SUBMARINE TELECOMS

If it’s July, it must be time for the Tour de France! This year’s event, unlike all others, won’t finish in Paris due to the Olympics; so, we are witnessing a very different race where much of the hard fought effort will be in the south. As of this writing, race leadership is pretty much as expected and few surprises have been seen. But it’s still early…

Thank you to all who have added the SubTel Forum App to their smartphones. This app provides real-time updates, comprehensive data, and interactive features for submarine cable projects, seamlessly integrating with our website for easy access to industry insights and collaboration tools. Dive in and explore it today.

The Submarine Telecoms Forum Directory enhances access to resources and celebrates the industry’s collaboration and technical prowess, aiming to be the premier reference for advancing global connectivity. Check it out and share your thoughts.

The next Submarine Cable Almanac, releasing in August and sponsored by TPG Telecom, features updated and validated data, organized by supplier for clarity on developments and upcoming systems, keeping you informed about global submarine cable advancements.

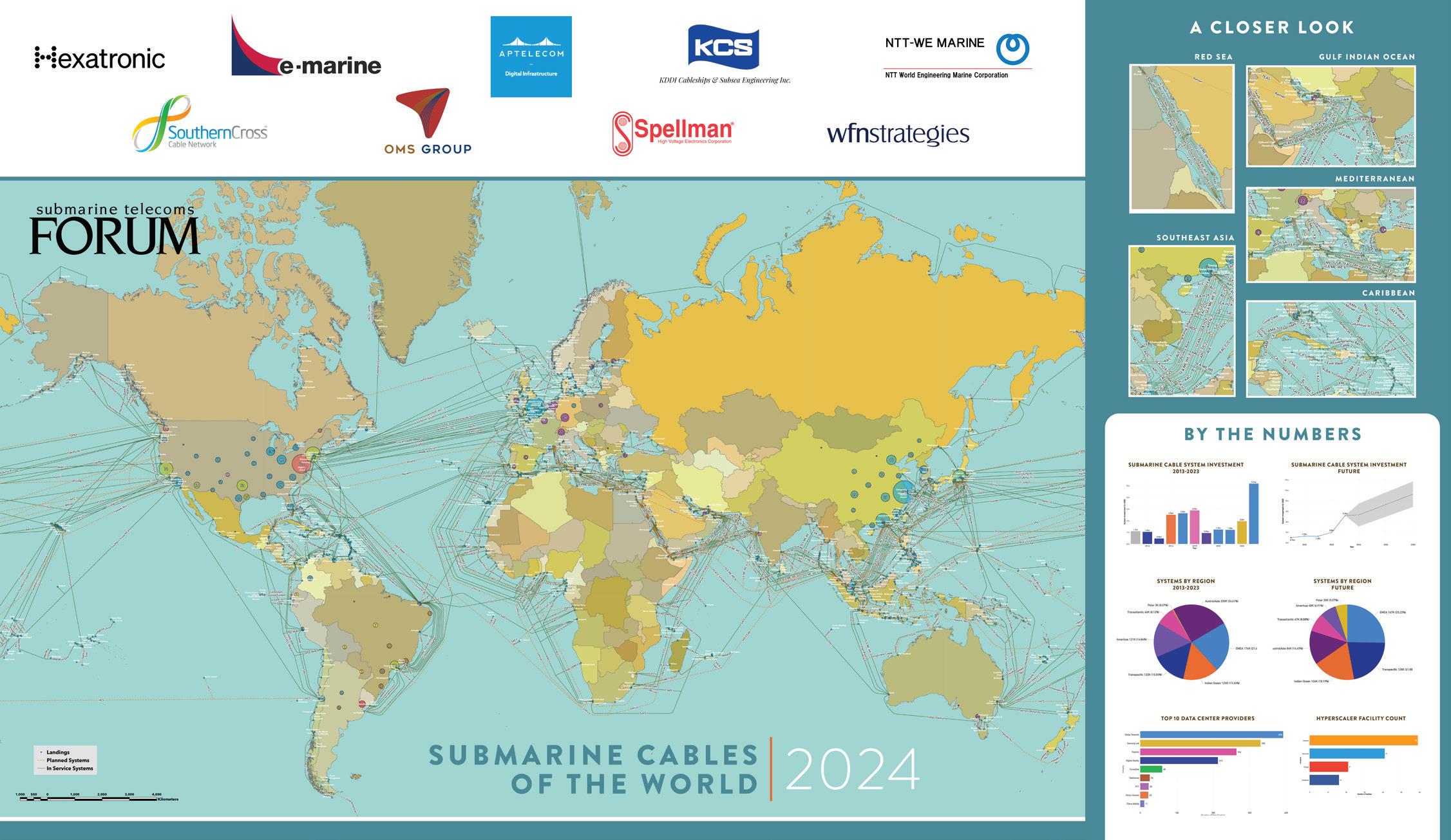

We’re releasing the updated 2024 Submarine Cables of the World wall map at Submarine Networks World in September. Advertisers can gain visibility among key industry stakeholders. Contact Nicola Tate for details.

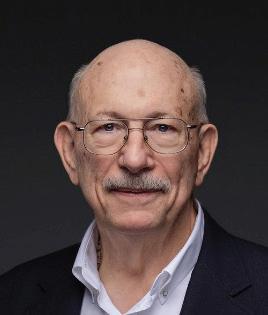

Roly Stansfield first visited my office in McLean, Virginia in 1985 when representing BTI Marine Services. He was looking for a Washington, DC based defense marketing consultant to grow their cableship business with the DoD. I barely understood ball valves and dynamometers or even ship shafts, and certainly knew nothing about submarine cables, but after negotiating a whopping $350 monthly retainer, set out with the two of us traversing the country in hopes of finding new business and within six months had secured a $6M contract to ‘fix’ the Commando Fox range for USAF offshore Okinawa. Three years later and a number of new contracts in hand and while drinking bitter and eating pickled eggs in his favorite pub in the Hampshire countryside, I let slip that I had decided to leave the firm, and the next day he marched me into a

meeting in Southampton with the newly minted BT Marine Board of Directors to discuss my future. Roly was the man who brought me into this business, my mentor, and lifelong friend. He was larger than life, could tell the best, longest, funniest stories that would make a hardened Marine Corps General blush and then bust out in uncontrolled laughter. He would reminisce about playing the ‘board’ for Yes, or play with my then babies under the kitchen table. He taught me how to drink whisky “with a wee bit of branch water” in his front room in Hamble. Later in life he would play his bagpipes on the Normandy beaches for several D-Day remembrances. A few years ago, Peg and I met Roly and his wife, Lyndsey, in a Lyndhurst pub and I had the chance to say thank you for changing my life and that of my family for the better.

We lost Roly Stansfield in May, and he will certainly be missed. But in his honor, I continue to carry forward the lessons he taught, savor his exuberant joie de vivre, and cherish the moments we shared.

Thank you as always to our awesome authors who have contributed to this issue of SubTel Forum. Thanks also for their support to this issue’s advertisers: AP Telecom, AP Procure, Fígoli Consulting, Indigo, IWCS, TPG Telecom, Submarine Networks World, and WFN Strategies. Of course, our ever popular “where in the world are all those pesky cableships” is included as well.

Good reading and vive le tour! – Slava Ukraini …STF

Wayne Nielsen, Publisher

Publication of Submarine Telecoms Forum, Inc. www.subtelforum.com | ISSN No. 1948-3031

PRESIDENT & PUBLISHER: Wayne Nielsen | wnielsen@subtelforum.com | [+1] (703) 444-2527

VICE PRESIDENT: Kristian Nielsen | knielsen@subtelforum.com | [+1] (703) 444-0845

ANALYTICS: Kieran Clark | kclark@subtelforum.com | [+1] (540) 533-6965

SALES: Nicola Tate | ntate@associationmediagroup.com | [+1] (804) 469-0324

DESIGN & PRODUCTION: Weswen Design | wendy@weswendesign.com

DEPARTMENT WRITERS:

Adam Ball, Andrés Fígoli, Isabelle Cherry, John Maguire, Kieran Clark, Nicola Tate, Philip Pilgrim, Syeda Humera, and Wayne Nielsen

FEATURE WRITERS:

Anders Ljung, Brendan Press, Guy Arnos, John Hibbard, Kristian Nielsen, Matt Reber, Paul McCann, and Saurabh Maral.

NEXT ISSUE: September 2024 – Offshore Energy

Submarine Telecoms Forum, Inc. www.subtelforum.com/corporate-information

BOARD OF DIRECTORS: Margaret Nielsen, Wayne Nielsen, Kristian Nielsen and Kacy Nielsen

SubTel Forum Continuing Education, Division of Submarine Telecoms Forum, Inc. www.subtelforum.com/education

Contributions are welcomed and should be forwarded to: pressroom@subtelforum.com.

Submarine Telecoms Forum magazine is published bimonthly by Submarine Telecoms Forum, Inc., and is an independent commercial publication, serving as a freely accessible forum for professionals in industries connected with submarine optical fiber technologies and techniques. Submarine Telecoms Forum may not be reproduced or transmitted in any form, in whole or in part, without the permission of the publishers.

Liability: While every care is taken in preparation of this publication, the publishers cannot be held

responsible for the accuracy of the information herein, or any errors which may occur in advertising or editorial content, or any consequence arising from any errors or omissions, and the editor reserves the right to edit any advertising or editorial material submitted for publication.

New Subscriptions, Enquiries and Changes of Address: 21495 Ridgetop Circle, Suite 201, Sterling, Virginia 20166, USA, or call [+1] (703) 444-0845, fax [+1] (703) 349-5562, or visit www.subtelforum.com.

Copyright © 2024 Submarine Telecoms Forum, Inc.

ISSUE 137 | JULY 2024

Talking Submarine Cable Industry With Submarine Network World’s General Manager / Agenda of SNW ’24 / WHY ATTEND SNW ‘24?

Highlighting their cost-effectiveness, unrepeatered submarine cables are crucial yet often overlooked for regional connectivity.

By Anders Ljung

Enhancing connectivity, TAM-1 aims to meet bandwidth demands and boost growth in Latin America and the Caribbean.

By Guy Arnos

Emphasizing the need for diverse digital connectivity through route diversification to mitigate Red Sea subsea cable disruptions.

By Brendan Press

Addressing commercial challenges Pacific Island countries face for reliable, affordable submarine cable connections. By John Hibbard and Paul McCann

Extending submarine cables to Antarctica enhances connectivity for critical research despite harsh conditions.

By Saurabh Maral

Addressing key digital infrastructure issues, PTC’DC will discuss technological advancements, geopolitical impacts, and cybersecurity.

By Matt Reber

Stressing the critical role of effective onboarding in aligning efforts, managing expectations, and fostering communication for successful projects.

By Kristian Nielsen

2 EXORDIUM

Find out about advertising opportunities to connect with our specialized audience.

3 IMPRESSUM/MASTHEAD

Meet our team, from editors to designers, establishing our commitment to transparency.

6 SU BTELFORUM.COM

8 INTERACTIVE CAB LE MAP UPDATES

Get the latest on global submarine cable infrastructure from our interactive map.

10 SUSTAINABLE SUBSEA

Discover industry innovations for reducing environmental impact and protecting marine life.

14 WHERE IN THE WORLD ARE ALL THOSE PESKY CABLESHIPS?

Follow the missions of cableships crucial to undersea connectivity.

19 CAPACITY CONNECTION

Effects of the Emergence and Growth in Artificial Intelligence.

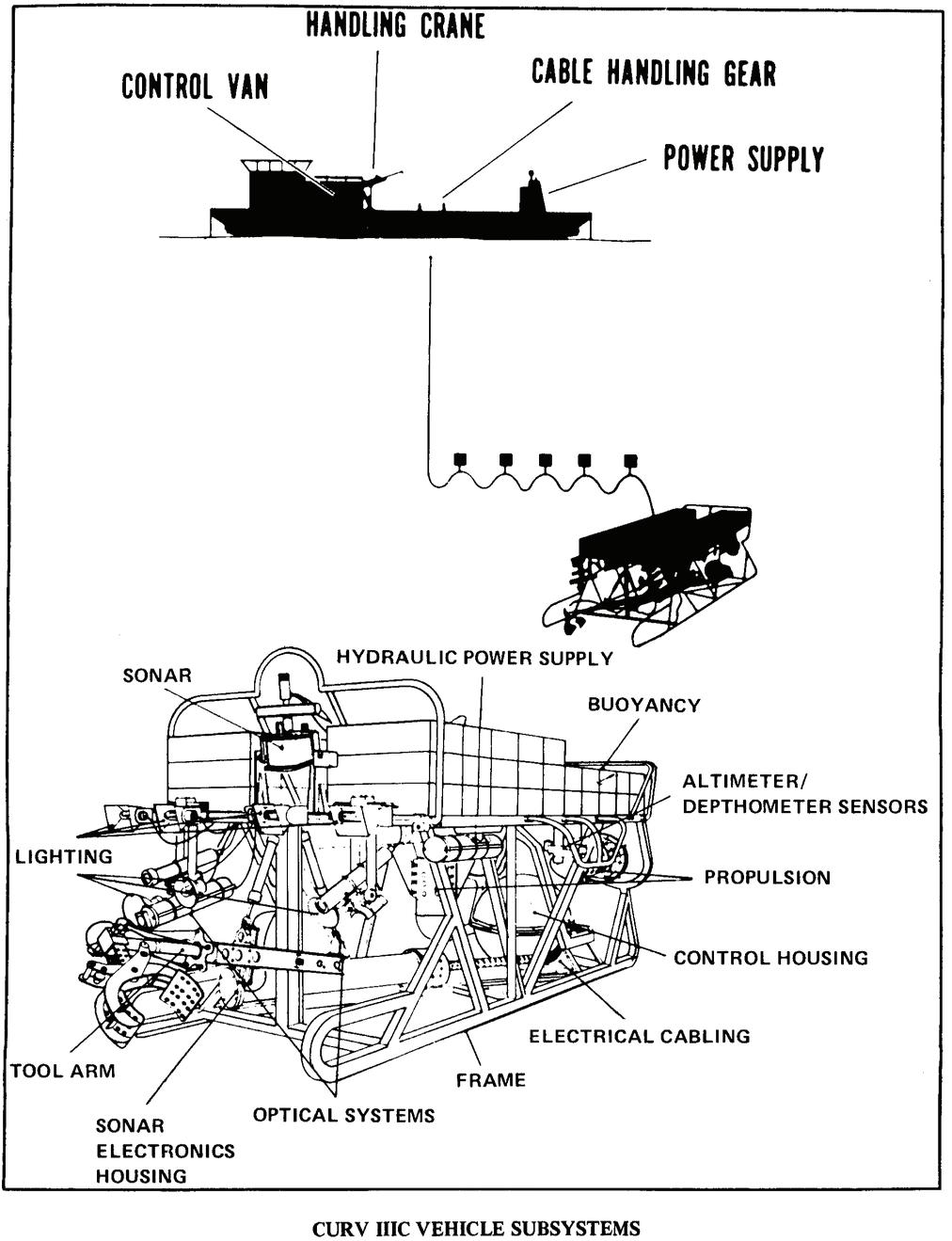

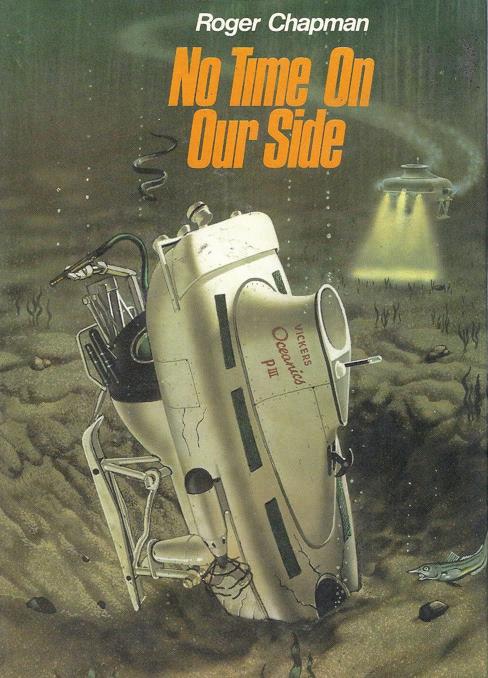

66 BACK REFLECTION

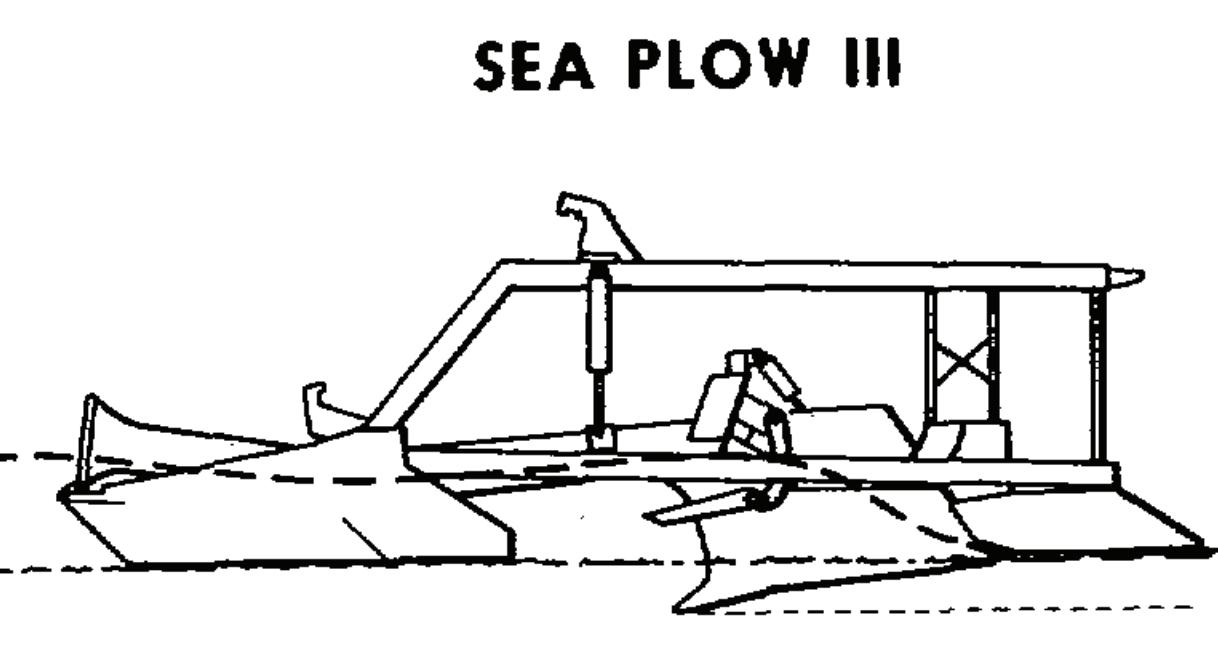

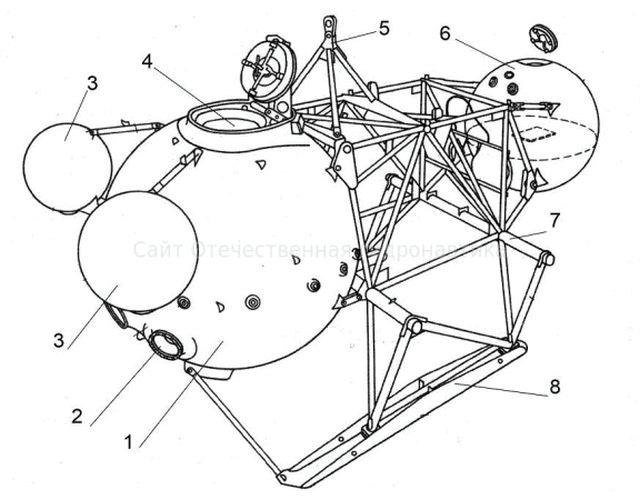

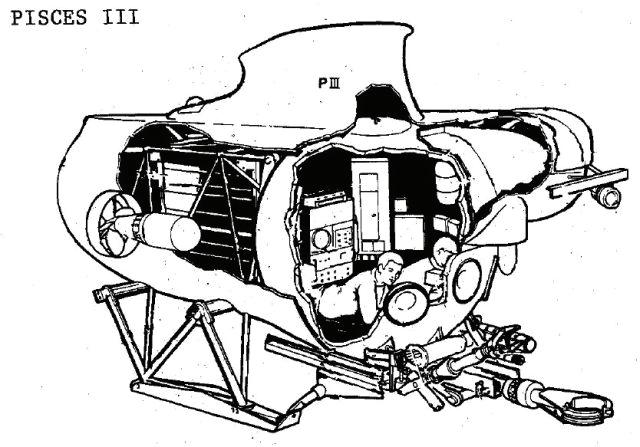

The Crash Of Pisces III (Sea Burial, Not Burial at Sea)

74 LEGAL & R EGULATORY MATTERS

How To Negotiate Agreements With the OTTs

80 ON THE MOVE

Track the career movements within the submarine telecom sector.

81 NEWS NOW

Stay updated with the latest developments in the submarine telecom world.

