Maybe it’s a sign of getting older or a coping mechanism for weathering unpredictable times, but I’m nothing if not a sucker for tradition. Seeing school supplies stock store shelves each August leaves me tingling with excitement. Though I’m a vegetarian, a Thanksgiving spread sans glistening, golden-brown turkey would just be any old Thursday-night dinner. So it goes without saying that I’ve been enthralled with all the pomp, circumstance and pageantry swirling around the death of Queen Elizabeth II.

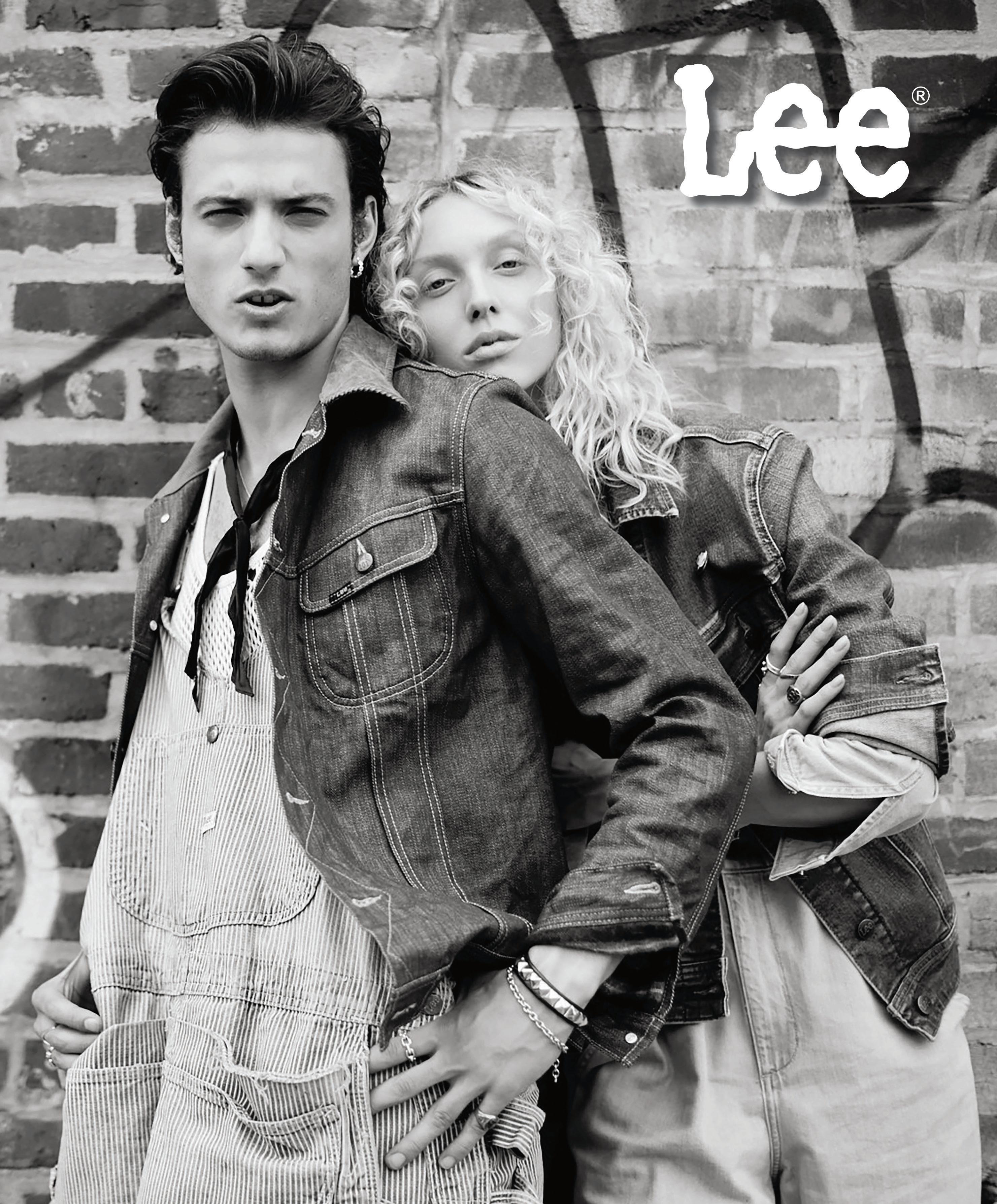

This fondness for rituals is also why I’m drawn to denim. Like the Queen, blue jeans have been a reliable, familiar and—if they’re made well—steadfast place in our lives. Denim’s day-to-day impact may often go unnoticed, but its absence would alter the fabric of the apparel sector, puncture parts of agriculture and rewrite some of pop culture’s most memorable moments. I’m certainly not alone in appreciating denim’s enduring qualities, as many of this year’s Rivet 50 honorees (pg. 28) are on a mission to improve and preserve what is arguably fashion’s most iconic fabric.

While the industry’s progressive leaders are united in replacing harmful, wasteful production techniques with more admirable alternatives, they also refuse to compromise denim’s authentic look. In “Generation Regeneration” (pg. 66), mills and brands share how they are supporting a new era of regenerative farming by rolling up their sleeves and getting down and dirty with the science of soil health. In “Spin Cycle” (pg. 72), fiber manufacturers unpack the nitty-gritty details of what it takes to convert recycled content into jeans that look and feel like they’re made from virgin sources. Meanwhile, zero-waste designers (“Waste Not” pg. 79) are shining a spotlight on one of fashion’s oldest traditions: patternmaking.

