Researchers evaluate the effects of heat stress in poults

Seeking sustainability in the poultry industry

Broiler vitamin nutrition guidelines

7/8

2023

Zootecnica International –July/August 2023 –POSTE ITALIANE Spa –Spedizione in Abbonamento Postale 70%, Firenze

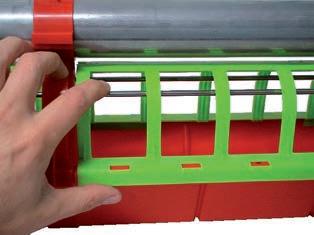

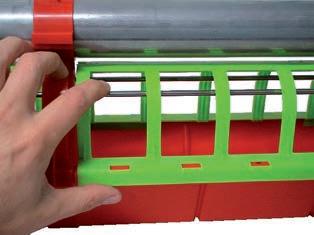

The

new

feeders

of the «Gió» range, specifically developed for great poultry farms, thanks to the easiness in the regulation of the feed and to the absence of grill (that avoid chicks perching) have many advantages: they are easy to use and their cleaning is extremely easy and fast too, leading to an overall reduction in labour costs.

CODAF Poultry Equipment Manufacturers • Via Cavour, 74/76 • 25010 Isorella (Brescia), ITALY Tel. +39 030 9958156 • Fax: +39 030 9952810 • info@codaf.net • www.codaf.net

EDITORIAL

What happens today with the use of electronic devices that monitor the functions of us human beings (just think of the new watches that control the number of steps, heartbeats, blood pressure, calories consumed, sleep quality and much more) are equally in recent years also being applied on modern livestock farms. In fact, the use of digital technologies has long been aimed at improving breeding management, evolving and increasingly refining its characteristics. In this regard, we are talking about PLF (Precision Livestock Farming), i.e. a set of farming techniques aimed at improving production efficiency, while protecting animal welfare. This technique, thanks to the use of hardware and software, makes it possible to collect data and compare the findings in order to highlight signs, trends, anomalies etc which can be extremely useful for observing, controlling and managing farms in the best possible way.

Increasing animal welfare and breeding productivity also has a substantial value for the European economy - just think that according to the European Commission, poultry farms have quadrupled in recent years compared to the figure for five to six years ago. With these numbers it is easy to understand how these devices, which collect and transmit information generated by animal behaviour, can be of help to the poultry supply chain. In fact, precision breeding management not only increases animal welfare, allowing intervention to resolve any critical issues, but also allows for greater production efficiency, with enormous savings in time and costs.

DELIVERING

IMPROVED PRODUCTIVITY AND SUSTAINABILITY for

19

REDUCED

28%LESS

in live weight, shorter grow-out periods and reduced feed production and transport =

%

Progress

19

LOWER ENERGY USE

POLLUTION

FCR = Better nutrient utilization

POTENTIAL Better

NITRATE/ PHOSPHATE EXCRETION

%

GREENHOUSE

FCR and shorter grow-out time = REDUCED GLOBAL WARMING POTENTIAL LESS FEED MEANS...

TRIPS

raw materials and feed for broilers Improved FCR = a 2.5 kg (5.5 lb) broiler consuming... 0.8 kg 1.7 lb LESS FEED required for the production of broiler feed 42% LESS AGRICULTURAL LAND REDUCED LAND USE & TRANSPORTATION

LESS

GASES PRODUCED Improved

FEWER ROAD

delivering

the broiler industry

the past 20 years

THE PLANET FOR FUTURE GENERATIONS while increasing livability, health and welfare through balanced selection The modern broiler is more biologically e cient Per kg of live weight, it requires... IMPROVED PERFORMANCE required per 1.0kg (2.2 lb) broiler 320 g 0.7 lb LESS FEED WATER USAGE BETTER WATER INTAKE = Better gut health Better litter quality Better footpad health More e cient/sustainable water use

over

PROTECTING

VIEW ONLINE 18.3% 40 EXTRA TOTAL EVISCERATED YIELD g 0.09 lb LESS WATER 0.15 US gal 0.57L

Find out more about how Aviagen® protects the planet for future generations

SUMMARY WORLDWIDE NEWS ......................................................................... 4 COMPANY NEWS 8 REPORTAGE FAO highlights contribution of animal source foods to healthy diets 10 Aviagen Turkeys Breeding Seminar - Montevarchi (AR), Italy .......................... 12 FIELD CASE Feed shortages exerts pressure on Egypt’s poultry industry 14 DOSSIER Researchers evaluate the effects of heat stress in poults 18 FOCUS Seeking sustainability in the poultry industry 20 MARKETING The remarkable dynamics of the global poultry industry: 50 years in retrospective Part 2 – Global poultry meat production ......................................................... 24 TECHNICAL COLUMN Lining hatcher baskets with paper ................................................................. 34 NUTRITION Broiler vitamin nutrition guidelines ................................................................. 36 MARKET GUIDE 44 UPCOMING EVENTS ......................................................................47 INTERNET GUIDE 48 36 18 20

Detection of antibodies against Chlamydia species in

chicken serum

Avian chlamydiosis is a bacterial infection caused by Chlamydia bacteria. The currently available tests distinguish Chlamydia species based on genetic material. Researchers from Wageningen Bioveterinary Research (WBVR) developed a test based on antibodies present in animal blood that can determine which Chlamydia species infected the animal.

Chlamydia bacteria are gram-negative, intracellular bacteria. The bacterial genus currently consists of fourteen species, each with its own preferred host. A number of these species can not only cause disease in their preferred hosts, but also have zoonotic potential. The infamous zoonotic species Chlamydia psittaci has been found in hundreds of bird species, including poultry. This bacterium can cause a severe form of pneumonia in humans, known as parrot fever.

Differentiate between species

C. gallinacea and C. psittaci can infect birds, but both species differ in epidemiology and zoonotic potential. It is therefore important to have diagnostic tools which enable detection and distinction between the bacteria species in poultry. The available tests are based on molecular methods (DNA). These tests only provide information about

the current infection status of animals, and work if there are enough bacteria in the samples taken.

A team of WBVR researchers led by Marloes Heijne and Fimme Jan van der Wal*, investigated whether it is possible to develop a test to detect antibodies against Chlamydia species in poultry. “Serology is suitable for monitoring flocks, as antibodies remain present for a long time after an infection,” explains Heijne. “At present, no differentiating test is available for Chlamydia serology.”

New test

To enable differentiating serology, a suspension array was designed, with peptides as antigens. These peptides are derived from known immunoreactive Chlamydia proteins. For the majority of these peptides, species-specific seroreactivity in mammalian sera has been described

4 - worldwide newsWORLDWIDE NEWS

©Australian Eggs

in the literature. For the suspension array, the peptides were immobilised on different coloured spheres, a mix of which was added to serum to capture the species-specific antibodies. “In fact, a serological suspension array is similar to an ELISA. However, using the array one can perform multiple ELISA’s for one sample simultaneously, in one reaction. For read-out of the assay we use dedicated equipment, a Luminex”, Heijne explains. With a number of additional measures, the test was made suitable for use in several animal species. “In our study, we showed that a number of peptides, which have been used in the literature as antigens for Chlamydia serology in mammals, also function in detecting and differentiating antibodies against the two for poultry important Chlamydia species.”

Conclusions

The suspension array can identify antibodies of four different Chlamydia

test is also able to distinguish between antibodies of C. psittaci and C. gallinacea in chicken sera. Because the reactivity of chicken sera was not the same as that of mice, signals from chicken sera from the field were difficult to interpret.

“Well-characterised chicken sera for evaluating the seroreactivity of the peptides are scarce. Nevertheless, results with field sera are consistent with published data on the occurrence of C. gallinacea in Dutch laying hens. With this, we have demonstrated the proof of concept of differentiating serology for antibodies against Chlamydia in poultry using peptides in a suspension array.”

* WBVR researcher Fimme Jan van der Wal is first author of the scientific publication, published in Veterinary

DRINKING FOR TURKEY EASYLINE 2.0

Consisting of a system with the pendulum as the main element, which ensures a perfect water supply at all times.

• The pendulum is activated every time the animal moves it with its head to drink.

• The new pendulum with two nipples guarantees even grater reliability of the drinker, both in terms of durability and ease manintenance.

• Cleaner litter and the best results in both the rearing and finishing phases at every age of the turkey.

WORLDWIDE NEWS

!lanigirO

Via Marco Polo, 33 - 35011 - Campodarsego (PD) ITALIA +39 0499202290 - lubingsystem.com - info@lubing.it

Avian Influenza decreases in poultry in Europe, seagulls heavily affected

The number of highly pathogenic Avian Influenza (HPAI) outbreaks in poultry has decreased in Europe but seagulls continue to be heavily affected by the virus. The risk to the general public in Europe remains low.

