moreradical calls forchange. Leading the chargeatthe General Assemblywas Mia Mottley,prime minister of Barbados,who called fora“newinternationalism”.

Mottley ’s plans included the IMF issuing another $650bn of its special drawingrights (SD Rs) re se rvec ur re ncyt oh elp finan ce clean- energy projects in developing econo mies.She also called forthe reallocation to developing economies of at least $100bn of the SDRs issued by the IMF last year,aswell as special channels of concessional finance forprojects strengthening resilience to climate change. TheIMF couldcreate its own“special environmental drawing rights”facility

Such proposals arebecomingmainstream. In September,Denmark became the first coun try to offer “loss and damage” compensation to stateshardest hitbyclimatechange. And UN Secretary General AntónioGuterres has been pushing countries to impose windfall taxes on oil and gas companiesmaking mega-profits crisis

The four horsemen of what meteorologists call the climate endgame –conflict,chroni food shortages,extreme weather and vector borne disease –are galloping at an ever faster pace towardsus. In the Sahel, the Indian Ocean seaboardand in the Horn of Africa, theyhavealready arrived and are tearing aswathethrough communities That is whyyoungactivists areonthe streets demanding serious action: anew greendealand the funding to go with it

Prote sters area lso joining up the dots,callingfor widerchange in the multilateral system.Thatstretchesfrom restructuring the UN SecurityCouncil, to reforming the UN’s specialisedagencies, as well as theIMF andthe WorldBank

Thismakes the lack of urgencyall the morepuzzling in therun-up to COP27, the first UN climate summit in Africa, in November.Preparatory talksatthe UN General Assembly attractedonly aderisory number of top decision-makers.The prospects of ground-breaking deal in Egypt,asour editors and correspondents explain in this edition, arefar from stellar.

It is the interconnectedness of the threats al ong si de clim ate chang e–d ee pening inequality,the food and energy crisis or the risksofanother pandemic–thatisdriving

Kris talin a es to help nous shocks damageare on is how ey,along and La tin odemands ernational raUNtax chanism and a emooted erence on year. Egypt climate on climate and comnthe calls louder.

Busine ss experience is not lacking among the top candidates for president in Nigeria’s elections.

Mozambique’s government is hyping up the revenues it expects from LNG production, but oil majors are wary due to rebel attacks.

Our ranking of the larges t companie s in the African financial services sector.

THE AFRICA REPORT

BIS, RUE D’AUTEUIL

PARIS FRANCE

TEL: (33) 1 44 30 19 60

FAX: (33) 1 44 30 19 30 www.theafricareport.com

DANIELLE BEN YAHMED publisher@theafricareport.com

EDITOR IN CHIEF PATRICK SMITH MANAGING EDITOR NICHOLAS NORBROOK editorial@theafricareport.comTo find the full editorial team, all our correspondents and much more on our new digital platform, please visit: www.theafricareport.com

Tel: +33 (0)1 44 30 18 34 l.kiraly@jeuneafrique.com

CONTACT FOR SUBSCRIPTION: Webscribe Ltd Unit 4 College Road Business Park College Road North Aston Clinton HP22 5EZ United Kingdom

Tel: + 44 (0)1 442 820580

Fax: + 44 (0)1 442 827912 Email: subs@webscribe.co.uk ExpressMag 8275 Avenue Marco Polo Montréal, QC H1E 7K1, Canada

T : +1 514 355 3333

1 year subscription (4 issues): All destinations: €27 $32 £24

TO ORDER ONLINE: www.theafricareportstore.com

INTERNATIONAL ADVERTISING AND COMMUNICATION AGENCY

57-BIS, RUE D’AUTEUIL 75016 PARIS FRANCE

Tel: (33) 1 44 30 19-60 Fax: (33) 1 44 30 18 34 advertising@theafricareport.com

PRINTER: SIEP 77 FRANCE N° DE COMMISSION PARITAIRE : 0725-I-86885 Dépôt légal à parution / ISSN 1950-4810

As asign of howhighfood insecurity is rising, nearlyeightmillion people–orhalfofSomalia’s population –are in need of humanitarian assis tance due to yearsofbad rains and the impact of Russia’s waronUkraine.Adam Abdelmoula, the UN humanitarian coor dinatorfor Somalia, toldmedia: “The faminereviewcommitteeassessedthat faminewouldhit Somalia sometime betweenmid-October andDecember, unlesswemiraculously manageto upscaleour humanitarian response. That is,byall accounts,a very big ‘if ’, given the current levelofresources that we have at hand.”

