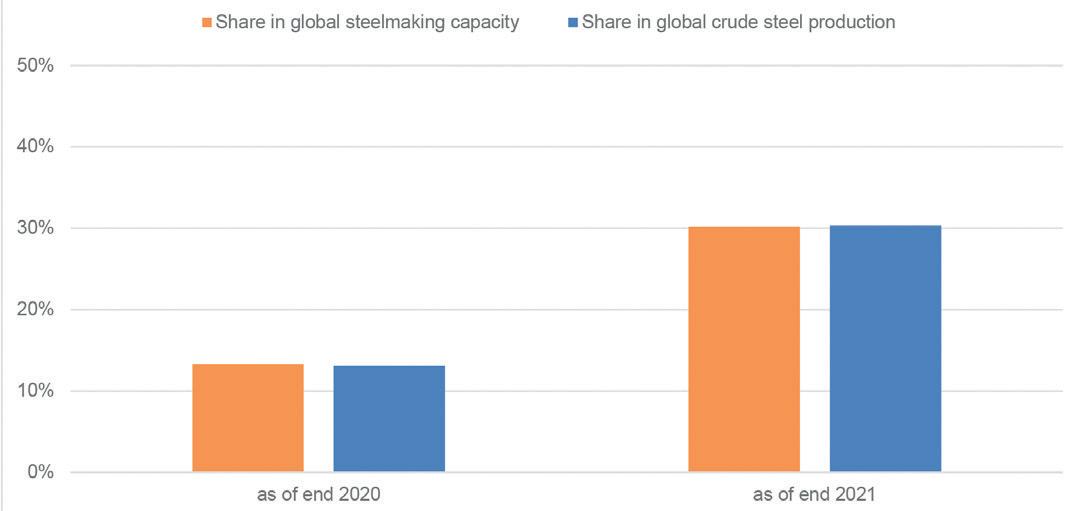

3. As implementers, are steel companies aligned with net-zero?

A mismatch between countries’ and corporate pledges

Companies as drivers of steel production are key implementers of decarbonization. To follow a net-zero pathway, it is, therefore, essential that countries’ pledges are mirrored by those of steel producers.

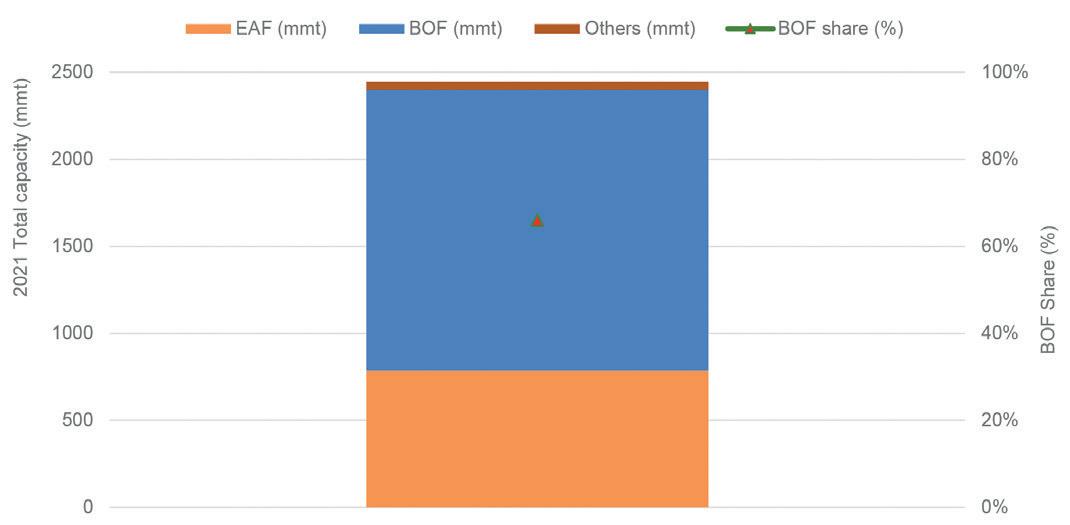

As of end-2021, 30% of global crude steel production and steelmaking capacity were covered by a corporate net-zero target2 (Fig 3). Similar to countries’ pledges, this share has significantly increased compared to 2020 levels. This doubling in coverage is mainly due to announcements from several top 10 steel producers in 2021.

