EXORIDUM FROM

THE PUBLISHER

HAPPY NEW YEAR AND WELCOME TO ISSUE 128, OUR GLOBAL OUTLOOK AND SUBOPTIC ’23 PREVIEW EDITION!

In December, I ran our church’s outside Christmas Festival, which had more than 1,000 parents and kids, including a friend and members of her orthodox church, who sold imported candy and talked about the war; the proceeds of which were sent to Lutheran World Relief in Ukraine. Then like many, we took advantage of the end of year and enjoyed an extended break from the fast paced 2022. Some of us traveled; some of us stayed home and recuperated from a crazy prior 12 months. This new year starts with its usual optimism and grandeur, and the pace of things is still fast. 2023 looks to be another busy, busy year for our industry.

We have been busy as well and start the new year with a number of interesting updates and additions.

NEW YEAR, NEW WEBSITE LOOK

With a new year comes a new look for the SubTel Forum Website. Redesigned to be cleaner and more responsive than ever, SubTel Forum’s new website enables notifications through all major desktop and Android browsers allowing subscribers to be notified of

news as it breaks! The website is wicked fast and provides the same if not more information quickly and easily. We hope you will agree…

PRINTED CABLE MAP

Our Submarine Cable Map for 2023, which showcases every major international submarine cable system, was again distributed at the PTC ’23 conference. It will then be mailed next month to industry movers and shakers, and we hope you are as excited as us on how it looks.

SUBOPTIC ’23 CONFERENCE PREVIEW

We are pleased to be supporting SubOptic ’23 again this year. SubOptic is a wonderful conference, and the association has provided some excellent articles this issue to better describe their submarine cable content we can all enjoy in March. They also provided an update on the SubOptic Foundation, which many of us actively support.

Since SubOptic 2010 in Yokohama, SubTel Forum has presented during the closing ceremony three “excellence” awards. This year we will present in Bangkok the following

SubOptic ‘23 Excellence In Industry Awards:

• Best Oral Presentation Award

• Best Poster Presentation Award

• Best Newcomer Award

SUBOPTIC ’23 PRINTED ALMANAC

We are printing again a Submarine Cable Almanac for SubOptic ’23 attendees, which will feature each major international system on its own page, along with a system map, landing points, system capacity, length, RFS year and other valuable data. This limited-edition hard copy will be available in the conference bags at SubOptic ’23 in Bangkok in March 2023, then live for months and years as a table-top reference tool for conference participants.

THANK YOU

Thanks for their support to this issue’s advertisers: Southern Cross, SubOptic, and WFN Strategies. Thanks also to the many authors who made this issue one of our largest and best to date. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

Mussorgsky’s ‘Great Gate of Kiev’ has played countless times in my head over the last year. How the world reached this place escapes me, but I take heart in the spirit of a people who will in spite of so many hardships fight to remain free – Slava Ukraini

See you in the Mai Tai Bar in January and somewhere similar in Bangkok in March. STF

A Publication of Submarine Telecoms Forum, Inc.

www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

PRODUCTION MANAGER: Hector Hernandez | hhernandez@wfnstrategies.com | [+1] (210) 338-5413

EDITOR: Stephen Nielsen | snielsen@subtelforum.com

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: sales@subtelforum.com | [+1] (703) 444-0845

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS: Hunter Vaughan, Kieran Clark, Iago Bojczuk, Kristian Nielsen, Nick Silcox, Nicole Starosielski, Philip Pilgrim, and Wayne Nielsen

FEATURE WRITERS: Alice Shelton, Bertrand Clesca, Chris Wood, Dallas Meggitt, Dr. Y. Niiro, Gisle M. Eckhoff, Jeffrey Wilson, John Hibbard, John Tibbles, Julian Rawle, Leigh Frame, Lynsey Thomas, Mattias Fridström, Paul McCann, Pernilla Eriksson, Paul Gabla, Peter Bannister, Philip DeGuzman, Raj Jayawardena, Ralph Manchester, Robert Haylock, Scott Mabin, Steve McLaughlin, and Wahab Jumrah

NEXT ISSUE: MARCH 2023 – Finance & Legal, featuring ICPC ’23 Conference Preview

AUTHOR & ARTICLE INDEX: www.subtelforum.com/onlineindex

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen and Kristian Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

CONTINUING EDUCATION DIRECTOR: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Wayne Nielsen, PublisherSubmarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers. Liability: While every care is taken in preparation of this publication, the publishers cannot be held

responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com.

Copyright © 2022 Submarine Telecoms Forum, Inc.

FORUM IN THIS ISSUE

ISSUE 128 | JANUARY 2023

FEATURES

5 QUESTIONS WITH PAUL GABLA

SUSTAINABLE DIGITAL INFRASTRUCTURE IS THE WORKING FOUNDATION FOR GLOBAL ECONOMIC GROWTH

By Gisle Eckhoff

By Gisle Eckhoff

45

SUBOPTIC 2023 IS IN BANGKOK, THAILAND ON 13-16 MARCH!

By Alice SheltonSUBMARINE TELECOMS FORUM EXCELLENCE IN INDUSTRY AWARDS

30 52

THE CARRIER GUIDE TO 2023

By Mattias Fridström48

42 36 37

OUT OF THE FRYING PAN AND INTO THE FIRE?

By Julian Rawle

By Julian Rawle

EXPANDING GLOBALLY SUBOPTIC SYMPOSIA

By Dr. Y. Niiro2022: REALISING THE PACIFIC

By John Hibbard and Paul McCann

By John Hibbard and Paul McCann

THE BEST PART OF BREAKING UP….

By Leigh FrameIMPROVED INSTALLATION ASSETS FOR THE GROWING SUBSEA FIBRE OPTIC INFRASTRUCTURE MARKET

By Ralph Manchester, Robert Haylock and Scott MabinA HOLISTIC APPROACH TO SUSTAINABLE DEVELOPMENT

By Pernilla Eriksson and Lynsey Thomas

By Pernilla Eriksson and Lynsey Thomas

A COLLABORATIVE APPROACH BETWEEN SUBSEA CABLES AND DATA CENTRES

By Peter Bannister

By Peter Bannister

BRIDGING THE LEGAL REGIME UNDER THE UNCLOS AND PRECAUTIONARY PRINCIPLE FOR SUBMARINE CABLE FIBRE OPTIC PROJECTS

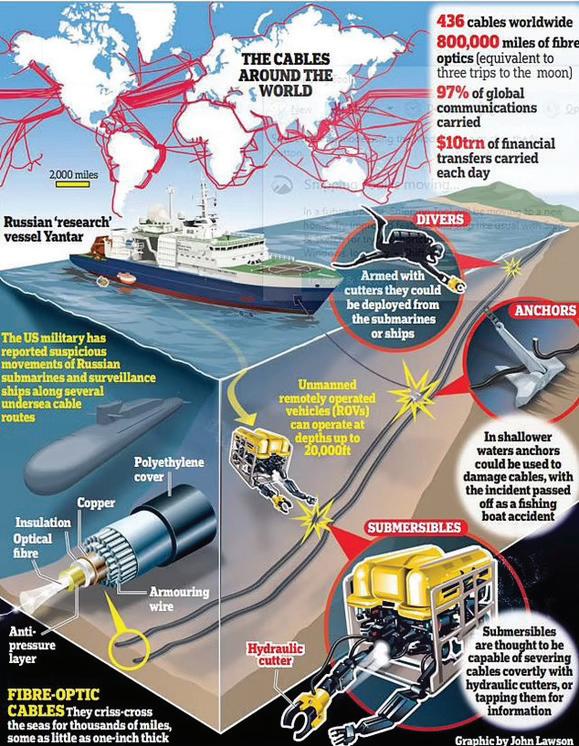

By Wahab JumrahTHE CHALLENGES OF PROTECTING CRITICAL SUBSEA INFRASTRUCTURE

By Dallas Meggitt, Steve McLaughlin and Jeffrey Wilson

SUBSEA CABLES: NO LONGER A CYCLICAL INDUSTRY?

