In an increasingly digital age where personal information is vulnerable to exploitation, Medical Identity Theft stands out as a particularly insidious crime. Unlike Financial Identity Theft, where credit card numbers or bank accounts are compromised, Medical Identity Theft involves the unauthorized use of an individual’s personal information to obtain medical services, prescriptions, or other healthcare benefits. This form of Identity Theft not only threatens personal finances but also endangers Health andWell-Being.

Understanding Medical Identity Theft

Medical Identity Theft occurs when someone steals or uses another person’s personal information, such as their Medicare or Social Security Number, without permission to fraudulently obtain medical services or products. The consequences can be severe, ranging from financial losses due to fraudulent medical bills to incorrect medical information contaminating the victim’s health records.

The Federal Trade Commission (FTC) defines Medical Identity Theft as “when someone steals your Personal Information (like your name, Social Security Number, or Medicare Number) to get medical care, or uses your information to submit fraudulent claims for medical services.” This definition underscores the importance of safeguarding personal

Data Breaches: Hackers targeting Healthcare Providers, Insurers, or Government Agencies to access Sensitive Patient Information.

Stolen Documents: Physical Theft of Medicare Cards, Insurance Forms, or other documents containing Personal Details.

Fraudulent Practices: Unscrupulous individuals posing as healthcare providers or insurers to obtain personal information.

Once obtained, this information can be used to file false claims with Insurers, obtain Prescription Drugs, or receive medical treatment—all at the expense of the victim’s insurance coverage and potentially their health.

Protecting Yourself from Medical Identity Theft

Given the serious implications of Medical Identity Theft, it is crucial to take

proactive steps to safeguard personal

Treat

these numbers like you would a credit card number. Only provide them to healthcare providers you trust or legitimate insurers.

Medicare Card: Guard your Medicare card carefully. Avoid carrying it unnecessarily and ensure it is stored securely.

Understand How Your Information is Used:

Familiarize yourself with how Medicare and other healthcare providers use and protect your personal information. Be cautious of unfamiliar requests for personal data.

Monitor Healthcare Statements:

Regularly review statements and Explanation of Benefits (EOB) Forms from Healthcare Providers and Insurers. Report any discrepancies or unfamiliar charges promptly.

Be Aware of Medicare Policies:

Medicare will never call you to sell you anything or visit your home for unsolic-

ited purposes. Be wary of unexpected calls requesting personal information.

Report Suspicious Activity:

If you suspect medical identity theft or fraud, report it immediately to the appropriate authorities. Visit: https://www. identitytheft.gov/ or contact Medicare directly for assistance.

What to Avoid

To reduce the risk of Medical Identity Theft, avoid the following practices:

Sharing Personal Information: Do not disclose your Medicare or Social Security Numbers unless necessary and to trusted entities.

Accepting Unsolicited Offers: Refrain from accepting money or gifts in exchange for medical care or providing Personal Information to unknown parties.

Unauthorized Access: Only allow Authorized Healthcare Providers to access your Medical Records or recommend services.

In conclusion, protecting oneself from Medical Identity Theft requires vigilance and awareness. By safeguarding personal information, understanding how it is used, and promptly reporting suspicious activities, individuals can mitigate the risks associated with this increasingly prevalent form of Identity Theft. As technology evolves, so too must our efforts to protect our Personal Data from exploitation and misuse.

By adhering to these guidelines and staying informed, individuals can minimize the likelihood of falling victim to Medical Identity Theft and ensure their healthcare remains secure and private.

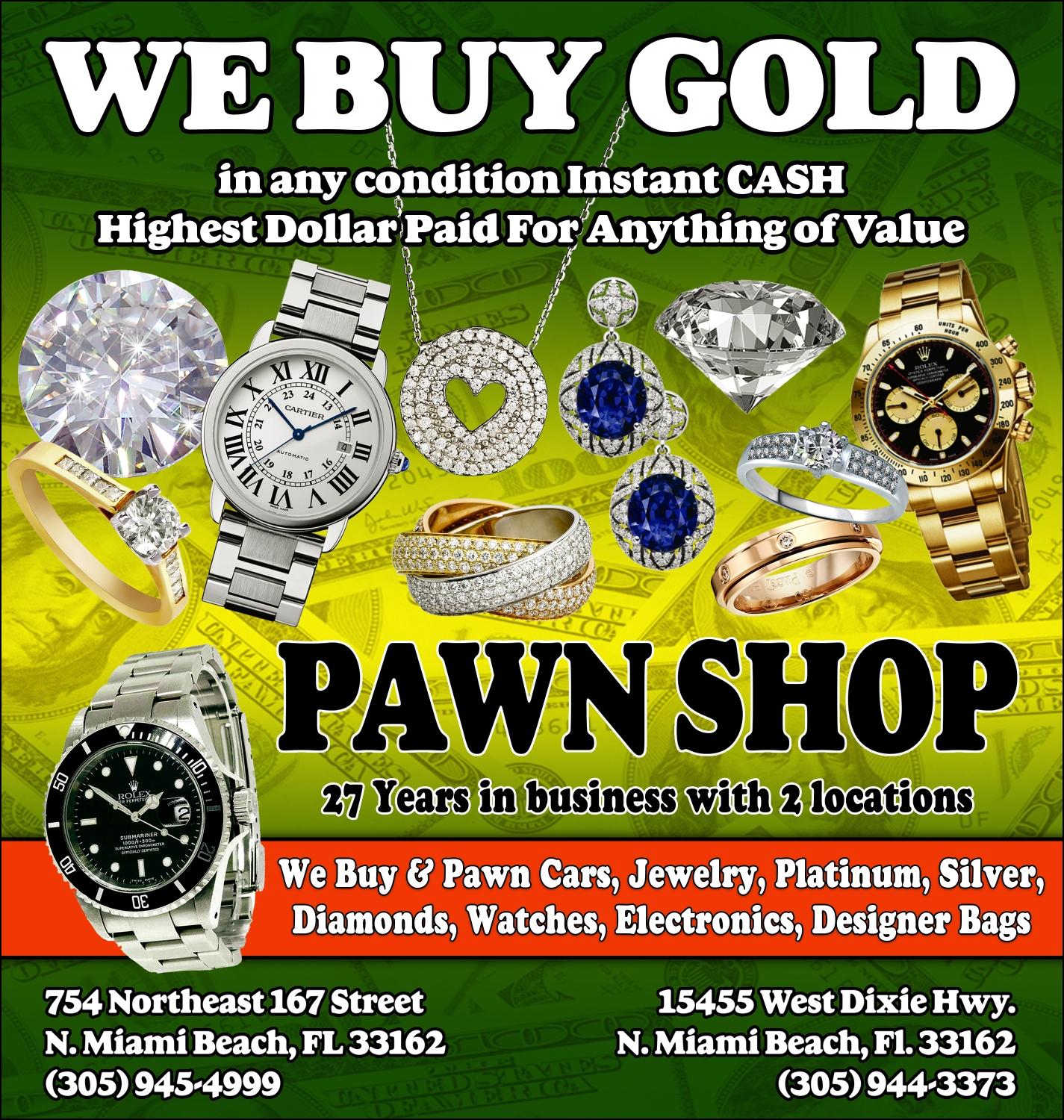

ART: old oil paintings, old watercolors, old etchings, lithographs, old movie posters, cartoon art, & more! STATUES: old bronze, carved jade, wood, marble, alabaster, pottery, porcelain. old toys, trains, old comics and baseball cards (prior to 1960), old Japanese toys, robots, old ban ORIENTAL ITEMS: jades, statues, figurines, netsuke, old swords, oriental glass and porcelains. letters, autographs (movie stars, presidents, political, etc.), old photos, political pins and ribb old pocket knives, swords, military items, American, Japanese, German medals, advertising items, old

We buy all types of

Jewelry, new, old, and broken. Rings (class rings, mother’s rings, wedding rings, etc.) Bracelets (charm, tennis, bangles, etc). Earrings do not need to be a matching pair. Chains and Pendants, broken is ok. We even buy old Yellow Gold teeth and crowns. Brooches, company year pins. We buy Diamonds, Emeralds, and Rubies. Any item made out of Sterling Silver. Silverware, forks, spoons, bowls, dishes, trays, tea sets, statues, Sterling and .999 Bars, Sterling and .999 Rounds, frames, candle sticks, trophies, salt and pepper shakers and Jewelry. Broken and smashed is ok.

