– Michael W. Dunagan: Chasing Property Damage Insurance: A Broken Model

– Mark Jones Appointed to TxDMV Board

– Lessons from a Hacker

– Dealer Spotlight: Selcuk Kaya

– Michael W. Dunagan: Chasing Property Damage Insurance: A Broken Model

– Mark Jones Appointed to TxDMV Board

– Lessons from a Hacker

– Dealer Spotlight: Selcuk Kaya

Combine your sales history with the power of AI

Recon Alerts

Never overlook a costly error

OEM Information

View original manufacturer window stickers

Enhanced Insights

Access

PRESIDENT

Greg Reine/Auto Liquidators 39670 LBJ Freeway Dallas, TX 75237

PRESIDENT ELECT

Greg Phea/Austin Rising Fast 8024 IH 35 North Austin, TX 78753

CHAIRMAN OF THE BOARD

Eddie Hale/Neighborhood Autos PO Box 1719 Decatur, TX 76234

SECRETARY

Russell Moore/Top Notch Used Cars 900 East Davis Conroe, TX 77301

VICE PRESIDENT, WEST TEXAS (REGION 1)

Cesar Stark/S&S Motors 7699 Alameda Ave. El Paso, TX 77915

VICE PRESIDENT, FORT WORTH (REGION 2)

Tyler Simmons/Abilene Used Car Sales, Inc. 2150 N. 1st Street Abilene, TX 79603

VICE PRESIDENT, DALLAS (REGION 3)

Chad Lancaster/Chacon Autos 11800 E. Northwest Hwy Dallas, TX 75218

VICE PRESIDENT, HOUSTON (REGION 4)

Lowell Rogers/11th Street Motors 1355 N 11th St, Beaumont, TX 77702

VICE PRESIDENT, SOUTH TEXAS (REGION 6)

Cesar Torres/Lofi Motors 4634 Ayers St. Corpus Christi, TX 78415

VICE PRESIDENT AT LARGE

Christina Sabillón/Mi Tierra Auto Sales 7935 Gulf Freeway Houston, TX 77017

VICE PRESIDENT AT LARGE

Lucas Ponder/Auto Smart 3202 Summerhill Rd. Texarkana, TX 75503

TIADA EXECUTIVE DIRECTOR

John Frullo

9951 Anderson Mill Rd., Suite 101 Austin, TX 78750

Office Hours M-F

Business Name

Select One Dealer Member Associate Member

Contact Person

E-mail addresss

Business Phone

Mobile Phone

Dealer P Number

Who referred you to TIADA?

Mailing Address (if different from above)

Experience the benefits of being a part of an 80-year old association.

Good through 12/31/2025. Pay the full amount today and receive the rest of 2024 for free.

Good through 12/31/2025.

Dues include NIADA and local chapter membership where applicable.

PLEASE INDICATE PAYMENT METHOD:

Check or Money Order (payable to TIADA)

Check# Credit Card Card Number: Expiration: CVC: via Bank Draft (Authorization Agreement Required –email accounting@txiada.org to get set up)

Payment via Credit

(Dealer Members Only; Please enter card information above) - $42.83 per month

Eleven years ago, I decided to start a business. I had attended college, received a degree, and worked in multiple family businesses over the years; how hard could this be? I love cars; I raced them, wrecked them, and I knew little about how to work on them. Well, let’s just say the first few months taught me a few hard lessons and made me seek education. Education is crucial to maintaining your dealership business, including how to look at underwriting, and all aspects of the six types of businesses I would be running in the future to manage a successful dealership.

In the competitive world of automotive sales, education remains an invaluable asset. For dealers, staying informed is not merely beneficial; it’s essential. As the industry evolves, so must the knowledge and skills of those operating within it. Educating oneself is key to fostering customer trust, enhancing service, and ultimately driving sales.

First and foremost, a well-informed dealer can better serve their customers. Many individuals who turn to BHPH options may need more credit histories or financial literacy. Dealers can provide accurate and empathetic guidance by understanding the nuances of financing, credit scores, and consumer rights. This not only aids customers in making informed decisions but also positions the dealership as a trustworthy partner in their automotive journey.

Moreover, continuous education allows dealers to adapt to changing market conditions and regulatory requirements. The automotive industry is influenced by various factors, including economic trends, technology advancements, and shifts in consumer behavior. By staying updated on these developments, dealers can adjust their strategies and offerings to effectively meet customer needs. This adaptability is crucial for long-term success in a dynamic marketplace.

by Russell Moore

Another vital aspect of education is enhancing customer relationships. Knowledgeable dealers can engage in meaningful conversations with clients, addressing their concerns and providing tailored solutions. This rapport-building fosters loyalty and encourages repeat business. When customers feel understood and supported, they are more likely to recommend the dealership to friends and family, expanding the dealer’s reach through positive word-of-mouth.

In addition, investing in staff education is equally important. A dealership’s success hinges not just on its leadership but also on its employees. Training programs that focus on sales techniques, customer service skills, and financial education can empower staff to excel in their roles. A knowledgeable team enhances the overall customer experience, as they can address questions confidently and provide insightful recommendations.

Lastly, embracing education cultivates a culture of growth within the dealership. When dealers prioritize learning, it sends a message to employees that professional development is valued. This culture not only boosts morale but also attracts talent who are eager to contribute to a progressive environment. A team committed to continuous improvement is better equipped to tackle challenges and seize opportunities in the marketplace.

In conclusion, the importance of education for independent automobile dealers cannot be overstated. By prioritizing knowledge acquisition, dealers enhance customer service, adapt to market changes, build stronger relationships, empower their teams, and foster a culture of growth. In an industry where trust and expertise are paramount, investing in education is a strategy that pays dividends — proving that, indeed, education is not out of style. Never stop learning and seek education daily.

Anonymous Donor Allen, Scott Avila, Jennifer Barrett, Stephen Black, Austin Boisture, Karen Brown, Mark Browning, Justin Davis, Vicki Edenfield, Robert Escajeda, Sergio Goodman, Jason Gregory, Tommy Hagler, Keith & Marcia Hale, Eddie Hanson, April Hobson, James

Please fill out the form on the facing page to help our efforts out at the Capitol!

Ingram, Blake Jackson, Rich Jones, Mark Kaya, Selcuk Lazo, Deyla & Felix Litz, Brian McClees, Jason

Moore, Bobby & Monica Moore, Gerald (G.R.) Moore, Russell Morrissey, Corey Muñoz, Jose Petersen, Shaun Reine, Greg Rice, Jenissa Rodriguez, Edgar Rogers, Lowell

Sabillón, Christina Sanchez, Hugo Simmons, Tyler Smith, Jerry and DeDe Smith, Linda Stark, Cesar Stoll, Kevin Sumrall, Cal Terkel, Ken Toledo, Elkin Turan, Jon Wienecke, Christie & Duane Williams, Lanny Winkelmann, Ryan Zak, Gregory Zak, Michael

by Stephen Pallas TIADA Director of Marketing and Communications

Selcuk Kaya’s journey to becoming a leading independent dealer in Houston, Texas, is one of resilience, vision, and a deep understanding of the automotive industry. Originally from Kayseri, Turkey, Selcuk started his entrepreneurial journey in Istanbul’s bustling market of Tahtakale, followed by establishing a prominent car dealership and rental company in Iraq. In 2017, he relocated with his family to the U.S., marking the beginning of Kayalar Motors, a thriving business with two locations in Houston.

When asked what inspired his move to Texas, Selcuk explained that it was both a personal and business decision. “Houston felt like the right place because of its economic growth and its diverse population, which reminded me of my personal history and wealth of knowledge that I have gained throughout my career,” Selcuk said. His transition into the Texas automotive industry leveraged the lessons he learned in Turkey, allowing him to carve out a niche in the used car market.

What sets Kayalar Motors apart is a deep commitment to customer satisfaction. “We don’t just sell cars — we build relationships,” Selcuk said. He emphasized the importance of trust, with many of his customers becoming repeat buyers, drawn back by the quality of vehicles and the integrity of the dealership. Every car sold at

Kayalar Motors undergoes a rigorous inspection process to meet their high standards, ensuring reliability for their customers.

Selcuk is an active member of both TIADA and NIADA, and credits these organizations for helping him succeed in a competitive industry. “Being part of TIADA and NIADA has been

“We don’t just sell cars — we build relationships.”