By John Tibbles

By John Tibbles

80

EXPEDITING AFRICA’S DIGITAL TRANSFORMATION

By Chris Wood

SUPPLY AND GREATER DEMAND

By Bertrand Clesca and Philip DeGuzman

THE EVOLUTION OF CABLE NETWORK MONITORING AND SENSING

By Raj Jayawardena

FREE RESOURCES FOR ALL OUR SUBTELFORUM.COM READERS

The most popular articles, Q&As of 2022. Find out what you missed!

TOP STORIES OF 2019

The most popular articles, Q&As of 2019. Find out what you missed!

NEWS NOW RSS FEED

a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

NEWS NOW RSS FEED

Keep on top of our world of coverage with our free News

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

PUBLICATIONS

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analysis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analysis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

CABLE MAP

PUBLICATIONS

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and mapping efforts by the analysts at SubTel Forum Analytics,

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of some 450+ current and planned cable systems, more than 1,200 landing points, over 1,700 data centers, 37 cable ships

as well as mobile subscriptions and internet accessibility data for 254 countries. Systems are also linked to SubTel Forum's News Now Feed, allowing viewing of current and archived news details.

The printed Cable Map is an annual publication showcasing the world's submarine fiber systems beautifully drawn on a large format map and mailed to SubTel Forum Readership and/or distributed during Pacific Telecommunications Conference in January each year.

CONTINUING EDUCATION

SubTel Forum designs educational courses and master classes that can then appear at industry conferences around the world. Classes are presented on a variety of topics dealing with key industry technical, business, or commercial issues. See what classes SubTel Forum is accrediting in support of the next generation of leaders in our industry.

AUTHORS INDEX

The Authors Index is a reference source to help readers locate magazine articles and authors on various subjects.

SUBTEL FORUM BESPOKE REPORTS

SubTel Forum provides industry analyses focused on a variety of topics. Our individualized reporting can provide industry insight for a perspective sale, business expansion or simply to assist in making solid business decisions and industry projections. We strive to make reporting easy to understand and keep the industry jargon to a minimum as we know not everyone who will see them are experts in submarine telecoms.

In the past we have provided analyses pertaining to a number of topics and are not limited to those listed below. Reach out to info@subtelforum.com to learn more about our bespoke reports.

DATA CENTER & OTT PROVIDERS: Details the increasingly shrinking divide between the cable landing station and the backhaul to interconnection services in order to maximize network efficiency throughout, bringing once disparate infrastructure into a single facility.

If you are interested in the world of Data Centers and its impact on Submarine Cables, this reporting is for you.

GLOBAL CAPACITY PRICING: Details historic and current capacity pricing for regional routes (Transatlantic, Transpacific, Americas, Intra-Asia and EMEA), delivering a comprehensive look at the global capacity pricing status of the submarine fiber industry. Capacity pricing trends and forecasting simplified.

GLOBAL OUTLOOK: Dive into the health and wellness of the global submarine telecoms market, with regional analysis and forecasting. This reporting gives an overview of planned systems, CIF and project completion rates, state of supplier activity and potential disruptive factors facing the market.

OFFSHORE ENERGY: Provides a detailed overview of the offshore oil & gas sector of the submarine fiber industry and covers system owners, system suppliers and various market trends. This reporting details how the industry is focusing on trends and new technologies to increase efficiency and automation as a key strategy to reduce cost and maintain margins, and its impact on the demand for new offshore fiber systems.

REGIONAL SYSTEMS: Drill down into the Regional Systems market, including focused analysis on the Transatlantic, Transpacific, EMEA, AustralAsia, Indian Ocean Pan-East Asian and Arctic regions. This reporting details the impact of increasing capacity demands on regional routes and contrasts potential overbuild concerns with the rapid pace of system development and the factors driving development demand.

SUBMARINE CABLE DATASET: Details more than 450 fiber optic cable systems, including physical aspects, cost, owners, suppliers, landings, financiers, component manufacturers, marine contractors, etc. STF

ANALYTICS

GLOBAL OUTLOOK OVERVIEW: A SNAPSHOT OF WHERE WE ARE AND WHERE WE ARE HEADED

[REPRINTED WITH PERMISSION FROM 2022/2023 SUBMARINE INDUSTRY REPORT]

SYSTEM GROWTH

As any avid follower of the submarine cable industry will know, the true effects of COVID on the submarine cable industry were not seen in 2020 or even 2021 but will be felt more over the next several years. Systems that were planned for installation during the pandemic were able to keep working towards their goals, albeit with some significant delays in some circumstances. However, planned systems that had not yet been surveyed, manufactured, or scheduled for installation suffered the most significant setbacks. From start to finish, the planning and preparation of a cable system takes far less time overall than the actual installation and commissioning. Therefore, the number of cable systems accomplished over the next several years will be less than the number anticipated prior to the pandemic.

After the last Industry Report was published, PRAT, CDSCN, NO-UK, CrossChannel Fibre and HAVSIL all accomplished commissioning and acceptance and were lit at the end of 2021, bringing the total to 18 for the year. So far in 2022 eleven more submarine cable systems have been lit, with Equiano and Grace Hopper additionally expected to be ready for service before the end of this year.

The four regions that have had new submarine cable systems accomplished this year are EMEA, Polar, Transpacific and AustralAsia. AustralAsia has experienced a steady decline in submarine cable installations over the past five years with only three systems having been installed in 2022 but still maintains the highest number of new systems added over the last five years, for a total of 29 systems. (Figure 15) The Indian Ocean has not added any new systems this year but the Americas and Transatlantic will soon see a system added once Amitié has entered service.

EMEA is the region with the second largest number of cable system installations over the past five years at 22, including five systems in 2022 alone. Africa has been go -

ing through a digital transformation over the past decade with almost every country in Africa having at least one submarine cable connection. The continued investment in submarine cable capacity will allow for the digital divide between Africa and the rest of the world to narrow even

farther. These new systems create a “significant reduction in international bandwidth costs, increased bandwidth consumption, and demand for emerging technologies.” (AFR-IX, 2021)

Southern Cross NEXT and Jupiter were both ready for service in July 2022 adding two new Transpacific systems. Five new systems have been added to this region over the last five years.

ANALYTICS

The total kilometers of cable installed gives a very different view than that of new systems added. While a given region may have had a larger number of new systems added, the overall length added has not been as high. For instance, while the Transpacific region only saw the addition of three cable systems this over the past five years, those cable systems collectively covered nearly 72,000 kilometers – more than any other region. (Figure 16) The Transpacific also received the largest amount of new cable in one year for the period 2018-2022 with a full 30,000 kilometers installed in 2022 alone.

Globally, there are 88 planned systems in the works over the next five years. (Figure 17) A significant portion of the 88 planned systems, 31 systems to be exact, are still publicizing a 2022 RFS date. Though some systems like Equiano, Grace Hopper, and Amitié are close to completion and will likely go live before the end of the year; it is very unlikely that all remaining systems planning for a 2022 RFS date will reach this goal. A few have already begun installation and should not be delayed too much – simply sliding into 2023 – while others will encounter more significant delays.

Regionally, EMEA and AustralAsia will see the largest growth percentage through 2025. EMEA has Africa1, Equiano, 2Africa, PEACE and SHARE among others, all aiming to be completed in the next few years, so it is no surprise that 29 percent of all announced future systems touch the region. Another 22 percent of all planned projects will touch the AustralAsia region, including ADC, PDSCN and Apricot to name a few.

