WEBINAR

Tuesday 7 February 2023 – 10.30 AM GMT

Tuesday 7 February 2023 – 10.30 AM GMT

This webinar is recorded

You will receive the recording and the presentation shortly after the webinar

Ask your questions in writing at anytime, we will answer them during the Q&A

A dedicated Q&A session at the end of the webinar to answer your questions

Senior Trade & Investment Adviser, Retail at DIT France

E-mail : marie.bicrel@fcdo.gov.uk

Follow us on Twitter

Nicola MADDOX

Follow us on LinkedIn

Sector Manager, Beauty I Consumer & Retail at DIT UK

E-mail : nicola.maddox@fcdo.gov.uk

Follow us on Twitter

Follow us on LinkedIn

Marie BICREL

Marie BICREL

We secure UK and global prosperity by promoting and financing international trade and investment; and championing free trade.

The Department for International Trade is a UK ministerial department formed in 2016 following the EU Referendum.

Our services are provided in over 100 markets throughout the world.

Reduce MarketAccess

Barriers

Facilitate UK Exports

Attract and Retain

Inward Investment

Champion rules-based

International Trading Systems

In partnership with :

Carys SMITH Regulatory Information Officer at CTPA

Laura RUDOE CEO & Founder at Evolve Organic Beauty

Catherine APOLINARIO Regulatory Affairs Manager at COSMED

Chloé ARJONA Senior Consulting Manager at NellyRodi

Carys SMITH Regulatory Information Officer at CTPA

Laura RUDOE CEO & Founder at Evolve Organic Beauty

Catherine APOLINARIO Regulatory Affairs Manager at COSMED

Chloé ARJONA Senior Consulting Manager at NellyRodi

Nelly Rodi

Follow NellyRodi on Twitter

NellyRodi Website

Chloé ARJONA

Senior Consulting Manager

Chloé ARJONA

Senior Consulting Manager

AN UNSTABLE CONTEXT

32% OF FRENCH PEOPLE SAY THEY OFTEN OR VERY OFTEN GIVE UP BEAUTY EXPENSES BECAUSE OF A LIMITED BUDGET.

65%

OF FRENCH WOMEN DO NOT TRUST "CONVENTIONAL" BEAUTY PRODUCTS.

Statista, 2022

Ipsos for the E.Leclerc Observatory of New Consumption, 2022.

20%

OF FRENCH PEOPLE NOW ASSOCIATE BEAUTY WITH THE NOTION OF SOCIAL AND ENVIRONMENTAL RESPONSIBILITY.

66%

OF FRENCH PEOPLE SAY THEY ARE READY TO BUY MORE LOCAL PRODUCTS MADE IN FRANCE.

