CONNECTING THE DOTS

ALSO INSIDE

Best in Class: AICC’s Educational Opportunities

Peeking Into Policy: Today’s HR Priorities

Member Profile: NEWW Packaging & Display

May/June 2023 Volume 27, No. 3

A PUBLICATION OF AICC, THE INDEPENDENT PACKAGING ASSOCIATION

stock of the state of digital printing

Taking

BOXSCORE www.AICCbox.org 1 TABLE OF CONTENTS May/June 2023 • Volume 27, No. 3 BoxScore is published bimonthly by AICC, e Independent Packaging Association, PO Box 25708, Alexandria, VA 22313, USA. Rates for reprints and permissions of articles printed are available upon request. e statements and opinions expressed herein are those of the individual authors and do not necessarily represent the views of AICC. e publisher reserves the right to accept or reject any editorial or advertising matter at its discretion. e publisher is not responsible for claims made by advertisers. POSTMASTER: Send change of address to BoxScore, AICC, PO Box 25708, Alexandria, VA 22313, USA. ©2023 AICC. All rights reserved. Visit www.NOW.AICCbox.org for Member News and even more great columns. Scan the QR code to check them out! Taking stock of the state of digital printing CONNECTING THE DOTS COLUMNS 3 CHAIRWOMAN’S MESSAGE 4 SCORING BOXES 8 LEGISLATIVE REPORT 10 ASK RALPH 12 ASK TOM 16 SELLING TODAY 20 ANDRAGOGY 22 LEADERSHIP 26 DESIGN SPACE 34 MEMBER PROFILE 58 THE ASSOCIATE ADVANTAGE 60 WHAT THE TECH? 62 STRENGTH IN NUMBERS 68 THE FINAL SCORE DEPARTMENTS 6 WELCOME, NEW & RETURNING MEMBERS 29 AICC INNOVATION 66 FOUNDATION FOR PACKAGING EDUCATION 40 46 52 FEATURES 40 CONNECTING THE DOTS Taking stock of the state of digital printing 46 BEST IN CLASS AICC continues to offer all of the education your teams need to grow and succeed 52 PEEKING INTO POLICY A top 10 rundown of today’s human resources issues in manufacturing ON THE COVER Description

OFFICERS

Chairwoman: Jana Harris, Harris Packaging/American Carton, Haltom City, Texas

First Vice Chairman: Matt Davis, Packaging Express, Colorado Springs, Colorado

Vice Chairs: Gary Brewer, Package Crafters, High Point, North Carolina Finn MacDonald, Independent II, Louisville, Kentucky

Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

Immediate Past Chairman: Gene Marino, Akers Packaging Service Group, Chicago, Illinois

Chairman, Past Chairmen’s Council: Jay Carman, StandFast Packaging Group, Carol Stream, Illinois

President: Michael D’Angelo, AICC Headquarters, Alexandria, Virginia

Secretary/General Counsel: David Goch, Webster, Chamberlain & Bean, Washington, D.C.

AICC Canada: Lee Gould

DIRECTORS

West: Sahar Mehrabzadeh-Garcia, Bay Cities, Pico Rivera, Califormia

Southwest: Jenise Cox, Harris Packaging/American Carton, Haltom City, Texas

Southeast: Michael Drummond, Packrite, High Point, North Carolina

Midwest: Casey Shaw, Batavia Container Inc., Batavia, Illinois

Great Lakes: Josh Sobel, Jamestown Container Cos.

Macedonia, Ohio

Northeast: Stuart Fenkel, McLean Packaging

Pennsauken, New Jersey

AICC Canada: Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada

AICC México: Sergio Menchaca, EKO Empaques de Cartón S.A. de C.V., Cortazar, Mexico

