MAJOR NEW NUCLEAR FUSION DISCOVERY HOW THE INFLATION REDUCTION ACT MAKES RENEWABLES MORE LUCRATIVE

AAPA CHAIRMAN, SEAN

MAJOR NEW NUCLEAR FUSION DISCOVERY HOW THE INFLATION REDUCTION ACT MAKES RENEWABLES MORE LUCRATIVE

We have moved to a new bigger station in San Antonio!

Sundays 2pm-3pm 930AM

San Antonio

THE ONLY OIL AND GAS SYNDICATED NATIONAL RADIO SHOW

WHERE INDUSTRY COMES TO SPEAK

MOST listened to show on Sunday nights! Thank you HOUSTON!

Saturdays 8am-9am

KSIX 1230AM / 96.1FM / 95.1FM

Corpus Christi

Sundays 8pm-9pm

KFXR 1190AM / simulcast on the iHeartRadio app

Dallas / Fort Worth Worldwide

Saturdays 1pm-2pm

KWEL 1070AM / 107.1FM

Midland Odessa Permian Basin

Sundays 2pm-3pm

The Answer 930AM

San Antonio / New Braunfels / San Marcos / Austin

Sundays 8pm-9pm

KTRH 740AM / Simulcast on the iHeartRadio app

Houston / Worldwide

Saturdays 6am-7am, 11am-12 noon

Sundays 6am-7am, 5pm-6pm AM 1440

To listen to the show: Visit shalemag.com or download iHeart mobile app to listen live!

The Port of Corpus Christi puts its energy into what matters most - the needs of our customers. With our proximity and connections to Eagle Ford Shale, the Permian Basin, and beyond, we are built to meet the increasing production throughout Texas and the rising demand for energy across the globe.

connect with us: portofcc.com

Finding and producing the oil and natural gas the world needs is what we do. And our commitment to our SPIRIT Values—Safety, People, Integrity, Responsibility, Innovation and Teamwork— is how we do it. That includes caring about the environment and the communities where we live and work – now and into the future.

CHIEF FINANCIAL OFFICER

Suzel Diego

PUBLICATION EDITOR

Zoe Vastakis

ASSOCIATE EDITOR

David Porter

COPY EDITOR

Tyler Reed

VIDEO CONTENT EDITOR

Barry Basse

ASSOCIATE EDITOR

David Porter

STAFF WRITERS

Felicity Bradstock, Tyler Reed

DESIGN DIRECTOR

Elisa Giordano

VICE PRESIDENT OF SALES & MARKETING james@shalemag.com

ACCOUNT EXECUTIVES

John Collins, Ashley Grimes, Doug Humphreys, Matt Reed

SOCIAL MEDIA DIRECTOR

Courtney Boedeker

CONTRIBUTING WRITERS

Seenu Akunuri

Kym Bolado

Felicity Bradstock

Matt Gertken

David Porter

Tyler Reed

Irina Slav

STAFF PHOTOGRAPHER

Malcolm Perez

EDITORIAL INTERN

LeAnna Castro

We are excited to bring you along with us as we cover the incoming energy transition. In this issue, we sat down with Sean Strawbridge to discuss his ascension as the new Chairman of the Board of the American Association of Port Authorities. Sean taking on this position gives the ports across the nation a new advocate, and reminds us of the voice we give to the industry.

2023 is going to bring some massive structural changes to SHALE Magazine. We are excited to cover the energy evolution and expand into exploring all areas within the upstream, midstream, and downstream. With all of these upcoming changes, we have felt as though we have outgrown our previous image as SHALE Magazine, and will now transition into Energy Network Media Group, also known as EN Media.

Thank you to our amazing team, and our readers.

KYM BOLADO CEO/Editor-in-Chief kym@shalemag.com

Acommon association for ports to unify under a common banner is through the American Association of Port Authorities (AAPA), based strategically in Washington, DC. Advocating for ports in general, while still proudly representing the Port of Corpus Christi, is industryveteran, Sean Strawbridge. Strawbridge has newly been elected as the Chairman of the Board of the AAPA and holds ambitious plans for the future as he moves ports to center stage. With an avalanche of negative headlines to mitigate against such as lingering supply chain issues, soaring inflation, the war in Ukraine, a global energy crisis, and intensifying weather and hurricanes, Sean Strawbridge certainly has his work cut out for him. We sat down with Strawbridge to capture his views on the state of the American port system, his perceived greatest challenges and threats, and a peek into the bold vision he has in mind.

Sean Strawbridge is a voracious reader, and starts his mornings in Corpus Christi, Texas flipping through several national and local newspapers “for perspective”. A workout before getting into the office helps the 56-years-young Strawbridge power through a daily schedule that would rival the CEOs of any Fortune-500 company—which is exactly what the Port of Corpus Christi Authority has become. A hands-on manager who admittedly likes to walk around and “surprise people”, Strawbridge loves to put on his protective gear and go out to be with the field operations crews or plop down in a cubicle with a financial analyst. He takes these opportunities to get candid feedback from all levels of the organization on what’s working and how they can improve.

With the “2022 cost of living crisis” in full swing, and ports bleakly painted front and center during the supply chain woes, Strawbridge takes the helm as Chairman of the Board of the AAPA during a tumultuous time. Undeterred, Strawbridge has an ambitious agenda and what he sees as a unique “window of opportunity”. But, to better understand where he’s heading, we wanted to know from whence he came.

Sean Strawbridge got his start with Sea-Land, a Maersk Company, in the early ’90s. From there, he’s continued in global transportation and energy for the better part of a long and storied career. With over three decades under his belt in senior leadership roles in both the public and private sectors, Strawbridge has proven himself in the trenches of business and corporate development, large-scale infrastructure development, capital structuring and finance, and public-private partnerships. Strawbridge has played key roles at top players in maritime commerce such as the Port of Long Beach, Ports America Group, and Oxbow Energy. This experience has all been brought to a head in his current role as CEO of the Port of Corpus Christi, which happens to be the #1 U.S. port in total revenue tonnage. Strawbridge also just so happens to have written extensively on how marine terminals are evolving, as well as paradigm shifts in vessel-based shipping.

As a proud representative of Texas, a seaports veteran, and a media personality who never shies away from talking about all things marine transport, Strawbridge is a bit of an outlier among American port CEOs—which is exactly how he plans to put ports back on the map for the critical infrastructure and national security roles they play across the U.S. Despite ports being so different, it’s up to Strawbridge to look for the commonalities across them to present a unified voice as the new Chairman of the Board of the AAPA.

Ask just about anyone what an airport is and they’ll easily tell you, but ask what a seaport is and they may struggle. The Federal Highway Administration pegs the average American as traveling 14,623 miles on highways and byways each year. This may be why roads are what the public thinks of when it comes to getting goods from A to B. And yet, the nation’s maritime ports move more international cargo by weight and value than any other mode of transportation.

When we talk about ports, it isn’t just docks, cranes, and big container ships that may come to mind. The BTS defines the Marine Transport System, as it is called, as “all the waterways, ports, terminals, and intermodal landside connections that allow the movement of people, and goods to, from, and on the water.” That means ports play a vital role as a connection point between those highways and byways, as well as pipelines, railroads, and other forms of multi-modal transportation.

Different ports have different capabilities as well. Strawbridge tells me there is a saying in the industry - “if you’ve seen one port, you’ve seen one port”. The commodity composition, infrastructure, workforce, surrounding community, and even culture can be vastly different from port to port. The Port of Corpus Christi, for example, can facilitate dry bulk, breakbulk, liquid bulk and wind energy cargo. They also play critical roles in storage, which is both more complicated and crucial than it sounds. Cargo docks give way to bulk terminals, liquid docks handle crude oil and refined petroleum, and oceanographic studies are conducted and re-conducted all to facilitate multi-modal logistics via the greater port system.

Ports themselves are an interesting quasi-government institution. Most are independently managed but hold a degree of oversight from the municipal government or state in which they find themselves. At the same time, they are relying on the federal government for cooperation with actions like grants used in capital improvement projects (CIPs), harbor deepening with the help of the U.S. Army Corps of Engineers, environmental compliance with the Environmental Protection Agency (EPA), security concerns with the U.S. Coast Guard and Department of Homeland Security (DHS), and even international diplomacy efforts. This means they are simultaneously beholden to local, state, national, and international politics all while trying to accomplish the mission-critical of keeping American ports open for business and competitive on a global scale.

