Optiro is a resource consulting and advisory group.

Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software.

In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results.

24

53

12 Immigration: The Mining Industry’s Lifeline

18

Codelco’s Copper: Why Copper Output is Falling: Delays, Accidents, & Maintenance Failures

22

Geotechnical Engineering in 2024: Groundbreaking Innovations & Their Influence on the Mining Sector

With the ongoing expansion and evolution of the mining industry, the importance of geotechnical engineering has become increasingly crucial.

05 American Rare Earths Secures $7.1M Grant to Advance Cowboy State Mine in Wyoming

06 Why Insurance is Crucial for Mining

14 Advanced Water Treatment Solutions Transform Industry Practices

16 Mining Transformed by Digital Technologies

20 Manganese Prices Surge as Cyclone Halts Australian Exports

The North American iron ore market in 2024 reflected broader economic and industry dynamics, with major trends and developments. This was the case all during the year.

Volume: 113. Issue.7. July 2024

39

Lithium: Mexico Seeks Agreement with Chinese Lithium Firm Over Disputed Mining Concessions

INSIGHTS FROM INDUSTRY PROFESSIONALS Enhancing Mining Practices: Leadership, Technology, & Community Engagement

20 What Caused Newmont Corporation (NEM) Stock to Decline While Market Rallied?

21 Rivian’s Path to Profit: Streamlining EV Production

29 Ministry of Mines Praises Bravura Group’s Readiness for Major Zimbabwe Projects

38 Caterpillar Loses Norwegian Pension Fund Investment

Southern Palladium’s Resource Update Paves Way for $408 M Project

Southern Palladium, a Johannesburg-listed platinum group metals (PGM) exploration firm, has achieved a significant milestone by completing 82 drill holes at its Bengwenyama deposit.

41 Lithiumbank Announces North America's Largest Lithium Brine Resource

42 Canada Adds 27,000 Jobs, but Unemployment Rate Rises to 6.2%

44 Revolutionizing Quartz Mining: Tomra’s Sensor-Based Sorting Unlocks Full Value Potential

46 Mining Stastistics

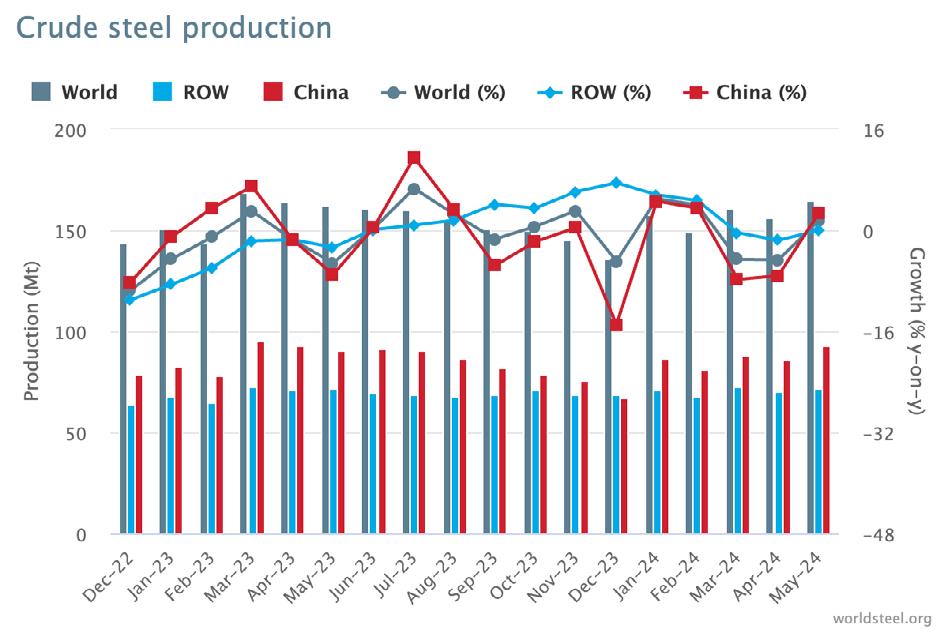

47 World Steel in Figures 2024

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284.

Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

SKILLINGS MINING

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284. Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

American Rare Earths (arr) has secured a substantial grant of up to $7.1 million from the State of Wyoming to advance its Cowboy State Mine at Halleck Creek.

This funding aims to accelerate the development of rare earth elements (REE) projects, which are crucial for both economic growth and environmental sustainability in Wyoming.

The non-dilutive funding agreement involves a strategic partnership with the Wyoming Energy Authority (WEA) and the University of Wyoming Energy Resources Council. Under the terms of the agreement, the grant is conditional upon a 1:1 match of government and pri-

vate investment from ARR, ensuring a collaborative effort towards the project’s success.

The grant, spanning over three years, will be utilized for extensive exploration and development activities at the Cowboy State Mine. ARR has committed to providing detailed technical reports on its findings and offering recommendations for future work programs to the WEA, ensuring transparency and accountability in the project’s progression.

This grant marks a significant milestone for ARR, enabling the company to further its exploration and development activities at Halleck Creek. The funding not only supports ARR’s mission to develop essential REE projects but also contributes to Wyoming’s economic diversification and environmental goals. The development of rare earth elements is critical for various high-tech industries, including renewable energy, electric vehicles, and advanced defense systems.

This esteemed panel, co-chaired by Ambassador Nozipho Joyce Mxakato-Diseko of South Africa and Ditte Juul Jørgensen, Director-General for Energy of the European Commission, is set to tackle key challenges in the mining sector.

The panel’s mission is clear: to foster trust between governments, local communities, and the mining industry.

By addressing critical issues of equity, transparency, investment, sustainability, and human rights, the panel aims to ensure that the extraction and use of critical minerals necessary for the renewable energy transition are conducted responsibly and fairly.

The panel has outlined several ambitious objectives:

Just and Equitable Transition: Supporting a fair shift to renewable energy sources while leveraging critical minerals for sustainable development.

Economic Benefits for Local Communities: Ensuring that countries and communities with these vital minerals gain significant economic benefits, including opportunities for local value addition, while protecting social and environmental interests.

Strengthened International Cooperation: Promoting international collaboration through the alignment and harmonization of existing norms and standards, and identifying areas for enhanced multilateral action.

The mining industry, crucial for global infrastructure and technology, faces unique risks and challenges.

The mining industry, pivotal in supplying raw materials essential for global infrastructure and technology, faces a unique array of risks and challenges. As operations delve deeper into the earth and environmental concerns rise, the need for comprehensive insurance solutions becomes increasingly critical.

Mining enterprises are exposed to a spectrum of risks, including natural disasters, equipment failures, and regulatory changes. The volatile nature of commodity prices adds another layer of uncertainty, making risk management a top priority. Insurance plays a crucial role in mitigating these risks, ensuring the sustainability and financial stability of mining operations.

tailored to cover property damage and business interruption are vital in safeguarding against these unpredictable incidents.

One of the primary concerns for mining companies is property damage and business interruption. Mines are often located in remote areas, susceptible to natural catastrophes like earthquakes, floods, and landslides. These events can halt production, leading to significant financial losses. Insurance policies tailored to cover property damage and business interruption are vital in safeguarding against these unpredictable incidents.

Liability insurance is another essential component, addressing the potential legal and financial repercussions of accidents and environmental damage. Mining activities can have substantial impacts on local communities and ecosystems, making companies vulnerable to lawsuits and regulatory penalties. Comprehensive liability coverage helps manage these risks, protecting the company’s assets and reputation.

