STAINLESS STEEL DECARBONIZATION

The market has softened significantly since last year

We visit Ovako’s Hofors plant in Sweden

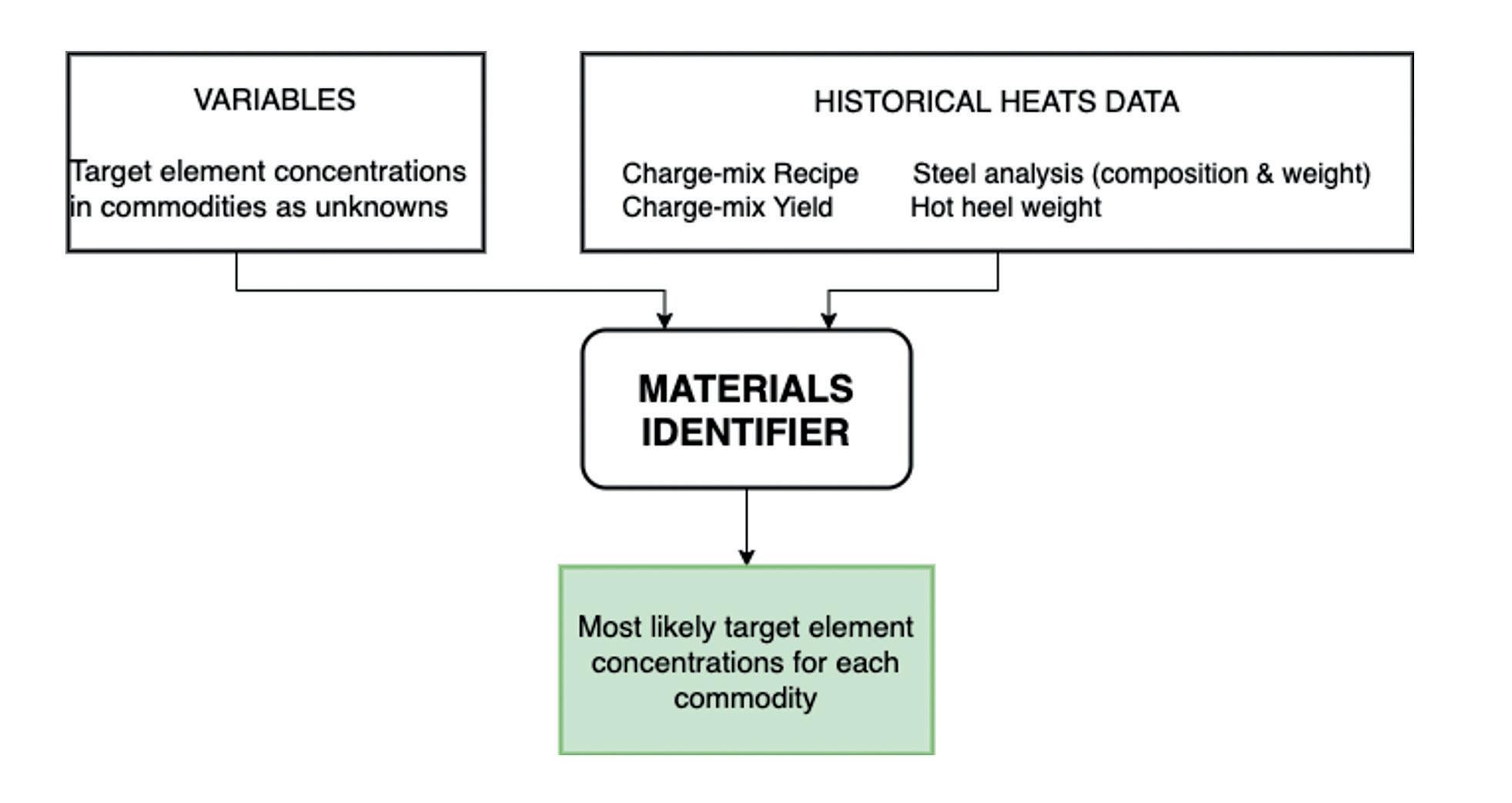

MACHINE LEARNING

Estimating copper content in raw materials made simple

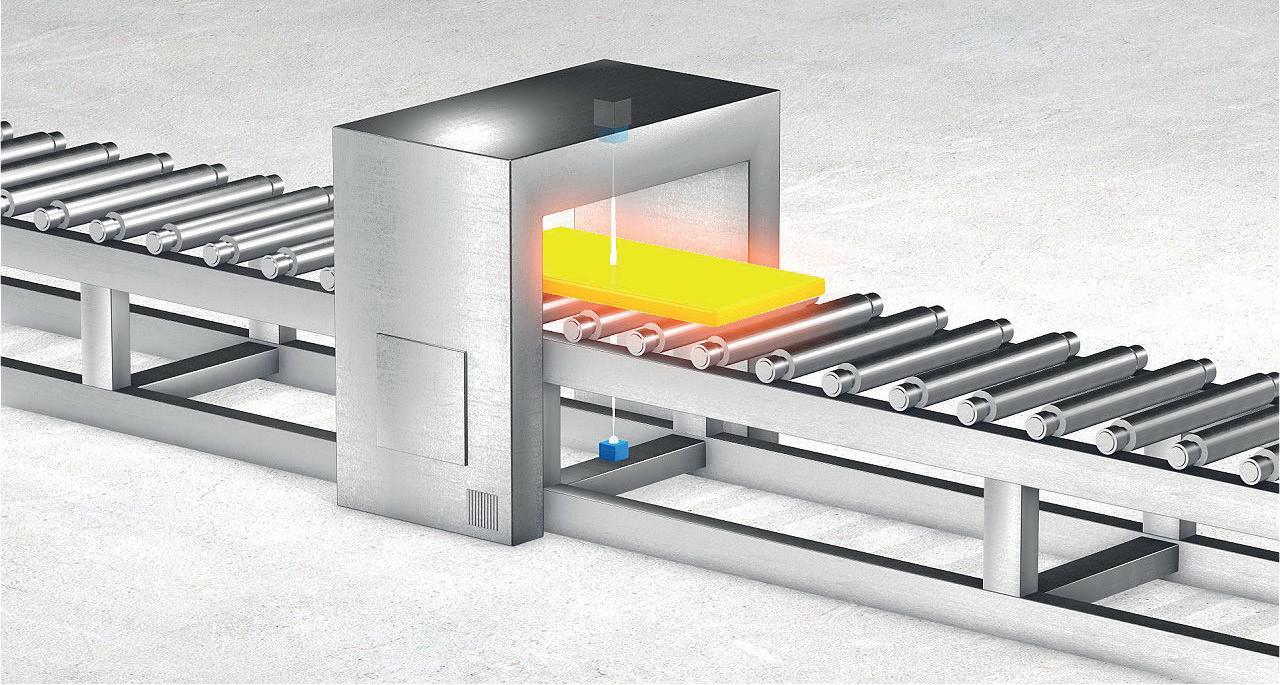

ROLLING

Innovative radar technology for rolling mills

www.steeltimesint.com September 2023 - Vol.47 No6

GLOBAL STEEL DYNAMICS FORUM – FULL REPORT

Since 1866

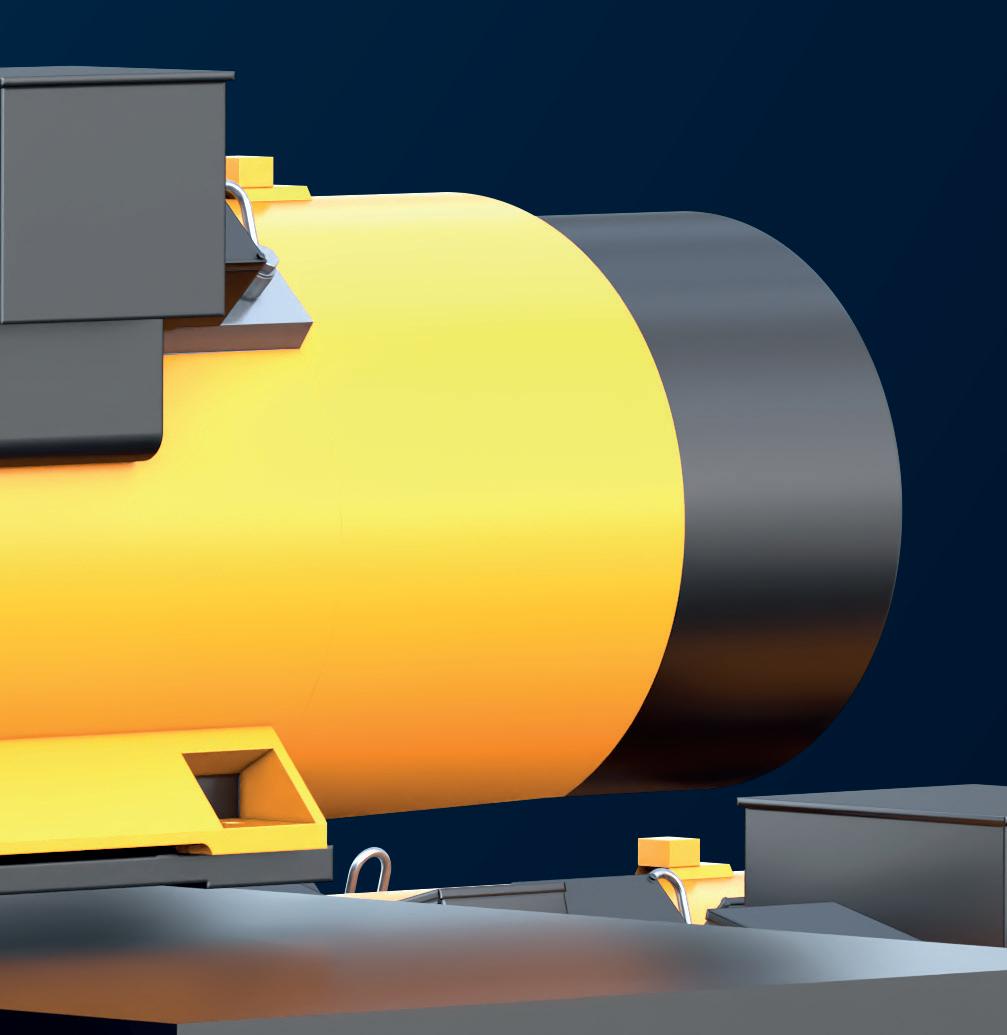

ORANGE IS THE NEW GREEN.

REDEFINING SUSTAINABLE METALS PRODUCTION

As the metals industry transforms in pursuit of green steel, the future of sustainability demands pioneers and leaders with vision, courage, and a willingness to push the boundaries of innovation and eco-friendly metals production. Primetals Technologies is redefining sustainable metals production.

We’re making orange the new green.

LEARN MORE AT METEC 2023

primetals.com

EDITORIAL

Editor Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production

Martin Lawrence

SALES

International Sales Manager

Paul Rossage paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Email subscriptions@quartzltd.com Steel

www.steeltimesint.com

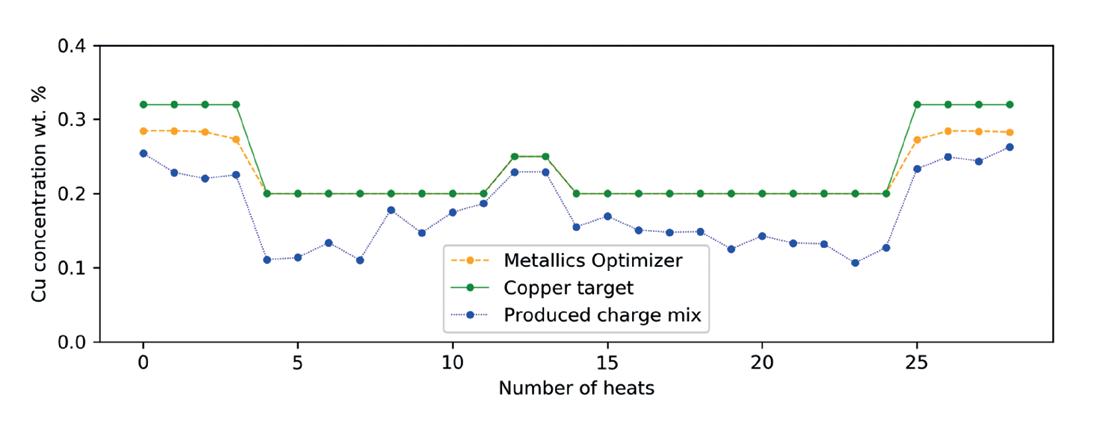

Times International is published eight times a year and is available on subscription. Annual subscription: UK £215.00 Other countries: £284.00 2 years subscription: UK £387.00 Other countries: £510.00 3 years subscription: UK £431.00 Other countries: £595.00 Single copy (inc postage): £47.00 Email: steel@quartzltd.com Published by: Quartz Business Media Ltd, Quartz House, 20 Clarendon Road, Redhill, Surrey, RH1 1QX, England. Tel: +44 (0)1737 855000 Fax: +44 (0)1737 855034 www.steeltimesint.com Steel Times International (USPS No: 020-958) is published monthly except Feb, May, July, Dec by Quartz Business Media Ltd and distributed in the US by DSW, 75 Aberdeen Road, Emigsville, PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER send address changes to Steel Times International c/o PO Box 437, Emigsville, PA 17318-0437. Printed in England by: Stephens and George Ltd • Goat Mill Road • Dowlais • Merthyr Tydfil • CF48 3TD. Tel: +44 (0)1685 352063 Web: www.stephensandgeorge.co.uk ©Quartz Business Media Ltd 2023 ISSN0143-7798 Cover courtesy of Taylor-Winfield CONTENTS – SEPTEMBER 1 September 2023 26 31 Rolling Radar technology for rolling mills. 34 Stainless steel Disappointing... 38 Machine Learning Calculating the lowest cost composition. 41 Decarbonization Solutions at every step. 44 Perspectives Flying above the radar 47 History Cort and the black metallurgists, Pt. 1. 2 Leader By Matthew Moggridge. 4 News round-up The latest global steel news. 6 Innovations The latest products and contracts. 9 Latin America update All change at Usiminas. 13 India update Secondary by name... 16 Global Steel Dynamics Forum Decarbonization under sharp focus. 26 Decarbonization Ovako – Sweden’s largest producer of green hydrogen

Join us in Vienna for the Future Steel Forum 2023...