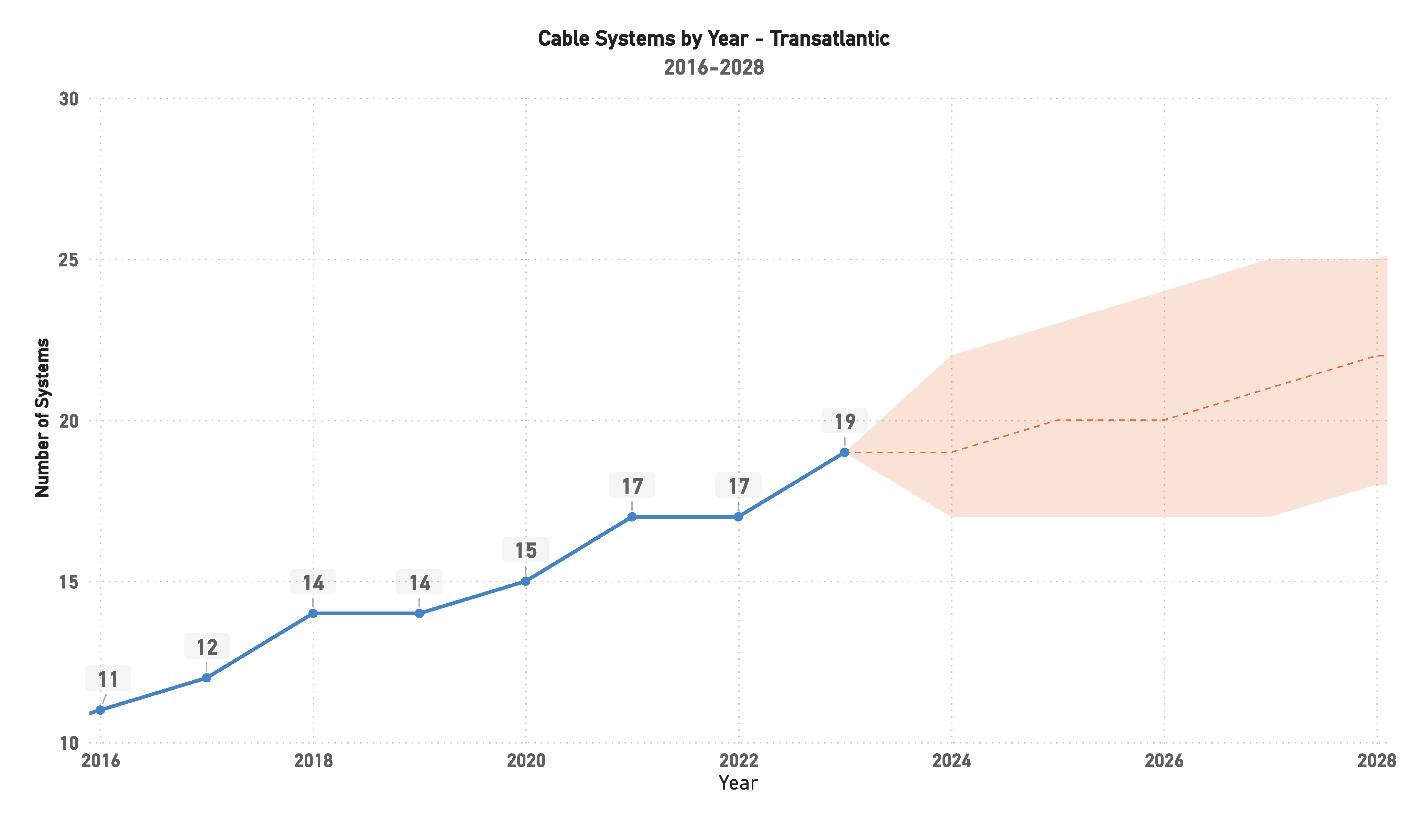

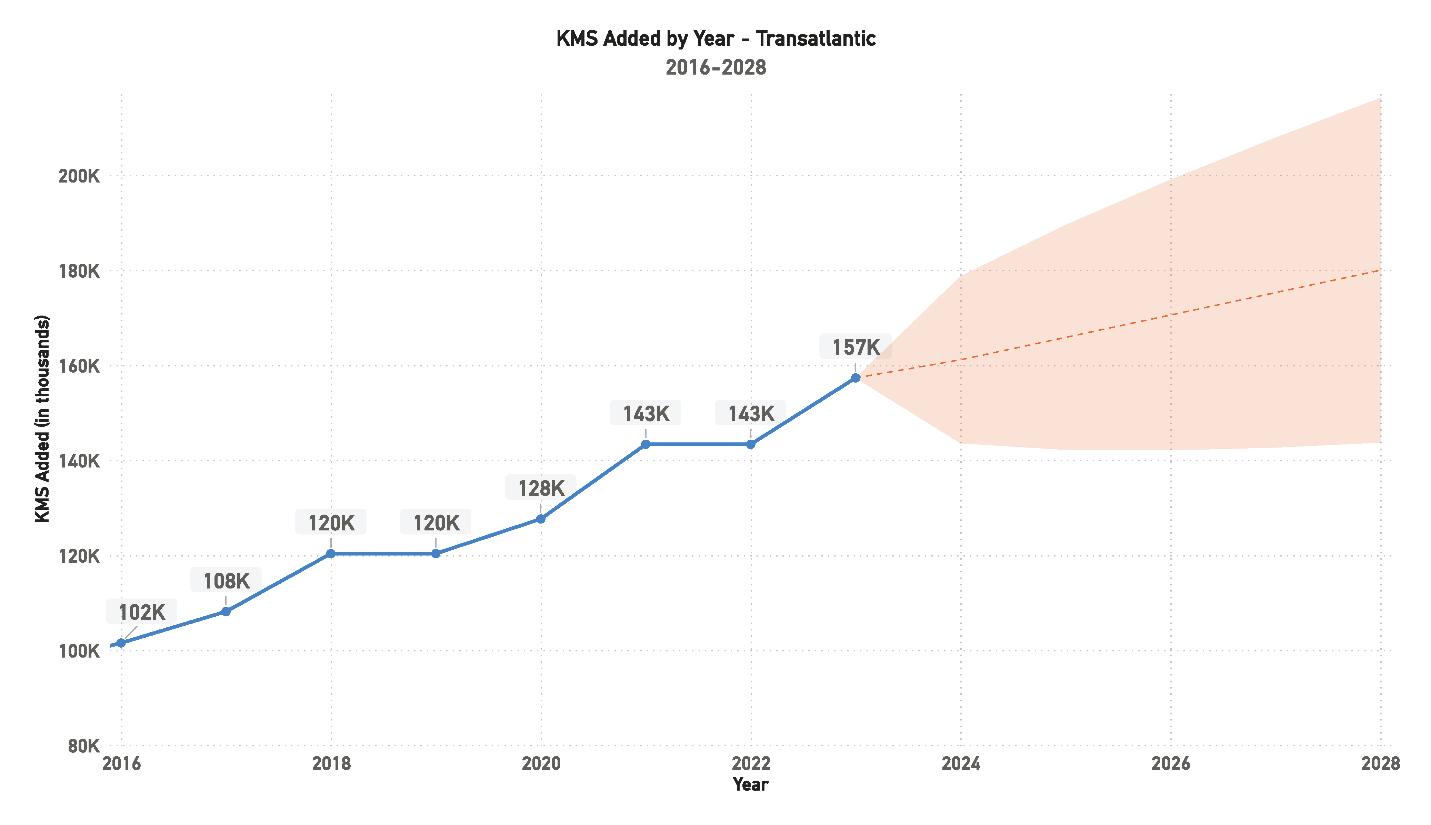

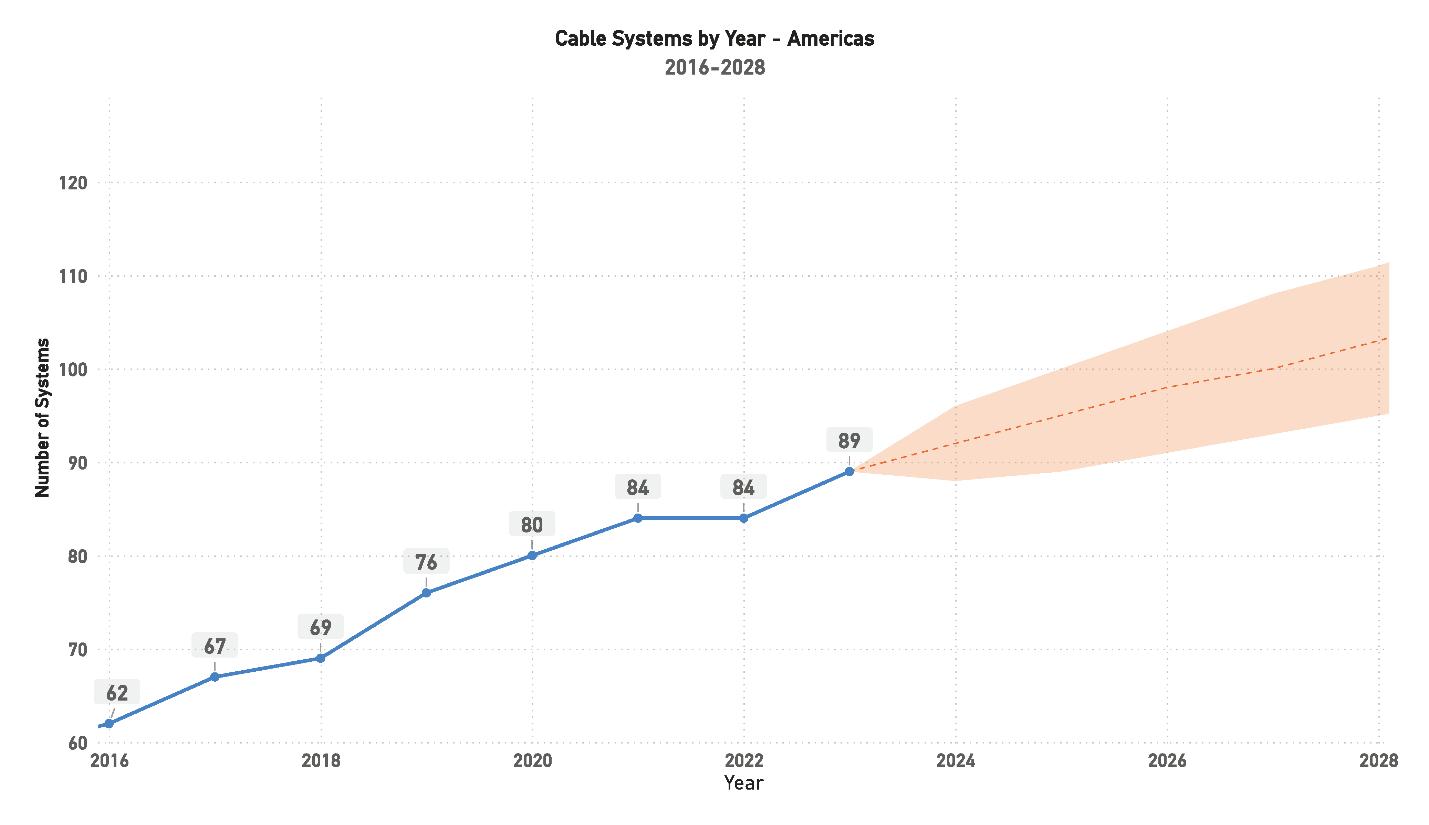

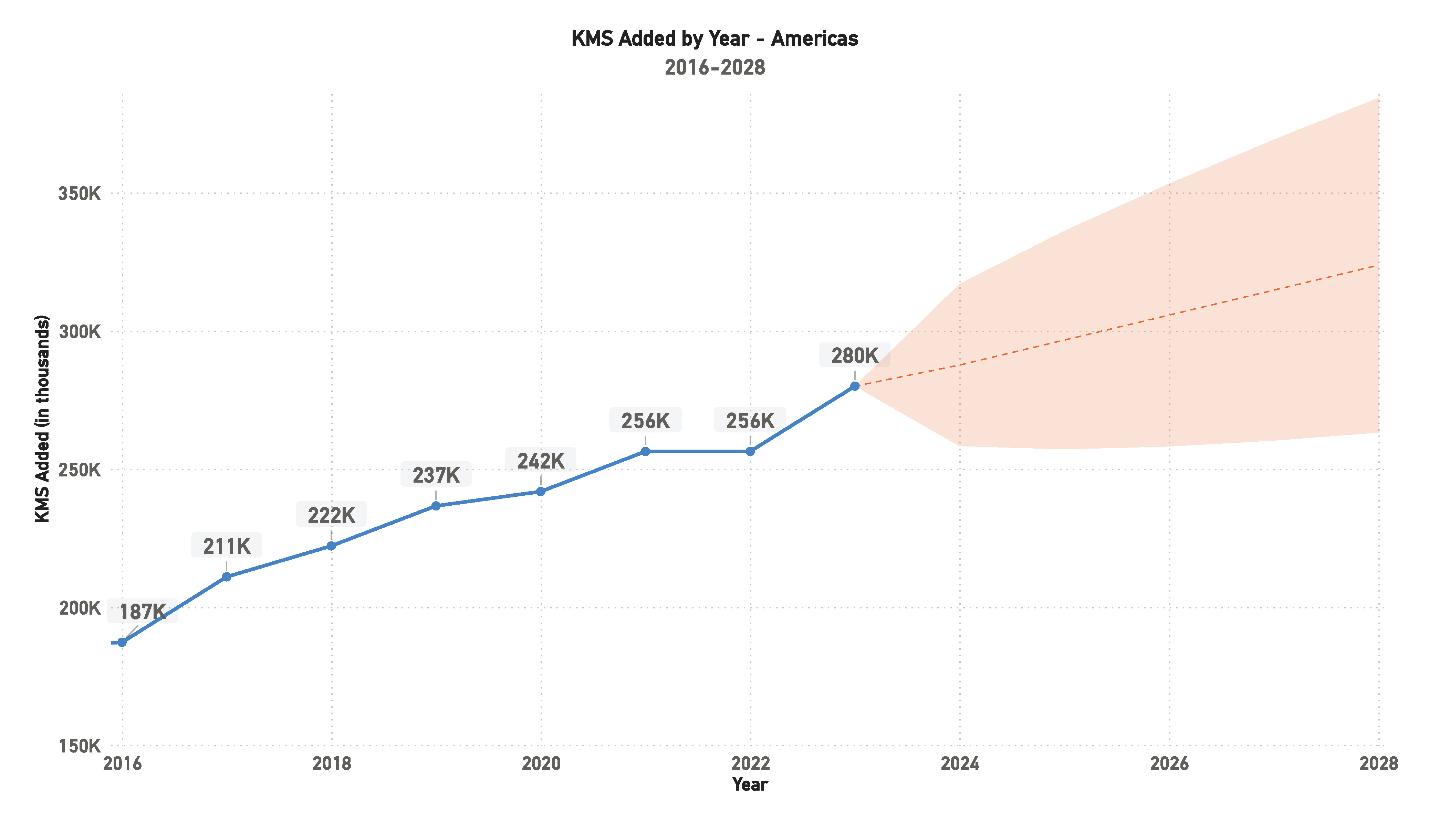

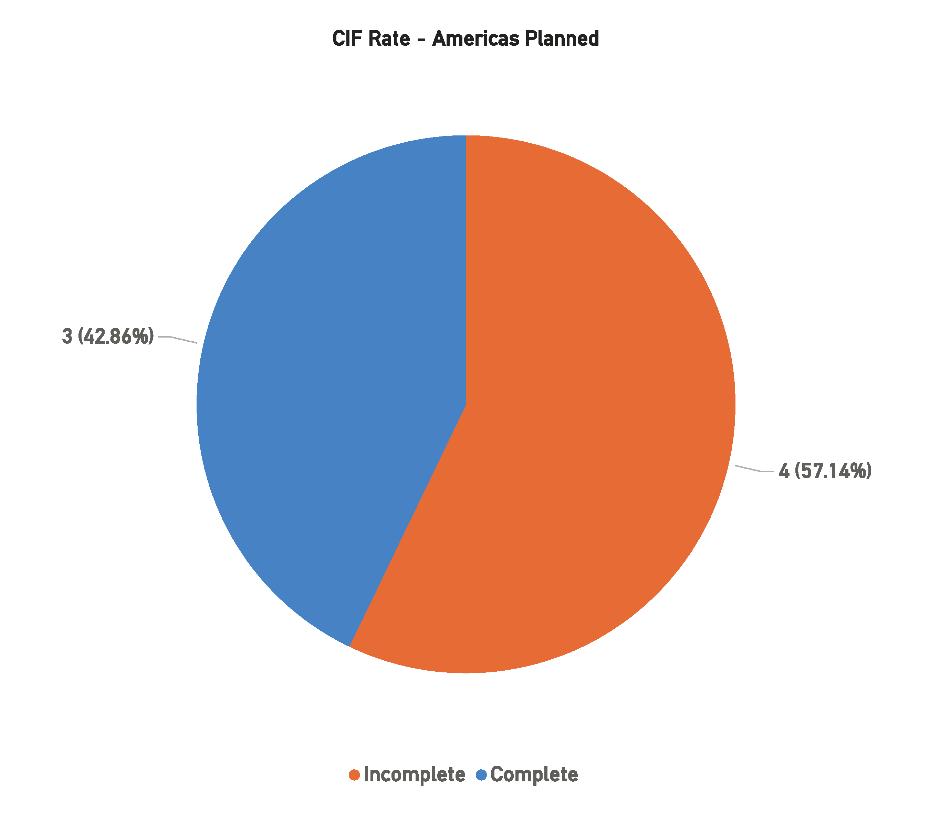

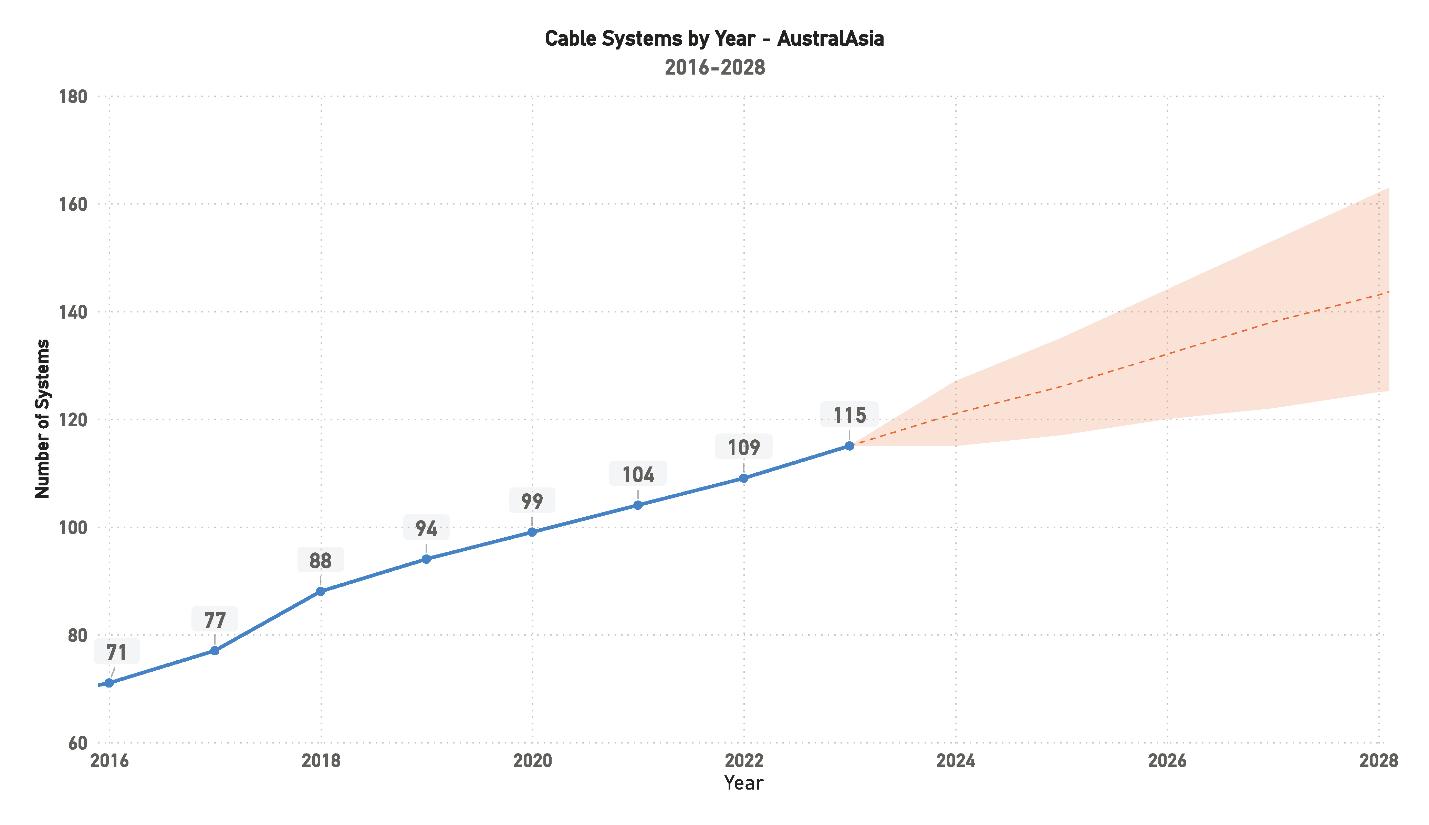

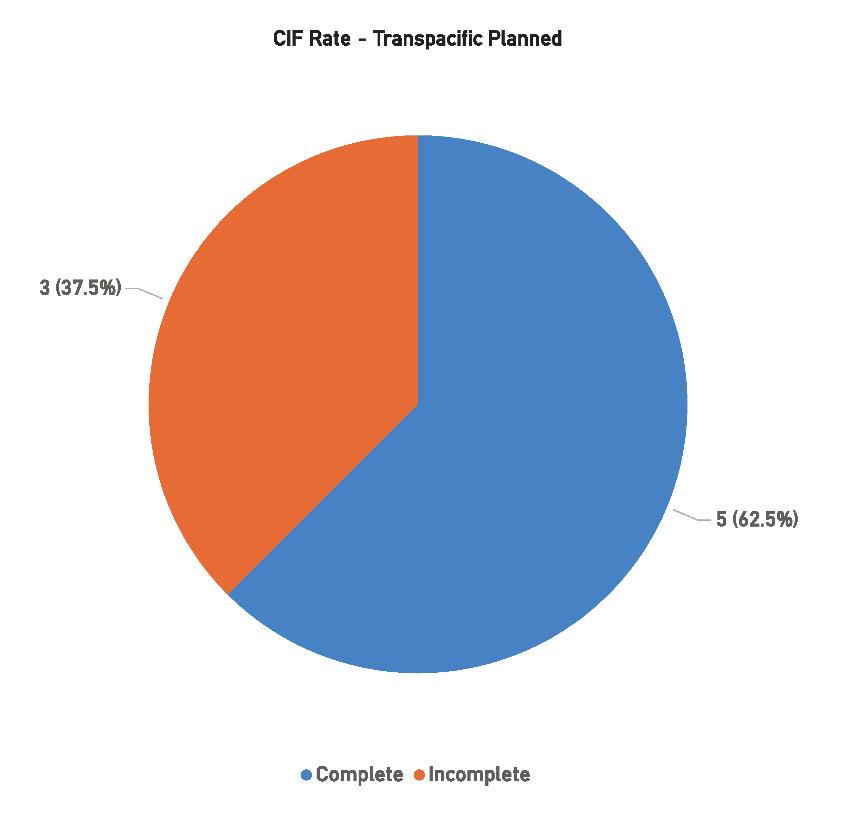

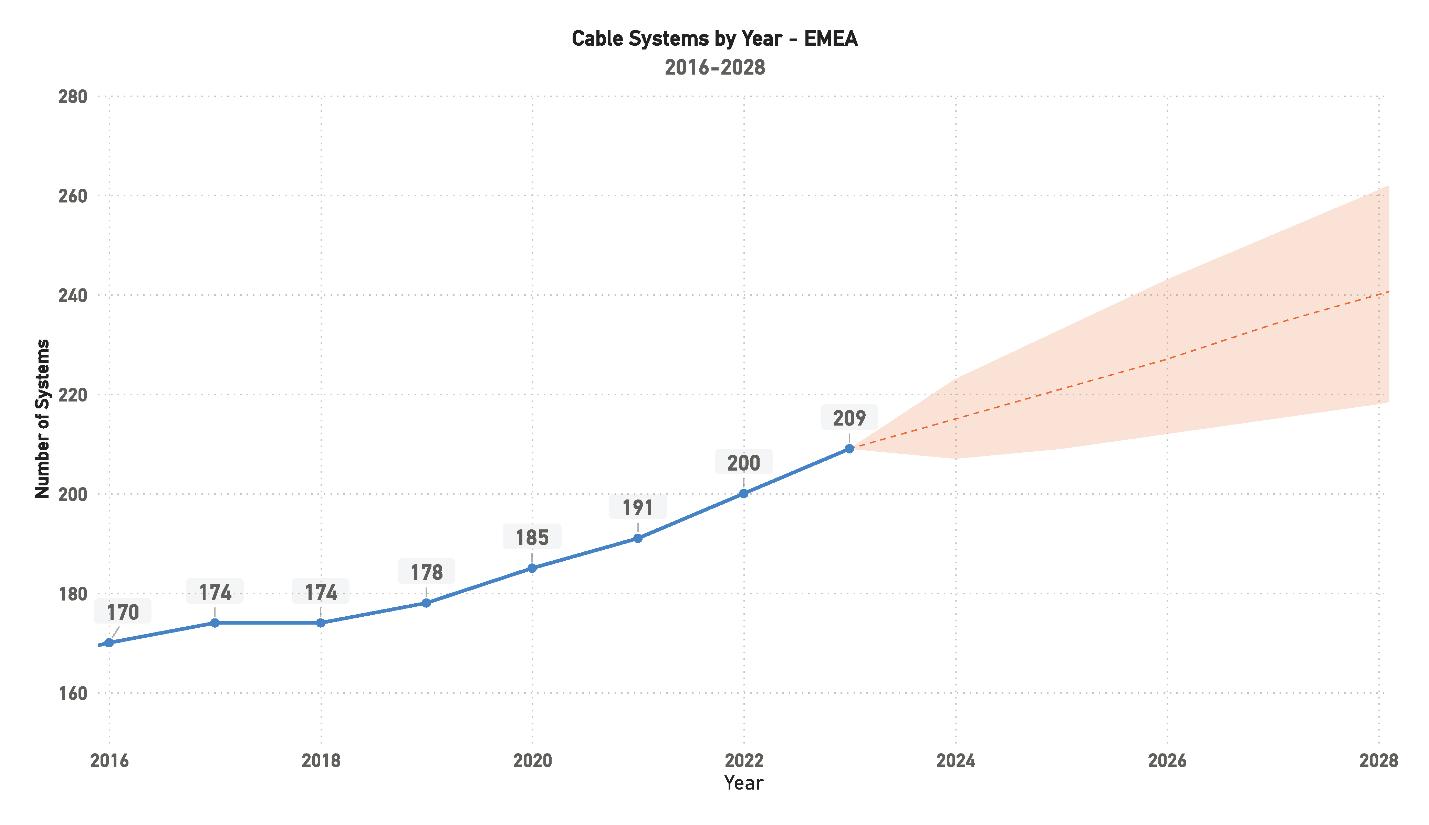

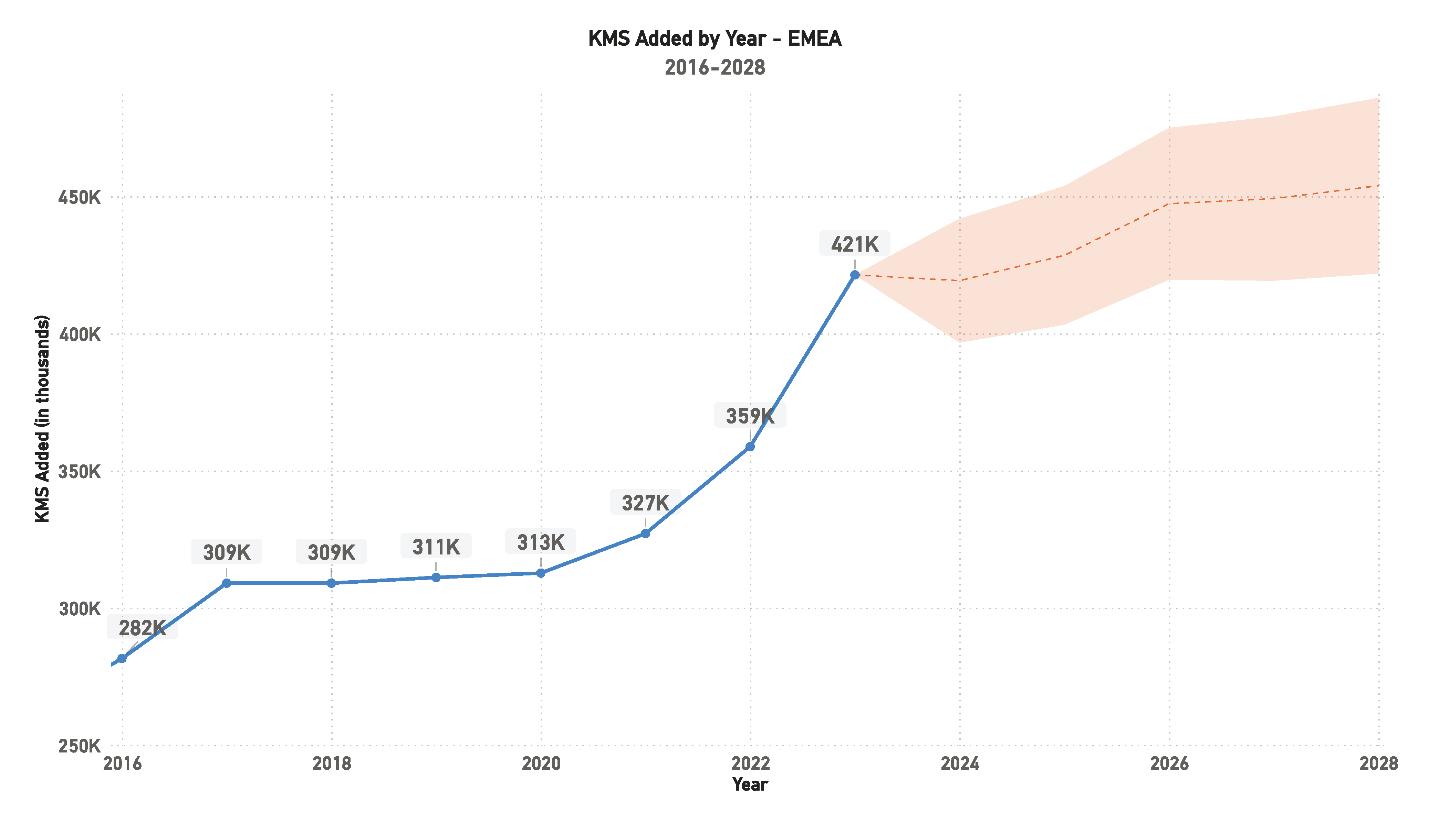

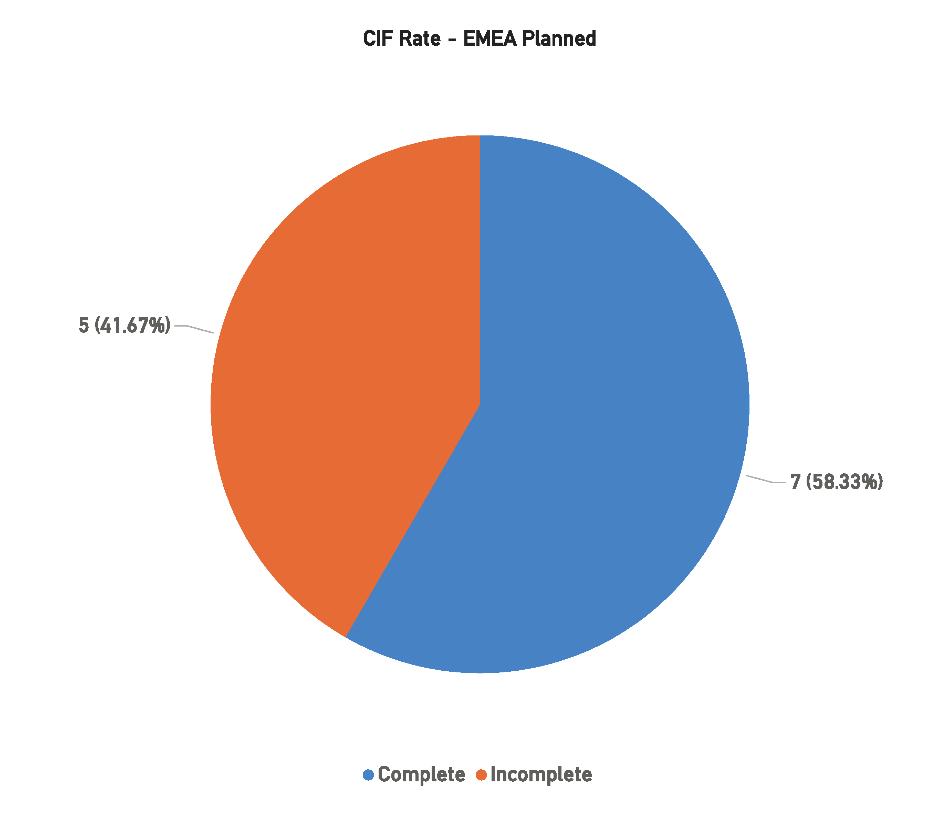

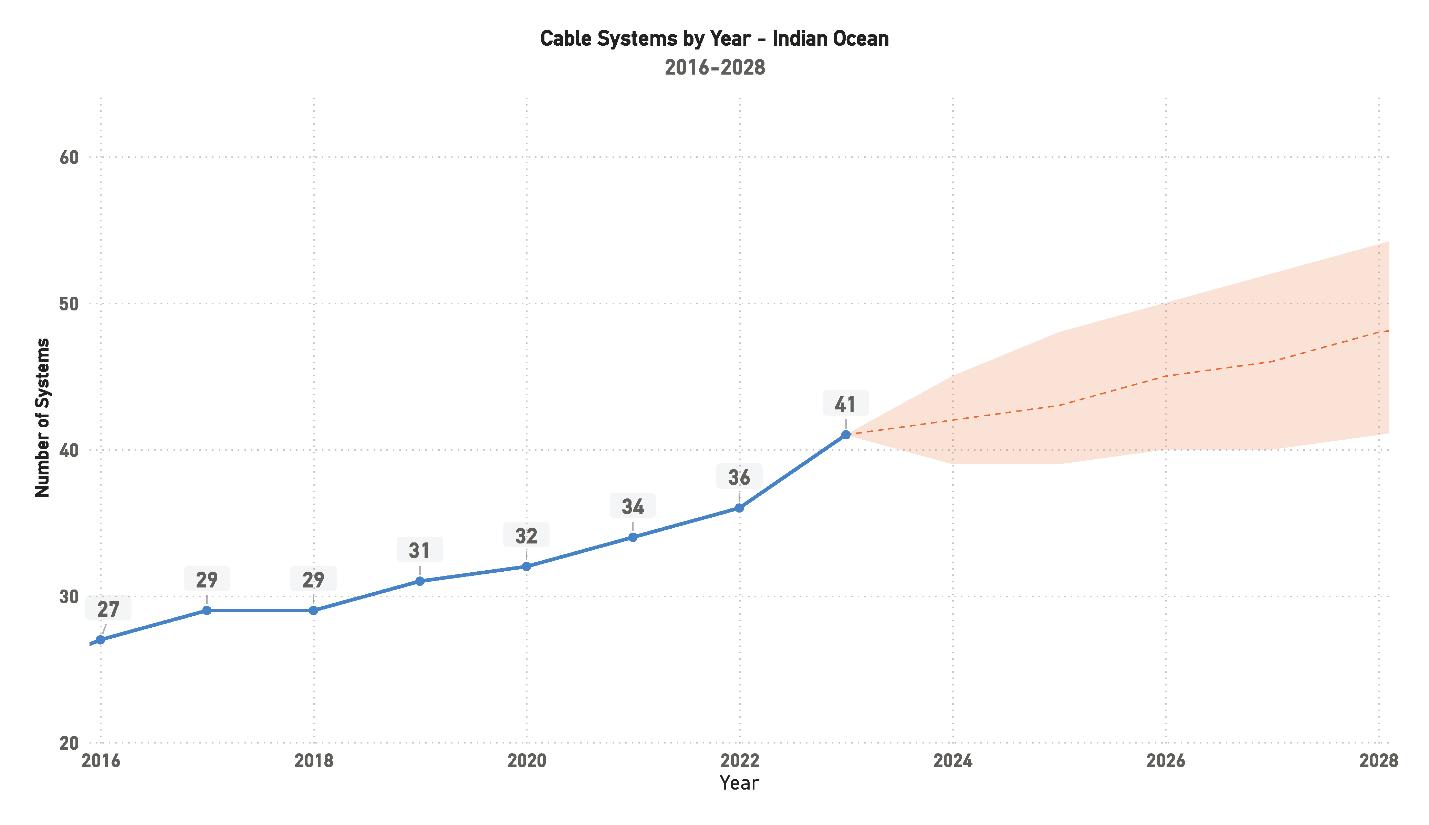

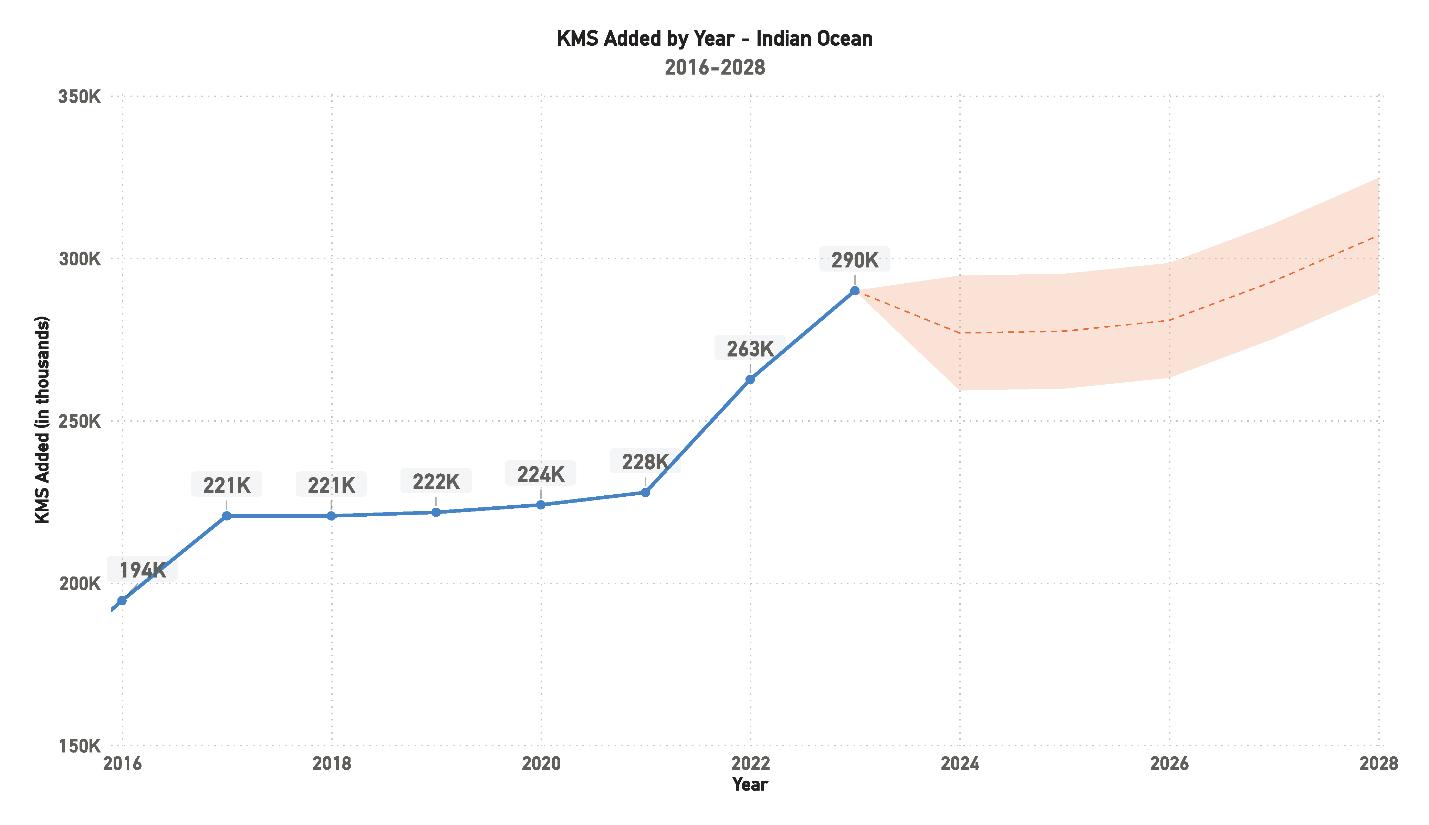

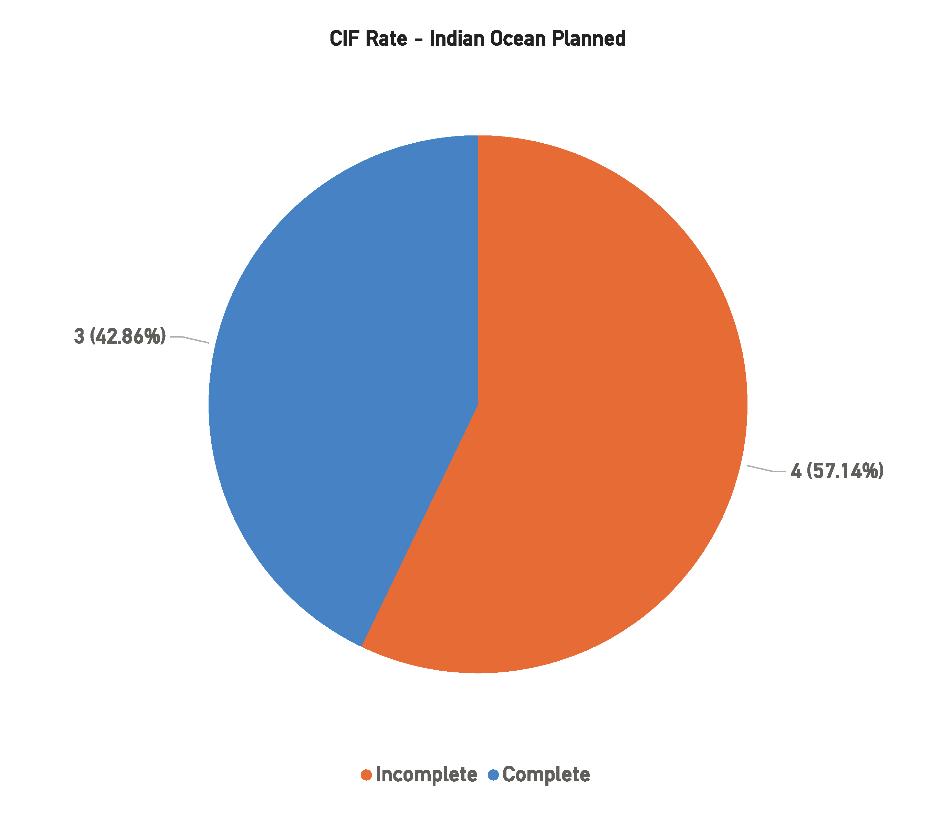

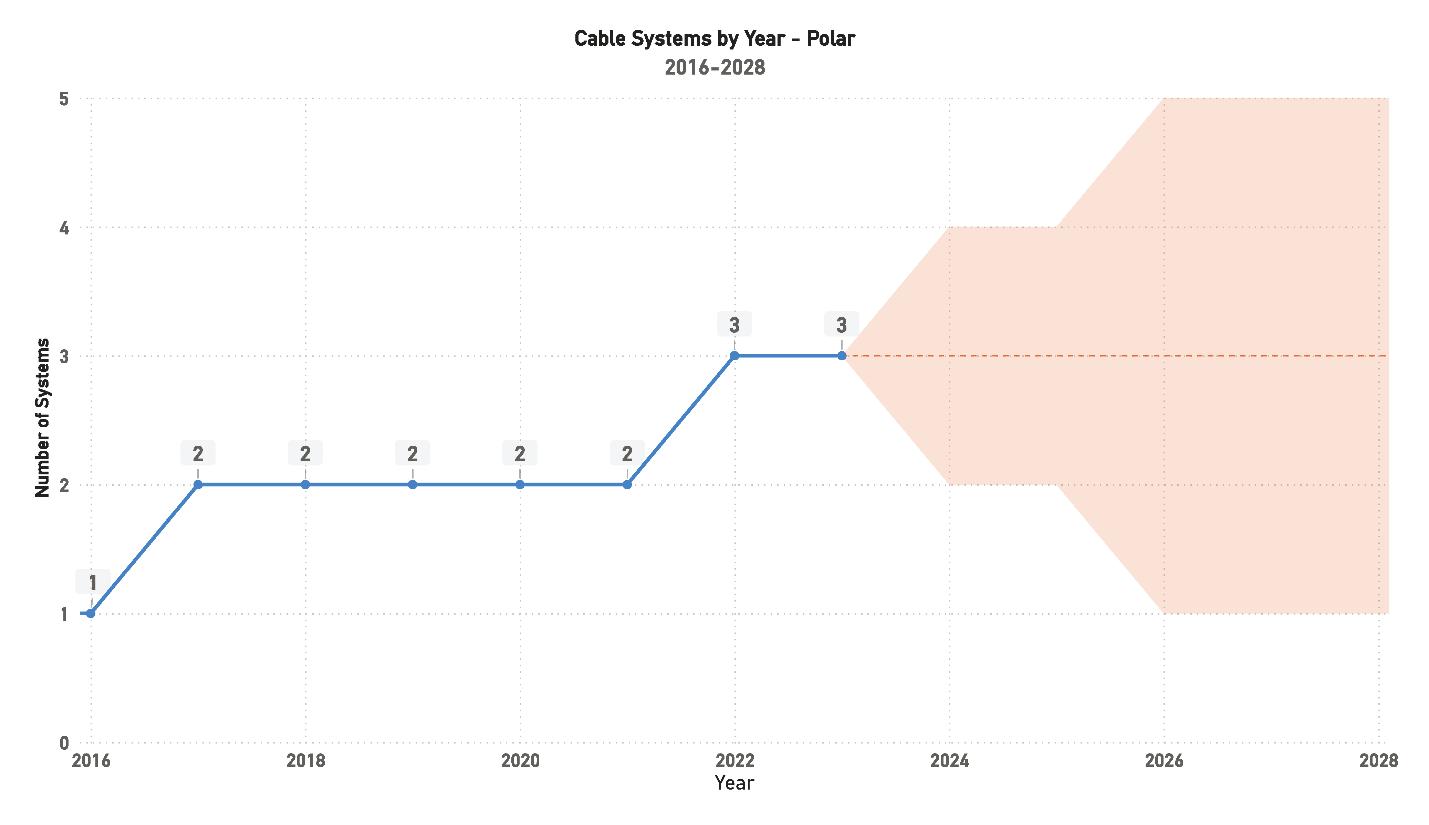

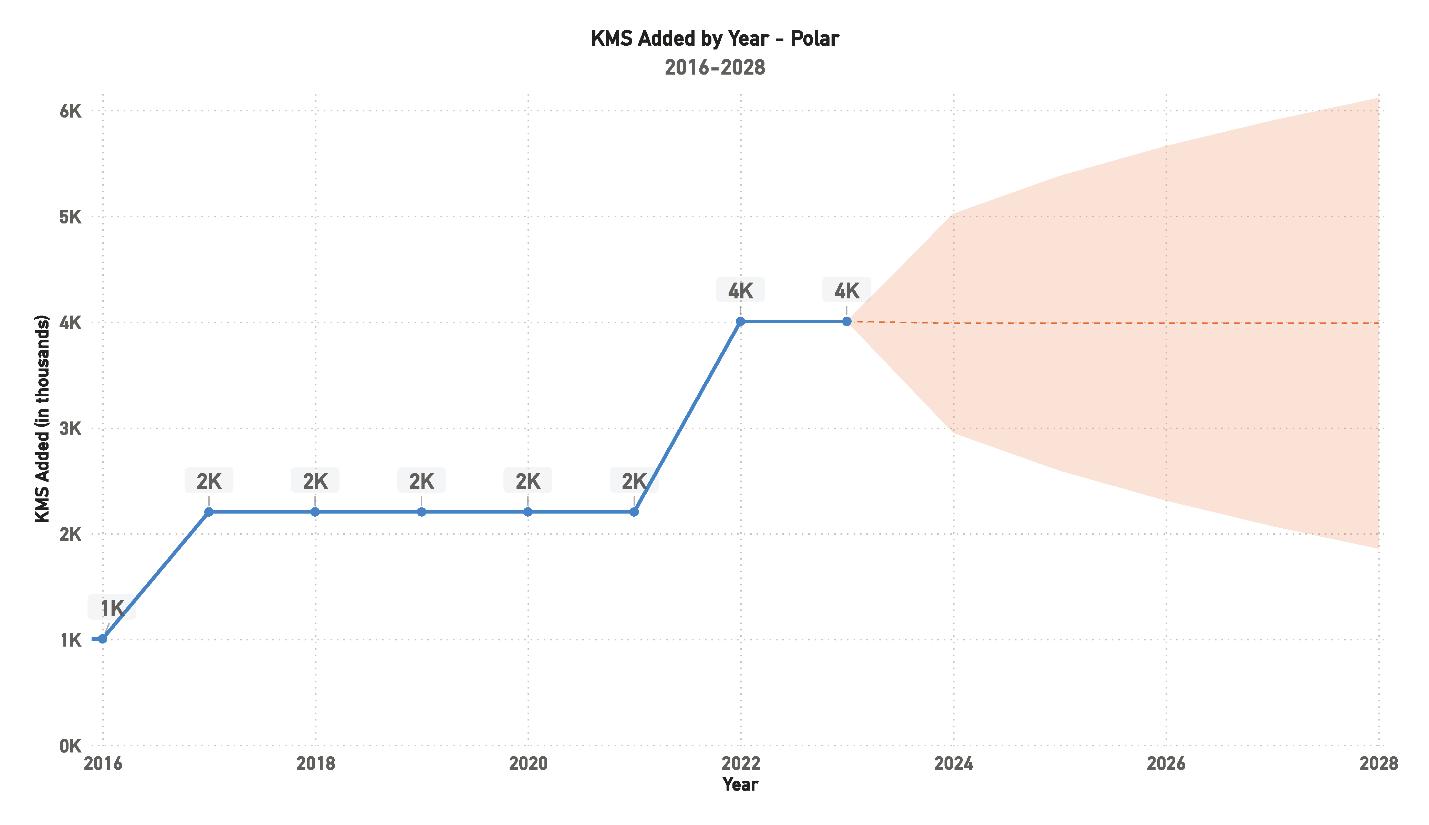

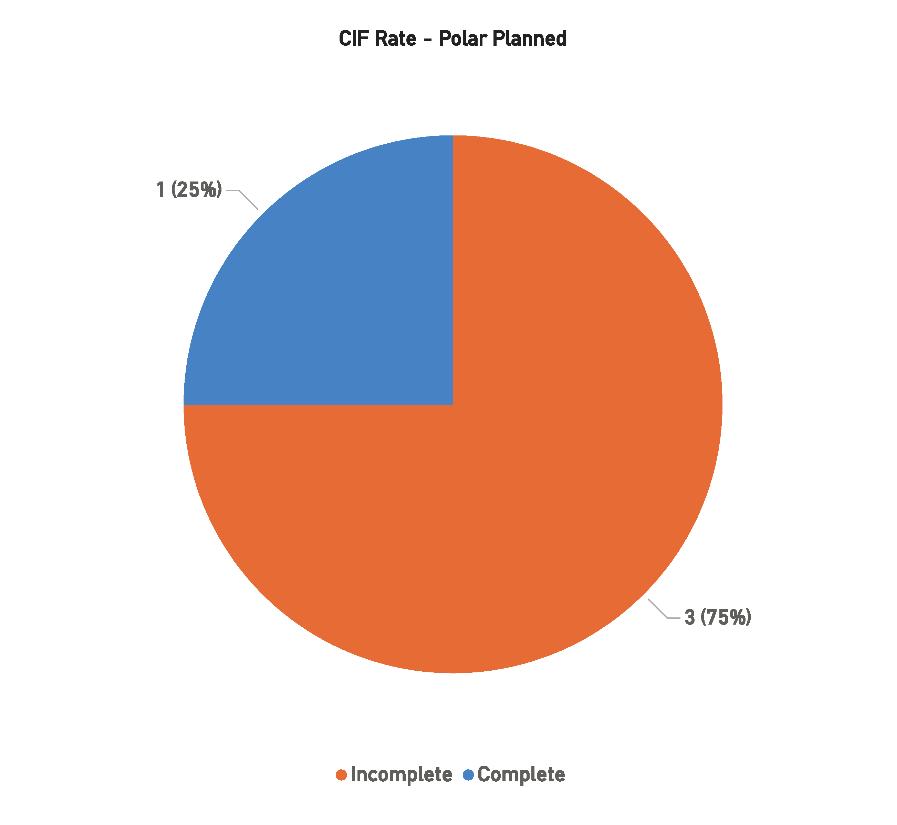

82 ANALYTICS

Regional Systems: A Snapshot of Where We Are and Where We Are Headed.

118 ADVERTISER CORNER

Find out about advertising opportunities to connect with our specialized audience.

The most popular articles, Q&As of 2019. Find out what you missed!

Welcome to an exclusive feature in our magazine, where we explore the captivating world of SubTelForum.com, a pivotal player in the submarine cable industry. This expedition takes us on a detailed journey through the myriad of resources and innovations that are key to understanding and connecting our world beneath the oceans.

mapping efforts by the analysts at SubTel Forum Analytics, a division of Submarine Telecoms Forum. This reference tool gives details on cable systems including a system map, landing points, system capacity, length, RFS year and other valuable data.

CONNECTING THE DEPTHS: YOUR ESSENTIAL GUIDE TO THE SUBTEL FORUM DIRECTORY

Keep on top of our world of coverage with our free News Now daily industry update. News Now is a daily RSS feed of news applicable to the submarine cable industry, highlighting Cable Faults & Maintenance, Conferences & Associations, Current Systems, Data Centers, Future Systems, Offshore Energy, State of the Industry and Technology & Upgrades.

Submarine Cable Almanac is a free quarterly publication made available through diligent data gathering and

Submarine Telecoms Industry Report is an annual free publication with analysis of data collected by the analysts of SubTel Forum Analytics, including system capacity analy sis, as well as the actual productivity and outlook of current and planned systems and the companies that service them.

In our guide to submarine cable resources, the SubTel Forum Directory shines as an essential tool, providing SubTel Forum.com readers with comprehensive access to an array of vetted industry contacts, services, and information. Designed for intuitive navigation, this expansive directory facilitates quick connections with leading vendors, offering detailed profiles and the latest in submarine cable innovations. As a dynamic hub for industry professionals, it fosters community engagement, ensuring our readers stay at the forefront of industry developments, free of charge.

