Optiro is a resource consulting and advisory group.

Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software.

In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results.

+$15 BILLION DEALS/ VALUATIONS

>780 MILLION oz Au RESOURCE AUDITS

+5 IRON ORE BILLION TONNES

>4,300 MILLION lb NICKEL

>64 MILLION oz Au RESOURCE ESTIMATES

24 COMMODITIES

53 COUNTRIES

+2,000 PEOPLE TRAINED

>5,100 MILLION lb COPPER

>3,000 CLIENTS

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters. Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service

All funds are monthly

PUBLISHER

CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS

ROB RAMOS

AALIYAH ZOLETA

MARIE GABRIELLE

MEDIA PRODUCTION

STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR

SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING

CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR

SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING

mining.profiles@skillings.net

GENERAL CONTACT INFORMATION

info@cfxnetwork.com

which

Magna Mining Inc. has announced the signing of a Definitive Off-Take Agreement with Vale Base Metals’ wholly-owned subsidiary Vale Canada for the advanced exploration portion of the Crean Hill Project in Ontario.

Jason Jessup, CEO of Magna Mining stated, “We are extremely pleased to be able to announce the signing of the Definitive Off-Take Agreement with Vale. This Agreement is the culmination of several months of work with Vale and we are quite pleased with the outcome.

Additionally, the recent announcement of the filed Amended Closure Plan has Magna on track to have all the permits in

place to develop the ramp from surface, which will allow for underground test mining and set up for a future commercial production decision.”

Under the Agreement, initial production would be shipped to Vale’s Clarabelle Mill in Sudbury for processing. This includes material from the Main, Intermediate, 9400, 9400 Footwall and 101 Footwall zones. The 109 Footwall zone is exclud-

ed from the Agreement and is planned to be processed through an alternative mill with potentially increased precious metal recovery during the advanced exploration period.

In advance of negotiating the Agreement, Magna completed an extensive test programme at a third-party metallurgical facility using representative ore samples from the Crean Hill deposit.

The newly activated Mining Marshal Corp, which currently has 2,220 personnel, is an inter-agency security outfit established to secure the mining environment. The Minister of Solid Minerals Development, Dele Alake, has directed mining new marshals drawn from the Nigerian Security and Civil Defence Corps (NSCDC) to smoke out illegal miners and all those who flout the nation’s mining laws.

Mr Alake gave the directive while inaugurating the first batch of mining marshals drawn from the NSCDC to combat illegal mining. He said that 60 marshals have been specially trained and deployed to the 36 states across the federation and the Federal Capital Territory.

The minister said the newly activated Mining Marshal Corp, which currently has 2,220 personnel, is an inter-agency security outfit established to secure the mining environment.

According to the minister, the ministry plays a pivotal role in supporting the operations of the mine marshals to ensure their success. ‘Effective intelligence gathering through our state mines inspectorate, harnessing valid data of troubled mining areas and giving the requisite directives for precise operations are necessary factors for coordination of the activities of the marshals.

Zimbabwe’s platinum industry is confronting a severe crisis as prices continue to plummet, leading major producers to consider widespread layoffs and operational downsizing.

The industry, which plays a significant role in the country’s economy, is grappling with dwindling profits and global market challenges. Despite efforts to mitigate the impact, experts warn of potential mine closures unless urgent interventions are made.

The platinum industry in Zimbabwe is facing unprecedented challenges as prices for Platinum Group of Metals (PGMs) experience a sharp decline. According to forecasts by the World Platinum Investment Council (WIPC), Zimbabwe’s platinum output is projected to decrease this year, with major producers such as Mimosa and Zimplats already announcing plans for workforce downsizing.

The downturn in Zimbabwe’s platinum sector mirrors a broader global trend of slowing demand and falling prices for PGMs. Factors such as geopolitical tensions, including the Russia-Ukraine conflict, have further exacerbated market instability. The Chamber of Mines of Zimbabwe highlights the urgent need for government intervention to address rising operational costs and safeguard the viability of mining projects.

With platinum constituting a significant portion of Zimbabwe’s export earnings, the decline in prices has substantial economic ramifications. Export earnings from the precious metal have dropped significantly in recent years, prompting industry stakeholders to urge the government to implement measures to reduce production costs and support struggling mining companies.

As the platinum industry navigates through turbulent times, stakeholders remain cautiously optimistic about the future. However, challenges persist, particularly with the automobile industry’s shift towards electric vehicles, which has contributed to reduced demand for catalytic converters. Despite these obstacles, efforts to streamline operations and pursue growth strategies are underway to ensure the long-term sustainability of Zimbabwe’s platinum sector.

Strict rules and laws govern the mining sector in a number of areas, such as safety, site operations, and mining processes. Relevant mining training is vital to ensure workers and staff have the required skills and knowledge to complete operations successfully and safely.

Understanding the procedures, abiding by occupational health and safety (OHS) requirements, staying current with pertinent standards and technologies, and enhancing safety and risk management at a mine site are all made possible with the aid of training. Mining businesses are using simulation training more and more to train personnel remotely and cut

costs. Mining Technology has compiled a list of training and simulation solution providers based on its insights, knowledge, and vast experience in the industry.

Providers of operator training services, mine training courses, training simulators, mining simulation software, graphics programming and virtual models, and training consultancy services are included in the list.

Process trainers, mine safety and training managers, operator trainers, and training executives are the target audience for the material in the booklet available for download. To help you make a purchase,

the download includes comprehensive information on the suppliers and their product lines, along with contact details.

You can also find related buyer’s guides here, which cover a wide range of suppliers, manufacturers, and solutions for mining equipment.

In order to train operators in a safe, controlled virtual environment quickly and affordably, mining companies use simulators. Without physically being there, mining operators can acquire the necessary skills and become acquainted with the mine site.

IN

OF MINING, where complexities abound and risks loom large, the need for expert guidance and strategic management is paramount.

Mining companies, grappling with the challenges of developing and managing large-scale projects, are increasingly turning to consultancy services for specialized assistance. These services, spanning project management, engineering, and financial expertise, serve as indispensable navigators, steering mining ventures towards success amidst a sea of uncertainties.

Mining companies, in their pursuit of excellence, seek the expertise of seasoned consultants to navigate the intricate pathways of project development. From inception to execution, these consultants offer invaluable insights and solutions, ensuring projects stay on course and meet stringent standards of safety and profitability.

The selection of mining consultancy partners is a critical decision, pivotal to the success of any venture. With an array of firms offering specialized services, mining companies often turn to trusted sources for recommendations.

Platforms like Mining Technology serve as beacons, spotlighting leading consult-

ants armed with years of experience and a track record of excellence.

Consultancy services in the mining sector encompass a wide spectrum of offerings, tailored to address the myriad challenges encountered throughout the project lifecycle. From mineral exploration to environmental compliance, from geological modeling to financial modeling, these services form the bedrock upon which successful projects are built.

At the heart of mining consultancy lies the fusion of technical prowess and strategic vision. Engineers, equipped with cutting-edge tools and expertise, play a pivotal role in shaping the trajectory of mining projects. Their contributions

span the gamut, from conceptual design to operational optimization, ensuring efficiency and sustainability at every turn.

In an industry where capital reigns supreme, financial acumen is indispensable. Consultants adept in financial modeling wield data-driven insights to assess the economic viability of projects, mitigating risks and maximizing returns. Their expertise serves as a compass, guiding stakeholders through the intricacies of investment decisions and asset valuation.

As the mining industry charts its course amidst evolving landscapes and shifting paradigms, the role of consultancy services stands as a beacon of guidance and expertise.

ME Elecmetal provides more than just mill liners — we o er a complete package encompassing innovation, comprehensive support, tailored designs, and valuable tools to create a fully customized comminution solution that aligns with your unique requirements. We believe in being on the ground with our customers — setting common goals and providing timely responses based on e ective collaboration. Leveraging over a century of experience and cutting-edge technologies, we aim to optimize processes, prolong the lifespan of wear parts, mitigate operational risks, and enhance pro tability for your operations.

