Pilot has earned CSD’s 2024 Chain of the Year Award for its commitment to operational excellence, innovation, a people-first culture and strategic direction.

Beth Mallory, guest services leader; Adam Wright, CEO; and Steve Smith, lead cashier, exemplify Pilot’s people-centric philosophy, creating a welcoming and supportive environment for guests and team members.

Pilot has earned CSD’s 2024 Chain of the Year Award for its commitment to operational excellence, innovation, a people-first culture and strategic direction.

Beth Mallory, guest services leader; Adam Wright, CEO; and Steve Smith, lead cashier, exemplify Pilot’s people-centric philosophy, creating a welcoming and supportive environment for guests and team members.

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

Tobacco Product Scanned Prompt to Scan for Age Validation

The AVT system saves on transaction times. AVT protects the future/viability of innovative products and harm reduction.

Verify and Scan I.D.

POS System Validates Transaction Continues

EDITORIAL

VP EDITORIAL Danny Klein dklein@wtwhmedia.com

EDITOR-IN-CHIEF Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR Kevin McIntyre kmcintyre@wtwhmedia.com

CONTRIBUTING EDITORS Anne Baye Ericksen Marilyn Odesser-Torpey

COLUMNISTS Tim Powell Bruce Reinstein

EDITOR EMERITUS John Lofstock

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MANAGER Jeannette Jelks jjelks@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

WTWH MEDIA, LLC 1111 Superior Ave.

OH 44114

Ph: 888-543-2447

www.cstoredecisions.com

SALES TEAM VP SALES Lindsay Buck lbuck@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Tony Bolla tbolla@wtwhmedia.com (773) 859-1107

SALES DIRECTOR Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES MANAGER Simran Toor stoor@wtwhmedia.com (770) 317-4640

MARKETING MANAGER Jane Cooper jcooper@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Annie Paoletta apaoletta@wtwhmedia.com

CONTENT STUDIO

VP, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Olivia Schuster oschuster@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Cole Kistler ckistler@wtwhmedia.com

VIDEOGRAPHER Tyler Kubisty tkubisty@wtwhmedia.com

LEADERSHIP

CEO Scott McCafferty smccafferty@wtwhmedia.com

SUBSCRIPTION INQUIRIES

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/ Copyright 2024, WTWH Media, LLC

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Nate Brazier, President and Chief Operating Officer

Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer

Sprint Mart • Ridgeland, Miss.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

Dyson Williams, Vice President

Dandy Mini Marts. • Sayre, Pa.

NATIONAL ADVISORY GROUP (NAG) BOARD (RETAILERS)

Vernon Young (Board Chairman), President and CEO

Young Oil Co. • Piedmont, Ala.

Greg Ehrlich (Chair Elect), President

Beck Suppliers Inc. • Fremont, Ohio

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Richard Cashion, Chief Operating Officer

Curby’s Express Market • Lubbock, Texas

Megan Chmura, Director of Center Store

GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Kalen Frese (Board Chairman), Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Alex Garoutte, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Derek Gaskins, Chief Marketing Officer Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Beth Hoffer, Vice President

Weigel’s • Powell, Tenn.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Lenny Smith, Vice President Crosby’s • Lockport, N.Y.

Dyson Williams, Vice President

Dandy Mini Marts • Sayre, Pa.

Hussein Yatim, Vice President YATCO • Marlborough, MA

Supplier Members

Kyle May, Director External Relations

Reynolds Marketing Services Co. • Winston-Salem, N.C.

Todd Verhoven, Vice President of Sales

Hunt Brothers Pizza • Nashville, Tenn.

Steve Yawn, Director of Sales

McLane Company Inc. • Temple, Texas

Pilot

Congratulations to Pilot, named CStore Decisions 2024 Convenience Store Chain of the Year!

With their history of serving drivers, support of local, regional and industry non-profit and charitable organizations, and commitment to shaping the future of energy, let’s celebrate Adam Wright and his Pilot Company Team for this well-deserved recognition!

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

On the evening of Oct. 8, CStore Decisions honored Pilot Company as our 2024 Chain of the Year and the 35th winner of the award at an event at the top of The Strat in Las Vegas.

We were thrilled to host nearly 230 guests from the cstore industry on the 108th floor, where they enjoyed dinner, drinks, breathtaking sunset views over Las Vegas and an exhilarating front-row seat to some bungee jumpers soaring off the edge of the building. My favorite part of the evening was listening to Adam Wright, CEO of Pilot, discuss the chain’s people-first culture as he accepted the award.

Over the past decade, we’ve found there are more and more chains deserving of our Chain of the Year Award. After all, as the industry continues to shift, more chains are modernizing for the future and embracing innovation.

But Pilot stood out for a multitude of reasons. There’s its commitment to modernization through its $1 billionplus New Horizons initiative. There’s also its innovative mindset that has spurred it to embrace foodservice evolution, roll out self-checkout kiosks and delivery, and partner to build an electric vehicle (EV) charging network from coast to coast to reduce range anxiety in EV drivers. Then there’s its strategic future-focused direction that drives its decisions. In this month’s cover story that features Pilot, Wright noted that as he looks to the next 100 years, he is steering the ship in a way that ensures Pilot remains relevant and in tune with evolving customer demands for decades to come.

But it’s Pilot’s people-centric philosophy, which extends from its customers to its employees, that I think especially sets Pilot apart in today’s retail landscape.

Every decision Pilot makes is made with its customers and employees in mind. As it remodels stores as part of its New Horizons initiative, for example, Pilot has sought and integrated feedback from both customers and employees and included changes that make workspaces more efficient for team members. From an upgraded

employee onboarding process to a new team member recognition program, Pilot prioritizes its people every step of the way.

“Our purpose statement is ‘Showing people they matter at every turn,’ and it’s something that we’re operationalizing,” Wright noted in this month’s cover story.

The concept, he added, is not just a saying or a bumper sticker slogan, but something that drives Pilot’s decisions.

“Everything we do involves thinking about how the decisions we make and the investments we put forward impact people’s lives, and that’s our team members, that’s our customers, and that’s our communities,” Wright said. “Everything is being structured around that. All of our initiatives, all our objectives, all of our key performance indicators, our compensation structures — everything is being structured by how we impact people.”

As c-store retailers acquire stores, build new-to-industry prototypes, upgrade menus and rush to implement the latest technology, they would be wise to follow Pilot’s example when it comes to prioritizing people. As Wright pointed out, a company is essentially a compilation of people. How those people are made to feel valued — or not — says a lot about a company’s culture, and it influences how employees treat customers.

Ultimately, prioritizing people is about creating a strong, sustainable foundation for future success — something Pilot understands well. As convenience store retailers expand and innovate, their greatest asset remains their workforce. When employees feel valued and engaged, they are more likely to bring passion, loyalty and exceptional service to their roles, enhancing the overall customer experience. By investing in their people, retailers not only build a positive company culture but also position themselves to attract top talent, reduce turnover and develop a team that will grow with them, leading to strong customer satisfaction and overall success in an increasingly competitive marketplace.

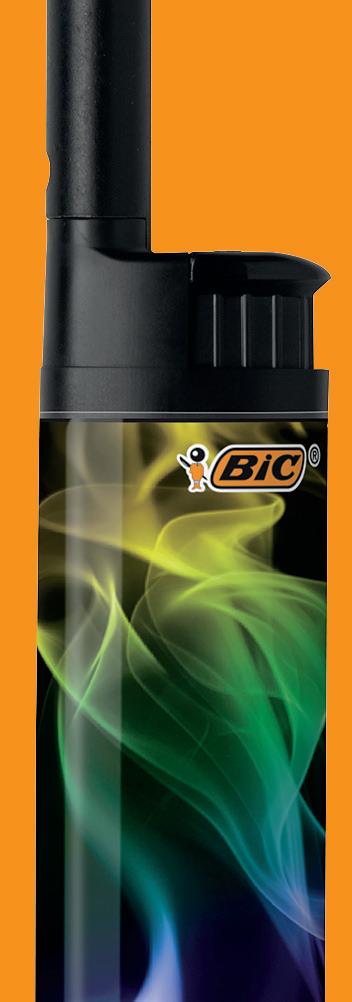

With the holidays approaching, consumers are factoring in potential savings, shopping timeframes and overall plans into their spending habits.

November looks to be the busiest time of the year for holiday retail spending, followed by December, according to Deloitte’s holiday retail survey.

Consumers take holiday preparation, gatherings, traveling and overall experience into account when considering their holiday plans. According to 84.51˚:

• Fewer people are making Thanksgiving plans last minute, while most shoppers are making plans for the holiday by early November.

• 74-80% of shoppers spend Thanksgiving with the same number of people each year.

• The majority of people travel less than 50 miles in December to celebrate the holidays, but there has been a slight uptick in those planning to travel 50 miles or more for the holidays during December.

• Only 20% of survey respondents strongly agreed with wanting their December holidays to be a similar experience to the previous year since 2021.

Source: 84.51˚’s “Unwrapping holiday insights: Trends from 2021 to 2023”

More consumers plan to shop during Thanksgiving week this year compared to 2023. According to Deloitte’s holiday retail survey: When asked, “What holiday shopping events are you likely to participate in?”

• 21% said Thanksgiving Day, compared to 12% in 2023.

• 47% said Black Friday, compared to 31% in 2023.

• 20% said Small Business Saturday, compared to 14% in 2023.

• 43% said Cyber Monday, compared to 31% in 2023.

Source: Deloitte, “2024 Holiday Retail Survey”

Although economic factors may influence consumer holiday spending, based on a Circana survey, positivity is increasing.

• This year’s household food and grocery costs will impact holiday shopping for 62% of consumers, but more holiday shoppers are feeling positive about their personal financial situation than last year (57%).

• More holiday shoppers are also feeling positive about the state of the economy this year (36%).

• Less than one-third of holiday shoppers say their holiday purchase decisions will be impacted by the election.

Source: Circana, annual holiday purchase intentions consumer survey, 2024

Consumers are prioritizing searching for deals and promotions when it comes to holiday shopping. Based on 84.51˚’s September Consumer Digest: Where will shoppers search for holiday deals?

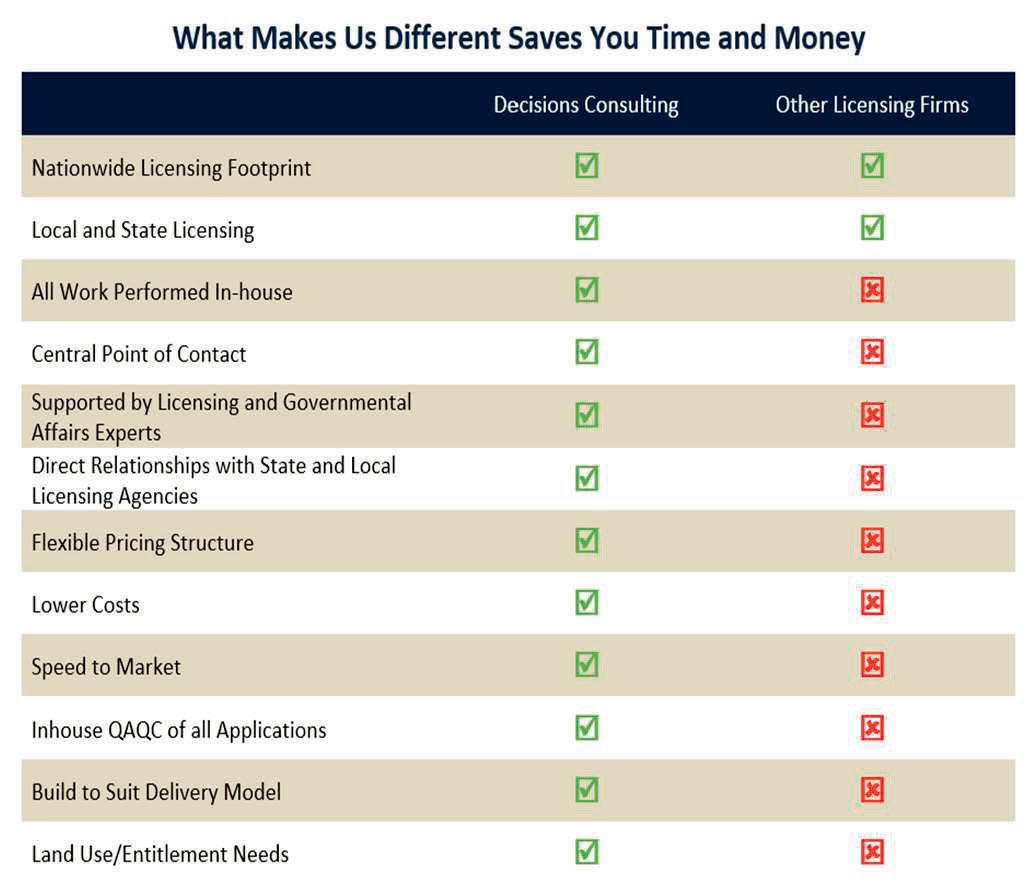

www.Decisions-Consulting.com

Decisions Consulting simplifies a complex process by providing clients with a single-source solution for all their licensing needs. Drawing upon an extensive team of in-house experts, our licensing professionals navigate the complexities of State and Local requirements for Alcohol Beverage, Food, Business Licensing, other license types, and land use entitlement across the US.

