BREAKING NEWS . . BREAKING NEWS . . BREAKING NEWS . .

to share the latest news of the domain. SubOptic 2004 is the fifth in the series, which started in 1986. Hosted each time by one of the members, the 2004 edition will be organized by Alcatel, following the last one, in 2001, in Kyoto, Japan hosted by KDD.

In 2004, SubOptic will be held in the Principality of Monaco, the conference and exhibition being set up in the Grimaldi Forum, with its stateof-the-art auditoriums and huge exhibition hall.

In February Tyco Capital Corporation, the financial services subsidiary of Tyco International Ltd. announced several significant initiatives, in concert with Tyco International’s announcement today to repurchase its commercial paper, designed to strengthen its financial position and prepare the company to serve its customers as an independent public company.

WorldCom Inc. recently said its MCI Communications Corp. unit will redeem $700 million of notes, and that the company’s cash position improved during the first quarter of the year.

WorldCom, which the Wall Street Journal reported is set to cut as much as 10 percent of its work force, said it would redeem all $700 million of MCI’s 6.125 percent callable/ redeemable notes.

Two telecoms companies, TELUS Corporation (Canada) and Verizon Global Solutions Inc. (USA), are to co-sponsor the Pacific Telecommunications Council (PTC) Mid-year Meetings and Seminar, entitled “Building Strong Partnerships,” in British Columbia, Canada, on 24-27 June, 2002. Canada has been the largest trading partner for telecoms equipment with the USA for many years. Mexico and Japan are also among the larger trading partners with Canada.

Anyone interested in conducting telecoms business internationally would benefit from attending because of the scope of topics to be discussed and the opportunities to network with industry leaders and experts. More information will be on PTC’s website at www.ptc.org.

WFN Strategies of Sterling, Virginia recently announced a strategic venture with Harrison & Associates of Annapolis, Maryland to provide recruitment services for the submarine cable industry.

WFN’s Recruitment Support Service provides company clients with two key components for their hiring of permanent or occasional staffing - Direct Placement Support and Executive Search Services.

Target clients come from the submarine cable sectors serving the oil & gas, telecoms and defense industries.

Harrison & Associates, which was founded in 1999, focuses on recruiting, business development and state-of-the-art immersion videoconferencing solutions for a host of international clients, primarily in the telecommunications and government arenas.

The Clinton, Mississippi, company said it had more than $2.2 billion in cash and cash equivalents as of March 31, up from $1.4 billion at Dec. 31, 2001. Its debt level was essentially unchanged from yearend at $30 billion, and the company has no bank debt or commercial paper outstanding, it said.

Keep those press releases and news items coming. Let our subscribers know what’s happening in your company, and our industry.

Submarine Telecoms Forum reaches all the key people.

editor @subtelforum.com

Email: editor@subtelforum.com

I nteroute (www.interoute.com), the Londonbased company behind i-21, the newest and largest Pan-European fiber optic network, has established a North American operation under the direction of veteran telecommunications executive Les Hankinson.

The new unit, Interoute Americas, will be based in Atlanta with offices in New York and San Diego. As Interoute’s senior vice president sales and marketing Americas, Hankinson will lead a five-person executive team,

Founded in 1995, Interoute is a panEuropean telecommunications company with established operations in 9 European countries (Austria, Belgium, France, Germany, Italy, Netherlands, Spain, Switzerland and the UK). Interoute’s fibre-optic network connects 45 cities in 9 countries throughout Europe. Its product portfolio includes optical network services, Internet services, MPLS VPNs and communications services. Customers include other carriers, network operators, Internet and application service providers, and e-commerce companies.

State-owned Indonesia phone giant PT Telkom recently signed a $63.5 million loan facility agreement with Citibank NA and Bank Central Asia to finance a telecoms project in Sumatra.

Last year, Telkom awarded the contract for the project, which will cover the turnkey construction of a fibre-optic network, to a consortium of Pirelli and Siemens IC Networks, a telecom networks unit of Siemens AG.

Covering a distance of about 2,200 km, the network will include a 345 km long submarine transmission link between the east coast of Sumatra and the industrial resort island of Batam that lies approximately 20 km off Singapore.

A new company to service the industry has recently been established in Houston, Texas. Oceanworks International supplies atmospheric diving, submarine rescue and remote tooling systems for the military, oil and gas and submarine telecom markets. More info can be found at www.oceanworks.cc. Enquiries: Peter MacInnes at pmacinnes@oceanworks.cc

A confidential service for the supply of specialized positions for the submarine cable sectors serving oil & gas, telecoms and defense industries

Direct Placement Support

Executive Search

Confidential Reply Service

Visit our website or contact: Lisa Fontaine Managing Associate – Recruitment WFN Strategies, LLC lfontaine@wfnstrategies.com [+1] 410-268-2036

Job seekers can forward CVRésumé to our confidential résumé database at resumes@wfnstrategies.com

Since March, 2000 we have seen the precipitous decline in the equity value of telecom operators and equipment manufacturers resulting in a rash of highvisibility bankruptcies including, in our submarine fiberoptic sector, 360 Networks, Global Crossing, WCI Cable, Flag and Pangea. These filings, however, represent only the tip of the iceberg and the seeds of our current turmoil were laid

By Robert W. Stuart, PhD President & Chief Executive Officer

InDepth Financial Advisors LLC

well before March, 2000. This article will seek to outline the principle causes of our current situation attributable to activities in the financial markets.

The root financial causes to be examined include: 1) the rush by telecom start-ups to the IPO market at highly inflated and non-sustainable valuations; 2) the shift in telecom operators and network builders to be more closely associated with

the high-flying Technology Sector and; 3) failure to appropriately assess the dangers of “Financial Risk”, attributable to leverage, as well as “Business Risk”.

Misleading Weather Reports Valuation Analysis

The tried and true methodology employed to value a company, even a start-up company, had been some multiple of its current and projected future cashflow generation capability over the next 5 years discounted back at a discount rate to reflect both the time-value of money and the uncertainty of the Business Plan’s “Execution Risk”. IPO candidates normally demonstrated 3 or more solid quarters of performance and positive cashflow that served to validate its underlying Business Model and assumptions.

But what were financiers to do when IPO investors clamored for more deals but the new crop of telecom start-ups showed negative values over the 5-year projection period under traditional, tried and true valuation methodologies? The answer, unfortunately, was to modify the valuation methodology (not once but twice) to meet

Bob Stuart is President & CEO of InDepth Financial Advisors, a financial advisory firm meeting the strategic and capital raising needs of Global Telecom players. An industry veteran, Bob successfully completed numerous subsea financings while leading Telecom Finance Groups at Chase Manhattan, Bankers Trust and most recently CIBC World Markets.

investor expectations. No cashflow?. . . multiples of projected revenues were employed to justify IPO prices; No revenues? . . . multiples of dollars deployed to build new networks would do the trick. Before blaming solely the bankers, the entrepreneurs were willing participants in

these “ego building” exercises, as they used the bankers’ competitive juices and the lure of extraordinary IPO underwriting fees to bid up initial valuations. Market share capture was, in many cases, substituted for profitability during the initial valuation period and could only be justified by extraordinary success in the out-years. This success was to be fueled, in no small part, by the anticipated insatiable demands of the Internet.

The promise of a safe harbor

Internet Traffic

In the period leading up to March, 2000, an interesting shift occurred in the language of telecom operator and network operator Business Plans. Increasing the focus was away from the traditional “blocking and tackling” of providing customer and operator services, respectively. Substituted were phrases such as “technology-driven solutions” and “internet enablers”. The “New Breed” had shifted their focus away from the traditional Telecom Services Sector to the Technology Sector to derive the benefit of the euphoria (and Equity Analyst forecasts) associated

with “All Things Internet”. There was apparently little concern that in addition to aligning themselves with the most highflying sector, they had also shifted their eventual fate to the most volatile sector populated as well by the dot.coms. Increasingly, start-ups were looking to anticipate demand in the Internet-related, data transport arena to justify their capital outlays, often with expensive borrowed money. However, not one company had demonstrated that data transport could constitute a successful, profitable Business Model over a reasonable investment horizon. The rush of new players chasing the Internet Revolution cluttered the playing field, adding to the problem. Prices plummeted as an ever-expanding universe of players chased prospective clients whom, while loss-leaders today, would be crucial to their future success. The storm clouds were thickening.

