Liquid cargo tonnage is up but dry cargo tonnage is struggling.

18 Focus: Dams Dispute

White House support for salmon recovery fails to resolve dispute.

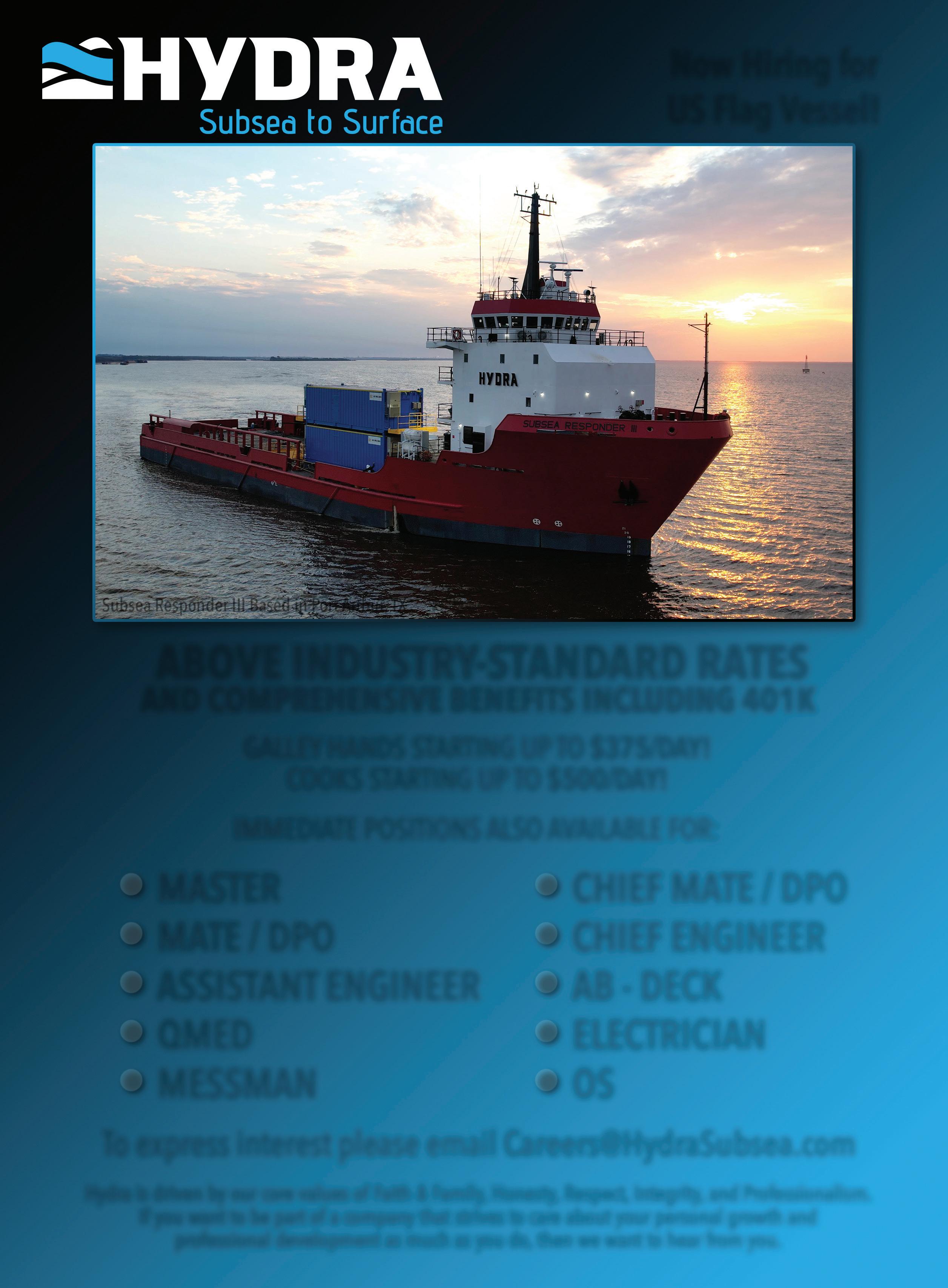

20 Vessel Report: Growth Spurt

More crew transfer vessels and updated designs are coming into the U.S. offshore wind industry.

26 Cover Story: Yin and Yang

Barge industry is in a good place, but challenges persist.

22 On the Ways

• Brix Marine delivers versatile workboat to Alaska • Yank Marine completes another passenger ferry for NY Waterway • St. Johns

Ship Building delivers second CTV for WINDEA CTV • Vigor begins production of U.S. Army landing craft

30 Cool It

Rising temperatures present heat-related problems for workboat laborers

8 On the Water: Baltimore officials made a bad bet.

8 Captain’s Table: You can't look back, but please look up.

9 Energy Level: The offshore industry midyear reset.

9 Nor'easter: Offshore energy, presidential politics and Florida.

10 Inland Insider: New steel and aluminum production plants

11 Tech Watch: Seaglider startup taking off.

13 Insurance Watch: Cyberattack liability insurance.

12 Legal Talk: Complex technologies sometimes lead to complex collisions.

16 ACBL announces reorganization plan, makes personnel changes.

16 Pilot wrestles runaway containership to safety.

16 U.S. Merchant Marine Academy graduates 214.

In this month’s cover story (see page 26) Austin Golding, president and CEO of Golding Barge Line, said, “We’re in a healthy market, but it’s not a peak market. We’ve seen a slow growth into a stronger market based on a number of factors. A strong international market mixed with strong gasoline and diesel demand have been really good to our inland market this year. And we’ve not dealt with low water since December. We’re now in a high-water stage, but we’ve had very healthy water on the river system so far this year.”

That all sounds great until he got to that last sentence. The part about the high water.

As I write this, it’s the end of June and a high-pressure system packing a heat dome from hell has set up shop from the mid-Atlantic to the Gulf of Mexico and a series of storms is running up the west side of it, dumping torrential rains into the nation’s midsection and swelling Mississippi River tributaries beyond their capacities. And all that water will eventually nd its way into Ol' Man River himself.

Anyone watching national news broadcasts from June 24 would think the entire Midwest was in danger of going under. From the reports I saw, the great state of Iowa is a loss. Which brings me to the real point of this commentary — insurance.

It seems as though everything is a natural disaster these days. It's not just ood waters but high winds too.

Almost three years ago, Hurricane Ida came crashing into my town of Mandeville, La. It came in as a Cat-

Ken Hocke, Senior Editor khocke@divcom.com

egory 4 storm — yes, stronger than Hurricane Katrina — and wrought havoc throughout our town. In my case two 65' oak trees took out my garage early on and for the next seven hours, Ida had a grand old time using my house as a punching bag.

Following the storm, insurance companies ed Louisiana like rats from a sinking ship. Those that have stayed have jacked their prices up to the absurd because they are being leaned on by the reinsurance companies they use following such disasters.

These natural disasters are pushing insurance companies to the brink. Where is the breaking point and how soon are we coming to it?

Will Washington come to the rescue?

Crews on board Offshore Service and Crew Transfer vessels perform a variety of complex operations.

Communication is critical to ensure the safe and efficient transport of cargo, equipment and personnel. David Clark Marine Headset Systems offer clear, reliable communications in the harshest marine environments, while enhancing the safety and situational awareness of crew members.

Call 800-900-3434 (508-751-5800 Outside the USA) to arrange a system demo or visit www.davidclark.com for more information.

Because they watch over us. Because they give so much. Give to the Coast Guard Foundation Sometimes, even the rescuers need to be rescued.

Sometimes, even the rescuers need to be rescued.

To learn more, visit RescueTheRescuers.org

Because they watch over us. Because they give so much. Give to the Coast Guard Foundation

To learn more, visit RescueTheRescuers.org

Krapf / dkrapf@divcom.com

Ken Hocke / khocke@divcom.com

Kirk Moore / kmoore@divcom.com

Capt. Alan Bernstein • Steve Blakely • Arnie Brennaman • G. • Michael Crowley • Jerry Fraser • Pamela Glass • Max Hardberger • Joel Milton

Hayden / bhayden@divcom.com

PROJECT MANAGER / ART DIRECTOR Doug Stewart / dstewart@divcom.com eremiah Karpowicz / jkarpowicz@divcom.com

ACCOUNT EXECUTIVE S 842-5439 / mcohen@divcom.com

207-842-5635 / kluke@divcom.com

207-842-5657 / krandall@divcom.com

207-842-5634 / dwalters@divcom.com

COORDINATOR

207-842-5616 / wjalbert@divcom.com

of The International WorkBoat Show and Pacific Marine Expo www.pacificmarineexpo.com

SALES DIRECTOR Christine Salmon salmon@divcom.com

PRESIDENT & CEO Theodore Wirth / twirth@divcom.com

GROUP VICE PRESIDENT Bob Callahan / bcallahan@divcom.com

PUBLISHING OFFICES

Main Office 121 Free St., P.O. Box 7438, Portland, ME 04112-7438 207-842-5608 • Fax: 207-842-5609

MAGAZINE SUBSCRIPTION INFORMATION

cs@e-circ.net • 978-671-0444 (Monday-Friday, 10 AM – 4 PM ET) © 2024 Diversified Communications PRINTED IN U.S.A.

Located in Northeast Florida, just two nautical miles from the Atlantic Ocean, BAE Systems Jacksonville Ship Repair offers dry dock facilities to commercial ship operators and owners.

Quality service on schedule, within budget and without difficulty.

From start to finish, we are your shipyard of choice. Upfront and honest.

baesystems.com/commercialshiprepair

Iappreciate the math attempt in your discussion on offshore wind energy (May issue, page 28), but I believe there might be a mistake.

You indicated that President Biden wants the U.S. to produce 30 gigawatts of electrical power by 2030. Later you discuss that there is a 45% electrical power loss due to power transmission factors. While that may be true, I would assume that the power losses were already factored into the 30 gigawatt goal, and I don't think you should have applied the loss again in your mathematical comparison.

Accordingly, 30,000 MW X 8760 hours/year = 263 million MWh/year. Regardless, that is still a drop in the bucket, but the longest journey starts with the rst step.

Germany is currently deriving 59.7% of its energy from renewable resources; wind, solar, biomass, and hydropower.

The U.S. could certainly do better. King Dobbins Ocean Springs, Miss.