OVERSEAS DIRECTOR

Kim Nelson, Royal Containers Ltd., Brampton, Ontario, Canada

DIRECTORS AT LARGE

Kevin Ausburn, SMC Packaging Group, Springfield, Missouri

Eric Elgin, Oklahoma Interpack, Muscogee, Oklahoma

Guy Ockerlund, OxBox, Addison, Illinois

Mike Schaefer, Tavens Packaging & Display, Bedford Heights, Ohio

Ben DeSollar, Sumter Packaging, Sumter, South Carolina

Jack Fiterman, Liberty Diversifies, Minneapolis, Minnesota

EMERGING LEADER DELEGATES

Lauren Frisch, Wasatch Container, North Salt Lake, Utah

John McQueary, CST Systems, Atlanta, Georgia

Jordan Dawson, Harris Packaging, Haltom City, Texas

ASSOCIATE MEMBER DIRECTORS

Chairman: Greg Jones, SUN Automation Group

Glen Arm, Maryland

Vice Chairman: Tim Connell, A.G. Stacker Inc Weyers Cave, Virginia

Secretary: John Burgess, Pamarco/Absolute, Roselle Park, New Jersey

Director: Jeff Dietz, Kolbus America Inc., Cleveland, Ohio

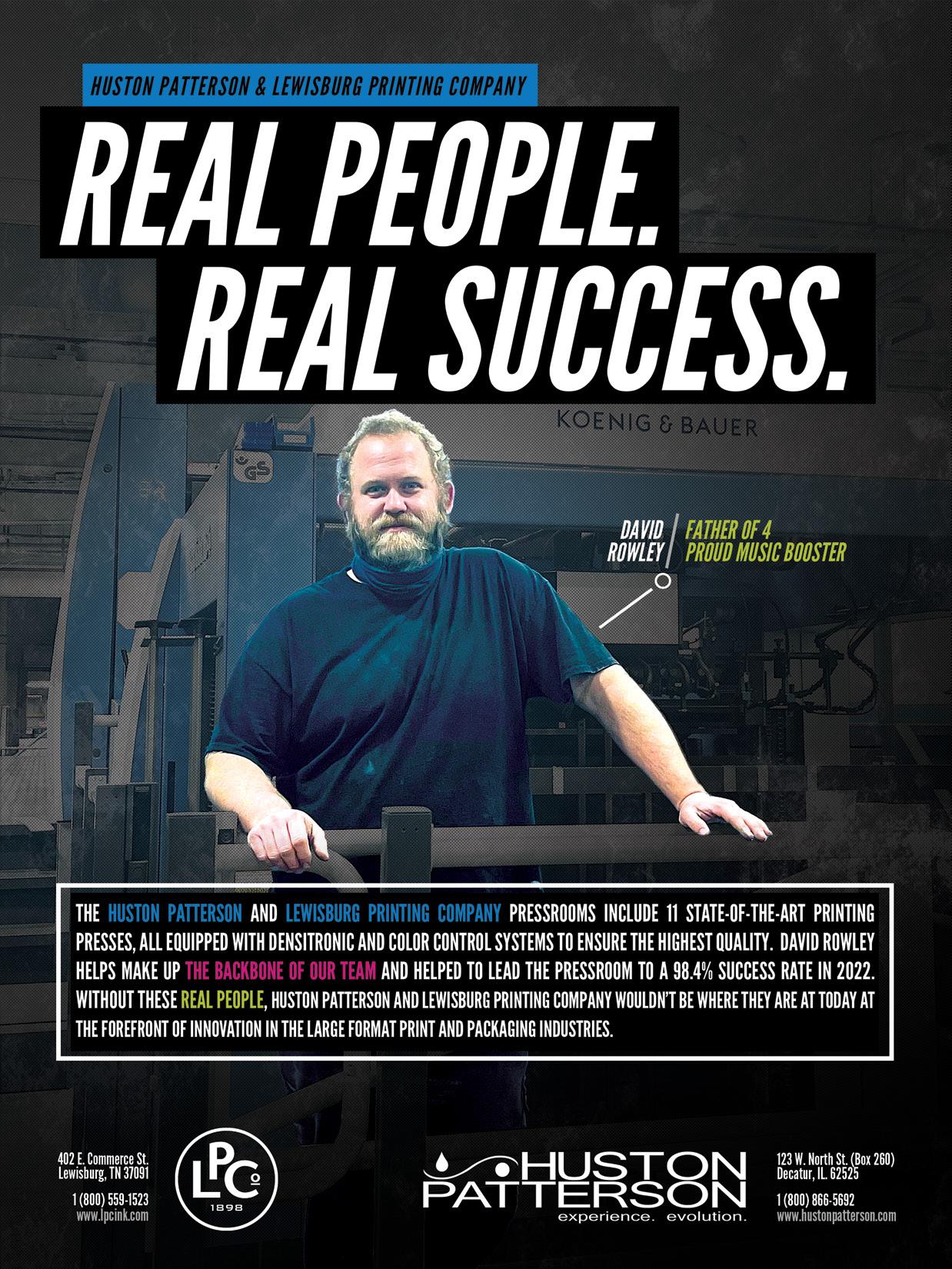

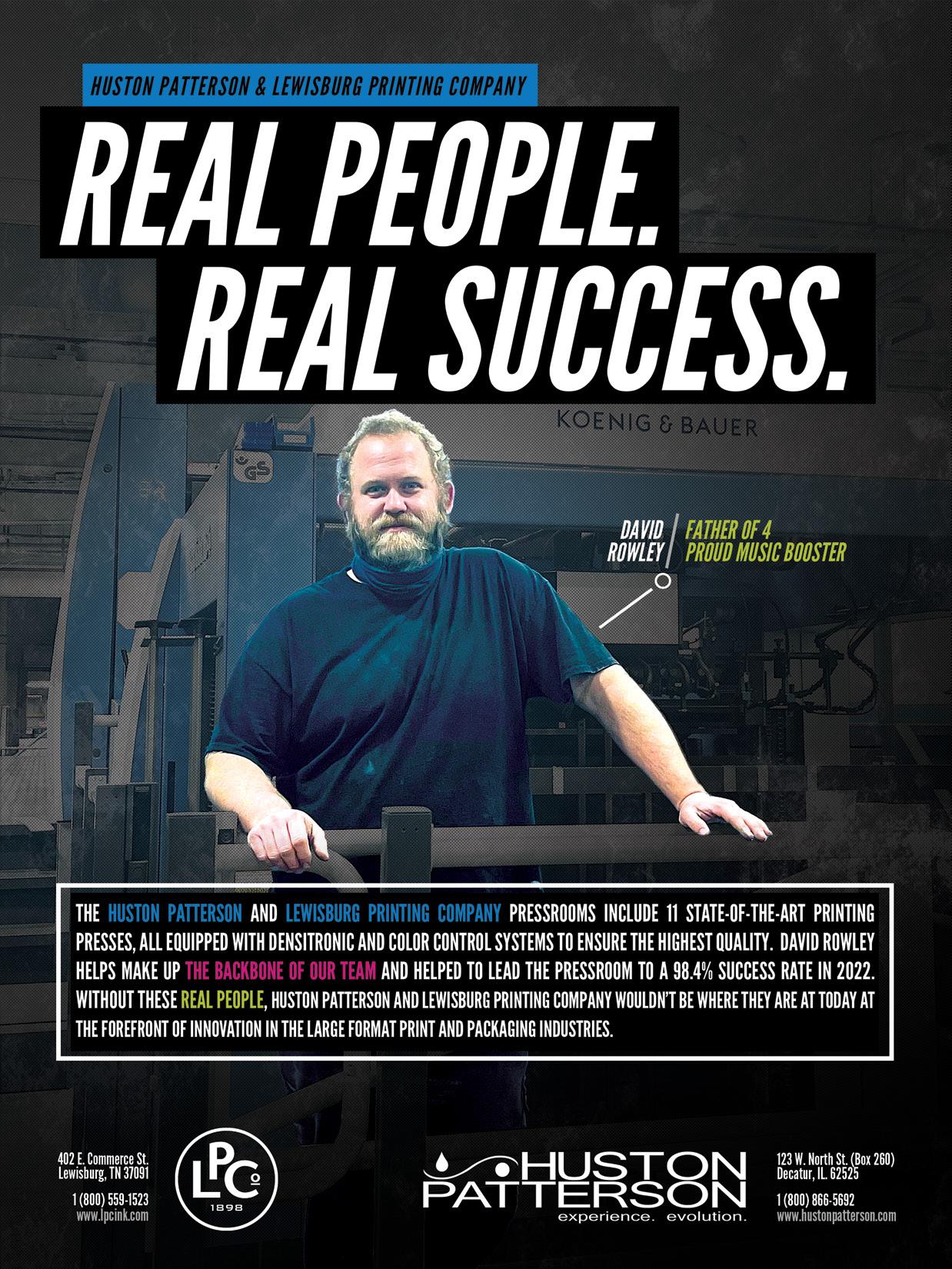

Immediate Past Chairman, Associate Members: Joseph Morelli, Huston Patterson Printers/Lewisburg Printing Co., Decatur, Illinois

ADVISORS TO THE CHAIRMAN

Al Hoodwin, Michigan City Paper Box, Michigan City, Indiana

Gene Marino, Akers Packaging Service Group Chicago, Illinois

Greg Jones, SUN Automation, Glen Arm, Maryland

PUBLICATION STAFF

Publisher: Michael D’Angelo, mdangelo@AICCbox.org

Editor: Virginia Humphrey, vhumphrey@AICCbox.org

ABOUT AICC

EDITORIAL/DESIGN SERVICES

The YGS Group • www.theYGSgroup.com

Vice President: Serena L. Spiezio

Senior Director of Content Strategy: Craig Lauer

Managing Editor: Therese Umerlik

Senior Editor: Sam Hoffmeister

Copy Editor: Steve Kennedy

Art Director: Alex Straughan

Account Manager: Frankie Singleton

SUBMIT EDITORIAL IDEAS, NEWS, & LETTERS TO: BoxScore@theYGSgroup.com

CONTRIBUTORS

Maria Frustaci, Director of Administration and Director of Latin America

Cindy Huber, Director of Conventions & Meetings

Chelsea May, Education and Training Manager

Laura Mihalick, Senior Meeting Manager

Patrick Moore, Membership Services Manager

Taryn Pyle, Director of Training, Education & Professional Development

Alyce Ryan, Marketing Manager

Steve Young, Ambassador-at-Large

ADVERTISING

Taryn Pyle

703-535-1391 • tpyle@AICCbox.org

Patrick Moore

703-535-1394 • pmoore@AICCbox.org

AICC

PO Box 25708

Alexandria, VA 22313

Phone 703-836-2422

Toll-free 877-836-2422

Fax 703-836-2795

www.AICCbox.org

PROVIDING BOXMAKERS WITH THE KNOWLEDGE NEEDED TO THRIVE IN THE PAPER-BASED PACKAGING INDUSTRY SINCE 1974

We are a growing membership association that serves independent corrugated, folding carton, and rigid box manufacturers and suppliers with education and information in print, in person, and online. AICC membership is for the full company, and employees at all locations have access to member benefits. AICC o ers free online education to all members to help the individual maximize their potential and the member company maximize its profit.

WHEN YOU INVEST AND ENGAGE, AICC DELIVERS SUCCESS.

TICCIT® : Trees Into Cartons, Cartons Into Trees

As you know, my theme this year is “Better Minds, Better Boxes.” The purpose of this theme is to find ways to invest in the future of our industry and our companies through education. This means getting the word out about our industry to the next generation of workers, as well as providing continuing education for our current employees.

AICC and the International Corrugated Packaging Foundation (ICPF) have done a good job with outreach to colleges, and AICC and the Foundation for Packaging Education have done a good job with providing the continuing education our members need. This year, AICC and ICPF are focusing on educating younger, school-age students about what this industry has to offer.

AICC reached out to our friends at the Paperboard Packaging Council (PPC) to inquire about sharing their award-winning TICCIT® program with our members. Ben Markens, president of PPC, graciously said yes and was excited to hear we wanted to promote their program.

So, what is TICCIT (pronounced “ticket”)? It is an educational outreach program that provides an opportunity to connect with local elementary schools. The prepared PowerPoint presentation and script highlight these key aspects about our industry:

• Benefits of trees.

• How paper is made.

• Renewability and sustainability of paper-based packaging.

• Paper-based packaging is biodegradable.

• Trees are a crop, just like fruits and vegetables.

• How we manage our forests.

• The importance of recycling.

After the presentation, we provide the students with a sapling they plant in a paper-based carton we provide. The student is instructed to plant the carton with the sapling directly in the ground. They are informed that as the tree grows, the carton will biodegrade, completing the life cycle of “trees into cartons, cartons into trees.”

Our company, American Carton, a proud AICC and PPC member, has participated in this program for more than 10 years. The benefits of participation have been many, but these mean the most to us. The program gives us a chance to gather a team of our employees to prepare for the presentation day. Those employees and previous participants have had a lot of fun working together to engage with a school (usually one of their kids’ schools), gather the materials needed, and present to the students. In addition to team building internally, participating in the TICCIT program has allowed us to connect with our community.

We have made connections with teachers and principals at our local schools who really appreciate us coming in to educate the students. Finally, we get to share the sustainability story and open the students’ minds to our industry. I cannot say enough good things about this program.

I hope you will go to www.ticcit.info and see how easy PPC has made it for you to participate in this fun and interactive program. As stated on the TICCIT website, “Plant a tree, grow a mind.”

Thank you, PPC, for sharing this opportunity!

Jana Harris CEO and Co-owner, Harris Packaging and American Carton Co. AICC Chairwoman

BOXSCORE www.AICCbox.org 3 Chairwoman’s Message

How Does Trade Really Impact Us?

BY DICK STORAT

Have you ever wondered how international trade really impacts our industry and your business opportunities? To answer this question, we have searched through the full list of imported and exported goods to flag those products that need corrugated packaging to protect them in transit. In a search through the U.S. Department of Commerce’s lists of exports and imports, 32 product categories were extracted for examination. Examples include all of the food and beverage categories and an assortment of other nondurable goods such as cleaning supplies and pharmaceuticals. Also included were electronics and appliances. These are the same types of goods made in the United States and packaged to protect them through the domestic supply chain to their end use. Both tables on this page show how the categories were summarized.

The next step is to look at detailed Commerce Department data to identify the value of exports and imports of these goods traded internationally this past year. U.S. manufacturers exported a

2022 EXPORTS OF PACKAGEABLE PRODUCTS ($ BILLIONS)

significant quantity of packageable goods in 2022. Although we focus mainly on imports when thinking of international trade, it is important to recognize that exports provide significant additional opportunities to supply boxes and other packaging materials that wouldn’t exist without these exports. The table above summarizes the value of these exports.

