a margin taxor washington: - Where are we now? 5 Mistakes to Avoid When Implementing the New Lease Standard Risks and Opportunities for the CPA in Client Bankruptcies WASHINGTON CPA THE Volume 66, Number 2 FALL 2022

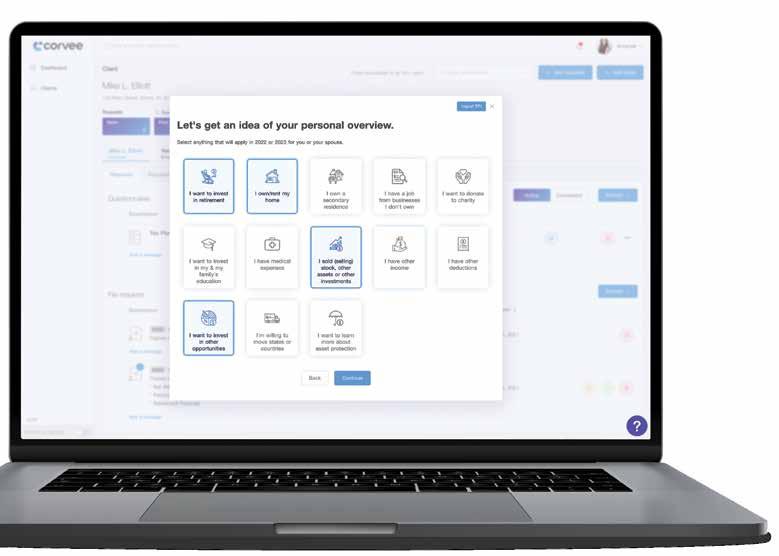

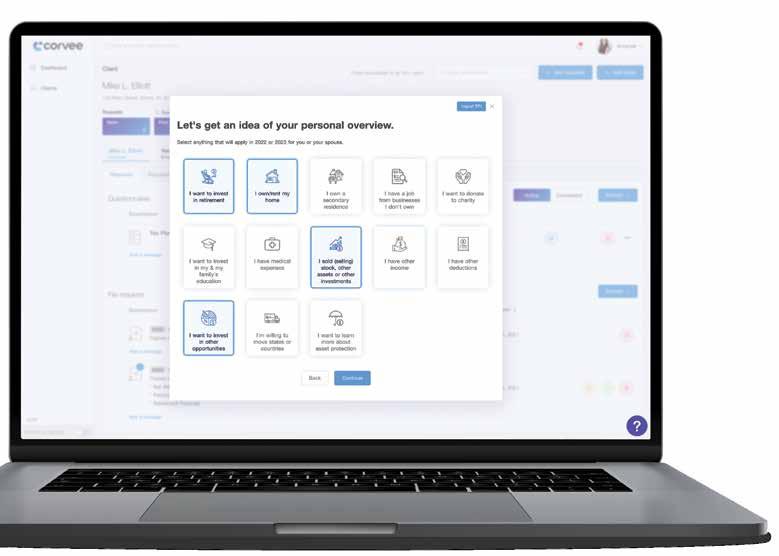

Request Your Demo at corvee.com/WACPA Save Clients Money on Taxes With Corvee Tax Planning Software

www.wscpa.org • memberservices@wscpa.org

Tel 425.644.4800

170 120th Ave NE Ste E101 Bellevue, WA 98005

BOARD OF DIRECTORS

Sara Bailey Chair

Andrew Brajcich Vice Chair Joyce Lee Treasurer

Writu Kakshapati Secretary

Thomas Sulewski Immediate Past Chair

Kimberly D. Scott President & CEO

Sarah Funk Ed Ramos

Norman Haugen Bryce Rassilyer

Courtney Hirata Jillian Robison

Jamie Hueners Bonnie Tse

Lowel Krueger Joel Williams

CHAPTER BOARD CHAIRS

TBD Bellingham Area

Charles Meyerson Everett Area

TBD Olympia Area

Brittany Malidore Seattle/Bellevue Area

Anna Smith Spokane Area

Jessica Packer Tacoma Area

Anthony Adams Tri-Cities Area

Connie Olson Tri-Cities Area

Canada Segura Yakima Area

Wade Helms Yakima Area

MAGAZINE PRODUCTION

Jeanette Kebede Editor

Jennifer Johnson Art Direction

The Washington CPA is published by the Wash ington Society of Certified Public Accountants for its members. Views and opinions appearing in this publication are not necessarily endorsed by the Washington Society of CPAs.

The products and services advertised in The Washington CPA have not been reviewed or endorsed by the Washington Society of Certified Public Accountants, its board of directors, or staff.

The Washington CPA is published quarterly by the Washington Society of Certified Public Accountants, 170 120th Ave NE Ste E101, Bellevue, WA 98005.

$12 of members’ annual dues goes toward a subscription to The Washington CPA

Periodicals postage paid at Bellevue, Washington and additional mailing offices.

Cover Graphics

Illustrations: © iStock/PaulMaguire, iStock/Ihor Kashurin, iStock/natrot, iStock/Hey Darlin

POSTMASTER:

Send address changes to The Washington CPA, c/o WSCPA, 170 120th Ave NE Ste E101, Bellevue, WA 98005.

5 Mistakes to Avoid When Implementing the New Lease Standard

A Margin Tax for Washington: Where Are We Now?

Risks and Opportunities for the CPA in Client Bankruptcies

THE WASHINGTON CPA FALL 2022 CONTENTS Membership Benefits 2022 Renewals with WBOA CPE Tracker On the Cover Membership News Leadership Lens Washington CPA Foundation Upcoming CPE WSCPA Peak Firms Classified Ads Spotlights Departments 4 10 20 24 29 30 7 8 12 16 22 @WashingtonCPAs 3www.wscpa.org The Washington CPA Fall 2022

Every year, the WSCPA honors individuals (and one company or firm) that have demonstrated their commitment to supporting the Society and maintaining the CPA's trusted and respected place in Washington State's professional community. Do you know someone who fits this description?

Nominate a superstar today at wscpa.org/awards

Find a CPA - Free WSCPA Resource!

Enroll your firm in the Find a CPA directory! Help prospective clients find your firm through an easy, interactive, and searchable directory, at no charge to your organization.

Explore the directory at wscpa.org/find-a-cpa

WSCPA Mailing List Policy

The WSCPA does not sell member email or mailing addresses. Members may occasionally receive mail from third-party partners that offer products or services deemed to provide value to members. To be excluded from these mailings, update your Communication Preferences online by clicking the "Update Preferences" link in any WSCPA email, or send a request to unsubscribe from third-party mailings to webmaster@wscpa.org

4 The Washington CPA Fall 2022 www.wscpa.org MEMBERSHIP NEWS

WSCPA

illustration: © iStock/Oleksandr Hruts

Year-End

Year-end planning is both critical and time-consuming. Paychex has the resources and tools to help. Visit the free online Accountant Year-End Reference Center for: • Accountant and client year-end guides • Current state and local filing updates • Year-end checklists • 2022 tax briefings and more Bookmark the page to stay informed of timely updates that could impact year-end plans. Paychex is proud to be an endorsed provider for the WSCPA Learn more: payx.me/wscpa_ye22 Complex

Planning? Let Paychex Help Simplify It. MEMBERSHIP NEWS 5www.wscpa.org The Washington CPA Fall 2022 Verifyle and the WSCPA have partnered to offer all members access to Verifyle Pro™️, Verifyle’s premium, ultrasecure online file sharing and messaging service (a $108 value) at no cost to WSCPA members Verifyle is an extremely simple-to-use cloud storage and sharing tool that offers: • The most powerful encryption technology available on the web (Cellucrypt®️)—each individual item stored or shared in Verifyle is secured with six unique encryption keys • A polished and professional way to present yourself to existing and prospective clients, while keeping your communications private and secure • Digital signatures capability for requesting clients sign, date and initial documents inside Verifyle To take advantage of this free benefit: Sign up at verifyle.com/wscpa using the email on your WSCPA member account. Introducing a free benefit for WSCPA members! NEW!

