A BUSINESS INTERACTION PUBLICATION Volume 9 | Issue 1 | January 2023 R65.00 Incl. VAT 9772411292008 23008 Information | Innovation | Inspiration | Transformation Leon Meyer: COVER STORY Reinventing the African hospitality sector 2023 South African economic outlook African tech startups Boosting performance of City of Cape Town’s success Alderman James Vos: 6ways to maximise ROI SA mining industry Future technologies driving

A new year generally implies a fresh start. There are new recruits (graduates), people have changed jobs or joined new industries, and people are more energised after a holiday break.

That being said, it’s been a challenging few years for many businesses, and there has also been some political turbulence and ongoing load-shedding, as witnessed towards the end of 2022.

As 2023 kicks-off it is imperative that businesses continue on the path of flexibility – realistically loadshedding is now a norm in South Africa, and we have to be smart to ensure that we all have plans in place to help mitigate this.

But it’s not just about load-shedding – people have changed, and business has to be sensitive to this. Employers need to be flexible with employees if they want to ensure retention.

Many businesses had not fully recovered from the pandemic before load-shedding returned with a vengeance. Added to this, the cost of living has increased dramatically. Unemployment remains a serious concern, however, employees seem to be more aware than ever before of their mental health and needs, such as growth and study opportunities.

If businesses are inflexible, this could negatively impact growth prospects. I think that 2023 could be a year of opportunity, but we have to be cognizant of the realities. Looking around and having engaged with many people, when I sit back I realise that we have incredible talent in our country. South Africans are smart, resilient and innovative, but they just need the platforms and opprtunities to thrive.

Wishing you and your teams a prosperous year of growth and innovation!

2 sabusinessintegrator.co.za

Tashne Si n gh

Tashne EDITOR’S NOTE Follow us... For print and digital advertising packages in SOUTH AFRICAN BUSINESS INTEGRATOR Contact Elroy van Heerden-Mays elroy@sabusinessintegrator.co.za South African Business Integrator @SABImagazine 021 424 3625 Seizing opportunities in 2023!

Out of this world web services Boost your business with cutting edge server technology that offers up to 20x the web-host speed and around the clock security. All the tools your website needs to thrive. Web Hosting Plans Basic R 65 /month 5GB Standard R 105 /month 10GB Advanced R 175 /month 25GB Master R 325 /month 50GB Visit www.ixist.co.za and sign up today Services include domain registration and web hosting support@ixist.co.za

4 sabusinessintegrator.co.za 8 Cover Story Reinventing the African hospitality sector 12 City of Cape Town’s success due to resilience of people and agility of businesses 18 South African economic outlook 2023 24 New guidelines aim to capture more notifiable mergers 26 Interoperable real-time payments draws closer 28 Advertorial – Youth Employment Service: Transform your business. Change youth lives 30 Boosting performance of African tech startups 34 A data breach can sink an SME 36 Advertorial – Aims International: Top tier executive search 38 Subsea cable connectivity: the key to accelerating digital transformation 40 Advertorial – MTN: Sharing is caring, and the road to a great digital future 42 Shattering the glass ceiling CONTENTS 30 24 12 44 Increase in insurance claims by incapacitated employees 46 Advertorial – NMG Benefits: Here’s how to plan for healthcare costs in retirement 48 Advertorial – NMG Benefits: Here’s how to increase your financial literacy 50 Are electronic product producers compliant? 44

52 Advertorial – Atlantis SEZ: Atlantis SEZ driving sustainable development and job creation 56 Sustainable short sea shipping – the way forward for SADC 58 6 ways to maximise ROI with real-time transport visibility

Unpacking SA’s agri international free trade agreements 68 Food: inflation, security and the gathering storm 72 Expropriation Bill will kill the necessary business of land speculation 74 SA’s shift to renewable energy must include plans for waste disposal 76 An alternative hydrogen beneficiation pathway 78 Dynamics of the local energy market and JUST transition 82 Mining companies need to adapt to a greener economy 86 Economic progress versus carbon footprints 90 Future technologies driving the mining industry 94 Promoting sustainable opportunities linked to mining

CONTENTS 5 sabusinessintegrator.co.za 82 76 62

62

6 Carlton Crescent, Parklands, 7441

Tel: 021 424 3625 Fax: 086 544 5217

E-mail: info@sabusinessintegrator.co.za Website: www.mediaxpose.co.za

Disclaimer: The views expressed in this publication are not necessarily those of the publisher or its agents. While every effort has been made to ensure the accuracy of the information published, the publisher does not accept responsibility for any error or omission contained herein. Consequently, no person connected with the publication of this journal will be liable for any loss or damage sustained by any reader as a result of action following statements or opinions expressed herein. The publisher will give consideration to all material submitted, but does not take responsibility for damage or its safe return.

PUBLISHER

Elroy van Heerden-Mays elroy@mediaxpose.co.za

EDITOR

Tashne Singh editor@sabusinessintegrator.co.za

SUB-EDITOR

Tessa O’Hara tessa.ohara@gmail.com

CONTENT MANAGER

Wadoeda Adams artwork@mediaxpose.co.za

DESIGNERS

Anja Bramley artwork1@mediaxpose.co.za Shaun van Heerden-Mays artwork2@mediaxpose.co.za

EDITORIAL CONTRIBUTORS

Dirk Mostert Dr Christie Viljoen Elisha Bhugwandeen Daryl Dingley Matone Ditlhake Linda Page Stephen Rushton Mpiyakhe Dhlamini

Aradhna Pandarum

Nirvasha Singh

Carryn Alexander

Jaqui Pinto

Giada Masina

Garyn Rapson

Lizle Louw Garth Zietsman

ADVERTISING SALES MANAGER

Rashieda Wyngaardt rashieda@sabusinessintegrator.co.za

ADVERTISING SALES Hester Kleynhans hester@mediaxpose.co.za

MEDIA PARTNERSHIPS

Maurisha Niewenhuys maurisha@mediaxpose.co.za

DIGITAL MARKETING MANAGER Jay-Dee van Rensburg digital@mediaxpose.co.za

SOCIAL MEDIA CO-ORDINATORS

Kyla van Heerden social@mediaxpose.co.za Ketsia Makola ketsia@mediaxpose.co.za

DISTRIBUTION & SUBSCRIPTIONS

Shihaam Gyer distribution@mediaxpose.co.za Sherwin Kastoor sherwin@mediaxpose.co.za

CHIEF FINANCIAL OFFICER

Shaun van Heerden-Mays shaun@mediaxpose.co.za

WEBSITE DEVELOPER/ADMINISTRATOR

Justin McGregor justin@mediaxpose.co.za

RECEPTION

Daniëla Daniels receptionist@mediaxpose.co.za

Image credits: 123rf.com A BUSINESS INTERACTION PUBLICATION Volume 9 Issue 1 January 2023 R65.00 Incl. VAT 9772411292008 23008 Information Innovation | Inspiration | Transformation Leon Meyer: COVER STORY Reinventing the African hospitality sector 2023 South African economic outlook African tech startups Boosting performance of Alderman James Vos: 6ways to maximise ROI SA mining industry Future technologies driving South African Business Integrator VOL ISSUE January 2023 www.sabusinessintegrator.co.za economy for growth and creation. scheduling of the company renewable energy sectors of of green technology promotion of resource efficient Special Economic Company Cape, your investment is sure manner. world’s green technology well as fruitful business community. Green skills the ASEZCo’s strategic grow the regional economy remains at the heart of what economy in a meaningful and economy manufacturing, top of its agenda. economy South African Business Integrator @SABImagazine

BY A BUSINESS INTERACTION PUBLICATION CTP printers CAPE TOWN Media Support | On the Dot