These are the main findings from the latest report on Avian Influenza by the European Food Safety Authority (EFSA), the European Centre for Disease Prevention and Control (ECDC), and the EU reference laboratory (EURL).

Poultry outbreaks occurred less frequently in March and April compared to the previous reporting period (3 December 2022 to 1 March 2023) and compared to spring 2022. The detection of cases in wild birds in March and April decreased compared to the previous reporting period but increased compared to spring 2022.

The virus showed signs of being well adapted to wild birds, heavily affecting black-headed gulls and increasing the mortality of threatened wild species such

as the peregrine falcon. HPAI continued to expand in the Americas and is expected to reach the Antarctic in the near future. Infections were detected in six new mammal species for the first time, including marine mammals and mustelids. Two cases were reported in cats in the USA and one case in a dog in Canada. As a precautionary measure, EFSA recommends preventing pets from being exposed to dead or diseased animals in areas affected by HPAI.

The risk to the general public in Europe remains low, and low to moderate for workers and other people in contact with potentially infected diseased and dead birds and mammals.

6 - worldwide newsWORLDWIDE NEWS

Equal, controlled and immediate distribution throughout the line.

The obstacle-free linear trough feeder allows an easy access for the animals which can easily spot the feed.

WATCH THE VIDEO explaining how the BREEDAZA system works

Manufactured from sturdy light plastic material for easy winching.

Easy cleaning and no residual feed inside the trough.

- july/august 2023WORLDWIDE NEWS AZA International s.r.l. Via Roma 29 24030 Medolago (BG) Italy Phone (+39) 035 - 901240 - E-mail: info@azainternational.it QUALITY MADE IN ITALY www.azainternational.it BREEDAZA

& poultry

Leader in pig

equipment

WANT AZA!

The innovative linear trough feeder I

THE REVOLUTIONARY RATIONING SYSTEM FOR BROILER BREEDERS AND LAYERS

ADJUSTABLE ANTI-COCK GRID NO OBSTACLE INSIDE EASY ACCESS TO FEED

GALVANISED STEEL MODEL

Expanding poultry processor commits to sustainability and

robotics

Avicarvil is a leading poultry producer, processor and retailer in Romania with an annual farming and processing capacity of over 30 million chickens/year. The company plans to double this capacity in the years to come by building a greenfield processing plant in close collaboration with Marel.

and ensures a good return on investment. By combining robotics and software, RoboBatcher optimizes the processing time, quality and safety of our products. In addition, Innova software will help us make data-driven, timely decisions, reduce costs, and increase our competitiveness.”

Sustainability trends

In Vâlcea County, Avicarvil will build the most modern poultry processing plant in South-Eastern Europe. Covering an area of 25,000 m2, it will be the largest chicken meat production unit in Romania.

First choice

The Avicarvil plant needed to expand to ensure competitiveness against international competition, producing more chicken of higher quality. Andrei Brumaru, executive director of the overarching Carmistin Group, explains, “For the best results and the best return on our investment, we decided to cooperate with Marel. For our new plant, we compared the efficiency of the lines in our two existing processing plants. Marel’s line was clearly superior and our first choice to equip our third processing plant with a capacity of 13,500 bph.”

The new project

The automated processing lines include robotization with Marel’s RoboBatcher. “The RoboBatcher in the filleting line makes a big difference in the speed and accuracy

“Our investments aim to mitigate climate change. We implement systems and technologies to optimize energy use and water consumption. Marel Water Treatment will build an innovative system for collecting, treating and reusing water, fully complying with the regulations in force. The significant amount of recycled water returning will result in 80% less water consumption,” says Andrei Brumaru.

The process

In Avicarvil’s new plant, the process starts with ATLAS, the most sustainable and humane live bird handling system in the industry. This is followed by Marel’s stunning, scalding, plucking and evisceration solutions, including the brand-new, intelligent Nuova-i eviscerator. The primary process is monitored real-time by IMPAQT software. After combined in-line immersion and air chilling, products are cut up in two ACM-NT lines and deboned in three AMF-i breast filleting systems. Then five Multihead Weighers and a RoboBatcher batch and pack the products. Marel checkweighers and labelers finish the process.

For more information: marel.com/poultry or carmistin.ro

8 - company newsCOMPANY NEWS

- july/august 2023COMPANY NEWS www.hubbardbreeders.com

FAO highlights contribution of animal source foods to healthy diets

FAO’s Committee on Agriculture requested a comprehensive, science- and evidence-based global assessment of the contribution of livestock to food security, sustainable food systems, nutrition and healthy diets, considering environmental, economic and social sustainability. The assessment consists of four component documents.

The FAO just published a report on the “contribution of terrestrial animal source food to healthy diets for improved nutrition and health outcomes – An evidence and policy overview on the state of knowledge and gaps”.

Diverse foods derived from livestock production systems, including grazing and pastoralist systems, and from the hunting of wild animals, provide high-quality proteins, important fatty acids and various vitamins and minerals – contributing to healthy diets for improved nutrition and health. The nutritional value of poultry meat is recognized and highlighted, especially in terms of high-quality protein, vitamin B12 and selenium.

Livestock species are adapted to a wide range of environments, including areas that are unsuitable for crop

production. Globally, more than a billion people depend on livestock value chains for their livelihoods. Smallscale livestock farmers and pastoralists make up a large proportion of livestock producers. Well integrated livestock production increases the resilience of small-scale farming systems. Livestock also provide other important ecosystem services in landscape management, provide energy and help to improve soil fertility. Rangeland or grassland ecosystems occupy some 40 percent of the world’s terrestrial area. Livestock keepers raise grazing animals to transform grassland vegetation into food.

Challenges related to high resource utilization and pollution, food–feed competition, greenhouse-gas emissions, antimicrobial resistance and animal welfare as well as

10 - reportageREPORTAGE

©FAO/Giuseppe Bizzarri

Animal source foods contribute to healthy diets

zoonotic and food-borne diseases, accessibility and affordability need to be solved if agrifood systems are to become more sustainable.

Another key finding focuses on the nutritional value of animal source food: science related to TASF alternatives, including plant-based food and cell-cultured “meat”, is relatively new. Evidence suggests that these products cannot replace TASF in terms of nutritional composition. Microalgae are highly regarded as a TASF alternative because of their rich nutritional composition and the advantages they may offer as a natural carbon sink.

Nevertheless, plant-based meat alternatives that are widely available on the market have been found to be deficient in some essential nutrients and high in saturated fat, sodium and sugar. Further research is also needed to complete food-safety risk assessment for cell-cultured “meat” produced at industrial scale.

The assessment of the contribution of livestock to food security, sustainable agrifood systems, nutrition and healthy diets will be based on four component documents prepared for consideration by governing body sessions. The process will be accompanied and guided by a multidisciplinary scientific advisory committee.

This document is the first component document of the assessment and focuses on the contribution of terrestrial animal source food (TASF) to healthy diets for improved nutrition and health. Although – in line with the mandate from COAG – the focus of the document is on TASF, it recognizes that human nutrition requires dietary diversity and a full spectrum

of healthy foods and food groups, including aquatic foods, to promote and maintain health. The document builds on Livestock-derived foods and sustainable healthy diets (UN Nutrition, 2021), a document prepared by UN Nutrition that provides a general overview of topics covered by the four component documents of the present assessment and considers the major health benefits, opportunities and potential trade-offs associated with sustainable production and consumption.

In this assessment, terrestrial animal source food (TASF) is taken to comprise all food products obtained from terrestrial animals.

The assessment covers TASFs derived from animal production systems of any scale, including integrated plant–animal production systems, specialized livestock production systems, and grazing systems and pastoralism. TASF includes food derived from the hunting of wild animals and from wildlife farming.

Food products covered include those derived from mammals, birds and insects. They are classified into the following food groups:

• eggs and egg products;

• milk and dairy products;

• meat and meat products;

• food from hunting and wildlife farming; and

• insects and insect products.

Each group includes subgroups (e.g. red meat and poultry) and multiple food items coming from different species (e.g. beef and chicken meat).

