Better times ahead for North American Infrastructure. Will steelworkers be the swing vote in 2024?

DECARBONIZATION

The blast furnace is not dead yet, says Rutger Gyllenram.

If EV demand rises, can we reduce the impact of mining?

Better times ahead for North American Infrastructure. Will steelworkers be the swing vote in 2024?

The blast furnace is not dead yet, says Rutger Gyllenram.

If EV demand rises, can we reduce the impact of mining?

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com / Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028 / Fax +44 (0) 1737 855034 Email subscriptions@quartzltd.com

Steel Times International is published eight times a year and is available on

Annual subscription: UK £226.00 Other countries: £299.00 2 years subscription: UK £407.00 Other countries: £536.00 3 years subscription: UK £453.00 Other countries: £625.00 Single copy (inc postage): £50.00 Email: steel@quartzltd.com Digital subscription: (8 times a year) - 1 year: £215.00 - 2 years: £344.00 3 years: £442.00. Singe issue: £34.00

Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com

Steel Times International (USPS No: 020-958)

Moggridge.

Mark Bulla Arise, the pellet king!

Reports of the end of blast furnaces are greatly exaggerated.

Minimizing mineral demand and mining impacts in the transition to

Steel, trade and the 2024 US presidential election.

Clean steel helps student racing team gear up for success.

toward the future.

Mono and composite tubes for green energy technologies.

The future of steel processing.

Sights set on optimization.

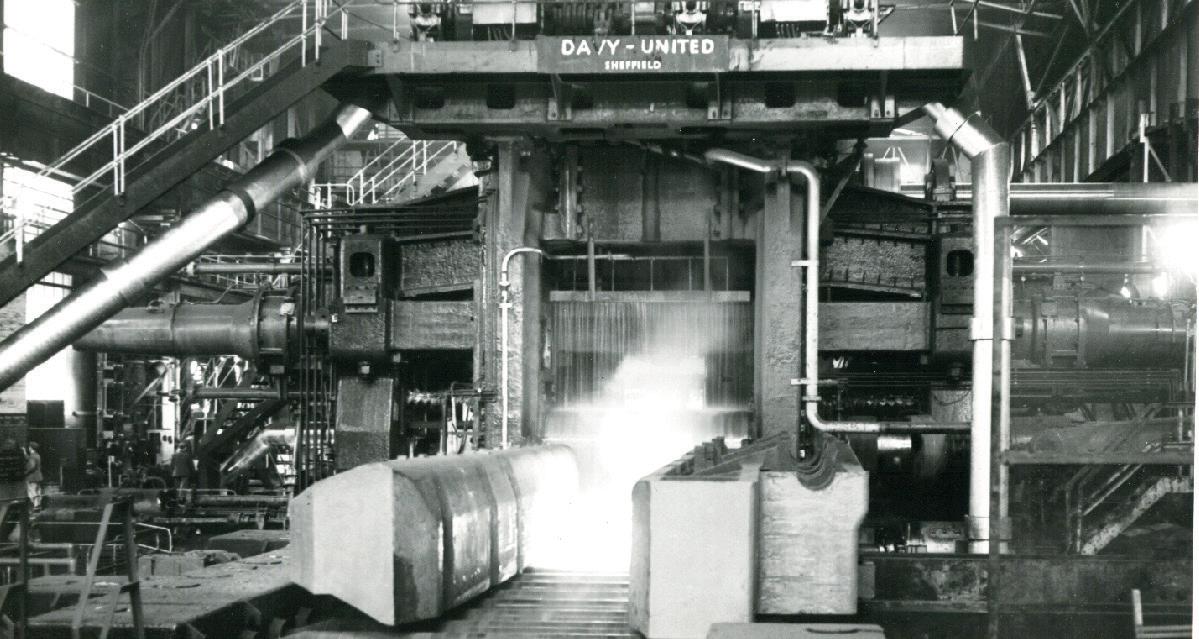

The growth of iron and steelmaking at Port Talbot – Part 2.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

There’s nothing like being offered the chance to moderate a discussion panel on hydrogen steelmaking to exercise the mind. And just as soon as I close our October edition (after completing this leader) I’ll be taking a closer look at a subject that is relatively new in the greater scheme of things, even if it seems to have been around for some time.

Over the past few weeks, and prior to my invitation to moderate, I have been collecting notes on the subject of hydrogen steelmaking and there are, of course, many aspects to the process that will need to be looked at in Linz, Austria, at the end of this month; and I must say I’m looking forward to it, especially considering the cutting edge panel of experts involved.

When people talk about decarbonizing the steelmaking process, a lot of the experts in the field of steel production technologies claim that to successfully decarbonize the steel industry will only become a reality if multiple technologies are employed. In other words, it’s not all about hydrogen; and of course we all know that. There are many different technologies under development designed to help steelmakers reduce their emissions

and we all know that while there seems to be a perception that, one day soon, the industry will press a button and everybody will be making steel using hydrogen and EAFs, the reality is completely different. For a start, to make zero carbon steel requires renewable energy, and it is argued that there simply isn’t enough of it ‘to support the aspirational demand for green hydrogen’.

Steel made from hydrogen is widely regarded as the ‘gold standard’ and it will be produced – initially at any rate –by a select few, including SSAB, with its pioneering HYBRIT initiative and, of course, H2 Green Steel (recently renamed Stegra). There are others, like BLASTR Green Steel (see exclusive interview with CEO Mark Bula on page 20) and there will be more, but as Rutger Gyllenram of Kobolde & Partners says in this issue, ‘new process ideas are nothing more than ideas until proven in full-scale’. In the meantime, he says, ‘we must do what we can with what we have – and produce low-emission sponge iron with natural gas using CCS in both EAFs and BFs.’ So don’t think you’ve heard the last of the traditional blast furnace...you haven’t.

To meet strong demand from China for green iron, mining company Fortescue is planning to build a pilot plant that will produce the product using renewable energy in 2025. Fortescue will use green electricity from solar farms at its Christmas Creek iron ore operation in Western Australia to produce 1.5kt of high-purity green iron per year. The company will allocate A$50 million for the project and expects to start production in 2025. Fortescue is testing several methods to produce green iron, and it is expected that renewable energy steelmaking will not be commercialized until the next decade.

Source: Yieh Corp Steel News, 2 September 2024.

Ukrainian steel and mining group Metinvest is considering the possibility of building or acquiring new

Arabian Gulf Steel Industries (AGSI), a company based in Abu Dhabi specialising in

More than 2,000 workers have applied for voluntary redundancy at Tata Steel’s south Wales sites, according to reports. The majority are based in Port Talbot. Tata Steel has already decommissioned one of the two blast furnaces at Port Talbot, the largest steel plant in the UK, as part of its strategy to transition to greener production methods.

The restructuring, which is expected to lead to approximately 2,800 job losses, aims to curb daily losses exceeding £1 million, according to the steelmaker.

Source: Manufacturing Management, 2 September 2024.

The Argentinian steelmaker Tenaris has launched its new electric arc furnace, based on Consteel technology, at the Campana Industrial Center Steelworks. The company said in a statement that the objective of this new furnace, which cost an investment of $100 million and involved the participation of more than 700 workers, is to improve the energy efficiency of the steel production process, increase operational safety and productivity, and reduce CO2 emissions.

Source: Yieh Corp Steel News, 2 September 2024.

facilities for the production of green steel outside Ukraine, which would then be powered by Ukrainian raw materials. One of these plants is planned to be built in Italy. In addition, the group is open to other opportunities, including the acquisition of assets in neighbouring countries.

Source: GMK Center, 4 September 2024.

manufacturing sustainable steel, has announced the achievement of net zero

US vice president Kamala Harris has said that US Steel should remain domestically owned, saying during a campaign stop in Pittsburgh that it is ‘vital for our nation to maintain strong American steel companies.’ Harris’ comments marked the first time she lent her voice to the dispute over the proposed sale of US Steel to Nippon Steel, Japan’s biggest steelmaker. “The president mentioned it: US Steel is a historic American company, and it is vital for our nation to maintain strong American steel companies,” Harris said at the Labour Day event after being introduced by Joe Biden. “US Steel should remain American-owned and American-operated.”