Ifop, 2021

Kantar, 2020

#INSECURITY

#UNCERTAINTY

#LOWER PURCHASING POWER

#LOSS OF TRUST

#TRANSPARENCY

#HYGENISM

#SEARCH FOR ALTERNATIVES

#TRACEABILITY

#ENGAGEMENT

#INSTABILITY

#MENTAL HEALTH

#SOVEREIGNTY

8%

MAKE UP BODY CARE

26% SELECTIVE DISTRIBUTION

49% LARGE AND MEDIUM-SIZED SUPERMARKET

5% HAIR SALON

20% PHARMACY AND PARAPHARMACY

EVERYDAYBEAUTYPARTNERS

THENEWCHALLENGERS

RESPONSIBILITY COMMITMENT

#TRANSPARENCY

#SUSTAINABILITY

#ACTOR OF CHANGE

HOLISTIC KINDNESS

#INCLUSIVITY

#EMPATHY

#NO TABOOS

EXPERIENCE IMMERSION

#DESIRABILITY

#INTERACTION

#AGILITY

PERFORMANCE CUSTOM MADE

#OPTIMISATION

#PROFESSIONALIZATION

#BEAUTY TECH

#TRANSPARENCY

#SUSTAINABILITY

#ACTOR OF CHANGE

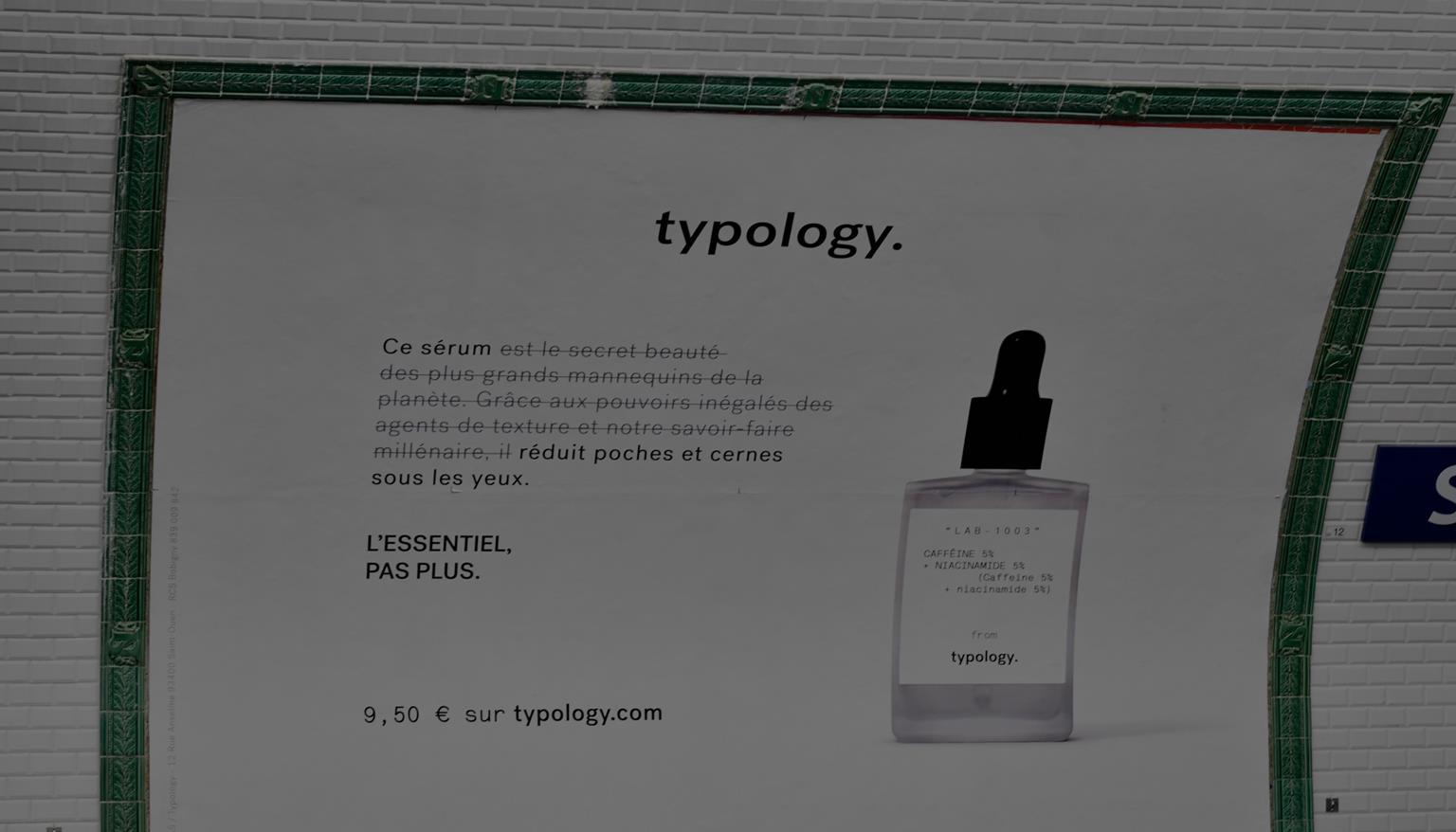

A VISION OF BEAUTY REDUCED TO THE ESSENTIAL: SHORT INGREDIENT LIST

AND HYPER TRANSPARENCY OF THE PRODUCTS COMPOSITION.

#CLEAN BEAUTY

#HONNEST BEAUTY

#AWARENESS

CLEAN BEAUTY IS REINVENTING ITSELF TO BECOME MORE VIRTUOUS THANKS TO

THE ALLIANCE OF NATURE AND BIO TECHNOLOGY, COUPLED WITH A LOCAL

APPROACH .

#GREEN CHEMISTRY

#TRACEABILITY

#MINIMAL IMPACT

#INCLUSIVITY

#EMPATHY

#NO TABOOS

REDEFINING MASCULINITY CODES: FROM NEW SKINCARE ROUTINE TO TINTED PRODUCTS & MAKE-UP.

