Ra mapho sama yn otbeable to de li ve ra‘ Ne wD ea l’. Hema yy etbecome th e‘ GodofSmallThings’.

HARVESHSEEGOLAM CentralBankGovernor, Mauritius:“Wewilllaunch adigitalrupee”

GREENGOLDRUSH Will Africabenefit fromstrategic minerals?

SAFARICOM’S PETERNDEGWA: “Weunderstood theEthiopiaopportunity”

Whichfirmshavecomeoutontop?

WhichcompanieshavethriveddespitetheCovid-19pandemic,and whoisinbestshapetoreapthebenefitofhighercommodityprices?

Our2023editionof Africa’stop500companies reveals areshufingofthepackamongthecontinent’sheavyweights.

’: H I K S T I = U U \ ^ U Z : ? k b c @ n @ a M0 8980 -1 23F: 7,90 E -R D AF RI CA MED IA GR OU P Bel gi um € 7 .9 0•C an ada CA $1 2•D enmar kD K8 0• D. R. C. US $1 0•F ra nce € 7 .9 0•G erm an y € 7. 90 Gha na GH ¢35 •K en ya KE S1 000 •M or occo DH 45 •N et he rl an ds € 7 .9 0•N ig er ia NG N2 000 Rw an da RW F7 ,50 0•S ou th Af ri ca R7 5( ta xi ncl .) •S wit ze rl an dF S1 0. 90 •T un is ia DT 15 UK £7 .2 0•U ni te dS ta te sU S$ 15 .9 9•Z am bia ZM W8 0•C FA Co un tr ie sF .C FA 3, 900 •E ur oZ one € 7 .9 0 IN TE RN AT ION AL ED ITI ON www.t he af ric ar ep or t. com N °123 •A PRIL -M AY -J UNE 202 3

24th edition

ABAN KFOR TH EN EW WORLD

totalpopulationof 1.4billionissetto double overthenext25 years,arguetheyare grossly under-representedindemographictermsat theBankandattheIMF

Thisunder-weightingoftheGlobalSouth translatesfromvotingrightsintoquotaallocations –the amount acountrycanborrow –attheIMF.Morewidely,Africanmember stateswantmoreseats intheBank andIMF boardrooms.AscellphonepioneerSirMo Ibrahimargues:“If we failtofind away for youngAfricatofitintotheagingmultilateral system,thenthesystemwillbecomesclerotic andirrelevant.”

WorldBankboffins have been workingthis yearon areform roadmaptoboostclimate finance.That worries thoseshareholderswho fearitcouldmarginaliseitsinitialmission offightingpoverty.Bangarightlyinsiststhe twoissuesare “intertwined”.Theriskisthat itcomesdowntochoosingbetweenfunds forthepoorestcountries andmorecashto stoshun

Whenfinanceministersandcentralbankers mullthechangingoftheguard at the Worl Banktheywill alsobe assessingthefutureo thisseptuagenarianinstitution. As intheUN Security CouncilandtheIMF,shareholders fromAfrica, Asiaand LatinAmerica want avoiceintheBankthat reflectsthe weight of demographicand economicchanges inthe21stcentury.

TheUS’s nomineetobethenext World Bankpresident,AjayBanga, has been welcomed acrossAfrica, AsiaandEurope. Yetanew chiefwillnotbeenough.He willberunninganorganisationplagued by financialpressures,geopoliticalchallenges andpolicydisputes. Banga,who steered therise ofMastercardtoa $300bn paymentsplatformfrom acredit-card companywortharound$20bn,is astar on WallStreet. Thatshould persuadebig firmsto workmore closelywiththeBank.

Someoftheknottiestproblemsconfronting Bangaarebeyondmoney. Suchas reforming quarrelsomebehemoth with189memberstates, 25 executivedirectorsand 27 vice-presidents

Acoregripeis structureand representation withintheBank.China,whichproducesabout 18%ofglobalGDP,complainsaboutits vo ingrightscompared to theUS,Germany an Japan.AfricanUnionmemberstates, whos

playingoutagainstthe ndfinance onomies, shington ndglobalisationin urofprotectionism,subsidisedmanywantto contain,China. onfiguraEuropeanUnionand happens pmentambitionsoftheGlobal ons such ean arena ithoutbetter coordinationandtoughernegotiatingstances, Asiaand rsasthebig

3 E 2023 EDITORIAL

THEAFRICAREPORT / N° 123 / APRIL-MAY-JUN

#123 /April-May-June2023

52 500CORPORATECHAMPIONS

Ourrankingofthe continent Top500 companies, covering 2021,shows notonlypost- Covid recovery but thehighest cumulativeturnoversince 2014.

82 INSIGHT /Africa-Germany

Thes cramblefor energy caus ed by Russia’s warinUkraine has prompted Germanytoturn it seyes tothecontinentfornew tradede als and par tner ships.

42 ENERGY DOSSIER

Symbion Poweris airliftinghydropowerto awholeof f- grid city, plus Eskom, Kenyan pricehikes and nuclear projects from Kore a.

90 LOGISTICS DOSSIER

Eg yptair’s pra gmatic approach, theSecond NigerBridgeand Transnet ’s PPP flop

THEAFRICAREPORT

57-BIS,RUED’AUTEUIL

75016 PARIS –FRANCE

TEL:(33) 144301960

FAX:(33) 144301930

www.theafricareport.com

CHAIRMANANDFOUNDER BÉCHIRBEN YAHMED

PUBLISHER

DANIELLEBEN YAHMED publisher@theafricareport.com

EDITORINCHIEF PATRICKSMITH

MANAGINGEDITOR

NICHOLASNORBROOK editorial@theafricareport.com

To findthefulleditorialteam, allourcorrespondentsand muchmoreonournewdigital platform,pleasevisit: www.theafricareport.com

SALES DISTRIBUTION

Tel:+33(0)144301834 l.kiraly@jeuneafrique.com

CONTACTFORSUBSCRIPTION: WebscribeLtd Unit 4College RoadBusinessPark CollegeRoadNorth AstonClintonHP225EZ

UnitedKingdom

Tel: +44(0)1442820580

Fax: +44(0)1442827912

Email:subs@webscribe.co.uk

ExpressMag

8275 AvenueMarcoPolo Montréal,QCH1E7K1,Canada

T: +15143553333

1yearsubscription(4issues):

Alldestinations:

€27 -$32 -£24

TOORDERONLINE: www.theafricareportstore.com

ADVERTISING DIFCOM

INTERNATIONALADVERTISING ANDCOMMUNICATION AGENCY

57-BIS,RUED’AUTEUIL

75016 PARIS -FRANCE Tel:(33) 1443019-60 –Fax:(33) 144301834 advertising@theafricareport.com

FEATURES

26 WIDEANGLE /Africaseeks‘greenminerals’advantage

Theracefor rare earthminerals and rivalr ybetween theUSand Chinapre sent s an ‘epo chal opportunit y’ formineral- rich countries.Z ambia, theDRCand Nigeriaare amongthecountries re adytos eize it.

34 SOUTHAFRICA /Thefirenexttime

As anew politics emerges in SouthAfrica, theANC is facingits toughes tbat tle yet,le avingPre sidentRamaphosa to dial downhis ambitions.

100 MAURITIUS FOCUS

Withtourists floo ding backand theopening of Africa’s third RenminbiClearing Centre, Mauritiusis bullish on grow th

PRINTER:SIEP77 -FRANCE N°DECOMMISSION

PARITAIRE :0725-I-86885 Dépôtlégal àparution/ ISSN1950-4810

THEAFRICAREPORT ispublishedby AFRICAMEDIAGROUP

4 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023

03 EDITORIAL 06 MAILBAG 08 COFFEEWITHTHEAFRICA REPORT/ JoselynDumas 12 Q2 /April 16 Q2 /May 18 Q2 /June

COVER CREDITS: MONT AGE JA

24th edition

BOTTOMLESS PIT

Pivotingtothe West by PresidentHichilemais not going to helplift Zambiaoutofpoverty inthe long run.Why?

WesternprivateFDI ishardly everaligned withAfricancountries’ sovereign economic interests.Itis almost alwaysexploitative financially,economicallyand ecologically.[…]

In my owncountry, Kenya,our President WilliamRutometwith BillGatesjustafterhis inaugurationin August last year andisnow aloud proponentof GMOagriculture, apet subjectwithGates. The economic, environmentaland foodsecurity concernsofmany Kenyanshave seemingly beenignored.

PresidentHichilema willneed to carefully considerZambia's engagementwiththese billionaires […]ashe pivots away fromChinese FDI.Otherwise,he'll be anothersad footnotein history,amongAfrica’s otherspinelessand clueless leaderswho

auctionedtheir nations’ wealthfortheproverbial 30pieces of silver.

AnthonyKuria

DEMOCRATIC ILLUSIONS

TheEmmersonadministrationislittledifferent from Mugabe’s;indeed it’sanextensionof it.Assuch,there'sno real democracyinthat economicallyblighted country.Mydeepsympathiesare with ordinary

HOWTOGETYOURCOPYOFTHEAFRICAREPORT

Forall your comments,sugge stionsand querie s, please writeto: TheEditor, TheAfricaRepor t, 57bis rue d’AuteuilParis 75016- France or editorial@ theafricareport.com

THEFALLOUT FROM PE ACE

Ifsustainablepeacein Ethiopiaisthe desired effect, [PrimeMinisterAbiyAhmed]isnot making therightchoices.[…]Hedidnotfree Tigray fromallforeignandnon-ENDFforces, hisforcesare colluding withtheirEritreanallies, andthe protectionofciviliansinTigrayisbeing neglected.Hehasalso beenagainstongoing initiatives ofthird-partyinvestigationsintoatrocitiescommitted.Sustainablepeacewillnotbe assured unlessthesebasic expectationsaremet […]Astothe choicethat Tigray authoritieshave to reintegrateintothe Ethiopianpolitical mainstream, Ifirmlydisagree.Whattheyshoulddo is maintainminimal representationatthefederal levelandconfinethemselves torunning Tigray Idon’tthinktheyhaveaplacein Ethiopian politics,and nor does theTigrayanconstituency.

Muluget a

Zimbabweans,whohave endured extraordinary hardshipsimposedby acorruptauthoritarian regimewhichtoleratesno opposition.

Gilber tAlabi Diche, Jos, Nigeria

MUTUALLY BENEFICIAL?