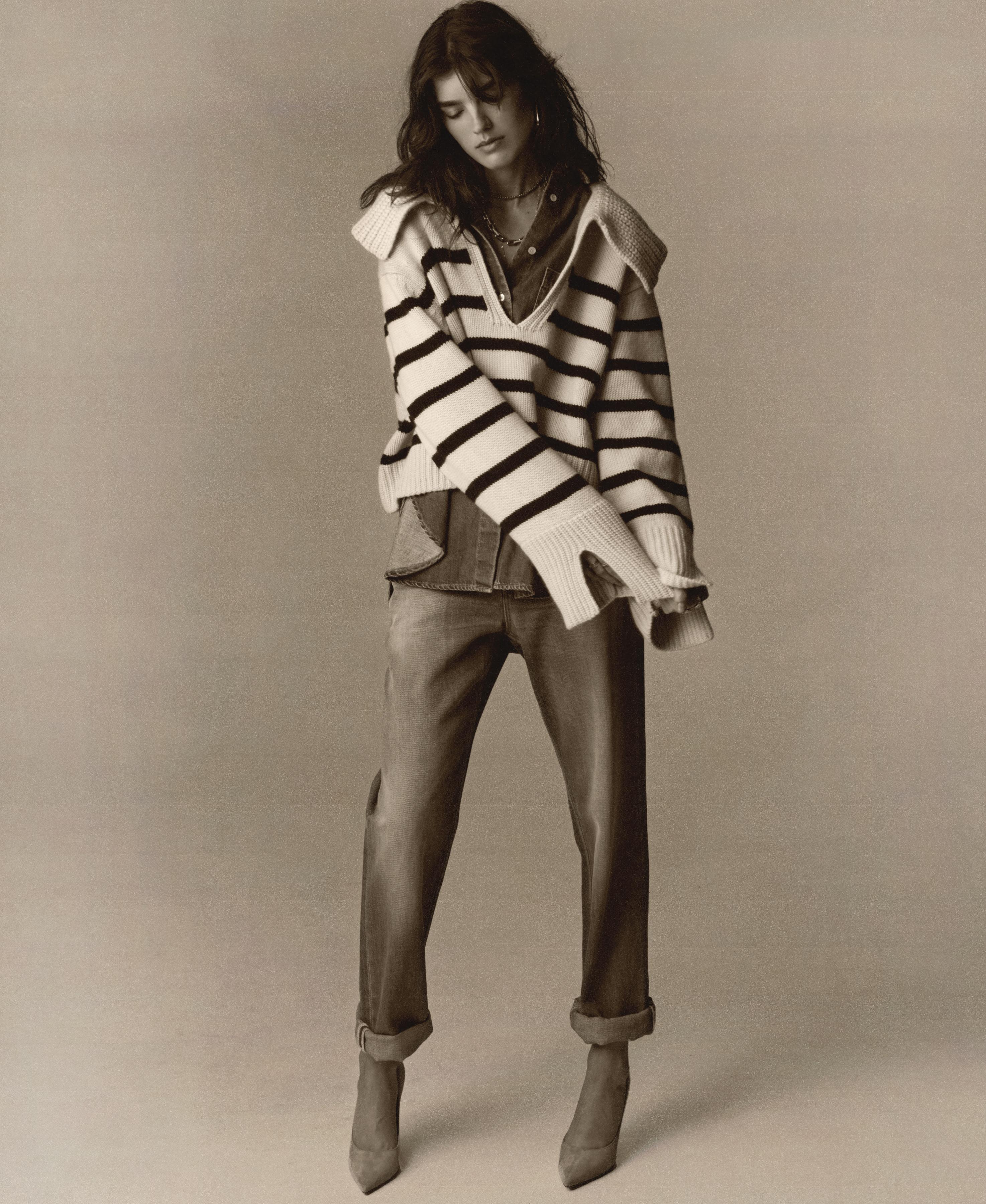

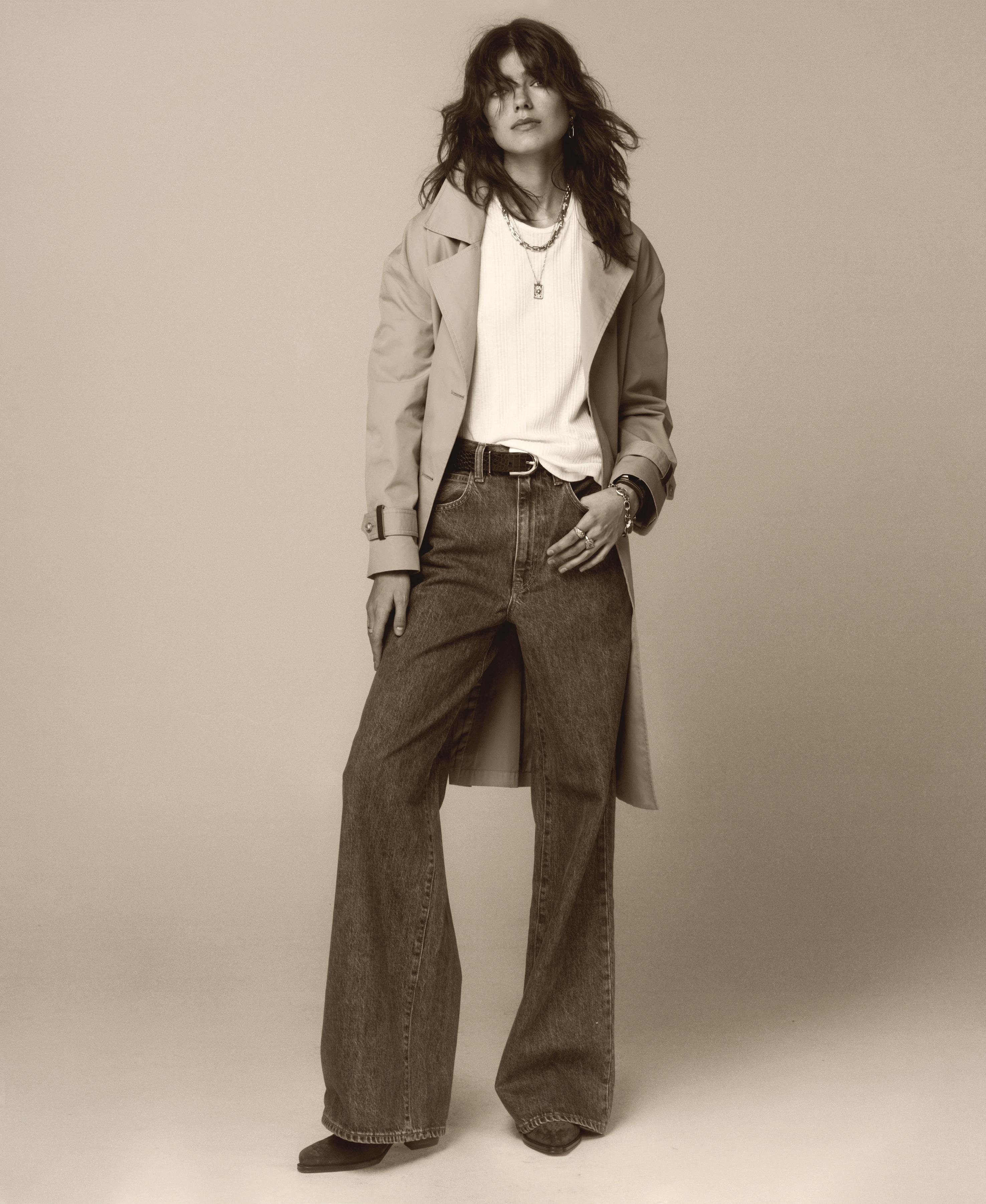

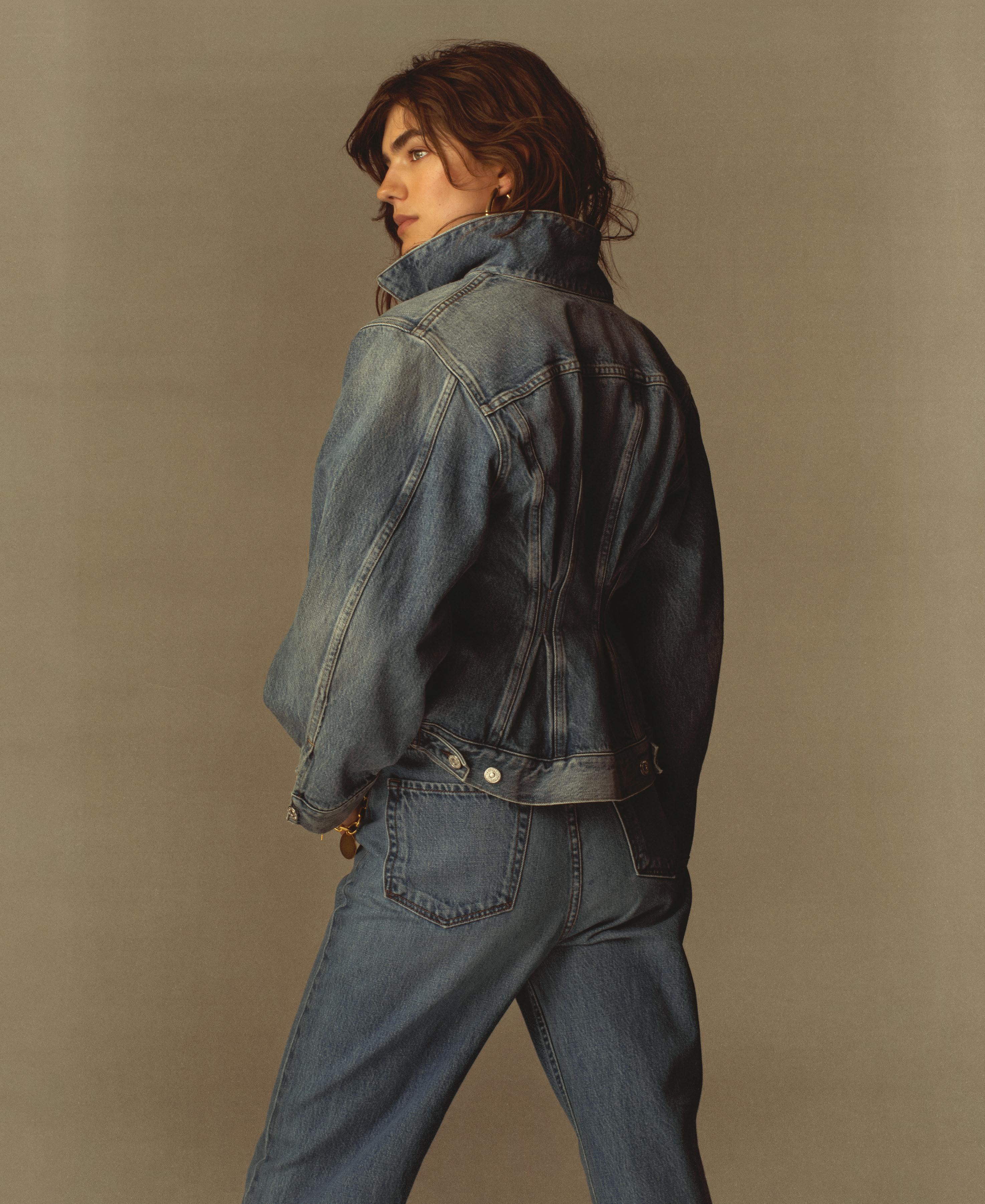

After seasons of—dare I say—garish Y2K trends, classic fits and traditional washes are emerging as something of a palate cleanser this fall. In “C’est la beauté” (pg. 54), the fashion team curates a swoon-worthy women’s wardrobe. One denim genre that’s unlikely to ever buck tradition is Western and rodeo, which is riding a revival of popular relevance. In “Rodeo Stars” (pg. 51), category leaders discuss how they balance performance with authenticity. Traditional retail is also bouncing back after unprecedented ecommerce growth. In “Open for Business” (pg. 25), leading denim brands explain why they’re seizing the moment to open new doors in the U.S. and abroad.

While I never want to see the denim industry regress, I hope this issue serves as a reminder of the lessons to be learned from valuing the past.

Angela Velasquez Executive Editor, Rivet

Peter Sadera Editor in Chief, Sourcing Journal

Jessica Binns Managing Editor

Arthur Friedman Senior Editor

Vicki M. Young Executive Financial Reporter

Jasmin Malik Chua Sourcing & Labor Editor

Kate Nishimura Features Editor

Kari Hamanaka Logistics Editor

Glenn Taylor Business Editor

Christopher Blomquist Denim Editor

Chuck Dobrosielski Staff Writer

Lauren Parker Branded Content Manager

Sarah Jones Senior Editor, Strategic Content Development

Andre Claudio, Staff Writer, Strategic Content

Tirso Gamboa VP, Creative, Fairchild Media

Celena Tang Associate Art Director

Libby Groden Associate Art Director

Yeni Cho Senior Designer

Arani Halder Designer

SOURCING JOURNAL ADVERTISING

Edward Hertzman Founder & President, Sourcing Journal & Rivet Executive Vice President, Fairchild

Rebecca Goldberg VP, Strategy & Business Development

Eric Hertzman Senior Director of Sales & Marketing

Deborah B. Baron Advertising Director

Allix Cowan Corporate Subscription Sales Associate

Aaron Buotte Media Coordinator

Sarah Sloand Executive Sales Assistant

Kevin Hurley Production Director

John Cross Production Manager

Therese Hurter PreMedia Specialist

SARLINA SEE CHIEF ACCOUNTING OFFICER

CRAIG PERREAULT CHIEF DIGITAL OFFICER

TODD GREENE EVP, BUSINESS AFFAIRS AND CHIEF LEGAL OFFICER

MARK HOWARD CHIEF ADVERTISING

PAUL RAINEY EVP,

TOM FINN EVP,

Executive Editor, Rivet

JENNY

PRESIDENT,

MARGOLIN SENIOR VICE PRESIDENT, DEPUTY GENERAL COUNSEL

DELALCAZAR

VICE PRESIDENT,

LAUREN UTECHT SENIOR VICE PRESIDENT, HUMAN RESOURCES

RACHEL

ANDERSON

VICE PRESIDENT,

VICE PRESIDENT, LICENSING & BRAND DEVELOPMENT

The latest news, collaborations, and events on Rivet editors’ radars.

Brands need to have realistic expectations about the impact NFTs have on revenue and marketing.

Meet the most influential people in denim.

Men’s wear often takes a backseat in the conversation around fast fashion and the industry's e orts to go green.

Authenticity is priority number one for jeanswear brands that want to ride high in rodeo and equestrian circles.

Savor the beauty of rich washes and e ortlessly cool silhouettes for fall.

Denim mills and brands are supporting a new class of regenerative farms.

Mills and brands join forces to advance recycled cotton.

The industry’s solution for producing less waste begins on the pattern cutting board.

jeans imports reach $2 billion, but

the boom last?

Religion

years

With more than 110 designers on the calendar, something special was in the air during New York Fashion Week—a hint of the early 2010s when editors rushed from show to show and the public lived out their fashion week fantasies during Fashion’s Night Out, the annual Vogueled event that mixed celebrities with consumers and shopping with champagne toasts. The legacy of the now-defunct initiative lived on a decade later with B2C events that combined fashion and education across the city in September.

In this tradition, Fairchild Fashion opened its first exhibition “A Matter of Style,” curated by Sourcing Journal’s sister brands Women’s Wear Daily, Footwear News and Beauty Inc. Open to the public, the two-day retrospective showcased more than 50 photographs from the legendary Fairchild archives, featuring celebrities, designers, parties, events, street style, and runway moments that have made New York fashion iconic.

To mark its 130th anniversary Vogue launched Vogue World, a ticketed event featuring multibrand runway shows, a pop-up shop and a street fair experience with curated newsstands and limited-edition items. Online retailer Revolve presented Revolve Gallery, a multibrand installation featuring emerging fashion designers, exclusive brands and a popup powered by Bolt stocked with Levi’s, All Saints and more. The exhibition also featured Cotton Incorporated’s immersive area with information about the natural fiber.

IMG’s series of conversations, NYFW: The Talks, featured industry thought leaders discussing topics on sustainably in the luxury sector and mindfulness in fashion. And Tommy Hilfiger returned to its stomping grounds with a “see now, buy now” collection presented at the Skyline Drive-In in Brooklyn and in a parallel metaverse activation.

In other words, fashion week—on and off the runway—is back.

Under the creative guidance of Glenn Martens, Diesel is quickly reclaiming its status as a denim marketing machine. This fall, the Milanese brand dropped a risqué campaign to promote the latest colors and sizes of its ‘It’ bag, the 1DR. In the campaign, Diesel presents the handbag as the only accessory needed by styling it with nude male and female models. In its F/W ’22 “Larger than Life” campaign, models wear the brand’s latest Y2K-insipred styles as billboard cutouts superimposed on soaring skyscrapers. The campaign highlights key design themes that run throughout Diesel’s new collection including trompe l’oeil denim on skirts, bags, trousers and shirts.

Frame revisits the Ritz Paris with a second collection that pays homage to the world-renowned hotel.