#FLUID MASCULINITY

#NEW GROOMING

#MAN POLISH

EMPATHETIC APPROACH OF BEAUTY: SERVING ALL SPECIFICITIES AND CREATING SAFE SPACES FOR EXPERIENCE SHARING.

#MENTAL HEALTH

#SEXUAL WELLNESS

#COMMUNITY

#DESIRABILITY

#INTERACTION

#AGILITY

WELLNESS

BEAUTY EXPANDS TO WELLNESS: NEW PRODUCTS & SERVICES AROUND

HAIRCARE, MASSAGES, SUPPLEMENTS, SEXUALITY, SPORTS,…

#HOLISTIC

#DESIRABILITY

#EXPERIENCE

A CURATED PRODUCT OFFER AROUND CLEAN BEAUTY WITH A PERSONALIZED BEAUTY CONSULTATION SERVICE TO ADDRESS SPECIFIC CONSUMER NEEDS.

#EXPERTISE

#INSPIRATIONAL

#BC TRAINING

#OPTIMISATION

#PERSONALIZATION

#BEAUTYTECH

DEMOCRATIZATION OF BEAUTY TECH DEVICES AND THE BIRTH OF A NEW KIND OF HIGH-TECH SPA WITH CUSTOM PRODUCTS & ROUTINES.

#PEFORMANCE

#MADE-TO-MEASURE

#INNOVATION

BEAUTY OPENS UP TO NEW TERRITORIES: PROFESSIONALIZATION & PREMIUMIZATION OF THE FUNCTIONNAL BEAUTY CATEGORIES.

#EVERYTHING CARE

#EXPERTISE

#PROFESSIONAL PRODUCTS

Partner with the right suppliers, show and measure your production’s positive impact on the local economic and social environment

Aim for complete transparency and traceability

Create ultra-specialized products to answer every customer’s needs

Expand to new categories traditionally belonging to the hygiene sector

Consider the brand as a complete ecosystem, becoming more hybrid & lifestyleoriented, and expressed well beyond the product

Develop an omnichannel mindset in which IRL and URL are complementary

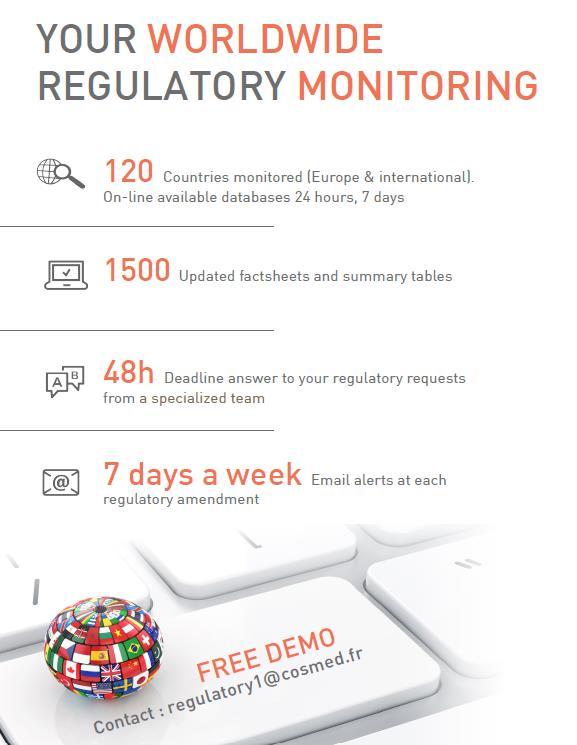

Cosmed: 1st French company trade association

1000 company members

Each year:

- 5000 regulatory questions supported

- 500 email alerts on regulatory news

Some provisions of the EC regulation n°1223/2009 open to national specificities. Each state can therefore legislate for example on :

• the language of labelling (and the PIF)

• sanctions

• the qualifications of the safety assessor

French specificities :

• All labelling information must be in French (Toubon law)

• The preferred language for the PIF is French but English may be used.

• For the safety assessor other recognised qualifications are: veterinarian, toxicologist (minimum credits)*

• Registration of manufacturing establishments

• Establishment of an annual declaration system for nanosubstances

.