Source: FAO

The consumption of animal source foods within healthy diets contributes to global nutrition targets and SDGs particularly: High quality macro- and micronutrients EGGS MILK MEAT POULTRY MEAT INSECTS CALCIUM IRON SELENIUM no data ZINC PROTEIN FATS VITAMIN B12 no data Risks associated with the consumption of eggs, milk and meat High-quality proteins •Increase muscle mass •Prevent loss of muscle mass Zinc •Vital functions in growth, development and immunity Long-fatty acids and ratios of essential fatty acids •Cognition •Neurodevelopment •Anti-inflammatory processes Calcium •Bone health Iron •Prevents iron deficiency anaemia Selenium •Anti-inflammatory •Genome-level processes Vitamin B12 •Neurodevelopment •Cell formation Choline •Growth •Brain function •Gene interactions Important nutrients for health and well-being Where risks are minimal and benefits exist, consumption of animal source foods must consider trade offs. Food-based dietary guidelines from at least 95 countries acknowledge the consumption of terrestrial animal source food as part of the daily healthy diet. However, most of these policy recommendations are qualitative and do not propose quantitative recommended consumption levels or address the health implications of consumption above or below any specific level. Contact: Livestock-Nutrition-Assessment@fao.org MICRONUTRIENTS MACRONUTRIENTS Evidence of risk Processed red meat: very low levels of consumption can elevate risk of mortality and chronic disease outcomes, including cardiovascular diseases and colorectal cancer. Evidence of risk but safe Unprocessed red meat consumption of modest amounts (ranging from 9 to 71 g/d): may have minimal risk but considered safe regarding chronic disease outcomes. Association between milk consumption and coronary health diseases (inconclusive). Consumption of eggs on blood cholesterol in association with coronary heart disease, stroke and hypertension in healthy adults (non-significant). Consumption of poultry meat in association with stroke (non-significant). Evidence inconclusive or non-significant mg g µg Governments agreed to consider the impact of livestock policies, programmes and legislative frameworks on nutrition outcomes; and to update national food-based dietary guidelines so that they adequately consider terrestrial animal source food and specific nutrient requirements during the life course of humans. Report of the First Session of the Committee on Agriculture's Sub-Committee on Livestock (16–18 March 2022). https://www.fao.org/3/ni966en/ni966en.pdf Source: FAO. 2023. Contribution of terrestrial animal source food to healthy diets for improved nutrition and health outcomes – An evidence and policy overview on the state of knowledge and gaps. Rome, FAO. https://doi.org/10.4060/cc3912en A serving of 100 grams provides: ©FAO, 2023 CC5304EN - july/august 2023 - 11 REPORTAGE

Aviagen Turkeys Breeding Seminar - Montevarchi (AR), Italy

The 5th Italian Seminar in breeder production organized by Aviagen Turkeys (ATL), which Zootecnica International was honoured to attend, was held on May 16 at the Valdarno hotel in Montevarchi (AR).

The seminar dedicated to the breeding of turkeys was organized and moderated by Carlo Norci, Management Specialist with Aviagen Turkeys. The seminar provided an ideal platform for discussion and the exchange of ideas and experiences related to turkey production as well as providing an opportunity to provide instructions and support to those companies present. The seminar was in fact attended by production managers, specialized technicians and owners of various companies in the sector from Italy, Germany, Poland, Holland and Israel.

The proceedings were opened by John Ralph, Research and Development Director of ATL , who presented the EW Group, of which Aviagen Turkeys is a part,

and he talked about the company and took stock of the European and World turkey markets. Peter Hunt, Management specialist, then spoke about the types of lights for breeding turkeys; Freek Leijten, Vencomatic Product Manager, who illustrated the characteristics of Vencomatic’s automatic turkey nests; Wiebke Oerlich, veterinary surgeon, who spoke about biosecurity and practices for its implementation and Luke Ramsay, Management Specialist Aviagen Turkeys, who spoke about good practice to ensure optimum fertility levels.

In the afternoon Carlo Norci illustrated the results of the questionnaires collected from customers on specific technical aspects; Ofer Ronen, CEO of MGH Ag. Technol -

12 - reportageREPORTAGE

Carlo Norci

ogies, a company specialized in automatic nests presented an overview of their products; Corinne Morvan, Management specialist ATL , talked about lighting programmes for breeder males (light and reproduction, lighting guidelines, lighting program); Marcus Kenny, ATL nutritionist, addressed the issue on the feeding of breeding turkeys; Karol Tarasiewicz from GERCZAK (Hatchery), a Polish customer of ATL, presented his breeding company and John Ralph concluded with a speech on the analysing of breeder egg production.

At the conclusion of the day’s procedings Richard Hutchinson, Sales and Marketing Director of Aviagen Turkeys thanked all the participants for their attendance and in particular Carlo Norci, who is close to retirement and to whom he gave a farewell thank you for his many years of work at Aviagen.

The following day, the participants concluded this experience with a tourist trip to Florence, a last moment for the sharing of thoughts between technicians and farmers before saying goodbye.

ON TRENDS AND CHALLENGES of poultry industry with

It’s been 50 years since Zootecnica International started serving the poultry industry and professionals. Today the magazine is edited in three languages (English, Italian and Russian) and delivered monthly in 120 countries, reaching around 30.000 readers all over the world. The target of Zootecnica International includes farmers, egg producers, breeding companies, hatcheries, feed mills, poultry and egg processing companies.

zootecnicainternational.com

Magazine and website offer a broad overview on the poultry industry, providing in-depth news on international markets, business management, trends and practices in poultry, genetics, incubation, nutrition, veterinary and management.

- july/august 2023 - 13 REPORTAGE

KEEP UP

Feed shortages exerts pressure on Egypt’s poultry industry

Egypt, Africa’s second biggest poultry market after South Africa, is grappling with US dollar shortages and rising inflation, that have negatively impacted the country’s poultry industry with feed manufacturers reporting an increase in the price of imported raw materials.

The invasion of Ukraine by Russia in the first quarter of 2022 worsened the shortage of poultry feed raw materials as the global supply of grains was disrupted hence constraining operations at many poultry farms in Egypt that spend an estimated 70% to 75% of their total cost of production on feeds.

Some of the poultry feed manufacturers were forced to diversify their sources of

the raw materials, especially soybeans and yellow corn as competition intensified for the available few US dollars, which is the world’s most frequently used currency in global trade.

“The effects of the Russian invasion of Ukraine caused a significant increase in corn and soybeans prices globally, which coincided with the rise in the foreign ex-

Oirere 14 - field reportFIELD REPORT

Shem

change rate in Egypt, causing poultry feed prices to double and, consequently, the cost of poultry production increased by more than 50%,” it is said in a report by USDA dated October 2022.

The report, titled Poultry Sector In Egypt Impacted by the Repercussions of War in Ukraine, stated: “Feed supply shortages impacted the poultry sector and ramped up cost of poultry production as well as consumer price of poultry in the domestic market thus placing a heavy burden on small-sized breeders in the past four months.” This refers to the period between June 2022 and October 2022.

At the beginning of the first quarter of 2023, Egypt’s Union of Poultry Producers (UPP) estimated there was 1.5 MMT of corn and 400,000 MT of soybeans detained at the country’s ports as the foreign exchange crisis intensified.

However, an intervention by UPP, working with the Ministry of Agriculture and Land Reclamation as well the

Central Bank of Egypt (CBE) led to the release of the soybeans from the ports. The Bank made available a specified amount of foreign exchange to enable the nearly 243 feed factories operated by companies such as Mit Ghamr Dakahlia, Wadi el Natroun, Dokki Giza, to access raw materials.

“The poultry industry crisis is severe and needs rapid and sustainable intervention, and this is what the government recently started to do by releasing 122,000 MT of soybeans from ports,” the USDA report says. Smallscale breeders opted either not to operate temporarily although in the last quarter of 2022, reports indicated small hatcheries “had to execute their chicks due to lack of feed availability or inflated poultry feed prices they can’t afford.”

Egypt, a net importer of soybeans for food and feed and yellow corn for feed use, lists the broiler feed segment to have the largest share of the country’s total feed industry with an estimated output of three million metric tons as at the end of 2021.

15 - july/august 2023FIELD REPORT

Eurosilos Sirp srl Isorella (BS) Tel. +39 030.9958205 contatti@eurosilos.it www.eurosilos.it WE KEEP YOUR VALUE SAFE Italian manufacturer

fiberglass silos, tanks and augers. Follow us We are Social

of

The North Africa country, with a per capita consumption of white meat estimated at 11.4 kg annually or 31.2 grams daily, imported an estimated 10 million metric tons (MMT) of yellow corn and 4.5 MMT of soybeans as feedstock for the country’s feed industry with USDA indicating a large share of imports originated from the US especially that utilized in poultry and dairy feed formulations.

According to Cairo Poultry Company (CPC), a leading vertically integrated poultry enterprise in Egypt, the instability of the global markets, triggered by the Russia/ Ukraine conflict, negatively impacted the price of raw materials for the feed industry.

CPC, which specializes on breeding and fattening chicks, producing animal feed, and hatching eggs, said in the first quarter of 2022 “prices jumped 19% over the same period last year, on the back of high commodity prices in the shadow of the global tensions which directly affected the prices of raw materials.” This increase was “partially passed on to the consumers.”

Egypt’s poultry market experienced a lot of volatility especially in the first quarter of 2022 triggering a 5% spike in parent chicks’ prices to reach EGP 65/chick (US$ 2.1) while the price of broiler chicks’ and live bird increased by 39% and 28% to reach EGP 10/chick and EGP 29/kg (US$ 0.32 and US$ 0.93) respectively.