Source: CNN, 2 September 2024.

carbon emissions within its steelmaking operations. The company claims to be the first steel plant in the world to achieve carbon neutrality (accredited by a leading global auditor). AGSI is the largest steel recycler in the UAE, with a facility producing

Miami-based investor Atlas Renewable Energy has inked a joint venture with the Brazilian arm of steel manufacturing giant ArcelorMittal – through which the two companies will promote sustainable steel production in Brazil. As part of this partnership, Atlas will invest in the construction of a 315 MWp solar photovoltaic plant within the Luiz Carlos Solar Photovoltaic Complex in Paracatu, Minas Gerais. This new facility will provide renewable energy to power ArcelorMittal’s steel plants in South and Southeastern Brazil.’

Source: Latin Lawyer, 3 September 2024.

600kt of steel products annually from 100% locally sourced steel raw material.

Source: Gulf News, 4 September 2024.

Emirates Steel Arkan, the UAE’s largest publicly listed steel and building materials company, has rebranded as EMSTEEL, as part of a broader strategy to ‘accelerate its operational transformation and extend its global presence.’ The new brand identity and operating model were officially launched at an event in Abu Dhabi attended by customers, partners and employees. The new brand identity represents the merger of Emirates Steel and Arkan Building Materials, completed in late 2021.

Source: ZAWYA, 5 September 2024.

Wales-based adventure company Zip World has announced its takeover of the ArcelorMittal Orbit sculpture at the Queen Elizabeth Olympic Park in Stratford, London.

The ArcelorMittal Orbit sculpture and observation tower designed by Anish Kapoor and Cecil Balmond will be Zip World’s ninth location and its first in the south-east of England. Zip World plans to invest £2.6 million into the visitor attraction, which stands at 114.5 metres tall and offers the world’s tallest and longest tunnel slide.

Source: Blooloop, 5 September 2024.

Brazil’s state-owned energy company Petróleo Brasileiro (Petrobras) has signed a memorandum of

India’s Ministry of Steel has set the target of achieving 500Mt of steel production by 2034, urging the industry to find new ways towards low emission processes, high productivity, and the use of AI. The country’s crude steel production shot up by over 35Mt in the last four years, from 109.14Mt in 2019-20 to 144.30Mt in 2023-24, as per the latest government data from August.

Source: Ommcom News, 5 September 2024.

understanding with Gerdau S/A to explore commercial opportunities and potential partnerships aligned with their diversification and decarbonization strategies.

"In a strategic move to face the environmental challenges of the 21st century, Petrobras and Gerdau have announced an agreement to explore and develop sustainable solutions within the scope of lowcarbon businesses”, Maurício Tolmasquim, Petrobras' director of energy transition and sustainability, said.

Source: RigZone, 13 September 2024.

Handling equipment supplier

Kalmar has signed an agreement to supply Finnish steel producer Outokumpu with three light electric forklift trucks and one medium electric forklift truck. The machines will be deployed at Outokumpu’s integrated stainless steel plant in Tornio, Finland. The order, which includes a preventive maintenance agreement, was booked in Kalmar’s Q3 2024 order intake. The light electric forklift trucks will be delivered during Q1 of 2025, while the medium electric forklift truck is scheduled for delivery during Q4 of 2025.

Source: StreetInsider.com, 6 September 2024.

An Italian appeals court has scrapped the convictions of the former owners of one of Europe's largest steelworks for failing to curb toxic emissions, ordering a retrial, lawyers told media. Brothers Fabio and Nicola Riva were sentenced to 20 and 22 years, respectively, in 2021 by a court in the southern city of Taranto after years of the plant's non-compliance with environmental controls.

To support Indonesia’s green transition, the International Finance Corp has issued a $60 million loan to steel manufacturer PT Gunung Raja Paksi, known as GRP, to expand low-carbon steel production using electric arc furnace technology. EAFs, which use electricity rather than coal as an energy source, can reduce the carbon intensity of steel production by up to 80% or 90%, depending on the source of the electricity. GRP is looking to halve the carbon intensity of its steel production and increase its metal recycling capacity.

Source: Impact Alpha, 9 September 2024.

But the Rivas' legal team appealed, arguing there was a conflict of interest in trying the case in Taranto, where judges may feel directly affected by the plant, which is located nearby the city. The objection was accepted by an appeals court, which ordered a retrial in Potenza.

Source: Barrons, 13 September 2024.

Plans to build the UK's first deep coal mine in more than 30 years have been quashed. Two campaign groups had brought legal action over the previous government's decision to grant planning permission for the site near Whitehaven in Cumbria. At the High Court, judge Justice Holgate said the assumption the mine would not increase greenhouse gas emissions was ‘legally flawed’.

Source: BBC, 13 September 2024.

Russian steelmaker Severstal is building an pellet plant at its Cherepovets site, the company has announced. "Work is underway to build roasting, pelletizing and crushing facilities, control and desulphurization facilities," said the company. It previously said in late 2023 that it planned to develop its own pellet production in Cherepovets. It signed a special investment contract to build a plant with a capacity of 10Mt/yr in June. The plant will cost 97 billion rubles, it has been reported. Source: Interfax, 24 September 2024.

A Chinese company is investing $1 billion to build a steel plant in the Sarangani province of the Philippines. It is the single biggest foreign direct investment so far under the Marcos administration, according to Secretary Frederick Go, the special assistant to the president for investment and economic affairs. Go said the venture of Panhua Integrated Steel Inc. was among those approved by various investment promotion agencies of the government, such as the Board of Investments and the Philippine Economic Zone Authority, in Mindanao.

Source: Inquirer.net 14 September 2024.

US Steel has announced that it is the first steel company in

A plaque has been unveiled in memory of two firefighters who died following an explosion at a steel plant in Sheffield, UK. Bob Smith, 47, and Paul Parkin, 27, died from injuries sustained in the blast at British Steel Corporation’s Tinsley Plant on 25 February 1974. Their story was a ‘vital part of local history and the history of the fire service’, the Fire Brigades Union said. The tribute was unveiled at Parkway Fire Station in Sheffield in a ceremony attended by serving and retired firefighters and family members.

Source: BBC, 14 September 2024.

the world to qualify to sell its products as ResponsibleSteel Certified Steel at its Big River facility in Osceola, Arkansas. Big River received the first ResponsibleSteel Site Certification in North America in 2022 and has now achieved certification for sustainably sourced and manufactured steel. “ResponsibleSteel

A worker at ArcelorMittal Dofasco died after being pinned between two large vehicles at the company’s plant in Hamilton, Ontario. The incident, which occurred on 20 September, is now under investigation by Ontario's ministry of labour, immigration, training, and skills development. “It was reported a worker was pinned between two vehicles, resulting in fatal injuries,” a ministry spokesperson said in a statement to Canadian Occupational Safety. Two inspectors were dispatched to the site, as part of the ongoing probe.

Source: Canadian Occupational Safety, 25 September 2024.

Jindal Steel (JSPL) and Jindal Renewables (JRPL) have signed a Memorandum of Understanding (MOU) to implement India's biggest investment in green hydrogen by any Indian steelmaker to date. The MOU outlines JSPL's plan to integrate green hydrogen into its DRI units in Angul, Odisha. In the first phase, JRPL will develop a green hydrogen generation capacity of up to 4.5kt/yr set to commence by December 2025.

Source: Business Standard, 16 September 2024.

employs a comprehensive approach to its certification standards, and that is evident in the work we do here at Big River Steel,” said Dan Brown, senior vice president of advanced technology steelmaking at US Steel and COO of Big River Steel Works. Source: US Steel, 24 September 2024

Tata Steel Nederland has launched a new decoiling line and an automated sheet packaging line at its Feijen steel service centre in Maastricht. Feijen's collaboration with Tata Steel IJmuiden targets customers worldwide in Europe and other regions, primarily in the agricultural and earthmoving machinery, trailer, crane, and shipbuilding industries. Tata Steel Nederland comprises of two business units: Tata Steel IJmuiden (TSIJ) and Tata Steel Downstream Europe (TSDE). The Maastricht service centre is part of TSDE and includes the Multisteel and Feijen plants.