Buls' article on the LCVP (Landing Craft Vehicle Personnel) was well written but had one small error. He said a replica of a Poppa boat was built by volunteers at the museum. It was an actual boat, found, I think, in Greece and rebuilt by those volunteers. Part of that team is Chris LaBure, a fellow surveyor and friend. He is the appraiser that valued the Poppa boat for the museum. I was involved with the museum’s insurance in the movement of the restored PT boat from the restoration center to the lake where it operated until Covid shut it down. I was the appraiser that valued the PT for the museum and got to spend a lot of time on it.

I have a deep interest in the LCVP as I was among the last Navy personnel to operate the boats, landing Marines on a number of Vietnamese beaches. I have been working on researching the end of their use at the last combat landing in Vietnam.

Norman F. Laskay ASA; NAMS-CMS (Ret.) New Orleans

(Editor-at-Large Bruce Buls' blog is available exclusively at workboat.com.)

Something on your mind?

WorkBoat encourages readers to write us about anything that appears in the magazine, on WorkBoat.com or pertains to the marine industry. To be published, letters must include the writer’s address and a daytime phone number. Email: khocke@divcom.com

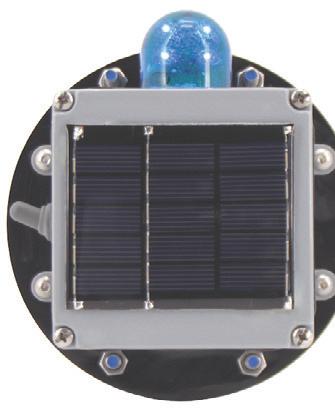

Meets 2 mile requirement for marking of dredge pipelines

Navigation

1 to 3 mile visibility for aids to navigation and applications such as buoys, docks, barges, and temporary lighting

Permanent mount LED lighting for bridges, docks, and barges

For vessels greater or less than 50 meters Certified to meet UL 1104 and Subchapter M Platform Marker Lights

Solar or battery powered barge navigation lights for unmanned barges per UL1104 Regulatory

Available for all applications

*Available with or without lighting*

BY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@ yahoo.com.

Baltimore officials made a bad bet

At 7:33 a.m. on May 9, 1980, the freighter Summit Venture, with a harbor pilot guiding it, was entering Tampa Bay approaching the Sunshine Skyway Bridge when the total reliance on luck proved, yet again, to be a bad bet.

The original Sunshine Skyway Bridge and the Francis Scott Key Bridge were in similarly vulnerable locations, spanning shipping channels at the mouths of busy harbors with only a single entrance, and of similar construction: steel truss bridges supported by piers. The support piers of both bridges immediately adjacent to the ship channels were not protected in any meaningful way given the size of the vessels using the channel, nor were any other significant measures taken to help offset that known vulnerability. But this was not a design flaw per se. It was a choice.

Unlike the containership Dali in Baltimore, the Summit Venture suffered no loss of steering or

BY CAPT. ALAN BERNSTEIN

Alan Bernstein, owner of BB Riverboats in Cincinnati, is a licensed master and a former president of the Passenger Vessel Association. He can be reached at 859-292-2449 or abernstein@ bbriverboats.com.

You can’t look back, but please look up

Literary scholar C.S. Lewis once said, “You can never go back and change the beginning, but you can start from where you are to change the end.”

In the early days of steamboats on the inland rivers of our nation, many pilots and captains navigated solely by memory. Some of these rugged individuals were for the most part illiterate, and they survived and succeeded as a result of their superb navigational skills. In addition to having almost photographic memories of the rivers, they also used tree stumps, brick walls, homes, buildings, or anything else on shore to give them a navigational reference point as they traversed the inland river system.

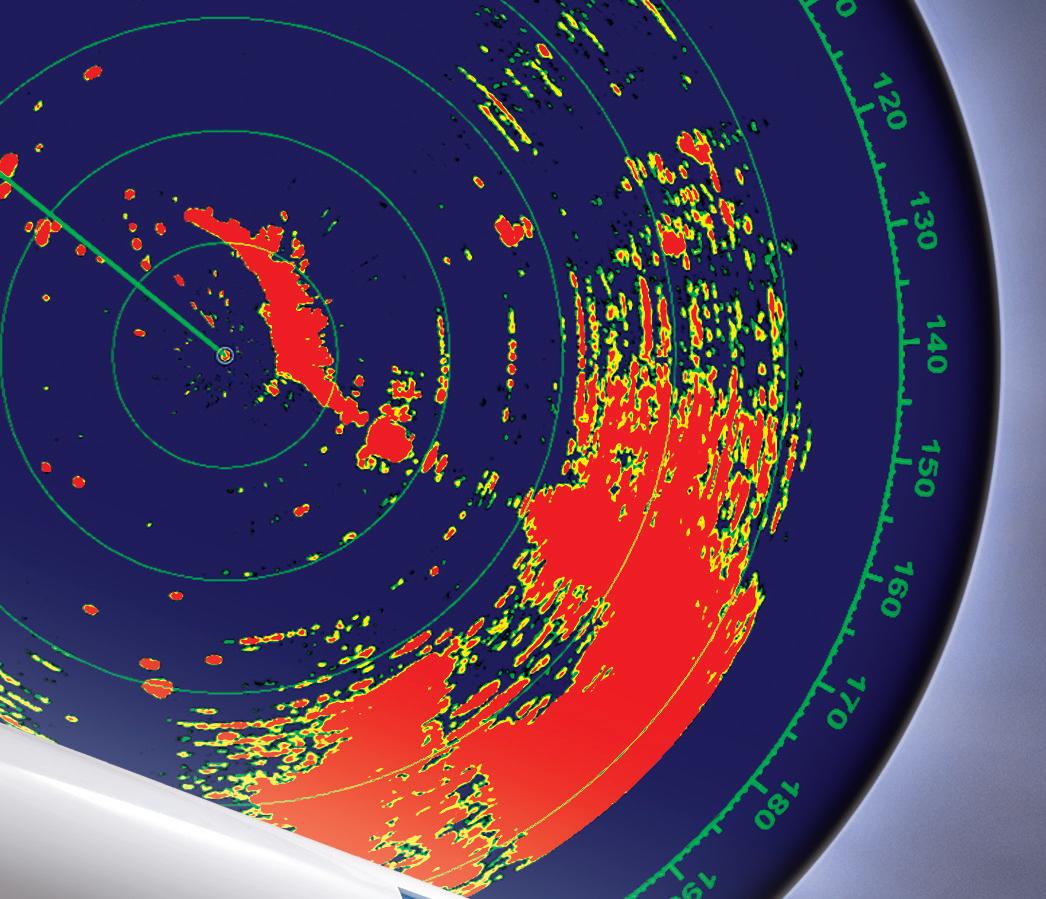

Today, river pilots and captains have a wide range of electronic tools at their disposal to assist in navigation. Radios allow them to make calls for passing arrangements. They have modern radar to help navigate channels. They have AIS, GPS, electronic charts, chart plotters, and much more. While this equipment is very useful and has contributed greatly to safe vessel operations, I am concerned that mariners have become too reliant

propulsion, or any other equipment failure. Heavy thunderstorms with squalls moved through as the ship arrived at the bridge. The resulting loss of visibility and strong winds proved disastrous, and the ship struck a support pier, collapsing the southbound span and killing 35 people.

The primary reason for failing to adequately protect critical infrastructure from even easily foreseeable events like a ship strike comes down to money and human nature. The Tampa Bay area made a bad bet and let it ride for 26 years until luck ran out. Baltimore made a bad bet and let it ride for 47 years despite receiving a loud-and-clear warning of what can happen less than three years after the Key Bridge opened. That warning went unheeded.

The question that should always be asked is “Can we afford to lose it?” Assume for the failure and honestly assess the costs of losing a given bridge, tunnel, viaduct, shipping channel, rail corridor, etc. — and then protect it accordingly.

For those who wish to learn from history, I highly recommend “Skyway: The True Story of Tampa Bay’s Signature Bridge and the Man Who Brought It Down” by Bill DeYoung.

on these electronic tools as their main means of navigation.

Are today’s young mariners equipped with the necessary skills to operate in an emergency, if and when one or more of these systems fail? Are they able to smoothly switch from a digital world to safely navigate without the assistance of electronics?

I believe looking out the front window is by far the best way to navigate. When you do this, you are seeing things happen in real time, and you can react quickly and efficiently to ever-changing situations around you. Electronics today are excellent, but they often do not tell the entire story. A mariner needs to look up and out the window to see fishing boats, kayakers, and many other often unnoticed obstructions and to make the necessary decisions to avoid hitting them.

I believe that safe vessel navigation is rooted in more than just understanding how to use all the navigational electronics available to today’s mariner. My recommendation is to take a multi-faceted approach to training that combines time-proven navigational skills, situational awareness and chart reading, while also using the electronic tools to enhance navigation and safety.

If safe operations are the goal, then comprehensive training is the key. While we can’t go back to the old ways, we can at least look up.

BY G. ALLEN BROOKS, CORRESPONDENT

Climbing a mountain requires pauses on the way to the summit to reassess the route and re-energize. Global oil markets are doing just that. Industry executives must consider the latest oil market forecasts and customer reactions to their plans.

Recently, the offshore industry was in the news for its M&A (mergers and acquisitions) activity, revised oil demand projections, and revised customer spending intentions. These events have created uncertainty among investors who have slammed share prices.

The major industry event was the acquisition of Diamond Offshore’s 12-rig fleet by fellow driller Noble Corp. The additional rigs will boost

BY KIRK MOORE, CONTRIBUTING EDITOR

Contributing

Editor Kirk Moore was a reporter for the Asbury Park Press for over 30 years before joining WorkBoat in 2015. He has also been an editor for WorkBoat’s sister publication, National Fisherman, for over 25 years.

Noble’s fleet into fourth place from its prior seventh-place ranking, surpassing Transocean. Importantly, the deal immediately boosts Noble’s cash flow per share allowing it to increase its dividend as a shareholder reward.

Although the Noble/Diamond transaction was small ($1.6 billion), compared with other deals such as this spring’s ConocoPhillips’ $22.5 billion purchase of Marathon Oil, and last year’s blockbuster ExxonMobil/Pioneer Natural’s $60 billion merger, and the $52 billion Chevron/Hess merger, it was significant for the industry. It further consolidated the global offshore drilling rig industry, creating a bigger, financially stronger company to counter the increased contract bargaining power of its international oil customers.