Overall, the share of steel production and capacity covered by corporate netzero targets (30%) is well short of the one related to steelmaking countries’ pledges (more than 90% coverage, Section 3). The reasons for this clear gap towards implementation are the following.

First, there may be a time lag between companies’ responses and the pledge announcements of the country in which they operate. In addition, and referring to section 2, it is worth noting that net-zero

countries’ pledges refer to their whole economy but are not written from a sectoral perspective. Furthermore, steel decarbonization related challenges (whether related to investments, technologies, and/ or competitiveness) may hinder companies’ ambition to commit to such targets.

Given the variety of company and country profiles, a tailored approach is warranted.

In terms of a company’s profile, an increasing number of the world’s top 10 producers have pledged for net-zero over the last year (Fig 4). As of end-2021, this category represented a quarter of the total number of listed steel producers having pledged for net-zero. However, in terms of the number of companies, the category of smaller companies is still important (companies below rank 45 of the largest steel producers according to (worldsteel, 2022[17]), with annual production below 10Mt).

From a regional perspective, Europe accounts for the majority of companies with net-zero targets. Whereas steel companies’ pledges have increased in various regions worldwide, the Asian region and the People’s Republic of China (hereafter “China”) have especially experienced a significant growth. They now represent the second regional pool, after Europe.

Overall, the diversity of companies committed to net-zero adds to the countries’ specificities raised previously. Typically, the EAF (or BOF) share ranges from 0% to 100% depending on the company (Global Energy Monitor, 2022[18]). Equally, the age and location of the assets, as well as their technological leadership (especially with respect to breakthrough

technologies) are other characteristics shaping each company’s decarbonization roadmap. The size of the firm and its investment capacity are key features driving decarbonization implementation. When combining all these aspects, low-carbon business strategies and related investments are likely to be specific to each company, and even project based. This further reinforces the imperative of a tailor-made approach to ensure a successful sectoral decarbonization.