Kaya Selcuk, Kayalar Motors

incredibly valuable. These organizations advocate for us and help ensure that our voices are heard at the state and national levels,” he explained. Through his involvement, Selcuk has had opportunities to discuss key industry issues, such as the Federal Trade Commission’s (FTC) Motor Vehicle Dealers Trade Regulation Rule and rising interest rates.

At the 2024 NIADA Policy Conference, he had the chance to meet lawmakers and discuss these pressing matters. “Conversations like these help shape the future of our industry,” he said. His membership with TIADA has also been pivotal, particularly through access to tools, resources, and training sessions that help him stay ahead of regulatory changes.

Kayalar Motors isn’t just content with the status quo. Always looking for ways to innovate, Selcuk recently co-founded TAPY CAR, a company specializing in NFC-embedded Smart Car Sale Tags. This new technology simplifies the carbuying process, making it more efficient for both the dealer and the customer. This innovative approach, combined with Selcuk’s experience and adaptability, positions Kayalar Motors as a leader in Houston’s used car market.

offers valuable advice to fellow independent dealers: “Stay focused on building trust with your customers. The car industry is competitive, but if you prioritize the customer experience and create long-term relationships, you’ll stand out.”

He also encourages others to get involved with organizations like TIADA and NIADA. “The resources, networking, and advocacy they provide are invaluable for independent dealers.”

In addition to running two dealerships, Selcuk is also working on a commercial real estate development project under Kayalar Construction. His focus on both the automotive and real estate sectors reflects his entrepreneurial spirit and vision for future growth.

As someone who has successfully navigated the challenges of running a dealership in a new country, Selcuk

Despite the challenges of inflation and the rising costs of vehicles, Selcuk remains optimistic about the future. He emphasizes the importance of adapting to changing market conditions and continuing to provide quality vehicles at fair prices. “With prices going higher and the cost of financing increasing, customers are keeping their cars longer. This makes it even more important for dealers like us to ensure we’re selling reliable, highquality cars.”

Selcuk is quick to point out that a major key to his success has been keeping up with the latest industry tools and regulations. “Every year, we attend TIADA conferences, and the sessions and expos are essential for our business. We’re always learning about new technologies and strategies to improve our operations.”

He highlighted how TIADA’s training sessions and access to the latest tools have helped Kayalar Motors remain competitive. “We are constantly

upgrading our company with new tools and regulations, which helps us run faster and more securely than others in the market.”

Selcuk’s journey from Turkey to Texas is a testament to his hard work, adaptability, and commitment to excellence. His dedication to providing high-quality vehicles and building lasting relationships with customers has positioned Kayalar Motors as one of Houston’s top independent dealerships. Through his involvement with TIADA and NIADA,

Selcuk is also playing an active role in shaping the future of the industry, advocating for dealers and ensuring that their voices are heard.

Looking ahead, Selcuk’s focus on innovation, customer satisfaction, and growth ensures that Kayalar Motors will continue to thrive in the years to come. Whether through embracing new technologies or expanding into commercial real estate, Selcuk’s entrepreneurial spirit will undoubtedly lead him to even greater success.

The buy-here-pay-here dealer had done everything by the book. The motor vehicle retail installment contract called for the debtor to obtain and maintain property damage insurance that protected the lien holder. New customers without current insurance were sent down the street to purchase policies that would protect the lien holder.

Dealership employees were trained to review binders and policy declarations to make sure that the dealer was listed as loss payee, and, if any question arose, to call the insurance company or agency to verify coverage.

Then, on the occasions when the dealership had received notices that policies were about to be cancelled for non-payment, staff members had called and written to remind debtors of the insurance requirement and to urge that payment be sent in. Records were kept and notations were made of the many calls and letters and copies of cancellation and reinstatement notices were duly filed away. The labor-intensive procedures to keep financed vehicles insured often required additional employees and great expense.

Yet, when the dealer’s collateral was damaged in an accident that rendered it a total loss, the insurance company refused to pay.

Several years ago, these steps would have been sufficient to protect a car creditor’s interest in the collateral in all but a few exceptional cases. Today, however, taking these same procedures is increasingly becoming a waste of time for lien holders who are finding that,

by Michael W. Dunagan

COUNSEL

...in the sub-prime vehicle market, where car buyers are rated as sub-prime insurance risks, the old model has broken down and is not working for buy-here-pay-here dealers and other sub-prime lien holders. Once an accident occurs, there seems to be a better-thaneven chance that coverage will be totally denied. If the lien holder gets lucky and liability is accepted by the insurer, the odds are good that a low-ball settlement offer will be made that is often thousands of dollars under the generally accepted price-guide valuations.

regardless of their due diligence in enforcing the property damage insurance requirement on their contracts, claims are routinely being denied and coverage contested by insurance companies.

What changes have taken place over the last decade or so that have

brought about this current state of affairs? What has transpired to turn a relatively safe system of insuring collateral to a hit-and-miss game of Russian Roulette when it comes to getting paid a fair price for repairs or replacement when an accident occurs?

There was a time in the nottoo-recent past when insurance companies issued a uniform driver’s policy that contained standard terms and condition, including the rights of a named loss payee (there were several variations of the Texas Personal Automobile Policy, but differences were mostly inconsequential). Under those policies, the lien holder could count on coverage applying to just about any damage, less the deductible. The most common dispute then was typically over the valuation of the vehicle in the case of a total loss or over reasonable repair costs if it was repairable, with the insurance adjustor arguing for as low an amount as possible (also known as “low-balling”). The loss payable clause that appeared in most standard policies actually gave the lien holder greater protection than the debtor, as the lien holder wasn’t subject to some of the defenses an insurer could

The Texas legislature in 2013 passed a bill that requires insurance companies to disclose to insureds in advance if the policy (either property damage or liability) excludes specific drivers or only covers the named party. Attempts then and in the 2015 session, both supported by TIADA, to prohibit limited policies were unsuccessful.

raise to avoid paying the named insured.

The Texas Personal Automobile Policy generally covered anyone lawfully driving the vehicle with the permission of the owner. By and large, the standard polices provided for at least 10 days’ notice of cancellation or change in policy to a loss

payee (the lien holder) before coverage would be denied, regardless of the reason for cancellation, giving the car creditor an opportunity to make alternative arrangements. All of that has now changed, especially in the sub-prime vehicle market, where car buyers are rated as sub-prime insurance risks. The old

model has broken down and is not working for buy-here-pay-here dealers and other sub-prime lien holders. Once an accident occurs, there seems to be a better-than-even chance that coverage will be totally denied. If the lien holder gets lucky and liability is accepted by the insurer, the odds are good that a low-ball settlement offer will be made that is often thousands of dollars under the generally accepted price-guide valuations. Adjusters are now commonly relying on insurance-industry insider price guides that appear to utilize the lowest possible prices one can find for a particular vehicle. The low-ball offer is usually pitched as a “take it or leave it” proposition, with a flat-out dare to take the insurance company to court.

What first precipitated the collapse of the old collateral-protection insurance model was the passage, by the Texas Legislature a few years ago, of a “de-regulation” bill that authorized insurance companies to take their pencils to the old standard policies and tailor-make their policies to meet the needs of individual customers. Immediately, agencies and companies began offering “limited coverage” policies to sub-prime customers at reduced prices.

Low income car buyers are lured to agents who sell the limited policies by TV and print ads that assure the car buyer of hundreds of dollars of saving. The main reason for the savings is the fact that coverage is limited in ways that drastically reduce the odds of the insurance company having to pay a loss.

Now that insurance companies are allowed to custom-write their own policies without meeting any minimum standards, it is natural to expect that, whenever a loss occurs, companies will change their policies to exclude coverage for that particular type of occurrence. Making matters worse, lien holders rarely see the actual policies which include the ever-expanding escape clauses. More

and more exceptions to coverage are being added to sub-prime policies as insurers seek to lower premiums for competitive purposes.

But the letter also warned that creditors could not reject policies that did not contain named-driver or excluded-driver limitations just because those policies were written by companies or agents that the creditor had bad experiences with.

The ability of car creditors to reject those limited policies for property-damage insurance obviously does not apply to liability policies. If, for instance, a car debtor (or any other driver for that matter) gets rear-ended by a vehicle that’s covered by a limited policy, there is a chance that the driver of the vehicle causing the accident is not a named covered driver or is an excluded driver. Unfortunately, there is no way the driving public can check on the status of the liability insurance covering the vehicle that is going to cause a future accident.