6 The Washington CPA Fall 2022 www.wscpa.org Building relationships. Building your success.

The best things in life are not free— they are priceless.

Here are the free perks included with your membership. Utilize your benefits and see how far they can take you.

Members’ Receptions & Annual Meeting Networking WSCPA is committed to having a free members’ reception in each chapter area in our state and those occur throughout the summer and early fall. This year members were able to visit the new WSCPA offices at the Seattle/Bellevue/Everett Members’ Reception. Members gathered at golf courses, waterfront venues, sunny patios, pubs and more this season across the state.

Free Member Exclusive Webinars

The Member Exclusive webinar series is still happening throughout the year on select Wednesdays at lunchtime. This year the free webinar series includes 15 free CPE hours (up from 10 in previous years). It’s not too late to take advantage of this free CPE. There's still 7 one-hour webinars left in your membership year. Visit the CPE catalog to sign up for all of them at once.

WSCPA Passport Card

Your membership includes this free benefit (a $150 value). Access 3,000+ discounts online and in your neighborhood. Great for dining, travel and shopping. See what they have to offer and bookmark a few new places to try.

Verifyle Pro

Verifyle’s premium secure online document sharing and messaging service, VerifyleProTM, which includes unlimited use of digital signature tools with SMS identity verification is available at no cost to WSCPA members.. a $108/year value!

Member Exclusive Communications

From the WSCPA’s Present Value newsletter to the Washington CPA Magazine, blog and features, WSCPA is working behind the scenes to make sure you have the most valuable and timely professional information.

WSCPA Connect

This online community is free to members and includes your new member directory and resource groups related to your specialty, such as the Sole Practitioners or Not-for-Profit Resource Groups. Members can also receive free and confidential feedback on their Financial Statements from other WSCPA members.

Find a CPA Service

If your firm is looking for additional clients and exposure, make sure you are registered on the Find A CPA service. This is free for members and allows the community to find trusted financial service providers like you.

Amplify Your Voice

The WSCPA provides advocacy on behalf of our professional community to amplify your voice at both the federal and state level. We track proposed changes to laws and regulations, serve as a resource to legislators on legislation affecting the profession, and recruit volunteers to meet with local legislators to help them understand the impact and consequences of proposed legislation.

Peak Firm Benefits

Join the 40 other Washington firms who support and provide membership for 100% of their licensed CPA staff and their students, exam candidates and exam passers as Peak Firm Members and amplify your access to additional benefits such as free job listings, free Passport Corporate Cards for all support staff/nonmembers, and a free WSCPA room rental.

Questions about benefits? Email memberservices@wscpa.org.

7www.wscpa.org The Washington CPA Fall 2022 MEMBERSHIP NEWS

illustration: ©iStock/Svetlana Krivenceva

Lessons Learned: 2022 Renewals with WBOA CPE Tracker

WBOA

2022 was the first renewal period in which individuals renewing their CPA license were required to report their completed CPE through the Washington State Board of Accountancy’s new CPE Tracker, which is located within the online licensing system.

illustration: © iStock/zhuweiyi49

8 The Washington CPA Fall 2022 www.wscpa.org WBOA NEWS

Your colleagues using the required tracker for the first time this renewal learned:

#1. First and foremost, don’t forget about your 20-hour minimum annual CPE requirement. So many of you needed to request a CPE extension after not completing at least 20 hours of CPE in one or more years of your CPE reporting period. Keep in mind, if you used a CPE extension in 2020, you are not eligible for a CPE extension in 2023.

#2. Log your CPE in the WBOA CPE Tracker throughout your reporting period. If you wait until after your CPE reporting period ends, you may not realize that you have missed part of your CPE requirement (i.e.: Washington State Board approved ethics course, minimum annual CPE requirement, etc.) and entering your CPE will take more time (at least it will seem this way if done all in one sitting).

#3. Do not wait until the last minute to log your CPE and complete your renewal application. If you run into problems or have questions, you will not be able to reach us after 5:00 p.m. on June 30. The next day is too late—your license will already be lapsed.

#4. Use the separate “Add WA Ethics” link to enter your Washington State Board approved ethics course. If you use the “Add CPE” link used for all other CPE, the tracker will not recognize that you have completed a required WA ethics course, and you will not be able to move past the CPE section in the renewal application.

#5. If you are requesting a CPE extension, or you are selected for the random CPE Audit, you must upload your course completion certificate (or other acceptable CPE documentation) to each course listing.

#6. Everyone must log their CPE (enter each individual CPE course completed), we strongly advise attaching your certificate of completion at the time you log your courses. Only those who request a CPE extension, or are selected for the CPE Audit, are required to upload (attach) the course completion certificate to the course listing. For those of you renewing in 2023 and 2024, this will be your first required CPE Tracker use.

You have the advantage of lessons learned from your predecessors—take heed. Learning new systems or ways of doing things can be difficult, but together we will get through it. It will become second nature soon enough.

If you have any questions about the WBOA CPE Tracker, please email customerservice@ acb.wa.gov. Published with permission of the Washington State Board of Accountancy. If you would like to share feedback with the WSCPA on the WBOA CPE Tracker, please send it to feedback@wscpa.org.

CPE Each and Every Year—20-hour Minimum Annual Requirement

Here we are again post-renewal time for the 2022 renewal crowd. You made it! You are renewed for another 3 years nicely done! But just because your renewal is complete, doesn’t mean that your business with the WBOA is done for the year.

Remember you must complete at least 20 hours of CPE by the end of the year. This goes for all licensed CPAs not just those of you who renewed this year. The minimum annual CPE requirement is 20 hours per year with an overall requirement of 120 hours, including a Washington State Board approved ethics course.

Keep in mind, instruction credit hours for a qualifying CPE or college course do not qualify toward the minimum annual requirement, nor do CPE hours earned for authorship of published articles, books, or other publications relevant to the profession. While these hours may count toward your overall CPE requirement, your minimum annual requirement must be met as a student of a program qualifying for CPE credit.

9www.wscpa.org The Washington CPA Fall 2022 WBOA NEWS

Your WSCPA Benefits: Advocacy to CPE

Sara Bailey, CPA

It’s hard to believe we are nearing the end of 2022 already. I’ve found the older my kids get, the quicker every year seems to pass. One of the things I’ve spent time talking to members about during the last couple months is the value of a WSCPA membership. While the value of the Society is different for everyone because of what resources they utilize, I thought I would share a few reasons why I personally value the WSCPA.

Advocacy

One of the most important things the WSCPA does is play a vital role in advocacy. The Society has spent years getting to know legislators, building connections within the Department of Revenue and cultivating relationships with the Washington

State Board of Accountancy (WBOA). There are many examples of why these areas are critical to our profession, but here are just a couple.

There are very aggressive efforts across the U.S. to eliminate licenses for many professions. What most of us may not immediately recognize is this type of legislation puts the CPA license at risk because anti-licensure proponents frequently do not consider the very technical, complex nature of the CPA profession. The WSCPA monitors any proposed legislation that could impact our profession and leverages relationships with key legislators to ensure they understand the importance of our CPA licenses. When we attend Hill Day in Olympia, this is always a key talking point to discuss with legislators because of the prevalence of these types of bills being put forward.

Another extraordinary advocacy-related accomplishment the WSCPA has had in the last few years is establishing a scholarship fund for students entering the accounting profession. Most of us remember the McCleary decision (McCleary v. Washington) in the state. At that time, the WBOA had a surplus in licensing fees that the state had earmarked to be swept into the general fund

illustrations: © iStock/antishock

10 The Washington CPA Fall 2022 www.wscpa.org LEADERSHIP LENS

to help with funding from the McCleary decision. The WSCPA again quickly mobilized and worked with the WBOA and several legislators to draft a bill for those funds to be moved into a scholarship fund (the Certified Public Accounting Scholarship Program), administered by the Washington CPA Foundation under a contract with WBOA, for students entering the accounting profession. Thanks to the bill sponsors and the many hours of work from the Society, WBOA, and other volunteers, this bill was successful. Those funds, along with generous donations from individuals and firms, allow the Foundation to annually award more than $500,000 of scholarships to more than 80 students in the state. As a result of this advocacy victory, the Foundation is the largest accounting scholarship provider in the state of Washington.

