The Nigeria Barometer

• Horn of Africa Ports and power plays • Migration Targeting the transit countries • South AfricaRamaphosa, the boa constrictor

N ° 10 2 • J U LY/A U G U S T 2 018

w w w.t he a f r ic a r ep o r t .c om

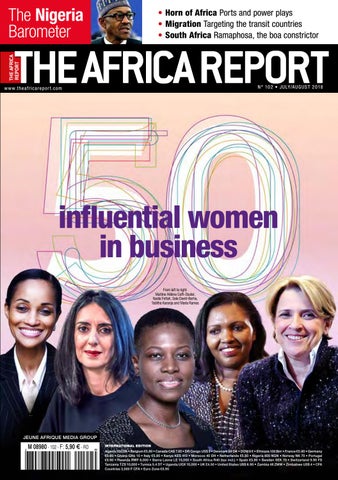

influential women in business From left to right: Martine Hélène Coffi-Studer, Nadia Fettah, Sola David-Borha, Tabitha Karanja and Maria Ramos

JEUNE AFRIQUE MEDIA GROUP INTERNATIONAL EDITION

Algeria 550 DA • Belgium €5.90 • Canada CA$ 7.95 • DR Congo US$ 9 • Denmark 60 DK • DOM 8 € • Ethiopia 130 Birr • France €5.90 • Germany €5.90 • Ghana GH¢ 10 • Italy €5.90 • Kenya KES 410 • Morocco 40 DH • Netherlands €5.90 • Nigeria 800 NGN • Norway NK 70 • Portugal €5.90 • Rwanda RWF 6,000 • Sierra Leone LE 15,000 • South Africa R40 (tax incl.) • Spain €5.90 • Sweden SEK 70 • Switzerland 9.90 FS Tanzania TZS 10,000 • Tunisia 5.4 DT • Uganda UGX 10,000 • UK £4.50 • United States US$ 6.95 • Zambia 48 ZMW • Zimbabwe US$ 4 • CFA Countries 3,500 F CFA • Euro Zone €5.90

The Nigeria Barometer

influential women n in business N ° 1 0 2 • J U LY/A U G U S T 2 018

N ° 10 2 • J U LY/A U G U S T 2 018

C

G

IN

EX

36

LU

3

• Horn of Africa Ports and power plays • Migration Targeting the transit countries • South Africa Ramaphosa, the boa constrictor

w w w.th e af r ic ar ep o r t . c o m

H OF T E ST

ES AT

The Nigeria Barometer

STA TE

w w w.th e af r ic ar ep o r t . c o m

SIVE RANK

Ahead of next year’s elections we assess the Buhari government’s record at the centre and in the states

influential women in business From left to right: Martine Coffi-Studer, Nadia Fettah, Sola David-Borha, Tabitha Karanja and Maria Ramos

THE AFRICA REPORT # 102 - JULY - AUGUST 2018

JEUNE AFRIQUE MEDIA GROUP

JEUNE AFRIQUE MEDIA GROUP NIGERIA EDITION

INTERNATIONAL EDITION

Algeria 550 DA • Belgium €5.90 • Canada CA$ 7.95 • DR Congo US$ 9 • Denmark 60 DK • DOM 8 € • Ethiopia 130 Birr • France €5.90 • Germany €5.90 • Ghana GH¢ 10 • Italy €5.90 • Kenya KES 410 • Morocco 40 DH • Netherlands €5.90 • Nigeria 800 NGN • Norway NK 70 • Portugal €5.90 • Rwanda RWF 6,000 • Sierra Leone LE 15,000 • South Africa R40 (tax incl.) • Spain €5.90 • Sweden SEK 70 • Switzerland 9.90 FS Tanzania TZS 10,000 • Tunisia 5.4 DT • Uganda UGX 10,000 • UK £4.50 • United States US$ 6.95 • Zambia 48 ZMW • Zimbabwe US$ 4 • CFA Countries 3,500 F CFA • Euro Zone €5.90

Algeria 550 DA • Belgium €5.90 • Canada CA$ 7.95 • DR Congo US$ 9 • Denmark 60 DK • DOM 8 € • Ethiopia 130 Birr • France €5.90 • Germany €5.90 • Ghana GH¢ 10 • Italy €5.90 • Kenya KES 410 • Morocco 40 DH • Netherlands €5.90 • Nigeria 800 NGN • Norway NK 70 • Portugal €5.90 • Rwanda RWF 6,000 • Sierra Leone LE 15,000 • South Africa R40 (tax incl.) • Spain €5.90 • Sweden SEK 70 • Switzerland 9.90 FS Tanzania TZS 10,000 • Tunisia 5.4 DT • Uganda UGX 10,000 • UK £4.50 • United States US$ 6.95 • Zambia 48 ZMW • Zimbabwe US$ 4 • CFA Countries 3,500 F CFA • Euro Zone €5.90

FREE with this issue: an INVESTING supplement on GUINEA. Not to be sold separately.

BUSINESS

04 EDITORIAL Revolution from within 06 LETTERS 08 THE QUESTION

BRIEFING 10 SIGNPOSTS

22

12 PEOPLE 14 INTERNATIONAL 16 CALENDAR 18 OPINION Nic Cheeseman, professor, University of Birmingham

COVER CREDITS: VINCENT KESSLER/REUTERS; VINCENT FOURNIER/JA; HASSAN OUAZZANI/JA; ALL RIGHTS RESERVED; LETTIE FERREIRA

30 DEBATE Information minister Lai Mohammed and presidential aspirant Donald Duke

72 FINANCE The winding road to bank consolidation in Tanzania 73 HANNIBAL

40

32 MIGRATION Niger at a crossroads The Africa Report examines the EU’s efforts to tamp down migration to its shores

46 ANANSI Voice of the people

74

COUNTRY FOCUS 51 MOROCCO The Casa challenge Can the Moroccan city make it as a continental leader? THE AFRICA REPORT

•

N ° 10 2

•

74 Ports and power plays Controversial ports deals put Djibouti and Somalia at the heart of a big-stakes game in the Horn of Africa 78 INTERVIEW Hadiza Bala Usman, Nigerian Ports Authority 80 INTERVIEW João Miguel Santos, MD, Boeing International SSA

ART & LIFE

36 INTERVIEW Aristides Gomes, Prime Minister, Guinea-Bissau

44 MALI IBK on the backfoot

LOGISTICS DOSSIER

60

POLITICS

40 SOUTH AFRICA Getting the band back together

68 LEADERS Arunma Oteh, Vice-president and treasurer, World Bank Group 70 INTERVIEW Imad Benmoussa, director for Egypt and North Africa, Coca-Cola

FRONTLINE 22 NIGERIA The state of the states Our ranking of Nigeria’s 36 states shows their performance on fighting poverty, providing electricity and raising revenue

60 TOP 50 Influential women in business The Africa Report, Jeune Afrique and the Africa CEO Forum assemble an exclusive list of the top African businesswomen shaping their sectors

J U LY - AU G U S T 2 018

82 DIASPORAS Home away from home The long road from Ejigbo, Nigeria to Abidjan, Côte d’Ivoire 86 BOOKS Poetry and politics in Somaliland 88 LIFESTYLE Cameroonian DJ Cyrius Black 89 TRAVEL A yoga retreat in Overberg, South Africa 90 DAY IN THE LIFE Djiboutian taxi driver Ali Hussein

4

THE AFRICA REPORT A Jeune Afrique Media Group publication

BY PATRICK SMITH

57‑BIS, RUE D’AUTEUIL – 75016 PARIS – FRANCE TEL: (33) 1 44 30 19 60 – FAX: (33) 1 44 30 19 30 www.theafricareport.com

Revolution from within

A

biy Ahmed, Ethiopia’s radical prime minister, is testing the outer limits of the possible. After releasing tens of thousands of prisoners, lambasting security officials for human rights abuses and promising to open the biggest state-owned companies to foreign capital, he announced that Ethiopia would withdraw its troops from the border with Eritrea and start negotiations for an enduring peace. And then you wake up. In fact, it continued. In Asmara, President Isaias Afwerki – perhaps the world’s most cantankerous negotiating partner – announced that he takes Abiy’s overtures seriously. So, on 26 June, just three days after someone tried to assassinate him at a rally in the capital, Abiy turned up at the airport to welcome Eritrea’s foreign minister, Osman Saleh. The Eritreans were welcomed with garlands of Ethiopian roses. “Our desire is to love rather than hate,” Abiy told the delegation. Of course, the negotiations to end one of Africa’s longest military stand-offs, in the wake of a border war that killed more than 80,000, will be fiendishly complex. What is new is the sense of common benefit in cutting a deal. Eritrea could end its isolation, while Ethiopia – one of the biggest landlocked countries in Africa – could get access to Eritrea’s ports. In a region where the geopolitics resemble a game of three-dimensional chess, a peace deal could simplify security calculations. But, as a long-time security adviser in Addis told us: “There are few guarantees in the Horn of Africa. This week, your enemy’s enemy will be your friend; next week, he could be your enemy as well.”