So far, the Americas look to add 14 more systems: 12 in the Indian Ocean and 10 in the Transpacific region through the end of 2025. The Transatlantic is expected to produce an additional four systems during this same period.

The Polar region, though still only four percent of the total announced systems through 2025, plans to add 4 systems, which would be a 166 percent increase. In late November 2021, Chile announced their interest in installing a cable to connect Antarctica, “to promote scientific and technological development of the southern regions of Chile.” It would be the first cable to connect to the continent should it come to fruition. (Wenger, 2021)

For a variety of reasons, some systems never make it past the planning stages. SubTel Forum has found that the announcement of being Contract in Force (CIF) is a good indicator of whether a system will enter service or not. Currently 51 percent of planned systems have announced they are CIF while 49 percent have yet to reach this important

milestone. (Figure 18) Some are still in early development stages, having just been announced recently and will provide further updates in the coming months. But some will never see the bottom of the ocean floor.

OUT OF SERVICE SYSTEMS

Unlike the commissioning of a new system, the decommissioning of an Out of Service (OOS) cable system hardly ever makes the headlines. In preparation for this year’s Industry Report, the analysts at SubTel Forum were not able to find news of any systems having been decommissioned over the last year, even though a fair number are well past their estimated End of Service (EOS) dates.

Though there were no announcements of out of service systems this year, two submarine cable systems are confirmed to have been decommissioned recently as ICPC spread the word of the cable recovery work being done by the team at Mertech Marine. Over the past 18 years Mertech Marine has developed a system by which they acquire the cable from the owner, recover sections as feasible and recycle the various materials. This year, they have worked to recover portions of six separate systems, according to the member notifications sent by the International Cable Protection Committee. A small number of other companies are also working to repurpose decommissioned cables to be utilized for scientific research.

Based on information found in the public domain, less than 60 submarine telecommunications cable systems have been taken OOS in the last 20 years. This is roughly 11 percent of the total number of cables that have ever been lit, according to available information on early cable systems. Once a system is taken out of service it is typically left at the bottom of the ocean floor. This practice is mainly to protect the marine life that may have grown around the cable, but also because it is a costly process to have the cable reclaimed.

EMEA has seen the largest number of cables removed, accounting for 46 percent of the total pool. 24 percent were in AustralAsia and the Transatlantic has lost less than 10. The Transpacific, Americas and Indian Ocean regions all decommissioned less than 5 systems in the last 20 years and the Polar region has not lost any as its oldest active cable was only activated 15 years ago.

(Figure 19)

With technology advancing every day, more cable systems are living past their estimated EOS dates. Though there are undoubtedly systems that have been taken out of service without a formal announcement, many are still actively used well passed their industry standard 25-year life span. This is possible with the aid of system upgrades and equipment replacements in the landing stations and data centers. As such, there are already dozens of systems

that have passed their EOS dates – some by as many as eight years.

Of those that have not yet reached their maturity dates, 85 systems will reach EOS in the next five years, and another 53 by 2032. (Figure 20) Considering that less than

ANALYTICS

60 systems have been taken out of service in the last 20 years, the number of maturing systems that will reach end of service in the coming 20 years is some cause for concern.

Altogether, 43 percent of the current submarine cable systems relied on today will be technologically obsolete or OOS within the next ten years. Some of these systems will be replaced by state-of-the-art projects that can fulfill the same capacity requirements using less cables, but the subsea cable industry cannot rest on its laurels over the next several years; new systems need to be implemented to replace aging infrastructure at a steady pace considering rising bandwidth demands.

EVOLUTION OF SYSTEM OWNERSHIP AND CUSTOMER BASE

Based on data in the public domain for systems accomplished between 2012 and 2022, as the number of systems increased, the split between single and multiple owner cable systems stayed consistent. Single owner cable systems averaged 57 percent of all cable systems installed in the last ten years. (Figure 21) Though there has been an increase in the number of Consortiums working together to bring a system to fruition, it is balanced by the number of companies that have the means to implement a cable without assistance.

Looking forward, the percentage of single owner cable systems is increasing and will account for roughly 75 percent of the projects planned over the next 4 years. (Figure 22)With the influx of Hyperscaler driven systems, it is no surprise that single owner cable systems are on the rise. Their ability to finance an entire system and desire to control all its capacity is shifting the industry norm. However, while single owner systems have more flexibility in the early design stages, it is not as easy for funding to be secured as it would be for consortia systems. Those single owner systems that are not Hyperscaler driven have a much higher rate of falling off, so these projections will certainly change over time. STF

SUBTEL CABLE MAP UPDATES

The SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of over 440 current and planned cable systems, 50+ cable ships and over 1,000 landing points. Systems are also linked to SubTel Forum’s News Now Feed, allowing viewing of current and archived news details.

This interactive map is a continual work and progress and regularly updated with pertinent data captured by analysts at SubTel Forum and feedback from our users. Our goal is to make easily available not only data from the Submarine Cable Almanac, but also more and more new layers of system information.

We hope you continue to make use of the SubTel Cable Map to learn more about the industry yourself and educate others on the importance of submarine cable systems.

All the submarine cable data for the Online Cable Map is pulled from the public domain and we always strive to keep the information as up to date as possible. If you are the point of contact for a company or system that needs to be updated, please don’t hesitate to reach out to rspence@ subtelforum.com.

The full list of updated systems since the last issue of the magazine are as follows:

NOVEMBER 21, 2022 SYSTEMS ADDED

2Africa/PEARLS

ALC

Deep Blue One

Highclere Cable

Medloop

Olisipo

Pencan-9

Unitirreno Systems Updated

2Africa

ACC-1

ADC

Amitié

BaSICS

Celtic Norse

CeltixConnect

EMIC-1

FEA

G2P2

Grace Hopper

HAVFRUE/AEC-2

Havhingsten/CC-2

Indigo West

Malbec

MENA

Norsea Com-1

PEACE

PEACE Singapore Extension

Saudi Vision Cable

SEA-H2X

Shefa 2

TLSSC STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Page 85

https://subtelforum.com/?s=AAE-1 Click the link to see news about this cable system almanac@subtelforum.com Have an update? Email us!

WHERE IN THE WORLD ARE THOSE PESKY CABLESHIPS?

BY KIERAN CLARKAs we welcome a new year of exciting possibilities and opportunities for the submarine cable industry it’s the perfect time to once again ask: Where in the World Are All Those Pesky Cableships?

SubTel Forum tracks AIS updates every 6 hours from 53 vessels that make up the global cable ship fleet. Between October 24th and December 23rd, the cableship fleet logged over 15,000 AIS updates based on SubTel Forum’s tracking system. Over half of these updates indicated no movement speed during this 60-day period marking a slight decrease in activity from the previous period. This lack of movement is generally attributed to

repairs, scheduled maintenance and upgrades, as well as a general end of year slowdown.

For this edition of Where in The World Are Those Pesky Cableships, our analysts have created a heat map showing where the cable ship fleet was most active around the world. Red, orange and then yellow indicate the highest amount of activity while lower activity is represented by increasing shades of blue. As indicated by the heat map, the main AIS zones of activity over the past 60 days were East Asia, Indonesia, North Sea, South East Asia and the Western Mediterranean. From the total 26 AIS zones, these five accounted for 46 percent of all AIS activity for the cable ship fleet.

The cableship fleet grew more in 2022 than any year in the last 10, and the distribution of vessel ownership has shifted quite significantly. At the end of 2021, SubTel Forum was only tracking 44 cableships but this number increased to include nine more vessels between December 2021 to December 2022. A handful of these additions are vessels that have only recently been added to SubTel Forums AIS tracking data. Some were added after seeing a shift in their focus from power cables to telecoms cables. In October, the Normand Clipper signed an extended contract with NTT for installation projects over the next several years.

