GLOBAL CAPACITY

EXORIDUM FROM THE PUBLISHER

WELCOME TO ISSUE 136, OUR GLOBAL CAPACITY EDITION!

As spring blossoms, a fresh season of industry conferences is upon us. This May has been particularly eventful, with key summits taking place in Singapore, Washington, DC, and London, all within a span of five weeks. The bustling schedule reflects the dynamic and ever-evolving nature of the submarine cable industry, setting the stage for another great year ahead.

The industry continues to make headlines globally, particularly with the recent cable breaks in the Red Sea and other new disruptions around Africa. As the industry responds to these challenges, a new round of diverse routes may be on the horizon. We’ll keep up with the pace and meet you whenever we can, ensuring we stay connected and informed as we navigate these exciting developments in global network infrastructure.

INTRODUCING THE SUBMARINE CABLE INDUSTRY DIRECTORY

We’re thrilled to introduce the Submarine Telecoms Forum Directory, a platform designed to cater to the intricate needs of industry professionals, fostering efficient connections between submarine cable projects and vendors offering critical products and services. With a user-centric interface, the directory streamlines navigation through its well-organized categories, making it an indispensable tool for consulting, equipment procurement, infrastructure deployment, and more. The directory not only enhances accessibility to a comprehensive array of resources but also celebrates the collaborative spirit and technical prowess driving the industry. We aspire for the SubTel Forum Directory to be the premier reference for those charting new territories in the submarine telecoms industry, guiding towards a more interconnected and sustainable global community. Take a look and tell us what you think.

SUBTEL FORUM APP

Our app has a few exciting new features since our last is-

sue, including a link to the SubTel Forum Directory. A big thank you to all the professionals who’ve added it to their smartphones, driving us forward at full steam. This app now provides real-time updates, comprehensive data, and interactive features designed for those involved in submarine cable projects.

With seamless integration with our website, the app offers an intuitive user interface and streamlined access to crucial industry insights. But it’s more than just an information source; it’s an interactive platform designed to facilitate learning and collaboration. Features like real-time project tracking and AI-driven analytics ensure it evolves to meet the changing needs of its users. Dive in and explore it today. (https://subtelforum.com/stf-app/)

2024 SUBMARINE CABLE MAP

We’re releasing our updated 2024 Submarine Cables of the World printed wall map, an indispensable resource for industry professionals. This crafted map offers a visually stunning and highly detailed representation of global submarine cable networks, making it an invaluable tool for anyone in the field. The updated map will be unveiled at Submarine Networks EMEA this month and Submarine

Networks World in September, ensuring it receives extensive visibility among key industry stakeholders.

We’re also inviting more advertisers to join us in this venture, offering unparalleled exposure to a focused audience deeply involved in the submarine cable and telecommunications sector. Interested in advertising? Contact Nicola Tate at ntate@associationmediagroup.com.

SUBMARINE CABLE ALMANAC

The May edition of the Submarine Cable Almanac is set for release. We’ve updated our data with the latest public news stories from the past three months and validated this information directly with cable owners to ensure accuracy. In this edition, cable systems are organized by region to provide a clearer view of developments in each area, and the new format makes it easier to identify upcoming systems. This comprehensive and user-friendly resource is designed to help you stay informed about the latest in submarine cable developments worldwide.

THANK YOU

Thank you as always to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: AP Telecom, AP Procure, Fígoli Consulting, Indigo, IWCS, and WFN Strategies. Of course, our ever popular “where in the world are all those pesky cableships” is included as well. STF

A Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Andrés Fígoli, Ella Herbert, Hesham Youssef, John Maguire, Iago Bojczuk, Kieran Clark, Michael Brand, Nicola Tate, Philip Pilgrim, Syeda Humera, and Wayne Nielsen

FEATURE WRITERS:

Chris Wood, Daniel Leza, Gilberto Guitarte, Javier Valdez, Jorge Lozano, Kathy Kirchner, Keith Shaw, Kieran Clark, Kristian Nielsen, Vineet Verma

NEXT ISSUE: July 2024 – Regional Systems

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS:

Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Good reading – Slava Ukraini STF

Wayne Nielsen, Publisher

Wayne Nielsen, Publisher

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers cannot be held

responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com.

Copyright © 2024 Submarine Telecoms Forum, Inc.

SUBMARINE TELECOMS

FORUM IN THIS ISSUE

ISSUE 136 | MAY 2024

FEATURES

STEPPING UP TO MEET SUBSEA SECURITY CHALLENGES

Advancing strategies to protect submarine cables against growing cyber threats and geopolitical tensions

By Kathy Kirchner

40 56 42 60 52 64

THE IMPORTANCE OF SUBSEA CABLE AND ROUTE DIVERSITY

Discovering the critical role of subsea cable route diversity in enhancing Africa's connectivity resilience

By Chris Wood

THE SYMBIOTIC RELATIONSHIP OF SUBMARINE AND TERRESTRIAL CABLES

Examining the evolution of submarine and terrestrial cables and their implications for climate change

By Jorge Lozano

LISBON: A DIGITAL GATEWAY ENABLING GROWTH AND RESILIENCE

Assessing the importance of Lisbon as a digital gateway and its unique location and infrastructure in bolstering global connectivity

By Keith ShawLIFE EXPECTANCY OF A FIBER OPTIC CABLE

Exploring the 25-year lifespan of submarine fiber optic cables and the factors prompting their frequent updates

By Javier Valdez and Gilberto Guitarte

INTRODUCING THE SUBMARINE CABLE INDUSTRY DIRECTORY

Launching a groundbreaking platform to enhance industry connectivity

By Kieran Clark

BEYOND BORDERS: ENSURING RESILIENCE IN SUBSEA CABLE INFRASTRUCTURE AMIDST GEOPOLITICAL CHALLENGES

Revealing how hybrid terrestrial-subsea networks can ensure global connectivity

By Vineet Verma

FORECASTING CAPACITY NEEDS IN FEASIBILITY STUDIES

Exploring the critical role of capacity forecasting in feasibility studies for submarine cable projects

By Daniel Leza and Kristian NielsenDEPARTMENTS

2 EXORDIUM

Find out about advertising opportunities to connect with our specialized audience.

3 IMPRESSUM/MASTHEAD

Meet our team, from editors to designers, establishing our commitment to transparency.

6 SUBTELFORUM.COM

8 INTERACTIVE CABLE MAP UPDATES

Get the latest on global submarine cable infrastructure from our interactive map.

10 SUSTAINABLE SUBSEA

Discover industry innovations for reducing environmental impact and protecting marine life.

16 WHERE IN THE WORLD ARE ALL THOSE PESKY CABLESHIPS?

Follow the missions of cableships crucial to undersea connectivity.

23 CAPACITY CONNECTION

Learn how collaborations and advancements are boosting global network capacity.

30 ANALYTICS

Delve into the latest trends and data shaping the future of submarine telecoms.

77 BACK REFLECTION

Explore the history and evolution of the submarine telecoms industry.

86 LEGAL & REGULATORY MATTERS

Understand the legal and regulatory issues affecting the submarine telecom industry.

90 ON THE MOVE

Track the career movements within the submarine telecom sector.

91 NEWS NOW

Stay updated with the latest developments in the submarine telecom world.

92 ADVERTISER CORNER

Find out about advertising opportunities to connect with our specialized audience.

