Zuverlässig.

Die selbstklebende Verbundentkopplung

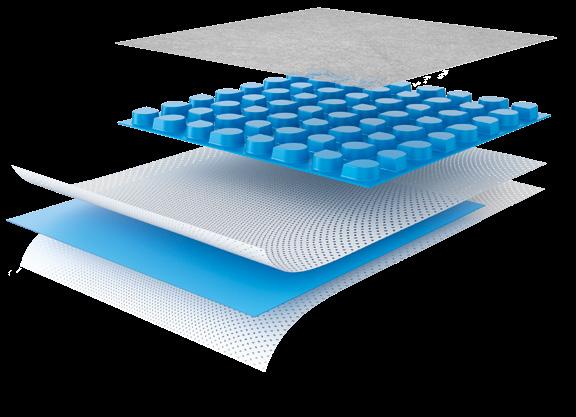

Genauso zuverlässig bei Entkopplung, Lastabtragung und Dampfdruckausgleich wie die klassische Schlüter-DITRA ist die SchlüterDITRA-PS (PS = Peel & Stick). Doch im Vergleich lässt sie sich noch unkomplizierter verlegen: einfach Schutzmembran abziehen und die Entkopplungsmatte auf den haftungsfreundlichen, staubfreien Untergrund kleben. Dank des selbsthaftenden Trägervlieses wird kein zusätzlicher Fliesenkleber benötigt. Das spart Material, Kosten und Zeit.

Self-adhesive bonded uncoupling

When it comes to uncoupling, load transfer and vapour pressure equalisation, Schlüter-DITRA-PS (PS = Peel & Stick) is just as dependable as the classic Schlüter-DITRA. In comparison, it is even easier to install: simply peel off the protective membrane on the underside and stick the uncoupling mat to the substrate, which must be suitable for adhesives and dust-free. The self-adhesive anchoring fleece eliminates the need to apply additional tile adhesive. That saves material, time and money. DITRA-PS is easy to reposition during installation, provided it has not yet been firmly pressed onto the substrate.

100 TO 1840 Strong Channel Partners

250 TO 4400 Robust team of winners KEROVIT, KAJARIA PLY & GRESBOND Diverse portfolio, Bathware, Plywood and Adhesives

PUBLISHER:

Kairos Media Group S.r.l.

Capitale Sociale: Euro 51.400,00

R.E.A. 329775

Periodico bimestrale registrato presso il Tribunale di Modena al n. 22/17 in data 10/08/2017

Iscrizione al ROC n. 9673

OFFICE:

Kairos Media Group S.r.l. Via Fossa Buracchione 84 41126 Baggiovara (Modena) - Italy

Tel. +39 059 512 103 - Fax +39 059 512 157 info@kairosmediagroup.it - www.surfacesinternational.com

EDITOR AND CEO: GIAN PAOLO CRASTA - g.crasta@kairosmediagroup.it

MANAGING EDITOR: DAVIDE MISERENDINO - d.miserendino@kairosmediagroup.it

CO-EDITOR:

Sabrina Tassini

CONTRIBUTING EDITORS:

Sara Falsetti

Paola Giacomini

Chiara Poggi

Sabrina Tassini

SECRETARIAT: info@kairosmediagroup.it

GRAPHIC LAYOUT:

Sara Falsetti

EACH COPY: Euro 4

SUBSCRIPTION: https://kairosmediagroup.it/en/shop/subscription-tile-international

• 1 year: Euro 20

• 2 years: Euro 35

L’abbonamento decorre dal mese di distribuzione. Tariffe speciali per gli abbonamenti collettivi sono disponibili su richiesta Conto Corrente Postale 20026415 intestato a Kairos Media Group srl. Spedizione in abbonamento postale presso la Filiale di Modena. L’IVA sugli abbonamenti, nonché sulla vendi-

ta dei fascicoli separati, è assolta dall’Editore ai sensi dell’art 74 primo comma lettera C del DPR 26.10.72 N. 633 e successive modificazioni.

ADVERTISING:

Kairos Media Group

Tel. +39 059 512 103

Fax +39 059 512 157

• Paola Giacomini

p.giacomini@kairosmediagroup.it +39 335 186 4257

Teresa Contissa

t.contissa@kairosmediagroup.it

· +39 342 092 8002

• Silvia Lepore s.lepore@kairosmediagroup.it

· +39 345 721 8245

• Elisa Verzelloni e.verzelloni@kairosmediagroup.it

· +39 338 536 1966

PRINT:

Faenza Printing Industries SpA Via Vittime Civili di Guerra, 35 48018 Faenza (RA) - Italy

http://www. .com INTERNATIONAL.COM

Tutti i diritti di riproduzione e traduzione degli articoli pubblicati sono riservati. E’ vietata la riproduzione anche parziale senza l’autorizzazione dell’Editore. Manoscritti, disegni, fotografie e altro materiale inviato in redazione, anche se non pubblicato, non verrà restituito. L’Editore non accetta alcuna pubblicità in sede redazionale. I nomi, le aziende e i prezzi eventualmente pubblicati sono citati senza responsabilità a puro titolo informativo per rendere un servizio ai lettori. La Direzione non assume responsabilità per opinioni espresse dagli autori dei testi redazionali e pubblicitari.

Entire contents Copyright Kairos Media Group srl All right reserved.

Opinions expressed by writers are not necessarily those held by the publisher who is not held responsible.

PP level DUO MAXI is the new range of adjustable supports for outdoor raised floors.

MAXI flexibility: thanks to the practical Fixed Head Ring, you can transform the tilting head, able to compensate for surface slopes up to 5%, into a fixed head, directly during installation.

MAXI strength: the new support guarantees excellent resistance to heavy loads and weather elements.

MAXI versatility: numerous accessories are available for any installation requirement, from extensions to aluminium joists, rubber mats and steel clips.

With PP level DUO MAXI the installation of the raised floor will be easy, fast and perfect.

RAIMONDI LEVELLING SYSTEM

available joint sizes

Joint from 0,5 mm

High tensile strength

Perfect clean removal, even with very thin joint clips

Protect your tiles when needed

Eliminate all the effort with battery-powered pliers

Picture: 0.5 mm joint clip chip and scratch protector PATENTED

tile thickness up to 20 mm

manual pliers and battery-operated automatic pliers

chip and scratch protector

We were in Rimini, the weather was hot and top-management figures from the cream of the ceramic, brick and sanitaryware industry were bunching together on the stage for a memorable group photo.

Let’s pick up from this moment, from this snapshot, to wave goodbye to 2024 and usher in a new year, which, we hope, will be full of achievements and even more full of ideas.

That photo, taken at Tecna, the world’s leading trade exhibition for technologies and supplies for surfaces, shows the closing scene of TecnAwards, a series of prizes that the exhibitors and an expert jury award to ceramic manufacturers. Implicitly, it also shows the key to success for the year ahead and every year thereafter: innovation. We’re living in a world where change happens so quickly that we’re often left playing catch-up.

That’s why the ability to imagine the future is becoming an ever more pivotal skill and remains

‘immune’ to artificial intelligence, which, despite being a useful tool, is not yet capable of stunning us with its clairvoyance. And that’s why strategic vision still makes the difference.

Davide Miserendino d.miserendino@kairosmediagroup.it

The other, ever more vital, pillar is data: data rides at the head of a powerful force and is jostling to become – one connection after another – the new grammar of thought. This is why we decided to share plenty of it in this issue, with our exclusive insight on ‘Global Production and Consumption of Ceramic Tiles’: our own small contribution to a successful 2025.

Italcer Group at the forefront of sustainability

In September 2024, Italcer Group took another step towards achieving its 2030 energy-saving targets with the installation of a 100% electric kiln at the Equipe Cerámicas facility in Onda, Castellón, Spain.

A benefit company committed to decarbonising its production processes, Italcer collaborated with Jaume I University of Castellón and Systemfoc on this project, which is expected to reduce CO2 emissions by 1,500 tonnes annually.

The aim of the new kiln is to completely eliminate CO2 emissions during the firing stage without affecting the technical and economic sustainability of the products and represents the first step towards achieving the CO2 reduction targets of the 2030 Agenda.

The project addressed two key challenges simultaneously: first, the complete electrification of the firing stage, replacing the gas kiln with a 100% electric kiln powered almost entirely by renewable energy; second, the development of a new raw material formulation to minimise emissions deriving from thermal decomposition during the firing process. The project also involves optimising the raw material formulation to create a product with excellent technical and aesthetic performance that adapts perfectly to the transition from gas to electric kiln firing technology.

“The start-up of this electric kiln is the first step in our strategy of fully electrifying the production process and entirely eliminating CO₂ emissions,” said Rogelio Vila Rodriguez, General Manager of Equipe Cerámicas. “An electric kiln offers numerous advantages over fuel-burning kilns powered by a blend of green hydrogen and natural gas, including immediate start-up without the need for gas infrastructure, reduced energy consumption and the potential

for energy autonomy if paired with electricity generation and self-consumption systems.”