IMPORTS OF PACKAGEABLE PRODUCTS ($

Exports of packageable goods offered a large market opportunity for additional packaging beyond that sold for domestic production for goods made only for U.S. consumption. Exports totaled almost $600 billion this past year.

Packaging-intensive foods, beverages, and fresh produce accounted for a total of $112 billion, or 19% of this past year’s total of packageable goods shipments abroad. Computers and electronic equipment is the largest export category this past year, amounting to $228 billion, or almost 40% of exports requiring corrugated packaging for protection. Another standout export sector is pharmaceuticals and medicines, which totaled $99 billion.

However, international trade doesn’t just stop with exports. The trade surplus generated by this past year’s exports of packageable goods needs to be reduced for imports of the same goods. Although there is some repackaging of imported goods in the U.S., imports are by and large packed in the needed paper-based packaging at the point of manufacture.

BOXSCORE May/June 2023 4 Scoring Boxes

PRODUCTS EXPORTS Computers & Electronic Equipment 228 Textiles & Apparel 23 Pharmaceuticals & Medicines 99 Other Packageable Goods 100 Food & Beverage 94 Appliances 8 Fruits, Vegetables, & Tree Nuts 18 Cleaning & Toilet Supplies 20 Total 590 Sources: Census, RSA Inc. 2022

PRODUCTS IMPORTS Computers & Electronic Equipment 491 Textiles & Apparel 194 Pharmaceuticals & Medicines 198 Other Packageable Goods 185 Food & Beverage 139 Appliances 43 Fruits, Vegetables, & Tree Nuts 37 Cleaning & Toilet Supplies 18 Total 1,305 Sources: Census, RSA Inc.

BILLIONS)

2022 PACKAGEABLE GOODS TRADE DEFICIT ($ BILLIONS)

In 2022, those imports totaled $1.305 billion as is detailed in the bottom table on p. 6. Countries worldwide have their eye on the lucrative opportunity created by a U.S. economy tuned for consumption rather than production. A U.S. dollar some 25% stronger than justified by economic fundamentals in the U.S. manufacturing sector facilitated this avalanche of goods again this past year. It was enough to wipe out the boost U.S. exports gave to the economy and its

independent paper packaging converters by more than two times over.

In the largest category, imports of computers and electronic equipment were twice the amount of this past year’s exports, thereby shrinking by more than $1 trillion the market opportunity for U.S. paper packaging suppliers. The same trend is true for other categories, as well. Imports of pharmaceuticals and medicines were about twice the level of exports.

Trade Balance for Pharmaceutical Products

The difference between imports and exports is the trade deficit. The table to the left shows the trade deficits this past year in billions of U.S. dollars. It also shows the change in the deficit from 2021. The overall trade deficit for packageable goods in 2022 was $715 billion. To get a sense of how enormous that is, consider that the gross domestic product (GDP) for the state of Ohio was $736 billion in 2021. That means the trade deficit for packageable goods in 2022 exceeded the state GDP of each state, except the seven largest states. By any measure, that is a sizeable market opportunity unavailable to producers of packaging in the U.S. Overall, the trade deficit worsened by $92 billion, or 15% this past year, compared with 2021. The trade deficit for computers and electronic equipment amounted to 37% of the total deficit and had eroded by an additional $33 billion, or 14%, this past year. Cleaning and toilet supplies and the other packageable goods categories were the only ones that did not worsen in 2022.

To get a sense of how the trade deficit has been worsening over time, look at the chart directly to the left, which shows how the trade deficit for pharmaceuticals and medicines has behaved since 2017. From a deficit of $57 billion in 2017, the difference between imports and exports rose to $99 billion this past year, a worsening of $42 billion.

So, the next time someone asks you how international trade affects independent paper packaging converters, just tell them it is like losing the state of Ohio from the U.S. economy. High impact, indeed.

Dick Storat is president of Richard Storat & Associates. He can be reached at 610-282-6033 or storatre@aol.com

BOXSCORE www.AICCbox.org 5 Scoring Boxes

TRADE DEFICIT CHANGE IN DEFICIT PRODUCTS 2022 2021–2022 % CHANGE Computers & Electronic Equipment 262 33 14% Textiles & Apparel 171 35 26% Pharmaceuticals & Medicines 99 21 28% Other Packageable Goods 85 (21) −20% Food & Beverage 45 15 51% Appliances 36 2 6% Fruits, Vegetables, & Tree Nuts 18 5 39% Cleaning & Toilet Supplies (2) 0 −18% Total 715 92 15% Sources: Census, RSA Inc. 2017 2018 2019 2020 2021 2022

($ Millions) −$120,000 −$100,000 −$80,000 −$60,000 −$40,000 −$20,000 −$0 (75,451) (56,823) (85,628) (86,179) (100,401) (99,419) Sources: Census, RSA Inc.

Welcome, New & Returning Members

Welcome, AICC’s New Members!

BETHLEHEM DIE CUTTING

JASON BOHANNON

Plant Manager

802 E. 8th St. New Albany, IN 47150

812-282-8740

www.kyanaind.com

TOPP CORRUGATED PRODUCTS

BRIAN KENTOPP

President

45 Market St. Morristown, NJ 07960 201-738-8623

www.toppcp.com

KADANT JOHNSON

KENNETH C. LAHRKE III

Director of Industrial Sales

805 Wood St. Three Rivers, MI 49093 269-278-1715

fluidhandling.kadant.com

HOT MELT TECHNOLOGIES, INC.

DOUG GEBOSKI

Trade Liaison

1723 W. Hamlin Rd. Rochester Hills, MI 48309 248-853-2011

www.hotmelt-tech.com

BAY MACHINERY COMPANY

FREDERICK D. SMITH

Sales Manager

11118 Thompson Hwy. Blissfield, MI 49228 419-727-1772

www.baymachinerycompany.com

HIFLOW SOLUTIONS

MARIUSZ SOSNOWSKI

CEO/President

66 W. Flagler St., Suite 935 Miami, FL 33130 305-646-9933

www.hiflowsolutions.com

FIRST LUKE WOODWORTH CEO

12485 E. 79th St. Indianapolis, IN 46236 463-249-4705

www.firstindustrialservices.com

JUST PACKAGING

MONTY WARRICK President

54340 Smilax Rd. New Carlisle, IN 46552 574-654-7555

www.just-packaging.net

ST. PETE PAPER COMPANY

TOM GOMEZ President

2324 20th St. East Palmetto, FL 34221 941-776-4194

www.stpetepaper.com

BOXSCORE May/June 2023 6

Quality & Consistency

Produce Better Quality Graphics

ThermaFlo™ Brings HD Graphics To Corrugated Printing o

W ith a consistent cell geometry that promotes , ink metering and due to our multi-hit technology - you can get extended volume ranges

Repeal the ‘Death Tax’

BY ERIC ELGIN

As I have noted in past columns, your Association is well-connected with other organizations in Washington, D.C., that work to advance the cause of small and medium-sized businesses. AICC President Mike D’Angelo sits on the board of directors of the Small Business Legislative Council, for example, and he actively engages with groups such as the S-Corp Association and the Family Business Coalition (FBC). The latter group describes itself as “the voice of America’s main economic engine—family businesses—working together towards a better business climate that promotes private business expansion and job growth.” Since so many AICC members are family-owned, your Association takes notice when this group speaks.

One issue of major importance to FBC is the repeal of federal estate taxes, aka the “death tax.” In a letter to U.S. Sen. John Thune (R-South Dakota) who recently reintroduced a bill to repeal the death tax, FBC, joined by AICC and other several other family business groups, wrote:

“Repealing the death tax would spur job creation and grow the economy. Many studies have quantified the potential job growth that would result from estate tax repeal. Last year, the Tax Foundation found that the U.S. could create over 150,000 jobs by repealing the estate tax.

“The death tax contributes a very small portion of federal revenues. The estate tax currently accounts for approximately one half of one percent of federal revenue. There is a good argument that not collecting the estate tax would create more economic growth and lead to an increase in federal

revenue from other taxes. A 2016 Tax Foundation analysis found repeal of the death tax would increase federal income taxes by $145 billion over 10 years using a more realistic, dynamic economic analysis.

“In addition, the death tax forces family businesses to waste money on expensive insurance policies and estate planning. These burdensome compliance costs make it even harder for business owners to expand their businesses and create more jobs. In poll after poll, a super-majority of likely voters supports eliminating the death tax. Typically, two-thirds of likely voters support full and permanent repeal of the death tax. People instinctively feel that the estate tax is not fair. A 2016 state poll by YouGov conducted in South Dakota showed 75% of voters

supported repealing the estate tax. The negative effects of the estate tax make permanent repeal the only solution for family businesses and farms. Your legislation will help America’s family businesses create jobs, expand operations, and grow the economy.”

If you agree with this sentiment, contact your state’s senators in Washington, D.C., and urge their support for Thune’s bill. You can call the Capitol switchboard at 202-224-3121 or go to www.senate.gov.