The Future Steel Forum 2023 will take place in Vienna, Austria, on 20-21 September at the Hilton Vienna Garden Hotel and I am pleased to say that this will be the event’s sixth outing.

While the inaugural event took place on the 14-15th of June 2017 – which is seven years ago – there was, of course, a pandemic lockdown in 2020 and that’s why the event in Vienna is the sixth and not the seventh outing for this very popular conference tackling the important subject of digital manufacturing for steelmakers.

This year’s event in Vienna marks the first time we have brought the Forum to a western European capital. We started with two Forums (in 2017 and 2018) in the Polish capital of Warsaw. In 2019 we moved to Budapest in Hungary and then after a year’s break due to the pandemic we regrouped in 2022 in Prague having organised a virtual get-together in 2021.

Matthew Moggridge Editor

matthewmoggridge@quartzltd.com

On a personal level, I am glad to say that an event I developed and then launched seven years ago has stood the test of time and is now a calendar event for steel professionals around the world.

My aim with the Forum has always been to invite experts in the field of digital

manufacturing to speak to the steel industry. It was also of great importance to me that global steelmakers were invited to speak. Over the years, I have been successful in attracting big names. Last year, Mark Bula, chief commercial officer of H2 Green Steel agreed to present the opening keynote. This year is no exception to the rule. In addition to specialists in the field of artificial intelligence, leading plant builders and trade associations, the 2023 event will open with a keynote presentation from Austrian steel giant voestalpine. Dr. Michael Eder, chief technology officer of the company’s High Performance Metals (HPM) Division and Philipp Horner, chief sustainability officer, will open the conference with an overview of the division’s sustainability strategy and its digital transformation.

Delegates will hear from South Korean steel giant POSCO, Japanese steelmaker JFE Steel, the Spanish CELSA Group, the Latin American steel manufacturer Ternium and Tata Steel India; and let’s not forget what promises to be an exciting decarbonization debate featuring Caroline Ashley, director of Steelwatch. To register, visit www.futuresteelforum.com – today!

PROFILEMASTER® SPS Profile Measuring System

The PROFILEMASTER® SPS is a light section measuring device for measuring contours and dimensions on profiles of all kinds in cold and hot steel applications.

Benefits:

Maximum measuring accuracy thanks to temperaturestabilized measuring systems

Shape fault detection (SFD) thanks to high sampling rate

High-precision measurements

Detects process problems at an early stage

Fast maintenance and easy cleaning

2 LEADER

Zumbach Electronic AG | Hauptstrasse 93 | 2552 Orpund | Schweiz Telefon: +41 (0)32 356 04 00 | sales@zumbach.ch | www.zumbach.com

4 - 8 Number of cameras min 5 Min. object diameter (mm) max 720 Max. object diameter (mm)

Q3-DYMS DANIELI YARD MANAGEMENT SYSTEM

Automatic Yard means no human on the floor, nor on the cranes. Q3-DYMS represents a breakthrough technology to automate semifinished and finished product logistic operations, simplifying the complex management of a yard during production in fully automatic mode. Its features make it part of a plant digitalization strategy.

Via Bonaldo Stringher, 4 33042 Buttrio (UD) Italy Phone +39 0432 518 111 www.digi-met.com www.dca.it Follow us on Linkedin

Indiana-based Steel Dynamics Inc. (SDI) has signed a renewable product purchase agreement with Nextera Energy Resources, for 308 MW of energy to be produced by a new wind farm project in Scurry County, Texas. Once operational, the new wind farm is expected to produce approximately 1.1 million MWh of electricity annually, equivalent to 16% of the company's steel mills' electricity usage in 2022. This also will contribute to SDI’s long-term reduction of Scope 2 greenhouse gas emissions intensity, the company has stated.

Source: Recycling Today,

3 August 2023

Liberty Steel is idling the only operational blast furnace at its recently acquired Dunaferr site in Hungary, as well as the steel plant. The steelmaker said the reason for the closure was due to the cost of production being unviable, given low finished steel prices. Liberty only won the bidding process for the stricken mill in mid-July, buying it out of liquidation for €55m. In the last stage of the bidding process, it was competing with Vulcan Steel. Ukraine's Metinvest, which was eliminated from bidding in an earlier round, said the value of the plant was close to €200million.

Source: Argus Media, 8 August 2023

Netherlands-based tech company Villari has announced a significant seed investment of €2.5 million aiming to propel its sensor technology, designed to detect and monitor small fractures or ‘fatigue cracks’ in steel structures. Led by FORWARD.one, along with coinvestors InnovationQuarter Capital and Delft Enterprises, the €2.5 million investment will fuel Villari’s international expansion efforts. CEO Olivier Baas and COO Floris Achterberg plan to expand their team with engineers and sales talents to accelerate the scaling process.

Source: EU-Startups, 8 August 2023

A plan by Jindal Steel & Power Ltd. to develop an iron-ore mine that will cost around $2 billion in South Africa is facing opposition from communities who say the operation would require thousands of homes and graves to be relocated. “Our community of Makhasaneni has been fighting Indian giant mining company, Jindal Mine, who for years ha[s] been intruding with plans to dig up iron ore in the lush hills that we have called home for generations,” community members said in a petition signed by more than 6,700 people.

Source: Zawya, 8 August 2023

ArcelorMittal Nippon Steel India (AM/NS India) delivered relief materials to villages in Kujang block, Jagatsinghpur, following severe flooding beginning in August, which, according to reports, has badly affected the citizens, cattle, and property. Under its corporate social responsibility agreements, AM/NS India handed over the relief material to Soumyashree Panigrahi, the local development officer. The resources included biscuits, baby food, and sanitary napkins to meet the immediate needs of the people. Additionally, the company also provided cattle feed to mitigate the shortage of food supplies to the animals. Source: OrissaDiary.com, 11 August 2023

Streaming service Netflix has announced the upcoming production of a new drama about a landmark toxic waste case in the UK. It took 15 years to demolish Corby's former steelworks and remove waste from the land after British Steel announced plans to stop operations in 1979. Council contractors employed to clean up sites were said to have had little expertise in dealing with toxic waste. Eighteen families claimed their 19 children, who were all born over the same 15-year period with upper limb defects, were affected by the removal operation, with many of them later reaching out-of-court settlements following Corby Borough Council’s admittance of negligence. Source: BBC, 11 August 2023

4 NEWS ROUND-UP

US Steel has announced a collaboration with Google Cloud that aims to leverage Google Cloud’s generative AI technology to enhance operations at the largest iron ore mine in North America. The first application to emerge from the partnership is named MineMind; a programme driven by GenAI that is designed to streamline equipment maintenance processes. By utilizing Google Cloud’s AI technologies such as Document AI and Vertex AI, MineMind seeks to improve the efficiency of the maintenance team’s operations.

Source: ERP Today, 11 August 2023

Thieves have stolen copper piping and stainless-steel worth thousands of pounds from a building site in Nottinghamshire, UK. Police said the materials were taken from the site at the Loughborough Road and Bridgford Road junction in West Bridgford. It happened after workmen packed up on 7 August –either during the evening or early on 8 August. Officers have launched an appeal following the burglary. Nottinghamshire Police said the offenders ‘may have looked like builders’ but added ‘there shouldn't have been anyone on site during this period’.

Source: BBC, 13 August 2023

Over 1,400 people who live around the Tata Steel factory in IJmuiden have joined a mass claim against the steel factory, citing health issues caused by dust, noise, poor air quality, and odours relating to the factory. According to local media reports, scientific research has established that people in the area are more likely to suffer

Singapore’s Meranti Steel announced that it will start a new green steel project in Thailand, in co-operation with Danieli, an Italy-based equipment supplier, for the development of a direct reduced iron (DRI)-based plant, which will produce green steel with the use of renewable energy solutions including solar and wind energy, and hydrogen. The new plant will feature an Energiron direct reduction plant with technology developed by Tenova and Danieli that is ready for a transition to 90% hydrogen, a Danieli Digimelter melting unit featuring a Q-One power feeder that can process green energy, and a Danieli QSPDUE thin-slab casting and rolling line. Source: Yieh Corp, 16 August 2023

Three miners have died in a fire at an ArcelorMittal coal mine in Kazakhstan, the company announced on 18 August. Efforts to contain the fire, which broke out on 17 August, and to restore normal ventilation followed, ArcelorMittal Temirtau, which represents the firm in Kazakhstan, said in a statement. ArcelorMittal Temirtau owns 15 coal and ore mines in Kazakhstan.

Source: Reuters,18 August 2023

from health problems like headaches and nausea than elsewhere in the Netherlands. Serious conditions, such as heart disease, diabetes and lung cancer, are also more common. Source: NL Times, 24 August 2023

Tata Steel’s CSR department organized a visit to the Tata Steel Zoological Park for 38 underprivileged children and their parents on World Humanitarian Day. According to the steelmaker, the children had the opportunity to explore the zoo and museum, gaining insights into various animal species, their habitats, and wildlife conservation. “TSLP’s management believes in adopting a holistic approach to education and learning for the targeted students from marginalized backgrounds’’, a departmental official stated.

Source: The Avenue Mail, 20 August 2023

The Indian arm of industrial gas giant Linde has won an order to install a 1,000 tonnes per day cryogenic oxygen plant at Rourkela steel plant, located in Odisha, India. The company signed a letter of acceptance with the Steel Authority of India (SAIL), with the agreement also including the provision of renewable gas following the construction and operation of the plant. Equipped with a production capacity of 4.5Mt/yr of hot metal, 4.2Mt/yr of crude steel and 3.9Mt/yr of saleable steel, the Rourkela steel plant was founded in 1955 and is India’s first fully integrated steel plant.

Source: Gasworld, 29 August 2023

5 NEWS ROUND-UP

New pump solution from RMI

When a steel rolling mill in Italy was looking to enhance the quality of its product while improving overall efficiency, it turned to a partnership of metallurgical plant solutions company Primetals Technologies and high-pressure pump specialist RMI Pressure Systems.

The mill decided to invest in new descaling equipment – with a view to raising quality standards while lowering overall energy and water costs. According to Kathryn Poke, RMI’s general manager for Europe, the Middle East and Africa, the company designed a bespoke solution based on its established Trimax Series of reciprocating plunger pumps.

“Engineered to order like all our solutions, we designed the system to suit the project requirements,” said Poke. “With the Trimax pump at its heart, the specialised system for the mill included controls, nozzles and headers to ensure reliable and efficient operation.”

RMI was required to provide a pump which could deliver hydraulic power at multiple pressures, using a variable speed drive and engineered nozzles. The result was a system capable of producing flow rates from 50 up to 670 litres per minute, at pressures up to 1,000 bar.

“The technical design of descaling equipment is an exact science,” she explained. “This requires precision nozzle design and high hydraulic pressures calculated to deliver the best descaling results for a variety of steel variants, at minimum cost and maximum efficiency.”

The variable speed drive and engineered nozzles ensured that the system delivered controlled hydraulic pressure and precision impact, while consuming less energy and water. The lower installation and maintenance costs resulted in a payback period of less than two years.

“Customers are increasingly looking for solutions and not just products,” said Joe Keenan,

Thermo Fisher Scientific adds to spectrometer range

Thermo Fisher Scientific has announced the latest iteration to its range of ARL iSpark Series Optical Emission Spectrometers. The Thermo Scientific™ ARL iSpark™ 8860 Inclusion Analyzer with Spark-DAT boasts all the features necessary for both thorough elemental analysis of steel and ultra-fast inclusion analysis, says the company. According to Thermo Fisher Scientific, it can help to guarantee keeping the lowest inclusion content of steel products at the point of manufacture to prevent costly production issues, like nozzle clogging during continuous casting processes.

The ARL iSpark 8860 Inclusion Analyzer is the first optical emission spectrometer on the market to combine full elemental coverage with rapid characterization of non-metallic inclusions in a single analysis. It can identify and determine fea-

tures such as the type, number, size, concentration and volume fraction of inclusions, allowing steel manufacturers to control inclusion content in steel products in real time. In turn, says Thermo Fisher Scientific, it can help to prevent costly process issues and the detrimental effects of inclusions on the mechanical properties of end products, ensuring high quality steel production and minimizing the risk of customer claims or product returns.

Features include:

• Ability to generate advanced elemental concentrations and inclusion data in steel

• 1m vacuum Paschen-Runge optics with photomultiplier tube (PMT) detectors

• Full elemental coverage, including gas ele-

RMI managing director. “This contract illustrates how RMI’s custom-design capability allows us to build fit-for-purpose solutions with our pumps as a central component.”

Keenan noted that the trend is toward OEMs gaining more specialised knowledge about how pumps are applied in specific applications, so that they can augment their offerings with other componentry, accessories and technology. This allows the customer to source more of their operational equipment from a single supplier, reducing the risk and resources associated with integrating and maintaining these different elements in-house.

For further information, log on to www.rmipsl.com

ments

• Fast inclusion analysis

• Comprehensive inclusion analysis software tools, including Spark Explorer, Inclusions Report and Statistical Process Control (SPC)

• Inclusion analysis method customization and training with Thermo Fisher Scientific experts

• Automated with the ARL Sample Manipulation System (SMS).

