LEADING LIQUOR INDUSTRY MAGAZINE vol. 41 no. 11 - December 2022/January 2023

AUSTRALIA’S

As Australia’s largest independent family-owned brewery and the custodians of originality, we’re incredibly proud to have won the 2022 ALIA Premium Domestic Beer of the Year with Coopers Original Pale Ale.

This is a testament to our brewing team and everyone at Coopers for delivering a top-quality product. We want to give a shout out to our suppliers and industry partners who allow us to bring this great-tasting Pale Ale to as many Australian drinkers as possible.

It’s only fitting that Original Pale Ale has been chosen as the hero beer in our new summer campaign, launched to raise awareness of the unique ‘Coopers Roll’ and ensure all drinkers are unlocking the full potential of their Coopers beer.

Featuring an augmented reality game and a brand-new short film, drinkers are encouraged to nail the perfect roll as part of this biggest single marketing campaign in our brewery’s 160-year history.

2022

Editor’s note

Welcome to the December/January issue of National Liquor News

Here we are again at the end of another huge year for the Australian drinks industry. When I say huge, I’m not necessarily talking about the numbers, the dollars or the growth, but the effort. Our drinks industry as a whole has been through a lot these past few years, and its resilience has been incredible, achievable only through a lot of hard work and determination.

There’s just one final slog to get through – the festive season and summer. It’s likely to be big this year, given that it’s the first season for a while were there are virtually no pandemic-related restrictions. And while the silly season often calls for more drinks for many consumers, this year more consumers may also be reaching for now and low alcohol options at the same time – Seamus May investigates this from page 44.

Some of the other topics covered in this month’s issue include vodka (Brendan Black reviews the current state of the category from page 52), and Australian Made drinks (I’ve delved into this sector of the market from page 34). We’ve also looked ahead

to the new year by collecting some of the hottest new releases, from page 30.

A not to be missed feature from this month is our massive wrap up of this year’s Australian Liquor Industry Awards (ALIA) from page 10. What a cracking night that was – reflecting on the winners and the celebration in this issue was a great way to end such a fabulous year.

Finally in this issue is our wine tasting review (rosé) and columns from regular contributors, Retail Drinks Australia, eLease Lawyers, Wine Australia and Strikeforce.

Wherever you are in Australia, have a safe, happy and prosperous busy season, and an excellent Christmas and New Year. I can’t wait to see you all on the other side!

Cheers, Brydie Brydie Allen, Editor 02 8586 6156 • ballen@intermedia.com.au

WE ENCOURAGE RESPONSIBLE DRINKING

Get the facts DrinkWise.org.au

PUBLISHED BY: Food and Beverage Media Pty Ltd A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au Editor: Brydie Allen ballen@intermedia.com.au

Journalist: Seamus May smay@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –

Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for $112.00 (inc GST)

– Saving 20%

3yrs (33 issues) for $147.00 (inc GST) – Saving 30%

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

Disclaimer

This publication is published by Food and Beverage Media Pty Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information.

The Intermedia Group takes its Corporate and Social Responsibilities (CSR) seriously and is committed to reducing its impact on the environment. We continuously strive to improve our environmental performance and to initiate additional CSR based projects and activities.

As part of our company policy

in

from environmentally responsible suppliers. This magazine has been printed on paper produced from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody.

of this

All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2022 - Food and Beverage Media Pty Ltd

Top Reads ➤ 10 ALIA ➤ 44 No and Low Alcohol ➤ 52 Vodka

we ensure that the products and services used

PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests. The wrapping used

the manufacture

magazine are sourced

in the delivery process of this magazine is 100% biodegradable.

The Intermedia Group’s Environmental Responsibility National Liquor News proudly partners with Retail Drinks Australia.

4 | National Liquor News

At the launch of Campari’s RARE portfolio, one of our favourite events of the past month.

2022

Contents

December 2022/January 2023

Regulars

8 Cover Story: Planning talent for 2023? 9 Changing Rank: BrightSide announces latest industry placements 20 News: The latest liquor industry news for retailers around Australia 24 Events: An exclusive look into the latest industry events 26 Marketplace: Brand news and promotions 39 Leasing: Overpriced outgoings

Retail Focused 10 Industry Event: Australian Liquor Industry Awards 2022 30 Hot To Stock: New releases tipped to explode in 2023 34 Australian Made: Future is bright for local producers

38 Retail Drinks Australia: Year In Review 42 Strikeforce: Why are service providers so important? 66 Retailer Profile: Blackhearts & Sparrows, Melbourne

Category Focused

40 Wine Australia: Things to know about Pinot 41 Australian Distillers: Holly Klintworth elected as new president 44 No and Low Alcohol: Let it NOLO this season 52 Vodka: The ever-wonderful world 60 Brew Review: Summer beers 62 Wine Tasting Review: Rosé

6 | National Liquor News

Planning for talent in 2023?

In a tight market, now is the time for drinks businesses to put their best foot forward in the recruitment process with BrightSide Executive Search.

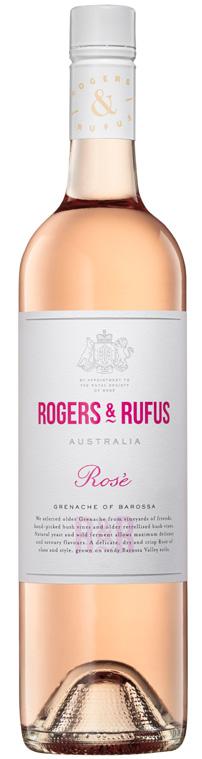

Recruitment is an incredibly competitive space at the moment. After the uncertainty of the pandemic, candidates are making measured choices about their careers, and businesses that aren’t on their toes will miss out on the best hires.

Luckily, there is a recruitment agency solely dedicated to connecting the drinks industry, by helping businesses attract and retain top talent.

BrightSide Executive Search is the only dedicated drinks specialist agency in the country. It’s headed up by Directors Amber King and Sue Lauritz, who are very passionate about the industry and love what they do in supporting it.

BrightSide works in partnership with drinks businesses to help them find the right person for each role. Being a national business with its finger on the pulse of the industry, it is connected to a wide network of talent which includes a huge array of potential candidates that often aren’t uncovered by internal recruitment processes.

“We work as a trusted business partner, so clients who regularly communicate their vision and their plans can get a better piece of that talent pool because we understand their ongoing needs,” Lauritz said.

Not only does this give you a higher

chance of finding the absolute right person for the role, but you can save on time and money – drinks businesses that work with BrightSide can keep their entire team focused on what they do best, while the BrightSide team does what they do best, taking over the time-consuming talent search process. It delivers a much more effective and efficient result than trying to do it yourself on Seek.

“We often say our net worth is our network, that’s why people come to us instead of doing it themselves. We’ve been specialists in drinks for over 15 years, and it’s our job to know everybody,” King said.

As we move full steam ahead into 2023, now is the time to be planning your key hires for the new year and taking advantage of what BrightSide can offer.

As Lauritz said: “It’s time to be strategic. Failing to plan is planning to fail, and I think in this tight market, that is something businesses cannot afford. If you want the right person for the role to start in early 2023, you need a considered and thorough search, and that needs to start now.

“You also want to be ahead of the competition as well. What we’re seeing is a lot of drinks companies looking for the same talent, so the sooner you are getting into the market, the more you can be ahead of the

curve in accessing the best talent.”

Late January is a busy time for BrightSide when it comes to candidate contact, as it is when people have had a chance to recharge and reflect on whether they are ready for a change in their professional lives. Companies that partner with BrightSide to talk long-term recruitment needs have added benefits at this time of year, as the team knows what roles are coming up soon and can keep this in mind when liaising with these candidates. It’s another efficiency benefit that comes with working with BrightSide.

King adds: “It’s all about open communication. The clients we work the best with are those that see us as an extension of their business. If we know what your headcount approval looks like and where your existing talent gaps are, then we can can work hand-inglove with you to create solutions and uncover quality candidates throughout the year.” ■

Plan to succeed for 2023

Stay front of mind with candidates in the year ahead by preplanning your growth strategy with BrightSide today.

BrightSide Executive Search www.brightside.careers

The BrightSide team 8 | National Liquor News Cover Story

Changing Rank

BrightSide announces recent placements

BrightSide Executive Search is the only dedicated drinks recruitment specialist nationally and has been a trusted advisor to the industry for well over a decade. Through accessing its wide-reaching network of potential candidates, BrightSide takes the hassle out of recruitment for drinks businesses, advising how they can stay nimble and competitive in a tight market to attract the absolute right person for each role. The latest BrightSide success stories below show the strong abilities of the recruitment agency in partnership with drinks businesses of all sizes, country-wide.