Source: Yieh Corp Steel News, 26 September 2024.

Hydnum Steel, the first green steel plant on the Iberian Peninsula, has entered into a Memorandum of Understanding (MOU) with Knauf Interfer, a European steel processing and distribution company. This partnership is designed to expand the availability of emission-free green steel across Europe and reinforce the commitment

International steel and technology group voestalpine has successfully issued its first green corporate bonds for €500 million, the company said in a statement. The bonds have a five-year maturity and a coupon of 3.75%, which reportedly meets high investor demand. All proceeds from the issue will be used to finance or refinance voestalpine’s sustainability projects, such as greentec steel.

Source: GMK Center, 26 September 2024.

to sustainability within the steel industry. Through the collaboration, Hydnum Steel will supply Knauf Interfer with green steel, worth approximately €80 million, annually.

Source: Chem Analyst, 2 October 2024.

French train manufacturer Alstom has signed a partnership agreement with Swedish steel firm SSAB for the supply of fossil-free steel for use in its new Traxx Shunter locomotives.

“We are very glad to sign this partnership agreement with SSAB,” said Christophe Gourlay, Alstom chief procurement officer. “By supplying steel with low carbon emission footprint for our Traxx Shunter™ locomotive, SSAB will contribute in the delivery of Alstom’s sustainable procurement strategy, which includes the reduction of the carbon emissions of purchased goods and services by 30% by 2030.”

Source: Hydrogen Insight, 27 September 2024.

India’s Ministry of Steel is pushing for a doubling of the basic customs duty on steel imports, suggesting an increase from the current rate of 7.5% to 15%. This is reportedly due to a substantial rise in steel imports from China, which now makes up around one-third of all steel imports in India, according to internal government assessments. Source: Swarajya, 3 October 2024.

Mining company Vale and renewable energy company Green Energy Park have announced a partnership to offer decarbonization solutions for the global steel sector. The companies will develop feasibility studies for the set-up of a green hydrogen production unit in Brazil to supply a future ‘mega-hub’, an industrial complex which will produce low-carbon steel products.

Source: Steel Orbis, 1 October 2024.

BZI®, a Utah-based group of steel construction and engineering companies, has announced it is now utilizing virtual reality technology to enhance customer experiences and products. The group is one of the first in the steel industry to adopt the technology as part of the systems and services offered, it claims. BZI is also integrating VR-simulation training into the safety, quality control and skills instruction provided at its training centre, SteelTech Academy.

Source: Business Wire, 3 October 2024.

We understand how it is important to efficiently extract and process precious metals and minerals.

You save valuable resources while keeping your employees and the environment safe.

Improve your processes with our comprehensive portfolio of measuring instruments, solutions and services:

Liquiline CM44 and CPS11E: Versatile transmitter and Memosens pH sensors ensure reliable measurement and safe calibration in the lab.

FieldPort SWA50: Intelligent Bluetooth or WirelessHART adapter for the easy connection of all HART field devices to the Netilion Cloud via Edge Devices.

Cerabar PMC71B: Absolute and gauge pressure transmitter combining measurement accuracy with IIoT functionalities.

Precision sensor manufacturer Micro-Epsilon has extended its surfaceCONTROL range of 3D snapshot measurement sensors for automated, inline measurement of geometry, shape and surface quality of objects. The surfaceCONTROL SC3xx0-30 offers a smaller measuring field of 30mm x 18 mm with a z-axis range of 12mm. The sensor delivers the measurement results at a z-axis distance of between 124 and 136mm.

With high repeatability of < 0.25 µm and a data processing speed of up to 2.2 million 3D points per second, the sensor sets a new benchmark in high precision 3D measurement technology, claims Micro–Epsilon.

The new 30mm measuring range is available in all classes and models of the surfaceCONTROL SC3xx0 series, i.e. the surfaceCONTROL 3D 3200 and surfaceCONTROL 3D 3500 ranges, with each offering a different measuring area. Both models are fully integrated industrial sensors that are protected to IP67 with passive cooling

(active cooling is available for higher operating temperatures).

The surfaceCONTROL SC35xx-30 is suitable for a wide range of flatness measurement, coplanarity measurement, and surface defect detection applications, including flatness inspection of circuit boards; planarity inspection of unpopulated PCB substrates; completeness check of electronic components on fitted PCBs; 3D measurement of high precision mechanical parts; width, tilt angle, and position measurement of rivets; detection and evaluation of breaks on clutch discs; 3D text recognition of embossments that cannot be solved using 2D image processing due to lack of contrast; inspection of height and thickness of adhesive beading on smartphone shells; and determination of shape deviation defects on injection moulded parts.

All surfaceCONTROL 3D systems support the very latest GigE Vision and GenICam standards for easy integration into third-party image

processing software. A comprehensive software development kit that allows customers to develop their own analysis software is also provided. Included in the scope of supply is Micro-Epsilon’s 3D Inspect software, which offers a convenient user interface for surfaceCONTROL sensors. The software allows for the commissioning and evaluation of the sensor, set up and optimisation of parameters, and ensures the correct positioning of the measuring object.

For further information, log on to www.micro-epsilon.co.uk

Swedish premium fastener manufacturer BUMAX AB has appointed Star Stainless Screw Company as its new master distribution partner in the US. The announcement, says the company, marks a step forward in the BUMAX route to market in the US and is part of BUMAX’s ongoing development strategy for the North America region.

“We at Star Stainless Screw Company are so excited to be partnering with BUMAX. We feel the quality of product from BUMAX, partnered with the reputation Star has for offering the highest of quality of product and service, will be a perfect fit. We look forward to our partner-

ship and thank BUMAX for their trust in Star’s excellence in distribution,” said Tim Roberto, president, Star Stainless Screw Co.

Star Stainless will be responsible for stocking and supplying the BUMAX range of high-strength stainless steel products to fastener distributors and industrial product suppliers throughout the US. This partnership will significantly improve the availability, accessibility and speed of supply of BUMAX products to customers in the US, says BUMAX.

“After a long road, I am happy to see our agreement finalized. A key challenge in the US

has always been the geographic size and diversity of the market. Bringing together the expertise of both companies, we can now begin the important work of raising awareness of the advantages of BUMAX high-strength stainless steel fasteners in the US market and making our products more readily available throughout the region,”said Jacob Bergström, BUMAX segment manager, distribution.

For further information, log on to https://www.bumax-fasteners.com/

The goal of Henkel Adhesive Technologies’ latest product innovation was to achieve more sustainability and greater process efficiency in colour coating processes. With Bonderite M CR 1405, the surface treatment experts have developed a RoHS-compliant (restriction of the use of certain hazardous substances) agent that, the company claims, provides coils with passivation and pre-treatment properties as well as corrosion resistance in a single pre-treatment step.

The classic treatment of metal surfaces uses two different lines: one for pre-treatment and one for passivation. With the conventional process, the parts go either directly to the user or on to the painting line. The rust preventive (RP) oil used before painting must be removed in the subsequent cleaning and rinsing stage. If a passivation coat is applied, a single rinse prior to the subsequent application of paint is sufficient.

Henkel’s new development aims to enable users to substantially shorten their process. Bonderite M CR 1405 can be used as a passivation for bare substrates and pretreatment for painted substrate. After passivation, the coils are either sent directly to the end user or on for painting. Bonderite M CR 1405 has good recoatability, and coils passivated with this product can be used on

the colour coating line without a cleaning step and can only be rinsed with hot water to remove any contamination. This results in savings with respect to energy and water usage, since the cleaner that has now been eliminated is typically used in large tanks at temperatures between 60-70°C. The absence of chemical cleaning agents also means that wastewater pollution is significantly lower, says Henkel.