The Texas legislature in 2013 passed a bill that requires insurance companies to disclose to insureds in advance if the policy (either property damage or liability) excludes specific drivers or only covers the named party. Attempts then and in the 2015 session, both supported by TIADA, to prohibit limited policies were unsuccessful.

We’ve seen a number of coverage denials recently that have made the pursuit by a car creditor of proof of insurance coverage a wasted exercise. The basis of denial was the fact that the debtor/insured bounced a check or stopped payment on the check given for the insurance premium down payment, installment payment, or reinstatement charge. In one case, the insurance company turned down the claim because the debtor/insured, who wrecked the vehicle within days of buying it, ran to the bank and stopped payment of the check it had just given to the

insurance agent for the premium. It apparently just didn’t make sense to give up money for insurance for a car that has been wrecked and would soon be abandoned. The insurance company used the stopped payment as the basis to proclaim that the policy was cancelled from its initiation despite the fact that a binder of coverage had been given to the dealer, and the dealer relied on the binder in good faith to believe that there was in fact coverage in place.

The general unfairness of the “retroactive cancellation” clause in a policy is readily apparent. A lien holder accepts the binder of coverage in good faith, and relies on the existence of coverage to release the vehicle to the debtor. Yet without any knowledge or control over the status of the premium check given to the agent, the lien holder’s protection can be taken away – under the legal fiction that the policy never existed.

Most policies provide that a lien holder will be notified of cancellation at least 10 days before coverage is cancelled. Yet, it is not uncommon for lien holders to find out — after the accident occurs — that the insurance company is claiming that the policy was cancelled prior to the accident although no notice of cancellation was received by the lien holder. In many of these situations, the insurance company will produce a multi-page print-out of notices supposedly sent. We’ve also seen coverage denials based on some exception that appears in the fine print of the policy (even though a copy of the policy was never given to the dealer) that allows the insurance company to escape the 10-day notice requirement under certain circumstances.

A similar type of claim denial involves the unilateral cancellation of the policy, or a change of covered vehicles by the debtor – without notice to the lien holder, of course. In a recent actual case, the policy holder

removed the car from coverage just hours before it was totaled.

Some lien holder claims are denied because the insurance company says it can’t find the insured, and takes the position that it can deny claims when an insured is “uncooperative” or can’t be located. In one case referred to in one of the newspaper articles, a liability claimant contended that he was told by the insurer that they couldn’t reach the policy holder, even though the policy holder had admitted liability. The claimant actually went to the insured party’s house and got him to call the insurance company to remind them where he was.

The recent experiences of subprime car creditors bring to mind the plot line of the best-selling John Grisham novel, and later the movie, The Rainmaker. A health insurance company had denied medical coverage for its insured who was dying

of leukemia. During the trial of the lawsuit against the fictionalized insurance company, testimony was elicited that the company automatically and intentionally denied all claims, hoping the claimants would eventually just give up.

The irony of the breakdown in lien holder protection under the traditional collateral insurance model is that dealers are constantly sending their customers out to purchase insurance policies, thus creating business and putting money into the cash registers of the very companies that are denying coverage after losses occur. Further, dealers and other car creditors are paying their employees to verify insurance coverage and diligently monitor non-payment notices. They then expend additional time to chase down debtors to urge them to take more money to those same insurers to keep the policies in effect.

More and more car creditors are questioning the wisdom of

spending their resources and employee time to generate business for companies that are selling products that don’t effectively cover the creditor’s interest in their vehicles, and will likely resist paying claims when damage to financed vehicles occurs. In future Legal Corner articles, we’ll review some of the other issues raised by insurers to deny coverage, and how to deal with them. We’ll also examine some of the alternative approaches available to car creditors in finding better, more cost-effective, arrangements for protecting their collateral.

Michael W. Dunagan is an attorney in Dallas, Texas who has represented the Texas Independent Automobile Dealers Association for over 45 years. He has written a number of books and hundreds of articles for trade journals and law reviews. His clientele includes dealers, banks, finance companies, auto auctions and credit unions.

Bayona Motor Works Marcus Bayona 1788 Austin Highway, San Antonio, TX 78218

Brandons Auto Group LLC Daniel Smallwood 4939 Seguin Rd, Kirby, TX 78219

Car 4 Sale Ruben Garcia

719 Brighton Ave, San Antonio, TX 78214

Comcar Auto Sales Jose San Miguel 1520 S Malinche Ave, Laredo, TX 78046

Enthusiast Autohaus LLC Zohair Quddusi

2636 Walnut Hill Lane, Suite 325, Dallas, TX 75229

Hanen Auto Sales John Hanen 230 Deahl St, Borger, TX 79007

Lozano Motors LLC Daniel Lozano 2728 Culebra Rd, San Antonio, TX 78228

Pendergraft Auto Sales Seth Pendergraft 1111 N Austin St, Seguin, TX 78155

Schneck Motor Company LLC Al Schneck 1200 Commerce Drive, Plano, TX 75093

Sherrard Auto Sales Charles Sherrard 2820 W Pioneer Parkway, Arlington, TX 76013

Shorty’s Full Auto Repair & Sales Juan Flores 5611 Evers Rd, San Antonio, TX 78238

STHRN Truck & Auto LLC Carson Miller

812 Lake Dr, Weatherford, TX 76085

Victory Auto Center LLC Marcy Valdez 2450 Culebra Rd Ste A, San Antonio, TX 78228