Brick Lane Brewing Community has welcomed Jarrod Grant as National Account Manager, to deliver sales and category growth.

Sara Saccon has joined House of Fine Wine, providing critical support to the sales team across analytics, promotions and financial admin.

Joval Wines is excited to have the extensive online experience Mark Faber brings as the National Account Manager E-Commerce.

Campari Australia is thrilled to have the highly experienced Ben Hallett leading from the front as Field Sales Manager NSW & ACT.

Four Pillars is delighted to welcome David Hogan as GTR & International Market Sales Director to drive growth in key channels.

Matt Talbot has joined Tellurian Wines as Sales & Marketing Manager to continue to build the brand and drive sales growth.

Zachary Morgan is loving bringing all of his industry experience to his new role as On-Premise Specialist Melbourne with Campari Australia.

De Bortoli is welcoming Luke Frost, who will drive sales growth with his extensive commercial skills as State Business Manager in QLD.

Proximo Spirits is enjoying the extensive sales experience

Nathan Hardacre brings to the team as Area Manager SA.

Chris Moutzouris brings his experience and passion for the beer category to his new role as Brand Ambassador NSW with CBCo.

For more information go to www.brightside.careers or to look for current opportunities check out the BrightSide LinkedIn page: www.linkedin.com/company/bright-side-executive-search

December 2022 / January 2023 | 9 Changing Rank

Up, up and away for ALIA 2022

The Australian Liquor Industry Awards (ALIA) made a triumphant return this year, with a sold-out event that brought the industry together again on a truly memorable night.

It’s been a long time between drinks, but that didn’t dampen the mood at this year’s Australian Liquor Industry Awards (ALIA), with almost 600 guests descending on Sydney Town Hall for the industry’s highly anticipated night of nights.

Due to uncertain and changing pandemic restrictions in recent years, this was the first time ALIA had been able to return to the industry’s calendar since 2019. The theme for this sell-out return was inspired by the lifting restrictions too – ‘dress for your next holiday’.

There’s always a lot to love about ALIA. One thing that stood out this year was how special it was to reconnect in a fun atmosphere.

Ray Noble, Managing Director at SouthTrade International, said: “We love ALIA as it represents everything great about the industry we are privileged to be part of. It is also a great time to try different products from various suppliers, build social

connections over a cold beverage and enjoy each other as a peer not a competitor on the night!”

This reconnection and spirit made for an electric feel on the night, as described by Ryan Anderson of Vanguard Luxury Brands.

“Such a buzz to have everyone back together under the one roof… The energy in the room was one of sheer joy! All the people and businesses that make up this great industry having a night to bask in each other’s company – it’s nights like this that remind us why we love this industry,” he said.

And for Jeremy Shipley of Lyre’s, the 2022 event lived up to its billings.

“I personally thought the night was excellent. I’ve always been a massive fan of ALIA (this was my 16th awards) and it has always been one of my favourite hospitality events for the year,” he said.

The MC for this year’s event was once again Bianca Dye, who helped keep the ALIA ship on course throughout the 60 awards presented on the night. As always, the winners were determined through a transparent, multi-step voting process, ending with the votes from a panel of more than 60 industry professionals.

Kylie Farquhar of Treasury Wine Estates said this method made the team in attendance appreciate the weight of each award they won.

“To be recognised by our peers for these awards makes them even more special,” she said.

Carlton United Breweries (CUB) was another multi-award winner that felt a similar appreciation.

“We are both humbled and delighted to have our portfolio so well recognised across various categories of the ALIA awards…

1A A 123 19 OCT 19 OCTOBER 2022 ALIA 2022 ALIA 2022 FIRST CLASS 2022 18:00 18:00 DESTINATION SYDNEY TOWN HALL 10 | National Liquor News ALIA 2022

This portfolio, along with our passion for industry-leading innovation, is delivering genuine category growth and delighting both customer and consumers alike,” said a CUB spokesperson.

Other than the awards, guests at ALIA 2022 enjoyed a delicious three course meal, complemented by an exceptional assortment of drinks and networking bars, as well as an extraordinary showstopping performance by LED Dancers Australia, and of course, the annual Best Dressed Competition.

An incredible lineup of networking bars

A distinct highlight for many ALIA attendees each year is the drinks – the night is a great opportunity to try new beverages while connecting with the people who make them. This year’s networking bars took this opportunity to the next level, with an absolutely incredible offering from bar sponsorsSouthTrade International, Kaddy, Lyre’s, Patrón, Bearface Whisky, Stone & Wood and Top Shelf International.

There was truly something for everyone at the ALIA 2022 networking bars as you moved around the event. Activations

began in the vestibule space, where SouthTrade operated a ‘shot roulette’ wheel alongside a range of mixed drinks; Kaddy created a tropical oasis filled with a variety of local craft beer and seltzer, as well as a photobooth; and Lyre’s provided a sophisticated sense of something different with non-alcoholic cocktails.

Stepping through into the ALIA 2022 main hall, guests were greeted by more networking bar offerings, ranging from Bearface Whisky Mules and samples from Vanguard Luxury Brands; to iconic local Stone & Wood beers from Lion; quality Australian spirit cocktails such as NED Australian Whisky and Grainshaker Australian Vodka from Top Shelf International; and finally, some Patrón Tequila cocktail favourites, the Margarita and Paloma, on tap from Bacardi-Martini Australia.

Demand for all the networking bars was high, as guests connected with the brands that were being showcased.

Samuel Dennett from Lyre’s described this demand well, noting how great it was to meet key industry players he wouldn’t usually have the chance to talk to, in a “relaxed atmosphere” that enabled guests to connect without hierarchy. ■

CO-HOSTED BY

December 2022 / January 2023 | 11 ALIA 2022

Bottlemart – Retail Group of the Year

“This award is a great acknowledgement for all the LMG team and Bottlemart retailers… The quality of our retailers with great promotional execution is the primary driver behind the results being achieved,” he said.

“LMG has invested significantly in our store refresh program – we completed 110 refreshed stores by the end of the financial year. Enhancing the store environments along with engaging and targeted promotional programs, and pricing, has enabled Bottlemart retailers to win shoppers who have discovered the benefits of local service and ranging.”

1A A 123 19 OCT 19 OCTOBER 2022 ALIA 2022 ALIA 2022 FIRST CLASS 2022 18:00 18:00 DESTINATION SYDNEY TOWN HALL CO-HOSTED BY Beer Categories Full Strength Winner: Great Northern Brewing Co Original Lager HC: Carlton Dry Light & Mid-Strength Winner: Balter Captain Sensible HC: Great Northern Super Crisp Premium Domestic Winner: Coopers Pale Ale HC: Byron Bay Premium Lager Premium International Winner: Asahi Super Dry HC: Peroni Nastro Azzurro Mainstream Craft Winner: Balter XPA HC: Little Creatures Pale Ale

the winners are… Independent Craft Winner: Young Henrys Newtowner HC: Capital Brewing XPA Cider Winner: Young

HC: Willie Smiths Organic Best Australian Brewery Winners: Balter Brewing Co,

Young Henrys HC: Stone & Wood

And

Henrys Cloudy Cider

and

Gavin Saunders, CEO of Liquor Marketing Group (LMG), said the team was thrilled to see their Bottlemart banner take out the top spot in Retail Group of the Year for 2022.

12 | National Liquor News ALIA 2022

NEW 6.5% ALCOHOL 2G CARBS SPARKLING WATER WITH ALCOHOL SURGE INTRODUCING WHITE CLAW®

And the winners are…

Wine Categories

Red Wine Brand under $14.99

Blackhearts & Sparrows

– Liquor Store of the Year

For the sibling Co-founders of Melbourne’s Blackhearts & Sparrows, Jess and Paul Ghaie, winning Liquor Retailer of the Year was overwhelming, and gave them a chance to reflect on the business and its success since they opened their first store in 2006.

“We don’t often stop and smell the roses… It’s probably true of all small business owners, but it’s not that often you actually take the time to sit back, enjoy success and look back on achievements. 2006 was such a long time ago, and we’ve grown and changed so much since then,” Paul said.

Read Jess and Paul’s full story on page 66.