Innovative Mill Lining Solutions for AG, SAG, Ball, Tower and Rod Mills

• Rubber

• Composite Grinding

Premium Quality Forged Steel Grinding Media for SAG, Ball and Rod Mills

Grinding Media Product Size Ranges:

• SAG Mills: 4.0” to 6.25”

• Ball Mills and Regrind Mills: 7/8” to 4.0”

• Rod Mills: 3.0” to 4.0” Diameter

Crusher Wear Parts

Wear Components for Primary, Secondary and Tertiary Crushers

• Gyratory Crushers

• Jaw Crushers

• Cone Crushers

www.me-elecmetal.com

Booth #626Located in Pilbara, that’s a pinnacle supplier of iron ore and lithium in the world, the centre serves mining and aggregates customers with comprehensive renovation and repair answers. The inauguration ceremony become hung on 21 March 2024.

TMetso has opened its biggest carrier centre globally in Karratha, Western Australia. The centre supports the developing demand of clients’ wishes, turning in more sustainable, state-of-the-art services.

he beginning of the brand new centre is an vital milestone and further evidence of our commitment to boost up strategic investments in serving customers from pit to port. Strengthening our presence to offer elevated productiveness, shorter lead times, and environmental benefits, will permit us to take carrier skills and client revel in to the subsequent degree,” said Sami Takaluoma, President, Services Business Area, Metso.

The Karratha Service Center, backed by using an investment totalling approximately €32 million (AUS$ fifty two million), spans a 35 000 m2 location, consisting of a workshop overlaying 5000 m2. Equipped with advanced facilities inclusive of excessive-ability cranes, CNC machines, a warmness remedy furnace, welding facilities, and meeting stations, this centre has received tremendous customer support.

The centre will be capable of provider a extensive variety of heavy mining system, which includes crushers, screens, generators, HIG mills, HPGRs, and vehicle dumpers, among others.

The centre additionally contributes to clients’ sustainability dreams. By extending the operating life of property, increasing strength and water performance, and minimising plant

downtime, Metso facilitates customers in achieving their environmental and safety objectives.

Further, through minimising the need for lengthy-haul freight among Perth and the Pilbara place, the centre reduces carbon emissions and offers faster get entry to to crucial spare elements. This no longer handiest benefits the surroundings, but also complements operational efficiency.

“This is an extended-time period and big commitment to the Pilbara vicinity and the communities right here. We are extraordinarily pleased that our local clients are already expressing extensive interest and self assurance in our offerings.

Metso has a enormous established base of device and a strong recognition in Asia Pacific; each day over 900 processing vegetation depend on Metso’s generation.

By making use of Metso’s provider understanding and understanding, authentic parts, specific materials, and OEM specifications, customers will attain good sized commercial enterprise and sustainability advantages,” added Stuart Sneyd, President, Asia Pacific, Metso.

THE SIXTEENTH EDITION OF THE AFRICA ENERGY INDABA, convened below the topic “African Energy Transitioning from Aspiration to Action – Delivering a Sustainable and Prosperous Future,” concluded on a excessive be aware, marking a pivotal moment for the destiny of power in Africa.

Hosted in Cape Town, South Africa, this seminal occasion drew industry leaders, policymakers, and innovators from throughout the globe to address the multifaceted demanding situations of energy sustainability and accessibility in Africa.

Delivering the keynote cope with, the Honourable Minister of Mineral Resources and Energy for South Africa, Mr. Gwede Mantashe, furnished key insights into his authorities’s strategic imaginative and prescient for electricity.

Highlighting the Integrated Resource Plan (IRP) and the Independent Power Producer Procurement Programme (IPPPP) as significant to diversifying the strength mix, Mr. Mantashe reaffirmed South Africa’s commitment to decreasing carbon emissions and enhancing sustainability.

A middle message from the conference turned into the emphasis on collaboration and innovation to conquer power poverty and transition towards a low-carbon destiny. By merging coverage insights and strategic initiative discussions, the occasion underscored the important function of sustainable financial growth, leveraging renewable strength resources, and growing an investment-pleasant weather to deal with energy demanding situations.

The Africa Energy Indaba (AEI) also served as an impetus for fostering a collaborative environment, permitting stakeholders from numerous sectors to exchange ideas and shape partnerships. This collaborative spirit is critical for addressing the multipronged demanding situations of the energy area, capitalising on possibilities for sustainable development, and ensuring an inclusive power transition that benefits all communities.

Participants from throughout the globe garnered worthwhile insights into the complexities and opportunities within Africa’s power zone via a huge scope of discussions, workshops, and keynote speeches.

The AEI 2024 not best represented a sizeable milestone inside the collective adventure in the direction of a sustainable energy future however additionally stood out as a powerful achievement by way of all measures.

In addition, the event furnished a dynamic platform for networking, allowing attendees to forge great contacts that span continents and sectors. These interactions, facilitated with the aid of the numerous structures to be had at the AEI, have sparked partnerships poised to force innovation and development in the energy panora -

ma. The synergy of ideas and the convergence of numerous perspectives underpinned the Indaba’s position as a crucible for transformative answers, making it an unmissable occasion for absolutely everyone invested in Africa’s electricity future.

Looking beforehand, the AEI 2024 laid out a vision for a resilient and rich power future for the continent. With a strategic focus on gasoline and renewable electricity, the conference mentioned the exploration and development of herbal sources, which includes uranium and herbal gasoline, as key drivers for electricity security and monetary growth.

The capacity of fuel as a recreation-changer, coupled with the strategic position of nuclear power, presents a complete roadmap for Africa’s power region. In conclusion, this yr’s AEI has solidified a cooperative dedication to a sustainable and inclusive power destiny for Africa.

The conference highlighted critical breakthroughs inside the continent’s strength adventure at the same time as also placing the stage for future initiatives, promising a horizon rich with possibilities for energy advancement, financial development, and environmental stewardship.

As the discussions from the AEI’s sixteenth edition pave the manner for actionable strategies and collaborative efforts, Africa stands getting ready to an power transformation that promises to redefine its economic landscape whilst ensuring no person is left at the back of within the transition to a low-carbon economy.

IRON ORE FUTURES RALLIED FOR THE SECOND CONSECUTIVE session, reaching their highest levels in nearly a week. The surge was propelled by increased interest in stockpiling in China, the world’s leading consumer of iron ore, driven in part by encouraging economic data.

Iron ore futures rallied for the second consecutive session on Tuesday, reaching their highest levels in nearly a week. The surge was propelled by increased interest in stockpiling in China, the world’s leading consumer of iron ore, driven in part by encouraging economic data.

This surge in iron ore prices has also influenced the prices of ferrochrome, with notable increases recorded. Additionally, Chinese consumer demand is on the rise, particularly in the online retail sector. Meanwhile, Japan’s economic landscape is experiencing a significant shift as the Bank of Japan moves away from negative interest rates after 17 years, aiming to stimulate economic growth.

Iron ore futures, a key indicator of global economic activity, soared to their highest levels since March 13. The most-traded May iron ore contract on China’s Dalian Commodity Exchange (DCE) climbed by 5.35%, closing at 827 yuan ($114.87) per metric ton.

Similarly, the benchmark April iron ore on the Singapore Exchange rose by 2.91% to $106.9 a ton. Analysts attribute this surge to growing fixed asset investment in China, which is expected to bolster steel demand.

Official data released on Monday revealed a 4.2% expansion in fixed asset investment during the January-February period compared to the previous year, surpassing expectations. This growth is anticipated to support steel demand, prompting some mills to re-enter the market for portside cargoes.

Transaction volumes of iron ore at major Chinese ports surged by 66%, indicating increasing liquidity in the spot market. Analysts predict a bottoming out of hot metal output and anticipate a rise in steel demand from the infrastructure sector in late March or early April.