Wild West Autoplex Brenda Dominguez 7549 W University Blvd, Odessa, TX 79764

ASSOCIATE MEMBERS

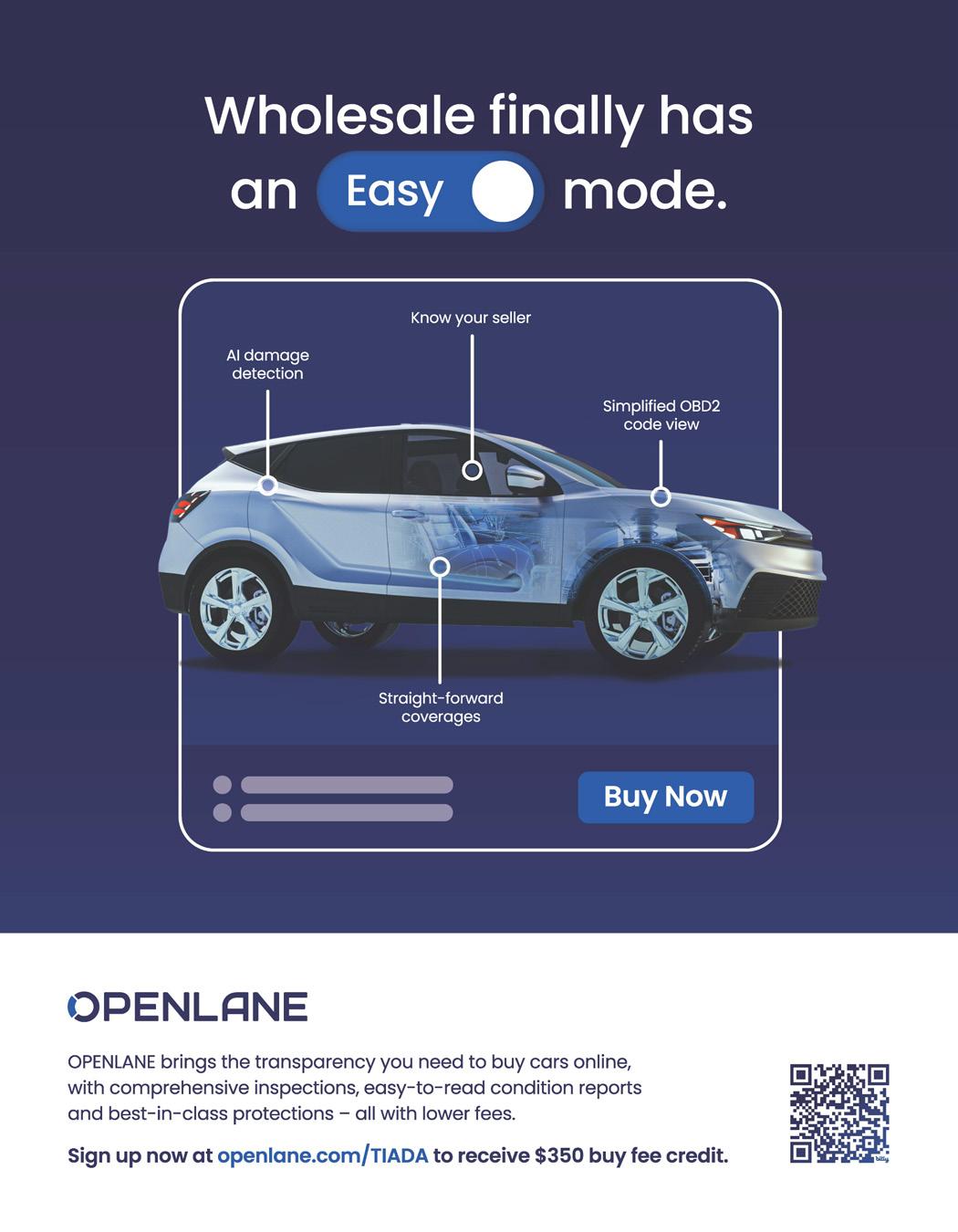

OPENLANE Dylan Grimm 11299 Illinois St, Carmel, IL 46032

Teks Solutions LLC Patricia Cerda

The Starting Line, LLC Paul Ragsdale

700 Highlander Blvd Suite 150, Arlington, TX 76015

6731 Frontier Drive, #1113, Springfield, VA 22150

The Texas License Renewal Education Course provides the ins and outs of being a dealer in Texas in a self-guided online course, available 24/7. This is the same course required by the TxDMV to renew a GDN license, so it covers all the important subjects including:

• Staying compliant with TxDMV regarding premises requirements

• Acquiring Inventory

• Temp Tags and Metal Dealer Plates

• Buyer’s Guide

• Deal Jacket Documents

• Transferring Titles

• Record Keeping

• Special Inventory Tax (VIT)

• Federal Requirements

• The OCCC

• Enforcement and Investigation

• Advertising Rules

“Great refresher course, helped me remember a lot of items that I need to be in tune with.”

“The course provides all the necessary information, links, and rules where I can find useful tools for my business.”

“If you want to learn more about a specific topic this course includes a direct link to the source you are trying to find out more information on.”

This course is perfect for managers that need an overall refresher or for the new employee that needs to be brought up to speed on all aspects of this industry in a fast, convenient and reliable way.

In addition to TxDMV’s approval, this course has been reviewed by the Tax-Assessor Collectors Association of Texas for accuracy so you’ll never have your title transfer paperwork rejected again.

To register visit TexasDealerEducation.com and select the Texas License Renewal Education Course.

“Overall, this program was great and I am happy that eLICENSING implemented this to ensure we know the basic stuff of running our dealers and running a clean ship without having to face violations or risk your license, this is awesome!”

“This is a good training course for all new dealers. It can also be recommended for old dealers as a refresher training course.”

by Stephen Pallas TIADA Director of Marketing and Communications

“Mark is a tireless advocate for consumer protection. His understanding of the industry and the challenges facing vehicle owners makes him the perfect person to help guide the TxDMV as it works to improve services for all Texans.”

Eddie Hale, TIADA Chairman of the Board

FOR HIS APPOINTMENT TO THE

TxDMV BOARD!

Governor Greg Abbott has appointed Mark Jones, CEO of Mike Carlson Motor Company, to the Texas Department of Motor Vehicles (TxDMV) Board. With nearly three decades of experience in the automobile industry, Jones brings a wealth of knowledge that will enhance the department’s consumer-focused initiatives. His term will run through February 1, 2029, and is expected to significantly contribute to the ongoing improvement of services and protections for Texas vehicle owners.

The TxDMV Board plays a critical role in overseeing vehicle registration, dealer regulation, and initiatives to curb vehicle theft and burglaries—key issues that affect millions of Texans. With Jones’s appointment, the board gains an industry leader and a dedicated public servant who prioritizes consumer interests. As the department seeks to expand its consumer protection measures and streamline services, Jones’s extensive expertise in the automotive industry will help ensure these objectives are met with efficiency and transparency.

One of the main reasons for Jones’s appointment is his deep commitment to consumer protection. Over the course of his career, Jones has advocated for transparency and fairness in vehicle sales and service—a focus that aligns with TxDMV’s mission to protect consumers while fostering a healthy vehicle marketplace. Whether ensuring that title and registration processes are simple and user-friendly or advocating for more robust consumer safeguards, Jones’s leadership will serve Texas drivers well.

Mark Jones is no stranger to leadership positions. In 2022, he served as the President of the Texas Independent Automobile Dealers Association (TIADA), where he was instrumental in shaping policies that balanced the needs of dealers and consumers. As someone who has always focused on ethical business practices, Jones has been praised for helping to raise the standards of consumer service across the industry.

Eddie Hale, TIADA’s Chairman of the Board, shared his strong support for Jones’s appointment, stating,

“Mark is a tireless advocate for consumer protection. His understanding of the industry and the challenges facing vehicle owners makes him the perfect person to help guide the TxDMV as it works to improve services for all Texans.”

Vehicle registration is one of the most direct ways in which TxDMV impacts Texas drivers. Each year, millions of Texans rely on the department to manage vehicle registrations in a timely and efficient manner. Jones’s deep experience with the administrative side of vehicle sales will allow him to offer valuable insights into how the registration process can be further streamlined to reduce wait times and improve convenience for consumers. His appointment comes when the TxDMV is already exploring ways to innovate and improve its digital services, making processes like vehicle registration and title transfers faster and more accessible.

Moreover, Jones’s leadership is expected to play a vital role in ensuring that TxDMV’s systems are up-to-date and user-friendly for all Texans, including those in rural or underserved areas where access to vehicle registration services may be more limited. His goal will be to help the department continue making registration more accessible for everyone, whether through enhanced online services or better in-person support at regional offices.

TIADA’s Executive Director John Frullo said, “Mark is the ideal person for this position. He knows and understands the independent automobile industry and as a member will be able to provide critical input to the board based on his experience.”

Another priority for the TxDMV is its work to combat vehicle theft, a growing concern for many Texas drivers. With Jones’s appointment, the department will gain a leader

In

will work closely with the department to strengthen its antitheft initiatives.

who understands both the scope of the problem and the practical steps needed to address it. Vehicle theft is a multi-faceted issue requiring a combination of technology, regulation, and public awareness

campaigns. Jones’s experience will help the department find innovative solutions to tackle this ongoing challenge.

In addition to improving consumer-facing processes like registration, Jones will work closely with the department to strengthen its anti-theft initiatives. These initiatives not only help protect vehicle owners but also play a critical role in reducing insurance costs and making Texas communities safer. His big-picture thinking will be essential in coordinating efforts between local law enforcement, state agencies, and automotive businesses to reduce vehicle-related crimes. Jones’ collaborative approach to problem-solving complements Jones’s history of advocating for consumer protection. He has shown time and again that he is capable of bringing together diverse stakeholders to address complex issues, and this quality will be invaluable as the TxDMV seeks to reduce vehicle theft and ensure that Texas drivers feel secure.

The TIADA Website: txiada.org

Members can log in with their username/ password and access our Dealer Member Directory, Legislative Action Center, Compliance Consultation Service and much more. Register for all upcoming TIADA events online through the Calendar of Events, access our online membership application, find contact information for all our Local Chapters, and access many additional resources through our Knowledge Base.

License Renewal Certificate

TexasDealerEducation.com

Texas Department of Motor Vehicles

888.368.4689

txdmv.gov

Office of Consumer

Credit Commissioner

800.538.1579

occc.texas.gov

Texas Comptroller

800.252.1382

comptroller.texas.gov

NIADA

817-640-3838

niada.com

REPOSSESSIONS

American Recovery Association

972.755.4755

repo.org or contact TIADA state office

FORMS

Burrell Printing

512.990.1188

burrellprinting.com

In addition to his industry experience, Jones has demonstrated a lifelong commitment to serving his community. He actively volunteers with organizations such as Harmony Baptist Church, Relay for Life, and the Rotary Club of Arlington. This passion for service extends to his professional life, where he has consistently sought to elevate the businesses he works with and the lives of those around him. His community involvement is a testament to his belief that strong leadership goes beyond business and includes giving back to the people and communities who need it most.

Jeff Martin, CEO of the National Independent Automobile Dealers Association (NIADA) and former TIADA Executive Director, described Jones as someone who “understands the importance of consumer protection and compliance. He will be an outstanding advocate for all Texans.” This praise underscores the trust Jones has earned across the industry and signals the positive impact his work will have on the department’s efforts to serve Texas drivers.