The Los Angeles-based brand launched a 44-piece capsule collection for men, women, children and pets that celebrates the legendary hotelier’s trademark crest and script. The motif adorns the collection’s varsity-style outerwear, unisex cashmere sweaters, classic tees and more.

its with year. Worn

pieces from with resale sites.

The collaboration taps into consumers’ unwavering wanderlust and underscores the popularity of niche partnerships. It follows Frame’s niche collaboration with New York’s iconic Carlyle Hotel and its first with the Ritz Paris in October last year. Worn by celebrities from Naomi Campbell to Hailey Bieber, Frame reports that pieces from the first collaboration sold out immediately, with items like the varsity jacket now selling for 10-times the original price on resale sites.

Frame and Ritz Paris aims to re-create the magic with new statement items like jeans covered with Ritz-themed patches, a puffer jacket and hi-top sneakers. The expanded collection also includes

items jeans covered

also includes and hotel such as striped

sneakers. The collection children’s tops essentials pajamas and embroidered

slippers. A dog jacket taps into the piping-hot trend for designer pet fashion.

A taps into trend

Actress Turner-Smith denim on the Venice Film Festival between tulle and Gucci and All” actress of fashion out in wash Balmain. Turner-Smith diamonds and blue

Actress Jodie Turner-Smith proved that denim belongs on the red carpet at the Venice Film Festival in September. In between donning tulle Valentino frocks and sparkling Gucci gowns, the “Bones and All” actress pushed the boundaries of red-carpet fashion when she stepped out in a light wash denim gown by Balmain. Turner-Smith paired figurehugging mermaid-style gown with diamonds and blue eyeliner.

Los denim—it’s also the focal festival. LA3C, event company, Penske Media celebrate L.A. as the and culture. Scheduled Dec. 10-11 Park, the attendees to experience

Los Angeles isn’t only the U.S. hub for denim—it’s also the focal point of a new festival. LA3C, a new event by Rivet’s parent company, Penske Media Company, will celebrate L.A. as the capital of creativity and culture. Scheduled to take place Dec. 10-11 at the LA State Historic Park, the multiday event will give attendees the opportunity to experience L.A. across music, art, entertainment, and food.

Jodie Turner-Smith at the Venice Film Festival

Robotics and digital apparel company Unspun made its New York Fashion debut with Collina Strada. In keeping with its mission to eliminate textile waste, Unspun created 100 percent bespoke and tailored jeans, which Collina Strada founder Hillary Taymour transformed into wearable art. The collaboration with Collina Strada marks the first time Unspun has worked with a designer on custom garments. Given Collina Strada’s commitment to inclusive sizing and design, Unspun described it as “the perfect pairing.”

created 100 Strada founder art.

Unspun has Collina Strada’s described

Native-owned denim gotten an Portland, Ore.–based

world, is an from Raven

Native-owned denim brand Ginew has just gotten an impactful Indigenous investment. The Portland, Ore.–based label, the only Native American–owned denim brand in the world, is getting an influx of $500,000 from Raven Indigenous Capital Partners, a Canadian Indigenous-led and -owned impact investment firm out of Vancouver that supports Native entrepreneurship.

Then-newlyweds Amanda Bruegl, who is of Oneida, Stockbridge-Munsee descent, and Erik Brodt of the Ojibwe tribe, began Ginew in 2010 as a small leather goods brand after they jointly crafted a series of belts from their wedding buffalo, which was hunted, prepared, tanned and hand-dyed by the pair and their families. They expanded the offering to include apparel in 2014.

Ginew, which means “brown eagle,” is now a contemporary collection of Native Americana sold worldwide at specialty retailers and online that draws inspiration from the proprietors’ culture, including the incorporation of family symbols and teachings into the garments and goods. The investment will help Ginew pursue initiatives that include transforming Native representation in the apparel business, nurturing a culture-centric business approach and developing a healthy Native economy, among other goals.

“Ginew is a very personal brand. We incorporate our Ojibwe, Oneida and

Stockbridge-Munsee heritage and family stories into our collection. Raven and Ginew are very compatible culturally which is very important to us as we look to accelerate Native opportunities. One of our first priorities is to thoughtfully expand our collection,” Bruegl said.

“We are very intentional about our supply chain and choosing collaborators that share our mission to bring positive social and economic outcomes. Amanda and I aim to transform the Native narrative in the apparel industry and we are grateful for Raven’s support,” Brodt added.

Kontoor Brands-owned Wrangler reveals another side in a collaboration with American sportswear label Gant.

The 30-piece capsule collection; including jeans, apparel and accessories for men and women, explores the intersection of East Coast preppy and Western denim. Stand-out pieces include bootcut jeans with collegiate patches, a varsity jacket with a western embroidered motif and a faux fur lined denim jacket inspired by the rock legends of the 1960s and 1970s.

With both brands founded in the 1940s, the original shirtmaker and denim stalwart helped shape and define the emergence of American sportswear, Wrangler stated.

“While Wrangler was embracing the western lifestyle, with pioneering products such as the western jean, jacket and shirt, Gant shaped preppy style with their definitive buttondown shirts,” said Sean Gormley, Wrangler global concept director, modern.

“The stories might be different—Wrangler dressed rodeo stars and ranch hands, while Gant defined the Ivy Leaguers’ look—but both created a lasting cultural impact.

The DNA of both brands runs through each piece in this celebration of our combined heritage.”

Pop-up shops are having a moment as brands test new markets and get to know established consumer bases better.

In July, German denim brand Closed landed in the U.S. blue jeans capital with a temporary shop in Los Angeles at Platform, a collection of independent and first-to-market merchants, eateries and creative businesses located in Culver City. The 1,044-square-foot space marked Closed’s first store in the U.S. and is the first of several “outposts” in L.A. A brick-and-mortar store was the next step for Closed after launching its U.S. online shop three years ago and expanding distribution to multi-brand partners like Nordstrom, Injeanius in Boston, and Felt in Chicago.

Platform is also the home to Billy Reid’s first L.A. store, its 15th in the U.S. Outfitted in traditional and modern furnishings, antiques and curated art, the store carries the brand’s men’s collection and “evokes a feeling of stepping into a friend’s living room,” the brand stated.

Cotton Citizen introduced its new denim line with a bright blue popup shop in Beverly Hills. The 10-year-old L.A.-based brand co-founded by brothers Adam and Liran Vanunu opened the 3,500-square-foot shop to showcase its new jeanswear offer which includes three women’s silhouettes and two men’s. The store, which will transform into a permanent one, is the brand’s fourth standalone store and joins the Cotton Citizen flagship on Melrose Place, an outpost in New York’s SoHo and one in Wynn Plaza in Las Vegas.

The Rivet x Project Awards honored the best in denim at Project Las Vegas.

words _____ANGELA VELASQUEZ

The Rivet x Project Awards honored the best in Spring/Summer 2023 denim at Project Las Vegas in August, recognizing established premium denim brands, newcomers to the U.S. market and labels that pay tribute to jeans’ heritage and craftsmanship. Congratulations to the winners.

Two new additions in Naked & Famous’ collection underpin the Canadian label’s knack for thinking outside the box. The brand presented men’s jeans made with silk recycled kimonos sourced from Japanese thrift stores. Naked & Famous achieved the 10 percent silk fabric by blending shredded kimonos with new cotton. The result is a dark indigo jean flecked with shimmery silk.

Naked & Famous also bowed a jean made with 20 percent recycled denim. The fabric contains offcuts in the warp, blended with new cotton. No dyes or chemicals are added to the jean, resulting in a unique light blue color derived from the indigo previously applied to the offcuts. A light pink selvedge line and backpatch made from recycled leather are finishing touches.

For the second consecutive season, Turkish label Mavi nabbed the honor for “Best Sustainable Collection,” this time by going au naturel in its new concept. The men’s and women’s Natural Dye Collection uses natural clay-based colorants and ratios to achieve its signature earthy colors. “Clay is an inherently occurring material and its unique crystal structure is non-toxic, UV resistant and antibacterial,” Mavi stated.

The result is 100 percent cotton shackets and jeans in shades of brown and green. Garments are also outfitted with biodegradable nutshell buttons, back patches made from biodegradable olive seeds and woven labels and threads made from recycled materials. The collection contains basil seeds that can be planted.

Donwan Harrell’s Artmeetschaos is an ode to understanding denim’s possibilities and limitations. The latest collection offers new slim carpenter jeans, PFD garment dyed straight fit jeans, and jeans tiedyed by hand to replicate the look of vintage painter pants. Paint splatter, laser prints and overdying keep each style new and fresh.

Despite the variety, the collection is made with a tight range of fabrics. Harrell sources fabrics from South America and produces the collection in Colombia at the top washhouse in the region to maintain duty-free treatment. Since he doesn’t have the “encyclopedia of fabrics” he would have access to if he sourced from Asia, Harrell said he spends time studying the fabrics to develop new finishes, fits and colors.

European denim heads will soon enjoy Harrell’s attention to detail. The brand recently joined Amsterdam showroom, Solotwentyfive.

Using color and versatile separates, Joe’s presented a cohesive story for women rich with new fits and subtle yet elevating details. After a season that saw most brands over-invest in straight fits, Joe’s is betting on flare and wide-leg jeans with cuffed details, flat cargo pockets, contrast stitching, shield-shaped back pockets and super high rises for Spring/Summer 2023.

The collection’s retro-inspired palette of indigo, ecru, medium yellows and sunset orange spans jeans, chore jackets and denim shorts, including a new relaxed fit. The denim pieces are supported by knit tank tops, blouses with voluminous sleeves and flutter sleeve dresses.

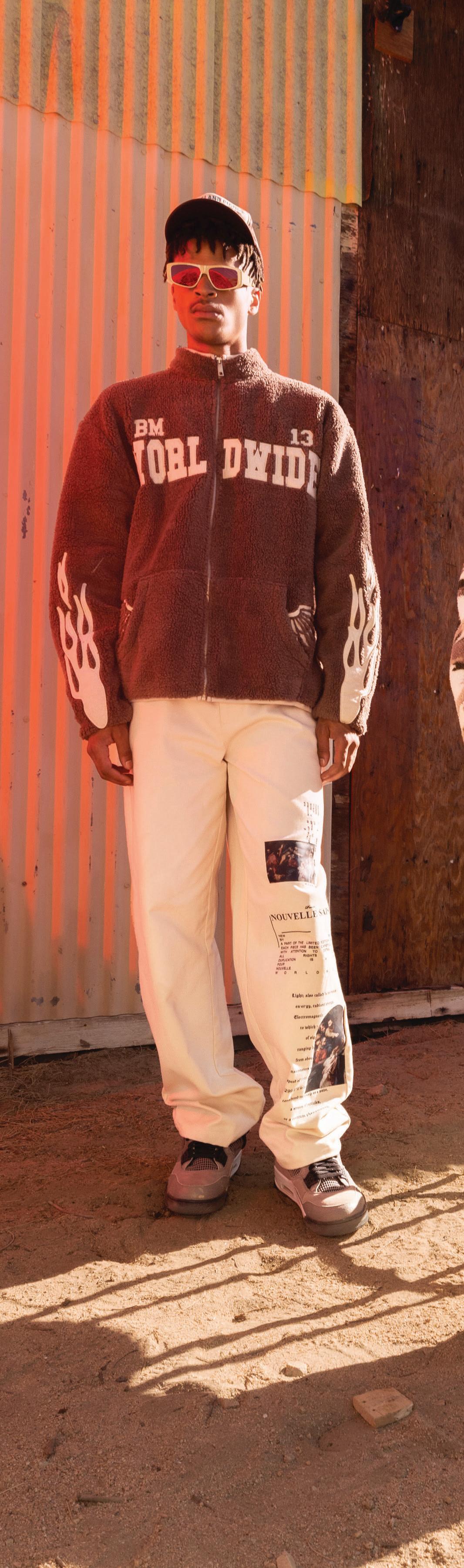

Portuguese men’s brand Redhouse made its U.S. debut at Project, presenting a high-end take on denim streetwear. Established in 2012 to offer the European market a bolder approach to slim and skinny fits, the brand combines Italian fabrics from Candiani Denim with one-of-a-kind details finished in Portugal. Silver chains trim a classic Trucker jacket. Studs, paint splatter and screenprinted logos decorate jeans. Moto details add an edgy look, while dye effects speak to the market demand for color.