Running a successful port is a lot like running a successful enterprise-level corporation.

In additional to coordinating broad teams and divisions within their port, port executives develop new business opportunities with prospective clients and foreign dignitaries, and ensure that their port’s voice is heard throughout the world. Keep in mind, this is all ontop of the million and one other day-to-day responsibilities. Manning the helm of a U.S. Port Authority operating 24/7 certainly isn’t for the faint of heart, but Sean Strawbridge shows it can be done exceedingly well—and even with a certain level of panache.

According to the White House’s Transportation Supply Chain Dashboard, the Ports of Los Angeles and Long Beach process upwards of 40 percent of the nation’s containerized imports. In 2021, these two behemoths in the world of seaports moved more goods than ever before. With ports across the country shattering records, one could hardly imagine any trouble in paradise. And yet, AAPA reports a projected $43 billion investment gap for ports is in store by 2040 if current trends continue.

“If you lift the hood of any economy globally, what you’ll see is ports,” Strawbridge is keen to point out. Simply put, ports drive the economy by providing the ability to move goods to the markets that need them. When ports can’t provide that core functionality, the world sees the widespread implications because it literally hits home with the everyday products our society consumes. In true lemons-to-lemonade fashion, Strawbridge sees this as an opportunity to “use the fragility that’s been highlighted in the supply chain as a launching pad for bipartisan permitting reform and funding.”

There is a bit of duality to Strawbridge’s current roles as both the CEO of a major seaport, as well as Chairman of the Board at AAPA. The balancing act requires finesse, which Strawbridge maintains in abundance. “I’ve been tapped by my peers to lead the association, which means I have to take off my port hat and put on my industry hat.” Someone with so much insight into how vital ports are seems perfectly suited to use the opportunity to catapult ports back into the limelight.

While ambitious, Strawbridge doesn’t think his “areas of focus” during his two-year term at AAPA are far-reaching. A three-pronged approach is his secret sauce for bringing internal and external port stakeholders (which includes all of us) to the table. Strawbridge outlined these as the three focus areas:

1. National Freight Policy Reform: Strawbridge aims to lean into the AAPA membership to develop, and eventually have codified with Congress, a more “cogent national freight policy.” COVID made it plain just how fragile the global supply chain is, and how port and transportation-related infrastructure disruptions have a profoundly negative impact on inflation. Strawbridge believes this to be an imminent risk that could and should be addressed with a robust reform of U.S. national freight policy.

2. Energy Security & Transition: The global energy insecurity has provided ports a chance to prove how valuable they are to the long-term supply of reliable and secure forms of energy. Similarly, the war in Ukraine has highlighted how very real global energy insecurity is for Europe and around the world. While great strides are continuing to be made in sustainability initiatives, “greener, cleaner”, as Strawbridge calls it, fossil fuels still propel the manufacturing economy. European powers that were long dependent on Russian oil and natural gas are looking at more favorable and secure energy climates, even if that means buying off-continent, providing a unique window of opportunity for American energy producers. “We want to protect today’s economy and provide for tomorrow,” Strawbridge reiterates.

3. Permitting Reform: “Mission-critical” is the phrase Strawbridge used when referring to permitting reform. Having long managed seaports, Strawbridge has seen firsthand how developing supporting infrastructure like ports drives the national economy, and yet, it takes twice as long on average to obtain a federal permit for a port infrastructure project as it does to construct the project itself. Permitting reform helps bring certainty to the markets and decision-makers who can truly make national infrastructure reform a reality.

Perhaps the greatest trick up Sean Strawbridge’s sleeves is his masterful use of media coverage as an outlet to get the word out about ports. An absolute “who’s who” in the world of media giants who have featured Strawbridge include CNBC, Fox News, Fox Business News, ABC News, Wall Street Journal, the Los Angeles Times, the New York Times, and the Washington Post, among many others.

While many might use these platforms for vanity, Strawbridge has made them a tool to help inform the masses. Votes can topple or build empires, and Strawbridge is on a mission to broadcast the strategic importance of seaports, and how critical they are for driving the economy. Every Congressional District in the country, and every U.S. territory, relies on ports. We have ports representing strong connections with key allies and nearly 200 trading partners worldwide. Without ports, goods don’t make it overseas or to U.S. shores.

Meeting global demand with a reliable supply, the U.S. has quickly become the number one exporter of aircraft and aircraft parts. We’re also number one for petroleum, crude oil, and LNG—all made possible by, you guessed it, ports. Energy hubs (especially those in Texas like Corpus Christi) are driving innovation and energy security. Strawbridge sees it as critical to showcase the symbiotic relationship between ports in the U.S. and mainstream America. Having so many different media platforms allows him to inform, educate, and advocate on behalf of the more than 120 Port Authorities who are members of AAPA. These members represent ports large and small, from Long Beach to Freeport, but each is vitally important in the cargo they handle and the economic impact they make for their respective communities.

Our elected officials need to transcend the political divisiveness that has plagued our country, because the political discord has long-term negative impacts on ports, which in turn hurts working American families.

Unfortunately, the “out of sight out of mind” mentality seems to have largely been applied to the vastly strategic U.S. port system. The pandemic highlighted both the criticality of the nation’s ports and the woeful inadequacy with regard to port modernization. Images of backed-up container ships made headlines nationwide and many were quick to point a finger at the individual ports themselves. With a recent round of funding, compliments of the Inflation Reduction Act, Port Authorities across the country are finally getting a piece of the transportation funding pipeline. But is it too little, too late?

The latest tranche of funding provided some $700 million to ports. That amount becomes quite paltry with the revelation that it will be divided between some 44 different ports. To put that number in perspective for other infrastructure-related projects around the U.S., here are a few recent examples that made headlines:

• L.A.’s half-mile 6th Street Bridge, which was finished in 2022, cost some $588 million, reports the LA Times.

• In 2020, Salt Lake City spent a staggering $4 billion to rebuild its airport, Deseret News first broke.

• The Florida Department of Transportation plans to spend $2.02 million on a new 0.7-mile sidewalk in a rural Florida county, according to the FDOT Five Year Work Program.

• Phase 1 of a new canal drainage project in North Beach in Corpus Christi carries a price tag of $7 million, reports the Corpus Christi Business News.

Perhaps the greatest trick up Sean Strawbridge’s sleeves is his masterful use of media coverage as an outlet to get the word out about ports

“$700 million is a great start. But nowhere near the need,” Strawbridge says. Nearly 30% of our nation’s entire GDP is tied to ports. He went on to explain that unequivocally, seaports facilitate, if not create the opportunity altogether, for the transport of goods on a global scale. They hold national criticality for the economy, national security, energy, and a large degree of foreign policy. That last point has been especially highlighted with the war in Ukraine and subsequent sanctions imposed on Russia, as well as shipping arms and supplies to key allies in the region. To accomplish all of the tasks set forth for seaports, there must be a consistent approach to infrastructure investments.

Doing some quick math, Strawbridge reasoned that if seaports account for 26% of the GDP, and the 2021 U.S. GDP was $23 trillion, per the Bureau of Economic Analysis, nearly $6 trillion (with a T) of the GDP is tied to seaports. $6 trillion against $700 million in funding leaves a bit to be desired. Not to seem ungrateful, Strawbridge is excited to see the funding put to use, and show just how desperately needed it is. The funding will be available for the various Port Authorities under competitive bids and grants.

Typically, grants are awarded based on need. With how important seaports are socioeconomically, they do hold a certain degree of clout. And, as with most things in life, poli-

tics do come into play. One port may lobby better for a given project, leaving another port the runner-up in the government’s version of the Hunger Games. The light at the end of the tunnel is AAPA, which helps even the playing field with fair representation at the national level for ports of all sizes.

Strawbridge sees his role as Chairman of the Board at AAPA as not so much seeing which port gets what, but rather recognizing that it is Congress who controls the purse, and getting them to see that current times dictate the purse needs to be opened wider than it has ever been historically for ports.

As vessel technology continues to evolve at a lightning pace, so must port infrastructure. Cranes need to be taller, berths made larger, and channels wider to handle larger classifications of vessels. Ports must also be realistic in what they can achieve, so they can be strategic in how they approach improving productivity for the long haul.