Transaction volumes of iron ore at major Chinese ports surged by 66%, indicating increasing liquidity in the spot market. Analysts predict a bottoming out of hot metal output and anticipate a rise in steel demand from the infrastructure sector in April.

In line with the rally in iron ore prices, other steelmaking ingredients experienced notable gains.

Chinese high carbon ferrochrome prices surged by around 2.9%, indicating a positive outlook for upcoming ferrochrome benchmark prices.

Meanwhile, coking coal and coke on the DCE registered increases of 3.59% and 2.49% respectively, reflecting the broader bullish sentiment in the steel industry.

China’s online retail sector witnessed a remarkable upswing, with sales rising by 15.3% compared to the previous year. This surge in consumer demand, which exceeded analysts’ expectations, is expected to have a positive impact on advertising revenues for internet companies and signals a favorable shift in consumer behavior.

After 17 years, the Bank of Japan announced the end of its era of negative interest rates, raising the key interest rate slightly to between 0 and 0.1%. This move, motivated by significant wage

increases and aimed at revitalizing Japan’s stagnant economy, is expected to stimulate economic growth. The Nikkei 225 responded positively to the news, rising by almost one percent.

The surge in iron ore futures to their highest levels in nearly a week reflects growing demand in China’s steel industry, fueled by positive economic indicators. This rally has also influenced the prices of ferrochrome and other steelmaking ingredients.

Moreover, Chinese consumer demand, particularly in the online retail sector, is on the rise, signaling a positive shift in the country’s economic landscape.

Additionally, Japan’s decision to move away from negative interest rates after 17 years aims to rejuvenate its stagnant economy, marking a significant development in the global financial markets.

Australia’s leading science agency, CSIRO, has initiated a groundbreaking mining survey in collaboration with data science company Voconiq.

Australia’s leading science agency, CSIRO, has initiated a groundbreaking mining survey in collaboration with data science company Voconiq. The nationwide study aims to delve into the attitudes and perceptions of Australians towards the mining industry in contemporary times.

The survey, open to all Australians, regardless of their affiliation with the mining sector, seeks to elicit insights into various facets of mining, including its economic significance, role in global development, and contribution to low emission technologies.

The CSIRO survey represents a concerted effort to engage with the Australian public and gain a comprehensive understanding of their views on the mining industry. Previous iterations of the survey conducted in 2014 and 2017 have provided valuable insights, guiding industry stakeholders and policymakers in navigating the complex dynamics of the mining landscape.

According to Rob Hough, CSIRO’s director of mineral resources, the survey serves as a crucial platform for fostering dialogue and shaping the future trajectory of the mining sector in alignment with community expectations.

As the world undergoes a transition towards sustainable energy solutions and low emission technologies, the role of mining assumes heightened significance. The survey aims to explore public perceptions regarding the pivotal role of mining in supplying essential materials for renewable energy infrastructure, global electrification efforts, and the broader energy transition agenda.

By soliciting input from a diverse cross-section of society, CSIRO endeavors to gain nuanced insights that will inform strategic decision-making and research initiatives in the mining domain.

Stellenbosch University PhD graduate Dr Steve Chingwaru has uncovered what is potentially the world’s largest invisible gold resource. The geometallurgist’s findings could help unlock gold to the value of R450-billion “hiding in plain sight” in mine dumps around Johannesburg.

Historical mine waste from the Witwatersrand, called tailings, contains over six-billion tons of material with significant gold content, Chingwaru explains. The research for his master’s degree, which was upgraded to a PhD, aimed to calculate and characterise these gold reserves. He also explored ways to extract the gold efficiently while addressing environmental concerns related to the tailings, such as the release of acid mine drainage (AMD) owing to pyrite oxidation.

Invisible gold refers to minuscule particles locked inside other minerals, and Chingwaru is the first scholar to calculate that the six-billion tons of tailings around Johannesburg’s mines contain up to 460 t of gold.

“Historically, the low concentration of gold inside tailings was considered too low-grade to be of value. But now that extensive mining has depleted most of the high-grade concentration of gold, it’s becoming unfeasible to mine – some shafts are already reaching 4 km underground. Looking for gold in low-concentration sources is becoming more viable,” Chingwaru notes.

The Federal Government has introduced legislation to establish the Net Zero Economy Authority, which will act as an independent statutory body that sits within the Prime Minister’s portfolio.

The Federal Government enacted legislation to create the Net Zero Economy Authority, this authority is considered an independent entity that is part of the Prime Minister’s portfolio. The Net Zero Economy Authority aims to promote the benefits of a net zero economy for Australia’s workers and regions.

The body will promote a net zero transformation of the economy by catalyzing private and public investment in large

The net zero transformation will be one of the most significant economic shifts since the Industrial Revolution. The scale and significance of global efforts to reduce emissions will transform industries and economies. In Australia, this transformation will lead to major economic and workforce change.

projects, creating new jobs, and transitioning into communities and skills.

Its duties will include:

Promoting the public and private sector’s participation in emissions reduction and complete transformation in Australia, including collaborating with existing funds dedicated to investment

Providing assistance to workers in industries that require emissions in order to gain access to new employment or improve their current employment,

Including a plan to assist with the transition of employees at the coal-fired power stations to new jobs. facilitating communities, including the First Nations, in taking part in and benefiting from the ecological shift to net zero emissions.

Disseminating information regarding the Australian government’s commitment to net zero, educating communities and providing a social license for the transition promoting consistency and coordination in government policy and programming.

” There is no country on earth that is better equipped to accomplish the energy transition at home, and to power it on the planet. ” Prime Minister Anthony

Albanese said this. We are home to every critical mineral and metal necessary to achieve net zero.

Our workforce is talented and appreciated, our safety standards are the highest in the world, and we have a proven history of producing and exporting energy and resources.

The “Net Zero Economy Authority” will have a significant impact on one of the most significant economic developments in Australian history, this will position the country as a leading energy source for the future. “We are dedicated to collaborating across jurisdictions, with regional communities and industries, and our international partners, in

order to achieve the goals of Australia’s net zero future.” CEO of Fortescue Metals, Dino Otranto, welcomed the news. “incorporating a specialist government agency at the core of skills development, investment coordination and economic planning is a wonderful addition to Australia’s longstanding climate policy design,” Otranto said.

The government should be commended for taking a holistic approach to the energy transition that places Australia back at the forefront of climate mitigation.

Through long-term, inclusive planning, the public’s faith in our transition to zero emissions will increase.

“The regions of Australia, workers and large corporations will gain benefits from the global transition to green fuels, methods, and commodities. To seize these opportunities, Fortescue advocates the enactment of this legislation and expects to have a substantive relationship with the Net Zero Economy Authority once it’s created.

The Authority will focus on supporting workers, communities, regions and industry to realise and share in the benefits of the net zero economy.

A Chief Executive Officer (CEO) will be responsible for day-to-day operations. The CEO will be appointed by the responsible Minister.

Economist and President Mnangagwa advisor Eddie Cross has said business mogul Kudakwashe Tagwirei left Zimbabwe’s biggest mining company Kuvimba Mining House (KMH).

In an interview with a local daily, Cross revealed that Kuda’s journey began with the fuel business, where he capitalized on sales and eventually secured a substantial share in the Zimbabwe-Mozambique fuel pipeline.

Cross said Tagwirei made considerable profits from these ventures, allowing him to diversify his portfolio into various properties and investments. Cross said Tagwirei made a strategic decision to channel his wealth into Kuvimba, a burgeoning enterprise with seven mines on its portfolio. Investing heavily in Kuvimba, Kuda played a pivotal role in its development and success.

“Kuda was Kuvimba. He took all the money he got from the fuel business, disposing of the sales, putting the pipeline back to NOIC because he had 50 per cent shares of the pipeline and NOIC bought him out.

He made a lot of money and bought a lot of properties and put it into Kuvimba. Now Kuvimba has been taken over by the National Wealth Fund (Mutapa Fund),” Eddie Cross said in the interview.