Overloaded ships ride low in the water

The Dangers of Leverage

Amidst this euphoria and sky-high stock prices, bankers and investors were more

than willing to provide the industry with additional capital in the form of High Yield debt and Bank Loans. After all, the debt holders were well protected by significant equity cushions and the promise of debt servicing cashflows just around the corner. Most troublesome was the perception that High Yield debt was nothing more than “Cheap Equity”. Bankers took comfort from the fact that these High Yield debt note holders sat below them in the capital structure pecking order. Junior, yes… but Quasi-Equity, no… Not when it paid a hefty interest coupon and had a doomsday final maturity. The “refinancing risk”, the inability to refinance the High Yield notes in a buoyant market and stretch out their maturity, went essentially ignored. After all, investor appetite was so strong.

Even as certain network players completed their build programs with a corresponding reduction in the “Business Risk”, their insatiable demand for borrowed money (i.e. Their increase in leverage) dramatically increased their “Financial Risk”. The latter, they would soon find out, would be every bit as real (and as potentially deadly) as the former.

Wind and Wave Rips through the Sector

As is often the case, the devastating storm was initially triggered by forces and events outside the submarine fiberoptic sector. The first to fall were operators in the Competitive Local Exchange Carrier (CLEC) and Digital Subscriber Line (DSL) segments as they badly missed their projections. Investors, already reeling from the bursting of the dot.com bubble, ravaged their stock prices as the already shakey High Yield debt window also slammed shut.

The telecommunications equipment manufacturers, whom had extended easy credit (and in certain cases equity) to these start-ups, had geared up their production capacity and inventories in anticipation of continuing robust sales. They were next to fall pry to the new market sentiment. Massive write-offs associated with rationalizing their vendor/investment portfolios as well as inventory write-downs and lay-offs fueled investor fears with daily headlines in the financial press.

The die was now caste and “Anything Telecom” was immediately suspect closely associated with similar sentiment in the

now more similarly perceived and suspect Technology Sector. Every set of projections and underlying assumption were immediately questioned. The Venture Capital Community, reeling from losses, effectively shut down as “Smart Money” took devastating hits. The storm was feeding on itself. Even well-capitalized players saw their stock price slide as their future business prospects were questioned. True to form, the Capital Markets had not reacted but rather had over-reacted to events in the Sector.

Interestingly in the Submarine Sector, it was in most cases the Senior Bank Lenders who precipitated the financial crisis. Seeing

Get in touch with the right staff by advertising your vacancies in Submarine Telecoms Forum and reaching all the key people in the submarine telecoms industry. advertising@subtelforum.com

4advertising@subtelforum.com

their equity cushion melt away with plummeting stock prices, their once comfortable leverage covenants were first pressured and then tripped. Choked off from both the Equity and High Yield Capital Markets and with no prospect of these markets reopening, the Banks, as usual, were the “Lenders of Last Resort”. Unwilling to extend additional credit to fund ongoing losses, bankruptcies were inevitable.

On January 28th, 2002, Global Crossing filed for Bankruptcy Court protection. The darling of the Sector just 2 years earlier had seen its stock price go from $64.00 per share to $.30 per share. Having completed its network build program, it was Global Crossing’s Financial Risk more than its Business Risk that caused its demise.

Aftermath of the Storm

The Telecom Industry is too important not to rebound from the events of the past 2 years. The timing of that rebound, however, remains uncertain. Investors, particularly those whose Telecom and Technology-laden portfolios were devastated, have long memories. Incredible sums of capital sit at the sidelines still unwilling to re-enter the

Sector. If any good is to come out of this painful experience, it will likely be the following:

Valuations will likely return to traditional methodology where cash is king and the value of a company is tied to its ability to return profits to its investors over a reasonable investment horizon;

Venture Capitalists and Bankers will be more discerning in seeking to differentiate between superior Business Plans and “MeToo” players seeking to ride a wave of investor sentiment and; Surviving Telecom Players, as well as those that successfully emerge from reorganization, will operate in a new competitive universe where “blocking & tackling” are again more important than rhetoric and hype.

The human toll, however, is harder to measure as hundreds of thousands of displaced former employees scan the wreckage and many leave the Sector for good. We are not likely to ever again see the combination of forces and circumstances that led to this Perfect Storm but the irreparable damage is something

that we will live with for the foreseeable future. While it is inappropriate and unfair to place the full blame for the debacle at the feet of the bankers and financiers, we played a role in a scenario with plenty of blame to be spread around.

We believe in encouraging lively debate amongst our industry subscribers. Any observations you wish to make regarding this article would be welcomed. Email us at editor@subtelforum.com.

1editor@subtelforum.com

by Pierre Tremblay

The last 5 years has seen an incredible amount of so called wealth being created and subsequently destroyed in the telecommunication sector, resulting in the accumulation of a mountain of debt. This article provides background on the telecom euphoria and attempts to unearth the extent of the debt problem. It also explores how companies are dealing with the problem.

Serious Debt

In their quest to prepare us for the Internet century, US providers of telecom services borrowed over $353 billion (figure 1) from the beginning of 1998 until the end of 2000, with much of that money going to build new infrastructure.

In the same period they raised approximately $87 billion on the stock market for a grand total of $440 billion.

Telecom Fund raising in the US

According to Leo Hindery (ex CEO of Global Crossing), the total world-wide telecom debt is a staggering $900 billion, of which $700 billion may never be retired. Looking at the type of debt contracted should have raised alarm bells. Telecom companies had access to capital at the short end of the curve and they used it to fund speculative infrastructure projects which would have normally required medium to long term loans. This situation was also encouraged by banks who prefer the short term nature of those loans to mitigate risks.

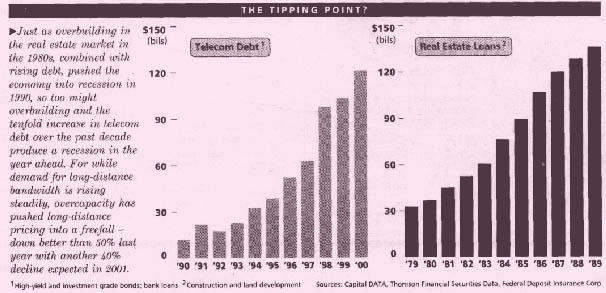

Most companies were happy to take that risk knowing that they could refinance debts in the bond market. As shown in figure 2, the borrowing frenzy by telecommunication companies had some uncanny similarities with the real estate bubble of the 80s.

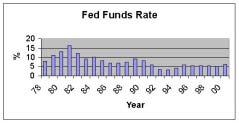

Figure 3

Looking Back

Below are some of the key reasons that explains this borrowing/investment frenzy: Deregulation, technological improvements, and increasing competition provided for significant investment opportunities. Unfortunately initial enthusiasm was contagious – no one could get enough technology stocks particularly in the telecom sector. Greed encouraged everyone to jump on the bandwagon. Venture Capital firms provided the early capital for companies to get off the ground and found themselves paying disproportionately high amounts for 2 nd and 3 rd round capital raising. Many banks could not get enough of these jumbo telecom debt issues with attractive spreads. Suppliers became part of the problem through aggressive vendor financing schemes, lending in some cases up to 200 % of purchase value. There was a very high level of liquidity on the market with the US interest and inflation rates at very low levels (figure 3). Too much capital encouraged companies to borrow excessively.

Figure 2

The party ended with the realisation that P/E in the hundreds (the historical average of the S&P 500 stands at about 16) did not make sense and that there was over (telecoms) capacity on some routes. Technologies that promised to absorb that extra capacity have been slow to materialise.

WAP was an almost total flop except in Japan and 3G is expecting to be quite late.

While broadband internet is starting to make inroads wider acceptance is a few years away for most markets.