As we’ve noted, ports are a bit of an oddball when it comes to who owns them. Ports are largely left to states or municipalities for governance even though they are intrinsically linked to our national economy and security. Local governments have their own politics at play and may not fully appreciate how critical port infrastructure is. This can have widespread rippling effects as local constituencies all vie for their own best interests. Strawbridge threw out the example of California ports, which bear the brunt of the American consumer appetite. Residents may not appreciate the congestion or emissions of all of the hustle and bustle the container imports initiate, and are quick to be vocal in their opposition of such to their local government.

Part of the AAPA’s role is to understand what the concerns are for all port stakeholders collectively. By bringing groups to the table like community leaders, social justice activists, business groups, elected officials, and labor unions you let everyone in a community have a voice. The macro and micro-complexities of all of these relationships between various constituencies make seeing the links between them indeed difficult. By bringing everyone to the table, Strawbridge seeks to facilitate widespread community buy-in for just how critical ports are now and will continue to be in the future.

When asked what he saw as his biggest challenge going forward, Strawbridge let out a sigh and was quick to say political instability was perhaps the greatest threat. The inertia causes a terribly detrimental effect on the fiscal success of a port in a given region. Our elected officials need to transcend the political divisiveness that has plagued our country, because the political discord has long-term negative impacts on ports, which in turn hurts working American families. His message to politicians: “Let’s agree that we’re not going to agree on everything, but we can agree to disagree without being disagreeable.” Amen, Mr. Ports. Amen.

About the author: Tyler Reed began his career in the world of finance managing a portfolio of municipal bonds at the Bank of New York Mellon. Four years later, he led the Marketing and Business Development team at a high-profile civil engineering firm with a focus on energy development in federal, state, and local pursuits and picked up an Executive MBA from the University of Florida along the way. Following an entrepreneurial spirit, he founded a content writing agency servicing marketing agencies, PR firms, and enterprise accounts on a global scale. A sought-after television personality and featured writer in too many leading publications to list, his penchant for research delivers crisp and intelligent prose his audience continually craves.

Located in the lively downtown Marina District, Omni Corpus Christi Hotel offers luxurious guest rooms with spectacular views of the Corpus Christi Bay. Stay with Omni to enjoy personalized service and the most luxurious accommodations by the sea during this ideal Texas coast getaway.

OMNIHOTELS.COM/CORPUSCHRISTI

Alaska’s oil industry has huge potential for greater development, with untapped oil reserves under its icy terrain. Yet, many projects have come to a halt in recent years due to environmental pressures and uncertainty about the impact of the drilling and maintenance of oil operations on the environment. Several Alaskan politicians continue to support further oil and gas development in the region, pushing for the U.S. government to approve longer-term projects while demand for fossil fuels remains high. However, President Biden has repeatedly imposed restrictions on the state’s oil developments due to climate pressures. Now, Alaska is once again attracting interest in its oil potential, but there are uncertainties over whether new projects will ever see the light of day.

ConocoPhillips has operated oil projects in Alaska for several decades and is well prepared for the challenges that the state’s icy landscape brings to exploration and project development. The oil major remains Alaska’s largest oil and gas producer, having completed several developments on Alaska’s North Slope. ConocoPhillips has drilled 58 exploration wells since 2000, making a landmark discovery in 2016 –Willow. The Willow area is thought to hold 450 million to 800 million barrels of oil equivalent (MMBOE), according to 2019 estimates, making it the biggest find since the 1990s.

Despite the huge oil potential lying beneath Alaska, it has not been easy to get this project off the ground. ConocoPhillips has been waiting for approval to carry out more exploration and development activities for years, experiencing major pushback both from environmentalists and the U.S. government. President Biden has put pressure on OPEC+ to increase its oil output over the last year, in response to global shortages and rising prices, following the Russian invasion of Ukraine. He has also approved higher production levels in already developed U.S. oil regions, such as the Permian Basin. However, he has put several limits on new exploration and development activities, instead pushing his green policy forward.

Biden’s Inflation Reduction Act offers subsidies, incentives, and grants for the development of renewable energy projects and carboncutting initiatives across the country. This policy was introduced not only in a bid to cut the rising inflation that’s been seen over the last year but to support America’s transition away from fossil fuels to cleaner alternatives. This has gone hand in hand with several of Biden’s other initiatives, such as banning the sale of new oil and gas leases. This has had a significant impact on oil-rich regions, such as Alaska, which were hoping to continue developing their oil prospects to boost state revenue and job creation. At the same time, demand for “black gold” remains high.

But now, Biden is facing mounting pressure to decide on the future of Alaska’s oil and gas production. Alaska has been in limbo for the last few years, unsure of whether new oil projects will go ahead. Now,

there are calls on Biden to approve or reject ConocoPhillips’ major Willow project, with the potential for construction on the North Slope to start immediately, during the short winter season. If no decision is made, the company will have to wait until next year to start any development. With Alaska’s economy struggling, several vested parties are pushing for the oil project to go ahead, including Alaska’s bipartisan congressional delegation.

Yet the local population and Alaskan Native leaders are split on their support for the development. While it could bring much-needed funds and jobs to the region, the development of new oil projects also poses a threat to the fragile environment. If approved, the Willow project is expected to produce 180,000 bpd of oil and create $10 billion in tax and royalty revenues, as well as 2,000 construction jobs and 300 permanent positions. However, it would require five drilling sites, a processing facility, 50 miles of new roads, seven bridges, and an airstrip to get up and running. The scale of this project is a cause of concern for environmentalists in a region that is already being threatened by climate change.

Climate activists gathered outside the White House in December to protest the Willow oil project. Magnolia Mead from the organization, This is Zero Hour, stated, “Our recent climate wins, the clean energy advancements we’ve made, President Biden’s 2030 goals—they’re all for nothing if the administration approves this colossal drilling project.” She explained, “Youth turned out to elect President Biden and Democrats because of their ambitious climate promises, and all eyes are on him to follow through.”

While there is significant debate about whether Willow should go ahead or not, ConocoPhillips has made its stance clear. In a December statement, the firm explained: “Any further delay [at Willow] is unwarranted after five years of environmental review of the project.” ConocoPhillips Alaska President, Erec Isaacson, also suggested that if the Biden Administration restricts the development to two drilling locations, the firm will back out of the project.

Alaska continues to wait in a state of limbo for President Biden to determine the future of its oil and gas industry. By proxy, the state’s immediate economic outcome, the battle between Big Oil and the Alaskan government with environmentalists across the U.S. will continue, and uncertainty will loom over the state.

About the author: Felicity Bradstock is a freelance writer specializing in Energy and Industry. She has a Master’s in International Development from the University of Birmingham, UK, and is now based in Mexico City.

If approved, the Willow project is expected to produce 180,000 bpd of oil and create $10 billion in tax and royalty revenues

Back in the early 2000s, peak oil supply was a big topic in the news world. That was before the U.S. shale revolution began, and the doomsday warnings abounded. But then the revolution began, turning the United States into the biggest oil producer in the world, and talk of peaking supply quietly disappeared.

Then it was time for peak demand. For years now, various forecasters, most of them from organizations with a vested interest in the energy transition, such as climate-focused Non-Governmental Organizations (NGOs), have been saying that the transition will eliminate oil demand within a few decades.

Wind and solar power, and the electrification of transport, would be the drivers of peak oil demand, these organizations said. This year they have seen additional momentum from

Russia’s invasion of Ukraine and the resulting oil and gas squeeze in Europe.

Now, the oil shortage is viewed as a catalyst for the transition to low-carbon energy and, as a result, peaking oil demand. The head of the International Energy Agency said as much in a recent interview with the FT.

“After rapid growth in gas consumption in the last 10 years, we think the golden age of gas is coming to an end,” Fatin Birol told the FT. “Together with the decline in coal and oil that we were already expecting, we now see a peak around 2030 for all fossil fuels.”

At the same time, however, OPEC, which has a vested interest in the longevity of oil demand, has unsurprisingly forecasted this demand will be around for longer than the IEA and its fellow transition champions, such as the European Union, expect or hope. And it

will be growing for at least another ten years.

Then again, according to the energy minister of one of OPEC’s members, the UAE, the longterm outlook for the oil industry is one showing a decline.