SouthAfricaisemerging as astrongnationof Africa, expressingand actingfreely,sometimes againsttheUS. Congress

[ispushing]theUS Presidentto[censure]

SouthAfricaso thatthe other[African] countries maycarefullydistance themselves fromRussia andChina. Sensingthe waningofAmerican prowess,warnings appear tohave noimpact onAfricancountries. Whilemaintaining good relationswith[theUS], theycontinueto deal with Russian and Asian economicpower. Anon

On saleat your usualoutlet.Ifyou experience problemsobt aining your copy,pleasecontact your lo caldistributor,asshown below.

ETHIOPIA: SHAMA PLC, AishaMohammed,+25111554 5290,aisham@shamaethiopia.com – GHANA: TM HUDU ENTERPRISE, T. M. Hudu,+23 3(0)20 9 007620,+23 3(0)2475 84 29 0, tmhuduenterprise@ gmail.com – KENYA, UGANDA ,TANZANIA: THENEW ZP OINT,D ennisLukho ola, +256 701793092, +254 724 825186,denluk07@ yaho o.com – NIGERIA: NE WS STANDAGENCIESLTD,Marketing manager,+23 4(0) 90 96 4610 00,new ss tand20 08@gmail com;STRIK AENTERTAINMENT NIGERIALIMITED, Mr sJoyceOlagesin,info.nig@ strika.com –

SOUTHERNAFRICA: SALES ANDSUBSCRIPTIONS:ALLIED PUBLISHING, Butch Cour tney;+27 08 327234 41,b erncour tney @gmail.com –

UNITEDKINGDOM: QUICKMARSH LT D, Pas caleShale,+ 44 (0) 207928 5443, pascale.shale @quickmarsh.com

UNITED STATES &CANADA: Disticor,KarineHalle,514 -4 34 -4 831, karineh@dis tico r.com

ZAMBIA: BO OKWORLDLTD, ShivaniPatel,+26 0(0)211230 60 6, bo ok wo rld@realtime.zm Forother re gions go to www.theafricarepor t.com

ADVERTISERS’INDEX

CIB P2;AFRASIABANK P5;LAGOSFREEZONE -TOLARAM P7;DIFCOMEVENTS P10;REP. OFNIGER P14-15; EBOMAFP19;REP. OFCOTED’IVOIRE P21-24; AFRICACEOFORUM2023 P33,89;REP.OFBENIN P41,73;MYTILINEOSHOLDINGS.A. P45;PERENCO P50-51;OCPAFRICA P63; ETEXNIGERIA P65; REP. OF GABON P68-69;SUBSCRIPTION TARP77;GFACONSULTINGGROUPGMBH P85;VERIDOSGMBH P85;UBAP 87;MSC P95;JETSTREAM P96; TANGERMEDENGINEERING P97; MAERSK P99;ROGERS P105;CIELGROUP P107;HARELMALLAC P109;EDBMAURITIUS P111; NINETYSIXHOTELCOLLECTION P113;EURONEWS P115;MCBGROUPP116

6 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023

MAILBAG

–

–

YOURGATEWAY TO ANEW FRONTIER like neverbefore Explore aseaofopportunitiesatLagos Free Zone. Giveyourbusinesstheedgeittruly deserves. Alucrativeincentivepackage, plug-and-playinfrastructure,andan unparalleledeaseofoperations. NIGERIA Unlock Industrial Plots LekkiDeepSea Port Ready-to-lease Facilities Reliablepower &gassupply Visit www.lagosfreezone.com orwritetousatlfzwebsite@tolaram.com to learnmore. ATolaramInitiative

Air freight to deliver hydro power

42 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

ENERGY DOSSIER

SymbionPowerCEOPaulHinkslovesa

By DAVIDWHITEHOUSE

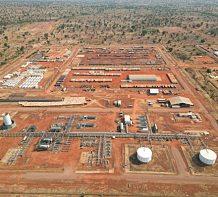

Fromthe startof2024, flights willbeused totransportturbines fromtheUS to theDemocratic Republic of Congo (DRC) for an initial project by Symbion Power becauseair freight ismuch faster thanshipping, CEO PaulHinks tells The Africa Report Shippingtimes from the US toAfricaare about fourtosix weeks, followed by a wait for port clearanceand the need to get the turbines by roadtoKinshasaand thenon to the final destination, the south-central cityofMbujiMayi. Thistimeframe is “unacceptable”, Hinks says.

Symbion,whichisbased in New York, develops, builds and operates power projectsintheMiddle East, AsiaandAfrica.The company to datehasinvested in 1,378MWof generationcapacityandbuiltmore than 4,000km of transmission and distributionlines.

Project logisticalissues have beenaggravated by Covid-19and theRussia-Ukraine war, Hinks says, withturbines now takingbetween three and six months longer tomanufacture.

“We want to short- circuitglobal supply-chain problems,” hesays Theurgency now isto “prove the conceptand deriskit. It’s worth

paying more for thefirst one.”

Havingused suchflightsto supplyprojectsin Iraq, theprospect doesn’t worryhim.Hiscompany undertook about 50flightsto Iraq between 2003 and2010tobringin materialssuch as steel and wiring

“Africa does not come close in difficultycompared to the challenges we faced”inIraqand Afghanistan, Hinks says.

Hugepotential

AccordingtotheAfrican DevelopmentBank(AfDB),the DRC’s hydro-powerpotential, at100,000MW,isthelargestin Africaandaccounts for13%ofthe world’s hydro-powerpotential. Yetthecountry ’s 6%electrification rateisoneofthe loweston thecontinent.

Factorsthathave prevented mobilisationofthe resource, theAfDB says, include poorly developed transmission and distributionsystemsandlackof infrastructure maintenance. The Electricité pourKapanga (ELKAP) non-profitorganisationinthe DRC says that the country’s hydro resources alonecould supplythree quarters ofAfrica’s energy needs.

Hinks has worked inruralelectrification for 40 years In developmentterms, ruralDRC is “as frontier asit gets”, whichispartof

43 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

challenge:afterhydro-powerprojectsinIraq andAfghanistan,heplanstouseairfreightto ‘short-circuitglobalsupply-chainproblems’ andgethisprojectsoffthegroundintheDRC PA BLO PORCIUNCULA / AFP

Symbionwilldevelopthe Makelelebiogasblock onLakeKivu

theattractiontothe entrepreneurial CEO: “Theplaces withthemost need are the ones where no one wantsto go.”

Experienceshows the security situation inconflict zones often improves whenelectricity becomes available, hesays. “Oncethepower isflowing, the localpopulations want it tobe continuous Our experience has been that ‘hot’ areas are oftencalmed by theadvent ofelectricity.”

Small-scale industries alsotend toquickly emerge insuchcases. “Someonewillbeginmillingflour andselling it, or they might build a workshop Once thishappens, village economies improve and the growthis exponential.”

Symbionhaspartnered upwith San Francisco-based Natel Energy, whichhasinventeda new type of hydropower turbine, for its Africa projects. Thepartnership, called MyHydro, planstoinvest$1bn over thenext10 yearstoinstall hydropower-based systemswith mini-grids acrossAfrica.

Poweringanoff-gridcity

TheDRC governmenthassigned anagreement for33MyHydro sites, whichHinks estimatesmay cost$500mto$600m.Theplanis toseekto raiseabout70%ofthat in equityand debt,withthe rest beingself-financed. Hinks says thatthecostings used are “veryconservative” and expectsthat turbine prices will fall over time The company isindiscussionsto raise debt for thefirst project, but would inany casebeable to go ahead on anall-equity approach,Hinks says.

Thefirst installations willbe onthe LubiRivernear MbujiMayi.The city was developed by Europeancolonialistsafter diamonds were foundthere in1909, butelectrification has passed it by. Mbuji-Mayihasa population of about 3 millionpeople andiscompletelyoffthegrid.

1.2MW

PhaseoneofSymbion’sprojectto deliverpowerintheDRC,withfirst electricityexpectedinQ32024

Construction of a 4.48MW facilityat Kabeya-Kamwangais expected tostart in the second quarterof2023. Theplan is to divert waterfromtheLubiRiver through a canaltothe power plant, where itwillpassthrough a turbine before being returned intotheriver a fewmetres away.

Thecompany says the process keepsthe river’s fishsafe, and that the turbines can be installed using locallabour and materials.

Phase1 ofthe project (1.2MW) willbe readywithin14months, whichmeansthatit willbe deliveringelectricityinthethird quarter of 2024. Thebalanceof 3.6MWwill becompleted inthe firstquarterof 2025. Inthe meantime, construction oftwo furtherplantsnearMbujiMayiisduetostart by theendof 2023, and other plantswillbebuilt inButemboandBukavu.

Symbionhasalso wona tender to develop theMakelele biogas blockon Lake Kivu.Thecompany willinvest$300mto developa 60MWgas-to-electricitysystem. EvenKivu with itsM23insurgency doesn’t faze Hinks. On a onetoten scale of danger, hesays the region ranks asfive orsix, compared to10 for IraqandAfghanistan.

Elsewhere,Symbion plansto build andoperate a $97m35MW geothermalpower plantin the Menengai volcanic craterin

$300m

Kenya’s Great Rift Valley. The company has a 25-year power purchaseagreementwith Kenya Power andLighting Company, and a steamsupplyagreement withthe GeothermalDevelopment Company parastatal.

DRC, Hinks notes, has 50% of Africa’s water, yet has oneofthe continent’s worst power supplies. Hinks argues thatthecase for hydropower isstrengthened when an existing grid system is lacking, becauseneithersolarnorwind power are constantly generated.

24/7generation

“[Solarandwind]arefinewhen theyareconnectedtogridsystems thathave other formsof generation capacity,” Hinkssays.“Butifthat isnot availableitmeansthatthere isashortfallofcapacity every time theystopoperating.”

Costtotheend-useristhe decisive factor. Off-grid solaris very expensive because analternative sourceofpower capacityis required, suchas a diesel generator Solarprices are also loaded in favourofurbanconsumers.

In Kenya, for example, thecost forahouseholdtobuypowerfrom thestateutilityinNairobiisabout $0.18per KWh,Hinkssays.In ruralareasthe rates forisolated mini-gridsareaminimumoftwice thatcost.That’swithouttaking intoaccountthe factthatdisposableincomesareusuallyhigherin cities andsothe real burdenonthe ruralconsumerishigher,headds.

Provided that theriversused are perennial,with verified historical flowrates, hydropower operates 24 hoursperday, 365days per year, Hinks says Thetariffs from a MyHydro power plant willbe closertothecostofthestateutility in Kenya in off-grid situations, at around $0.19, Hinks says. Ifthe power ismade available on-grid, thecostislikelyto be closer to 10 cents, headds.