“Mark is the ideal person for this position. He knows and understands the independent automobile industry and as a member will be able to provide critical input to the board based on his experience.”

John Frullo, TIADA Executive Director

As Mark Jones steps into his new role on the TxDMV Board, Texas vehicle owners can expect positive changes. His leadership and dedication to consumer protection, combined with his vast industry knowledge, will ensure that the department continues to serve the best interests of the public. From enhancing vehicle registration processes to combating vehicle theft, Jones is poised to make a lasting impact.

TIADA congratulates Mark Jones on this well-deserved appointment and looks forward to seeing the meaningful contributions he will bring to the Texas Department of Motor Vehicles. His service will undoubtedly strengthen the department’s ability to protect and support Texas vehicle owners for years to come.

Travel to Orlando, Vegas, or somewhere else!

Recruit 20 members and you will receive an all-expense trip for you and a guest to attend the 2026 NIADA Convention & Expo 4

Relax with the family and turn work into pleasure.

Recruit 10 new members by June 30th, 2025 and you will receive your hotel room for free (up to two nights) at the Gaylord Texan Resort & Convention Center in Grapevine during the TIADA conference. 3

top-notch

Recruit 5 new members by June 30th, 2025 and you will receive one free registration to the 2025 TIADA Conference & Expo.

by Andrew Smith CEO of AutoRaptor

In the highly competitive automotive industry, dealerships constantly strive to achieve outstanding performance. Whether it’s closing more sales, delivering exceptional customer service, or optimizing operational efficiency, there are always areas that can be improved upon. This article will explore five key areas of dealership performance that can benefit from continuous enhancement.

Before delving into specific areas of improvement, it’s important to understand the significance of dealership performance as a whole. Successful dealerships are not stagnant entities; they are constantly evolving and looking

for ways to refine their processes. Continuous improvement is vital for remaining competitive and staying ahead of the game.

Dealership performance is not just about numbers and sales figures; it encompasses the entire customer experience journey. From the moment a potential buyer steps onto the lot to the after-sales service they receive, every interaction shapes the dealership’s reputation. Building a positive brand image and fostering customer loyalty are key components of dealership performance.

Continuous improvement is crucial for dealerships to remain relevant in a rapidly changing market. By constantly assessing and enhancing various aspects of their operations, dealerships can adapt to new customer expectations, market trends, and industry challenges. It allows them to stay one step ahead of competitors and deliver exceptional results.

Moreover, continuous improve ment fosters a culture of innovation within the dealership. Employees are encouraged to think creatively, suggest new ideas, and implement best practices. This culture not only boosts morale and engagement but also leads to long-term success and sustainability.

When it comes to measuring dealership performance, key per formance indicators (KPIs) play a crucial role. These metrics provide valuable insights into the dealer ship’s overall effectiveness and high light areas that need improvement. Common KPIs in the automotive industry include sales conversion rates, customer satisfaction scores, and inventory turnover ratios. However, KPIs should not be viewed in isolation. They are inter connected and influence each other. For example, a high sales conver sion rate may indicate effective sales strategies, but if customer satisfaction scores are low, it could point to issues in the post-sales service. Dealerships need to analyze KPIs holistically to drive comprehensive improvements across all aspects of their operations.

relationship management strategies, dealerships can boost their bottom line and establish long-lasting relationships with customers.

One key aspect of enhancing sales performance is the continuous training and development of sales professionals. Providing ongoing education on product knowledge, sales strategies, and customer psychology can empower sales teams to better understand and meet the

sales operations, provide valuable insights into customer behavior, and improve overall sales efficiency. By embracing technology as a sales enabler, dealerships can stay ahead of the competition and adapt to the evolving needs of modern consumers.

Sales professionals should focus on active listening, asking openended questions, and identifying opportunities to upsell or cross-sell additional products and services.

Customer relationship management (CRM) systems are essential tools for managing customer interactions and maximizing sales opportunities. CRM platforms allow dealerships to track leads, nurture customer relationships, and personalize sales efforts. By leveraging CRM capabilities effectively, dealerships can enhance sales performance and build customer loyalty. Furthermore, establishing a strong online presence and engaging with customers through various digital channels can also play a crucial role in improving sales performance. Through social media platforms, email marketing campaigns, and personalized online promotions, dealerships can reach a wider audience, create brand awareness, and drive more sales. By embracing digital marketing strategies, dealerships can adapt to the changing landscape of consumer behavior and capitalize on new opportunities

Sales performance is a fundamental aspect of any dealership’s success. By improving sales techniques and adopting effective customer

volve understanding the customer’s needs, building trust, and delivering value. Sales professionals should focus on active listening, asking openended questions, and identifying opportunities to upsell or cross-sell additional products and services.

Moreover, incorporating technology into sales processes can also significantly enhance sales performance. Utilizing customer relationship management (CRM) software, sales automation tools, and data analytics can streamline

Efficient inventory management is critical for reducing costs, improving cash flow, and enhancing customer satisfaction. By implementing effective inventory control techniques and streamlining processes, dealerships can achieve greater profitability and meet customer demands more effectively.

One key aspect of optimizing inventory management is understanding the importance of inventory turnover. Inventory turnover measures how quickly a dealership

sells its inventory and replaces it with new stock. A high turnover rate indicates that products are selling quickly, reducing the risk of obsolescence and maximizing cash flow. Dealerships can calcu late their inventory turnover ratio by dividing the cost of goods sold by the average inventory value.

Efficient inventory control en sures that dealerships have the right products in stock at the right time. It reduces the risk of

stockouts or overstocking, both of which can lead to financial losses. Effective inventory management allows dealerships to deliver a seamless customer experience and maintain a competitive edge. Moreover, efficient inventory control can also positively impact supplier relationships. By accurately forecasting demand and maintaining optimal stock levels, dealerships can build stronger partnerships with suppliers. This can lead to better pricing, timely deliveries, and access to new products, ultimately enhancing the overall efficiency of the supply

Implementing inventory management best practices can help dealerships maximize profitability and minimize operational inefficiencies. These practices include forecasting demand, optimizing stock levels, adopting just-in-time inventory methods, and leveraging technology to automate inventory tracking and replenishment processes. Another technique that can significantly improve inventory management is the implementation of ABC analysis. This method categorizes inventory based on its value and contribution to sales. Dealerships can then prioritize their focus on high-value items (A items) that have a significant impact on revenue, ensuring that they are always well-stocked and readily available to customers.

Excellent customer service is a hallmark of successful dealerships. Satisfied customers not only become loyal, repeat buyers but also act as brand advocates, recommending the dealership to friends and family. Therefore, continuously improving customer service is essential for long-term success and growth.

Delivering exceptional customer service builds trust, fosters positive customer experiences, and differentiates dealerships from their competitors. In a highly competitive industry, excellent customer service can be the deciding factor in a customer’s choice to purchase a vehicle or seek services elsewhere.

Superior customer experiences can be achieved by training staff to prioritize customer satisfaction, ef fectively resolving customer issues, and going the extra mile. Providing prompt responses, personalized recommendations, and proactive communication can significantly en hance the overall customer experi ence and reinforce customer loyalty.

The smoother the dealership’s operations, the more efficiently it can serve customers and maximize profitability. By identifying bottle necks, eliminating unnecessary steps, and implementing stream lined processes, dealerships can op timize their operations for greater efficiency.

Smooth operations enable deal erships to reduce costs, minimize errors, and ensure timely delivery of products and services. They also contribute to better employee mo rale and job satisfaction, resulting in happier and more productive staff members.

lean principles, embracing technology solutions, and fostering a culture of continuous improvement. By eliminating waste, automating repetitive tasks, and empowering employees to contribute ideas for streamlining processes, dealerships can achieve smoother operations and maximize productivity.

CORPUS CHRISTI

G.R. Moore

The Car Shack (dates and times can be found at txiada.org/Calendar_List.asp, when scheduled)

Excellent customer service is a hallmark of successful dealerships. Satisfied customers not only become loyal, repeat buyers but also act as brand advocates, recommending the dealership to friends and family.

Improving operational efficiency can be achieved by implementing

performance indicators, enhancing sales techniques, optimizing inventory management, boosting customer service, and streamlining operations, dealerships can achieve exceptional results and stay ahead in the competitive automotive industry.