This combination is made possible by a newly developed product: Bonderite M CR 1405, a chromium III-based passivation pre-treatment. “Normally, when paint is applied to a passivated coil without subsequent treatments, insufficient paint adhesion and corrosion resistance is achieved. Conversely, pre-treatment used as passivation usually fails within one day,” said Gerko Odink, senior manager, PD Metals EU, at Henkel Adhesive Technologies. “We have an agent here that combines the best of both worlds and is compatible with both chromium-based and chromium-free primers.”

As this is a chromium III-based product, it meets users’ performance expectations for high corrosion protection while also being RoHS-compliant. This directive prohibits the use of hexavalent chromium in Europe. “We are closing

the gap between legislation and performance by using a bridging technology that meets the requirements for architectural applications, for example,” added Odink. Testing on galvanized and Galvalume substrate shows blank corrosion resistance of more than 96 hours. The salt spray test shows resistance of 800 hours with a chromium primer and 500 hours with a chromium-free primer.

By reducing the number of process steps and the associated energy and water consumption, the new product is in line with Henkel’s long-standing commitment to sustainability. “Enabling safer, cleaner and more efficient processes is at the heart of our business,” says Volker Mansfeld, vice president, industry, EIMEA region, at Henkel Adhesive Technologies. “Together with our customers, we strive to rethink design and processes to identify opportunities for sustainable innovation and defossilization of the industry while delivering the highest performance.”

For further information, log on to https://www.henkel-adhesives.com/uk/ en.html

Sinosteel Engineering & Technology Co., Ltd. (Sinosteel E&T), an industrial technology and engineering service provider offering low-carbon metallurgy full lifecycle solutions, and Tenova, a developer and provider of sustainable solutions for the metals industry, have recently completed the performance test for Baosteel Zhanjiang Iron & Steel Co., Ltd.’s new hydrogen-based 1Mt/yr ENERGIRON Direct Reduction (DR) plant.

The plant, designed by Tenova using ENERGIRON, the DRI technology jointly developed by Tenova and Danieli, and completed with engineering by Sinosteel, is located in the Zhanjiang Economic and Technological Zone, Guangdong Province. During the performance test, the plant achieved a milestone production of a total of 21.62kt of direct reduced iron, after 168 hours of continuous full-load production, with a metalliza-

tion rate of more than 94% and using a 70% hydrogen-based reducing gas.

The ENERGIRON solution is the most flexible DR technology for virgin metallic unit production in terms of make-up gas utilization, and the most sustainable as it is designed to maximize reduction of CO2 emissions, Tenova claims. The plant installed at Baosteel, a Baowu Group company, has the flexibility to use different reducing gases, like Hydrogen (H2), Natural Gas (NG), and Coke Oven Gas (COG), in any combination or proportion, using the same ENERGIRON Zero Reformer (ZR) scheme.

“The successful operation of the Baosteel Zhanjiang 1Mt hydrogen-based shaft furnace stands as a pivotal initiative in Baowu’s efforts to promote low-carbon production. Thanks to this project, Baosteel is proceeding towards its path

of reducing carbon emissions, paving a new way for green steel production,” stated Liang Lisheng, assistant general manager of Baosteel Zhanjiang Iron & Steel Co., Ltd., and director of the ironmaking plant.

“We are really satisfied with this project which confirms the great collaboration among all parties that participated in this achievement. Thanks to our ENERGIRON technology, we have provided Baosteel with the first direct reduction iron production line integrating hydrogen, natural gas, and coke oven gas for industrial production”, added Stefano Maggiolino, president and CEO at Tenova HYL.

For further information, log on to www.tenova.com

Calderys has reached a significant milestone in its global growth strategy with the commencement earlier this year of a project in the state of Odisha, India. This project will be the world’s largest single-site greenfield plant dedicated to refractories and steel casting fluxes, the company says. It represents a strategic move from Calderys to expand its product range with acidic and basic bricks, and overall production capacity in line with the evolving needs of the Indian refractory market, particularly in the eastern and southern regions.

When finished, the 40-acre plant will include five production lines for acidic and basic bricks and monolithics, ready-shaped products, and steel casting fluxes, as well as quality testing facilities. Construction began five months ago, and

several manufacturing lines will be progressively commissioned starting from late 2025.

During its construction, and when it is fully operational, the new plant will benefit from the latest safety management standards and technical innovations, says Calderys, to ensure the project complies with safety protocols and Indian regulations, at every stage of its life cycle.

Michel Cornelissen, president and CEO of Calderys, said: ‘‘This project is the largest single site investment in the history of Calderys. It demonstrates our commitment to India and is an important step in Calderys’ global production strategy. It is further evidence of the group’s solid growth and potential, and we are grateful to the Odisha state for its trust in Calderys.’’

Ish Mohan Garg, senior vice president and

managing director of the Asia Pacific region of the group, stated: ‘‘This landmark project is a strategic move towards broadening our product portfolio to meet the evolving and unprecedented demand of the Indian refractory market. It reaffirms our commitment to giving the best products and possible service to our customers. We would like to express our deepest gratitude to the government and people of Odisha for their valuable support. Our collaboration will accelerate Calderys’ growth but, vitally, it will also make a huge contribution to the economic and industrial advancement of the city and the region.’’

For further information, log on to www.calderys.com

As the election campaign heats up, political opposition to the Nippon-US Steel merger rises, with Cleveland-Cliffs applauding US president Biden’s decision to block the deal. By Manik Mehta*

THE controversy over the US Steel takeover bid by Nippon Steel threatens to become a major issue for politicians eager to gain support both from the domestic industry and the powerful steelworkers’ union in the ongoing presidential election campaigning. The Biden administration keeps harping that the acquisition would be harmful not just for the overall steel industry’s interests but would also collide with the principles of fair competition, giving monopolistic advantages to Nippon and resulting in job losses. But the question also being asked is to what extent the Biden administration would go against Japan, a staunch US ally. US politicians and steel industry experts are ‘deeply concerned’ over the acquisition’s impact on steel supply for infrastructure projects requiring large quantities of steel. Cleveland-Cliffs Inc., North America’s largest flat-rolled steel company and a leading supplier of automotive-grade steel, strongly opposes the deal. The company, which had made an unsuccessful $7.3 billion bid to purchase US Steel, applauded President Biden’s warning to block the deal. In a statement, Cleveland-Cliffs’ chairman/ CEO, Lourenco Goncalves commended president Biden for his decision, and said that the industry was ‘best served by American companies that are committed to the long-term prosperity of domestic manufacturing, supported by good paying

union jobs, under American ownership’. Goncalves also said that it was ‘no surprise’ that the United Steelworkers (USW) union opposed any transaction involving Nippon Steel, ‘a company with an extensive track record of injurious trade practices’. He described US Steel’s threat of shutting down integrated steelmaking production, firing union workers, and moving their headquarters from Pittsburgh if the deal did not close, as ‘a pathetic blackmail attempt on the United States government and the Commonwealth of Pennsylvania. By taking immediate action, our government is showing that this type of shameless behaviour will never be tolerated’.

He reiterated Cleveland-Cliffs’ interest in buying unionized mills that US Steel is threatening to close, should its takeover by Japan’s Nippon Steel get blocked by President Biden.

‘Hot-button

Indeed, the deal has become what experts describe as a ‘hot-button issue’ in the ongoing election campaigning, with neither Republicans nor Democrats showing any softening on the ‘sensitive issue of the nation’s steel sovereignty’. There are also deep underlying security concerns over the deal.

Senators in the Midwest’s steel-producing

*US correspondent, Steel Times International.

states point to Nippon’s partnership with Baoshan Iron & Steel, a state-owned firm linked to the Chinese Communist Party, even though Nippon withdrew from the partnership arrangement with Baoshan in August 2024. Senator Sherrod Brown (D-OH), facing a tight re-election race, was among the first lawmakers to publicly oppose the deal.

Nippon’s $14.9 billion takeover bid was also criticized by vice president and Democrat presidential nominee, Kamala Harris who, while addressing union leaders in Pittsburgh, ‘the heart of the steel industry’, on Labour Day (3 September), in President Biden’s company, announced that US Steel should remain domestically owned. She described the company as a ‘historic American company … and it is vital for our country to maintain strong American steel companies’.