Community

Another area the WSCPA plays a critical role is creating a community for CPAs across the state. The Society creates opportunities for CPAs to connect with each other, provides valuable resources to CPAs in all stages of their careers, and helps students navigate from their academic journey to an accounting career. There are endless examples of how the WSCPA does this. WSCPA staff spend time on university campuses across the state. They talk to students about the profession, invite them to events to meet others in the profession, and make introductions as they look to start interviewing and exploring intern and full-time career opportunities.

I had the opportunity to meet several accounting students and new professionals over the summer who were well connected with the WSCPA at a members’ reception. A few of them were young mothers working or going to school while navigating parenthood. I left feeling energized and inspired by each of their stories and was so happy to have a setting where we were all brought together to connect. It was also a great opportunity for others in the profession to network in a low-pressure setting with each other. Community and connection are so important, and the WSCPA provides opportunities for us to get together with others outside of our own firms or organizations.

Education

The last area the WSCPA provides significant value to its members is in its Continuing Professional Education (CPE). You may be most familiar with the WSCPA’s CPE. From in-person conferences to online CPE (including new Flexcasts) and the Prix Fixe CPE series, the quality and availability of CPE is tough to beat. Whether you are in public accounting, at a non-profit or in private industry, there are CPE events curated for your area of expertise. There are also numerous non-technical CPE events and courses available – from competencies and skills required by virtual CFOs to a new DEI Training Series (starting November 4) and Workshop (December 2). The WSCPA’s quality of CPE is impressive and tough to beat.

These are just a few examples of why I value my WSCPA membership and am excited to share with other CPAs in the state. I hope you are all as proud of being a part of the WSCPA and can share the importance of the Society with others in our community and students who are considering entering the profession. I also want to invite everyone to get involved – attend your local chapter’s next event, register for a conference, or check out a resource group! Hope to see you at an event soon!

Sara Bailey, CPA, is a partner at Moss Adams LLP and WSCPA Chair. You can contact Sara at sara.bailey@mossadams.com.

ADVOCACY COMMUNITY EDUCATION 11www.wscpa.org LEADERSHIP LENS

5 Mistakes to Avoid When Implementing the New Lease Standard

Ane Ohm

Simplify your lease accounting implementation by learning from the mistakes of public and international companies that are in their fourth year of following the new lease standard.

While many are tempted to delay addressing the new lease accounting standard until the last possible moment, your life will be easier if you learn what to do—and what not to do—sooner rather than later.

This article outlines the top five mistakes I’ve seen when it comes to implementing the new lease standard so you can avoid these challenges for your organization or your clients.

Allow sufficient time to analyze leases, especially real estate leases

Office space and other real estate leases often carry the largest dollar value and will be the most complex leases within an organization. Because these are likely to have a material effect on your balance sheet, you should allow plenty of time to

analyze these leases. If you want to minimize your lease liability and your lease contract includes nonlease components, you have extra work to calculate the breakout between lease and nonlease components.

First, you have to identify whether nonlease components exist. Commonly, a nonlease component might be the fee for common area maintenance when renting office space. Parking is another nonlease component.

Another example of a nonlease component is a service contract where a truck is operated on behalf of a lessee. While the truck itself may be a lease (see below for more information about embedded leases), providing a driver, maintenance and gas are nonlease components.

Costs related to securing the leased asset itself are considered a lease payment for classifying and measuring the lease. For example, a nonrefundable upfront deposit is a lease component.

illustrations: © iStock/syolacan, iStock/olegback and iStock/Iaroslava Kaliuzhna 12 The Washington CPA Fall 2022 www.wscpa.org ACCOUNTING

As you can see, the intent of lease-related payments must be analyzed in the context of each lease to determine if it is a lease component, nonlease component or neither. This is because ASC 842 is a judgment-based standard. As such, the standard does not provide a definitive list of lease and nonlease components because it could never be complete or make sense in all circumstances. Where parties are creative with their lease terms, the initial determinations are more difficult.

With that said, we offer the following as a good starting place when considering how to group lease-related payments.

Likely to be Lease Components

• Fixed lease payments

• Lease payments that vary based on an index or rate

• A fixed portion or minimum for a variable lease payment

• Nonrefundable deposit

• Early termination fees (if reasonably certain to terminate lease early)

• Residual value guarantees

Likely to be Nonlease Components

• Service contracts for leased asset (fuel, operating, consulting, maintenance)

• Included parking spaces, if in an area where parking is at a premium

• Common area maintenance (CAM)

Not Likely to be a Lease Component or a Nonlease Component

• Real estate taxes

• Insurance

Once the lease and nonlease components are identified, the lease standard requires payments to be allocated between the components based on available stand-alone pricing, not just the values provided in a lease contract.

Additionally, it’s important to identify the correct lease term when renewal options and termination clauses exist. Based on what you know now about your organization, are you reasonably certain to exercise a renewal option or a termination clause? What matters is your economic incentive to remain or terminate, and inaccurately identifying the length of the lease can result in a material misstatement on your balance sheet.

It’s all leases

One of the first and most common questions we receive on the new lease standard is, “But wait, is my {insert anything} lease included in this standard?” It might be a vehicle, a piece of equipment or land. Whichever it is, my response is a resounding, “Yes.”

The standard offers you the ability to elect a practical expedient to exempt leases that are fewer than 12 months. Other than that,

there is no explicit exemption for any lease type, nor is there any explicit allowance for materiality under ASC 842.

In other words, if you have a contract that meets the definition of a lease, it must now be recorded on the balance sheet. This means, all leases must be recognized as both an asset and offsetting liability for future lease payments.

Watch out for hidden leases

Because all leases must be recorded on the balance sheet, identifying embedded leases is more important than ever. Many organizations are unaware that certain service, outsourcing and other contracts must now be analyzed for assets that could be classified as a lease.

A service contract requiring an outside vendor to use equipment on your behalf does not automatically result in an embedded lease. That determination is driven by the nature and use of the equipment in the service contract. If the vendor dedicates equipment to your specific production needs, then you might have an embedded lease. If the vendor transports items for you and specific vehicles are dedicated to your organization, you also might have an embedded lease. You must understand – and document – the underlying nature of the arrangement in order to determine if you have an embedded lease.

Don’t underestimate how long it will take to implement the standard

We are hearing that implementing the new lease standard is taking about three times longer than expected and therefore costing three times as much, especially when done with spreadsheets.

13www.wscpa.org The Washington CPA Fall 2022 ACCOUNTING

With the changes brought on by these new lease considerations, many companies find that identifying and analyzing their leases require more resources and expertise than they have available. Don’t underestimate the requirements for this initial step. In fact, you may want to consider engaging outside advisers from the start to avoid errors and higher costs after implementation.

As accountants, we are often tempted to use spreadsheets for any calculations. Due to the complexity of the required footnote disclosures, creating a lease accounting spreadsheet is timeconsuming and at risk of being inaccurate. If you would like to reduce your time to implement the new standard, easy-to-use software is the way to go. Big side benefits are the availability of SOC reports to provide confidence in calculations, secured data, version control, audit trails . . . the list of benefits is long.

Leases can’t have a big impact on my business, can they?

The largest business impact we’ve seen is on banking relationships. For any organization that has to comply with covenants for a bank loan, adding a significant liability to the books can affect how a bank considers credit availability and borrowing rates.