The advancement of technology in mining operations introduces new risks related to cybersecurity and machinery breakdowns. As mines become more automated and reliant on digital systems, the threat of cyberattacks and technical failures increases. Insurance policies that cover cyber risks and equipment malfunctions are becoming indispensable, ensuring that technological advancements do not become liabilities.

Glencore employees are accused of paying millions in bribes to officials in multiple African nations over a decade-long scheme to secure preferential business agreements.

Glencore, one of the world’s largest commodity trading and mining companies, is expected to face charges related to pervasive corruption in Africa. This includes numerous former employees. Glencore employees are accused of paying millions in bribes to officials in multiple African

nations, including Nigeria, Cameroon, Ivory Coast, and Equatorial Guinea, over a decade-long scheme to secure preferential business agreements.

Former Glencore senior trader Anthony Stimler is one of the prominent figures facing accusations. Stimler has previously admitted to conspiring to violate the Foreign Corrupt Practices Act (FCPA) and to commit money laundering.

His collaboration has been instrumental in exposing the company’s extensive bribery network. Stimler’s admissions

suggest that through its subsidiaries, Glencore paid intermediaries an estimated $79.6 million to use the funds to gain lucrative contracts with state-owned enterprises and bribe foreign officials.

These allegations have been brought to light by the U.S. Department of Justice and the U.K.’s Serious Fraud Office (SFO). Glencore has already consented to pay more than $1.1 billion in fines and penalties as part of its settlement with U.S. authorities. Additional penalties for market manipulation and other violations are included in this settlement, in addition to a criminal fine of $428.5 million.

IN A DECISIVE MOVE, THE U.S. HOUSE of Representatives passed a significant amendment to the Homeland Security Appropriations Bill, redirecting funds from the Office of the Secretary of Homeland Security to the U.S. Coast Guard.

This icebreaker, already authorized, is essential for maintaining winter deliveries of raw materials to the U.S. steel manufacturing industry, which supports nationwide automobile and appliance manufacturing, and for responding to winter flooding in Great Lakes coastal communities.

The amendment was championed by Representative John James (MI-10).

The Lake Carriers’ Association, along with its 13 member companies, praised the amendment, emphasizing that it sends a clear message to the Department of Homeland Security, which oversees the U.S. Coast Guard, about the critical economic role of the Great Lakes and the need for dedicated resources.

Great Lakes icebreaker ensure smoother commerce in the Great Lakes region

“The procurement of this already authorized Great Lakes icebreaker will ensure smoother commerce in the Great Lakes region during the winter months. The Great Lakes are vital to countless jobs in Michigan and the entire upper Midwest, and its economy is crucial to the overall health of American commerce

and trade. I am proud to have led these efforts in the House and urge the Senate to swiftly adopt these measures so this amendment can be signed into law,” stated Representative John James.

In the President’s Fiscal Year 2024 budget, the U.S. Coast Guard requested $55 million for the GLIB but received only $20 million. “Representative James has taken a major positive step toward ensuring the Great Lakes maritime supply chain remains viable during winter months.

The new Great Lakes icebreaker will not only facilitate safe and efficient commerce but also protect Michigan’s shoreline communities from devastating ice jam flooding, which occurs almost annually in the St. Clair River,” said Jim Weakley, President of the Lake Carriers’ Association.

The construction timeline for the new Great Lakes icebreaker hinges on adequate and timely funding for the U.S. Coast Guard.

With only one heavy Great Lakes icebreaker and an aging fleet of smaller icebreakers, the U.S. Coast Guard faces increasing challenges in maintaining the winter supply chain on the Great Lakes. The U.S. economy relies heavily on Great Lakes shipping for raw materials essential for producing U.S.-made steel and other manufacturing building blocks.

An economic analysis commissioned by the Lake Carriers’ Association equated inadequate icebreaking on the Great Lakes to a $2 billion loss in economic activity and over 10,000 jobs in the past decade.

Innovative Solutions - Proven Performance

ME Elecmetal goes beyond simply providing mill liners. We offer a comprehensive package that includes innovation, extensive support, customized designs, and valuable tools to deliver a fully tailored comminution solution that meets your specific needs. Our approach involves being present and engaged with our customers, working together to establish shared objectives and offering timely responses through effective collaboration. Drawing on over a century of experience and utilizing cutting-edge technologies, our goal is to optimize processes, extend the lifespan of wear parts, mitigate operational risks, and ultimately improve profitability for your operations.

The considerable role that enslaved Africans played in the development of the U.S. mining industry is a lesser-known aspect of this history.

African enslavement in the mining industry dates back to the early 17th century, with the first documented instance occurring in the British colonies of North America. As the British began to explore and exploit the mineral-rich lands of the colonies, African slaves were compelled to work in the mines alongside European and native laborers. The mining of precious metals such as gold, silver, and copper, as well as minerals such as lead, iron, and coal, was a significant contributor to the colonial economy, and enslaved Africans played a crucial role in the extraction and refining of these valuable resources.

In several colonies, the use of enslaved Africans in the mining industry had become pervasive by the middle of the 18th century. In the southern states, plantation owners frequently “rented” their enslaved laborers to mining operations, which provided a lucrative source of income for the plantation owners and a valuable labor force for the mines. This practice was prevalent in the coal mines of Virginia, North Carolina, and Tennessee, as well as the lead mines of Missouri, well into the 19th century.

In the mines, conditions for African slaves were frequently brutal and inhumane. These individuals suffered from respiratory diseases, malnutrition, and physical injuries as a result of being forced to work long hours without adequate leisure or safety precautions. The mortality rate of enslaved laborers in the mines was significantly higher than that of their counterparts in agriculture, but the mining industry’s profitability frequently outweighed the cost of human life.

Yes, enslaved Africans were utilized in American mining. In the summer of 1849, white southerners brought Black slaves to the California mines. In fact, the first test of California’s Fugitive Slave Law involved three formerly enslaved African men who had established a prosperous mining supply company.

The 1848 beginning of the California Gold Rush is a defining moment in American history that attracted tens of thousands of foreign miners. The discovery of gold at Sutter’s Mill in Coloma, California, ushered in a period of swift economic expansion and territorial growth. While the Gold Rush is commonly associated with tales of fortune-seekers and “Forty-Niners,” the contribution of subjugated Africans to the development of California’s mining industry is often forgotten.

During the Gold Rush, California was flooded with miners from across the United States, including slave-holding states in the South. These miners brought enslaved Africans with them, who were forced to labor in the gold mines and contribute to their enslavers’ wealth.

IMMIGRATION HAS EMERGED AS A CRITICAL SOLUTION TO address the increasing demands of the global mining industry, which is currently experiencing substantial labor shortages.

A dual challenge is being faced by countries worldwide: the necessity for specialized labor to support mining operations and an aging workforce. An aging workforce and a decrease in interest among newer generations in mining careers are exacerbating the mining industry’s persistent labor shortage. For example, the domestic pool of skilled labor is diminishing, and the average age of miners in Canada is consistently increasing.

The mining operations have become significantly dependent on immigrant workers to fulfill critical duties and maintain operations as a result of this shortage.

Companies in Sudbury, Ontario, which is recognized as the mining capital of the world, have implemented international recruitment strategies to satisfy labor shortages. The demand for skilled tradespeople continues to be unmet, despite efforts to recruit local workers through job fairs and advertising campaigns.

during the late 19th and early 20th centuries. Despite the harsh conditions and interethnic tensions, these laborers made substantial contributions to the labor movement and the industry’s expansion.