INSIDE THE WORLD OF SUBTEL FORUM: A COMPREHENSIVE GUIDE TO SUBMARINE CABLE RESOURCES

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

DISCOVER THE FUTURE: THE SUBTEL FORUM APP

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

PUBLICATIONS

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

YOUR DAILY UPDATE: NEWS NOW RSS FEED

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

THE KNOWLEDGE HUB: MUST-READS & Q&AS

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

IN-DEPTH PUBLICATIONS

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

VISUALIZING CONNECTIONS: CABLE MAPS

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

EDUCATIONAL OPPORTUNITIES: CONTINUING EDUCATION

SubTel Forum’s commitment to education is evident in our courses and master classes, covering various aspects of the industry. Whether you’re a seasoned professional or new to the field, these learning opportunities are fantastic for deepening your understanding of both technical and commercial aspects of submarine telecoms.

SCAN THE QR CODE TO ACCESS ALL THE RESOURCES THAT SUBTELFORUM.COM HAS TO OFFER

FIND THE EXPERTS: AUTHORS INDEX

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

TAILORED INSIGHTS: SUBTEL FORUM BESPOKE REPORTS

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

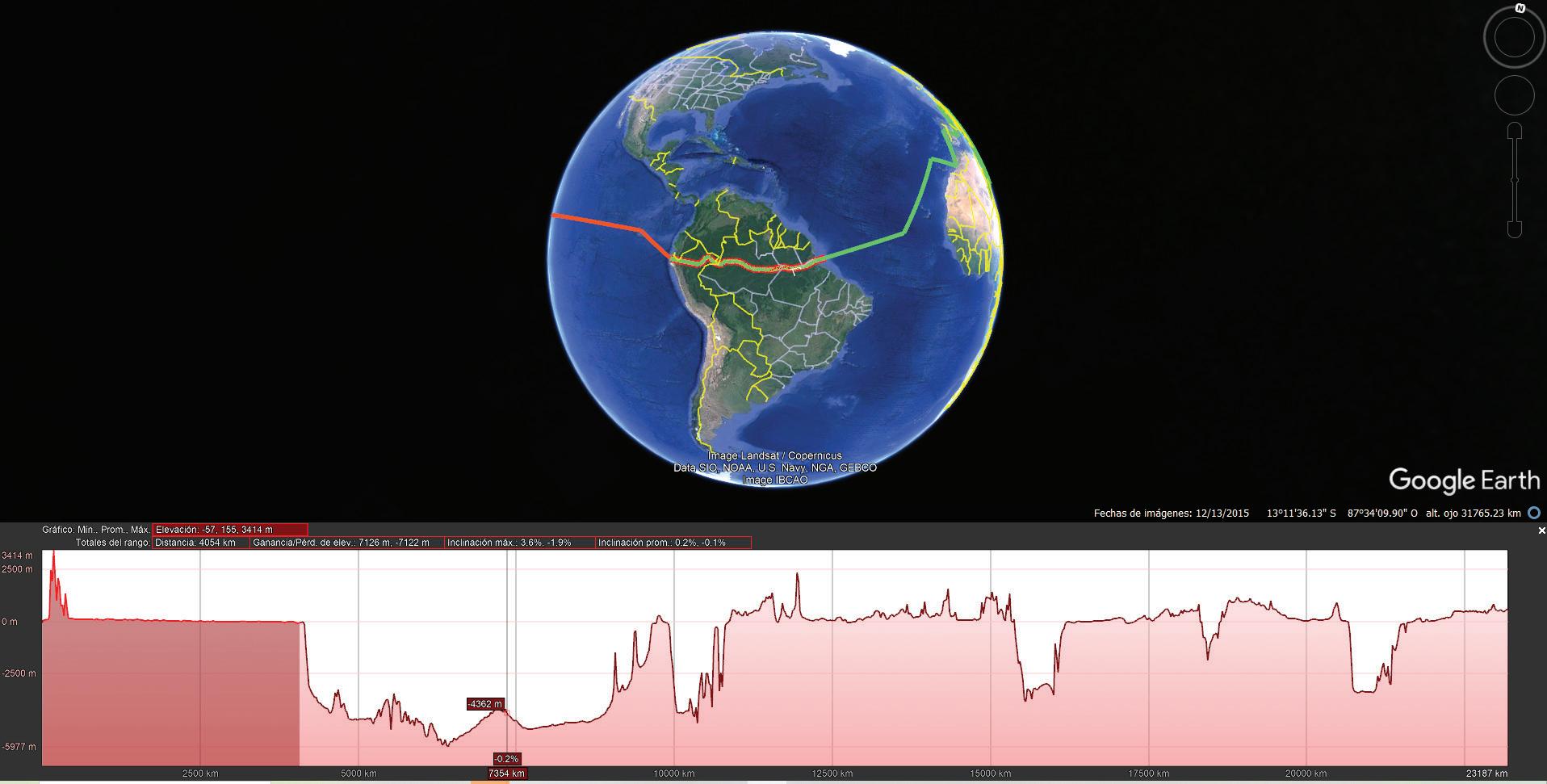

SUBTEL CABLE MAP UPDATES

The SubTel Cable Map, built on the industry leading Esri ArcGIS platform, offers a dynamic and engaging way to explore over 440 current and planned cable systems, 50+ cable ships, and more than 1,000 landing points. This interactive tool is linked to the SubTel Forum Submarine Cable Database, providing users with a comprehensive view of the industry.

We’re thrilled to announce a new partnership with ACS Cable Systems, a leading provider of wholesale carrier services, as the official sponsor of the SubTel Cable Map. With this collaboration, the ACS logo will now be prominently displayed on the map, serving as a direct link to their comprehensive offerings at Alaska Communications. This partnership underscores our mutual commitment to supporting the submarine telecommunications industry by providing critical infrastructure and connectivity solutions. ACS Cable Systems specializes in delivering high-quality, reliable services tailored to meet the needs of global carriers, enhancing the value they provide to their clients. This integration ensures that our users have instant access to a trusted partner renowned for their expertise in connectivity and customer service.

For more information about ACS Cable Systems and their services, please visit their website.

Submarine cables play a pivotal role in global communications, acting as the backbone of the internet. They are responsible for transmitting over 99% of all international data, connecting continents and enabling global connectivity. Without these underwater highways, the speed and efficiency of global internet communication that we enjoy today would not be possible.

system (GIS) for working with maps and geographic information. It is used for creating and using maps, compiling geographic data, analyzing mapped information, sharing and discovering geographic information, and using maps and geographic information in a range of applications. Its robust capabilities make it an ideal platform for the SubTel Cable Map, allowing for dynamic, interactive exploration of complex data.

With systems connected to SubTel Forum’s News Now Feed, users can easily view current and archived news details related to each system. This interactive map is an ongoing effort, updated frequently with valuable data collected by SubTel Forum analysts and insightful feedback from our users. Our aim is to provide not only data from the Submarine Cable Almanac, but also to incorporate additional layers of system information for a comprehensive view of the industry.

The Esri ArcGIS platform, upon which the SubTel Cable Map is built, is a powerful geographic information

We encourage you to explore the SubTel Cable Map to deepen your understanding of the industry and to educate others on the critical role that submarine cable systems play

in global communications. All submarine cable data for the Online Cable Map is sourced from the public domain, and we’re committed to keeping the information as current as possible. If you are the point of contact for a company or system that needs updating, please don’t hesitate to reach out to kclark@subtelforum.com

To the right, find the full list of systems added and updated since the last issue of the magazine:

We hope the SubTel Cable Map serves as a valuable resource to you and invites you to dive into the ever-evolving world of submarine cable systems. We invite you to start your exploration today and see firsthand the intricate network that powers our global communications. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

MAY 20, 2024

SYSTEMS ADDED:

• Far North Fiber

• Hawaiian Islands Fiber Link

SYSTEMS UPDATED:

• AAG

• Americas 1-North

• Americas-II

• Balalink

• IONIAN

• JGA North

• JGA South

• Orval/Alval

Do you have further questions on this topic?