CHA I R M A N A ND F O UND E R BÉCHIR BEN YAHMED P UB L I S HE R DANIELLE BEN YAHMED publisher@theafricareport.com E X E CUT I VE P UB L I S HE R JÉRÔME MILLAN

The most obvious losers from the new détente are Tigrayan military and business leaders, who have dominated Ethiopia’s politics since 1991. In rallies across the country, Abiy – an Oromo, the country’s biggest ethnic group – has been talking of patriotism and national unity, trying to shortcircuit identity politics. Hundreds of thousands of Ethiopians flock to his rallies, entranced by his flights of rhetoric. For now, it looks like a weirdly personalised revolution. With the peace talks in train, the big symbolic gestures have been made and the political test has started. That At rallies means Abiy’s team has to get stuck into policy Abiy talks and strategy ahead of of national elections in 2020. He unity, has promised freedom for banned civil society trying to groups and a dialogue short-circuit with the opposition to ensure those elections identity are credible. politics Those pledges will be on trial in Ethiopia’s regions. First, in the south, where clashes in early June forced the resignation of the regional leader. And more so in the Ogaden, where rival factions are battling to control the contraband trade and will push back hard against attempts to wield control from the centre. In tandem with that, Abiy has to boost the economy to show his liberalisation can work. After the Eritrea talks, that ideological battle over strategy will loom largest. As for the risks of Abiy pushing so fast on so many fronts at the same time, one of his supporters compared his leadership to riding a bike: “If you slow down, you’re going to fall off.”

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

M A R K E T I NG & D E VE L O P M E NT ALISON KINGSLEY‑HALL E D I T O R I N CHI E F PATRICK SMITH M A NA G I NG E D I T O R NICHOLAS NORBROOK editorial@theafricareport.com A S S O CI AT E E D I T O R MARSHALL VAN VALEN R E S E A R CH & P R O D UCT I O N OHENEBA AMA NTI OSEI RE G IO NA L E D I T O R CRYSTAL ORDERSON (SOUTHERN AFRICA) A RT & L I F E E D I T O R BILLIE ADWOA MCTERNAN S UB - E D I T O R ALISON CULLIFORD P R O O F R E A D I NG KATHLEEN GRAY CHLOÉ BAKER A RT DI R E CT O R MARC TRENSON DESIGN VALÉRIE OLIVIER (LEAD DESIGNER) SYDONIE GHAYEB CHRISTOPHE CHAUVIN (INFOGRAPHICS) CAMILLE CHAUVIN R E S E A R CH SYLVIE FOURNIER P HO T O G R A P HY CLAIRE VATTEBLED XAVIER ROUSSEAU LAURA LAFON FRANÇOIS GRIVELET SALES A JUSTE TITRE Tel: (33) 9 70 75 81 77 contact‑ajt‑sifija@ajustetitres.fr CONTACT FOR SUBSCRIPTION: Webscribe Ltd Unit 4 College Road Business Park College Road North Aston Clinton HP22 5EZ United Kingdom Tel: + 44 (0) 1442 820580 Fax: + 44 (0) 1442 827912 Email: subs@webscribe.co.uk ExpressMag 8275 Avenue Marco Polo Montréal, QC H1E 7K1, Canada T : +1 514 355 3333 1 year subscription (10 issues): All destinations: €39 ‑ $60 ‑ £35 TO ORDER ONLINE: www.theafricareportstore.com A D VE RT I S I NG D I F CO M INTERNATIONAL ADVERTISING AND COMMUNICATION AGENCY 57‑BIS, RUE D’AUTEUIL 75016 PARIS ‑ FRANCE Tel: (33) 1 44 30 19‑60 – Fax: (33) 1 44 30 18 34 advertising@theafricareport.com PRINTER: SIEP 77 ‑ FRANCE N° DE COMMISSION PARITAIRE : 0720 I 86885 Dépôt légal à parution / ISSN 1950‑4810 THE AFRICA REPORT is published by GROUPE JEUNE AFRIQUE

6

ALLIANCES AND OPPORTUNITIES

I

New Ethiopia PM takes on Somali strongman

Abiy Ahmed, Ethiopian PM

• Old Mutual The giant must dance • Zimbabwe Young blood tests old guard • Agribiz East Africa’s caffeine kick

t is the duty of the UK government to protect Africa must stop its homeland in whatever way it deems necessary bleeding cash to criminals says Nigeria’s – stern immigration policies inclusive [‘Brexit Ngozi OkonjoIweala brings hard choices’, TAR101 June 2018]. However, it is expected of any country or region affected by such policies to probe for favourable treatment through its present comparative advantage, which Face to face with in Africa’s case are trade agreements. Now is the perfect time for African governments to come with equal opportunities to the table by demanding the UK reconsider its hostile policies on African residents in exchange for trade agreements. Britain is already paying hefty prices for Brexit to work and to think they will reconsider rigid immigration policies at this time without highly beneficial trade-offs, is daydreaming. Africans, especially those in the diaspora, should demand actions from their governments rather than exclusively criticize the UK government. Ibrahim Anoba, Advocate, Young Voices N ° 101 • J U N E 2 018

w w w.t h e a f r i c a r e p o r t .co m

corruption

JEUNE AFRIQUE MEDIA GROUP

INTERNATIONAL EDITION

Algeria 550 DA • Belgium €5.90 • Canada CA$ 7.95 • DR Congo US$ 9 • Denmark 60 DK • DOM 8 € • Ethiopia 130 Birr • France €5.90 • Germany €5.90 • Ghana GH¢ 10 • Italy €5.90 • Kenya KES 410 • Morocco 40 DH • Netherlands €5.90 • Nigeria 800 NGN • Norway NK 70 • Portugal €5.90 • Rwanda RWF 6,000 • Sierra Leone LE 15,000 • South Africa R40 (tax incl.) • Spain €5.90 • Sweden SEK 70 • Switzerland 9.90 FS Tanzania TZS 10,000 • Tunisia 5.4 DT • Uganda UGX 10,000 • UK £4.50 • United States US$ 6.95 • Zambia 48 ZMW • Zimbabwe US$ 4 • CFA Countries 3,500 F CFA • Euro Zone €5.90

CAFFEINE WITHDRAWAL Africa has lost its commanding market share in world coffee production because the market has changed beyond recognition over the past 30 years [‘A caffeine kick’, TAR101 June 2018]. Africa cannot compete on volume with Vietnam, Brazil or Colombia, and must develop niche markets. Côte d’Ivoire is a prime example, exporting over 80% of its crop to the Mediterranean, where consumers like the bitter Ivorian robusta. Boosting local consumption is crucial to the sector’s health in Africa: Ethiopia has shown the way, consuming so much of its crop that buyers have to compete to secure

present start-ups to build new ones in fintech or agritech because that’s where the money is. This is a terrible trend, as […] they become robots trying to copy already established brands. [...] Early this year, I was in an accelerator programme powered by Microsoft and I met this brilliant start-up founder with a brilliant e-commerce start-up. Frustrated that he couldn’t land an investor, he exited it for an agritech start-up, something he has no interest or experience in. These are the kinds of entrepreneurs the bad African economy is breeding. Money over value. Chidi Nwaogu, Co-founder, Publiseer, Nigeria

MISSING AFRICAN VOICES

Missing in all of the debate and analysis about Black Panther [‘Black Panther: Beyond the hype,’ TAR101 June 2018] are the voices, experiences and cultural productions of Africans who understand Marvel’s ‘Africa’ as simplistic and flat. […] Edward George, African support for authentic Head of group research, Ecobank depictions of their world on the big screen should be an alternative to the Western publicity machine’s manufactured Africa. And black FICKLE STARTUPPERS American longing for depictions of The average start-up founder in Africa Africa should be sourced from vibrant African films like Supa Modo. Bridging is no longer passionate about the this divide and launching new visions problem his or her start-up is solving of African futures would realise the [‘Start-ups: Slow-motion revolution’, potential of a film like Black Panther. TAR100 May 2018]. Rather, they’re Robyn C. Spencer, passionate about investment potential. Professor of history, Lehman College, US […] Many founders have exited their supplies. But Africa must be wary of mono-cultivation – coffee is well suited to mix with other crops (e.g. cocoa, palm oil) and this should be encouraged so that farmers are not at the mercy of traders when prices fall.