We have developed a delivery model for national licensing and local government land use entitlement needs that is unmatched in the industry. By providing each client with a central point of contact for accountability, we streamline communications and ensure timely responses. Decisions has built an in-house staff capable of filing hundreds of applications per week across many states and hundreds of localities. We confidently offer both NTE and flat fee pricing structures aimed at keeping costs as predictable as possible. We offer build-to-suit delivery models for our clients.

Licensing & Land Use services include:

Alcohol, Food, & Business Licensing & Permitting

Local & State Compliance

Licensing Services for Tobacco, Propane, Alarm, Waste, Sales, F.O.G., SNAP, Lottery, COAM, and other License Types

Tax Clearance Assistance

Land Use Variances, Map Amendments, Rezonings, Conditional Use Permits, and Special Use Permits

Site Evaluation for Use Compatibility

National Discount Variety Chain Scope: Turn-key alcohol licensing services for over 4,000 retail stores in 40 states within 24 months.

Filed over 3,000 alcohol license applications in 40 states, including 1,000s of local jurisdictions.

Obtained over 1,000 alcohol licenses in 12 months and over 1,650 licenses in 24 months.

Eliminated third party delays in response times to client and jurisdictions.

Seamlessly integrated real-time data reporting and evaluation of project progress.

Reduced per-site licensing costs by approximately 20%.

Completed pre-filing evaluation of jurisdictional restrictions on all store locations.

www.Decisions-Consulting.com

“With over 15 years’ experience in licensing, I can say that no one else in this field can accomplish what Decisions has helped our company achieve in obtaining licenses nationally.” Sharon, Manager, Nationwide Retailer

Industry leaders gather at The Strat in Las Vegas to celebrate Pilot Company earning CStore Decisions’ 2024 Chain of the Year Award.

Emily Boes • Senior Editor

On the evening of Oct. 8, nearly 230 c-store industry members gathered at the top of The Strat in Las Vegas to celebrate Pilot Company, CStore Decisions’ 2024 Chain of the Year.

“This year marks the 35th anniversary of our Chain of the Year Award,” said Erin Del Conte, editor-in-chief of CStore Decisions, “which is the oldest and most prestigious award in convenience retailing.”

Del Conte noted Pilot received the award due to its operational excellence, strong forward direction, focus on modernization and innovation — such as its commitment to building out an electric vehicle charging infrastructure across the country — and its people-centric culture.

In particular, Pilot was acknowledged for its New Horizons initiative to remodel up to 400 stores, which prioritizes foodservice evolution.

Pilot has a travel center network of nearly 900 locations across 44 states and six Canadian provinces.

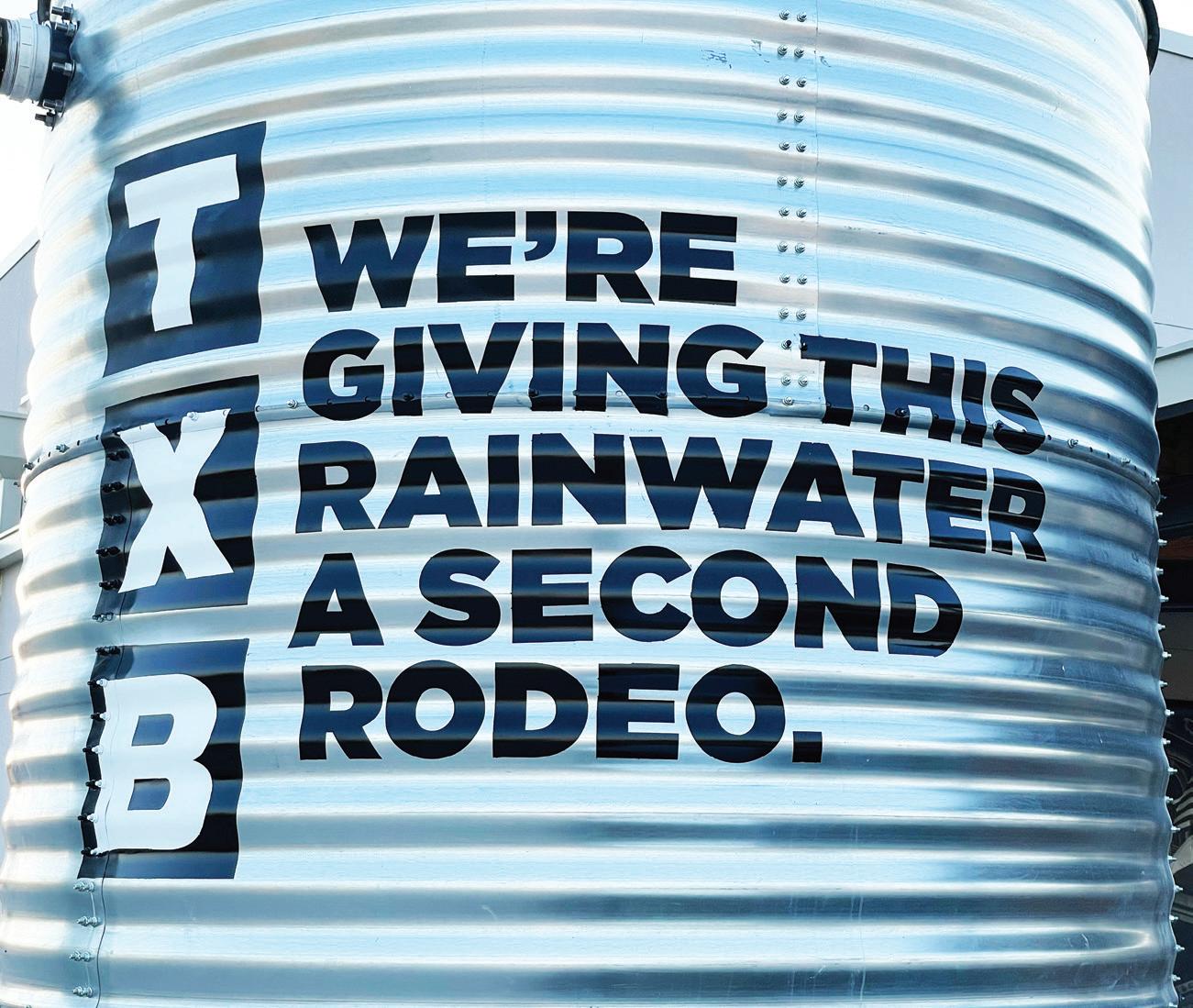

Kevin Smartt, president and CEO of the 2023 Chain of the Year winner TXB, presented the award to Pilot CEO Adam Wright, who took the CEO mantle in May 2023.

“This year, CStore Decisions has named Pilot Company as the 2024 Chain of the Year, and this accolade is not just a title. It reflects years of hard work, resilience and relentless pursuit of excellence,” said Smartt.

Smartt noted Pilot’s dedication to innovation, quality and community service.

“What truly impresses me about the Pilot Company is the relentless focus on enhancing the customer experience,” he continued.

Speaking directly to Wright and the Pilot team, Smartt expressed that their hard work has not gone unnoticed and that they’ve earned this recognition through passion and vision.

“You’re a pioneer of the shape and future of retail,” he said.

Smartt shared with guests that the Chain of the Year Award is a reminder of the responsibility of everyone to push boundaries and elevate the industry.

In his final acknowledgement of the Pilot team, Smartt raised a glass to the company in praise of its leadership and inspiration.

In his introduction, Wright noted that recognizing Pilot is recognizing the company’s 30,000 team members, as well as its partners.

SUCCESS NEVER TASTED SO SWEET!

Hostess proudly congratulates the Pilot Company on being named 2024 Chain of The Year!

“While it says Pilot, it’s really about people,” said Wright.

He doesn’t want Pilot to be known as a convenience store retailer, but rather as a part of people’s lives.

To emphasize his point, he mentioned one of his team members who lost her home to Hurricane Helene. She brought her food to a Pilot store and cooked it for the community.

“People rally to our stores. We’re like the last one standing, the first ones back on. We’re a place that intersects people’s lives literally where the rubber meets the road,” Wright said.

This speaks to Pilot’s fervent dedication to maintaining a people-centric culture.

“We’re well resourced, we’re talented, we’re tenacious. We have what it takes. We fall short, no way we did our best. There’s something we can learn and improve on. I think all those things speak true for the industry, not just Pilot,” he continued.

Chain of the Year attendees finished the night with food, drinks and picturesque views from 108 stories high at the top of The Strat.

Congratulations on being named CSD’s 2024 Chain of the Year. Your passion for the c-store industry and continuous e orts to evolve and enhance customer experiences are truly inspiring.

Pilot has earned CSD’s 2024 Chain of the Year Award for its commitment to operational excellence, innovation, a people-first culture and strategic direction.

Erin Del Conte • Editor-in-Chief

Pilot Company (Pilot) is standing out for operational excellence driven by its people-first culture, an innovation mindset and a strong future-focused direction as it modernizes locations through its $1 billion-plus New Horizons Initiative.

As Pilot remodels sites, it’s embracing foodservice evolution, upgrading fuel dispensers, and adding selfcheckout kiosks and delivery with plans for mobile ordering. At the same time, it’s shaping the future of energy by building out electric vehicle (EV) infrastructure across the country from coast to coast.

Founded in 1958, the Knoxville, Tenn.-based company has grown to become one of the leading fuel suppliers and the largest operator of travel centers in North America. A wholly owned subsidiary of Berkshire Hathaway, Pilot’s travel center network includes nearly 900 locations across 44 states and six Canadian provinces, where the chain’s 30,000 team members serve 1.2 million customers per day.

CStore Decisions is proud to honor Pilot as its 2024 Chain of the Year. Pilot marks the 35th winner of the award, which is the oldest and most prestigious award in convenience retailing.

“We are humbled and honored to be recognized as Chain of the Year by CStore Decisions,” said Adam Wright, CEO of Pilot. “This award reflects our team members’ hard work and dedication to serve our customers, guests and each other. We’re committed to being the leading energy and experience provider people can rely on to fuel their journeys and meet their needs every time they stop with us.”

Pilot got its start 66 years ago in 1958 with a single gas station when James “Jim” Haslam II debuted the first Pilot location in Gate City, Va. By 1981, Pilot had grown to 100 convenience stores and, in the same year, would open its first travel center in Corbin, Ky.

Top: Through its $1 billion-plus New Horizons initiative Pilot is remodeling and modernizing up to 400 stores. Right: Adam Wright joined Pilot as CEO in May 2023, bringing over two decades of experience as a leader in the energy sector and expertise in strategic planning and operational excellence.

Pilot joined Marathon Ashland Petroleum LLC in 2001 to form Pilot Travel Centers LLC, operating a network of more than 230 travel centers across the country. In 2008, Pilot bought out Marathon Petroleum’s interest in the company and partnered with CVC Capital Partners, a European private-equity firm.

In 2010 Pilot Travel Centers LLC merged with Flying J Inc. to form Pilot Flying J for a combined network of more than 550 travel centers. In 2015, Pilot bought CVC Capital Partners’ investment in Pilot Flying J.

In 2017, Berkshire Hathaway began a multiyear acquisition of the company with a 38.6% equity stake in Pilot. In 2024, Pilot became wholly owned by Berkshire Hathaway.

Pilot welcomed Wright as CEO in May 2023. Wright brings over two decades of experience as a leader in the energy sector and expertise in strategic planning and operational excellence to help lead Pilot into the future.

When Wright was first approached with the opportunity to lead Pilot, he was impressed by the huge impact a travel center chain like Pilot has on America’s economy.