*Arrêté du 25 février 2015 relatif à la qualification professionnelle des évaluateurs de la sécurité des produits cosmétiques pour la santé humaine

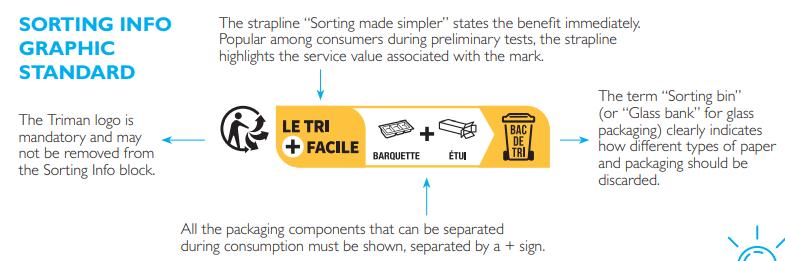

Measures put in place by the AGEC law (law n°2020-105 of 10 Feb 2020):

• Mandatory Triman logo (Article 17)

• Mandatory display of sorting instructions (Article 17)

• Prohibition of confusing markings (Article 62)

Green dot: Banned in France since 1 January 2021.

Products intended ONLY for professionals are not required to be marked with a sorting mark

Regulation (EC) No 1223/2009: compulsory affixing of the country of origin for imported products.

• Consumer Code rules : The words "Made in France", like any claim, must comply with the rules of the Consumer Code: the professional must be able to justify them and the claim must not mislead the consumer.

To be labelled "Made in France", a manufactured product must

• derive a significant part of its value from one or more manufacturing stages located in France

• to have undergone its last substantial transformation in France.

This is why a product bearing a "Made in France" indication may be made of imported raw materials.

• Define the tariff classification of the product: HS code (e.g. 3304 for face creams)

• A product finished in France must have changed its product category from what it was when it entered the country

• Not always sufficient

• Knowledge of the supply process

• place(s) of origin of the RM and/or finished products, country of departure of the products etc…

• Has the product been sufficiently transformed? Has it acquired new functions?

• Not always sufficient

• Added value

• the selling price must exceed by 45% (on average) the purchase price of the non-originating raw material (i.e. originating in a country outside the area concerned).

Bulk of Argan oil

(SH code 1515)

Transformation with active ingredients (value !!!)

Skin care

(SH code 3304)

+ Packaging

+ Packaging

Bulk of Argan oil

(SH code 1515)

Addition of antioxydant

Bulk of Skin care

(SH code 3304)

+ addition of active ingredients

+ Addition of fragrance

+ pack

The General Directorate of Customs and Indirect Duties (DGDDI) has made available a procedure concerning Made In France (not compulsory).

send a form to obtain confirmation that the product is made in France

https://www.douane.gouv.fr/demarche/obtenir-une-information-sur-le-made-france-imf

Online sales :

The cosmetic regulation does not specify anything about online sales.

The product must comply at least with the regulations of the country where the company is based and where the website is based.

For sales in Europe: products sold on the Internet must comply with the regulations of the country to which the product is sent.

Additional Decision criteria:

- Language of the website (example : If the site is translated into Japanese, the Japanese consumer will expect to have products compliant and labelled in their language.

-

How is the website : .fr, French language...) it can be considered that it is up to the Japanese consumer to take responsibility. It is the same if they had come to France to buy a product in a shop.

- Currency : In what currency does the customer pay?

To Conclude :

• On environmental issues, France is a pioneer and leader on regulations

• Other European countries are starting to follow this trend

• Europe is also inspired by France to develop regulations on these topics

Follow the CTPA on Twitter

CTPA Website

→Read more about the CTPA public guidance on the UK and EU relationship here

The Cosmetic Toiletry and Perfumery Association

Carys Smith Regulatory Information Officer

The Cosmetic Toiletry and Perfumery Association

Carys Smith Regulatory Information Officer

UK Retained Regulation (EC) No 1223/2009 of the European Parliament and of the Council of 30 November 2009 on cosmetic products (recast) (Text with EEA relevance) for cosmetic products marketed in Great Britain (GB), which includes England, Wales and Scotland.

EU Cosmetic Products Regulation (EC) No. 1223/2009 in the EU including France.

