CONFERENCE REPORT NORTH AMERICAN STEEL PERSPECTIVES DECARBONISATION

We report from the Badische-Stahl Symposium in Germany. Can the US steel industry get any greener? Myra Pinkham finds out.

The role of home-produced waste in the greening of the UK steel industry.

LAP Measurement Technology are the subject of this month’s Q&A.

www.steeltimesint.com

November/December 2022 - Vol.46 No8

BLOWSTAB HSS ®

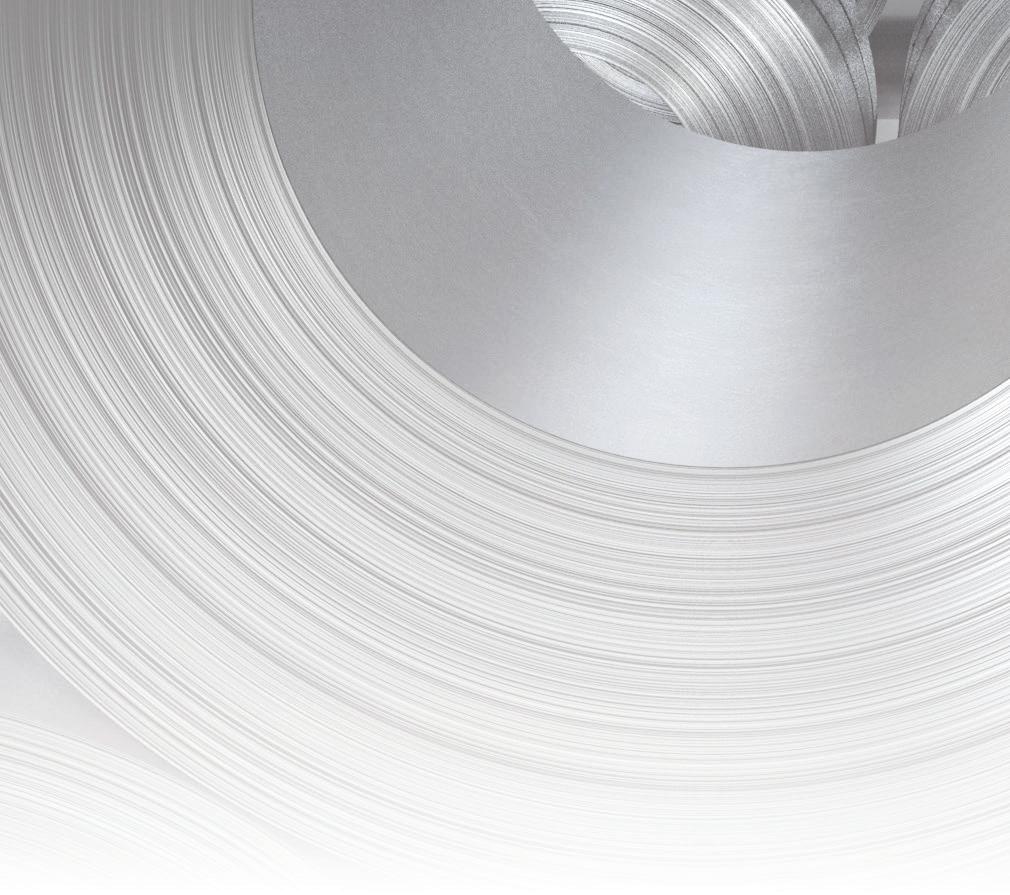

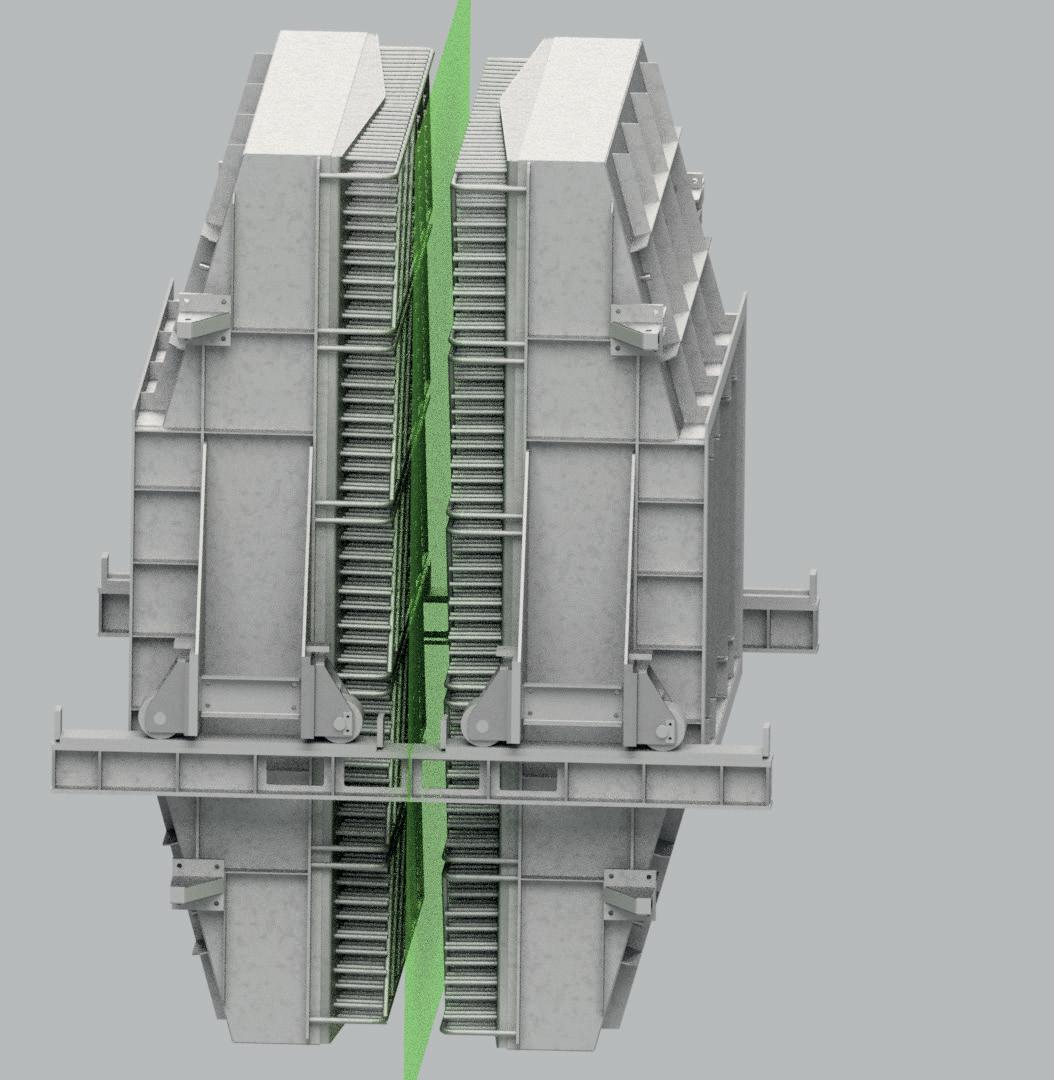

John Cockerill’s ultrafast cooling to process next-generation High Strength Steels.

All while maintaining strip stability and reducing energy consumption, this ultra-fast strip cooling system improves cooling rates & uniformity.

TIMES INTERNATIONAL –November/December 2022 –Vol.46 No8 STRAIGHT TALKING ON DECARBONIZATION – SEE PAGE 42