EL PASO

Cesar Stark

S & S Motors

Meeting – 3rd Friday (Monthly)

FORT WORTH

Jerry Smith

H J Smith Automobiles

(dates and times can be found at txiada.org/Calendar_List.asp, when scheduled)

HOUSTON

Robert Edenfield

Mi Pueblo BRP

Meeting – 2nd Tuesday (Monthly)

SAN ANTONIO

Nory Pakravan

210 Auto Credit

(dates and times can be found at txiada.org/Calendar_List.asp, when scheduled)

Abilene

ALLIANCE AUTO AUCTION ABILENE**

www.allianceautoauction.com

6657 US Highway 80 West, Abilene, TX 79605

325.698.4391

GM: Brandon Denison

Friday, 9:45 a.m.

$AVE : $200

IAA ABILENE*

www.iaai.com

7700 US 277, Hawley, TX 79601

325.675.0699

GM: Shaun Lemke

Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee Amarillo

DAX of AMARILLO**

www.daxofamarillo.com

3208 SE 10th Ave., Amarillo, TX 79104

806.374.8982

GM: Kelsy Allen

Every Tuesday, 11:00 a.m.

$AVE : $200

IAA AMARILLO*

www.iaai.com

11150 S. FM 1541, Amarillo, TX 79118

806.622.1322

GM: Shawn Norris

Monday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Austin

ADESA AUSTIN**

www.adesa.com

2108 Ferguson Ln., Austin, TX 78754

512.873.4000

GM: Michele Arguijo

Tuesday, 9:30 a.m.

$AVE : $200

ALLIANCE AUTO AUCTION AUSTIN**

www.allianceautoauction.com

1550 CR 107, Hutto, TX 78634

737.300.6300

GM: Brad Wilson

Thursday, 9:15 a.m.

$AVE : $200

AMERICA’S AA AUSTIN**

www.americasaa.com

16611 S. IH-35, Buda, TX 78610

512.268.6600

GM: Jamie McCollum

Tuesday, 1:00 p.m. / Thursday, 1:00 p.m.

$AVE : $200

AMERICA’S AA LONE STAR AUSTIN

www.americasaa.com

8408 Shoal Creek Blvd., Austin, TX 78757

214.483.3597

GM: Sara Edgington

Friday and Every Other Thursday, 11:00 a.m.

$AVE : $200

IAA AUSTIN*

www.iaai.com

2191 Highway 21 West, Dale, TX 78616

512.385.3126

GM: Rick Hahn

Tuesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

METRO AUTO AUCTION AUSTIN

www.metroautoauction.com

2221 Hwy 21 W., Dale, TX 78616

512.282.7900

GM: Brent Rhodes

3rd Saturday monthly, 9:00 a.m.

$AVE : $200

Corpus Christi

AMERICA’S AUTO AUCTION

CORPUS CHRISTI**

www.americasaa.com

2149 IH-69 Access Road, Robstown, TX 78380

361.767.4100

GM: Hunter Dunn

Friday, 10:00 a.m.

$AVE : $200

IAA CORPUS CHRISTI*

www.iaai.com

4701 Agnes Street, Corpus Christi, TX 78405

361.881.9555

GM: Patricia Kohlstrand

Wednesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Dallas-Ft.

ADESA DALLAS**

www.adesa.com

3501 Lancaster-Hutchins Rd., Hutchins, TX 75141

972.225.6000

GM: Eric Jenkins

Thursday, 9:30 a.m.

$AVE : $200

ALLIANCE AUTO AUCTION DALLAS**

www.allianceautoauction.com

9426 Lakefield Blvd., Dallas, TX 75220

214.646.3136

GM: Anthony Herrera

Wednesday, 12:30 p.m.

$AVE : $200

AMERICA’S AA DALLAS**

www.americasaa.com

219 N. Loop 12, Irving, TX 75061

972.445.1044

GM: Ruben Figueroa

Tuesday, 12:00 p.m. / Thursday, 12:30 p.m.

$AVE : $200

DAX of ROCKWALL**

www.daxofrockwall.com

1810 E I-30, Rockwall, TX 75087

972.771.9919

GM: Tim Clement

Tuesday, 6:00 p.m. / Thursday, 2:00 p.m.

$AVE : $200

IAA DALLAS*

www.iaai.com

204 Mars Rd., Wilmer, TX 75172

972.525.6401

GM: Terrie Smith

Wednesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

IAA DFW*

www.iaai.com

4226 East Main St., Grand Prairie, TX 75050

972.522.5000

GM: Julissa Reyes

Monday, 9:30 a.m.

$AVE : up to $200 Sell Fee

IAA FORT WORTH NORTH*

www.iaai.com

3748 McPherson Dr., Justin, TX 76247

940.648.5541

GM: Jack Panczyk

Tuesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

MANHEIM DALLAS** www.manheim.com

5333 W. Kiest Blvd., Dallas, TX 75236

214.330.1800

GM: Rich Curtis

Tuesday 9:30am / Wednesday, 9:00 a.m.

$AVE : $100

MANHEIM DALLAS FORT WORTH** www.manheim.com

12101 Trinity Blvd., Fort Worth, TX 76040 817.399.4000

GM: Glenna Bishop Thursday, 9:30 a.m.

$AVE : $100

METRO AUTO AUCTION DALLAS** www.metroaa.com

1836 Midway Road, Lewisville, TX 75056

972.492.0900

GM: Scott Stalder

Tuesday, 9:30 a.m.

$AVE : $200

AMERICA’S AUTO AUCTION EL PASO www.aaaelpaso.com

7930 Artcraft Rd., El Paso, TX 79932

915.587.6700

GM: Judith Ayub

Wednesday, 9:30 a.m. MST

$AVE : $200

IAA EL PASO* www.iaai.com

14751 Marina Ave, El Paso, TX 79938

915.852.2489

GM: Hector Escobar

Wednesday, 9:30 a.m. MST

$AVE : up to $200 Sell Fee

MANHEIM EL PASO**

www.manheim.com

485 Coates Drive, El Paso, TX 79932

915.833.9333

GM: JD Guerrero

Thursday, 10:00 a.m. MST

$AVE : $100

IAA M c ALLEN*

www.iaai.com

900 N. Hutto Road, Donna, TX 78537

956.464.8393

GM: Ydalia Sandoval

Tuesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

BIG VALLEY AUTO AUCTION**

www.bigvalleyaa.com

4315 N. Hutto Road, Donna, TX 78537

956.461.9000

GM: Lisa Franz

Thursday, 9:30 a.m.

$AVE : $200

Houston

ADESA HOUSTON**

www.adesa.com

4526 N. Sam Houston, Houston, TX 77086

281.580.1800

GM: Keyvan Nayeri

Wednesday, 9:30 a.m.

$AVE : $200

AMERICA’S AA HOUSTON**

www.americasaa.com

1826 Almeda Genoa Rd., Houston, TX 77047

281.819.3600

GM: Kyle Drake

Thursday, 2:00 p.m.

$AVE : $200

AMERICA’S AA NORTH HOUSTON**

www.americasaa.com

1440 FM 3083, Conroe, TX 77301

936.441.2882

GM: Buddy Cheney

Tuesday, 1:00 p.m.

$AVE : $200

AUTONATION AUTO AUCTION - HOUSTON**

www.autonationautoauction.com

608 W. Mitchell Road, Houston, TX 77037

855.905.2622

GM: Juan Gallo

Friday, 9:15 a.m.

$AVE : $200

EBLOCK**

www.houstonautoauction.com

2000 Cavalcade, Houston, TX 77009

713.644.5566

GM: Rich Levene

Tuesday, 12:00 p.m.

$AVE : $200

IAA HOUSTON*

www.iaai.com

2535 West. Mt. Houston, Houston, TX 77038

281.847.4700

GM: Alvin Banks

Wednesday, 9:30 a.m.

$AVE : up to $200 Sell Fee

IAA HOUSTON NORTH*

www.iaai.com

16602 East Hardy Rd., Houston-North, TX 77032

281.443.1300

GM: Aracelia Palacios

Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee

IAA HOUSTON SOUTH*

www.iaai.com

2839 E. FM 1462, Rosharon, TX 77583

281.369.1010

GM: Roxy Castillo

Friday, 9:30 a.m.

$AVE : up to $200 Sell Fee

MANHEIM HOUSTON**

www.manheim.com

14450 West Road, Houston, TX 77041

281.890.4300

GM: Nick Hanson

Tuesday, 9:30 a.m.