DISTRIBUTION PUBLISHED

IMAGES

CREDITS 6 sabusinessintegrator.co.za

Reinventing the African hospitality sector

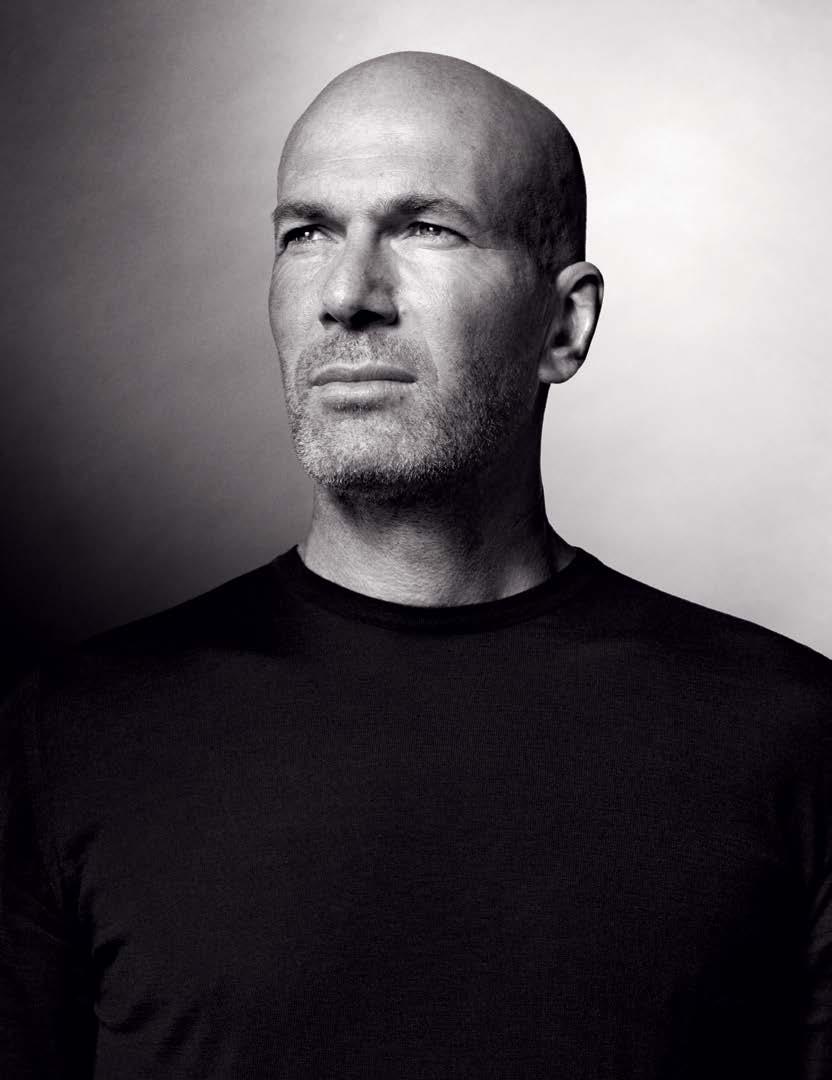

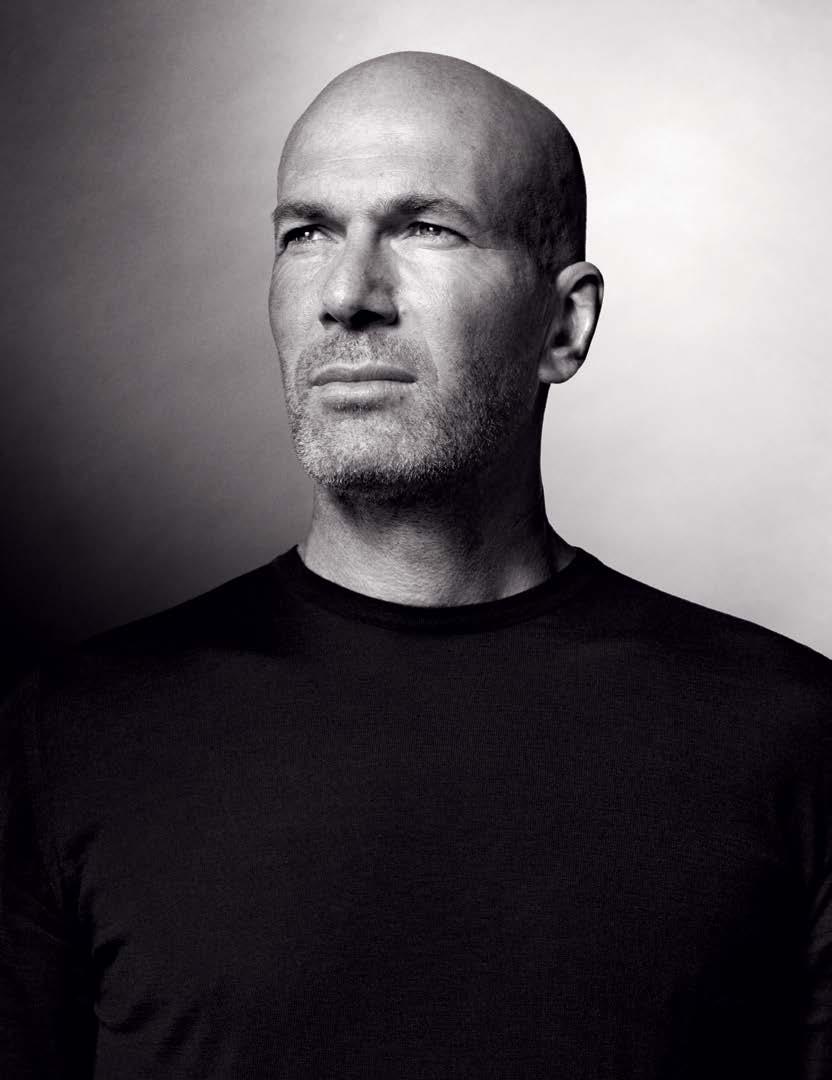

The iconic 5-Star Cape Grace Hotel (Cape Town, Western Cape), under new ownership and management, heralds positive investment for the sub-Saharan region. Leon Meyer, General Manager of Cape Grace Hotel shares some insights pertaining to this investment that will most certainly have a ripple effect in Cape Town and even beyond the borders of South Africa.

Unlocking opportunities to rise to even greater heights

“In 2022 the Cape Grace underwent an ownership and management change. Cape Grace was aquired by Kasada Capital Management, which is an independent investment platform within the

Kasada Group, dedicated to hospitality in subSaharan Africa. The firm was launched in 2018 with the backing of Qatar Investment Authority, the sovereign wealth fund of the State of Qatar, and Accor, a world leading augmented hospitality group,” says Leon Meyer, General Manager of Cape

8 sabusinessintegrator.co.za COVER STORY

Grace Hotel.

“While already an iconic fixture on the V&A Waterfront and having been voted as one of the ‘Top Luxury Hotels’ on the continent and the ‘Best City Hotel in Africa’, the new ownership brings about a new opportunity for Cape Grace to rise to even greater heights as a result of being the beneficiary of the Kasada Group’s and Accor’s expertise,” comments Meyer.

Daring reinvention to realise the vision

“Cape Town deserves a truly iconic luxury property and who better than Accor to achieve this in the light of their proven track record with other highend luxury hotel and hospitality brands such as Raffles, Fairmont Hotels and Resorts, Sofitel, Sofitel Grand, Orient Express & Emblems and Banyan Tree. The Group will strive to amplify luxury hotel experiences through a distinctive collection of unrivaled hotels under the Accor Luxury brands banner within the Western Cape and beyond,” says Meyer.

“Taking into account the bold vision the Kasada Group has for the region, the Accor Group is wellplaced as this kind of daring reinvention is part of the Accor DNA. For more than half a century, Accor has continuously been reinventing the hospitality business by making daring moves, challenging the status quo, and responding to global shifts as well as guests’ evolving needs. They do this through instilling the same values into the heart of the organisation and the more than 230 000 women and men who form part of its global reach. Accor works tirelessly to build a reputation as an employer of choice that empowers and supports its people. Team members at Cape Grace will benefit from the same philosophy that will cascade to all touchpoints. But they are not the only ones who will benefit. Accor’s business and performance are closely linked to those of its partners, the suppliers and owners of Accor establishments operated

under management and franchise contracts. This describes a wider arc of responsibility and commitment,” continues Meyer.

Embracing ESG values

Well-known for its tasteful elegance with regard to its aesthetic, Cape Grace is set to mark a new chapter in its history. “While being cognizant and staying true to the rich legacy, cultural essence and authenticity of Cape Grace, we will be undertaking certain renovations with the view of obtaining the EDGE green-building certification,” says Meyer.

According to Olivier Granet, Kasada's Managing Partner and CEO of Kasada Group, "Our value creation strategy will be driven by our sustainability values and highest ESG standards for the benefit of our guests, employees and local communities."

Meyer adds, “The Accor Group is committed to guaranteeing not only a quality offering and worldclass service but also a high environmental and social ethic, constantly forging strong bonds around sustainable development issues so that guests can enjoy a more responsible hotel experience. Zero carbon, zero waste, recycling, and controlled water consumption are just a few of the targets that Accor has set for all its properties. While there are changes planned, these seek to enhance and do not detract from our commitment to luxury and the ultimate guest experience.”

Challenges, lessons learned and looking ahead

Reflecting on the challenges of the past few years, Meyer notes that the Covid-19 pandemic left deep scars on the industry, which is now perceived as an ‘unreliable’ sector for employment or career prospects.