STEEL

Since 1866

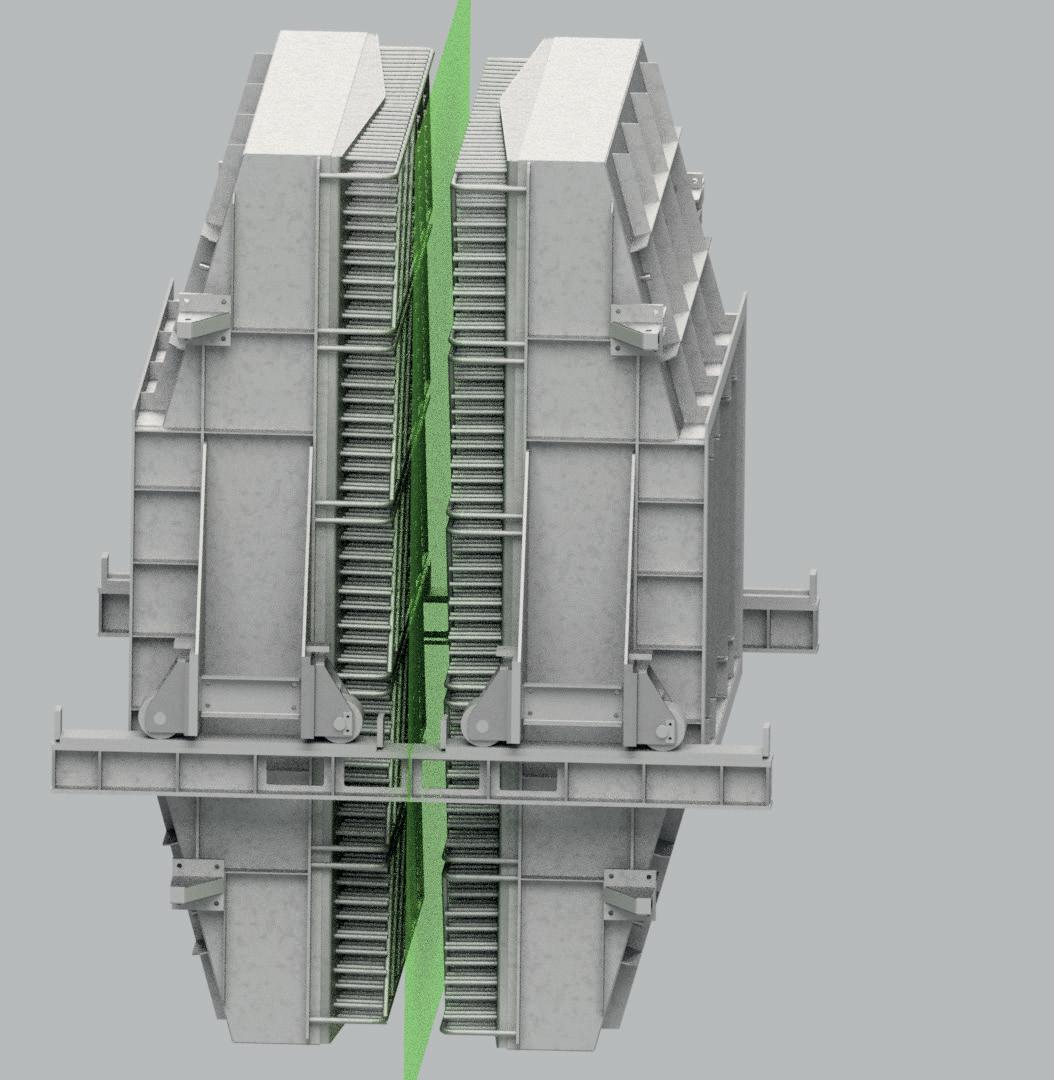

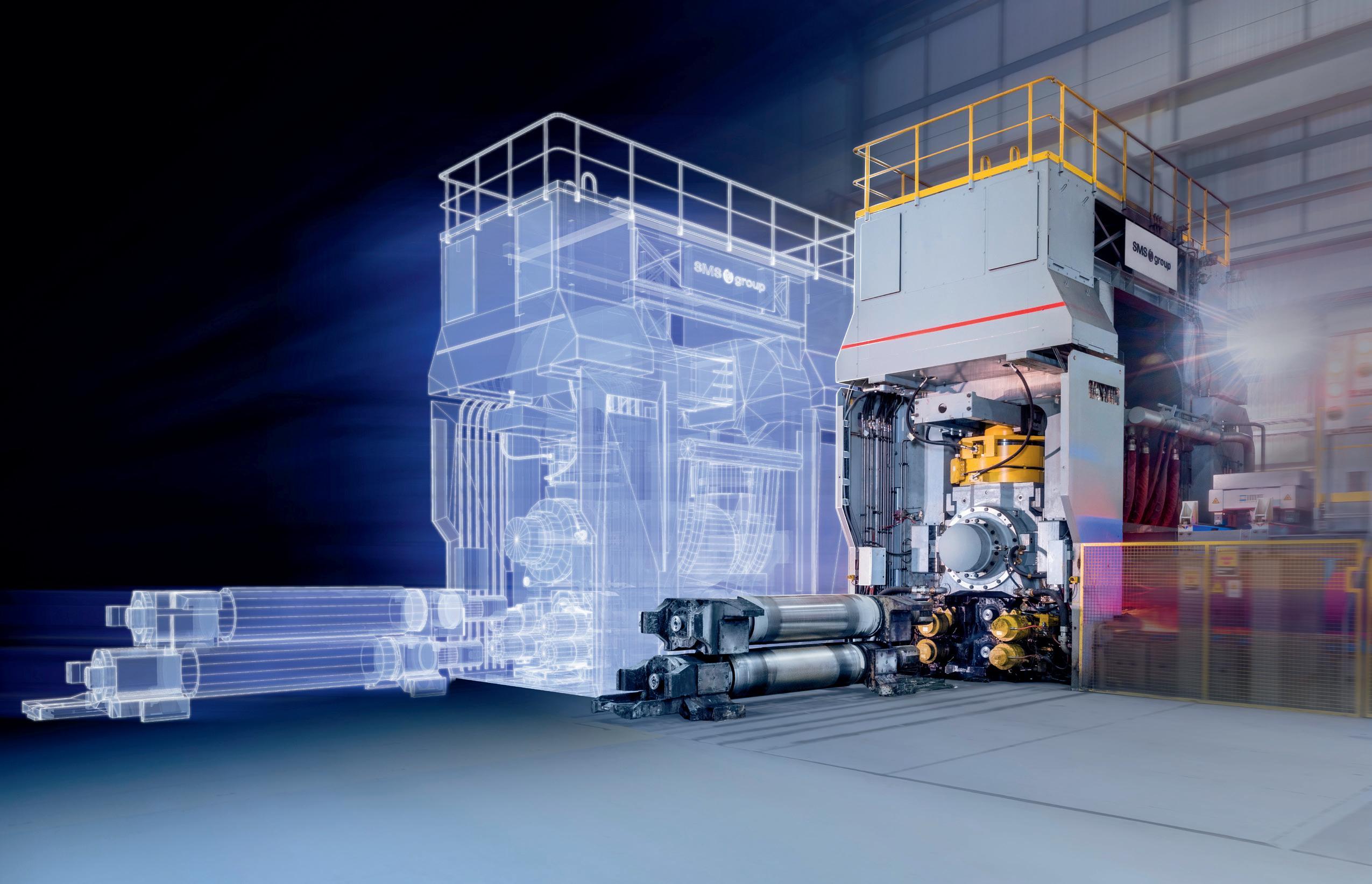

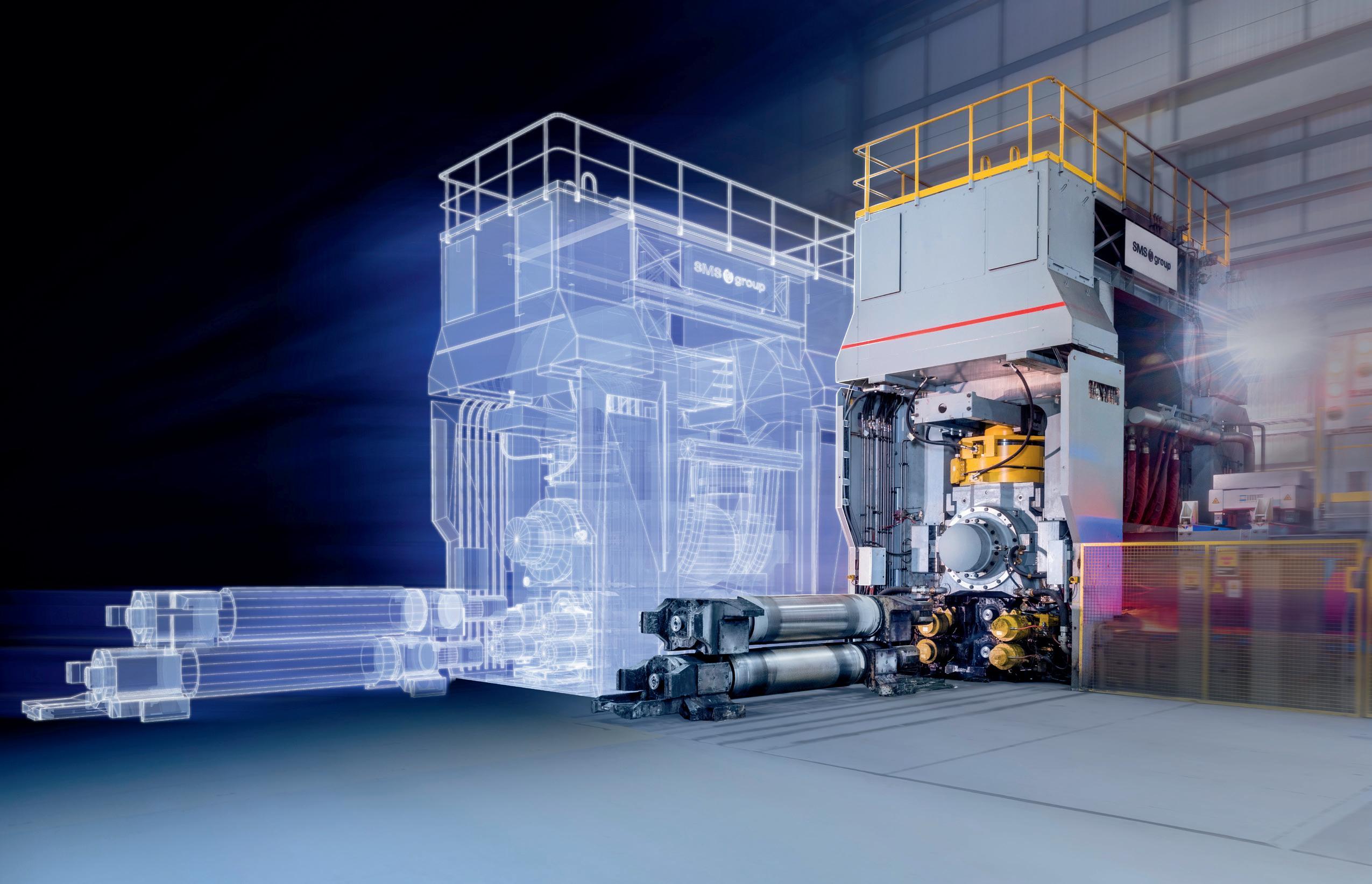

WE BRING THE DIGITAL TWIN TO LIFE WITH OUR PLUG & WORK INTEGRATION TEST

Fast run-up and stable operation are key for the successful commissioning of your plant. We can use the digital twin of your plant to run our 3D simulations and test the entire automation hardware and software prior to installation on site. Digital twins perfectly fit into our lifecycle services approach because we use it to also train your future operators upfront and can offer extended remote support for commissioning or performance improvements.

Discover more: https://www.sms-group.com/services/ process-automation-for-steelmaking

#XPactAutomation

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151 matthewmoggridge@quartzltd.com

Editorial assistant Catherine Hill Tel:+44 (0) 1737855021

Consultant Editor Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028 Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com

Steel

Published by:

www.steeltimesint.com

Times International is published eight times a year and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00 2 years subscription: UK £387.00 Other countries: £510.00 3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com

published monthly except Feb,

Dec

Quartz Business Media Ltd and distributed

US

DSW,

Periodicals postage paid

Steel Times

Printed in England by: Pensord, Tram Road, Pontlanfraith, Blackwood, Gwent NP12 2YA, UK ©Quartz Business Media Ltd 2022 ISSN0143-7798 Cover courtesy of John Cockerill STEEL We report from the Badische-Stahl Can the US steel industry get any LAP Measurement Technology are the The role home-produced waste STEEL TIMES INTERNATIONAL November/December 2022 Vol.46 No8 STRAIGHT TALKING ON DECARBONIZATION – SEE PAGE 42 Sinc 1866 BLOWSTAB HSS fast cooling to process All while maintaining strip consumption, this ultra-fast uniformity. CONTENTS – NOVEMBER/DECEMBER 1 2 Leader By Matthew Moggridge. 4 News round-up The latest global steel news. 12 Innovations New products and contracts. 19 USA update Tough times ahead. 23 Latin America update COSAN – a new Vale shareholder. 27 India update Consumption drives growth. 30 Calcium treatment Improved calcium injection. 35 Environment Can US steelmakers get any greener? 38 Decarbonization Waste not, want not 42 Straight talking Rutger Gyllenram, Kobolde & Partners 46 Badische-Stahl Symposium 2022 Innovation through adversity. 50 Perspectives Q&A: LAP Measurement Technology. 52 History Ironmaking in Scunthorpe. Part 3: 1939 to present day 38

Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is

May, July,

by

in the

by

75 Aberdeen Road, Emigsville, PA 17318-0437.

at Emigsville, PA. POSTMASTER send address changes to

International c/o PO Box 437, Emigsville, PA 17318-0437.

With ‘green’ steel it’s not a case of all or nothing

Towards the end of the summer I found myself in Sweden. I was there to interview Mark Bula, chief commercial officer at H2 Green Steel. The article was published in last month’s issue of Steel Times International and has been wellreceived by the industry at large. While in Stockholm I dropped into the offices of Rutger Gyllenram, founder and CEO of Kobolde & Partners, and we got chatting about green steelmaking. I suggested we put something on tape and the interview can be found on p42 of this issue.

For Rutger, the whole notion of ‘either we reach the top or we don’t go anywhere’ is misguided when it comes to green steelmaking. Yes, there are ambitious companies out there, like H2 Green Steel and HYBRIT, but most steelmakers will not reach that level for a very long time, he said.

about standards, degrees of ‘greenness’ and how the steel industry’s customers of the future will likely be presented with varying levels of ‘green’ steel. There might be the Holy Grail – that of ‘fossil-free’ steel (think HYRBIT and H2 Green Steel) but what about ‘climate-improved’ steel or ‘climate neutral’ steel? In other words, not fossil-free, but steel to which something has been done (think offsetting or carbon capture and sequestration).

For Rutger, standards – or levels of ‘greenness’ – are essential in the aforementioned ‘brave new world of green steelmaking’ and yes, fossil-free is best, the gold standard, but there are alternatives and ‘we’ll have to see where we land in the future,’ said Rutger.