Currently, the mining and quarrying sectors in the Organization for Economic Cooperation and Development (OECD) countries continue to depend on immigrants to cover labor shortages.

Throughout history, the mining industry has been significantly influenced by immigrants. The coal mining industry in the United States was significantly dependent on immigrants from Southern and Eastern Europe

Currently, the mining and quarrying sectors in the Organization for Economic Cooperation and Development (OECD) countries continue to depend on immigrants to cover labor shortages.

Australia and New Zealand have a mining workforce that is 24% and 15% expatriate, respectively. These employees are indispensable for the purpose of addressing skill shortages and sustaining productivity.

Successful integration and retention are among the most significant obstacles to relying on immigrant labor. In order to foster cultural diversity and provide immigrant workers with sufficient training and career development opportunities, companies must establish inclusive workplaces.

In order to facilitate the entry of skilled laborers into the mining sector, governments are instrumental in the development of immigration policies. For

instance, Canada has implemented programs such as the Federal Skilled Trades Class and the Express Entry system to attract qualified immigrants.

Interethnic tensions have historically presented obstacles in mining communities. In order to address these concerns, it is imperative that governments and corporations foster cooperation and intercultural understanding.

Skilled immigrant laborers can be attracted and retained by providing them with competitive salaries and benefits.

The mining industry must adjust in order to guarantee a consistent supply of skilled labor as the global demand for minerals and metals continues to increase. Immigration will continue to be a crucial element of this strategy, as it will assist in the mitigation of workforce shortages and the maintenance of industry expansion.

Immigration is not merely a transitory solution; it is a strategic necessity for the mining industry. Governments and businesses can leverage the potential of immigrant labor to address workforce challenges and advance the industry by implementing appropriate policies and practices.

THE MINING INDUSTRY IS INCREASINGLY GRAPPLING WITH the dual challenges of stringent environmental regulations and water scarcity. As a result, efficient water management has become a critical focus.

Recent reports predict significant growth in the global water treatment market for mining, driven by the need for sustainable and cost-effective solutions. Enter Evoqua’s VAF™ (Vortex Automatic Filter) technology, which promises to revolutionize water treatment in mining operations.

Filtration Methods: Limitations and Challenges

Mining operations, often situated in remote and arid regions, rely heavily on traditional filtration methods like sand filters. These methods come with notable drawbacks:

Space Requirement: Sand filters necessitate large physical spaces, which are often unavailable in mining sites. Maintenance and Downtime: Regular replacement of sand can lead to significant downtime, costing mines thousands to millions of dollars depending on the scale of operations.

Advanced Filtration Technologies: VAF™ V-Series Self-Cleaning Screen Filters

Fleet Space Technologies’ ExoSphere and its collaboration with Inflection Resources spotlight the potential of advanced technologies in the mining sector.

Here’s why Evoqua’s VAF™ filters are becoming a game-changer: Continuous Operation and Self-Cleaning- VAF filters

are designed to operate without interruption. They can automatically self-clean while maintaining at least 95% filtration efficiency. The flush cycle is brief, taking only 15 seconds, which minimizes disruption.

Unlike traditional sand filters, VAF filters require minimal space. For example, six VAF filters, housed in a standard 12-meter container, can filter 1,000 cubic meters per hour at 50 microns. This compact footprint is particularly beneficial for mining sites with space limitations.

VAF filters operate without hydraulic systems, motors, or electrical mechanisms. Instead, they utilize a pressure difference to drive the cleaning process, reducing the risk of mechanical failures and the need for specialized maintenance—a crucial advantage for remote mining locations.

Roch Distributors brings world-renowned water treatment technologies and products to the African market. We offer leading global innovations, technical support, and world-class logistics services that are cost-effective, reliable, and compliant with all safety standards and regulations.

The VAF filter’s operational mechanism is both simple and effective:

Dirty water enters the filter, passing through a coarse screen and then a fine screen, where impurities are trapped. Clean water exits through the outlet.

As impurities accumulate, the pressure drop across the fine screen increases. When a preset differential pressure is reached, the filter initiates a flush cycle, opening a flush valve that creates a suction effect to remove dirt from the fine screen.

The dirt collector, equipped with suction nozzles, rotates due to water jets, ensuring thorough cleaning of the screen. A reverser mechanism ensures comprehensive coverage and efficient cleaning.

The adoption of innovative water treatment technologies like Evoqua’s VAF™ filters marks a significant advancement

for the mining industry. These systems provide reliable, low-maintenance, and space-efficient solutions to the limitations of traditional filtration methods.

The VAF filters offer several benefits tailored to the mining industry:

Reduced Moving Parts: With 70% fewer moving parts than traditional systems, VAF filters require less maintenance.

Efficient Cleaning: The patented design ensures complete screen cleaning with controlled suction nozzle rotation, resulting in greater efficiency and minimal waste.

Versatile Applications: VAF filters accommodate flow rates from 7 to 2,274 cubic meters per hour and filtration capabilities from 10 to 1,500 microns, making them suitable for various pre-treatment steps.

The report “Connected Mining Market 2024” outlines important developments in digital technologies that are about to revolutionize the mining sector.

Adoption of edge computing, robots, and digital twin technology are important trends that all seek to improve mining operations’ operational effectiveness and safety.

Increasingly important is digital twin technology, which produces virtual copies of real-world objects, procedures, and settings. Significantly increasing decision-making and operational efficiency in mining operations, these digital models enable predictive maintenance, performance optimization, and scenario analysis.

An additional important trend that enables real-time data processing at the source is edge computing. In distant mining sites where prompt reactions to operational changes are required, this technology decreases latency and allows instantaneous decision-making.

Additionally growing in popularity is the use of robotics in mining, which is motivated by the necessity to boost productivity and lower human exposure to dangerous situations. Both productivity and safety are being improved by the integration of digital systems with automated mining excavators, load haul dump units, and sophisticated drillers for real-time data analysis and remote operation.

These tools are a component of a larger movement in connected mining to use data analytics, AI, and the Internet of Things. By maximizing resource management and lowering environmental effects, these developments not only increase efficiency and safety but also promote sustainable mining methods.

The Department of Labor of the United States of America has announced the availability of $10.5 million in funding to enhance mine safety and health training nationwide.

The Department of Labor of the United States of America has announced the availability of $10.5 million in funding to enhance mine safety and health tr aining nationwide.This funding, which is a component of the State Grants program for the fiscal year 2024 and is administered by the Mine Safety and Health Administration (MSHA), is intended to be used to provide mandatory training to miners employed in metal and nonmetal mines, as well as surface and underground coal mines.

State, tribal, and territory administrations are eligible to receive grants of this nature, which may cover up to eighty percent of the program’s expenses. The application submission deadline is August 20, 2024, and the funds will be distributed by September 30, 2024.

Chile’s Codelco, the world’s largest copper producer, is still experiencing major declines in copper output, worsened by several operational and environmental issues.

Chile’s Codelco, the world’s largest copper producer, is still experiencing major declines in copper output, worsened by several operational and environmental issues. The corporation, which is critical to the global copper market, has seen its output figures fall due to a combination of delayed projects, maintenance concerns, and external pressures.

One of the most serious concerns is its key projects’ ongoing delay and cost overrun. The PMCHS project, which

Despite these problems, Codelco’s leadership is optimistic about the future. CEO Ruben Alvarado and Chairman Maximo Pacheco have implemented a number of efforts to stabilize production and address the underlying concerns.

was anticipated to be a cornerstone of Codelco’s future output, has fallen far short of its production targets.