A letter sent by the Committee on Foreign Investment in the US (CFIUS) to Nippon Steel and US Steel, maintained that Nippon’s decisions could create a reduction in domestic steel production capacity. The CFIUS said that the takeover would harm national security, particularly transportation, infrastructure, construction and agriculture.

Nippon Steel reaction

In a letter to the CFIUS, Nippon Steel said that it would invest billions of dollars to

maintain and boost US Steel facilities that otherwise would have been idled. Nippon added that the deal ‘indisputably will maintain and potentially increase domestic steelmaking capacity in the United States.’

According to CFIUS, a continued loss of visible commercial production capabilities and jobs would jeopardize the US steel industry’s ability to meet the ‘full spectrum of national security requirements’.

Nippon assured that it would not transfer any US Steel production capacity or jobs outside the US, nor would it interfere in US Steel’s decisions on trade issues. Indeed, Nippon even proposed a detailed draft agreement to address CFIUS’ concerns.

In a recent statement, the Washingtonbased Japan-US Business Council said that the group was ‘very alarmed’ by attempts to politicize the CFIUS review process which should be conducted objectively based on fair rules and processes.

Japanese politicians have generally maintained a stoic silence, but Taro Kono, a prime ministerial candidate, said governments should not intervene in deals

in an arbitrary manner, when asked by Japanese journalists about US attempts to block the Nippon Steel-US Steel deal. Washington cannot fully ignore the sensitivities involved, since Japan is a close US ally; Japan is also the biggest foreign investor in the US.

US Steel, on its part, has warned that it may have to move its headquarters from Pittsburgh and thousands of unionized jobs could be at risk if the Nippon takeover deal collapsed. US Steel said that its own employees would rally in support of the sale at its Pittsburgh headquarters.

US Steel’s CEO, David Burritt, who had remarked at the Global Steel Dynamics Forum in June in New York that the deal would pass in the end, noted in his latest comment that the workers’ rally was to demonstrate support for the Nippon deal. “We want elected leaders and other key decision makers to recognize the benefits of the deal as well as the unavoidable consequences if the deal fails,” Burritt said in a press release. The company would then ‘largely pivot away’ from its blast furnace

facilities, risking thousands of jobs.

On another note, Midrex Technologies Inc., a company specializing in direct reduction ironmaking technology and aftermarket solutions for the steel industry, signed a technical co-operation agreement with iron-ore mining company Vale to further collaborate over the use of ironore briquettes in direct reduction plants. The companies said that initial test results have shown promising results in using iron-ore briquettes in the direct reduction process. Both partners plan to evaluate the creation of a joint venture to provide briquette technology to the market as most direct reduction plants use iron ore pellets as a feedstock. Vale’s briquette production process represents an alternative to the pelletizing process with reportedly lower production costs, lower investment intensity, and approximately 80% less emissions. According to both companies, the technology would vastly help in decarbonizing the global steel industry. �

to

For 135 years, steel producers and steel service centers have counted on Butech Bliss to deliver the design, engineering and technological advantages necessary to help them succeed. From entry to exit end we build it all. Our product lines include roller and stretch leveling technology, a full line of shears, material handling equipment and complete coil processing lines. We are more than a scrap chopper manufacturer. Learn more about our world-renowned coil processing technology call +1 (330) 337-0000, visit ButechBliss.com or email sales@butech.com. If our name is on the machine, it’s built better.

Volatile economic conditions have forced Chilean steelmaker Compañía Siderúrgica Huachipato into decline, impacting thousands of workers, as well as the financial stability of the region. By Germano Mendes de Paula*

EARLIER this year, Compañía Siderúrgica Huachipato (CSH), a subsidiary of Compañía de Acero del Pacífico (also known by its acronym CAP Group) briefly outmanoeuvred Chinese steelmakers (STI Digital, June 2024, pp. 18-19) as Chile’s Anti-Price Distortion Commission imposed provisional antidumping duties (AD) of 33.5% on steel grinding balls and 24.9% on steel bars imported from China. The measure was in force from April-September 2024.

In response, the Chinese ambassador to Chile, Niu Qingbao, issued a strongly worded statement, which was notable given his diplomatic position. He argued: a) the Chinese steel companies do not receive government subsidies and their products are not sold at prices below normal or unfair value, thus the AD were unjust; b) the competitive edge of Chinese steelmakers stems from their high efficiency; c) the Chilean steel mills’ difficulties and operating losses are mainly due to their technological obsolescence and poor management, leading to a loss of competitive advantage over the years. The ambassador claimed that blaming China for issues within Chilean companies lacks evidence and does not aid in resolving these internal challenges. He also mentioned China’s intent to contest

the imposed duties.

The ambassador emphasized that the AD were detrimental to the bilateral relationship, recalling Chilean president Gabriel Boric’s visit to Xi Jinping in October 2023. He expressed concern that these duties could harm the friendly ties between Chile and China. It is worth noting that, in 2023, Chile exported $37.45 billion to China and imported $19.83 billion, resulting in a significant trade surplus. The Chile-China free trade agreement was signed in November 2005.

The virulent attack from China’s ambassador could be considered an overreaction as the country’s steel exports to Chile, impacted by the AD, were modest. However, his response is further contextualised by two factors. Firstly, in a strategic deal, Chinese lithium miner Tianqi, which owns about a fifth of Sociedad Quimica y Minera de Chile (SQM), has appealed a ruling by a Chilean financial regulator, which proposes that shareholder approval is not needed to proceed with a major tie-up set to boost state control over the country’s lithium sector, regarding a planned partnership between state miner Codelco and SQM. Secondly, Qingbao’s statement can be understood as a proactive

attempt to discourage the imposition of AD from countries with significant trade surpluses with China.

Chilean steelmaker lost the war In August 2024, CSH announced it would indefinitely cease steel operations by September, citing over $500 million in losses over two years due to an increase in imports from China. This decision was influenced by several factors: a) the inability to pass on the price hikes recommended by the Anti-Price Distortion Commission, as they could not reach a sales and pricing agreement with local steel ball manufacturer Molycop, a key steel customer; b) intensified Chinese dumping; c) long-standing financial difficulties.

Chile’s government, led by the minister of economy, Nicolás Grau, expressed dissatisfaction with CSH and Molycop for failing to develop a sustainable business strategy despite interventions like the AD duties. On its side, CSH justified that the temporary AD alone would not sufficiently transform the market to secure the steel business’s financial viability. From 2019 through Q1 2024, when Chinese exports surged, CSH incurred losses exceeding $700 million, with a deficit of $386 million in

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

2023 and an additional $42 million in Q1 2024, a trend that continued in subsequent months.

CSH will maintain other activities in the Bío Bío Region, including port and logistics services, limestone extraction and sales, rare earth extraction, and a green steel pilot project. However, the specifics of its engagement in the latter, following the closure of their steel operations, remain unclear. Though the project may herald innovative steel production, its associated risks are likely elevated.

In early September, the Anti-Price Distortion Commission announced that it had unanimously decided to end early the AD investigation into imports of Chinese steel grinding balls. This decision was preceded by the announcement of the indefinite suspension of operations at the CSH, the main driver of the analysis of the commercial defence measure for this type of product.

The shutdown of CSH, the country’s only coke-integrated mill, is expected to conclude by late 2024, affecting

approximately 20,200 direct and indirect jobs in the Bío Bío region. This region has a population of 1.5 million inhabitants, and is divided into three provinces: Arauco, Bío Bío, and Concepción (where CSH is located). The company plans to offer a comprehensive exit strategy, including financial compensation, and support for retraining and new job placements.

