9 minute read

Hike In Indian Cotton Prices To Negatively Impact Exports And Viability Of Fabric And Garments: A Thought Matrix by Munish Tyagi

HIKE IN INDIAN COTTON PRICES TO NEGATIVELY IMPACT EXPORTS AND VIABILITY OF FABRIC AND GARMENTS : A THOUGHT MATRIX

MUNISH TYAGI

Advertisement

International Textile consultant and Textile Industry thought leader

India’s global standing

India is presently the No.1 producer of Cottons, in different varieties, and averaging production of 35 to 33 million Bales per year [ Avg. 170 Kg weight per bale]. The output of the current ongoing Crop 2020-2021 is pegged at 33 Million bales. However, a strange and `unjustifiable ` foreplay has been observed for Indian cottons, with a hike of an average 30% since the first crop deliveries started in Oct. 2020. Despite low ‘pull forward’ demand from Indian or export trade that has been reeling, with much subdued demand during the Covid pandamic period, that is yet on. With reduced overall fabric and apparels exports from India, the one and only tenable reason for the above seem to be depletion of ‘in the pipeline’ stocks in 2020; and increased demand for India s cotton overseas, where the supply chain been drastically disrupted e.g., in China, Pakistan and especially with embargo and sanctions on cotton exports from trouble Xingyiang region in north of China, and the lower price favors Indian cotton at below $0.9/L, today on ICE Cot look at 0.9. This has led to an export of 0.4 Million Bales; and exports can get further boost if Pakistan opens its market for Indian cotton. This too surely will impact Domestic markets.

Domestic demand v/s exports

Post recovery and growing demand from India s yarn spinning industry. Yarn spinning sector of Indian textiles industry was one of the first to restart, amid the Covid crisis as soon as August 2020. Its capacity utilization remained a low of 30 to 40% till upto 3rd Quarter of 2020. However, with an `empty Stock in pipeline’, such capacity utilization of the SPG mill industry moved fast to 65 to 75% level by January 2021 to fill in the exhausted stocks. The above spurt in the mill activity of SPG industry, led to quick ongoing consumption of the new Cotton crop that had come into market by Oct. 2020. At the same time, and especially with the spike in export demand from Jan. 2021. The exports of Indian cottons picked up fast and have reached 0.4 Mln Bales, by now. This is surely leading to pressure on domestic supply and stress for mills.

Game changer for Indian Cotton sector

The real Game changer for India s Cotton industry came as a gift from the National Budget policy on Feb.01, 2021, which `increased` the Import duty on overseas cotton supplies by +5%, making it to 10% on import CIF value. This negatively impacted the imports of cottons especially from Central African countries, and from Uzbekistan which have provided cottons of good quality and at a price lower or competitive to India s best variety Shankar 6, which has now become quite competitive. The impact of this anti-import move made Indian cottons as almost a `monopoly` player in the Domestic Market leading to price increase of S6 popular variety from INR 42,000 to INR 46,000 per candy [of 355.5Kg] just in 2 months. And the price increase game is continuing. Badly impacted by sudden and erratic rise in cotton prices, majority of the Yarn Spinng Mills infact created the initial much needed demand for cotton; amid Covid period, got worst hit by such rising cotton prices. Most of the mills are now buying only ‘just in time’ and only limited/required volumes. The Spinning mills will be in dire stress if more Cotton is exported out. Further, export target of 0.40 Million bales in current cotton year, and impact of rising domestic cotton prices, is leading to an unfair play for very vital and large spinning mills individually.

Call for Ban on yarn exports, to bring down prices of fabrics and garments

Apparel exporters in textile clusters in South India have sought the Union government's intervention to check incessant surge in yarn prices, under the discussed impact of rising Cotton prices. Usually, yarn prices increase with increase in cotton prices. However, 'Prices go up by Rs 2 to Rs 5 per kilogram. But, since Dec. 2020, there has been a continuous increase, disproportionate with cotton prices. Since December, the yarn prices got increased by Rs 65 per kilogram; which is expected to go up further, once more of Cottons are withdrawn for increased export targets. Yarn prices have never gone up so steep in the last few decades. This is sure to impact the viabil-

ity of fabric and garment manufacturers and exporters, and eventually to hit the exports. Over the last 3 months alone, the Yarn price of standard 30 Ne Comb went up by 30%, from Rs 215/Kg in mid-Dec. 2020 to today’s very high level of Rs 280/Kg, mid-Mar. 2021. This may even lead to a negative offtake of India s yarns/fabrics/ garments into the export markets; which will be like putting an axe on own feet by India s own Cotton industry. This will also impact India’s share in global export. Cotton price correction is vital and important for India’s textile exports to remain globally competitive; and not slide down from current global No. 5 position as textile exporter.