“When I thought about the chance to influence and impact millions of people every single day across 44 states and two countries, I thought, ‘What a great opportunity to have impact and influence more people, more places,’ … and I was very attracted to the position for those reasons,” Wright said.

In March of 2022, Pilot announced its $1 billion-plus New Horizons initiative to remodel and modernize up to 400 stores across its more than 680 company-owned and -operated locations. At press time, Pilot was on track to have more than 200 sites remodeled by the end of 2024.

With a fleet of great locations across the U.S., Pilot’s focus through New Horizons is ensuring its facilities match

customers’ evolving expectations when it comes to their look, feel and the overall experience they provide, noted Wright. “Are they having memorable experiences when they walk in? Are the main things that they come to the travel center for front and center?”

Each site is being upgraded according to its needs.

“We gather individual feedback from team members and guests for each specific location, and we make the updates based on the feedback,” said Brad Anderson, chief operating officer for Pilot.

Updates can involve interior and/or exterior makeovers. Exterior refreshes include LED lighting, updated branding, refaced walls and various touches to modernize the look of the store. Inside, stores are being redesigned to appear lighter, brighter and feature industrialstyle accents. Restrooms, showers and laundry facilities are being upgraded, and in some cases, expanded or added to a site.

As Pilot remodels locations, it’s bringing foodservice front and center in the stores, adding kitchens and expanding lounges, dining areas and its signature fresh deli menu. It’s also adding more cooler doors and, in some cases, expanding the retail footprint to offer more retail products, Anderson explained. The chain is also upgrading equipment throughout the store.

Pilot is focused on foodservice evolution, which includes bringing food front and center in stores, adding space for kitchens and expanding its signature fresh deli menu.

Another key focus of New Horizons is to improve the team member experience, making it more welcoming for employees while ensuring the facilities are designed with them in mind.

“We’re constantly getting feedback from our team and looking for ways to make their jobs more efficient and better. We’re redesigning our buildings to make the activities that they need to do easier and more efficient,” Anderson noted.

That can include small shifts like moving the location of trash bins and storage for equipment to bigger changes like upgrading breakrooms.

Pilot’s average travel center spans 11,000 square feet but, having grown through both new-to-industry (NTI) sites and acquisitions, its store sizes vary. As it remodels, Pilot aims to keep stores as consistent as possible, especially when it comes to the design elements, while honoring the needs of each individual location. That might mean expanding storage in one store, while adding space for food in another.

“We want each store to feel familiar when you walk in, regardless of shape and size, with the same memorable touch points throughout the location,” Anderson said.

After the New Horizons initiative concludes, Pilot plans to continue to prioritize site upgrades to remain relevant and contemporary and ensure stores continue to align with guest and team member needs.

Pilot is also expanding its footprint through NTI builds. The chain introduced nine NTI sites in 2023 and will open eight more by the end of 2024.

“We want to always look for where our customers need us,” Wright noted. “If they need us in a certain location, we’re going to evaluate that and look to build a new store or expand one as appropriate for that.”

In October, Pilot debuted its most recent NTI store. Located in Laredo, Texas, the new site spans more than 12,000 square feet and features a modern look and feel, the chain’s full deli offering, and 53 additional parking spaces, among other amenities.

As part of New Horizons, Pilot is expanding its signature fresh deli menu with feature programs such as pizza, wings, homestyle meals and grab-and-go food. Guests can also order an array of sandwiches, wraps and salads.

“We’re well known for our fresh pizzeria-style pizza with our signature handmade roped crust,” Anderson said. “For those craving a homestyle meal, we offer fresh-cooked meals at many of our locations, and our wings, tenders and breakfast sandwiches are some of our most popular items.”

Customers can find a variety of quick and tasty meal options, including heat-and-serve dishes like carne asada with rice, chicken alfredo and butter chicken with rice, he pointed out.

Grab-and-go items include seasonal fruit cups, burgers, chicken sandwiches, burritos, egg rolls and corndogs.

In addition to its proprietary offerings Pilot also operates more than 600 quick-service restaurants (QSRs) across eight different brands, including Dunkin’, Cinnabon, Wendy’s and Subway.

Wright noted that by offering a food-forward presence, Pilot is satisfying a growing customer need for convenient food options. Pilot is also working to create menu consistency between locations so guests can count on certain offerings no matter which Pilot they visit.

Tech innovation has been another cornerstone of Pilot’s expansion.

“It’s about people, pace and performance. If (an innovation) meets the needs of people and we can implement at a pace that doesn’t outstrip the value of it, and it improves the performance of our business and service to our guests, we’re going to pursue it,” Wright said.

In 2023, Pilot partnered with NCR to add three to four self-checkout kiosks to each remodeled and NTI location, depending on store size and layout. To date, Pilot has completed the installation of more than 200 selfcheckout kiosks. A dedicated team member is available to assist self-checkout customers.

“Self-checkout is an important part of providing an expedited and more convenient, streamlined experience for our guests,” Anderson said.

“E-commerce will be a big part of our business,” Anderson added. “We really want to meet guests where they are. That could be, obviously in our stores or on our property, but also digitally.”

Pilot is working with its QSR partners, including Wendy’s and Taco Bell, to use their operating system to unlock mobile ordering.

“If you go to our Wendy’s locations, you could use the Wendy’s app to (place a) digital order and get DoorDash delivery. In addition, we’ve now used DoorDash to deliver our Pilot signature deli products” starting with pizza and chicken, Anderson noted.

By the end of 2024, Pilot plans to have expanded its third-party delivery partners to include Grubhub and Uber Eats, and by early 2025 it plans to make select retail products — such as major brands of soda and chips, as well as other items that will complement its foodservice offerings — available for delivery.

The company is exploring more options for mobile ordering to enhance its digital ordering capabilities.

The chain is also implementing new systems, including new tablets and handhelds, to assist with inventory counts and guest questions.

It also launched PilotCo, a centralized ecosystem designed to streamline internal communication, foster collaboration and provide employees with access to important resources from training to the ability to clock in on their phone.

Customers can use the MyRewards app to reserve showers and parking spaces in addition to accessing rewards. Through the app, professional drivers can earn points per gallon when they purchase diesel fuel, which can be redeemed for purchases in-store, including foodservice items. Everyday customers can also take advantage of promotions and deals within the app, which are personalized for each guest.

And those are just a few of the ways that Pilot is innovating today.

One thing that sets Pilot apart is its people-first culture, which extends from its customers to its employees.

“People are at the heart of everything we do. Our purpose is showing people they matter at every turn, and that really starts with our team members,” acknowledged Anderson.

“Our role is to help our team be at their best, which starts with intentionally shaping the experience our team members have daily,” said Julius Cox, chief people officer of Pilot.

Pilot works to create an environment where its team members feel listened to and have a sense of belonging.

“We know that if our people feel as if they matter, that’s how they will make our guests and customers feel as well,” Cox said.

The company has launched several team-focused initiatives internally.

In 2023, the chain launched the Fueling Recognition

Congratulations to Pilot Company for being named CStore Decision’s Chain of the Year.

program, an employee engagement, rewards and recognition program that includes in-app points awarded for great work and milestones and that promotes peer-topeer recognition.

“This platform is available to all team members as a way to express appreciation for each other and the hard work we do every day,” Cox said. “Team members are awarded points for actions and behaviors and special moments such as career milestones, service anniversaries and even birthdays. Sometimes, it is just a simple message of appreciation, or the recognition can be via Fueling Recognition Points.”

These points can then in turn be redeemed for items like gift cards, company swag, concert tickets and charitable donations.

“Since launching the program, we’ve consistently received positive feedback from team members, with many sharing that it has fostered a culture of gratitude and appreciation,” Cox said.

Pilot also launched a new onboarding program last year called the First Five program, which focuses on creating strong connections and training experiences for new hires during the first moments of employment.

The program includes elements like having lunch or a snack with a company leader to help make connections, ease anxiety and answer questions. It also involves working through a set of tasks shoulder to shoulder with a trainer and then building on that training over time.

“It has really helped improve our retention and reduce our turnover numbers,” Anderson said.

Pilot is also driving widespread team member-focused

changes across its sites as it looks to continuously improve guest and team member experiences, Cox noted.

The chain continues to expand team member benefits with options such as tuition reimbursement, parental leave, low-cost affordable healthcare plans, fuel discounts, and free meals and drinks for team members in-store during their shifts, among others.

“Many of those changes have come through listening as we create ways to ensure that our team members know that they matter,” Cox said.

For the fifth year in a row, Pilot was honored as part of Training magazine’s APEX Awards, which ranks companies’ excellence in employer-sponsored training and development programs.

“Companies are nothing but a compilation of people,” Wright said. “Everything starts and stops with people at Pilot. We say here that the P in Pilot stands for people. Our 30,000 team members make this place what it is. They create all the experiences. They serve the guests. They have all the best ideas. We just want to continue to honor and serve them, but harness their good ideas.”

Wright noted he wants employees to know that they work for a great company, that what they do matters, and that it makes a difference in North America’s economy and people’s lives.

“I tell our team every time I talk that they matter, that we don’t want people checking themselves at the door or at the parking lot,” he said. “Bring your full self to work, all your ideas, all your perspective, all your energy, all your thought. We need you to show up … because we’re counting on you.”

Pilot is committed to building an EV charging network across the country, leveraging its nationwide footprint. It’s in the process of installing 350-kilowatt EV fast chargers at up to 500 locations — 2,000 total chargers — in partnership with General Motors and EVgo.

“The purpose behind (this initiative) was to try to create the first coast-to-coast charging network, and we felt we were best positioned to partner with General Motors and EVgo because of our strategic locations along the interstate,” Wright said.

“When we look at when charging occurs, we see a significant increase in the number of charging sessions and energy dispensed on the weekends and holidays, which tells us that people do want to take their EVs outside the urban setting on longer trips,” Wright said. “We’re seeing early results that are positive.”

Wright noted that by the end of the decade he expects Pilot will have completed the work necessary to put a coast-to-coast charging network in place, potentially exceeding the 500 locations to get there.

“We’re committed to developing a network that accomplishes the coast-to-coast idea,” Wright said.

Pilot aims to meet customers where they are through gasoline, diesel and EV charging while remaining “fuel agnostic and customer focused,” Wright explained.

“There’s medium- to heavy-duty truck opportunities where we’re starting to think about hydrogen, so we’re really just focused on meeting the customer’s needs,” he said.

Pilot operates Pilot Energy, which handles supply, distribution and trucking. It has the third-largest tanker fleet in the country.

“We drop a load of fuel — anywhere from 7,000 to 9,000 gallons of diesel or gasoline — every 25 seconds,” Wright said.

As Wright looks ahead to the next 100 years, his main goal is to ensure Pilot remains relevant by staying in tune with changing customer demands while strengthening Pilot’s business-to-business relationships.

Wright is also optimizing Pilot’s core travel center business so it can continue to reinvest and provide the best customer experience going forward.

“We’ll be focusing on that over the next several years,” Wright said. “Then, making sure we’re listening to our customers and business-to-business partners and innovating for the future.”

“We’re excited for the future,” Wright added. “The opportunity we have to impact communities and people’s lives is the reason we show up. Our purpose statement is ‘Showing people they matter at every turn,’ and it’s something that we’re operationalizing.”

The concept, he noted is not just a saying or a bumper sticker slogan, but something that drives Pilot’s decisions.

“Everything we do involves thinking about how the decisions we make and the investments we put forward impact people’s lives, and that’s our team members, that’s our customers, and that’s our communities,” Wright said. “Everything is being structured around that. All of our initiatives, all our objectives, all of our key performance indicators, our compensation structures — everything is being structured by how we impact people.” CSD

Competition remains hot for packaged beverages in c-store cold vaults as better-for-you beverages heat up.

Anne Baye Ericksen • Contributing Editor

What do customers expect to see behind cold-vault doors? Soda, juice and water? Yes, of course, those products still command prime real estate in convenience stores. But over the years, ready-to-drink (RTD) coffees or teas and energy drinks squeezed their way onto shelves. Now, customers also seek out innovative concoctions such as rapid hydration drinks.

Finding the right inventory harmony between old favorites and new products within the packaged beverage category can be challenging as trends continue to evolve. So what’s the hottest craze right now for c-stores? Market research and store-level insights point to “better-foryou” quenchers.

From Your Friends at

Rutter’s packaged beverages outperformed last year’s numbers, especially the “rapid hydration” space.