He comments, “Looking at the impact, some hotels had to open in phases due to the lack of business demand or having been reliant on international travellers who are not yet back travelling

9 sabusinessintegrator.co.za COVER STORY

to long-haul destinations. Globally our clients have been disrupted and the global cadence for travel is still in the process of being reset. Granted the view at the beginning of Covid-19 was a recovery in 2025 or beyond to 2019 levels. However, we have seen that around the world, holistically speaking, results in Q3 & Q4 2022 are better than 2019 – supported by a strong pipeline entering 2023.

“Liquidity presents itself as an immediate challenge for hotel owners and operators who remain laser-focused on understanding cash flow management and the importance of accurate forecasting. Realistically, the cost of running businesses remains eye-watering compared to just 3 years ago! The pressure that poor planning and government infrastructures place on business makes it challenging when one takes into consideration the increase in labour cost, fuel prices, basic food items and then the issues we are having with electricity supply and loadshedding daily.

“We also saw a shift in consumer behaviour –Covid-19 ushered in an unprecedented level of channel switching and brand loyalty disruption. In general terms 75% of consumers tried new shopping behaviours, with many of them citing convenience and value. A large percentage, mainly Gen Z and Millennials, deserted trusted brands for new ones. That means we as big hotel brands need to be relentless in making sure we communicate well to our younger consumers and underpin our hotel brands commitment to reflecting their values.

In conclusion, Meyer says, “As hotel leaders, we need to make sure that our hotels are known

for truly looking after our employees and that we are seen as an employer of choice. For me, this is a principle I will be focusing on at Cape Grace, and success will mean that we need to make sure we look after the local communities we serve, focusing on sustainability and our commitment to ESG and finding that sweet spot where we can be driven, successful in running our properties but importantly do so whilst having a lot of fun.”

Cape Grace Awards

Consistently rated as one of the top hotels globally:

• Best Hotel in the World/World’s Best City Hotel/ Best Hotel Africa and the Middle East/ Best Hotel South Africa: Travel and Leisure Magazine’s World Travel Awards

• Best Hotel in the World/ Best Hotel in Africa: Conde Nast Traveller Awards

• 2nd Best Hotel in the World; Top Hotel with Exceptional Service in South Africa; Top luxury Hotel Africa; Top Hotel South Africa: Tripadvisor Travellers Choice Awards:

• Best Hotel in Africa & Indian Ocean: Ultratravel (US & UK Poll)

www.capegrace.com

10 sabusinessintegrator.co.za COVER STORY

Travel & Leisure Magazine World Travel Awards 2022 Voted Best City Hotel Africa

City of Cape Town’s success due to resilience of people

and agility of businesses

What do you attribute Cape Town’s continued progressive economic growth to?

Cape Town’s success is due in large part to the resilience of our people and the agility of businesses in the region. Innovation is at the heart of everything we do. The City works hard to establish a collaborative, forward-looking environment where big companies, as well as entrepreneurs and small start-ups, thrive.

We’ve spent substantially on IT infrastructure, particularly the rollout of fibre-optic cable; have initiatives to make doing business in the city easier; and fund and promote skills development programmes.

One of our flagship projects is The Business Hub initiative, which provides practical solutions to simplify starting and developing a small business.

On a practical level, the metro’s physical infrastructure, stable government, and fibreoptic telecoms make it a sensible destination for businesses to establish their operations. International companies benefit from the large pool of available skilled professionals and the relatively low labour and living costs.

In addition, Cape Town is the only metro in the country able to protect City customers from up to two stages of Eskom load-shedding, a huge help

12 sabusinessintegrator.co.za

The City of Cape Town’s Mayoral Committee Member for Economic Growth, James Vos, talks to SA BUSINESS INTEGRATOR about current and future plans for the city.

Q&A

for businesses. Between February and July 2022, the city protected its customers from 722 hours of load-shedding in total. To sustain this, we have also recently announced the construction of a solar megawatt plant in Atlantis, with more planned for other parts of the city.

How does tourism link in with driving other business growth opportunities?

Travel connects the world and through specific tourism markets, we are unlocking economic opportunities in the metro. We invest in platforms that increase our aviation profile because this is critical to international trade. For a similar reason, we work to raise Cape Town’s brand as a cruise destination because of the business it creates in terms of ship maintenance, the hospitality sector, and other downstream and upstream markets.

This is also the case for our MICE (meetings, incentives, conferences, and events) profile. Travellers might visit for the wines or the beaches, but investors stay for the opportunities. Through tourism, a local delicacy becomes a global trend; a design goes from Khayelitsha’s streets to London’s catwalks; or investors realising the potential of Atlantis’s green-tech developments, go from curious, to signing on the dotted line. Thus, more livelihoods are sustained.

We’ve worked hard to promote Cape Town as a world-leading city, and the perfect place to visit, live, work, study, play and invest – supporting a healthy work-life balance.

What is the City doing to enable SME growth in the tourism sector?

The City of Cape Town offers several programmes to support and encourage SME growth. One such support service is the City’s Business Hub, established to provide practical solutions to simplify starting and developing small businesses.

Through a single point of access, we help SMMEs to navigate various processes and reduce possible red tape they may encounter. We also host skills

development workshops for entrepreneurs across industries.

In addition, Cape Town Tourism, the City’s official destination marketing organisation, has rolled out a Neighbourhood Experience Development training manual to help guide SMEs in developing their businesses, and to encourage neighbourhood readiness for travellers. They also host regular workshops and networking sessions for their 1 000+ members. These platforms in turn help businesses to sustain and grow.

What do you feel are the major challenges from a tourism perspective?

Challenges on a global and macro-economic level include the geo-political situation in the Ukraine and the economic constraints in our key source markets due to rising fuel and energy prices.

Diminishing disposable income and the movement from long haul tourism purchases into a luxury purchase may dampen the demand in the short term.

Macro political challenges include the slow progress in terms of an e-Visa, as well as red tape hampering fast turnaround time on applications and approvals. On a micro level, our challenges are to ensure water and energy resilience.

To this end, the City has embarked on the rollout of an extensive Resilience Strategy to ensure that we achieve our growth and sustainability objectives. The strategy, developed in partnership with 100 Resilient Cities, was the outcome of significant engagement with stakeholders across Cape Town and followed an extensive resilience evaluation that attempted to identify the most critical vulnerabilities and the most relevant shocks.

Key opportunities are vested in property developments that range from hotel investments, both in management contracts and property acquisitions as well as new built properties.

With the increase in airlift and rapid growth in

13 sabusinessintegrator.co.za

Q&A

the cruise industry, e.g., the bounce back postCovid currently surpassing 2019 peak season figures for 2022/23, affiliated services are unlocked in retail, freight forwarding and technical services.

Our events calendar is also picking up momentum and we see a keen interest in Cape Town for conventions and general business tourism. Our international airport also has an extensive expansion plan, and this brings about opportunities in construction and affiliated services.

What are some of the key sectors and projects in the pipeline that the City is pushing to usher in further development?

To ensure further development, the City has recently approved the Inclusive Economic Growth Strategy (IEGS) for Cape Town. This plan, which is a successor to the 2013 Economic Growth Strategy, will serve as the foundation on which the City will further develop the economic growth systems, and create economic opportunities for more citizens.

It recognises that Cape Town comprises diverse industries that provide a range of job and growth opportunities, from clothing and design, to call centres and green energy, marine manufacturing and information technology.

By collaborating with our many valued business partners to support and grow these industries, the City has secured billions of rands in investments, created employment opportunities for thousands of people, and helped to improve the prospects of thousands more through work readiness training. Through the IEGS, the City will expand on this work, and breathe more life into these and other economic growth and opportunity-creation mechanisms.

Ongoing initiatives include the Ease-of-doingbusiness Programme, which focuses on creating an enabling business environment; the Workforce Development Initiative, to create training and employment opportunities for Capetonians; and the Growth Coalitions Project.

There has been sustainable responsiveness calls for collaborative partnerships between all sectors – government, business, communities and academia in the form of growth coalitions within Cape Town’s most high-value industries. These structured and outcome-driven stakeholder engagements are critical for sharing knowledge, planning and implementing together, ensuring alignment for the realisation of growth opportunities and resolution of challenges.

One of the most important matters that I have advocated for is the reduction of red tape, which stifles foreign investment and growth of local businesses.

As part of our plan to drive foreign investment into Cape Town, the City has established a special Investment Facilitation Branch (IFB) within the Enterprise and Investment Department dedicated to helping businesses of different sizes, across industries, land and expand their operations in Cape Town.