44 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

Symbion’sexpectedinvestmentinthe MakelelebiogasblockonLakeKivu

ENERGYDOSSIER /Airfreighttodeliverhydropower

“MYTILINEOS -ANINTEGRATEDENERGYUTILITY”

2022 wasa milestone year forMYTILINEOS, aleadingglobalindustrialandenergy companywitha strongpresenceinall five continents.Itwas theyearoftransitiontoa newera throughitscorporatetransformationinto MY TILINEOS Energy & Metals andnowthecompanyiscovering twobusiness Sectors, theEnergy andthe Metallurgy Sector. Strategicallyplaced attheforefront of theenergy transition as aleadingandintegrated greenutility,withaninternationalpresence, MY TILINEOS is also establishingitselfasareferencepoint of greenmetallurgy.

THE“ENERGY EXPERT ”

Especiallyinthe EnergySector,MYTILINEOSis rapidlytransforminginto anintegratedenergyutility,aimingtoprovideits customerswitha wide range of solutions,derivingfromthe digitalacceleration of energy services. Simultaneously, the companysustainsitsleadingpositionintheentirespectrum of energy,fromthedevelopment, constructionandoperation of thermalunitsandRESprojectstothedesignand construction of electricityinfrastructureprojectsandsupplyandtrading of naturalgas. It is aglobalmanufacturerand contractor of solar energy and energystorageprojects, providingreliablesolutions acrosstheprojectdevelopmentspectrum,fromstandalone projects to complexhybrid systems. With strongknow-how, internationaloperationsandunparalleled responsiveness, MYTILINEOSdesignsandimplementshigh-qualityprojects foritsclients, resultingin agrowingportfolio of 9.1GWinRES projects (all technologies)andstoragein Greeceandabroad. In addition,MYTILINEOSis aleadinginternational contractorinthe construction of specialized, large-scale turnkey energyprojects, undertakingthefull range of services required forsuccessfulimplementation,whetheritis conventionalelectricitygeneration projects,energytransitionprojects (e.g.distributionnetworks, hydrogen etc),orelectricitysavingprojects,digitaltransition, smartcities& IoTplatforms

MY TILINEOS IN AFRICA

In Africa,MYTILINEOShas astrongpresenceensuringaccess to sustainable, afordable, reliable, and modern energy to all citizens,alwaysbasedonthelatest technological developments andinternationalbestpractice. Especiallyin Ghana,thecompanyhas worked for3 projects.Firstly,the Combinedthe Cycle

PowerPlantprojectin Takoradi thatincludesthe engineering, procurement, constructionand commissioning of a192MW combinedcyclepowerplantinTakoradi. Theplantwillbeimplementedwiththe capability to operateonbothnaturalgas andlightcrudeoilandwillutilizethelatestadvancedversion of GeneralElectric’s well proven9Egasturbine.Secondly,the LPG PowerPlant projectin Tema,thatincludestheengineering,procurement, construction and commissioning of a200 MWpowerproject capable of beingfueledbyLPG, NaturalGas and Diesel.Lastbutnotleast,theengineering,procurement, installation, commissioning,and operation &maintenanceof10 GeneralElectricTM2500+ mobilegasturbinepowergenerating setswith atotaloutputof256MW at ISO conditionsin Takoradi. InNigeria MYTILINEOS’ of-Grid Hybrid PowerProject of 7,5MW willelectrify four Nigerianuniversities. Thepowerplantcomplexconsistsofonepowerplantof3MW,two of 2MWandone of0.5MWoutputpower. Furthermore,in TunisiaMYTILINEOS undertook a5.5MWphybridpowerplant, close to theADAM existingoil concession of EniTunisia, consisting of solarpower togetherwith abattery energy storage systemandan Energy Management System. Theproject’stargetistoreducefuelgas consumptionup to 50% of thegeneratorthanks to Energyfrom theADAM hybridpowerplant.

Alongwithitsenergyprojectsintheareaandits continued commitmenttodeliver to allcitizens afuture withenergyautonomy, MYTILINEOSalsohas alonghistoryofcommitmentto social responsibilityandenvironmentalsustainability.Through itsdonations to the St NicholasSchool,itssupporttoenvironmentalinitiativesanditsscholarshipstodistrictcommunity childrenshelters,the companysupportsand contributes to theneeds of local communities,actingasanenabler of growth andprogress.

www.mytilineos.gr

ADVERTORIAL JAMG -P HOT OS DR

SOUTHAFRICA

Eskom’s slide from first-in-class to murderous dysf unct ion

SouthAfricanstate-ownedutilityEskom,onceapowerhouseofthecountry,isnowits albatross,plaguedwithdebtandcorruption.Howdiditgetthisbad,andcantheruling ANCgetthelightsbackonforSouthAfricansbeforethe2024elections?

By JONMARKS

Only four yearsafterapartheid’s whiteminorityrule fell,South Africain1998 produceda new White Paper on Energy Policy that was settoendow its power industry with a state-of-the-artcommercial and governancestructure. It would unbundle the giantstate utility Eskom, whosesize andtechnical capacity, and abilityto deliver infrastructure, meantthe national champion was rated amongthe world’s top fourpower companies.

Fast-forward 25 years, andEskom has declined from continentalpowerhouse to flounderinginan ever more severe crisis SouthAfrican consumershave beencondemned to rollingblackoutsandonerous debts; allofwhichhave shaved percentage pointsoff the country’s gross domestic product (GDP).

Statebailout

Sograve are Eskom’s financial problemsthat finance minister Enoch Godongwana – backed by mineral resources andenergy ministerGwede Mantashe,a key power broker – has committed the cash-strapped governmenttotake onuptotwo-thirds ofthe ailing utility’s debt, whichtheNational Treasurylast Octoberput ataround R400bn($23.5bn).In February, heannounced that thestate would cover R184bn of debtpaymentsas they falldueandtake over R70bn of the debtatthe endofthree years

The extenttowhichEskom has becomeprey tothe worst aspectsof SouthAfrican factionalpolitics and crony capitalism was underlined in enquiries into ‘statecapture’ during JacobZuma’s graft-ridden presidency. Zuma's allies the Guptasand othersmanipulated the coal supply and other Eskomcontractswith hugelydamagingconsequences.

Theabuses have continued into Cyril Ramaphosa’s presidency. In Januarytherewere chilling reports thatEskomCEO André de Ruyter hadsurvived anattemptto kill him with cyanide-laced coffee on 12 December. Two days after the alleged assassinationattempt, DeRuyter resigned – as demanded by Mantashe among others, who favourstrongstatecontrol ofthe economy andpreferto find scapegoatsbeyondthe AfricanNational Congress (ANC) establishment.

Sixthingstofix

Mantashehadcomplained that DeRuyter was too focused on anti-corruption campaigns, at the expenseof restoringthe power supply. Oneofthe ANC’s more internationally respected figures (andnow responsible for Eskom),public enterprises minister Pravin Gordhan,said theattemptonDeRuyter’s life would bethoroughlyinvestigated andthose responsible “must be charged”. Anotherday, another Eskominvestigation.

Ramaphosahasmobiliseda National EnergyCrisis Committee, amongother things, toturn round thesector. For SouthAfricato emerge fromthis crisis, sixissues need tobetackled: incomplete reforms,politicalinterference, bad planning, financialand strategic miscalculations, managementand governance failure, and a culture that permits corruption.

46 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023 ENERGYDOSSIER

REUTERS

REUTERS

Eskomhasbeenshiftedtotheenergyministry, ledbyinfluentialGwedeMantashe

FormerCEOAndrédeRuyter:toofocusedon fightingcorruption,accordingtoMantashe

Unbundlingandothersector reformshave beenenvisaged since at least the 1998 White Paper, but theelectricity supplyindustry(ESI) remains‘verticallyintegrated’, withEskom retainingthecentral role in generation, transmission anddistribution.

Amidstthe rolling blackouts, the ESI has become a political football. Some arguethat greater independence for commercial companies would allow thesector to overcomeitsproblems, while thoseonthe leftwing of the ANC coalitionbelieve more statecontrol isneeded. As a result, Eskom willbeamajorissueinthe2024 elections–potentially definingjust how farbelow 50%ofthenational votetheANC descends.

Projectslike thegiant 4.8GW Kusile and 4.2GW Medupi coalfired plantsoffered a big capacity increase as a key part ofEskom’s New Build Programme, butthey have suffered huge cost overruns and delays. Underconstruction for somany yearsthatthey were able to secure finance fromthe World Bank Group(WBG)andothersbefore donorscametoshun bigcarbon projects, the two power stations have hugelyadded toSouthAfrica’s external debt Meanwhile, developingcriticalareas like transmission have been overlooked toooften for thesector’s comfort

Windandsolar

TheSouthAfricanenergyscene hasnotbeenunremittinglybleak: the RenewableEnergyIndependent Power Producer Procurement Programme(REIPPP)hasinstalled large amountsofsolarandwind capacity.ButREIPPP–nowinits sixth roundofbidding– wasdriven by theNational Treasury ’s IPP Officein Pretoria, ratherthan by offtakerEskom.

There are realconcernsthat thesupposedlyground-breaking $8.5bn JustEnergy Transition

Partnershipcommitment to sustainableinvestmentinSouth Africa will founder. Thepact, made withmajor western donors at COP26in November2021, could failamid concernsthefunds would merelybeused for yet another Eskom refinancing.

DeRuyter lefthisjobon

22 February, afterhis notice period was curtailed, but theappointment ofEskom’s latestCEO could take several months more asbigpolitical playerspromote‘their’ own candidates. There has beenmuchdiscussionofsacking theboard. Gordhan believes filling “vacantpositionsat board level isanurgentmatter”.

Downthroughthe ranks, Eskom’s managementhas beenhollowed out, with many techniciansand otherspecialists emigratingto work abroad. One recent government plan isto recruitor rehire experienced formerEskomstaff.

In2021, News24 exposed internal documentsshowingan estimated R178bnhadbeen losttoEskom tenderfraudduring Zuma’s decade inpower. The cases continueto ramp up:in October, former CEO Matshela Koko and 16 senior

$256bn

officials were arrested on charges relatingtoallegedlyfraudulent contracts worth R2bn.In December, WestminsterMagistrates Court in Londonapproveda National Prosecuting Authority request to extradite formerEskom contractor Michael Lomastostand trial in a R745mfraudcase.

Rottentothecore

Many believe DeRuyter was fighting suchabuses. He “had soughtto turn roundEskom by takingonalleged criminal syndicates thathave beendraining thestate utilitythrough corruptcoal andothercontracts,” the Financial Times said when reporting on his attempted poisoning. DeRuyter had called coal-producingMpumalanga “a gangsterprovince”.