At Rutter’s, virtually all packagedbeverage subcategories have outperformed last year’s numbers throughout the first three quarters of this year, noted Joe Bortner, senior category manager for the York, Pa.based chain, which owns and operates more than 80 stores in Pennsylvania, Maryland and West Virginia.

“None more than the ‘rapid hydration’ space,” he said. “Consumers are becoming more educated and aware of what they’re putting in their

bodies, which is leading into this functional beverage growth trend.”

Hydration beverages earned over $35 billion last year, and the subcategory could grow to nearly $59 billion by 2032, according to Precedence Research, a market research and consulting organization. These drinks are distinguished by ingredients to promote hydration benefits such as electrolytes — i.e., sodium, potassium and magnesium — and coconut water or fruit flavorings.

NielsenIQ data also showed a substantial uptick in two carbonated beverages that boast a wide range of natural components. Sales of Poppi by VNGR Beverages, which contains agave inulin, apple cider vinegar and fruit juice, posted year-over-year dollar sales gains of 167% for the 52 weeks ending Sept. 21 and a nearly 179% increase in volume, noted a Goldman Sachs Oct. 1 report.

It also registered triple-digit growth in the low-calorie carbonated beverage segment.

Low-calorie Olipop, featuring cassava root fiber and kudzu root extract among other ingredients, logged gains of 129% in dollar sales and 133% in volume for the same 52-week period.

Many other product groupings, including big-brand carbonated beverages and bottled water, showed nominal growth or posted losses.

Overall, the energy drink category grew 5% in dollar sales for the 52 weeks ending Sept. 21, 2024. Of note, Alani Nutrition finished with a 53% gain in dollar sales and 62% jump in volume.

Sales of RTD coffees have dipped. Circana research revealed that RTD cappuccino/iced coffee, cold brew and refrigerated RTD coffee fell in both dollar and unit sales for the 52 weeks ending Sept. 8.

“Brands within RTD coffee are all trying to figure out what resonates the most with consumers. The coffee subcategory is a relatively indulgent one, which combats where we’re seeing growth in the rest of the cold-vault category,” noted Bortner.

That said, he’s observed younger shoppers continue to show strong interest in the caffeinated drinks along with energy options.

“Gen Z will likely be the group that grows this category the most. Millennials and Gen Z are more af-

fluent with tech, and so we leverage targeted offers through our app and loyalty platform to create value and build the overall basket of the RTD coffee consumer,” said Bortner. “I think there’s something to be said that the consumer that was once seeking an RTD coffee beverage in the morning has shifted to drinking energy drinks. They’re able to source the caffeinated boost in morning without all the calories and sugar that are present in RTD coffees.”

Don’t count out the impact of seasonal promotions brewing business for coffees, however.

“Seasonal trends offer opportunities for packaged beverages and RTD coffee in the U.S. to engage consumers with unique and timely offerings,” said Kelsey Olsen,

Overall, the cold vault continues to pour on the profits for c-stores. Energy drinks saw the largest year-over-year growth with a 5% uptick in dollar sales.

• Hydration beverages earned more than $35 billion last year, per Precedence Research.

• Younger shoppers continue to show strong interest in caffeinated drinks and energy options.

• Packaging innovations outpace product or flavor launches.

food and drink analyst for Mintel. “Within coffee and RTD coffee innovation, consumers are most aligned on interest in new seasonal coffee flavors and seasonal coffee creamers, showcasing the appeal of seasonal innovation.”

Research also indicates packaging influences purchases, whether it’s varying sizes priced right or the use of sustainable materials. Actually, the packaging innovation trend is a carryover from last year.

“In 2023, new packaging led beverage launch types, surpassing new product varieties and range extensions,” said Olsen. “This shift indicates a strategic focus on packaging innovation as a means to capture consumer attention amid rising ingredient costs and inflation.” CSD

Transformative software solutions that deliver intelligent payments orchestration

C-stores that focus on key trends from visual appeal to competitive pricing stand to gain as dispensed beverages continue to evolve.

The dispensed beverage category in convenience stores is an evolving space, and the consumer preferences driving changes in the category offer insights into future opportunities for c-store operators.

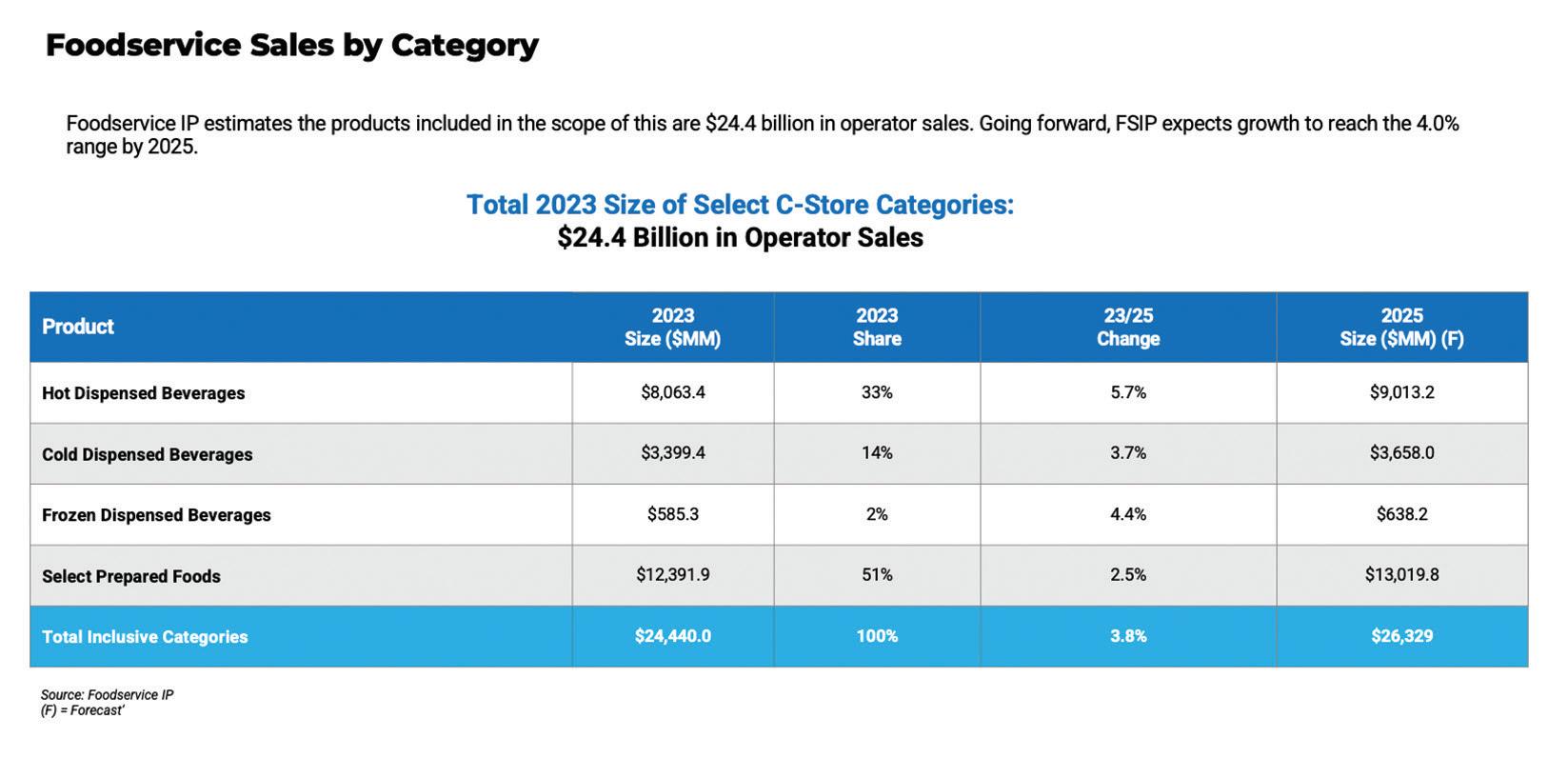

Here are five major trends impacting dispensed beverages in convenience stores today, with statistics from Foodservice IP’s recent research.

Options. Consumer preferences for healthier drink alternatives are reshaping the cold dispensed beverage market. While carbonated soft drinks (CSDs) continue to dominate with a 65% market share, an increasing number of c-store patrons are opting for healthier choices. According to recent data from Foodservice IP, 33% of cold dispensed beverage buyers chose something other than a soft drink, such as iced tea or water. Packaged beverage sales are also seeing a similar trend, with 44%

of consumers opting for non-soda drinks, such as energy drinks, water and iced coffee.

Operators are taking note of this trend and expanding their offerings to include, not only healthier options, but also beverages that cater to specific dietary preferences. For example, Texas Born (TXB) has introduced rehydration beverages in various flavors like strawberry and mango, along with proprietary “Made in Texas” sodas made from pure sugar cane. This movement toward healthier beverages aligns with broader foodservice trends where consumers are seeking out natural ingredients, organic products and non-GMO options.

Although price and convenience are critical factors for c-store patrons, the visual appeal of dispensed beverage areas can’t be overlooked. A significant 15% of consumers reported they didn’t purchase a drink because the beverage center did not look appealing. Operators are now recognizing that cleanliness and a well-organized beverage station are essential to driving sales. Beverage merchandising must be visually inviting, clean and neatly arranged, from the beverage fountains to the surrounding areas where patrons prepare their drinks.

C-store operators are investing in redesigns and better maintenance of

Q. If you did not purchase a DISPENSED HOT OR COLD BEVERAGE the most recent times you visited a convenience store, what were the main reasons? (Select up to three)

beverage stations. Brands like ExtraMile have launched extensive store image refresh programs, which include clear signage and dedicated zones for various beverage categories, such as the “Recharge Zone” for cold drinks and the “Fizz” area for cold and frozen dispensed beverages. This increased focus on the aesthetic and functional aspects of beverage merchandising helps elevate the overall shopping experience, attracting customers and encouraging impulse purchases.

3. Price Sensitivity and Promotional Offers Drive Sales. Price continues to be a primary driver for dispensed beverage sales in c-stores. More than half (56%) of consumers indicated that a price discount would motivate them to try a new item, while 49% noted that free samples would have the same effect. Given the thin profit margins in foodservice, c-store operators need to balance offering value to customers with managing food costs effectively.

Promotions, such as discounted beverage bundles or “buy one, get one” offers, remain effective tools for driving sales and encouraging trial of new beverage options. C-store operators are also leveraging loyalty programs, fostering repeat business and building long-term customer loyalty. These efforts are especially important as the cold dispensed beverage market is projected to grow by 3.7% to $3.6 billion by 2025, with price-sensitive promotions playing a key role in that growth.

4. Growth of Frozen and Specialty Beverages. Frozen dispensed beverages are a small yet significant segment in the c-store beverage landscape, representing about 8% of total dispensed beverage purchases.

Although niche, frozen drinks like slushies and milkshakes have strong appeal, particularly with younger consumers. Innovative c-store operators are expanding their frozen beverage offerings to include more specialized options, such as energy-infused slushies and bold, new flavors.

TXB, for instance, has introduced a range of new frozen drinks, including sour apple and strawberry lemonade flavors, and has added an energy-infused slushy called “Frazzle Energy” to its lineup. Meanwhile, QuickChek rolled out a zero-sugar frozen energy drink made with Prime Energy as part of its summer menu, highlighting the trend toward functional and specialty frozen drinks. Frozen dispensed beverages are expected to grow at a rate of 4.4%, reaching $638 million by 2025, driven by these innovative offerings.

5. Customization and Flavor Innovation. Customization and flavor innovation are becoming key differentiators in the dispensed beverage category. Consumers are seeking unique flavor combinations and the ability to personalize their drinks. C-store operators are capitalizing on this by offering diverse flavor options and integrating advanced beverage dispensers that allow customers to mix and match drinks.

Brands like TXB have expanded their soda fountain assortments with exclusive flavors like horchata, melon and hibiscus. Meanwhile, the introduction of new technologies enable c-stores to provide more exotic flavors in their dispensed beverages, offering a level of customization that rivals traditional restaurants and cafés. There is also a growing interest in beverages that combine both hydration and functionality, such as mocktails and beverages infused with vitamins, fruits and energy supplements. These functional drinks are resonating with health-conscious consumers looking for refreshing, yet beneficial, beverage options.