Kuvimba has since undergone a significant transformation, being taken over by the National Wealth Fund, also known as the Mutapa Fund. Tagwirei’s investment into Kuvimba has seen the rise of the Shamva gold mine located 90km northeast of Harare.

The Wits Mining Institute (WMI), at the University of the Witwatersrand in Johannesburg, will be hosting a number of dynamic programmes during 2024, to assist the local and global mining industry to come to grips with emerging challenges.

The increasing use of mechanised and automated equipment at mine sites, as well as the ongoing focus on ESG and the need for spatial data, are some of the challenges the mining industry is facing. To address these topics and capitalise on opportunities, the WMI will work in collaboration with industry players to present short courses, equipping people to better tackle these challenges.

Speaking on the back of their first short course, titled ‘Fundamentals of Occupational Health and Safety in Practice’, offered to members of Sibanye Stillwater, WMI Director Professor Glen Nwaila highlighted that the Institute received only positive feedback from participants. Held during the week of 11th March, the course catered to mine health and safety practitioners, as well as executives from Sibanye Stillwater. “This was a fully attended course,” he noted, adding that participants called the course a ‘game-changer.’

“This is one of those unique undertakings where a university designs a course based on direct input, feedback and collaboration with the mining industry to solve the problems that the practitioners face. Participants lauded the program’s focus on professionalising safety practices and fostering greater awareness of safety issues in mining operations,” he said.

WMI believes the course will allow these practitioners to build their capacity and skills in the industry. Led by a seasoned Mine Health and Safety Practitioner, Mr Terence Parker and Dr Nelson Chipangamate, participants were exposed to cutting-edge methodologies and real-world case studies aimed at enhancing their competence in safeguarding mining operations.

“Through collaboration with industry leaders like Sibanye Stillwater, we are reshaping the landscape of mining education,” said Nwaila “These skills accelerator programmes represent a pivotal step towards enhancing safety practices and driving innovation in the mining sector.”Due to overwhelming demand, the WMI and Sibanye Stillwater have committed to offering these programmes on an annual basis, opening the course to the rest of the industry from 2025 onwards.

Mayfair Gold Corp. (Mayfair or the Company) has announced that its Board of Directors has approved advancing the 100% controlled Fenn-Gib gold project in the Timmins region of Ontario to the pre-feasibility study phase.

Building on the metallurgical, geotechnical, hydrogeological, and environmental evaluations that have already been completed, the company’s pre-feasibility study will create a well-defined project description that will support an environmental assessment.

To complete the pre-feasibility study, Mayfair has hired AGP Mining Consultants (AGP) to serve as the lead engineers

of a multidisciplinary team (AGP Group). Initiation of the Fenn-Gib pre-feasibility study is a major milestone towards the potential development of the Fenn-Gib project.

Since acquiring Fenn-Gib approximately three years ago, Mayfair has increased the mineral resource by more than 70 percent and ongoing drilling continues to deliver encouraging results that are expected to further grow the resource.-

said Patrick Evans, President and CEO, Mayfair Gold Corp.

Patrick Evans added, “In 2023, Mayfair completed pre-feasibility level metallurgical, geotechnical, and hydrogeology studies to de-risk the project ahead of the pre-feasibility study. Three years of baseline environmental studies have also confirmed that there are no species at risk within the Fenn-Gib project area.

Proud

We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources.

Together, we power northeastern Minnesota’s economy. mnpower.com/EnergyForward

WITHIN THE DYNAMIC framework of the world economy, the surface mining sector is leading a revolutionary wave driven mainly by the pressing need to shift to clean energy.

The PwC Global Mine Report 2023 has thrown light on this key juncture, indicating that despite the challenges of growing prices and economic uncertainties, the top 40 mining companies managed to retain a consistent revenue of US$711 billion in 2022.

This resilience is particularly striking against the backdrop of a world coping with the demands of climate change and the push for a net-zero future.

Central to this tale is the rising importance of essential minerals—elements indispensable for the manufacture of renewable energy systems, electric automobiles, and other pillars of the green transformation. The demand for these minerals is not only expanding; it is altering the industry's dynamics. Mining activity and deals are increasingly concentrated around these key resources, accounting for a large share of industry deal-making.

The stage is not merely occupied by traditional mining titans. A new cadre of stakeholders, including governments and automobile corporations, are entering the fray, highlighting the

strategic importance of these minerals. Governments worldwide, understanding the dual imperatives of safeguarding their technical futures and promoting their ecological agendas, are taking bold efforts to assure access to these resources. This includes creating alliances, crafting favorable legislation, and even actively investing in mining operations.

The presence of vehicle manufacturers and other non-traditional actors into the mineral supply chain is a tribute to the changing times. As these corporations battle to protect their places in a future defined by electric mobility and sustainable technology, their involvement emphasizes the strategic relevance of essential minerals. This change is not without its problems. The mining industry, usually marked by periods of booms and busts, must now traverse a landscape filled with geopolitical tensions, environmental concerns, and the

technical complexity of collecting and processing these crucial minerals. Furthermore, the industry's shift toward sustainability puts further pressure on mining businesses to innovate and adopt greener practices, even as they work to meet rising demand for vital minerals.

In response, the industry is seeing an influx of technology and innovation, ranging from better exploration techniques and more efficient processing procedures to the use of renewable energy sources in mining operations. The purpose is straightforward: to ensure the supply of vital minerals in accordance with the global imperative for environmental stewardship and sustainability.

The PwC research captures this watershed moment in the mining industry, which has long been linked with extraction and exploitation but is now at the forefront of the shift to a cleaner, greener future. As the world works to achieve carbon neutrality, the surface mining industry's narrative is being rewritten, ushering in a new era defined by key minerals and the pursuit of sustainability.

This developing narrative of the surface mining industry, outlined in the PwC Global Mine Report 2023, is more than just a sectoral transformation; it symbolizes a fundamental realignment of global economic and environmental goals.

Collaboration emerges as a key aspect in this unfolding plot. The convergence of interests among governments, industry players, and even competitors suggests that collective action and alliances may pave the way for long-term mineral supply chains. Initiatives aimed at boosting traceability, expanding recycling capabilities, and promoting responsible sourcing methods are gaining pace, thanks to a shared understanding of the stakeholder groups.

This shift relies heavily on education and community engagement. Ensuring that the benefits of mining vital minerals are equally distributed and that environmental safeguards are in place necessitates a commitment to open dialogue and participatory decision-making. The industry's shift toward integrating digital technology and adopting circular economy concepts creates new opportunities for decreasing waste, increasing resource efficiency, and minimizing environmental impacts.

This developing narrative of the surface mining industry, outlined in the PwC Global Mine Report 2023, is more than just a sectoral transformation; it symbolizes a fundamental realignment of global economic and environmental goals.

The effects of the industry's shift can be felt well beyond the mines and quarries that dot the landscapes across the world. They address the fundamentals of global supply chains, production paradigms, and, ultimately, consumer markets that drive the desire for cleaner, more sustainable products.

The route to a net-zero planet is surely a marathon, not a sprint. The mining industry's shift to crucial minerals is both a response to and a trigger for this transition. However, this path is riddled with obstacles.

The environmental impact of mining activities, the socioeconomic consequences for mining communities, and the geopolitical complexity surrounding mineral rights and access are all difficulties that necessitate novel solutions and collaborative initiatives.

As we approach the start of a new age, the tale of the surface mining industry and its role in the clean energy transition continues to unfold. The PwC Global Mine Report 2023 provides a view into the future, outlining both the opportunities and difficulties that await. With the appropriate combination of innovation, collaboration, and governance, the mining industry can play a critical role in creating a sustainable, net-zero world.

The surface mining industry doesn't just change with the times; it becomes a main character in the global quest for sustainability, pushing the clean energy transition forward with every ton of important minerals that are mined, processed, and sent to markets that need them so badly. The route ahead is complicated, but the goal is clear: a greener, more sustainable future for everybody.