HOW TO GET YOUR COPY OF THE AFRICA REPORT

On sale at your usual outlet. If you experience problems obtaining your copy, please contact your local distributor, as shown below. ETHIOPIA: SHAMA PLC, Aisha Mohammed, +251 11 554 5290, aisham@shamaethiopia.com – GHANA: TM HUDU ENTERPRISE, T. M. Hudu, +233 (0)209 007 620, +233 (0)247 584 290, tmhuduenterprise@gmail.com – KENYA: LASTING SOLUTIONS LIMITED, Anthony Origi, +254 723 320 108, a.origi@yahoo.com – NIGERIA: NEWSSTAND AGENCIES LTD, Marketing manager, +234 (0) 909 6461 000, newsstand2008@gmail.com; MAGAZINE CIRCULATION NIGERIA LIMITED (MCNL), Distribution manager, +234 (0)803 727 5590/805 357 0984, mcnl3@yahoo.com – SIERRA LEONE: RAI GERB ENTERPRISES, Mohammad Gerber, +232 (0)336 72 469, raigerbenterprise@gmail. com – SOUTHERN AFRICA: SALES AND SUBSCRIPTIONS: ALLIED PUBLISHING, Butch Courtney; +27 083 27 23 441, berncourtney@gmail.com – TANZANIA: MWANANCHI COMMUNICATIONS, Milli Makula, +255 716 500 500, mmakula@tz.nationmedia.com – UGANDA: MONITOR PUBLICATIONS LTD, Micheal Kazinda, +256 (0)702 178 198, mkazinda@ug.nationmedia.com – UNITED KINGDOM: QUICKMARSH LTD, Pascale Shale, +44 (0) 2079285443, pascale.shale@quickmarsh.com – UNITED STATES & CANADA: LMPI, Sylvain Fournier, +1 514 355 5610, lmpi@lmpi.com – ZAMBIA: BOOKWORLD LTD, Shivani Patel, +260 (0)211 230 606, bookworld@realtime.zm – ZIMBABWE: For other regions go to www.theafricareport.com PRINT MEDIA DISTRIBUTION, Ian Munn, +263 778 075 147, ianmunn@mweb.co.zw

ADVERTISERS’ INDEX ENI p 2; STANDARD BANK p 5; WOLF OIL CORP. p 7; IFC THE WORLD BANK p 9; TAR SUBSCRIPTION p 15, 81; ALLIANCE MEDIA p 17; BEIJING REVIEW p 20-21; CHANNELS TV p 43; REP. OF GABON p 47-50; ENTERPRISE SINGAPORE p 55; JAGUAR p 59; VECTURIS SA p 73; DHL p 77; MIX TELEMATICS p 77; AHIF p 81; BOLLORE TRANSPORT & LOGISTICS p 91; MAROC TELECOM p 92

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

PREMIUM QUALITY

LUBRICANTS

Complete range of high quality lubricants, following the latest technolo ogy designed to serve all engines used in extreme conditions. Guaranteeing eng gine protection and high performance.

Find out more about the Champion lubricants on www.championlubes.c com

RELE AS E TH E F U L L P OTENTIA L

8

To respond to this month’s Question, visit www.theafricareport.com. You can also find The Africa Report on Facebook and on Twitter @theafricareport. Comments, suggestions and queries can also be sent to: The Editor, The Africa Report, 57bis Rue d’Auteuil, Paris 75016, France or editorial@theafricareport.com

After reporter Anas’ report on dodgy deals brought down the leadership of the Ghana Football Association in June, everyone who spoke to The Africa Report was unanimous in saying that graft is hurting the game

Has corruption held back African football?

Yes ERICK MWANZA Club licensing manager, Football Association of Zambia & CAF Media Manager

The abuse of authority at any level of governance has hindered the development of the sport in Africa. Countless players are denied the chance to represent their countries because an official has a certain player preference or a coach has connived with an agent to preselect a team. The result is shambolic performances and pitiable technical development. Money, donations of equipment and false promises directed at football stakeholders and offerings of other gifts have thrust football power into the hands of people whose interests lie far from advancing the game. This has resulted in the stagnation of various projects. Grassroots and youth investment has suffered; and poor workmanship on infrastructure has left leagues with a very sad state of playing fields. It is not uncommon to find stadiums and technical centres that are incomplete, derelict, without reinvestment and unsafe because resources for these programmes have had to be shared between contractors and officials who want to withhold ‘something’ for their luxury lifestyles. That poor state is evident across the continent in the kind of playing fields and turfs that characterise even the top divisions. The impact of this is discernible from the position the continent occupies in global football development. Yet, elsewhere, African talents rule the world’s top leagues.

Yes, but KAY SARPONG FIFAlicensed football agent

As bad as the evidence has been, corruption is not a problem for Africa alone. African football doesn’t have a corruption problem, football does. We have seen numerous occurrences of corruption in FIFA. It is institutional, not isolated to Africa. Africa has so much unrealised football potential. Unfortunately, the venality of some officials has stagnated the continent. We are yet to see an African team progress to the semi-final stage of a World Cup. George Weah is the first and only African player to win a Ballon d’Or. Since then, we haven’t seen an African player feature in the three-man shortlist. I don’t believe there hasn’t been a player good enough in over two decades. In the wake of the Anas investigations into corruption – which has seen the dissolution of the Ghanaian Football Association – the reaction from the public was that of expectation, as opposed to shock. That, in itself, tells a story. This is the norm. Personal gain is too often given more importance than continental progression. As a continent with a proud heritage, Africa must be its own barometer of morality. There must be a public abhorrence to corrupt practices. We have seen how effective the Time’s Up and #metoo movements have been. It will take a collective effort to effect real change and hold those who abuse their positions accountable.

Players are not chosen on merit. Some are selected on tribal lines, while others are selected based on the promise that the coach will be getting a percent of the player’s salary. Albert Fwamba Well, FIFA is itself facing corruption investigations as we speak, no? So perhaps African football only follows in the same steps as FIFA. Mukiria A. Nderitu Yes, as long as [it is] in Africa, we are all corrupt. That’s why FIFA introduced the issue of the video assistant referee [because] they knew that African referees are corrupt. Mike Maseya We all know how bad things have been and how Anas’ exposé took it to another level. It’s disappointing for a sport that is so loved by the people to be tainted this much. People have stopped going to the stadium now because they’ve lost all hope in the game. Prosper Nyarko Certainly, yes, money is stolen at all levels – sports development, training budgets, players’ salaries and incentives. Player selection is not on merit. It’s just a mess. Football administrators are busy pampering themselves. @FactZimbabwe

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

MESSAGE

Sérgio Pimenta, Vice President for the Middle East and Africa IFC

While IFC’s talent pool is strong, we need to increase our focus on attracting, developing and retaining staff from the region and creating opportunities for them across IFC. In the coming years, IFC expects to grow even faster in the world’s most challenging markets. We will benefit from having a diverse workforce that knows these markets well. We also want to create career paths that allow Africans to gain experience in other parts of the world, to share the knowledge from this region, and bring back that global knowledge over the course of their careers. To this end, we have recently launched a recruitment drive aimed to attract nationals of Sub-Saharan and Caribbean countries. We are planning to fill positions in operations across the regional hubs in Africa as well as in other regions. We are also looking for staff to fill positions in business and corporate support functions. I encourage professionals to apply for positions at IFC if you feel you would fit well into the mission of creating markets and taking on the development challenges, and if you want global careers in the emerging markets where you would be privileged to make a difference.

« We want to welcome more Africans to our teams and offer them career opportunities. »

What kind of difference can qualified Sub Saharan Africans make at IFC and in international development ? There are still 390 million people in Africa living in extreme poverty, and many more globally. We need massive scale-up in investment and the roll-out of new solutions in the emerging markets. Investments in infrastructure, health and education are critical for the developing world to exploit opportunities across sectors. Technology-based solutions—such as remote health care, computer-assisted teaching, and off-grid solar—provide new opportunities for leapfrogging. As the main driver of investment and innovation, the private sector needs to play a much greater role.IFC has a central role to play across the international community in addressing the development needs and helping to achieve the Sustainable Development Goals. IFC is implementing a new strategy to push ourselves to support investors willing to take more risk with the right incentives. The cornerstone of this new strategy — called IFC 3.0 — is to systematically create new markets, country by country and sector by sector, by tackling market and regulatory imperfections and by collaborating upstream on the policy side. Professionals at IFC are implementing this strategy, and we want more Africans to be part of our team to help lead the development community.

What skills do you expect from applicants ? The World Bank Group seeks experienced professionals. We look strong academic record at the masters or PhD level, more than five years relevant experience, and demonstrated professional achievements. IFC is especially interested in candidates with an MBA or master’s degree in finance or financial services, investment banking, private equity, or investment management. Varied international experience and an understanding of development is important. We are also looking for professionals that can support our investment activity through environmental and social or legal expertise, and in other corporate service functions. We expect candidates to be ready for a demanding, international work environment, and also one that supports them. To ensure effective development and retention of the staff we are recruiting, I have committed to sponsor a cohort of new mid-career hires who will be provided with a well-defined on-boarding and a support system to enhance their growth, satisfaction and retention.