This all speaks notonlyof poor management by plodding publicsector officials, or ofbasic but accidentalfinancialmiscalculations made in government departments and Washington DC, but of a system rotten to the core. Bad managers have beenprotected by a political establishment thathas playeda vitalhistoric role, butat a pricethatmay now betoo great.

Eskomboasteda longtradition of bringing togethertalented people in a culture that promoted survivalofthe enterprise above all.But history shows that even the strongest ofnationalandcorporate cultures can implode.

47 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

100% 90% 80% 70% 60% 50% 40% 30% 2009201120132015201720192021

POWERPLANTPERFORMANCE – SOUTHAFRICAvsUS - Energy Available Factor

UNITED STATES Wansley plant Schererplant SOUTHAFRICA Tutukapowerstation Duvhapowerstation

Eskomanditsmega-projectsaccount foraroundaquarterofSouthAfrica’s $256bnnationaldebt.

SOURCE: DAIL Y INVESTOR

GORDIANKNOT

Kenyan power-pr ice hikes ta ke business to the br in k

Whilegovernmentwants topushKenya’spower pricesup,manufacturers saytheywillbeforcedout ofbusiness,damagingthe country’seconomy

By HERALDONYANGO inNairobi

Risingcoststriggered by Russia’s invasionofUkrainehave made lifeimpossible forAfrica’s utilities.Havingalreadyincreased prices by 10%inMarch, Kenya PowerandLighting Company (KPLC) wantstoimplement another roundofelectricity pricehikes

Butmanufacturers, forwhom powercostsareamajor factorin theiroutput,arepushinginthe oppositedirection.The Kenya AssociationofManufacturers (KAM),a lobbygroup, wantspower tariffstobe loweredtoboost industry.Inflationsurgedto 9.2% in February,mainlyduetoincreasingenergycosts.

To reducethepower levy would furthersqueezethecoffersof thestrugglingpowerdistributor, whichsunktoa KSh1.1bn(nearly $265m)net loss by lastDecember, largelybecauseofpowercutsand

a depreciatingshilling.

The KAM estimatesthatelectricitypricehikes couldcostmanufacturers KSh19bn(around$4.6bn) –a23%riseinthecostof doing business,which wouldfurther batterthealreadybeleaguered economy. As itstands, Kenya’s powercostsarehigherthanin mostotherAfricancountries, includingEgypt, Ethiopia, TanzaniaandSouthAfrica.

“Theproposaltoincrease electricitytariffsshallhave detrimentaleffectsonthe economyif implemented,” KAMCEOAnthony Mwangitells The Africa Report

KSh31

“Formanufacturers,theproposal is especiallyjarringbecauseKPLC seekstotransferthe lossesithas madetotheconsumer.”

KPLC wantstohiketheprice perkWhfromthecurrent KSh12 to KSh16.48 forthecommercial andindustrialcategory–meaning customerswhousemorethan 15,000unitsmonthly.

Choicesneedtobemade Taxe s and levies willtake the finalelectricity cost for industrial consumers upto KSh31($0.25) per KWh inApril,should the proposals get the regulator ’s nod.

Governmentofficialshave defended thepower hike move, arguingthat thepriceincrease is overdueand was suppose d to occurback in2019. “We re ceived their[themanufacturers’] re commendation.Itis a revenueallocationissue and we ne ed to lookat

48 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

ThetotalcostofpowerperKWhifthe proposedpricehikesfromKenyaPower gothroughinApril.

ENERGYDOSSIER

Electricity pricehikesfor industryget passedonto consumers

FISSILEAMBITION

South Korea wantsslice of Africa’s nuclearmarket

AsAfricancountriesfirmuptheirnuclearambitions, KoreaHydro&NuclearPower(KHNP)iscomingfora shareofthecontinent’semergingmarket

By MUSINGUZIBLANSHE inKampala

Africa’s ongoingindustrialisationandelectricity deficitmake nuclear power inevitable, given skyrocketing demand.The World Bank estimates thatatthecurrent electrification rates, over half a billionpeople insub-Saharan Africawill stillbewithout electricity in 2030

Africa’s nuclear power agenda has so far beenshaped andfunded by globalsuperpowerssuchas the US, Chinaand Russia, raising fearsthat it could turnouttobe an extensionof a global political schismasRussia’s war with Ukraineentersitssecond year.

produces 1400MW, itsAPR 1000, which generates 1000MW, as wellasits SmallModular Reactor (SMR).Ugandahasshowninterest inthe APR 1000 model,Chaseop tells The Africa Report

Ready, steady…

About a dozen Africancountries have shownfirminterest in developingnuclear energy Ghana, Kenya,Morocco,Niger, Nigeria andSudanhave engaged with theInternational Atomic Energy Agency toassesstheir readinessto embarkon a nuclear programme. Algeria, Tunisia,Ugandaand Zambiaare alsostudying thepossibilityofnuclearpower.

theentire context,” says Daniel Kiptoo, director generalatthe Energy Regulatory Commission of Kenya,the stateagency mandated withpower pricing for thestateutility

Kenya Power is frustrate d at beingtheonlyonetoshoulder the costsandrisks associate d with power distribution,whichtakes a toll on itsbottomline. Itsfinance s were de alt a majorblow by a 15% tariffcut ordere d byformer PresidentUhuru Kenyatta.

Manufacturersand industries contributemore thanhalfof Kenya Power’s revenue, de spite comprisingonlyabout 10%ofits customerbase. “If you re duce one here,youle avea hole somewhere else. Sothequestionis, wheredo we plugthathole?If were duce for manufacturers, are we willingto increase for domestic consumers orstreetlights?”asks Kiptoo.

South Korea, one ofthefive countries inthe world thatcan exportnuclear power, is keen to stake a claim fora share ofthe continent’s market.

At the Africa Nuclear Business Platformin Kampala on14March, South Korea hadthelargest delegationandits expo tent was the biggest. Korea Hydro& Nuclear Power (KHNP)signed a memorandumofunderstanding (MoU)with Uganda,which hasan ambition of producingnuclear energy by 2030.

ThoughtheMoUisnonbinding, ChaseopKim,KHNP ’s generalmanager for overseas business development, tells The Africa Report thatitis vital sinceitwillunlockcooperation channels:“We are focusing on human-resourcemanagement becausebuilding a nuclear power plant requires well-trained human resources.”

South Korea was promotingits standard design Advanced Nuclear Power Reactor(APR)1400, which

South Africa istheonlycountry inAfricawith a nuclear power plant Egypt is currentlyconstructing a nuclear plant worth$25bn, financed by a Russian loan.The 4.8GW project, whoseconstructionbegan inJulylast year, is being developed by theRussian stateenergycorporation Rosatom.

Last year, Ghanasaid it was in thefinalstages ofannouncing a site fora nuclear power plant, whattechnologywillbeused and thecontractorwhowillbuild it.

ThoughAfricancountries have shownambitions, funding for nuclear power technology remains a key obstacle for the continent, accordingtoIbrahimAbabou, head ofAfrica andMiddle Eastat theNuclear Business Platform.

Ababouargues thattheinternationalcommunityneeds topush financialinstitutionstoprovide financing for nuclear power, given that many internationalbanks will not financeitatall. “That is harming thesector,” he says.

49 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

SIMON MAINA / AFP

PERENCO, CREATINGENERGY OPPORTUNITIES FOR30YEARS

30yearsago,HubertPerrodo, FounderoftheGroup,hadtheidea oftakinganinterestinmatureoil fields,closetoabandonment, tobringthembacktolife.

ThestrengthofPerenco’smodel isthereforeforgedonitsabilityto revitalisetheproductionofmature ormarginalfields:takeoverand investto renovate,adapt,optimise and redeveloptoproducethem responsiblyandprofitablyfor allitsstakeholders.

Thus,eachyear,Perencoinvests nearly 3billiondollarsinitsfields andfacilitiestoapplythe latesttechnologiesinvented andpatentedbyitsteams.

TheOguendjofieldinGabon,thefirstfieldtaken overbytheGroup,isanexcellentillustration. Commissionedin1983thenboughtin1992by Perenco,itsendoflifewasestimatedat5years. 30yearslater,however,itstillproduces1,000barrels perdayandisduetoundergo amajor redevelopment projectintheyearstocome.

Otherfieldsfollowed,othercompaniesaswell,proof ofthemodel.

15yearslater,Perencomadethesameobservation ontheassociatedgasproducedwithoil.

Initiallyburnt,Perencowonderedhowto recoverthis other resourceassociatedwithoilproduction.

PERENCOTHENINITIATED APROCESSOFGASRECOVERY INAFRICATOPRODUCEELECTRICITY

•InGabon,Perencohasbeensupplyingthegas necessaryfortheproductionofnationalelectricity since2008,whichtoday represents100%ofthe electricityinPort-Gentiland70%inLibreville,as wellasgasfor anumberofindustries.

•InCameroon,KPDC(KribiPowerDevelopment Company)startedup a250MWplantin2013 powered100%bygassuppliedbyPerenco.This plant represents30%ofnationalelectricity

•IntheDRC,Perencohasbeensupplyinggasand electricitytotheentirecityofMuandasince2001, includingvariousinstitutions,suchasthegeneral hospital,andalmostallthevillagesintheterritory

www.perenco.com

•orerecentlyinChad, 7monthsaftertakingoverthe BadilaandMangarafields,Perencoisproviding thegasneededtoproduceelectricitytosupply Moundou,thecountry’seconomiccapitaland secondcity,whichuntilthenhadnocontinuous publicsupply.

INLIGHTOFTHESEACHIEVEMENTS, PERENCODECIDEDTOINDUSTRIALISEITSGASPRODUCTION BYDUPLICATINGITSSUCCESSFUL MODELFORTHEDEVELOPMENTOF MARGINALOILFIELDS

•IntheDRC,inordertostoptheflaring,Perenco hasstartedtheinstallationof anetworkof compressorsandpipelineswhichwilleventually connectnearly400wellstomakethemconverge towards aplannedLPGproductionplantof10,000 tonnesperyear.

•InGabon,intheprovinceofOgooué-Maritime, theBatangaplantcurrentlyunderconstruction willmakeitpossibletoproduce,fromthesecond halfof2023,15,000tonnesofLPGperyearfor theGabonesemarket,enablinga reductioninits importsbymorethan40%.

Perencoinvestsinthe recoveryofgasintheformof LPG(LiquefiedPetroleumGas)andLNG(Liquefied NaturalGas).