Medium term (Oct.’22 –Jan. ’23)

Presence countries

Minimal

Stressed Crisis Emergency Famine

Notmapped

NET

FEWS

Remote monitoring countries

Minimal Stressed SOURCE:Crisisorhigher

Climate changeisamajor factor, bringingmoreunpredictability Abdelmoula said: “The current unprec edenteddrought –a result of four consecutivefailed rainyseasons –with thefifth and thesixth projectedtoalso be belowaverage,iscausing huge food insecurity.”

Conflict also plays arole. As the map shows,Somalia is not the only African region experiencingafood security crisis. Areasofthe Sahel, Ethiopia,Sudan, South Sudanand Kenyawillalsohavevery high levels of need forfood assistance.Kenya is theonly country with food insecurity notcurrently host to an armed conflict.A report from the WorldFood Programme

says:“High staple food pricesare constraining householdpurchasingpowerand food access in both urbanand rural areas. Staplefood pricesrangefrom 22% to 63% above averagefor maize, and12% to 44% above averagefor beans.” Estimatesare that 4.1 million people, mostly in Kenya’snorth, areexperiencingacute food insecurity. With theCOP27climate summit set for Egypt in November,the pressureisonpolicymakers to find solutions to thecurrent and futureproblems caused by climate change across Africa andthe world.

NEDBANK’SOFENTSE THELEDI on therisks of SouthAfricabeing named on theFinancial Action Task Force’s grey list forweakanti- moneylaunderingand counter-terrorismfinancingmeasures

Kenya’sPre sident William Ruto will havea tough decisiontomakeon 14 October, when thenew fuel priceregimecome sto an end.Prices have alre ady risenafter thegovernment optedtocut subsidie s, and ares et to ris efur ther

On 1October,Emrie Brown take soveras chiefexecutive of SouthAfrica’sRand Merchant Bank (RMB). SheisanRMB veteran, having recently served as head of banking and head of inve stment banking.

‘Global correspondent banksand other financial institutions […]are likely to demand ahigher level of duediligence’

TheAfricaand Middle East operations of US carmaker GM will be runbyJack Uppal, aGMveteranofmorethan20 ye ar s. He will be seekingtotakeless ons fromhis most recent positioninChinato expand auto sale sonthe continent.

Index scores for climate resilience of African countries in 2022

>70 60-69

Africa Risen: ANew EraofSpeculative Fiction feature s32s cience fiction,fantasyand other storie sfromAfrican writer s, highlighting their creativity and world-building.

TheUnitedNations es timate sthatonthe eve of thet wo -yearanniver sary of thes tart of theconflict in TigrayinNovember 2020,that alarge segment of thepopulationof115 million is in need of humanitarianassis tance, es timatedtocos t$ 3.1bn.

Medium Lower

Higher 27 Africa

50-59 40-49 35-39 25-29 15-19

47 Southern Europe

*Averages basedon10countries in Southern Europe, N53inAfrica odata

The world’sdeveloping countries have their best chance in recent timesofgetting abetter deal on climate justice with Egypt’s hosting of the UN COP27climate conference on 6-18 November African policy-makers argue that theyneed to be unitedand have aclear agenda when going into these tough negotiations

Former WorldTrade Organisation director Pascal Lamy told media his thoughts about the continent’sfocus.“Africa’s main problem is not reducing itscarbon emissions.[…] Africa’s population is going to doubleby2050,which is the time we have adopted fornet zero carbon economies.Africa’s energy needswill grow, Africa’s energy consumption will grow,and then the question is howcan Africabestmanagethis trajectory.”