2024 marks a groundbreaking era for SubTel Forum with the launch of its innovative app. This cutting-edge tool is revolutionizing access to submarine telecommunications insights, blending real-time updates, AI-driven analytics,

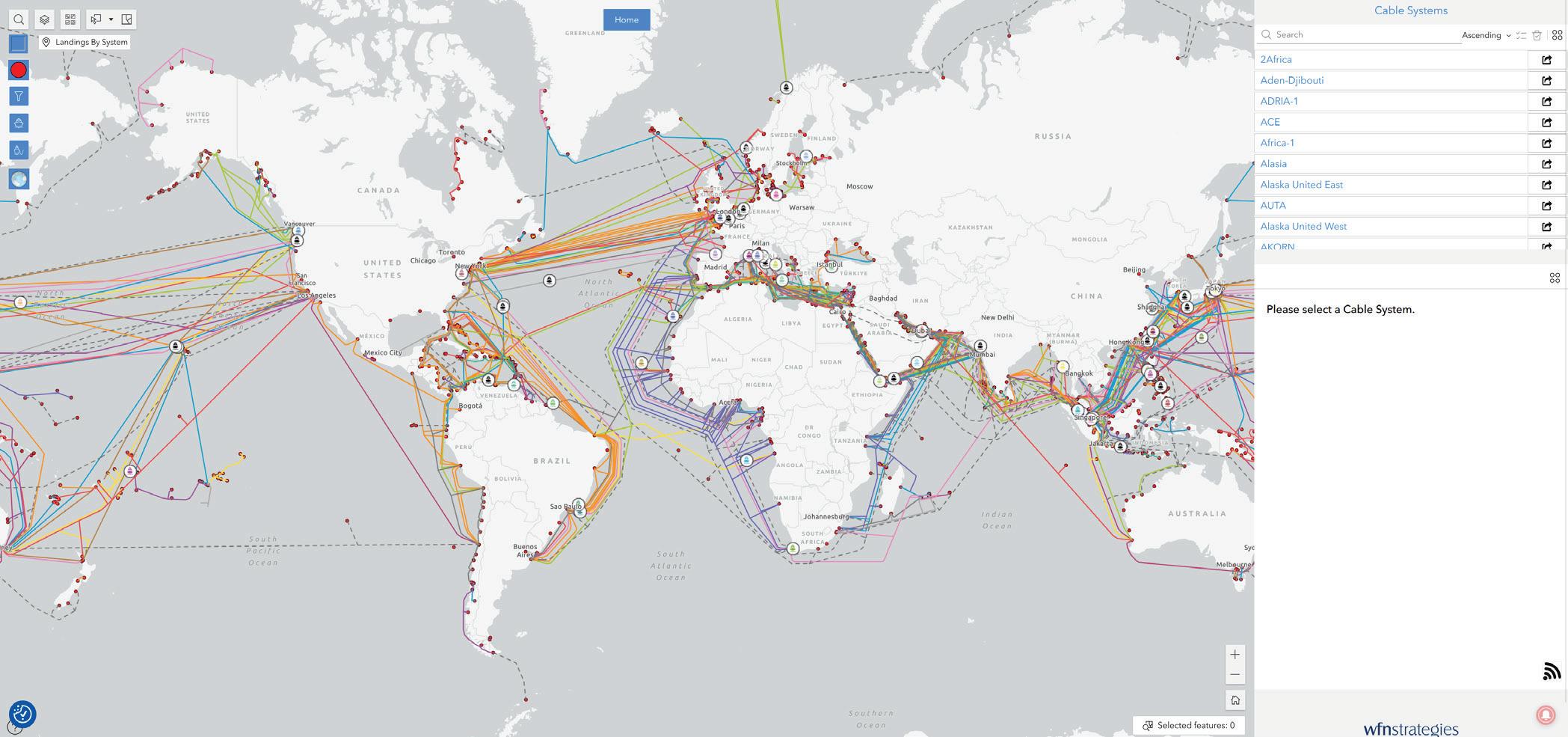

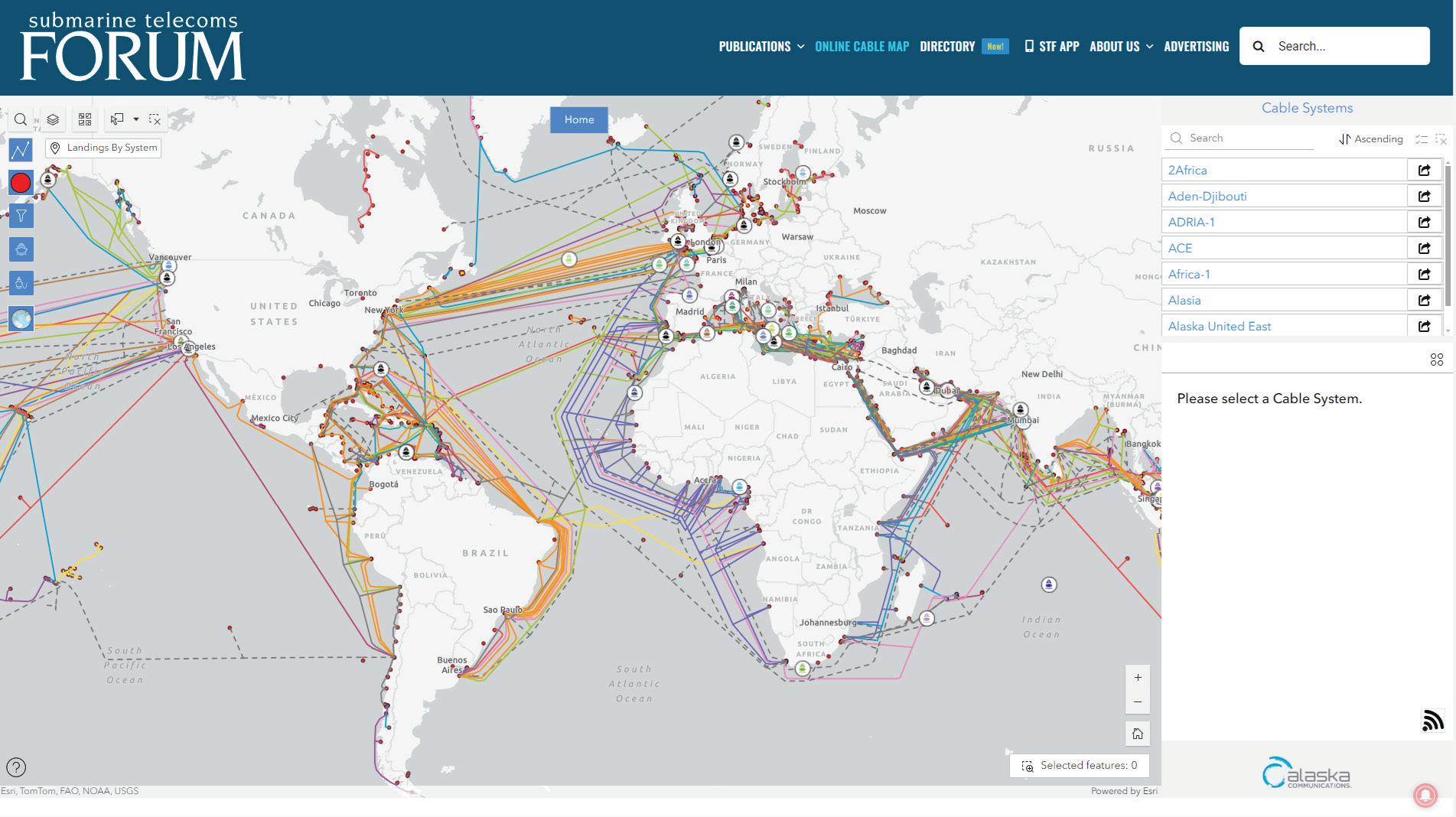

The online SubTel Cable Map is built with the industry standard Esri ArcGIS platform and linked to the SubTel Forum Submarine Cable Database. It tracks the progress of

and a user-centric interface into an indispensable resource for industry professionals. More than just a technological advancement, this app is a platform fostering community, learning, and industry progression. We encourage you to download the SubTel Forum App and join a community at the forefront of undersea communications innovation.

Our journey begins with the News Now updates, providing daily insights into the submarine cable sector. Covering everything from the latest technical developments to significant industry milestones, this feed ensures you’re always informed about the latest trends and happenings. It’s an essential tool for professionals who need to stay on top of industry news.

Dive deeper into the world of submarine communications with our curated collection of articles and Q&As. These insightful pieces offer a comprehensive look at both the history and current state of the industry, enriching your understanding and providing a broader perspective on the challenges and triumphs faced by submarine cable professionals.

• Submarine Cable Almanac: This quarterly treasure trove provides detailed information on global cable systems. You can expect rich content including maps, data on system capacity, length, and other critical details that sketch a vivid picture of the global network.

• Submarine Telecoms Industry Report: Our annual report takes an analytical approach to the industry, covering everything from current trends to capacity analysis and future predictions. It’s an invaluable resource for anyone seeking to understand the market’s trajectory.

• Online SubTel Cable Map: An interactive tool mapping over 550 cable systems, perfect for digital natives who prefer an online method to explore global connections.

• Printed Cable Map: Our annual printed map caters to those who appreciate a tangible representation of the world’s submarine fiber systems, detailed in a visually appealing and informative format.

SubTel Forum’s commitment to education is evident in our courses and master classes, covering various aspects of the industry. Whether you’re a seasoned professional or new to the field, these learning opportunities are fantastic for deepening your understanding of both technical and commercial aspects of submarine telecoms.

SCAN THE QR CODE TO ACCESS ALL THE RESOURCES THAT SUBTELFORUM.COM HAS TO OFFER

Our Authors Index is a valuable tool for locating specific articles and authors. It simplifies the process of finding the information you need or following the work of your favorite contributors in the field.

• Data Center & OTT Providers Report: This report delves into the evolving relationship between cable landing stations and data centers, highlighting trends in efficiency and integration.

• Global Outlook Report: Offering a comprehensive analysis of the submarine telecoms market, this report includes regional overviews and market forecasts, providing a global perspective on the industry.

• Offshore Energy Report: Focusing on the submarine fiber industry’s oil & gas sector, this report examines market trends and technological advancements, offering insights into this specialized area.

• Regional Systems Report: This analysis of regional submarine cable markets discusses capacity demands, development strategies, and market dynamics, providing a detailed look at different global regions.

• Unrepeatered Systems Report: A thorough examination of unrepeatered cable systems, this report covers project timelines, costs, and operational aspects, essential for understanding this segment of the industry.

• Submarine Cable Dataset: An exhaustive resource detailing over 550 fiber optic cable systems, this dataset covers a wide range of operational data, making it a go-to reference for industry specifics.

SubTelForum.com stands as a comprehensive portal to the dynamic and intricate world of submarine cable communications. It brings together a diverse range of tools, insights, and resources, each designed to enhance understanding and engagement within this crucial industry. From the cutting-edge SubTel Forum App to in-depth reports and interactive maps, the platform caters to a wide audience, offering unique perspectives and valuable knowledge. Whether you’re a seasoned professional or new to the field, SubTelForum.com is an indispensable resource for anyone looking to deepen their understanding or stay updated in the field of submarine telecommunications.