•InTunisia,theOumChiahprojecthasbeen producing26,000tonnesofLPGperyearsince 2008.

•InCameroon,PerencobuiltanLPGproduction unitin2018toproducedomesticgas,whichuntil thenwasmainlyimportedandsubsidizedbythe CameroonianState.The restofthegasis recovered in afloatingliquefactionunit,theHilliEpiseyo,the world’sfirstFLNGvesselconvertedfromanLNG carrier.ThisproductionnowallowsCameroonto reduceitsLPGimportsbynearly40%.

•InFebruary2023,Perencoannounced anew projectworthmorethan abilliondollarsforthe transformationandmodernisationoftheCap Lopez TerminalinGabonandtheconstruction ofanLNGproductionunit.Inthefirstquarterof 2026,itwillallowGabontobecomeself-sufficient inLPGandanexporterofLNGwith along-term annualproductiontargetof700,000tonnesofLNG and30,000tonnesofLPG,whilecreatingseveral hundreddirectandindirectjobsinthecountry.

Bycarryingoutseveralpioneeringprojectsinthe gassector,Perencohasestablisheditselfasoneof themajorplayersinitsdevelopmentontheAfrican continent.

Furthermore,bycombiningoperationalexcellence andsustainabilityin theimplementationof its operations,Perencocontributestotheprovision ofnew revenuesforStatesandtothesupport ofstrategiesforenergyindependenceandthe reductionofcarbonemissions.

ADVERTORIAL

AFRICA

82 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023 INSIGHT /

83 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023 THEMBA HADEBE/AP PHOTO/SIP A ChancellorScholzvisited AfricalastMay Goodbye Russia,it’s been agas. Hello African continent Africaisemergingasanattractive tradingpartnerforGermanyamid aglobalrealignmenttriggeredby Russia’swarwithUkraine GERMANY

By XOLISAPHILLIP inJohannesburg

German businesses have long overlooked thecontinentin favour oflucrative marketselsewhere. In 2021, only 1% of Germany’s foreign direct investment wentintoAfrica –a figure of €1.6bn($1.7bn), of which €1.1bn was sub-Saharan Africa.Butthisisallduetochange. Risingtensionswith Moscow and Beijinghaveforced a rethinkand the governmentis keen to foster opportunities inthe world’s fastestgrowingcontinent.

“Russia’s war ofaggression inUkraine represents a clear break in German foreignand economic policy,” says Christoph Kannengiesser, CEOofthe Berlinbased German-AfricanBusiness Association (Afrika-Verein).

“Africancountries, whichhave so far received onlymarginal attention,are now emergingas attractive partners,” hesays.

Now 90 yearsold,theAfrikaVerein counts550members, representing 85%of German business interestsinAfrica.Itsmembers workin numeroussectors, from financialservices, energyand manufacturingtochemicals, pharmaceuticalsand shipping. They include suchcorporategiants as Allianz,Airbus Defenceand Space, BASF South AfricaandBayer.

Middle-classmarkets

Economic indicators pointtothe continentas the nextmajorgrowth regioninthe world,addsMartina Biene, managingdirectorandchairperson for the VolkswagenGroup SouthAfrica(VWSA). She says the company is determined nottomiss outonthe wave ofgrowthcoming toAfrica,hometothe world’s fastest-growingmiddle class

In all,some600 German companies are doing business inSouthAfrica,withtotaltrade between thetwo countries adding uptoR266bn ($14.7bn) a year

In2022, South African exports to Germany wereworth$8.83bn, accordingtothe UN Comtrade database, with vehicles asthe major earner

Oneimmediate consequence of theconflictinUkraine has been Germany’s overnightscramble to secure new energysuppliers.

For more than a decade, businesses andhouseholds inEurope enjoyeda steadystreamofRussian gasflowingthrough the 1,200-km Nord Stream pipelineunderthe Baltic Sea. WithNord Stream 2 comingonline, thepipelines were projected to secure Europe’s energy supply for thenext50 years.

ButNordstream1 isclosed indefinitely and mired incontroversy over whoplanted explosionsthat have caused leaks, and Germany suspended certification ofNord Stream2 as a sanctionagainst Russiaatthestartoftheconflict.

AccordingtotheAfrika-Verein, thecontinent is well positioned as

Senegal’sgascouldease theGermanenergycrisis

analternative source for Germany’s energyneeds, while helping efforts todiversifysupply and value chains. Senegal’s gas fieldscould easethe Germanenergybottleneck while Namibiaoffersthe potential toproducegreen hydrogen,says Kannengiesser

Unlockinginvestment

TheAfrican Energy Chamber (AEC), aSouthAfrica-based trade groupthat billsitself as ‘the voice oftheAfricanenergysector’, aimsto capitaliseonthepositive sentimentstounlockEuropean investment. The continent requires upto$1.7trn to boost upstream gas productionand become a significant force inglobal gassupply.

InpartnershipwiththeAfrican Export-Import Bank andmarketresearch firm RystadEnergy, theAEC is on a charmoffensive inEuropethat kicked offin Londonand Oslo in January. On 23 February, theChamber hosted an InvestinAfricanEnergy reception in Frankfurt to arguethatthe continentholdsthe keys toEurope’s energycrisis.

“German companies have the technologyand expertisethat Africaneeds,” says NJ Ayuk, theChamber’s executive

84 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023 INSIGHTAFRICA/GERMANY /GoodbyeRussia,it’sbeenagas.HelloAfricancontinent

BP

‘Germancompanies havethetechnology andexpertisethat Africaneeds’

Email:info@veridos.com

Tel:

InvestinlocalIDdocumentproduction!

Internationally re cognize dI D documentsguaranteeaccessto the wo rld –n otonlybecaus et he y allo wc itizenstotr ave l.The yg ain re cogni tion and thu sb ri ng economicgr ow thto ac ountr y.

WhenofferingsafeIDs tructures, ac ountry fuelst henationaltrave l industr y, whichleadstomoretourists,butalsoenhancedinternational exchangeandknowledgetransfer.

Sure,establishingsuch ac omplex sys temtakestime, especi ally when ex istingstructuresha ve no t beenupdated re cently.W hatour ex pertsfr om Ve ridos re commend

insuchsituations:startfromthe scratchan de va luate ho wtob rin g significantpartsof va luechain insid et hecountr y.

Oneofourcustomer sw ho ve nturedthi ss tepisUganda.The state-ownedUgandaPrintingand PublishingCompan y( UPPC)joine d fo rc eswith Ve ridosto fo rmthe UgandaSecurit yP rintingCompany (USPC).Thi se nablesthecountr y topr ov ideitscitizenswithst ateof-the-artidentit yd ocumentsinc ludin ge Pa ssports. An ew lyconstructed facilitywillcre atej obsfor highlyskilled wo rker s–ani mpor-

tantsteptomakethecountr ymore independentandcost-efficientin theprocess.

Ve ridos,itself aj oin tv entur e betweenBundesdruckereiand Gieseck e+ Devrient,bring sk nowho wa ndmor et han150 ye ar so f ex periencetothe tabl e. Wi thour holisticapproach,wecanimpr ove theentir eIDs ys tem -f ro mp hy sicaldocu ments t oIDm anagement sys temsandbordercont ro l solutions. We beli ev einp erso na l exc hanges andinvolvementofloca le xperts. Th is isth eo nl yw ay tocreate as ustainab ledocument

lifecyclethatpr ov ideseconomi c de ve lopmen tforbothgo ve rnment and citizens.

GFAConsulting Group GmbH Eulenkrugstraße82 -22359Hamburg

Email:info@gfa-group.de

Phone:+4940603060 www.gf a-g roup.de

Newtrendsin theenergysector

WhatisGFA’sexpertise?

GFAC onsultingGroupisoneof theleadin gE uropea nc onsulting firmsinthede ve lopmentcooperationsector.For ove r40y ear s,we ha ve pr ov idedconsultingservices in ove r1 30countriesfromour headquarter sinG ermany.A frica hasalw ay sb ee nak ey re gio nf or us. We conductcomple xs tudies andprojectsonbehalfofleading de ve lopmentagencies,ministries, andgo ve rnmenta la gen cies .O ur ex pertise co ve rs manyareasthat ar ec rucial fo rs ustainable de ve lopmentin Af rica.

WhatisGFA’s

contributiontotheenergy sectortransformation

in Africa?

Un derourClimate &E ne rg y Cluster,wei mplementsustainabl ee ner gy pr oject sa lon gt he va luechain –f ro mg eneratio nt o consumption .W eh ave gathered ex pertise,knowledge,andskill s todealwithcomple xc hallenges inth ee ner gy sectorthus helping Af ricancountriessupplytheir pe opl ew ithcleanan da ffordabl e electricity

Whatarethenewtrends intheenergysector?

Digita lisationha sl ongbecom e anessentialconsideratio nint he ene rg ys ector.C ur re ntl y, app ro ximat ely70 %o fo urprojectsha ve digitalcomponents .T heproductionanduseofgreen hy drogen wil lbea gamechange ri nt he ener gy se ctor(seeH2Globa lA dv isor y, ac ompanyofGFAG ro up: www.h2-global.d e) .AtG FA ,w ea re buildingcompetenciesinthistopic,whichhasbecomeaninte gr al partofourportfolio.

Theuerkauf, Director,Energy Depar tment, GFA Consulting Group

MESS AG E

Xavier Prost, Vice President BusinessLineIDMS at Veridos; IDMSsindIdentity ManagementSystems.

Veridos GmbH Oranienstraße91,10969 Berlin,Germany

+493025899840 www.veridos.com EXPERTADVICE

MESS AG E

Ulrich

CDEQB Subscribetoournewsletter:www.gfa-group.de/newsletter/

Asecureandsustainable energysupplyis acrucial factorfor development. EXPERTADVICE

chairman. “We hopeInvestin AfricanEnergywill foster a newera of improved cooperation.”

Meanwhile, the corridorsof politicalpower are also wakingup tothecontinent’s strategic importance, withseveral ministries in ChancellorOlaf Scholz’s administrationupdating theirAfrica strategies to align with the shifting international dynamics.

Delegationsgetbusy

InMay 2022,Chancellor Scholz visited Senegal,Niger and South Africa,accompanied by a German business delegation keen to deepen trade, investmentandenergy cooperation. Vice-Chancellor Robert Habeck(who is alsothe minister for economic affairsand climate action) followed suit in December withvisitstoNamibia andSouthAfrica.