Eric Elgin is owner of Oklahoma Interpak and chairman of AICC’s Government Affairs subcommittee. He can be reached at 918-687-1681 or eric@okinterpak.com

BOXSCORE May/June 2023 8 Legislative Report

Truck. Loads . More.

Corrugated printing has gone from basic to beautiful in 10 year s. With the explosion of packaging demands and shor ter print runs, speed has become the #1 capacit y driver. One of our customers tells us automated complete plate cleaning in < 4 minutes adds 25% capacit y in a working week with FlexoCleanerBrush™

He calls it ‘Truckloads More Capacit y’. You can do your own math.

ESG, Part Two

BY RALPH YOUNG

It has been almost two years since we alerted members and Associates to environmental, social, and governance (ESG) issues through a BoxScore article. While we will develop an update in this article, the main issues for financial investors and maybe your clients is the extended producer responsibility (EPR) initiative, which has been present longer and has more traction. Be on the lookout for producer responsibility organizations.

Although this unwieldy initiative is global, pushed forward by the United Nations Sustainable Development Goals, the United States and various states have adopted it in part as they attempt to implement recycling and diversion strategies.

This ESG program has a very large umbrella that may have started with sustainability but has grown into a much broader scope after the Paris Agreement, also known as the Paris Climate Accord, of 2015. It encompasses many issues not likely to apply to you, even though the carbon-neutral element may be an issue considering our consumption of electricity from various fuel sources.

Our joint response to the components must first be addressed for the whole industry: forest, mills, transportation, converting plants, and fiber recovery. I believe every box plant will need to focus on where its energy comes from—waste recovery such as office materials and metals and die boards, water consumption, dust usages, electrical consumption, and truck gallons consumed.

Terry Webber, vice president of industry affairs for the American Forest & Paper Association (AF&PA), has said

stakeholder engagement on EPR bills could make or break legislation. AF&PA plans to be an “active participant” in EPR for packaging discussions because of the potential for such laws to affect packaging costs and material flows. See AF&PA’s letter to the State of Connecticut from February 27, available on the AICC website. We will keep you posted.

According to McKinsey & Co., the targeted industries are not forest products (i.e., containerboard and corrugated) but they concern banks; automotive, aerospace, defense, and technology; transportation, logistics, and infrastructure; telecommunications and media; energy and materials; resources; and consumer goods.

Your AICC is attempting to develop an updatable white paper or template to assist you in responding to client and community requests, along with access to a new Packaging University course. We are gathering relevant perspectives from several other larger trade organizations and a few investment firms.

Challenges remain. For example, Germany’s plan to be carbon neutral by 2045 had a major setback when it stopped buying Russian natural gas because of the latter’s invasion into Ukraine. Germany’s desire to use hydrogen as a fuel source will take many years to develop, even with government subsidies.

Focus on your waste. No materials should be leaving your plant to go to a landfill or for incineration. Recover plastic and metal drinking containers, food packaging, die boards to be chipped, rule to be recovered, and office papers to be separated as a start.

Right to repair legislation, if passed, states you will need to keep that old slow

computer longer, since it can be usable. Batteries remain in question, although they are not toxic.

It should all be about value creation, but it will come at a cost! Consider the social aspect of the ESG movement, which includes better safety procedures, health and welfare, and community aspects such as charities and food drives.

PFAS

We get questions about corrugated and per- and polyfluoroalkyl substances (PFAS). It is found almost universally throughout the environment in water, air, soil, plants, printing inks, and animals. It is found in your phone, linings and coatings of ink buckets, plastic water and soda bottles, shampoo bottles, plastic agricultural chemical containers, and inside and outside your buildings.

The U.S. Environmental Protection Agency website has much to say about this issue but no solution because it is considered a “forever chemical.” On average, the levels are 30–50 parts per trillion, but no research can determine at what exposure levels a substance becomes an issue to human health and longevity.

This fluoride product has been around and is a major component of Teflon. While this product is not currently under the ESG umbrella, all that can change.

Ralph Young is the principal of Alternative Paper Solutions and is AICC’s technical advisor. Contact Ralph directly about technical issues that impact our industry at

askralph@AICCbox.org

BOXSCORE May/June 2023 10

Ask Ralph

Upsize your output

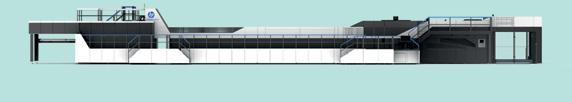

EMBA 295 QS Ultima™

It’s time to unbox the latest model in the Ultima machine family –EMBA 295 QS Ultima ™. Delivering outstanding productivity and quality as well as material efficiency to large box operations. That’s what we call big news.

benefits you’d expect and like all our Ultima machines it features our unique Non-Crush Converting ™ and Quick-Set ™ technologies.

By introducing the EMBA 295 QS Ultima ™, we now offer a complete machine range to fit any customer need. It comes loaded with all the

The 295 QS Ultima ™ offers true DualBox ™ production through TwinFeed ™ and XL slotter, as well as complex internal box die-cutting and creasing with the bottom diecutter. Several available options, like for example HighBox ™ and the award winning LiquidCreaser ™ , further enhance its true flexibility and top-class performance.

Liljedal Communication 2021 www.emba.com

Inspired by the challenges of our customers, developed for ultimate results.

XL boxes + XL slotter = XXL output.

Going the Extra Mile for Employee Recruitment, Satisfaction, and Retention

BY TOM WEBER

The “great resignation” has continued for far longer than many had anticipated, with approximately 4 million Americans continuing to leave their jobs each month since April 2021. Th is trend persisted, even during the shaky economy of 2022, with the onset of a technical recession doing little to stop the turnover juggernaut.

Benefits packages are one of the key factors that can influence an employee’s decision to stay or go, which is why many companies have been beefi ng up their offerings in recent months. With the competition for exceptional talent remaining fierce, these five innovative benefits trends can act as powerful differentiators for companies that want to maintain an edge in recruiting and retention for 2023 and beyond.

100% Health Plans

It’s no secret that U.S. health care costs have risen dramatically in the past several years. According to a 2021 Kaiser Family Foundation survey, half of responding adults say expensive health care is a top fi nancial worry and a burden on their families. To alleviate these negative outcomes and attract scarce talent, more companies have decided to pay 100% of monthly health care premiums for their employees. The decision to embrace 100% premium coverage, rather than the national average of 83%, can be an incredible diff erentiator in the eyes of candidates. Currently, this practice is more common in smaller fi rms than larger ones, with 29% and only 5% off ering full premium coverage, respectively.

However, the perpetually tight labor market of the 2020s appears to be changing this equation, with many larger fi rms embracing 100% coverage plans in recent months. Although this can be a fairly expensive proposition, many think it is ultimately good for the bottom line because it boosts the physical and mental well-being of employees, increases engagement and productivity, and improves recruitment and retention.

Here are some key questions employers may want to ask themselves when considering a 100% paid health plan:

• Will the company pay 100% for employee-only coverage or extend this benefit to spouses and dependents? It’s more common to see employers cover 100% of premiums for employee only, with other plan participants needing to buy up.

• What about other aspects of a 100% plan design? While paying premiums looks good on its own, shifting costs to employees through increased deductibles and out-of-pocket maximums can undercut actual savings for plan users who think they are getting a good bargain.

• How does the cost for a 100% plan compare with hiring a new employee? According to the Kaiser Family Foundation’s 2021 Employer Health Benefi ts Survey, the standard company-provided health care policy totaled about $7,739 for single coverage and $22,221 for family coverage. According to the Society for Human Resource Management, the cost to attract, hire, and onboard

a new employee averages $4,129. Depending on industry specifics and the severity of one’s turnover problem, paying 100% of premiums may or may not make fi nancial sense.

Expanded Voluntary Benefits

You can’t please all the people all the time—unless you embrace voluntary benefits. Voluntary benefits, also called supplemental benefits, refer to optional perks off ered to employees at a discounted group rate, which employers negotiate with providers. While employees still need to pay to use these benefits, the amount is typically far less than it would be without company subsidies.

Th ese types of benefits give employees the chance to customize their benefits package to best suit their particular needs. Whether it’s aff ordable veterinary insurance for pet owners, subsidized pre-K child care for new parents, or discounted food delivery for the culinary-challenged, off ering these types of policies can directly improve the quality of life of employees who choose to take advantage of them. Th ese off erings can play a crucially important role in recruitment and retention strategies, with MetLife’s 20th Annual Employee Benefi t Trends Study 2022 fi nding that 73% of employee respondents would stay at their current employer longer if they had a wider selection of benefits.

Holistic Leave for Caregivers

Since the COVID-19 pandemic abruptly normalized remote work for millions

BOXSCORE May/June 2023 12

Ask Tom

© Copyright 2023 HP Development Company, L P The information contained herein is subject to change without notice Productive. Economical. Sustainable. Optimize the cost of manufacturing high-quality boxes, improve operational efficiencies and grow your business with digital post-print flexibility at scaled-volume production. Find out more: www.hp.com/pagewide-C550

HP PageW ide C550 Press

Ask Tom

of U.S. employees, those caring for young children or elderly relatives have been particularly reluctant to work in positions that do not offer them the flexibility to tend to these important family obligations. The truth is that conventional employment models are simply not conducive to people with these types of responsibilities. Because of this, hundreds of thousands of caregivers, particularly young mothers, have chosen to leave the labor force entirely over the past two years rather than put up with unnecessary commutes, rigid schedules, and stingy leave policies. The past two years have proved that in-person employment and the conventional 40-hour workweek are not necessarily required to build high-performing teams, and companies worried about recruitment and retention have taken note.