Founded in 1999 and acquired by the Italcer Group in 2021, Equipe Cerámicas has over 350 employees and has established itself as a global leader in the small-format floor and wall tile sector. It markets its products worldwide and has a particularly strong presence in Europe and America.

Alongside the Equipe Cerámicas project, Italcer has achieved another milestone in terms of sustainability. After years of research, the Italian ceramic group has designed and patented a cutting-edge plant to capture and transform CO2 emissions from its production facilities, as well as convert and recover other organic and inorganic pollutants present.

According to Italcer’s CEO Graziano

Verdi, implementing these projects at an industrial scale is a vital and tangible step in the group’s journey towards decarbonisation.

“Thanks to the extensive use of electricity from renewable sources, we are achieving a substantial reduction in direct CO2 emissions,” Verdi explains.

“At the same time, natural gas will remain an essential energy component throughout the ecological transition, so our newly obtained patent for CO2 capture technology will enable us to promote sustainable, eco-friendly ceramic products through innovative and efficient production processes based on the principles of the circular economy.”

The Italcer Group invested €5 million in social and environmental projects in 2023 alone. These efforts have been widely recognised and earned the company the Sustainability Award 2024, with Italcer taking first place in the “TOP 100 ENVIRONMENTAL>250”, in other words the top 100 companies in the “environment” category with revenues exceeding €250 million.

Duravit AG appoints

Lüder Fromm as new Chief Marketing Officer

Duravit AG announced the appointment of Lüder Fromm as Chief Marketing Officer (CMO). Mr. Fromm has decades of experience in leading marketing positions at globally renowned companies. Most recently, he was Senior Vice President Global Marketing & Brand Communications at HUGO BOSS AG, where he successfully developed and implemented the company’s global brand and marketing strategies. Prior to that, Mr. Fromm held several leading marketing roles, including at the luxury brand Montblanc and Mercedes-Benz AG. His international experience and his strategic flair for brand management and digitalization make him the ideal

person to position Duravit as an innovative and customer-oriented company in international competition.

“Duravit is an exceptional premium brand with international appeal, characterized by design, innovation and customer focus. I am delighted to take on the role of global CMO and, together with the highly motivated team, to take this love brand to a new level,” says Lüder Fromm about his new role.

Kajaria, India’s largest ceramic tile manufacturer and 8th in the world, has made an impressive leap into the UK market with the grand opening of its largest luxury tile showroom in London, last summer. Spanning an impressive 14,000 square feet (1,300 sqm), this new showroom aims to redefine the tile shopping experience, setting a new standard for design enthusiasts and homeowners alike. The showroom is meticulously designed to offer an immersive journey through a world of tile possibilities.

With over 300 unique designs and 50 intricately crafted mock-ups, it presents a diverse range of options that go beyond mere product displays. Each space is thoughtfully curated to showcase how tiles can transform a room, allowing customers to visualize the potential impact on their own interiors.

Kajaria’s UK footprint was further expanded in September, when the company completed a deal to acquire seven stores from the administrators of CTD Tiles, which fell into administration in August. The deal will see Kajaria UKP JV take ownership of stores in Brierley Hill, Chester, Colchester, Coventry, Croydon, Derby and Nottingham. The company hopes to retain as many of the original workforce as possible across the newly acquired stores.

Aliplast and Mirage team up on plastic waste recovery project

Mirage, a renowned high-end Italian ceramic tile producer based in Pavullo in the province of Modena, has reaffirmed its longstanding commitment to sustainability. Its efforts are not limited to reducing the environmental impact of its products and production processes, but also focus on packaging.

In cooperation with Aliplast, part of Hera Group company Herambiente, Mirage initiated a circular process for the recovery of plastic films used in ceramic tile packaging.

Aliplast is not only a leading producer of flexible PE film, PET sheet and regenerated polymers but also has extensive experience in the ceramic sector, where it covers about 67% of the Italian market thanks to its wide range of solutions for recovering, recycling and regenerating

plastic film.The first step in the Aliplast plastic film recovery process adopted by Mirage involves sorting and compacting the waste material, an operation that takes place directly at the Mirage site. The material is then sent to the Aliplast hub, where it is reconverted into granules and subsequently into new packaging film ready for reuse in the Mirage production cycle.

The recovery process is based on the closed-loop principle aimed at ensuring maximum sustainability. This involves collecting plastic waste from companies and then processing and regenerating it to produce a high-quality material with comparable technical properties to those of virgin material and ready for reintroduction into the production cycle.

Each year, Aliplast supplies Mirage with more than 500 tonnes of Reload shrink film, a trademark for Aliplast products containing an extremely high percentage of recycled material, typically more than 80%. The use of this type of material avoids approximately 1,200 tonnes of greenhouse gas emissions annually. Furthermore, by collecting and repurposing customers’ waste materials, Aliplast avoids sending these materials to landfill, thus embracing circular economy principles and enhancing environmental sustainability.

ABK Group and MOOOI announce partnership

On the occasion of the last Cersaie fair, ABK Group announces the signing of a long-term agreement with the Dutch lifestyle brand MOOOI. The agreement is for a new line of high-end ceramic surfaces under the MOOOI ceramics brand. Alessandro Fabbri, Managing Director Sales & Marketing of ABK Group,

says: “The agreement with MOOOI is fully in line with the company’s strategy of consolidating our position in the high-end sector, thanks to the skills, expertise and cutting-edge technology that have always distinguished us in the market. MOOOI is an ideal partner for us, not only because of its prominent role in the world of design, but also because of its unconventional creative approach, which is entirely in line with that of ABK Group. We intend to create products and solutions capable of responding to the demands of an extremely demanding clientele and at the same time, we seek to surprise them, contributing to the success of made in Italy products at an international level.” This is the first time that MOOOI has

dedicated its revolutionary creativity to a ceramic floor and wall tile collection: the decision to collaborate with ABK Group is motivated by the Italian company’s know-how, as well as its cutting-edge technology and production capacity. Also linking the two brands are shared values such as a focus on quality, innovation and a constant search for creative excellence. With this partnership, ABK Group seeks to strengthen its position both in the high-end segment of residential solutions and in the no less competitive and challenging segment of high-end architecture.

The debut of the collection is set for 2025 and its distribution will be jointly handled by the sales channels of both ABK Group and MOOOI. The production processes will be concentrated in the ABK Group’s plants in Solignano Nuovo and Finale Emilia, both in the province of Modena, in the ceramic district, using the most advanced technologies to create surfaces of different sizes and customised solutions with a more marked decorative vocation. ABK Group’s research laboratories will be personally involved in all the steps from the preventive phase to production: the task awaiting the Italian brand’s specialised collaborators is to translate MOOOI’s original, and unexpected creativity into ceramics.

Operating through Polyglass Netherlands, the Dutch subsidiary of Polyglass, the Mapei Group has acquired Wecal Isolatie Techniek, a local company specialising in products and systems for flat roofing and façade insulation, which reported revenues of 25 million euros in 2023. “The acquisition of Wecal and its structure strengthens Ma-

pei Group’s position in the Netherlands,” explains Veronica Squinzi, Mapei’s CEO, “where we have been operating since 2009 through a logistics and sales office.

Europe accounts for 55% of our group’s global revenues and remains a vitally important market for us, so we aim to continue our expansion there.”

“By extending the range of waterproofing and insulation products we offer,” adds Marco Squinzi, Mapei’s Co-CEO, “we will be able to meet the needs of local customers and play an active role in the growth of the Netherlands’ construction market, which is expected to grow at an average annual rate of over 2% in the period 2025-2028.” Summing up the deal, Pierluigi Ciferni, CEO of Polyglass, says: “Thanks to this acquisition in the Netherlands, Polyglass will be able to provide the local market with even better service and develop its potential, especially in logistics, large-scale distribution and, of course, the residential sector.”

Operating in 57 countries worldwide with 96 companies and over 12,500 employees, Mapei Group is continuing to pursue a growth strategy based on internationalisation and localisation, and reported consolidated turnover of 4.2 billion euros in 2023.

Progress Profiles opens sites in USA, Portugal and UAE

Progress Profiles is continuing its global growth drive with the opening of three new sites, one in Bolingbrook (Illinois) United States, one in Lisbon and one in Abu Dhabi. The decision to cover these areas forms part of the strategic growth plan adopted by the company, which already has three foreign branches, one in Randolph, New Jersey, another in Alicante and a third in Dubai.

“The opening of these new sites marks a big step forward in our expansion programme,” explains Dennis Bordin, CEO of Progress Profiles, “and brings us closer to our international customers, so that we can give them more direct and tailored support. It will also enable us to respond more quickly to opportunities arising in rapidly changing markets.”