Impact on telecom service providers

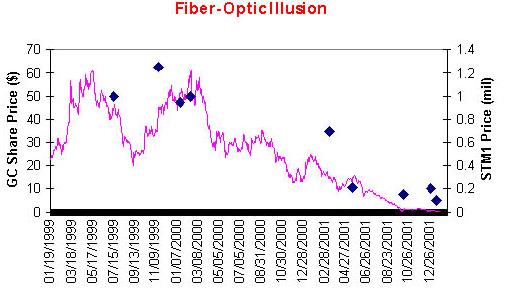

In the end excess supply drove prices down. As a result many telcos have seen their share prices collapsed in line with bandwidth prices. Figure 4 is a case in point with the solid line representing Global Crossing share price and the diamonds representing the price of an annual contract for an STM1 between Los Angeles and New York.

This caused many companies to collapse with Global Crossing being only the latest of a long list of bankruptcies:

GST Telecommunications, with $1.2 billion of debt,

Figure 4

ICG Communications, with $2.81 billion of debt,

360networks with $3.7 billion of debt, Pangea and Viatel

The surviving telcos have seen their debt rating being downgraded further. New comers such as Level 3 have seen their rating fall further into junk bond territories in recent times. Level 3 Communications had close to $10 billion dollars in debt and

current liabilities as of 30 June 01. Its debt to equity (total liability/total equity) ratio stood at 3.4 and its senior unsecured debt rating stands at Caa1.

Although not in default the debt burden of incumbents is impressive:

Verizon with $60 billion debt

France Telecom with $60 billion debt

Deutsche Telecom with $60 billion in gross debt

AT&T with $47.5 billion debt

British Telecom with $45 billion of debt with its rating falling below investment grade in April 2001.

Netherlands Royal KPN with $18 billion in debt and with all its free cash flows consumed by debt service

It may have been possible to service those levels of debt in good times but with earnings falling the situation has become untenable for many.

The downgrade of their debt rating means that telcos must now pay higher interest rates when refinancing. In addition a debt rating downgrade reduces the ability to raise capital from shareholders.

The blow of the rating downgrade has been somewhat cushioned because of aggressive monetary easing in the US but long term yields have stayed stubbornly high.

To make matters worse the high concentration of telecom debt among banks means that they are very reluctant to lend more.

Estimates vary as to the precise proportion of bank debt from this sector, but it is somewhere around half of all debt

raised in the European syndicated loan market in 2000.

The problem was serious enough that about 18 months ago European regulators gave notice that they were watching the issue carefully and were concerned about the level of telecom debt.

As of October 99 some 70% of outstanding debt in the high yield European sector was from the telecom/ media sector.

Now the high yield bond market has virtually shut down for telcos. Similarly, investment grade corporate bond issuance pushed the boundaries of market capacity and telcos are having to pay a premium to access this market.

Many telcos are resorting to asset disposal to reduce debt. BT disposed of its Yellow Page business, and its stake in Maxis, Bharti and Clear to raise $7 billion. AT&T is seeking a buyer for its cable assets which allow it to shift roughly $13.5 billion of debt (out of $47.5 currently) to the new owner.

Securitization

For companies left with assets capable of generating stable cashflows, securitization

Pierre Tremblay Area Manager, Alcatel Submarine Networks (Asia Pacific Region)

Based in Singapore since 1998, Pierre Tremblay is the Area Manager responsible for business development and marketing activities in Australasia. Prior to his posting to Singapore, Pierre was responsible for systems testing at the Port Botany Factory (Australia) from 1996 to 1998.

From 1994 to 1996, Pierre was in France working on the development of the first optical amplifier based repeaters. Pierre joined Alcatel Submarine Networks as a systems engineer in 1991. He spent the first two years of his career working on the installation and commissioning of several optical systems including Tasman 2, Sea Me We 2, and PacRim East.

Pierre holds a bachelor of electrical engineering from Universite de Sherbrooke, a Masters of Science from the University of Alberta, and a Masters of Business Administration from Macquarie University.

assets available to service unsecured debt.

We believe in encouraging lively debate amongst our industry subscribers. Any observations you wish to make regarding this article would be welcomed. Email us at editor@subtelforum.com. becomes one way out of the quagmire. It offers the advantages of having long term maturities and of providing cheaper fund than unsecured borrowings. In essence securitization is a loan/bond secured against cashflows from income producing assets.

Prime candidates for securitisation are real estate, receivables, equipment leases, and fixed line networks. It is estimated that the total securitization volume potential for these telco operators as follows: plant and equipment, $156 billion; land and buildings, $38 billion; and receivables, $38 billion.

With a growing investor base for assetbacked bonds and an increasingly favourable regulatory environment, securitization might seem the answer to many European companies’ prayers.

Telecom Italia has already jumped on the opportunity and raised $4.7 billion of debt secured by telephone bill receivables whilst BT also raised funds through its real estate assets. It is also believed that France Telecom is considering a similar deal.

But this market is no easy option. Securitization hurts companies’ existing debt holders by reducing the amount of

The two leading rating agencies, Moody’s and Standard & Poor’s, recently released guidelines about what impact securitization would have on senior ratings. Perhaps surprisingly, they claim that a little securitization does no harm to a company’s general creditworthiness.

If, as a general rule, asset-backed bonds are less than 15% of a company’s debt, they should not impact on senior unsecured credit ratings. Such tacit approval may give struggling companies the incentive to securitize assets at the expense of unsecured debt holders.

Conclusion

The future of telecoms is bright but the years ahead promise to be challenging for all players involved. The industry is in need of cash at a time when capital markets give telecoms the cold shoulder. This is forcing telcos to look at innovative ways (securitization) to raise liquidity.

With deregulation in full swing the arrival of many new comers threatened the position of incumbents such as AT&T, France Telecom and BT. For a while, the

2editor@subtelforum.com

premise that new economy companies (Level 3, Global Crossing) were going to dominate the world of telecom almost proved true.

As the fairy tale turned into a nightmare, many new comers were driven to the brink of bankruptcy. Incumbents operators (such as KPN and BT) and equipment suppliers have not been spared either and their salvation is not yet assured.

In the end, telecom companies with strong balance sheets are in a position to benefit from the situation by acquiring assets at reduced prices. For many new comers, the road ahead is uncertain and many will fall by the wayside in their quest for riches.

The mountain of wealth came to become the mountain of debt. In the end, all that is left is a mountain of losses for too many investors and financial institutions.

The news is repetitive: layoffs in the thousands, debt in the billions, attempts to strengthen balance sheets. Reporters quote financial analysts talking about a “market correction” and “the worst I’ve seen it.” Colleagues depart, budgets get cut, the frequency of staff meetings—and the scrutiny of management—both rise.

But as bad as it is right now, the worldwide telecom market continues to grow. It continues to employ thousands of people and provide them careers and livings at many economic levels. It continues to enjoy robust technology development and even hints of optimism when you look past these immediate difficult times.

We are in the middle of a bad storm…maybe golf-ball-sized hail. But it’s

A Bad Storm, Not a Perfect Storm: A Bad Storm, Not a Perfect Storm:

The Submarine Market in Context

George Miller and Sally Sheedy, KMI Research

not a so-called perfect storm, whose promise is an end to all.

When this storm passes, the worldwide telecom industry will not have been dismantled, nor its millions of kilometers of infrastructure abandoned. It will not undergo a catastrophic meltdown, as the dot-coms did. It has a real and steady core in the millions of phone conversations and data transmissions that take place every day, all around the world.

It will resume steady growth, enjoying robust technology development and providing thousands of people with careers and livings at many economic levels.

The How and The When

To put the submarine market in context, look first at the state of the worldwide telecom market.

A general measure of its health and growth is deployment of fiberoptic cable. It is measured in several ways, among them route-kilometers (the length of cable deployed) and fiber-kilometers (the number of fibers within a cable multiplied by the length of cable deployed).

It’s common knowledge that longdistance system deployments in some terrestrial markets underwent a severe turnaround in 2001; a growth phase in these long-distance markets may not resume for two or three years. Further, the “peak” deployments in 2001 may never be reached again.

