November

th 12 London

Call for entries! We know the economic environment is tough but we also know UK manufacturing is strong and resilient - if there were ever a year when the successes of UK Manufacturing need to be recognised then surely 2009 is it! Shout about your success! And let us help you be recognised by your staff, customers, suppliers, shareholders and the wider community as a world class manufacturer. The Manufacturer Of The Year Awards scheme is specifically designed to recognise world class excellence and best practice being achieved throughout UK manufacturing. Previous winners include Smith & Nephew, InterfaceFLOR, Bombardier Aerospace, Boss Design, Willerby Holiday Homes.

Leadership and strategy

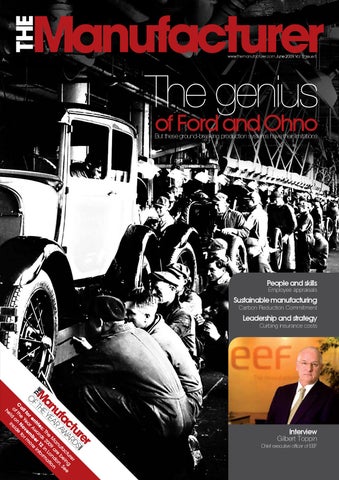

of Ford and Ohno

Design and innovation World class manufacturing

But these ground-breaking production systems have their limitations

Skills and productivity IT in manufacturing Logistics and supply chain Operations and maintenance Sustainable manufacturing SME manufacturer of the year Automotive Aerospace and defence Food and beverage

People and skills Employee appraisals

Pharmaceutical and medical devices

Sustainable manufacturing Carbon Reduction Commitment

Leadership and strategy

Export manufacturer of the year

And the winner of winners category – The Manufacturer of the Year

Curbing insurance costs

r re tu ng e ac ei Se uf b n. an re o M 9 a ond tion he 00 L a : T s 2 in rm es rd 12 fo tri wa er in en r A b re or a m o l f Ye ove or m f al C the n N e of ld o nsid i he

For further details contact Alexis Catchpole on 01603 671300, mail a.catchpole@sayonemedia.com or download an entry form at www.themanufacturer.com/awards. The winners will be announced during a black tie gala dinner and awards ceremony in London on 12th November 2009. And if you are interested in sponsoring an Award, contact David Alstin on 01603 671307 or email: d.alstin@sayonemedia.com

The genius

The awards categories this year are:

www.themanufacturer.com June 2009 Vol 12 Issue 5

ENTER NOW, visit: www.themanufacturer.com/awards

www.themanufacturer.com June 2009 Vol 12 Issue 5

Interview

Gilbert Toppin

Chief executive officer of EEF