WHAT’S IN AN EFFICIENCY METRIC?

The Case of Power Usage Effectiveness (PUE) at the Cable Landing Station

BY IAGO BOJCZUK, ELLA HERBERT, MICHAEL BRAND, HESHAM YOUSSEF, AND NICOLE STAROSIELSKIThe Sustainable Subsea Networks research project, an initiative of the SubOptic Foundation, recently released the Report on Best Practices in Subsea Telecommunications Cable Sustainability. In that report, we concluded that there was a need for sustainability metrics in the industry. Many of our interviewees reported, “If you can’t measure it, you can’t manage it.” Metrics can not only help to set internal benchmarks, but also to shape future investments and regulation. We believe that metrics can also help the subsea cable industry explore possible win-win scenarios that are good both for business and the planet.

As a first step, we begin with an investigation of existing metrics from adjacent industries. There is no need to reinvent the wheel when it comes to measurement. At the same time, the struggles over metrics — and their limitations — are instructive as we attempt to develop appropriate metrics for the subsea cable network.

In this month’s column, we focus on a metric that has been established to gauge energy efficiency of facilities housing information technology (IT) equipment worldwide: Power Usage Effectiveness (PUE). This is one of the most widely disseminated metrics in the data center industry. It has been codified in ISO standards and absorbed into regulation. In our research, we have found that

some Cable Landing Station (CLS) facilities are already using PUE as an internal measurement.

Is this use of PUE a good idea for the subsea cable industry? What are the limitations of this metric? In this article, we cover the basic definitions of PUE and describe how it became used across the globe. We also describe the pitfalls of PUE. As academic and industry literature has shown, PUE can at times lead to misleading conclusions, especially when it is used to compare facilities around the world.

We conclude that, by itself, using PUE as a gauge of the sustainability of the CLS is far from sufficient. However, as the subsea cable industry faces the challenge of identifying, developing, standardizing, and adopting the right suite of metrics, it is nonetheless a good starting point.

THE RISE OF PUE AS AN ALLENCOMPASSING METRIC

In its original definition, the Power Usage Effectiveness (PUE) (per ISO/ IEC 30134-2) of a facility refers to the ratio between total power used by a data center and the power used by its IT systems. A lower value indicates greater energy efficiency, ideally approaching 1.0 — this signifies that a greater portion of the facility’s power consumption is being used directly for computing, rather than cooling or other overhead, thus indicating higher operational efficiency.

PUE as a metric was first developed by the Green Grid in 2007, and was the first standardized metric measuring the energy efficiency of an entire data center (Lin et. al, 2021). Since its inception, the main goal of implementing PUE measurement has been to motivate data center operators to eliminate waste in their facility power

structure, primarily through reducing energy used for cooling, power delivery components, and other internal component loads (The Green Grid, 2012). The ownership, development, standardization, and dissemination of PUE now lie in the hands of the International Organization for Standardization and the International Electrotechnical Commission (Future-Tech, 2020). In addition to PUE, the Green Grid created a handful of other sustainability metrics such as Carbon Usage Effectiveness (CUE) and Water Usage Effectiveness (WUE). The combination of these metrics (often referred to as the xUE family of metrics) co-exist to provide operators with a quick sustainability assessment for their facilities.

According to Uptime, the average annual PUE for the data center industry was 2.6 in 2007 — meaning that the data center subsystems used 2.5x more power than the IT systems they were supporting. However, in 2022 this number was closer to 1.55 globally, with companies such as Google, with a global-spanning infrastructural footprint, reaching an average PUE as low as 1.1 in their data center facilities — in many cases relying on water-cooling. However, when it was created, the plain nature of PUE was especially attractive as it just focused on total power and IT power, instead of creating new measurements which would require an industry consensus to define (Neudorfer and Ohlhorst, 2010). These changes in the PUE as a measurement reflect in large part the broad adoption of new techniques such as hot/cold air containment, optimized cooling control, and increased air supply temperatures, among others.

The attractiveness of this metric comes from its simplicity. PUE does not require too much technical understanding of data center standards or equipment to comprehend its values, making

it ideal for business practices. Given its standardization, simplicity, and focus on energy efficiency, PUE was quickly adopted by the industry and stands as the widely used performance metric for data centers (Voort et al, 2017).

PUE has since become a core metric for government regulations — from nation-states to municipalities. China’s second-largest city, Beijing, for example, has a handful of different PUE benchmarks depending on the size of the data center. Additionally, PUE has become a core targeting metric for associations looking to transition the industry toward energy efficiency. The European Data Center Association calls for new data centers to meet a PUE of 1.3 (for centers in cold weather) or 1.4 (for centers in warm climates). In the context of Singapore, which has recently lifted a two-year data center construction moratorium, the requirement is for a PUE of 1.3. All of these show that metrics are becoming an important tool for sustainability that may affect the future of the industry.

THE LIMITS TO PUE

Despite PUE being a prominent and useful metric, it does have several important limitations. First of all, despite its wide use for over 15 years, PUE was never intended to compare energy efficiency between facilities, given their varying climatic and technical conditions (Kosik, 2021). John Booth and Nick Morris of Carbon3IT, consulting for Sustainable Subsea Network, observe that PUE is often a misunderstood and inappropriately applied metric. “Too many organizations have misinterpreted its use and have attempted to use it as an absolute measure of energy efficiency performance for their facilities compared to those of others,” they report. “PUE is merely a ratio that

acts as an improvement metric specific for the facility in question, you calculate it to get a baseline number, implement some energy efficiency improvements such as the best practices found in the EU Code of Conduct for Data Centres (Energy Efficiency), and then measure again, the ultimate aim is to reduce the ratio to as close to 1 as possible.”

Echoing this, Thomas J. Moran, sustainability researcher and advisor to the Global Enabling Sustainability Initiative, argues: “PUE should never have been anything other than a temporary, internal operational metric and is already dangerously outdated. Its use today is best viewed as an indicator of a lack of sustainability maturity in the data center industry.”

In general, smaller data centers have a larger PUE than larger ones, as the latter has more capital to implement more efficient technologies and techniques (Davis, 2024). CLSs would also naturally have a higher PUE because they require far less IT equipment. Facilities based in warmer climates will generally have a higher PUE than those in colder locations. The use of PUE in regulation also does not take into account the specificity of individual facilities, especially considering their age.

If we strictly followed PUE in developing plans for sustainability, this might lead us to only build super-efficient, brand-new hyperscale facilities in cold climates. A comprehensive plan for sustainability, however, includes many more considerations, including renewable power. In short, it is not a good idea to simply use PUE to compare data centers or CLS facilities to one another.

A second key pitfall of PUE is that, if decreasing PUE is the only goal, it is possible to manipulate energy ratios to make the PUE measurement lower without reducing energy use.

For example, when a facility’s cooling set point is increased, PUE will decrease due to less energy used for the cooling system, and increased IT load due to the higher use of server fans. This can result in a higher amount of total energy consumed, but a lower PUE value.

In turn, total energy usage may go down, both in the facility overall and within the IT load, but if they decrease proportionately to each other, the metric will not reflect an improvement. Introducing a new, more efficient IT technology might decrease the IT load, but will make PUE appear larger despite this being a positive change for energy usage. The data center industry is aware of these limitations, with companies like Mitsubishi Electric telling their customers that, “siloed improvements in efficiencies can result in a higher PUE.” As a result, cooling has to be adjusted when new equipment is installed in order to maintain the same PUE.

industry used an equivalent metric to PUE, when you asked a car maker what sort of mileage a vehicle gets, their answer would be, “we have no idea, but the air conditioner is about 10 percent of the total.””

closer and closer to the minimum value of 1, and the industry may require a more granular metric to capture energy efficiency changes.