There have also been several conversions, like ASN’s Ile de Molene, which was christened this past summer. Orange Marine’s new vessel the Sophie Germain is now active and will be tracked accordingly in the SubTel Forum system moving forward. She is the first battery powered, energy efficient submarine cable laying vessel in the entire fleet and a further indication of how committed this industry is to overall sustainability and lowering its environmental impact.

Despite this high amount of activity and new vessels added to the fleet, there is a real concern that there is a cable ship capacity crunch. As Dan Swinhoe of DatacenterDynamics discussed in early December, and based on new cable activity observed by SubTel Forum there is

some concern that there is not enough cable ship capacity to keep up with new cable demand. Several installers such as ASN are fully booked through 2024 and external vessels are being hired on a more frequent basis to keep up with project workloads. Additionally, the overall age of the fleet is quite high – between 20 and 30 years old – with only a handful of new, modern vessels coming into service over the last few years.

However, it is clear the cable ship fleet will remain busy for the foreseeable future. This is always a nice problem to have! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

A NEW ERA OF SUSTAINABLE NETWORK HUBS?

The Subsea Cable - Data Center - Renewable Energy Connection

BY IAGO BOJCZUK, NICK SILCOX, NICOLE STAROSIELSKI AND HUNTER VAUGHANAsea change is underway in global network geography. In the past, subsea cable routes were designed to link major population centers. Following the rise of cloud computing, cables increasingly interconnect data centers, which may or may not be located near the populations they serve. Content providers will account for a majority of CAPEX spending from 2022-2024 across Atlantic, Pacific, and U.S.-Latin America cable routes, observes analyst Tim Stronge of TeleGeography. An important consideration for these companies, he points out, is how to connect their data centers. As just one example, the cable landing point at Virginia Beach in the United States was “the safest spot to land with the shortest distance to ‘Data Center Alley’” in Ashburn, Virginia (Glose 2018).

Around the world, data centers are also being established near cable landing sites. Many cables today even land in data centers and network exchanges. As Nigel Bayliff, CEO of Aqua Comms, tells us: “cable landing stations and data centers go hand-inhand to create the foundation layer of the internet in any country, and as such they are symbiotic--they both lead and lag each other. Data centers get built near landings—landings are built to serve data center locations.”

Now, with the increasing pressure of global climate change, a third kind of infrastructure has entered

the mix: the electrical network. Data centers demand huge amounts of power, and for reasons both economic and environmental, operators are looking to both cheap and renewable energy sources. A cluster of data centers at The Dalles, Oregon, in the United States, was located there in part because of the inexpensive and abundant hydropower. Google’s Chilean data center sources power from a massive solar farm in the Atacama region. Locations such as Iceland and Norway have attracted data center investment in part by leveraging their cool climates and renewable resources.

Subsea cable landing stations themselves require relatively little

power to operate, but the cable - data center - energy connection means that network design and decisions about terminal locations are increasingly power-sensitive. This month’s Sustainable Subsea column, brought to you by the SubOptic Foundation’s Sustainable Subsea Networks research project, asks: how have certain locations emerged as cable hubs, and how did these cable connections become intertwined with the data center landscape? Given that companies are increasingly pursuing net-zero goals, how can networks of the future be connected to renewable energy developments?

As case studies, we hone in on two important nodes in the global

cable network: Ireland and Fortaleza, Brazil. We chose these for several reasons. First, these locations have historically been critical gateways for telecommunications rather than end-destinations in themselves. Their story reveals how existing on-the-way hubs may adapt to a new ecosystem. Second, each has a substantial number of cable connections as well as a relatively green grid. While they do not offer the level of green energy available in Iceland and Norway, they have more cable systems than many Nordic countries and provide a strong foundation of connectivity. Third, although they are not hubs of data center development such as Singapore, they have nonetheless attracted data centers (unlike, for example, the cable hubs of Djibouti). Below, we describe how each location became a telecommunications hub and speculate about how renewable energy might affect its future potential.

In an earlier article of the Sustainable Subsea column, “More Cables = Less Carbon?”, we suggested that, because cables have a low carbon footprint, a sustainable future might involve laying many more cables to renewable network hubs. Ireland and Fortaleza are two locations that hold possibility as sustainable network hubs: they have cables, data centers, and vast renewable energy potential. The industry has yet to fully embrace this possibility.

This and other green topics will be under discussion at the upcoming Pacific Telecommunications Conference in Hawaii. We invite you to join us at Sunday’s submarine cable panels, sev-

eral of which will be focused around the theme of sustainability.

IRELAND: AN ESTABLISHED “DATA GATEWAY” INTO EUROPE

Our first case study, Ireland, has a rich and unique history of subsea connections, which had little to do with either data center development or the country’s energy matrix. The laying of the first transatlantic subsea telegraph cables in the 1850s brought Ireland to the center of the connected world, and for decades the telegraph had enormous social and economic effects on Valentia Island and Galway.

Following the telegraph, however, Ireland was often overlooked in terms of technological advancement and economic investment, leading to a lull in the country’s role in global telecommunications. British colonial rule meant Ireland was not able to self-determine its economy and resources were extracted and redirected

to British economic concerns. Despite playing an early role in the subsea industry, Ireland was mostly ignored until its independence from Britain in the 1920s. Following attempts at internal economic development, Ireland finally began to emphasize exports as a key economic driver in the mid-twentieth century, which in turn promoted the importance of international connectivity. Cable connectivity, however, was primarily routed through Britain until the PTAT cable was established in 1989.

Today Ireland plays a unique role as a connection point for the global subsea network, claiming fourteen cable connections as of 2020—in comparison to 4 in New Zealand, a nation of similar population size. Ireland’s convenient location as a “gateway to Europe” and comparatively low tax rates made the country a destination for businesses seeking to export their operations. Data

SUBSEA sustainable

centers have become a key feature of the Irish economy, as the country has over 50 operational data centers and dozens of others either under construction or with permission to be built. Business-friendly policies are one of the primary reasons for the development of data center infrastructure in Ireland, alongside the country’s cool climate. Lower temperatures are strategic for data center operations as they keep energy costs down. Despite this, Ireland was famously passed over by Microsoft in 1999 as a potential site for a data center because of the perceived lack of connectivity on the island.

This changed soon after as Ireland expanded connection via fiber optic subsea cables. Since 2014, seven new trans-Atlantic cables have entered service, with a total of 72 fiber pairs. Three of these connect to Ireland, and account for 20 new fiber pairs. Nigel Bayliff, CEO of Aqua Comms, states that the original and subsequent choice of Ireland as a landing location was the concentration of usage—they are driven by the market and the concentration of data centers. “With no cables,” he tells us, “there is little lifespan in data centers on an island.”

In addition to increased connectivity, a key element in the rapid growth of data centers in Ireland was the economic fallout of the global economic crash in 2007 and 2008. Ireland’s low tax rates became a primary attraction for companies seeking to expand connectivity during the global economic downturn (Brodie & Bresnihan, 2021). This expansion was met with enthusiasm for those concerned with economic prosperity but has also received significant pushback from environmentalists because of data centers’ massive energy demands.

The public pressure from environmentalists, along with technical and logistical concerns about the Irish energy grid, culminated in 2022 with a moratorium on data center expansion. Ireland’s state-owned national grid, EirGrid, decided to halt all data center expansion and consider proposals on a case-by-case basis. This followed a decision by the Commission for Regulation of Utilities to limit the energy and environmental impacts of data centers in Ireland. The city of Dublin’s local government

infrastructure that is not simply efficient, but environmentally sustainable and energy-conscious. Ireland will remain an important subsea landing spot and data center location for all the reasons already described; however, the continued expansion of Ireland as a telecommunications hub will likely need to happen alongside a serious commitment to reduce carbon emissions and energy demands.

has moved to codify a data center moratorium but has received pushback from national leaders, including the Office of the Minister of State at the Department of Housing and Development, though the EirGrid moratorium is ongoing. The issue of data center expansion is fraught within Irish politics and the Irish national discourse at large.