Matthew Moggridge Editor matthewmoggridge@quartzltd.com

Kobolde & Partners has been auditing new steelmaking technologies and so far has listed 25 initiatives, some of which are very ambitious and others less so, highlighting a potential issue with standardization and posing the question: What is green steel? What indeed! Well, Kobolde’s audit got the company thinking

In the USA where, by 2050, it is estimated that 90% of steelmaking will be handled by EAFs, it is believed that hydrogen-based EAF steelmaking could cut emissions by 91%. Unfortunately, the costs would increase by 20% per ton of steel produced and, as one commentator noted: “Everyone wants clean steel, but nobody wants to pay 20% more for it.” So it looks as if degrees of greenness will be the answer.

2 www.steeltimesint.com November/December 2022 LEADER

BeyondRefractories

Optimize your Flow Control –from ladle to mold

Let’s go beyond refractories and dive into our customized solutions for clean steel, safety, productivity, and green steel that will support you in achieving all your goals. beyond-refractories.com

Vietnam's Hoa Phat Group, Southeast Asia's top steelmaker, has opened a factory for air conditioners and other home appliances in an aim to generate $1 billion in annual revenue by 2030. The plant in Vietnam's northern province of Ha Nam will also produce water purifiers and air purifiers, with an annual capacity of 1 million products. The factory in Hoa Mac Industrial Park cost over $41.8 million.

Source: Nikkei Asia, 4 October 2022

ArcelorMittal Nippon Steel (AM/NS) India has received environmental clearance to expand the capacity at its flagship plant in Hazira, Gujarat, from 9Mt/yr to 15 Mt/yr. The clearance from the Union Ministry of Environment, Forest, and Climate Change was a result of a stipulated detailed environmental impact assessment. The assessment report was submitted to the Gujarat Pollution Control Board, which held a public consultation in July in Hazira under the chairmanship of the district collector and magistrate of Surat District.

Source: The Hindu Business Line, 6 October 2022

German multinational conglomerate Thyssenkrupp and automotive industry partner Mubea have signed a memorandum of understanding for the supply of low-carbon steel from Thyssenkrupp’s planned direct-reduction plant, starting in 2026. Thyssenkrupp plans to replace blast furnaces at its Duisburg facility with directreduced iron (DRI) modules with a 2.5Mt/yr capacity.

Source: Fastmarkets, 6 October 2022

BHP Group Ltd. is seeking approval from Australia’s government to extend the life of a metallurgical coal mine in Queensland for almost a century, drawing criticism from climate groups. The development application, via a joint venture with Mitsubishi Corp., would ensure the continuation of the Peak Downs Mine ‘for up to approximately 93 years,’ according to a filing published by the Australian government.

Source: Bloomberg News, 6 October 2022

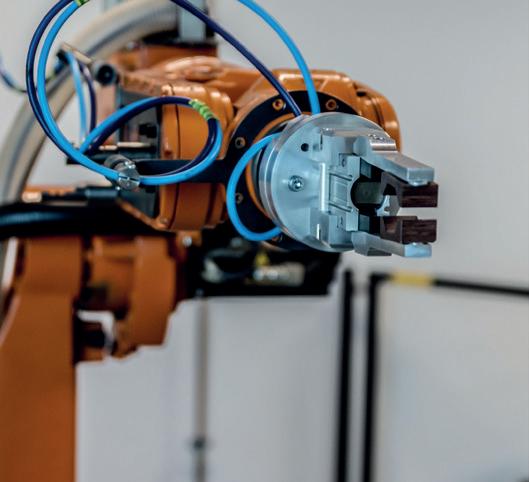

ArcelorMittal Kryvyi Rih has put a new welding robotmanipulator into operation within its foundry and mechanical plant. The robot performs welding in difficultto-access places. The task of the electric welder is to control and manage the operation of the unit. Due to this, the process and terms of surfacing and welding of rotors were accelerated, the company stated in a press release.

Source: GMK Center, 6 October 2022

Vale, the world's largest producer of iron ore and nickel, has announced that it has signed a memorandum of understanding with Germany's SHS Stahl-Holding Saar GmbH & Co. KG to reduce the

output of carbon during the steelmaking process. SHS, a holding and management

company for the steel industry in Germany's Saarland that carries out tasks for steel producers Saarstahl and Dillinger Hütte, will work with Vale on ways to make greater use of the iron-ore miner's green briquette product and its iron-ore pellets to directly reduce carbon emissions.

Source: MarketWatch, 6 October 2022

People living next to the UK's largest opencast coal mine have said they are ‘devastated’ by plans to keep it working. Coal extraction at Ffos-y-Fran in South Wales had been set to stop in September after 15 years, but the owner is now hoping to persuade the local council to let it keep going. Merthyr Ltd said it wanted to continue supplying the steel industry with Welsh coal. The company initially applied for a nine-month extension, but hopes to prepare another planning application for a further three years of coal extraction.

Source: BBC, 7 October 2022

November/December 2022 4 NEWS ROUND-UP www.steeltimesint.com

UK projects aiming to use AI to make steelmaking more productive and to use 3D printing at ‘record scale’ are among schemes awarded £13.7m in British government funding. Targeting improvements in the energy efficiency, productivity and sustainability of manufacturing processes, the Sustainable Smart Factory Competition, led by UK Research and Innovation (UKRI), will fund projects that harness digital innovations such as AI, ‘big data’ and virtual reality. The 12 projects awarded funding aim to optimise the use of materials, reduce and re-use waste, or lower energy consumption to increase sustainability in production and drive growth.

Source: Institution of Mechanical Engineers, 7 October 2022

JM Steel, a steel processor located in South Carolina, has announced the purchase of Five Star Roll Form, a roll forming company. Five Star Roll Form, a woman-owned business, opened in 2017 with a single roll former. All senior employees and management teams of Five Star Roll Form will remain.

Source: Cision, 8 October 2022

Technology Metals Australia Ltd (TMT) has executed a non-binding memorandum of understanding with Tata Steel, setting the course for vanadium offtake discussions. Together with Tata Steel, TMT will investigate whether there is scope for a downstream technical collaboration, which could lead both parties to jointly develop ferrovanadium production facilities in India and Western Australia.

Source: Proactive, 10 October 2022

UK doctors were left shocked after finding a steel cup inside a patient’s body. The man arrived at the hospital complaining of stomach pains – which medics discovered were being caused by a steel cup. It then took a team of 11 doctors to remove the cup during a risky and complex surgery. The metal cup was blocking the 22-year-old's bowel movements, leaving him in agony.

Source: Hull Live, 10 October 2022

The United Steelworkers union (USW) has announced that 2,000 Cleveland-Cliffs workers at its iron ore mining and pelletizing facilities have ratified a new labour agreement at northern Minnesota and Michigan’s Upper Peninsula plants. USW claims the deal ‘features significant wage and benefit improvements’ and a company ‘commitment to invest in the future of the USW represented facilities.’

Source: World Socialist Web Site, 10 October 2022

A research team from North China's Shanxi Province with an average age of 30 has developed the world's thinnest ‘hand-torn steel’ at 0.02mm after 711 failures in 2018. They rolled the thickness from 0.02mm to 0.015mm, setting a new world record. The steel is only 1/6 the thickness of a human hair.

Source: Global Times, 10 October 2022

JSW Steel, the flagship company of the diversified JSW Group, has announced that it has joined the United Nations Global Compact (UNGC) network – the world’s largest voluntary corporate sustainability initiative. JSW Steel is the fifth Indian company in the ‘Industrial Mining and Manufacturing’ category to join the UN Global Compact initiative, the company said in a regulatory filing. JSW Steel is one of thousands of businesses around the world that have joined the network in an effort to 'advance sustainable business practices'. Source: MoneyControl, 11 October 2022

November/December 2022 NEWS ROUND-UP 5 www.steeltimesint.com

ArcelorMittal México will invest $15 million in its plant in Escobedo, Nuevo Leon. The plant produces pipes for the automotive industry, according to Jaime Luján Valladolid, director of industry and flat steel sales. “The investment will be used for the installation of a fifth pipe mill at the plant and production will be dedicated to serving Tier 1 and Tier 2 suppliers, which in turn supply companies such as Volkswagen, General Motors and Ford for vehicles such as the Suburban, Tahoe and Fusion,” said Luján Valladolid.

Source: Mexico Now, 11 October 2022

ThyssenKruppSteel Europe (TKSE) and the German producer of household appliances, Miele Group, have signed a memorandum of understanding on the supply of green steel from TKSE's Duisburg. The enterprise, to be launched in 2026, reports the Thyssenkrupp website. ThyssenKrupp will supply its patented Bluemint steel for the home appliance producer. In the following years, the volume of purchases will gradually increase. By 2030, Miele and Thyssenkrupp plan to switch 100% to Bluemint.

Source: GMK Center, 13 October 2022

PT Gunung Raja Paksi

Tbk (GRP), a member of Gunung Steel Group and one of the largest private steelmakers in Indonesia, has announced the launch of its new Environmental, Social and Governance (ESG) Strategy Handbook, with the set-up of a new sustainability department aimed at addressing rising concerns about climate change and social issues, such as equality and human rights. The ESG Strategy Handbook was developed from GRP’s partnership with multinational consultancy firm, Environmental Resources Management.

Source: Macau Business, 13 October 2022

Canadian prime minister Justin Trudeau attended a ceremony on 13 October, in celebration of ArcelorMittal Dofasco’s $1.8 billion decarbonization plan. Trudeau stated that the $400 million federal investment announced last July is helping Dofasco become the world’s first major steel producer to move toward a cleaner process of making steel. The federal and provincial governments have each contributed millions toward ArcelorMittal Dofasco’s decarbonization plan, which aims to shut down the steelmaker’s coke ovens and blast furnaces by 2028 and expand the use of electric arc furnace technology.

Source: Global News, 13 October 2022

UK-based metal artist, Luke Perry, has created a steel sculpture of an orangutan for Dudley Zoo. The piece features around 100 steel poles of which 97 are cut to knee-height to represent deforestation. At the heart of the work is a female Bornean orangutan who is clinging on to two of the remaining poles, trying to reach out to her young child. "Steel is a very hard medium, it's often very flat and it's great for structural things – but orangutans are well known for their softness, and for their organic shapes, so the difficulty was to make something which complements that," Perry said.

Source: Express and Star, 14 October 2022

Scotland has in effect banned coal mining by confirming no support will be given to future extraction. While there are no mines in Scotland, a conditional licence has been granted for a site in Cumbria which extends into Dumfries and Galloway. Powers over coal exploitation are reserved to Westminster, but Holyrood's planning role means it can block developments. A consultation was held on Scotland's coal extraction policy position over the summer, and the government said it had now agreed its "preferred policy position is no support for coal extraction in Scotland".

Source: BBC, 15 October 2022

6 NEWS ROUND-UP www.steeltimesint.com November/December 2022

Brazilian steelmaker Gerdau has invested $132m to align its production processes with expected growing demand for electric vehicles. "Our objective when investing in our special steel plants is to increase productivity and meet the needs and growing demand of our customers, under a plan to fully modernize operations by 2025," Rubens Pereira, vice president of Gerdau's specialty steel division in Brazil commented.

Source: BNamericas, 17 October 2022

In an endeavour to make noninvasive early-stage cancer diagnosis an affordable reality, Tata Steel’s new materials business has signed a technology transfer agreement with IIT Roorkee for a breathbased cancer detector. “IIT Roorkee’s team of professors – Professor Indranil Lahiri, Professor Partha Roy, Professor Debrupa Lahiri and researchers along with their groups have developed a simple, easy-to-use breathbased detector (BLO detector) for early detection of cancer," the company has announced.