The increased presence on foreign markets is being backed up by substantial investments in the Asolo headquarters, where all of Progress Profiles’ solutions are made. Last year, the office area was enlarged with the addition of a dedicated floor for the company’s sales department and marketing division, and work is now in progress on completing an extension of the production area and a new, fully automated 3,000m2 warehouse. Next year, this

will house the renovated Academy, with floor-space of 300 to 400m2. One of the company’s flagship initiatives, the Academy is a specialist training school that regularly hosts theory and practice courses on key construction topics and the regulatory requirements governing the installation of coverings.

On the strength of almost 40 years’ experience and the company’s long-standing leadership of the Italian market, Progress Profiles is more committed than ever to internationalisation and innovation, as these various projects show, and is consolidating its position as a global benchmark in technical and decorative profiles and installation systems.

At BAU 2025, Schlüter-Systems will present forward-thinking solutions for sustainable and eco-friendly construction and renovation. On Stand 518 in Hall A4, the German company from Iserlohn will demonstrate how the combination of ceramic tiles and intelligent system solutions can create comfortable, energy-efficient and attractive living spaces. Visitors to the generously proportioned and informative 230 square metre stand can look forward to daily practical

demonstrations with tips and tricks on a variety of products, including new products for the year 2025 for areas such as bathroom design, for example.

A central aspect of the trade fair exhibition will be resource-saving construction.

The special focus will be on the energy-efficient radiant panel heating systems from Schlüter-Systems. For example, the BEKOTEC-THERM water-based floor heating system is ideal for use with renewable energy sources and saves a significant amount of raw materials in the installation process thanks to the low screed cover.

The wide range of possibilities for interior design with Schlüter products will also be presented in Munich – from system solutions for comfortable, easy-access bathrooms to bespoke lighting concepts with illuminated profiles and structural designs for balconies and terraces through to creative and functional design with profiles.

Schlüter-Systems will also be celebrating a golden anniversary in the profile segment at BAU: Schlüter-SCHIENE will turn 50 years old in 2025. In 1975, Werner Schlüter’s invention laid the foundation for what is now a second-generation family-run business – this success story will be honoured accordingly on the trade fair stand.

Raimondi S.p.A. celebrates 50th anniversary

Raimondi S.p.A., a historic company from the Modena area and a world-leading manufacturer of ceramic tiling equipment, celebrated its 50th anniversary on Thursday 30 and Friday 31 May this year.

Over 100 guests, including agents and distributors from various parts of the world, plus authorities and representatives of institutions such as the Region of Emilia Romagna, Confindustria Emilia and Confindustria Ceramica, came together to mark the occasion.

Raimondi S.p.A, a committed exponent of the quality that goes hand in hand with the Made in Italy label, was proud to be able to show its guests the wonderful sights and top-quality produce of its home-city, Modena, and the surrounding area. As well as going on a guided tour of the city, agents and distributors got a chance to see the manufacturing process and museum of the

Victoria PLC sells Turkish company Graniser

Victoria PLC, a British flooring group listed on the London Stock Exchange AIM market, has announced the sale of its Izmir-based tile manufacturer Graniser, which it acquired in 2021. The transaction, valued at €36.8 million, comprises a €10 million cash payment and the assumption of €26.8 million in net debt. The buyer, Hasan Akgün, is the founder of the Akgün Group, a prominent Turkish conglomerate operating in sectors such as ceramics and building materials, automotive, logistics and oil which employs over 5,000 people across 17 factories.

The transaction is part of a strategy to improve Victoria’s profitability, further supported by a long-term supply

hyper-exclusive super-sports car brand Pagani, as well as doing a tasting of traditional Modena balsamic vinegar and learning how the condiment is made. The event culminated in a gala dinner on the Friday evening in the magnificent Ducal Palace at the Modena Military Academy.

The highlights of this unique event in-

agreement with Hasan Akgün to procure tiles at production cost prices. As stated by Philippe Hamers, CEO of Victoria, the sale and the new partnership with Akgün will positively impact Victoria’s earnings by reducing the group’s leverage by approximately 0.5 times. Graniser has been negatively impacted by recent instability in several of its key markets, and for the 12 months ended 30 March 2024, Graniser generated audited underlying revenues of TL994.8 million (about £30.1 million) and underlying EBITDA of TL13.4 million (about £0.9 million).

For Victoria PLC, which already operates in the ceramic tile sector in Italy and Spain, the investment in Graniser three years ago was driven by the desire to diversify the Group’s ceramic tile manufacturing footprint into a low-

cluded speeches by Vincenzo Colla, the Emilia Romagna Region’s Commissioner for Economic Development and Internationalisation and Giovanni Savorani, the outgoing President of Confindustria Ceramica, plus the award of the prestigious 50th anniversary celebratory plaque by Tiziana Ferrari, Director General of Confindustria Emilia.

er energy, labour and raw material price environment. With the stipulated manufactured-cost supply agreement, Victoria has kept this strategy intact, while freeing up capital to redeploy into other business areas.

Victoria PLC’s ceramics division (UK & Europe Ceramic Tiles) ended the first half of the 2025 fiscal year (to 28 September 2024) with a sales volume of 17.4 million sqm (-4.9% on the same period of the previous year), earnings of £151.4 million (-9%) and an EBITDA margin of 12.9%.

Maison&Objet is going to return to Paris for the first edition of 2025, from 16th to 20th January, presenting new design and décor novelties with the inspirational theme Sur/ Reality.

A new Surrealism that feeds on fantasy, distortion, randomness, humour and poetry to construct a narrative of new creative landscapes and of productions that are as surprising as they are desirable. At the show, this trend takes shape in unexpected objects and dreamlike settings that invite us to let

go, and addresses consumers’ newfound appetite for the strange and the surprising.

While the theme pays tribute to the artistic legacy of such illustrious names as Magritte and Dalí via particular aesthetic codes that have become universal, it is firmly rooted in the contemporary world. Sur/Reality highlights the lively topicality of Surrealism’s creative processes. The unreal and the absurd prove to be incredible stage-design tools, revealing dreamlike worlds that appeal more to the emotions and the unconscious than to reason.

Sur/Reality will be a common thread running through the show, staged by Maison&Objet’s curators and accompanied by Talks, and will also permeate the entire Maison&Objet ecosystem, from the selections on the MOM platform to the Paris In The City events. These are just some of the angles through which we can explore the creative and inspiring variations on this unique theme.

Maison&Objet has also named Faye Toogood as Designer of the Year 2025. The British designer strives to “unite the artistic with the everyday so as to make the landscape of our lives less ordinary,” with eclectic productions for the worlds of design and fashion.

Landscapes inspired by her rigorous, poetic and avant-garde work, the productions of her studio and her brilliant collaborations with leading publishers of objects and furniture will take on a new form at the January edition of the show.

“Surreality is the human ability to take creativity beyond the usual boundaries. It’s a very creative theme! – comments Faye. “Concerning the pavilion project that I’m currently thinking about, I can tell you that the welcome into Surrealism will be very warm. I’m going to delve deeply into my eccentric side. Beyond the objects, I’m going to show a creative process.”

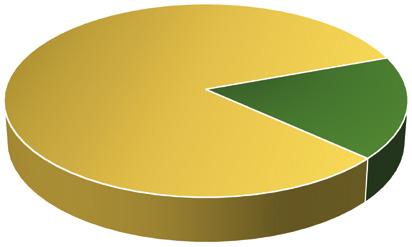

Luca Baraldi, MECS / Acimac Research Centre (l.baraldi@mecs.org)

The twelfth edition of the study “World production and consumption of ceramic tiles” produced by MECS / Acimac Research Centre was published

last October. Consisting of almost 300 pages of charts, tables and commentary, the study provides detailed analysis of the trends occurring over the ten-year period to

1) Overall, the global ceramic industry and market continued to experience a downturn in 2023, following the negative trends observed in 2022. The continuation of the general economic slowdown marked by high inflation and high interest rates led to a further cooling of global tile demand. This in turn resulted in a continued contraction in global production and import-export volumes, although the declines were less severe than those experienced in 2022.

2) Global tile production decreased by 5.5% in 2023, falling to 15,937 million sqm from 16,862 million sqm in 2022. This reduction of approximately 900 million sqm was spread across all continents except for Africa.

Production in Asia fell by 5% from 12.2 to 11.6 billion sqm, equivalent to 73% of global output. China and Vietnam contributed losses of 580 million sqm and 180 million sqm respectively to this decline.

The European continent produced a total of 1,654 million sqm (10.4% of world production). The biggest contraction was in the European Union (down 18% from 1,267 million to 1,039 million sqm), with Italy and Spain both dropping below an output of

2023 in terms of industry, markets, per capita consumption and export flows in geographical macro-regions and in the 76 largest tile producer, consumer, exporter and importer

400 million sqm. Non-EU Europe held up better (615 million sqm; -4.2%), but was negatively affected by the contractions in Turkey and Russia.