Recently, investment bank Barclays’s energy research team updated its 39th yearly exploration and production (E&P) spending survey. While the overall message was a slower spending increase than expected at the start of

Offshore wind energy got its prime-time national spot when former president Donald Trump promised to shut down all U.S. projects if he wins the White House again.

“We are going to make sure that ends on day one, I’m going to write it out as an executive order,” Trump said.

In the days following, other Republican politicians hastened to enhance their anti-renewable energy credentials. Florida Gov. Ron DeSantis signed a law to prevent offshore wind development in state waters, repeal requirements for considering climate change in energy policies, and end state renewable energy and conservation programs.

The new law, effective July 1, “will keep windmills off our beaches, gas in our tanks, and China out of our state,” DeSantis wrote on social media. “We’re restoring sanity in our approach to energy and rejecting the agenda of the radical

2024, the bright spot is offshore spending. It should grow by 18% this year, up from the 13% increase that was projected last January. Additionally, 2025’s offshore spending will likely grow.

International E&P spending will also rise, albeit more slowly than originally expected. This year’s North American onshore spending’s modest decline will be larger. These revised spending trends will force oil service company executives to adjust their business plans.

A potential threat to that path is a decline in oil and gas consumption. Although the International Energy Agency (IEA) cut its 2024 oil demand forecast, the Energy Information Administration raised its projection, and OPEC+ reaffirmed its healthy growth forecast. The biggest news, however, was the IEA’s agenda-driven study claiming global oil consumption will peak in 2029 and that the world will face an eight million barrel-a-day oil glut a year later. Will the industry blindly head off a cliff? I doubt it.

green zealots.”

DeSantis signed the law two weeks before the start of what veteran hurricane watchers at Weather Bell Analytics predicted as early as Dec. 7 to be “a hurricane season from hell” owing to a confluence of factors.

Record-setting sea surface temperatures in the Atlantic basin and Gulf of Mexico preceded a shift from El Niño to La Niña conditions in the Pacific, optimizing prospects for the highest number of tropical storms in years, according to the National Hurricane Center, Colorado State University and other research centers.

To critics it looks like DeSantis and his allies in the Florida Legislature have hung a “kick me” sign on their own backs. Southwest Florida still struggles with the long-term impacts from Hurricane Ian’s category 4 landfall in 2022.

Insurance companies, looking at increased hurricane risks, are boosting homeowners’ annual premiums. Florida’s political establishment appears unable to do much about it, and that’s threatening the state’s real estate market — the engine that drives Florida’s economic success.

But no worries about the sight of future wind turbines driving down those home prices!

BY PAMELA GLASS

Pamela Glass is the Washington, D.C., correspondent for WorkBoat. She reports on the congressional committees and federal agencies that affect the maritime industry, including the Coast Guard, Marad and Army Corps of Engineers.

Inland barge operators are seeing a positive sign in the increasing number of industries that are setting up shop or expanding operations along the inland river system, many motivated by Biden administration initiatives to address climate change.

Last October, Nucor opened a new $1.7 billion steel plate mill on the Ohio River in Brandenburg, Ky. It will be the only mill in the U.S. to manufacture heavy gauge plate used in monopile foundations for offshore wind towers. Nucor states that the facility will be a “critical part of the supply chain for the continued development of offshore winds power infrastructure,” and notes that the Biden administration’s goal to build 30 gigawatts of offshore wind power by 2030 could result in approximately 7.5 million tons of additional steel demand.

Nucor received a $2.3 million Marine Highway Grant from Marad in 2020 to nance construc-

tion of a marine terminal at the new plant that will receive raw materials and ship nished steel products by barge.

Nucor also plans to build a new state-of-the-art sheet steel mill along the Ohio River in Apple Grove, W.V., that will make steel from scrap arriving by barge, and plans to build a transloading facility in Weirton, W.V., that would receive materials shipped by barge from Apple Grove.

“This will all go by barge,” said Peter Stephaich, president and CEO of Campbell Transportation, Pittsburgh, which operates on the Ohio River. “These are multibillion-dollar investments all along the river that will add to volume on the water.”

Meanwhile, the aluminum industry, which over the past two decades has either temporarily halted or closed primary aluminum plants along inland rivers, is poised to make a comeback, according to River Transport News

In March, Chicago-based Century Aluminum was selected to receive $500 million from the Department of Energy’s Of ce of Clean Energy Demonstrations to develop and build the rst new primarily aluminum smelter in 45 years.

BY BENJAMIN HAYDEN

Seaglider startup taking off

Recent dinner discussions at a Propeller Club meeting in Portland, Maine, led me to a new maritime startup that’s been accumulating partnerships across the globe. Regent Craft Inc. (REGENT), North Kingstown, R.I., builds Seagliders — the first form of zero-emission, high-speed coastal transportation. REGENT expects its flagship vehicle, Viceroy, to transport commercial passengers by 2025.

Seagliders are a new type of wing-in-groundeffect vehicle that uses hydrofoils and distributed propulsion systems. The company has two models — the Viceroy (57.5’x65’x15.5’) is expected to carry 12 passengers with a 180-mile range, while the Monarch will carry 100 passengers with a 350mile range. Both models are projected to reach top speeds of 180 mph.

REGENT claims its seagliders offer significant advantages — they are half the cost of traditional aircraft and six times faster than conventional ferries. Additionally, their electric motors make them

30 decibels quieter than comparable aircraft or helicopters.

A quarter-scale prototype of the Viceroy underwent sea (and air) trials in the fall of 2022, which revealed the vehicles can “float, foil, and fly” as expected. Nicknamed the Squire, the smaller prototype was able to motor out of a Rhode Island harbor before launching from a speed of roughly 40 mph into the air, where it flew about 10 feet above open ocean at a speed of 50 mph.

Last fall, venture funding and a partnership with Japan Airlines raised $90 million. Additionally, in March 2023, Lockheed Martin Ventures made a strategic investment in the company for an undisclosed sum, while also allowing REGENT access to Lockheed’s facilities and expertise in developing sea gliders for military operations.

In May of this year, REGENT announced a $300 million deal with maritime and aviation lessor, MONTE, to provide financing solutions for seagliders. Under the agreement, MONTE will purchase up to $300 million of REGENT’s new high-speed, zero-emissions coastal vessels and provide leasing and financing options of the Viceroy and Monarch seagliders to customers.

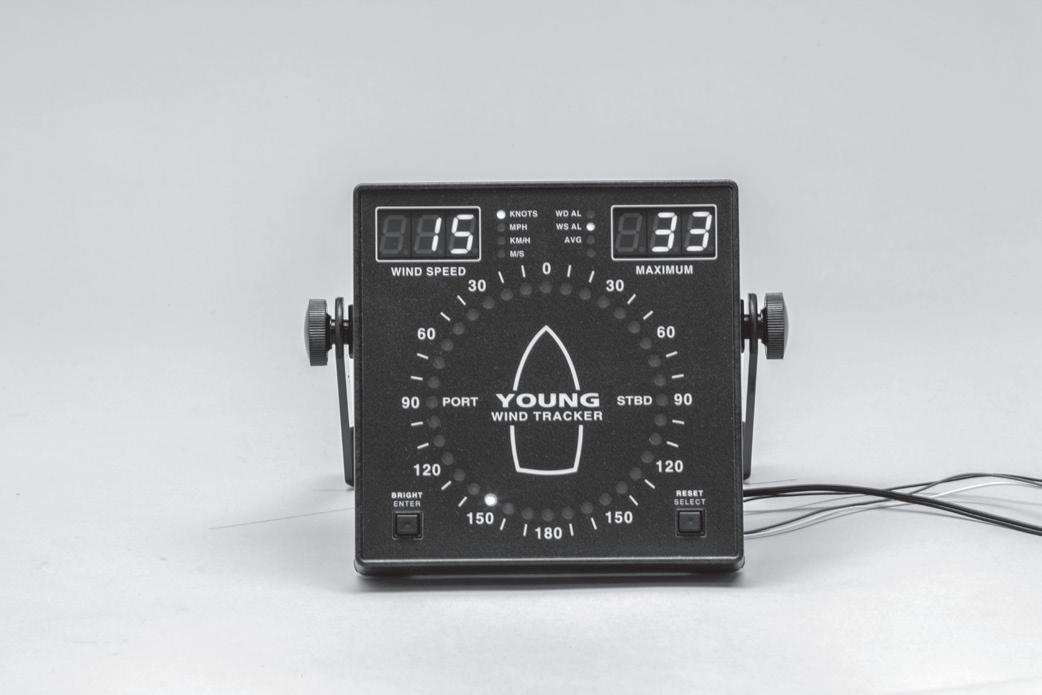

BY TIM AKPINAR

Tim Akpinar is a Little Neck, N.Y.based maritime attorney and former marine engineer. He can be reached at 718-224-9824 or t.akpinar@verizon. net

If we were to go back in time about a hundred years, we would notice a remarkable simplicity in the pilothouses of commercial vessels. There was no such thing as GPS or ECDIS. In the case of RMS Titanic, the tragic brush with the iceberg in April 1912 had nothing to do with complex navigation electronics.

Some four decades later in July 1956, the passenger liners Andrea Doria and Stockholm collided off the foggy waters of Nantucket in what some have described as a “radar-assisted collision.” Despite the fact that both vessels were tracking each other for about 20 minutes before impact, a series of misguided decisions led to a tragic intersection of their headings.

Although today’s navigation resources prevent untold accidents, new technologies introduce complexities that deserve to be respected, This was underscored in a recent investigation by the

National Transportation Safety Board with the 2022 collision between the containership MSC Rita and shing vessel Tremont. The NTSB determined that the shing vessel had not been maintaining a proper lookout, with the autopilot engaged, while troubleshooting the vessel’s gyrocompass. The autopilot had been receiving heading information from the gyrocompass. The NTSB used the term “simultaneous operations” to describe such a dynamic of two or more operations that occur at the same time that might interfere with each other. (NTSB Report MIR-23-27)

In an allision tied to complex navigation electronics, a shing vessel struck an offshore platform in the Gulf of Mexico in 2004. It was equipped with a Furuno 1731 Mark-3 radar and autopilot. However, vessel operators had not provided the captain with training in the use of the radar, nor did they have policies for the use of the anti-collision alarm. The vessel was doing around 10 knots in the calm seas when it struck an oil platform. (In the Matter of the Complaint of Omega Protein v. Samsun Contour Energy, Nov. 2008, Case No. 07-30725). Liability was divided because the platform was not displaying lights.