Speaking at the ADIPEC conference in Abu Dhabi in November 2022, Suhail al-Mazrouei said, as quoted by Bloomberg, “To assume oil is going to be there forever is wishful thinking. No matter how much we defend it, it’s in decline mode.”

In other words, right now we have two competing narratives about the future of oil. One sees the danger in peaking supply and the other sees the danger in peaking demand. Neither of these narratives is helping enhance the world’s energy security, however, and this could become a bigger problem than either of the peaks being forecast.

Now, the oil shortage is viewed as a catalyst for the transition to low-carbon energy and, as a result, peaking oil demand

There is already a shortage of investment in new oil exploration, and, respectively, production. OPEC has been sounding the alarm on this shortage for months now.

Saudi Energy Minister, Abdulaziz bin Salman, warned in December 2021 that insufficient investment in new oil production threatens a longterm shortage. None other than the IEA called in its Oil Market Report from October of the same year of an imminent shortage and price rally unless more is invested in new oil production.

This is giving the oil industry rather mixed signals. Especially coupled with the unrelenting pressure on Big Oil majors from shareholders, governments, and climate organizations to pivot further away from their core business and focus on low-carbon energy—a call Big Oil is heeding.

Add to all these Western sanctions on Russian oil, which could see the country’s production drop by more than 1 million barrels daily next year, and a supply squeeze begins to seem unavoidable. Some, such as the IEA’s Birol and various E.U. officials still believe this squeeze would only accelerate the energy transition.

One would think they’d know better after the last few months in Europe, but this does not seem to be the case. The belief stems from an assumption that all raw materials for this accelerated transition will be readily available and affordable in sufficient volumes. This, however, is not the case. Presently, there’s a massive copper shortage on the way, and wind and solar costs are going up rather than down.

What this means is that we might find ourselves stuck in a situation where there is not enough oil or gas to avoid a prolonged recession; which, compared to what is currently happening in Europe, would look like a picnic.

At the same time, there will not be enough copper, cobalt, and lithium to replace those missing hydrocarbons with low-carbon electricity. Instead of energy progress, we might well witness energy regress back to

wood and coal. In fact, we are already seeing this in parts of Europe. This regression would be accompanied by higher carbon emissions, as well.

Years ago, one of the main arguments favoring the energy transition was the finite nature of oil and gas. Some researchers, however, have counter-argued that oil and gas is not limited. Others have pointed to technological advancements in the extraction of fossil fuels as a reason to believe we will have oil and gas for decades, if not centuries, to come, as long as the price makes these resources economical.

A supply squeeze in the absence of competitive wind, solar, and hydrogen, will change the economics of such fossil fuel resources. Peak oil demand might well be delayed once again, as it has been repeatedly in the past.

This suggests reports of oil’s imminent death have been greatly exaggerated. At the same time, reports of an imminent supply shortage may turn out to be pretty accurate, with prices going up considerably in the absence of large-scale investment.

Since there is no indication of large-scale investments on the horizon, the world would need to brace for those higher prices. They, in turn, would eventually motivate higher spending on new production but chances are this spending will be guarded as transition pressure does not show any signs of letting up, either.

About the author: Irina Slav has been writing about energy, with a focus on the oil and gas industry, since 2006. Her articles have appeared in Oilprice, Fortune, Insider, and Time magazine, among others.

A supply squeeze in the absence of competitive wind, solar, and hydrogen, will change the economics of such fossil fuel resources.

