Preventive maintenance is the best thing you can do for your health. If you’re 45 or older, now is a great time to schedule a colonoscopy. Early detection with regular colon screenings can give you the peace of mind can keep you focused on the road ahead.

Start your preventive health journey as early as age 45 for a lifetime of wellness. Schedule a colonoscopy today.

For more information, visit uticaparkclinic.com/colon-screening.

Inflation has many seniors reevaluating their nest eggs. Hear from Jean Chatzky, AARP’s personal finance ambassador, about some moves you can consider to stretch your dollars to their fullest.

BY JULIE WENGER WATSON

BY JULIE WENGER WATSON

Who doesn’t like a discount? Don’t go shopping without this list of discounts available to older adults. And when you’re ready to have fun, check out some free and low-cost date ideas.

BY LINDSAY MORRISFrom pre-statehood days through the booms and busts of the oil industry, Oklahoma banks have had a big role in building local communities, according to an author and historian.

BY STEVE CLEM

BY STEVE CLEM

Jean Chatzky, journalist and AARP’s personal finance ambassador, gives advice for making your money last as long as you do, page 14.

PHOTO BY SANDRA WONG GEROUX

PHOTO BY SANDRA WONG GEROUX

There are many reasons people struggle with debt accumulation, and help is available. Get expert advice on protecting your credit score from the folks at the Tulsa Financial Empowerment Center.

BY ALYSSA DILLARD

BY ALYSSA DILLARD

Dear Vintage Reader,

Happy New Year! My hope for you in 2023 is a good year filled with purpose and fun. ‘Tis the season for resolutions. As the year turns over, we aspire to improve on many fronts. Many of us pledge to eat less and move more. Many others commit to having more intentional time with friends and family.

Money is also the subject of many New Year’s resolutions. If you fall into the money resolution camp, this is the issue for you! We explore a variety of topics designed to help you manage the ins and outs of personal finances.

Money is a very personal issue –and one with few universal truths. I have two dear friends who have been married to each other for almost 40 years. She saves her money, spending carefully and investing wisely. She is motivated by the goal of leaving a healthy inheritance for their children and grandchildren, something her own parents were not able to do. He has a completely different philosophy. He explains that he worked a lifetime to earn money and is planning to enjoy it now. He wryly comments that the real trick is to decipher how long he will live: “I plan to enjoy it all

and bounce my final check.” They have very different approaches, but somehow make it work in one household.

Now that 2023 is officially here, we are pleased to spend this year celebrating with you the 50th anniversary of the founding of LIFE Senior Services. The trends and services with respect to aging have changed in this half-century, but the goal of ensuring that older adults can remain active and engaged has not. Each issue of LIFE’s Vintage Newsmagazine in 2023 will highlight a different aspect of LIFE Senior Services and its affiliates. This month we focus on Vintage Housing, which provides affordable housing communities to over 700 seniors in Tulsa and the surrounding communities. I hope you will take time each month to

Vol. 37, No. 7

EILEEN BRADSHAWPresident & CEO of LIFE Senior Services, LIFE PACE & Vintage Housing

KELLY KIRCHHOFF

KELLY KIRCHHOFF

Senior Director of Communications

DEE DUREN

Managing Editor

dduren@LIFEseniorservices.org

BERNIE DORNBLASER

Advertising Director

bdornblaser@LIFEseniorservices.org

PAULA BROWN

Assistant Editor

pbrown@LIFEseniorservices.org

LIFE’s Vintage Newsmagazine accepts advertising to defray the cost of production and distribution, and appreciates the support of its advertisers. The publisher does not specifically endorse advertisers or their products or services. LIFE’s Vintage Newsmagazine reserves the right to refuse advertising. Rates are available upon request by calling (918) 664-9000.

© LIFE’s Vintage Newsmagazine and LIFE Senior Services, Inc., 2023.

All rights reserved. Reproduction without consent of the publisher is prohibited.

Volume 37, Issue 7, January 2023

LIFE’s Vintage Newsmagazine (ISSN 2168-8494) (USPS 18320) is published monthly by LIFE Senior Services, 5950 E. 31st St., Tulsa, OK 74135.

Periodicals postage paid at Tulsa, OK.

No matter what time it is or where you are in Oklahoma, you can conveniently connect to a locally-based Saint Francis provider through Warren Clinic 24/7 Virtual Urgent Care.

Through a simple video visit, adult and pediatric patients with minor illnesses or non-emergency conditions can be evaluated and provided with a treatment plan.

To access Warren Clinic 24/7 Virtual Urgent Care through your smartphone or computer, visit saintfrancis.com/urgentcare or sign in to your Saint Francis MyChart account to start your visit. saintfrancis.com/urgentcare

Tulsa Historical Society & Museum 2445 S. Peoria Ave., Tulsa

An unidentified World War I serviceman poses in front of the War Savings Stamps Bank in Tulsa in 1918. The bank was located at the corner of 2nd Street and South Main Street in Tulsa. It was the first War Savings Bank to open in the United States. The serviceman is wounded and stands on crutches. A new building was eventually constructed for the bank at 401 S. Main Street. The building also served as a pay station for the American Red Cross, YMCA, and other war funds.

A couple in a horse-drawn carriage pass by the front of the First National Bank in the Bynum Building, located at 201 S. Main Ave. in Tulsa, Creek Nation. R.N. Bynum financed the construction of the brick building which was completed in 1902.

In the final play of his NFL career, New England Patriots player Doug Flutie surprised the crowds with the first successful drop kick in an NFL game since 1941. Coach Bill Belichick challenged the 43-year-old player to make the trick play. Flutie dropped the ball and successfully kicked it between the uprights before being mobbed by his teammates. The last drop kick in NFL play had been converted two weeks after Pearl Harbor.

An explosion rocked the Sago Mine in Sago, West Virginia, trapping 13 coal miners. All but one eventually died. The tragedy was exacerbated by false reports that 12 of the miners were rescued. According to sole survivor Randal McCloy, Jr., the miners were equipped with emergency oxygen “rescuers,” but several failed to function. McCloy recalled the group praying and writing letters to their loved ones as, one by one, they lost consciousness.

Henry Ford set a land-speed record of 91.37 mph on the frozen surface of Michigan’s Lake St. Clair. He became involved in auto racing to promote himself and gather investors for future auto-making ventures. On June 16, 1903, Ford incorporated the Ford Motor Company. He later won a New Yorkto-Seattle race with his Model T. Although he was to be disqualified by a technicality, the event provided great advertising for Ford.

Hattie Ophelia Wyatt Caraway, an Arkansas Democrat, became the first woman to be elected to the U.S. Senate. Caraway was appointed to the Senate two months earlier to fill the vacancy left by her late husband. With the support of a powerful Louisiana senator, Caraway was elected to the seat, then reelected in 1938. She lost the renomination in 1944 and was appointed to the Federal Employees Compensation Commission by President Franklin Roosevelt.

The comedy series “Sam ‘n’ Henry” debuted on Chicago’s WGN radio station. Two years later, the station changed the series name to “Amos ‘n’ Andy.” Over the next 22 years, it became the highestrated comedy in radio history. The show eventually made it to television — the first to feature an all-Black cast. African American advocacy groups criticized the show for promoting racial stereotypes which led to its cancellation in 1953.

Bill Clinton chose Fleetwood Mac’s “Don’t Stop” (as in “thinking about tomorrow”) as his unofficial theme song during the 1992 presidential campaign. Clinton’s team accomplished a diplomatic feat that seemed to bode well for his presidency by reuniting the group. It had been more than five years since the entire Fleetwood Mac band shared a stage, but the squabbling band members reunited for a live performance at Clinton’s inaugural ball.

Few people plan to be a caregiver; it’s often a job you were given, stepped into, married into, but never actually applied for. Understandably, that can leave many caregivers feeling ill-equipped for the role, searching for the instruction manual, or having to get on-thejob training as issues arise. When talking with caregivers, I often refer to “tools in your caregiving tool belt.”

A tool can be anything that helps you along the caregiving journey. Certain communication techniques that you regularly use to take the tension out of the room, having the right documentation at your fingertips in case of emergencies, or strategies to help build an informal support system – all of these are tools you can use to make the job of caregiving feel a little more manageable.

This year in the Caregiver Corner, we’ll be adding some tools to your caregiving toolbelt, and we are kicking off the new year with the most important tool of all – self-care.