Seynabou Ba Manager, Environmental and Social, Sub-Saharan Africa

« I am passionate about working with private sector clients on development projects across Africa. Being part of this journey to convince companies to adopt strong E&S risk management practices to improve on the ground development impacts coupled with being part of a diverse community of people that actually believe that we will make a difference in the fight against poverty are some of the reasons I joined IFC.».

International Finance Corporation 2121 Pennsylvania Avenue, NW Washington, DC 20433 USA Tel. : (202) 473-1000

For more information and to apply : www.ifc.org/careers

©DIFCOM - PICTURES : D.R.

Why are you seeking to recruit more Sub Saharan Africans to work at IFC ?

10

MOZAMBIQUE

On the defensive

JOAQUIM NHAMIRRE/AFP

Villages have been torched in the north

A

head of general elections planned for October 2019, a series of security crises have shaken the Frente de Libertação de Moçambique government of President Filipe Nyusi, which is already on the back foot due to the disastrous economic impact of the previous government’s huge secret loans (see TAR101, June 2018). Peace talks with the Resistência Nacional Moçambicana (Renamo) opposition/ armed group are in doubt after the May death of former rebel leader

Afonso Dhlakama, and the government is responding with violence to a growing Islamist insurgency in the north, home to large natural gas reserves that multinationals want to exploit. At the time of his death, Dhlakama was negotiating with Nyusi about security reforms and devolution – two key issues that need to be addressed in order to create a viable peace plan. The party chose Ossufo Momade, a former guerrilla fighter, to be the interim party leader and

“If we don’t watch

Sub-Saharan Africa, world mobile-banking leader 22% 14 6 0

2014

East Asia & Pacific

2017

Europe & Central Asia

South Asia

Latin America Middle East & Sub-Saharan Africa & Caribbean North Africa

out, [corruption] will engulf us. […] My report was completely ignored nored ”

Kenya’s auditor general, Edward Ouko, who loo oked into the Nationa al Youth Service scanda al, says it was not a one-off.

THOMAS MUKOYA/REUTERS

are worried about the boom in lending on mobile-money platforms and are pushing for the urgent roll-out of new regulations to prevent a mobile-powered financial shock. Read more about the growth of Kenya’s mobile-money sector in next month’s special finance issue of The Africa Report.

SOURCE: WORLD BANK GLOBAL FINDEX DATABASE

MOBILE MONEY LEADING THE WAY Sub-Saharan Africa remains the top region for mobilemoney activity, with nearly a fifth of the population aged 15 and upwards holding accounts in 2017. This technology is expanding the African continent’s small banked population. But even the best innovations have their downsides. Kenya’s regulators

continue talks with the government. The military is said to oppose the integration of Renamo fighters, so Momade may have doubts about the government’s demands for disarmament, which would limit Renamo’s powers to destabilise. A new rebel group, the Islamist Ahlus Sunnah wal Jamaah, entered the fray last October. Some 30 men attacked three police stations in Mocímboa da Praia, in Cabo Delgado province. Composed of young and marginalised fighters, Ahlus Sunnah wal Jamaah has parallels with Nigeria’s Boko Haram. Ignoring Nigeria’s lessons with those Islamist militants, Nyusi’s government arrested nearly 500 people, closed mosques, and bombed villages suspected of hosting Ahlus Sunnah wal Jamaah members, while the intelligence agency is negotiating with Erik Prince, the founder of private security company Blackwater, to protect oil and gas infrastructure. Nongovernmental organisation Human Rights Watch estimates that the Islamist attacks and the government’s response to them have killed about 40 people and already displaced 3,000. Mozambique’s gas offers potential for economic growth, but, as with the government’s secret loans, many Mozambicans worry that such big deals will bring little positive change for the citizens of the country, more than half of whom live in poverty.

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

DAVID GOLDBLATT/GOODMAN GALLERY

BRIEFING 11

PICTURE OF THE MONTH David Goldblatt, the legendary South African photographer whose searing portraits bore witness to apartheid, died on 25 June aged 87. This photograph: An elder of the Dutch Reformed Church walking home with his family after the Sunday service, Carnarvon, Cape Province (Northern Cape), January 1968.

PRESIDENTS WHO IS TESTING TERM LIMITS?

START-UPS FINDING FUNDS

Leader left office when limit reached Limit not yet met by any president Retained after attempt to modify/eliminate Modified or eliminated No two-term limit Some African leaders are finding it hard to organise elections and become presidentsfor-life (see page 18). Remaining in power for more than two terms used to be the norm, but there is now a strong trend developing that opposes long-stay presidents. Oppositionists in Togo are putting pressure on President Faure Gnassingbé to introduce term limits. Meanwhile Burundi’s Pierre Nkurunziza successfully swept term limits away in May, opening the possibility of his staying in power until 2034. Many eyes are on the DRC, where President Joseph Kabila has overstayed the end of his mandate and is delaying elections. THE AFRICA REPORT

•

N ° 10 2

•

J U LY - AU G U S T 2 018

SOURCE: AFRICA CENTRE FOR STRATEGIC STUDIES

Under current constitution, February 2018

Startup investment in Africa Venture capital raised by African startups Number of funding rounds SOURCE: PARTECH VENTURES

Constitutional two-term limits for African leaders

Africa is but a tiny corner of the global start-up ecosystem, but fundraising continues to grow rapidly. In May, the French government announced the creation of a $76m African start-up fund. That is small beer, and company founders are still clamouring for more. Companies need different levels of funding according to the stages of their growth. Huge digital-payment company Cellulant landed $47.5m in its latest funding round in May to finance its expansion on the continent. Meanwhile, in the same month, savings-focused start-up Piggybank.ng received $1.1m to help it to develop a new line of products.

$600m

150

450

120

300

90

150

60

0

2015

2016

2017

30

12

SPOTLIGHT

Adem Mohammed Ethiopia’s spy boss is focusing on reforming the intelligence services, investigating threats and keeping an eye on a troubled neighbourhood THE TODO LIST FOR Ethiopia’s new spy chief, General Adem Mohammed, is formidable. Less than two weeks into the job, Adem had to deal with an assassination attempt on Prime Minister Abiy Ahmed as Abiy was addressing more than 700,000 people in Meskel Square, Addis Ababa, on 23 June. At least 26 officials, five of them police commanders, were arrested after the grenade attack. That attack shows the high stakes as Abiy pushes through Ethiopia’s most radical changes in more than two decades. They include restructuring

the federal system, opening up the economy, releasing tens of thousands of prisoners – political and otherwise – and pursuing a peace deal with Eritrea. Meanwhile, Ethiopia is a key force in the Horn of Africa, where Somalia has been hit hard by Islamist insurgents and Saudi Arabia, Egypt, Qatar and Iran are jockeying for influence (see page 74). Abiy appointed Adem, an Amhara and a former commander of the air force, on 7 June, the same day that he selected a Tigrayan, General Seare Mekonnen, as the new chief

of defence staff. On state television that night, Abiy declared: “Defence doesn’t have ethnicity or race […] we die together for one country.” That said, the replacement of long-time spy chief Getachew Assefa was a bold move: he represented the power of the Tigrayan People’s Liberation Front, which led the war to oust Mengistu Haile Mariam in 1991. His removal signalled the shrinking power of the Tigrayan securocrats within the ruling coalition, the Ethiopian People’s Revolutionary Democratic Front (EPRDF). A rebellion in Oromia over the past three years helped bring an Oromo – Abiy – into the prime minister’s office. Getachew had orchestrated the crackdown on the Oromo Liberation Front, which human rights groups say included extrajudicial killings and imprisonment without due process. Under the new order – in which the hugely popular prime minister has lambasted the security services AIRCRAFT AND SPYCRAFT 2013 Named chief of the Ethiopian air force February 2018 Became a full general and was promoted to deputy chief of staff

ALL RIGHTS RESERVED

7 June 2018 Appointed head of the National Intelligence and Security Services 13 June 2018 Abiy appoints him to the board of industrial conglomerate Metec

“The elections are going to take place without the participation of President Kabila”

“I did nothing. There are people who just like to make trouble for me”

The DRC’s prime minister, Bruno Tshibala, sought to reassure voters that President Kabila would respect consitutional term limits.

South Africa’s former president Jacob Zuma says he is innocent of the many corruption charges he is now facing. THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

BRIEFING 13

DAVID MOININA SENGEH With a doctorate from the Massachusetts Institute of Technology and experience as a research scientist at IBM in Nairobi, the Sierra Leonean engineer became the country’s chief innovation officer in May.