Initially predicted to produce 385,000 metric tons by 2023, the actual results were far lower, with only 178,000 metric tons produced in the first nine months of 2023. This gap is due to slower project rollouts and unexpected operational issues.

Maintenance issues have played a significant role in Codelco’s woes. The COVID-19 epidemic prompted the corporation to prioritize production over regular maintenance, resulting in long-term equipment failures and operational inefficiencies affecting output today.

The Chuquicamata mine, in particular, has suffered from maintenance negligence, resulting in major operational disruptions.

Accidents have also caused severe production delays. A deadly accident in March 2023, combined with a huge landslide at the Ministro Hales mine in 2022, has resulted in significant delays and operational setbacks.

Environmental considerations have exacerbated Codelco’s condition. Extreme

weather occurrences, such as a severe drought followed by massive flooding, have hampered mining operations and exacerbated the company’s issues.

Furthermore, a decline in ore grade has made it difficult for Codelco to sustain production levels.

Despite these problems, Codelco’s leadership is optimistic about the future. CEO Ruben Alvarado and Chairman Maximo Pacheco have implemented a number of efforts to stabilize production and address the underlying concerns. These include higher maintenance investments and restructuring

the management team to better project performance.

Higher copper prices have also brought some financial respite, potentially allowing Codelco to stabilize its earnings despite the current production decline.

Codelco’s efforts to reverse its production fall are critical for the corporation and the world copper market, which is significantly dependent on Codelco’s output.

The road to recovery will be difficult, but with judicious investments and improved project management, Codelco hopes to regain its position as a dependable leader in the copper sector.

Chile's Codelco, the world's largest copper producer, on Friday posted a 29% drop in its pre-tax profit for the first three months of this year, landing at $849 million. The state-owned miner said output totalled 295,000 metric tons, down 10% from the same period last year.

Codelco has been battling to boost its production, which has fallen for two straight years to reach a quarter-century low, despite delays, cost overruns and accidents.

Codelco had provided an estimate for its production figures earlier this month, with Chairman Maximo Pacheco saying recovery was underway.

Global markets are witnessing a remarkable surge in manganese prices this year, surpassing gains seen in traditional commodities like copper and gold. This surge is driven by supply disruptions and robust demand from steelmakers and battery manufacturers.

Manganese, a critical component in steel production for its ability to enhance metal strength and reduce brittleness, has seen prices for 44% grade ore nearly double since the beginning of 2024. This increase outstrips the 15% rise in copper, 12% in gold, and almost 30% in tin over the same period.

The surge in manganese prices was triggered by a devastating cyclone that struck the Groote Eylandt Mining Co. (GEMCO) operation in northern Australia earlier this year. The hurricane severely damaged port and haulage infrastructure, forcing a suspension of high-grade manganese ore exports until 2025. GEMCO, jointly owned by South32 Ltd. (60%) and Anglo American Plc (40%), is the world’s second-largest manganese mine.

“Manganese is a crucial ingredient in steelmaking, and its sudden price rise underscores its indispensable role in global industrial processes,” noted Zach Parsons, an analyst at Benchmark Mineral Intelligence. He explained that while initial delays were buffered by existing stockpiles elsewhere, the supply shock eventually impacted prices across the manganese supply chain.

In a notable divergence from the overall market trend, Newmont Corporation (NYSE: NEM) experienced a decline in its stock value.

This drop occurred as broader market indices marked gains, drawing attention to the mining giant’s specific challenges and investor sentiment. Newmont Corporation’s stock closed at a loss, falling by 2.3% to settle at $42.55. This decline contrasts sharply with the S&P 500, which saw an uptick of 0.5%, indicating a positive day for the broader market.

The dip in Newmont’s stock comes despite a general uptrend in the materials sector, which often correlates with broader market movements. The Materials Select Sector SPDR Fund (XLB), a benchmark for the industry, gained 0.8% on the same day. As a leading gold producer, Newmont’s performance is closely tied to fluctuations in gold prices. On Wednesday, gold futures remained relatively stable, showing a modest increase of 0.1% to $1,785.30 per ounce. The tepid movement in gold prices might have contributed to the muted investor response to Newmont’s stock.

Investors are likely reacting to the company’s recent earnings report, which revealed a decrease in quarterly revenue and profit. The report indicated that Newmont is facing higher operational costs and logistical challenges, which have squeezed margins despite stable gold prices. Broader market sentiment appears to favor sectors less impacted by current economic uncertainties. Investors are gravitating towards technology and healthcare stocks, which have shown resilience and growth potential in recent months. This shift in investor preference might be detracting attention and capital from traditional safe-haven assets like gold and related stocks.

Market analysts suggest that Newmont’s current stock performance might be a short-term response to specific operational and financial challenges. However, they emphasize the company’s strong fundamentals and significant gold reserves, which position it well for long-term stability once current issues are addressed. Looking ahead, Newmont’s performance will likely hinge on its ability to manage operational costs and navigate the logistical challenges posed by the current economic environment. Additionally, any significant movement in gold prices will be a critical factor influencing investor confidence and stock performance.

Electric vehicle (ev) manufacturer Rivian has announced a strategic shift aimed at cutting costs and streamlining its production process.

Electric vehicle (EV) manufacturer Rivian has announced a strategic shift aimed at cutting costs and streamlining its production process. This comes as the company strives to achieve its first profit by the end of 2024. The adjustments include simplifying its output and focusing on efficiency to enhance overall profitability.

A key aspect of Rivian’s plan involves the optimization of its supply chain, particularly concerning the sourcing

and use of mined minerals essential for manufacturing. These minerals, which include lithium, cobalt, and nickel, are critical components in the production of EV batteries. Rivian’s strategy includes securing more stable and cost-effective sources of these materials to ensure a steady supply and reduce expenses.

The EV industry as a whole faces significant challenges related to the supply and cost of mined minerals. The demand for lithium, cobalt, and nickel has surged

with the growing popularity of electric vehicles, leading to increased competition and price volatility.

Rivian’s proactive approach to managing these resources is aimed at mitigating risks associated with supply chain disruptions and fluctuating mineral prices.

In addition to supply chain enhancements, Rivian is also investing in technological innovations to reduce its reliance on scarce minerals.

We have long supported the region’s mining industry by providing safe, reliable and competitively priced electricity. In 2021, half of the energy we provide to all of our customers will come from renewable sources.

Together, we power northeastern Minnesota’s economy.

mnpower.com/EnergyForward

the importance of geotechnical engineering has become increasingly crucial. By 2024, breakthroughs in geotechnical engineering are offering unparalleled prospects for improving the safety, productivity, and environmental friendliness of mining activities.

The current status of geotechnical engineering in the mining industry.

Geotechnical engineering plays a crucial role in the mining industry by ensuring the stability of excavations, managing tailings, and reducing environmental impacts. With the increasing depth and complexity of mining operations, there is a growing demand for advanced geotechnical solutions.

Primary areas of concentration encompass:

1. Ensuring stability and security: Ensuring the stability of underground and open-pit mines is of utmost importance. Geotechnical engineers are responsible for evaluating soil condi-

tions, forecasting possible failures, and developing support systems to avert collapses.

The incorporation of sophisticated monitoring systems and predictive modeling tools has greatly improved the capacity to handle these hazards.

2. Management of tailings:

The disposal and management of mine tailings provide substantial environmental and safety difficulties.

Geotechnical engineers have a vital role in the construction of tailings storage facilities (TSFs) that are secure, steady, and able to endure severe weather conditions. The industry is undergoing a transformation in its ap-

proach to tailings management through advancements in tailings dewatering techniques and the adoption of alternate materials for tailings dams.