I may talk to too many caregivers because in my head I just heard a collective “groan.” “Self-care, again?! If I have ONE MORE PERSON tell me I need to take care of myself….” Yes. I’ve heard these exact words from a caregiver’s mouth.

But here’s the thing, everyone says it’s important –because it is.

I won’t go into the horror stories that I’ve heard and seen; instead, I’ll lay out a hypothetical scenario: If you can no longer be the caregiver for your loved one, then what? Caring for yourself may not feel like the most pressing item on your to-do list; some may feel it’s selfish to prioritize caring for themselves when their loved one is sick or struggling. But the reality of the caregiving role is that someone else now depends on you. You are a critical variable in this equation.

I like to talk about self-care in terms of a metaphor: filling your emotional gas tank.

Imagine, if you will, that everyone on earth has an emotional gas tank with an allotted amount of emotional energy to get through each day.

All kinds of things burn through our emotional energy, especially those situations and people that leave you feeling wiped out – like you need a nap, a good cry, or a conversation with a close friend.

We also have things that fill our tank! That nap, cry, or conversation could be something that helps you recharge. The things that burn our fuel and fill our tanks are different for everyone. I love to use the example of introverts and extroverts. Introverts are people that recharge (or fill their tanks) by finding comfort in solitude while spending time with groups of people “burns their fuel.” The opposite is true of extroverts – too much time alone for an extrovert can leave them feeling depressed and frazzled, but a group setting can have them buzzing.

Now that you’ve got the concept, I want you to start asking yourself questions: What burns my fuel? Also, what fills my tank?

As a caregiver, you may already be starting your day with a lower tank. You’ve got less time for yourself, less energy, and there’s a lot more demand for your fuel. You are like a gas-guzzling 18-wheeler (in the best possible way, of course, because you are helping people, after all!) But this also means that knowing strategies to refuel will become imperative.

Trying to run on no fuel? Well, that’s burnout. No one wants to burn out.

So, what puts a little gas in your emotional gas tank? Maybe it’s something small like getting in the garden to pull weeds, or getting to window-shop without feeling time pressure to be somewhere else. Maybe it’s a trip to see family, coffee with a close friend, a walk, or the chance to regularly exercise your mind. It could be a meditation, a prayer, or a breathing exercise that helps calm you.

Make a list! Keep your list handy so you can access it easily when you start to feel your fuel is low. This is a critical tool in your tool belt. It’s like your your level or your carpenter’s pencil. You should be pulling this tool out every day.

Next month we’ll talk about a tool you hope you won’t need, but one that you’ll never regret having when you do need it – the critical documents you may need as a caregiver.

BIXBY

Autumn Park

8401 E. 134th St. S. (918) 369-8888

BRISTOW

Woodland Village 131 E. 9th Ave. (918) 367-8300

BROKEN ARROW

Kenosha Landing 2602 W. Oakland Pl. (918) 258-0331

Vandever House 3102 S. Juniper Ave. (918) 451-3100

COLLINSVILLE

Cardinal Heights 224 S. 19th St. (918) 371-9116

COWETA

Carriage Crossing 28530 E. 141st St. (918) 486-4460

GLENPOOL

Redbud Village 14900 S. Broadway St. (918) 322-5100

JENKS

Pioneer Village 315 S. Birch St. (918) 298-2992

OWASSO

Prairie Village 12877 E. 116th St. N. (918) 371-3221

SAND SPRINGS

Heartland Village 109 E. 38th St. (918) 241-1200

SAPULPA

Hickory Crossing 2101 S. Hickory St. (918) 224-5116

SKIATOOK

West Oak Village 1002 S. Fairfax Ave. (918) 396-9009

Covenant Living at Inverness | Tulsa, OK

3800 West 71st Street

Limited availability! • Independent & Assisted Living Skilled Nursing • Memory Care • Rehabilitation

To schedule a tour today, call (877) 478-8455, or visit us online at CovLivingInverness.org

Covenant Living of Bixby | Bixby, OK

7300 East 121st Place South

Available now! • Independent & Assisted Living

Excellent service, worry-free living • No buy-in fee!

To schedule a tour today, call (877) 312-3248, or visit us online at CovLivingBixby.org.

TULSA

Brookhollow Landing 2910 S. 129th E. Ave. (918) 622-2700

Cornerstone Village 1045 N. Yale Ave. (918) 835-1300

Country Oaks 5648 S. 33rd W. Ave. (918) 446-3400

Heritage Landing 3102 E. Apache St. (918) 836-7070

Park Village 650 S. Memorial Dr. (918) 834-6400

Whittier Heights 64 N. Lewis Ave. (918) 392-3393 55 and older

Whittier Villas 53 N. Gillette Ave. (918) 901-0027

Knowing when you can make changes to your Medicare coverage can be confusing at times. We all know what it’s like to have second thoughts about a decision, especially when it comes to healthcare. Below is some information about changes you may be able to make to your coverage now through the first quarter of 2023.

January 1 – March 31

If you are enrolled in a Medicare Advantage Plan (like an HMO or PPO), you can change from one Medicare Advantage Plan to another or go back to Original Medicare between January 1 and March 31 each year. Your coverage will start the first of the month following the change.

Remember if you change from a Medicare Advantage Plan to Original Medicare, you have an opportunity to join a separate Part D prescription drug plan.

During this period, you cannot:

• Change from Original Medicare to a Medicare Advantage Plan

• Change from one Medicare Prescription Drug Plan to another

January 1 – March 31

Usually there is no monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. If you are not eligible for premium-free Part A and didn’t buy it when you were first eligible, you can sign up during the General Enrollment Period, January 1 through March 31, and your coverage will begin the first of the month following the date you signed up. Your monthly premium may go up 10% for every 12 months you didn’t have coverage. You will have to pay the higher premium for twice the number of years you could have had Part A but did not sign up for it.

• If you didn’t sign up for Part B coverage (for which you pay a monthly premium) when you were first eligible, you can sign up during this period. Your coverage will start the first of the month following the date you signed up. You may have to pay a late enrollment penalty for as long as you have Part B. Your monthly premium may go up 10% for each full 12-month period you could have had Part B, but didn’t sign up for it.

• If you didn’t sign up for Part A and/or Part B when you were first eligible because you or your spouse are still working and covered by a group health plan as good as Medicare, you will be eligible for a Special Enrollment Period once you (or your spouse) stops working or the group health plan coverage ends, whichever happens first. You usually don’t have to pay a late enrollment penalty if you sign up during a Special Enrollment Period.

• You can sign up for Part A and/or Part B at your local Social Security office, on Social Security’s website at ssa.gov, or (800) 772-1213. TTY users should call (800) 325-0778. If you get benefits from the Railroad Retirement Board (RRB), call your local RRB office at (877) 722-5772. TTY users should call (312) 751-4701.

Source: www.medicare.gov

Tax season is upon us, and April 15 will be here before you know it! Like many taxpayers, you may find yourself dreading those confusing forms, worrying that you will make a mistake or have to pay a sky-high cost to have them professionally prepared. If so, you are not alone. According to the IRS, millions of people will spend an average of $220 in tax preparation and filing fees this year instead of saving that money and filing their taxes for free

From February 6 until April 15, trained and IRS-certified volunteers will be available to help seniors age 60 and older who make $60,000 or less annually with free, basic income tax preparation and electronic filing. Appointments are available for the service which will be held throughout the tax filing season.

To schedule your appointment beginning January 15, call LIFE's Tax Assistance program at (918) 664-9000, ext. 1189.

For more information on Chatzky, visit her website at jeanchatzky.com.

– Jean Chatzky

BY JULIE WENGER WATSONMoney may not buy happiness, but it does buy food, car repairs, and utilities. If you’re contemplating retirement, or just assessing your finances as you head into a new stage in life, financial security is definitely part of the equation.

According to the Center for Retirement Research at Boston College, the average age for retirement in the United States has risen three years over the past three decades to reach 65 for men and 62 for women. Even taking into account the impact of COVID-19, the Centers for Disease Control and Prevention places the average life expectancy in this country at 73.2 years for men and 79.1 years for women. Many people live well beyond that average. Planning for those years “in-between” is crucial.

“Unless you have some really good reason to assume otherwise because of your general health or maybe genetics, you’ve got to assume that you’re going to have an incredibly long lifespan,” said Jean Chatzky, CEO of HerMoney.com and host of the podcast, “Her Money with Jean Chatzky.”

