JOHNSON’S SHOES TURNS 100 • COOL COLLABORATIONS • BOOMER BUYING POWER

VOL. 24 • ISSUE 2 • FEBRUARY 2014 • $10

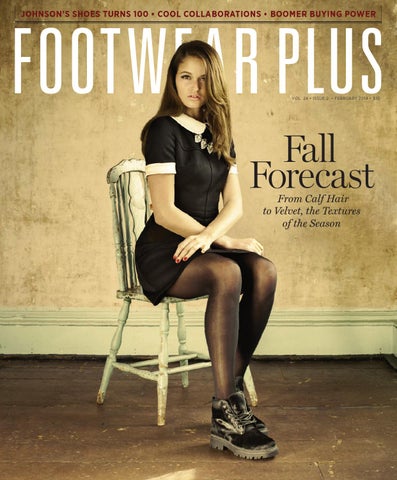

Fall Forecast From Calf Hair to Velvet, the Textures of the Season

fw_02_14_cover_02.indd 38

1/21/14 3:36 PM

JOHNSON’S SHOES TURNS 100 • COOL COLLABORATIONS • BOOMER BUYING POWER

VOL. 24 • ISSUE 2 • FEBRUARY 2014 • $10

Fall Forecast From Calf Hair to Velvet, the Textures of the Season

fw_02_14_cover_02.indd 38

1/21/14 3:36 PM