CSH and the trade union have finalised the details of the agreement reached in the context of the indefinite suspension of the plant’s operations. In addition to the benefits stipulated in the law, the workers

will receive ‘special compensation’, from $4k to $17.5k based on the working years in the company: a) less than one year: $4k; b) one to four years: $9.4k; c) four to six years: $13.5k; d) six or more years: $17.5k. Those aged 50 or older will be compensated directly with the $17.5k

The Bío Bío region has witnessed a long history of deindustrialisation. A similar crisis occurred with the collapse of sugar-producing companies (mid1970s), coal mining (early 1990s), and wood textiles (early 2010s). CSH’s closure poses additional significant threats to economic stability in the region, prompting calls for immediate revitalisation efforts and potential fiscal incentives to attract alternative activities and sustain employment. Regional leaders stress the urgency of strategic planning to combat rising unemployment and uphold economic vitality. Thus, while CSH has lost its battle against Chinese steel, the region faces the daunting challenge of transforming an economy heavily reliant on the steel industry. �

Already facing several headwinds, a new challenge has emerged for Indian steel mills in the form of a new mining cess imposed by some states, following a recent judgement by the Supreme Court of India (SCI). This development is poised to compress

primary and secondary producers.

By Dilip Kumar Jha*

across the steel

IN August, India’s Supreme Court confirmed that the authority of states would impose taxes on mineral rights and mineral-bearing land, allowing them to claim refunds of royalties dating back to 1 April 2005. This implies that mineral-rich states may charge a mining cess for the extraction of minerals with retrospective effect from April 2005. Odisha, which accounts for 46% of the value of minerals, plays a key role in the levy of the mining cess. The recent Supreme Court ruling has brought renewed focus on the Orissa Rural Infrastructure and SocioEconomic Development Act, 2004 (ORISED), which allows for approximately 15% cess on iron ore and coal.

If fully enforced, this could result in around an 11% increase in the landed costs of iron ore, directly affecting the cost competitiveness of domestic steel companies. The new mining cess is bound to raise the procurement cost of minerals such as iron ore and chrome ore, which will eventually lead to higher steel production costs, thereby lowering India’s competitiveness in the global market. In a related move, the Jharkhand government

Source: Ministry of Mines: Annual Report (Financial Year 2023-24).

recently imposed a modest cess increase of INR 100/tonne on iron ore and coal, setting a precedent for other states to follow. This increase is expected to have a minimal impact on steel companies’ operating margins, reducing them by around 30-40 basis points (bps).

It is worth noting that India’s steel

industry has been struggling to cope with a slowdown in demand during April-June 2024 due to the Parliamentary elections and the resulting slowdown in infrastructure development. While new infrastructure project sanctions were deferred, work on existing sites was delayed during the June quarter. As a result, India’s

steel demand remained stable throughout this time period.

According to T V Narendran, managing director at Tata Steel, “Levying cess on minerals has a huge impact across industries, as it will ultimately raise questions about a company’s profitability and investment capabilities. The effective tax rates on minerals in India are the highest in the world. If the tax is too high at an early stage, it will affect the motivation for production.”

As a preventive measure, Tata Steel has already set aside INR 177.34 billion for mining taxes following the SCI order. Tata Steel reported an 18% decline in net profit at INR 33.29 billion in the April-June 2024 quarter, down from INR 40.50 billion in the previous sequential quarter. During this time period, subdued steel demand across most regions weighed on global steel prices. In India, steel demand remained broadly stable despite some impact from the Parliamentary elections and heat waves.

Credit rating agency ICRA estimates that

primary steel producers’ margins could shrink by approximately 60-180 basis points, while secondary producers, with already lower profitability, may face a more severe impact, with margin declines ranging from 80 to 250 basis points, depending on various scenarios where cess rates could vary between 5% and 15%. The power sector, which heavily depends on coal, may see a rise in supply costs by 0.6% to 1.5%, potentially leading to higher retail tariffs.

Girishkumar Kadam, senior vice-president and group head of corporate sector ratings at ICRA Ltd, said, “The enforcement of the new mining cess by key mineral-rich states could heighten cost pressures for the steel industry. While most states haven’t set the rates yet, any substantial cess could adversely impact margins, especially for secondary steel producers, as merchant miners are expected to pass on the increased costs. Consequently, the strategies adopted by various state governments will be crucial in shaping the competitive landscape of the steel industry”.

A Fitch Ratings report added, “Steel mills could face increased risks from a sustained weakening of their profit margins because of mining cess levies. Given limited ability to pass on the potential increase in operating costs, metal and mining companies are likely to be more affected by the SCI’s ruling compared to power and cement companies.”

Experts have warned that the SCI’s ruling on mining royalties, with retrospective effect from April 2005, could deal a substantial blow to the Indian mining sector, with potential financial repercussions amounting to INR 1.5-2 trillion. The premier industry body, the Federation of Indian Mining Industries (FIMI), believes that the Indian mining sector is already burdened with the highest taxation in the world. The Supreme Court’s judgement has granted unchecked powers to impose various taxes and levies, which will severely impact not only the mining sector but also the entire value chain, leading to significant inflationary pressures on end products. �

GLAMA Maschinenbau GmbH

Hornstr. 19, 45964 Gladbeck, Germany fon: +49 2043 9738 0 fax: +49 2043 9738 50

GLAMA Maschinenbau GmbH

email: info@glama.de

Hornstr. 19, 45964 Gladbeck, Germany

GLAMA USA Inc.

fon: +49 2043 9738 0 fax: +49 2043 9738 50 email: info@glama.de

60 Helwig St., Berea, Ohio 44017 fon: +1 877 452 62 66 email: sales@glama-us.com

“STEEL follows population growth,” said Mark Bula. He believes that the future of steel usage will be in the MENA region so when he took a surprise call from a member of the Jindal family asking if he would be interested in a CEO role at Vulcan Green Steel in Oman, he jumped at the chance.

Vulcan was looking at developing something akin to H2 Green Steel (H2GS), where, at the time, Mark was chief commercial officer.

“I’d promised H2 that I would see through developing a go-to-market strategy, getting a certain level of offtake agreements that would get them financed and I felt comfortable that I had accomplished that,” Mark said.

He liked the idea of Oman as a place to live and work and agreed an amicable exit deal with H2GS. “They were gracious enough to come up with an agreement that made sense for us to exit from each other and so I moved to Muscat.”

He described his time in Oman as a wonderful experience where he gained valuable insights into what it was like to be a CEO.

“In the Middle East, there’s a lot of cheap, natural gas and they have a very good solar profile, but Oman brought a wind profile that was very attractive,” said Mark. “Probably one of the best wind profiles in the world,” he added.

Mark didn’t stay long at Vulcan Green Steel. His plan had been to inject a more global management style into the business. “And in the end that wasn’t as easy as I thought and maybe I wasn’t the right guy to make it happen,” he said, explaining how, since his departure, other Western managers (from US Steel and Nucor Corporation) had been and gone too.

Mark then received a call from Norwegian start-up BLASTR Green Steel asking if he’d be interested in a consultancy role at the company. He was looking to move out of Oman and one thing led to another. “They called when they thought I was still employed and said ‘would you consider making a change?’ I said, as luck would have it, I’m probably making a change and that’s how it really happened.”

He had considered taking time off, recharging his batteries and finding the right opportunity that would suit him best – and not necessarily in the steel industry. He’d thought about returning to the United

Mark Bula is very familiar with the phrase ‘cutting edge’. He was chief commercial officer at US-based Big River Steel, which offered the steel industry its first ever ‘learning mill’, he took on a similar role at H2 Green Steel in Sweden, a leading player in the race towards the realization of hydrogen steelmaking, and now he is CEO of Norwegian start-up BLASTR Green Steel, a company with a ‘mine-to-gate’ business model and a strong vision of decarbonizing the steel value chain. Matthew Moggridge* meets Mark Bula**

States, but realized he enjoyed working overseas and that he was a steel man to the core. He views himself as more of a steel guy than a company guy.

According to BLASTR’s website, the company was established in 2021 ‘to leverage Nordic advantages and become an integrated low CO2 steel producer, based on a vision of decarbonizing the steel value chain’.