Dispensed beverages are a cornerstone of c-store foodservice, offering high margins and driving customer loyalty. The trends shaping the future of this category reflect broader shifts in consumer preferences, including a growing interest in healthier, customizable and visually appealing drinks. Operators who focus on cleanliness, visual appeal, competitive pricing and innovative offerings will be best positioned to capitalize on the ongoing evolution of this category. With the cold and frozen dispensed beverage markets expected to see steady growth through 2025, c-store operators have significant opportunities to capture a larger share of the foodservice market by responding to these emerging consumer trends.

Tim Powell is a principal with Foodservice IP, a research-based consulting firm based in Chicago. For more information contact Tim Powell (tpowell@foodserviceip.com) or learn more at Foodserviceip.com.

Premier Manufacturing is excited to introduce NIC-S®. Premium tobacco-free nicotine pouches backed by extensive scientific research, made with pharmaceutical grade nicotine, and is setting a higher standard for nicotine pouches.

PHARMACEUTICAL GRADE NICOTINE

6 FLAVOR PROFILES WITH 3 STRENGTHS (3MG, 6MG, AND 9MG)

EXTENDED NICOTINE RELEASE

LONG LASTING FLAVOR

PREMIUM SOFT POUCHES

C-stores are grappling with declining cigarette and cigar sales, rising tobacco prices and ongoing regulatory pressures as cost-conscious smokers look to deep-discount tobacco products.

Erin Del Conte • Editor-in-Chief

C-stores today are contending with declining cigarette volumes, price hikes on cigarettes and cigars, and a customer base that is becoming more health conscious and cost conscious. This shift in consumer behavior is driving a growing trend toward trading down to deep-discount products.

“Along with most of our market we

are seeing declining consumption in cigarettes due to increased health awareness and stricter regulations,” confirmed Hussein Yatim, VP of Yatco Energy, which operates 13 company-owned and -operated c-stores and six company-owned, dealer-operated sites in Massachusetts, Connecticut and Rhode Island. “Massachusetts, a few years

back, banned menthol and flavored tobacco, which shrunk the category from an assortment perspective and moved consumer dollars across state lines to purchase those products. Also, the steady price increases on cigarettes have lessened the purchasing power of consumers, which in turn leads to less packs being sold.”

Over the past two years, customers have been increasingly gravitating to the deep-discount tier, Don Burke, senior vice president of Management Science Associates (MSA), noted.

“What we’re seeing with cigarettes is that consumers are still continuing to buy down because of the current inflation level, which is mitigating somewhat, but given that credit is at an all-time high, consumers are feeling as if they have … less money in their pocket,” said Burke.

As a result, the deep-discount tier is performing better than other cigarette tiers, a trend he expects will continue in the near and mediumlength future.

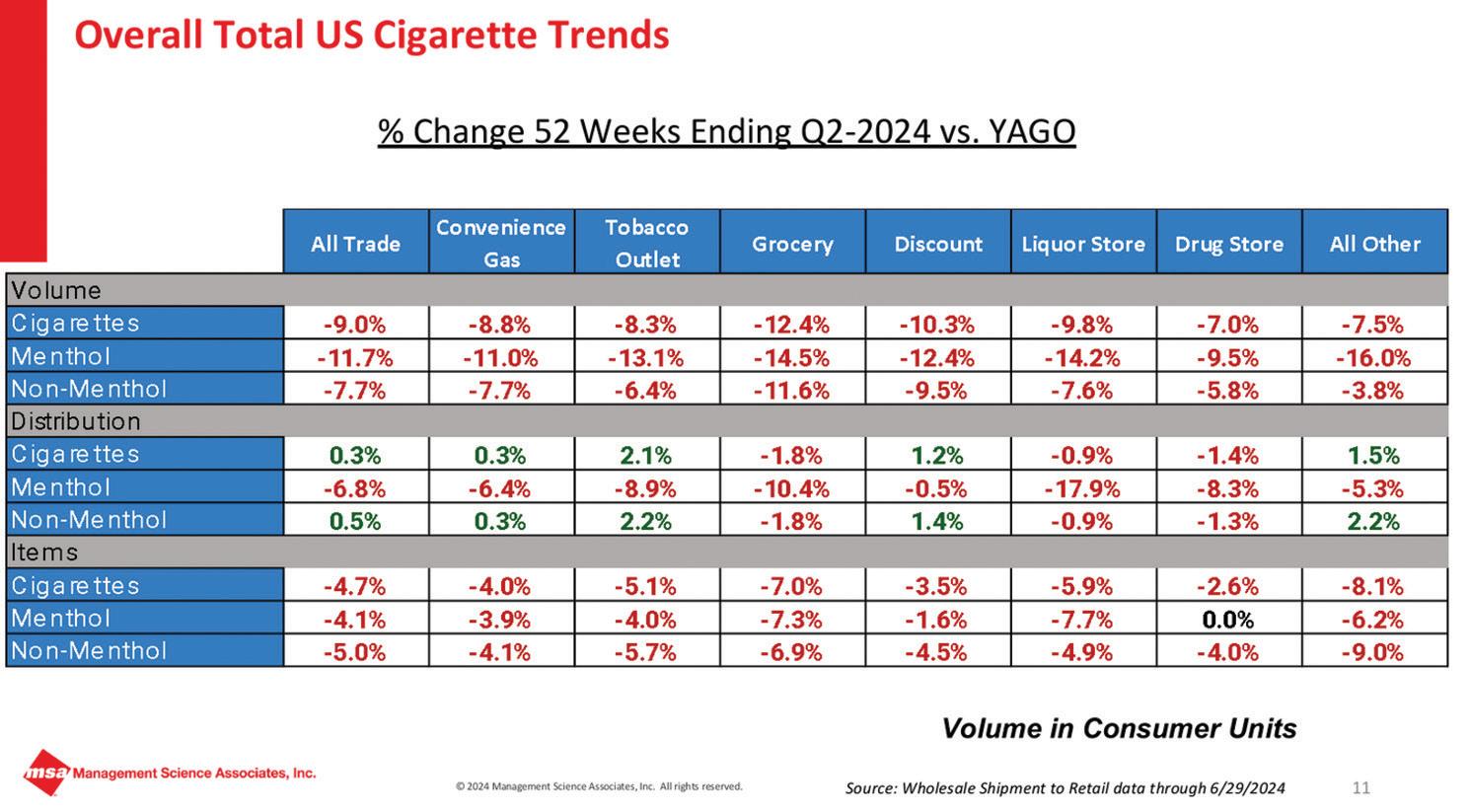

While all cigarette price tiers saw declines in Q2 of 2024, the deepdiscount tier held relatively steady (down 0.3%), followed by super premium (down 5.9%), discount (down 13.5%) and premium (down 13.6%) compared to the year prior, per distributor shipment data managed by MSA.

Super premium is declining at a lower level than premium and discount because most consumers who are smoking super premium have decided that if they’re going to pay so much for cigarettes, they’re going to buy the best regardless of cost, Burke pointed out.

“There are a lot more loyal consumers in the super-premium category than in any of the other price tiers,” Burke noted.

Yatim is seeing these trends play out at Yatco convenience stores. He agreed that more shoppers appear to be trading down due to economic pressures and rising prices on premium brands.

“This trend is particularly pronounced among price-sensitive smokers looking for more affordable options,” Yatim said. “Some customers in this segment still seek

Source: Distributor shipment data managed by Management Science Associates

a balance between quality and price, gravitating toward brands that offer perceived value without sacrificing too much on quality.”

Additionally, Yatim is seeing newer niche brands gaining traction by appealing to those consumers who are seeking unique flavors or experiences, even within the premium category.

“While some consumers may trade down, brand loyalty remains strong among certain demographics, particularly older smokers who prefer established brands,” he said.

Cigarette volume fell 9% across all trade channels and dropped 8.8% in the c-store channel for the 52 weeks ending June 29, compared to the year prior, according to MSA data. But Burke pointed out that while data sources across the board show cigarette declines in the high single digits, he believes that level is overstated because a significant part of the market is moving to the black or gray market due to local and state level bans and thus not being

tracked by data sources. Therefore, he estimated cigarette declines were actually between 4-7% through Q2. Burke pointed to the 2023 study commissioned by Altria Group Inc. that found evidence of a large illicit market for flavored e-vapor and menthol cigarette products in California following the 2022 ban on flavors in the state. The study was conducted by independent research firm WPSM Group, which collected 15,000 empty discarded cigarette packs and 4,529 e-vapor product packages between May 1 and June 28 across 10 California cities. The study concluded that the flavor ban had not dampened access or demand for menthol cigarettes. Only 45% of discarded cigarette packages had a California tax stamp, meaning the packs were stamped outside the state or not at all.

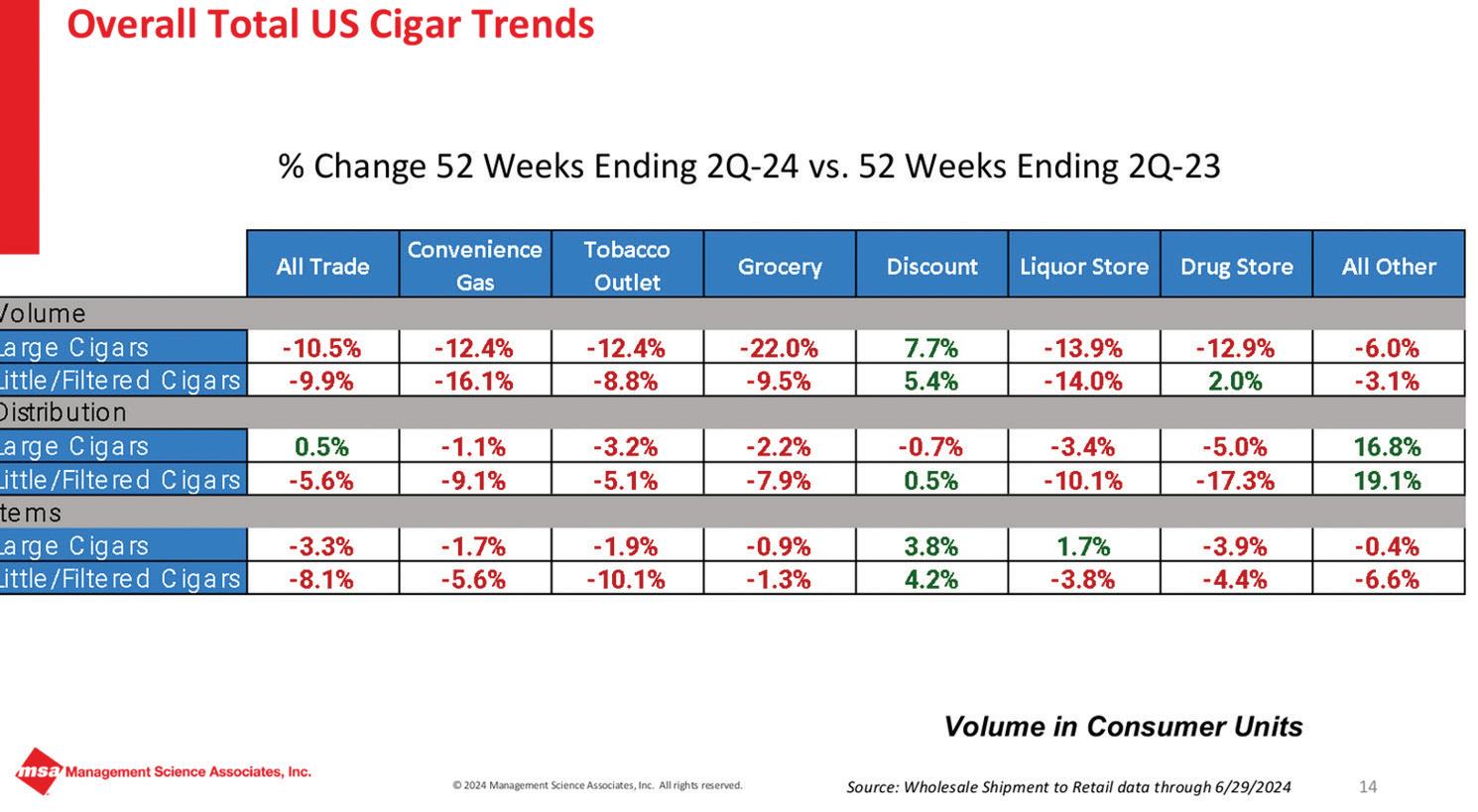

Cigar sales are struggling as well. For the first half of 2024, large cigars

(cigarillos) declined 10.5% across all trade channels and 12.4% in the c-store channel, while little filtered cigars were down 9.9% across all trade channels and down 16.1% in convenience stores, per MSA.