The best way to satisfy this highly skilled demographic of workers is to offer holistic leave and flexibility policies that don’t make them choose between being good caretakers and good employees. Competitive companies are getting ahead of the curve by offering unlimited paid time off, build-your-own-schedule provisions, reduced hours for those with young children, and sabbaticals for tenured employees. Studies have found that being aggressive and experimental in this area is a great way to attract and retain talented workers who desire more agency in how they spend their days. For example, LinkedIn’s 2022 Global Talent Trends Report found that employees satisfied with their company’s time and location flexibility are 2.6 times as likely to report being happy and 2.1 times as likely to recommend their employer to others.

Scientific Approach to Benefits

Providing a solid benefits package is a great way to increase retention, boost recruitment efforts, and show employees they are valued. According

to a 2018 study by Randstad, 42% of employees said they were considering leaving their current job because of inadequate benefits packages, while 55% had left jobs because they found better benefits or perks elsewhere. As an employer, it’s smart to know exactly what existing employees and potential hires want with regard to employee benefits. Because of this, data-driven benefits offerings are becoming more prevalent in the era of the great resignation, with internal employee surveys and external expertise being leveraged to improve offerings.

Conducting regular surveys is the most effective way to determine whether employees feel their wants and needs are being adequately addressed by current benefit offerings. In this regard, less can be more—consider adopting frequent pulse surveys with only a few questions rather than 20-page annual surveys. This sort of continuous employee listening strategy is excellent for measuring satisfaction and collecting feedback that can be addressed in real time. According to Qualtrics, this type of responsive action can make employees up to 12 times as likely to recommend their employer to others. By enacting a benefits strategy anchored in a scientific approach, employers can align offerings with larger business goals and maximize the impact of their benefits spend.

Personalization and Malleability

The U.S. workforce is currently home to five distinct generations working shoulder to shoulder. These different age cohorts have different needs, and it is difficult for a traditional benefits plan to give adequate attention and resources to everyone. This dynamic can push employees to decline offerings they personally do not want or need, which can effectively result in them forfeiting substantial monetary resources.

For example, a generous 401(k) matching scheme may not be as valuable to recent college graduates bogged down with student loans. Or a Gen X employee may choose to decline health care coverage because their spouse has a richer plan, resulting in the company spending much less on their benefits than for most other employees.

To combat this uneven distribution of benefits resources—and perhaps unintentionally ageist outcomes— employers may find it helpful to reconceptualize benefits as a malleable pool of resources that individual employees may allocate according to their specific needs. If a doctorateholding baby boomer is unlikely to take advantage of a company policy that reimburses the cost of higher education, let them reallocate those dollars to attend an industry conference that piques their interest. If an employee has a few more years of coverage under their parent’s health insurance plan but is struggling to afford veterinarian bills, allow them to take the cost of their unused health benefits and apply it to caring for their furry friend(s). This personalized approach to benefits can effectively foster more equitable outcomes, boost employee morale, and broadcast a positive corporate culture.

To learn more about these topics and others, visit NOW.AICCbox.org. You can also connect with AICC Director of Education and Leadership Taryn Pyle at tpyle@AICCbox.org or Education and Training Manager Chelsea May at cmay@AICCbox.org

Tom Weber is president of WeberSource LLC and is AICC’s folding carton and rigid box technical advisor. Contact Tom directly at asktom@AICCbox.org

BOXSCORE May/June 2023 14

Italy knows a thing or two about quality & innovation.

maserati

michelangelo

lamborghini

Ducati

botticelli

LEONARDO DA VINCI

ferrari

alfa romeo

encore fd 618

Say Ciao to the Encore FD 618.

Next-level machinery, world-class quality.

hairegroup.com

Maximizing Your CRM for Success

BY TODD M. ZIELINSKI AND LISA BENSON

As inflation and interest rates soar, savings dry up, and consumer spending shifts to essentials, boxmakers face uncertainty about sales in the coming months. This comes on the heels of the 2022 fourth quarter, which experienced the largest decline in box shipments since the great recession in 2009. Although the current picture may not seem optimistic, it provides an opportunity to gain market share for companies with a strategy.

A successful downturn strategy will include the mandatory use of a customer relationship management (CRM) system. Having a centralized depository with up-to-date customer information can provide a trove of valuable data to assist in sales and marketing activities. Effectively used CRM systems allow you to identify sales opportunities, track sales activity, and analyze customer buying behavior, all of which can lead to increased sales and

revenue. In addition, by analyzing customer data, businesses can create targeted marketing campaigns that are more likely to resonate with their customers, leading to increased marketing effectiveness.

But for a CRM to be effective, it must be used consistently, which means getting buy-in across all levels of the organization. Additionally, thought must be put into how it is set up so impediments to its use are reduced, and its fullest potential is reached. Using a CRM with a mobile app and email integration and automation will make it easier to use and promote consistent use.

At any given time, anyone using your CRM should know whether a contact is a prospect or a customer. Your current client list should be accessible, and it should be clear where opportunities are in the pipeline. They should be able to view records and create reports based on segmentations (e.g., product, territory,

industry), sales data (e.g., order history, revenue, projections), and a salesperson’s performance.

If you are setting up a new CRM or are not getting the most out of your current CRM, below are several recommendations to help you maximize its use and performance.

Understand Your Goals

Before your CRM is set up, it is important to understand how you want to use it and what you expect to get from it. Consider all departments using it, such as sales, marketing, customer service, operations, and finance. Each department may have its own needs and goals.

Creating a CRM strategy will allow you to tailor your CRM to meet the goals of all who can benefit from its data. A crucial step is to figure out where you have gaps—data you need but currently do not have easy access to.

BOXSCORE May/June 2023 16 Selling Today

MagnumInks.com | sales@magnuminks.com | 877.460.8406 ©2023 Magnum Inks & Coatings. All rights reserved. CorrPrint Rod Coating Colors are designed to withstand heat, moisture, and abrasion of corrugated manufacturing. With excellent printability and a glueable coat, Magnum inks deliver consistent performance on rod coaters with very low rod wear and exceptionally smooth coating on the substrate. Our water-based colors are available in standard GCMI, Pantone,® or custom-matched. Responsive and agile, Magnum Inks & Coatings offers excellent technical expertise and outstanding service. Contact us and learn how the right partner can make all the difference in your printing/coating processes. The Corr of your printing success.

Goals should be specific and measurable. With goals in mind, you can begin to set up the fields and properties within the CRM.

Define Data and Pipeline Requirements

Setting up a CRM can be overwhelming, but getting it right is critical to success. It is recommended that you have a CRM administrator who can maintain and manage data and users, as well as ensure best practices are adhered to.

Defi ne the data points and fields that are required. Data should include identifying and quantifiable information. Identifiable data might consist of company information (e.g., name, location, industry, prospect, customer) and contact information (e.g., name, title, phone, email). Quantitative data might include the value of opportunities and sales and engagement with emails and your website if your CRM is tied into your marketing automation.

Create pipelines based on the stages of your sales process and buyers’ journeys. Pipelines allow you to defi ne benchmarks and activities that will be used to move opportunities to the next stage. Th is allows you to see where each opportunity is and what needs to be done to move it along in the pipeline.

Setting up automation and integrations increases efficiency. For example, when integrated with Microsoft Outlook, email exchanges with a prospect or customer can be captured without manually entering them. Integration with marketing automation allows marketers to segment and create email campaigns that can drive engagement and sales. Also, using a rotting or last-touch feature prevents opportunities from being lost because the CRM will notify you of deals that have been idle for too long.

Maintain Clean, Accurate Data

Data integrity is crucial to a successful CRM system. If you are doing a data

dump when it is set up, scrub data to ensure it is clean. Gather and store data in a standardized format whenever possible. Use drop-down select or multiselect properties whenever possible, unless you’re collecting unique values (e.g., contact name, company name, messages). Doing so eliminates human error and makes segmenting and fi ltering data for marketing or analysis easier. It also improves the user experience.

SEGMENTATION AND FILTERS

The contacts in your CRM are in various stages and have different needs. Segmentation allows you to build useful lists of customers grouped by data points such as products, location, relationship type, account owner, and revenue. An exclusion fi lter is helpful for marketing activities so that emails are being sent to only those that should get them. With these lists, you can conduct more targeted marketing and sales efforts, and automate activities on those contacts.

USE AUTOMATION

Automation relieves your sales and marketing teams of repetitive tasks and boosts productivity. It can support your sales and marketing teams throughout the sales cycle by sending out internal emails, assigning tasks, creating workflows, or sending trigger automated emails based on an action or inaction. Automation allows you to keep activities moving and ensures data remains current.