As the mining industry moves toward a future dominated by digital and sustainable practices, a significant pattern emerges: an increase in the number of mergers and acquisitions. This consolidation is motivated by the necessity for strategic repositioning and diversification in an era dominated by energy transition and sustainability regulations.

According to a recent analysis, a large number of the top M&A acquisitions in the mining sector are in reaction to

customers' and shareholders' increased needs for portfolio diversification and sustainability. Another fascinating development is the industry's shift to greenfield exploration.

With the constant demand for metals and minerals, mining corporations are pushing into previously undiscovered or underexplored areas, ushering in a new era of discovery and the potential for new mineral resources.

Cloud computing is quickly becoming a critical component of modern mining operations. It improves data processing capabilities while also drastically reducing the demand for costly IT infrastructure.

This change not only reduces operational costs but also promotes improved collaboration throughout the supply chain by allowing remote access to critical mining data.

The industry's commitment to the circular economy is being demonstrated by increased recycling initiatives. By processing more recycled materials, companies like Glencore are not only meeting rising demand but also setting sustainability norms, demonstrating the sector's ability to balance economic goals with environmental responsibility.

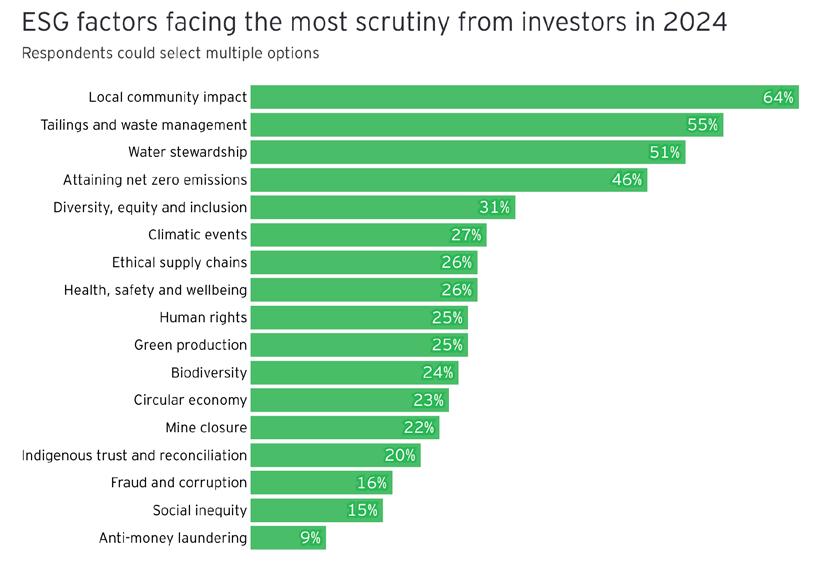

A bar chart showing which ESG factors are facing the most scrutiny from investors in 2024, as chosen by the respondents to the survey. Local community impact and tailings and waste management are the top two in this example.

Source: EY mining and metals business risks and opportunities survey data 2024.

A list of the top ten risks and opportunities for mining and metals companies in 2024 and, where they ranked in 2023.

Among these technical and strategic advancements, the emphasis on developing a more inclusive and diverse workforce in the mining sector is gaining traction. Recognizing the necessity of building a culturally safe workplace demonstrates the industry's overall commitment to social responsibility and sustainability.

Building resilient supply chains has become a top priority, with AI and machine learning playing crucial roles in improving risk analysis and guaranteeing operational continuity in the face of a variety of threats.

The most important thing about these trends is that they all center on sustainability and ESG (Environmental, Social, and Governance) factors.

To meet global climate targets, the mining industry is looking at new ways such as alternative fuels, asset electrification, and waste minimization. Leading mining corporations are already spearheading steps to achieve these goals, demonstrating the industry's dedication to a sustainable future. By embracing these technical advances and trends, the mining

sector not only improves efficiency and safety, but also contributes considerably to the global agenda of sustainability and responsible resource management.

The trip ahead is fraught with obstacles, but also with enormous opportunity to reimagine mining's legacy in harmony with the world and its people.

The surface mining industry is facing challenging times, characterized by an unstable global order and economic instability. However, the industry is also ahead of the curve in terms of meeting Environmental, Social, and Governance (ESG) objectives, with significant progress expected by 2024. The World Economic Forum's executive director predicts a year of conflicting narratives and instability, underlining the need of ESG imperatives.

Net-Zero Acceleration and biodiversity are among the top ESG topics for 2024, with climate change risk, decarbonization, and habitat loss taking center stage. There is a clear movement to reach Net-Zero promises that go beyond scope 1 and 2 emissions and include scope 3. The mining industry is rapidly adopting the Taskforce on Nature-related Financial Disclosures (TNFD) guidelines, which seek to include nature into financial decision-making.

Tailings management remains a critical focus, fueled by investor interest and technological advancements toward more responsible management practices. Equity, Diversity, and Inclusion (EDI) initiatives are gaining traction, reflecting a global trend toward workplace inclusivity.

Furthermore, the standardization of ESG reporting for capital markets is expected to transform voluntary sustainability reporting by bringing much-needed consistency and comparability.

As the industry moves forward, collaboration within the mining sector is deemed critical for addressing pressing issues and meeting sustainability targets. ESG imperatives are shaping the future, with external stakeholders increasingly influencing mining companies' approach to ESG priorities.

This includes pressure from activists, governments, customers, and a new generation of workers who expect companies to respond to ESG issues.

The global pandemic has accelerated the transition to data, automation, and artificial intelligence, putting pressure on the mining and metals industries to overcome resistance to modernization. Adopting digital technologies is critical for increasing productivity and thriving in a new energy landscape.

Companies with higher ESG ratings are already outperforming the market, demonstrating the practical benefits of following ESG principles. This trend emphasizes the importance of ESG performance and transparency to investors and stakeholders alike.

Leading mining companies, such as Fortescue Metals and Boliden, are setting the standard for ESG excellence. Their strong position is due to their ability to effectively navigate ESG challenges, demonstrating the potential for long-term success in the mining industry through strategic ESG investments.

The emphasis on ESG in the mining industry reflects a larger commitment to sustainability, transparency, and social responsibility, laying the groundwork for a more sustainable future.

As the surface mining industry works toward a more sustainable future, meeting ESG standards is about more than simply risk reduction; it's about unlocking new sources of

value and innovation. The journey ahead requires bold action and a visionary approach that combines environmental stewardship, societal value, and governance excellence.

The imperatives of the energy transition are unsettling traditional value creation models in the mining sector, with a barrage of geopolitical, technological, capital, and human forces reshaping the industry landscape.

This transition provides both hazards and exceptional opportunity. Companies that can navigate these changes, particularly by integrating ESG principles into their core operations, stand to not only future-proof their businesses but also lead the sector into a new era of responsible mining.

Mining's impact on local climates and communities cannot be understated, necessitating a shift towards a do-no-harm model. As companies like Vale and Freeport-McMoran demonstrate, long-term mining interests must transcend financial goals to embody societal aspirations, fostering transparency and collaborative frameworks for decarbonization. This holistic engagement strategy is being ingrained in ESG benchmarks, challenging corporations to integrate their operations with broader environmental and social aims.

Critical metals like lithium and cobalt, essential for the energy shift, typically come from politically risky places. This geopolitical complexity adds another layer to the ESG narrative, requiring mining companies to navigate supply chain challenges and foster cooperation even in challenging political landscapes. The industry's response, involving innovative battery designs and a reduced reliance on contentious materials, highlights a proactive stance towards geopolitical and environmental challenges.

The global pandemic has expedited the industry’s embrace of digital technologies, from data analytics to AI and automation. This movement is more than just about operational efficiency; it is a deliberate move toward sustainability. By leveraging digital tools, the sector may increase efficiency, minimize its environmental impact, and better comply with ESG goals. The mining and metals sector's journey towards

digitalization and modernization is reflective of a broader trend towards innovation-driven sustainability.