Winner: 19 Crimes HC: Yalumba

Red Wine Brand $15-$34.99

White Wine Brand over $35

Winner: Petaluma HCs: Shaw & Smith, and Vasse Felix

Rosé Brand

Winner: Pepperjack HC: Taylors

Red Wine Brand over $35

Winner: Henschke HC: St Hugo

White Wine Brand under $14.99

Winner: Evans & Tate HC: Giesen

White Wine Brand $15-$34.99

Winner: Shaw & Smith

HC: Bird in Hand

Winner: La Vieille Ferme HC: Squealing Pig

Australian and International Sparkling

Winner: Jansz HC: Chandon Champagne

Winner: GH Mumm HC: Veuve Cliquot

Dessert and Fortified

Winner: De Bortoli Noble One HC: Galway Pipe

Best Australian Winery

Winner: Penfolds HC: Vasse Felix

1A A 123 19 OCT 19 OCTOBER 2022 ALIA 2022 ALIA 2022 FIRST CLASS 2022 18:00 18:00 DESTINATION SYDNEY TOWN HALL CO-HOSTED BY ALIA 2022

14 | National Liquor News

lmg.com.au | bottlemart.com.au PERSONALISED TO YOUR STORE BUILT FOR MEMBERS DEDICATED TARGETED MARKETING PROGRAM eCOMMERCE SOLUTIONS THAT ARE 2022 RETAIL GROUP OF THE YEAR

1A A 123 19 OCT 19 OCTOBER 2022 ALIA 2022 ALIA 2022 FIRST CLASS 2022 18:00 18:00 DESTINATION SYDNEY TOWN HALL CO-HOSTED BY ALIA 2022 Spirits Categories Dark Spirit up to $69.99 Winner: Starward Two Fold Whisky HCs: The Kraken and Jack Daniel’s Light Spirit up to $69.99 Winner: Bombay Sapphire HC: Roku Luxury Dark Spirit over $70 Winner: Archie Rose Single Malt HCs: Starward Nova, and The Macallan 12 Year Old Luxury Light Spirit over $70 Winner: Four Pillars Rare Dry Gin HC: Archie Rose Signature Dry Gin Dark RTD-RTS Winner: Canadian Club HC: Starward (New) Old Fashioned Light RTD-RTS Winner: White Claw HC: Brookvale Union Seltzer Best No-Low Alcohol Product (all categories) Winner: Heaps Normal Quiet XPA HC: Heineken 0.0 Liqueurs Winner: Aperol HC: Mr Black Best Australian Distillery Winner: Four Pillars HC: Archie Rose And the winners are… 16 | National Liquor News

2022 WINNER Dark RTD of the Year!

And

SouthTrade International – Off-premise Supplier of the Year

Ray Noble, Managing Director at SouthTrade International, said winning Off-premise Supplier of the Year was a big moment for the company, which began as an on-premise specialist before deliberately shifting focus.

“As a business we have significantly grown in terms of volume, people capability and retail footprint. Over the last few years we have doubled in size to now be a $200M business with plans to double again before too long. We can only achieve these results by building strong partnerships with our trade partners and selling exciting brands that consumers want,” he said.

“We’re extremely proud of how far we have come with our retail ambitions over the last few years, and very appreciative of the ongoing support we have been given from the trade as we continue to learn our craft and excited about what the future holds.”

1A A 123 19 OCT 19 OCTOBER 2022 ALIA 2022 ALIA 2022 FIRST CLASS 2022 18:00 18:00 DESTINATION SYDNEY TOWN HALL ALIA 2022

the

New Product of the Year

Archie Rose Bone Dry Gin

Jose

Sparkling

Liquor Brand of the Year

Four Pillars

and Fireball Retail Group of the Year

Bottlemart

Cellarbrations Liquor Store of the Year

Blackhearts and Sparrows, Melbourne

Liquor Emporium, Marrickville Off-Premise Supplier of the Year

SouthTrade International

Lion

winners are… Major Winners

Winner:

HC:

Cuervo

Margarita

Winner:

HCs: Archie Rose,

Winner:

HC:

Winner:

HC:

Winner:

HC:

18 | National Liquor News

Thanks to our sponsors

2022

CO-HOSTED BY

NETWORKING BARS BY

AFTER PARTY & OFFICIAL MIXER BY AWARD SPONSORS

AUDITING SPONSOR

ALIA 2022 CO-HOSTED BY

December 2022 / January 2023 | 19

The latest liquor industry

For retailers around the country

ILG launches Liquor Co-op Warehouse

Independent Liquor Group (ILG) has announced the launch of the Liquor Co-op Warehouse, its own B2B marketplace platform.

The platform aims to be a ‘one stop shopping experience’ for all companies holding a liquor license across NSW, by helping the liquor industry connect and conduct business via a simplified online ordering system. Upon its launch, the platform is said to offer over 5,000 drinks across all categories at wholesale prices.

Paul Esposito, CEO of ILG, said that the Liquor Co-op Warehouse also aims to reduce the incidence of independent businesses purchasing from national chains or other thirdparty operators.

“This initiative is designed to give hotels, bars, restaurants, and others in the liquor industry better buying opportunities with freight free options,” Esposito said.

Another element of the Liquor Co-op Warehouse that ILG has highlighted is how it is the ‘ultimate hybrid shopping experience’, combining online convenience and the expertise of human customer service, with a dedicated team available to chat specifically about your enquiry.

LMG launches new Bottlemart and SipnSave apps

Liquor Marketing Group (LMG) has gone live with the new apps it has developed for its Bottlemart and SipnSave banners.

Along with the apps, the website and e-commerce sites have also been relaunched, with enhanced features together in one digital home.

Damien Page, General Manager Merchandise and Marketing, said the apps “present nothing short of a game changer for our members and customers. The apps offer new features and opportunities for LMG to engage with our customers in new ways.”

LMG noted research shows 88 per cent of customers are browsing before they shop – the new apps aim to meet that trend with expanded search and localisation functions.

“This has dramatically expanded our marketing capabilities, allowing us to reach more people, more often with offers targeted to their preferences,” Page explained.

Customers and members will find further convenience in streamlined processes behind both promotions and competitions, and shopping with local store pricing and catalogues.

“Greater platform flexibility and enhanced features linked with our CRM have supercharged our ability to be dynamic with promotional offers and more engaging for our customers,” said David Gyte, Head of Digital Marketing at LMG.

“E-commerce is set to be a major focus for us in 2023. A 91 per cent increase in spend sees a significant investment in digital marketing and e-commerce plans and capabilities. We currently have 234 stores on e-commerce but this development allows us to be even more far reaching so all our members can benefit from online sales and customer loyalty.”

News

20 | National Liquor News

New DrinkWise campaign targets parents of teenagers

DrinkWise has announced its latest campaign, ‘It’s okay to say nay,’ which targets the parents of teenagers in Australia.

The campaign was developed after research showed an increase in parents supplying alcohol to their underage teenagers. While it’s encouraging that the research shows most 14-17 year olds (72.5 per cent) are still abstaining from drinking, an increasing amount of those that are drinking underage report their main source of alcohol was their parents.

Adolescent psychologist Dr Michael Carr-Gregg has endorsed the new DrinkWise campaign.

“A lot of parents think that young people are drinking more. In fact, they are drinking less and parents need to capitalise on this trend and recognise the importance of not giving alcohol to their underage teenagers,” Dr Carr-Gregg said.

“We know that the teenage brain is a work-in-progress and we know it won’t be fully mature until the mid-twenties. Alcohol has been found to disrupt that process.”

DrinkWise CEO, Simon Strahan, noted the positives of the decline in teenage drinking rates, but said more can be done to further reduce harm.

“Education is critical and DrinkWise is committed to working with parents to help look after the next generation,” Strahan said.

Kaddy focuses fulfilment operations on trade

Kaddy’s newly appointed CEO Steve Voorma has undertaken a strategic review of the business and as a result Kaddy will now reposition its fulfilment division as a “pure play B2B Fulfilment services provider” by exiting all consumer fulfilment services.

Kaddy will now operate two divisions; Kaddy Marketplace, a wholesale trading platform that connects trade buyers with beverage suppliers across Australia; and Kaddy Fulfilment – which provides specialised B2B services.

Voorma said: “Having completed the first stage of my strategic review, the potential of what we’re building is clear.”

“The opportunity to be a best-in-class end-to-end Marketplace and Fulfilment solution in B2B relies on operational excellence across both divisions.

“Unfortunately for our Fulfilment division there have been extreme complexities by offering trade and consumer services which would require significant investment to get right.

“We have taken the decision to double down on our strengths and exit the consumer Fulfilment business to become a pure B2B player and deliver on our mission of making wholesale beverage distribution easy,” Voorma concluded.

The new go-to-market strategy will take effect immediately with last consumer deliveries being made by 7 February 2023.

News

December 2022 / January 2023 | 21

Newsletter reads Sign up to our fortnightly Newsletter by going to this URL: https://theshout.com.au/ national-liquor-news/ subscribe/ ➤ Cellarbrations gets festive with Good Shout campaign ➤ Government outlines plans to regulate ‘buy now, pay later’ ➤ What will the rising cost of living mean for sustainable wine?