Since its establishment in 2017, the branch has engaged hundreds of businesses and has assisted more than 20 companies, unlocked investments worth billions of rand and created thousands of job opportunities.

Tell us a bit about the City’s plans regarding renewable energy investment.

Our goal is to take full advantage of the solar and wind energy opportunity, while simultaneously empowering Capetonians with job and business opportunities in a market that is booming.

In the green-tech sector, the City works closely with partners such as the South Africa Renewable Energy Business Incubator (Sarebi) and the Atlantis Special Economic Zone Company (AsezCo) to enable small businesses and individuals with knowledge and skills to create meaningful opportunities in this market.

14 sabusinessintegrator.co.za Q&A

To what extent is Cape Town’s reputation as an investor-friendly city driving fintech?

Cape Town is home to Africa’s oldest tech incubator, the Cape Innovation and Technology Initiative (CiTi), through which over 3 000 entrepreneurs have been trained.

The City’s partnership with CiTi, the Western Cape Government, and Wesgro – the Trade and Investment Promotion Agency – has ensured over the years, that efforts to improve and strengthen the business environment produce the successes that are seen today.

It is by no accident that the Western Cape is home to 47% of South Africa’s tech start-ups.

Another important point to mention is that Cape Town accounts for 75% of South Africa’s venture capital deals – this is a clear indication that Cape Town is doing something right.

Maintaining current infrastructure and rolling out future projects, such as current efforts of reducing reliance on Eskom, make a great investment case for the region.

What are three key aspects to drive growth in the city?

During my time in government, I have learned that empathy, collaboration, innovation and consistency are key to growth.

With empathy, we listen to our communities so as to understand their needs and then respond to it. Through collaboration, we successfully enact programmes that drive change and empower people. With an innovative mindset, we can better respond to shocks and trends.

What does the future of Cape Town look like?

Our goal is to position Cape Town as the easiest place to do business in Africa. The City is committed to increasing jobs and investment in

the Cape Town economy by simplifying regulations and processes so that it is easy for businesses to start and grow.

We want to create an economy of hope and confidence in Cape Town. Our objective is not to compete with other municipalities, but to prove that it is possible to have a city in South Africa where anyone’s dreams of success can be realised. We have had numerous engagements with other municipalities, where we’ve shared ideas. We are working towards the same goal: a better South Africa for all who call her home.

I have to be a champion for Cape Town because of my job but engaging with people in every corner of this city makes me feel invigorated and I want to be a champion for Cape Town. The future of Cape Town is bright because we are making it so.

James Vos

James Vos is the Mayoral Committee Member for Economic Growth in the City of Cape Town. With a portfolio that covers matters of trade, tourism, investment, and business support, James heads up a team that is instrumental in driving meaningful economic opportunity in Cape Town.

During his time as a public representative, when he also served as a Ward Councillor, Member of Parliament and Shadow Minister of Tourism, James received numerous civic awards, including the International Merit Award.

He is also among the youngest public servants to receive the life title of Aldermanship. James believes that the most powerful instrument for improving the quality of life and create jobs is economic growth. To achieve this, his mission is to drive travel and trade to Cape Town and make the metro the easiest place to do business.

15 sabusinessintegrator.co.za Q&A

MANUFACTURING CITY

CAPE TOWN, WHERE GREEN ENERGY, MANUFACTURING AND SKILLS WORK TOGETHER.

Cape Town is an established manufacturing base, offering excellent transport connectivity and port infrastructure for exporting to the rest of Africa and beyond.

www.investcapetown.com

South African

economic outlook 2023

By Dirk Mostert and Dr Christie Viljoen of Strategy &, Part of the PwC Network

With global inflationary pressures and related headwinds expected to last into 2023, South Africa will need to focus its energy on the reforms that will allow our economy to become more productive and competitive.

ECONOMY

18 sabusinessintegrator.co.za

Persistently high global inflation

The global macroeconomic environment continues to suffer under levels of inflation not witnessed in decades on the back of supply chain disruptions and reduced fiscal buffers. European countries, affected by the ongoing Russian invasion of Ukraine, are grappling with energy supply concerns as winter approaches. These inflated energy prices could also pass through to non-energy prices, especially food. Indeed, Russia’s announcement on 29 October to suspend their participation in the United Nations-brokered grain export treaty via the Black Sea corridor and their subsequent reversal of this decision four days later highlights the uncertainty around food security that will likely fuel inflation further.

Rising interest rates and investment outflows

To counter persistent inflation, key central banks including the US Federal Reserve, the Bank of England, and the European Central Bank had to aggressively raise interest rates during the course of 2022. The current outlook is for these policy rate increases to continue, then to peak during the first quarter of 2023 and, once inflation eases off, to decrease to 2.0%-2.5% towards the end of 2024.

Conversely, developing economies like South Africa have seen investment outflows due to the reduced interest rate yield spreads.

Amid these uncertain times and attractive interest rates from a riskreward perspective, the US dollar has been the beneficiary of investor flight to safety, trading at parity with the euro since 11 July. Conversely, developing economies like South Africa have seen investment outflows due to the reduced interest rate yield spreads.

ECONOMY Policy/Repo Rate and Headline Inflation (YTD) for selected markets Central Bank Rate % 0 1 2 3 4 5 6 7 0 2 4 6 8 10 12 Headline Inflation % January February March April May June July August September October November South Africa Repo Race USA Fed Rate UK Policy Rate Euro Zone Policy rate South Africa CPI USA CPI UK CPI Euro Zone CPI

Sources: SARB, Trading Economics, Investing.com

19 sabusinessintegrator.co.za

Economic growth and commodity prices

Globally, the cost-of-living crisis under these tightening financial conditions is pressuring households and consumers, negatively affecting their overall demand, ability to service mortgage debts as well as their levels of savings.

The next two quarters could potentially see recessions in Europe, the US, Canada, and some economies in Latin America. China faces a property market downturn and a slowdown in their manufacturing and service sectors.

However, Asia Pacific, the Middle East, and Africa are expected to show modest growth during this period, which could avoid a global downturn in 2023. The International Monetary Fund’s (IMF) October world economic outlook growth projections indicate a real GDP growth rate of 3.2% in 2022 followed by a 2.7% growth rate in the year thereafter.

Commodity prices

As the global growth slowdown intensifies, commodity prices are expected to ease in the next two years, but they will remain considerably above their average over the past five years. The uncertainties around the war in Ukraine leave ample room for further supply-side shocks and subsequent commodity price volatility.

Impact on South Africa

South Africa is widely expected to achieve a real GDP growth rate of approximately 2% in 2022. However, the global macroeconomic environment has led to exchange rate weakness of the local currency and higher interest rates. These headwinds, coupled with South Africa’s local, structural challenges – with electricity supply disruptions arguably being chief among them – mean that economic growth in 2023 could be curbed to 1.5%.

The projected reduction in global growth over the next couple of quarters could allow supply

chain pressures to ease somewhat and aid the expectation of a deceleration in inflationary pressures into 2023.

Expectations are that South Africa will record an average headline inflation rate of 6.8% in 2022, returning to around 5.1% in 2023. Similar to the global trend, the Reserve Bank’s Monetary Policy Committee (MPC) is expected to raise interest rates further by 50 basis points to 6.75% on 24 November and another 50 basis points to 7.25% in 22Q1, before allowing the rate to subside to 7% by 22Q4.

South Africa’s outlook – factors that we can influence Notwithstanding the global economic outlook, South Africa needs to address a number of local challenges to improve productivity and global competitiveness to unlock economic growth and job creation opportunities.

Failing this, the risk faced by South Africa at present is that the breakdown in social cohesion experienced in recent years continues on a negative trend over the short- to mediumterm. For private companies, this increases operational and security risk for business activities.

Minister of Finance, Enoch Godongwana, delivered the Medium-Term Budget Policy Statement (MTBPS) in Parliament on 26 October. On a positive note, revenue collection exceeded projections across most tax categories and disciplined budgeting and high commodity prices allowed the budget deficit to narrow from 5.5% in February to 4.9%.

The country’s debt burden remains substantial, having increased sevenfold from R577 billion in 2007/08 to over R4 trillion in 2021/22. However, a primary budget surplus of 0.7% of GDP is projected for 2023/24 and net government debt is expected to stabilise at 69% of GDP in 2024/25.