You might be thinking, “Yes, but that lease liability was part of my organization all along. Why would this change anything?” And you’d be correct: your organization hasn’t changed with the implementation of a new lease accounting standard.

At the same time, your financial institution now has more information about your lease portfolio, and we’ve been told by some banks that this could be an opportunity for them to adjust certain client relationships. We’ve also been told by those banks that early communication about the impact of the coming lease standard on financial statements is the best way to mitigate any effect it might have on the banking relationship.

There are many challenges that exist when implementing the new lease standards. However, looking at what other firms and organizations are doing well and not so well should provide valuable insight when it comes to correctly implementing lease standards for your clients.

Ane Ohm is co-founder and CEO of LeaseCrunch, a cloud-based lease accounting software company.

This article originally published in CPA Practice Advisor, September 29, 2022 - https://www.cpapracticeadvisor.com/2022/09/29/5-mistakes-toavoid-when-implementing-the-new-lease-standard/71263/ and is published with permission.

We take a more personal approach to business lending. At Columbia Bank, we care as much about your business as you do. That’s why our lenders take the time to truly understand your business needs, then work closely with you every step of the process, through closing and beyond. So you can feel good that you’re getting the best loan for your business, and for you. Visit ColumbiaBank.com.

Member FDIC Equal Housing Lender

WE’VE GOT YOUR BUSINESS. AND YOUR BACK. 14 The Washington CPA Fall 2022 www.wscpa.org ACCOUNTING

Get started with CPACharge today cpacharge.com/wscpa *** PAY CPA 22% increase in cash flow with online payments 65% of consumers prefer to pay electronically 62% of bills sent online are paid in 24 hours CPACharge is a registered agent of Synovus Bank, Columbus, GA., and Fifth Third Bank, N.A., Cincinnati, OH. AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere. – Cantor Forensic Accounting, PLLC CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles. + Member Benefit Provider

A Margin Tax for Washington: Where Are We Now?

Mike Nelson

Washington has long had the Business and Occupation (B&O) tax as the primary business tax which brings in roughly a quarter of all state tax collections. Over the years many changes have been made to the B&O tax which have been attempts, in the eyes of the legislature, to attract various industries to the state. Despite these tweaks, many B&O taxpayers have argued that it remains an unfair tax with many unnecessary complications.

The Tax Structure Work Group (TSWG) was founded in 2017 by the legislature and its voting members are primarily legislators from all four caucuses. The purpose of the TSWG is to find revenue neutral ways to make Washington’s tax code more simple and fair. After many rounds of debate, public testimony, and advisory work, the TSWG voted to stop considering personal or business income taxes, as well as some other taxes. As part of this five-year effort, the TSWG is seriously considering recommending that the legislature replace the B&O tax with what many are calling a Texas-style margin tax. A margin tax is a tax levied on the gross

16 The Washington CPA Fall 2022 www.wscpa.org ADVOCACY

Mike Nelson is the WSCPA Manager of Government Affairs. You can contact Mike at mnelson@wscpa.org.

1935 B&O Tax Begins 2017 TSWG Founded

receipts of a business entity after a deduction has been applied. The deduction is meant to remove the costs of operating the business and so the tax should be predominantly applied to the “margin” that the business has earned as profit. Typically, four types of deductions are associated with a margin tax: a flat deduction that is meant to exempt small businesses, a compensation deduction, a cost of goods sold deduction, and a single percentage deduction.

Since the TSWG is required to only consider revenue neutral options, the Department of Revenue (DOR) has been assisting the TSWG with advanced modeling of the taxes and the detailed proposals once the TSWG has decided on specific deductions

Based on this additional direction from the TSWG, DOR expects to present their models on what a margin tax would look like in Washington and the sort of rates that would be required in order to replace the B&O at the TSWG virtual meeting on November 14.

While the TSWG members voted to direct DOR to model the tax a certain way, the members emphasized that some of the decisions shaping the compensation and COGS deductions would likely be reconsidered for the actual tax proposal.

What role is WSCPA taking in the process?

The WSCPA Advocacy Team and several members have been involved with the ongoing process of the TSWG. As members of the Technical Advisory Group, we participated in the initial economic review of various tax types. We have also met with and provided feedback to workgroup members and DOR on the implications, and potential unintended consequences, of certain tax options that were being considered. Several WSCPA Government Affairs Committee members have been diligently providing this feedback and have been working with other groups and individual firms to provide similar feedback on behalf of the profession. We have expressed a number of concerns with some aspects of the administration of this new tax or decisions that the TSWG may make with certain deductions.

and language. In December, the TSWG will vote whether to recommend any specific proposals to the legislature for their 2023 session (which starts in January).

What would a margin tax look like?

In May the TSWG voted to recommend the following guidelines for a proposed margin tax: consolidate corporate entities; use the current nexus standards; use single-factor apportionment; rate basis based on receipts; maintain current B&O surcharges; maintain the current B&O tax base; eliminate current preferential rates, deductions, credits, exclusions, and exemptions; use a standard deduction; and not include the public utility tax.

Part of the margin tax would be the applicable deduction that a business can select. Building off the Texas tax structure four deductions are being considered: compensation paid, cost of goods sold (COGS), a fixed percentage of gross receipts (30%), and a flat amount ($1 million). DOR requested some clarification around the compensation and COGS deductions to assist in their modeling. At the TSWG meeting on September 21, they decided that for the purposes of DOR’s model, the compensation deduction should be limited to wages reported on IRS Form W-2, not include contractor compensation, cap the deduction up to $400,000 per employee, but not cap the total deduction at a percentage of compensation costs. For the COGS deduction they voted to direct DOR to model COGS based on the IRS calculations but again not cap the total deduction at a certain percentage.

What will happen next?

Some of the issues that will need to be resolved before the final TSWG meeting on December 13 will be: how this impacts local jurisdictions that currently impose B&O taxes; what the rates will be; how certain industries will be impacted and what exemptions may be put into the new tax; the timing of the transition and how long it will take DOR to make rules for aspects of a new tax.

The TSWG has said they will make these decisions and considerations in the one month they have between November 14 and December 13, in order to prepare the legislation for the 2023 Legislative Session. Many business groups in the state have remained cautious about commenting publicly on the margin tax until more details have been determined. Once the proposal goes to the legislature it is not bound by the restrictions placed on the TSWG to remain revenue neutral. During the 2023 session the legislature will be adopting a new two-year budget so this tax proposal could be a part of that process.

For updates related to the margin tax, read the WSCPA Present Value newsletter and All Things Advocacy blog.

17www.wscpa.org The Washington CPA Fall 2022

ADVOCACY

Delivering Results - One Practice At a time IF YOU ARE READInG THIS... So Is Your Buyer! CONNECTING MORE SELLERS AND BUYERS Scan Here Sherif Boctor, CPA Sherif@APS.net 888 783 7822 x1 www.APS.net

Accountin g Where can take you? The Washington CPA Foundation is excited to be able to offer over $500,000 in scholarships for students in Washington State. Students entering junior year or higher in the fall of 2023. fifthyear, master's, and PhD candidates, as well as, community college transfers are encouraged to apply for this scholarship level. AWARD AMOUNT $5,000 - $10,000* * $10,000 scholarships for master’s / PhD candidates APPLICATION DEADLINE February 14, 2023 Win a $5,000 Accounting Scholarship! APPLY NOW! WSCPA.ORG/CPASEAS BECOME A SCHOLARSHIP REVIEWER Help us give away over $500,000 in Accounting Scholarships! TIME COMMITMENT 12-20 hours Scholarship applications are reviewed in your home or office through our secure, online portal with a provided scoring matrix and guidelines. Contact Benjamin Warren at bwarren@wscpa.org APPLY NOW FOR A $2,000 ACCOUNTING SCHOLARSHIP! Where can accounting take you? Apply by April 14, 2023 WSCPA.ORG/AA22 Are you are a 1st- or 2nd-year student (fall of 2023) who's interested in pursuing a career in accounting? 19www.wscpa.org The Washington CPA Fall 2022 FOUNDATION SCHOLARSHIPS

Foundation to Grant up to $30,000 to Improve Diversity in CPA Pipeline

Monette Anderson

The Washington CPA Foundation is accepting applications for its 2023 grant program. This will be the sixth award cycle for the Washington CPA Foundation grant program, which aims to improve the diversity of the CPA pipeline in Washington. The Foundation intends to provide up to $30,000 in awards this year to organizations and programs that meet the following criteria:

• Organization or program’s target group is students, high school to early college.