P.C.G.S -N.G.C Gold & Silver Coins •

Pennies before 1959, Dimes & Quarters before 1965, Half Dollars before 1970, Dollar Coins before 1936, Bullion (Gold, Silver & Platinum), Foreign Gold/Silver Coins, All US Gold Coins, Old Paper Currency WIND UP ONLY, Gold, Silver, Gold-Filled, Pocket & Wrist, Working or Not

When you make your living as a freelancer, have a professional practice, or own your own business, everything depends on you – and it can be hard to take off even one day from work. But what if a serious illness or injury prevented you from working and you had no income for months? How would your business or practice survive?What would you live on?

Disability Insurance – also called Disability Income Insurance – is coverage you may need to help protect yourself in the event of a serious illness or injury. Disability isn’t just a theoretical possibility: One in four working adults will become disabled during their working years.

As a sole proprietor, this coverage is doubly important: it helps protect the income of your most essential employee – i.e., you – and keeps your business going.

This article will help you understand how to get the protection you need by explaining:

• How Disability Insurance works for you & your business

• How much protection you need

•What a policy typically costs and how to get it

• Along with other frequently asked questions

Generally speaking, there are two types of Disability Insurance for people who work. Short Term Disability Insurance (STD) provides temporary income protection for employees, typically for up to six months of disability. Long Term-Disability Insurance (LTD) provides protection that lasts for years – and even through retirement –depending on the terms of the specific policy.

However, Disability Insurance for people who own their own business works a little differently – and the process of getting coverage can be more involved:

• Many insurance companies require proof that you’ve been self-employed for two years and will likely ask to see tax returns.

• STD, which is typically bought as group coverage by an employer for its workers, is difficult and expensive to obtain as an individual.

• It may not be enough to get protection for the income you draw; you should also get coverage for business expenses – like rent, utilities, employee salaries.

As a business owner, there are several types of coverage you should consider:

1. Individual Disability Income Insurance – an insurance policy that protects your personal income if you’re unable to work due to injury or illness. Your policy is an individual contract with an insurance company that defines the following:

• Premium:The amount you pay for coverage.

• Benefit:The amount you get each month if you are unable to work. It should be between 60% to 80% of your monthly salary and typically isn’t taxed – unless paid for with pre-tax dollars.

• Benefit period:The length of time you receive a benefit, which can range from two years to retirement, or until you recover.

•Waiting period: Also called an elimination period, it’s the amount of time after you are disabled until you can start receiving benefits.

• Definition of disability:Your policy’s specific definition

of what it means to be disabled in order to qualify for benefits. An own-occupation definition means you qualify if you can’t work in your specialty or field; anyoccupation means you only qualify if you can’t do any work at all.

It also makes sense to get a Residual or Partial Benefit Rider: With this option, if you are able to do some work, you can receive a portion of your monthly benefit as you recover and work to rebuild your business.

2. Business Overhead Expense Disability Insurance –If you become disabled, your business’ income will drop – even as business expenses go on, including: Rent, Utilities, Taxes, and Employee Salaries. Major carriers such as Guardian offer overhead expense coverage that can reimburse up to 100% of covered expenses to ease your cash flow worries.

Guardian also offers more specialized protection that provides Business Loan Coverage. This feature protects your ability to pay Business Loans and other Contractual Financial Obligations, such as Business Purchase or Start-Up Loans, Equipment Purchases or Lease Agreements, and Business Expansion Loans. This coverage can fund up to 100% of regular payments and allows you to tailor the length of the policy to the duration of your Loan or Loans, so you only pay for the coverage required.

How much Disability Insurance coverage do you need?

To answer that question, start by estimating your current monthly living expenses, including: Housing, Utilities, Food, Childcare, Loan Payments, College Savings or Tuition, Retirement Savings, Auto Expenses, and any other Regular Expenses.

Next, assess your Monthly Business Expenses: Rent or Mortgage, Utilities, Insurance, Salaries, Benefits, and other compensation, Taxes, Loan Payments and Miscellaneous.

While you can usually only get coverage to replace up to 80% of your Personal Income, it’s possible to get coverage for up to 100% of your Fixed Monthly Business Expenses. If you have substantial savings or other Liquid Assets, you can take those into account and adjust your needs accordingly.You may also decide later in the process that certain expenses may not be necessary; however, you need to have a solid estimate of your Personal and Business Expenses as you start shopping for a policy.

you can expect to pay for coverage – and how to get it?

Your lifestyle and needs are uniquely your own – and your business is a unique entity with its own customer base, processes, assets, and liabilities. Your policy needs to be tailored with a specific benefit amount and length that reflects those requirements, along with other provisions that address additional concerns, for example, by getting a Cost-Of-Living Adjustment Rider to account for inflation*.

A policy with a smaller benefit amount, longer waiting period, and shorter benefit period will cost less than a policy with a larger benefit, shorter waiting period, and benefit payments stretching into retirement. Factors such as age, gender, lifestyle, and occupation will also affect your premium costs. One rule of thumb: expect to pay between 1% to 3% of your Annual Income for a pol-

icy that offers the coverage you need.

The most comprehensive type of Disability Insurance Policy is non-cancellable and guaranteed renewable. That means that as long as you pay your premiums, the insurance company cannot raise your rates, change your Monthly Benefits or revise policy provisions (such as a Cost-Of-Living Adjustment Rider) – unless you ask to revise your policy.

Some policies are only guaranteed renewable, with such a policy, the insurer can raise premiums, lower benefits, or change policy provisions – but only if they get approval to do so for the entire rate class from your state’s insurance department.

There is also a conditionally renewable Disability Policy. With these plans, the insurer can change rates, benefits, and provisions at will, so the policy you get today could cost far more – and cover far less – a few years down the road.

Disability Coverage is one of the most important tools you can have to protect your business and livelihood –but that protection is only as good as the policy contract you sign. Start by talking with your Financial Professional or a trusted Insurance Broker. They should be able to suggest possibilities beyond the basic items covered in this article. For example, if you have a few employees, you may be able to have your personal protection needs met with lower-cost group rate Disability Insurance for both Short-Term and Long-Term needs.

If you don’t have a Financial Professional or Broker, a Guardian Financial Professional can help craft the right solutions and provide a Disability Insurance quote. You should be prepared to share as much as you can about your Personal and Business Financial Situation and goals.

Can I get Social Security Disability if I am self-employed?

Social Security Disability Insurance (or SSDI) is a part of your Social Security Benefits, which are paid for by your self-employment taxes. However, it’s usually much harder to qualify for than an insurance policy purchased individually or through a group. Most SSDI applicants are rejected – and the benefits are typically lower than with a private disability policy. Also, SSDI provides no financial protection for your Business Overhead Expenses – Rent, Utilities, etc.

Can I buy Disability Insurance on my own?

Yes. Long Term Disability Insurance Policies can be purchased by individuals. A Guardian Financial Professional can help craft the right solution for you and your business and provide a Disability Insurance quote.

Are Long-Term Disability Insurance Benefits taxable?

Since LTD Premiums are usually paid for with post-tax income by the individual policyholder, the monthly benefit received is typically free of taxes.You should consult with your Financial Professional about the specifics for your business.

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of Out-Of-Pocket Costs in Original Medicare. Generally, you must have Original Medicare – Part A (Hospital Insurance) and Part B (Medical Insurance) – to buy a Medigap policy.

All Medigap policies are standardized. This means, policies with the same letter offer the same basic benefits no matter where you live or which insurance com pany you buy the policy from. There are 10 different types of Medigap plans offered in most states, which are named by letters: A-D, F, G, and K-N. Price is the only difference between plans with the same letter that are sold by different insurance companies.

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

Every Medigap policy must follow federal and state laws designed to protect you. It’s important to watch out for illegal practices by insurance companies, and protect yourself when you’re shopping for a Medigap policy.

health care costs. In most Medigap policies, you agree to have the Medigap insurance company get your Part B claim information directly from Medicare. Then, your Medigap policy will pay your doctor whatever amount you owe under your policy and you’re responsible for any costs that are left. Some Medigap insurance companies also provide this service for Part A claims.

If your Medigap insurance company doesn’t get your claims information

enroll in a Medicare Advantage Plan, but you can’t have both.