Production in the American continent also fell, dropping to 1,473 million sqm. North America saw a decline in output from 378 to 349 million sqm (-7.7%), while production in Central and South America fell to 1,124 million sqm, a decrease of -10.3%.

As mentioned, Africa bucked the global trend with a further increase in production in 2023 to 1,178 million sqm (+9.9%), thanks to increases in Egypt (400 million sqm), Algeria (185 million sqm), Ghana (120 million sqm) and Nigeria (125 million sqm).

3) At the same time, world tile consumption dropped from 16,455 million to 15,627 million sqm in 2023 (-5%). All areas experienced a decline, again with the exception of Africa which saw a 12.5% increase in consumption to 1,421 million sqm, while non-EU Europe remained stable at 2022 levels (636 million sqm). In Asia, consumption dropped from 11.7 to 10.9 billion sqm (-6.5%), equivalent to 70% of the world total. The European Union again experienced the biggest decline from 1,002 to 831 million

countries.

It includes an in-depth analysis of the breakdown of import and export volumes for each individual country by product

type (porcelain stoneware, single and double-fired tiles, other materials). Once again this year, the study will be accompanied by the publication of the volume

sqm (-17.1%). In the Americas, consumption contracted both in Central and South America (1,217 million sqm; -1.9%) and in North America (551 million sqm; -5%).

4) In 2023, global exports continued the downward trend that began in the previous year, although the decline eased slightly, registering a drop of 2.3% compared to a 7% decrease in 2022. Total world exports amounted to 2,753 million sqm, 66 million sqm less than the previous year. The contraction affected all geographical areas with the sole exception of Asia, whose exports grew by 15% from 1,354 million to 1,557 million sqm, thanks to the recovery of China (+6.2%) and the continued surge in Indian exports (+39.6%).

This contrasts with a double-digit contraction in exports from the European Union (from 965 million to 772 million sqm; -20%), non-EU Europe (from 174 million to 132 million sqm; -24.4%) and from Central and South America (from 167 million to 138 million sqm; -17.4%). North America saw a smaller decline in exports (from 48 million to 43 million sqm; -9%), while exports from African countries remained stable at 111 million sqm.

entitled “Ceramic Tile Market Forecast Analysis 2024-2028”, which provides an updated five-year forecast for the global ceramic tile market.

5) As for the export propensity of the various continents or macro-regions, the European Union remained the area with the highest export share in 2023 at 74.3% of its production. All the other areas lagged well behind: non-EU Europe exported 21.5% of its output volumes, Asia 13.4%, North and South America both 12.3% and Africa 9.4%.

The trend in import/export flows confirms the tendency for tiles to be produced close to markets. World exports stood at 17.3% of production and 17.6% of global consumption, with 61.3% consisting of exports shipped within the same geographical region as that of production (79% of South America’s exports remained in South America; 82.7% of North America’s exports were sold within the NAFTA region; 63.8% of Asia’s exports were shipped to other Asian countries; 90% of African exports remained in Africa). The European Union continued to be a partial exception with 46.4% of its exports sold in non-EU markets.

This tendency is further underscored by the fact that each continent’s contributions to world production and consumption are fairly similar. In 2023, Asia accounted for 73% of global production and 70% of consumption, while the corresponding fig-

ures for Europe (EU + non-EU) were 10.4% and 9.4%, the Americas 9.3% and 11.3% and Africa 7.4% and 9.1%.

6) China, the world’s largest producer, consumer and exporter of ceramic tiles, experienced a further decline in its production and sales volumes in 2023. According to the China Building and Sanitary Ceramics Association, the contraction in domestic and export demand has forced Chinese companies to scale back their output to no more than 50% of the country’s installed capacity of around 12.6 billion sqm.

According to the country’s national trade association, China’s output fell by 8% in 2023 from 7,312 to 6,730 million sqm, equivalent to 42.2% of global production. Domestic consumption fell by 9.2% from 6,737 million to 6,118 million sqm, equivalent to 39% of total world tile consumption.

There were a total of 1,022 ceramic tile producer companies in business at the end of 2023, 4 fewer than in 2022.

Following ten consecutive years of decline, China’s exports saw a recovery for the first time in 2023, increasing by 6.2% to 615 million sqm. This volume represented 9% of China’s domestic production and accounted for 22% of global tile exports. As a result, China maintained its supremacy as the world’s largest exporter of tiles, a position threatened by the rapid growth of India. This strong performance was driven almost exclusively by growth in sales in Latin America (74 million sqm, an increase of 53% compared to 2022) and in Africa (48 million sqm, 6 million sqm more than in 2022). Meanwhile, sales in the Asian con-

tinent remained steady at 438.6 million sqm, accounting for 71% of China’s total exports. In 2023, no fewer than 13 of the top 20 markets for Chinese ceramic tiles were in Asia, led by the Philippines, Indonesia, South Korea, Malaysia and Thailand. Australia, the sixth largest market, maintained stable levels of Chinese imports at 30 million sqm.

7) In 2023, India maintained its position as the second largest tile producer and consumer country, while also overtaking Spain as the world’s second largest exporter. Although domestic tile demand remained lukewarm (domestic consumption fell by 2.9% to 1,700 million sqm), India’s production rose to 2,450 million sqm. This 6.5% increase compared to 2022 represents the biggest increase of any of the world’s major tile producer countries. The recovery in production was driven by the astonishing surge in exports, which grew by 39.6% from 422 million to 589 million sqm, just a short way behind China. India’s share of total world exports increased from 15% in 2022 to 21.4% in 2023, while exports as a percentage of domestic production rose from 18% to 24%.

The value of exports reached €2,254 million (+28%), corresponding to an average selling price of 3.8 €/sqm, the lowest of any of the major exporting countries. In 2023, Asian markets continued to absorb the largest share of Indian exports (42.3% of total volumes), but it was outside Asia that India achieved the biggest growth. Africa was the second largest export region (+68.8% in volume and +45.5% in value), followed by North America and Mexico (65.4 million sqm) and the European Union where exports reached almost 60 million sqm

Source : Mecs / Acimac Research dept. “World production and consumption of ceramic tiles”, 12th edition 2024

(+75%); exports to South America and non-EU Europe more than doubled.

The ranking of India’s top countries of export underwent a number of changes in 2023 compared to 2022. The top 10 continued to be led by the USA (35.3 million sqm; +25.5%), followed by the United Arab Emirates (34 million sqm; +36%), Iraq (32.6 million sqm; +26%), Mexico (27 million sqm; +128.5%) and Kuwait (25 million sqm; +27%). In the space of a year, India more than doubled its exports to Russia (+127.7%), Israel (+145.6%) and South Africa (+123%), which ranked sixth, seventh and ninth respectively. The only one of India’s top ten markets to see a contraction was Saudi Arabia (18 million sqm; -26%), where import duties on Indian tiles have been in place for three years. On the subject of import duties, a Federal Government investigation is currently underway in the US following the petition filed last April by the Coalition for Fair Trade in Ceramic Tile requesting the introduction of anti-dumping duties (between 400% and 800%) and countervailing duties on tile imports from India, with retroactive effect from May 2024.

8) Brazil, the world’s third largest producer and consumer country, experienced a sharp decline in production in 2023 for the second consecutive year, dropping from 927 million sqm to 793 million sqm (-14.5%), in response to a contraction in both domestic sales and exports. Domestic demand fell by 5.7% to 694 million sqm, while exports dropped to 89 million sqm (-21.8%), with contractions observed in all destination markets. The USA remained Brazil’s largest export market with sales of 16 million sqm (-21.4%). The value of Brazilian ex-

ports fell to €362 million (-23.6%), with an average selling price of €4.1/sqm. The trade association Anfacer is predicting a partial recovery in both exports (+6.6%) and domestic sales (+3%) in 2024.

9) Spain, Europe’s largest producer and the world’s third largest exporter, experienced a severe decline in production in 2023, dropping from 500 million to 394 million sqm (-21.2%). As a result, it fell to eighth place among the world’s largest producer countries. According to data published by the country’s national trade association Ascer, national consumption fell for the second year running, from 159 million to 135 million sqm (-15%) and was almost entirely covered by domestic production. Exports also fell sharply from 431 million to 344 million sqm (-20%), equivalent to 87% of national production. The Spanish tile industry’s total sales revenue dropped to €4.86 billion (-14.3%), of which €1,300 million was generated by domestic sales (-7%) and €3,553 million by exports (-16.6%) at an average selling price of €10.3/sqm. Internationally, France remained the leading export market in volume (44.7 million sqm; -10.3%) and second in value (€455 million; -5.7%), followed by the United States with 36 million sqm (-9.7%) and a value of €456 million (-11.6%), the UK (17.6 million sqm; -25.3% to a value of €208 million; -18.5%), Italy (17 million sqm; -11.2%, to a value of €185 million; -4.8%), and Morocco (15.3 million sqm; -13.8%). Considering macro-regions, Europe accounted for 49.5% of Spain’s exports by volume, Asia for 15.2%, Africa for 14.1%, North America for 13.4% and South America for 7.2%.