$AVE : $100

MANHEIM TEXAS HOBBY**

www.manheim.com

8215 Kopman Road, Houston, TX 77061

713.649.8233

GM: Darren Slack

Thursday, 9:00 a.m.

$AVE : $100

ALLIANCE AUTO AUCTION LONGVIEW**

www.allianceautoauction.com

6000 SE Loop 281, Longview, TX 75602

903.212.2955

GM: Billy Fitzgerald

Friday, 9:30 a.m.

$AVE : $200

IAA LONGVIEW*

www.iaai.com

5577 Highway 80 East, Longview, TX 75605

903.553.9248

GM: Ulysses Else

Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee

AMERICAS AA LONE STAR LUBBOCK**

www.americasaa.com

2706 E. Slaton Road., Lubbock, TX 79404

806.745.6606

GM: Dale Martin

Wednesday, 9:00 a.m

$AVE : $75/Quarterly

IAA LUBBOCK*

www.iaai.com

5311 N. CR 2000, Lubbock, TX 79415

806.747.5458

GM: Chris Foster

Tuesday, 9:30 a.m.

$AVE : up to $200 Sell Fee Lufkin

LUFKIN DEALERS AUTO AUCTION

www.lufkindealers.com

2109 N. John Reddit Dr., Lufkin, TX 75904

936.632.4299

GM: Wayne Cook

Thursday, 5:30 p.m.

$AVE : $200

IAA PERMIAN BASIN*

www.iaai.com

701 W. 81st Street, Odessa, TX 79764

432.550.7277

GM: Sheila Gray

Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee

AMERICA’S AUTO AUCTION

SAN ANTONIO**

www.sanantonioautoauction.com

13510 Toepperwein Rd., San Antonio, TX 78233

210.298.5477

GM: Brandon Walston

Tuesday, 9:00 a.m

$AVE : $200

ADESA SAN ANTONIO** www.adesa.com

200 S. Callaghan Rd., San Antonio, TX 78227

210.434.4999

GM: Clifton Sprenger

Thursday, 9:00 a.m.

$AVE : $200

IAA SAN ANTONIO*

www.iaai.com

11275 S. Zarzamora, San Antonio, TX 78224

210.628.6770

GM: Paula Booker

Monday, 9:30 a.m.

$AVE : up to $200 Sell Fee

MANHEIM SAN ANTONIO**

www.manheim.com

2042 Ackerman Road, San Antonio, TX 78219

210.661.4200

GM: Mike Browning Wednesday, 9:00 a.m.

$AVE : $100

GREATER TYLER AUTO AUCTION**

www.greatertyleraa.com

11654 Hwy 64W, Tyler, TX 75704

903.597.2800

GM: Daylon Waynick Thursday, 2:30 p.m.

$AVE : $200

VICTORIA AUTO AUCTION** 835 Industrial Park Drive, Victoria, TX 77905

361.576.0058

GM: Shelly Griffin Thursday, 11:30 a.m.

$AVE : $100

ALLIANCE AUTO AUCTION WACO** www.allianceautoauction.com

15735 I-35 Frontage Road, Elm Mott, TX 76640

254.829.0123

GM: Christina Thomas Friday, 9:45 a.m.

$AVE : $200

DAX of WICHITA FALLS**

www.daxofwichitafalls.com

2206 Sheppard Access Rd., Wichita Falls, TX 76306

940.720.0435

GM: Lisa Shelton

Every Other Wednesday, 5:00 p.m.

$AVE : $200

Ensure your staff knows how to protect consumer information to

Ensure your staff knows how to protect consumer information to comply with the FTC requirements and avoid inadvertent comply with the FTC requirements and avoid inadvertent exposure of your customer's information, government exposure of your customer's information, government enforcement actions, lawsuits, and bad press. enforcement actions, lawsuits, and bad press.

Brought to you by the Texas Independent Automobile Dealers Brought to you by the Texas Independent Automobile Dealers Association. Powered by the Dealer Education Portal. Association. Powered by the Dealer Education Portal. Visit

THIS IS RECON REBUILT.

Time is money. And used car reconditioning can waste a lot of it - until now.

Introducing Repair360: the first recon system designed for Fixed Ops teams by Fixed Ops pros. Automate tedious tasks, eliminate bottlenecks, and give your team real-time visibility into every step of the process. Less friction. Less frustration. Just smoother, faster recon that finally works the way it should.

Saves an hour of admin work per car.

Gain up to 200% more efficiency in parts & labor.

Take the complexity out of vendor management.

Keep everyone on pace and in their own lanes.

Inspections to front-line ready, all in one system.

Configure Repair360 to match your shop’s workflow.

Get started: Book your demo today at ReconditioningSucks.com

by Kendra Brown Strategy & Operations Director of Dream Team Media Company

Aside from the frustrating and archaic walled garden of automotive software, automotive marketing has a huge prevalence of bad behavior when controlling dealer data for marketing.

In recent weeks, the automotive industry has experienced firsthand the pitfalls of siloed technology and the cost of not having control of one’s first-party data. We at The Dream Team Media have been speaking about the importance of data ownership in automotive and the need to improve the tech stack for dealerships, giving them autonomy and access to industry-agnostic software technology. The recent events have shown us that having all of one’s tech in one giant industry basket can lead to disaster. However, this is not the only instance where things can go wrong, and we must learn that ownership is key to preventing such situations. Aside from the frustrating and archaic walled garden of automotive software, automotive marketing has a huge prevalence of bad behavior when controlling dealer data for marketing. Digital marketing adheres to a decades-old tradition of showing inventory and nothing more.

TIADA designed and implemented some important on-demand courses to give dealers quality educational programs they can access throughout the year. These programs are essential for dealers to stay compliant. They offer flexibility, so you can complete them according to your schedule. These courses are designed for any dealers with questions related to various regulations that affect their businesses.

In this two-part video course TIADA counsel Michael Dunagan answers repossession related questions for both the dealer starting out and those dealers who want a refresher. Dunagan goes through the basics of self-help repossession, repossession when a client has filed bankruptcy, and using the courts to regain collateral through sequestration. The course also covers all the repossession letters and includes a downloadable deck of slides to follow along with the course.

$ 98 for two 1-hour videos

Want to avoid having your title transfer paperwork rejected at the tax office? This online course is designed to walk you through the title transfer process and is best suited for people new to transferring titles or those who want to brush up on the basics. This course has been reviewed for accuracy by the Tax Assessor-Collectors Association of Texas.

$ 48 for the course * Also available in Spanish

When car dealers moved from magazines and newspaper classifieds to online marketplaces, AutoTrader stepped up to the plate with an online marketplace and integration to dealer software programs via ADF/XML, which only exists in automotive. Do we need to keep using this? No. Are we still using it? But, of course! Why fix it if it isn’t broken? It’s broken if it holds you hostage to technology that is not at the level your operation needs. I have zero hate for AutoTrader, by the way. Quite the opposite, I am grateful for their innovation at a time when it was needed. However, innovation has been at a standstill for quite some time in our industry. We are ripe for a sea change.

When I started working in marketing for my dealership,

Having worked as a dealer and a vendor, I concluded that websites belong to marketers and developers, not inventory management systems, underwriting platforms, or CRM providers.

I worked through my pain points to dominate the entire search results page on Google in my metro area. When I started working with dealerships to help them dominate, I encountered the pain points of the siloed technology of the automotive industry. Having worked as a dealer and a vendor, I concluded that websites belong to marketers and developers, not inventory management systems, underwriting platforms, or CRM providers. This change can’t happen overnight, but there are steps we can take now to change the tides within our industry.

You need solutions now. You choose a tech partner for one aspect of your dealership,

and it seems harmless to tolerate the other services they provide to get the best they offer. That is until something brings that house of cards tumbling down or until you get tired of tech support stonewalling your requests. While we can’t change the industry overnight, we can approach each day with the same mindset. Here are some ways we can collectively turn the tables in automotive so that the demand shapes the supply rather than vice versa.

1. Ask questions.

2. Ask for more.

3. Tell them why you turned them down.

There is a common tactic in technology companies that we have all experienced. It’s a free trial to access all the bells and whistles. Once you have all of your data stored with them, upgrading and staying is easier than transferring everything to a new provider. We all know this very well in the automotive space. The difference in automotive is that there is little integration among diverse software systems. Meanwhile, in the rest of the tech world, technology systems constantly work to improve integrative capabilities to give users what they want. Here are some key questions to ask a company and potential answers that indicate your autonomy after signing the dotted line.