For further information, log on to www.thermofisher.com/order/catalog/ product/IQLAAHGABDFAOOMBOD

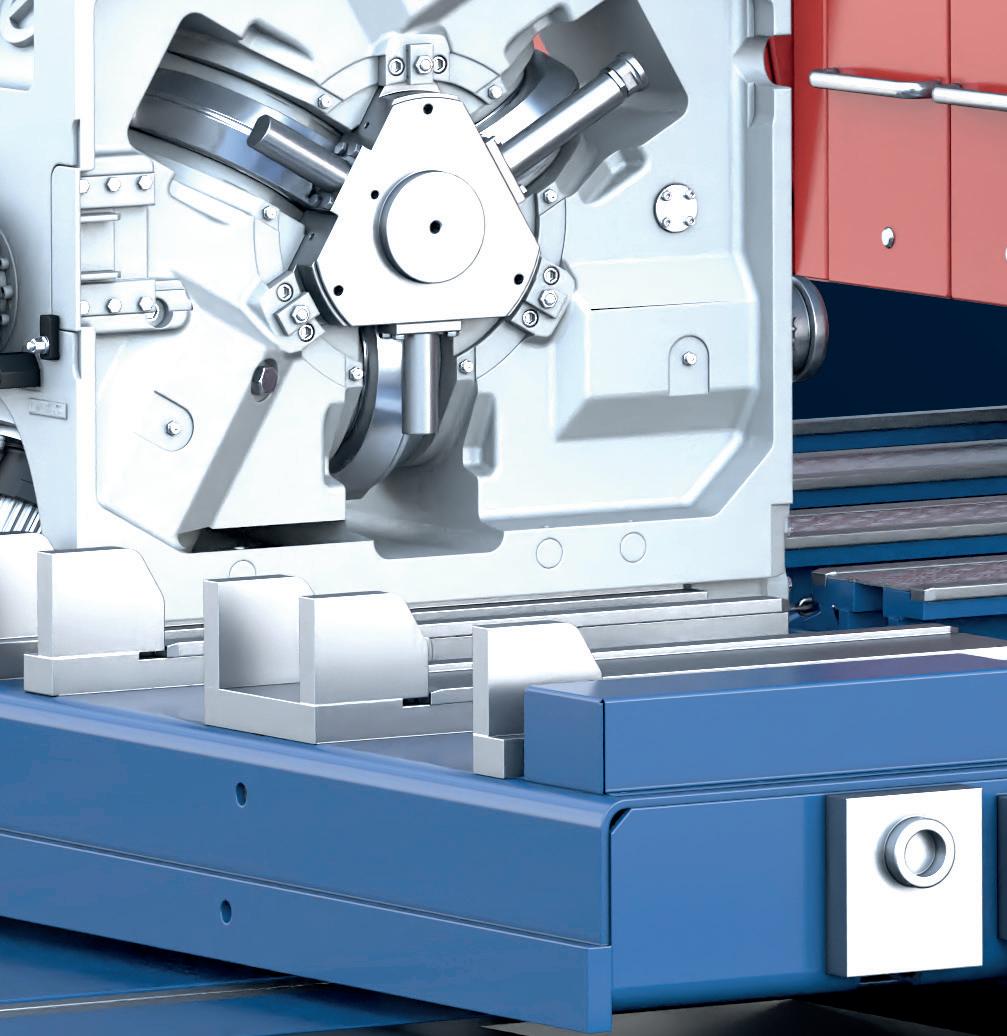

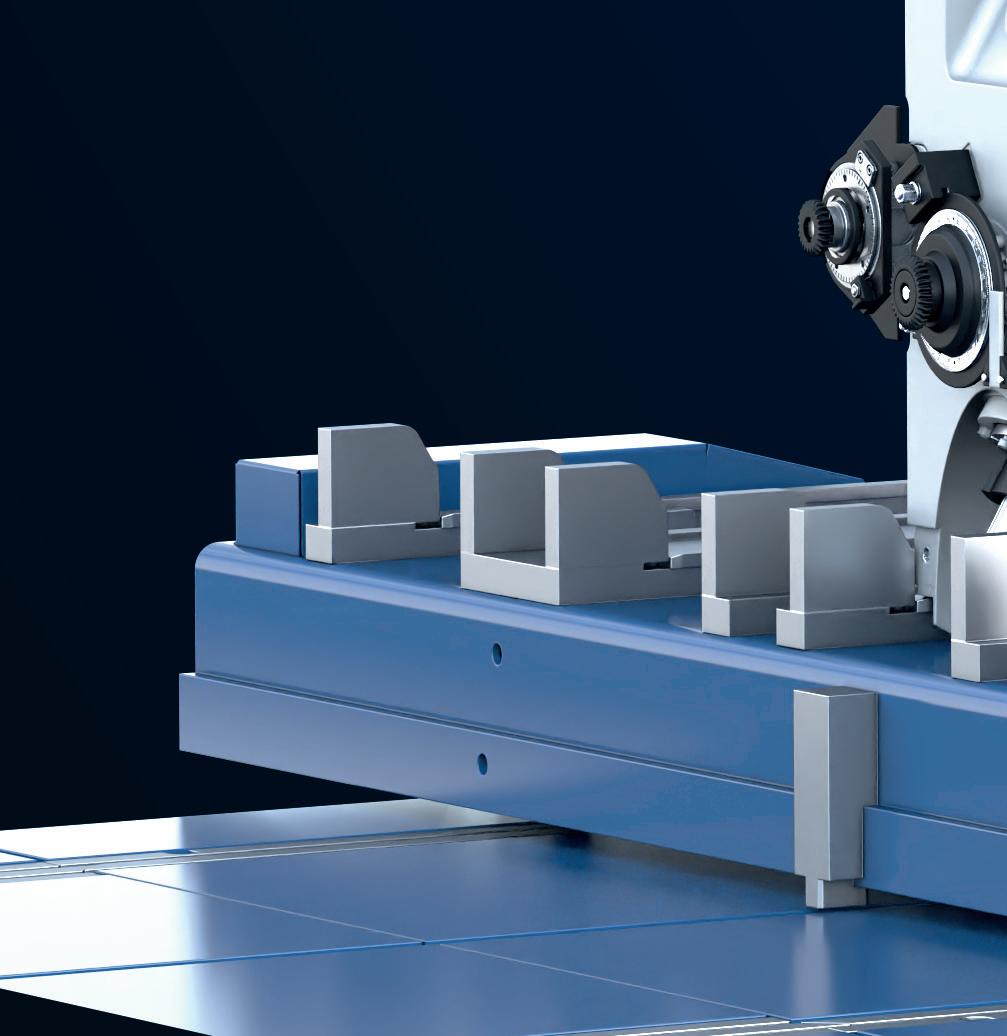

Pomini Tenova roll grinders for Hoa Phat Group

Tenova, a global company specialized in sustainable solutions for the green transition of the metals industry, has been awarded a new contract by Hoa Phat Group, a leading industrial manufacturing group in Vietnam. The contract is for new roll grinders supplied by Pomini Tenova, a Tenova brand that specializes in roll shop equipment, with the roll grinders to be utilized in Hoa Phat’s new hot rolling mill in Dung Quat, Quang Ngai province.

The scope of work for the roll shop includes the full set of roll grinders for grinding work rolls and back-up roll, with and without being

mounted on chocks. All machines are equipped with Pomini HMI (Human Machine Interface), the Pomini Inspektor3 with Eddy Current and Ultrasound probes for roll inspection. The digital package with Tenova Edge technology and Tenova adVisor will provide remote constant condition monitoring for each machine as well as operational and maintenance support.

For further information, log on to www.tenova.com

www.steeltimesint.com INNOVATIONS 6

Fives to supply hydrogen burner project

Fives, an international engineering group, has partnered with leading European companies and research institutions to collaborate on the development and testing of hybrid burners with hydrogen content in industrial reheating furnaces. The TWINGHY project was launched in the CELSA Barcelona plant in Spain and aims to demonstrate an optimized heat transfer process based on hybrid burners in reheating furnaces. According to Fives, it will allow the steelmaker to progressively decarbonize the reheating process through an increase of hydrogen in combination with oxygen by monitoring and controlling it through a digital twin.

With the ultimate goal of reducing emissions and increasing energy efficiency within the steel industry, this project involves testing and optimizing hybrid burners in real-world settings, developing new control systems and monitoring techniques to ensure a safe, efficient operation.

Testing will take place on the existing Stein Digit@l Furnace®, installed by Fives at CELSA’s Barcelona plant in 2009. This is a walking beam furnace of 180 tons/hr capacity designated for the production of different merchant bars in the construction industry.

Two types of hybrid burners (natural gas-hy-

drogen) will be developed and tested: one based on air-combustion and the other on oxy-combustion. Fives will be providing its thermal reheating expertise to test the hybrid burners by using hydrogen as a partial replacement for natural gas.

To support hydrogen transition, a digital twin methodology will be developed by partners and applied to the demonstrator as well as the replication site. The digital twin will analyse the impact of different fuel blends, energy efficiency, reliability and safety.

In addition, new challenges related to hydrogen usage, such as security of supply, optimal fuel blends and quantities, CAPEX, OPEX, impact on process, required infrastructure and safety regulations, will be also addressed during the anticipated 54-month project life.

The TWINGHY project will bring together combustion system optimization and furnace digitalization, ultimately avoiding the need to replace an entire furnace with a long lifespan ahead and accelerating the decarbonization of the steel industry, says Fives. For

Welding system from AMADA

AMADA WELD TECH has launched its Jupiter Laser Welding System, a semi-automatic production system for welding battery modules for use in electric vehicles, power tools, energy storage and military battery module applications. The Jupiter is ideal for battery modules measuring up to 300 x 300 x 300 mm, says the company.

The Jupiter system can be equipped with several lasers and a laser weld head with fixed optics or a galvo (scanner). The Jupiter Laser Welding System features a Class 1 laser welding enclosure for battery tab welding, which is safe to operate in a regular production environment. An integrated combustion suppression unit (CSU) safeguards both the system and the operator, while integrated fume extraction keeps the enclosure safe from

contamination.The Jupiter comes with a 500W power fibre laser in the near infra-red (NIR) wavelength range. A manually operated front door provides manual loading, while an automatically operated side door may be used for robotic/ in-line loading. The down-holder provides joint quality and traceability via part-to-part contact.

For further information, log on to https://www.amadaweldtech.eu/

September 2023 www.steeltimesint.com

+1.914.968.8400 www.GRAPHALLOY.com Yonkers, NY USA Handle High Temperatures and Harsh Operating Conditions with Ease. • Survives when others fail

Run hot, cold, wet or dry • Corrosion resistant • Self-lubricating • Low maintenance • -400˚F to 1000˚F (-240˚C to 535˚C) • Ovens, furnaces, conveyors, mixers, dampers GRAPHALLOY® Bearings... We Go to Extremes HeatAd_60mmx270mm.qxp_Layout 1 11/9/20 11:55 A

further information, log on to www.fives.com

•

· Honours existing mill attachment points and guide base, no machining on your stands required

· Made from stainless steel and speci cally tailored to your mill ensuring perfect t, operation and longevity

· Single point, centralized adjustment during operation

· 2, 3 and 4 roller con gurations

· Rigid, stainless steel construction

· Broad size range

· Fewer surface defects and better scale control

· Available in Box, Trough and Restbar-mounted con gurations

info@fabris.com www.fabris.com 905.643.4111 Contact Us ® spiral cooling system ® Our roller entry guides keep your product on the pass Maximize your mill speed while meeting your quenching requirements on all bar sizes. Not just controlled cooling, but correct cooling Traversing Restbars allow for quick and accurate pass changes

box con guration

trough con guration

With over 50 years in the Steel Industry, we have a wide variety of solutions to keep your mill rolling.