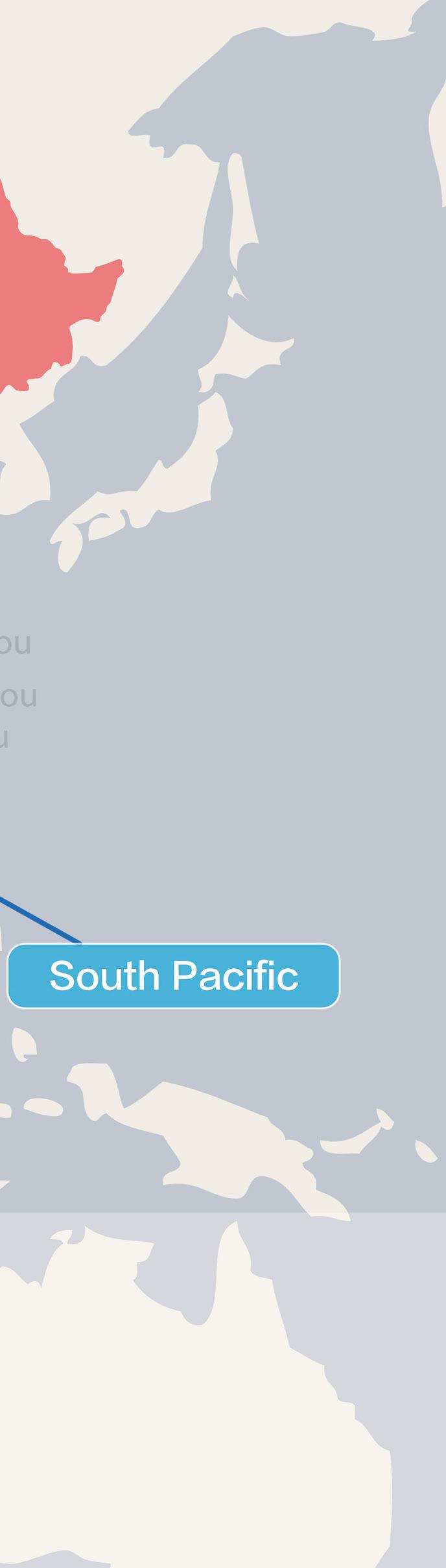

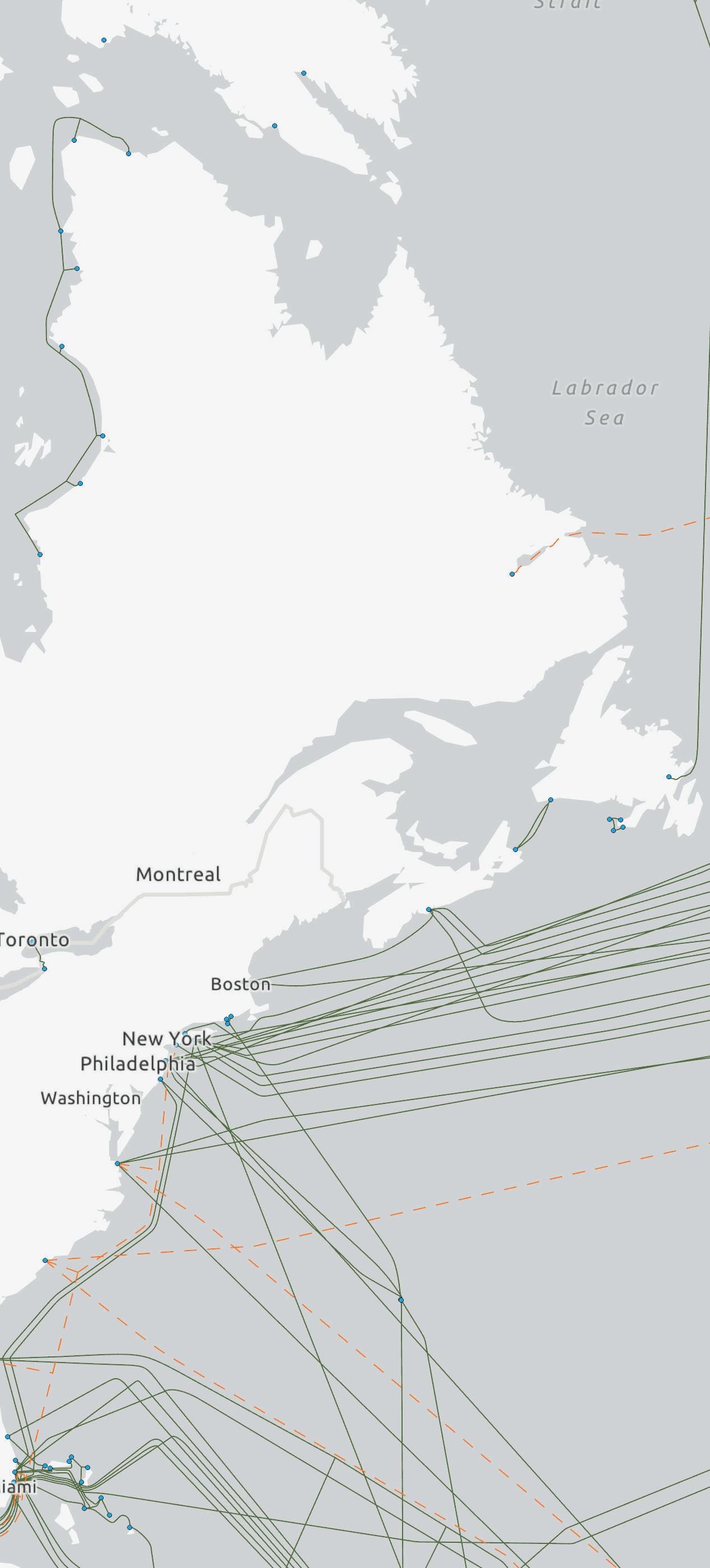

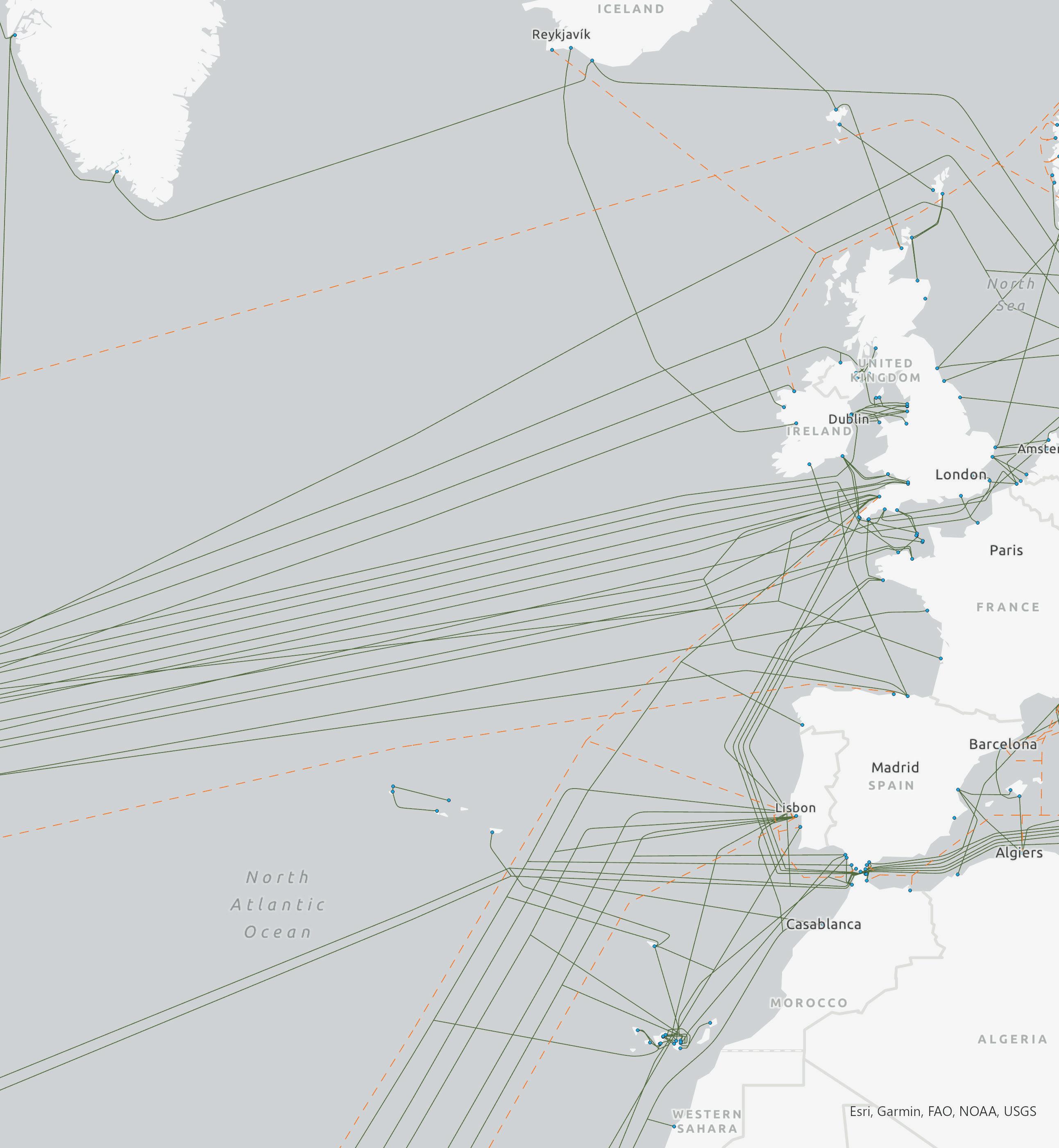

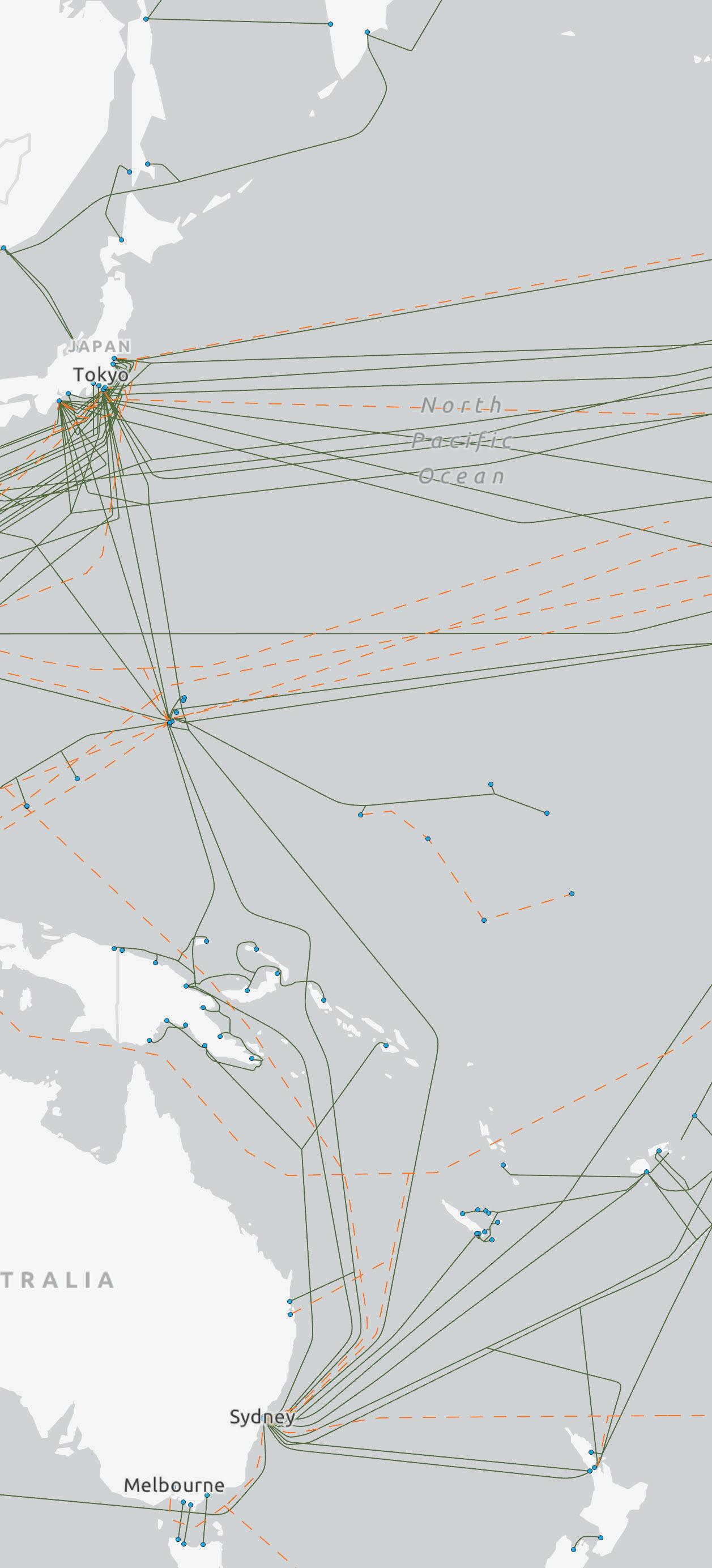

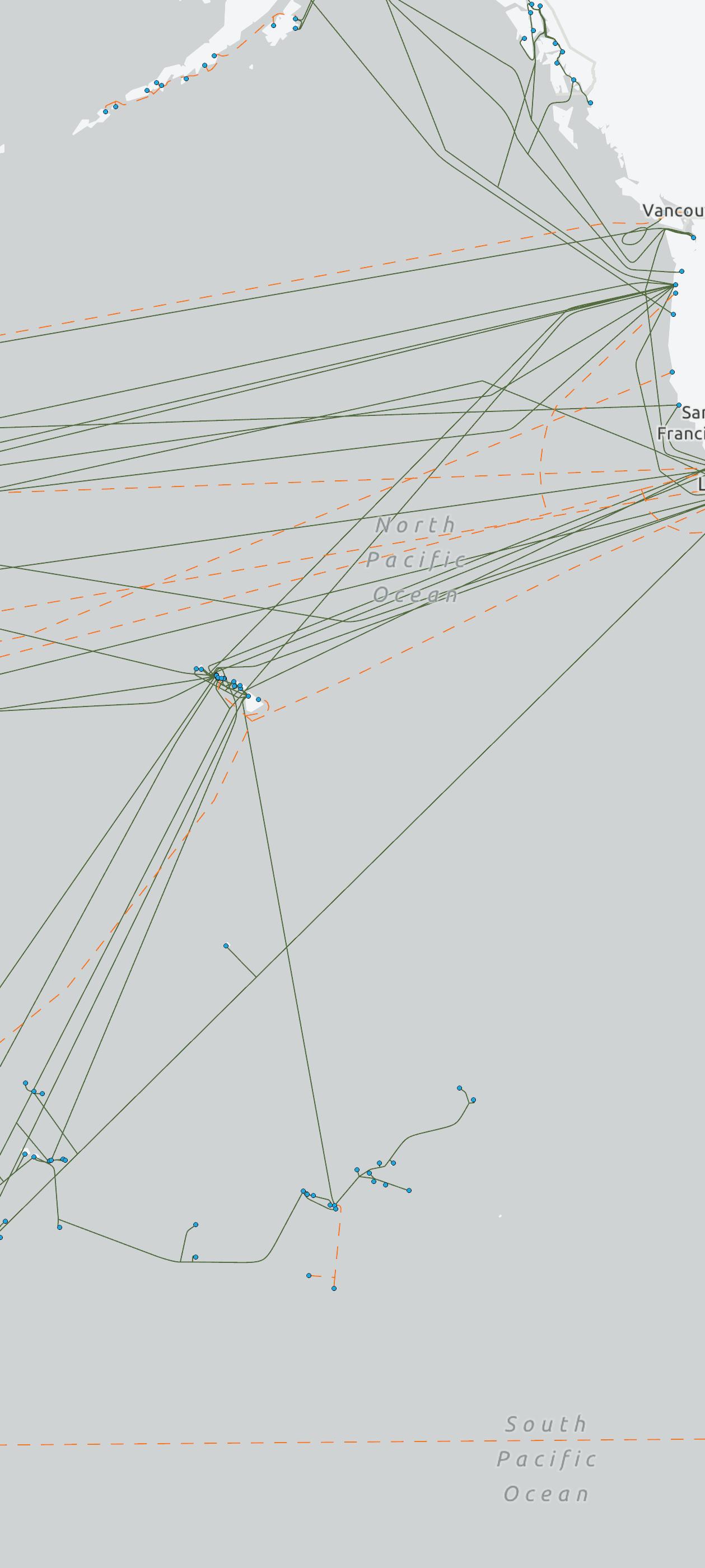

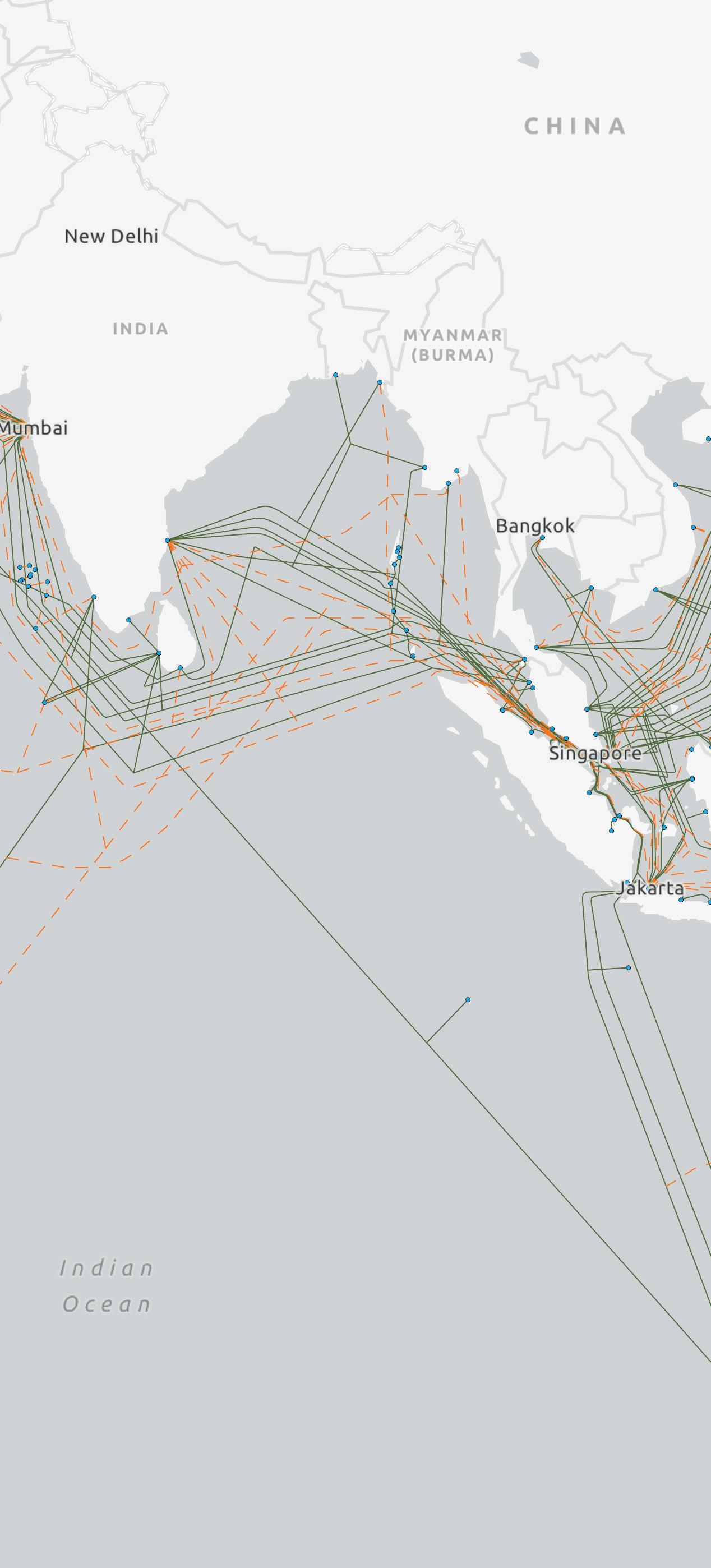

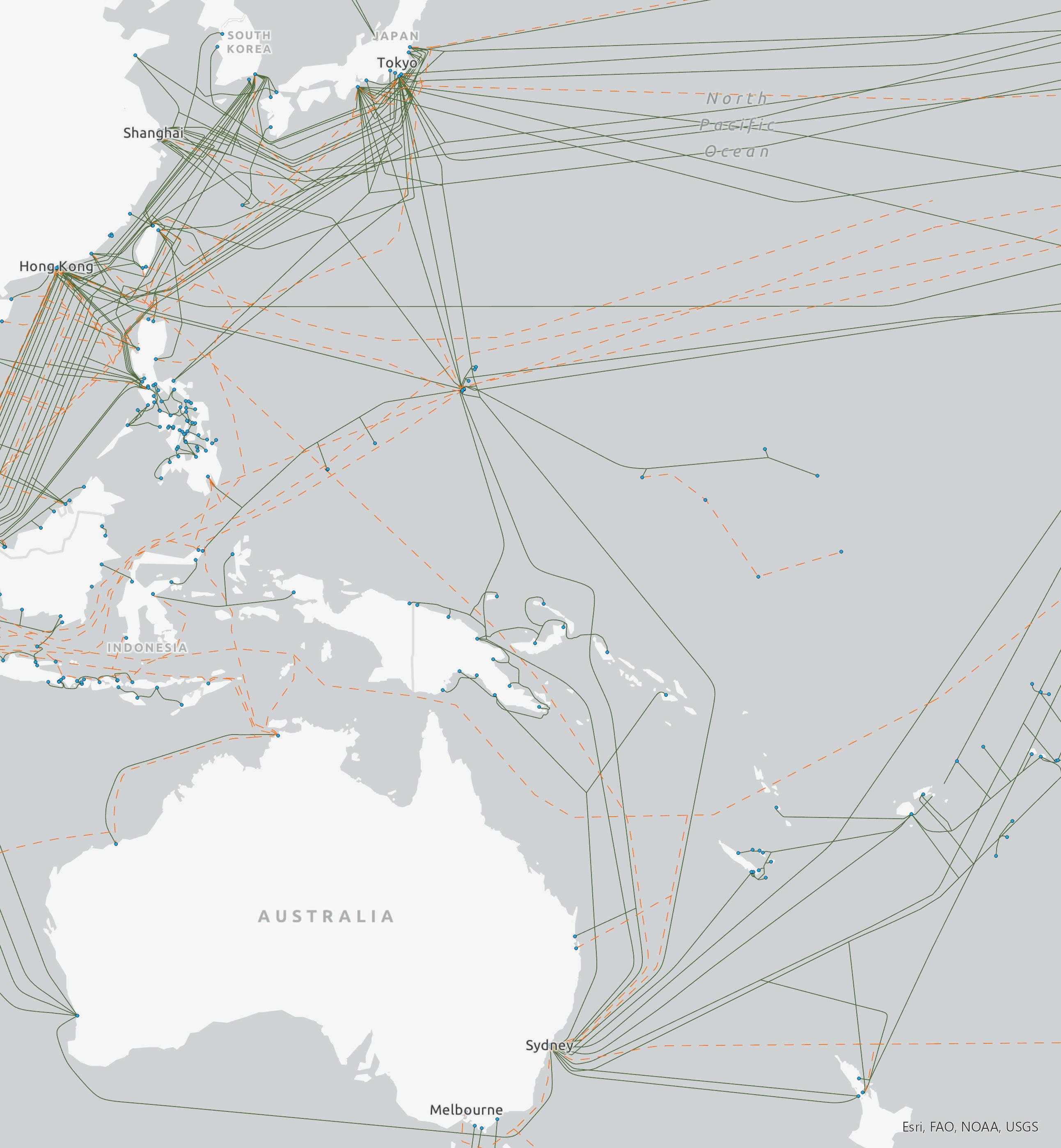

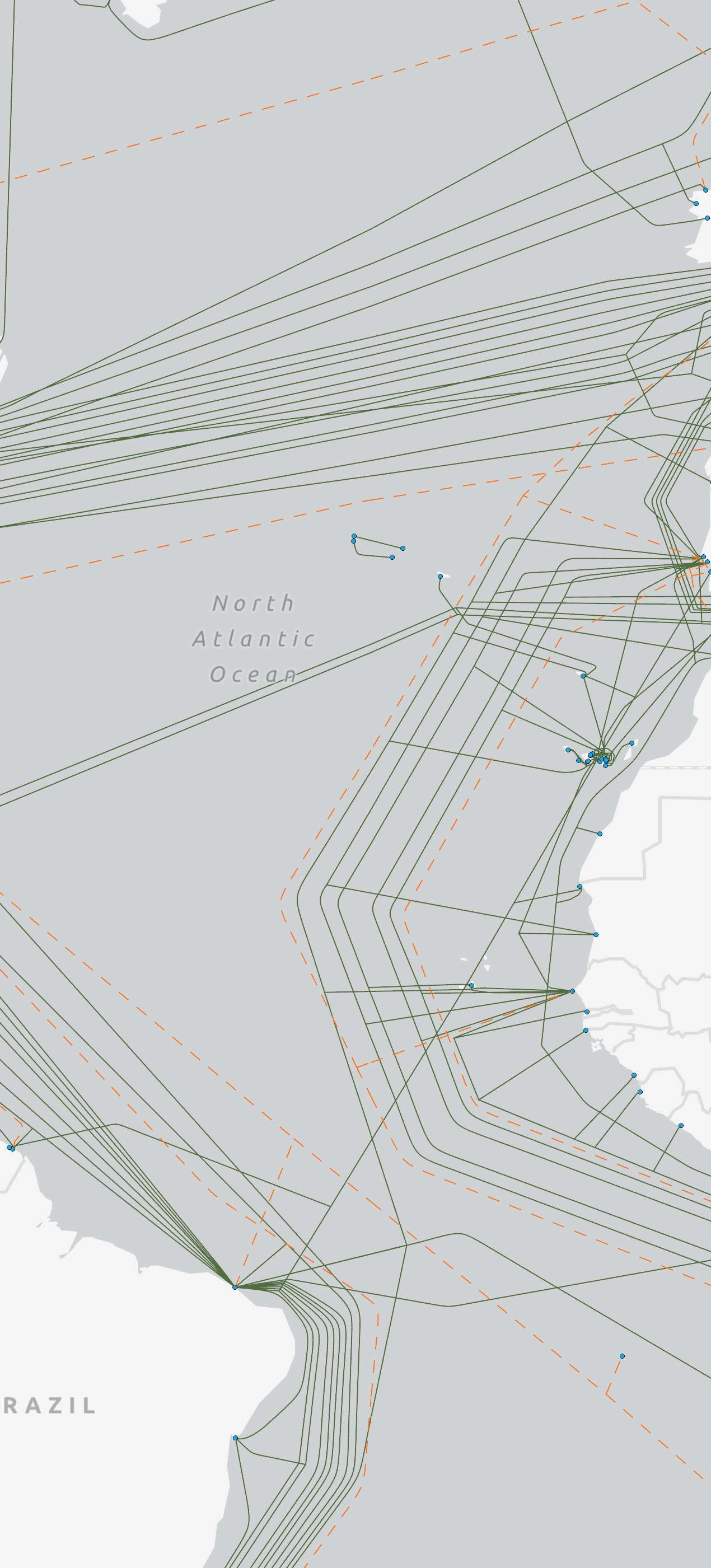

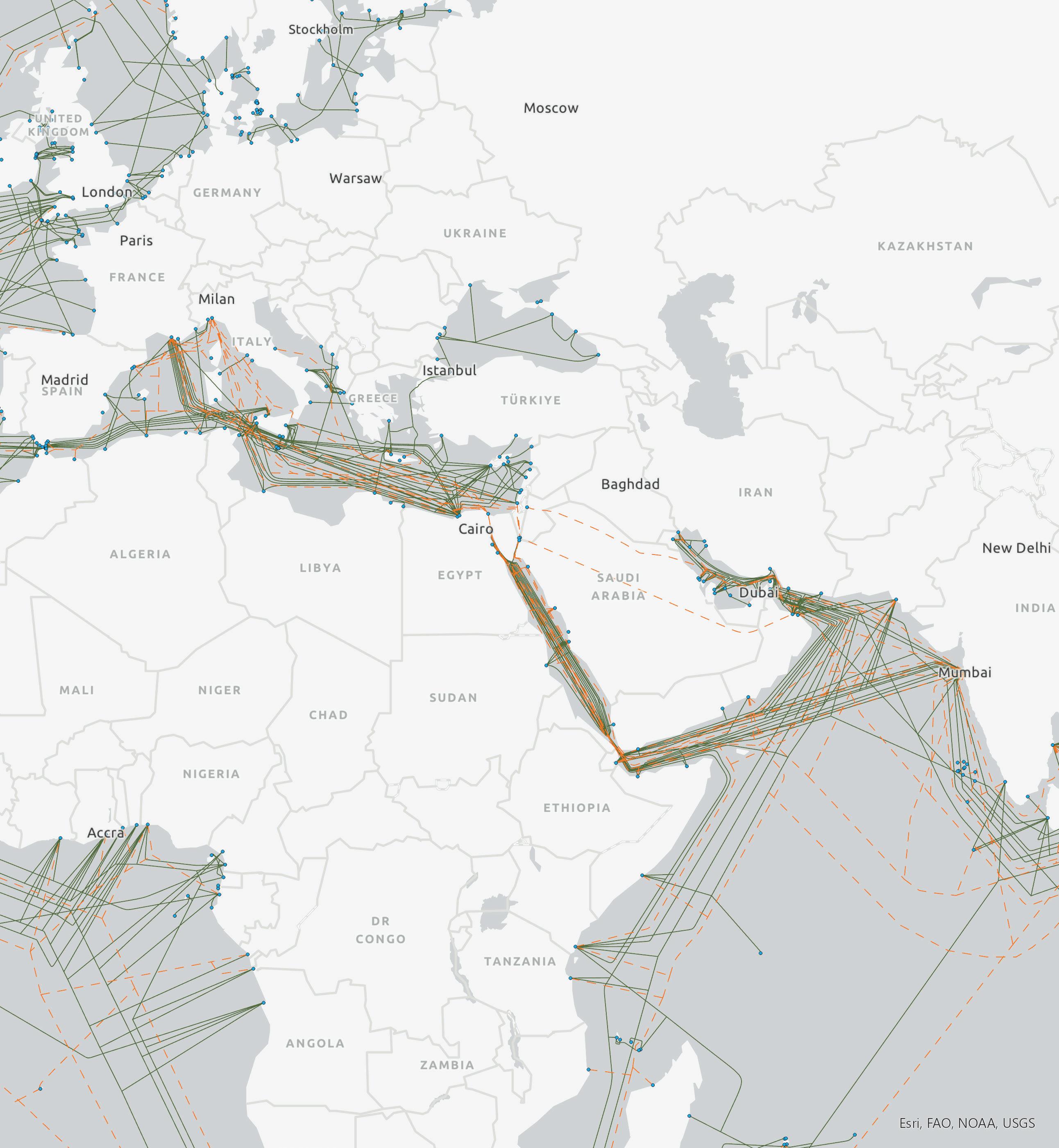

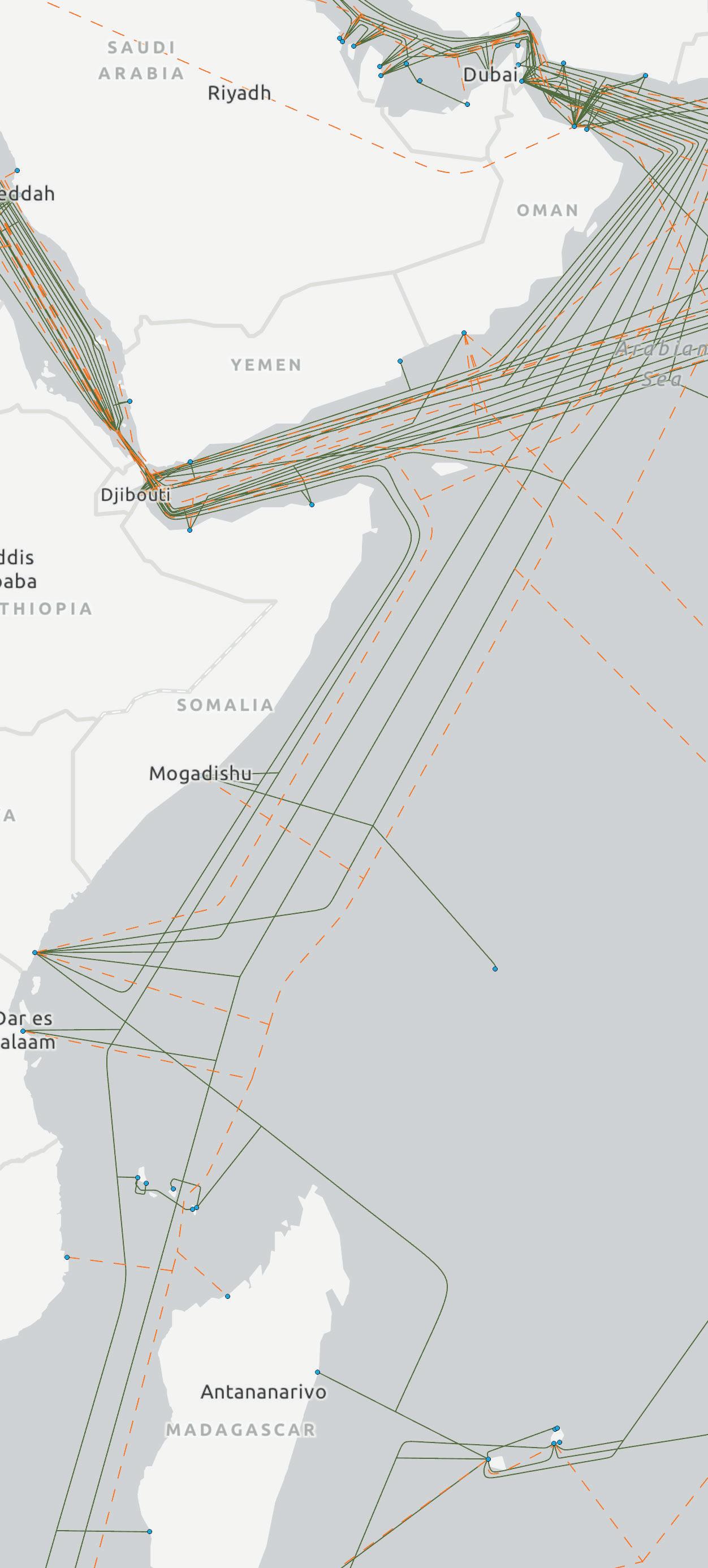

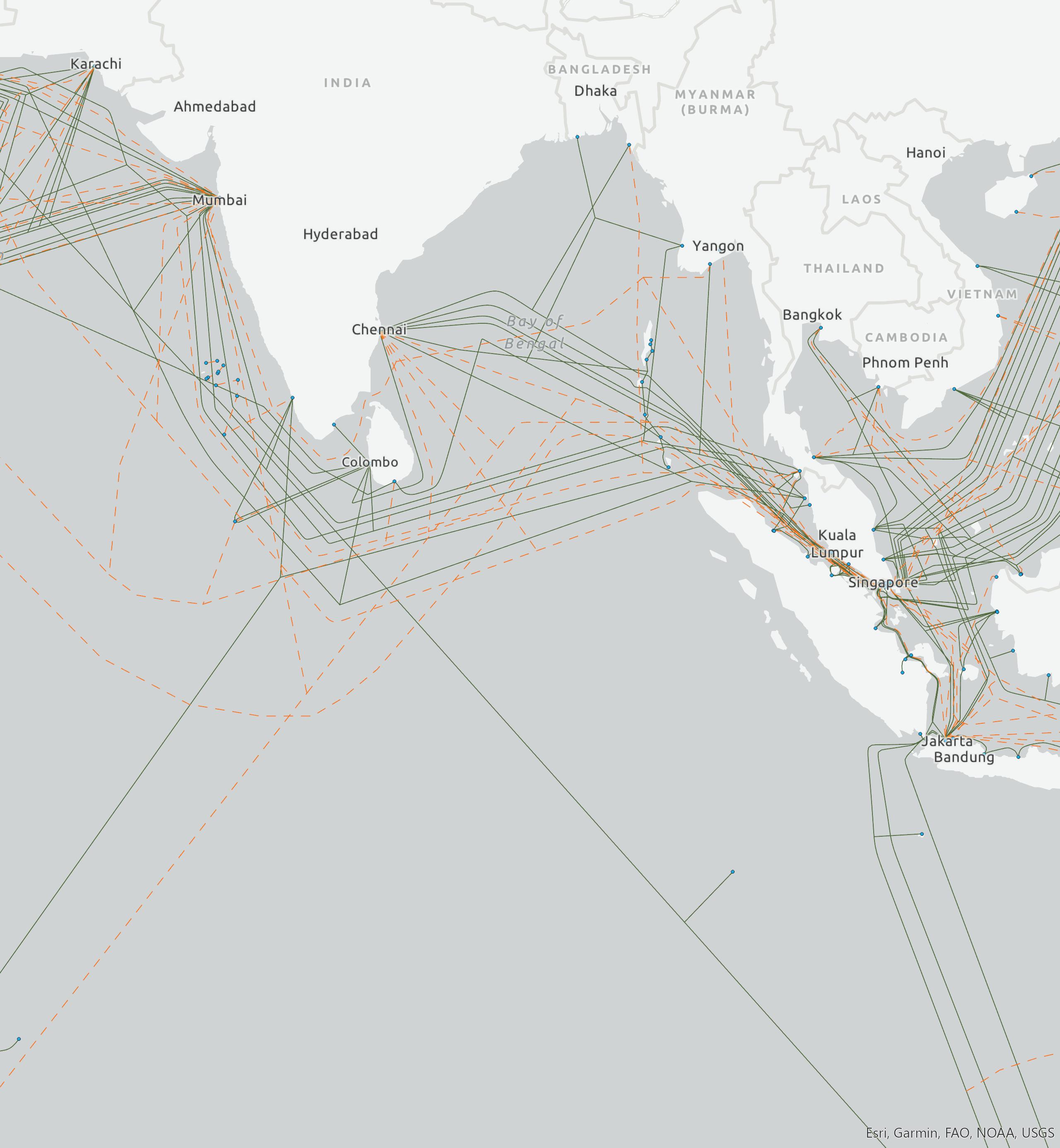

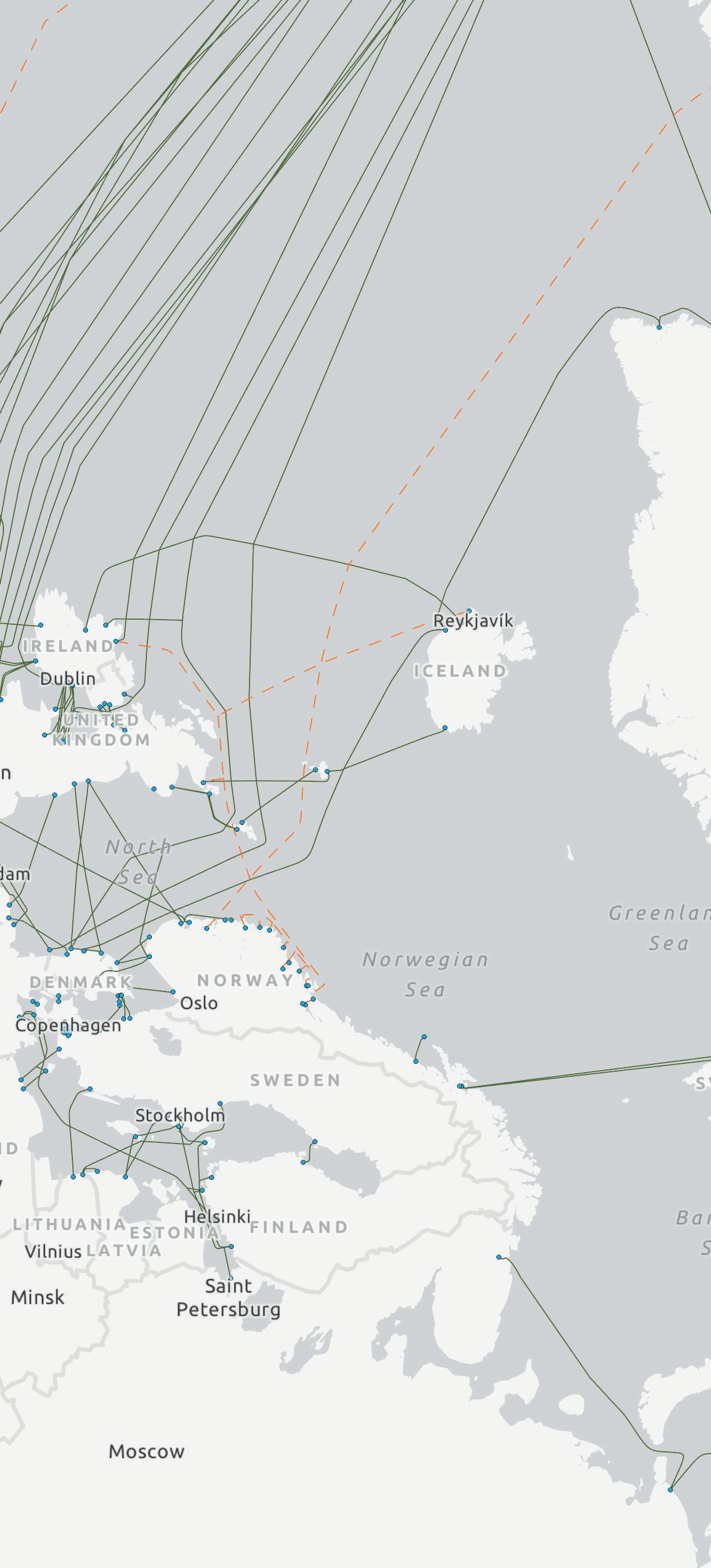

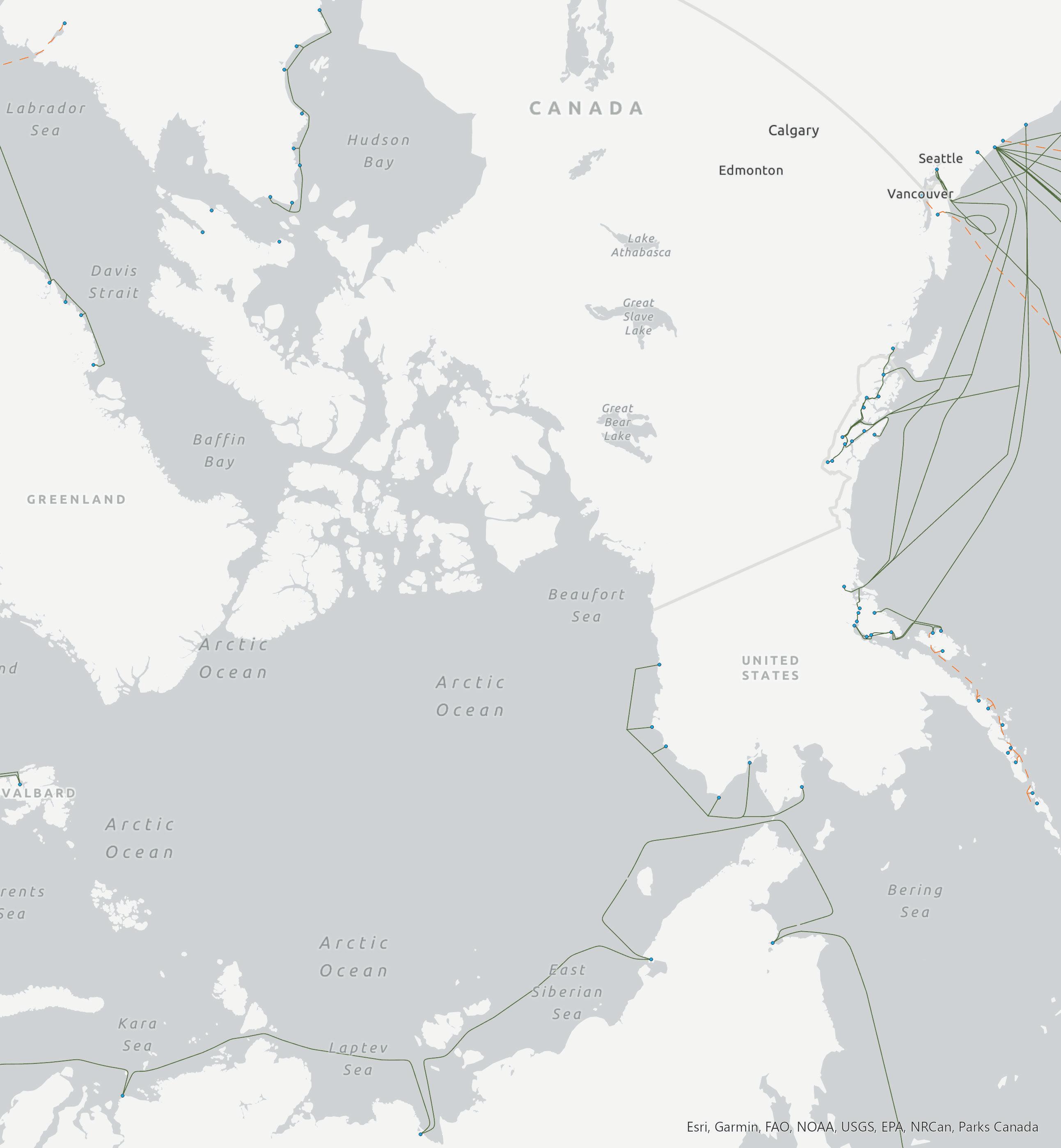

BY KIERAN CLARK

The SubTel Cable Map, built on the industry leading Esri ArcGIS platform, offers a dynamic and engaging way to explore over 440 current and planned cable systems, 50+ cable ships, and more than 1,000 landing points. This interactive tool is linked to the SubTel Forum Submarine Cable Database, providing users with a comprehensive view of the industry.

We are proud to highlight ACS Cable Systems, a leading provider of wholesale carrier services, as the official sponsor of the SubTel Cable Map. The ACS logo is prominently displayed on the map, serving as a direct link to their comprehensive offerings at Alaska Communications. This sponsorship underscores our mutual commitment to supporting the submarine telecommunications industry by providing critical infrastructure and connectivity solutions. ACS Cable Systems specializes in delivering high-quality, reliable services tailored to meet the needs of global carriers, enhancing the value they provide to their clients. This integration ensures that our users have instant access to a trusted partner renowned for their expertise in connectivity and customer service.

For more information about ACS Cable Systems and their services, please visit their website.

Submarine cables play a pivotal role in global communications, acting as the backbone of the internet. They are responsible for transmitting over 99% of all international data, connecting continents and enabling global connectivity. Without these underwater highways, the speed and efficiency of global internet communication that we enjoy today would not be possible.

The Esri ArcGIS platform, upon which the SubTel Cable Map is built, is a powerful geographic information system (GIS) for working with maps and geographic information. It is used for creating and using maps, compiling geographic data, analyzing mapped information, sharing and discovering geographic information, and using maps and geographic information in a range of applications. Its

robust capabilities make it an ideal platform for the SubTel Cable Map, allowing for dynamic, interactive exploration of complex data.

With systems connected to SubTel Forum’s News Now Feed, users can easily view current and archived news details related to each system. This interactive map is an ongoing effort, updated frequently with valuable data collected by SubTel Forum analysts and insightful feedback from our users. Our aim is to provide not only data from the Submarine Cable Almanac, but also to incorporate additional layers of system information for a comprehensive view of the industry.

We encourage you to explore the SubTel Cable Map to deepen your understanding of the industry and to educate others on the critical role that submarine cable systems play in global communications. All submarine cable data for the Online Cable Map is sourced from the public domain, and we’re committed to keeping the information as current as possible. If you are the point of contact for a company or system that needs updating, please don’t hesitate to reach out to kclark@subtelforum.com

We hope the SubTel Cable Map serves as a valuable resource to you and invites you to dive into the ever-evolving world of submarine cable systems. We invite you to

start your exploration today and see firsthand the intricate network that powers our global communications. Happy exploring! STF

KIERAN CLARK is the Lead Analyst for SubTel Forum. He originally joined SubTel Forum in 2013 as a Broadcast Technician to provide support for live event video streaming. He has 6+ years of live production experience and has worked alongside some of the premier organizations in video web streaming. In 2014, Kieran was promoted to Analyst and is currently responsible for the research and maintenance that supports the Submarine Cable Database. In 2016, he was promoted to Lead Analyst and his analysis is featured in almost the entire array of Subtel Forum Publications.

Do you have further questions on this topic?

Below is the full list of systems added and updated since the last issue of the magazine:

JULY 15, 2024

SYSTEMS ADDED:

• Halaihai

• Honomoana

• North Pacific Connect Interlink

• Proa

• South Pacific Connect Interlink

• Tabua

• Umoja

SYSTEMS UPDATED:

• Asia-America Gateway

• Bangladesh to Myanmar

• Barat Timur Indonesia

• Central Pacific Cable

• Chile Antarctica

• Hawaiian Islands Fiber Link

• Japan-Guam-Australia South

• Nuvem

• Trans Americas Fiber System

BY ISABELLE CHERRY

In the first of a new Sustainable Subsea interview series, undergraduate UC Berkeley Environmental Policy and Management student Isabelle Cherry interviews Alwyn du Plessis of Mertech Marine about his experience in cable recovery and recycling.

This series will feature interviews of subsea cable leaders and experts conducted by students and young professionals. These interviews offer a view for the next generation of the challenges and opportunities of working in the cable industry, especially while keeping sustainability in mind.

Since recovery and recycling of subsea cables contributes to the circular economy and enhances sustainability, we begin with this emerging area.

In the following dialogue, Alwyn du Plessis recounts the challenges and memorable experiences of his time at Mertech Marine, and comments on the significance of recognizing sustainability in his career. The conversation offers insights into the continued difficulty of working on the ocean despite all technological advancements, the need to stay agile and adaptive, and the ongoing importance of collaboration.

What are some of the biggest challenges in subsea cable recovery and recycling that you have encountered over the course of your career?

The entire journey was actually quite challenging. When we started off, we were really pioneering the commercial recovery and recycling of subsea cables. Everything we did was new, and there were not really any people we could go and ask. It took quite a lot of time and capital investment.

One of the challenges that does stand out is working in the high seas, which is quite difficult by itself. In this industry, there are more things that are out of your control than in your control. You’ve got the sea that you have to contend with. You’ve got weather, you’ve got specific weather windows. You don’t know whether the cable is actually still there. There might have been an earthquake or a landslide or sand migration. All sorts of things could have happened. And you might not find the cable. Some of the older cables that we recovered, there was very little information around for those cables. We didn’t know exactly what the makeup of the cable was from a value point of view, exactly what the water depths were, or the exact lay positions.

Commodity pricing can also vary. You may be pursuing a cable for years and then by the time you get it, the commodity prices might be completely different from when you started off on that journey.

The industry has moved quite a lot from where initially recovery and

recycling wasn’t something anybody thought about. Today, a lot of companies are thinking about recycling and they see it as an opportunity. But in the beginning, you really had to twist people’s arms to get them to agree.

Yes, that definitely sounds like significant uncertainty and a lot of figuring out things on the fly. That leads to my next question: is there a particularly memorable project that you could share with us?

It’s difficult to just identify one specific project. I think the ones that stand out for me are the recovery of the TAT-1 cable, which ran from Canada to the UK. This was the first submarine telephone cable laid across the Atlantic, although there were obviously telegraph cables before that. It was the first telephone cable ever recovered. Some of the equipment in that system was really quite high-tech at the time. Obviously, it was laid in around 1961, so by the time we recovered it in 2016, it was quite outdated. But the technology that was in there was really quite cutting-edge back in the 1960s.

Then there’s China-US, for which we did a turnkey decommissioning. This was actually the first turnkey, let’s call it a “mega-decommissioning” of a cable system, where the cable owners engaged with us even before

the cable system was switched off. We started planning with them how we were going to recover the shore ends (which needed to be recovered from a regulatory point of view) and to clear out the cable depots of spare cables. I think there was something like four and a half thousand tonnes of spare cable in the depots. And then, the recovery of the deep water sections running from China to the US, that was a memorable one. I always say that I went to the University of Decommissioning at the University of China-US. We learned a lot of expensive lessons in that project.

Another project, which isn’t necessarily a cable, but we recently launched a new vessel. She’s currently busy with a maiden voyage. We’re really excited to get that going. That was a big milestone for us. We have a remote processing facility in the Philippines, which has been running for the past 18 months or so, which is also very exciting. There have been lots of new things that we’ve learned in the process.

I would say something which for me really propelled my own enthusiasm for where we are going is when we got some external people in to help us analyze our carbon footprint. We looked at the various scope one, scope two, and scope three emissions to ask the question: is what we’re doing, is it really good? What is the net impact of what we’re doing? It was satisfying to actually see that the numbers do add up and that by recovering and recycling these cables from a carbon point of view, it does actually add a lot of benefit overall.

ISABELLE:

Looking to the future, are there any upcoming technologies or trends that you’re particularly excited about?

I wouldn’t say that there are trends. It’s not like we’re a mainstream business. Most of the R&D that we have is done by us. We obviously try to see whether there are clever technologies that we can borrow from other industries or from our peers in the cable laying and cable maintenance industries. We are working on some exciting technology internally on the R&D side, but I can’t really tell you what that is, but within the next year, I think we will be deploying some new technology that we’ve been developing that we think might make a big difference.

I think for us, the main thing is really about staying agile and to make sure that we can adopt solutions and adapt to changing circumstances really quickly. The way cables are laid and recovered is still done very much the way it was done many years ago. I think part of it is just the challenges of working at these depths, there’s not much that you can do to change that.