BY CHRIS RICHMOND

Chris Richmond is a licensed mariner and marine insurance agent with Allen Insurance and Financial. He can be reached at 800-439-4311 or crichmond@allenif. com

Today’s marine industry relies on computers, smart phones and the Internet to operate and is just as vulnerable as any other industry for cyberattacks. An attack can have a signi cant impact on your employees, your customers, your reputation and can bring you serious nancial loss. A cyber liability policy can provide risk management services useful to you before, during and after a data breach.

There are two important types of cyber liability to know about: First party and third party.

A rst party cyber liability occurs when your own data is stolen. This can include your own employees’ personal information or information about your customers. A cyber liability policy will provide credit-monitoring services to assist the affected individuals which could help minimize the risk of identity theft. Included in the category of rst-party cyber liability are:

• Funds transfer fraud is an intentional, unauthorized instruction transmitted via email to a nancial institution to transfer funds. If your computer

system is compromised, a hacker can have access to your banking information and initiate fraudulent electronic wire transfers.

• Lost business income due to cyber theft, (a hack or data breach), is not covered unless cyber coverage is in place. Your regular business insurance policy covers you for things like re, theft and wind, but not anything cyber-related.

Third party liability coverage can provide protection for damage caused by your business to third parties due to a hack. This could be condential client information that you store in your system. Coverages included in this category are:

• Breach of privacy: A client’s personally identi able information has been accessed by an unauthorized party.

• Misuse of personal data: Personal data is stolen or misused, and the victim(s) suffer nancial damages.

• Transmission of malicious content: Failure to stop the transmission of virus, malware or other malicious content.

Computers, smart phones and the Internet are as important as any other business tool. They also leave you vulnerable to losses.

Whether you’re powering an offshore service vessel, a passenger vessel, or an inland pushboat, Louisiana Cat has the right engine for your hard working fleet. We focus on you, the customer, and the reliability, safety and profitability of your business. Let us help you navigate every waterway. Visit us online to request an engine quote for your next project: www.LouisianaCat.com/Marine

Working on the waterfront requires a commitment to safety. As a leading USL&H provider, we take that commitment seriously. That’s why each year we celebrate our members with the strongest safety cultures in the business. Congratulations to our 2023 Safety Award winners.

Anderson Diving, Inc.

Austal USA, LLC

Bay Bridge Texas, LLC

Blakeley BoatWorks

CemBulk Services

Clam Equipment Mfg Co.

Conrad Shipyard

Cooper/Ports America

Core Process Technologies

Dakota Creek Industries, Inc.

Delta Marine & Environmental Services, LLC

DHD Offshore Services, LLC

Donjon Marine Co., Inc.

Donjon Shipbuilding and Repair, LLC

Evansville Marine Service, Inc.

First Marine LLC

FRS Clipper

Gulf South Services Inc.

Hughes Bros. Inc.

Manson Construction Co.

Middle River Marine, LLC

Northwest Sandblasting & Painting

Pacific Fishermen Shipyard and Electric

Prime Time Coatings, Inc.

Rio Marine

Seven Seas International LLC

Southcoast Welding & Manufacturing

T&T Group of Companies

Titan Talent Development, LLC

TMT Clam Dredgers, LLC

Upper River Services, LLC

VLS Marine Services, LLC

Walashek Industrial & Marine, Inc.

Waterfront Services Co.

World Direct Shipping, LLC

Learn

In June, American Commercial Barge Line (ACBL) announced that the company is going through a reorganization designed to enhance and optimize operational ef ciency, customer satisfaction and ensure successful execution of ACBL’s eet strategy.

To oversee that execution, Patrick Sutton will assume the new role of senior vice president of eet development and strategy. In this position, Sutton will be responsible for vessel reliability, leasing, building, and acquisitions. He will continue to report to Mike Ellis, chief executive of cer and board member, and be a member of ACBL’s executive team.

Brent Cervenka will be joining the ACBL team as its chief operating of cer, also reporting to Ellis. He will oversee logistics and network operations, vessel operations, eet and facility operations, safety and operational training.

Ellis said earlier this year that the dry cargo industry was in a “shortterm down cycle.”

ACBL's dry cargo division senior vice president Bob Blocker will be retiring effective June 2025. As a part of his planned retirement, ACBL has undergone a strategic reorganization of its dry cargo division and introduced the new role of chief commercial of cer.

After a comprehensive national search, ACBL hired Ricky Stover to ll Blocker's position. Stover brings over 20 years of transportation industry experience in the rail and trucking sectors, most recently serving as a sales and marketing of cer at Canadian Paci c Kansas City Railway. He will be responsible for all non-liquid commercial activity, business development, mergers, and acquisitions and will report to Ellis.

Blocker will work closely with Stover and the dry cargo team over the next year until his of cial retirement in June 2025.

Additionally, Jeff Carman has been promoted to vice president of sales and marketing and will be responsible for all dry cargo markets, except grain, which will continue to be led by Rich McCarty.

“This reorganization con rms our commitment to building a strong and diversi ed team capable of executing our strategic initiatives,” said Ellis.

For nearly 90 minutes Charleston, S.C., pilot Christopher Thornton steered a runaway 70,000-ton, 979'x130' containership Michigan VII on a slalom course 20 miles along the Cooper River, making fi ve major turns and shooting under the landmark Arthur Ravenel Jr. Bridge — all at nearly twice the normal speed of ships through the harbor. According to the Coast Guard, the June 5 incident began when Coast Guard Sector Charleston command center watchstanders received a reportfrom the Charleston Harbor Pilots dispatch that the MSC Michigan VII was experiencing a malfunction with the systems controlling their propulsion on the Cooper River while outbound from the North Charleston Container Terminal. As a precaution, local law enforcement closed vehicle traffi c to the Arthur Ravenel Jr. Bridge, which reopened once the vessel safely passed underneath.

The U.S. Merchant Marine Academy graduated 214 new offi cers in its Class of 2024 commencement ceremony June 22 at Kings Point, N.Y., attended by a crowd of more than 3,000, including graduates and family members.

Registration is now open for the mustattend event of the year for anyone involved in the maritime industry. This year's International WorkBoat Show takes place Nov. 12-14 at the Morial Convention Center in New Orleans. To register, go to internationalworkboatshow.com

Shell PANOLIN offers a wide range of high-performance biodegradable* lubricants, delivering unrivalled protection** for your equipment and the environment you’re working in. Helping you meet your dredging goals with less impact. *