“African countries are gaining inimportance for the German administration,” Kannengiesser says. “Germanpoliticiansare also becomingincreasingly aware that the German privatesector isan importantpartnerincooperation with Africancountries,” headds

Kannengiesserpointsto reforms totheinstrumentsof foreign tradepromotionputinmotion by Habeck’s ministry.TheMinistry forEconomic Cooperation andDevelopment’snew ‘Africa Strategy’isanother exampleof how GermanthinkingaboutAfrica is evolving(seepage88).

Germany isalso leadingthe charge inengagingwithAfrica atthemultilateral level,says Kannengiesser. TheG20 Compact with Africa was initiated under the German presidency in2017 topromoteprivateinvestmenton thecontinent Along with the 2021 GlobalGateway initiative that provides theframework for the EuropeanUnion’s externalinvestment, these effortssignal a new normalwiththecontinent.

LastJune, ChancellorScholz invited President Cyril Ramaphosa ofSouthAfricatoattendthe G7 SummitinMunichashisguest. He said thatheconsidered SouthAfrica a key partnercountry.

Despite all therhetorical overtures, Kannengiessersays the German government needs to do more tomeetthe demands for private-sectorcooperationthat Afrika-Vereinhearsabout from its Africanpartners: “Unfortunately, we stillsee far too few concrete approaches by the German administrationtosupport German companies inAfricaeffectively.”

Greenopportunities

Inothersectors, Kannengiesser notes that EastAfricais experiencing a strongdrive fora circular economy, while SouthAfricais becominganattractive market for Germanelectric cars.

Bienesays sheasked the German Association ofthe Automotive Industrypresident,Hildegard Müller, tosupport the push for cleaner fuel quality duringMüller’s recent visittothe region.

Poorfuel quality“limits us, to a certain extent, intermsofmodels we cansupply”, Bienesays. Cleaner fuel would also helpaddress climate change on the continent.

Despitethechallenges,Biene says Africa’s economic potential is “huge” and Germancompanies such as VW want in.

“Ithink Europe has realised this istheone and onlygrowing region it wouldbe goodtobepartofwhen itkicks off,” shesays “Everybody wantstotapintoit. And we want to be in thefirst wave.”

Germancars,African supplychains

VolkswagenGroupSouthAfrica (VWSA)operates thebiggest car factoryonthe continentinKariega, in the coastal provinceofEastern Cape. There,thecompanybuilds several models fromitsPololineof cars, employing about4,000people.

MartinaBiene, managing director and chairpersonforVWSA,saysVW believesinthe region’s potential. “Everywhere I go, Itelleverybody thatwewanttoventure intoAfrica – andthatwe’vestartedthatjourney already,” shesays.

TheVWSAbosshas a laundry listof itemsthattheGerman governmentand African states can assistwith to boost the auto industryonthe continent.

“Weneedsupportinvehicle production,”saysBiene.“Wewould wantGermanytoencouragesuppliers tocometoAfricatogetherwith usasanOEM[originalequipment manufacturer],tobeinaposition tomanufactureordomorethan vehicleassembly.”

“Howcanyougrowanindustry tothelevelandstandardsthatweas aEuropeanheritagemanufacturer wouldbehappywith?[With]skills transfer,education[andby]encouragingsuppliers.”

Biene addsthatAfricacan help lay the groundwork forfuture investment bytightening up its regionalauto policy, looking into the development ofcleanerfuelsandcurtailing a sizeablesecond-handcar market

“We need automotive policiesto increase new-cardemand andto come to a thresholdofvehicles.The same applies to South Africa,” saysBiene. “What limitsinvestment onlocal content isthatwe need morevolume.”

TheKariegafacility ison the smallersideforVWand is comparable totheOsnabrückandPune plants inGermanyandIndia.“The higherthe productionnumbers,thebetterthe localisation,andthe moreattractive forsuppliers,”saysBiene.

86 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023 INSIGHTAFRICA/GERMANY /GoodbyeRussia,it’sbeenagas.HelloAfricancontinent

Africa’seconomic potentialis‘huge’, andGerman companieswantin

Thewoman, thefutureof achanging world! EBOMAFGROUP: SIEGESOCIAL,SISBOULEVARDDESTANGSOBA, OUAGADOUGOU,BURKINA FASO. 10BP13 395OUAGADOUGOU10,TEL:+22625 3723 83, FAX: +22625 37 24 66, E-mail:ebomafbureauouaga@ebomaf.com TOGOCASABLANCA,Bvd du 30Août Siègedela filiale togolaise :08BP81545Lomé08 Tel:0022822 21 11 48 /Fax :0022822 21 11 35 BENIN: Résidenceles Cocotiers/01BP5259Cotonou Tel:00229 21 15 4539 /21304395/65000800 CÔTED’IVOIRE: 26BP 31 Abidjan26,Deux Plateau Tel:+22522 41 42 26

INTERVIEW

Bärbel Kofler

By NICHOLASNORBROOK

A new ‘AfricaStrategy ’ from Germany’s Ministry of Economic Cooperationand Development aims for climate-change solutions thatacceptthe responsibility of industrialised countries, and a more humane way tomanage migration. Thestrategy has been over a year inthemaking, says parliamentary statesecretary Bärbel Kofler, and involved conversations withscientists, business, politicians, civil society and youth in both Germany andonthecontinent.

While the economic focusis oncreating the 25million ‘decent jobs’ for youth needed each year inAfrica,thepolitical content “is aboutthree basics:itshould be more social, more ecological,and more feminist,” says Kofler.

Germany does not wantto hide itsbusinessinterestson the continent. Rather, “we see that thoseinterests will only cometo a positive endifthere is economic development”. There willbe a focus oncreating local value. “We are one

ofthe few ministries supporting theAfricanUnionwiththeAfrican Continental Free Trade Area,” Koflersays.

There is alsocapacitybuildingto allow Africancountries to get the most from theirnatural resource projects “You need strong administrative skillsontheonehand, andalsothe negotiatingskills,” says Kofler, pointing to aBerlinbacked plancalled CONNEX which supports governments around the world intheirnegotiationswith energyandmineral multinationals.

Thesearch for win-winsolutions alsoincludes integrating European plans for climate-friendlyenergy options, suchasgreen hydrogen production in Africa “If you look attheEuropeanNew Green Deal, we need this exchange,” says

Kofler “And we also, ofcourse, need thesupport from the African side onthat.”

Onclimatechange, “we as Europeans, ormaybecountries from a richeror more industrialised part ofthe world,have a great responsibility ”. Germany will, for example, supportaninsurance network for agricultural losses caused by climate change.

Trainingfuturemigrants

Koflerisclear that Germany willnotbe followingthe leadof countries like the UK andNorway, whoare signing dealswith Rwanda tosend migrants toAfrica for processing. She says Germany is workingwith the AU tocome up with solutionsthatare mutually beneficial, “and fair for everybody” Itiscreating ‘Centres for Migration andDevelopment’infive countries inAfrica,which willprovide vocationaltraining for thosewho want tomigrateintoparticularindustries inEurope

There isalso a desire toengage withthearrival of China as a lead partner onthecontinent “It’s easier to do thefingerpointing”, says Kofler, “but that’s not reallyhelpful. We have tocomeup withbetter instruments and betteroffers for Africanpartners.”

88 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023 INSIGHTAFRICA/GERMANY /

‘We have to come up with beter ofers’

The ParliamentaryStateSecretaryintheMinistry forEconomicCooperationandDevelopment outlines Germany’snew‘AfricaStrategy’

STEFFENKUGLER.DE

‘WE ARE LOOKING FORSOLUTIONS THAT ARE FA IR FOREVERYBODY’

SAVETHE DATE REGISTER www.theafricaceoforum.com 5&6 JUNE2023 ABIDJAN CO-HOST FOUNDER

Egyptair liftsof af ter Covid

90 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

LOGISTICS DOSSIER

Despitetensionsover theGrandEthiopian RenaissanceDam, Egyptairisstill collaboratingwith EthiopianAirlines, andisrevivingits valuableRussian tourismmarket

By NELLYFUALDES

The Covid-19pandemic wasa litmus test for the world’s airlines, showing how nimble they could be.Ethiopian Airlines quickly reacted to the crisis, converting passenger planes tofreight tobecomeAfrica’s humanitarianhub for thetransportationofmedical equipmentand vaccines. Unlike its Ethiopiancounterpart, Egyptair, which flew nine millionpassengersin 2022, hasnotmanaged to establishitselfas aninternational hub, despiteits size and geographicaladvantages. Transit traffic accounts for only 25%ofCairo InternationalAirport’s traffic, compared with 70%at Bole Airportin Addis Ababa, accordingto data compiled by traveldatafirm OAG. “ThemainassetofEgyptair? The pyramids,” says Jean Adadevi,consultantat Lufthansa Systems

But22 million airtravellerslanded inEgyptin2022,which is higherthan thepre-pandemic levels(20.8 million in 2019).Theincrease was even registered before the returnoftheChinese clientele. Egypt is among20 destinationstowhichChina reopened group travelon February 20.

Egyptair relaunched its routes to Guangzhou, Beijingand Hangzhou inMarch, restoringits pre-Covid

91 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

KHALED DESOUKI/AFP

Covid-awareHurghada welcomestouristsback inJune2020

levelofgeographicalcoverage andfrequency. “Wehavealready received verypositivefeedback onbooking volumes,” says YehiaZakaria,Egyptair’sgroup chairman andCEO.“Egyptis a strongproduct.”

Zakaria wasappointedin early2022asheadofEgyptair Maintenance &Engineering,just10 monthsbeforebeingpromotedto thegroup’s topposition.

Egyptair,whichturned 90 in May 2022,istheonlyAfricancarrier aside from EthiopianAirlinesto have more than100 aircraft at its disposal. At thetimeof goingto press, theairlineowns 74planes, both BoeingandAirbus,including thefirstAirbusA321neoinAfrica, and leases around29furtherplanes.

Whatmaybesurprising, however, isthatwhile Cairo and AddisAbabaareatloggerheads overthe Grand Ethiopian RenaissanceDam,theirtwo nationalairlinesare collaborating.Thetwostatecompanies are members oftheStarAlliance, alongside theLufthansa group, United(US)andAirChina.They have also co -signedmoreadvanced code-sharingagreements for certainroutes.

Partnershiphelps...

“Thispartnership beganin2010 toenablethetwocompanies to strengthentheirpresenceinAfrica, theMiddle East,LatinAmericaand Europe,” says Zakaria.

Theagreementbetweenboth carriersismainly forthe Addis Ababa-Cairoroute,inadditionto whatZakaria describesas“white spots”inAfrica,or destinations that EthiopianAirlinesoperates flightstoandandEgyptair does not.TheseincludeBujumbura, Ndola, Lome,andHargeisa.