EU Cosmetics Regulation

UK Cosmetics Regulation

• Responsible Person

• Product Information File

• Safety Assessment

• Labelling

• Cosmetic product definition

• Claims self-regulation

• Notification Portal (CPNP)

• Cosmetovigilance

• Ingredients monitoring and restrictions

• Responsible Person

• Product Information File

• Safety Assessment

• Labelling

• Cosmetic product definition

• Claims self-regulation

• Notification Portal (SCPN)

• Cosmetovigilance

• Ingredients monitoring and restrictions

Responsible for ensuring that products are fully compliant with Articles 3, 8, 10, 11, 12, 13, 14, 15, 16, 17, 18, Article 19(1), (2) and (5), as well as Articles 20, 21, 23 and 24 of the UK and EU Cosmetic Regulations.

A Responsible person should:

• Be a legal or a natural person

• For the UK, they must be located in Great Britain or Northern Ireland

• For France, they must be located in an EU Member State

• Have access to the PIF

• Be adequately mandated

Before placing a cosmetic product on the market, the RP must notify it on the SCPN for UK or CPNP for France. This includes:

• the name and address of the RP;

• details of contact person in the case of urgency;

• nanomaterials;

• any ingredients National Poisons Information Service (NPIS) needs to know about

• the formulation details;

• the original labelling and, where possible, a photograph of the corresponding packaging

Titanium dioxide (Annex III, IV and VI – restrictions for certain particle sizes for inhalation exposure)

Applied from 1 October 2021

Salicylic acid – 3%, 2% and 0.5% restrictions in specified product types

Applied from 17 June 2021

Tetrahydropyranyloxy phenol (deoxyarbutin) (Annex II)

Applied from 26 July 2021

DHA (Annex III entry 321, restricted to 10% in self-tan and 6.25% in nonoxidative hair dye)

Will apply from 22 April 2022

Butylphenyl methylpropional (Annex II)

Applied from 1 March 2022

Methoxyethyl acrylate (Annex II)

Applied from 1 March 2022

Sodium hydroxymethylglycinate (ban if free formaldehyde is ≥ 0,1 % w/w)

Applied from 1 March 2022

Zinc pyrithione (Annex II)

Applied from 1 March 2022

Methyl-N-methylanthranilate (Annex III)

Will apply from 21 November 2022

Titanium dioxide (Annex III, IV and VI – restrictions as per EU situation prior to 01.10.21, which means fewer restrictions currently than in EU)

Cosmetic safety assessment likely to occur soon. GB will not follow EU food ban

Salicylic acid 3% and 2% restrictions in specified product types

UK Restrictions to match EU from 15 December 2022 (placing on market) and 15 March 2023 (making available)

No ban published yet

UK ban from 15 December 2022 (placing on market) and 15 March 2023 (making available)

No restriction published yet

SAG-CS reviewing a UK safety dossier supporting higher levels in leave-on and rinse-off self tan in addition to the hair dye use

No ban published yet

UK ban from 15 October 2022 (placing on market) and 15 December 2022 (making available)

No ban published yet

UK ban from 15 October 2022 (placing on market) and 15 December 2022 (making available)

No ban published yet

UK ban from 15 October 2022 (placing on market) and 15 December 2022 (making available)

No ban published yet

UK ban from 15 October 2022 (placing on market) and 15 December 2022 (making available)

No restriction published yet

Currently undergoing SAG-CS review

Information available at https://www.ctpa.org.uk/uk-cosmetic-regulations-amendments

• Scientific Advisory Group on Chemical Safety in Consumer Products

• Responsible for cosmetics, toys and textiles

• Currently meeting five times per year

https://www.gov.uk/government/groups/scientific-advisory-group-on-chemical-safety-in-consumer-products (Or search ‘SAG CS’!)

Retained EU Law (Revocation and Reform) Bill announced on 22 September 2022.

Gives until 31 December 2023 to review all retained EU legislation (possible extension until 23 June 2026)

Gives powers to the UK Government to amend, replace and repeal.

Follow Evolve Beauty on Twitter

Evolve Beauty Website

Laura Rudoe CEO & Founder

Laura Rudoe CEO & Founder

“

to change or develop slowly often into a better, more complex, or more advanced state”

Evolve Organic Beauty is the UK’s leading ethical, sustainable and certified organic beauty brand.

Founded by Laura Rudoe in 2009, our mission is to make products that deliver effective results, yet are healthier, greener and kinder for you and the planet, making it easier for you to live better.

Each product is lovingly handmade in small batches with the finest clinically-proven natural and organic ingredients. This ensures the freshness of the natural oils, butters and extracts that we use, helping you to have healthy, radiant-looking skin.