By: Felicity Bradstock

By: Felicity Bradstock

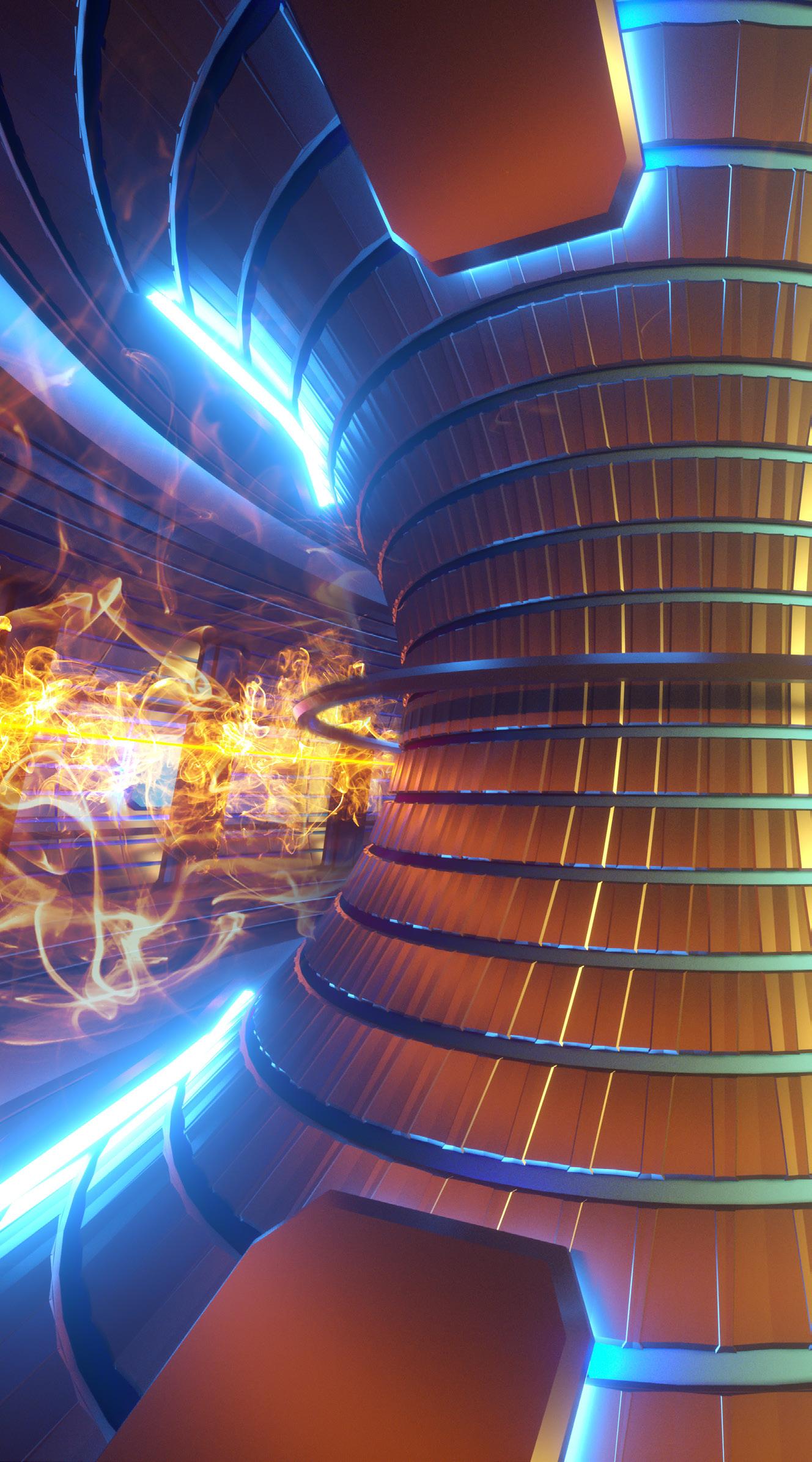

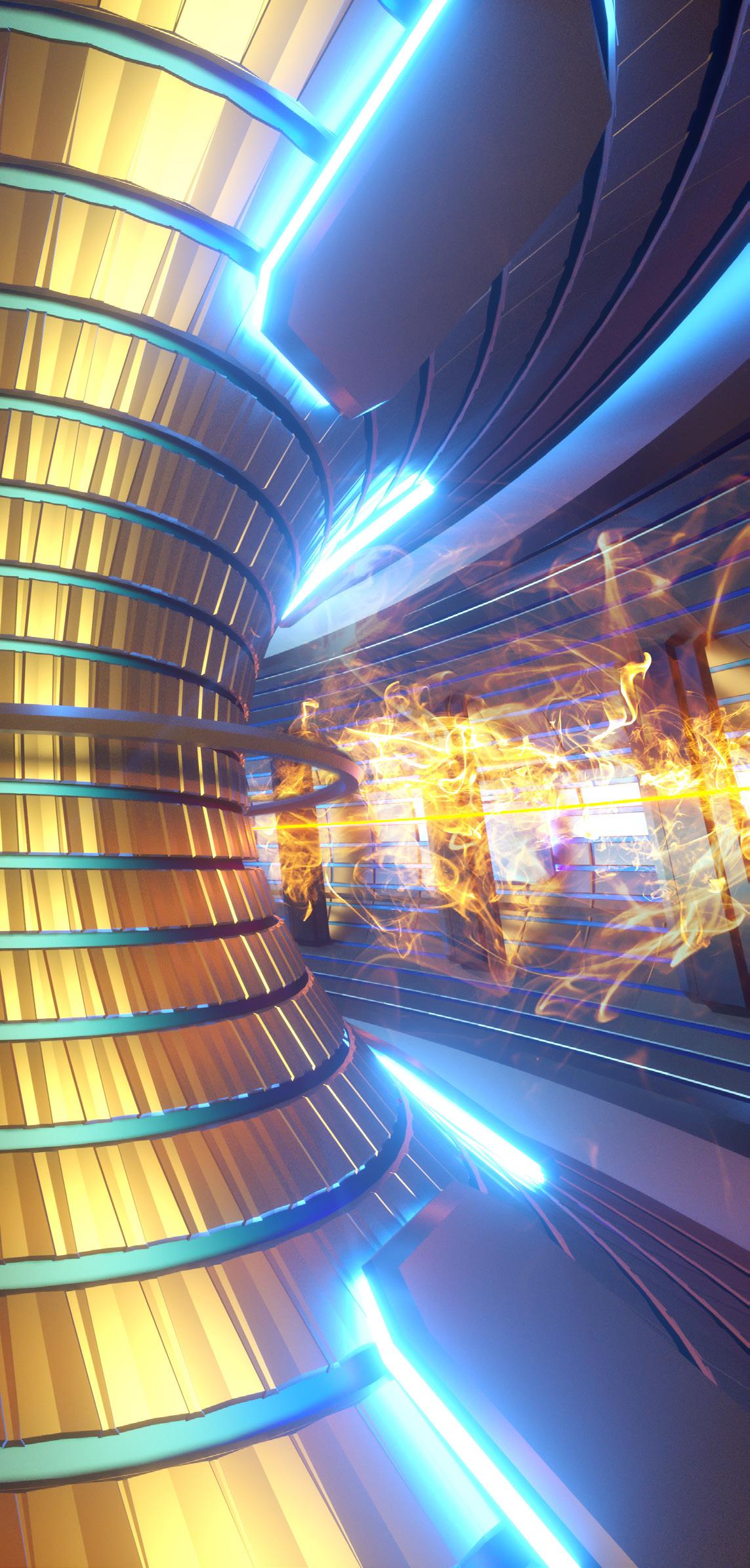

In December, American scientists announced a breakthrough in the race to achieve nuclear fusion. Physicists have long been chasing nuclear fusion as it offers the potential for almost limitless clean energy. This can provide a possible way to effectively transition away from the global reliance on fossil fuels. But in the weeks following the development, experts quickly pointed out that we are likely still a long way off from making nuclear fusion a reality.

According to the International Energy Agency definition,

Nuclear fusion is the process by which two light atomic nuclei combine to form a single heavier one while releasing massive amounts of energy. Fusion reactions take place in a state of matter called plasma—a hot, charged gas made of positive ions and free-moving electrons with unique properties distinct from solids, liquids, or gases… nuclei need to collide with each other at extremely high temperatures – around ten million degrees Celsius. When the nuclei come within a very close range of each other, the attractive nuclear force between them will outweigh the electrical repulsion and allow them to fuse. For this to happen, the nuclei must be confined within a small space to increase the chances of collision.

This process occurs naturally in the sun and other stars. The reason that researchers have been working so hard over the past decades to achieve nuclear fusion is that this process could generate four times more energy per kilogram of fuel than nuclear fission—the opposite process, currently used in plants. It would produce almost four million times as much energy as burning oil or coal. In addition, nuclear fusion would produce far less radioactive waste than fission. Waste has been a major deterrent to developing nuclear

energy operations in several countries worldwide.

A group of scientists announced in December that they were able to overcome a major hurdle in the achievement of nuclear fusion. They produced a greater level of energy from a fusion experience than was put in. The event took place at the National Ignition Facility (NIF) at the Lawrence Livermore National Laboratory (LLNL) in California. The Director of LLNL, Dr. Kim Budil, stated: “This is a historic achievement…over the past 60 years thousands of people have contributed to this endeavor and it took real vision to get us here.”

The NIF experiment involved putting a minuscule amount of hydrogen into a capsule the size of a peppercorn and blasting it with a 192-beam laser to heat and compress the fuel. The laser heats the capsule to around 100 million degrees Celsius to compress it to over 100 billion times that of Earth’s atmosphere. The capsule then implodes on itself, meaning that hydrogen atoms can fuse and release energy. The energy input totaled 2.05 megajoules to achieve an output of 3.15 megajoules of fusion energy output.

The amount of energy created in the experiment is miniscule. However, getting more energy out than was put in marks a major advancement in the field. To get to this point, billions of dollars were pumped into the experiment, which will need to be repeated and perfected before any further advances can be made. This is a slow and laborious process, but the potential payout – abundant clean energy –is huge.

Yet, researchers must overcome a host of barriers to get anywhere near

commercial-scale nuclear fusion. While the NIF lasers fire once per day, a nuclear power plant would require targets to be heated around 10 times a second. The price of these targets is extremely high, with each one in the experiment costing tens of thousands of dollars. This cost needs to be reduced dramatically, to around 10 cents a target, for it to be economically viable. Further, scientists must work out how to get the energy out in the form of heat.

Dr. Budil believes that with the necessary level of funding, a “few decades of research could put us in a position to build a power plant.” She suggested that a power plant using an alternative technology used at the Joint European Torus (JET) in Oxfordshire could be possible even sooner. But experts have been quick to respond to these claims. Justin Wark, Director of the Oxford Centre for High Energy Density Science, explained “I understand that everyone wants to think of this as being the great solution to the energy crisis. It is not, and whoever says it is with any certainty is misleading.” He added, “It is highly unlikely that fusion will impact on a timescale sufficiently short to impact our current climate change crisis, so there must be no let up on our efforts in that regard.”

The recent breakthrough in nuclear fusion provides a hugely optimistic step towards achieving abundant clean energy and offering a possible move away from polluting fossil fuels. However, it will likely take decades of more research and experiments, as well as huge levels of investment, to advance this achievement to anywhere near the commercial scale.

Physicists have long been chasing nuclear fusion as it offers the potential for almost limitless clean energy

There are a series of energy policies that need consideration to put our nation on a path of positive and lucrative change.

First, the Strategic Petroleum Reserve’s (SPR’s) purpose is for emergency use, such as natural disasters, war, or international incidents that impact the global supply chain. At its highest point in 2010, the reserve had 726.6 million bbl. of oil. When Biden took office, it contained 640 million bbl. By September of 2022, the SPR was depleted to 450 million bbl, a 30% decrease in our stockpile since Biden took office. The SPR needs to be restored as quickly and efficiently as possible in preparation for a potential crisis.

There is a popular concept circulating in environmental circles that all renewable energy sources are non-polluting and have no potential problems. Simultaneously, all fossil fuels are depicted as irredeemable, can’t be improved, and should simply be shut down. However, the clean-up of wind power and solar sites does have environmental effects and costs.

It’s also crucial to consider the financial and environmental costs of disposing of old

The SPR needs to be restored as quickly and efficiently as possible in preparation for a potential crisis

batteries. Much of the improvement in battery function in the past few years comes from the use of rare earth elements. The mining of which also takes a highly negative environmental toll. We also need to consider the implications on international relations of the high proportion of rare earth elements from the People’s Republic of China. The importance of rare earth minerals to the world’s economic well-being points to the negative consequenc-

es economically and balance of power-wise to the United States if China continues to maintain its place as the dominant player in this space.

The Impact of Ethanol

Discontinuing the use of ethanol in gasoline is a no-brainer. Even many environmentalists with whom I have no other area of agreement in policy matters agree on this issue. Ethanol usage, especially made from corn, has a worse environmental impact than fossil fuel. The usage of water and fertilizer in corn production is exceptionally high. It is a highly inefficient use of resources to use good cropland to produce corn for ethanol rather than food. I also question the morality of using corn-based ethanol when it tends to drive up the cost of food and make inefficient use of the land and other resources. Doing away with the ethanol requirement could make a considerable difference since 40% of the US corn crop is now used for ethanol production.