Elsewhere, the World Bank says Egypt’s inflation level threatens to erode “incomes and constraining business activity.” Egypt’s inflation, which hit 21.3% in December 2022, was preceded by the country’s loss of its value by nearly 50%, the highest since 2017. “Growth is expected to decline to 4% in 2023 from 6.6% in 2022” a reflection of improvements in reserve increases in tourism, Suez Canal revenues, and foreign financing. Despite growth in revenues, the Bank says the “hard currency shortages persist.”

President Abdel Fattah el-Sisi’s government has in recent months made attempts to address the crisis by developing dollar resources from earnings such as exports, remittances from Egyptians working abroad, tourism, indirect foreign investment, and the revenues of the Suez Canal, the country’s poultry industry continues to be under severe pressure with a relentless spike in feed prices that is constraining overall poultry production.

Egypt, which is 95% self-sufficient in poultry production, has an estimated 10,731 licensed poultry farms across the country. According to 2021 estimates by the Ministry of Agriculture and Land Reclamation, Egypt had estimated 1.5 billion commercial broilers with farmers producing approximately 13 billion eggs by the end of that year.

In an endeavour to support the poultry industry, Egypt is implementing measures that would see the country increase commercial broiler numbers to 2 billion and double production of table eggs by 2030.

For example, the issuance of permits to start poultry project has now been fast-tracked with the government allocating at least nine areas in four governorates, covering approximately 19,000 acres, for the poultry investments. An additional 13 sites, which are linked to the General Authority for Reconstruction Projects and Agricultural Development, an affiliate to the Egyptian Agriculture Ministry, have been set aside for development of poultry projects.

Furthermore, the government has facilitated access by small-scale poultry breeders to a soft loan on a 5% interest to woo them from pursuing open breeding system and embrace closed breeding system. Nevertheless, Egypt’s poultry is still grappling with some challenges, according to the Food and Agriculture Organization (FAO), such as “high input prices, regular disease outbreaks, consumer preferences for live birds among others.”

“The absence of a national strategy for developing the poultry industry limits the capacity to coherently address some of these challenges,” reported FAO. The future of the Egyptian Poultry sector looks optimistic especially on the back of previous signs of resilience “in face of price shocks of inputs needed by the industry.” And as the USDA aptly puts it, the sector, is able to “bear the high prices of industry inputs given the increase in supply of such inputs to level (equal) with poultry production.”

16 - field reportFIELD REPORT

for breeding

PP Belts

• Egg collection

• Manure drying system

• Manure belt collection

• PP woven egg belts

• PP hole egg belts

4002 H

• 360 degrees opening

• Highly strong and durable material

• “SOFT” action

4626

• Suitable for fattening turkeys

• Perfectly dry bedding

• Simultaneous watering of 2 and more animals

4006 H

• 360 degrees opening

• Highly strong and durable material

• “EXTRASOFT” action

4901 N

• Essential design

• No chicks in the pan!

• Regulation of minimun and maximum feed level

• Available in caged broilers version

Pressure regulator with bypass

INFINITY

CORTI ZOOTECNICI

ARTICLES ACCESSORIES

Corti Zootecnici Srl | Via Volta, 4 21020 Monvalle (VA) Italy| www.cortizootecnici.it |

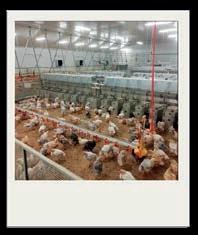

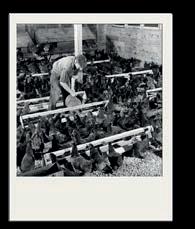

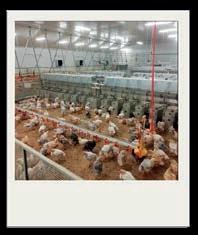

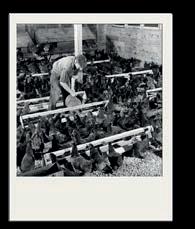

Dr. Rocio Crespo, Department of Population Health and Pathobiology, North Carolina State University, Raleigh, N.C

Researchers evaluate the effects of heat stress in poults

USPOULTRY and the USPOULTRY Foundation announced the completion of a funded research project at North Carolina State University in which researchers evaluated the effects of heat stress in poults. The research was made possible in part by an endowing Foundation gift from Prestage Farms and proceeds from the International Poultry Expo, part of the International Production & Processing Expo (IPPE). The research is part of the Association’s comprehensive research program encompassing all phases of poultry and egg production and processing.

18

DOSSIER - dossier -

Project #F104: Blood chemistry led environment manipulations to reduce poult mortality

Dr. Rocio Crespo at North Carolina State University recently completed a research project to investigate the effect of heat stress on blood parameters as an objective measure of poult comfort and its association with early poult mortality. Findings indicated that heat stress may be associated with increased incidence of pendulous crop and decreased performance. However, further research is needed to better understand the effect of environment on blood chemistry.

Many turkey poults may experience poor starting performance for reasons that are not well understood. Turkey flocks may even suffer mortality up to 3% within the first three weeks of life. Factors, including delayed feeding, starvation, genetics and age of the parental flock have been investigated, but the true etiology remains elusive. Heat stress can cause serious physiological dysfunction that may result in heat stroke, cardiac dysfunction and death, yet its impact on young poult health has not been investigated. The only recognized measures of comfort in young birds today are subjective, such as visual (i.e., poult distribution) and noise (i.e., excessive noise may indicate inadequate temperature) observations.

Hematologic parameters and the levels of certain plasma metabolites offer an objective measure and real-time insight into the physiological status of an animal. Some analyzes change due to external stressors and health challenges before obvious behavioral or clinical signs are observed.

To investigate the effect of heat stress on blood parameters as an objective measure of poult comfort and its association with early poult mortality, the objectives of this project were to:

1. identify how temperature and relative humidity affect blood parameters of turkey poults.

2. investigate whether heat stress is associated with increased incidence of flip-over, dilated cardiomyopathy, higher mortality and overall poorer performance in turkey poults.

Four treatment groups were evaluated in the study, ranging from lowest temperature to highest temperature (T1, T2, T3 and T4). Maintaining temperatures and relative humidity within the target ranges was difficult due to the small variances in treatment group parameters. The brooding environmental temperature affected pH, partial

carbon dioxide (pCO2), potassium (K) and sodium (Na) the most. The higher pH and lower pCO2 in treatments T3 and T4 were likely secondary to the poults’ effort to cool down through panting. Na was significantly depressed while K was increased in the two treatments with higher brooding temperatures (T3 and T4). While researchers did not measure water intake in each room, they hypothesized that the lower concentration of Na in the blood was due to increased water intake. Upon completion of the experiment, more birds in T3 and T4 groups had distended crops compared to poults in groups T1 and T2, possibly due to increased water intake. The increase of plasma ketones at 3 days of age for poults in T3 and T4 suggests that these birds were consuming less feed and using more fat as their main fuel source.

Findings supported the hypothesis that heat stress can be associated with increased incidence of pendulous crop and decreased performance. Further, warmer brooding temperatures may increase the incidence of dilated cardiomyopathy. There was not a significant difference in the concentration of creatinine kinase (CK) or cardiac troponin I (cTnI) between the groups. The results did not demonstrate that warmer brooding temperatures results in increased flip-overs. Low brooding temperatures were associated with higher mortality during the first week of age.

Further research is needed to better understand the effect of environment on blood chemistry. This research revealed that blood analysis could assist with the evaluation of poult thermal comfort in an objective manner.

The research summary can be found on the USPOULTRY website

Information on other Association research may also be obtained by visiting the USPOULTRY website, www. uspoultry.org

19 - july/august 2023DOSSIER

Aitor Arrazola, Research biologist, Ph.D. in Animal Behaviour & Welfare

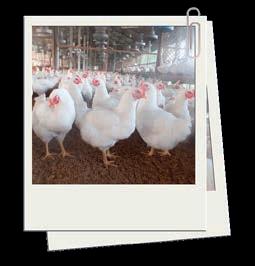

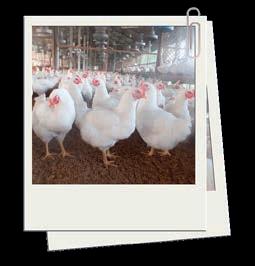

Seeking sustainability in the poultry industry

Becoming sustainable is a must for long-term viability and profitability, and the poultry industry has to meet the needs of the industry, consumers, and birds for economical, social, and environmental sustainability. All of them are core components to succeed in an ever-changing world.