Our products are independently verified and certified Cosmos organic & natural, vegan, cruelty free, plastic negative and carbon neutral.

EVOLVE HEALTHIER EVOLVE KINDER EVOLVE GREENER EVOLVE BETTER

✓ Certified COSMOS organic and natural

✓ % organic & natural ingredients shown for each product

✓ GMO free

✓ Small batch production for freshness

✓ B Corp certified

✓ Certified Vegan

✓ Certified Cruelty Free

✓ Sustainable sourcing

✓ Annual sustainability reporting

✓ Living wage employer

✓ Female founded & led

✓ Carbon neutral

✓ Committed to Net Zero

✓ Plastic Negative Certified

✓ Upcycled ingredients

✓ Wind powered eco studio

✓ Recycled and recyclable

✓ FSC grass paper cartons

✓ Highly effective clinically proven ingredients including HyaluronicAcid, Peptides, Bioretinol and Vitamin C

✓ Over 30 years’ expertise in natural formulations

✓ 100 beauty industry awards

✓ Over 1,000 5-star reviews

Evolve is available worldwide in selected retailers

● France is the third largest economy in Europe

● The French cosmetics market in 2022 was valued at more than 12 billion euros

● It’s highly competitive with several European and local brands battling for limelight

● The well established French giants still own the majority of the market shares (L'Oréal Paris, Guerlain, Lancôme and Garnier)

● Fragmented retail landscape (independent retailers and parapharmacies)

● Labelling complexity

Source: https://www.statista.com/topics/7555/online-cosmetics-and-personal-care-industry-infrance/#:~:text=In%202022%2C%20French%20brands%20dominated,more%20than%2012%20billion%20euros.

https://www.statista.com/statistics/764471/products-beauty-brands-francaises-values-world/ https://statisticstimes.com/economy/european-countries-bygdp.php#:~:text=Germany%20is%20the%20largest%20economy,economies%20represent%20almost%2080%25%2 0share.