In the first half of 2024, Spanish exports contracted

Source : Mecs / Acimac Research dept. “World production and consumption of ceramic tiles”, 12th edition 2024

by 5.5% in volume and 7.1% in value.

10) Italy also saw a double-digit decline in production in 2023, dropping to ninth place among the world’s largest producer countries but remaining the world’s fourth largest exporter in volume and the leader in terms of value. The 125 companies in the sector produced a total of 373.7 million sqm, a 13.3% decline from the 431 million sqm recorded in 2022 in response to a sharp fall in market demand. Total sales dropped to 369.2 million sqm (down 17.8% on 2022, a fall of around 80 million sqm), generating revenue of €6.2 billion (down 14.1% on the €7.2 billion of 2022). Domestic sales fell to 84.4 million sqm (-9%), generating revenue of €1,126 million at an average selling price of €13.3/sqm. Including imports (32.6 million sqm), national consumption totalled 117 million sqm (-8.6%). Exports, accounting for 76% of production, fell by 20.1% to 284.8 million sqm, generating revenue of €5 billion (down 15.4% compared to 2022) thanks to an increase in average selling price from €16.8/sqm to €17.7/sqm. The contraction affected all the main destination markets for Italian tiles, the top ten being Germany (43.4 million sqm; -30.2%), France (42.5 million sqm; -17.2%), the US (30 million sqm; -14.8%), Austria (9 million sqm; -29%), Belgium (8.5 million sqm; -30%), Switzerland (8.2 million sqm; -19%), the UK (7.7 million sqm; -21%), the Netherlands (7.3 million sqm; -26%), Canada (-23%) and Croatia (-10%), both 6.8 million sqm.

In terms of macro-regions, sales in Europe fell from

248 million to 192 million sqm, including 165 million sqm in EU countries (-23%). Sales in North America also fell by 7 million sqm (38 million sqm; -16.6%), while exports to Asia dropped from 36.6 million to 31.7 million sqm.

In the first five months of 2024, Italian exports grew by 2.8% in volume, but declined by 3.1% in value.

11) The two Asian giants China and India and the two largest European producer countries Spain and Italy together accounted for a total of 66.5% of world exports last year. Adding in the other 6 major exporting countries brings the figure to 84.9%, similar to that of 2022. Spain and Italy maintained the highest export shares at 87% and 76% of national production respectively, followed by Poland at 53%, Iran at 45%, India at 24%, Turkey at 21%, Mexico at 14%, Brazil at 11% and China at just 9%. Italy also maintained its leadership position in terms of average selling price at 17.7 €/sqm, followed by Spain at 10.3 €/sqm, Poland at 10 €/sqm, Turkey at 8 €/ sqm, China at 6.9 €/sqm and India at 3.8 €/sqm.

12) Indonesia and Vietnam in the Far East and Iran in the Middle East continued to rank amongst the largest producer countries in 2023. Production in Indonesia fell by 4% to 413 million sqm and consumption rose to 495 million sqm (+1.2%), partly met by imports (86 million sqm; +11.8%), almost entirely from China. Exports were very low at just 10.7 million sqm.

Vietnam saw a bigger decline in production, which

Source : Mecs / Acimac Research dept. “World

fell to 397 million sqm (-31%) in line with the drop in domestic demand to 375 million sqm. Exports amounted to approximately 38.5 million sqm and imports around 17 million sqm. In Iran, the output of the 142 active factories fell from 480 million to 450 million sqm (-6.3%). Domestic consumption stood at less than 200 million sqm, while exports increased by 4.5% to 203 million sqm, of which more than 70% was sold in Iraq.

13) Turkey, the world’s tenth largest producer and seventh largest exporter, produced 372 million sqm in 2023 (-3.4%), This almost entirely covered domestic demand, which rose to 264 million sqm (+1.5%). Exports fell sharply for the second year running, from 127 million to 79 million sqm (-38%), generating revenue of €632 million, with an average selling price of 8 €/sqm. Turkish exports were mainly spread out over three macro-regions: 49% in Europe (38.6 million sqm; -40%), including 27 million sqm in the EU (-43%); 23.5% in the NAFTA region (18.6 million sqm; -34%); and 21.3% in the Middle East and Asia (16.8 million sqm; -39.4%). The USA remained Turkey’s largest export market (15.2 million sqm; -31%), followed by Germany (10 million sqm; -49%), and the UK (6.7 million sqm; -40%).

14) In 2023, the 10 largest importing countries imported a total of 1,014 million sqm (down 3% on 2022), accounting for 36.8% of global import/export flows. In most cases, imports made up over 70% of total sales, with peaks of 98% in Iraq and

Germany, 95% in Israel and 94% in France. Three of the top ten importing countries recorded an increase in imports in 2023: Iraq (188 million sqm; +8.5%), Indonesia (86 million sqm; +11.8%) and Russia (60 million sqm; +41.7%). The two largest exporters to Russia were India (23 million sqm) and Belarus (19 million sqm).

15) While remaining the world’s largest tile importer country, in 2023 the United States saw a 4.8% decrease in imports to 195 million sqm, equivalent to 73.8% of domestic consumption (264 million sqm; -7.4%). No less than 85.5% of US imports originated from the 6 largest exporter countries: India (36.9 million sqm; +31.3%), Spain (36 million sqm; -9.7%), Mexico (31 million sqm; -7.8%), Italy (30 million sqm; -14.8%), Brazil (17 million sqm; -17.7%) and Turkey (15 million sqm; -31.2%).

Customs data for the first half of 2024 show no signs of a recovery in US tile imports, which fell by 1% in volume and 3.9% in value between January and June. India remained the top supplier to the United States in the first six months of the year with 20.5 million sqm (+13.5% over the first half of 2023). Spain also saw a recovery (+7.8% in volume and -4% in value), as did Italy (+9.6% in volume and +1.6% in value). Mexico, Turkey, Peru and Brazil all saw declines in their exports to the US. ✕

Source : Mecs / Acimac Research dept. “World

Luca Baraldi, MECS / Acimac Research Centre (l.baraldi@mecs.org)

In the period 2010-2023, global import/export flows of ceramic sanitaryware grew by 59.8% from 2.16 million to 3.45 million tonnes, corresponding to a compound annual growth rate of 4%. Following more

Asia remained the world’s largest sanitaryware exporter, increasing its share of global exports to 67.6% despite a 4.5% fall to 2.33 million tonnes in 2023. This was a combined result of contractions in China and Thailand, partially offset by higher exports from India, Vietnam and Iran.

Exports from the European Union, the world’s second largest exporter, also fell by 16.6% to 433,000 tonnes. The three largest exporting countries in the region –Poland, Germany and Portugal, which alone account for half of EU exports – all recorded declines of around 16%.

Following the negative performance in 2022, North America (NAFTA) resumed its growth in exports in 2023 with a total of 336,000 tonnes (+18.4%), almost entirely from Mexico (302,000 tonnes, +20%).

Exports from non-EU European countries also experienced a severe contraction (-21.4% to 199,000 tonnes), with Turkey down 17.7% (153,000 tonnes), followed by South America (69,000 tonnes, -18%) and Africa, which remained stable at around 80,000 tonnes.

Source: Mecs / Acimac Research dept. on BSRIA and ITC data

than a decade of almost uninterrupted growth (the pandemic year 2020 saw the only contraction between 2010

A glance at the thirteen-year period as a whole provides a clear picture of how exports have evolved in each area and in particular reveals the growth of Asia, whose exports have more than doubled from 1.1 million to 2.3 million tonnes (CAGR 2023/2010 +6.7%), matching the result achieved in 2019. Asia’s percentage share of global exports has risen from 51% in 2010 to the current figure of 67.6%, winning shares from almost all the other regions.

By contrast, the EU’s exports experienced a decline during the period in question (CAGR -1.5%), with their share of world trade falling from 24.2% to 12.6%. The NAFTA region’s share fell from 12.4% to 9.7% despite overall 25% growth in exports since 2010. South America, which in 2010 accounted for 4.6% of world exports, saw its share drop to 2%, while volumes remained stable over the 13-year period. The only exceptions were non-EU European countries and Africa. Non-EU Europe maintained its share of world exports at around 6% over the 13-year period thanks to 50% growth in export volumes, while Africa’s exports grew by 122% over the same period, increasing its share of global trade from 1.7% to 2.3%.

and 2021), global exports of ceramic sanitaryware experienced a second consecutive year of decline in 2023,

falling by 5.8% compared to 2022. The downward trend was observed in virtually all areas of production with

The 2023 ranking of the top 10 exporter countries has remained unchanged with respect to 2022.