One detailed example that illustrates the problem with PUE, especially at the CLS, is the fact that much transmission equipment has its own fans to cool down when the temperature is too high or when airflow is not properly distributed. This can somewhat distort the concept of consumption, suggesting that an increase in the transmission equipment’s energy use is solely due to increases in IT power, rather than this increase in cooling needs.

Moran points out that the best way to understand the value of PUE is to imagine a different industry using a comparable metric: “If the auto

Due to new methods of cooling on the horizon that are not compatible with the way PUE is calculated, some even claim that PUE is on the verge of becoming outdated. Jacqueline Davis (2021), in an opinion piece for Data Center Dynamics, argued, “its simplicity could limit its future relevance, as techniques such as direct liquid cooling (DLC) profoundly change the profile of data center energy consumption.” She brings up the point that if technology such as direct liquid cooling becomes more prominent, PUE may become less applicable. Direct liquid cooling in data centers tends to lessen the total IT power because it has a lower partial PUE and removes the need for fans in the server. However, these upgrades reduce IT load, so without adjustments, they could appear to be making PUE worse.

And lastly, as several industry experts claim: PUE levels are getting

The original goal of PUE was to measure the efficiency of data centers to avoid unnecessary energy expenditure. But PUE was never intended to be an all-encompassing measurement of sustainability in data centers. Even the Green Grid itself describes PUE as only the “first step” in examining data center efficiency. The over-emphasis and mis-use may have serious implications if all stakeholders rely on this metric alone. “PUE tells you nothing about the processing performance in terms of energy use of the core IT or telecoms equipment: two facilities could have the same PUE value yet one may be way more performant in terms of its output or capacity in compute, storage, network or data transmission,” Booth and Morris point out.

Properly contextualized with more detailed information and a suite of other metrics, and used to measure internal improvements, year-on-year, PUE can still tell a part of the story, even if it does not give a full picture.

PUE at the Cable Landing Station

On one hand, the CLS can be considered a small kind of data center, simply with a much lower power capacity (approximately 1 to 1.5 MW), smaller size, and different kinds of stakeholders involved. As a result, PUE can be used, as it is in the data center industry, to gauge improvements internally. We have seen promising projects to retrofit existing CLSs with newer, more efficient technologies and to integrate systems that allow for enhanced data collection and reporting. R&G Telecom, which has been working with operators, has been using PUE measurement especially when there is a need to compare results before and after an upgrade. Andrea Reschini, Head of Energy Efficiency and Sustainability at R&G, argues that this is something best done in collaboration.

Our team recently had a chance to visit the Etisalat SmartHub Fujairah Data Center, a facility that supports connectivity between Europe, Asia, Africa, and the Middle East. Here we learned that in SmartHub’s CLS there has also been a routine collection of power data and the calculation of PUE, although there is no metering in place. e&’s data collection helped to pave the way for improvements in increasing energy efficiency, such as the installation of new chillers aimed at reducing temperatures and optimizing energy use — and thus reducing PUE.

Another company that has been utilizing PUE as a metric to assess the efficiency of subsea cable landing stations is Orange. The company has also been using PUE to help plan the renewal and renovation of data center cooling and conversion systems, as well as in challenging equipment suppliers to achieve more optimal electrical

designs. Ricardo Ona, Subsea Project Manager at Orange, notes that this metric is promising for future activities aimed at enhancing the sustainability portfolio of the company. “The numbers have shown a positive PUE evolution over the years, and it is expected that future common initiatives may help further extend this tendency,” says Ona.

NEW EUROPEAN UNION REGULATIONS ON THE HORIZON

The European Union has been at the forefront of data center regulation globally and new regulations, of which PUE is a part, are on the Horizon. The EU has, to date, worked with the industry to offer best practices in data centers (via the EU Data Center Code of Conduct), which sets ambitious voluntary standards for companies and focuses on key issues and agreed-upon solutions. The Code of Conduct provides detailed best practices for improving energy efficiency in data centers, covering IT and power equipment management, cooling systems, building design, and monitoring.

In September 2023, the EU Parliament passed a Directive on the Energy Efficiency Directive, with the goal of reducing Europe’s energy consumption by 11.7% by 2030. Article 12 of the directive proposes new regulations on reporting for data centers. With the new directive now in place, the key regulations require data center owners and operators with significant power demands (above 500 kW) to publicly disclose detailed information about their energy consumption, power utilization, PUE, temperature set points, data volumes, water usage, heat utilization, and the use of renewables (see Annex VII for more details).

At a regional level, the directive also

mandates the establishment of a European database to aggregate data center information, enhancing oversight and public access to energy metrics. Moreover, the EU has expanded discussions on the first phase of establishing a common Union rating scheme for data centers through an associated delegated act (C (2024) 1639). By 15 September 2024, then by 15 May 2025, and annually thereafter, reporting data center operators must communicate their information and key performance indicators to the European database. Based on this, the delegated act specifies that the following will be publicly available in the European database in an aggregated manner, at both Member State and Union levels: Power Usage Effectiveness (PUE), Water Usage Effectiveness (WUE), Energy Reuse Factor (ERF), and Renewable Energy Factor (REF). While CLSs are not directly cited in these new rules, these legislative moves suggest that additional measures — both at the country and regional levels — could be introduced to enforce these standards more rigorously across other parts of the network, including cable landing stations. This means that EU member states are now required to enact it in their own way within their legal frameworks, which in turn will foster transparency and encourage the adoption of best practices in data center operations.

THE FUTURE OF SUSTAINABILITY METRICS

Sustainability and technology are two complex fields that are always evolving — why should one simple metric try to cover their intersection for years to come? PUE has certainly helped propel the efficiency movement in the data center sector–and is now enshrined in oncoming regulation. But as we describe

here, it should not be over-used or used by itself in the subsea cable industry. As Thomas J. Moran cautions: “At its worst PUE is now regularly used in clumsy attempts at virtue signaling that misrepresent it as a metric for comparing facilities to each other rather than to older, less efficient versions of themselves.”

CLS operators concerned with energy use might draw inspiration from other categories of metrics that have also been developed for use in the data center sector. Among these are metrics that describe the energy source itself. This includes the proportion of renewable energy used, whether it was generated on or off-site, and whether the energy was reused. Andrea Reschini reminds us that such other metrics would also come handy for enhancing sustainability: “It would be useful to know more about the breakdown of the energy — for example, the energy produced in the station, which is different from renewables acquired through certificates,” she says. Working alongside each other, industry members might also look at something that is often overlooked: kW/h consumed. They might look at the data transmission rate (or capacity) over energy used (e.g. Tbps/kW).

In short, if used, PUE needs to be interpreted in tandem with other performance attributes to fully characterize the operating energy efficiency of a facility — including Cable Landing Stations. As we suggest, it takes a suite of metrics, rather than a one-size-fitsall approach, to grasp the bigger picture of facility sustainability. This points to the need for the subsea cable industry to continue working together to facilitate data exchange and collaboration that can help the industry be prepared for tighter regulations emerging in Europe and other parts of the globe.

This article is an output from a SubOptic Foundation project funded by the Internet Society Foundation. STF

IAGO BOJCZUK is a Global Policy Consultant for the Sustainable Subsea Networks research project and a Ph.D. candidate in the Department of Sociology at the University of Cambridge, UK. His work investigates the material, cultural, economic, and political dimensions of digital infrastructures in the Global South.