“This is where we go wrong. In so many cases, we don’t assume that we’re going to live long enough. Without that assumption in place, the chances that you’re going to run out of money before you run out of time are much greater.”

Once you’ve accounted for a good, long life, Chatzky says the next step is to determine how much you’ll need for retirement.

“There’s a rule of thumb that says you should probably plan on spending 70% to 80% of your pre-retirement income in retirement,” Chatzky said. “But what we’re finding is that because we’re so much healthier and more vital than we were in prior years, for today’s retirees, it’s higher than that. It’s often closer to 100%.”

Need some help making that determination? Many websites, like AARP.org or Vanguard’s Retirement Nest Egg Calculator, offer free retirement calculators.

Once you have an idea of what your financial needs will be, it’s time to determine how you’ll fund them.

MAKING YOUR MONEY LAST, continued on page 16.

How do you make your money last? Let’s look at some strategies.

“I love the idea of working in retirement, and not just for financial reasons. I think it keeps you healthier and happier because it maintains important connections and a feeling of purpose.”

Assessor: John A. Wright, Tulsa County (918) 596-5100

Assessor: Ed Quinton, Jr., Osage County (918) 287-3448

Assessor: JaNell Enlow, Creek County (918) 224-4508

Assessor: Scott Marsh, Rogers County (918) 923-4795

Assessor: Sandy Hodges, Wagoner County (918) 485-2367

According to Chatzky, Social Security is probably one of the biggest retirement resources for most people, and thus it’s important to have a smart strategy when it comes to accessing it.

Social Security benefits are based on many factors, including marital status, age, lifetime earnings, etc. More information, including a calculator to estimate payments under different scenarios, can be found at ssa.gov. Although there are multiple variables that impact the amount to which you’re entitled, delaying the age at which you access those benefits ultimately increases the amount you’ll receive.

“For most people, it makes sense financially to try your best to put off taking Social Security until you’re as close to 70 as possible,” Chatzky said. “In general, you get a bump in benefits of about 8% a year for every year that you wait to take them between ages 62 and 70, and that bump is guaranteed. When we hit periods of inflation like we’re in right now, that bump in benefits is incredibly meaningful.”

After estimating your potential income from Social Security, you need to look at other guaranteed sources of income and savings –things like pensions, 401(k)s, and IRAs. At this point, you should have a better idea of how your retirement needs stack up against your resources. You may discover that there is a gap between how you envision your retirement and what is available to fund it. Work of some kind may be the answer.

“Many people these days are working in retirement, part or full-time. Some people who decided they would retire during the pandemic have now unretired,” Chatzky said. “I love the

idea of working in retirement, and not just for financial reasons. I think it keeps you healthier and happier because it maintains important connections and a feeling of purpose, in many cases.”

Let’s say you’ve figured it out. You’re ready to retire, or at least slow down, and you’ve determined what income and assets are available to you. How do you start? You need a withdrawal strategy.

“This is where a lot of people get stuck,” Chatzky said. “We’ve spent years and years talking about accumulate, accumulate, accumulate, and this need to save as much as you can for your own retirement. But we haven’t really cleared our throats when it comes to making this money last.” Chatzky encourages working with a qualified financial advisor on this piece of the puzzle.

“It can be hugely important. If you have one, great. If you don’t have one, it’s time to reach out and make an appointment with one to have a retirement checkup because it gets complicated in terms of how to access that money, in what order to access that money, how to minimize the taxes that you pay on that money, and whether you should take the step of converting a chunk of that money into an additional guaranteed source of income,” she said.

Not everyone has the benefit of a fully-funded retirement account and a nice cushion of savings. For those who find themselves coming up short, Chatzky has a few suggestions, in addition to continuing to work.

“If you’re starting late in life, you need to look at what you have on your plate and how you can use that in a way to support you,” she said. “Maybe you don’t have a fully-funded retirement account, but your house is paid off. What are the moves that you could make in order to reduce your cost of living so that some of the value in that house becomes accessible to you? Could you downsize sooner rather than later, allowing yourself to save more money, or at least spend less money? Could you move into an area with lower taxes? Could you rent out part of that house? What are the moves you could make to bring in additional income?”

There is a lot to think about as we age. Chatzky believes one of the bigger issues facing seniors is long-term care.

“Many people are under the impression that Medicare will pay for long-term care. It doesn’t. That means that if you need long-term care, you’re going to have to come up with some other way to either fund it or to get it from a family member,” she said. “I think that the long-term care puzzle is best not solved alone, but solved by families.”

Chatzky suggests having conversations with children and other family members as you head toward that period of your life. There are also other resources to consider. Websites like the National Institute on Aging at nia.nih.gov and, locally, the Oklahoma Health Care Authority at oklahoma.gov/ohca, have more information.

At its base, money is simply a tool, but it can be a complicated one with many emotional and philosophical nuances. We spend a lifetime trying to accumulate it, and it can be difficult when it comes time to spend it down. Again, Chatzky recommends consulting with a qualified financial advisor as a way to help approach this time of transition.

“It’s not only stressful, we see it resulting in behavior that doesn’t necessarily serve people well. People have a reluctance to spend it, even when they are fully funded and they’ve saved and saved and saved,” she said. “There’s often such a high element of fear of running out of money that we see people not being willing to dig into principle. As a result, they’re not living the life they could live. Sometimes I think having a financial advisor in the picture who can give you license to use these assets that you’ve worked so hard to accumulate to spend to enjoy yourself is really helpful.”

“Many people these days are working in retirement, part or full-time. Some people who decided they would retire during the pandemic have now unretired.”

– Jean Chatzky

Formerly known as Food Stamps, SNAP provides nutrition benefits to augment the food budget of needy families, including seniors, to purchase healthy fare at grocery stores. Learn more at Oklahoma.gov/okdhs/services.

Provides federally-funded assistance to reduce the costs associated with home energy bills, energy crises, weatherization, and minor energy-related home repairs. Go to Oklahoma.gov/okdhs/services to find out more.

Helps low-income families reduce their energy bills by making their homes more energy efficient through repairs and equipment replacement. Get details at okcommerce.gov/weatherization.

Helps households pay for water and sewer services by providing up to $5,000 per family towards past-due invoices to avoid service disruptions. If you need help, go to okdhsLive.org.

This type of mortgage is available for seniors who have equity in their homes and want to supplement their income. Get more information at hud.gov.

If you or your spouse is a veteran, you may qualify for additional benefits. Visit va.gov or check LIFE’s Vintage Guide to Housing & Services at LIFEseniorservices.org under the education and resources tab.

If you’re a Tribal Citizen, you can also contact your specific Tribe for information about other benefits that may be available to you.

“Raising Your Credit Score”

Tuesday, January 24 • 10 to 11 a.m.

Legacy Plaza East Conference Center • 5330 E. 31st St. Call (918) 664-9000, ext. 1181 to register

Financial Counselor Lian Cing of the Tulsa Financial Empowerment Center will provide tips on raising your credit score.

I was referred to him by a well respected orthopedic doctor.

What procedure did you have done?

Kyphoplasty, at least 6 treatments.

What was your experience like?

Very calming atmosphere, Dr. Webb is friendly and he made sure to explain in detail what I could expect for the procedure. After a detailed explanation he answered any questions I had before proceeding. I was completely comfortable throughout the process with no pain afterwards. He still remembers me years after my procedure, which made me feel like he truly cares for his patients individually.

Oh Yes!! I tell everyone about him.

Jenneth, Satisfied Patient

Looking for a place to take your sweetheart that won’t break the bank?

Several local and chain businesses offer discounts for seniors.

Some of the best, yet underutilized perks of growing older in the United States are the many discounts available to older adults.

“Older adults, without ever realizing it, are leaving billions of dollars in aid on

the table each year. That money can help pay for utilities, rent, prescription drugs, groceries, and more,” said AARP Oklahoma State Director Sean Voskuhl.

There are thousands of discounts on a wide variety of products and services,

including restaurants, grocery stores, travel and lodging, entertainment, retail and apparel, health and beauty, automotive services, and much more. These discounts – typically ranging between 5% and 25% off – can add up to save you hundreds of dollars each year.