“When I look at the European steel industry, I wonder why it has not transitioned away from blast furnace steelmaking,” he said. “Nobody can give me a straight answer. Some say it’s because they don’t think that the EAF and scrap make good steel. But we know in the United States that EAF steelmaking has been extremely successful.”

He cited the stock valuations of Nucor and Steel Dynamics Inc and said that stateside EAF steelmaking had flipped in the last 20-30 years from being the minority of

the volume to most of the volume. “There’s a new steel mill built in the United States every five to seven years. Three of them are under construction right now. When was the last real mill, integrated mill, built in Europe? 1967? 1971?”

Mark, an American through and through, has an absolute right to big up the US steel industry and big it up he did, citing a report by the Steel Manufacturers Association showing that the US industry has one of the lowest CO2 footprints on the planet and leads the world in terms of being a green steelmaker. “The bottom line is the US steel industry has transformed itself from blast furnace steelmaking to EAF steelmaking and leads in steel recycling. I think the automotive recycling rate in the United States is higher than in Europe and this is when I look at Europe and say there’s an opportunity here,” Mark said.

He believes in the entrepreneurial spirit; he likes interesting projects and is happy

*Editor, Steel Times International, **CEO, BLASTR Green Steel

to put in the long hours, thriving on the adrenaline rush and the anxiety, everything that comes with trying to raise money and build a business from scratch.

The opportunity at BLASTR revolves around the company’s ‘really good mineto-gate value proposition’ and it is this, said Mark, that sets the company apart.

We were sitting in the London headquarters of Cargill on a sunny day in the City of London and it was no accident. “Our partnership with Cargill brings a lot of credibility and ability to the project,” explained Mark. “They also bring with them marketing rights to mines around the world, particularly in the Nordics, and they’re building this out. So, in essence, we’re able to de-risk our project because we’re sourcing iron ore from Cargill that has multiple sources around the world and some of those are exclusive agreements,” he added.

The Cargill link drew Mark in because he saw the competitive advantage it afforded BLASTR. “It’s not only being able to control

your iron ore and your raw materials sourcing, but it also allows us to go back and track all the way to the mines,” he said, explaining how, going forward, BLASTR may have an even more symbiotic relationship with mining companies that would make the business stratospherically more attractive to investors and steel buyers. So, let’s talk pelletising.

“We see ourselves as having three business units: pelletising; green iron; and low emissions steel. Decarbonization really happens at the ironmaking stage, that’s where the magic happens,” he said, explaining how it’s the most important and key component of the process and why BLASTR’s focus has been on how to solve that part of the value chain. It’s all about changing the model a little bit and asking the question: ‘do we have to be in the hydrogen business?’

BLASTR’s focus, then, is on iron. “Let’s focus on the pelletising, that’s a mine-togate value proposition that is unique in the industry and I think it’s something we

can sell on the marketplace,” said Mark, explaining how buyers of steel ‘will see us owning the mine-to-gate process and that will give the company the necessary leverage to get agreements in place. It means somebody wanting to build a hydrogen plant adjacent to BLASTR’s steel plant [in Finland] would have the confidence to do so, he said, “Because we’ll be the off-take for it, we’ll be the green ironmaking company – and that’s the difference of thinking.”

At this stage in BLASTR’s development, it’s all about attracting investors and Mark believes that a strong sense of entrepreneurialism will give greater credence to the project.

“Why have US minimills been so successful? It’s man hours per ton, or it’s tons per employee,” he said, referencing the very real aspirations of big US minimill operators who, claims Mark, produce in the region of 3,500 to 4,000 tons of steel per employee. “If you look at the man hours per ton in Europe, I guarantee you it’s probably well under 1,000 tons per employee,” he added. It is Mark’s belief, therefore, that the European steel industry needs to create a more efficient and fastmoving business model powered by an entrepreneurial spirit.

BLASTR aspires to being the lowest-cost producer of green steel in Europe, making it a more attractive proposition for investors. “We believe we are going to be at the lower cost percentile of green steelmaking,” he said. Whether other companies in the green steel sphere are following similar models is anybody’s guess, but Mark believes iron ore sourcing is where the challenge lies. “But you also have to source the pellets and if you’re sourcing from different parts of the world there’s also transportation costs,” he said.

Cargill moves 50Mt of iron ore annually, most of which comes out of blast furnaces. “But the point is, they know the flows of iron ore around the world, and they have a logistics business that owns vessels that move iron ore, it’s a huge advantage,” he said.

BLASTR will need high purity iron ore pellets for its EAF. Cargill has been establishing relationships with mines that produce higher purity iron ore, but some of them don’t have pelletising facilities. “Which is why we’re going to build a pelletiser,” said Mark. “Most pelletising is owned by the mine, we’re going to be a

steel mill that owns it.”

The pelletising plant will be located in the UK, on Teesside, because BLASTR’s steel plant, which is to be located in Inkoo, Finland – where BLASTR can exploit affordable energy on-site – can only handle Panamax vessels even if the port there is expanded.

The Teesside facility (an old British Steel plant) incorporates a terminal owned by Red Bulk Terminals, which can accommodate larger Cape size vessels, allowing BLASTR to leverage Nordic iron ore – which Mark thinks the company can secure – but also ore from Canada and potentially Brazil and Australia. The plan is to sell 50% of the ore shipped into the UK and converted by BLASTR to DR pellets to other steelmakers globally.

“The Teesside location is really central when you think about North America and the Nordics,” said Mark, explaining how the UK port’s ability to handle large vessels is a ‘big deal’. The Inkoo facility – ‘for the most part’ – does not need high-end ice class vessels which are limited in number and fuelled by fossil energy. “We’ve tried to eliminate all the disadvantages of being in an iced port six months of the year,” he added.

In essence, phase one of the project is the pellet plant and phase two is DRI and the steel plant. “Hydrogen will come from the natural development of the Inkoo facility,” said Mark, adding that it will be developed either in conjunction with a third party or a third party will use BLASTR as the offtake and develop the hydrogen plant themselves. “I’d be comfortable with that,” said Mark. BLASTR has signed a Memorandum of Understanding (MoU) with Austrian production technology company Primetals Technologies to provide the Inkoo electric arc furnace, the hot mill and all the

“When I look at the European steel industry, I wonder why it has not transitioned away from blast furnace steelmaking. Nobody can give me a straight answer. Some say it’s because they don’t think that the EAF and scrap make good steel. But we know in the United States that EAF steelmaking has been extremely successful.”

ultimately produce 2.5Mt of ultra-low CO2 steel based on ‘gross embodied emissions’, which means the total greenhouse gases emitted during a product’s production –“I’m a purist in this way,” said Mark, adding that BLASTR aims to reduce emissions by 90% ‘from what is traditional steelmaking’. It all recalls the big question: what is ‘green’ steel? Mark says the green steel industry is still evolving, as is the terminology, and everybody will have a different opinion. “All that should really matter in the end is what are you willing to pay for a gross embodied emission of a number that means something to you as a customer,” he said. With a plan to be producing 2.5Mt of green steel by 2029 – and with predictions of global demand for low CO2 flat steel of 30-40Mt by 2030 (and 100Mt by 2050) – the question of expansion entered the conversation. “We’re already looking at other sites to build either more pelletising capacity and/or pelletising and DRI capacity, again, to serve other steelmakers,” he said.

While all businesses exist primarily to turn a profit, BLASTR wants to be seen as a company that helped to decarbonize the steel industry. “We think the best way to do that is to have green ironmaking, and to have that you’ve got to have iron ore; so it’s been our focus, but I think there’s an opportunity to sell hot-rolled coil as a semifinished product for those unable to make hot-roll affordably – or in a culture where we think we can make it,” and by that he means producing 3,500 tons per employee. “It’ll be a multi-faceted business and the whole of it goes towards making the steel industry greener,” he said.

Asked if everything was going to plan, Mark commented, “Let’s be honest, things never go to plan.”

automation surrounding it. “We’ve signed an MoU with Midrex to be the DRI provider but have not yet announced the technology provider for the pellet plant in the UK.