While little filtered cigars have been on the decline for a while, just a few years ago large-cigar sales were experiencing an upswing. Price increases across the cigar category could be behind the decline, Burke noted.

“Cigarette pricing has increased as well, and in many cases, the large manufacturers, when they increase cigarette (prices), they also do something on cigars. I do think that cigars have become a little more expensive,” he said.

Little filtered cigars tend to be packed in sticks of 20 and are smoked just like a cigarette, Burke noted. “What we’re seeing right now in little filtered cigars is that in most cases, the fourth-tier ciga-

rettes are very close in price to little filtered cigars, and therefore a lot of consumers have left little cigars and gone to just a regular cigarette,” he said, although he added in some municipalities there is still a price advantage to little cigars.

When it comes to large cigars, consumers today are seeking a natural leaf product, Burke noted, but he added most manufacturers making large cigars are experiencing some issues around production capabilities on natural leaf.

The popularity of natural leaf for large cigars, also known as cigarillos, is creating difficulties for many manufacturers in keeping up with the demand, he elaborated. “That could be impacting (sales) as well.”

While MSA doesn’t track price tiers in cigars, data is showing that across all tobacco segments customers are moving toward the deep-discount tier. Burke noted it is reasonable to assume that might be

Source: Distributor shipment data managed by Management Science Associates

happening in cigars as well where the lower-priced cigars are likely growing or not declining as much as other price tiers.

Retailers continue to await final rules on characterizing flavors in cigars and a menthol ban in cigarettes on the federal level. The Biden administration delayed finalization of the rules until after the election. David Spross, executive director of the National Association of Tobacco Outlets, recently pointed out three likely scenarios for what might happen around finalization. If VP Kamala Harris wins the election, it’s possible the rules could be finalized following the election. If VP Harris loses the election, the rules could be finalized before the new administration takes office. If Former President Donald Trump wins the election, his administration could hold the rules and prevent finalization.

“Regardless of when the rule is finalized, there will be an effective date of at least one year from pub-

lication, and this timing is likely to be extended due to expected Court challenges,” Spross explained.

Meanwhile, many retailers are contending with bans on the state and local levels.

“Many regions, if not already, are considering or implementing bans on flavored tobacco products, including cigars. This is aimed at reducing youth consumption and is a significant concern for brands offering flavored options,” Yatim noted.

C-stores are also grappling with rising taxes on tobacco products in various states and municipalities, which in turn impacts customer purchasing behavior, he added.

“Monitoring these changes is crucial for strategic pricing decisions,” Yatim said.

And that’s not all.

“Local jurisdictions are implementing stricter regulations on e-cigarettes and vaping products, including sales restrictions and advertising limits, which can have ripple effects on the broader tobacco market,” he said. “We are dealing with this in a

few of our stores. Some cities are enacting specific ordinances that affect where tobacco products can be sold and limiting the number of licenses granted for tobacco retailers.”

With a potential federal menthol ban on the horizon, attempts at state and local bans increasing, and a growing base of health-conscious shoppers, many retailers are watching tobacco-free and nicotine-free product developments that might appeal to former menthol cigarette smokers or smokers looking for a healthier option.

“Overall, smokers expect highquality products that deliver a consistent experience in terms of taste and performance,” Yatim said. “There is a growing demand for alternatives perceived as less harmful, such as e-cigarettes and heated tobacco products, as consumers seek safer choices.”

Yatco is among the convenience store chains adding tobacco-free products to its backbar.

“Many consumers are becoming more health conscious and are seeking alternatives that do not contain tobacco or nicotine, aiming to reduce their exposure to harmful substances,” Yatim said. “Many brands are increasingly developing a range of tobacco-free products, including herbal cigarettes and nicotine-free options that still provide a similar sensory experience.”

He also found that as regulations around tobacco products increase, offering nicotine-free options can help to navigate regulatory challenges while continuing to meet customer demand. “Also, in Massachusetts where flavored tobacco is banned, we are able to offer flavored tobacco-free products to diversify.” CSD

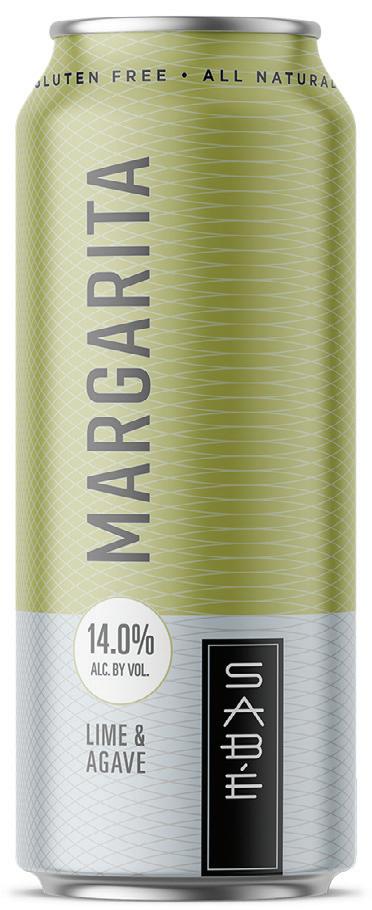

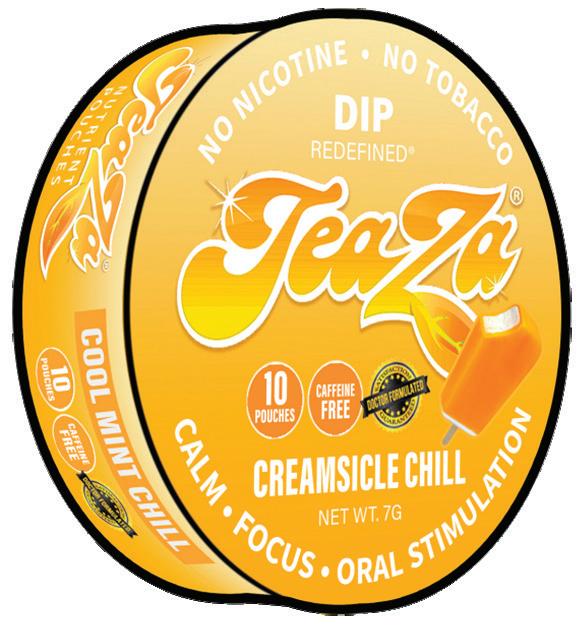

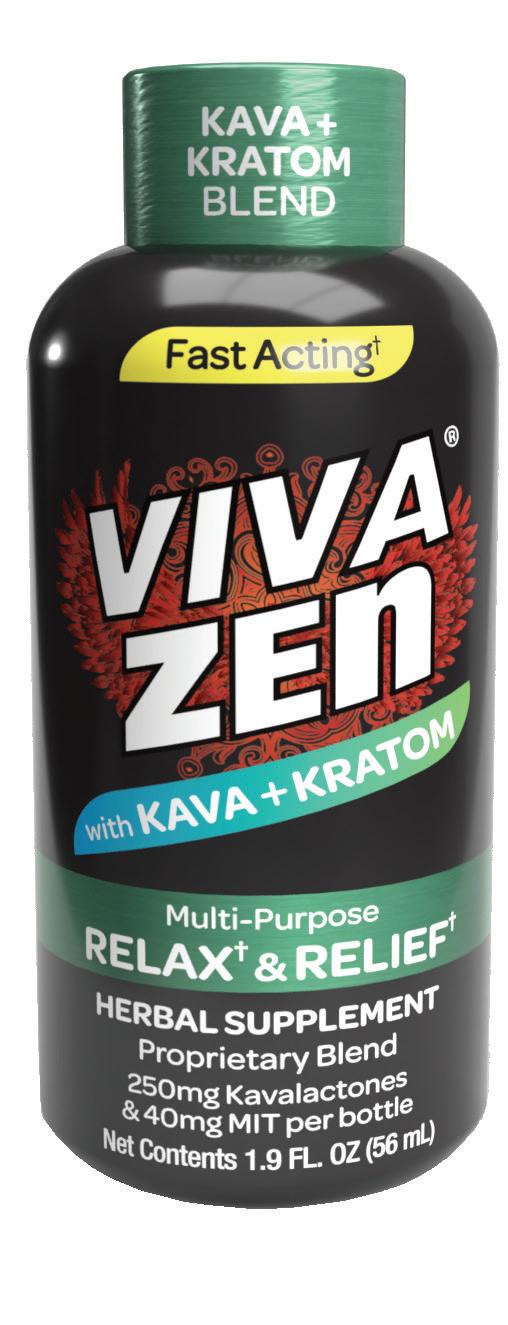

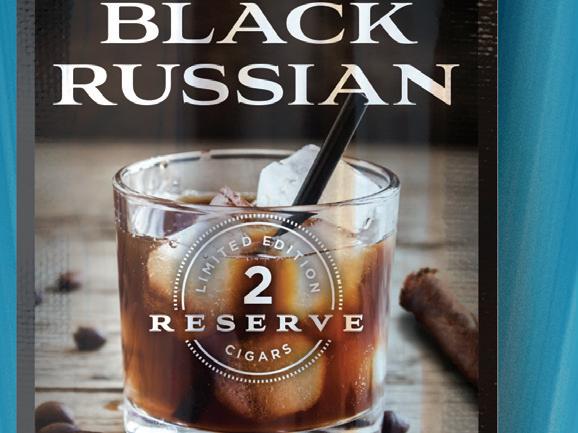

Winners were determined based on key factors for success at c-stores, including innovation, packaging and more.

Each year, thousands of new products and services enter the convenience store industry. But which ones will thrive in today’s competitive marketplace?

CStore Decisions’ 2024 Hot New Products Contest evaluated a number of new product launches and is awarding the products set for success at c-stores this year.

CStore Decisions received numerous entries across categories. A panel of retailer experts judged this year’s entries. Winners were determined using a point system that examined key factors for success, including innovation, packaging/ appearance and more. New products and services are defined as having launched in the past year.

Introducing the 2024 CStore Decisions Hot New Products contest winners...

Sigma’s sweet, crispy and creamy Dulce de Leche Churro Snack Bites are stuffed with dulce de leche filling then dusted with a flavorful, exterior churro-style coating, sprinkled with a hint of cinnamon and sugar. This unique, indulgent, bite-sized snack performs great under multiple heating applications and is perfect for consumers looking to savor a classic Mexican favorite, now in a convenient on-thego, portable format. Each package contains three 15-count one-ounce bites with 90 individual bites per case.

Sigma’s rich, sweet and creamy Chocolate Brownie Snack Bites are surrounded by a soft-baked brownie shell loaded with a thick,

ing. This unique, indulgent, craveable snack performs great under multiple heating applications and is ideal for consumers looking to savor a classic hot dessert, now in a convenient on-the-go, bite-sized, portable format. Each individually sealed package contains three 15-count one-ounce bites with 90 bites total per case.

Funfetti Cake Parfait is a decadent solution to meet the increasing demand for grab-and-go dessert options in cstores. The indulgent treat features layers of white cake loaded with colorful candy bits, icing and sprinkles, all packaged in a convenient 3.7-ounce cup. It’s an incredible option for laborchallenged c-stores looking to offer portable sweets. This snacking solution arrives frozen, fully finished and retail ready. The frozen shelf life is 365 days, 10 days refrigerated, and the parfaits come eight per case.

Enjoy the iconic sweet and savory flavor combination of chicken and waffles any time, any place, with quality all-whitemeat chicken and pockets of real cheese coated in an irresistible golden waffle batter breading with real maple sugar glaze.

This hot dog has more flavor than consumers thought possible, made with cumin, chili pepper, taco spices and whole chunks of real cheddar cheese. All of that is stuffed inside a beef and pork frank to deliver all the flavor with none of the mess.

These delectable Tornados are packed with the guilty-pleasure flavors of stadium nachos: seasoned ground beef; slightly spicy jalapeños; and, of course, that gooey, melty nacho cheese consumers crave. Operators can now easily bring on one of the most ubiquitous trending Mexican food forms in the U.S.

At Home Market Foods, we offer a huge selection of bold, blow-away flavors for every time of day, including award-winning products like these. Quality white meat chicken, pockets of real cheese, coated in waffle batter and real maple sugar glaze.

Cumin, chili pepper, taco spices and whole chunks of

cheddar cheese, all stuffed inside!