Sonic

Offers 10% discount for seniors 60+

Burger King

Offers 10% discount (60+), depending on location

IHOP

Offers a 10% discount and a special menu for seniors (55+), varies by location

McDonald’s

Discounts on coffee and other beverages (55+), varies by location

Wendy’s

Offers free coffee and other discounts, varies by location

Whataburger

Depending on location, free drink with purchase of a meal (55+)

Chick-fil-A

10% off or free small drink (60+), varies by location

Chili’s

10% off for 60+

Dunkin Donuts

10% off or a free donut for 55+

Most businesses don’t advertise them, but many give senior discounts just for the asking, so don’t be shy.

“A first stop should be visiting AARP.org,” Voskuhl said. “You don’t have to be an AARP member to learn about discounts at retailers, restaurants, and even grocery stores. You can also find ways to cut your gas costs, utility bills, prescription drugs, travel expenses, and much more.”

Tuesdays at Goodwill are Senior Savings Days. Folks 60+ can get 10% off their purchases. Also on Tuesdays, Ross Dress for Less offers seniors 55+ 10% off.

Walgreens offers a Senior Day on the first Tuesday of each month, with 20% off for seniors. You must be 55+ years or an AARP member

If you enroll in an AARP or Association of Mature American Citizens (AMAC) membership on your 50th birthday, you will have a head start cashing in on senior discounts. Some stores that participate in AARP discounts include Ace Hardware, AT&T Wireless, Consumer Cellular, and Outback Steakhouse.

Some stores offer senior discount days, so you will want to plan your shopping trips accordingly. Be prepared to present a state-issued photo ID at all these stores upon checkout to claim your discount.

and have a myWalgreens account. Walgreens.com offers 20% off eligible online orders several days per month as well.

If you’re looking for a discount on getting your dog groomed, Pet Smart offers seniors 65+ a 10% discount on Tuesdays for grooming. Kohl’s offers 15% off to

seniors 60 and older on Wednesdays.

Periodically, JoAnn Fabric and Craft Stores holds a Senior Day, when seniors 55+ receive 20% off. Check your local store to find out when the next Senior Day will be.

Your golden years can mean you get to save on your gold (or money!) at many local and national retailers. Who doesn’t love a discount?

Here are three tips to help you find the discounts you may be eligible for:

Aside from Senior Days, there are some amazing savings out there for seniors any day of the week!

This Broken Arrow meat market gives a 10% discount to seniors who are 65 and older. It’s good any day you shop, but meat bundles are excluded.

Offers a 10% discount to seniors 55+ any day of the week. You must present a valid ID at the register.

Offers a 10% discount any day of the week. Age requirements may vary. Discounts and terms are at the discretion of store managers.

Offers a 10% discount to seniors 55+ any day of the week. Check your local store to confirm participation.

5.

Offer seniors a phenomenal deal. Individuals 62+ can purchase a lifetime pass to the National Parks for $80, or an annual pass for $20. Senior Passes can be purchased at any federal recreation site, including national parks, that charges an entrance or standard amenity (day-use) fee. Proof of age and residency are required. Visit www.nps. gov/planyourvisit/senior-pass-changes for more details.

Did you know the Oklahoma Real ID is free for adults 65+? Talk about sweet savings! Go to oklahoma.gov/dps/real-id/ real-id-cost for more info.

While this may not apply to every senior adult, Cox has a program where you can get lower-cost internet if you qualify – for example, individuals who qualify for SNAP, Medicaid, or are at or below 200% of the federal poverty guidelines. Go to www.cox.com/residential/internet/ affordable-connectivity-program for more info. Also, seniors who are recipients of SNAP, SSI, or other government assistance can receive 50% off an Amazon Prime membership.

Seniors are understandably concerned about making their dollars last in today’s economy, according to AARP Oklahoma State Director Sean Voskuhl.

SEAN VOSKUHL AARP Oklahoma State Director

SEAN VOSKUHL AARP Oklahoma State Director

“Historic inflation has everyone taking a hard look at what they spend,” he said. “Any disposable income is gobbled up to cover the essentials; sometimes, it’s not enough. Seniors are forced to choose between groceries, prescription drugs, and a constant stream of utility rate hikes. Every penny counts, especially for those on fixed incomes.”

Some positive developments on the national scene will help in 2023, he noted.

“A good way to start the year is with an increase in Social Security payments by 8.7%, or approximately $140 per month,” Voskuhl said. “Additional savings involved Medicare changes that include a cap on insulin costs and coverage of vaccines like shingles. Also, there’s a slight decrease in Medicare payments, about $5 a month, and the deductible dropping by $7 a month.”

The Supplemental Nutrition Assistance Program (SNAP) helps with monthly benefits to buy groceries at the supermarket and farmers’ markets. Nearly 26 million adults 50 and older were eligible for this program in 2018. AARP found that 63% did not take advantage of this benefit.

Medicare Savings Program helps pay eligible older adults’ Part A and Part B deductibles, coinsurance, and copayments. Older adults can save more than $2,000 per year through this program, yet more than 3 million eligible adults 65 and older are not enrolled, leaving billions in available benefits unused.

Also known as Extra Help, this benefit can cover monthly

premiums, annual deductibles, and copayments for Medicare prescription coverage.

According to the Social Security Administration, Extra Help is worth around $5,100 per year for eligible participants, and AARP found that about $7.6 billion a year goes unused.

Seniors can put in their zip code and search for things like food and nutrition, disability services, and many other things.

Low-Income Energy Assistance Program (LIHEAP) recipients get a one-time payment to help defray winter heating costs. With this program, recipients get a one-time payment to help defray winter heating costs. The payment can be as high as $1,400, although the average payment is $500.

Life happens, and your credit score may suffer after financial setbacks. While there’s rarely a quick fix, there are actions you can take to repair and protect your credit score.

Credit is a puzzling concept for many, and it can feel hopeless trying to crawl out of the low credit score range. A credit score is a three-digit number usually ranging from 300 to 850 that every American gets after opening their first credit account. This number is determined from information on a credit report that puts a numerical value to the likelihood of you paying back debt on time. On-time payments, credit usage, and the length of credit history all factor into this score.

Typically, a number between 670 and 739 is considered a good credit score, and anything above that is even better. Your credit score can affect your ability to obtain insurance, loans, housing, and even jobs. A negative credit history will also mean paying more interest on loans. Negative information will remain on credit reports for seven years, and bankruptcy will be on file for 10 years.

The world of credit can be intimidating and confusing, almost like trying to learn a new language. A shining credit report can set you up for great opportunities, however, like a new car or a vacation home on the beach. While there are no secret hacks or shortcuts to save your credit score, there are some steps you can take to gradually get your credit score numbers to climb.

When looking to improve your credit score, it’s easy to fall prey to potential scammers. False credit repair companies may offer to remove negative information from credit reports. This is likely a scam as accurate information cannot be removed. If a credit repair company tells you not to contact the three nationwide credit bureaus or tries to get you to pay money upfront, these are also signs of credit scams.

Always do your research on any company before giving them personal information or money. Scammers may try to trick you with just a onetime payment, but others can cause more serious damage like accessing your bank account or stealing your identity. “When looking at your credit report, are we seeing things that are not familiar to you that are inaccurate? Do we need to perhaps look for identity theft?’” said Lian Cing, financial counselor. “Check your bank accounts for weird charges.”

If you suspect you may be a victim of fraud, you can report a ‘fraud alert’ to one of the three national credit reporting companies who will then notify the other two. A fraud alert requires creditors to take extra steps to verify your identity before making any changes like opening an additional account or issuing a new credit card. Another option is to put a “security freeze” on your credit report which prevents creditors from opening an account in your name until you lift the freeze.

One of the easiest ways to boost your credit is to pay your loans on time. To ensure timely payments, set up reminders on your phone or mark due dates on your calendar. Some companies will allow you to set up automatic withdrawal payments online. Also, try to

avoid getting too close to maxing out your credit limit. Experts recommend keeping your use to no more than 30% of your total credit limit.

An extensive credit history will bump up your score, and there

are many ways to gain credit experience such as credit-builder loans. Unlike traditional loans, you pay the fees, but don’t see the money until the end of the loan term. This shows creditors that you can consistently pay monthly bills. Another option is to link other payments to your credit such as phone bills or rent. Consider

You can report credit scams to the Federal Trade Commission at reportfraud.ftc.gov

It’s important to check your credit report for errors that could prevent you from getting approved for loans or housing. Every citizen is entitled to a free credit report every 12 months from each of the three national consumer reporting companies: Equifax, Experian, and TransUnion.

opening a credit card account with retail stores or gas stations as these are usually easier to obtain than regular credit cards.