Top

Hunter Valley meadery loses 90 per cent of its bee hives

Honey Wines Australia, a mead business in the NSW Hunter Valley, has reported the loss of 90 per cent of its bee hives due to the Varroa mite hive cull.

The NSW Government’s Department of Primary Industries (NSW DPI) first detected the Varroa mite in surveillance hives of the Port of Newcastle in June. Since then, it has been undertaking an eradication plan, citing that the mite could cost the local honey industry more than $70 million/year. Mead is of course reliant on this, with fermented honey its primary ingredient.

The eradication plan included the establishment of ‘red zones’ in which hives would be euthanised. Beekeepers such as Martin and Angelica Jackson from Honey Wines Australia, anxiously watched these zones expand over recent months, until it included their own hives.

“We will likely have to source raw honey from other local beekeepers in the Hunter Valley area until we build up our beehives again at our new property in Broke (which hopefully will remain a safe zone). This will allow us to retain consistent flavour in our meads – Hunter Valley honey has a delicious flavour so we don’t want to lose that,” Martin said.

As the NSW DPI now also turns its anti-Varroa mite action to also manage impacted wild European honey bee populations, it has announced reimbursement payment options for those that have lost hives.

St Hubert’s The Stag announces new sustainable partnership

Australian wine label St Hubert’s The Stag has announced a new partnership with environmental restoration company, AirSeed.

AirSeed aims to help preserve biodiversity, protect ecosystems and tackle climate change through its combination of drone technology, artificial and data driven intelligence, and proprietary seed pod bio-technology.

Over the next year, St Hubert’s The Stag has committed to planting seed pods for 100,000 trees using this technology, across areas of Australia that have been impacted by recent extreme weather and climate change.

“With our roots quite literally embedded in agriculture, it’s crucial as an industry we do what we can when it comes to preserving the Australian landscape. St Hubert’s The Stag has long had a focus on the wilderness, so the opportunity to partner with a company such as AirSeed was a natural fit,” says Ben Culligan, Marketing and Category Director for Treasury Premium Brands (which owns St Hubert’s The Stag).

Andrew Walker, AirSeed CEO and Co-founder, said the company is proud to be partnering with St Hubert’s The Stag.

Walker said the wine label has “a genuine interest and investment in driving sustainability and they will now have a significant impact on important rewilding projects across Australia.”

News

Read more of this story via The Shout: https://bit.ly/3GZ0wdZ 22 | National Liquor News

JOIN THE CARAVAN LAUNCHED BY A SPONTANEOUS BUNCH OF PUBLICANS NEARLY 15 YEARS AGO, THIRSTY CAMEL HAS BECOME ONE OF AUSTRALIA’S MOST RECOGNISED INDEPENDENT RETAIL BRANDS; WE’RE THE LOVABLE MAVERICK OF THE LIQUOR WORLD, AND PROUD OF IT. FOR DETAILS ON HOW TO JOIN THE CARAVAN Contact: info@thirstycamel.com.au Phone: 03 8573 4100 FOOTPRINT 350 Thirsty Camel stores dotted across the country. CONVENIENCE IS KING The best in drive through convenience. SHOPPER LOYALTY State specific loyalty programs to drive retention and repeat purchase. MARKETING SUPPORT Insight driven marketing campaigns all year round. CORE RANGE A succinct core range of products allows venues to work with supply partners to accommodate their local needs and customer base, utilising data driven insights and trends our core range covers all categories delivering strong margins and profitability. ADDITIONAL PROGRAMS State based opt in programs including a Craft Beer and Premium Spirits program allow flexibility to work with global leading brands and up and coming local products to reflect current trends.

Events The latest liquor industry

Brown-Forman showcases its premium Scotch portfolio

Brown-Forman recently highlighted the qualities behind its premium Scotch portfolio, hosting an exclusive tasting of a range of Glendronach and Benriach whiskies at Sydney bar, Frank Mac’s. Brown-Forman Master Blender, Dr Rachel Barrie, introduced the portfolio in a pre-recorded video, while local brand ambassadors Andy Tsai and Grant Shearon, took guests through the tasting itself. The event ended with a special extra treat –a tasting of the Glenglassaugh 47 Year Old Pedro Ximénez Cask (1972 vintage).

Howard Park highlights Australia’s place in the world of sparkling wine

Campari Australia unveils RARE portfolio

Campari Australia revealed its new RARE Collection portfolio at an exclusive event on Sydney Harbour in November. Guests were introduced to the range, which includes premium Champagne house Lallier as well as several premium spirits labels, while being entertained by immersive performances and live music inspired by each style of drink in the collection. Sweeping harbour views on board the Starship Sydney provided the perfect backdrop for the industry to sample and learn about the new collection, which is set to be a huge contender in Australia’s premium drinks market.

The Macallan brings the latest M Collection Whisky to Australia

The Macallan has brought the latest SKU in its super premium M Collection to Australia. The Macallan M Copper is the most premium of the range to arrive in the country, with a highly limited number of bottles available. The launch was celebrated in Sydney with events at Campbell Stores, in an immersive sensory experience led by Brand Ambassador Mark Hickey. Media and trade guests explored the essence of the whole Macallan M Collection on the night, paired with a menu specially curated by chef Nelly Robinson.

Renowned Margaret River winery, Howard Park, recently hosted its second annual Global Sparkling Tasting, bringing together luminaries from across the wine industry to taste and discuss how local sparkling compares to other styles across the globe. The event was led by Howard Park’s Chief Winemaker Nic Bowen, House of Arras Sparkling Winemaker Ed Carr and Wine Advocate critic, Erin Larkin. In attendance were more than 30 wine producers, media and members of the trade, who explored the diversity of the sparkling wine category across the globe, including the growing space for premium examples outside the Champagne region.

24 | National Liquor News

Tastin’France brings a splash of France to Australian trade

In November, Business France hosted its annual professional wine tasting that brings together all areas of the trade to explore interesting and high quality French drinks products that may not be in Australia much as of yet. The day is designed to introduce local importers and distributors, wine buyers, educators, and media to different French producers. The event saw two iterations in Sydney and Melbourne, with 16 French producers from different regions involved.

Westward Whiskey’s Miles Munroe comes to Australia

American single malt whiskey producer, Westward Whiskey, celebrated the launch of its Cascadia Creative Series in Australia recently, through a series of events with its Head Distiller, Miles Munroe, who flew over especially for the occasion. The Cascadia Creative Series features Westward Whiskey Single Barrel releases at cask strength, aged in barrels from Dominio IV Wines, located near Westward’s distillery in the Cascade Mountains of Oregon. The boxes for these special releases feature ‘shape tasting’ artwork, drawn by Dominio IV’s Founder, Patrick Reuter. Guests to the events in Australia also participated in a shape tasting – an activity where you illustrate what you are tasting, rather than using traditional tasting note descriptions.

Bayfields Liquor Industry Lunch breaks another fundraising record

The Bayfield family hosted its 22nd Annual Liquor Industry Trade Lunch in November, which raised a $380,262 for the Children’s Cancer Institute through ticket sales, auctions and a raffle. It was a record-breaking effort, pushing the total amount raised by the lunch event since its inception to over $4m. Leaders from the liquor industry enjoyed a great event, the first of its kind to be held without restrictions since before the pandemic, hosted again at Sydney’s Belrose Hotel.

Events

December 2022 / January 2023 | 25

Marketplace

Brand news and promotions

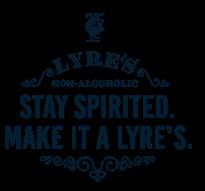

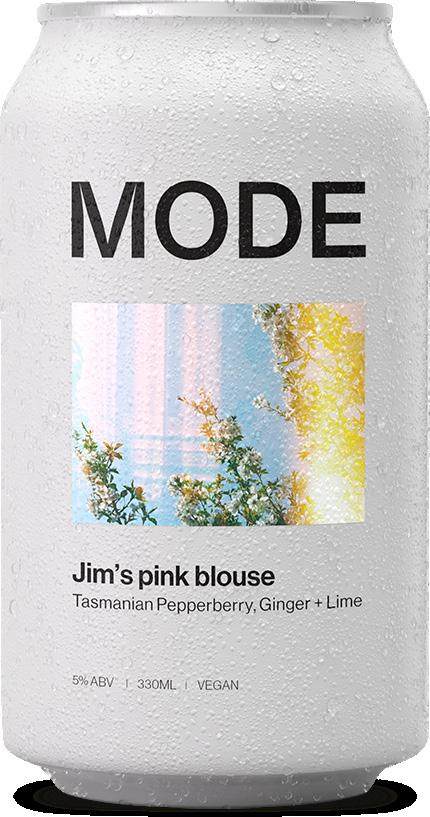

New Australian seltzer brand launches

There’s a new local player in Australia’s booming hard seltzer market, with Mode seltzer announcing its launch ahead of summer. The locally owned brand is inspired by native Australian ingredients, with four hard seltzer varieties that aim to help consumers explore what’s possible in the local hard seltzer space.