JEAN-PIERRE BEMBA

LEON BENNETT/WIREIMAGE

South Africa’s DJ Black Coffee says prejudice is a major stumbling block for African artists internationally. N ° 10 2

•

J U LY - AU G U S T 2 018

MARGARET MWANAKATWE With the Lusaka government and the IMF quarreling over Zambia’s debt figures, and a bailout hanging in the balance, finance minister Mwanakatwe must do some tough negotiating and implement austerity measures.

SADAKA EDMOND/SIPA; ALL RIGHTS RESERVED;

BRIAN GITTA The Ugandan engineer and his team at Matibabu won the $25,000 Africa Prize for Engineering Innovation in June for creating a device that allows health professionals to test for malaria without taking blood.

“Next to my face on the flyer, they will put an African mask and the bongos and the congas ” •

The DRC singer is set to go on trial in France, standing accused of having sexually abused and imprisoned four of his dancers between 2002 and 2006. He is said to be the subject of an international arrest warrant.

The ICC threw out the former rebel leader's guilty verdict for war crimes in June. Bemba could soon be freed, and he might run in the DRC's presidential election planned for this year.

Honoré Banda

THE AFRICA REPORT

KOFFI OLOMIDE

ALL RIGHTS RESERVED; ARMIN TASLAMAN/ICC-CPI; ALL RIGHTS RESERVED

for past brutalities – what chances are there of smiling reconciliation between Abiy and the securocrats from the old order? “People have to make their choices,” says an analyst formerly based in Ethiopia. “They see the pace and extent of change and realise that their options are limited. […] For the moment, with that wave of popular support, Abiy is a really powerful figure.” Insiders report that Adem has moved quickly to replace several divisional commanders within the National Intelligence and Security Services and is working hard to ensure the loyalty of the extensive middle ranks. Abiy’s reforms are hurting some of the powerful and rich in the security and business establishment. He also appointed Adem to the board of the Metals and Engineering Corporation (Metec), the troubled conglomerate billed as the vanguard of Ethiopia’s industrial renaissance. Metec failed to deliver the 10 sugar factories that the government had commissioned, despite being paid nearly in full for some of them. Adem and new Metec board chairman Ambachew Mekonnen, the industry minister, want to put the company on a sounder footing – and that is not a simple task. It will also not be an easy time for Adem to oversee the security aspects of a potential peace settlement with Eritrea. Eritrea, under mercurial leader Issayas Afewerki, fought a bloody border war with Ethiopia that ended in 2000 but still causes repercussions today. Abiy says he wants lasting peace, and a delegation from Asmara was due in Addis Ababa in late June to open discussions. Adem’s diary will certainly be very full for the next few months.

DANIEL MATJILA Some oppositionists in parliament have called for South Africa’s Public Investment Corporation (PIC) boss to be suspended and investigated for corruption. Campaigners say the internal PIC investigation was not enough.

14

1

WORLD

410

parts per million (ppm) carbon dioxide emissions were recorded in April and May, marking a new record as pollutants continue to skyrocket. Such emissions were close to 300ppm in the 1950s. Countries are due to begin implementing their emission reductions under the Paris Agreement from 2020.

4

EUROPEAN UNION

Testing principles

2

ASMAA WAGUIH/REDUX-REA

Yemeni forces advance on Hodeidah on 13 May

A new Eurosceptic government in Rome, and quarreling in the governing German coalition, have thrown the European Union into renewed turmoil as migration again jumps to the top of the agenda (see page 32). A crisis was sparked in early June when Prime Minister Giuseppe Conte’s government refused to receive a boat filled with migrants. The spark received more oxygen when Chancellor Angel Merkel faced off a threat to her government over her policy of welcoming immigrants. The stage is now set for a big battle over reforming Brussels’ asylum and immigration policy, as southern states bristle under the challenges of receiving hundreds of thousands of migrants from Africa, the Middle East and Asia each year.

YEMEN

An end in sight?

The Saudi-led coalition of forces fighting the Iran-backed Houthi rebels may be close to victory, but the death and destruction from the recent conflict will cast a long shadow into the future. The United Nations (UN) estimates that eight million Yemeni risk starvation and the World Health Organisation will soon have identified 1m cases of cholera in the country. As of June, the port city of Hodeidah was one of the rebels’ last strongholds and a key space on the chessboard for its links to international supply routes. Yemeni, Saudi and United Arab Emirates forces launched a big push to retake it in June. The rebels have promised to launch more guerilla operations and fight to the death if a Saudi blockage becomes effective. The UN has been pushing for the formation of a transitional government. But with some southern forces calling for secession and an unstable Yemen potentially continuing to serve as a base for Al Qaeda in the Arabian Peninsula, the path to peace and stability remains perilous. 3

5

UNITED STATES

“You have

to take the children away ” US President Donald Trump tried to justify his policy of separating immigrant families at the US border, before reversing his position after widespread public anger.

NICARAGUA

President Daniel Ortega, a former leftist guerilla leader, provoked the country’s current political crisis by naming family members to positions of power, weakening checks on the presidency and trying to implement painful economic reforms. Nearly 200 people died in violent confrontations over the past two months, with the opposition calling for a new vote with international observers in 2019. Ortega is refusing, but his security forces have been unable to return stability to opposition strongholds like Masaya.

NICHOLAS KAMM/AFP

Stuck in stalemate

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

Subscribe online: www.theafricareportstore.com www.webscribe.co.uk/magazine/theafricareport shop.exacteditions.com/gb/the-africa-report People to watch, key data and analysis to guide you through the political and economic year ahead

w w w.t h ea f r i c a re por t.co m

reports 54 country N ° 9 6 • D E C E M B E R 2 017 - J A N U A R Y 2 0 18

Double issue

Africa in

2018

JEUNE AFRIQUE MEDIA GROUP

INTERNATIONAL EDITION

Algeria 550 DA • Belgium €5.90 • Canada CA$ 7.95 • DR Congo US$ 9 • Denmark 60 DK • DOM 8 € • Ethiopia 90 Birr • France €5.90 • Germany €5.90 • Ghana GH¢ 10 • Italy €5.90 • Kenya KES 410 • Morocco 40 DH • Netherlands €5.90 • Nigeria 800 NGN • Norway NK 70 • Portugal €5.90 • Rwanda RWF 6,000 • Sierra Leone LE 15,000 • South Africa R40 (tax incl.) • Spain €5.90 • Sweden SEK 70 • Switzerland 9.90 FS Tanzania TZS 10,000 • Tunisia 5.4 DT • Uganda UGX 10,000 • UK £4.50 • United States US$ 6.95 • Zambia 48 ZMW • Zimbabwe US$ 4 • CFA Countries 3,500 F CFA • Euro Zone €5.90

Print edition Digital edition

Subscribe now!

to propel your business forward SUBSCRIPTION ORDER FORM SEND TO: Webscribe Ltd - Unit 4 College Road Business Park - College Road North - Aston Clinton - HP22 5EZ - Tel: +44 (0) 1442 820580

YES, I would like to subscribe

PAYMENT IN

to THE AFRICA REPORT

Euro Zone €35

UK only £27

Other countries $42

❏ US Dollars ❏ £ Sterling ❏ Euros ❏ Cheque enclosed payable to THE AFRICA REPORT ❏ Visa ❏ Mastercard ❏ Amex N° Expires Last 3 numbers on back ❏ Send me a receipt of payment

❏ 6 issues

Print edition

€28

❏ 6 issues

€44

£36

$52

Name.......................................................................................... Surname..................................................................................

€71

£54

$83

Address...............................................................................................................................................................................................

❏ 12 issues ❏ 12 issues

Digital edition

Print edition

Digital edition

€62

£22 £51

$33 $74

€50

£38

$58

€125

£102

$148

€81

£66

$96

Offer valid until 30/06/2018. In accordance with Article 34 of the Information Technology and Freedom law, you have the right to access, modify or delete data concerning you by contacting The Africa Report.