3. Environmental Sustainability:

Given the growing attention to the environmental consequences of mining operations, geotechnical engineering plays a crucial role in the development of sustainable methods.

This includes the reduction of land disruption, the proper handling of waste, and the restoration of mining sites after they have been closed. Methods such as bio-engineering and the utilization of geosynthetics are being utilized to improve environmental results.

New technologies are causing a revolution in geotechnical engineering in the mining industry. Several significant advancements are leading the way:

Artificial Intelligence (AI) and Machine Learning (ML) are two closely related fields in computer science that focus on developing intelligent systems and algorithms.

AI refers to the simulation of human intelligence in machines, allowing them to do tasks that typically require human intelligence, such as speech recognition, decision-making, and problem-solving.

The incorporation of artificial intelligence (AI) and machine learning (ML) into geotechnical engineering is revolutionizing the process of analyzing data and creating predictive models.

These technologies empower engineers to efficiently analyze vast amounts of data from diverse sources, detect trends, and make well-informed judgments. Machine learning algorithms have the capability to forecast ground movements and identify prospective hazards, enabling the implementation of proactive actions.

Advanced Ground Penetrating Radar (GPR) is a sophisticated technology that uses electromagnetic waves to penetrate the ground and gather information about what lies under the surface.

Remote sensing refers to the collection of data about an object or phenomenon from a distance, typically using sensors or instruments. Drones, also known as unmanned aerial vehicles (UAVs), are aircraft that are operated without a human pilot on board.

They are often equipped with remote Geotechnical surveys and are increasingly relying on drones that are equipped with high-resolution cameras and LiDAR sensors, as these technologies have become essential.

They offer comprehensive topographic maps and three-dimensional models of mining sites, which are crucial for the purposes of strategic planning and ongoing surveillance. Drones provide a cost-efficient and secure approach for conducting surveys in dangerous or hard-to-reach locations, hence minimizing the requirement for manned inspections.

As mining operations expand into urban areas, the difficulties related to limited land availability and intricate ground conditions become more severe. Geotechnical engineers are responsible for creating inventive foundation designs and ground improvement strategies to guarantee the stability of structures in challenging conditions.

Recent developments in Ground Penetrating Radar (GPR) technology have enhanced the precision and range of subsurface imaging. Understanding the geological conditions is essential in mining, as it plays a vital role in planning and ensuring safety.

Advanced Ground Penetrating Radar (GPR) systems have the capability to accurately identify empty spaces, cracks, and alterations in the composition of soil. This ability is beneficial in improving the planning and execution of mining operations, making them safer and more effective.

Building Information Modeling (BIM) is a method used in the construction industry to create and manage digital representations of physical and functional characteristics of buildings. It involves the use of advanced software to generate 3D models that contain detailed information on various aspects of a building, such as BIM is becoming more commonly included into geotechnical engineering projects.

This technology enables the generation of intricate computer models that accurately depict the physical and operational attributes of a mining site. BIM enhances communication and collaboration among diverse engineering specialties, resulting in more streamlined design and construction procedures.

Notwithstanding the progress made, the mining business encounters numerous geotechnical obstacles that necessitate inventive resolutions:

Urbanization refers to the process of population growth and the expansion of cities. Land scarcity, on the other hand, is the limited availability of land for various purposes.

As mining operations expand into urban areas, the difficulties related to limited land availability and intricate ground conditions become more severe. Geotechnical engineers are responsible for creating inventive foundation designs and ground improvement strategies to guarantee the stability of structures in challenging conditions. This frequently entails increased project expenses and prolonged timeframes.

Adhering to rigorous regulatory standards poses a substantial difficulty. Geotechnical engineers are required to handle intricate rules pertaining to environmental impact, land usage, and construction safety. Keeping up with changing standards and using optimal methods is crucial to prevent legal and financial consequences.

Although technological improvements provide a wide range of advantages, their implementation necessitates substantial investment in both training and infrastructure.

Smaller companies, specifically, may face difficulties in keeping up with these changes because of financial limitations. It is essential to establish a connection between conventional methods and contemporary technology in order to facilitate the industry's overall development.

The future of geotechnical engineering in the mining sector appears to be highly promising, as there are numerous rising trends and research paths that are expected to significantly influence the field:

IoT and smart sensors are anticipated to become increasingly common in mining operations. These technologies enable the continuous monitoring of soil conditions, structural integrity, and environmental factors in real-time.

The acquired data can be utilized for preventative maintenance, early warning systems, and improving the overall safety and dependability of infrastructure.

Bio-Engineering and Geo-Environmental Solutions: The study of bio-engineering methods, such as utilizing plant roots to stabilize slopes and using microbial-induced calcite precipitation to enhance soil quality, is attracting increasing attention and interest. These techniques provide eco-friendly

SUMMARY OF THE PROJECT:

A prominent mining corporation in Australia has adopted sustainable techniques in its operations as a result of environmental concerns and regulatory demands.

The project entails the operation of an open-pit mine situated in an area characterized by difficult geotechnical conditions, such as soft soils and a high water table.

ADVANCEMENTS IN TECHNOLOGY:

The company utilized sophisticated soil stabilization methods, such as deep cement mixing, to enhance the robustness and steadiness of the

ground. This was enhanced by the utilization of Internet of Things (IoT) sensors for immediate monitoring of ground movement and water levels.

The incorporation of these technologies has greatly improved the safety and productivity of the mining operations.

In order to reduce the negative effects on the environment, the project implemented bio-engineering methods, including the utilization of indigenous plants for the purpose of stabilizing slopes and preventing erosion.

alternatives to conventional geotechnical processes and are especially pertinent in the mining industry, where environmental impact is a crucial consideration.

Further advancements in computer techniques, like finite element analysis and discrete element modeling, will continue to improve the accuracy of geotechnical analysis.

These tools facilitate engineers in simulating intricate soil-structure interactions and forecasting the performance of geotechnical systems under diverse circumstances, resulting in enhanced efficiency and safety in mining operations.

Subsequent investigations will prioritize the development of infrastructure that is capable of adjusting to fluctuating environmental circumstances and enduring severe occurrences.

This encompasses the creation of materials that possess the ability to repair themselves and structures that can adapt their performance in real-time when subjected to external pressures. These innovations are essential for guaranteeing the durability and robustness of mining infrastructure.

In addition, a thorough water management system was created to recycle and reuse process water, hence decreasing the mine's water impact.

OBSTACLES AND RESOLUTIONS:

The project encountered substantial obstacles as a result of the existence of cohesive clays and elevated groundwater levels. Engineers utilized preloading and vertical drains to expedite soil consolidation and mitigate settlement hazards.

By closely collaborating with environmental organizations, we were able to meet strict requirements and limit any negative effects on the environment.

In order to accommodate the changing needs of the sector, there will be a heightened focus on education and the enhancement of skills. Specialized courses and training programs focused on the newest technology and sustainable practices in geotechnical engineering are commonly provided by universities and professional organizations.

The integration of geotechnical engineering, environmental science, data analytics, and urban planning in interdisciplinary training will provide future engineers with a com-

prehensive range of skills necessary to address intricate infrastructure concerns.

Professional development is essential in a time characterized by swift technical advancements. Geotechnical engineers are advised to participate in continuous learning by attending workshops, obtaining certifications, and pursuing further degrees. Continuous professional development guarantees that industry professionals remain up-to-date with new tools, processes, and regulatory changes.