• The goal is to increase underrepresented populations in the field of accounting.

• Programs will be evaluated both on quality of the interaction and quantity of students reached.

• Programs or events can be existing or new.

If you know a school or non-profit organization that may be a fit for this grant, please send them to www.wscpa.org/grant to find our grant application and important information about applying. Applications are due December 1, 2022.

To learn more about previous grant awards and recipients please reach out to me at manderson@wscpa.org.

Monette Anderson, CAE, is the Executive Director of the Washington CPA Foundation and WSCPA Director of Member Services.

20 The Washington CPA Fall 2022 www.wscpa.org FOUNDATION GRANTS

photo: © iStock/Rawpixel

Summer EVENTS

21www.wscpa.org The Washington CPA Fall 2022 PHOTO GALLERY

illustration: © iStock/Tanya Shulga

WOMEN'S LEADERSHIP SUMMIT SOUNDERS GAME CHAPTER NETWORKING EVENTS

Risks and Opportunities for the CPA in Client Bankruptcies

Economists warn that a fiscal storm is brewing, with prolonged recession the likely result. Bankruptcy filings seem imminent, and there will be a growing need for CPAs to assist their clients in financial distress. CPAs should be aware of the following key issues and opportunities when their clients face Chapter 11.

Risks to CPAs During Bankruptcy Proceedings

During a Chapter 11 proceeding, CPAs can seek to be retained and paid for services rendered to their client during bankruptcy. Allowed professional fees must be provided for in a debtor’s confirmed plan of reorganization (11 U.S.C. § 1129(a)(9)). Despite this requirement, the risk of non-payment must be considered before servicing a bankrupt client.

• For CPAs who work with clients prior to bankruptcy, the automatic stay (11 U.S.C. § 362) must be considered. The filing of a bankruptcy petition automatically stays creditors’ actions to collect debts. Accordingly, it is critical that CPAs’ invoices be paid prior to bankruptcy, otherwise, any amounts owed as of the bankruptcy filing could be paid pennies on the dollar or discharged.

• A company in bankruptcy (or party acting on its behalf) may seek to “claw back” payments made prior to bankruptcy. These are called avoidance actions and include fraudulent transfers and preferences.

• Fraudulent transfer actions seek recovery of money or property transferred by debtors in the two years prior to bankruptcy. Debtors may also invoke state laws, which include longer look-back periods. Plaintiffs must establish that the debtor: (a) made a transfer with actual intent to hinder, delay or defraud any entity; or (b) received less than reasonably equivalent value in exchange for such transfer or transaction, and at the time of the transfer (i) was insolvent, (ii) was rendered insolvent as a result, (iii) incurred or intended to incur debts it would be unable to repay or (iv) made the transfer to benefit an insider (11 U.S.C. § 548).

• Preference actions seek to “claw back” payments made on preexisting debt by an insolvent debtor within the 90 days prior to bankruptcy (one year if an insider). Targets of these actions may assert defenses by arguing that such payments (i) were not for an “existing debt,” (ii) were made

in a “contemporaneous exchange” for the existing debt, (iii) were made in the “ordinary course of business” or (iv) that liability should be reduced by “new value” provided to the debtor following such payments (11 U.S.C. § 547).

Tips to Mitigate Risks of Nonpayment

CPAs can minimize risk of nonpayment by:

• Utilizing and strictly adhering to engagement agreements that either require payment in advance (the best defense to avoidance) or ensure a steady payment schedule to support an “ordinary course of business” defense. Avoid “dunning” clients for payment, as dunning can undermine this defense.

• Carefully maintaining billing records and ensuring billing terms are stringently followed. To minimize exposure, cease work and require current payment if clients fall in arrears. When a client is in arrears, insist on current payment for new services performed, to argue that such payment represents new payment for new work.

• Filing an affidavit of “disinterestedness” (to be retained and paid for services following bankruptcy) to prove they do not have any disqualifying conflicts and allow for their retention to be approved by court order. CPAs owed money at the time of a bankruptcy, or who were paid within 90 days prior to commencement of bankruptcy, may face challenges to their retention.

FINANCE

John W. Weiss, Esq., and Dillon J. McGuire, Esq., Pashman Stein Walder Hayden P.C.

22 The Washington CPA Fall 2022 www.wscpa.org

Opportunities for CPAs with Distressed Clients

CPAs add tremendous value in bankruptcy, as debtors and their attorneys need accounting advice. But CPAs should be careful, as the rules are complex and present traps for the unwary. CPAs would be wise to consult their own bankruptcy counsel when faced with a client in distress. As the potential for an economic downturn increases, proceeding with counsel’s advice should greatly reduce the risk of costly lawsuits and related liability, while allowing CPAs to capitalize on continued retention during bankruptcy.

The information contained herein is for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. Reprinted with permission of the New Jersey Society of CPAs, njcpa.org.

John W. Weiss, Esq., is a partner and chair of the Bankruptcy, Restructuring & Creditors’ Rights practice at Pashman Stein Walder Hayden. John can be reached at jweiss@pashmanstein.com.

Dillon J. McGuire, Esq., is an associate with Pashman Stein Walder Hayden. Dillon can be reached at dmcguire@pashmanstein.com.

www.wscpa.org

illustration: © iStock/ Nuthawut Somsuk

Upcoming CPE

A selection of WSCPA CPE events scheduled November - January are listed.

Pacific Tax Institute

Nov 9-10 | Lynnwood & Webcast | 16 credits

Prepare to advise your clients through the next round of tax returns! The Pacific Tax Institute, a conference designed for experienced tax professionals, will provide you with comprehensive updates of the most recent federal tax developments. Maximize your ability to reduce your clients' liabilities with the many strategies you will learn at this in-depth conference.

Not-For-Profit Conference

Nov 16-17 | Lynnwood & Webcast | 16 credits

Those working in the not-for-profit community are all moving toward a common goal: to advance the mission of your organization. At this year’s conference, get guidance on best practices from your colleagues. Plus, catch up with updates on GAAP developments, lease standards, single audits, state and local tax topics, and more!

Diversity, Equity & Inclusion

Training Series Nov 4, 18, Dec 9 | Webcast | 1 credit each Workshop Dec 2 | Bothell | 3 credits

Our firms, companies, and profession are stronger when we make space for everyone, but we still have work to do in order make that vision a reality. The Diversity, Equity & Inclusion Training Series is designed to give you the tools you need to improve your personal understanding of DEI and also to start or advance DEI initiatives at your organization.

Fraud Conference

Dec 1 | Bellevue & Webcast | 8 credits

Even the most vigilant CPAs can be susceptible to fraud. Bad actors are constantly finding new ways to defraud your clients or organization. Come to the Fraud Conference to learn how to stop fraud in its tracks. Hear real life case studies and get the facts you need to recognize and prevent fraudulent activity. Whether you work in public accounting, industry or government, you will gain an understanding of how recent fraud cases unfolded.

The Washington Society of CPAs is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of group-live and group-internet-based continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org

For more information regarding refunds, complaints, program cancellations or other policies visit www.wscpa. org/cpe/cpe-policies or call 425.644.4800

To view the thousands of courses and complete details, please visit the CPE & Event Catalog at wscpa.org/cpe.