It is a human tendency to make the perfect the enemy of the good. The anti-fossil fuel advocates don’t want incremental improvements in fossil fuel efficiency and reduction in pollution. They demand immediate action regardless of the cost. They don’t want improvements in oil and gas; they want it gone, and if they can accomplish that by pricing fossil fuels out of existence, so much better.

The foreign policy implications of the Russian Federation and various middle eastern countries using their oil and gas supplies to serve their various policy aims have loomed large over the last 50 years. It makes sense to allow the oil and gas industry here in America the freedom of production so that we can reduce the influence and impact those countries have on the world economy. It also makes more sense to produce higher amounts of oil rather than risk the lives and limbs of our servicemen as well as billions, and in some cases trillions, of dollars in aid and weapons to fight the effects of influence earned from money received by hostile and potentially

hostile countries from the sale of their oil and gas production.

About a decade ago, when I was a commissioner on the Railroad Commission of Texas, I spoke out against the Russian attempts to manipulate public opinion by furnishing money and messaging to the anti-fracturing collection active in the United States and Europe. They did this not because of any concern for the environment, but because they wanted to reduce the production of oil and natural gas in the U.S., thereby increasing the Russian Federation’s market share and cash flow. Of course, I was attacked by the media at that time for those statements. However, Russia has been, and is, still using its oil and gas production market position as an important part of its foreign policy strategy.

Energy production is probably the most important facet of the modern economy. That is why we need an “all of the above energy policy” to produce energy as cheaply and efficiently as possible. The competition will sort out the cheapest and most efficient forms of energy production in the long run. This should be left to the free market rather than governmental mandates.

Tax credits should be terminated for vehicle purchases be they ZEV, EV, or hybrid vehicles. Requirements and or goals mandating either the terminating of the manufacture of gas-powered vehicles or requiring a certain percent sale of non-gas-powered cars should be ended. Requirements requiring certain percentages of electric power production to come from renewable sources should be terminated. Government should not be in the business of picking winners and losers. While these policy changes will not solve all the world’s energy problems immediately, I sincerely believe their adoption will improve the economy and efficiency of energy production in 2023.

About the author: David Porter has served as a Railroad Commissioner (2011–17) and Chairman (2015–16), as well as Vice Chairman of the Interstate Oil and Gas Compact Commission (2016). Prior to service on the Commission, Porter spent 30 years in Midland, Texas, as a CPA working with oil and gas producers, service companies and royalty owners. Since leaving the Commission, Porter works as a consultant for oil and gas companies. He also serves as Chairman of the 98th Meridian Foundation, a nonprofit concerned with water, energy and land issues.

Energy production is probably the most important facet of the modern economy.

Geopolitics has played a large role in creating the bear market and economic slowdown in 2022. These unfortunate conditions are expected to continue into 2023, or at least until major changes occur. Investors should remain cautious and conservative heading into the New Year.

There is a structural imbalance in the geopolitical system. Russia, China, Iran and others are rejecting the United States’ global leadership. They now strive to create spheres of influence in their regions that are separate from the U.S.-led democratic world order. The U.S. is internally divided, creating a window of opportunity for these nations to continue to do so. Moreover, each of them is domestically unstable and may seek to distract their populations from their woes through conflicts abroad. This dynamic is clear with Russia and Iran in 2023, and it may or may not prove to be the case with China.

Investors have very little certainty about U.S. policy due to the 2024 election, not to mention Russian, Chinese, and Iranian policies. If these revisionist states achieve their spheres of influence, the world order will rupture and the global economy will fragment. If they fail, then the world order could be reinvigorated— but that will not happen until 2025 at the earliest due to the immense influence and uncertainty around U.S. policy. So the world order is unstable and could get worse before it gets better.

This geopolitical predicament is causing immediate conflicts that disrupt economic activity, such as the war in Ukraine. It is also driving up the odds of conflicts in the Middle

East in the short run. Similarly, this is driving the geopolitical risk in East Asia is also increasing in the long run and potentially in the short run.

The U.S. needs to improve its understanding and relationships with Russia, China and Iran. Specifically, a Ukraine ceasefire, a resumption of EU-Russia energy trade, a deescalation of the U.S.-China trade and tech war, a solid reaffirmation of the status quo in the Taiwan Strait and a U.S.-Iran nuclear agreement. All of these positives could happen in 2023, but few of them are likely. A resumption of Russian energy flows would be the likeliest candidate for a positive geopolitical surprise in 2023, but that may not happen until late in 2023 if at all.

Presently, none of these positive surprises are rising in odds, whereas negative surprises are still likely. Russian military leaders have intensified their attacks on critical infrastructure in Ukraine and are preparing to renew their general offensive. Russia is forming a closer military alliance with Iran as a supplier not only of drones, but also of ballistic missiles. Hence the U.S. is moving to provide Ukraine with upgraded missile defense, in addition to continued robust military and financial support. Russia has threatened to attack these defensive systems in Ukraine.

Russian strategy has backfired across the board, and President Vladimir Putin’s regime should be seen as dangerous and unpredict-

able. Russia is threatening to cut off European oil and gas further, as the European Union tries to implement an oil embargo, sanctions on shipping and insurance and a price-cap scheme. Europe has not resolved its long-term energy crisis resulting from the break in Russian energy imports, so its economy faces more downside surprises.

The EU is losing the willingness to impose stricter sanctions on Russia, which is incentivizing Russia to put more pressure on Europe, via energy squeeze and refugee flows. Moscow wants to create a better environment for diplomatic negotiations. They hope that it will result in a de facto acceptance of Russia’s territorial annexations. The implication is that negative news will precede positive news.

Iran is attempting to defeat revolutionary social forces at home through police repression and provocative foreign policy abroad. Not only is Tehran helping Russia in Ukraine. It will also likely stage militant actions in the Middle East to warn the US and Israel against efforts to destabilize it.

Saudi Arabia will remain geopolitically aligned with the United States in the context of Iranian regional aggression, Russo-Iranian cooperation, and Chinese instability and inability to project power in the Persian Gulf. But Crown Prince Mohammed bin Salman and US President Joe Biden do not see eye to eye. OPEC production will react to global economic conditions, up or down, and will not accommodate the US election cycle.

Given the separate but related Russian and Iranian dynamics, the potential for global energy shocks is high in 2023. Large and unexpected supply disruptions should be taken as a base case.

Oil supply shocks might not push up prices for very long in the context of a global slowdown, but prices will rise before they fall because of a simultaneous shift in Chinese policy to try to stabilize the economy.

General Secretary Xi Jinping has changed tactics after consolidating power at the twentieth national party congress in October. He is relaxing social restrictions and reopening the economy to prevent Covid-19 from exacerbating economic slowdown and social unrest any further. He will continue to provide monetary and fiscal stimulus in 2023, while easing heavy-handed regulations, including on the ailing property sector. The implication is that Chinese growth will at least temporarily stabilize— which is positive for global commodity prices in the short run.

However, China faces a historic confluence of internal and external risks, including structural debt-deleveraging, structural drivers of social unrest and structural competition with the U.S. It’s anticipated that 2023 will not provide much respite from these concerns. U.S.-China re-engagement will not be in the cards until China recognizes that a stimulus is not the solution to their structural socio-economic problems. So, any boost to commodity prices from Chinese stabilization in 2023 will be overshadowed by medium-term and long-term structural trends that are negative for Chinese growth potential.

In short, geopolitics point toward a temporary Chinese economic stabilization with persistent energy supply problems, which is expected to push commodity prices up until recession drags them back down. A global recession is likely in 2023-24, aside from geopolitics due to high inflation and restrictive monetary policy. Any large new energy shocks will weigh on private consumption and corporate profit margins and reinforce uncertainty over the path of headline inflation and central banks’ interest rate hikes. The good news for commodities is that supply constraints will likely impose a higher floor than in the recent past.

Investors should stay cautious and conservative in 2023 and favor government bonds over stocks, U.S. stocks over global stocks and defensive sectors over cyclical sectors.