4. Beyond the pledges, are steel production and capacity on the right track?

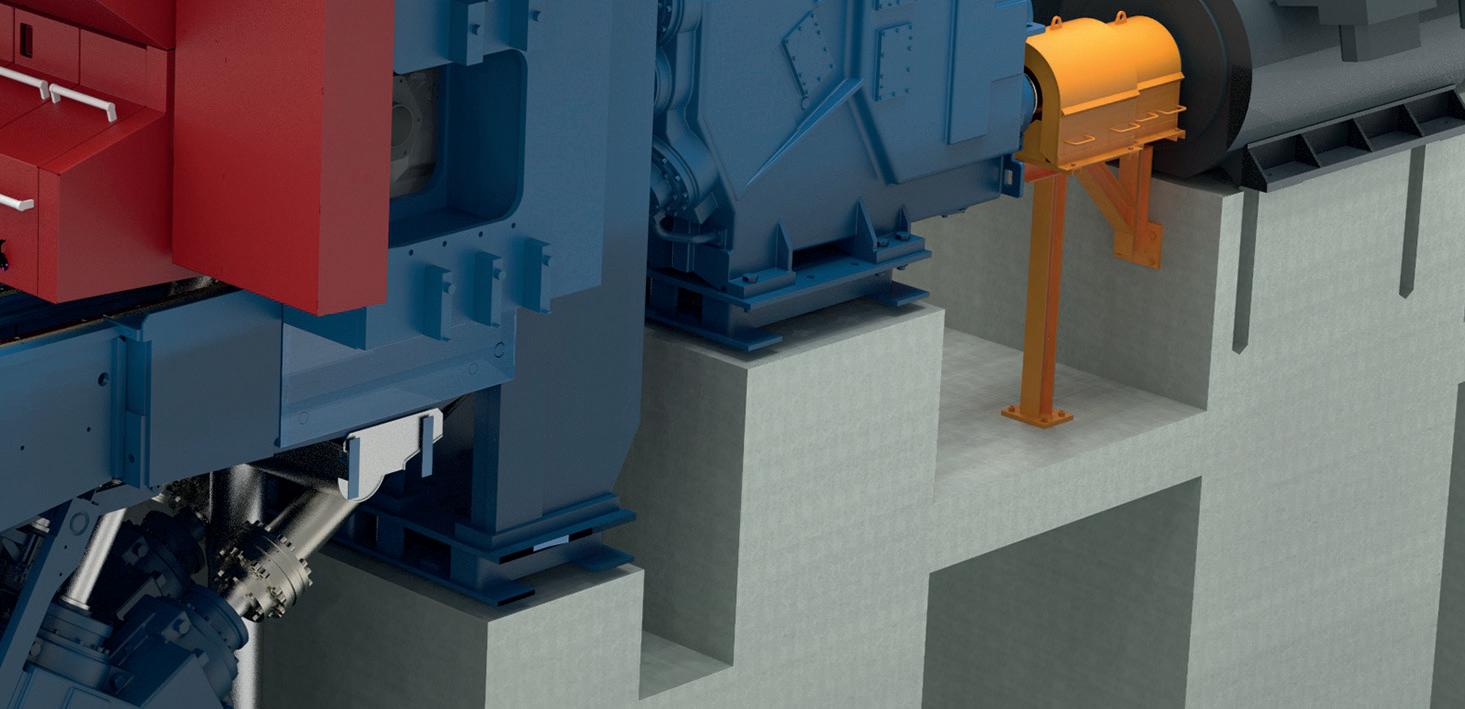

Achieving near zero emission steel relies on a diversification of production routes ‘Near zero emission steel production’ refers to crude steel production whose emission intensity is compatible with a global net zero pathway by 2050. To identify the steelmaking routes complying with this requirement, the quantitative thresholds of emission intensity defined by the IEA (IEA, 2022[19]) are leveraged.

Based on these considerations, production levels compatible with a near zero emission pathway amounted to 20% of global crude steel production, scrapbased EAF being the contributing route ((worldsteel, 2021[5]), (IEA, 2021[20])). Next to scrap-based EAF, a further structural shift in production methods for decarbonization purposes is needed.

The lack of diversified near zero emission steel production routes currently available at commercial scale hinders the ability to significantly increase this share in the shortterm. Scaling-up breakthrough technologies

DECARBONIZATION 31 www.steeltimesint.com Digital Edition - February 2023

Fig 3. Steel producing companies with a net-zero target – related share in global steelmaking capacity/production. Source: Calculations based on companies websites, (Global Energy Monitor, Caitlin Swalec, Christine Shearer, 2021[12]), (Vogl, 2021[16]), (worldsteel, 2021[5]), (worldsteel, 2022[17]), (worldsteel, 2022[13]), (Global Energy Monitor, 2022[18]), (OECD, 2022[15]).

Fig 4. Steel producing companies covered by a net-zero target – production ranking breakdown. Note: Companies breakdown according to the ranking defined in (worldsteel, 2022[17]). Source: Calculations based on companies websites, (Global Energy Monitor, Caitlin Swalec, Christine Shearer, 2021[12]), (Vogl, 2021[16]), (worldsteel, 2022[17]).

(such as CCUS and hydrogen) will be particularly crucial to unlock this potential.