LEVERAGE REPORTING AND ANALYTICS

Th ere is power in CRM data when it is used. While your CRM subscription level will govern the depth of reporting available, all of the above eff orts and anything else you do in your CRM can’t be truly maximized, unless you can understand the data and make decisions based on it. Building dashboards can help you understand the eff ectiveness of marketing campaigns

and sales eff orts. You can set up shared views and reports in advance that can quickly answer regularly asked questions about marketing, sales, and forecasting data. Evaluating the data will allow you to recognize if you are meeting the goals you created, uncover additional sales opportunities, spot issues in your processes, and make appropriate changes.

CONTINUE TO MONITOR YOUR CRM

Keeping data clean and ensuring the CRM is being used will require ongoing eff orts. Th is is why having a designated CRM administrator is essential, and the expectations for all users should be clear from the start. Establish a regularly executed process for cleanup, which can include removing hard-bounced emails and identifying gaps or missing data. Determine why data is missing (the salesperson didn’t input it from a form, etc.), and have the appropriate person populate the data or make corrections in forms or processes to prevent future occurrences.

Get the Most Out of Your CRM

Effectively and consistently using a CRM opens the door to countless more opportunities hidden in your data. All you need to do is take the fi rst step, and start using the tools and features to their fullest potential.

Todd M. Zielinski is managing director and CEO at Athena SWC LLC. He can be reached at 716-250-5547 or tzielinski@athenaswc.com

Lisa Benson is senior marketing content consultant at Athena SWC LLC. She can be reached at lbenson@athenaswc.com

BOXSCORE May/June 2023 18 Selling Today

A Holistic Packaging Education

BY JULIE RICE-SUGGS, PH.D.

Security questions. We all know them; we all forget them. But answers to questions like “What is your mother’s maiden name?” or “What was the name of your first pet?” or “What was your first car?” are seared into our brain so we can avoid the hassle of resetting the account. For me, the question asking for a childhood hero is my favorite because it makes me think of my dad—my forever hero. Why not Batman, Wonder Woman, or the wholesome Mr. Rogers, you might ask? Well, not to discount any of these heroes, but my dad shaped my views from a very early age on what I believe is one of the most empowering experiences to seek—education.

When I was growing up, my dad was constantly pulling wide-ranging subjects into our conversations. He was insistent that learning about everything around you is the key to understanding the bigger picture of life. This broad worldview translated to me attending a liberal arts college—in my dad’s footsteps, of course—where I took a variety of classes such as history, literature, theater, writing, philosophy, and chemistry. The classes were interdisciplinary, holistic examinations of a sweeping range of topics that allowed me to see the interconnectedness of the subjects, with learning seamlessly flowing from one class to the next through seemingly very different coursework.

Keeping that train of thought, let’s apply it to you amazing folks in the corrugated industry because this same worldview is just as relevant when it comes to packaging education. As skilled professionals in the corrugated realm, you are well versed in all things corrugated—from understanding the composition of the material to the specific flute type best suited for various applications. You speak the language of corrugated board. However, at the Packaging

School, we invite you to become a bit more “packaging agnostic” in your educational approach. We believe that to do your job effectively and efficiently as a corrugated expert, you need to speak the language of packaging as a whole.

What would that look like in practical terms? Let’s say you work in sales at a familyowned corrugated box company, and your client wants to ship thousands of wine bottles across the country. To understand glass as a material alongside corrugated not only helps to level up your knowledge, but it also serves to actively help your client make educated decisions on the best box for shipping their product. If you know to ask your client questions about the weight, volume, neck finish, etc. of the glass bottle they need to have shipped across several states, they will have confidence that you know what you are talking about.

Our students in the Certificate of Packaging Science (CPS) program have bought into this methodology of learning. Many come from one specific industry and are now taking the time to grapple with the various materials, processes, and influences shaping the advancement of the industry. From design conception to production and end of life, students are gaining a comprehensive knowledge of packaging and utilizing it as a key differentiator for themselves and their company. The CPS offers 60 hours of content, 12 courses, and six continuing education units (CEUs).

One student, a sales manager from a paper-based packaging company, had this to say about the CPS: “It is great to learn about the production of paper after being in the industry for 15 years. However, I got to learn about the more technical processes of other materials, too, that our clients use, since it is not only important what you do but also what your clients do.”

Another student, a sales representative for product inspection equipment, echoed these thoughts when discussing another certificate program we offer, the Certificate of Mastery in Packaging Management (CMPM). He said, “Th is program gave me the knowledge to speak about the full scope of a line design to better service my customers. The detailed coursework on primary, secondary, and tertiary packaging was invaluable for my sales process.”

The CMPM is a 12-week program offering 80 hours of content, 14 courses, and eight CEUs. The beauty of this program is that it has a completely customizable project based on your needs and interest, and it is led by a professor with a doctorate in packaging over the course of 12 weeks. Educating yourself about everything possible is invaluable for your growth as a human being. Like my dad is fond of saying, “Learning never stops.” And when it comes to a packaging education, a holistic understanding of packaging will contribute to your growth as a packaging professional, allowing you to strengthen your individual value proposition and enhance your choice of packaging solutions for your customers.

Julie Rice Suggs, Ph.D., is academic director at the Packaging School. She can be reached at 330-774-8542 or julie@packagingschool.com

Alli Keigley, who contributed to this article, is production coordinator at the Packaging School. She can be reached at alli@packagingschool.com

BOXSCORE May/June 2023 20 Andragogy

AD

Secret Sauce Recipe

BY SCOTT ELLIS, ED.D.

BY SCOTT ELLIS, ED.D.

Company culture is the way you get things done by planning and by what happens automatically. The secret sauce is concocted by embracing a system for deploying your values and intentions and sticking with them. At this point, I may be agnostic when it comes to which system is best for your company. The primary objective is to be consistent within a system that fits your values.

There have been many excellent ways of getting things done over the decades, I have observed. The quality systems of Deming, Juran, and Crosby gave us a way of gaining clear requirements and aligning our daily practices to improve our methods and communication. Carnegie taught us to communicate, Greenleaf encouraged leaders to serve their people, and Covey broke down the keys to being effective individually and corporately. The Toyota Production System focused everyone in the company on continuous improvement. In recent years, Holly Green has helped many to develop destination models to organize and reach objectives. Today, the Entrepreneurial Operating System is being used effectively to organize, involve, and engage individuals and teams for greater success. Each script for getting things done seems to have adopted key points from those that came before, adapting to the times.

The secret sauce recipes, regardless of the brand, share some key ingredients that cause allergic reactions in entrepreneurs. Companies founded by opportunistic innovators thrive on the heroic effort but balk at doing the same thing every day. As one such leader put it, “We are great at getting a job out today. We just can’t seem to get one out next Tuesday.” Consequently, most of us need to set up a system and ease our way into consistent deployment. With

respect to Jim Collins and all those mentioned above, the commonalities of sustainable execution include the following.

Humble Leadership

The smartest person in the room has been known to serve the team by equipping them through modeling and allowing time on task to develop critical-thinking skills. This is a discipline common to those who lead a team of problem preventers. When problems occur, they ask why it happened before they ask who is to blame. They overcommunicate the vision and model the values to which they aspire. Most effectively, this includes taking responsibility when the company strays from its goals and leading a quick recovery. Recovery time is a key performance indicator (KPI) of cultural fitness.

Educate and Involve the Entire Team This takes longer than we first expect. It involves showing the team the plan, helping them to understand how they fit in and benefit from the plan, and holding everyone to the same standard in deploying the plan. It also includes a robust system for repeating this process when new team members are added.

Shared Responsibility

Every leader in the company has the consistent deployment of the system as a key component of their performance evaluation. Consistency is essential, and it does not run on charisma or force of personality. If a particular manager is given day-to-day responsibility for incorporating the effort (e.g., quality, process improvement, training, and development),

they must be seen as a choir leader rather than a soloist. Their job is not to sing all the parts but to equip everyone to sing off the same sheet of music.

Clear Requirements

Quality has been defined as conformance to requirements. Engaging cultures have clear requirements for excellent behavior, as well as for products. Team members know what it takes to perform well, and they are confident everyone will

SECRET SAUCE

Combine all ingredients daily:

• Humble leadership

• Educated staff

• Shared responsibility

• Clear requirements

• Measurement

• Communication

• Recognition Substitutions:

• Caffeine

• High-fructose corn syrup

• MSG

BOXSCORE May/June 2023 22 Leadership

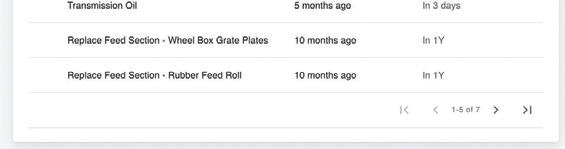

Machinery and Handling for the Corrugated Board Industry EVERYTHING CORRUGATED UNDER SUN IS THE OFFICIAL REPRESENTATIVE FOR TAIWAN-BASED LATITUDE MACHINERY CORPORATION, ITALY-BASED PARA, AND ISRAEL-BASED HIGHCON 1-410-472-2900 sunautomation.com Data in the Drivers Seat Improve your Converting Equipment’s Performance with Data-Driven Decisions EVERYTHING CORRUGATED UNDER powered by Determine when to perform key maintenance based on use, not set schedules Analyze operator and machine behavior to reveal training or tooling needs Accurately predict critical component failures and expected consumable use

Build Better Board.