China retained the top spot with exports of 1.81 million tonnes (down 5.4% on 2022), alone accounting for 78% of Asian and 52.5% of world exports. Mexico, the second largest exporter with an 8.8% share of global exports, recorded a 20.2% increase to 302,000 tonnes, while India recovered from the 2022 contraction with 5.5% growth to reach 265,000 tonnes. Next came Turkey, Poland, Thailand, Germany and Portugal, all with declines of between 16% and 18%. Vietnam and Iran completed the top 10 with 3.5% and 1.5% increases compared to 2022, respectively. Overall, the 10 largest sanitaryware exporter countries accounted for 85% of global exports.

An analysis of 2023 imports to the various continents not only confirms Asia and North America as the two regions accounting for the majority of sanitaryware im-

Source: Mecs / Acimac Research dept. on BSRIA and ITC data

the sole exception of the NAFTA region, which was sustained by the strong growth of Mexican exports.

ports but also shows that they have relatively similar levels of imported volumes: Asia 1 million tonnes (29% of global imports, down 10% on 2022); North America 931,000 tonnes (27% of global imports, -5.9% on 2022).

Trailing at a distance, the EU accounted for 20.5% of global imports with 709,000 tonnes (-8% on 2022).

The remaining 23% of world imports were divided between Africa, South America, non-EU European countries and Oceania.

The 2023 ranking of the top 10 sanitaryware importing countries saw a number of changes in position compared to the previous year, as well as the exit of Vietnam and the return of Italy. Overall, the ten largest sanitaryware importers accounted for 47.8% of global sanitaryware imports (1.65 million tonnes).

In 2023, the United States was once again the world’s largest sanitaryware importer with 759,000 tonnes

(8.7% down on 2022). It retained a strong lead over all other importing countries with 22% of world imports, as well as almost all (82%) of imports to the NAFTA region. This marked the continuation of a longstanding tradition considering that in 2010 the USA imported more than 500,000 tonnes, 23% of world imports.

France climbed to second place with imports of almost 123,000 tonnes (-5.6% over 2021), overtaking Germany, whose imports fell by 20.5% to 119,000 tonnes. Next came the UK (113,000 tonnes, +1.2%), followed by Canada, Spain, South Korea, Saudi Arabia, Italy and the Philippines.

Germany was the only country to rank among both the top 10 exporters and the top 10 importers of sanitaryware, with higher import than export volumes.

One final point of interest is the analysis of the main export destinations with respect to the geographical areas of production. Four out of seven areas sell the vast majority of their exports within their own geographical regions or continents: 96.5% of NAFTA area exports (mainly from Mexico) remain in North America, which essentially means the USA; 84% of South American exports remain in Latin America; 78% of EU exports are sold in EU markets and 64% of Oceania’s exports remain in Oceania.

At the other extreme, 83% of exports from non-EU Europe are sold in other regions, particularly the EU (Turkey’s largest export market). Similarly, 77% of African exports are sold outside Africa and 60% of Asian exports are shipped outside the Asian continent, driven by China’s ability to sell its products in almost all areas of the world. ✕

Source: Mecs / Acimac Research dept. on BSRIA and ITC data

La soddisfazione del cliente è la nostra priorità.

Attraverso le soluzioni innovative dei nostri designer, le sapienti mani dei nostri artigiani, l’utilizzo di materie prime di qualità, attrezzature all’avanguardia e tecnologie sofisticate trasformiamo le idee in realtà.

Customer satisfaction is our top priority.

Through innovative solutions of our designers, skilled hands of our craftsmen, the use of high quality materials, cutting-edge equipment and sophisticated technologies, we turn ideas into reality.

Mohawk Industries, the world’s largest flooring multinational, posted net sales of US $2.72 billion in the third quarter of 2024 (period ending 28 September), marking a 1.7% decrease from the

“This year, we are investing approximately $450 million in capital projects focused on growth, reducing costs and asset maintenance,” added Lorberbaum

$2.77 billion of Q3 2023. In the same quarter, net earnings reached $162 million.

Net sales in the first nine months of 2024 totalled $8.2 billion, down 3.8%

Some 39% of the group’s sales are generated by the Global Ceramic Segment, the world’s largest producer of ceramic tiles with facilities in the USA, Mexico, Brazil, Italy, Spain, Bulgaria, Poland and Russia and the brands American Olean, DalTile, Marazzi, Ragno, Emilgroup, Eliane, Elizabeth, Vitromex, Kai and Kerama Marazzi.

The segment posted net sales of $1,058 million in the third quarter (down 3.1% on Q3 2023) and an operating margin of 7.9%, bringing sales for the first nine months of the year to $3.2 billion (down 2.7% on 2023).

from $8.5 billion in the same period last year.

Net earnings were $425 million compared to a net loss of $579 million in the previous year.

The Segment’s margins expanded due to increased productivity, while lower material and energy costs offset labour and freight inflation. Alongside cost containment initiatives, including product reformulations, process enhancements and improved administrative efficiencies, the segment focuses continuously on enhancing its mix through the adoption of new technologies. Lorberbaum highlighted some of the key initiatives carried out in the various geographical areas where the segment is present: “In the U.S., we increased our builder partnerships by providing a complete product offering and superior service. Our quartz countertops are outperforming other work surfaces, and we will start up our new production next year. In Europe, our volumes exceeded the prior year, and product mix from advanced technologies and expanded participation in the commercial channel partially offset pricing pressures.”

Commenting on the company’s third quarter results, Chairman and CEO Jeff Lorberbaum said that the Calhoun, Georgia-based group had “delivered a solid performance in soft

market conditions, which reflects the positive impact of our sales initiatives, productivity and restructuring actions as well as lower input costs” Due to its increased earnings and

management of working capital, Mohawk Industries generated free cash flow of $204 million in the quarter, for a total of $443 million in the year to date.

The group has also announced targeted price increases in Mexico, and volume in Brazil has begun to strengthen.

As previously reported, Mauro Vandini took over as President of the Global Ceramic segment on 15 September, while maintaining his role as CEO of the Marazzi Group and head of the European ceramic business

of Mohawk Industries.

The forecast for the coming months

Throughout 2024, global conflicts, political uncertainty and inflation have been weighing on consumer confidence and discretionary spending around the world. The higher value renovation segment is continuing to

contract and has been overtaken by the commercial building segment, which has also lost momentum in recent months. As short-term macroeconomic condi-

tions remain unpredictable, the group does not anticipate an improvement in demand until 2025.

“Central banks are shifting from a restrictive policy to a

more balanced approach to stimulate their economies, which should benefit our industry as consumer and business spending expands,” commented Lorberbaum

“We expect that recent interest rate cuts in the U.S., Europe and Latin America will strengthen housing markets and increase flooring sales next year.” ✕

Mohawk Industries, Inc. has announced the promotion of Mauro Vandini to President of the company’s Global Ceramic Segment, effective 15 September 2024. Vandini will also retain his current role as CEO of Marazzi Group and head of the American multinational’s ceramic business in Europe.

Mauro Vandini, a graduate in engineering from the University of Bologna, boasts unique experience in the ceramic industry. He began his career with Marazzi Group in 1983, initially working as Technical Director and later as General Manager of Marazzi’s International Operations (France, Spain, and the USA). He served as CEO of Marazzi Group from 2006 to 2009. Since Mohawk Industries’ acquisition of Marazzi in 2013, Vandini has once again led Marazzi Group and Mohawk’s ceramic business in Europe. He has been instrumental in the growth of Mohawk’s ceramic segment, driving an investment plan in Italy and Europe aimed at improving products and processes, developing exclusive new technologies, new product categories and new sales channels. This plan has led to technological upgrades at all factories, the development of successful new product segments such as large slabs and small formats, the opening of flagship showrooms in major design capitals, and the acquisition and growth of complementary businesses in Italy, Bulgaria and Poland. At

the same time, Vandini has put together a talented leadership team that has supported him over the years. “I’ve worked with Mauro since 2013 and I respect his deep knowledge of ceramic manufacturing, sales and marketing and his ability to drive improvements in all areas of the business,” said Jeff Lorberbaum, Mohawk’s Chairman and CEO. “He has built strong partnerships with our regional ceramic business leaders and will bring outstanding design, quality and value to our customers.”

Commenting on his promotion, Vandini noted that it recognises “the good work done in Europe in recent years, both personally and as a team. Marazzi Group has grown significantly in terms of technological, organisational and product development, and I am pleased to continue leading it as CEO.”

Together with Vandini’s promotion to President of the Global Ceramic Segment, Leonardo Tavani, Vice-President of Marketing and Distribution of Marazzi group, has been appointed General Manager of the group. This appointment, said Vandini, “represents a guarantee of continuity and further momentum towards product innovation and brand positioning, areas in which excellent work has been done over the years”.

Milena Bernardi

The Villeroy & Boch Group’s acquisition of Ideal Standard –announced on 18 September 2023 and completed on 29 February 2024 – has proved a big success, establishing the

company as one of the world’s largest sanitaryware manufacturers and propelling it past the one-billion-euro revenue mark for the first time ever.