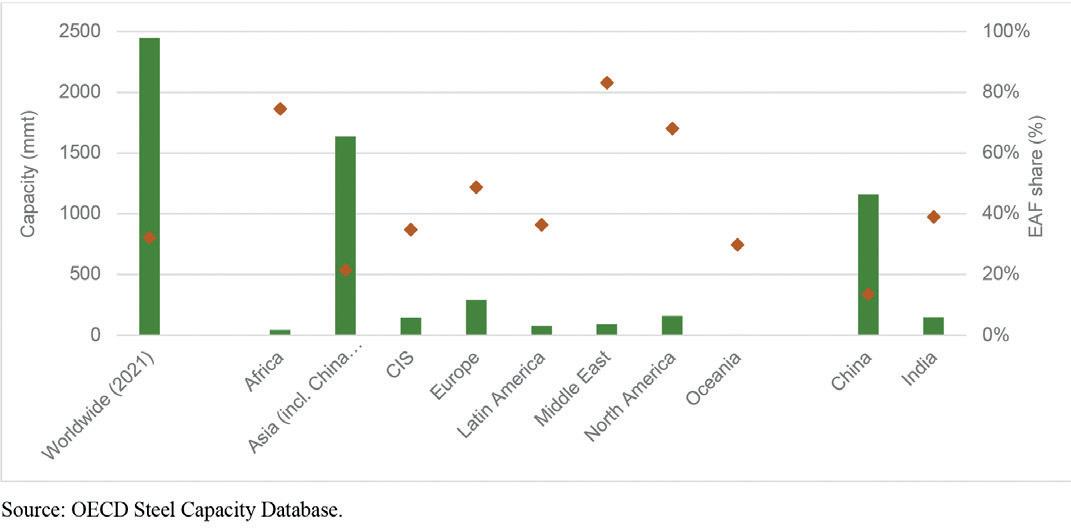

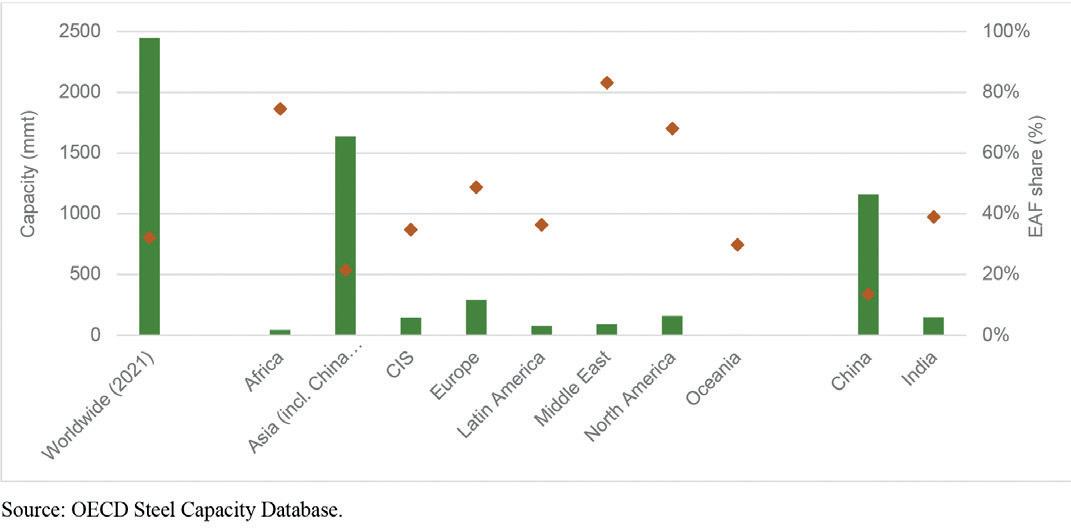

Carbon emissions-intensive assets prevail, with regional disparities

As of end-2021, BOF assets clearly dominate the global landscape, accounting for around two-thirds of total capacity (Fig 5). Since the BF-BOF production routes are not equipped with carbon capture utilisation and storage (CCUS), the current structure of assets is not yet aligned with a net-zero pathway.

The regional picture reveals strong disparities, with EAF shares ranging from less than 15% to more than 80% (Fig 6). When combining the BOF/EAF share with capacity levels, Asia stands as a critical region. Accounting for nearly 70% of global capacity, its EAF share is only around 20%.