ELLA HERBERT is an undergraduate student at UC Berkeley pursuing her B.S. in Environmental Science. She is currently a research assistant for the SubOptic Susbsea Sustainable Networks research team, focusing on data center sustainability by exploring metrics, industry trends, and publications within the field of telecommunications.

MICHAEL BRAND is an undergraduate student at the University of California, Berkeley pursuing a B.S. in Environment Economics and Policy. He is also a research assistant on the Sustainable Subsea Networks research team. His research focuses on the intersection of behavioral economics, environmental policy, and public communication for the development and regulation of digital infrastructure.

HESHAM YOUSSEF is a senior transmission engineer at Telecom Egypt, which is the leading provider of telecom, data, and internet services in the region. He has over 12 years of experience in the field of optical communications and submarine cable operations. He holds a master’s degree in electrical, electronics, and communications engineering from Alexandria University, and has also published several papers on novel optical amplifiers and modems.

NICOLE STAROSIELSKI is Professor of Media Studies at UC Berkeley. Dr. Starosielski’s research focuses on the history of the cable industry and the social aspects of submarine cable construction and maintenance. She is author of The Undersea Network (2015), which examines the cultural

and environmental dimensions of transoceanic cable systems, beginning with the telegraph cables that formed the first global communications network and extending to the fiber-optic infrastructure. Starosielski has published over forty essays and is author or editor of five books on media, communications technology, and the environment. She is co-convener of SubOptic’s Global Citizen Working Group and a principal investigator on the SubOptic Foundation’s Sustainable Subsea Networks research initiative.

Do you have further questions on this topic?

ASK AN EXPERT

References

Davis, J. (2024). Large Data Centers are Mostly More Efficient, Analysis Confirm. Uptime Institute. Retrieved 13 March, 2024, from https://journal.uptimeinstitute. com/large-data-centers-are-mostly-more-efficient-analysis-confirms/

Future-Tech. (2020). Introduction: The ISO/IEC 30134 Series of Standardised KPIS. Retrieved from https://www. future-tech.co.uk/introduction-the-iso-iec-30134-seriesof-standardised-kpis/

Lin, P., Bunger, R., Avelar V. (2021). Guide to Environmental Sustainability Metrics for Data Centers. Schneider Electric. Retrieved from https://download.schneider-electric.com/files?p_enDocType=White+Paper&p_Doc_ Ref=WP67_SPD_EN

Neudorfer, J. and Ohlhorst, F., (2010). Data Center Efficiency Metrics and Methods. Search Data Center. Retrieved from https://viewer.media.bitpipe.com/979246 117_954/1279665297_327/Handbook_SearchDataCenter_efficiency-metrics_final.pdf

The Green Grid. (2012). Carbon Usage Effectiveness (CUE): A Green Grid Data Center Sustainability Metric. Retrieved from http://nikom.in/Downloads/0a58778dfc96-4482-8c46-13abe76b015c.pdf.

The Green Grid. (2012). PUE: A Comprehensive Examination of the Metric. Center of Expertise of Energy Effiency in Data Centers. Retrieved from http://nikom. in/Downloads/0a58778d-fc96-4482-8c46-13abe76b015c. pdf.

Voort, T. V. D., Zaverl, V., Galdiz, I. T., & Hensen, J. (2017, February). Analysis of Performance Metrics for Data Center Efficiency. Rehva Journal. Retrieved from https://www.rehva.eu/fileadmin/REHVA_Journal/REHVA_Journal_2017/RJ1/p.05/05-11_RJ1701_WEB.pdf

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY SYEDA HUMERAMARITIME NAVIGATION DATA INSIGHTS: A MICROSOFT POWER BI VISUAL ANALYSIS

INTRODUCTION :

In an age dominated by data, the maritime sector stands at the forefront of a transformative wave, primed to capitalize on advanced analytical insights. As stewards of the vast, ever-changing oceans, our commitment to steering the global lifeline of commerce through innovative and efficient maritime operations has never been more crucial. This 2024 Power BI report delves deeper into the vast ocean of data provided by the Automatic Identification System (AIS), articulating a more nuanced narrative of ship movements, traffic patterns, and navigational trends. Our analysis this year reflects profound technological advancements and significant geopolitical shifts that redefine maritime logistics.

The core aim of this report is to elevate the utility of AIS data from mere numbers to a cornerstone strategic asset. We have re-engineered our suite of Power BI visuals to offer stakeholders an enhanced, dynamic dashboard of knowledge. This includes sophisticated real-time positional mapping integrated with advanced predictive analytics to forecast potential maritime congestion and collision zones. Each visual not only contributes to a comprehensive understanding but also empowers decision-makers with actionable insights for superior route planning, fleet management, and optimized maritime operations.

Embracing the technological frontier, our report expands its lens to include the revolutionary integration of auton-

omous vessels and the application of digital twin technologies in maritime logistics. These advancements promise to reshape the operational paradigms of shipping fleets worldwide, enhancing efficiency while reducing the need for extensive human crews.

As we chart this analytical voyage, we also turn our attention to the submarine telecommunications network— a silent yet formidable force enabling our digital conversations. The network’s sprawling, unseen channels are the backbone of our global connectivity, making it a pivotal infrastructure in our digital age. The 2024 report explores the dynamic interplay of innovation, demand, and strategic maneuvering that molds the submarine telecommunications landscape.

Below the ocean’s surface, the complex matrix of submarine cables, both slender and robust, not only facilitates our connectivity but increasingly mirrors significant geopolitical concerns and environmental considerations. We offer updated visual mappings of the global submarine cable network, reflecting recent deployments, retirements, and strategic expansions. Our visuals chronicle the industry’s progress through critical technological milestones, painting a vivid picture of a network that underpins the communication capabilities of nations and enterprises alike.

This year, we invite you to embark on a data-driven journey into the horizon of 2024, where every data point serves as a guiding beacon towards smarter, safer, and more efficient maritime and digital navigation. With each Power BI visual, we illuminate pathways through the vast data seascape.

VISUALIZING THE CABLE SHIP FLEET

Our visuals now map out a more intricate web of submarine cables that traverse the ocean floor, meticulously updated to reflect the connectivity grid of 2024. This new mapping includes the latest cable deployments which incorporate advanced materials for increased durability and data transmission capabilities. We also feature the pioneering use of AI-driven routing technologies that optimize signal integrity across vast distances, responding dynamically to underwater conditions and global data demands.

The industry’s timeline, enriched with the most recent data, chronicles pivotal advancements that have occurred over the past year. We highlight the deployment of ultra-low-loss fiber optics that have significantly expanded bandwidth capacities, meeting the burgeoning global demand for faster and more reliable internet connections. Additionally, our visuals capture the emergence of environmentally sensitive cable laying techniques that minimize the ecological impact on marine ecosystems, a reflection of the industry’s shift towards sustainability. These updates paint a vivid picture of technological

progress and the evolution of a network that not only undergirds the communication capabilities of nations and enterprises but also demonstrates a commitment to environmental stewardship and technological innovation. Through these enhanced Power BI visuals, stakeholders can gain a comprehensive understanding of how recent innovations influence both the current state and future trajectory of global communications infrastructure.

Amidst the bustling activity of the maritime industry, the importance of data remains paramount as it flows through the arteries of global trade and communication. Within this extensive realm of marine navigation, the analysis of vessel speeds continues to offer a vital perspective on the dynamics of sea traffic. Building upon our earlier focus on January’s Day 20, we now turn our attention to another significant temporal marker—March’s Day 24. This day commands a notable 5.18% share in the sum of AIS speeds, emerging as a critical point for a detailed examination of its significance and the various elements influencing this statistic.