ECONOMY

20 sabusinessintegrator.co.za

6 key challenges to the country’s economic and fiscal sustainability

PwC highlighted six key challenges to the country’s economic and fiscal sustainability:

A transfer of Eskom’s debt to the sovereign balance sheet

The National Treasury plans to transfer between a third and two-thirds of Eskom’s R400 billion debt to ensure the power utility becomes financially stable. While the relevant debt instruments and method of implementing the relief are not yet finalised, Finance Minister Enoch Godongwana’s comments have led Moody’s Investor Services to confirm on 1 November a change to their outlook for Eskom from negative to positive. More detail will be provided in the annual budget during February 2023.

Actions to avoid Financial Action Task Force (FATF) grey listing

The National Treasury took a leading role over the past 12 months in finding answers to the FATF grey listing risk. The Finance Minister said the state is “doing everything necessary” to prevent the grey listing.

This includes two bills tabled to parliament to address weaknesses in the legislative framework which are expected to be passed by the end of this year. However, the MTBPS did not comment on the fact that in-progress legislation will likely not count towards the progress report that South Africa needs to provide the FATF in November 2022. In other words, the key legislative changes needed to avoid grey listing might be approved too late to succeed in this endeavour.

Lullu Krugel, PwC South Africa Chief Economist, says: “If grey listed, South Africa would see its private sector endure increased international transactional and compliance costs. Research by the IMF shows that in the 89 emerging and developing countries grey listed during 2000-2017, this resulted in a drop in capital flows equal to 7.6% of GDP over a period of nine months. This would result in negative pressure on the rand exchange rate, higher import inflation, and possibly additional interest rate increases.”

However, the National Treasury’s sense of urgency is a positive step in achieving critical reforms to curb corruption in South Africa.

Clearing the backlog in processing critical skills visas

While most foreign-owned firms in South Africa have a majority of local representation among their staff, their operations are frequently dependent on the presence of foreign nationals in key positions. Foreign-owned firms have voiced their frustration with the current delays in getting these visas approved.

The importance of skilled workers for business performance and economic growth has been highlighter before. However, the MTBPS did not address the delays in processing the applications, which we hoped would be supported with additional finance and human resource capacity.

A framework for a comprehensive social security system

The Finance Minister indicated in September that the MTBPS was likely to contain some comments about income support as part of a larger framework for a comprehensive social security plan. For now, the temporary R350 COVID-19 Social Relief of Distress (SRD) grant was extended for another year (to

ECONOMY

1 2 3 4 21 sabusinessintegrator.co.za

March 2024) as the National Treasury continues to look at how a possible permanent extension thereof can be financed.

This would require increased fiscal revenue, reduced spending elsewhere, or a combination of the two. The MTBPS did not elaborate on progress in fleshing out the details of the comprehensive social security plan.

Management of the public wage bill

The MTBPS was expected to firmly reiterate that the government is not reneging on its pledge to reduce the pressure exerted on the budget by remuneration costs. Indeed, the Finance Minister pencilled in a 3% increase for public servants. The increment is notably lower than what labour unions are currently asking for.

At the time of writing, the Public Servants Association has indicated that members will embark on a strike on 10 November that will affect the activities of government departments, especially home affairs and transport. Further strike action by other associations remains a possibility.

It is worth noting that the levels of inequality in South Africa leave large numbers of communities reliant on critical state-funded services. To this end, as per the MTBPS, education, health and social development will receive the lion's share of the R3.56 trillion social wage over the next three years.

Progress with the Infrastructure Fund pipeline

February 2022 saw the last substantive update on project feasibility for the government’s keystone infrastructure endeavour aimed at crowding-in private investment into major infrastructure projects.

While Minister Godongwana noted that the government is still committed to crowding-in private investment into the delivery of public sector infrastructure, the MTBPS document provided no substantive update about the pipeline of projects.

It also highlighted a likely R4.2 billion in unspent allocations to the Infrastructure Fund during the current fiscal year. On a positive note, the National Treasury recommitted to allocating R100 billion to the fund over 10 years. Given the country’s electricity generation and water distribution infrastructure inefficiencies, one should expect large allocations to bolster supply in these two critical areas.

The Presidency published an investment plan on 4 November providing more details on how they intend to allocate the US$8.5 billion (over R150 billion), pledged by the US, the UK, the European Union, Germany and France at 2021’s United Nations-led climate talks (more commonly referred to as COP26).

Over the next five years, R136 billion will be invested in electricity infrastructure, R12.5 billion in developing green-hydrogen projects, and R3.5 billion in the electric-vehicle industry.

Finally, to this list of six, we also add consideration for the Just Energy Transition. With the 2022 United Nations Climate Change Conference (COP27) ongoing, there is a keen focus on any official statements that could provide more detail on this topic.

Climate risk was mentioned several times in the MTBPS, and it noted that fiscal policy will continue to play a role in shifting economic incentives towards cleaner forms of energy. In this regard, the Finance Minister noted that South Africa is finalising negotiations on the pledges by the International Partners Group for the country’s Just Energy Transition. The MTBPS did not contain anything new about this topic and we suspect the government is keeping major announcements for COP27.

*Ed’s note: Article supplied beginning of November 2022

5 ECONOMY

6

22 sabusinessintegrator.co.za

New guidelines aim to capture more notifiable mergers

By Elisha Bhugwandeen, Senior Knowledge Lawyer & Daryl Dingley, Partner at Webber Wentzel

By Elisha Bhugwandeen, Senior Knowledge Lawyer & Daryl Dingley, Partner at Webber Wentzel

MERGERS & ACQUISITIONS

24 sabusinessintegrator.co.za

On 23 September 2022, the Competition Commission published final Guidelines on Small Merger Notification (Small Merger Guidelines) which significantly expand the scope of potentially notifiable mergers. Small mergers are transactions that do not meet the prescribed intermediate or large merger thresholds. The Small Merger Guidelines propose that, if certain criteria are met, the Commission must be informed of all small mergers and acquisitions.

The previous draft of these guidelines was specifically aimed at capturing small mergers where the merger parties operate in digital or technology markets due to concerns that acquisitions in this space often escape regulatory scrutiny. However, the final version of the Small Merger Guidelines places an obligation on merger parties to inform the Commission of all small mergers that meet the requisite criteria, not just those in the digital space.

When will firms need to inform the Commission about small mergers?

• The Small Merger Guidelines still state that, if at the time of entering into the transaction, any of the firms (or firms within their groups) are subject to a prohibited practice investigation by the Commission or are respondents to pending proceedings following a referral by the Commission

to the Competition Tribunal, then the Commission must be informed in writing before implementation of the small merger.

• However, the Commission will require that it also be informed of all small mergers and share acquisitions where the acquiring firm’s turnover or asset value alone exceeds the large merger combined asset/turnover threshold (currently R6.6 billion) and at least one of the following criteria must be met for the target firm:

• the consideration for the acquisition or investment exceeds the combined asset/ turnover threshold for intermediate mergers (currently R190 million) [Note: this amount is an error, which the Commission has undertaken to correct]

• the consideration for the acquisition of a part of the target firm is less than R190 million threshold but effectively values the target firm at R190 million or more.

What is the procedure for informing the Commission?

Parties to small mergers which meet the above criteria are advised to inform the Commission in writing, of their intention to enter into the transaction. The parties should provide sufficient detail on the acquiring and target firms, the proposed transaction, and the relevant markets in which the firms compete.

There are many aspects of the Small Merger Guidelines that raise concerns. There is uncertainty as to how the thresholds should be interpreted, and it remains to be seen if there will be any consequences for firms involved in mergers that meet the relevant criteria and fail to inform the Commission. This additional administrative obligation also adds a layer of regulatory red tape that may be seen to hinder, instead of facilitate, investment into the country.

MERGERS & ACQUISITIONS

25 sabusinessintegrator.co.za

Interoperable real-time payments

draws closer

PayShap, South Africa’s first low value, interbank, real-time digital payments service will be offered by participating banks in 2023.

BANKING 26 sabusinessintegrator.co.za

“Making a low value (under R3 000) payment to an account at any other bank should be quick, easy and affordable,” says Mpho Sadiki, Head of Real-time Payments at BankservAfrica.

The underbanked, cash dominant market will benefit the most “While most banked South Africans will enjoy the convenience of this service, we believe it is the underbanked, cash dominant market that will benefit the most,” he says.

PayShap reduces the need for cash on hand which makes it a safer option for South Africans to use in their daily transactions including taxi fares, barbers/ hair salons, school fees, restaurants or to reimburse friends or family.

Consumers will be able to access PayShap through their banks’ selected banking channels such as internet banking, banking apps or their bank’s USSD. PayShap will initially be offered by four banks, including Absa, FNB, Nedbank and Standard Bank. The roll-out will then extend to more banks who will start offering the service in the months to follow.