Precison & Durability Saves

be accountable to those standards. Th is can even include attitude if the effort is expended to defi ne target attitudes behaviorally (aka operational defi nitions).

Measurement

KPIs help every team and individual keep score and track their own performance. When the requirements are clear, and performance is measured by them, management and improvement are simplified.

Communication

Every team member has a communication pathway by which to be heard. This is best accomplished when it is direct rather than channeled through a supervisor. The ability to identify issues, share improvement ideas, and ask questions is key to engagement.

Recognition

Team members get credit for their ideas. Th is may include a gain-sharing fi nancial reward. Sustainable programs always include a personal thank-you.

These are offered as observations on common ingredients to secret sauce. Yours will likely include caffeine; mine has high-fructose corn syrup. When a company has the secret sauce, it is evidenced by a purposeful energy and enthusiasm rather than a frenetic pace and frustration seen elsewhere. It has adopted a way of doing things that is consistently deployed regardless of the challenges of the day. It has owned an “our way.”

Scott Ellis, Ed.D., delivers training, coaching, and resources that develop the ability to eliminate obstacles and sustain more eff ective and profitable results. He recently published Dammit: Learning Judgment Th rough Experience. His books and process improvement resources are available at workingwell.bz . AICC members enjoy a 20% discount with code AICC21.

BOXSCORE May/June 2023 24 Leadership

apexinternational.com

Why the K1X Jumbo? • Extremely rugged construction • Triple wall capable • Speeds up to 6,000 sph • Full width die cutting and stacker • ERP controlled computerized set-up • Non-stop downstacker w/post compression section • Quick delivery machines can ship in as little as 4 months How can Global support you? • 24/7 service and support • In-house install and service team • Compehensive training • Spare parts inventory in U.S.A When to contact Global? NOW! • www.boxmachine.com • sales@boxmachine.com • 847-949-5900 800-621-4343 What are the options? • Available as a Flexo Folder Gluer or a Printer Slotter/Die Cutter K1X Sizes • 86” x 210” • 98” x 210 • Widths available up to 225”

FOUR QUESTIONS...

Design Space

The Future Perspective in Packaging Design

BY BRIAN ROMANKOW

Since the start of the COVID-19 pandemic, many things have changed in the way we do business, and many things continue to change even “post-pandemic.” Communication on Teams, Zoom, etc. has become the norm. Shopping online and picking up your groceries at the local store parking lot, without having to get out of your car, are now common. Even home food delivery shopping opportunities are more prevalent in small towns today, just as they are in big cities. The pandemic accelerated the way we live, how we do our daily chores, and what is to come. At the inception, no one knew what the best approach was, so everyone tried something a little different and then developed data to adjust and drive a more positive consumer experience.

The same can be said about how a lot of people are now processing customer requests for manufacturing—and not just in packaging. Ideally, things are now expected to happen a little faster and with more accuracy, based on data supplied by the customer.

Corrugated designers face greater challenges to deliver designs and prototypes of all kinds in less time than what was typically given four years ago. Ten years before that, the expectations of the time it would take for design to process through development and prototype to the customer for approvals were slightly longer.

Of course, not all design requests apply, but most do today. New product development, for instance, requires the time for validation and consumer feedback studies

or International Safe Transit Association testing for supply chain validation. Extra steps will always be communicated, and timing expectations are set, but whoever can get to the validated and best solution first will win!

Because of these increased expectations, companies are looking for ways to further automate steps in the development process. What’s scary about this is that automation is reliant on data—yes, zeroes and ones. So, a lot of software companies are creating new artificial intelligence and digital-twin solutions and bringing them to market as the next best thing to improve speed.

Data gets a mixed reaction depending on who is in the room at any given time. Older generations who like to touch and feel the product may tend to not trust data, whereas newer engineers and designers in the workforce rely on data because it is what they are used to from training at technical schools and universities. Imagine creating a design and sending it to your customer digitally so they can “see” in dimension and “feel” the weight and texture using virtual reality goggles and haptic gloves. Physical prototypes may soon be a thing of the past!

For a designer, this is scary and exciting. Job security, for one thing, comes to mind; if the computer is making the design, why am I still needed as a designer? Adversely and in a positive light, I see

opportunity—opportunity to get out of the sizing of boxes day to day and making like-for-like specifications and to get more involved in the creative projects and new product developments that separate one supplier from the next. Ideally, this can allow companies to capitalize on creative and innovative design by utilizing the talented engineers and designers to bring ideas to life.

Additionally, our businesses work with many business systems, most of which are not integrated. Moving ideas more quickly to manufacture and market will call for systems to talk and work with each other automatically (no human interaction), so expected turnaround times also decrease. You will need to rely on good data in the system to output the same.

Bringing the next innovation to market is what most companies are striving for today. It is not an easy task, and choosing where to focus your talent will become a key in winning the race to the top of the podium. Understanding the tools of design’s future will be important for success.

Brian Romankow is NA design and innovation manager at DS Smith.

BOXSCORE May/June 2023 26

Design Type Flexo Die Cut Display (Standard Floor Stand) 2010 Turnaround Time 3 Days 5 Days 7 Days 2023 Turnaround Time 1 Day 3 Days 4–5 Days Note: The above considers like items and is not necessarily based on new item development.

Headline

BYLINE

Member Communications

AICC Benefi ts in Small Bites: AICC Update

AICC has launched a new weekly podcast, AICC Update. Each week in less than five minutes, members can hear about upcoming AICC events and learn about benefits.

AICC member companies are investing in their teams by giving them access to AICC member benefits. AICC Update is another way to inform everyone at an AICC member company about the Association’s benefits.

“The Association offers so much to members that it can be difficult to be

aware of everything. We wanted to give our members a quick reference to stay on top of the ways AICC can help team members and their companies grow,” says Virginia Humphrey, director of membership and marketing at AICC and the host of the podcast.

The podcast will remind members of event deadlines, upcoming learning opportunities, and member benefits.

AICC President Mike D’Angelo says, “AICC is constantly working to keep our members out front. We always offer

something new. Th is podcast will be impactful because in a few short minutes, members can be updated and ready to access programs that will help them achieve success.”

Subscribe to AICC Update on all major podcast platforms including:

• Apple Podcasts: apple.co/3LvFCoG

• Spotify: spoti.fi/3JDwddr

• Google Podcasts: bit.ly/3ZS1Wxh

• Amazon Music: amzn.to/3LmiFo0

Or visit www.AICCbox.org/update.

BOXSCORE www.AICCbox.org 29

Sustainability Moving Beyond Good Intentions

BY JULIE RICE SUGGS, PH.D., AND ALLI KEIGLEY

BY JULIE RICE SUGGS, PH.D., AND ALLI KEIGLEY

We all need goals to move us forward in life. Companies without goals remain stagnant, or worse, regress, without them. So, when you think about your company, what are some of the goals you hope to accomplish in the next five, 10, or 15 years?

More than likely, environmental, social, and governance (ESG) efforts factor into your plans. In recent years, ESG goals have become an essential and expected part of business strategy and operational management. Maybe your company wants to set a goal along the lines of ensuring that 95% of your packaging will be produced from renewable, recycled, or recyclable sources by the year 2025—an incredible goal. But you may be at a loss as to how this is accomplished.

With that in mind, AICC and the Packaging School have crafted a sustainability program that enables member companies to develop internal champions who will transform sustainability intent into action. To begin a multifaceted program such as this, we plan to start with an overview of the key terminology a learner needs to speak the language of sustainability with colleagues and customers.

Here are a few of the key sustainability terms we will cover in this program:

• Biodegradable: biological decomposition process of carbon-based materials by microorganisms (no time frame)

• Compostable: subset of biodegradable, with measurable time frames and specific requirements for degradation and toxicity

• Extended producer responsibility (EPR): environmental policy approach in which a producer’s responsibility for a product is extended to the postconsumer stage of a product’s life cycle

• Carbon neutrality: net-zero carbon footprint reached when the same amount of carbon dioxide is released into the atmosphere as is removed, in turn, leaving a zero balance

• Carbon dioxide equivalent (CO2e): number of metric tons of CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas.

After becoming well versed in sustainable terminology, learners will work to set United Nations-based sustainability targets and goals, develop sustainable system designs (on the material level), measure the carbon footprint of their packaging, and select relevant offset programs to achieve carbon neutrality at a per-product level or per-box level. This program is meant not only to be deployed internally but also externally to map packaging solutions for members’ customer-specific sustainability goals.

Overall, this four-phase program consisting of an online sustainability course, a goal-setting workshop, a carbon workshop, and a demonstration of findings at the AICC 2023 Annual Meeting in September will help establish your organization as a thought leader in the ever-expanding

sustainability sector. Being able to discuss how carbon is measured, show examples of projects that offset emissions, and present opportunities and alternative solutions to reduce carbon positions you as a packaging consultant and leader.

If you’re inspired to take this step of becoming a sustainability champion within your company and for your customers and prospects, please contact Taryn Pyle for more information at tpyle@AICCbox.org.