Currently, the expectation is that no new data centers will be added until near the end of this decade. The implications of this are wide-ranging for the Irish economy and to connectivity across the Atlantic to Europe. However, most significantly, the moratorium suggests that Ireland could become a case study for the development of telecommunications

Fortaleza, located in the Brazilian northeast state of Ceará, is one of the most connected subsea landings in Latin America and the Caribbean. As of 2022, Fortaleza is home to 16 in-operation cable systems, with at least 10 of them being systems of international capacity. Industry and government stakeholders go as far as to refer to Fortaleza as an “intercontinental hub,” “a corner of the world,” or a “nodal point of global connectivity.” The city and its surroundings do not generate the same buzz in comparison to other hot locations for hyperscale data center developments—such as the Mexican state of Querétaro or the commune of Quilicura, in Chile. Despite this, Fortaleza has still become a critical node in the

In addition to increased connectivity, a key element in the rapid growth of data centers in Ireland was the economic fallout of the global economic crash in 2007 and 2008.

global network of data trafficking.

The deployment of submarine cables to support internet-related data transmission started in the second half of the 1990s in Brazil. While the vast majority of ICT and telecommunication infrastructure could be found in the major southeast metropolis of São Paulo and Rio de Janeiro, virtually all the subsea cable systems that leave for other continents stop in Fortaleza. As Erick Contag, Vice-President of SubOptic and Trustee of the SubOptic Foundation observes, “Fortaleza’s geographic location represented an ideal point for optical signal regeneration. The subsea and optical technology from this era balanced distance versus capacity per fiber pair, and Fortaleza was perfect for it.”

However, in the early 2000s, Fortaleza was far from being a cable hub as we know it today. Although the city attracted tourists for its large dunes and beaches, the existing infrastructures were mostly for oil and gas. In fact, workers would often commute to nearby cities as economic opportunities were scarce. It took about ten years for Fortaleza to lay the groundwork to interlink cable and data center development. Operators established partnerships with local IT firms for win-win economic competition and benefited from government incentives. Since 2014, Brazil as a whole has been witnessing a new wave of subsea cable system developments, with the industry planning and deploying systems with an increased data transfer capacity of up to 138 Tbps. As of 2022, the subsea cable systems arriving in Brazil give the country access to a network of nearly 180,000 km—with connections to Colombia, Venezuela,

Bermuda, United States, Cameroon, Portugal, Spain, Senegal, Cape Verde, Argentina, French Guiana, among others (OCDE, 2020). As Tim Stronge points out, there is a long tradition here: “Fortaleza was a major landing site well before the content providers emerged as large consumers of demand and investors in new systems.” Today, geography remains

cable landing station and the establishment of the infrastructural capacity built in the Brazilian state of Ceará. Fortaleza’s development as a data center hub has also been strengthened by state policy. As is true for Ireland, the Government of Ceará has been keen on catalyzing investments in the areas of digital, port infrastructure, and the air travel industries (Anuário do Ceará, 2022). The Municipality of Fortaleza also sought to create a favorable environment for these businesses and their sustainable portfolios with tax benefits.

Brazil is a center for data center investment—it concentrates nearly 50% of all the data center investments in the Latin American and Caribbean region (Research and Markets, 2022). And within the country, Fortaleza’s capacity is expanding. In the state of Ceará alone, the number of data centers quadrupled since the start of the COVID-19 pandemic, with the majority being in the metropolitan area of Fortaleza. Angola Cables, Century Link, Ascenty, Hostweb, GlobeNet, Amazon, and Google are just some of the private stakeholders expanding their investments in Fortaleza through cables or data centers.

a major draw. Clara Casanova of EllaLink says Fortaleza’s geographic location as “decisive” for the choice of their recent cable landing.

It is in part because of its long-standing role as a stopover for cables that Fortaleza is today attracting new data center investments from some of the major operators and tech companies in the world. Other factors have also facilitated its emergence as a digital hub, including the attraction of an Internet Exchange to GlobeNet’s

LEVERAGING RENEWABLE ENERGY POTENTIAL

Ireland and Fortaleza each became data center hubs based on similar drivers: tax benefits, local infrastructural capacity, and—decisively—cable connections. Not all cable hubs become data center hubs. Oman and Djibouti, for example, are essential cable hubs but have relatively little data center development. However, cable connectivity is essential for data center development. In turn, more cables are being laid to each of these

While the vast majority of ICT and telecommunication infrastructure could be found in the major southeast metropolis of São Paulo and Rio de Janeiro, virtually all the subsea cable systems that leave for other continents stop in Fortaleza.

SUBSEA sustainable

locations to connect growing data center infrastructure. Energy is also beginning to play a role in these decisions. There are a host of power-related factors at play in the establishment of cable--data center hubs, Tim Stronge elaborates, including wholesale electricity rates, cooling costs, availability of power from the local grid, local and national taxes on power, and now “the location of these data centers are (in part) determined by the availability of green energy.” The case of Singapore is instructive: as a cable—data center hub, it has nonetheless been limited by the availability of (green) energy.

While Singapore struggles to import green energy from its neighbors (and even from a massive solar farm in Australia), the future of green energy in Ireland and Brazil is much more promising, especially as new regulations pressure the private sector to adopt it, which in turn accelerates research and development to promote more sustainable solutions. According to Andrea Reschini, Energy Efficiency and Sustainability Program Manager at R&G Telecomm Group, renewables are swiftly evolving and the efficiency to deploy them will increase in the years ahead. “The change in the sector will produce more cost-effective solutions, maybe with systems that do not need huge constructions that are hard to deploy or that have negative environmental effects,” she says.

In locations like Ireland and Fortaleza, the possibilities deserve special attention. In both of these sites, there

are a dramatically increasing number of investments in renewables and ambitious policy frameworks to promote a more environmentally-friendly future. Alongside the rise in data centers, Ireland also expanded its commitment to and investment in renewable energy, particularly in the development of wind energy technologies. Historically, its main energy

source had been natural gas. Fueled in part by the EU’s Renewable Energy Directives in 2001 and 2009, Ireland expanded its energy production by renewable sources from three percent in the early 2000s to over 13 percent by 2020, most significantly in wind energy. Today, Ireland is one of eight countries in the world that generates more than 30 percent of its electric-

While Singapore struggles to import green energy from its neighbors (and even from a massive solar farm in Australia), the future of green energy in Ireland and Brazil is much more promising, especially as new regulations pressure the private sector to adopt it, which in turn accelerates research and development to promote more sustainable solutions.

ity from wind and solar (EMBER, 2022).

In light of the economic impacts of the pandemic and the Russia-Ukraine conflict, including inflation and rising energy prices, and the heatwaves of the past several years, energy infrastructure has been stretched thin in Ireland and, as a result, there is some concern about the long-term viability of data center development. The data center moratorium has brought these concerns onto the national and international stages, wedding the future of data centers in Ireland to the country’s climate goal and politics.

As a result, while Ireland’s investment in renewable energy infrastructure was not a motivating reason for the data center development initially, the two have since become intertwined. Amazon has entered into contracts with wind farms to power several of their data centers in Ireland, and Microsoft has agreed to share the capacity of their lithium batteries in their data centers to support the development of renewable energy elsewhere in Ireland. Given the future outlook of energy and climate change, any development in the industry will likely need to be tied to renewable energy to promote long-term economic and ecological sustainability. Without this push for renewable energy, Ireland’s energy infrastructure and public pressure would continue to be obstacles to the development of data centers, and

therefore subsea cables as well.