Banking institutions support PayShap

“As a full-service financial institution that serves customers from all walks of life, Absa is delighted to be among the first cohort of banks to bring PayShap to the South African market. As the payments ecosystem evolves providing safe, quick, and convenient solutions is vital to enable greater financial inclusion. We look forward to the official launch of PayShap in 2023 and continue to work hand-in-hand with the industry to ensure a successful roll-out,” says Charl Smedley, Absa’s Head of Payments.

Ravi Shunmugam, CEO of FNB EFT Product House, says, “FNB is proud to be a founding member of this modernised, inclusive payment infrastructure and we look forward to bringing innovative instant-payment solutions to our customers.”

“Ensuring accessible payments solutions for all South Africans has been a key focus at Nedbank, evidenced by the number of innovative services introduced to date, for example Tap on Phone and Money Message, which are designed to empower merchants to accept digital payments. Our participation in this industry initiative is a declaration of our commitment to ensuring that all types of payments offered by Nedbank are simple enough to be understood and adopted by all, accessible, and most importantly, affordable allowing value exchange across all parts of our economy,” says Chipo Mushwana, Nedbank Executive for Emerging Innovation.

“Our purpose is to drive Africa’s growth. Our participation in the PayShap programme to build a payment service which truly serves the banked and underbanked customer. It enables us to continue to accelerate financial inclusion through safe, affordable, accessible and convenient digital solutions,’’ says Rufaida Banoobhai, Head of Payment SA, at Standard Bank.

Released to the market in two stages

The PayShap service will be released to the market in two stages. The first will see the launch of the instant clearing feature which includes the ability to either pay-by-account (using account details) or pay-by-proxy (using a unique identifier such as a cellphone number). The second stage will introduce an additional request-to-pay function which makes it possible for a person to request payment and receive money securely and immediately in their bank account.

“We are excited to see this collaborative partnership between BankservAfrica and the banking community to bringing PayShap to the market and making it part of everyday life. PayShap will kick-start the economy of the future and create the opportunity for digital enablement and inclusion of all South Africans,” concludes Sadiki.

BANKING

27 sabusinessintegrator.co.za

Transform your business. Change youth lives

The Youth Employment Service (YES) is one of the biggest private sector youth employment programmes in the country that is affecting broad-based change across sectors, provinces and communities. We’ve injected over R5 billion in youth salaries into the economy in just under four years, with no government funding.

As a private sector led initiative, we help tackle the country’s youth unemployment crisis by empowering businesses to create 12-month quality work experiences for unemployed youth. In return for creating these jobs, businesses receive up to two levels on their B-BBEE scorecard.

For your first year with YES, your business can receive its B-BBEE level up almost immediately if youth are contracted before your financial year-end.

Businesses can place youth internally in their own structures, or in YES vetted host partners through the turnkey solution. The turnkey solution works with host partners across South Africa to place youth. These partners are working in high-impact sectors such as digital, agriculture, small business development and the green economy. Youth are placed in their communities, which means they can play an important part in building their own economies.

Register for YES today. Gain B-BBEE levels immediately. Change lives forever.

Here are the top reasons over 2 200 businesses have signed on to co-create a future that works:

1. The YES model creates measurable and meaningful broad-based impact.

2. It’s an effective way to gain B-BBEE levels and transform your business.

3. YES programmes are easily integrated with a business’ environmental, social and governance (ESG) strategies.

4. YES partners with businesses to create programmes that directly uplift communities.

5. YES programmes create a critical talent pipeline for your business.

6. YES has placed strong focus on ensuring excellent governance and processes leading to four years’ worth of clean audits.

Join the movement!

28 sabusinessintegrator.co.za

ADVERTORIAL: YOUTH EMPLOYMENT SERVICE

Number 1 risk to your business: 2 in 3 youth are unemployed.

Over 2,200 businesses are creating 12-month work experiences for youth. Join the movement and gain up to two B-BBEE levels almost immediately and/or integrate into your ESG strategy. Join YES now.

YES20222221

of African tech startups Boosting performance

New research at Stellenbosch Business School has identified and developed a model of the most critical capabilities that enable startups to identify and exploit opportunities, drive the delivery of innovative products and services to consumers, and build sustainable businesses that attract investment.

The research and model are set to disrupt the future of entrepreneurship education and challenge the prevailing mindset of entrepreneurship in Africa. Understanding the key drivers that turn an entrepreneurial mindset and innovative ideas into high-performing businesses could hold the key to reducing the 95% first-year failure rate of African tech startups and unlocking their potential to boost economic growth and job creation.

STARTUPS

30 sabusinessintegrator.co.za

Entrepreneurship is seen as the catalyst for addressing Africa’s socio-economic challenges, but while the continent has no shortage of innovators and entrepreneurs willing to take risks, the performance of many startups is limited by their lack of the know-how to achieve growth and scale.

Less than two percent of internationally recognised high-tech startups originate from the African continent. Of the 600 “unicorn” tech startups (companies valued at over $1 billion) in the world, the African continent, with over a billion people, has produced just seven.

Critical capabilities that enable startups to succeed

New research at Stellenbosch Business School has identified and developed a model of the most critical capabilities that enable startups to identify and exploit opportunities, drive delivery of innovative products and services to consumers, and build sustainable businesses that attract investment.

Stellenbosch Business School PhD Business Management and Administration graduate, Dr Ekene Onwu, surveyed more than 250 people engaged in tech startups in four African countries – Ghana, Kenya, Nigeria and South Africa – for his study on the drivers of entrepreneurial orientation and innovation capabilities in African tech startups.

The four countries together have attracted the most startup investment on the continent to date.

“The research indicates that tech startups that cultivate a comprehensive, developmental approach that looks at their top management capabilities, their technological competencies as well as their ability to foster rapid and locally relevant learning, have a better chance of succeeding despite the obvious macro-economic challenges in Africa's dynamic and complex business terrain,” Onwu says.

He hopes that by applying his “sense-seizetransform” African model of interlinked, dynamic

capabilities, startups and their founders will have a better set of performance indicators to assess their “culture, mindset, behaviours and ability to succeed, where so many seem to have failed before.”

Seizing opportunities and transforming them into sustainable business success

His research identified that the capabilities of top management, the business’s technological competency and the ability of the organisation to learn and adapt to a changing environment are the key factors that enable the business to identify (sense) and seize opportunities and transform them into sustainable business success through an entrepreneurial mindset and ability to innovate.

“Having the ‘technological DNA’ alone is not enough to guarantee success in highly competitive and rapidly evolving digital environments. Many businesses fail because they lack the knowledge, networks and capabilities to effectively drive their performance.”

“To achieve favourable business outcomes in high-tech environments, startups must be able to constantly sense opportunities, and strengthen their capabilities to seize and transform opportunities and tackle complex business problems, threats, and opportunities as and when they appear.”

“Achieving these capabilities allows the tech startup to drive productivity and bring changes in the market that its competitors are unable to,” he said.

Important in helping nations combat socioeconomic challenges

The knowledge gap in many developing countries, on what business capabilities to foster and focus on, has led to low levels of sustainable innovation and entrepreneurial activity, threatening much-needed employment creation and economic productivity.

“Ensuring the success of tech startups on the African continent has become increasingly important in helping nations combat socio-economic

STARTUPS

31 sabusinessintegrator.co.za

challenges such as high rates of unemployment, food and healthcare insecurity, environmental sustainability, financial exclusion, and infrastructural deficiencies.

“Tech startups need to succeed as they are drivers of economic development and productivity improvements and are the catalysts for novel industry, product and service creation as well as attracting foreign direct investment to developmental sectors,” Onwu says.

However, the performance of tech startups across multiple sectors and industries on the African continent had been “dismal”, he said, with very few attracting venture capital investment or being targeted for acquisitions by larger, more established businesses, in comparison to startups in the West. These are considered key indicators of startup success.

Internal dynamic capabilities that enable startups to survive, adapt to change and grow

While venture capital investment of $560 million in some 80 African startups in 2017, showing year-on-year growth of over 50%, could be seen as positive for the continent, he said this was negligible compared to the USA alone. In the same period, over 8 700 US tech startups attracted $85 billion dollars in investment, representing growth of over 400%. In Onwu’s research sample, 37% of the businesses were self-funded, while only 7% had attracted venture capital investment.

Infrastructure challenges on the African continent play a significant role in hampering business startups, with 61% of the startups that Onwu surveyed struggling with access to electricity and 71% lacking reliable internet access. However, since these challenges are largely out of the business’s control, Onwu focused on the internal dynamic capabilities that enable startups to survive, adapt to change and grow despite Africa’s complex and dynamic business landscape.