24 The Washington CPA Fall 2022 www.wscpa.org

DATE COURSE TITLE

11/9 Critical Issues That CPAs in Industry Will Need to Face This Year WEBCAST 4

11/9 Employer's Handbook: Health Care, Retirement, and Fringe Benefit Tax Issues WEBCAST 4

11/9 Member Exclusive: Skills to Be an Effective Board Contributor WEBINAR 1

11/911/10 Pacific Tax Institute, Lynnwood & WEBCAST 16

11/10 Construction Contractors: Non-Revenue and Non-Lease Accounting Considerations WEBCAST 4

11/10 Contract Accounting and Lease Accounting and Their Impact on Construction Contractors WEBCAST 2

11/10 Federal Tax Update -Individuals (Form 1040) by Pat Garverick WEBCAST 8

11/11 Washington Sales Tax With Mark Hugh WEBCAST 2

11/11 Financial & Retirement Planning Conference WEBCAST presented by the Oregon Society of CPAs 8

11/11 Federal Tax Update - C & S Corporations, Partnerships & LLCs (Forms 1120, 1120S & 1065) By Pat Garverick WEBCAST 8

11/1411/17 Management and Leadership Essentials -Level 4 WEBCAST 24

11/14 U.S. GAAP: Review of New Guidance and Hot Topics WEBCAST 8

11/14 K2's 2022 Technology Seminar WEBCAST 8

11/1411/15 S Corporations: Hot Issues Of 2022 WEBCAST 16

11/15 Real Estate Professionals and Other Exceptions for Rental Properties WEBCAST 8

11/16 IRS Tax Examinations and Hot Issues WEBCAST 4

11/16 Guide to Payroll Taxes and 1099 Issues WEBCAST 4

11/1611/17 Not-For-Profit Conference, Lynnwood & WEBCAST 16

11/17 Surgent's Comprehensive Guide to Tax Depreciation, Expensing, and Property Transactions WEBCAST 8

11/18 Diversity, Equity & Inclusion Training Series WEBCAST 1

11/18 Practical Small Business SEP-IRA's, , SIMPLE IRA's, Traditional and Roth IRA's WEBCAST 2

11/18 Practical Small Business Retirement Planning WEBCAST 2

11/21 CFO Series: Creating Competitive Advantage WEBCAST 8

11/22 Washington Ethics and New Developments 2022 With Mark Hugh WEBCAST 4

11/29 Washington Ethics and New Developments 2022 With Mark Hugh WEBCAST 4

11/30 Common Deficiencies in SSARS Engagement WEBCAST 4

12/1 Fraud Conference, Bellevue & WEBCAST 8

12/9 Diversity, Equity & Inclusion Workshop, Bothell 3 12/2 IRS Disputes WEBCAST

CREDITS

4 Online CPE Register at www.wscpa.org/cpe IN-PERSON EVENT IN-PERSON EVENT IN-PERSON EVENT IN-PERSON EVENT 25www.wscpa.org The Washington CPA Fall 2022 EDUCATION AND EVENTS

12/2 Prix Fixe: Getting the Most from Your MS Office 365 WEBINAR 1

12/5 Federal Tax Update Business with Greg & George WEBCAST 4

12/5 Federal Tax Update Individuals with Greg & George WEBCAST 4

12/6 Choice and Formation of Entity WEBCAST 4

12/6 Accounting & Auditing Update for Small Businesses WEBCAST 4

12/6 CFO Series: Financial Communications 8

12/6 In House Hagen Kurth & Perman & Co: 2022 Rules, Regulations, and Ethics for CPAs in Washington by Thomas Neill WEBCAST 4

12/7 Government GAAP Update WEBCAST 2

12/7 Preparing Individual Tax Returns for New Staff and Paraprofessionals WEBCAST 8

12/7 Member Exclusive: Improving Your Client Communication Strategy: A Guide for Accounting Professionals WEBINAR 1

12/8 S Corporations: Advanced Workshop WEBCAST 8

12/8 Multistate Tax Update WEBCAST 8

12/9 Diversity, Equity & Inclusion Training Series WEBCAST 1

12/9 Advanced Controller and CFO Skills WEBCAST 8

12/9 K2's An Accountant's Guide to Blockchain and Cryptocurrency WEBCAST 4

12/9 K2'S 2022'S Biggest Security and Privacy Concerns WEBCAST 4

12/9 Washington Taxation for Service Businesses With Mark Hugh WEBCAST 2

12/9 Prix Fixe: Fraud and Embezzlement: Risk Management Strategies for Understanding, Communicating & Addressing Risk WEBINAR 1

12/1212/15 Advanced Management and Leadership Essentials -Level 5 WEBCAST 16

12/12 Washington Ethics and New Developments 2022 With Mark Hugh WEBCAST 4

12/12 Federal Tax Update - Individual & Business Current Developments by Pat Garverick WEBCAST 8

12/12 The Complete Guide to Washington Death Taxation WEBCAST 8

12/13 Hottest Tax Topics for 2022 WEBCAST 8

12/13 A Complete Guide to the Yellow Book WEBCAST 8

12/13 CFO Series: Numbers Rule the World WEBCAST 8

12/13 Federal Tax Update -Individuals (Form 1040) by Pat Garverick WEBCAST 8

12/14 Tax Planning for Small Businesses WEBCAST 8

12/14 Compilations, Reviews, and Preparations: Engagement Performance and Annual Update WEBCAST 8

12/14 Federal Tax Update - C & S Corporations, Partnerships & LLCs (Forms 1120, 1120S & 1065) By Pat Garverick WEBCAST 8

Online CPE

DATE COURSE TITLE CREDITS Register at www.wscpa.org/cpe 26 The Washington CPA Fall 2022 www.wscpa.org EDUCATION AND EVENTS

12/14 Member Exclusive: WSCPA Year-End Update WEBINAR

12/15 Revenue Recognition: Mastering the New FASB Requirements WEBCAST

12/16 Leases: Mastering the New FASB Requirements WEBCAST

12/16 Washington Sales Tax With Mark Hugh WEBCAST

12/16 Prix Fixe: Should You Manage Your Investments Yourself or Hire a Professional? WEBINAR

12/19 Federal Tax Update Business with Greg & George WEBCAST

12/19 Federal Tax Update Individuals with Greg & George WEBCAST

12/20 Reviewing S Corporation Tax Returns: What Are You Missing? WEBCAST

12/27 Making the Best of Bad Situations WEBCAST

12/28 2022 Rules, Regulations, and Ethics for CPAs in Washington by Thomas Neill (A WA Requirement) WEBCAST

12/28 2022 Rules, Regulations, and Ethics for CPAs in Washington by Thomas Neill (A WA Requirement) WEBCAST

12/30 Washington Ethics and New Developments 2022 With Mark Hugh WEBCAST

1/6 Prix Fixe: Federal Tax Update WEBINAR

1/9 Federal Tax Update Business with Greg & George WEBCAST

1/9 Federal Tax Update Individuals with Greg & George WEBCAST

1/11 Member Exclusive: The Internal Auditor's Role in ESG WEBINAR

1/12 Washington Ethics and New Developments 2023 With Mark Hugh WEBCAST 4

1/20 Prix Fixe: Creating a Risk Awareness Culture WEBINAR

1/231/24 Tax Advisors Update, Bellevue & WEBCAST

1/27 Prix Fixe: Make Technology Your Secret Sauce WEBINAR

Register at www.wscpa.org/cpe

1

8

8

2

1

4

4

4

8

4

4

4

1

4

4

1

1

16

1 DATE COURSE TITLE CREDITS Online CPE IN-PERSON EVENT Introducing A new way to get CPE! • No tests to take! • Hybrid of live webcast & self-study Visit wscpa.org/flexcast 27www.wscpa.org The Washington CPA Fall 2022 EDUCATION AND EVENTS

WE WALK THE TALK.

CAMICO knows CPAs, because we are CPAs.

Created by CPAs, for CPAs, CAMICO’s guiding principle since 1986 has been to protect our policyholders through thick and thin. We are the program of choice for more than 8,700 accounting firms nationwide. Why?