By

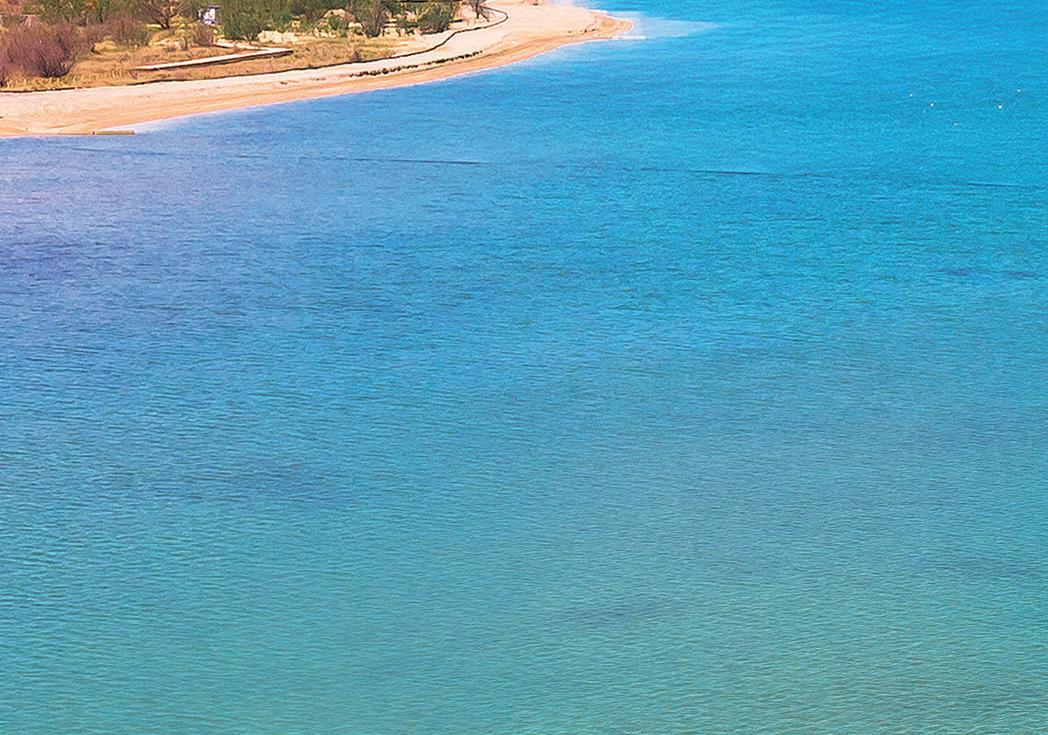

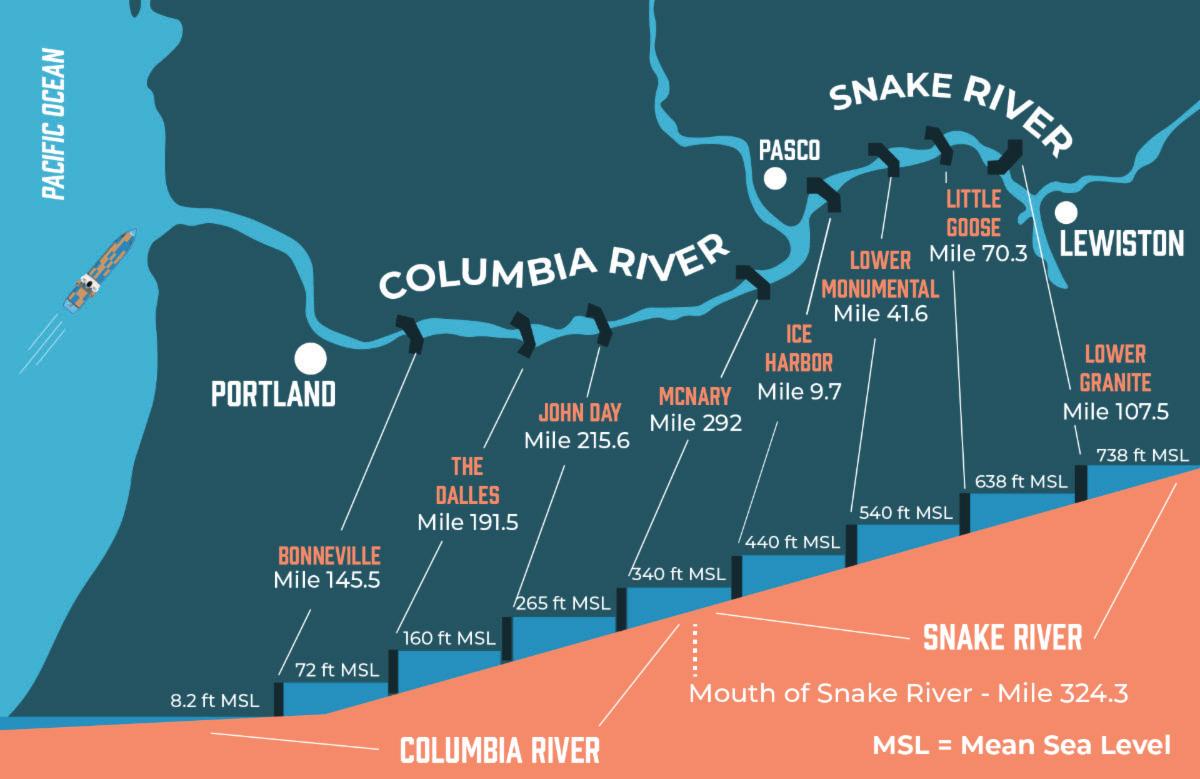

To breach or not to breach, that has been the question for decades here in the Paci c Northwest. It’s all about the future of four federal dams on the Lower Snake River, a tributary of the Columbia River in Washington state.

For those whose main concern is potentially extinct species of sh, mostly salmon, the answer is breach. For those who rely on the existing infrastructure of locks and dams for clean hydropower, navigation, irrigation and recreation, the answer is never breach.

The two sides of this dispute have been ghting in federal court since the 1990s at a cost of millions of dollars. Despite, or because of this legal haggling, the con ict has been stalemated and the dams, which were built in the 1960s and 1970s, have continued to operate. That said, an agreement

announced last December may mark a turning point in favor of the breachers, at least according to those in favor of removing the Lower Snake River dams. It also puts the extended legal battle on hold.

On Dec. 14, the White House announced, “a ten-year partnership with tribes and states to restore wild salmon, expand clean energy production, increase resilience, and provide energy stability in the Columbia River Basin.” The announcement revealed the publication of a plan to accomplish these objectives.

Many of the details are laid out in a document titled “U.S. Government Commitments in Support of the ‘Columbia Basin Restoration Initiative’ and in Partnership with the Six Sovereigns.” The six sovereigns are the states of

Washington and Oregon and four tribal groups.

For Earthjustice, an environmental law nonpro t, the plan clearly sets the stage for breaching. Its Dec. 14 press release was titled “The Government Just Took a Big Step Toward Breaching Salmon-Killing Dams.” Earthjustice said breaching the dams is “the best and only way to prevent extinction and rebuild healthy populations [of salmon].” The organization also vowed to continue to push the Biden Administration and Congress to “ nish the job.”

But to nish the job, viable alternatives have to be in place. In 2022, Sen. Patty Murray, D-Wash., and Gov. Jay Inslee released their recommendations on Columbia River salmon recovery, including Snake River sh. With respect to the dams in question, they said the services provided by them would need to be replaced or mitigated before any breaching.

For the commercial marine operators on the Lower Snake River, there is no suitable transportation replacement. They say that barging is the only affordable, safe and environmentally friendly way to carry cargo, primarily wheat, from eastern Washington and Idaho to Portland, Ore., where much of it is transferred to ships for export. In 2020, Columbia Snake River System (CSRS) barges moved 4.2 million tons of cargo, mostly wheat. The CSRS is rst in the nation for wheat exports and second in corn and soybean exports.

Yes, trucks and trains could potentially haul the grain instead of barges, but at a signi cant cost increase.

In 2011, the Texas Transportation Institute released a study that compares fuel ef ciency for trucks, trains and inland barges. The study was updated in 2022, and it found that a truck can carry a ton of cargo 151 miles on a gallon of diesel. Trains can carry 476 tons per gallon of diesel. Inland barges can carry 675 tons per gallon.

And then there’s highway traf c. “If you took the annual amount of wheat that goes down the Snake River, and you put it on a semi, that would be over 148,000 semis,” said Rob Rich, vice president,

marine service, for Shaver Transportation, a tug and barge operator based in Portland. “So, in two years, you would have 300,000 semis carrying what had been barged. And we’re talking long haul on county roads and twisty twolane highways. I don’t think anybody’s reached out to ask county commissioners about what they think of that.”

You’ve also got the cost, said Rich. “Trucking is more expensive compared to barging, so the wheat ends up being no longer market competitive.”

Another loser if the dams are removed is passenger cruise operators. “We have a burgeoning cruise industry here on Columbia/Snake rivers,” said Anthony Peña, government relations manager at the Pacific Northwest Waterways Association, a trade group representing commercial marine operators on the rivers and Puget Sound, as well as many ports. “American Cruise Lines has been building one new ship every year to come on the Columbia/ Snake rivers. We’ve had millions of dollars invested at a lot of small ports up the river system to bring in this great tourism revenue. It’s really been a godsend for them. But American Cruise Lines, and other cruise operators, have been very upfront that if those four dams go, they’re no longer coming to the Columbia because it just doesn’t pencil out for their business.”

“With American Cruise Lines and Queen of the West and Lindblad-Na-

tional Geographic, there are now tens of thousands of passengers on the rivers every year,” said Rich. “It all revolves around the Snake because it’s a very twisty, picturesque river compared to the Lower Columbia, which is just the highway to get to the Snake.”

The other major issue regarding dam breaching is electric power. The combined output of the four dams is as much as 3,500 megawatts. Right now, there is no concrete plan for replacing that power. The U.S. Government Commitments document envisions development of new clean energy sources, especially by tribes in the Six Sovereigns who are partners to the new federal agreement. The Yakama Nation has applied to the U.S. Department of Agriculture for a partially forgivable loan program for utility-scale, cleanenergy generation, but the loan is still in process.

“We’ve received a lot of support on the energy side to support the dams,” said Peña. Support can also be found within the government, at the Department of Energy, and the Bonneville Power Administration, the DOE’s power marketing administration, he said. “Folks like John Podesta, who’s currently the climate czar, have expressed to us the need to have these clean energy projects like the dams, and that we can’t remove them.”

He also pointed out that more and more of the economy is being electrified in order to reach climate goals, “but you just can’t do that without the LSRD [Lower Snake River District] project as part of our grid up here.”

So, there it stands. One side says that breaching the dams will return the Snake River to its natural state and save dwindling runs of wild salmon. Breaching would also honor treaties signed with the tribes several generations ago. The other side says there’s no way of knowing if breaching would save the salmon. Other North American rivers like the Fraser in Canada have declining runs and no dams.

Maybe the problem is salmon predators like Steller sea lions and Caspian terns at the mouth of the Columbia. One side basically understands that transportation and irrigation and energy production would take a hit from breaching but believes that’s the price that has to be paid in order to save the fish. The other side says that salmon and dams can coexist. The one thing that both sides understand and agree on is that Congress will have the final word.

More crew transfer vessels and updated designs are coming into the U.S. offshore wind industry.

By Ben Hayden, Content Specialist

As the offshore wind industry further cements its place in the future of energy production, support boats like crew transfer vessels (CTVs) have become a popular build over the past few years.

Different iterations of CTVs, variations in their con guration, alternative operations, and propulsion methods, are becoming part of the offshore wind eet. Most CTVs are newbuilds, though conversions occur, like Coast Line Transfer’s charter shing boat turned CTV for the Vineyard Wind 1 Project. The original boat, constructed by Geo Shipyard, New Iberia, La., in 2007, was modi ed in a four-month turnaround time that allowed the vessel to maintain its Jones Act compliance.

During a recent WorkBoat shipyard tour, three New England yards within 30 miles of each other shared a notable commonality — all were constructing CTVs.

Senesco Marine, North Kingstown, R.I., is currently working on the nal two of six WindServe Marine CTVs.

Gladding-Hearn Shipbuilding, The Duclos Corp., Som-

erset, Mass., is building the 89'x30' Patriot Leader for Patriot Offshore Maritime Services, New Bedford, Mass.

Blount Boats, Warren, R.I., is working on its second of two 99'x36.7' CTVs that are owned and operated by American Offshore Services (AOS), Providence, R.I. The rst CTV, Gripper, was delivered in March 2024.

Senesco has already delivered the Windserve Journey, Windserve Odyssey, Windserve Explorer and Windserve Genesis. All four CTVs measure 88.6'x29.5'x5.6' and can carry up to 24 technicians.

The aluminum catamarans were built with conventional Volvo Penta D13 main engines, each rated at 690 hp at 2,300 rpm, and a Volvo Penta IPS 900 integrated propulsion system. The vessels can achieve a service speed of 24 knots, with top speed capability of 27 knots.

WindServe Genesis is providing crew transfer support at Ørsted’s South Fork Wind project off the coast of Long Island, N.Y., before heading to work on the Revolution Wind project (R.I.), and Sunrise Wind project (New York).

For the nal two CTVs currently under construction, the engine control rooms have been pushed out an additional six feet to accommodate hybrid-ready battery capabilities.

“We’re not supplying the hybrid system at this time, but in

the event a customer in the future wants that, there’s enough room in the back of the engine room to go hybrid,” said Ted Williams, Senesco’s president.

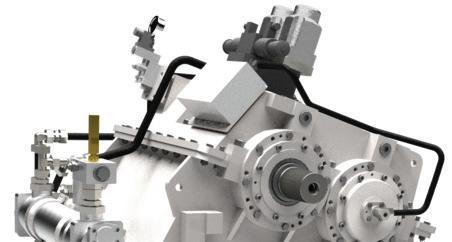

Offshore vessel operator WINDEA CTV LLC is having three aluminum 98'5"x32'10"x14'5" CTVs built in the U.S. St. Johns Ship Building, Jacksonville, Fla., delivered the rst two vessels in February 2024 and June 2024, respectively. The third WINDEA CTV will be built by Gulf Craft, Franklin, La.