But even if poorer countries areabletoget big commitment to financing agreen revolution and climate adaption policies,the battleground will shift to getting rich countries to respect their promises–something that continuestoprove difficult.

More and more, clientsare looking forwaystokeep their staff productiveina dynamically changing business environment.Whether your people areworking from home, theoffice or abroad, thereisagrowing recognitionthat digitising your operations can offer unprecedented commercial value in flexibility,pro ductivity and growth. This new, digitalrealitymeans that it is moreimportant than evertostayagile -if thereisanything that can slow abusiness down, it is being burdened by old technology

Having made substantial investmentsinfibretech nology,high-speed terrestrial and undersea net works andnew frequency spectrum across the mar kets wherein it operates, MTN is perfectly positioned to respond to this shift in the market Afew yearsago,MTN also made the decision to build an IP capable radio network fortheir mobile servic es, giving their corenetwork the ability to seamlessly integratewith enterprise IP networks. Their mobile towers deliver services to enterprise clientsabsolutely anywheretheyhavea network, shortening the last mile and removing complexity and cost Nowthereisincreasing demand from clientstoconnect their remotesites in all areas, including rural and semi-rural. MTN has assisted clientswith overcoming this connectivity hurdle, enabling their staff to getthe job done wherevertheyare

ForMTN, the focus has shifted from just being acore telecommunications services provider,towards also becoming atechnology solutions provider.Their ser vice offering nowalso includes the Internet of Things (IoT), Unified communication, Cloud solutions, Security as aService and Managed network. The scope has changed to being client and industry specific, so the requirementsand service portfolio vary from one client to the next.The expectation is that acompany likeMTN must respond to these challenges, helping clientstoget business done better as theyshift from old to newtechnologies

As manybusinesses continue to grapple with adigitally dynamic world, theyfacenew challenges that havetobesolved. This environment will benefit those that aremoredigitally enabled and agile. It is abrave newworld that will favour online overon-site, wireless overwired and fluid overformulaic. Businesses will seek out partnersand suppliersthat areevery bit as flexible and forward-looking as theyare Ultimately,clientsneed partnerslikeMTN Business that will invest in infrastructure, deliver the services theyrequire,havemarket credibility,are financially sound and havea long-term commitment to their market presence.

The ar t scene will de scend on Ar t X Lagos from 4- 6 November to bask in the creativity of the continent’s intere sting and innovating ar tists, with talks, prizes and other events The ar t fair created by Tokini Peterside-Schwebig, is in its seventh year, with a theme on ar t’s ability to convoke: ‘Who Will Gather Under the Baobab Tree?’

Power is the backbone of industry and South African utility Eskom is in the midst of a crisis hitting businesses and households across the countr y. Years of mismanagement have hurt the state- owned enterprise, with blackouts a regular occurrence due to an inability to manage planned maintenance on infrastructure.

Eskom is at the centre of debates about South Africa’s energ y transition. It is seeking a $476m loan from the World Bank to conver t the 1,000MW Komati coal-fired facility into a renewable producer and batter y station.

Eskom is dogged by unplanned breakdowns

its plants

Unplanned

losses

Interrupted by Covid lo ckdowns in 2020, Ghanaian British ar tist Lynet te YiadomBoak ye’s Fly in League with the Night exhibition of painting s of creative por traits will return to the Tate Britain museum from 24 November

Last year ’s event showcased 120 artists

The three-day art fair is in its seventh year

Galleries from across the globe and continent will show off their talents. AFIK ARIS in France will highlight paintings by Nigerian ar tist Matthew Eguavoen dealing with themes of love, mental health and intersectionalit y. Ghana’s Galler y 1957, Stevenson of South Africa and Côte d’Ivoire’s Galerie Cécile Fakhoury will also be there.