If you have a Medicare Advantage Plan, you can’t buy a Medigap policy. It’s illegal for anyone to sell you a Medigap policy unless you’re switching back to Original Medicare. If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you have a Medigap policy and join a Medicare Advantage Plan for the first

company decides how it will set the price, or premium. for its Medigap policies, which can affect how much you pay now and in the future.

The benefits in each lettered plan are the same, no matter which insurance company sells it. The premium amount is the only difference between policies with the same plan letter sold by different companies. There can be big differences in the premiums that different insurance companies charge for the same coverage, so be sure you compare Medigap plans with the same letter (for example, compare Plan G from one company with Plan G from another company).

Medigap policies help cover Out-Of-Pocket Costs associated in Original Medicare, like: Copayments, Coinsurance, and Deductibles.

Some Medigap policies cover services that Original Medicare doesn’t cover, like Emergency Medical Care when you travel outside the U.S. (Foreign Travel Emergency Care).

Medigap doesn’t cover everything. Medigap plans generally don’t cover: Long-Term Care (like Non-Skilled Care you get in a Nursing Home), Vision or Dental Care, Hearing Aids, Eyeglasses, and Private-Duty Nursing.

Generally, you must have Original Medicare — Part A and Part B — to buy a Medigap policy. A Medigap policy only covers one person, so if you and your spouse both want Medigap coverage, you each have to buy your own policy.

If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered

means that they “accept assignment” for all Medicare patients. If your doctor participates, your Medigap insurance company is required to pay your doctor directly, if you ask them to.

Once you buy a policy, you’ll keep it as long as you pay your Medigap premiums. All standardized Medigap policies are automatically renewed every year, even if you have health problems. Your Medigap insurance company can only drop you if: You stop paying your premiums, You weren’t truthful on the Medigap policy application and the insurance company goes bankrupt or goes out of business.

A Medigap policy is different from a Medicare Advantage Plan (Part C). A Medicare Advantage Plan is another way to get your Medicare coverage besides Original Medicare. A Medigap policy is a supplement to Original Medicare coverage. When you’re getting started with Medicare, you can either buy Medigap or

erage you can’t use. If after you join a Medicare Advantage Plan for the first time and you’re not happy with your plan, you’ll have a single 12-month period (your trial right period) to get your Medigap policy back if the same insurance company still sells it once you return to Original Medicare. After that period, you might have to wait to drop your Medicare Advantage Plan, and you might not be able to buy a Medigap policy, or it may cost more.

Medigap plans sold after 2005 don’t include Prescription Drug Coverage. So, if you enroll in Medigap for the first time, it won’t include Drug Coverage. If you want Prescription Drug Coverage, you can join a separate Medicare Drug Plan (Part D).

Medigap premiums vary widely depending on the insurance company, the plan, and where you live. Each insurance

When you compare Medigap plans, you’ll see their estimated costs so make sure you contact the insurance company for a more accurate price.

The cost of your Medigap policy may also depend on whether the insurance company:

• Offers discounts (like discounts for women, non-smokers, or married people; discounts for paying yearly; discounts for paying your premiums using electronic funds transfer (automatic payment from checking account or credit card); or discounts for multiple policies).

• Uses medical underwriting or applies a different premium when you don’t have a guaranteed issue right or aren’t in your Medigap Open Enrollment Period.

• Sells Medicare SELECT policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be lower.

• Offers a “high-deductible option.”

When you buy a Medigap policy, you’ll pay the private insurance company a monthly premium. Your insurance company will let you know how to pay for your monthly premium. You also have to pay your monthly Medicare Part B premium. Medicare doesn’t pay the premiums for your Medigap policy. Premium amounts typically increase each year.

To compare the costs of Medigap plans in your area, visit: https://www.medicare.gov/ medigap-supplemental-insurance-plans/#/ m?year=2024&lang=en

Enjoy a stress-free ride with family and friends to fun and excitement. Broward County Transit is an easy, simple and affordable way to enjoy the experience.

A Fort Lauderdale-based Private NonProfit Organization dedicated to enriching the lives of children and adults with Intellectual and Developmental Disabilities – is proud to announce it has completed renovations to its Adult Day Training Program Facility. The program reopened last month, after a multi-year hiatus.

After experiencing significant damage from Hurricane Irma in 2017, ASC began renovations to its Adult Day Training Program in May 2022. The $1.5 Million Adult Day Training renovation project aims to revitalize and enhance the facilities dedicated to serving adults with Developmental Disabilities.

ASC accommodates 96 permanent residents and serves more than 300 clients daily through an array of critical care, learning and ability focused programs. Throughout all its programs and services, the Center intends for individuals to discover ability and build independence so that individuals live happier, more independent, fulfilling lives.

ASC’s Adult Day Training Program is an on-site facility where residents go to participate in a diverse range of activities, fostering Social Interaction and Skill Development for adults with Intellectual and Developmental Disabilities. The center-based program cultivates an atmosphere of structure and excitement, where participants eagerly anticipate reuniting with friends and staff members each day. Community involvement is a key focus, and ASC provides a variety of engaging activities to support individuals in achieving their goals while exploring

new interests and hobbies. Depending on each participant’s individualized plan, they may engage in goal-oriented classes or activities such as music therapy, art therapy, computer training, physical fitness, cooking and daily living skills.

The renovation project consisted of several key components designed to improve the functionality, accessibility and overall quality of the Adult Day Training Program including:

Facility Upgrades: The renovation involved updating the 7,000-Square-Foot Physical Infrastructure of the Adult Day Training Facilities to create a more conducive environment for learning, socialization and skill development. This included refurbishing interior spaces such as classrooms, activity areas and common areas to improve aesthetics, comfort and functionality.

With the renovation, the Adult Day Training Program facility is now fully wheelchair accessible and has four classrooms including an expressive arts room, a music room, a sensory room and a life skills room; six full bathrooms including showers; and a conference room.

The full renovation included painting the inside and outside; refurbishing the floors and walls; adding new electrical, fire and plumbing equipment; and a brand-new air conditioner. The building is equipped with all new furniture and equipment. All safety elements have been upgraded including a generator hook-up in case of hurricanes or emergencies. The building can also be converted into a residential option if necessary.

Technology Integration: The renovation project also included the integration of technology solutions to support program delivery and enhance participant engagement. This involved installing multimedia equipment, interactive displays and assistive technology devices to facilitate learning, communication and skill development.

Program Expansion: With the renovated facilities, the Adult Day Training Program can now accommodate 70 participants and offer a wider range of activities and services. The renovation project was a collaborative effort involving various stakeholders, including ASC Staff and Board Members, Architect Neal Schofel of Architecture Dynamics and General Contractor HITT. The project team worked closely to develop design plans, coordinate construction activities and ensure that the renovation meets the specific needs and requirements of the Adult Day Training Program. This project represents a significant investment in enhancing the quality of life and opportunities for adults with Developmental Disabilities. By creating a more modern, accessible and inclusive environment, the renovated facilities enable participants to participate in meaningful activities, develop essential skills, and foster social connections, ultimately promoting independence and empowerment within the community. “The completion of our Adult Day Training Program renovation is an exciting milestone for Ann Storck Center. This expansion allows us to serve more individuals with Developmental

Disabilities in the community and meet the growing demand for adult day training services,” said Ann Storck Center CEO Patricia (Pat) Murphy. “We want to celebrate our accomplishments but look forward with renewed determination and optimism that our work is far from over. Dreams, hard work and commitment can make a difference in lives.We will not rest until our good gets better and our better gets best.”

The Ann Storck Center, a 501(c)(3) NonProfit Organization, is the heart of uncompromising care, supporting children and adults of All Abilities with Developmental, Educational and Residential Programs that foster lives of discovery and fulfillment. The center is building a village of love and purpose, changing how those with Intellectual and Developmental Disabilities are included as inspiring, valuable members of our communities. ASC has been serving the community for more than 65 years, originally known as the Pediatric Care Center, then in 1981 becoming ASC. Today, ASC accommodates 300 children and adults on six separate sites including a School/ Therapy Center, Adult Day Training Program, two Intermediate Care Facilities offering Specialized Residential Services, as well as ten Group Homes embedded in the community offering a more independent lifestyle.

For more information, visit: https:// www.annstorckcenter.org/, or on Social Media visit: Facebook or Instagram.