A tiny Italian flag on the button-fly of jeans serves as a reminder of its premium roots. Landing prices for jeans hover around $178 but a brand rep said prices depends on finishing treatments.

The denim collection is complemented by a sport range encompassing 100 percent cotton regular fit and oversized tees and terry shorts— some decorated with the same techniques used for denim.

How do you update a garment steeped in workwear heritage? Just add color.

Caterpillar teamed with Jordan Page, the Brooklyn-based DJ, stylist, curator behind the fashion Instagram account @veryadvanced and founder of Colour Plus Companie, a collection that serves as a “meditation on color theory” and muses on how utility and streetwear intermingle. Based on a “muted palette that draws from rich natural tones,” Colour in Uniform examines the “intersectionality between utility and form in relation to fabrics and garments.”

Workwear staples like a plaid button-down shirt, utility vests, double-front pants and carpenter pants and shorts in corduroy and denim feature co-branded elements. Zip and pull-over hoodies and terry shorts round out the collection. The collaboration will launch in November, with a bigger drop scheduled for Spring/Summer 2023.

Before venturing into NFTs, brands need to have realistic expectations about their impact on revenue and marketing.

When Pacsun sold its first non-fungible token (NFT) for the equivalent of $776 last December, the crypto market was running at full fervor.

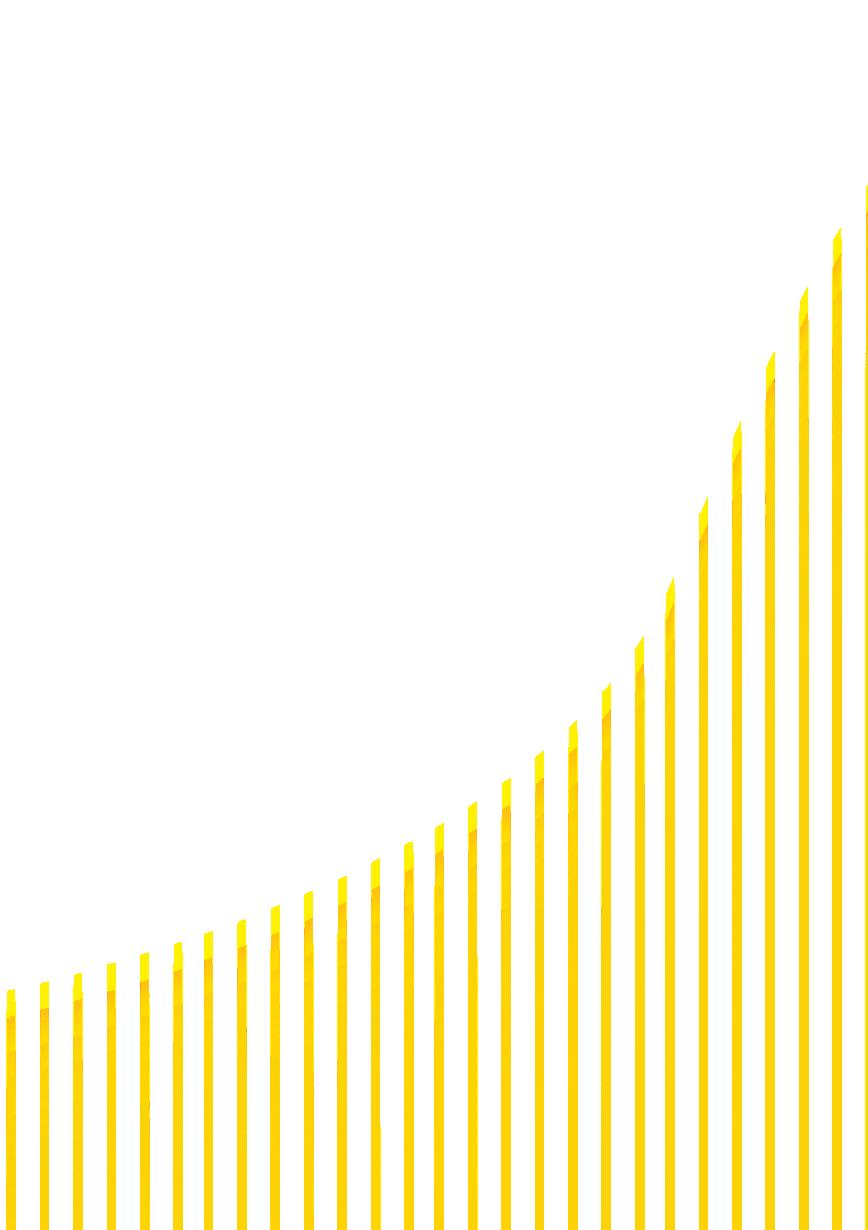

The day the retailer listed its debut token—a gif of its wave logo— more than 160,000 NFT transactions took place, according to the website NonFungible. Daily NFT sales totaled nearly $106 million and there were more than 83,000 active market wallets, the market tracker’s data shows. By late August of this year, total daily sales were in the mid-30,000s to low 40,000s, daily revenue was hovering around $25 million and the number of active market wallets was a little over 20,000, per NonFungible.

By late August, Pacsun had yet to surpass its original sale. A single NFT, “The PS Reserve Rat” technically beat it in May, selling for 0.222 ETH, easily above its predecessor’s 0.1792 ETH. In U.S. dollars, however, the NFT sold for the equivalent of $399.08, a consequence of Ether’s diminished value. Of the first 40 tokens Pacsun listed on the NFT trading platform OpenSea, more than half have never received a bid.

Though NFTs often make headlines for making massive amounts of money, Pacsun president Brie Olson said the retailer sees them as “a way to try to build a further sense of community and loyalty to the brand.” In the beginning, that meant exploring “alongside” consumers to see what they resonated with.

“I would say out of the NFTs that we’ve launched to-date, we’ve sold about 50 percent of them, which in a learning phase I actually consider quite good,” Olson added. “I try to encourage our team to constantly be curious and push the boundaries and explore alongside the consumer. So, if something doesn't work, then like rethink it, and maybe there's a layer of loyalty or maybe the NFT has also a physical component to it.”

The PS Reserve Rat NFT, for example, came with a free pair of $300 Air Jordan 1 Retro High sneakers from its resale platform PS Reserve. The sale, Olson noted, made Pacsun one of the only brands featured in ComplexLand’s NFT gallery in May to actually sell its NFT. “I think having

that physical quality of a one-of-a-kind item matched back with a virtual item is something that our consumer is really excited about, and just creates more added value,” she said.

“We’ve also had some learnings in terms of price elasticity and how much the consumer is willing to pay and also, to be very transparent, our best-selling NFTs to-date actually have had 100 percent charitable donations,” Olson added. “So another signal from our consumer that they do care about philanthropically giving back to the community.”

Looking ahead, Jeff Hood, the CEO and co-founder of the Web3 strategy company Metacurio, believes more brands will approach NFTs with a focus on marketing rather than revenue. Brands like Adidas, which made around $23 million in December from its debut NFT collection, “were early in the bull market,” Hood noted. “We’re in a bear market now.”

out of consumers free mint allows Doron Sherman, image and video the “real promise”

I think it’s going for luxury brands, premium, NFTs experience that With the supply demand a premium this just looks nice,’” on utility, and the consumers who just bought my physical products until now will also by my NFT. They have to consider the question of what's in it for them. So, I think that's where we're getting to the point where there's going to have to be very specific benefits for consumers that come with NFTs in order to continue keeping the prices up at a premium for those NFTs.”

The “biggest mistake” Hood sees is from brands approaching Web3 as they would Web2. “You need to work with a creative agency that understands Web3, that understands the technology and understands the community aspect of a new emerging market,” he said. This partner, he noted, should already be successful in this space, and should understand the mentality of the crypto crowd.

JEFF HOOD, METACURIO

JEFF HOOD, METACURIO

“Appetite for NFTs—the volumes have dropped, for sure, on a lot of these platforms,” Hood said. “But there's still healthy trading going on. We still have projects that are making real money, but I think you're going to see more and more brands enter the space leveraging NFTs as a tool within a solution stack for integrating into Web3, versus ‘Hey, how can we go make $5 million.’”

The projects doing the most volume today, Hood noted, are what are known as “free mints.” Exactly what they sound like, free mints are NFT collections that are free to mint. Once the small supply of tokens is minted, the limited pool of owners can choose to sell their tokens—often for high amounts if demand is strong enough and supply low. Creators, in turn, can earn royalties off these sales. Though this strategy can generate money in its own right—Hood said one project he worked on did $3 million in secondary sales in about a week—free mints offer brands a marketing opportunity as well.

“Brands want to onboard users, they want to aggregate users, they want to get more eyeballs and exposure on their projects,” Hood said. “When you do a free mint, you can onboard a community instantaneously and then you can support that community long term and still have economic value. The opposite looks kind of like a money grab. Especially if a brand is already rich, why do they need to come in and extract value

“It's not the same as working with a digital ad agency to run a print campaign or activation on social media,” he said. “Because you are dealing with technology, you're dealing with a completely new set of buyers that don't operate the same way that Web2 buyers operate…There is a very finite amount of people on Twitter that actually moves the needle within these communities because they have a platform and people trust them. And you need to be able to access those people as well as access and understand what the appetite for certain types of content is.”

Given the limited pool of talent with expertise in this space, Hood admitted that integration “is not cheap.” While they're charging a premium today, he doesn’t think it will be that way forever.

“We work with brands all the time,” Hood said. “Some of those brands are spending tens of thousands. Some of those brands are spending hundreds of thousands of dollars to create campaigns to enter Web3. I mean, it's a real activation with real users and real potential upside, so there typically needs to be real budget to execute that.”

As someone who works precisely in this space, Hood said the first question he then asks all his customers is “What is your definition of success?”

If a brand wants to increase its social imprint, exactly how many Twitter followers or Discord users does it want to add? If it is looking to build a Web3 community, what type? If it’s focused on revenue, exactly how many dollars and does it want to rely on primary or secondary sales?

“Make sure that your creative agency is actually building out a campaign that helps you meet those KPIs,” Hood said. “It needs to be pragmatic and professional just like any typical engagement for a brand that they're working on.”

“Brands want to onboard users, they want to aggregate users, they want to get more eyeballs and exposure on their projects.”