The Cameroonian government would like to see the country supplying the Central Africa region with 'Made in Cameroon' goods and diversify the economy,but how much progress is being made?

Doula port often sees extended waiting times

Cameroon, with a population of 27 million people, has the potential to feed and produce for many of the smaller countries of the Central African region, including landlocked neighbours Chad and Central African Republic. Agriculture, oil and gas, mining, construction and finance are important economic sectors, with unexploited iron ore deposits and other projects holding potential for future growth.

Are the government and private sector doing enough to diversify the economy, create jobs and develop new sectors? The government says it is making progress, but the business community and international financial institutions argue that the country needs vast reforms, stronger policies and better infrastructure for companies to be able to meet national demand and export more to the region and beyond.

In an August report, the International Monetary Fund said that there are many things standing in the way of the development of a stronger business environment: “These obstacles include inadequate infrastructure, high factor costs, limited access to financing, and various distortions (legal and judicial system requiring improvement).”

It also mentioned that: “Cameroon could not envisage its industrialisation relying solely on domestic markets The author ities also aim to facilitate the emergence of the private sector as the main driver of economic growth, with targeted public interventions in highly strategic sectors, using the public procurement lever, while promoting the emergence of national champions in the sectors leading to structural transformation.”

The government and some members of the business community have a tense relationship. Celestin Tawamba, the president of the Groupement Inter patronal du Cameroun (GICAM) a business lobby is vocal about what he and his colleagues think should be done to improve the business climate. GICAM came up with a series of ideas for reforms in 2020, with Tawamba regularly critical about the country ’s taxation system. He argues that the country ’s taxes on turnover rather than profits slows economic growth. He says he hopes the government will listen to GICAM’s concerns about this and other concerns to launch a proper dialogue and more cooperation.

He told sister publication Jeune Afrique in June that Africa needs to build up its champions in order to help it grow and protect itself from external shocks like the war in Ukraine. “The first step must be national, and at this level, the prerequisite is the improvement of the business climate. [...] It requires awareness and publicprivate partner leadership based on a strong [...] state, a developer, a catalyst of energies and that is capable of making strategic choices.” In its two most recent

studies, the development finance institution has complained about the slow progress of President Paul Biya’s government on reforms that are part of its aid programme

The government spent an estimated $1bn on projects linked to the hosting of the 2022 African Cup of Nations football tournament, while critical infrastructure lacks investment. For example, the port at Douala is used for the vast majority of the country’s imports and exports in addition to being a critical link for Chad and the Central African Republic but has been operating beyond its capacity for years This means extended waiting times for shippers and higher costs for imports and exports.

The port of Douala has recently been processing between 12m-13m tonnes of goods per year, with nameplate capacity of just 10m tonnes. To boost capacity, the port authorities signed a build, operate and transfer deal with British-Lebanese company Karam Trading Holding to build a new port terminal in Douala at a cost of about $350m. Once completed, the project is set to more than double Douala’s port capacity to 21m tonnes per annum. There are also plans under discussion for a deep -sea port at Manoka. Cameroon’s top exports in terms of value in 2020 were oil, cocoa beans, timber, gold and bauxite and most of those produced were sold unprocessed or with little processing Some entrepreneurs are boosting local processing, however. Kate Fotso, one of Cameroon’s richest business women, runs Telcar Cocoa, the country ’s leading exporter of cocoa beans, beating Singapore’s Olam. Telcar is planning on building a cocoa processing plant in Kribi, southern Cameroon, to earn more profits by processing locally.

Since its founding, the NANA BOUBA GROUP hasbeen avital pillar in the Cameroonian and sub-regional food chain, ensuring the supply of basic foodstufsina tough global economy and setting up business lines to fight food insecurity and ensure people’s well-being. Its slogan “Living Quality” encompasses the self-sufciency and socio-economic development generated by the Group’s companies. With industrial and distribution operations, the Group has developed better quality products and an efcient distribution network, building consumer confidence and trust.

sively for export, responding to ever-increasing demand and diverse consumer habits. The same goes for SAGRI SA,foundedin2011, which produces the NEIMA brand of double concentrated tomato paste in its state-of-the-art factory in Bomono near Douala.