Road Map, and course correction for India’s cotton and textile industry

It is vital for India to maintain a minimum 5% share in the Global Textile Exports, and to remain competitive v/s newly emerging and new textile exporting countries. India Govt. to direct all Export Associations to get their member mills to focus on export of value adding textiles like Yarns, Fabrics, Apparels and Technical textiles. For the future, as strategy to get into the Worlds’ Synthetic textile markets, India to shift priority from Cotton to Polyester and blended textiles. For viability of downstream Textile value chain, the Govt. needs to reduce the target for Cotton export, and enhance export incentives to MMF/synthetics. While increasing export incentives on Export of MMF/synthetic textiles from India, the govt. needs to reconsider reducing import duty on cotton to only 5%.

EVENT UPDATE

The Intex South Asia – Bangladesh edition virtual expo concluded successfully on 25 March, 2021 (Thursday) on Bee2bee.asia. This international textile sourcing platform was visited by 2421 trade visitors from the textile and apparel industry of Bangladesh as well as attracted overseas buyers from Sri Lanka, Spain, Mauritius, Finland, Italy, Peru and Algeria. The textile buyers interacted with 70+ global suppliers participating from India, Bangladesh, Sri Lanka, China, Korea, Thailand, Malaysia, Indonesia and the United Kingdom (UK) through pre-arranged B2B meetings over Zoom and through the Bee2Bee platform. The Indian Pavilion was formed by the Federation of Indian Chamber of Commerce & Industry (FICCI), China Pavilion with Zhejiang Province Department of Commerce and Thai Pavilion with Thailand Textile Institute (THTI). Over 400 B2B Meetings were arranged for the exhibitors that showcased fibers, yarns, apparel & denim fabrics, clothing accessories, etc. for the textile buyers from Bangladesh and other international markets.

Some of the leading buyers from Bangladesh who visited our virtual platform and attended B2B meetings with interested suppliers were Aaron Denim Ltd, Epyllion Group, Asrotex Group, S. Oliver Overseas Ltd, Tom Tailor Sourcing, Decathlon Bangladesh, Windy Group, Asmara International Ltd, Bitopi Group, Dewhirst Group Ltd., Hoplun BD Ltd, Palmal Group, LCWAIKIKI, Herma Group, Puls Trading – H&M Bangladesh, Li & Fung, Louietex Manufacturing and Dird Group. One of the leading buyers from Bangladesh, Mr. Main Uddin Miah, CEO, Dresban Global Sourcing, who interacted with textile suppliers on our Bee2Bee platform and had also registered for the pre-arranged meetings commented that, “World trade is facing huge crisis due to Covid-19. The B2B platform arranged by Intex for discussion between buyer and seller will greatly help to move trade forward. I hope Intex will arrange this platform a couple of times a year. Wish all the success to Bee2Bee.”

This international sourcing event enabled industry buyers to source raw materials and textiles to grow the export and domestic market thus creating new opportunities to supply to global markets, increasing market share and strengthening the brand image of Bangladesh as a sourcing destination for high-fashion and value-added garments.

Intex South Asia Bangladesh Virtual Expo was very well received by all, confirmed by both Exhibitors & Buyers’ feedback that were positive about all aspects of this fair. These promising views are expected to keep growing year-on-year with increasing trade and investments. Intex South Asia Bangladesh will soon become the country’s must-attend trade show for the textile and apparel industry stakeholders of Bangladesh and region at-large. Intex South Asia Bangladesh is endorsed and supported by Bangladesh Knitwear Manufacturers & Exporters Association (BKMEA), Bangladesh Garment Buying House Association (BGBA), Chittagong Chamber Of Commerce & Industry, India-Bangladesh Chamber of Commerce and Industry, Islampur Cloth Market Association, Bangladesh Chemical Importers & Merchants Association, and Dutch-Bangla Chamber of Commerce & Industry.