Founder, Michael Clifford, has a strong history in the drinks market, working as a senior executive in London at major brewer, SABMiller plc, as well as independent spirits distillery Quintessential Brands.

Clifford said: “I wanted to create a sophisticated product that’s focused on the incredible ingredients from our own backyard. We have amazing native flavours in Australia, why do we need to drink something generic from overseas?”

“For so long, customers could only choose between drinking a beer, wine, spirit, or a cocktail, and more recently, an army of seemingly similar brewed seltzers without much flavour. Mode is here to change that and offer a real alternative to the bland. Alcoholic seltzer is a fast-growing category, and I thought it was time that consumers should be able to enjoy a premium product with exceptional Australian flavours, which is why we created Mode.”

Mode Seltzers are available in a variety of interestingly named SKUs. There’s Frankie’s Sunset Dress (mango and pomegranate flavour), Jim’s Pink Blouse (Tasmanian pepper berry, ginger and lime flavour), Salt Brushed Skin (Davidson plum and forest berry flavour) and No More Elevator Music (yuzu, cucumber and basil flavour).

Mode Seltzer is available in 330ml cans, and comes in 12-packs for $75.

Thirsty Camel VIC gears up for a big summer

As we head into a restriction-free summer, Thirsty Camel is tipping Aussies will celebrate hard this summer, pointing to predicted growth of 16 per cent in consumer spend on socialising and entertainment this year, compared to the 2021 holiday season.

Thirsty Camel is already gearing up to make the most of this, starting its national summer campaign at the end of November in order to reach three million Aussies (aged 18-54) at least 2.5 times over the summer trading period, through a combination of outdoor, digital and radio. The retailer has also partnered with a digital agency to geo target its digital catalogues to recent liquor shoppers, which will help reach up to 2.5 million consumers.

The summer will stay hot for Thirsty Camel VIC after Christmas too, with the Summer Shots promotion running from Boxing Day through to 22 January. In this promotion, shoppers simply scan a QR code which directs them to a game where they’ll need to land as many hoops as they can in 45 seconds to win up to $50k. Plus, there are $500 gift cards to win each week.

Heading into the Australia Day long weekend, Thirsty Camel VIC will be running an exclusive loyalty campaign in the state, rewarding its most loyal Hump Club members with over 2000 prizes. This promotion focuses on classic Aussie consumer favourites, which will be further brought to life with a unique partnership with Triple M.

All of this shows summer will be a bit different for Thirsty Camel VIC, to give its retailers an edge this season.

26 | National Liquor News

Wild Turkey focuses on a lighter way to drink bourbon this summer

With the temperatures rising, consumers are all about refreshment when it comes to choosing drinks for backyard social occasions. This season, Wild Turkey is showing how this is possible with its latest national RTD release, Wild Turkey Discovery Series.

This latest range is a lighter way to enjoy bourbon, with two SKUS on offer - Dry & Lime and Sparkling Lemon Soda. Each come in at 4.2 per cent ABV per 330ml bottle and are available in handy four packs for consumers looking for a relaxed drink on a long hot summer afternoon.

Wild Turkey Discovery Series illustrates what is possible for bourbon drinkers outside of the traditional cola. It’s a fresh and interesting take on the dark RTD category, heroing the versatility of good quality bourbon from the iconic Wild Turkey brand.

For more information, contact your local Campari Australia representative.

MONIN releases new Fuji Red Apple flavour

Known for its juicy, crispy, Asian pear-like flesh with a hint of honey flavour and a pleasant fruity-floral aroma, Fuji apples are also considered to be a good source of vitamin C. The brand new Le Fruit de MONIN Fuji Red Apple captures the essence of the real fruit’s flavour and aroma and is readily applicable across different drink applications and culinary creations.

John Davidson, Head of Advocacy and Innovation at MONIN’s exclusive Australian distributor, Stuart Alexander & Co., said: “We are so excited to launch Le Fruit de MONIN Fuji Red Apple into the Australian market. Aussies have had a long, sweet love affair with Fuji apples and it’s time to bring some apple shape love to our summer drinks menus.”

Fuji Red Apple’s honey crisp, fruity-floral taste profile is the delicious must-have flavour for drinks creations this summer. The new MONIN Fuji Red Apple is made with 50 per cent real fruit, natural colouring and natural flaavouring, and is vegan friendly, while being free from GMO, allergens, lactose and gluten.

Starward releases premium canned cocktail range

Starward has announced the release of its first line of premium RTD canned cocktails, inspired by the popular cocktails at the distillery’s bar. The Starward Canned Cocktails range launches with three SKUs – Starward Whisky, Tonic and Juicy Ruby Grapefruit; Starward Whisky, Ginger Beer and Zesty Orange; and Starward Whisky, Soda and Tangy Finger Lime.

Marketing Director, Brendan Moynihan, said the range aims to recruit new consumers into the whisky category.

“It was important to us that Starward’s Canned Cocktails offered something new to the category. We didn’t want to follow the rulebook and mix our whisky with expected flavours. Not to mention, we’re lucky to have a whisky that can mix with light and bright flavours, so well,” Moynihan said.

“This is why we have released our Canned Cocktails range in bright, fruity and highly refreshing serves. We know that consumers will be on the hunt for convenient yet delicious drink solutions this summer and breaking away from tradition with unexpected yet highly refreshing serves could be key in recruiting a new wave of whisky drinkers.”

December 2022 / January 2023 | 27 Marketplace

Beneficial Beer Co partners with BetaCarbon

Non-alcoholic beer brand, Beneficial Beer Co (BBCo) has announced a partnership with BetaCarbon, an Australian fintech company that enables retail investors to take part in the Australian carbon market.

BBCo is the first FMCG brand to partner with BetaCarbon, which offers a digital token based on a regulated carbon credit – it converts carbon credits into carbon tokens, which represent one kilogram of CO2 that has been avoided or removed from the atmosphere. In the deal, BetaCarbon QR codes will be added to all BBCo Stone Cold Lager cans, encouraging customers to redeem 100 free Australian Carbon Tokens.

It’s the latest in a line of sustainability efforts for BBCo, which also works with solar-powered brewing partners and recycles spent grain to feed livestock.

BBCo Co-founder David Jackson said: “We brewed our first batch of Stone Cold Lager in March, so to know that in our first year of business we’re going to be contributing to BetaCarbon’s vision and efforts is not only a win for BBCo but for me personally as well.

“In the short-term, BBCo customers will each receive the tokenised equivalent of 100 kg of Australian carbon, but in the long-term, the more the community invests, the more influence it will have on how emissions are priced in Australia and therefore what it costs big business to pollute.”

This latest partnership comes after BBCo closed its second round of seed funding, which will be used to produce a pale ale and Pilsner in 2023, increase national distribution and grow the BBCo team nationally.

Graham Norton’s Own Irish GiN arrives in Australia

The local gin market has recently expanded, with the arrival of a gin created in collaboration between actor, author, comedian, commentator, and presenter, Graham Norton, Invivo & Co, and West Cork Distillers.

Graham Norton’s Own Irish GiN builds on the success of his collection of wines, also created in collaboration with Invivo, and comes in both a regular and pink gin iteration.

Bernard Budel, Invivo Global Sales Director, said Norton was very hands-on in the creation of the gins, working closely with Invivo Cofounders, Tim Lightbourne and Rob Cameron, to make sure the taste and balance of each spirit is just right.

“We know that Australian customers are gin afficionados and have a huge amount of choice on shelf, so it was important to Invivo and Graham to create a range of premium gins that speak to quality inside and outside of the bottle,” Budel said.

“The ‘GN Gins’ are distilled with locally foraged botanicals from Graham’s native town of West Cork, Ireland. The selection of botanicals represents Graham’s expression of the perfect gin so while you’ll find classic botanicals present – think juniper berry, coriander, angelica, orris root, liquorice root – we’ve also used some more unusual ones – such as rose hips, fuchsia flowers, basil and gooseberry.

“‘GN Gins’ can hold their own as great quality gins, but importantly they’re flexible and work well with a good quality tonic and in a classic cocktail. Graham is well-known in Australia so we hope his recognisable name – combined with the quality spirit that he has developed – will appeal to consumers.”