All change at Usiminas

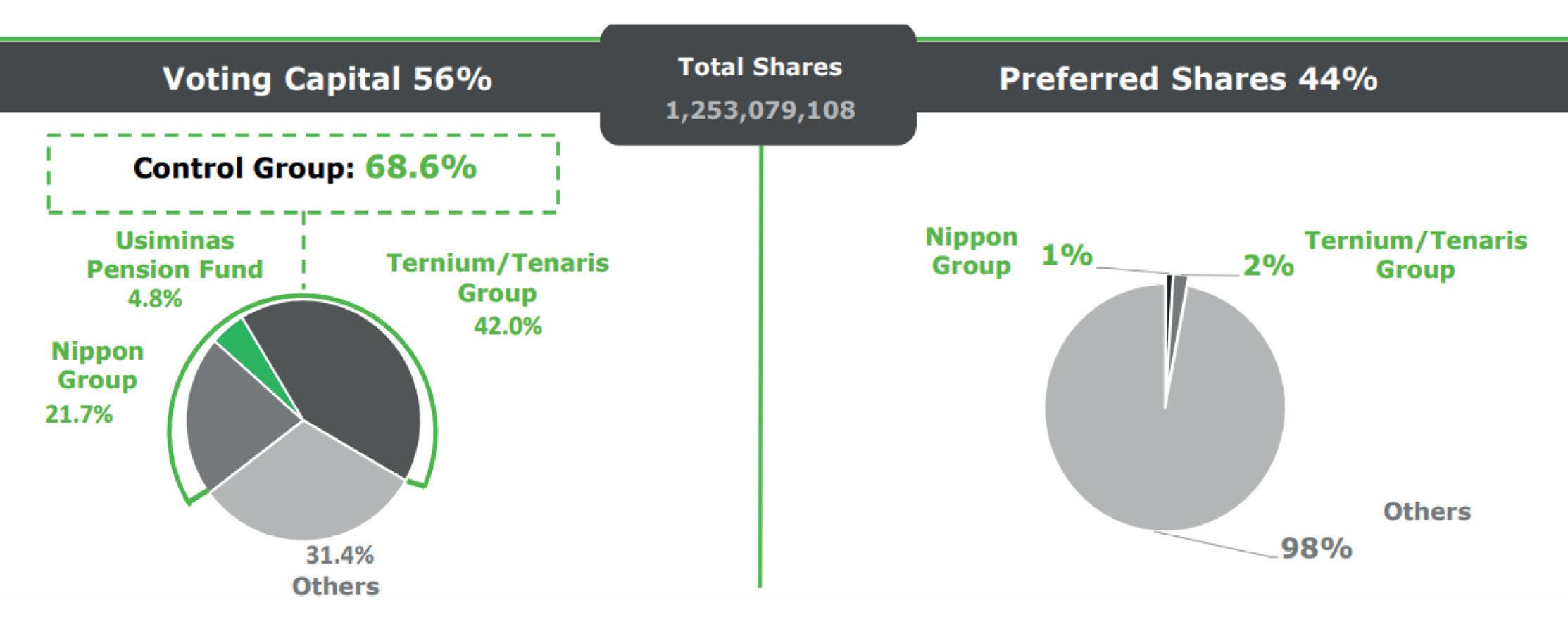

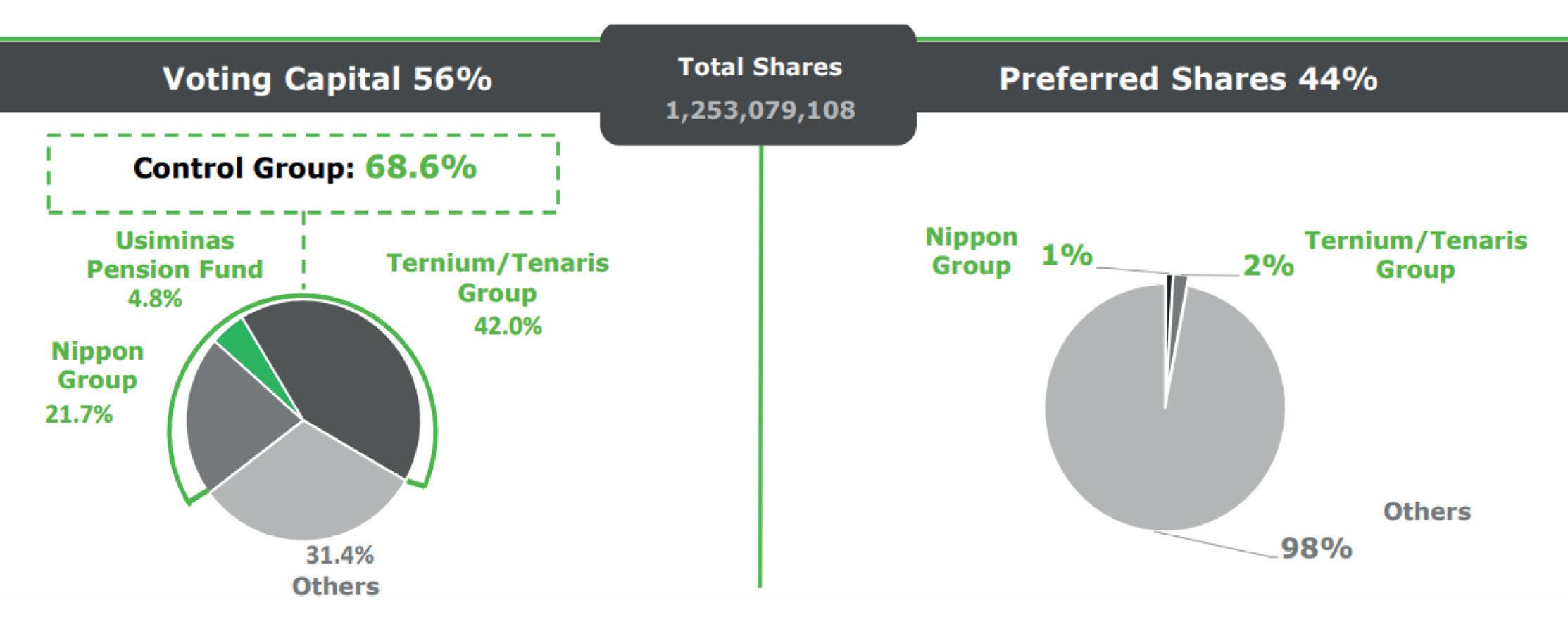

In March 2023, Usiminas announced that controlling shareholders Nippon Steel and Ternium had agreed on a new governance structure, which would consolidate control of the company in the hands of Ternium.

By Germano Mendes

THE new Usiminas agreement entails several changes to the previous structure of the business. T/T group (including Ternium, Tenaris and their affiliates, all of them subsidiaries of Techint group) agreed to purchase 69 million shares from Nippon group (comprising Nippon Steel, Mitsubishi and MetalOne) at R$10 (or US$2.06) per voting share. This implied a ~35% premium over the previous day’s closing price.

After the deal is concluded, T/T group would own 61.3% of the controlling group’s shares, while the Nippon group would hold 31.7% and Previdência Usiminas (pension fund for company employees) remains with 7.1%. In terms of Usiminas’ total voting shares, T/T group would retain 49.3% and Nippon group, 22.7%. Fig 1 shows the new ownership structure, stressing that the controlling group retain 68.6% of the voting capital. Ternium would purchase 57.7 million shares for around $111 million in cash, while Tenaris would acquire the remaining shares.

A revised shareholder agreement would be implemented, in which: a) T/T group would nominate a majority of Usiminas’ Board of Directors; b) Nippon group would designate the chairman of the board; c) T/T group would nominate the CEO and four other executives; d) Nippon group would designate the VP of technology & quality; e) any decision by the controlling group would require support of 55%

of the votes, which means that the T/T group would have a final say on ordinary decisions given that its stake would jump to 61.3% of the controlling group; f) under the new agreement, two years after the deal is closed, T/T group will have the right to buy Nippon group’s remaining shares (153 million voting shares) at the higher price of US$2.06 per share and the 40-trading day average price immediately prior to the date of exercising the option. In addition, Nippon group will have the right to withdraw its remaining shares from the control group and sell them in the open market after giving T/T group the opportunity to buy them at the 40-trading day average price immediately prior to the notice of withdrawal, as well as the right, at any time after the second anniversary of the closing, to sell such shares to the T/T group at US$2.06 per share.

The initial capital market’s reaction Generally speaking, the financial analysts understood that the transaction was positive both for Usiminas and Ternium. For instance, according to JPM: “The past history of governance at Usiminas was marked by a number of disagreements between shareholders which culminated in a structured form of shared control. T/T taking control of Usiminas allows the Techint group, a great operator, to effectively run the company, potentially

turning the business around and bringing additional value to all shareholders (including Ternium itself).”

A similar conclusion was provided by BTG Pactual Bank: “In our view, this is shapingout to be a win-win move for the two. For Usiminas, it’s clear that the company has been struggling with its operations over the last few years (several operational setbacks in a five-year range). We argue that historical shareholder disputes and the lack of a solid/clear controlling entity could be one of the reasons for the underperformance. So having Ternium, (one of the best steel operators in the world, a LatAm player) as its main reference shareholder should be seen as positive for the company”.

BTG Pactual Bank also remembered the trajectory of Ternium’s investment in Usiminas: “Late 2011, Ternium entered the control block of Usiminas by acquiring Votorantim/Camargo Correa’s stake for R$4.1bn. At the time, Ternium paid R$36 per share for Usiminas, which proved to be an excessive price tag for the move over the past years. It’s important to remember that at the time there was a bidding for the asset between Ternium and CSN, which inflated the price tag of the transaction materially”. Bank of America stressed that this deal had a ~84% premium to the stock price at the day prior to the acquisition.

Ternium has a very comfortable situation,

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

9 www.steeltimesint.com September 2023

de Paula*

LATIN AMERICA UPDATE

as it reported a $2.6bn net cash position as of Q4 22. The total cash disbursement for purchasing additional shares of Usiminas, therefore, would be immaterial for the company, as $111 million represents only 4% of its net cash position and 1% of its market capitalisation. Thus, it is a relatively small amount of money when the benefits of a higher integration between Usiminas and other Ternium assets in the region is taken into consideration. Moreover, Ternium will fully consolidate Usiminas’ balance sheet and results of operations in its financial statements at the beginning of July 2023.

New management team and perspectives

The purchase of additional shares by Ternium was approved by the Brazilian antitrust watchdog CADE in June 2023 and the deal concluded in early July 2023.

Immediately, a new managerial team was designated. The most important changes were: Alberto Akikazu Ono moved from CEO to chairman, whereas Marcelo Chara, CEO of Ternium Brasil, became CEO of Usiminas.

As can be observed in Fig 2, after interrupting the blast furnaces and steel shop at Cubatão steel mill, Usiminas has been obliged to purchase a considerable volume of slabs. The amount was around 1.3Mt/yr during the period 2018-2020 and 2.1Mt/yr between 2021 and 2022. Annualised figures for 2023 show a similar rhythm this year. Ternium Brasil, for its part, is a 5Mt/yr coke integrated mill dedicated only to slabs. There is already a good complementarity between Usiminas and Ternium Brasil.

Fig 2 demonstrates that Usiminas’ crude steel production was, on average, 3Mt/ yr along the period 2018-2022. The sharp

decline in 2023 is a consequence of the revamping of its largest blast furnace, at a cost of $540M. Its maintenance stoppage faced some delays, as it is now expected to end by September (from August, previously). Additionally, Usiminas estimates the ramp-up will take a few weeks, which will likely help profitability only by 2024. Management expects that production rates at blast furnace #3 – which were close to 60%-70% of capacity utilisation before the maintenance stoppage – will return to close to its 3Mt/yr nominal capacity after the work is completed. This could lead to a higher dilution of fixed costs, while the renovated furnace is expected to be highly efficient and require less maintenance.

Currently, Usiminas is modernising its steel shop # 2 at its Ipatinga steelworks. The company is still pondering the revamping of blast furnaces #1 and #2 (which is idle) at the same site. It is understood that the company’s Cubatão mill will continue to operate solely as a re-roller, producing HRC and CRC, by processing slab from third parties.

Usiminas released financial performance figures for Q2 2023 in late July. Mr Chara, the new CEO, said that his primary commitment is to improve overall business competitiveness and help the transition to a more sustainable company. Chara noted that the use of natural gas (replacing coal) could be an alternative for Usiminas in the near future as it seeks to be a more ESG-friendly business. Obviously, it is too soon to expect significant change in Usiminas’ strategies, but definitely moving from a joint-venture model to one large owner tends to enable considerable transformations in the term. �

www.steeltimesint.com September 2023 LATIN AMERICA UPDATE 10

Fig 1. Usiminas’ ownership structure (%)

Fig 2. Usiminas’ crude steel and rolled steel production and slab purchased, 2018-2023 (Mt)

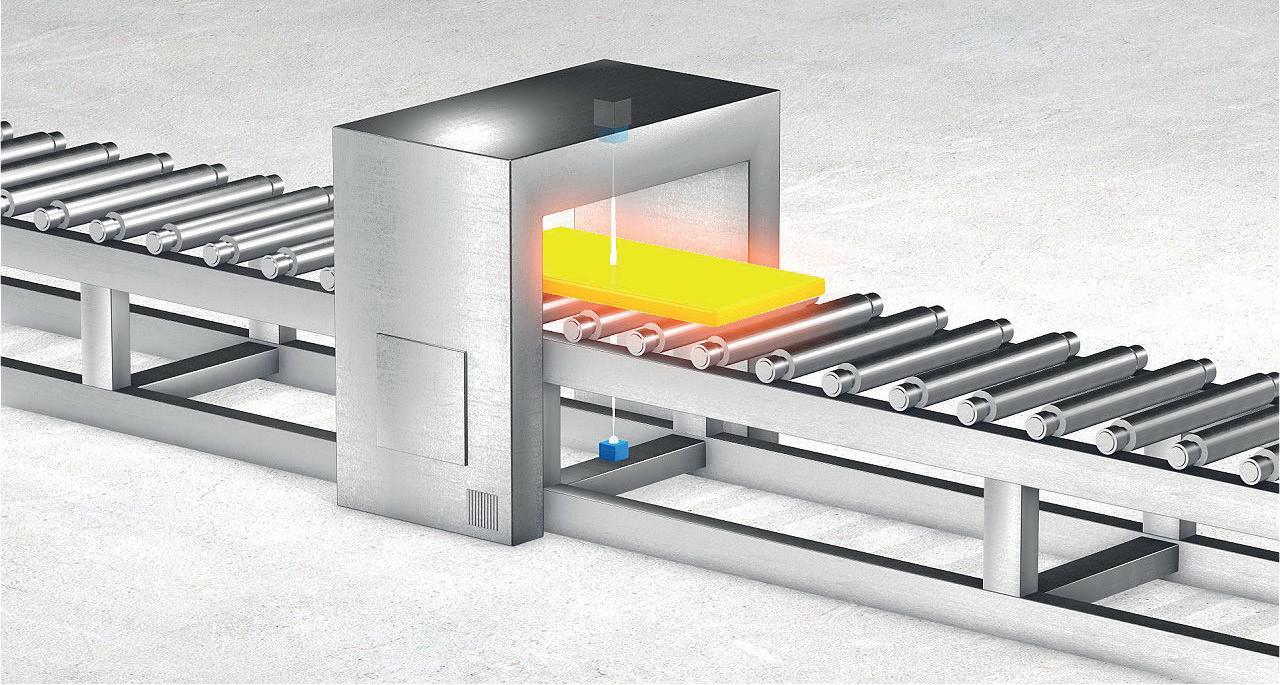

Other developments & technologies aiming at decarbonizing the steel industry:

VolteronTM: CO2-free Steel

Production Process

Furnace Electrification

Carbon Capture

Heat Recovery

Towards green steel

Technologies turning steelmakers’ decarbonization goals into reality.

Jet Vapor Deposition (JVD): Sustainable, highquality and cost-effective steel coating

The JVD line introduces a technological breakthrough in the steel coating of advanced high resistant steel grades difficult to galvanize by hot dipping. This genuine alternative to Electro-Galvanizing and Hot-Dip-Galvanizing considerably reduces the cost of galvanized steel and provides multiple advantages when it comes to quality, speed and OPEX. Developed for ArcelorMittal with the help of our experts, John Cockerill is in charge of commercializing this unique technology worldwide.

Electrical Steel Processing Technologies to produce the steel grades of tomorrow

Our E-SiTM equipment and processing lines are designed for the production of strong, ultrathin, lightweight, and highquality Non-Grain Oriented (NGO) steel grades essential for the future of e-mobility.