The industrial division produces essential consumer products at four plants, 24 hours aday GREENFIL,established in 2013 in Nkam, in Cameroon’s Littoral region, produces quality palm oil in an environmentally sustainable way,ensuringaconstant daily supply.The factory is now an essential link in the Group production chain, just like AZUR SA,its leading manufacturing facility.Azur SA produces household soap and refined oil. This quality product and an efcient distribution service has made Azur the leading soap and refined oil brand on the domestic market, as well as in Chad and throughout the CEMACregion, which is supplied by IBI SA.Located in Dibamba, not far from Douala,the IBI SA factory produces household soap exclu-

The NANA BOUBA GROUP has built alocal distribution chain to ensure uninterrupted supplies of its own products and those of its clients. It’sflagship company, SOACAM SA,isatthe top of this chain. Founded in 1984, the Société Alimentaire du Cameroun distributes rice,soap,refined oil, tomatoes and more.It’sefcient logistics and extensive distribution network throughout Cameroon makeita national leader,resulting in exclusive distribution partnerships with several local and international companies. NEIMA SHOP,conceived by SOACAM’s young, dynamic teams, has opened stores supplying quality foods in every region of the country and is already asource of pride for consumers. This is yet further proof that the NANA BOUBA GROUP is resolutely committed to serving the people of Cameroon and the Central African sub-region every day,masterfully led by its top management under the supervision of its founder

The Memvé’élé hydroelectric dam will soon produce at full capacity

She is from Cameroon’s South-West Region, one of the areas involved in the conflict around the marginalisation of English-speaking areas of the country Fighting in North-West and South-West Cameroon, in addition to instability in the Far North due to the activities of Boko Haram, have hurt the economy in recent years. The anglophone regions are major agricultural areas they produced much of the country ’s cocoa up until 2018 but the Central Region is now the top cocoa producer.

Elsewhere, companies are also investing in Cameroon’s agricultural production. Compagnie Fermière Camerounaise, owned by France’s Castel through the Société Anonyme des Brasseries du Cameroun, has its eyes on the poultry and animal feed sector This year it announced plans for a maize plantation set to produce 40,000tn per year The goal is to cut down on imports by growing corn locally for corn grits used in the beer brewing process Alongside this project, it is growing chicks and selling eggs.

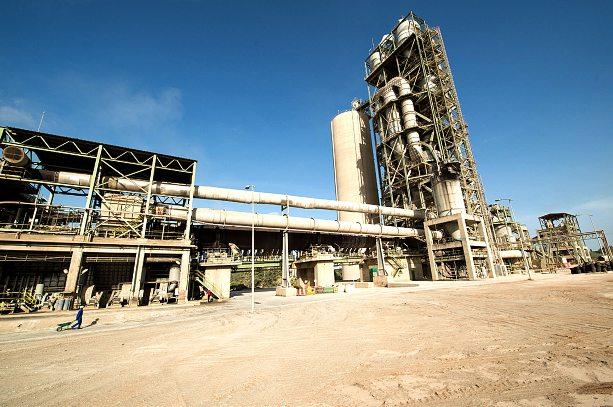

Cameroon’s cement production companies continue to expand their capacity with the hopes of meeting national demand and exporting to the region (see page 116). And elsewhere in the construction

sector, there are success stories in steel manufacturing (see page 118).

International investors are betting that rising gross domestic product will spur the development of the middle classes, and with it, increase consumption. In July, CFAO owned by Japan’s Toyota Tsusho Corporation inaugurated the PlaYce Yaoundé shopping mall, billed as one of the biggest shopping centres in Central Africa.