About the author: Matt Gertken is BCA Research’s Chief Strategist, Geopolitical Strategy and US Political Strategy. He oversees the firm’s coverage of market-relevant policy developments across the world. Prior to joining BCA in 2015, Matt worked as a Senior Analyst at Strategic Forcasting, Inc (Stratfor) and in various academic and publishing roles. Matt holds a MPhil from the University of Cambridge and a Ph.D. from the University of Texas in Austin.

By: Seenu Akunuri

By: Seenu Akunuri

As companies shift their focus to sustainability and ESG initiatives, the oil and gas industry is investing in a long-term future that goes beyond their reliance on fossil fuels. The world is beginning to transition towards renewables and other lower-carbon alternatives. Government incentives, like the Inflation Reduction Act (IRA), can help the industry’s decarbonization journey by making cleaner energy more economically viable.

Billed as the largest climate legislation in U.S. history, the IRA stands as one of the best opportunities to speed up the pace of the clean energy transition. We can expect substantial acceleration in the coming years due to the incentives contained within. Nearly $370 billion has been made available in climate and clean energy provisions that will enable and streamline various decarbonized investments.

These incentives will remain in place for a decade, allowing companies greater certainty as they consider investing in renewables.

The IRA is anticipated to encourage more deal activity and investor interest, specifically in cleaner assets and technology. In the coming year, PwC projects that companies are likely to focus on monetizing non-core assets to expand portfolios in new direc-

tions. These areas include carbon capture technology, liquefied natural gas (LNG) and renewables, especially hydrogen and biofuels.

As executives consider how carbon reduction could change their company’s cost structure, they need to understand the far-reaching impact the IRA makes on the cost of doing business. Beyond potentially making it easier and more economical to advance their company’s cleaner energy agenda, provisions within the act could also have negative implications for their margins and cash flow.

The IRA’s 15% minimum tax on corporate profits requires a deeper assessment of how it’s calculated. It’s imperative to understand where the 15% will get applied and how companies can protect their business and value for shareholders. Also, operating costs could change as companies continue to decarbonize. Offering the same product that is decarbonized, versus one that is not, could come at a price differential with profit and loss (P&L) implications.

Of course, it depends on how much the end customer values decarbonized products. For instance, sought-after sustainable aviation fuel can cost four-to-five times as much

as standard fuel. This can offset the cost to produce the product, add more margin and positively impact P&L. Conversely, if there is no price premium to capture, the cost to produce decarbonized products can have a negative impact.

The act also allows more flexibility with direct pay for qualifying companies and transferable credit options. This flexibility could have a significant impact on companies relying on financing arrangements for energy-related projects. While not a requirement of the provision, the ability to transfer credits to another entity may encourage companies to form new partnerships or joint ventures to gain more access to clean energy, tap into new revenue sources, or explore new business configurations.

For instance, we could see more strategic relationships where a traditional energy company teams up with a small, modular reactor provider offering nuclear as a zero-carbon backup to wind and solar. Or, more hydrogen producers and nuclear operators could forge symbiotic relationships where the output from nuclear supports hydrogen production. All players in these scenarios could potentially benefit from various IRA incentives.

Hydrogen: An IRA Beneficiary in Focus

Before the IRA was enacted, deals in the energy sector focused on renewables may have taken several years for companies to see a return on investment. The credits awarded via the IRA make these deals more lucrative, with companies seeing their ROI quicker. As a result, we expect to see an increased interest and investment in renewables, especially hydrogen.

Take refiners, for example. While downstream deal activity has remained sluggish for many years now, refiners are making an effort to increase their ESG initiatives, focusing on renewable diesel, biofuels, etc. Hydrogen investment appeals to downstream players, offering the potential for an alternative, clean-burning fuel. Given that the IRA offers incentives that make biofuels and hydrogen production more economical, it would behoove refiners to consider making more significant investments.

In fact, they should probably consider the option sooner rather than later, as players who have already placed big bets on the energy

transition are likely reaping the benefits more than anyone. Those who moved early on the research and development of hydrogen now have the green light to keep the momentum going, thanks to the IRA’s 10-year production tax credit for clean hydrogen.

Other industries working to reduce their carbon footprint may drive long-term deals focused on developing blue hydrogen, otherwise known as hydrogen made from natural gas in which the emissions are offset by carbon capture. The IRA creates longer-term incentives that may make investing in blue hydrogen development more attractive.

The IRA is accelerating our collective energy transition and presents the energy sector with a great opportunity to take the lead on reducing its emissions. Over the long run, it may encourage a flood of deal activity and investor interest in areas such as carbon capture, a technology that can help companies on their ESG journey and is more attractive because of tax credits. Likewise, the provision that allows for the transfer of credits to another entity may lead to an uptick in companies forming new partnerships, seeking joint ventures or exploring new markets to expand or evolve their portfolio.

All that is to say that while it’s up to oil and gas companies to decide whether they want to invest in renewables, the Inflation Reduction Act helps make it far more economical than in years past.

About the author:

Seenu Akunuri is PwC’s US Energy, Utilities and Resources Deals Leader, where he consults with both audit and non-audit clients on deals, valuation trends, hot topics and industry issues. With 20+ years of worldwide business valuation experience, Seenu has built a solid reputation for solving complex valuation issues around mergers, acquisitions, divestitures and other domestic, global and cross-border transactions.

As companies shift their focus to sustainability and ESG initiatives, the oil and gas industry is investing in a long-term future that goes beyond their reliance on fossil fuels

Social media has become an essential part of any marketing strategy, regardless of size or industry. Companies cannot afford to ignore social networks, as the potential benefits for both their business and their customers are immense. Social media offers the opportunity to interact with customers, build relationships, create a favorable brand image, and generate high levels of customer engagement.

Companies that leverage social media can benefit from increased visibility, as social networks offer a huge platform for businesses to reach potential customers. When incorporated into a company’s marketing strategy, social media can help increase website traffic, boost brand awareness and legitimacy, increase sale conversion rates, and gain insights into the preferences of their target audience.

For example, business owners can use social media to keep up with current trends in their industry by monitoring what their competitors are doing online, as well as identifying emerging opportunities in the marketplace. Additionally, they can use social network analytics tools to track conversations related to their brand or product. This data can prove invaluable in improving customer service and product development efforts.

Social media also provides businesses with a low-cost platform for advertising products and services directly to customers on an individual basis. Plus, through paid campaigns on Facebook or Twitter Ads, companies can target specific geographic areas or demographic groups that may be interested in purchasing their goods or services.

Similarly, businesses can fortify relationships with customers by engaging directly with them over comments on posts on their page. Proactive customer service strategies, such as responding quickly to complaints or inquiries about a product or service offered by the business, will go a long way toward creating loyal customers who feel heard and appreciated by the company they patronize.

Overall, it is clear that businesses must embrace social media if they want to stay competitive in today’s digital world. By taking advantage of its many benefits including increased visibility and influence in the marketplace; improved customer service; deeper insights into user preferences; cost-effective advertising opportunities; and building positive relationships with consumers through active engagement – any business can maximize its potential growth through proper implementation of its own personalized social media strategy.

About the author: As the publisher and CEO of SHALE Magazine and the host of In the Oil Patch radio show, Kym Bolado has conducted more than 250 interviews with energy experts. With 25 years of entrepreneurial experience, Kym Bolado started SHALE Magazine in 2013 as a result of her interest in the economic development taking place in Texas. The magazine thrived early on and has seen exponential growth since. Along with the growth of the magazine, Bolado took on the new challenge of becoming a radio talk show host on In the Oil Patch. In the Oil Patch was started in 2015 on San Antonio’s KTSA 550 AM. Within six months the show was in syndication. The show now airs on iHeart’s KTRH 740 AM in Houston, the number-one talk radio station in the U.S. The radio show also airs in major metropolitan areas in Texas including Dallas, Midland, San Antonio, Austin, and Corpus Christi, as well as parts of New Mexico, Louisiana, and Mexico.

Businesses must embrace social media if they want to stay competitive in today’s digital world

Companies cannot afford to ignore social networks, as the potential benefits for both their business and their customers are immense

By: Kym Bolado

By: Kym Bolado

The use of artificial intelligence (AI) in the energy sector has been mainly focused on improving operational efficiency and predictive analytics. Companies are using AI-driven technologies to analyze large amounts of data to make accurate predictions about future events, giving them a competitive advantage over their peers. By leveraging AI technology, companies are able to reduce costs, improve productivity and find new ways to increase their profits. Additionally, AI is being used to optimize asset performance and detect potential issues before they become serious problems.