Source: Mint, 21 October 2022

The trial of a firm accused of safety failures at Port Talbot's Tata steelworks after an employee suffered serious head injuries has been halted halfway through after a judge ruled there was insufficient evidence to convict. Monolithic Refractories Limited was on trial at Swansea Crown Court charged with failing to ensure the health, safety and welfare of its employees in relation to the risks arising from the use of a piece of machinery called a refractory mixer at the works. Source: Wales Online, 20 October 2022

Global chemical company Linde has announced that it has expanded its existing long-term agreement for the supply of industrial gases with Jindal Stainless Limited (JSL), one of the largest stainless-steel producers in India. The additional supply will support the significant expansion of JSL’s facility. The Indian steelmaker's new Air Separation Unit is expected to start up in the first half of 2024 and will be an additional supply source for the local merchant market. Source: yahoo!finance, 21 October 2022

Emirates Steel Arkan (ESA), the UAE's largest steel and building materials manufacturer, has received an exemption from Saudi Arabia on the 15% rules of origin duty, an industry source aware of the details said. “A formal letter was issued by the United Arab Emirates Federal Authority for Identity, Citizenship, Customs & Port Security yesterday (20 October 2022) stating that ESA has been granted a duty exemption for the Saudi market for the sale of steel products,” the industry source stated. Source: Zawya, 21 October 2022

In a village near Mvuma, a small mining town about 192km south of Zimbabwe’s capital Harare, Chinese steel giant Tsingshan Holding Group is building a $1 billion iron and steel plant. It will make use of the abundant iron ore, chrome, coal, nickel and limestone available in Zimbabwe to make iron and steel products and help Zimbabwe develop its steel value chain. The plant, which will be ready by next year, will initially produce 600kt per annum – with capacity to double its output when it is running at full throttle. Source: South China Morning Post, 22 October 2022

Anglo American has said that it has signed a memorandum of understanding with Thyssenkrupp Steel Europe AG, a subsidiary of German steel producer thyssenkrupp AG, to focus on decarbonizing steelmaking. "The collaboration will focus on joint research to accelerate the development of high-quality feedstock for lower carbon steel production, using both conventional blast furnace and direct reduction iron steelmaking – the latter being a less carbonintensive method which requires iron ore of a particularly high quality," Anglo American said.

Source: AJ Bell, 20 October 2022

www.steeltimesint.com NEWS ROUND-UP 7

Gerdau Special Steel North America is upgrading its Monroe, Michigan, SBQ line to the tune of $40.4 million, according to a report by Kallanish. The company procured a new bundler table, bundler area, and a third saw. The project has two phases. During the first, in 2023, the new bundler table and area will be installed. The second phase is the installation of the new saw and will be completed in 2024.

Source: Kallanish, 24 October 2022

South Africa’s government has said that it has ‘no reason’ to apply sanctions brought against Russian tycoon Alexey Mordashov, the biggest shareholder in steelmaker Severstal, and that his $500 million mega yacht is free to dock at its ports. Mordashov was sanctioned by the European Union, the UK and US after Russia’s invasion of Ukraine. The mogul’s 142-metre yacht is expected to arrive in Cape Town in November.

Source: News24, 25 October 2022

ArcelorMittal Kryvyi Rih is transferring its largest blast furnace no.9 into conservation mode as part of preparations for the winter. Blast furnace no.9 was shut down at the beginning of a full-scale Russian invasion, but work on the unit has continued –with it now being prepared for winter. The main task was to dehydrate all the BF’s conduits, so that during frosts excess moisture would not damage the cooling system. According to Sergiy Myazin, head of blast shop№2, this is the first time this procedure has been carried out on the unit. Source: GMK Center, 25 October 2022

Sustainable technologies provider Metso Outotec is launching a DRI smelting furnace to, it says, substitute blast furnaces used in iron and steel making. The DRI smelting furnace is one of Metso Outotec’s key solutions for decarbonizing the iron and steel industry. Jyrki Makkonen, vice president, smelting at Metso Outotec, said: “The DRI smelting furnace is a true breakthrough technology. It will help the iron and steel industry to reach their CO2 emission reduction targets and limit global warming. The new high-capacity 6-in-line DRI smelting furnace is part of Metso Outotec’s Planet Positive offering, which is focused on environmentally efficient technologies.”

Source: International Mining, 25 October 2022

Six companies within the Metinvest Group, including Azovstal and Ilyich Iron and Steel Works of Mariupol, have filed lawsuits with the European Court of Human Rights (ECHR) against Russia for the damage caused by the

Russian Federation to the property and ownership of the Group in Mariupol and other territories of Ukraine from 24 February onwards. Metinvest claims that the Russian Federation has violated the rights of the company in accordance with Art. 1 of Protocol 1 of the European Convention on Human Rights, causing significant damage and destruction to assets, and depriving the company of ownership of the assets.

Source: GMK Center, 25 October 2022

POSCO held the second Hydrogen Iron & Steel making Forum in Fotografiska, Stockholm on 12 October. HyIS is a forum where experts from the steel industry,

raw material suppliers, engineering firms, academics, and associations gather to discuss carbon-neutral strategies and sustainable growth in the steelmaking industry based on hydrogen iron. The steelmaker hosted the world's first HyIS forum in Seoul last year, proposing cross-border co-operation and solidarity to speed up the realization of carbon neutrality. This year's HyIS forum was jointly held by POSCO and Swedish steelmaker SSAB. Source: The Korea Times, 27 October 2022

A 72-foot steel gun built in Oxford has been dubbed ‘the Big Friendly Gun’ by inventors who think they’re close to cracking nuclear fusion. Scientists at First Light Fusion are using over six pounds of gunpower to fire a high-velocity piston to enter a cone segment that crushes gas, causing it to shoot from a metal seal. A projectile then hits a nuclear fusion target and temporarily produces conditions that allow the nuclei to fuse. CEO Nick Hawker told reporters that he hopes the First Light Fusion reactor will be generating usable electricity by the 2030s, with power on the grid in the following decade. Source: The Daily Star, 28 October 2022

8 NEWS ROUND-UP

Sumangala Steel Private Limited, a steel producer based in Southern India, is in the process of setting up a modern scrap shredder and thermo mechanical treatment finishing infrastructure to make blue steel at its plant in Puducherry, said a senior official. “The modern scrap shredder will be imported to process end-of-life vehicles, white goods and light scrap. It will become operational by 23 December,” Ashwin Sabanayagam, president and director told reporters. According to Sabanayagam, it will be the first scrap shredder facility in Puducherry.

Source: The Hindu, 29 October 2022

Local steel fabrication company S FABS Southern fabrication presented £2,125 to the Selsey, UK branch of the Royal National Lifeboat Institution, a charity which provides a 24-hour search and rescue service around the United Kingdom and Republic of Ireland coasts. The money was raised from a charity raffle organised to coincide with a function that was held on 14 September where the draw took place.

Source: RNLI.org, 30 October 2022

Tata Steel's future course of action with respect to its UK business will be based on the British government's response to the company's proposal seeking financial support to sustain the business there, CEO T V Narendran has announced. Tata Steel owns the UK's largest steelworks at Port Talbot in South Wales and employs around 8,000 people across all its operations in the country. The company is seeking £1.5 billion from the UK government to execute its decarbonization plans.

Source: Moneycontrol, 31 October 2022

Condolences from across India have poured in following the death of the 'Steel Man of India', J.J. Irani, who passed away at the age of 86 in Jamshedpur. Irani had retired from the board of Tata Steel in June 2011, leaving behind a legacy of 43 years, which won him and the company international acclaim in various fields. He became joint managing director of Tata Steel in 1988, and managing director in 1992. Irani was the recipient of multiple honours and awards, including the Lifetime Achievement Award, bestowed by the Government of India in 2008 in acknowledgement of his services in the area of metallurgy. Source: NDTV, 1 November 2022

‘Meals to make Steel!’ a short film to document a personal recollection of working in what was one of the UK’s largest industrial catering operations has been published by the Wales National Archive, Peoples Collection. Produced by volunteer and heritage community filmmaker, John Butler, it features the voice of veteran industrial caterer, Kath Tellett who, at 21 commenced her long career at John Summers steelworks in Shotton, Wales. Kath’s story tells of restaurants, canteens and mobile catering vans which, every-day, prepared and delivered a variety of on-site meals to suit the needs and appetites of thousands of hungry steelworkers.

Source: Deeside.com, 2 November 2022

China’s iron and steel association has said that it will accelerate efforts to promote mergers and acquisitions (M&As) to increase the industry’s concentration and profits amid challenges such as an increasingly complex international landscape, domestic COVID-19 resurgences and soaring raw material prices. The association said that it will closely follow market trends to help steel companies reduce costs while increasing profits. It said that it will strengthen co-operation among steel firms and varied levels of government, try to establish a new mechanism of steel production capacity management that accommodates the new environment, and optimize the policy environment to greatly boost industry M&As.

Source: Hellenic Shipping News, 1 October 2022

civic body that governs the city of Chandigarh, the capital of Punjab and Haryana, India, will be installing 3,300 new stainless steel twin dustbins in the city’s green belts and parks. Mayor Sarbjit Kaur started the bins’ installation work at the central park in Manimajra in the presence of municipal commissioner Anindita Mitra.

Source: The Hindustan Times, 2 November 2022

9 NEWS ROUND-UP

Working towards 100% segregation of waste at source, the Chandigarh municipal corporation, the

Britain has sanctioned four Russian steel and petrochemical business owners, including the former head of steel producer Evraz, the government said on 2 November, its latest measures taken against Moscow over the war in Ukraine. Those sanctioned include Alexander Abramov and Alexander Frolov, who Britain described as known associates of oligarch Roman Abramovich, himself sanctioned earlier this year. "We are sanctioning an additional four oligarchs who rely on Putin for their positions of authority and in turn fund his military machine," UK foreign secretary James Cleverly commented. The sanctions implemented include travel bans, asset freezes and transport sanctions, the foreign office said.

Source: Reuters, 2 November 2022

The American Iron and Steel Institute (AISI) has released recommended steel industry greenhouse gas (GHG) emissions calculation guidelines to provide data across the industry on GHG emissions from steel production, with a focus on product-level disclosures and corporate-level reporting. The proposed guidelines are the result of monthslong collaboration with key American steel producers and Institute staff. The institute added that the recommendations are not intended to be a formal industry standard, but a means to inform efforts underway by American and international steel producers and others working to develop GHG emissions calculation methodologies.

Source: Green Car Congress, 4 November 2022

Europe's largest steelmaker, ArcelorMittal, will idle blast furnace 2 at its Fos-sur-Mer site in France from December. The 2Mt/yr unit will be idled in response to low demand and high import levels. There are two furnaces at the Fos plant, 1 and 2, both with the same capacity. ArcelorMittal announced a spate of idlings in recent months, citing energy costs, imports and low demand and prices as the main drivers.

Source: Argus Media, 4 November 2022

China's steel production has continued to show a modest decline despite steelmakers facing poor profit margins, on the back of new pig iron and crude steel capacity launched in recent months, while a lack of any large-scale output cuts is failing to add pressure on production, says a report by S&P Global. Northern China, home to large steelmakers, could see winter output cuts from mid-November, especially in the Hebei steel hub, market sources said, adding that despite this, curbs are expected to remain smaller than the previous year. Source: S&P Global, 4 November 2022

McNeilus Truck and Manufacturing Inc., an Oshkosh Corp. company, has announced a partnership with Swedish steel manufacturer SSAB, in fossil fuel-free steel

applications for severe-duty commercial vehicles. The first use of this fossil fuel-free steel will be to prototype advanced, environmentally sustainable McNeilus refuse collection vehicles. Oshkosh Corp. and McNeilus, Dodge Centre, Minnesota, are working on research and development initiatives across multiple commercial vehicle product lines.