The future of mining is obviously connected with ESG imperatives. As the sector evolves, teamwork, innovation, and a persistent commitment to environmental and social responsibility will be vital. The potential for the mining sector to contribute positively to the global sustainability agenda while unlocking new avenues for growth and wealth generation is considerable. With industry leaders already proving the benefits of a solid ESG framework, the stage is set for a transformative path towards a sustainable and profitable future for mining.

Through strategic collaboration, technical innovation, and a deep commitment to ESG principles, the surface mining industry is positioned to negotiate the difficulties of the 21st century, assuring resilience, sustainability, and long-term value creation.

COMPANIES WITH higher ESG ratings are already outperforming the market, demonstrating the practical benefits of following ESG principles. This trend emphasizes the importance of ESG performance and transparency to investors and stakeholders alike.

In a recent Skillings roundtable Q&A discussion, five mining professionals with over a decade of experience each shared their insights on leadership, career development, and the future of the industry. The participants included DAVID ERNESTO, MUKUL KUMAR SINGH, MATT MCCLELLAND, AND CLAUDE BISAILLON

SPECIALIST IN MINING SAFETY, RISK MANAGEMENT, & CRISIS MANAGEMENT

David Ernesto, a specialist in Mining Safety, Risk Management, & Crisis Management, emphasizes leadership as indispensable due to the sensitive issues his field addresses.

PRODUCT EXPERT IN COLD ROLLING,GALVANIZING, PREPAINTED STEEL INDUSTRY, MAGHREB STEEL, MOROCCO.

Worked over 20 years in cold rolling steel industry in India & abroad. Where I had worked in various fields of products like CR, Galvanizing , prepainted steel & steel pipe -tube. I had been visited major destinations of world site including USA, Canada,UK, EU, Russia, Thailand , Egypt ,Morocco & various gulf & African countries!!

In the ever-evolving landscape of professional industries, the path to success is paved with leadership skills, adaptability, and a keen understanding of the balance between work and life. A recent roundtable discussion brought together four seasoned professionals from various sectors to share their insights and experiences, offering valuable lessons for aspiring leaders and industry newcomers alike.

SToday, we gather insights from professionals across various industries, delving into the importance of leadership skills, the impact of formal education on career preparation, and the significance of aligning with company culture, among other topics. Let's hear from David Ernesto, Mukul Kumar Singh, Matt McClelland, and Claude Bisaillon on their career impressions, additional comments, and advice for the new generation.

David Ernesto, a specialist in Mining Safety, Risk Management, & Crisis Management, emphasizes leadership as indispensable due to the sensitive issues his field addresses.

Similarly, Mukul Kumar Singh, a Product expert in the cold rolling, galvanizing, and prepainted steel industry, believes leadership experiences gained in

the industry can significantly elevate one's career. Matt McClelland, General Manager at Dyer Quarry Inc., asserts that being a good leader is critical to operational success. In the same vein, Claude Bisaillon, a Senior Geotechnical Engineer, highlights leadership as very important.

While David Ernesto sees formal education as significantly extending career preparation, Mukul reflects on it as the "base bone" of his career.

Matt, however, presents a different perspective, noting that the lack of a bachelor’s degree initially limited his opportunities, but his track record of success eventually made up for it. Claude also views formal education as having widened his career preparation.

All panelists agree on the importance of adapting to company culture. David notes the necessity of making it clear to employees about their responsibility to adapt or leave, highlighting the difficulty in molding individual culture.

Mukul emphasizes the impossibility of surviving without understanding a company's work culture. Matt shares his approach of bringing in outsiders to help shift the company culture when necessary, while Claude mentions the unfortunate reality that new employees are often set on a specific career path and are not willing to adapt.

David advises young professionals to seek happiness and transcendence with respect for others, emphasizing the importance of showcasing the benefits of the mining industry. Mukul warns against the pitfalls of industry lobbying and encourages finding one’s passion. Matt discusses the challenge of bridging the

Experienced mining operations manager with a demonstrated history of excelling within a wide array of mining projects including large scale contract mining, green site development, mine expansion, processing plant management and reclamation.

Senior Geotechnical Engineer with DRA Global in Montreal office. Worked on various mining and geotechnical projects for open pit mines in Alberta, British Columbia, Mongolia, DRC, Papua New Guinea, Nevada and South America while assuming multiple roles from core logger to project manager to Project Engineer.

culture gap between traditional and newer generations of workers, urging the industry to put action to their words. Claude advises learning to adapt to downturns and to cherish the ability to do so.

David suggests making the results of Environmental, Social, and Governance (ESG) efforts visible and promoting education around them to demystify mining. Mukul believes in avoiding lobbying and ensuring equal rights for all, regardless of sect, religion, or gender. Matt calls for the industry to move beyond talk and show real action. Claude emphasizes the importance of continuous education about the technological origins and contributions of the industry.

Our panelists underscore the multifaceted nature of career development, from the indispensable role of leadership and adaptability to company culture, to the broader challenges and responsibilities of improving industry image and fostering an inclusive environment.

Their experiences and advice offer a roadmap for young professionals navigating the complexities of their careers, highlighting the importance of personal growth, commitment, and ethical responsibility.

Continuing with the insights and discussions from our esteemed panelists, let's delve deeper into specific aspects of career development, leadership, and the future of industry practices.

Our panelists shared varied perspectives on how job goals have evolved over time. David Ernesto noted that job goals are now more specific, requiring more effort for compliance, reflecting perhaps the increasing complexity and specialization within industries.

Mukul Kumar Singh believes that job descriptions and goals are clearer today than in the past, a sign of the evolving clarity in career pathways. Matt McClelland, however, feels that with the advent of social media and internet exposure, career goals have become broader and less specific, suggesting a diversification of career aspirations among professionals.

THE PANELISTS UNANIMOUSLY agree on the significance of maintaining a proper life/work balance. David views it as vital, alongside self-motivation. When discussing promotion and the balance between technical and managerial skills, a consensus emerges on the importance of both skill sets, yet with nuanced views on their relative importance.

When discussing promotion and the balance between technical and managerial skills, a consensus emerges on the importance of both skill sets, yet with nuanced views on their relative importance. David argues that while both technical and managerial skills are necessary, individual culture is very difficult to mold, emphasizing the adaptability to company culture as crucial.

Mukul advocates for a balance between technical and managerial skills, noting that the level of importance may vary depending on the position. Matt shares that in his experience, management skill promotion is more common, yet technical knowledge remains crucial. Claude leans towards a heavier emphasis on managerial skills, highlighting the necessity of leadership in his role.

The panelists unanimously agree on the significance of maintaining a proper life/work balance. David views it as vital, alongside self-motivation. Mukul stresses that without a balanced life, maintaining work life becomes challenging. Matt believes that as one climbs the career ladder, this balance becomes increasingly important to avoid being consumed by work-related problems.

Claude reflects on personal regrets, missing significant family milestones, underscoring the importance of balance for career satisfaction and personal well-being.

David Ernesto highlights the challenge of demonstrating the benefits of the mining industry, emphasizing the importance of promoting ESG results and education. Mukul Kumar Singh addresses the issue of industry lobbying and discrimination, advocating for equality and integrity.

Matt McClelland identifies the culture gap between generations as a critical challenge, stressing the need for operational transparency and genuine commitment. Claude Bisaillon advises professionals to adapt to downturns and appreciate the dynamic nature of their industries.

Concluding their insights, our panelists offer invaluable advice to the next generation. David encourages seeking transcendence and making meaningful impacts with respect for others. Mukul emphasizes self-belief, goal-setting, and pursuing passion. Matt advises bridging generational gaps and creating inclusive environments for success. Claude suggests embracing adaptability and cherishing the journey.

From leadership skills and career planning to addressing industry challenges and fostering an inclusive, balanced professional life, our panelists provide a comprehensive roadmap for navigating the complexities of modern careers.