The organizational planning of the poultry industry is complex and varies over time. Since industrialization, early mindset in

agricultural systems has been remarkedly productivity focused looking at maximizing production outcomes, even at a greater

20 FOCUS - focus -

cost. However, more than a half century later, mentality is switching gears toward producing more efficiently while considering aspects of animal, human, and environmental health. Along these lines, meeting the needs of industry, animals, and consumers is paramount to enhance the long-term viability of a profitable, sustainable industry. To achieve this goal, three core aspects should be taken into account: economical sustainability, ecological sustainability, and social sustainability.

Meeting the needs of the industry, birds, and consumers

This current, multidisciplinary approach of economical, social, and ecological sustainability brings new challenges, opportunities, and trends that the poultry industry needs to acknowledge for success. Meeting consumers’ demand for healthy, safe, and welfare-friendly poultry products is necessary for public acceptability and competitiveness of the poultry industry. Moreover, resources

depletion and livestock pollution on environmental systems have also become a global concern. Yet, growing population demand for meat products is on the rise, but this trend for higher need of poultry-based food products must be met without putting at risk economical, ecological, and social needs. In other words, a sustainable poultry industry should satisfy the growing demand for healthy, cost-effective food products from birds that are well taken care of within environmentally-friendly production systems.

This approach goes beyond the scope of only considering the needs of poultry industry by embracing the needs of birds raised for production and its impact on the environment. From this perspective, issues faced within any of these three core aspects (from producers to consumers) must be identified accurately and addressed suitably at any step during production, processing, or distribution. Firstly, all poultry products sold to consumers must be profitable for economical sustainability. Secondly, these products must meet consumers’ demands and expec -

- july/august 2023 - 21 FOCUS

tations for food safety and welfare standards at a reasonably price. For this reason, understanding consumers’ attitudes toward poultry production systems is a must to support and reinforce public confidence and acceptability. The best approach to succeed at it is indeed being flexible, adjustable, and adaptable to upcoming challenges regarding consumer needs, attitudes, and expectations. Current consumer concerns, for example, demand proof of food products that are ethically produced including care for animal welfare, environment, work safety, and fair trade. Indeed, responsible stewardship addressing these issues along the production chain is so much needed to move forward and guarantee continued success of the poultry industry. Thirdly, poultry industry is responsible for providing appropriate management and conditions to support birds’ health and well-being. To do so, effective management should be in place through-

out the production cycle (from breeder to production flocks) to maximize birds’ health, performance, and welfare. This tripartite approach considering the needs of the industry, consumers, and birds brings together a novel comprehensive insight from which industry can develop poultry products that are economically and socially sustainable.

Aiming for environmental sustainability

The need of caring for the environmental health rises due to social concerns about limited global resources, livestock footprint and pollution, and consequences on biodiversity and ecological functioning. These challenges offer new opportunities to improve waste management and disposal, enhance litter and air quality as well as reduce carbon and nitrogen footprint. Indeed, resources employed by the poultry industry must be used efficiently to

be profitable and refinements in resources management and usage can help control and minimize production costs. For example, further improvements in feed efficiency and advancements to reduce feed wastage can allow industry to produce poultry products from broilers and table-egg layers at a lower cost. Energy inputs and water usage should also be contemplated from an environmental and economic point of view, not only throughout production but during product processing and distribution as well. Certainly, due to changing rainfall patterns and rising temperatures associated with climate change worldwide, the amount of clean water that poultry industry uses for production and processing should be reviewed and find pioneering solutions to reduce clean water usage. Same considerations apply to the energy inputs required for product development from farm to fork. Lastly, understanding the relationship between production practices and environmental impact is needed to prevent negative side consequences on ecosystems and societies.

Evaluating the needs of the industry, consumers, and birds should be considered periodically to assess current challenges and foresee upcoming ones. For long-term sustainability, maintaining a clear direction toward addressing these needs is essential as well as staying flexible and open to adjust in case of emerging challenges or if needs change. To conclude, poultry industry should aim to be productive, profitable and cost effective by optimizing productivity while reducing costs, supporting poultry health and welfare, enhancing resource effectiveness, and minimizing the impact of industry activity on the environment.

22 FOCUS - focus -

Mobile Poultry Shed

60 m2 Surface Mobile Poultry Shed. Professional design, made in Italy, suitable for free range poultry breeding.

- july/august 2023 - 23 FOCUS

r.a.

commerce@agritech.it

5

unassembled sheds in one truckload

Agritech s.r.l. Via Rimembranze, 7 25012 Calvisano (BS) Italy Tel. + 39 030 9968222

Fax + 39 030 9968444

www.agritech.it

The remarkable dynamics of the global poultry industry:

50 years in retrospective

Part 2 – Global poultry meat production

In this paper the author will analyse the development of the poultry industry over the past fifty years and he will document the remarkable growth of global poultry meat production.

Hans-Wilhelm Windhorst

Hans-Wilhelm Windhorst

The author is Prof. Emeritus of the University of Vechta and visiting Professor at the Hannover Veterinary University, Germany

An extraordinary temporal and spatial dynamics

Between 1970 and 2020, global poultry meat production increased from 15.1 mill. t to 137 mill. t or by 807.8%. It was by far the fastest growing animal product. The pro -

duction volume grew much faster from 2000 on than in the previous decades. Between 2000 and 2020 it increased by over 68 mill. t. A detailed analysis of the development at continent level reveals the extraordinary role, which Asia played in the booming development (Table 1, Figure 1). To the abso -

24 MARKETING - marketing -

Continent 1970 1980 1990 2000 2010 2020 Increase absolute % Africa Asia Europe N America CS America Oceania 598 2,702 5,315 5,092 1,25 142 1,056 5,216 9,115 7,014 3,92 353 1,969 10,037 11,758 11,492 5,258 403 2,962 22,907 11,859 17,640 12,522 767 4,782 34,814 16,227 20,801 21,549 1,144 7,329 53,401 22,380 24,642 27,740 1,537 6,731 50,699 17,065 19,547 26,495 1,395 1,125 6 1,876.4 321.1 383.9 2,128.1 982.4 World 15,095 25,946 40,997 68,656 99,317 137,029 121,934 807.8

Table 1 – The development of global poultry meat production at continent level between 1970 and 2020; data in 1,000 t (source: FAO database).

lute growth of 121.9 mill. t in the decades under review, Asia contributed 41.6%, followed by Central and South America with 16.8%, North America with 16.0% and Europe with 14.0%. Africa and Oceania fell far behind. The highest relative growth showed Central and South America and Asia. Even in Africa, it was higher than in Europe and North America.

When breaking down the growth of poultry meat production by meat species, it is obvious that it was mainly a result of the extraordinary increase of chicken meat production (Table 2). To the absolute growth of the production volume, chicken meat contributed 108.3 mill. t or 88.1%. The highest relative growth rate showed however goose and duck meat. From Figure 3, one can see that chicken meat shared between 85.5% and 88.2% in the global production volume. While duck and goose meat were able to expand their shares that of turkey meat fluctuated considerably.

Until 1990, Europe produced more poultry meat than Asia; then the extraordinary growth in several Asian countries began, as will be documented in a later part of the article. In 2000, the Americas surpassed Europe. The different dynamics at continent level caused remarkable changes in the continents’ shares in the global production volume. In the decades under review, Asia gained 21%, Central and South America 12%. In contrast, Europe lost almost 19% and North America more than 15%. These figures document a spatial shift of the regions with the highest dynamics from Europe and North America to Asia and Central and South America (Figure 2).

In a next step, the development of chicken and turkey meat production at continent level in the decades under review will be analysed separately. Figure 4 documents the dynamics in chicken meat production. As expected, the dominance of this meat type resembles the dynamics for poultry meat. Because of the dominating role, which Asian countries played in duck and goose meat production, the dominance of the continent was lower than in poultry meat in total. Until the 1990s, Europe and North

25 - july/august 2023MARKETING

Africa Asia Europe N America CS America Oceania World 0 35 70 105 140 1970 1980 1990 2000 2010 2020

Figure 1 – The development of global poultry meat production at continent level between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

1970 1980 1990 2000 2010 2020 0 25 50 75 100 20.2 21.7 18.2 12.8 12.3 8.2 18,0 20.9 25.7 28.0 27.0 33.7 16.3 16.3 17.3 28.7 35.1 35.2 39.0 35.1 33.4 24.5 20.1 17.9 Africa Asia Europe N America CS America Oceania

Figure 2 – The changing contribution of the continents to global poultry meat production between 1970 and 2020; data in % (design: A.S. Kauer, based on FAO data).

1970 1980 1990 2000 2010 2020 0 25 50 75 100 4.4 5.5 7.5 9.1 7.9 8.1 3.2 2.5 2.8 1.5 1.1 1.5 4.5 4.1 4.2 3.0 2.7 3.3 87.9 87.9 85.5 86.4 88.2 87.0 Chicken Duck

Turkey

Geese

Figure 3 – The share of the poultry meat species in global poultry meat production between 1970 and 2020; data in % (design: A.S. Kauer, based on FAO data).