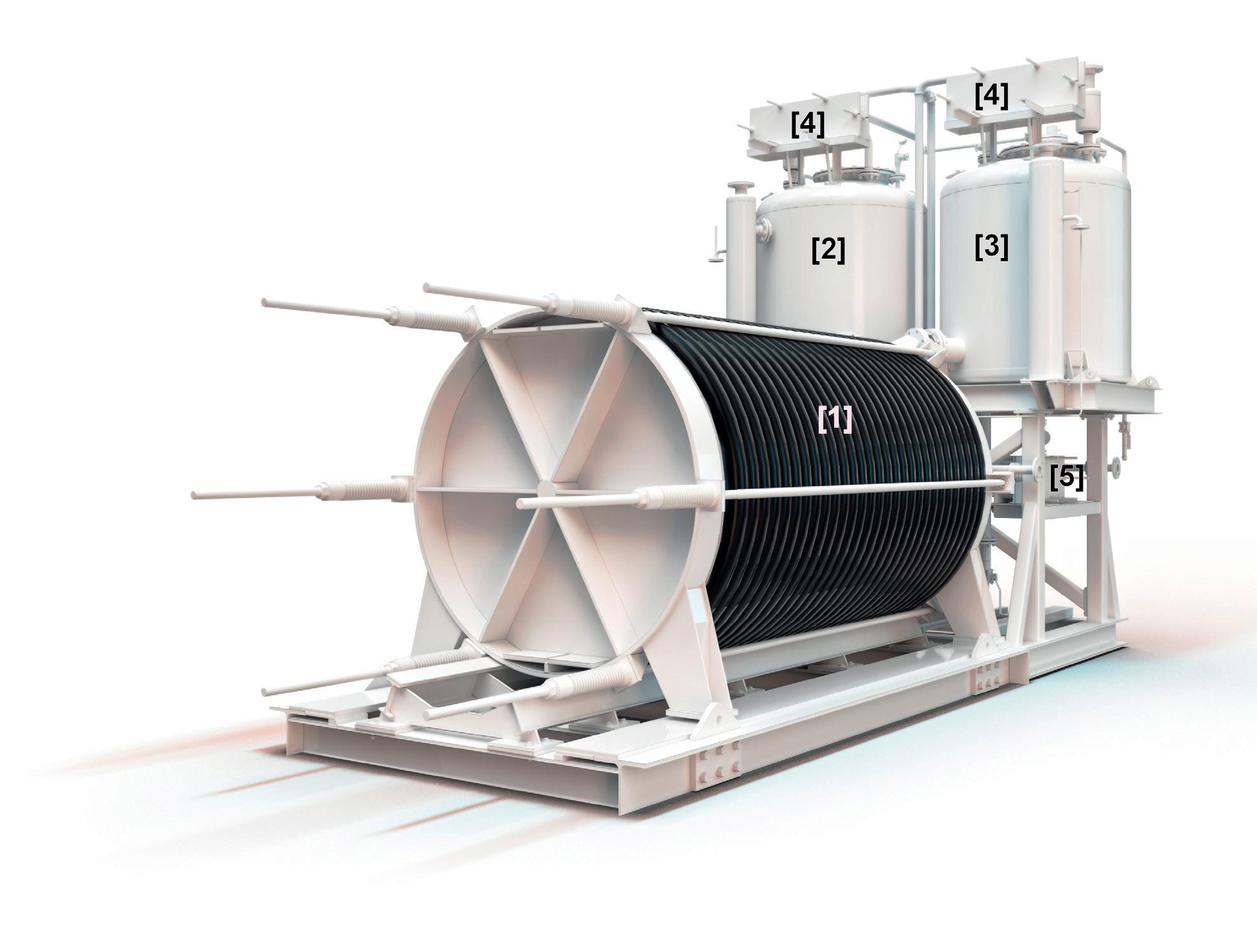

High-performance Acid Regeneration supporting responsible steel making and the circular economy

John Cockerill Industry’s ARPs come with smart plant control systems, provide waste energy recovery and drastically reduce pickling process plants’ fresh acid demands and waste streams in general. What is more, they are providing the lowest emissions in the market.

Follow us on

johncockerill.com/industry

JVD (Jet Vapor Deposition) Line

Electrical Steel Processing Technologies

Eco-friendly Acid Regeneration Plants

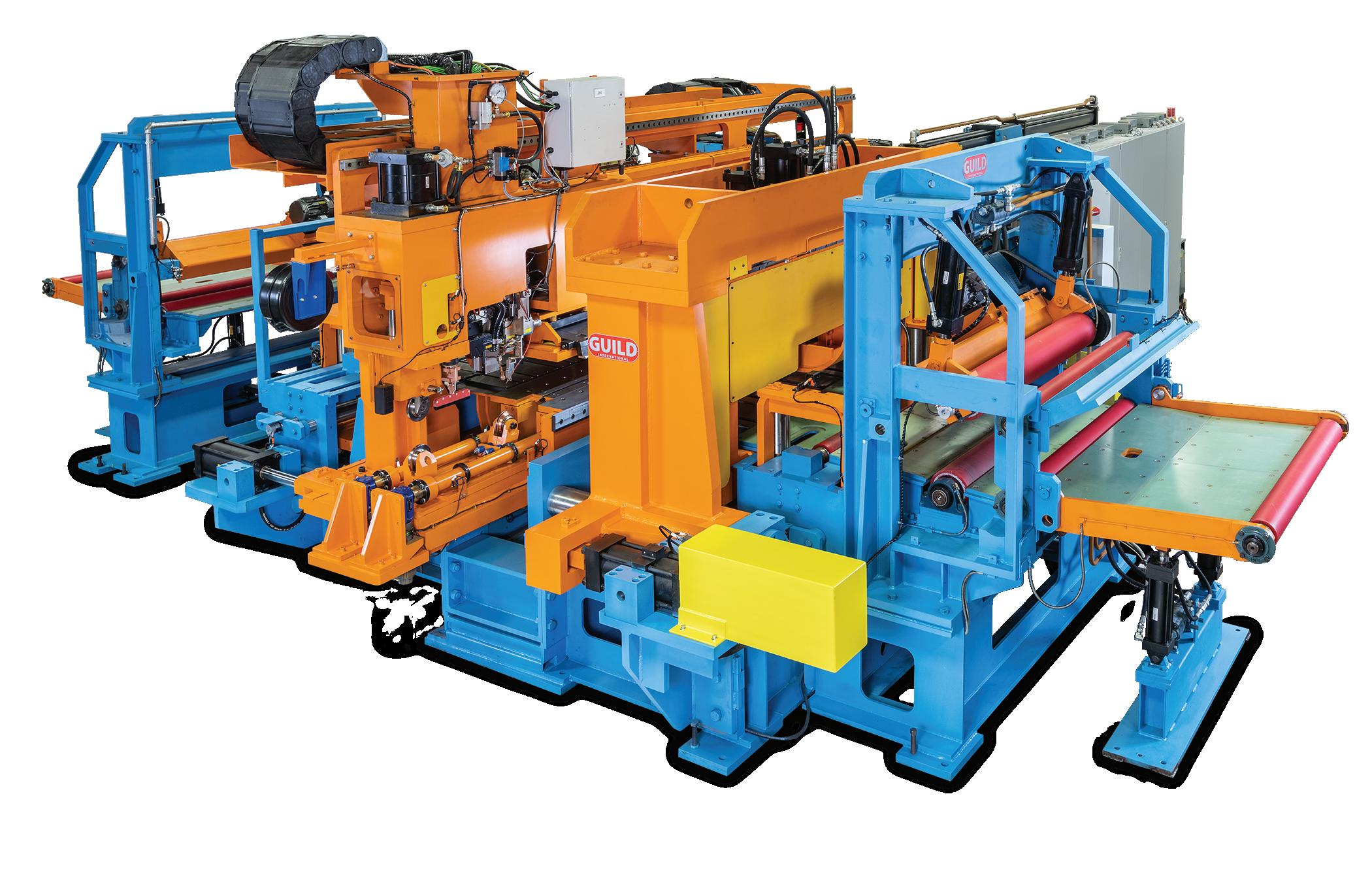

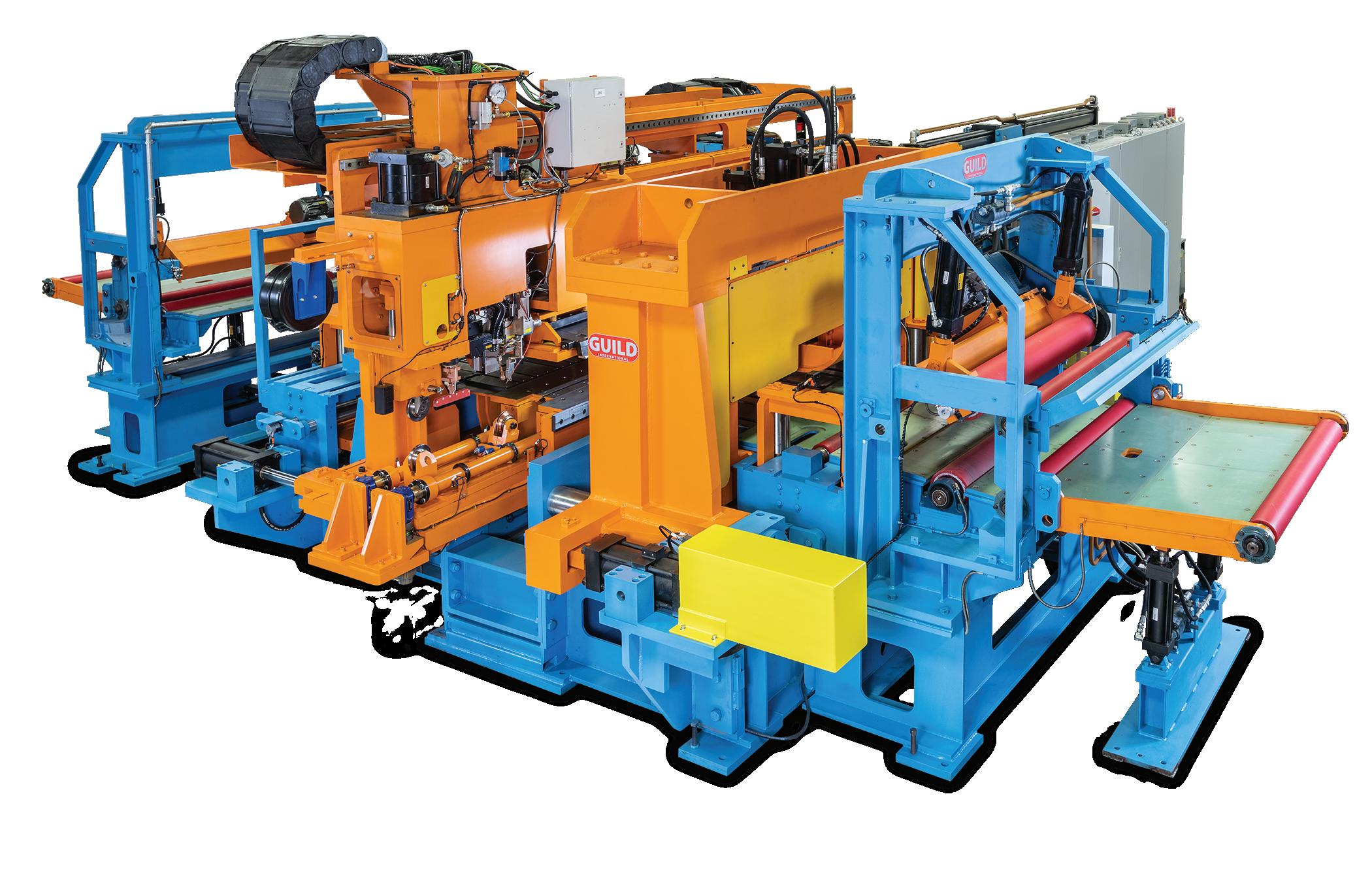

The most technically advanced coil joining equipment available. Period.

Guild International can design and build the welding machinery you need to keep your coil processing lines up and running smoothly and profitably. We are the world leader in supplying highly-engineered coil processing equipment known for reliability and performance. Contact us today to begin designing the perfect coil joining equipment for your processing lines.

For more information, visit our website at www.guildint.com or call +1.440.232.5887

World Leader in Coil Processing Equipment for the Steel Processing, Tube Producing and Stamping Industries Since 1958

Secondary by name…

In India, secondary steelmaking is not as vibrant as it is elsewhere in the world. Declining capacity utilization levels, an inability to invest in cutting edge technology and being unable to reap the benefits of India’s robust steel consumption growth in recent years has put them on a back foot.

By Dilip Kumar Jha*

INDIA claimed the second largest position in world steel production with a record output of over 126Mt in the financial year 2022-23 (April-March), thanks to primary producers who raised their capacity exponentially in the past eight years to catch the speed of growth in its consumption following a rampant increase in infrastructure development.

However, the secondary steel producers have lost their substantial market share during the same period due to the lack of scale, market accessibility, and working capital, which hindered their greenfield and brownfield expansions, to compete with primary producers. The average size of Indian secondary steel units is so small that they never fall within the ambit of the giant-size primary steel producers. Due to scattered plant spread, even the government sidestepped the secondary producers by prioritizing primary steelmakers.

According to the Ministry of Steel, Government of India, the secondary steelmaking industry has recorded a growth of just 9% in production to 48.91Mt/yr

(metric) in the financial year (FY) 2022-23, compared to 45.02Mt/yr in FY 2014-15. However, primary steel producers witnessed 49% growth during the same period, with finished steel production at 122.28Mt/yr in the recently ended FY 2022-23, compared to 81.86Mt/yr eight years ago. Crude steel production reported a rise of 42% during

the period between FY 2014-15 and FY 2022-23. Overall crude steel production capacity during the last eight years rose 46% to 160.3Mt/yr. With production capacity expansion remaining skewed in favour of primary producers, secondary steelmakers lost their market share substantially in the last eight years, which

13 www.steeltimesint.com September 2023

India’s

Financial year (April

Quantity (million tonnes) 2017-18 4.53 2018-19 5.75 2019-20 5.46 2020-21 4.20 2021-22 3.60 2022-23 9.80

*India correspondent, Steel Times International

import of steel scrap

– March)

Source: Ministry of Steel, Government of India

INDIA UPDATE

Key parameters FY 2014-15 FY 2022-23 Variations (%) Crude steel capacity 109.85 160.3 46 Crude steel production 88.98 126.26 42 Finished steel production 81.86 122.28 49 Secondary steel production 45.02 48.91 9 Consumption 76.99 119.86 57 Per capita consumption (Kgs) 60.8 86.7 43

Expansion

all around (million tonnes)

Source: Ministry of Steel, Government of India, FY = Financial Year beginning April 1 – March 31

currently stands at 40%, compared to 55% in FY 2014-15.

Secondary steelmaking in India

Growing urbanization, industrialization, and the quick development of the auto and construction businesses have expanded the interest in using secondary steel due to its nature of being a cheaper substitute for primary steel in specific applications in these two sectors. Due to its infinite recyclability, scrap recycling has proven to be one of the fastest-growing industries in the world. However, India is yet to catch up with the pace of this growth. The Covid-induced lockdown impacted the production of the big six integrated steel players as well, but they have recovered remarkably once the pandemic abated. The direct impact was felt due to supply disruptions of coking coal. Secondary steel producers are largely dependent on imported thermal coal as they are unable to participate and succeed in government auctions. Owing to the lack of iron ore linkage, scrap price volatility has badly hurt Indian ferrous scrap recycling units.

India’s recycling rate for ferrous metal is significantly lower than the global benchmark. A recent study conducted by the Federation of Indian Chambers of Commerce and Industry (FICCI), the voice for industrial policy advocacy, estimates India’s secondary steelmaking share to be a mere 2.2% (with an overall industry size of US$ 11 billion) in a world market of US$500 billion. However, industrialists have slowly increased their recognition of the importance of large-scale countrywide scrap collection and re-melting.