While January sets the tone for the year, the impact of March 24 on speed metrics is not just a mere statistic but a reflection of evolving trends and operational dynamics as the year progresses. This report dives into the intricacies of this specific day, exploring the myriad of factors that shape vessel velocities and, by extension, influence the rhythm of maritime telecommunications.

The significance of the 5.18% contribution on this March day is multifaceted. To decode its importance, we

CABLESHIPS

engage with various potential drivers—from shifting environmental conditions and seasonal adjustments that favor certain navigational speeds to strategic vessel deployments in response to fluctuating market demands or geopolitical developments. Each percentage point represents a snapshot of the operational environment, depicting a complex scenario of maritime mobility.

In delving into this data, we aim to determine if this increase represents an outlier or is part of a predictable pattern influenced by recurring factors. Does this surge align with specific routes or geographic regions? Is it indicative of advancements in navigation systems or improvements in propulsion efficiency? Or does it correspond with an increase in economic activities, as the industry accelerates in response to heightened commercial demands post-winter?

As the year progresses, this report will continue to serve as a lodestar, leading the maritime telecommunications industry toward informed, data-driven decision-making and robust industry analysis.

The prominent average speed on March 24 has a ripple effect across the industry, affecting operational protocols and strategic decision-making frameworks of maritime enterprises. It impacts scheduling, fuel consumption, port operations, and the supply chain logistics crucial for the timely arrival of cargo. By understanding the implications of this speed surge, industry stakeholders can better anticipate similar trends, allocate resources more efficiently, and refine their route planning strategies.

By situating March 24 within the broader operational landscape of the year, this analysis not only benchmarks the increase but also sets a precedent for predictive analytics in maritime operations. The data captured on this day becomes a benchmark for comparative analysis, serving as a metric for gauging the performance and efficiency of the industry at large.

The exploration of March 24 and its 5.18% contribution to the sum of AIS speed transcends simple statistical analysis. It is a quest to extract actionable insights from the depths of data, guiding us through the complex waters of maritime navigation with a compass calibrated by knowledge. For stakeholders in this industry, these insights are not just numerical waypoints but are crucial navigational aids that steer strategic thinking and operational excellence.

In the intricate tapestry of global maritime operations, the nuanced dynamics of vessel statuses unfold, captured poignantly by the Automated Identification System (AIS). Our analytical journey dives deep into this profound sea of data, charting the diverse states that rhythmically pulse through the arteries of maritime commerce and navigation.

In our latest analysis, the “Moored” status emerges with even greater prominence, now recorded at a towering count of 3,982. This figure is not just a statistic; it embodies the multitude of vessels securely anchored within the world’s ports. Representing more than a temporary pause, “Moored” is a symphony of orchestrated efforts involving crew rest, cargo handling, and essential maintenance, playing a cornerstone role in facilitating the seamless flow of global trade.

However, a striking contrast is found in the status “Not Under Command,” which has a solitary count of 1. This status signals a vessel’s compromised maneuverability, serving as a stark reminder of the unpredictability and inherent perils of maritime journeys. Though minimal statistically, this outlier underscores the moments when even the mightiest ocean giants are at the mercy of nature’s caprices.

Adding to the narrative, status 5, which generally denotes “Underway Using Engine,” now stands as the status with the highest count at 3,982, making it 398,100.00% higher than the status 15, which has the lowest count at

just 1. This vast disparity illuminates the operational diversity of the maritime sector, from serene harbors to vessels powering through open waters.

The spectrum of AIS data reveals a rich landscape of operational dynamics across seven navigational statuses, with “Moored” accounting for 36.78% of the total count. This dominant proportion further affirms its pivotal role in maritime operations. The dramatic range in status counts—from 3,982 for “Moored” to 1 for “Not Under Command”—encapsulates the full breadth of maritime activity, governed by a myriad of factors including environmental conditions, regulatory frameworks, and the relentless demands of global logistics.

emplify exceptional performance in these domains, setting new standards in maritime operations.

As we distill the essence of AIS data into coherent narratives, we uncover more than mere figures; we navigate through the lifeblood of maritime operations. This exploration into the realm of vessel states is not just analytical—it is a saga woven from the strategic, operational, and logistical fibers that unite to form the complex fabric of international maritime travel.

With these insights, the AIS data acts as a navigational beacon, guiding the maritime industry towards a horizon marked by increased safety, efficiency, and environmental responsibility. It underscores the critical importance of understanding not only where we are but also where we are heading—charting a course for the future of maritime navigation that is as informed as it is ambitious.

In closing, the voyage through maritime data is a continuous journey, one that underscores the robustness and adaptiveness of this essential industry. Each data point, each trend, represents a narrative of resilience, chronicling the strategic ingenuity that propels the ceaseless journey of our global fleet.

In the complex and ever-evolving realm of global maritime operations, the nuanced dance of vessel capabilities unfolds, captured intricately by the Automated Identification System (AIS). Our analytical voyage delves into the critical relationship between two pivotal attributes: SPEED and DRAUGHT. This year, our focus sharpens on POLARIS 3 and ASEAN RESTORER, two vessels that ex-

POLARIS 3: THE VELOCITY VANGUARD

POLARIS 3 has redefined maritime speed, recording an impressive average AIS.SPEED of 10.97. This remarkable velocity not only underscores its capability to navigate vast oceanic expanses efficiently but also positions it as a leader in the maritime race against time. Its prowess in speed makes it an essential study in operational efficiency and technological advancement in ship engineering. On our analytical scatter plot, POLARIS 3’s data points ascend towards the zenith of speed, vividly illustrating its dominant stance as the velocity vanguard in the high seas.

ASEAN RESTORER: THE DEPTHS DOMINATOR

ASEAN RESTORER stands as a testament to robustness and capacity, commanding the highest average AIS. DRAUGHT of 6.73. This significant draught is indicative of its ability to navigate through varied marine environments while bearing substantial loads. This measure not only highlights its operational depth but also its crucial role in heavy cargo operations, integral to global logistics and trade. On the scatter plot, the data points of ASEAN RESTORER are expected to cluster prominently at the upper extremes of the draught spectrum, marking it as the depth’s dominator.

The dynamic scatter plot analysis serves as more than just a visual tool; it is a narrative device that brings to light the intricate interactions between SPEED and DRAUGHT.

CABLESHIPS

This comparative analysis is designed to unearth potential correlations or distinctive patterns that may define the operational envelopes of POLARIS 3 and ASEAN RESTORER.

Identifying outliers within this data is particularly revealing, offering a window into extraordinary operational capabilities or groundbreaking navigational strategies that these vessels might employ. These statistical deviations are explored not as anomalies but as insights into innovative practices that could redefine industry standards or highlight areas for potential technological advancements.

This deeper exploration into the attributes of SPEED and DRAUGHT, particularly focusing on POLARIS 3 and ASEAN RESTORER, illuminates the vast array of navigational dynamics that characterize the maritime industry. By mapping these attributes on an advanced scatter plot, we celebrate the unique characteristics of these vessels, enhancing our collective understanding of the intricate interplay between speed and draught in maritime operations.

Through this analysis, we bear witness to the diversity and richness of operational strategies within the maritime domain, gaining invaluable perspectives that aid in optimizing vessel performance and operational efficiency. This comprehensive view not only educates but also inspires strategic thinking and operational finesse among maritime

industry stakeholders.