PLEASE COMPLETE

❏ Mr

❏ Ms

❏ Mrs

Zip code................................................................................... City................................................................................................ State .......................................................................................... Country ..................................................................................... Tel. ................................................................................................ E-mail......................................................................................... Date and signature:

TAR2018

❏

16

JULY

NELSON MANDELA INTERNATIONAL DAY 18 July

Ibrahim Boubacar Keïta wants a second chance

AFRICA CEO FORUM WOMEN IN BUSINESS 2-3 July

Inspiring citizens of the world to make a difference. mandeladay.com

VINCENT FOURNIER/JA/REA

PARIS | FRANCE A new event co-hosted by Groupe Jeune Afrique, organisers of the Africa CEO Forum, and the Organisation Internationale de la Francophonie. acfwomeninbusiness.com

NIGERIA OIL & GAS 2-5 July ABUJA | NIGERIA cwcnog.com

CAINE PRIZE FOR AFRICAN WRITING 3 July LONDON | UK Three Nigerians, a Kenyan and a South African compete for the annual literary prize. caineprize.com/

MINING ON TOP: AFRICA SUMMIT 3-4 July GENEVA | SWITZERLAND miningontopafrica.com

PRESIDENT MACRON VISITS NIGERIA 3-4 July ZANZIBAR INTERNATIONAL FILM FESTIVAL (ZIFF) 7-15 July ZANZIBAR | TANZANIA With a record 4,000 entries this year, new categories for TV and web series and a focus on women in cinema. ziff.or.tz

MALI PRESIDENTIAL ELECTIONS 29 July In office since 2013, Ibrahim Boubacar Keïta is running again for president, much to the displeasure of a large section of the population (see page 44). Last month, thousands of Malians, including some opposition candidates, took to the streets to protest against the 73-year old leader, who has been accused of incompetence and corruption during his first-term mandate. Former minister of finance Soumaïla Cissé has warned the administration against using force on his supporters. He is widely considered the strongest opposition candidate, and likely to pose a serious threat to Keïta in the elections. Overcoming security hurdles is another major issue for government, which faces ongoing challenges in the north of the country.

WEST AFRICA COM 10-11 July DAKAR | SENEGAL All about digital and ICT development in the sub-region. tmt.knect365.com/west-africa-com

GHANA UK-BASED ACHIEVEMENT AWARDS (GUBA) 13-14 July LONDON | UK A seminar on Africa entrepreneurship on 13 July and prize-giving on the 14th. gubaawards.co.uk

GHANA TECH SUMMIT 18-20 July ACCRA | GHANA West Africa’s largest tech summit, with 100 global speakers on the programme. ghanatechsummit.com

ZIMBABWE GENERAL ELECTIONS 30 July AUGUST

CEM AFRICA SUMMIT 1-2 August CAPE TOWN | SOUTH AFRICA Customer experience management in Africa. cemafricasummit.com

MOBILE 360 SERIES – AFRICA 17-19 July KIGALI | RWANDA Elevating mobile access and inclusion across sub-Saharan Africa. mobile360series.com/africa/

AFRICAN WORLD FESTIVAL 17-19 August DETROIT | US thewright.org

POWER-GEN AFRICA & DISTRIBUTECH AFRICA 17-19 July

AFRICA-SINGAPORE BUSINESS FORUM (ASBF) 28-29 August

JOHANNESBURG | SOUTH AFRICA Twin energy sector events. powergenafrica.com

SINGAPORE Fostering trade between Africa and Asia. gems.gevme.com/ASBF18-interest

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

18

N Cheeseman Nic

Profes ssor of democracy and international development, University of Birmingham, UK

How to rig an African election

I

t is a tough time to be an African dictator. Forced to hold elections against their will by civil society groups and the international community, they now have to participate in political processes that they neither believe in nor respect. Strongman rulers are challenged by increasingly assertive opposition parties and the rise of social media. Holding on to power has become more difficult – especially for the many countries in which the economy is failing to create enough new jobs. With the rise of election observation and biometric technology to prevent multiple voting, things now look very different to the heyday of authoritarianism in the early 1980s, when ‘presidents for life’ were the norm. Facing such a hostile environment, despots risk becoming an endangered species. But if you are an aspiring dictator, do not despair because you still have plenty of options left. Our new book, How to Rig an Election*, draws together the greatest hits of the most corrupt and venal leaders around the world to explain how to manipulate elections and retain power. With this knowledge, even inexperienced autocrats like Edgar Lungu can stay in power. To follow in the footsteps of past masters like Teodoro Obiang Nguema Mbasogo or Idriss Déby, all you need to do is follow these five easy lessons:

1

Start before anyone is looking

International observers can really undermine autocrats’ efforts to control an election outcome. Don’t worry too much about the African Union, you can rely on them to pull their punches. But if you end up with the European Union and the Carter Centre, you need to be more careful – not only will they try and catch you in the act on election day, but they will send long-term observers to the country a few months before the polls. It is therefore important to start early. The best dictators get their plans in place for the next election as soon as they have ‘won’ the last one. There is no time to waste. Tell the bureaucrats not to give out identification documents to those living in opposition-run areas to make it harder for them to register to vote. And you should extend government control over the

banks so that only your allies get access to credit. Without money, your rivals will find it almost impossible to beat you! If you do this step well, everything else will become easier – and the best thing is that these tactics go under the radar and are almost never used as evidence that the election was rigged, so you have your cake and eat it.

2

Manage the message

Your people will be less likely to kick you out of office if they have no idea how badly you have been performing, so make sure you get tight control of the media. Savvy dictators subsidise the state press through unnecessary government adverts and get rid of opposition media by targeting them with trumped-up charges of defamation or tax fraud. Remember that social media is not your friend. Left unattended, Twitter and Facebook will reflect popular opinion, which is a problem because many people do not like you. But don’t worry, you have more money than the opposition, so use it to buy friends and have them flood social media with positive messages. Once these networks are set up, clever dictators use them to circulate fake news detailing their accomplishments while discrediting their main rivals – a good story to start with is that the opposition is funded by the former colonial power!

3

Get someone else to do the nasty stuff for you

Using physical violence all the time is costly and likely to upset observers. If you do have to use physical violence, the lesson from history is to make sure that the blood doesn’t end up on your own hands. Use militias and gangs because you can give them money, send them out to do your dirty work and then deny all knowledge of it if anyone turns up asking difficult questions. The fact that these THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

BRIEFING 19

5

groups are not part of the state means that it will be harder for anyone to pin the blame on you. And even if the International Criminal Court launches an investigation, they are unlikely to be able to get the evidence they need to secure a prosecution, allowing you to get away with murder.

4

Pretend to be a reformer

Everyone loves a reformer, so give them what they are looking for. Tell them that you have changed, that you are an authoritarian developmentalist. Once they believe you, persuade your international allies that you would love to hold a more democratic election but that this could generate instability, undermining the prospects for economic growth – and no one would want that, would they? If you are looking for a tried and tested catchphrase as part of your rebranding, try ‘open for business’ – it works like a charm. Special tip: As part of this strategy it is advisable to do some interviews with international media in which you can mention your aspiration to emulate the inspiring example of Paul Kagame in Rwanda.

Use technology to your own advantage

You might be thinking that new election technology will make it harder to manipulate the polls in the same way as in the past. But don’t worry, the most creative dictators out there have already shown how you can turn it to your own advantage. If you can’t avoid introducing biometric verification at polling stations – thus making ghost voting impossible – just ensure that the officials you appointed to the electoral commission know when to crash the system. After that, the commission will revert back to its old manual processes and you can get all of your fake voters through before putting the electronic system back online. Special tip: Deliberately buy new technology so late that it cannot be properly tested. That way, you can blame the problem on an unspecified ‘server error’ and everyone will have to believe you. If observers tell you that they want to conduct a parallel vote tabulation to check that no one is fiddling the counting of the ballots, don’t panic! Remember that only amateurs rig at this stage. The best in the business know that they have won the election well before a vote was cast, so they do not fear a parallel count. After all, it will just provide external confirmation that you got more votes than your rivals, while saying nothing about all the other strategies you have used to manipulate your way into power. As a result, as soon as the count is announced, criticism of the election will melt away – leaving youwith a democratic legitimacy you never dreamed of. Congratulations – you are now free to govern as a respectable member of the international community. *How to Rig an Election by Nic Cheeseman and Brian Klaas (Yale University Press) seeks to expose the way that elections are rigged around the world so that we can learn how to better defend democracy.

Five Fingers of One Hand

BRICS cooperation has established a major force in shaping the modernization of international governance By Lin Songtian

I

n July this year, South Africa hosts the 10th BRICS Summit in Johannesburg. The venue for the summit returns to South Africa after it was hosted in Durban in 2013, and BRICS now enters its second decade as an influential group. BRICS cooperation was established as a response to the 2008 international financial crisis. South Africa joined BRICS in 2010. Since its establishment, BRICS has associated itself with Africa, the continent with the largest number of developing countries, and has become an emerging powers cooperation mechanism that reaches across Asia, Africa, Latin America and Europe. After 10 years of development, BRICS cooperation has shed the outdated practices of political and military alliance, and instead established a new type of partnership. BRICS cooperation has walked a path of mutual respect and common progress. It is also the cooperation that has transcended the old idea of a zero-sum game and the winner taking all, and has implemented the new concept of win-win cooperation for common development. Today, BRICS has established itself as a major force in shaping the modernization of international governance.