Home Market Foods Chicken Club RollerBites are stacked with classic club flavors uniting tender all-whitemeat chicken, crispy turkey bacon, pockets of real cheese and custom seasonings coated in a golden breaded exterior to satisfy consumers’ hunger mess free any time, any place.

Developed for the c-store, restaurant, college/university and foodservice distributor segments, Sigma’s four-ounce breakfast-style corn dogs are made with a fluffy, soft buttermilk pancake-flavored batter, wrapped around a hearty, savory all-pork sausage link, seasoned with black pepper and spices. This product provides operators with a protein-rich offering to be used on a variety of menus. Each fully cooked corn dog is ready to heat and serve, packed with eight corn dogs per inner package and 48 units per case.

Tyson Foods’ Hillshire Farm Stuffed Croissants are not the ordinary prebaked sandwiches. These stuffed croissants are premium quality and the ultimate high-protein comfort food from start to finish. While croissant sandwiches typically lean toward breakfast, the meat and cheese in the Hillshire Farm Stuffed Croissants stretch its craveability from brunch to lunch to dinner, too. Tyson Foods’ gourmet croissants require minimal prep, so no high labor cost for operators, just a highly portable, quality handheld protein grab-and-go snack for customers.

Introducing Market Sandwich’s new saucy sub flavors, including Smoked Turkey and Provolone with Dijon mustard sub sauce, Smoked Ham and Swiss with honey mustard sub sauce, and an Italian-Style Sub with Italian sub sauce. All three subs feature a 30-day shelf life helping to reduce waste and save on labor. This extended shelf life is achieved using modified atmosphere packaging. This innovative packaging solution slows spoilage, preserves product quality, and ensures that food remains appealing and edible for an extended period. The exceptional taste and convenience of these new subs enhance retailers’ on-the-go offerings, catering to busy consumers seeking quality and flavor in their meals.

Pierre Toasted Melts are grab-and-go sandwiches that come in specially designed paper wrappers that actually toast them to crispy perfection outside and cheesy, melty goodness inside — in the microwave. Customers will come back for their homemade flavor and their convenience. Pierre Toasted Melts are available in four flavors, all packed with protein and served between two buttered, grilled Texas Toast slices to deliver all-day sales. Pierre Toasted Melt flavors are: Classic Grilled Cheese, Cheesy Bacon, Philly Cheesesteak and BBQ Pulled Pork Melts.

by Ruiz Foods Inc.

On-the-go consumers will love snacking on these crispy, mess-free stuffed nachos from America’s No. 1 brand of frozen Mexican foods. Each bite is loaded with a threecheese blend, seasoned ground beef, mild jalapeños, tomatoes and Mexican spices. These are definitely “notcho” regular, messy nachos.

Rich’s Meat Trio Fully Topped Flatbread is the ideal pizza solution for c-stores looking to attract customers seeking a quick and easy lunch, dinner or snack. Made from quality ingredients, the 12-inch-by-five-inch rustic oval flatbread crust is topped with mozzarella and provolone cheese, pepperoni, Italian sausage, beef crumbles and a savory pizza sauce. Grill marks on the bottom add to the premium appearance. Perfect for a hot slice program or as a take-and-bake option, it goes from freezer to oven for an easy meal solution. Each retailready flatbread is individually wrapped with a label on the bottom. The Meat Trio Fully Topped Flatbread is 10.45 ounces, 10 per case, with a suggested retail price of $5.49.

Cheesewich Factory’s Breakfast Taco provides the highest-quality grab-and-go snacks for the health-conscious fast-paced consumer — a taste that adults and children both love. Cheesewich Factory’s Breakfast Taco consists of three slices, which includes uncured turkey bacon, a scrambled egg and Colby Jack cheese on a flour tortilla.

In September of 2023, Chester’s introduced a labor-saving frozen poultry solution for its operators. Chester’s frozen marinated chicken breast chunks provide a high-quality solution for serving boneless chicken bites. The Chester’s frozen breast chunks have a oneyear shelf life, reducing the complexity of managing fresh poultry. This product also offers stabilized pricing, allowing operators to manage food costs, and it is flatpack frozen in individually sealed five-pound bags for quick, easy thawing.

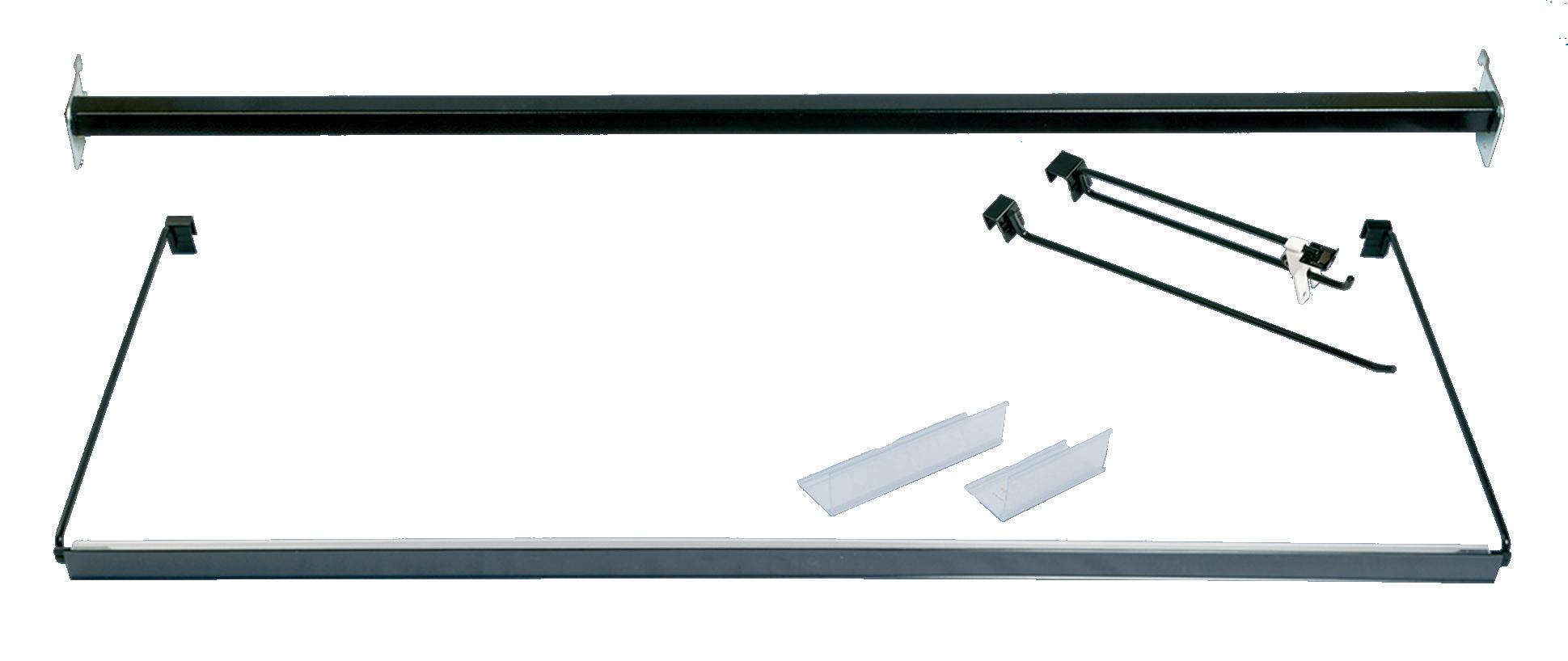

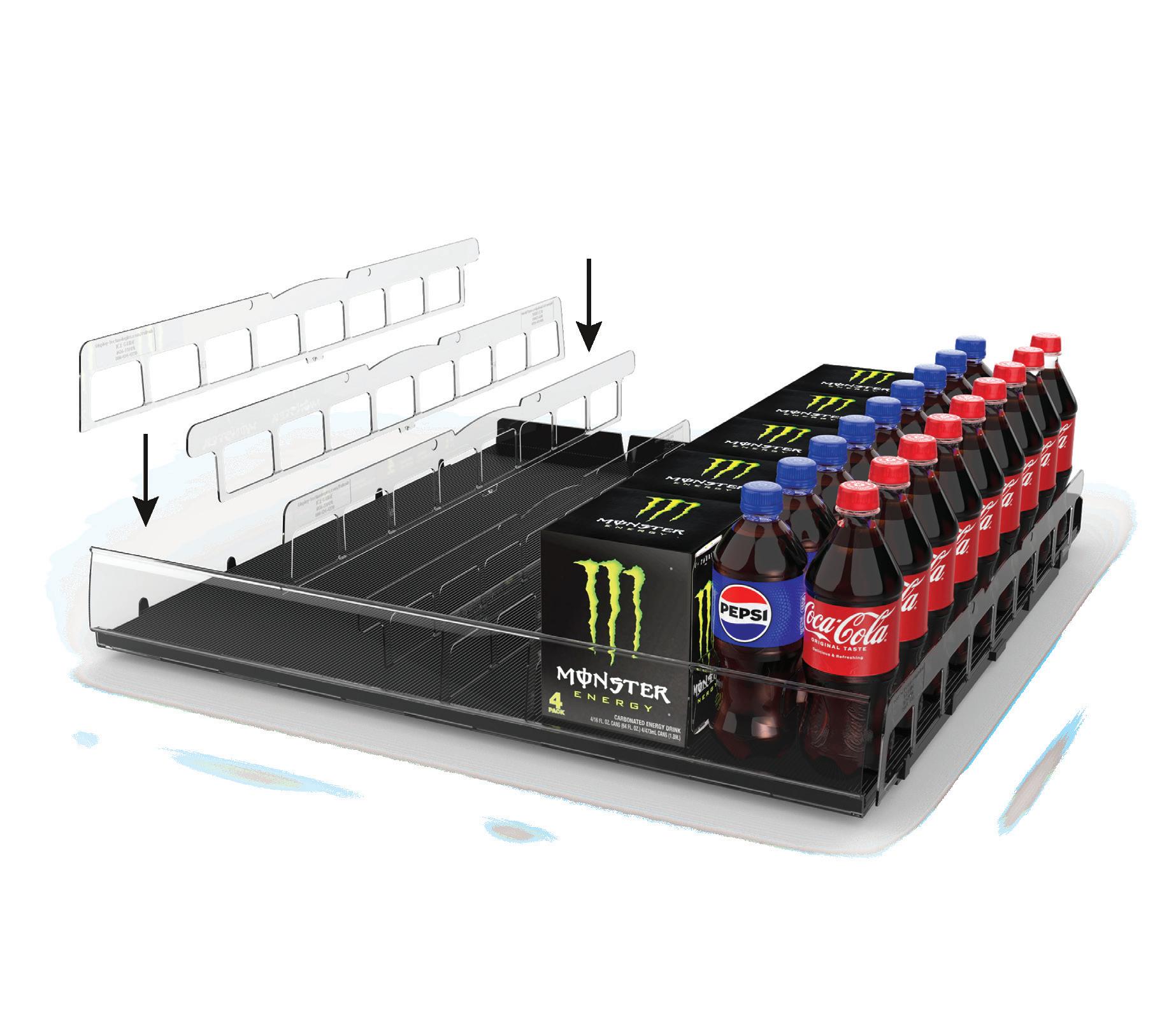

Standard Tray with Finger Product Stop Mini Tray

Dual Lane Tray

n Made from U.S. steel and heavy-duty wire frames.

n Multiple-depths range from 13" to 24".

n Adjustable-widths adapt from 1 3/4" to 17 1/2".

n Tool-free installation.

n Bar and shelf capable.

n Auto feed any product.

Radius or Square Tray Sidewalls

Oversize

Double-Wide Tray

Standard Tray with Locking, Molded Pusher

n Fit many more items, sell families of products in different sizes and increase impulse buying with cross-sells and adjacencies.

n Asymmetrical lanes sell different-width products.

n Each lane adjusts to fit products as small as 13/4" wide.

n Unique design features a separate paddle to push each item forward individually in its own lane.

Improve rotation and reduce shrinkage

WonderBar® Trays

n Face more packages, accommodate a wider range of shapes and sizes, restock easily, and manage dated produce better.

n Air baffles maintain product temperature and extend shelf life.

n Durable cooler-capable steel construction ensures long life.

n Trays lift out for rear restocking and proper rotation.

n Versatile spring tension is gentle on delicate produce.