It’s important to check your credit report for errors that could prevent you from getting approved for loans or housing. Every citizen is entitled to a free credit report every 12 months from each of the three national consumer reporting companies: Equifax, Experian, and TransUnion. You can order all three credit reports at once or request them one at a time to check them throughout the year. You can request a copy by mail or by calling this number: (877) 322-8228. You can also review your credit report online at annualcreditreport.com. The three credit bureaus are also offering free weekly online credit reports throughout the COVID-19 pandemic.

Of course, you don’t have to figure everything out on your own. Consider consulting with a financial coach. The Tulsa Financial Empowerment Center, a partnership between Goodwill Industries of Tulsa and the City of Tulsa, is one of several local programs that provide credit counseling at little to no cost.

Credit financial counselors can assist in disputing incorrect data on your credit report. “If it is inaccurate information, there are steps for us to guide you through, and that will improve your credit score,” said Tulsa Financial Empowerment Center Financial Counselor Lian Cing. Experts like Cing are ready to assist any resident living or working in Tulsa over the age of 18 with one-on-one free personalized financial counseling. They can help you work through a wide range of financial issues such as credit, building a budget, taking control of debt, and more. You can learn more and schedule an appointment at goodwilltulsa.org/fec.

Cing will be the guest speaker at a LIFE Senior Services community education event on Tuesday, January 24 from 10 – 11 a.m. Register to attend by calling (918) 664-9000, ext. 1181 or online at LIFEseniorservices.org/education.

Sources: consumerfinance.gov, consumer.ftc.gov

LIFE Senior Services is celebrating its golden anniversary in 2023. LIFE offers a wide range of programs and services for Oklahoma seniors. LIFE’s Vintage Newsmagazine will highlight a program in each issue this year. We hope you or someone you love will benefit from knowing about the resources offered through LIFE.

Vintage Housing has provided seniors with affordable housing since 1995. Today Vintage Housing has 19 apartment communities throughout northeastern Oklahoma for low- to moderate-income older adults. An affiliate of LIFE Senior Services, Vintage Housing proudly held a ribbon cutting last fall for its newest properties in the historic Kendall Whittier District of Tulsa.

“Whittier Heights and Whittier Villas are places anyone would love to call home,” said Sarah Tirrell, director of Vintage Housing. “Having a safe, welcoming, and supportive home environment gives our residents security and a wonderful sense of community.”

Vintage Housing developments have from 32 to 52 apartments and multiple common areas designed to encourage socialization. The properties are generally for adults aged 62 and up, with the new Whittier Heights serving seniors starting at 55. For more information about Vintage Housing, go to LIFEseniorservices.org, or call (918) 664-9000.or call toll-free (866) 664-9009.

Satoshi Nakamoto is a pseudonym for a single person (or possibly a group of people) who

BY ERIN SHACKELFORDI think it’s important to begin this article by admitting one thing: after hours of research on cryptocurrency, there is still much for me to learn. It’s a cryptic currency for sure!

It’s also critical to preface the article with a reminder that any major financial decision should be well-researched and planned. In this case, if you decide that cryptocurrency is a good investment strategy for you, I would strongly recommend consulting with a seasoned advisor before leaping into the world of cryptocurrency. Before we consider any leaps, let’s dip our toe in the water, shall we?

According to the IRS, cryptocurrency “is a type of virtual currency that uses cryptography to secure transactions that are digitally recorded on a (publicly maintained) distributed ledger, such as a blockchain.” This type of currency does not rely on central banks or third parties to verify transactions or create new currency units.

There are thousands of different cryptocurrencies out there at any given time and thousands more that are now defunct. According to CoinMarketCap, there were 13,669 cryptocurrencies in late 2021 with new ones constantly being created.

Sending money internationally is less expensive compared to other methods. Plus, the cost of using crypto is lower than using most financial institUtions.

Cryptocurrency transactions are expedient, taking just a few minutes to confirm.

Unlike normal banking and finance, you don’t need a valid ID to use crypto. There are also no credit checks, and no personal information is collected.

The encrypted and impenetrable blockchain ensures better security than debit cards or the internet. Transactions are also generally anonymous.

If you accidentally send too much crypto to someone or you don’t get what you expected, there is no way to dispute or reverse a transaction. Once transactions are on the blockchain, they’re final. The only way to rectify an issue is to hope the other party is agreeable.

While funds in a U.S. bank account are typically insured through the FDIC, there is no such thing with cryptocurrency.

If you lose your private key (a part of your digital wallet), you’re toast. You have lost total access to your funds.

The cryptocurrency market regularly swings back and forth daily.

developing the first Bitcoin software and introducing the concept of cryptocurrency to the world. Nakamoto published “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008, spiking interest in the cryptocurrency.

At that time, cryptocurrency was not a new concept – there had been many previous attempts to create a digital currency. However, Bitcoin solved a significant issue with preceding forms of digital currency: the “double-spend” problem.

Since digital currency doesn’t occupy a physical space – like a normal dollar or coin – it could be duplicated in multiple transactions by being doubly spent. Nakamoto fixed this problem by creating something called a blockchain, which in the plainest terms, is an encrypted digital collection of linked transaction data that is incredibly difficult – if not impossible – to hack or alter.

Nakamoto has never been positively identified; although, there has been speculation.

Reportedly, Nakamoto holds 1 million bitcoins. Since Bitcoin and other cryptocurrency is highly volatile, it depends upon market conditions as to what that means in terms of value. But, for example, if Bitcoin had a current market value of $29,000, the total value of 1 million bitcoins would be $29 billion.

Source: investopedia.com

However, there are certainly some top dogs in the cryptocurrency world, including Bitcoin and Ethereum. “Altcoin” is an umbrella term for all types of cryptocurrencies other than Bitcoin.

Cryptocurrency can be bought or sold using a cryptocurrency exchange or brokerage. First-time buyers get started by using fiat currency –government issueed money not backed by a tangible asset like gold – such as the U.S. dollar. To make a transaction and purchase a product or service using cryptocurrency, you need a digital “wallet.” These wallets aren’t made of leather, though. This wallet is your unique address for your funds on the blockchain. It also encompasses special private and public keys that ensure security and authenticity when transferring cryptocurrency.

Now, at this point, you’re likely asking, why? Excellent question.

Cryptocurrency has maintained and even gained popularity as more and more businesses, service providers, and individuals are adopting it as a payment method. Many people see cryptocurrency as an attractive investment. While it is considered a volatile market, it can pay off handsomely. You don’t have to look very far on the internet to find a “rags to riches” story of someone profiting off of crypto. Others believe cryptocurrency is the future of money and doing business.

There is so much more to learn and explore in the world of cryptocurrency. This is truly just the tiny tip of the puzzling currency. Even though it is a bit confusing, it looks like crypto has staying power!

The time was 1982. The place, an Oklahoma City shopping mall bank riding the crest of an oil boom. An examiner investigating the free-wheeling practices of Penn Square Bank returned to the building and was surprised to find some remodeling had taken place over the weekend.

A wall had been temporarily removed to make way for a Rolls Royce now parked in the lobby. A promotional sign near the car announced: Deposit one million dollars, leave it in the bank for five years, and the luxury automobile was yours.

This audacious offer, occurring as authorities were on the scene scrutinizing the bank’s books, illuminates the brazen antics of the most bizarre and far-reaching chapter in Oklahoma banking history: 1982’s collapse of Penn Square Bank in Oklahoma City.

“The event nearly brought down some of the biggest banks in the country,” said historian Michael Hightower, who has chronicled the Sooner state’s banking history in two volumes, “Banking in Oklahoma Before Statehood,” and “Banking in Oklahoma 1907–2000.”

Hightower says the Penn Square failure was fueled by hubris and greed. “They sent loan officers out like gunslingers in the old west looking for loan participations. The auto industry, lumber, different industries were not doing well so they were looking for one red hot industry where they could run to, and that was oil and gas,” Hightower said. These “participations” were then peddled to other banks.

The small Penn Square bank, located in fashionable Penn Square Mall in Oklahoma City, found a lucrative niche – partnering with larger banks on huge loans related to extracting the natural gas deposits of the Anadarko basin in west Central Oklahoma. “The participants in these loans thought the price of oil could only go up,” said Hightower.