Graham Norton’s Own Irish GiN is distributed in Australia by Deja Vu. Wine Co.

28 | National Liquor News Marketplace

Graham Norton with Invivo Co-founders, Tim Lightbourne and Rob Cameron

Hot new releases for 2023

There’s been a wide range of new releases across multiple categories as 2022 comes to a close. Here are some of the big ones to keep your eye on for the new year and beyond.

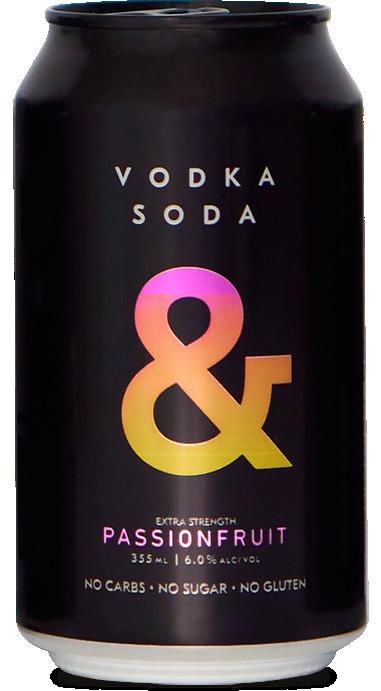

Ampersand Projects adds to its higher strength RTD range

Local independent drinks producer, Ampersand Projects, has added to its range of higher strength RTDs, designed to deliver on the latest consumer trends ahead of summer. Pine Lime is the latest flavour in the six per cent ABV range and showcases the classic Aussie flavour pairing of pineapple and lime. Like all of Ampersand Projects’ RTDs, this range caters to consumers looking for delicious tasting drinks that are ‘better for you’ with no sugar.

Willie Smith’s Tasmanian has announced its newest cider release, adding a non-alcoholic SKU to its line of award-winning organic ciders. The new Willie Smith’s Non-Alc Apple Cider has been crafted to adult tastes, balancing sweetness, tannin and acidity.

The non-alcoholic cider is created using the same production methods and principles that guide the rest of the Willie Smith’s brand - with only organic Tasmanian apples and nothing artificial used, and the cidermaking staying on the farm to ensure the freshest flavours. In this way, it replicates the complex flavours and qualities of the alcoholic range, giving it a point of difference amongst other carbonated apple juice soft drinks on the market.

Distribution: Willie Smith’s

Ampersand Projects has been building this range to cater to a rising consumer desire for higher ABV drinks, which has emerged alongside the trend for lower strength beverages as the hard seltzer market developed in Australia over the past two years. This higher ABV range replicates the serve and strength that consumers expect from the on-premise when they order a vodka soda, and delivers on taste, using high quality vodka and light flavours that leave no aftertaste (unlike many seltzers).

Pine Lime is the fourth in a stellar lineup of six per cent ABV flavours, including the original vodka soda, passionfruit and watermelon.

Distribution: Ampersand Projects

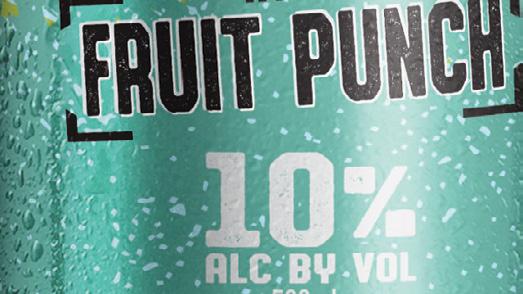

Hard Rock stomps into Australian cocktail market leaving

a massive initial footprint

From the home of the big serve, and following successful launches in the US, Europe and Asia, Hard Rock Expert Cocktails have hit Australian shores for summer. Partnering with Hawkesbury Brewing Co to develop a full serve, full flavour, cocktailstyle RTD at unbeatable value, the giant 500ml Hard Fruit Punch hits a clear point of difference in a surging category of flavour-forward higher ABV drinks.

Hard Fruit Punch delivers on trend flavour available in two distinct but familiar profiles: Lime & Mint and Passionfruit, Lime & Ginger. Distribution: Drink Craft

Willie Smith’s takes first steps into non-alcoholic category

30 | National Liquor News Hot To Stock

Grainshaker releases new Black Label RTD series

The summer of Grainshaker is upon us and the team have developed a range of new flavours perfectly matched to their Australian made vodka. The new six per cent ‘black label’ series of ready-to-drink 330ml cans include Wild Berry & Soda, Lemon Lime & Soda, Apple & Soda and the pictured Grape & Soda. Perfect straight out of the fridge for sharing and celebrating this summer, these are full-bodied expressions of bright, bold relatable flavours. Low sugar, gluten free and made with natural flavour – the cans carry less than 125 calories per serve.

The flavours of this range blossom on a base of Grainshaker Australian vodka. Handmade in Victoria from Australian grains distilled through copper pot still, this is a vodka full of character that resembles the country and people it comes from. It’s been a few summers since we’ve been able to properly gather around the country, so make sure you’re drinking the best this year!

Distribution: Top Shelf International

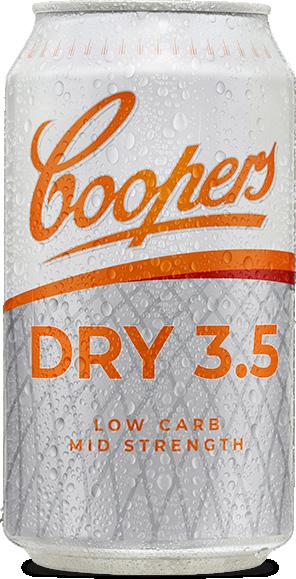

Coopers Brewery rolls out first mid-strength lager

Coopers Brewery has announced it is releasing its first mid-strength lager, after a successful customer trial earlier in 2022. Coopers Dry 3.5 features the same qualities and credentials of the popular full-strength Coopers Dry, just with less alcohol. It is low carb, low calorie and fine filtered, available in 375ml cans in sixpacks and cartons.

Coopers Dry 3.5 was trialled over six months, becoming one of the top mid-strength brands sold in NSW independent retailers during that time, as well as a top 10 brand at several mining sites in WA.

Distribution: Coopers

White Claw launches Surge range of hard seltzers

White Claw has brought two flavours from its higher strength hard seltzer range to Australia. At 6.5 per cent, White Claw Surge will be available in Blood Orange and Blackberry expressions, which are two of the most popular flavours for the range in its home in the US. White Claw Surge is available in 330ml cans, with each can containing just two grams of carbohydrates, no artificial sweeteners and no gluten. Four-packs have a RRP of $30.

Distribution: Lion

December 2022 / January 2023 | 31 Hot To Stock

Fourth Wave Wine expands its portfolio with Crate and Fuzzy Bare

Fourth Wave Wine is continuing to grow its portfolio, announcing the introduction of two new brands. The first is an eco-friendly and sustainably packaged wine brand called Crate, delivering high quality barrel matured wines at exceptional value. It’s bottled in zero waste glass and only sold in sustainable six pack cartons, featuring the Crate Barossa Shiraz 2021, McLaren Vale Shiraz 2021, and Coonawarra Cabernet Sauvignon 2021.

Fourth Wave Wine has also introduced the first product of new brand Fuzzy Bare, launching with a Pinot Gris Piquette. Made by adding water to bare press grape skins and leaving the liquid to naturally ferment, this gently fizzy Piquette is organically grown and lower in alcohol (at four per cent ABV), available in both bottle format and 330ml cans.

Distribution: Fourth Wave Wine

Champagne Pommery heads

to Tibet with 2022 World Collection release

Champagne Pommery has announced the latest inspiration for its World Collection series, with the bespoke 2022 edition bringing consumers a taste of Tibet. This latest iteration in the series is dubbed Mandala, named after the intricate design on the gift boxes that embodies the powerful symbol of universal unity often used in meditation.

Mandala features five limited-edition boxes, with eye catching designs and exceptional Champagne inside each bottle helping give the range a point of difference on the shelf.

Distribution: Vranken-Pommery

Matso’s creates two new ginger beer drinks for after dark

Matso’s has built on the success of its original alcoholic ginger beer with the creation of the Nightlife range. This new range features two ginger beer SKUs coming in at six per cent ABV, designed for consuming after dark. Matso’s Nightlife Alcoholic Ginger Beer and Matso’s Nightlife Alcoholic Ginger Beer with Rum and Lime provide the refreshment and taste that fans love about the original Matso’s ginger beer, and are available in 330ml cans.

This latest expansion from Matso’s is driven by the surging popularity of the ginger beer category, growing at a rate of more than 50 per cent and nearly seven times faster than craft beer overall.