CAMICO’s Professional Liability Insurance policy addresses the scope of services CPA’s provide.

Includes unlimited, no-cost access to specialists and risk management resources to help address the concerns and issues you face as a CPA.

Provides potential claim counseling and expert claim assistance from internal specialists who will help you navigate the situation with tact, knowledge and expertise.

Does your insurance program go the extra mile?

Visit www.camico.com to learn more.

CPA PROFESSIONAL LIABILITY INSURANCE AND RISK MANAGEMENT SOLUTIONS

Harris Hauptman

Senior Account Executive

T: 800.652.1772 Ext. 6727

E: hhauptman@camico.com

W: www.camico.com

Accountants Professional Liability Insurance may be underwritten by CAMICO Mutual Insurance Company or through CAMICO Insurance Services by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©CAMICO Services, Inc., dba CAMICO Insurance Services. All Rights Reserved.

WSCPA PEAK FIRMS

The WSCPA Peak Firm program recognizes and awards special benefits to firms that sign up 100% of their eligible staff for WSCPA membership. Being a Peak Firm establishes you as a leader in the profession and provides an array of discounts and benefits.

Learn more and enroll your firm at wscpa.org/peak-enroll

CURRENT PEAK FIRMS

Alegria & Company PS

Bader Martin PS

Brantley Janson Yost & Ellison

Clark & Associates CPA PS

Clark Nuber PS

Cordell, Neher & Company PLLC

Dwyer Pemberton & Coulson PC

Eide Bailly LLP

Falco Sult & Co

FBCPA Group PS Inc

Finney Neill & Co PS

Greenwood Ohlund & Co LLP

Hauser Jones & Sas

Hellam Varon & Co Inc PS

HMA CPA PS

Hunt Jackson PLLC

Hutchinson & Walter PLLC

Jacobson Jarvis & Co PLLC

James Russell PLLC

Johnson Stone & Pagano PS

King & Oliason PLLC

Kovarik & Kim PLLC Larson Gross PLLC

Martin Bircher Thompson PC McDevitt & Duffy CPAs

Moss Adams LLP

Nicholas Knapton PS

Norris Lutkewitte PLLC

Opsahl Dawson PS

Ryan Jorgenson & Limoli PS

Shannon & Associates LLP Smith & DeKay PS

Starr & Leaf CPA Group PLLC

Strader Hallett PS

Sweeney Conrad PS

The Doty Group PS

The Myers Associates PC

Vine Dahlen PLLC

Werner O'Meara & Co PLLC

NEW PEAK FIRMS

Photo: © iStock/lightphoto

29www.wscpa.org The Washington CPA Fall 2022 PEAK FIRMS

Mergers & Sales

IBA Sells Privately Held Companies: Do you represent a client who is ready to retire or has taken a company as far as they want to or can?

IBA is the Pacific Northwest’s oldest business brokerage (M&A) firm. We are professional negotiators with over 4200 completed transactions. Please contact us if we can be of assistance at 425.454.3052, 509.907.9406, or www.ibainc.com.

Washington Business Brokers - Confidentiality. Transaction Expertise. Results. - No upfront fees: You are an expert on your business. We are experts on the process of selling a business. Expect results, market knowledge, and transaction expertise. 100% confidential. No upfront fees - pay only at closing. Call 937344-8750 or visit wabusinessbrokers.com for more info. Put us to work for you!

WSCPA

E, Bellevue, Washington 98005-3051 11. Known Bondholders, Mortgagees, and Other Security Holders Owning or Holding 1 Percent or More of Total Amount of Bonds, Mortgages, or Other Securities: None 12. Tax Status Has Not Changed During Preceding 12 Months 13. Publication Name: The Washington CPA 14. Issue Date for Circulation Data Below: 08/15/2022 15. Extent and Nature of Circulation (Avg. No. Copies Each Issue During Preceding 12 Months, Actual No. Copies of Single Issue Published Nearest to Filing Date). a. Total No. Copies (Net press run): 6,537, 6,200. b. Paid Circulation (By Mail and Outside the Mail): (1) Mailed Outside-County Paid Subscriptions Stated on PS Form 3541: 3,631, 3,498. (2) Mailed In-County Subscriptions Stated on PS Form 3541: 2,661, 2,546. (3) Paid Distribution Outside the Mail Including Sales through Dealers and Carriers, Street Vendors, Counter Sales, and Other Paid Distribution Outside USPS: 0, 0. (4) Paid Distribution by Other Classes of Mail Through the USPS (e.g., First-Class Mail®): 0, 0 c. Total Paid Distribution [Sum of 15b (1), (2), (3) and (4)]: 6,292, 6,044. d. Free or Nominal Rate Distribution (By Mail and Outside the Mail): (1) Free or Nominal Rate Outside-County Copies included on PS Form 3541: 49, 37 (2) Free or Nominal Rate In-County Copies included on PS Form 3541: 0, 0. (3) Free or Nominal Rate Copies Mailed at Other Classes Mailed Through the USPS: 51, 26. (4) Free or Nominal Rate Distribution Outside the Mail: 0, 0. e. Total Free or Nominal Rate Distribution (Sum of 15c and 15e): 100, 63. f. Total Distribution (Sum of 15c and e): 6,392, 6,107. g. Copies not Distributed: 145, 93. h. Total (Sum of 15f and g): 6,537, 6,200. i. Percent Paid: 98.44%, 98.97%. 16. Electronic Copy Circulation n/a 17. Publication of Statement of Ownership If the publication is a general publication, publication of this statement is required. Will be printed in the 11/4/2022 issue of this publication. 18. Signature and Title of Editor, Publisher, Business Manager, or Owner: Jeanette Kebede, Editor, Date 09/28/2022

CLASSIFIED ADS

STATEMENT OF OWNERSHIP, MANAGEMENT, AND CIRCULATION (REQUIRED BY 39 U.S.C. 3685) 1. Publication Title: The Washington CPA 2. Publication No.: 0000-9754 3. Filing Date: 28 September 2022 4. Issue Frequency: Quarterly 5. No. of Issues Published Annually: 4 6. Annual Subscription Price: $12 7. Complete Mailing Address of Known Office of Publication: 170 120th Avenue NE Ste 101 Bldg E, Bellevue, Washington 98005-3051 Contact Person: Jeanette Kebede, Telephone: 425.586.1120 8. Complete Mailing Address of Headquarters or General Business Office of Publisher: Same as #7 9. Full Names and Complete Mailing Addresses of Publisher, Editor, and Managing Editor: Publisher: Washington Society of Certified Public Accountants, Editor: Jeanette Kebede, Managing Editor: n/a, Washington Society of Certified Public Accountants, 170 120th Avenue NE Ste 101 Bldg E, Bellevue, Washington 98005-3051. Owner: Washington Society of Certified Public Accountants, 170 120th Avenue NE Ste 101 Bldg

Visit the WSCPA Job Board! Post your opening and be seen by some of Washington's finest CPAs and finance professionals. Learn more at: wscpa.org/job-board

Passport Card Your WSCPA membership includes this free benefit (a $150 value). Access 3,000+ discounts online and in your neighborhood. Great for dining, travel and shopping. Find your next adventure at wscpa.org/ passport Interested in using your CPA skills to make an impact in your local community? WSCPA has a list of volunteer opportunities for you to check out! Backpack Brigade Greyhound Pets, Inc. Seattle Perugia Sister City Association Shorewood High School Boosters The Washington Poison Center United Way of King County Find or submit an opportunity at: wscpa.org/volunteer-opportunities 30 The Washington CPA Fall 2022 www.wscpa.org Learn more: wscpa.org/classifieds or contact Sharon Olene-Marander at smarander@wscpa.org Advertise with the WSCPA