All three vessels will be propelled by four Volvo Penta IPS units driven by Volvo D13 main engines, producing 690 hp each. The vessels will be fully hybrid-ready, meaning the integration of the hybrid system is completely accommodated in the design, including dedicated voids for batteries, reserved cabling space, and battery removal hatches. The propulsion package will give the WINDEA boats a running speed of 26 knots.

Dave Brown, director of marine diesel sales at Volvo Penta, highlighted the distinct advantages that their integrated propulsion system offers, speci cally in its thrust capabilities, which he said outperform traditional propulsion methods.

“What IPS does when you really start talking about it within the offshore wind market, in the capabilities that it provides, above and beyond traditional propulsion, is that thrust. And the ability to put this boat up against a piling, in a type of sea state, and allow for operators to get on and off that wind farm platform in a safe manner,” Brown said.

He noted that a lot of the buzz around

Volvo’s IPS is customer-driven, and he spoke to the fuel savings that comes with the propulsion system. “The developers of offshore wind, since they pay the fuel bill, are extremely interested in having IPS because there is a signi cant fuel savings when you’re running with IPS, typically, somewhere in the 30 percent range. And so those things in coordination with the support that we’ve done on a global scale, we’re bringing that expertise here in the states,” he said.

With offshore wind more advanced in Europe than in the U.S., maritime professionals note that the American offshore wind industry is adopting the trends it sees abroad.

New CTV concepts are being designed in response to the demand for larger CTVs servicing bigger turbine installations farther from shore. An

example of this is the 180'x52.5'x14.8' Midi-SOV (service operations vessel), adopted in June 2024 by UK-based operator North Star. The vessel is a product of naval architect Chartwell Marine Ltd., Southampton, U.K. and Vard, Alesund, Norway, designed to address the gap between current CTVs and larger SOVs.

Andy Page, director at Chartwell Marine, spoke to the need for this vessel design’s hybridization. “We don’t have the luxury that we have in Europe of having lots of vessel availability,” he said. “So, we’re going to have to use possibly fewer vessels to do more work. That’s really where the SOV is important. But perhaps the market can’t afford the full scale, and that’s where the Midi nds a perfect place in the market.”

The Midi-SOV is designed to be Jones Act compliant and ready for construction in U.S. shipyards.

Announced in April 2024, the world’s rst retro tted, electric CTV will be powered by a Volvo Penta electric propulsion system, replacing the diesel engines with a 100% emissions-free solution. Volvo Penta will supply its IPS system for the Ginny Louise, a 65', diesel-powered Mercurio vessel. The Mercurio Group is a parent of Astilleros Mercurio Plastics and Astilleros de Cartagena, Madrid, Spain.

The old propulsion system will be replaced with a quad installation of Volvo Penta IPS 30s, paired with fully electric motors.

Brix Marine, Port Angeles, Wash., delivered the new 46'x16'x4'9" aluminum workboat Jackpot Bay to Chenega Corp., Anchorage, Alaska. Chenega Corp. is a Native village corporation headquartered in Anchorage, but the village of Chenega and its traditional Native lands are located on a remote island in the southwestern corner of Prince William Sound, about 120 miles southeast of Anchorage.

“The corporation sought to custombuild a boat speci c to the corporate needs of accessing the village and our surrounding properties as well as supporting commercial customers with a variety of small workboat requirements to include crew transportation,” said Adam Turner, general manager, Chenega Regional Development Group LLC. “We were excited to partner with Brix on this project for our second vessel built by their team. Brix’s level of versatility within not only their customization process, but their willingness and ability to see a vision and bring it to reality is what brought us back for another boat. The quality of their manufacturing plant, innovative process ow, and project management is what continues to

give us con dence in their ability to hit the mark Chenega needs.”

A common day trip for the landing craft catamaran vessel Jackpot Bay is 180 miles round trip by water. Among the boat’s responsibilities are crew transport, accessing property, commercial customer support and various other workboat-related requirements.

Main propulsion comes from four Yamaha 450-hp outboard engines whose XTO stainless steel 16-5/8"x18", 3-bladed wheels spin at 1,800 rpm. The propulsion package gives the boat a top speed of 44 knots.

Ship’s service power is the responsibility of a Northern Lights 12-kW genset. Two-station controls, and the steering system are part of Yamaha’s Helm Master packages.

The cargo deck can handle up to 10,000 lbs. of freight, and there are accommodations for one crewmember and up to 18 passengers.

Capacities include 600 gals. of fuel and 55 gals. water. Ancillary equipment includes a hydraulic bow landing ramp and Morgan Marine 200.3 crane.

The Garmin electronics suite contains two 16" GPS MAP touchscreen,

xHD 4-kW six open-array radar, 1 kW transducer, VHF, PA system, and two cameras.

“In a business day, our work team can travel from Anchorage, Alaska, to the Native Village of Chenega,” said Turner.

“The boat was built to move employees, residents, contractors, and all the necessary gear for our numerous projects, all in a day trip. It makes Prince William Sound that much smaller and our remote journeys that much less complicated. This translates to more ef cient travel. Additionally, this stable vessel travels faster so we need smaller weather windows for safe transit, giving us more operational days over the year.”

Jackpot Bay is USCG certi ed, Subchapter T, and was delivered in May 2024. — Ken Hocke

Yank Marine, Tuckahoe, N.J., is about to deliver a new 109'x33.3'x12.2', 499-passenger ferry

— Jackie Robinson — to NY Waterway. The LeMole Naval Architecturedesigned aluminum ferry will have a 4' draft. The ferry’s hull construction is made up of 5086 aluminum plate and 6061 aluminum extrusions.

“Yank Marine is getting ready to deliver the new vessel in the next two to three weeks,” Bette Jean Yank, the shipyard’s president, said earlier this summer.

Main propulsion comes from a pair of Cummins QSK38 engines, each producing 1,000 hp at 1,800 rpm. The engines will turn a pair of ZF 5-bladed, 50"x46.5" nibral wheels through Twin Disc marine gears. The package will give the ferry a service speed of 20 knots.

Ship’s service power is provided by a Kohler 65EOZCJ 99-kW generator. Controls are from Twin Disc (EC300s) and the steering system comes from Kobelt/Skipper

Tankage will include 2,400 gals. of fuel, 100 gals. water per side, and 200 gals. sewage per side. The ferry will feature electronics from Simrad. — K. Hocke

St. Johns Ship Building, Palatka, Fla., in June delivered the Windea Enterprise, the second of three Jones Act-compliant Incat Crowther 98'5"x32'10"x14'5" crew transport vessels (CTV) ordered by U.S. offshore operator WINDEA CTV LLC.

All three WINDEA vessels will initially be chartered by GE on the Vineyard Wind Offshore wind farm 15 miles off the coast of Massachusetts.

“I’m incredibly proud of all the ship builders and support staff who helped bring this vessel to life,” St. Johns Ship Building president Joe Rella said in a statement announcing the delivery. “As we advance our CTVs, barges, and other vessel orders, we are supporting the proud tradition of American shipbuilding, which is the backbone of the U.S. economy, right here in Palatka. We aim to make Putnam County, Florida’s 6th Congressional District, the regional leader in maritime job creation and operational excellence.”

The vessels feature a large foredeck with a 23-metric-ton knuckle-boom crane and container securing lugs offering needed exibility. The vessels incorporate Incat Crowther’s resilient bow technology designed to minimize boat landing impact forces. As is common with all Incat Crowther CTVs, the vessels have a deadweight capability in excess of 50 metric tons.

A resiliently mounted superstructure is designed to increase comfort for both technicians and crew with six crew berths provided in above-deck staterooms.

Other notable features include a large wet room and stores warehouse, fully featured bathrooms and a discreet mess area. Workshop and utility spaces in the hulls are immediately accessible from the cabin.

Main propulsion is provided by four Volvo Penta IPS units driven by Volvo D13 main engines, each producing 690 hp. The mains are fully hybridready, meaning the integration of the hybrid system is completely accommodated in the design, including dedicated voids for batteries, reserved cabling space and battery removal hatches. The propulsion package will give the boats a running speed of 26 knots.

Ship’s service power comes from two gensets, each sparking 40 kW of electrical power. (The genset manufacturer was not identi ed.)

The vessels are designed and built under Bureau Veritas class and comply with USCG CFR 46 Subchapter L regulations.

Tankage includes 9,510 gals. of fuel

oil and 925 gals. fresh water. The boats will carry a crew of six and 24 technicians.

The WINDEA CTV eet is owned and operated by MidOcean Wind LLC and Hornblower Wind LLC with technical and operational support from WINDEA Offshore shareholder Ems Maritime Offshore LLC, Emden, Germany, which operates a eet of CTVs in the European market with more than 10 years of experience. MidOcean brings over 40-years of experience in U.S. Jones Act ship ownership in various vessel classes. Hornblower’s global footprint includes operating more than 150 vessels on the Northeast coast and providing full value-chain marine services, including design, build, delivery, maintenance, and operations services for clients across government, municipal, military, and private sectors.

The partnership was created to build and operate a large eet of CTVs, which will be needed to serve the rapid expansion of offshore wind.

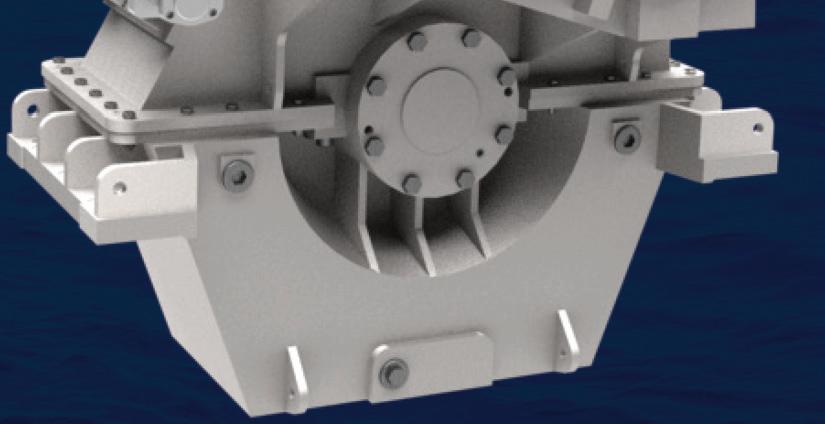

Vi gor has begun low-rate initial production on the maneuver support vehicle (light) at its facility in Vancouver, Wash. The new generation 117'x28' U.S. Army landing craft is replacing the landing craft mechanized 8 (LCM-8), a design that now dates back decades to the Vietnam War era of the 1960s and 1970s. Vigor completed and launched the prototype vessel, SSG Elroy F. Wells, in 2022. The next phase of the $1 billion contract will employ more than 180 skilled workers to support the project over the next five years, according to Vigor officials. The MSV(L) landing craft features an aluminum tribow monohull designed to provide maneuverability and stability in high sea states on coastal littoral waters and inland waterways to support Army land operations. Vigor officials say the design “is a natural evolution of the BMT Caimen-90, leveraging more than a decade of extensively tested performance and adapted by the Vigor-BMT team to meet U.S. Army requirements.