Yes, it seems like this is an interesting environment in terms of how you have to research and develop internally and yet also work with other industries. I’m curious, was there ever a point where you met a major supply chain challenge and how did you address it?

ALWYN:

Shortly after COVID, there was a massive increase in freight rates, especially from Asia. That really took us by surprise. It was really sudden and it was really sharp. I mean, the increase of the freight cost of moving our material to our processing facility was significant, not just double or triple. It was

more than that. That’s actually how our Philippines operation was born. Our remote processing facility is a backup site to be able to have a failover solution in case transport rates go completely out of sync. You’ve got a facility where you can recycle at least for a temporary period, you can process some cable there and keep the business going. That lasted for a couple of years, but we managed to actually field that one well by being agile and dealing with it in a practical way.

That sounds difficult, but amazing that you were able to set up a new facility and be able to expand your operations to have that resiliency. Shifting gears a little, what do you think the most significant regulatory issues are that impact your operations?

ALWYN:

I think the most significant ones are the most recent ones, the ones from the BBNJ (Biodiversity Beyond National Jurisdiction). It is still very uncertain exactly how this regulation is going to be implemented and managed. Nobody really knows exactly what’s going to happen there. In our business, your logistics have to be extremely sharp. You can’t have vessels lying around idling. You really need to work constantly, continuously. If we get significant delays because of further regulations in international waters, which is more in line with what you get in territorial waters, that will definitely have a significant impact on our business. At this stage, we don’t know exactly what those impacts are going to be. We’re really waiting with bated breath to see what the outcome is going to be.

It also goes hand in hand with ma-

rine protected areas and how different jurisdictions will be dealing with those. Then there’s obviously deep sea mining, which is becoming more and more active. So just the contestation of the use of the seabed over time will become more and more difficult to manage. It’s not a regulatory issue as such, but I think regulation will probably be a solution to solving some of those challenges.

ISABELLE:

Given that there’s a lot of people trying to use the same seabed areas, what have been some of your most significant partnerships?

ALWYN:

If you ask me about the most significant partnerships in our business, then that’s certainly our marine operations team based in the Netherlands, where we’ve got a very strong team in the Netherlands, where we’ve got a partial joint venture with wind in the Netherlands. They’ve been a really good partner to us from a regulatory point of view. We’ve worked with various consultants and specialists around the globe, whether it’s Brazil or Spain or the US, where you need skills around making sure that from a regulatory point of view, your vessels are up to standard, you have the necessary permits and approvals before you start doing work. The partnerships are a really important part of our business.

ISABELLE:

That’s great that you really get to connect with people and work together on making sure that everything flows smoothly. As a student, it has been amazing to hear more

about your experience in the industry and the fact that your work increases sustainability. What advice would you give to younger people who may be interested in learning more about cables and recycling?

If you say cables, specifically submarine telecommunication cables, what is really important is to realize that it’s really quite tough. You need a bit of tenacity if you want to get into the industry. It’s very unknown. Sometimes you might think a lack of regulation might be a benefit, but often it’s also a challenge because your business can fall in between the cracks of where regulations are helping to facilitate business. If you come up to a country or a regulator or an authority and you explain something you’re doing which is unknown to most people, it’s sometimes difficult to do your work. Awareness, creating awareness of what you’re doing is an important part of promoting the business. Otherwise, you really struggle because of a lack of awareness and people not really understanding what you’re trying to achieve and not knowing exactly how a government or authority can actually support your business.

I think another thing which is really important is you cannot look at our work on subsea cables in isolation. This is part of a bigger universe of recycling, of the use of the seabed, of being responsible, of looking at sustainability. It’s really a wide field, so you should not have blinders on. You should really be looking. There’s geopolitical issues to keep in consideration. There’s extreme weather considerations. You’ve got to be a gen-

eralist, but you can’t be too shallow. You need to have a really wide and a medium level of understanding.

Ultimately, I think the big thing for me is teamwork. We’ve partnered with some really good people around the globe. If you can work in a team, then whether it’s recycling or something else, I think that’s really the key to success: having a good team that you can trust.

Thank you. Some wise words, and especially since as I’m learning more about it, I’m seeing that the cable industry is really interconnected. Everyone’s connected.

This series is brought to you by the Sustainable Subsea Networks initiative of the SubOptic Foundation, established early in 2021 as the charitable arm of the SubOptic Association. The SubOptic Foundation focuses its efforts on education & research. The Foundation’s educational programs are designed to support the development of the future subsea workforce. The Foundation’s research programs are centered in areas where broad research and cooperative data-sharing benefit the industry as a whole, including sustainability and resilience. STF

ISABELLE CHERRY is an undergraduate student pursuing a B.S. degree in Environmental Policy and Management at the University of California, Berkeley. She is also a research assistant on the SubOptic Foundation’s Sustainable Subsea Networks research team. Her research explores sustainability metrics relating to the global manufacturing, deployment, and disposal of subsea telecommunications cables with a particular focus on how regulations impact cable recycling efforts.

BY SYEDA HUMERA

INTRODUCTION:

In today’s data-driven world, the maritime sector stands to gain significantly from advanced analytical insights. Managing the vast expanse of the oceans, our role in maintaining global commerce through innovative and efficient maritime operations is crucial. This month’s report delves into the extensive data from the Automatic Identification System (AIS), providing detailed insights into ship movements, traffic patterns, and navigational trends. Key technological advancements and significant geopolitical changes impacting maritime logistics are highlighted in our analysis.

The primary goal of this report is to transform AIS data from mere numbers into a strategic asset. Our redesigned Power BI visuals offer stakeholders a dynamic, interactive dashboard. This includes real-time positional mapping and advanced predictive analytics to forecast potential maritime congestion and collision zones. Each visual not only enhances understanding but also empowers decision-makers with actionable insights for optimal route planning, fleet management, and optimized maritime operations.

Embracing the technological frontier, we also explore the integration of autonomous vessels and the use of digital twin technologies in maritime logistics. These advancements promise to reshape operational practices, improving efficiency and reducing the reliance on large human crews. By incorporating these cutting-edge technologies, the

maritime sector can enhance its operational efficiency and adaptability to changing conditions.

Additionally, the submarine telecommunications network plays a vital role in global connectivity. These extensive channels form the backbone of our digital communications, making them essential infrastructure in the digital age. Our report examines the interplay of innovation, demand, and strategic planning that shapes the submarine telecommunications landscape.

Our visuals map the intricate web of submarine cables on the ocean floor, updated to reflect the connectivity grid of 2024. This mapping includes the latest cable deploy-

ments with advanced materials for increased durability and data transmission capabilities. We highlight the use of AI-driven routing technologies that optimize signal integrity across vast distances, dynamically responding to underwater conditions and global data demands.

The industry’s timeline, enriched with the most recent data, chronicles key advancements over the past year. We emphasize the deployment of ultra-low-loss fiber optics, significantly expanding bandwidth capacities to meet the growing global demand for faster and more reliable internet connections. Additionally, our visuals capture the emergence of environmentally sensitive cable-laying techniques that minimize the ecological impact on marine ecosystems, reflecting the industry’s shift towards sustainability.

dynamics. This report explores the factors that shape vessel velocities and influence maritime telecommunications.

Through these enhanced Power BI visuals, stakeholders gain a comprehensive understanding of the technological progress and evolution of a network that supports the communication capabilities of nations and enterprises. These updates demonstrate a commitment to environmental stewardship and innovation, illustrating how recent advancements influence both the current state and future trajectory of global communications infrastructure.

By integrating these elements, our report provides a holistic view of the maritime and digital navigation sectors, offering valuable insights into their ongoing transformation. Stakeholders can leverage this information to make informed decisions, ensuring that maritime operations and global communications continue to advance efficiently and sustainably.

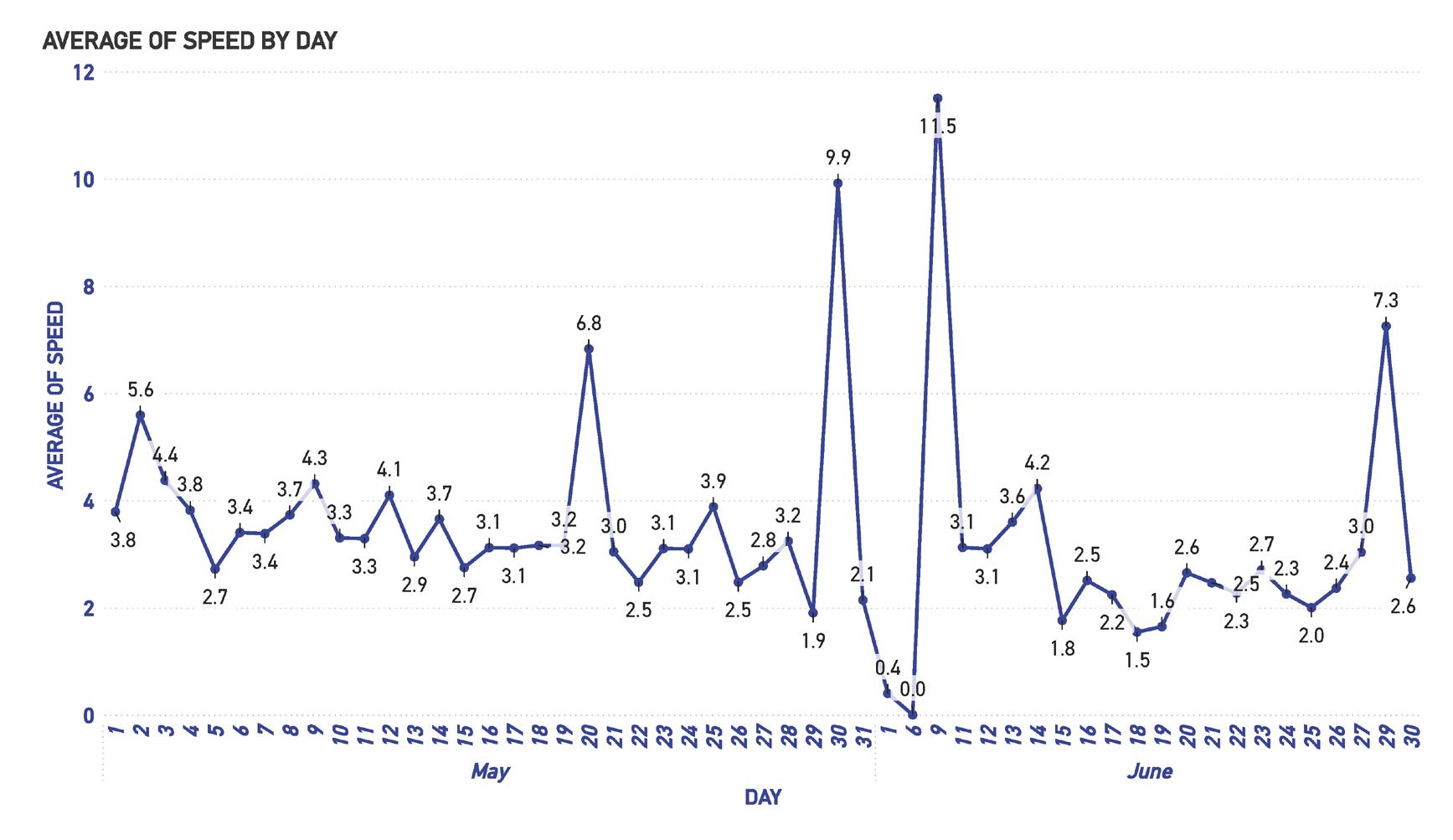

In the maritime industry, data is crucial for global trade and communication. Analyzing vessel speeds offers essential insights into sea traffic dynamics. Building on our previous analysis from last issue, we now focus on June 9, which accounts for 8.54% of the total AIS speeds. This makes it a significant point for detailed examination of its significance and the factors influencing this statistic.

The impact of June 9 on speed metrics goes beyond mere statistics; it reflects evolving trends and operational

The 8.54% contribution on June 9 is multifaceted. Various potential drivers include shifting environmental conditions, seasonal adjustments, and strategic vessel deployments in response to market demands or geopolitical developments. Each percentage point represents a snapshot of the operational environment, depicting maritime mobility.