While Ireland is a site where concerns about data centers’ energy impacts are quite advanced, such concerns have just begun to emerge in Fortaleza. Luckily, the state’s renewable infrastructure is also relatively advanced— making it, like Ireland, an ideal site for the development of a sustainable cable--data center hub. Since early 2020, half of Ceará’s energy matrix has been made up of renewable energies. Across the state, wind energy is a huge source of electricity generation—it is home to 20% of Brazil’s wind farms. Additionally, not only does Ceará take a big chunk of the share of wind farms, but the state also produces far more than the global average–60% higher, due to its geographic characteristics (BRIC Group, 2022).

Yet the state only emerged as a renewable energy hub in recent years—and its development shows

just how quickly energy transition can occur. Until 2007, Ceará was totally dependent on energy suppliers from other states. At the time, the state “imported” 100% of the energy it needed and had only a couple of thermoelectric plants that worked on an emergency basis (Carta Capital, 2012). Until about three years ago, thermal plants still dominated the matrix. Although the state’s wind power potential was investigated in the late 1990s, Ceará has since become the home of the first commercial wind parks in the country as well as the first commercial solar power plant in Brazil. The development of wind options in Ceará was so swift that it catapulted Brazil onto the world stage: in 2012, Brazil was in 15th place in the world ranking of installed wind energy capacity. Currently, Brazil is in 6th place (Global Wind Energy Council, 2022).

SUBSEA sustainable

Nowadays hydroelectric power is pervasive in Brazil, yet Fortaleza continues to have many petroleum refineries that pose challenges for the climate, as well as cable and data center operators who will increasingly demand greener energy-efficient facilities. Solar options are present, but largely behind wind capacity. Until the beginning of 2022, there were more than 88 photovoltaic solar power plants, registering about 498 MW of power, totaling nearly 10% share of the energy produced locally. The Municipality of Fortaleza alone has an area with a solar potential of 229.5 km², with estimates of a capacity of 458.9 MW alone, which is yet to be fully explored (Silva, 2021).

Just as geography and tax incentives combined to make Fortaleza a cable— data center hub, so too have Fortaleza and the municipalities across Ceará offered consolidated tax incentives and clear legislation that provides legal certainty to investors of new energy systems. The state is at the forefront of streamlining the environmental licensing process, which is one of the most modern in Brazil (SEMACE, 2012).

The State is innovative in making the advocacy and awareness of renewables as clear and open as possible. In fact, Ceará was the first public agency in Brazil to launch an Atlas for renewable energy to better inform and drive more sustainable practices amongst private sector stakeholders. Its most current version is multilingual, available for smartphones, and it covers the potential of wind and solar energy across its territory.

With government support and legislation, new developments began to grow in the state, indicating possible directions for the use of renewables by ICT companies. These examples

include the Ceará 2050 Program–Energy and Business, which aims to turn the state into Brazil’s hub for renewable energy by modernizing infrastructure, increasing energy efficiency across sectors, and attracting renewable investments. In parallel, in July 2021, a law was passed at the state level that introduces the Program for Attracting and Supporting the Generation of Renewable Energy in Ceará (Law No. 17,553). Complementing these public-funded initiatives, the government of Ceará also instituted the State Energy Transition Plan in 2022, with technical and financial support from the World Bank. Named Ceará Verde (Green Ceará), one of the objectives of the project is to support scientific and technological development associated with the production, processing, and use of renewable energies.

TOWARD MORE SUSTAINABLE CABLE NETWORK HUBS

Concerns about data centers’ energy draw can produce community resistance and spur governmental moratoriums, which in turn preempt network development. As an alternative, looking to the future—and linking cables and data centers to renewable energy in advance of any

opposition would not only be good for the planet, but good for future data center and cable development. How can these links be made?

First of all, companies might deploy renewable energy at the cable landing station. Renewable technologies have yet to be fully considered in the subsea industry. This is not simply because of the low power draw, but because of the industry’s small scale. According to Winston Qiu, Senior Vice President at Pacific Light Data Communication Co., Limited, the problem of adapting renewable energy is in part a structural one: technical teams usually focus on cable system stability, leaving energy cost considerations to top management. As a result, options for energy generation via renewable means remain largely unexplored. “While the industry may lack the economic scale for massive production of applications and facilities for renewable energy, the subsea cable industry provides new possibilities to explore sustainable alternatives and applications,” says Qiu.

Another option involves purchasing renewable power already available via the grid itself. It is here that state investments in renewable power will become useful—there are more and more opportunities to connect to

Nowadays hydroelectric power is pervasive in Brazil, yet Fortaleza continues to have many petroleum refineries that pose challenges for the climate, as well as cable and data center operators who will increasingly demand greener energy-efficient facilities.

wind and solar energy being created on the grid. Tapping into renewables underscores company commitments to the environment. In places like Ireland, where development is already contentious, and in Fortaleza, where it could become a site of conflict, such commitments are essential to the network’s continued development.

To take a step further, both of these locations have the potential to develop as sustainable network hubs. They each face challenges, of course. Ireland is dependent on its advantageous tax policy, which could be affected by UK or EU taxation initiatives. Likewise, Fortaleza remains distant from the major metropolitan ICT hubs in Brazil and Argentina, and it may be preferable to simply skip directly to the south in the future. To become sustainable network hubs, the ca-

Ireland is dependent on its advantageous tax policy, which could be affected by UK or EU taxation initiatives. Likewise, Fortaleza remains distant from the major metropolitan ICT hubs in Brazil and Argentina, and it may be preferable to simply skip directly to the south in the future.

ble--data center constellation should be linked—via technical means, but also in the public imagination—to available renewable energy infrastructure and the aforementioned government policies for green energy development. In our research we have found that private equity, investors, and content providers are increasingly considering green factors, and such sustainable network hubs will be even more valuable in the future. By intentionally and explicitly finding ways to link to renewable power, cable owners and operators have a chance to participate in a larger movement. This document is an output from the Sustainable Subsea Networks research initiative, funded by the Internet Society Foundation. STF

NICOLE STAROSIELSKI is Associate Professor of Media, Culture, and Communication at NYU. Dr. Starosielski’s research focuses on the history of the cable industry and the social aspects of submarine cable construction and maintenance. She is author of The Undersea Network (2015), which examines the cultural and environmental dimensions of transoceanic cable systems, beginning with the telegraph cables that formed the first global communications network and extending to the fiber-optic infrastructure. Starosielski has published over forty essays and is author or editor of five books on media, communications technology, and the environment. She is co-convener of SubOptic’s Global Citizen Working Group and a principal investigator on the SubOptic Foundation’s Sustainable Subsea Networks research initiative.

IAGO BOJCZUK is a PhD student in the Department of Sociology at the University of Cambridge, where his work investigates the material, cultural, economic, and political dimensions of Big Tech infrastructures in the Global South.

NICK SILCOX is a Ph.D. candidate in the department of English at New York University where he is working on a dissertation on sensing and sensor technologies and environmentality. Nick is also a research assistant on the Sustainable Subsea Networks project.