Julie Rice Suggs, Ph.D., is academic director at the Packaging School. She can be reached at 3307748542 or julie@ packagingschool.com

BOXSCORE May/June 2023 30 AICC Innovation

Alli Keigley is production coordinator at the Packaging School. She can be reached at alli@ packagingschool.com

Productivity — Quality — Pro tability JB Machinery Inc., | +1-203-544-0101 | jbmachinery.com Since 1998 JB Machinery has been developing innovative solutions to maximize productivity, quality and PROFITABILITY. ... And friendships that have spanned decades. Celebrating a quarter century of innovation Visit us at FEFCO booth 101, October 25-27, 2023

Recycling Packaging Industry Unites Behind Residential Recycling Initiative

Unable to ignore the climate crisis any longer, businesses are increasingly searching for more sustainable solutions. Switching to paper-based packaging is one of the easiest and most substantial ways to make an impact.

According to the U.S. Department of Energy, 68% of paper-based products are recycled, compared with only 5% of plastics.

With e-commerce on the rise, the onus is increasingly on consumers to correctly dispose of their boxes. The majority of consumers believe corrugated is worth recycling. However, 2 out of 3 consumers confess to not always recycling. Education is imperative to increasing the residential recycling rate and creating a circular economy. Th at’s why manufacturers and brands from across the packaging industry are uniting behind Box to Nature, a new residential recycling initiative.

Unlike other recycling programs, Box to Nature is specific to paper-based packaging. The campaign mark provides instructions on how to properly recycle the material right on the box—“Empty, Flatten, Recycle”—and directs consumers

to scan a QR code that leads to a microsite (box2nature.org ) with an interactive quiz and additional recycling tips. The mark is free to use by any company shipping goods to consumers and is a great way for brands to showcase their commitment to sustainability.

Rolled out just this past year, the program has already made waves throughout the packaging sphere, with 10 million boxes bearing the mark printed in the fourth quarter of 2022 alone. To date, 22 box producers have signed on to the program. Th is figure includes large manufacturers and smaller independent companies alike. “The need to increase the recovery of reusable material is bigger than any one company. We need all hands on deck to achieve our goal of raising the residential recycling rate,” says Mary Anne Hansan, president of the Paper and Packaging Board (P+PB), the national consumer marketing campaign spearheading the program.

Adds Greg Tucker, chairman and CEO of Bay Cities, “Only 40% of the corrugated boxes shipped to our homes in America are getting recycled. This is hampering our ability to produce new boxes from old boxes because we are not encouraging consumers to break down these boxes and put them in a recycling bin.”

With a solid foundation, Box to Nature is ramping up efforts to bring more brands and companies into the fold. As well as targeting

additional independent boxmakers, the program is prioritizing building awareness among large e-commerce brands through a LinkedIn campaign and direct outreach. New sales resources also have been launched to provide further support to participating companies. The program is optimistic about reaching its goal of having 125 million boxes with the mark printed in 2023.

Join the movement to get every residential box back and give corrugated fibers up to seven lives! If you would like to participate or learn more about Box to Nature, contact P+PB at box2nature@paperandpackaging.org or visit paperandpackaging.org.

BOXSCORE May/June 2023 32 AICC Innovation

AICC Innovation

Sixth and Seventh NEWW TAKES PRIDE IN THE UNUSUAL OVER MANY GENERATIONS

BY STEVE YOUNG

COMPANY: NEWW Packaging & Display

ESTABLISHED: 1834

JOINED AICC: 1978

PHONE: 978-632-3600

WEBSITE: www.newwpkg.com

HEADQUARTERS: Gardner, Massachusetts

President and CEO: David Urquhart

This is not a story about a 189-year-old New England company. It is not a story about how it was founded in 1834 by Elisha Murdoch to manufacture wooden household products such as buckets, firkins, and washboards and hence was eventually called New England Wooden Ware. Nor is it a story about how, in 1929, at the start of the Great Depression, the company gambled on a new packaging technology called “corrugated fiberboard.”

Rather, this is a story about NEWW Packaging & Display and the vision that the sixth and seventh generations of ownership envision for the future of this family business in a consolidating, challenging market. It is a story about a

successful and thriving independent with a reputation for quality, service, and a “willingness to do the unusual.”

Ben Urquhart, 45, has been with the company for 12 years. He graduated from Princeton University with a bachelor’s degree in ecology and evolutionary biology. He also holds a master’s degree in forest management from Yale University. Before becoming a sales manager three years ago, he served as a corrugator supervisor, prepress manager, and production manager. “This is my fourth job at NEWW,” he says. “I keep my old business cards to remind me of my history here.”

Ben’s partner in leading NEWW Packaging & Display is his father, David Urquhart, president and CEO. The

senior Urquhart, 73, is also a graduate of Princeton, as well as the University of Alaska and Worcester Polytechnic Institute. After a stint working for Alaska’s Institute of Marine Science, he returned to New England in 1981 to join the family business. He served on the AICC board of directors for more than 10 years and as the Association’s chairman in 2010–2011.

David remembers that Ben’s decision to work at NEWW 12 years ago was “of his own volition,” adding, “I did not ask him to come to work at NEWW. This event was of great significance to the eventual path to be followed by this now 189-yearold company. NEWW is very fortunate to have Ben working and now guiding

BOXSCORE May/June 2023 34

Member Profile

Photos courtesy of NEWW Packaging & Display.

David Urquhart, president (left), and Ben Urquhart, sales manager, are the sixth and seventh generations of the Urquhart family, respectively, at NEWW Packaging & Display.

this company through the present and into the future.”

NEWW Packaging & Display’s principal production facility is housed in a 300,000-square-foot plant in Gardner, Massachusetts, about 65 miles west-northwest of Boston. The company employs 150 people working three shifts, producing about 500 million square feet of corrugated packaging products annually.

The New England corrugated packaging market is, in Ben Urquhart’s view, a challenge. “One of the things I sometime hear is, ‘There is no new business in New England.’”

Ticking off a list of issues in the region vis-à-vis other parts of the country, he adds, “You know, who would invest in building new manufacturing capacity in this part of the world? Your energy costs are high, your labor costs are high, and the weather’s unpredictable.”

Yet, despite the market area headwinds, NEWW Packaging & Display continues to excel in serving a diverse range of stable corrugated users such as consumer goods, biomedical, food, and beverage. This customer-base stability allows NEWW to focus on long-term, core customers with unusual packaging needs. Says Ben, “I haven’t seen dramatic changes in our mix of customers over the past 10 years. Some come and go; we acquire opportunities, but our success is very much based on our capabilities and our consistency.

“We see ourselves as occupying a specialty niche,” he adds. “We think that we are good at serving customers with challenging structures, challenging artwork, and challenging expectations.”

Ben cited one area in which the company excels: specialty die cuts. In the past three years, the company has made major investments to support this niche. It acquired a Bobst VISIONCUT flat-bed die cutter, a Baysek die cutter, and a 113" Kolbus five-color rotary die cutter. “The investments we’ve made in our machines

and our systems are very much about supporting this niche,” he says.

He also noted that NEWW’s production excellence is a critical support for those customers who rely on automatic case-erectors and related packaging-line equipment with tight tolerances that demand precision. “I think our success is very much based on our die-cutting capabilities,” he says, adding that NEWW’s customers value the peace of mind knowing their lines will be running smoothly. “And yes, we also satisfy our customers’ psychological expectations.”

David agrees with his son’s take on NEWW’s ability to run demanding and challenging orders. “Some companies’ whole push is 90 black and 30,000 kicks an hour,” he says. “That’s not our niche.”

Offering a confirming metric to emphasize the point, Ben says, “You know, on an average day we are shipping a couple million square feet, but the total throughput of the factory is often much higher. So, the amount of board passing through our machines is an indication of how many orders require multiple passes.”

A corrugator plant, NEWW’s 98" Fosber corrugator produces B, C, and E flutes. In recent years, the corrugator has seen several upgrades, which Ben says have been “gradual and judicious.” A new Fosber dry end was installed in the past three years, and plans are in the works to add more upgrades to the double-backer, splicers, and roll stands. “We are making gradual, judicious investments to bring the corrugator up to a more modern and capable system,” he says. “We are running substantially faster and better than we used to,” Ben adds.

Additional improvements for the corrugator could be in the future, as well, he says. “I entertain myself by looking for new and interesting opportunities to do unusual things. So, if our niche is the strange and the difficult, what about F flute?” This enthusiasm recently led Urquhart to experiment with unique

grades of paper—running acid-free linerboard and vat-dyed liners. “I daydream about doing more unconventional things with our corrugator,” Ben adds.

NEWW is also a shareholder in New England Sheets in Devens, Massachusetts, a joint venture founded in 2010 with original partners Rand-Whitney, Horn Packaging, Interstate Container, and Norampac. The project is managed by Schwarz Partners. New England Sheets has a 110" Marquip corrugator running B, C, and E flutes. “We became involved with Schwarz Partners and got the ball rolling with Ed Davis at Rand-Whitney, the guys from Norampac, and Peter Hamilton at Horn Packaging,” Ben says. He says the decision to invest in a sheet feeder raised eyebrows among some of his business advisors. “A couple of the people who may read this article have been consultants to us in the past. Some of them felt very strongly that we were dooming ourselves to the trash heap by trying to be some sort of bizarre hybrid,” Ben recalls. “I remember one of them saying to me, ‘Nobody does this. You can either be a sheet plant, or you can be a corrugator plant. There’s nothing in the middle; don’t do it!’”