Source: Recycling Today, 5 November 2022

US Steel is investing $150 million at its Keewatin plant to produce a higher-grade iron ore pellet that would serve electric furnaces. ‘’As mini mills make higher quality steel, they require highquality iron to supplement scrap metal. That's where the new pellets come in,’’ said Kevin Kangas, director of the Natural Resources Research Institute in Coleraine, part of the University of Minnesota Duluth. "This is a great step forward for the Minnesota iron ore industry." Source: Star Tribune, 5 November 2022

UK business secretary Grant Shapps will hold talks with the steelmaker, Jingye Group, owner of British Steel, amid dwindling hopes that a government aid package will prevent thousands of job losses. One source said that British Steel had begun placing orders for equipment that would be required in order to permanently close one of Scunthorpe's blast furnaces. Such a move would entail as many as 2,000 redundancies, the source added, in what would be a further blow to Britain's industrial manufacturing capability.

Source: Sky News, 6 November 2022

10 NEWS ROUND-UP

Konecranes receives order for eight forklifts

Kemi Shipping Oy, owned by Finnish Metsä Group, has ordered eight award-winning Konecranes E-VER fully electric forklifts, including full-service contracts for their operations in the Port of Kemi. The order was received in June 2022 and will be delivered in the first half of 2023.

Kemi Shipping provides a range of harbour services for customers in the region. With Metsä opening a new mill for bioproducts in the north, Kemi Shipping is taking the step to invest in new lift trucks for its warehouse operations. The port facility has ordered eight Konecranes E-VER electric forklifts that will serve the mill with its product handling as it reaches full production capacity.

“Sustainability is at the core of our business, so the first thing that attracted us to the Kone cranes E-VER was the fact that it is fully electric,” said Kari Lundell, CEO of Kemi Shipping. “We

had one Konecranes E-VER delivered earlier this year for paper board handling, and we could see its advantages immediately. Besides eliminating tailpipe emissions, it offers outstanding efficiency, and our drivers love it. Once all eight E-VER elec tric forklifts are on-site, they will mark another big step on our journey to greater productivity and lower emissions.”

“Kemi Shipping has been a loyal Konecranes customer for over two decades, sharing our mu tual commitment to the environment” comment ed Klaus Kaukovalta, product manager, lift trucks for Konecranes Finland. “Konecranes E-VER, which won the sawmill industry Product Novelty Competition for improving the environmental performance, gives us the perfect opportunity to provide Kemi Shipping equipment that meets their specific requirements in a demanding industry.”

The eight additional lift trucks are Konecranes

E-VER 16-1200C forklifts, with a fully-electric driveline and a capacity of 16 tons. Lithium-ion batteries manufactured with clean energy power each truck, taking 45 minutes to fully recharge and re-generating brake energy back to its bat tery. With less heat, oil and fewer moving parts, the electric forklift requires less maintenance, says Konecranes, and produces less chemical waste. The trucks will be supplied with special bale clamps to securely handle wood pulp.

Konecranes E-VER electric forklifts are also Smart Connected Lift Trucks, in which TRUCON NECT® Remote Monitoring follows each truck’s performance and maximizes battery life through analytics such as charge optimization and energy consumption.

For further information, log on to www.konecranes.com

Ward welcomes York scrap merchant into the family

Midlands-based metal recycling and waste management specialist, Ward, has welcomed York scrap merchant, L. Clancey & Sons into its extended family with the acquisition of its metal processing business in York.

Ward, an independent, fourth generation family-run business, has completed a deal with L. Clancey & Sons for its 3.9-acre scrap metal site in York and the business as a going concern. The acquisition of the business will further enhance the nationwide capabilities of Ward, offering greater coverage in the North of England, while enabling the succession planning of Clancey’s, as two of its partners take retirement.

Clancey’s has a well-established reputation, developed over its 160-year history and this successful operating model will be maintained, as will the business name. One of the sellers, Richard Clancey, a member of the founding family, will

stay on as site operations manager, employed by Ward and all other staff are being retained.

Thomas Ward, commercial director at Ward, said: “This is a really exciting time for both our family businesses. Clancey’s have a solid repu tation in metal recycling, they share our values, outlook and approach to customers. We hope they will become an extension of the Ward team operationally, while retaining their own identity.

‘‘This new site gives us even more geographical reach for both businesses with good transport links to our Midlands, Immingham and Redcar sites.”

Richard Clancey, partner, at L. Clancey & Sons, said: “Both our businesses are strongly family orientated and we have very similar values, from the way we look after our teams to the way we support our customers. This will be a really posi tive step for us all. Both myself and my daughter

are looking forward to working with Ward and seeing what we can achieve together.”

For further information, log on to www.ward.com

INNOVATIONS 12 www.steeltimesint.com November/December 2022

A new LD converter (BOF) implemented by Primetals Technologies was started up at Arce lorMittal Belgium’s steel plant in Gent, Belgium. To meet the demands on pre-assembly works, the Austrian production technology specialist came up with several ideas.

ArcelorMittal Belgium wanted most of the pre-assembly works to be done at the manu facturing site in Poland as a way of avoiding possible delays. The vessel and trunnion ring had been assembled as one unit in Poland, rendering the result too big to pass underneath an existing pipe bridge at the steel plant in Gent. Therefore, using a 1kt crane, Primetals Technologies lifted the vessel and trunnion ring – weighing around 380 tons altogether – over the 10-metre-high pipe bridge.

Thanks to good planning and preparation, Primetals met the customer’s tight 35-day timeline without any interruption in the ongoing production at LD converter No. 3 during the shutdown. Primetals Technologies made key preparations during a pre-shutdown in June 2021 to ensure that everything would be running smoothly during the revamp.

“From the start of our project until com missioning we experienced a very professional collaboration with the project team of Primetals

Technologies,” commented Glenn Gosseye, pro ject manager at ArcelorMittal Belgium.

“Although it was performed in a very challeng ing environment, we managed to stay within our target of a 35-day shutdown,” said Hannes Seys, project engineer at ArcelorMittal Belgium.

The LD converter supplied to ArcelorMittal Belgium by Primetals Technologies features an optimized converter shape. This, it is claimed, will further increase both the yield and energy efficiency of the steelmaking process. Another important feature is the Vaicon Link 2.0 – a sus pension system that keeps the vessel stable in all directions and still allows for thermal expansion. According to Primetals Technologies, it ensures ideal conditions during the whole lifetime of the converter. Primetals Technologies developed this system more than 20 years ago and has continu ously refined it.

Average LD converter heat sizes are around 180 tons, hence a heat size of 330 tons makes this LD converter one of the world’s largest. In to tal, Primetals Technologies supplied ArcelorMittal Belgium with 1kt of equipment while installing the LD converter in Gent.

For further information, log on to www.primetals.com

13 www.steeltimesint.com November/December 2022 INNOVATIONS

Primetals converter starts up at Gent plant +1.914.968.8400 www.GRAPHALLOY.com Yonkers, NY USA Handle High Temperatures and Harsh Operating Conditions with Ease. • Survives when others fail • Run hot, cold, wet or dry • Corrosion resistant • Self-lubricating • Low maintenance • -400˚F to 1000˚F (-240˚C to 535˚C) • Ovens, furnaces, conveyors, mixers, dampers GRAPHALLOY® Bearings... We Go to Extremes HeatAd_60mmx270mm.qxp_Layout 1 11/9/20 11:55 A

When you need to know it’s safe

ARL iSpark. The trusted standard.

*

Metal is the backbone of our society. It’s in the structures we ride, work and live on every day. That’s why you’ve trusted the detection technology inside every ARL iSpark for over 80 years to ensure every piece of steel and metal you produce is safe. With so much riding on that, why would you choose anything else?

Find out more at thermofisher.com/ispark

*Based on a data comparison, completed by Thermo Fisher Scientific in 2021, of detection limits for OES systems using data published in specifications and applications notes for ARL iSpark and competitors.

©2022 Thermo Fisher Scientific Inc. All rights reserved. All trademarks are the property of Thermo Fisher Scientific and its subsidiaries unless otherwise specified. AD41408 0922

NSK releases long-life bearings NSK releases long-life bearings

NSK, a Japanese bearings manufacturer, has developed a new bearing for the steelmaking industry that aims to improve productivity through stable equipment operation and reduce maintenance costs with its sealing and lubrica tion technologies.

NSK set about developing a solution which utilises sealing technology optimised for rolling mill bearings, alongside grease technology that minimises the effects of water intrusion. The outcome is a long-life, four-row tapered roller bearing that claims to be both more water-re sistant than conventional bearings, and able to deliver optimal performance in steelmaking

equipment applications.

The oil seal on the new bearing is compact, while a new processing method for the cage has increased roller length and diameter, and increased the number of rollers, resulting in a high load capacity design.

According to NSK, optimising the internal design of the new bearing increases the basic dynamic load rating by up to 25% compared with its conventional product. Furthermore, tight sealing not only suppresses the ingress of particulates and water to extend service life, it also reduces the need for grease replenishment during maintenance periods.

Available in sizes from 345 to 615.95 mm (outer diameter), NSK’s new sealed-clean, fourrow tapered roller bearings with water-resistant grease are suitable for work rolls in hot/cold rolling mills and other steelmaking equipment. Moving forward, the company will continue its development programme in support of steel makers, creating products that contribute to both process advancement and environmental preservation.

For further information, log on to www.nsk.com

FH Warden releases light truck range

A Birmingham, UK-based steel stockholder has become one of the first customers in Britain for a vehicle from the latest FUSO Canter light truck range.

FH Warden (Steel)’s new 7.5-tonner features a redesigned cab with eye-catching ‘face’, as well as improvements over the outgoing model in comfort and safety.

FH Warden’s truck is powered by a 3.0-litre common-rail turbodiesel that produces 110 kW (150 hp), and is paired with a DUONIC dual-clutch automated manual transmission. Its 23ft platform body is by Fred Smith & Sons, of West Bromwich.

Director Dave Hughes is well placed to ap preciate the advances that FUSO has made with its new range – this is the third Canter that his company has purchased from Midlands Truck & Van since it resolved in 2013 to dispense with third-party contractors and bring its local trans port function ‘in-house’.

Key to the Canter’s appeal for FH Warden, is the industry-leading carrying capacity that aims to ensure high productivity. “It’s all about payload,” explained Dave Hughes, director of FH Warden. “We can get nearly 4.0 tonnes on the back of this truck. That’s the best part of a full tonne more than you’d achieve with a conven tional 7.5-tonner.”

FH Warden was established in 1850 by Francis Hollins Warden. It was subject to a management buyout in 1995 by Mr Hughes’ parents, Dave Sr and Pat. They remain the sole owners of the business.

For further information, log on to www.fhwarden.co.uk

15 www.steeltimesint.com INNOVATIONS

Fives awarded contract for inspection line

Nucor Corporation, the largest steel producer in the United States, awarded Fives a contract for a recoiling and inspection line to support automo tive applications at the new Nucor steel plant in West Virginia.

This contract comes in addition to the two gal vanizing lines already won by Fives for this same greenfield facility.

With a total investment of about $2.7 billion, Nucor is building a new steel mill for sheet metal

production on the Ohio River which is to start operations in the second half of 2024.

The recoiling and inspection line includes Fives’ digital solution EyeronTM, an intelligent quality management system that collects upstream process data, checks consistency with quality rules and automatically assesses product quality grading. EyeronTM will be tracking quality on the vertical galvanizing line and the recoiling and inspection line to ensure the products meet the

automotive quality standards.