New projects are not going in the right direction, increasing the risk of stranded assets.

The previous trends are even more pronounced when looking at future steelmaking projects. As of end-2021, there were about 160 Mmt of new capacity projects underway or planned over the next three years (2022-24). Most of the capacity relates to BOF (55%) (Fig 7). From a regional perspective, more than half of the capacity planned is located in Asia, and 90% of planned capacity in Asia are BOF projects (OECD, 2022[15]).

BF-BOF plants (if not equipped with CCUS) risk to become stranded assets. The high share of BOF assets in planned projects further increases this risk, by contributing to locked-in emissions for decades. This risk does not only arise from a domestic

perspective, but also from an international one. Such assets are unlikely to be able to compete in future markets for low-carbon emission steel, or as trade aspects based on carbon content criteria emerge.

Complying with emission reduction objectives and mitigating the risk of stranded assets would imply massive retrofits or early retirements. In addition to increasing the cost of the low-carbon transition, this equally involves high social impacts on workers and communities. In view of the current structure of assets, it is, therefore, critical to develop specific strategies for the management of existing assets.

5. Are the next technologies ready to take over?

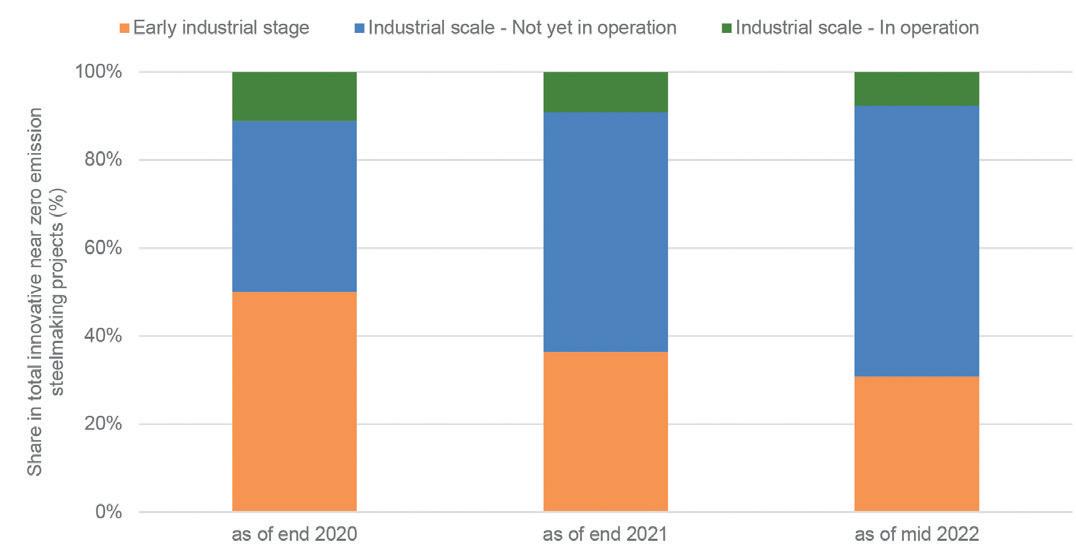

Projects implying innovative routes keep on growing

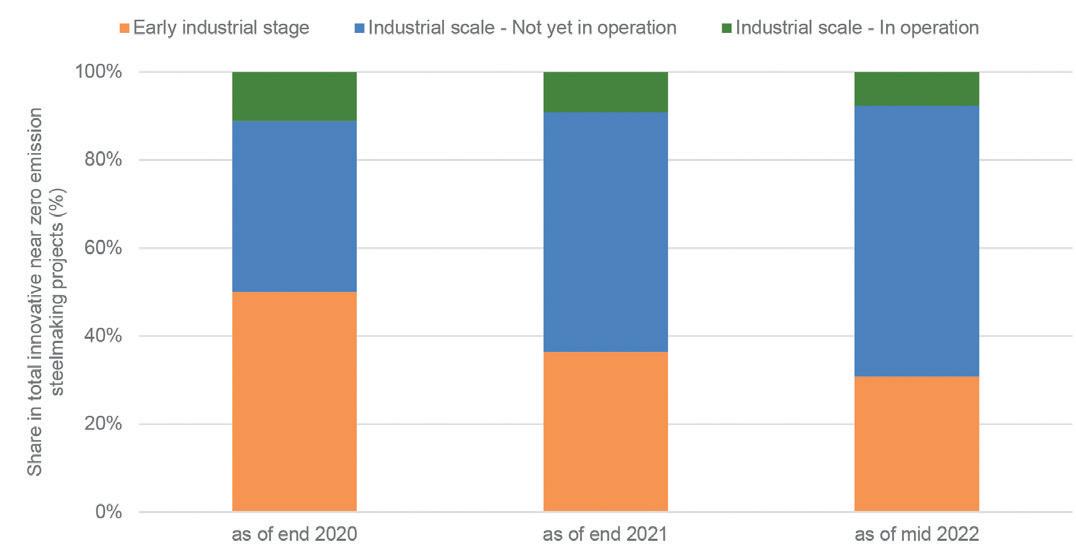

Achieving near zero emission steel production strongly relies on the uptake of innovative routes. As of mid-2022, there were around 40 innovative near zero emission steelmaking projects worldwide (Fig 8). This project pipeline covers announced projects involving a facility plant based on an innovative near zero emission production route (hydrogen-based DRI4 EAF, CCUS, or others such as direct iron ore electrolysis (IEA, 2022[19])). The number of such projects has grown steadily in recent years, more than doubling between 2020 and mid-2022. This trend is consistent with the increasing announcements in terms of emission reductions, both from governments and steel companies (sections 3 and 4).