By Carol Foley, Licensed Insurance Agent and Senior Medicare Specialist

Congress recently made a number of changes to Medicare’s “Part D” prescription drug benefit. The changes were part of the Inflation Reduction Act.The legislation was intended to make it easier for seniors to afford their medicines. Some of the changes will indeed help seniors. But other changes could inadvertently raise seniors’ costs, and reduce their access to medicines.

First, the good news. Seniors using Insulin now have their costs capped at $35 each month. This has already made a huge difference for those living with Diabetes. Starting next year, seniors’ yearly out-of-pocket Part D drug costs will be capped at $2,000. Seniors will also have the option to spread these costs out over the entire year through a new program called the “Medicare Prescription Payment Plan.” Both of these changes can help seniors who rely on multiple brand-name medicines and those on fixed incomes.

Now the bad news: because of the law, many insurers have shifted some medications to “non-preferred” or “specialty” tiers that require higher out-of-pocket costs, restricting beneficiaries’ access to previously covered drugs. Some insurers have also created rules that make it harder to get the drugs your doctor recommends, like making patients first try cheaper options. It is important that seniors learn about these changes — and the impact they will have on their access to medicines.

As we approach the Medicare annual enrollment period, it’s essential to equip yourself with the knowledge and resources to make informed decisions about your healthcare coverage. It is best to work with a licensed agent to help navigate these complex changes. My name is Carol Foley, and I am a licensed insurance agent, Medicare specialist, and small business benefits counselor with over 25 years of experience. Our offices are conveniently located right here in Hallandale. The best part – Our services come at no cost to you.

We can assist you with Medigap plans, Medicare Advantage plans, Part D prescription drug plans, dental, vision, hearing plans, gap insurance, Cancer policies, long-term care, life insurance, and final expense coverage. Our offices are open 7 days a week during open enrollment, staffed from 8am-8pm. We are also happy to come to your residence if you prefer a home consultation.

Medicare Open Enrollment occurs from October 15 to December 7 each year. This window offers beneficiaries the opportunity to review and make changes to their Medicare coverage. There are several compelling reasons why this period demands your attention:

Plan Review and Comparison:

During open enrollment, Medicare beneficiaries can assess their current Medicare plans, including Original Medicare (Part A and Part B), Medicare Advantage, and Prescription Drug Plans. Comparing plans can help you find better options tailored to your specific needs.

Did you know that all supplement plans are standard ized? Plans like F, G, or N offer identical coverage, so why do prices differ so significantly among carriers? Open enrollment is the perfect time to price shop and secure the best pricing for your chosen plan.

Changes

Health requirements can change over time. During open enrollment, beneficiaries have the opportunity to evaluate whether their current coverage adequately meets their evolving healthcare needs.

Cost Savings:

Medicare plans can alter their premiums, deductibles, copayments, and coverage from year to year. Beneficiaries can potentially find cost-effective options that better align with their financial circumstances.

Network Changes:

Medicare Advantage plans come with provider networks. Beneficiaries should verify whether their preferred doctors and healthcare facilities remain in-network with their chosen plan.

Plan Ratings and Quality:

Medicare assesses the quality and performance of healthcare plans, including Medicare Advantage and Part D prescription drug plans. Utilize open enrollment to select plans with higher ratings and superior quality of care.

Medicare Savings Programs:

Some beneficiaries may qualify for Medicare Savings Programs or Extra Help, offering assistance with Medicare costs. We can check your eligibility and help you enroll in these programs if you qualify.

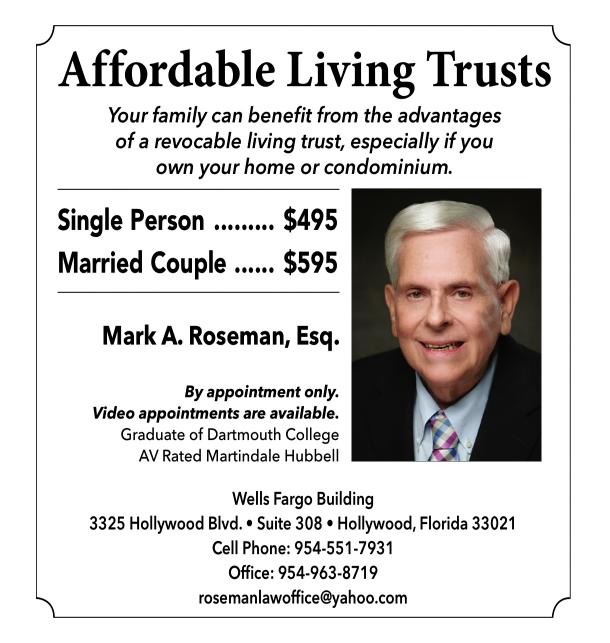

Now that you have a great medicare plan selected, complete your Senior Care Checklist by making sure you have a long term care strategy. Without long-term care insurance, individuals may have to deplete their savings or sell assets to pay for care. Insurance helps protect these assets, ensuring that they can be preserved for other purposes or passed on to heirs.

Long-term Care Insurance Is Crucial For Several Reasons:

The cost of long-term care services, such as nursing home care, assisted living, and in-home care, is continually rising. Long-term care insurance can help cover these costs, preventing a significant financial burden on individuals and their families.

Comprehensive Care Options:

Long-term care insurance policies typically offer a range of care options, including in-home care, adult day care, assisted living, and nursing home care.This flexibility allows individuals to choose the type of care that best suits their needs and preferences.

Medicaid does provide long-term care coverage, but it requires individuals to meet strict income and asset eligibility criteria. Long-term care insurance provides an alternative for those who do not qualify for Medicaid or prefer not to spend down their assets to become eligible.

Without insurance, the responsibility of providing care often falls on family members, which can be physically, emotionally, and financially taxing. Long-term care insurance can cover professional care services, reducing the burden on family caregivers.

Having long-term care insurance provides peace of mind, knowing that future care needs will be met without causing financial strain. This can be particularly important for those who want to ensure they receive quality care in their later years.

Increasing Life Expectancy:

As people live longer, the likelihood of needing longterm care increases. Insurance helps prepare for this possibility, ensuring that individuals have the resources to cover extended periods of care if needed.

Overall, long-term care insurance is a critical component of financial planning, helping individuals and families manage the potential high costs of long-term care and maintain their financial well-being. If you have any questions or need assistance, we are here to help. My team looks forward to working with you, and remember, our services come at no cost.We are also happy to simply review your current policy and review your coverage with you.

Retirement marks a significant mile stone in one’s life, often accompanied by transitions in healthcare coverage. For many retirees, understanding how retiree insurance interacts with Medicare becomes crucial for maintaining compre hensive health benefits. As you approach this phase of life, it’s essential to grasp the intricacies to make informed decisions that safeguard your Health and Financial Well-Being.

Upon retirement, individuals may be eligible for continued health coverage through their former employer, com monly known as retiree insurance. This coverage can vary widely in terms of benefits and costs, prompting retirees to carefully assess its compatibility with Medicare. Medicare, the Federal Health Insurance Program primarily for those aged 65 and older, consists of Part A (Hospital Insurance) and Part B (Medical Insurance), which cover Hospital Stays, DoctorVisits, and other Medical Services.

Retiree health benefits often differ from active employee benefits and may vary depending on your former employer or union. It’s crucial to consult with your employer’s benefits administrator to ascertain:

Determine if your retiree benefits differ from those provided during your employment.

Verify if your retiree plan offers Prescription Drug Coverage that is considered creditable under Medicare Guidelines.

ing the specifics and limitations of your retiree coverage is vital to avoid unexpected costs.

Most retirees become eligible for Medicare at age 65. It’s important to enroll in Medicare Part A and Part B to ensure you receive full benefits, especially if your retiree coverage requires Medicare enrollment for coordination. Delaying enrollment beyond your initial eligibility period can result in penalties, so timely enrollment is advised unless you qualify for a special enrollment period due to active employment.

Check if your retiree plan includes Supplemental Coverage that coordinates effectively with Medicare, potentially reducing Out-Of-Pocket Expenses.

Retiree plans may offer additional benefits, such as Extended Hospital Stays or coverage for services not typically covered by Medicare. However, understand-

When you have both Medicare and retiree coverage, Medicare generally pays first for your healthcare expenses, with any remaining costs submitted to your retiree plan. This coordination ensures that you receive comprehensive coverage without unnecessary expenses.