Main propulsion comes from four Colt-Pielstick diesel engines generating a total of 40,000 hp.

UK-based North Star is the first offshore operator to adopt the Midi-SOV, a new service operations vessel design developed by Chartwell Marine, Southampton, U.K., and VARD, Alesund, Norway, and designed to bridge the gap between CTVs and full-size operations vessels. The 180' Midi-SOV is designed to provide enhanced comfort and workability while offering a cost-effective alternative to full scale SOVs, according to the designers. With a design that has been optimized based on operational data to meet the niche requirements of offshore wind developers and operators, the Midi-SOV is intended to directly complement existing fleets. North Star entered an agreement with Chartwell and VARD becoming the first to adopt and utilize the Midi-SOV on offshore wind projects, investing in upfront design fees to facilitate vessel construction for European operations.

Representatives from Bollinger Shipyards, Houma, La., gathered in June alongside senior U.S. Navy officials at Bollinger Houma to christen the U.S. Navy’s newest towing, rescue, and salvage ship, the 263'x59'x24'6" USNS Cherokee Nation Cherokee Nation is the second Bollinger-

built ship of the Navy’s Navajo class. The Navajo class is a new series of towing, salvage, and rescue ships being constructed for the U.S. Navy. It’s a multi-mission common hull platform that will support a range of missions such as towing, rescue, salvage, humanitarian assistance, oil spill response, and wide-area search and surveillance operations using unmanned underwater vehicles and unmanned aerial vehicles.

Philly Shipyard ASA announced it has entered into a share purchase agreement with Hanwha Systems and Hanwha Ocean of South Korea to sell the Philadelphia yard for $100 million. Norwegian investment firm Aker ASA acquired Philly Shipyard in 2005. Korean industrial conglomerate Hanwha acquired Daewoo Shipbuilding & Marine Engineering in 2023 and renamed the group Hanwha Ocean. According to a statement from Philly Shipyard, the deal is expected to close during the fourth quarter of this year, subject to approval by regulators.

American Cruise Lines officials said in June that the company has seven new ships on order, all scheduled for delivery before the end of 2026. Three of the seven new ACL boats on order are yet to be named; the company says additional details about each boat will be announced later this summer. The new ships include six in the company’s Project Blue series of ships and a brand-new American Riverboat. The new American Riverboat “will feature several new design elements,” according to the company.

12-14, 2024 / NEW

Morial Convention Center, Halls B, C, D, E & F

Register for your free pass workboatshow.com

Underwater Intervention returns in 2024 alongside The International WorkBoat Show!

Underwater Intervention attracts a global audience of engineers, technical specialists, industry leaders, and experts, to share ideas, debate the issues of the moment, and create common agendas for the industry’s future.

Underwater Intervention features some of the world’s leading figures within the upstream oil and gas industry coupled with technical sessions covering the most current challenges and up-to-date strategies and technologies.

Barge industry is in a good place, but challenges persist.

By Pamela Glass, Washington Correspondent

After a turbulent 2023 marked by high water then historic low water conditions, the inland barge industry has entered a new phase. While water levels have calmed, barge operators are navigating a mix of strong and weak market conditions in its two main sectors and an array of other challenges including a persistent worker shortage, impacts of in ation and high interest rates on operations, and slow improvements of aging waterways infrastructure that is often beset by closures.

“I would say it’s a pretty good climate overall,” said Jennifer Carpenter, president and CEO of the American Waterways Operators (AWO), which represents the inland towing and barge industry in Washington. “People are feeling very good in the liquid segment about rates and demand.”

However, she added, “On the dry side it’s less rosy,” with operators experiencing a business slump but feeling that they have learned from last year how to operate more effectively in challenging river and weather conditions.

Ken Eriksen, senior leader and strategic advisor in commodities at Polaris Analytics and Consulting, Memphis, agreed. “I call it unsettled waters because this sector is losing the domestic coal market, and the U.S. has lost a rather signi cant share of the global grain market,” he said.

When Brazil, Russia, Ukraine and Australia have good-crop years they put a lot of grain on the world market for food and livestock feed. Brazil, for example, doubled its grain exports between 2018 and 2023, fueled by rising grain production, according to the U.S. Department of Agriculture.

“It’s been incredible how much market share they have gained, and there’s been a slowing of consumption, especially in China as population and income growth decline,” Eriksen said.

The situation will likely stabilize if not produce a small upturn in grain demand this fall, he predicts, as American farmers ramp up grain production and work through the current stockpiled inventory, keeping barges busy during the harvest

aluminum, cement, and salt had sharp declines, according to a commodity analysis by River Transport News

season. He noted that the USDA has predicted strong exports for corn and soybeans in the new crop year, which begins Sept. 1.

As domestic coal transport declines, a saving grace for the dry business has been an uptick in demand for export coal to feed utilities in Europe, India and China. India and China continue to rely on coal for energy, Eriksen said, while Europe is curbing back for environmental reasons and has turned to the U.S. to supply its shrinking demand for coal that is no longer bought from Russia since it invaded Ukraine.

Meanwhile, during the first few months of this year, barges in the lower Mississippi were busy moving robust imports of steel raw material, pig iron and fertilizer, while imports of

Mike Ellis, CEO of American Commercial Barge Line (ACBL), which operates one of the nation’s largest inland river barge fleets, said in June that the dry barge industry was in a “shortterm down cycle,” as domestic coal movements dropped, materials used to build new infrastructure projects around the country became slow to reach the rivers, and grain transport was sluggish. Farmers had a good crop last year but weak global demand for U.S. grains, largely due to fierce competition from high producer Brazil, has slowed the

demand for barge transportation.

As a result, there’s a large amount of grain sitting in storage, and when grains, which account for 30% of dry commodity river traffic, don’t move, “this slows down the whole market for both dry covered and open barges,” Ellis said earlier this year. An uptick in demand for export coal has not been robust enough to offset the drop in grain, he added.

But this will change as barged volumes of dry commodities, except domestic coal, are expected to grow over the next 10 years.

“The long-term outlook is good,” Ellis said. “We’re in a down cycle because

of grain and because of a few other macro-economic challenges we’re faced with. But we’re still making long-term investment decisions based on what we think is an optimistic future of barges shrinking in supply and demand for commodities increasing.”

On the tank barge side, it’s another story. “It’s been very steady and very strong, and the word is that operators are comfortable,” said Eriksen, the analyst who tracks the barge industry. “With record crude oil production in the United States, we’re growing, and if it wasn’t for the United States, the world would not see a growth in crude oil production. This is good for the river system.”

Strong demand to move liquid products, such as diesel, petrochemicals and gasoline, combined with a tight supply of barges helped keep the tank barge sector busy and profitable over the past year, and the outlook remains very positive.

Kirby Corp., the largest U.S. tank barge operator, reported in April a 15% jump in revenue in its marine transportation division during the first quarter of 2024 compared with the same time last year. Inland barging was a major factor in growth, despite difficult operating conditions that included wind and fog in the Gulf of Mexico and lock closures at various points throughout the inland river system. Higher spot prices and rate

increases in contract business helped boost revenue.

“In inland marine, our 2024 outlook anticipates positive market dynamics with steady customer demand and tight conditions due to limited new barge construction in the industry,” David Grzebinski, Kirby’s CEO, said in a statement announcing the company’s first quarter 2024 results.

The supply of barges is tight due to limited new barge construction — slowed by the high price of steel, backlogged shipyards, elevated interest rates, and high shipyard labor costs. Also playing a role is a heavy industry-wide maintenance and inspection schedule

this year and next as U.S. Coast Guard Certificates of Inspection expire. This will remove many barges from service for a while.

Kirby says its barge utilization has climbed to the mid-90% range as a result of these factors, up slightly from the low-90% range at the end of last year, and that the company will have an average of 80 barges drydocked from its inland fleet for inspections and maintenance this year. To meet demand, Kirby recently acquired 13 barges and two high-horsepower boats from an undisclosed seller.

“We have the vessels we need to move cargo, but we don’t have the vessels and cargo sitting around waiting for something to do,” said AWO’s Carpenter. “That’s a good thing. Those high steel prices have been helpful in guarding against an overbuilding that we have sometimes seen in the past.”

Austin Golding, president and CEO of Golding Barge Line, Vicksburg, Miss., said his tank barge business has been consistent and profitable.

“We’re in a healthy market, but it’s not a peak market. We’ve seen a slow growth into a stronger market based on a number of factors. A strong international market mixed with strong gasoline and diesel demand have been really good to our inland market this year. And we’ve not dealt with low water since December. We’re now in

a high-water stage, but we’ve had very healthy water on the river system so far this year.”

But while the good equilibrium between demand and barge supply has helped, lingering inflation has sent prices soaring for new equipment and repairs, and high interest rates have discouraged investments in boats and onshore, Golding said.

A growing refinery business in the Gulf of Mexico has encouraged Campbell Transportation Corp. (CTC), Pittsburgh, to diversify its business lines beyond the Ohio River area and launch into the tank barge business in the Gulf and lower Mississippi River. Over the past two years, CTC has bought the assets of two Gulf marine companies and set up offices in Houston and Channelview, Texas. The expansion brings CTC’s fleet to a total of 1,250 barges throughout the inland system, including 95 tank barges and more than 60 towboats.

“In a little over two and one-half years, we went from pretty much zero in the Gulf to a pretty big operation,” said Peter Stephaich, Campbell’s chairman and CEO.

He said his company didn’t put new barges into operation in the Gulf, but rather consolidated two companies that had existing customers and equipment. “We didn’t put new capacity into the market, which means from our competitors’ point of view, there was no

increase in the supply of equipment. Things got moved around a bit, and all of this equipment was busy when we bought it.”