“India is still in its early stages, with low recycling awareness. Unfortunately, only 30% of India’s recyclable ferrous scrap is recycled due to consumers’ negligence and lack of awareness. While the volume of scrap collection has increased in recent years, India has a long road ahead to reach 100%. In contrast to countries that take pride in using increasing amounts of steel scrap to produce secondary ferrous metal such as TMT bars and thus reduce carbon dioxide (CO2) emissions, India only uses around 30Mt/yr of scrap annually,” said the aforementioned FICCI study.

Constant decline in capacity utilization

The decline in downstream steel units’ share in production is primarily because of a constant decline in their capacity

utilization level, which currently stands at an alarmingly low level of 50.35% in FY 2022-23. Those making crude steel mostly through the induction furnace and electric arc furnace routes are utilizing 55% of their capacity. Units making finished steel, like re-rollers, are struggling at around 46%, nearly the halfway mark of the ideal level of 85-90% of average capacity utilization for a manufacturing sector. Producers in the value-added segment such as cold-rollers, and manufacturers of tinplate, pipes, and colour-coated steel are reporting even lower capacity utilization of around 37%. Sponge iron and pellet makers have witnessed slightly higher capacity utilization at 54%. Most secondary steelmakers operate with obsolete technologies, which they don’t want to upgrade because of the lack of access to banks. A large number of them have been found not maintaining their annual books of account and hence, operate on a day-to-day profit and loss basis. As a result, they end up spending over a maximum of INR 1,000-2,000 more for each tonne of steel production

compared to large producers in the same sector, and sometimes even primary producers, for the same products with matching quality. In the absence of required technologies such as ladle refining facilities, they are unable to ensure product quality by meeting with the requirements of the Bureau of Indian Standard (BIS) and, therefore, end up losing customers.

Another reason for their losing market share is their confinement to local markets. Their freight cost becomes a profit-determining factor. So, downstream players in the steel industry prefer to sell their output to local consumers instead of dispatching the same to distant consumers for higher profit. Additionally, most units in the secondary steelmaking sector are family-run, small-sized, and not rated by rating agencies. Poor corporate governance is also an issue. Hence, banks are reluctant to extend loan facilities to them fearing the piling up of non-performing assets (NPAs). These units lack professional management, skilled manpower, and long-lasting marketing support.

Looming consolidation

The secondary steelmaking industry in India is facing a major threat from the large players within the industry for acquisition. Being much smaller in size, the scrap recycling units do not fit in the ambit of acquisition for primary steel producers. With an average production capacity of a mere 25kt through ferrous scrap recycling, the total 2,500 units scattered throughout the country generate a total production capacity of around 62.5Mt but operate with a lower average rate. While around six recycling units possess a production capacity of around 500kt/ yr, others – around 500 producers – enjoy 100kt/yr, with the remaining producers struggling with between 10-20kt/yr. Most tiny units are family-run businesses with a lack of corporate governance and financial strength to acquire modern technologies for expansion. So, they always look for acquiring similar size or even smaller units that make an insignificant impact on India’s overall steel production.

According to V R Sharma, managing director of Steel Infra Solution Pvt Ltd and former managing director of JSPL, “Secondary steel producers are not on the radar of the big primary steel-producing companies for acquisition. Their small size business does not fit into the larger

www.steeltimesint.com September 2023 INDIA UPDATE 14

companies’ plans. The cost of acquiring them and converting them into profitmaking ventures would be very high. They are also scattered across the country. But these units need government assistance in the form of goods and services tax (GST) exemption and cluster making, among others. They need to scale-up and acquire modern technology to produce the BIS quality product, with environment-friendly units. With their ‘nil’ presence in exports, secondary steel producers need to team up to procure modern types of machinery to

compete with primary producers.”

Anil Nachrani, president of the Chhattisgarh Sponge Iron Manufacturers’ Association, urged the government to allocate 15% of India’s coal production to secondary steel producers from the current level of 5%, in addition to ensuring raw material supply and curbing pellets exports with a duty levy.

Recognizing the importance of their role in the ambitious capacity target of 300Mt/ yr by FY 2030-31 and 500Mt/yr by 2047, India’s centenary year of Independence, the

Central government is formulating a policy exclusively for secondary steel producers to increase their share in overall steel production. For the recycling of steel scrap scientifically, the government has opened six vehicle scrapping centres, with three more planning to begin operations soon. Also, the government has encouraged recycling unit owners to use End-of-Life Vehicles (ELVs) as raw materials for secondary steel production for both public and private sectors.

Conclusion

Secondary producers have, so far, failed to reap the benefits of India’s robust steel consumption growth in recent years, backed by long-term infrastructure growth plans. It is highly unlikely that tiny units in this segment will be able to get any significant stake in India’s future growth story, despite being cost-effective to save up to 90% of energy, conserving iron ore and coal for the future, and contributing to the conservation of the environment by reducing mineral extraction. �

15 www.steeltimesint.com September 2023

INDIA UPDATE

CONNECT WITH US AT: INFOSIGHT.COM Visit 20700 US Highway 23, Chillicothe, OH, 45601 WE BARCODE DIFFICULT STUFF ® • Annealing • UV Exposure • 1800oF (982oC) • Pickling IDENTIFICATION THAT SURVIVES: May 6-9, 2024 | Columbus, OH Booth #2603

India is still catching up after the Covid lockdown

Decarbonization under sharp focus

The Global Steel Dynamics Forum (GSDF), held from 26-28 June in New York, attracted a large turn-out of leading steel producers, their service providers and senior US politicians, underlining not only the importance of the event – it was being held for the first time in New York since the pandemic – but also the steel industry’s significance for the US economy.

By Manik Mehta*

By Manik Mehta*

IN

steel,” he averred.

Ron

the executive director of the Association for Iron and Streel Technology (AIST), which co-organized the event with World Steel Dynamics, said that North America accounted for some 22% of total global steel production. World steel production in 2022 amounted to some 1.9 billion tons, of which North America’s share was 111Mt – a decline of 23% over the previous year.

According to Ashburn, decarbonization was of concern to the steel industry, though he was confident that America would continue to lead in the production of ‘clean steel’. “America can show the world its latest technology and how to make clean

Ashburn also spoke of the ‘very favourable policy’ US administrations had pursued – both the previous administration of President Donald Trump and the current President Joe Biden – underscoring the significance of steel. “America’s future has looked good … it looks better today,” he said.

Taking the lead on decarbonization Decarbonization is the mantra to be followed by the US steel industry.

According to steel industry representatives at the GSDF, a regulation being proposed by the Federal Acquisition Regulatory Council (FARC) would make it mandatory for

*USA correspondent

companies receiving more than $7.5 million in orders annually to disclose greenhouse gas emissions from their business and supply chain.

Firms that contract business above $50 million would also be required to disclose emission levels, conduct a climate risk assessment and set non-binding greenhouse gas reduction targets. But there are some who oppose such mandatory disclosures. Indeed, US Senator Joni Ernst (R-LA) has voiced her opposition to the regulation, cautioning that monitoring supplier emissions will adversely affect even the smallest of contractors.

“If a small business owner determines there is no business case for staying in or

CONFERENCE REPORT 16 www.steeltimesint.com September 2023

his speech opening the conference,

Ashburn,

entering the federal marketplace due to the high regulatory burden, they will leave the federal marketplace altogether, leaving fewer vendors capable and willing to meet government’s needs,” she maintained in a letter she wrote in February.

Ashburn moderated three technologyfocused panel discussions. In one of the panels, Ashish Gupta, chief strategy officer of Primetals Technologies, and Olivier Randet, corporate vice president

of Air Liquide, gave their insights on the question of technology in decarbonization. Gupta noted that projections for global steel production made by various trade associations and government and financial bodies, varied widely between 1.5 and 3 billion tons by 2050.

Randet underscored that the DRI process is the most effective way to transfer hydrogen which is an important element for the steel industry. His assessment was that 70% of steel production in the US is based on scrap.

The importance of scrap

The domestic US steel industry recycles millions of metric tons per year of steel cans, automobiles, appliances, construction materials, and other steel products. The primary source of obsolete steel is the automobile. The re-melting of scrap requires much less energy than the production of iron and steel products from iron ore. Consumption of iron and steel scrap by re-melting reduces the burden on landfill disposal facilities and prevents the accumulation of abandoned steel products in the environment.

Brad Davey, ArcelorMittal’s executive vice president, underscored the importance of scrap and steel recycling in the future, with scrap material accounting for half of global steel demand by 2050.

‘Steel will be made in different ways’ Blast furnaces and direct reduction will also be employed, he said, but the industry would use technologies that recirculate existing carbon instead of unlocking stored carbon. One such project, he said, is ArcelorMittal’s Torero project which converts wood waste and end-of-life plastic into bio-carbon. There were several ways for the industry to reduce carbon emissions,

CONFERENCE REPORT 17 www.steeltimesint.com September 2023

“It is important for this part of the world to be recognized for its lowest carbon steel production.”

Philip Bell, president, Steel Manufacturers Association

“

I see a lot of positive moments in terms of growth, demand and production in the US steel industry in part to meet increased demand for steel for clean energy projects.”

Kevin Dempsey, president, AISI.

but ‘steel will be made in different ways in different parts of the world,’ he contended.

Speaking on the sideline, Olivier Randet told Steel Times International that Air Liquide, a leader in industrial gases, was ‘firmly committed’ to climate protection, and provided technology and services for the cause of decarbonization. “Our biggest markets are the steel, chemical, energy industries … we cater to 76 countries around the world and we are market leaders in the United States,” he said. Air Liquide, which is headquartered in Paris, France, operates a regional office in Houston, Texas.

“Hydrogen is today produced from hydrocarbon … we are actively processing hydrogen from carbons. The DRI process operates with the use of hydrogen,” Randet said.

Later, in his presentation about the global steel industry, Jeong-Woo Choi, chairman of the World Steel Association and CEO of South Korea-based POSCO Holdings, said renewable energy was an important element in steel production. He expected dual technologies to become widespread by 2050, ‘on the condition that hydrogen is abundantly available by then’. He said that renewable energy demand would skyrocket.

Asian steel makers, said Choi, had prepared roadmaps for a 22% reduction of emissions by 2035.

Citing POSCO’s example, he said that his company has a production of 40Mt of steel for which 7.3Mt of hydrogen were required. “We will need hydrogen in Australia, Middle East, India, etc.” he said.

Goncalves warns about Mexico

Lourenco Goncalves, CEO of ClevelandCliffs, Inc., said that two factors expected to drive growth in steel demand are vehicle electrification and massive investment which the US administration has signalled

it will make in the modernization and development of infrastructure.

Goncalves said that in his view batteryelectric vehicles and the facilities that are meant to support them, such as charging stations and electrical grid enhancements, and new infrastructure projects made possible by recent legislation, would benefit steel producers.

“The opportunities are there … demand is there,” summed up Goncalves who was bullish, in particular, about the automotive sector. With demand being ‘so fantastic’, he wondered that ‘the recession they have been talking about (is) nowhere to be seen if you look at the automotive (sector) and the employment (opportunities)’.

Nevertheless, Goncalves warned about attempts to circumvent trade laws and the USMCA (US-Mexico-Canada-Free Trade Agreement) content requirement by using Mexico to supply to the US. He was critical about suppliers taking the Mexican route –a veiled reference, perhaps, to attempts by some supplier countries, notably China, to make deliveries of government-subsidized, high carbon content steel to the US – and said that the ‘USMCA is being exploited. The ‘M’ (in USMCA) is not a license for

dumped things to come to the US through Mexico”.

US Sen. Joe Manchin, a West Virginia Democrat who chairs the Energy and Natural Resources Committee, said Congress and trade officials were keeping a close eye on the Mexico transshipment issue.

Despite the alleged transshipment of steel via Mexico, the USMCA, on the whole, had been a positive factor for North America and its steel producers, according to Alan Kestenbaum, executive chairman of Stelco Inc.

“The USMCA has been a resounding success,” he said. “Despite some holes, I think it is encouraging companies to come and invest millions and millions of dollars (in new North American facilities).”

Ternium’s CEO Maximo Vedoya, during his presentation, denied that Mexico had become a ‘transshipment capital’. He acknowledged that transshipments to the US via Mexico was a problem but not an exceptionally acute problem. “We know we have some problem (with transshipments) but the US has the same or bigger problems,” he said, trying to correct the view that Mexico was the “transshipment capital of the world”.

US Congressman Frank Mrvan, vice chairman of the Congressional Steel Caucus – Mrvan’s congressional district in Indiana is home to Cleveland-Cliffs’ East Chicago facilities – said that imports subsidized by foreign governments posed a threat to the US industry. He supported the bipartisan ‘Level the Playing Field Act’ which would allow the US International Trade Commission more flexibility in adjudicating cases and speed up the process.

“The bipartisan effort is to make sure that the steel industry continues to thrive,”

CONFERENCE REPORT 18 www.steeltimesint.com September 2023

Barbara Smith, chairperson/CEO of Commercial Metals Co (centre) receiving the Willy Korf/Ken Iverson Steel Vision Award.

Congressman Mrvan (second from left) receiving a plaque from Cleveland Cliffs’ Lourenco Goncalves (second from right) and flanked by Philipp Englin, CEO of World Steel Dynamics (far left) and Ron Ashburn, executive director AIST (far right).

Green steel

Nucor Corp’s chairman and CEO Leon Topalian said that the steel-consuming industries, particularly those producing higher-end product, were increasingly demanding green steel, a euphemism for the metal produced with the lowest possible carbon emissions.

Topalian seemed to be making a pitch for his own company’s product portfolio, saying that green steel had become important for Nucor’s line of products, considering that green steel was ‘incredibly important’, especially for automotive and higher-end manufacturers. “(These) segments are demanding cleaner and cleaner steels, and waiting for a true-net product,” he said.

He referred to Nucor’s green steel offering Econiq, which was launched in 2021. The first coil was delivered to General Motors in 2022, and the company expects to supply more than 1Mt in the next 12 months. “The segment is growing, and so is demand,” he said.

But producing green steel would also require skilled workers: steel producers were now looking for people who could make it, but the industry was unsure if those workers would be there, Topalian said.