Chosen

Online shopping has its benefits, but denim brands are investing in new brick-and-mortar stores to enhance their consumers’ experiences.

words KATE NISHIMURA

words KATE NISHIMURA

Following more than two years of online acceleration, brick-and-mortar retail is back, and the denim sector is taking note.

This summer, German brand Closed opened its first U.S. store in L.A. Cotton Citizens feted the opening of a new Beverly Hills boutique dedicated to denim. Following a series of popups in Nordstrom and Saks Fifth Avenue locations, Rag & Bone marked its 20th anniversary by opening a gallery-like shop in East Hampton, N.Y. Meanwhile, other premium denim brands like Frame and Re/Done have focused efforts on opening their first international stores.

It turns out that shoppers have missed the sensory experience of browsing and buying, the personalized service, and the social outlet that a trip to retail can provide.

AG Jeans director of retail James Bishop likened the act of shopping for jeans to dating in search of true love. “I want to be romanced. I want to touch the fabric, to feel its hand. I want to see the beautifully aged heritage hardware,” he said.

That’s why the Los Angeles label is—and has been—intent on creating new venues for meet-cutes between shoppers and their next pairs of denim. In the early days of the pandemic, AG opened a massive, threestory flagship on Madison Avenue in the heart of Manhattan, along with pop-up shops in San Diego and Atlanta.

“Whilst the Atlanta store was opened to test a new market for us, the Madison Ave. and San Diego stores were chosen for their connection to our solid base of local clients,” Bishop said. “We realized that many of our customers were limiting travel due to the pandemic,” he added, and the brand sought to open stores in neighborhoods close to loyal patrons. The retail director said that personal relationships between stylists and clients have been a key fixture in the brand’s expansion strategy. “We did not want [consumers] to simply rely on e-commerce, therefore, we reopened all our stores quickly and added new ones in key markets,” he said.

The new ventures rounded out a network of 17 stores across the U.S. “We plan to grow thoughtfully and organically, at the pace of about two or three stores per year,” Bishop said. AG Jeans is also looking at international

brick-and-mortar expansion in the coming years, though for now, its collection is available globally only online.

“We don’t believe in rushing to open stores based on just traffic data; we don’t want to open in every mall or outlet center,” he added. “I see our growth of retail stores as an organic result of our carefully curated relationships with our clients themselves.” The brand has targeted several hotspots for domestic expansion, he said, “but I can’t give all our secrets away.”

Bishop believes that even in the digital age, where terms like “omnichannel” and “social shopping” have become entrenched in the retail lexicon, physical stores will continue to play an important role in driving commerce. “Some retailers will tell you it’s good for branding, and to a certain point, this is true,” he said, noting that AG tends to see a significant increase in online sales when it opens stores in new markets. “But this is not why we open new stores, neither is it why I believe brickand-mortar is more important than ever.”

“Our retail stores and the passionate stylists that work within them create immersive experiences that stir emotional responses from our clients,” Bishop explained. “There is not a website or a chatbot that can

duplicate this.” Real face time with customers can underscore relationships that last a lifetime, he said. “Direct-to-consumer brands have realized this, and we now see many of them rush to open brick-and-mortar.”

Stores also provide the optimal stage for storytelling about new silhouettes and fabrications. “I love listening to our knowledgeable stylists talk about different fits, natural indigo dye, wash techniques and our sustainable, environmentally conscious production,” he said. Last year, AG Jeans launched a selvedge collection using fabric from 12 of the world’s most respected heritage denim mills. “Sharing stories with clients on the sales floor about the uniqueness of each fabric, weaving techniques, shades of indigo and the custom fades and fit their wear provides is simply not an experience that placing an item into an online cart and clicking ‘check out’ can provide,” Bishop argued.

While the brand saw a boom in online sales throughout the pandemic, personalized service is an integral element of AG’s sales strategy. “The social rewards of shopping in person are profound,” Bishop said.

The sentiment was echoed by Re/Done CEO and co-founder Sean Barron. “Denim is one article of clothing that really benefits from an inperson shopping experience,” he said. “There are so many details to a given jean that will determine your preference—silhouette, fabrication, wash pattern, fit and feel.”

“Denim is meant to be lived in, so trying it on in person guarantees you will purchase the exact pair perfect for your lifestyle,” he added.

The L.A.-based upcycled denim and ready-to-wear brand recently opened its first international store in Paris this summer—a personal dream of Barron’s. “I have a very special relationship with the city,” he said. “It was the perfect location for our first international retail store, as the French have an equally strong affinity toward vintage, denim, and California culture.” The group sought out a location in the city’s left bank—its original arts district—where local tastemakers tend to convene.

The store showcases a curated range of best-sellers, including products made from reconstructed Levi’s denim and vintage marketplace collectibles that reference Parisian culture. Opened just months after the

brand’s Paris Fashion Week debut, the custom build-out was inspired by architect Rudolph Schindler’s early mid-century interiors.

Re/Done in Paris joins the company’s six-store retail fleet, which includes shops in Malibu, West Hollywood, East Hampton, Miami and Aspen—a roster that reads like a travel bucket list for culture and leisure lovers. “Our goal is just to keep on expanding,” Barron said. “We want to bring our brand to as much of the world as we can, particularly in places with parallel cultures and to Los Angeles, our hometown, and the city that inspires our creations.”

And while the brand has seen sales climb online as a result of the pandemic, it’s doubling down on its commitment to stores. “Between experiencing the quality and breadth of our collection firsthand, learning from our expert sales associates, and immersing in the vintage-inspired store design, we’ve found brick-and-mortar to be the perfect opportunity for customers to forge a deeper relationship with our brand,” Barron said.

Fellow L.A. brand Frame has also made its foray into overseas retail, adding to its 15-store fleet with a location in London this past March. The store adds to a roster that includes locations in metropolitan hubs like Boston, Austin, Dallas, New York City, Palm Beach and San Francisco.

A Frame spokesperson called the European opening “a homecoming of sorts,” noting that the concept for the brand was developed in London. “The city holds a special place in the brand’s identity and history,” they said. “We wanted to give our U.K. customers an in-person touchpoint where they could fully immerse themselves in the Frame experience.” The minimalistic South Kensington storefront, with its white walls and modern finishes, has proven a hit with neighborhood shoppers. Frame already has plans to open its second London location in 2023.

“Brick-and-mortar provides an incredible opportunity for both new and returning customers to experience the Frame brand,” the spokesperson said, calling the process of finding the right denim “a unique opportunity to educate consumers.”

“Online shopping is convenient, but retail is the full brand immersive experience with personal service,” they added.

Not all brands are ready to commit to an all-out brick-and-mortar strategy, but even DTCs are seeing the value of having a physical home base. Good American, the brainchild of Khloe Kardashian and Emma Grede, announced plans to open its first location in L.A. Located at the Westfield Century City mall adjacent to Beverly Hills, the store will offer Good American’s full 00-32+ size range. Opening in early 2023, the brand said that two additional stores will follow soon after.

Grede said that Good American looked to physical retail as a means of creating new and exciting experiences for its shoppers, who have thus far only engaged with the brand online.

“Denim is a staple in everyone’s closet, but we know it’s challenging for many women to find that perfect fit that makes them feel confident and empowered, especially as most brands still aren’t going above an XL equivalent,” she said. With a multitude of washes, rises, silhouettes and more sizes than most denim brands develop—much less have on hand at a retail store—Grede believes Good American’s new location will accelerate the process of finding the right fit. Inclusivity is central to the brand’s ethos, she said, and it is seeking to reflect that value at retail.

“When you step into our stores, our community will know we have thought about everything, not only through a product lens but also throughout the entire shopping experience,” she said.

Grede believes that DTC will always drive the majority of Good American’s sales, but the brand is ready to see brick-and-mortar act as a complement to its online business—potentially reaching “locations all over the U.S.”

“Our mission is to serve even more customers, and we know that when customers try Good American for the first time, they are sold,” she said.

As a fourth-generation apparel leader, William R. Adler has always been craftsmanship. His grand father ran America’s oldest and second largest apparel manufacturing company, which become part of PVH, his grandparents were tailors in Europe, and his men in suits and slacks.

Today’s less formal fashion vibe might have Adler’s relatives shuddering, but they would approve of his Ai-driven True Fit and Fashion Genome, decoding

active True Fit shoppers to millions of styles. The pan demic’s online surge made denim brand’s success—

lifting loyalty and sales up while driving returns downs. It is truly True Fit’s time to shine.

“Retailers using True percent reduction in size sampling related returns,” Adler said. “It’s a privilege for True Fit to remove size

experience and connect the consumer to the brand they love.”

Artistic Denim Mills Ltd., CEO

Artistic Denim Mills Ltd. (ADM) has seen its fair share of expansion over the past year, with the denim manufacturer opening a new facility in Pakistan that produces day. This is enough to fabric a day. The vertically integrated denim manufacturer also entered a strategic partnership with

The company recently collaborated with the premium denim brand on a sustainable denim exhibit in London. The event included an immersive “Indigo” exhibit that fea-

recycled cotton in fabric collections. The multiyear partnership enables ADM to scale its use of recycled cotton from post-consumer denim and bolster transparency in the process.

ADM’s investments in innovation are powering some of the most buzzed-about collections, Tag Project, which is a QR code on the inside waist of its jeans that allows consumers access to information about the garment’s journey from

ners Recover and Tencel.

Naveena Denim (NDL), general manager, product development

As Naveena Denim Limited (NDL) aims to align fashion with function, Zeeshan Ahmed Ch is the man responsible for recognizing top trends and developing innovative products in line with those movements. He leads the Lahore, Pakistan-based denim manufacturer’s R&D team, which is undergoing a concerted effort to double down on product collaborations with brands.

NDL recently teamed with German fashion retailer Tom Tailor to develop a hemp denim collection, with the idea

of hemp-blended fabrics (hemp, recycled cotton and Tencel) used across men’s, women’s and children’s jeans and jackets. A concept collection developed with Lenzing called Bast Recast gave push forward with hemp. After debuting the Bast Recast collection, NDL developed its own ropefabric. The experimental fabric is designed to pay

that were ever woven, likely with hemp.

Other products led by Ahmed Ch is NDL’s new mechanical stretch denims. The natural

percent stretch, have better shrinkage rates than jeans with elastane.

Amiri, founder, creative director and CEO

he had the opportunity to design a capsule collection for high-end L.A.

Amiri the brand was born, making its initial mark on the industry with an aesthetic characterized by grunge-inspired designs, denim, leather and detailed craftsmanship.

Over the past eight years, the OTB Group-owned label has

NPD Group placed Amiri at the top of the list for men’s luxury jeans in

working to defend its title through advancements

that bridge physical retail and the virtual realm.

With the help of OTB, Amiri is also looking to develop products for the metaverse.

Artistic Milliners, managing director

From growing garment capacity to implementing sustainable cotton programs, Artistic Milliners managing director Murtaza Ahmed has been essential to the vertically integrated denim manufacturer’s recent expansion efforts, including those that venture outside the denim space.

The company opened a $60 million state-of-theart garment facility which added around 30 percent additional capacity to its overall group portfolio. With the new factory, Artistic Milliners can produce 44 million jeans annually and is adding 4,000 jobs to the Pakistani workforce. Additionally, Artistic Milliners has completed Circular Park, a purpose-built fiber recovery facility powered by clean energy, capable of recovering up to half a million kilograms of textile waste every month. The plant enables the company to recycle both post-industrial and post-consumer waste with better staple strength.