Their shared experiences and wisdom not only illuminate the path for aspiring professionals but also contribute to the ongoing dialogue on improving industry practices for a more equitable and sustainable future.

The iron ore mining industry embraces a new era of sustainability and innovation.

FROM AUTONOMOUS machinery enhancing safety and efficiency to groundbreaking commitments to renewable energy, we explore how these developments are shaping the future of mining, marking a significant shift towards environmentally friendly and technologically advanced operations.

Rio Tinto's Gudai-Darri mine in Western Australia has set a new standard for the mining sector with its innovative use of technology and commitment to sustainability. The mine, which will be officially inaugurated in June 2022, represents the cutting edge of Rio Tinto innovation, demonstrating a suite of sophisticated technology and processes aimed at improving safety, efficiency, and environmental stewardship.

Gudai-Darri's technical innovations revolve upon autonomous haul trucks and drills, which are aimed to improve operating efficiency and safety. The mine employs 23 CAT 793F autonomous haul trucks and three CAT MD6310 autonomous drills, with real-time ore tracking and data-driven modeling used to optimize mining operations.

These improvements are part of a larger plan to automate and digitize the mining process in order to reduce human exposure to dangerous circumstances while increasing output.

Gudai-Darri is also home to the world's first autonomous water carts, developed in collaboration with Caterpillar. These carts are used to suppress dust on-site, with clever technologies that detect dry and dusty conditions and automatically apply water to maintain road conditions. This feature not only increases productivity by keeping mine operations running smoothly, but it also helps to conserve water by efficiently monitoring its consumption.

The mine's iron ore sample facility uses modern robots to test ore grades quickly and accurately. This automation ex-

tends to the heavy mobility equipment (HME) warehouse, where self-guided vehicles handle pallet frames, decreasing manual handling and boosting safety. Gudai-Darri has also produced a rotable bucketwheel reclaimer, which improves maintenance efficiency and safety by allowing the complete bucket wheel module to be replaced for maintenance.

Gudai-Darri's operations are also built on digital innovation, which includes the utilization of digital twins and real-time, paperless monitoring. Tablets allow mine operators and workers to access current information, improving communication and operational efficiency.

The digital twin of the processing plant enables a highly detailed and interactive 3D environment for virtual reality training, improving safety and productivity. These technologies aim to create a safer working environment in addition to streamlining operations.

Sustainability is at the heart of Gudai-Darri's operational strategy, with a strong emphasis on renewable energy. The mine's solar farm business aims to use renewable energy to power a significant amount of its activities, with a goal of meeting 65% of the mine's average electricity demand. This project will help to considerably reduce the mine's carbon footprint.

Gudai-Darri signifies a shift toward more environmentally friendly, efficient, and safe mining operations. It serves as a prototype for the mine of the future, combining technological innovation and environmental responsibility to set new norms in the mining sector.

The Gudai-Darri mine continues to set the standard for innovative technology use, highlighting Rio Tinto's overall Mine of the Future plan. This strategy supports the company's aim to connect all areas of the mining value chain through automation and digitization, hence increasing recovery methods, efficiency, and safety. Gudai-Darri's holistic strategy, which includes autonomous trucks and digital monitoring systems, establishes a new benchmark in the mining industry for integrating technology to provide safer, more efficient, and ecologically responsible operations.

The mine's activities are more than just harnessing technology for operational improvements; they also demonstrate a strong commitment to sustainability and community participation. Rio Tinto has worked closely with the land's traditional owners, the Banjima and Yindjibarndi People, to

ensure the mine provides considerable social and economic advantages. This collaboration is critical, showing the industry's changing approach to recognizing and working with indigenous populations.

The installation of a solar farm, as well as the planned development of a one-gigawatt solar and wind farm, demonstrate Rio Tinto's commitment to leading in sustainability. These renewable energy sources are critical in minimizing the mine's carbon emissions and contribute to Rio Tinto's goal of considerably reducing its environmental impact. The solar farm alone is estimated to meet 65% of the mine's typical electricity demand, demonstrating the potential for renewable energy in large-scale mining operations.

Gudai-Darri's technology and sustainability initiatives establish it as a model for future mining ventures worldwide. The mine's effective integration of autonomous technology, digital systems for real-time monitoring, and a dedication to renewable energy and community partnerships demonstrates the mining sector's ability to innovate while improving safety, efficiency, and environmental stewardship. As the industry looks to the future, Gudai-Darri exemplifies what is possible when technology and sustainability are valued.

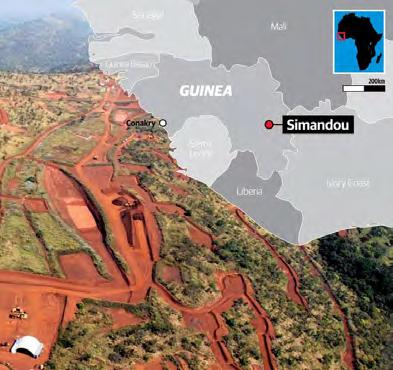

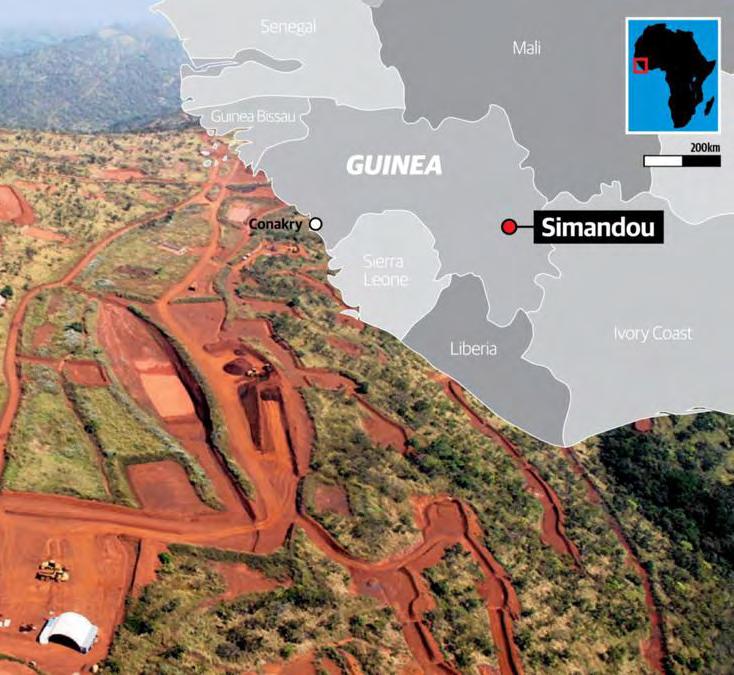

Project in Guinea, described as the world's largest undeveloped high-grade iron ore deposit, has made substantial progress toward development. The Guinean government, Rio Tinto, and the Winning Consortium Simandou (WCS) have entered into a cooperative development agreement for this gigantic project, which is expected to reshape the global iron ore supply landscape.

the project, which is expected to cost around $US6.2 billion to develop blocks 3 and 4 of the Simandou mine, as well as the accompanying rail and port infrastructure.

Furthermore, a framework agreement agreed in March 2022 by Guinea, Rio Tinto, and other partners, including the Aluminium Corp of China (Chinalco) and the Chinese-backed SMB-Winning consortium, represents a significant step toward settling earlier infrastructural problems.

This deal specifies the construction of a 670-kilometer railway from the Simandou site to a new deepwater port, at a cost of approximately $15 billion. The development of this infrastructure will greatly improve Guinea's mining and transportation capacities.

The Simandou Iron Ore Project is more than just a mining operation; it's a game-changing economic effort with far-reaching consequences for Guinea and the worldwide iron ore market. Its development emphasizes the necessity of international cooperation and investment in establishing long-term, high-capacity mining operations.