The German multinational achieved

Bathroom & Wellness Division’s sales climb to €800 million

With the inclusion of Ideal Standard, Villeroy & Boch’s Bathroom & Wellness Division accounted for nearly 80% of the Mettlach-based group’s total sales in the first nine months of the year. Revenue reached €799.5 million, marking an 83.5% increase compared to the €435.8 million achieved in the same period the previous year. Without Ideal Standard’s contribution, the division would have maintained a stable performance over the nine-month period. The biggest revenue growth was achieved in the business areas of ceramic sanitaryware (+€151.6 million) and fittings (+€150.8 million).

In terms of geographic markets, sales in the EMEA region more than doubled, reaching €697.2 million compared to €341.4 million in the first nine months

this milestone on 30 September 2024, when its consolidated revenue for the first nine months of the year reached €1,007.8 million (including licence income), a 55% increase compared

of 2023. The Asia Pacific/America region also saw strong organic growth, up 8.3%.

The division’s operating profit (EBIT) rose to €52.3 million, a 14.4% increase year-on-year.

The Dining & Lifestyle Division showed a less dynamic performance over the nine-month period, with sales reaching €206.2 million, a decline of 2.9% (or €6.1 million) compared to the same period in 2023.

This was primarily due to cyclically weak consumer demand. E-commerce sales increased slightly year-on-year (+1.2%), while revenue from the company’s own retail stores remained essentially stable. By contrast, sales declined in concession shops (-12.1%) and among stationary retail partners (-9.2%).

to €650.6 million in the same period of 2023. The result was significantly bolstered by the €364.6 million contribution from Ideal Standard since 1 March 2024.

Operating EBIT saw double-digit growth, increasing to €64.5 million in the first nine months of 2024, up from €57.8 million during the same period in 2023 (+11.6%). However,

net profit declined from €37.7 million in 2023 to €5.6 million in 2024, impacted by one-off effects related to the acquisition of Ideal Standard and associated financing costs.

From January to September 2024, Villeroy & Boch invested a total of €31 million, an increase of €6.5 million compared to the same period in 2023. Of this, €26.7 million was allocated to the Bathroom & Wellness Division (+€9.8 million). Key investments in this division

included the continued development of the new sanitaryware factory in Thailand, which involved the purchase of a pressure casting system. A similar system was also installed at the Hungarian site, and production capacity was expanded at the bathroom furniture factory in Treuchtlingen, Germany.

The remaining €4.3 million was allocated to the Dining

& Lifestyle Division, covering the purchase of new machinery and moulding equipment for the Merzig and Torgau sites, as well as modernisation of the retail stores.

Villeroy & Boch received the TecnAward 2024 in the Best Sanitaryware Manufacturers category at Tecna in Rimini on 25 September in recognition of its ongoing investments in its production facilities.

Outlook for 2024 as a whole

Despite the uncertain conditions in the construction market, the Management Board of Villeroy & Boch has confirmed its 2024 forecast for significant growth in revenue, operating profit (EBIT) and investments. ✕

A restyling by Iosa Ghini Associati, focusing on the quality of work-spaces and the well-being of their occupants, through shrewd design and the use of Active Surfaces® eco-active ceramic coverings.

In Castellarano, in the vicinity of Reggio Emilia, the historic administrative headquarters of Fiandre – a high-end brand of ceramic surfaces belonging to the Iris Ceramica Group – has been completely redesigned and renovated. The interior architectural design and creative direction are by Iosa Ghini Associati, which also designed bespoke furniture and complements for the new headquarters.

LIGHT, PERMEABILITY, WELL-BEING, SUSTAINABILITY

Throughout the Fiandre headquarters – occupying three storeys with total floor-space of 2,400 square meters – ceramic surfaces have been applied to floors and walls like a changing, decorative skin,

sometimes embellished with finely crafted detailing, to furnish the spaces without ever weighing them down. The overarching aim of the design is to promote people’s well-being, and various solutions have been used to achieve this: from acoustic insulation to the permeability of spaces, with glass walls to let natural light into both the offices and the common areas; from polarised screening systems, to ensure privacy, to combinations of colours and materials, such as porcelain tile, glass, metal and lacquer, based on the principles of colour-therapy, to instil feelings of harmony and visual balance, without compromising on appeal.

For the flooring of the three storeys of the headquarters, for the office desks and meeting tables designed

by the architect Iosa Ghini, for the bar area, including the counter and coffee tables, and for the bathrooms with specially designed washbasins, the architects opted for Active Surfaces® eco-active ceramic with antibacterial, antiviral, anti-pollution, anti-odour and self-cleaning properties. As well as featuring carefully developed design, these innovative surfaces meet the needs of safety and well-being, because they provide an ideal solution for places, such as offices, that need to be kept clean and hygienic at all times. The patented Active Surfaces® technology turns each tile into a photo-catalytic material capable of eliminating bacteria, viruses and polluting molecules, by converting them into substances that are harmless to human health and the environment. Active Surfaces® leaves all the other characteristics of porcelain tile unchanged, so it can be used in all the usual contexts, such as floor and wall tiling, but also for furnishings and complements such as coffee tables and countertops,

thanks to the properties that make these surfaces suitable for food contact, while also ensuring that they retain their brightness and original appearance over the years. The University of Milan’s Department of Chemistry has calculated that the use of 5,058 square meters of Active Surfaces® inside the building, combined with the use of LED lighting, cuts NOx emissions by 6.0 kg/year, equating to 3,800 square metres of green space, as well removing VOCs and odours from over 10,000 cubic metres of air.

Chiara Bruzzichelli c.bruzzichelli@tiledizioni.it

The Fiandre headquarters is spread over three floors, whose interior layout has been totally rearranged.

The floor coverings on the lower-ground floor are a combination of Active Surfaces® tiling in Pietra Grey Maximum and Seminato Beige from the Il Veneziano collection. Ceramic surfaces from the Pulsar throughbody collection in the reception area are juxtaposed with the furnishings in the bar area,

which, like the tops of the coffee tables in the reception area, are made with Veneziano Active in beige

The first floor of the building houses the C-suite offices. When you walk into the building, you enter a lobby served by a lift and staircase. This area is embellished with a large wall displaying an artwork by Becha, in the form of an 18m x 3m mural, printed on large-format ceramic panels using Design Your Slabs technology, illustrating the Group’s values, namely sustainability, innovation, beauty and excellence.

Spread over all three floors of the building, the offices are designed to foster productivity and well-being. The desks have tops made of 12mm SapienStone Platinum White Active Surfaces®, ensuring the utmost hygiene and durability.

The bespoke bathroom furnishings are made of Invisible Maximum surfaces in the Active Surfaces® version. There are comfortable, flexible meeting rooms on each floor, which are furnished with large tables made with SapienStone 4D Ceramic in the Active Surfaces® version for the colour Calacatta. The tables also feature lighting adjustment systems and polarised glass controlled by means of Hypertouch, a capacitive surface designed to activate an integrated system of building automation sensors in response to a brush of the hand, thus enhancing the design and the seamless continuity of the material.

An energy-efficient prefabricated home with a predilection for timeless, functional furnishings made of high-quality materials.

Located on the outskirts of San Cugat and designed in line the principles of sustainable architecture by the Spanish architect Pablo Serrano of DOM Arquitectura in Barcelona, “Casa de Madera” consists of a prefabricated residential building offering strong environmental credentials and high energy-efficiency, without compromising on contemporary, design-led styling.

In terms of materials, wood is the common thread running through the project, not only because it is natural and healthy, but also because it offers firstclass thermal performance. That is why the architects chose spruce for the façade, and pine for the interior, both from the Catalan Pyrenees. All the construction materials were sourced in the immediate vi-

cinity to reduce transport distances, and all the raw materials are recyclable, for compatibility with the circular economy. The amount of rubble and scrap plaster was also kept to a minimum, as was the consumption of resources, to reduce the environmental impact of the construction site and the building work.

The final orientation and positioning were precisely analysed, to minimise interference with the natural surroundings, limit energy consumption and optimise the site’s climatic characteristics. The sun warms the house in winter, thanks to the long south wall fitted with large windows, while the trees surrounding the house provide shade in summer. Meanwhile, the windows ensure natural through-ventilation. The fireplace separating the living-area from the

c.bruzzichelli@tiledizioni.it

study provides additional heating, and the photovoltaic system on the roof produces hot water.

The interior design takes the same forward-looking approach as the structure. The functional, minimalist styling uses wood as a backdrop for simple, time-

less furnishings. In the bathroom, for example, the evergreen design of Duravit’s Scola washbasin, dating back to the 1960s, maximises floor-space, while offering high levels of durability and practicality, thanks to its compact shape and high-quality ceramic.