AI can also be used by oil and gas companies for marketing purposes. Automated campaigns powered by machine learning algorithms allow companies to target specific audiences with personalized messages that speak directly to their needs. This type of targeted marketing helps oil and gas companies reach more customers and drive more sales.

AI is also being used to improve safety and security in the energy industry. Companies are leveraging AI-driven technologies to monitor equipment, detect potential risks, and alert workers of any potential danger. By using predictive analytics, companies can take proactive steps to protect their people, processes, and assets from harm.

As AI technology continues to evolve at a rapid pace, the role it will play in the energy sector remains uncertain. However, one thing is for sure: AI has revolutionized the way oil and gas companies operate and find success in today’s competitive market. As digital marketing evolves and new technologies are developed, we will continue to see innovative applications of artificial intelligence within the energy industry.

With the rapid advancement of technology, AI is becoming increasingly important for oil and gas companies to stay competitive. AI-based applications provide a wealth of opportunities for companies in the energy industry, from improved operational efficiency to targeted marketing campaigns. It is clear that AI will continue to revolutionize the way we do business in this sector for years to come.

By leveraging Artificial Intelligence (AI) technology, oil and gas companies can make more accurate decisions, optimize their assets and processes, improve safety, and target potential customers with personalized messages — all while reducing costs and increasing profits. In the age of digital transformation, it’s essential that oil & gas companies embrace AI solutions if they wish to remain competitive in today processes, from exploration and drilling practices to customer engagement strategies.

About the author: As the publisher and CEO of SHALE Magazine and the host of In the Oil Patch radio show, Kym Bolado has conducted more than 250 interviews with energy experts. With 25 years of entrepreneurial experience, Kym Bolado started SHALE Magazine in 2013 as a result of her interest in the economic development taking place in Texas. The magazine thrived early on and has seen exponential growth since. Along with the growth of the magazine, Bolado took on the new challenge of becoming a radio talk show host on In the Oil Patch. In the Oil Patch was started in 2015 on San Antonio’s KTSA 550 AM. Within six months the show was in syndication. The show now airs on iHeart’s KTRH 740 AM in Houston, the number-one talk radio station in the U.S. The radio show also airs in major metropolitan areas in Texas including Dallas, Midland, San Antonio, Austin, and Corpus Christi, as well as parts of New Mexico, Louisiana, and Mexico.

By leveraging AI technology, companies are able to reduce costs, improve productivity and find new ways to increase their profits.

In the age of digital transformation, it’s essential that oil & gas companies embrace AI solutions if they wish to remain competitive in today processes

The Listings grade is a reflection of your business’s online listings. Each listing source is assigned a score based on how popular the site is. For example, having an accurate listing on a popular site like Google will have a greater influence on your Listing Score. The Listings grade is determined by the percentile range your business falls into when compared to other businesses in the same industry.

Review grades are a reflection of your business’s online review performance. Each grade in the Reviews section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

Social grades are a reflection of your business’s social media presence. Each grade in the Social section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

Website grades are a reflection of your business’s website performance, based on Google’s PageSpeed Insights. Each grade in the Website section is determined by the percentile range your business falls into when compared to other businesses in the same industry.

The Advertising grade is a reflection of your business’s online campaign performance. The grade is determined by the percentile range your campaign’s estimated cost per click falls into when compared to other businesses in the same industry.

The Search Engine Optimization (SEO) grade is a reflection of your business’s search engine visibility. The grade is determined by the percentile range your keywords’ estimated value per click falls into when compared to other businesses in the same industry.

Earlier this month, our publisher and CEO Kym Bolado attended the American Association of Port Authorities POWERS conference. There, she moderated a panel for Dr. Merkel from the University of Texas in Austin on carbon capture and storage.

Reaping

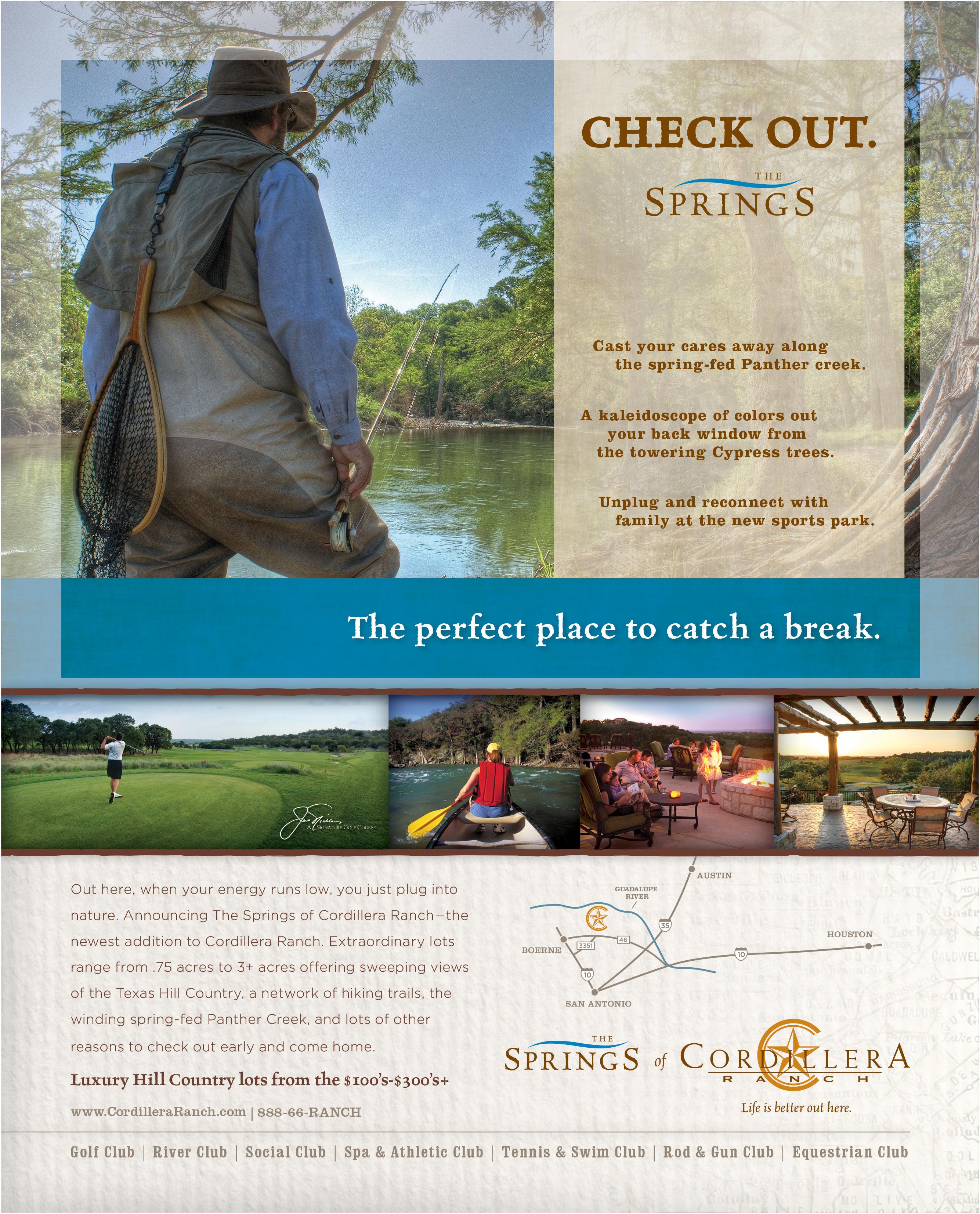

| Chris J. | Orvis.com Review

| Chris J. | Orvis.com Review

...I have been to several high-end hunting lodges over the years. Some of which have something that needs significant improvement. Not Joshua Creek Ranch! From accommodations, to the dining, to the guides, and especially the hunting, we had one terrific time. We will definitely be back!”

– UPLAND BIRD HUNTS FOR QUAIL, PHEASANT & CHUKAR –– EUROPEAN-STYLE DRIVEN PHEASANT SHOOTS –– DECOYED MALLARD DUCK HUNTS –– FREE-RANGE TROPHY AXIS DEER HUNTS –– SPORTING CLAYS & FLY-FISHING –– LUXURY LODGING, FINE DINING & RESORT AMENITIES –