If Penn Square Bank seemed more like a fraternity house than a bank, they came by it honestly. Their head of oil and gas lending, Bill Patterson, was just a few years removed from the Sigma Chi fraternity at The University of

Oklahoma. At the bank, he was known for guzzling champagne and beer from his cowboy boot. In one six-month period, Bill Patterson’s energy lending department generated $900 million in loans.

Epic Animal-House-style food fights in an establishment called Cowboys and milliondollar deals drawn on cocktail napkins are part of the documented shenanigans of the Penn Square Bank story.

However, during the oil glut of the early 1980s, it all came crashing down with the price of crude. It was the fourth of July weekend, 1982.

“Continental Illinois, Seattle First, and Chase Manhattan, huge banks, they lost buckets of money, because they participated in all of these oil and gas loans that originated at Penn Square Bank,” Hightower explained.

The Tulsa institution that had helped build the Oil Capital of the World, Bank of Oklahoma (BOK), fared slightly better. The former Exchange National Bank, then National Bank of Tulsa, BOK was brought back to respectability by Chairman George Kaiser and President and CEO Stan Lybarger, to become the largest bank in the state.

From frontier days through roller coaster booms and busts of the oil and gas industry, the Oklahoma banking industry has grown along with the state it serves.Michael J. Hightower, PhD Historian & Biographer Penn Square Bank collapsed in 1982 after agressively making high-risk loans to the oil and gas industry. Photo courtesy of Oklahoma Historical Society By Steve Clem Bill Patterson Photo courtesy of Oklahoma Historical Society

Of course, one bank’s failure is another’s opportunity. Changes in banking laws gave rise to companies like MidFirst Bank and BancFirst. They would buy up the assets and liabilities of distressed banks. “That’s how BancFirst built their empire,” Hightower said.

For his books, Hightower interviewed bankers from Boise City to Idabel, Woodward to Checotah. Fourth-and sometimes fifth-generation bankers told Hightower how their fathers, grandfathers, or great-grandfathers ran their banks through the Great Depression, World Wars, and booms and busts. They talked about how different life was from today’s no-contact, automated banking services. “Back then, the local bank president in a suit was the lynchpin of the whole town,” said Hightower, recalling an era when your handshake was your contract. “These folks spent their lives making sure their customers succeeded because that’s the only way they were going to succeed. Everybody working together.”

Some of these family-owned banks began in territorial days before statehood, pre-1907. “It was dirt cheap to start a bank. For a $10 filing fee, you could get a bank charter. A lot of them started that way,” Hightower said.

In areas settled by a land run, like the Cherokee Outlet, towns sprang up overnight. There would be fierce competition to get the funds together to send to the territorial secretary and get the first bank charter. “Then they’d gather a few men, construct a building on a corner lot, and automatically be at the center of that town and at the center of that economy,” Hightower related.

Other banks’ origins were more organic. According to Hightower, in Indian Territory, people might ask the dry goods or general merchandise stores to hold their valuables for them. “A gold coin, or whatever it might be,” he said. The business might even start extending credit, or a loan, from those items. Since they were already performing the functions of a bank in a corner of their store, eventually, they would apply for a charter.

You’ll find remnants of these early banks in small towns across Oklahoma. Positioned on their corner lots, many are now abandoned, but some are repurposed with a name recalling their former glories, such as The Vault restaurants in Atoka and Comanche.

Oklahoma’s early bankers personified the handed-down wisdom that was passed along to Hightower: “leave the woodpile higher than you found it.” It’s a lesson some of the bankers behind the Penn Square Bank collapse would have done well to learn.

BY BRIAN CRAIN, SOUTH TULSA LAW

BY BRIAN CRAIN, SOUTH TULSA LAW

We’re all feeling the sting of inflation these days in almost every area of our lives, from the gas pump to the grocery store – and even to our estate plans. While some experts believe our current inflation trends are the temporary result of pent-up pandemic demands, others worry we are on a trajectory of inflation that could last years. Time will tell which economists got it right, but it is important to take steps to protect your estate plan from the possibility of increasing inflation.

Inflation, a general increase in prices that results in a decrease in our purchasing power, has been near a 40-year high in the U.S. since the start of 2022. To combat this, the U.S. Federal Reserve Bank is aggressively raising interest rates to limit the supply of money and bring down the costs of goods.

While this is the right course of action from an economic

policy perspective, these rising rates impact several areas of our lives. Mortgage rates are increasing, housing values are decreasing, prices are rising, earnings are falling, and stock prices are dropping. All of this can make estate planning tricky! We may know the value of our assets today, but we don’t necessarily know the value of our assets tomorrow.

If financial stability for your spouse, children, grandchildren, or disabled loved one matters to you, it is important to pay attention to increasing inflation. That’s because it has a direct effect on the money you plan to leave behind.

For example, let’s say you plan to leave $500,000 to a child with disabilities to purchase a home. While this might seem like enough to buy real estate now, inflation may continue to impact the housing market. By the time your child inherits that $500,000, it may not be enough to buy a home. Inflation can cause unexpected and unwanted outcomes for your estate plan without proper planning.

Many people assume estate planning is only for the wealthy, but the fact is everyone needs an estate plan. If you don’t have an estate plan, you’re not alone – 67% of Americans don’t have one. But if you have a house, a bank account, or a car, you have an estate. It’s important to understand that in addition to stating who gets what when you die, estate planning also includes planning for yourself in the event of your incapacity. Accidents and health issues can happen at any age, which is why every person aged 18 and older needs some basic estate planning documents in place.

Here are a few tips to protect your estate plan and beat inflation

Estate planning is not a “one-and-done” event. Your estate plan needs to change as your life changes. Any life event – marriage, divorce, the birth of a child or grandchild – should trigger a review of your estate plan. And inflation counts as one of those life events. It’s important to evaluate your portfolio by reviewing each asset, its current worth, and the change in its value since the last time you reviewed your plan.

The old saying, “don’t put all your eggs in one basket” is particularly true for estate planning. Diversification is one of the best ways to limit inflation’s impact on your estate plan. Spreading your investments across stocks, bonds, real estate, and other vehicles can protect your assets, ensure growth, and increase liquidity.

One of the prices that increases during periods of inflation is the price of real estate. If you have real estate as part of your investment portfolio, the increase in value could expose your beneficiaries to future tax liability. Irrevocable trusts and charitable trusts can keep your estate intact while reducing your tax liability. For example, with real estate in an irrevocable trust, the appreciated value of the real estate does not increase your taxable estate.

With inflation on the rise, there has never been a better time to meet with a trusted estate planning attorney to review your goals and adjust your plans. Current inflation concerns aside, it is important to remember that there’s always a degree of uncertainty to consider when making estate plans. No one knows what tomorrow might bring, and by making proactive decisions now, you can guard against the very worstcase scenarios. Working with a professional can help you find the right strategy for your goals and loved ones.

Join us every Wednesday on LIFE’s Facebook page for short segments on a variety of topics including upcoming events, Senior Center Spotlight, Ask SeniorLine and living your best life.

The Caregiver Toolbelt

Wednesday, January 11

Join Erin Powell from LIFE’s Caregiver Support program as she introduces the concept of the Caregiver Tool Belt and the role it plays in successful caregiving. The first tool will be self-care for the caregiver.

Wednesday, January 18

Sean Voskuhl from AARP Oklahoma will talk about the scams that are currently making the rounds and how you can protect yourself.

Wednesday, January 25

Join Roxanne as she gives step-by-step instructions for making a tiered snowman globe. You’ll need three 4-inch glass bubble vases, miniature houses, people, snowmen, Santas, etc., craft snow, red ribbon, black heavy card stock, hot glue for use on glass, and regular craft glue.

All classes are at Legacy Plaza East Conference Center, 5330 E. 31st St. in Tulsa, unless otherwise noted.

“Basic of Medicare”

Wednesday, January 18 • 10 a.m. – Noon

Legacy Plaza East Conference Center, 5330 E. 31st St. “Basics of Medicare” is designed specifically for those newly eligible or soon-to-be eligible for Medicare. Advance reservations are required and can be made by calling LIFE’s Medicare Assistance Program at (918) 664-9000, ext. 1189.