Artistic Milliners is also growing the company beyond denim with Artmill, which offers retailers, manufacturers and brands turnkey solutions for their woven casualwear programs or tailor custom offerings for startup and premium labels.

Los Angeles-born Mike Amiri began his career as a designer in Hollywood, crafting stage pieces for rock n’ roll legends playing gigs on the Sunset Strip.

The creative’s streetmeets-couture aesthetic

one of few American brands to occupy a place on L.A.’s Rodeo Drive next to world renowned European fashion houses. Amiri is on track for global domination, with stores in Las Vegas, New York, Miami and plans to plant its stake in Chicago and Atlanta, as well as Dubai, Shanghai and Tokyo. Global market data from

Remi Bader has accomplished what most brands and celebrities hire teams of social media specialists to do with varying degrees of success: create authentic content. Though 2.1 million followers watch Bader’s videos, the New York-based creator and curve model strikes a personable, relatable and body-positive note that feels like you’re watching your best—albeit funnier and more stylish—friend. With humor and vulnerability, her “realistic try-on hauls” show the highs and lows of online shopping, while her commentary on fashion’s lack of options for curvy bodies is sparking change in the industry.

If you had one request for denim brands, what would that be? To offer a full size range to accommodate as many different body types as possible and to have those denim styles focus on different body parts. For example, make jeans for someone that has a smaller waist and larger hips.

I just bought a denim skirt from Good American for the summertime.

Modeling in my dad’s showroom for Bongo when I was industry because my dad has been working in it for over

Levi Strauss & Co., president and CEO honoree, Chip Bergh said he has experienced one of the toughest periods of his career as CEO and president of Levi Strauss & Co., citing the effects of the global pandemic, social reckoning, ongoing supply

that stand to have massive macroeconomic impacts for seasons to come. But there have been victories, too. The executive has helped Levi’s navigate the turbulence and grow its revenue by double digits from pre-Covid numbers. The brand published

work with him and learning all about his day to day.

work with him and all about his to pers

jean, encouraged shoppers to “Buy Better, Wear Longer” to keep jeans out

its Levi’s SecondHand resale business—all to contribute to the circular economy.

While steering the world’s leading jeans brand through a year of recovery, Bergh demonstrated a willingness to wade into debates on critical social issues that most other corporate executives avoid. In addition to developing a strategy to ensure the company’s

world’s brand recovery, strated most national programs, prevention

also advocated for national paid family leave programs, gun violence prevention legislation, and reproductive rights.

Bergh declines to shy away from these issues and has spearheaded the company’s efforts to

the Community Justice Action Fund and Giffords Courage to Fight Gun Violence. Levi’s has called protecting women’s rights to safe abortions “a business imperative,” and provides grants to the Center for Reproductive Rights through the Levi Strauss Foundation. The hallmark of Bergh’s time at Levi’s has been a philoso-

through principles,” his colleagues said, and he is committed to using the company’s brands and platform to drive positive social change.

Every generation has their style icons, and modelturned-beauty entrepreneur Hailey Bieber has Gen Z swooning for her effortlessly cool signature uniform of casual tops and slouchy jeans. From wearing cargo pants to wide-leg jeans pulled straight from ’90s streetwear archives, Bieber’s influence on fashion has spurred numerous denim trend articles online, nudging her fans to break out of the skinny jean cycle and try new proportions. Consumers and brands are taking note. Balenciaga, EB Denim and Vetements are among labels to receive Bieber’s golden touch.

A longtime ambassador for Levi’s, Bieber was one of five “visionaries” selected to star in the 2022 campaign “Levi’s 501: The Number That Changed Everything.” The campaign, which highlights the jean style’s enduring appeal ahead of its 150th anniversary next year, includes conversations that touch on moments that forever changed each personality’s own trajectory as well as a series of images.

HBO’s “Euphoria” is in an elite class of television shows with a costume department worthy of fashion recaps, dedicated slideshows and how-to guides to help fans emulate the style of their favorite character. Stylist and costume designer Heidi Bivens is behind the looks. While working extensively in fash-

credits span Purple, Vogue, i-D magazine, “Spring

Bivens bridges the gap between two disciplines that gives her a unique perspective and vision.

In “Euphoria,” Biven curates the character-de-

cast, and in the process

watchers. From low-rise miniskirts, corset tops and keyhole bodycon dresses to non-binary tops and jeans, the pieces she selects eventually land on the mood boards and in the shopping carts of young consumers.

consumers.

EB Denim, founder

Levi Strauss & Co., director design men’s bottoms, Truckers and denim outerwear

Steven Burns has always been inspired by workwear and military uniforms, seeking to bring the functionality and durability of utilitarian garments to Levi’s men’s jeans and pants. Denim epitomizes “product with purpose,” he believes, and his designs, like the fabric itself, are built to last through trials, tribulations and changing trends.

Burns’ diverse career path began in activewear design, and was followed by a stint with a Savile Row tailor, pattern cutting and working with emerging denim lines that combined old-school tailoring techniques with contemporary denim styling. Sixteen years ago, he joined Levi’s as a men’s denim designer. Now, he leads the men’s bottoms category for the brand globally.

The designer continues to be inspired by the timeless appeal of denim, from “the beauty of indigo and how it wears in over time,” to the “beautiful blue hues” that evolve as the fabric is worn and washed. “It’s the only fabric I know that is alive—it ages just like we all do,” he added. “It can be with you for a lifetime if you look after it properly.”

and sustainably manufactured jeans, came up with her brand after noticing a gap in the vintage denim market between women’s and men’s jeans. Where

there was a huge supply of men’s jeans, there was a

Steven Burnsprocess, which uses an

of women’s jeans. To bridge that gap, Bonvicini started reworking vintage men’s jeans into women’s jeans until eventually scaling her business to what is known today as EB Denim.

until as EB

percent fewer chemicals than conventional indigo dyeing methods. The jeans are then washed at Star Fades International located in Los Angeles.

former Y2K darling to Gen Z, thus orchestrating True Religion’s massive comeback. “True Religion grew to popularity during

The entrepreneur into the denim

The entrepreneur stepped into further into the denim world last year when she introduced

True Religion, CEO

trend on the rise and our brand collaborations and new consumer age ranges, it was only natural that our brand would represent Y2K fashion,” Buckley said.

The strategy worked. After re-adjusting wholesale positions to

True Religion has grown its ecommerce channel

Elena Bonvicini discovered the appeal of upcycled denim before it became her generation’s pandemic hobby. The founder and designer of EB Denim, a Los Angeles-based brand that focuses on producing upcycled

founder and Denim, on

Bonvicinifabrics. Bonvicini Artistic

made with brand-new fabrics. Bonvicini tapped Artistic Milliners for the collection, using the mill’s cotton and recycled cotton blend fabrics, along with its Crystal Clear indigo dyeing

As True Religion celethis year, CEO Michael Buckley deserves the biggest piece of cake. The former company president, who rejoined the bankrupt brand in

revenues exceeded $255

popups continue to draw buzz (a Supreme collection sold out in three minutes), and the company partners with famous rappers including 2 Chainz and Chief Keef, up-and-coming creatives such as Jaffa Saba, Elijah Popo and Madeline Kraemer, as well as artists like Soldier. Licensing is a new push, and fresh partnerships with Amiee Lynn and Concept One/Cappelli add accessories and cross-gender categories to the mix, incorporating True Religion’s classic horseshoe and Buddha symbols. While denim

Limited editions, collabs, licenses and

on the horizon, royalties from licensee sales will sales in coming years.

Blue of a Kind, founder and CEO

For Fabrizio Consoli, “Remade in Italy” is the new “Made in Italy.” Consoli’s denim brand Blue of a Kind combines Italy’s attention to craft and quality with circular design. The brand focuses on upcycling pre-existing denim gar ments and repurposing scrap fabrics into new elevated items like twotone jeans and slouchy unisex fits. All production for the brand takes place from its headquarters in Milan.

Consoli began Blue

having worked as a brand manager for Replay. Since then, Blue of a Kind has been a place where all Consoli’s professional experiences and skills converge, as well as his passions in life: from photography to storytelling, from cre ativity to love for nature.

“Blue of a Kind [is a] dream come true and at the same time a chal lenge to the traditional apparel business model…

It is not just what I do, it is doing what I love the way I love doing things.

It has been and still is an incredible journey to give a deeper meaning to my work,” he said.

Consoli added another storytelling platform this year when he opened Blue of a Kind’s first brickand-mortar store in Milan’s Porta Nuova shopping district. The

which previously housed a Christian Louboutin boutique, reflects the

brand’s sustainable ethos by almost exclu sively using existing elements.

Purple Brand co-founder and owner Luke Cosby saw a white space in the market for jeans at a contem porary price point that weren’t basic or overdone. Founded on the idea that style and innovation shouldn’t be limited to designer denim, Cosby and Rob Lo launched the brand

combine the aesthetics of luxury fashion with everyday accessibility with Purple Brand. Together, they put together a team that traveled the globe to find production part ners that would assist in creating a supply chain for top-quality products. Designer-inspired fits, premium hardware and unique details charac terize the brand’s line of denim, which it calls “the anchor of the modern man’s wardrobe.”

In recent years, the label has amassed a cult following based on its signature den im-meets-streetwear focus. Distressed fin ishes, bleached washes and patchwork effects enliven the brand’s line of jeans, which have become go-to pieces for hip-hop artists like Jer maine Dupri, Kid Cudi, Gunna, Polo G, and The Kid Laroi.

Bayer, industry affairs lead

in the global cotton, textile, and apparel indus tries, with expertise in other agricultural areas.

She believes buyers of cotton deserve to know where their cotton comes from and how it was grown, both in terms of environmental practices as well as labor standards.

Dovetail Workwear, co-founder and designer

Sara DeLuca joined Dovetail Workwear when co-founders Kate and Kyle Marie designed her garden and sparked a conversation about their ideal work pant. Since then, Dovetail Workwear

outerwear and accesso

Dovetail Workwear in

and Canada.

The brand also makes a pledge to sustainability through its low-wa

increased use of recycled

United Nations Global Compact (UNGC), which encourages businesses to adopt sustainable and socially responsible poli cies, and to report on their implementation. Addition ally, the workwear brand prioritizes relationships with factories and mills who raise the bar on industry standards through additional train

Jennifer Crumpler is the industry affairs lead at Bayer, a German multi national pharmaceutical and life sciences company. She previously worked for BASF, a German multina tional chemical company where she took on the role as regional seed sustainability lead and

manager. Crumpler

years of experience in the agriculture industry, working with farmers across the country to improve their pro duction practices.

She also has extensive experience

Demna Gvasalia, or “Demna” as he now goes by to distinguish his creative work from his birthname, is simultaneously elevating denim to the haute couture level while making designer fashion accessible. The Balenciaga creative director with a streetwear edge revived the fashion house’s couture business last year, combining made-to-order jeans with modern nods to archival Cristobal Balenciaga pieces. Demna’s second collection featured indigo and black denim jackets and jeans as well jean skirts with a train.