Driving economic growth

BRICS cooperation has become the main engine driving the world’s economic growth. The combined population of Brazil, Russia, India, China and South Africa accounts for 40 percent of the world’s total. Together, BRICS countries contribute over 50 percent to the world economic growth, which exceeds the contribution of all developed countries

combined. BRICS countries’ voting share in the World Bank and the share quota in the International Monetary Fund (IMF) have respectively increased to 13.19 percent and 14.84 percent. BRICS unity and cooperation have helped strengthen the force for fairness and justice in the international community. The member countries hold high the banner of peace, development and cooperation, while maintaining effective coordination and collaboration in the United Nations (UN), G20 and other major international fora. As regards the implementation of the UN Millennium Development Goals and the Sustainable Development Goals, BRICS countries are actively involved. On contentious issues and major global challenges such as climate change, the five countries have demonstrated BRICS wisdom, contributed BRICS plans, and expressed BRICS voices, upholding the fundamental principles and authority of the UN and international laws, effectively safeguarding the common interest of all developing countries. In addition, the BRICS Plus initiative, proposed during last year’s BRICS Xiamen Summit, has opened up a new prospect of broadening the BRICS’ circle of friends, and has gained extensive attention and popular support.

Results oriented

BRICS cooperation has produced remarkable results and brought concrete benefits to the peoples of BRICS member states. Over the past 10 years, BRICS’ total GDP has grown by 179 percent, trade expanded by 94 percent, and

urban population increased by 28 percent, bringing the sense of achievement to over 3 billion population across the member states. With increased progress in the Strategy for BRICS Economic Partnership, BRICS mutually-beneficial economic cooperation is expected to produce more fruitful results. The New Development Bank (NDB) established in 2015 has already reserved sufficient capital to support member states in infrastructure development and production cooperation. A contingency reserve with $100 billion offers member states a robust line of defense against financial risks. These milestones mark major steps of emerging countries to jointly tackle global challenges through the establishment of a collective financial safety net. By doing so, the BRICS mechanism has been operating in a fundamentally different way from the global financial system long held by the West, and offers a new choice for all the developing countries in their pursuit of self-sustainable development. Unlike the World Bank and the IMF, the capitalization of the NDB is equally shared among five BRICS

The five BRICS members are like the five fingers of a hand, each one is different, but they all complement each other. The shared strategic interests of BRICS offer robust and constant strengths of cohesion, making the hand wellcoordinated and flexible. countries and accordingly, the decisions of the bank are on consultation on an equal footing and on the rules of the market. Consistent with the trend of times, the NDB fully encapsulates the principle of equal partnership, mutual benefit, and win-win cooperation, and has become an accelerator and an engine for the financial stability of BRICS countries and of the whole world. For the BRICS, South Africa is a major participant, contributor and beneficiary. More importantly, South Africa is a leader and a bridge in connecting BRICS’ development and cooperation with Africa. China is South Africa’s strongest BRICS partner. In 2017, bilateral trade between China and South Africa increased by 11.65 www.chinafrica.cn

XINHUA

Leaders of BRICS members and some developing countries pose before their dialogue during the Ninth BRICS Summit in Xiamen in September 2017

percent year on year to reach $39.17 billion. Today, China is South Africa’s largest trading partner and a major source of foreign investment and overseas tourists. In 2017, the NDB opened its Africa Regional Center in Johannesburg and committed to approve $1.5 billion of loans within 18 months of its opening. It is certain that BRICS cooperation will create more strength for the development of South Africa and Africa as a whole.

Creating unity

The five BRICS members are like the five fingers of a hand, each one is different, but they all complement each other. The shared strategic interests of BRICS offer robust and constant strengths of cohesion, making the hand well-coordinated and flexible. The world has been going through profound changes in terms of the global structure and shifting strengths between the North and the South. As protectionism and exclusivism makes its way into certain major powers, the world is increasingly confronted with the willful acts of a trade war, challenges against economic globalization and www.chinafrica.cn

multilateral trade regime, and increasing instabilities and uncertainties in international political, economic and security domains. Against such complicated and acute challenges, stronger unity and cooperation among the BRICS and the developing countries are the inevitable and the only correct path forward. As the BRICS chair for this year’s BRICS, South Africa has proposed the Fourth Industrial Revolution and inclusive growth as priorities for this year’s summit, along with concrete measures to deepen BRICS Plus cooperation. These proposals have been warmly welcomed and actively supported by China and other BRICS members. China will give its full support to South Africa for a successful BRICS Summit, and will work together to inject new momentum into fully deepening BRICS strategic partnership, and creating a new chapter for BRICS cooperation. This year marks the centenary of the birth of former South African President Nelson Mandela. The BRICS’ open, inclusive, cooperative and win-win spirit is highly consistent with the Mandela spirit. It is also the long-cherished wish

of Mandela and all other revolutionary leaders of the African National Congress to fight for a more fair, just and equitable international order. We are fully convinced that, as long as the BRICS countries strengthen unity and commit to win-win cooperation for common development, BRICS cooperation will embrace new vigor and dynamism in its second golden decade of development. In this way, BRICS will become an example and make new contributions to the establishment of a new type of international relations featuring winwin cooperation and a community with a shared future for humanity. CA The author is the Chinese Ambassador to South Africa * Comments to niyanshuo@chinafrica.cn

Scan QR code to visit ChinAfrica’s website

22

NIGERIA

The state

Ahead of elections planned for 2019, The Africa Report presents its first ranking of Nigeria’s 36 states, showing what is working and what is not. We also feature a debate between heavyweights about the country’s current direction

Lagos: an economy the size of a country despite the tangles of red tape

23

of the states P

resident Muhammadu Buhari’s government and its opponents agree on one thing: that Nigeria’s system of federal government is broken. Although the central government allocates just less than half of national revenue to the state and local governments – far more than any other system of devolved power in Africa – this has not resulted in good public services or more accountability. Our ranking of Nigeria’s states (see page 24) – with Lagos at the top and Yobe at the bottom – highlights which states are fighting poverty, providing access to electricity, facilitating business and raising local revenue. In fact, few of them are doing any of these things. Although states and local governments are responsible for primary and secondary education, basic healthcare, water and sanitation, and feeder roads, the standards of these services are falling. More people are stretching their budgets to send their children to private schools and clinics. Two-thirds of

FRÉDÉRIC SOLTAN/CORBIS VIA GETTY IMAGES

By Eromo Egbejule in Calabar

24 FRONTLINE | THE STATE OF THE STATES

ACCESS TO ELECTRICITY (%)

RANK

RANK

EASE OF DOING BUSINESS

INTERNET USERS AS SHARE OF 2016 POPULATION

RANK

1

99.3

1

24,096.9

1

98

30

108.6

2

2

Kwara

0.099

10

90.6

3

5,402.6

7

55

10

68.3

6

3

Edo

0.08

5

82.4

6

5,439.6

6

86

24

76.4

4

4

Ogun

0.112

12

72

9

13,971.6

2

65

14

123.3

1

5

Osun

0.043

2

89.4

4

1,887.1

19

77

20

51.2

11

6

Anambra

0.05

3

88.1

5

13,891.6

3

113

34

49.1

15

7

Delta

0.107

11

78.3

8

7,779.8

5

93

26

57.5

8

8

Rivers

0.088

8

65.1

14

11,677.3

4

96

29

51.2

12

9

Kogi

0.113

13

62.9

15

2,139.3

16

54

9

46.3

16

10

Abia

0.088

7

81.7

7

3,404.5

11

128

36

52.6

10

11

Ekiti

0.051

4

92.7

2

9,14.2

29

74

19

27

32

12

Akwa Ibom

0.099

9

68

11

4,244.7

8

103

32

32.5

25

13

Oyo

0.0155

18

66.6

12

2,407.9

13

86

24

68.7

5

14

Cross River

0.146

17

57.4

16

3,822.8

9

77

20

35.3

24

15

Bayelsa

0.12

14

52.5

19

3,472.4

10

80

23

29.9

26

16

Ondo

0.127

16

66.3

13

1,858

20

77

20

50.3

13

17

Imo

0.083

6

69.9

10

1,085.3

25

127

35

36.4

21

18

Nasarawa

0.251

19

33.2

28

1,347.4

23

58

12

89.8

3

19

Enugu

0.123

15

55.4

17

3,228.2

12

99

31

43.7

17

20

Plateau

0.273

21

36.3

27

2,187.9

15

73

17

50.2

14

21

Kaduna

0.311

24

53.5

18

2,066.1

17

73

17

54.6

9

22

Niger

0.324

25

51.7

21

1,058.3

26

41

6

63.5

7

23

Benue

0.28

22

22.1

34

1,665

21

72

16

40.9

19

24

Taraba

0.448

28

10.9

36

1,923.8

18

62

13

41.8

18

25

Kano

0.434

27

52.1

20

2,367.5

14

93

27

35.4

23

26

Gombe

0.471

29

48.1

22

902.7

31

48

8

35.8

22

27

Adamawa

0.295

23

37.6

26

1,362.8

22

95

28

39.9

20

28

Katsina

0.52

30

31.3

30

7,08.7

33

28

1

28

30

29

Bauchi

0.583

34

29.3

31

1,327.8

24

34

2

27.5

31

30

Borno

0.401

26

33

29

457.3

36

55

10

28.7

29

31

Kebbi

0.553

33

44.4

23

704.9

34

37

3

29

28

32

Ebonyi

0.265

20

39.2

24

812.4

32

104

33

26

34

33

Zamfara

0.605

35

29.1

32

1,040.9

27

40

5

22.6

35

34

Sokoto

0.548

31

38.9

25

910.3

30

70

15

26.4

33

35

Jigawa

0.552

32

26

33

607.4

35

37

3

17.9

36

36

Yobe

0.635

36

18.1

35

983.6

28

46

7

29.2

27

RANK

RANK

0.035

MULTIDIMENS. POVERTY INDEX

Lagos

STATE

1

RANK SOURCES: OXFORD POVERTY & HUMAN DEVELOPMENT INDEX/UN DEVELOPMENT PROGRAMME; NATIONAL BUREAU OF STATISTICS; WORLD BANK