“Raising Your Credit Score”

Tuesday, January 24 • 10 a.m. – 11 a.m.Legacy

Legacy Plaza East Conference Center, 5330 E. 31st St. Financial Counselor Lian Cing, from Goodwill, will be sharing tips on how to raise your credit score as well as giving an overview of the programs Tulsa Financial Empowerment Center provides. Register online at LIFEseniorservices.org/education or by calling (918) 664-9000, ext. 1181.

For some, 2022 was the year of the Great Resignation. For others, it was the year of rebound, of recovering from the weirdness that has been the pandemic.

For Vintage Publications Advertising Director Bernie Dornblaser and me, it was the Year of the Burger.

Bernie and I have been friends for nearly a decade now, and we’ve reached the point in our friendship where it’s not uncommon for us to have lunch together monthly. So we decided, why not document it? Because who doesn’t love ogling photos of our beautiful food?

Separate from LIFE’s Vintage Newsmagazine, I have an Instagram and Facebook page, @tulsaplaces, where I photograph and write about places in the Tulsa area I enjoy going. Bernie had the marvelous idea (and everyone who knows Bernie knows that all her ideas are indeed marvelous) to use my social media accounts as an excuse to eat burgers all year round.

Naturally, I was game for trying a different burger in Tulsa every month. Now, mind you… we had to tell ourselves: The calories don’t count! Bern and I tend to be pretty health-conscious gals… but we decided it was perfectly acceptable to gorge on burgers, fries, and tater tots once a month to discover Tulsa’s best burger. That’s just an example of the type of sacrifice we make in this line of work. You’re welcome.

societyburger.com 1419 E. 15th St., Suite B •Tulsa 9999 S. Mingo Rd Ste A • Tulsa 935 E. Kenosha St. • Broken Arrow

Society Burger, owned by Rib Crib, has three locations (two in Tulsa and one in Broken Arrow). We visited the Cherry Street location, which has a nice screened-in patio, a large bar space, and a dining room. There are multiple TVs throughout the restaurant, making it a great place to watch a game.

The atmosphere is unpretentious, but the menu is more upscale than a traditional burger joint.

We decided to split our burgers so we could each try something different. First was the Impossible Burger. This was the first time I had tried one, so I was curious to find out if it would taste like a piece of rubber. Honestly, it tasted like a real hamburger to me. Plus, Society Burger’s Impossible Burger has so much happening on top of it, that it may mask any un-hamburger-like qualities. It’s topped with a tasty Tzatziki sauce, lettuce, and tomato. It was a light, guilt-free burger. To balance the scales, we also tried the Pim and Jam – a burger oozing with pimento cheese, bacon jam, lettuce, tomato, and house sauce. This was not guilt-free, but it was worth it!

Mother Road Market location. The restaurant is an endeavor of McNellie’s Group.

Howdy Burger prides itself on serving classic burgers cooked on a flat-top grill. The fluffy potato buns make the burgers here extra special.

We both had the Original Howdy Burger –double meat, double cheese, lettuce, tomato, onion, and rodeo sauce for just $7. The rodeo sauce really adds something unique to the burger. You can also choose a single version for $5 or a triple for $9.

Their menu is not huge, but the Howdy Burger is all I’d ever need. I’d like to go back sometime to try the Rodeo Fries (topped with cheese, rodeo sauce, and bacon).

flosburgerdiner.net 2604 E. 11th St., Tulsa 19322 E. Admiral Pl., Catoosa

Flo’s on East 11th Street has perhaps the most options of any place we tried. They offer a ton of interesting toppings on their burgers. I tried the Floyaki (teriyaki mayo, cheese, onion, pineapple, and bacon), and Bernie tried the Shroom Burger (mayo, swiss, onion, bacon, and fried mushrooms).

Flo’s burgers are greasy; there’s no denying that! Each table has a roll of paper towels to help you manage the grease you’re about to battle!

6558 E. 41st St. • Tulsa

Howdy Burger has two locations: one on 11th Street near Peoria (drive-thru), and another inside Mother Road Market. We visited the

Chances are you’ve driven by Jumbo’s on 41st Street near Sheridan but had no idea it was there. Their sign says, “Gyros,” but wow… you

Two Dinner Belles took a tour of Tulsa hamburger joints – one for each month of 2022. The results are in!

do not want to miss their burgers. We haven’t tried their gyros but look forward to returning!

The Jumbo’s staff was the kindest of any restaurant we tried. We arrived at 11:30 on a weekday, and only a few tables were occupied. By the time we left, though, a line of firefighters was out the door!

We each tried the Cheeseburger Combo, which comes with a generously sized cheeseburger, fries, and a drink for $10. The fries are nicely seasoned. The burger comes with fresh lettuce, tomato, and onions. We were both impressed by this hole-in-the-wall!

1534 S. Harvard Ave. • Tulsa

Since 1991, Ty’s has been serving delicious burgers, fries, chili, and more. Everything is made to order and extremely fresh. It does take a little more time than McDonald’s, per se, since it is all made to order! But it’s well worth the wait.

I tried the Jalapeño Bacon Cheeseburger with Qs (curly fries), and Bernie had the Hickory Burger. Ty’s is known for their chili, so I’ll be back for a cup of chili soon!

facebook.com/BrowniesBurgersHarvard 2130 S. Harvard Ave. • Tulsa

We discovered why generations of people have been frequenting Brownie’s since 1956. Brownie’s burgers are traditional and small, but that’s a good thing, because we also chowed down on tater tots, fries, and chocolate custard pie! I had the Onion Burger, and it was as good as a classic Oklahoma Onion Burger comes…melty cheese and plenty of perfectly grilled onions!

You don’t want to miss out on their crispy tots, and be sure to save room for pie.

arnoldsoldfasionedhamburgers.com 4253 Southwest Blvd. • Tulsa

Since 1986, Arnold’s has been serving delicious burgers, fries, and onion rings to Tulsans. Located in west Tulsa, we were surprised how hopping this place was at 11:30 on a weekday! We each got a burger plus either fries or onion rings for around $8! We think Arnold’s is the best bang for the buck of all the places we tried (and one of the tastiest, no doubt!).

I also loved the unique decorative touches at Arnold’s, like the wall of license plates and the wall of classic lunch boxes.

webersoftulsa.com 3817 S. Peoria Ave. • Tulsa

Weber’s on Brookside is known for its root beer, but they have pretty tasty burgers as well! Their indoor dining area is extremely limited (we’re talking, space for less than 10). But if it’s a nice day, you can grab a burger and a root beer and sit outside on a picnic bench. The tater tots here were some of my favorites. The burgers are simple, and the root beer is an absolute must.

The iconic Brookside burger joint Claud’s Hamburgers closed in October following the death of its owner, Robert Paul Hobson (son of founder Claud Hobson).

Claud’s was one of the spots we tried this year, and undoubtedly one of the most memorable. Having opened in 1954, this legendary, family-operated restaurant served delicious burgers and fries in a classic 1950s-era bar-top diner.

We were equally saddened when we learned that another spot we tried this year, J.J.’s Gourmet Burgers, also closed in October. Owner J.J. Conley, a Vietnam veteran and former set designer in Hollywood, had operated the restaurant since 1969 and opted to retire. J.J.’s was known for having a very set menu (three courses, including shrimp cocktail, a ribeye burger, a barbecued baby back rib, baked beans, and a Nassau Royal Cake and cappuccino) and very fixed hours (11 a.m. to 1 p.m. Tuesday through Friday).

Claud’s and J.J.’s will both be missed in the Tulsa burger scene!

Please note that due to deadlines and a couple of restaurants closing (sad!), this article does not include all 12 restaurants we tried during 2022. All meals were paid for by the two of us (not LIFE Senior Services).

Check out @tulsaplaces on Facebook or Instagram for more of our adventures.

Writing fiction – creating plot and characters –from imagination is already a mystery to me. But add the demands of historical fiction that require authentic historical time, place, characters, and dialogue.... How do authors do it?

“GIVING UP THE GHOST”

Hilary Mantel is the most celebrated writer of historical fiction of recent times. Her magnificent trilogy of the rise and fall of Thomas Cromwell, the skillful political fixer for Henry VIII, won her Britain’s Booker prize twice, inspired stage and screen adaptations, and brought her commercial success. When she died this year at age 70, I learned that she had published a memoir in 2003, long before her success.