His research found that improving top management capabilities (to think, to network, to lead and to effectively deploy technical resources) and the business’s overall technological competence had the greatest positive effect on both its entrepreneurial orientation and innovation capabilities and strengthened their combined impact on the firm’s ability to perform.

“The findings also indicated that there was a positive effect on the performance of tech startups who comprehensively focused on improving both their entrepreneurial orientation (being proactive, risk taking, autonomous etc.) and their innovation capabilities (product, process and marketing innovation) simultaneously,” Onwu said.

A comprehensive, integrated view The significance of his research is that the capabilities and drivers are usually studied and considered in isolation and inferences made from them are often over simplistic and impractical, but his model takes a comprehensive, integrated view that highlights their linkages and directly links a key set of capabilities to organisational performance.

“Startups often look at capabilities in isolation as drivers of success, but this limited focus does not give them the comprehensive overview needed to drive success in an increasingly digitised business climate,” says Onwu.

“Startups that develop the appropriate internal capabilities, and take a holistic, integrated view, can better understand where exactly investments are needed internally to foster their growth, scalability and ability to drive performance. It is about simultaneously looking at the capabilities of the top managers, the technological skills, knowledge and will of the whole startup, their ability to learn and unlearn processes in a way that's entrepreneurially deep and innovatively robust that will impact their ability to perform and survive doing business in Africa,” he adds.

STARTUPS

32 sabusinessintegrator.co.za

PRECISION, SIMPLICITY, COMPATIBILITY. THE 6X ®. OUT NOW!

new 6X radar level sensor

we

customers value

everyday life

less

VEGA

measurement technology

value. VEGA. HOME OF VALUES. www.vega.com/radar PRECISION, SIMPLICITY, COMPATIBILITY. THE 6X ®. OUT NOW!

customers

VEGA. HOME OF VALUES. www.vega.com/radar

The

is so easy to use, it’s simply a pleasure. Because

know

not just ‘perfect technology’, but also making

better and

complicated. We wouldn’t be

if

was our only

The new 6X radar level sensor is so easy to use, it’s simply a pleasure. Because we know

value not just ‘perfect technology’, but also making everyday life better and less complicated. We wouldn’t be VEGA if measurement technology was our only value.

A data breach

can sink an SME

Cybersecurity experts GoldPhish warns of the damaging consequences of data breaches for SMEs, and that a more proactive approach to cyber protection is imperative to survive an inevitable breach.

When it comes to reporting on cybercrime, we tend to only come across the stories impacting major companies or industries. Apart from the obvious reputational damage, we don't really grasp the consequences of something like a data breach on a company and its customers. There are no headline articles about the troubles that emerge in the wake of a data breach, some of which literally grind small and medium enterprises (SMEs) into the ground.

The media focuses on corporate giants as the

only victims of cybercrime, lulls us into a false reality where data breaches seem to happen mostly to corporate behemoths but not the small or medium size business owners. Cybercriminals, who are often well-organised and well-resourced, launch constant attacks on data targets, probing for the weak spots. SMEs typically invest far less resources in cybersecurity than big corporations, which can make them a far more attractive mark to criminals, and their businesses far more vulnerable.

DATA SECURITY

34 sabusinessintegrator.co.za

SMEs who are not cyber savvy or don’t have suitable measures in place are the easiest targets when it comes to exploitation by cybercriminals.

SMEs at greater risk of becoming a target for cybercrime

According to Dan Thornton, CEO of cybersecurity awareness training business, GoldPhish, the often false perception that “it won’t happen to us,” puts SMEs at greater risk of becoming a target for cybercrime.

"Perpetrators of these crimes are well-aware that while big companies are investing heavily in their cybersecurity, SMEs who also collect and store significant client and customer data, aren't taking preventative action in the same ways.

It's a myth that hackers and scammers are only interested in the big data collected by corporates or governments. SMEs who are not cyber savvy or don’t have suitable measures in place are the easiest targets when it comes to exploitation by cybercriminals," he explains.

There are many SMEs that collect customer data, which includes banking, financial and tax information, contact and residential details, consumer purchasing history and even sensitive medical records, the consequences of a data breach can be dire.

"We all read the headlines saying that yet again millions of customers' data has been breached. Shock, horror, and then that's it. But it's not like that. Data breaches have longterm consequences. Many of them actually sink companies, and many expose consumers to ongoing risks,” Thornton says.

What happens after a data breach?

After a data breach, companies can potentially face regulatory liability and third party liability, but

this is not the full extent of the possible damages. Cybercriminals may hold the data hostage to extort a ransom from the company, and they may also mine sufficient data to target consumers - a data breach is not an end-result but a pathway to ongoing cybercrimes.

According to IBM data, by mid-2022 the average cost of a data breach was $4.3 million, a new high record.

"Reputational damage for companies that we trust with our data can be devastating, and many businesses never recover from a data breach. Companies need to take their data protection seriously and establish full visibility of what data they’re holding, where they are storing it, and also justify why they’re holding it. In addition, they need to implement data protection strategies and ensure their staff are well-trained when it comes to cybersecurity. Ensuring that your employees are trained to be cyber savvy has become critical to the mission of every business, small, medium and large,” Thornton notes.

Cybersecurity should be front of mind for all SMEs. Meticulous processes governing data collection, storage and sharing in accordance with regulations should be controlled and the following approach is recommended:

• Ongoing, company-wide cybersecurity training,

• Implementation and maintenance of proven cybersecurity strategies,

• Investment in cyber insurance coverage, Cybersecurity for SMEs needs to be embedded along with all other efforts to create a secure working culture. Employees, business leaders and customers all value this. No business can afford a 'it won't happen to us' mindset.

Cybercrime is set to become the greatest security threat to all kinds of business, and it's important to invest the same care in your digital assets and consumer data. Understanding the threats and knowing how to mitigate the risks is essential.

DATA SECURITY

35 sabusinessintegrator.co.za

AIMS International: top tier executive search

Successful businesses depend on highly effective professionals and executive management with impeccable business acumen, technical know-how and a leadership capacity that is out of the ordinary. Such people are not easy to find in a diverse and fragmented world. When considering the diversity of the African business markets, it is even more important to understand the nuances of each market on our continent.

Our executive search framework at AIMS International is part science, part art. We painstakingly analyse data, biometric evaluations, skills assessments while combining cutting edge assessment tools with our experienced consultants’ behavioural interview evaluations to give our clients guaranteed success. We are proactive in our research practices, hand-picking only the best talent for our clients to choose from. With partner offices in over 50 countries around the world, our clients have the added advantage of an additional 260 search and talent management experts at their fingertips.

To give our clients value added services, we have an in-house organisational psychologist who supports our clients to make the best decisions to acquire fit for purpose candidates. With more than two decades of experience on the continent, our recruitment expertise spans across professional, senior and executive management roles in the following industries: Industrial, FMCG, Financial and Professional services, Energy and Natural resources, Life Sciences, Media and Technology and Automotive.

Our lineage of expertise from around the world helps us to infuse global best practise with local knowledge so that we can find and grow world class teams that increase organisational performance.

We have a dedicated qualified team and sustainability programme, allowing us to keep abreast with new trends and the changing needs of our clients. In a time where women empowerment is a top agenda item for governments and businesses, we have started tracking gender statistics in our international repertoire, ensuring that we assist our clients to achieve gender parity and inclusive growth. At AIMS South Africa, we believe that happy staff are synonymous with high performers and are passionate about the organisational happiness of our client companies.

Be part of our great expansion. Visit us at www.aimsinternational.com/za for more.

ADVERTORIAL: AIMS INTERNATIONAL

Arthur Nkuna Partner arthur@aimsinternational.co.za

Leonie Pentz Managing Partner leonie@aimsinternational.co.za

36 sabusinessintegrator.co.za

Ashleigh Ball Consultant ashleigh@aimsinternational.co.za

leonie@aimsinternational.com arthur.nkuna@aimsinternational.com aimsinternational.com/za

leonie@aimsinternational.com arthur.nkuna@aimsinternational.com aimsinternational.com/za

leonie@aimsinternational.com arthur.nkuna@aimsinternational.com aimsinternational.com/za

MOVING YOUR ORGANISATION

MOVING YOUR ORGANISATION

MOVING YOUR ORGANISATION

Environment. Society. Governance.

Environment. Society. Governance.

Environment. Society. Governance.