Medicare Part D provides Prescription Drug Coverage, but retirees with existing

retiree drug plans must assess if their coverage is creditable. Creditable coverage is equivalent to Medicare’s prescription drug coverage, preventing penalties for late enrollment in Part D. Retiree plans are required to inform you annually whether their drug coverage meets Medicare’s standards. Retirees facing financial constraints may qualify for Extra Help, a Medicare program that assists with prescription drug costs. Even with creditable retiree drug coverage, exploring eligibility for Extra Help could significantly reduce Out-Of-Pocket Expenses. It’s advisable to consult your benefits administrator to explore this option thoroughly.

While Medicare covers a significant portion of healthcare expenses, it doesn’t cover all costs. Retirees often consider purchasing Medicare Supplement Insurance (Medigap) policies to fill gaps in coverage, such as deductibles and coinsurance. It’s crucial to note that purchasing a Medigap policy is easiest during your Initial Enrollment Period for Medicare Part B. Delaying enrollment may limit your options or increase costs.

Deciding whether to purchase a Medigap policy alongside retiree coverage requires careful consideration of individual healthcare needs and financial circumstances. State Health Insurance Assistance Programs (SHIPs) offer free counseling to retirees, providing unbiased guidance on Medigap policies and other Medicare-related concerns.

Navigating retiree insurance and Medicare can seem daunting, but with proper understanding and proactive planning, retirees can secure comprehensive healthcare coverage tailored to their needs. Consultation with your employer’s benefits administrator and leveraging resources like SHIPs ensures informed decisions that optimize healthcare benefits and financial security during retirement.

As you prepare for this new chapter, remember that staying informed and seeking personalized advice are key to navigating the complexities of retiree health coverage with confidence. By taking these steps, retirees can embrace their new phase of life with peace of mind and assurance in their healthcare coverage.

Snoring Is No Laughing Matter!

It may be more than just an annoying habit, it may be a sign of Sleep Apnea

What Exactly is Sleep Apnea?

When the muscles that control the upper airway relax, some people begin to snore. When the airway becomes completely blocked and the person temporarily stops breathing, this is an episode of “Obstructive Apnea.” Each Apnea event may last for a few seconds or up to a couple minutes or more. Events may happen frequently - even several hundred times a night.

Can This Condition Be Treated? How?

There are many effective treatments for snoring. A widely accepted treatment for Sleep Apnea is oral appliance therapy. An oral device custom fit by your dentist is designed to keep your airway open and help prevent Apneas.

The American Academy of Sleep Medicine

Recommends an oral appliance as a first-line treatment option for patients with mild to moderate Obstructive Sleep Apnea (OSA), and for those with severe OSA who either decline CPAP Therapy or are unable to successfully use CPAP Therapy. This treatment does not involve medications or surgery and helps hundreds of thousands of people all over the world enjoy sleeping safely for a healthier life. Many experience the benefits quickly - often during the first night of use.

Most Of The Health Insurances And Medicare Will Pay For Sleep Apnea Treatment - Call (954) 922-4633 For More Info.

Choose the nearly invisible way to straighten your teeth with “Invisalign”

• Get the confidence of a

• Show the world who you

• Invisible Removable Comfortable

Restore your Smile with Dental Implants

Regain your confidence & enjoy your meals. Replace one, few or all missing teeth

Stabilize your partial or full dentures

(Family Features)

Every day, criminals target older Americans with one goal - to steal their Medicare numbers and other protected health information. To fraudsters, this information is just as valuable as credit card information. These criminals steal Medicare numbers and unlawfully bill Medicare for medical services that were never provided to the patient or overbill for provided services.

When criminals commit fraud, and falsely bill Medicare, people’s medical records may become inaccurate and they can suffer delayed or even be denied care. In the end, Medicare fraud costs taxpayers billions of dollars every year. Each dollar lost to fraud takes away resources intended for people with Medicare.

Fraudsters are getting creative and new scams are continually emerging. The best thing you can do is beware of people who contact you for your Medicare number or other personal information. You

may be contacted by phone, text or email by someone posing as a Medicare representative, a health care provider or even a medical equipment company. If someone you don’t know asks for your Medicare number, hang up or delete the message - this is a scam.

Consider these tips to help protect yourself against Medicare fraud and stay one step ahead of fraudsters:

• Guard your Medicare card & information just like your Social Security card and credit card.

• Only share your Medicare information with your trusted health care providers.

• Be skeptical of free gifts, free medical services, discount packages or any offer that sounds too good to be true.

• Always check your Medicare claims statements to make sure they are accurate. Call 1-800-MEDICARE if you sus-

pect you or Medicare has been billed for a service you did not receive.

Beware of scammers offering older Americans in-home perks, like free cooking, cleaning and home health services, while they are unknowingly being signed up for hospice services. The scammers then unlawfully bill Medicare for these services in your name.

Criminals are using every avenue they can to sign you up including door-to-door visits, false advertising, phone, text and email. Hospice care is for people who are terminally ill and only you and your doctor can make this serious decision if you need end-of-life care.

•Your doctor is the only one who can certify you’re terminally ill (with a life expectancy of 6 months or less). If you are not terminally ill, you should not receive hospice care.

• Never accept perks or gifts in return for signing up for hospice services.

• Medicare will never provide “free” services like housekeeping.

• Be suspicious if someone offers you free services like housekeeping or cooking in return for your Medicare number.

• Medicare will never come to your home.

Reporting Medicare fraud protects you and millions of other people with Medicare and those with disabilities. If you or someone you know has experienced Medicare fraud or suspect an offer you’ve received is a scam, report it as soon as possible.You will never be in trouble for reporting fraud.

To learn more, visit Medicare.gov/fraud To report potential fraud, call: 1-800-MEDICARE (1-800-633-4227).

fat-like substance - to work properly,” said Stephen Pinkosky, PhD, Vice President, Drug Discovery and Early Development at Esperion. “However, having too much LDL Cholesterol can lead to blockages in your Arteries. Often impacted by both lifestyle choices and genetics, it’s important to maintain an LDL Cholesterol level recommended by your healthcare provider.”

What are the Risks of High LDL Cholesterol?

“It’s often not until there may be a large blockage of the Artery that you notice something is wrong, such as chest pain, pain in the arms or jaw, nausea, sweating, shortness of breath or weakness,” Pinkosky said. “These symptoms can occur when Blood Supply to the Heart or Brain is being slowed or blocked.”

These blockages, which may not have previously caused symptoms, can rupture and cause major problems, including Heart Attack or Stroke. According to the American Heart Association, the first sign of Elevated LDL Cholesterol may be a deadly Cardiovascular event for some people.

According to the World Health Organization, Elevated LDL Cholesterol causes more deaths than all forms of Cancer combined and accounts for around 1 in 3 deaths in the U.S. and Europe. The Centers for Disease Control and Prevention estimates Heart Disease deaths will increase 25% by 2030.

One of the best ways to take care of your health is to be proactive. Even if you’re feeling fine, it’s a good idea to get your LDL Cholesterol Levels checked and discuss the results with your health care provider to determine the best treatment option for you, if needed. Your care team will consider your LDL Cholesterol Level, along with any other factors that make a Heart Attack or need for a heart procedure more likely to occur, such as your age, sex, family history (genetics), presence of

Diabetes or High Blood Pressure and lifestyle (like whether or not you smoke and your diet). For those with High LDL Cholesterol, there are options to get your levels under control. Studies show reducing LDL-C Levels with certain Cholesterol lowering medications may reduce the risk of major Cardiovascular events. Consult your health care provider if you are unsure of your LDL Cholesterol Levels or want to discuss options to lower your levels.To learn more about High LDL Cholesterol risks and management, visit: https://www.cardiosmart.org/

(BPT) - As a nursing student, Nicole, 32, has a busy yet rewarding life. She works 12-hour hospital shifts as a nursing assistant and spends her free time traveling and playing with her dogs, Bailey and Snoopy. She’s also lived with the invisible, excruciating pain and complexities of Migraine Disease since she was a child.