International cooperation is crucial for the progress of the geotechnical engineering discipline. International conferences and workshops provide forums for scholars and practitioners to disseminate their discoveries, engage in intellectual discourse, and cooperate on innovative initiatives. These events cultivate a feeling of unity and stimulate creativity within the sector.

The shift towards open access research and data sharing is enabling increased collaboration and fostering innovation. Researchers are progressively providing their data and discoveries to the worldwide community, enabling others

to expand on their work and expedite advancement in the discipline. This phenomenon is augmenting the shared reservoir of information and propelling progress in the field of geotechnical engineering methodologies.

In 2024, geotechnical engineering is a rapidly changing and developing discipline, marked by notable technological progress, a prominent focus on sustainability, and the requirement to tackle intricate problems. These advancements are especially pertinent to the mining sector.

By improving safety, efficiency, and environmental stewardship, they increase these aspects.

Geotechnical engineers are changing their approach to mining projects by incorporating advanced technology such as AI, IoT, and other innovative methods. Modern mining processes prioritize the use of innovative ground improvement techniques, advanced monitoring systems, and climate-responsive designs.

Given the ongoing issues of urbanization, climate change, and regulatory requirements, the importance of geotechnical engineering in the business will only increase.

SUMMARY OF THE PROJECT:

Situated in a geologically active area, a mining operation of significant magnitude in Chile necessitated inventive measures to guarantee the stability and security of its infrastructure.

The project involved the construction of a subterranean mine with intricate geological circumstances.

ADVANCEMENTS IN TECHNOLOGY:

In order to mitigate seismic hazards, engineers utilized sophisticated numerical modeling techniques to accurately replicate the mine's response to seismic activity. These findings influenced the development of strong support systems, such as

rock bolts and shotcrete, to improve the stability of underground excavations. Furthermore, seismic isolation bearings were employed to separate vital infrastructure from the effects of ground motion.

The project emphasized environmental sustainability by integrating renewable energy sources, such as solar and wind power, to decrease the mine's carbon impact.

The waste management methods involved the utilization of tailings for recycling purposes in the production of construction materials, with the

aim of reducing the adverse effects on the environment.

OBSTACLES AND RESOLUTIONS:

The mine's placement in a region prone to frequent seismic activity presented considerable difficulties. Engineers performed thorough seismic hazard studies and utilized advanced modeling techniques to guarantee the infrastructure's ability to withstand and recover from seismic events.

Continuous surveillance with sophisticated geotechnical devices offers up-to-the-minute information on soil conditions, allowing for preemptive upkeep.

IN A STRATEGIC MOVE TO MAXIMIZE THE country’s earnings from its natural resources, the Zambian Cabinet announced the establishment of a new entity dedicated to mineral investment and trading.

In a strategic move to maximize the country’s earnings from its natural resources, the Zambian Cabinet announced the establishment of a new entity dedicated to mineral investment and trading. This decision aims to shift the country’s revenue model from dividend payments to a production-based sharing mechanism.

As Africa’s second-largest copper producer, Zambia currently owns several mining assets through ZCCM Investment Holdings. The new special purpose vehicle (SPV) will enhance Zambia’s control over its mineral wealth. The Cabinet stated that the SPV will facilitate the sharing of minerals produced, enabling the government to negotiate prices and

ensure accurate declarations of mineral consignments for export and domestic use.

“The creation of this entity marks a significant shift in how Zambia will benefit from its mineral resources,” the Cabinet announced. “Moving away from a dividend payment model to a production-based sharing mechanism ensures that the benefits accrue directly to the people of Zambia, beyond statutory obligations.”

The new business model aims to provide a more equitable distribution of profits

from mineral production, ensuring that Zambia reaps more substantial rewards from its rich natural resources. This approach is expected to provide greater transparency and accuracy in the declaration of mineral exports, a challenge in the past.

ZCCM Investment Holdings holds interests ranging from 10% to 20% in major mining operations, including those owned by Barrick Gold, Vedanta Resources, and First Quantum Minerals. Recently, ZCCM sold a 51% stake in Mopani Copper Mines to a unit of the United Arab Emirates International Holding Company while retaining the remaining interest.

In an interview with Reuters in February, Mines Minister Paul Kabuswe indicated Zambia’s intention to negotiate larger stakes in new mining projects. This is part of a broader strategy to increase national revenue and encourage greater investment in social projects by mining companies.

Zambia produced 698,000 metric tons of copper in 2023, a decline from 763,000 metric tons in 2022. However, the country has set an ambitious target to triple its annual copper output to three million metric tons within the next decade. This increase is driven by the rising global demand for copper, essential for the electricity and construction industries.

of Mines and Mining Development have commended the Bravura Group for its exceptional preparedness and significant investment in state-of-the-art mining equipment and technologies.

The Pan-African diversified mining company’s efforts signal substantial progress in establishing Zimbabwe as a premier mining destination.

During a fact-finding mission to inspect equipment and plants, the Ministry’s delegation expressed excitement over Bravura’s commitment. The company has invested hundreds of millions of USD in advanced yellow machines, currently stationed at CWC in South Africa, ready for the Selous PGM project box cut stage. These machines are awaiting importation approval and duty exemptions from the Zimbabwean government.

Bravura is also poised to transform the Kamativi dump with a cutting-edge lithium Tailings Storage Facility (TSF) processing plant, under construction by Manhattan Corporation in South Africa.

Wilfred Runyararo Munetsi, Deputy Director of Communications for the Min-

istry of Mines and Mining Development, praised Bravura’s dedication. “We’ve seen massive equipment purchased by Bravura for the development of a mine, especially an underground mine.

The equipment they have shown us, including drill rigs and dump trucks, is geared for large-scale mining.

Bravura is set to become a major player in the platinum field. This investment demonstrates their serious commitment to Zimbabwe, given the high cost of the equipment. We hope it will pay dividends for them.”

Munetsi highlighted the Ministry’s role in overseeing mining development, emphasizing the importance of such investments. “As the Minister of Mines always mentions, our role also includes overseeing mining development.

In this regard, you can see the progress made on this project by Bravura. We have inspected their equipment, particularly the DMS plant, which is now fully assembled and ready for shipment to the site in Kamativi. We are very excited about this development and will continue to monitor the project until its completion, benefiting Zimbabwe.”

Bravura’s investments and preparedness reflect a significant step forward for Zimbabwe’s mining sector, promising to boost the country’s position in the global mining industry. With the Selous PGM project and Kamativi lithium TSF processing plant, Bravura is set to revolutionize mining operations in Zimbabwe, enhancing economic growth and development in the region.

MINE TECHNICAL SERVICES,MINE PLANNING, MINERAL

RESOURCE EVALUATION, DIGITAL MINE MONITORING

I have about 35 years of experience in mining operations, covering both opencast and underground coal mines. My career has been a journey of continuous learning and adaptation to new technologies and methodologies. Starting with greenfield mining projects and progressing to my current role as Chief of the Natural Resource Division at Tata Steel, I have always strived to ensure raw material security and enhance the quality and efficiency of mining operations.

CONSTRUCTION SUPERINTENDENT EC&I, SALDANHA BAY

LOCAL MUNICIPALITY, WESTERN CAPE, SOUTH AFRICA

My career as a Senior Control & Instrumentation Engineer has been rewarding and dynamic. I’ve worked across various industries including Mining, Water & Wastewater, Industrial, Oil & Gas, and Petrochemical.

Each sector has its unique challenges, but the common thread has been the implementation of robust systems to enhance productivity and improve ROI. My work has often involved innovative solutions that reduce delivery times and increase capabilities.