“We choose Fives to supply an inspection line as an extension of our galvanizing line N1 using their automotive expertise supported with a real-time quality system,” said John Farris, vice president and general manager of Nucor Steel West Virginia.

For further information, log on to www.fives.com

SIJ Acroni contracts Primetals for cycloconverter

Slovenian steel producer SIJ Acroni, which is part of SIJ Group, tasked Primetals Technologies with the replacement of the existing cycloconverter drive control for the upper and lower motors on the plate mill’s roughing stand at the Jesenice production site in Slovenia. Rendering the old drives obsolete, Primetals Technologies installed the VarioVerter cycloconverter solution.

The project aimed to increase availability and secure the supply of spare parts for the drives. Two main factors played a role when SIJ Acroni

chose Primetals Technologies as supplier: a variable replacement concept and competitive investment costs.

Primetals Technologies’ scope of supply includ ed implementing two VarioVerter cycloconverter controllers, replacing the field control units, and providing a new workstation for easy and remote maintenance and diagnosis of the drive system. The integration into the plate mill’s existing basic automation control system was re-established, leaving the interface largely unchanged.

Installation and start-up were completed on schedule. After a short start-up period, the VarioVerter was adjusted to handle all products and yield strengths without restrictions. Addi tional technological functions, like ski control, were included in the control of the VarioVerter cycloconverter.

For further information, log on to www.primetals.com

INNOVATIONS 16

LINEAR POSITION SOLUTIONS FOR STEEL APPLICATIONS ABSOLUTE POSITION SENSORS WITH INDEPENDENT DETACHED ELECTRONICS Highest performance with Industry 4.0 and 85 ºC (185 ºF) Higher temperatures up to +105 °C (+221 °F) temposonics.com | info.us@temposonics.com | 800 633 7609 MTS Systems Corporation, Sensors Division • 3001 Sheldon Drive Cary, NC www.mtssensors.com/industrial Temposonics® Magnetostrictive Linear Position Sensors SOLUTIONS FOR HIGH TEMPERATURE APPLICATIONS Absolute Position Sensors with Independent Detached Electronics Accurate Measurement | Varied Operating Temperatures up to +105 °C (+221 °F) Contact applications support at 1-800-633-7609 / sensorsinfo@mts.com Model RD4 Model GBS Model ET V

Tough times ahead

Though the steel industry’s mood, by and large, has been characterized by optimism based on bullish market signs, there are also some indicators that are causing unease in the US market, says Manik Mehta*, one of which is the soaring inflation rate leading some experts to utter the dreaded ‘R’ word –recession.

PUNDITS have been talking for some time about the dark clouds gathering in the skies. According to Fitch Ratings, a mild US recession in 2023 and overall weak demand and pricing could create some challenges for the steel sector. But urbanization, mobility, and automobile electrification are trends that will support long-term steel demand, while federal stimulus, trade regulations and the $1.2 trillion Infrastructure Investment and Jobs Act should provide near to mediumterm support. The pandemic and the Russia/Ukraine conflict emphasized the importance of reshoring manufacturing and infrastructure investments, which also supports medium-term demand.

Fitch expects healthy single-digit percentage increases in private nonresidential investment spending to support construction demand; however, nonresidential construction starts to point to decelerating activity. Moreover, rising interest rates, lingering supply chain constraints and a US recession in 2023 may affect the timing and magnitude of construction spending. Labour shortages and supply chain disruptions also delayed construction activity during 2021 and 2022. However, Fitch expects public construction spending will start to see the benefits of the Infrastructure Investment and Jobs Act, including $110 billion of incremental funding for roads and bridges.

US auto steel demand will remain under pressure through the first half of 2023, but could improve thereafter as supply chain issues, including component shortages for semiconductors, abate. Fitch expects vehicle production to marginally increase in 2023 and 2024, as improved semiconductor availability allows large-volume auto manufacturers to increase production. However, this assumes that healthy consumer balance sheets and spending, in addition to pent up auto demand, are enough to offset inflationary pressures on the consumer, including rising interest rates.

Like Fitch, others see a sharp fall-off in demand resulting in a downturn scenario, together with a period of sustained low prices. China is expected to increase exports as its domestic steel demand softens, keeping in check the galloping prices worldwide. The strong US dollar could also impact domestic steel prices if it results in steel imports becoming more attractive.

Overall, US steel companies seem to be bullish for 2023, as recent comments by leading steel executives during company earnings calls suggest. This bullish mood is based on a number of ‘positive signs, such as the pent-up demand for automobiles’, as senior executives of major steel companies have been suggesting, including US Steel, Nucor, Steel Dynamics Inc., and Cleveland Cliffs. Supply chain bottlenecks will

also ease in 2023, fuelling demand and supporting cash flows.

Indeed, Lourenco Goncalves, chairman, president and CEO of Cleveland Cliffs, said that the automotive sector could now ‘carry the market’ when speaking during a recent company earnings call, referring to ‘clear evidence that fleet inventories need to be replenished’, and the ‘unique opportunity’ available for the automotive industry in 2023 backed by microchips, may be the only sector with pent-up demand.

Similar views were also expressed by David Burritt, the chief executive of US Steel, who during a conference call on 28 October maintained that automotive customers were ‘already signaling higher steel consumption in 2023’. Burritt also saw demand being generated in the energy and appliance end markets.

Leon Topalian, Nucor’s president and CEO, was equally optimistic in a conference earnings call on 20 October about the automotive industry, while identifying the non-residential construction and energy sectors as two other drivers of demand for steel.

The steel industry has, meanwhile, cushioned itself against market volatility by entering into fixed price contracts to maintain price stability in 2023. These would cushion the industry, at least, for a year against ‘rising upward trends in prices of all materials’, as one steel industry

19 www.steeltimesint.com November/December 2022

* US correspondent, New York

USA UPDATE

manager put it, preferring to remain anonymous.

Indeed, as Burritt has been saying, the fixed and longer-term contracts ‘take some of the noise out of market price fluctuations’.

The steel industry’s confidence is also strengthened by Washington’s investment plans following the passage of the CHIPS Act and the Inflation Reduction Act in Congress. These initiatives are expected to boost domestic manufacturing, and open up opportunities for the nation’s steel industry, with Topalian anticipating the impact of new federal infrastructure spending in 2023 as states continue to move forward with their projects. Senior executives of the big steel companies are expecting the infrastructure programme to start to drive steel demand in 2023 and even beyond.

On another front, US Trade Representative Katherine Tai met recently, for the second time in a matter of weeks, with the European Commission’s executive vice president Valdis Dombrovsky, to discuss, among other things, the issue of carbon intensity and overcapacity in the steel and aluminium sectors. The USTR reinforced the USA’s commitment to pursue ‘a high ambition global arrangement with the European Union to address these issues’, according to a statement released by the USTR’s office.

While both sides have not released details about their talks, Kevin Dempsey, the president and CEO of the American Iron and Steel Institute (AISI), has been saying that while efforts were made in the

past to address the issue of global steel overcapacities, no concrete action had been taken and the issue of overcapacities persisted. Though he supported the Biden administration’s efforts to address these important issues, Dempsey said that “it’s very important that we actually reach a result that will create effective enforceable mechanisms that discourage the importing of steel that’s much higher in carbon intensity, and that actually put some type of penalty on countries that are exacerbating the global overcapacity crisis”.

options in the event of a Union Pacific railway strike taking place in the critical winter season. Such a strike could impact the industry’s shipments. The steel industry’s vulnerability becomes obvious when one considers that roughly a third of all US exports are facilitated by rail transport. In particular, there is a dense concentration of steel mills in Illinois, Eastern Texas, and the Pacific Northwest that utilize Union Pacific railways.

Indeed, not just metal but also other products and commodities – such as food, timber and coal – are transported across the country along the nearly 140,000 miles of cargo-transportation routes. It may be recalled that in September two of the 12 major US railway unions had rejected negotiations and revived the possibility of a strike in winter.

The AISI also recently released the recommended steel industry greenhouse gas emissions (GHG) calculation guidelines to provide consistent and comprehensive data across the industry on GHG emissions from steel production, with a focus on product level disclosures and corporate level reporting. The AISI said that the guidelines were the ‘result of months-long collaboration with key American steel producers and institute staff’.

As of writing this update, the steel industry was quietly looking for transport

More than 50% of freight moved across the US consists of bulk commodities, with coal, iron ore, and steel scrap material being the three large categories of goods moved across the nation. The categories include coking coal used for steel production. In 2021, US railroad freight routes transported more than 560kt of steel and raw materials across the country. These are then finished into products like pig iron, steel wire, and steel plates.

Indeed, steel mills in the country rely heavily on rail transportation of these goods. The winter, as many predict, will not be an easy one, given rising energy prices. A strike at such a critical time will not only hit a sensitive nerve of the steel industry, but also have repercussions for the nation’s economy. �

www.steeltimesint.com November/December 2022 USA UPDATE 20

CONTACT US: www.solarturbines.com, +41 91 851 1511 (Europe) or +1 619 544 5352 (US) infocorp@solarturbines.com

ONE DAY IT COULD BE LIKE THIS BETTER ENERGY RECOVERY LESS CO2, HIGHER RETURN Hydrogen Off Gas

(H2 +

High hydrogen, high CO, low or high BTU - Solar Turbines designs and manufactures gas turbines in combined heat and power applications with wide fuel capabilities to help our customers improve their bottom line and CO2 footprint. Syngas

CO)

COSAN – a new Vale shareholder

In October 2022, the capital market and the iron and steel industry were surprised by the fact that the Brazilian conglomerate Cosan announced the acquisition of a relevant stake in Vale, writes Germano Mendes de Paula*

Vale plays a crucial role in the global iron ore industry. With a production of 316Mt in 2021, the company occupied second place in the world ranking, just after Rio Tinto (322Mt). Vale achieved a worldwide market share of 13.5%. The respective ratio for Latin America and Brazil was 73.8% and 80.8%. Last year, Vale exported 278Mt of iron ore, equivalent to a 16.8% share of global exports. Vale’s exports as a proportion of Latin American exports was 74.2% and, as a proportion of Brazilian exports, 81.1%.

Vale’s ownership history

Vale was incorporated in 1942 as a stateowned enterprise (SOE). It was privatised in 1997, when two consortia disputed its majority control: one headed by Companhia Siderúrgica Nacional (CSN) and the other by Votorantim, a large Brazilian conglomerate. The first, which was formed by CSN, pension funds and banks, won the auction. By adopting this particular method of

privatisations, the governmental aim was to assure a stable group of large investors and thereby avoiding the possibility of a hostile take-over. It is important to stress that Vale, for its part, owned a 10.3% stake in CSN as the latter was privatised in 1992.

Nonetheless, in 2001, the crossownership between Vale and CSN was dismantled. A new shareholders’ agreement was signed and renewed afterwards, which guaranteed control by a relatively stable group of large investors, such as the Brazilian Development Bank (BNDES), pension funds, financial institutions, and Mitsui. However, two important changes were observed in the last five years. In December 2017, all preferential shares without voting shares were converted into common shares with voting rights. In November 2020, Vale’s shareholding agreement expired, turning it into a corporation (a company without defined shareholding control).

As of September 2022, Vale’s stakes were

controlled by Previ (the largest Brazilian pension fund, with 8.6%), Capital World Investors (a US investment firm, with 6.7%), Blackrock (a US investment firm, with 6.3%) and Mitsui (a Japanese conglomerate, with 6%). The remaining shares were pulverised by investors with lower than a 5% stake (67.5%) and maintained by the company’s treasury (4.9%).