This is a dramatic turnaround from the previous few years. In part riding the dotcom bubble of perceived bandwidth need and easy funding, the worldwide demand for cabled fiber grew by 47% in 2000, the second consecutive year that demand exceeded 40%.

The worldwide demand of 99 million fiber-km in 2000 was more than double the 47 million fiber-km of just two years earlier. The euphoria ended, however, more quickly than it came. The growth represented too much investment in new fiber networks and too many operators in several key geographic markets.

For example, in the United States alone, 33 long-distance network operators were established between 1996 and 2001. More significantly, the number of nationwide long-haul carriers grew to 17

Source: KMI Research

Source: KMI Research

from three. The effect of these nationwide long-distance carrier networks was to double the cumulative installed base twice in three years!

The new network operators were more than could reasonably be sustained in the mature United States telecom market. The combination of increased competition and declining bandwidth prices meant that carrier business models could not support the debt of new operators. Europe faced a similar situation.

The charts show how many fiber-based long-distance carriers were operating in the United States each year, and how much fiberoptic cable they had in their networks

in that year. The route-kilometer figure therefore refers to the installed base, and specifically to cable the carriers had installed themselves and not leased. We grouped the carriers into three major size categories, based on the quantity of fiberoptic route-kilometers. Thus, some carriers “moved up” to the next category as they installed more cable. In the United States, a network of 20,000 route-km is characterized as a nationwide network. The smaller size categories include some regional and even state-wide networks. Thus the number of nationwide operators jumped to 15 from 3 in five years (1996-2000), while the number of operators

United States Long-Distance Carriers

European Long-Distance Carriers

jumped to 62 from 36. The pan-European figures refer to carriers that have installed fiber to link cities in different countries. Some of these carriers span the major countries throughout the continent, and some focus on specific regions. The data again show the significant amount of cableroute construction in just five years.

Latin America Cumulative Fiber Deployment

Source: KMI Research

In Latin America, long-haul backbone building is nearing completion, though it never reached the fevered pitch found in North America and Europe. Latin America is emerging from a period of pulling itself up by its telecom bootstraps.

other world regions.

Nonetheless, cumulative fiber deployment will enjoy a slow by steady rise region-wide through 2006, although annual fiber deployment will spike downward country-by-country, leveling off and then beginning to rise again in 2004.

Signs of Light in the East

George Miller is a Senior Analyst at KMI Research, a fiberoptics market consultancy in Providence, RI. He is co-chair of KMI’s 8 th Annual Fiberoptics Submarine Systems Symposium, “Strategies for a Down Market” (June 13-14, 2002, in San Diego), and Publisher of the twice-monthly newsletter, Fiberoptics Market Intelligence.

Mr. Miller can be reached at gmiller@kmicorp.com.

In the past five years, most of the telecom markets that comprise the region have opened to competition. Attendant with the market openings have been teledensity and level-of-service requirements imposed by governments. The result has been a transformation of the region’s telecom sector from a mishmash of individual country initiatives to a cohesive and region-wide infrastructure.

Latin America is currently transitioning from long haul to metro/access buildout. Economic as well as market conditions are conspiring to apply the fiberdeployment brakes on a country-bycountry basis to a greater extent than in

Cumulative Fiber Network Installation in China

Source: KMI Research

In contrast to the Americas and Europe, China is still enjoying robust telecom growth. Continuing deregulation and ascension to the World Trade Organization will accelerate China’s fiberoptic network expansion beyond the 10% annual growth it has experienced in the last decade.

UNDERSEA RAMP-UP, MAJOR MARKETS

Route-Km12,76212,11514,45010,00017,50053,56112,000132,388

Fiber-Km51,04848,460115,60040,00092,000531,28896,000974,396

Est. Investment ($Millions)7305207152431,0704,3091,2008,787

Investment ($Millions)1,2503,5001,2601,7007,710 North-South/Latin America* Systems13419

Totals Systems221766226

Route-Km35,32236,51714,450111,83770,15083,16136,200387,637

Fiber-Km141,288238,268115,600758,932476,600865,530483,2003,079,418

Est. Investment ($Millions)1,9801,6127154,7403,6645,9692,90021,580

*Major systems linking North to South America: Latin America regional systems

Most carriers in China are expanding their networks, especially at the local access level. Annual demand for fiber for national long-haul networks will decrease while demand for intra-provincial local access network fiber will continue to grow.

From Land to Sea

The market for fiberoptic undersea systems is consistent with that of the long-distance telecom market as a whole. Undersea systems differ from terrestrial or domestic intercity networks in terms of rights-of-way, fiber counts, installation and maintenance, access to repeaters and cable for upgrades, and—in the case of consortium cables—in ownership.

But in many respects, undersea cable operators are experiencing many of the

same market and financial problems as their terrestrial counterparts.

These problems include: erosion in circuit prices, shorter-term commitments from high-capacity customers, high debt burdens, and low revenues relative to operational expenses. In short, too many carriers spent too much money too quickly, borrowing too much money relative to the near-term market opportunity.

These similarities are apparent in such developed undersea markets as the transatlantic. Statistics show a similar ramp-up in the major undersea markets. For these markets, 26 systems were cut over between 1995 and 2002, compared to only 12 between 1988 and 1994.

In the chart, a system is a named system that may have multiple segments, so it could be large (transoceanic) or small (a link between islands).

Like the terrestrial markets, the worldwide undersea markets saw record growth between 1999 and 2001. In 2001, more fiber –1.94 million km – was cutover than in any previous year. And the $12.4 billion invested in systems cut over that year is the largest for any year to date.

Another contributor to the dramatic ramp up in the late 1990s is technological: the recent systems have orders of magnitude more capacity than earlier generations. The amount of cable installed

since bit rates passed 2.5 Gbps is more than three times as much as installed with previous generations of technology. But the real contributor to capacity is WDM, which can multiply the capacity of one fiber by a factor of 80 or more.

So there has been a dramatic buildup in both undersea and terrestrial capacity. And in both cases, the picture has changed dramatically in the past 18 months. Undersea carriers, like their terrestrial counterparts, are experiencing financial difficulties. Global Crossing is notable among those currently in the auditors’ crosshairs. But it is not alone.

Sally Sheedy is Database Manager at KMI Research. She is responsible for KMI’s undersea fiberoptics database, corporate library, and research for KMI’s annual submarine systems report. She holds an MS in library and information science from the University of Rhode Island. She can be reached at ssheedy@kmicorp.com.

Give your exhibition or conference maximum exposure to the submarine telecoms industry.

Advertise your event in Submarine Telecoms Forum and reach all the key people.

production and installation of undersea systems.This slowdown will last longer than some of the previous downturns in the number of new undersea systems installed, and the recovery in this business may be more gradual than in previous years.

5advertising@subtelforum.com

advertising @subtelforum.com

Email advertising@subtelforum.com

Further, the telecom climate has been studied carefully by the investment community, and the result has been a reduction in the number of new systems being funded. The chart shows the number of new systems announced in past years, and a nearly 50% drop-off in announcements in 2001. In addition, no major systems have been announced in the first quarter of 2002, so we are tracking towards a low number announced this year. Fewer announced systems means fewer to be surveyed, engineered and installed. So 2002 and 2003 will be slow years for companies that are involved in the

One reason is that the trend away from consortium ownership experienced in the late-1990s will reverse itself partially as large operators seek partners or consortium-type deals as a way to mitigate risks and reduce overall investment per system.

To the extent that the industry’s recovery depends on consortium-owned systems, there will be slightly longer planning cycles before the ships depart to lay cable.

In the meantime, however, there is evidence of continued technological progress and efforts to pursue new markets.

One example is the recently announced Corvis/Dorsal agreement, which is noteworthy as a consolidation of two suppliers —one whose strength is submarine equipment, the other’s is terrestrial—whose technology development efforts involve streamlining the sea-to-land communications system interface.