“Wealso keptKigaliinthe contractafter openingourdirect routefromCairo,togiveour customers moreoptionsand

flexibility,” says theEgyptairCEO, who describestheagreementas an “ongoing process”.São Paulo via AddisAbaba wasaddedin November2022

TheagreementallowsEthiopian Airlinestoofferitscustomers tripstosomeoftheEuropean andMiddle Eastern destinations thatEgyptairflies to,including Amsterdam,Athens,Budapest, IstanbulandAman.

Thecooperation existson aneed-to-knowbasis: even Egyptair ’s senior executives and commercialpartnerssaythey arenot awareofit.Travelsearch engines, includingthoseofthe twocompanies,offer possibilities otherthanthose resultingfrom thepartnershipbetweenEgyptair

and EthiopianAirlines. “Alliances do notalwaysbenefitbothparties Theycan evenendupcostingone ofthepartners dearly iftheyare toounbalanced,”saysasource familiarwiththematter.

...butcompetitionisstillkey

InOctober2020,Egyptairsigned amemorandumofunderstanding with Accraforthecreationof Ghana’s nationalcarrier –under thenoseof EthiopianAirlines, whichcovetedthe deal.Egyptair waseventuallyditchedbyAccra in favourof AshantiAirlines. Meanwhile, ithasbeentryingto buildits ownAfricannetwork.

“Wehaverecentlylaunchednew destinationsinAfrica,namely Kinshasa,DoualaandMoroni,” says Zakaria. “Other routes will be operatedinthefuture, depending ontheir economicviability.”

Egyptair,whose logo features the ancient falcon-headed godHorus, demonstratesacertainknow-how intermsof realpolitik. In 2022,the companywas able toadaptto anew

92 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023

ALL

TheGrandEthiopian RenaissanceDam: flyingoveritprovides perspective

RIGHTS RESER VED

YEHIAZ AKARIA

74

Graduatingfrom Military Technical Collegein198 4, Zakarias tar tedhis career in the Eg yptianvir Force, endingup as As sis tant AirForce Commander.

LOGITICSDOSSIER /EgyptairliftsoffafterCovid

NumbersofplanesownedbyEgyptair, of afleetof101planesoperated bythecompany

geopolitical reality: the Russian aggressioninUkraine

AlthoughEgyptcondemned the offensive in the two UN votes of MarchandOctober2022, Egyptair increased itsservices toRussia, a key grain suppliertothe North Africannation. Last December, it doubled itsflightstoMoscow from seven to 14a week

To Russia,withlove

Egyptisalsopreparingtointensify directconnectionsbetweenRussia andthe RedSea resortsofSharm El-SheikhandHurghada,capitalisingonthegrowingglobaltravel restrictionsonRussiannationals. Thelattermakeuponethelargest singletouristgroupstoEgypt.

The restorationofdirect links between EgyptandRussiabreathes new life intoEgyptiantourism, which was abysmally impacted by the2015bombingof aRussian plane over centralSinai,and later the repercussionsof Covid-19.

Metrojetflight9268,achartered AirbusA321,tookofffromSharm

SinceDecember2022,Cairohas doubleditsflightstoMoscow

El-SheikhinNovember2015, onlyto explodeshortlyafterin theair.Theattack,which leftall 224passengersandcrew members dead, wasclaimed by theterrorist groupIslamicState.However, anEgyptiancourtruled in2020 thatthecrash wasnotanactof terrorismandthatthere were no grounds forcompensation.

Fewerthan50,000airpassengerstravelled fromRussiatoEgypt in2018. Accordingto OAG, this hadrisento 667,000in2022,and 715,000in2021.

Howmuch does Egyptaircost theEgyptianstate?Thisquestion ishardtoanswer,giventhehidden subsidies involved instate- owned airlines. But, even beforethe Covid crisis,the losses were increasingly colossal: €105m($113m)in2015, €251min2016, €1.1bnin2019,

and €164min2020,according toch-aviation.2018istheonly yearinwhichwhenthecompany bucked thetrend, recording €164mprofit.

“The eventsoftheArabSpring, which devastatedthe regionin 2011, madeactivityinEgypt unstable, particularlyaffecting theairline.In2018,amorestable politicaland economicenvironmentimprovedour results,” commentsZakaria.

Dynamicstructures

Adadevi,theconsultantat Lufthansa Systems,says that “2018 wasa year of economicboom whichbenefitedglobaltourism,in Egyptaselsewhere.”

To securea $3bn loanthrough theIMF’s Extended Credit Facility, which was greenlit on December16, Egypt needs toproduceanannual report and a quarterly follow-upon paymentsin the budgetarysector, whichincludes public companies suchasEgyptair.

EgyptairCEO Zakariasays: “After Covid-19, ourstrategy isto focus on restructuringthe network,modernisingthefleet and improvingourservices to achieve better results;and this was reflected duringthepastfinancial year.” He adds that turnover for the 2021-2022 financial yearstoodatE£42.4bn (around$1.37bn).

Accordingto Adadevi, despite itscapabilities anditsstatusasthe secondairlineonthe continent, Egyptair isnot as dynamic as Ethiopian Airlines: “On the one hand, there is a company [Ethiopian Airlines] that hasalways known how to renew itself, is verysensitive tocosts, andstrives to do the maximum by itself, fromtraining totechnique On the other[hand], [Egyptair’s] structure [is]heavier, [its]organisationchart depends on politics, and [it]is veryslow totake a decision,asseen by its relatively slow digitaltransformation.”

93 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

MINASSE WONDIMU HAILU / ANADOLU AGENCY VIA AFP

x2

Ju lius Berger’s br idge to prosperity

Theopeningofthelong-awaitedSecondNigerBridge marksoutabrightfuturefortheNigerianconstruction firm,aswellasforthecountry’sSouthEast

By TEMITAYOLAWAL inLagos

Cause for celebration:the Nigerian constructionconglomerateJulius Bergerhasfinally delivered onan age-old promise by the country’s leaders to builda secondbridge across the NigerRiver.

PresidentOlusegun Obasanjo made the promiseonhisarrival as civilian presidentin 1999… but only flagged off construction a few days before he leftoffice, in 2007.

Fitsandstartsand years later, thebridge finally opened totraffic on15December. LinkingOnitsha inAnambra State with Asaba,the capital of Delta State, it is hoped it will help restart economic activity inthe regionafterthe end oftheoil boom and Covid-19.

Theconstructionsector’s contributiontoNigeria’s GDP fellfrom

4.35%in2015 to -5.95%in2016, accordingtothe National Bureau ofStatistics(NBS).Mirroringthat, Julius Berger recorded itsbiggest lossin years, hit by thedisappearance of itsmajorcapital sources – governmentspendingand foreign direct investment – andhighadministrative costs.

Civil works constitutethe company’s biggestearneroutof itsthree core segments, which alsoinclude building works and services. In its 2016financialstatements, it posted more than N3.8bn

N9.5bn

JuliusBerger’sprofitaftertaxfor2021, showingaturnaroundinfortunesfor theconstructioncompany

(nearly$8.3m) loss aftertax, a sharp declinefromits N2.4bn profit aftertax a year earlier.

Signs of recoverycame in2021 when JuliusBerger paid its highest dividendinfive yearsatN2,500 pershare, upfrom N400inthe previous year Its recently released 2022unaudited results also show thatthecompany is returningtothe profitabilitypath.

Compared to2021’s results, the company grew its revenue by 23% toN440bn;grossprofit by 3%to N68.5bn;profit before tax by 8.5% toN15.4bn; andprofitafter tax by 11.7% toN9.45bn,accordingto Nairametrics analysis. This, along with Julius Berger’s stringof big projects, brightenits2023outlook.

A salveand a symbol

TheSecondNigerBridgehas nationalandpoliticalimportance inNigeria forseveral reasons.It connectsthesoutheasternpartof Nigeria,wherethereare regular calls forsuccession,tothree other regions:South West,North Central andSouth-South.Italsocomplementstheoldandonlybridgeused forthispurposeuntilnow. Built in1965,theRiverNigerBridgeis perenniallycongested.

Stanley Anyadufu,director generaloftheOnitshaChamber of Commerceand Industry, says thebridge willsignificantly reduce traffic congestionand ease doing businessin the SouthEast, which is a keymanufacturing region.

A recent report by theNational Inland WaterwaysAuthority revealed that65%ofimported containers are destined for the region.

“With the bridge, and the reductionintraffic congestion that it will facilitate, there willbe man-hourgains and faster logistics movement ofinputs for [the]manufacturingthat the regionisknown for,” Anyadufusays

Consideringthatthisimportant bridge has been a political

94 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

FINALDELIVERY

JULIUS BERGER

LOGISITICSDOSSIER

Jobwelldone: theSecondNigerBridge

campaignmattersincethe1979elections, it wasa major achievement for Julius Berger to be selected tobuild it by PresidentMuhammadu Buhari,after the project was renegotiated andits funding retooled Thecompany finallytook over theconstructionofthe bridge in 2015, but there was stillpublic scepticismthat it was ever goingto becompleted.

Theopeningto vehiculartraffic of the 1.6kmlongbridge duringtheChristmas and New Year celebrationsis a majorstep, but otherpartsofthe infrastructure projectare still to be completed. They include the constructionof a 10.3km highway, anOwerriinterchange, and a toll station atObosicity.

As the construction company that eventually surmounted thedauntingtask, Julius Berger saw its stock go up Itisfurther positioned asthe construction company of choice for otherprojects ofsuchnationalsignificance.

Insidetrackwithgovernment

“Wieser, congratulationson an excellentjob done onthisproject byyou and your workers

You have justified our investmentin this project,” theminister offinance, budget and national planning, ZainabAhmed,told Julius Berger’s projectdirector Friedrich Wieser during her visit tothesite inApril 2022.She alsocommended the company for the numberof womenitemployed onthe constructionsite.

Other keyprojectsthatthecompany iscurrently buildinginclude the Abuja-Kano Road,which is a DualCarriageway of375.9km fromthe Federal Capital TerritoryAbuja,throughcities in Kaduna andthen to Kano(part of the Lagos-Algiers Trans-AfricanHighway); key industrialcities innorthernNigeria;andthe38km(including17 bridges) Bodo -Bonny Road,whichwillconnect Bonny Island,partof Nigeria’s key oil and gas base, tothe restofRiversState andNigeria.

Nigeria is by far thebiggest market for the Abuja-headquartered company, which floated on theNigerianStock Exchange in1991 In2020, Julius Berger generated N237bnin revenuefrom Nigeriaand the remainingN5bn fromits operationsinEuropeand Asia.