Distribution: Good Drinks

Oxford Landing unveils Sunlight collection

South Australian winery, Oxford Landing, has proudly announced the introduction of a new collection of sustainably made wines that are lower in alcohol and calories. Sunlight by Oxford Landing delivers on flavour and quality, despite its lighter credentials, and caters to consumers seeking out brands which support their lifestyle choices.

The bright and colourful packaging is reflective of the warm Australian sun over the river in Oxford Landing’s Riverland home, which inspired the creation of the collection.

Distribution: Samuel Smith & Son

32 | National Liquor News Hot To Stock

You beauty!

Brydie Allen reviews the momentum of the ‘shop local’ trend, and how it is impacting the Australian drinks market.

Over the past few years, there’s been a more concerted push behind the consumer movement to support local businesses. While not brought on solely by the pandemic, the unique situation of the past few years has certainly helped the momentum, as shoppers seek out locally made products on bottle shop shelves.

Carolyn Macleod, Senior Brand Manager at Riverland wine label, Oxford Landing, said there are several elements that are driving the trend to support local products.

“Shopping local is certainly not a short-term trend, but rather a shift in consumer behaviour, particularly as we continue to face increasing economic pressures and global supply chain issues. Buying local avoids food miles, is more consistent and reliable in regards to quality, supports the community by putting money back into the local region, and has better transparency around ethical standards,” Macleod said.

These elements are also impacting how the local brands operate too, as they review their production processes and logistics to reduce dependence on the international space. Earlier this year, NAB research revealed that local business lending has risen, showing more activity in the space overall.

NAB Executive for Small Business, Ana Marinkovic, said: “Since the onset of the pandemic, more customers are choosing to support local businesses and buy Australian made. This is reflected in our lending to local manufacturers over the past 12 months.”

NAB’s research also showed that 34 per cent of consumers surveyed were mindful of supporting businesses local to their area. Shoppers are finding there is something extra special about supporting hyper localised products.

Kathleen Davies, Founder of Australian craft spirit distributor, Nip of Courage, said the pandemic has assisted this part of the shop local movement.

34 | National Liquor News Australian Made

“There is a thirst for Aussie craft spirits in regional and rural areas of Australia since people from major cities have relocated for better work life balance since the pandemic,” she said.

“The variety of local spirits is endless and consumers love being able to meet the makers and support their local communities by choosing to buy Aussie craft spirits over imported spirits.”

Macleod has also seen this in the wine industry, with South Australian consumers in particular opting to go hyperlocal.

“There is a genuine emotional attachment for consumers supporting local business and it will be important for business to remain part of the community and continue to engage with consumers at that personal level in order to sustain,” she said.

The big question for many pandemic-fuelled industry trends at the moment is about longevity – now that we are living in a largely restriction-free world again, will consumers continue to seek out local products at the same rate?

The answer is yes for Marty Williams, Head of Marketing at Mr Black, who says: “I believe that demand will remain strong for locally made products throughout the next 12 months and long into the future.”

Williams’ key reasoning for this is about consumers recognising the quality credentials of local products, which are communicated when brands are truly transparent.

“More and more consumers are interested in the story of how the things they drink make their way into a bottle or can. Mr Black has found that being transparent with ingredients and process adds to the quality perception around our products and belief in our brand,” he said.

For Macleod as well, the localised consumer movement will continue to be driven by this transparency.

“Buying local satisfies the consumer’s increased desire to know the origins, processes and background of the products that they are purchasing and consuming,” she said.

With the rising cost of living and a possible recession on the cards, Davies predicted the trend will focus on the more accessible end of the industry, which allows consumers to invest in local products at a more affordable price point, and begin to explore the possibilities of Australian made drinks from there.

“With rising interest rates and living expenses I believe that the shop local trend will continue into next year with a heavy focus on Australian craft spirits priced under $100,” Davies said.

“For example, we have noticed already a significant rise in demand for products like Starward’s Two-Fold Double Grain Australian Whisky, which has been a game changer in the local whisky category, making it more approachable to consumers and trade alike.”

As Australian producers keep on innovating the local drinks industry, there is no doubt Australian consumers will stay interested in supporting them, in one way or another. ■

Supporting the success of local products

While demand for local products is predicted to persist in 2023, simply stocking Australian brands in-store isn’t enough to ensure their sustainable success.

As Davies notes: “If the smaller producer’s brands are unsupported and not marketed well they can be delisted very quickly or end up in the bargain bin, which is detrimental to brand equity.”

This is why it’s important for retailers and producers to work together to make sure local products can be surfaced better to consumers, leading to more sales for both sides, and a satisfied shopper who has been able to complete their mission of supporting local.

December 2022 / January 2023 | 35 Australian Made

Flamin’ new

Wrap your laughing gear around a new quality, locally made example from each of the wine, beer and spirit categories.

New hazy beer from KAIJU!

An exciting new beer is coming from independent Australian brewer, KAIJU!

Pleazure Kruze is the latest in the brand’s popular range of craft beers, and is a hazy pale ale ideal for the upcoming season. It features a pleasantly hazy sun kissed straw colour and pillowy soft mouthfeel. Tasting notes for the new beer describe hop flavours blending perfectly with juicy aromas of grapefruit, lemon zest, pineapple and lychee, creating a super clean finish with just a hint of quenching bitterness.

Oxford Landing launches new lifestyle wine collection

South Australian Riverland winery, Oxford Landing, has announced the January launch of a new collection of wines, proudly introducing Riverlife by Oxford Landing.

The Riverlife collection is inspired by the Riverland area it calls home, and is targeted at younger adult consumers looking for fun, lifestyle and flavour driven wines. It consists of three wines – Wake Making Moscato, Sun Chasing Pinot Grigio and Star Gazing Juicy Red - all of which come alive with augmented reality (AR) labels.

Senior Marketing Manager, Carolyn Macleod, describes how the collection is inspired by the lifeblood of the community, the Murray River, and said: “Riverlife by Oxford Landing is all about days spent basking in the sun, making waves on the water, or a peaceful kayak along the bank, balmy evenings and wide-open skies. The peaceful sounds of the river beneath the cyclic calls of wildlife.”

The eye-catching and energetic labels of Riverlife by Oxford Landing are designed by local artist, Ant Candish, and illustrate native flora and fauna of the area. The AR capability on these labels adds extra engagement for consumers, helping them to learn about Oxford Landing’s important sustainability initiatives.

Mr Black releases COCONUTS! Coffee Liqueur in collaboration with Bundaberg Rum

After the sell-out success of the 2021 collaboration, Mr Black has again teamed up with Bundaberg Rum on a second seasonal release. The new Mr Black COCONUTS! Rum and Coffee Liqueur is a tropical blend of the Mr Black signature cold brew coffee, Bundaberg Small Batch Reserve Rum, and coconut.

Managing Founder, Tom Baker, said: “Our last three releases have been real spirits-nerd stuff. Lots of oak, barrel-ageing - serious nose-in-the-glass products. This is the opposite, it’s tropical fun in a bottle.

“This year, we were lucky enough to travel to Bundy to hand-select the spirits used in this edition. In 2021 we were locked out of QLD so we had to send barrels instead. We’ve really upped the rum in this year’s edition. Between the coconuts and coffee there’s a lot of flavours competing for your attention, yet it’s still incredibly well balanced.”

The livery for this latest Mr Black seasonal creation also extends the brand’s long-time partnership with Brooklyn creative studio, The Young Jerks.

Mr Black COCONUTS! Rum and Coffee Liqueur is available now with a RRP of $74.99.

36 | National Liquor News Australian Made

ENJOY THE ‘RIVERLIFE’ WITH OXFORD LANDING’S EXCITING NEW COLLECTION WAKE MAKING MOSCATO SUN CHASING PINOT GRIGIO STAR GAZING JUICY RED AVAILABLE IN 2023 DISTRIBUTED THROUGH SAMUEL SMITH & SON FOR ENQUIRIES CONTACT INFO@SAMSMITH.COM

2022: Retail Drinks year in review

Waters, CEO of Retail Drinks Australia, looks back on the highlights of the organisation this year.

Without a doubt, 2022 has been another challenging, yet successful year for Retail Drinks. This year marked just our fourth year as a unified national industry body, following a merger of state and territory Liquor Stores Associations in late 2018 to better represent the needs and interests of Australia’s retail liquor sector.

For our members and the broader retail liquor industry, coming out of various COVID-19 lockdowns across the country has seen our members and the entire retail liquor supply chain having to adjust to the ‘new normal’, with liquor retailers responding to likely permanent shifts in consumer patterns and preferences.