To be profitable, manufacturing requires inexpensive and reliable sources of electricity So the government is developing a series of hydroelectric dams to expand access to electricity to households and businesses. The $1.1bn Nachtigal Dam, 65km to the north- east from Yaoundé, is set to add 420MW of capacity to the national grid in 2024. Meanwhile, the 211MW Memvé’élé Dam is set to begin producing at full capacity in October of this year

The crisis in Ukraine could lead to more investment in Cameroon’s oil and gas, where production is substantially lower than in several countries in the region. Cameroon’s

The cost of the Nachtigal Dam, which is set to add 420MW of capacity to the national grid in 2024

state- owned Société Nationale des Hydrocarbures and Anglo-French oil and gas company Perenco have stakes in the floating liquefied natural gas plant at Hilli Episeyo, offshore Kribi, which started operations in 2018

Perenco is bullish on Cameroon’s hydrocarbon potential and announced plans to buy New Age’s stake in the Etinde permit in June. But that project could take a long time to develop, as it is close to the border with Equatorial Guinea and it is not clear if it would be possible to get both governments to agree on a deal to use Equatorial Guinean gas-processing infrastructure

Gas is also being used by Cameroonian industry. Victoria Oil & Gas supplies industrial customers in Douala from the nearby Logbaba field, for example.

Much of this investment is taking place in a difficult business climate and from a low national base. Before it was done away with due to concerns about its fairness, the World Bank’s 2020 Doing Business ranking put Cameroon as 167 out of 190 global economies. It had par ticularly low scores for registering property, paying taxes, enforcing contracts and trading across borders If there is going to be a business revolution in Cameroon, it is going to take a lot more work.

KMN LAW

485 Ruedes Écoles, Akwa

B.P. 3792 Douala, Cameroon

Tel: (+237) 233 434 376

Email: info@kmnlaw.cm nkongho.agbor@kmnlaw.cm www.kmnlaw.cm

How will AfCFTA facilitate Africa’s economic integration?

TommyNkonghoAgbor: The AfCFTA wasdesigned to facilitate intra-Africantrade andboost economic activity. It enteredintoforce in May2020,a month after the required 22 signatory nations deposited their instrumentsofratification and constitutes one of the largest markets in the world due to the number of ratifying countries and the volume of foreign exchange it will generate. Itssubstantial legislativeframework focuses mainlyon investment, competition, intellectualpropertyrights and electronic commerce aspects.

TNA: ArecentWorld Bank-AfCFTASecretariatstudypre dictsthatthe resulting intra-African trade will increase income by 9% ($571 billion)by2035–a boontoAfrican economies affectedbya particularlyaustere context of exogenous shocks.Progressivedismantling of high and fluctuating tariffswill boost the volume of goodsand services moving between membercountries while increased human capital mobilitywill spreadvaluable skills and knowhowacross the continent. Dependence on imported products will be reducedasAfrican countries establish asolid, stable economic fabric by processing natural resources, limiting outflowofforeign currency and creating wealth.

TNA: Cameroon is one of eightcountries soon to enter the operational phase and is gearing up forrevitalisedeconomic activity.Concretegovernmentactions include digitising its visa application process,adopting alegal framework secur ing cross-border financial transactions, and strengthening the industrial componentofits agricultural value chains. The AfCFTAwill undoubtedlyramp up trade, facilitate the movementofpeople, establish afreetrade zone andstimulate employment, thus reducing the social divide. Yet, thereare real concerns as to howAfCFTA’sobjectives

Partner,KMN Law

“The Af CFTAw ill undoub tedl y ra mp up tr ade, fa cilitate the move ment of people, establish af re et ra de zo ne and stimulate emplo yment, thus re ducing the social divide.”

can be integrated into national legislation and whether existing international treaties andagreements should be abrogatedinfavour of the AfCFTA. Practitionersand project initiatorsmust answerthese questions.

TNA: KOUENGOUA MINOU &NKONGHO LAWFIRM is fully committed to contributing to thistransition by providing companies with firstclass legal advice on the certainty and guarantee of their investments and the requiredimmigration formalities. Provenbusiness lawexperiencepositions KMNLaw as an essential link in the compliance of the provisions of the AfCFTA agreementwithin the Organization forthe Harmonization of BusinessLaw in Africa (OHADA) membercountries and well beyond.