EXPERTS IN FINDING LEADERS FOR DIVERSE TEAMS

FORWARD

INTERNATIONAL

FORWARD

EXPERTS IN FINDING LEADERS FOR DIVERSE TEAMS

INTERNATIONAL

EXPERTS IN FINDING LEADERS FOR DIVERSE TEAMS

FORWARD

INTERNATIONAL

Subsea cable connectivity: the key to accelerating digital transformation

By Matone Ditlhake, CEO of Corridor Africa

Subsea cable connectivity is the key to accelerating digital transformation in Africa. Google launched its $1 billion Equiano cable, a connection between Western Europe and South Africa. This announcement also coincides with Meta-backed 2Africa, the world's longest subsea cable which is expected to come online in 2024.

DIGITAL TRANSFORMATION

38 sabusinessintegrator.co.za

The Equiano 144Tbps, 12 fibre pair cable will ensure faster internet speeds and reduced internet prices when it is switched on before the end of the year. It will be Africa's highest capacity cable and stretches more than 15 000km from Portugal to South Africa.

Subsea cable connectivity will help governments throughout Africa achieve their digital transformation goals and objectives. In South Africa, it will contribute considerably to Government's NDP2030, and SA Connect strategies.

Infrastructure development and digital and socio-economic transformation were the key topics at the 2022 GovTech conference, the annual meeting platform for representatives from government and industry to connect in serving citizens to better use information and communications technologies.

Government committed to delivering broadband objectives Khumbudzo Ntshavheni, the Minister of Communications and Digital Technologies, promised that Government was committed to delivering on broadband objectives as key enablers for the delivery of an economic step change for South Africa.

Government is implementing a broadband connectivity drive through SA Connect and its goal is to ensure that all South Africans have access to the internet. According to Google, the Equiano subsea cable will lead to the creation of 1.6 million jobs, and it expects data prices to drop by at least 20 percent.

Through SA Connect, Government plans to connect over 400 sites in the Eastern Cape and the Northern Cape and then provide internet access for everyone across the country in phase two. This programme aims to connect over 33 000 community Wi-Fi hotspots over three years.

Government partnership with ISPs Ntshavheni recently said a revised model for SA Connect would include a partnership with ISPs, access network service providers, and mobile virtual network operators in the SME space. She referred to this collaboration as part of Government's commitment to the transformation of the telecoms industry.

Digital transformation involves the ongoing application of the latest technology to improve a government’s performance and help meet the expectations of its citizens. There is no doubt it is important; digital transformation offers many solutions to e-Government services as it addresses most of the challenges in e-Government.

It is clear that the Government has put policies in place to support digital transformation and with advances in infrastructure and digital technologies, it might successfully address its challenges to realise its global digital strategy successfully.

South African Government is certainly lagging behind with digital transformation in realising its goal for e-Government. It needs to work in close cooperation with stakeholders to achieve e-Government through digital transformation. Citizens will be seeing more and more of this digital transformation over the next few years.

It is clear that the Government has put policies in place to support digital transformation and with advances in infrastructure and digital technologies, it might successfully address its challenges to realise its global digital strategy successfully.

DIGITAL TRANSFORMATION

39 sabusinessintegrator.co.za

Sharing is caring, and the road to a

great digital future

Being an entrepreneur and having a good business idea is not enough, especially in the competitive and every-changing digital space. Success is directly linked to education; the more you learn about business, handling income and expenditure, legal requirements and running a business, the better the chance that what you create will be sustainable.

Notes Technologies, the recent MTN Enactus Digital Innovation Challenge winner, is a case in point. Notes Technologies, an app created by students for students, has reached the pinnacle of achievement through the Enactus Digital Innovation Challenge programme and as a graduate of the MTN-funded 12-month Business Support Programme for SMMEs within the ICT Sector.

At the 2022 MTN Business App of the Year event, the business, which is a part of the Enactus programme at the Vaal University of Technology, also won first place in the Campus Cup Challenge category, walking away with a R50 000 cash prize that will be used to take the app to the next level.

Notes Technologies’ success is based on the belief that by sharing notes, students can simplify their tertiary studies, help others and cut the costs of studying. Their app, built for mobile devices, enables students with good notes across various subjects to load their study notes for others to use. When others use the notes, they receive payment. For users, a fee of R15 a month gives unlimited access to material that can be filed in the app for easy access.

The MTN SA Foundation is a long-time supporter of entrepreneurs and South Africa’s SMME sector.

Over the past eight years, the Foundation has taken a holistic approach to driving small business development in South Africa. Through enabling the success of many graduates of its various skills development and upliftment programmes, the Foundation has proved what can be achieved by strong partnerships and focused, complementary initiatives.

Developing future entrepreneurial leaders within the tech space

Notes Technologies

graduated from the MTN Foundation’s annual Business Support Programme for SMMEs in December 2021. They joined another 99 selected ICT SMME entrepreneurs in the first national rollout of the programme. For 12 months, they participated in workshops, group training sessions, one-on-one mentorships and coaching, which focused on access to markets, funds, skills and access to technology.

40 sabusinessintegrator.co.za

ADVERTORIAL: MTN SA FOUNDATION

An app created by students for students

Offered by the Foundation in partnership with Datacomb Development Hub, Hodisang Dipeu Holdings and the University of the Free State, the entrepreneurs were provided with training courses and learned about developing and drafting business plans – essential skills when looking for finance or backers.

“Enactus Digital Innovation Challenge, which MTN has funded for seven years, is vital to developing future entrepreneurial leaders within the tech space. The challenge requires university students to identify socioeconomic challenges across the agriculture, education, and health sectors, and create solutions that are technologically driven,” says Kusile Mtunzi-Hairwadzi, General Manager of the MTN SA Foundation.

“The development of digital services that address the United Nation’s Sustainable Development Goals, which is aimed at eradicating poverty and bringing global prosperity by 2030, is our key focus.

“Student entrepreneurs first identify the top socioeconomic concerns within their respective province and then leverage the design thinking methodology to build and launch meaningful digital solutions to these challenges across the selected sectors. The best ideas are then funded so that a protype of the app can be developed,” adds Mtunzi-Hairwadzi.

Notes Technologies came out top in this process in 2019 when they, along with five other selected student-led project teams, were required to pitch their ideas and have them thoroughly scrutinised by a panel of experts.

“From six finalists in 2019 where Notes Technologies was the trailblazers from the shortlist, the Challenge has since grown to award 12 digital innovators each year, who all take home between R60 000 and R70 000 towards the development of their winning app concepts, business registration (CIPC) and marketing-related costs for their businesses.

A holistic approach to encouraging growth in the SMME sector

“Due to the sheer volume and success of businesses that have been bred in the MTN Digital Innovation Programme, it has quickly grown into the most popular special competition within the annual Enactus South Africa roll-out. Over the years we have seen a steady increase in the quality of solutions that that are being produced from the universities and look forward to celebrating their growth trajectory as we are seeing with Notes Technology today”, says Enactus South Africa NPC ‘s CEO and Country Director, Letitia de Wet.

“Notes Technologies took these learning and growth opportunities, developed their app and excelled further to win the Campus Challenge at the MTN Business App of the Year Award-distinguishing themselves at what is now Africa’s premier digital event.”

The MTN SA Foundation believes that a holistic approach to encouraging growth in the SMME sector is essential

if small companies and the entrepreneurs that drive them are to take their rightful place as innovators and future employers in the national economy.

“Key to achieving these two objectives is encouraging participation in the digitally based Fourth Industrial Revolution and creating a generation of young, digitally orientated entrepreneurs with the skills to ensure South Africa is internationally competitive. The MTN SA Foundation is proud that we are part of this nationbuilding process by enabling developers like Notes Technologies to develop their skills,” concludes MtunziHairwadzi.

For more information and other MTN SA Foundation programmes, visit www.mtn.co.za

41 sabusinessintegrator.co.za ADVERTORIAL: MTN SA FOUNDATION

Shattering

the glass ceiling

Gender equality, diversity, and inclusion in the built environment professions.

Despite the strong business case for gender diversity in the built environment, the gender representation, advancement, and retention of women in the sector remains an elusive dream with the latest figures released by StatsSA showing that women make up more than 50% of the South African population; however, only 13% of registered persons within the built environment professions were women in 2021.

“Like any other professions in the country, the built environment sector is facing serious challenges: Slow pace of transformation, ageing personnel, shortage of critical skills and high unemployment rates, especially amongst our youth,” says Msizi Myeza, CEO at the Council for the Built Environment.

“It is therefore important for the sector to take strides and develops strategies on how best to address crucial issues identified in the skills pipeline strategy for the built environment, especially gender representation, participation, and retention.”

Gender gap in the built environment commences in primary school

Various studies corroborate that while it is important to raise alarms about the slow pace of transformation, the gender gap in the built environment commences in primary school and that is where we must intervene.