IGR PER CAPITA (N)

F ro Fo our ranking methodology, please see www.theafricareport.com

Nigeria’s 36 states ranked

THE AFRICA REPORT

•

N ° 10 2

•

J U LY - A U G U S T 2 018

THE STATE OF THE STATES | FRONTLINE 25

Land Cruiser states The landcruiser states are making it farthest and fastest, with a few bumps in the road. Lagos – Nigeria’s business hub – tops the charts, but its scores on the World Bank’s Doing Business rankings show that it has much to do to cut the complications of getting construction permits and other bureaucratic tasks. Lagos blows the competition away on collecting taxes. And, despite widening inequalities, it is doing better than its peers at cutting poverty and boosting education and healthcare.

Danfo states Like the ubiquitous bus that gives them their name, the danfo states are getting close to their destination quickly, breaking a few rules on the way and on a smaller budget. Their performances are mixed, with Ekiti, for example, doing well on electricity but poorly for internet access. Cross River State’s governor Ben Ayade launched his “budget of kinetic crystallisation” for 2018, but has been accused of a land grab for his Ekuri forest superhighway project.

With even smaller budgets, these okada states are moving forward but are unable to travel long distances over rough roads. Crash helmets are compulsory. Gombe, one of the best, brought in just N902.7 ($2.5) in internally generated revenue per inhabitant in 2017, giving it a small budget to invest in infrastructure. The north-eastern state of Adamawa is currently battling cholera outbreaks and communal violence between Fulani herders and settled communities.

Waka waka states The states travelling by foot are not getting anywhere very fast. Those in this group have some of the highest levels of poverty and lowest access to electricity and the internet. The UN estimates that 1.7 million people have been displaced by Boko Haram and the government’s fightback in Borno, Adamawa and Yobe. With a combined unemployment and underemployment rate of 62.4% in 2017, Jigawa State is the worst place in the country to be looking for a job. THE AFRICA REPORT

•

N ° 10 2

•

THE NOUN PROJECT : CREATICCA CREATIVE AGENCY; SYMBOLON; YU LUCK; UCK; ADRIEN COQUET

Okada states

the 36 states have been unable an agreement with the governors that to pay their employees on time. at least 50% of the first tranche would Neither has federalism opened the be used to pay arrears on salaries and pensions. Within days, seven governors door to more open or accountable were said to have used the funds for government. Most state governments other purposes. The bailout did not are at least three years behind with their audited accounts; most also refuse to help much either. According to BudgIT, answer questions about how they are a civil society monitoring group, the cumulative domestic debt of the 36 states spending public funds. rose by N1.64trn between December Today’s division of labour between the 2014 and December 2017. federal, state and local government dates back to the 1999 constitution. Every For the country’s information minister, government since then has promised to Lai Mohammed (see page 30), this gets rewrite it but failed to get a consensus to the heart of the clash between the for change. The two main parties – the centre and the states: “The constitution allows allocations to the states, but there All Progressives Congress (APC) and are no constraints on how they spend the the People’s Democratic Party (PDP) – fighting the 2019 election say they want revenues.” Under the 1999 constitution, true federalism. At the minimum, this States are critically dependent on oil would give states that revenue – but even less accountable produce oil, gas and minthan the federal government erals a greater share of the revenue they produce. That the federal government gets 52.68% of is something that makes most politicians in Abuja nervous, whatever they say at the federation account – which is funded by a mix of oil and gas revenue and election time. national taxation – and it has exclusive The biggest fight will be over money powers over foreign policy, defence, the and who controls it. Two years ago, central bank and debt management, 24 state governments appealed to the federal government in Abuja for a bailout customs, air transport and seaports. The because they could not pay civil servant states get 26.72%. Local governments are salaries. Almost as many state governmeant to get 20.6% via the state governments. Together, they are responsible ments were unable to service their debts, for education, basic healthcare, water owed mainly to local commercial banks. Although the immediate cause of and agricultural services. the crisis was the crash in the oil price, Some of information minister which halved Nigeria’s export revenue, Mohammed’s colleagues want the strict the bigger causes are structural. Like the rules on spending and debt that apply to federal government, state governments the federal government to be extended to states in a new version of the Fiscal are critically dependent on oil revenue. But states are even less accountable Responsibility Act. They want tougher than the federal government. rules on disclosure and spending, and audits on state-owned enterprises. But SPENDING THE BAILOUT most state governors push back hard Like the president, governors enjoy at such moves. immunity from prosecution while in Donald Duke (see page 30), a forpower. The national assembly can promer governor of Cross River State and vide checks and balances, even when the a presidential contender in the 2019 president’s party has a clear majority in elections, wholeheartedly supports both chambers. Governors typically rule constitutional restructuring that would give more financial power to the states. supreme in their domain. In most cases, they dominate the election process, The resource-rich states, such as his own ensuring that state houses of assembly oil-producing state, would keep most of and local government authorities are their own revenues, but he argues that filled with their own allies, controlling states without natural resources can find solutions: “Look at what Kebbi is doing them with patronage from public funds. Faced with demands for a bailout with rice. If all Kebbi did was focus on rice […] Kebbi alone can fill half of Nigeria’s from the indigent state governments in 2016, finance minister Kemi Adeosun rice needs, and the state will be rich.” offered a package worth N1.75trn Kelechi Udeogu, an aide in the Rivers State governor’s office, is also a fan of ($4.8bn). Adeosun said that there was

J U LY - AU G U S T 2 018

26 FRONTLINE | THE STATE OF THE STATES

more local control of the money. “If we had fiscal federalism, we would have becomeanadvancedanddevelopedeconomy,” he says. “This ‘mama put’ federalism we practice has ruined this country with corrupt, lazy and irresponsible leaders. I’d propose that states manage their resources and pay a percentage of this to the federal government. States should also manage internal security. These are the two most important [issues].” CAMOUFLAGE CASH

Most of the country’s security problems – including Boko Haram’s Islamist insurgency in the north-east, the herder-farmer clashes in the Middle Belt and north central states, secessionist agitation in the south-east and militancy in the Niger Delta – have been shaped by political fights, often between the federal and state governments. After vice-president Yemi Osinbajo made several peacemaking trips to the Niger Delta and the government boosted the budget for the amnesty of former militants by N35bn, attacks in oil-producing areas fell off. But, according to Saatah Nubari of the Nigerian Nationalist Youth Movement, which defends Ogoni rights, “there is a growing disaffection from Ogoni to Efik, Ibibio, Itsekiris, Ijaws and other ethnic groups. There are many

The federal government doles out amounts averaging N500m monthly to governors in their capacity as chief security officers of their states. This money is not publicly accounted for and has often been used for political patronage. A joint investigation by the Civil Society L egislative Advocac y Centre and Transparency The N500m paid monthly as ‘security International found in May votes’ to state governors is often used that the federal government had paid an annual average for political patronage of $579m in so-called ‘security votes’ to state governments in 2016 militia groups forming underground. If and 2017. The organisations called the any oil company tries to explore any well in Ogoniland before the elections, that transfers ‘camouflage cash’, arguing that they fuelled corruption. might cause violence that could spill over across the Niger Delta.” Certainly, the security votes are doing little to dampen down smouldering The Middle Belt, meanwhile, has been conflicts. In many states, the federal the focus of escalating clashes between herders and farmers. A violent flaregovernment has deployed the army up in June resulted in the deaths of 87 to deal with insurgents, militants and – sometimes – cattle-rustling gangs. people. Shrinking Sahelian grasslands

are forcing herders to move south in search of grazing land for their cattle, and grazing areas and livestock paths set out in law before the civil war in 1967 have been supplanted by roads, residential settlements and factories. Some states have endorsed a new antigrazing law to establish ranches for the herders and to reduce clashes with the farmers. It is due to be implemented later

Ayodele Fayose