In2017, thecompany ventured intothe oiland gassector by acquiring a 20% stake in Petralon Energy Limited, in afirstmajordiversification move. InSeptember last year, italso diversified into agro-processing by buildingand commissioningits Lagos-based cashew processing plant, Mighty Kashoo.

forAfrican

enquiry@jetstreamafrica.com www.jetstreamafrica.com Door-to-doorvisisbility Fast TradeFinancing Tech-drivenEfficiency LOGISTICSDOSSIER

Simplifying Global Logistics

Businesses

SOUTHAFRICA

Transnet too risk y for pr ivate investors

PresidentRamaphosahastoldthestate-ownedlogistics companyto‘implementreformsswiftly’afterthefailureof itspublic-privatepartnershipofferin2022

By XOLISAPHILLIP inJohannesburg

SouthAfrica’s state- owned logistics company needs aninjectionof private-sectormoney. The government’s Operation Vulindlelais a programmeof reforms designed to unlockit. Thus, in February 2022, President Cyril Ramaphosa was allsmiles whenheannounced that national railoperator Transnet would beallowingthird parties accesstothe Transnet Freight Rail (TFR)network.

On28March2023,thepresident wasbeatingadifferentdrum.He putoutastatementsayinghehad ‘directed Transnettoimplement reformsswiftlyandcompletely toturnaroundthecrisisinSouth Africa’s logisticssystem’.

Transnetadvertisedthesaleof 16slotsonatwo-yearcontract

basis.Biddingisathree-stage process:thesuccessfulfirst-stage bidderis requiredtocomplete asecondstage, whichinvolves gettingthegreenlightfromthe RailSafety Regulatorandother conditionsimposed by Transnet. Shouldthebidderfulfilall requirements,third-partyaccess wasdue tokickoffinthe2023/24 financial year,whichstartson1April.

However, by theendof Novemberonlyonebidder, TraxtionSheltam,hadsuccessfully completedthefirstphase.

African RailIndustry Association (ARIA)CEOMeselaNhlapo says 18companies initiallyshowed interest. “Two [companies] applied for access andonlyone was successful. This provesthat Transnet’s onerousterms and conditionsare notappealingtoprivate investors,” shetold journalistsat a November mediabriefing

Longgameapproach

Nhlaposays ARIAconsiders third-partyaccess “a longgame”. Therefore, thetwo-yeartrialperiod offered by Transnet is insufficient considering theupfrontcapital costswhichwill be incurred for participation.

“You can’t have anassetthat costs R50m ($2.9m)thatisonly going to work for two years. It’snotinvestmentfriendly,” shesays.

Furthermore, shebemoans Transnet’s retention ofgrandfatheringrights, the lackofsecurity guarantees, and voetstootsprovision, whichmeansaccess willbe provided tothe freight railnetwork infrastructure asis, no matterwhat condition it is in.

Universityof Johannesburg’s transportprofessor Jackie Walters tells The Africa Report that there are “huge issues” withTFR’s current operation. “You can see itall the way downtotheRichardsBay port with coal. Last year, they managed onlyabout 55m tonnes, where[as] thecapacity oftheport is 71m tonnes,” Walterssays Transnet cites vandalismandtheunavailabilityof locomotives as constraints toTFR’s performance

Some18companieswereinterestedin takingupslotson Transnet’sfreight routes;onlytwoapplied

Inthesix monthsto30September 2022, Transnet reported R36.1bn ($2.116bn) in revenue, equivalentto the company’s debt repayments, and R5bn profit, afteranR8bn lossthe previous year.Nhlapo issceptical abouthow the company reevalued its assets, and wentso far as tosay that Transnetis “another Zondo commission” waiting to happen.

98 THEAFRICAREPORT /N°123/APRIL-MAY-JUNE2023

18

WA LDO SWIEGERS/BLOOMBERG VIA GETTY IMAGES

LOGISTICSDOSSIER

Transnettriedtodigitself outofacrisisandfailed

End-to-endLogisticsinAfrica

ShapingAfrica’slogisticslandscape

On acontinentclockingupdevelopmentmilestonesat arapid rate,including aContinentalFreeTradeArea, solidsupplychainsandend-to-end logisticsarekeyto ensuringseamlessandsustainable interregional and internationaltrade.Maersk,presentinAfricasince the 1950’s,is tailoringitsintegrated logistics strategies and solutions to partnerAfricainmeetingAUAgenda2063 goals and contributetothe continent’s potentialas akey playeringlobaltrade.

Infrastructure challenge

Despit er ecentl yu pgradedandefficientports, developmentisbeingheldbackby weak roadand rail densityandpooraccesstoelectricity.With theAfrican Continental Free Tr adeArea(AfCFTA)set to spark ap ro je c te d2 8%increaseinintra-Africantradeand demand foralmost2million trucks,100,000 railwagons, 250aircraftand ove r1 00 ve ss elsby2030 ,t ra nsport, localinfrastructureand logisticsarecrucialareas for investment.

Maerskaims to connectandsimplifyglobalsupply chains byaddressingthe bottlenecksfacedby their customers inAfrica. Variousinvestmentshavebeenmadeacross the continentin termsofLogistics Parks,ColdStores andintegratedsolutions to driveeconomicgrowthand improve the flowof food ,goodsanddatathatsustain people,businessesandeconomiesthe world over.

Trainingandupskilling

Increasedmanufacturing andlocalsupplychainsmeans bringin gal argelyi nformal ,u nskilled wo rk fo rcei nto the formalsectorwhiletheadventofdigitaltechnology haschangedthe conventional skillsetin everysector, requiringupskillingof traditional rolesandintroducing

newones.Maerskhascreated acultureoflearningwithin thecompany to build apoolofhighquality,skilledand knowledgeableemployees,launchingtraining courses inthenecessaryskillsfor atechnology-drivenfutureand developinganinternalAfricaLeadershipDevelopment Programme. We alsostrivetoattractyoungpeopleto ourindustryand,throughourpartnershipwithLawhill Maritime CentreatSimonsTownSchoolinSouthAfrica, prepare them formaritimeandrelatedindustries.

Digital transformation

Theanswertomany ofAfrica’s supplychain woesare digital.Cloud-based supplyc hainsof fe ra two- wa y information exchangewithsupplychainpartnersinnear real-time,easyaccess to information,scalabilityand reliability, reconfigurability,andhighperformance–all withoutcomplex infrastructure management.As aleading end-to-end logisticscompany,Maerskhasdeveloped logisticsandsupplychainplatforms,continues to design digitaltools thatprovidevisibilityas wellaspredictability that supports companies to anticipateand predictmarket changesand disruptionsacrosstheirsupplychainsothat theycan scalequickly in response.

Streamliningcustoms

Africa’sdigitaltransformationstrategy (DTS)aims to build digitalinfrastructureanddigitalpublicinfrastructure (DPI),essential to supportingtheAfCFTAandenabling smooth cross-borderinteractions.

Maersk’sSupplyChain Managementplatformintegrates thecustomsprocessfor exportdatamanagementand downstreamimportbenefits,inlinewithAfrica’sdigital singlemarket(DSM)aspartoftheAfCFTA,wheredigital solutionsandaccess to datawillalso streamlinecustoms procedures. www.maersk.com

ADVERTORIAL JAMG -© D.R.

UK MIGR AT ION DEALSN EED AR ET HI NK

ne ed immigrationinorderto remain economicallyproductive.

The government’s controversial Rwanda policy,w hichit de scribe so n its we bsite as a‘worldfirstpartnership totackle [the] globalmigrationcrisis’,hasalsocomeunder scrutiny.Critics describethepolicy of flying asylumseekerstoKigali for‘processing’and apotential ‘new andprosperouslife’ inthe Africancountryasan exerciseinsmokeand mirrors.Rwandaisonlyabletotakein1,000 asylumseekersduringthetrialperiod, at a costofover£170m($208m).Thistranslates to astaggering£170,000cost perperson.

Furthermo re ,t hepropose dI llegal MigrationBilllists57countries fora similar deal.Only 19% oftheseare Africancountries, andonlythree arewilling toaccept women. SomeAfricannationshave already rejecte d the ide a,suchasGhana.

TheUK’spropose dIllegalMigrationBill, introduce dbyH omeSecretarySuella Braverman,hasdrawncriticismforitsperceive dnarrow focuson domesticsolutions to acomplex globalproblem.

Aimedasa deterrentto ‘smallboatcrossings’,thebillmakesprovisionto detainand remove fromtheUKanyonewhoarrives by illegalmeans.Withthe UN estimatingthat morethan100millionpeopleare forcibly displacedworldwide,criticsarguethatthe government’scriminalisation andstigmatisation ofso -called ‘illegal’migrantsisbothmorally reprehensibleand economicallyshort-sighted

Numerousstudies have shownthatimmigrationhas anetpositiveeffectoneconomies, particularlyintermsoftax revenue s.

Researchconducted by ChristianDustmann and TommasoFrattini ofUniversity College London foundthatimmigrantswhoarrived intheUKsince2000have madeconsistently positivefiscalcontributions,regardlessof theircountryoforigin.

As such,manyarguethat boththeUKand Europe

As sumingthat ea chcountry re quires a similarfinancial de al to t hat ofRwa nda, thecostcouldamounttonearly£9.79bnon partnershipsalone,afigurethatcouldbe betterspentinve stinginclearerand fairer policies that allowfor secure, safe and legal immigration intothe country

Giventhe re ality ofthebuildingglobalmigrationcrisis,criticsarguethatitis hightime fortheUK governmenttoadopt am oreh umane and ec onomicallysound app ro ac htoi mmigrat io n. Criminalising andstigmatisingvulnerablepopulationsis not aviablesolution.

Instead,the governmentshouldinvestin policies that re cognisethe economicand moralbenefitsofimmigration.The va rie dethnicbackgroundofthis government suggeststhatthesesortsofargumentsmay alreadybestaringtheminthe mirror

Anincrea sing number of mi grant st o Europe hailfromAfrica,whetherthrough displacementornot.Africanshave barely contribute dtot heclimat ec risispushing themout oftheirhomes;forcing themonto planes addsinsulttoinjury.

114 THEAFRICAREPORT /N°123 /APRIL-MAY-JUNE2023 LASTWORD

OADEBAYO Writer ALL RIGHTS RESER VED

ADOBESTCOK

ANOPENWINDOWONAFRICA

Africa’sgrowthpotentialinallitsvastnessiscalling. Embarksafelyonthis venturewiththerightpartner.