At age 11, Nicole began experiencing pain and sickness, symptoms that she would later learn were that of Migraine Disease. Unfortunately, Nicole’s path to diagnosis mirrors one many Migraine patients experience - years of doctors overlooking her symptoms, delaying her diagnosis and treatment for over a decade - until she finally received a Chronic Migraine diagnosis in her mid-20’s. There are over 150 different classifications of Headache Disorders and a myriad of associated symptoms, so it is important to seek out a Neurologist, who understands the impact Migraines can have on someone’s life, when experiencing Migraine symptoms.

Becoming empowered and confident in advocating for herself came slowly for Nicole. In her years searching for an effective treatment, Nicole’s Migraine Disease became more severe and the stress of being a full-time student and part-time employee seemed to increase her vulnerability to Migraine Attacks. She was no longer able to function at work, spend time with her friends or do any of the other activities she previously enjoyed.

“I went from having the typical life of a young working professional to dealing with debilitating Migraine Attacks with nausea, vomiting and fatigue,” says Nicole. “I lost friends, my job, and my financial and physical independence.” She tried multiple medications and lifestyle changes to reduce her symptoms, but the Migraine Attacks persisted.

After unsuccessful treatments, Nicole learned about VYEPTI® (Eptinezumabjjmr), a prescription medicine used for the preventive treatment of Migraine in adults, by way of various talks she attended during her advocacy work. She began researching more about the treatment, its clinical trials, and its route of administration - she was intrigued by the Intravenous (IV) Infusion Treatment delivery that’s given by a healthcare professional every 3 months. She wondered if it could be a good fit for her and wanted

to try it, so she brought it up with her doctor. They discussed the treatment, its benefits and risks, and based on their clinical judgment, Nicole’s neurologist decided to prescribe it for her.

“I am in a much better place,” said Nicole. “If my Migraine wasn’t well managed, my 12-hour shifts in the hospital would feel unbearable.” Since starting preventive treatment onVYEPTI, Nicole is able to spend less time managing her Migraine and more time enjoying school, work and life. “I never would have imagined that I could enjoy trips like the one I recently took to Portugal.”

VYEPTI is a Calcitonin Gene-Related Peptide Antagonist (Anti-CGRP) and is the first and only FDA-Approved preventive treatment for Migraines delivered by IV Infusion. In patients with four or more Migraine days per month, VYEPTI has been proven to reduce average monthly Migraine days over months 1-3 compared to placebo. Individual results may vary.

Do not receive VYEPTI if you are allergic to Eptinezumab-jjmr or any of the ingredients in VYEPTI. See additional Important Safety Information for VYEPTI below.

When Nicole moved from New York to Chicago, she found it difficult to connect with a doctor who did not dismiss her debilitating symptoms. She visited four different doctors but none of them were the right fit for her.

“I didn’t feel heard or respected with some of the doctors,” said Nicole. “One wanted to change the treatment plan that was working for me. And others weren’t comfortable with my medical profile, which is complex and comes with comorbidities.”

Given Nicole’s struggle to feel connected with a new healthcare partner in Chicago, and her happiness with the twoway partnership and treatment experience with her doctor in New York, she chooses to travel from Chicago to New York for her quarterly VYEPTI Infusion Treatments. Nicole’s NewYork-based doctor, a Migraine and Headache Specialist, recognizes the disabling nature of the disease, respects what she says about the impact of symptoms on her daily activities, and values her input. This collaborative and supportive partnership is essential to Nicole’s health and WellBeing.

sider making a change. You shouldn’t feel like you’re a burden for asking for better options to meet your treatment goals,” advises Nicole. “It’s important to ask about alternatives to help prevent your Migraine Attacks, especially if they are affecting your daily life.”

There are resources available to those seeking more information about treatment options, Nicole notes. Migraine organizations, such as National Headache Foundation and American Migraine Foundation, serve as valuable community resources helping to educate patients, Healthcare Professionals and the public on Migraine and Headache Disorder Symptoms, advocacy efforts, support for treatment research, and offer tools to locate a headache specialist. While there is a higher concentration of specialists in larger cities, many of which are in high demand, the emergence of telehealth is helping to expand access to specialists for people not located near these city hubs.

better manage my symptoms so I can continue doing things I enjoy?

• Are there alternative options I have not tried yet that can help me manage my Migraine Disease with my comorbidities?

• Are there any new advancements in Migraine and Headache treatments?

Nicole wants others to feel inspired by her experiences. She encourages everyone with Migraines to speak up, especially if they feel they are still highly impacted by Migraines or if they are not feeling heard by their doctor. “You can still do a lot with Migraines and all the symptoms. Sure, you can have horrible days. We all have horrible days. But there’s always hope with preventive treatment to have more good days. Now there are some days when I completely forget I have a Migraine, and those are the best days of all.”

By Joyce R. Forchion

Hallandale Beach is setting a precedent for delivering quality intergenerational healthcare innovations that cater to the varied needs, preferences, and budgets of its patients.

Recognized for its sprawling Intracoastal Waterways, multicultural neighborhood dining haunts, mixed-use Infrastructure and prime real estate, the city is cultivating its reputation for offering access to excellence in chiropractic care after announcing an unprecedented merger between two of Florida’s most for midable chiropractic offices.

On Thursday, September 12th, 2024, a ribbon cutting ceremony marked the official grand opening of Amazing Spine Care’s first South Florida location, signaling the launch of its seventh Florida-based office branching out from its estab lished offices in Jacksonville, St. Augustine, and Orange Park. The event also signified the rebranding of Amunategui Chiropractic Care, the familyowned mainstay in Hallandale Beach known for demonstrating best practices in the preventive medical industry for over 50 years. The Amazing Spine Care team recently moved into Amunategui Chiropractic Care’s medical office located at 1025 East Hallandale Beach Boulevard, which has served as the headquarters for Dr. Joseph Amunategui II’s popular prac tice for the past 30 years. This new chapter for Dr. Amunategui, inarguably one Hallandale Beach’s most respected community pillars, offers a wealth of developmen tal opportunities Amazing Spine Care and Dr. Alan Khiger, the practice’s President and Founder whom is still a full time Chiropractic Physician. Armed with a local foundation of supporters, Dr. Khiger and his staff are uniquely positioned to maneuver the city’s international landscape and broad population of patients in dire need of relief from chronic back pain, debilitating Arthritis, critical injuries, and pre-existing conditions.

standards upheld over the decades,” stated Denisse Garcia, Marketing Director for Amazing Spine Care. “Integrating into such a fantastic and phenomenal growing community is a privilege, and we hope to grow with it and become assets to the locals for all of their needs.”

Patients seeking proactive pain relief solutions instead of strong painkillers or complex surgical procedures should look no further than Amazing Spine Care. Practitioners are trained to introduce patients to alternative methods that not

afflictions– differentiates its scope of services from comparable chiropractic medical centers in the region. According to the Florida Department of Highway Safety and Motor Vehicles (FLHSMV), nearly 25,000 men, women, and children suffered injuries from automobile accidents occurring in Broward County. Considering the frequency of such emergencies, Amazing Spine Care practitioners remain on standby to treat accident victims. If needed, Individuals who have been in a car accident and are without transpor-

company, Amazing Spine Care, reflects his desire to incorporate time-tested, traditional methods of chiropractic care with contemporary methods of delivering client results through accessible treatments, and virtual appointments. While treating thousands of loyal patients throughout the duration of his career, Dr. Amunategui leads and participates in countless charitable endeavors and community service initiatives. Due to his relentless benevolence and volunteerism over the decades, the Hallandale Beach Mayor proclaimed January 19, 2008 as “Dr. Joseph Amunategui II Day.” A graduate of Life University’s Doctor of Chiropractic degree program, his extensive catalog of scholarly healthcare articles has established Dr. Amunategui as a respected thought leader in his profession. A former President and Charter Member of the Kiwanis Club Hallandale Beach, he holds leadership positions and board memberships with the Hallandale Beach Chamber of Commerce, City of Hallandale Beach Police Athletic League (PAL), YMCA of Hallandale Beach, and the Florida Sheriffs Association. He is also a lifetime member of the International Chiropractic Association (ICA) and Founding Member of the organization’s Council on Fitness and Sports Health Science. Relishing the opportunity to extend his family’s accomplished legacy, he is a father of four and secondgeneration Chiropractic Physician, who has practiced in the same location as his father since 1973.