The project is significant because it has the potential to add nearly 5% to the worldwide supply of seaborne iron ore, making it the world's largest and highest-grade new iron ore mine. Rio Tinto hopes to start infrastructure work on the Simandou project in 2024, after nearly three decades of obstacles.

The first finance requirement for the project's development is approximately $11.6 billion, demonstrating its immense scale. Rio Tinto's blocks are expected to begin production over a 30-month period beginning in 2025, with a yearly capacity of 60 million tonnes.

A major component of the project is the development of a 600-kilometer multi-purpose and multi-user railway and port infrastructure, which is required for delivering iron ore from the mine to worldwide markets. This TransGuinean railway route, which is scheduled to be finished in 2024, will require the building of 235 bridges and more than 24 kilometers of tunnels, demonstrating the project's lofty infrastructural aims.

A important milestone was reached in February 2024, when the Guinean government, Rio Tinto, and WCS agreed to a cooperative development arrangement. This deal is critical to

With the development of the Simandou Iron Ore Project, Guinea is on the verge of becoming a key player in the global iron ore market. This enormous project is more than just a mining operation; it represents substantial economic progress for Guinea and has the ability to reshape the country's infrastructure and economic landscape.

The Guinean government, Rio Tinto, and the Winning Consortium Simandou formed a joint venture to create the infrastructure for the Simandou project, demonstrating the project's huge scope and potential. The alliance seeks to build more than 600 kilometers of rail infrastructure and port facilities, representing one of Guinea's greatest investments in history.

This project has received attention not just for its potential to deliver high-quality iron ore to the worldwide market, but also for its implications for the steel industry's decarbonization efforts.

High-grade ore from Simandou is expected to minimize the quantity of ore required in the blast furnace process, cutting carbon emissions. This element is consistent with the global trend for more sustainable industrial processes, establishing Simandou as a vital contributor to green steelmaking methods.

The Simandou Iron Ore Project also demonstrates the value of international collaboration in large-scale mining projects. The initiative, which involves China, the UK-Australia mining giant Rio Tinto, and the Guinean government, is an excellent illustration of how cross-border collaboration may achieve mutual economic and environmental goals.

The involvement of Chinese steelmakers, who are among the project's key stakeholders, underscores the global nature of the iron ore market and the steelmaking industry's international ties.

When completed, the Simandou project is expected to have a revolutionary influence on Guinea, producing thousands of employment and promoting economic development outside the mining sector.

The infrastructure created by this project will help numerous sectors of the Guinean economy, improving trading capacity and accessibility within the region. Furthermore, the project has the potential to greatly increase Guinea's GDP while also contributing to long-term sustainable growth.

To put it simply, the Simandou Iron Ore Project exemplifies the complexity and opportunities of modern mining projects. Its development is a major endeavor that requires overcoming logistical hurdles, securing big financing, and navigating international alliances.

However, the economic and environmental benefits might be significant, establishing a new benchmark for future mining ventures globally.

FORTESCUE METALS GROUP HAS MADE a significant step toward sustainable iron production by approving a $50 million investment to build a Green Iron Trial Commercial Plant at its Christmas Creek mine in Western Australia.

This effort marks a big step forward in the company's quest toward green iron production, with green hydrogen infrastructure currently in place at Christmas Creek to support this novel process. Beginning in 2025, the factory plans to generate more than 1,500 tonnes of green iron per year and will investigate technology alternatives for both magnetite and hematite ores.

The project is part of Fortescue's overall aim to reduce carbon emissions in its operations and the iron and steel industry. It is not only about shifting to renewable energy, but also about creating new standards for iron production, which is vital to the world economy. This program may also encourage additional innovation and investment in green technologies throughout the economy.

In addition to the Christmas Creek project, Fortescue is increasing its commitment to green energy with initiatives such as the Gladstone PEM50 project in Queensland. This 50-megawatt green hydrogen facility, which is planned to start production in 2025, demonstrates the company's commitment to developing

industrial-scale hydrogen generation capabilities. With a projected expenditure of $228 million, the Gladstone project is another critical component of Fortescue's green energy plan.

These projects demonstrate Fortescue's proactive attitude to adopting new technologies and moving away from fossil fuels. By investing in green iron and hydrogen generation, Fortescue hopes to not only reduce its environmental effect but also open up new, high-value markets, ultimately boosting the amount of iron units sold. This strategy puts Fortescue as a leader in the industry's transition to more sustainable and responsible mining practices.

Fortescue's pioneering effort to build a Green Iron Trial Commercial Plant at Christmas Creek is a strategic move that aligns with the global trend toward more environmentally friendly industrial operations. The $50 million investment in this initiative marks a tangible step toward decreasing the environmental effect of iron manufacturing.

By utilizing green hydrogen, this effort promises to create approximately 1,500 tons of green iron per year beginning in 2025, demonstrating the potential for renewable energy sources to replace fossil fuels in heavy industries.

The Christmas Creek green iron project, which is part of Fortescue's overall green energy and metals strategy, demonstrates the company's proactive attitude to the transition to green energy. It demonstrates how industrial processes, particularly those with large carbon footprints, such as iron manufacturing, can progress toward sustainability.

Furthermore, the effort compliments Fortescue's green energy portfolio, including the Gladstone PEM50 project.

This initiative, along with the Christmas Creek plant, underlines Fortescue's desire to be a leader in the production of green iron and hydrogen, thereby setting new standards for the mining and metals industries.

Fortescue's effort extends beyond decreasing its own carbon impact. By pioneering green iron manufacturing, the company hopes to influence the larger industry, driving growth through the introduction of innovative, high-value goods in new markets.

The Christmas Creek green iron project, which is part of Fortescue's overall green energy and metals strategy, demonstrates the company's proactive attitude to the transition to green energy. It demonstrates how industrial processes, particularly those with large carbon footprints, such as iron manufacturing, can progress toward sustainability.

This forward-thinking strategy not only predicts the growing demand for ecologically responsible raw resources, but it also puts Fortescue at the forefront of the industry's transition to sustainability. The successful completion of these projects could spur additional investments in green technologies across the sector, providing a model for other enterprises to follow.

Fortescue Metals Group's initiatives are representative of a rising trend in the mining and metals industry to adopt cleaner, more sustainable production processes. As the world's attention shifts to climate change and the reduction of greenhouse gas emissions, initiatives like the Christmas Creek Green Iron Trial Commercial Plant are critical steps toward a greener future. They not only show the feasibility of such changes, but also emphasize the importance of innovation and leadership in molding the future of industrial production.

In addition to Rio Tinto's efforts, the sector has witnessed substantial progress toward sustainability. For example, Anglo American's acquisition of the Serra da Serpentina iron ore reserve in Brazil,

while not mentioned in the listed sources, exemplifies the industry's pursuit of resource expansion with a focus on sustainable development.

While specifics about this acquisition were not disclosed in recent reports, Anglo American's global portfolio and known commitment to sustainable mining practices indicate that such an expansion is consistent with broader industry trends toward responsible resource management and environmental stewardship.

Furthermore, the industry's focus on building green iron production hubs and implementing emissions-reduction technology represents a concerted effort toward a more sustainable future. These activities are critical, given the iron and steel industry's huge environmental footprint, which has historically relied on coal and other fossil fuels for smelting processes.

Strategic alliances between mining behemoths like Rio Tinto and governments, as well as cooperation with other industry leaders, demonstrate a substantial shift. The sector understands the need of lowering its carbon footprint and the potential for green technologies to transform manufacturing processes. By investing in decarbonization technology and

green manufacturing hubs, the mining industry not only reduces its environmental effect but also positions itself to satisfy the growing demand for sustainable resources required for the green economy.

These changes in the industry, ranging from government-funded projects to corporate investments in green technology, show a greater realization of the critical need for environmental sustainability in the mining sector. As these projects proceed, they will most likely serve as models for innovation and sustainability, motivating other advancements and collaborations targeted at lowering the environmental implications of resource extraction and processing.