In the dynamic and challenging world of mining, experience and innovation are key to navigating the complexities of the industry. Today, we have the privilege of speaking with two esteemed professionals who have made significant contributions to the field: Piyush Srivastava, Chief of the Natural Resource Division at Tata Steel, and James Olls, a Senior Control & Instrumentation Engineer with extensive experience across various industries.

With decades of combined expertise, Piyush and James share their career insights, the importance of leadership, and their visions for the future of mining. This interview delves into their professional journeys, highlighting the critical role of technology, the necessity of continuous learning, and the steps needed to enhance the industry's sustainability and public perception.

Piyush Srivastava: Leadership skills are as important as technical skills. They not only help in climbing the career ladder but also make one more effective in any role. Leadership involves humility, courage, discipline, and the ability to delve deep into issues when necessary.

James Olls: Leadership is very important. It involves guiding teams through complex projects and ensuring that everyone is aligned with the common goals. Effective leadership fosters a collaborative environment and drives success.

Did your formal education narrow or widen your career preparation?

Piyush Srivastava: It definitely widened my career preparation. The diverse knowledge gained through formal education has been crucial in tackling various challenges in the mining sector.

James Olls: My formal education widened my career preparation by providing a solid foundation of knowledge and skills that I’ve been able to apply across multiple industries.

Do you think engendering commitment is important to be a successful manager?

Piyush Srivastava: Yes, engendering commitment is vital. A committed team is more productive and motivated to achieve organizational goals.

James Olls: Absolutely. A manager must be able to inspire commitment to ensure that the team works towards common objectives with enthusiasm and dedication.

Are job goals more defined now or when you first started in the industry?

Piyush Srivastava: Job goals were defined both then and now. However, current goals are broader and more holistic, considering the advancements in technology and changing regulatory frameworks.

James Olls: Job goals are more defined now due to the clearer career paths and structured project goals that come with experience and industry evolution.

Do you feel there was a clear promotion plan for your career?

Piyush Srivastava: Not really. The path wasn’t always clear, but continuous learning and seizing opportunities helped in career progression.

James Olls: Yes, especially with Coastal Energy (Pty) Ltd, where I had a clear trajectory and support for career advancement.

Do you feel it is important for new employees to fit into the company culture?

Piyush Srivastava: Very much so. Fitting into the company culture ensures a smoother integration into the team and alignment with the company’s values and goals.

James Olls: Yes, it’s crucial. A good cultural fit leads to better teamwork and job satisfaction.

Should the promotion of managers be based on technical rather than managerial skills?

Piyush Srivastava: Both are important. A balance of technical expertise and managerial skills ensures that managers can lead effectively while understanding the technical aspects of the work.

James Olls: Managerial skills should take precedence, but a solid technical background is also essential to understand and guide the team effectively.

How important is a life/work balance at this career stage?

Piyush Srivastava: Extremely important. Maintaining a healthy balance helps in managing stress and enhances overall productivity and job satisfaction.

James Olls: Very important. A balanced life allows for better focus and energy at work, leading to higher quality performance.

What is the biggest challenge ahead or advice to share with young professionals?

Piyush Srivastava: The most important traits of leadership are humility, courage, discipline, and the ability to dive deep when required. For young professionals, continuous learning and adaptability are key.

James Olls: Be diligent and respectful. Embrace continuous skills training and upliftment to stay ahead in the industry.

Srivastava and James Olls has provided a wealth of knowledge and inspiration for both seasoned professionals and newcomers to the mining industry. By fostering a culture of safety, environmental responsibility, and community engagement, the mining industry can improve its practices and enhance its public image. We thank Piyush and James for sharing their valuable insights and advice, which will undoubtedly serve as a guiding light for many in the field.

What can be done to improve the industry image even better?

Piyush Srivastava: Increasing safety, mine reclamation, and improving the quality of life for people around mines are crucial. Innovative use of waste generated during mining and integrating digital technologies into mining education can also help.

James Olls: Focusing on skills training and upliftment will improve the industry’s image. Ensuring sustainable practices and community engagement are also essential.

Could you share more about how your roles have evolved over the years and any significant projects that have shaped your career?

Piyush Srivastava: My roles have evolved significantly, from working on the ground in mining operations to leading the Natural Resource Division at Tata Steel. One of the most significant projects I was involved in was the 30 mtpa opencast coal mine for the CTL project, a joint venture between Sasol of South Africa and the Tata Group. This project provided me with invaluable experience in planning and executing large-scale mining projects. Additionally, my involvement in implementing TOC flow management initiatives and six sigma projects has greatly influenced my approach to improving operational efficiencies and safety.

James Olls: My career has been marked by a series of challenging and rewarding projects across various industries. A standout project was redesigning and commissioning the Metalkol DCS Control, IT, Fire, and CCTV Communication systems, which resulted in significant cost savings and efficiency improvements.

Another major milestone was the commissioning of Control and Instrumentation systems for the HUSAB mine plant, where we managed to reduce the commissioning time significantly. These projects not only honed my technical skills but also enhanced my project management and leadership capabilities.

Piyush Srivastava: Technology and innovation are critical for the future of mining. The use of GIS mapping, drone-based surveys, and digital mine mapping will revolutionize mine planning and operational effectiveness.

The integration of these technologies can lead to more accurate resource modeling, improved safety measures, and better environmental compliance. Additionally, leveraging data analytics and automation can significantly enhance productivity and reduce operational costs.

James Olls: The future of mining is deeply intertwined with technological advancements. Innovations such as IoT, automation, and advanced control systems can transform how we approach mining operations.

For example, using fiber and Bluetooth protocols can streamline communication systems and improve efficiency. Embracing these technologies will not only improve productivity but also enhance safety and reduce environmental impact.

What advice would you give to young professionals entering the mining industry today?

Piyush Srivastava: Stay curious and committed to learning. The mining industry is constantly evolving, and keeping up with the latest technologies and methodologies is crucial.

Cultivate leadership skills and be willing to dive deep into technical and operational challenges. Building a strong network and finding mentors can also provide valuable guidance and support throughout your career.

James Olls: Be diligent, respectful, and open to continuous learning. The mining industry offers numerous opportunities for growth, but it requires dedication and hard work. Focus on developing both technical and managerial skills, as both are essential for career advancement. Additionally, strive to contribute to safety and sustainability initiatives, as these are increasingly important in today’s industry.

What initiatives or changes do you believe could further enhance the sustainability and public perception of the mining industry?

Piyush Srivastava: To enhance sustainability and public perception, the industry needs to prioritize mine reclamation and environmental conservation. Increasing safety standards and improving the quality of life for communities around mining areas are also crucial.

Innovative use of mining waste and incorporating digital technologies into mining education can play a significant role. Furthermore, transparency in operations and proactive engagement with stakeholders can help build trust and a positive image.

James Olls: Focusing on skills training and upliftment can significantly improve the industry’s image. Emphasizing sustainable practices, such as reducing environmental impact and enhancing community welfare, is vital.

Public perception can be improved by showcasing the positive contributions of mining to the economy and society, and by demonstrating a commitment to responsible and ethical practices. This continuation of the interview provides further insights into the evolving roles of mining professionals, the importance of technology and innovation, and the critical aspects of sustainability and public perception in the mining industry.

Our conversation with Piyush Srivastava and James Olls has provided a wealth of knowledge and inspiration for both seasoned professionals and newcomers to the mining industry. Their experiences underscore the importance of leadership, adaptability, and the integration of innovative technologies in driving the industry forward. As they emphasized, continuous learning and a commitment to sustainability are crucial for future success.