Considering the sale or purchase of a private practice? As the preeminent provider of business brokerage and consulting services in the Northwest, we work exclusively with owners of professional practices in the legal, healthcare, financial services, and tech industries. Need to prepare your practice for sale? Looking for a business valuation? Ready to sell your practice for top dollar? Let our team guide you through this life-changing transition. Call us at 253.509.9224 or visit our website to learn more about our services and top-notch team waiting to help you: PrivatePracticeTransitions.com

Lucrative South Puget Sound Tax and Accounting Firm: For nearly 40 years, this Washington CPA firm has offered a wide range of services to both business and individual clients. The Practice has a diverse, loyal, and growing client base of ~2,200 active clients. The Practice is full-service and excels at tax preparation and planning, business advice and consulting, providing bookkeeping, accounting, and financial statements, as well as business valuation and personal financial planning. In 2021, the Practice accomplished a 24.1% year-over-year growth with gross revenues of $3,565,322. Additionally, the Practice has sixteen (16) staff, including the Owners who are willing to continue employment and/or provide transition assistance and help with goodwill transfer, business development, and other “mentoring” functions for an agreed-upon period, if desired. To learn more, call 253.509.9224 or, send an email to info@privatepracticetransitions.com, with "1204 Lucrative South Puget Sound Tax and Accounting Firm" in the subject line.

Highly Rated Methow Valley Tax & Accounting Firm: Over the past 39+ years, this Washington tax and accounting firm has offered tax and bookkeeping services to both business and individual clients in Winthrop and surrounding areas.

As of June 2022, the Practice has approximately ~662 active clients and has seen great client retention as is evidenced by the increase in client counts year-over-year. The Practice’s service by revenue breakdown is 72% Tax Preparation & Consulting, and 28% Bookkeeping. In 2021 the Practice brought in $597,220 in gross receipts which was a 12.6% YoY increase! Including the Owner, the Practice has seven (7) loyal staff members. The Owner is willing to stay on part-time for up to two (2) to three (3) years if desired. To take advantage of this “turnkey” business opportunity, call us at 253.509.9224 or send an email to info@ privatepracticetransitions.com, with “1205 Highly Rated Methow Valley Tax & Accounting Firm” in the subject line.

Clackamas County CPA Firm Seeking New Ownership: Established in 1954, this CPA Practice has provided tax preparation and planning, and other accounting services to countless clients with a service by revenue breakdown of 35% Business Tax Preparation & Planning, 30% Individual Tax Preparation & Planning, 23% Bookkeeping and Payroll Services, 6% Estate Work, 3% Financial Statements and 3% Advisory. The Practice is known for doing quality work and as such, has a great reputation within the community. Because of this, the Practice receives a lot of word-of-mouth referrals and has incredibly high client retention. 2022 projections show year-end gross revenues at ~$1M. The two partners are seeking a buyer that will bring additional production capacity and/or take over the Practice’s administrative functions. The partners would like to stay with the firm as employees post transition to new ownership. With ~1,020 active clients, this is a great opportunity for any buyer looking to buy an already thriving business. For more information on this listing, call 253.509.9224 or email info@privatepracticetransitions.com, with “1178 Clackamas County CPA Firm Seeking New Ownership” in the subject line.

CPA Turnkey Opportunity in Oregon-Idaho Treasure Valley: Private Practice Transitions is assisting in the sale of a long-established, highly profitable CPA firm located in the Western Treasure Valley of Oregon and Idaho. The firm’s two largest revenue streams are from Income Tax Preparation (48%) and Bookkeeping/Payroll (32%). The rest is made up of Management Advisory, Reviews, and Compilations. The Practice has shown increasing revenues year-over-year even during the COVID-19 pandemic. With average gross revenues (20192021) of ~$515,000 and ~430 active clients, the firm is poised to have another successful year. The practice operates from a ~2,999 sq. ft. office building which could be part of the package deal. There are currently four staff including the owner who is willing to provide transition assistance for up to a year to help ensure the new owner’s success. With an established clientele, seasoned staff, and well-regarded reputation, this firm is a turnkey opportunity for the right buyer. For more information, call us at 253.509.9224 or email info@ privatepracticetransitions.com, with “1136 CPA Turnkey Opportunity in Oregon-Idaho Treasure Valley” in the subject line.

Profitable King County Tax and Accounting Firm: Established in 2009, this tax and accounting firm is a one-stop shop for all tax and accounting services. The Practice owes its success to its established name, loyal clients, and collaborative staff amenable to helping the Practice continue to thrive. The Practice’s service by revenue breakdown

is 68% Tax Services, and 32% Accounting and Controlling. In 2021, the Practice brought in an impressive $5,126,147 in gross receipts. Of its ~2,424 active clients, ~500 are business client groups and ~1,924 are a mixture of high-net-worth individuals, young professionals, investors, and community leaders. The Practice has incredible workflow efficiency, is entirely paperless, uses cloud-based software, and has an efficient remote working environment. With a great reputation and such a robust client base, this is an excellent opportunity for any buyer. If interested, call us at 253.509.9224 or, send an email to info@privatepracticetransitions. com, with “1155 Profitable King County Tax and Accounting Firm” in the subject line.

Profitable South King County Tax and Accounting Practice for Sale: Established in 1985, this south King County tax and accounting firm has become well-known for its integrity, service, and reputation for going above and beyond for each client. The Practice’s service by revenue breakdown is 59% Tax, 24% Controller Services, 13% Bookkeeping, 2% Financial, and 2% Other. As of November 2021, the Practice has approximately ~413 active clients comprised of ~80% individuals and ~20% businesses. Over the past three (3) years, the Practice has averaged gross revenue of approximately $437,591 (2019-2021). The Practice is stable, profitable, and poised for growth under new ownership. To learn more, call 253.509.9224 or email info@privatepracticetransitions.com.

Successful King County Tax and Accounting Firm: Established in 2003, this King County tax and accounting firm is highly respected in the community and prides itself on providing topnotch personalized customer service. The Practice’s service by revenue breakdown is 68% Tax Services, 26% Accounting Services, 3% General and 3% Consulting Services. As of September 2021, the Practice has approximately 804 active clients and four dedicated staff. Over the past three (3) years, the Practice has averaged gross revenue of approximately $979,355 (2019-2021). Additionally, the Practice has experienced yearover-year (YoY) growth each of the last three years! The Owner is willing to provide transition assistance and help with goodwill transfer, business development, and other “mentoring” functions for one to two tax seasons to ensure the new owner’s return on investment is realized. With impressive revenues, stellar SDE, and YOY growth, this is one opportunity you don’t want to miss. If interested, call us at 253.509.9224 or email info@privatepracticetransitions.com, with "1174 Successful King County Tax and Accounting Firm" in the subject line.

Successful Tax and Accounting Firm in SoughtAfter Clark County, WA: For over 29 years, this Washington tax and accounting firm has offered a wide range of tax and accounting services to both business and individual clients. The Practice’s service by revenue breakdown is 58.8% Tax Prep and 42.8% Accounting. The Practice has experienced year-over-year growth each of the last two years with an incredible 19.6% increase from 2018-2019 and a 6.7% increase from 20192020 even amidst the pandemic. The owners are willing to provide transition assistance and help with goodwill transfer, business development, and other “mentoring” functions for an agreedupon period of up to one year to ensure the new owner’s return on investment is realized. To learn more, call 253.509.9224 or email info@ privatepracticetransitions.com.

CLASSIFIED ADS

31www.wscpa.org The Washington CPA Fall 2022

Diversity, Equity & Inclusion Conference $ Pacific Tax Institute Not-For-Profit ConferenceNov 9-10 Nov 16-17 Dec 1 Nov 4 Nov 18 Dec 2 Dec 9 Enrich your skills and earn CPE credits by attending our fall conferences. Register today! wscpa.org/canvas Fall Conferences 170 120th Ave NE Ste E101 Bellevue WA 98005 Periodicals postage paid at Bellevue WA and additional mailing offices AREA CLEAR