GLOBAL TURNOVER 2020 DROPPED -9%

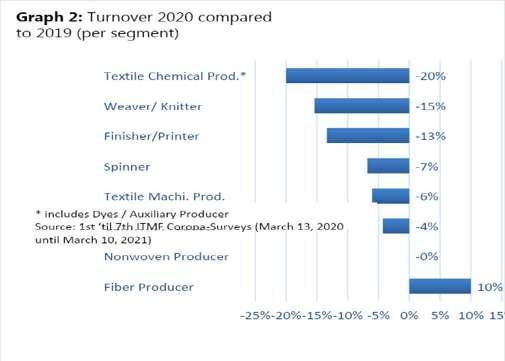

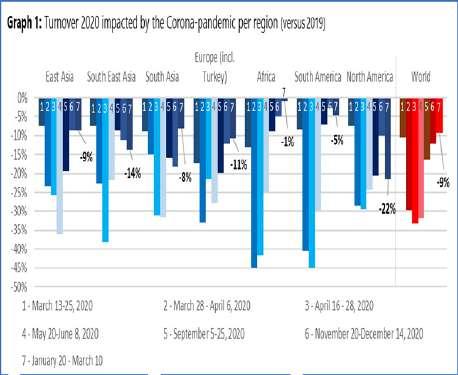

Between January 25th and March 10th, 2021, ITMF has conducted the 7th ITMF Corona-Survey among ITMF members and affiliated companies and associations about the impact the Corona-pandemic has on the global textile value chain. In total, 196 companies from around the world participated. The 1st ITMF Corona-Survey was conducted in March 2020 when the first lockdowns were announced in Europe. The 7th survey revealed that actual turnover in 2020 was -9% lower compared to 2019 (see Graph 1). While this decrease is significantly better than the expected drop of -33% in the 3rd survey at the height of the first Corona- wave in April 2020, the year 2020 will go down into history as one of the worst years for the global textile and apparel industry. In comparison to the expectations expressed in the 6th ITMF Corona-Survey (November 20th – December 14th,

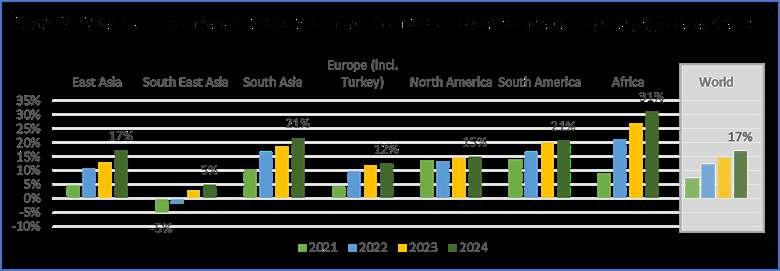

2020), actual turnover for 2020 compared to 2019 has improved by 3 percentage points from -12% to now -9% (Graph 1). Source: 1st ‘til 7th ITMF Corona-Surveys (March 13, 2020 until March 10, 2021) As could be expected the entire textile value chain was hit hard by the pandemic including textile machinery producers. Practically all segments under review were impacted negatively to different degrees in 2020 (see Graph 2). The two segments standing out positively are the producers of nonwovens (+/-0%) and of fibres (+10%). It can be assumed that those two segments have benefitted from the extraordinary demand for masks during 2020, which compensated to a significant extent for the loss in other areas like automotive or apparel. For 2021 and the following years up to 2024, turnover expectations are positive (see Graph 3) and have overall not changed compared to previous surveys. On a global level, turnover expectations are especially strong for 2021 and 2022, an indication that companies are expecting a strong recovery. For 2023 and 2024 companies’ growth expectations are weaker. Looking at the various regions the most striking result is the positive expectations of companies in Africa (+31% by 2024), compared to the other regions that range between +12 and +21%.