Initiatives of the combined company will involve simplifying the submarine-cable/ landing-station/PoP routing now in use to make it easier for carriers to achieve the kind of PoP-to-PoP setup they desire, even when an ocean may separate the PoPs. It’s understandable that such deals become all but overlooked in the company of “worst-ever” headlines. But their presence is a harbinger of the submarine market’s next phase. Similar deals—on both the supplier side and the carrier side—will follow. Stranded assets will be acquired and put to use. Manufacturers will develop equipment tuned to helping suppliers get all they can out of existing infrastructure. And the submarine sector will continue its contribution to the worldwide telecom market, which will continue to employ thousands of people and provide them careers and livings at many economic levels.

We believe in encouraging lively debate amongst our industry subscribers. Any observations you wish to make regarding this article would be welcomed. Email us at editor@subtelforum.com.

3editor@subtelforum.com

In a recent McKinsey emerging markets report entitled, “Broadband’s Latin Future,” Ernesto Flores-Roux, Carsten Kipping, and Alejandro Sanchez stated that Latin America’s broadband market is “bigger and better than it seems.”

Despite reports of a telecom slump and a fibre glut, these analysts predicted that by 2004, there will be anything from 3.3 million to 4.3 million broadband subscribers in Latin America. That would make for a growth rate of from 88 to 102 percent in the years since 2000.

Whilst small in the absolute sense, the numbers show that broadband has already achieved a substantial penetration rate— from 21 to 43 percent—in the Latin American market, as compared with estimated rates of 38 and 65 percent in the European Union and United States, respectively. The affordability of broadband services will be the main source of difference amongst these regions.

The telecom industry in Latin America that was once dominated by government and monopolistic policies is now moving in a different direction, thanks in part to an increase in deregulation and

privatization. However, aside from that, many companies are responding to a call to move forward. They are providing the necessary communications tools to break down barriers, integrate economies and provide the region with leading-edge technology solutions for the 21st century. Internet penetration, pent-up demand and underserved markets are key reasons why telecom companies are moving south. According to an IDC study, there will be 75 million Internet users in Latin America by 2005, up 15 million from the year 2000.

Regional Connectivity

The best opportunities lie in narrowing our focus. Motorola went from mobiles to diversity: Nokia took the opposite approach and went from very great diversity to principally mobile phones, with huge success. Focus seems like common sense, but paradoxically the majority of business leaders would rather be a Motorola.

We will win by being focussed. By being a big fish in a contained pond or region and then by making the pond bigger by selective process. This will be achieved

by taking the existing successful capacity platform as the foundation for a service business taking advantage of building cooperation with our partners in the cable system. We can then make the small pond bigger by encompassing additional countries in the ring such as Haiti, Jamaica, the Cayman Islands, among others, and expanding our service portfolio.

New World Network focussed on a niche market: 15 countries in the Caribbean and the Americas. We wanted to be a big fish in a small pond; a major player in an underserved region.

Our company was founded in 1998 on the belief that while the larger market economies in South America, Europe and Asia already had sophisticated fibre networks, there were a few underserved nations with some 200 million people that had been largely ignored. Many did not view the Caribbean as a strong consumer market.

Yankee Group analysts predict a 68% compound annual growth rate for Latin America broadband, with an explosion in demand from 110 Gbps for the region in 2001 to 1,492 Gbps in 2006.

Our company was founded to fill a demand for broadband capacity that existed in the marketplace. We are opening a place that has a deep telephone penetration and previously never had a dedicated cable system with interconnection between countries. The increasing demand for faster, more reliable connections in the Caribbean and the Americas prompted our founders and executive management team to design a future-proof multi-gigabit submarine cable system that would satisfy this growing demand for bandwidth capacity in an underserved region. Our mission was to identify and address telecommunications opportunities in Latin America and the Caribbean with significant upside potential in both growth and value. Our business model was based on three key differentiators: Regional connectivity

Leading-edge technology with high security

Unique private-plus ownership structure

ARCOS is the first regional cable system to interconnect 15 countries in the

Caribbean and the Americas. ARCOS is a regional cable with global reach. It interconnects the U.S., Bahamas, Turks & Caicos, Dominican Republic, Puerto Rico, Curacao, Venezuela, Colombia, Panama, Costa Rica, Nicaragua, Honduras, Guatemala, Belize and México.

By serving a niche, underserved market, New World Network is enabling new business in the Americas. We are providing enhanced telecommunications services and unparalleled connectivity to and between 14 countries in the Caribbean, Central and South America.

Festooned, Future-Proof Technology

The ARCOS network was built as the region’s largest unrepeatered undersea network. It is a 8,600-km fully protected ring, consisting of 22 non-repeatered and two repeatered segments.

Unlike other repeatered systems in the region, ARCOS is capable of integrating future transmission technologies as they develop.

ARCOS has a unique festooned architecture rather than traditional spur

architecture that is common on repeatered undersea links.

Systems like ARCOS that are principally unrepeatered are effectively superior to those with repeatered sections because the repeatered systems have effectively built in obsolescence as technology evolves unless the whole cable is pulled up and repeaters modified. Cables such as ARCOS with short haul nonrepeatered links contain high fibre counts. These cables, containing up to 12 fibre pairs, offer sufficient reserves to meet future demand for capacity growth throughout the ARCOS ring.

This creates economies of scale that are similar to those achieved by terrestrial networks where incremental upgrades can be performed in days rather than months, making the system future-proof and abundant in capacity.

The technology of our cable allows for flexibility and scalability as well as the provision of capacity on an as-needed basis. We can reach distances in excess of 400 metres unrepeatered – this saves costs and provides flexibility.

David Warnes is President and Chief Executive Officer of New World Network.

Before joining New World Network in June 2000, Mr. Warnes was Chief Operating Officer of Global Light Telecommunications, Inc.

Prior to joining Global Light Telecommunications, he was Assistant Managing Director of Tele2 from 1992 to 1995, a telecoms service provider in Sweden that is partially owned by Cable & Wireless.. From 1982 to 1988 Mr. Warnes held various managerial positions with Cable & Wireless and its affiliated companies.

Mr. Warnes is a graduate of the University of East London. He is a chartered engineer and a Fellow of the Institution of Electrical Engineers.

Advantages of Redundancy

Due to the ring configuration with electrical and physical redundancy (the signal is transmitted in both directions simultaneously), full redundancy can be ensured in the event of a cable break.

To enhance network security, the entire system is controlled and monitored from two operation centers at separate locations, one in Miami, the other in Curaçao. In addition, landing stations are in buildings that have been pre-fabricated to meet all requirements for the severest weather expected in the region. This is advantageous to carriers because all benefit from the upgradability potential and reduced unit cost, in addition to having connectivity to 15 countries in the region.

Because ARCOS is a true physical ring, it provides complete signal redundancy, allowing ARCOS to automatically select the strongest signal for optimal transmission quality and reliability, while providing built-in, real-time traffic restoration. Open architecture allows easy upgrades of the number of channels in the future.

The ARCOS Architecture and design is:

A true ring configuration

Immediate traffic restoration

Built-in redundancy

Able to incorporate future technology

ARCOS is the only system that requires so few kilometers of cable (8,600) to

connect so many countries (15) in a true ring configuration. Now, the region’s growing demand for bandwidth can be met. New services, e.g. Gigabit Internet, will contribute to the economic development in the region. New World Network has contracted skilled experts to develop and install ARCOS throughout the Americas. Corning (NSW), TyCom (US) Inc. and Siemens A.G., are jointly constructing ARCOS.

Benefits include increased bandwidth availability, competitive prices and redundant or alternative paths. By use of this single ring, customers have access to high-speed bandwidth capacity in a reliable, fully protected communications network.

Private-plus ownership structure

New World Network has strategic alliances with 28 leading carriers in the region that provide network support, landing rights and interconnection to existing local networks.

The private-plus ownership structure combines the advantages of a private company with benefits of established relationships with leading strategic carriers.