Stephaich said CTC hasn’t finished its expansion in the Gulf. “We’re looking for good acquisition opportunities,” he said. “We’re not done with this yet.”

Meanwhile, he said his Ohio River operations continue to haul a steady amount of coal to domestic coal-fired utilities that are meeting the demand for electricity from a growing U.S. economy. “Eventually it will happen that steam coal will go away,” he said.

Although some say recruiting and retention have marginally improved over the past year, industry leaders are still troubled by the lingering labor shortage. Barge lines are venturing further afield to reach candidates, hiring recruiting managers, asking vessel crews to attend recruiting events, making crew schedules more flexible, beefing up training and employment benefits, and expanding waterway education outreach to students as young as middle and elementary school. Filling entry jobs on boats is important, they say, but so is creating a pipeline of people to replace experienced captains as they retire.

Ellis of ACBL said that the industry must assure a safe workplace, and companies must invest in training during

both down and up cycles of business. “We will train our way out of the shortage, not pay our way out,” he said.

Despite an influx of billions of federal dollars over the past few years, and progress in dredging key harbors and waterways to make them more accessible during low-water events, there still is much more to do to improve river navigation. Lock and dam projects, many delayed for years because of inconsistent budgets, now face cost overruns. Inflation has eroded investments, and funds allocated by Congress remain far less than the overall needs to modernize the inland system.

“Through the infrastructure package we thought we got all the money we believed was needed to finish the Montgomery lock and dam project (on the Monongahela River in Pennsylvania), but then the numbers doubled” from inflation, Stephaich of CTC said. “It’s like we take one step forward and fall back two steps. It’s very frustrating.”

Meanwhile, a large operations and maintenance backlog persists on locks and dams across the system, while a few projects, such as replacement of the 84-year-old Chickamauga Lock on the Tennessee River near Chattanooga, a shortcut for barge traffic to the Gulf, is limping toward completion.

Luciano Vera/U.S. Army Corps of Engineers

Barge lines are also starting to look to the future as climate change challenges their operations with more frequent, ferocious storms and erratic water conditions that cause draft restrictions and lock closures. This escalates the cost per ton or barrel of moving commodities exponentially, according to ACBL’s Ellis. “In the past, big weather events didn’t happen that often so the [barge] operator typically carried a higher level of that risk than the customer,” he said, but now these big events are happening more often, and the industry should be asking customers to share the costs.

He said ACBL has introduced surcharges in its contracts in the event of high water, low water, lock delays and fog. “We don’t want to build them into our regular rates, but rather as surcharges so that when these events happen the customer bears some of the cost."

By Michael Crowley, Correspondent

Across the U.S., record-breaking temperatures are being predicted for much of the summer, with temperatures 15° to 25° above average. Early predictions say it could be the hottest on record in the U.S. Now throw in the humidity factor and life on the water for those working aboard tugs, towboats and barges is likely to be more than just uncomfortable.

Under those heat conditions and for many land-based jobs you wouldn’t

be faulted for wearing shorts and a T-shirt, but that doesn’t work on the water. Some companies, such as Campbell Transportation have a dress code with a requirement “for long pants, long-sleeve shirt when conducting cargo operations and mixing chemicals, and safety-toed boots where appropriate,” said Ryan Newton, Campbell Transportation’s manager, river operations, Houston. Michael Breslin, director of safety and sustainability at American Waterways Operators (AWO), Arlington,

Va., said he’s firmly in the “pants” camp because while shorts might be cooler than pants they have a lot of risks. They don’t protect your skin from direct sunlight, which can lead to sunburn and skin cancer.

Boats and barges are “like floating skillets in the summertime, causing contact-burn injuries whenever skin touches metal,” he said, whereas pants provide protection against that type of injury, as well as abrasions and lacerations from wires, ropes and tools and chemical injuries from cargo and fuel spills.

Brunt, North Reading, Mass., manufactures The Costello Pant designed for warm-weather work and made with something called a “mini ripstop fabric” that gives the pants a four-way stretch. The pants also feature a DWR (durable water repellent) coating that deflects moisture.

With the heat that’s expected this summer, clothing that helps river crews stay cooler includes moisturewicking and UV protection shirts, such as the Carhartt Force Sun Defender long sleeve and hooded shirt that “blocks the sun’s harmful UV rays,” said Breslin, “while drawing sweat away from the body to the garments outer surface, where it can evaporate quickly.”

On those really hot days, a cooling vest might be the apparel item of choice. “It’s probably one of the newer things in the last five years,” said Campbell Transportation’s James Werner, senior manager, safety & vetting. A cooling vest is designed to be worn under a particular work vest. It’s in contact with the skin and has pockets that hold inserts that have been pre-chilled in a freezer or cooler. The cooling vest’s heat liner is designed to keep heat out while trapping cooler air. Grainger offers insert-cooled vests in high-visibility colors with reflective colors on the front and back.

Just because it’s very hot doesn’t mean you’ll be able to get away with donning tennis shoes or any other form of lightweight footwear. Boots have always been a part of water-

way apparel. Recent advances in work boot design have produced a “longer lasting, more comfortable, lighter, tougher and safer shoes for deck work,” said Breslin. A feature that’s gained in acceptance is the safety toe.

“More and more people are wearing safetytoed boots,” Werner said. That’s usually a steel-toed boot, though composite materials are also employed. “Steel or composite toes, that’s always going be a basic requirement on a towing vessel,” said Shea Milton, a pilot at American Commercial Barge Lines (ACBL) in Westlake, La.

liner for hard hats from Ergodyn When soaked in water for two to five minutes, polymer crystals are activated that retain cooled water up to four hours, helping to draw heat away from the body. Re-wet to reactivate.

Campbell.

Metatarsal (referring to the five long midfoot bones) guards and heel shank protection “add full protection to the foot,” said Campbell Transportation’s Newton, noting an advantage to boots that use composite construction. During winter months, composites don’t conduct heat through the boot.

Besides protecting your foot from impact injuries, boots must also be oil resistant, and the soles resistant to slip and shocks. Newton also likes boots that prevent the wearer’s leg when climbing a ladder from sliding forward and through the opening in the ladder.

Boots with a speed-lacing system can be quickly put on and, in case of going overboard, quickly pulled off. Lace-on boots provide ankle support, “something that pull-on boots may not provide,” said Breslin.

At the other end of the body, there are ways to beat back the heat encircling a river worker’s head. That includes the Chill-IT 6716 cooling

Cooling towels are also a weapon against the heat. After being soaked in water and put in a cooler, they are wrapped around the “neck, wrists; somewhere there’s a lot of blood flow on the skin surface, and it helps cool your core,” said Werner. A slightly different option is hardhat sunshades and visors that attach to the hard hat and shade the river worker’s face and neck, helping him or her stay cooler.

It’s fitting that with the increasing temperatures, June is National Safety Month. One of the things Campbell Transportation highlights on its National Safety Month website is its “30 and 15 rule” for hydration and heat stress prevention. That comes into play “when the heat index — a combination of relative humidity and air temperature — is 103°F or higher,” which represents a temperature of about 94° and 50% humidity. Once that happens, the 30 and 15 rule goes into effect. The rule states that after working 30 minutes, a 15-minute break should occur to cool down and re-hydrate. “That’s especially important in the Gulf [of Mexico] where humidity is a huge factor,” noted

Gloves are another workboat protection item with a changing focus. Being phased out is the standard leather-palm work glove. ACBL has switched from that, said Milton, to impact-resistant gloves. That’s a leather glove with a rubber-like armor coating on top of the gloved hand. “Basically, it looks like armor and the harder it’s hit, the harder that rubber instantly turns,” said Milton. “We’ve seen great success.” ACBL used to average four to five hand injuries a year, but with “the impact-resistant gloves, now we have zero hand injuries.”

UV-protected eyewear is an item that previous generations of watermen lacked. “We didn’t have those before,” said Milton. “You need that on the waterway,” both for protection from light coming directly from the sun and sunlight “that bounces off the surface of the water.” Using UV protected eyewear should help to ensure that future generations are less likely to suffer cataract and other eye deformities than past generations would have.

Should one be blinded by the sun or slip because of boots with inadequate soles, if you do go overboard, you’d want to be wearing a personal flotation device that is adjustable and well-fitting. The Coast Guard “requires the deck crew to wear a Type 5 PFD,” said Milton. The only exclusion “is tankermen are allowed to wear a Type 3 PFD while doing a transfer.”

Type 5 PFDs have a neck pillow that will keep the wearer’s head above water. A Type 3 PFD will not turn the wearer face up.

Wearing the PFD gives a deckhand a good chance of being hauled back aboard, ready for another day of working the water.

Wheelhouse positions: Captain, Mate, Purser Engine Room positions: Chief Engineer, 1st Assistant, 2nd Assistant, Oiler, Fishmeal Technician

Galley positions: Chief Steward, Cook, Prep Cook, Galley Assistant, Housekeeper Deck positions: Bosun, Deck Boss, Deckhand, Deckhand Trainee

Factory positions: Baader Technician, Surimi Technician, Quality Control, Foreman, Factory Mechanic, Processor

•

•

•

•

Heavy

Modular:

•

•

•

1964

• A 35', 24-passenger hydrofoil craft made largely of aluminum — the rst of 40 being built by Ludwig Honold Manufacturing Corp. for American Hydrofoil Corp. — was tested recently in the Delaware River. Some of the hydrofoils are being used to transport visitors to the New York World's Fair. The boats lift to their aluminum foils at a speed of 18 mph, then attain speeds

up to 40 mph fully loaded. The boats are powered by a single 185-hp diesel engine and use only 3.5 gph of fuel traveling on their foils.

• Capital Marine Supply Inc., Baton Rouge, La., has placed an unusual oating boat store in service on the lower Mississippi River. The boat store was developed by converting the steel-hulled 225'x50' twin-screw river

1984

1974

• Although shipments of steel mill products were up 21.4% last year and are predicted by the Cost of Living Council to grow at a compound annual rate of 5% to 6% for the remainder of the 1970s, increased demand for steel has resulted in acute shortages, higher prices, and an allocation system that forces some shipyards to pay premium prices for steel. A recent Maritime Administration (Marad) survey of 135 shipbuilding and repair facilities on the East, West and Gulf coasts revealed

towboat Iowa into a oating combination supermarket and supply warehouse.