The Inkoo facility, says Mark, will

BLASTR was first introduced to the market over two years ago. Since then, there has been a leadership change with Mark now in charge. The company has successfully raised the first round of funding. “We’re going to be capital-hungry for a very long time,” he said, adding that every day since he started, he’s felt as if he was taking a step forward and improving the business model along the way. “It’s all about solidifying and connecting the dots on the mine-to-gate value chain and involving Cargill more,” he said, but it’s also about building a USstyle minimill culture in Europe based on a tons per employee scenario with a view to creating a more sustainable business over a longer period of time.

Mark recognizes the differences between European and North American trade policies, arguing that the former is more protectionist of the consumer than the latter. In other words, he believes, “EU trade policy by favouring the consumer, discourages risk taking by the existing industrial companies”. And that creates a different scenario here in Europe and you have to navigate it, it’s part of the challenge, because there are great things that I’ve learned from how to build steel companies and entrepreneurial thinking in the United States that may not work in Europe,” he said.

“Right now, in Europe there’s been a push-by policy; I think there will be a pull-by demand [for green steel] and that’s when things are really going to take off,” Mark explained.

Since 2021, when the likes of H2Green Steel first arrived on the scene, the capital markets have changed, thanks to Russia’s invasion of Ukraine, rising interest rates and the energy crisis. For BLASTR, therefore, it’s no longer sufficient just to have a good story, it needs data to support what it is claiming is a viable proposition.

While there is plenty of talk about dramatically changing supply chains because of the ongoing ‘green steel transition’ Mark wants to see DRI, green ironmaking and hot-rolled coils made somewhere in Europe. That, he said, is BLASTR’s plan. “We don’t want to add finishing capacity, there’s plenty of that already,” he said. “So, let’s not add more, let’s build an efficient operation that’s focused on cost sensitivity that allows us to be on the lower quartile of the cost curve,” he said.

While BLASTR is busy building up its team, Mark admits it could have been faster conveying the key facets of its business model to investors. “If we had done that, we’d probably have attracted more financing by now and ultimately, the judge of success is can you get the project funded and start the company?”

And can you?

“I reckon we can.” �

For more information on BLASTR Green Steel, visit: https://www.blastr.no

and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment.

Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE

Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

There seems to be a consensus today that renewable energy and hydrogen are the means by which the steel industry shall be decarbonized. Billions are put into research projects for new processes and yet very little so far has happened. European integrated plants struggle with reinvestment plans in technology that they know will never be profitable or just give up and convert to scrap-based production. In the meantime, new blast furnace plants are being built around the world and nothing indicates that the process will lose its dominant position in the period until 2050 or even this century. To paraphrase the American writer Samuel Langhorne Clemens, better known as Mark Twain: ‘The reports of the death [of the blast furnace] are greatly exaggerated.’ By Rutger Gyllenram*

IN principle there are three energy sources for low-emission ironmaking:

1) fossil reductants coal and natural gas combined with CCS.

2) low emission electricity from wind, solar, and nuclear power.

3) biomass.

The products are either a liquid hot metal with or without carbon or a solid sponge iron also with or without carbon. Without pretence of being exhaustive, some of the possible process alternatives are shown in figure 1. Low-emission hydrogen can be made from natural gas with CCS (blue H2),

electrolysis of water using low-emission electricity or from biomass (both considered green H2). Future process development will tell whether it is preferable to have a mix of carbon monoxide and hydrogen as reductants or if pure hydrogen is more efficient. Reduction mechanisms are complex, and it is doubtful whether one can draw far-reaching conclusions from calculations, simple lab experiments, or even pilot plant tests.

Fossil reductants and CCS

To the left in Fig 1 we have the processes

that use fossil coal and natural gas which all face the challenge of abating the upstream emissions of methane from coal mining and gas extraction that can be as important as capturing and storing the inherent carbon dioxide emissions. The blast furnace (BF) whether it is using a blast of oxygen enriched air, or as in the oxygen blast furnace with top gas recycling (O2BF TGR), pure oxygen, needs a minimum amount of coke to ensure a permeable bed, often said to be around 280-300 kg/ton hot metal. When that is satisfied, alternative non-fossil reductants or sponge iron with a

*Founder of Kobolde & Partners AB, co-founder of FerroSilva AB (email: rutger.gyllenram@kobolde.com)

low-carbon footprint can be used to reduce the emissions and avoid another 200 kg of coke. HIsarna has the advantage of not needing agglomerated raw materials but is dependent upon carbon capture and storage to decrease emissions if fossil coal is used. All alternatives have been tried in pilot plant tests but have not yet had a commercial breakthrough.

MIDREX, which is the dominant sponge iron process patented by the eponymous company, has announced a variant where the ironmaker starts with natural gas and then increases the hydrogen level when hydrogen is available. Until then, the carbon dioxide has to be captured from a diluted flue gas. Energiron, a process jointly developed by Tenova and Danieli, uses natural gas as a reductant but the companies claim that they can increase the hydrogen level to close to 100%. On the other hand, the process today uses carbon capture as an inherent part of the process in order to recycle carbon monoxide into the shaft and, therefore, a process enhancement capturing most of the carbon dioxide would be possible with only minor adjustments to the layout.

Low emission electricity as energy source

Molten Oxide Electrolysis (MOE) is a process that is currently developed for the reduction of both iron and ferroalloys. An MOE plant is designed to run multiple cells in parallel with oxygen as an off gas and the production of a carbon-free liquid metal with a high temperature. Siderwin is another electrolysis process that produces iron cathodes at a low temperature. MOE and Siderwin are both at an early stage of

development and the outline with many small cells makes the competitiveness with shaft furnaces something of a challenge for a low-cost material like iron, despite an expected low energy use.

Hybrit can serve as the first example of producing an initially carbon-free sponge iron with hydrogen made from the electrolysis of water. Pilot plant tests have concluded and a demonstration project is planned with a production rate of 1.3 Mt/ yr, with construction due to begin in 2025. A challenge identified by the Hybrit team is the efficiency and stability of electrolysers for production of the large volumes of hydrogen needed in a commercial plant. Circored, Hymet and Hyrex are fluidised bed processes intended to produce coalfree sponge from fines. They all have a

background in reduction with reformed natural gas or gasified coal but have now been redesigned for hydrogen.

Carbon dioxide emissions from biogenic sources are considered to be non-existent in most carbon accounting systems, except when captured and stored (or used to replace fossil carbon), when they are then given a negative value as a carbon sink. A smelter process is suggested as a way to do the smelting, final reduction, and carburisation of sponge iron before a converter step. Today most smelters use electrodes from fossil carbon which in the future must be produced from biogenic carbon to produce low emission iron. In the Tecnored process, charcoal is used to reduce iron ore in the form of cold-bound briquettes producing a hot metal similar to that from a blast furnace. Tecnored can be considered an alternative to charcoal blast furnaces. By gasifying biomass like forest residuals, as well as other biogenic materials, a syngas can be produced with the same composition as the reformed natural gas used in the MIDREX process. The FerroSilva process uses biogenic syngas to produce sponge iron with a normal carbon content while capturing the biogenic carbon dioxide for offtake. The project is in the early stages of development, with the first production of 50kt/yr planned for 2028.

MIDREX and Energiron can of course use green hydrogen, and Hybrit in the same

way uses blue hydrogen, and to conclude, the fluidised beds may use any reducing gas. However, the way they are developed and marketed today indicates the most likely alternative.

Producing low-emission iron and steel

Paramount to low-emission iron and steelmaking are the availabilities of coal and natural gas with low upstream emissions, CCS capacity, low-emission electricity, and biomass. These will vary with location, time and available means of transportation. Technology readiness is an issue, although it does not seem to be recognised today. In my mind: new process ideas are nothing more than ideas until proven in full-scale and only then can they be put into any trustworthy pathway and the improvement of existing and functioning processes may be put aside to give room for new inventions.

The role of low-emission sponge iron

When more and more blast furnaces close and switch to electric arc furnaces, the need for sponge iron increases to ensure a high steel quality. If the admixture is in the order of 20%, the gangue content is