The private model:

Quick decision making

Efficient contract execution

Expedite construction time

Reduce up-front capital requirements

Reduce risk in forecasting capacity needs

Flexible, low cost pricing

Carrier participation benefits:

Landing rights

Backhaul

Local network interconnection

Planning insight

Local O&M support

The Landing Parties have been assembled from telecoms companies already operating in each of the landing countries. This is highly advantageous to ARCOS as it allows for integration of service offerings into existing networks. Furthermore, it creates a barrier to other cable operators entering the region where ARCOS is the preferred system of the incumbent operators. New World Network, as a proven low cost carrier’s carrier, is not in competition with other systems and is a complementary network.

A global guide to the latest known locations of the world’s cableships, as at MARCH, 2002.

C.S.WAVEMERCURY1982GLOBALMARINESYSTEMS101051627/12/01WakamatsuJapan

CABLEINNOVATOR1995GLOBALMARINESYSTEMS1427711SingaporeRepublicofSingapore

CABLEINSTALLER1980GLOBALMARINESYSTEMS298612SydneyAustralia

CABLERETRIEVER1997SINGAPORETELECOMMUNICATIONS110261624/12/01SubicBayPhilippines

CERTAMEN1965ITALMARE49831412/02/02PozzalloItaly

DISCOVERY1990FRIARYOCEAN82481202/02/02continentalshelfUnitedKingdom

DOCKEXPRESS201983DOCKWISE147931515/02/02LisbonPortugal

ELEKTRON1969STATNETTENTREPENOR1628017/01/02TyneUnitedKingdom

FJORDKABEL1985UNKOWNPARENT331021/02/02HammerfestNorway

FRESNEL1997FRANCETELECOM647514.526/12/01PortSaidArabRepublicofEgypt

GIULIOVERNE1983PIRELLICAVI106171023/12/01BrindisiItaly

GLOBALMARINER1992TRANSOCEANICC ABLESHIP1251813.826/01/02HonoluluUnitedStatesofAmerica

HAVILAREEL1976HAVILASHIPPING31861129/12/01FalmouthUnitedKingdom

HAVILASKAGERRAK1976HAVILASHIPPING71721006/12/01HaldenNorway

HEIMDAL1983ALCATELSUBMARINENETWORKS104711620/02/02BusanRepublicofKorea

IBERUS1978TRANSOCEANICCABLESHIP83341701/02/02HitachiJapan

KDDOCEANLINK1992KOKUSAICABLE95101503/03/02YokohamaJapan

KDDPACIFICLINK1993TOKYOLEASE796013MojiJapan

KOUSHINMARU1998DOKAITUGBOAT482212MojiJapan

LEONTHEVENIN1983FRANCETELECOM484515BrestFrance

LODBROG1985ALCATELSUBMARINENETWORKS1024314.503/02/02DoverStraitUnitedKingdom

MAERSKDEFENDER1996MOLLERA.P.5746008/02/02RecifeBrazil

MAERSKFORWARDER29/12/01TyneUnitedKingdom

MAERSKRECORDER2000MOLLERA.P.62921405/01/02NagasakiJapan

MAERSKRELIANCE2001MOLLERA.P.629214SubicBayPhilippines

MAERSKREPEATER2000MOLLERA.P.629214ShanghaiPeople’sRepublicofChina

MAERSKRESPONDER2000MOLLERA.P.62921430/12/01PortSaidArabRepublicofEgypt

MANTA1992JADE-DIENST27231512/12/01HoustonUnitedStatesofAmerica

MIDNIGHTCARRIER1976TORCH26701320/02/02NewOrleansUnitedStatesofAmerica

MISSCLEMENTINE1996COASTLINEMARITIME3637916/01/02PulauBatamIndonesia

MISSMARIE1998COASTLINEMARITIME3639021/02/02SingaporeRepublicofSingapore

NORDKABEL1969UNKOWNPARENT3951012/02/02HarstadNorway

NORMANDCUTTER2001SOLSTADSHIPPING122911521/01/02BristolUnitedKingdom

OCEANCHALLENGER2000ROVDESHIPPING523516.711/01/02BusanRepublicofKorea

OCEANICKING2000POLARSHIPMANAGEMENT128671608/12/01SydneyAustralia

“With the exception of the instinct for self preservation, the propensity for emulation is probably the strongest and most alert and most persistent of the economic motives”. In today’s parlance this statement by Veblen in 1899 roughly translates to “if you see a bandwagon, jump on it”! In these simple statements lie the source of our current woes.

In January 2000, when it seemed that the litany of our industry was ‘Explosive

growth’ I wrote an article that at the time was almost a heretical treatise. Among other things it said, “In these magical times …such unprecedented and explosive growth contains the seeds of our future destruction…” and “…where [players] misread the market, miss the peak or are just plain over optimistic the results can be catastrophic…”

During the second half of 2001, as our industry crumpled into the buffers, numerous luminaries persisted in making

statements like “ a cyclical business …we are just in a down trend…”, or “…we have seen this sort of downturn before…” and “…This sort of thing happens every 5 or 6 years….”

We are now all aware that the telecom industry is not going through a ‘down’ cycle. What we are experiencing is a sector ‘crash’ that is unique in the telecoms industry and outside anyone’s experience in this market.

The structure and economics of our industry have fundamentally changed - and will continue to do so.

The purpose of this article touches on two elements of interest given the current state of the market. One is the potential short-term effect on delivery and service in the submarine sector. The second is the more macro view of ‘what happens next?’

Short Term Impacts – and how to deal with them

For submarine system contractors the short term really refers to the next eighteen to twenty-four months - and the prognosis is distinctly unfavourable. With overcapacity and debt plaguing purchasers top-level demand will be minimal and customers will

seek to expend as little cash as possible. With significant asset overcapacity in the system supply side any opportunities will be fiercely contested and any project that does proceed will do so at minimal prices.

A foretaste of market conditions under these circumstances has shown that on the system design and planning side there can be high variability in the quality in system engineering and, once funded, an undue rush to get systems ‘to market’ both of which can result in less than optimum planning and execution of projects.

On the commercial front, intense competition, a ‘Dutch auction’ environment and a ‘price war’ negotiating approach will squeeze contract prices to contribution levels if one is lucky and to cash costs if not! This in turn is likely to lead to more problems around payment and delivery, a higher level of contract disputes and claims and difficulties with managing cash flow in companies that are not robust enough to ride out these difficult times.

Such conditions tend naturally to increase the adversarial elements of contracts and execution – and much will rely on the relationship between Customer

and the Contractor as to how bad this becomes. In the first (undesirable) model, the customer, having awarded the contract, seeks to find ways of reducing costs and minimising cash out-flows by possibly reducing the work scope and engineering, trying to force through extra work without contract variations, disputing invoices, paying late, and generally seeking to reduce the contact value. Having won the contract the supplier/contractor seeks to increase the scope of work, seek all possible contract variations for extra work, minimise cost exposure during execution by adjusting work plans and deploying his cheapest assets. Both sides will probably get what they deserve and end up in arbitration – or worse – expending ever more money with lawyers trying to sort out the disputes.

The second way, even in these difficult times, is for both sides to be ‘honest’ about their problems early on, to express desired outcomes and advise on internal pressure points - in short to communicate! It is possible to develop a good relationship even under these tough market conditions. While it is best if this is done during the front-end negotiation it should still be done

In April 2000, after spending three years in Shanghai as General Manager of a company in joint venture with China Telecom, Murray returned as Director of Strategy for Global Marine Systems.

In January 2001 he became Director of Customer Services.

In 1984 Murray completed 13 years at sea as a Master Mariner in the North Sea Oil & Gas industry and has been a Chartering Manager, Project Manager and General Manager in the sub-sea oilfield construction industry.

Murray joined BT Marine in 1990 and was Regional Manager, Asia Pacific prior to going to China where, in 1999, the Shanghai Government honoured him with the coveted Magnolia Award for business performance. Murray has an MBA and is a member of the Institute of Directors and the Institute of Management.

even if after contract award. When organisations have a problem they generally form an internal team of experts to discuss and develop the optimum solution. It is amazing therefore that the minute a contract is in place between two parties the tendency is to form up into

isolated camps, work separately and occasionally get together to see how each camp is progressing. This style of working is counterproductive under normal market conditions but in today’s environment it can be a recipe for disaster for both parties. If an environment of mutual support can be created, where discussions of problems are immediate, open and frank, better solutions will be generated sooner with all the implementation benefits this brings.