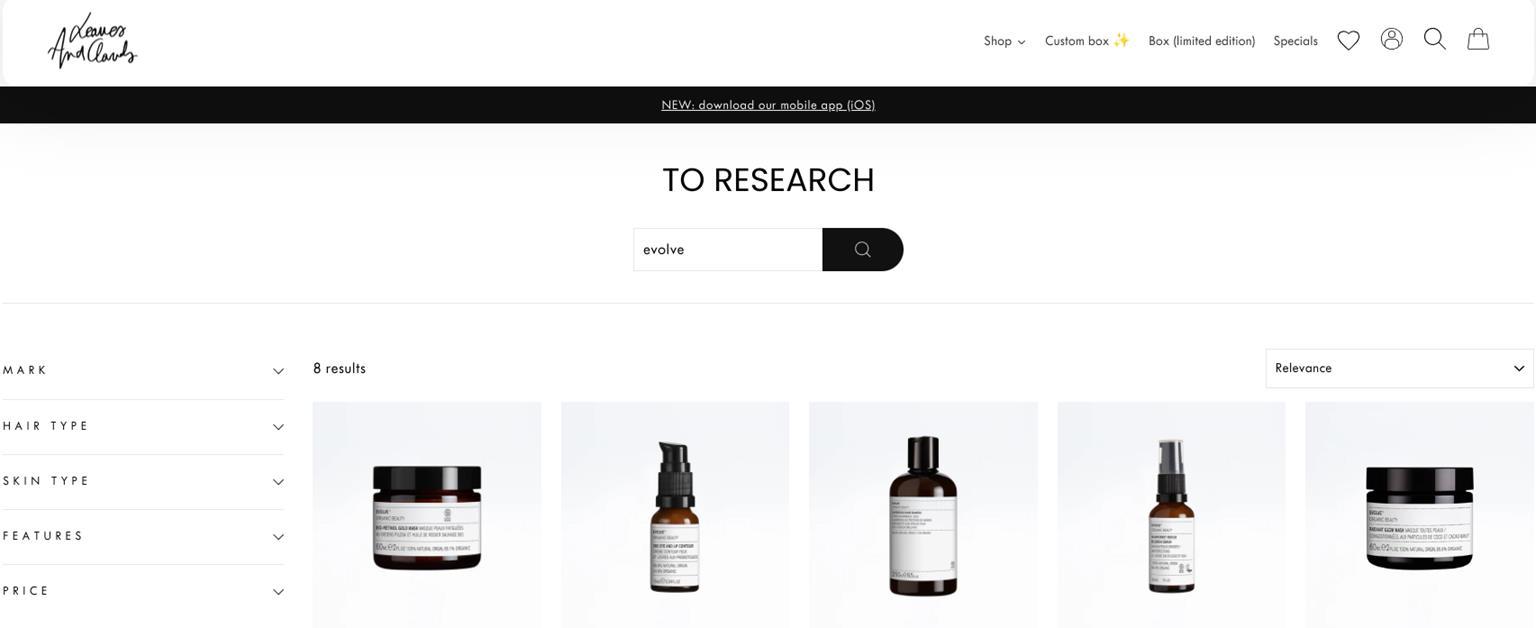

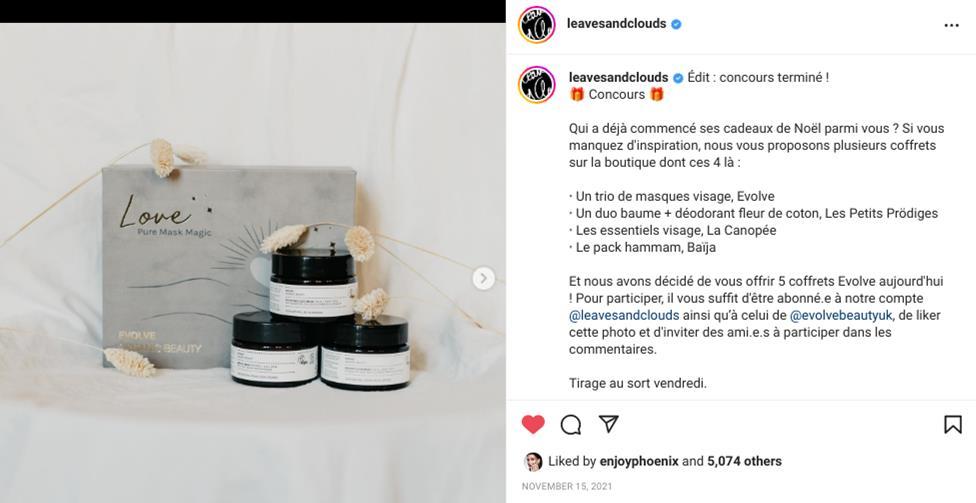

We launched in France in 2012, directly targeting independent beauty retailers which specialise in organic products/eco friendly or niche/luxury.

Over the years we have grown brand recognition and revenue from the UK, progressively recruiting larger beauty partners and branching out to the wellbeing and grocery sectors.

In 2021 we appointed a PR agency in France.

In 2022 when moved to a distribution model to simplify Brexit logistics and further grow scale and brand presence, especially in brick & mortar, which usually requires in-market service.

Today France is our second biggest export market.

Today Evolve Organic Beauty is available in 50+ retailers including Galeries Lafayette, Nocibé, Le Comptoir du Soin spa and many other prestigious locations.

Galeries Lafayette

Galeries Lafayette

French labels - Ensure your product labels are compliant with the local legislations

Hire a French speaking account manager - English is not as popular as you’d think in France. A French speaking team member is essential to keep smooth communication

Invest in localised PR and translations - France is a popular market, local PR and marketing will help you to be seen

Revise your trade prices - French retailers expect higher than normal margins as well as marketing support. Keep this in mind when calculating your landed prices

Pharmacies - unlike other markets, pharmacies and parapharmacies are a huge market in France. They come with bespoke needs so do your research

Trade Shows :

NatExpo Paris – 22th to 24th October 2023

NatExpo Lyon – September 2024

Cosmetic 360 – 18 & 19 October 2023 in Paris

Beauté Sélection – 26 & 27 November 2023 in Lyon

Decoding the Chinese Beauty Market

FEBRUARY 23, 2023

REGISTRATION HERE

Come and meet DIT at COSMOPROF

MARCH 16 – 18, 2023

Pre event webinar : REGISTRATION HERE

Apply to the Made in the UK

Sold to the World Awards

Deadline for submissions: 23 February 2023

Winners announced: Mid April 2023

Please ask your questions in the chat box or raise your online hand so we can open your microphone access.