In examining this data, we aim to determine whether this increase is an outlier or part of a predictable pattern. Does this surge align with specific routes or regions? Is it indicative of advancements in navigation systems or propulsion efficiency? Or does it correspond with increased economic activities mid-year?

The average speed on June 9 impacts operational protocols and strategic decision-making in maritime enterprises. This includes scheduling, fuel consumption, port operations, and supply chain logistics. Understanding the implications of this speed surge allows stakeholders to anticipate similar trends, allocate resources more efficiently, and refine route planning strategies.

Situating June 9 within the broader operational landscape of the year, this analysis benchmarks the increase and sets a precedent for predictive analytics in maritime operations. The data from this day serves as a benchmark for comparative analysis, gauging the industry’s performance and efficiency.

Environmental conditions significantly influence vessel speeds. Seasonal changes, such as weather patterns and sea

states, impact navigational conditions. Calmer seas may allow for higher speeds, while rougher conditions necessitate slower navigation. Understanding these patterns helps in forecasting and preparing for seasonal variations.

Geopolitical developments also influence vessel speeds and maritime traffic. Strategic vessel deployments respond to geopolitical tensions or economic sanctions, affecting ship movements and speeds in specific regions. Increased military presence or trade embargoes can lead to rerouting and adjustments in speed for safe navigation through sensitive areas. Monitoring these developments provides valuable context for analyzing speed variations.

Economic activities drive changes in vessel speeds. As global trade fluctuates, the demand for shipping services changes. Mid-year, particularly around June, often sees an uptick in commercial activities. This surge can lead to increased vessel speeds as shipping companies meet delivery schedules and capitalize on market opportunities. Analyzing these economic indicators alongside speed data offers a comprehensive view of the industry’s performance.

Advancements in technology, including improvements in propulsion systems and navigation tools, contribute to variations in vessel speeds. Innovations enhance the efficiency and capability of modern ships, allowing them to travel faster and more safely. The adoption of more efficient engines or advanced route optimization software can result in noticeable changes in average speeds. Tracking technological trends and their adoption rates within the industry is essential for understanding speed metrics.

By analyzing June 9 within the broader operational context, we provide stakeholders with a comprehensive understanding of the factors driving changes in vessel speeds. This detailed examination of environmental, geopolitical, economic, and technological influences offers a holistic view of maritime operations. As the report progresses, we will continue to explore these themes, providing deeper insights and actionable intelligence to support strategic decision-making in the maritime industry.

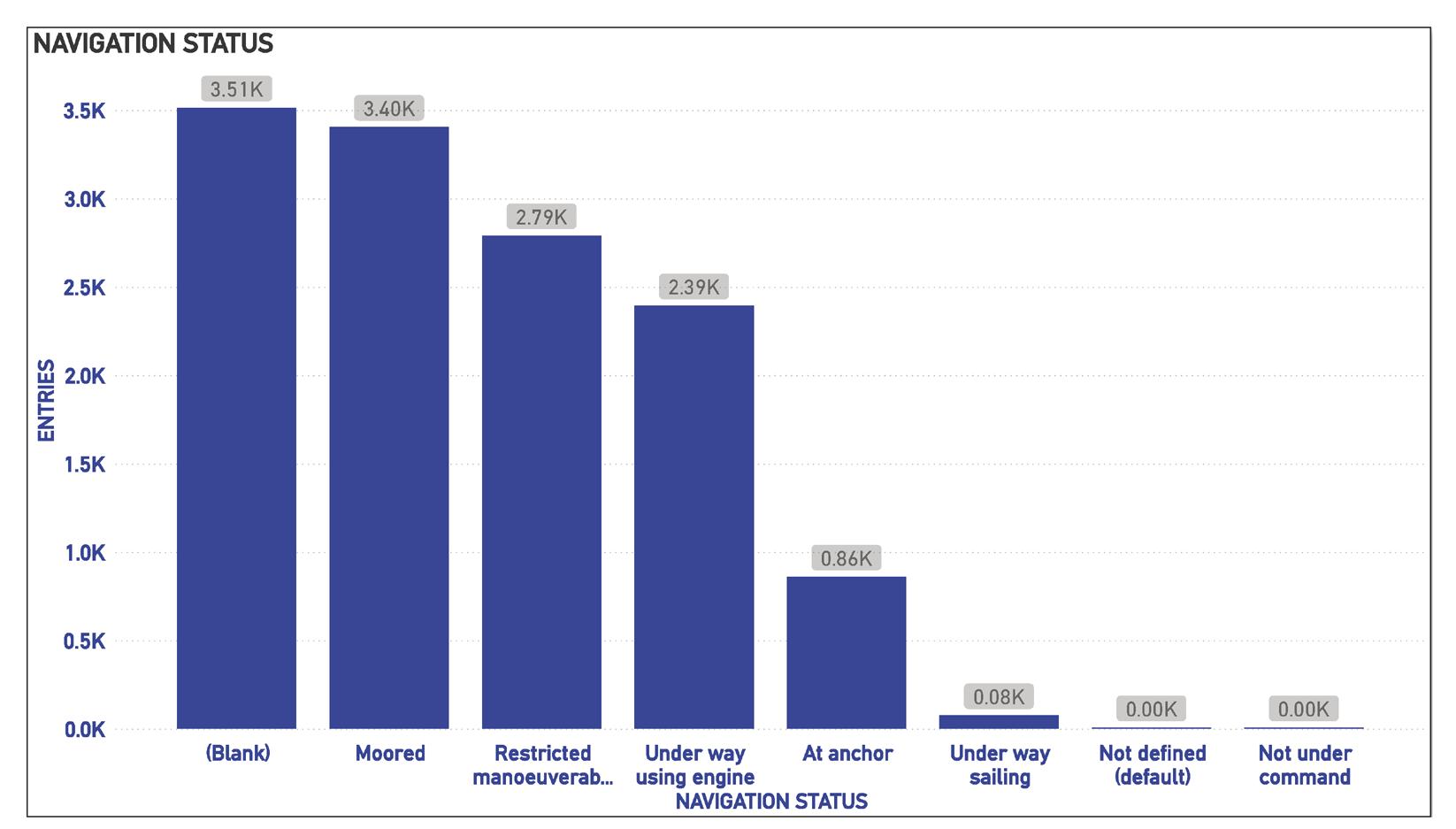

In our latest analysis, the “Underway Using Engine” status emerges with prominence, recorded at 3,512 instances. This figure represents the multitude of vessels actively navigating the world’s oceans. “Underway Using Engine” involves coordinated efforts in crew operations, cargo transport, and essential navigation, playing a crucial role in facilitating the seamless flow of global trade.

In stark contrast, the status “Not Under Command” has a solitary count of 1. This status signals a vessel’s compromised maneuverability, highlighting the unpredictability and inherent risks of maritime journeys. Although minimal statistically, this outlier underscores the moments when even the largest ships are at the mercy of nature’s forces.

The “Underway Using Engine” status, with its 3,512 counts, is 351,100.00% higher than the “Not Under Command” status. This vast disparity highlights the operational diversity within the maritime sector, from serene harbors to vessels powering through open waters. “Underway Using Engine” accounts for 26.94% of the total count, affirming its pivotal role in maritime operations.

The range in status counts—from 3,512 for “Underway Using Engine” to 1 for “Not Under Command”—encapsulates the full breadth of maritime activity. This variation is influenced by factors such as environmental conditions, regulatory frameworks, and the demands of global logistics. By analyzing these data points, we gain a comprehensive understanding of maritime operations.

AIS data provides a detailed picture of the maritime sector’s operational dynamics. “Underway Using Engine”

status represents vessels in active transit, reflecting the continuous movement essential for global trade. In contrast, the “Not Under Command” status emphasizes the need for robust safety measures and preparedness for unforeseen events.

This analysis shows the strategic, operational, and logistical elements that form the complex fabric of international maritime travel. With these insights, AIS data acts as a guide, steering the maritime industry towards increased safety, efficiency, and environmental responsibility. It underscores the importance of understanding our current position and future trajectory, charting a course for maritime navigation that is both informed and ambitious.

The exploration of maritime data is a continuous journey, highlighting the robustness and adaptability of this essential industry. Each data point and trend represents resilience, chronicling the strategic ingenuity that propels the global fleet. This analysis provides valuable insights into the operational landscape, enabling better decision-making and strategic planning in the maritime sector. By understanding the various navigational statuses and their implications, stakeholders can enhance operational protocols, improve safety measures, and optimize resource allocation.

In the complex realm of global maritime operations, vessel capabilities are intricately captured by the Automated Identification System (AIS). Our analysis focuses on the critical relationship between two key attributes: speed and draught. This year, we examine POLARIS 3 and ASEAN RESTORER, two vessels that exemplify exceptional performance in these domains, setting new standards in maritime operations.

POLARIS 3: The POLARIS 3 has redefined maritime speed, recording an average AIS speed of 102.30. This high velocity underscores its capability to navigate vast oceanic expanses efficiently, positioning it as a leader in operational efficiency and technological advancement in ship engineering. On our scatter plot, POLARIS 3’s data points reach the highest levels of speed, illustrating its dominant stance in maritime navigation.

ASEAN RESTORER: The ASEAN RESTORER is notable for its significant draught, commanding the highest average AIS draught of 9.50. This substantial draught indicates its ability to navigate various marine environments while bearing heavy loads. It highlights the vessel’s role in global logistics and trade, crucial for heavy cargo operations. On the scatter plot, ASEAN RESTORER’s data points cluster at the upper extremes of the draught spectrum, marking it as a key player in heavy load capacity.

Our dynamic scatter plot analysis highlights the interactions between speed and draught, unearthing potential correlations or distinctive patterns that define the operational profiles of POLARIS 3 and ASEAN RESTORER. Notably, the analysis reveals that POLARIS 3’s average speed of 102.30 is significantly higher than the lowest recorded average speed of 0, showcasing its remarkable speed capabilities. Additionally, the data indicates a negative correlation between average speed and average draught, suggesting that as one increases, the other tends to decrease. This highlights the trade-offs in vessel design and operational strategies.

The divergence between average speed and average draught is most pronounced when the speed was 102.20, with the average speed being 96.59 higher than the average draught. This significant divergence underscores the distinct operational profiles of vessels optimized for speed versus those designed for carrying heavy loads. Across all 160 recorded speeds, the average speed ranged from 0 to 102.30, and the average draught ranged from

4.28 to 9.50. This spectrum highlights the diversity of vessel operations and various design philosophies to meet different maritime needs.

Identifying outliers within this data is particularly revealing, offering insights into extraordinary operational capabilities or groundbreaking navigational strategies. These statistical deviations are explored not as anomalies but as insights into innovative practices that could redefine industry standards or highlight areas for potential technological advancements.

This deeper exploration into speed and draught attributes, focusing on POLARIS 3 and ASEAN RESTORER, sheds light on the navigational dynamics that characterize the maritime industry. By mapping these attributes on an advanced scatter plot, we enhance our understanding of the interplay between speed and draught in maritime operations.

Through this analysis, we gain valuable perspectives that aid in optimizing vessel performance and operational efficiency. This comprehensive view educates and inspires strategic thinking and operational improvements among maritime industry stakeholders.

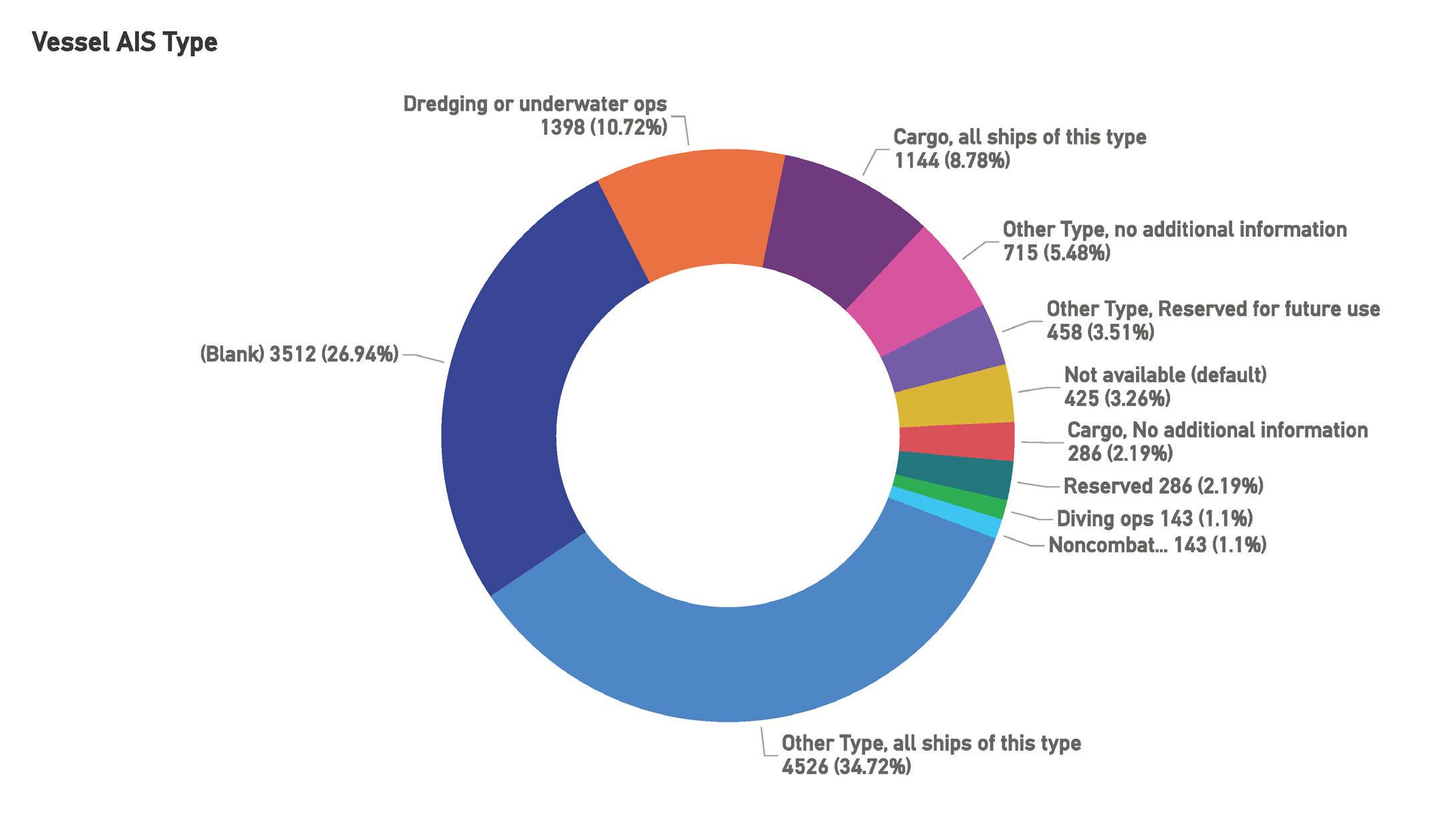

Understanding the distribution of vessel types through AIS data is critical for numerous stakeholders within the

maritime industry, including regulatory bodies, shipping companies, and maritime safety organizations. The AIS. TYPE classification serves as a key indicator of the composition of the maritime fleet, offering insights into shipping trends, operational priorities, and potential areas for policy development.

The focused analysis reveals a distinct pattern of distribution across different AIS.TYPE categories within the dataset. This examination highlights the predominance of specific vessel types, shedding light on the current dynamics of maritime operations.

Highest Count Observed: The dataset shows that the “Other Type, all ships of this type” category recorded the highest count with 4,526 instances. This figure significantly surpasses the counts of other vessel types, marking it as the most prevalent within the maritime data analyzed.

Percentage Share: The “Other Type, all ships of this type” accounted for 34.70% of the total AIS.TYPE count observed in the dataset. This substantial proportion underscores the central role of this vessel type in maritime operations, suggesting widespread application and critical importance in the industry’s ecosystem.

Following Leaders: While the “Other Type” leads in prevalence, categories such as “Dredging or underwater ops” and “Cargo” also emerged as notable vessel types within the dataset. Though these categories do not match the volume represented by the “Other Type,” their presence is crucial in demonstrating the diversity and range of vessel operations captured through AIS data.

Operational Implications: The variation in the count of AIS.TYPE categories reflects the multifaceted nature of maritime operations. The high prevalence of the “Other Type” might indicate specific operational or logistical preferences within the industry, potentially driven by factors such as vessel functionality, regulatory compliance, or market demands.

Strategic Insights: Stakeholders can leverage these insights to strategize fleet management, regulatory oversight, and safety measures. The dominance of a particular vessel type may inform targeted strategies for enhancing operational efficiency, compliance monitoring, and safety protocols.

Future Research Directions: The findings also open avenues for further research into the specific characteristics, uses, and operational patterns associated with the leading vessel types. Understanding the reasons behind the dominance of the “Other Type” and its implications for maritime

logistics and safety represents a valuable area for in-depth investigation.

The detailed analysis of AIS.TYPE distribution enhances our understanding of the current maritime operational landscape and informs future strategic decisions and policy development within the maritime sector. The data shows a range across all 11 Type Descriptions, from 143 to 4,526, further highlighting the diversity within the maritime fleet and pointing to areas where targeted interventions could yield significant improvements in operational effectiveness.

This comprehensive view of vessel type distribution, centered on the significant presence of the “Other Type” category, underscores the diverse and dynamic nature of global maritime operations. By leveraging these insights, stakeholders can drive forward more informed, efficient, and safe maritime practices.

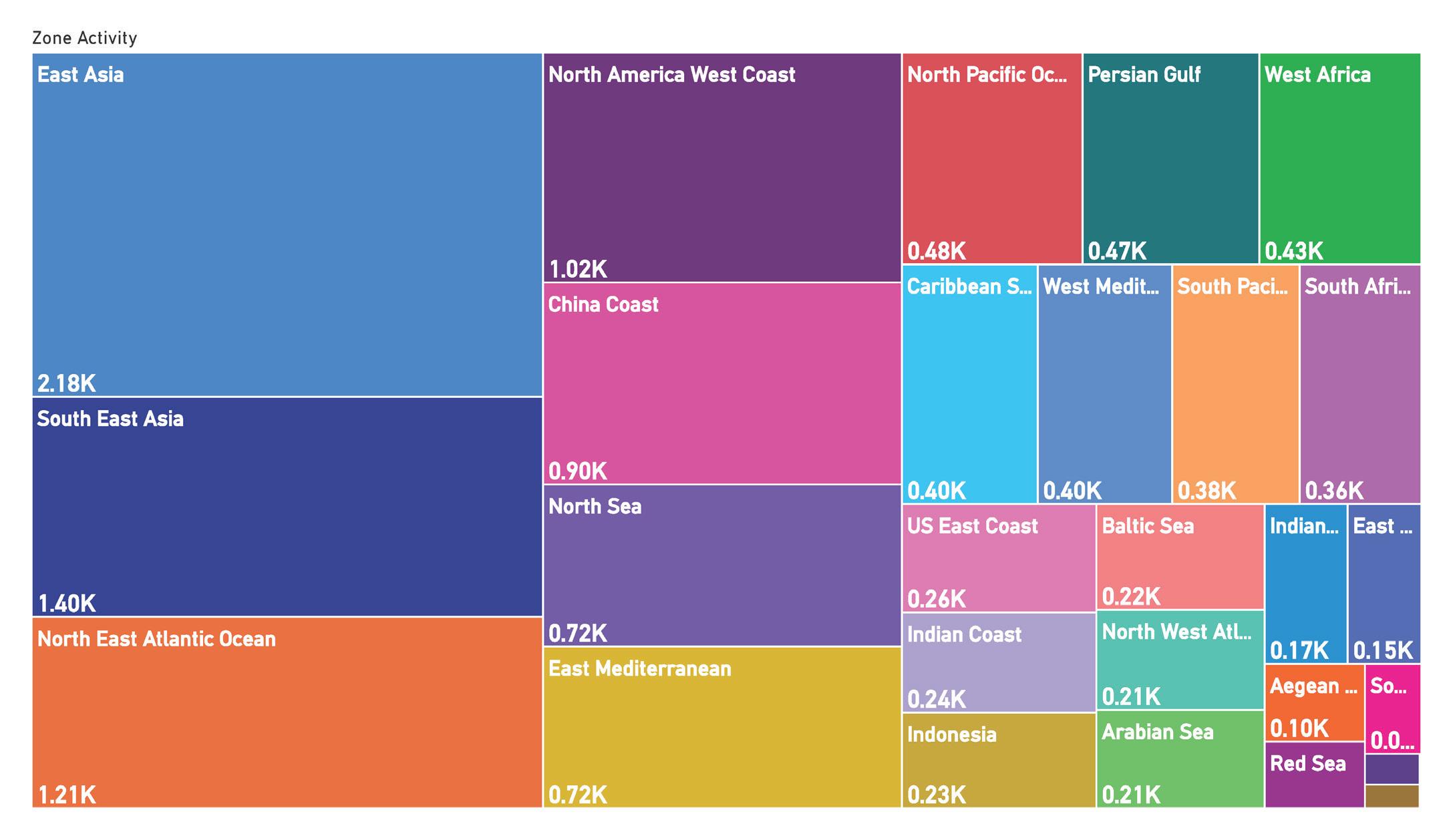

The zone activity chart provides a detailed visualization of AIS entries across various geographic zones, highlighting the distribution and concentration of maritime activities globally. Understanding these patterns is crucial for stakeholders, including shipping companies, regulatory bodies, and maritime safety organizations, to optimize operations and enhance strategic planning.

• East Asia: Dominating the chart, East Asia accounts for

the highest activity with 2.18K AIS entries. This region’s prominence underscores its critical role in global maritime trade, driven by major ports and shipping routes.

• S outh East Asia: With 1.40K AIS entries, South East Asia also shows significant maritime activity. This region’s strategic location and bustling ports contribute to its high entry count.

• North East Atlantic Ocean: Recording 1.21K AIS entries, this zone is a vital corridor for transatlantic shipping, reflecting the heavy traffic and economic importance of the area.

• North America West Coast: The chart shows 1.02K AIS entries, highlighting the busy maritime routes along the North American west coast, which are essential for trade with Asia.

• North Pacific Ocean and Persian Gulf: Both zones exhibit notable activity with 0.48K and 0.47K entries respectively, indicating their importance in connecting major global trade routes.

• China Coast: With 0.90K AIS entries, the China Coast is a critical area for maritime operations, reflecting the country’s robust shipping industry.

• North Sea and East Mediterranean: Each showing significant entries, these regions are key players in European maritime activities.

The distribution of AIS entries across these zones highlights the strategic importance of certain regions in global maritime logistics. The high concentration in East and South East Asia indicates a focus on these areas for shipping companies, which need to manage port congestion and optimize route planning.

Stakeholders can leverage this data to enhance fleet management, ensure compliance with regional regulations, and improve safety protocols. The insights gained from the zone activity chart can inform targeted strategies for resource allocation and operational efficiency.

Further analysis can explore the reasons behind high AIS activity in specific zones and identify emerging trends. Understanding the underlying factors driving maritime traffic in these regions can lead to improved predictive analytics and more effective maritime strategies.

This comprehensive view of geographic zone activity, centered on the significant presence of East Asia, South East Asia, and the North East Atlantic Ocean, underscores the dynamic nature of global maritime operations. By lever-

aging these insights, stakeholders can drive forward more informed, efficient, and safe maritime practices.

The analysis presented in this report highlights the intricate dynamics and operational complexities of the maritime industry. By leveraging AIS data and advanced Power BI visuals, stakeholders can gain deep insights into vessel movements, speed, draught, type distributions, and geographic zone activities. The examination of key metrics, such as the predominance of the “Underway Using Engine” status, the significant presence of the “Other Type” category, and the high AIS activity in East Asia, underscores the diversity and critical functions of the global maritime fleet.

Understanding these patterns enables stakeholders to optimize route planning, enhance fleet management, and implement effective safety protocols. The integration of cutting-edge technologies, such as autonomous vessels and digital twin applications, promises to further revolutionize maritime operations, improving efficiency and reducing reliance on human crews.

Environmental, geopolitical, and economic factors continue to shape maritime logistics, requiring adaptive strategies and informed decision-making. The zone activity analysis reveals the strategic importance of regions like East Asia, South East Asia, and the North East Atlantic Ocean, highlighting the need for focused resource allocation and operational efficiency.

This report serves as a valuable resource for navigating these challenges, providing actionable intelligence to support the ongoing transformation of the maritime sector. As the industry moves forward, embracing technological advancements and sustainable practices will be crucial in maintaining operational excellence and ensuring the safety and efficiency of global maritime operations. This data-driven approach not only enhances current practices but also paves the way for future innovations, driving the maritime industry towards a more resilient and informed future. STF

SYEDA HUMERA, a graduate from JNTUH and Central Michigan University, holds a Bachelor’s degree in Electronics and Communication Science and a Master’s degree in Computer Science. She has practical experience as a Software Developer at ALM Software Solutions, India, where she honed her skills in MLflow, JavaScript, GCP, Docker, DevOps, and more. Her expertise includes Data Visualization, Scikit-Learn, Databases, Ansible, Data Analytics, AI, and Programming. Having completed her Master’s degree, Humera is now poised to apply her comprehensive skills and knowledge in the field of computer science.

BY JOHN MAGUIRE

Welcome to Edition Four of Capacity Connections. Over the past few editions, we have traced the technical and commercial history of submarine cables and have drilled down from an overall historical point of view, identifying how some technological, regulatory and commercial developments affected the market and, most recently, on the effects of cloud computing and data centers. In this edition we delve a little deeper—although I’m not sure with any improved resolution—into the matter of artificial intelligence and its possible effects on the submarine bandwidth market.