Demna’s creative relationship with rapper and Yeezy designer, Ye, has landed him on the radar of pop culture enthusiasts. In addition to providing creative direction for the rapper’s release events for

Demna has joined forces in bringing Ye’s utilitarian

designs to the masses with “Yeezy Gap Engineered by Balenciaga.” Collaborative pieces have included moto-inspired denim jack-

hoodies and tees with a dove motif that represents “unnamed hope for the future.”

The Flax Company/Marmara Hemp, president and CEO

Company projects it will

clothes for school and try to re-create all the looks from my favorite fashion magazines that covered my bedroom walls.”

and that they can build the wardrobe of their dreams in an accessible and sustainable way.

technical applications such as insulation for both apparel and automobiles. Additionally, the company is producing 4 million meters of pure linen

pieces of home textiles.

Already selling cottonized

The Flax Company CEO Denis Druon sought to

could meet the spinning industry’s technical requirements in response to market demands. After a two-year development stage, The Flax Company’s Marmara Original

ized hemp in the industry

Blazed and Glazed, digital personality and content creator

While sustainability may feel like a race against time, it isn’t a competition. But if it was, Blazed and Glazed TikTok personality Macy Eleni would have bragging rights for being a thrifting maverick. “I realized thrifting was my superpower well over a decade

OCACIA organization. The hemp also includes non-GMO seeds, has no phytosanitary products and is only rain-fed, with

includes no with is intefactories, the of batch

waste since everything is being used in the plant.

Produced in its integrated partner factories, all The Flax Company’s full traceability from the product. Every step of each production batch is independently traced, checked and blend of cottonized

power well over a decade ago,” Eleni said. in high school, I’d celebrate who are”

TikTok followers on shopping excursions to Los Angeles area thrift stores, flea markets and estate sales to scour the racks for Y2K-era lowrise jeans, leather moto jackets, blinged tees and platform boots. Her “thrift the look” videos encourage viewers to find budget-friendly versions of runway looks and Bella Hadid’s latest street style, while her “thrift with me” videos highlight the thrill of finding a deal. It all comes together in Eleni’s thrift haul videos where she brings the preowned garments to life with her fearless styling and positivity. Eleni said she hopes her followers feel “utter and complete permission to be themselves and celebrate who they are”

The New Denim Project, co-founder

The New Denim Project is a family affair, with co-founder Arianne Engelberg working alongside sister Joanna and father Jaime in a circular design lab startup within their Guatemalan third-generation textile mill Iris Textiles. But the family has grown to include like-minded companies who share their vision. Via its recently launched Circularity System that helps smaller brands recycle at scale, The New Denim Projects collects, sorts and upcycles post-industrial textile and denim waste from local garment factories, grinding the scraps back into chemical-free,

at their store. “This is more than a process,” said Engelberg about inspiring others. “It is a goal that is ethical, economical,

and woven into upcycled

goods in the company’s curated textile collection.

from local ries, back into and woven in cotton from new it to

guiding us in changing our practices to emulate sustainable natural cycles, where all discarded materials are designed to become valuable resources for others to use.”

Even cottonseed and cotton lint leftover from upcycling gets a new life; it is passed on to coffee-growers Finca San Jeronimo Miramar, who use it as compost to cultivate coffee in the Guatemalan highlands.

San Jeronimo who use it

Guatemalan was their own

Partner denim brand Still Here NY was inspired to turn their own scraps into compost, and even sells Still Here coffee beans

Outerknown face mask collab grew into a capsules made from closed loop upcycled denim textiles. “We are seeing a stimulating demand for responsible and recycled materials, for implementing clothing collection at scale, for pursuing technological innovation as well as aligning denim design with regenerative processes,” she said. “And that is certainly relieving and exciting.”

"I REALIZED THRIFTING WAS MY SUPERPOWER WELL OVER A DECADE AGO."

MACY ELENI, BLAZED AND GLAZEDMacy Eleni

The co-founder and creative director of Eco-Age, Livia Firth leads one of Europe’s premier consulting and creative agencies specializing in integrating sustainability into business. Over the past decade, Eco-Age has worked closely with NGOs, industry insider and global governments to advocate for sustainable sourcing. The organization established the Green Carpet Challenge—soliciting stars and public

produced, ecologically friendly designs or repurposed garments.

Firth and Eco-Age also produced “The True Cost,” a documentary directed by Andrew Morgan that explored the fashion industry’s impact on workers and the environment, as well as “Fashionscapes,” a candid look at the industry’s efforts to develop a circular economy, and the greenwashing that threatens progress.

economy, and progress. fashion and unconventional issues like was

Firth is known for examining fashion and sustainability through an unconventional lens, speaking to issues like diversity and inclusion, climate change and digitization. with candor and directness. She was honored as a United Nations Leader of Change and has been recognized with the U.N. Fashion 4 Development Award.

Thanks to Julia Fox and kicked off with double-denim on the minds and lips of fashion watchers around the world when the duo stepped out at Men’s Paris Fashion Week dressed in Canadian tuxedos. Fox’s pairing of Schiaparelli’s cone-bra denim jacket and slouchy Carhartt jeans from Schiaparelli creative director Daniel Roseberry’s own closet drove searches

percent week-on-week following the public display, according to Lyst. Searches for baggy low-rise jeans spiked 74 percent.

Since then, the “Uncut Gems” actress has become

of the denim industry’s new trend cycle, sporting low-rise jeans and crop tops, and sharing DIY

Trinidad3, founder

Los Angeles-based men’s a long way from classic

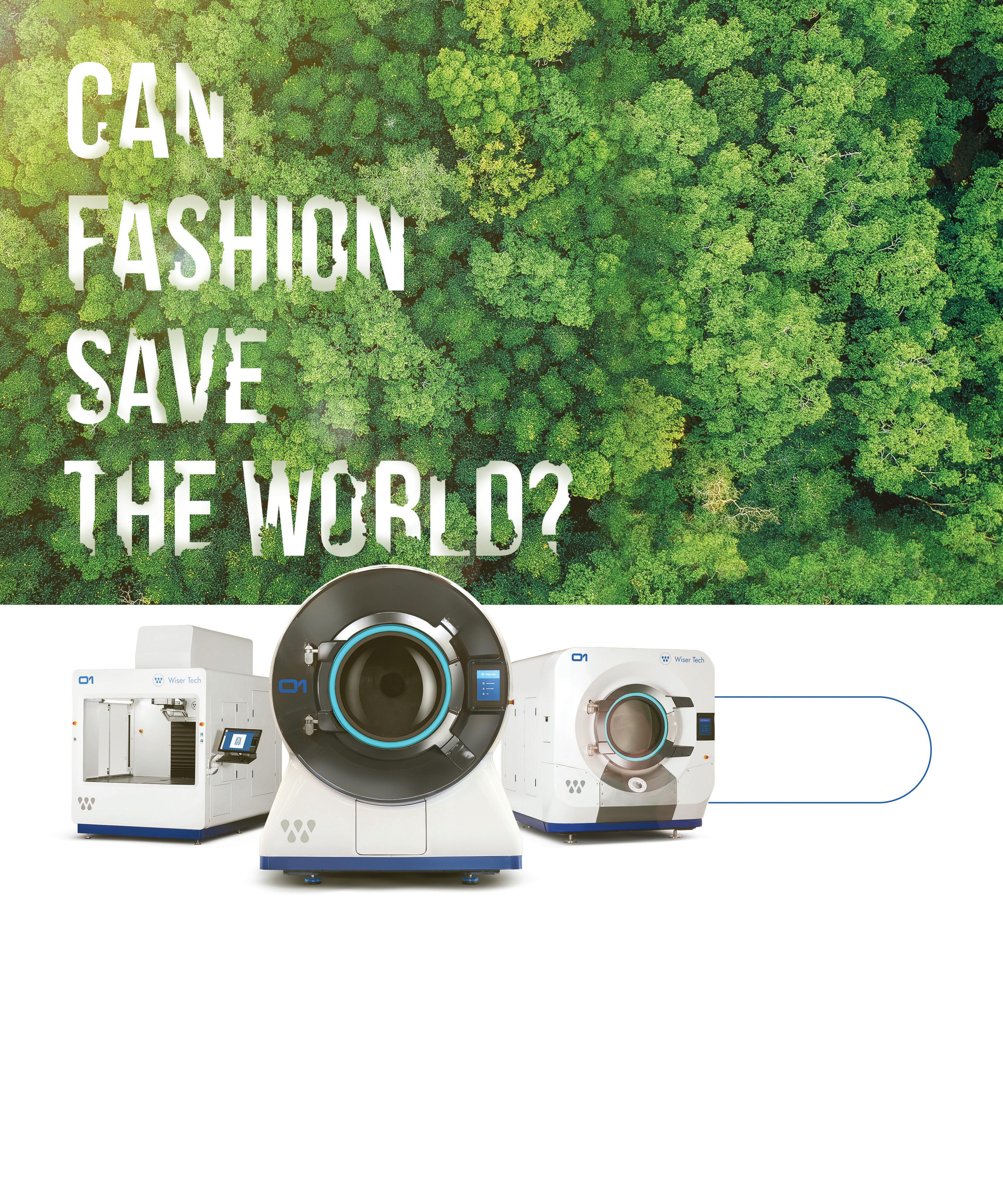

The back end of the denim production process has been an area many in the industry have scrambled to improve on, but Fuat Gozacan has thus far been one of the biggest success stories in ushering in a more tech-savvy future. In founding Wiser Tech, Gozacan has spearheaded the development of technologies like the denim bleaching Wiser Wash and the complementary WOX system, which combines an ozone drum and generator with AI-based algorithms to providing an analysis

Instagram followers. the gas this year

U.S. Marine veteran Trinidad Garcia III, the brand is hitting the gas pedal hard this year by expanding its assortment to include stretch PFD bottoms, stretch twill bottoms, “Made in L.A.” sweatshirts and tees, and a special collection made with Vidalia Mills’ “Made in USA” selvedge. The brand is also experimenting with streetwear designs and

stretch PFD stretch twill and and a USA” is also streetwear of the The brand accommodate veterans’

The heart and soul of the brand, however, remains Garcia’s work to assist fellow veterans.

The brand designs adaptive jeans that accommodate prosthetic limbs and it provides support to veterans’ groups.

while identifying bottlenecks, improvement areas and maintenance requirements. Wiser Wash’s patented ozone bleaching process has eliminated pumice stone and hazardous chemicals from conventional bleaching techniques, therefore saving a noteworthy amount of water and energy.

The company says that its unique technique

million liters of water. In the finishing process alone, Wiser Wash cuts

But there’s more, as this number can increase to

wastewater treatment systems. Improving efficiencies at all levels, the Wiser Wash process

energy and 28 percent less time.

"WE ARE SEEING A STIMULATING DEMAND FOR RESPONSIBLE AND RECYCLED MATERIALS..." ARIANNE ENGELBERG, THE NEW DENIM PROJECT

To compare Good American to most other celebrity-backed clothing lines would be a disservice to the blueprint that the Los Angeles-based premium denim brand co-founded by Khloé Kardashian and Emma Grede in 2016 has provided for the industry as it navigates size inclusivity. Backed by campaigns with diverse casting, retail partners that carry the full size range and an e-comm sizing tool allowing shoppers to see what styles look like on a similar-size model, Good American has broken the traditional mold in a style and language that resonates with millennial and Gen Z consumers.