Alternative Artefacts Danto is the latest creative venture launched by Danto, one of Japan’s most historic ceramic manufacturers, which has been based on the island of Awajishima, in the Seto Inland Sea, since 1885. The brand is rewriting the rules of interior design by creating painstakingly developed surfaces that combine tradition with trailblazing innovation.

A.a. Danto’s latest releases include a tile collection produced with the designer India Mahdavi, which marks the brand’s first international collaboration. The series uses the medium of ceramic to express a new-found sense of colour, by reprising the signature textures of Danto’s experimental back-catalogue and channelling them into contemporary designs, sometimes in three-dimensional compositions that physically stand out in space as objects in their own right.

The LATICRETE laboratories have developed a range of technical products for installing parquet floors that meet the needs of expert installers at every stage of installation, suitable for all types and formats of wood floors. These are solvent-free Primers and Adhesives made in Italy, that offer maximum performance with respect for the environment and quality of living.

The trend in recent years highlights substantial steady growth in the parquet market and Laticrete adhesives provide the technical quality needed to ensure the solidity and beauty of wood floors over time. Installing a wood floor, with ASOWOOD SMP 100 adhesive, also means choosing an environmentally friendly product that enhances the space with a “green and sustainable” footprint.

Ceramiche Marca Corona presents its first collection of “gelosie”, Arialuce. The series consists of extruded terracotta volumes, shaped into three forms – Curve, Pertuse, and Asole – and available in three finishes: Natural, Ivory, and White glaze. The design of the three elements has been developed to align with other typical decorations from Marca Corona collections, offering various patterns and degrees of visual filtering, from the most intense Pertuse to the lighter Asole. Arialuce goes beyond surface cladding and embraces three-dimensionality: it creates grid structures for both indoor and outdoor spaces, allowing a wide range of combinations between solids and voids. It generates volume in the space while letting air and light filter through.

The series is the result of a collaboration between Marca Corona and the Fornace S.Anselmo. Arialuce initiates a dialogue between terracotta and porcelain stoneware, starting from their common origin: clay. The water that mixes it and the fire that ensures its compactness become the elements that bind these materials together, allowing them to coexist harmoniously in a single design vision. Arialuce is the first series to introduce the new Lesagome container: an abacus of solutions within Linea 1741, inspired by artisanal tradition reinterpreted in a contemporary key.

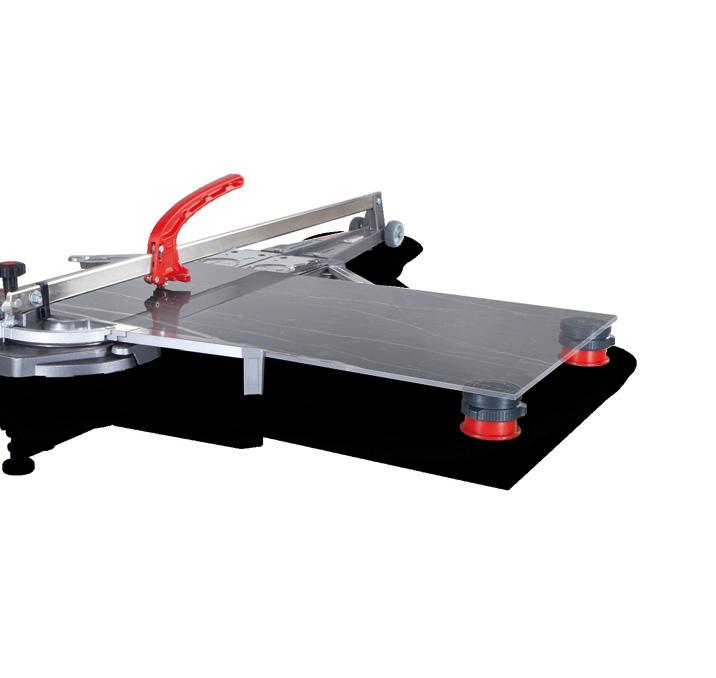

Masterpiuma P5 is Brevetti Montolit’s range-topping tile-cutter, designed in response to the latest developments in the formats produced by ceramic manufacturers.

This new line of machines is designed according to the “All in One” principle, aimed at providing operators with a tool that is ready for use in every situation: everything has been redesigned – in close collaboration with the Polytechnic University of Milan – around the latest and most innovative ceramic materials (new formats of ever-tougher porcelain tile, as well as exceptionally delicate vitrified tiles), with a view to improving overall performance.

The technical highlights of the new project are as follows:

• The lightweight alloy frames are suitably sized and structured at the points of highest stress with ribs and reinforcement plates that optimise the performance of the machine when cutting high-thickness tiles or through-body porcelain tiles. Robust die-cast aluminium support arms are built into the frames to provide progressive support for large tiles and so that tiles do not protrude beyond the profile of the machine even when positioned for diagonal cutting.

• The measuring square is also oversized, almost symmetrical and capable of rotating +/-45°, so that you can make precise cuts, at any angle, in quick succession, with the aid of the flip-up tile-stop. The measuring square – with clearly legible laser-engraved numbering – can be folded away into the machine, so that you don’t need to remove it when handling and transporting the tile-cutter.

• The ergonomic scoring-wheel handle has a wealth of features, one of which enables operators to control scoring pressure and splitting power with the aid of indicators that provide guidance on different types of material.

• The double splitting-head system, made of scratch-resistant polymer, is designed in a single component and can be used in the closed position for standard cuts (without having to pull the handle back at all after scoring) and in the open position for diagonal cuts from the corner of the tile or for cutting mosaics. The splitting-head is also equipped with a patented sight that gives you a clear view

of the cutting line at all times.

• The built-in lubricator is operated by pressing gently on the dispenser.

• The titanium-coated tungsten carbide scoring wheel is mounted rigidly and directly on the aluminium body and is optimised with double sharpening to ensure the best performance on both vitrified glazes and corrugated or three-dimensional tiles. Guaranteed for a total scoring distance of 5,000 metres, it is quick and easy to replace when necessary.

Masterpiuma Power 5 is also supplied (optional) with two important accessories:

• “Carapax”, an all-new, futuristic-looking protective shell made of high-density polypropylene, is lightweight and outstandingly effective at absorbing shocks. Designed to protect the Masterpiuma tile-cutter’s “vital organs”, such as the scoring-wheel carriage and the measuring square, it shields them against accidental knocks and unintentional loads. “Carapax” is covered by a patent for its unique technical features and trailblazing design.

“Atlas”, a universal elastic support for adjusting compression force: choose a firmer setting to support large or extra-thick tiles or a softer setting for slim-gauge large-format panels or delicate ceramic tiles. “Atlas” ensures that the tile is correctly supported on the scoring table even if it is overhanging the machine or positioned diagonally and off-centre, without jeopardising the effectiveness of the cut or forcing the operator work in awkward, unergonomic positions. It acts as a progressive shock absorber, which can be set according to your needs. As well as ensuring correct positioning of the tile during scoring, it gives the cut part the support it needs as it falls after splitting, for a perfect result every time. “Atlas” can be used on all the leading professional machines currently on the market. Made of fully recyclable ABS, it is impact-resistant to the point of being almost indestructible, and extremely weather-resistant.

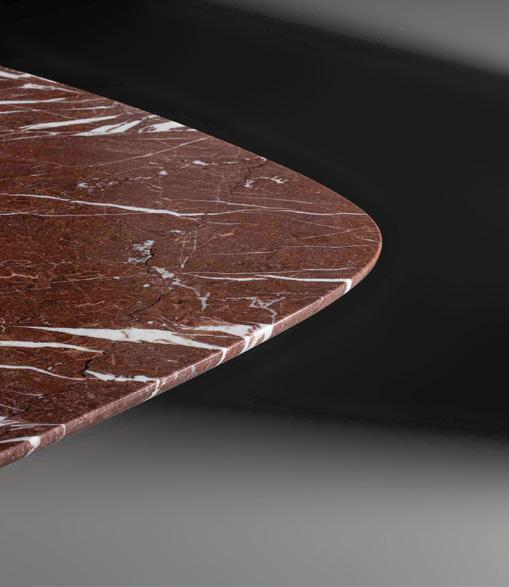

The ESSENTIA collection, designed by Marco Piva for Giovanni De Maio, embodies the fundamental nature of the material it is crafted from, representing the very essence of the material and expressing its true identity through a design that enhances its purity and substance.

Ceramics and terracotta reveal their most authentic essence through a collection defined by simple shapes and clean lines. Each piece features a rigorous design with minimal decorations, carefully conceived to serve specific functions. The modular concept allows each element to be adapted to the specific needs of any environment, ensuring a unique and distinctive result. ESSENTIA is composed of three independent patterns, seemingly disconnected from one another but strongly linked through their creative genesis. Each design stems from a contemporary approach, aimed at interpreting how we live and interact with the spaces around us.

The textures, graphics, and colors chosen for Doxa, Eidos, and Aurea are born from computer graphics, from the digital world, an opposite reality to the artisanal and material world of ceramics.