“We are honored and humbled to join forces with Dr. Joseph Amunategui and his dedicated team– especially given the esteemed reputation of his Hallandale Beach practice and exceptional medical

bility to promote physical strength and ultimate recovery. The chiropractic care options offered at the facility focus on minimally invasive and therapeutic methods of prevention. Patients who are averse to complicated medical procedures and excessive prescriptions now have another option of care as each individual leaves the practice with a personalized recovery plan, enabling the prioritization of holistic health and optimal wellness.

Amazing Spine Care’s specialization in treating personal injury cases– such as auto accidents, slip-and-falls, and sports

arrange a complimentary ride to the facility for on-the-spot service. To facilitate a comfortable chiropractic experience, the staff offers same-day appointments, flexible service hours, and multilingual communication options for patients who speak English, Spanish, Russian, and Ukrainian.

Dr. Joseph A. Amunategui II, has been a practicing Chiropractic Physician in the City of Hallandale Beach since December 1993. His historic merger with Dr. Khiger’s

After expanding to open his new Hallandale Beach practice, Dr. Alan Khiger, D.C. is pleased to open the seventh location for Amazing Spine Care in the state of Florida. A fellow graduate of Life University’s Doctor of Chiropractic Degree program in Atlanta, Georgia, he specializes in the capacity of personal injury, workers compensation, and cash practice patients for the past several years. Certified by the American College of Addictionology in AuricularTherapy for patients struggling with substance abuse disorders, Dr. Khiger’s passion also lies in treating patients representing diverse CONTINUED ON PAGE 19

such as Heart Disease, Diabetes, and Cancer. The new prices will go into effect for people with Medicare Part D prescription drug coverage beginning January 1, 2026. If the new prices had been in effect last year, Medicare would have saved an estimated $6 billion, or approximately 22 percent, across the 10 selected drugs. These negotiated prices range from 38 to 79 percent discounts off of list prices. About nine million people with Medicare use at least one of the 10 drugs selected for negotiation. People with Medicare prescription drug coverage are expected to see aggregated estimated savings of $1.5 billion in their personal out-of-pocket costs in 2026. For more detailed information about the negotiated prices please see the Centers for Medicare & Medicaid Services (CMS) Negotiated Prices Fact Sheet.

“Americans pay too much for their prescription drugs. That makes today’s announcement historic. For the first time ever, Medicare negotiated directly with drug companies and the American people are better off for it,” said U.S. Department of Health and Human Services (HHS) Secretary Xavier Becerra. “Congressional budget estimators (Congressional Budget

for generations to come, but also puts a check on skyrocketing drug prices.”

“CMS is proud to have negotiated drug prices for people with Medicare for the first time.These negotiations will not only lower the prices of critically important medications for Cancer, Diabetes, Heart Failure, and more, but will also save billions of dollars,” said CMS Administrator Chiquita Brooks-LaSure. “Medicare drug price negotiation and the lower prices announced today demonstrate the commitment of CMS and the Biden-Harris Administration to lower health care and prescription drug costs for Americans. We made a promise to the American people, and today, we are thrilled to share that we have fulfilled that promise.”

As a hypothetical example, a senior with Medicare who takes Stelara pays a 25% coinsurance on the drug which may amount to about $3,400 today for a 30day supply. When the negotiated price goes into effect in 2026, that same 25% coinsurance would cost the beneficiary about $1,100 before the person reaches the catastrophic cap, after which the beneficiary will pay no more out of pocket on their prescription drugs. A beneficiary’s actual costs will depend on their

more than doubled from 2018 to 2022, from about $20 billion to about $46 billion, an increase of 134 percent. Medicare enrollees paid a total of $3.4 billion in outof-pocket costs in 2022 for these drugs.

“CMS negotiated in good faith on behalf of the millions of people who rely on these 10 drugs for their health and well-being.The new negotiated prices will bring much needed financial relief, affordability, and access,” said Meena Seshamani, MD, PhD, CMS Deputy Administrator and Director of the Center for Medicare. “Throughout the process, we remained true to our commitment to be thoughtful and transparent, meeting publicly with patients, providers, health plans, pharmacies, drug companies and others to help inform the process. We will continue to do so for future cycles. Our team is actively working on the next cycle of negotiations where we will combine what we have learned from this first cycle and apply it in negotiating prices for the next round of up to 15 selected drugs.”

The Office of the Assistant Secretary for Planning and Evaluation (ASPE) also released new data today detailing historic pricing trends of the 10 drugs selected for the first cycle of the negotiation program.

The report finds that from 2018 to 2023,

CMS will select up to 15 more drugs covered under Part D for negotiation for 2027 by February 1, 2025. CMS will select up to 15 more drugs covered by Part B or Part D for 2028, and up to 20 more Part B or Part D drugs for each year after that, as

In addition to these newly negotiated prices, people with Medicare are already experiencing lower drug costs thanks to the Inflation Reduction Act. And, next year, all Medicare Part D enrollees will benefit from a $2,000 out-of-pocket cap on their prescription drug costs, further making prescription drugs more affordable for seniors and people with disabilities.

View the CMS Negotiated Prices Fact Sheet at: https://www.cms.gov/files/ document/fact-sheet-negotiated-pricesinitial-price-applicability-year-2026.pdf

View the Historic Trends Fact Sheet from the Office of the Assistant Secretary for Planning and Evaluation (ASPE) at: https://aspe.hhs.gov/reports/medicaredrug-price-negotiation-programcomparing-drug-price

View a CMS Plain Language infographic at: https://www.cms.gov/files/ document/infographic-negotiatedprices-maximum-fair-prices.pdf

For more information about the Inflation Reduction Act, including plain language materials, please visit: LowerDrugCosts.gov. For more information available in Spanish, please visit: MedicamentosBajoPrecio.gov

Continued From Pg 16

generations, such as the elderly population, children, pregnant women, new mothers, and infants. He has held professional capacities as a specialist and general practitioner for chiropractic care, with a concentration in NeuroMusculoskeletal Disorders, for over 15 years. Not only is he considered a gifted “healer,” but also well-versed in assisting his patients in finding physical alignment and adopting healthy habits.

The future of the business looks bright for Amazing Spine Care as Drs. Khiger and Amunategui collaborate to elevate the profile of their joint venture in a crowded chiropractic care market. Accessibility, convenience, and innovation are driving the mission as both physicians believe in meeting patients wherever they are regarding budgetary restrictions and transportation needs. “Our philosophy is centered on never giving up without trying when it comes to patient care,” Garcia said. “We’re committed to delivering results and applying our collective experience to carry out our mission–maximizing our family-oriented business to change the lives of families everywhere. Our 97% success rate is attributed to taking on high-risk conditions and procedures that pay off in benefiting our patient.What others fail to do, we successfully get done!”

Now that the Hallandale Beach branch of Amazing Spine Care is open and currently welcoming new patients to its facility, Drs. Khiger and Amunategui express the value of the community partnerships that have made their merger a seamless success. They enthusiastically look forward to embarking on this new chapter together and express high hopes for 2025. “We’re here to help as many people as possible and give our patients the appropriate care they deserve,” Garcia assured. “We’re focused on creating easy access to care for people of all ages and reserve a special place in our hearts for infant care. We encourage potential clients to reach out to us for a same-day appointment, with the assurance of knowing that their requests will be immediately addressed. A nurse

practitioner is also on hand to facilitate telemedicine appointments for patients who are limited to virtual capabilities.”

Amazing Spine Care appeals to multigenerational clients and guarantees exemplary patient satisfaction while administering the highest quality in chiropractic service with a smile. When selecting a chiropractor in the South Florida community, Garcia recommends giving their practice careful consideration. “We want to be known as the doctor’s office that serves families first. Plus,

Left to Right: Dr. Alan Khiger, D.C.(CEO & Founder of Amazing Spine Care), Denisse Garcia (Marketing Director), Irina Khiger (COO & Dr. Khiger’s Wife) Introducing South Florida’s New Family oriented Chiropractic Medical Facility.

we will always go the extra mile in doing what other practitioners won’t do to implement preventative therapy and healing solutions. As the Public Relations Manager Hazel Hernandez emphasizes, “Amazing care awaits you!”

To read more about Amazing Spine Care, visit: www.amazingspinecare.com Or make an appointment with one of their practitioners at: (954) 458-1223. Appointments can also be requested through the submission of a completed online contact form powered by Google

(https://www.amazingspinecare.com/ contact-us/), and prospective clients should expect to receive a response within 24 hours.