Who is COSAN?

In 1936, Cosan started life as a sugar producer. In 2008, it acquired ExxonMobil’s assets in Brazil and entered the fuel and lubricant distribution sector. In the same year, it established Rumo, a railway, in order to improve the logistics efficiency of Cosan’s sugar exports, and Radar, a company engaged in identifying rural properties with high potential for agricultural operations and price appreciation. In 2011, Raízen was established as a joint-venture between Cosan and Shell to produce sugar and ethanol from sugarcane, and fuel

23 www.steeltimesint.com November/December 2022

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

LATIN AMERICA UPDATE

distribution. In 2012, it purchased Comgás, a leading natural gas distributor, in order to foster its presence in the energy sector. In 2014, Rumo merged with ALL, another railway company. Cosan Lubricants was renamed as Moove in 2016. In 2008, Cosan engaged in an intense strategy of diversification, acquired some competitors, and gained market share in many segments.

Currently, Cosan’s main assets are a 44% stake in Raízen and a 30% stake in Rumo, both listed enterprises. Moreover, it controls 70% of Moove (non-listed) and 88% of Compass (non-listed, but Compass’ main asset is Comgás, listed with a limited free float). COSAN usually has a relatively large participation in the invested companies, exercising a prominent managerial role. In the day before Vale’s transaction announcement, Cosan’s market capitalisation reached $6.7bn.

Cosan has previously manifested interest in investing in the mining industry. It tried to acquire Previ’s stake in Vale in 2018, but negotiations terminated after the Brumadinho incident. In September 2021, it purchased a port in São Luís, in the State of Maranhão, which belonged to the Chinese CCCC, for a consideration of $136M, and announced a joint-venture for iron ore exploration in the State of Pará with Paulo Brito, a controlling shareholder of Aura Minerals (a gold and copper mining company). The JV is for a relatively small 10Mt/yr greenfield iron ore project, to be commissioned by 2025, and contingent on ongoing technical studies.

Complex

structure and goals

Cosan announced its intention to purchase a 6.5% stake in Vale, becoming one of the latter’s top five shareholders. The

transaction was divided into three tranches: a) the purchase of 1.5% of Vale’s common shares; b) a bridging loan to acquire 3.4% of Vale’s common shares and also derivatives that protect against any share price downside; c) another derivative operation that grants Cosan the right to acquire 1.6% of Vale within five years, which can be converted into voting shares in the future, pending antitrust authority CADE’s approval.

All three parts would be funded by two collar structures, which is an option strategy that limits the range of underlying or specific positive or negative returns. The value of the transaction, assuming Cosan eventually converts all derivatives in Vale’s shares, could reach $4.2bn or roughly 63% of Cosan’s pre-deal announcement market capitalisation. These collars will be somewhat guaranteed by the dividends that Cosan would receive from Raízen and

partnership with several players, such as Shell (partner in Raízen) and the private equity fund CVC (partner in Moove).

The outcomes so far Vale has not been impacted by the transaction yet, because it has not concluded. In addition, it is understood that Cosan may influence more directly Vale’s strategy if it obtains a position on Vale’s board of directors. According to an Itaú BBA report, during a Q3 2022 conference call: “Vale’s management said that it considers Cosan’s investment in Vale as a testimony to the company’s potential to unlock value in the future and to the significant de-risking after the Brumadinho crisis that has been achieved. Vale welcomes the potential contributions that Cosan could make to its strategic planning, considering Cosan’s strong track record for value-creation”. Nonetheless, mostly because of the Chinese iron ore market weakness, Vale’s share prices dropped 10.3% from the day before the transaction announcement until the conclusion of this article.

Compass, plus the Vale shares that Cosan is now acquiring and will purchase over the next five years.

Cosan justified the transaction by five main motivations: a) Vale has a great competitive advantage in the iron ore business, owning unique and irreplicable assets; b) it is a relevant player in energy transition and decarbonization; c) it has large exposure to strong currencies; d) it represents an investment opportunity that increases Cosan’s portfolio diversification and the deal takes place at a time when Vale’s share is undervalued; e) with a significant minority stake, Cosan intends to contribute to value creation with current shareholders and the company’s management. Cosan highlighted that it was not a hostile transaction, as it talked previously with key shareholders, and has demonstrated its ability to work in

It is worth noting that after the transaction, Moody’s reaffirmed Cosan’s rating and maintained its outlook as stable. However, the reaction of capital markets was mixed. Its share prices plummeted 15.6% in the days before the announcement. Even after a partial recovery, its current level is 10.4% lower than the pre-deal notification. In other words, Cosan’s market capitalisation diminished approximately $756M during the post-deal period. As BTG Pactual bank clearly explained, for Cosan, the transaction can be summarised as follows: “Dreaming (really) big; putting its splendid track record to test”. �

www.steeltimesint.com November/December 2022 LATIN AMERICA UPDATE 24

Our innovations aiming at decarbonizing the steel industry: CO2-free steel production process Siderwin, Furnace Electrification, Carbon Capture, Heat Recovery, Jet Vapor Deposition (JVD), E-Qual® Electrical Steel Processing Technologies Technologies for cleaner and smarter steel making Innovation is part of our Group’s DNA. For over 200 years John Cockerill Industry has demonstrated its ability to think differently and its capacity of seeing things from another angle. Still today, we are combining talent and technology, history and modernity, engineering and services. Virtues that help us to accompany our steelmaking clients in their digital transformation journey and their transition to responsible, zero carbon steel making. TrainLab™ Virtual reality & immersive e-training platform for considerably improved learning retention. Follow us on johncockerill.com/industry Eagle Eye Coating® A unique and intelligent zinc coating technology. JOHN COCKERILL INDUSTRY METALS Reheating Furnaces Pickling Acid Regeneration Cold Rolling Strip Processing Automation

Proven solutions for carbon capture

Ready to invest in carbon capture?

Munters has the expertise and equipment to support your project. We have decades of experience in Mass Transfer and Mist Elimination – Clean technologies that are essential to any successful carbon capture project, no matter the industry. You can count on Munters proven solutions to support your carbon capture project.

Learn more at

Clean technologies by Munters

www.munters.com/cleantechnologies

Consumption drives growth

A boost in construction projects, government support, and the rebound of real estate has enabled India’s steel industry to grow, despite a gloomy global outlook.

By Dilip Kumar Jha*

By Dilip Kumar Jha*

THE government’s thrust towards infrastructure projects, pick-up in construction and real estate activities as well as healthy demand from the automobile sector bodes well for the growth of the steel industry in India. Despite subdued global economic growth forecasts and a slowdown in Indian GDP, the steel industry performed well during the first seven months of the current financial year (April 2022 – March 2023). This indicates that the government’s attempt to support consumption-led industries by enabling favourable policies for the infrastructureconnected other sectors, enabled a robust growth in Indian steel demand this year.

April-October production

According to the Centre for Monitoring Indian Economy (CMIE), one of the leading industry think tanks in India, the country’s steel demand jumped by 12% to 66Mt during the period between April and October 2022, compared to 59Mt reported in the corresponding period last year. India’s steel consumption stood at 106Mt in the financial year (FY) 2022, an increase of 11.6% from the low base of 95Mt in the previous year, thanks to a number of varied new infrastructure projects announced by the government, as well as the resumption of real estate and construction work.

During the same period, the production

OUTBOUND SPIRAL

India’s steel shipment trend (Mts)

Financial year (April-March) Imports Exports

2020 6.8 8.4 2021 4.8 10.8 2022 4.7 13.5

Apr-Oct 2021 2.8 8.8 Apr-Oct 2022 3.2 4.0

Source: Centre for Monitoring Indian Economy (CMIE)

ROBUST DEMAND

India’s steel consumption trend (Mts) Financial year (April-March)

Consumption Growth (%)

2020 100 1.5 2021 95 (-)5 2022 106 11.6

Apr-Oct 2021 59 28 Apr-Oct 2022 66 12

Source: Centre for Monitoring Indian Economy (CMIE)

of crude and finished steel also increased by 5.3% and 6.4% respectively on a yearon-year basis. The growth in finished steel production was supported by a strong increase in consumption.

The government’s focus on infrastructure projects is a major contributor to the rise in demand in the Indian market. However, demand in the international market is expected to remain subdued going forward due to weak external environments such as high inflation, rising interest rates, soaring energy prices in Europe and the

deceleration of the real estate market in China.

An increase in demand from the construction sector, along with an uptick in the real estate and automobile sector, is expected to boost demand for steel products. With robust government spending on roads, railways, airports, ports, mass transport, waterways and logistics infrastructure, a 36% year-on-year increase in capex allocation and government initiatives to support steel production will continue to augment domestic steel demand in the country. With this, India’s

27 www.steeltimesint.com November/December 2022 *

India correspondent

INDIA UPDATE

steel production is expected to remain in the range of 115118Mt, a growth rate of around 3-5% in the financial year 2023. The strong domestic demand outlook is likely to benefit manufacturers in the industry.

Record export and duty imposition

The imposition of export duty has led to a de-growth in exports from India in April-October 2022, thereby resulting in increased supply and moderation in steel prices in the domestic market.

India exported a record high of 13.5Mt of steel in the financial year 2021-22, due to international factors like environmental concerns surrounding China’s steel industry, an uptrend in global steel prices, and higher demand from European nations. India’s import of steel has, however, decreased by a staggering 31% to 4.7Mt in the financial year 2021-22 from 6.8Mt in the previous year, backed by higher capacity utilisations as well as on-streaming of large capacities that were acquired by incumbents through bankruptcy proceedings.

India’s steel exports, however, witnessed a reversal in trend during the period April-October 2022, after maintaining an uptrend for three consecutive years ending in March 2022.

India’s steel exports declined sharply by 55% as compared to the same period in the previous year. This was mainly because of weak international demand, continued geopolitical tension and inflationary headwinds globally. Furthermore, the 15% export duty imposed by the Indian government on steel products also affected exports from India.

Consequently, India’s steel exports plunged to 4Mt over the period April-October 2022 from over 8.8Mt during the same period the previous year. This was primarily due to the imposition of export duty on a range of finished steel products. While the exports were less attractive, they increased steel’s domestic availability as reflected in the expansion of production and consumption volumes. On account of an abundance of availability, steel prices in India declined by a fourth from INR 96,079 per tonne in April to INR 73,158 per tonne by the end of October 2022.

The path ahead

India’s overall steel demand growth is expected to remain strong at 9-10% during the current financial year (April 2022-March 2023) due to the government’s infrastructure push and increased investment in real estate and construction sectors amid a post-Covid economic rebound. Additionally, lower raw material prices on account of the increase in export duty on iron ore from 30% to 50% in May 2022, will support steel production in India, although steel prices will continue to remain moderate. Thus the operating profit margins of Indian steel players are likely to remain under pressure because of moderation in realizations despite relatively lower raw material costs and a contraction in realization. Similarly, India’s steel exports may witness a de-growth in the current financial year due to the global economic recession.