Q: Do you integrate with other companies?

A: No, we have our own options for you to use. Red Flag

A: Yes, we work with XYZ and ABC companies. Here’s a list of who we integrate with. Yellow Flag

A: We can integrate with any browser-based company with an open API. Green Flag

More and more small players want to work in the automotive space, especially regarding websites, CRMs, and even DMS providers. New companies spring from pain points, so it’s best to ask the company about their origin story.

Q: So, how did your company get started?

The answers here may vary, but ultimately, what you are trying to discern is the following:

A: They started because they exited another big company and wanted to start their own. Red Flag if the story stops there.

A: I worked at ABC Company and wanted to improve dealers’ ability to do all these wonderful things and save money, etc. Green Flag because the reason is dealer-driven.

You may not need to leave your current vendor to get better results. It may be a matter of consistently asking for what you want. Vendors can’t read your mind, so the more you proactively and professionally communicate what you would like to see in their program, the more receptive they may be to considering it.

A: I struggled as a vendor because I couldn’t integrate with other vendors, so I solved that problem. Green Flag and maybe consider being an investor.

A: I’m a [insert skill like software engineer, web developer, or marketer] and saw a need for dealers to be able to… Green Flag.

A: I’m a [insert skill like software engineer, web developer, or marketer] and swwaw an opportunity to provide something no one else was doing… Red Flag. See the difference?

You may not need to leave your current vendor to get better results. It may be a matter of consistently asking for what you want. Vendors can’t read your mind, so the more you proactively and professionally communicate what you would like to see in their program, the more receptive they may be to considering it. As a vendor in this space, I have seen a lot of vendor-hopping among dealers. However, I have improved upon my services thanks to the dealers who actively communicate what they’d like to see done differently. They also get the first to market with new or improved services they helped create, giving them

a competitive edge. Not every investment has to yield a dollar-for-dollar return. Sometimes, investing in a long-term relationship with your vendor gives you a competitive advantage in a tight market.

Dealers turn down vendors every day. Ignoring their call or email relays a lack of interest, even if you aren’t openly saying no. Any good salesperson knows that silence should not be interpreted as a no, so vendors persist. However, these dealer vendors differ from the extended warranty salesperson or the debt consolidation telemarketer. Dealer vendors can only provide services to the extent they know what you want. Your “no,” “not now,” or “not sure” reason can help shape the services dealers have available to them. As a vendor, the reason I get a no is like gold. It fuels how I shape and price my services for dealers. I am grateful for every “no” I’ve received that was followed by a why. It’s the “why” that bears new vendors, new ideas, and new solutions to help dealers achieve their goals. Dealers, your “no” can help shape your industry.

As a dealer turned vendor, I’ve built The Dream Team Media Company’s services and partner relationships that help combat the automotive industry’s walled garden conundrum. Marketing is the business of attracting buyers in a world that is evolving. Websites need to integrate with the platforms that reach people, like Google and Facebook, and their structure and performance should reflect that. Websites should cater to how users shop and how dealers sell. How buyers shopped 2 – 5 – 10 years ago differs from today. If the website and marketing aren’t evolving with the times, then all it takes is one industry disruptor to dictate how you

change. (Hello, Tesla! or Carvana!) While these companies aren’t dominating, they’ve changed your business. You can either react or act ahead of your current and future competitors.

I don’t know about you, but I’d prefer to run my business from a proactive rather than reactive perspective.

Kendra Brown founded The Dream Team Media Company and serves as the Director of Client Strategy. In her eleventh year as Dealer Principal of Brown Family Auto Sales, she launched her marketing and consulting company to provide expertise in process improvement to an area of constant scrutiny for used car dealerships — sales and marketing. She possesses over 17 years of experience in the automotive industry as a dealer and service provider to dealerships.

Since 1944, TIADA has been and continues to be the only statewide organization for independent automobile dealers. You are connected with more than one thousand independent automobile dealers across Texas, who are all committed to creating a better image for the industry, while protecting our rights as business owners and increasing our bottom line. Individually, you are strong, but together, as an association, we are powerful .

Get involved with the association’s advocacy efforts, find out what policies may be affecting used car dealers. Have a say, make a difference.

Join other successful dealers. Membership dues include full membership to TIADA and the national association, NIADA.

Connect with industry leaders. Attend the annual TIADA Conference & Expo, access the member-only online directory.

Education offerings designed with you in mind, your personal copy of the Texas Dealer magazine, twice monthly industry updates, exclusive access to industry articles—a wealth of knowledge at your fingertips.

The perks are many, starting with over $10,000 in auction and vendor savings through TIADA’s mobile app. Redeem just a few auction discounts and you’ve basically covered the cost of membership for the year.

Get quick answers on industry, regulatory or compliance issues.

As we enter another year full of opportunities and challenges in the auto dealer industry, let’s take a moment to reflect on some things fundamental to the success of our industry. We all not only produce our living from, but support the great people that work alongside us and that we provide transportation for. TIADA has long stood as a cornerstone of the independent automobile dealer industry in Texas, and your continued support keeps our association successful. That’s because TIADA isn’t just an organization — it’s YOUR organization, owned and governed by you, the members. The benefits of renewing your membership are vast, and the impact of your involvement extends well beyond your own business and oftentimes into areas you don’t even have to worry about. Your organization has your back. When TIADA was founded 80 years ago, in 1944, it was built on the idea that dealers needed a voice, a resource, and a partner in navigating the ever-changing regulatory and business landscape. That idea hasn’t changed, and if anything, it has become increasingly more important. The TIADA mission remains clear: to provide you with the tools,

by John Frullo

TIADA EXECUTIVE DIRECTOR

advocacy, and knowledge you need to operate efficiently and effectively. TIADA only works if we work together. As a member-driven association, TIADA’s strength comes directly from its members. When you renew your membership, you’re investing in more than just a set of benefits — you’re investing in the future of our entire industry.

Speaking of benefits, let’s talk about what TIADA brings to you. Whether it’s our world-class education opportunities, like the Compliance Summits, online courses tailored specifically to the needs of Texas dealers, or our expert legal and legislative support, TIADA is here to help you run your business smoothly and effectively. Just this year, we’ve had countless calls from dealers seeking guidance on complex issues, from title disputes to understanding new federal regulations to the major change of transitioning from paper tags to metal plates. In each case, TIADA’s experienced team was there to step in, work on solutions and keep you apprised of activity affecting your business.

Beyond individual support, there’s also a broader mission. Your membership helps you be a powerful

When you renew your membership, you’re investing in more than just a set of benefits — you’re investing in the future of our entire industry.

TIADA General Counsel, author of Dealer Financing of Used Car Sales and Texas Automobile Repossession: A Lien Holder’s Legal Guide

In this two-part video course TIADA counsel Michael Dunagan answers repossession related questions for both the dealer starting out and those dealers who want a refresher. Dunagan goes through the basics of selfhelp repossession, repossession when a client has filed bankruptcy, and using the courts to regain collateral through sequestration. The course also covers all the repossession letters and includes a downloadable deck of slides to follow along with the course.

• Preliminary Considerations Before Repossession

• When is a Customer Considered in Default

• Avoiding Liability from Repossession

• Types of Disposition

• Required Notices to the Debtors

• Handling Personal Property

• Using the Courts to Get Your Car Back Registration $98 for two 1-hour videos

Visit txiada.org/on demand for more information.

voice in Austin, advocating for the rights and interests of independent dealers. Our legislative team works tirelessly to ensure that state lawmakers and regulatory agencies hear your business concerns. We’re proud to be your advocate in these arenas, and your membership ensures we can keep up the fight.

Let me remind you: TIADA is not a passive association. It is governed by a board of dealers — your fellow dealers — who make decisions with your best interests at heart. They understand the challenges you face because they face them, too. When you renew, you’re ensuring that your voice is heard, and you’re keeping this association strong and responsive to the needs of our industry.

So, as the year winds down and you consider your plans for 2025, take a moment to renew your membership. Remember that when you invest in TIADA, you’re not just gaining

When you renew, you’re ensuring that your voice is heard, and you’re keeping this association strong and responsive to the needs of our industry.

access to benefits and services — you’re empowering an association that exists solely to serve you. Together, we are stronger, more resilient, and better prepared for whatever comes next. Let’s keep the momentum going. Please renew your membership today, and let’s continue to build the future of independent dealerships in Texas.