REFERENCES

Anuário do Ceára. 2022. “Agenda de infrastrutura.” www.anuariodoceara.com.br/infraestrutura/

Bresnihan, P. and Brodie, P., 2021. “New extractive frontiers in Ireland and the Moebius strip of wind/data.” Environment and Planning E: Nature and Space, 4(4), pp.1645-1664. https://doi.org/10.1177/2514848620970121

Brodie, P. & Bresnihan, P. 2021. “Energy vacuums: data Centres, renewable energy, and rural politics.” Rupture, Eco-Socialist Quarterly. https://rupture.ie/articles/severedthe-metabolic-rift-between-humans-and-nature-b5x6w

BRIC Group. 2022. “Ceará stands out for renewable energies in Brazil.” https://bric-group.com/article/cearastands-out-for-renewable-energies-in-brazil

Carta Capital. 2012. “Ceará será autosuficiente apenas com energia eólica, diz governador.” www.cartacapital. com.br/tecnologia/ceara-sera-autosuficiente-apenascom-energia-eolica-diz-governador

EMBER. 2022. “Global electricity review.” https://emberclimate.org/insights/research/global-electricity-review2022/#supporting-material-downloads

Global Wind Energy Council. 2022. “Global wind report.” https://gwec.net/global-wind-report-2022/

Glose, B. 2018. “Transatlantic Cables Anchored in Virginia Beach Make the Area a Digital Port.” The Business Magazine of Coastal Virginia. https://covabizmag.com/ transatlantic-cables-anchored-in-virginia-beach-makethe-area-a-digital-port/

OECD. 2020.” Avaliação da OCDE sobre telecomunicações e radiodifusão no Brasil.” OECD Publishing, Paris. https://doi. org/10.1787/0a4936dd-pt

Research and Markets. 2022. “Latin America modular data center market - industry outlook and forecast 2022-2027.” https://bit.ly/3Tt4gY6

SEMACE., 2022. “Legislações para empreendimentos de geração de energia elétrica por Fonte Solar e Eólica.” www.semace.ce.gov.br/resolucoes-estaduais-energiasrenovaveis/

Silva, D. 2021. “Estudo de viabilidade de utiliazção de energia solar em duas unidades públicas do município de Fortaleza-CE.” Centro Universitário Christus. https://repositorio.unichristus.edu.br/jspui/ bitstream/123456789/1130/1/David%20Oliveira%20da%20 Silva.pdf

5 QUESTIONS WITH PAUL GABLA

Talking Subsea Networks Industry with SubOptic’s President

1.

WHAT IS SUBOPTIC’S MISSION?

We were founded on the belief that we should openly share ideas and address issues in a neutral forum representing the global submarine communications industry and ecosystem. We aim to be the voice of the industry, promoting innovation and fostering sustainability of the global communications fabric.

To expand on this a little, the SubOptic Association exists as an open forum to promote the industry, foster debate, exchange ideas and effectuate vital advancement, education and collaboration across the submarine cable telecommunications and wider global communications industries. SubOptic is the place at which the global telecommunications subsea industry can come together to holistically address, and collectively discuss, the industry’s most pressing challenges and innovations.

The SubOptic Association, which gathers subsea telecommunications industry companies and professionals, aims to foster sustainable development of subsea telecommunications networks through a number of focused

initiatives such as the SubOptic Con ference, industry working groups and education drive to nurture the future generation of subsea industry professionals and leaders.

2. HOW DOES SUBOPTIC PARTICIPATE IN THE SUBMARINE CABLE MARKET?

Obviously SubOptic is best known for the triennial conferences it organizes, widely considered to be the global summit of the submarine cable, and now broader, communications community. It stands out as the only event organised by the industry itself, bringing together the whole spectrum of industry professionals. The SubOptic Conference addresses a wide range of topics, from enabling technologies and project development to project implementation and industry future.The SubOptic Association maintains complete editorial and program development responsibility to ensure the conference truly remains “for the industryby the industry”.

But SubOptic is now much more thant just the Sub-

Optic Conference. By creating and driving participation across working groups, forums and conferences, educational partnerships and initiating funds to aid in overall industry workforce development and sustainability, SubOptic delivers most needed vehicles for the alignment, improvement and future of the subsea industry, empowering companies throughout with opportunities to go work with and for the telecommunications subsea industry. SubOptic aligns the greatest minds, serving as a cornerstone and guiding force for the future of global subsea connectivity.

3.

WHAT ARE THE ELEMENTS OF SUBOPTIC’S SUCCESS?

Since changing our mandate in 2017, when we set out to widen our scope and extend membership to all participants in the sector, with the aim of becoming the industry’s global trade association, the SubOptic Assocaition has taken on more than 100 members.

Our membership roster covers all the bases of our industry, from carriers and service providers to global and sub-system suppliers, with also a good representation of consulting firms and industry experts.

I believe this is what makes SubOptic unique and meaningful, as all voices can be heard and our industry challenges can be addressed with a wide variety of points of view and perspectives. With SubOptic, our industry’s future is shaped by the same people who have made it what it is, and have the most profound motivation for it to shine in the future.

In practical terms, to gather all this expertise and energy and apply it to strengthening our industry’s future, we have launched multiple Working Groups, where individuals from companies across the industry come together to tackle global industry challenges. These challenges range from purely technical topics, such as “Fiber Colouring and SDM” or “Open Cable Management”, where experts aim at better technical standardization for sumarine systems, to more societal challenges such as “Diversity, Inclusion and Belonging” (DIB). A notable achievement of this DIB working group is our mentorship programme, now in its second season, pairing young professionals (mentees) with industry experts and figureheads (mentors).

Expanding on that concept of passing the baton between

generations, we have also recognised that our industry has an aging workforce, hence we have been particularly focussed on raising awareness of subsea communications and bringing more young people into the industry, with a particular emphasis on education and research.

To boost the effectiveness of our actions in this line of thought, we thought that a new kind of vehicle would be useful, to provide more visibility for our long-term ultimate goal, which is to ensure a bright future to our industry, and to allow companies and individuals who want to contribute towards these specific objectives to be able to do so in a financially sensible manner. This is the concept behind the SubOptic Foundation, which we have launched in 2021, as an offspring of the SubOptic Association. The SubOptic Foundation is of course maintaining strong ties with the SubOptic Association, as the overarching goals are the same: ensuring the sustainability of our great industry.

4. TELL US MORE ABOUT THE SUBOPTIC FOUNDATION?

From an operational perspective, a dual US-UK legal structure has been established, which allows companies, endowments, foundations, and individuals to contribute to the SubOptic Foundation and its growing programs through tax-deductible contributions and donations. Funding will help to support scholarships and travel, the development of new educational and research programs, fellowships, prizes and competitions for students, etc. For the time being, the SubOptic Foundation is ramping up with the support of the SubOptic Association members, through contribution from their membership fees, but the SubOptic Foundation will embark in a fund-raising campaign in 2023.

The SubOptic Foundation is energized by a group of industry veterans, whose mission is to shape the vision for the SubOptic Foundation initiatives and help implement them. Let me expand on some of these initiatives.

First, we have sponsored, in partnership with Optica Foundation and Google, two editions of the Subsea Optical Fiber Communications Schools (also known as the “Summer Schools”), where we aim to provide to a roster of university students and early-career professionals a deep-dive in technologies for subsea cables networks. The Summer

With SubOptic, our industry’s future is shaped by the same people who have made it what it is, and have the most profound motivation for it to shine in the future.

Schools have already been held twice in full format, in Finland and Sweden, complemented with online mini-meets. The next one is planned for 2024.

With the same motive of sharing experience, we have developed a collection of videos (dubbed ‘Crew Tube’) where industry veterans and experts tell their favourite subsea stories or talk about how they entered the industry to help inspire anyone considering subsea telecommunications as a career choice.

We also acknowledged that, even though most of the proceedings in our industry are conducted in English, the prominent language for international business, we are probably losing some people along the way, as for many, English is not their native language. So starting with Japan in 2020, we have established a series of local-language symposia, targeting primarily local academic communities. In 2022, we have conducted local-language symposia in Japan, France, UK, North America and Latin America, each of these being very well attended with a few hundred students. The success of these symposia may lead to the creation of local SubOptic student chapters, the first one as an offspring of the Latin America symposium.

On the Research front, the Internet Society Foundation (ISOC) awarded in 2021 a grant to a group of researchers led by Dr. Nicole Starosielski. Research is focused on sustainability and the development of a carbon footprint model for the industry. In partnership with Telegeography, this research group will also unveil at our PTC 2023 event the “Undersea Cable Sustainability Initiatives Map”, a graphic depiction of major activities for “greening” the industry.