Africa Asia Europe N America CS America Oceania World 0 35 70 105 140 1970 1980 1990 2000 2010 2020

Figure 4 – The development of global chicken meat production at continent level between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

America produced more chicken meat than Asia, and in 2020, the gap between Asia and Europe respectively the Americas in the production volume was much smaller than for poultry meat in total.

Figure 5 shows the changes in the contribution of the continents to global chicken meat production in the analysed time-period. A comparison with Figure 2 reveals that the shares of North America and Europe were similar while that of Asia was lower and that of Central and South America was higher. A later part of the paper will show which countries caused the differences.

to have reached a plateau in the past decade. While North America and Europe almost contributed the same amount to the absolute growth, the relative growth rates were highest in Africa and Central and South America. The different dynamics changed the continents´ shares in global turkey meat production considerably (Figure 7 ).

The dynamics in turkey meat production differed considerably from that in chicken meat. Figure 6 shows that North America and Europe dominated the production of this meat type over the analysed decades. In all other continents, the production volume was much lower and it was not before 2010 that Central and South America showed higher absolute growth rates.

When analysing the development over time, one can see that the absolute and relative growth rates were highest until the 1990s. From then on, they decreased and seem

Between 1970 and 2020, Europe gained 14.4% and Central and South America 8.9%, in contrast, North America

26 MARKETING - marketing -

1970 1980 1990 2000 2010 2020 0 25 50 75 100 22.4 23.9 20.9 14.4 13.5 9.1 18.1 20.7 25.5 26.2 25.3 31.8 16.4 15.8 15.8 28.7 35.7 36.9 36.1 33.2 31.8 24.3 19.5 17.1 Africa Asia Europe N America CS America Oceania

Figure 5 – The changing contribution of the continents to global chicken meat production between 1970 and 2020; data in % (design: A.S. Kauer, based on FAO data).

1970 1980 1990 2000 2010 2020 0 25 50 75 100 11.4 11.5 4.9 3.3 3.3 2.5 45.9 49.2 50.7 58.5 57.4 72.7 35.9 34.0 39.6 34.4 35.5 21.4 2.6 2.4 3.3 2.0 2.7 2.0 Africa Asia Europe N America CS America Oceania

Figure 7 – The changing contribution of the continents to global turkey meat production between 1970 and 2020; data in % (design: A.S. Kauer, based on FAO data).

Meat species 1970 1980 1990 2000 2010 2020 Increase absolute % Chicken Duck Goose Turkey Others 13,140 501 226 1,219 9 22,896 713 282 2,047 8 35,416 1,239 608 3,718 16 58,698 2,872 1,903 5,141 42 87,270 4,046 2,499 5,527 25 120,461 6,160 4,359 6,029 20 107,321 5,659 4,138 4,801 11 816.8 1,129.5 1,828.8 394.6 122.2 Total 15,095 25,946 40,997 68,656 99,317 137,029 121,934 807.8 Africa Asia Europe N America CS America Oceania World 0 2 4 5 7 1970 1980 1990 2000 2010 2020

Table 2 – The share of the poultry meat species in global poultry meat production between 1970 and 2020; data in 1,000 t (source: FAO database).

Figure 6 – The development of global turkey meat production at continent level between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

lost 26.8%. To the increase in the global production volume, Europe contributed 39.6% and North America 39.1%. The contribution of the other continents was much lower. This reflects the large differences in the per capita consumption of turkey meat. While this meat species is mainly consumed in Europe and North America, it has not reached a tradition as a meal in Asia and, with the exception of Algeria and Morocco, not in Africa.

Remarkable changes at country level

Over the past fifty years, the composition and ranking of the leading poultry meat producing countries changed considerably (Figure 8). The USA ranked in first place until 2019. In 2020, they were surpassed by China, which in that year produced 442,000 t more than the USA. An extraordinary dynamical development showed Brazil. It climbed from rank ten in 1970 to third place in 2020. Until 1990, the USSR held the second place. After the political and economic collapse, the production volume decreased dramatically and it was not before the past decade that the Russian Federation showed up in the top group again. The drastic decrease of pig meat production, which resulted from massive outbreaks of the African Swine Fever, initiated a dynamical expansion of broiler growing. While in 1970 five European countries ranked in the top ten group, here the USSR is included, in 2020, only two, the Russian Federation and Poland, reached high ranks. The composition of the ten leading countries in 2020 reflects the already mentioned

spatial shift. Five of the countries were located in Asia, three in the Americas and only two in Europe. Worth noting is the growing importance of India, Indonesia and Iran.

The regional concentration in poultry meat production was highest in 1970 when the ten leading countries contributed 67.8%. In the following

decades, their share fluctuated between 62% and 65%. Figure 9 documents the changes in the composition and ranking of the ten leading countries. It reveals the declining importance of European and the growing importance of Asian and South American countries. With Poland, a European newcomer was however

27 - july/august 2023MARKETING

Rank 197019801990200020102020 1 China 2 USA 3 Brazil 4 Russia 5 India 6 Indonesia 7 Mexico 8 Poland 9 Iran 10 Japan D CDN USSR THAI AR F I U.K. ES JP CDN

Figure 8 – The changing composition and ranking of the ten leading poultry meat producing countries between 1970 and 2020 (design: author, based on FAO data).

UNIQUE BLEND STRONGER THROUGH INNOVATION

SMART, CHOOSE SAFETY!

in future proof solutions

PT02, PT03, PT04, PT05

INTRA HYDROCARE DOES COMPLY WITH THE LATEST REGULATIONS

BE

Pioneers

able to climb to rank eight in 2020. With a few exceptions, the composition and ranking of the ten leading countries in chicken meat production resembles that in poultry meat in total. In 2020, the USA ranked however before China in first place, producing about six mill. t more than China. Argentina ranked in tenth place,

substituting Poland. Figure 10 shows the declining regional concentration in chicken meat production. While in 1970 the ten top countries shared exactly two thirds in the global production volume, their contribution declined to 59.9% in 2020. This not only reflects the growing importance of Asian countries but also the gen-

eral spatial spread of chicken meat production. The lack of religious barriers regarding consumption and the excellent feed conversion rate were the main steering factors behind this dynamics.

The composition and ranking of the leading turkey meat producing countries differed considerably from that of chicken meat. Figure 11 shows that European countries played a major role. In 1970 and 2020, six of the ten leading countries were located in Europe. A detailed analysis of the dynamics in the ranking of the countries reveals some remarkable changes. The USA ranked in first place during the decades under review. Brazil, which did not belong to the top countries in 1970, climbed from tenth to second place in 2010 and could maintain that rank.

A similar dynamics showed Germany, which ranked as number three in 2020. In contrast, Italy and France lost several places since 1980 and Canada as well as the United Kingdom plummeted from upper rankings to near the bottom. Poland and Spain became major turkey meat producers only in the course of the past decade. Israel ranked among the top producing countries from 1970 until 2010, but was then replaced by Morocco. Several countries belonged to the top group only for a short period, such as Yugoslavia, Hungary or Argentina.

As can be seen from Figure 12, the regional concentration in turkey meat production was much higher than in chicken meat. The fluctuation was also much smaller; it differed only between 88.0% in 2010 and 93.7% in 1970. In 1970, the USA held a dominating position with a share of 64.3% in the global pro -

28 MARKETING - marketing -

32.1% 2.5% 3.0% 3.2% 3.3% 3.8% 4.2% 4,2% 5.7% 7.1% 30.9% USA USSR China France Italy Un. Kingd. Spain Japan Canada Brazil Others Total: 15.1 mill. t 1970 Total: 41.0 mill. t 35.9% 1.9% 2.0% 2.4% 2.7% 3.4% 3,9% 5.9% 7.7% 8.0% 26.2% USA USSR China Brazil France Japan Italy Un. Kingd. Spain Mexico Others 1990 Total: 99.3 mill. t 38.0% 1.6% 1.7% 1.7% 1.8% 2.2% 2.6% 2.7% 11.3% 16.7% 19.7% USA China Brazil Mexico Russia India France Iran Argentina Un. Kingd. Others 2010 35.8% 2.1% 2.9% 2.9% 3.9% 4.3% 4.3% 5.2% 5.4% 8.2% 25.0% USA USSR Brazil China Japan France Italy Spain Un. Kingd. Germany Others Total: 25.9 mill. t 1980 Total: 68.7 mill. t 35.1% 1.6% 1.6% 1.7% 1.7% 2.2% 2.7% 3.1% 8.9% 17.3% 24.1% USA China Brazil France Mexico Un. Kingd. Japan Poland Italy Canada Others 2000 Total: 137.0 mill. t 38.0% 1.7% 1.8% 2.0% 2.6% 2.7% 3.3% 3.3% 10.5% 16.9% 17.2% China USA Brazil Russia India Indonesia Mexico Poland Iran Japan Others 2020

Figure 9 – The share of the ten leading poultry meat producing countries in global poultry meat production between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

CHOOSE HOW YOU WANT TO

ENJOY

It’s been 50 years since Zootecnica International started serving the poultry industry and professionals. Today the magazine is edited in three languages (English, Italian and Russian) and delivered monthly in 120 countries, reaching around 30.000 readers all over the world.