If you had one request for denim brands, what would that be? Our focus at Good American has always been inclusivity in everything we do—across sizing and how we design, in campaigns, and e-commerce shoots; it’s ingrained into our brand DNA, and we set a standard for other brands to do the same. I, like so many

right pair of jeans. Denim is a staple in everyone’s wardrobe, and no matter your body size or shape, all

in their jeans. My one request would be for fashion brands to put the same level of focus and energy toward becoming more inclusive.

denim industry? So many women struggle when it the only apparel category that requires the level of size range. Shoes and swim, for example, historically lack inclusive options that don’t compromise on style, and there are many elements of denim production and material innovation that can be translated to other product categories.

Growing up, I’ve always been inspired by my mother’s and my grand-

them. Fashion, to me, is such a bonding moment and I have so many fond memories watching my mother and grandmother getting ready and I love sharing those same moments with my daughter now. I get so excited that through Good American I’m able to play such an in what they wear.

Frame & Brady Brand co-founder; Skims co-founder & CEO

for circularity, the brand introduced a collection made with biodegradable denim. More than half of

denim styles was made with sustainable fabrics and washes.

Frame co-founders Jens Grede and Erik Torstensof Le Skinny de Jeanne

didn’t slow Grede’s and Torstensson’s vision of evolving Frame, however. What began as a Los Angeles denim label has become a lifestyle brand— spanning ready-to-wear, footwear, handbags, and accessories—with celebrity cachet and a sustainable future. A year after Frame introduced

that follows the Ellen MacArthur Foundation’s Jeans Redesign guidelines

The decade’s worth of lessons in denim has teed up new opportunities for Grede outside of indigo. His newest venture is co-founding Brady with seven-time Super Bowl champion Tom Brady. Grede is also the co-founder and CEO of Kim Kardashian’s Skims.

Strom Denim, co-owner and CEO

the current sustainability priorities. To adhere to its sustainability goals, Strom uses ozone technology that can reduce the laundry’s water, chemicals and energy consumption. The technology uses cold “ozonated” water or direct ozone gas, which cuts energy consumption during bleaching.

Calik Denim, CEO

Strom Denim’s impact on the denim industry is wide and far reaching. The company has become a go-to source for small collections of on-trend sustainable denim. An average order comes in at

Despite Calik Denim’s role as a fabric manufacturer, the mill wants itself to be seen as something much more—a true thought leader in the space. Following a two-year hiatus, Calik brought back the Ever Evolving Talks, an event that covers industry issues, such as sustainability and adapting for the metaverse and Web

of the manufacturer’s vertically integrated process is co-owner and CEO Baris Izcimen, who works alongside denim brands to source the most appropriate raw materials.

Under Izcimen, the Strom Denim prepares mood boards and trend reports to develop new looks. The company also shares customer feedback with the fabric mills’ R&D teams to create new fabrics or make modifications, all aimed at fitting within

CEO of Calik Denim, identified Ever Evolving Talks as need to bring the industry back to normalcy, while at the same time determining its future path.

It certainly is good timing to have these discussions, especially given the constant dialogue about sustainability, circularity and in

nomic issues that could impact consumer spending. In that vein, Ever Evolving Talks serves as a platform to guide and inspire positive transformation.

A strong advocate for making denim circular and abolishing chemicals, Sara Ladd puts her beliefs to work as the head of product art Hiut Denim Co., a U.K.-based brand dedicated to sustainability. The brand is known for valuing quality over quantity, producing its apparel in small batches of no more

per week. Despite being a small brand, Hiut and Ladd

Hiut Denim Co. produced

free, biodegradable jeans with the help of Candiani Denim. The brand used the mill’s patented, plant based Coreva stretch technology for its line

This year, Hiut Denim Co. debuted its lowest-impact denim line to date, featuring a limited-edition micro collection of zero waste men’s and women’s jeans. The line was produced using scraps from the denim label’s previous collections, saving them from going to waste.

Nudie Jeans, sustainability manager

way that feels both fresh and nostalgic.

Expansion is in the cards. The company is

Sandya Lang, Nudie Jeans sustainability manager, knows what’s at stake within the denim industry, and what her label needs to do to continue advancing the conversation. With Lang leading the way, the Swedish brand is taking steps to ensure that the brand is measuring up to its sustainable promise. Nudie, which uses

for its jeans, offers free denim mending for life. The repair program has gained traction over the years as more consumers have become vocal about extending their jeans’ life-

brand was able to repair

As the owner and CEO of Fred Segal, the Los Angeles-based store that established the blueprint for premium denim retail

Jeff Lotman is responsible for its business and maintaining its legacy. For the past 57 years, Fred Segal has been credited with pioneering the designer denim craze and amassing an A-list celebrity following throughout the decades, from Elvis Presley to Britney Spears.

square foot stand-alone Jean Bar locations separate from Fred

locations in “every major city” across the country, beginning with New York and Miami, and plans to expand the concept internationally in the next few years.

Nudie teamed with the United Nations Industrial Development Organization (UNIDO) as part of the EU-funded circular accelerator, SwitchMed, on a two-phase pilot project to test the denim recycling process at scale. The initiative started by combining

ond-choice jeans with virgin denim material to

new fabric in phase one. Within phase two, the company also furthered circularity efforts by developing a post-industrial denim recycling program with Tunisian designers, which ended pairs of new jeans.

With denim deep in a retro cycle, the iconic retailer recently relaunched its famous Denim Bar, featuring top denim brands that embody the ideals of today’s customer by centering on sustainability and inclusivity. Now called The Original Jean Bar, the curated space features brands like Closed, EB Denim, and Re/ Done, showcasing sustainable development in a

Five years after becoming the fastest solo sailor to make it around the globe in

thur launched a charity designed to advance the circular economy. The Ellen MacArthur Foundation aims to establish an economic system that

creating and funding research about how to combat climate change and biodiversity loss. Over

her group have worked to develop a network of leaders in government, academia, NGOs and business, including designers and innovators looking to change the way their industries function.

That commitment has extended to the fashion realm and has trickled down to one of the industry’s most resource-intensive fab-

the Ellen MacArthur Make Fashion Circular

Initiative launched the Jeans Redesign Project—a set of minimum requirements for fabric durability, material health, recyclability and traceability that are based on the principles of the circular economy. Companies who commit to these standards agree to make jeans that last longer and can be easily recycled.

In the ensuing years, the Jeans Redesign Project has advanced, bringing in more partners and adding more voices to the discussion about the denim circular

the platform added a mandatory recycled content requirement, reflecting the industry’s ambition to push forward in bringing new life to old textiles. To date, more than half a million jeans have been produced under project guidelines.

A versatile creative leader with the ability to move seamlessly between luxury and mainstream apparel design across categories, Betty Madden, Lee’s vice president, global head of design, is one who can do it all. Since joining the

Madden has worked to align Lee’s iconic details with consumers’ demand for comfort, fit and the freedom to style it how every they wish. From core men’s items to performance-driven denim for women, Madden’s designs for Lee are resonating with consumers. Lee brand

in Q2. Lee U.S. revenue driven by strength in U.S. wholesale demand and increases in digital. Sponsoring the music festival Bonnaroo and a summer campaign “Free Your Originality” also helped the brand reach a younger demographic.

The need to reduce the denim industry’s global impact is a real defining moment for Lee. “A great brand inspires, conjures emotion and memories, and makes you feel a certain way when you are wearing or engaging with it,” Madden added. “I am proud of how the whole Lee organization has worked so hard to create great products.”

"I AM VERY PROUD OF THE RENEWED INTEREST AND EXCITEMENT SURROUNDING LEE GENERATED BY GREAT DESIGN..." BETTY MADDEN, LEEJe Lotman

Target, director of merchan dising for women’s denim and Universal Thread

Thread team is also working to help close the loop by using Better

cotton, recycled cotton and recycled polyester. The Fair Trade USA

percent of Target’s total wash water reductions.

Thanks to Marybeth Mahoney Cahill’s eye for on point denim trends and wardrobe solutions, Target has become more than a big box store to its female consumers. Since joining the company in

merchandising for wom en’s denim and Universal Threads has applied her previous experiences to help turn Target into a one-stop-shop for jeans.

Universal Thread,

size-inclusive lifestyle brand—offers ward robe-building denim, Additionally, to ensure inclusivity was “at the core of the brand,” Cahill and Target designed adaptive jeans that features elements like no back pockets and side zippers at the hem for any adaptive needs. Capturing trends is just one part of her job, however. The Universal

ThredUp, president

ThredUp president Anthony Marino wants people to “think second

educating consumers on why resale is good for the planet, or convincing retail execs on why it’s good for business, the initiative is working. Data-driven resale platform ThredUp, has processed and diverted

unique secondhand items

Gap to Gucci) from land

billion off retail price, and billion pounds of carbon emissions. But, Marino

admits, the industry has a long way to go in terms of impact.

Gen Z and Millennials saying they look for an item secondhand before purchasing it new, ThredUp actively courts this consumer. This spring, ThredUp collaborated with celebrity stylist Karla Welch to combat single-use fashion during festival and wedding sea sons, and created a Tunnel

pounds of secondhand clothes clothes during Coachella.

Unspun, director of product innovation

Brooke McEver, director of product innovation at Unspun, has spent her career leading high-impact teams to challenge modern production and design in the fashion industry. By using special software

and a production method developed by the brand itself, B Corp Unspun is working to reduce global

percent through newly developed products and processes in the fashion industry. Their technology uses algorithms to digitally

jeans automatically around eliminating the need for inventory and reducing the waste created by current production methods. The

is available through the brand’s mobile app or at one of its three locations in the U.S. and Hong Kong.

American Eagle Outfitters (AEO, Inc.), EVP, chief supply chain officer

(AEO) is a preeminent

industry, but the specialty retailer’s foray into full supply chain oversight is what is getting people talking. Shekar Natarajan has been at the forefront of the changes at AEO as it acquired logistics company

operator Quiet Logistics and last-mile delivery com pany AirTerra last year, merging the operations into one new logistics busi ness, Quiet Platforms.

In his role as AEO EVP,

Natarajan aims to create a supply chain platform that

everyone. “Networks are built analog, but supply chains and commerce have become more digital.

We’re basically trying to put the two together,” he said, noting that AEO

per every order, lower than the industry average

shipments for every order. “And it’s not just fewer packages showing up faster at your doorstep, but more importantly, it’s showing up cheaper as well.”

earnings call in April, the company revealed it slashed delivery times

percent. All these facts are crucial for the denim industry given all the current concerns within the supply chain regarding shipping delays and rising prices. At the NRF Supply

June, Natarajan showed off a modular, collapsible shipping box system that the company is developing with the idea it could be used to ship items from multiple brands to a cus tomer’s doorstep.

"WE HOPE TO RAISE AWARE NESS AROUND RESALE'S IMPACT AND CELEBRATE BRANDS DRIV ING THE BIGGEST CHANGE." ANTHONY MARINO, THREDUPNatalie Nelson Marybeth Mahoney Cahill

Aritzia, head of denim

Natalie Nelson has headed up the denim program at contemporary women’s wear label Aritzia for four years. A veteran of Gap and Levi’s, the seasoned designer and product development specialist has spent her career steeped in indigo. A self-described “jean queen,” Nelson’s creations have been featured in top fashion magazines and on curated “best of” lists, evincing a laid back, casual style with retro appeal.