5.

WHAT IS NEXT FOR SUBOPTIC?

Just around the corner, we are organizing a special event at the upcoming PTC conference in Hawaii in January. Industry experts will discuss two exciting topics central to subsea communications networks: regional connectivity development and subsea cable sustainability.

Also at the very beginning of 2023, the SubOptic Association members will elect half of our Executive Committee for the following cycle. The Executive Committee is our governance body, which oversees strategic development for the SubOptic Association and drives all the initiatives I just talked about. Hence I encourage our members to vote when the poll opens.

After that comes the event on which we have been focusing a lot of energy in the last two years, the SubOptic’23 Conference. The whole subsea cable industry is eager to come back together, especially after the recent Covid years. The previous conference was held 4 years ago in New Orleans with strong attendance, and we expect an even more thrilling and successful event in March 2023 in Bangkok.

Throughout the year, we will endeavour to re-energize and further develop upon the good work already done in our Industry Working Groups, possibly add one or two more working groups on topics that are really important for the continued development of our industry. And the SubOptic Foundation will also intensify its efforts towards nurturing the next generation of professionals and leaders, by consolidating and expanding local-language symposia, among other initiatives.

Stay tuned, 2023 will be a very exciting year for SubOptic! Looking forward to seeing you in Bangkok in March! STF

PAUL GABLA is a highly respected executive with over 30 years’ experience in the Telecommunications, Aerospace and Defense industries, including more than 20 years directly involved in the subsea cable networks industry.

Prior to his current tenure as Chief Sales & Marketing Officer at ASN (Alcatel Submarine Networks), Paul has been Vice President, Asia Pacific for Alcatel’s former Optical Networking division, and has also held senior management roles in Sales & Marketing at Alcatel Alenia Space, Thales and Rockwell Collins.

Trained as an optical telecommunications engineer, Paul has a dual background in optical systems technology as well as commercial/business development for submarine network projects.

Paul has been involved with SubOptic for many years, and currently serves as President of the SubOptic Association.

The SubOptic Foundation will also intensify its efforts towards nurturing the next generation of professionals and leaders, by consolidating and expanding locallanguage symposia, among other initiatives.

SUBOPTIC 2023 IS IN BANGKOK, THAILAND ON 13-16 MARCH!

BY ALICE SHELTON

BY ALICE SHELTON

The SubOptic 2023 conference is now less than 3 months away. The conference will be held in Bangkok, Thailand from 13-16 March. As always, the conference programme will run alongside an exhibition showcasing the latest in submarine cable technology, services and operations and a social programme allowing multiple networking opportunities.

The SubOptic conference is the premier event for the submarine cable industry. Run by the SubOptic Association and bringing together all members of the community every three years, it is the only event of its kind put on by the industry, for the industry. All content shown at the conference is generated and presented by members of the industry, whose papers are selected by teams of independent experts based on the merit of the proposed subject matter.

The SubOptic Association is a non-profit association active in the international submarine cable industry which historically has been best known for its conference. Over the last two conference cycles, SubOptic has expanded its programs and built its membership. Today, the SubOptic Association is proud to have more than 100 active member companies, each of whom plays an important role in the submarine cable industry. The Association exists to promote the industry, foster debate, exchange ideas and act as an

SubOptic 2023 is the eleventh conference to be organized under the SubOptic banner and will mark the 36th anniversary of the first event which took place in Versailles in 1986. The conference has been held twice before in Asia (Kyoto in 2001 and Yokohama in 2010), Thailand is the first Asian country outside of Japan to host a SubOptic conference. The conference, both because of its reputation as a stellar industry event, as well as its unique location, has already attracted several hundred registrations, and the Association is expecting the 2023 conference will exceed pre

THEME AND PROGRAMME STRUCTURE

The 2023 conference theme is Navigating the Open Seas – Collaboration on our Critical Infrastructure. The criticality of reliable and diverse global connectivity to the world has been accentuated by the COVID-19 pandemic. Today’s new age of remote working, coupled with increased social, commercial and economic dependence on the internet, cloud services, IoT, etc all of which ride over the global fibre backbone beneath the seas, have collectively increased the importance of our industry to the world. Submarine cables, which carry well over 95% of today’s intercontinental com-

munications, are broadly recognized as critical infrastructure. SubOptic 2023 will provide a forum for updating people throughout the industry on the latest technology, commercial approaches, marine challenges and progress, regulatory issues and unique project solutions - all underpinning how submarine cables will continue to be the backbone of global communications in the future in a sustainable way.

Fundamental changes that require cross-industry collaboration are needed to keep pace with the growth in demand being experienced by the submarine industry. Closing the digital divide via increased connectivity and access is underway with new systems being built across the world, and as the industry builds an ever-expanding cable infrastructure, the environmental and social responsibility of the submarine cable community is more crucial now than ever.

The SubOptic Association Executive Committee has entrusted the overall programme development to Maja Summers, Vodafone, as Chair of the Programme Committee. Together with Valey Kamalov, Google, as Papers Chair, they have developed a programme with an incredible range and depth of content. The presentation of papers, either oral or poster, has always been at the heart of the conference programme; it is an opportunity for everybody in the industry to contribute and participate in the conference and to share knowledge in the spirit of collaboration on our submarine cable infrastructure. More on the paper presentations below.

The four-day programme will feature over 100 technical and commercial paper presentations, plus a variety of other interesting sessions. Keynote speakers, panel discussions and round table debates will all focus on important and timely topics within the submarine cable industry. SubOptic has always made educational opportunities for its attendees a priority in planning the content for the conference programme. Masterclass sessions before the official opening of the conference will include a rich set of masterclasses reflecting the latest topics of interest to the conference attendees whether they be technical, commercial or regulatory. The conference will also feature a Shark Tank event, updates from SubOptic’s Working Groups (each focused on a specific topic of interest to the industry), and a new installment of TeleGeography’s renowned ‘Mythbuster’ series.

MASTERCLASSES

SubOptic 2023’s six masterclasses are each outlined below, and as can be seen from the list of presenters, SubOptic has indeed lined up a set of ‘masters’ to lead each class.

SEISMOLOGY WITH SUBMARINE CABLES

This masterclass will provide an introduction on sensing technology for complementary usage of global submarine communication assets for earthquake and tsunami detection to enable positive societal impact.

Presented by: Mattia Cantono, Google; Zhongwen Zhan, Caltech and Giuseppe Marra, UK National Physical Laboratory

FROM TELEGRAPHS TO PETABITS: A BRIEF HISTORY OF SUBMARINE CABLES

This masterclass will provide an overview of submarine cable system technology through three generations; telegraph, coaxial and optical systems, looking at the technology evolution over time, cable ships, cable installation methods and other engineering aspects as well as the investment models in place at the time.

Presented by: Philip Pilgrim, Nokia; Eduardo Mateo, NEC and Gary Waterworth, Meta

OPEN NETWORK EVOLUTION

This masterclass is an update from two SubOptic Working Groups - Open Cables and Open Cable Management. New ideas and recommendations for capacity estimation, spectrum sharing and Commissioning & Acceptance programs, alongside common Open interfaces for wet plant management will be shared and explained.

Presented by: Massimiliano Salsi, Google; Elizabeth Rivera Hartling, Meta and Darwin Evans, Ciena

MARINE SURVEY

This masterclass will introduce the audience to the theory and practice of marine route surveys, and the vital role they play in the installation and long-term reliability of submarine cables.

Presented by: Graham Evans, EGS; René d’Avezac de Moran, Fugro; Stuart Wilson, OceanIQ (GMSL) and Dr. Martin Gutowski, Kongsberg

LEGAL AND REGULATORY