Expandable Wire Tray for refrigerated retail

n Quick drop-on, one-piece installation.

n Accommodates any style or size package adjusting from 3 3/8" to 17 1/2" lane width.

n Various built-in mounting capabilities available based on shelf component.

n Molded pusher paddle available, both locking and non-locking styles with wire- or metal-sided trays.

n Auto feed any product.

n Clear or Imprinted Front Product Stops.

n Vends oversize items like pizza.

n A simple, inexpensive design.

n Use with Quick Back® to maximize product density, provide easy mounting and relocation of stocked hooks in tight places, under shelves or in fully loaded displays, and speed re-merchandising and display changeover.

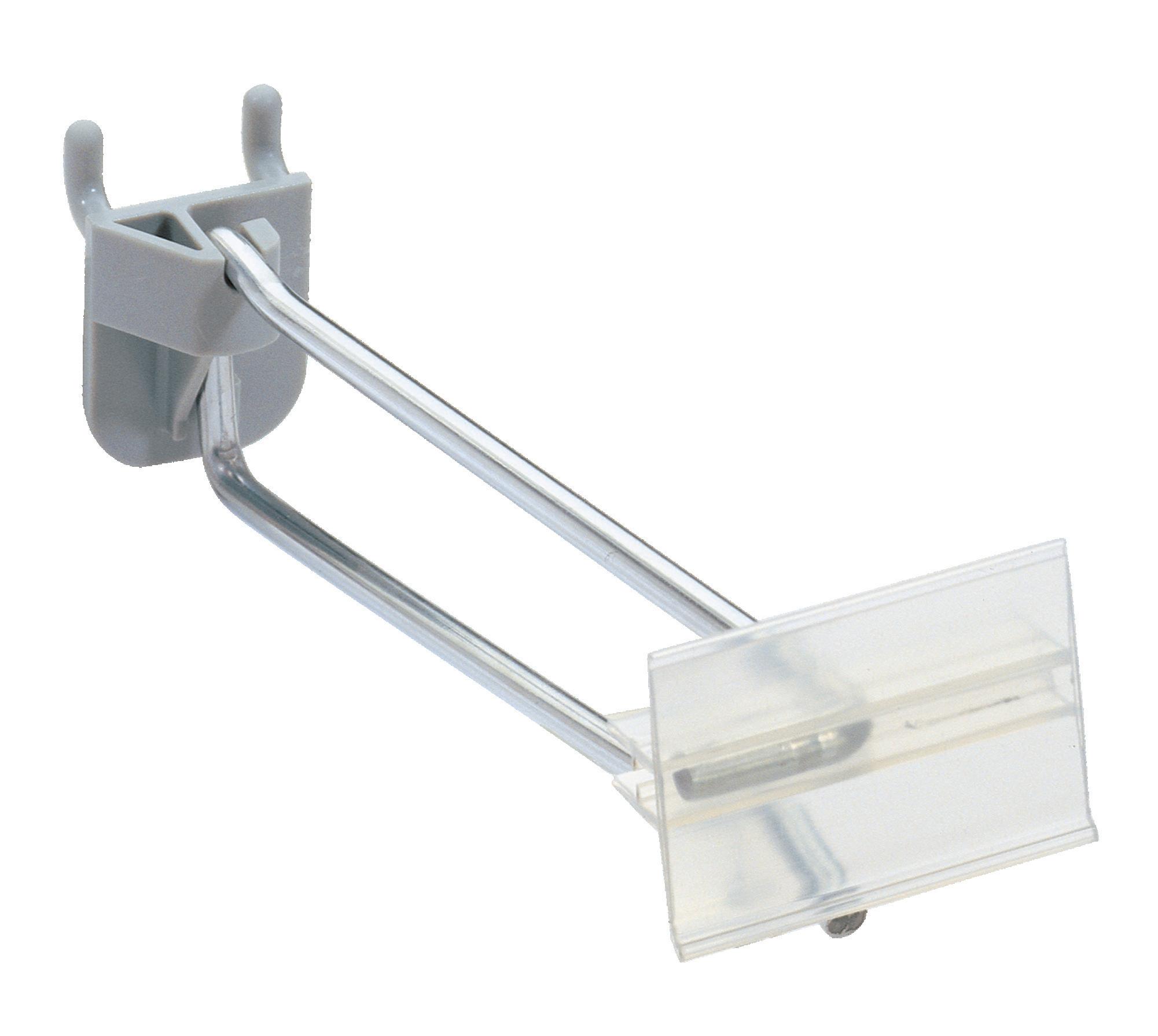

Right Angle Label Holder Hook

Economical

All Wire Hook

Slatwall Hooks

n Safer, rounded Ball-End Tips are available on all hooks at no extra charge and no minimum order.

n Use the Peg Hook Overlay to quickly convert All Wire Hooks to Scan Hooks.

n Standard and Gravity-Feed options keep items forwarded and automatically faced.

n Tool-free installation on most common gondola and cooler uprights.

n Stocked in 4 lengths compatible with all standard shelf sizes allowing mixed use in display.

Flip-front Label Holder swings up for easy access and product removal.

Anti-theft security hooks

n Easy-to-use, inexpensive key-lock system.

n Prevent the removal of any stock or display 1 or 2 items unlocked to prevent sweeping.

Anti-Sweep™ Hooks

n Camel-back profile prevents sweeping while providing direct access for customers.

n Flip Scan® Label Holder swings up and out of the way.

n Use of plain-paper labels can save up to 65% on labels and up to 75% on labor.

AMT ® for dairy, freezer and center store

n Molded-in openings improve refrigeration air circulation.

n Top-tier sidewall available for support and containment of tall or multi-tier products.

n Adjustable width trays, designed for yogurts, ice cream, and other difficult to organize products.

n Trays lift out with easy-grip handles to allow quick restocking or cleaning.

The complete shelf edge labeling system

n Easy-to-use design flexes open at a touch for fast, drop-in, plain-paper labeling, then automatically springs shut to secure the label in place.

n Unsurpassed range of sizes, styles & lengths.

n Labels shielded from dirt, spills, moisture & wear so they last longer, read easier & scan more accurately.

n Long lasting PVC construction retains “memory” and shape, resists yellowing, darkening & aging.

Choice of magnetic, adhesive or clip-on mounting systems.

Culinary Tamper Safe anti-fog, vented polypropylene containers withstand temperatures to 230 degrees Fahrenheit, enabling tamper-evident security for hot or cold case display. They are perfect for hot and cold foods and microwave safe. Culinary Tamper Safe containers protect food quality and provide easy, convenient storage of leftovers. The clear nine-inch-by-nine-inch one-compartment and three-compartment options provide flexibility for single and multiple portions in an easy-to-eat on-the-go shape. The 100% homopolymer design meets recyclability design guidelines, and the intuitive “hold and lift,” no-tear-strip tamper-evident design means no loose tear-strip waste. Dishwasher safe for consumer reuse, Culinary Tamper Safe packages remain eligible for home curbside recycling after multiple uses.

Introducing the new PrimeWare Cellulosic Compostable Straw from ACR. Crystal clear and crafted from cellulosic material, this groundbreaking straw combines the performance of a plastic straw with the sustainability footprint of a paper straw. C-stores now can align with consumer preferences for eco-friendly products while providing an exceptional user experience.

Available in four in-demand sizes, the innovative PrimeWare Compostable Straw addresses the pressing need for eco-friendly alternatives to traditional single-use plastic straws. These revolutionary straws boast the same durability, flexibility and functionality as plastic straws. Unlike paper straws that can become soggy and deteriorate quickly, the PrimeWare compostable straw maintains its integrity, providing an exceptional drinking experience.

With a strong commitment to sustainability, the PrimeWare compostable straw has obtained both the BPI Industrial Compostability Certification and TUV OK Home Compostable Certification, guaranteeing the highest compostability standards.

Werner Gourmet Meat Snacks start with premium beef, season it with its family’s own blend of spices, then natural-woodsmoke it to perfection. Slightly sweet with a warm-burn finish, Werner Gourmet Meat Snacks’ Sweet Smoked Jalapeño jerky is so delicioso, consumers won’t mind that Werner Gourmet Meat Snacks turned up the heat a bit. It is currently available in its four-ounce one-fourth pound and eightounce one-half-pound packages. Both package sizes come in a shelf-ready display case with a 12, four-ounce case pack for the four ounces and an eight, eight-ounce case pack for the eight-ounce package.

by Fiorucci Foods, Inc.

Create a party tray instantly with Fiorucci Foods’ new Fiorucci Paninos Party Pack, featuring three meat-and-cheese combinations that are ready to serve and eat anytime. Each 15-ounce package contains seven hand-wrapped rolls of pepperoni, prosciutto and hard salami, all surrounding individual sticks of creamy white mozzarella cheese. Made from pork containing no artificial flavors, colors or ingredients, the zesty pepperoni, silky prosciutto and smoky hard salami are all made from select cuts of pork that are cured, aged and spiced using classic Italian recipes then wrapped around cool, buttery mozzarella. Each serving is an excellent source of calcium and protein, gluten free, low-carb, keto friendly and contains zero grams of sugar. This product is great for c-store customers on the go looking at snacks for the whole family or to entertain and socially connect with their colleagues and friends.

by Pearson Ranch Elk & Bison Jerky

Pearson Ranch Duck Snack Sticks three-ounce packages are the ultimate blend of flavor, nutri tion and heritage. Plus, they’re seasoned to perfection with sea salt, adding just the right amount of savory goodness. These sticks are gluten free, soy free and contain no monosodium glutamate (MSG). Pearson Ranch also skipped the nitrites and nitrates so consumers can snack guilt free.

Werner Gourmet

Werner Gourmet Meat Snacks start with premium beef, season it with its own blend of spices, then natural-wood-smoke it to spicy perfection. So spicy with a hint of sweet, it’s an oasis for consumers’ tastebuds.

Werner All Natural Mango Habanero Beef Jerky is currently available in an eightounce half-pound package with an eight, eight-ounce case pack shelf-ready display.

Each nut is specially roasted to have its own unique flavor — which makes them perfect to snack on individually, but even better when enjoyed together for the most dynamic of duos. The combination of flavors and crunchy textures in these duos satisfies on any occasion, whether consumers are feeling fancy or not. A convenient shelf-stable, resealable bag keeps these nut duos fresh and handy as snacks for road trips, offices, lunchboxes and more.

Tastebuds deserve a revolution not repetition. With an innovative blend of fresh citrus and savory pepper, OMG! Pretzels Lemon Pepper variety boasts a two-note tasting experience. Every bite of these scrumptious and tangy sourdough pretzel nuggets has a sweet and peppery goodness to remind consumers of sunshine and summertime. Made from family recipes without artificial ingredients and a light, airy crunch, OMG! Pretzels are the only authentically aged, seasoned sourdough pretzel nuggets on the market.

It is available now in one-ounce, 4.4-ounce and 6.7-ounce bags. Data shows consumers want flavorful, better-for-you and ready-to-eat popcorn options. Consumers find cheddar jalapeño to be on brand and appealing for SkinnyPop. Using jalapeño to add spice reinforces the use of natural ingredients. The flavor is appealing, with the creaminess of cheddar balancing jalapeño heat.

by Kellanova

Apple Jacks Pop-Tarts packs a punch with two consumer favorites in one: a perfectly balanced snack full of warm cinnamon aroma and sweet apple flavor, just like the classic cereal. They feature green- and orange-sprinkled frosting and are perfect at breakfast or a snack any time of day. Apple Jacks Pop-Tarts is the No. 4 Portable Wholesome Snacks innovation item in 2024 across all manufacturers, per Nielsen Discover, Total U.S. Convenience data, year-to-date, for the latest 16 weeks ending April 20, 2024.

by Oh Snap! Pickling LLC

The perfect snack in a snap — Tangerine Cranberry Sweeties. Oh Snap! starts with plump cranberries, removes the tart juice and then infuses them using a proprietary process with a fruity, flavorful blend of juice for a delight in every bite. The result is a sweet, dreamy new taste that’s absolutely irresistible. These Tangerine Cranberry Sweeties are gluten free, fat free, vegan and only 50 calories for guilt free snacking. With consumers continuously looking for healthier and better-for-you options, Oh Snap! Sweeties are a great snack on their own or as a super tasty compliment to salads, yogurt, oatmeal and so much more. On top of all that, Sweeties are packaged for grab and go in a convenient, single-serve pouch for peak portability to wherever consumers’ taste buds take them.