In a major relief to Indian steel producers, however, domestic consumption will continue to grow, primarily because of improved economic activity and the government’s continued investment in infrastructure and construction. To serve growing domestic demand, local steel production will grow mainlybecause of sustained high-capacity utilisation levels. �

www.steeltimesint.com

UPDATE 28

INDIA

combilift.com

Storage Efficiency Manage your steel more safely and more productively using less space with Combilift’s materials handling solutions

Safety

ww w.magnesitasnavarras.es MAGNA North America Minneapolis, USA +1 (612) 638 2160 MAGNA Magnesitas Navarras Navarra, Spain +34 948 421 644 MAGNA Refractarios México Monterrey, Mexico + 52 (81) 83367196 From the mine to the steel mill

Improved calcium injection

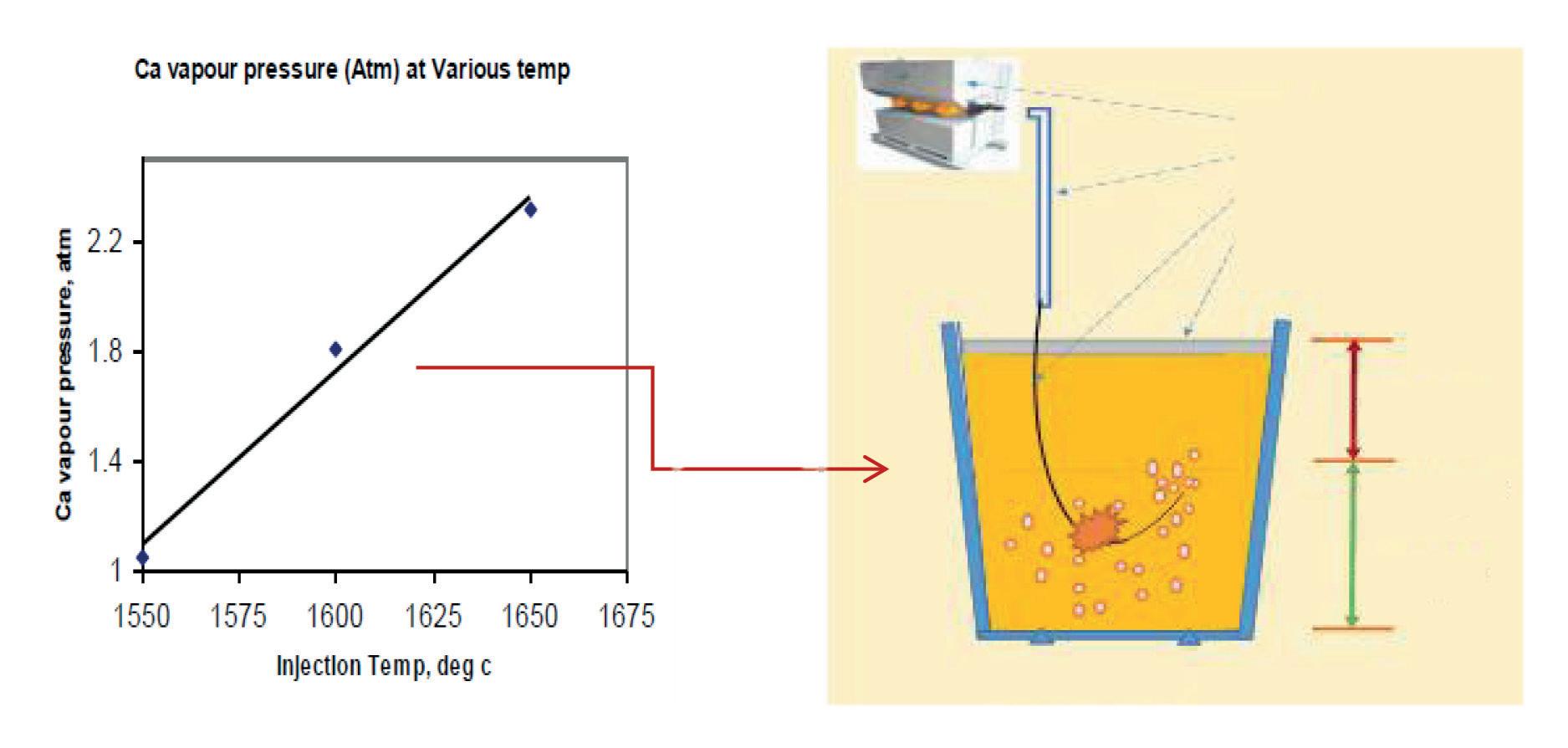

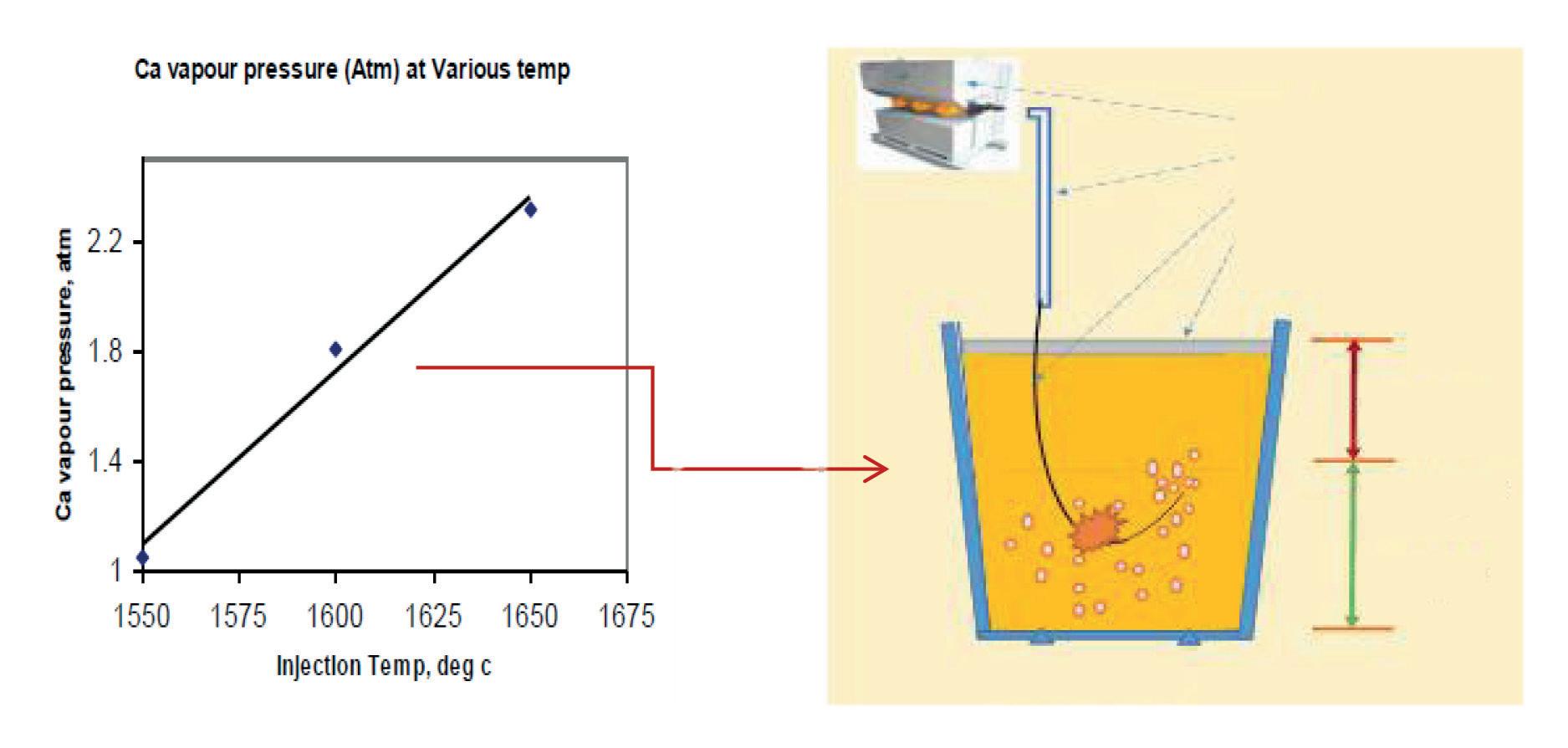

Minex has improved the injection of calcium to modify inclusions in steel by developing high density packed wire containing either a core of Ca-Si alloy or, when the steel Si specification must be low, pure calcium, as the core of laser welded wire. This approach delays the release of calcium until immersed deep in the steel ladle, improving average Ca yield from 17% to 25% for pure Ca injection and to 20% for CaSi, as well as reducing surface emissions of CaO and thereby improving the working environment.

AMONG all the processes in secondary metallurgy, calcium treatment is certainly the most difficult due to its low density, low melting and boiling temperatures as well as its high vapour pressure. A failure in calcium treatment may have catastrophic consequences. These problems have led to the development of special addition techniques injecting steel wire with calcium in its core into molten steel in the ladle.

Minex Metallurgical Company Ltd, started its journey almost four decades ago pioneering cored wire injection systems as well as cored wire manufacturing technology. The company has launched its first ‘Green CaSi’ injection cored wire for the steel and foundry industries, manufactured in Brazil partly using renewable energy. It has also introduced Accurate Density Control (ADC) using a PLC-based weighing system to measure and control the density of the core material which ultimately improves the quality of the wire in terms of stable density. This article examines recent results.

Calcium treatment of liquid steel has become an important means and essential feature of deoxidation, desulphurisation and inclusion modification[1] of steel. The use of calcium controls the shape, size and distribution of oxide and sulphide inclusions[2,3]. In Al-killed steels, alumina inclusions form and are the main inclusions. At steelmaking temperatures, these alumina inclusions are mainly present in solid form. The mechanical properties of steel is affected by the volume fraction, size, distribution, composition and morphology of these inclusions. In addition to lowering the properties of the steel, solid inclusions affect steel castability by nozzle clogging. Nozzle clogging occurs when solid inclusions accumulate in the

Fig1. CaO-Al2O3 binary phase diagram

Atomic Weight 40.08

Density 1.55 g/cm3 (at room temp.)

Melting Point 842°C /1115K

Boiling Point 1483°C /1757K

Vapour pressure at 1550°C 1.05 Atm Vapour pressure at 1600°C 1.81 Atm

Table 1 Physical properties of Calcium

caster pouring system such as in the ladle shroud or submerged entry nozzle (SEN). Thus it is important to understand

how to achieve acceptable inclusion characteristics in terms of shape, size and chemistry. Benefits directly attribute to calcium treatment include greater fluidity, smoother continuous casting by reducing nozzle blockage and improved cleanliness, machinability, ductility and impact strength in the final product[4]. Calcium treatment is commonly applied to modify the products of deoxidation into fluid inclusions by lowering the melting point. The amount of calcium added is the most important parameter of treatment. Pure calcium or calcium alloy are normally added into the molten steel at the final stage of refining after complete deoxidation of the steel. Introduction of calcium in steel has always has been a challenge to steelmakers due to its physical properties of low melting point (842°C), low boiling point (1483°C) high vapour pressure and low solubility in steel. The solubility of calcium in liquid iron (Fe) is reported to be 300ppm at 1600°C and one atmosphere of calcium vapour pressure (Table 1). Most grades of steel are treated with calcium using either a CaSi alloy or Pure Ca wire depending on the silicon

wire feeder guide pipe cored wire slag layer ca-vapor critical depth ca-liquid calcium injection

Fig 2. Critical depth of Ca wire injection

CALCIUM TREATMENT 30 www.steeltimesint.com November/December 2022

The authors are with Minex Metallurgical Co Ltd, Andheri (E), Mumbai 400069, India

S Ghosh, V Ranjan, S Kumar and SB Misra* V Ranjan, S Kumar & S B Misra

Parameter Cal-Lock

Compactness High Moderate

Recovery Higher by 20 -25% from regular Pure Ca 17 -22%