This view was echoed later by Barbara Smith, chairperson/CEO of Commercial Metals Co., as she accepted the Willy Korf/ Ken Iverson Steel Vision Award presented to her at the GSDF. She said that recruiting a talented and capable pool of workers should become the steel industry’s priority, emphasizing that the industry had a ‘compelling case to make as a career choice’.

“We have a great story to tell about our technology-driven operations. We offer young people who increasingly want to

work for mission-driven companies and who are hungry to change the world, a unique opportunity unavailable to them elsewhere,” she said.

The US steel industry has been engaged in an internal debate on whether the country was engulfed in a recession, though there are presently no tell-tale signs.

adding that the medium and long-term economic outlook for the US is very bright.

Dempsey optimistic

Kevin Dempsey, president of the American Iron & Steel Institute (AISI), in an interview with Steel Times International, commenting on the current situation in the US steel industry, recalled that a number of forecasters at the start of the year talked about recession, slowdown, etc., “but I think… things are moving in the opposite direction and are getting stronger in the US industry. So, we see the numbers improve and we are optimistic for the rest of the year on growth and demand”.

Inflation

However, he acknowledged that inflation is a “very difficult issue and the Federal Reserve is very much focused on it. I think we see signs of inflation moderating, coming down to some extent … it’s not been fully tackled, so I think it is going to be a big challenge, but I think, again, things are generally moving in the right direction … and we’re going to see interest rates at the current (high) level or even a bit higher up, but overall I think it is still manageable. However, I think it will take longer than it was originally hoped to resolve it. The Federal Reserve and the other central banks are very focused on it (and) I think it’s going to be dealt with”.

Dempsey explained that he had highlighted the US industry’s plans on sustainability over the next decade.

Inflation has been at a peak for some time – it has, meanwhile, moderated slightly –but there are plenty of job opportunities. Indeed, some industries, starved of skilled workers, are willing to pay attractive compensation for those qualified.

Roy Sweet, chief US Economist at Oxford Economics, tried to put ‘things in perspective’. In his view, employers would be very reluctant to lay off staff unlike in the past when jobs were simply axed. He drew comparisons with 1980 stagflation which was ‘simply a nightmare’. “But now we have inflation while wages will also rise in keeping with rising prices. Today, we have a soft-landing recession. It’s a medium form of recession which is preferable to stagflation … In short, it’s not a severe recession, just a mild one. The economy is growing less quickly than expected. Demand for homes will be strong,” he said,

“I see a lot of positive moments in terms of growth, demand and production in the US steel industry in part to meet increased demand for steel for clean energy projects and other sustainability projects that are being spurred by the ‘Inflation Reduction Act’, but I did note that the one issue that still required work was to establish a new trade policy scheme that takes carbon intensity into account because the investments to decarbonize are very expensive and US industry is spending a lot on that,” he said.

Dempsey was worried about information gathered from presentations by Southeast Asian steel industry representatives, showing that there ‘is a lot of additional capacity in Southeast Asia that is very high emission-intensive; that steel will probably be very competitive on a cost basis and the fear is that if we don’t have tariffs to level the playing field, we could see new

Myvan said.

CONFERENCE REPORT 19 www.steeltimesint.com September 2023

Lourenco Goncalves, CEO of Cleveland Cliffs Inc (left) said vehicle electrification will drive growth in steel demand.

Olivier Randet of Air Liquide.

surges in low-cost but dirty steel from other regions that could undermine efforts at sustainability in terms of new investment in the US.”

Asked what he thought about US Congressman Frank J. Mrvan’s comments on subsidies for decarbonization for other countries, he replied that he did not recall what Congressman Mrvan had said, but felt that there are government efforts to incentivize decarbonization. However, he added that the incentives were, for the most part, being given not on an industryspecific basis, but in ways through the tax code that would benefit many different industries.

“In that sense, I don’t think they will be trade-distorting subsidies. The WTO rules generally distinguish subsidies that are specific to an industry that are considered trade distorting, and subsidies or government assistance that generally are available in the economy. I can refer to roads and bridges that benefit all businesses … what the Inflation Reduction Act provides for are tax credits to incentivize building of clean energy... solar, nuclear, hydrogen … but those are all things that are going to benefit not just the steel industry but also many other industries.”

He maintained that this would be helpful and encourage the move generally towards further decarbonization in the US, and were not intended as subsidies that provide advantage, from a trade perspective, to specific industries or specific companies.

The ‘Infrastructure Bill’ is designed to fulfill the requirements of using USproduced steel under the “Buy America” policy. The rider also includes money to promote the ‘Buy Clean’ policy where the government is looking to procure goods and will seek to buy the cleanest goods. “That’s designed to incentivize … to further move towards clean energy. It is designed to send a signal to the market about the government’s view on the importance of decarbonization,” Dempsey explained, adding that it will highlight the value of the environmental product declaration – EPDs – as a way to document the environmental performance of different steel products.

Nuclear energy?

Leon Topalian, vice chairman of the World Steel Association and CEO of Nucor Corp, had earlier talked about the use of nuclear energy in the steel industry. He said that the use of nuclear energy in the steel industry

was ‘very realistic’. But he clarified that this was not ‘the nuclear energy of bygone years’. Nucor had made its own investments in a particular company in the US that is building small modular reactors designed to be scalable and located at a particular plant to provide energy for that facility. The company is going through the approval process.

Asked about any risks in using nuclear energy, Dempsey said that there would be safeguards “and, besides, it will be on a much smaller scale than the very big nuclear power plants. I think it’s very exciting and it’s a great opportunity for steel and probably other industry, especially if you are building electric arc furnaces and you need a steady supply of clean energy,” he

said, predicting that small modular nuclear reactors will be game changers. One of the tax credits in the Inflation Reduction Act is for nuclear energy.

Amid the automotive industry’s move towards electric vehicles (EVs), Dempsey revealed that the AISI was undertaking research on how steel could be best used to make boxes that protect EV batteries. He said the AISI had one – unnamed –company producing electric steels essential for EV batteries and motors. “EVs are a huge growth area for steel and an important market.”

Dempsey was bullish about steel industry growth this year and next, citing benefits and incentives designed to promote the semiconductor industry.

He said it was difficult to say how long steel tariffs under Section 232 against steel imports would continue. The tariffs were imposed to tackle overcapacity, which is ongoing. “Earlier this year in March, the OECD steel committee reported that their estimates for global overcapacity for steel last year had increased from 517 million metric tons (mmt) to 632 mmt, an increase of 100 mmt in one year. Unfortunately, the problem of overcapacity is getting worse. That’s why we need those tariffs …. they are going to continue until we can get a handle on the problem,” he said.

Bell praises US low carbon steel Philip Bell, president of the Steel Manufacturers’ Association (SMA), while lauding government measures to prop up the steel industry, endorsed its policy to stimulate growth in supply and demand of steel.

In an exclusive interview with Steel Times International, Bell said that the ‘big takeaway’ from the panel he moderated at the GSDF was that North American steelmakers consistently produced the lowest carbon intensity steel in the world. “It is important for this part of the world to be recognized for its lowest carbon steel production and other parts of the world need to see how they emulate that,” he said.

Some Chinese steel representatives, in private conversations, called US trade policies ‘unfair’ – an obvious reference to US steel tariffs enforced since 2018 – and wanted to have these withdrawn. “In North America, we believe in free trade, but it has to be fair trade also. In the case of tariffs, the reason we have them is two-

CONFERENCE REPORT 20 www.steeltimesint.com September 2023

“America can show the world its latest technology and how to make clean steel.”

Ron Ashburn, executive director, AIST

Ryan Sweet, Chief U.S. Economist, Oxford Economics.

TECHNOLOGIES, INC. taylor-winfield.com +1.330.259.8500 Taylor-Winfield’s Technology is Unlocking Profitability in Finishing Lines More Data. Less Weld Breaks. Less Downtime. Weld breaks – and the related downtime – are the enemy of every finishing line. With the rising cost of raw materials and labor, downtime is getting more expensive. That is why steel producers are turning to advanced technology & machine automation o ered by Taylor-Winfield. Our coil

with the most advanced features in the world, all of which work

the line. The question isn’t if you can a ord to

to. Force, Current and Carriage Monitoring & Validation Veriweld ™ Weld Quality Verification Automatic Weld Parameter Download and Set Up Fully Automatic Machine Operation Smart Machine Compatible & Remote Connectivity Inline Pre & Post Weld Induction Heat Treatment More Profitability.

joining welders are equipped

together to virtually eliminate weld breaks in

upgrade or replace your coil joining welder, but if you can a ord not

fold: one, to prevent state-subsidized steel from flooding our market and, secondly, to reduce the amount of high carbon emitting steel that is coming to our market. When China exports subsidized state-owned high carbon steel, they are stealing jobs from North Americans and producing CO2 emissions that make our environment worse,” Bell explained.

Steel producers optimistic

Calling the present market conditions ‘pretty good’, Bell discerned some optimism among North American steel producers, with strong demand fundamentals and government policies as well as some legislation to support steel demand. The Infrastructure Investment and Jobs Act passed two years ago, and the Inflation Reduction Act should increase steel demand and help reduce emissions. “There are a lot incentives that are for solar, wind, hydro, electric vehicles, hydrogen hubs and all of those solutions to CO2 emissions involve steel. So I think we are really good. Other things like the Chips Act come into play as well as the Department of Energy’s decarbonization roadmap,” he said.

The Infrastructure and Jobs Act was aimed at using American taxpayers’ dollars to buy American steel – steel that is melted, poured and processed in the United States. “And that’s a good thing because the US is already the lowest carbon producer in the world … having this requirement will not only increase domestic steel demand but it will lower carbon emissions. So, this policy has a dual benefit,” he noted.

One of the subjects discussed at the GSDF conference was the production of light steel suited for use in EVs which need a special steel, but some analysts asked if the US can produce it in sufficient quantities.

“Yes, there is enough capacity as well as process technology for American steel producers to make every grade of steel that is needed for the growth of the electric vehicle market – whether that is advanced, light-weight high-strung steel for the exposed bodies of the cars, whether that is electric steel needed for the electric batteries. We are in a position to make all of it and we are adding state-ofthe-art capacity … that’s modernizing, decarbonizing and electrifying the domestic steel industry,” Bell replied.

Besides EV production, the construction industry is very promising, according to Bell. “As far as the end-user market is concerned,

keep in mind that 75% of steel goes either into construction projects or automotive manufacturing and both these sectors are looking good. We also see an increase in demand in advanced manufacturing –the type of manufacturing that requires state-of-the-art advanced high-strip next generation steel. I think all three markets are going to do very well.”

Quotas and tariffs

The Biden administration has negotiated a deal with the EU exempting it from blanket tariffs and, instead, allowing a quota system. If that quota is exceeded, such supplies would attract tariffs. Asked if similar arrangements could apply to Asian suppliers, Bell said that ‘remains to be seen’.

“The American market will always need a certain percentage of fairly traded imports. I am not naïve, I understand that. But the fact of the matter remains that those imports need to be fairly traded. They cannot be subsidized imports, they cannot be state-owned imports, they cannot be the result of global excess steel capacity,” he explained.

But Bell said that one under-reported

fact was that there ‘isn’t really as much steel subject to tariffs as people think. I want you to just think for a moment: when the (Section) 232 tariffs were put in place, very slowly the steel covered by 232 began to decline. You first saw it with the USMCA (United States, Mexico, Canada) agreement which basically meant that steel from Mexico and Canada were no longer subject to tariffs. Keep in mind that Brazil, Argentina and South Korea were all on quotas, not subject to tariffs but on quotas which allows them to export up to a certain volume.”

Robust exclusions process

The US, he emphasized, had a robust exclusions process which allowed a steel buyer, unable to source the steel domestically – either due to reasons of availability, lead times or quality – to apply for exclusions, and in most cases they did get it. Millions of tons of steel are subject to exclusions. “So between the USMCA, the quotas and the exclusions, a lot more imported steel got into this country without tariffs than people realize.”

On the continuing high inflation in the country, Bell admitted that there had been some inflationary pressures over the last couple of years but “we do see them moderating“. Most of those inflationary pressures were related to energy and food costs, not so much to steel or raw-material costs. “I think it is starting to moderate and I don’t necessarily think it will continue into the near future. So, we are cautiously optimistic that inflation will be under control in the US and North America and it won’t negatively impact the steel industry,” he said.

Asked if he agreed with the characterization of the ongoing economic scenario as a ‘recession with a soft landing’, as stated by one of the speakers at the conference, Bell replied that a ‘lot of pricing decisions in the US are based on market fundamentals and demand. If there is steel demand, steel producers will implement modest price increases and recently you saw this with most major producers. Also, the job numbers in the US … are actually pretty good’. The people were employed, they made good money and would buy steelintensive goods, whether that is housing, appliances or automobiles. “So, I think the soft-landing scenario is relatively accurate but, of course, none of us has a crystal ball. We cannot predict everything …” �

CONFERENCE REPORT 22 www.steeltimesint.com September 2023

[ State of the art Roll Texturing technology ]

The Multi-Servo Array EDT delivers unrivalled roll texture control and consistency. The informed choice for surface critical strip. First orders secured. Please enquire below for further information.

[ Rollscan Roll Inspection ]

Surface to core roll inspection for back up and working rolls in hot and cold mill applications. A choice of units to meet your needs, backed by local engineering, service and support.

[ Strand Condition Monitors for Continuous Casting ]

sales@sarclad.com

sales@sarcladna.com

sales.china@sarclad.com

sarclad.india@sarclad.com

Sarclad is your proven partner for a bespoke solution for your caster. In-Chain and off-line SCM solutions available. Please enquire below. sarclad.com

RolltexMSA

Italy, Germany, Sweden, Austria, France, The Netherlands, UK, Spain, Turkey, USA, Brazil, Thailand, India, China, Japan

DAN IELI T R U E GRE EN ME T A L

MIDA–QLP QSP–DUE

in Buttrio,

www.danieli.com

Buy the Original

Danieli Headquarters

Udine, Italy

@danieligroup

MIDA–QLP and QSP–DUE are the winning Danieli direct-rolling technologies for the most competitive production of long and flat green-steel products.

They are the result of the research and continuous improvement profused over 20 years, along with multi-million dollars of investment. Their unmatched performances have fueled their success worldwide, thanks to lower resource consumption and carbon emissions, unbeaten OpEx, and outstanding product quality.