Understanding the distribution of vessel types through AIS data is critical for numerous stakeholders within the maritime industry, including regulatory bodies, shipping companies, and maritime safety organizations. The AIS. TYPE classification serves as a key indicator of the composition of the maritime fleet, offering insights into shipping trends, operational priorities, and potential areas for policy development.

The focused analysis reveals a distinct pattern of distribution across different AIS.TYPE categories within the dataset. This examination highlights the predominance of specific vessel types, shedding light on the current dynamics of maritime operations.

• Highest Count Observed: The dataset shows that the “Other Type, all ships of this type” category recorded the highest count with 4,526 instances. This figure significantly surpasses the counts of other vessel types, marking it as the most prevalent within the maritime data analyzed.

• Percentage Share: Remarkably, the “Other Type, all ships of this type” accounted for 41.80% of the total AIS. TYPE count observed in the dataset. This substantial proportion underscores the central role of this vessel type in maritime operations, suggesting a widespread application and critical importance in the industry’s ecosystem.

COMPARISON WITH OTHER CATEGORIES

• Following Leaders: While the “Other Type” leads in prevalence, categories such as “Dredging or underwater ops” and “Cargo” also emerged as notable vessel types within the dataset. Though these categories do not match the volume represented by the “Other Type,” their presence is crucial in demonstrating the diversity and range of vessel operations captured through AIS data.

• Operational Implications: The variation in the count of AIS.TYPE categories reflects the multifaceted nature of maritime operations. The high prevalence of the “Other Type” might indicate specific operational or logistical preferences within the industry, potentially driven by factors such as vessel functionality, regulatory compliance, or market demands.

• Strategic Insights: Stakeholders can leverage these insights to strategize fleet management, regulatory oversight, and safety measures. The dominance of a particular vessel type may inform targeted strategies for enhancing operational efficiency, compliance monitoring, and safety protocols.

• Future Research Directions: The findings also open avenues for further research into the specific characteristics, uses, and operational patterns associated with the leading vessel types. Understanding the reasons behind the dominance of the “Other Type” and its implications for

maritime logistics and safety represents a valuable area for in-depth investigation.

The detailed analysis of AIS.TYPE distribution not only enhances our understanding of the current maritime operational landscape but also informs future strategic decisions and policy development within the maritime sector. The data shows a range across all 11 Type Description, from 143 to 4,526, further highlighting the diversity within the maritime fleet and pointing to areas where targeted interventions could yield significant improvements in operational effectiveness.

The network graph presented in this report aims to provide a visual representation of the relationships between different sources and their corresponding destinations. This analysis is essential for understanding the patterns of connections and interactions in a complex system, such as transportation, data flow, or supply chains.

The dataset used for this analysis includes information on various sources and their associated destinations. Sources and destinations can represent a range of entities, from airports and cities in transportation networks to data centers and endpoints in telecommunications.

The network graph below illustrates the connections between sources (nodes) and their destinations (edges). The size of the nodes and the thickness of the edges are propor-

CABLESHIPS

tional to the frequency or significance of connections.

In the network graph, some sources and destinations serve as hubs with numerous connections. These hubs play a crucial role in facilitating connectivity within the system. The degree centrality of nodes (sources or destinations) can be used to identify the most connected entities. High-degree nodes are potential hubs.

Analyzing the directionality of edges can reveal patterns of flow. For example, in transportation networks, arrows may indicate the direction of travel from source to destination. The presence of bidirectional edges suggests mutual interactions between sources and destinations.

The network may exhibit clusters or communities of sources and destinations that have stronger connections within their groups than with entities outside of their clusters. Detecting and analyzing such clusters can provide insights into the structure and organization of the system.

Practical Applications: Understanding the network of sources and destinations has several practical applications: Optimization: Identifying hubs and high-traffic routes can help optimize resource allocation and logistics.

Resilience Planning: Analyzing network connectivity aids in resilience planning by identifying critical nodes and potential vulnerabilities.

Route Planning: In transportation networks, this analysis can inform route planning for efficiency and reduced congestion.

The network graph of sources and destinations provides a valuable visual representation of the connectivity and relationships within a complex system. By analyzing this graph, we gain insights into hubs, flow patterns, and potential communities within the network.

This analysis serves as a foundation for making informed decisions, optimizing operations, and enhancing the resilience of the system. As we continue to navigate and understand complex systems, network graph analysis remains an indispensable tool for uncovering hidden patterns and connections. STF

SYEDA HUMERA, a graduate from JNTUH and Central Michigan University, holds a Bachelor’s degree in Electronics and Communication Science and a Master’s degree in Computer Science. She has practical experience as a Software Developer at ALM Software Solutions, India, where she honed her skills in MLflow, JavaScript, GCP, Docker, DevOps, and more. Her expertise includes Data Visualization, Scikit-Learn, Databases, Ansible, Data Analytics, AI, and Programming. Having completed her Master’s degree, Humera is now poised to apply her comprehensive skills and knowledge in the field of computer science.

CAPACITY CONNECTION

EDITION THREE: DYNAMICS OF THE SUBMARINE CABLE BANDWIDTH MARKET: EFFECTS OF THE GROWTH IN CLOUD AND DATA CENTERS

BY JOHN MAGUIREINTRODUCTION

Welcome back to Capacity Connections, Submarine Telecom Forum’s department concerned with commercial aspects of the submarine cable capacity business.

In this third article of our series, we are going to look at the commercial effects on our business of continued burgeoning growth in the cloud and data center market.

In our first article, we presented a high-level overview of the sector, identifying cloud and data centers as one among a number of a key factors driving subsea bandwidth demand. The expansion of cloud services, the rapid growth in the number of cloud regions and the consequent establishment of increasing numbers of large-scale data centers globally, were identified as key factors driving bandwidth demand. It is a dimension that has come even more sharply into relief considering developments, specifically in the Pacific, in the few short months since that article was written, about which a bit more later.

In the second Capacity Connections article, on the evolution of commercialization (and to some extent regulation), in the subsea sector, cloud and data centers were identified as the key driver of growth in bandwidth demand. Simply put, demand

is converging on cloud. So, now let us have a slightly closer look.

'

ENVIRONMENT

At the risk of stating the bleeding obvious, but probably made necessary by the preceding remark, it is useful to consider briefly what “the cloud” is—and why it is generally bundled with data centers. There are a plethora of definitions, from the long-pastits-use-before-date “someone else’s computer” to the long and descriptive, the interesting and useful. I have decided to cite the following, in attempt to balance brevity and utility:

“’The cloud’ refers to servers that are accessed over the Internet, and the software and databases that run on those servers. Cloud servers are located in data centers all over the world. By using cloud computing, users and companies do not have to manage physical servers themselves or run software applications on their own machines.”1

We might otherwise, depending on our location and consumer interests, know ‘the cloud’ as amazon. com, AppleTV, Blackberry Messen-

1 https://www.cloudflare.com/en-gb/learning/cloud/ what-is-the-cloud/ (The quote is approximately 20% of the definition of “What is Cloud Computing?”)

CAPACITY CONNECTION

1 Those included in this

ger (R.I.P.), Gmail, Instagram, Line, Microsoft 365, Netflix or TikTok. Or, indeed, all the above.

While both are important, it is difficult, partly owing to their fundamentally different nature, to determine the breakdown of cloud demand/consumption between enterprise and consumer applications. Having said that, the key driver of cloud demand is considered to be enterprise applications2

Regardless of who they serve, however, and what they serve them with, cloud providers rely heavily on robust, high-capacity global networks—our area of interest—to ensure seamless access to data and applications hosted in data centers. Submarine cables, specifically through the Internet they support, play an

2 https://www.idc.com/getdoc.jsp?containerId=prUS51280423

integral and critical role in connecting these data centers across the globe.