By fostering a culture of safety, environmental responsibility, and community engagement, the mining industry can improve its practices and enhance its public image. We thank Piyush and James for sharing their valuable insights and advice, which will undoubtedly serve as a guiding light for many in the field.

The North American iron ore market in 2024 reflected broader economic and industry dynamics, with major trends and developments. This was the case all during the year.

The market witnessed a decrease in consumption, which is a continuation of a negative trend that has been going on for ten years. In 2023, the market is estimated to be worth roughly $4.8 billion, indicating that it has stabilized but is still much lower than its high value of $7.2 billion in 2012.

Raw steel output in the United States experienced a modest reduction, reaching 38.79 million net tons by June 2024. This represents a decrease of 2.8% compared to the previous year. The capability utilization rate fell to 76.4% from its previous level.

With the help of technology developments in automation and artificial intelligence, the Great Lakes region continues to be the principal manufacturing hub. These advancements help to optimize operations and promote safety.

Both imports and exports are included.

When it comes to iron ore imports in North America, the United States and Canada are the leaders. Because of the characteristics of the global market in 2023, import prices were subject to fluctuations.

The United States maintained higher import prices than Canada, which reflected the fact that the two countries had different market conditions and supply chain factors. The volume of exports continues to be restricted, as a result of the influence of global demand and competitive pricing strategies.

The iron ore sector in North America is dominated by a number of prominent businesses, each of which makes significant contributions to the market and implements strategic initiatives in order to maintain their competitive edge.

In North America, Cleveland-Cliffs Inc. is the largest manufacturer of iron ore pellets, and the company places a strong emphasis on environmentally responsible business practices and strategic acquisitions.

Cleveland-Cliffs is the most important supplier of iron ore pellets to the steel industry in North America. It is the largest producer of iron ore pellets in the continental United States. A variety of business activities, such as mining, beneficiation, and pelletizing, are included in the company's operations. Cleveland-Cliffs is dedicated to sustainability and is concentrating on lowering its carbon footprint by incorporating more environmentally friendly methods. In addition to this, the company is enhancing its presence in the market for steel manufacturing by means of strategic acquisitions.

U.S. Steel is a leading steel producer that also operates significant mining activities. The company is making investments in updating its facilities and implementing cutting-edge innovative technologies.

The United States Steel Corporation, more generally referred to as U.S. Steel, is capable of operating multiple mines in both the United States and Canada. In addition to being a dominant manufacturer of steel products, it also has a substantial influence on the market for iron ore because of the integrated steel mills that it operates.

U.S. Steel is making investments in the modernization of its facilities and the deployment of cutting-edge technologies in order to enhance operational efficiency and decrease emissions. Additionally, in order to improve its raw material supply chain, the company is investigating potential collaborations.

As one of the largest steel makers in the world, ArcelorMittal is working toward becoming carbon neutral by the year 2050. Additionally, the company has significant mining interests in North America.

Mining, industrial steel production, and distribution are all incorporated into the company's operations. As part of its efforts to attain carbon neutrality by the year 2050, ArcelorMittal is putting an emphasis on both innovation and sustainability. For the purpose of satisfying its requirements for steel production and preserving a reliable supply chain, the company is working to improve its mining operations.

Innovative technology developments and strategic initiatives are being utilized by key companies in order to manage hurdles and grasp opportunities in a global market that is constantly evolving.

To ensure the continued expansion and resilience of the industry in the future, it will be essential to maintain investments in infrastructure and environmentally responsible practices.

Environmental restrictions: Stricter environmental restrictions necessitate that large expenditures be made in cleaner technologies and sustainable practices, which in turn has an effect on operational expenses.

Demand from large markets such as China and fluctuations in the price of iron ore around the world both contribute to market volatility, which in turn creates uncertainty for producers in North America.

Infrastructure Projects: Infrastructure projects that are led by the government give considerable prospects for increased demand for steel and iron ore.

Innovation in Technology: Developments in mining and processing technologies have the potential to increase productivity while simultaneously lowering costs, thereby offering a competitive advantage in the international market.

The iron ore market in North America is anticipated to experience moderate growth, with demand anticipated to

remain stable or slightly increase. This growth is projected to be driven by the economic recovery and infrastructure projects. Alterations in local production capacities and fluctuations in international markets will continue to have an impact on the dynamics of the business.

The region surrounding the Great Lakes continues to be the key hub for the production of iron ore in North America, representing a considerable contribution to the entire output. The Northeast, the Midwest, the South, and the Western regions are also important production locations besides the Western region.

Companies are progressively using automation and AI-driven technology to enhance mining operations, cut costs, and increase safety. The use of these improvements is absolutely necessary in order to keep production levels competitive in a worldwide market.

There is a strong correlation between the demand for iron ore and the steel industry, an industry that consumes the majority of the iron ore that is produced. For the most part, the demand for steel and, by extension, the consumption of iron ore is driven by construction activities, car manufacture, and infrastructure projects.

A significant emphasis is being placed on environmentally responsible mining operations as well as the utilization of recovered materials. In the process of the industry adapting to more environmentally friendly practices, it is anticipated that this shift will have an effect on the patterns of iron ore use.

The market for iron ore in North America is influenced by a number of factors included:

Demand throughout the World: Variations in demand throughout the world, particularly from large customers such as China, have a substantial impact on the demand for iron ore and its availability.

Production at Home: The quantity of domestic production capacity and the utilization rates of that capacity have an impact on the supply of goods on the market.

The demand for iron ore is significantly influenced by broader economic conditions, which include industrial activity

and investments in infrastructure. There is a significant relationship between these two factors.

It is still the case that the United States of America and Canada are the most significant importers of iron ore in North America. The conditions of the global market, the exchange rates, and the difficulties associated with logistics have all contributed to the fluctuation of import prices. In general, the United States imports iron ore at greater prices than Canada does.

This is due to the fact that the market conditions and quality criteria in the United States are different. The export volumes of North America continue to be modest, with the primary focus being on local consumption, with some shipments being made to nations that are adjacent to North America.

In the year 2024, the iron ore market in North America is characterized by consistent output, changing consumption patterns, and an emphasis on sustainability.

Innovative technology developments and strategic initiatives are being utilized by key companies in order to manage hurdles and grasp opportunities in a global market that is constantly evolving. To ensure the continued expansion and resilience of the industry in the future, it will be essential to maintain investments in infrastructure and environmentally responsible practices.

The core of this disagreement revolves around the valuable cobalt reserves in the Indian Ocean Region (IOR), which are crucial for advanced industries and the production of electric car batteries.

Geopolitical tension has emerged in the Indian Ocean as India contests China-backed Sri Lanka for mining rights in the area. The core of this disagreement revolves around the valuable cobalt reserves in the Indian Ocean Region (IOR), which are crucial for advanced industries and the production of electric car batteries.

India’s claim for mining rights in the IOR demonstrates its strategic intention to oppose China’s expanding influence in the area. With the backing of Chinese investments and military infrastructure, Sri Lanka has established itself as a crucial participant in this developing conflict. The island nation has given China considerable autonomy in developing its ports and infrastructure, including the contentious Hambantota Port, which China currently oversees through a lease deal lasting 99 years.

The intensification of this “Cobalt War” carries substantial consequences for the region’s stability and the functioning of global supply lines. India’s decision is a component of a wider plan to strengthen its capacities in the marine domain and safeguard its access to resources.