Global Marine has examples of this latter model wherein the benefits are astoundingly clear and where, under difficult circumstances, key requirements have been delivered and complex adjustments have been with work ‘inprogress’ to the mutual acceptance and benefit of both.

The Longer Term

While statistics abound regarding capacity, pricing, PC and Internet usage, etc. I have deliberately avoided them in this article since I might be accused of using them rather as a drunk uses a lamppost – more for support than illumination!

For the TelecomsMediaTechnolgy (TMT) sector as a whole I am extremely optimistic for the long term. This view is predicated on the hypothesis that recent global political, regulatory, commercial and social developments have turned the maturing telecoms, entertainment and computer industries into a new sector that is in its embryo phase.

While the current ‘crash’ may be extremely painful it is entirely understandable in an industry that has not

even reached the first point of inflection on its ‘lifecycle’ curve.

I believe that this will be the most exciting industry to be in for the next 25 years as we see TMT infrastructure, innovation and services permeate every facet of our lives. If we thought television was big – watch this space for what comes next!

Clearly over the next few years we will see some ‘chicken and egg’ bottlenecks as infrastructure oversupply waits for applications and services demand. This in turn will be followed by such high capacity services being frustrated by slow infrastructure development. However, overall we will see the gradient of the growth curve increase as we cycle through these supply and demand bottlenecks, with each cycle

happening more quickly than the previous. The start of this sustained growth will be the delivery of ubiquitous, high capacity, broadband availability followed by increasing speed and robustness of the global ‘transport platform’.

However, one of the biggest breakthroughs will occur when the primary communicating and input medium for all devices is voice rather than a keyboard or stylus.

Moving more specifically to the submarine segment of the industry, optimism for recovery depends on numerous factors. In seeking to learn from similar events in other industries pundits have often drawn parallels with the oil industry crash of 1986.

The worrying aspect of this model is that even now, some 16 years later, in a period of very healthy demand, sub-sea engineering service companies in the Oil and Gas business sector are unable to deliver high returns – despite strong revenue growth.

The residual impact of cut-throat competition, high barriers to exit and a small customer base that communicates

amongst itself has prevented a return to really healthy margins.

Optimism for the submarine sector of our industry and avoidance of the oil & gas model will rely upon the customer base remaining large, diverse and geographically dispersed. It will also rely on the hope that the current difficulties do not lead to moves by governments to de-liberalise the sector and re-introduce elements regulation.

It will also require that universal high speed, high capacity access is closely matched by applications of increasing sophistication and consumer desirability.

At the system & marine supply side of the sector a return to health is predicated on the fact that the sector must continue its current, painful, rationalisation.

Perversely, quicker recovery in the industry would disadvantage strong companies as it would enable weaker competitors to just scrape through and prolong oversupply and poor returns.

For those strategists in the submarine supply sector the key questions revolve around, “What will recovery look like”? Will it be 50,000km per year? 60,000km? What we do know is that it is unlikely to

be the 140,000km we have seen in recent years – and so even for the medium term the industry is likely to be operating at levels last seen in 1996/97.

To conclude, I do not believe we face the crossroads immortalised by Woody Allen, who said, “one path leads to despair and utter hopelessness, the other to total destruction – let us pray we have the wisdom to choose correctly” . There is a strong case that says we are where we are today as a result of the financial institutions that funded the telecoms bubble failing to take account of the age-old adage that says, “by the time you see a bandwagon you are already too late to jump on it”.

Let us hope that when the recovery takes hold in a couple of year’s time a more rigorous approach towards lending and investment strategies leads to a more sane and sustained period of growth.

We believe in encouraging lively debate amongst our industry subscribers. Any observations you wish to make regarding this article would be welcomed. Email us at editor@subtelforum.com.

4editor@subtelforum.com

On January 7, 2002, NJDEP published proposed regulations dealing with submerged cables. In separate official comments filed by the International Cable Protection Committee (ICPC) and North American Submarine Cable Association (NASCA), cable owners served notice that New Jersey has gone too far.

The NJDEP Proposed Rules include 27 prohibitions and restrictions on cable laying, repair, and maintenance, and impose for the first time a financial penalty on submarine telecoms and power cables which will cost the cable industry millions of dollars over the life of each new cable installed. All of these changes were the result of political pressure applied by local New Jersey fishing groups on NJDEP who rely on clam dredging and bottom trawling as their principal marine activity.

The Proposed Rules in effect seek to expand the state of New Jersey’s claimed Atlantic Ocean jurisdiction over submarine cables from the present acknowledged three nautical mile limit of the state’s territorial

seas. They seek unprecedented jurisdiction expansion to between the 110 and 120 meters depth curves.

Using the 110 meter curve, the reach of the state’s jurisdiction ranges from roughlyy 60 to 80 nautical miles seaward of the coastal baseline and covers an area of roughly17,380 square miles of new jurisdiction territory.

Specifically, the Proposed Rules in this new area would have the following effects beyond three nautical miles:

The discouragement, which under the Proposed Rules is tantamount to denial, of undersea ring systems landing in New Jersey from other landings in the United States or from Canada which require transit of surf clam areas or areas where marine fish are commercially harvested in favor of land routes. Such land routes would involve crossing scores of sensitive land habitats, wetlands, rivers, and private and pubic lands prohibitive financial and delay costs. (If such regulations had existed when TAT-14 was built, the wet link of that ring system would have been impossible as it is presently constructed.)

A requirement that cables be buried with depth of 1.2 meters.

Restrictions on cable crossings and removal of third party out-of-service cables.

Mandating cable route restrictions to avoid fishing grounds.

Establishing mandatory inspections and periodic re-inspections of cables, with corresponding reburial, removal, and annual reporting requirements.

Payment of $100 per meter as a penalty for any cable not buried to a depth of 1.6 meters.

The Proposed New Jersey Rules envision using the Coastal Zone Management Act (“CZMA”) as a means to allow New Jersey to export its restrictions and penalties on cables beyond its threemile territorial sea out to depths of 120 meters, or even beyond if commercial fishermen want to fish in those waters in the future.

While New Jersey may have regulatory powers within its own three-mile territorial sea, the cable owners in their opposition comments highlighted the fact that (1) the New Jersey territorial sea is limited to three nautical miles and, (2) the U.S. Army Corps

Douglas R. Burnett practices primarily in the areas of telecommunications, international law and transportation litigation in the New York office of Holland & Knight LLP.

Mr. Burnett is the International Law Advisor to the International Cable Protection Committee (ICPC), an international organization of over 67 administrations and commercial companies from 39 countries owning or operating submarine cables. In his capacity, he advises members of their rights and responsibilities under international law and associated treaties and national legislation regarding undersea telecommunication cables. His unique experience includes litigation in numerous cases in U.S. and foreign courts concerning internationally protected submarine cables.

Mr. Burnett is a member of the Maritime Law Association of the United States where he has been Chairman of the Committee on International Law of the Sea since 1994, and the Intituto Iberoamericano de Derecho Maritimo.

For all your personnel requirements:

of Engineers’ jurisdiction over cables is also limited to three nautical miles. As a result, the CZMA may not be used as intended by the Proposed Rules.

In challenging this dramatic extension or New Jersey’s jurisdiction, the cable owners relied on the United Nations Law of the Sea Convention (UNCLOS) and other treaties to which the United States is party. The international law embodied in these

treaties limits coastal nation jurisdiction to 12 nautical miles.

Furthermore, in the case of the United States, Congress has not passed any legislation which would allow the state of New Jersey or the U.S. Army Corps of Engineers to expand their present threemile jurisdictions to the 12 mile limit, and certainly not beyond.

In a new development, the cable owners argued that the proposed NJDEP restriction against wet links is a violation of the Telecommunication Act of 1966 (TCA). Under the §253(a) of TCA, no state or local statute or regulation may prohibit or have the effect of prohibiting the ability of any telecom entity to provide any interstate or intrastate telecommunication services.