Interestingly, while artificial intelligence is the hot topic of the moment, and while there are clear impacts that arise because of it, including in the market for submarine cables and bandwidth, most of the effects play out under-the-hoods of the hyperscalers who generate so much of the activity.

Artificial intelligence (AI) is headline news across the spectrum of human endeavor. It has burgeoning application in financial markets, medicine, pharmaceuticals, energy, retail and, of course, in cloud computing and telecommunication networks… There is a long list. But what is AI?

For our purpose, we really need only consider AI as that range or spectrum

of machine performed activities from machine learning (where devices use real-world feedback internally to improve their performance of some defined tasks) through deep learning1 (using neural networks), through application of natural language processing (NLP) and large language models (LLM) that we may be familiar with in customer services “bots” or helpful applications like ChatGPT, through to the esoteric probabilistic graphical models2 used in complex risk assessments and diagnostics.

1 https://www.ibm.com/topics/deep-learning

2 https://towardsdatascience.com/introduction-to-probabilistic-graphical-models-b8e0bf459812

In the context of our broad information and communication technologies (ICT) sector, AI has more than one important dimension. On one hand, AI may be used in designing networks, network traffic flows and in optimizing redundancy/protection arrangements. But at Subtel Forum, we are concerned, on the other hand, especially with how the higher order AI activities generate huge demand for compute power and consequently for data center capacity, feeding these effects into demand for international bandwidth.

For as long as traffic specific to AI applications remains separately indiscernible from other traffic generated

by hyperscalers who are the prime generators of AI volumes, we must use a proxy for this traffic and the most obvious of these is our familiar friend: the data center.

Data centers are currently being built with what may previously have been considered incredible power density, in no small part to accommodate AI’s expected demand for power (in compute and consequently energy terms). Certain factors in this equation, specifically access to sufficient energy to supply the data centers, becomes a critical design issue, particularly in respect of where new data centers are going to be built. This has a knock-on effect on bandwidth demand including, as we shall see, on submarine networks.

Data centers originally emerged as, inter alia, neutral “meet-me” facilities for competing telcos. Accordingly, they evolved in population centers, not surprisingly, as this is where telcos tended to have their international gateways. As the sector has developed, especially in respect of cloud computing, subsequent growth has occurred largely in these same (and similar) population centers. Over time, the power density of data centers has continuously increased with both accelerating miniaturization of telco equipment and in particular as data centers have evolved from serving predominantly communications applications to serving predominantly cloud applications. It is an evolution that continues with AI.

Humankind’s use of the planet’s resources has been an issue for a gen-

Figure 1: Amazon’s renewable energy deals Source: https://sustainability.aboutamazon.com/products-services/the-cloud?energyType=true#renewable-energy

eration, if not longer. Recognizing that the science of this is beyond our remit, prudence—and perhaps compliance— demands that we must strive to reduce our consumption of non-renewable natural resources, especially fossil fuels. There are two main ways of doing this: use less energy in absolute terms and replace non-renewable with renewable sources.

While growth in demand for their services shows no sign of easing, indeed with AI it may be accelerating, the data center industry is addressing the energy imperative in several ways. Some of these, to the extent they do not impact submarine cables directly, we can largely ignore here. These include use of energy efficient devices, energy management systems, some advanced cooling technologies (e.g., liquid cooling) and integration of renewable sources on site, or nearby.

The change that does affect submarine cables is the emerging trend to locate new data centers close to large renewable energy sources such as solar photo-voltaic and wind generation facilities and in cold climates. Of necessity, large scale solar and wind energy sources are separate from large

population centers, in more sparsely populated areas. Accordingly, we can expect to see data centers in future built in sunny or windy areas, or in cold climates where free cooling3 may be more readily available, or where geo-thermal power can be harnessed.

Figure 1 shows Amazon’s currently reported renewable energy arrangements. What we see, drilling down into this map to the individual deal level— which we don’t do here for reasons of space, but a link is provided—is that there is huge purchase of solar energy in hot, sparsely populated areas and of wind in cold, sparsely populated areas.

Since it is far more difficult and expensive to transport power than data, it is logical—especially when the price of land is taken into consideration—to expect many more data centers to be built in such regions.

Historically, submarine cables have been built to connect countries to countries, or perhaps cities to cities. A telco’s international gateway was connected to others. As the indus-

3 https://www.techtarget.com/searchdatacenter/definition/ free-cooling

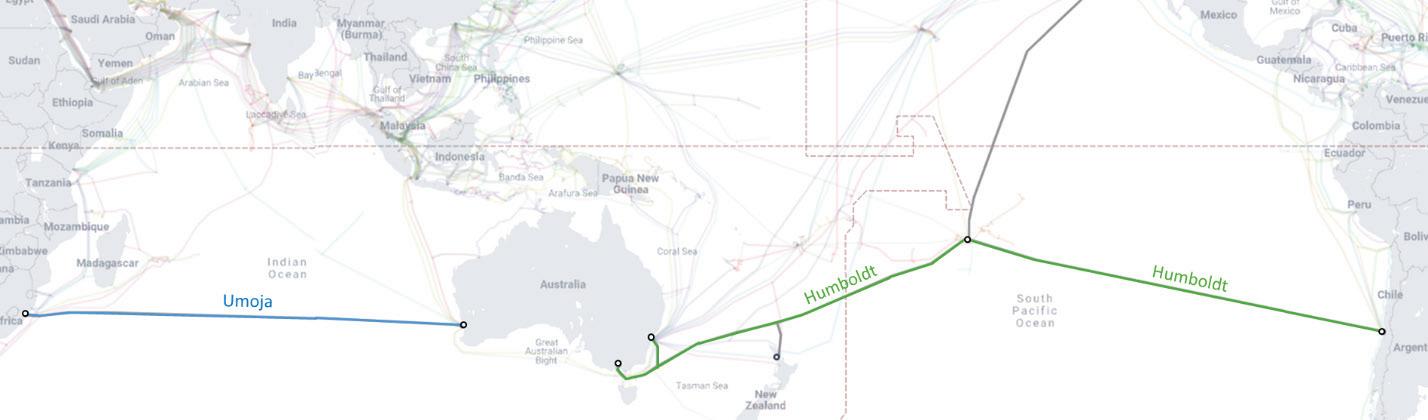

Figure 2: Submarine cable routes recently announced by Google. https://cloud.google.com/blog/products/infrastructure/investing-in-connectivity-and-growth-for-africa (Umoja, MAY24) https://cloud.google.com/blog/products/infrastructure/announcing-humboldt-the-first-cable-route-between-south-america-and-asia-pacific (Humboldt, JAN24)

try has evolved—as competition has increased and as technological developments have lowered barriers to entry historically enjoyed by PTTs—telco international gateways were initially joined by data centers as service endpoints for submarine cables, and eventually superseded by them. Today, a submarine cable can be thought of as a facility that principally connects data centers to other data centers. The open cable concept means that a single cable landing can serve multiple data centers, at the fibre-pair level, in the same general geographical area.

Having regard then for where data centers are moving to, we expect to see submarine cable routes following them as shown, for example, in Figure 2. The recent announcements by Google of these cables connecting Australia west to South Africa and east to Chile— two non-traditional routes that do not connect significant population centers—are cases in point.

It may well be the case that the underlying core purpose of these cables is to increase diversity and resilience, but even if that is the case, the need for resilience is, as we saw in the previous edition, a requirement of data centers and cloud communications—and remains no less the case for AI applications.

The effects of AI on the submarine cable bandwidth market are real. Thus far, however, they occur at a level, or levels, generally below that which is to be perceived in the bandwidth market through offer prices or available capacity on city-pair routes. Rather the effects, to date, are to be seen in the new routes being developed by hyperscalers to accommodate them refocusing their data center locations.

Over time, we can expect other effects to emerge. Comparing the cables in Figure 2, and cables on traditional transpacific or trans-Indian ocean routes, we may previously have more confidently expected to see an active secondary market, where promoters sell fiber-pairs or spectrum to wholesalers, than we can expect in respect of these new cables. Bearing in mind the distance of some of these new landings from the traditional interconnect nodes used by telcos, and from concentrations of data centers, it is rather to be expected that the secondary market—if it emerges—will exist elsewhere.

Interesting developments are also like to emerge in regional areas, where hyperscalers alone do not currently have a business case for a dedicated cable and seek to build in cooperation with regional wholesale and local telco players.

Other possible effects of the expected growth in AI also remain to be seen. Will the huge demand for energy open the industry up to the prospect of different categories within the data center ecosystem—viz., AI, cloud, and telecommunications—competing for available energy? Given their close symbiotic interrelationships, that sounds like an equation that will quickly find equilibrium, but finding it may, nonetheless, turn out to be an interesting process. STF

Currently Director, EMEA, with APTelecom, JOHN MAGUIRE has experience gained across a broad spectrum of telecommunications roles and businesses over the past 30 years. He has sold security and network control software to mobile networks worldwide; established a regional federation fibre network across a family of affiliated telcos and, several times, established interconnect networks and wholesale structures for leading telco brands in new entry and emerging markets. He’s done this in roles across the business: using satellite and cable technology, for OEM and service provider companies and in fixed and mobile domains—including for start-ups and mature companies. His roles have encompassed general management, sales management, direct and indirect sales, business development, market development and operations. A native of Dublin, Ireland, he’s also lived and worked in Australia, UK, Singapore, Hong Kong, Thailand, Qatar, UAE and Malaysia. John holds a B.Tech. degree from University of Limerick in Ireland and an M.A. from Macquarie University Graduate School of Management in Sydney, Australia.

1.

WORLD AND WHAT IS THE CONFERENCE’S MISSION?

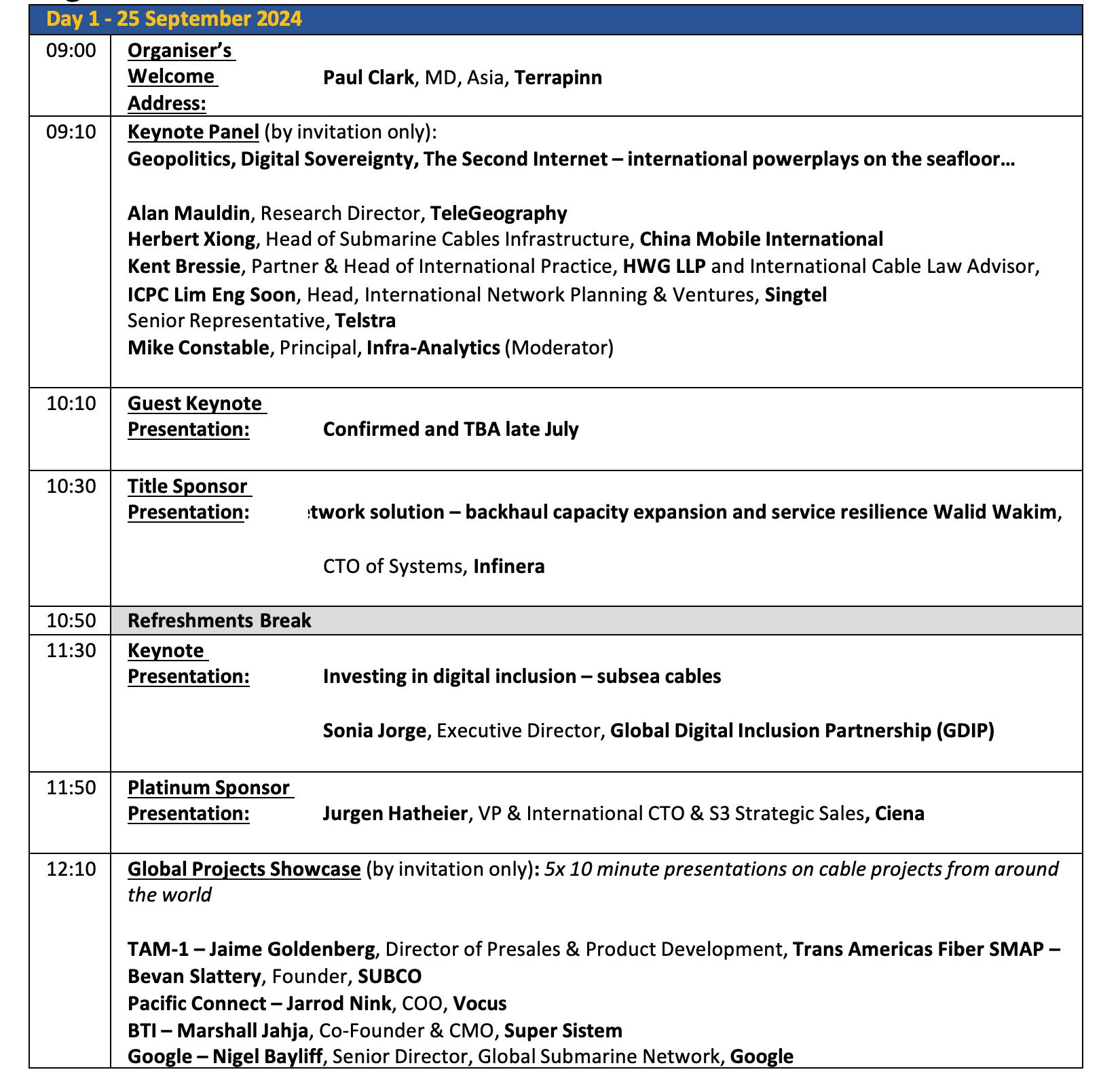

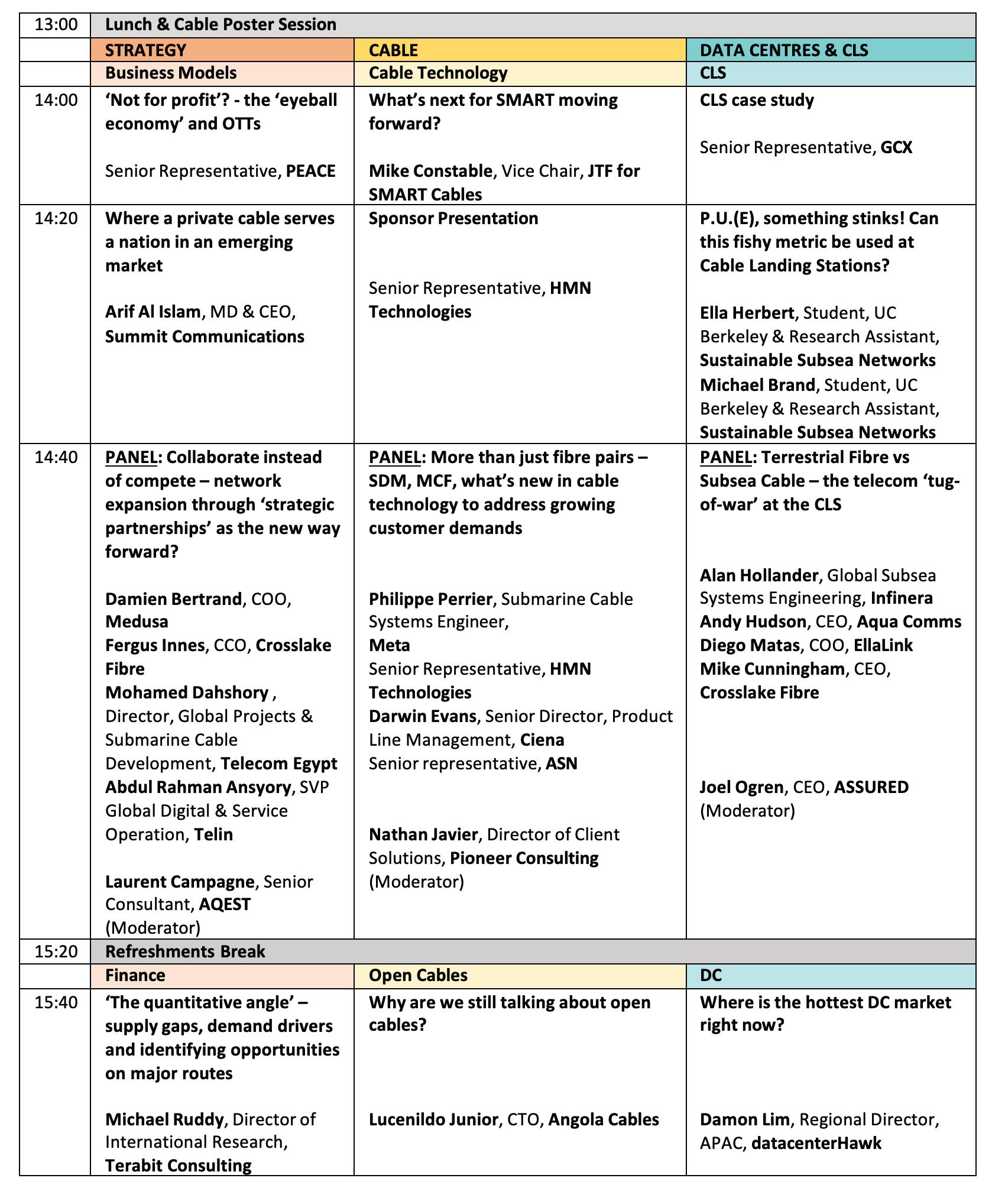

SNW is the leading global subsea telecoms event. The mission (should we choose to accept it – which we always do) is to remain No.1, and most important, rightfully so.

2.

HOW DOES SUBMARINE NETWORKS WORLD PARTICIPATE IN THE SUBMARINE CABLE MARKET?

By providing a closed-door, subsea telecoms–only, private event where ‘both ends of the cable (and everyone in between) meet and do business.’ No other subsea event offers the same level of global coverage.

3.

WHAT ADVANCEMENTS IN SUBMARINE CABLE DESIGN OR APPLICATIONS ARE INCLUDED IN SUBMARINE NETWORKS WORLD ‘24?

SNW is the place to present news to a genuinely

‘hear it here first’ – there is no reason why 2024 would be any different.

4.

WHAT ARE THE ELEMENTS OF SUBMARINE NETWORKS WORLD’S SUCCESS?

People come from across the globe to participate and attend in Singapore every September and this level of global coverage that gets delivered, year after year (and is only growing) is essentially what makes SNW unique.

Add in the respecting of a long-term pedigree product, combine with not being afraid to make changes (for better or worse – we don’t always get it right) and constantly strive year-on-year to improve the event wherever possible. We can only keep it fresh; we can only keep it forefront and most importantly of all we can only make sure the event delivers on a business level.

HOW IS SUBMARINE NETWORKS WORLD HELPING TO PROMOTE A MORE DIVERSE AND INCLUSIVE CABLE INDUSTRY?

In 2022 SNW started an initiative where ALL companies who are attending or participating at the event are entitled to FREE CONFERENCE PASSES FOR EMPLOYEES AGED 25 AND UNDER.

I write this in capitals because we receive a remarkably low number of applications each year. What better place for those on graduate schemes to listen, learn and meet with the heads of the industry all in one room? Invaluable experience.

6. AS SUSTAINABILITY HAS BECOME A HOT BUTTON ISSUE, HOW IS SUBMARINE NETWORKS WORLD ALSO GETTING INVOLVED?

Look out for the Day 2 Keynote Panel ‘Sustainability and Subsea – threat or ally?’ along with the presentation in the CLS session on Day 1 from The SubOptic Foundation initiative Sustainable Subsea Networks.

Sustainability from a different angle to that usually discussed onstage and the two students from UC Berkeley bringing their CLS research – it doesn’t get more ‘hot button’ than that!

7.

SUBMARINE NETWORKS WORLD ’24 IS AROUND THE CORNER, WHAT DO WE HAVE TO LOOK FORWARD TO THAT’S NEW AND DIFFERENT?

Each year we scour the globe to find ‘new to the event’ in every format. As a result, SNW 2024 is no exception to the upward trajectory of the event.

I can guarantee anyone who attends will experience new speakers presenting/discussing on panels, topics they have never seen onstage anywhere before. New suppliers offering products, solutions and services for every stage of any cable project – from concept to completion. New companies across every profile, new cable projects being presented/announced at the event and even new countries being represented onsite for the first time.

Serious about subsea? Then see you in Singapore in September - you’d be bonkers to miss it! STF

ADAM BALL is General Manager of Terrapinn responsible for the management of Submarine Networks World since 2018. He is an experienced sales leader with a proven track record in both London and Singapore. Coupling an affable nature with outstanding influencing and communication skills, he has directly formed and maintained long-term business relationships of integrity and success across a variety of high value/high profile products and services.

With the demand for global submarine cable capacity growing at almost an exponential rate, the role of subsea networks has clearly evolved into mission critical infrastructure, facilitating all communications across the globe.

In line with the growing connectivity and appetite for greater bandwidth - lower latency, greater capacity and more diverse networks continues to escalate. Meeting these ongoing challenges will require agility, scalability and further innovation.

Submarine Networks World is established as the premier subsea communications conference - offering a dedicated setting to exchange knowledge, explore the latest projects, develop strategies, and form lucrative new partnerships to drive the industry forward.

In 2024, you will meet with more than 900 subsea influencers and decision-makers from every continent, over 130 top-tier speakers and more than 60 sponsors and exhibitors waiting to showcase what they can do to design, build, install, maintain, and manage your network.

Get ready for inspirational keynotes, lively and thought-provoking debates, and new ideas and new connections to help grow your business at the world’s largest annual gathering of the global subsea communications community, Submarine Networks World.

For event information and the full conference agenda, visit www.terrapinn.com/snwsubtel. Group bookings, with savings of up to S$1,500 per person, are available.

BY GUY ARNOS

Over the last 35 years I’ve watched the international subsea market and technology develop in ways that we only dreamed of at the advent of fiber optic telecommunications. We now live in a time where digital connectivity is crucial to economic growth and social development, and submarine cables serve as the backbone of global internet infrastructure. The capacity of those cables has grown from single digit gigabits per second to hundreds of terabits per second. Over 98% of global internet traffic is transmitted through a sprawling network of over four hundred submarine cable systems, collectively stretching 1.2 million kilometers across the ocean floor. This critical infrastructure is essential to supporting the relentless growth of digital data, especially in regions like Latin America and the Caribbean, where bandwidth demand is skyrocketing to the tune of a 30% growth rate annually. This surge has been driven by the increasing penetration of streaming services, mobile internet usage, cloud data centers, artificial intelligence (AI), virtual reality (VR), and the advent of 5G technology; all of which is driven by our daily dependence on having the internet immediately accessible to our phones and other mobile devices. Having worked in this region for several decades, I am staggered to see the effect these new technologies is having

on capacity requirements across the Americas. Yet, the region faces significant challenges in meeting these demands due to outdated infrastructure, limited competition, monopoly pricing, and a heavy reliance on connecting to the United States for internet access. Amidst these challenges, the launch of TAM-1 submarine cable system by Trans Americas Fiber System represents a pivotal development. TAM-1 has been designed to enhance digital connectivity and support the burgeoning data transmission needs of the region. Scheduled for completion in late 2025, our 7,000-kilometer cable system promises to transform the digital landscape of Latin America and the Caribbean, addressing both current and future demands. In this article I’ll explain the rationale behind the system’s design and delve into our current build status and future plans.

The ownership and investment landscape of submarine cable systems is undergoing a significant transformation. As we know, historically, the majority of these systems were consortium-owned, with a few privately built systems, but in recent times there is a growing trend of investment from global technology giants like Google, Meta, Amazon, and Microsoft. These companies are driving demand for high-capacity

infrastructure to support their extensive digital services, and several of them are happy to go-it-alone on new international system builds. This shift in ownership profile is crucial for addressing the mounting bandwidth requirements spurred by the evolving consumer and industry trends mentioned above.

Despite the soaring bandwidth requirements, the trans Americas region confronts formidable challenges in internet access and connectivity. Issues such as limited competition, monopoly pricing, reliance on outdated submarine systems, and the imperative for Caribbean and South American nations to connect to the US for internet access pose significant obstacles. Furthermore, existing regional cables are approaching the end of their operational lives, lacking the necessary accessibility, capacity, and scalability to meet rapidly escalating future demands.

It is clear that new build activity is required to break the monopolistic status-quo created by mergers in the region, to foster competition and to incentivize cost-based pricing for essential internet services. Once the pricing challenges and bandwidth limitations of the existing infrastructure are addressed with new systems, we can expect the market to grow. Several systems have been announced over the few years, all designed to replace the aging infrastructure and add diversity to the region, but not many have realistically progressed. The TAM-1 network is fully funded and moving ahead on schedule with its impressive specifications and high connectivity design.

The TAM-1 submarine cable system is made up of two separate segments which we call the North and South Systems. The South System consists of 24 fiber pairs from Vero Beach, Florida to a branching unit (BU) just north and east of the Turks & Caicos Islands. From the BU, 20 fiber pairs are directed towards Panama, Colombia and Costa Rica and 8 fiber pairs are directed towards the Dominican Republic, Puerto Rico, and the US and British Virgin Islands. Two of the fiber pairs are routed from Panama to the USVI. The North System is made up of a 12 fiber trunk from Hollywood, Florida to Honduras with 8 fiber branches to Mexico and Guatemala.

The longest digital line segments (DLS) are capable of delivering a minimum of 18 terabits per second of bandwidth with shorter DLS capable of even higher line rates. These line rates, combined with fiber counts create a huge amount of capacity not previously available to the region. This capacity is essential for addressing the escalating demand for high-speed internet and data services in the region. As the existing older systems near the end of their operational life, TAM-1’s advanced technology will provide much-needed capacity, accessibility, and scalability. Our product offering consists of dark fibers, spectrum and lit capacity solutions which will allow customers to dynamically tailor their networks while maintaining their desired level

of autonomy. Connections will be low latency and secure, thanks to a high-reliability system design.