Cement companies are raising the stakes in Cameroon

After catching up with the Nigerian cement-maker ’s subsidiary, the Lebanese-Chinese group will soon be eyeing first place in the Cameroonian market

By OMER MBADI in YaoundéDangote Cameroon owned by Nigerian billionaire Aliko Dangote is being pushed around on its own turf. Since August, it has been neck-and-neck in second place in terms of production capacity on the local market with Mira Cement. The subsidiary of the LebaneseChinese group Mira, represented by Helen Lu and Hassan Mortada, has tripled its capacity to 1.5m tonnes.

Two years ago, Mira Cement decided to invest nearly 30bn CFA francs ($46m) in a second packaging line, which began a shake-up in the sector Moroccan Cimaf (owned by Addoha group), with a capacity of 500,000tn, is soon to increase it to 1.5m tonnes, while Medcem Cameroun trails behind with 600,000tn.

With its planned investment of 120bn CFA francs to install a 700,000tn unit in the north of the country, Mira is set to take the lead from Cimenteries du Cameroun (Cimencam, owned by LafargeHolcim) later this year Cimencam has a production capacity of 2.2m tonnes.

This situation will be short-lived, as Cimencam says it will be able to produce 2.5m tonnes by the end of 2023, by adding 300,000tn to the capacity of its Figuil plant in the Northern Region. Two other

Capacity in tonnes of the Cameroonian leader, Cimencam, which Mira Cement plans to match by the end of the year

producers are due to start operations, including the cement plant of Ivorian tycoon Bernard Koné Dossongui in the port area of Kribi.

In the wake of this, Mira Cement has decided to reduce its prices to wholesalers. The news was announced enthusiastically by the commerce minister, Luc Magloire Mbarga Atangana, who hopes that it will be passed on to the consumer. With this approach, Mira is sailing against the tide of its competitors, grouped together in the Association des Producteurs de Ciment du Cameroun (AP CC).

The AP CC is arguing for an increase, given the high cost of inputs and the upward revision of the price of energy recently imposed on local cement manufacturers “We are looking at this carefully and will not be surprised if this decrease is offset by benefits in return,” says a competitor

Adnen Bouattour, the commercial director of Mira Cement, disagrees.

“If I have 1.5m tonnes, I can afford this concession by counting on the volume effect,” he argues. The Tunisian points to two other assets. The clinker quarry recently licensed to Mira in Limbé, in the South-West Region, reduces its dependence on importing this input by almost 60%.

The other advantage, which the group shares with Dangote, is the internal fleet of 500 trucks managed by Mira Transport, which allows savings in the distribution of its products in Cameroon. “We plan to double this fleet in six months’ time,” Bouattour adds

In addition to increasing capacity, Mira Cement is diversifying its products with the help of the Tunisian company Oasis Ciment, adding 32.5 cement and soon cement glue to its range. Mira’s goal is to take at least 35% market share, compared to the current 20%.

What is the starti ng point fo ra successful public project?

H.F. The strict respect of procedure is apre requisi te fora su cces sful public project proc urement andany publiccontract awarded without following the mandatory public procurementprocess is neithervalid norenforceable under Cameroonian law. It starts with a formally expressed need by the Project Owner to carry out the project, followedbythe Maturity Visa

What is aMaturity Visa andwhy is it so important?

H.F. The Maturity Visa wasintroduced in June 2018 by a Prime Ministerial Decree to ensurepublic project feasibi lityand successfulexecution, therebyavo iding projects being abandonedand resulting in financial losses by the St at eo rp ublic enti tie s. It as cer tai ns the co mpletionofthe public investment preparationprocesses

The ma turat ion process cove rs all aspects of proj ect design andthe preparation of itsexecution, operation and main tenance and includes fe asibility,s ocial and environmen tal impact studies, among ot her s, as we ll as the ad minis trati ve ,l ega land re gulato ry aspe ct sof the project. The issuance of the Maturity Visa is the main tri ggerfor the sourcing of fi nancing. No procurement process can be initiated without ascertaining theavail ability of funding.