So, top technology becomes copied technology, the shortest route for competitors that, abandoning their solutions, now try to imitate MIDA–QLP and QSP–DUE Equipment and layout may be copied, but experts know that details make the difference. Automation and process solutions are not easy to copy, and this will be the experience of anyone trusting in those imitations.

The competitive advantage for our customers, obtained by field results, is the best defense for our technology – more than court rulings protecting our patents.

Danieli offers the best guarantees for speedy learning curves, steady performances, and now Digital Plants with no men on the floor. Buy the Original.

GIANPIETRO BENEDETTI CHAIRMAN OF THE BOARD OF DIRECTORS

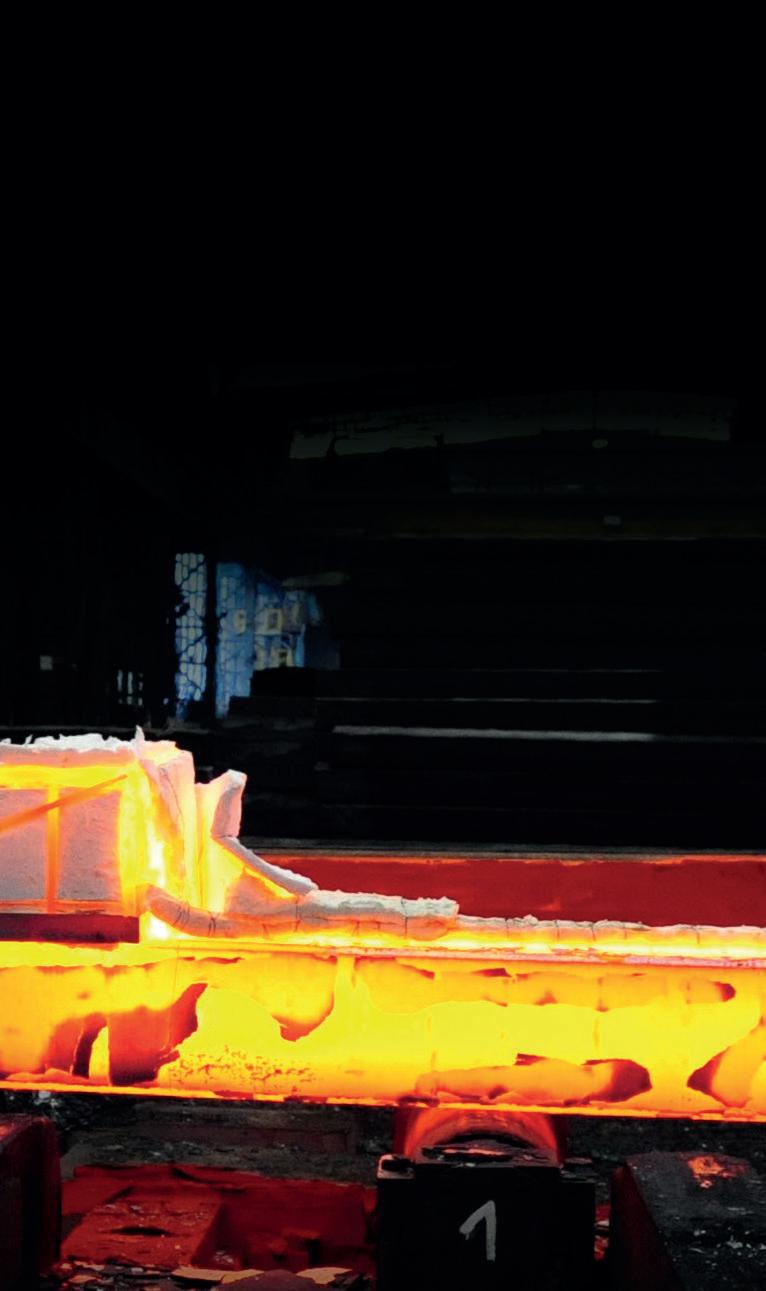

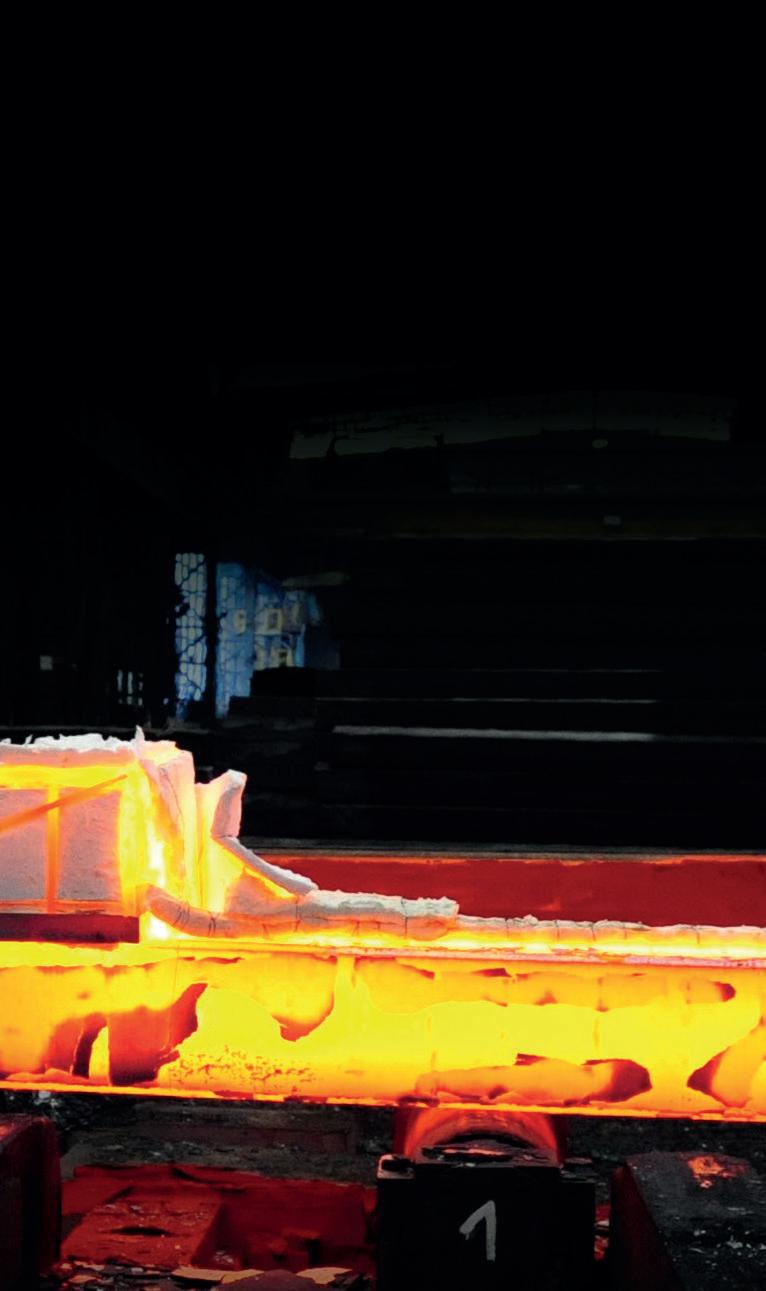

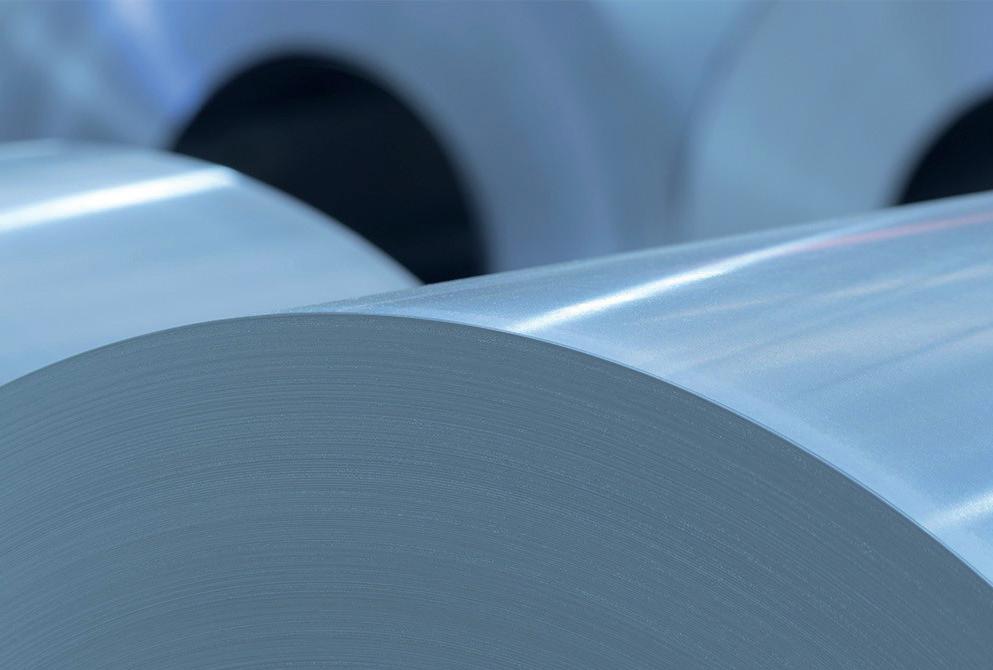

Ovako – Sweden’s largest producer of green hydrogen

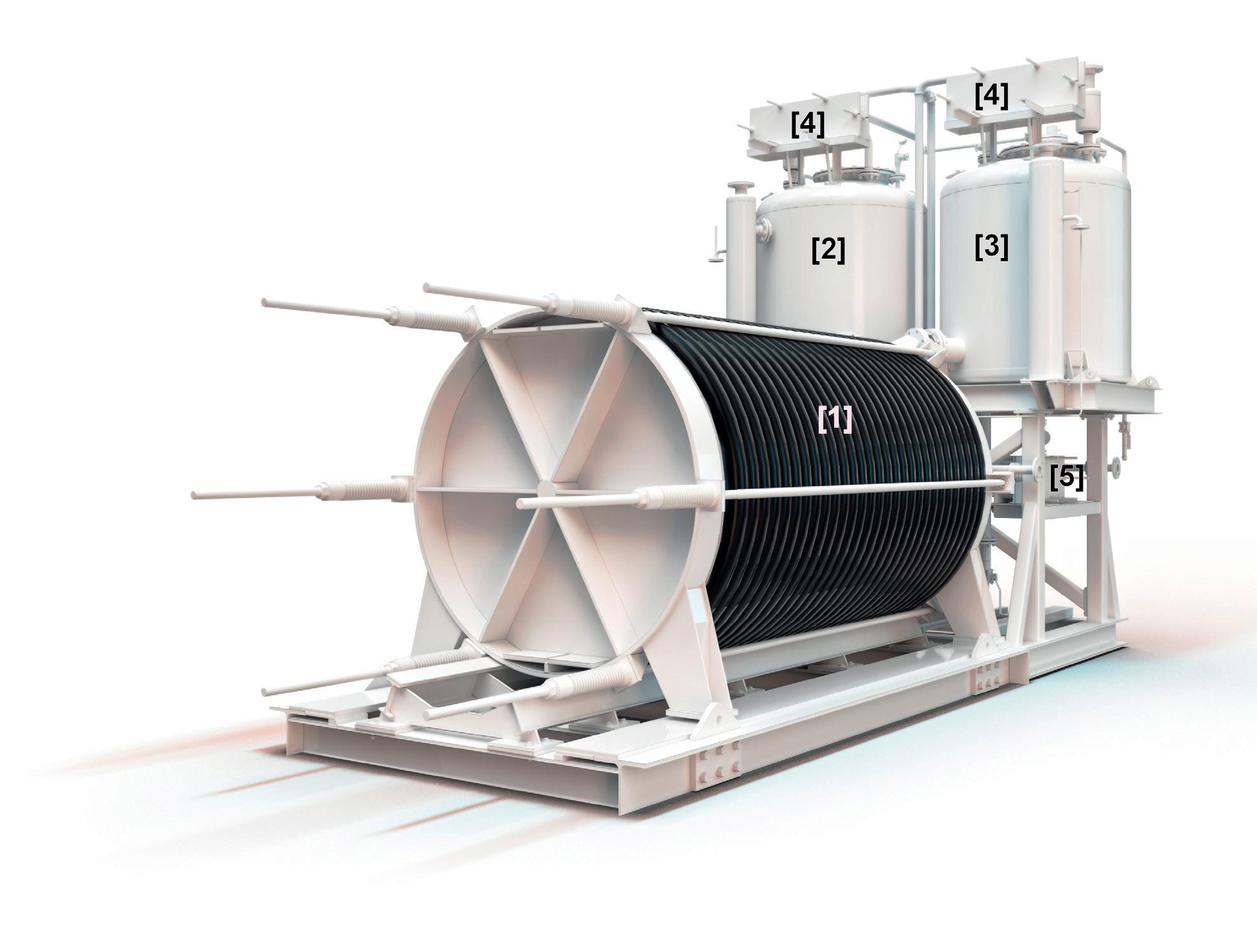

The world steel industry accounts for between 7-8% of global CO2 emissions, hence alternatives to fossil-based fuels are being sought to lower the carbon footprint of steel production. Hydrogen produced from renewable electricity is a fossil-free alternative which is actively being developed as an alternative fuel and reductant. This article is the result of a visit to Ovako’s Hofors plant where an eight tonne per day hydrogen plant is nearing completion.

By Tim Smith*

OVAKO specializes in the production of high-quality long products by the electric arc furnace (EAF) route using 100% scrap steel as its raw input. The Group was formed in May 2005 by the merger of bearing manufacturer SKF Hofors steelmaking plant, Fundia’s steel plant at Smedjebacken – both in Sweden – and Rautaruuki’s Imatra Steel in Finland. In

addition to these three steelmaking plants there are a further six processing plants. The Group members, which have a heritage of steelmaking stretching back some 500 years, was acquired by Nippon Steel Sumitomo Metal Corp in June 2018 and grouped with their specialist steelmaking division, Sanyo Special Steels. A profile of Ovako and a description of their steel

*Consulting editor, Steel Times International

products was published in Steel Times International April 2019 pp42-48.

The company has one of the lowest carbon footprints for steel production in the world. In 2020, the carbon footprint to cast steel from its three steelmaking sites ranged from 60kg/t at Smedjebacken, through 80kg/t at Imatra and 124kg/t at Hofors. This compares with an average for

DECARBONIZATION 26 www.steeltimesint.com September 2023