The cable owners point out that the proposed rules discourage ring systems and effectively limit the ability of companies to provide telecommunications to consumers in the United States.

On a positive note, the proposed New Jersey regulations do recognize and approve the use of “obsolete submarine cables in artificial reef projects, because they attain many of the biological and ecological

attributes of the natural reef.” This is de facto admission by NJDEP that submarine cables in the marine environment are environmentally benign is in harmony with the December 5, 2001 ruling by the FCC which reaffirmed their prior determination that submarine cables have no significant impact on the marine environment.

In their comments, the cable owners urged NJDEP not to adopt the Proposed Rules until they are modified to be in compliance with international and federal law.

These laws preempt attempts by local domestic states to interfere with telecoms through regulations which are contrary to established norms of international and national law. Whether NJDEP heeds this position remains to be seen.

The one thing for certain, however, is that the cable industry will be closely following the NJDEP response to their comments. We believe in encouraging lively debate amongst our industry subscribers. Any observations you wish to make regarding this article would be welcomed. Email us at editor@subtelforum.com.

5editor@subtelforum.com

In the submarine telecoms industry, trickle-down is not a theory when it comes to marine services. The “scheduleis-king” mantra of 18 months ago has been replaced by an emphasis on cost and cash, resulting in deferrals, lay-ups and lay-offs. Previously purchasers wanted the highest capacity, maximum diversity and the latest installation technologies. Now there is a perceived bandwidth glut so new systems are being shelved, fleets are being “optimized” and ROVs are finding their way back into the oil patch. The marine service segment, like the rest of the industry, is hunkering down, focusing on survival not innovation.

Great Expectations

Prior to the downturn there was a growing awareness of a gap between the expectations of system purchasers and other stakeholders with respect to installation and the ability of installers to satisfy those expectations. This expectation gap arose from several factors including the deployment of new technologies, competitive pressures and an evolving regulatory environment.

Does a 3m plow really bury to 3m? How often does an ROV attain the advertised 1m burial at a 1 km/hour production rate? Are burial depth measurements always reliable? Can we guarantee fisherman unmitigated access to their traditional and future grounds with 100% burial? The frequent answer to these questions was “not as often as expected”.

To an extent, the expectation gap was the result of overselling and expediency. A vendor developed a new tool that, under certain circumstances, extended the previous performance limits. This tool was marketed up the supply chain to installers, system suppliers, purchasers and, in some cases, to the bandwidth end users to differentiate one system from another. The installer, the actual user of the tool, recognized its limitations, but wanted it in his tool kit.

Further up the supply chain, the less the limitations were appreciated and the more the enhanced performance was taken as a given. The feature became integral to a perceived competitive advantage, whether it was faster time to market or better system performance and security. In the frenzy

of applications for new cable landings and routes through various administrative jurisdictions, it was expedient to acquiesce to requirements of 100% burial or suspension-free installations rather than to try to educate the authorities of the limits of technology. Win the time to market race first, then manage the consequences of practical realities later.

The result was the expectation gap, which challenged the industry’s credibility. Many installations, which by any historical measure were well performed, still did not meet the new “standard” of performance. Instead, permit authorities challenged permits, fishing interests forced reroutes and purchasers and suppliers had contract disputes, which trickled down to the installers in the form of delays, extended warranties and commercial settlements.

Closing the Gap

The current slowdown provides an opportunity to rectify many of the bad habits acquired by the industry during the period of unbridled expansion. Included among these is the closing of the expectation gap. Even while licking their

wounds, this is the time for installers and suppliers to improve their processes through good engineering, innovation and exploiting lessons learned. This is also the time to educate stakeholders, including those above and below in the supply chain, the end users and regulatory agencies. Here are some areas where the gap needs to be closed:

Burial : Deeper is not always better, both in terms of depth of burial and the water depth to which burial is performed. New plows and ROVs enable work to depths in excess of 2000m. Standard plows have also been enhanced to deliver deep (3 m) burial. High-powered ROVs are now on the market to provide deep post lay burial. So

why not sign up for contracts requiring deep burial to 2000m water depth? Despite available technology, targets are not consistently achieved except under ideal circumstances.

Recent results from a 3m burial program indicate 3m or deeper burial was achieved 87% of the time. While this is an excellent result, the 13% that is not buried to 3m could be a commercial liability, but not necessarily a protection risk.

Similar data from a 1.0m burial project in a difficult region indicate the target was met or exceeded 60% of the total buried distance of 1500km. In both cases, bottom conditions were the primary factor in determining the burial depth achieved and the extent to which the results provided adequate protection far exceeded the percentage of the target depth achieved. Nevertheless, the results from these cases may not meet permit requirements negotiated by the purchaser with the cognizant authority, putting the parties at risk of a violation.

Maintenance of a deep buried cable is also problematic. Tools capable of recovering a cable from a 3 m trench are

just now being developed. As a result, the industry is currently accumulating hundreds of kilometers of 3 m buried cable that can not yet be effectively repaired.

The water depth issue is similar.

Plowing is now routinely targeted to depths seaward of the continental shelf break on the continental slope. Successful plowing is limited to slopes less than approximately 15°; such features are typical on the continental slope and occur at various depths between 500 and 2000 m depending on the local geology. Plow burial seaward of those locations is unlikely to be possible. System-wide specifications of burial to a nominal depth may lead to a deficient commercial performance at certain sites.

The purpose of burial is protection. If adequate protection can be obtained at 1m out to 1000 m water depth, there is no competitive advantage to a more stringent specification. Questions raised by the inability of an installer to meet an enhanced specification may actually be a competitive disadvantage. It also costs more to do more, even if not totally successfully.

The limits of burial need also to be understood. It is extremely difficult to find

Mr. Munier has a 25 year career in the marine industry, including interests in commercial undersea cable systems, military ranges, ocean energy and operations.

He has an undergraduate degree in geology and advanced degrees in ocean engineering and business.

Mr. Munier is the Managing Director for Engineering and Construction at Tyco Telecommunications, a leading supplier of undersea bandwidth and fiber optic cable systems based in Morristown, New Jersey. His responsibilities include the construction of undersea and terrestrial infrastructure for the Tyco Global Network and third party systems.

Prior to joining Tyco, he was Vice President of General Offshore Corporation where he was in charge of the US business unit.

a route across the continental shelf that will support 100% burial. Hard ground and uneven topography are as common on the ocean floor as road cuts on the interstate. As such, owners of systems and other sea bed users need to understand fully the risks of the route and the limitations of the tools.

The problem may not be solved by a more stringent specification or a blind faith in technology. Sometimes surface laying properly armored cable through a difficult terrain will provide better protection than a marginal burial program.

Cable Laying Precision : A variety of new tools have been developed to control the cable laying process by computer. In fact, these systems are moving towards a seamless management of the process from planning to simulation to cable laying and ultimately, documentation. They also are moving towards full integration and control of cable machinery and vessel operations so that complex lay plans can be managed automatically. These systems provide major improvements to manual methods, with their most compelling attraction being precise slack management. With perfect information, these systems can

theoretically install cables without suspensions. Unfortunately in this context, perfect information is an oxymoron. In deep water, significant topographic features may not be detected in electronic surveys because of the relative scale of the feature to the depth. Transients in operations such as loss of navigation, dynamic positioning failures and cable faults tend to confound even the best lay plan and most sophisticated algorithm. High tech, aesthetically pleasing screens with graphical, real time representations and data expressed to many decimal places give the impression of precision that may not be supported by the precision of the inputs.

Post lay inspection by ROV is the most reliable method of ground truthing an installation and is becoming standard practice, both as a quality control device and to meet verification requirements of contracts and permits. The increase in inspections has served to demonstrate the difficulty in delivering a suspension free installation over uneven topography, using computer controlled installation methods or otherwise. There is not an increase in the number of poor installations. There is

an increase in the kilometers of cable installed and the percentage of installed cable being inspected.