Europe stands at the forefront of

innovative near zero emission steelmaking projects since 2020, driving the global project pipeline growth. As of mid-2022, Europe accounted for about 65% of the project portfolio, China accounted for almost 15%, and North America for 8% of the projects. Alongside the pledge of carbon neutrality by 2060 and the target for emissions peaking by 2030, major Chinese steel producers have launched projects involving innovative steelmaking technologies (HBIS, Baowu).

DRI technology is the cornerstone of innovative projects

DRI technology is by far the major route, representing nearly 75% of the innovative near zero emission project pipeline as of mid-2022. Besides innovation challenges, the impetus for the hydrogen-based DRI route brings new strategic inputs, for which securing access becomes crucial. The remaining projects involved CCUS-based technologies, and less advanced routes in terms of technology readiness, such as direct iron ore electrolysis.

A low-level of industrial maturity calls for a massive technology scale-up

More than 60% of the innovative near zero emission steelmaking projects are designed to run on an industrial scale, but are not yet in operation (Figure 9). Project announcements for industrial scale plants have more than tripled in the last two years, underlining both advances in technology readiness and the growing engagement of steel companies towards decarbonization (Section 4). Early industrial stage projects represent a further third, implying pilot or

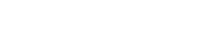

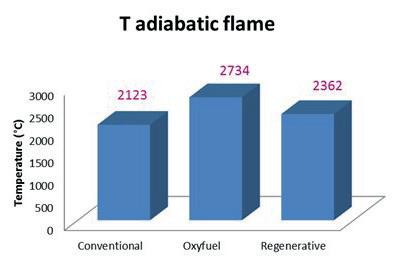

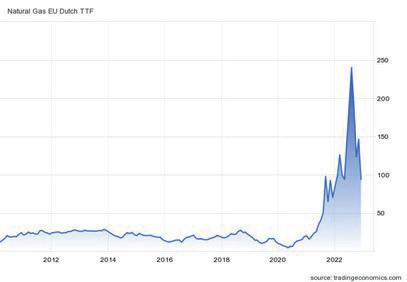

DECARBONIZATION 32 www.steeltimesint.com Digital Edition - February 2023