The target of Zootecnica International includes farmers, egg producers, breeding companies, hatcheries, feed mills, poultry and egg processing companies.

Magazine and website offer a broad overview on the poultry industry, providing in-depth news on international markets, business management, trends and practices in poultry, genetics, incubation, nutrition, veterinary and management.

PRINT ONLY

(print magazine delivered to your door)

DIGITAL ONLY

(digital magazine sent to your mailbox)

PRINT + DIGITAL

€ 99

€ 49

Subscribe by money transfer:

1. effect a money transfer to: Zootecnica International, Vicolo Libri, 4 50063 Figline Incisa Valdarno (FI), Italy; bank: UNICREDIT, BIC: UNICRITM1OU9

Iban: IT 81 H 02008 38083 000020067507

2. send us your complete shipping address by email: subscription@zootecnica.it.

€ 109

- july/august MARKETING

duction volume. With the increasing production in Brazil and Germany, its contribution declined to 43.3% in 2020. The fact that the share of the four leading countries ranged between 83.7% in 1970 and 67.3% in 2020 documents the high regional concentration. Despite the lack

of religious barriers regarding the consumption of turkey meat, it never reached a two-digit percentage in the decades under review. The less favourable feed conversion and the frequent outbreaks of the Avian Influenza virus in turkey flocks in the USA and in Europe also limited the

growth of this meat species. In addition, the fact that turkey meat was not able to find its way into systems gastronomy and that it did not reach a similar position as broiler meat in Asian countries, explains the low growth rates respectively stagnation during the past two decades.

Summary and perspectives

The preceding analysis documented the extraordinary dynamics in poultry meat production over the past fifty years. In the decades under review, the production increased eightfold and reached a volume of nearly 122 mill. t in 2020. Poultry meat was by far the fastest growing animal product. This dynamics was mainly a result of the remarkable growth of chicken meat production, which shared between 85% and almost 88% in the overall production volume.

The application of the hybridization-technology made the extraordinary success of chicken meat production possible. It reduced the days needed to grow a broiler to slaughter weight dramatically. In combination with a high-energy compound feed it reduced the production cost considerably and made broiler meat attractive for the consumers as the retail price was much lower than for beef or pork. Worth noting is also that similar to the egg industry, production in most leading countries is organized in vertically integrated agribusiness companies. There is one difference however. While in the egg industry all steps of production are organized under one roof, in broiler and turkey production, contract growing became the standard form of operation, at least in

30 MARKETING - marketing -

32.8% 3.0% 2.8% 3.7% 3.8% 3.8% 4.0% 4.3% 4.4% 8.2% 29.2% USA USSR China Italy France Spain Un. Kingd. Japan Brazil Canada Others Total: 13,140 t 1970 37.5% 2.1% 2.2% 2.3% 2.3% 3.0% 3.9% 6.2% 6.7% 9.3% 24.5% USA USSR Brazil China Japan France Italy Spain Un. Kingd. Mexico Others Total: 35,416 t 1990 Total: 87,270 t 39.3% 1.7% 1.8% 1.8% 2.5% 2.9% 3.1% 12.3% 13.3% 19.4% USA China Brazil Mexico Russia India Iran Argentina Indonesia S. Africa Others 2010 1.9% 37.0% 2.1% 2.7% 3.3% 3.4% 3.7% 4.1% 4.9% 6.0% 9.3% 23.5% USA USSR Brazil Japan China France Italy Spain Un. Kingd. Germany Others Total: 22,896 t 1980 37.5% 1.6% 1.6% 1.9% 2.1% 3.1% 10.2% 14.2% 24.0% USA China Brazil Mexico Un. Kingd. Japan France Thailand Spain Argentina Others Total: 58,698 t 2000 1.8%2.0% Total: 120,461 t 40.3% 1.8% 1.9% 2.0% 3.0% 3.0% 3.7% 3.8% 11.4% 12.1% 17.0% USA China Brazil Russia India Indonesia Mexico Iran Japan Argentina Others 2020

Figure 10 – The share of the ten leading chicken meat producing countries in global chicken meat production between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

market-oriented economies. Turkey, duck and goose meat fell far behind and reached only one-digit percentages.

The dynamics in the continents and countries differed considerably, resulting in a drastic spatial shift. While the contribution of Asia grew from 23.8% in 1970 to 62.2% in 2020 and that of Central and South America from 8.2% to 20.2%, the shares of Europe and North America declined drastically. Europe lost nearly 30% and North America over 15% of their former shares.

The composition and ranking of the countries reflects the spatial dynamics. Even though the USA was able to maintain its leading position in chicken meat, China and several

“The application of the hybridization-technology made the extraordinary success of chicken meat production possible. It reduced the days needed to grow a broiler to slaughter weight dramatically. In combination with a high-energy compound feed it reduced the production cost considerably and made broiler meat attractive for the consumers as the retail price was much lower than for beef or pork”

31 - july/august 2023MARKETING

other Asian countries (India, Indonesia, Iran) were the main winners beside Brazil in poultry meat production. European countries fell far behind. In 2020, only the Russian Federation and Poland ranked in the top group. The spatial patterns of turkey, duck and goose meat production differed considerably from that of chicken meat. Turkey meat was mainly produced in North America and Europe, duck and goose meat in Asia.

In the OECD/FAO Agricultural Outlook until 2030, an increase of poultry meat production to 153 mill. t is projected. Asia and Central and South America will strengthen their positions while North America and Europe will lose shares despite a growing production volume. Chicken meat will show the highest absolute growth, duck and goose meat production will further grow in Asia. In contrast, turkey meat will show only a moderate growth, it may even decrease in North America and several European countries because of a falling per capita consumption. In addition, the risk of massive Avian Influenza outbreaks in turkey flocks in North America and Europe may have incisive impacts. The current decade has shown that the Avian Influenza virus has become endemic in many countries of the northern hemisphere. A vaccination of turkeys and laying hens could reduce the

32 MARKETING - marketingRank 197019801990200020102020 1 USA 2 Brazil 3 Germany 4 Poland 5 France 6 Italy 7 Spain 8 Un. Kingd. 9 Canada 10 Morocco YUG MEX H PL ISR ARG NL

6.4% 0.7% 1.0% 1.3% 1.5% 4.6% 5.3% 5.7% 8.4% 64.3% USA Canada Un. Kingd. Italy France Mexico Israel Yugoslavia Poland Hungary Others Total: 1,219 t 1970 0.8% 8.9% 1.1% 1.4% 1.5% 3.4% 3.5% 4.6% 7.5% 11.8% 55.1% USA Italy France Un. Kingd. Canada Germany Israel Brazil Hungary Argentina Others Total: 3,718 t 1990 1.2% 11.9% 1.8% 1.8% 2.3% 2.9% 2.9% 5.4% 7.3% 8.6% 8.8% 46.3% USA Brazil Germany France Italy Un. Kingd. Canada Spain Poland Israel Others Total: 5,527 t 2010 Total: 2,047 t 8.1% 0.9% 1.7% 1.9% 2.1% 4.9% 6.0% 9.9% 11.0% 52.5% USA Italy France Un. Kingd. Canada Germany Israel Mexico Yugoslavia Brazil Others 1980 1.0% Total: 5,141 t 8,9% 1.1% 1.9% 2.7% 2.7% 3.0% 5.0% 5.8% 6.4% 14.8% 47.7% USA France Italy Germany Un. Kingd. Canada Israel Brazil Hungary Netherl. Others 2000 Total: 6,029 t 11.3% 1.7% 2.6% 2.9% 3.7% 5.2% 5.3% 6.8% 7.9% 9.3% 43.3% USA Brazil Germany Poland France Italy Spain Un. Kingd. Canada Marocco Others 2020

Figure 11 – The changing composition and ranking of the ten leading turkey meat producing countries between 1970 and 2020 (design: author, based on FAO data).

Figure 12 – The share of the ten leading turkey meat producing countries in global turkey meat production between 1970 and 2020 (design: A.S. Kauer, based on FAO data).

risk of further epidemics, but a strong opposition against a compulsory vaccination can be observed in several of the leading poultry meat exporting countries, because they fear negative impacts on their export opportunities.