EVOLUTION

At the nexus of enterprise and personal computing, Blackberry was possibly one of the earlier exposures many of us had to true cloud. Blackberry servers provided secure, remote storage, initially, of our enterprise email

data—very personal to use, very enterprise to provide. Similarly, Gmail began life as a free consumer service and rapidly evolved to one Google successfully markets to enterprises.

As the sector has evolved, it has grown rapidly in both enterprise and consumer categories, with the massive growth in demand enabling great broadening of underlying cloud fabric. This latter aspect is important because the growth in cloud regions, and especially in their local zones, has reduced some of the key early objections to cloud, particularly around the vexed questions of data security and, most especially, data sovereignty.

6 Sources: https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf https://abc.xyz/assets/95/eb/9cef90184e09bac553796896c633/2023q4-alphabet-earnings-release.pdf https://www.microsoft.com/investor/reports/ar23/index.html https://s21.q4cdn.com/399680738/files/doc_news/Meta-Reports-Fourth-Quarter-and-Full-Year-2023-Results-Initiates-QuarterlyDividend-2024.pdf

IDC reports that year-on-year spending on cloud infrastructure in 2Q2023 grew by just shy of 8%, while spending in the non-cloud sector fell by a marginally higher proportion of just over 8%. The cloud segment ($24.6 billion) is some 70% bigger than non-cloud ($14.4 billion)—and the gap is rapidly widening rapidly.

On the revenue side, Statista reports total cloud services revenues of an eye-watering $76 billion in 1Q2024. The leading service providers are shown in Figure 2. When we add the shares that make it to the graph (80%) we can see there is also a considerable long tail to this market.

The revenue positions of the players, shown in Figure 3, is also noteworthy. We see that each of the top three cloud services providers has a significant business beyond cloud—be it in search, retail, hardware or software— on top of which the cloud business has been built. Of the top four revenue

earners, only Meta, principally through its Facebook, WhatsApp and Instagram platforms, is an outlier in being a purely cloud player and having purely a consumer product3.

Each of the names in chart are well known to us in the subsea sector as active, evolving, fast growing participants in the business.

CONTINUING GROWTH IN CLOUD— AND A CASE STUDY

The cloud computing market is poised to continue its incessant rapid growth, with projections estimating its value to reach $1.44 trillion by 20294. This points to a compound annual growth rate of more than 16% from today’s baseline. Apart from the migration from non-cloud to cloud infrastructure already identified, as new applications come along and evolve— artificial intelligence, for example, with

3 I’ve tried to phrase this carefully. Meta’s revenues come significantly, of course, from enterprise customers who purchase advertising. But on the basis that what Meta customers are purchasing is not a cloud service, but access to consumers and their data, consumers, literally, are the product.

4 https://www.mordorintelligence.com/industry-reports/ cloud-computing-market

its attendant data-hungry processes— they will drive substantial new demand for cloud computing services. The inevitable consequence, in this globalised world, is demand for more and more submarine cable capacity.

Unpacking the growth numbers, we have already mentioned the growth in cloud regions. The addition of regions and the attendant globalisation of cloud offerings is the element that feeds demand into the subsea bandwidth category.

While growth is exhibited by each of the players in the space, we are going to focus briefly here on Google as an exemplar. Google’s blog at https:// cloud.google.com/blog/products/infrastructure/ is a great source for firsthand information in this area.

• In the last year—most recently last month (April 2024)—Google has announced a mind-boggling seven new submarine cables in the Pacific.

A blog entry on Google Cloud regions revealed that Google had at the time (in September 2023) 39 cloud regions, globally. The post goes on to

CAPACITY CONNECTION

detail completed deliveries (which we assume are included in the total) in Israel, Italy, Qatar, Germany and Saudi Arabia. Meanwhile, it announced upcoming new regions in New Zealand, Thailand, Kuwait, South Africa5, Sweden, Greece, Mexico and Norway.

In Figure 4, we have filtered the data displayed in Figure 1 to show only Google presences. While the map presents readable numbers of only cloud on-ramp locations, we can unscientifically estimate that Google has of the order of half the total in North America and Europe—and significantly fewer than this in Asia-Pacific. One can only assume that will change over the next couple of years.

CONCLUSION

The brief for this article was to examine how cloud and data center growth might be expected to affect the submarine cable bandwidth busi-

5 Subsequently announced on January 31, 2024 as being open for business. (https://cloud.google.com/blog/products/infrastructure/heita-south-africa-new-cloud-region)

ness and to seek to identify any likely commercial effects. After this briefest examination of the issue, what to conclude? Well, if you are in the infrastructure business—building or maintaining submarine cables—this is a busy time and that is not going to change soon. What, however, if you are in the bandwidth business? According to the definition of cloud services that we have used, it is probably not unreasonable to posit that all international telecommunications (if not all telecommunications) will move to the cloud sooner rather than later. Traditional service providers, telecommunications companies, continue to participate actively in developing submarine cables and they do that based on business cases that forecast sales of bandwidth in particular quantities at particular times and at particular prices.

What we see happening, however, is that the major cloud service providers are moving, or have already moved from being customers of the telecom companies, to being partners

in building, to being builders. At some point one must wonder, even if based on a sample size of N=1, whether the players formerly known as “OTT customers” will instead become the underlying suppliers of bandwidth to the telecommunications industry. STF

Currently Director, EMEA, with APTelecom, JOHN MAGUIRE has experience gained across a broad spectrum of telecommunications roles and businesses over the past 30 years. He has sold security and network control software to mobile networks worldwide; established a regional federation fibre network across a family of affiliated telcos and, several times, established interconnect networks and wholesale structures for leading telco brands in new entry and emerging markets. He’s done this in roles across the business: using satellite and cable technology, for OEM and service provider companies and in fixed and mobile domains—including for start-ups and mature companies. His roles have encompassed general management, sales management, direct and indirect sales, business development, market development and operations. A native of Dublin, Ireland, he’s also lived and worked in Australia, UK, Singapore, Hong Kong, Thailand, Qatar, UAE and Malaysia. John holds a B.Tech. degree from University of Limerick in Ireland and an M.A. from Macquarie University Graduate School of Management in Sydney, Australia.

[Reprinted from SubTel Forum 2023/2024

Submarine Industry Report]

GLOBAL CAPACITY ANALYTICS

The unceasing global demand for data is reaching unprecedented levels, driven by several key factors such as the widespread adoption of cloud-based services, the ubiquity of mobile devices, and the rapid deployment of next-generation technologies like 5G. This burgeoning demand presents the submarine fiber industry with ample opportunities to address the world’s ever-increasing connectivity needs.

From 2018 to 2023, the submarine fiber capacity on major routes grew at a Compound Annual Growth Rate (CAGR) of 13.3%. This rate accounts for both capacity upgrades and the construction of new systems, highlighting the industry’s agility in meeting rising data demands. However, it’s worth noting that this growth rate is a slight dip from the 18.2% CAGR observed in the previous year’s analysis.

As the global appetite for data continues to swell, the industry faces impending challenges. Balancing the soaring demand for data transmission with sustainable infrastructure growth is a significant hurdle. In some instances, data capacity demand could even outstrip supply. To mitigate this, the industry must remain committed to further capacity expansion. Cutting-edge

Global Capacity Growth on Major Routes, 2019-2023

technologies like 400G wavelengths and high fiber pair count systems are crucial for ensuring that the submarine fiber industry keeps pace with the growing global data transmission needs.