Howare public contracts awarded?

H.F. Public contracts areawarded either by competitive bid af ter ac all fo rt ende rs or exce pt ionallybym ut ual agreement. In the case of acompetitivebid, acall for tender is published, bids arerece ived an de xa mined, and an awa rd de ci si on is ta ke nbyt he competen ta u-

thority.T he su ccessful bidder is thereupon notifiedof thecommercial contract. Foraward by mutual agreement wherethereisnocom pe ti ti ve bid ,p rior authorisa tion must be given by the Min ister of Pu bli cP ro cureme nt .T he awa rd process must complywith aspecific procedureand the award dec ision shall be ma d ew ith in 45 da ys fo llo wing the Minister of Pub lic Procurement’sauthoris at ion under penaltyofforeclosure.

What role does thefirm playinthis proce ss?

H.F. Et ah Na n&C o’se xperti se in naviga ting through the str ict regulatoryp ro ce ss an dits maste ring of the legal and regulatoryenvironmentpositions the firm as an unavoidablePartner to potential biddersand sponsorswishing to get involvedinthe Public Procurement

in

Prometal group, founded by Franco-Lebanese industrialist Hayssam el Jammal, has reversed the trend for importing steel projects in Cameroon and the region

By OMER MBADI

By OMER MBADI

On the morning of 13 June, Hayssam el Jammal was smiling under his hard hat His fluorescent green vest masked the medal of the Ordre National de la Valeur he had just received from Gabriel Dodo Ndoke, Cameroon’s mines and industry minister.

President Paul Biya awarded the distinction “exceptionally” in recognition of Jammal’s contribution to Cameroon’s industrialisation. In a decade, this discreet Franco-Lebanese 50-year-old, who arrived in Cameroon at the age of seven, has succeeded in making Prometal the leader of the steel and metallurgy industry in his adopted country. Prometal now controls more than half of the Cameroonian steel market.

“Our main objective was to produce building materials

locally that conform to interna tional standards. On the basis of a framework negotiated with the government, we made major investments. And then opted for a diversification of our products in line with the needs of the market,” explains the entrepreneur.

Prometal has contributed to the construction of major infrastructure in recent years, such as the Japoma stadium, the second bridge over the Wouri River in Douala and the dams currently being built Its production centre in the Bassa indus trial zone in Douala brings together a number of activities, some of

Cost to Cameroon of importing butane gas cylinders and steel frame, which Prometal5 will manufacture locally

which did not exist in the country when the company started up, such as steel melting, hot rolling, wire rod creation and roll forming.

Prometal started in 2010 with an induction furnace at the Prometal1 plant, and later launched the electric arc furnace at Prometal3, increasing productivity tenfold. This furnace can produce materials for concrete reinforcing bars and large-calibre steel beams, angle bars and wire rods Prometal2 specialises in agricultural tools and construction materials. Operations at Prometal4 began this year

A company official explains:

“We have reversed the trend for these products, 80% of which were imported. Today, we cover, at more than 120% capacity, the national and regional demand for concrete reinforcing bars and wire rods, and more than 90% of the steel products [in the region] are produced by Prometal.”

Prometal’s next goal is to save Cameroon about 8bn CFA francs ($12m) the amount it spends each year importing butane gas cylinders and steel frame Prometal5 will begin at the end of 2022 with a production capacity of 600,000 cylinders and 6,000tn of steel frame, creating 250 jobs.

Jammal did not go into the details of Prometal’s medium-term projects but says they will require invest ment of around 100bn CFA francs.

“We are working on mining projections for full integration in the sector As soon as we have the minerals available, we will invest to transform them into raw materials and finished products, via industrial complexes likely to satisfy needs on the continent,” he says He is counting on the earliest possible start-up of mining projects and on the 10 or so local banks that have been supporting him since he began his industrial journey