“Giving Up the Ghost,” only 4” x 6” and not much larger than a small prayer book, is a fascinating, unconventional memoir. Rather than a plodding “and then this happened” chronology of her life, she dances over the past like a garden of fireflies – lighting here, skipping there, detailing this, summarizing that. Even so, she writes with candor and bluntness, bitterness sometimes and rightly so. All the while, her genius is on display as she remembers her life before she became famous in her fifties.

“I was unsuited to being a child,” she wrote. Born into a Roman Catholic family in postwar rural

England, she lived an unhappy childhood made worse by sickness. From the age of 19, she suffered dismissive medical misdiagnoses and treatments that were egregiously wrong and eventually harmful. Treatment left the pixy child trapped inside an enormous body she didn’t recognize. That’s why most of the photos we saw of her show only her face. “The story of my own childhood is a complicated sentence that I am always trying to finish and put behind me,” she wrote.

“Beset by pain and sadness,” says the introduction to her memoir, she decided to ‘write [herself] into being.’” The memoir is as full of magic as her historical fiction. It ends with her writing, “…God willing, I am going to write. But when was God ever willing? And what is this dim country, what is this tenuous path I lose so often – where am I trying to get to, when the light is so uncertain?”

Hilary Mantel’s little memoir is like no other, but neither was she.

Rilla Askew, an Oklahoma award-winning novelist and essayist, also writes historical fiction. She is famous for “Fire in Beulah,” “The Mercy Seat,” and “Harpsong,” all featuring Oklahoma events or characters. Her new book, “Prize for the Fire,” leaps across time and geography to tell the story of 16th Century Anne Askew, a real historical figure known as the first woman to write in the English

language and a fervent Protestant who defied male authority. In the roiling political and religious conflicts of Henry VIII, Anne was burned at the stake as a heretic. I ask myself, what do I believe in so strongly that I would be burned alive for it? I have no answer.

We can see contemporary parallels to Anne’s story: the tangle of church and state, the long shadow of patriarchy, and the still precarious role of independent women. “Prize for the Fire” brings the Tudor world alive as when Anne, feeling lost and frightened, prays alone in a small chapel for help. “A warmth settles upon her like a mantle, a sense of calmness, peace. Her clenched heart slowly opens, her breathing slows, deepens, becomes even. She feels herself bathed in warmth and love and an ineffable, permeating sorrow so tinged with tenderness and mercy she feels it does not, cannot, arise from within but has eased inside her from without.”

Some of Rilla Askew’s books and mine are published by the University of Oklahoma Press. Last month was National University Press month, celebrating university presses for helping keep American literature alive. When shopping for books as gifts, check university press websites.

To submit a Noteworthy event, contact Paula Brown at pbrown@LIFEseniorservices.org or (918) 664-9000, ext. 1207.

The 20th Annual Green Country Home & Garden Show returns to Tulsa January 27-29, 2023. This three-day event is held in The Exchange Center at Expo Square and is the largest FREE wintertime home and garden show in Green Country. The show features more than 100 vendors onsite, including home companies, outdoor living, cookware, storm shelters, and more. Some vendors will be available to schedule appointments to give bids and/or scope out projects, and others will have items available for purchase onsite.

Friday, January 27 • 12 - 8 p.m. Saturday, January 28 • 10 a.m. – 8 p.m. Sunday, January 29 • 11 a.m. – 5 p.m.

All of the CMG Tulsa radio stations (KRMG, Mix 96.5, K95.5, and 103.3 The Eagle) will have talent onsite to meet with attendees. And, instead of the traditional $1,000 cash giveaway as in years past, they are upping the game to celebrate their 20th year by offering a chance to win $20,000 cash. There will be a prize vault sponsored by Mazzio’s, where attendees have the opportunity to type in a code for a chance to win. Only people age 18+ are eligible.

For more information, contact Lisa Burkman at (918) 493-8532 or Lisa.Burkman@CMG.com, or visit coxradiotulsa.com.

Kick off the new year by learning about Tulsa’s incredible architectural heritage. The Tulsa Foundation for Architecture’s (TFA) monthly walking tours are held on the second Saturday of the month and feature a different historical area or topic each month. On various tours,

you may see beautiful examples of Art Deco, Beaux-Arts, Gothic Revival, and Mid-Century Modern buildings. Tulsa has a rich architectural heritage, and TFA is passionate about sharing that knowledge with residents and others.

TFA’s 2nd Saturday Walking Tour in the new year will be at Will Rogers High School: A Deco Darling, Saturday, January 14, 2023. The first tour starts at 10 a.m. and lasts about two hours. On this tour, you’ll have the chance to see the inside of this beautiful building and learn more about its history.

Tickets are $20 for nonmembers and $15 for members. TFA wants to help cultivate the next generation of architecture lovers, so children 12 and under are always welcome to join tours without charge. Check-in will take place at the front entrance of Will Rogers High School, 3909 E. 5th Pl. There’s ample parking at the school.

Who knew education could be so fun? For more details, go to tulsaarchitecture.org/programs or email info@tulsaarchitecture.com.

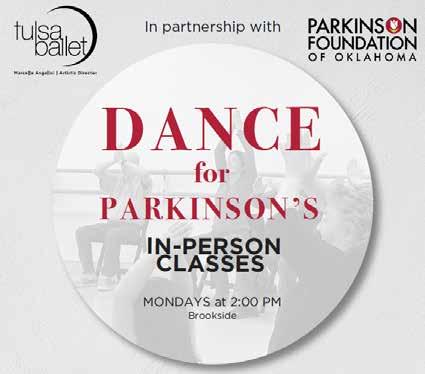

The CDE offers classes for all ages, and they just launched January classes for ages 3 to adult. Their “Dance for Parkinson’s” class series meets in person on Mondays from 2 – 3 p.m. at the Brookside campus. Classes are free to all Parkinson’s Disease patients and their caregivers.

Classes start: January 9, 2023 1212 E. 45th Pl. S., Tulsa

The registration process is simple – just complete the class waiver online, and email or bring it to your first class. Printed copies will also be available at class check-in. The dress code is clothing and shoes that are comfortable for you. Students should arrive about 10 minutes before class time so they have time to get settled.

For 60 years, Tulsa Ballet has been an integral part of the city of Tulsa and the state of Oklahoma. Their Center for Dance Education (CDE) provides high-quality ballet training for students of all ages. Beginner to advanced classes

span the first introduction to movement up through pre-professional training at their Brookside and Broken Arrow locations. Teachers have performed with prestigious companies around the world.

If you have questions about this particular class, call or email: (918) 392-5948 or education@tulsaballet.org. For more general information, call (918) 712-5327, (918) 749-6030, or visit their website, tulsaballet.org/classes.

Since its founding in 1914, YWCA Tulsa has served the needs of women, their families, and

community. YWCA Tulsa programs have guided women through times of crisis, helped newcomers to America find their way in a new culture, and provided a variety of opportunities to help the young, the old, and the physically disadvantaged reach their full potential. Today, the

focuses on

for immigrants and refugees, and on providing services through their

centers. YWCA Tulsa will serve more than 13,000 Tulsans this year through

community centers. For volunteer information, email info@ywcatulsa. org or call (918) 587-2100.

The Greenwood Cultural Center’s mission is promoting, preserving, and celebrating African American culture and heritage. It stands as a monument to pioneers, trailblazers, entrepreneurs, professionals, politicos, and citizens who created a renowned and respected community despite formidable odds. The Center needs volunteers in their Mable B. Little Heritage House to give visitors access to the first floor of the historic home. It is the only house still standing in the original Greenwood residential area of the 1920s. Volunteers are needed Monday through Friday from 10 a.m. to 1 p.m. For details, call (918) 596-1020, email Michelle at mbburdex@greenwoodculturalcenter.com, or visit greenwoodculturalcenter.org.

John 3:16 Mission is an interdenominational Christian ministry that endeavors to be the “hands and feet of Christ” to the homeless, hungry, poor, and at-risk in the Tulsa community. The Mission is not affiliated with any church or denomination. As a nonprofit, John 3:16 is funded solely by donations from individuals, companies, foundations, churches, etc., throughout Tulsa and beyond who wish to make relief and recovery programs available. Last year, volunteers gave over 30,000 hours of their time and talents – the equivalent of nearly 15 full-time jobs! To view volunteer opportunities, visit john316mission. org/volunteer or direct inquiries to the volunteer coordinator at volunteer@john316mission.org or call (918) 587-1186.