Throughout the year, Retail Drinks has been involved extensively in advocating on the industry’s behalf with all levels of government, and across all jurisdictions. We’ve contributed to over 12 key government reviews across issues ranging from online alcohol sale and delivery, age verification, privacy acts, automatic mutual recognition, preventative health frameworks, drug and alcohol strategies, container deposit schemes, minimum unit pricing, and banned drinker registers. We also provided comprehensive policy priorities on behalf of industry prior to both the Victorian and South Australian state elections.

We also helped chalk up some policy and advocacy wins for the industry too, including but not limited to: ensuring that liquor stores, as an ‘essential service’ were removed from the WA Government’s ‘proof of vaccination’ requirements; liquor licence fee waivers for all WA liquor stores for 2022-23; and recognition of prior learning in the ACT for interstate RSA training.

This year, Retail Drinks also commissioned two new independent research projects; one on Accessibility and Harm, and the other on Online Alcohol Sale &

Delivery. Both studies are the first of their kind and will not only support our ongoing advocacy work, but the data and insights should be of great interest and value amongst members and the broader industry.

Our Online Alcohol Sale & Delivery Code of Conduct continues to do great things, not only helping to enhance industry responsibility and compliance, but lead and shape policy development. We’ve welcomed new Code Signatories every month, and by the end of 2022 will have undertaken a whopping 7000 ‘mystery shop’ compliance audits for the year. It’s incredible to fathom that since launching the Code and commencing our audit program in January 2020, over 15,000 audits have been completed – an absolutely massive number and amount of data, which is simply unprecedented anywhere in the world.

On the Member Services front, a few major highlights for the year include our Industry Training project, plus the launch of our new Merchant Service Fee ‘Pricing Comparison Service’ – the first of its kind in Australia, which so far, has identified average annual savings of around 34 per cent, or nearly $4,000, which is significant.

Lastly, our annual flagship events, the Retail Drinks Industry Summit and Awards, which we were finally able to host in-person again for the first time since 2019, saw over 400 members and industry stakeholders come together in Sydney late last month to connect, learn and celebrate the successes of people and companies in our industry.

On behalf of Retail Drinks, thank you to all members for their ongoing support in 2022 – we wish you all a safe and prosperous festive trading period and look forward to supporting you better in 2023! ■

Michael

38 | National Liquor News Retail Drinks Australia

Overpriced outgoings in retail leases

Don’t overpay for outgoings under your retail lease. It is important to understand what the landlord is charging and if they can charge these costs. Just because a lease states a tenant must pay for certain outgoings does not mean the landlord can claim these costs.

Each state has legislation in place to protect the retail tenant including what outgoings the tenant can be requested to pay and which are prohibited. Outgoings can include:

• Expenses attributable to the management, operation, maintenance or repair of the retail shop building or land

• Charges, premiums, levies and rates or taxes payable by the landlord

• Fees charged by a landlord for services provided by the landlord in connection with the management, operation, maintenance or repair of the retail shop building or land

• GST paid by the landlord

Prohibited outgoings

In most states, a tenant is not required to pay for the following items:

• Contribution to outgoings not specifically referrable to the shop. That is, the shop must receive a benefit resulting from the outgoing

• Cost of any finishes, fixtures, fittings, equipment or services in or for the shop unless the tenant’s requirement to contribute was disclosed in the landlord’s disclosure statement

• Capital expenditure

• Interest and charges incurred by a landlord on borrowings

• Rent and other costs associated with land not used by or for the benefit of the shopping centre

• Land tax (variable depending on the state).

• Management fees (variable depending on the state)

• Contributions to a depreciation or sinking fund

• Insurance premiums for loss of profits

• Excess payments in relation to a claim on the landlord’s insurance policy for the centre or building

• Payment of interest and charges on amounts borrowed by the landlord

• Landlord’s contributions to merchants’ associations and centre promotion funds

in most cases, the landlord must provide the tenant with the following:

1. A disclosure statement before the lease is entered into which specifies the outgoings payable; and

2. They must also give the tenant an annual estimate of the outgoings. In most cases, the written outgoings statement must be accompanied by a report prepared by a registered company auditor confirming whether or not the statement correctly states the landlord’s expenditure and whether or not the total amount of estimated outgoings exceeded the total actual outgoings.

Adjustment of outgoings

What

should the lease state about outgoings?

The lease should specify the following:

• What outgoings are payable

• How the outgoings will be determined

• The apportionment to the tenant

• How the outgoings may be recovered

How is the proportion of outgoings determined?

The proportion of outgoings payable by a tenant is determined based on the tenants who enjoy or share the benefit resulting from the outgoing.

Estimate and statement of outgoings

The requirement for each state varies but,

An adjustment for outgoings must be made within a specified period (which varies in each state) after an outgoings statement is issued to the tenant. That is, the tenant pays for the gap, or the tenant is reimbursed for overpaid outgoings.

Promotion and advertising outgoings

This can only be charged if the landlord makes available to the tenant its marketing plan and shows where the costs have been spent.

In conclusion, it is advisable for tenants to have a lawyer specialising in retail leases review their lease so that they can be informed of what outgoings are payable and which are prohibited so that they avoid paying more than they should. ■

December 2022 / January 2023 | 39 Leasing

Marianna Idas, Principal at eLease Lawyers, describes what to look out for with outgoings in retail leases.

Things to know about Pinot

Pinot Noir is the fourth largest red wine grape variety grown in Australia, with a five per cent volume share of red varieties. Australia’s Pinot Noir crush in 2022 was 44,271 tonnes, 19 per cent down from the 2021 record crop and nine per cent below the five year average.

The warmer inland regions of Riverland, Murray DarlingSwan Hill and Riverina make up three out of the top four regions producing Pinot Noir. Together, the Pinot Noir crush of these three regions has grown by nearly 30 per cent since 2020. Outside of the warmer inland regions, Tasmania, Adelaide Hills and Yarra Valley produce the most Pinot Noir.

The average price of Pinot Noir in 2022 was $1,200 per tonne across all of Australia. The average price increased in both warm inland regions (up six per cent to $682 per tonne) and cool/temperate regions (up 10 per cent to $2,171). In the past 10 years, the average price of Pinot Noir has risen steadily, at an average of five per cent per year. Pinot Noir has the second highest average price per tonne of the top 10 red wine grape varieties in the cool/temperate regions, second only to Grenache ($2,201/tonne).

The sales volume and value of most of the top red wine grape varieties in the Australian off-trade channel declined in 2022. However, sales of Pinot Noir increased by seven per cent in

Figure 1: Year-on-year change in offtrade volume, value, and average value, moving annual total July 2022

Figure 2: Share of red wine on-trade listings by variety

value and six per cent in volume. The largest share of Pinot Noir sales in the Australian off-trade sits in the $20-$29.99 segment, with a 31 per cent volume share.

For Australian Pinot Noir, the Yarra Valley holds the highest share of value in the off-trade at 16 per cent, although this has declined over the past two years. Tamar Valley, South Eastern Australia and South Australia have also declined in share. Meanwhile, gaining share of off-trade value are Tasmania (12 per cent share), Adelaide Hills (eight per cent share), and Barossa Valley (three per cent share).

In the Australian on-trade, Pinot Noir has the most listings of red wine varieties on wine lists in bars and restaurants, with an 18.5 per cent share. However, this was down from a 19.3 per cent share in 2021.

Tasmania (16 per cent share), Mornington Peninsula (10 per cent), and Geelong (four per cent) all increased their share of Pinot Noir on-trade listings in 2022, compared to 2021. Meanwhile, Gippsland, Adelaide Hills, and Yarra Valley declined in share. Tasmania overtook Yarra Valley as the top regional Pinot Noir listing in 2022. ■

40 | National Liquor News

Angelica Crabb, Senior Analyst at Wine Australia, dives into the top things to know about Pinot Noir in Australia.

Australia

Wine

Australian Distillers Association elects its first female president

Holly Klintworth was elected to take over from Stu Gregor at the last AGM.

The Australian Distillers Association has elected its first female president at its AGM in November.

Holly Klintworth, Director and Distiller at Bass & Flinders Distillery, was elected to take over from outgoing president, Stu Gregor of Four Pillars, who has been at the helm for eight years. Over this time, the Association grew from 30 members to over 400, and has achieved a number of big wins for the flourishing Australian distilling community.

Klintworth is excited to take on the role and continue this great work of the Association.

“The future is laced with opportunity for our incredible craft spirits industry which is at the frontier of truly incredible growth. As our industry continues to develop and innovate, my focus will be to ensure we gain greater recognition from Government on the contribution distilleries make to the Australian economy,” she said.