Despite the success of plant-based meat alternatives and the beginning market approval of cultured meat, alternative meat products will only gain market shares in the one-digit percentage in the current decade. High production costs, problems in the scaling up of cultured meat production and an obvious scepticism against consuming the expensive and high tech products will limit the fast diffusion of alternative meat.

Data sources and suggestions for further reading

FAO database: https://www.fao.org/faostat/en

Windhorst, H.-W.: The Champions League of the chicken meat producing countries. In: Zootecnica International 42 (2020), no. 7/8, p. 22-26.

Windhorst, H.-W.: The red-white shift in global meat production: In: Zootecnica International 43 (2021), no. 5, p. 32-37

Windhorst, H.-W.: A glimpse into the future. Projection of global meat production and consumption until 2030. In: Fleischwirtschaft international 2021, no. 3, p. 28-31.

Windhorst, H.-W.: Alternative Proteins – Development and Availability. In Meatingpoint 43 (2022), p. 58-62.

Windhorst, H.-W.: Patterns of the poultry industry in the MEA region. Poultry meat production and trade. In: Zootecnica International 44 (2022), no. 9, p. 32-35.

Windhorst, H.-W.: Dynamics and patterns of the poultry industry in the G 19 countries between 2010 and 2020. In: Zootecnica International 44 (2022), no. 12, p. 22-27.

Windhorst, H.-W.: Patterns and dynamics of global turkey meat production and trade. Part 1: Turkey meat production. In: Zootecnica International 45 (2023), no. 2, p. 2024.

Windhorst, H.-W.: The revolution is taking shape. In: Fleischwirtschaft international 2023, no. 1, p. 34-39.

Windhorst, H.-W.: A documentation and analysis of the AI epidemic in the USA in 2022. In: Zootecnica International 45 (2023), no. 3, p. 8-17.

DACS climate solutions ensure dry well-ventilated houses with uniform temperatures and perfect climate that vastly improve animal welfare and comfort, allowing animals to grow to their full potential

33 - july/august 2023MARKETING

INNOVATION IN VENTILATION +45 75771922 • mail@dacs.dk • www.dacs.dk

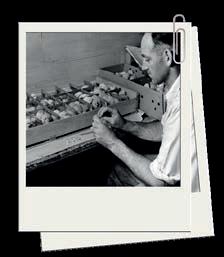

Lining hatcher baskets with paper

In normal hatchery practice, eggs are transferred from setter trays to hatcher baskets at day 18-19 of incubation. It is important that these hatcher baskets are properly cleaned, disinfected and dried to ensure a hygienic start for the newborn chicks. Starting the hatch period with wet baskets will cause a temperature drop due to the energy needed to evaporate the remaining water, which will delay the hatch, widen the hatch window and negatively affect chick quality.

Gerd de Lange, Senior Poultry Specialist, Pas Reform Academy

It is not uncommon to see these basic conditions not being met.

The reasons for this are:

• Poor washing process: hatcher baskets pass too quickly through the washing machine, worn-out nozzles, low water temperature, not enough detergent, etc.

• Dirt: disinfection is only effective on a clean surface!

• Insufficient drying time until next transfer: this is especially a problem when using the hatching baskets intensively (‘hatch in the morning,

transfer in the afternoon’). The drying time can be reduced by increasing the air flow over the wet baskets, ideally in empty hatchers set to ‘drying mode’ to avoid unnecessary alarms.

In situations like this, not only are the hatch results compromised, but increased first week mortality can also be expected.

The best way to address these issues is to tackle the root cause and optimize the washing, disinfecting and drying process, and perhaps invest in an extra set of hatcher baskets.

34 - technical columnTECHNICAL COLUMN

Some hatcheries choose to keep the hatcher baskets clean during the hatching process by lining them with paper prior to transfer. While this does not remove the need to wash the baskets after a hatch, it will be much easier to clean them properly, which is essential for successful disinfection. Another valid reason for applying paper would be to deal with batches of eggs with a higher number of potential ‘exploders’, as the paper prevents the bacteria-loaded mess from dripping into the baskets below.

Advice

• Understand that hatcher baskets are designed to be used without

paper. Depending on the brand of hatcher, the holes in the bottom of the basket could play an important role in ensuring a sufficient airflow over the eggs and hatched chicks. Find out from your incubator manufacturer whether the bottom of the baskets can be covered.

• Only consider lining hatcher baskets with paper if good cleaning results cannot otherwise be guaranteed. An exception is when transferring a batch with too many exploders.

• Understand that the rule ‘hatcher baskets should be dry’ still applies when using paper.

• Ensure the paper lies flat in the

bottom of the baskets, as it will otherwise hamper the airflow over the eggs. The paper should therefore be slightly smaller than the basket.

• Ensure the paper is evenly covered by eggs to avoid an ‘empty’ part of the paper lifting due to the airflow in the hatcher and being folded over the eggs.

• Use rough paper with sufficient ‘grip’ for the chicks feet to avoid splay-legged chicks. Newspaper is not suitable!

• Use highly absorbent paper to catch the dirt from exploding eggs.

• Accept the extra costs and issues with the automation of handling hatch residue.

35 - july/august 2023TECHNICAL COLUMN

VISIT OUR WEBSITE zootecnicainternational.com FOR A DEEP INSIGHT INTO THE POULTRY INDUSTRY! and latest technical and scientific advances at zootecnicainternational.com! NEW PRODUCTS COMPANY NEWS INTERVIEWS FIELD REPORTS MARKET TRENDS EVENTS PROFILES

Nelson E. Ward, PhD - DSM Nutritional Products

Broiler vitamin nutrition guidelines

In a time of record feed prices, nutritionists and production managers continue to look for opportunities to lower growout costs. Even though their contribution seldom exceeds 1-2% of feed costs, vitamins are not immune to this cost-crunching scrutiny. Furthermore, in late 2017, an unparalleled drop in global vitamin supply resulted in sharply increased prices, and in some cases, outright shortages. Such events have placed pressure on vitamin fortification levels in broiler feeds.

36 NUTRITION - nutrition -

Marginal vitamin shortages can be more costly than acute deficiencies. Seemingly trivial insufficiencies can translate in nothing more than a slight drop in target weights, or 1-2 point increases in F/G, or egg production or shell quality that lingers below expectations. These are difficult to differentiate from management and housing issues, hatchery problems, chick quality, and the list goes on. At today’s feed prices, 1 point in feed conversion is worth about $2/ton feed.

Vitamin requirements can be dynamic

Nutritionists decide on the fortification rates based on a variety of criteria – bird age, production phase, field experience, research trials, and so forth. The rapid change in broiler genetics is recognized as the biggest factor that affects long-term fortification levels.

Broiler growth rates have climbed 3-4% every year with less feed being consumed/lb live gain. To this end, the feed conversion ratio (FCR) improved by nearly 2 points/ year over the past 10 years. The days required to attain a 5.1 lb slaughter weight have declined from 52 days 1995 to 40 days today, which reduces the time to correct missteps in nutrition, management, or health programs.

Faster growing strains generally experience more mortality and meat disorders, bone deformities, and contact dermatitis, as opposed to slow-growth strains. The pressure for more skeleton and body weight in a shorter time impact vitamin fortification requirements. Yet, commercial fortification levels did not change appreciably from 1993 to 2012.

Vitamins are not equal

Vitamins perform within a complex metabolic system, and function in catalytic, developmental, and protective roles. Generally defined, this group of organic compounds is essential for life and is required in small quantities in the diet because they cannot be synthesized by the body or are synthesized in insufficient quantities to meet the demand for metabolic purposes. Still, individual vitamins vary in chemical composition and identity, and each serves a specific metabolic purpose of ten expressed during acute deficiencies.

Of the 13 commonly accepted vitamins, all but vitamin C are found in the egg, and serve as the only source of

vitamins for the developing embryo. Many factors affect vitamin deposition in eggs such as dietary level, absorption rate, interactions with other vitamins and nutrients, and body storage characteristics – and not the least – the blood-to-egg transference efficiency. Whereas vitamin D3 can be elevated to super-high levels in the egg, other vitamins are far more restricted, which in turn, can have a pronounced effect on fertility, embryonic survival, and early chick performance.

Fat-soluble vitamins are hydrophobic and are emulsified in the upper intestinal tract through mastication and intestinal churning. Mixed micelles – a combination of free fatty acids, monoglycerides, and bile acids – deliver the fat-soluble vitamins to the microvilli surface. For some animal species, regional intestinal differences exist for absorption: proximal for vitamin A, medial for vitamin D3, and distal for vitamins E and K. The uptake of vitamins D3, E, and K by Caco-2 cells was adversely affected by the presence of vitamin A. Conversely, the individual presence of vitamins D3, E, and K had less effect on vitamin A transport, a relationship generally mirrored in the accumulation of fat-soluble vitamins in eggs. The extent to which interactions occur among the fat-soluble vitamins can be impacted by levels in the feed.