Cover Picture Ribbon Cutting from left to right: Polina Dibrova (Chiropractic Assistant), Hazel Hernandez (PR Manager), Dr. Joseph A. Amunategui II, D.C., Dr. Alan Khiger, D.C.(Founder & CEO of Amazing Spine Care), Irina Khiger (COO & Dr. Khiger’sWife), Denisse Garcia (Marketing Director), Joseph Fiore (Hallandale Beach Office Supervisor)

As individuals approach the age of 65, one of the most critical considerations looming on the horizon is Medicare. Designed as Health Insurance primarily for seniors, Medicare ensures access to essential medical services and coverage for a wide range of health needs. However, the process of enrolling in Medicare can be intricate, often requiring careful planning and understanding of eligibility criteria and enrollment periods.

Medicare is structured into several parts, each covering different aspects of healthcare:

Part A (Hospital Insurance):

Covers Inpatient Hospital Stays, Skilled Nursing Facility Care, Hospice Care, and some Home Health Care Services.

Part B (Medical Insurance):

Covers services from doctors and other Healthcare Providers, Outpatient Care, Durable Medical Equipment, and Preventive Services.

Part C (Medicare Advantage Plans):

Offered by private companies approved by Medicare, these plans pro-

vide all Part A and Part B Benefits and often include Prescription Drug Coverage (Part D).

Part D (Prescription Drug Coverage):

Adds Prescription Drug Coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-forService Plans, and Medicare Medical Savings Account Plans.

Eligibility for Medicare typically begins at age 65, but individuals under 65 may qualify if they have certain disabilities, End-Stage Renal Disease (ESRD), or Amyotrophic Lateral Sclerosis (ALS, or Lou Gehrig’s Disease).

For many individuals, enrollment into Medicare is automatic if they are already receiving Social Security or Railroad Retirement Board benefits at least 4 months before turning 65. This automatic enrollment includes both Part A and Part B coverage. However, those who are not automatically enrolled must actively sign up for Medicare during specific enrollment periods:

Initial Enrollment Period (IEP): This is

the 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. It’s crucial to enroll during this period to avoid potential late enrollment penalties.

Special Enrollment Periods (SEPs):

These are available for those who delay enrollment due to having group health coverage through an employer or union. SEPs also apply to individuals who lose their employer-based coverage.

General Enrollment Period (GEP): If you missed your Initial Enrollment Period, you can sign up during the GEP, which runs from January 1 to March 31 each year. Coverage will begin on July 1st of that year.

For individuals who plan to continue working beyond age 65 and have health coverage through their employer or union, decisions about when to enroll in Medicare require careful consideration.

If you or your spouse are still working and covered by an employer’s group health plan, you may delay enrollment in Medicare Part B without facing penalties. However, it’s crucial to understand the rules and ensure timely enrollment once employer coverage ends or changes.

Understanding how Medicare works with other types of coverage is essential to avoid gaps and maximize benefits. Employers with fewer than 20 employees may require Medicare as the primary payer, so enrolling in Part A and Part B at the right time is critical.

Each individual’s Medicare journey is unique and influenced by various factors such as work status, health needs, and existing insurance coverage. Navigating this complex landscape can be very confusing so it often benefits to seek guidance from trusted sources, such as: https://www.medicare.gov/ or a professional specializing in senior healthcare plans.

As the population ages, understanding Medicare and its intricacies becomes increasingly important. From knowing when to enroll to exploring coverage options that best suit individual needs, taking proactive steps can ensure a smooth transition into this vital healthcare program.Whether preparing to retire or continuing to work, staying informed about Medicare empowers individuals to make informed decisions that safeguard their health and financial well-being in the years ahead.

Medicare drug coverage helps pay for prescription drugs you need. It’s optional and offered to everyone with Medicare. Even if you don’t take prescription drugs now, consider getting Medicare drug coverage. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage, you must join a Medicareapproved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage:

1. Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee-for-Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan.

2. Medicare Advantage Plan (Part C) or other Medicare health plan with drug cov-

erage. You get all of your Part A, Part B, and drug coverage, through these plans.

Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.

Visit: Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP) at: https:// www.shiphelp.org

Once you choose a Medicare drug plan, here’s how to get prescription drug coverage:

• Enroll on the Medicare Plan Finder: https://www.medicare.gov/plancompare/#/?year=2024&lang=en or on the plan’s website.

• Complete a paper enrollment form.

• Call the plan.

• Call Medicare at: 1-800-MEDICARE (1800-633-4227).TTY: 1-877-486-2048.

When you join a Medicare drug plan, you’ll give your Medicare number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs (VA), the Indian Health Service, or a Medicare Supplement Insurance (Medigap) policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider.Talk to your benefits administrator, insurer, or plan provider before you

make any changes to your current coverage.

Joining a Medicare drug plan may affect your Medicare Advantage Plan

If you join a Medicare Advantage Plan, you’ll usually get drug coverage through that plan. In certain types of plans that can’t offer drug coverage (like Medical Savings Account plans) or choose not to offer drug coverage (like certain Private Fee-for-Service plans), you can join a separate Medicare drug plan. If you’re in a Health Maintenance Organization, HMO Point-of-Service plan, or Preferred Provider Organization, and you join a separate drug plan, you’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a:

• Private Fee-for-Service Plan

• Medical Savings Account Plan

• Cost Plan

• Certain employer-sponsored Medicare health plans

You may be able to get Extra Help to pay for the Monthly Premiums, Annual Deductibles, and co-payments related to the Medicare Prescription Drug Program.

“Extra Help” is a Medicare Program to help people with limited income and resources pay Medicare Drug Coverage (Part D) Premiums, Deductibles, Coinsurance, and other costs. Some people qualify for Extra Help auto matically, and other people have to apply.

Who gets Extra Help automatically?

You’ll get Extra Help automatically if you get:

• Full Medicaid Coverage

• Help from your state paying your Part B Premiums (from a Medicare Savings Program)

• Supplemental Security Income (SSI) Benefits from Social Security

You’ll get a letter about your Extra Help. It tells you things like how much you’ll pay, and your new Medicare Drug Plan, if you don’t have one already.

The Medicare Prescription Drug Program gives you a choice of Prescription Plans that offer various types of coverage.You may be able to get Extra Help to pay for the Monthly Premiums, Annual Deductibles, and copayments related to the Medicare Prescription Drug Program. However, you must be enrolled in a Medicare Prescription Drug Plan to get this Extra Help.

You should complete the application for Extra Help on the Internet if:

•You have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance); and

•You live in one of the 50 States or the District of Columbia; and

•Your combined savings, investments, and real estate are not worth more than $34,360, if you are married and living with your spouse, or $17,220 if you are not currently married or not living with your spouse. (Do NOT count your home, vehicles, personal possessions, Life Insurance, burial plots, irrevocable burial contracts or back payments from Social Security or SSI.) If you have more than those amounts, you may not qualify for the Extra Help. However, you can still enroll in an approved Medicare Prescription Drug Plan for coverage.

To get Extra Help with Medicare Prescription Drug Plan Costs, you must complete and submit the application. Medicare will review your application and send you a letter to let you know if you qualify for Extra Help. If you need help completing this application, call Social Security Toll-Free at: 1-800-772-1213 (TTY 1-800325-0778).

EXCEPTION: Even if you meet these conditions, DO NOT complete this application if you have Medicare and Supplemental Security Income (SSI) or Medicare and Medicaid because you automatically will get the Extra Help.

You also may be able to get help from your State with other Medicare costs under the Medicare Savings Programs. By completing this form, you will start your application process for a Medicare Savings Program. We will send information to your State who will contact you to help you apply for a Medicare Savings Program unless

you tell us not to when you complete this application. If you need information about Medicare Savings Programs, Medicare Prescription Drug Plans or how to enroll in a plan, call: 1-800-MEDICARE (TTY 1-877-4862048). Or visit: https://www.medicare.gov/. You also can request information about how to contact your State Health Insurance Counseling and Assistance Program (SHIP). The SHIP offers help with your Medicare questions.

To apply, you must live in one of the 50 States or the District of Columbia. If you don’t automatically get Extra Help, you can apply for it at: https://secure.ssa.gov/i1020/start